Meeting of the

Hawke's Bay Regional Council

Date: Wednesday 28 February 2024

Time: 9.00am

|

Venue:

|

Council

Chamber

Hawke's

Bay Regional Council

159

Dalton Street

NAPIER

|

Agenda

Item Title Page

1. Welcome/Karakia/Apologies/Notices

2. Conflict

of Interest Declarations

3. Confirmation of Minutes of

the Hawke's Bay Regional Council meeting held on 13 February 2024

4. Call

for minor items not on the Agenda 3

Decision

Items

5. Affixing

of Common Seal 5

6. Revenue

and Finacing Policy Review deliberations - Introduction 7

7. Revenue

and Financing Policy Review deliberations - Regional Economic Development Rate 11

8. Revenue

and Financing Policy Review deliberations - Flood Protection and Drainage

Scheme Rates 15

9. Revenue

and Financing Policy Review deliberations - Passenger Transport Rate 21

10. Revenue

and Financing Policy Review deliberations - Freshwater Science Charges and a

new Targeted Rate 27

11. Revenue

and Financing Policy Review deliberations - Sustainable Land Management,

Biodiversity and Biosecurity Rates 33

12. Revenue

and Financing Policy Review deliberations - Rates Remission and Postponement

Policies 39

13. Revenue

and Financing Policy Review deliberations - proposed move from Land Value to

Capital Value for the General Rate 51

14. Revenue

and Financing Policy Review deliberations - Revenue and Financing Policy 61

Information

or Performance Monitoring

15. Discussion

of minor items not on the Agenda

HAWKE’S BAY REGIONAL

COUNCIL

28

February 2024

Subject: Call for minor items not on the Agenda

Reason for

Report

1. This item provides the

means for councillors to raise minor matters they wish to bring to the

attention of the meeting.

2. Hawke’s Bay Regional

Council standing order 9.13

states:

2.1. “A meeting may discuss an item that is

not on the agenda only if it is a minor matter relating to the general business

of the meeting and the Chairperson explains at the beginning of the public part

of the meeting that the item will be discussed. However, the meeting may not

make a resolution, decision or recommendation about the item, except to refer

it to a subsequent meeting for further discussion.”

Recommendations

That Hawke’s Bay Regional

Council accepts the following minor items not on the agenda for

discussion as item 15.

HAWKE’S BAY REGIONAL

COUNCIL

28

February 2024

Subject: Affixing of Common Seal

Reason for Report

1. The Common Seal of the Council has

been affixed to the following documents and signed by the Chair or Deputy Chair

and Chief Executive or a Group Manager.

|

|

|

Seal

No.

|

Date

|

|

1.1

|

Staff Warrants

1.1.1 T.

Petrie

J.

Castro Lopez

(Delegations

under Resource Management Act 1991 (Sections 34A(1) and 38(1); Soil

Conservation and Rivers Control Act 1941; Land Drainage Act 1908; Local

Government Act 2002 (section 177)) and Civil Defence

Emergency Management Act 2002 (s.86-92) and Local Government Act 2002

(Section 177))

1.1.2 P.

Eady

(Delegations

under Resource Management Act 1991 (Sections 34A(1) and 38(1); Soil

Conservation and Rivers Control Act 1941; Land Drainage Act 1908; and Civil

Defence Emergency Management Act 2002 (s.86-92) and Local Government Act 2002

(s.177))

1.1.3 Z.

Hawke

M.

Smiles

S.

Perry-Purchas

S.

Potbury

(Delegations

under Resource Management Act 1991 (Sections 34A(1) and 38(1) and Civil

Defence Emergency Management Act 2002 (s.86-92) and Local Government Act 2002

(Section 177))

1.1.4 J.

Ellmers

(Delegations

under the Civil Defence Emergency Management Act 2002 (s.86-92 inclusive) and

Local

Government Act 2002 (section 177))

1.1.5 A.

McNatty

S.

Courtnell

(Delegations

under the Biosecurity Act 1993 (Sections 103 and 105)

|

4588

4589

4590

4584

4585

4586

4587

4583

4591

4592

|

30

January 2024

30

January 2024

30

January 2024

30

January 2024

30

January 2024

30

January 2024

30

January 2024

30

January 2024

14

February 2024

14

February 2024

|

2. The Common Seal is used twice during a

Leasehold Land Sale, once on the Sale and Purchase Agreement and once on the

Land Transfer document. More often than not, there is a delay between the

second issue (Land Transfer document) of the Common Seal per property.

This delay could result in the second issue of the Seal not appearing until the

following month.

3. As a result of sales, the current

numbers of Leasehold properties owned by Council are:

3.1 No cross lease properties were

freeholded, with 61 remaining on Council’s books

3.2 2 single leasehold properties were

freeholded, with 76 remaining on Council’s books.

Decision-making

process

4. Council is required to make every

decision in accordance with the provisions of Sections 77, 78, 80, 81 and 82 of

the Local Government Act 2002 (the Act). Staff have assessed the requirements

contained within these sections of the Act in relation to this item and have

concluded:

4.1 Sections 97 and 88 of the Act do not

apply.

4.2 Council can exercise its

discretion under Section 79(1)(a) and 82(3) of the Act and make a decision on

this issue without conferring directly with the community or others due to the

nature and significance of the issue to be considered and decided.

4.3 That the decision to apply the Common

Seal reflects previous policy or other decisions of Council which (where

applicable) will have been subject to the Act’s required decision-making

process.

Recommendations

That

Hawke’s Bay Regional Council:

1. Agrees that the decisions to be made

are not significant under the criteria contained in Council’s adopted

Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without conferring directly with

the community or persons likely to have an interest in the decision.

2. Confirms the action to affix the

Common Seal.

Authored by:

|

Diane Wisely

Executive

Assistant

|

Vanessa Fauth

Finance

Manager

|

Approved by:

Attachment/s

There are no attachments for this

report.

HAWKE’S

BAY REGIONAL COUNCIL

Wednesday

28 February 2024

Subject: Revenue and Finacing Policy Review deliberations - Introduction

Reason

for Report

1. This item outlines the remaining

process steps for Council leading to the adoption of the final Revenue and

Financing Policy. It also provides a brief overview of the review process

leading up to the decisions today.

Background

2. Under the Local Government Act 2002

(LGA), Council must have a Revenue and Financing Policy (as well as other

funding and financial policies) to provide predictability and certainty about

sources and levels of funding. Sector advice states it is good practice to review

revenue and financing (R&F) policies approximately every ten years on a

‘first principles’ basis.

3. Hawke’s Bay Regional

Council’s R&F Policy has not been reviewed in its entirety for at

least four long term plan cycles. In its 2021-31 Long Term Plan, the Council

signaled its intention to review its rating policy before the next long term

plan and a specific undertaking was given to review the Upper Tukituki flood

scheme targeted rates.

4. The objectives of the review were to:

4.1. improve transparency for who pays

what,

4.2. ensure legal compliance and good

practice, and

4.3. simplify the policy thereby providing

more flexibility in application, for example stating a rating range and/or

bundling sub-activities together.

5. The review process followed the

requirements of the two steps set out in the Local Government Act 2002 (LGA).

The process took nearly two years including a period of disruption due to

Cyclone Gabrielle. The extensive review considered the various funding

mechanisms available to Council to funds its activities. Council and staff were

supported throughout the review by an experienced external rating expert.

Steps one

and two

6. Council undertook an initial

assessment of the requirements of step one by way of a series of workshops between

1 June and 24 August 2022. These workshops assessed each of Council’s

activities against the requirements in s101(3) of the LGA, which are community

outcomes, benefit distribution, period of benefit, whose action or inaction

causes the need, and costs and benefits of funding separately. This culminated

in the adoption by Council of the step one funding needs assessment on

28 September 2022.

7. Between 31 May and 11 October 2023,

the newly-elected Council considered the step one outcomes and went on to apply

the step two overall impact tests for each activity culminating in the proposed

Draft Revenue and Financing Policy for consultation adopted by Council

on 29 November 2023. Council also considered changes to its inter-related Rates

Remission and Postponement Policies.

Consultation

8. Consultation on ‘Your

Community Your Rates’ HBRC’s Revenue and Financing Policy

review was publicly notified on Friday 1 December 2023 and consultation closed

on Sunday 28 January 2024. A deadline extension of 8 February was given to the

most affected ratepayers on the utilities valuation rolls. This gave these

ratepayers two extra weeks to submit following a tailored letter with property

assessments sent on 26 January 2024.

9. Advertisements in both

traditional and social media signposted the community/ratepayers to a unique

page on the website consultations.nz/hbrc/. The page included an introductory

message including key consultation topics, timeline for consultation,

consultation document and supporting documents, and online submission form.

10. The community was

encouraged to review the documentation and make a submission.

Submissions

process

11. The total number of submissions

received by HBRC was 541 which included 2 submissions marked as

‘late’ (received after the 28 January 2024 deadline).

12. In total, 1,582 pieces of feedback

were received on the seven consultation topics and open question.

13. Submissions were accepted via a number

of channels including the online submission form (majority of submissions),

email and hand delivered.

Verbal

submissions

14. A hearing was held on Tuesday 13

February 2024, where the Council heard 12 verbal submissions. Each speaker was

allotted 10 minutes which included time for councillors’ questions.

