Meeting of the

Corporate and Strategic Committee

Date: Wednesday 19 February 2025

Time: 9.00am

|

Venue:

|

Council

Chamber

Hawke's

Bay Regional Council

159

Dalton Street

NAPIER

|

Agenda

Item Title Page

1. Welcome/Karakia/Housekeeping/Apologies

2. Conflict

of Interest Declaration

3. Confirmation of Minutes of

the Corporate and Strategic Committee meeting

held on 13 November 2024

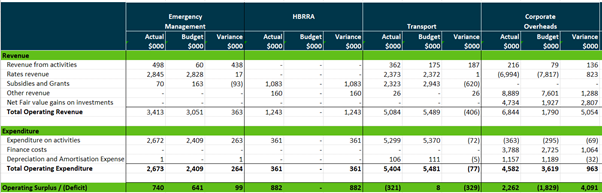

4. Public

Forum 3

Information

or Performance Monitoring

5. Financial

Report for FY24-25 to 31 December 2024 7

6. Organisational

Performance Report for the period 1 October - 31 December 2024 13

7. Regional

Economic Development Agency update 15

8. HBRIC

quarterly update 19

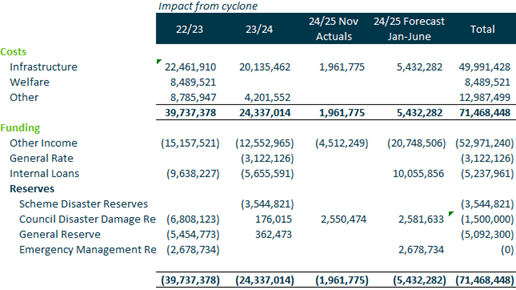

Hawke’s Bay Regional

Council

Corporate

and Strategic Committee

19

February 2025

Subject: Public Forum

Reason for report

1. This item provides the

means for the Committee to give members of the public an opportunity to address

the Committee on matters within its terms of reference.

Background

2. The Hawke’s Bay

Regional Council’s Standing Orders (14.) provide for public forums

which are run as follows.

2.1. Public forums are a defined

period of time of up to 30 minutes, usually at the start of a meeting, put

aside for the purpose of public input. Public forums are designed to enable

members of the public to bring matters to the attention of the local authority.

2.2. Any issue, idea or matter

raised in a public forum must fall within the terms of reference and ideally,

relate to an agenda item for that meeting.

2.3. Requests to speak at public

forums are to be submitted to the HBRC Governance Team (06 88359200 or governanceteam@hbrc.govt.nz) at least 2 working days

prior to the meeting

it relates to.

3. Some time limits and

restrictions apply, including:

3.1. A period of up to 30

minutes will be set aside for the Public Forum and each speaker allocated up to

5 minutes to speak. If the number of people wishing to speak in the public

forum exceeds 6 in total, the meeting Chairperson has discretion to restrict

the speaking time permitted for all presenters.

3.2. The meeting Chairperson has

the discretion to decline to hear a speaker or to terminate a presentation at

any time if:

3.2.1. the speaker’s topic / issue is

not within the terms of reference for the Committee or on the Agenda for the

meeting

3.2.2. the speaker is repeating views

presented by a previous speaker

3.2.3. the speaker is criticising elected

members and/or staff

3.2.4. the speaker is being repetitious,

disrespectful or offensive

3.2.5. the speaker has previously

spoken on the same issue

3.2.6. the matter is subject to

legal proceedings

3.2.7. the matter is subject to a hearing,

including the hearing of submissions where the local authority or committee

sits in a quasi-judicial capacity.

4. At the conclusion of a

speaker’s time, the Chairperson has the discretion to allow committee

members to ask questions of speakers to obtain information or clarification on

matters raised by the speaker.

5. Following the public forum

no debate or decisions will be made at the meeting on issues raised during the

forum unless related to decision items already on the agenda.

Decision-making process

6. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

the Corporate

and Strategic Committee receives and notes the Public Forum speakers’

verbal presentations.

Authored by:

|

Leeanne Hooper

Team Leader Governance

|

|

Approved by:

|

Desiree Cull

Strategy & Governance Manager

|

|

Attachment/s

|

1⇩

|

Corporate and Strategic Committee

Terms of Reference

|

|

|

|

Corporate and Strategic Committee Terms

of Reference

|

Attachment

1

|

Hawke’s Bay Regional

Council

Corporate

and Strategic Committee

19

February 2025

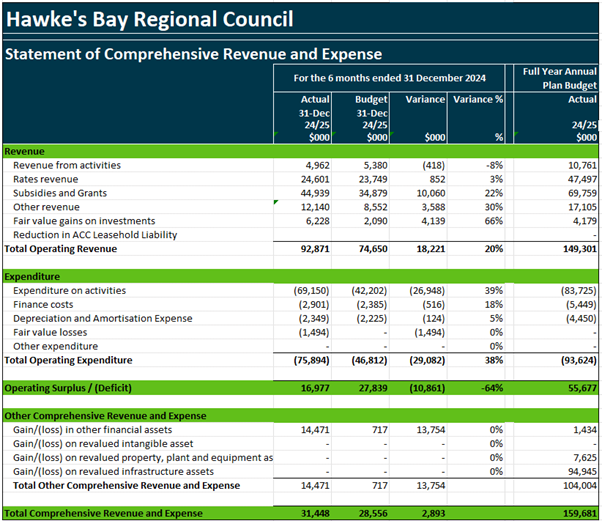

Subject: Financial Report for FY24-25

to 31 December 2024

Reason for report

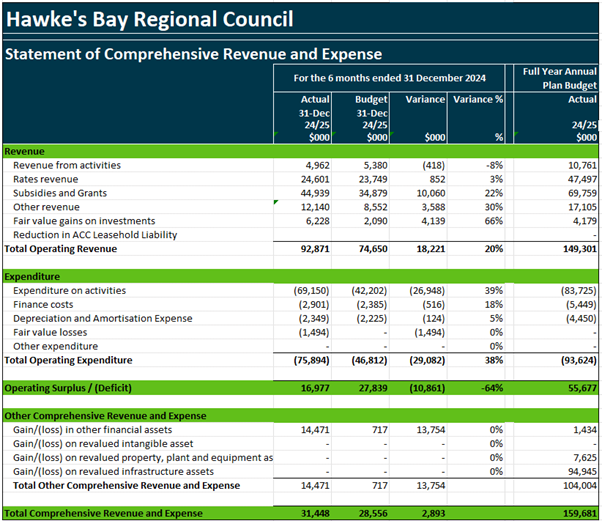

1. This report presents the

financial results of the Council for the six months to 31 December 2024.

