Meeting of the Risk

& Audit Sub-committee

Date: Wednesday 18 October 2023

Time: 9.00am

|

Venue:

|

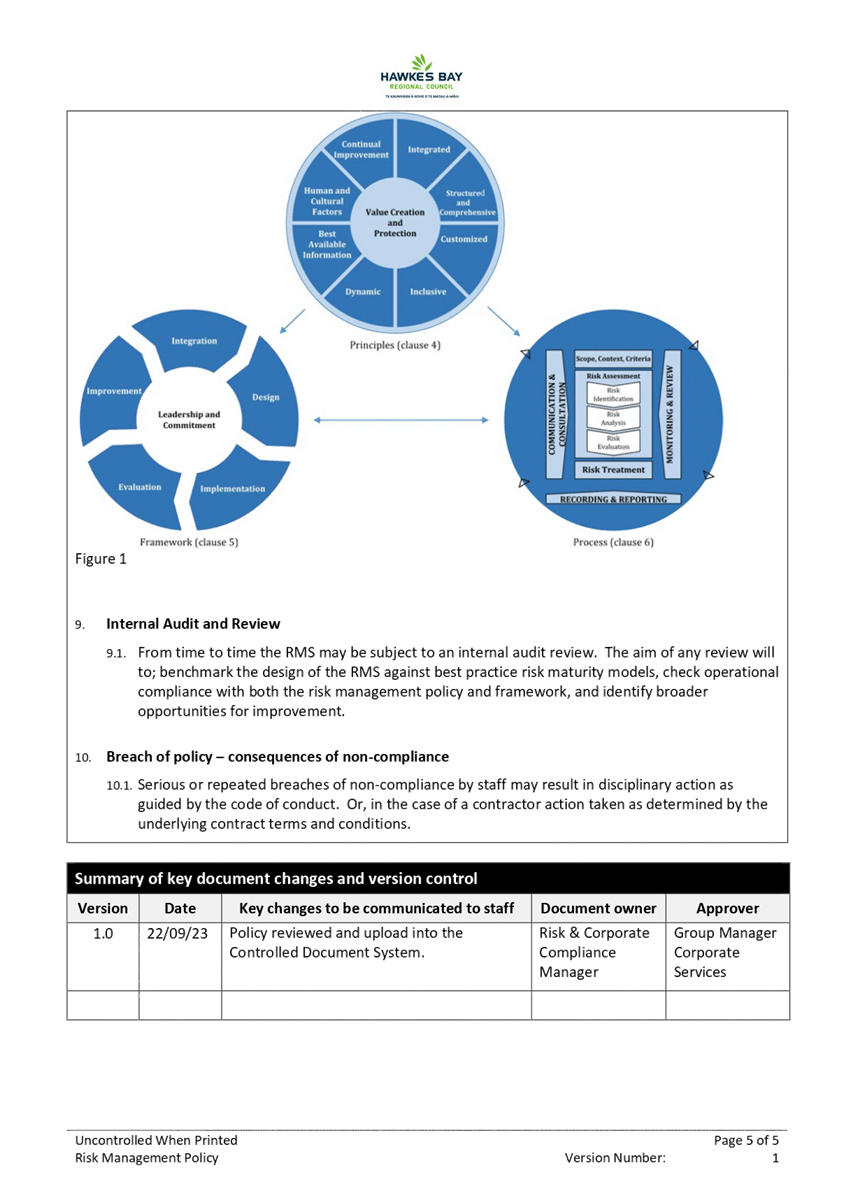

Council

Chamber

Hawke's

Bay Regional Council

159

Dalton Street

NAPIER

|

Agenda

Item Title Page

1. Welcome/Karakia/Notices/Apologies

2. Conflict

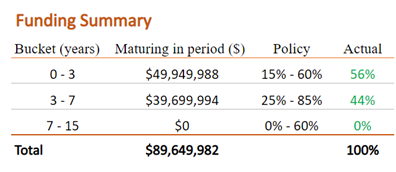

of Interest Declarations

3. Confirmation of Minutes of

the Risk and Audit Committee held on 10 May 2023

Decision

Items

4. Risk

Management Policy Renewal 3

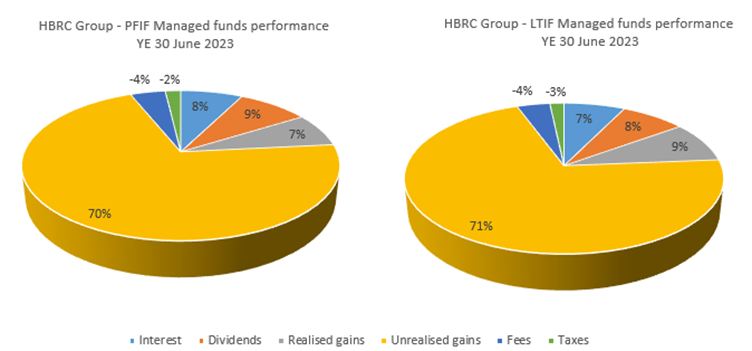

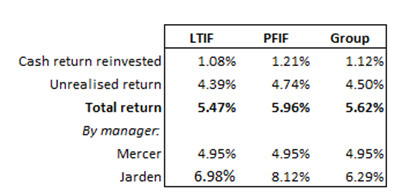

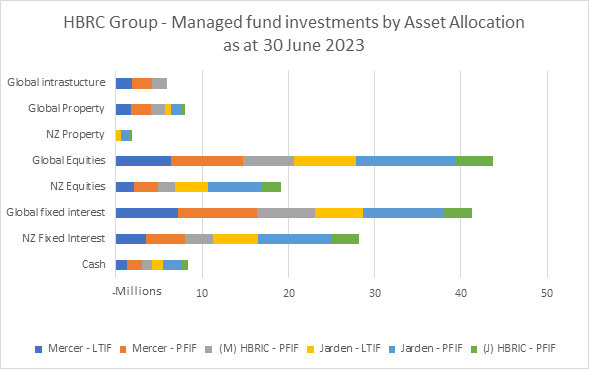

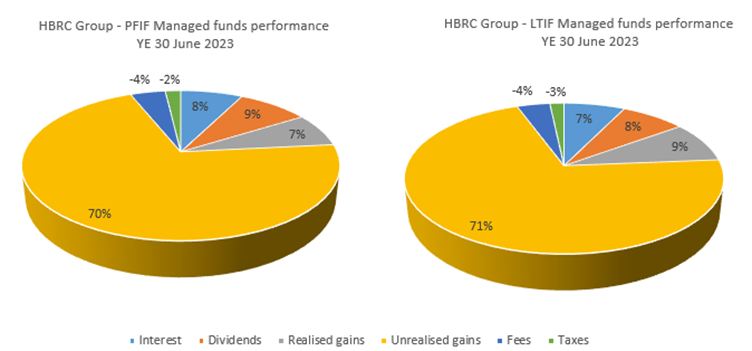

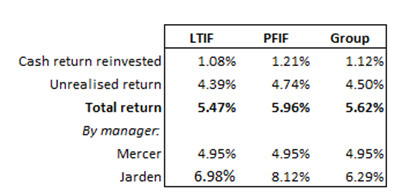

5. Treasury

Compliance Report 11

6. Insurance

– annual review and update 17

Information

or Performance Monitoring

7. Health,

Safety and Wellbeing Management System review 23

8. EY

Audit Close report on year end 30 June 2023 27

Decision

Items (Public Excluded)

9. Confirmation

of 10 May 2023 Risk and Audit Sub-committee Public Excluded Minutes 57

10. Risk

Maturity Refresh 59

11. Incident

report 61

12. Internal

assurance dashboards 63

HAWKE’S BAY REGIONAL COUNCIL

Risk and Audit Committee

Wednesday

18 October 2023

Subject: Risk Management Policy Renewal

Reason

for Report

1. This item seeks Risk and Audit

Committee endorsement for the revised Council Risk Management Policy (CD0023)

in the form of a recommendation to Council that it approve the policy.

Officers’

Recommendation

2. Staff recommend that the Risk and

Audit Committee considers Council’s revised Risk Management Policy

(CD0023) and recommends to Council it approves the Policy.

