HAWKE’S

BAY REGIONAL COUNCIL

Wednesday

27 September 2023

Subject: Report and recommendations from the Corporate & Strategic

Committee

Reason

for Report

1. The following matters were

considered by the Corporate and Strategic Committee (C&S) meeting on 20

September 2023 and the recommendations agreed to are now presented for

Council’s consideration alongside any additional commentary that the

Committee Chair, Councillor Neil Kirton, wishes to offer.

Agenda items

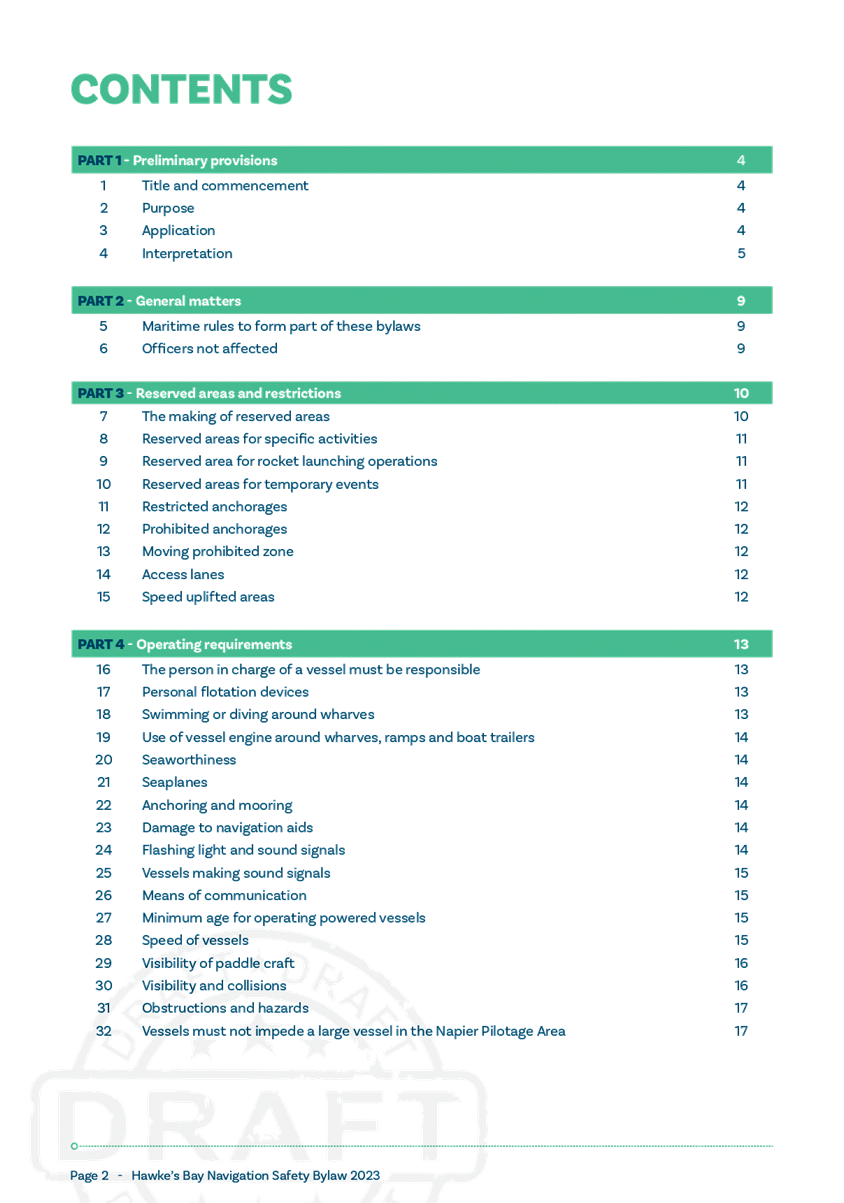

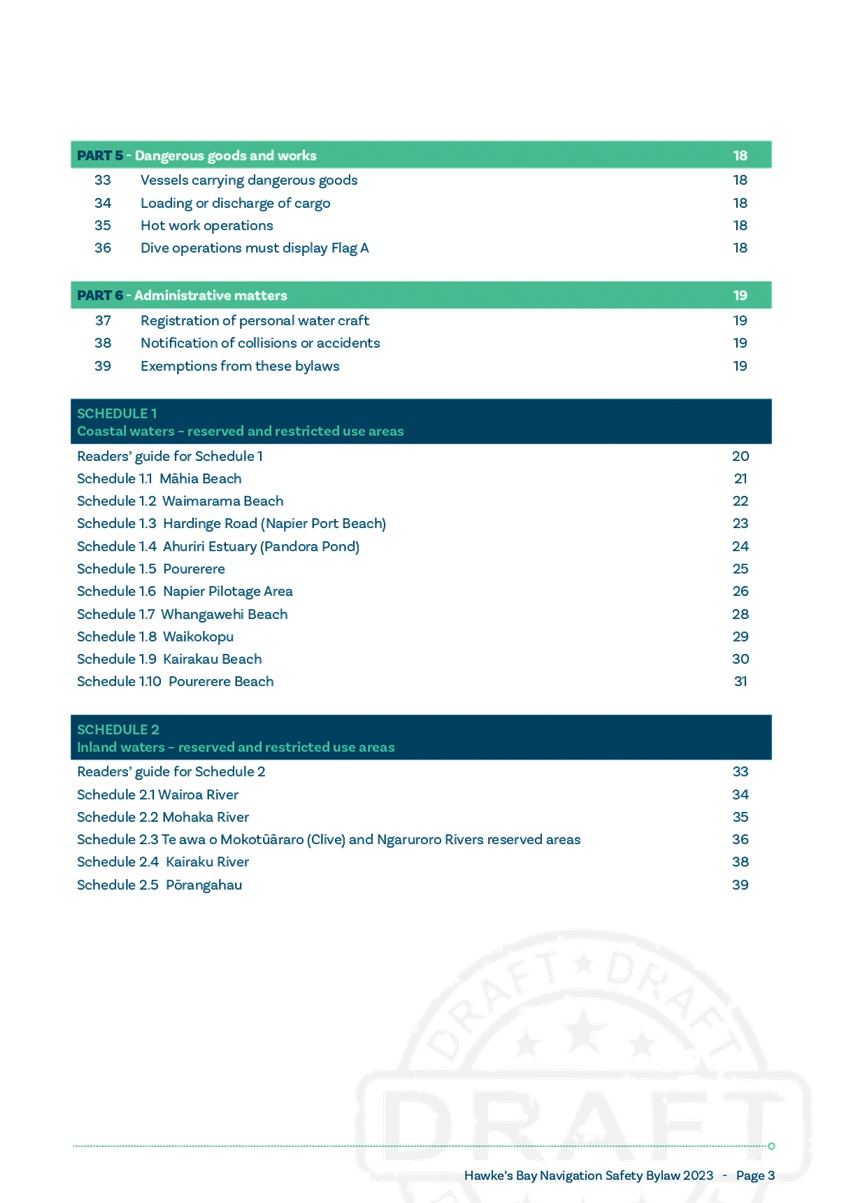

2. The 2023 Navigation Safety Bylaw

approval for consultation item outlined the process to date to develop a

draft bylaw and highlighted changes to the existing bylaw. Attached to

the paper was the draft bylaw, the Statement of Proposal (SOP) document and the

Consultation Document (CD) for approval ahead of the engagement process. The

Committee requested some minor wording changes, (included in the attached

document) which were agreed on and recommended that the Council adopt the draft

Bylaw, SOP and CD for community engagement and agree to the engagement

period 29 September to 29 October 2023.

3. The 2022-2023 Carry Forwards

decision item listed unspent opex and capex for specific projects/work that are

requested to be carried forward to cover the expected costs to completion,

noting that any carry forward of general funding will impact the forecast

operating deficit for the financial year. This year’s carry forwards are

significantly impacted by Cyclone Gabrielle response and recovery activities.

