Meeting of the

Corporate and Strategic Committee

Date: Wednesday 6 December 2023

Time: 11.00am

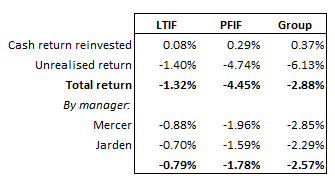

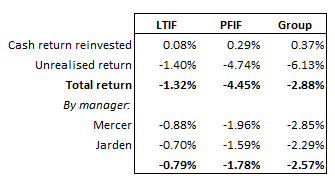

|

Venue:

|

Council

Chamber

Hawke's

Bay Regional Council

159

Dalton Street

NAPIER

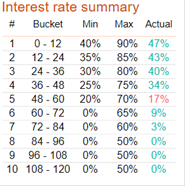

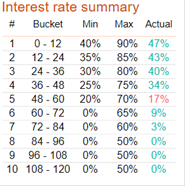

|

Agenda

Item Title Page

1. Welcome/Karakia/Notices/Apologies

2. Conflict

of Interest Declarations

3. Confirmation of Minutes of

the Corporate and Strategic Committee held on 20 September 2023

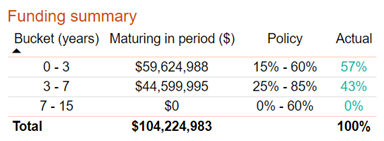

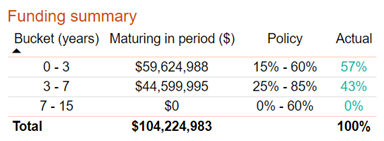

Information

or Performance Monitoring

4. Financial

report for the period 1 July - 30 September 2023 3

5. Organisational

Performance report for the period 1 July – 30 September 2023 9

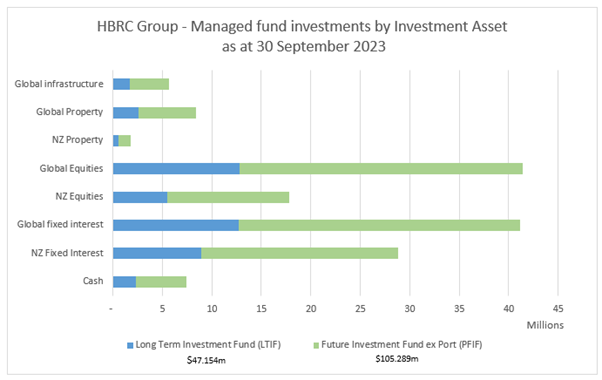

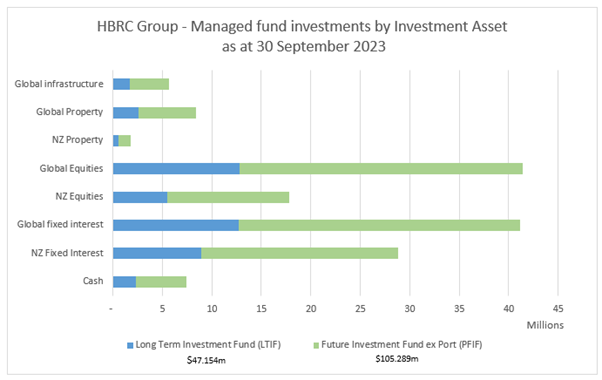

6. 2024

Long Term Plan project update 13

7. Treasury

Compliance report for Q1 FY 2023-2024 17

8. Investment

Strategy Review update 23

9. HBRIC

Ltd quarterly update 27

10. Port

of Napier 2022-2023 year-end results 39

Decision

Items (Public Excluded)

11. Confirmation

of 14 June 2023 Public Excluded Minutes 41

12. Confirmation

of 20 September 2023 Public Excluded Minutes 43

HAWKE’S BAY REGIONAL COUNCIL

Corporate and Strategic Committee

Wednesday

06 December 2023

Subject: Financial report for the period 1 July - 30 September 2023

Reason

for report

1. This item presents the Committee with

a summary of financial results for the first quarter of the 2023-2024 financial

year.

Executive

Summary

2. The overall funding position (operating

income, expenditure and capex) for the Council to 30 September 2023 was $4.7m

more favourable than budget, $6.3m favourable on business as usual (BAU)

activities and $1.6m adverse for cyclone related areas.

3. Year to date (YTD) operating income

from BAU activities was $4.5m against a budget of $5.1m with a shortfall in

Works Group external activity being the main factor as attention has been on

cyclone recovery.

4. Operating expenditure for the BAU

Groups of Activities for the three months to 30 September 2023 was $17.5m

against a budget of $22.8m. Asset Management and Integrated Catchment

Management have both seen delays in activities in the first quarter due to

cyclone recovery work and wet weather.

5. These factors have also seen BAU

capital expenditure (net of capital grants) being underspent by $1.6m for the

first quarter.

6. Cyclone related activities are overall

$1.6m adverse to budget for the first quarter. This represents NEMA and

insurance claims not being processed as quickly as planned and some areas of

expenditure not being as prominent as the even phasing of the budget would have

assumed.

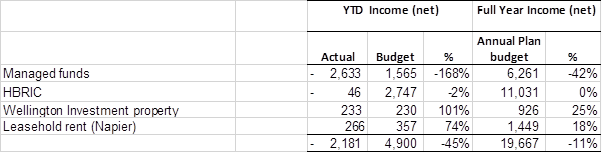

7. Investment income net of investment

expenditure shows a loss of $2.1m rather than the budgeted gain of $4.9m for

the quarter. This reflects the uncertainty around the HBRIC dividend.

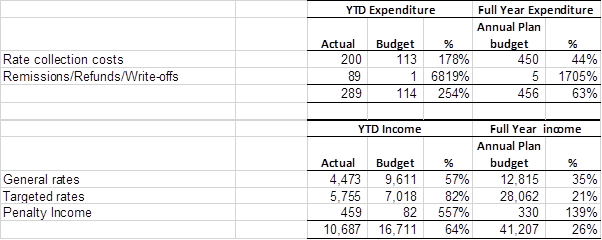

8. Rates income is $10.7m YTD and

reflects 26% of the annual budget. Rates remissions for extreme financial

hardship resulting from the cyclone are being processed and approved weekly and

are likely to be within the $500k allocated in the Annual Plan.

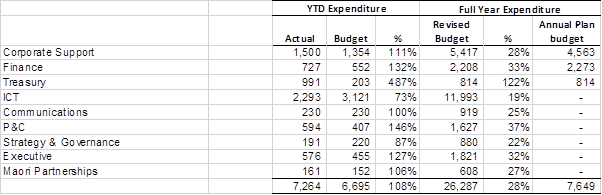

9. Overhead cost centers have

spend of $7.3m for the first quarter compared to a budget of $6.7m. Underspend

on ICT projects is offsetting overspends related to additional support work

post cyclone in other areas.

10. Staff are currently

designing a new look financial report for use from quarter two. This will more

closely align to the Annual Plan statements.

Background

11. Rates funding allocations, reserve

movements and loan funding have not been included in this report as these have,

historically, been calculated at year end.

12. Groups of activities (GOA) expenditure

include each activity’s external expenditure, internal staff time,

finance costs (interest and debt repayments), depreciation/amortisation and a

share of overheads. The operating income presented for each GOA, includes fees

and charges, user charges and recoveries and grants, and excludes rates, loans

or investment income (which are allocated to activities at year end).

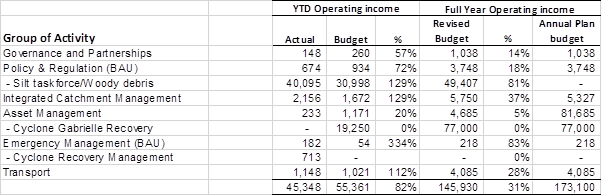

GOA

Operating income and expenditure ($,000)

13. Figures presented in the tables above

are in thousands.

14. Governance and Partnerships

expenditure is 7% over budget year to date.

14.1. Economic development expenditure is

over budget year to date by $0.6m due to the delayed establishment of the

Regional Economic Development Agency (REDA), which will be offset by external

income.

14.2. Tangata Whenua Partnerships is under

budget by $0.2m due to timing delay in engaging consultants to support Kotahi

engagement activities (anticipated to pick up in the new year).

15. Policy and Regulation income (after

excluding the Silt Taskforce) is $0.7m against a budget of $0.9m. On the

expenditure side this is at 70% of YTD budget, an underspend of $0.9m.

15.1. Under spends in compliance are a

result of low staff numbers and the subsequent reduced level of activity.

Transport overspend is due to the significant indexation increases.

15.2. Consents income is lower than budget

due to there being fewer resource consents and a significant amount of staff

time spent on non-recoverable activities, including training.

15.3. Transport income is favourable year to

date representing Waka Kotahi’s share of the indexation costs.

16. Integrated Catchment Managements

revenue is ahead of budget by $0.5m and expenditure is under budget by $1.7m.

16.1. The main underspends are

in biodiversity and catchment management where there were delays due to the

weather. Work is now well underway in Q2.

