Meeting of the Risk

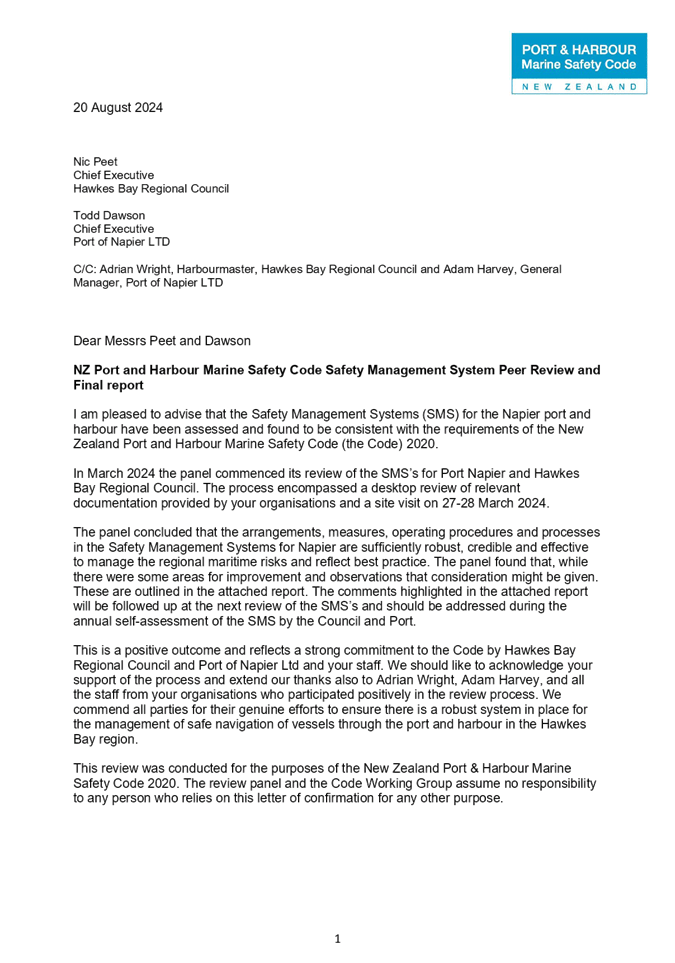

and Audit Committee

Date: 23 October 2024

Time: 9.00am

|

Venue:

|

Council

Chamber

Hawke's

Bay Regional Council

159

Dalton Street

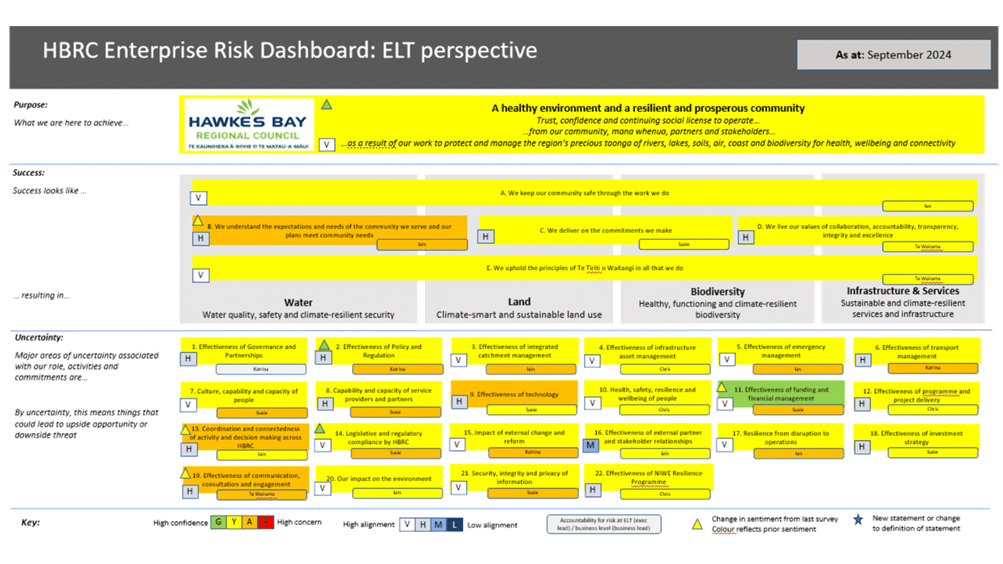

NAPIER

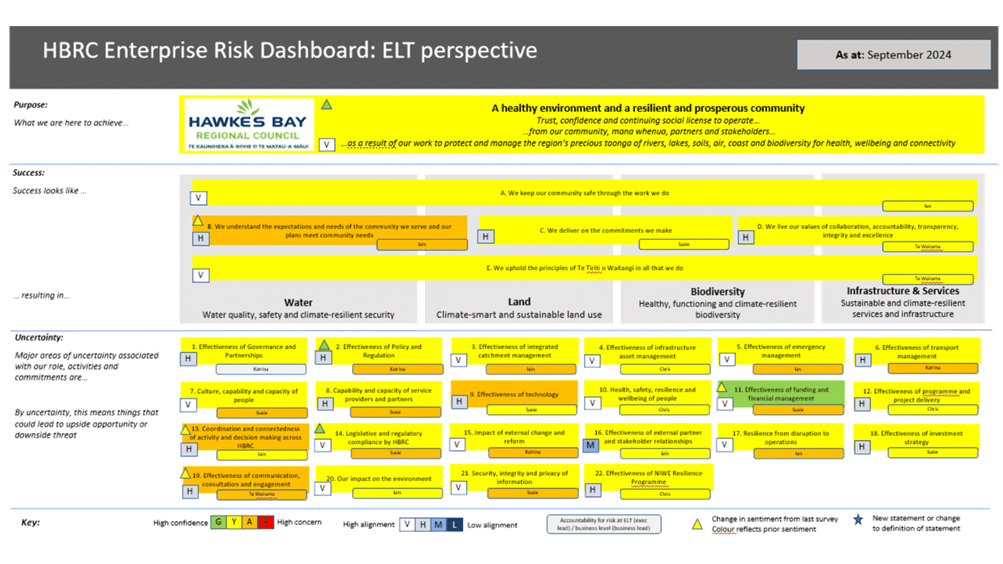

|

Agenda

Item Title Page

1. Welcome/Karakia/Housekeeping/Apologies

2. Conflict

of Interest Declaration

3. Confirmation of Minutes of

the Risk and Audit Committee meeting held on 31 July 2024

4. Risk

Management update 3

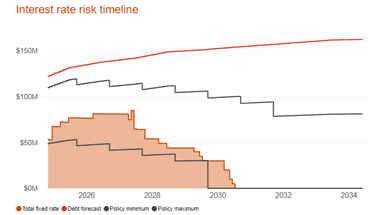

5. Port

and Harbour Marine Safety Code Review 17

6. Treasury

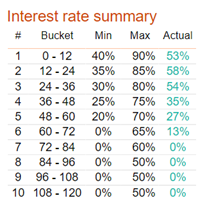

Compliance Report for the period 1 July - 30 September 2024 23

7. Ernst

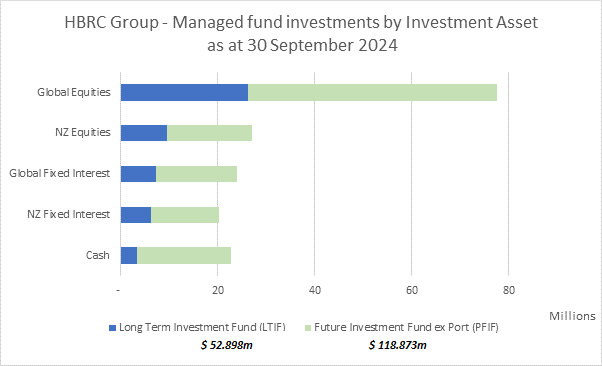

& Young Audit Close report on year ended 30 June 2024 29

Public

Excluded

8. Confirmation

of 31 July 2024 Public Excluded Minutes 31

9. Legal

update 33

Hawke’s Bay Regional

Council

Risk

and Audit Committee

23 October

2024

Subject: Risk Management update

Reason for report

1. This item provides the Risk

and Audit Committee (RAC) with a quarterly update of:

1.1. the strategic risk profile

for HBRC, expressed in terms of HBRC’s purpose, strategic priorities, and

definition of success, together with an outline of the major areas of

uncertainty/risk relating to this.

