Meeting of the

Corporate and Strategic Committee

Date: 13 November 2024

Time: 2.00pm

|

Venue:

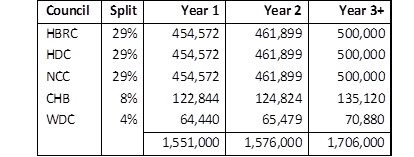

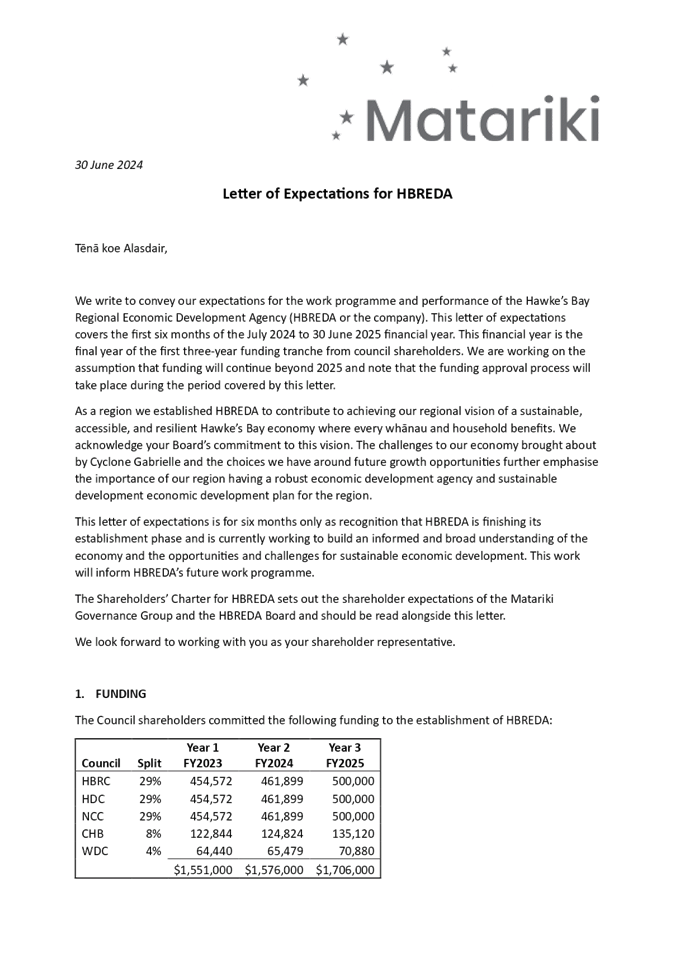

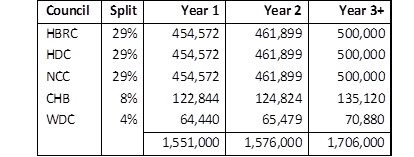

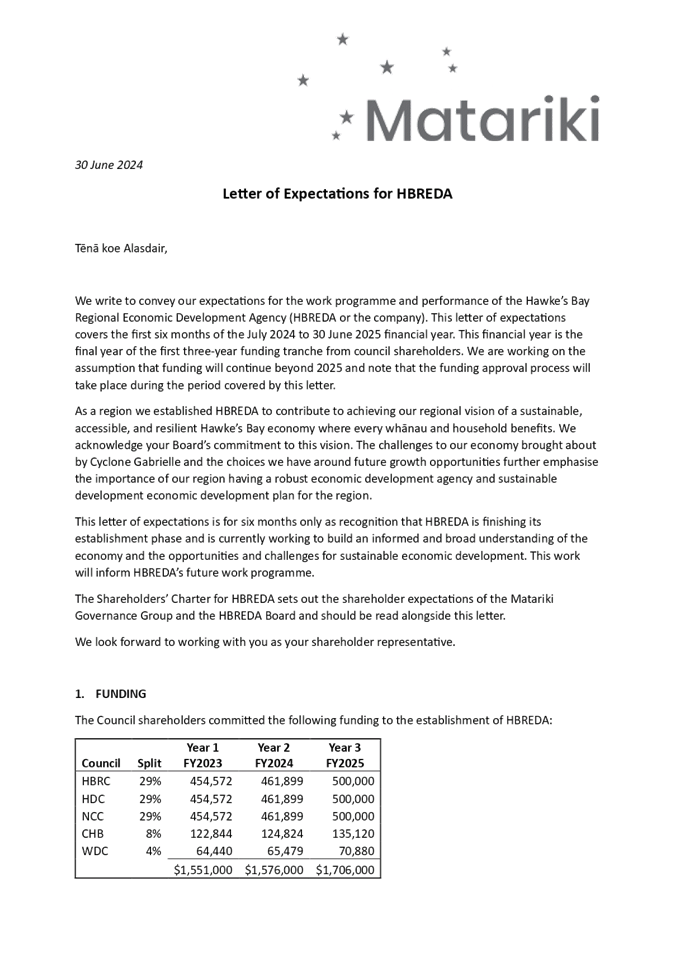

|

Council

Chamber

Hawke's

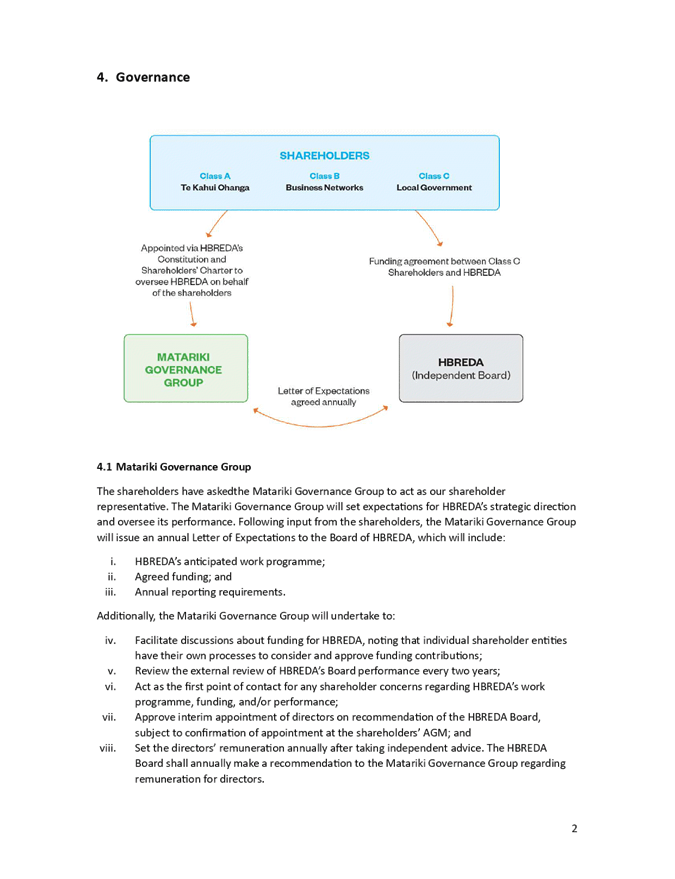

Bay Regional Council

159

Dalton Street

NAPIER

|

Agenda

Item Title Page

1. Welcome/Karakia/Housekeeping/Apologies

2. Conflict

of Interest Declaration

3. Confirmation of Minutes of

the Corporate and Strategic Committee held on 4 September 2024

4. Public

Forum 3

Information

or Performance Monitoring

5. Regional

Economic Development Agency update 7

6. HB

Tourism update 25

7. HBRIC

quarterly update 27

8. Organisational

Performance Report for the period 1 July - 30 September 2024 31

9. Financial

report for FY24-25 to 30 September 2024 33

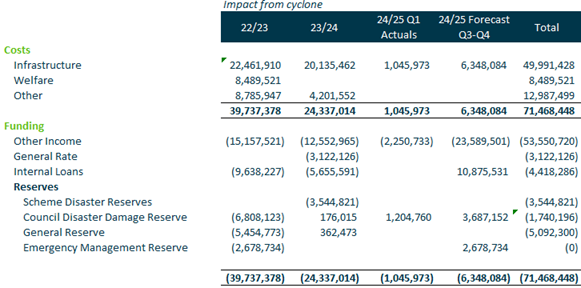

Hawke’s Bay Regional

Council

Corporate

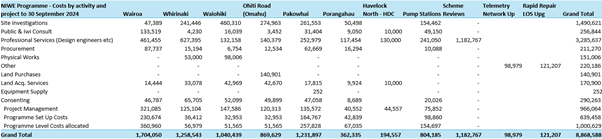

and Strategic Committee

13

November 2024

Subject:

Public Forum

Reason for report

1. This item provides the

means for the Committee to give members of the public an opportunity to address

the Committee on matters within its terms of reference.

Background

2. The Hawke’s Bay

Regional Council’s Standing Orders provide for public forums as follows:

14.

Public

Forums

Public

forums are a defined period of time, usually at the start of a meeting, which,

at the discretion of a meeting, is put aside for the purpose of public input.

