Meeting of the Risk

and Audit Committee

Date: 1 May 2024

Time: 9.00am

|

Venue:

|

Council

Chamber

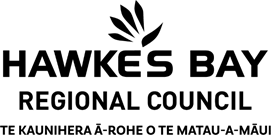

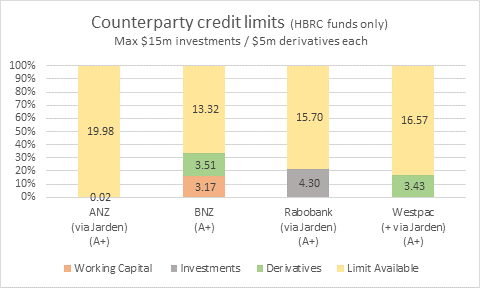

Hawke's

Bay Regional Council

159

Dalton Street

NAPIER

|

Agenda

Item Title Page

1. Welcome/Karakia/Notices/Apologies

2. Conflict

of Interest Declarations

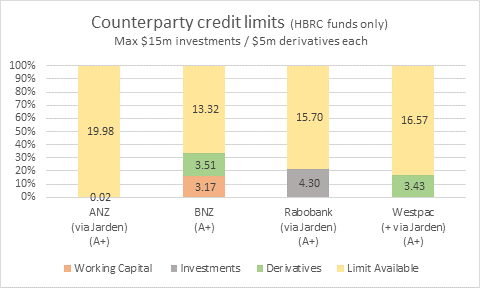

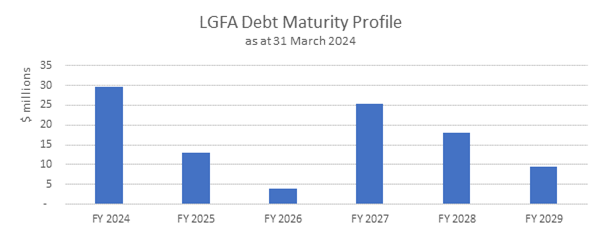

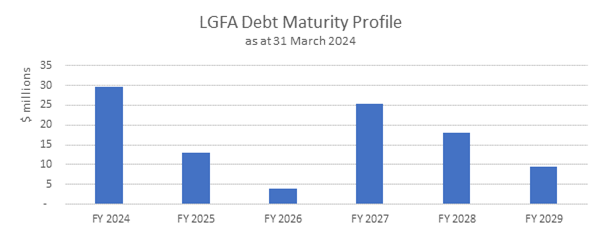

3. Confirmation of Minutes of

the Risk and Audit Committee meeting held on 15 February 2024

Decision

Items

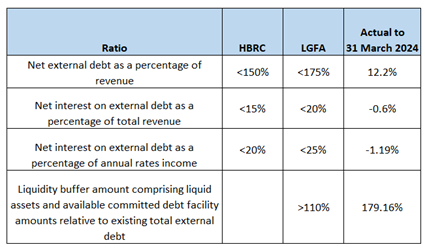

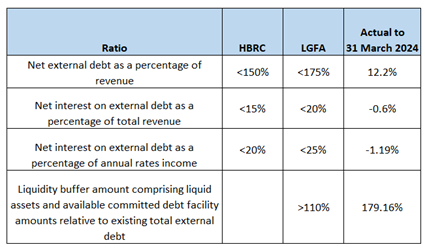

4. Risk

Management update 3

5. Treasury

Compliance Report for the period 1 January - 31 March 2024 9

6. Health,

Safety and Wellbeing update 15

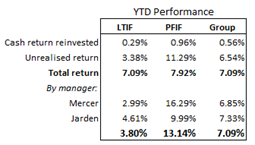

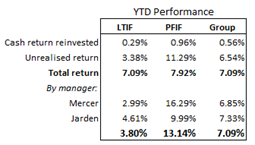

7. Enterprise

Assurance update 31

Decision

Items (Public Excluded)

8. Incident

report - Payroll Holidays Act compliance 45

9. Strategic

risk deep dives 47

Hawke’s Bay Regional

Council

Risk

and Audit Committee

1 May 2024

Subject: Risk Management update

Reason for Report

1. This item and the

accompanying enterprise risk report provide the Risk and Audit Committee (RAC)

with a quarterly update of Council’s risk profile, risk activities and surrounding

environment for discussion and awareness.

Executive

Summary

2. HBRC continues to develop

and work on enhancing risk management and systems in place. With the departure

of the Risk Manager, HBRC has engaged the services of David Nalder, an experienced

Risk Consultant with a background in local and central government. The

primary objective of this work has been to:

2.1. Increase the quality,

relevance, and awareness of HBRC’s risk profile and risk management

process at governance, executive and management levels

2.2. More directly link risk to

decision making, with explicit linkages between HBRC’s purpose and

commitments, major areas of uncertainty presenting both upside opportunity and

down-side threat, and controls/activities that manage these areas of

uncertainty/risk

2.3. Provide a simple and

transparent method of describing key areas of risk, consequences related to

this, critical controls, assurance, and related monitoring mechanism.

3. A review has

been undertaken to validate the strategic risk profile of HBRC by looking at

areas of risk identified by other organisations. Specific sources of information

were: the Office of the Auditor General’s

report into risk within local government; Department

of Prime Minister and Cabinet’s New Zealand national risk register;

LGNZ’s key risks/issues for local government;

and other material such as white papers and thought

leadership from external professional services consultancies, including PwC,

KPMG, EY, Deloitte, AON, Grant Thornton and others across NZ, Australia and the

UK. Pleasingly, common risk themes

identified were all reflected within the Enterprise Dashboard (strategic risk

profile) or supporting one-page management plans (risk assessments).

4. The delivery of the North

Island Weather Events (NIWE) programme (Infrastructure PMO) is critical to the

ongoing success of HBRC and this risk/uncertainty has been added to the

overarching risk profile for HBRC as a new risk (refer to Risk 22 - Rated

moderate). There is significant political pressure being applied to execution

timeframes for delivery. Ensuring there is a balance between political

pressure, winter weather for construction and community engagement will be

crucial to the success of the programme and for mitigating both reputational and

financial risks associated with non-delivery.

5. HBRC was the subject of a

procurement probity check in March 2024 for the Silt and Debris

taskforce. There were no material issues noted in processes supporting

the procurement of contractors for the further $40m funding received in

February 2024.

6. An incident report

pertaining to Holiday Payments has been escalated through to RAC this quarter

and will be considered in public excluded.

7. During March 2024, Hawke’s Bay Civil

Defence Emergency Management Group’s response to Cyclone Gabrielle (the

Mike Bush review) was released. The CDEM Group Joint Committee has formally agreed that

an independent role will be established to lead the remediation of the report’s

recommendations. It is expected that RAC will be provided with the plan and

timeline for actions on the recommendations for oversight and awareness only,

and that the Joint Committee will be accountable for approving and monitoring

the implementation of the work programme for the transformational change required.

Discussion

Risk Environment and Sentiment Surveys

8. The one-page Enterprise

Dashboard represents the strategic risk profile. This is intended to be a

live document with updates to reflect the changing priorities and risks for the

organisation. Since the last RAC meeting, this dashboard has been updated

to reflect feedback at that meeting and the transition from cyclone recovery to

the wider focus on future resilience to extreme weather events. Engagement has

been positive across the organisation.

9. Key insights on the

dashboard this quarter are:

9.1. The removal of the risk

around Impacts of cyclone and recovery. This risk was a point in time

and reflected the uncertainty at the time of creation of cyclone-related

matters such as categorisation, remediation funding, and insurance claim

activities. With the closure of Recovery as a separate matter at ELT,

this risk has now been replaced with the Effectiveness of the NIWE

Resilience programme, and a more general Effectiveness of Emergency

Management.

9.2. The small deterioration

(from low to moderate) for Effectiveness of governance and partnerships,

Our impact on the environment and Effectiveness of infrastructure

asset management. In part, Council officers believe this is due to

staff awareness and further consideration of risks since the creation of the

dashboard and supporting one-page management plans. In one respect this

is positive as it indicates greater clarity and transparency in defining risk

and how this is managed and causes officers to reconsider the extent to which

there are opportunities to increase rigour around how these areas are managed.

9.3. Effectiveness of Technology continues to be of shared

concern from ELT and councillors. With the recent appointment of a new Chief

Information Officer, renewed attention is being applied to getting the critical

controls and infrastructure in place. We expect, over time, this will improve

along with considered control improvements across our network and

infrastructure. Positive strides have been achieved with the

implementation of Techone in particular within the finance team.

9.4. All ELT members and ten

councillors have contributed to the sentiment survey this quarter, the results

of which will be considered in Public Excluded with the Risk deep dives.

Overall, there has been a marked increase in the general level of confidence

expressed by councillors since February, although there is a high degree of

divergence of views between individual councillors. Insights from this

include:

9.4.1. A relatively higher level

of concern in the mind of councillors than that of the ELT

9.4.2. A higher degree of

alignment of view exists at an ELT level than at Council

9.4.3. Amongst councillors, there

were very different viewpoints on common areas of risk/uncertainty – in

some cases, the overall level of confidence expressed by individuals in the

overall risk statements (i.e. trust and confidence from the community that HBRC

enables a healthy environment and a resilient and prosperous community) is much

higher that the aggregate of the individual areas of risk that contribute to

this. This suggested that councillors are more confident in HBRC’s

overall performance than the aggregate of the specific aspects that contribute

to this performance.

9.5. The consultation on the

Long Term Plan continues to generate public feedback and in some areas negative

sentiment (similar to all local authorities across NZ) due to the national and regional

planned rate rises. This is putting pressure on delivery teams (Finance

and Governance) and Communication and Engagement teams to ensure our community

has appropriate information. In part, this negative sentiment is reflected in

uncertainties shown across the councillor sentiment survey by amber ratings for

a number of risks, such as those relating to HBRC’s groups of activities

(e.g. Emergency Management and Transport Management), wider community

engagement (effectiveness of communication, consultation and engagement,

coordination and connectedness of activity and decision making across HBRC) and

ultimate outcomes (we keep our community safe / our impact on the environment).

9.6. A number of regulatory

settings are currently being reformed by Government with potential impacts on

Council’s business. These include the reform and replacement of the

Resource Management Act (during this term of Parliament), changes to national

direction (principally the National Policy Statement for Freshwater Management,

the National Poilcy Statement for Highly Productive Land, and the National

Policy Statement for Indigenous Biodiversity), and changes to the consenting

processes via the fast track regime currently before Parliament. Additional

changes are contemplated to the farm planning system. There is uncertainty

about the final shape of reform of which is reflected as a high risk on our

risk profile.

9.7. Officers have prioritised

the Regional Policy Statement as part of Kotahi and have focussed on the vision

and values work related to freshwater. These are no regrets areas of

work. Farm planning work is largely on hold. HBRC continues to work with

the regional sector through Te Uru Kahika to provide advice to Government and,

where appropriate, HBRC will submit to the select committee on proposed

reforms.

10. This quarter, deep dives

into the following specific areas of risk/uncertainty will be provided in

public excluded time.

10.1. Effectiveness of technology

10.2. Impact of external change

and reform

10.3. Effectiveness of the

investment strategy

10.4. Security, integrity and

privacy of information

10.5. Cyber security.

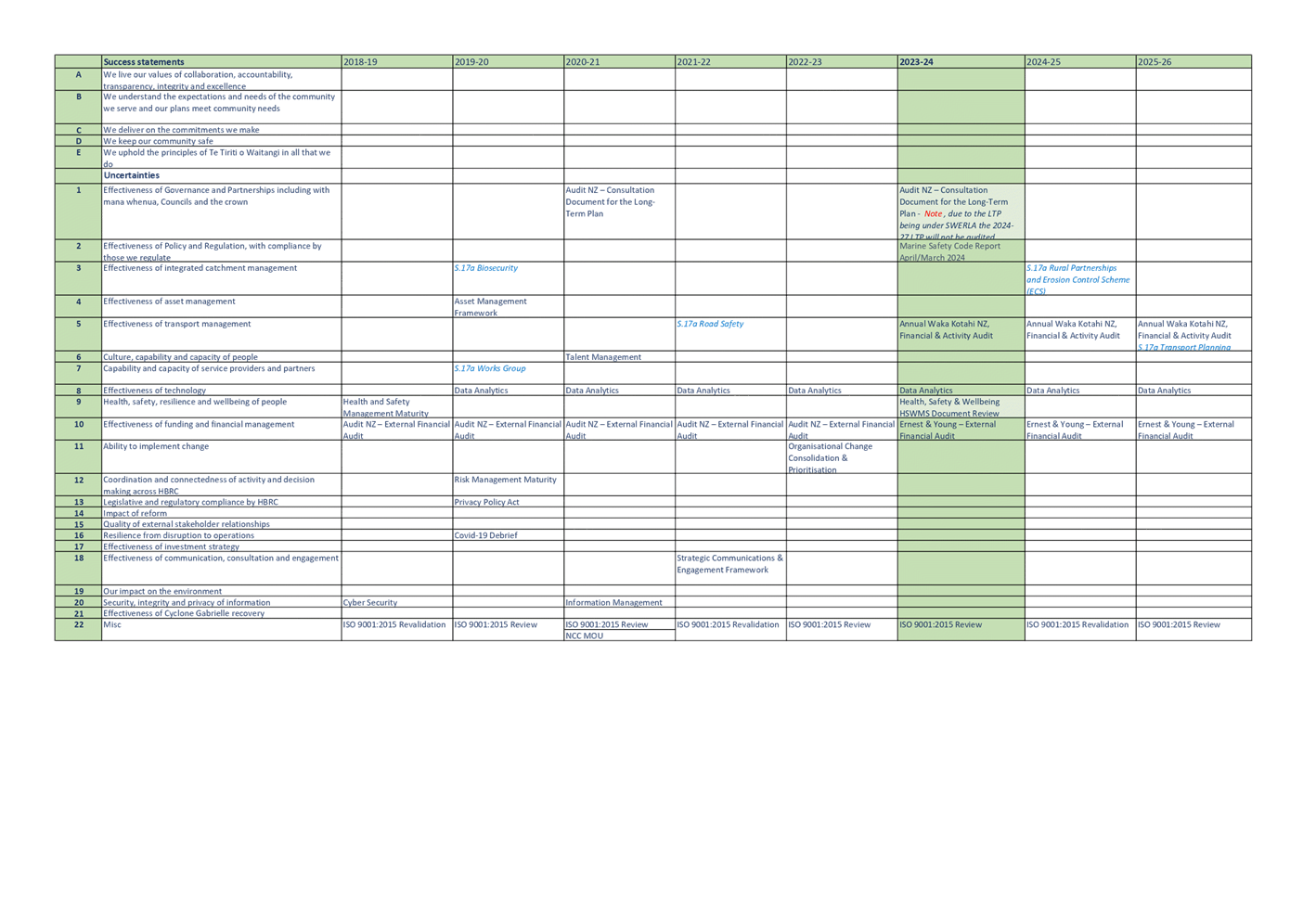

11. A proposed review and deep

dive schedule is attached and will be used to present information to RAC going

forward.

12. This is intended to give

councillors a common understanding of major areas of importance to HBRC

(purpose, success and uncertainties/risks tied to success) together with

transparency on the control environment underpinning this. This is

important to enable RAC to deliver on its governance obligation or ensuring

that there is an effective system of risk management and internal control in

place.

Assurance

Activities

Organisational Change and

Prioritisation Report

13. Recently Crowe, our

external assurance provider, released the final draft report for Organisational

Change and Prioritisation. (This was agreed within the Enterprise

Internal Audit Plan for 2022-2023.)

14. The scope of the review

looked at opportunities to strengthen decision-making to ensure organisational

change effectively drives the creation of value while ensuring the organisation

is protected from undue risk, e.g., impact on people, compliance, etc, which is

sometimes referred to as ‘risk in change’. (The audit did not

cover the strategic decision-making process on each individual organisational

change initiative and project management process as that was out of scope.)

15. While there was one high

priority finding observed (being that staff members interviewed had differing

interpretations of what a change initiative is), it is pleasing that the

auditors noted that the organisation has the correct tools to enable good

project management going forward. The main themes of the findings for

corrective action and improvement, include:

15.1. A lack of clear definitions

relating to change initiatives

15.2. A lack of formal policies

relating to change and project management

15.3. Development of a change

management methodology

15.4. Project management

requirements

15.5. Prioritisation of

activities.

16. Management will address

recommendations made with the owner being Group Manager Corporate Services.

