Meeting of the

Hawke's Bay Regional Council

Date: 13 December 2023

Time: 1.30pm

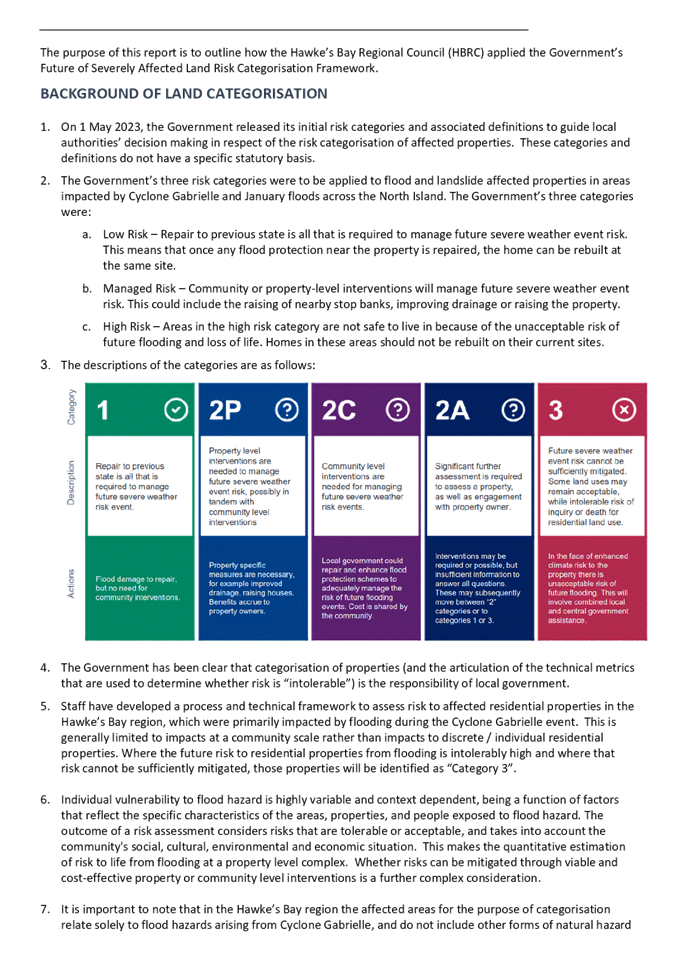

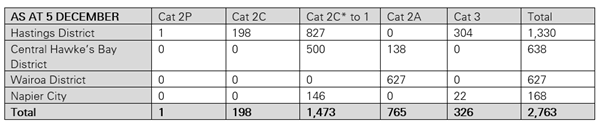

|

Venue:

|

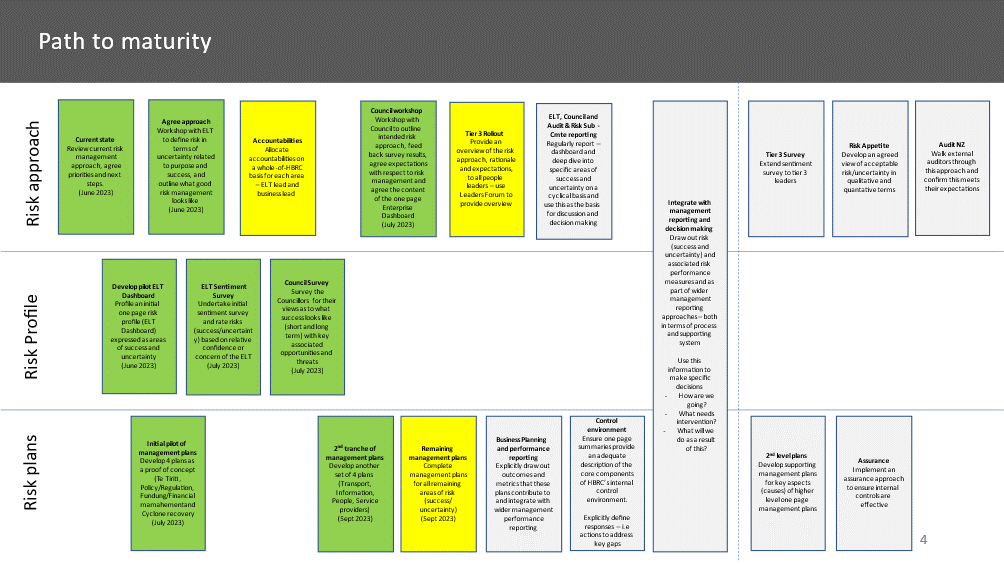

Council

Chamber

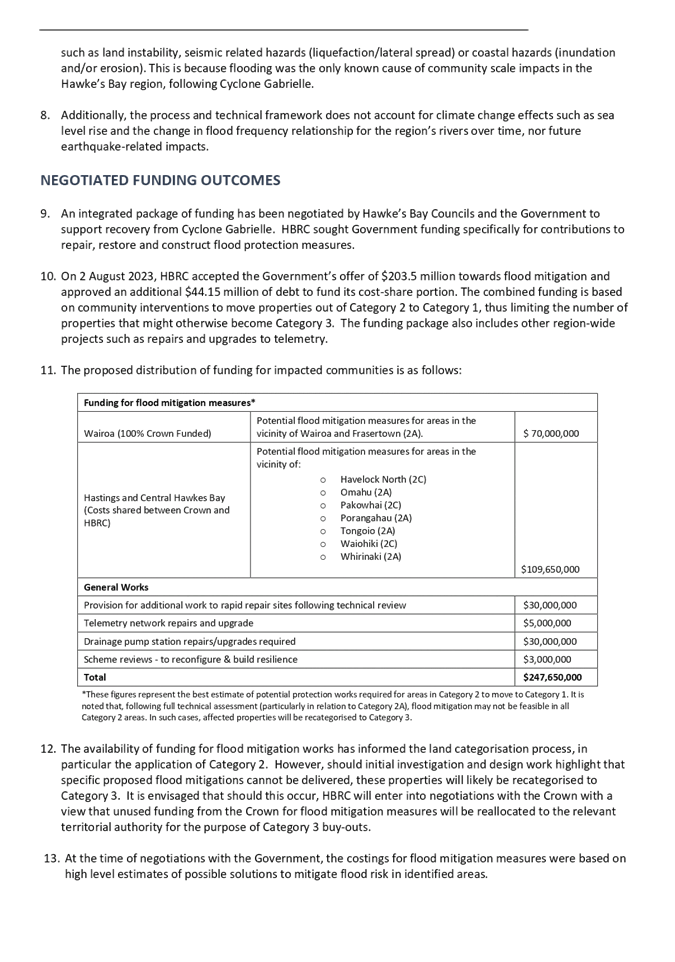

Hawke's

Bay Regional Council

159

Dalton Street

NAPIER

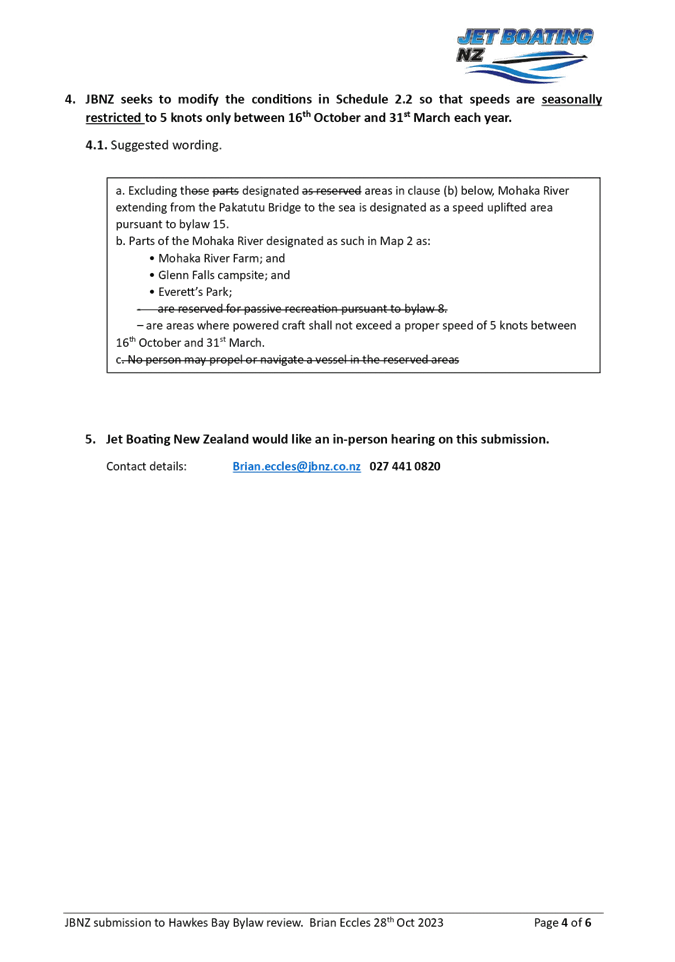

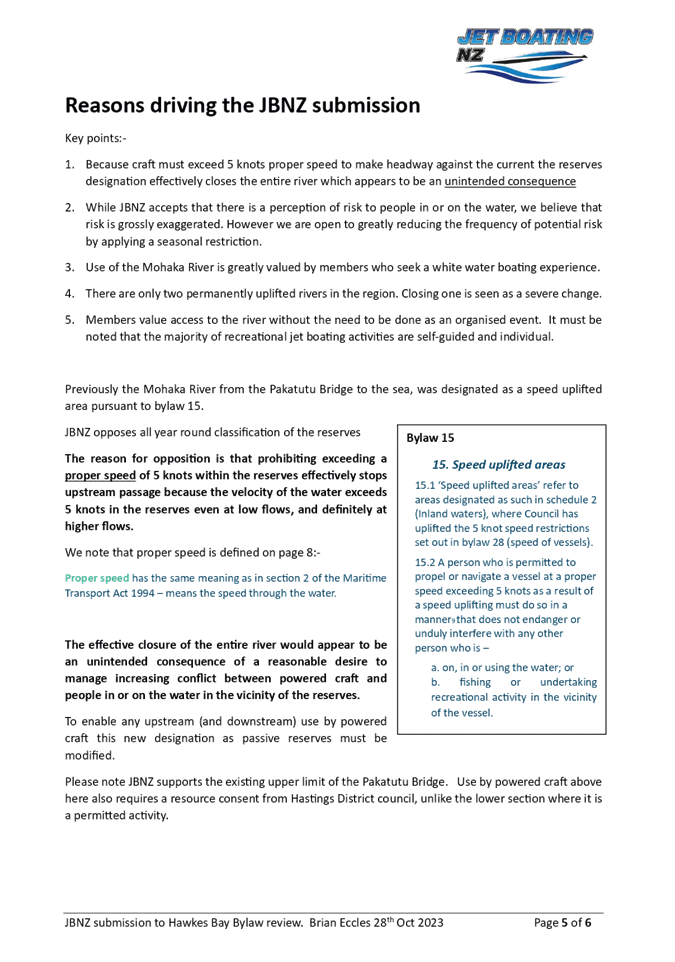

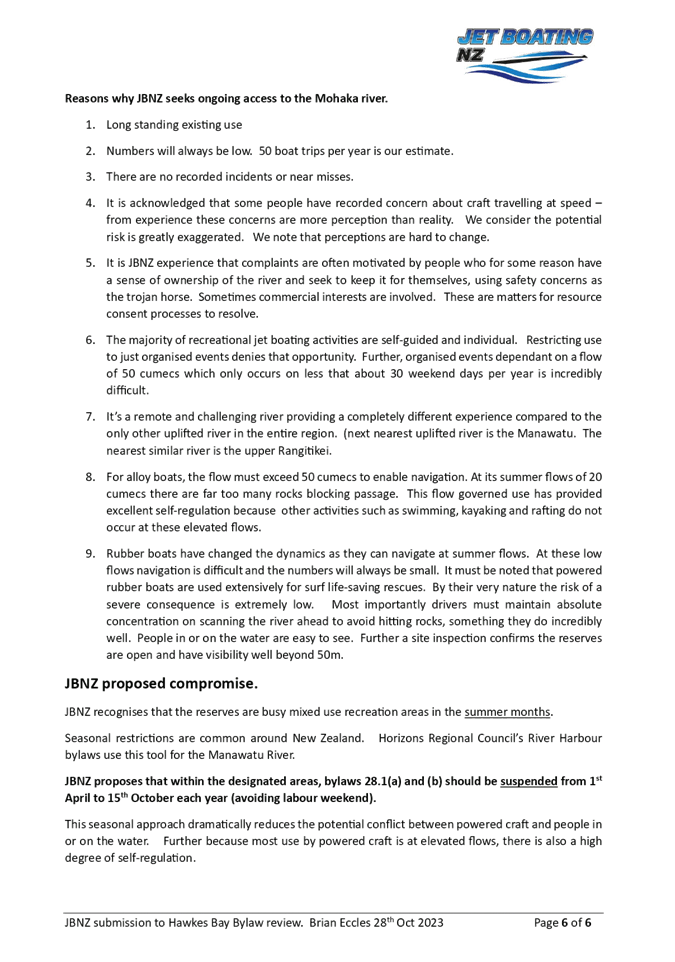

|

Agenda

Item Title Page

1. Welcome/Karakia/Apologies/Notices

2. Conflict

of Interest Declarations

3. Confirmation of Minutes of

the Regional Council meeting held on 29 November 2023

4. Call

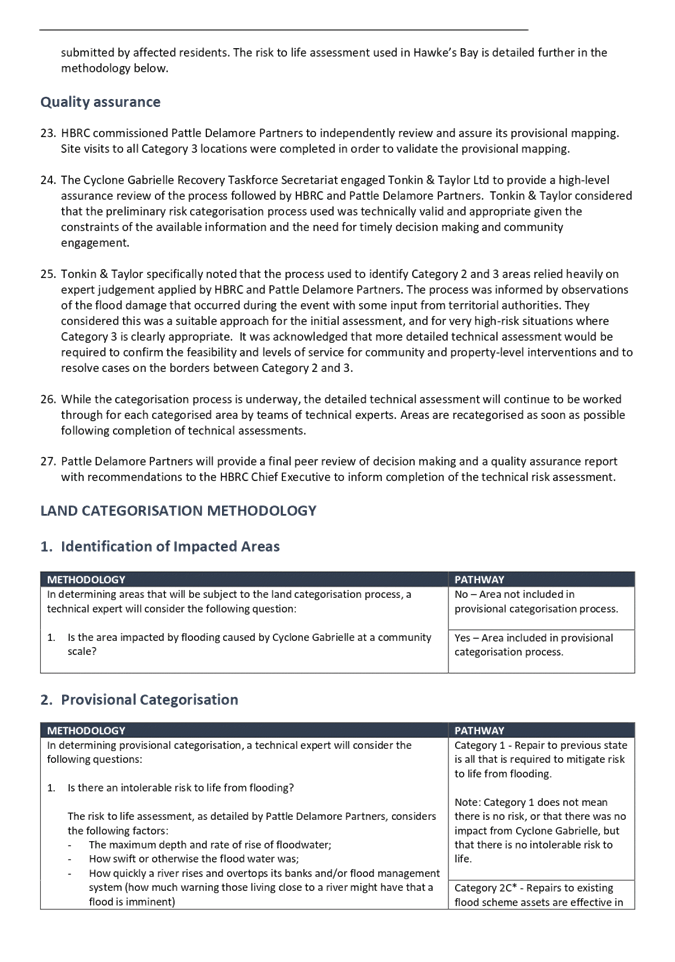

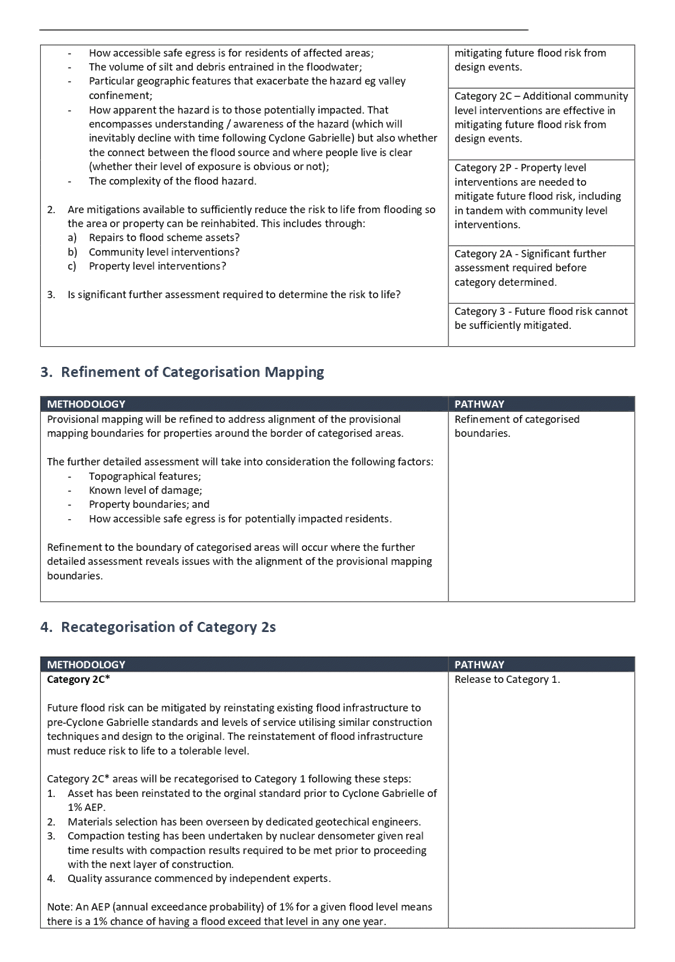

for minor items not on the Agenda 3

Decision

Items

5. Hawke's

Bay Navigation Safety Bylaw 2023 5

6. HBRC

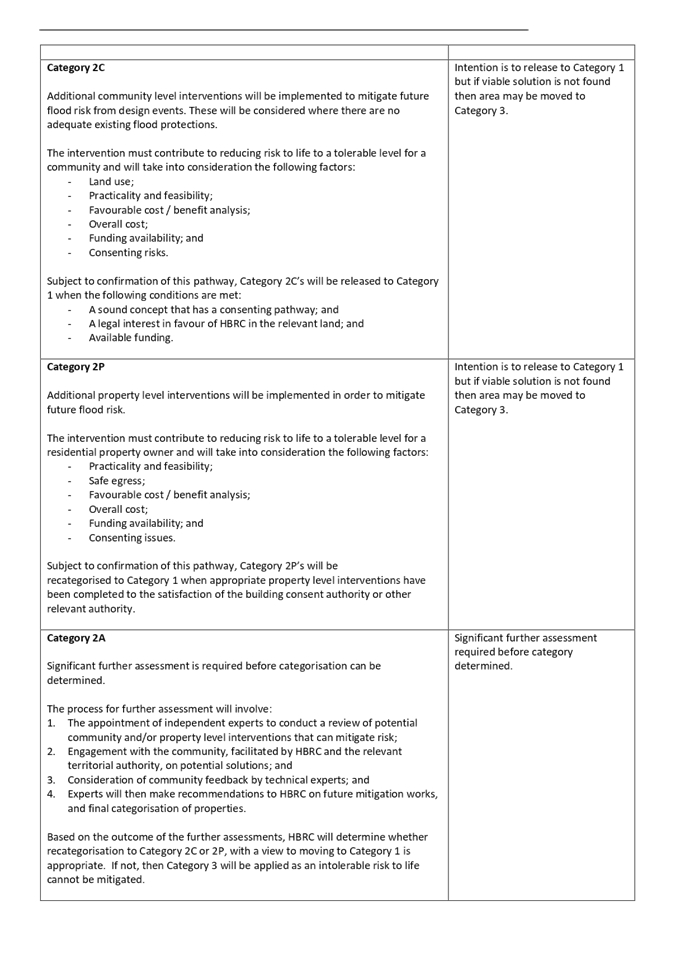

Group Statement of Investment Policies and Objectives 15

7. Report

and recommendations from the Risk and Audit Committee 19

8. Issuance

of Security Stock under Debenture Trust Deed 29

9. Affixing

of Common Seal 33

Information

or Performance Monitoring

10. Land

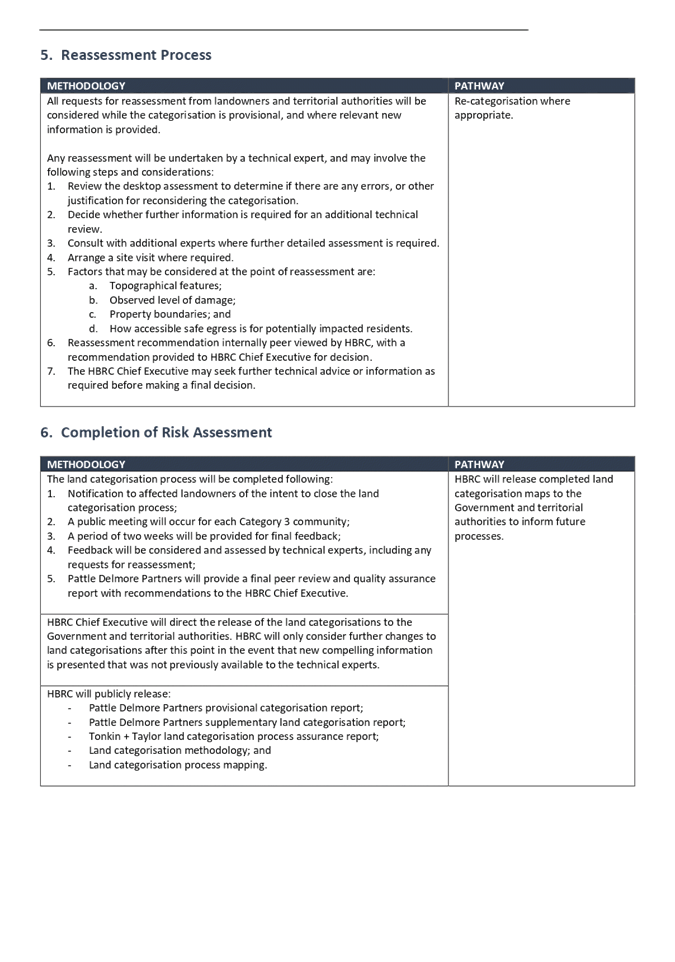

Categorisation update 35

11. Discussion

of minor items not on the Agenda

Hawke’s Bay Regional Council

13

December 2023

Subject: Call for minor items not on

the Agenda

Reason for Report

1. This item provides the

means for councillors to raise minor matters relating to the general business of

the meeting

they wish to bring to the attention of the meeting.

2. Hawke’s Bay Regional

Council standing order 9.13

states:

2.1. A meeting may discuss an

item that is not on the agenda only if it is a minor matter relating to

the general business of the meeting and the Chairperson explains at the

beginning of the public part of the meeting that the item will be discussed.

However, the meeting may not make a resolution, decision or recommendation

about the item, except to refer it to a subsequent meeting for further discussion.

Recommendations

3. That Council accepts the

following Minor items not on the Agenda for discussion as Item 11.

|

Leeanne

Hooper

Governance

Team Leader

|

Desiree

Cull

Strategy

& Governance Manager

|

Hawke’s Bay Regional Council

13

December 2023

Subject:

Hawke's Bay Navigation Safety Bylaw 2023

Reason for Report

1. This item provides Council

with the proposed Hawke’s Bay Navigation Safety Bylaw 2023 (the Bylaw) as

updated through consultation and submissions, for decision-making to enable the

Bylaw’s adoption for notification.

Officers’

recommendations

2. Council officers recommend

that councillors consider the submissions received, and the officers’

considerations and adopt the Bylaw as proposed, for notification to the general

public.

Consultation outputs

3. The results of the

consultation feedback have been reviewed by the Harbourmaster and project team.

This has led to a number of marked-up changes to the draft document attached.

All markups have been ‘authored’ and are shown in black

strike-through text to indicate deletions, and red highlight to indicate an

addition.

Background

4. In April 2023 a project

team was formed to undertake the process of updating the 2018 Navigation Bylaw.

Pre-engagement feedback from key stakeholders alongside the identification of

known navigational issues in the region, was the starting point for the

drafting process. A further key consideration was the need to simplify and

refine the document to make it more readable and relevant to a wider variety of

recreational water users.

5. Overall, it was felt that

the existing Bylaw was working well but changes were needed to address the

increased popularity and patronage of some mixed-use areas, coupled with the

advent of new water recreation technologies, including:

5.1. The Hardinge Rd waterfront

in Napier which is becoming increasingly popular with ocean swimmers, surfers

and paddle boarders, foil-boarders, recreational boaties and jet-skiers. The

area is relatively confined and gets very busy over the summer months.