Public forums are designed to enable

members of the public to bring matters to the attention of the local authority.

In

the case of a committee or sub-committee, any issue, idea or matter raised in a

public forum must also fall within the terms of reference of that meeting.

Requests

must be made to the HBRC Governance Team (06 835 9200 or governanceteam@hbrc.govt.nz) at least one clear day

before the meeting;

however this requirement may be waived by the Chairperson.

14.1 Time limits

A

period of up to 30 minutes, or such longer time as the meeting may determine,

will be available for the public forum at each scheduled Regional Council,

Corporate & Strategic Committee, Environment & Integrated Catchments

Committee and Regional Transport Committee meeting.

Speakers

can speak for up to 5 minutes. No more than two speakers can speak on

behalf of an organisation during a public forum. Where the number of speakers

presenting in the public forum exceeds 6 in total, the Chairperson has

discretion to restrict the speaking time permitted for all presenters.

14.2 Restrictions

The

Chairperson has the discretion to decline to hear a speaker or to terminate a

presentation at any time where:

a speaker is repeating views

presented by an earlier speaker at the same public forum

the speaker is criticising

elected members and/or staff

the speaker is being

repetitious, disrespectful or offensive

the speaker has previously

spoken on the same issue

the matter is subject to legal

proceedings

the matter is subject to a

hearing, including the hearing of submissions, where the local authority or

committee sits in a quasi-judicial capacity.

14.3 Questions at public forums

At

the conclusion of the presentation, with the permission of the Chairperson,

elected members may ask questions of speakers. Questions are to be confined to

obtaining information or clarification on matters raised by a speaker.

14.4 No resolutions

Following

the public forum no debate or decisions will be made at the meeting on issues

raised during the forum unless related to items already on the agenda.

Decision-making process

3. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

the Corporate

and Strategic Committee receives and notes the Public Forum speakers’

verbal presentations.

Authored by:

|

Leeanne Hooper

Team Leader Governance

|

|

Approved by:

|

Desiree Cull

Strategy & Governance Manager

|

|

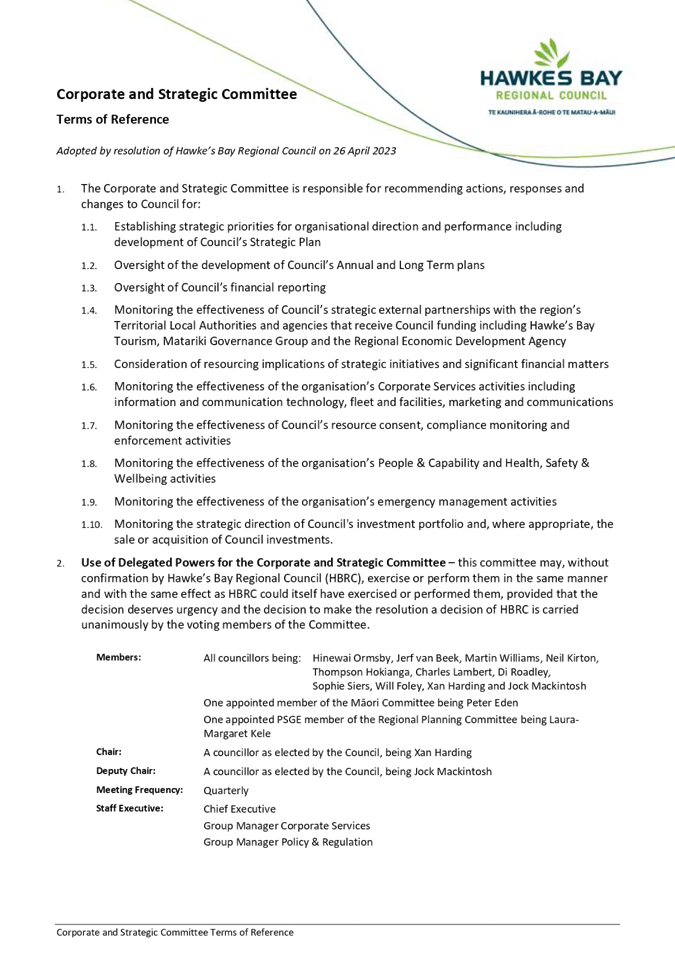

Attachment/s

|

1⇩

|

Corporate and Strategic Committee

Terms of Reference 2023-2025

|

|

|

|

Corporate and Strategic Committee Terms

of Reference 2023-2025

|

Attachment

1

|

Hawke’s Bay Regional

Council

Corporate

and Strategic Committee

13

November 2024

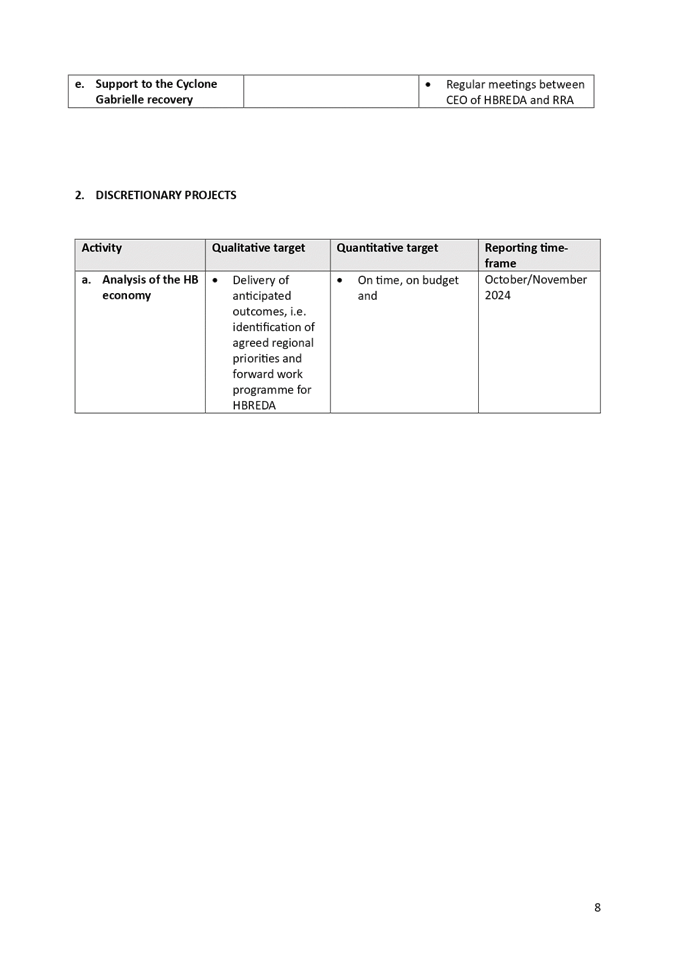

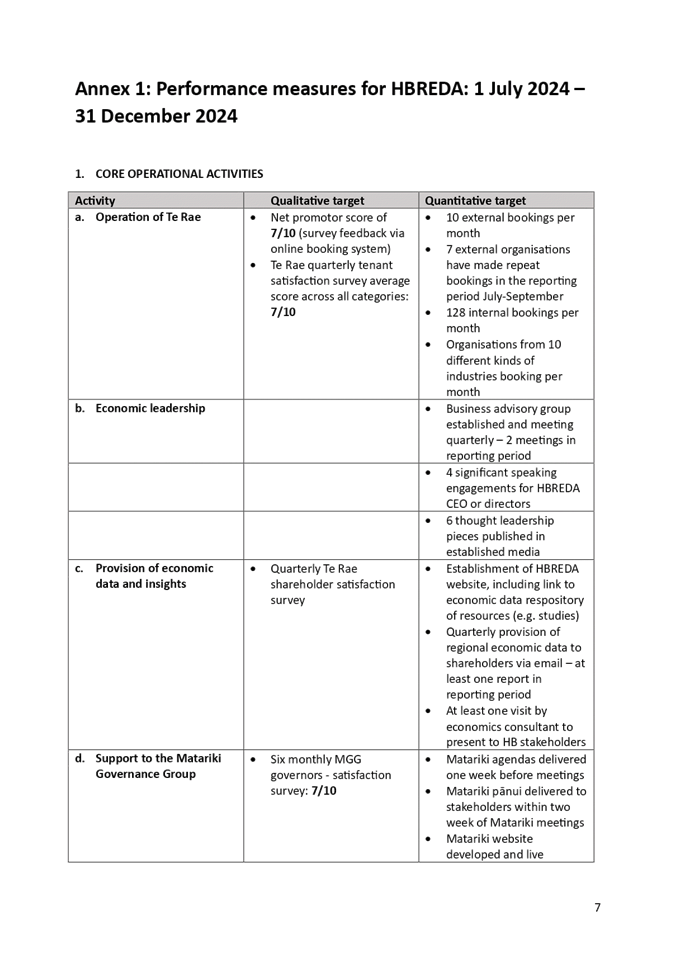

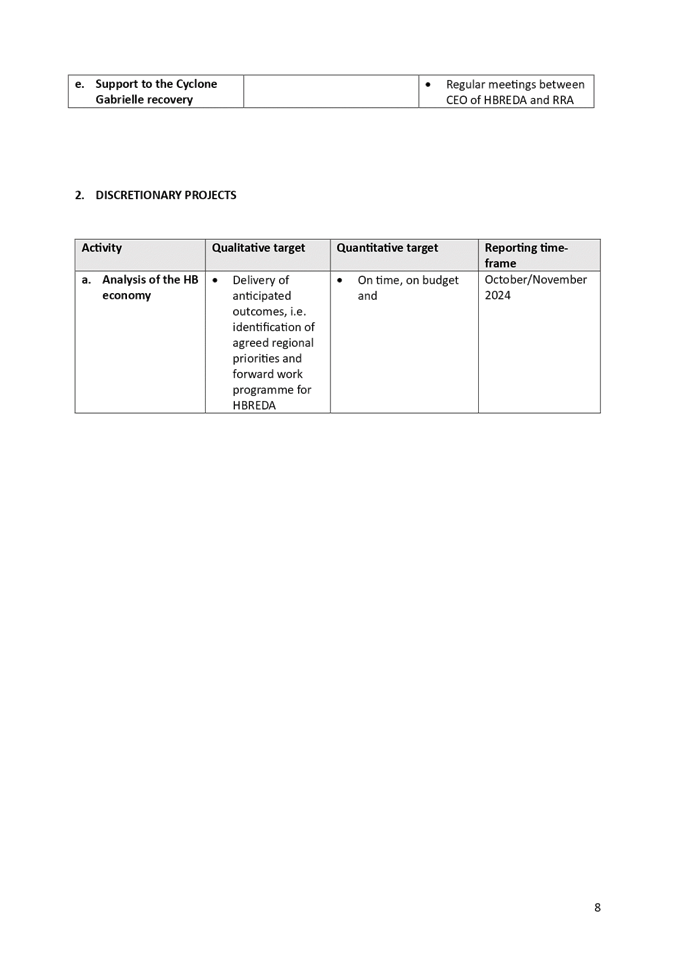

Subject: Regional Economic Development

Agency update

Reason for report

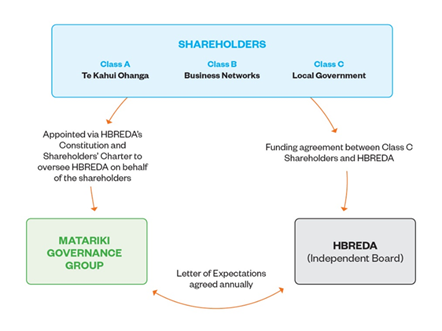

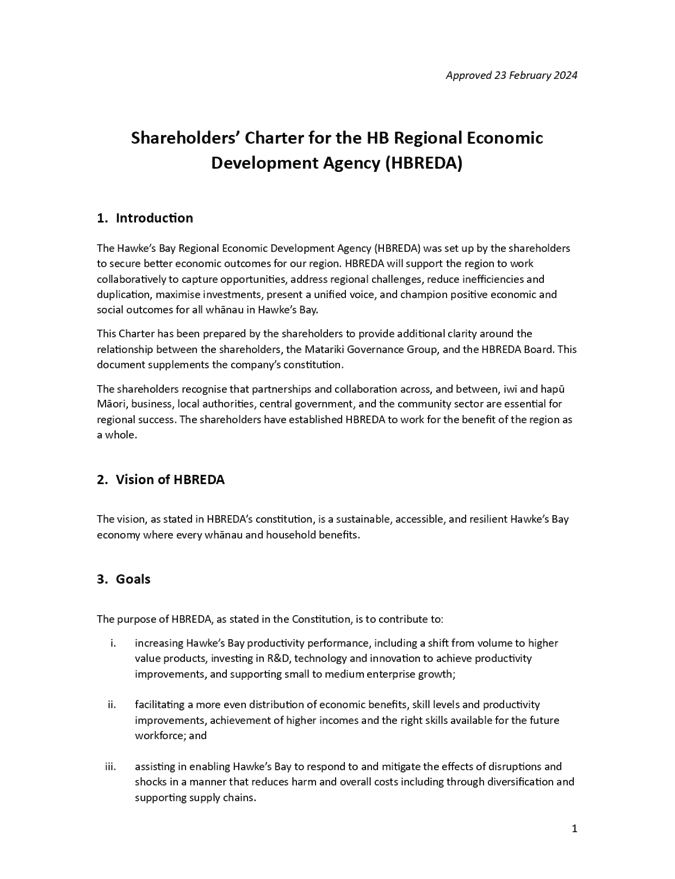

1. This paper provides an

update on the establishment and operations of the Hawke’s Bay Regional

Economic Development Agency (HBREDA).

Background

2. Councils in the

Hawke’s Bay region resolved to fund HBREDA in late 2021. The organisation

was formed as partnership between local government, business, and

iwi/hapū.

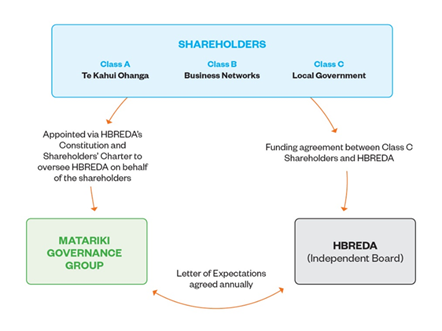

3. Following legal advice, the

legal structure for HBREDA was confirmed to be a council organisation (but not

a CCO) in the form of a limited liability company and governed by an

independent skills-based board. Shareholdings in the HBREDA company were agreed

by council CEs and the Matariki Governance Group (MGG) to be in equal thirds

between business, iwi/hapū and local government. Fourteen shareholder

entities are represented within these three groupings.

4. The MGG set up a board

appointments panel and appointed the Board in December 2022. Board members are:

4.1. Alasdair MacLeod (Chair)

4.2. Shayne Walker

4.3. Caren Rangi

4.4. Erin Simpson

4.5. Rawinia Kamau (resigned May

2024).

5. The Matariki Governance

Group was nominated by shareholders, via the HBREDA constitution, as the

shareholder representative.

6. The funding committed by

councils in December 2021 is allocated between councils as outlined in the

table below.

7. Prior to HBREDA’s

establishment, some of the funds set aside for HBREDA were allocated to the

operation of the Business Hub in Ahuriri, shifting the business support

agencies to Hastings and setting up a new business hub, the Regional Freight

Distribution Strategy, consultant support to assess the needs of business

post-cyclone, and consultant and legal costs for the establishment of HBREDA.

HBREDA

establishment update

8. Lucy Laitinen was appointed

as Chief Executive of HBREDA and commenced in 14 August 2023.

9. HBRREDA was incorporated on

14 September 2023 with a constitution that outlined the shareholder

arrangements and appointed the Matariki Governance Group as the shareholder

representative.