Background

2. Financial performance is

reported to the Corporate and Strategic committee quarterly. The report

presented today is for the second quarter of the 2024-2025 financial year.

3. The financial performance

statements included are:

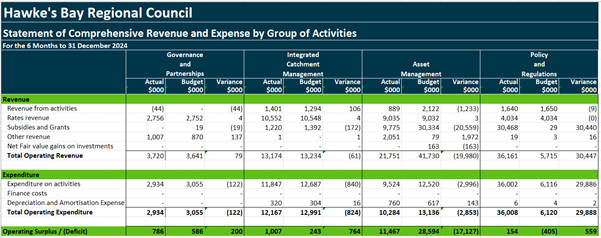

3.1. HBRC Statement of

Comprehensive Revenue and Expense

3.2. HBRC Statement of Financial

Position

3.3. Comprehensive Revenue and

Expense by Group of Activities.

Key

points

4. Total operating revenue for

the period is $92.8M, which is $18M above budget. Subsidies and grants

make up $10m of that variance, with Sediment & Debris and Hawke’s Bay

Regional Recovery Agency (HBRRA) being the major contributors.

5. Comparably, total operating

expenses for the period are $29M above budget at $75.9M, again largely impacted

by expenditure on Sediment & Debris as this programme utilises and expends

all funds in line with the DIA Sediment & Debris Funding contractor.

6. Borrowings continue to be

high in our short-term position while we continue to work through the National

Emergency Management Agency (NEMA) and insurance claims. Reimbursement of costs

from Cyclone Gabrielle insurance claims are ongoing and a recent meeting with

insurers have been positive to enable us to progress at pace with these to 30

June 2024. to progress these. We have received payments for NEMA claims 7 and 8

during the quarter, totalling over $700K.

7. To 31 December 2024

liquidity was maintained at a high level due to external borrowing in

anticipation of cashflow required for the NIWE project. From February 2025 the LGFA

has eliminated additional costs to borrow outside tender dates, allowing HBRC

to reconsider their liquidity strategy. Rather than hold additional cash on

hand, Council will instead increase their Standby Facility to ensure compliance

to their liquidity ratio. It is not anticipating any future drawn-down

against the standby facility and Council will instead draw funds from the LGFA

as required.

8. The budgets reflected in

this report are year 1 of the Three-Year Plan 2024-2027. Revised budgets are used

for management reporting which include the Council-approved carry forwards of

2023-2024 budgets.

Commentary on Statement of Comprehensive Revenue and Expense

9. The actual result to 31

December 2024 for the total Comprehensive Revenue and Expense is a surplus of

$31.4M while the budget was $28.6M surplus.

10. Sediment & Debris

(HBRRA) and the Silt Taskforce (HBRC) continue to be significant activities for

the organisation. These were due to be completed by 31 December 2024, but an

extension to 30 June 2025 has been negotiated. The net position for HBRC

from Silt & Debris will be a net $0 result with no cost overruns expected.

11. After removing HBRRA ($1M)

and Silt Taskforce funding ($30M), subsidies and grants are $13.6m year to

date, $21.2M behind budget, primarily due to the timing of the NIWE programme.

12. Other revenue is exceeding

budget by $3.5M due to unbudgeted income on insurance claims and interest

income received from holding HBRRA funds.

13. Total operating expenses

for the quarter were $75.9M of which $30.4M is for HBRRA and Silt Taskforce,

leaving $45M spent year to date against a budget of $46.8M, an underspend of

4%.

14. The remaining $1.8M

operating underspend is spread across several areas, including IRG,

biosecurity, biodiversity, and ECS/Land for Life. Partially offsetting these

underspent areas, there are a couple of key areas of overspend. Legal fees

related to the Land Categorisation process are expected to total $90K this

financial year, with additional costs anticipated in future years. Furthermore,

the ongoing task of opening and maintaining river mouths is projected to result

in a $0.5M overspend this year. Continuous drain clearing is also contributing

to these overspends.

15. Further detail on financial

and non-financial information for Groups of Activities is detailed in the

Organisational Performance Report.

16. Due to the increased value

of our infrastructure assets from the revaluation, our depreciation costs have

gone up. We did not allocate funds in the LTP to cover the additional

$250K of infrastructure depreciation in 2024-25 (in layman’s terms, we

did not rate to cover this).