Navigational risk occurs in such areas where high-speed or powered vessels are

in close proximity to passive recreational water users. Similar issues are

present at Napier’s Pandora Pond and the Pourerere Stream.

5.2. Minor changes have been

included to Part 3, clause 9 ‘Reserved area for Rocket Launching’.

The main reason for this is to make the process of providing public notice for

rocket launches simpler.

6. Pre-engagement with key

contacts was undertaken in mid-April 2023 and drafting the updated Bylaw began

in May 2023, with attention also given to overall document refinement and

further navigational risk identification.

7. Subject to final Council

approval, it is anticipated that the updated Bylaw will come into effect in

late December 2023 or early January 2024.

Public

consultation and submissions

8. The public engagement phase

of the Navigation Bylaw review took place across a four-week period between 30

September 2023 and 30 October 2023. It was advertised widely in print and

on-line media, and an on-line ‘have your say’ submission web page

was designed and promoted. Key Harbourmaster and tangata whenua contacts were

notified in advance of the opening date and were encouraged to participate.

Four public meetings were held during the period in Wairoa, Waipawa, Clive and

Napier.

9. In total, 23 submissions

were received – 17 through the on-line format, one from Jetboating NZ

(JBNZ) and three in-person submissions were also received during the Sailing

Club meeting in Napier. Feedback came from Maritime NZ (MNZ), and an in-person

meeting took place between a member of the Sailing Club and Harbourmaster

representatives as a follow up to this submission.

Submission questions

|

1

|

Do you think the proposed bylaws will be effective (or

otherwise) in managing risks to navigation and safety in Hawkes' Bay?

|

|

2

|

What if any changes do you seek to the proposed bylaw to address

issues, gaps and /or manage risks to navigation and safety in Hawkes Bay?

|

|

3

|

Do you support restricting the use of motorised vessels for the

Napier Hardinge Road as shown in the map?

|

|

3.1

|

Do you have any other feedback or views about the use of

motorised vessels at Hardinge Road?

|

|

4

|

Do you support the use of high-speed foiling craft from Napier's

Pandora Pond as shown in the map?

|

|

4.1

|

Do you have any other feedback or views about high-speed foiling

craft, or similar, at Napier Pandora Pond?

|

|

5

|

Do you support restricting the use of motorised vessels and

high-speed foiling craft, between the bridge and the coast of the Pourerere

Stream/ lagoon area?

|

|

5.1

|

Do you have any other feedback or views about the use of

motorised vessels and high-speed foiling craft at the Pourerere

Stream/lagoon?

|

|

6

|

Do you have any feedback on potential regulatory or educational

requirements for new technologies, such as inflatable jet boats, foiling

bikes/ commuter craft or underwater drones?

|

|

7

|

Do you have any further safety issues or feedback on the draft

consultant document or proposed bylaw?

|

Key themes

10. Four of the questions

(1,3,4 and 5) were considered key in terms of gauging a clear ‘for and

against’ opinion. The remaining six questions were posed to gather

additional feedback.

11. Of the 48 responses to the

four key questions, 35 were in support of the changes (73%), with eight opposed

(17%) and five were categorised as ‘other’ (10%). This indicates a

large majority of respondents were in agreement with the risks and emerging

issues identified at the outset of the Bylaw update project.

12. Answers to the additional

six questions were more varied, so identifying common themes was challenging.

Notably, however, respondents did provide further feedback around a desire to

restrict the use of motorised or high-speed craft in passive recreational

areas.

Maritime

NZ

13. Maritime New Zealand (MNZ)

submitted a number of points before and during the engagement period. Their

comments centred largely on matters of detail pertaining to inconsistencies or

perceived inconsistencies between the Maritime Transport Act (1994), Maritime

Rules and what was stated in the draft Bylaw. Officers are of the view that the

identification of these items is helpful and assists with factual accuracy and,

therefore, suggest that all MNZ marked-up changes identified be adopted as a

matter of course.

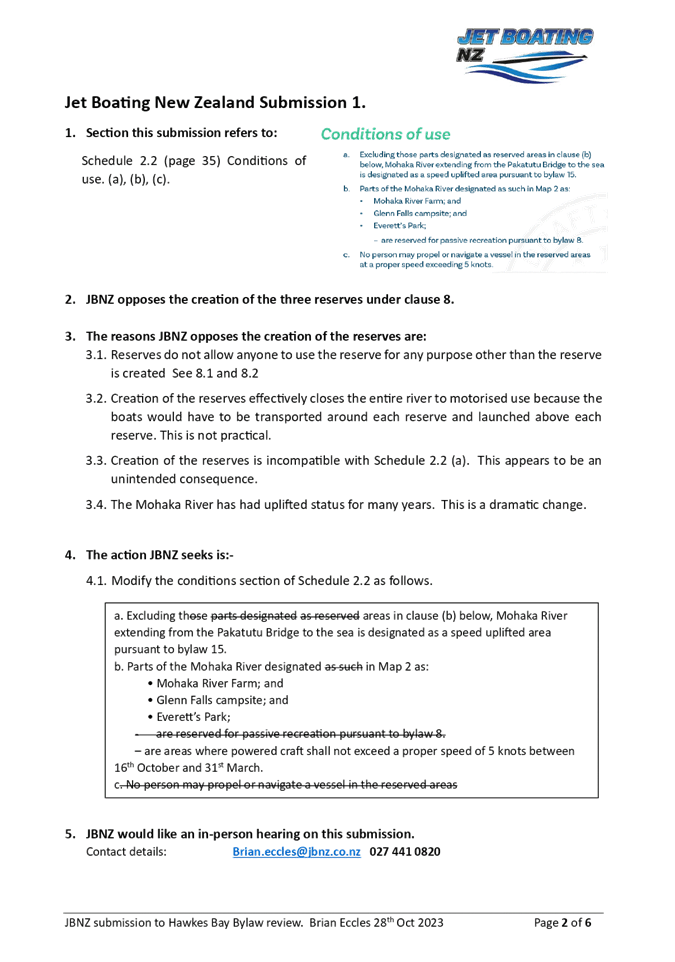

Jetboating NZ

14. A submission was received

from Jetboating NZ (JBNZ). At issue was the suggested changes proposed by HBRC

to create three 5-knot restricted reserves on the Mohaka River. JBNZ pointed

out that these sections of river have had a speed-uplifted status for many

years and imposing such restrictions would effectively close the river to

jetboats as they are incapable of navigating this waterway at 5 knots. The

possibility of a seasonal provision was suggested by the Harbourmaster and

agreed to by JBNZ. Under the proposal, powered craft would be excluded from the

three reserves (Mohaka River Farm, Glenfalls Campsite and Everetts Ford

Campsite) during the period of 16 October to 31 March each year. The rationale

being that during the summer months, when passive recreation water users

frequent the areas, river volumes are too low to navigate by jetboat, and at

other times of the year when conditions suit jetboating, there is a

much-reduced presence of recreational water users.

Engagement

with Tangata Whenua

15. Key Treaty partners were

approached for feedback at the project’s inception. However, this was not

able to be effectively obtained at the time due to cyclone recovery efforts

taking priority. At the time HBRC indicated that a further opportunity for

participation would be available later in the year during the public

consultation period. Accordingly, tangata whenua were approached directly for

further feedback prior to the public consultation phase but unfortunately none

was received. The project team suspects that resourcing constraints

post-cyclone were likely to still be a factor.

Financial

and resource implications

16. All implementation costs

including signage, equipment and asset upgrades have been budgeted for. Such

costs are modest and will be funded as part of business-as-usual activity.

Decision-making process

17. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

17.1. The decision does not

significantly alter the service provision or affect a strategic asset, nor is

it inconsistent with an existing policy or plan.

17.2. The use of the special

consultative procedure is prescribed by legislation. The Council must consult

directly with the community or others

having an interest in the decision.

17.3. The decision is not

significant under the criteria contained in Council’s adopted

Significance and Engagement Policy.

17.4. The persons affected by

this decision are all persons with an interest in the region’s

waterbodies that are used for navigation and recreation.

Recommendations

That Hawke’s Bay Regional

Council:

1. Receives and considers the Hawke's

Bay Navigation Safety Bylaw 2023 staff report in conjunction with the

public submissions received and the marked-up version of the draft Bylaw.

2. Agrees with the staff

analysis of submissions received and consequential amendments made to the Hawke's

Bay Navigation Safety Bylaw 2023.

3. Delegates authority to the

Group Manager Policy and Regulation to finalise the Hawke's Bay Navigation

Safety Bylaw 2023 to incorporate the following amendments specified during

deliberations, being:

3.1. ...

3.2. …

4. Adopts the Hawke's Bay

Navigation Safety Bylaw 2023 (which incorporates the amendments specified

in 3. above)

for notification.

Authored by:

|

Jason Doyle

Project Manager Policy &

Planning

|

Martin Moore

Harbourmaster

|

Approved by:

|

Katrina Brunton

Group Manager Policy &

Regulation

|

|

Attachment/s

|

1

|

Draft HB Navigation Safety Bylaw

2023

|

|

Under Separate Cover

|

|

2

|

Navigation Safety Bylaw Submissions

table

|

|

Under Separate Cover

|

|

3⇩

|

Jet Boating NZ Navigation Safety

Bylaw submission

|

|

|

|

Jet Boating NZ Navigation Safety Bylaw

submission

|

Attachment

3

|

Hawke’s Bay Regional

Council

13

December 2023

Subject:

HBRC Group Statement of Investment Policies and Objectives

Reason for report

1. This item presents a new

Statement of Investment Policy and Objectives (SIPO) for HBRC Group Managed

Fund’s investments for Council’s approval.

2. The Statement of Investment

Policy and Objectives (SIPO) is a formal document that outlines an

organisation's investment goals, strategies, risk tolerance, and guidelines. It

serves as a blueprint for overseeing and administering the Group’s

Managed Funds portfolio and is used to ensure that investment decisions align

with the organisation's overall objectives and financial requirements. This

document typically includes details on asset allocation, investment limits,

performance benchmarks, and responsibilities of the investment managers. It's

an essential tool for guiding investment decisions and monitoring performance.

Officers’

recommendations

3. Officers recommend that

Council considers and approves the revised SIPO as proposed.

Executive

Summary

4. A revised Statement of

Investment Policy and Objectives (SIPO) is required to guide the HBRC Group's

investment strategy.

5. The update is overdue

following significant growth in the Council's managed funds following the

Napier Port IPO and aims to realign the investment strategy for increased

resilience and income.

6. Key changes include

designating HBRIC as the Investment Manager, transitioning management of

various investment assets, and targeting improved financial returns through a

rebalanced asset allocation.

Background

/Discussion

7. The current SIPO was

updated in 2018. It preceded the Napier Port IPO which subsequently tripled

Council’s managed funds portfolio.

8. Following a twelve month

review process, on 25 October 2023 Council resolved to implement changes to the

management and oversight of the HBRC and Hawke’s Bay Regional Investment

Company Limited (HBRIC) investment portfolios. These were documented in a

Statement of Expectations issues by HBRC to HBRIC on 9 November 2023. Of note

are the following changes:

8.1. Council reinforces the

importance of a building resilience into the Group, and the value of deriving a

constantly growing income stream from those assets.

8.2. Council confirmed the role

of HBRIC as the Investment Manager for the overall Group’s investment

assets. This role includes management of HBRIC’s own assets (such

as the Port and other investments), but also includes oversight of

Council’s investment assets including Forestry, Investment Property and

Managed Funds.

8.3. Council is looking to

transition management of the Managed Fund function on or after 1 December

2023. Other asset classes will be as at 1 July 2024 at the earliest.

8.4. Council desires that HBRIC

identify ways to create a reserve portfolio, initially equivalent to one

year’s distribution from the Port, over the duration of the 2024 Long

Term Plan, to buffer Council from the impacts of downturns such as we are

currently seeing from Cyclone Gabrielle. HBRIC can build reserves from

any distribution from the Port in excess of the levels forecast in support of

the Council 2024 Long Term Plan or outperformance in other Group assets.

8.5. Initial draft Investment

return targets have been set but are subject to revision as Council works

through the 2024 Long Term Plan process and are reflected in the final

Statement of Intent for HBRIC. The targets reflect Council’s cash income

expectations from the existing assets owned and to be managed by HBRIC under

the SOE, less budgeted HBRIC costs. For the first three years of the LTP

these are proposed as:

8.5.1. LTP 1 (2024) – $12.5m

8.5.2. LTP 2 (2025) – $13.0m

8.5.3. LTP 3 (2026) – $13.5m.

8.6. Council wishes to see HBRIC

grow resilience equivalent to one year’s dividend from the Port, through

the retention of capital gains and any surplus cash from Investment Assets over

and above the distribution proposed in the Long Term Plan.