1.2. the sentiment of both the

Executive Leadership Team and Councillors as to the aggregate level of

confidence/concern (i.e. risk rating) with respect to the strategic risk

profile of HBRC.

2. This item also provides an

update on the wider external environment and specific issues for the attention

of the Risk and Audit Committee, as well as a draft forward work plan (attachment

1) for discussion and feedback.

Executive

summary

3. The external environment

continues to impact on HBRC – both in terms of the political landscape,

economic landscape, and climate-related events.

4. Specific areas of focus

since the last meeting include work associated with:

4.1. Continuing to embed the

strategic risk approach across HBRC

4.2. Drawing out the key

HBRC-wide internal controls from each of the one-page risk plans and

aggregating this so that there is a common view of the critical controls within

HBRC and sources of monitoring, oversight and assurance related to these

4.3. Defining key risks related

to the NIWE Flood Resilience Programme at both a programme-wide strategic risk

level, and project specific delivery risk level

4.4. Updating Business

Continuity Plans and Emergency Management Procedures for the organisation

4.5. Developing a supporting ICT

Business Continuity Plan and associated Disaster Recovery Plans

4.6. Commissioning or completing

external assurance over areas such as financial transactions, cyber security

and ICT operational infrastructure.

5. Updates are provided on

specific matters including:

5.1. An incident related to

patched gang members entering the Council Chamber

5.2. A potential issue

associated with the subsidised Public Transport Targeted Rate

5.3. Remediation of historical

holiday pay calculation issues

5.4. Public health and safety

incidents related to aggressive public behaviour directed at staff

5.5. Health and safety incidents

relating to the towing of trailers.

Discussion

External – Wider External Context

Legislative

and regulatory changes

6. In July, Prime Minister

Christopher Luxon’s publicly challenged local government “to rein

in the fantasies and to get back to delivering the basics brilliantly” as

part of central governments’ focus on fiscal restraint. This was after

their statement that communities’ economic, social, environmental and

cultural wellbeing are to be removed from the Local Government Act.

7. In September the Government

announced plans for the Resource Management Act replacement with two acts

– one focused on driving urban development and infrastructure and the

other on managing environmental effects.

8. 149 projects across New

Zealand eligible for the NZ Government’s fast track legislation were

announced in early October

9. The legislation has proven

controversial since it was first announced. Initially, it gave three ministers

final sign-off over what projects would be fast-tracked, while perception was

it didn’t put enough weight on the environmental impacts of potential

developments.

NIWE

Flood Resilience Programme

10. There continues to be

challenge and focus from central government on our ability to deliver critical

category 2 flood mitigation. The NIWE team has put in place measures to

provide assurance to our Council that effective and transparent processes are

in place.

11. A successful request for

proposal has been completed for the Preferred List of Suppliers for the NIWE

Land Category earthworks projects (total value c$100-120m). A larger pool A

($20m+) and pool B (less than $20m) is complete. A Probity Officer is now in

place to provide oversight and challenge for this programme. A further process

is now underway for pump station work.

12. The Programme Steering

Committee has changed memberships; namely the CEO of Crown Infrastructure

Partners, the HBRC CEO, and Crown Manager are now attending members for

oversight, challenge and review of the programme. These memberships

supplement the existence of an independent specialist and Group Manager

Corporate Services.

Internal Council Operating Environment

Risk

management

13. HBRC continues to work on

increasing the maturity of risk management and internal controls across the

organisation. The focus of work to date has been to:

13.1. Define ‘risk’

in terms of the major areas of uncertainty related to the purpose, commitments

and priorities of HBRC (as set out in the Long-Term Plan), provide a simple and

easy to use way of articulating this through the HBRC Enterprise Risk

Dashboard.

13.2. Develop one page management

plans for each of the areas of uncertainty (i.e. strategic risk) that enable a

consistent understanding of:

13.2.1. what this area of risk is

13.2.2. why it matters in terms of

the opportunities/threats this presents to HBRC

13.2.3. what contributes to this

and how this is managed through HBRC internal control environment

13.2.4. how this is assured

13.2.5. to draw out any gaps, areas

of improvement of actions to strengthen risk management in this area.

14. The collective assessment

of ELT and councillors as to HBRC’s strategic risk profile is shown in

the attached HBRC Enterprise Risk Dashboard.

Progress

on Independent Reviews

15. Consolidation and oversight

of review findings is underway and will be managed via the following Council

meetings.

|

Third Party Reviews

|

|

|

HBIFR,

& Wairoa Flood Review (Mike Bush and Independents)

|

HBRC

response to Flood Reviews is being collated and managed as a Programme of

work within Asset Management. 53 recommendations have been assessed, and

actions plans are being put in place to address.

Regular

reporting will be completed monthly through to HBRC Full council. The last

full update was provided to HBRC in August 2024.

|

|

CDEM

|

An

independent consultant (Matt Boags) has been appointed as transformational

manager for the CDEM reviews. These will be managed and overseen through the

CDEM Joint Committee.

|

Key internal controls and assurance

16. Work has started to define

and document the key aspects of HBRC’s internal control

environment. In this work reference has been made to the industry

standard lines of defence (also known as three lines) model as defined by the

Institute of Internal Auditors (IIA) and endorsed by the Office of the Auditor

General (OAG), where there is a distinction between:

16.1. Actions and controls that

directly manage risk and ensure HBRC delivers on its objectives (first line

roles)

16.2. Supporting monitoring and

oversight to ensure these actions and controls are effective and to challenge

of risk related matters (second line roles)

16.3. Independent and objective

assurance and advice (third line roles).

17. Critical controls have been

defined in the following broad areas:

|

Purpose

|

Examples of critical

HBRC-wider internal controls

|

|

Sets expectations

Ensures staff understand what

is expected of them and that they are clear on their authority to act

|

Critical controls include:

Policies

and procedures

Delegations

of authority

Segregations

of duties

Strategic

and annual planning

|

|

Delivers on expectations

Supports operational delivery and ensures

work performed is managed appropriately, in line with expectations set

|

Critical controls include:

Stakeholder

engagement and communication

Funding,

budget setting and financial management

People

management

Health,

safety, and wellbeing management

Procurement

and vendor management

Project

delivery and change management

Flood

protection asset management

Corporate

asset management

Investment

management

Information,

record and data management

Technology

and communication management

Physical

security and site access management

Logical

security and system access management

Business

continuity and disaster recovery management

|

|

Ensures expectations are met

Checks that actions taken and

work delivered is consistent with the expectations set above

|

Critical controls include:

Regulatory

compliance management

Corporate

compliance management

|

18. RAC can expect to see

ongoing assurance activities through this committee as appropriate through both

internal and external assurance mechanisms.

Compliance

Management

19. HBRC has committed to

enhancing oversight and assurance mechanisms of how to demonstrate compliance

with corporate legal compliance obligations, e.g. the Privacy Act, Local

Government Act, Resource Management Act, etc.

20. Discussions are underway

with an external company called ComplyWith, used across many other Council

entities. The appointment of a Senior Solicitor will drive this solution in

FY25.

Business

and ICT continuity management

21. HBRC has proactively

updated the Business Continuity and Emergency Procedures documentation.

There is a legislative requirement for HBRC to support the GECC in an

emergency, and council staff have been providing certainty of essential

functions (and names) that need to support HBRC, and those that will be able to

be seconded to the GECC in an event. Plans are underway to address any

shortfalls in the required FTE (on a rotational basis) including options to

outsource or form engagements with other regional areas to supplement

resourcing and SME requirements.

22. HBRC plans to proactively

be part of the ‘shake-out exercise on 24 October. After this exercise a

drop-in meeting room will be used to enhance the internal knowledge of how the

BCP and Emergency procedures apply to all staff and improve knowledge.