Background

/Discussion

3. On 30 August 2023 Council adopted a

Terms of Reference for the newly formed Risk and Audit Committee. Section

one of the Terms of Reference states; the purpose of the Committee is to provide advice and recommend

actions, responses, and changes to Council about risk management, assurance activities,

governance oversight and internal control matters, including external reporting

and audit matters. Section 1.1 stated this specifically

and includes the

robustness of Council’s risk management systems, policies, practice, and

assurance processes.

4. Council’s Risk Management Policy

sets out the boundaries for establishing a Council-specific risk management

framework. As part of risk management maturity and under the newly formed

Risk and Audit Committee improvements to Council’s risk management

practices and processes (framework) were identified. Therefore,

Council’s current Risk Management Policy was reviewed to ensure alignment

between Council’s new framework. And, also to confirm that under

the new Terms of Reference Council’s Risk Management Policy would ensure

that the Risk and Audit Committee would fulfil certain obligations.

5. The review of Council’s Risk

Management Policy (CD0023) against Council’s new risk management

framework did not highlight any material differences.

6. The main changes to Council’s

Risk Management Policy (CD0023) relate to the:

6.1. frequency of risk review and reporting

6.2. the inclusion of Councillor’s

and Executive Leadership’s requirement to undertake regular sentiment

surveys, and

6.3. the removal of the Risk Champion role

that is no longer required under the new risk practices.

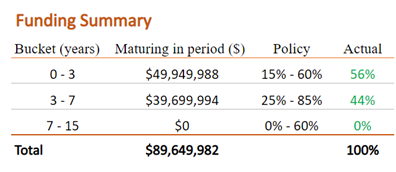

7. Council’s Risk Management Policy

(CD0023) and therefore Council’s new risk management framework continue

to be benchmarked and aligned to the principles of ISO 31000:2018 Risk

Management Standard and the All of Government Risk Maturity Model.

8. Council’s Risk Management Policy

(CD0023) when approved by Council will be published, managed, and maintained

through Council’s controlled document system.

Significance

and Engagement Policy Assessment

9. The significance of this decision is

very low according to Council’s policy.

Financial

and Resource Implications

10. Any financial impact in relation to

changes to the Risk Management Policy will be managed within budget.

Decision

Making Process

11. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

11.1. The decision does not

significantly alter the service provision or affect a strategic asset, nor is

it inconsistent with an existing policy or plan.

11.2. The use of the special

consultative procedure is not prescribed by legislation.

11.3. The decision is not

significant under the criteria contained in Council’s adopted

Significance and Engagement Policy.

11.4. The persons affected by this decision

are staff and Councillors.

11.5. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by, or have an interest in the decisions made, Council

can exercise its discretion and make a decision without consulting directly

with the community or others

having an interest in the decision.

Recommendations

That

Hawke’s Bay Regional Council:

1. Receives and considers the risk

management policy renewal staff report.

2. Agrees that the decisions to be made

are not significant under the criteria contained in Council’s adopted

Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without conferring directly with

the community or persons likely to have an interest in the decision.

3. Adopt and approve the revised Risk

Management Policy (CD0023).

Authored by:

|

Helen Marsden

Risk &

Corporate Compliance Manager

|

|

Approved by:

|

Susie Young

General

Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

Risk Management Policy (CD0023)

|

|

|

|

Risk Management Policy (CD0023)

|

Attachment

1

|

HAWKE’S BAY REGIONAL COUNCIL

Risk and Audit Committee

Wednesday

18 October 2023

Subject: Treasury Compliance Report

Reason

for Report

1. This item provides compliance

monitoring of Hawke’s Bay Regional Council (HBRC) treasury activity and

reports the performance of Council’s investment portfolio for the quarter

ended 30 June 2023.

Overview

of the Quarter – ending 30 June 2023

2. At the end of the quarter to 30 June

2023, HBRC was compliant with all measures in its Treasury Policy, however

during the period it breached the counterparty risk policy.

3. In June 2023 HBRC received a dividend

of $1.87m from HBRIC following their receipt of the Napier Port dividend of the

same value.

4. Cyclone Gabrielle has impacted both

cash balances and borrowing requirements, with ongoing additional borrowing

required to fund the recovery. Insurance proceeds when received will

soften the effects of additional borrowing. The full impact of the

cyclone on long-term funding is yet to be determined.

5. Additional borrowing has implications

on the liquidity ratio and credit rate risks.

Background

6. Council’s Treasury Policy

requires a quarterly Treasury Report to be presented to the Audit and Risk

Sub-committee. The policy states that the Treasury Report is to include:

6.1. Treasury Exceptions report

6.2. Policy compliance

6.3. Borrowing Limit report

6.4. Funding and liquidity report

6.5. Debt maturity profile Interest rate

report

6.6. Investment management report**

6.7. Treasury investments*

6.8. Cost of funds report Cash flow and

debt forecast report

6.9. Debt and interest rate strategy and

commentary

6.10. Counterparty credit report

6.11. Loan advances.

7. The Investment Management report has

specific requirements outlined in the Treasury Policy. This requires quarterly

reporting on all treasury investments plus annual reporting on all equities and

property investments.

8. In addition to the Treasury Policy,

Council has a Statement of Investment Policy and Objectives (SIPO) document

setting out the parameters required for funds under management for the HBRC

Long Term Investment Fund.

9. Since 2018, HBRC has procured treasury

advice and services from PricewaterhouseCoopers (PwC) and their quarterly

Treasury Report containing the reports noted in paragraph 8 is attached.

Treasury exceptions report &

policy compliance

10. During the quarter to 30 June 2023,

there were 4 instances of noncompliance with the HBRC counterparty risk

policy. These arose due to the lumpy receipt of disaster recovery funds and

the need to hold additional funds to pay third parties at short notice.

The breaches were corrected as soon as practical. HBRC was compliant with

all other measures in its Treasury policy.

11. The maximum breach was $23.49m which

is $8.49m over the counterparty credit limit of $15m. The remaining 3 breaches

were all under $20m and therefore within $5m of the credit limit.

12. This remains an on-going issue while

the Council works through the cyclone recovery.

Funding & Liquidity

13. To ensure HBRC has the ability to

adequately fund its operations, current policy requires HBRC to maintain a

liquid balance of “greater than 10% of existing total external

debt”. Current liquidity ratio is 14.4% and therefore meets policy.

14. The following table reports the cash

and cash equivalents on 30 June 2023.

|

30

June 2023

|

$000

|

|

Cash on

Call

|

7,186

|

|

Short-term

bank deposits

|

-

|

|

Total

Cash & and Deposits

|

7,186

|

15. To manage HBRC liquidity risk, HBRC

retains a Standby Facility with BNZ. This facility

provides HBRC with a same day draw down option, to any amount between

$0.3-$10.0m, and with a 7 day minimum draw period.

Debt

Management

16. On 30 June 2023 the current external

debt for the Council group was $84.2m which includes $1m of pre-funded debt

($100.863m including the loan from HBRIC).

17. Since the March quarter an additional

$25m in borrowings were received to assist with increased cash requirements following

Cyclone Gabrielle. $15m of this funding is short-term, with the remaining $10m

is medium term.

18. The following summarises the

year-to-date movements in Council’s debt position.

Summary

of HBRC Debt

|

|

HBRC only

$000

|

HBRC Group

$000

|

|

Opening

Debt – 1 July 2022 – excl HBRIC Loan

|

46,725

|

46,725

|

|

New

Loans raised

|

43,850

|

43,850

|

|

Less

amounts repaid

|

(6,375)

|

(6,375)

|

|

Closing

Debt 30 June 2023 (excluding HBRIC loan)

|

84,200*

|

84,200

|

|

Plus

opening balance - loan from HBRIC

|

16,663

|

-

|

|

Total

Borrowing as at 30 June 2023

|

100,863

|

84,200

|

*Includes

pre-funding debt of $1m.