Hawke’s Bay Civil Defence

Emergency Management Group’s response to Cyclone Gabrielle– Mike Bush

17. This review report was

finalised and released in March 2024, with the purpose of the independent

review being to assess the operational performance of the Hawke’s Bay

Civil Defence Emergency Management Group’s immediate response to Cyclone

Gabrielle, with a particular emphasis on the systems and processes, and roles

and responsibilities of Group members and partners.

18. The formal report has now

been received. A sub-working group of the Coordinating Executive Group (CEG)

has been formed and will provide recommendations on the short-term

recommendations and actions to be undertake to the CEG initially, to then be

presented to the Joint Committee along with a recommendation on an appropriate

structure to successfully implement the review outcomes for the future.

The intention is that this will be presented at the Joint Committee’s

July meeting, if not earlier.

19. Further recommendations are

expected to be relevant to Hawke’s Bay Civil Defence Emergency Management

from the Report of the Government Inquiry into the Response to the North

Island Severe Weather Events. At the time of writing of this paper there

was no indication of how this report will impact other recommendations and what

remediation will be required.

Ernst and Young – Half Year

Financial Statement Review

20. Ernst and Young, our

external auditors are currently onsite performing mid-year controls review as

part of the half year Financial Statement audit. This review involved updating

understanding of processes and controls as well as testing transactional

information for 8 months of the year for certain accounts. No issues have been

identified to date.

21. Last year HBRC received a

qualified audit opinion, primarily based on the decision by HBRC not to

formally value infrastructure assets (due to valuation and impairment work

continuing post cyclone with uncertainty). Formal external valuations

will be completed this year.

Probity Check – Silt and Debris

Taskforce

22. A probity check on the

contracting for the Silt and Debris taskforce was undertaken in March 2024 in

response to concerns raised by the public to government officials pertaining to

potential conflicts or inappropriate controls supporting the programme. In

offering further funding of $40m to the Silt and Debris Taskforce, central

government requested a probity check be undertaken by McHale Group – a

public sector assurance company.

23. While a formal report is

yet to be received, initial email correspondence with McHale Group has

concluded “From a probity perspective and from HBRC’s perspective,

the current tender process is appropriate, justified, and appropriately

approved in relation to supporting the response to the original emergency

situation. The very tight response timeframe (5 ½ working days plus a

weekend) within which companies were required to respond to the tender

invitation was justified within the context of emergency procurement although

with hindsight, improvements could have been made to the process.“

24. This outcome is positive

and further supports other assurance work HBRC has received across the Silt and

Debris programmes, in particular the Agreed-Upon Procedure work

undertaken by PricewaterhouseCoopers in December 2023 specifically looking at

how the Silt and Debris Taskforce operated within the boundaries of eligibility

criteria and the allocation of jobs within the programme. No material issues

were noted in this review.

Decision-making process

25. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that:

25.1. The decisions of the

Committee are in accordance with the Terms of Reference and decision-making

delegations adopted by Hawke’s Bay Regional Council 30 August 2023,

specifically the Risk and Audit Committee shall have responsibility and

authority to provide advice and recommend actions,

responses and changes to the Council about risk management, assurance

activities, governance oversight and internal control matters, including

external reporting and audit matters. Specifically this includes:

25.1.1. The robustness of

Council’s risk management systems, policies, practice and assurance

processes. (1.1)

25.1.2. Review whether Council

management has a current and comprehensive risk management framework and

associated procedures for effective identification and management of the

Council’s significant risks in place. (2.1)

25.1.3. Undertake periodic

monitoring of corporate risk assessment, and the internal controls instituted

in response to such risks. (2.2)

25.2. Because this report is for

information only, the decision-making provisions do not apply.

Recommendations

That

the Risk and Audit Committee receives and considers the Risk Management

update staff report.

Authored by:

|

David Nalder

Acting Risk Manager

|

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1

|

Risk management update 1 May 2024

|

|

Under Separate Cover

|

Hawke’s

Bay Regional Council

Risk

and Audit Committee

1 May 2024

Subject: Treasury Compliance Report

for the period 1 January - 31 March 2024

Reason for report

1. This item provides

compliance monitoring of Hawke’s Bay Regional Council’s (HBRC)

Treasury activity and reports the performance of Council’s investment

portfolio for the quarter ended 31 March 2024.

Overview of the quarter ending 31 March 2024

2. At the end of the quarter

to 31 March 2024, HBRC was compliant with all measures in its Treasury Policy

with the exception of the counterparty risk policy as a result of the

management of recovery funds.

3. During the quarter HBRC

appointed credit rating agency Fitch to provide a public credit rating for

Council and HBRC is expecting an outcome before the end of April. A public

notice will be issued by Fitch on the outcome.

4. The effects of Cyclone

Gabrielle and its recovery continue to impact both cash balances and borrowing

requirements. Additional ongoing borrowing to fund recovery will continue

over the next 3-4 years, while proceeds from insurance claims are slower than

earlier forecast.

Background

5. Council’s Treasury

Policy requires a quarterly Treasury Report to be presented to the Risk and

Audit Committee. The policy states that the Treasury Report is to include:

5.1. Treasury exceptions report

5.2. Policy compliance

5.3. Borrowing limit report

5.4. Funding and liquidity

report

5.5. Debt maturity profile Interest

rate report

5.6. Investment management

report

5.7. Treasury investments

5.8. Cost of funds report, cash

flow and debt forecast report

5.9. Debt and interest rate

strategy and commentary

5.10. Counterparty credit report

5.11. Loan advances.

6. The Investment Management

report has specific requirements outlined in the Treasury Policy. This requires

quarterly reporting on all treasury investments plus annual reporting on all

equities and property investments.

7. In addition to the Treasury

Policy, Council has a Statement of Investment Policy and Objectives (SIPO)

document setting out the parameters required for funds under management for the

HBRC Long Term Investment Fund and the Future Investment Fund.

8. Since 2018, HBRC has

procured treasury advice and services from PricewaterhouseCoopers (PwC) who

provide quarterly Treasury reporting for internal monitoring purposes.

Treasury

exceptions report and policy compliance

9. As at 31 March 2024 all

counterparty exposures were within limits.

10. There were no Investment

Limit breaches in this period relating to funds held by HBRC for its normal

activities.

11. However, during the quarter

to 31 March 2024, there continued to be a number of Investment Limit breaches

relating to cyclone recovery funding received from the Crown and held in the

Jarden and BNZ Recovery accounts. During this quarter total recovery

funds held ranged from ~$32m to ~$78m. HBRC continues to mitigate

potential risks by Jarden managing their funds across both ANZ and Westpac,

meaning funds are split across 3 main registered NZ banks.

12. Council officers maintain

the view that management of Recovery Funding held on behalf sits outside

HBRC’s treasury policy for normal operations, and although reported on,

does not cause a formal breach to limits.

13. This will remain an issue

while HBRC works through the Silt and Debris recovery on behalf of the

Crown. As HBRC moves into the FRP programme with the Crown we expect to

manage cashflow on a monthly basis.

Funding

and Liquidity

14. To ensure HBRC has the

ability to adequately fund its operations, current policy requires us to

maintain a liquid balance of “greater than 10% of existing total

external debt”. Current liquidity ratio is 13.33% and therefore meets policy.

15. The following table reports

the cash and cash equivalents on 31 March 2024.

|

31

March 2024

|

$000

|

|

Cash

on Call

|

3,192

|

|

Short-term

bank deposits

|

―

|

|

Total

Cash & and Deposits

|

3,192

|

16. To manage liquidity risk,

HBRC retains a Standby Facility with BNZ. This

facility provides HBRC with a same-day draw-down option, to any amount between

$0.3-$10.0m, and with a 7-day minimum draw period.

Debt

Management

17. On 31 March 2024 the

current external debt for the Council group was $103m which includes $4.3m of

pre-funded debt ($119.9m including loan from HBRIC).

18. Since Q2 there has been no

additional new borrowing. However, during this quarter we have continued

to push our short-term borrowing out in anticipating of a credit rating,

allowing us to capture lower interest rates.

19. The following summarises

the year-to-date movements in Council’s debt position.

Summary of HBRC Debt

|

|

HBRC only

$000

|

HBRC Group

$000

|

|

Opening Debt – 1 July 2023 – excl HBRIC

Loan

|

84,830

|

84,830

|

|

New Loans raised*

|

84,500

|

84,500

|

|

Less amounts repaid

|

(66,015)

|

(66,015)

|

|

Closing Debt 31 March 2024 (excluding HBRIC

loan)

|

103,315

|

103,315

|

|

Plus opening balance - loan from HBRIC

|

16,663

|

―

|

|

Total Borrowing as at 31 March 2024 *

|

119,978

|

103,315

|

*Includes pre-funding

debt of $4.3m.

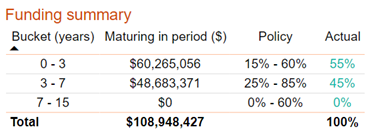

20. Council’s debt

maturity profile remained compliant, however short-term drawdowns continue to

put pressure on the policy limit in the 0–3-year bucket. This is

expected to remain high while the credit rating process is underway. We

will then look to transition short-term debt out to longer term, utilising any

insurance proceeds to minimise future funding. The table below includes

our $10m BNZ overdraft in total debt.

Funding

summary

21. HBRC had no new borrowing

in Q3 but rolled over $25m short term borrowing. We anticipate relieving

the pressure on the 0–3-year bucket by converting short-term debt to long

term after the credit rating process is complete.

22. HBRC officers are currently

investigating the options of ‘Green Loans’ with LGFA, as an

alternative to standard bonds. These are available to fund sustainability

projects that promote environmental and social wellbeing, or act on climate

change and reduce greenhouse gas emissions. Projects that fit these

criteria attract lower interest rate charges than standard LGFA bonds.

23. Any insurance or NEMA

proceeds will be used to offset further funding requirements anticipated in the

new financial year.

Borrowing

limits

24. Council continues to

monitor and work within the agreed borrowing limits set by both Council and the

LGFA.

Interest

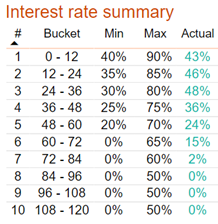

rate risk

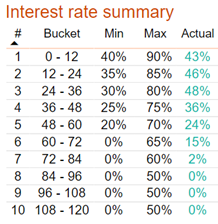

25. Council currently holds

$50m in fixed rate instruments, hedging 46% of current external debt, and

remains compliant to policy. This is based on the draft FY2025-2027 LTP

plan.

Managed

funds

26. Total Investment Fund

portfolios capital at 31 March 2024 is $167m. Adjusted for inflation this is

$0.938m below the inflation-adjusted contribution target. No divestments have

been made from managed funds this year.

27. Based on results to date,

the current fund structures are not sufficient to deliver the returns required

to meet Council’s requirement. This is being addressed by the

updates to the Investment Strategy and the transfer of management of these

assets to HBRIC which is currently undertaking an RFP process for new investment

managers.

28. Council currently budgets

separately for revenue from directly-held managed funds and those held by

HBRIC. HBRIC is required to deliver an overall portfolio return by way of an

annual dividend agreed through an annual Statement of Intent. The composition

between revenues from managed funds and other sources such as Port dividends,

is up to the HBRIC board. While the Council budgeted to receive $10.9m in

dividends from HBRIC within the FY 2023-2024, Council has received only $3.9m

to date due to reduced earnings from the Port. It is anticipated the overall

dividend will fall short of the Council budget for the year.

29. The following table summarises the fund balances at the

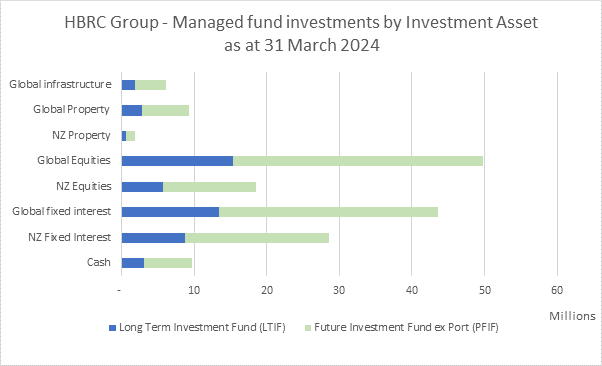

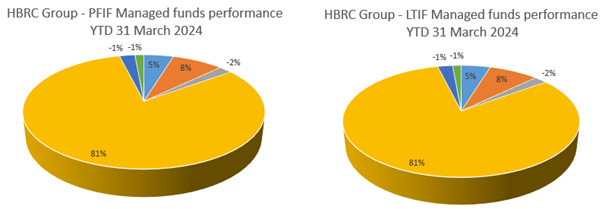

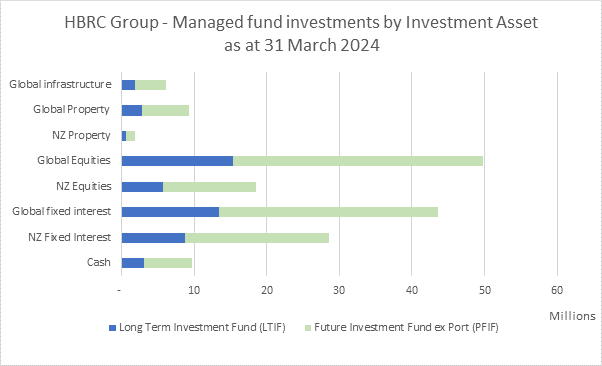

end of each period and the graph illustrates the asset allocations within each

fund at 31 March 2024.

|

|

30 Sept 2023

|

31 Dec 2023

|

31 Mar 2024

|

|

Fund Balances HBRC

|

$000

|

$000

|

$000

|

|

Fund Balance HBRC

|

108,038

|

114,407

|

118,752

|

|

Capital Protected Amount HBRC (2% compounded since

inception)

|

117,124

|

117,709

|

118,298

|

|

Current HBRC value above/(below) capital protected amount

|

(9,086)

|

(3,302)

|

(454)

|

|

Funds Balances (Group + HBRIC)

|

|

Long-Term Investment Fund (HBRC)

|

47,164

|

49,975

|

51,844

|

|

Future Investment Fund (HBRC)

|

60,874

|

64,432

|

66,908

|

|

Total HBRC

|

108,038

|

114,407

|

118,752

|

|

Plus HBRIC Managed Funds (FIF)

|

44,415

|

47,138

|

48,810

|

|

Total Group Managed Funds

|

152,453

|

161,545

|

167,563

|

|

Capital Protected Amount (2% compound inflation)

|

166,828

|

167,662

|

168,500

|

|

Current group value above/(below) protected amount

|

(14,375)

|

(6,117)

|

(938)

|

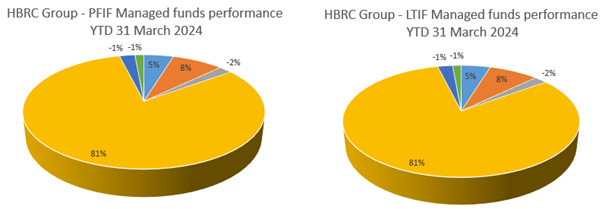

30. Financial markets have

continued to rally this quarter and as at 31 March 2024 the consolidated

portfolio value was up 7.09% on 30 June 2023. Fund performances have also

improved this quarter, although much of this is in unrealised gains and

therefore subject to market volatility. Under current policy all cash returns

reinvested.

Cost

of funds

31. Rolling 12 months to 31 March

2024, Gross Cost of Funds (COF) was 4.15% and Net COF was 3.99%.

HBRIC

Ltd

32. In accordance with Council

Policy, HBRIC provides separate quarterly updates to the Corporate and

Strategic Committee.

Decision-making process

33. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

33.1. The decisions of the

Committee are in accordance with the Terms of Reference and decision-making

delegations adopted by Hawke’s Bay Regional Council 30 August 2023,

specifically the Risk and Audit Committee shall have responsibility and

authority to:

33.1.1. Review the Council’s revenue and expenditure

policies, amongst others, and the effectiveness of those policies in ensuring

limited risk is generated. (1.3)

33.2. Because this report is for

information only, the decision-making provisions do not apply.

Recommendation

That

the Risk and Audit Committee receives and notes the Treasury Compliance

Report for the period 1 January – 31 March 2024.

Authored by: Approved

by:

|

Tracey O'Shaughnessy

Treasury & Investments

Accountant

|

Susie Young

Group

Manager Corporate Services

|

Attachment/s There are no attachments

for this report.