16.2. The revenue is ahead of

budget due to new third party funding agreements (including support for nature

based solutions for flood / drought mitigations).

17. Asset Management expenditure for the

three months totalled $3.3m against a budget of $5.2m.

17.1. Operating expenditure is underspent

across most LTP activities, especially in flood protection & control works

and open spaces, which will be driven by a focus on cyclone recovery work.

17.2. The shortfall in operating funding is

mainly due to the postponement of the Tangoio harvest and reduced external

contracting in Works Group.

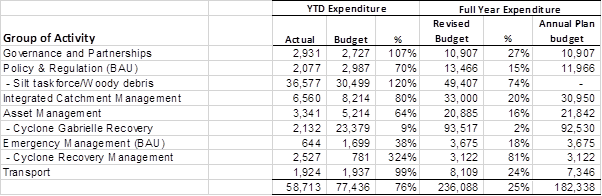

Capital

expenditure (net of capital grants) ($,000)

18. ICM was underspent on capital items by

$391k mostly in Land for Life due to the original use of capital not being

required during the pilot.

19. Asset Management capital expenditure

was underspent by $1.1m which is mostly in regional water security, where the

Heretaunga Water Storage project is on a go-slow pathway, and the CHB Water

Security project is progressing to a business case for a go/no go decision to

Council in June 2024. The total budget will not be required this financial year

(mix of Kanoa funding and long-term investment reserve).

20. Corporate Services ICT underspend of

$0.2m is due to the new treatment of software development costs as expenditure

rather than capital (it was budgeted as a capital spend).

21. Corporate services capital overspend

(excluding ICT) totals $0.2m, most of which is timing of vehicle renewals in

the first quarter this year.

22. The Cyclone Gabrielle response

operating and capital income and expenditure is overall $1.6m adverse to

budget.

22.1. Income from insurance and NEMA claims

had been budgeted evenly across the year, however, claims are taking longer to

be agreed.

22.2. Expenditure on silt and debris is

ahead of the budget timing but is being closely monitored to ensure it is

within the overall funding.

22.3. Expenditure on other recovery is

behind budget as the budget was spread evenly for the year based on the limited

information we had at the time.

Investment

income ($,000)

23. The income figures presented in the table

above are presented net of investment expenses, and exclude property fair value

gains (not yet assessed).

24. Managed Funds returns are as expected,

however, the portfolio values are impacted by the continuing downward trend of

global markets, pulling overall returns significantly down on budget.

25. The HBRIC annual budget includes the

dividends issued on the back of the Napier Port dividend. For accounting

purposes this has been spread over 12 months, while the actual dividends are

paid six-monthly on a cash basis in December and June. An accrual was not made

at Q1 due to uncertainty at the time of the likely dividend.

Rates

collection ($,000)

26. We have remitted $99k for extreme

financial hardship due to the cyclone. This was for 98 different

applications. We also have 53 pending application and anticipate a

possible further $110k in remissions based on the current applications.

Overheads ($,000)

27. Overhead costs overall are $0.6M

overspent.

27.1. Operating expenditure overspends are

in a number of areas including Communications, Corporate Support, Finance,

Investments and GIS. These largely relate to the increased workloads still

being experienced post cyclone, investment strategy support, and several annual

software licence costs coming due in the first quarter.

27.2. P&C are overspent by $187K with an

increase in H&S training due to a catch up in training requirements, plus

recruitment costs related to high staff turnover and a tight job market.

27.3. Executive is overspent by $121K

predominantly due to increased legal costs.

Debtors

28. Outstanding trade receivables for HBRC

as at 30 September 2023 was $24.6m compared to $10.4m at the end of the

2022-2023 financial year. The large increase relates to an $11.5m invoice to

Department of Internal Affairs for silt and debris and a $7.7m increase in

rates and sustainable homes due to the annual billing cycle (total outstanding

at 30 September 2023 $11.2m).

29. The balance of the debt (excluding

rates and DIA) of $1.9m mainly consists of outstanding freshwater science

charges ($0.7m), cyclone-related recoveries for helicopters and generators

($0.3m) and deferred leasehold rentals ($0.4m) which are fully recoverable when

the lease is sold.

Decision-making

process

30. Staff have assessed the requirements

of the Local Government Act 2002 in relation to this item and have concluded

that, as this report is for information only, the decision-making provisions do

not apply.

Recommendation

That the Corporate and Strategic Committee

receives and notes the Financial summary for the period 1 July - 30

September 2023 report.

Authored by:

|

Pam Bicknell

Senior

Group Accountant

|

Chris Comber

Chief

Financial Officer

|

Approved by:

|

Susie Young

Group Manager

Corporate Services

|

|

Attachment/s

There are no attachments for this

report.

HAWKE’S

BAY REGIONAL COUNCIL

Corporate and Strategic Committee

06

December 2023

Subject: Organisational Performance report for the period 1 July – 30

September 2023

Reason

for Report

1. This item presents the Organisational

Performance Report for the period 1 July – 30 September 2023.

Organisational

Performance Report content

2. The report contains four parts:

2.1. Executive summary continues to have a focus on our

region’s cyclone response (pp 4-6)

2.2. Corporate metrics that focus on how well we are

performing across a number of corporate-wide measures such as employee turnover

and corporate carbon footprint (pp 7-13)

2.3. Activity reporting by groups of activities with non-financial and financial traffic light status and commentary

(pp 14-27)

2.4. NEW Strategic Projects report that provides the most

recent monthly project management report on our 12 key strategic projects (pp

28-30).

3. Organisational performance reports

were established in 2018. The status and commentary reporting are rolled up

from cost centre to activity level. Commentary

by cost centre is still available to committee members via the PowerBI

dashboard (see points 16-20 below).

4. Staff complete their reporting in a

software tool called Opal3. For LOSM and activity reporting, staff select the

status (red, amber, green) and provide commentary on what they did in the

quarter against their annual work plans.

5. The financial ‘lines’ are

broken down (where applicable) to:

5.1. operating expenditure (opex) which

includes external costs only

5.2. capital expenditure (capex) which

includes external costs only

5.3. other revenue which includes fees and

charges, grants, and proceeds from other income – both opex and capex.

Points of

interest

6. Levels of service measures

are not included for the first quarter reporting.

Corporate

metrics (pp 7-13)

7. LGOIMA requests have dropped to 41

this quarter but are still high compared to an average of 25 per quarter over

the last five years.

8. Employee count of 365 staff remains at

a high due to the extra staff across the organisation brought in to help with

recovery.

9. Our customer experience team received

the highest number of calls in a month (August), with rates being the top

topic. This was higher than the peak of the cyclone response.

Activity

reporting (pp 14-27)

10. Staff have reported 13 activities as

‘off track’ from their usual workplans. This is down from 16 last

quarter. Most of these are from the Asset Management and Corporate Services

groups.

11. Financial reporting now shows

underspend as green rather than red. At this early period in the financial

year, most activities are reporting underspent budgets due to phasing.

Overspends are largely due to recovery cots.

12. The Executive Advisory Group of People

& Capability, Strategy & Governance and Māori Partnerships team

has been separated out from Corporate Services.

Strategic

projects reporting (pp 28-30)

13. This is new to the quarterly reporting

cycle. Strategic Projects were previously reported to Council monthly.

14. This most recent month (October 2023)

is presented as an ‘exceptions’ report meaning the commentary

highlights key issues rather than an overview. Emphasis is given to schedule,

budget and risk with a status flagged green (on track), amber (at risk) and red

(off track). The status is provided for the last six months.

15. The Reporting Dashboard (PowerBI) has

additional commentary not included in this report, which is edited for

readability.

Reporting

dashboard (PowerBI)

16. The dashboard is produced using

PowerBI to give a visual representation of the results over time. The

Organisational Performance Report document is produced from the dashboard.

17. The dashboard also provides committee

members with the ability to delve deeper into activities of interest (via cost

centres) particularly under Work Programmes. There is often more commentary in

the dashboard than in the published report.

18. To access the dashboard, please open

your PowerBI app on your iPad. The link to the dashboard is https://shorturl.at/csEQY. Staff from the Strategy and

Performance team are available to go over the dashboard with councillors who

would like to review its content.

19. Strategic projects commentary and

status by schedule, risk, and budget are updated on a monthly basis on the

dashboard. The most recent month is now included in the Quarterly

Organisational Performance Report presented to this committee on a quarterly

basis. Note that the last month of updates was October 2023.

20. We are continuously improving the

dashboard and improving the data reliability across all areas and would

appreciate any feedback you have.

Decision-making

process

21. Staff have assessed the requirements

of the Local Government Act 2002 in relation to this item and have concluded

that, as this report is for information only, the decision-making provisions do

not apply.

Recommendation

That the

Corporate and Strategic Committee

receives and notes the Organisational Performance Report for the period 1

July – 30 September 2023.