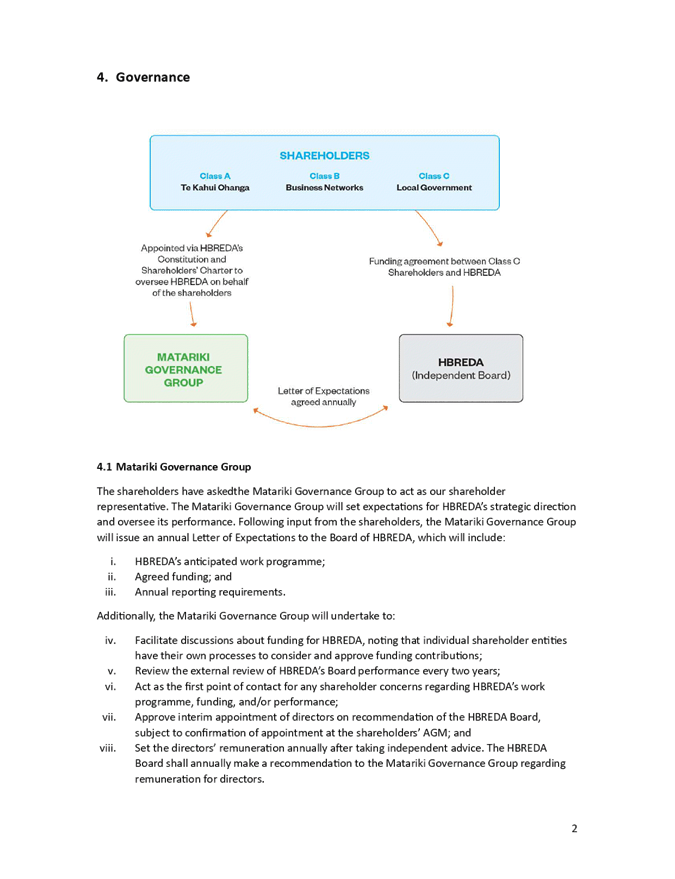

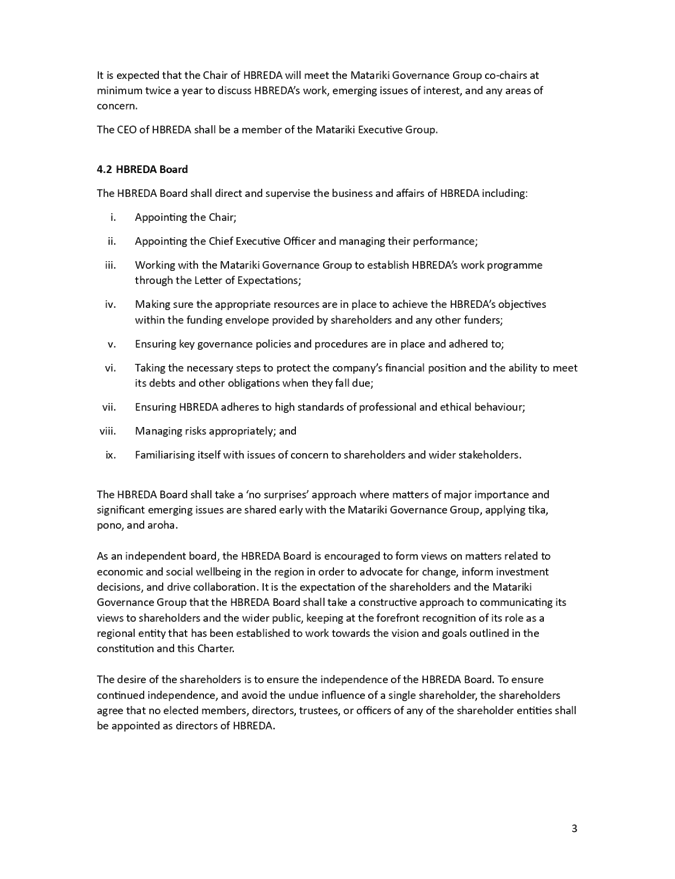

10. The Shareholders’

Charter was approved at a meeting of shareholders on 23 February 2024. This

lays out the governance, reporting, and funding arrangements for the company.

The Charter states that the Matariki Governance Group, as the shareholder representative,

shall agree an annual letter of expectations (LOE) with the HBREDA Board. The

process for agreeing the annual letter of expectations must allow for an

opportunity for shareholder entities to provide their input/feedback into the

letter. The Matariki Governance Group has the final signing authority, on

behalf of shareholders. HBREDA’s governance arrangements are illustrated

below.

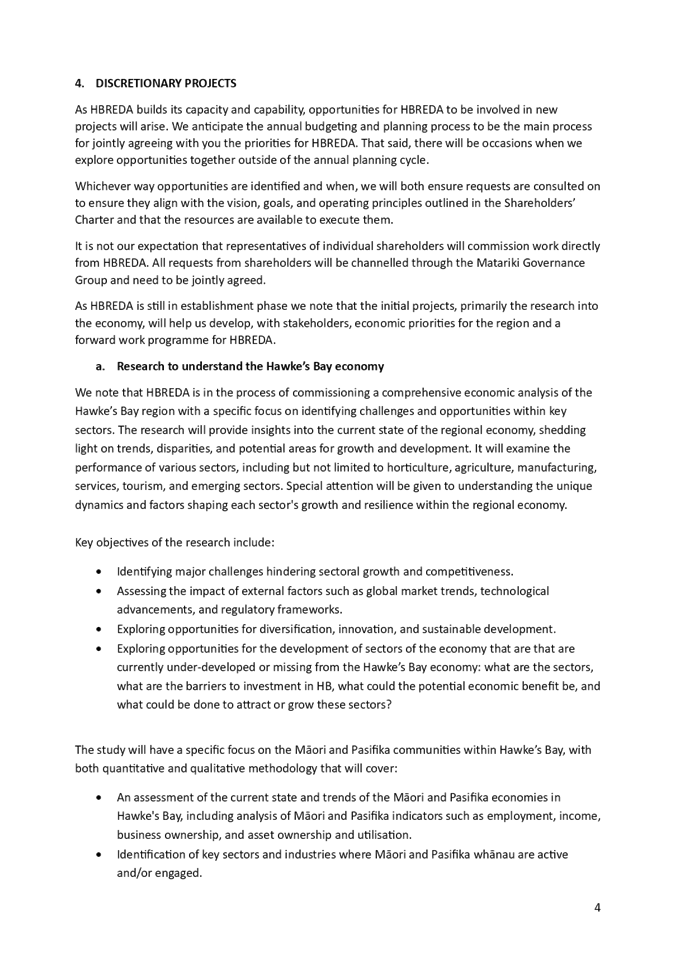

11. The Shareholders’

Charter lays out 8 operating principles to assist HBREDA in determining its

work programme (to be detailed in the LOE). The full Charter can be referred to in

Attachment 1.

12. The HBREDA Shareholders’

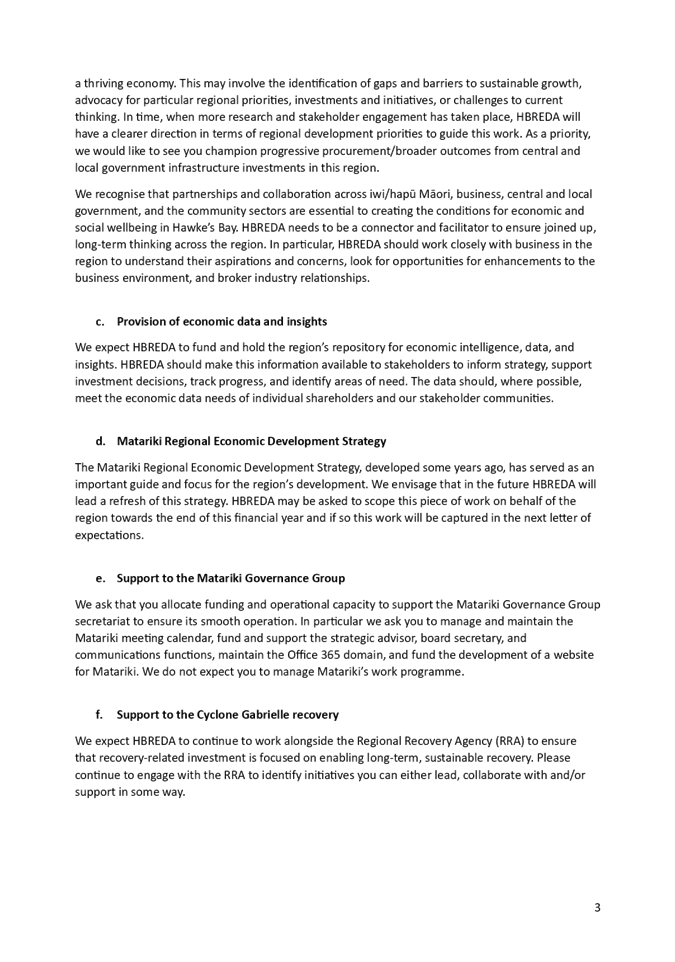

Charter, approved on 23 February, defines the letter of expectations (LOE) as

the mechanism for Matariki, the shareholder representative, and HBREDA to agree

work programme priorities, reporting, and performance measures for the company.

13. HBREDA provided the Matariki

Governance Group a draft LOE for the six month period starting 1 July 2024 at

the 5 April 2024 meeting, asking the MGG to provide it to shareholder entities

for feedback with a view to agreeing the LOE at the 21 June 2024 Matariki

meeting.

14. Over time, when Matariki has the

capacity available, HBREDA has recommended a move to a process where Matariki

prepares a LOE each year, with input from all shareholder entities, and

provides it to HBREDA, which then responds with a Statement of Intent. This

would allow for the development of a robust and transparent process to secure

shareholder feedback and input and allow HBREDA to exercise its independence

through developing a Statement of Intent in response.

15. The MGG is reviewing an LOE

laying out HBREDA’s work programme, performance measures, and reporting

requirements for a six-month period. The LOE will be annexed to HBREDA’s

funding agreement with councils.

16. The financial reporting

provided by HBREDA to the Matariki Governance Group will meet the reporting

requirements for local government expenditure. It is Matariki’s

responsibility to ensure this reporting, along with narrative reporting, is

disseminated to shareholder organisations. It is not expected there will be any

additional formal reporting mechanisms to shareholders outside of those

outlined in the Letter of Expectations, nor separate KPIs. HBREDA will continue

to respond to requests from shareholders, such as HBRC, to provide updates

directly on its activities. These will not be considered part of HBREDA’s

formal reporting to shareholders.

17. Following the approval of

HBREDA’s first LOE, HBREDA will sign a funding agreement with the funding

councils. HBREDA is currently receiving tax and accounting advice on the draft

agreement. We are also in the process of clarifying the treatment of

pre-incorporation expenses, which is relevant to HBRC because HBRC held

HBREDA’s funding before it was established.