Hawke’s

Bay Regional Council

Risk

and Audit Committee

1 May 2024

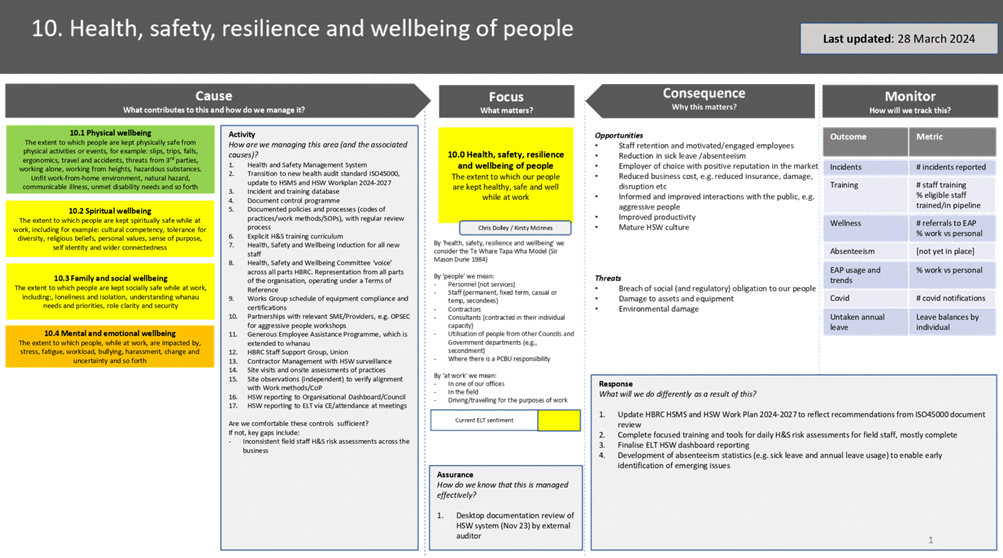

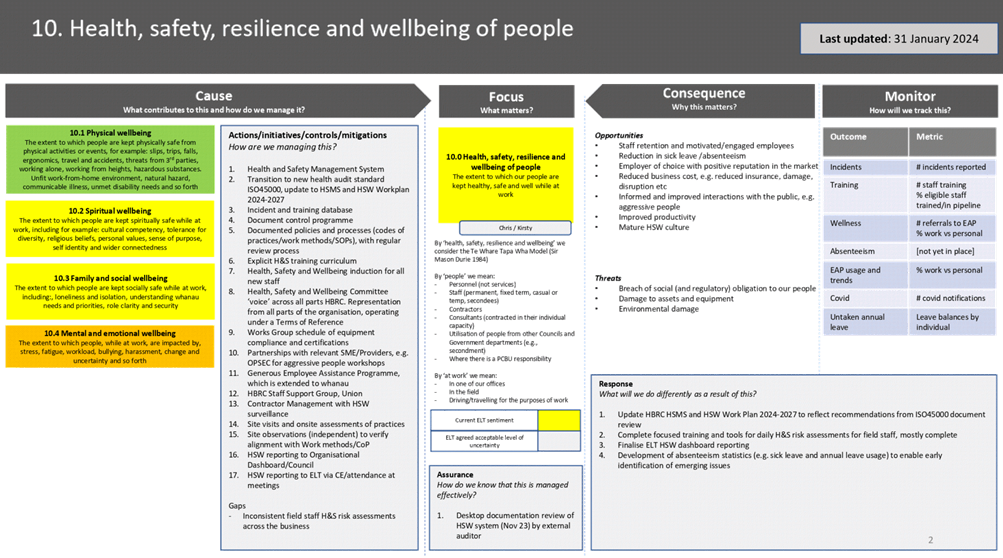

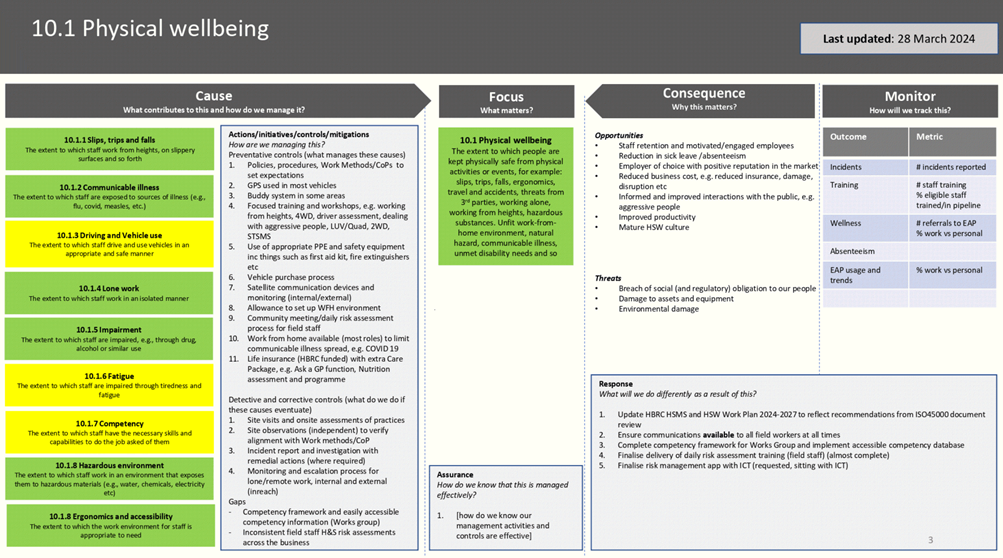

Subject: Health, Safety and Wellbeing

update

Reason for report

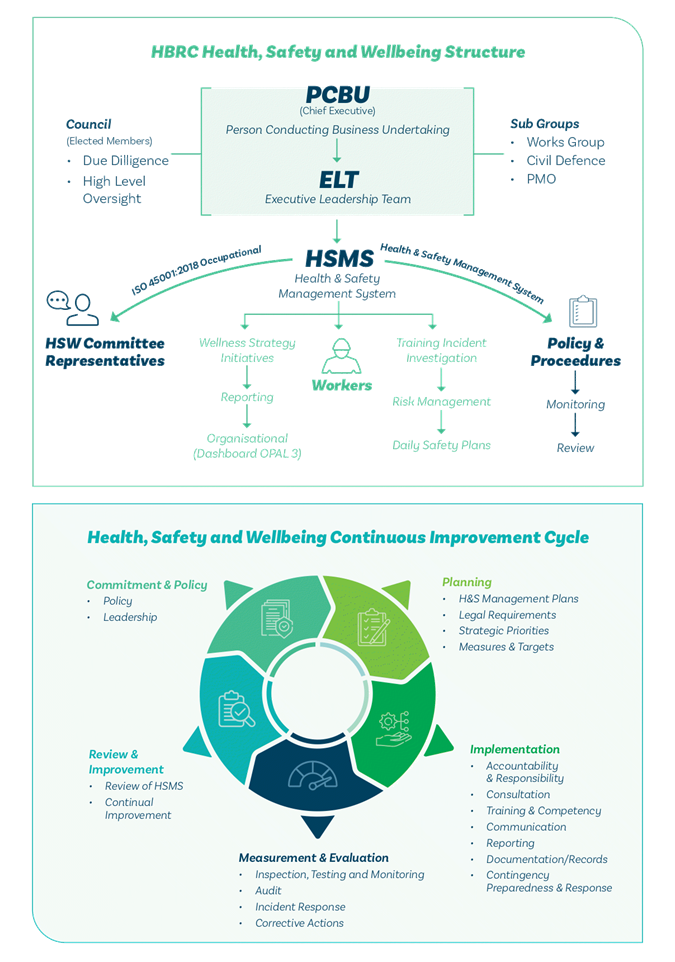

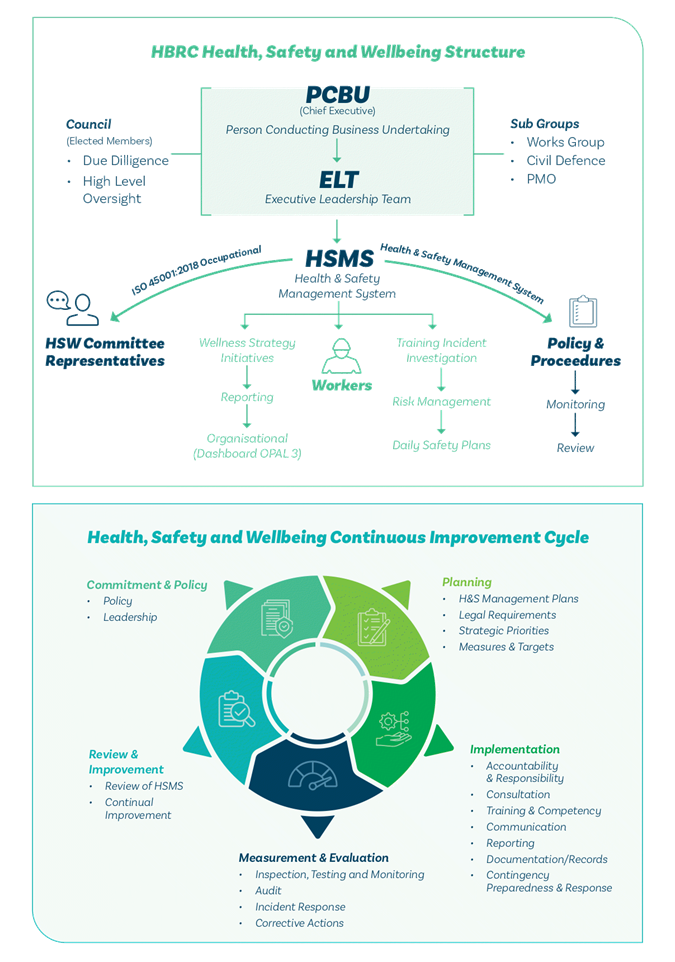

1. This item provides the

Audit and Risk Committee with:

1.1. An update on progress

transitioning the Council’s Health, Safety and Wellbeing Management

Framework (HSWMF) to comply with the ISO 45001:2018 Occupational health and safety management

systems requirements,

including the findings of the desktop review.

1.2. An overview of HBRC’s

HSWMF including the roles of governors and Council staff, and H&S incident

reporting.

Executive

Summary

2. The HSW Team Leader

reported to the Risk and Audit Committee in October 2023 on the intended alignment of the HBRC Health, Safety and Wellbeing

Management System (HSWMS) with the ISO45001 framework,

including ongoing assurance over Health and Safety matters. This item provides

a summary of findings of the ECAAS Certification’s Gap Analysis and the report itself is

attached.

3. The purpose of providing an

explanation of the Council’s health, safety and wellbeing system, is to

provide a broad understanding of how the system works.

Background

4. From 2001 to 2019

HBRC’s HSWMS was audited and certified under the ACC Workplace Safety

Management Practice (WSMP) audit standard. The WSMP audit standard aligned with

AS/NZS 4801:2001, the joint Australia/New Zealand Standard for Occupational

Health and Safety Management Systems. While organisations may have sought

certification under AS/NZ4801 or OHSA 18001, this was generally in response to

parent company and/or customer requirements and not common. In terms of market

acceptance within NZ, ACC WSMP was the ‘default’ standard.

5. Despite the impacts of

Covid 19 lockdowns of 2020-2021 and the staffing levels within the HSW team,

HBRC’s HSWMS was maintained at a level commensurate with WSMP Tertiary.

This was verified via an internal review conducted in 2022.

6. In 2022, the HSW Team and

ELT agreed to the need for a new HSW audit programme to replace the defunct ACC

WSMP and investigations to determine which might best suit HBRC.

7. As an initial step in the

investigation, the HSW team sought information from the wider health and safety

community, which included other councils such as Napier City and Horizons

(Manawatu-Whanganui Regional Council), about their progression from ACC WSMP

into other audit programmes. From the discussions held and evidence observed,

the majority had maintained their HSMS (updated as relevant to meet any

applicable legislative or industry changes) but had not progressed into another

certification programme. Organisations who had moved to another certification

programme undertook one of the following options:

|

Programme

|

Programme Status

|

Certification availability

|

|

AS/NZ4801

|

Available superseded until

13 July 2023. After 13/7/23 refer to ISO45001.

|

N/a

|

|

OHSA 18001

|

Withdrawn replaced by

ISO45001

|

N/a

|

|

ISO45001

|

Current

|

Yes

|

|

Safe+

|

Current

|

No* outcome defined by 3 performance levels

|

8. In October 2023 it was

agreed that a review of the current health and safety management systems would

be undertaken with the intention of moving to ISO 45001 Occupational health and

safety management systems requirements as the Council’s new HSW audit programme.

The review was undertaken in November 2023 and the findings and actions to

remediate those are outlined following and contained in attachments 1 and 2.

ISO

45001 Gap analysis

9. The ECAAS Certification’s Gap Analysis occurred

on 28 and 29 November 2023 with the review report being provided to the CE (as

the PCBU) in December 2023 for discussion at the 19 February 2024

Executive Leadership Team meeting.

10. Key findings of

the review, and actions to address them, include:

10.1. Consultation

and Participation – the HSW Committee is well established, however, the Terms

of Reference need to be made more explicit.

10.1.1. After

consultation with the HSW Committee, this is now complete. The HSW Committee

will have further opportunities to consult and participate in the HSWMS, and

for this to be evidenced as per the requirements of the standard.

10.2. Internal Audit

– future internal audits will need to be conducted against ISO45001.

10.2.1. The document

review forms part of the HSW internal audit programme, and will serve to meet

the requirements (in the first instance) as we move forward.

10.3. Legal

requirements – Work Methods need to detail the exact requirements of

10.3.1. HBRC uses Work

Methods (previously called Codes of Practice) to outline the procedure,

inherent risks, and the controls related to a specific task. Each Work Method

(WM) refers to applicable legislation, industry guidelines, standards, Approved

Codes of Practice, etc. Most of the WM do not detail

the exact requirements of these, e.g. will refer to Civil Aviation Rules

but not specify which part of the rules apply. There is no central repository

for this information. The knowledge for the level of detail the standard

requires very likely exists within the HBRC, but it will take some time and

resource to map out.

10.3.2. As the

specifics are mapped, HBRC must also evaluate its compliance with the

requirements. Compliance evaluation outcomes will feed into the requirements

for monitoring, measurement, analysing, evaluation, and

management review.

10.4. Management of

change

10.4.1. The current

change management process will need to be redefined in line with ISO45001

requirements.

10.5. Non-conformances

& continuous improvement

10.5.1. Under ISO45001,

non-conformances are not limited to just incidents (injury, damage, near miss

etc) but also include any instances of not meeting the performance measures of

the HSWMS itself. A process to record HSWMS non-conformances has been included

in the Incident Report Form and will also feed into the requirements for

monitoring, measurement, analysing, evaluation, and management review.

10.6. Objectives

– HBRC needs to establish HSW objectives at relevant functions and

levels (PDP).

10.6.1. Objectives for

the HSW Committee have recently been finalised, and the HSW Team objectives are

included in the 2024 and 2025-2027 work plans.

10.6.2. Objectives for

management or similar will need to be scoped and will be related to things such

as completing investigations of incidents or closing out incidents within a

specified time period.

10.6.3. The first two

objectives are part of the incident management process already, albeit without

the specific measures. Including measures (objectives) will contribute to the

improvement of HBRC’s HSWMS, provide more structure and accountability

for the incident management process, and feed into the criteria HBRC uses to

monitor the performance of the HSWMS.

10.7. Monitoring,

measurement, analysis, evaluation and management review – HBRC

has established safety performance reporting, and a new HSW performance

dashboard is in the process of being developed.

10.7.1. HBRC had

established safety performance reporting; it was also noted that a new HSW

performance dashboard was in the process of being developed. This area

will need further development to ensure that not only is HSW performance being

measured, monitored, evaluated, and updated, but that also the performance of

HBRC’s HSWMS is being measured, monitored, evaluated and updated.

10.7.2. The Management

Review process (of the HSWMS) will need to be updated to capture the above

points and any other specifics required for ISO45001.

11. Being based on

the ACC WSMP standard, it was expected that updates to the HBRC HSWMS would be

required to meet ISO45001 requirements. However, not meeting requirements of a

standard does not mean an organisation is not meeting the intent of relevant

legislation, e.g. The Health and Safety at Work Act 2015.

12. With the HSW

Strategy and Workplan due for renewal, the timing is opportune to update the

HSWMS as part of the new HSW 2024-2027 Strategy and Workplan.

HBRC’s Health, Safety and Wellbeing Management Framework

Overview

13. The HSWM system that HBRC

operates under is a framework to support and maintain a level of employee

safety, health, and wellbeing excellence. It enables the organisation to

identify, manage and reduce risk to create a safe working environment for

everyone under our umbrella – staff, volunteers, contractors and the

wider public. Underpinning this framework is leadership, management, a vast

number of policies, work methods (procedures with risk controls), staff

participation, training, investigations, and assurance.