23. The above has been

supplemented with an internal ICT Business Continuity Plan (BCP) and a Disaster

Recovery (DR) Plan. This confirmed the inherent resilience provided by our

cloud infrastructure, however, some improvements have been identified to

further bolster our ability to continue critical operations in the event of a

significant event.

24. On 18 September, the

Information Computer Technology (ICT) team held an ICT incident simulation.

Under false pretenses, ICT gathered all the members of the Critical Response

Team (CRT) and presented them with an outage scenario whereby all access in and

out of 159 Dalton had been cut. This was a valuable exercise and will now be

added on a bi-annual basis to our operational calendar. The lessons arising

from this have also been added to our Incident Response Plan. In

cooperation with the Hydro and Asset Management teams, Phase 2 of the review is

now extending out of ICT into other critical technical infrastructure such as

Hydro and Pumped, with some good resilience improvements already underway.

Health,

Safety and Wellbeing Management System (HSWMS) Update

25. Risk work continues the

HSWMS. This includes aligning the system with the requirements of ISO45001 and

ensuring that other activities undertaken across HBRC are integrated within the

HSWMS, e.g., the one-page management plans referred to under the heading: Internal Council Operating

Environment – Risk Management (point 13) and Key internal controls and

assurance (points

16 and 17).

26. HBRC’s Health, Safety

and Wellbeing Committee (HSWC), is managing HBRC’s

‘shake-out’ and subsequent Hikoi exercise as mentioned under the

heading: Internal

Council Operating Environment - Business and ICT continuity management

(point

21). Management of this exercise forms part of the HSWC’s annual

objectives and is included as part of the overall performance of the HSWMS.

27. Progress to align the

HSWMS with ISO45001 continues. The HSW team has developed their 2024-2027

strategy, and workplan. HSWMS performance metrics have been defined and

reported to ELT. Reporting will occur quarterly with an annual review of the

HSWMS set to occur each June. The HSWMS will be externally reviewed every two

years, with the next review due in November 2025. This will be undertaken by

ECAAS, who conducted the previous review.

28. The requirement to consult

with workers exists under the Health and Safety at Work Act and are further

defined under ISO45001. In effect this means that all changes to align the

HSWMS must go through the worker consultation process. As the HSWC is

Council’s main worker engagement mechanism, the HSWC, along with relevant

subject matter experts (SMEs) have been and continue to be, important

stakeholders in this process.

Key

strategic risk themes

29. Each month, the Executive

Leadership Team provides their perspective as to the relative level of

confidence or concern related to the major areas of uncertainty/risk reflected

in HBRC’s strategic risk profile. This enables ELT to consider are

where there is shared concern, a divergence of viewpoints or significant change

from prior periods. The most recent ELT sentiment is provided in the

appendix.

30. Similarly, each quarter,

Councillors are invited to provide their perspective on these strategic risk

areas. Five Councillors took the opportunity to do so this quarter.

31. The results of this

‘sentiment survey’, reflecting the collective views of ELT and

Councillors, highlights the following:

31.1. There is a relatively high

level of alignment of views across the ELT which contrasts to a quite low level

of alignment of views amongst Councillors. This indicates that, while ELT

has a relatively consistent view on the state of HBRC’s priorities and

risks, Councillors do not.

31.2. The effectiveness of

communication, consultation and engagement continues to be an area of high

interest and concern, particularly with respect to HBRC’s reputation,

connection with communities, Wairoa relationships, media portrayal, and clarity

of message re choices, constraints and rationale for decisions made.

31.3. There is a shared level of

confidence across ELT and Councillors in the effectiveness of funding and

financial management.

31.4. The area where there is a

greatest difference between the perspective of ELT and Councillors related to

the effectiveness of emergency management.

Significant

Events

32. This quarter, high risk

events are outlined below.

|

Type

|

Number of Medium/High-Risk Events

|

|

Non-financial Risk Incidents

|

2 (1)

|

|

Health, Safety and Wellbeing

|

3

|

33. Additionally, we continue

to address historical holiday pay issue with PricewaterhouseCoopers engaged to

assist with remediation. We expect to have this issue addressed by February

2025.

Gang

insignia

34. On 28 August 2024, patched

Mongrel Mob members entered the Hawke’s Bay Regional Council chambers

public meeting (in relation to the vote to keep Māori constituencies). The

Group (circa 6 members) came into the meeting late and sat at the front of the

Chamber. At the time, albeit late arrival, their attendance was uneventful and

no issues arose. However, the attendance of patched members drew negative

public feedback, including the receipt of a letter from the Minister of Local

Government. The public display of gang insignia within public buildings,

including the Council Chambers, is illegal. The Prohibition of Gang Insignia in

Government Premises Act 2013 clearly prohibits the wearing or display of gang

patches or insignia in public buildings, including those owned by local

authorities, to uphold the safety and integrity of these spaces.

35. Feedback given to the

Minister was that it was certainly not the intent of the Council to celebrate

gang culture and those in the Council at the time were concerned about not

escalating the situation given the number of people in our chamber. HBRC reviewed

pictures of the event immediately after the Council meeting and removed those

with gang insignia in them from our social media accounts. This was a

first-time occurrence for us in a Council meeting. Actions undertaken post this

event include:

35.1. Putting signage at the

entrance to our Council building about the law and gang insignia

35.2. Ensuring our social media

staff understand the law in relation to insignia

35.3. Looking at additional

security to assist with large meetings

35.4. Briefings to committee

chairs on the law

35.5. Ensuring we continue to

have a strong working relationship with police

35.6. The maximum capacity of our

chambers is 85 pax and, for larger meetings, a proactive count measure will be

put in place.

36. Napier City Council held a

similar meeting a week later and under the guidance of the HSW and facilities

teams, HBRC took proactive measures to engage local Māori Wardens, Police

and community assist staff to ensure public safety.

Subsidised

public transport targeted rate

37. As part of the recent issue

of Rates invoices, a potential issue with the Subsidised Public Transport

targeted rate (PTTR), adopted on 10 July 2024 was identified. The

Council’s financial modelling regarding the PTTR was based on a wide

geographic area being rated for public transport activities. However, in the

consultation documents provided to the public, and in the Council staff advice

provided to elected members, two rating valuation rolls (the Specified Rolls)

were unintentionally excluded from the maps showing the area to be rated.

Residents on the Specified Rolls have since been invoiced for the PTTR, and

some of those residents have complained that the PTTR should not apply to them

given that they were not part of the rating proposal put out to the

community. Legal advice received highlighted that the Revenue and

Financing Policy effectively excludes the two rolls, so HBRC has reissued those

invoices without the public transport rate – a proposed loss of revenue

of $157k.

Holiday

pay

38. PricewaterhouseCoopers

continues to work through the Holiday Pay calculation and errors. This was

first identified and scoped in April 2024. The recalculation is complex and has

been hindered with data issues obtaining required data points from TechOne. However,

PWC have made good progress such that we are expecting the draft preliminary

number for total errors in October 2024. Health, Safety and Wellbeing

39. Three Health, Safety and

Wellbeing incidents that have involved the public have been identified

pertaining to negative public feedback, aggressive in nature. Namely:

39.1. A member of the public came

in to pay rates, suggested they would bring a balaclava and shotgun in if rates

go up again. The ratepayer was annoyed but staff felt like it was a throw away

comment.

39.2. Email received from a

member of the public regarding HBRC payments being collected through Debt

Collection Agency specifically referencing HBRC as ‘scum’ linking

HBRC to suicide rates.

39.3. Dalton Street Reception.

Member of the public, and a total mobility card holder was yelling, abusive and

demanding HBRC speak to the taxi drivers regarding the use of his card as it

was peeling.

40. In all instances corrective

actions were undertaken, such as a formal letter sent to the individual to

outline HBRC expectations for appropriate communication when engaging with our

staff and the continued use of his card within the parameters of the programme.