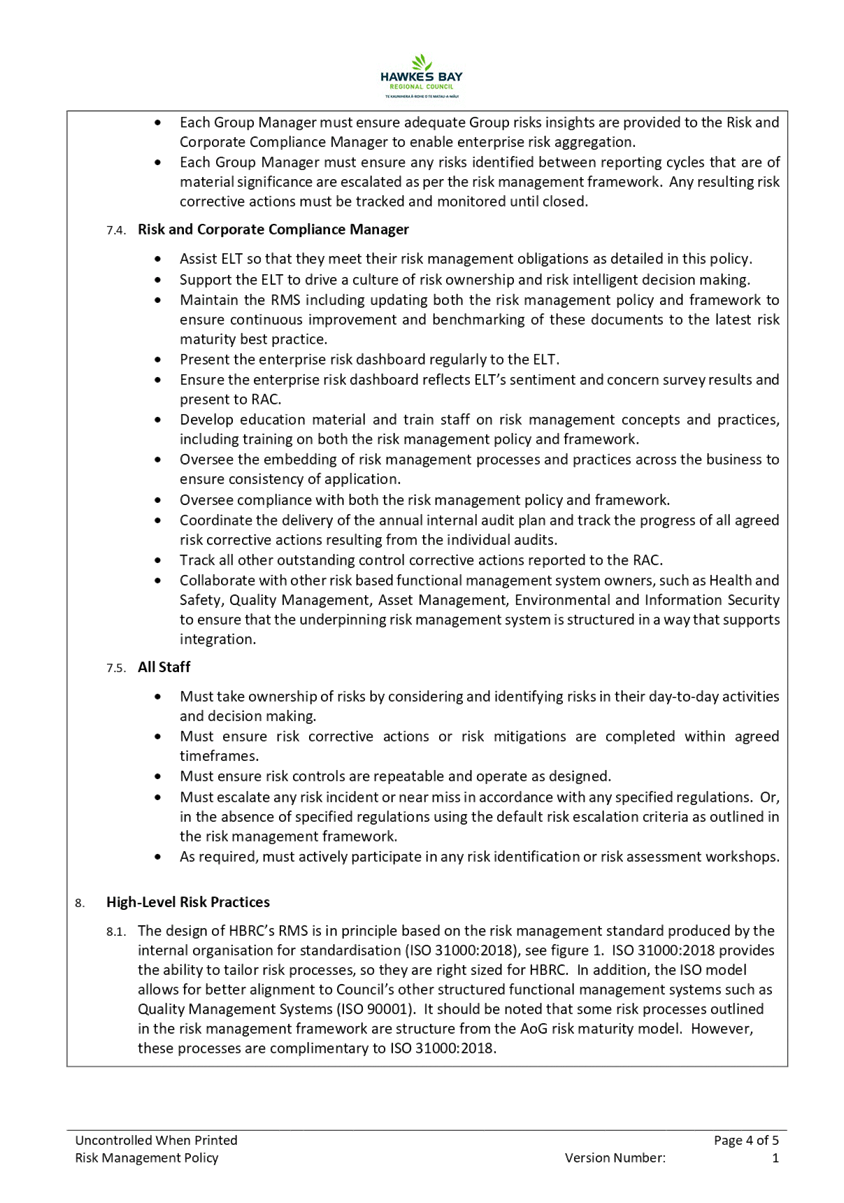

19. Council debt maturity profile remains

compliant, however short term drawdowns have pushed the policy limit in the 0-3

year bucket. This will remain high while we work through the cyclone

funding. The below infographic includes our $10m BNZ overdraft in total

debt.

20. We have borrowed a further $15m on in

the quarter to 30 September 2023 and are currently forecasting further

drawdowns being required in Q3 between 1 January 2024 and 31 March 2024.

However, the amounts required and timing is yet to be confirmed and will depend

on the execution of the capital programme planned between now and then.

21. Any insurance or NEMA proceeds will be

used to repay the short-term debt which is currently c$30m.

22. We are continuing to assess the

interest rate risk as this is also impacting maturity profiles, putting pressure

on the short-term buckets.

23. Our action to rectify this is to

confirm our new debt forecast and monitor our swap options.

Managed

Funds

24. Total Investment Fund portfolios

capital, adjusted for inflation at 30 June 2023 was $9.532m below the inflation-adjusted

contribution target. Based on results to date and the value of the protected

amount of funds, funds held are not sufficient to deliver the returns required

to meet Council’s requirement. No divestments have been made from

managed funds this year.

25. Council budgets separately for revenue

from directly-held managed funds and those held by HBRIC. HBRIC is required to

deliver an overall portfolio return by way of an annual dividend agreed through

an annual Statement of Intent. The composition between revenues from managed

funds and other sources such as port dividends, is up to the HBRIC board. While

the Council has budgeted to receive $10.5m in dividends from HBRIC within the

FY 2022-2023, the Council has only received $6.87m due to significant

downgrading of the port dividend.

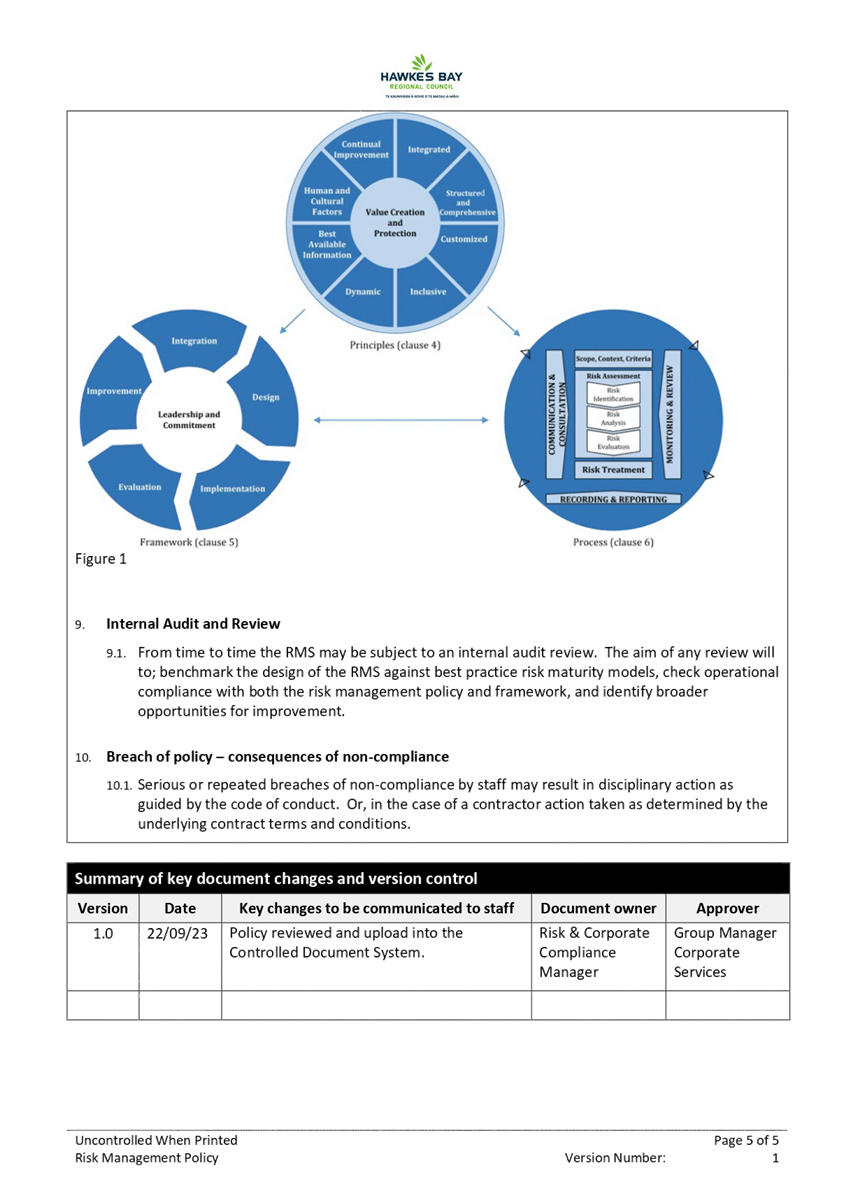

26. The following table summarises the fund balances at the end of each

period and the graph illustrates the asset allocations within each fund at 30

June 2023.

|

|

30 Jun 2022

|

31 Dec 2022

|

30 June 2023

|

|

Fund

Balances HBRC

|

$000

|

$000

|

$000

|

|

Fund

Balance HBRC

|

104,449

|

104,421

|

110,828

|

|

Capital

Protected Amount HBRC (2% compounded since inception)

|

114,239

|

115,384

|

115,895

|

|

Current

HBRC value above/(below) capital protected

amount

|

(9,790)

|

(10,963)

|

(5,067)

|

|

Funds

Balances (Group + HBRIC)

|

|

Long-Term

Investment Fund (HBRC)

|

45,679

|

45,713

|

48,400

|

|

Future

Investment Fund (HBRC)

|

58,770

|

58,708

|

62,428

|

|

Total

HBRC

|

104,449

|

104,421

|

110,828

|

|

Plus

HBRIC

|

43,226

|

43,315

|

45,638

|

|

Total

Group Managed Funds

|

147,675

|

147,736

|

156,466

|

|

Capital

Protected Amount (2% compound inflation)

|

162,720

|

164,350

|

164,798

|

|

Current

group value above/(below) protected amount

|

(15,045)

|

(16,614)

|

(8,332)

|

27. Fund performances have been steady

this year with all cash returns reinvested.