The Committee received the paper and deferred decision making to Council once

further information on general rate-funded carry forwards was provided.

4. The Debt Drawdown decision item

sought a recommendation to Council to delegate borrowing of new debt. The

Committee agreed and recommended that the Council delegates borrowing up to the

2023-2024 Annual Plan total debt amount of $134.6m to the Hawke’s Bay

Regional Council Chief Executive and Group Manager Corporate Services, as

required under the Council’s Treasury Policy

5. The Annual Report 2022-2023 –

Interim Non-Financial Results information paper presented the interim level

of service measure results for 2022-23 for feedback prior to auditing and

publication in the Annual Report. The Committee queried the

implications of a lower than usual percentage of “high-risk”

consents monitored and the scope of the corporate carbon footprint

report.

6. The Organisational Performance

Report for the period 1 April – 30 June 2023 was presented for

information. The Committee Chair noted the “sea of red” (red

traffic-light reporting for level of service performance measures, activity and

financials) from cyclone disruption. The use of the colour red for

reporting underspent budget was queried. Points of interest this quarter were:

6.1. LGOIMA requests jumped to 57 compared

with 37 last quarter.

6.2. There are three new graphs from our

Customer Experience team around daily feedback sentiment and response time for

customer enquiries.

6.3. The quarterly employee turnover has

trended downwards, with the rolling 12-month turnover down to 19.8% from 21.5%

last quarter.

7. The Hawke’s Bay Tourism

Annual Report was presented for information and to meet its obligation to

report against KPIs in the ‘Funding Agreement for the Operation of a Regional

Tourism Organisation’ (the Agreement) between HBRC and HB Tourism. KPIs include (amongst other things)

market share of domestic visitor spend and industry contribution (including

cash investment, in-kind support and membership). Figures on the value of

tourism for the HB economy were also presented. Better line of site of

financial statements was requested.

8. The HBRIC Ltd Quarterly update

information item was presented by the Chair of HBRIC, Dan Druzianic with

additional commentary from the Chair of Napier Port, Blair O’Keeffe. HBRIC’s unaudited financials to

30 June 2023 were attached and key items to note were:

8.1. Statement of Financial Performance

8.1.1. Year-end surplus of $7.2 million

(excluding fair value movements through other comprehensive income)

8.1.2. Year-end $628k interest income

8.1.3. $7.04 million of dividend revenue

received from Napier Port Holdings Limited (NPHL) in the year, with $6.87

million paid to HBRC

8.2. Statement of Financial Position

8.2.1. Decrease in net assets of $25 million

to $344 million for the year to 30 June 2023.

8.2.2. NPHL share price had decreased during

the year 9% from $2.75 to $2.50 – total decrease is $ 27.5m

8.2.3. Increase in managed fund value $43.2m

to $45.6m at year-end 30 June 2023.

9. The Cyclone Financials Update

information item, considered in Public Excluded session, provided an outline of

costs incurred to date by HBRC. The paper also included Regional Recovery

Agency funding.

Decision

Making Process

10. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

10.1. Given the items were

specifically considered by the Corporate and Strategic Committee on 20

September 2023 the Council can exercise its discretion and make the relevant

decisions without consulting directly with the community or others having an interest in those in

accordance with

the following recommendations.

Recommendations

The

Corporate and Strategic Committee recommends that Hawke’s Bay Regional

Council:

1. Receives and considers the Report

and recommendations from the Corporate and Strategic Committee.

2. Agrees that the decisions to be made

are not significant under the criteria contained in Council’s adopted

Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without conferring directly with

the community or persons likely to have an interest in the decision.

2023 Navigation Safety Bylaw approval for consultation

3. Delegates authority to the Group

Manager Policy and Regulation to make any required minor amendments or edits to

the document prior to publication and the start of engagement.

4. Adopts the proposed 2023 Navigation

Bylaw for public consultation 29 September to 29 October 2023.

