Meeting of the

Corporate and Strategic Committee

Date: 4 September 2024

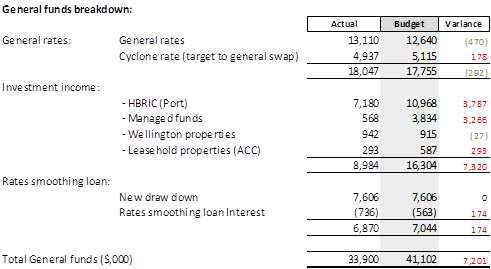

Time: 1.30pm

|

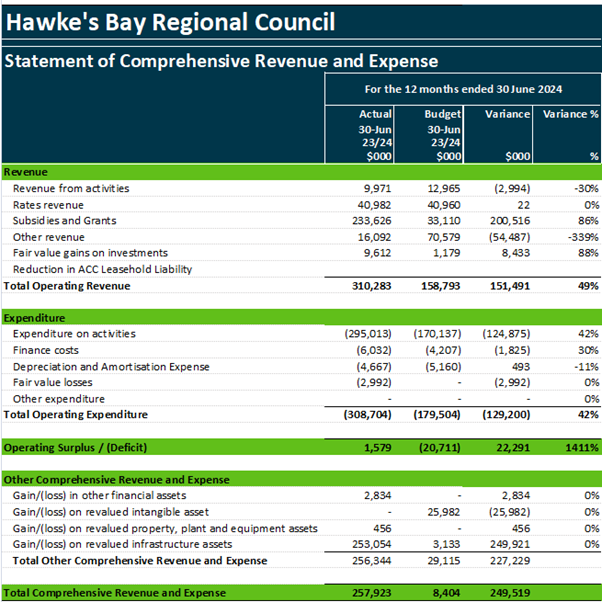

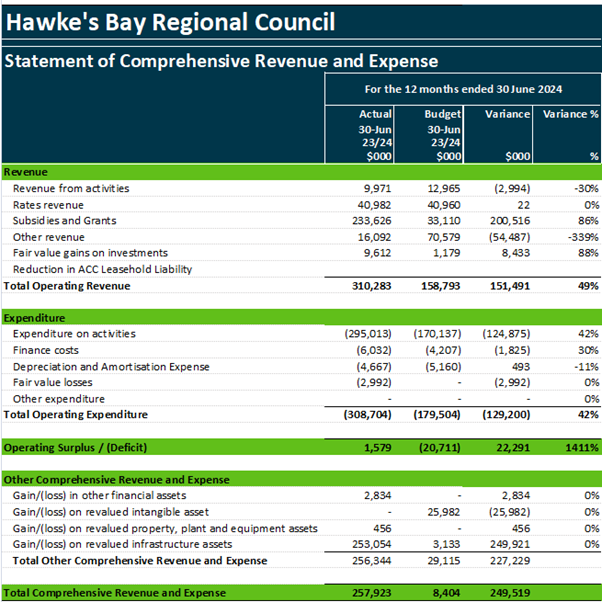

Venue:

|

Council

Chamber

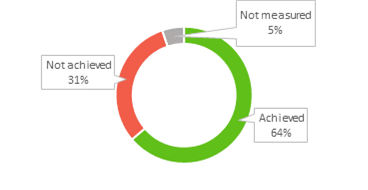

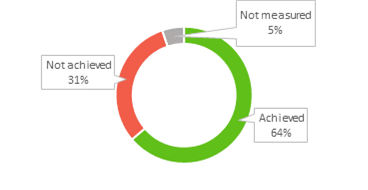

Hawke's

Bay Regional Council

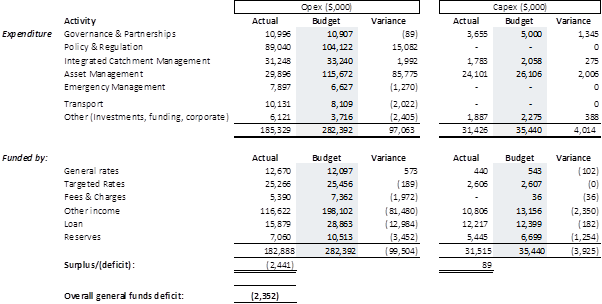

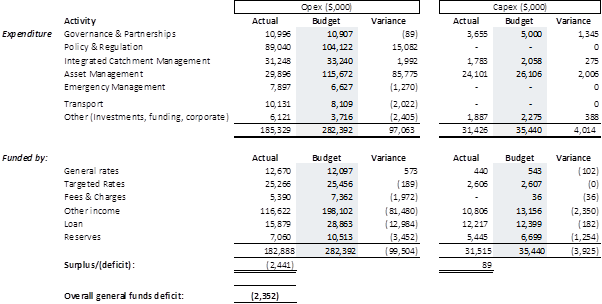

159

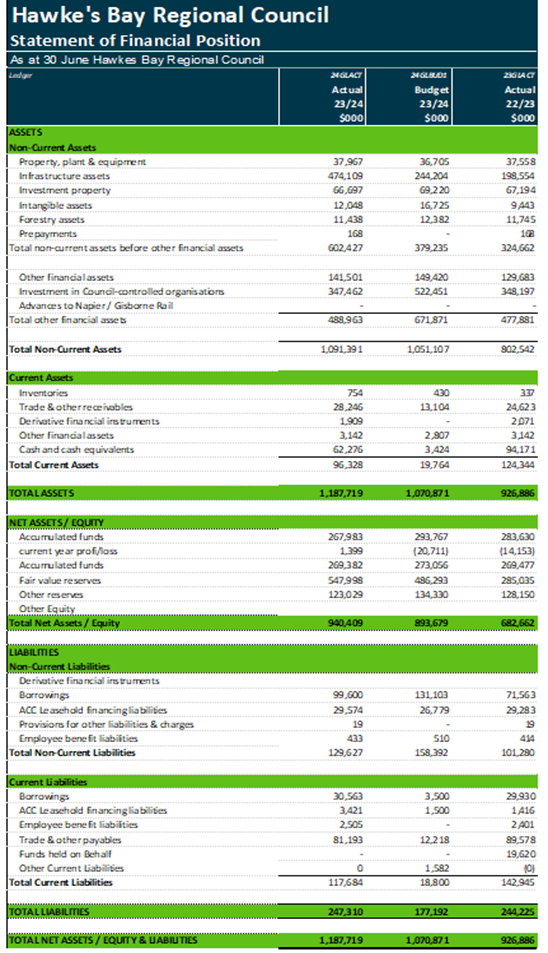

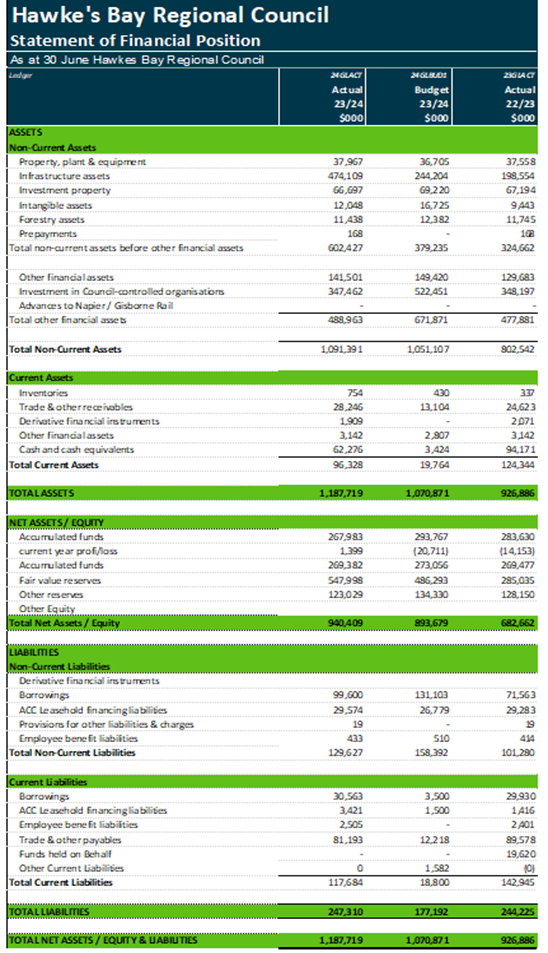

Dalton Street

NAPIER

|

Agenda

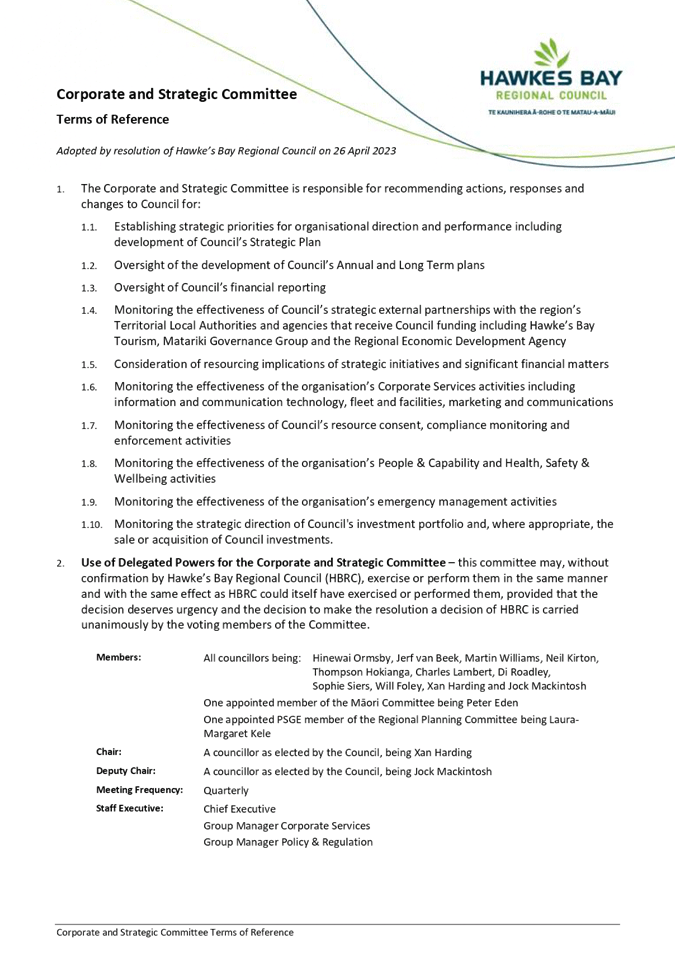

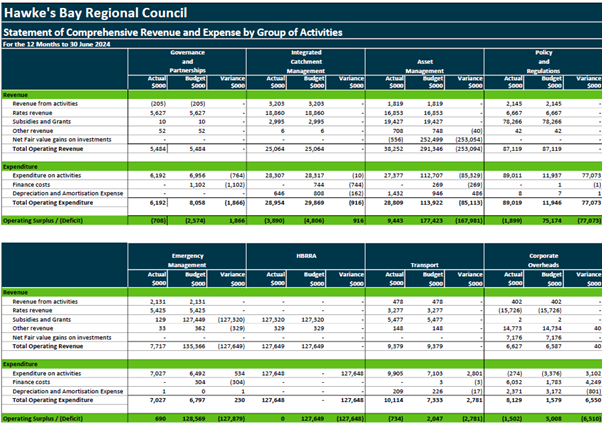

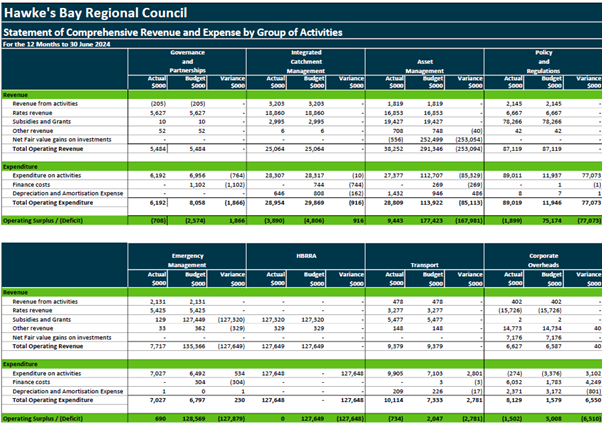

Item Title Page

1. Welcome/Karakia/Notices/Apologies

2. Conflict

of Interest Declarations

3. Confirmation of Minutes of

the Corporate and Strategic Committee meeting held on 15 May 2024

4. Public

Forum 3

Decision

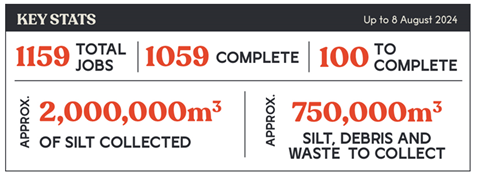

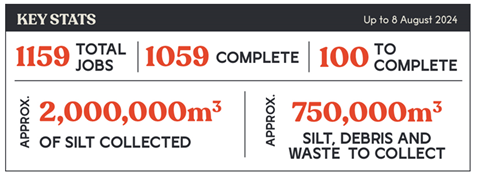

Items

5. 2023-2024

Carry forwards 7

6. Annual

Compliance, Monitoring, and Enforcement Report 2022-2023 17

Information

or Performance Monitoring

7. Organisational

Performance Report for the period 1 April - 30 June 2024 21

8. Interim

financial results 2023-2024 23

9. Annual

Report 2023-2024 Interim non-financial results 33

10. Health,

Safety and Wellbeing Strategic Plan 2024-2027 37

11. Annual

reporting on climate action 41

12. HBRIC

Ltd quarterly update 45

13. HB

Regional Recovery Agency update 51

Hawke’s Bay Regional

Council

Corporate

and Strategic Committee

4

September 2024

Subject:

Public Forum

Reason for report

1. This item provides the

means for the Committee to give members of the public an opportunity to address

the Committee on matters within its terms of reference.

Background

2. The Hawke’s Bay

Regional Council’s Standing Orders provide for public forums as follows:

14.

Public

Forums

Public

forums are a defined period of time, usually at the start of a meeting, which,

at the discretion of a meeting, is put aside for the purpose of public input.

Public forums are designed to enable

members of the public to bring matters to the attention of the local authority.

In

the case of a committee or sub-committee, any issue, idea or matter raised in a

public forum must also fall within the terms of reference of that meeting.

Requests

must be made to the HBRC Governance Team (06 835 9200 or governanceteam@hbrc.govt.nz) at least one clear day

before the meeting;

however this requirement may be waived by the Chairperson.

14.1 Time limits

A

period of up to 30 minutes, or such longer time as the meeting may determine,

will be available for the public forum at each scheduled Regional Council,

Corporate & Strategic Committee, Environment & Integrated Catchments

Committee and Regional Transport Committee meeting.

Speakers

can speak for up to 5 minutes. No more than two speakers can speak on

behalf of an organisation during a public forum. Where the number of speakers

presenting in the public forum exceeds 6 in total, the Chairperson has

discretion to restrict the speaking time permitted for all presenters.

14.2 Restrictions

The

Chairperson has the discretion to decline to hear a speaker or to terminate a

presentation at any time where:

a speaker is repeating views

presented by an earlier speaker at the same public forum

the speaker is criticising

elected members and/or staff

the speaker is being

repetitious, disrespectful or offensive

the speaker has previously

spoken on the same issue

the matter is subject to legal

proceedings

the matter is subject to a

hearing, including the hearing of submissions, where the local authority or

committee sits in a quasi-judicial capacity.

14.3 Questions at public forums

At

the conclusion of the presentation, with the permission of the Chairperson,

elected members may ask questions of speakers. Questions are to be confined to

obtaining information or clarification on matters raised by a speaker.

14.4 No resolutions

Following

the public forum no debate or decisions will be made at the meeting on issues

raised during the forum unless related to items already on the agenda.

Decision-making process

3. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

the Corporate

and Strategic Committee receives and notes the Public Forum speakers’

verbal presentations.

Authored by:

|

Leeanne Hooper

Team Leader Governance

|

|

Approved by:

|

Desiree Cull

Strategy & Governance Manager

|

|

Attachment/s

|

1⇩

|

Corporate and Strategic Committee

Terms of Reference 2023-2025

|

|

|

|

Corporate and Strategic Committee Terms

of Reference 2023-2025

|

Attachment

1

|

Hawke’s Bay Regional

Council

Corporate

and Strategic Committee

4

September 2024

Subject: 2023-2024 Carry forwards

Reason for report

1. This item seeks approval

from the Corporate and Strategic Committee, in the form of a recommendation to

Council, to carry forward expenditure budgets from 2023-2024 to 2024-2025.

Executive

summary

2. During 2023-24 a number of

work programmes experienced delays and were unable to be completed as

originally planned. Where this work cannot be reprioritised from within

the 2023-2024 Annual Plan budget, unspent expenditure budgets are requested to

be carried forward to cover the expected costs of completion.

3. The interim financial

results for 2023-24 indicate a deficit in general funds of $2.3m. On this

basis, carry forward requests have been restricted to debt, reserve or

externally funded carry forwards, as these are just a timing difference when

funding is drawn or recognized, and have no immediate impact on Council’s

financial position.

4. A total of $20.086m is

requested to be carried forward into the 2024-25 Annual Plan budget, split as

$17.681m capital expenditure (capex) and $2.404m operating expenditure (opex).

5. The source of funds

required for the total carry forward request is split as following:

4.1 $3.005m debt funding

4.2 $1.588m reserve funds

4.3 $15.493m external income.