Deliberations

reports

15. The deliberations reports

are written by topic – one for each of the seven consultation topics

– plus a further one to cover the remaining areas of change in the

Revenue and Financing Policy. They are:

15.1. Regional economic

development rate

15.2. Flood protection and

drainage scheme rates

15.3. Passenger transport rate

15.4. Freshwater science

charges, and a new targeted rate

15.5. Sustainable land

management, biodiversity and biosecurity rates

15.6. Rates Remission and

Postponement Policies

15.7. Proposed move from land

value to capital value for the general rate

15.8. Revenue and Financing

Policy (this is the report that asks Council to adopt the Policy).

16. Each deliberations report

references the relevant submissions and includes staff analysis.

17. Council will be asked to

consider the submission points relating to the topic and any comments made by

Council staff, and to agree or not agree to the proposal consulted on or a

variation.

18. Staff note that the approach to this review has been

“nothing is agreed until everything is agreed”.

19. As the proposed changes are

inter-related Council may want to discuss the cumulative impacts first, before

deciding on each topic.

Post-adoption

20. Following adoption of the

new policy, each submitter will receive a response from Council setting out

Council’s resolutions pertinent to their specific submission(s), and the

reasons for those resolutions.

21. The final Revenue and Financing Policy

will be implemented with the 2024 Three-year Plan.

Decision-making

process

22. Staff have assessed the requirements

of the Local Government Act 2002 in relation to this item and have concluded

that, as this report is for information only, the decision-making provisions do

not apply.

Recommendation

That

the Hawke’s Bay

Regional Council receives and notes the Revenue and Financing Policy Review

Deliberations - Introduction staff report.

Authored by:

|

Desiree Cull

Strategy

and Governance Manager

|

Sarah Bell

Team Leader

Strategy and Performance

|

Approved by:

Attachment/s

There are no attachments for this

report.

HAWKE’S

BAY REGIONAL COUNCIL

Wednesday

28 February 2024

Subject: Revenue and Financing Policy Review deliberations - Regional

Economic Development Rate

Reason for report

1. This deliberations report provides the

Council with submission themes and officers’ analysis of submissions and

seeks a decision of Council on the consultation topic – Regional

Economic Development Rate.

Officers’

recommendations

2. Staff recommend that the Council

considers the submission points (as received by Council resolution on 13 February 2024) on the Regional Economic

Development Rate consultation topic alongside the officers’ analysis

to enable an informed decision.

Consultation

topic

3. The Regional Economic Development

rate proposal was one of seven key consultation topics that the Council

sought public submissions on through Your Community Your Rates

consultation document for the review of HBRC’s Revenue & Financing

Policy.

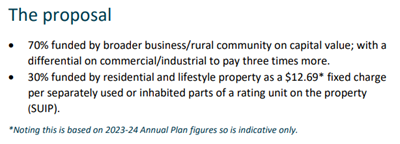

4. The proposal was presented in the

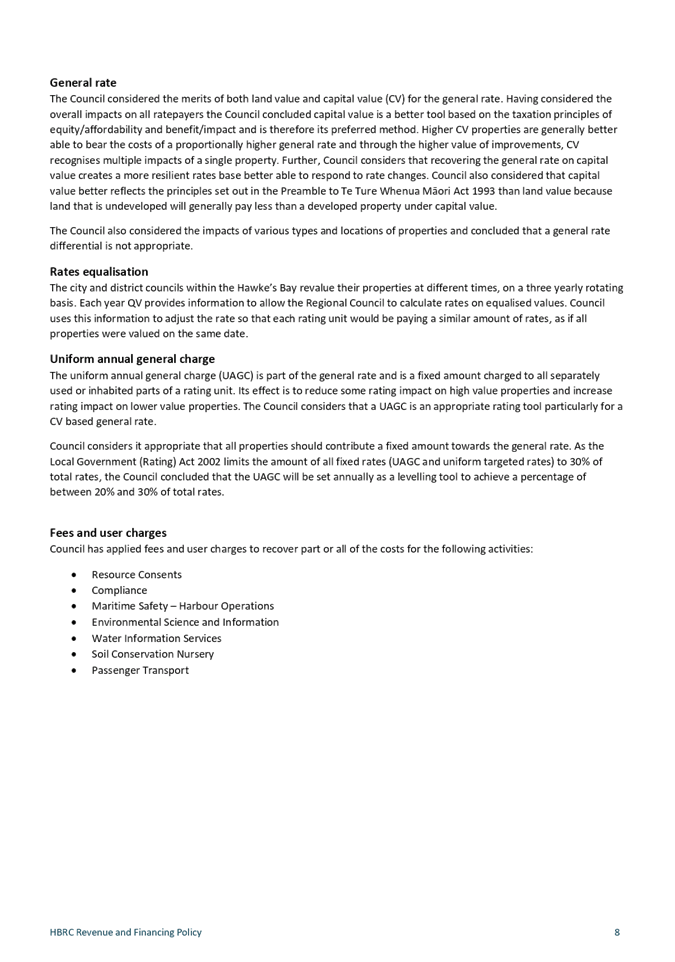

consultation document as shown following:

Submissions

received

5. Of the submissions received, 49

supported the proposal, 305 did not support it, 133 didn’t know and 55 did not select an option.

6. 204 submitters made a comment under

this proposal, noting that many comments related to how

the submitter felt about the activity itself and are better suited to

consultation on the Long Term Plan.

7. Key themes were:

7.1. Theme 1: Benefit challenged

7.2. Theme 2: Capital

value.

8. Other themes focused on:

8.1. HBRC should not be doing this

activity, and/or other agencies should pay

8.2. General unaffordability of rates

and/or pressures from cost of living

9. These ‘other themes’ that

ran through all the consultation topics will be addressed in the deliberations

report entitled “Revenue and Financing Policy”.

Summary of submissions

and officers’ analysis

Theme

1: Benefit challenged

10. Overall, there was some disagreement over who benefits

from this activity, and what proportion of the rate they should pay. This was

most strongly heard from the rural/horticultural sector.

10.1. “Unfair to put so

much onto horticulture when they do not gain an advantage from tourism” (#15)

10.2. “…rural

properties, as aside from horticulture and in particular vintners, gain no real

economic benefit from tourism.”

(#355)

10.3. “…it might

be fair to assume that certain agricultural business such as vineyards and

orchards do benefit to some degree from tourism, but certainly not pastoral

farms.” (#494)

10.4. “We are

particularly concerned about the transfer of costs associated with the regional

economic development, … components of the proposal. These are costs that

many of our members will struggle to find as equitable based on their analysis

of the benefits to their businesses.” (#531)

10.5. “Rural rate payers

do not, as a majority, receive any benefit from tourism- especially Wairoa rate

payers. This should be a targeted rate to those businesses/locations

where tourism is of the greatest benefit.” (#538)

Staff

response

11. Opposition to this proposal is centred

around perceived benefits from tourism by rural properties.

12. Tourism is one component, albeit the

largest dollar amount, of the regional economic development rate. This rate

supports a regionally-agreed framework which includes not only funding for

tourism but also the Regional Economic Development Agency and in previous years

has included other initiatives such as feasibility studies for horticulture in

Wairoa, support for the Business Hub and the Regional Business Partners

Programme. All businesses benefit from this activity through jobs creation,

technological innovation, increased investment, labour supply and tourism among

others.

13. Submitters do not appear to challenge

the underlying principle of the change, which is that all non-residential and

lifestyle properties, are a type of business because they can generate income

therefore should pay like other businesses, which is on CV (rather than a fixed

charge paid by residential and lifestyle properties, which was $11.58 per SUIP

in 2023-24).

14. On a similar theme, other submitters

thought only commercial properties and businesses should fund this rate.

14.1. “There should be

no Regional Economic Development rate for residential and lifestyle property

owners. It should be 100% funded by broader business/rural community on capital

value; with a differential on commercial/industrial to pay three times

more.” (#408)

14.2. “History would

show the benefits of these regional economic development projects (and others)

tend to benefit the selective few of the business sector (…) to which the

returns rarely flow on to the wider community that justifies a blanket approach

of rate payers funding regional economic development projects ...” (#479)

Staff

response

15. The proposed changes are based on the

premise that the whole community benefits from this activity, and not just

commercial properties. Residential and lifestyle ratepayers benefit to a lesser

extent from better access to modern amenities, prosperous community, sense of

security and job opportunities.

16. If this rate is only applied to the

non-residential/lifestyle properties, the burden would be borne by just 13% of

the rating base. This represents the removal of 64,000 ratepayers who currently

pay the fixed charge ($11.58 per SUIP for 2023/24 which equates to $744K

overall).

17. There were a number of submitters who

supported the proposal, including the tiered rating system and how the

beneficiaries were identified.

17.1. “I agree that

business will be the direct beneficiary, but the region as a whole will also

benefit.” (#108)

17.2. “I think it is

fair that rural landowners should contribute to this as they do generate income

from their property.” (#295)

17.3. “The new proposal

more fairly link costs to the beneficiaries.” (#491)

17.4. “Agree in

principle to broaden the rate out to wineries, orchards etc. A lot of the

effort and work in this area directly benefits them / their workforces. Agree

also to keep this a targeted rate versus basing on CV.” (#545)

Theme

2: Capital value

18. Using capital value to determine any

of HBRC’s rates was a theme running through all topics of this

consultation. Commentary was often copied and pasted into all topics – or

made a similar point. Capital value was not a strong theme in this consultation

topic.