Debt Drawdown

5. Delegates borrowing up to the

2023-2024 Annual Plan total debt amount of $134.6m to the Hawke’s Bay

Regional Council Chief Executive and Group Manager Corporate Services, noting

that further delegation over and above this level, if required, will be a

Council decision.

Authored by:

|

Allison Doak

Governance

Advisor

|

|

Approved by:

|

Desiree Cull

Strategy

and Governance Manager

|

|

Attachment/s

|

1⇩

|

Draft Navigation and Safety Bylaw

|

|

|

HAWKE’S BAY REGIONAL

COUNCIL

Wednesday

27 September 2023

Subject: 2022-2023 Carry forwards

Reason

for Report

1. This item seeks approval from the Council

to carry forward expenditure budgets from 2022-2023 to 2023-2024.

Executive

Summary

2. During 2022-2023 a number of work

programmes experienced delays and were unable to be completed as originally

planned. Where this work cannot be reprioritised from within the

2023-2024 Annual Plan budget, unspent expenditure budgets are requested to be

carried forward to cover the expected costs of completion.

3. A total of $8.343m unspent opex and

$3.806m unspent capex is requested to be carried forward into the 2023-2024

Annual Plan budget.

4. The source of funds required

($12.149m) for the total carry forward request is split as following:

4.1 $3.535m debt funding (already planned

lending that hasn’t yet been drawn down),

4.2 $5.048m reserve funds (existing

reserves built up from previous rates),

4.3 $1.626m external funds (revenue from

other organisations), and

4.4 $1.940m general funds (from operating

surpluses in prior years).

5. The interim financial results

presented to Council on 30 August, indicated that Council will have an

operating deficit for the 2022-2023 financial year. Even after allocating

cyclone expenditure to the Emergency Management and Regional Disaster Damage

Reserves this will still result in a deficit to general funds for the year due

to the reduced investment income.

6. Any carry over of general funds into

the 2023-2024 year would therefore require a drawdown from accumulated funds

(i.e.: from general fund surpluses accumulated over previous financial years)

and should be considered in this context.

7. The opening balance of accumulated

funds as at 1 July 2022 was $275 million (excluding $46m of internal

loans). The movements for the 2022-2023 financial year are still being

finalised.

8. External, debt and reserve funded

carry forwards have no immediate impact on Council’s financial position

as they are just a timing difference of when funding is drawn or recognised.

Background

9. Carry forwards is a common practice

within councils and allows for unspent funds against projects to be moved

forward so that projects can be completed. These include the funding of final

costs of projects, contracts that were unable to be completed by the financial

year end, and the carry forward of external income received for specific projects.

10. The funding types are categorised as:

7.1 General funding is from General Rates

which includes investment income.

7.2 Reserve funding is from targeted rates

that have flowed through to specific reserves (including asset replacement and

disaster damage reserves).

7.3 External is external funding from

other organisations received for specific projects.

7.4 Debt is for debt funding not drawn

down this year and is covered by interest and principal repayments that are

already included in the LTP and/or Annual Plan.

11. Officers informed the Corporate &

Strategic Committee on 14 June 2023 that, based on the full year forecast at

that time, the indicative carry forwards from 2022-2023 would be $9.5m opex and

$6.1m capex. These were reduced to $9.0m opex and $3.8m capex in the updated

paper to C&S on 20 September 2023 following detailed reviews with Group

Managers. The carry forwards presented in this paper have further been reduced.

12. The interim financial results

presented to Council on 30 August, indicated that HBRC will have an operating

deficit for the 2022-2023 financial year, however the general reserve

(represented by accumulated funds in the balance sheet) does have an opening

balance of $275m.

13. The carry forward decision this year

is significantly impacted by Cyclone Gabrielle response and recovery

activities.

13.1. It has been a key driver for delays to originally planned

activities, thus causing many of the requests for carry forwards.

13.2. It has also had significant adverse impact on

Council’s financial situation, limiting our capacity to fund planned

activities.