Authored by:

|

Hariza Adlan

Performance

& Data Analyst

|

Sarah Bell

Team Leader

Strategy and Performance

|

Approved by:

|

Desiree Cull

Strategy

and Governance Manager

|

|

Attachment/s

|

1⇨

|

HBRC Organisation Performance Report

Q1 2024 year

|

|

Under Separate Cover

|

HAWKE’S

BAY REGIONAL COUNCIL

Corporate and Strategic Committee

Wednesday

06 December 2023

Subject: 2024 Long Term Plan project update

Reason

for Report

1. This information paper provides the

Corporate and Strategic Committee with a progress update on the 2024-27 Long

Term Plan project. As per its terms of reference, the C&S Committee is

responsible for recommending actions, responses and changes to Council for

(amongst other things) oversight of the development of Council’s annual

and long term plans.

Background

2. The Local Government Act 2002 (LG Act)

requires the adoption of a Long Term Plan (LTP) every three years. The LTP

ensures councillors and staff take a long-term view of HBRC’s operations

and assets and the macro-factors influencing its business. The three-yearly

planning cycle provides an opportunity to consult with the community on the

community outcomes it aims to achieve, and the activities it funds to achieve

them.

3. The LTP must meet the requirements of

the LGA 2002, in terms of both content and process (including timing,

consultation, decision-making and audit). As a document, it includes financial,

asset and service performance information.

4. As a process, the LTP contains a lot

of moving parts (referred to by Taituarā as the LTP Jigsaw). As such it

requires careful sequencing of information and recording of decisions. It

involves staff from across HBRC who must actively engage elected members as the

owners of the plan.

5. This is HBRC’s eighth Long Term

Plan under the LG Act. Like in previous years, staff manage its

development as a project.

Project

goals

6. The LTP project goals are to develop a

‘fit for purpose’ LTP in consultation with our community that:

6.1. Sets the overall direction of HBRC for

the period 2024-2034

6.2. Defines what activities, services and

projects HBRC will deliver and how it will deliver them

6.3. Complies with legislation.

Project

scope

7. In September 2023, an Order in Council

under the Severe Weather Emergency Recovery Act (SWERLA) was made to replace

the 10-year 2024 Long Term Plan with a three-year unaudited plan and relax some

disclosure requirements for eight councils. This temporary change is to enable

these eight councils - Kaipara and Far North District Councils, Gisborne, and

all councils within the Hawke’s Bay region - to focus on cyclone

recovery.

8. It recognises that the affected

councils will find it too hard to forecast spending beyond three years with

enough certainty to meet the standards required under normal LTP

requirements.

9. Under the new legislative requirements

the Council is still required to consult and must adopt its Long Term Plan by

30 June 2023.

Project

timeline

10. The table below shows the key dates

for the project, including consultation in April 2024.

|

Date

|

Milestone

|

|

June -Aug 2023

|

Strategic-direction setting

|

|

Aug-Oct 2023

|

Top down budgeting

|

|

Oct-Nov 2023

|

Content pieces - Forecasting Assumptions, Infrastructure

Strategy, Level of Service measures

|

|

Nov-Jan 2024

|

Detailed budgeting

|

|

Feb-March 2024

|

Consultation material developed

|

|

27 March 204

|

Council adopts draft for consultation

|

|

April 2024

|

Public consultation

|

|

May 2024

|

Hearings and Deliberations

|

|

June 2024

|

Council adopt Long Term Plan

|

Project

risks

11. Council’s is facing

a challenging financial outlook leading into this long term plan. Council is

committed to delivering a $247M flood mitigation works programme for Category 2

properties while facing inflationary cost increases and reduced funding options

due to investment returns and borrowing carried out for the previous LTP.

Project

interdependencies

12. At the same time as the

development of the Long Term Plan, Council is working on two interrelated

documents, being a review of its Revenue and Financing Policy (R&F Policy)

and its Regional Land Transport Plan (RLTP).

13. The Draft R&F Policy

was adopted for consultation on 29 November 2023, for a period of 8 weeks.

Following hearing and deliberating on submissions, the Council will decide

whether to adopt the new policy at the council meeting at the end of February. If

adopted, the new policy will take effect from 1 July, the first year of the

2024 Long Term Plan. The R&F Policy sets how we fund our activities such as

the split between general rates, targeted rates and user-charges. The LTP

determines which activities are funded.

14. The RLTP sets the

strategic direction of our regional transport system (including all roads and

modes of transport) and the 10-year transport priorities, as well as the policy

environment that will help support and enable them. The RLTP is the statutory

responsibility of the Regional Transport Committee (RTC), a joint Committee

made up of all Territorial Authority Councils, HBRC, Waka Kotahi, and advisory

representatives from key areas of our community. Consultation on the RLTP is

planned for February 2024.

15. The RLTP is the single

avenue to secure funding through the National Land Transport Fund (NLTF). Funds

are allocated based on the applicable Funding Assistance Rate (FAR). Typically

Waka Kothi will provide up to 51% of the total cost. The remaining amount must

be sought through the relevant council’s LTP process. In the case of

HBRC, this is for Public Transport and Road Safety.

Decision-making

process

16. Staff have assessed the requirements

of the Local Government Act 2002 in relation to this item and have concluded

that, as this report is for information only, the decision making provisions do

not apply.

Recommendation

That

the Corporate and

Strategy Committee receives and notes the 2024 Long Term Plan project update

report.

Authored by:

|

Desiree Cull

Strategy

and Governance Manager

|

|

Approved by:

Attachment/s

There are no attachments for this

report.

HAWKE’S

BAY REGIONAL COUNCIL

Corporate and Strategic Committee

06

December 2023

Subject: Treasury Compliance report for Q1 FY 2023-2024

Reason for Report

1. This item provides compliance

monitoring of Hawke’s Bay Regional Council (HBRC) treasury activity and

reports the performance of Council’s investment portfolio for the quarter

ended 30 September 2023.

2. This reports usually forms an agenda

item on the Risk and Audit Committee, however, due to the timing of the next

RAC being February 2024, officers thought it was prudent for oversight purposes

to bring to this forum.

Overview

of the quarter – ending 30 September 2023

3. At the end of the quarter to 30

September 2023, HBRC was compliant with all measures in its Treasury Policy

with the exceptions of:

3.1. the interest rate risk control

limit.

3.2. the counterparty risk policy during

the period.

4. Cyclone Gabrielle has impacted both

cash balances and borrowing requirements, with ongoing additional borrowing

required to fund the recovery. Insurance proceeds when received will

soften the effects of additional borrowing. The full impact of the cyclone

on long-term funding is yet to be determined.

5. Additional borrowing has implications

on the liquidity ratio and credit rate risks.

Background

6. Council’s Treasury Policy

requires a quarterly Treasury Report to be presented to the Audit and Risk

Sub-committee. The policy states that the Treasury Report is to include:

6.1. Treasury Exceptions report

6.2. Policy compliance

6.3. Borrowing Limit report

6.4. Funding and liquidity report

6.5. Debt maturity profile Interest rate

report

6.6. Investment management report **(see

point 7)

6.7. Treasury investments

6.8. Cost of funds report Cash flow and

debt forecast report

6.9. Debt and interest rate strategy and

commentary

6.10. Counterparty credit report

6.11. Loan advances.

7. The Investment Management Report** has

specific requirements outlined in the Treasury Policy. This requires quarterly

reporting on all treasury investments plus annual reporting on all equities and

property investments.

8. In addition to the Treasury Policy,

Council has a Statement of Investment Policy and Objectives (SIPO) document

setting out the parameters required for funds under management for the HBRC

Long Term Investment Fund.

9. Since 2018, HBRC has procured treasury

advice and services from PricewaterhouseCoopers (PwC) and their confidential

quarterly Treasury Report containing the reports noted in paragraph 6 is

provided to Committee members in Stellar.

Treasury

exceptions report & policy compliance

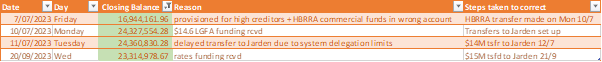

10. During the quarter to 30 September

2023, there were 4 instances of noncompliance with the HBRC counterparty risk

policy as outlined below.

11. In all cases, the purpose behind the

transfers being made to Jarden (of which sat with ANZ) was to ensure that short

term returns (through higher interest rates) were received by Council rather

than large sums of funds held in non-interest bearing facilities.

Jarden have supported HBRC in cyclone activities and funding with offering

limited fees to support our cyclone work.

12. The counterparty breaches were

corrected as soon as practical and officers can foresee this becoming more

difficult to manage within existing policy limits due to the increase in

expenditure required as part of Council recovery activities.

13. Officers will be recommending a review

of these limits in the Treasury Policy as part of the LTP process

14. HBRC is currently non-compliant with

interest rate risk control limits as follows:

15. This is mainly due to the delays in

firming up our long term debt requirements as this poses greater risk of over

or under hedging until confirmed. Officers intend that this will be back within

policy by 31 March 2024.

Funding

& Liquidity

16. To ensure HBRC has the ability to

adequately fund its operations, current policy requires HBRC to maintain a

liquid balance of “greater than 10% of existing total external

debt”. Current liquidity ratio is 23.73% and therefore meets policy.

17. The following table reports the cash

and cash equivalents on 30 September 2023.

|

30 September

2023

|

$000

|

|

Cash on

Call

|

18,550

|

|

Short-term

bank deposits

|

-

|

|

Total

Cash & and Deposits

|

18,550

|

18. To manage HBRC liquidity risk, HBRC

retains a Standby Facility with BNZ. This facility

provides HBRC with a same day draw down option, to any amount between

$0.3-$10.0m, and with a 7 day minimum draw period.