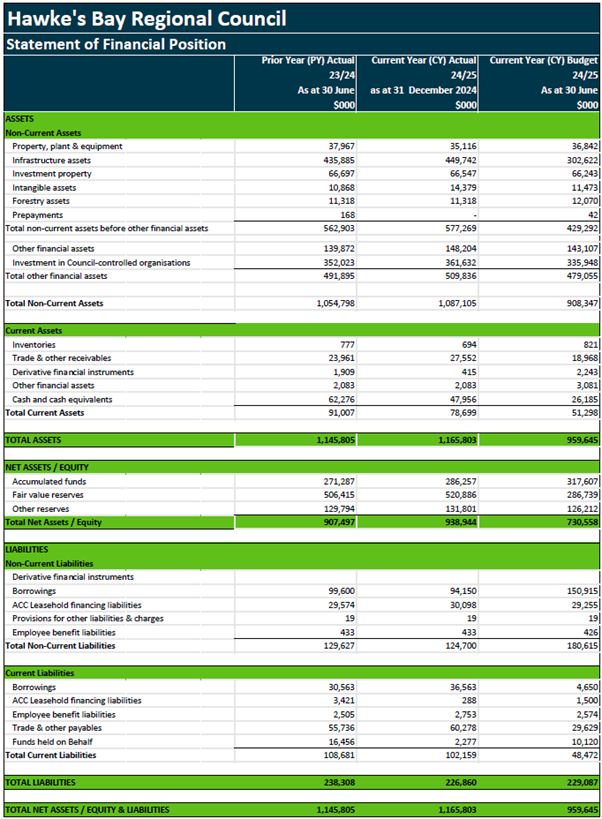

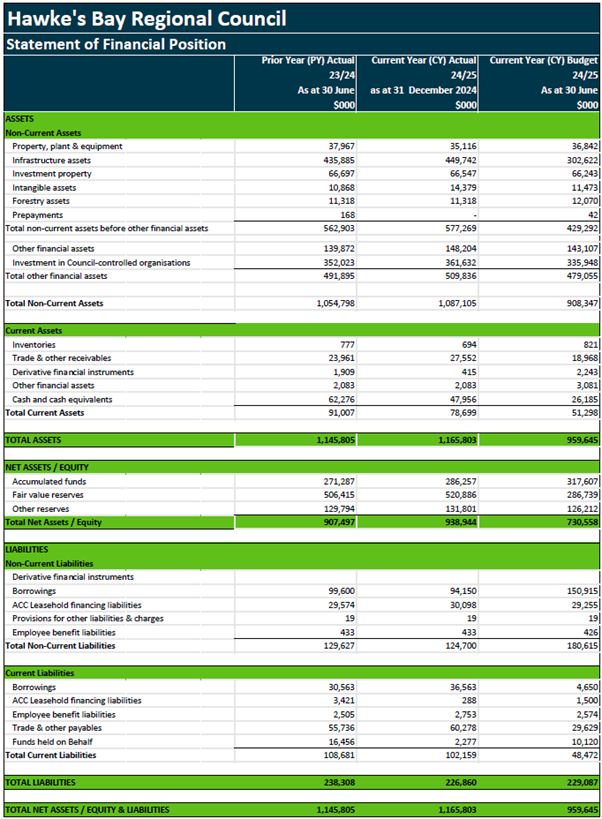

Commentary

on Statement of Financial Position

17. Infrastructure assets

continue to increase due to the significant amount of capital work being

undertaken to repair assets damaged by Cyclone Gabrielle. The value has

increased from $442.4M to $449.7M since the last quarter, giving a $7.3M

increase. The end of year budget in the LTP does not include the significant

revaluation of infrastructure assets that occurred during the 2023-2024 annual

reporting process.

18. Intangible assets value has

increased this quarter by $300K, predominantly due to the carbon credits

movement in price.

19. Napier Port share price as

at 31 December 2024 was $2.57 against $2.26 at 30 September 2024, a total

increase of $34M. This is reflected in the investment in council-controlled organisations.

20. Trade and other receivables

have decreased since the last quarter by $1.5M due to payments received for

rates and our continued focus on collections.

21. Cash and Cash equivalents

is at $48M as of 31 December 2024, a decrease of $15M since the last quarter.

$8M has been set aside in a short-term deposit to repay the LGFA loan maturing

in April 2025.

22. Trade payables are sitting

at $60.2M, a decrease of $2.4M from the last quarter which was $62.6M. With

spend increasing on capital projects, the value of payables is likely to remain

quite high for the balance of the year.

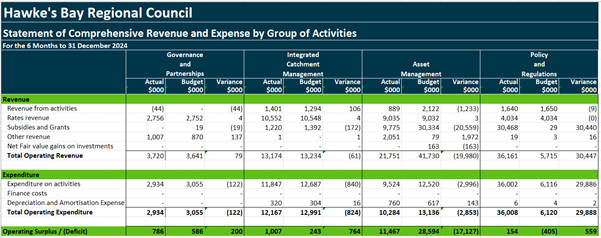

Financial

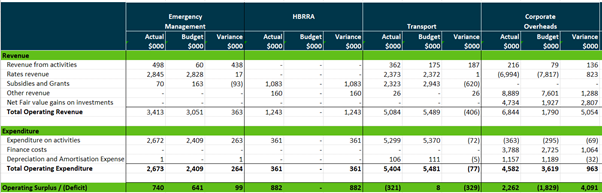

summary by Group of Activities (GOA)

23. The following table

provides a breakdown of the statement of comprehensive revenue and expense by

Group of Activities (GOA). The Organisational Performance Report includes

further financial and non-financial commentary for each GOA. Please note that

the budgets used in this report are from the LTP and the budgets used in the

Organisational Performance Report include subsequent adjustments, including

approved carry forwards from 2023-2024.

24. GOA expenditure includes

each activity’s external expenditure, internal staff time, finance costs

(interest), depreciation/amortisation and a share of corporate overheads.

Rates collection

25. Rates penalties issued in

2024 totalled $700K (12,111 ratepayers). In 2023 we issued $552K of penalties

to 11,720 ratepayers.

26. Year to date at 31 December

2024 the team has processed remissions for utility charges to local authorities

($187K), Public Transport ($99K), Natural Calamity ($71K) and Hardship as a

Result of the Policy Changes ($7K).

27. There are 25 remaining

hardship remissions received relating to Revenue & Financing Policy changes

and natural calamity. These are being assessed and remitted where appropriate.

Debt

collection

28. As at 31 December 2024 the

Council had $2.49M of outstanding trade debtors. This compares to $9.1M at the

end of last financial year (June 2024). Receivables from government agencies

had inflated previous balances.

29. For rates specifically, an

outstanding of balance of $3.6M remains unpaid with $1.2M related to the latest

rates invoices issued for 2024-2025. At the same time last year, we had $5.0M

outstanding with $3.0M related to the 2023-2024 rates invoices that had just

passed their due date.

Commentary

– Treasury

30. With the Silt & Debris

operations wrapping up, almost all the funds held on behalf have been

exhausted. In the past HBRC has used the interest received on these funds

to offset Council’s cost of funds and, moving forward, expects net costs

of funds to increase.

31. During the quarter to 31

December 2024 HBRC repaid $5M long term debt to the LGFA and has

pre- funded $8M of debt maturing in April 2025.

32. In December HBRC commenced

a programme of short-term borrowing to fund the Crown’s portion of the

NIWE project costs. This is initially a commercial note for 4 months

while HBRC finalises reimbursement terms with the Crown. HBRC may be required

to hold additional debt (estimated at $13M) to fund this cashflow throughout

the entire NIWE project.

33. HBRC continues to work

through its application to LGFA for a Green Loan to cover its share of the NIWE

project costs. This is a slow process; however, once approved, any

existing long-term borrowing for this can be converted to a Green Loan at reduced

cost of borrowing.

34. All Managed Fund Portfolios

are now held with Harbour Asset Management and performing well. Markets

have been favourable and to 31 December 2024 the managed funds have returned

net 7.56% year to date. Looking forward it is possible HBRIC may, after

ensuring inflation protection of the assets, realise a portion of fair value

gains to fund the cash dividend required from investment assets under the SOE

to HBRIC. Any gains realised will be held in a resilience reserve.

