Hawke’s Bay Regional

Council

Risk

and Audit Committee

Wednesday

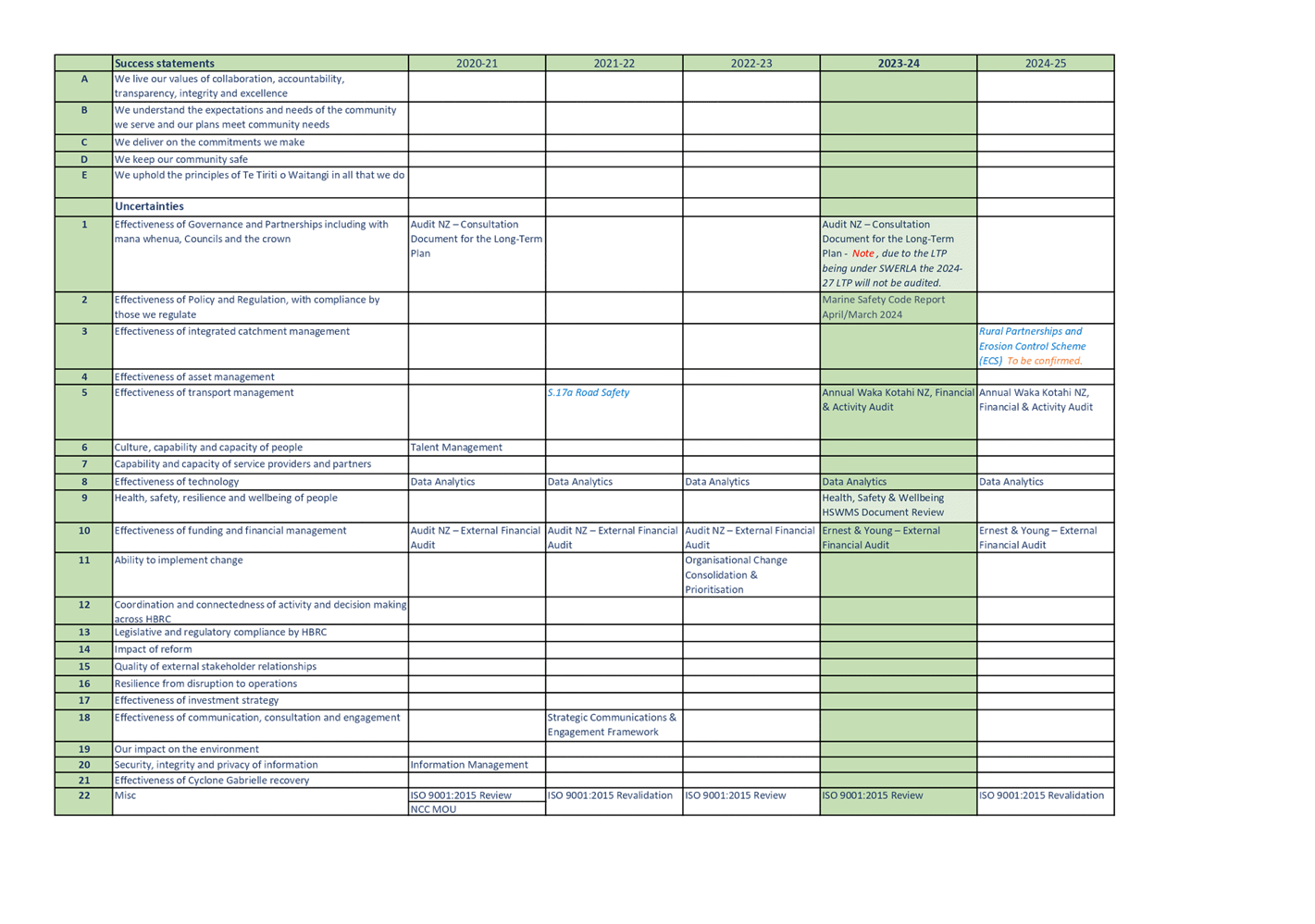

31 July 2024

Subject: Treasury Compliance Report

for the period 1 April - 30 June 2024

Reason for report

1. This item provides

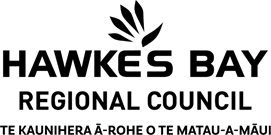

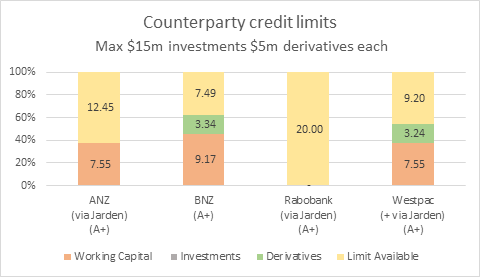

compliance monitoring of Hawke’s Bay Regional Council’s (HBRC)

Treasury activity and reports the performance of Council’s investment

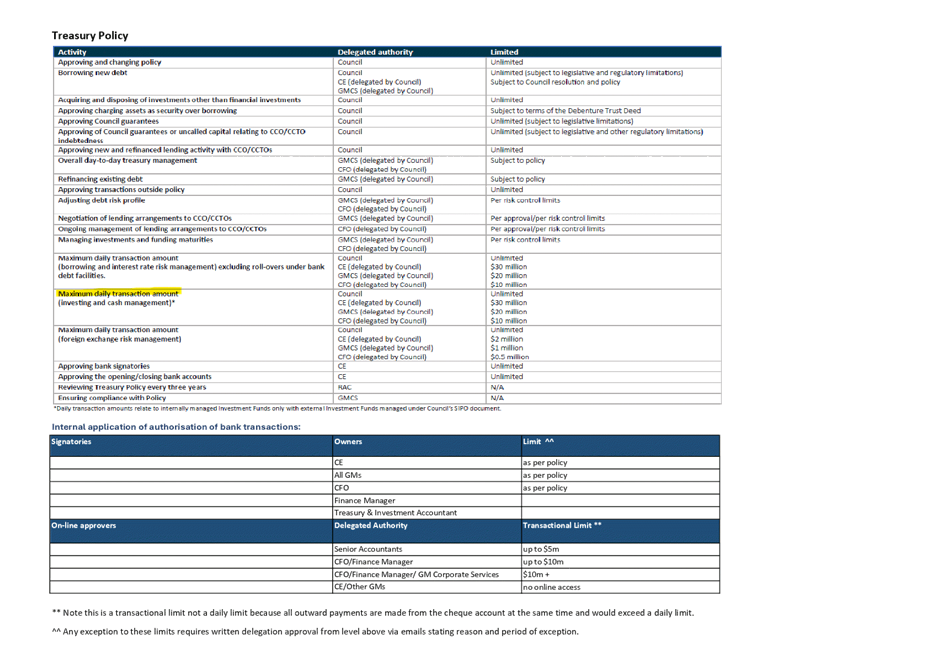

portfolio for the quarter ended 30 June 2024.

Overview of the quarter ending 30 June 2024

2. At the end of the quarter

to 30 June 2024, HBRC was compliant with all measures in its Treasury Policy,

however, during the quarter did breach the counterparty risk policy with BNZ

over 2 weekends due to the requirement to hold additional funds for loan

repayments due on Monday mornings.

3. During the quarter HBRC

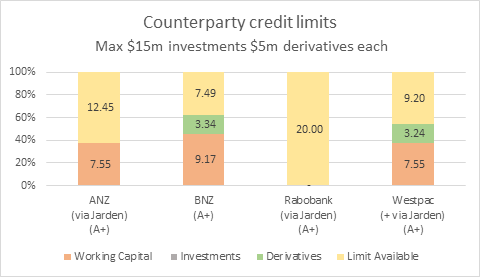

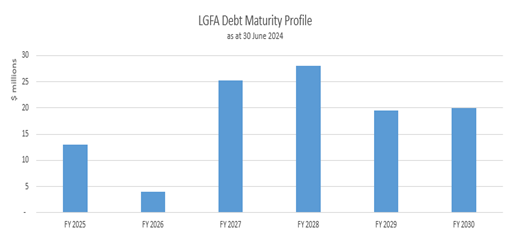

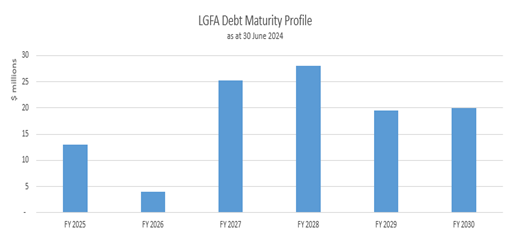

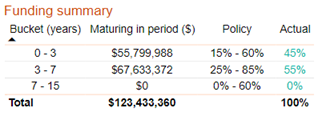

confirmed and updated where appropriate the delegated authorities and

signatories with BNZ and Jarden. There was no requirement to file with

the Covenant Trustee Service during this quarter. The next return is due

by 31 October 2024.