14. HBRC has a system of

continuous improvement and reviews to ensure that the health, safety, and

wellbeing of all is an evolving process – supported by a work plan that

is reviewed annually and agreed by the Executive Leadership Team (ELT) then signed

off by the Chief Executive (CE).

15. Overarching the HSW work

plan is the Health, Safety and Wellbeing Strategic Plan (HSWSP), which is due

for its 3-yearly update. The 2021-2024 HSWSP will be updated for acceptance by

the ELT and the CE before being presented to Council in July 2024. The

underpinning HSW work plan is currently being updated to incorporate the desk

top review recommendations and updates to general health, safety and wellbeing

objectives for the next 3 years and will be presented to the CE and ELT for

approval.

Role of Council governors and management

16. The

difference between Governance and Management, in the simplest terms, is that governance is responsible for oversight and planning while

management takes care of the daily operations, for example:

16.1. HBRC

governors and ELT sign off the HSW Strategy every 3 years.

16.2. The

HSW Team Lead reports to ELT when required as well as in future, presenting a

monthly HSW dashboard with metrics (under development).

16.3. The

HSW team updates the HBRC Organisational Performance report every 3 months

(OPAL3) which includes incidents, training, and wellbeing which ELT and

governors have access to.

16.4. A

monthly Health

Safety and Wellbeing of people report is part of the Risk and Assurance Maturity work

programme as a live document with the Asset Management Group Manager as the

risk champion. This document is accessed by ELT and presented to the Risk and

Audit Committee by David Nalder (Consultant).

HBRC health and safety incident reporting

17. An incident form (PINC) is

used to record all health, safety or wellbeing incidents and allows for a single process across Council to manage

reportable events. An event can

be an accident, near miss, incident,

complaint, work related injury or illness, or property damage. All events must be notified immediately, or as soon as

reasonably practicable. As soon as the event is lodged in the HSW system,

notifications go to the reporting Group Manager, direct manager and HSW.

18. Incidents are investigated

by the HSW team in conjunction with the worker, the person they report directly

to and their Manager. This includes actions required to minimise the likelihood

of the event (or a similar event) happening again and a review of current controls,

policy or Work Method if the event is linked to a risk/hazard that is already

being managed. If additions or amendments to policies or the Work Method are required,

these will be discussed with all

relevant staff immediately and training will be provided if the risk/hazard

process or controls change. Any

changes are circulated back through the HSW Committee and circulated through

group meetings and internal communications (Snappy and Team Connect).

19. All incident reports are

collated monthly for reporting to the wider business and presented at all group

meetings. Quarterly updates are presented to the Health, Safety and Wellbeing

Committee, the Executive Leadership Team and, through the Organisational

Performance Report, the Corporate and Strategy Committee.

Financial and resource implications

20. The transition to align

with ISO45001 is

an ambitious piece of work, however, at this stage there are no financial or

resource implications to consider.

Next steps

21. Recommendations from the ECAAS

Certification Gap Analysis will be incorporated into the HBRC HSW Work Plan for

2024-2027. This is underway but is an extensive piece of work, alongside the

general HSW objectives in the workplan for the HSW team. This will take more

than 12 months to change, document, socialise, and embed before a further

review of documentation or gap analysis can be considered.

22. The Health, Safety and

Wellbeing Strategy for 2024-2027 will be updated and presented to ELT and RAC

for approval.

23. ECAAS

Certification’s Gap Analysis recommendations will be reported via

the Audit Assurance Dashboard (similar to attachment 2), to update RAC

quarterly on progress.

Decision-making process

24. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

24.1. The decisions of the

Committee are in accordance with the Terms of Reference and decision-making

delegations adopted by Hawke’s Bay Regional Council 30 August 2023.

The Risk and Audit Committee has responsibility and authority to:

24.1.1. provide advice and

recommend actions, responses and changes to the Council about risk management,

assurance activities, governance oversight and internal control matters,

including external reporting and audit matters. Specifically, this includes:

24.1.1.1. the appropriateness of controls

to safeguard the Council’s financial and non-financial assets, the integrity

of internal and external reporting and accountability arrangements. (1.2)

24.1.1.2. Council’s compliance

with applicable laws, regulations, standards and best practice guidelines. (1.5)

24.1.1.3. receive the internal and

external audit report(s) and review actions to be taken by management on

significant issues and recommendations raised within the report(s). (2.8)

Recommendations

That the Risk and Audit Committee:

1. Receives and considers the Health,

Safety and Well-being update staff report.

2. Confirms that the actions

taken to address the ECAAS Certification Gap Analysis findings are adequate in the

circumstances explained.

Authored by:

|

Kirsty McInnes

Team Leader Health Safety &

Wellbeing

|

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1

|

ECAAS HSWMS Gap Analysis Nov23

report

|

|

Under Separate Cover

|

|

2⇩

|

ISO45001 Document Review

recommendations

|

|

|

|

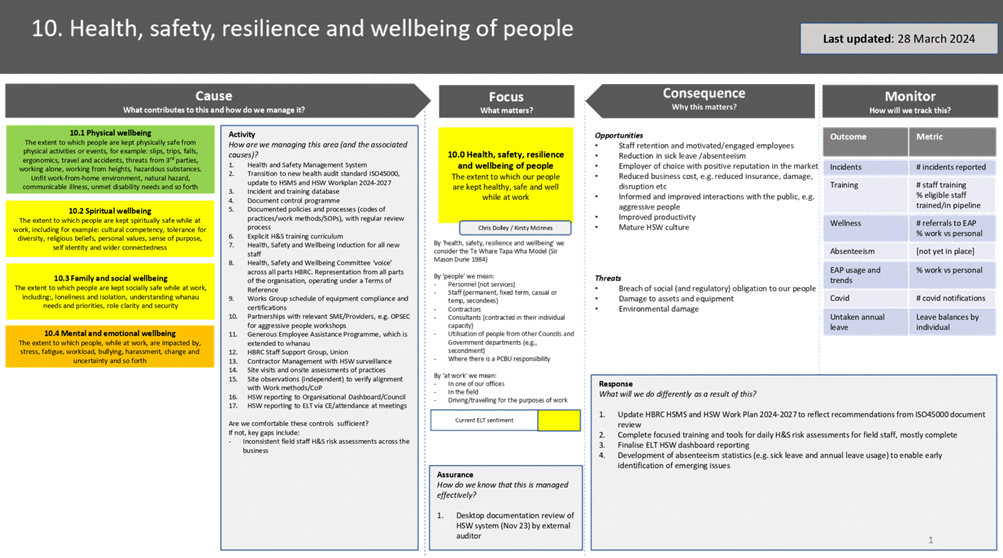

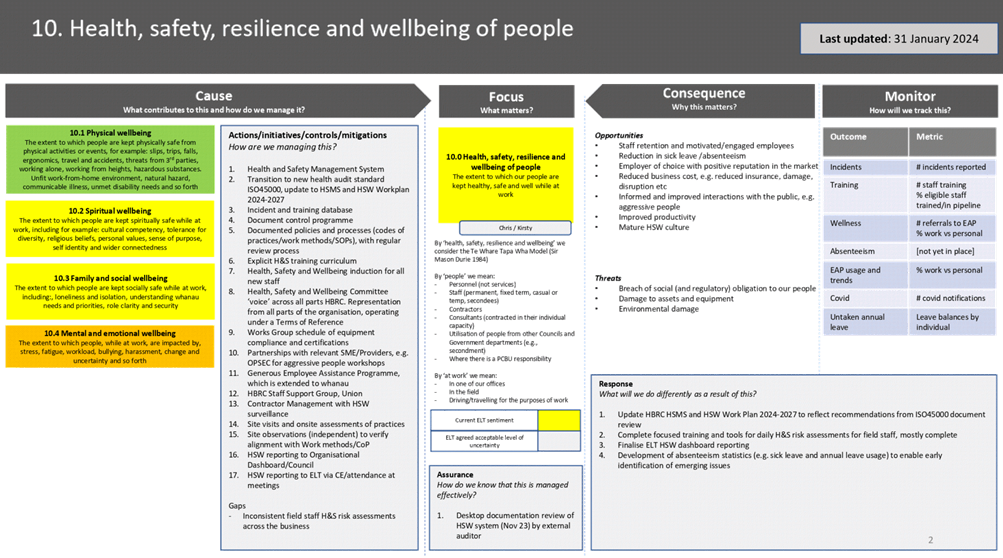

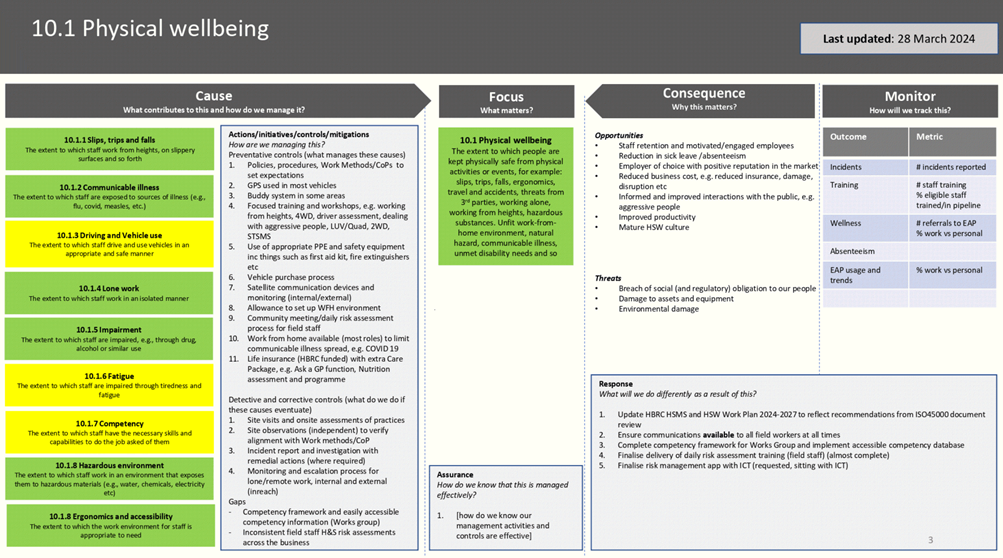

3⇩

|

Health and Safey on a Page

|

|

|

|

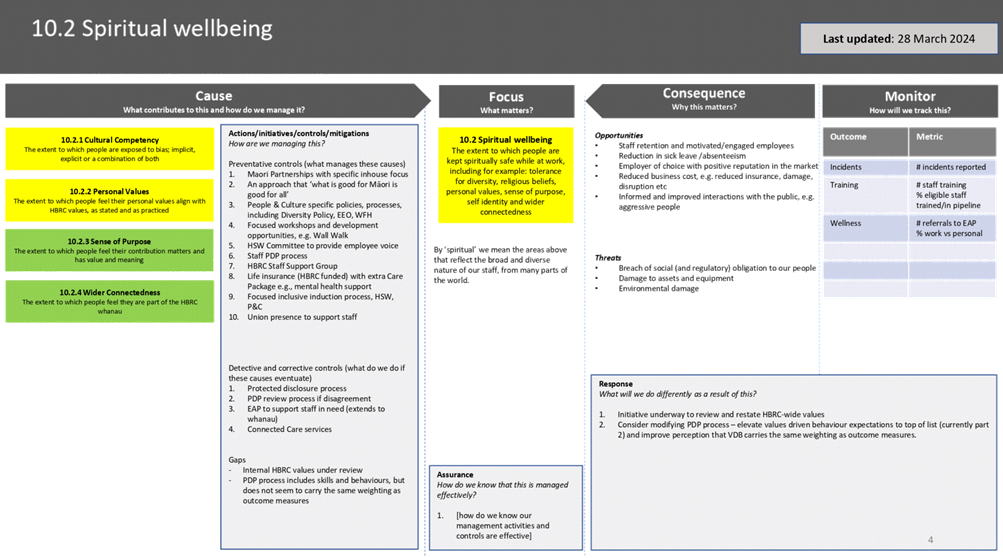

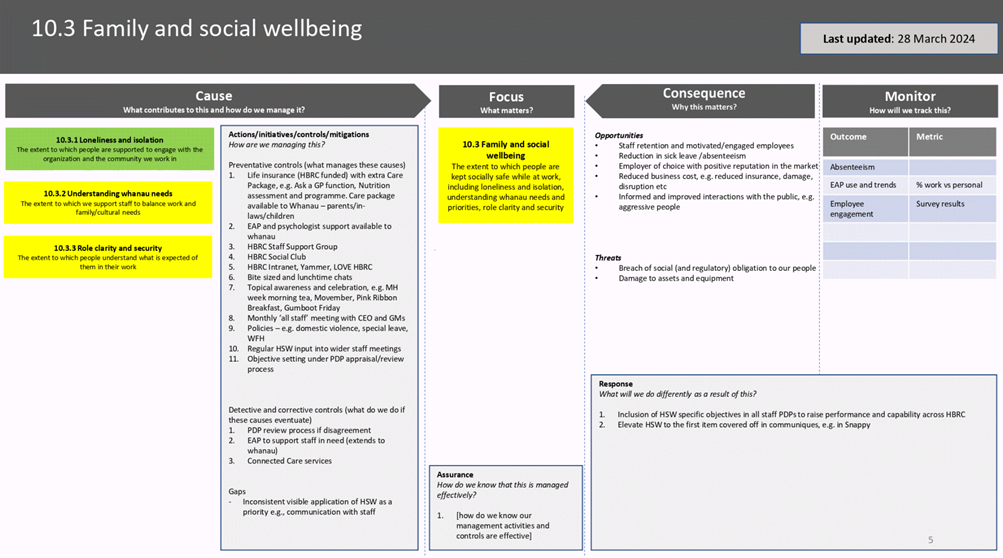

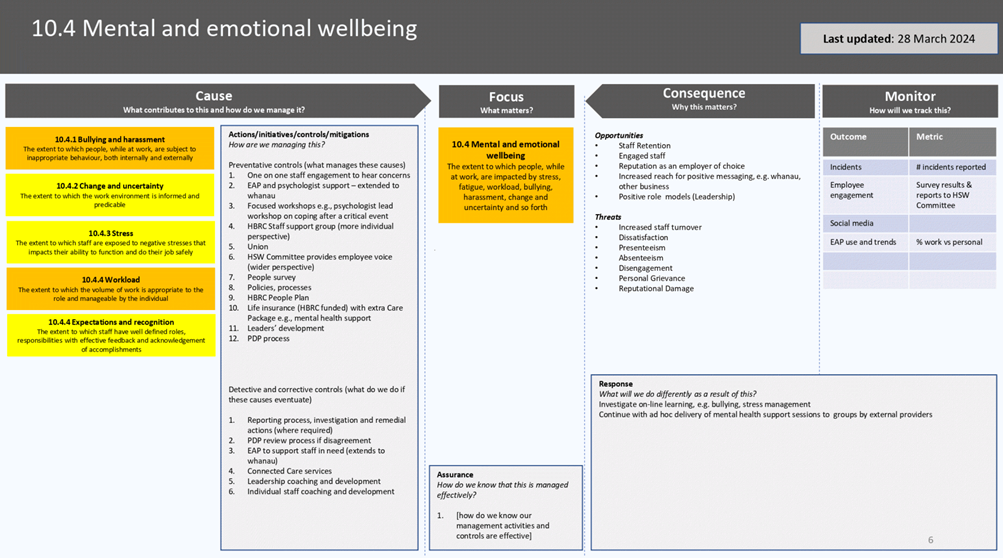

4⇩

|

Health, safety, resilience and

wellbeing of people - One-page Risk Management Plan

|

|

|

|

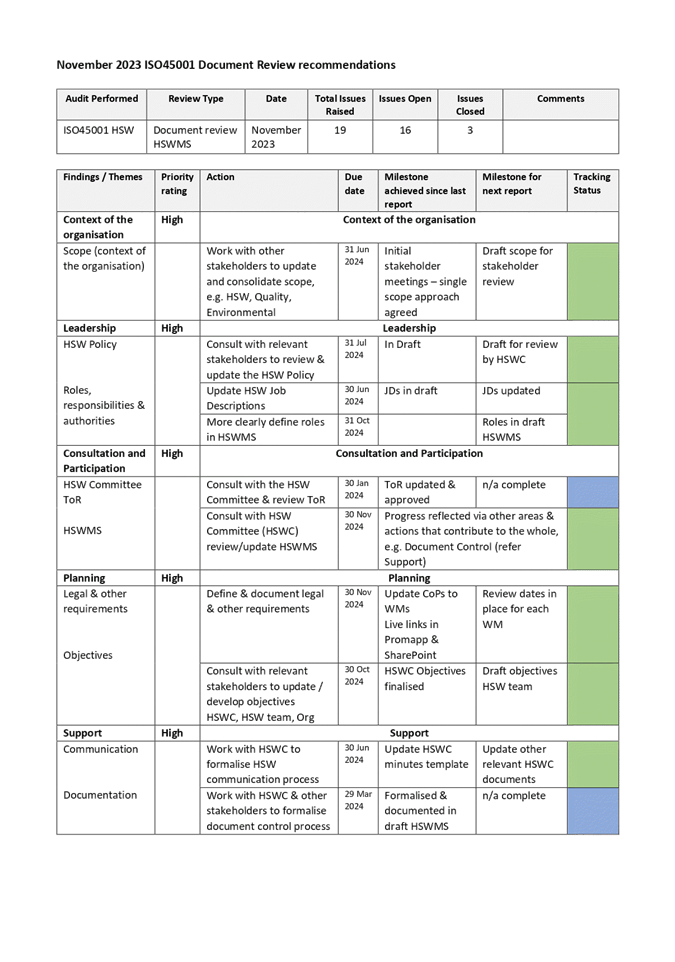

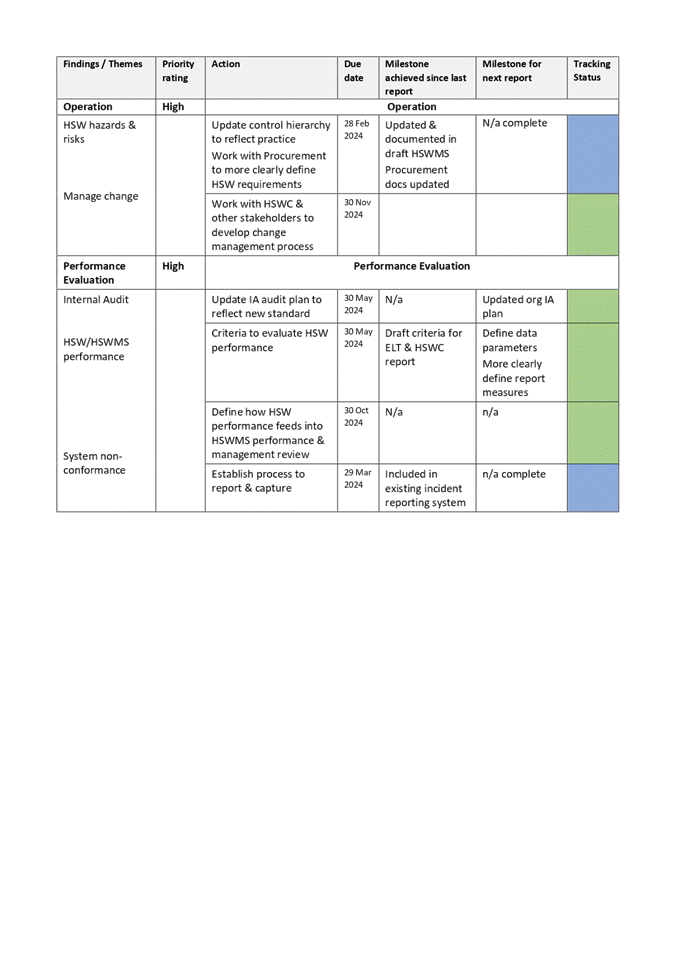

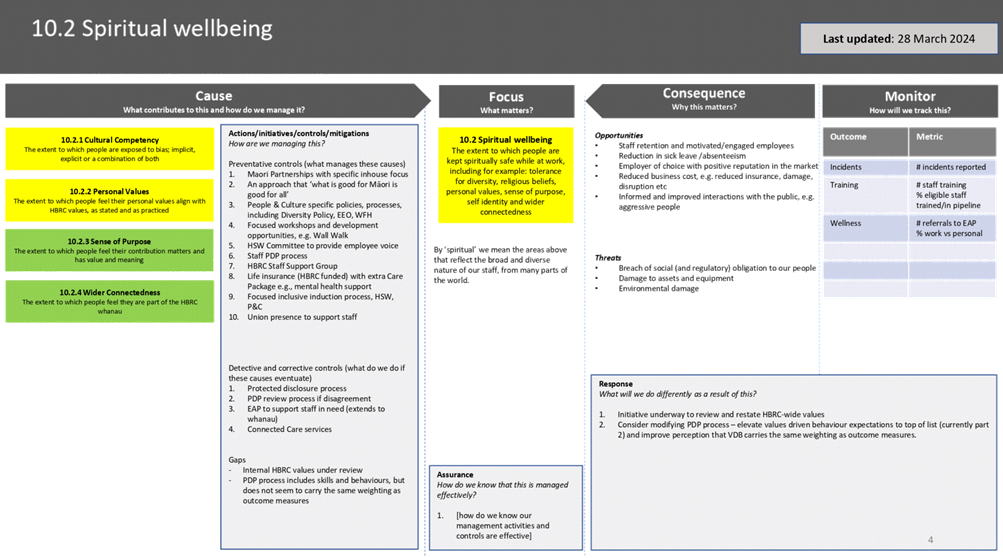

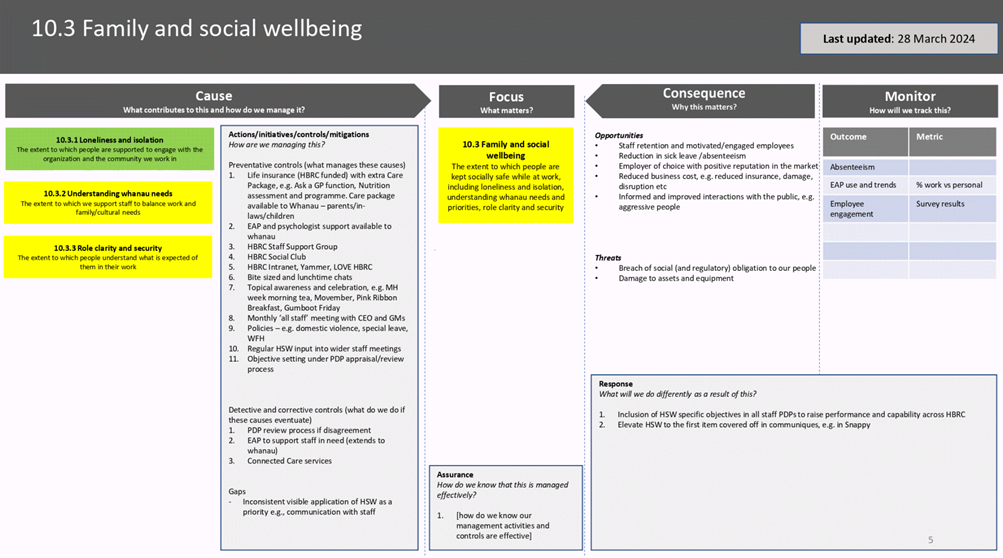