Also, the HSW team continues to manage and coordinate relevant training, e.g., dealing

with aggressive people and Psychological First Aid. Training

is delivered to front-facing staff with CX/Reception, Debt Recovery staff

included, the HSWC, and relevant support staff such as People &

Capability. Any threat to life will be automatically referred to the

Police for further investigation.

41. Three medium events have

occurred pertaining to towing trailers; the most serious of which was a CDEM

staff member towing the Mobile Emergency trailer. A ‘puff’ of smoke

was seen to come from rear of the trailer with a fire in the trailer a short

time afterwards, which was subsequently put out using CO2 fire extinguisher.

There was no immediate threat to life however this incident had to be reported

to WorkSafe NZ under the legislation. Central Hawke’s Bay District

Council took responsibility, given they manage the asset, completed the

investigation, signed off by the CHB CE, notified and forwarded to HBRC. This was closed

out with No Action (as expected).

Assurance

Activities

42. There are several internal

audits, independent assessments and external assurance reviews that routinely

take place over aspects of HBRC’s operations and controls. We draw

the Committee’s attention to the following work planned or completed:

Data

analytics review of transactions

43. The annual review of Data

Analytics is underway across Hawke’s Bay Regional Council and expected to

be completed by November 2024. The objective of this review is to perform

specified tests to detect suspicious transactions and master data. The testing

areas are payroll and accounts payable payments and master data. Specific tests

look for, and not limited to, duplicate payments, vendors, payments without

purchase orders or multiple purchase orders raised on a single day, and

payments made to vendors that are deactivated. An update will be made to this

Committee at the next meeting.

Review

of ICT operational infrastructure

44. In October, with our CCL

partners (a Spark subsidiary), HBRC conducted a thorough audit of our

operational infrastructure encompassing public cloud, in-country hosted cloud

and on-premises infrastructures. The main objective is to provide HBRC with

visibility of our current IT environment, hosted services, potential cost

savings, current good practices, and risks. The report has identified a

few cost-saving and infrastructure-optimising recommendations, as well as some

risks to investigate further. A plan will be developed to work through

these, with remedial action expected to start from January-2025 (when our

Infrastructure Engineer is onboarded).

Cyber

Security Audit

45. We are in the process of

commissioning a review of our cyber security management practices from Ernst

Young and have received their Statement of Work. The intent is to use

this first audit to benchmark HBRC’s cyber security practices against relevant

industry peers, and provide key recommendations where weaknesses are

identified. The audit absorbs all of the cyber security budget for this

financial year ($60k), so we will action remediation actions internally, or

fund via other infrastructure budget, or defer until next financial year if

feasible. The audit is expected to commence in November.

Quality

Management Systems revalidation audit

46. ISO cert –

revalidation. This is an External Audit – Management System Assessment

Report, produced by Telarc. The scope includes the provision of local

government services to the Hawkes Bay Regional Council from the following

teams: Environmental Science, Environmental Information, Consents, Compliance

and Harbourmaster and the activities of the Works Group including Civil

Construction, Asset, and Infrastructure Maintenance.

Outstanding

audit issues and recommendations

47. All recommendations from

prior audit and assurance reviews undertaken are formally captured and progress

to address these recommendations monitored. The following table provides

an update on progress in this area:

|

Audit Performed

|

Review

Type

|

Date

|

Total Issues raised

|

Issues

Closed

|

Issues

Open

|

Comments

|

|

Regional Assets

|

Section 17a

|

March 2020

|

N/A

|

0

|

3

|

Of the three remaining actions, two are on track and

one is at risk.

|

|

ISO45001 - ECAAS Certification’s Gap

Analysis

|

Review

|

30 November 2023

|

19

|

6

|

13

|

All actions on track

|

|

Organisational Change Consolidation and Prioritisation

|

Internal Audit

|

July 2025

|

5

|

0

|

5

|

Priority has not been given currently to addressing

issues within this report, as resource reallocated to other priority work. It

is expected these actions will be picked up in 2025.

|

Decision-making considerations

48. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that:

48.1. The decisions of the

Committee are in accordance with the Terms of Reference and decision-making

delegations adopted by Hawke’s Bay Regional Council 30 August 2023,

specifically the Risk and Audit Committee shall have responsibility and authority

to provide advice and recommend actions, responses, and

changes to the Council about risk management, assurance activities, governance

oversight and internal control matters, including external reporting and audit

matters. Specifically, this includes:

48.1.1. The robustness of

Council’s risk management systems, policies, practice and assurance

processes. (1.1)

48.1.2. Review whether Council

management has a current and comprehensive risk management framework and

associated procedures for effective identification and management of the

Council’s significant risks in place. (2.1)

48.1.3. Undertake periodic

monitoring of corporate risk assessment, and the internal controls instituted

in response to such risks. (2.2)

48.2. Because this report is for

information only, the decision-making provisions do not apply.

Recommendations

That

the Risk and Audit Committee receives and considers the Risk Management

update staff report.

Authored by:

|

Jess Bennett

Programme Finance & Controls

Manager

|

Katrina Brunton

Group Manager Policy &

Regulation

|

|

Karina Campbell

Strategic Advisor

|

David Nalder

Acting Risk Manager

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

HBRC Enterprise Risk Dashboard

September 2024

|

|

|

|

HBRC Enterprise Risk Dashboard September

2024

|

Attachment

1

|

Risk and Audit

Committee – forward work programme

This paper provides a forward view of

intended agenda items for the Risk and Audit Committee, mapped to specific

areas of responsibility as per the Terms of Reference for the committee,

adopted by Hawke’s Bay Regional Council resolution 30 August 2023

The Terms of Reference for the Risk

and Audit Committee is provided here: 2019-22 Finance Audit and Risk

Sub-committee ToR adopted 20200325 (hbrc.govt.nz)

In summary, the purpose of the Committee is to provide

advice and recommend actions, responses and changes to the Council about risk

management, assurance activities, governance oversight and internal control

matters, including external reporting and audit matters. Specifically this

includes the following matters:

·

The

robustness of Council’s risk management systems, policies, practice and

assurance processes.

·

The

appropriateness of controls to safeguard the Council’s financial and

non-financial assets, the integrity of internal and external reporting and

accountability arrangements.

·

Review

the Council’s revenue and expenditure policies, amongst others, and the

effectiveness of those policies in ensuring limited risk is generated.

·

Assurance

on the independence and adequacy of internal and external audit functions.

·

Council’s

compliance with applicable laws, regulations, standards and best practice

guidelines.

|

Specific responsibilities

|

July 2024

(last meeting)

|

October 2024

(this meeting)

|

February 2025

(next meeting)

|

May 2025

|

|

Review whether Council management has a current and

comprehensive risk management framework and associated procedures for

effective identification and management of the Council’s significant

risks in place

|

Risk Management update

|

Risk Management update

|

Risk Management update

|

Risk Management update

|

|

Undertake periodic monitoring of corporate risk

assessment, and the internal controls instituted in response to such risks

|

Strategic risk deep dives:

1.

Effectiveness

of funding and financial management

2.

Coordination

and connectedness of activity and decision-making across HBRC

3.

Extent

to which we understand expectation needs of our community

4.

Effectiveness

of the NIWE Resilience Programme

Wairoa flood event

reviews

|

Summary of HBRC wide critical controls,

risks these relate to, monitoring and assurance activities

|

Suggested future focus of Internal Audit programme,

aligned to critical controls.