Debt

Management

19. On 30 September 2023 the current

external debt for the Council group was $99.35m. At 30 September

HBRC had no pre-funded debt. ($115.9m including the loan from HBRIC).

20. Since the June quarter an additional

$15m in borrowings were received to assist with increased cash requirements

following Cyclone Gabrielle. $5m of this funding is short-term, with the

remaining $10m is medium term.

21. The following summarises the

year-to-date movements in Council’s debt position.

|

Summary

of HBRC Debt

|

HBRC only

|

|

$000

|

|

Opening

Debt 1 July 23 -

excluding HBRIC Loan

|

84,830

|

|

New Loans

Raised (principal only)

|

30,000

|

|

Less

amounts paid (principal only)

|

(15,480)

|

|

Closing Debt 30 September 2023

|

99,350

|

|

Net

Interest repaid on LGFA coupons not included in PwC balances

|

(125)

|

|

PwC Closing balance 30 September 2023

|

99,225

|

|

HBRIC Loan (Related

party loan)

|

16,663

|

|

Total Borrowings as at 30 September 2023

|

115,888

|

22. Council debt maturity profile remains

compliant, however continued short term drawdowns continues to put pressure on

the policy limit in the 0-3 year bucket. This will remain high while we

work through the cyclone funding. The below infographic includes our $5m

Undrawn bank facilities in 0-3 year bucket for the purposes of the funding

profile.

23. During the quarter ended 30 September,

Council have borrowed a further $15m on in the and are forecasting further

drawdowns being required in Q3 between 1 January 2024 and 31 March 2024.

However, the amounts required and timing is yet to be confirmed and will depend

on the execution of the capital programme planned and further cyclone repairs

between now and then.

24. Any insurance or NEMA proceeds will be

used to repay the short-term debt which is currently c$30m.

Cost of

funds

25. For the quarter ended 30 September

2023, Gross Cost of Funds was 3.29%.

26. HBRC are progressing with the proposal

to obtain a credit rating in early 2024 to support future funds required to

support our business for the future required funding for Category 2 Flood

Mitigation.

Managed

Funds

27. Total Investment Fund portfolios

capital, adjusted for inflation at 30 September 2023 was $14.375m below the inflation-adjusted

contribution target. Based on results to date and the value of the protected

amount of funds, funds held are not sufficient to deliver the returns required

to meet Council’s requirement. No divestments have been made from managed

funds this year.

28. The following table summarises the fund balances at the end of each

period and the graph illustrates the asset allocations within each fund at 30

September 2023.

|

|

30

June 2023

|

30

Sept 2023

|

|

Fund

Balances HBRC

|

$000

|

$000

|

|

Fund

Balance HBRC

|

110,828

|

108,039

|

|

Capital

Protected Amount HBRC (2% compounded since inception)

|

116,541

|

117,124

|

|

Current

HBRC value above/(below) capital protected

amount

|

(5,713)

|

(9,085)

|

|

Funds

Balances (Group + HBRIC)

|

|

Total

HBRC

|

110,828

|

108,038

|

|

Plus

HBRIC

|

45,638

|

44,415

|

|

Total

Group Managed Funds

|

156,467

|

152,453

|

|

Capital

Protected Amount (2% compound inflation)

|

165,999

|

166,828

|

|

Current

group value above/(below) protected amount

|

(9,532)

|

(14,375)

|

29. Financial markets have continued to be

volatile this year and at 30 September the consolidate portfolio value was down

2.57% on 30 June 2023. Fund performances have been steady this year with

all cash returns reinvested.

Decision

Making Process

30. Staff have assessed the requirements

of the Local Government Act 2002 in relation to this item and have concluded

that, as this report is for information only, the decision-making provisions do

not apply.

Recommendation

That the Corporate and Strategic Committee

receives and notes the Treasury Compliance report for Q1 2023-2024.

Authored by:

|

Jess Bennett

Senior

Manager Finance Recovery

|

Tracey O'Shaughnessy

Treasury

& Investments Accountant

|

Approved by:

|

Susie Young

Group

Manager Corporate Services

|

|

Attachment/s

There are no attachments for this

report.

HAWKE’S

BAY REGIONAL COUNCIL

Corporate and Strategic Committee

06

December 2023

Subject: Investment Strategy Review update

Reason

for report

1. This paper provides a high level

update to the Committee on progress with implementing the steps being taken to

address phase 2 work of the Investment Strategy review of HBRC and HBRIC

entities.

Executive

Summary

2. A joint HBRC-HBRIC Investment Review

Implementation project team has been established through to 30 June 2024 to

proactively address transition activities as identified as phase 2 actions of

the Investment Strategy review.

3. The project team will ensure a smooth

transition of responsibilities, to ensure appropriate reporting, controls and

delegations are in place, and to maintain good alignment and line of sight for

both organisations on those parts of Council’s LTP Financial Strategy

that are impacted by the Investment Strategy.

4. HBRIC intend to propose to Council the

Statement of Investment Policy and Objectives (SIPO), for endorsement on 13

December 2023. This SIPO is a revised document to enable better returns across

our managed funds and ensure return expectations can be achieved.

Background

5. The outcome of HBRC’s Investment

Strategy review, led by Susie Young and Scott Hamilton, was manifested in a

series of resolutions of Council on 25 October 2023. These resolutions

triggered a series of implementation steps including, but not limited to:

5.1. HBRC to issue an updated Statement of

Expectations (SoE) to HBRIC – this has been completed and formally issued

to HBRIC following that meeting as final.

5.2. The following actions are underway and

are likely to be presented back to Council for approval in the coming months:

5.2.1. HBRIC to submit an updated SIPO for

council approval in relation to the Group’s Investment Assets.

5.2.2. HBRIC to submit an updated Statement

of Intent (SoI) that reflects the SoE in the first quarter of 2024 for Council

approval.

5.2.3. HBRIC and HBRC to collaborate on the

development of the Financial Strategy for 24/33 Long Term Plan (for Investment

Strategy related matters).

5.2.4. HBRIC to review its own operational

and investment strategy to accommodate the changes to the SoE and to implement

accordingly.

Discussion

6. HBRIC and HBRC are underway with

planning to execute the transition of asset investment management

responsibilities as directed by the SoE.

7. The following table sets out the

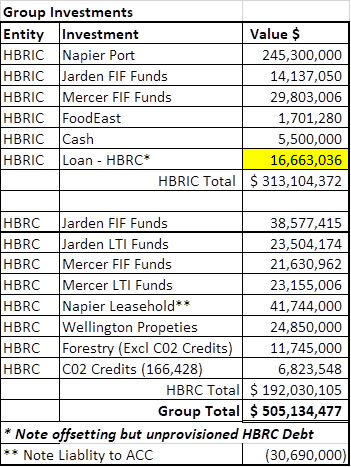

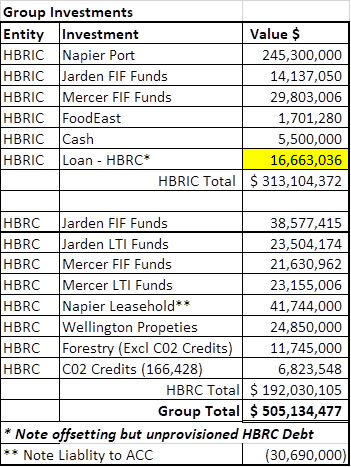

Group’s investment assets and approximate value:

8. A joint HBRC/HBRIC project team (with

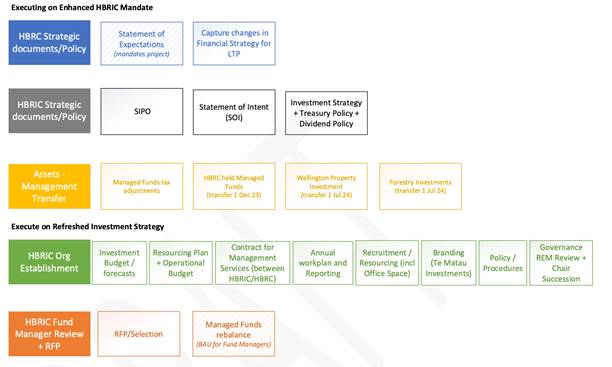

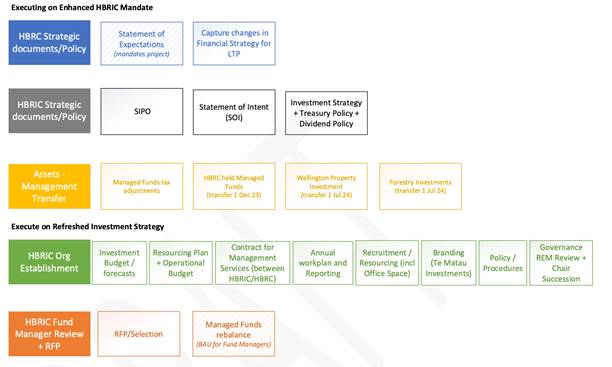

Dan Druzianic and Susie Young as project sponsors) has been established to

drive these outcomes that have been committed to. Initial scoping of

workstreams include those outlined in the table below.