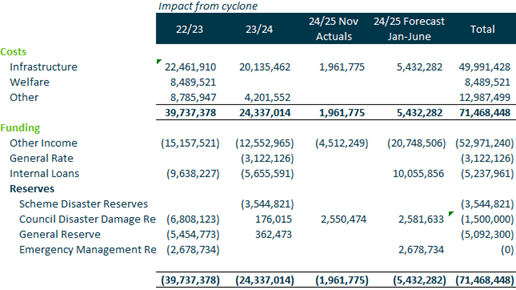

Cyclone Recovery

35. The following table

summarises the current forecast financial impact from Cyclone Gabrielle

response and recovery. It excludes work on sediment and debris and NIWE.

36. Overall, we expect to have

spent a total of $71.5M in responding to and recovering from the cyclone. The

other costs relate to staff time that is not claimable, independent reviews and

the like.

37. NEMA and insurance monies

received will be used to repay external loans taken out to cover the

expenditure incurred. The balance of the borrowing and the recovery of the Council

and scheme disaster damage reserves will be funded from general rate funding

already included in the LTP.

Decision-making considerations

38. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision making

provisions do not apply.

Recommendation

That

the Corporate

and Strategic Committee receives and notes the Financial Report for FY24-25

to 31 December 2024 staff report.

Authored

by:

|

Pam Bicknell

Senior Group Accountant

|

Megan McKenzie

Senior Business Partner

|

|

Tracey O'Shaughnessy

Treasury & Investments

Accountant

|

Tuesday Walker

Graduate Financial Accountant

|

|

Chris Comber

Chief Financial Officer

|

|

Approved

by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s There are no attachments

for this report.

Hawke’s

Bay Regional Council

Corporate

and Strategic Committee

Wednesday

19 February 2025

Subject: Organisational Performance

Report for the period 1 October - 31 December 2024

Reason for report

1. This item presents the

Organisational Performance report for the period 1 October –

31 December 2024.

Organisational Performance Report content

2. The attached report

contains four parts:

2.1. Executive summary including highlights and

challenges.

2.2. Corporate metrics that focus on how we are

performing across a number of corporate-wide measures such as employee turnover

and official information requests.

2.3. Level of service measures by group of

activities by exception (i.e. measures with red or orange traffic light status

with commentary).

2.4. Activity

reporting with

non-financial traffic light status and commentary, and financial status and

commentary rolled up to the group of activities.

3. Organisational performance

reports were established in 2018. The status and commentary reporting are

rolled up from budget lines to activity level. Commentary by budget lines is still

available to committee members on request to staff.

4. Staff complete their

reporting in a software tool called Opal3. For LOSM and activity reporting,

staff select the status (red, amber, green) and provide commentary on what they

did in the quarter against their annual work plans.

Corporate

metrics

5. Employee numbers have

dropped for the second quarter in a row despite further recruitment to support

additional flood resilience work programmes. HBRC continues to hold at least 20

vacancies as part of its fiscal savings plan.

Level

of service measures

6. Staff have reported 11

performance measures as ‘off track’. A further 6 are reported as

‘not due’ and will be reported on at the year-end in the Annual

Report.

Activity

reporting

7. Staff have reported 3

activities as ‘off track’ from their usual workplans. This is 1

more than last quarter.

8. Financial reporting shows

that 1 of the 6 Groups of Activities is over budget. Commentary is provided to

provide context.

Decision-making considerations

9. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

the Corporate and Strategic Committee receives and notes the Organisational

Performance Report for the period 1 October - 31 December 2024.

Authored by:

|

Sarah Bell

Team Leader Strategy and Performance

|

|

Approved by:

|

Desiree Cull

Strategy & Governance Manager

|

|

Attachment/s

|

1⇨

|

2024-25 Q2 HBRC Organisational

Performance Report

|

|

Under Separate Cover

online only

|

Hawke’s

Bay Regional Council

Corporate

and Strategic Committee

19

February 2025

Subject: Regional Economic Development

Agency update

Reason for report

1. This item provides a brief

update from the Regional Economic Development Agency (REDA), which will be

presented by Lucy Laitinen, CEO. This memo provides an update of HBREDA’s

activity since HBREDA’s last update to HBRC in November 2024. Lucy will

provide an overview of the key findings of HBREDA’s recently published

research into the HB economy at the meeting. Hard copies of the research and

the HBREDA Annual Report have already been provided to councillors.

Background

2. HBREDA held its inaugural

shareholders’ AGM on 13 December where it tabled its annual report and

approved annual accounts and reported against its letter of expectations (LOE).

3. Prior to the

shareholders’ AGM, HBREDA contracted independent consultant Kevin Jenkins

to undertake an external review of the Board, as required by its Governance

Charter every two years. The review was provided to shareholders at the

Shareholders’ AGM.

4. HBREDA’s first LOE

ended in December 2024 and the Matariki Governance Group will shortly issue a

new LOE to HBREDA following input from shareholders. Following receipt of the

LOE, HBREDA will present a statement of intent to shareholders outlining its

intended work programme for the year

General

5. HBREDA is supporting the

Regional Recovery Agency, where possible, with the regional deal process,

primarily through providing economic research and insights to support the

application process.

6. HBREDA has been continuing

to find opportunities to advocate for increased resilience in HB’s

telecommunications network and the two-year anniversary of Cyclone Gabrielle

has enabled HBREDA to provide messaging in the media around our continued

telecommunications vulnerabilities.

7. The four latest district-level Community

Compass reports are now on the HB REDA website: https://www.hbreda.co.nz/community-compass.

Current

projects

8. Understanding the HB

Economy’’ research. HBREDA launched its study into the HB economy in

December at an event for business, followed by a presentation to the Matariki

Governance Group. The research gives a comprehensive overview of our economy

and the main barriers and opportunities for growth. There are a number of high

level recommendations, which we are currently working through and which will

inform our work programme

as well as regional priority-setting.

9. The connection between productivity

and Māori health outcomes (NZIER). This project is a partnership between HBREDA and

Tīhei Takitimū the Iwi Māori Partnership Board. It aims to

estimate the value of lost productivity due to priority health conditions in

working age Māori in Hawke’s Bay with a view to building a case for

increased and more targeted investment in Māori health. Low productivity

is arguably the number one problem in our economy and with an increasing

Māori population it makes sense to address systemic issues such as the

health profile of Māori as one avenue with the potential to lift

productivity by ensuring a more productive workforce.