Establishment

of Te Rae

18. The responsibility for

running the new business hub was given to HBREDA before the company was

established. Due to the shift of the previous business hub away from Ahuriri to

Hastings, HBREDA ‘inherited’ a building project.

19. HBREDA turned the building

project into ’Te Rae’, the new business hub, which was blessed and

opened to the public on 23 February 2024. Te Rae houses the business support

agencies (Chamber of Commerce, NZTE, Business Central, and Export NZ) and

HBREDA, and provides six meeting rooms for public hire. HBREDA has partnered

with Toi Mairangi to provide gallery space for local artists in the

events/meeting space.

20. The Te Rae website can be

accessed at www.terae.nz. HBREDA is seeking

clarification from the MGG that all councils should receive free use of the

rooms.

21. HBREDA has just taken over

the lease on 101 Queen St East, where Te Rae is located, from Hastings District

Council and now has licenses to occupy with tenants. A considerable portion of HBREDA

funds have been put toward the design and fitout of Te Rae. Landlord and

operational responsibility for Te Rae will be an ongoing part of HBREDA’s

responsibilities.

Telecommunications

resilience report

22. HBREDA engaged consultant

Jonathan Brewer to conduct a review of Hawke’s Bay’s

telecommunications resilience as a contribution to the recovery, to investigate

the widespread telecommunications outage

that occurred after Cyclone Gabrielle and develop recommendations. The Regional

Recovery Agency

is responsible for developing an action plan for next steps. The report will be

released shortly.

RFPs:

‘Research into understanding the HB Economy’ and ‘Provision

of Regional Dashboard and Economic Insights’

23. HBREDA published two RFPs in May and

is currently evaluating esponses. Both the research and the ongoing provision

of economic and wellbeing data will inform HBREDA’s future work programme

and will provide useful insights and data for all of our stakeholders.

Matariki

secretariat

24. HBREDA has been asked to

fund and support the Matariki secretariat. It has contracted a board secretary,

communications function, and just recently a strategic advisor. A grant of

$60,000 has recently been provided by MSD to support these costs as well as the

development costs of a Matariki website, when appropriate.

Decision-making considerations

25. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That the Corporate and Strategic

Committee receives and notes the Regional Economic Development Agency update.

Authored by:

|

Tracey O'Shaughnessy

Treasury & Investments

Accountant

|

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

HBREDA Charter

|

|

|

|

2⇩

|

Matariki letter of expectations

|

|

|

|

3

|

July 2024 economic performance

report

|

|

Under Separate Cover online only

|

|

HBREDA Charter

|

Attachment

1

|

|

Matariki letter of expectations

|

Attachment

2

|

Hawke’s Bay Regional

Council

Corporate

and Strategic Committee

13

November 2024

Subject: HB Tourism update

Reason for Report

1. This item introduces the

update from Hawke’s Bay Tourism.

Background

2. HB Tourism’s

2023-2024 Annual Report is attached for information.

Decision-making considerations

3. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision making

provisions do not apply.

Recommendation

That the Corporate and Strategic Committee

receives and notes the HB Tourism update.

Authored & Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1

|

Hawke's Bay Tourism FY24 Annual

Report

|

|

Under Separate Cover online only

|

Hawke’s

Bay Regional Council

Corporate

and Strategic Committee

13

November 2024

Subject: HBRIC quarterly update

Reason for report

1. This item provides

HBRIC’s quarterly update.

Executive summary

2. During the first quarter of

FY24/25, the Group transitioned its managed funds portfolio to Harbour Asset

Management.

3. Managed Funds: From 1 July

to 31 October, the Group portfolio grew by $6.9 million, representing a 4.2%

year-to-date increase.

4. FoodEast: While new tenants

are signing on, market conditions remain challenging.

5. The HBRIC FY24 Group

financial statements have been approved, and the audit is now complete.

6. Investment Strategy: HBRIC

continues implementing Council’s new investment objectives. Further

updates are provided on Council’s forestry investments, Napier Leasehold

Properties and Wellington leasehold properties.

Managed

Funds

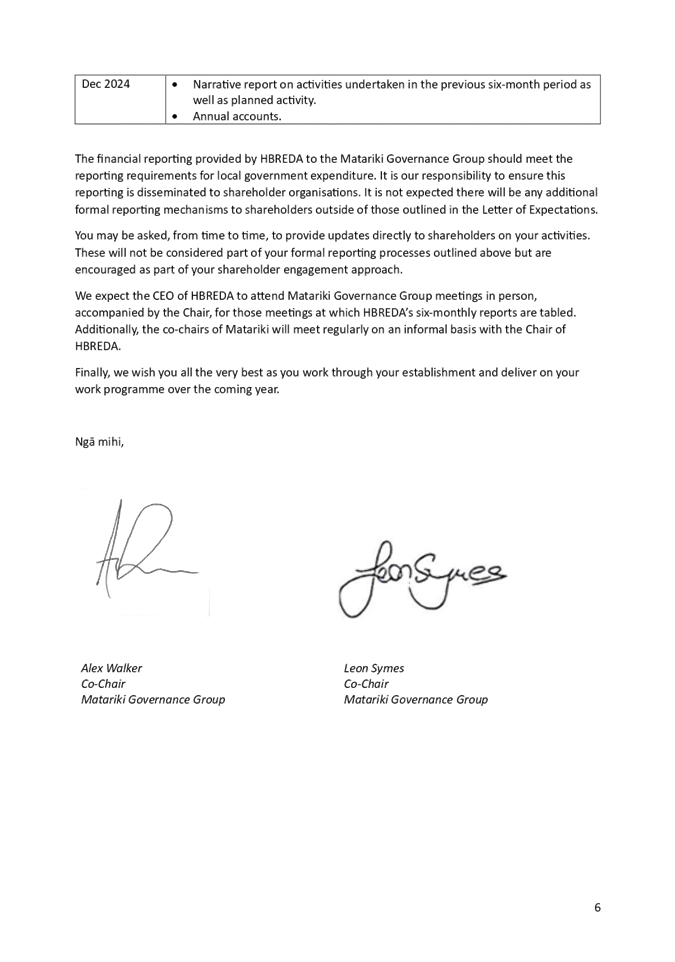

7. As of 30 June 2024, HBRC

and HBRIC held the following managed funds portfolios:

|

Fund

|

Jarden

|

Mercer

|

Total

|

|

HBRC - LTIF

|

$25,999,654

|

$25,830,971

|

$51,830,625

|

|

HBRC - FIF

|

$42,717,326

|

$24,130,757

|

$66,848,083

|

|

|

|

HBRC Total

|

$118,678,708

|

|

HBRIC - FIF

|

$15,607,038

|

$33,247,264

|

$48,854,302

|

|

|

|

Group Total

|

$167,533,010

|

8. HBRC’s portfolio was

fully transferred to Harbour by the end of July. As of 31 October, the combined

HBRC portfolio had increased by 4.1% ($4,905,494).

9. HBRIC’s portfolio was

fully transferred by the end of October and, as of 31 October, had increased by

4.3% ($2,085,279).

FoodEast

10. FoodEast is not immune to

the current state of the commercial and industrial property markets and,

despite good progress, faces challenges in securing tenants. Management is

actively exploring opportunities to promote the facilities and attract new

tenants in this challenging leasing market. The team takes a proactive

approach to delivering an effective commercial strategy while adhering to

Kanoa’s innovation funding requirements.

11. The AGM was held on-site on

14 October, and the facility’s official opening is scheduled for early

December.

Napier

Port

12. Napier Port reported a 3.4%

increase in container cargo volumes and a 9% rise in bulk cargo for the year

ending 30 September 2024. The growth in container volumes was driven by the

recovery of refrigerated exports and higher exports of wood pulp and timber, as

Pan Pac’s production mills resumed full operations. Bulk cargo volumes

also grew, primarily due to strong log exports, including windthrown and

unprocessed logs from Pan Pac. Additionally, Napier Port received 89 cruise

vessel calls over the 2023/24 period.

13. The final dividend will be

announced in late November, with the Annual Shareholder Meeting scheduled for

early December.