9. As noted through the

Investment Strategy Review process, the legacy split in management between

Council’s and HBRIC’s investment portfolios obscured an overarching

Group portfolio viewpoint. The review identified that the Group’s circa

$150m managed funds portfolio was too defensively positioned in the context of

the Group’s investment goals and wider mix of investment property and

infrastructure assets owned.

10. As a first step in

delivering on the Statement of Expectations the HBRIC Board has drafted the

attached SIPO for Managed Funds for the Group’s portfolio. The portfolio

is currently allocated as follows.

Table 1. Breakdown of Managed Funds holdings between

managers, Future Investment Funds (FTI) and Long Term Investment Funds (LTI)

|

Fund Manager

|

HBRC

|

HBRIC

|

Total

|

|

Jarden FIF Funds

|

38,577,415

|

14,137,050

|

|

|

Jarden LTI Funds

|

23,504,174

|

|

$76,218,639

|

|

Mercer FIF Funds

|

21,630,962

|

29,803,006

|

|

|

Mercer LTI Funds

|

23,155,006

|

|

$74,588,974

|

|

Total

|

$106,867,557

|

$43,940,056

|

$150,807,613

|

11. Approval of the SIPO is a

necessary first step to a review of the Managed Funds by HBRIC – including

a Request for Proposal process involving the incumbent providers and others

interested parties. Preferably this would be initiated by the end of December.

Resetting of the portfolios in line with the revised SIPO forms a key component

of delivering on Council’s overall investment portfolio return

expectations.

12. Scott Hamilton will present

the changes at the meeting. Key changes include:

12.1. A shift from a 50:50 fully

hedged growth/defensive allocation to a 70:30 partially hedged growth / defensive

allocation.

12.2. Affirming the minimum

expectations of the Managed Funds is a 3% cash yield for Council and inflation

proofing of the portfolio (at 2.5%). Returns are targeted to be in excess

of this over time, supporting the rebuilding of Group resilience.

12.3. Expansion of the Groups

policy on Ethical Investment to a Responsible Investment based on a combination

of principles and exclusions. The Group will draw on the examples of

leading Crown-owned investment institutions.

12.4. A requirement for fund

managers to take into account the Group’s wider investment portfolio when

building fund allocations.

12.5. Confirmation that HBRIC has

delegated authority to implement and administer the SIPO.

12.6. Requirements for a

structured process between HBRIC and HBRC to plan capital contributions or

withdrawals (e.g. for annual reserve requirements).

Non-managed

funds investments

13. As noted earlier, as has

been the case previously, the SIPO only relates to the Group’s Managed

Funds Portfolio. Following receipt of Council’s Statement of

Expectation, HBRIC has initiated a number of implementation workstreams give

effect to the changes, including:

13.1. Establishment of a joint

HBRIC-HBRC project implementation team for the transition of management

oversight for HBRC’s investment assets. This includes establishing

appropriate reporting and delegation frameworks, and confirming management

hand-over timeframes.

13.2. HBRIC Investment Strategy

reset – a review of the group investment assets, individually and as a

portfolio, and reporting to Council with any recommendations, noting the

restraints around key Strategic Assets such as Napier Port of course. A phase

one workshop has been completed and the follow-up is scheduled for February

2024 following the Managed Fund’s RFP.

13.3. HBRIC resourcing response

– as the outcomes of the above two workstreams emerge HBRIC will develop

and the finalise the appropriate staffing and operating model for the Group

Investment Manager function.

13.4. Working alongside Council to

support the development of 2024-2027 Long Term Plan, particularly the

Investment Strategy.

Strategic fit

14. The changes set out in the

Statement of Expectations aim to positively impact Council’s Investment

Strategy for the 2024-2027 Long Term Plan. The approvals sought in this paper

are consistent with implementing the changes sought by Council.

Significance

and Engagement Policy assessment

15. The Future Investment Fund

(inflation adjusted capital base retention of net proceeds from partial sell-down

of 45% ownership of Napier Port following Initial Public Offering) is a

Strategic Asset, currently owned and managed by HBRIC and HBRC.

16. The significance of

approvals sought are determined to be low/medium. The impacts of the changes

are expected to have a favourable financial impact for Council.

17. While changes are sought to

the settings through which a strategic asset (Future Investment Fund) is

managed, there are no changes proposed to the nature of the strategic asset

itself.

Climate

Change considerations

18. In the aftermath of Cyclone

Gabrielle, Council has committed to building greater financial resilience to

regional exposure and vulnerability to climate-related events. Council has

directed HBRIC to establish and build financial resilience equivalent to one

year’s dividend from the Port of Napier, through the retention of capital

gains and any surplus cash from Investment Assets over and above the

distribution proposed in the Long-Term Plan. The approvals sought are aligned

with the Council’s objectives.

Financial

and resource implications

19. The approvals sought

represent the first step in lifting the long-term performance of the

Group’s Managed Funds portfolio.

20. The financial outcomes will

be more accurately quantifiable at the conclusion of the Investment Manager

selection process. But it is expected that the improvement in Managed Funds net

returns could be in the order of 1.0% per annum over time as a result of

changes in Strategic Asset Allocation.

Decision-making process

21. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

21.1. The decision does not

significantly alter the service provision or affect a strategic asset, nor is

it inconsistent with an existing policy or plan.

21.2. The use of the special

consultative procedure is not prescribed by legislation.

21.3. The decision is not

significant under the criteria contained in Council’s adopted

Significance and Engagement Policy.

21.4. The persons affected by

this decision are all ratepayers.

21.5. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by, or have an interest in the decisions made, Council

can exercise its discretion and make a decision without consulting directly

with the community or others

having an interest in the decision.

Recommendations

That Hawke’s Bay Regional

Council:

1. Receives and considers the HBRC

Group Statement of Investment Policies and Objectives staff report.

2. Agrees that the decisions

to be made are not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without conferring directly with

the community or persons likely to have an interest in the decision.

3. Adopts the HBRC Group Statement of

Investment Policies and Objectives 2023 as proposed.

Authored by:

|

Tom Skerman

HBRIC Commercial Manager

|

Scott Hamilton

Rautaki

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1

|

Draft HBRC Group SIPO 2023

|

|

Under Separate Cover

|

Hawke’s

Bay Regional Council

13

December 2023

Subject:

Report and recommendations from the Risk and Audit Committee

Reason for report

1. The following matters were

considered by the Risk and Audit Committee (RAC) on 18 October 2023 and the

recommendations to Council are now presented for the Council’s

consideration and resolution.

Agenda

items for Council decision

2. The Insurance – annual

review and update

item sought RAC’s recommendations to Council in relation to insurance

coverage renewals. The RAC recommendations to Council are to:

3.1. Note the MWLASS

Infrastructure Insurance Layers Update report (attached).

3.2. Progress with participation

in the excess layer of infrastructure asset cover with MWLASS of $200m.

3.3. Investigate how HBRC might

review and assess how alternative means of insurance may be implemented across

the business.

Information

items

3. The Ernst & Young Audit Close

report on year ended 30 June 2023 item presented the report (attached). Highlights from

the EY report include:

3.1. The Audit Opinion includes

2 non-standard opinions, an emphasis of matter relating to greenhouse

gasses (which is standard amongst local government) and a qualification

specific to HBRC about the revaluation of infrastructure assets not having been

done.

3.2. In relation to

infrastructure asset valuations, as the repair and rebuild of stopbanks is completed,

staff will have those assets revalued at the earliest opportunity.

4. The Risk Management Policy

Renewal

item proposed an updated policy for the Committee’s consideration.

Discussions on the day highlighted:

4.1. Day to day management of

risks is operational and the responsibility of the Chief Executive, and the

Policy is about managing the risks to Council (the organisation).

4.2. Suggested amendments to the

Policy included that a link to HBRC’s purpose and community commitments

be included in the purpose of the Risk Management Policy, and that the Risk

Management Framework document be attached to the Policy for context.

4.3. Staff will incorporate

suggested amendments and seek RAC’s approval to the updated Policy at the

next meeting.

5. The Treasury Compliance Report item presented the RAC

with the compliance monitoring report of HBRC treasury activity and the

performance of Council’s investment portfolio for the quarter ended 30

June 2023, and highlighted:

5.1. Non-compliance with third

party limits occurred due to management of the funding received from central

government associated with the Cyclone Gabrielle response, particularly silt

taskforce funding.

5.2. Some of the debt limits set

previously will need to be adjusted through the Investment Strategy review and

Long Term Plan processes currently under way.

5.3. Exceptions are managed and

rectified on a day-to-day basis by the CFO and reported to the Risk and Audit

Committee via the quarterly Treasury Compliance Report and managed monthly in

liaison with PWC, as per Council’s Treasury Policy.

6. The Health, Safety and

Wellbeing Management System review item provided RAC with an update on progress to align

the HBRC Health, Safety and Wellbeing Management System (HSWMS) with the

ISO45001 framework, and noted:

6.1. Despite the impacts of

Covid 19 lockdowns of 2020-2021 and the staffing levels within the HSW team,

HBRC’s HSWMS was maintained at a level commensurate with WSMP Tertiary.

This was verified via an internal review conducted in 2022.

6.2. HSWMS strategy and work

plans covering 2021-2024 are built around the health and safety cornerstones

of:

6.2.1. Knowledgeable workplace

leadership

6.2.2. Actively identifying,

managing, and monitoring risk

6.2.3. Managing the pandemic

response to Covid-19 and variants

6.2.4. Improving the management of

contractors

6.2.5. Improving health, safety

and wellbeing engagement and culture

6.2.6. Enabling an effective

implementation plan and reviewing annually

6.2.7. Improving reporting and

provision of relevant information.

6.3. Activity to date includes:

|

Time period

|

Activity

|

|

2001-2019

|

HBRC certified under ACC WSMP programme

|

|

2018

|

Crowe Horwath Internal Audit

Decision by the Group Manager Office of the Chief

Executive and Chair, the HR Manager re recommendations HBRC to adopt

HBRC WSMP certification extended to 2019

|

|

2019

|

Work begins to implement recommendations

ACC WSMP programme ceases; HBRC certification ends

|

|

2020

|

HSW TL new into role, manages HBRC Covid response;

picks up and continues implementation of recommendations as part of HSW

workplan

|

|

2021

|

HSW TL continues with recommendations (as part of HSW

workplan)

|

|

2022

|

Internal review of HSMS against ACC WSMP standard

Investigation into alternative safety standard

programmes – findings and recommended pathway presented to ELT

|

|

2023

|

ELT approves recommendation to align HSMS with ISO45001

Pathway stages mapped and stage 1 to occur

|

6.4. Timeframes for transition

to ISO45001 are:

|

Programme

|

Year one

(2023)

|

Year two

(2024)

|

Year

three (2025)

|

Year

five (2027)

|

|

ISO45001

Programme as recommended by External Auditors

|

Stage 1 Document review

Review processes. Post review 12 months to

update/amend (based on recommendations) and collect evidence of any changes

in practice as a result of those. ‘In general, 12 months evidence of

operational implementation required

|

Onsite Gap Analysis

Review processes alongside updates from

previous recommendations and evidence of practice. Conducted onsite.

|

Onsite Gap Analysis

Review processes alongside updates from previous

recommendations and evidence of practice. Conducted onsite.