14. Unplanned expenditure for the response

to Cyclone Gabrielle will be charged to the Emergency Management and Regional

Disaster Damage Reserves. A significant proportion of this shortfall is

anticipated to be repaid via NEMA, and insurance and other claims over the

coming 12 months.

15. It should be noted that the deficits

in the Emergency Management and Regional Disaster Damage Reserves will need to

be addressed as part of the Long-Term Plan 2024-2034.

16. The impact of the carry forwards on

the 2023-2024 annual plan is that the planned operating deficit would increase

from the current $20.7m deficit by the amount of operating expenditure budget

carried forward less any external revenue carried forward. The funding impact

statement would remain in balance as all expenditure carried forward is fully

funded from the sources identified and as such does not impact on existing

forecasts of future rates.

17. All of the reserves identified as

funding sources will be in surplus at the end of the 2022-2023 financial year.

Operating

expenditure carry forward requests

|

Activity / Project

|

Amount Requested

|

Source of funds

|

|

General

|

Reserve

|

External

|

Debt

|

|

Integrated Catchment Management (ICM)

|

|

|

|

|

|

|

1

|

Biodiversity

|

$429,000

|

|

|

$229,000

|

$200,000

|

|

2

|

Predator Free Hawkes Bay

|

$423,000

|

|

|

$423,000

|

|

|

3

|

Land for life

|

$277,000

|

|

$277,000

|

|

|

|

4

|

Environm’l Science data models

|

$502,000

|

|

|

|

$502,000

|

|

5

|

Environm’l Enhancement Prog

|

$320,000

|

$208,000

|

|

$112,000

|

|

|

6

|

Land research & investigations

|

$99,500

|

|

|

$99,500

|

|

|

Asset Management

|

|

|

|

|

|

|

7

|

Central & Southern Rivers – flood protection

|

$30,000

|

$ 3,750

|

$26,250

|

|

|

|

8

|

Regional Water Security

|

$3,500,000

|

|

$3,500,000

|

|

|

|

Governance & Partnerships

|

|

|

|

|

|

|

9

|

Tangata Whenua Partnerships

|

$450,000

|

$450,000

|

|

|

|

|

Policy & Regulation

|

|

|

|

|

|

|

10

|

Kotahi (policy & planning)

|

$1,050,000

|

$1,050,000

|

|

|

|

|

Transport

|

|

|

|

|

|

|

11

|

Passenger Transport

|

$763,000

|

|

|

$763,000

|

|

|

Corporate Services

|

|

|

|

|

|

|

12

|

Software-as-a-service dvlpt

|

$500,000

|

|

|

|

$500,000

|

|

Total

|

$8,343,500

|

$1,711,750

|

$3,803,250

|

$1,626,500

|

$1,202,000

|

Biodiversity - (opex – 1)

18. Integrated Catchment Management (ICM)

seeks to carry forward a total of $429k to cover various biodiversity projects

supported by external funding agreements with the Department of Conservation

(DOC) and the Ministry for the Environment (MFE).

18.1. $200k of the Covid Recovery fund approved in 2020/21

(debt funding at $100k per project) for the Department of Conservation Jobs for

nature fencing project, and the Porangahau catchment group Freshwater

improvement fund project;

18.2. $194k is required to complete fencing projects supported

by the DoC Jobs for Nature funding.

18.3. $35k is required to continue the support of the

Porangahau catchment group Freshwater Improvement fund project.

19. Financial Assessment: The $200k loan

funding was not drawn in 2022-2023, but repayment and interest costs have been

accounted for in the 2023-2024 annual plan as if it had been. $229k

of the unspent funds was received from external parties under Deeds of Funding

agreements.

20. Recommendation: That Council approves

the carry forward of $200k of debt funding, and $229k of external funding in

external funds from the general reserve.

Predator Free Hawkes Bay - (opex – 2)

21. ICM seeks to carry forward $423k to

cover the final milestones for the Predator Free Hawkes Bay project in Mahia,

as supported by a new funding agreement with Predator Free NZ 2050 Ltd.

22. Financial Assessment: $423k of

external funding was not spent in 2022-23.