Control Testing – 4-5 tests.

|

Control Testing – 4-5 tests.

|

|

Review the effectiveness of the system for monitoring

the Council’s compliance with laws (including governance legislation,

regulations and associated government policies), Council’s own

standards, and best practice guidelines, including health and safety

|

Health and Safety Framework review – proposal

foward.

|

Overview of HBRC’s compliance

management approach, adoption of ComplyWith and deep dive into the strategic

risk related to legislative and regulatory compliance by HBRC

|

|

|

|

Consider the appropriateness of the Council’s

existing accounting policies and principles and any proposed changes

|

|

Undertaken in conjunction with external

audit (Ernst and Young)

|

|

|

|

Satisfy itself that the financial statements and

statements of service performance are supported by adequate management

sign-off and adequate internal controls

|

Treasury Compliance Report

|

|

|

|

Confirm that processes are in place to ensure that

financial information included in Council’s Annual Report is consistent

with the signed financial statements

|

|

|

|

|

Confirm the terms of appointment and engagement of

external auditors, including the nature and scope of the audit, timetable,

and fees

|

|

To be completed in conjunction with

finalisation of FY24 Financial Audit

|

Appointment of the External Financial Auditors

Confirmation of the External Audit plan

|

|

|

Specific responsibilities

|

July 2024

(last meeting)

|

October 2024

(this meeting)

|

February 2025

(next meeting)

|

May 2025

|

|

Receive the internal and external audit report(s) and

review actions to be taken by management on significant issues and recommendations

raised within the report(s)

|

Enterprise Assurance update, including:

1.

Corrective

action status update

2.

Assurance

universe

|

External Audit report

|

Internal audit report on data analytics review of

accounts payable and payroll

ISO9001 review of quality management system

|

Internal audit report on procurement

Annual NZTA / Waka Kotahi financial and activity audit

report

|

|

Enquire of internal and external auditors any

information that affects the quality and clarity of the Council’s

financial statements and statements of service performance, and assess

whether appropriate action has been taken by management in response to this

|

|

|

|

Conduct a Committee members-only session with

Council’s appointed Auditors to discuss any matters that the auditors

wish to bring to the Committee’s attention and/or any issues of

independence

|

|

External auditor only session, with Ernst

& Young

|

Internal auditor only session with Crowe Horwath

|

|

|

Review and recommend to Council the approach to

insurance strategy and placements as part of its risk management practices

|

Workshop: HBRC Insurance arrangements (facilitated by

AON)

|

|

Update on November 2024 insurance renewal process/QA

over renewals

|

|

Hawke’s

Bay Regional Council

Risk

and Audit Committee

23 October

2024

Subject: Port and Harbour Marine

Safety Code Review

Reason for report

1. This item provides the Risk

and Audit Committee with information on the Regional Council’s compliance

with the Port & Harbour Marine Safety Code. It includes the findings and

corrective actions.

Executive

summary

2. This report outlines the

key findings, recommendations, and conclusion from the audit conducted on 27

and 28 March 2024.

3. The objective of the audit

was to assess the adequacy and effectiveness of internal controls, operational

efficiency, and compliance with the provisions of the Port and Harbour Marine

Safety Code (the Code). The audit focused on specific areas of the Council’s

management of the port and harbour.

4. The methodology included

reviewing documentation, conducting a site visit, and assessing the

effectiveness of the Council’s risk assessment and safety management

system as it applies to Hawke’s Bay regional waters.

5. Key findings include:

5.1. Policies and procedures are

aligned with the principles of the Port and Harbour Marine Safety Code

5.2. The risk assessment and

safety management system are fit for purpose and adequately address the scope

and scale of both commercial operations and recreational activities within the

region

5.3. Collaboration between the

maritime stakeholders in the region is excellent. There are regular meetings

and forums with commercial and recreational organisations

5.4. The Harbourmaster’s

office is understaffed for the size of the region and scale of operations

5.5. The Harbourmaster’s

office should engage with the Councillors on a regular basis regarding maritime

affairs/risks, which have implications on marine pollution, infrastructure, and

regional commerce

5.6. The Hawke’s Bay

Regional Council is far too reliant on external contractors and the HB

Coastguard (volunteer organisation) to satisfy regulatory functions and remains

the only Council that does not have a Harbourmaster vessel.

6. Recommendations include:

6.1. Conduct a risk assessment

to determine the number of staff required to adequately manage maritime safety

within the region

6.2. Acquire a Harbourmaster

vessel that can be utilised for on-water compliance, emergency response,

maritime safety maintenance and pollution response

6.3. Minimise the use of

external contractors for regulatory and maritime safety functions.

Background

7. The Port and Harbour Marine

Safety Code is a tripartite agreement between Maritime New Zealand, regional

councils, and Port companies. The Code provides a standard for maritime

operations within the respective regions to ensure that commercial and

recreational water users can operate safely.

8. It involves a high level of

collaboration between Code signatories to ensure that all operations comply

with the applicable legislations, safety management systems, risk

analysis/assessments, and standard operating procedures. The foundation of the

Code is based on the identification, mitigation, and management of all maritime

risks.

9. A panel representing the

signatories conduct audits of the councils and port companies to determine if

the operations, documentation, policies, and practices are aligned with the

principles of the Code.

Strategic

Fit

10. Maritime Safety and

compliance with the Port and Harbour Marine Safety Code are connected to the

core focus areas of the Strategic Plan of water safety and infrastructure

services. Napier Port is a key regional asset, damage to critical port

infrastructure would have a severe impact on regional trade and commerce.

Ensuring our Maritime Safety operations, documentation, policies, and practices

are aligned with the principles of the Code helps to protect the marine

environment and this regionally significant asset.

Discussion

Focus areas and findings

11. Organisational Structure

– It was noted that the organisational structure was aligned with many

other regional councils. The majority of Harbourmasters across the region are

tier three managers. The panel was pleased with the expression of commitment to

the Code that was made by the Group Manager for Policy and Regulation and

commended the fact that the Council had a structure that was functioning well.

The panel was interested in the visibility of the Harbourmaster and maritime

safety matters to other areas of council, particularly around some of the

issues being faced nationally. There should be more interaction with Councillors

regarding maritime issues and the implications both regionally and nationally.

12. Collaboration – The

collaboration was assessed both internally and externally. The

Harbourmaster’s Office was observed to have great collaboration with

other areas of council, specific attention was drawn to departments within the

Policy and Regulation group such as Compliance, Consents and Policy, and

extended to ICM, Assets and Corporate Services. External collaboration with

commercial and recreational stakeholders was also assessed as being positive.

It was noted that there is room for increased collaboration with local Iwi.

13. Aids to navigation –

The Harbourmaster is responsible for the installation and maintenance of a

variety of aids to navigation within the region. This includes navigation

buoys, navigation lights, navigation leads, demarcated access lanes, and the associated

signage as reflected in the Navigation Safety Bylaw. The processes were aligned

with the undertaking; however, the Council is heavily reliant on contractors to

carry out maintenance. This is identified as a risk that needs to be mitigated

- aids to navigation have a direct impact on the safety of lives and the

environment.

14. Memoranda of Understanding

(MoU) – The Council currently has two memoranda of understanding in

place, one with Napier Port and the other with Napier City Council. The

delineation of responsibilities, management of assets, and incident response

are some of the key areas outlined in the MoU. The Napier City Council MoU is

due to be updated based on a change to the fees and charges between the

councils.

15. Council resourcing –

The Harbourmaster’s office is understaffed for the requirements of the

region. The Hawke’s Bay region has the second largest export port by

volume in the North Island, a commercial Inner Harbour and rocket launching/recovery

operations that are all regulated and monitored by the Harbourmaster’s

office. In addition, there are a variety of recreational activities within the

region that are regulated by the Harbourmaster’s Office using primary and

secondary legislation. Harbourmaster’s offices across the country of a

similar scale have a minimum of five staff which usually includes a

Harbourmaster, Deputy Harbourmaster, and three Maritime officers. It was also

noted that the region does not have a Harbourmaster vessel and is the only one in

the country without one. This raises questions as to the Council’s

ability to effectively respond to incidents, adequately monitor and enforce

compliance with maritime legislation, respond to maritime emergencies, and

respond to marine pollution, all of which the Council has a statutory

responsibility to fulfil. This is a significant risk for the Council and would

be the subject of investigation in the event of an adverse occurrence.

16. Incident/Emergency

management – There are robust procedures in place for the management of

incidents, near-misses, accidents, and emergencies. Evidence of that was

demonstrated for both commercial operations and recreational activities within

the region. Examples of these were vessel groundings, sinkings, collisions,

fire, engine failures and steering gear failures. The incidents were managed in

a way that mitigated or averted adverse outcomes. However, it must be

re-emphasised that the Harbourmaster was heavily reliant on the use of external

contractors as well as the Coastguard, which is a volunteer service, to carry

out this response. These incidents also involved or could have involved marine

pollution. This puts the Council in an untenable position if these external

parties are unavailable or unfit at the time of an incident.

