Meeting of the

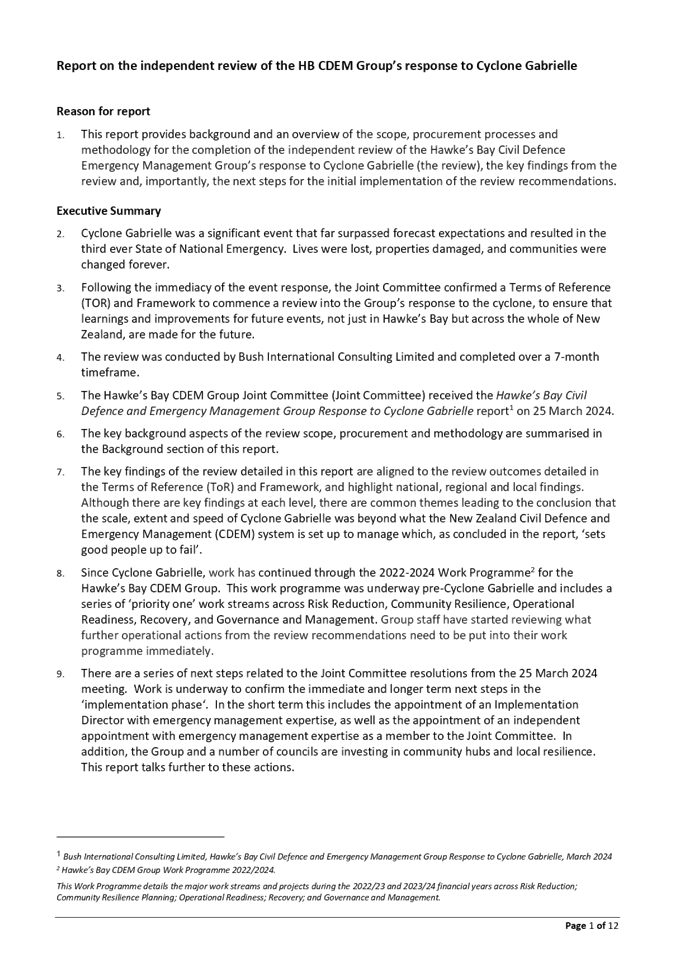

Corporate and Strategic Committee

Date: 15 May 2024

Time: 9.00am

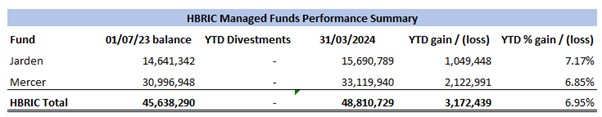

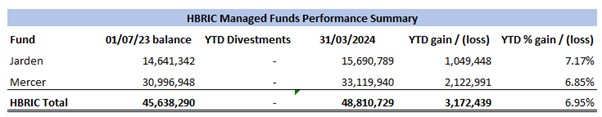

|

Venue:

|

Council

Chamber

Hawke's

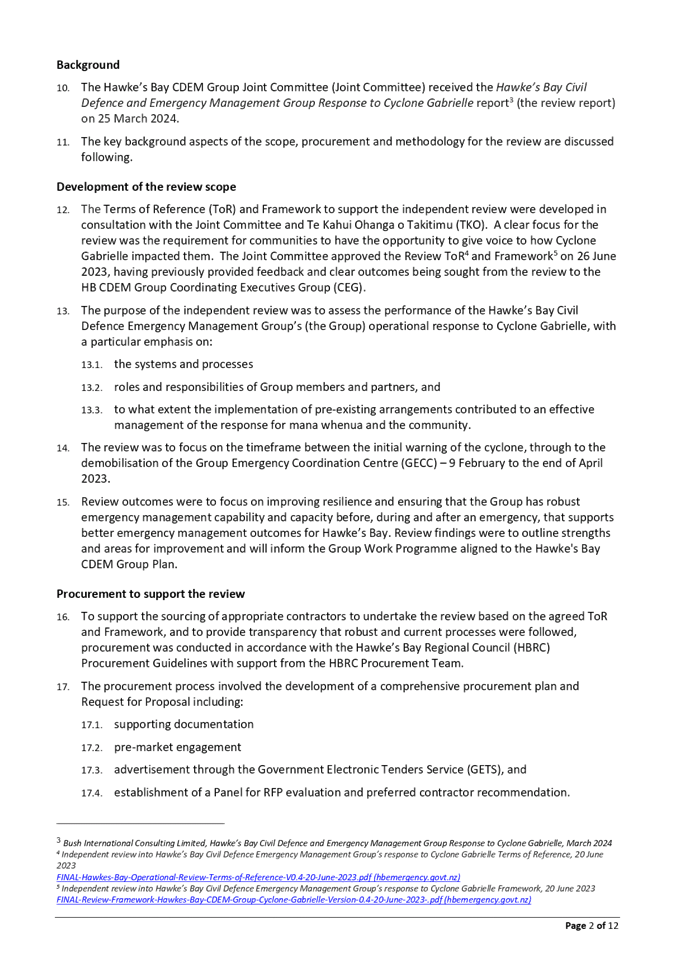

Bay Regional Council

159

Dalton Street

NAPIER

|

Agenda

Item Title Page

1. Welcome/Karakia/Notices/Apologies

2. Conflict

of Interest Declarations

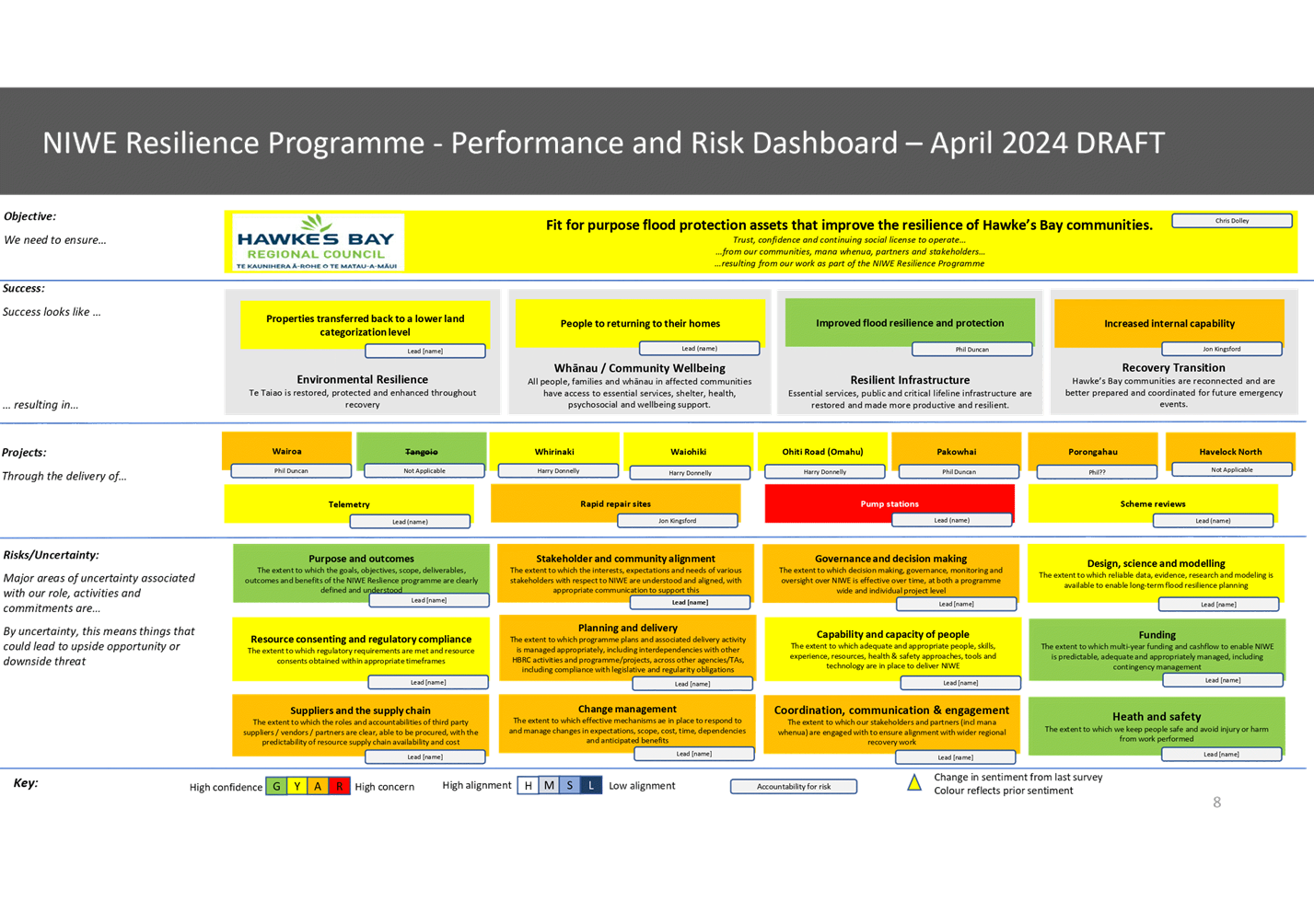

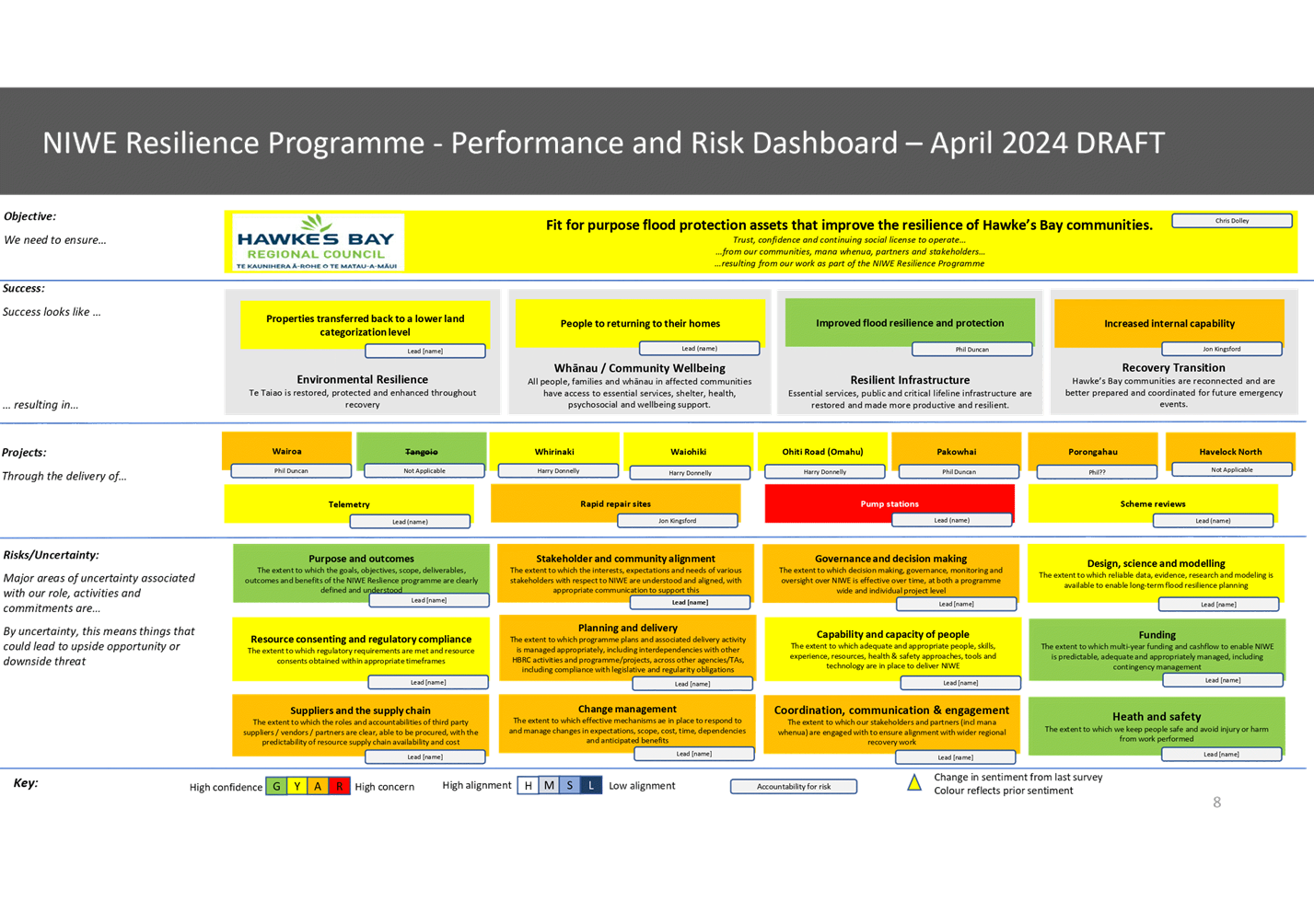

3. Confirmation of Minutes of

the Corporate and Strategic Committee held on 21 February 2024

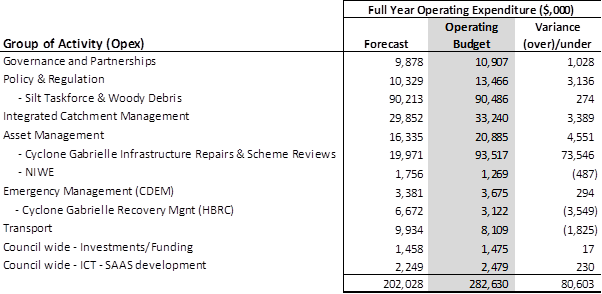

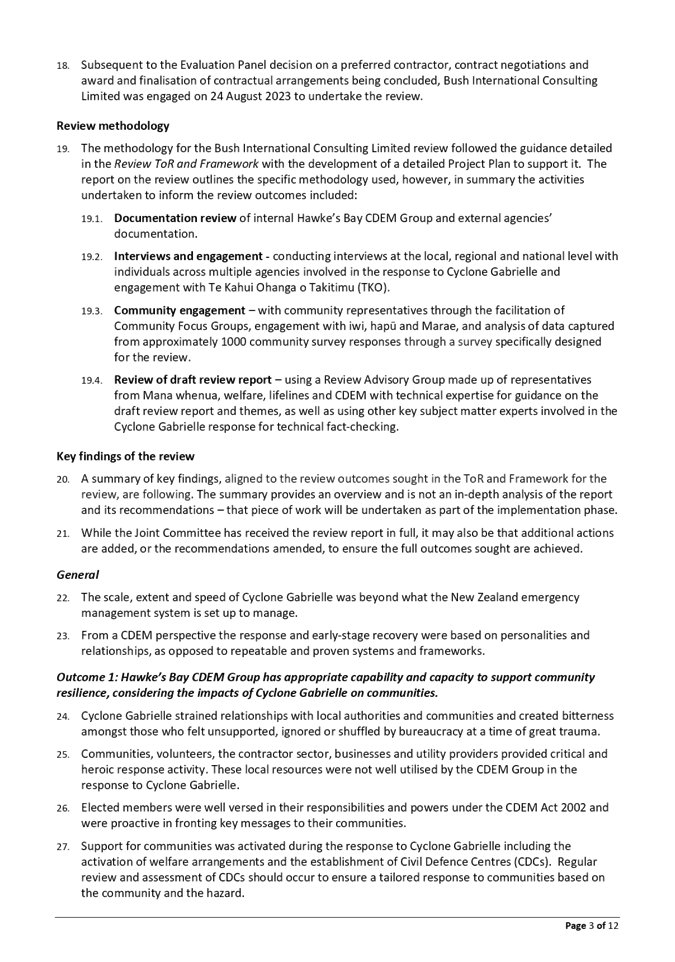

4. Public

Forum 3

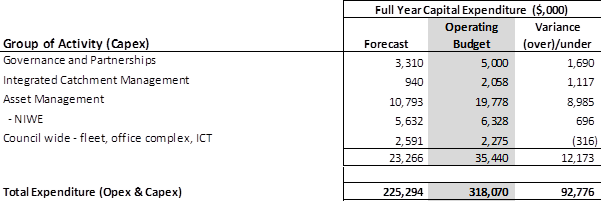

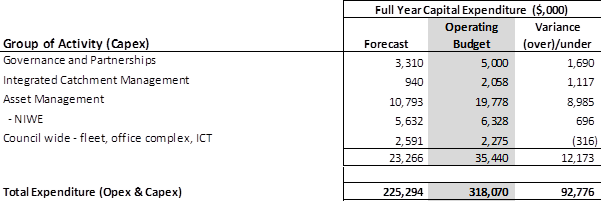

Decision

Items

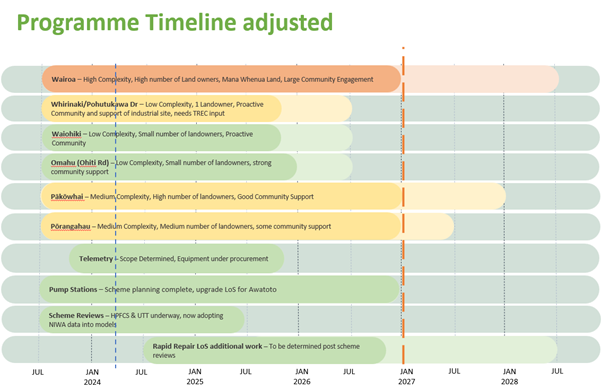

5. Future

of Severely Affected Land (FOSAL) delivery 7

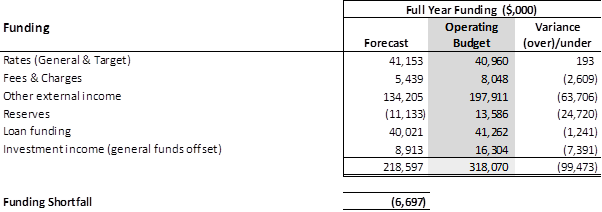

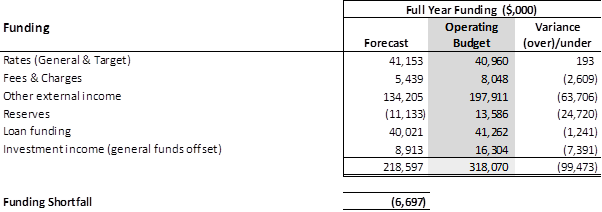

Information

or Performance Monitoring

6. Report

on the independent review of the HB CDEM Group’s response to Cyclone

Gabrielle 17

7. Financial

report for FY23-24 to 31 March 2024 31

8. Organisational

Performance report for the period 1 January – 31 March 2024 41

9. HBRIC

Ltd quarterly update 43

Hawke’s Bay Regional

Council

Corporate

and Strategic Committee

15 May

2024

Subject: Public Forum

Reason for report

1. This item provides the

means for the Committee to give members of the public an opportunity to address

the Committee on matters within its terms of reference.

Background

2. The Hawke’s Bay

Regional Council’s Standing Orders provide for public forums as follows:

14.

Public

Forums

Public

forums are a defined period of time, usually at the start of a meeting, which,

at the discretion of a meeting, is put aside for the purpose of public input.

Public forums are designed to enable

members of the public to bring matters to the attention of the local authority.

In

the case of a committee or sub-committee, any issue, idea or matter raised in a

public forum must also fall within the terms of reference of that meeting.

Requests

must be made to the HBRC Governance Team (06 835 9200 or governanceteam@hbrc.govt.nz) at least one clear day

before the meeting;

however this requirement may be waived by the Chairperson.

14.1 Time limits

A

period of up to 30 minutes, or such longer time as the meeting may determine,

will be available for the public forum at each scheduled Regional Council,

Corporate & Strategic Committee, Environment & Integrated Catchments

Committee and Regional Transport Committee meeting.

Speakers

can speak for up to 5 minutes. No more than two speakers can speak on

behalf of an organisation during a public forum. Where the number of speakers

presenting in the public forum exceeds 6 in total, the Chairperson has discretion

to restrict the speaking time permitted for all presenters.

14.2 Restrictions

The

Chairperson has the discretion to decline to hear a speaker or to terminate a

presentation at any time where:

• a

speaker is repeating views presented by an earlier speaker at the same public

forum

• the

speaker is criticising elected members and/or staff

• the

speaker is being repetitious, disrespectful or offensive

• the

speaker has previously spoken on the same issue

• the

matter is subject to legal proceedings

• the

matter is subject to a hearing, including the hearing of submissions, where the

local authority or committee sits in a quasi-judicial capacity.

14.3

Questions

at public forums

At

the conclusion of the presentation, with the permission of the Chairperson, elected

members may ask questions of speakers. Questions are to be confined to

obtaining information or clarification on matters raised by a speaker.

14.4 No resolutions

Following

the public forum no debate or decisions will be made at the meeting on issues

raised during the forum unless related to items already on the agenda.

Decision-making process

3. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

the Corporate

and Strategic Committee receives and notes the Public Forum speakers’

verbal presentations.

Authored by:

|

Leeanne Hooper

Team Leader Governance

|

|

Approved by:

|

Desiree Cull

Strategy and Governance Manager

|

|

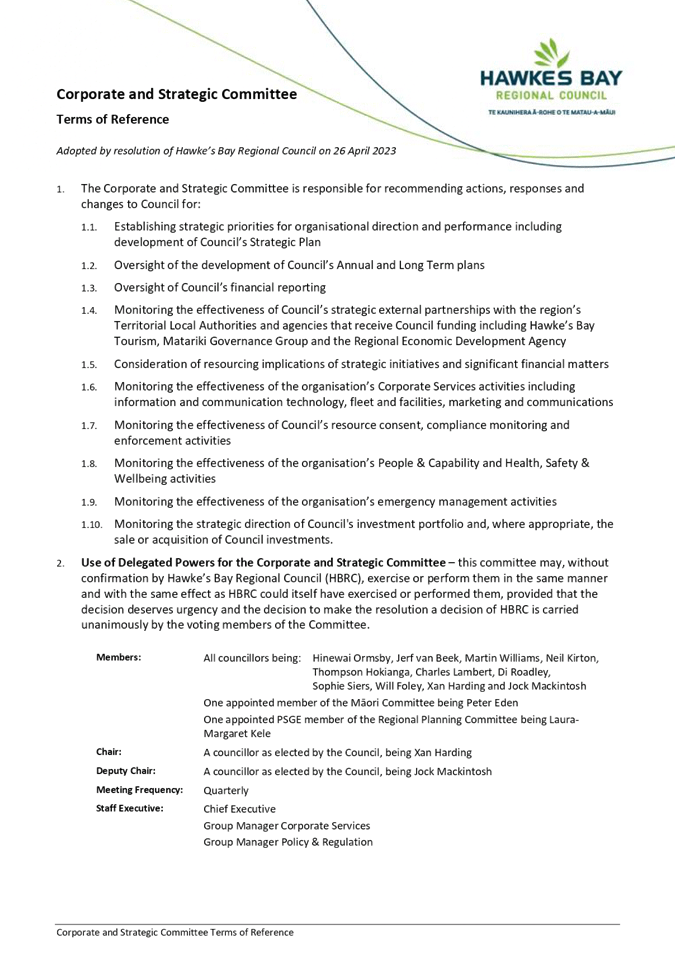

Attachment/s

|

1⇩

|

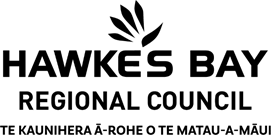

Corporate and Strategic Committee

Terms of Reference 2023-2025

|

|

|

|

Corporate and Strategic Committee Terms

of Reference 2023-2025

|

Attachment

1

|

Hawke’s Bay Regional

Council

Corporate

and Strategic Committee

15 May

2024

Subject: Future of Severely Affected

Land (FOSAL) delivery

Reason for report

1. This item presents the

approach to the delivery of the North Island Weather Event (NIWE) programme to

enable the Corporate and Strategic Committee (C&S) to effectively provide

oversight of this strategic programme of work. Included in this item are:

1.1. an overview of the proposed

programme and delivery mechanisms

1.2. financials and a request

for a change of the CE’s financial delegations

1.3. risk and assurance

activities.

Officers’

recommendations

2. Council staff recommend

that financial delegations to the Chief Executive are increased to $15m (from

$10m currently) specifically within the NIWE Resilience Programme to enable

contract execution and loading of purchase orders and payments as they pertain

to the NIWE programme.

3. Staff also recommend that

specific approval by exception is delegated to the Chief Executive for

contracts within the NIWE Resilience Programme, beyond the Chief

Executive’s delegation of $15m, to enable contract execution and loading

of purchase orders and payments as they pertain to the NIWE programme.