23. Recommendation: That Council approves

the carry forward of $423k in external funding from revenue received in

advance.

Land

for life - (opex – 3)

24. ICM seeks to carry forward $277k for

the Land for Life project for implementation planning and scale up to support

primary sector recovery subject to due diligence on the business case.

25. Financial Assessment: The $277k

reserve funding was not drawn in 2022-2023, due to the impacts of the Cyclone

and the subsequent repositioning of the project.

26. Recommendation: That Council approves

the carry forward of $277k from the long-term investment fund reserve.

Environmental

Science Data models - (opex – 4)

27. ICM seeks to carry forward $502k for

environmental science data model projects that were unable to progress as

intended due to science staff turnover, difficulty securing contractors and

Cyclone Gabrielle impacts. Each of these multi-year projects provide a critical

role in the science decision support for PC6 and Kotahi, and have contractual

commitments now delayed into the 2023-2024 financial year.

27.1. $147k for the LiDAR tools project (data modelling for the

completed LiDAR mapping project)

27.2. $240k for the final milestones of the 3D Aquifer project

27.3. $115k for the Ruataniwha Groundwater modelling

28. Financial Assessment: The $502k loan

funding was not drawn in 2022-2023, but repayment and interest costs have been

accounted for in the 2023-2024 annual plan as if it had been.

29. Recommendation: That Council approves

the carry forward of $502k in loan funding.

Environmental Enhancement

Programme - (opex – 5)

30. ICM seeks to carry forward a total of

$320k to cover:

23.1 $208k for the final year of the

Whakaki Environment Enhancement project which is a multi-year project which has

suffered accumulated delays in deliverables due to extended community

consultation, covid-19 impacts and adverse weather. This project is co-funded

by MfE via the Freshwater Improvement fund.

23.2 $112k for the Fonterra sponsored

wetland construction at Tukipo as this was delayed due to restricted access due

to adverse weather conditions.

31. Financial Assessment: $208k for

Whakaki is general rate funded as part of the wider Enviro Enhancement

Programme, which had an underspend of $811k in 2022-2023. $112k is

external funds received from Fonterra, which were note spent in 2022-2023.

32. Recommendation: That Council approves

the carry forward of $112k external funds and $208k from the general

reserve.

Land

Research Investigations - (opex – 6)

33. ICM seeks to carry forward a total of

$99.5k for the completion of landslide mapping work with delivery of the

contractual commitments delayed into 2023-2024.

34. Financial Assessment: $114k external

funds were received from Ministry of Primary Industries (MPI) to support this

work, and $99.5k has not been spent.

35. Recommendation: That Council approves

the carry forward of $99.5k external funds from the general reserve.

Central & Southern

rivers flood protection - (opex – 7)

36. Asset Management seeks to carry

forward a total of $30k for flood protection work in the Central & Southern

rivers, which was originally programmed to commence in Autumn 2023, but was

unable to begin due to the Cyclone.

37. Financial Assessment: The Central

& Southern rivers flood protection workstream was underspent in 2022-2023

by $52k.

38. Recommendation: That Council approves

the carry forward of $3.750k from the general reserve and $26.250k from the

Central & Southern rivers scheme reserve (representing the unspent targeted

rates collected in 2022-2023).

Regional Water Security Programme - (opex – 8)

39. Asset Management seeks to carry

forward a total of $3.5m for the continuation of the multi-year Regional Water

Security Programme, including the Water Demand Study as planned in the LTP, and

the Te Tua and CHB water storage and reticulation infrastructure (the latter of

which is expected to begin construction in 2023-2024).

40. Financial Assessment: The Regional

Water Security Programme was underspent in 2022-2023 by $3.5m.

41. Recommendation: That Council approves

the carry forward of $3.5m from the long-term investment reserve.