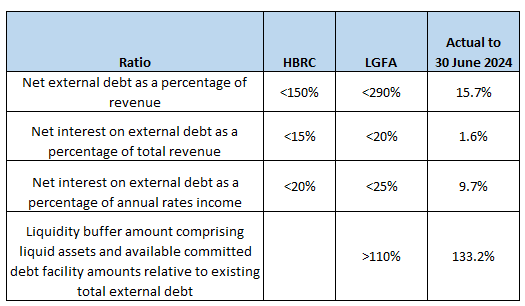

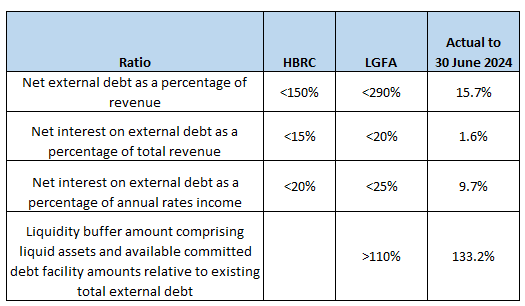

4. The effects of Cyclone

Gabrielle and its recovery continue to impact both cash balances and borrowing

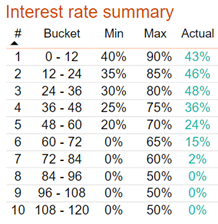

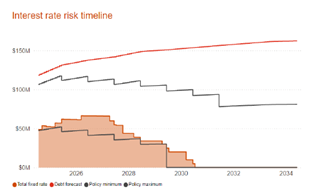

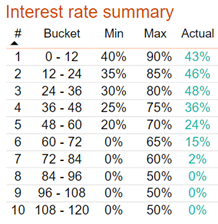

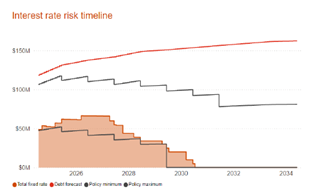

requirements. Additional ongoing borrowing to fund recovery will continue

over the next 3-4 years, while proceeds from insurance claims are slower than

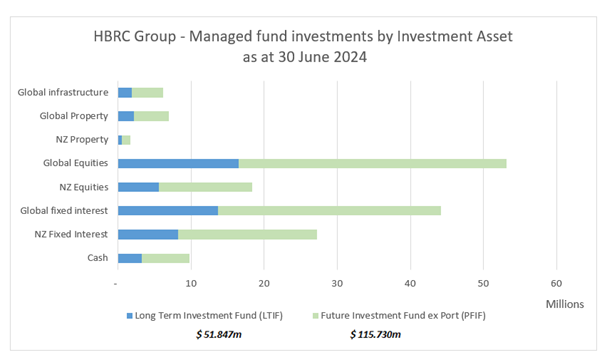

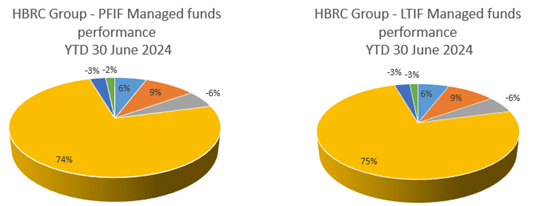

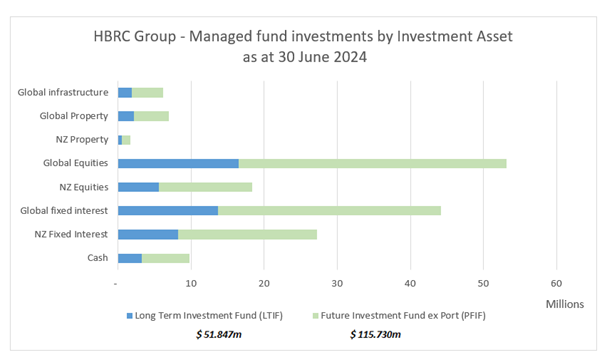

earlier forecast.

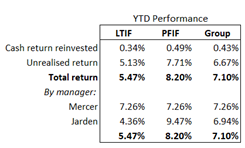

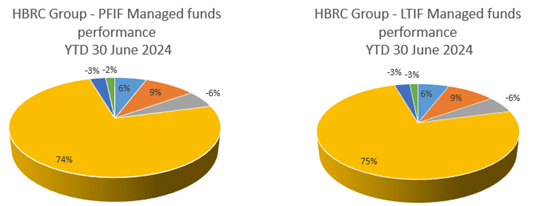

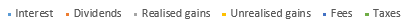

5. In June, Fitch confirmed it

issued to Council a Long-Term Local-Currency Issuer Default Rating of

‘AA’. This rating allows any lending from LGFA to be at a

discounted rate (generally 20 base points). It also increases the Council’s

Lending Policy Covenants with LGFA.

Background

6. Council’s Treasury

Policy requires a quarterly Treasury Report to be presented to the Risk and

Audit Committee. The policy states that the Treasury Report is to include:

6.1. Treasury exceptions report

6.2. Policy compliance

6.3. Borrowing limit report

6.4. Funding and liquidity

report

6.5. Debt maturity profile

6.6. Interest rate report

6.7. Investment management

report

6.8. Treasury investments

6.9. Cost of funds report, cash

flow and debt forecast report

6.10. Debt and interest rate

strategy and commentary

6.11. Counterparty credit report

6.12. Loan advances.

7. The Investment Management

report has specific requirements outlined in the Treasury Policy.This requires

quarterly reporting on all treasury investments plus annual reporting on all

equities and property investments.

8. In addition to the Treasury

Policy, Council has a Statement of Investment Policy and Objectives (SIPO)

document setting out the parameters required for funds under management for the

HBRC Long Term Investment Fund and the Future Investment Fund.

9. Since 2018, HBRC has

procured treasury advice and services from PricewaterhouseCoopers (PwC) who

provide quarterly treasury reporting for internal monitoring purposes.

Treasury

exceptions report and policy compliance

10. In June, the Council

borrowed an additional $40m from LGFA as detailed in the debt management

section below and resulted in holding larger than normal funds. As per

policy they were placed with multiple counterparties and via Jarden were split

between 2 banks. From 1 July 2024the counterparty limits in the treasury policy

has lifted to be $25m each.

11. Council staff continue to

maintain the view that management of Recovery Funding held on behalf sits

outside HBRC’s treasury Policy for normal operations and is excluded from

treasury reporting.

12. The Treasury Policy states

the CFO formally delegates to accountants the responsibility for executing

treasury transactions in accordance with approved limits, managing the

operation of all bank accounts, reviewing electronic batch payments to

creditors, and arranging for approval by authorised signatories.

Practical application of the Treasury Policy limits for authorisation of bank

transactions has not been documented to date so we outlined how this is applied

internally the attached report provides a breakdown of the policy and the

internal application of limits.

Funding

and liquidity

13. To ensure HBRC can

adequately fund its operations, current policy requires us to maintain a liquid

balance of ‘greater than 10% of existing total external debt’.

Current liquidity ratio is 30.22% and therefore

meets policy.

14. The following table reports

the cash and cash equivalents on 30 June 2024.

|

30-Jun-24

|

$0

|

|

Cash on Call

|

24,275

|

|

Short-term bank deposits

|

-

|

|

Total Cash & and Deposits

|

24,275

|

15. To manage liquidity risk,

HBRC retains a Standby Facility with BNZ. This facility provides HBRC

with a same-day draw down option, to any amount between $0.3m-$10m, and with a

7-day minimum draw period.

16. With no change to the OCR,

the return on on-call funds remains high with BNZ at 4.75% and Jarden at

5.45%. Because the current cash on hand is required for cashflow purposes

it is not practical for this to be placed on long term deposit. Short

term deposit rates with counterparties currently return less than the above

on-call rates.

Debt

management

17. On 30 June 2024 the current

external debt for the Council group was $113m. There was no pre-funding

of loans due to mature. ($130.16m including loan from HBRIC).

18. Since Q3 Council has

borrowed $40m from LGFA. $25m was utilised to repay short term borrowing

(cyclone related), with the balance to cover operational costs until the next

rates intake and fund expected capital projects related to cyclone recovery.

19. The following summarises

the year-to-date movements in Council’s debt position.