6. Outstanding commitments

exist for a number of activities not completed during 2023-24, which were

intended to be funded from general funds. Because there are no surplus

general funds to carry forward, these commitments will be reviewed by staff for

reprioritisation within existing budgets in the first instance. This will

put pressure on operating budgets, and staff will provide an update on budget

pressures in the first finance report update for 2024-25.

Background

7. Carry forwards allow for

unspent approved funds against projects to be moved forward to the next

financial year so that projects can be completed. These include the funding of

final costs of multi-year projects, contracts that were unable to be completed

by the financial year end, and the carry forward of external income received

for specific projects.

8. The funding types are

categorised as:

8.1. General funding is from

General Rates, rates smoothing loan and investment income (net of costs).

8.2. Reserve funding is from

targeted rates that have flowed through to specific reserves (e.g. asset

replacement reserves, scheme reserves).

8.3. External is external income

(including subsidies and grants) received for specific projects.

8.4. Debt is for loan funding

not drawn down, and is covered by interest and principal repayments that are

already included in the LTP and/or Annual Plan.

9. The table below summarises

the analysis of 2023-24 activity expenditure and funding. This subtotals the

different funding sources allocated against each council group of activity. The

budget is the management budget (annual plan plus carry forwards and new

external funding agreements confirmed after the annual plan budget was set).

10. The interim financial

results indicate that while many activities were underspent for the 2023-24

financial year, this underspend was not enough to offset the shortfall in

general funds caused by the lower than planned investment income.

11. Total general funds for

2023-24 were $7.2m under budget, mostly related to the Port dividend being down

on budget expectations due to Cyclone impact on port trading activities, and in

managed funds due to the portfolio makeup weighted towards portfolio growth

rather than cash distribution.

12. As there is no surplus in

general funds for 2023-24, the carry forward requests this year have excluded

general funded activities.

Operating expenditure carry forward requests

|

Activity/Project

|

Amount Requested

|

Source of funds

|

|

Debt

|

Reserves

|

External

|

|

Asset Management

|

|

|

|

|

|

1

|

Coastal Hazards

|

$37,500

|

|

$37,500

|

|

|

2

|

NIWE

|

$1,269,200

|

$317,300

|

|

$951,900*

|

|

Integrated Catchment Management

|

|

|

|

|

|

3

|

Biodiversity

|

$52,300

|

$52,300

|

|

|

|

4

|

Ruataniwha Model

|

$64,600

|

$64,600

|

|

|

|

5

|

Environmental Science

|

$332,700

|

|

|

$332,700

|

|

6

|

Land for Life

|

$57,500

|

|

$57,500

|

|

|

Governance & Partnerships

|

|

|

|

|

|

7

|

Sustainable Homes

|

$17,800

|

|

$17,800

|

|

|

Corporate services

|

|

|

|

|

|

8

|

ICT Software as a service development (SAAS)

|

$572,600

|

$572,600

|

|

|

|

Total opex

|

$2,404,200

|

$1,006,800

|

$112,800

|

$1,284,600

|

*Funds not yet

received but will be claimed on completion of milestones (as per funding

agreements).

Coastal hazards (opex – 1)

13. The timeline for the

Coastal Hazards strategy development continues into 2024-25, with work to

prepare for Council decision on strategy adoption and consultation.

Targeted rates fund HBRC’s contribution to the strategy development, and

Napier City Council and Hastings District Council co-fund the balance.

14. Financial Assessment:

Surplus targeted rates were collected in 2023-24 and are available for carry

forward.

15. Recommendation: That the

carry forward of $37.5k target rates funding is approved.

NIWE (opex – 2)

16. The opex portion of the

North Island Weather Event programme (NIWE) carry forward relates to the

planned scheme reviews. The multi-year programme budget was included in

the 2024-25 Three Year Plan (3YP), including assumptions on expenditure forecast

for 2023-24. The underspend against the forecast for 2023-24 is requested

to be carried forward to retain the full programme budget (i.e., the carry

forward is to align the budget to the programme expenditure and funding draw

down).

17. Financial Assessment:

NIWE Government Grants and loan funding have not yet been drawn. Internal loan

interest and repayments for this loan have been allowed for in the 2024-25

budget.

18. Recommendation: That the

carry forward of $1,269k external funds and loan funding is approved.

Biodiversity (opex –

3)

19. Delays due to weather have

prevented completion of co-funded Department of Conservation (DOC) Jobs for

Nature projects for this financial year, including deer fencing for Baldwins

Bbush, an existing QEII remnant. HBRC’s contribution to the project

is loan funded, as approved in 2020-21 (Covid recovery fund).

20. Financial Assessment: Loan

funding has not yet been drawn. Internal loan interest and repayments for

this loan have been allowed for in the 2024-25 budget.

21. Recommendation: That the

carry forward of $52.3k loan funding is approved.

Ruataniwha model (opex

– 4)

22. Completion of the

groundwater and surface water models being developed to inform limit setting in

the Tukituki catchment has been delayed into 2024-25. A consultant is

engaged and this contract is committed.

23. Financial Assessment: The

total unspent funds related to this project was $200k, however, $136k was from

general funds. Loan funding of $64.6k has not yet been drawn. Internal

loan interest and repayments for this loan have been allowed for in the 2024-25

budget.

24. Recommendation: That the

carry forward of $64.6k loan funding is approved.

Environmental Science

(opex – 5)

25. HBRC has received funding

contributions from DOC and Ministry for the Environment (MfE) towards post

Cyclone Gabrielle land and water quality research and monitoring, including a

multi-year research investigation into nature-based solutions for flood/drought

mitigations. Deliverables have been delayed into 2024/25 as a result of

resource capacity constraints within the Science team, and lengthy timeframes

for sediment sample analysis (sent overseas).

26. Financial Assessment: The

total unspent funds related to these activities was $430k, of which $332k was

grant funding received from DOC and MFE, and $97k from general funds.

27. Recommendation: That the

carry forward of $332.7k external funds received is approved.

Land for Life (opex

– 6)

28. Due to delays in

confirmation of Central Government funding approvals, the unspent funds from

2023-24 funds are requested to be used in 2024-25 to continue the project

support until alternative funding is available.

29. Financial Assessment: Use

of the long-term investment fund requires divestment of assets to repay the

reserve.

30. Recommendation: That the

carry forward of $57.5k from the long-term investment fund reserve is approved.

Sustainable Homes (opex

– 7)

31. The Sustainable Homes

programme was discontinued at the end of the 2023-24 financial year, as per the

decision in the 3YP. A carry forward is requested to honour applications for

clean heat grants received before 30 June 2024.

32. Financial Assessment: The

programme grants were under budget for 2023-24. Funding for these grants

would be drawn from the healthy homes scheme reserve. This reserve is in

deficit, with repayments planned from targeted rates anticipated over the next

12 years to clear.

33. Recommendation: That the

carry forward of $17.8k from the Healthy Homes scheme reserve is approved.

ICT Software as a service

development (SAAS) (opex – 7)

34. The ICT digital

transformational work programme was underspent in 2023/24 due to timing delays

in implementations resulting from staff turnover, and reprioritisation to work

on the cyclone response. A carry forward of this underspend is required

to maintain the planned investment in multi-year business application software

projects (including TechONE Rates, SEAM, and IRIS Next Generation).

35. Financial Assessment: Loan

funding has not yet been drawn. Internal loan interest and repayments for

this loan have been allowed for in the 2024-25 budget.

36. Recommendation: That the

carry forward of $572.6k loan funding is approved.

Capital expenditure carry forward requests

|

Activity/Project

|

Amount Requested

|

Source of funds

|

|

Debt

|

Reserves

|

External

|

|

Asset Management

|

|

|

|

|

|

1

|

Cyclone Gabrielle infrastructure repairs

|

$10,000,000

|

|

|

$10,000,000*

|

|

2

|

NIWE

|

$1,801,700

|

$331,825

|

|

$1,469,875*

|

|

3

|

IRG – HPFCS

|

$2,514,200

|

|

$125,710

|

$2,388,490*

|

|

4

|

Flood control

|

$293,400

|

|

$293,400

|

|

|

5

|

Regional Water Security

|

$567,800

|

|

$567,800

|

|

|

6

|

Regional Parks

|

$1,220,000

|

$870,000

|

|

$350,000*

|

|

7

|

Forestry

|

$198,000

|

|

$198,000

|

|

|

Integrated Catchment Management

|

|

|

|

|

|

8

|

Whakaki Weir

|

$100,000

|

$100,000

|

|

|

|

9

|

Monitoring drilling

|

$32,900

|

$32,900

|

|

|

|

Governance & Partnerships

|

|

|

|

|

|

10

|

Sustainable Homes

|

$594,000

|

$594,000

|

|

|

|

Corporate services

|

|

|

|

|

|

11

|

ICT

|

$359,500

|

$69,500

|

$290,000

|

|

|

Total capex

|

$17,681,500

|

$1,998,225

|

$1,474,910

|

$14,208,365

|

*Funds not yet

received but will be claimed on completion of milestones (as per funding

agreements).