Executive

summary

4. The NIWE programme is

making good progress with establishment of core project assurance and programme

frameworks for delivery. These include primary documents such as the Programme

Assurance Management Plan and NIWE Programme Management Plan. Accompanying

plans are covering communications and engagement, health and safety,

procurement, risk management, assurance, quality assurance and controls. All

programme and plan documentation integrates with HBRC policies.

5. The first Programme

Assurance Board meeting was held with the purpose of establishing protocol and

gathering attendees for initial discussions. The PAG includes representation

from Crown Infrastructure Partners (CIP) and an independent Programme Assurance

Advisor from RCP as recommended by CIP. CIP has been appointed by the

DPMC Cyclone Recovery Unit to manage the Cyclone Recovery Programme of work.

6. Progress has been made on

understanding risks and controls at both a programme and project level to

ensure that appropriate management and mitigation occurs for these, and

controls can be relied upon to manage key risks.

7. To date, the programme has

incurred $2.75m in costs (1% of total costs). While considered low, this was

for the establishment of the above frameworks and smaller amounts of design

work for optioning. Considerable work is going into engagement with our communities

on options, which doesn’t incur large financial cost to undertake.

8. It is anticipated that

monthly reimbursements will be made back to HBRC for cashflow purposes.

Therefore HBRC will only likely carry 1 month working capital risk as an

organisation and limit our interest exposure on short term debt.

9. It is evident there is

natural tension on the programme to deliver to government timeframes (see risk

and assurance para 28). This will be an ongoing challenge to manage the

expectations of CIP to progress at pace, with the required community and mana

whenua engagement, design, cultural assessments and build weather conditions.

10. It is anticipated that the

C&S will review financial spend and analysis through the quarterly

financial reports as an activity within Asset Management, and receive any

change escalations where they may pertain to cost or resourcing requests over

and above any programme allocations set.

Background

11. Under the NIWE Agreement,

the Crown reserved aggregate amounts of funding under the National Resilience

Plan (NRP) to assist with funding Category 2 Risk Mitigation projects, Regional

Transport Projects and Category 3 Voluntary Buyouts to be delivered in the

Hawke’s Bay region.

12. The total value of the

Category 2 programme amounts to $232m, of which HBRC’s contribution is

$44m, which represents a significant investment on behalf of the Hawke’s

Bay community.

13. The packages of work funded

through this agreement are highlighted below:

|

Severely Affected Land Areas

|

Co- Funding

|

HBRC Funding

|

Total

|

|

Wairoa

|

$70,000,000

|

|

$70,000,000

|

|

Pākōwhai

|

$70,676,470*

|

$23,373,530*

|

$94,050,000*

|

|

Whirinaki

|

|

Ohiti

|

|

Waiohiki

|

|

Pōrangahau

|

|

Sub Total

|

|

$164,050,000

|

|

Pumpstation Upgrades

|

$22,544,329

|

$7,455,671

|

$30,000,000

|

|

Rapid Repair – stopbank height increases

|

$22,544,329

|

$7,455,671

|

$30,000,000

|

|

Telemetry

|

$3,757,388

|

$1,242,612

|

$

5,000,000

|

|

Scheme Reviews

|

$2,254,433

|

$745,567

|

$

3,000,000

|

|

Total

|

|

|

$232,050,000

|

*For

the purposed of this table the value for Tangoio (now Cat 3) and Joll Road (to

be delivered by HDC) have been excluded from these values.

Current

Status of the Programme

14. As reported to the recent

Programme Assurance Board the programme is tracking as GREEN status and

progressing well with the following key milestones being achieved:

14.1. CIP

engagement through various in-person and online meetings, including an

independent review of the programme via CIP and Aurecon consultant Matt Flannery

and Altacon consultant Jamie Ferguson. The review was requested due to concerns

expressed at a Ministerial level that there wasn’t the desired level of

visibility of progress on the approved projects.

14.2. The programme team is

progressing through business case submissions for each project via project

development plans. We have submitted 3 drafts for comment to date and

subsequently been asked by CIP to bundle our projects together.

14.3. HBRC is currently in

discussions with Hastings District Council (HDC) regarding the Havelock North

Streams project as they own this asset and are responsible for maintaining this

scheme. It would be efficient and appropriate that HDC rates pay for the

local share. A formal Council decision on the progress and funding for this

will be presented at a future meeting. In the meantime, work is progressing so

the mitigation works are not being held up.

Delivering the programme

15. A programme the size of

which HBRC faces will have a significant impact on roles both within the traditional

function of the Project Delivery team and across the organisation.

16. As well as a significant

increase in demands on project management resources, the programme will require

significant input from communications, community engagement, risk, health and

safety, procurement and financial resources.

17. To better empower the

successful delivery of this programme of work to meet the above objectives, an

integrated approach to resourcing was proposed. With total programme escalation

costs sitting at around $2m per month, to not resource the programme with

resources of sufficient capacity and capability presents a significant

financial risk to the organisation and the programme as a whole.

18. On this basis, the

independent consultants recommended HBRC move to a Programme Management Office

(PMO) approach to deliver the identified programme of infrastructure related

projects.

19. The approved structure for

the PMO represents an integrated team of 30+ professionals. Resources from the

original Regional Projects team have transferred into the new PMO which,

together with recent recruiting success, has filled 5 roles to date. A further

11 roles are in active recruiting processes.

Programme Assurance and Delivery

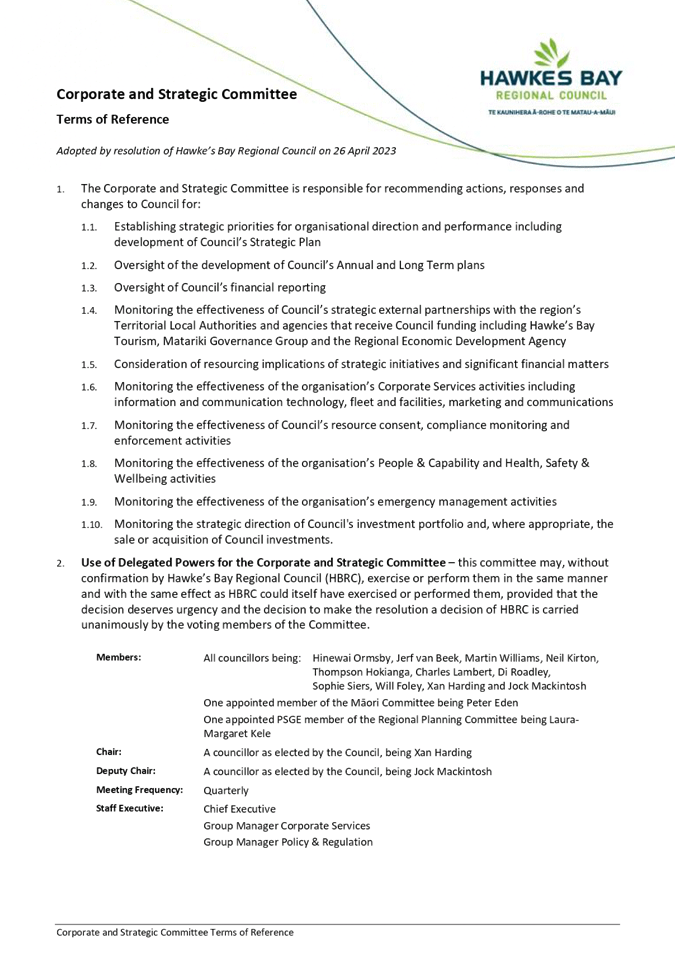

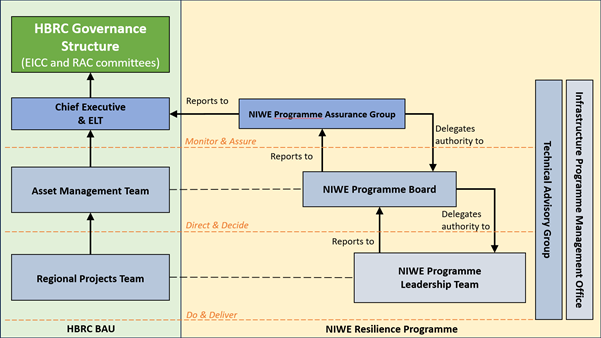

20. The proposed Governance and

Assurance Framework has been documented and a high-level approach to how this

operates is described in the following diagram.

21. The key feature of this

governance framework is the Programme Assurance Board (PAG), which includes

members of the Executive Leadership team to represent Asset Management, Finance

and Supervisory Control and Data Acquisition (SCADA), Crown Infrastructure

Partners (CIP) and an independent assurance member providing programme-specific

oversight expertise.

22. The proposed inclusion of

CIP within the Programme Governance Board fulfils a requirement of our funding

agreement with the Crown.

23. In addition to Programme

Governance Board meetings, the PMO Programme Director, Land Category Programme

Manager, and Programme Finance and Controls Manager meet with CIP on a weekly

basis at an operational level to provide regular updates on various aspects of

the programme and individual projects. This also fulfils a requirement of our

funding agreement with the Crown.

24. HBRC will use the Project

Lifecycle Management Framework and related processes to form the basis of what

is now the PMO process and control systems. The framework is based on

international best practice for project management.

25. The structure of the PLM

framework is illustrated below. Gateways requiring Manager/Sponsor approval

exist between each phase to ensure that projects are adequately progressed

before embarking on the next phase of work.

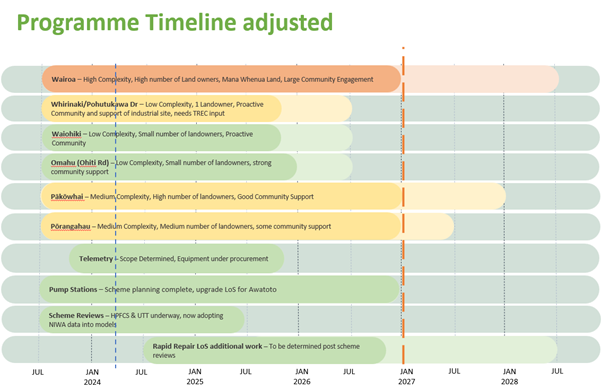

26. Delivery of the programme

is tracking at an operational level (contractual delivery) including an overlay

from a political delivery timeline (refer to the diagram below). As

noted, the delivery of a large number of projects is targeted for delivery, in

some cases up to 12 months earlier than expected. In order to achieve delivery,

risks will be elevated such that engagement and design timelines will be

compressed, consenting fast tracked, and building will be required through

winter periods.

27. In order to mitigate

probable bottlenecks, Council staff are proposing to increase financial

delegations for engagement and processing to speed up processing (see para 36).

Programme assurance, risk and controls

28. The Assurance Management

Plan outlines that the programme will operate the following principles, such as

amongst others:

28.1. Independence – RCP

has been appointed to the role of Programme Assurance Advisor for the

Crown-funded NIWE Resilience Programme. This will provide a level of independence,

so that assurance activities are able to be carried out by someone who has no

direct control over the project outputs or programme outcomes, etc. The Crown

Infrastructure Partners (CIP) could also undertake assurance activities for

Crown-funded programmes of work, while an external third party could understand

assurance activities for business-as-usual projects and programmes of work.

28.2. Risk based – The

assurance activity should be focused on the high to very high-risk areas, such

as commercial, funding, consenting and land acquisitions. This activity should

be based on an independent risk assessment.

29. Specific Assurance

Activities will include:

29.1. Health Checks – Form

an effective assurance control by assessing how well the programme or project

is performing at a specific point in time, i.e., whether it remains on track to

deliver the expected benefits within the agreed key parameters. It tests

adherence to the principles of programme and project delivery and provides

value by highlighting what is working well, as well as any areas that could be

improved or require escalation.

29.2. Phase gate reviews –

An effective way to apply assurance controls, as a project can’t progress

to its next phase unless it has undergone a gated review.

29.3. Technical assurance reviews

– Form an effective assurance control for compliance with Council’s

design and asset standards, relevant regulatory codes, as well as the overall

suitability of a project’s design (i.e. alignment with project objectives

and overarching programme outcomes and benefits).

29.4. Risk reviews –

Regular review of key risks to the projects and programmes of work (e.g.

funding, or consenting requirements).

30. The programme has

undertaken a risk assessment for the overarching delivery, including having

individual risk registers per project. At this early stage of the

project, inevitably a number of risks exist that require actions to be taken.