Summary of HBRC Debt

|

|

HBRC only

$000

|

HBRC Group

$000

|

|

Opening Debt – 1 July 2023 – excl HBRIC

Loan

|

84,830

|

84,830

|

|

New Loans raised*

|

124,500

|

124,500

|

|

Less amounts repaid

|

(95,830)

|

(95,830)

|

|

Closing Debt 30 June 2024 (excluding HBRIC

loan)

|

113,500

|

113,500

|

|

Plus opening balance - loan from HBRIC

|

16,663

|

―

|

|

Total Borrowing as at 30 June 2024 *

|

130,163

|

113,500

|

20. Council’s debt

maturity profile remained compliant and with the conversion of cyclone related

short-term borrowing to longer term, the pressure has reduced on the 0-3 year

period. As mentioned last quarter, the Council plans to utilise any insurance

proceeds to minimise future borrowing. The infographic below includes our

$10m BNZ overdraft facility in total debt but excludes internal (HBRIC) debt.

Funding

summary

21. The decision for HBRC to

borrow $40m in June was a result of several factors falling at the same

time. With the insurance claim process taking longer than initial

anticipated (although NEMA has applauded our claims information and advised our

claims are well ahead of other councils) it was prudent to roll the expensive

short-term borrowing of $25m into longer terms, knowing insurance proceeds

received in the future would assist to limit further borrowing required for

capital projects. Additional funding was also required to fund our

cashflow as well to allow have sufficient funds on hand for the major flood

mitigation project.

22. HBRC staff are working to

firm up a cashflow forecast for the capital projects which have been

challenging and this will inform the timing of any future borrowings.

23. The LTP debt forecast

anticipates debt levels rising to $176m by the end of FY27.

Borrowing

limits

24. Council continues to

monitor and work within the agreed borrowing limits set by both Council and the

LGFA.

25. The ratios below excludes

all HB Recovery cash & cash equivalents held and any return on these funds

but does include LTIF managed funds as a liquid asset for assessing net debt.

Interest

rate risk

26. Council currently holds

$49m in fixed rate instruments, 42% hedging of current external debt, and

remains compliant to policy. This is based on the draft FY2025-2027 LTP

plan.

27. These instruments are

currently held with two banks, Westpac and BNZ. Since 30 June, interest rates

have shown movement and Council is considering additional swaps to increase

hedging and proposes to spread risk by introducing swaps from ANZ.

Managed

funds

28. Total Group Investment Fund

portfolios capital on 30 June 2024 is $167m. Adjusted for inflation this is

$1.82m below the inflation-adjusted contribution target. No divestments have

been made from managed funds this year.

29. Markets have overall

remained static in Q4, with the portfolio decreasing by $67k (full year growth

was $11.m). The funds have returned an overall 7.10% after fees and

taxes, with all income reinvested into the fund.

30. The following table summarises the fund balances at the

end of each period and the graph illustrates the asset allocations within each

fund on 30 June 2024.

|

|

30 June 2022

|

30 June 2023

|

30 June 2024

|

|

Fund Balances HBRC

|

$000

|

$000

|

$000

|

|

Fund Balance HBRC

|

104,449

|

110,828

|

118,722

|

|

Capital Protected Amount HBRC (2% compounded since

inception)

|

114,239

|

115,895

|

118,890

|

|

Current HBRC value above/(below) capital protected amount

|

(9,790)

|

(5,067)

|

(168)

|

|

Funds Balances (Group + HBRIC)

|

|

Long-Term Investment Fund (HBRC)

|

45,679

|

48,400

|

51,847

|

|

Future Investment Fund (HBRC)

|

58,770

|

62,428

|

66,875

|

|

Total HBRC

|

104,449

|

110,828

|

118,722

|

|

Plus HBRIC Managed Funds (FIF)

|

43,226

|

45,638

|

48,854

|

|

Total Group Managed Funds

|

147,675

|

156,466

|

167,576

|

|

Capital Protected Amount (2% compound inflation)

|

162,720

|

164,798

|

169,344

|

|

Current group value above/(below) protected amount

|

(15,045)

|

(8,332)

|

(1,768)

|

31. From 1 July HBRIC, on

behalf of the Council, will transition the HBRC-managed fund portfolios to a

new provider, Harbour Asset Management. The transition plan should see

all assets transferred and re-invested by 31 July. Harbour has indicated

that due to the nature of some of the assets transferred they may not be fully

compliant with the SIPO initially but will work as quickly as possible to align

to all SIPO requirements.

32. Financial markets have

rallied to June and recovered earlier valuation falls within the group

portfolio of up $11m on June 2023. The performance of all

portfolio’s has improved this year, in part supported by all cash returns

which are reinvested, leading to all gains as unrealised.

Cost

of funds

33. Rolling 12 months to 30

June 2024, Gross Cost of Funds (COF) was 3.93% and Net COF was 3.83%.

HBRIC

Ltd

34. In accordance with Council

policy, HBRIC provides separate quarterly updates to the Corporate and

Strategic Committee.

Decision-making process

35. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

35.1. The decisions of the

Committee are in accordance with the Terms of Reference and decision-making

delegations adopted by Hawke’s Bay Regional Council 30 August 2023,

specifically the Risk and Audit Committee shall have responsibility and authority

to:

35.1.1. Review the Council’s revenue and

expenditure policies, amongst others, and the effectiveness of those policies

in ensuring limited risk is generated. (1.3)

35.2. Because this report is for

information only, the decision-making provisions do not apply.

Recommendation

That

the Risk and Audit Committee receives and notes the Treasury Compliance

Report for the period 1 April– 30 June 2024.

Authored by:

|

Tracey O'Shaughnessy

Treasury & Investments

Accountant

|

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

Treasury Policy application of bank

authorities July 2024

|

|

|

Hawke’s

Bay Regional Council

Risk

and Audit Committee

Wednesday

31 July 2024

Subject: Enterprise Assurance update

Reason for report

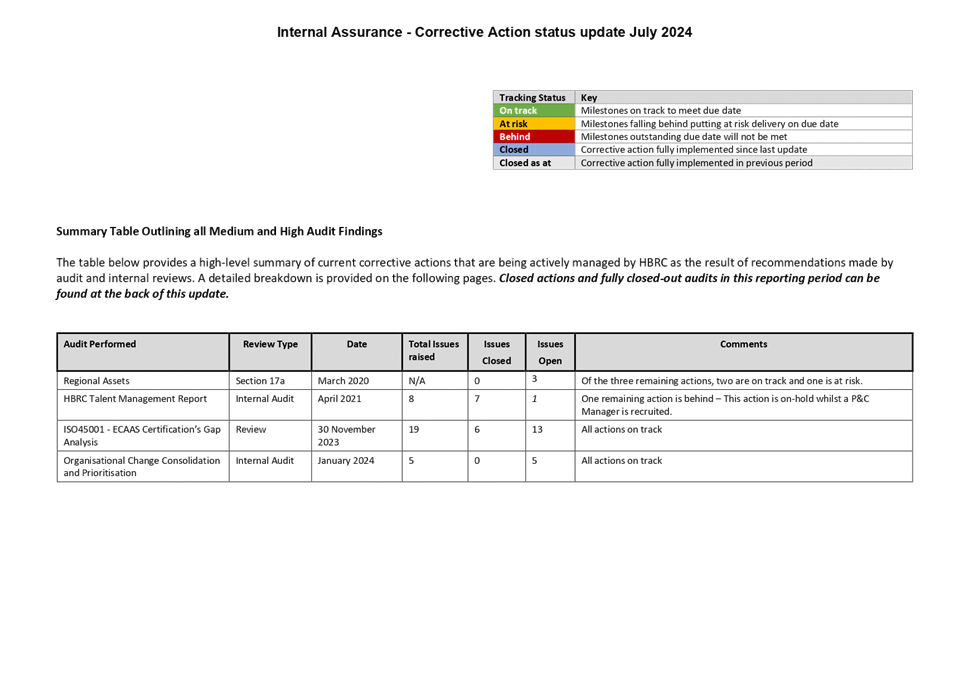

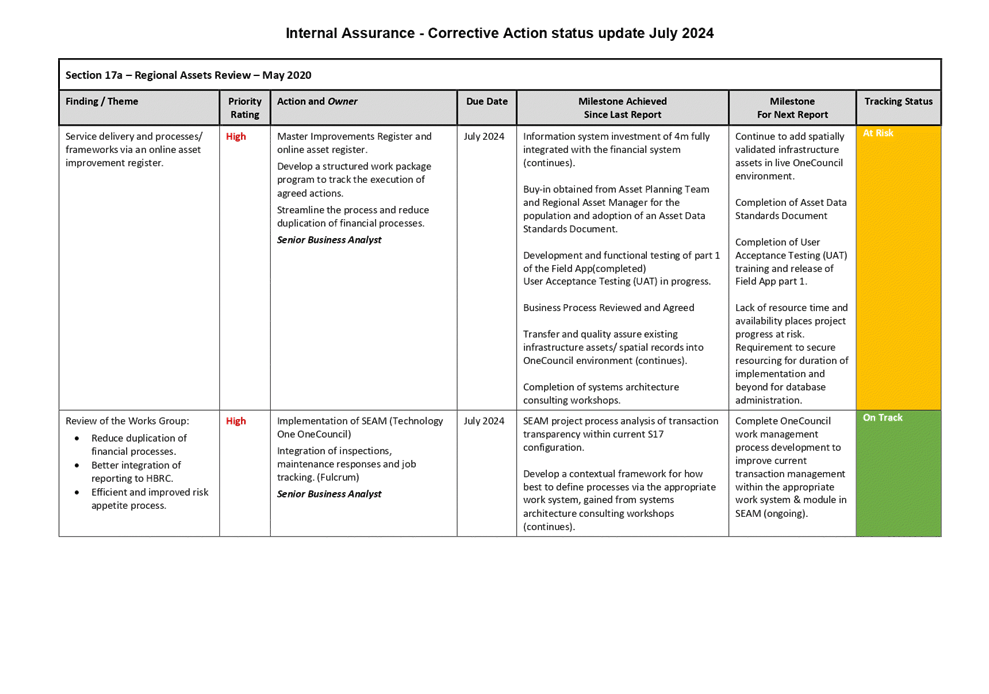

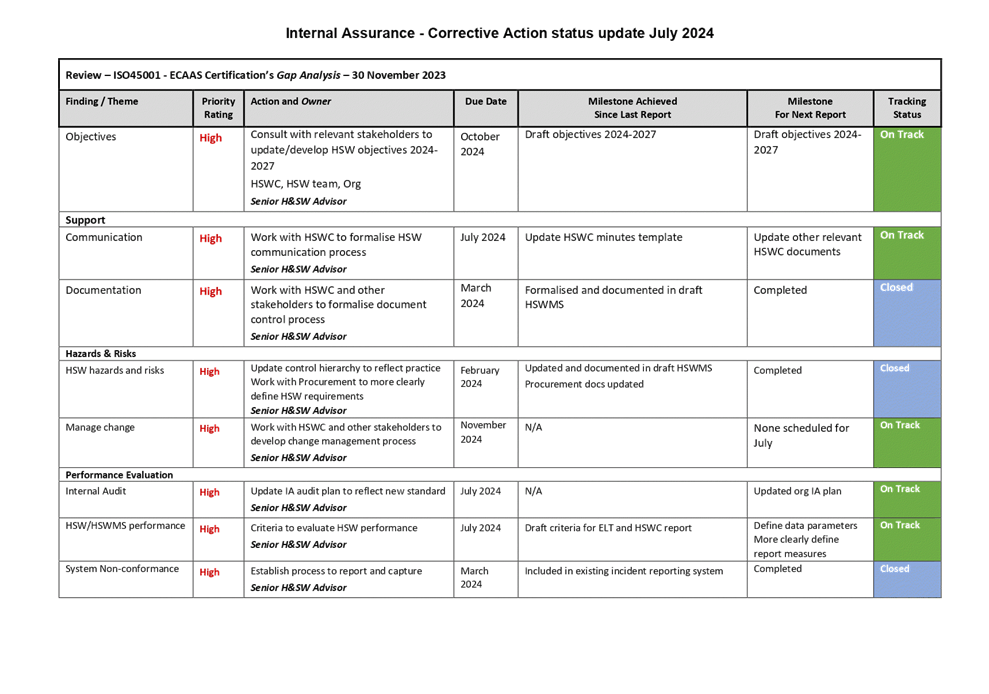

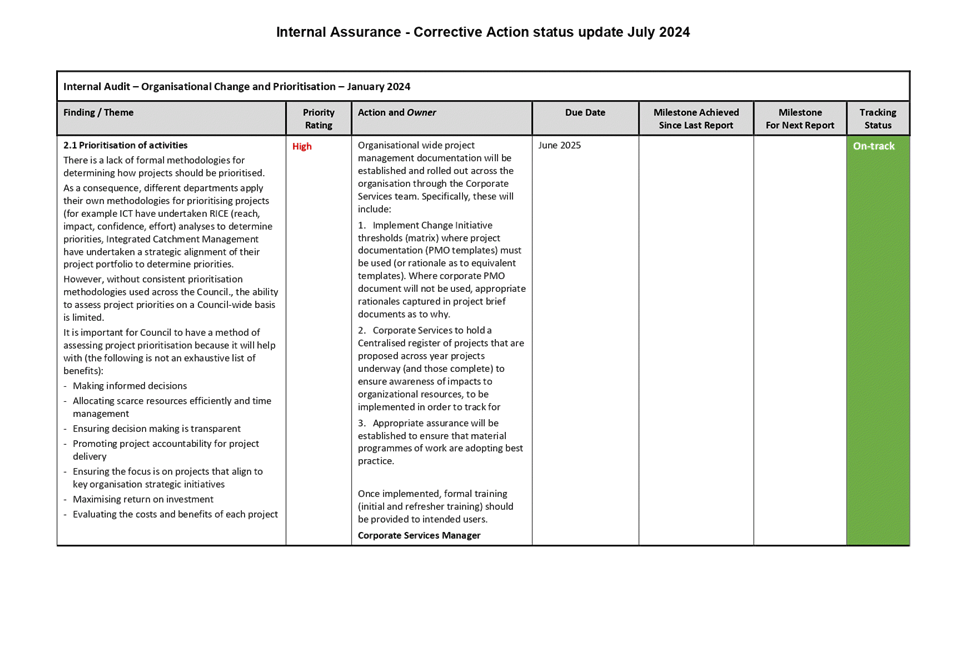

