Meeting of the Risk

& Audit Sub-committee

Date: 15 February 2024

Time: 10.00am

|

Venue:

|

Council

Chamber

Hawke's

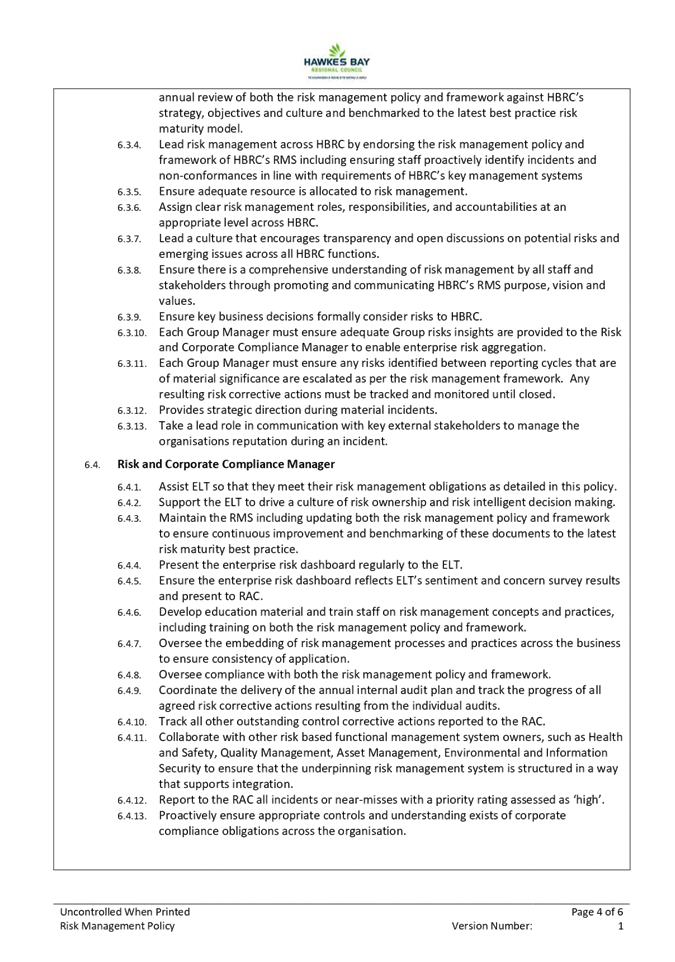

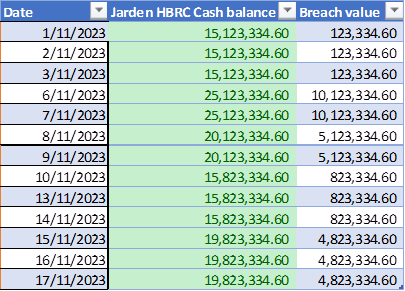

Bay Regional Council

159

Dalton Street

NAPIER

|

Agenda

Item Title Page

1. Welcome/Karakia/Housekeeping/Apologies

2. Conflict

of Interest Declarations

3. Confirmation of Minutes of

the Risk and Audit Committee held on 18 October 2023

4. Risk

Maturity Refresh 3

5. Risk

Management Policy 7

6. External

Audit Report - Control Findings for the year ended 30 June 2023 17

7. Audit

Plan for the 2023-2024 Annual Report 19

8. External

Audit Report - ISO 9001-2015 certification 21

9. Treasury

Compliance Report for the period 30 September - 31 December 2023 23

10. Internal

Audit Report - Data Analytics 29

11. Internal

Assurance dashboards update 33

Public

Excluded Decision Item

12. Confirmation

of 18 October 2023 Public Excluded Minutes 47

Hawke’s Bay Regional

Council

Risk

and Audit Committee

15

February 2024

Subject:

Risk Maturity Refresh

Reason for report

1. This paper provides the

Risk and Audit Committee (RAC) with an update on the reset of the approach to

risk management within Hawke’s Bay Regional Council.

Executive Summary

2. HBRC is well advanced in

adopting a different approach to risk management.

3. The purpose of the change

in approach is to improve the quality of risk information and enable a

comprehensive understanding of the risk profile of HBRC to feed into executive

and governance discussion, planning, decision-making and monitoring.

4. The key concepts that

underpin this approach are:

4.1. Defining risk in terms of

HBRC’s purpose, what success looks like, and the major areas of

uncertainty associated with this.

4.2. Single point

accountabilities for each area of success/uncertainty (i.e. risk) at the ELT

level, with supporting business leads to develop and maintain the one-page

management plans for each area.

4.3. One-page management plans

for each area to drive explicit action and decision-making.

4.4. Monthly sentiment surveys

completed by the ELT to gauge the overall level of confidence/concern (i.e.

risk rating) associated with each area, and the consistency of views across

ELT.

4.5. The Enterprise Dashboard

used by ELT, Council, and the Risk & Assurance Sub-committee each meeting

to focus risk discussion, with two or three one-page management plans to enable

deep-dives into specific areas of risk.

5. The role of Council is to

enable democratic decision-making and to provide governance over the operations

of HBRC. Central to this is the need for an understanding of the key

risks faced by the Council and to factor this into Council decision making.

6. The role of the Risk and

Audit Committee is to ensure that an effective system of risk management is in

place and that this is working effectively.

7. In this regard, there is a

distinction between the respective roles of the full Council and the Risk and

Audit Committee of Council:

7.1. Full Council: makes

effective decisions, and that decision-making takes into account the major

areas of risk/uncertainty faced by HBRC (both upside opportunities and downside

threats) – i.e. the content of risk management

7.2. Risk and Audit Committee:

ensures there is an effective and enduring approach to identify, assess, manage

and report on risk/uncertainty, and that this information is used as part of

decision-making – i.e. the process of risk management.

Background

8. From a Council workshop on

18 July 2023 and councillors’ feedback, a one-page Enterprise Dashboard

was developed, representing the collective view of the Executive Leadership

Team and Council as to the risk profile of HBRC, expressed in terms of:

8.1. Purpose: what is most

important to HBRC.

8.2. Success: what success looks

like, reflecting the strategic priorities per the Long-Term Plan.

8.3. Uncertainty: the major

areas of uncertainty (i.e., risk) associated with HBRC’s role and

commitments.

9. Subsequent to the workshop

with Council, several of the specific areas of success/uncertainty (i.e., risks

reflected within the Enterprise Dashboard) have been workshopped and one page

management plans developed to provide a simple way to define and describe:

9.1. the underlying risk (i.e.,

what matters to us).

9.2. the consequences of this

(i.e., why this matters) expressed in terms of opportunities and threats.

9.3. the potential causes of

this risk (i.e., what needs to be managed).

9.4. activities, controls, and

mitigations in place (i.e., how this is managed).

9.5. outcomes and metrics

related to this risk (i.e., how this will be monitored as part of wider

organizational performance reporting).

9.6. a response plan (i.e.,

based on the current state, what do we want to do differently going forward).

Discussion

10. The attachment provides:

10.1. a recap on the risk

maturity work that has been undertaken to date, including what we are doing in

risk maturity, why we are doing the risk maturity work, and why risk maturity

matters.

10.2. a summary of current state,

including key work completed, emerging themes from the work completed, and

insights from the implementation process to date.

10.3. HBRC’s current

Enterprise Dashboards which summarise ELT’s sentiment from the December

2023 survey and Council’s sentiment from the January 2024 survey.

10.4. deep dives on two

enterprise uncertainty areas, being:

10.4.1. Capability and Capacity of

Service Providers and Partners

10.4.2. Health, Safety, Resilience

and Wellbeing of People.

11. The two Enterprise

Dashboards are based on the sentiment surveys of ELT and of Council whereas the

two deep dive one-pagers are workshop assessments that include Tier 3 Managers

and other Subject Matter Experts from across the business. The workshop

assessments consider controls effectiveness, causes in relation to the internal

and external environment, and potential gaps and issues, which is similar to a

traditional risk analysis.

Next Steps

12. To further mature risk and

continue to embed the new approach to risk management the following activities

will occur over the next quarter:

12.1. reconfirm accountabilities

for each area across the Executive Leadership Team

12.2. increase visibility of this

work through communication and awareness-raising with staff (particularly tier

three managers)

12.3. formalise the monthly

sentiment survey

12.4. implement a process for

monthly update/confirmation of the one-page management plans

12.5. cleanse identified controls

for each of the success and uncertainty one pagers and develop an Enterprise

control library

12.6. using the Enterprise

control library establish a controls assurance programme.

Decision-making process

13. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That the Risk and Audit Committee receives and

notes the Risk Maturity Refresh staff report.

Authored by:

|

Helen Marsden

Risk & Corporate Compliance Manager

|

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1

|

Feburary 2024 Risk update

|

|

Under Separate Cover

|

Hawke’s

Bay Regional Council

Risk

and Audit Committee

15

February 2024

Subject: Risk Management Policy

Reason for report

1. This item seeks Risk and

Audit Committee (RAC) endorsement for the revised Council Risk Management

Policy (CD0023) in the form of a recommendation to Council.

Officers’

recommendation

2. Staff recommend that the

RAC considers the revised Risk Management Policy (CD0023) and recommends its

approval to Council.

Background

3. Council’s Risk Management

Policy sets out the boundaries for establishing a Council-specific risk

management framework. As part of risk management maturity and under the

newly formed Risk and Audit Committee improvements to Council’s risk

management practices and processes (framework) were identified.

Therefore, Council’s current Risk Management Policy was reviewed to

ensure alignment between Council’s new framework. And, also to

confirm that under the new Terms of Reference Council’s Risk Management

Policy would ensure that the Risk and Audit Committee would fulfil certain

obligations.

4. At the 18 October 2023 RAC

meeting staff were asked to:

4.1. articulate the culture of

risk management in the Policy’s purpose or goal

4.2. link the policy to the risk

management framework and strategic plan, and

4.3. provide an accompanying

framework that supports the policy based on the new risk methodology.

5. The review of

Council’s Risk Management Policy (CD0023) against Council’s new

risk management framework did not highlight any material differences. The

main changes to Council’s Risk Management Policy (CD0023) relate to the:

5.1. frequency of risk review

and reporting

5.2. the inclusion of

Councillor’s and Executive Leadership’s requirement to undertake

regular sentiment surveys

5.3. the removal of the Risk

Champion role that is no longer required under the new risk practices.