17. Stakeholder meetings

– The Harbourmaster, Maritime New Zealand, and Napier Port

representatives meet at least monthly to discuss maritime issues. Meetings are

also held ad hoc in response to any situations that arise. The Harbourmaster

also meets with other commercial and recreational clubs/organisations, and key

stakeholders around the region on a regular basis.

18. Policies and processes

– The software utilised by the Harbourmaster’s Office for document

storage/management adequately incorporated the provisions of the Code. There

were clear links to the implementation, management, and review of policies and

procedures. This is an excellent tool and will be recommended other Councils

during future reviews.

19. Hydrographic surveys and

dredging – Adequate measures were demonstrated for risk mitigation

associated with hydrography. The Harbourmaster’s Office oversees the

dredging and survey programmes for Napier Port and Napier City Council. There

are clauses in the respective MOU that outlines the responsibility for

maintenance dredging in high-risk areas. There are also policies that address

the frequency of dredging and surveys. Evidence was shown of the most recent

dredging and survey campaigns within the region. Surveys and dredging were also

undertaken post cyclone to ensure that the region could safely accommodate

vessel movements, this prevented shipping delays and assisted the recovery of

the region.

20. Anchorage – The

Harbourmaster is responsible for the designation, management, and maintenance

of the anchorage areas used by commercial ships within the region. Measures to

ensure that the depths and nature of the seabed were accurately depicted on

navigational charts and in navigational publications were adequately

demonstrated. The Harbourmaster utilises the Vesper-Garmin Automatic

Identification System (AIS) to monitor ships at anchor as well as vessel

movements within the region. It was discussed that there would be upcoming

changes to the designated areas and a new procedure would be implemented to

further reduce risks and optimise the use of the anchorage areas.

21. Marine Pollution Response

– The Pollution Response Team, which falls within the Compliance Group

manages marine pollution. The team has staff that have been trained in marine

pollution response, and the region has a Regional On-scene Commander (ROSC), as

well as an alternate ROSC that provides cover. The team will also be in a

position of relying on the availability of external contractors, or the

Coastguard to effectively respond to marine pollution due to a lack of on-water

capabilities. This would also be the case for conducting training exercises.

Decision-making considerations

22. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that:

22.1. The decisions of the

Committee are in accordance with the Terms of Reference and decision-making

delegations adopted by Hawke’s Bay Regional Council 30 August 2023,

specifically the Risk and Audit Committee shall have responsibility and authority

to provide advice and recommend actions, responses, and changes to the Council

about risk management, assurance activities, governance oversight and internal

control matters, including external reporting and audit matters. Specifically,

this includes:

22.1.1. The robustness of

Council’s risk management systems, policies, practice and assurance

processes. (1.1)

22.1.2. Review whether Council

management has a current and comprehensive risk management framework and

associated procedures for effective identification and management of the

Council’s significant risks in place. (2.1)

22.1.3. Undertake periodic

monitoring of corporate risk assessment, and the internal controls instituted

in response to such risks. (2.2)

22.2. Because this report is for

information only, the decision-making provisions do not apply.

Recommendations

That

the Risk and Audit Committee receives and considers the Port Harbour Marine

Safety Code Review staff report.

Authored by:

|

Adrian Wright

Harbourmaster

|

|

Approved by:

|

Katrina Brunton

Group Manager Policy &

Regulation

|

|

Attachment/s

|

1⇨

|

Hawke's Bay Port & Harbour

Marine Safety Code Review Report - 2024

|

|

Under Separate Cover

|

|

2⇩

|

20 August 2024 HB Code Consistency

Letter - PHMSC NZ

|

|

|

|

20 August 2024 HB Code Consistency Letter

- PHMSC NZ

|

Attachment

2

|

Hawke’s Bay Regional

Council

Risk

and Audit Committee

23 October

2024

Subject:

Treasury Compliance Report for the period 1 July - 30 September 2024

Reason for report

1. This item provides

compliance monitoring of Hawke’s Bay Regional Council’s (HBRC)

Treasury activity and reports the performance of Council’s investment

portfolio for the quarter ended 30 September 2024.

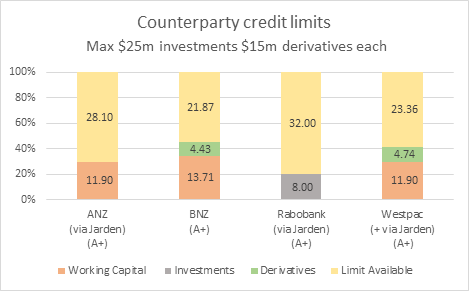

Overview of the quarter ending 30 September 2024

2. On 30 September 2024 and

during the preceding quarter, HBRC was compliant with all measures in its

Treasury Policy except for six days during the quarter where the counterparty

risk policy was breached as managed funds were transferred between managers.

3. During the quarter HBRC

transitioned its Managed Portfolio investments from Mercer and Jarden to

Harbour Asset Management and the HBRIC portfolio transition is in progress.

4. The effects of Cyclone

Gabrielle and its recovery continue to impact both cash balances and borrowing

requirements. Additional ongoing borrowing to fund recovery will continue

over the next 3-4 years, while proceeds from insurance claims are slower than

initially forecast.

5. During the quarter HBRC

took advantage of favourable movements in the interest rate swap curve and

executed two interest rate swaps with a total notional value of $25m.

Background

6. Council’s Treasury

Policy requires a quarterly Treasury Report to be presented to the Risk and

Audit Committee. The policy states that the Treasury Report is to include:

6.1. Treasury exceptions report

6.2. Policy compliance

6.3. Borrowing limit report

6.4. Funding and liquidity

report

6.5. Debt maturity profile

6.6. Interest rate report

6.7. Investment management

report

6.8. Treasury investments

6.9. Cost of funds report, cash

flow and debt forecast report

6.10. Debt and interest rate

strategy and commentary

6.11. Counterparty credit report

6.12. Loan advances.

7. The Investment Management

report has specific requirements outlined in the Treasury Policy. This requires

quarterly reporting on all treasury investments plus annual reporting on all

equities and property investments.

8. In addition to the Treasury

Policy, Council has a Statement of Investment Policy and Objectives (SIPO)

document setting out the parameters required for all HBRC Group funds under

management.

9. Since 2018, HBRC has

procured treasury advice and services from PricewaterhouseCoopers (PwC) who

provide quarterly treasury reporting for internal monitoring purposes.

Treasury

exceptions report and policy compliance

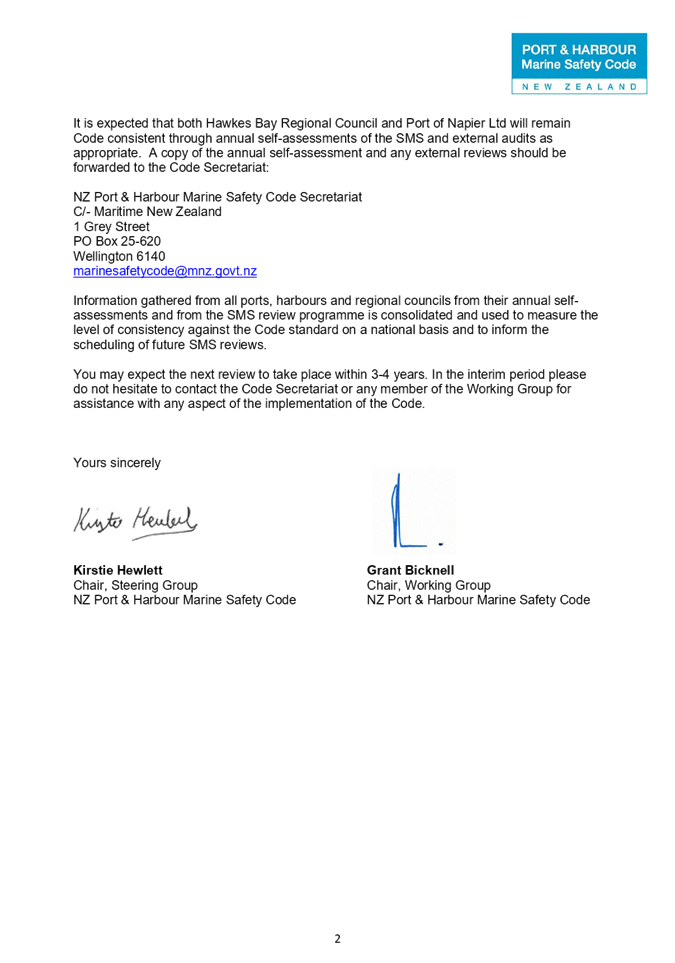

10. During the quarter HBRC was

non-compliant with the counterparty risk policy with BNZ for three days in July

as it transitioned both managed portfolio investments to new providers through

their BNZ account. It occurred again in late September as the annual

rates intake was received. Both non-compliance incidents occurred over a

weekend and were rectified within one business day.