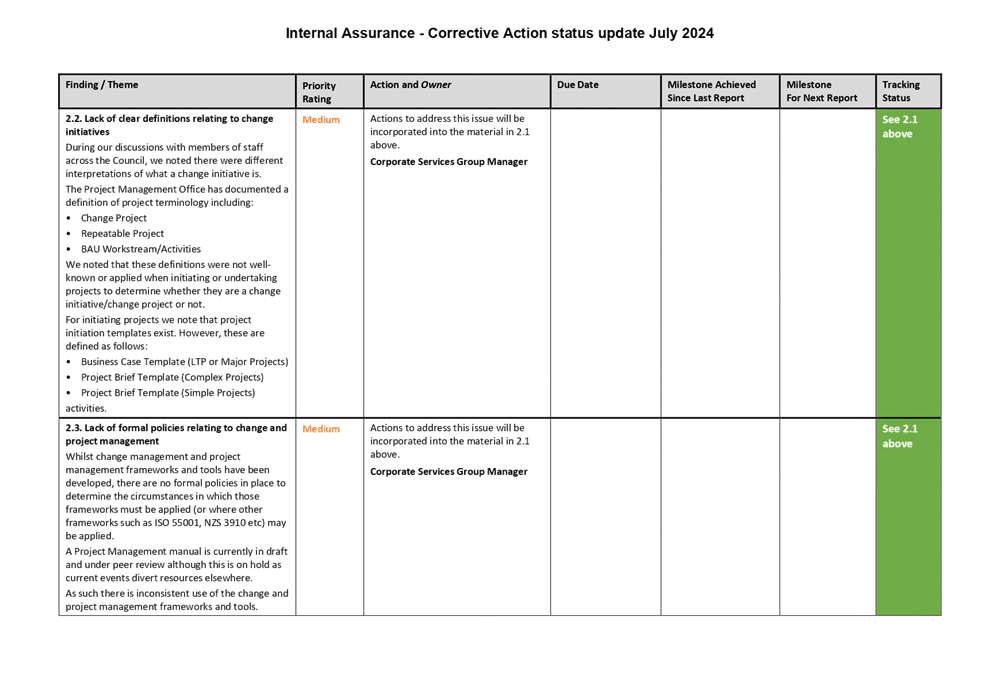

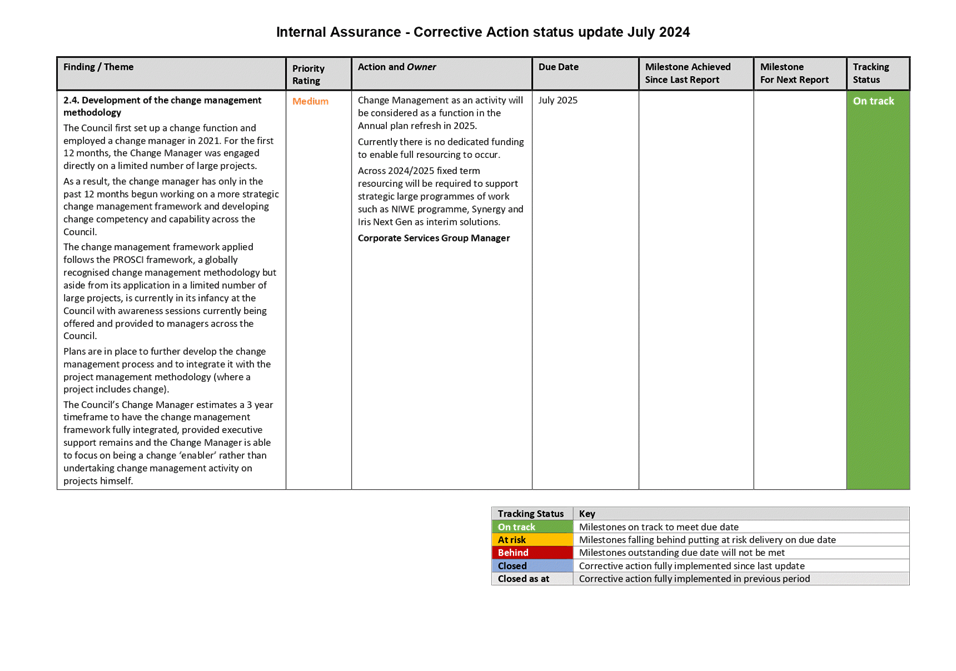

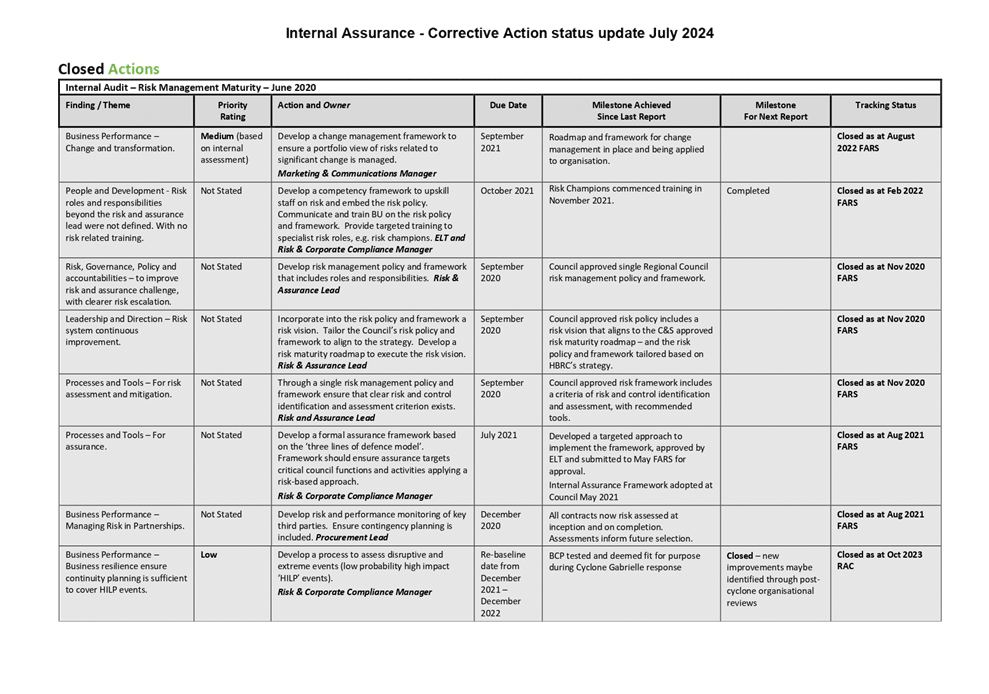

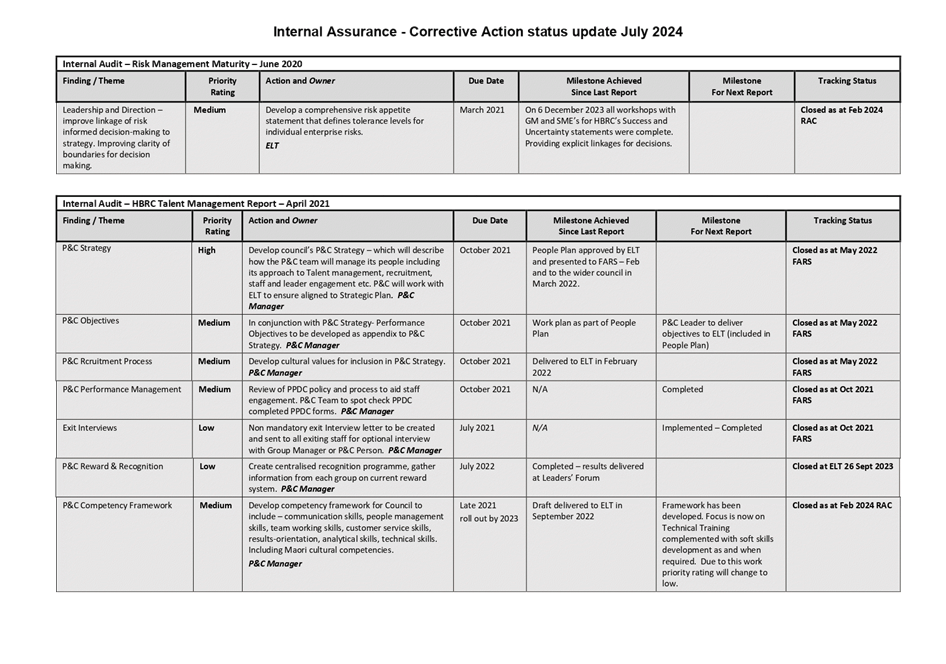

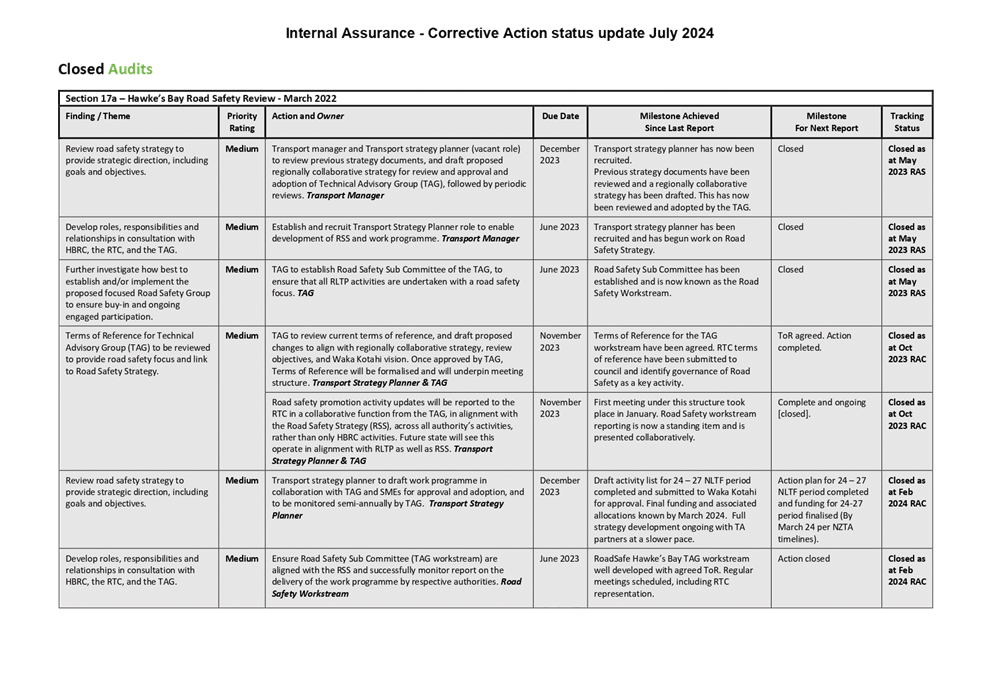

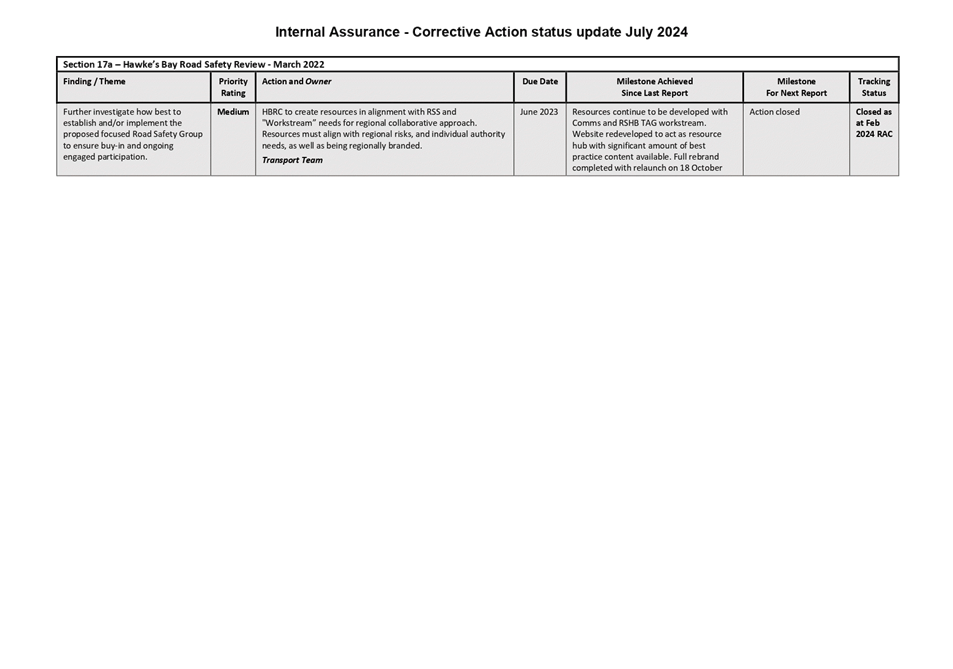

1. This item updates the Risk

and Audit Committee (RAC) on the progress of:

1.1. the agreed corrective

actions (with priority risk ratings medium and high) that respond to findings

from enterprise internal assurance reviews that have been previously reported