18.1. “While it's

crucial to support economic development, the funding mechanism should ensure

that it does not discourage land improvements or disproportionately burden

certain property owners.” (#414)

18.2. “I think it makes

sense to charge different rates, but based on residential/agricultural/

viticultural etc. land. Not by size of a house on land. Look at what a property

is used for and the size of that property.” (#317)

Staff

response

19. Staff point out that the current rate

is already based on capital value so this is not a proposed change.

Scope

of the decision

20. The scope of the decision is to adopt

the proposal as consulted on, revert to the status quo or vary the composition

of the capital value component of the rate i.e. the differential on

commercial/industrial.

21. Staff consider that all other options

would require further modelling and potentially consultation.

Decision-making

process

22. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

22.1. The decision does not significantly

alter the service provision or affect a strategic asset, nor is it inconsistent

with an existing policy or plan.

22.2. The use of a consultation process required by

legislation under LGA s102(4) has been undertaken.

22.3. The decision is significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy.

22.4. The persons affected by this decision

are the region’s ratepayers.

Recommendations

That

Hawke’s Bay Regional Council:

1. Receives and considers the Revenue

and Financing Policy Review deliberations - Regional Economic Development Rate

staff report.

2. Agrees that the Council can exercise

its discretion and make decisions on this issue, having undertaken the consultation process required by

legislation under LGA s102(4).

3. Agree to adopt the Regional Economic

Development rate proposal as consulted on being:

3.1. 70% funded by broader business/rural

community on capital value; with a differential on commercial/industrial to pay

three times more, and

3.2. 30% funded by residential and

lifestyle property as a fixed charge per separately used or inhabited parts of

a rating unit on the property (SUIP).

OR

4. Agree to retain the status quo being:

4.1. 70% funded by commercial/industrial

properties based on capital value, and

4.2. 30% funded by all other rating

categories as a fixed charge.

Authored by:

|

Desiree Cull

Strategy

and Governance Manager

|

Sarah Bell

Team Leader

Strategy and Performance

|

|

Beth Postlewaight

Workstream

Lead - Property & Rates Project

|

Vanessa Fauth

Finance

Manager

|

|

Chris Comber

Chief

Financial Officer

|

|

Approved by:

Attachment/s

There are no attachments for this

report.

HAWKE’S

BAY REGIONAL COUNCIL

Wednesday

28 February 2024

Subject: Revenue and Financing Policy Review deliberations - Flood

Protection and Drainage Scheme Rates

Reason for report

1. This deliberations report provides the

Council with submission themes and officers’ analysis of submissions and seeks a decision of Council on the consultation

topic – Flood Protection and Drainage Scheme Rate.

Officers’

recommendations

2. Staff recommend that the Council

considers the submission points (as received by Council resolution on 13 February 2024) on the Flood Protection and

Drainage Scheme Rate consultation topic alongside the officers’

analysis to enable an informed decision.

Consultation

topic

3. The Flood Protection and Drainage

Scheme Rate proposal was one of key seven consultation topics that the

Council sought public submissions on through Your Community Your Rates

consultation document for the review of HBRC’s Revenue & Financing

Policy.

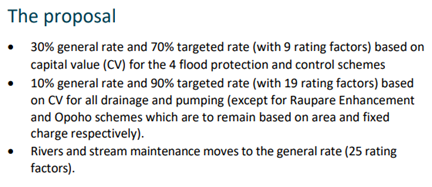

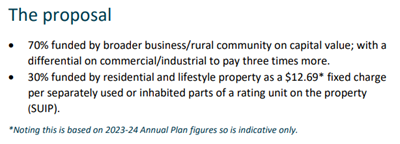

4. The proposal was presented in the

consultation document as shown following:

Submissions

received

5. Of submissions received, 152 supported

the proposal, 198 did not support it, 126 didn’t know and 66 did not

select an option.

6. 200 submitters made a comment on this

proposal.

7. The majority of submissions focussed

on the flood protection element of this proposal with a very small number

commenting on the proposed drainage schemes rates or the rivers and stream

maintenance rate. Many comments related to how the submitter felt about the

activity itself and are better suited to consultation on the Long Term Plan.

8. Key themes were:

8.1. Theme 1: Benefit challenged

8.2. Theme 2: Capital value

8.3. Theme 3: Timing.

9. Other themes focused on:

9.1. HBRC is doing a poor job; given it is

only 12 months on from Cyclone Gabrielle, flood protection was top of mind for

many submitters.

9.2. General unaffordability of rates

and/or pressures from cost of living.

10. These ‘other themes’ that

ran through all the consultation topics will be addressed in the deliberations

report entitled “Revenue and Financing Policy”.

Summary

of submissions and officers’ analysis

Theme

1: Benefit challenged

11. Overall, there were a number of

submissions from ratepayers who don’t believe they should be rated for

this activity as they don’t live in a flood-prone area, or that people

should accept the risk that they live in one.

11.1. “But

only rate payers who would be impacted by this protection should pay for example

residents who live by rivers or beaches etc not those who choose to live inland

they should not have to pay for something they will never need to use.”

(#55)

11.2. “My house isn't

affected by floods, those who are should be the ones paying to improve it,

especially if they bought or built in a known flood zone.” (#125)

11.3. “Everyone should

fend for themselves. If you are in a flood risk and can't afford

insurance/rebuild sell up move. Don't open land in high flood areas.” (#198)

11.4. “People have

choices where they live and any house in a flood or erosion prone area should

bear the cost of protection measures.” (#337)

11.5. “With elevated

location (other than road access and proximity to poorly maintained riverbeds

and catchments) our property does not require 'flood protection or drainage

schemes'” (#512)

12. A number of submitters agreed that

this activity is a shared responsibility, and that the rating proposals were

sound with some ratepayers paying more of the share.

12.1. “It strikes the

right balance between ratepayers who directly benefit from flood protection and

drainage and the benefit to ratepayers more generally. It also sends the right

message for future developments. i.e. costs for prone areas should come with

the correct pricing signal...” (#108)

12.2. “As a rate payer

for farmland beside waterways and beach property, I think rates should be

allocated/tiered based on cost of maintaining the area/zone the property is

in… Essentially the rating risk is shared but with the immediate properties

to the risk contributing the most.” (#362)

12.3. “Using the User

pays principle those who benefit most (who live along the rivers with higher

levels of flood protection and drainage schemes should pay the most).” (#541)

13. On a similar theme, there were

comments that it had simplified a complex rating system.

13.1. “There is a

certain logic to what you are proposing as I agree that it will bring

consistency and simplification.” (#435)

13.2. “(Federated

Farmers) believe that the proposed changes achieve Council’s desired

outcomes of more consistency between similar schemes, simplified rating

differentials and spreading the costs fairly across scheme

beneficiaries.” (#494)

13.3. “The current

system is very complex and the proposal appears to simplify this… We all

benefit from and expect to see well-maintained rivers and streams, the cost of

this should be shared cross ratepayers in a small way.” (#541)

14. Others expressed that the proposed

rates demonstrate fairness.

14.1. “It needs to be

fair to all the community as a whole, all citizens of HB should contribute not

just those who own land.” (#437)

14.2. “Is a small

proportion of the rates but support drainage systems being paid for in part by

those directly impacted.” (#439)

14.3. “All residents of

HB benefit from the flood protection and drainage schemes as these are

connected to the infrastructure in all our communities across the region. If

they operate effectively then our entire community can continue to go about

their lives without the disruption flooding can cause and other infrastructure

such as roads do not get damaged by flooding.” (#524)

Staff response

15. Flood protection is about protecting

public infrastructure as much as individual properties. Districts are

interwoven so regardless of where the flooding occurs, it will have wider

economic and social impacts. Infrastructure includes such things as roads and

bridges, railway lines, airports, the Napier Port and access to hospitals,

healthcare, schools, places of employment, supermarkets etc.

16. The rating areas within each flood

protection ‘zone’ are tiered according to risk and benefit which

means that some ratepayers pay a higher targeted rate than others. Council

consulted on simplifying the rating structure for Makara and Upper Tukituki

Flood Protection Schemes and for a number of drainage schemes. The review

has successfully reduced rating factors from 82 to 29. The maps included in the

Supporting Documents (pp10-13 on the webpage consultations.nz/hbrc/revenue-and-financing-policy/)

show these changes. Overall, the changes to the tiers generated little feedback

during the consultation process.

17. Much of the Hastings and Napier urban

and rural ratepayers contribute to the Heretaunga Plains flood control scheme (HPFCS),

while urban and rural areas of central Hawke’s Bay contribute to the

Upper Tukituki flood control scheme.

18. The proposal to move River and Stream

Maintenance creates minimal impact to ratepayers as all rateable properties

currently contribute on a differential targeted rate.

Theme

2: Capital value

19. Use of capital value to determine any

of HBRC’s rates was a theme running through all consultation topics.

Commentary was often copied and pasted across multiple or all consultation

topics – or made similar points. Below are some of the comments relating

to this topic.

19.1. “I would prefer to

see it on the basis of land value than capital value. Yes the growers with

valuable land will see most of the apparent benefit of a secure flood

protection scheme. Gabrielle taught us many things, perhaps one of them being

the number of people who those growers provide food and/or employment/business

for. It would therefore make sense for the rating for flood protection to be

shared all.”