Council-initiated

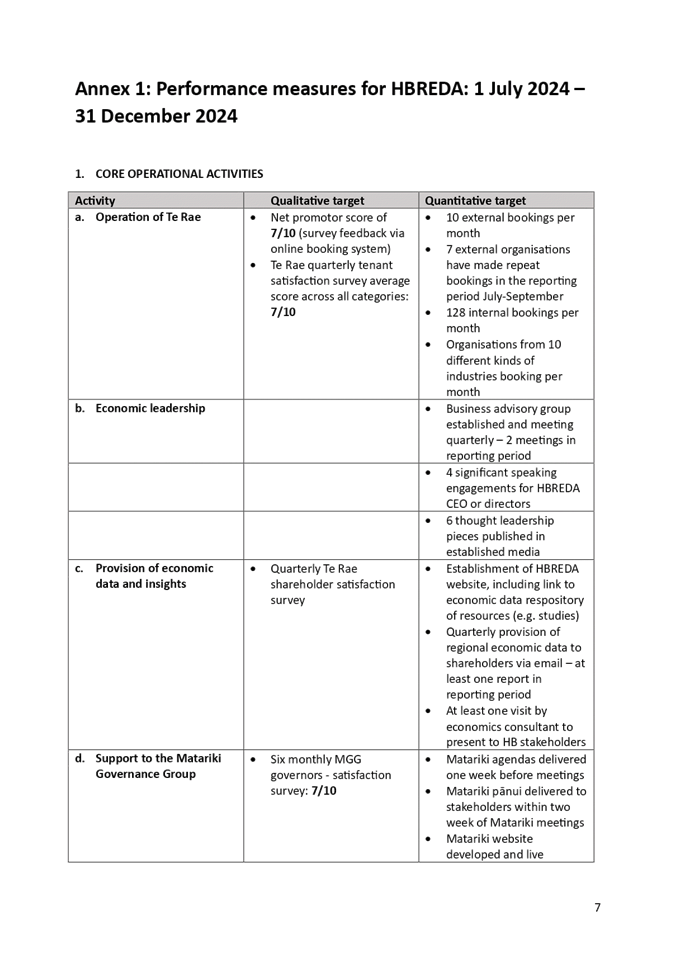

Investment Performance Review

14. In 2023, the Council

reviewed its approach to managing investments, which are either directly owned

or held by its wholly owned CCTO, HBRIC Ltd.

|

Asset (June ’24)

|

HBRIC

$000

|

HBRC$000

|

|

Napier

Port

|

272,800

|

|

|

FoodEast

|

3,203

|

|

|

Managed

Funds

|

48,854

|

118,723

|

|

Wellington

Leasehold

|

|

24,100

|

|

Napier

Leasehold*

|

|

9,017

|

|

Forestry

Tree Crop

|

|

11,898

|

|

Forestry

(NZUs)**

|

|

8,404

|

|

Entity

Total (Gross)

|

$324,857

|

$172,142

|

|

Group

Total (Gross)

|

$496,000

|

*Accounting for

estimated $33 million lease receivables liability to ACC.

**Based on NZU value of $50.50 as of 30/6/24.

Council’s

Investment Objectives

15. HBRIC has been directed to

maximise the commercial value of the Group’s investment portfolio,

ensuring a steadily growing dividend for the Council. The targeted outcomes

from this portfolio include:

Cash

dividend generation

15.1. FY24/25: $12.5 million

(plus a special dividend of $2.5 million)

15.2. FY25/26: $13.0 million

(plus a special dividend of $300,000)

15.3. FY26/27: $13.5 million.

Capital

protection

15.4. Aiming to safeguard the

managed funds portfolio at approximately $4.5 million per annum, based on a

long-term inflation target of 2.5%.

Resilience

Fund

15.5. Establishing a new fund

equivalent to one year’s Napier Port dividend, estimated at

$7-8 million.

16. While the Group’s

portfolio, valued near $500 million, may seem sufficient to achieve these

targets, various assets are either held for non-financial purposes (fully or

partially) or consist of legacy investments that yield low returns.

Forestry

Tree Crop

17. Despite projected forestry revenue

of approximately $12 million over the next four years, net returns are expected

to be minimal after accounting for direct harvest and internal costs. Although

listed as an investment asset, the tree crop primarily serves as an irregular

source of internal funding for Council objectives (e.g. erosion control) across

these properties.

18. HBRIC believes the forestry

estate should not be considered a core investment asset contributing to the

Group’s primary financial objectives.

19. Notably, two Central

Hawke’s Bay properties in the forestry estate—originally acquired

for proposed land-based wastewater treatment initiatives that did not

proceed—are planted with relatively low-value species. The Council may

wish to consider a process that investigates reallocating this capital to

higher-priority activities.

NZUs

20. HBRC currently holds

186,472 New Zealand Units (NZUs). Of these, 13,705 are not associated with a

carbon accounting area and are thus ‘unencumbered’, meaning they

can be sold at any time on the spot market. An additional 118,569 units are considered

low-risk and also available for immediate sale, although it is recommended that

a 20% buffer be retained to account for various modeling and real-world

uncertainties.

21. With the current price of

NZUs around $60, the unencumbered units are valued at approximately $178,000,

while the low-risk units, after accounting for a 20% contingency, are valued at

$5.69 million.

22. The Council may consider

selling NZUs valued at up to $2 million to meet increased dividend requirements

under the Long Term Plan. This proactive approach could help bridge potential

shortfalls in returns from the managed funds portfolio, which may fluctuate

annually due to credit and equity market volatility. Before proceeding, the

Council should ensure these NZUs are not required to support other

organisational objectives.

Napier

Leasehold Property Portfolio

23. In 2013 the ex-Harbour

Board portfolio comprised 628 individual properties sited on leasehold land. In

some cases, the leasehold interest had been cross-leased and, therefore, had

multiple dwellings on a single leasehold estate. The portfolio valuation for

the leasehold interest at the time was $48m.

24. In return for a lump sum of

$37.651, HBRC sold the cashflows arising from rents from this portfolio to ACC

for 50 years from 1 July 2013 until 30 June 2063. These funds sit within

Council’s managed funds reserves.

25. Since the agreement was

signed, 358 individual properties (occupying 285 leases) have been freeholded.

As at 30 June 2024, the value of the remaining properties is $42m but this is

partially offset by the outstanding liability to ACC arising from the obligation

to pass rental cashflows through.

26. HBRC receives a portion of

rental income and proceeds of property freeholding, but this is a very complex

financial arrangement which makes returns forecasting very difficult. For the

period 1 January 2019 to 30 June 2024 investment income has averaged approximately

$400,000 pa.

27. HBRIC and HBRC have agreed

to jointly develop a detailed financial model to better forecast future

returns. In the meantime, the investment income is being treated as forming

part of the Group’s cash dividend requirement.

Wellington Leasehold Property Portfolio

28. Leasehold interest in 11

inner-city residential and central area properties increased from 2020

valuation of $17.75 million to the current $24.1 million, with one property

sold for $628,000 in FY24. This represents an annualised value increase of 6.8%

pa.

29. Rental income rose from

$813,596 in 2020 to $930,959, contracted for FY25. Rent reviews occur every 14

years, with a weighted average lease term of approximately 7 years across all

properties. Current gross yield from this investment is 3.9%.

30. In October, HBRIC directors

toured the properties and consulted with a professional advisor for a portfolio

review. Key observations include that the properties are located in three

premium, well-positioned areas in Wellington. However, market conditions in

Wellington’s property sector are currently very weak. It is generally

recognised that the best buyer for a leasehold interest in land is often the

lessee, and lease renewal is an ideal opportunity to explore a sale. The

portfolio is relatively illiquid, and transactions may take some time.

31. Notably, three properties,

representing about half the portfolio’s value and income, are leased to a

single tenant and are due for lease renewal in October 2025. This upcoming

renewal provides an opportunity to assess the tenant’s interest in

freeholding the property.

Decision-making considerations

32. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision making provisions

do not apply.

Recommendation

That

the Corporate

and Strategic Committee receives and notes the HBRIC - strategic assets and

investment structure report.

Authored by:

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

There are no attachments for this

report.

Hawke’s

Bay Regional Council

Corporate

and Strategic Committee

13

November 2024

Subject: Organisational Performance

Report for the period 1 July - 30 September 2024

Reason for report

1. This item presents the

Organisational Performance report for the period 1 July – 30 September

2024.

Organisational Performance Report content

2. The attached report

contains four parts:

2.1. Executive summary including highlights and

challenges.

2.2. Corporate metrics that focus on how we are

performing across a number of corporate-wide measures such as employee turnover

and official information requests.

2.3. Level of service measures by group of activities with

traffic light status and commentary.

2.4. Activity

reporting with

non-financial traffic light status and commentary, and financial status and

commentary rolled up to the group of activities.

3. Organisational performance

reports were established in 2018. The status and commentary reporting are

rolled up from budget lines to activity level. Commentary by budget lines is still

available to committee members on request to staff.

4. Staff complete their

reporting in a software tool called Opal3. For LOSM and activity reporting,

staff select the status (red, amber, green) and provide commentary on what they

did in the quarter against their annual work plans.

Points

of interest

5. Level of

service performance measures (LOSMs) are included in their totality this

quarter rather than by exception. This is the first quarter of the new

Three-Year Plan, and there are 16 new measures and a further 3 that have been

adjusted from the previous Long Term Plan.

6. Summarised financial

reporting shows actual versus budget by activity. This includes

operational and capital expenditure by activity, plus funding for the group.

Commentary is also provided for the group.

Corporate

metrics

7. Annual staff turnover

continues to drop from its high two years ago.

8. Our Customer Service team

has had an extremely busy quarter following rates invoices being sent out. All

key forms of contact with the public are up on the same quarter last year.