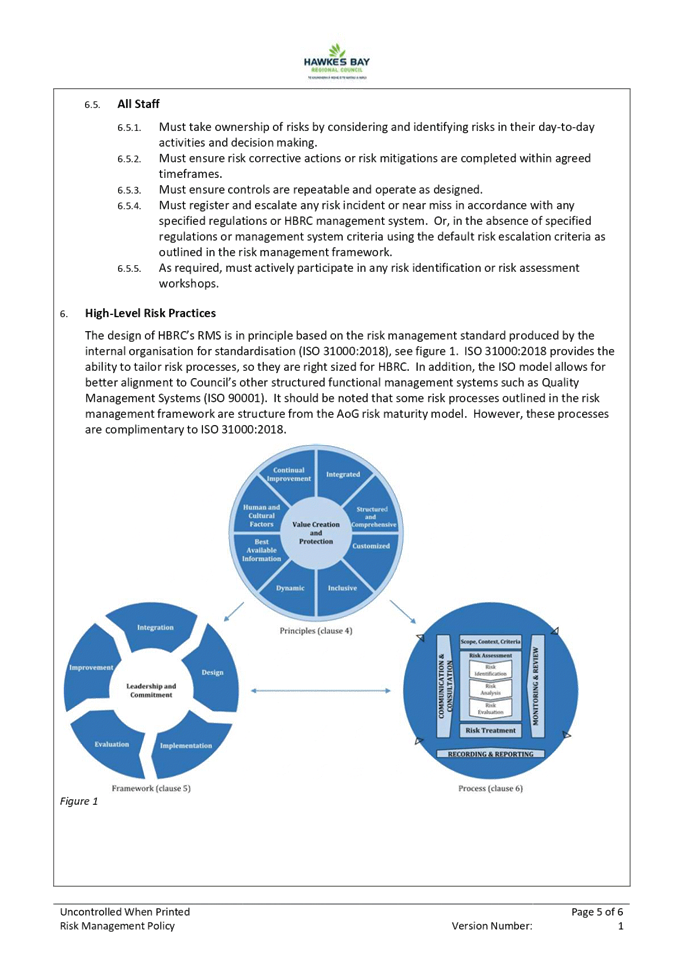

6. Council’s Risk

Management Policy (CD0023) and therefore Council’s new risk management

framework will continue to be benchmarked and aligned to the principles of ISO

31000:2018 Risk Management Standard and the All of Government Risk Maturity

Model.

Discussion

Incident Reporting - Risk and

Escalation Rating Context

7. At the 18 October 2023 RAC

meeting the Committee also requested that management establish an incident

escalation scale and report the new scale back to the RAC on how risk events

will be reported to RAC.

8. Management then established

an incident escalation scale which the Executive Leadership Team (ELT) reviewed

and endorsed. ELT recommended in their review that the scale be

incorporated into Council’s Risk Management Framework that accompanies

Council’s Risk Management Policy (CD0023). Incorporating the

incident escalation scale into Council’s Risk Management Policy and Risk

Management Framework would provide a consistent approach to that which is

applied in the Council’s key Risk-Based Management Systems including

Health and Safety Management and Asset Management.

9. As a result, management

have included in the Risk Management Framework a separate Incident and

Non-conformance Management section (8.1.11 of the Framework). Figure 7 in

section 8.1.11 details the new Incident Escalation Scale. In addition,

the roles, and responsibilities in Council’s Risk Management Policy have

been expanded to include content on incident management.

10. In setting Council’s

incident escalation scale management considered and aligned to the Risk and

Cause Rating Scale that is set out in the Risk Management Framework under

section 8.1.6 Figure 6.

11. RAC will receive High-rated

incidents for oversight. High-rated incidents have a wide impact, potential

impact or operational disruption and need managing through a large scale CIMS

structure. High-rated incidents highlight that immediate improvement is

needed and urgent action required. Council Chair, RAC Chair, CE, ELT as

well as Group Manager, Team Leader and Management System Advisor are informed

at the time and there is ongoing reporting through separate report to the Risk

and Audit Committee.

12. In addition to the above,

it is expected management will bring to the attention of RAC any systemic

issues deemed necessary as a result of thematic analysis of lower level issues.

13. As a result of the new

incident escalation criteria there are no new operational risk incidents to

report to RAC for this quarter. We have, however, noted a number of

breaches in the Treasury Counterparty risk limits, which are presented as part

of the Treasury Compliance Reporting agenda item.

Significance

and Engagement Policy assessment

14. The significance of this

decision is very low according to Council’s policy.

Financial

and resource implications

15. Any financial impact in relation

to changes to the Risk Management Policy will be managed within approved

budgets.

Decision-making process

16. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

16.1. The decisions of the Risk

and Audit Committee are in accordance with the Terms of Reference and

decision-making delegations adopted by Hawke’s Bay Regional Council

30 August 2023, specifically to provide advice and recommend actions,

responses, and changes to the Council about risk management, assurance

activities, governance oversight and internal control matters, including

external reporting and audit matters. Specifically, this includes:

16.1.1. (1.1) The robustness of

Council’s risk management systems, policies, practice, and assurance

processes.

16.1.2. (2.1) Review whether Council

management has a current and comprehensive risk management framework and

associated procedures for effective identification and management of the

Council’s significant risks in place.

Recommendations

That the Risk and Audit Committee:

1. Receives and considers the Risk

Management Policy staff report.

2. Recommends that

Hawke’s Bay Regional Council:

2.1. Agrees that the decisions

to be made are not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without conferring directly with

the community or persons likely to have an interest in the decision.

2.2. Approves the revised Risk

Management Policy (CD0023) as proposed.

Authored by:

|

Helen Marsden

Risk & Corporate Compliance

Manager

|

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

CD0023 Risk Management Policy 2024

|

|

|

|

2

|

Risk Management Framework 2024

|

|

Under Separate Cover

|

|

CD0023 Risk Management Policy 2024

|

Attachment

1

|

Hawke’s Bay Regional

Council

Risk

and Audit Committee

15

February 2024

Subject: External Audit Report -

Control Findings for the year ended 30 June 2023

Reason for Report

1. This report presents the

Audit and Risk Committee with the Ernst & Young (EY) Control Findings

report from the year ended 30 June 2023.

2. Representatives from EY

will attend the meeting to present their report and take any questions.

Executive

Summary

3. The EY Control

Findings report (attached) highlights 8 control observations identified

(including two additional observations audit have identified since presenting

their preliminary report).

4. Corrective actions have

been assigned an owner by HBRC and timeline as appropriate.

Background

5. Each year,

following the completion of the audit of HBRC’s Annual Report, the

auditor’s report back to the governing body on any findings from the

audit. The report provides commentary on areas where the auditors identified

control matters during their audit procedures, their recommendations for

improvement, and HBRC management’s response to these findings.

6. The preliminary EY Audit

Close Report was presented to the committee on 18 October 2023.

7. Seven Low-rated and one

Medium-rated audit observations were raised for the June 2023 external audit.

8. One of the

observations has been deemed as Medium-risk needing significant improvement,

ideally within the next 6 months; this relates to the reconciliation of community

loans – an ongoing issue that management is aware of. Due to system

limitations, HBRC is currently unable to extract a report that details all

outstanding loans to support the total community loans balance shown in

the financial statements. HBRC has historically calculated a manual estimate

using various data extracted from our systems, however, due to the level of

estimation involved and the significance of the community loans balance, there

is a greater risk that inaccuracies may not be identified.

9. The future of

the Sustainable Home’s activity is currently being reviewed as part of

the LTP process with these issues in mind and the outcome of this review will

steer any action that may be taken.

10. The remaining 7

observations have been deemed as low risk and needing some improvement ideally

within the next 6-12 months. Management has no significant concerns about these

observations and is comfortable that processes are underway to resolve them.

11. In a year of

significant impacts on our transactional and financial position this is seen as

a positive result for HBRC.

Decision-making process

12. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

13. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

13.1. The decisions of the

Committee are in accordance with the Terms of Reference and decision-making

delegations adopted by Hawke’s Bay Regional Council 30 August 2023,

specifically the Risk and Audit Committee shall have responsibility and

authority to:

13.1.1. (2.8) Receive the internal and

external audit report(s) and review actions to be taken by management on

significant issues and recommendations raised within the report(s).

13.1.2. (3.5) Ensure that

recommendations in audit management reports are considered and, if appropriate,

actioned by management.

Recommendations

That the Risk and Audit Committee:

1. Receives and considers the External

Audit Report - Control Findings for the year ended 30 June 2023 from Ernst

and Young and the staff paper.

2. Agrees that the actions to

be taken to address findings are adequate in the circumstances explained.

Authored by:

|

Chelsea Spencer

Senior Group Accountant

|

Chris Comber

Chief Financial Officer

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1

|

Ernst and Young Report on Control

Findings for the year ended 30 June 2023

|

|

Under Separate Cover

|

Hawke’s

Bay Regional Council

Risk

and Audit Committee

15

February 2024

Subject: Audit Plan for the 2023-2024

Annual Report

Reason for Report

1. This item provides an

update on the timing for the audit of HBRC’s 2023-2024 Annual Report.

Executive

Summary

2. The statutory deadline for

the adoption of the HBRC Annual Report is 31 October 2024.

3. Our auditors, Ernst &

Young (EY), are planning to perform an interim visit in the two weeks beginning

8 April and intend to begin the Year End audit in the week commencing 23 September

2024.

4. The Audit Planning Report

from EY is attached and representatives from EY will attend the meeting to

present their Audit Plan and take questions.

Background

/Discussion

5. The audit and adoption of

the Annual Report follows timelines set out in the Local Government Act 2002.

5.1. Section 98 (3) states that

the annual report of a Council “must be completed and adopted, by resolution, within 4 months after the

end of the financial year to which it relates”.

6. Officers have had

discussions with our auditors, EY, about audit timing (see table below). This

may change as our auditors refine their work plans and resourcing.

|

Dates

|

Description

|

|

w/b

8 April through

w/e

19 April 2024

|

Audit

interim visit will be conducted (est 4 people onsite for 2 weeks to complete

the interim work for HBRC, HBRIC and FoodEast)

|

|

w/b 9 Sep through

w/e 20 Sep 2024

|

Audit of HBRIC and FoodEast (2 weeks)

|

|

w/b

23 Sep through

w/e

11 Oct 2024

|

Audit

of the

annual report (2 weeks onsite, remainder from Wellington)

|

7. This timing is consistent

with the previous year, and although we are yet to develop our internal project

plan we intend to follow a similar internal process timeline to that followed

last year.

8. A number of key

considerations need to be addressed, specifically:

8.1. For infrastructure assets

planned to be revalued this year, EY will review the respective valuations for

appropriateness. Valuations are usually prepared internally by staff and

reviewed by AON valuation services. Given no valuations were undertaken in FY23

due to the significant cyclone damage, HBRC’s Asset Management Group is

in the process of developing a detailed project plan for how valuations will be

completed in FY24 including determining what level of external involvement may

be required and by whom.

Decision-making process

9. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

the Risk and Audit Committee receives and considers the Audit Plan for the

2023-2024 Annual Report.

Authored by:

|

Chris Comber

Chief Financial Officer

|

Chelsea Spencer

Senior Group Accountant

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1

|

Ernst and Young Audit Plan for the

year ending 30 June 2024

|

|

Under Separate Cover

|

Hawke’s

Bay Regional Council

Risk

and Audit Committee

15

February 2024

Subject: External Audit Report - ISO

9001-2015 certification

Reason for report

1. This item provides the Risk

and Audit Committee (RAC) with the external audit report on ISO 9001:2015

Annual Review undertaken by Telarc.

Executive

Summary

2. The ISO 9001:2015 Annual

Review was carried out in December 2023 in accordance with the 2023-2024

Internal Audit Plan. The scope of the review was to establish the effectiveness

of the current Quality Management System (QMS) against the ISO9001:2015

standard and to establish actions to reduce the risk of non-conformance

outcomes.

3. The Executive Leadership

Team reviewed and agreed the findings at its meeting on 30 January 2024.

4. There were no major

non-conformances observed. The report noted that, given that HBRC had been at

the centre of the Cyclone Gabrielle recovery efforts, our QMS is operating

effectively. We received two minor non-conformances:

4.1. Inconsistencies were

identified in the retention of documented information required by HBRC, with

respect to job sheet checklists, to the extent necessary to have confidence

that the processes have been carried out as planned.

4.2. Non-conformance and

corrective action information captured in the Hazmate system is currently not

included in the data analysis for the quarterly management review meetings.