11. Council staff continue to

maintain the view that management of Recovery Funding held on behalf of others

sits outside HBRC’s Treasury Policy for normal operations and is excluded

from treasury reporting.

12. The Treasury Policy states

the CFO formally delegates to accountants the responsibility for executing

treasury transactions in accordance with approved limits, managing the

operation of all bank accounts, reviewing electronic batch payments to

creditors, and arranging for approval by authorised signatories.

Practical application of the Treasury Policy limits for authorisation of bank

transactions has not been previously documented so we have outlined how this is

applied internally in the attached report which provides a breakdown of the

policy and the internal application of limits.

Funding

and liquidity

13. To ensure HBRC can adequately

fund its operations, current policy requires us to maintain a liquid balance of

‘greater than 10% of existing total external debt’. Current

liquidity ratio is 45.16% and therefore meets

policy.

14. The following table reports

the cash and cash equivalents on 30 September 2024.

|

30 Sept 2024

|

$000

|

|

Cash on Call

|

36,750

|

|

Short-term bank deposits

|

8,000

|

|

Total Cash & Deposits

|

44,750

|

15. To manage liquidity risk,

HBRC retains a Standby Facility with BNZ. This facility provides HBRC

with a same-day draw down option, to any amount between $0.3m-$10m, and with a

7-day minimum draw period.

16. $40m was received during

the quarter from the annual rates intake. These funds have been deposited

between 3 banks to maintain the Council’s counterparty policy and $8m

placed on term deposit to pre-fund a LGFA loan maturing in April 2025.

17. The OCR reduced on 14

August to 5.25%, with corresponding reduction in returns to on-call funds with

Jarden dropping to 5.25% and BNZ reducing to 5.2%. The Term deposit of

$8m with Rabo for six months returns 5.9%. Because the current cash on

hand is required for cashflow purposes it is not practical for this to be

placed on long term deposit.

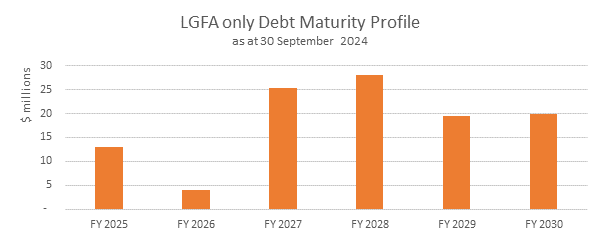

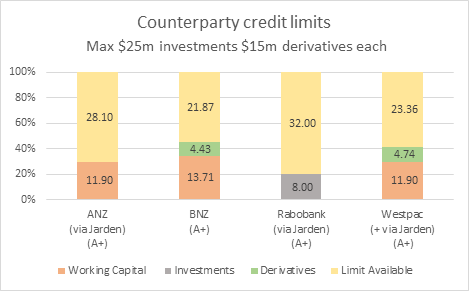

Debt

management

18. On 30 September 2024 the

current external debt for the Council group was $113m of which $8m is due to

mature in April 2025. This has been pre-funded from the 2024 rates intake.

(external debt is $129m including loan from HBRIC).

19. Since Q4 of FY24 there has

been no additional new borrowing.

20. The following summarises

the year-to-date movements in Council’s debt position.

Summary of HBRC Debt

|

|

HBRC only

$000

|

HBRC Group

$000

|

|

Opening debt – 1 July 2024 – excluding

HBRIC loan

|

113,500

|

113,500

|

|

New loans raised

|

-

|

-

|

|

Less amounts repaid

|

(225)

|

(225)

|

|

Closing Debt 30 September 2024 (excluding

HBRIC loan)

|

113,275

|

113,275

|

|

Plus loan from HBRIC

|

16,663

|

-

|

|

Total Borrowing as at 30 June 2024

|

129,938

|

113,275

|

21. Council’s debt

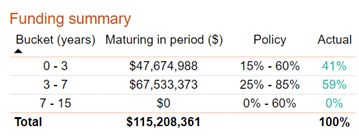

maturity profile remains compliant. The infographic below includes our

$10m BNZ overdraft facility in total debt and planned $8m repayment utilising

term deposit. The internal (HBRIC) debt is excluded.

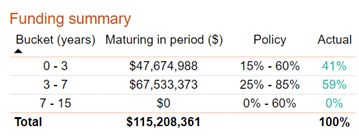

Funding

summary

22. HBRC had no new borrowing

in Q1 but anticipates further borrowing before Christmas to fund costs relating

to the major flood mitigation projects.

23. HBRC staff continue to work

on firming up the challenging cashflow forecast for the capital projects and

this will inform the timing of any future borrowings.

24. The LTP debt forecast

anticipates debt levels rising to $176m by the end of FY27.

Borrowing

limits

25. Council continues to

monitor and work within the agreed borrowing limits set by both Council and the

LGFA.

26. The ratios below exclude

all HB Recovery cash & cash equivalents held and any return on these funds

but does include LTIF managed funds as a liquid asset for assessing net debt.

|

Ratio

|

HBRC

|

LGFA

|

Actual to 30 September 2024

|

|

Net external debt as a percentage of

revenue

|

<250%

|

<285%

|

23.97%

|

|

Net interest on external debt as a

percentage of total revenue

|

<30%

|

<20%

|

1.09%

|

|

Net interest on external debt as a

percentage of annual rates income

|

<20%

|

<25%

|

6.90%

|

|

Liquidity buffer amount comprising liquid

assets and available committed debt facility amounts relative to existing

total external debt

|

>110%

|

>110%

|

145.16%

|

Interest

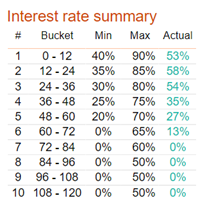

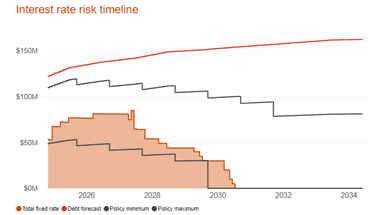

rate risk

27. Council currently holds

$54m in fixed rate instruments, hedging 44% of current external debt, and

remains compliant to policy. This is based on the FY2025-2027 LTP plan.

28. These hedging instruments

are currently held with two banks, Westpac and BNZ. Since 30 June, interest

rates have shown movement and Council has increased their hedging instruments

with these banks. Council has also created a facility with ANZ for possible

future swaps.

Managed

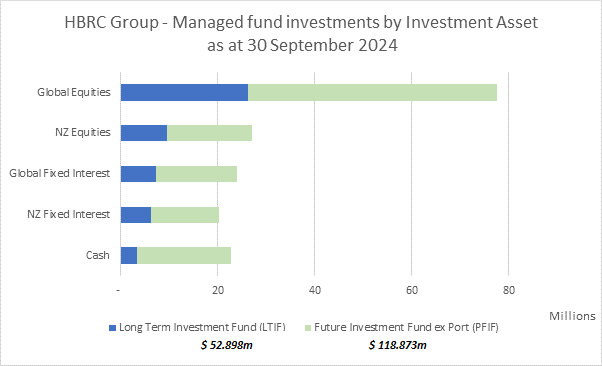

funds

29. Total Group Investment Fund

portfolios capital on 30 September 2024 is $172m. No divestments have been made

from managed funds this year.