9. LGOIMAs are at an all-time

quarterly high of 57 – previous high of 56 was the quarter following

Cyclone Gabrielle.

Performance

measures reporting

10. Staff have reported 7

performance measures as ‘off track’. A further 7 cannot be reported

on until later in the year, and reporting was ‘not available’ for 3

measures (all in HBCDEM).

Activity

reporting

11. Staff have reported 2

activities as ‘off track’ from their usual workplans. This is the

same as last quarter.

12. Financial reporting shows

that 4 of the 6 Groups of Activities are over budget. Commentary is provided to

provide context.

Decision-making considerations

13. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

the Corporate and Strategic Committee receives and notes the Organisational

Performance Report for the period 1 July - 30 September 2024.

Authored by:

|

Sarah Bell

Team Leader Strategy and Performance

|

|

Approved by:

|

Desiree Cull

Strategy & Governance Manager

|

|

Attachment/s

|

1

|

Quarterly Organisational Performance

Report 1 July – 30 September 2024

|

|

Under Separate Cover online only

|

Hawke’s

Bay Regional Council

Corporate

and Strategic Committee

13 November

2024

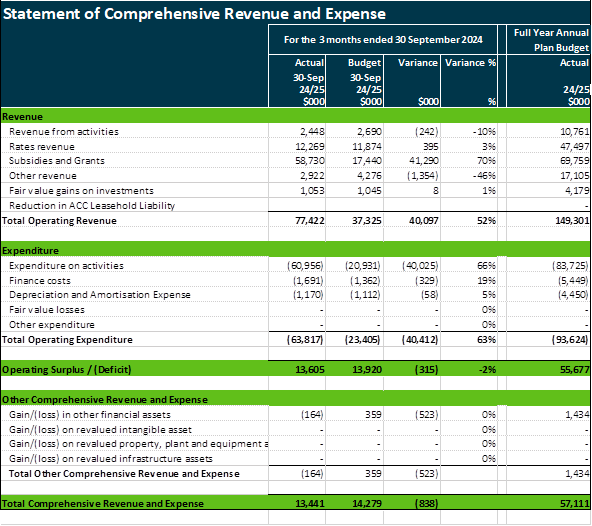

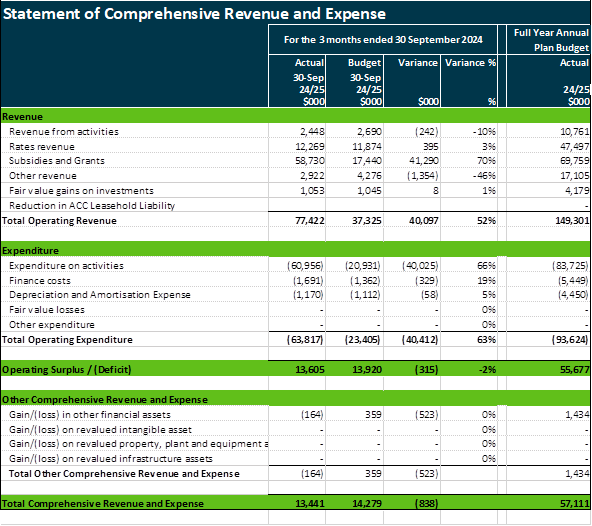

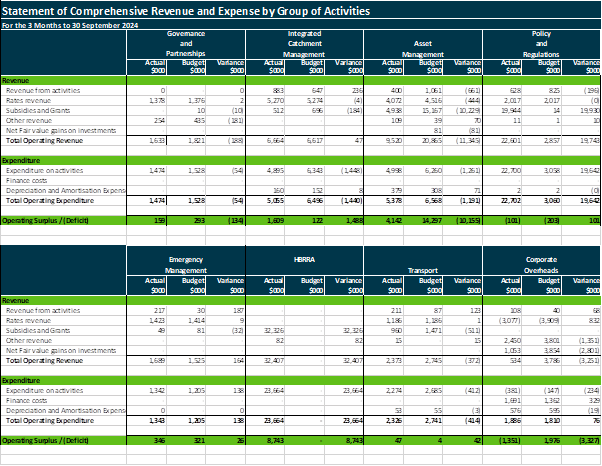

Subject: Financial report for FY24-25

to 30 September 2024

Reason for report

1. This report presents the

financial results of the Council for the three months to 30 September 2024.

Background

2. Financial performance is

reported to the Corporate and Strategic committee quarterly. The report

presented today is for the first quarter of the 2024-25 financial year.

3. The financial performance

statements included are:

3.1. HBRC Statement of

Comprehensive Revenue and Expense

3.2. HBRC Statement of Financial

Position

3.3. Comprehensive Revenue and

Expense by Group of Activities.

Key

Points

4. Total operating revenue for

the period is $77.4m, which is $40m above budget. Subsidies and grants

for sediment and debris and HBRRA are ahead of budget as funding is received

ahead of the work being done. Income related to the flood resilience programme

of work is behind budget due to timing.

5. Comparably, total operating

expenses for the period are $40m above budget at $63.8m, again largely impacted

by expenditure on sediment and debris.

6. Borrowings continue to be

high while we continue to work through the National Emergency Management Agency

(NEMA) and insurance claims. We have received payments for NEMA claims 5

and 6 during the quarter, totaling over $2m. We continue to work on

further claims.

7. Liquidity remains high due

to the annual rates intake and preparatory work on the NIWE project.

Council has pre-funded an external loan repayment of $8m due in April 2025.

8. All managed funds

portfolio’s have transition to the new Group Investment Manager.

9. The budgets reflected in

this report are year 1 of the Three-Year Plan 2024-2027. Revised budgets are

used for management reporting which include the carry forwards of 2023-24

budgets.

Commentary on Statement of Comprehensive Revenue and Expense

10. The actual result to 30

September 2024 is a gain of $13.4m while HBRC budgeted a gain of $14.3m

11. Sediment and Debris (HBRRA)

and the Silt Taskforce (HBRC) continue to be significant activities for the

organisation, making up $52m of the revenue and $43.4m of the expenditure

reflected above ($8.6m of sediment & debris funding has been received that

will be spent in Q2). The continuation of this activity was not budgeted in the

Three-Year Plan 2024-2027 and, therefore, is the main contributor to the

significant variances in revenue and expenditure.

12. After taking out the

Hawke’s Bay Regional Recovery Agency (HBRRA) and silt taskforce funding,

subsidies and grants are $28m, $10.7m behind budget. This is mainly due to the

time taken to work through the NEMA and insurance claims and to start claiming

for the Government contribution to the NIWE schemes.

13. The shortfall in other

revenue reflects the timing of the HBRIC dividend. The budget is phased evenly

across the year but the dividend is received in two installments in Q2 and Q4.

14. Total operating expenses

for the quarter were $63.8m of which $23.6m is for the HBRRA (sediment and

debris) and $19.6m for the silt taskforce, leaving $20.6m against a budget of

$23.4m.

15. The remaining $2.8m

operating underspend of is across a number of areas including biosecurity and

biodiversity work that increases over the summer months, Total Mobility costs

lower than planned and some rephasing required in flood protection budgets. Further

detail on financial and non financial information for Groups of Activities is

detailed in the Organisational Performance Report.