5. There were also a small

number of opportunities for improvement. All activities assessed were

observed to be appropriately controlled. The minor non-conformities will

be reviewed at the revalidation of the ISO9001:2015 to be carried out in

September/October 2024.

Decision-making process

6. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

7. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

7.1. The decisions of the

Committee are in accordance with the Terms of Reference and decision-making

delegations adopted by Hawke’s Bay Regional Council 30 August 2023,

specifically the Risk and Audit Committee shall have responsibility and

authority to:

7.1.1. (2.8) Receive the internal and

external audit report(s) and review actions to be taken by management on

significant issues and recommendations raised within the report(s).

7.1.2. (3.5) Ensure that

recommendations in audit management reports are considered and, if appropriate,

actioned by management.

Recommendations

That the Risk and Audit Committee:

1. Receives and considers the External

Audit Report - ISO 9001-2015 Annual Review.

2. Confirms that the actions

to be taken to address the findings are adequate in the circumstances

explained.

Authored by:

|

Olivia Giraud-Burrell

Quality & Assurance Advisor

|

Helen Marsden

Risk & Corporate Compliance

Manager

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1

|

External Audit Report - ISO

9001:2015 Annual Review

|

|

Under Separate Cover

|

Hawke’s

Bay Regional Council

Risk

and Audit Committee

15

February 2024

Subject: Treasury Compliance Report

for the period 30 September - 31 December 2023

Reason for report

1. This item provides

compliance monitoring of Hawke’s Bay Regional Council’s (HBRC)

Treasury activity and reports the performance of Council’s investment

portfolio for the quarter ended 31 December 2023.

Overview of the quarter ending 31 December 2023

2. At the end of the quarter

to 31 December 2023, HBRC was compliant with all measures in its Treasury

Policy with the exception of the counterparty risk policy during the period.

3. In December 2023, HBRC

received a dividend of $3.905m from HBRIC following receipt of the Napier Port

dividend of the same value.

4. Cyclone Gabrielle has

impacted both cash balances and borrowing requirements, with ongoing additional

borrowing required to fund the recovery. Insurance proceeds when received

will soften the effects of additional borrowing.

Background

5. Council’s Treasury

Policy requires a quarterly Treasury Report to be presented to the Audit and

Risk Sub-committee. The policy states that the Treasury Report is to include:

5.1. Treasury exceptions report

5.2. Policy compliance

5.3. Borrowing limit report

5.4. Funding and liquidity

report

5.5. Debt maturity profile

Interest rate report

5.6. Investment management

report**

5.7. Treasury investments*

5.8. Cost of funds report, cash

flow and debt forecast report

5.9. Debt and interest rate

strategy and commentary

5.10. Counterparty credit report

5.11. Loan advances.

6. The Investment Management

report has specific requirements outlined in the Treasury Policy. This requires

quarterly reporting on all treasury investments plus annual reporting on all

equities and property investments.

7. In addition to the Treasury

Policy, Council has a Statement of Investment Policy and Objectives (SIPO)

document setting out the parameters required for funds under management for the

HBRC Long Term Investment Fund and the Future Investment Fund.

8. Since 2018, HBRC has

procured treasury advice and services from PricewaterhouseCoopers (PwC) who

provide quarterly Treasury reporting for internal monitoring purposes.

Treasury

exceptions report and policy compliance

9. As at 31 December all

counterparty exposures were within limits.

10. However, during the quarter

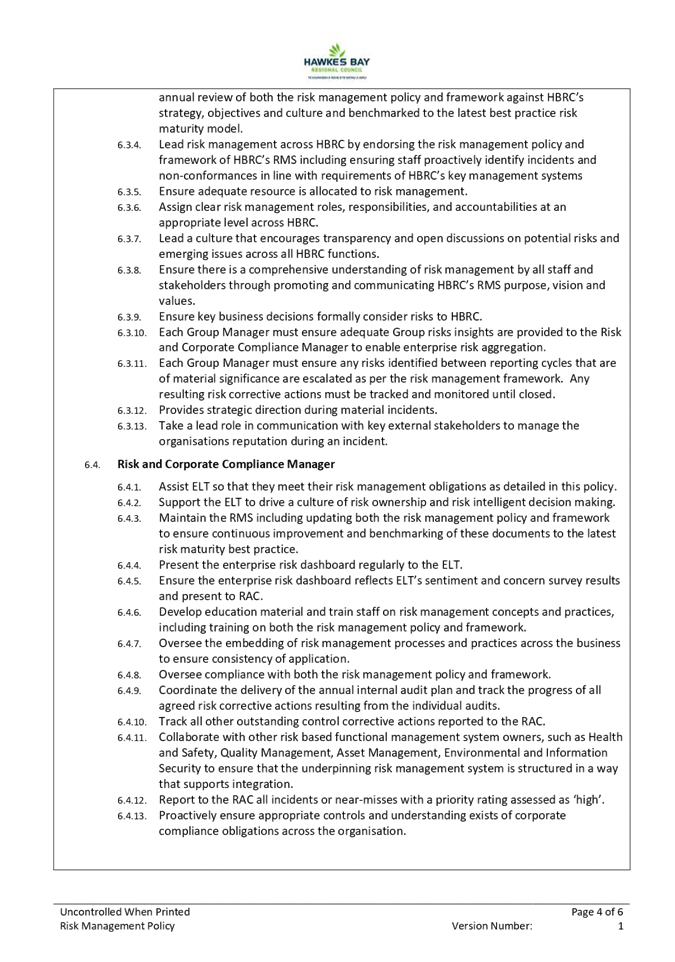

to 31 December 2023, there were a number of Investment Limit breaches noted on

the Jarden HBRC cash balance as outlined in the table below. (A $15m cash

investment limit exists on all our Counterparties).

11. Of all breaches noted

between 1/11/2023 to 17/11/2023, only 1 is primarily because of HBRC direct

cash management. This was due to excess funds received for

recovery-related activities and delays in receiving expected creditor invoices,

therefore funds were not required until later in November as expected.

12. Other breaches are related

to Recovery Funding received from the Crown held on behalf in the Jarden and

BNZ Recovery accounts, i.e. silt and debris. Total recovery funds held

during Q2 period ranged from c$70m in October to $45m at the end of the

quarter. HBRC mitigated potential risks early on by Jarden managing their funds

both across ANZ and Westpac, with remaining funds in the HBRC Recovery Funds account

with BNZ. This means these funds are split across 3 main registered NZ banks.

13. Council officers are of the

view that the management of the Recovery Funding held on behalf should sit

outside our current HBRC Treasury policies because holding these funds is

specific and is generally for a short period while programmes of work are

executed, i.e. silt and debris, RRA recovery.

14. This remains an on-going

issue while HBRC works through the cyclone recovery.

Funding

and Liquidity

15. To ensure HBRC has the

ability to adequately fund its operations, current policy requires us to

maintain a liquid balance of “greater than 10% of existing total

external debt”. Current liquidity ratio is 25.03% and therefore meets policy.

16. The following table reports

the cash and cash equivalents on 31 December 2023.

|

31

December 2023

|

$000

|

|

Cash

on Call

|

19,958

|

|

Short-term

bank deposits

|

4,300

|

|

Total

Cash & and Deposits

|

24,258

|

17. To manage liquidity risk,

HBRC retains a Standby Facility with BNZ. This

facility provides HBRC with a same-day draw-down option, to any amount between

$0.3-$10.0m, and with a 7-day minimum draw period.

Debt

Management

18. On 31 December 2023 the current

external debt for the Council group was $103m which includes $4.3m of

pre-funded debt ($120.3m including the loan from HBRIC).

19. Since Q4 an additional

$4.3m in borrowings were received to pre-fund long-term debt maturing in April

2024.

20. The following summarises

the year-to-date movements in Council’s debt position.

Summary

of HBRC Debt

|

|

HBRC

only

$000

|

HBRC

Group

$000

|

|

Opening

Debt – 1 July 2023 – excl HBRIC Loan

|

84,830

|

84,830

|

|

New

Loans raised*

|

59,500

|

59,500

|

|

Less

amounts repaid

|

(40,648)

|

(40,648)

|

|

Closing

Debt 31 December 2023 (excluding HBRIC loan)

|

103,682

|

103,682

|

|

Plus

opening balance - loan from HBRIC

|

16,663

|

-

|

|

Total

Borrowing as at 31 December 2023

|

120,345

|

103,682

|

*Includes pre-funding

debt of $4.3m.

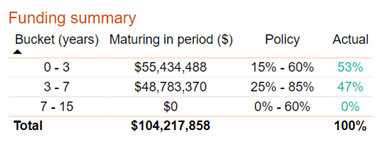

21. Council’s debt

maturity profile remained compliant, however continued short term drawdowns put

pressure on the policy limit in the 0-3 year bucket. This is expected to

remain high while we work through the cyclone funding and insurance claims.

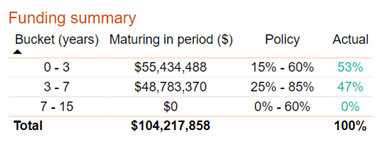

The infographic below includes our $10m BNZ overdraft in total debt.

Funding

summary

22. We have borrowed a further

$4.3m in the quarter to 31 December 2023 and staff are forecasting the need for

further drawdowns in Q3 to March 2024. However, the timing and values are

still to be confirmed and will depend upon the execution of the capital

programme planned between now and then.

23. Any insurance or NEMA

proceeds will be used to repay the short-term debt which is currently $30m.

24. We have entered into 4 swap

rate options during the quarter to mitigate our interest rate risk and

alleviate pressure on the short-term buckets.

Managed

Funds

25. Total Investment Fund

portfolios capital, adjusted for inflation at 31 December 2023, was $6.117m

below the inflation-adjusted contribution target. Based on results to date and

the value of the protected amount of funds, funds held are not sufficient to

deliver the returns required to meet Council’s requirement. No

divestments have been made from managed funds this year.

26. Council budgets separately

for revenue from directly-held managed funds and those held by HBRIC. HBRIC is

required to deliver an overall portfolio return by way of an annual dividend

agreed through an annual Statement of Intent. The composition between revenues

from managed funds and other sources such as port dividends, is up to the HBRIC

board. While the Council budgeted to receive $10.9m in dividends from HBRIC

within the FY 2023-2024, Council has received only $3.9m to date due to reduced

earnings from the Port. It is anticipated the overall dividend will fall short

of the Council budget for the year.