|

Move to standard 2-yearly review cycle

|

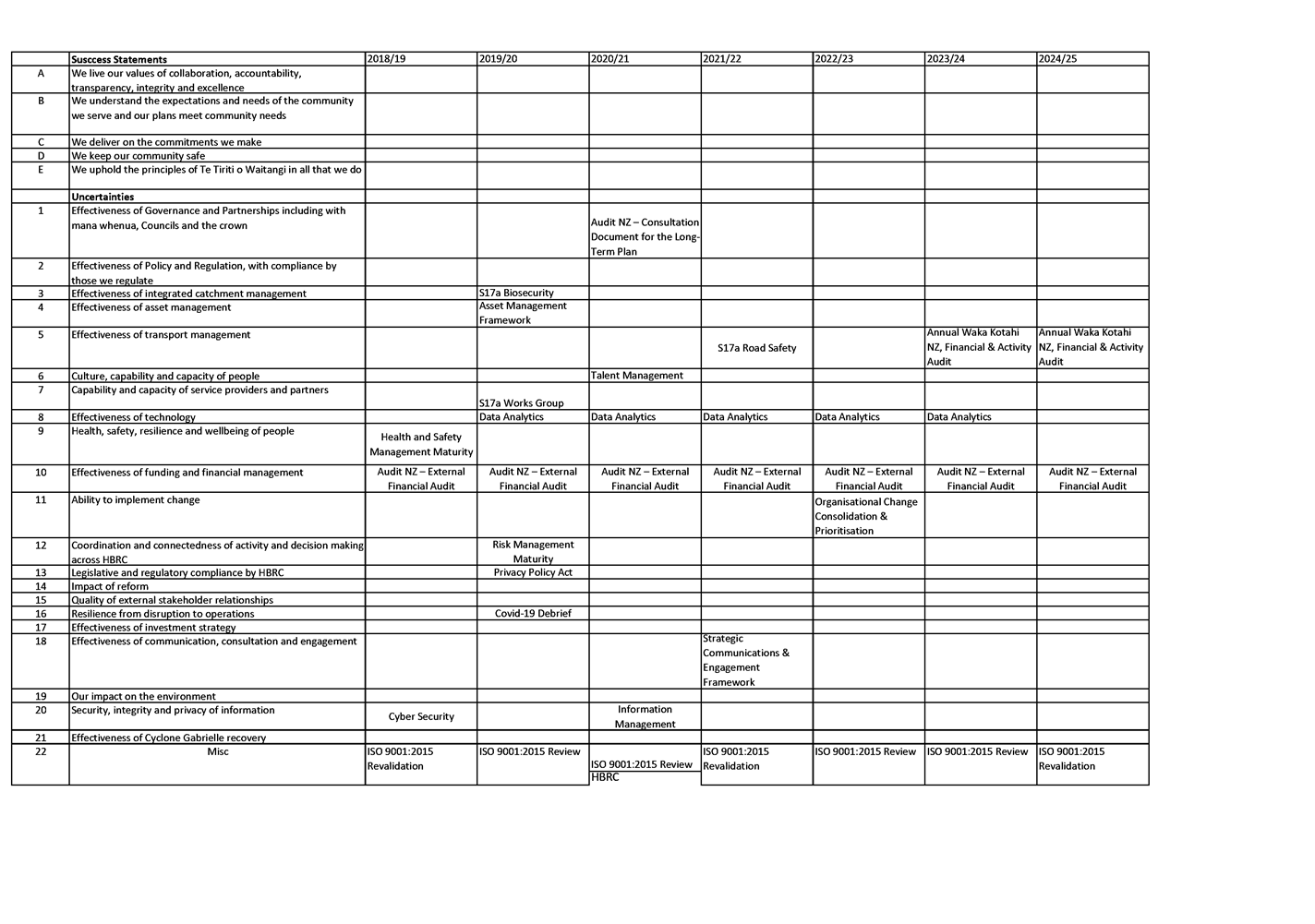

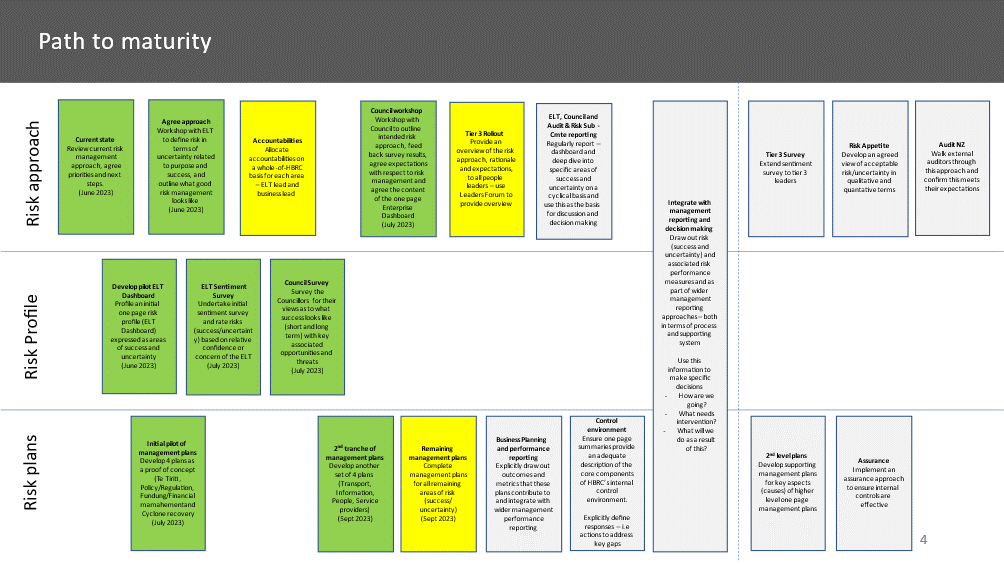

7. The Risk Maturity Refresh item, presented by David

Nalder and Helen Marsden in the public excluded session, provided the reset of the approach to

risk management within Hawke’s Bay Regional Council. The purpose of adopting a different

approach to risk management

is to improve

the quality of risk information and enable a comprehensive understanding of the

risk profile of HBRC to feed into executive (ELT) and governance discussion,

planning, decision-making and monitoring.

8. The key concepts that

underpin the new approach are:

8.1. Defining risk in terms of

HBRC’s purpose, what success looks like, and the major areas of

uncertainty associated with this.

8.2. Single point

accountabilities for each area of success/uncertainty (risk) at the ELT level,

with supporting business leads to develop and maintain the one-page management

plans for each area.

8.3. One page management plans

for each area to drive explicit action and decision-making.

8.4. Monthly sentiment surveys

completed by the ELT to gauge the overall level of confidence/concern (risk

rating) associated with each area, and the consistency of views across ELT.

8.5. The Enterprise Dashboard

used by ELT, Council, and the Risk and Audit Committee each meeting to focus

risk discussion, with three one-page management plans to enable deep-dives into

specific areas of risk.

9. The distinction between the

roles of the full Council and the Risk and Audit Committee is that:

9.1. RAC ensures that an

effective risk management process is in place and working effectively

to identify, assess, manage and report on risk.

9.2. Council uses the content

of risk management to take into account the major areas of risk faced by HBRC

in decision-making.

10. The RAC resolved to receive

and note the report, specifically the:

10.1. concept of the Enterprise

Dashboard and One Page Management Plans

10.2. path to maturity to

implement the approach (attached)

10.3. Enterprise Dashboard for

October 2023, reflecting the current state risk profile

10.4. three examples of 1-page

Management Plans.

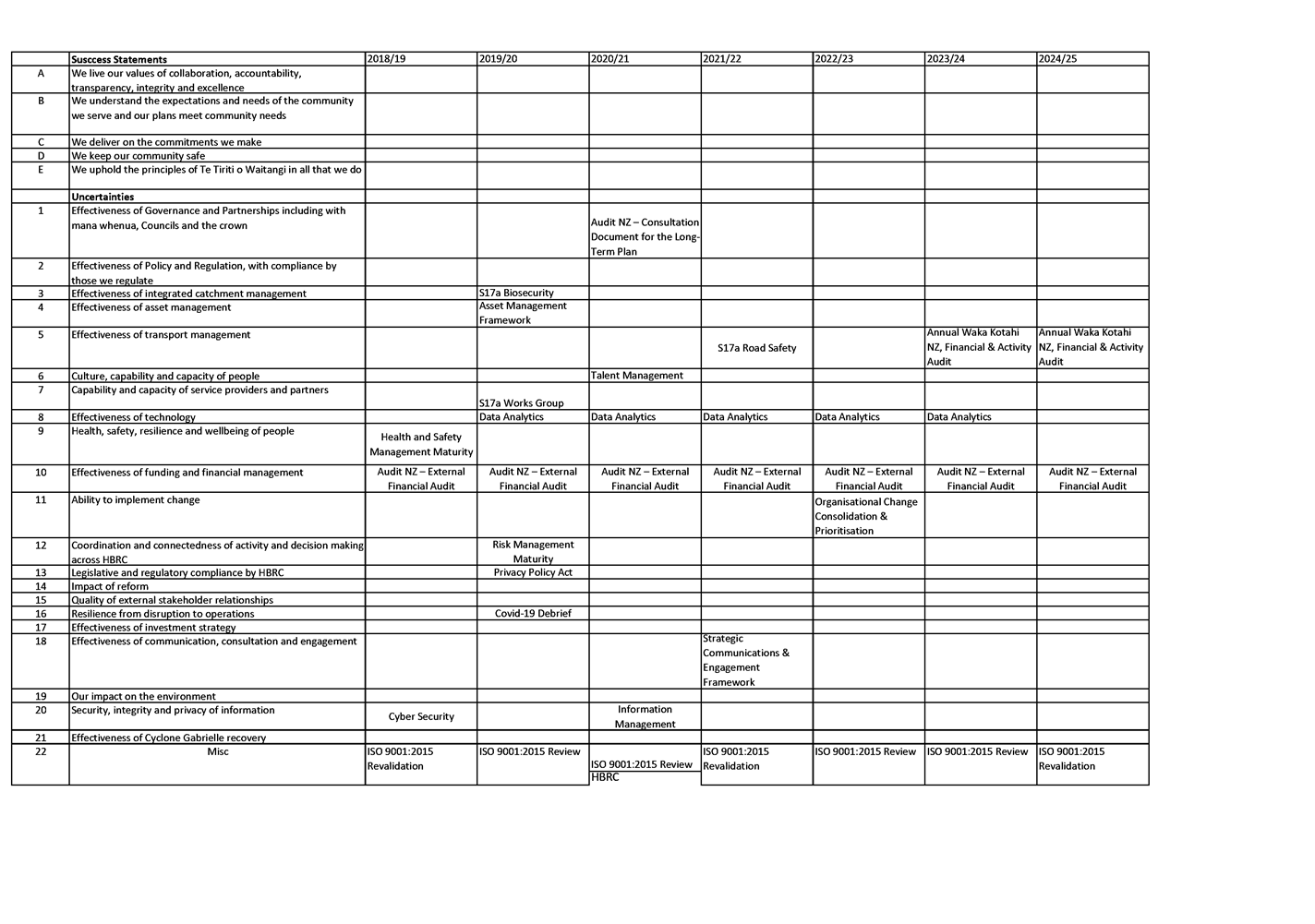

11. The Internal Assurance

Dashboards

item (in Public Excluded session) provided an update to RAC on progress on

management actions from previous audits and the status of internal audits and

reviews under way. The Assurance Universe (attached) is aligned to the Risk

framework and is a snapshot of what is currently on the work plan. The Risk and

Audit Committee resolved:

11.1. Receives and notes the Internal

Assurance Dashboards update staff report.

11.2. Confirms that the Internal

Assurance Corrective actions update report has provided adequate

information on the status of the Internal Assurance Corrective Actions.

Decision-making process

12. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

12.1. The decisions do not

significantly alter the service provision or affect a strategic asset, nor is

it inconsistent with an existing policy or plan.

12.2. The items were specifically

considered by the Risk

and Audit Committee on 18 October 2023.

12.3. The persons affected by

this decision are staff and governors of HBRC.

12.4. Given the nature and

significance of the issues to be considered and decided, and also the persons

likely to be affected by, or have an interest in the decisions made, Council

can exercise its discretion and make these decisions without consulting

directly with the community.

Recommendations

That Hawke’s Bay Regional

Council:

1. Receives and considers the Report

and recommendations from the Risk and Audit Committee staff report.

2. Agrees that the decisions

to be made are not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without conferring directly with

the community or persons likely to have an interest in the decision.

Insurance – annual review and

update

3. Notes MWLASS Infrastructure

Insurance Layers update report attached.

4. Progresses with

participation in the excess layer of infrastructure asset cover with MWLASS of

$200m.

5. Investigates how HBRC might

review and assess how alternative means of insurance may be implemented across

the business.

Authored by:

|

Jess Bennett

Senior Manager Finance Recovery

|

Chris Comber

Chief Financial Officer

|

|

Leeanne Hooper

Team Leader Governance

|

Helen Marsden

Risk & Corporate Compliance

Manager

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1

|

MWLASS Infrastructure Insurance

Layers Update

|

|

Under Separate Cover

|

|

2

|

Ernst Young Audit Close Report -

HBRC year ended 30 June 2023

|

|

Under Separate Cover

|

|

3⇩

|

Pathway to risk maturity

|

|

|

|

4⇩

|

HBRC Assurance Universe 2018-2025

|

|

|

|

Pathway to risk maturity

|

Attachment

3

|

|

HBRC Assurance Universe 2018-2025

|

Attachment

4

|

Hawke’s

Bay Regional Council

13

December 2023

Subject:

Issuance of Security Stock under Debenture Trust Deed

Reason for report

1. This item seeks approval

for the issuance of variable security stock under the existing Debenture Trust

Deed to ANZ, with the primary objective of setting up a facility for interest

rate hedging transactions specifically with ANZ.