Cost

of funds

28. For the last financial year to 30 June

2023, Gross Cost of Funds (COF) was 3.72% and Net COF was 3.55%

HBRIC

Ltd

29. In accordance with Council Policy,

HBRIC provides separate quarterly updates to the Corporate and Strategic

Committee. However, given the missed meeting due to the cyclone the December

2022 quarterly update was provided to Council on 29 March 2023.

Decision

Making Process

30. Staff have assessed the requirements of

the Local Government Act 2002 in relation to this item and have concluded that,

as this report is for information only, the decision-making provisions do not

apply.

Recommendations

That the Risk

and Audit Committee receives and considers the Treasury Compliance Report.

Authored by:

|

Jess Bennett

Senior

Manager - Finance Recovery

|

Tracey O'Shaughnessy

Treasury

& Investments Accountant

|

Approved by:

|

Susie Young

General

Manager Corporate Services

|

|

Attachment/s

There are no attachments for this

report.

HAWKE’S

BAY REGIONAL COUNCIL

Risk and Audit Committee

Wednesday

18 October 2023

Subject: Insurance – annual review and update

Reason

for Report

1. This item provides the Committee with

an update on the levels of insurance cover that are operating across HBRC and

to ensure that Councillors are aware of the cover in place and where risk

exists in obtaining further limits.

2. The TOR for the Risk and Audit

Committee is for this committee to review and recommend to Council the approach

to insurance strategy and placements as part of its risk management practices.

Officers’

Recommendations

1. Councillors acknowledge the level of

insurance cover in place across Hawkes Bay Regional Council and support staff

to maintain levels of cover already in place.

2. Council officers support a further $200m

group policy being entered into by HBRC (along with MWLASS participants).

Executive

Summary

3. Our insurance brokers have indicated

to HBRC that they expect premiums will increase up to 20% in the coming year

upon renegotiation. HBRC currently pay $1.1m per annum for current

policies in place.

4. In addition to an increase cost, a

proposal to have a further $200m underground cover has been proposed as a group

policy through MWLASS. This is over and above our current group policy limit of

$300m taking the full cover to $500m(Group).

5. Investigation into self-insurance, or

other mechanisms to meet cover and needs of the organisation, needs to be

reviewed.

Background

/Discussion

3. HBRC has predominantly held insurance

for commercial motor vehicles, material damage to commercial and residential

assets, infrastructure, contract works, marine and harbour master,

employers’ liability and statutory liability, professional indemnity and

cyber. HBRC has, to date, had reasonable comfort with the ability to obtain

insurance in offshore markets and hase received cover requested.

4. Over the last 12 months, insurers in

NZ (through offshore global reinsurers) have indicated the unease of reinsurers

to provide cover to specific industries, and global protection gaps caused by

the combination of climate change, cyber threats and social and demographic

changes are been seen.

5. The National Climate Change Risk

Assessment for Aotearoa New Zealand (NCCRA) highlighted recently that

“New Zealand’s financial system is highly exposed to climate change

through local changes and international markets”. Financial instability

could result from a single shock or a series of events (such as cyclones,

fires, or floods) which trigger a revaluation of assets in Aotearoa New Zealand

or indirectly via international markets. Additionally, the pricing of ongoing,

gradual changes (such as sea-level rise) might precipitate sudden reappraisals,

such as insurance retreat from coastal assets, new debt limits, or interest

rate hikes.

6. The period of Insurance Cover is due

31 October 2023, and we are anticipating an increase in premiums

charges, including possible challenges to obtain full cover at this time.

7. Recently, HBRC encountered issues with

obtaining Harbourmaster Insurance. HBRC has an excess layer, which is

$75mil over $25mil on Harbourmasters Liability. Our insurer Markel (through

Singapore) only offered 50% cover for this, with co-insurance having to be

obtained through London via Munich Re.

Current

Insurance Cover

8. Attachment 1, outlines all insurance

policies currently in place across HBRC. Insights from our current policies

are:

8.1. Material Damage - Commercial &

Residential – This is a Group Policy with Hawke's Bay Council Group and

has a Limit $600m (HBRC sub-limit is $20m). A memorandum of understanding

is yet to be put in place across Councils. A follow up has been made with

Legal and HDC.

8.2. Standing Timber Insurance Policy

(Forestry) – The market damage resulting from past cyclones has meant

that insurers are asking for more details around our risk. Some are just

not insuring certain types of trees (meaning an increased risk to carbon

credits etc (probably requiring more buffer). HBRC are engaging with PF Olsen

to understand impacts once we receive new information from AON on this.

8.3. Commercial Marine Hull – All

Hydro assets that 'live' on water must be transferred to this policy. This is

as a result of the Coastal Monitoring Buoy that was lost at sea back in June

2022. It was noted that these assets should not be on the MDBI policy but on a

specific Marine Policy. So far we have roughly identified $2.4m (TBC) of Hydro

assets that may need to be transferred. Complexities are some of these assets

are groups of individual fixed assets (ie monitoring equipment).

8.4. Contract Works – A formal review

is required of this based on contracted works we expect in the coming years for

rebuild. Work is required between Asset Management and Works Group to

understand the risks to the organisation. In normal conditions HBRC cover Works

Group external contracts within the $250k contract limit (i.e this is manly

used for small contracts) any other larger contracts are required to have their

own contract works insurance.

8.5. Infrastructure Disaster Damage - Per

MW LASS. The last full review of this was in 2018. It’s proposed that a

third layer of $200m is needed to take the Group limit to $500m. This is

covering c$4.48b of sum insured assets across the 9 Councils, with varying

sub-limits. The excess layers haven't been reviewed for some years while asset

values have continued to increase during this time. Refer to below decision.

Additional

MWLASS above ground cover.

1. Selected councils in the lower North

Island currently have a group infrastructure policy of $300m for infrastructure

assets (Group limit). This is made up of a Primary layer $125m and

Secondary layer $175M.

2. HBRC has a principal sub-limit of $65m

(HBRC’s loss limit). Of this 40% insured on total limit only with the

assumption all other assets are flood critical and therefore covered by NEMA.

9. Other councils within this policy are

Hastings District Council, Central Hawkes Bay District Council, Manawatu

District Council, Whanganui District Council, Rangitikei District Council,

Horizons Regional Council, Ruapehu District Council and Tararua District

Council.

10. In 2018 when this policy was last

reviewed total assets across the councils was circa $2bn. Assets now held

across these councils is double, i.e. upward of $4.4bn.

11. In 2023 Manawatu-Whanganui Local Authority

Shared Services and Hawkes Bay Councils (MWLASS+HB) engaged Aon Global Risk

Consulting (Aon) to assess the potential damage and loss from a large

earthquake event affecting the group portfolio. MWLASS+HB has identified the

need to undertake an earthquake loss modelling exercise to evaluate the

suitability of their shared natural catastrophe limit, as declared on the group

infrastructure policy, prior to the 2023/24 renewal. (refer to attachment 2a

AON: Earthquake Loss Analysis for Infrastructure Assets and attachment 3 MWLASS

– Infrastructure Insurance Layers and 3a Example of Pooled Insurance).

12. The report has highlighted that in an

earthquake, assets located in areas susceptible to liquefaction or landslides

can experience greater damage. Hawkes Bay Councils have a high percentage

exposure to liquefaction.

13. HBRC has assets worth $340m (cost to

fully rebuild all assets). In an event such as an earthquake it could be

foreseeable that the damage would be significant compared to the recent flooding.