Specific highlights include:

30.1. Pump Stations – this

is noted as Red. This is due to design confirmation still being determined and

potential lead times of fish-friendly passage pumps being required which

currently pose a risk to both cost and timing.

30.2. We expect once embedded

programme documentation and forums are operating as intended that key risks

such as design, procurement, and costs will be mitigated.

30.3. The timeline for delivery

remains on watch and is reflected in the attached NIWE

Resilience Programme – Performance and Risk dashboard.

Change

Management

31. The change control process

provides the NIWE Resilience Programme with the ability to make informed

decisions on how to respond to events that could have an impact to the

programme and its constituent projects. By knowing about an event early, it

allows time to influence the change with the relevant stakeholders, avoiding

unnecessary time, cost or reputational implications for things that do not help

achieve the programme’s objectives.

32. Managing change at the

programme-level is significantly more complicated compared to managing change

on the project-level. Managing change at the programme-level includes

understanding how a project-level change may impact the overall programme of

works, including interfacing projects. A change event that may be considered a

normal change for a project, will require greater attention at the programme

level. The Programme Board and Programme Assurance Group have been established

and empowered to make the best for programme decisions on the NIWE Resilience

Programme and its two sub-programmes.

33. Escalation pathways and

limits are still being confirmed and we will report back on this in our next

update.

34. Programme Change Notices

(PgCNs) will be reviewed, approved and/or rejected at the PAG, unless the

change impact exceeds the delegated limit for the Programme Sponsor, in which

case the change decision will be escalated to the Environment and Integrated

Catchments Committee and/or Risk and Audit Committee.

35. Programme change requests

will be funded either from the existing general risk and contingency allowance

held at programme-level or via the provision of additional budget from the

general risk and contingency allowance held at portfolio-level.

Delegations

36. The NIWE programme as a

total package has been approved by Council through the Three Year Plan and

adoption of the FOSAL agreement in August 2023. The Three Year Plan has the

full commitment for spend across the coming 4 years.

37. For operational

effectiveness and budget management, Council officers would like to propose an

increase in some high-level financial delegations to expedite decision making

and speed up potential bottle necks in payments and engagement.

38. It is anticipated that in

some instances the value of contracts required for design and build may exceed

$15m, given the value of works required in larger projects over 2 years. In

instances where a contract value exceeds that of the CE, urgent approval to

proceed will be sought from Council.

39. As currently allowed within

the Financial Delegation Manual, Sub delegations are allowed from the Chief

Executive to sub delegate powers, duties or functions and 3.1 Make changes

to delegation levels within his or her operational control. In

addition, 3.2. General Managers may sub-delegate their authority where it is

permitted in the appendices to this policy.

|

.

|

|

|

|

Delegated Authority Level

|

Financial Delegation

|

|

|

CEO

|

$15,000,000.00

|

|

|

Group Manager - Asset Management

(NIWE)

|

$5,000,000.00

|

|

|

Group Managers (including

Programme Manager NIWE)

|

$1,000,000.00

|

|

|

Functional Managers (including NIWE Direct Reports)

|

$150,000.00

|

|

|

Operation Managers

|

$75,000.00

|

|

|

Senior Financial Accountant

|

$50,000.00

|

|

|

Level 1

|

$10,000.00

|

|

|

Level 2

|

$7,500.00

|

|

|

Level 3

|

$5,000.00

|

|

|

Level 4

|

$3,000.00

|

|

|

Level 5

|

$2,000.00

|

|

|

Level 6

|

$1,000.00

|

|

|

Level 7

|

$500.00

|

|

|

Level 8

|

$250.00

|

|

40. Further to the

above and to ensure Council does not expose further risks to the wider

organisation by a blanket increase in financial delegations, Council staff

propose to provide delegation by exception to the Chief Executive for NIWE

Resilience Programme contracts beyond the financial delegation of $15m but

within the scope and limits of the FOSAL agreement of $250m.

41. These contracts

will be provided for within documented procurement management plans according

to Council policies, and the phasing on these costs have been forecast within

the Three Year Plan process.

Strategic fit

42. Delivery of the NIWE

programme is a key priority for Hawke’s Bay Regional Council due to the

commitments given to the Crown through the FOSAL Agreement and in the Three

Year Plan proposed for FY25-FY28.

43. Success for HBRC will be

completion of these works within financial boundaries such that communities are

able to move back into homes and on land impacted by Cyclone Gabrielle and have

resilient prosperous communities.

Financial

and resource implications

44. There will be no resource

or budget implications as the agreed budget exists for this work. It is

anticipated that this will be accommodated within existing budgets only.

Decision-making process

45. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

45.1. The decision does not

significantly alter the service provision or affect a strategic asset, nor is

it inconsistent with an existing policy or plan.

45.2. The use of the special

consultative procedure is not prescribed by legislation.

45.3. The decision is not

significant under the criteria contained in Council’s adopted

Significance and Engagement Policy.

45.4. The persons affected by

this decision are the ratepayers of the region and anyone interested in local

government decision-making.

45.5. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by, or have an interest in the decisions made, Council

can exercise its discretion and make a decision without consulting directly with

the community.

Recommendations

That the Corporate and Strategic

Committee:

1. Receives and considers the Future

of Severely Affected Land (FOSAL) delivery staff report.

2. Recommends that

Hawke’s Bay Regional Council:

2.1. Agrees that the decisions

to be made are not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without conferring directly with

the community or persons likely to have an interest in the decision.

2.2. Increases the financial

delegations to the Chief Executive to $15m (from $10m currently) to enable

contract execution and loading of purchase orders and payments as they pertain

to the North Island Weather Events Resilience Programme (NIWE).

2.3. Agrees that for contracts

beyond the Chief Executive delegation of $15m, specifically within the North

Island Weather Events (NIWE) Resilience Programme per the Future of Severely

Affected Land agreement of $250m and as documented in the Hawke’s Bay

Regional Council Three Year Plan 2024-2027, specific approval by exception is

delegated to the Chief Executive to enable contract execution and loading of

purchase orders and payments as they pertain to the NIWE programme.

Authored by:

|

Jess Bennett

Senior Manager Finance Recovery

|

Jon Kingsford

Manager Regional Projects

|

Approved by:

|

Chris Dolley

Group Manager Asset Management

|

Susie Young

Group Manager Corporate Services

|

Attachment/s

|

1⇩

|

NIWE Risk Dashboard - April 2024

|

|

|

|

NIWE Risk Dashboard - April 2024

|

Attachment

1

|

Hawke’s Bay Regional

Council

Corporate

and Strategic Committee

15 May

2024

Subject:

Report on the independent review of the HB CDEM Group’s response to

Cyclone Gabrielle

Reason for report

1. This item introduces a

report (attached) on the Bush International Consulting Limited report Hawke’s

Bay Civil Defence and Emergency Management Group Response to Cyclone Gabrielle

(also attached) from Doug Tate, HB CDEM Coordinating Executives Group Chair.

2. The report provides an

overview of the review process and outcomes and an outline of work underway at

the time of writing in response to the review. The report has been provided to

all councils in the region.

3. HBRC’s role in

relation to the report is twofold. First, HBRC is the administering authority

for HBCDEM Group and, secondly, HBRC will need to respond to recommendations in

the report, particularly around intelligence provision in support of CDEM.

4. HBRC is the Administering

Authority for the HB CDEM Group pursuant to section 23 of the Civil Defence

Emergency Management Act 2002 (the Act).

5. The role of HBRC in

performing this function (and, as appropriate, the role of the Chief Executive

of HBRC) is prescribed in section 24 of the Act as being responsible for the

provision of administrative and related services that may from time to time be

required by the [Group]. The costs for these administrative and related

services for the Group are agreed by the Joint Committee. HBRC rates for these

costs on behalf of the Group, also as agreed by the Joint Committee.

6. In a practical sense, this

means that HBRC and its Chief Executive have responsibility for hosting the

Group Office (Hawke’s Bay Emergency Management) and employing its staff.

However, the Governance responsibility for these functions rests with the Joint

Committee and operational direction for the Group Office is provided by the

Coordinating Executives Group. The Regional Council does not have a direct

governance role in relation to HBCDEM. Instead HBRC appoints its Chaiperson to

the Joint Committee.

7. As well as staff support to

the Group office, HBRC supplies important data and intelligence, for example in

relation to flood modelling and river levels. Members will be provided with an

overview of activities underway in these areas as part of an agenda item at a

future meeting.

Decision-making process

8. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That Hawke’s Bay Regional

Council receives

and notes the Report on the independent review of the HB CDEM Group’s

response to Cyclone Gabrielle.

Authored

& Approved by:

Attachment/s

|

1⇩

|

HB CDEM CEG report on Bush review

findings and implementation

|

|

|

|

2

|

HB CDEM Group response to Cyclone

Gabrielle - Bush report

|

|

Under Separate Cover

|

|

HB CDEM CEG report on Bush review

findings and implementation

|

Attachment

1

|

Hawke’s Bay Regional

Council

Corporate

and Strategic Committee

15 May

2024

Subject: Financial report for FY23-24

to 31 March 2024

Reason for report

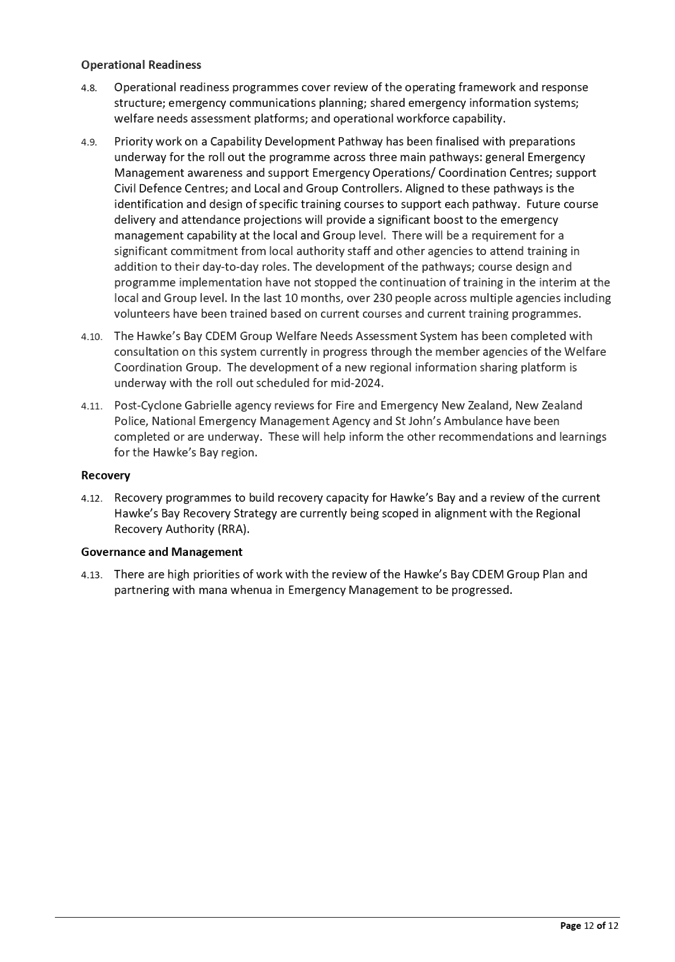

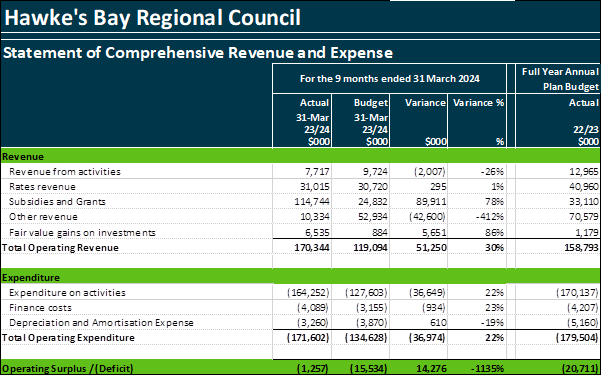

1. This report presents the

financial results of the Council for the nine months to 31 March 2024

including a full year forecast of the Group of Activity expenditure and

funding.

2. In addition, this item

provides updates on treasury activities and HBRC’s credit rating

application, as well as information about Green Loans.

Background

3. Financial performance is

reported to the Corporate and Strategic committee quarterly. The report presented

today is for the third quarter of the 2023-24 financial year.