(#403)

19.2. “It should be

based on land value - agreed bare land does not suffer quite the same harm as

improvement values in flooding, but occupiers/owners are already paying greatly

increased insurance premiums for the cost of the improvements.” (#516)

19.3. “Again, due to

changing to a CV rate versus LV - feel we are going to wear the brunt of this

which is not proportionate to the benefit. Seems unfair. Why not a targeted

fixed rate?” (#545)

Staff

response

20. Staff note that 2 of the 4 flood

schemes – Maraetotara and HPFCS, which is the largest with most of

Hawke’s Bay population residing within it – are already based on

CV. The proposal is to bring consistency by changing Upper Tukituki

from LV and Makara from Area to CV.

21. As noted in the Consultation Document

“CV is considered the most appropriate basis for the targeted rate

component given flood and drainage activities benefit improvements on land as

well as land, and the productive earning potential resulting from the

activity”.

22. Staff consider that the submitters who

directly commented on this proposed rate based on land value did not have a

compelling rationale why land value is fairer than capital value given that

those with higher capital value have more to protect.

23. Insurance premiums are calculated on

the basis of risk. If flood protection was not in place, insurance premiums

would reflect a higher level of risk. Staff also noted that a high percentage

of people who applied for assistance after Cyclone Gabrielle (HBDRT, Commercial

Fund, and Rates Remission) were either uninsured or significantly under-insured

due to unaffordability.

Theme 3: Timing

24. This theme was commented on by two

submitters who believed HBRC should wait for post-cyclone reviews before

changing this rate (particularly the rating areas) and is summarised via the

extracts below.

24.1. “…I do not

trust a fair system was used to allocate the U.T.T.F.C.S rating categories and

rates portions or that it was checked if properties were in the right rating

category. No changes should be made to the way overall Flood Protection and

Drainage schemes are rated until post Cyclone Gabrielle reviews and plans are

finished and any changes or new Flood Protection and Drainage schemes are decided

and agreed to.” (#408)

24.2. “How can you put

something forward when we are still waiting for engineers report to cyclone

Gabriel damage you need to get flood victims homes sorted and fixed then bring

to the table these decisions have them discussed then make decisions and have

that voted on.”

(#440)

Staff

response

25. The process to undertake a review of

the Revenue and Financing Policy pre-dated Cyclone Gabrielle. Council signalled

in its 2021 Long Term Plan, that it would undertake a first principles review

in time for the next Long Term Plan with a specific undertaking to review Upper

Tukituki flood scheme.

26. In step two the Council agreed to a

light touch approach to simplify the administration of existing schemes and

therefore not change the rating outer-boundary. This was in recognition

that new schemes resulting from land categorisation or changes to existing

schemes may arise due to post-Cyclone reviews. This was noted on p12 of

the consultation document.

27. Furthermore, Council can amend its

Revenue and Financing Policy at any time subject to consultation so if changes

to existing schemes are required, these can be made when needed.

Scope

of decision

28. The scope of the decision is to adopt

the proposal as consulted on or revert to the status quo. Having considered the submissions received on this topic,

staff have determined there are no new options for Council to consider.

29. There are multiple layers to the

proposal, including:

29.1. Flood Protection and Drainage Schemes

– move from LV/Area/Fixed to CV rating; change to rating percentage split

between general and targeted rate; and rating differential adjustments.

29.2. River and Stream Maintenance –

move to general rate.

30. Staff do not recommend delaying any

aspects of this proposal, as it closely aligns with the guiding principles of

the rates review which were clear and fair, simple, consistent and flexible.

31. In particular, staff support the

change to rating differentials as it significantly reduces administration and

improves understanding for ratepayers.

Decision-making process

32. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

32.1. The decision does not significantly

alter the service provision or affect a strategic asset, nor is it inconsistent

with an existing policy or plan.

32.2. The use of a consultation process required by

legislation under LGA s102(4) has been undertaken.

32.3. The decision is significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy.

32.4. The persons affected by this decision

are the region’s ratepayers.

Recommendations

That

Hawke’s Bay Regional Council:

1. Receives and considers the Revenue

and Financing Policy Review deliberations - Flood Protection and Drainage

Scheme Rates staff report.

2. Agrees that the Council can exercise

its discretion and make decisions on this issue, having undertaken the consultation process required by

legislation under LGA s102(4).

3. Agrees to adopt the Flood Protection

and Drainage Scheme rate proposal as consulted on being:

3.1. All four flood schemes (HPFCS, UTT,

Upper Makara and Maraetotara) are rated at 30% general rate and 70% targeted

rate with 9 rating factors) based on capital value,

3.2. All drainage schemes (except for

Raupare Enhancement and Opoho which remain based on area and fixed charge

respectively) are rated at 10% general rate and 90% targeted rate (with 19

rating factors), and

3.3. Rivers and stream maintenance moves to

the general rate (25 rating factors).

OR

4. Agrees to retain the status quo being:

4.1. Flood schemes are currently general

and targeted rate funded, with targeted rates varying between 70-95%, (with 24

rating factors) based on a mix of CV and land value (LV),

4.2. Drainage and pumping is general and

targeted rate funded, with targeted rates between 88%-95%, (with 33 rating

factors) based on a mix of CV, LV, Fixed Charge, and Area, and

4.3. Rivers and stream maintenance is 10%

general rate and 90% targeted rate funded.

Authored by:

|

Desiree Cull

Strategy

and Governance Manager

|

Sarah Bell

Team Leader

Strategy and Performance

|

|

Beth Postlewaight

Workstream

Lead - Property & Rates Project

|

Vanessa Fauth

Finance

Manager

|

|

Chris Comber

Chief

Financial Officer

|

|

Approved by:

Attachment/s

There are no attachments for this

report.

HAWKE’S

BAY REGIONAL COUNCIL

Wednesday

28 February 2024

Subject: Revenue and Financing Policy Review deliberations - Passenger

Transport Rate

Reason for report

1. This deliberations report provides the

Council with submission themes and officers’ analysis of submissions and

seeks a decision of Council on the consultation topic – Passenger

Transport Rate.

Officers’

recommendations

2. Staff recommend that the Council

considers the submission points (as received by council resolution on 13 February 2024) on the Passenger Transport Rate

consultation topic alongside the officers’ analysis to enable an informed

decision.

Consultation

topic

3. The Passenger Transport Rate proposal

was one of seven key consultation topics that the Council sought public

submissions on through Your Community Your Rates consultation document

for the review of HBRC’s Revenue & Financing Policy.

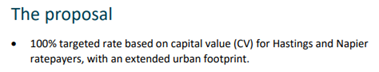

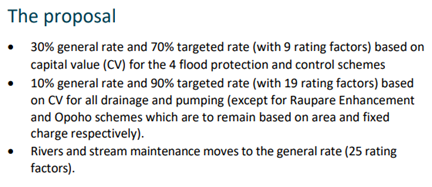

4. The proposal was presented in the

consultation document as shown following:

Submissions

received

5. Of the submissions received, 73

supported the proposal, 260 did not support it, 137 didn’t know and 72

did not select an option.

6. 194 submitters made a comment on this

proposal and it is noted that the

majority of submissions focussed on the activity/service itself. There were

very few submissions that addressed the proposed changes.

7. Key themes were:

7.1. Theme 1: Passenger Transport (PT)

footprint

7.2. Theme 2: Capital

value.

8. Other themes focused on:

8.1. HBRC should not be doing this

activity, and/or other agencies should pay

8.2. General unaffordability of rates

and/or pressures from the cost of living

9. These ‘other themes’ that

ran through all the consultation topics will be addressed in the deliberations

report entitled Revenue and Financing Policy.

Summary of

submissions and officers’ analysis

Theme

1: PT Footprint

10. The majority of submissions on this

theme commented that extending the rating area was unfair as they believed the

extended boundary incorporated properties that could not access public

transport.

10.1. “Your increase in

the area covered by this is not consistent with services offered. For those in

the area north of the Airport we have limited services which you have to drive

to get to a bus stop in the first place,..” (#268)

10.2. “Why should those

that don't have easy access to passenger transport be charged for it? we live

less than a km from the urban area of Hastings but there’s no bus stop

nearby.” (#395)

10.3. “…While we

agree that it makes good sense to expand the footprint to account for urban

development, the proposed map shows the inclusion of some rural areas that seem

unlikely to benefit from or have the need for public transport services.” (#494)

10.4. “The changes to

Passenger Transport including the funding areas spread are not

supported.” (#549) Nigel

Bickle of Hastings District Council expanded on this in a verbal submission that

asked HBRC to consider the impact on the new ratepayers added to the proposed

rating area map.

11. Of the smaller number in favour of the

extended rating area, they cited that it was a fairer approach.

11.1. “Not directly

impacted, but agree with extension of rating area based on development, this

makes sense.”

(#545)

Staff response

12. The rationale for the revised

footprint as proposed in the consultation document reflects:

12.1 those

properties within a zone with reasonable access to public transport (for

example

people

who drive a short distance to a bus stop where free parking is available, then

take

public

transport to their workplace)

12.2 urban

development of previous rural areas and alignment with valuation roll

footprint.

This

corrects a policy anomaly which saw a LV rating cap on Clive, and Bay View not

being

rated

for a service provided

12.3 widespread

benefit of reduced traffic congestion and pollution from less vehicles on the

road.