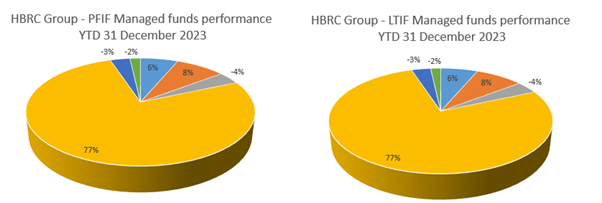

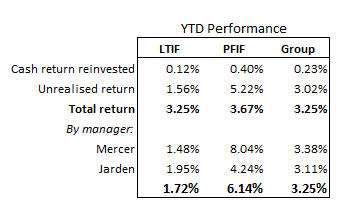

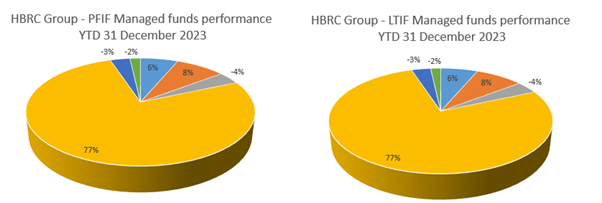

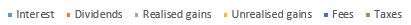

27. The following table summarises the fund balances at the

end of each period and the graph illustrates the asset allocations within each

fund at 31 December 2023.

|

|

30 June 2023

|

30 Sept 2023

|

31 Dec 2023

|

|

Fund Balances HBRC

|

$000

|

$000

|

$000

|

|

Fund Balance HBRC

|

110,828

|

108,038

|

114,407

|

|

Capital Protected Amount HBRC (2% compounded since

inception)

|

116,541

|

117,124

|

117,709

|

|

Current HBRC value above/(below) capital protected amount

|

(5,713)

|

(9,086)

|

(3,302)

|

|

Funds Balances (Group + HBRIC)

|

|

Long-Term Investment Fund (HBRC)

|

48,400

|

47,164

|

49,975

|

|

Future Investment Fund (HBRC)

|

62,428

|

60,874

|

64,432

|

|

Total HBRC

|

110,828

|

108,038

|

114,407

|

|

Plus HBRIC Managed Funds (FIF)

|

45,638

|

44,415

|

47,138

|

|

Total Group Managed Funds

|

156,466

|

152,453

|

161,545

|

|

Capital Protected Amount (2% compound inflation)

|

165,998

|

166,828

|

167,662

|

|

Current group value above/(below) protected amount

|

(9,532)

|

(14,375)

|

(6,117)

|

28. Fund performances continue

to be volatile this year and as at 31 December the consolidated portfolio value

was up 3.2% on 30 June 2023 (to 30 September portfolio was down 2.57%).

Fund performances have been steady this year with all cash returns reinvested.

Cost

of funds

29. Rolling 12 months to 31

December 2023, Gross Cost of Funds (COF) was 4.33% and Net COF was 4.26%.

HBRIC

Ltd

30. In accordance with Council

Policy, HBRIC provides separate quarterly updates to the Corporate and Strategic

Committee.

Decision-making process

31. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

the Risk and Audit Committee receives and notes the Treasury Compliance

Report for the period 30 September - 31 December 2023.

Authored by:

|

Jess Bennett

Senior Manager Finance Recovery

|

Tracey O'Shaughnessy

Treasury & Investments

Accountant

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

There are no attachments for this

report.

Hawke’s

Bay Regional Council

Risk

and Audit Committee

15

February 2024

Subject: Internal Audit Report - Data

Analytics

Reason for report

1. This item presents the

internal audit report (attached) for the Data Analytics audit undertaken by

Crowe in October 2023.

Executive

Summary

2. The Risk and Audit

Committee (RAC) agreed at its meeting on 10 May 2023, as part of the internal

audit work programme, to engage Crowe to conduct an internal audit of

Council’s Data Analytics.

3. This annual review is used

primarily for identification of fraud or suspicious transactions across our

business. Although backward-looking, it provides management with assurances on

processes followed throughout the reporting period.

4. The agreed scope and

purpose of the audit was to review payables and payroll, and master and

transactional data for the financial year ended 30 June 2023. This data was

then analysed independently by Crowe for any potential anomalies or suspicious

transactions.

5. The report was then

provided to staff, along with separate spreadsheets listing the transactions

that required review. These spreadsheets were initially analysed by the

Team Leader Payroll and the Team Leader Finance and then reviewed by the Chief

Financial Officer to identify any findings requiring further investigation.

6. This is the sixth

consecutive annual Data Analytics audit conducted by Crowe. Previous

reporting of the findings of the 2021-22 audit was to the Finance, Audit and

Risk Sub-committee on 10 August 2022.

7. It is important to note

that, when a transaction is identified, it does not necessarily indicate that

there is anything suspicious. There are often legitimate business reasons

for a transaction being identified, such as different types of payments from a

Council (rates credits versus payment for services). These types of

transactions may display in areas such as ‘duplicate address’,

‘GST/non-GST transactions’, or ‘duplicate IRD number’.

8. In addition, some

transactions are listed purely for review purposes due to their deemed higher

risk nature, such as ‘top 50 vendors by amount’. This allows staff

to easily assess whether vendors are in line with expectations and would

highlight any vendors that may appear erroneous.

9. Given the small size of

Hawke’s Bay, there are times when an employee may share the same address

as a vendor, usually a spouse. Transactional processing staff ensure that

employee approvals are not allowed where any known conflicts exist between an

employee and a vendor.

Audit

findings

10. The sample transactions

this year were significantly higher due to cyclone spend.

11. The report includes three high

risk results pertaining to:

11.1. Vendors with multiple

purchase orders on same day that would exceed approver's delegation – 149

cases identified this year (33 in 2022). These were all reviewed and found that

the final approver (where the approval was escalated) was not included in the

data. The data extract will be reviewed for next year. There is also an issue

that amendments to purchase orders show as multiple purchase orders.

11.2. Invoices approved by

persons over or on their delegated authorities – 622 cases identified

this year (40 in 2022). Of the 622 cases identified 603 do have an appropriate

approver – and is a data issue to be resolved for next year. Of the

remaining 19, 18 had the appropriate delegation at the time of the approval.

The remaining case was a known issue at the time and has been raised with our

software provider to identify how this occurred.

11.3. Payments to Vendors with an

employee master data match approved by the employee – seven records

identified this year (compared to one in 2022). All seven relate to the same

company and employee. All requisitions were approved by the employee’s

team leader or manager.

12. All other findings have

been reviewed in detail, and no unusual or unexpected transactions were identified.

Comparison

to the last (2022) Audit

13. An improvement has been

seen in the vendor details sections which is as expected as we get used to the

new system.

14. Records identified relating

to purchase order approvals have increased significantly but this is a data

issue rather than any underlying problem. The data extraction process will be

reviewed ahead of the next audit.

15. There was an expected

increase in overtime and allowances this year as a result of the cyclone.

Actions to address findings

16. While reviewing the

findings of the audit, corrective action has been taken where needed to remove

duplicates and complete any missing details. Staff are also looking at the

vendor creation process to increase checks for duplicates before setup of a new

vendor is finalised.

17. Staff have also been asked

to update their contact details in the system, which most have now done.

18. Finance continues to train

users on processes with the financial system, especially the raising of

requisitions and purchase orders before goods and services are received. There

is also fraud training for staff, which includes reminders about ensuring any

situations where a conflict of interest may be perceived are appropriately

managed.

Decision-making process

19. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

19.1. The decisions of the

Committee are in accordance with the Terms of Reference and decision-making

delegations adopted by Hawke’s Bay Regional Council 30 August 2023,

specifically the Risk and Audit Committee shall have responsibility and

authority to:

19.1.1. (2.8) Receive the internal and

external audit report(s) and review actions to be taken by management on

significant issues and recommendations raised within the report(s).

19.1.2. (3.5) Ensure that

recommendations in audit management reports are considered and, if appropriate,

actioned by management.

Recommendations

That Risk and Audit Committee:

1. Receives and considers the Internal

Audit Report - Data Analytics

2. Confirms that the actions

taken to address findings are adequate in the circumstances explained.

Authored by:

|

Olivia Giraud-Burrell

Quality & Assurance Advisor

|

Chris Comber

Chief Financial Officer

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1

|

Crowe October 2023 Internal Audit

Data Analytics Report

|

|

Under Separate Cover

|

Hawke’s Bay Regional

Council

Risk

and Audit Committee

15

February 2024

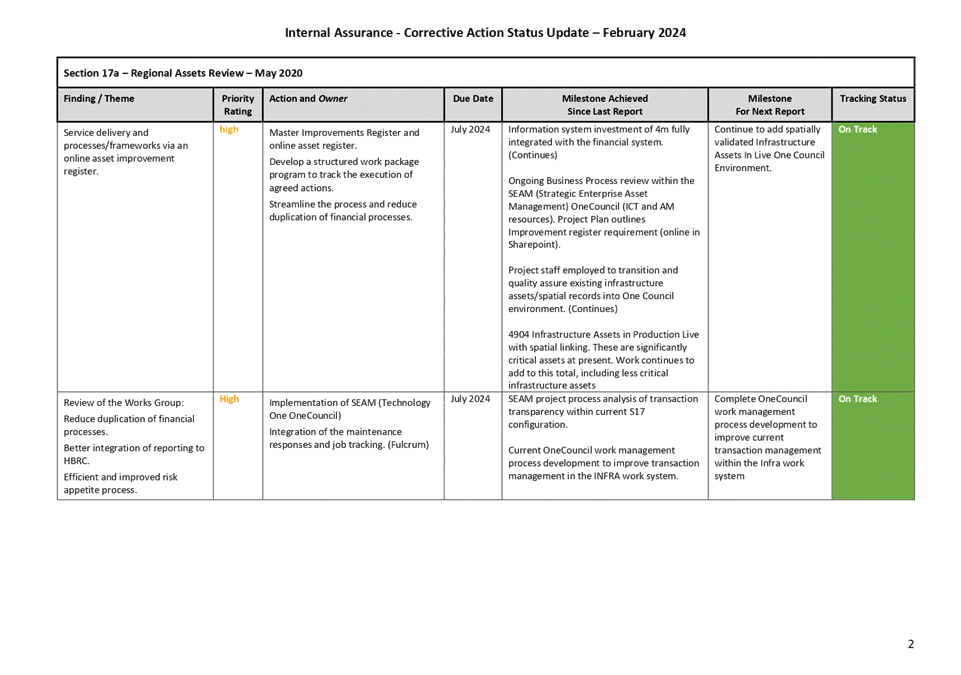

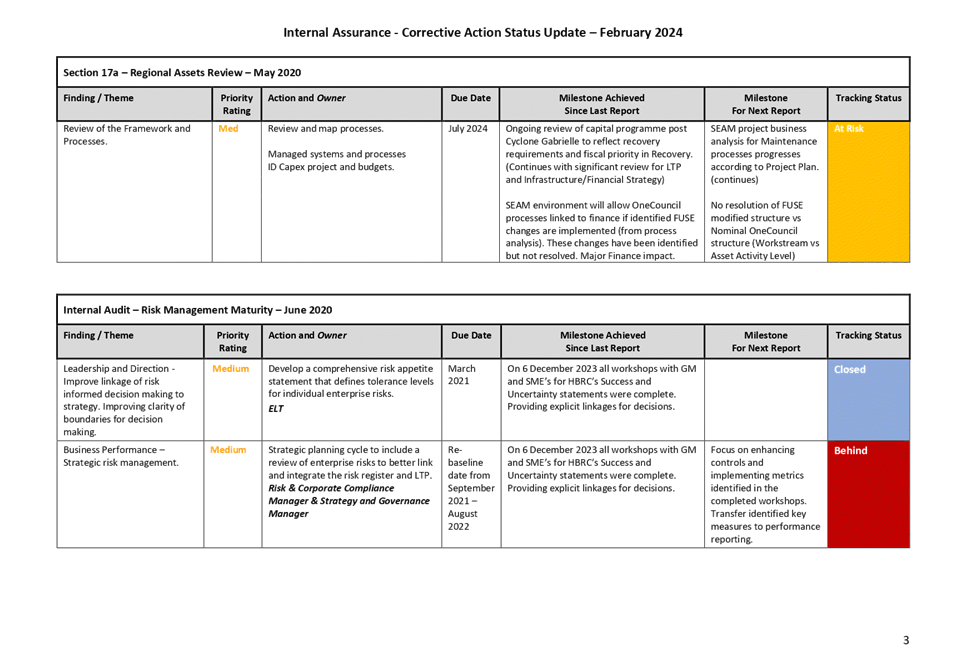

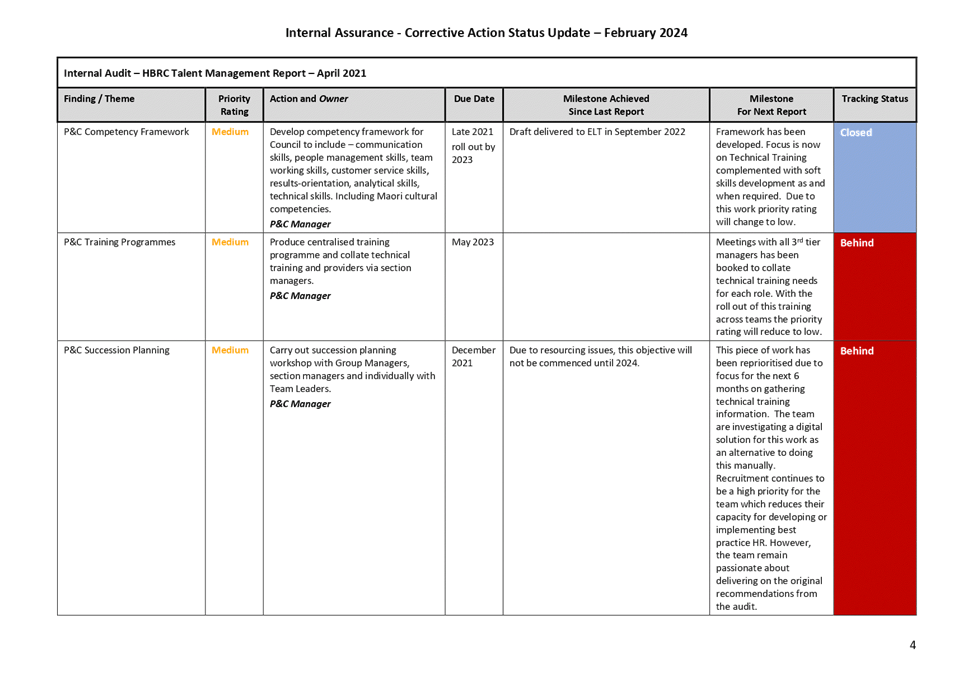

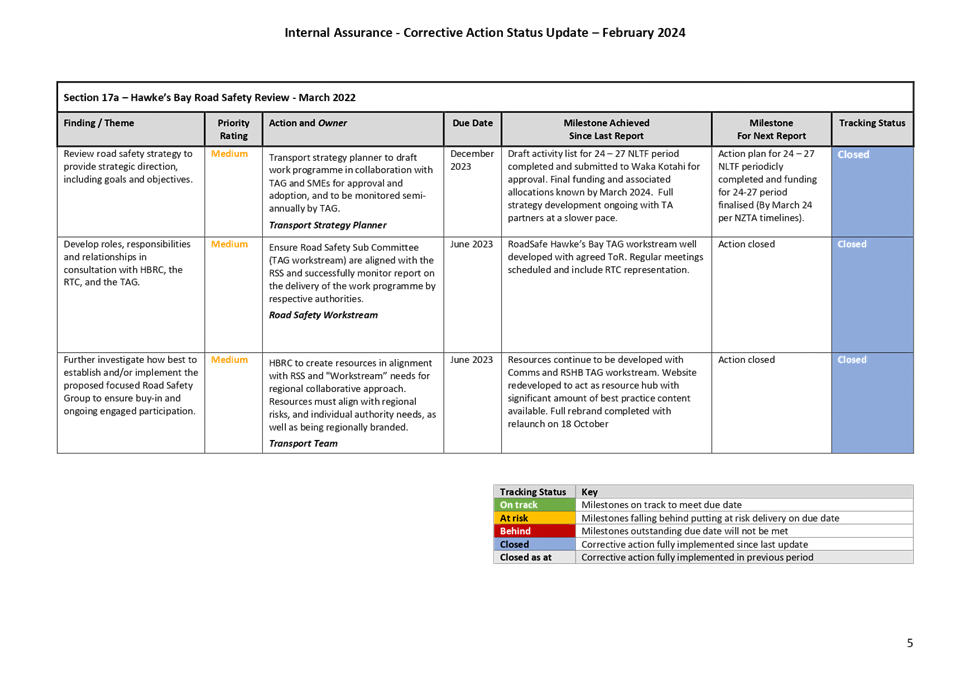

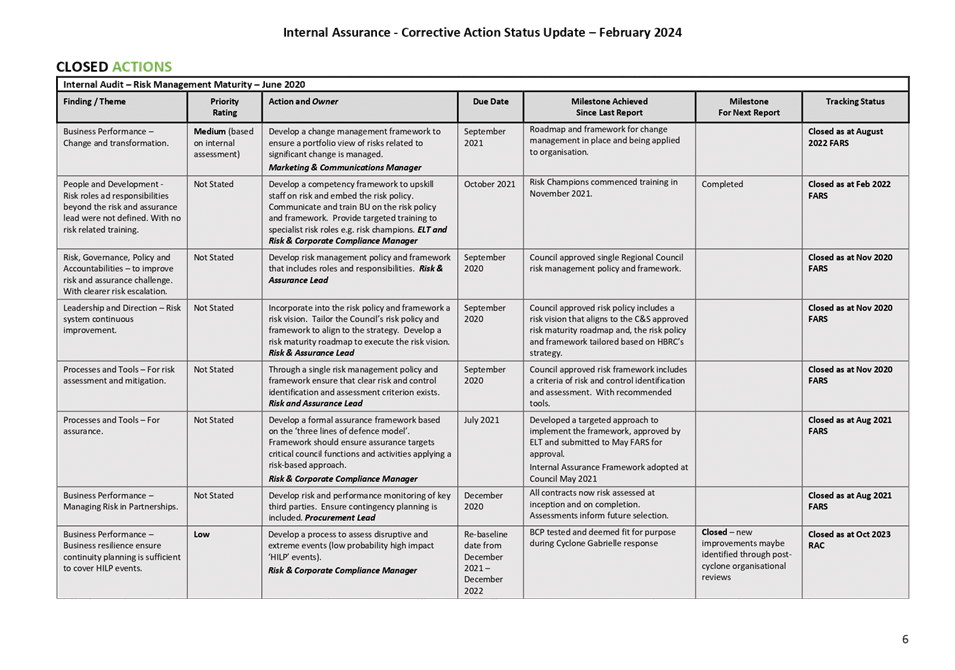

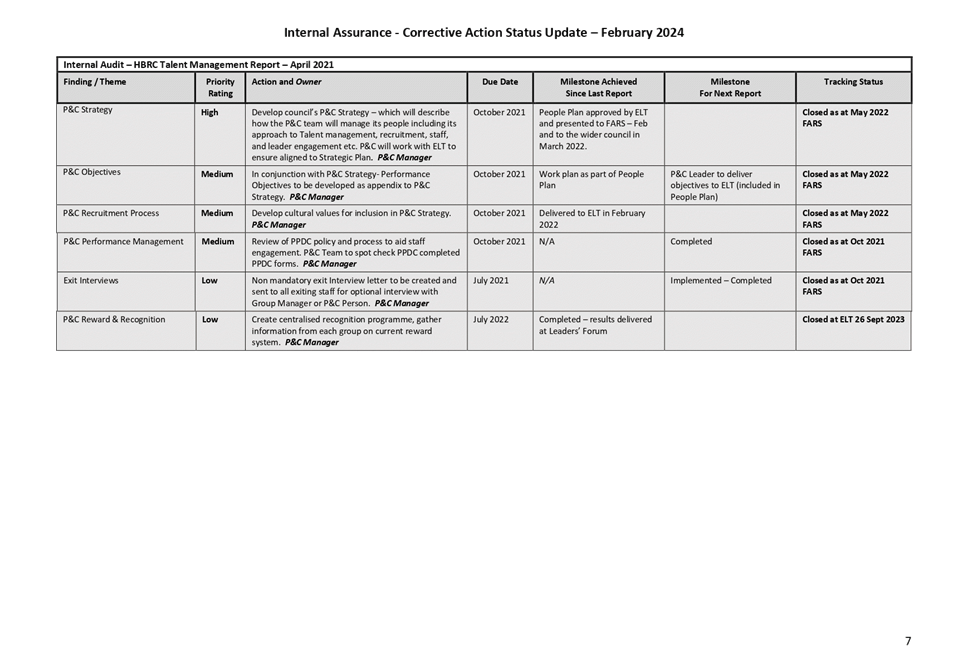

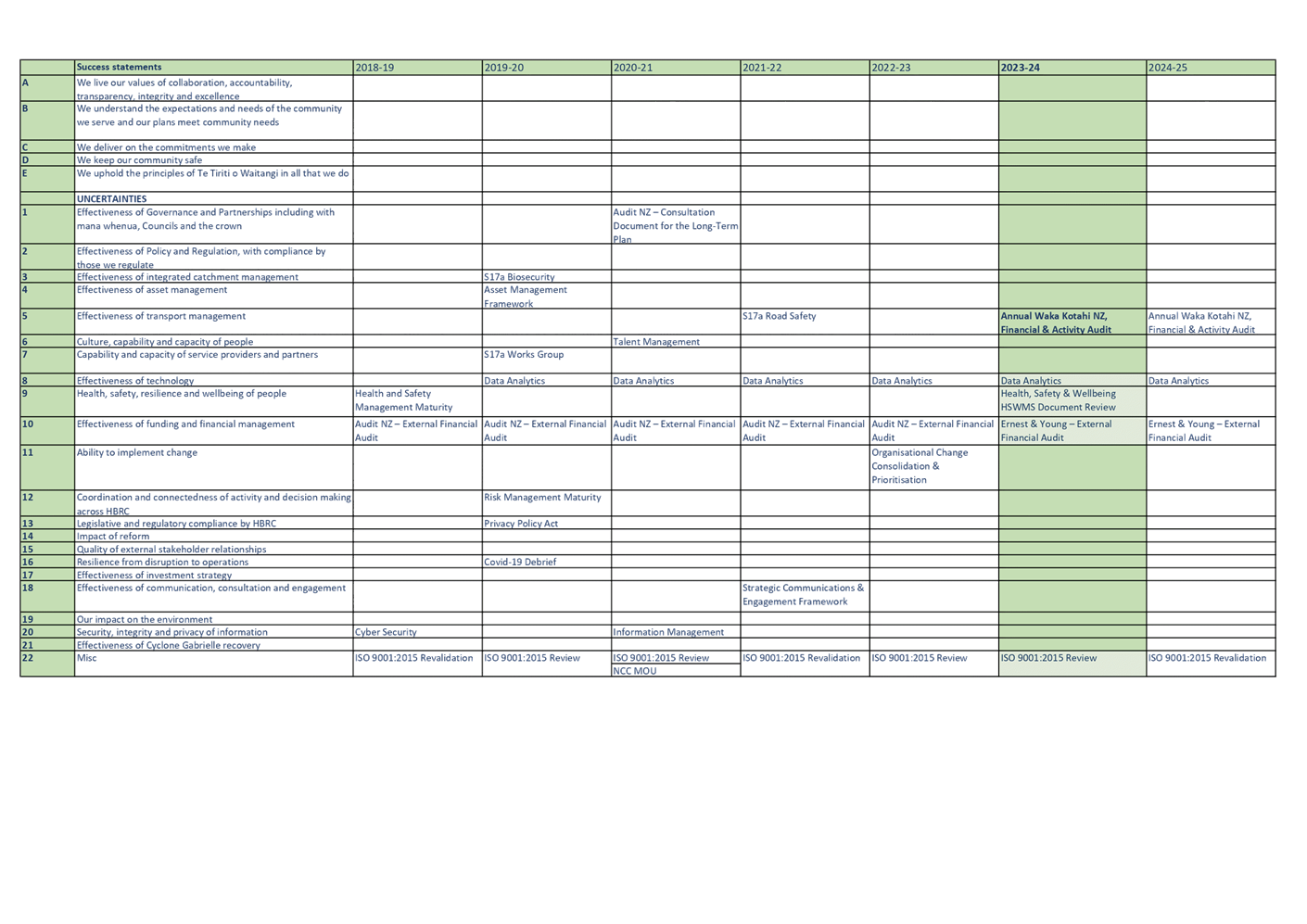