14. A very large central NZ earthquake is

also likely to impact all the 9 councils therefore putting pressure on the

available group funds to be allocated. Scenario modelling review

was undertaken by Aon Risk Consulting – refer to Attachment 3: Manawatu-Whanganui

Local Authority Shared Services and Hawkes Bay Councils (MWLASS+HB) Earthquake

Loss Analysis for Infrastructure Assets.

15. The report is highlighting that the

Hawkes Bay region is susceptible to high risk of liquefaction, including predicted

damage from a large quake.

16. The expected cost for this additional

cover has been proposed at $800k-$900k. All Councils wishing to be

part of this, need to advise MWLASS by the end of October 2023. It is likely

not all Councils will chose to be part of this, and cost may be lower/higher

dependent on participants.

17. The MWLASS board has requested that MW

LASS member councils review the completed report and analysis (scenario

modelling) with a request that member councils receive the report provided, and

acknowledge whether the member council may wish to participate.

Alternative

methods of insurance

6. In response to recent events,

reinsurance costs have increased substantially. Insurers have to manage

these extra costs by increasing premiums. Recently, insurers have been using an

increase in excess to ensure that insurance remains accessible. However, in

some situations, the excess may be so high that the cover makes the cost of

insurance difficult to justify.

7. Mōhio’s Climate Innovation

Lab, at Auckland University, released an options report on financing climate

adaptation (Attachment 4: Adaptation Finance – Risks and Opportunities

Aotearoa New Zealand - report attached for interest only). Insights from

this report identify options and alternative means of mitigating risks, such as

environmental, green, social and sustainability bonds.

8. In 2022 Auckland City Council moved to

self-insurance fund model. Auckland Council ring-fenced managed funds creating

an asset backed self-insurance fund (SIF) and requires the management of the

investment fund to be outsourced to an external provider.

9. The MIF was initially seeded with NZD

20 million and is expected to grow over time through future premiums (less

claims), investment returns and potentially further capital injections.

9.1. The MIF must maintain a moderate

level of liquidity to pay claims, as required and must minimise the correlation

of the portfolio to events that might impact Auckland negatively.

Strategic

Fit

10. Insurance to cover future climate

change events is in the best interest of Hawkes Bay Regional Council to ensure

ongoing protection of our above and below ground assets.

11. Protecting our $340m of infrastructure

will ensure value is maintained by our ratepayers, that in addition provides

vital flood mitigation to our region.

12. However further investigation is

required to find alternative cheaper mitigations for insurance risks given the

large and continued increases in premiums as shown.

Significance

and Engagement Policy Assessment

13. The decisions presented in this paper

would not be considered to trigger the significant and engagement policy.

Financial

and Resource Implications

14. Our insurance brokers have indicated

to HBRC that they expect premiums will increase up to 20% in the coming year

upon renegotiation. Increase in premiums must be met by general rates.

Any increase will directly impact available funds.

15. In addition, lack of insurance cover

for material and critical assets may lead to unrecoverable losses in the future

and HBRC having no ability to fund replacements/re-establishment.

Decision

Making Process

16. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

16.1. The decision does not

significantly alter the service provision or affect a strategic asset, nor is

it inconsistent with an existing policy or plan.

16.2. The use of the special

consultative procedure is not prescribed by legislation.

16.3. The decision is not

significant under the criteria contained in Council’s adopted

Significance and Engagement Policy.

16.4. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by, or have an interest in the decisions made, Council

can exercise its discretion and make a decision without consulting directly with

the community or others

having an interest in the decision.

Recommendations

That

the Risk and Audit Committee:

1. Receives and considers the Insurance

– annual review and update staff report.

2. Agrees that the decisions to be made

are not significant under the criteria contained in Council’s adopted

Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without conferring directly with

the community or persons likely to have an interest in the decision.

3. Recommends that Hawke’s Bay

Regional Council:

3.1. Note the report from the board of

MWLASS;

3.2. Progress with participation of excess

layer of infrastructure with MWLASS of $200m.

3.3. Review how HBRC may review and look

into how alternative means of Insurance may be implemented across our business.

Authored by:

|

Chris Comber

Chief

Financial Officer

|

Chris Dolley

Group

Manager Asset Management

|

Approved by:

|

Susie Young

General

Manager Corporate Services

|

|

Attachment/s

|

1⇨

|

HBRC Insurance Policy Cover Oct 2023

|

|

Under Separate Cover

|

|

2⇨

|

AON: Earthquake Loss Analysis for

Infrastructure Assets

|

|

Under Separate Cover

|

|

3⇨

|

MWLASS – Infrastructure

Insurance Layers

|

|

Under Separate Cover

|

|

4⇨

|

Example of Pooled Insurance

|

|

Under Separate Cover

|

|

5⇨

|

Adaptation Finance – Risks and

Opportunities Aotearoa New Zealand

|

|

Under Separate Cover

|

HAWKE’S BAY REGIONAL COUNCIL

Risk and Audit Committee

Wednesday

18 October 2023

Subject: Health, Safety and Wellbeing Management System review

Reason for Report

1. This item provides the Committee with

an update on the intended alignment of the HBRC Health, Safety and Wellbeing

Management System (HSWMS) with the ISO45001 framework, including ongoing

assurance over Health and Safety matters.

Background

ACC Workplace Safety Management Practice (WSMP)

2. From 2001 to 2019 HBRC’s HSWMS

was audited and certified under the ACC Workplace Safety Management Practice

(WSMP) audit standard.

3. The WSMP audit standard aligned with

AS/NZS 4801:2001, the joint Australia/New Zealand Standard for Occupational

Health and Safety Management Systems.

4. Audit delivery differed between WSMP

and AS/NZS 4801; with AS/NZ 4801 being a higher-level audit process.

5. While organisations may have sought

certification under AS/NZ4801 or OHSA 18001, this was generally in response to

parent company and/or customer requirements and not common. In terms of market

acceptance within NZ, ACC WSMP was the ‘default’ standard.

6. WSMP had three levels of achievement,

each attracting a workplace levy discount. To enter and remain in the

programme, organisations had to achieve and maintain Primary level (at a

minimum) and undertake reaudit every two years. HBRC achieved and maintained

Tertiary level.

|

Level

|

Workplace Levy Discount

|

|

Primary

|

10%

|

|

Secondary

|

15%

|

|

Tertiary

|

20%

|

7. ACC ceased the WSMP programme in 2019

and as part of the cessation process extended HBRC’s achievement and

discount level for a further 12 months

Crowe

Horwath

8. In 2018 Crowe Horwath conducted a

review of HBRC’s HSWMS. Their audit programme was based on the key

requirements of:

8.1. Health and Safety at Work Act 2015

8.2. ISO0 45001:2018 Occupational health

and safety management systems

8.3. Health and Safety Guide: Good

Governance for Directors (Institute of Directors & WorkSafe).

9. The review was conducted by applying

discussion, observation and review techniques; it included the material

requirements of the above ‘good practice’ health and safety

management systems and incorporated the following:

9.1. Policy, planning, resources,

responsibilities

9.2. Leadership, worker participation &

engagement

9.3. Governance

9.4. Hazard and risk management

9.5. Information, training and supervision

9.6. Contractor (PCBU) engagement

9.7. Incident management

9.8. Health and wellness

9.9. Emergency management

9.10. Audit and review.

10. Review outcomes included

recommendations related to both Risk and Health & Safety. The (then)

GM Group Manager Office of the Chief Executive and Chair and the HBRC HR

Manager implemented the update/development of recommendations to be adopted by

HBRC as part of the H&S workplan. The (then) HBRC HR Manager also held

responsibility for the HBRC HSWMS, and as such began working on the adopted

recommendations. After he left, the HR & Safety roles were reconfigured,

and the HSW Team Leader picked up the implementation of the

recommendations. The HBRC Risk Manager reported back to RAS until completed.

Areas that continue to be matured are risk management and contractor

management.

2021 to

present

11. Despite the impacts of Covid 19

lockdowns of 2020/2021 and the staffing levels within the HSW team,

HBRC’s HSWMS was maintained at a level commensurate with WSMP Tertiary.

This was verified via an internal review conducted in 2022.