13. Staff note that rating of PT is not directly

linked to the service provided to individual properties but the benefit of the

service to the group of properties.

14. The passenger transport rate also

funds the Total Mobility Scheme, which is available for people who are unable

to use public transport (through location or disability) for taxi travel to

medical and other appointments. This has a wider availability than the public

bus routes.

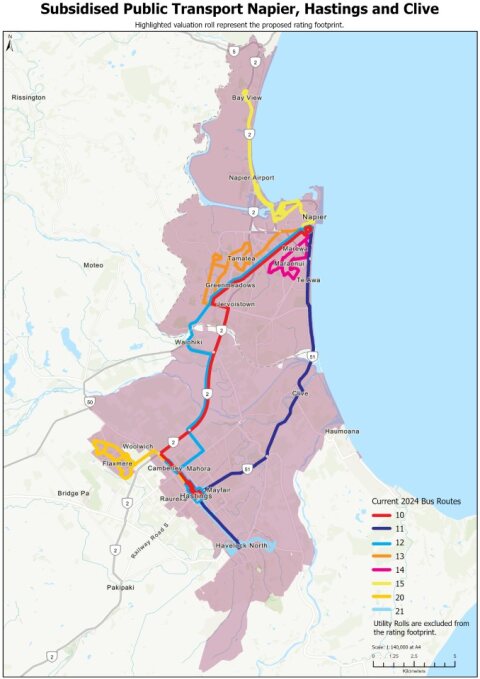

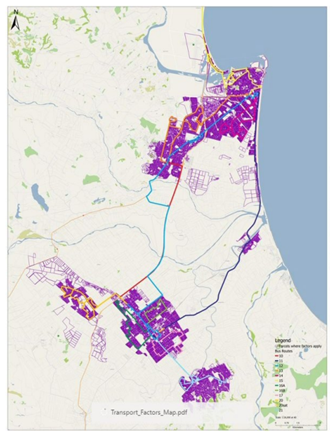

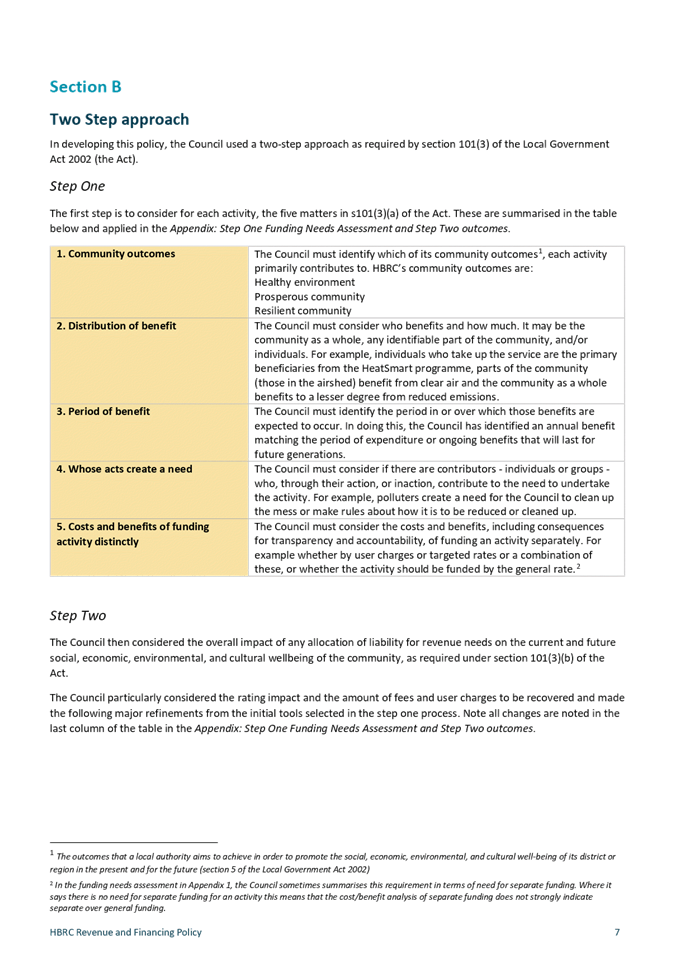

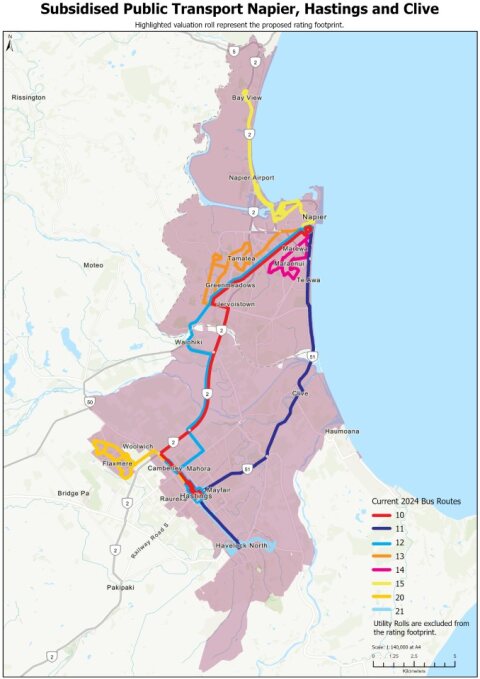

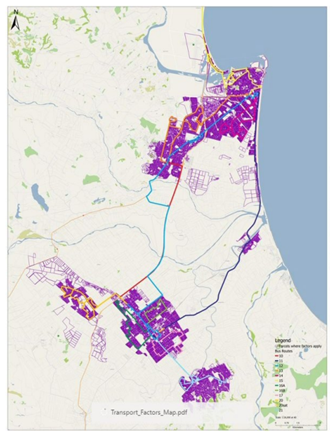

15. A map of the proposed footprint with

the current bus routes overlaid and a map of the current footprint is shown

below for comparison.