2. The Treasury Policy states

that “External borrowing, treasury investment and interest/foreign

exchange risk management related transactions would only be entered into with

organisations specifically approved by Council”.

3. This item also seeks

approval to enter into a banking relationship with ANZ as approved hedging

relationships already exist with Westpac and BNZ.

Officers’

recommendation

4. Officers recommend that

Council considers and approves the issuance of security stock to new

stockholder ANZ under the Debenture Trust Deed for the purposes of setting up a

facility to transact interest rate hedging.

Executive

Summary

5. HBRC has a Debenture Trust

Deed, which is a deed entered into between a local authority and a trustee

under which the local authority grants a security interest in its rates and

rates revenue to the trustee to hold on behalf of holders of "stock"

issued under the Debenture Trust Deed.

6. The local authority can

then issue "stock" to creditors which has the benefit of the security

granted to the trustee. Council currently grants security (being a charge over

its rates and rates revenue) to financiers by issuing security certificates

under its Debenture. The security is recorded on the register kept by the

Council.

7. The proposed issuance of

security stock allows ANZ to set up a credit facility, or dealing line, to

enable financial instruments such as interest rate swaps to be entered into by

Council for the purpose of managing interest rate risk.

8. Council is required to

approve new bank relationships under para 14 of the Treasury Policy and

approval of new issuance of variable security stock to a new stockholder under

the Debenture Trust Deed.

Background

/ Discussion

9. As highlighted to the

Council at the Corporate and Strategic Committee meeting on 6 December,

HBRC remains challenged in complying with Counterparty risk measures given the

significant volume of financial transactions incurred since the cyclone, with

an expected further spend profile in the coming LTP.

10. Diversification of banking

partnerships is important and can assist with financial resilience and

flexibility for the future of Council’s operations. In addition,

Council benefit from the ability to leverage these relationships for the best

possible advice and information across various banks and sectors.

11. Council currently has

existing banking relationships with BNZ, our main transactional bank, and

Westpac directly and an indirect relationship with ANZ via cash management

facilities held with Jarden.

12. ANZ’s involvement provides

an additional layer of assurance as they bring their expertise and experience

in interest rate hedging transactions.

Significance

and Engagement Policy assessment

13. The significance of

approvals sought are determined to be low including the overall default risk of

HBRC defaulting on any obligation. The impacts of the proposal are expected to

have a favourable financial impact for Council.

14. While the proposal is

adding a security stockholder to our existing Debenture Trust Deed, there are

no changes proposed to the interest rate risk management policy, this proposal

enables us to better carry out our management of the interest rate management.

Climate

Change considerations

15. In the aftermath of Cyclone

Gabrielle, Council has committed to building greater financial resilience to

regional exposure and vulnerability to climate-related events. The approvals

sought are aligned with these Council objectives.

Financial

and resource implications

16. Council delegates

management of interest rate risk to Chief Executive and Group Manager Corporate

Services within delegated authority daily limits of $15m and $10m respectively.

17. The approvals sought

represent the first step in lifting the long-term performance of the

Group’s Managed Funds portfolio.

18. The financial outcomes will

be more accurately quantifiable at the conclusion of the Investment Manager

selection process. But it is expected that the improvement in Managed Funds net

returns could be in the order of 1.0% per annum over time as a result of changes

in Strategic Asset Allocation.

19. Default risk, that HBRC

defaults on any repayments, is considered extremely low.

Decision-making process

20. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

20.1. The decision does not

significantly alter the service provision or affect a strategic asset, nor is

it inconsistent with an existing policy or plan.

20.2. The use of the special

consultative procedure is not prescribed by legislation.

20.3. The decision is not

significant under the criteria contained in Council’s adopted

Significance and Engagement Policy.

20.4. The persons affected by

this decision are all ratepayers.

20.5. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by, or have an interest in the decisions made, Council

can exercise its discretion and make a decision without consulting directly

with the community or others

having an interest in the decision.

Recommendations

That Hawke’s Bay Regional

Council:

1. Receives and considers the Issuance of Security Stock

under Debenture Trust Deed

staff report.

2. Agrees that the decisions

to be made are not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without conferring directly with

the community or persons likely to have an interest in the decision.

3. Adopts the Issuance of

Security Stock under Debenture Trust Deed as proposed.

Authored by:

|

Jess Bennett

Senior Manager Finance Recovery

|

Tracey O'Shaughnessy

Treasury & Investments

Accountant

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

There are no attachments for this

report.

Hawke’s

Bay Regional Council

13

December 2023

Subject:

Affixing of Common Seal

Reason for Report

1. The Common Seal of the

Council has been affixed to the following documents and signed by the Chair or

Deputy Chair and Chief Executive or a Group Manager.

|

|

|

Seal

No.

|

Date

|

|

1.1

|

Leasehold

Land Sales

1.1.1 Lot 243

DP 11258

CT B3/577

- Agreement for Sale and Purchase

1.1.2 Lot 53

DP 11604

CT C2/563

- Agreement for Sale and

Purchase

1.1.3 Lot 216

DP 6598

CT C2/336

- Agreement for Sale and

Purchase

1.1.4 Lot 3

DP 13099

CT E3/139

- Agreement for Sale and

Purchase

|

4576

4577

4578

4579

|

28

November 2023

28

November 2023

28

November 2023

28

November 2023

|

|

1.2

|

Staff

Warrants

1.2.1 N. Hannan

(Delegations under Soil

Conservation and Rivers Control Act 1941; Land Drainage Act 1908; Civil

Defence Emergency Management Act 2002 (s.86-92) and Local Government Act 2002

(s.177))

|

4580

|

4

December 2023

|

2. The Common Seal is used

twice during a Leasehold Land Sale, once on the Sale and Purchase Agreement and

once on the Land Transfer document. More often than not, there is a delay

between the second issue (Land Transfer document) of the Common Seal per property.

This delay could result in the second issue of the Seal not appearing until the

following month.

3. As a result of sales, the

current numbers of Leasehold properties owned by Council are:

3.1 No cross lease properties

were freeholded, with 62 remaining on Council’s books

3.2 No single leasehold

properties were freeholded, with 77 remaining on Council’s books

3.3 The Agreement for Sale and

Purchase have been for properties that have subdivided, moving from cross lease

to a single lease.

Decision-making

process

4. Council is required to make

every decision in accordance with the provisions of Sections 77, 78, 80, 81 and

82 of the Local Government Act 2002 (the Act). Staff have assessed the

requirements contained within these sections of the Act in relation to this

item and have concluded the following:

4.1 Sections 97 and 88 of the

Act do not apply.

4.2 Council can

exercise its discretion under Section 79(1)(a) and 82(3) of the Act and make a

decision on this issue without conferring directly with the community or others

due to the nature and significance of the issue to be considered and decided.

4.3 That the decision to apply

the Common Seal reflects previous policy or other decisions of Council which

(where applicable) will have been subject to the Act’s required decision

making process.

Recommendations

That Hawke’s Bay Regional

Council:

1. Agrees that the decisions

to be made are not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without conferring directly with the

community or persons likely to have an interest in the decision.

2. Confirms the action to

affix the Common Seal.

Authored by:

|

Diane Wisely

Executive Assistant

|

Vanessa Fauth

Finance Manager

|

Approved by:

Attachment/s

There are no attachments for this

report.

Hawke’s Bay Regional

Council

13 December

2023

Subject:

Land Categorisation update

Reason for report

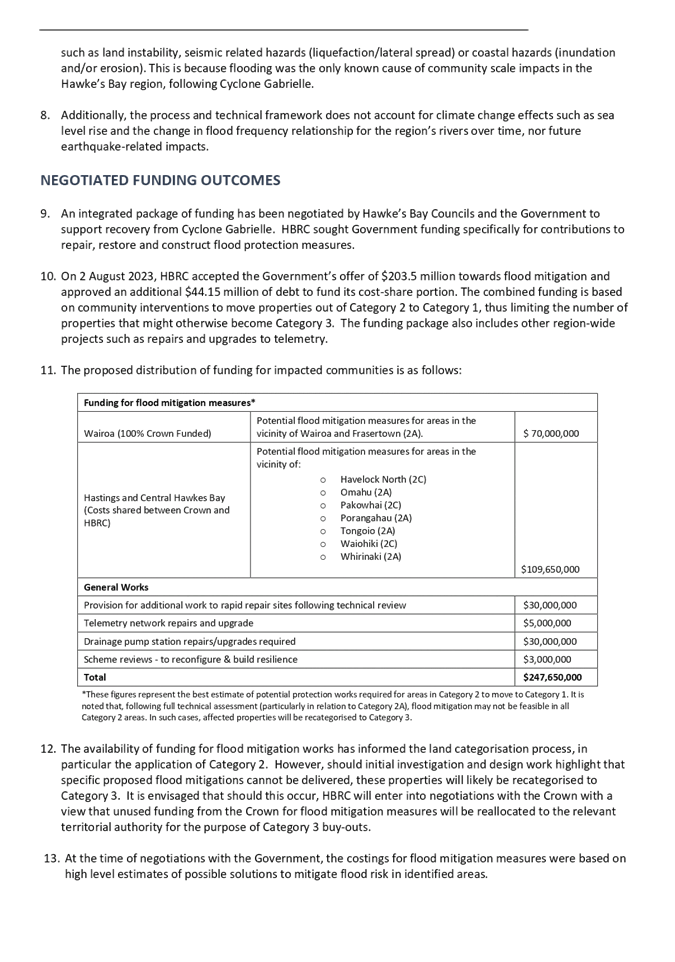

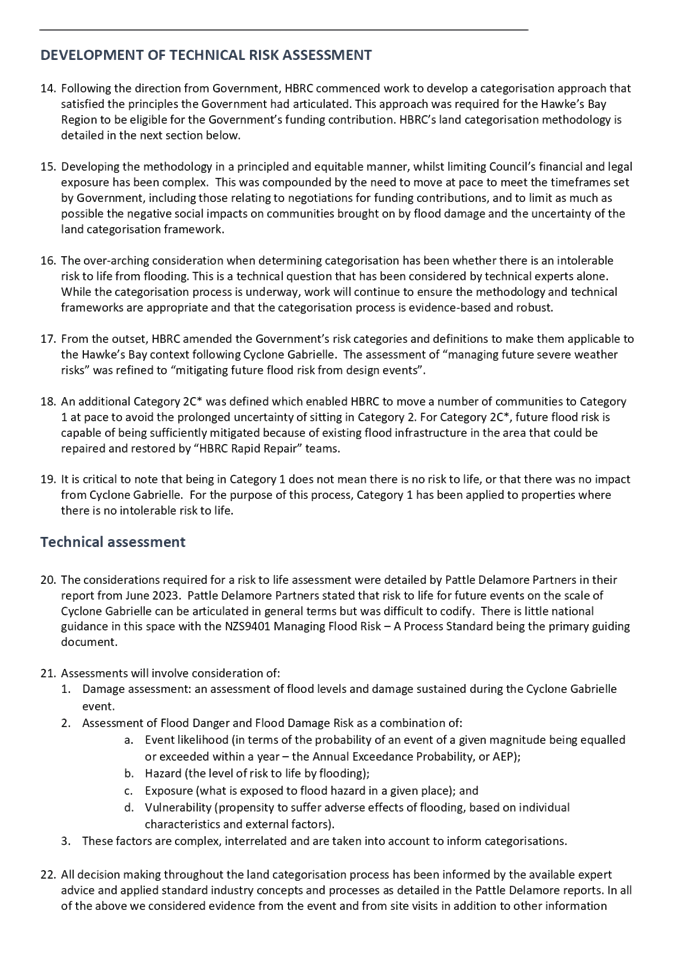

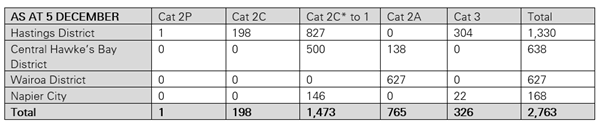

1. This item provides an

update of the land categorisation process and decisions to date, and outlines

the remaining land categorisation decisions to be progressed.