9. All activities will and need to be

aligned with all proposed activities across our Long Term Plan specifically the

Investment Strategy, Treasury Policy and Dividend Policy outlined in the LTP.

10. The new Independent Directors of

HBRIC, including current members remain motivated in ensuring the success of

the Investment Strategy outcomes.

11. In order to execute and give HBRIC

confidence and ability to execute on long term (and short term) deliverables,

it is likely that HBRC will require changes in the articulation of how

strategic and non-strategic assets may be used. Current descriptions used

in the Long Term Plan limit ability to use (for the purposes to make further

returns) our strategic assets. As such there are limited opportunities to

improve returns as in some instances funds are “locked down”.

Next

Steps

12. Challenges are already existing with

the proposed SOE finalised, and budgetary constraints presented in the LTP. It

is expected that further engagement may be required with the HBRIC board should

small changes be needed in Y1 return expectations.

13. The implementation team will continue

to finalise:

13.1. The Budgets for the expanded HBRIC team

and functions (staff, board, accommodation, due diligence). This will be

partially offset by savings inside Council.

13.2. Create a dividend policy to allow both

a feed into 2024 LTP and achieve a Letter of Expectation and Reserving

objectives.

13.3. HBRIC to create a SIPO to achieve the

objectives of the HBRC/HBRIC Group.

13.4. Bring a recommendation on Strategic

Assets to the Long Term Plan meetings.

Decision-making

process

14. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendations

That the Corporate and Strategic

Committee receives and notes the Investment Strategy Review update report.

Authored by:

|

Tom Skerman

HBRIC

Commercial Manager

|

|

Approved by:

|

Susie Young

Group

Manager Corporate Services

|

|

Attachment/s

There are no attachments for this

report.

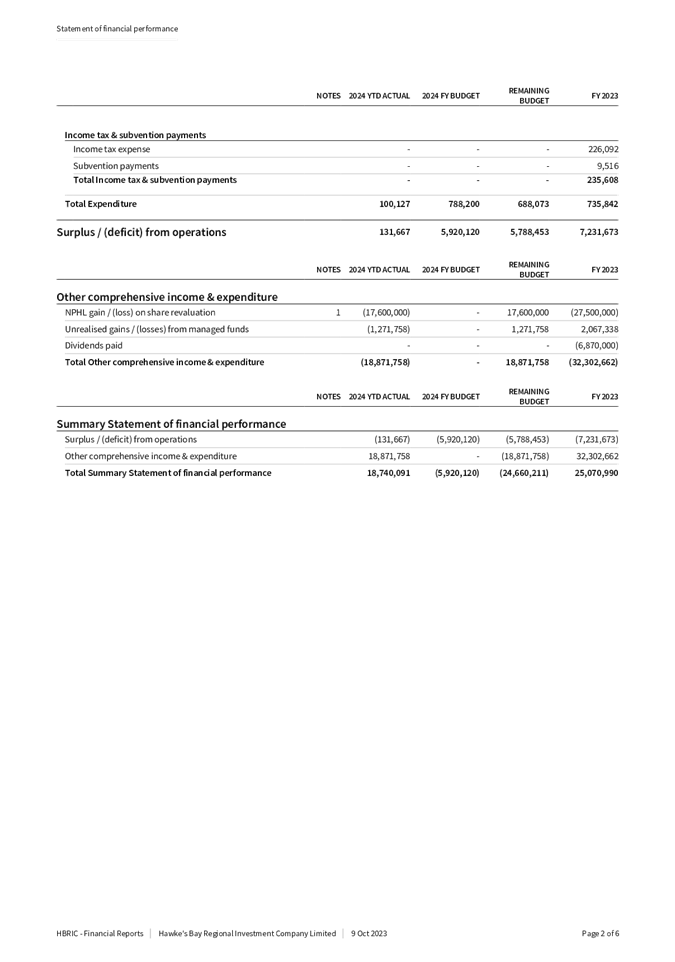

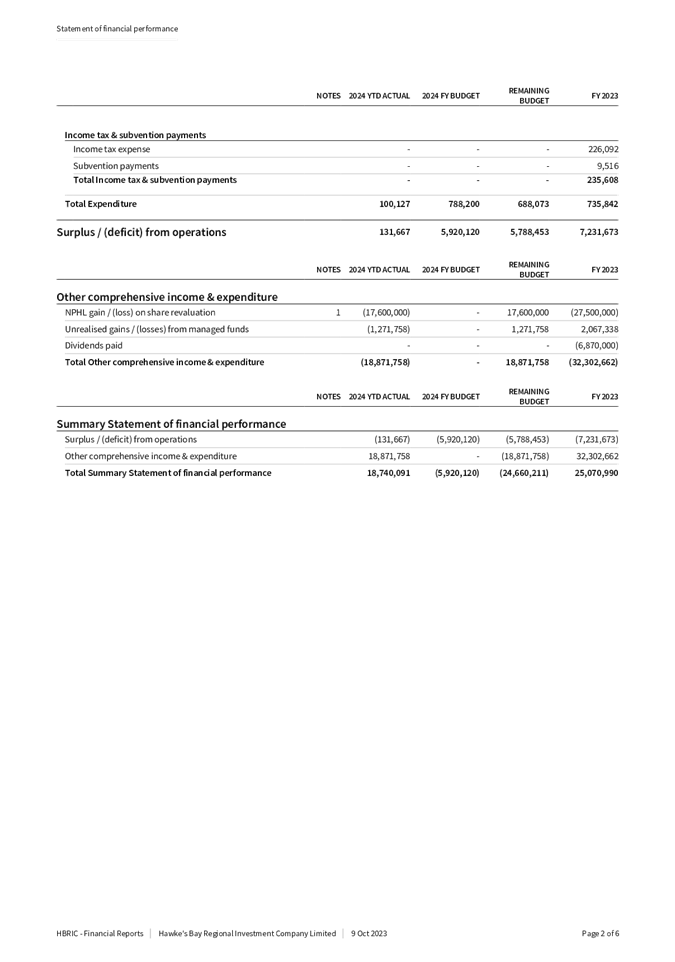

HAWKE’S

BAY REGIONAL COUNCIL

Corporate and Strategic Committee

Wednesday

06 December 2023

Subject: HBRIC Ltd quarterly update

Reason for Report

1. This item presents the HBRIC quarterly

update for Q1 July to Sept 2023.