Subject: Internal Assurance dashboards

update

Reason for Report

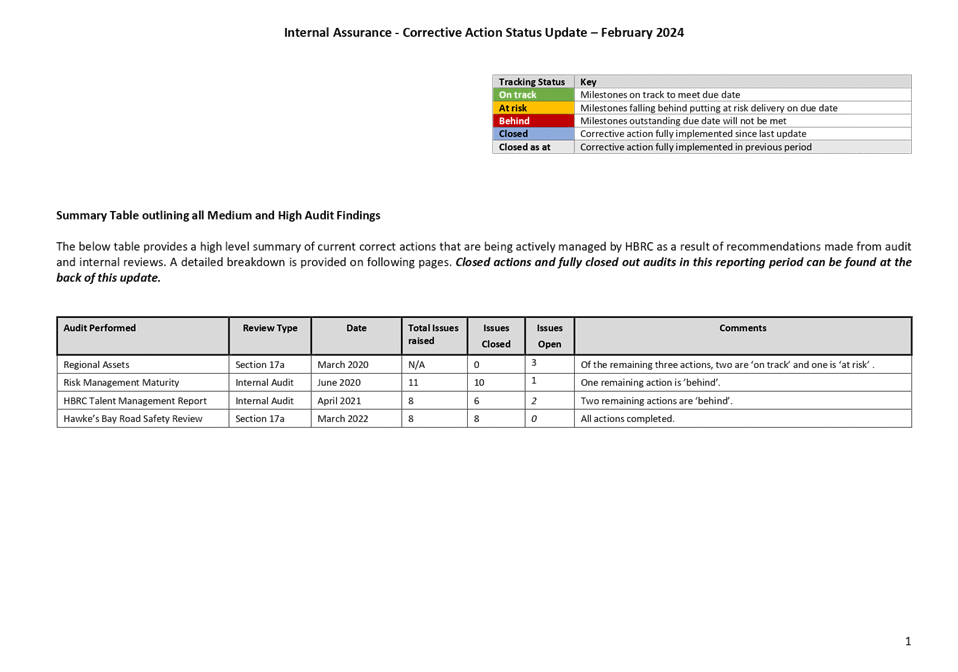

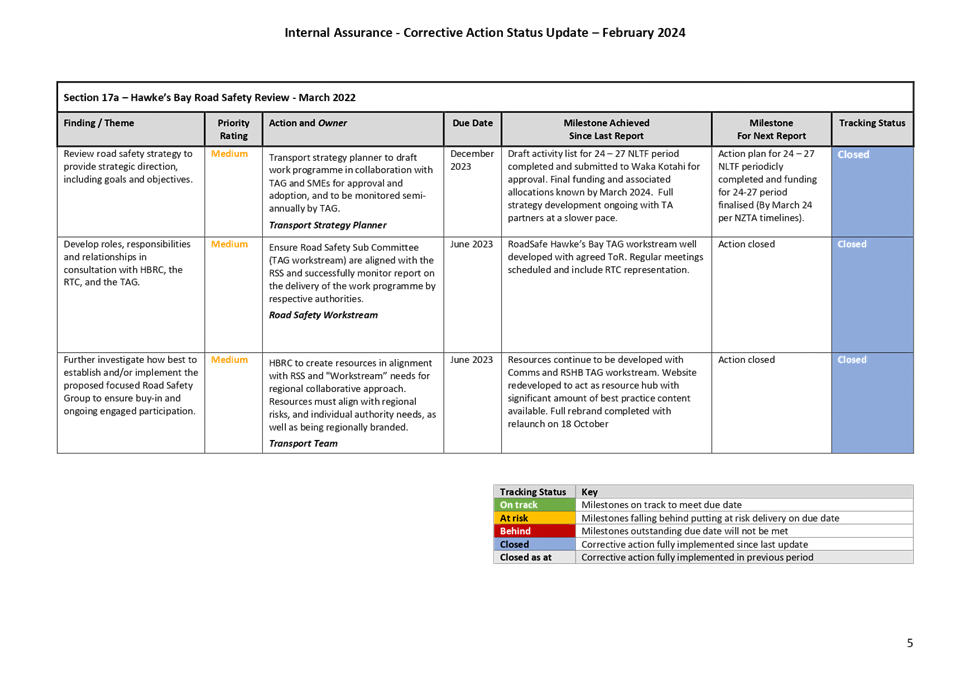

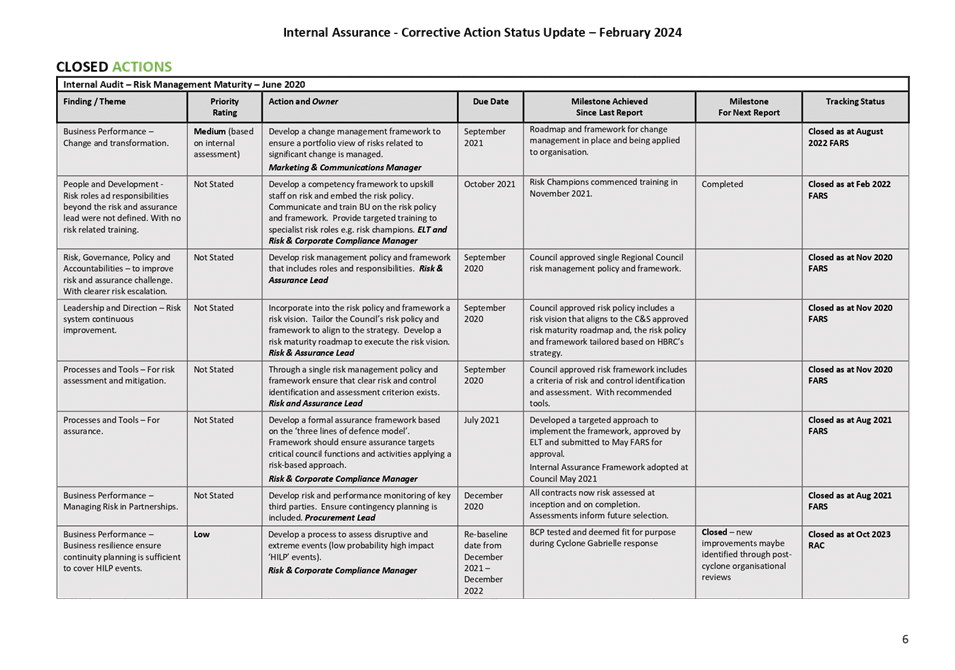

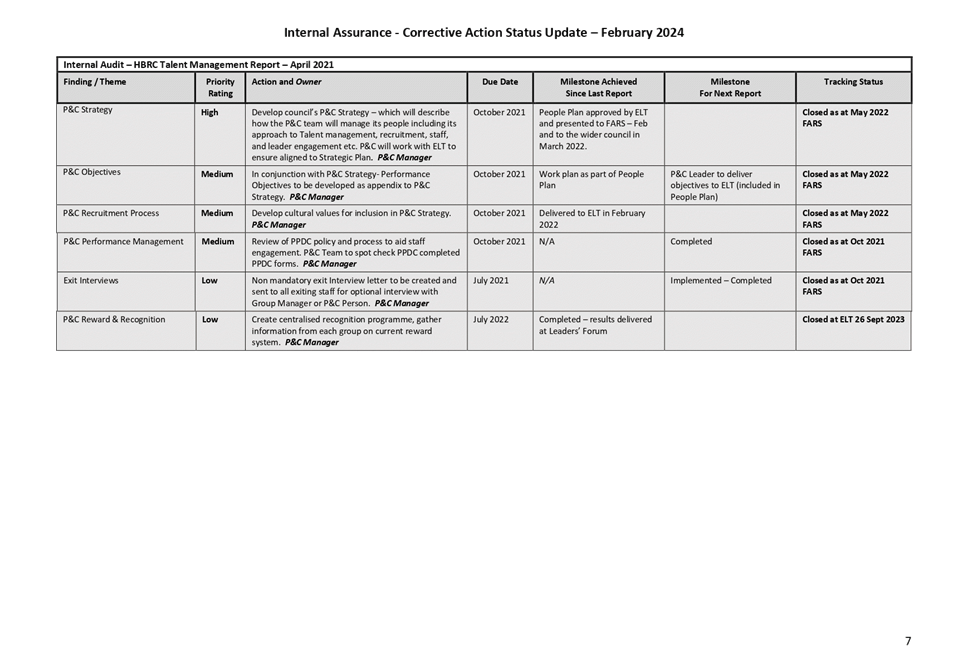

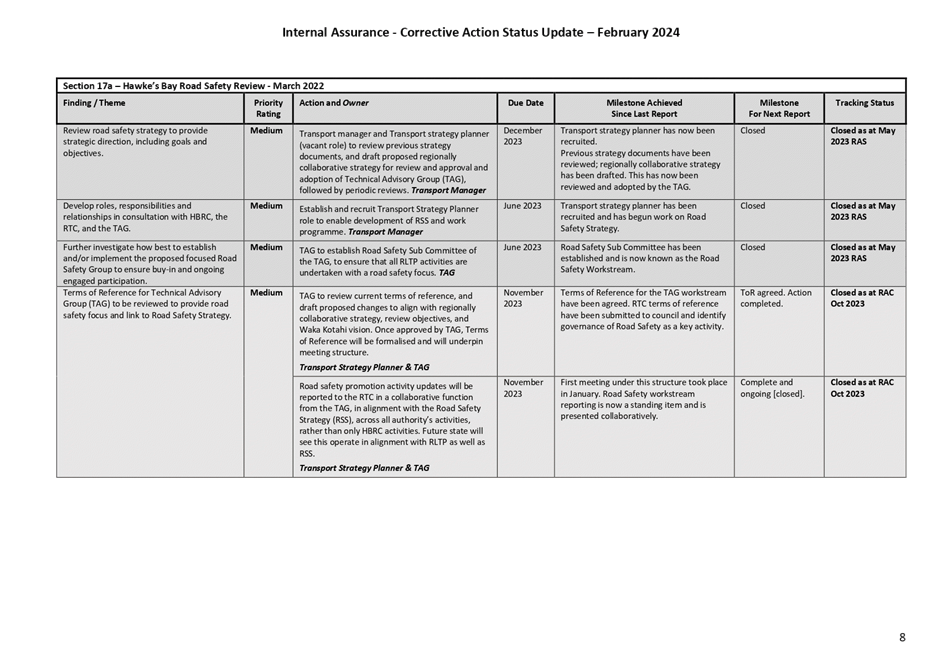

1. This item updates the Risk

and Audit Committee (RAC) on the progress of the following dashboards:

1.1. Internal Assurance

Corrective Actions Dashboard outlines progress of the agreed corrective actions

(with priority risk ratings medium and high) that respond to findings from

enterprise internal assurance reviews that have been previously reported to the

RAC.