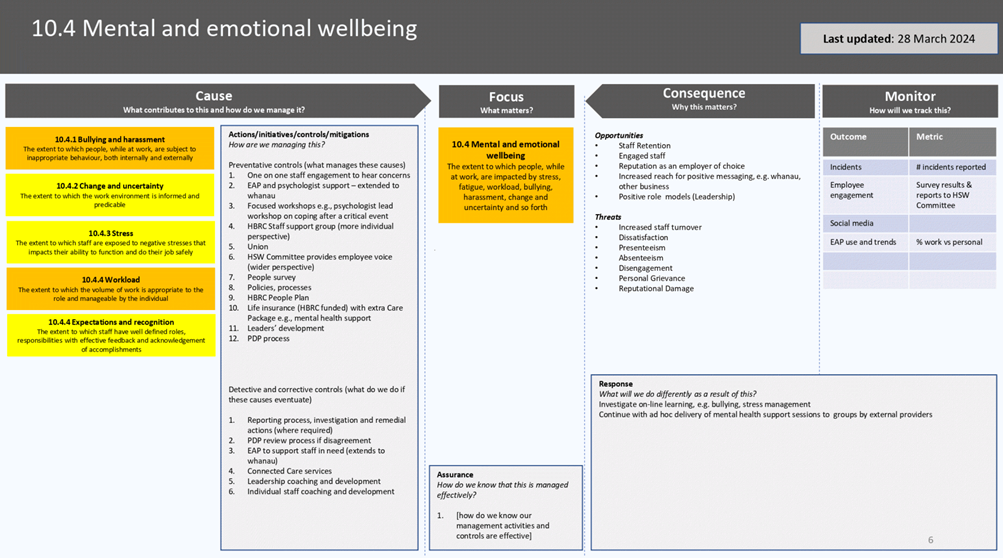

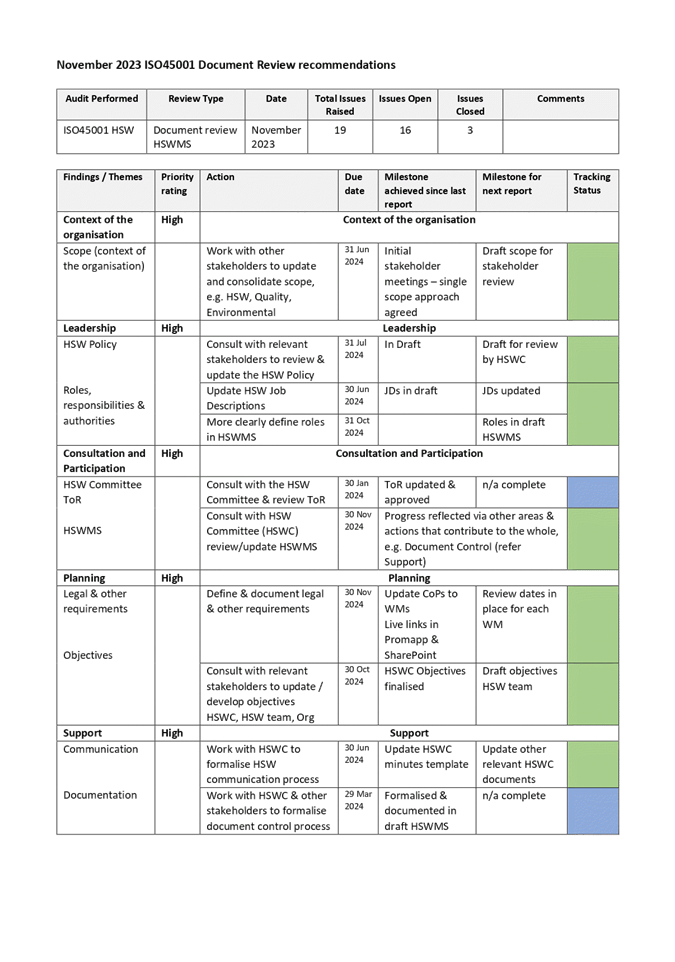

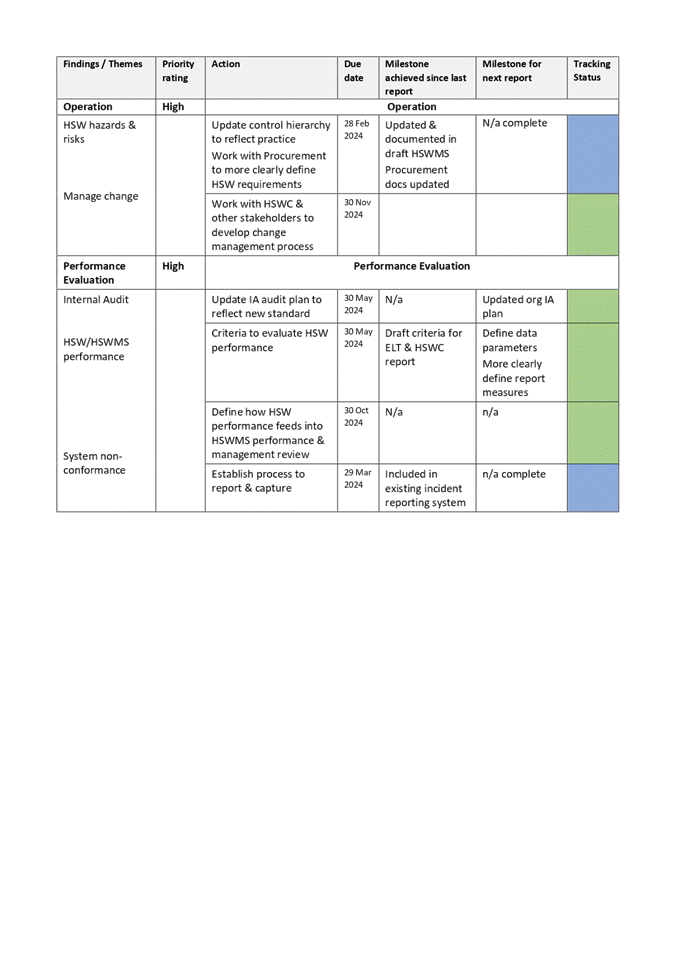

ISO45001 Document Review recommendations

|

Attachment

2

|

|

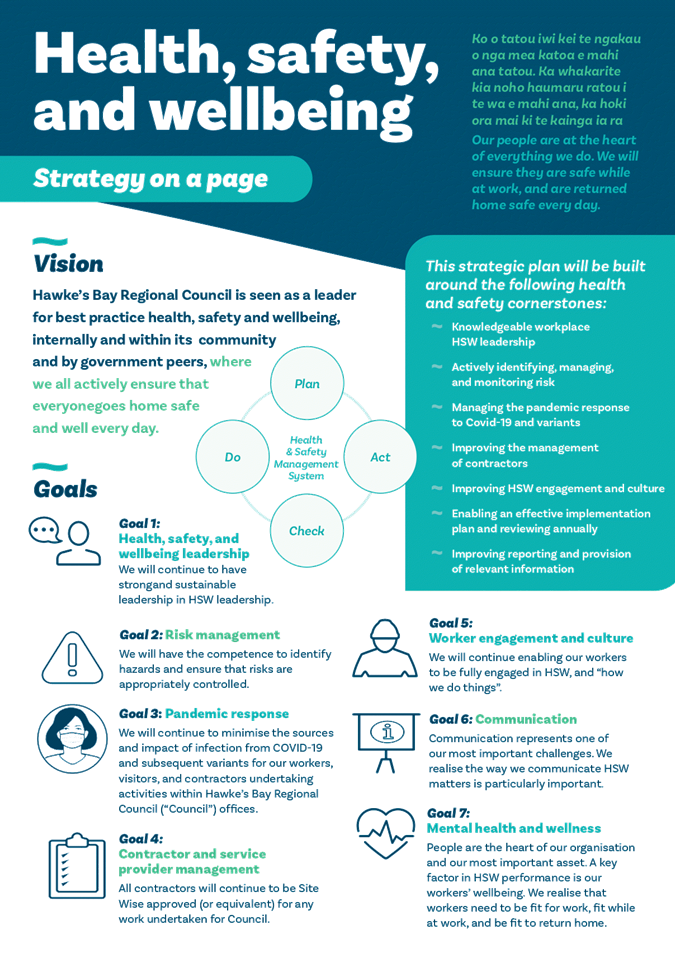

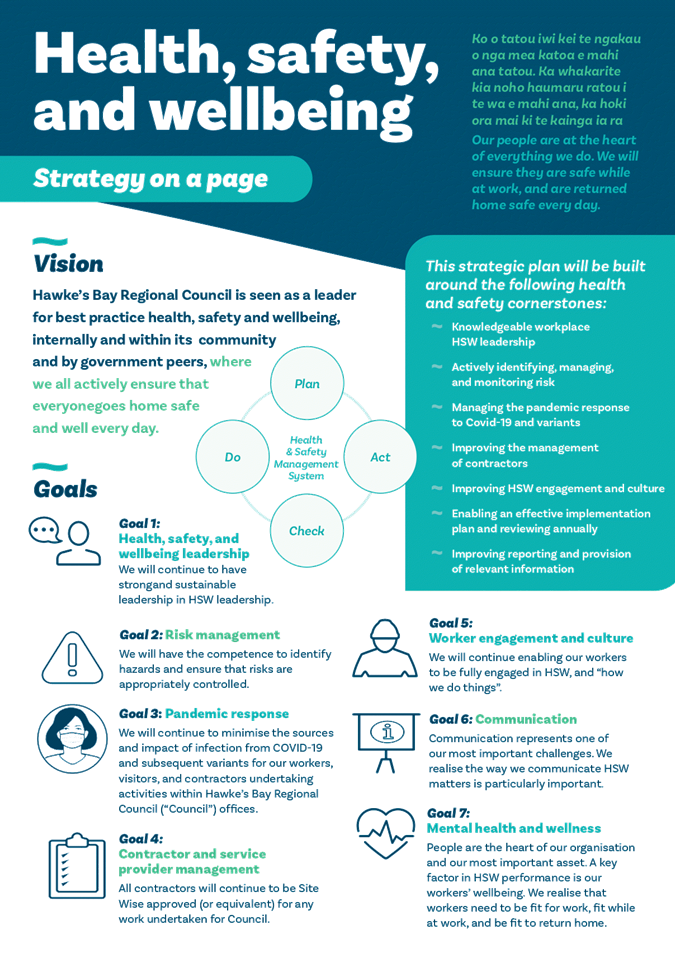

Health and Safey on a Page

|

Attachment

3

|

|

Health, safety, resilience and wellbeing of people - One-page

Risk Management Plan

|

Attachment

4

|

Hawke’s Bay Regional

Council

Risk

and Audit Committee

1 May 2024

Subject: Enterprise Assurance update

Reason for Report

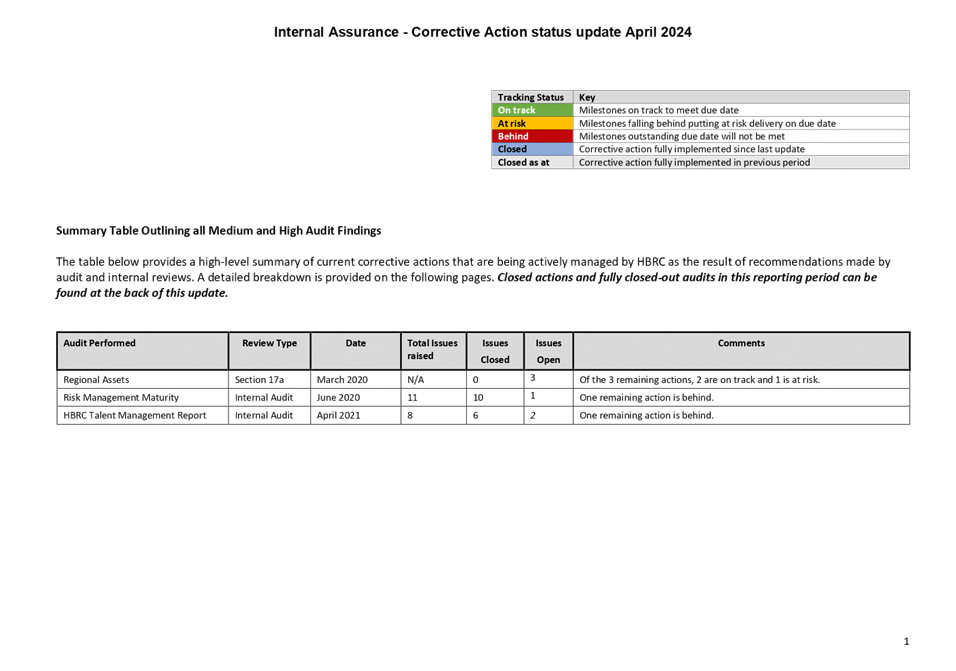

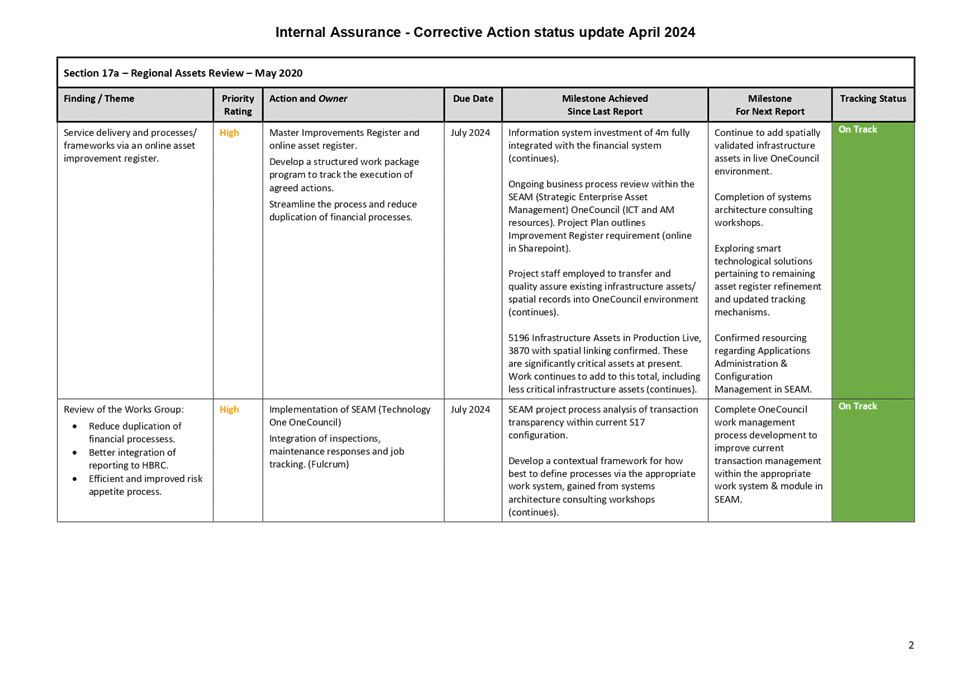

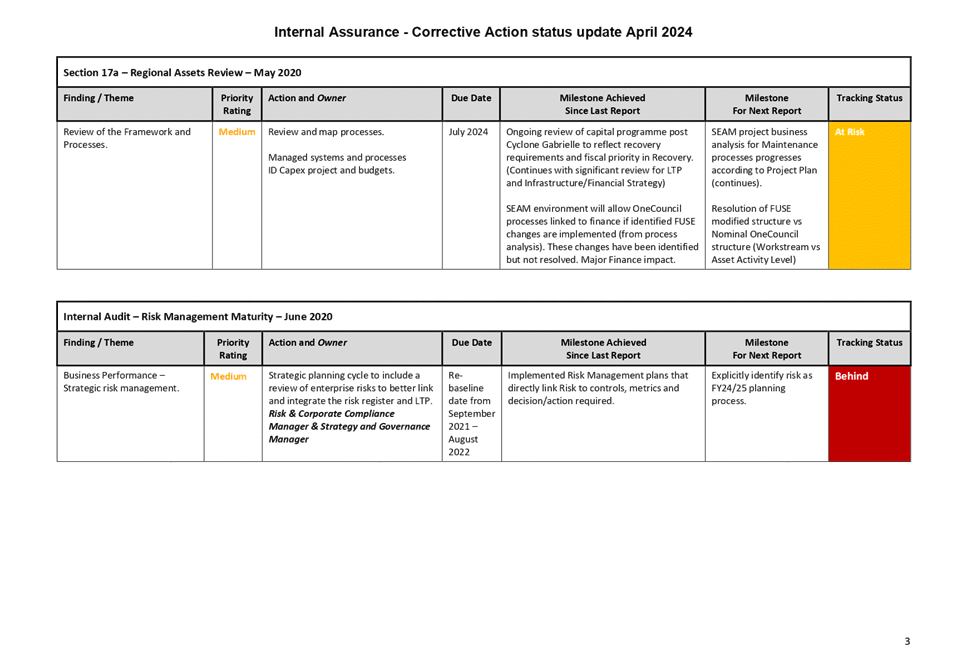

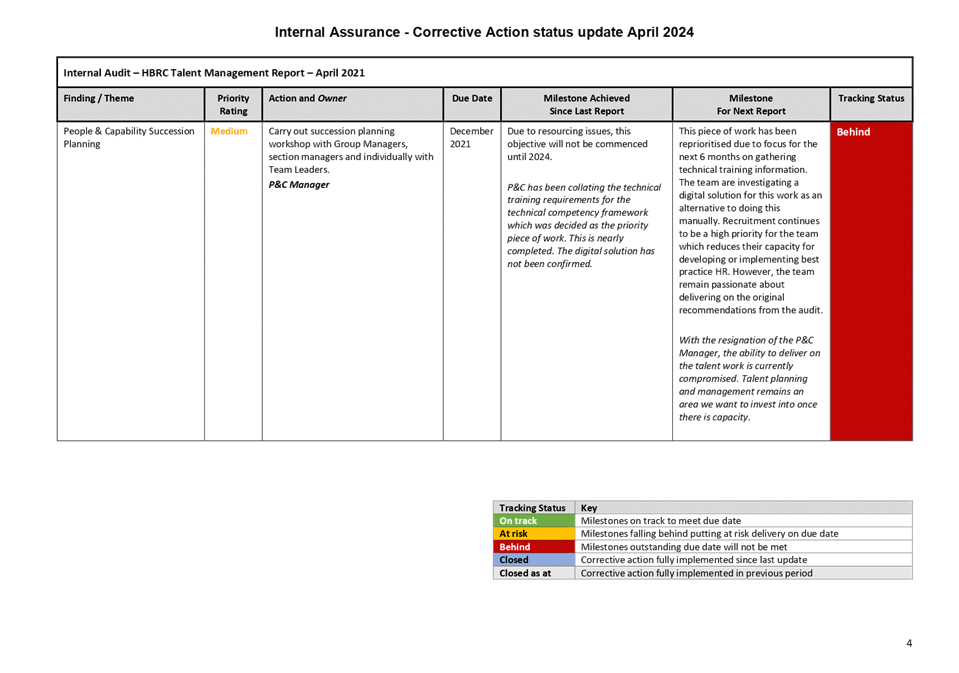

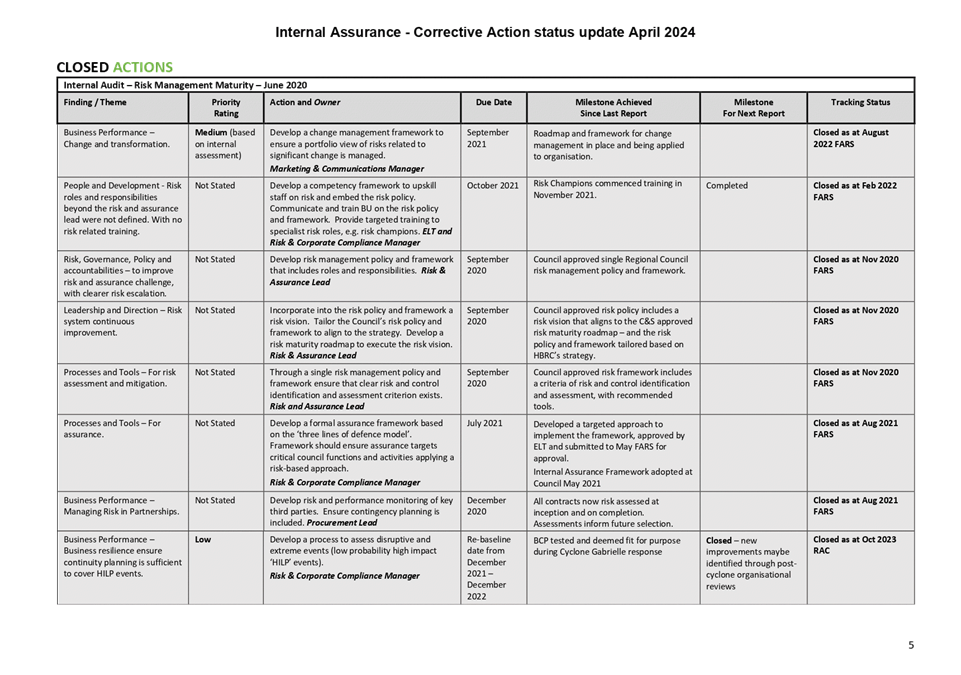

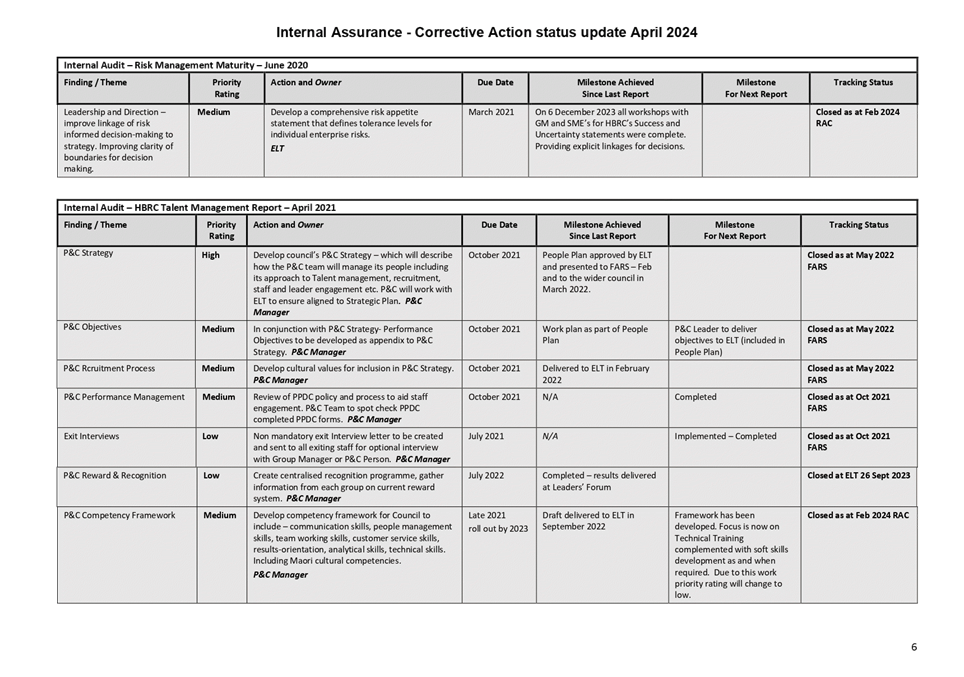