Kotahi and Tangata Whenua Partnerships - (opex – 9 & 10)

42. Policy & Regulation and Governance

& Partnerships seek to carry forward a total of $1.5m, for tangata whenua

engagement regarding te mana o te wai, which stalled due to the inability to

progress discussions 'at place' for visions and values (for Kotahi) and set up

contracts with tāngata whenua. This was due to a change to the work

programme direction from All Governors and exacerbated by the inability to meet

at place because of Cyclone Gabrielle.

43. The visions and values work programmed

for 2022-2023 is still required as per the NPSFM. The budget was

established for Kotahi not on a year on year spend but an anticipated total

amount for the 3 years of the LTP to enable this work to be undertaken.

Visions and values is one piece of the work which needs to be progressed and

contracted. The next stage which will require funding is attributes,

limits, targets and matauranga maori, and this stage will fully utilise the

existing budget allocated to Kotahi in the 2023-2024 annual plan.

44. Financial assessment: Tangata Whenua

Partnerships were underspent by $783k and the Kotahi external expenses budget

was underspent by $1.5m. The remainder of the underspend will be factored in to

the LTP process for future years.

45. Recommendation: That Council approves

the carry forward of $1.5m from the general reserve and notes that officers may

come back to Council to approve bringing forward some LTP funding if required

to maintain momentum in the delivery of tangata whenua engagement regarding te

mana o te wai.

Passenger Transport - (opex – 11)

46. Policy & Regulation seek to carry

forward the $763k shortfall funding received from Waka Kotahi to contribute

towards increased operational costs. The additional operational costs

will impact in the 2023-2024 financial year as indexation costs on the GoBus

contract are applied.

47. Financial Assessment: The passenger

transport cost centre had a $947k surplus in the 2022-2023 financial

year. Note a carry forward of surplus only addresses cost pressures for

one financial year, and ongoing cost pressures will need to be addressed in the

2024 LTP.

48. Recommendation: That Council approves

the carry forward of $763k from external funding. This will be done via the

transport reserve as the Waka Kotahi funding needs to be recognised in the year

it is received.

Software-as-a-service ICT

- (opex – 12)

49. ICT seeks to carry forward $500k for

the digital transformational work programme, which was not progressed due to

the suspension or slowing of work on the Finance and Biodiversity systems,

caused by unavailability of business teams to assist with scoping due to staff

turnover, and reprioritisation to work on the cyclone response.

50. Financial Assessment: The $500k loan

funding was not drawn in 2022-2023, but repayment and interest costs have been

accounted for in the 2023-2024 annual plan as if it had been.

51. Recommendation: That Council approves

the carry forward of $500k in loan funding.

Capital

expenditure carry forward requests

|

Activity / Project

|

Amount Requested

|

Type of

funding

|

|

General Funds

|

Reserve

|

Debt

|

|

Integrated Catchment Management (ICM)

|

|

|

|

|

|

1

|

SOE ground water monitoring drilling

|

$275,000

|

|

$208,000

|

$67,000

|

|

2

|

Enviro info technical equipment

|

$102,000

|

|

$102,000

|

|

|

Asset Management

|

|

|

|

|

|

3

|

Flood protection schemes

|

$397,000

|

|

$397,000

|

|

|

4

|

Flood risk assessment & warning

|

$113,000

|

$113,000

|

|

|

|

5

|

Forestry

|

$45,000

|

|

$45,000

|

|

|

6

|

Regional cycleways

|

$115,000

|

$115,000

|

|

|

|

7

|

Regional Parks

|

$707,000

|

|

|

$707,000

|

|

8

|

IRG – HPFCS and gravel extraction

|

$1,101,000

|

|

$212,000

|

$889,000

|

|

Corporate Services

|

|

|

|

|

|

9

|

Office renovations (including furniture & fittings)

|

$730,000

|

|

$164,000

|

$566,000

|

|

10

|

Radio network

|

$44,000

|

|

$44,000

|

|

|

11

|

ICT network & equipment

|

$72,500

|

|

$72,500

|

|

|

12

|

Aerial Imagery (GIS)

|

$104,000

|

|

|

$104,000

|

|

Total

|

$3,805,500

|

$228,000

|

$1,244,500

|

$2,333,000

|

SOE Ground water monitoring drilling - (capex – 1)

52. ICM seeks to carry forward $275k to

cover the contractually committed drilling programme delayed into 2023-2024.