to the RAC via the Internal Assurance Corrective Actions Dashboard

1.2. the audits/reviews

(including S.17a) completed and proposed for the future via the Assurance

Universe Dashboard

1.3. the position of reviews for

the current financial year shown on the Assurance Plan for 2023-24.

Discussion

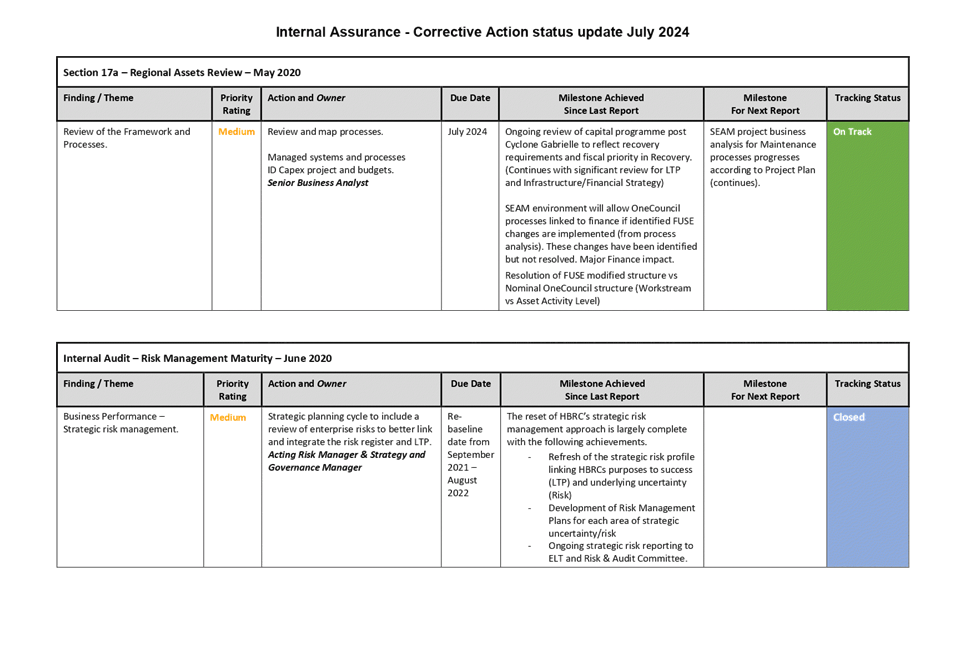

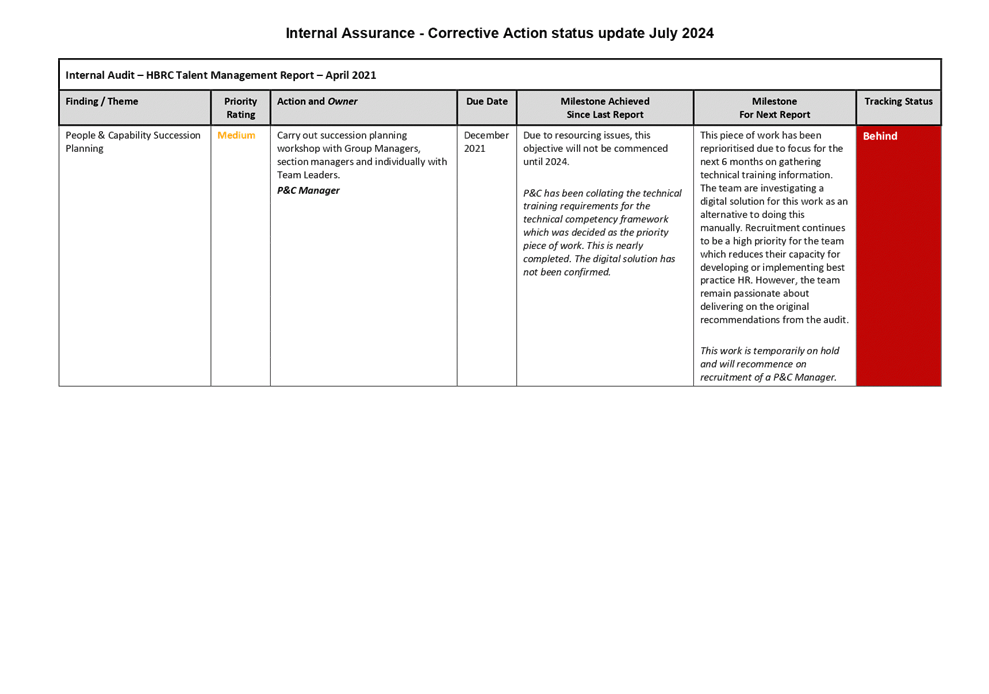

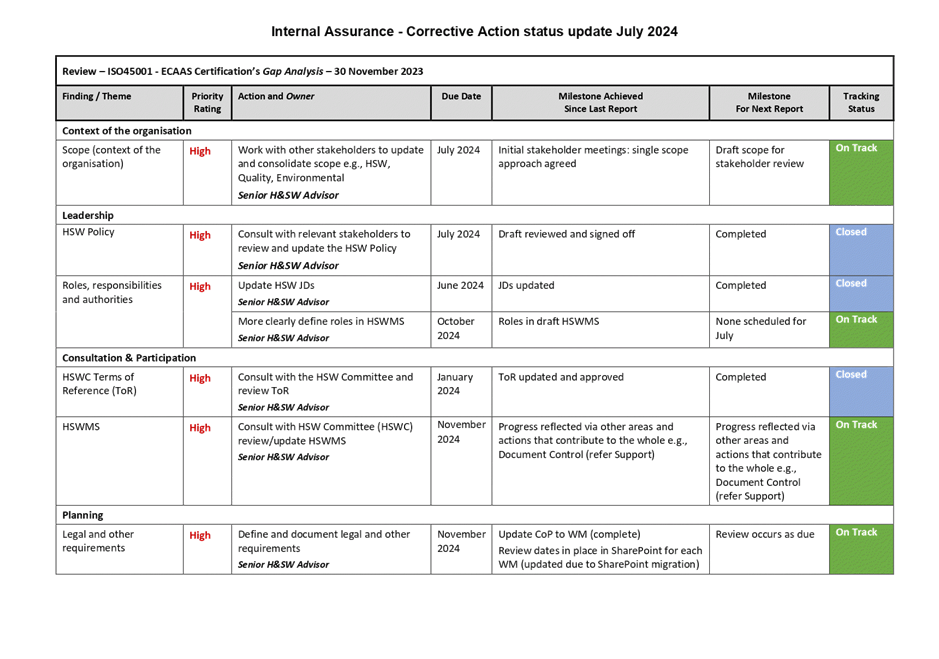

2. The Internal Assurance

Corrective Actions Dashboard is attached.