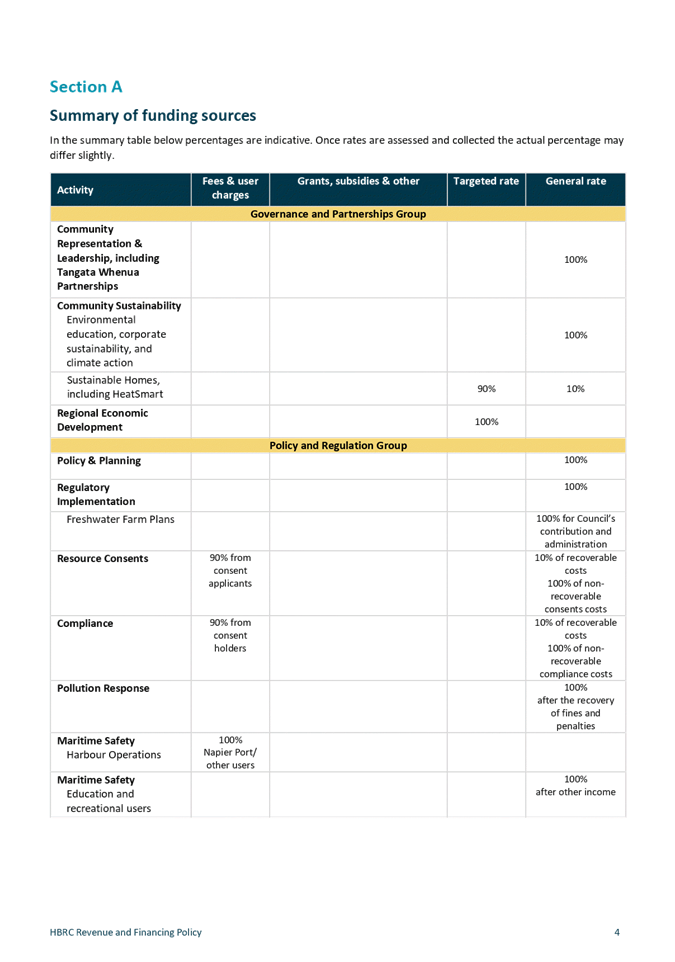

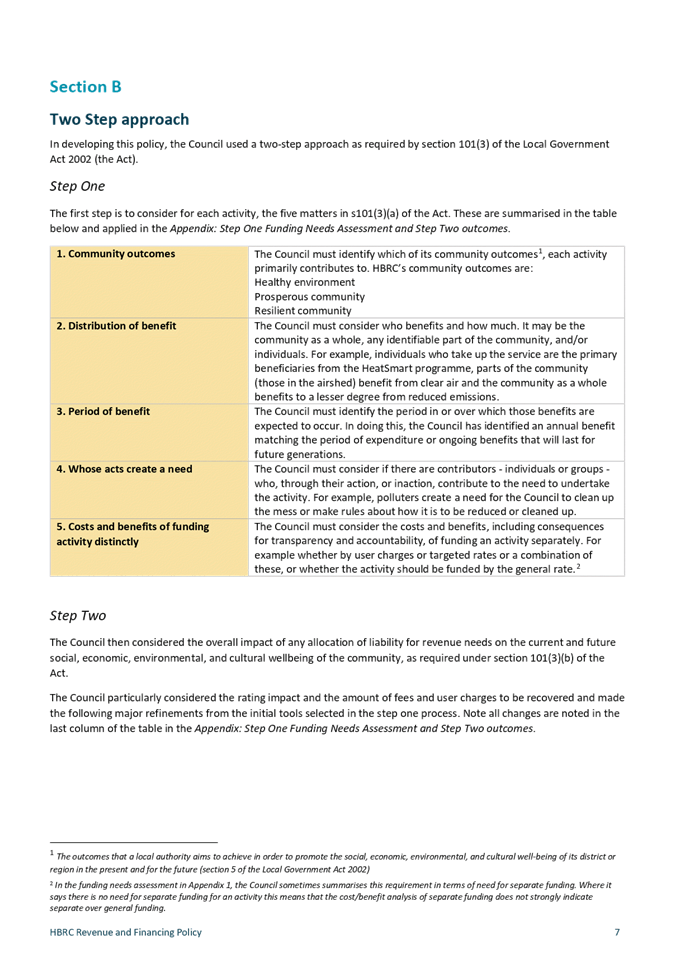

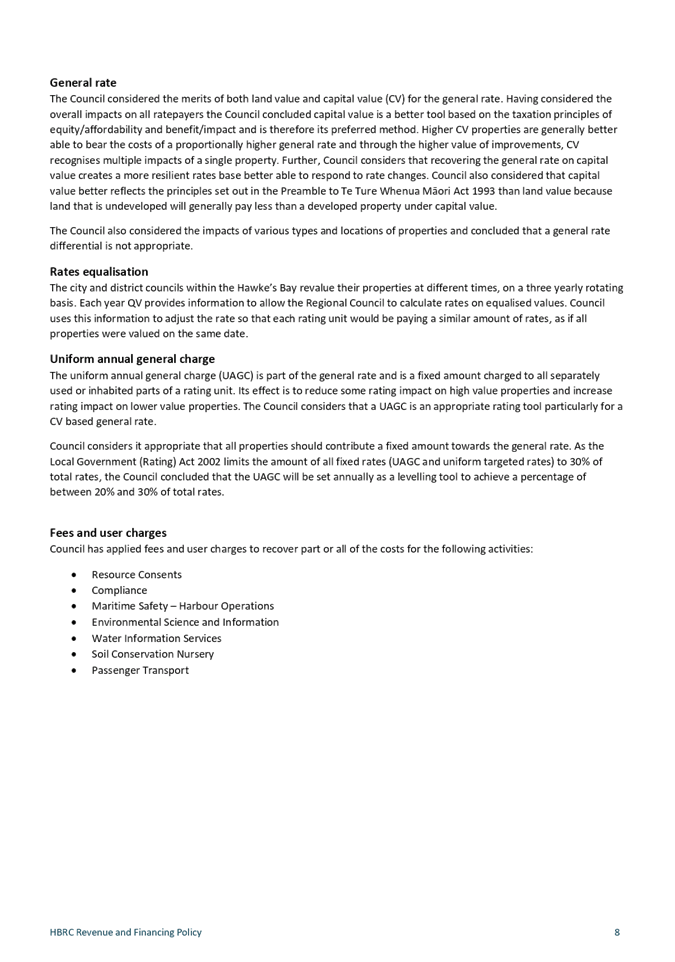

Figure 1 Proposed

rating area with current bus routes overlaid (Passenger Transport)

Figure 2 Current rating area

(Passenger Transport)

Theme

2: Capital value

16. Overall, there were few submitters who

commented on using capital value for the passenger transport rate.

16.1. “A CV-based tax

for passenger transport would not accurately reflect the individual benefits

received, especially if the tax is significantly influenced by the value of

property improvements rather than the use or benefit of the transport

services…”

(#414)

16.2. “Moving to CV

means higher value properties will pay a greater share of this service for an

extremely inefficient service that benefits very few.” (#479)

16.3. “Strongly support,

as transport is very much a people and business based activity, much more

fairly represented on a Capital rather than a Land value system.” (#491)

16.4. “This aligns with

the rationale that passenger transport provides greater benefit to properties

that have higher capital values through enabling economic opportunities.”

(#494)

Staff response

17. It is noted in the consultation

document “PT delivers benefits more closely aligned with CV. For

example, capital improvements to land [business developments such as a

factory or the Regional Sports Park] may result in more jobs therefore more

people needing PT. ”

18. The step one and two rationale

considered that CV is fairer because it reflects improved properties as opposed

to vacant land.

Individual

topics

19. One submitter did not support the

proposal or the status quo:

19.1. “I don't support

rating this by either CV or LV as I don't think either will result in an

equitable distribution of rates to the categories based on who most benefits

from the service. eg why should horticultural and pastoral rate payers pay more

than commercial/ industrial? And why should lifestyle rate

payers pay more than residential? (#410)

20. One submitter offered an alternative

way to rate for this activity:

20.1. “Although this

service benefits all ratepayers, the cost is related to usage by the population

and should be allocated on a fixed rate per SUIP I agree with the proposed

increase in public transport area.” (#527)

21. One submitter questioned the

affordability of the Passenger Transport rate on their rates bill:

21.1. “neither the

proposed or status quo approach are acceptable. This item is the 2nd costliest

on our current rates bill ($164.73 per annum)…” (#493)

21.2. “Planning for

public transport cost increases is not something that happens as a

surprise. We question why the amount is so big, so suddenly. Going from

0.00 to 414.10 in one year does not seem reasonable.” (#539)

Scope

of decision

24. The scope of the decision consists of

two parts:

24.1. Updated footprint - staff

consider that, because the review has identified ratepayers who have been

receiving this service without charge (Bay View) or receiving a subsidy

(Clive), this change should go ahead and deferring this proposed change is not

recommended. Failure to implement would retain current flaws in the rating

footprint (e.g. some ratepayers not paying for a service they receive,

subsidised by those in the current rating footprint).

24.2. LV to CV rating - staff

note there was a significant affordability theme in the submissions. Due to

this, the Council could consider deferring the proposed change to CV or

changing back to LV to lessen the impact of change.

Decision-making

process

25. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

25.1. The decision does not significantly

alter the service provision or affect a strategic asset, nor is it inconsistent

with an existing policy or plan.

25.2. The use of a consultation process required by

legislation under LGA s102(4) has been undertaken.

25.3. The decision is significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy.

25.4. The persons affected by this decision

are the region’s ratepayers.

Recommendations

That

Hawke’s Bay Regional Council:

1. Receives and considers the Revenue

and Financing Policy Review deliberations - Passenger Transport Rate staff

report.

2. Agrees that the Council can exercise

its discretion and make decisions on this issue, having undertaken the consultation process required by

legislation under LGA s102(4).

3. Agree to adopt the Passenger Transport

rate proposal as consulted on being:

3.1. 100% targeted rated based on capital

value for Hastings and Napier ratepayers, with an extended urban footprint.

OR

4. Agree to retain the status quo (with

adjusted footprint), being 100% targeted rated based on land value for Hastings

and Napier ratepayers.

Authored by:

|

Desiree Cull

Strategy

and Governance Manager

|

Sarah Bell

Team Leader

Strategy and Performance

|

|

Beth Postlewaight

Workstream

Lead - Property & Rates Project

|

Vanessa Fauth

Finance

Manager

|

|

Chris Comber

Chief

Financial Officer

|

|

Approved by:

Attachment/s

There are no attachments for this

report.

HAWKE’S

BAY REGIONAL COUNCIL

Wednesday

28 February 2024

Subject: Revenue and Financing Policy Review deliberations - Freshwater

Science Charges and a new Targeted Rate

Reason

for report

1. This deliberations report provides the

Council with submission themes and officers’ analysis of submissions and

seeks a decision of Council on the consultation topic – Freshwater

science charges, and a new targeted rate.

Officers’

recommendations

2. Staff recommend that the Council

considers the submission points (as received by Council resolution on 13 February 2024) on the Freshwater science charges,

and a new targeted rate consultation topic alongside the officers’

analysis to enable an informed decision.

Consultation

topic

3. The Freshwater science charges, and

a new targeted rate proposal was one of seven consultation topics that the

Council sought public submissions on through Your Community Your Rates

consultation document for the review of HBRC’s Revenue & Financing

Policy.

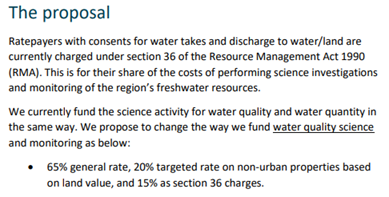

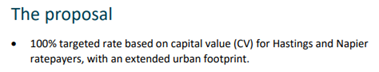

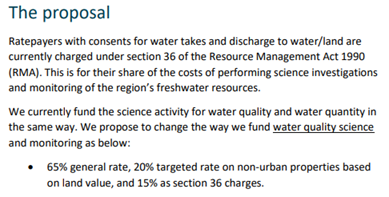

4. The proposal was presented in the

consultation document as shown following:

Submissions

received

5. Of the submissions received, 83

supported the proposal, 227 did not support it, 158 didn’t know and 74

did not select an option.

6. 145 submitters made a comment under

this proposal.

7. The majority of submissions focussed

on the activity/service itself and are better suited to consultation for the

Long Term Plan. There were very few submissions that addressed the proposed

changes in the proposal.