Financial

Reporting

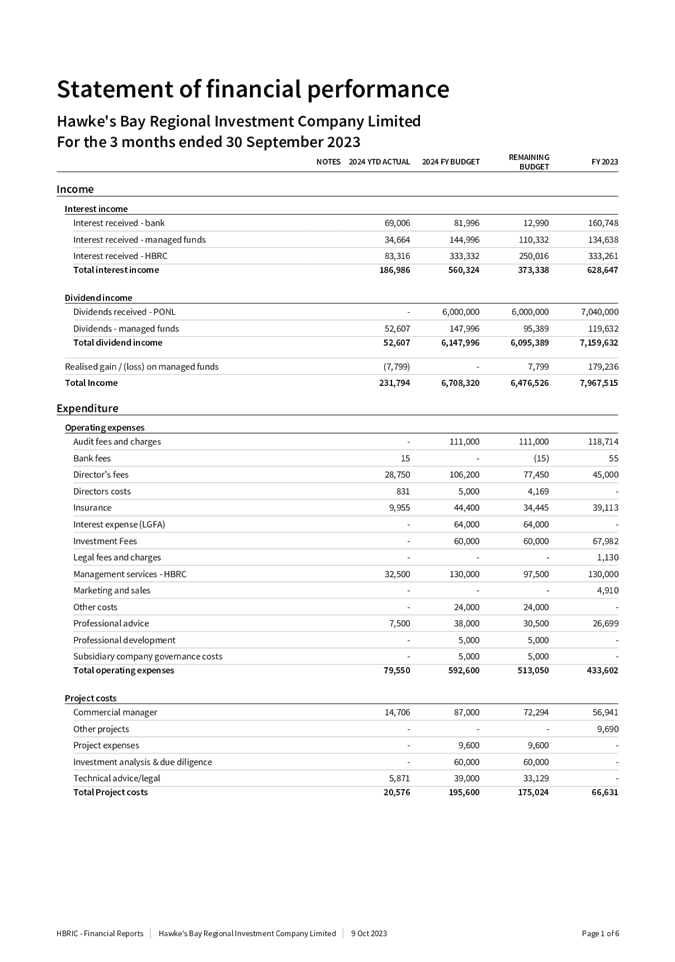

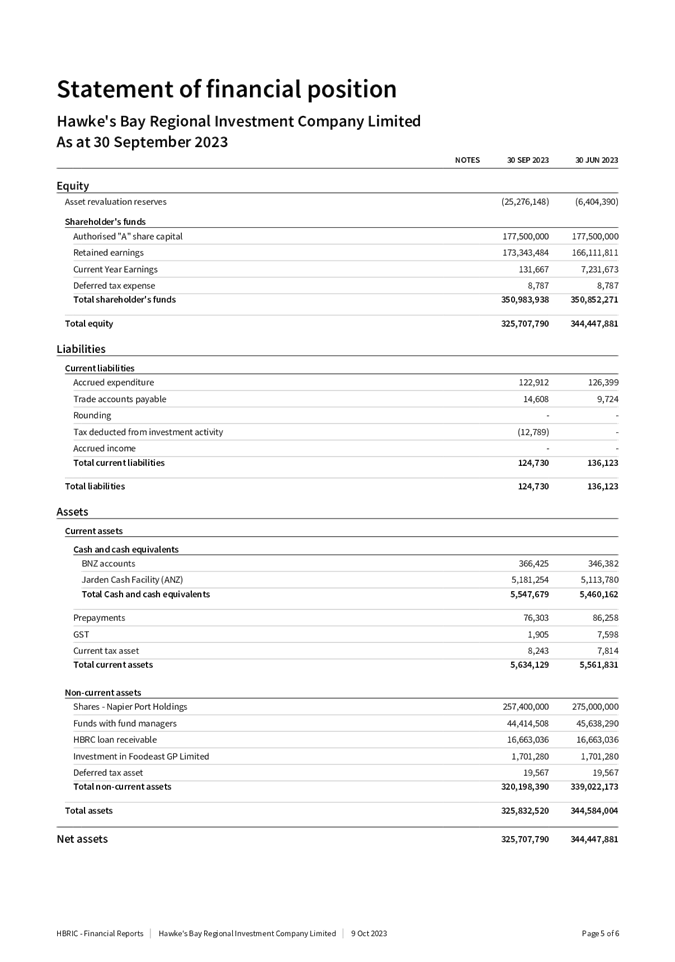

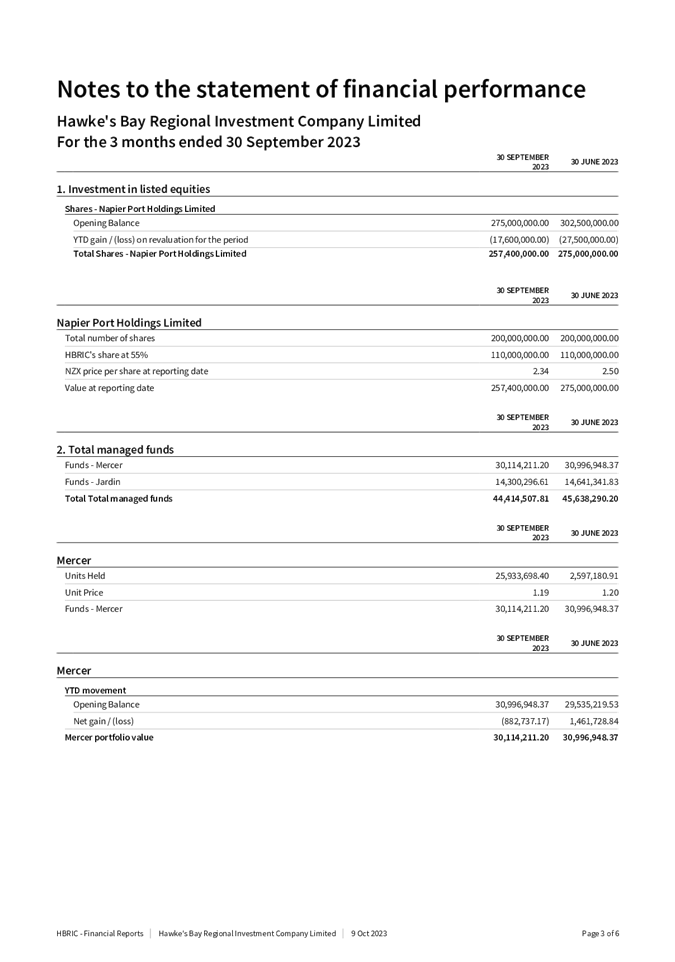

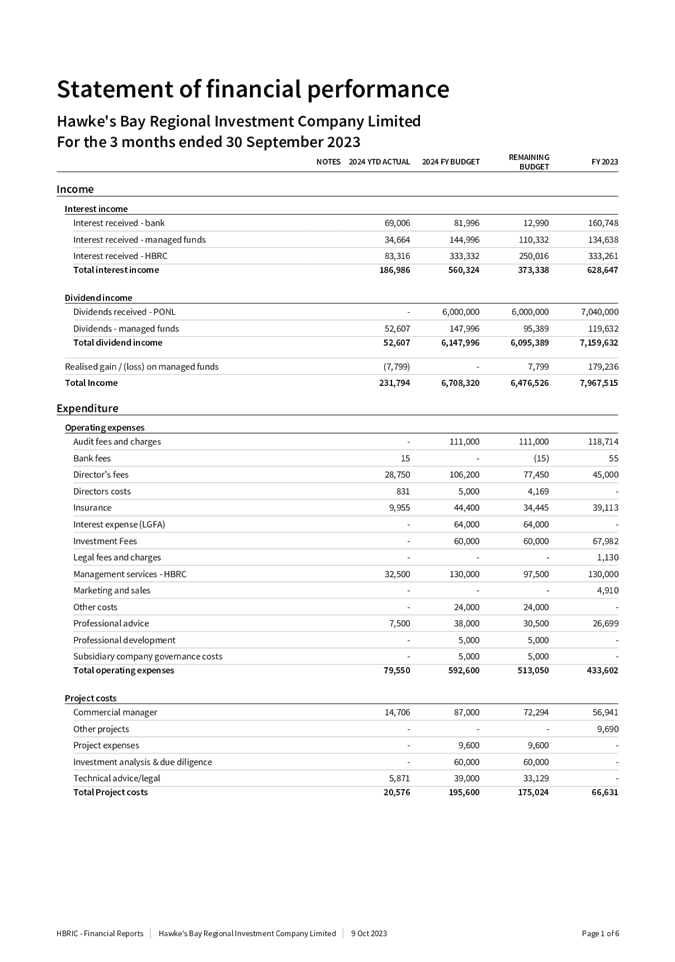

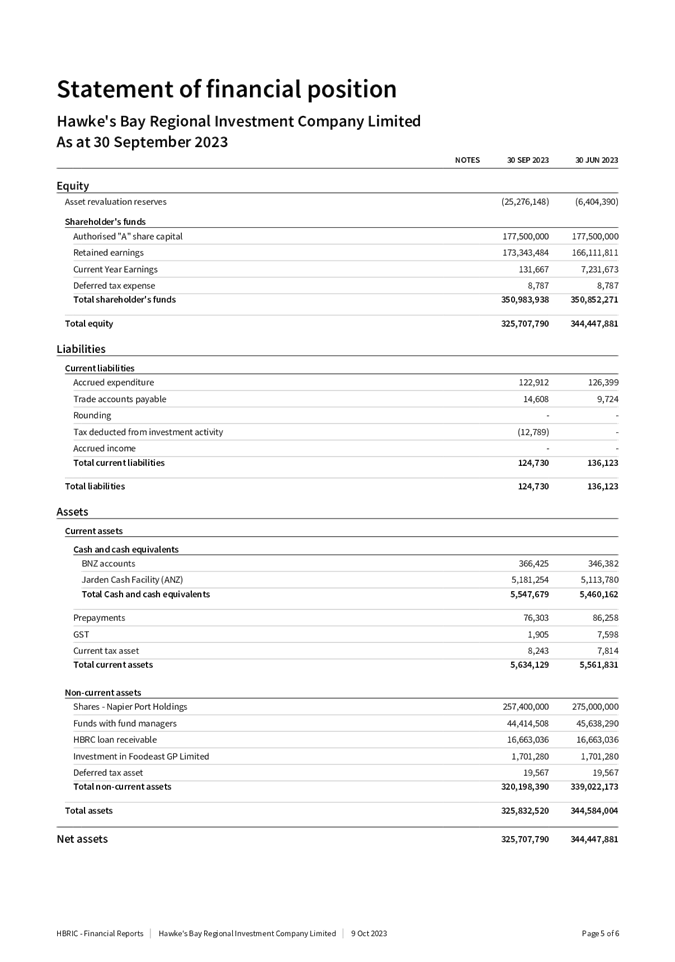

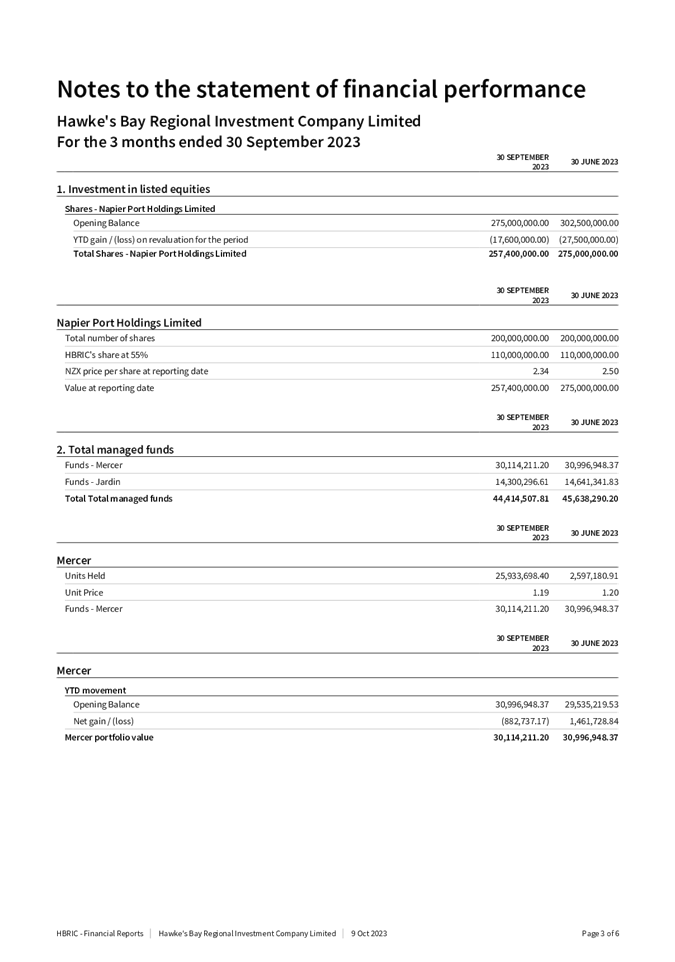

2. HBRIC’s YTD Financial Statements

as at 30 September 2023 are attached to this report.

3. Key Items to note:

3.1. Statement of Financial Performance

3.1.1. YTD surplus of $131k (excluding fair

value movements through other comprehensive income)

3.1.2. YTD $186k interest income

3.2. Statement of Financial Position

3.2.1. Decrease in net assets of $18.7m to

$325.7m as at 30 September 2023.

3.2.2. NPHL share price had decreased YTD 6%

from $2.50 to $2.34 – total decrease is $17.6m

3.2.3. Decrease in managed fund value of

$1.2m

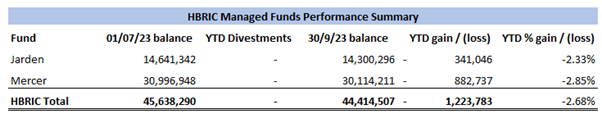

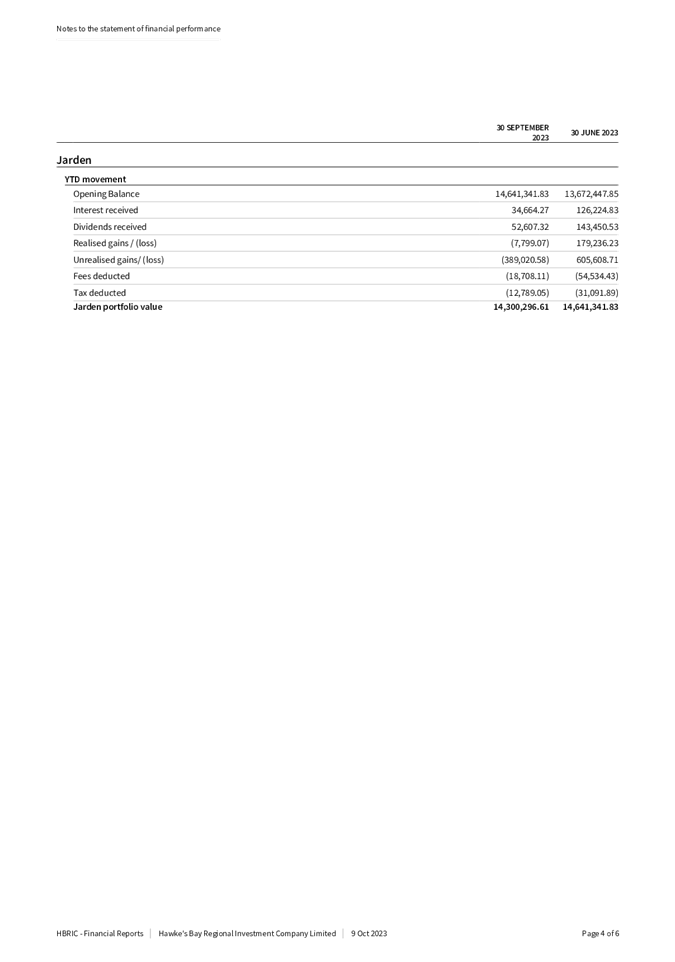

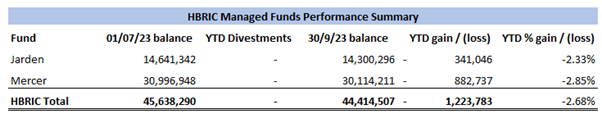

Managed

Funds

4. The funds remain under management in

compliance with Council’s SIPO.

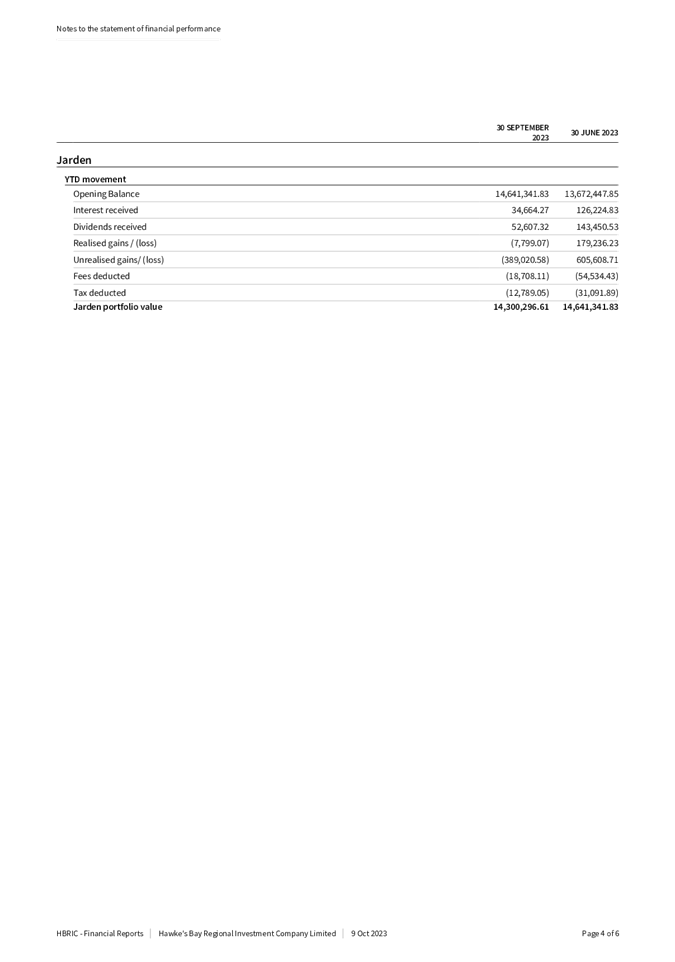

5. The value of managed funds with HBRIC

after divestments as at 30 September 2023 amounted to $44.4 million, a movement

of approximately -$1.2m (-2.68%) year to date.

FoodEast

6. Since the last report:

6.1. The FoodEast AGM took place on 9

October 2023 – with the HBRIC Chair thanking outgoing HBRIC director

Craig Foss for his efforts.

6.2. The new FoodEast Board held an

induction and first meeting on 17 October 2023, at which HBRIC-appointed

Director Nicky Solomon was appointed as the new FoodEast Chairperson.

6.3. The FoodEast Board hosted a Strategy

Refresh workshop on 13 November 2023 involving FoodEast partners (including

HBRC’s Chairperson) and industry experts.

