Meeting of the

Hawke's Bay Regional Council

Late Items

Date: Wednesday 28 February 2024

Time: 9.00am

|

Venue:

|

Council

Chamber

Hawke's

Bay Regional Council

159

Dalton Street

NAPIER

|

Agenda

Item Title Page

Information

or Performance Monitoring

16. Revenue

and Financing Policy review– Further analysis for deliberations 3

Hawke’s Bay Regional Council

Wednesday

28 February 2024

Subject: Revenue and Financing Policy Review– further

analysis for deliberations

Reason

for Report

1. Attached is further analysis

undertaken to support decision-making on the Revenue and Financing Policy

review. This information was either requested by Councillors at the Hearing on

13 February or in response to common themes raised in submissions.

Attachments

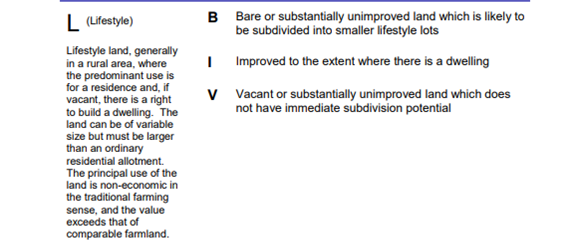

2. Socio-economic assessment: As referred to in paragraph 31 in the

report entitled “Revenue and Financing Policy Review Deliberations - Proposed Move from

Land Value To Capital Value For The General Rate” and paragraph 16 in the report entitled

“Revenue And Financing Policy Review Deliberations - Revenue And

Financing Policy”. It compares the impact on 30 high socio-economic

status properties and 30 low/medium socio economic properties across the region

(predominately residential) using the New Zealand

Index of Deprivation, 2018 (NZDep2018) (arcgis.com). The results indicate that

areas of low socio-economic status are less impacted by the cumulative changes

than high socio-economic areas. Note this is not a definitive analysis of

all properties rather a test of social impact including ability to respond to

the change.

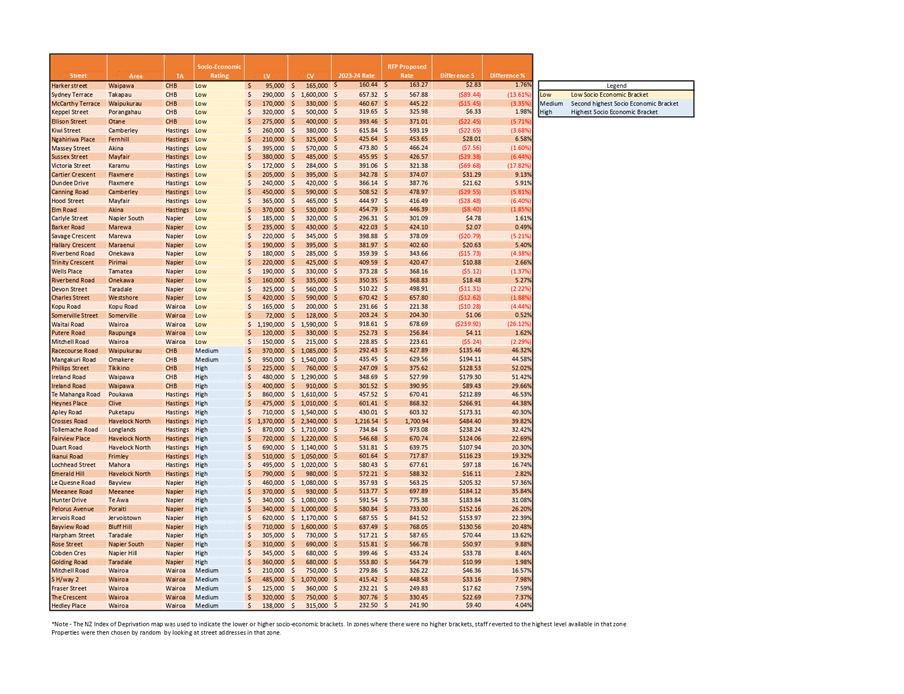

3. Sustainable Land Management,

Biodiversity/Biosecurity rates:

As referred to in

paragraph 22 in the report entitled “Revenue and Financing Policy Review

Deliberations - Sustainable Land Management, Biodiversity and Biosecurity

Rates”. Staff have modelled two additional splits for these two

rates which were moved to the general rate in the proposal. The new splits are

75 GR : 25 TR and 90 GR : 10 TR (*note this was incorrectly noted as 50/50

split in the report). Council could consider shifting some cost back to a

targeted rate if it agrees that identifiable parts of the community benefit or

cause the need more than others; and the net benefit of a separate targeted

rate outweighs the benefits of including it in the general rate (a step one

decision). The effect is to move burden off urban and onto non-urban.

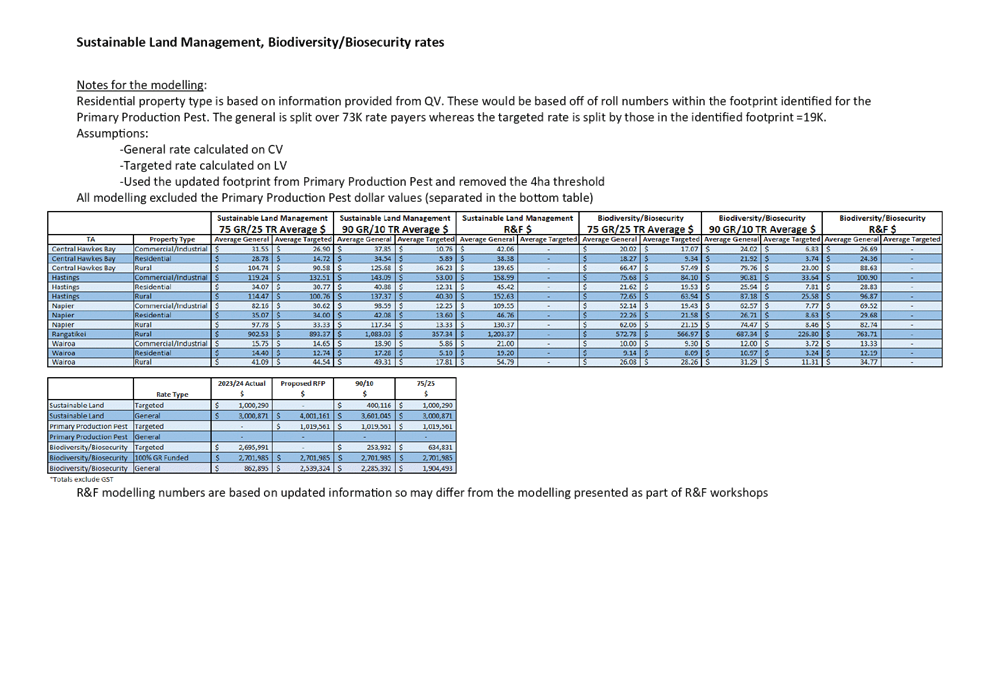

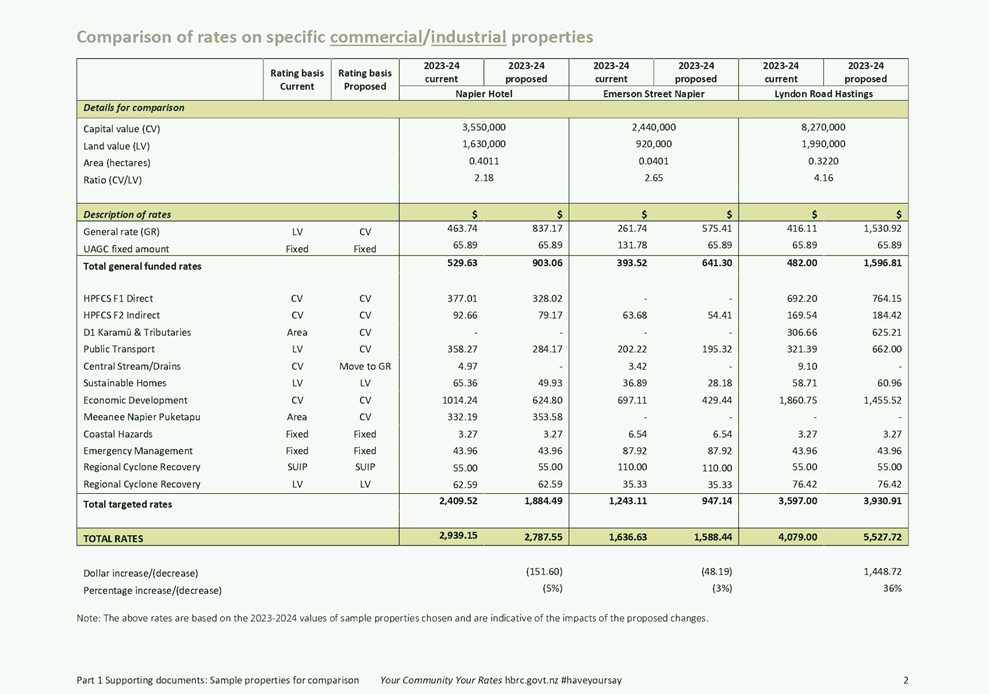