8. The key theme was:

8.1. Theme 1: Tiered rates

9. Other themes focused on:

9.1. HBRC should not be doing this

activity, and/or other agencies should pay

9.2. General unaffordability of rates and/or

pressures from cost of living

10. These ‘other themes’ that

ran through all the consultation topics will be addressed in the agenda item Revenue

and Financing Policy.

11. It was noted that many of the comments

referred to water storage and/or water takes rather than water discharges (to

land or water) that relate to the section 36 charges that water quality science

monitoring is paid by.

Summary of

submissions and officers’ analysis

Theme

1: Tiered rates

12. Overall, there was more support for this proposal to include a

new targeted rate than to retain the status quo.

12.1. “Some permitted

activities if not maintained and managed properly can have the same or even a

greater impact as a single consented activity that is well managed and

monitored.” (#344)

12.2. “I support the

Freshwater science charges, and a new targeted rate. Understanding and managing

water quality (which can be affected by diverse, dispersed sources) is a public

service that affects Land Value and so should be allocated as such.” (#414)

12.3. “Inclusion of a

greater proportion these costs on those who mostly contribute to changes in

water quality (i.e. non-urban landowners) is demonstrably a fairer way of

meeting some of these costs.” (#491)

13. Only one submitter expressed concern

for the new targeted rate. This came from Federated Farmers, with the request

that this targeted rate be split more broadly. The second submitter pointed out

that farmers will be paying for water quality regulations next year.

13.1. “While we agree

that diffuse sources impact water quality, urban areas also contribute to

freshwater pollution through stormwater discharges, wastewater overflows,

contaminants from roads and other sources. Singling out rural ratepayers to

fully fund the targeted portion of this rate does not seem equitable.” (#494)

13.2. “Farmers by

default will be forced to pay higher freshwater regulations charges as the

National Freshwater Standards Policy is introduced in 2025, why force them to

pay twice?” (#538)

14. One submitter thought the targeted

rate might not go far enough to address water quality.

14.1. “The basis for

allocation (consent holders only) seems incorrect when a major contributor to

water quality is related to upstream (pastoral) activities - nitrate leaching

and runoff. It continues to be a critical issue across the region therefore

changing to a more targeted approach (Pastoral and Other sectors) with a lower

general rate impact would more fairly levy those who contribute to poor water

quality. All rate payers are currently levied for the upstream activities of

land use - how equitable or fair is hat upon a residential property

owner?” (#493)

Staff response

15. In response to the submissions that

urban areas contribute to poor water quality so should also be included in the

targeted rate – territorial authorities are consented for urban

discharges on behalf of urban ratepayers which includes a S36 charge. So it is

not correct to say we are “singling out rural ratepayers”.

16. The proposed methodology supports the

tiered approach. The proposal is to split the requirement three ways: general

rate, targeted rate, and user charges. The rationale behind the creation of the

targeted rate was that all activity on the land (including permitted activities

that do not require a consent) has the potential to impact water quality as a

diffuse source which is why a portion of the total fund requirement was

proposed to be a targeted rate. Staff consider this rationale is still sound

and is well-documented against the required s101 considerations in the Appendix

to the new Revenue & Finance Policy. Staff are confident that due

process has been followed to support a new rate.

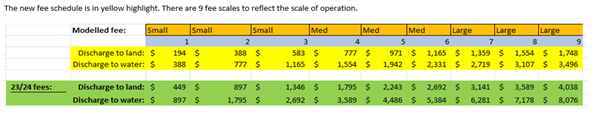

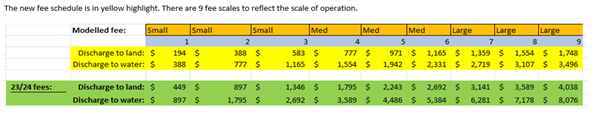

Net impact of s36 charges and rate changes by sector

17. As noted in the CD, the

proposed changes to the funding model for water quality science will see $635k

... removed from user charges and applied to the new targeted rate.

18. During the consultation,

ratepayers could request a property assessment to find out the impact of the

policy changes on their rates. Another piece of the puzzle is the impact of the

proposed changes to s36 charges on consent holders. There are

approximately 700 consent holders, many of which are horticultural or pastoral.

19. Unfortunately, we are

unable to show the net impact of the proposed rates and s36 charge on the ~700

consent holders as resource consents are not linked to a rating valuation

number but instead to a consent holder (i.e., they are two distinct databases)

20. The new fee schedule is in

yellow highlight. There are 9 fee scales to reflect the scale of operation.

21. From the schedule above,

it is clear the dollar impact, particularly for large-scale consent holders

such as packhouses which often have multiple consents, is not

insignificant. For example, a consent holder with a consent to discharge

to water with a large-scale score of 9, saves $4,580 per year per consent.

22. Staff consider it likely

that some submitters have overstated the financial impact of the policy changes

in total as they didn’t factor in the impact of s36 charges.

Other

themes

23. Three submitters singled out section

36 charges and the consent holders. One submitter queried the fairness of

charging a consent holder that was not using their consent.

23.1. “Consented

discharges can exacerbate impacts on water quality more so holders should pay

at least 35% of water quality science activity via section 36 charges. Other

land and property owners can pay their share via the general rates.” (#408)

23.2. “This is

essentially giving Water Holding Hawke's Bay Ltd a 57% reduction in their Sec

36 charges as they do not own any landed property so are exempt from the

proposed targeted rate on non-urban properties based on land value. I don't

know how land owners who are going to have to make up for this reduction feel

about this, but if it were me I would not be a happy camper.” (435)

23.3. “I think end users

and area consents should pay more than 50% i.e.: a majority of the

costs.” (#413)

23.4. “Council has an obligation

to ensure these are fair and reasonable. It is completely unreasonable and

against public law principles for HBRC to charge any consent holder that is not

having any effect on the environment, just because they hold a consent for an

activity that may happen at a future stage.” (#519) This view was also supported

by #546.

Staff response

24. Under the existing fees and charges

policy, consent holders are charged freshwater science charges based on

consented activity, not actual use. This is not being changed as part of this

review. The research and monitoring activities performed by Regional Council

are to inform on effects or potential effects on the region’s freshwater

resources. The RMA provides for remissions on charges to be made and this can

be used to ensure charges are fair and reasonable.

Scope of decision

25. The scope of the decision is to adopt

the proposal as consulted on or revert to the status quo. Having considered the

submissions received on this topic, staff have determined there are no new

options for Council to consider.

26. Deferring this proposed change is not

recommended as we have identified part of the community that contributes to the

need for Council’s monitoring programmes in addition to those that hold

consent for discharges, and therefore should contribute to the fees and charges

for these activities.

Decision-making process

27. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

27.1. The decision does not significantly

alter the service provision or affect a strategic asset, nor is it inconsistent

with an existing policy or plan.

27.2. The use of a consultation process required by

legislation under LGA s102(4) has been undertaken.

27.3. The decision is significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy.

27.4. The persons affected by this decision

are the region’s ratepayers.

Recommendations

That

Hawke’s Bay Regional Council:

1. Receives and considers the Revenue

and Financing Policy Review deliberations - Freshwater Science Charges and a

new Targeted Rate staff report.

2. Agrees that the Council can exercise

its discretion and make decisions on this issue, having undertaken the consultation process required by

legislation under LGA s102(4).

3. Agrees to adopt the Freshwater

science charges, and a new targeted rate proposal as consulted on being:

3.1. 65% general rate, 20% targeted rate on

non-urban properties based on land value, and 15% as section 36 charges.

OR

4. Agrees to retain the status quo, being

65% general rates and 35% as section 36 charges.

Authored by:

|

Desiree Cull

Strategy

and Governance Manager

|

Sarah Bell

Team Leader

Strategy and Performance

|

|

Beth Postlewaight

Workstream

Lead - Property & Rates Project

|

Vanessa Fauth

Finance

Manager

|

|

Chris Comber

Chief

Financial Officer

|

|

Approved by:

Attachment/s

There are no attachments for this

report.

HAWKE’S

BAY REGIONAL COUNCIL

Wednesday

28 February 2024

Subject: Revenue and Financing Policy Review deliberations - Sustainable

Land Management, Biodiversity and Biosecurity Rates

Reason for Report

1. This deliberations report provides the

Council with submission themes and officers’ analysis of submissions and

seeks a decision of Council on the consultation topic – Sustainable

Land Management, Biodiversity and Biosecurity Rates.

Officers’

recommendations

2. Staff recommend that the Council

considers the submission points (as received by Council resolution on 13 February 2024) on the Sustainable Land

Management, Biodiversity and Biosecurity Rates consultation topic alongside

the officers’ analysis to enable an informed decision.

Consultation

topic

3. The Sustainable Land Management,

Biodiversity and Biosecurity Rates proposal was one of seven key

consultation topics that the Council sought public submissions on through Your

Community Your Rates consultation document for the review of HBRC’s

Revenue & Financing Policy.

4. The proposal was presented in the

consultation document as shown following:

Submissions

received

5. Of the submissions received, 102

supported the proposal, 201 did not support it, 164 didn’t know and 75

did not select an option.

6. 132 submitters made a comment under

this proposal, noting that many comments related to how the submitter felt

about the activity itself and are better suited to consultation on the Long

Term Plan.

7. Key themes were:

7.1. Theme 1: Benefit challenged

7.2. Theme 2: Forestry.

Summary of

submissions and officers’ analysis

Theme

1: Benefit challenged

8. A number of submitters who thought it was unfair to shift

these activities to the general rate and/or thought landowners/farmers should

be paying most of the costs.