Executive Summary

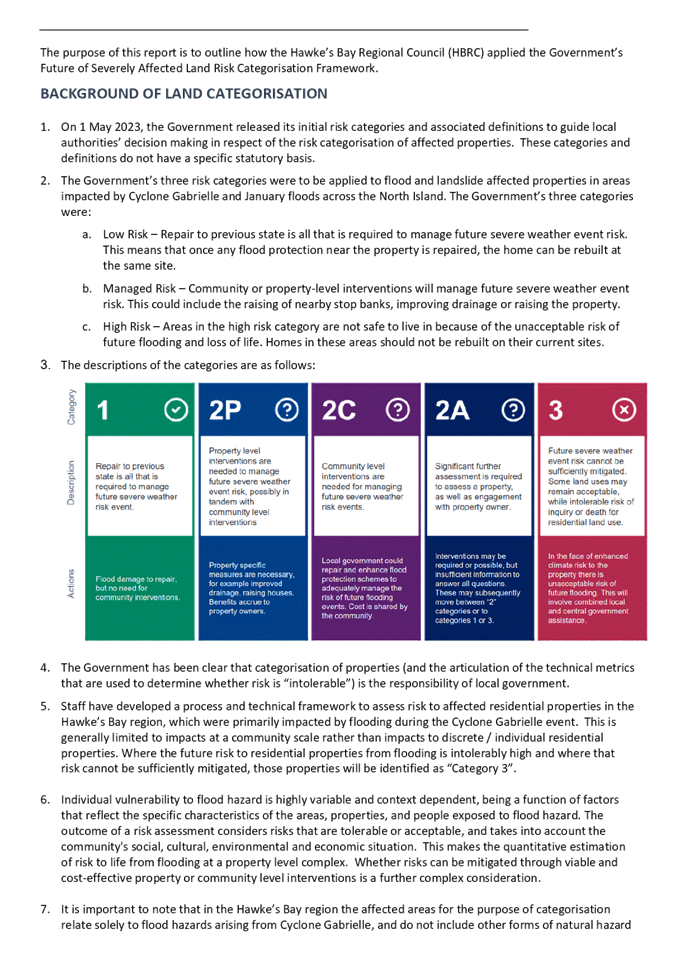

2. On 1 May 2023, the

Government released its initial risk categories and associated definitions to

guide local authorities’ decision-making in respect of the risk categorisation

of affected properties following Cyclone Gabrielle.

3. Staff developed a process

and framework to assess risk to affected residential properties in the

Hawke’s Bay region.

4. Nearly 3000 properties

across Hawke’s Bay have been assessed through the land categorisation

process and assigned a category which are defined as follows:

4.1. Category 1 - Repair to

previous state is all that is required to mitigate risk to life from flooding

4.2. Category 2C* - Repairs to

existing flood scheme assets are effective in mitigating future flood risk from

design events

4.3. Category 2C –

Additional community level interventions are effective in mitigating future

flood risk from design events

4.4. Category 2P - Property

level interventions are needed to mitigate future flood risk, including in

tandem with community level interventions

4.5. Category 2A - Significant

further assessment required before category determined

4.6. Category 3 - Future flood

risk cannot be sufficiently mitigated.

5. At the date of writing,

Council has confirmed the Category 3 status of 326 properties and these

property owners are now progressing through the Voluntary Buy-Out Programme

with their respective local authority. This is being managed by a

newly-established Voluntary Buy-out Office (VBO) led by Hastings District

Council.

6. There are five areas that

remain in Category 2C – Omāhu, Pohutakawa Drive / Whirinaki,

Pākōwhai, Waiohiki and Havelock North. Additionally, there are the two

remaining areas in Category 2A – Porangahau and Wairoa – which are

intended to move to Category 2C if viable solutions can be identified.

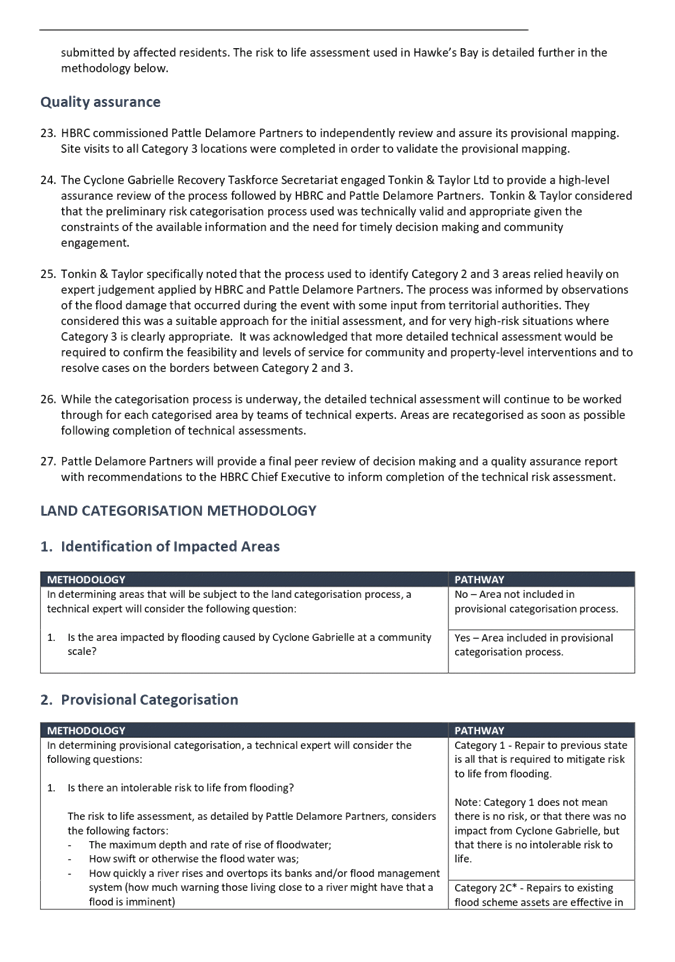

Background of Land Categorisation process and framework

7. On 1 May 2023, the

Government released its initial risk categories and associated definitions to

guide local authorities’ decision-making in respect of the risk

categorisation of affected properties.

8. These categories and

definitions did not have a specific statutory basis and, therefore, Council

commenced work to develop a categorisation approach that satisfied the

principles the Government had articulated. The Government was clear that

categorisation of properties (and the articulation of the technical metrics

that are used to determine whether risk is “intolerable”) was the

responsibility of local government.

9. Staff developed a process

and framework to assess risk to affected residential properties in the

Hawke’s Bay region, which were primarily impacted by flooding during the

Cyclone Gabrielle event. This focused on impacts at a community scale rather

than impacts to discrete / individual residential properties.

10. The over-arching

consideration when determining categorisation has been whether there is an

intolerable risk to life from flooding. This is a technical question that has

been considered by technical experts alone. Where the future risk to

residential properties from flooding is intolerably high and where that risk

cannot be sufficiently mitigated, those properties were identified as Category

3.

11. Developing the methodology

in a principled and equitable manner, while limiting Council’s financial

and legal exposure has been complex. This was compounded by the need to move at

pace to not only meet the timeframes set by Government, including those

relating to negotiations for funding contributions, but also to limit as much

as possible the negative social impacts on communities brought on by flood

damage and the uncertainty of the land categorisation framework.

12. Attached is the Land Categorisation

Process and Framework which is a public document that outlines how Council

applied the Government’s Future of Severely Affected Land Risk

Categorisation Framework. This document provides further detail on the risk

assessment process.

13. This information has also

been shared publicly on the Hawke’s Bay Land Categorisation website - Land Categorisation Hawke's

Bay | Hastings District Council (hastingsdc.govt.nz).

14. This website includes other

relevant information including the various iterations of maps for impacted

communities.

15. Nearly 3000 properties

across Hawke’s Bay have been assessed through the land categorisation

process with the breakdown between categories as follows:

How land categorisation

has progressed in Hawke’s Bay

Provisional mapping

16. On 1 June, affected

landowners in Hawke’s Bay were notified by email of the provisional land

categorisation for impacted communities. There were 18 provisional hazard

maps produced which were intended to provide a rough guide of the land

categorisation status of impacted communities. A further and more considered

process of refinement followed the provisional mapping exercise.

17. The provisional maps were

prepared using the following information:

17.1. Approximate flood extents

derived from air photos taken on or around 16 February 2023 (post Cyclone

Gabrielle) by Skycan

17.2. Rapid building assessment

data for Hastings District Council, Wairoa District Council, Napier City

Council, and Central Hawke’s Bay District Council

17.3. Contour information derived

from LiDAR data collection November 2020

17.4. Photographs of flood

extents and flood damage and information supplied during public meetings and

discussions with residents

17.5. Information from insurance

providers.

18. Council commissioned Pattle

Delamore Partners to independently review and assure the provisional mapping

process. Site visits to all Category 3 areas were completed in order to

validate the provisional mapping.

19. The Cyclone Gabrielle

Recovery Taskforce Secretariat engaged Tonkin & Taylor Ltd to provide a

high-level assurance review of the process followed by Council and Pattle

Delamore Partners. Tonkin & Taylor considered that the preliminary risk

categorisation process used was technically valid and appropriate given the

constraints of the available information and the need for timely decision

making and community engagement.

Category

2C*

20. An additional Category 2C*

was defined by Council, following the release of the Government risk

categories.

21. For those communities that

were in Category 2C*, future flood risk was capable of being sufficiently

mitigated because of existing flood infrastructure in the area that could be

repaired and restored by HBRC Rapid Repair teams. Once the asset was rebuilt

back to the original standard prior to Cyclone Gabrielle of 1% AEP, the impacted

community was released to Category 1.

22. This work enabled Council

to move a number of communities to Category 1 at pace to avoid the prolonged

uncertainty of remaining in Category 2, which became the initial focus of staff

following the provisional mapping exercise. It was acknowledged early on by

Council that there are significant social implications for prolonged periods in

Category 2. Examples include: living in temporary accommodation, withholding of

new building consents, builders declining work due to builders’ insurance

concerns, insurance companies with-holding payments, financial pressures

associated with mortgage repayments and people highly stressed that any

financial help they had with short term accommodation was fixed at 6 or 12 months.

23. The Category 2C* related

work entailed the repair of 5.6 kilometres of stopbank breaches and

approximately 20 kilometres of weakened stopbanks. All breaches in the

Heretaunga Plains Flood Control Scheme were repaired in under 4 months, at

which point the focus shifted to repairing weakened stopbanks.

24. Current outstanding

stopbank repairs are Ebberts, Ohiti Rd (scour) and Stablefords. These repairs

are expected to be completed by the end of April 2024. However, these three

sites do not impact on land categorisation.

Category

2P

25. Category 2P was the most

complex to navigate as potential solutions were focussed at an individual

property level, there was no clear funding pathway for individual property

owners, and the building consent process that flowed from a Category 2P

determination was unclear.

26. An additional complexity

for Category 2P is the possibility of a notice identifying that the land is

subject to a natural hazard remaining on the property’s Record of Title,

pursuant to sections 72-74 of the Building Act 2004, even after the completion

of the Category 2P works. This was not palatable for many property owners

and raised issues around insurability.

27. As much as possible, it was

the preference of Council to move property owners out of Category 2P into other

categories where there was greater certainty around funding availability and

future processes. Three impacted communities were re-categorised from Category

2P to Categories 1, 2A and/or 3.

28. For the one property

remaining in Category 2P in Rissington, the property owner is currently working

through the building consent process and Council is exploring options for a

funding contribution if the works are to proceed.

Requests

for reassessment and refinement of category boundaries

29. Following the initial

provisional mapping exercise, property owners had the opportunity to request

reassessment of their land categorisation. All requests for reassessment

were considered by a technical expert and responded to by staff. There were around

330 requests for reassessment over 3 months.

30. Reassessment involved the

following steps and considerations:

30.1. Review the desktop

assessment to determine if there were any errors, or other justification for

reconsidering the categorisation.

30.2. Decide whether further

information is required for an additional technical review.

30.3. Consult with additional

experts where further detailed assessment is required.

30.4. Arrange a site visit where

required.

30.5. Factors that may be

considered at the point of reassessment were:

30.5.1. Topographical features

30.5.2. Observed level of damage

30.5.3. Property boundaries, and

30.5.4. How accessible safe egress

is for potentially impacted residents.