Cyclone Gabrielle infrastructure repairs

(capex – 1)

37. Annual plan 2023-24

included the total estimated budget for the Cyclone Gabrielle infrastructure

repairs/rebuild of $92.5m in one year, whereas the works will be spread over 3

financial years. Work began after the cyclone with $22.6m spent in 2022-23

FY, and $20.1m spent in 2023-24. Repair works will continue into 2024-25.

38. Financial Assessment:

Insurance and NEMA claims are still being finalised for works completed to

date, and further work completed in 2024-25 will also have insurance and NEMA

claims where eligible.

39. Recommendation: That the

carry forward of $10m external income (insurance and grants yet to be claimed)

is approved.

NIWE

(capex- 2)

40. The capex portion of the

North Island Weather Event programme (NIWE) carry forward relates to the flood

mitigation solutions for land category 2 areas in Wairoa, Waiohiki, Whirinaki,

Pakowhai and Porangahau. The multi-year programme budget was included in

the 2024-25 3YP, including assumptions on expenditure forecast for

2023-24. The underspend against the forecast for 2023-24 is requested to

be carried forward to retain the full programme budget (i.e., the carry forward

is to align the budget to the programme expenditure and funding draw down).

41. Financial Assessment: NIWE

Government Grants and loan funding have not yet been drawn. Internal loan

interest and repayments for this loan have been allowed for in the 2024-25

budget.

42. Recommendation: That the

carry forward of $1.801m external funds and loan funding is approved.

IRG

- HPFCS (capex- 3)

43. The planned work programme

for improvements to the infrastructure network within the Heretaunga Plains

Flood Control Scheme (HPFCS) has been impacted by cyclone repairs. A

variation agreement was reached with the Ministry of Business, Innovation and

Employment (MBIE) to extend this project to 30 June 2025.

44. Financial Assessment:

Infrastructure Reference Group (IRG) Government Grants and scheme reserve funds

have not yet been drawn.

45. Recommendation: That the

carry forward of $2.514m external funds and HPFCS scheme reserve funding is

approved.

Flood

control (capex- 4)

46. Planned flood control pump

renewal activities at Muddy Creek ($30k), Opoho ($11.8k), Karamu ($129k) and

the Scada project to upgrade pumpstation automation ($59k) will continue into

2024-25, mostly related to supplier delays. Additionally, a health and safety

(H&S) requirement to lift the gantry for the plantation pumpstation was

identified late in 2023-24 ($80k). This activity had not been planned in

2024-25, therefore we have included a request in the carry forwards for a draw

of reserve funds from the Napier/Meeanee/Puketapu scheme depreciation reserve

to complete this work.

47. Financial Assessment: The

renewal works are funded from the specific scheme reserves, and the delayed

activity is a timing delay on the draw from these reserves. The

Napier/Meeanee/Puketapu scheme reserve has a balance available to fund the

H&S improvement activity. The SCADA project is 70% funded via the

HPFCS target rate, and the surplus target rates in 2023-24 have been

transferred to the scheme reserve. The general rate contribution to the

SCADA project will need to be reprioritised from the existing budget in

2024-25.

48. Recommendation: That the

carry forward of $293k scheme reserve funding is approved.

Regional

Water Security (capex- 5)

49. The Regional Water Security

programme budget was re-baselined in the 2024 3YP. The carry forward

requested is for unspent funds that were forecast to be spent by June 2024. The

unspent programme funds to carry forward relate to the Heretaunga water

security pre-construction assessment, and the CHB MAR pilot.

50. Financial Assessment: Use

of the long-term investment fund requires divestment of assets to repay the

reserve.

51. Recommendation: That the

carry forward of $567.8k from the long-term investment fund reserve is

approved.

Regional

Parks (capex- 6)

52. Waitangi Regional Park

requires a sanitation facility to meet the needs of its expanding visitor base.

The project was postponed due to the cyclone's impact on stakeholders,

preventing us from advancing with its implementation in 2023-24. The carry

forward of $700K, is funded 50/50 with MBIE, with HBRC’s contribution

loan funded.

53. Hawea Historical Park

represents a collaborative effort, with a 50/50 partnership involving 4

hapū. This project has also experienced delays due to the cyclone recovery

efforts, and the unspent funds ($520k) are requested to be carried over to meet

the commitments made to stakeholders.

54. Financial Assessment: MBIE

Government Grants and loan funding have not yet been drawn. Internal loan

interest and repayments for this loan have been allowed for in the 2024-25

budget.

55. Recommendation: That the

carry forward of $870k loan funding, and $350k grant funding (not yet claimed)

is approved.

Forestry

(capex- 7)

56. The White Pine bridge in

the Tangoio Soil Conservation Reserve is essential for soil conservation,

forestry, recreation, and emergency access. Damage from Cyclone Gabrielle,

including a scour hole and damaged retaining walls, needs repair for safe

access, and the bridge must meet Class 1 standards for logging trucks. This

asset was not insured. A carry forward of unspent funds in 2023-24 are

requested to be reprioritised for the repairs needed for the forestry road and

water controls to prevent further damage and costs.

57. Financial Assessment: The

Tangoio Soil Conservation Reserve has a surplus balance.

58. Recommendation: That the

carry forward of $198k from the Tangoio Soil Conservation Reserve is approved.

Whakaki

Weir (capex- 8)

59. The Integrated Catchment

Management Group (ICM) seeks to reprioritise $100k from the biodiversity

underspend from 2023-24 to complete the construction of the Whakaki

Weir. Weather and unforeseen project complexity has delayed

completion of this project into the 2024-25 financial year.

60. Financial Assessment: The

funds requested to be reprioritised relate to the loan funding from the 2021

Covid recovery fund not drawn in 2023-24, and no longer required. Internal loan

interest and repayments for this loan have been allowed for in the 2024-25

budget.

61. Recommendation: That the

carry forward of $100k loan funding is approved.

Monitoring

drilling (capex- 9)

62. The final deliverables of

the contractually committed monitoring drilling programme have been delayed

into 2024-25 due to resource capacity of drilling companies. ICM seeks to

carry forward $32.9k to complete the programme.

63. Financial Assessment: The

full budget for monitoring drilling loans was not drawn in 2023-24. Internal

loan interest and repayments for this loan have been allowed for in the 2024-25

budget.

64. Recommendation: That the

carry forward of $32.9k loan funding is approved.

Sustainable

Homes (capex- 10)

65. The Sustainable Homes

programme was discontinued at the end of the 2023-24 financial year, as per the

decision in the 3YP. A carry forward is requested to honour applications

received before 30 June 2024 for Clean Heat ($4.5k) and Sustainable Home ($589.5k)

loans.

66. Financial Assessment:

The full budget for Sustainable Homes loans was not drawn in 2023-24.

Internal loan interest and repayments for this loan have been allowed for in

the 2024-25 budget. Loan repayments and interest expenses for the loans

are recovered from homeowners via VTR (voluntary targeted rates).

67. Recommendation: That the

carry forward of $594k loan funding is approved.

ICT

(capex- 10)

68. ICT seeks to carry forward

$359K to cover the replacement of SAN server equipment, and hardware for

geoprocessing to support regional aerial photography and LiDAR datasets.

The replacement has been delayed into 2024-25 in part due to awaiting delivery

of the datasets.

69. Financial Assessment:

Budgeted ICT capex loans and asset replacement reserves were not drawn in full

in 2023-24. Internal loan interest and repayments for this loan have been

allowed for in the 2024-25 budget.

70. Recommendation: That the

carry forward of $295k asset replacement reserve and $69.5k loan funding is

approved.

Unfunded

commitments from 2023-24

|

Group

|

Project

|

Opex/Capex

|

Unspent general funds

|

|

Asset Management

|

Flood risk/flood forecasting (including flood

monitoring room)

|

Capex

|

$113,000

|

|

SCADA Project

|

Capex

|

$17,700

|

|

Westshore (coastal)

|

Opex

|

$71,116

|

|

Integrated Catchment Management

|

Ruataniwha model

|

Opex

|

$136,776

|

|

Biodiversity (Tukipo wetlands)

|

Opex

|

$19,648

|

|

Environmental science (land monitoring science and

research)

|

Opex

|

$96,696

|

|

Policy & Regulation

|

Kotahi

|

Opex

|

$874,000

|

|

Total

|

|

|

$1,328,936

|

71. The table above notes the

projects which were underspent in 2023-24 and have commitments which will

likely become a cost in the 2024-25 financial year. These activities are

general rate funded, but as no surplus funds exist for a carry forward, funding

to cover these activities will need to be reprioritised from existing budgets.

Options assessment

72. Option 1: Council approves the

carry forward of reserve, debt and externally funded expenditure only, leaving

the general-funded carry forward expenditure requests to be reprioritised

through 2024-25 annual plan budgets.