8.1. “Disagree with

100% general rate for sustainable land management and biodiversity. While all

rate payers' benefit, I feel it is mainly how non-residential land is managed

and activities related to non-residential land that exacerbates this cost.”

(#410)

8.2. “The cost of

sustainable land practices should be borne by the landowners that require

consistent guidance to ensure the residential land owners safety from slash,

animal bacteria invasion into ground water.” (#413)

8.3. “This seems to be

spreading the cost to those who are seen as able to pay but can have no

influence over those land management or biodiversity practices.” (#516)

8.4. “Don't agree with

… non-rural ratepayers contributing more to this - when they already will

be contributing more to district rate increases that many of the rural

properties do not, and do not impact these targeted areas as much with their

properties.”

(#545)

9. The majority of submitters who

directly commented on this topic supported the proposal for sustainable land

management and biodiversity work to be funded from the general rate, as a

shared, common goal.

9.1. “If we are serious

about Predator Free goals then we as an urban ratepayer I would be happy to

further support rural ratepayers to do more in this space.” (#435)

9.2. “[Federated

Farmers] supports the proposed changes to fund sustainable land management and

biodiversity fully through the general rate, and to fund primary production

pests fully through a targeted rate on non-urban properties based on land

value. This appropriately reflects the community-wide benefits of sustainable

land management and biodiversity, while targeting costs of managing primary

production pests to the direct beneficiaries.” (#494)

9.3. “The whole

community is responsible for our environment and biodiversity, sharing the

burden of cost across all ratepayers is a fairer distribution rather than just

a small sector of the community. It is also a way for residential ratepayers to

contribute in a small way to these important obligations, keeping in mind that

rural landowners use large amounts of their own funds to do the work required

in reducing erosion, retiring land from their business and taking positive

actions to improve water quality.” (#541)

10. Two submitters commented on how to

fund Primary Production Pests while one supported the proposal (Federated

Farmers) and the other did not support it (lifestyle ratepayer).

10.1. Federated Farmers

supports the proposed changes to [...] fund primary production pests fully

through a targeted rate on non-urban properties based on land value. This

appropriately reflects the community-wide benefits of sustainable land

management and biodiversity, while targeting costs of managing primary

production pests to the direct beneficiaries." (#494)

10.2. “I disagree with

the 100% targeted rate on nonurban ratepayers based on land value for primary

production pests. Rural Lifestyle property owners with less than 4 hectares are

seldom involved with primary production. 4 hectares is seldom viable for an

economic business and isn't large high value productive land.” (#408)

Individual

Topics

11. One submitter supported the proposal

in principle but thought the timing wasn’t appropriate.

11.1. “When [compliance

with farm plans are] uniformly achieved I'm sure the community wouldn’t

object to the proposed general rate but in the interim I think non-urban

properties should pay considerably more.” (#493)

12. One submitter suggested an alternative

proposal. To keep sustainable land management on 75%/25% split on non-urban

properties of 4ha and over would be to put Primary Production Pests with

biodiversity and move both 100% to the general rate.

12.1. “The activity

Sustainable Land Management (Farm Environmental Management Plans) should be

paid by businesses that have them. They are a separately identifiable, group

which causes a need for them.” (#408)

13. Two submitters referenced forestry in

relation to this consultation topic.

13.1. “This activity

should be largely funded …, especially Forestry, which provides a

significant pest environment.” (#491)

Staff response

14. This proposal wraps up all the

activity under Sustainable Land Management and moves it to the general rate.

The general rate was considered the most appropriate funding source as work

done with landowners, as well as catchment and sector groups, results in good

land management practices that result in beyond boundary benefits to the whole

community through healthy soils, freshwater, estuaries, coastal/marine and

air/climate.

15. The Biodiversity activity is also

proposed to move to the general rate. As noted in the Consultation Document Combined,

this results in $2.7M net moving from targeted rates to the general rate. Urban

ratepayers will be most impacted from the shift to the general rate.

16. Like SLM, the general rate was deemed

the most appropriate funding source for biodiversity activities, due to the

whole-of-region and community-wide benefits from this work. Possum

control is a large component of this activity. In the past, possum control was

done to reduce the risk of TB. This has changed over time to achieving

biodiversity outcomes. Possums are the number one browser affecting

reforestation. Under the current policy, possum control is rated 30%

general and 70% targeted rate.

17. Another driver was to simplify how we

rate for biodiversity and biosecurity activities by treating all work we do for

biodiversity outcomes as one group. The current policy has a mix of 5 different

rating combinations depending on the pest, area, and perceived level of

public/private benefit. This proposal significantly simplifies rating which had

become increasingly hard to justify.

18. Primary Production Pests is a new

targeted rate specifically for animal and plant pests managed for primary

production reasons, including rooks, rabbits, and other plant pests. As noted

above possums and other animal and plant pests managed for biodiversity reasons

are proposed to move to the general rate. The proposal to retain primary

production pest to a non-urban footprint reflects the benefit received by

non-urban ratepayers.

19. The removal of the 4 hectare threshold

recognises that many small parcels of land are part of larger rural operations.

Additionally, all rating units benefit from this activity regardless of the size

of the land parcel.

20. A number of other regional councils

include these activities as part of the general rate including Greater

Wellington, and Bay of Plenty.

Scope

of decision

21. The scope of the decision is to adopt

the proposal as consulted on or revert to the status quo or a variation.

22. Staff are undertaking additional

modelling to show the isolated impact of rating SLM and

Biodiversity/Biosecurity in two different ways to what was consulted on, which

was 100% general rate. The modelling will be on a 75/25 split and 50/50 split.

This will be distributed as soon as available.

23. Staff note that the proposal as

consulted on aligns with the guiding principles of the rates review which were

clear and fair, simple, consistent, and flexible.

24. Staff strongly recommend the removal

of the 4 hectare threshold for Biodiversity and

Primary Production Pest and alignment with the non-urban rolls regardless of

other aspects of the proposal.

Decision-making

process

25. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

25.1. The decision does not significantly

alter the service provision or affect a strategic asset, nor is it inconsistent

with an existing policy or plan.

25.2. The use of a consultation process required by

legislation under LGA s102(4) has been undertaken.

25.3. The decision is significant under the

criteria contained in Council’s adopted Significance and Engagement Policy.

25.4. The persons affected by this decision

are the region’s ratepayers.

Recommendations

That

Hawke’s Bay Regional Council:

1. Receives and considers the Revenue

and Financing Policy Review deliberations - Sustainable Land Management, Biodiversity

and Biosecurity Rates staff report.

2. Agrees that the Council can exercise

its discretion and make decisions on this issue, having undertaken the consultation process required by

legislation under LGA s102(4).

3. Agrees to adopt the Sustainable

Land Management, Biodiversity and Biosecurity rates proposal as consulted

on being:

3.1. 100% general rate for sustainable land

management and biodiversity activity, and

3.2. 100% targeted rate on non-urban

ratepayers based on land value for primary production pests activity.

OR

4. Agrees to retain the status quo with

removal of the 4-hectare threshold being:

4.1. 75% general rate, and 25% targeted

rate on non-urban land based on area for sustainable land management

4.2. 5 different rating combinations for

biodiversity and biosecurity activities depending on the pest, dividing

northern and southern areas, and a differential rate for identified forestry.

OR

5. Agrees to a new rating split for Sustainable

Land Management, Biodiversity and Biosecurity rates being:

5.1. X % general rate, and x% targeted rate

on non-urban ratepayers based on land value.

Authored by:

|

Desiree Cull

Strategy

and Governance Manager

|

Sarah Bell

Team Leader

Strategy and Performance

|

|

Beth Postlewaight

Workstream

Lead - Property & Rates Project

|

Vanessa Fauth

Finance Manager

|

|

Chris Comber

Chief

Financial Officer

|

|

Approved by:

Attachment/s

There are no attachments for this

report.

HAWKE’S

BAY REGIONAL COUNCIL

Wednesday

28 February 2024

Subject: Revenue and Financing Policy Review deliberations - Rates

Remission and Postponement Policies

Reason for Report

1. This deliberations report provides the

Council with submission themes and officers’ analysis of submissions and

seeks a decision of Council on the consultation topic – Rates

Remission and Postponement Policies.

2. Having considered this information, it

seeks a decision of Council to adopt the Rates Remission and Postponement

Policies (see attached).

Officers’ recommendations

3. Staff recommend that the Council

considers the submission points (as received by Council resolution on 13 February 2024) on the Rates Remission and

Postponement Policies consultation topic alongside the officers’

analysis to enable an informed decision.

Consultation

topic

4. The Rates Remission and

Postponement Policies draft was one of seven key consultation topics that

the Council sought public submissions on through Your Community Your Rates

consultation document for the review of HBRC’s Revenue & Financing

Policy.

5. The proposal was presented in the

consultation document as shown following:

Submissions

received

6. Of the submissions received, 100

supported the proposal, 167 did not support it, 195 didn’t know and 79

did not select an option.

7. 105 submitters made a comment on this

proposal.

8. A main theme was:

8.1. Theme 1: Remissions vs no

remissions

9. Other themes focused on general

unaffordability of rates and/or pressures from the cost of living. These