3. The corrective actions

status update provides oversight to the RAC of how the actions taken to address

open internal assurance findings are progressing, including total issues

raised, how many closed and how many remain open. The table below is a summary

of the open audits/reviews.

|

Audit Performed

|

Review

Type

|

Date

|

Total Issues raised

|

Issues

Closed

|

Issues

Open

|

Comments

|

|

Regional Assets

|

Section 17a

|

March 2020

|

N/A

|

0

|

3

|

Of the remaining three actions, two are ‘on

track’ and one is ‘at risk’.

|

|

HBRC Talent Management Report

|

Internal Audit

|

April 2021

|

8

|

7

|

1

|

One remaining action is behind – This action is

on-hold whilst a P&C Manager is recruited.

|

4. The dashboard gives

visibility of:

4.1. open findings of the

milestones, the milestones completed and to be completed by the next RAC, plus

the tracking status since last reported

4.2. a summary of closed actions

since the last RAC report.

5. The Assurance Universe

Dashboard is attached. This links

enterprise reviews or audits undertaken over the past five years, the current

year, and future years to an enterprise risk. Reviews and audits in the

Assurance Universe include external audits, enterprise internal audits, business

reviews with an enterprise focus, and section 17a reviews.

6. The Assurance

Plan for 2023-24 is below. This gives a status of approved audits and

the current status.

|

Approved Audit FY23-24

|

Provider

|

Quarter

Due

|

Date

Commenced

|

Management

Comments

|

Reported

to RAC

|

|

Data Analytics (2023-2024)

|

Crowe

|

Q1

|

August 2024

|

Startup meeting in place with Crowe with extraction

expected end of August

|

No

|

Financial and resource implications

7. The budget provided for

internal assurance in 2024-2025 is $64,600.

8. Budget provisions for s.17a

reviews are allocated via the budgets for the activities identified in the

Assurance Universe.

Decision-making process

9. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

9.1. The decisions of the

Committee are in accordance with the Terms of Reference and decision-making

delegations adopted by Hawke’s Bay Regional Council 30 August 2023,

specifically the Risk and Audit Committee shall have responsibility and authority

to:

9.1.1. Receive the internal and

external audit report(s) and review actions to be taken by management on

significant issues and recommendations raised within the report(s). (2.8)

9.1.2. Ensure that recommendations

in audit management reports are considered and, if appropriate, actioned by

management.

(3.5)

Recommendations

That the Risk and Audit Committee

1. Receives and notes the Enterprise Assurance update staff report.

2. Confirms that the Internal

Assurance Corrective actions update report has provided adequate

information on the status of the Internal Assurance Corrective Actions.

Authored by:

|

Olivia Giraud-Burrell

Quality & Assurance Advisor

|

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

Internal Assurance Dashboard July

2024

|

|

|

|

2⇩

|

Assurance Universe 1 July 2024

|

|

|

Hawke’s

Bay Regional Council

Risk

and Audit Committee

31 July

2024

Subject: Risk Management update

Reason for report

1. This item and the

accompanying strategic risk report provide the Risk and Audit Committee (RAC)

with a quarterly update of:

1.1. the strategic risk profile

for HBRC, expressed in terms of HBRC’s purpose, strategic priorities and

definition of success, together with an outline of the major areas of

uncertainty/risk relating to this

1.2. the sentiment of both the

Executive Leadership Team and Councillors as to the aggregate level of

confidence/concern (i.e risk rating) with respect to the strategic risk profile

of HBRC

1.3. a deep dive into specific

areas of uncertainty/risk, with the associated One Page Management Plans that

provide transparency as to what these areas are, why these matter, what

contributes to these, how these are managed and monitored, and specific actions

recommended.

2. This item also provides an

update on the wider external environment and specific issues for the attention

of the Risk and Audit Committee, as well as a draft forward work plan (attachment

1) for discussion and feedback.

Executive

summary

3. The external environment

continues to impact on HBRC – both in terms of the political landscape,

economic landscape and climate-related events.

4. Specific areas of focus

since the last meeting include work associated with:

4.1. central government led

priorities and the legislative reform work

4.2. the insurance renewal

process and wider changes within the insurance landscape

4.3. affordability pressures

related to the conclusion of the Long Term Plan

4.4. management of continued

cyber security threats and resilience

4.5. the recent 26th June

weather related event and impact on the Wairoa community and HBRC

4.6. engagement with the Cyclone

Recovery Unit and work related to the North Island Weather Event (NIWE)

Resilience Programme for delivery of Category 2 flood mitigations.

Discussion

Central Government priorities and

legislative reform

5. As at mid-2024, the

coalition Government continues strong momentum in its ambitious resource

management and legislative reform work programme. There are ‘big

ticket’ items such as the Fast-track Approvals Bill, re-setting

legislation for the ‘Local Water Done Well’ programme and the

three-phased reforms of the RMA. There are also a number of more focussed

proposals – some new and others remain a legacy from the previous

Government. Other examples are amendments to national Policy Statements (for

housing, highly productive land and renewable energy) and laws to grant 20-year

extensions to existing marine farms and ports. For Hawke’s Bay in

particular, there may be an ongoing need for further temporary relaxation of

laws to support our recovery from the impacts of Cyclone Gabrielle.

6. The Government’s

reform programme presents some opportunities for re-focussing HBRC’s own

work, but it also poses risks including:

6.1. uncertainty of content and

timing (e.g. how long do we continue working to the current laws, before we

face a switch?)

6.2. short-term policy resets by

Government impact on service delivery and environmental outcomes in our

communities

6.3. increasing number and

complexity of reform proposals across multiple tranches over time

6.4. should we invest in

responding/submitting on all of these proposals, while we also need to focus on

our own BAU programmes

6.5. community misunderstanding

about what are the Government’s proposals and what HBRC might be

proposing (or responding)

6.6. HBRC needing to revisit

some of its previous decisions (e.g. establishment of Māori Wards),

reduced Crown funding for some of HBRC’s activities as a result of public

sector personnel cuts, and Budget 2024

6.7. further uncertainty beyond

this current term of Government if the programme will be maintained or face

further U-turns by the next Government.

7. Treaty partners are

increasingly feeling vulnerable given the combined effect and intent of the

Government’s reforms on the role and interests of Māori in resource

management.

8. The Government has

initiated a targeted review of the Public Works Act 1981. The review

seeks to facilitate the delivery of critical infrastructure projects.

9. The programme of work

related to the Cyclone Gabrielle Category 2 risk mitigation projects, including

flood protection measures continues to progress. Pressure continues to be felt

from central government in particular the Cyclone Recovery Unit, Crown Infrastructure

partners for delivery of Category 2 Flood Mitigations. Timeframes and

scheduling for delivery has limited contingency with pressure to deliver.

The

insurance renewal process

10. Navigating the challenging

insurance market continues to present difficulties for HBRC. Namely, due to the

market conditions for capacity in different types of insurances and the effects

that the natural catastrophes around the world in 2023 have had on the

markets.

11. The global market is facing

affordability issues for insurance for risks in the natural catastrophe exposed

locations and pricing locally is being driven by the increasing frequency of

weather-related claims as well as inflationary pressures.

12. Prior to 30 June 2024, HBRC

held various insurance policies via AON, Asteron and Marsh.

13. In June Marsh advised 13

councils across New Zealand that they could no longer obtain insurance for

Professional /Public Liability, citing a significant deterioration in the

council claims being presented to the London Market as the primary driver for

London Markets exiting this offer. This was mainly due to the professional

exposure associated with building control, which is considered high risk.

14. HBRC immediately engaged

with AON for an offering of this product leveraging existing relationships. AON

have provided a primary layer of cover $15m, however this is a significantly

reduced capacity and cover from our previous $300m cover with Marsh. Further

work is being undertaken to access secondary layers of protection.

15. AON holds the following

policies which are due for renewal on 1 November 2024.

|

Forestry

(Standing Timber)

|

Infrastructure

(40%)

|

|

Contract

Works

|

Material

Damage & Business Interruption

|

|

Commercial

Motor Vehicle

|

Commercial

Marine Hull

|

|

Aviation

Hull (Drone)

|

Travel

Policy

|

|

Statutory

Liability Policy

|

Employers

Liability

|

|

Personal

Accident

|

Crime

Liability

|

16. From 30 June 2024, AON also

holds:

16.1. Public Liability &

Professional Indemnity

16.2. Harbour Masters Wreck

Removal ($10m)

17. Staff are working with AON

regarding the Environmental Impairment insurance and reviewing the cover

required and the HBRC insurable risk that might exist. There is currently no

cover in place for this and we will report back once appropriate cover is found.

18. Marsh held the following

policies:

18.1. Public Liability &

Professional Indemnity

18.2. Harbour Masters Liability

18.3. Environmental Impairment.

19. As of 1 July 2024, HBRC

does not hold any other current policies with Marsh.

20. Asteron held the following

policies:

20.1. Employee Income Protection

20.2. Employee Life.

21. Staff are still working

with AON regarding further excess layers for the Public Liability &

Professional Indemnity, Harbourmasters Wreck Removal and Environmental Impairment

insurance following the change from Marsh.