73. Option 2: Council does not approve

the carry forwards as proposed and provides staff with direction on which carry

forwards, if any, should be approved.

Financial and resource implications

74. Debt funded expenditure can

be carried forward with no impact to the ratepayer in future years as the

repayment of these funds have already been included in the LTP and Annual Plan.

75. Funding from reserves can

be carried forward with no impact, as the expenditure has not been drawn from

the reserve and is therefore available to be drawn in 2024-25 instead.

76. Funding from targeted rates

will be automatically carried forward through the associated reserve to enable

the funds to be drawn down to complete the work in subsequent years.

77. Approved external funded

carry forward requests will be funded from the income received in 2023-24 (ICM

$332,700) and from additional funding claimed per grant agreements and

insurance during 2024-25.

Decision-making

considerations

78. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded:

78.1. The decision does not

significantly alter the service provision or affect a strategic asset, nor is

it inconsistent with an existing policy or plan.

78.2. The use of the special

consultative procedure is not prescribed by legislation.

78.3. The decision is not

significant under the criteria contained in Council’s adopted

Significance and Engagement Policy.

78.4. The persons affected by

this decision are Council’s ratepayers.

79. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by, or have an interest in the decisions made, Council

can exercise its discretion and make a decision without consulting directly with

the community.

Recommendations

1. That

the Corporate and Strategic Committee receives and notes the 2023-2024 Carry

forwards staff report.

2. The Corporate and Strategic

Committee recommends that Hawke’ Bay Regional Council:

2.1. Agrees that the decisions

to be made are not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without conferring directly with

the community.

2.2. Approves the carry forward

of all expenditure requests from the 2023-24 budgets to 2024-25 budgets, being:

Operating expenditure carry forward requests

|

Activity/Project

|

Amount Requested

|

Source of funds

|

|

Debt

|

Reserves

|

External

|

|

Asset Management

|

|

|

|

|

|

1

|

Coastal Hazards

|

$37,500

|

|

$37,500

|

|

|

2

|

NIWE

|

$1,269,200

|

$317,300

|

|

$951,90*

|

|

Integrated Catchment Management

|

|

|

|

|

|

3

|

Biodiversity

|

$52,300

|

$52,300

|

|

|

|

4

|

Ruataniwha Model

|

$64,600

|

$64,600

|

|

|

|

5

|

Environmental Science

|

$332,700

|

|

|

$332,700

|

|

6

|

Land for life

|

$57,500

|

|

$57,500

|

|

|

Governance & Partnerships

|

|

|

|

|

|

7

|

Sustainable homes

|

$17,800

|

|

$17,800

|

|

|

Corporate services

|

|

|

|

|

|

8

|

ICT Software as a service development (SAAS)

|

$572,600

|

$572,600

|

|

|

|

Total opex

|

$2,404,200

|

$1,006,800

|

$112,800

|

$1,284,600

|

Capital expenditure carry forward requests

|

Activity/Project

|

Amount Requested

|

Source of funds

|

|

Debt

|

Reserves

|

External

|

|

Asset Management

|

|

|

|

|

|

1

|

Cyclone Gabrielle infrastructure repairs

|

$10,000,000

|

|

|

$10,000,000

|

|

2

|

NIWE

|

$1,801,700

|

$331,825

|

|

$1,469,875

|

|

3

|

IRG – HPFCS

|

$2,514,200

|

|

$125,710

|

$2,388,490

|

|

4

|

Flood control

|

$293,400

|

|

$293,400

|

|

|

5

|

Regional Water Security

|

$567,800

|

|

$567,800

|

|

|

6

|

Regional Parks

|

$1,220,000

|

$870,000

|

|

$350,000

|

|

7

|

Forestry

|

$198,000

|

|

$198,000

|

|

|

Integrated Catchment Management

|

|

|

|

|

|

8

|

Whakaki Weir

|

$100,000

|

$100,000

|

|

|

|

9

|

Monitoring drilling

|

$32,900

|

$32,900

|

|

|

|

Governance & Partnerships

|

|

|

|

|

|

10

|

Sustainable homes

|

$594,000

|

$594,000

|

|

|

|

Corporate services

|

|

|

|

|

|

11

|

ICT

|

$359,500

|

$69,500

|

$290,000

|

|

|

Total capex

|

$17,681,500

|

$1,998,225

|

$1,474,910

|

$14,208,365

|

Authored by:

|

Amy Allan

Senior Business Partner

|

Chris Comber

Chief Financial Officer

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

Nic Peet

Chief Executive

|

Attachment/s

There are no attachments for this

report.

Hawke’s

Bay Regional Council

Corporate

and Strategic Committee

4

September 2024

Subject: Annual Compliance,

Monitoring, and Enforcement Report 2022-2023

Reason for report

1. This item presents the

Hawke’s Bay Regional Council’s (HBRC) 2022-2023 Compliance

Monitoring and Enforcement Annual Report for discussion and recommendation to

Council for adoption.

Executive

summary

2. The attached report on

HBRC’s Compliance Monitoring and Enforcement (CME) activities provides

transparency to our communities and those regulated by HBRC.

3. The report summarises HBRC’s

compliance monitoring and enforcement functions undertaken under the RMA. It details compliance with

consent conditions, breaches of the Resource Management Act 1991 (RMA) and Regional Resource

Management Plan interventions.

It also covers the breadth of monitoring undertaken, the levels of compliance

reported, and a summary of enforcement action taken during the year.

4. Detailed information can be

found in the report and staff will present highlights to the Committee and be

available to answer any questions.

5. The forthcoming HBRC

2023-2024 Compliance Monitoring and Enforcement Annual Report that is currently

been worked on will show the increased rate of monitoring completed and the

various issues arising post Cyclone Gabrielle.

Background

6. For the Committee’s

information, reporting on monitoring and enforcement occurs through the

following mechanisms to Council or Committee:

6.1. Compliance Annual Report.

6.2. HBRC Annual Report –

results are presented through the Regulation Group of Activities within the

Annual Report document.

6.3. Quarterly Organisational

Performance Report.

7. Internally, a weekly

incident report is prepared for the Group Manager of Policy and Regulation

which details complaints, incidents and the associated outcomes.

8. Staff have also established

an approach whereby a media release will be issued at the conclusion of any

prosecution carried out by HBRC, regardless of the outcome of the prosecution.

Strategic fit

9. Undertaking compliance

monitoring and enforcement where necessary helps us to:

9.1. Protect aquatic ecosystems

and ensure water use is sustainable (Priority Area: Water)

9.2. Ensure sustainable land use

(Priority Area: Land)

9.3. Maintain a healthy and

functioning biodiversity (Priority Area: Biodiversity).

Significance and Engagement Policy assessment

10. Although the matters

discussed in this report are of interest to the community, they do not directly

impact or affect the community. There are no financial or levels of service

implications associated with deciding to adopt this report and, as such, this

report is of low significance.

Considerations

of tangata whenua

11. The attached report sets

out ways we have improved our engagement with tangata whenua on compliance

matters. This includes:

11.1. Keeping tangata whenua and

iwi representatives informed in relation to high level enforcement action

11.2. Working closely with iwi

and iwi trusts to seek victim impact statements for prosecution offences,

facilitated by our Māori Partnerships team

11.3. Ensuring consent conditions

that require consultation and engagement with iwi are met by the consent holder

11.4. Building cultural

competency within the Compliance team with internal training.

12. It is becoming increasingly

common for resource consents to include more complex conditions that better

recognise Te Ao Māori; for example, conditions requiring development of

cultural monitoring plans in consultation with iwi/ marae/ hapū and Treaty

groups.

13. Future areas of focus are:

13.1. Improving how we report

incidents, particularly discharges to water, to tangata whenua and kaitiaki so

we can inform their decision-making, and so their observations and involvement

can inform cultural assessments.

14. Establishing regular

meetings and workshops with tangata whenua across the region to further

strengthen communication and relationships, build trust, and increase

accountability.

Financial

and resource implications

15. There are currently no

financial and funding implications associated with adopting the report.

Decision-making considerations

16. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

16.1. The decision does not

significantly alter the service provision or affect a strategic asset, nor is

it significant under the criteria contained in Council’s adopted

Significance and Engagement Policy.

16.2. Given the nature and

significance of the issue to be considered and decided, Council can exercise

its discretion and make a decision without consulting with the community or others having an interest

in the decision.

Recommendations

That the Corporate and Strategic

Committee:

1. Receives and considers the Annual

Compliance, Monitoring, and Enforcement Report 2022-2023.

2. Recommends that

Hawke’s Bay Regional Council:

2.1. Agrees that the decisions

to be made are not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without consulting the community or

persons with an interest in the decision.

2.2. Adopts the Annual Compliance,

Monitoring, and Enforcement Report 2022-2023 for publication (or) as

amended as agreed by the Corporate and Strategic Committee on 4 September

2024.