7. Building update:

7.1. The building project continues on time

and budget.

7.2. Building A: is now ‘water

tight’, with roofing, walls and windows fitted. It is due for

completion in March 2024.

7.3. Building B: is due for completion at

the end of this month although the site remains a construction zone until

building A has been completed.

Napier Port

8. Napier Port released their FY23

Financial Results on 14 November 2023 and will hold their Annual Shareholders

Meeting on 15 December 2023.

9. New shipping services calling into

Napier, new customers, and cargo arriving through the gates created buoyant

cargo flows. Strong growth of trade revenue in the first half

demonstrated the Port’s ability to deliver under “normal”

circumstances.

10. Cyclone Gabrielle affected customers,

exporters and regional infrastructure, diluted trade volumes and dented the

rebound gains since the pandemic. However, good progress in regional

recovery efforts, key export trade positivity and increased cruise activity

sees the port now looking to a resumption of earlier momentum.

11. Highlights included a revenue rise of

3.5% to $118.4 million on the back of yield improvements and the return of

cruise vessels, while operating activities fell 7.1%. However, inflationary

cost pressures were not fully offset by the increase in revenue.

12. Insurance claims of $7.25 million

contributed to earnings.

13. Net profit after tax dropped from

$18.6 million in 2022 to $10.7 million. Reported net profit is down 18.8%

from $20.4 million to $16.6 million.

14. Final dividend was declared at 3.55

cents, fully imputed, bringing the total dividends for the 2023 financial year

to 5.25 cents per share (7.5 cents per share in 2022).