1.2. Assurance Universe

Dashboard provides a clear picture of the audits completed and proposed for the

future.

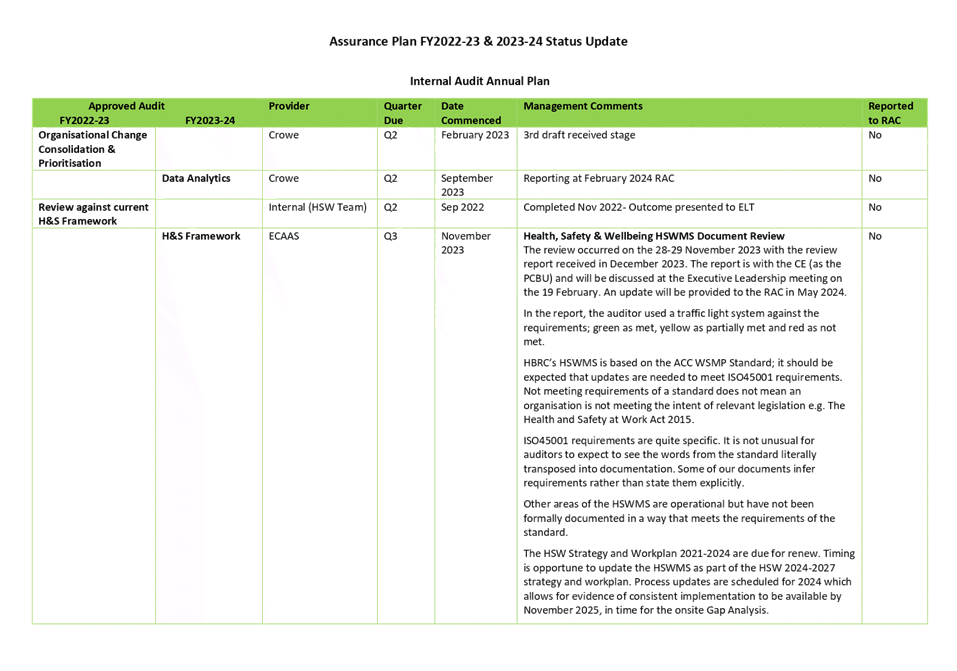

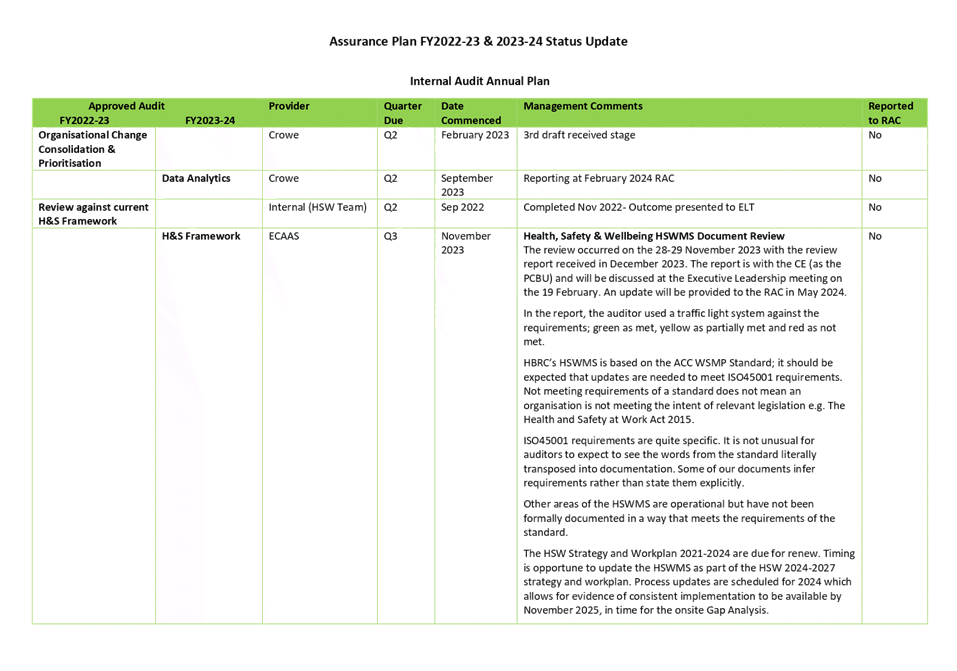

1.3. Assurance Plan for FY

2022-23 and 2023-24 gives the position of the reviews for the last and current

financial years.

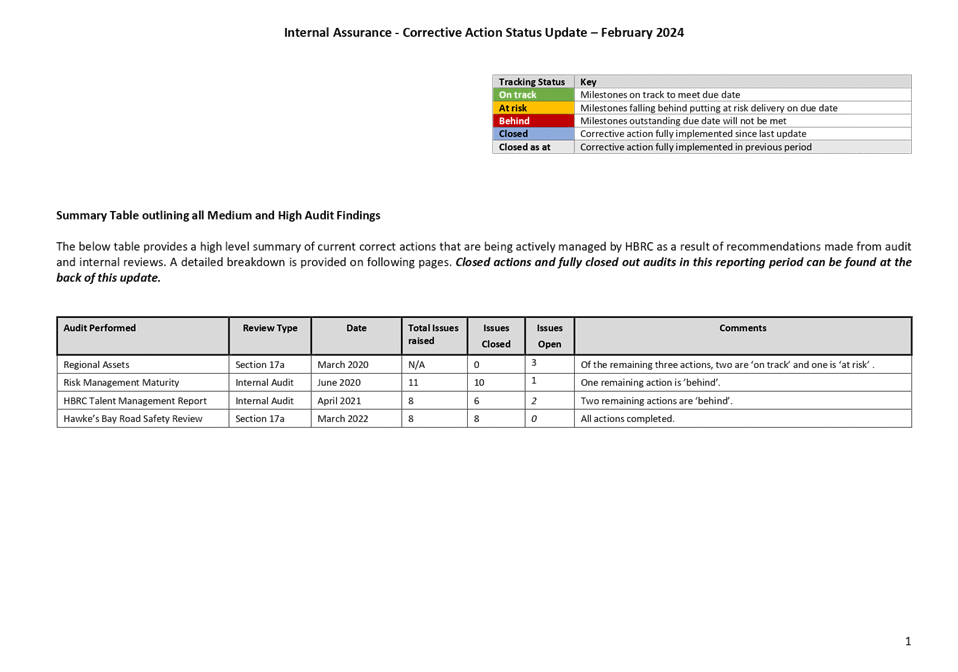

Discussion

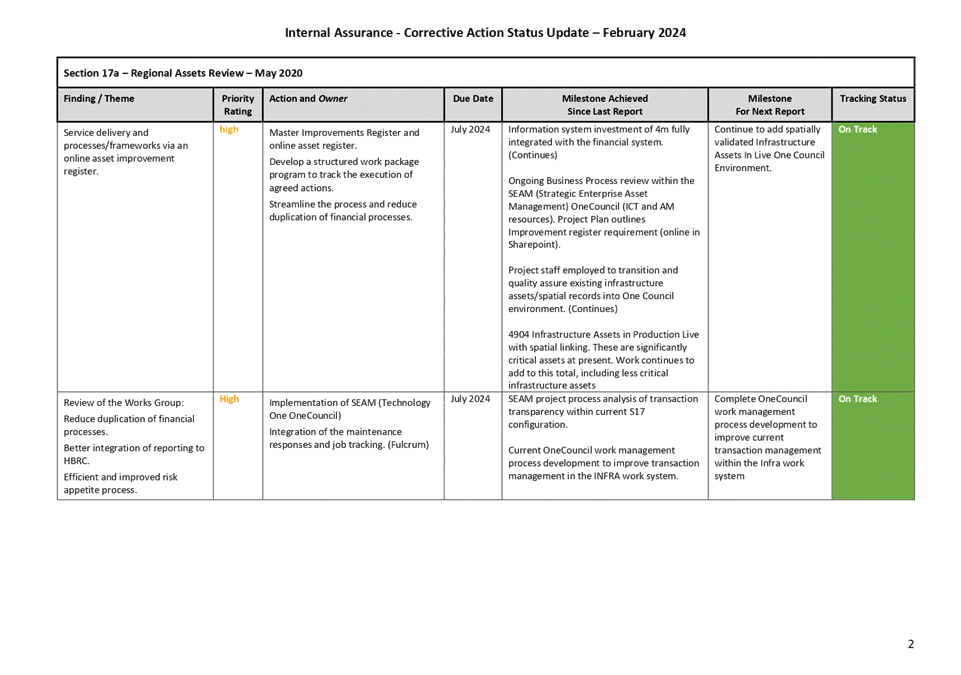

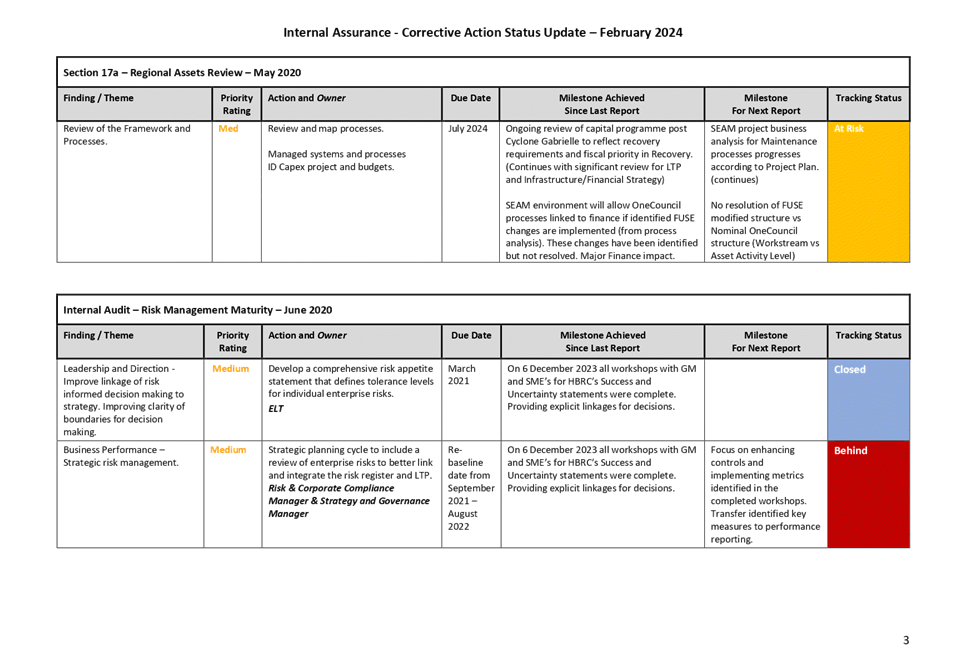

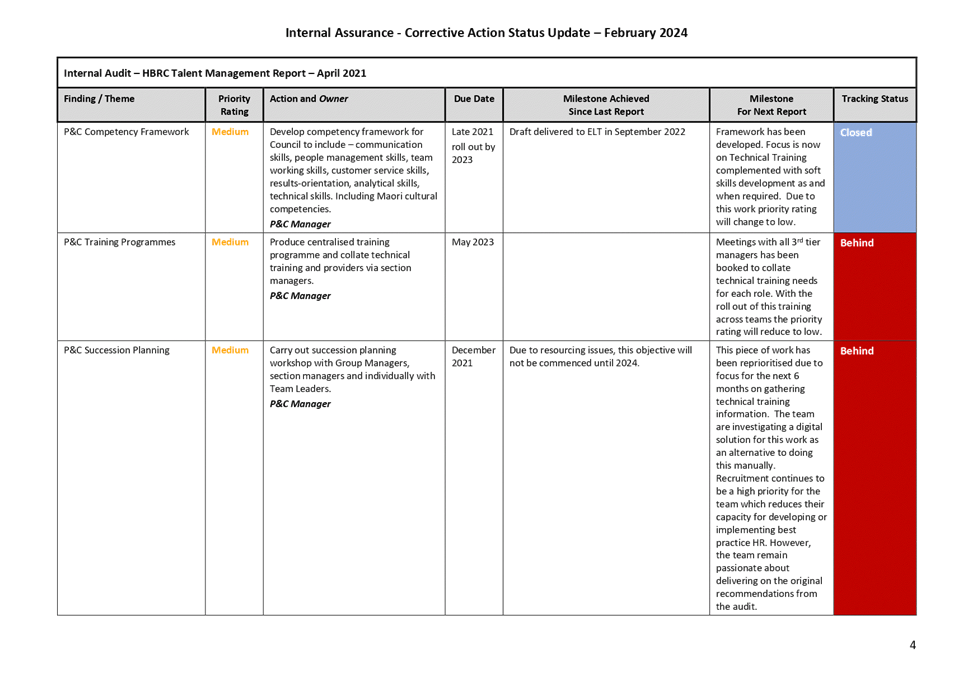

2. The Internal Assurance

Corrective Actions Dashboard is attached.