Authored by:

|

Rob Hogan

Manager Compliance

|

Neville Pettersson

Environmental Compliance Officer

|

Approved by:

|

Katrina Brunton

Group Manager Policy &

Regulation

|

|

Attachment/s

|

1

|

Annual Compliance, Monitoring and

Enforcement Report 2022-2023

|

|

Under Separate Cover

online

only

|

Hawke’s Bay Regional

Council

Corporate

and Strategic Committee

4 September

2024

Subject: Organisational Performance

Report for the period 1 April - 30 June 2024

Reason for report

1. This item presents the

Organisational Performance report for the period 1 April – 30 June 2024.

Organisational Performance Report content

2. The attached report

contains four parts:

2.1. Executive summary including highlights and

lowlights.

2.2. Corporate metrics that focus on how well we

are performing across a number of corporate-wide measures such as employee

turnover and customer service.

2.3. Activity

reporting with

non-financial traffic light status and commentary, and financial status and

commentary rolled up to the group of activities.

3. Organisational performance

reports were established in 2018. The status and commentary reporting are

rolled up from cost centre to activity level. Commentary by cost centre is still

available to committee members on request to staff.

4. Staff complete their

reporting in a software tool called Opal3. For LOSM and activity reporting,

staff select the status (red, amber, green) and provide commentary on what they

did in the quarter against their annual work plans.

Points

of interest

5. Our employee count data and

graphs (p7) show permanent staff only. This has been updated for all data going

back to 2021-22.

6. Our Performance

Measures (LOSMs) are not included in quarter four. They are carried into the

Annual Report 2023-24 and cover the whole financial year.

7. Summarised (interim)

financial reporting shows actual versus budget by activity in

more detail than prior reports. This includes operational and capital

expenditure by activity, plus funding for the group. Commentary is also

provided for the group.

8. Strategic Projects

reporting is not included in quarter four.

Corporate

metrics

9. Annual staff turnover

continues to drop from its high two years ago.

Activity

reporting

10. Staff have reported 2 activities as

‘off track’ from their usual workplans. This has improved from 6

last quarter.

11. Financial reporting shows that the

Groups of Activities had a general funding surplus, with the exception of

Transport which had a minor deficit of $111k (1.4%).

12. Council’s investment income,

which offsets the general rates requirement was underachieved against budget,

leading to an overall deficit in general funds of $2.3M.

Decision-making considerations

13. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

the Corporate and Strategic Committee receives and notes the Organisational

Performance report for the period 1 April - 30 June 2024.

Authored by:

|

Sarah Bell

Team Leader Strategy and Performance

|

|

Approved by:

|

Desiree Cull

Strategy & Governance Manager

|

|

Attachment/s

|

1

|

HBRC 2023-24 Q4 Organisational

Performance Report

|

|

Under Separate Cover

online

only

|

Hawke’s

Bay Regional Council

Corporate

and Strategic Committee

4

September 2024

Subject: Interim financial results

2023-2024

Reason for report

1. This item presents the

draft financial results of the Council to 30 June 2024 including updates on

treasury activities, status of Cyclone Gabrielle insurance claims, silt &

debris removal, and HBRC’s credit rating application.

Executive

summary

2. The financial statements

prepared for this update to Corporate and Strategic committee are draft and are

pending some possible final adjustments before being submitted to Ernst Young

for audit.

3. Preliminary results to 30

June 2024, indicate an

operating surplus of $1.58m against the 2023-2024 Annual Plans budgeted deficit

of $20.7m. The principal driver of this difference is funds received from

Government for regional recovery and other cyclone activities still to be

undertaken.

4. It is envisaged that

changes may be required post audit for any insurance claims or NEMA claims that

are accepted / agreed between the other party and HBRC before the completion of

the audit process. We have taken a cautious approach to recognising

submitted claims that have not been accepted yet.

Statement of comprehensive revenue and

expense

5. The actual result to 30

June 2024 is an operating surplus of $1.58m against a budgeted deficit of

$20.7m.

6. The principal driver of

this difference are the Subsidies and Grants received of $200.5m over

budget. $127.319m of this is the Regional Recovery Agency Grants and

$78.179m within Policy and Regulation for Cyclone Recovery Waste Management.

7. After taking out the

Hawke’s Bay Regional Recovery Agency (HBRRA) and silt taskforce funding,

subsidies and grants are $28m, which is $5m behind budget. This is mainly due

to the time taken to work through the NEMA claims. We may still recognise some

of the claims from NEMA if they are settled before the audit is complete.

At the moment those numbers are not “virtually certain” and, hence,

do not meet the threshold to include them in the results.

8. The shortfall in other

revenue reflects the associated delay in receiving insurance claim money and

the lower than budgeted investment returns, particularly from Napier Port.

These are somewhat offset by fair value gains on investments as they recover; however,

these are not available to fund activities as they are not cash returns.

9. Total expenses were $308.7m

of which $125m is for the HBRRA (sediment and debris) and $78.4m for the silt

taskforce, leaving $105.3m spent against a budget of $179.5m.

10. The results above also

include our year end revaluation results. Our infrastructure assets were

not revalued last financial year as it was impractical to do so soon after the

cyclone. We accepted a qualified audit opinion on that decision.

This year we decided to get an external valuer to undertake a full revaluation

after interrogating the data and undertaking some site visits.

11. As a result of valuation,

including analysis of actual cost of repair and replacement from Cyclone

Gabrielle infrastructure assets have been revalued from $199m to $474m. This is

more than doubled the value. This increase is shown in the Statement of

comprehensive Revenue and Expense. The implications for this on our

insurance cover is still being worked through.

|

Asset type

|

FY23

reported closing values (000’s)

|

New

assets capitalised (000’s)

|

FY24

revaluation gains (losses) (000’s)

|

Depreciation

per year (000’s)

|

Depreciated

replacement value 2024 (000’s)

|

|

Stop banks

|

52,815

|

23,928

|

223,319

|

-

|

300,062

|

|

Detention Dams

|

3,527

|

-

|

411

|

54

|

3,884

|

|

Drainage Networks

|

39,075

|

260

|

15,795

|

2

|

55,128

|

|

Pumpstations

|

5,432

|

456

|

1,487

|

484

|

6,892

|

|

Structures & Pipelines

|

5,812

|

47

|

1,841

|

326

|

7,374

|

|

Drainage Telemetry

|

77

|

74

|

(23)

|

36

|

91

|

|

Regional Parks

|

4,614

|

85

|

(936)

|

58

|

3,705

|

|

Bank & Edge Protection

|

31,635

|

375

|

12,266

|

-

|

44,276

|

|

River & Sea Groynes

|

2,022

|

-

|

391

|

-

|

2,413

|

|

Sawfly Works

|

13,062

|

-

|

(4,585)

|

-

|

8,477

|

|

River Works Land

|

15,513

|

764

|

2,000

|

-

|

18,276

|

|

Pathways and Roadways

|

3,909

|

176

|

1,088

|

-

|

5,173

|

|

Work In Progress increase

|

|

|

|

|

18,358

|

|

Totals

|

198,554

|

26,165

|

253,054

|

960

|

474,109

|

Statement of Financial Position

12. Infrastructure Assets have

been shown at the draft values provided by the external valuers. This

shows a significant increase in the values as covered earlier in the report.

13. Intangible assets values

are higher than last year. The predominant driver of this is carbon

credits. At 30 June 2024 we held 174,065 units at a market rate of $50.50

each. (2023 166,428 units at $41.00 each).

14. Total borrowing is sitting

at $130m (up $29m from 2023 balance of $101m).

15. Cash and Cash equivalents

is sitting at $62m (down $32m from 2023 balance of $94m).

Financial

summary by Group of Activities (GOA)

16. The following table

provides a breakdown of the statement of comprehensive revenue and expense by

Group of Activities (GOA). The Organisational Performance Report includes

further financial and non-financial commentary for each GOA.

17. GOA expenditure includes

each activity’s external expenditure, internal staff time, finance costs

(interest), depreciation/amortization and a share of corporate overheads.

Full

year GOA expenditure and funding

18. A summary of group of the

full year activity expenditure and income, and variance commentary against the

management budget is provided in the organisation performance report. Note that

the management budgets include approved carryforwards from the 2022-23

financial year, and additional external income and associated expenditure based

on funding agreements confirmed after the 2023-24 Annual Plan was

adopted.

Treasury

activities update

19. Fitch, the international

Credit Rating Agency, issued HBRC with an AA rating on 27 May, enabling Council

to utilise the 20 bases point discount offered by LGFA for future lending. This

was utilised immediately in the June LGFA tender. A total of $40m was drawn

down, $25m to roll short-term cyclone related costs onto longer, more favorable

terms and a further $15m for working capital to fund IRG and NIWE projects.

Total external debt at 30 June is $130m.