22. Insurance renewal processes

(roll over/annual reviews) for all insurance policies for HBRC is underway and

will continue to renew until November 2024.

23. HBRC expects more premium

increases, with lower cover due to international insurance markets.

24. Officers have begun looking

at self-insurance options, our current valuation methods used across asset

types and other Councils approaches to their insurances in preparation for the

impending renewal of our HBRC policies.

25. A workshop with the Risk

and Audit Committee on 31 July will provide an overview of the current state of

the insurance market, HBRC’s insurable risk and the nature of cover

provided/sought. We would then look to confirm HBRC’s risk appetite for

insurable risk with Council prior to renewal.

Long Term Plan and affordability

26. The recent Long Term Plan

deliberations and rate payer sentiment have raised affordability concerns

across our region. This sentiment has been felt not only across Hawke’s

Bay but nationally across all of the local government sector.

27. Nationally, economists have

stated New Zealand is in a state of recession, a combination of relative high

interest rates, stubborn persistent inflation and increasing levels of

unemployment.

28. These factors have

implications on HBRC in terms of the affordability of rates by ratepayers and

need for strong community engagement and support, with clear narrative as to

trade-off choices made and LTP priorities in the near term.

29. HBRC have budgeted ~$1.2M

for the impact of rates remissions and expect that days to payment for rates

may increase outwards of 90 days+.

30. To enable appropriate

management of remissions and bad debts, HBRC have recruited short term

assistance to manage the increasing assistance our rate payers may require with

expected increase in payment plan options, and remissions.

Cyber

security

31. We continue to see

increased cyber activity across NZ and into our organisation. The overall focus

in the industry currently pertains to human-introduced vulnerabilities as

phishing becomes increasingly sophisticated.

32. At the start of June 2024,

the Government Communications Security Bureau advised us of a new phishing

campaign that’s targeting NZ organisations. The emails look like they

originate from trusted or known contacts, thus deceiving people into clicking

on them. This reinforces the need for HBRC to remain vigilant around security

controls and cyber training.

33. Most recently, on 19 July,

HBRC was impacted by the global IT outage as a result of the routine but faulty

security software update by global firm crowdstrike. This resulted in

one of the largest operating system outages across the world has

experienced. HBRC experienced computer crashes (the blue screen) and

inability to restart.

34. HBRC immediately triggered

incident response lead by the Information technology team, manually applying

fixes to desk machines, and putting in place weekend drop ins for staff across

the weekend. There were very limited impacts as the result of the immediate

response HBRC put in place.

35. Since the presentation to

the RAC in April pertaining to cyber risk, further controls around staff

adherence to phishing training have been undertaken:

35.1. Phishing training for new

employees has been increased from 2 introduction courses to completion of all 3

introduction modules within the first 6 months of tenure.

35.2. The completion of an

additional phishing training course will now be required of all staff each

year, upon their annual anniversary.

35.3. Further courses and

communications will be available each October, during “Cyber Security

Awareness” month.

35.4. Course completion is

monitored and provided to the GMs each quarter.

36. In response to this focused

campaign, we have increased our Phishing training completion rates from ~50% to

71.25% over the past 8 weeks.

Issues

and concerns

37. This quarter, high risk

events are outlined below.

|

Type

|

Number of High-Risk

Events

|

|

Non-financial Risk

Incidents

|

1

|

|

Health and Safety

|

3

|

38. One significant

non-financial risk incident was recorded this quarter, relating to an outage of

Hilltop data display on the HBRC public website. This was deemed high

risk, at that time, given the high reputational potential damage this had, with

external media enquiries, community enquires combined with a potential rain

event at that time. A copy of the Post Implementation Report is attachment

2 to this report.

39. This was caused by an

internal action, where an unidentified / generic external Hilltop user account

was disabled, without going through standard ICT change procedures and approval

processes. This action resulted in an interruption to the flow of data to the

website. The issue was resolved with follow up actions taken to ensure this is

not repeated.

40. Three public health and

safety incidents were noted that all involved NZ Police.

40.1. An external contractor

working for HBRC in Wairoa was threatened whilst on site specifically threat to

life and tried to the contractor’s boat. Police were called at the time

with immediate escalation. Increased communications with Police, Wairoa District

Council, local Iwi and Community Groups has been undertaken.

40.2. Late one evening in June

the HBRC Dalton Street security card readers were intentionally smashed from

fittings. Police were notified immediately with the sharing of security

footage. The offender was caught and charged. Reader cards were immediately

fixed with reminders sent to all staff regarding the need for vigilance when

entering and exiting buildings.

40.3. HBRC has and continues to

receive threatening messages, notably one threatening email which was received

suggesting harm and a bomb threat through info@HBRC email address. This was

immediately notified to the Chief Executive and reported to Police via 105

Police Report. Police Intelligence Unit conducted a sophisticated search and found no

matches for the email supplied and were unable to identify a source or who sent

the email. As a result, a security guard has been placed in HBRC reception.

Dealing with Aggressive People training has been undertaken by CX/Reception

staff.

Assurance

Activities

Security Reviews

41. For sensitive data (held

on-premise but residing outside of our core enterprise stack), we requested a

review of data security and access controls.

41.1. Rates (MagiQ): All user

access is controlled at a role-level, with read-only access provided where

needed.

41.2. HR (Sharepoint): A review

of user access to the P&C folders has been completed, and access

streamlined to critical users only.

Audits

42. This quarter saw two

separate audits undertaken.

Information Management

43. This audit was conducted by

Increment, (funded by Microsoft), across HBRC’s data and information

management policies, with a focus on data classification, how to then manage

the storage and sharing of documents labelled ‘confidential’ or

‘restricted’, and record retention and disposal.

44. This is an area which has

not been addressed within HBRC over the past few years, as the Information

Management role within the organisation has not been funded.

45. Unsurprisingly, this

highlighted several known issues in our Information Management space regarding

the use of metadata, rules around storage and sharing of documents with

specific classifications, and lack of retention & disposal.

46. ICT has received approval

for a Fixed Term 1-Year Information Management role in FY24/25 to work through

these recommendations and provide an initial IM framework. This is expected to

occur in early 2025.

External Security

47. This complimentary audit,

conducted by Orange Cyber defence, was a 1-week trial of their external attack

programme, which seeks to find vulnerabilities in our external facing network.

48. HBRC obtained

‘Hero’ status, with only 3 prioritised findings relating to

dead-link sites on the HBRC website. These have been addressed.

Financial Reviews

49. Ernst and Young is

currently preparing for the HBRC onsite audit review.

50. Next quarter will focus on

preparing for the annual security audit with EY. This is scheduled for Sept/Oct

2024.

51. A forward workplan is

attached as Appendix 2 outlining tasks that the Risk and Audit Committee will

undertake aligned with the Terms of Reference for clarity.

Independent Flood Review

52. At the time of submission

of this paper, the independent

review into the performance of all HBRC-owned and operated flood protection,

control, and drainage schemes during Cyclone Gabrielle (HBIFR) was released.

53. On 24 July the Council

received the report on the HBIFR from the panel, noting that the range of

recommendations from the review will be considered in detail by the Executive

Leadership Team in conjunction with flood scheme reviews and mitigation works currently

under way.

Decision-making process

54. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that:

54.1. The decisions of the

Committee are in accordance with the Terms of Reference and decision-making

delegations adopted by Hawke’s Bay Regional Council 30 August 2023,

specifically the Risk and Audit Committee shall have responsibility and authority

to provide advice and recommend actions, responses, and

changes to the Council about risk management, assurance activities, governance

oversight and internal control matters, including external reporting and audit

matters. Specifically, this includes:

54.1.1. The robustness of

Council’s risk management systems, policies, practice and assurance

processes. (1.1)

54.1.2. Review whether Council

management has a current and comprehensive risk management framework and

associated procedures for effective identification and management of the

Council’s significant risks in place. (2.1)

54.1.3. Undertake periodic

monitoring of corporate risk assessment, and the internal controls instituted

in response to such risks. (2.2)

54.2. Because this report is for

information only, the decision-making provisions do not apply.

Recommendations

That

the Risk and Audit Committee receives and considers the Risk Management

update staff report.

Authored by:

|

Jess Bennett

Programme Finance & Controls

Manager

|

Katrina Brunton

Group Manager Policy &

Regulation

|

|

Karina Campbell

Strategic Advisor

|

David Nalder

Acting Risk Manager

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

Risk & Audit Committee forward

work plan

|

|

|

|

2⇩

|

21 May 2024 Hilltop Data Display

Incident Report

|

|

|