12. HBRC’s HSWMS strategy and work

plans covering 2021-2024 have been built around the following health and safety

cornerstones. These cornerstones reflect the HSMS system in use at the time of

developing the strategy and work plan as well as the items that were reviewed

as above in 2018:

12.1. Knowledgeable workplace leadership

12.2. Actively identifying, managing, and monitoring risk

12.3. Managing the pandemic response to Covid-19 and variants

12.4. Improving the management of contractors

12.5. Improving health, safety and wellbeing engagement and

culture

12.6. Enabling an effective implementation plan and reviewing

annually

12.7. Improving reporting and provision of relevant

information.

13. In 2022, HSW and ELT discussed the

need to scope a new HS audit programme and the focus was to determine which

programme might best suit HBRC.

14. The HSW team sought information from

the wider health and safety community, which included other Councils such as

Napier City and Horizons about their progression from ACC WSMP into other audit

programmes.

15. From the discussions held and evidence

observed, the majority had maintained their HSMS, updated as relevant to meet

any applicable legislative or industry changes but had not progressed into

another certification programme.

16. The objective of the review is to

align the Hawkes Bay Regional Council’s health and safety management

systems to a recognised and current standard.

Discussion

17. Organisations who had moved to another

certification programme undertook one of the following options.

|

Programme

|

Programme Status

|

Certification availability

|

|

AS/NZ4801

|

Available

Superseded

until 13 July 2023. Post (July) refer to ISO45001

|

N/a

|

|

OHSA

18001

|

Withdrawn

replaced

by ISO45001

|

N/a

|

|

ISO45001

|

Current

|

Yes

|

|

Safe+

|

Current

|

No*

outcome defined by 3 performance levels

|

18. Both Napier City and Horizons councils

have undertaken Safe+.

19. While Safe+ is independently audited

by approved auditors, it is not based on an accredited audit standard. It is

also not recognised outside of NZ and has not been widely adopted by NZ

organisations.

20. ISO45001 is an

internationally-recognised certification standard. ISO standards provide an

overarching management system framework that is recognisable across the suite

of certification products, for example ‘Leadership’ includes

components of commitment, policy, roles, responsibilities and authorities.

These components appear across the various ISO standards, and their

implementation is contextualised to the audit standard being undertaken.

21. HBRC holds current ISO9001:2015

certification for several areas of the business. As such, the QMS in the

business areas covered by that certification already conform to the general ISO

framework. Aligning with that framework, albeit in a health and safety context

under ISO45001, provides HBRC with natural QMS / HSWMS synergies.

22. The objective of the review is to

align the Hawke’s Bay Regional Council’s health, safety, and

wellbeing management system to a recognised and current standard.

23. The table below summarises activity to

date

|

Time period

|

Activity

|

|

2001-2019

|

HBRC

certified under ACC WSMP programme

|

|

2018

|

Crowe

Horwath Internal Audit

Decision

by the Group Manager Office of the Chief Executive and Chair, the HR Manager

re recommendations HBRC to adopt

HBRC

WSMP certification extended to 2019

|

|

2019

|

Work

begins to implement recommendations

ACC

WSMP programme ceases; HBRC certification ends

|

|

2020

|

HSW

TL new into role, manages HBRC Covid response; picks up and continues

implementation of recommendations as part of HSW workplan

|

|

2021

|

HSW

TL continues with recommendations (as part of HSW workplan)

|

|

2022

|

Internal

review of HSMS against ACC WSMP standard

Investigation

into alternative safety standard ‘programmes’ – findings

and recommended pathway presented to ELT

|

|

2023

|

ELT

approves recommendation to align HSMS with ISO45001

Pathway

stages mapped and stage 1 to occur

|

Financial

and resource implications

|

Programme

|

Year one (2023)

|

Year two (2024)

|

Year three (2025)

|

Year five (2027)

|

|

ISO45001

Programme

as recommended by External Auditors

|

Stage

1 Document review

Review

processes. Post review 12 months to update/amend (based on recommendations)

and collect evidence of any changes in practice as a result of those.

‘In general, 12 months evidence of operational implementation required

|

Onsite

Gap Analysis

Review

processes alongside updates from previous recommendations and evidence of

practice. Conducted onsite.

|

Onsite

Gap Analysis

Review

processes alongside updates from previous recommendations and evidence of

practice. Conducted onsite.

|

Move

to standard 2 yearly review cycle

|

|

Cost:

excl GST

|

Approx.

$ 2500

|

Approx.

$ 4800

|

Approx.

$4800

|

|

|

Time

|

1.5

days inc report writing

|

2

days inc report writing

|

2

days inc report writing

|

|

Next

steps

24. External auditor confirmed for desktop

document review in November 2023.

25. Document review completed; report

received with recommendations.

26. Recommendations and remedial plan of

activity provided for ELT and Risk and Audit Committee.

27. Recommendations included into the HSW

Strategic Plan and Work Plan for 2024-2026.

Decision-making

process

28. Staff have assessed the requirements

of the Local Government Act 2002 in relation to this item and have concluded

that, as this report is for information only, the decision-making provisions do

not apply.

Recommendation

That the Risk

and Audit Committee receives and considers the Health, Safety and Wellbeing

Management System review staff report.

Authored by:

|

Kirsty McInnes

Team Leader

Health Safety & Wellbeing

|

Liana Monteith

Manager

People & Capability

|

Approved by:

|

Susie Young

General

Manager Corporate Services

|

|

Attachment/s

There are no attachments for this report.

HAWKE’S

BAY REGIONAL COUNCIL

Risk and Audit Committee

Wednesday

18 October 2023

Subject: EY Audit Close report on year end 30 June 2023

Reason for Report

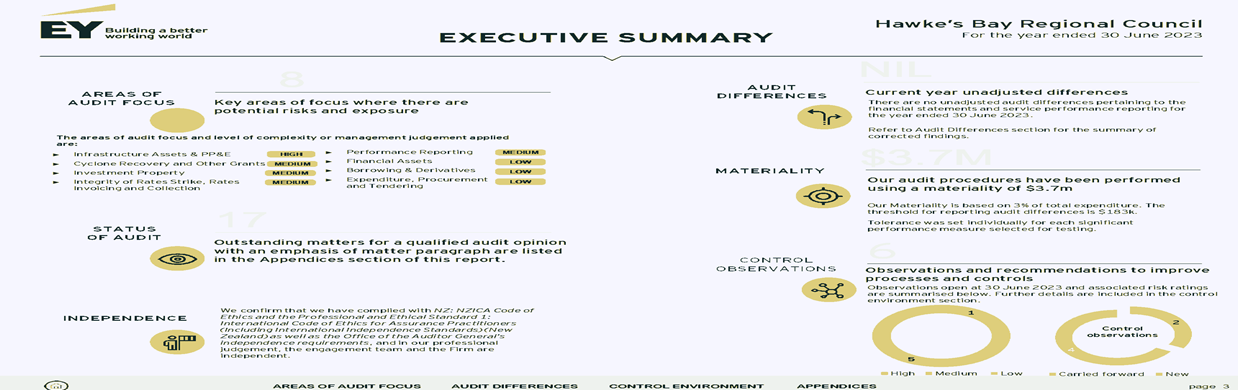

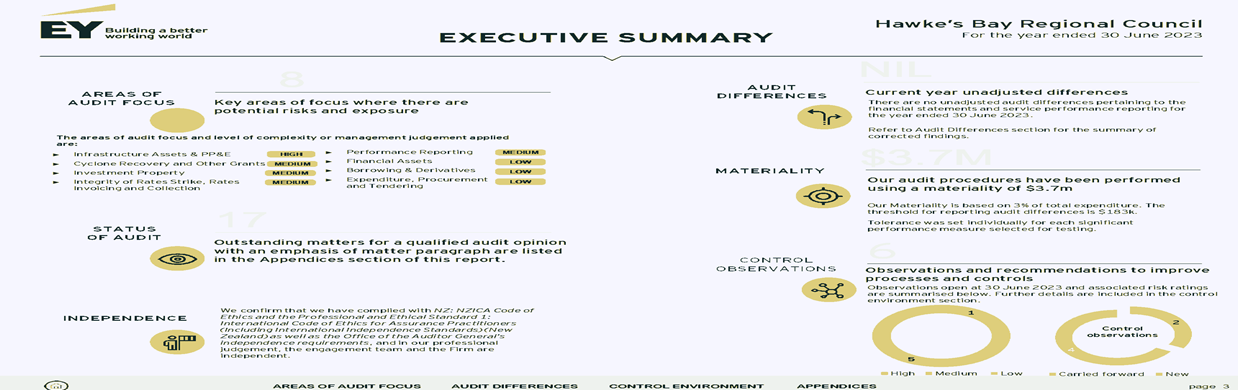

1. This report presents the Audit and

Risk Committee with the auditor’s preliminary findings from the year

ended 30 June 2023 audit.