10. Analysis of the economic value of SH2

(NZIER). This project

is a partnership between HBREDA and Trust Tairāwhiti. Its aim is to

investigate the economic and social impacts of investing in more resilient road

infrastructure between Napier and Gisborne. This includes future potential

impacts from investment not only to existing businesses but also to other

stakeholders within the region as well as wider socioeconomic benefits such as

educational and health benefits. If a solid evidence base can be built this piece

of work will be used to advocate for increased investment.

11. FoodEast business case. HBREDA will shortly start a project

with MartinJenkins looking at the opportunity to develop a fermentation

capability at FoodEast as well as explore other options to activate the site.

12. Review of tourism in Hawke’s Bay. HBREDA is shortly about to start a

project with MartinJenkins to investigate the value of tourism in Hawke’s

Bay and opportunities to grow that sector.

Operation

of Te Rae

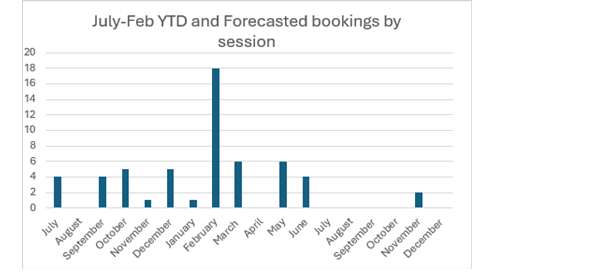

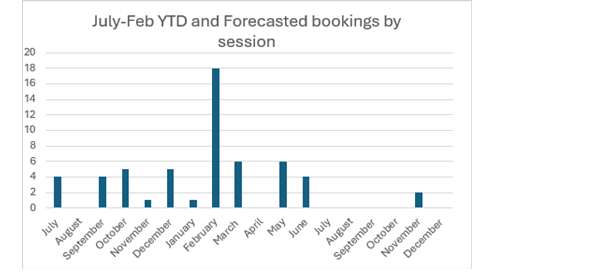

13. The number of clients continues to

grow and feedback remains positive. HBRC past and forecast use of the Te Rae

rooms is shown below. The ‘value’ of the rooms at our rates was $9730 from July 2024 to

February 2025. All councils receive free use of the rooms.

Next steps

14. HBREDA will respond to the

LOE with a statement of intent outlining its planned work programme, which will

largely be based on the recommendations of our research into the economy.

Decision-making considerations

15. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision making

provisions do not apply.

Recommendation

That

the Corporate

and Strategic Committee receives and notes the Regional Economic Development

Agency update.

Authored & approved by:

|

Lucy Laitinen

HB REDA Chief Executive

|

|

Attachment/s

There are no attachments for this

report.