30. HBRC has fully transferred

their Managed Investment Portfolio’s from both Mercer and Jarden to

Harbour Asset Management Ltd. On 30 September HBRIC’s portfolio is

still in transition.

31. As all portfolios were in a

sell-down/purchase phase, the performance of the portfolios has not been

benchmarked. Once all are fully transferred to their new

portfolio’s we will commence reporting on performance.

32. It will also need to be

confirmed if the Capital Protected Amount HBRIC as manager of the funds will be

reset to the value transferred. With the improvement in market values this

quarter the total funds are now back above the historical capital protected

amount.

33. The following table summarises the fund balances at the

end of each period and the graph illustrates the asset allocations within each

fund on 30 September 2024.

|

|

30 June 2023

|

30 June 2024

|

30 Sept 2024

|

|

Fund Balances HBRC

|

$000

|

$000

|

$000

|

|

Fund Balance HBRC

|

110,828

|

118,722

|

121,112

|

|

Capital Protected Amount HBRC (2% compounded since

inception)

|

115,895

|

118,890

|

119,484

|

|

Current HBRC value above/(below) capital protected amount

|

(5,067)

|

(168)

|

1,628

|

|

Funds Balances (HBRC + HBRIC)

|

|

Long-Term Investment Fund (HBRC)

|

48,400

|

51,847

|

52,898

|

|

Future Investment Fund (HBRC)

|

62,428

|

66,875

|

68,214

|

|

Total HBRC

|

110,828

|

118,722

|

121,112

|

|

Plus HBRIC Managed Funds (FIF)

|

45,638

|

48,854

|

50,658

|

|

Total Group Managed Funds

|

156,466

|

167,576

|

171,770

|

|

Capital Protected Amount (2% compound inflation)

|

164,798

|

169,344

|

170,191

|

|

Current group value above/(below) protected amount

|

(8,332)

|

(1,768)

|

1,579

|

Cost

of funds

34. Rolling 12 months to 30

September 2024, Gross Cost of Funds (COF) was 4.19% and Net COF was 4.09%.

HBRIC

Ltd

35. In accordance with Council

policy, HBRIC provides separate quarterly updates to the Corporate and

Strategic Committee.

Decision-making process

36. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

36.1. The decisions of the

Committee are in accordance with the Terms of Reference and decision-making

delegations adopted by Hawke’s Bay Regional Council 30 August 2023,

specifically the Risk and Audit Committee shall have responsibility and

authority to:

36.1.1. Review the Council’s revenue and

expenditure policies, amongst others, and the effectiveness of those policies

in ensuring limited risk is generated. (1.3)

36.2. Because this report is for

information only, the decision-making provisions do not apply.

Recommendation

That

the Risk and Audit Committee receives and notes the Treasury Compliance

Report for the period 1 July - 30 September 2024.

Authored by:

|

Tracey O'Shaughnessy

Treasury & Investments

Accountant

|

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

There are no attachments for this

report.

Hawke’s

Bay Regional Council

Risk

and Audit Committee

23 October

2024

Subject: Ernst & Young Audit Close

report on year ended 30 June 2024

Reason for Report

1. This report presents the

Audit and Risk Committee with the auditor’s preliminary findings from the

year ended 30 June 2024 audit.

2. Staff from Ernst &

Young will speak to their report (Attachment 1) on Wednesday 23 October

2024. They will present their findings and be available to answer questions and

provide clarification to the committee as required.

Background

3. Each year, following the

completion of the audit of HBRC’s Annual Report, the auditor’s

report back to the governing body on any findings from the audit. The report

provides commentary on areas where the auditors identified control matters during

their audit procedures and makes recommendations for improvement.

4. This is Ernst &

Young’s (the auditors) third year completing the HBRC audit.

Discussion

5. The year end audit

commenced on 23 September and is ongoing however, HBRC management had a status

update with the auditors on Friday 11 October where the following specific

matters were covered:

5.1. Corrections to be made to

Financial Statements, notably a correction to the unit rates used to value

Carbon Credits

5.2. A change to the valuation

method for HBRIC, which management agreed with

5.3. Outstanding sample testing

and other audit procedures. Please note this is in the hands of both HBRC

staff and EY staff.

Audit

adjustments made

6. Recognition of NEMA

infrastructure claims received after balance date as income.

7. Adjustment to the values of

carbon credits and HBRIC valuation methodology as above.

8. Management agrees with each

of these adjustments and has corrected these within the financial statements.

9. As the audit process is

ongoing there may be additional audit adjustments identified.

10. E&Y have identified

five control findings in their report, one medium risk relating to community

loan reconciliations and four low risks.

Next steps

11. The 2023-2024 Annual Report

will be presented at the Regional Council meeting on 30 October 2024 for

adoption.

Decision-making considerations

12. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

the Audit and

Risk Committee receives and notes the Ernst & Young Audit Close Report

on Year ended 30 June 2024 staff report.

Authored by:

|

Pam Bicknell

Senior Group Accountant

|

Chris Comber

Chief Financial Officer

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1⇨

|

HBRC EY Audit Close Report for the

year ended 30 June 2024

|

|

Under Separate Cover

|

Hawke’s Bay Regional

Council

Risk

and Audit Committee

23 October

2024

Subject: Confirmation of Public

Excluded Minutes

That the Risk

and Audit Committee excludes the public from this section of the meeting being

Confirmation of Public Excluded Minutes Agenda Item 8 with the

general subject of the item to be considered while the public is excluded. The

reasons for passing the resolution and the specific grounds under Section 48

(1) of the Local Government Official Information and Meetings Act 1987 for the

passing of this resolution are:

|

General

subject of the item to be considered

|

Reason

for passing this resolution

|

Grounds

under section 48(1) for the passing of the resolution

|

|

Strategic risk deep

dives

|

To prevent information

about Council’s critical controls being accessed.

The public interest is

protected by not allowing the information to be accessed by anyone outside

the organisation.

|

s7(2)(j) to prevent

disclosing information that could be used for improper gain or improper

advantage.

|

|

Wairoa Flood Event

reviews

|

The matters being

discussed may potentially be the subject of litigation and the Council has

engaged legal advisors to provide advice on associated issues.

In relation to the

public interest, the fact that reviews are under way has been widely shared

by the Council and by the media so it is considered the public interest has

been served in that way.

|

s7(2)(g) Excluding the

public is necessary to prevent disclosure of information that is legally

privileged.

|

Authored by:

|

Leeanne Hooper

Team Leader Governance

|

|

Approved by:

|

Desiree Cull

Strategy & Governance Manager

|

|

Hawke’s

Bay Regional Council

Risk

and Audit Committee

23 October

2024

Subject: Legal update

That the Risk

and Audit Committee excludes the public from this section of the

meeting, being Agenda Item 9 Legal updatewith the general subject of the item to be considered while the

public is excluded. The reasons for passing the resolution and the specific

grounds under Section 48 (1) of the Local Government Official Information and

Meetings Act 1987 for the passing of this resolution are:

|

General

subject of the item to be considered

|

Grounds

under section 48(1) for the passing of the resolution

|

Reason

or rationale for passing this resolution, including how the public interest

has been considered

|

|

Legal update

|

s7(2)(g) Excluding the

public is necessary to prevent disclosure of information that is legally

privileged.

|

The matters being

discussed may potentially be the subject of litigation and the Council has

engaged legal advisors to provide advice on associated issues.

In relation to the

public interest, the fact that reviews are under way has been widely shared

by the Council and by the media so it is considered the public interest has

been served in that way.

|

Authored by:

|

Matt McGrath

Chief Legal Advisor

|

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|