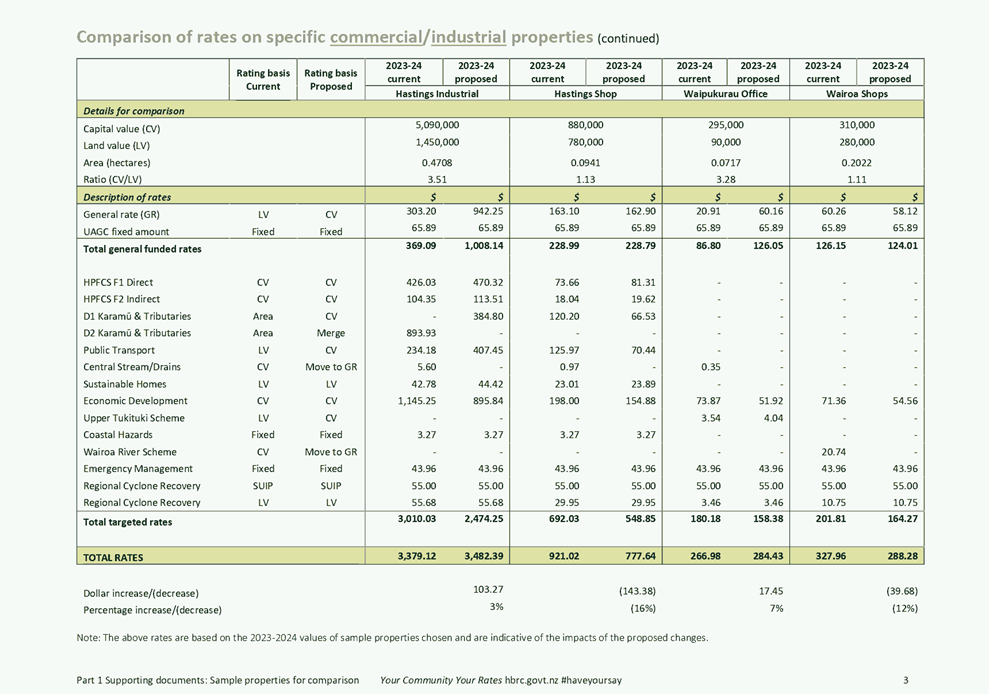

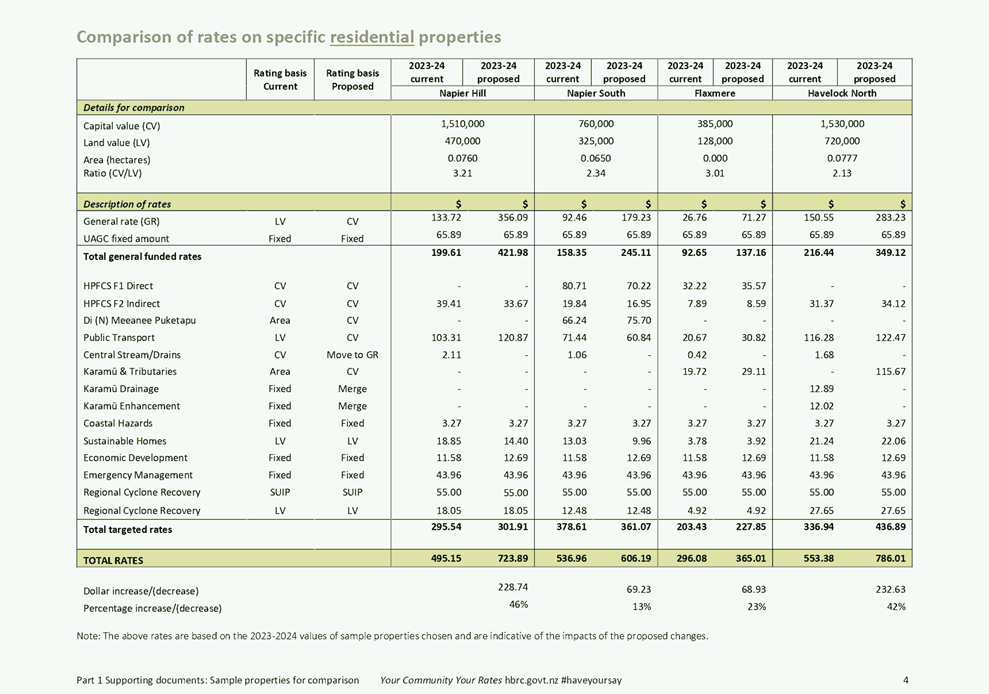

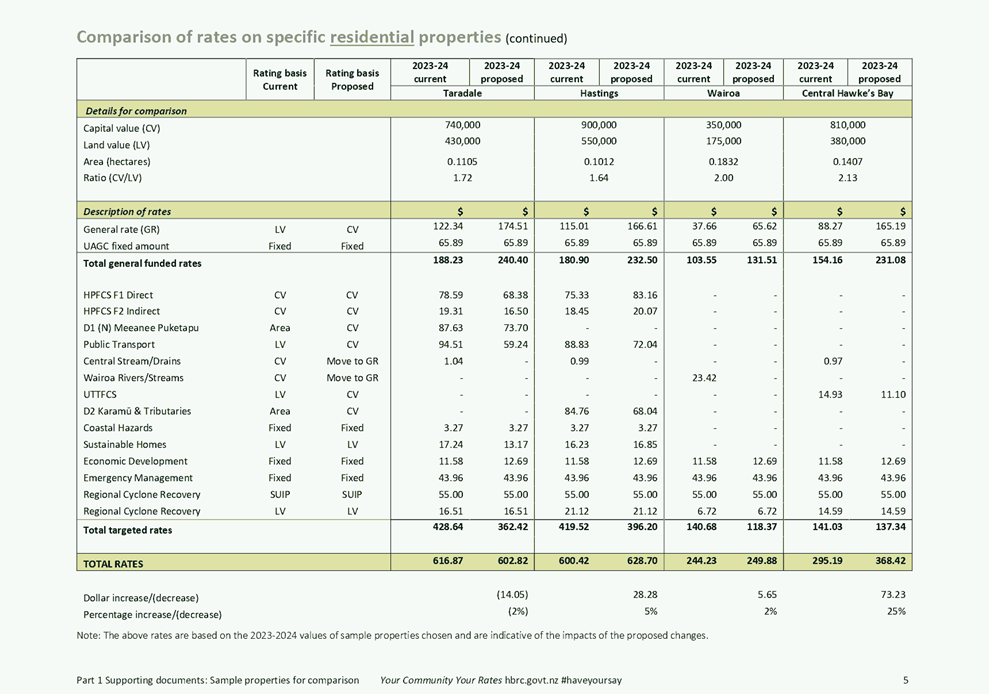

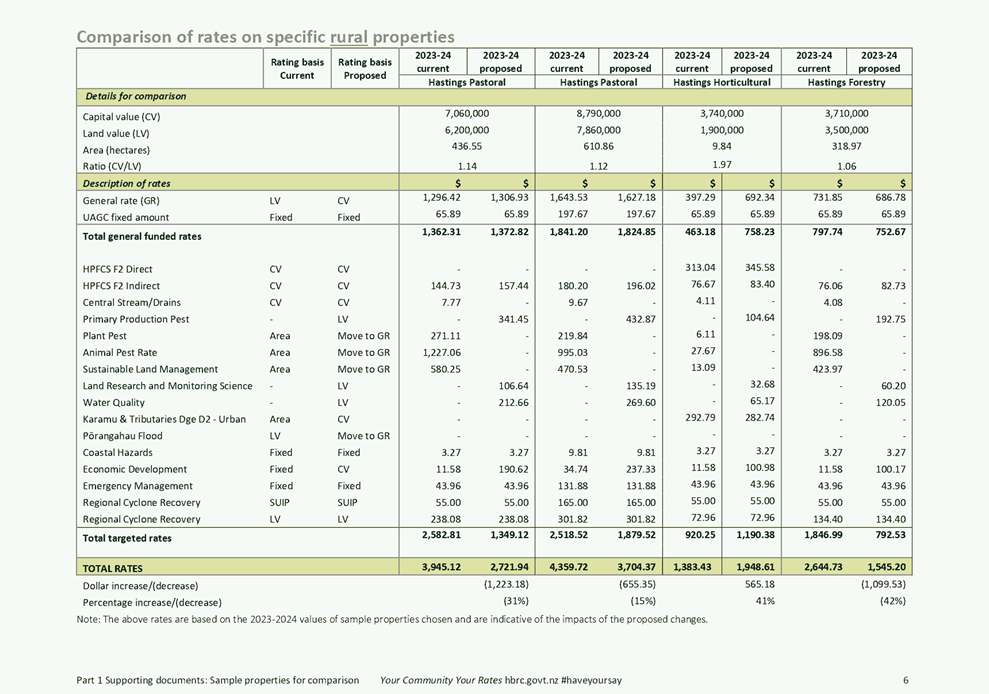

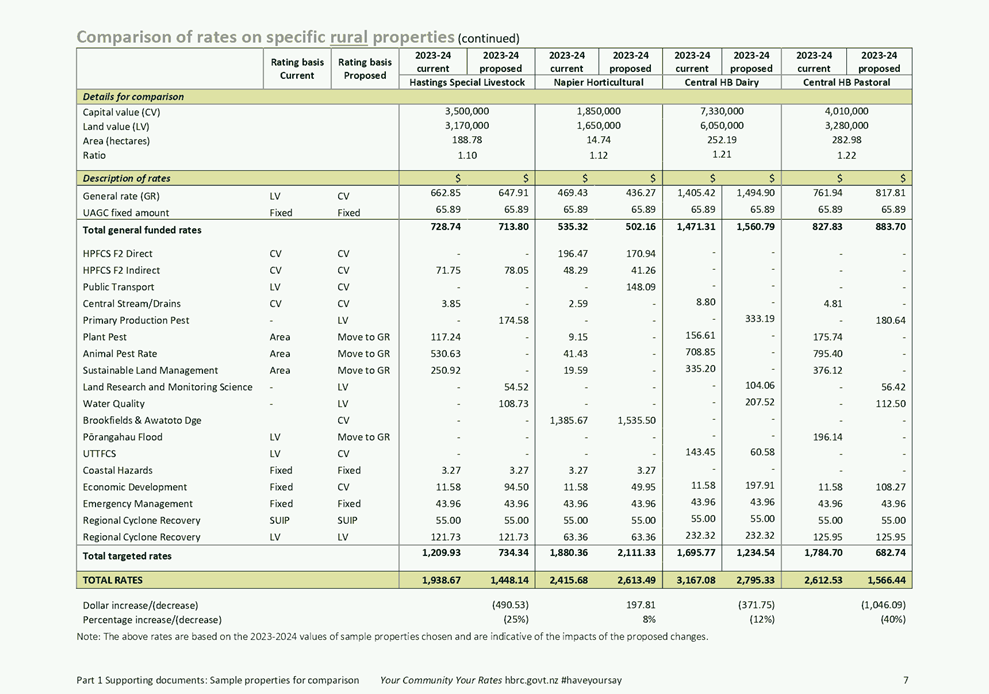

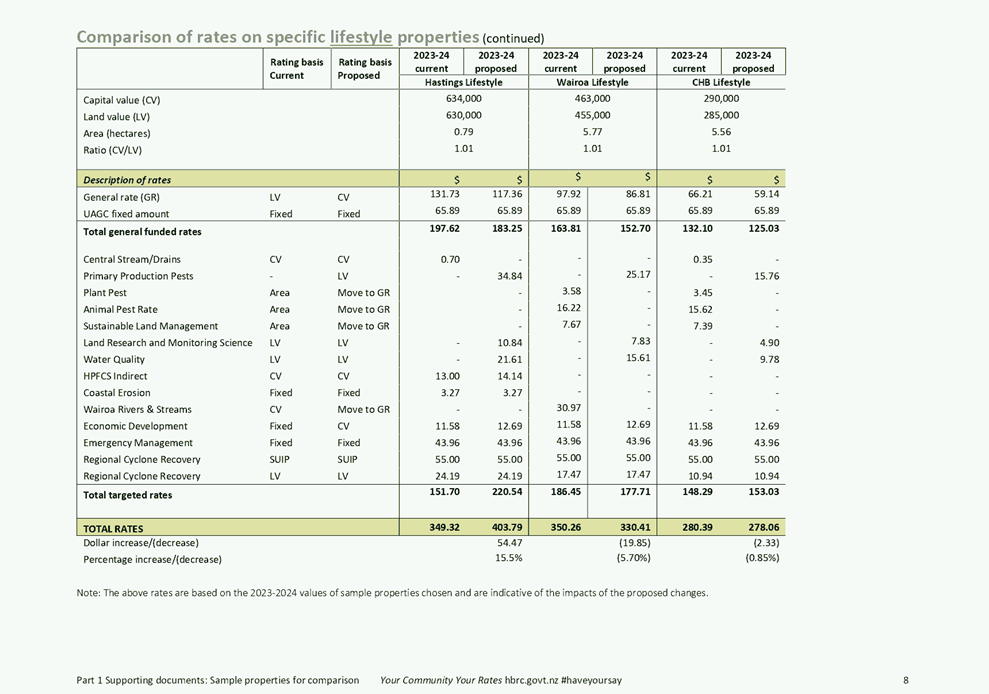

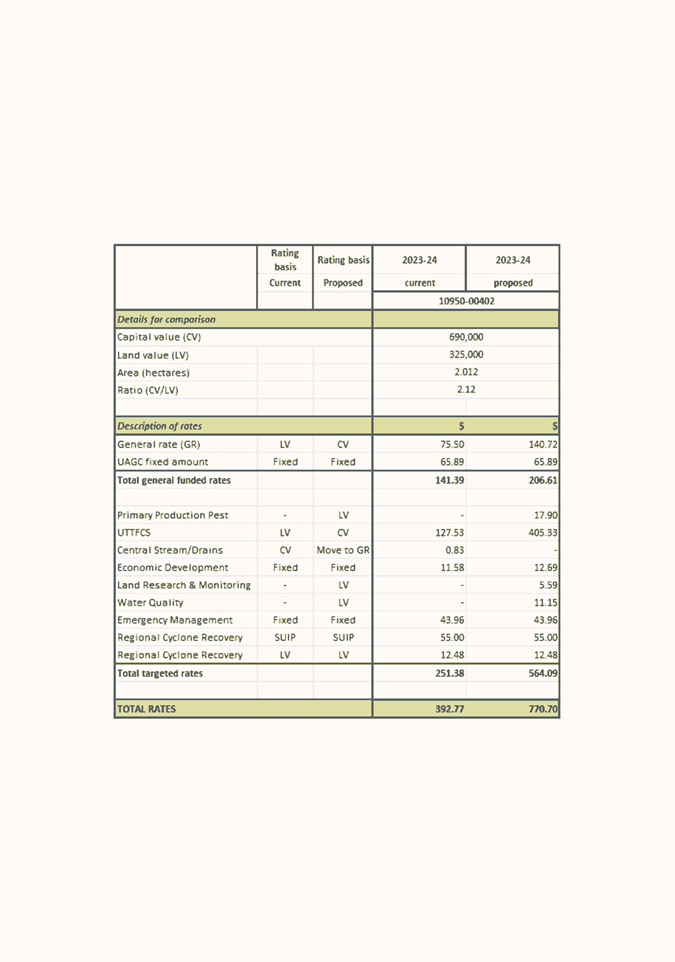

4. Sample Rates and Property Assessment

for Lifestyle Properties: Staff

have provided additional sample rates to show the impact on lifestyle

properties. These are p8 of the attached sample properties for comparison of

rates. Also attached is a property assessment done for a lifestyle property

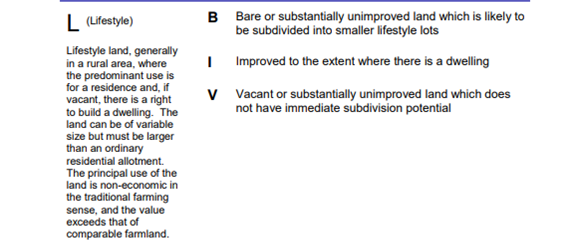

experiencing a large percentage increase. Changes to the flood protection

rate and the PT footprint are two of the changes having the biggest impact for

some lifestyle properties. A lifestyle property is defined by QV as:

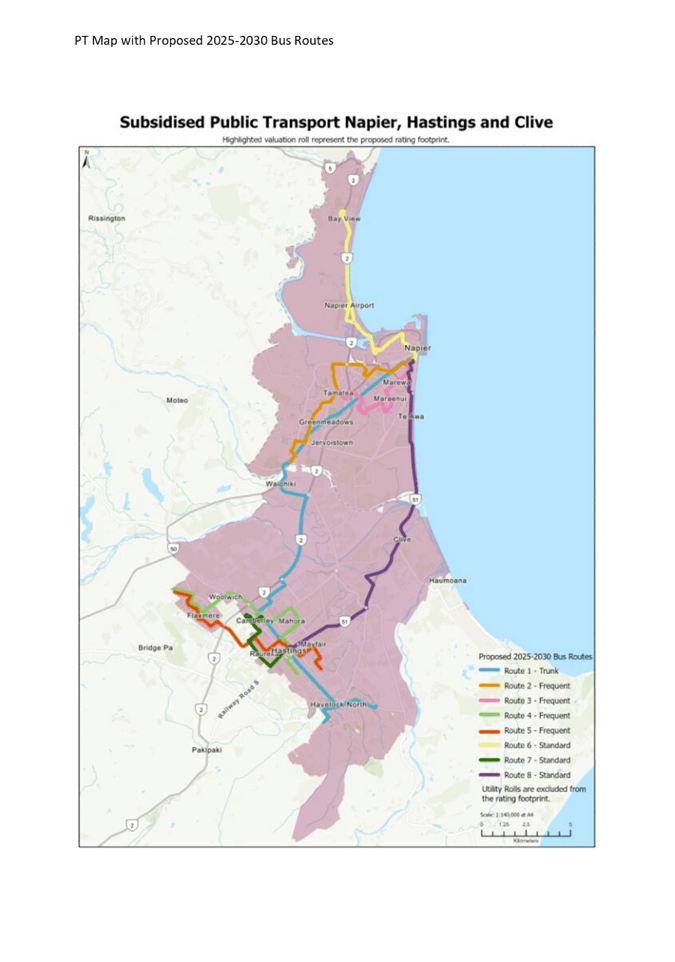

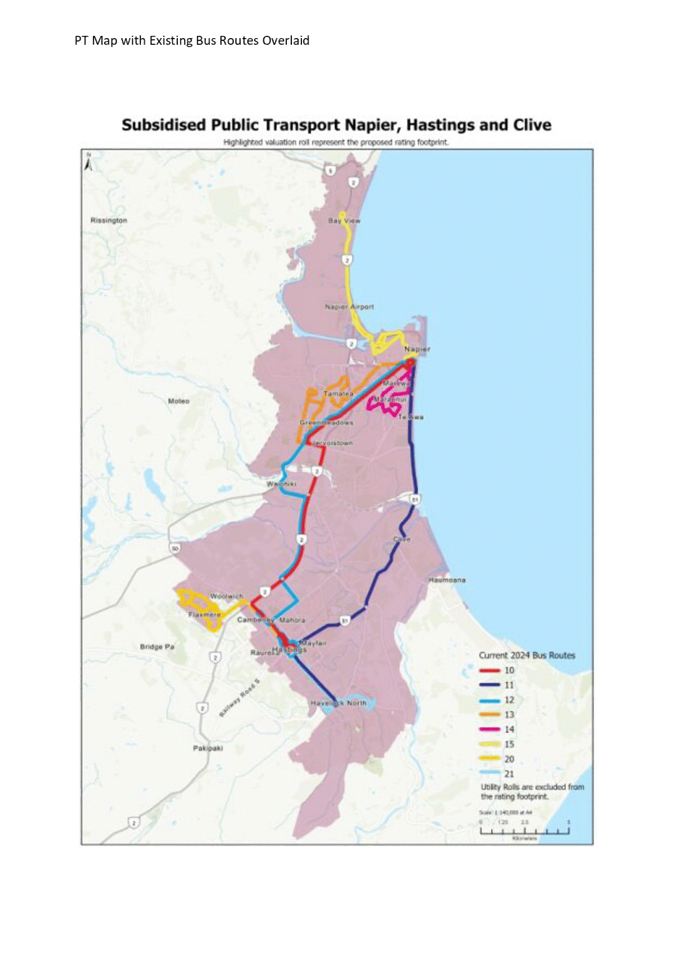

5. Public Transport maps: the first map shows the new passenger

transport rate footprint with future bus routes as proposed under the Regional Land Transport Plan. The second

map shows the new PT footprint with existing bus routes. The second map is

included in the report entitled Revenue and Financing Policy Review

Deliberations - Passenger Transport Rate.

Decision

Making Process

6. Staff have assessed the requirements

of the Local Government Act 2002 in relation to this item and have concluded

that, as this report is for information only, the decision making provisions do

not apply.

Recommendation

That

the Regional Council

receives and notes the Revenue and Financing Policy review– Further

analysis for deliberations staff report.

Authored by:

|

Desiree Cull

Strategy And Governance Manager

|

|

Approved by:

Attachment/s

|

1⇩

|

Socio-economic assessment

|

|

|

|

2⇩

|

Sustainable Land Management,

Biodiversity/Biosecurity rates

|

|

|

|

3⇩

|

Sample Rates for Lifestyle

Properties

|

|

|

|

4⇩

|

Property Assessment for Lifestyle

Properties

|

|

|

|

5⇩

|

Public Transport Maps

|

|

|