3. The corrective action

status update provides oversight to the RAC of the progress of actions taken to

address open internal assurance findings, including total issues raised, how

many closed and how many remain open. The table below is a summary of the

open audits/reviews.

|

Audit Performed

|

Review

Type

|

Date

|

Total Issues raised

|

Issues

Closed

|

Issues

Open

|

Comments

|

|

Regional Assets

|

Section 17a

|

March 2020

|

N/A

|

0

|

3

|

Of the remaining three actions, two are ‘on

track’ and one is ‘at risk’.

|

|

Risk Management Maturity

|

Internal Audit

|

June 2020

|

11

|

10

|

1

|

One remaining action is ’behind’.

|

|

HBRC Talent Management Report

|

Internal Audit

|

April 2021

|

8

|

6

|

2

|

Two remaining actions are ‘behind’.

|

|

Hawke’s Bay Road Safety Review

|

Section 17a

|

March 2022

|

8

|

8

|

0

|

All actions are closed.

|

4. The dashboard gives

visibility of:

4.1. open findings of the

milestones plus milestones completed and to be completed by the next RAC plus

the tracking status since last reported.

4.2. a summary of closed actions

since the last RAC report.

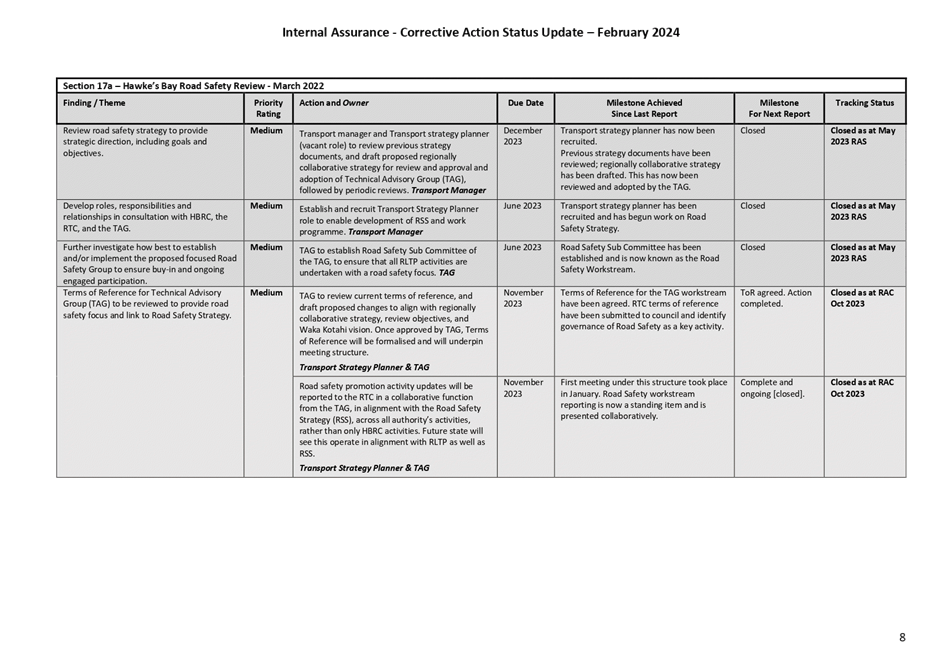

5. The Assurance Universe

Dashboard is attached. This links enterprise reviews or audits undertaken

over the past five years, the current year, and future years to an enterprise

risk. Reviews and audits in the Assurance Universe include external

audits, enterprise internal audits, business reviews with an enterprise focus,

and section 17a reviews.

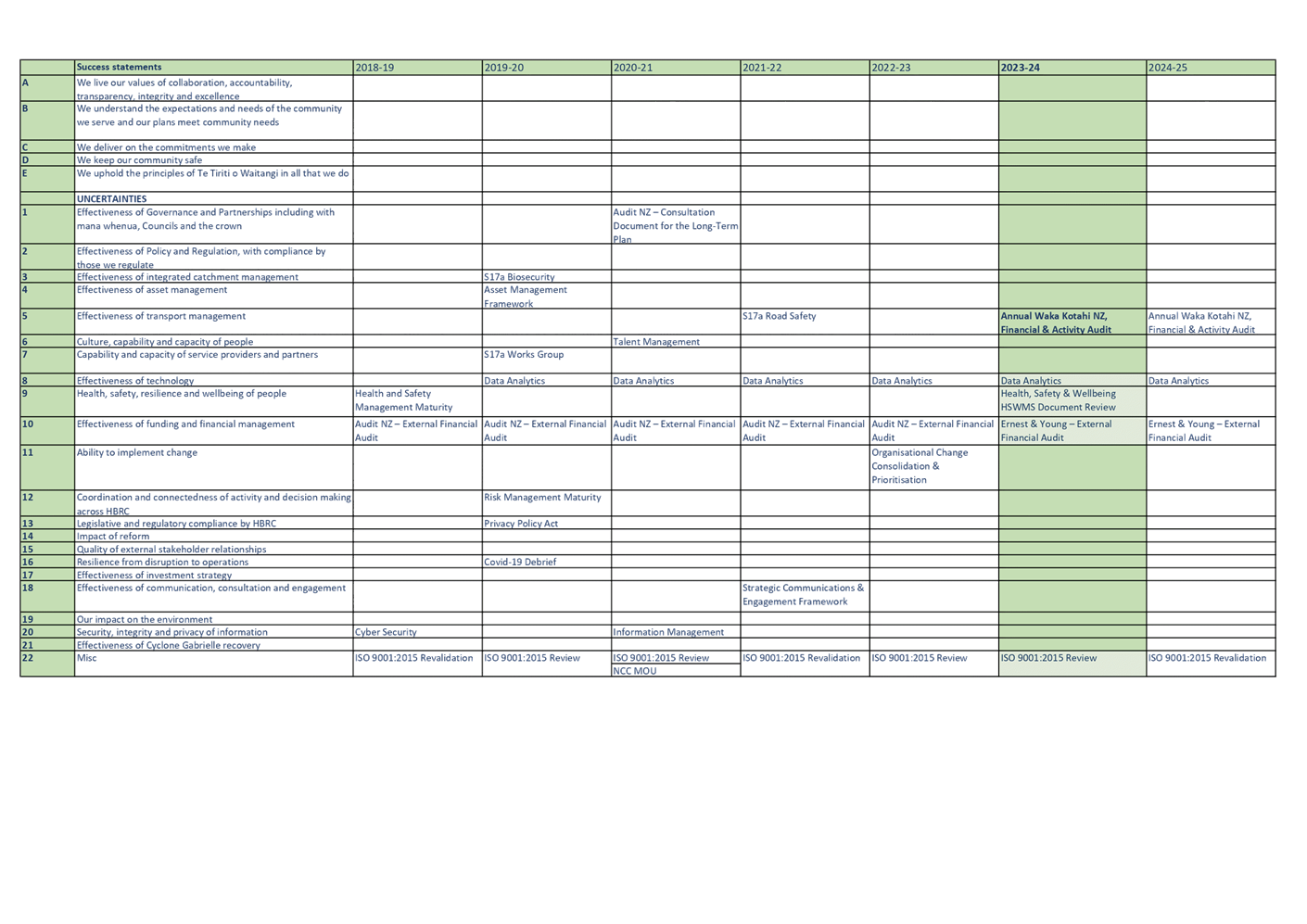

6. The Assurance

Plan for FY 2022-23 and 2023-24 is attached. This gives a status of

overflow from 2022-23 approved audits and the current status of FY 2023-24.

Financial and resource implications

7. There are no financial

implications or additional resource requirements resulting from this internal

audit programme update.

Decision-making process

8. Staff have assessed the requirements

of the Local Government Act 2002 in relation to this item and have concluded

that, as this report is for information only, the decision-making provisions do

not apply.

Recommendations

That the Risk and Audit Committee

1. Receives and notes the Internal

Assurance Dashboards update.

2. Confirms that the Internal

Assurance Corrective actions update report has provided adequate

information on the status of the Internal Assurance Corrective Actions.

Authored by:

|

Olivia Giraud-Burrell

Quality & Assurance Advisor

|

Helen Marsden

Risk & Corporate Compliance

Manager

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

February 2024 Internal Assurance

Dashboard

|

|

|

|

2⇩

|

January 2024 Assurance Universe

|

|

|

|

3⇩

|

FY22-23 and 2023-24 Internal

Assurance Plan Status - February 2024 update

|

|

|

|

February 2024 Internal Assurance

Dashboard

|

Attachment

1

|

|

January 2024 Assurance Universe

|

Attachment

2

|

|

FY22-23 and 2023-24 Internal Assurance

Plan Status - February 2024 update

|

Attachment

3

|

Hawke’s Bay Regional

Council

Risk

and Audit Committee

Thursday

15 February 2024

Subject: Confirmation of 18 October 2023 Public Excluded

Minutes

That the Risk

and Audit Committee excludes the public from this section of the meeting being

Confirmation of Public Excluded Minutes Agenda Item 12 with the

general subject of the item to be considered while the public is excluded. The

reasons for passing the resolution and the specific grounds under Section 48

(1) of the Local Government Official Information and Meetings Act 1987 for the

passing of this resolution are:

|

General

subject of the item to be considered

Risk Maturity Refresh

Incident Report

Internal

assurance dashboards

|

Reason

for passing this resolution

s7(2)(j) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to prevent

the disclosure or use of official information for improper gain or improper

advantage.

s7(2)(e) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to avoid

prejudice to measures that prevent or mitigate loss to members of the public.

s7(2)(j) That the public conduct of this agenda item would be likely to

result in the disclosure of information where the withholding of the information

is necessary to prevent the disclosure or use of official information for

improper gain or improper advantage.

|

Grounds

under section 48(1) for the passing of the resolution

Cyber security measures

HB CDEM Group operational

response

Cyber security measures

|

Authored by:

|

Leeanne Hooper

Team Leader Governance

|

|

Approved by:

|

Desiree Cull

Strategy and Governance Manager

|

|