Hawke’s

Bay Regional Council

Corporate

and Strategic Committee

Wednesday

19 February 2025

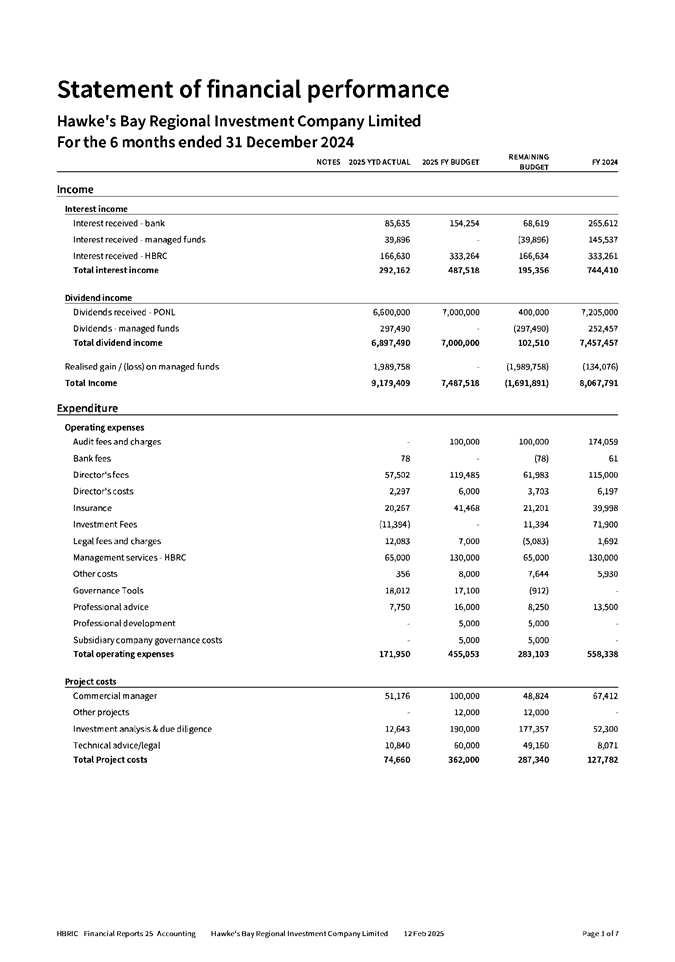

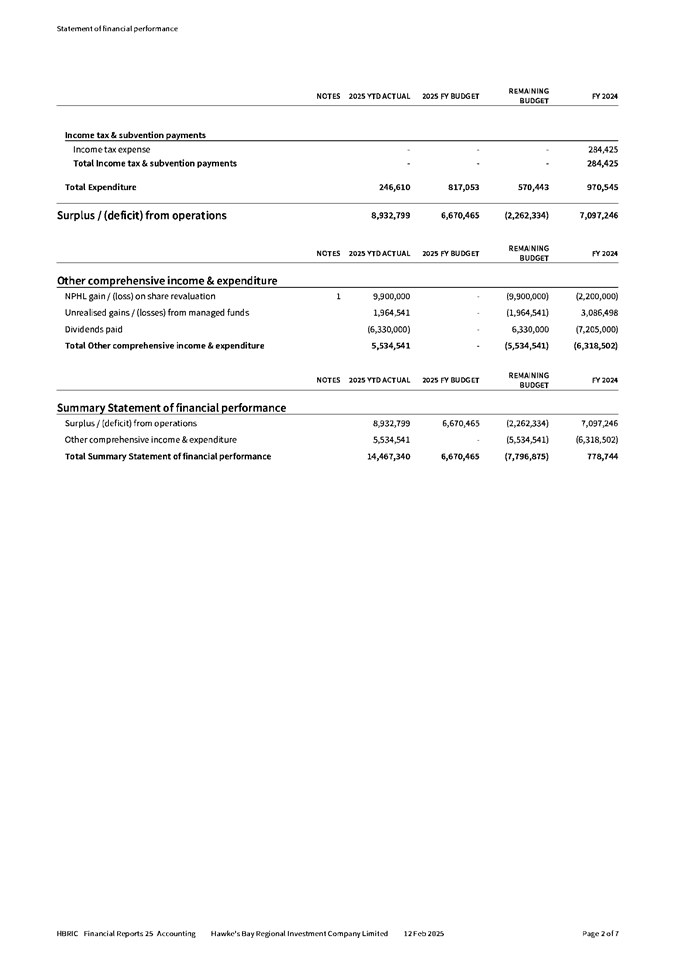

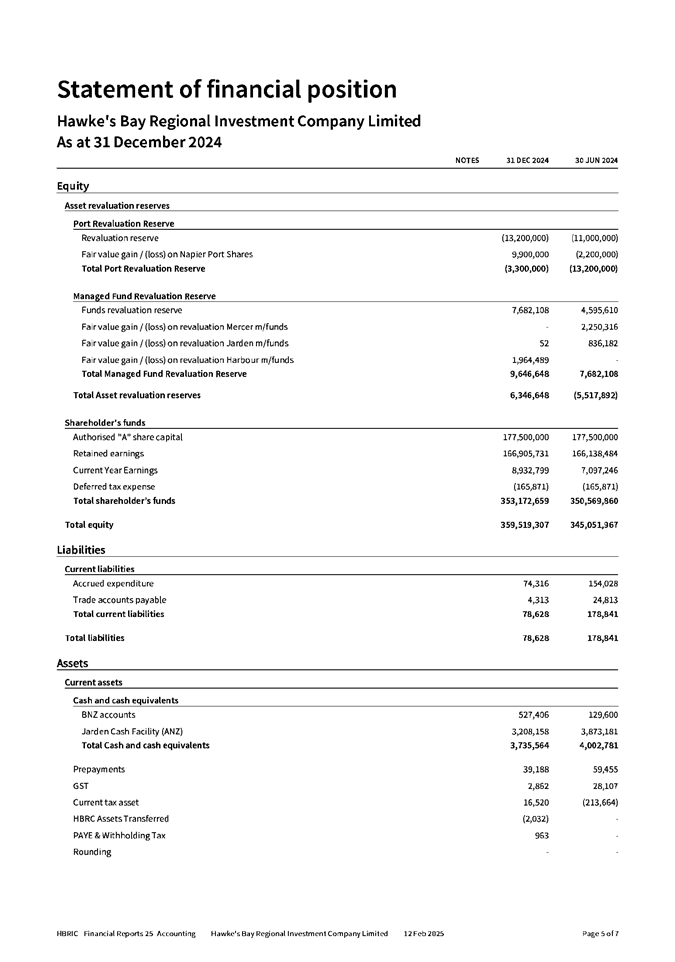

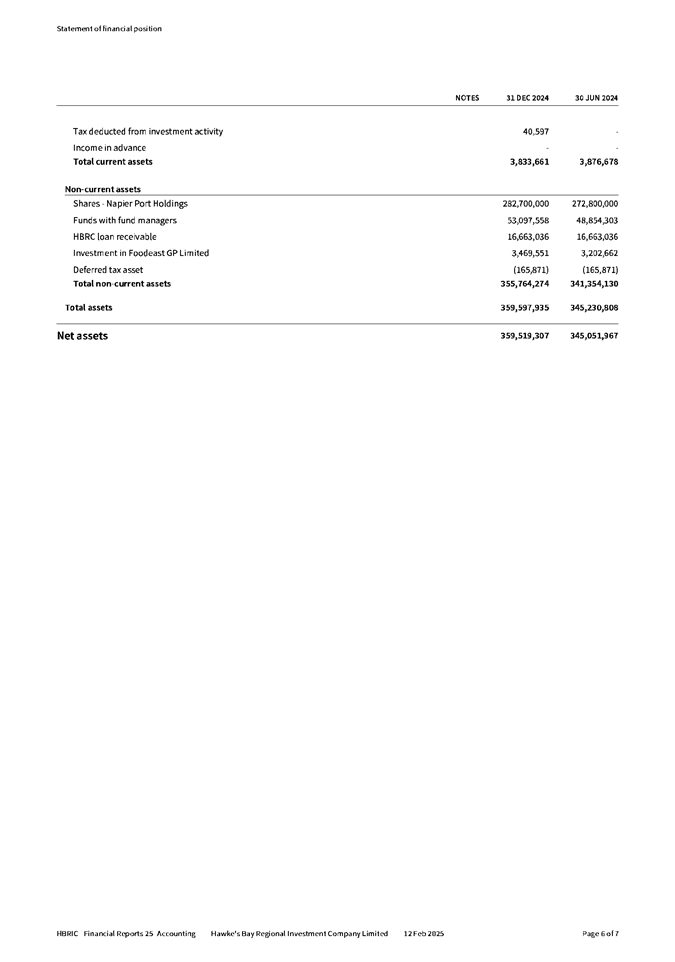

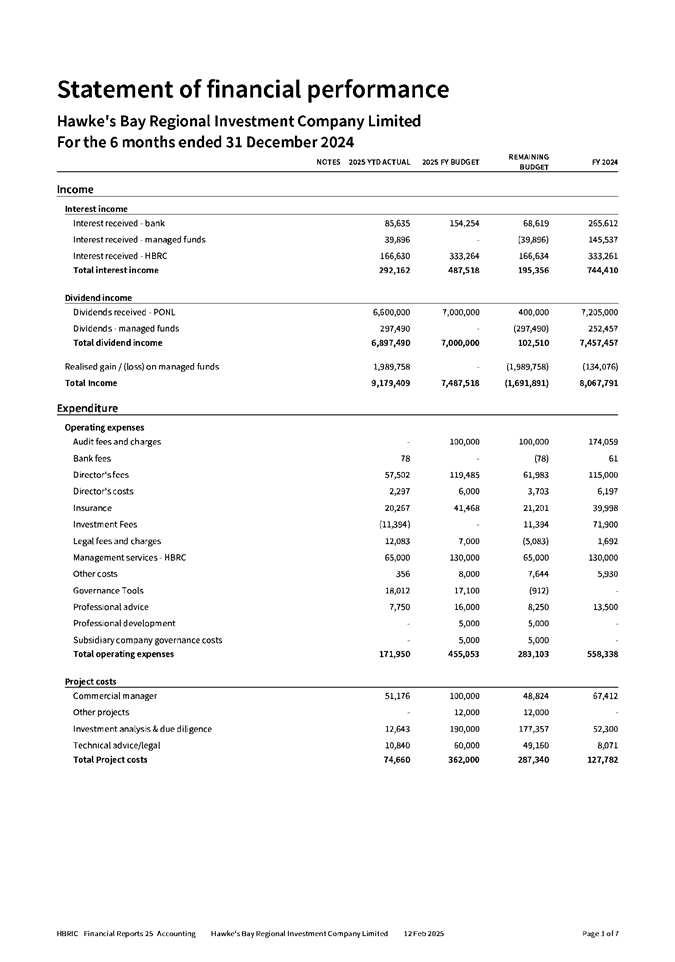

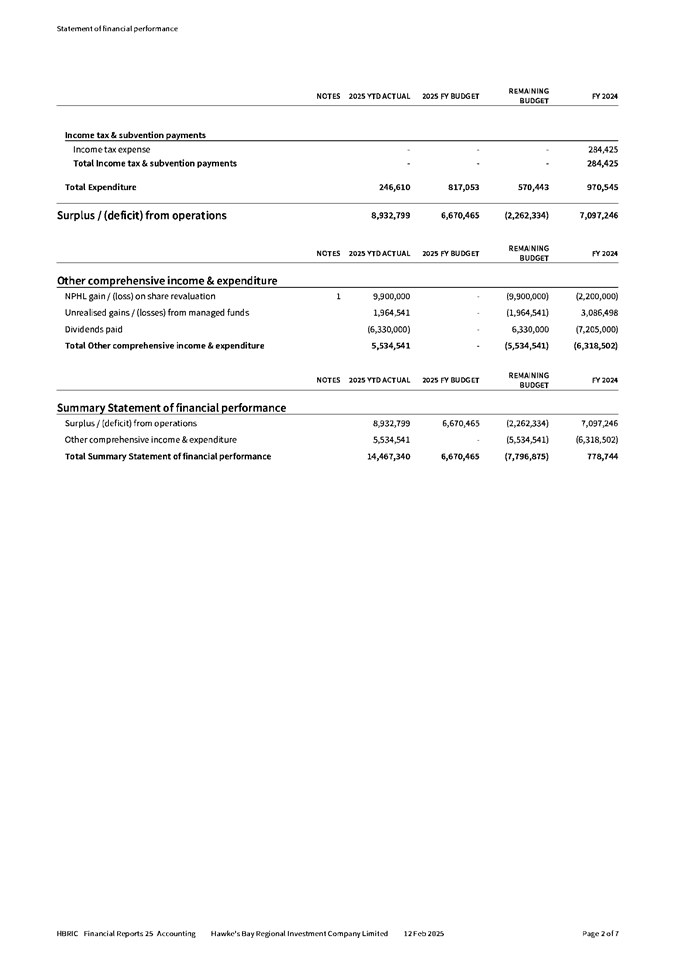

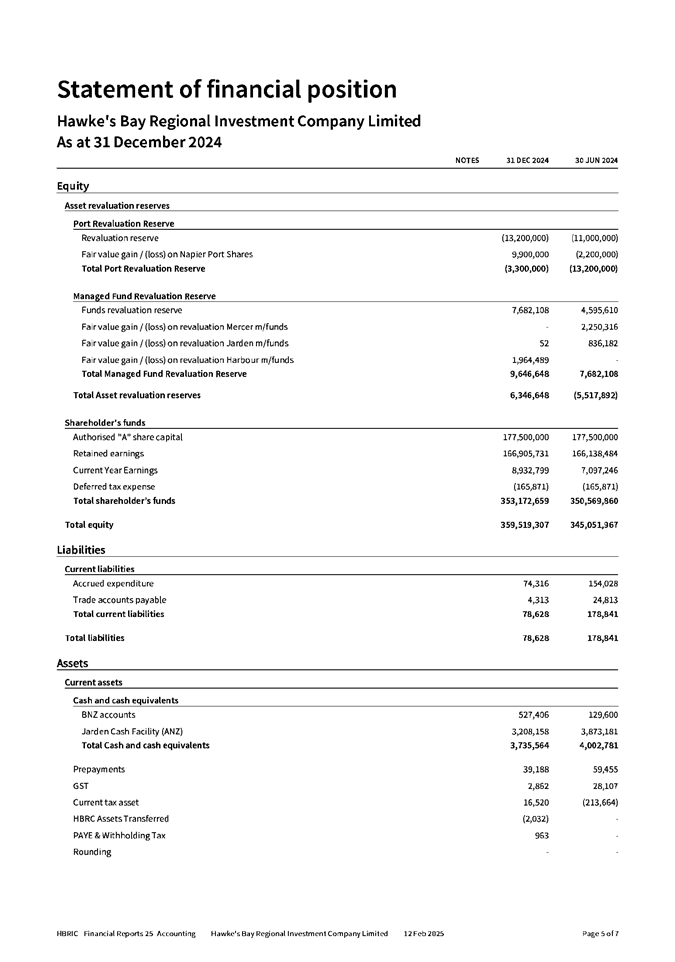

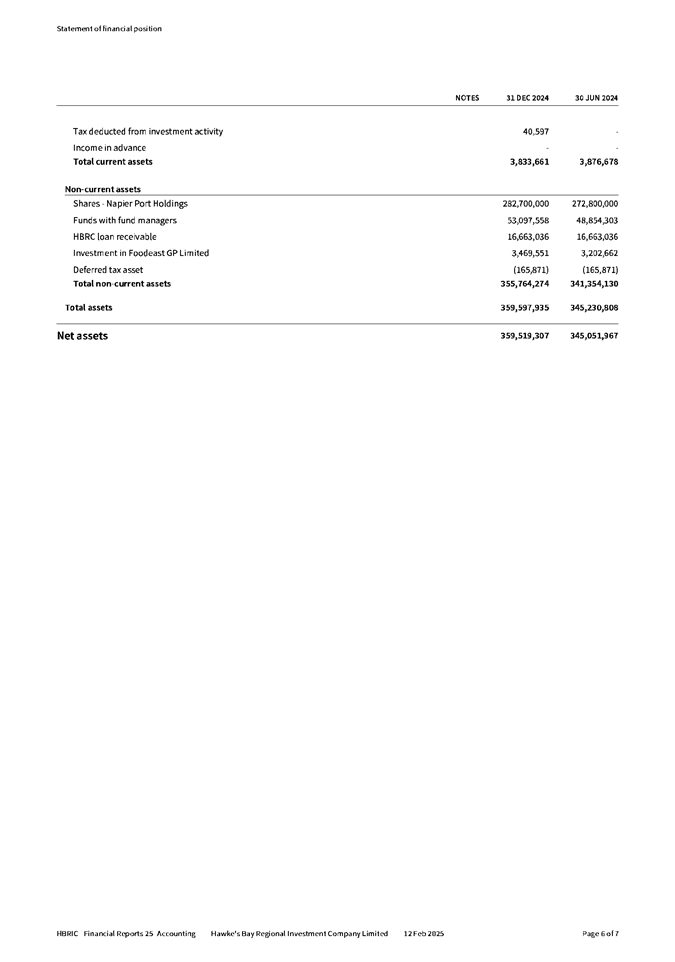

Subject: HBRIC quarterly update

Reason for report

1. This item provides

HBRIC’s quarterly update.

Executive summary

2. During the second quarter

of FY24/25, the Group assets increased by $25.6m, made up by a $9.9m increase

in NPHL share price, a $13.6m increase in managed funds and $2.1m increase on

property and carbon credits revaluation.

3. Managed Funds: From 1 July

to 31 December, the Group portfolio grew by $13.6 million, representing an

8.11% year-to-date increase.

4. FoodEast: Progress in

tenanting has been made given challenging market conditions

5. Investment Strategy: HBRIC

continues to focus on delivering Council’s new investment objectives.

Managed

funds

6. As of 30 December 2024,

HBRC and HBRIC held the following managed funds portfolios with Harbour Asset

Management:

|

Fund

|

Total

|

|

HBRIC - FIF

|

$53,097,613

|

|

HBRC - FIF

|

$72,135,842

|

|

|

$125,233,455

|

|

HBRC - LTIF

|

$55,957,261

|

|

|

$181,190,716

|

7. Chris Di Leva, Harbour

Asset Management’s Head of Global & Multi Asset Investment, will be

in attendance and provide an overview presentation to the Committee.

FoodEast

8. FoodEast management

continues to make progress in tenanting in challenging market conditions. Focus has shifted from

food-producing businesses to agritech businesses, and a strategy is in place

for engaging with the regional agritech industry.

9. The highlight of Q2 was the

official opening of FEH, with the Hon. Shane Jones attending and unveiling a