4. The financial performance

statements included are:

4.1. HBRC Statement of

Comprehensive Revenue and Expense for the nine months to 31 March 2024

4.2. HBRC Statement of Financial

Position as at 31 March 2024

4.3. Comprehensive Revenue and

Expense by Group of Activities.

Key

Points

5. Total operating revenue for

the period is $170.3m, $51.3m above budget, principally due to funding for

sediment and debris activity which was not included in the Annual Plan.

6. Comparably, total operating

expenses for the period are $37m above budget at $171.6m, again largely

impacted by expenditure on sediment and debris.

7. Borrowings continue to be

higher than expected due to additional funding required since the cyclone to

fund response and recovery activities while we work through the National

Emergency Management Agency (NEMA) and insurance claims.

8. The full year forecast

indicates a potential $6.7m shortfall in funding driven by investment income.

This impacts our working capital position and cash management.

9. To help counter increased

borrowing, officers are working on green loans and a credit rating application

to reduce the cost of borrowing.

10. Good progress has been made

by HBRC and HBRIC on setting up to deliver the Statement of Expectations for

the next three years as approved by this Council earlier this year.

Statement

of Comprehensive Revenue and Expense

Commentary on Statement of Comprehensive Revenue and Expense

11. The actual result to 31

March 2024 is a loss of $1.3m while HBRC budgeted a deficit of $15.5m for the

first nine months of the year.

12. Sediment and Debris (HBRRA)

and the Silt Taskforce (HBRC) continue to be significant activities for the

organisation, making up $104.6m of the revenue and $103.6m of the expenditure

reflected above (all sediment and debris revenue and most of the silt taskforce

are currently offset by expenditure). This activity was not budgeted in the

Annual Plan 2023-2024 and, therefore, is the main contributor to the

significant variances in revenue and expenditure.

13. After taking out the

Hawke’s Bay Regional Recovery Agency (HBRRA) and silt taskforce funding,

subsidies and grants are $10m, $14.8m behind budget. This is mainly due to the

time taken to work through the NEMA claims. We are likely to see payments for

the initial claims before the end of the financial year.

14. The shortfall in other

revenue reflects the associated delay in receiving insurance claim money and

the lower than budgeted investment returns, particularly from Napier Port.

These are somewhat offset by fair value gains on investments as they recover,

however, these are not available to fund activities as they are not cash returns.

15. Total expenses for the

period were $171.6m of which $42.7m is for the HBRRA (sediment and debris) and

$60.9m for the silt taskforce, leaving $68m against a budget of $134.6m.

16. The operating underspend of

$66.6m is across a number of areas which are detailed in the Organisational

Performance Report.

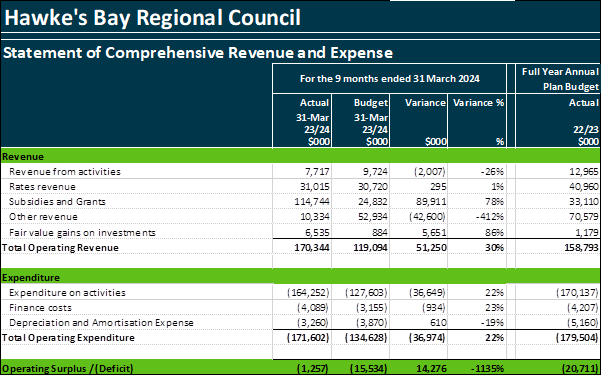

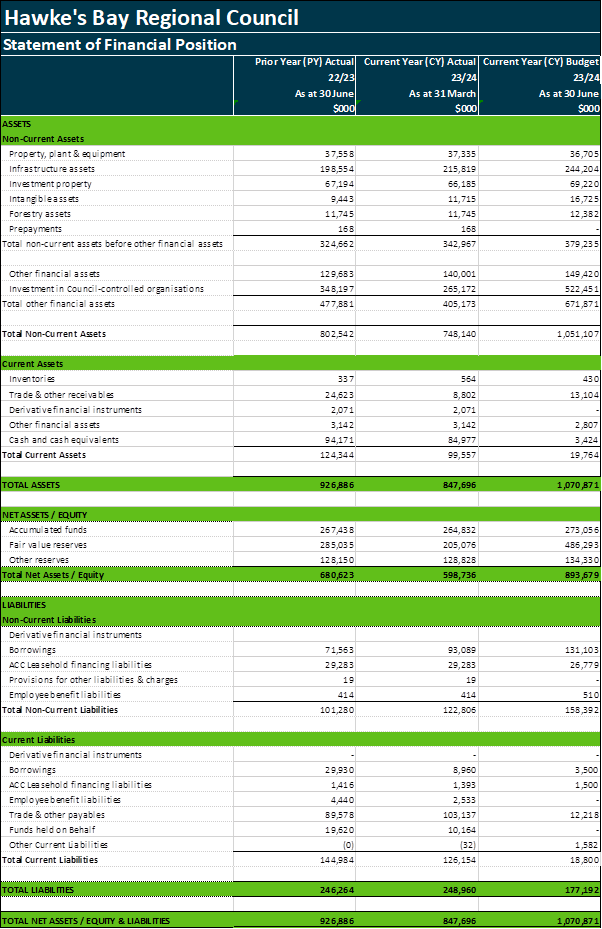

Statement

of Financial Position

Commentary

on Statement of Financial Position

17. Infrastructure Assets has

increased by $17.2m due to the significant amount of capital work being undertaken

to repair assets damaged by Cyclone Gabrielle. The budget for the full

year shows an expected value of $244m which will be a combination of capital

works and the revaluation of these assets by external valuers as part of our

Annual Reporting process.

18. Intangible assets value has

fallen this quarter, predominantly due to the carbon credits movement.

The unit rate for last quarter was $69.15 and that has fallen to $58.53 at the

end of Q3. This resulted in a $1.7m write down of the value of our carbon

credits. However, the current value is still above the $41.00 per unit at the

end of the last financial year.

19. There has also been some

volatility on the Napier Port shares which were down to $2.36 as at 31 March

(was $2.51 as at 31 December 2023 and $2.50 at the end of last year). This is

reflected in the Investment in Council-controlled organisations.

20. Cash and Cash equivalents

is showing at $85m as at 31 March 2024. We received $46m (GST Inclusive)

for further Sediment and Debris work. See the Treasury commentary for

further details on overall cash position.

21. Trade payables are sitting

at $103.1m with $49.6m held as income in advance (HBRRA) and Accrued

Expenditure totaling $24m, a large portion of which is the sediment and debris

work.

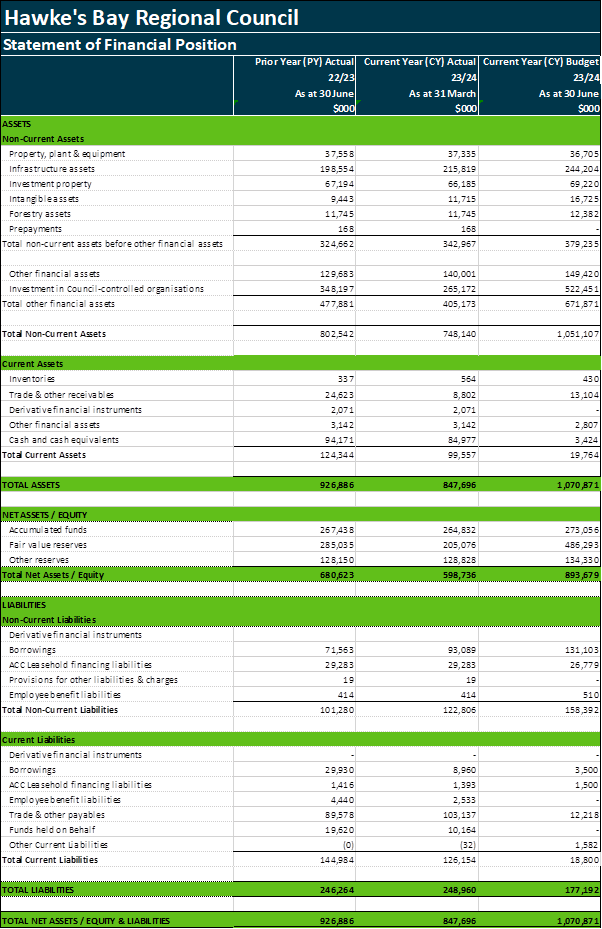

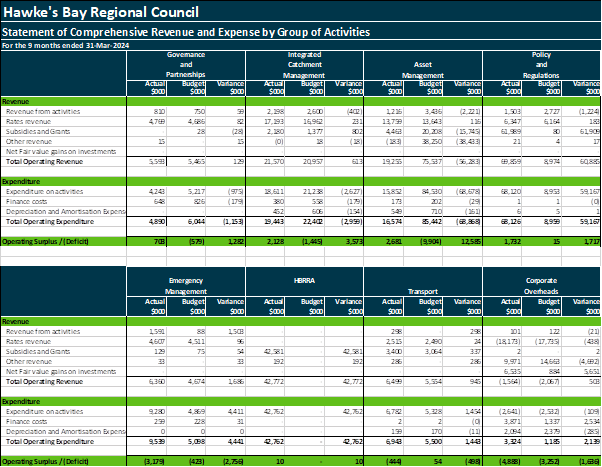

Financial

summary by Group of Activities (GOA)

22. The following table

provides a breakdown of the statement of comprehensive revenue and expense by

Group of Activities (GOA). The Organisational Performance Report includes

further financial and non-financial commentary for each GOA.

23. GOA expenditure includes

each activity’s external expenditure, internal staff time, finance costs

(interest), depreciation/amortization and a share of corporate overheads.

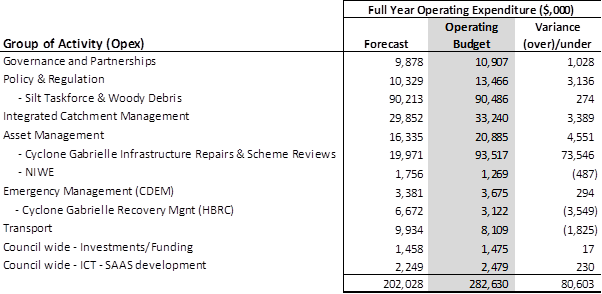

Full year forecast of GOA expenditure and funding

24. The full year forecast

operating and capital activity expenditure and corresponding forecast funding

is outlined in the tables below. The operating budget included in the

tables is the Annual Plan budget revised for approved carryforwards and new funding

agreements since finalisation of the Annual Plan budget.

25. Operating expenditure is

currently forecast to be $80.6m under budget, which is predominately due to the

budget assumptions made for the cyclone infrastructure repair works. An

operating expenditure budget of $92.5m was included in the 2023-24 Annual Plan

budget based on the total anticipated cost of repair works. Some of those costs

were then incurred in the 2022-23 FY ($29m). A further $19.9m is

anticipated to be spent this financial year with another $21m still required,

for a total forecast of $69.9m (down from the original $92.5m and spread over

three years). A carryforward request will be presented to Council early

in the new financial year to confirm the final budget requirements for

remaining repair works in the 2024-25 FY.

26. Excluding the cyclone

infrastructure repairs, BAU activity expenditure is forecast to be $19.3m

underspent for the year, with $12.2m in capital, and $7.1m in operating

expenditure. The main drivers of the forecast underspends are delayed

forestry harvest, postponed open spaces development projects, delays to the

regional water security programme, and delays in BAU flood protection works

(mostly in the IRG Levels of Service upgrade programme). Some of this

work may require a carryforward of unspent budgets where commitments continue

past 30 June 2024.

27. Cyclone recovery management

activity is currently drawing more of the corporate overhead than budgeted,

which contributes to some of the BAU expenditure underspends. This will

be reviewed and refined for the final overhead allocations at year end.

28. The full year funding

forecast indicates a potential $6.7m shortfall in covering our activity

expenditure. This is mainly driven by investment income being significantly

down on budget assumptions ($2.5m on managed funds and $5m related to the

reduced Napier Port dividends). While BAU activity is forecast to be

underspent, the majority of the reduced spend is offset by reduced borrowing

required, reduced external income or reduced reserves requirements. The funding

shortfall impacts our working capital position and cash management.