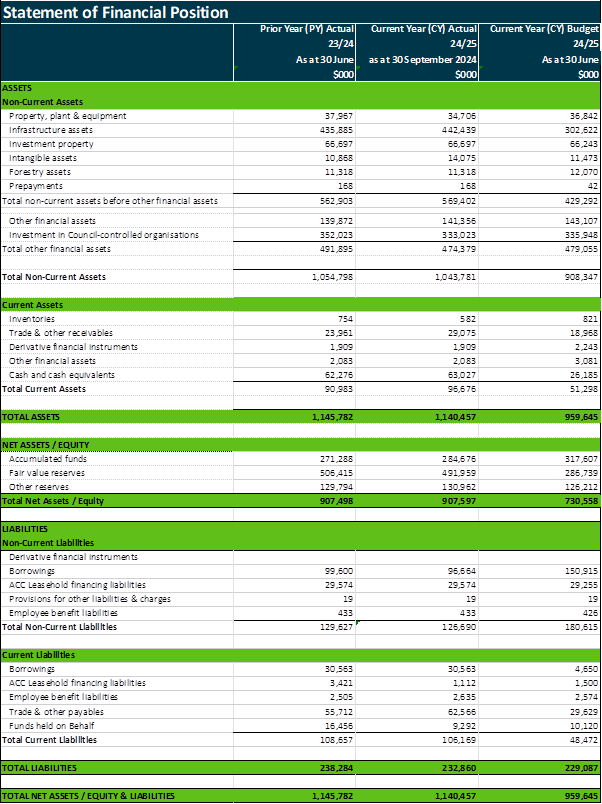

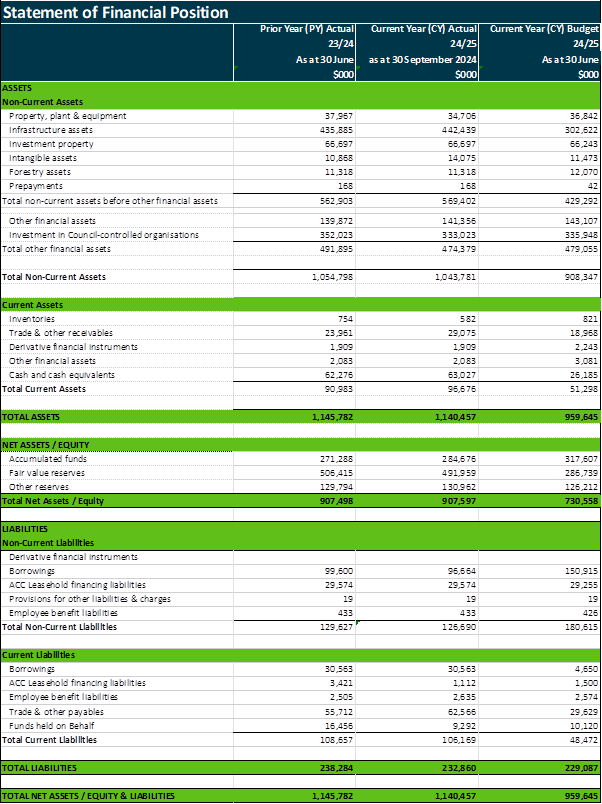

Commentary

on Statement of Financial Position

16. Infrastructure assets

continue to increase due to the significant amount of capital work being

undertaken to repair assets damaged by Cyclone Gabrielle. The value has

increased by $6.5m over the quarter. The end of year budget in the LTP does not

include the significant revaluation of infrastructure assets that occurred

during the 2023-24 year end.

17. Intangible assets value has

increased this quarter by 3.2m, predominantly due to the carbon credits

movement trading price increased from $50.50 to $74.88.

18. Napier Port share price is

sitting at $2.26 at 30 September, down from $2.48 at the beginning of the

financial year. The price on 5 November was $2.23. The driver of

the price change has been attributed to the closure of two mills in the Ruapehu

District, both of which put cargo through the Napier Port. This is reflected in

the Investment in Council-controlled organisations.

19. Trade and other receivables

have increased over the quarter as a result of the issue of the annual rates

invoices.

20. Cash and Cash equivalents

is showing at $63m as of 30 September 2024 with $8m set aside in a short term

deposit to repay the LGFA loan maturing in April 2025. See the Treasury

commentary for further details on overall cash position.

21. Trade payables are sitting

at $62.6m a large portion of which is the sediment and debris work.

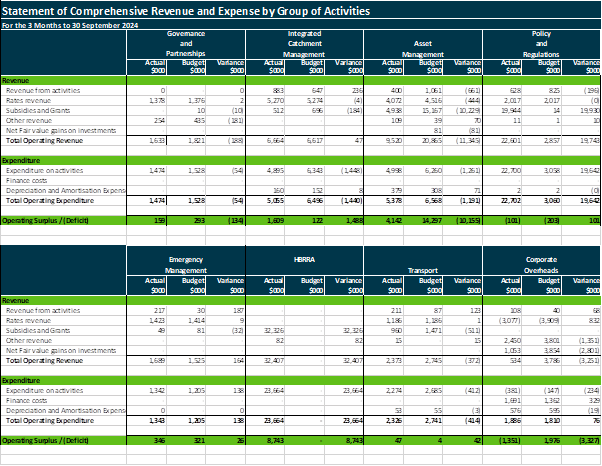

Financial

summary by Group of Activities (GOA)

22. The following table

provides a breakdown of the statement of comprehensive revenue and expense by

Group of Activities (GOA). The Organisational Performance Report includes

further financial and non-financial commentary for each GOA. Please note that

the budgets used in this report are from the LTP and the budgets used in the

Organisational Performance Report include subsequent adjustments including

approved carry forwards from 2023-24.

23. GOA expenditure includes

each activity’s external expenditure, internal staff time, finance costs

(interest), depreciation/amortisation and a share of corporate overheads.

Rates

Collection

24. The rates and customer

experience teams have experienced very high volumes of enquiries and requests

for payment plans and remissions, especially following the issue of the rates

penalty letters after the due date of 20 September 2024.

25. Rates penalties issued this

year totaled $700k (12,111 ratepayers). Last year we issued $552k of penalties

to 11,720 ratepayers.

26. Year to date at September

the team have processed remissions for utility charges to local authorities

($163k) and $90k of public transport remissions.

27. 140 hardship remissions

have been received relating to revenue & financing policy changes and

natural calamity. These are now being assessed and remitted where appropriate.

Debt

Collection

28. As at 30 September 2024 the

Council had $4.2m of outstanding trade debtors. This compares to $9.1m at the

end of last financial year (June 2024) and $13.4m a year ago (September 2023).

Receivables from government agencies had inflated previous balances.

29. The level of debt overdue

by more than 60 days has decreased from $1.3m a year ago to $753k now.

30. On the rates side we

currently have $12.5m outstanding (including sustainable homes $1.5m) with

$9.6m related to the latest rates invoices issued for 2024/25. At the same time

last year we had $11.2m outstanding (sustainable homes $1.5m) with $8.6m related

to the 2023/24 rates invoices that had just passed their due date. This

increase is in line with the average rates increase for the year and as such

does not reflect a significant change in the number of ratepayers not able to

pay their rates (also reflected in the small increase in the number of rates

penalties issued).

Commentary

- Treasury

31. All short-term borrowings

held to fund cyclone recovery operations were either repaid or rolled into long

term debt prior to 30 June due to the uncertainly of insurance proceeds value

and timings.

32. No new borrowing has been

drawn during the quarter and it is anticipated Council may enter the

December/January LGFA tender to assist with funding of the NIWE project.

33. HBRC has however submitted

an application for a Green Loan with LGFA to fund the NIWE project and if

successful will replace the proposed draw-downs above. While green loans

provide an additional 5 basis points reduction on interest costs they carry

additional requirements and the criteria is tight. We expect an outcome on our

application prior to Christmas.

34. The annual insurance

renewal process is now complete and we are awaiting insurance invoices. While

the premium levels are in line with prior years, additional asset coverage is

up by 35-40%. A full breakdown of insurances will be provided to Risk and Audit

once all invoices are received.

35. At 31 October HBRIC had

completed the transition of all managed portfolio’s to Harbour Asset

Management. All portfolios are operating within the Group SIPO.

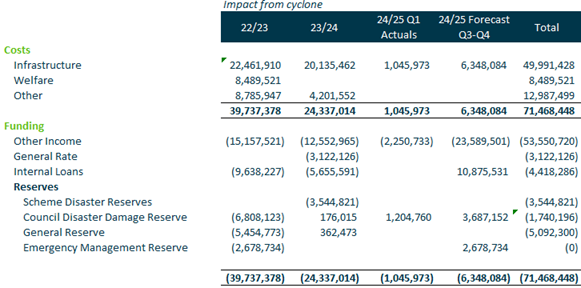

Cyclone

Recovery

36. The below table summarises

the current forecast financial impact from Cyclone Gabrielle response and

recovery. It excludes work on sediment & debris and NIWE.

37. Overall we expect to have

spent a total of $71.5m in responding to and recovering from the cyclone. The

other costs relate to staff time that is not claimable, independent reviews and

the like.

38. NEMA and insurance monies

received will be used to repay external loans taken out to cover the

expenditure incurred. The balance of the borrowing and the recovery of the

council and scheme disaster damage reserves will be funded from general rate

funding already included in the LTP.

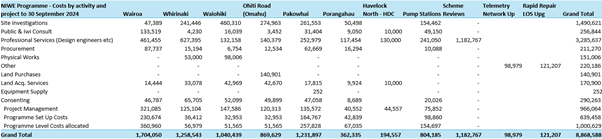

NIWE

Update

39. The following table

reflects the spend to date on the various NIWE projects.

40. The majority of the spend to date has

been in early design and site investigations across the projects. We are

working closely with Crown Infrastructure Partners (CIP) to get our approved

Project Delivery Plan (PDP) schedules and milestones confirmed so we can

progress our first claim which we expect to be before the end of the calendar

year.

41. We anticipate this first claim will be

approximately $1.6m. The team are working at pace to get four more PDPs ready

for submission also, which will allow for a further claim of circa $2.7m once

approved.

42. As mentioned above we are also

progressing with Green Loan applications from LGFA for the co-funding portions

of the NIWE projects to minimise the cost of borrowing.

Decision-making

process

43. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

the Corporate

and Strategic Committee receives and notes the Financial report for FY24-25

to 30 September 2024.

Authored by:

|

Pam Bicknell

Senior Group Accountant

|

Tracey O'Shaughnessy

Treasury & Investments

Accountant

|

|

James Park

Management Accountant

|

Chris Comber

Chief Financial Officer

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

There are no attachments for this

report.