commemorative plaque marking the occasion.

10. FoodEast also reported

progress in the development of its commercial and innovation activities. Total rents received,

inclusive of conference room income and on-charge costs less lease incentives

were $78,199 for the first half of the financial year relative to budget of

$90,687. Unbudgeted project income of $12,500 was received from Sustainable is

Attainable (with a further $12,500 to be received in Q3, and $25,000 per year

in FY2026 and FY2027) along with unbudgeted grant income of $10,000. Overall

revenue was $100,699 relative to a budget of $90,687.

Napier

Port

11. The Napier Port Annual

Shareholder Meeting was held on 19 December 2024.

11.1. Revenue for the 2024

financial year increased 15.9% to $141.4 million from $122.0 million in the

previous year, following growth across all trade areas.

11.2. Underlying net profit after

tax of $20.7 million was up 94.6% from $10.7 million in the prior year.

11.3. Reported net profit after

tax of $24.8 million was up 49.7% on the prior year’s $16.6 million.

11.4. Post-Cyclone Gabrielle

business interruption insurance claim contributed further $9.25 million to

earnings.

12. Directors declared a fully

imputed final dividend 6 cents per share, taking total dividends for the 2024

financial year to 9 cents per share, up from 5.25 cents for the prior year, and

representing a gross dividend yield of 5.5%.

Council’s

cash investment expectations

13. Council set FY24/25 cash

return expectations from its Group investment portfolio of $15,050,000. This

comprised a $12,500,000 base Annual Plan expectation plus a one-off special

dividend of $2,550,000.

14. To date, the following cash

receipts from investment assets have been paid to Council:

14.1. Napier Port Dividend (Ex

HBRIC) $6,330,000

14.2. Wellington Leasehold Income $

496,770

14.3. Napier Leasehold Income $

312,215

Total $7,138,985