29. Rates funding is in line

with budget. Fees and charges income is tracking to be $2.6m behind

budget, mostly related to consent and compliance activity where there has been

a lower proportion of directly recoverable activity (e.g. increased time spend

on advice, especially around cyclone recovery). External income is

forecast to be $63.7m down on budget, mostly related to the timing of cyclone

infrastructure repair claims (insurance and NEMA). Loan funding and

reserves will be used to manage the timing difference. The net funding

forecast for reserves is in debit, as we are anticipating significant pay back

to reserves from insurance proceeds this financial year for the costs incurred

in 2022-23.

Commentary

- Treasury

30. Short-term borrowings

continue to be higher than anticipated as cyclone related NEMA and insurance

proceeds have yet to be received. With Council currently undertaking a

credit rating assessment with credit rating agents Fitch, management has held

off rolling short-term debt to long term and will do so when the credit rating

is received before year end. It is also anticipated an additional $20m

long-term debt will be drawn in June, bringing total external debt to $120m.

31. Cyclone insurance claims

and NEMA infrastructure reimbursements are progressing well. The NEMA

management team processing claims were on site at HBRC in April 2023. Prior to

end of 2023 HBRC had discussed with NEMA how submissions were needed to be

outlined, described and presented such that HBRC have produced six versions of

the claims to date due to various data integrity and presentational issues.

HBRC had been working hard to fulfil the data requirements. NEMA have

reviewed our first claim (seven stop banks totaling $14.2m of eligible costs)

and have advised that they expect to make a reimbursement of 60% before the end

of May 2024.

32. This will allow HBRC to

progress further claims at pace now data and formatting is confirmed, including

making insurance claims for the 40% not covered by NEMA. This is positive

for HBRC and will reimburse short term debt taken for cyclone purposes.

33. Movement on the investment

property portfolios up to the end of Q3 saw 4 Napier (Endowment) properties

complete freeholding. A further 2 were completed in April, together with

1 Wellington leasehold property. No further freeholding of Wellington

properties will be undertaken without consultation with HBRIC as new managers

of the Investment Portfolio.

34. HBRC continues to work with

the Crown on recovery projects and at the end of Q3 held $55.8m on behalf of

the Crown (note this is spread across funds held in advance and income in

advance on the face of the Statement of Financial Position). It is

anticipated the Sediment and Debris programme will be completed by end of

financial year apart from $5m to close down sites, together with operational

funds for the HB Recovery Agency for the FY25 still held on behalf.

LGFA Green Loans

35. HBRC officers are currently

investigating the options of Green Loans with LGFA (Local Government Funding

Agency) as an alternative to standard bonds. These are available to fund

sustainability projects that promote environmental and social wellbeing, or act

on climate change and reduce greenhouse gas emissions. Projects that fit the

criteria attract lower interest rate charges than standard LGFA bonds.

36. We have submitted two

applications, with a third pending and another two identified as possible if

required.

36.1. Climate Action Loan for

General funding – The criterion for this loan is linked the reduction in

scope 1 and 2 emissions and engagement with our vendors on reducing their

emissions (i.e. our scope 3 emissions) for the organisation against our

baseline (2019-2020 year). We are working with our external measurement vendor

to align our reduction targets to meet the LGFA criteria. Currently the ask is

for a 42% reduction by 2030 (from baseline) which aligns with SBTi (Science

Based Targets).

36.2. Erosion Control Scheme

– Although this is an existing programme, we can move any of our future

loan funding requirements for the programme to a GSS climate action linked

loan. Our initial submission was not seen as been ‘additive’ to the

current programme to justify the climate loan. We are working with our

Catchment managers on incentives and additional offerings that can be done

through the programme to meet the LGFA criteria. The focus for this is encouraging

native species planting.

36.3. NIWE Loan funding –

for the $44 million of funding required for the NIWE work, this should meet the

criteria required for the climate adaption loans, we are finalising the

submission for a 23 May LGFA committee review.

36.4. Once the IRG scheme review

has been completed, providing this has post cyclone additive work to be done

above and beyond the programme baseline that we adopt, this is a candidate for

a GSS climate action linked funding loan.

36.5. Post consultation for the

LTP and subsequent finalisation and adoption, the sustainable homes and Land

for Life programmes if they require further loan funding, we believe would also

be candidates for this programme.

36.6. We continue to look for

other programmes of work internally that we could work with the LGFA on.

37. Under the scheme HBRC will

benefit from a materially lower interest rate on borrowings that qualify for

the green climate adaptation loans. We currently report annually on our

greenhouse gas (GHG) emissions. We will have some additional cost to include

the scope 3 emissions (currently waiting on a quote from our provider for

this). As part of the criteria laid out by the LGFA our Emissions Reduction

Plan (ERP) needs to contain projects with their specific reduction impact. We

are pending a workshop (quote to come) with our provider to identify and

finalise the actions available to us to meet our target. This will also allow

us to understand the cost of compliance vs. the savings to be realised from the

lower offered interest rates. Once this is fully understood we can evaluate if

we want to proceed.

38. If HBRC were to commit to,

but then be unable to meet or track our committed reduction target, we would

have a period of review and restitution that would typically cover 3 years with

the LGFA. If we were unable to get back on track, we would risk being

de-classified, meaning that we would no longer qualify for new green loans

(either new borrowing or rolling existing loans). Any existing loans would be

unaffected.

Credit

Rating process update

39. In December 2023 HBRC

issued an RFP to credit rating agencies to provide a credit rating for the

Council. After a review, Fitch Ratings was appointed to undertake the

assessment of HBRC and provide a provisional rating in recognition of their

strong local government presence, including providing rating for Environment

Canterbury. A review of the Council’s financial status is currently

ongoing, both looking forward and back, and expected to be completed in May.

40. Fitch will then issue a

provisional rating which remains private giving the council two weeks to

consider. If agreed, the rating is then made public along with agreed

financial analysis to support the rating. This rating will be shared with

LGFA to enable HBRC to borrow funds at a reduced rate at their next tender

round in June.

Investment

Strategy update

41. HBRIC is now focused on

delivering the Statement of Expectations for the next three years as approved

by this Council earlier this year. With the new SOE and SIPO agreed HBRIC

has turned its attention to the managed funds, progressed through the RFP

process and appointed Jarden/First Cape as sole investment managers for all

managed funds.

42. A transition plan is

currently being prepared and independent tax advice sought on the best outcome

for HBRIC and HBRC for management of assets. Transition is hoped to be

completed by 30 June 2024. During transition returns may be affected as the

managed fund portfolio is positioned to deliver HBRC’s requirements for

the 2024-27 Three Year Plan and beyond.

43. HBRIC then intends to

investigate HBRC’s other investment assets to ensure optimal returns and

will continue to monitor the Napier Port through oversight, noting this is a

strategic asset and ownership is not currently under review.

44. HBRIC will undertake full

analysis and advice will be sought on the investment property portfolios and

their liabilities. It is anticipated HBRIC will then assess the forestry

operations noting their dual objectives for erosion control and financial

returns.

Decision-making

process

45. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

the Corporate

and Strategic Committee receives and notes the Financial report for FY23-24

to 31 March 2024.

Authored

by:

|

Amy Allan

Senior Business Partner

|

Pam Bicknell

Senior Group Accountant

|

|

Chris Comber

Chief Financial Officer

|

Tracey O'Shaughnessy

Treasury & Investments

Accountant

|

|

James Park

Management Accountant

|

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s There are no attachments

for this report.

Hawke’s

Bay Regional Council

Corporate

and Strategic Committee

15 May

2024

Subject:

Organisational Performance report for the period 1 January – 31 March

2024

Reason for Report

1. This item presents the

Organisational Performance report for the period 1 January – 31 March

2024.

Organisational Performance Report content

2. The report contains four

parts:

2.1. Executive summary including highlights and

lowlights.

2.2. Corporate metrics that focus on how well we

are performing across a number of corporate-wide measures such as employee

turnover and customer service.

2.3. Level of

Service Measures (LOSM) by group of activities for red or orange traffic light

status measures with commentary (i.e. exception reporting).

2.4. Activity

reporting with

non-financial traffic light status and commentary and financial status and

commentary rolled up to group of activities.

3. Organisational performance

reports were established in 2018. The status and commentary reporting are

rolled up from cost centre to activity level. Commentary by cost centre is still

available to committee members on request to staff.

4. Staff complete their

reporting in a software tool called Opal3. For LOSM and activity reporting,

staff select the status (red, amber, green) and provide commentary on what they

did in the quarter against their annual work plans.

Points

of interest

5. Communications

and Engagement page has been split into two, to include a page on Digital Media

with new and updated graphs, metrics and commentary to reflect

councillors’ interests

(see pages 10 & 11).

6. Electricity and gas data

and commentary has been removed. This information is provided in detail in the

annual HBRC Carbon Footprint report and in the HBRC Annual Report.

7. Strategic

projects reporting has been reintroduced this quarter.

8. Due to a staff

vacancy, the Reporting Dashboard (PowerBI) is not available for councillors

this quarter.

Corporate

metrics

9. Annual staff turnover is at

the lowest point since March 2022.

Levels

of service performance reporting

10. Staff have reported 11

performance measures as ‘off track’, and 5 as ‘not

achieved’ by the end of the year. This is up from 7 marked as ‘off

track’ from last quarter.

Activity

reporting

11. Staff have reported 6

activities as ‘off track’ from their usual workplans. This has

improved from 7 last quarter.

12. Financial reporting shows 2

groups of activities are ‘off track’ compared with 5 last quarter.

Decision-making process

13. Staff have assessed the requirements

of the Local Government Act 2002 in relation to this item and have concluded

that, as this report is for information only, the decision-making provisions do

not apply.

Recommendation

That

the Corporate and Strategic Committee receives and notes the Organisational Performance

report for the period 1 January – 31 March 2024.

Authored by:

|

Sarah Bell

Team Leader Strategy and Performance

|

|

Approved by:

|

Desiree Cull

Strategy and Governance Manager

|

|

Attachment/s

|

1

|

2023-24 Q3 HBRC Organisational

Performance Report

|

|

Under Separate Cover

|

Hawke’s

Bay Regional Council

Corporate

and Strategic Committee

15 May

2024

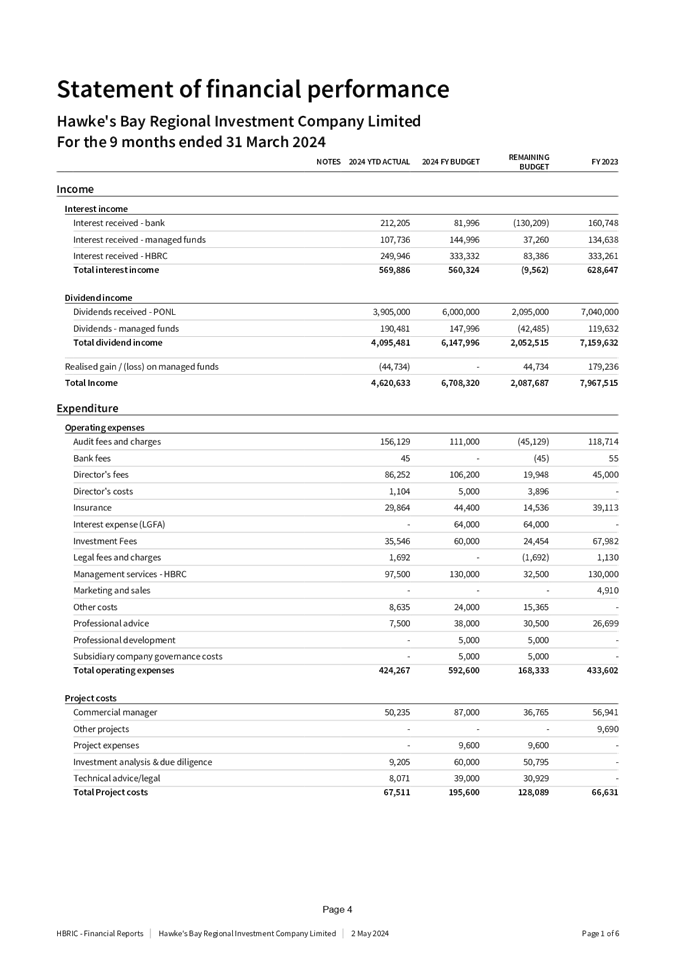

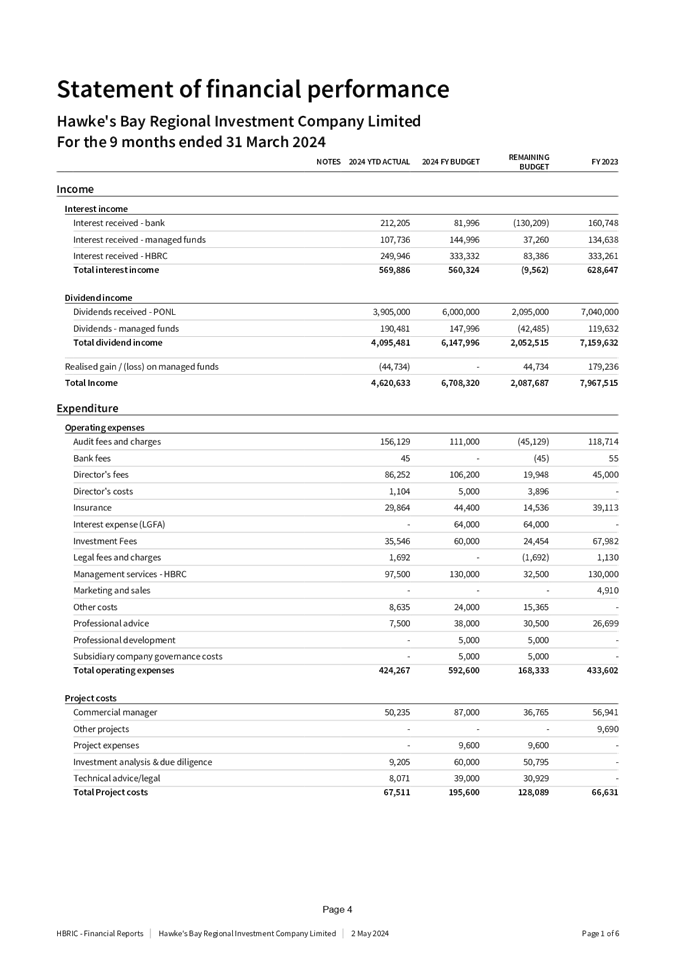

Subject: HBRIC Ltd quarterly update

Reason for Report

1. This item presents the

HBRIC quarterly update for Q3 January – 31 March 2024.