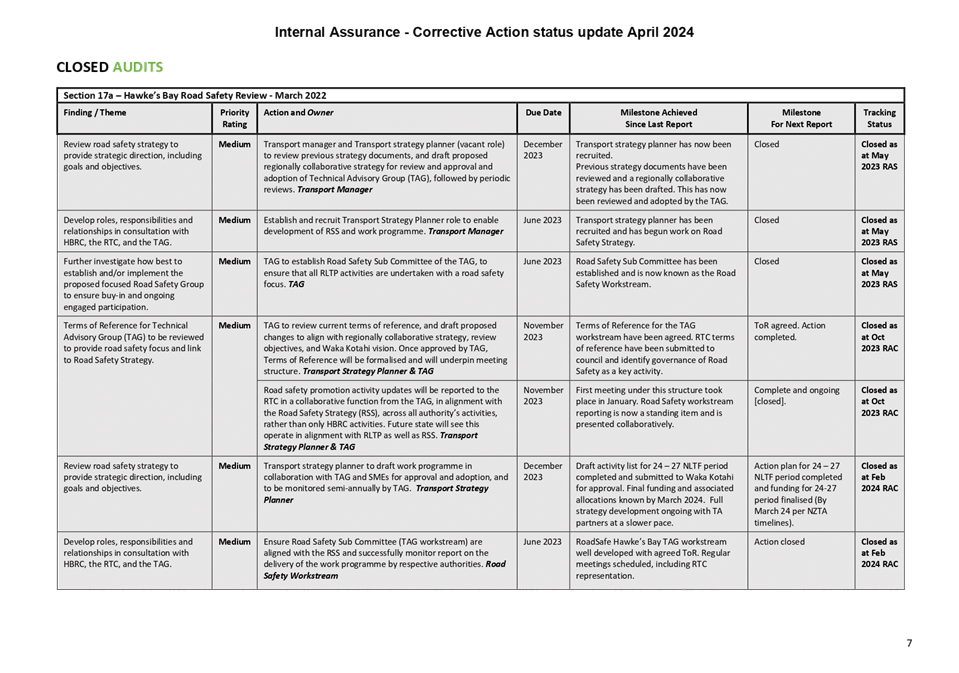

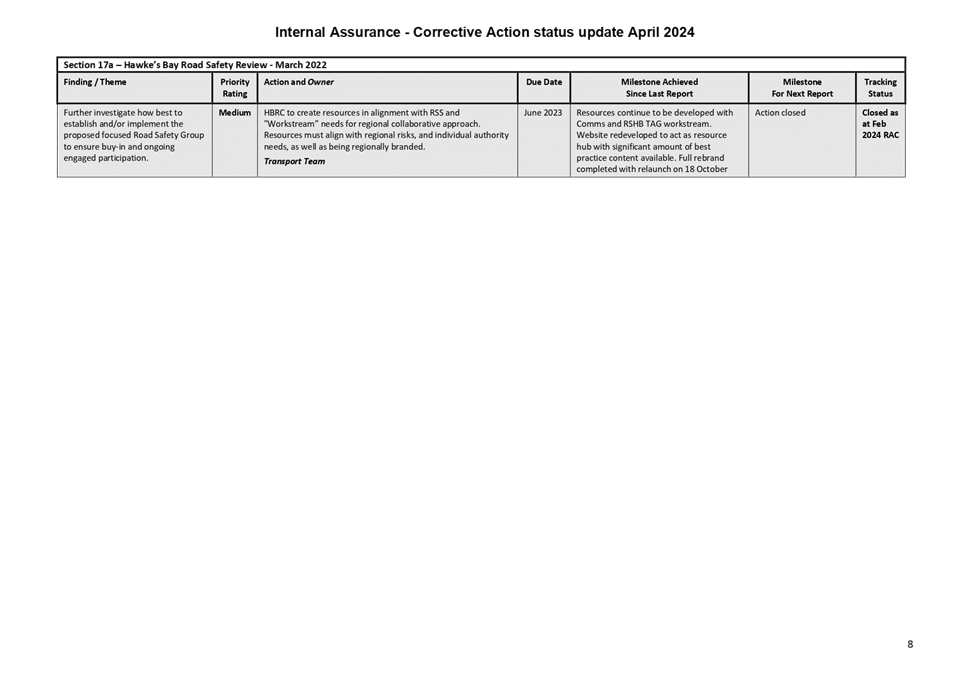

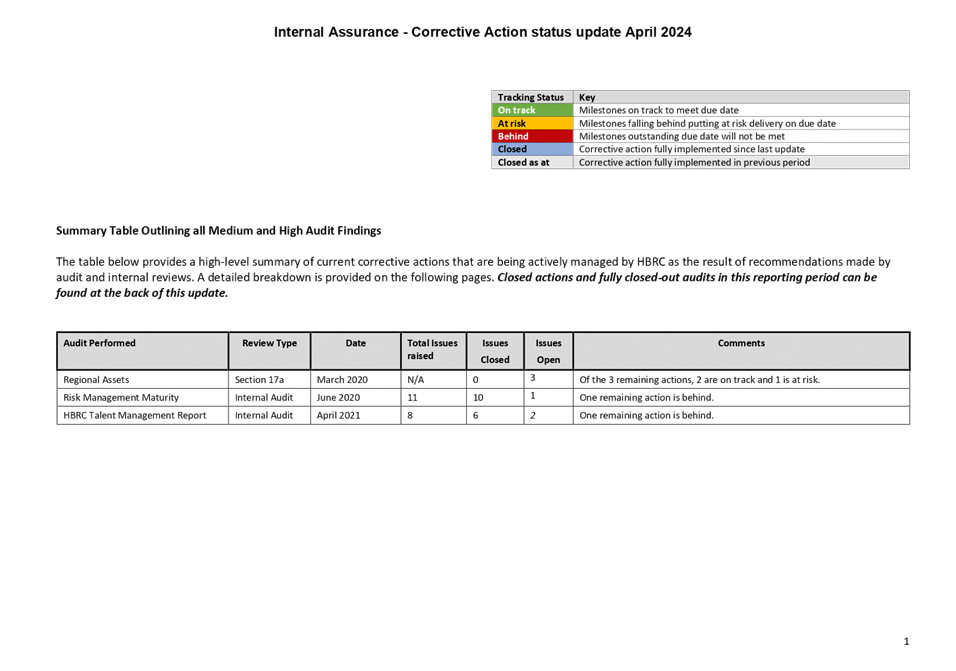

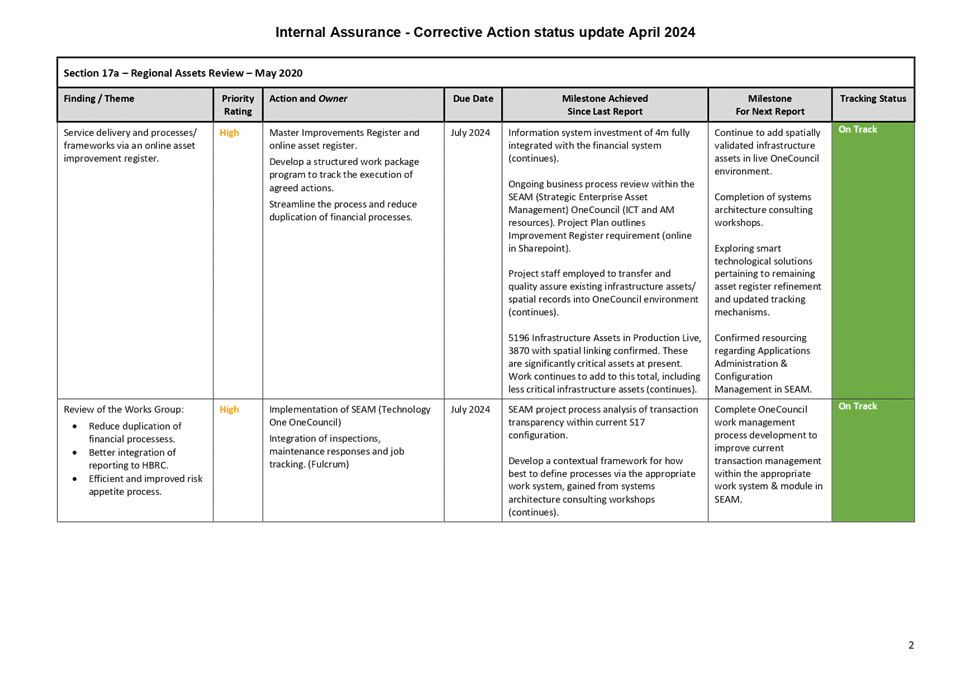

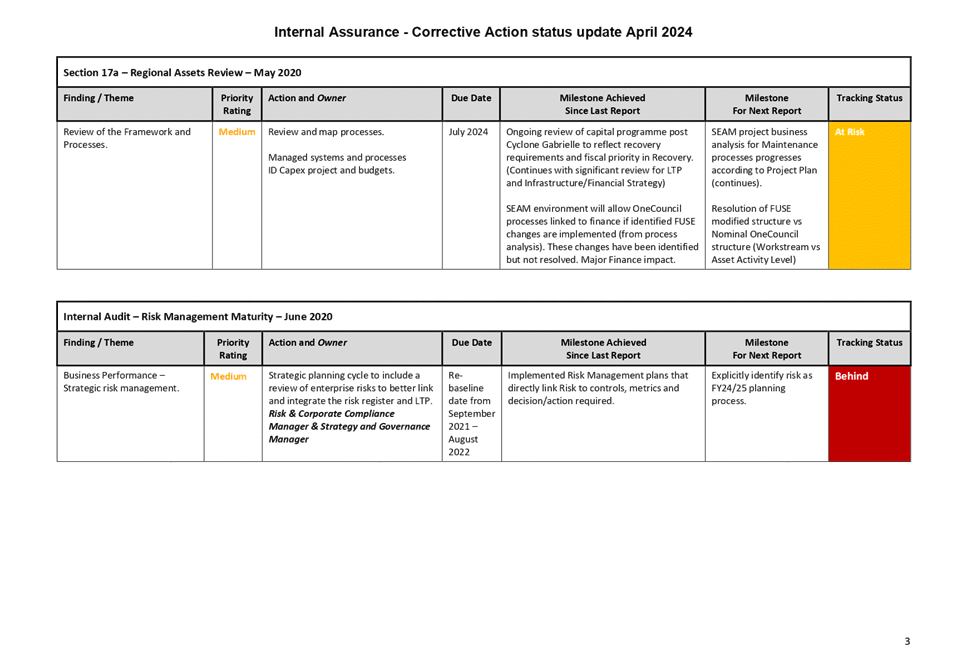

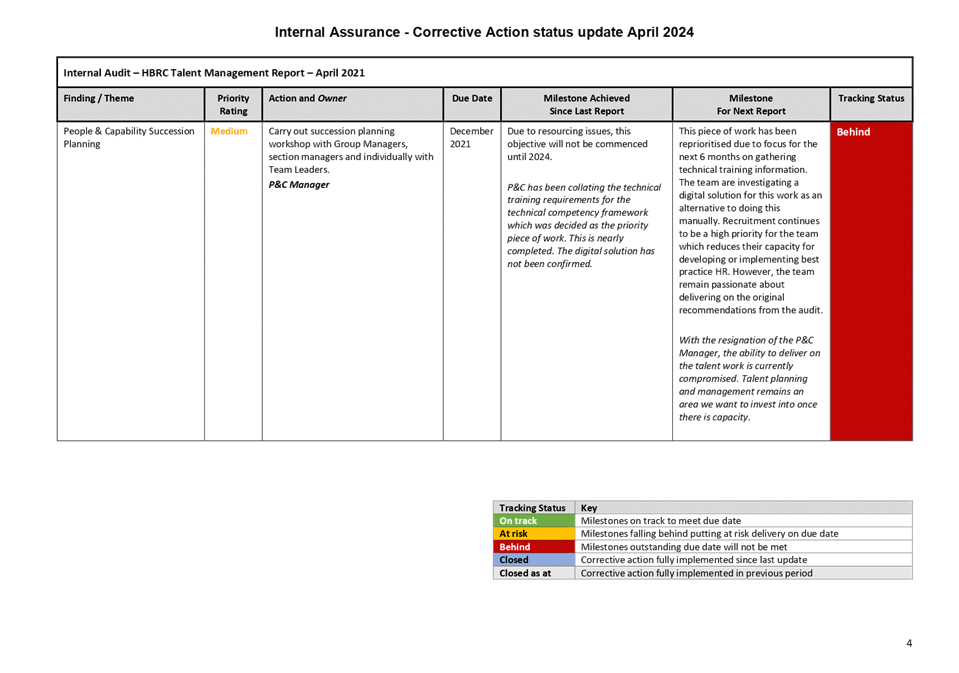

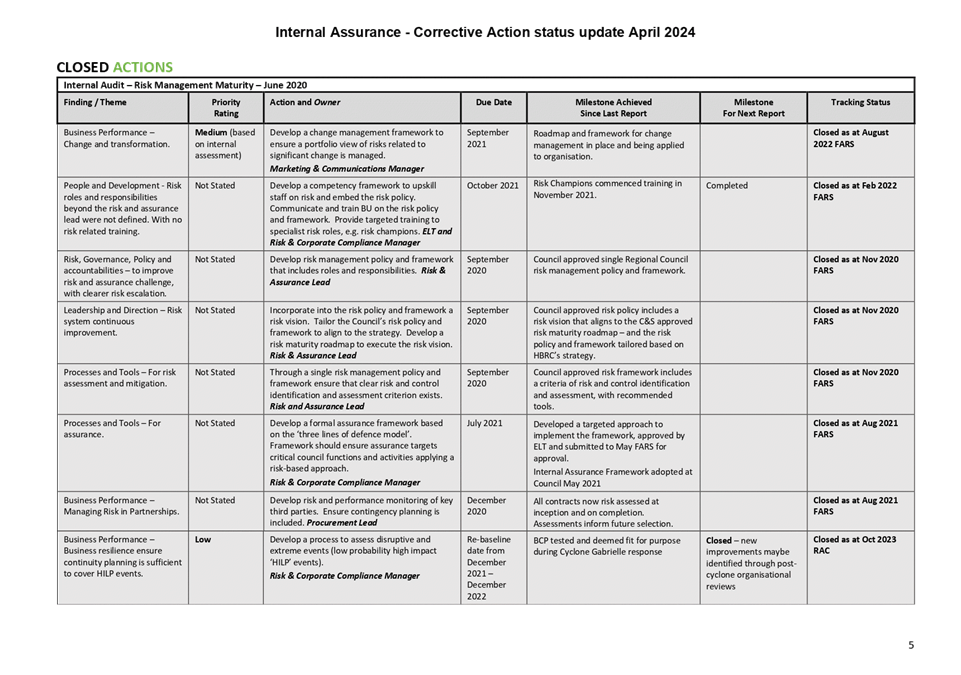

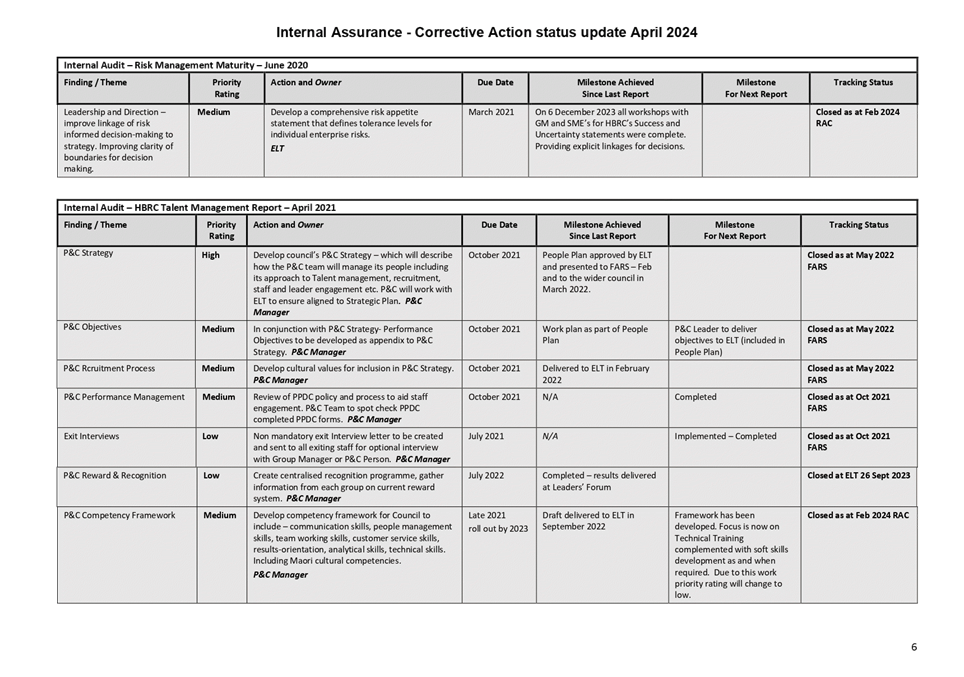

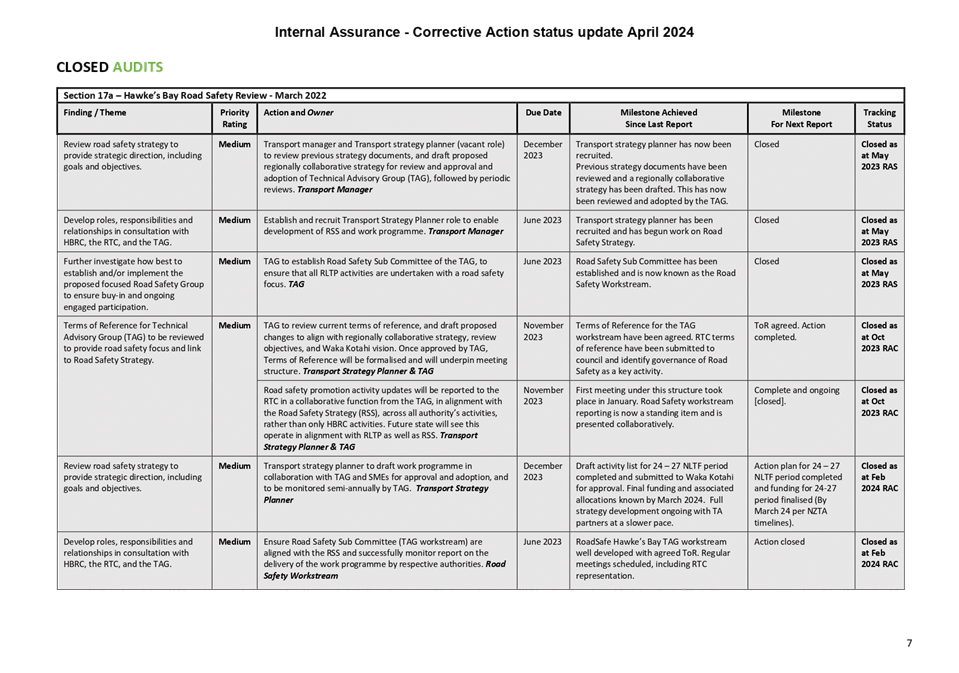

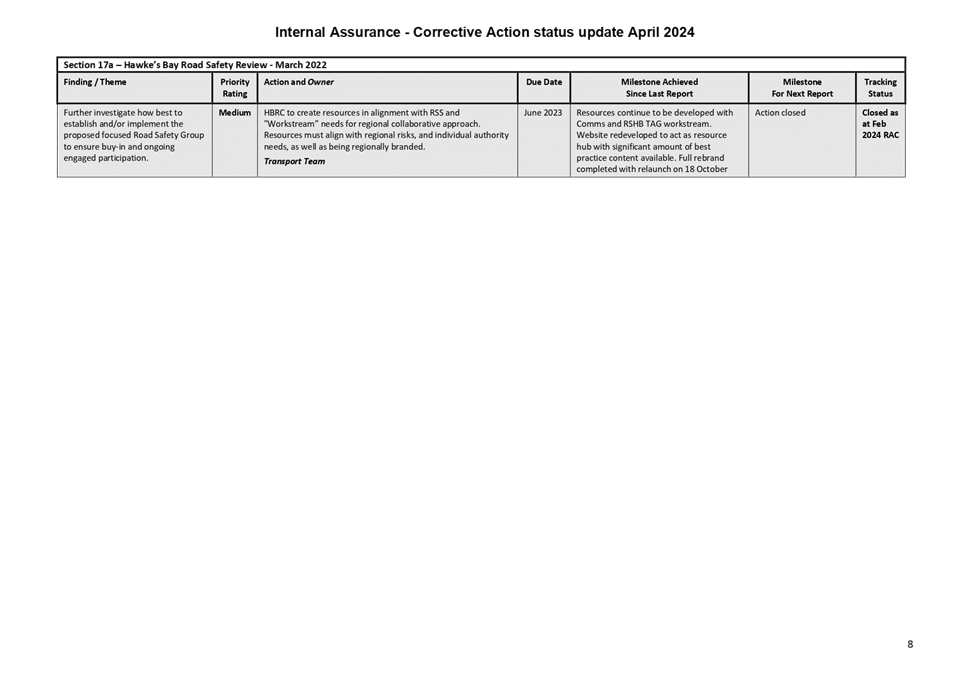

1. This item updates the Risk

and Audit Committee (RAC) on the progress of the following dashboards:

1.1. Internal Assurance

Corrective Actions Dashboard outlines progress of the agreed corrective actions

(with priority risk ratings medium and high) that respond to findings from

enterprise internal assurance reviews that have been previously reported to the

RAC.