20. Cyclone insurance claims

and NEMA infrastructure reimbursements continue to progress well. All

NEMA claims are anticipated to be completed by the end of the year. The

progress for claims to AON for the remaining 40% of costs is currently being

worked through with most claims under the MDBI policy expected to be processed

by Christmas.

21. Four Napier (Endowment)

properties completed freeholding in the quarter, a total of eight for the

year. Only one Wellington leasehold property was freeholded in the year.

Cash proceeds from any further freeholding will be held in trust for reinvestment

by HBRIC on behalf of Council.

LGFA Green Loans

22. HBRC officers have been

investigating the option of Green Loans with LGFA (Local Government Funding

Agency) as an alternative to standard bonds. These are available to fund

sustainability projects that promote environmental and social wellbeing, or act

on climate change and reduce greenhouse gas emissions. Projects that fit the

criteria attract lower interest rate charges than standard LGFA bonds.

23. A summary of our

applications is as below:

23.1. Climate Action Loan for

General funding – The criterion for this loan is linked ro the reduction

in scope 1 and 2 emissions, and engagement with our vendors on reducing their

emissions (i.e., our scope 3 emissions) for the organisation against our baseline

(2019-2020 year). Having analysed the investment required / cost of compliance,

short window of implementation, and the potential reputational and financial

risk of failing to comply, HBRC will not be proceeding with an application for

this loan at this time.

23.2. Erosion Control Scheme

– Our initial submission was not seen as been ‘additive’ to

the current programme to justify the climate loan. We are working with our

Catchment managers on incentives and additional offerings that can be done

through the programme to meet the LGFA criteria. The focus for this is

encouraging native species planting. We are also examining the Land for Life

programme’s implications for this application.

23.3. NIWE Loan funding –

for the $44 million of funding required for the NIWE work, this should meet the

criteria required for the climate adaption loans, pending finalisation of the

programme’s budgeting internally we will be taking this as an application

to the LGFA.

23.4. With the completion of the

IRG review and subsequent moves to adopt the recommendations, work on an

application for the funding requirements of this programme will begin, given

this is new work to deal with climate change and adaptation.

23.5. We continue to look for

other programmes of work internally that we could work with the LGFA on.

24. Under the scheme HBRC will

benefit from a lower interest rate on borrowings that qualify for the green

climate adaptation loans. We currently report annually on our greenhouse gas

(GHG) emissions.

Silt and Debris Programme – to

30 June update

25. To date, of the $152.6

million allocated to the Local Authority Fund, $114,093,351 of costs have been

spent or committed to June 2024, and it is estimated 3.87 million tonnes of

sediment and debris has been managed across Hawke’s Bay. An increase of

426, 681 tonnes in the last quarter.

26. In September 2023, $12m was

transferred from the Commercial fund to the Local Authority Fund. At the end of

September, the Central Government provided an additional $10m of funding to

allow sediment and debris collection and management to continue into October

2023, and an additional $10m in early November 2023 increasing the total amount

in the local authority fund from $70.6m to $102.6m at the end of Q2.

27. Quarter 2 saw a large

downscale of operations as future funding was unclear. A business case was

submitted to Cyclone Recovery Unit on 15 December 2023, with an addendum sent

on 10 January 2024 outlining the required funding to complete the activities in

the programme. Funding is not sufficient to complete all the jobs in the

system, with an estimated 1.2 million m3 of sediment and debris

still in the system waiting to be collected.

28. In February 2024, a further

$39.6m was administered for the completion of taskforce and Wairoa Woody Debris

activities, increasing the total in the Local Authority Fund to $142.6m. A

procurement exercise was undertaken to re-engage contractors and work on the

remaining silt collection jobs, continuing site management and eventual

handover of sites back to landowners has recommenced.

29. Quarter 4 of 2023-24 saw an

increase in activity following the completion of procurement and restart, with

426, 681 tonnes of material deal with, and a number of sites transitioned to

closure. Expenditure of $22.9m in the quarter was across all the local

authority activities.

30. In Budget 2024, an addition

$10m was provisioned, and the Local Authority Fund budget has now increased to

$152.6m. The funding agreement schedule amendments will be addressed in next

month’s reporting as these fall in the period commencing 1 July 2024.

31. $38.5m of budget remains to

be spent in the period 1 July to 31 December 2024.

32. Key activities now for the

Local Authority Silt and Debris Fund are to close out remaining tasks and close

down sites. HBRC doesn’t anticipate any further costs to be

incurred after funds have been exhausted at 31 December 2024.

Insurance

33. Cyclone Gabrielle insurance

and NEMA claims have been progressing well.

34. To date we have submitted 6

claims to NEMA for our stopbank repair works with costs totalling $24m. A

summary of NEMA claims to date is in the table below.

|

NEMA Claim Summary

|

Amount

|

|

Total

costs submitted

|

24,070,143.84

|

|

less:

Ineligible costs (internal time etc)

|

-

1,040,960.66

|

|

Total

costs submitted for approval

|

23,029,183.18

|

|

Cost

on hold while further information is sought

|

-

505,557.41

|

|

Total

costs approved by NEMA

|

22,523,625.77

|

|

Less:

HBRC Threshold (similar to excess paid)

|

-

1,215,076.14

|

|

Total

claimable portion

|

21,308,549.63

|

|

Total

NEMA funded portion (60%) approved for payment

|

12,785,129.78

|

35. We are still preparing

claim information for our repairs to drains and culverts and edge protection

for infrastructure assets, and we are hoping to submit the first of these next

tranches of assets in the September 2024.

36. We have also submitted the

following insurance claims against our various policies which are being

assessed by loss adjustors currently:

36.1. Material Damage and

Business Interruption (Sum insured cover)

|

Hydrology

assets

|

$387,441

|

|

Nursery

assets

|

$291,274

|

|

Pump

Station assets

|

c$4,218,153

|

36.2. Infrastructure Policy (40%

cover only)

|

Stopbanks

|

$22,317,260

|

|

Regional

Parks

|

$266,321

|

37. The Material Damage and Infrastructure

claims require further information requests for insurance purposes. The team is

working through these currently to clarify queries with loss adjustors and

provide further information as to extent of damage and repairs completed to

date.

38. Smaller claims are also

being progressed under the Commercial Fleet Policy for c$213,078.

39. The next priorities are to

answer all outstanding queries and begin submission of all drains claims to

both NEMA and Insurance.

Investment

Strategy update

40. Under their investment

management mandate HBRIC has now fully transitioned HBRC’s managed fund

portfolios from Jarden and Mercer across to Harbour Asset Management.

HBRIC’s managed fund portfolios are next in line, with the planning currently

in progress and transition expected to take 6 weeks.

41. HBRIC is also undertaking a

deep dive into all other investment assets, reviewing past performance against

expectations, strengths and constraints. This will assist HBRIC to

identify any areas of concern, set priorities on further investigations and

proposed recommendations.

42. Reporting to Council is

also a key focus of HBRIC, with attention focused on drafting meaningful key

data to provide a complete assessment of all asset performance. These

reports will be presented at the next C&S meeting.

Decision-making

considerations

43. Staff have

assessed the requirements of the Local Government Act 2002 in relation to this

item and have concluded that, as this report is for information only, the

decision- making provisions

do not apply.

Recommendation

That the

Corporate and Strategic Committee receives and notes the Interim

financial results 2023-2024 staff

report.

Authored by:

|

Amy Allan

Senior Business Partner

|

Jess Bennett

Programme Finance & Controls

Manager

|

|

Pam Bicknell

Senior Group Accountant

|

Chris Comber

Chief Financial Officer

|

|

Tracey O'Shaughnessy

Treasury & Investments

Accountant

|

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

There are no attachments for this

report.

Hawke’s

Bay Regional Council

Corporate

and Strategic Committee

4

September 2024

Subject: Annual Report 2023-2024

Interim non-financial results

Reason for report

1. This item provides the

Corporate and Strategic Committee with the interim non-financial results for

inclusion in the Annual Report 2023-2024. Feedback from the Committee can be

incorporated into the final results.

Background

Levels

of Service

2. The purpose of the

non-financial performance measures, as specified in the Local Government Act

2002, is to enable the public to assess the actual versus intended levels of

service achieved for major aspects of groups of activities. In other words, to

demonstrate we have done what we said we would do.

3. There are 58 performance

measures in total across six groups of activities as per the Long Term Plan

2021-2031 (LTP).

4. The groups of activities

are:

4.1. Governance and Partnerships

4.2. Policy and Regulation

4.3. Integrated Catchment

Management

4.4. Asset Management

4.5. Emergency Management

4.6. Transport.

5. We report on actual

performance against targets set for the corresponding year in the LTP. In

previous years, we have used the following format to report performance.

6. Based on feedback from our

auditors, we have avoided using ‘partially achieved’ since the

2021-22 Annual Report and have kept to ‘achieved’ and ‘not

achieved’ in subsequent reporting.