Financial

Reporting

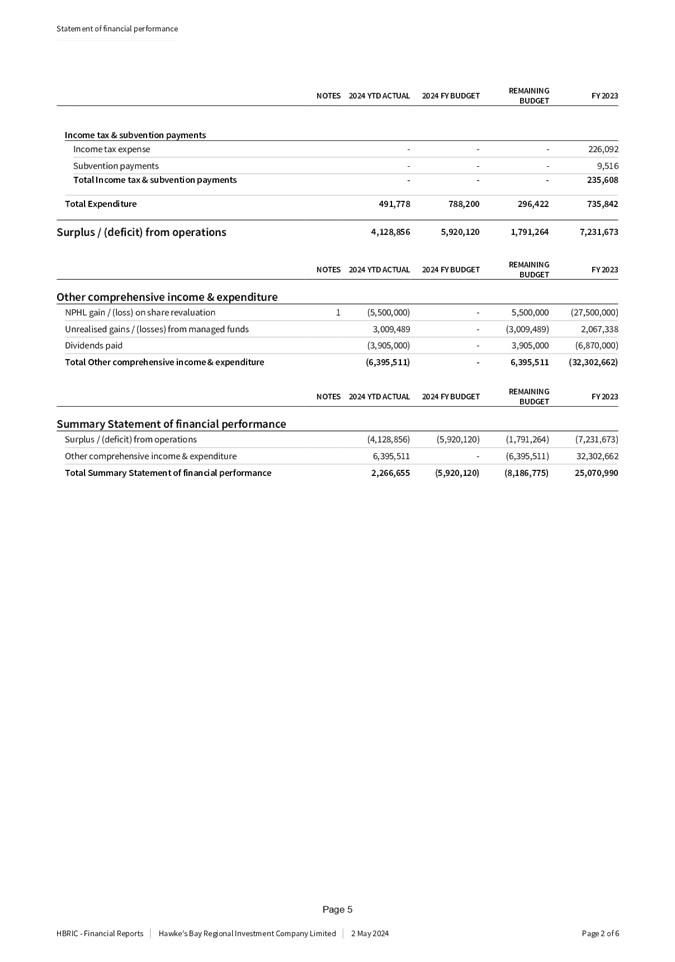

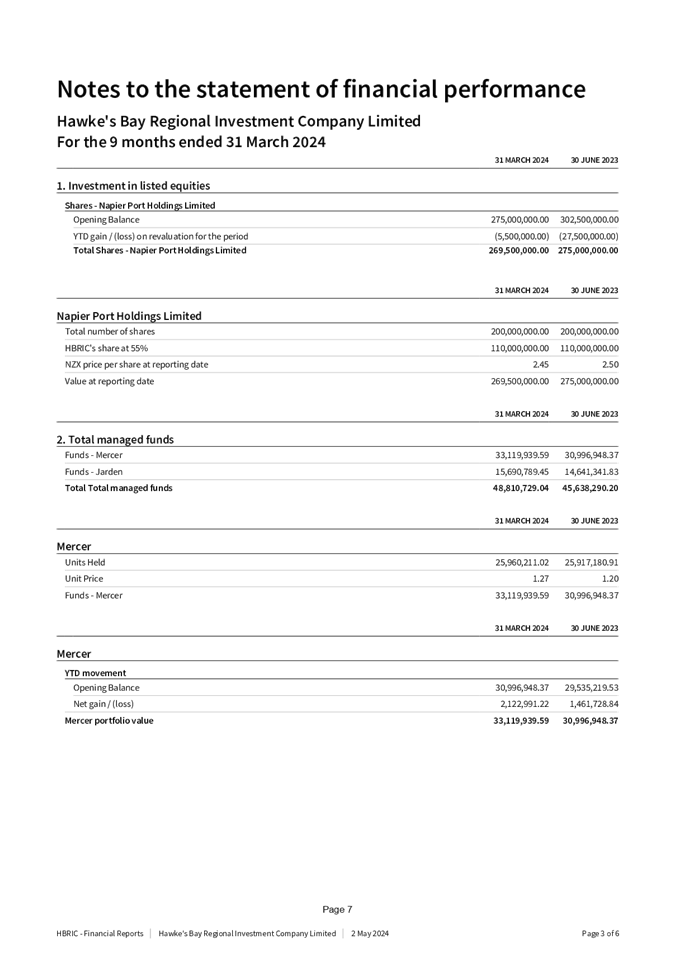

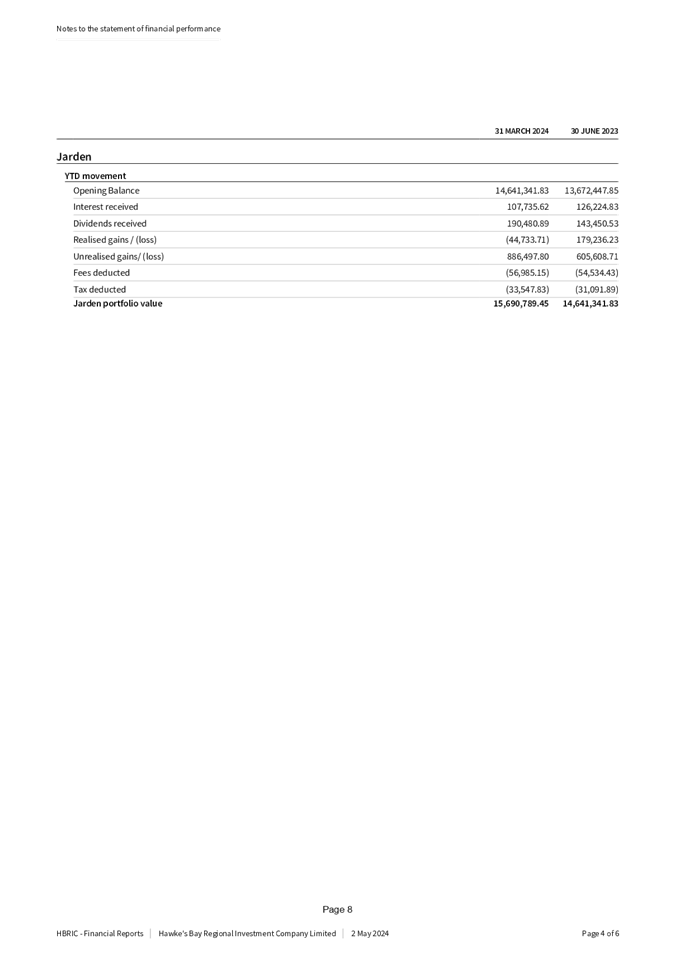

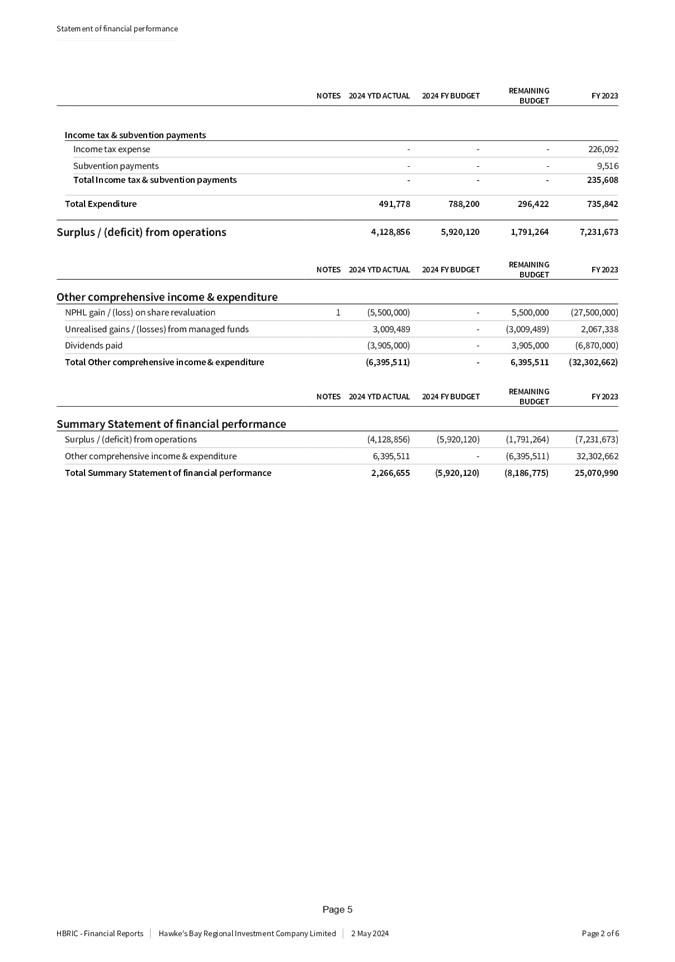

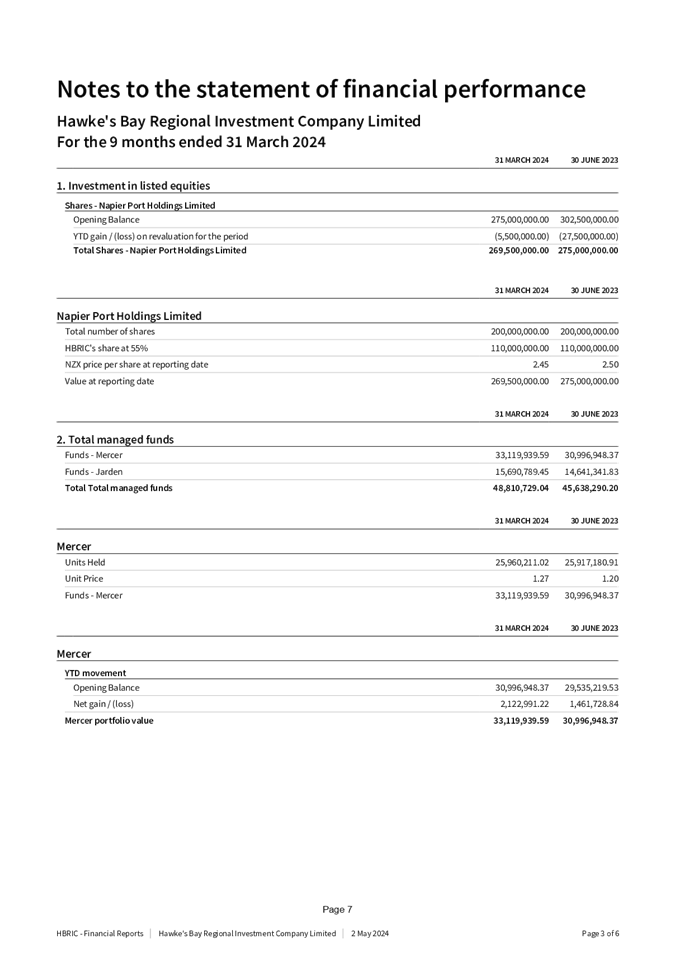

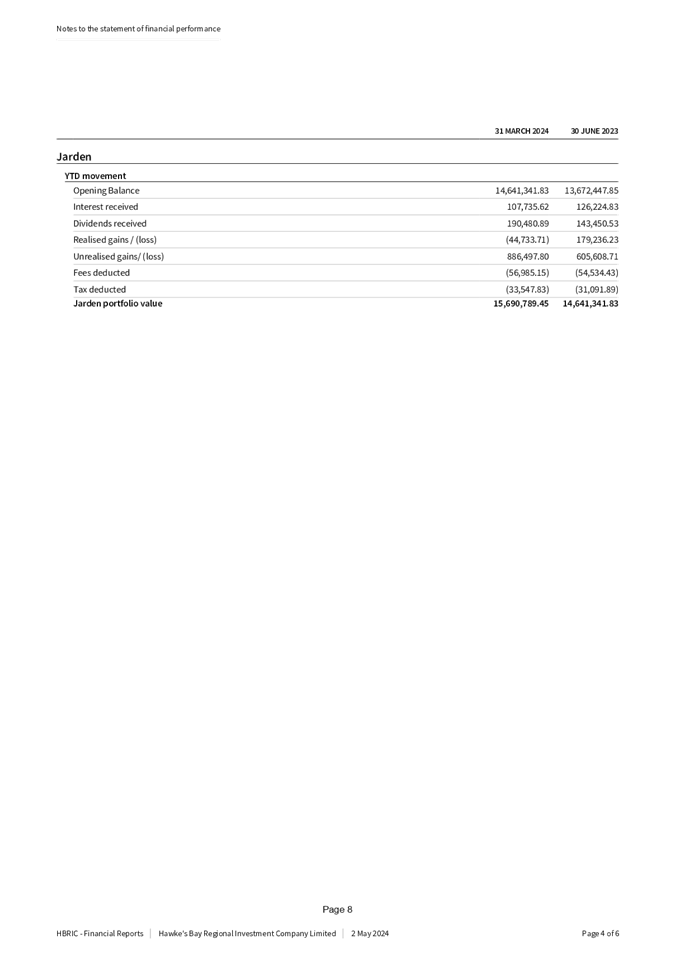

2. HBRIC’s YTD Financial

Statements as at 31 March 2024 are attached to this report.

3. Key Items to note:

3.1. Statement of Financial

Performance

3.1.1. YTD surplus of $223k

(excluding fair value movements through other comprehensive income).

3.1.2. YTD $462k interest income

(excluding managed funds)

3.1.3. YTD $253k net return from

managed funds (excluding unrealised gains).

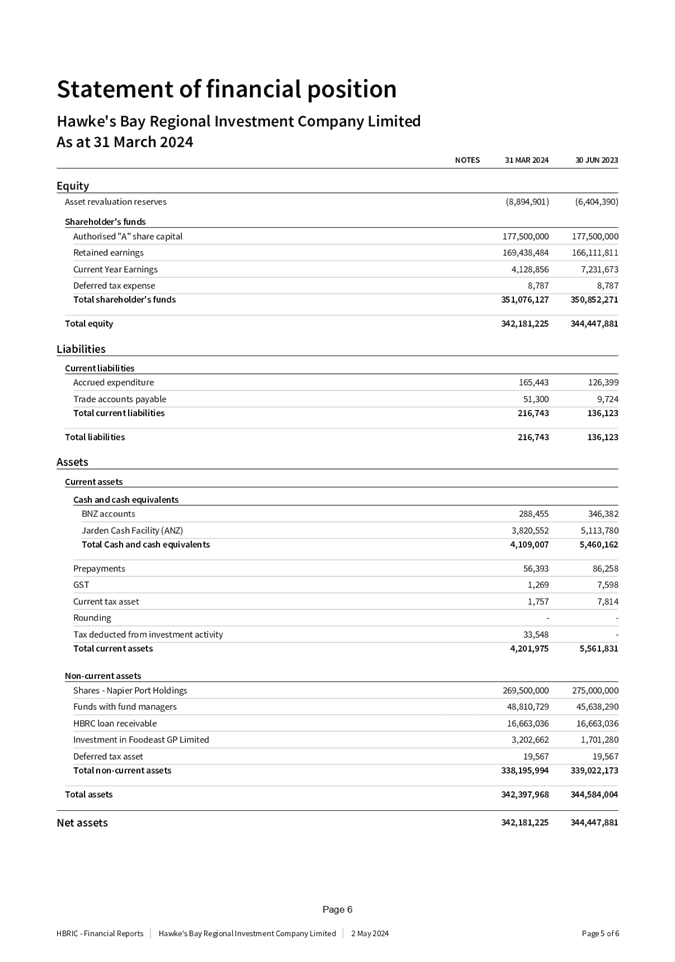

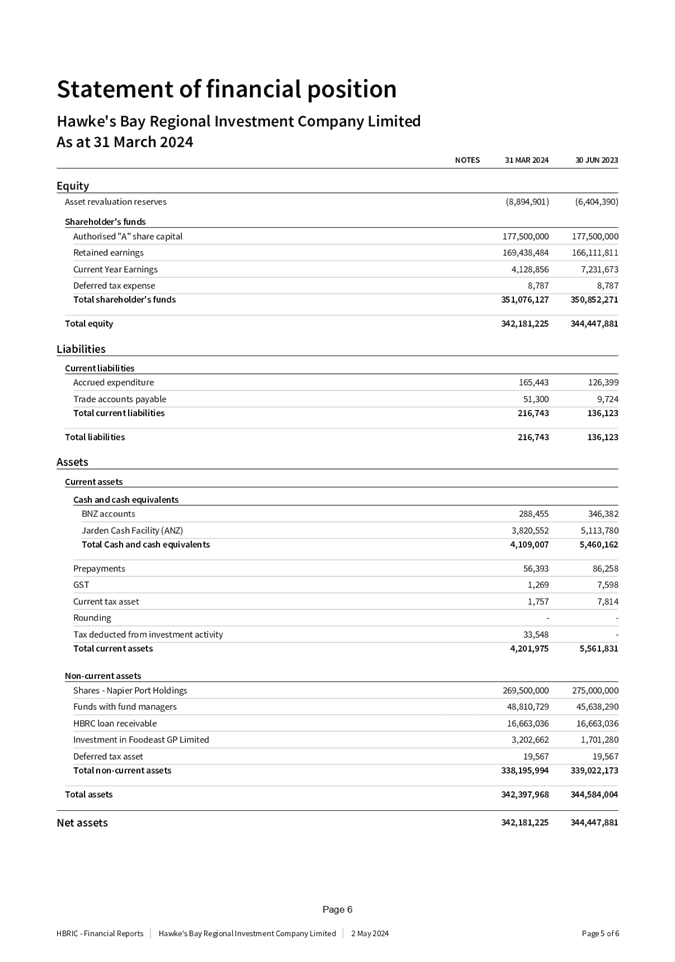

3.2. Statement of Financial

Position

3.2.1. Decrease in net assets of

$2.2 million as at 31 March 2024

3.2.2. NPHL share price has

decreased 2% YTD from $2.50 to $2.45 – total decrease is $5.5million

3.2.3. Increase in managed fund

value of $3.1million.

Managed Funds

4. These funds were formed

using proceeds raised from the Napier Port IPO and are considered a strategic

asset. They remain under management in compliance with Council’s

SIPO.

5. The value of managed funds

for HBRIC as at 31 March 2024 amounted to $48.8 million, a movement of

approximately $3.1m (6.95%) year to date.

6. This is below the capital

protected value of the asset of $50.2m (2% compounded inflation since

inception). No divestments have been made YTD.

Port Dividend

7. Each year HBRIC receives

dividends from Napier Port Holdings Ltd. HBRIC received $3.905m in

December, against budget YTD of $3.840m. 100% of this dividend was passed

through to the HBRC.

FoodEast

8. The third-quarter financial

report for Foodeast Limited Partnership ending 31 March 2024 reported

significant developments, including the nearing completion of Building A with a

planned handover by the end of April. Although there was no operating revenue

reported, the operating costs were notably lower than projected. The financial

period saw the drawdown of the final tranches of the $12 million grant from the

Kānoa Provincial Development Unit, directed towards construction and

pre-construction expenses. Contributions from the three Limited Partners to

date amounted to $4.8 million. Notable financial entries included a

lower-than-expected operating cost of $336,515 against a forecast of $506,288.

9. Strategically,

Foodeast-Haumako is enhancing its commercial strategy to develop revenue

streams beyond tenancies, with several industry-related events and tenant

bookings in planning. The board is also actively engaging with local iwi to

explore collaborative opportunities and has started recruitment for key

operational roles to strengthen its management team. Looking forward,

Foodeast-Haumako is preparing for the operational phase, focusing on internal

fit-outs and setting up for tenant occupancy and events.

Napier

Port

10. Napier Port half-year 2024

trade volume report for Half Year Ended 31 March 2024

10.1. Total Container Volumes:

Decreased by 17.3% compared to the same period last year

10.1.1. Second Quarter 2024: Total

container volumes decreased by 6.3% to 56k TEU

10.1.2. Half Year 2024: Total

container volumes decreased by 17.3% to 98k TEU

10.1.3. Reefer Export Cargo:

Increased by 25.9% driven by favourable growing conditions in Hawke’s Bay

10.1.4. Dry Export Cargo: Decreased

by 34.8%, influenced by Cyclone Gabrielle's impact on production facilities.

10.2. Total Bulk Cargo Volumes

Increased by 21.6% compared to the same period last year

10.2.1. Second Quarter 2024: Bulk

cargo volume increased by 53.1% to 0.87 million tonnes

10.2.2. Half Year 2024: Bulk cargo

volume increased by 21.6% to 1.88 million tonnes

10.2.3. Log Exports: Increased

significantly, driven by windthrown forests and additional unprocessed log

volumes.

11. With market conditions

remaining affected by Cyclone Gabrielle and the subsequent recovery in some

sectors, Napier Port anticipates a recovery in some trade sectors and will

provide a financial update on 22 May 2024.

New

Investment Strategy implementation

12. The major focus

this quarter has been the commission and completion of a Request for Proposal

for Council’s Managed Funds Portfolio. Council’s portfolio

totalling $166m is currently split between Jarden and Mercer. Six candidates

were short-listed and interviewed by a HBRIC panel with its recommendation

being supported by the full HBRIC Board.

13. Accordingly,

the decision has been made to appoint Harbour Asset Management as the HBRC

Group’s sole fund manager. This is a leading NZ funds

management firm with extensive experience managing investment portfolios for

charitable trusts, community trusts, iwi, crown financial institutions and

superannuation scheme. We will also continue to retain the services of Jarden

locally to provide in-depth banking and investment advice, and aligns

closely with HBRIC’s goals to boost Council’s investment

performance and returns.

14. While

remaining separate entitles, alongside the National Australia Bank both Harbour

Asset Management and Jarden are now a part of the newly-formed FirstCape group with $44 billion worth of funds under management or

administration and advice.

15. We are in the final stages

of initiating the transition of funds from the incumbent managers to Harbour

Asset Management, including legal and tax due diligence matters and we propose

to have FirstCape representatives present at the next C&S meeting.

16. With the priority Managed

funds RFP now mostly competed, at its meeting on 9 May HBRIC will confirm a

proposal for a comprehensive assessment of the Group’s remaining

investment assets (excluding Napier Port) to ensure alignment with the Council’s

overall risk/return investment objectives set out in the Statement of

Expectations. An update will be provided to this meeting.

Decision-making process

17. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, ass this report is for information only, the decision-making

provisions do not apply.

Recommendations

That

the Corporate and Strategic Committee receives and notes the HBRIC Ltd

quarterly update report.

Authored by:

|

Tom Skerman

HBRIC Commercial Manager

|

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

HBRIC Financials

|

Attachment

1

|