1.2. Assurance Universe

Dashboard provides a clear picture of the audits/reviews (including S.17a)

completed and proposed for the future.

1.3. Assurance Plan for FY

2022-23 and 2023-24 gives the position of the reviews for the last and current

financial years.

Discussion

2. The Internal Assurance

Corrective Actions Dashboard is attached.

3. The corrective action

status update provides oversight to the RAC of the progress of actions taken to

address open internal assurance findings, including total issues raised, how

many closed and how many remain open. The table below is a summary of the

open audits/reviews.

|

Audit Performed

|

Review

Type

|

Date

|

Total Issues raised

|

Issues

Closed

|

Issues

Open

|

Comments

|

|

Regional Assets

|

Section 17a

|

March 2020

|

N/A

|

0

|

3

|

Of the remaining three actions, two are ‘on

track’ and one is ‘at risk’.

|

|

Risk Management Maturity

|

Internal Audit

|

June 2020

|

11

|

10

|

1

|

One remaining action is ’behind’.

|

|

HBRC Talent Management Report

|

Internal Audit

|

April 2021

|

8

|

6

|

2

|

Two remaining actions are ‘behind’.

|

4. The dashboard gives

visibility of:

4.1. open findings of the

milestones plus milestones completed and to be completed by the next RAC plus

the tracking status since last reported.

4.2. a summary of closed actions

since the last RAC report.

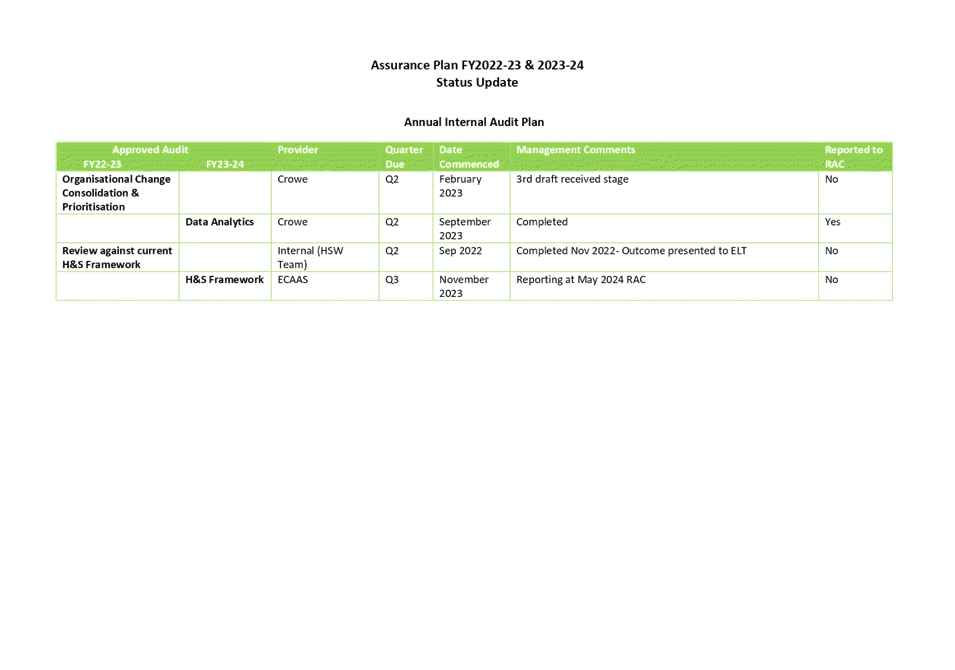

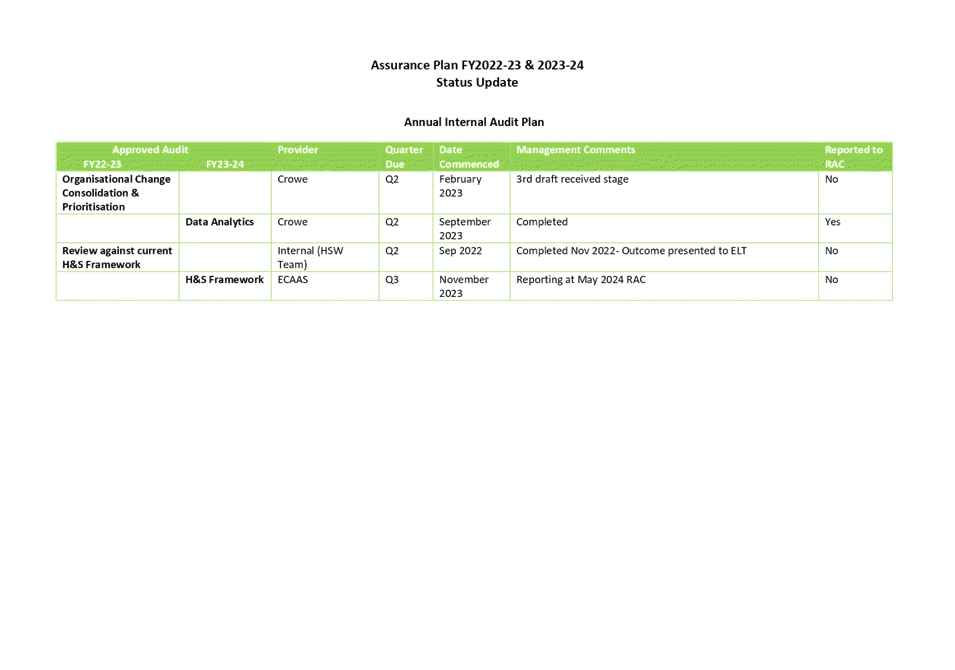

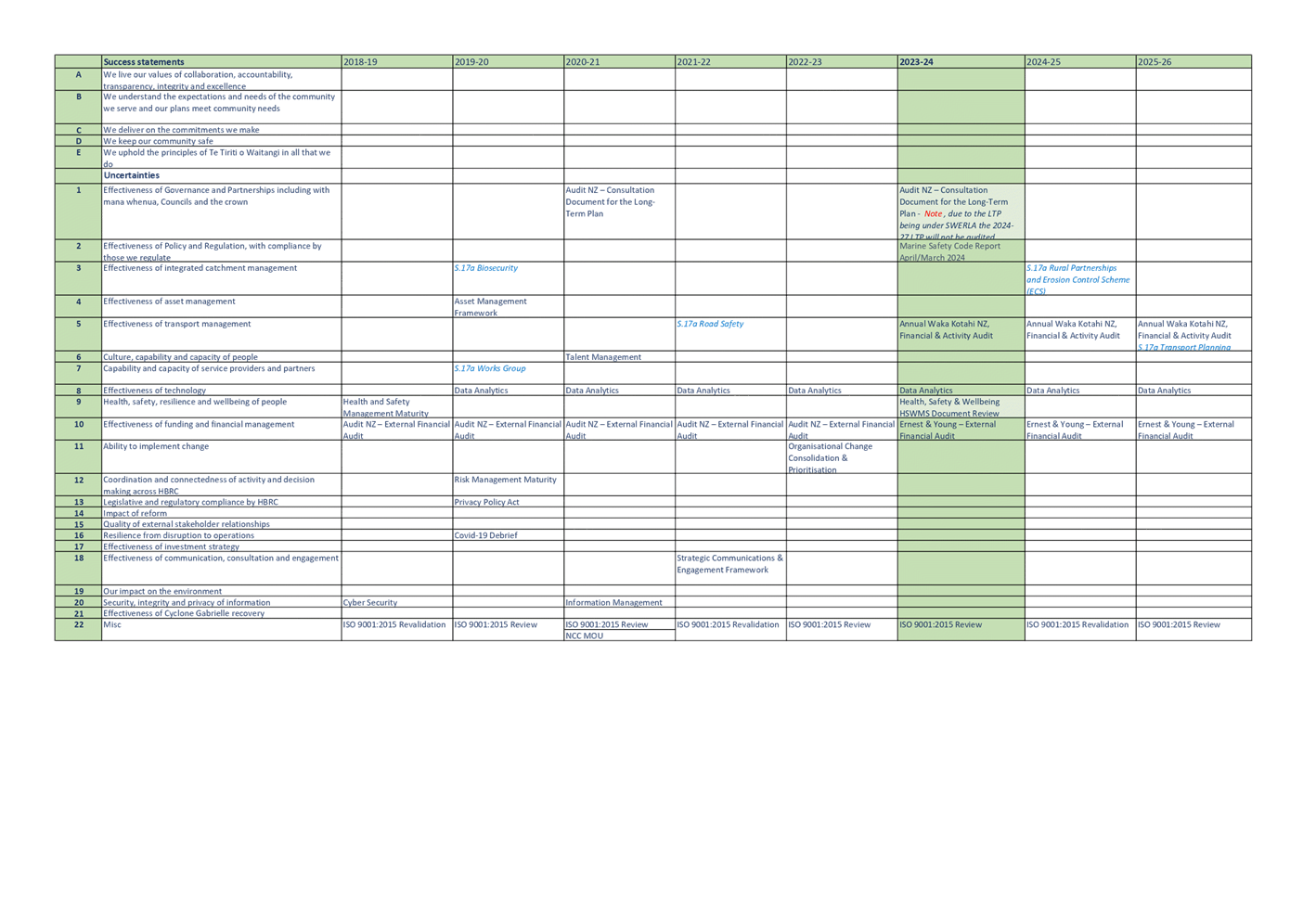

5. The Assurance Universe

Dashboard is attached. This links

enterprise reviews or audits undertaken over the past five years, the current

year, and future years to an enterprise risk. Reviews and audits in the Assurance

Universe include external audits, enterprise internal audits, business reviews

with an enterprise focus, and section 17a reviews.

6. The Assurance

Plan for FY 2022-23 and 2023-24 is attached. This gives a status of

overflow from 2022-23 approved audits and the current status of FY 2023-24.

Financial and resource implications

7. The budget provided for

internal assurance in 2024-2025 is $64,600.

8. Budget provisions for s.17a

reviews are allocated via the budgets of those activities identified in the

Assurance Universe.

Decision-making process

9. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

9.1. The decisions of the

Committee are in accordance with the Terms of Reference and decision-making

delegations adopted by Hawke’s Bay Regional Council 30 August 2023,

specifically the Risk and Audit Committee shall have responsibility and

authority to:

9.1.1. Receive the internal and

external audit report(s) and review actions to be taken by management on

significant issues and recommendations raised within the report(s). (2.8)

9.1.2. Ensure that recommendations

in audit management reports are considered and, if appropriate, actioned by

management.

(3.5)

Recommendations

That the Risk and Audit Committee

1. Receives and notes the Enterprise Assurance update staff report.

2. Confirms that the Internal

Assurance Corrective actions update report has provided adequate

information on the status of the Internal Assurance Corrective Actions.

Authored by:

|

Olivia Giraud-Burrell

Quality & Assurance Advisor

|

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

Internal Assurance Dashboard May

2024

|

|

|

|

2⇩

|

Internal Assurance Plan FY22-23 and

2023-24 May 2024

|

|

|

|

3⇩

|

Assurance Universe

|

|

|

|

Internal Assurance Dashboard May 2024

|

Attachment

1

|

|

Internal Assurance Plan FY22-23 and 2023-24 May 2024

|

Attachment

2

|

|

Assurance Universe

|

Attachment

3

|

Hawke’s Bay Regional

Council

Risk

and Audit Committee

1 May 2024

Subject: Incident report - Payroll

Holidays Act compliance

That the Risk

and Audit Committee excludes the public from this section of the meeting, being

Agenda Item 8 Incident report - Payroll Holidays Act compliancewith the general

subject of the item to be considered while the public is excluded. The reasons

for passing the resolution and the specific grounds under Section 48 (1) of the

Local Government Official Information and Meetings Act 1987 for the passing of

this resolution are:

|

General

subject of the item to be considered

|

Plain

English reason for excluding the public

|

Rationale

|

Grounds under Section 48 (1) for the passing of the resolution

|

|

Incident report -

Payroll Holidays Act compliance

|

s7(2)(g) Excluding the

public is necessary to prevent disclosure of information that is legally privileged.

s7(2)(i) Excluding the

public is necessary to enable the local authority holding the information to

carry out, without prejudice or disadvantage, negotiations (including

commercial and industrial negotiations).

|

The information contained in this paper may result in

both industrial negotiations with affected staff members and commercial

negotiations with the vendor of the TechOne product. The premature disclosure

of information contained in the paper may prejudice the position of HBRC in

such negotiations.

The paper also contains information derived from legal

advice provided by in-house and external counsel. Inclusion of such material

in public-facing papers is likely to prejudice the free-flow of information

and advice in-confidence with HBRC’s legal advisors.

While there may be public interest

in this matter, as it relates to the expenditure of public monies, such

public interest is unlikely to outweigh the justifications for withholding

the information. The public interest may be satisfied by the matter being

reported on, with legally privileged material removed or redacted once the

public disclosure of these matters would not affect these industrial and

commercial positions. Moreover, relevant disclosures of these matters will be

made to the appropriate unions, satisfying the need to ensure accountability

in HBRC’s dealings with staff.

|

The Council is

specified, in the First Schedule to this Act, as a body to which the Act

applies.

|

Authored

& Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Hawke’s

Bay Regional Council

Risk

and Audit Committee

1 May 2024

Subject: Strategic risk deep dives

That the Risk

and Audit Committee excludes the public from this section of the meeting, being

Agenda Item 9 Strategic risk deep diveswith the general subject of the item to

be considered while the public is excluded. The reasons for passing the

resolution and the specific grounds under Section 48 (1) of the Local

Government Official Information and Meetings Act 1987 for the passing of this

resolution are:

|

General

subject of the item to be considered

|

Plain

English reason for excluding the public

|

Rationale

|

Grounds

under section 48(1) for the passing of the resolution

|

|

Strategic risk deep

dives

|

s7(2)(j) to prevent

disclosing information that could be used for improper gain or improper

advantage.

|

To prevent information

about Council’s critical controls being accessed.

The public interest is

protected by not allowing the information to be accessed by anyone outside

the organisation.

|

The Council is

specified, in the First Schedule to this Act, as a body to which the Act

applies.

|

Authored by:

|

Leeanne Hooper

Team Leader Governance

|

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|