31. In addition to addressing

requests for reassessment, the technical experts refined their risk analysis of

impacted areas which resulted in boundary adjustments in all areas. For

example, there were many minor boundary adjustments in the Esk Valley following

site visits, aerial view assessments, and analysis of the silt line and

contours of the land.

32. One of the biggest changes

was the inclusion of Aropaoanui which was omitted from the initial provisional

mapping exercise. This impacted community was assigned a Category 3 status.

Confirming

Category 3 boundaries

33. Following completion of the

reassessment and refinement process, staff focussed on confirming the Category

3 boundaries across the region in order to provide property owners with

certainty and to enable them to move through to the territorial authority-led

Voluntary Buy-Out Programme.

34. Throughout August and

September, Council told affected property owners of its intent to close the

land categorisation process for provisional Category 3 areas and public

meetings were held for each provisional Category 3 community. All information

and feedback submitted as part of the community engagement process was

considered and the technical experts provided the Chief Executive with a final

recommendation on the risk to life of affected property owners.

35. On 3 October 2023, Council

wrote to Category 3 property owners to confirm that there was an intolerable

risk to life from future flooding events and mitigations were not available to

sufficiently reduce this risk at their property. Property owners were

informed that it was considered unsafe for them to have a residential dwelling

in areas that were designated Category 3.

36. Council was able to confirm

the Category 3 status of 297 properties and these property owners are now

progressing through the Voluntary Buy-Out Programme with their respective local

authority. This is being managed by a newly-established Voluntary Buy-out

Office (VBO) led by Hastings District Council.

37. Council will only consider

further changes to confirmed land categorisations in the event that new

compelling information was presented that was not previously available to

technical experts.

38. There were approximately 40

queries and/or requests for reassessment after confirmation of the Category 3

areas. A large majority of queries related to points of clarification that were

dealt with easily and only a handful of queries required a more substantive

response. There were five requests for reassessment that did result in a change

to the property owners Category 3 boundary during this stage of the process.

Category

2A

39. There were six areas that

were classified as Category 2A. These areas have required significant further

assessment before land categorisation can be determined.

40. The process for further

assessment has involved the appointment of independent experts to conduct a

review of potential community and/or property level interventions that can

mitigate risk. Council and the relevant territorial authority have engaged with

communities on potential solutions.

41. Based on the outcome of the

further assessments, Council determined whether recategorisation to Category 2C

or 2P, with a view to moving to Category 1 was appropriate. If not, then

Category 3 would be applied as an intolerable risk to life cannot be mitigated.

42. Currently, Tangoio Beach is

the only area where a viable solution has not been identified. This community

has recently been advised of the confirmed Category 3 status.

43. The independent experts are

still working on identifying engineering solutions for Porangahau and

Wairoa. These two impacted communities are the last with a Category 2A

status. Staff are currently focussed on these two impacted communities to find

viable engineering solutions ideally before Christmas, so that property owners

can have certainty of their future land categorisation.

44. The process to move

communities out of Category 2A has been arduous with the scale of the

assessments and the project planning and design being unprecedented in

Hawke’s Bay. This has been coupled by resourcing challenges,

although teams have been in place since May and working at pace to identify

solutions. HBRC is, within a matter of months, designing several large and

difficult flood scheme projects that would normally take years. All

projects are being progressed as fast as possible.

Category

2C

45. There are five areas that

remain in Category 2C; Omāhu, Pohutakawa Drive / Whirinaki,

Pākōwhai, Waiohiki and Havelock North. Additionally, there are the two

remaining areas in Category 2A, as noted above, which are intended to move to

Category 2C if viable solutions can be identified.

46. These Category 2C

properties will be released to Category 1 when the following conditions are

met:

46.1. A sound concept that has a

consenting pathway, and

46.2. A legal interest in favour

of HBRC in the relevant land, and

46.3. Available funding

confirmed.

47. Council accepted the

Government’s offer of $203.5 million towards flood mitigation and

approved an additional $44.15 million of debt to fund its cost-share

portion. The cost-share agreement with the Crown was signed by all five

Hawke’s Bay councils in October following the initial acceptance subject

to consultation in August.

48. The Asset Management

Engineer Pods are working through the solution investigation phase with key

partners. Each area is at different stages in the process due to their individual

technical complexities, but this work continues to progress at pace.

49. In order to successfully

deliver this infrastructure programme of works, Council is moving to a

Programme Management Office approach to infrastructure delivery supported by

the capital funding arrangement with Government. Implementing a Programme

Management Office approach will create a single integrated delivery entity to

provide guidance, support, tracking, reporting services and structure to better

enable successful delivery of a myriad of projects simultaneously. This will

see the current delivery team scale up from 9 staff to around 30 staff and will

include support functions in the programme office including communications, iwi

engagement, legal, procurement, PMO reporting, financial, consenting, digital

solutions and health and safety.

Confirming

Category 1 boundaries

50. In order to close out the

land categorisation process, the final step will be to confirm the Category 1

areas and in particular the boundary of these areas. Currently, the

entire region has a Category 1 layer over it which might imply that the entire

region has been subject to a risk assessment, which is not the case.

51. Staff will refine the

boundaries to the impacted communities that were assessed. It is likely that

the Category 1 boundaries will closely follow the silt line left by flooding.

Outside of these boundaries, there will be no land categorisation applied.

52. It is critical to note that

being in Category 1 does not mean there is no risk to life, or that there was

no impact from Cyclone Gabrielle. For the purpose of this process, Category 1

has been applied to properties where there is no intolerable risk to life.

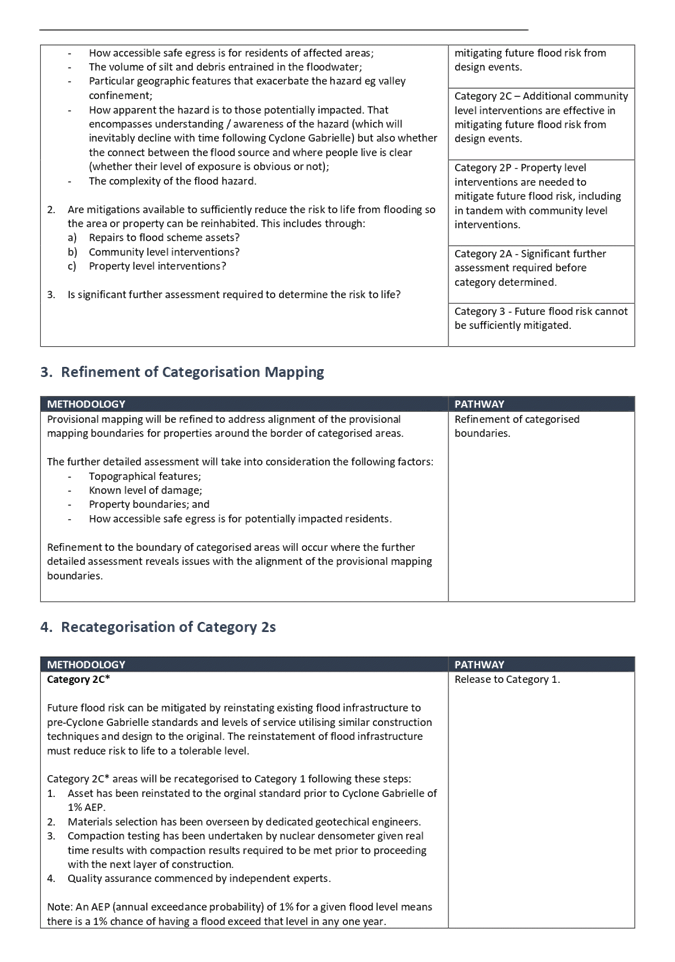

Timeline

of land categorisation decisions

|

Date of Decision

|

Impacted Area

|

Decision

|

|

1 June 2023

|

All impacted areas

|

Provisional maps released

|

|

26 June 2023

|

Brookfields / Awatoto

|

Re-categorisation from Category 2C* to Category 1

|

|

26 June 2023

|

Omāhu

|

Re-categorisation from Category 2C* to Category 1

|

|

4 July 2023

|

Twyford – Ruapere Sites 1 & 2

|

Re-categorisation from Category 2C* to Category 1

|

|

4 July 2023

|

Korokipo Road

|

Re-categorisation from Category 2C* to Category 1

|

|

4 July 2023

|

Moteo, Swamp Road

|

Re-categorisation from Category 2C* to Category 1

|

|

6 July 2023

|

Ōmarunui

|

Re-categorisation from Category 2C* to Category 1

|

|

6 July 2023

|

Waipawa

|

Re-categorisation from Category 2C* to Category 1

|

|

7 July 2023

|

Te Aute, Papanui

|

Re-categorisation from Category 2C* to Category 1

|

|

7 July 2023

|

Wairoa

|

Re-categorisation from Category 2P to Category 2A

|

|

26 July 3023

|

Pākōwhai (Franklin Rd)

|

Re-categorisation from Category 2C* to Category 1

|

|

2 August 2023

|

Hawke’s Bay

|

HBRC accepted the

Government’s offer of $203.5 million towards flood mitigation and

approved an additional $44.15 million of debt to fund its cost-share portion.

|

|

4 August 2023

|

Pākōwhai

|

Re-categorisation from

Category 2A to Category 2C and 3

|

|

16 August 2023

|

Dartmoor Road

|

Re-categorisation from Category 2C* to Category 1 and

Category 2A to Category 3

|

|

30 August 2023

|

Puketapu

|

Re-categorisation from Category 2C* to Category 1

|

|

30 August 2023

|

Tamumu Bridge

|

De-categorisation of Category 2P area

|

|

30 August 2023

|

Waipawa

|

De-categorisation of Category 2P area

|

|

30 August 2023

|

Omāhu

|

Re-categorisation from Category 2P to Category 1, 2A

and 3

|

|

30 August 2023

|

Waiohiki (Springfield Rd)

|

Re-categorisation from Category 2P to Category 3 and

Category 1

|

|

19 Sept 2023

|

Mangaone, Rissington

|

Re-categorisation from Category 2P and 3 to Category 1,

2P and 3

|

|

2 October 2023

|

All Category 3 areas

|

Confirmed Category 3 areas in:

1. Arapaoanui-Arapawanui

2. Dartmoor

3. Esk

4. Mangaone

Rissington

5. Omāhu

6. Pākōwhai

7. Tangoio,

Te Ngarue, Pākuratahi

8. Waiohiki

- Springfield Rd

|

|

31 October 2023

|

Tangoio Beach

|

Re-categorisation from Category 2A to 3

|

|

6 Nov 2023

|

Omāhu

|

Re-categorisation from Category 2A to Category 2C

|

|

13 Nov 2023

|

Esk – Pohutakawa Drive / Whirinaki

|

Re-categorisation from Category 2A to Category 2C

|

|

5 Dec 2023

|

Tangoio Beach

|

Confirmed Category 3 for Tangoio Beach

|

Remaining

land categorisation decisions

|

Remaining Impacted Areas

|

Current Status

|

Intended Decision

|

|

Porangahau

|

Category 2A

|

Move to Category 2C and 2P to 1

|

|

Wairoa

|

Category 2A

|

Move to Category 2C to 1

|

|

Mangaone, Rissington

|

Category 2P

|

Move to Category 1

|

|

Tangoio Beach

|

Category 3

|

Confirm Category 3

|

|

Omāhu

|

Category 2C

|

Move to Category 1

|

|

Esk – Pohutakawa Drive / Whirinaki

|

Category 2C

|

Move to Category 1

|

|

Pākōwhai

|

Category 2C

|

Move to Category 1

|

|

Waiohiki

|

Category 2C

|

Move to Category 1

|

|

Havelock North

|

Category 2C

|

Move to Category 1

|

|

All Category 1 areas

|

Category 1

|

Confirm Category 1 boundaries

|

Next steps

53. There are five areas that

remain in Category 2C – Omāhu, Pohutakawa Drive / Whirinaki,

Pākōwhai, Waiohiki and Havelock North. Additionally, there are the two

remaining areas in Category 2A,

Porangahau and Wairoa, which are intended to move to Category 2C if viable solutions

can be identified.

Decision-making process

54. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

Hawke’s Bay Regional Council receives and notes the Land Categorisation update

staff report.

Authored by:

|

Jessica Easton

Legal Counsel

|

Matthew McGrath

Legal Counsel

|

|

Chris Dolley

Group Manager Asset Management

|

|

Approved by:

Attachment/s

|

1⇩

|

HBRC Land Categorisation Process and

Framework

|

|

|

|

HBRC Land Categorisation Process and

Framework

|

Attachment

1

|