2. Staff from Ernst & Young will

provide their report on Friday 13 October. They will present their findings and

be available to answer questions and provide clarification to the committee as

required.

Background

3. Each year, following the completion of

the audit of HBRC’s Annual Report, the auditor’s report back to the

governing body on any findings from the audit. The report provides commentary

on areas where the auditors identified control matters during their audit

procedures and makes recommendations for improvement.

4. The production of the Annual Report

2022-2023 has been a time-pressured process for staff due to late adoption of

the Annual Plan and tightened annual report adoption timeframe. This is the

first time in 3 years that the reporting deadline has been 31 October after

extensions to 31 December for the previous two years. 31 October is the normal

statutory deadline that is expected going forward.

5. This is Ernst & Youngs (the auditors)

second year completing the HBRC audit.

Discussion

6. The year end audit commenced on 18

September and is ongoing however, HBRC management had a status update with the

auditors on Friday 6 October where the following specific matters were covered:

6.1. The auditors have completed or

substantially completed the majority of their areas of focus, however, there

are still some areas of testing and internal review to be completed.

6.2. Consolidated group accounts are still

to be received and reviewed by the auditors in the week beginning 9 October

2023.

6.3. The auditors were complimentary of

HBRC staff and their positive engagement and support to perform the audit.

6.4. The auditors also signaled some audit

adjustments. These have been summarised by HBRC management below with audit

commentary to come in their report.

6.5. The auditors have indicated they will

be including some control findings and improvements in their report but have

not yet finalised what these are with staff at the time of preparing the paper.

These will be included in their report.

6.6. As previously indicated to the

Corporate and Strategic committee on 14 June 2023 and HBRC Council workshop on

11 October 2023, the auditors are expecting to issue a modified or qualified audit

opinion on the basis that no valuation has been completed for infrastructure.

7. Audit Adjustments

8. Recognition of HBDRT bank account –

This

is a bank account held by HBRC on behalf of the Hawkes Bay Disaster Relief

Trust as an administrator. As HBRC are deemed to have control of the account

(through access and approval rights) the auditors require us to recognise the

cash balance asset of $2.5m at 30 June 2023 and an offsetting liability for

funds held on behalf of the HBDRT.

9. Adjustment to valuation of HBRC

investment in HBRIC –

As

part of their audit process, Foodeast (subsidiary of HBRIC) had an audit

adjustment to their net assets which we need to reflect in our valuation

calculation. This adjustment will increase our investment by $4m.

10. LGFA interest reclassification –

HBRC

holds some zero-coupon loans with LGFA. As they are zero coupon the auditors

require us to reclassify the interest of $0.63m from accrued interest to the

loan principal balance.

11. Insurance proceeds –

In

May 2023 HBRC’s co-insurers agreed to paying HBRC $4m as a partial

settlement of claims under our policy for losses arising from Cyclone Gabrielle

to stopbanks and other specified assets. These funds were not received until

July 2023, however, as they were approved before 30 June 2023 the auditors

require us to recognise the revenue and receivable.

12. Management agrees with each of these

adjustments and intend to correct these within the financial statements.

13. As the audit process is ongoing there

may be additional audit adjustments identified.

14. Control Findings –

These will

be communicated by the auditors in their report.

Next

Steps

15. The 2022-2023 Annual Report will be

presented at the Regional Council meeting on 25 October 2023 for adoption.

Decision

Making Process

16. Staff have assessed the requirements

of the Local Government Act 2002 in relation to this item and have concluded

that, as this report is for information only, the decision-making provisions do

not apply.

Recommendation

That the Audit and Risk Committee receives and notes the EY

Audit Close Report on Year End 30 June 2023 staff report.

Authored by:

|

Chelsea Spencer

Senior

Group Accountant

|

Sarah Bell

Team Leader

Strategy and Performance

|

|

Chris Comber

Chief

Financial Officer

|

|

Approved by:

|

Susie Young

Executive

Officer Recovery

|

|

Attachment/s

|

1⇩

|

Ernst & Young Audit Close Report

and Report on Control findings

|

|

|

|

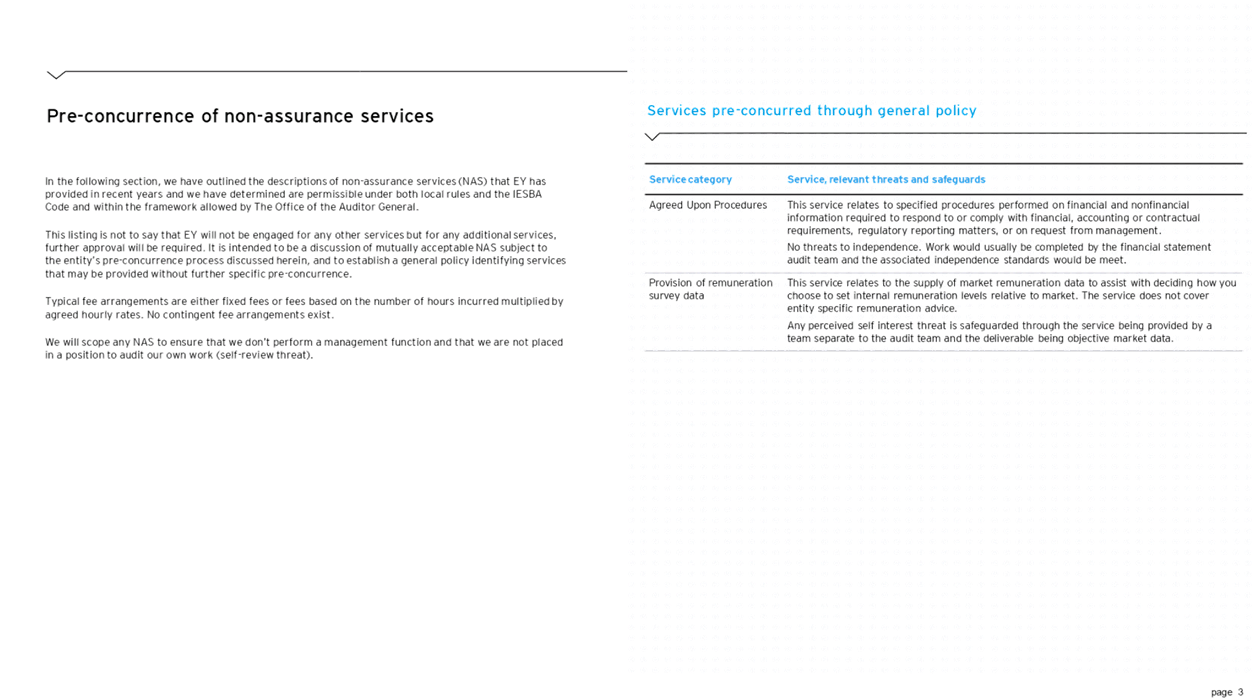

2⇩

|

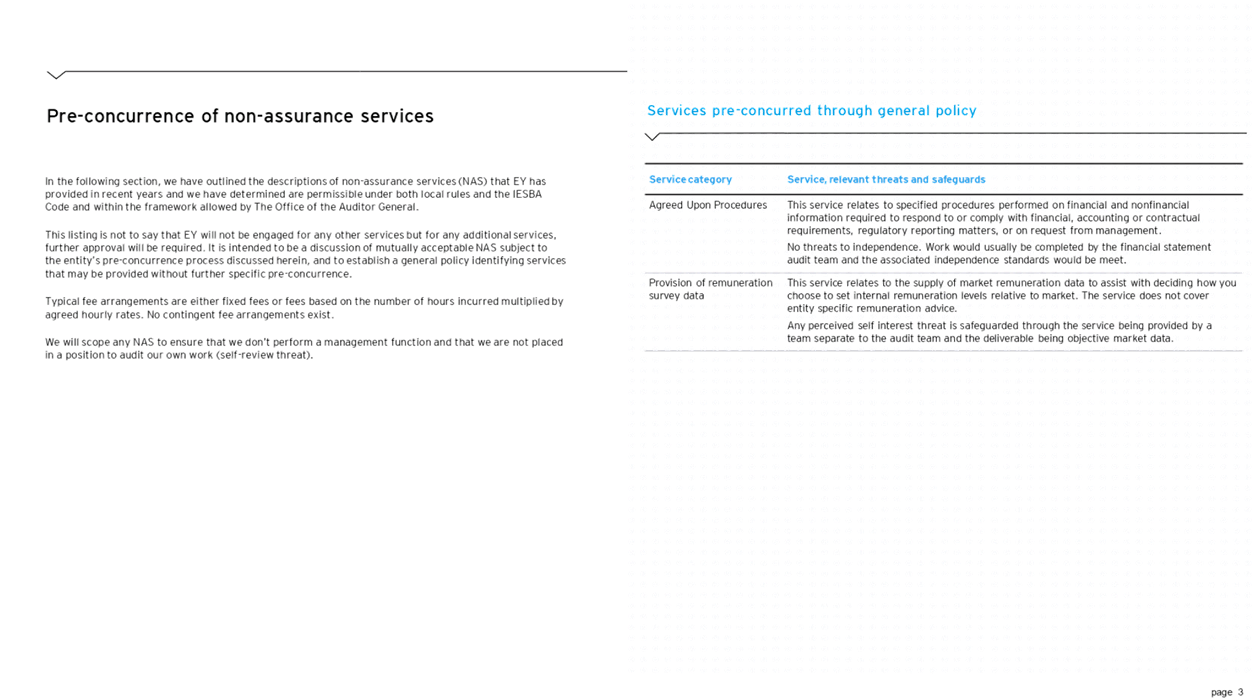

2023 HBRC IESBA Approval report

|

|

|

|

Ernst & Young Audit Close Report and

Report on Control findings

|

Attachment

1

|

|

2023 HBRC IESBA Approval report

|

Attachment

2

|

Hawke’s

Bay Regional Council

Risk and Audit Committee

Wednesday

18 October 2023

Subject:

Confirmation of Public Excluded Minutes

That the Risk

and Audit Committee excludes the public from this section of the meeting being

Confirmation of Public Excluded Minutes Agenda Item 9 with the

general subject of the item to be considered while the public is excluded. The

reasons for passing the resolution and the specific grounds under Section 48

(1) of the Local Government Official Information and Meetings Act 1987 for the

passing of this resolution are:

|

General subject of the item to

be considered

|

Reason for passing this

resolution

|

Grounds under section 48(1) for

the passing of the resolution

|

|

Enterprise Risk Report

|

7(2)(f)(ii) The withholding of

the information is necessary to maintain the effective conduct of public

affairs through the protection of such members, officers, employees, and

persons from improper pressure or harassment

s7(2)(j) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to prevent

the disclosure or use of official information for improper gain or improper

advantage

|

The Council is specified, in

the First Schedule to this Act, as a body to which the Act applies.

|

|

Internal Assurance corrective

actions update

|

7(2)(f)(ii) The withholding of

the information is necessary to maintain the effective conduct of public

affairs through the protection of such members, officers, employees, and

persons from improper pressure or harassment

s7(2)(j) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to prevent

the disclosure or use of official information for improper gain or improper

advantage

s7(2)(e) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to avoid

prejudice to measures that prevent or mitigate loss to members of the public

|

The Council is specified, in

the First Schedule to this Act, as a body to which the Act applies.

|

|

Privacy event

|

7(2)(f)(ii) The withholding of

the information is necessary to maintain the effective conduct of public

affairs through the protection of such members, officers, employees, and

persons from improper pressure or harassment

s7(2)(j) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to prevent

the disclosure or use of official information for improper gain or improper

advantage

s7(2)(e) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to avoid

prejudice to measures that prevent or mitigate loss to members of the public

|

The Council is specified, in

the First Schedule to this Act, as a body to which the Act applies.

|

Authored by:

|

Leeanne Hooper

Team Leader

Governance

|

|

Approved by:

|

Desiree Cull

Strategy

and Governance Manager

|

|

HAWKE’S

BAY REGIONAL COUNCIL

Risk and Audit Committee

Wednesday

18 October 2023

Subject: Risk Maturity Refresh

That

the Risk and

Audit Committee excludes the public from this section of the meeting, being

Agenda Item 10 Risk Maturity Refresh with the general subject of the item to be

considered while the public is excluded. The reasons for passing the resolution

and the specific grounds under Section 48 (1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are:

|

General

subject of the item to be considered

|

Reason

for passing this resolution

|

Grounds

under section 48(1) for the passing of the resolution

|

|

Risk Maturity Refresh

|

7(2)s7(2)(c)(ii) That the public conduct of this agenda item

would be likely to result in the disclosure of information where the

withholding of that information is necessary to protect information which is

subject to an obligation of confidence or which any person has been or could

be compelled to provide and would be likely otherwise to damage the public

interest.

7(2)s7(2)(j) That the public conduct of this agenda item would

be likely to result in the disclosure of information where the withholding of

the information is necessary to prevent the disclosure or use of official

information for improper gain or improper advantage.

|

The Council is specified,

in the First Schedule to this Act, as a body to which the Act applies.

|

Authored by:

|

Helen Marsden

Risk &

Corporate Compliance Manager

|

|

Approved by:

|

Susie Young

General

Manager Corporate Services

|

|

HAWKE’S

BAY REGIONAL COUNCIL

Risk and Audit Committee

Wednesday

18 October 2023

Subject: Incident report

That

the Risk and

Audit Committee excludes the public from this section of the meeting, being

Agenda Item 11 Incident reportwith the general subject of the item to be

considered while the public is excluded. The reasons for passing the resolution

and the specific grounds under Section 48 (1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are:

|

General

subject of the item to be considered

|

Reason

for passing this resolution

|

Grounds

under section 48(1) for the passing of the resolution

|

|

Incident report

|

7(2)7(2)(f)(ii) The withholding of the information is necessary

to maintain the effective conduct of public affairs through the protection of

such members, officers, employees, and persons from improper pressure or

harassment.

7(2)s7(2)(e) That the public conduct of this agenda item would

be likely to result in the disclosure of information where the withholding of

the information is necessary to avoid prejudice to measures that prevent or

mitigate loss to members of the public.

7(2)s7(2)(j) That the public conduct of this agenda item would

be likely to result in the disclosure of information where the withholding of

the information is necessary to prevent the disclosure or use of official

information for improper gain or improper advantage.

|

The Council is specified,

in the First Schedule to this Act, as a body to which the Act applies.

|

Authored by:

|

Helen Marsden

Risk &

Corporate Compliance Manager

|

|

Approved by:

|

Susie Young

General

Manager Corporate Services

|

|

HAWKE’S

BAY REGIONAL COUNCIL

Risk and Audit Committee

Wednesday

18 October 2023

Subject: Internal assurance dashboards

That

Risk and

Audit Committee excludes the public from this section of the meeting, being Agenda

Item 12 Internal assurance dashboards with the general subject of the item to

be considered while the public is excluded. The reasons for passing the

resolution and the specific grounds under Section 48 (1) of the Local

Government Official Information and Meetings Act 1987 for the passing of this

resolution are:

|

General

subject of the item to be considered

|

Reason

for passing this resolution

|

Grounds

under section 48(1) for the passing of the resolution

|

|

Internal assurance

dashboards

|

7(2)7(2)(f)(ii) The withholding of the information is necessary

to maintain the effective conduct of public affairs through the protection of

such members, officers, employees, and persons from improper pressure or

harassment.

7(2)s7(2)(e) That the public conduct of this agenda item would

be likely to result in the disclosure of information where the withholding of

the information is necessary to avoid prejudice to measures that prevent or

mitigate loss to members of the public.

7(2)s7(2)(j) That the public conduct of this agenda item would

be likely to result in the disclosure of information where the withholding of

the information is necessary to prevent the disclosure or use of official

information for improper gain or improper advantage.

|

The Council is specified,

in the First Schedule to this Act, as a body to which the Act applies.

|

Authored by:

|

Olivia Giraud-Burrell

Quality

& Assurance Advisor

|

Helen Marsden

Risk &

Corporate Compliance Manager

|

Approved by:

|

Susie Young

General

Manager Corporate Services

|

|