15. Following a six-month

performance review of the Group’s Managed Funds Portfolio managed by

Harbour Asset Management, at its 10 February 2025 Board meeting HBRIC

recommended that $5,000,000 be drawn against the $12,676,439 YTD group

portfolio gains. This sum to be split between HBRC ($3.7m) and HBRIC (1.3m).

16. Following these payments $12,138,985 (or 81%) of the full year cash

requirements will have been delivered and the managed funds’ portfolios

will remain in compliance with their capital protection thresholds.

17. Of the remaining $2,911,015

scheduled to be paid to Council before the end of the financial year, HBRIC is

budgeting to receive a further $3,220,000 by way of interim dividend from

Napier Port, which provides confidence that Council’s 2024-2025 cash

expectations from Group Investments will be fully met.

18. In summary, the early

payment to Council is the result of a higher than budgeted final dividend from Napier

Port and a strong six-month performance from the managed funds portfolio.

However, a solid H1 performance is not guarantee for a similar result in H2. A

further update will be provided at HBRIC’s next quarterly update to the

Committee, including HBRIC’s projections for the establishment and

seeding of the Income Resilience Reserve, as requested by Council.

Decision-making considerations

19. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision making

provisions do not apply.

Recommendation

That

the Corporate

and Strategic Committee receives and notes the HBRIC quarterly update.

Authored by:

|

Tracey O'Shaughnessy

Treasury & Investments

Accountant

|

Tom Skerman

HBRIC Ltd Commercial Manager

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

HBRIC December 2024 Financial

Statement

|

|

|

|

2⇨

|

HBRIC Investment Performance update

February 2025

|

|

Under Separate Cover

online only

|

|

HBRIC December 2024 Financial Statement

|

Attachment

1

|