HBRC

Investment Strategy

15. As resolved by Council at its 25

October meeting, a new Statement of Expectations was issued to the HBRIC board

on 9 November, reflecting that wider suite of workshop outputs and formal

resolutions that were made to conclude HBRC’s Investment Strategy Review.

16. At its 27 November 2023 Board Meeting,

HBRIC held a workshop dedicated to implementation of the changes to give effect

to Council’s decision to assume the role of Investment Manager for the

Group’s investment assets, including managed funds, investment property

and forestry assets (that will continue to remain in HBRC ownership).

17. Ahead of that meeting, a joint

HBRC-HBRIC Investment Review Implementation project team has been established

through to 30 June 2024 to ensure a smooth transition of responsibilities

occurs, to ensure appropriate reporting, controls and delegations are in place,

and to maintain good alignment and line of sight for both organisations on

those parts of Council’s LTP Financial Strategy that are impacted by the

Investment Strategy.

Decision-making

process

18. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, ass this report is for information only, the decision-making

provisions do not apply.

Recommendations

That the

Corporate and Strategic Committee receives and notes the HBRIC Ltd quarterly

update report.

Authored by:

|

Jess Bennett

Senior

Manager Finance Recovery

|

Tracey O'Shaughnessy

Treasury

& Investments Accountant

|

|

Tom Skerman

HBRIC

Commercial Manager

|

|

Approved by:

|

Susie Young

Group

Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

HBRIC Ltd Financial Reports Q1 2024

year

|

|

|

|

2⇩

|

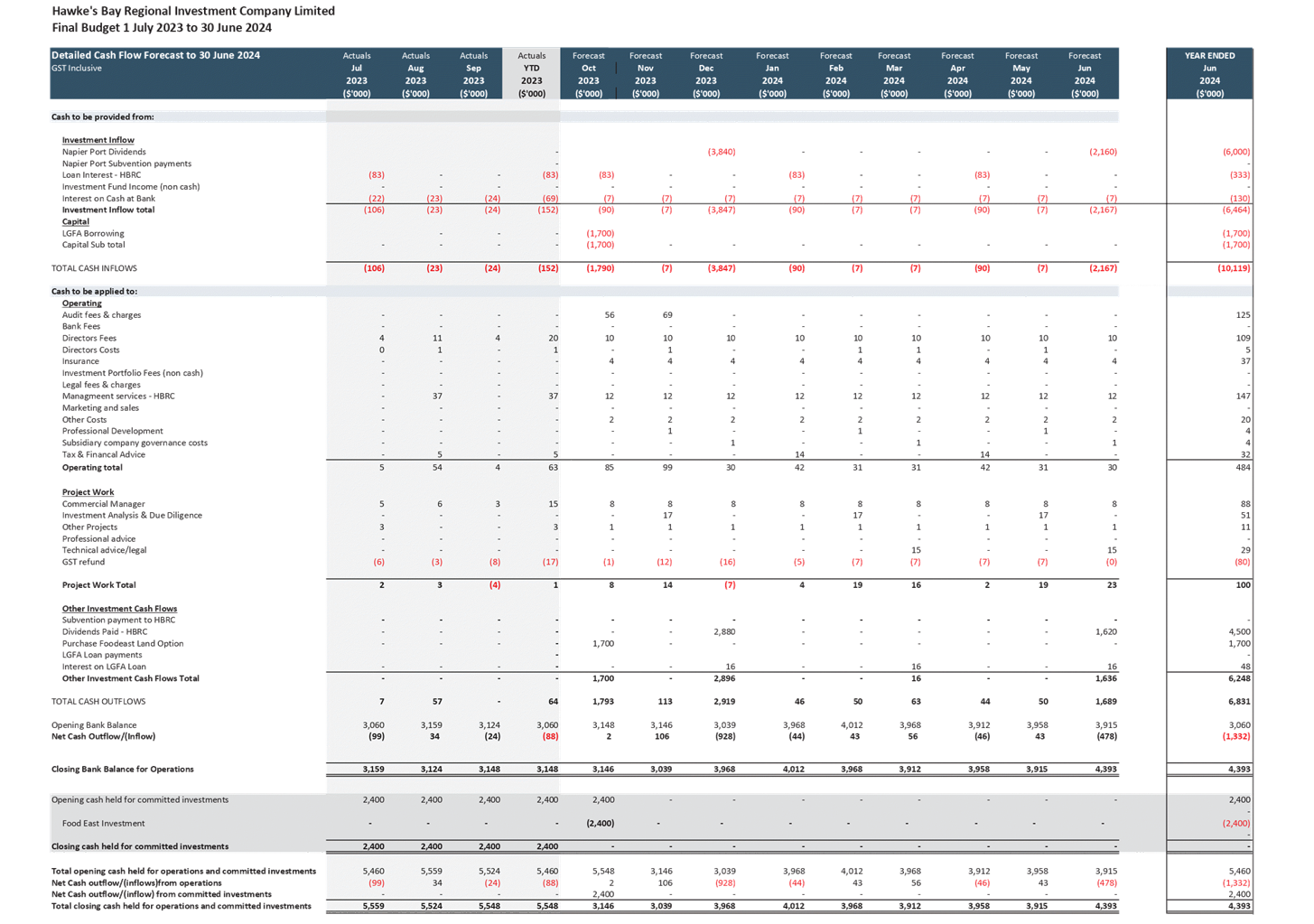

September 2023 HBRIC Ltd Cashflow

2023 to 24

|

|

|

|

HBRIC Ltd Financial Reports Q1 2024 year

|

Attachment

1

|

|

September 2023 HBRIC Ltd Cashflow 2023 to 24

|

Attachment

2

|

HAWKE’S

BAY REGIONAL COUNCIL

Corporate and Strategic Committee

Wednesday

06 December 2023

Subject: Port of Napier 2022-2023

year-end results

Reason for Report

1. This item introduces the Napier Port presentation

of the 2022-2023 financial year results, which will be presented in person at

the meeting.

Decision

Making Process

2. Staff have assessed the requirements

of the Local Government Act 2002 in relation to this item and have concluded

that, as this report is for information only, the decision-making provisions do

not apply.

Recommendation

That the Corporate and Strategic Committee

receives and notes the Napier Port 2022-2023 year-end results presentation.

Authored by:

|

Susie Young

Group Manager

Corporate Services

|

|

Approved by:

|

Susie Young

Group

Manager Corporate Services

|

|

Attachment/s

There are no attachments for this

report.

Hawke’s Bay Regional Council

Corporate and Strategic Committee

Wednesday

06 December 2023

Subject:

Confirmation of 14 June 2023 Public Excluded Minutes

That the Corporate and

Strategic Committee excludes the public from this section of the meeting being

Confirmation of Public Excluded Minutes Agenda Item 11 with the

general subject of the item to be considered while the public is excluded. The

reasons for passing the resolution and the specific grounds under Section 48

(1) of the Local Government Official Information and Meetings Act 1987 for the

passing of this resolution are:

|

General subject of the item to

be considered

|

Reason for passing this

resolution

|

Grounds under section 48(1) for

the passing of the resolution

|

|

Port of Napier 2022-2023 Half

Year results

|

s7(2)(c)(ii) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of that information is necessary to protect

information which is subject to an obligation of confidence or which any

person has been or could be compelled to provide and would be likely

otherwise to damage the public interest

|

The Council is specified, in

the First Schedule to this Act, as a body to which the Act applies.

|

|

HBRIC independent director

remuneration

|

s7(2)(i) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to enable

the local authority holding the information to carry out, without prejudice

or disadvantage, negotiations (including commercial and industrial negotiations)

|

The Council is specified, in

the First Schedule to this Act, as a body to which the Act applies.

|

Authored by:

|

Leeanne Hooper

Team Leader

Governance

|

|

Approved by:

|

Desiree Cull

Strategy

and Governance Manager

|

|

Hawke’s

Bay Regional Council

Corporate and Strategic Committee

Wednesday

06 December 2023

Subject:

Confirmation of 20 September 2023 Public Excluded Minutes

That the Corporate and

Strategic Committee excludes the public from this section of the meeting being

Confirmation of Public Excluded Minutes Agenda Item 12 with the

general subject of the item to be considered while the public is excluded. The

reasons for passing the resolution and the specific grounds under Section 48

(1) of the Local Government Official Information and Meetings Act 1987 for the

passing of this resolution are:

|

General subject of the item to

be considered

|

Reason for passing this

resolution

|

Grounds under section 48(1) for

the passing of the resolution

|

|

HBRIC Chairperson appointment

|

s7(2)(a) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to protect

the privacy of natural persons

|

The Council is specified, in

the First Schedule to this Act, as a body to which the Act applies.

|

|

Cyclone financials update

|

s7(2)(i) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to enable

the local authority holding the information to carry out, without prejudice or

disadvantage, negotiations (including commercial and industrial negotiations)

|

The Council is specified, in

the First Schedule to this Act, as a body to which the Act applies.

|

Authored by:

|

Leeanne Hooper

Team Leader

Governance

|

|

Approved by:

|

Desiree Cull

Strategy

and Governance Manager

|

|