7. The 2023-2024 financial

year is the third and final year of the 2021-31 LTP.

Other non-financial sections –

to be completed

8. The non-financial sections

of the full Annual Report document will also include:

8.1. forewords by the Regional

Council Chair, Chief Executive and Co-Chairs of the Māori Committee

8.2. a statement around

Māori participation in decision-making

8.3. measurement undertaken

during the year of progress towards the achievement of community outcomes

8.4. summary of what we have

achieved as we support our region’s recovery and build resilience

8.5. highlights by geographical

area to describe what we did during the year in more detail.

Discussion

Aggregated

results for levels of service performance measures

9. Of the 58 measures, 37 were

achieved, 18 were not achieved and 3 were not measured or not due for reporting

this year. This compares to 33 achieved, 21 not achieved and 5 not measured

last year.

10. Staff analysis suggests the

reasons for not achieving the targets generally fall into the following areas:

10.1. knock-on effects of Cyclone

Gabrielle including staff being diverted into other programmes of work, and

workloads escalating as a result of the cyclone

10.2. external forces impacting

staff’s ability to do their work and hampering work progress included

staff turnover, vacancies of key roles, and change in legislation at a national

level

10.3. results outside our direct

control, for example road crashes, marine incidents and cancelled bus routes

10.4. continuation of a downward

trend, for example public transport passenger numbers.

11. Commentary has been added

to the quantitative results to understand

the situation-specific factors affecting performance and, in particular, explain why

measures have not been achieved. These are completed with care to meet the PBE

FRS 48 Service Performance Reporting requirements.

12. Where data allows, graphs

showing a timeseries to illustrate trends have been included to give further

context.

Next Steps

13. The full Annual Report is

due to go to Ernst & Young (EY) for auditing between 23 September and 11

October. This will include the financial statements and other components.

14. Our auditors, EY will

present its Preliminary Audit Findings report to the Risk and Audit Committee

on 23 October.

15. The final Annual Report

2023-2024 will be presented to Council on 30 October for adoption.

16. The Annual Report Summary

will be produced and audited by 27 November. This does not need to be adopted

by Council.

Decision-making considerations

17. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That the Corporate and Strategic Committee

receives and notes the Annual Report 2023-2024 Interim non-financial results

staff report.

Authored by:

|

Sarah Bell

Team Leader Strategy and Performance

|

|

Approved by:

|

Desiree Cull

Strategy & Governance Manager

|

|

Attachment/s

|

1

|

interim 2023-24 Annual Report Part 4

|

|

Under Separate Cover

online

only

|

Hawke’s

Bay Regional Council

Corporate

and Strategic Committee

4

September 2024

Subject: Health, Safety and Wellbeing

Strategic Plan 2024-2027

Reason for report

1. This item introduces the

Council’s Health, Safety and Wellbeing Strategic Plan 2024-2027 for the

Committee’s information.

Background

2. The Health and Safety

(H&S) and Wellbeing Strategic Plan is renewed every 3 years.

3. Key changes proposed as

part of this 3-year plan are:

3.1. H&S and the Wellbeing

Strategy are included in one document (attached)

3.2. Focus on wellbeing for our

staff given prolonged fatigue from cyclone, recovery activities and continued

reviews and investigations

3.3. Specific continuous

Improvement opportunities such as:

3.3.1. Aligning our HSWMS to

ISO45001:2018 and ensuring consistent and effective implementation will be a

major focus for 2024 - 2027, and

3.3.2. Moving to digital solutions

to capture and enhance analysis and reporting capabilities.

4. Under the Health and Safety

at Work Act Act 2015, HBRC (as an organisation) is the Person Conducting a

Business or Undertaking (PCBU).

5. Councillors and the CEO are

likely to be considered as Officers of the PCBU and that is that approach the

HBRC takes to delineating responsibilities.

5.1. However, Councillors are

immune from Prosecution as Officers under the Health and Safety at Work Act

2015 (HSWA). Accordingly, HBRC adopts delineated Officer responsibilities for

the CEO and Councillors, respectively.

6. The Primary Duty of Care

for the PCBU is to ensure, so far as is reasonably practicable, the health and

safety of its workers and any other workers who are influenced or directed by

the PCBU. It must also ensure, so far as is reasonably practicable, that the

health and safety of other persons is not put at risk from work carried out as

part of the conduct of the business or undertaking.

7. The Duty of Officers it to

exercise due diligence to make sure that the PCBU complies with its health and

safety duties. They must exercise the care, diligence and skill a reasonable

officer would exercise in the same circumstances, taking into account matters

including the nature of the business or undertaking, and officer’s

position and nature of their responsibilities.

8. As the only Officer of the

PCBU liable to personal prosecution under HSWA, and as the official responsible

for the day-to-day operational management of the PCBU, in his Job Description,

the CEO has “the key responsibility as an Officer to exercise due

diligence to ensure the Council meets its health and safety obligations under

the Act.”

9. The H&S strategic Plan

is proposed for awareness to the Council and is approved by the CEO.

Discussion

10. The plan differs from

previous years with the move to align to the internationally recognised health and safety management system

standard ISO45000:2018. This is an ambitious move that will provide a structured framework to ensure workplace

safety and legal compliance. The HSW team are ensuring that implementing

ISO45001:2018 demonstrates the commitment to our employees and those we engage

with. The intention of this move is to further build on sustainable

integration and consistent engagement of health safety and wellbeing within the

Council and those we influence.

11. The 2024-2027 strategic

plan is built around the following principles:

Leadership

Commitment

11.1. We continue to have strong

leadership from the CE, Executive Leadership Team (ELT) and Council.

Councillors have a collective and individual understanding of the direction for

HSW management; they are provided with a high-level view of activity on a

quarterly basis and risk maturity and critical risk reports provided through

the Risk and Assurance committee. HSW leadership must also be outwardly visible

throughout management, our workforce, and those that we engage. Our continued

focus will be to grow visible and demonstrable leadership through a cycle of

continuous improvement to enable a sustainable HSW culture.

11.2. Generally, Councillors are

required to have a good understanding of Council operations and health and

safety risks, and ensure those risks are managed. The duty of officers (Council) is to

exercise due diligence to make sure that the PCBU complies with its health and

safety duties. Councillors are not required to be involved with the day-to-day

management of health and safety operations within Council, as this

responsibility sits with the Chief Executive to manage.

11.3. The primary duty of care

for the PCBU is to ensure, so far as is reasonably practicable, the health and

safety of its workers and any other workers who are influenced or directed by

the PCBU. It must also ensure, so far as is reasonably practicable, that the

health and safety of other persons is not put at risk from work carried out as

part of the conduct of the business or undertaking.

Personal

responsibility

11.4. Personal responsibility

exists throughout all levels within Council, our contractors and service

providers. Individual responsibility differs but shared responsibility will

continue to allow us to build on our safety culture. HSW starts at the

‘top’ with our Executive Leadership Team and Council having a

collective and individual role to play. We are all responsible and accountable

for championing HSW, such that no business objective sacrifices the health

safety and wellbeing of our people.

Partnership

and collaboration

11.5. The organisation strongly

supports the participation of our workers, consultants, contractors, and the

community to make the best use of skills, knowledge, and experience when it

comes to HSW being effective. This partnership approach allows a collective

view to identify hazards/risks in the field, with community input when

required, to adopt the most appropriate measures to mitigate and reduce

risk/harm to all those involved.

11.6. We will actively seek ways

to secure a sustainable level of engagement and participation on a wide range

of HSW matters. We do engage with other Councils and industry bodies to build

local knowledge, collaborate on innovative initiatives, and create consistency

that benefits not only ourselves, our neighbouring Councils but also the

region.

Accountability

11.7. Data creates the

opportunity to know, learn and provide a high level of assurance that health

safety and wellbeing policy, process and continuous improvement occur. The organisational

incident reporting culture has continued to improve which encourages staff to

report near miss, incident, and improvement ideas without prejudice or fear.

Transparency

11.8. Performance data is

provided within applicable timeframes for intended audiences.

11.8.1. Regular reporting to ELT

with metrics

11.8.2. Quarterly Organisational

Performance report for ELT and Council

11.8.3. Council Risk and Assurance

committee receives quarterly risk maturity reporting and high-risk incident

reporting

11.8.4. HSW team present

organisational monthly updates with incident data to all groups across Council

11.8.5. Quarterly HSW committee

reporting to committee representatives across the business.

Continuous

Improvement

11.9. HSW business as usual

activity alongside the planned improvements aligning the HSWMS to ISO45000:2018

is the major focus for 2024-2027 with the HSW work plan detailing the updates

that meet the recommendations of the desk top review in 2023, to which the HSW

Team Lead has assigned a dedicated HSW resource. Part of the ongoing

commitment to continuous to improvement is to maintain an active