Resource capacity of drilling companies continues to be a limiting factor to

achieving the annual programme of work in line with the financial year, and

this was exasperated in 2022-2023 by the cyclone disruptions.

53. Financial Assessment: The groundwater

monitoring drilling workstream was underspent by $275k.

54. Recommendation: That Council approves

the carry forward of $67k loan funding and $208k of asset replacement reserve

funding.

Environmental monitoring equipment replacements - (capex –

2)

55. ICM seeks to carry forward $102k for

scheduled equipment replacements postponed due to staff capacity redirected to

repair and replacement of equipment damaged in the cyclone.

56. Financial Assessment: The

environmental monitoring equipment cost centres were underspent by $102k.

57. Recommendation: That Council approves

the carry forward of $102k of asset replacement reserve funding.

Flood protection schemes - (capex – 3)

58. Asset Management seeks to carry

forward a total of $397k for cyclone-disrupted projects as follows:

58.1. Wairoa River and streams scheme – $120k for the

extension of the rock wall bank protection of the true right of the Wairoa

River upstream of the mouth.

58.2. Ohuia- Whakaki – $277k for renewal works including

pump installations, power supply and pump station screens.

59. Financial Assessment: The Wairoa

scheme opex budget was underspent by $120k, and it is this budget that is

requested to be carried forward and converted to capex. The Ohuia-Whakaki

workstream was underspent by the amount of carry forward requested above.

60. Recommendation: That Council approves

the carry forward of $120k from the Wairoa river and streams scheme reserve

(representing the unspent targeted rates collected in 2022-2023) and $277k from

the asset replacement reserve.

Flood risk assessment & warning - (capex – 4)

61. Asset Management seeks to carry

forward $113k for software developments for flood forecasting, where the

project was not started due to reprioritisation of staff capacity for the

cyclone response.

62. Financial Assessment: The flood risk

assessment and flood forecasting workstreams were underspent by the amount of

carry forward requested above. There is no budget for this work in the

2023-2024 annual plan.

63. Recommendation: That Council approves

the carry forward of $113k from the general reserve.

Forestry - (capex – 5)

64. Asset Management seeks to carry

forward $45k for the development of roading and access for three blocks around

the Devil’s Elbow due to be harvested, which were unable to be accessed

due to closures of SH2 following the cyclone.

65. Financial Assessment: The forestry

capex workstream was underspent by the amount of the carryfoward requested.

66. Recommendation: That Council approves

the carry forward of $45k from the long-term investment fund reserve.

Regional cycleways - (capex – 6)

67. Asset Management seeks to carry

forward a total of $115k for the extension of the Ngaruroro explorer cycleway,

which will be progressed once repairs on the cyclone-damaged section of the

trail are completed. This project has co-funding contributions from MBIE

and Hastings District Council and is the only such project still supported by

MBIE. Other cycleway projects will be reassessed as part of the LTP as a

reflection of the withdrawn MBIE cofounding.

68. Financial Assessment: The regional

cycleways capex budget was not spent in 2022-2023.

69. Recommendation: That Council approves

the carry forward of $115k from the general reserve.

Regional Parks - (capex – 7)

70. Asset Management seeks to carry

forward a total of $707k for Regional Park developments unable to be progressed

in 2022-2023:

70.1. Hawea Historical Park and Waitangi Park (toilet block)

– $605k

70.2. Ahuriri Regional Park, – establishment of project

manager for planning work – $102k

71. Whilst the budgets are being carried

forward the drawdown of the loan and actual spending will need to be consistent

with decisions around new infrastructure in Open Spaces being framed in the

preparation of the LTP.

72. Financial Assessment: The $707k loan

funding was not drawn in 2022-2023, but repayment and interest costs have been

accounted for in the 2023-2024 annual plan as if it had been.

73. Recommendation: That Council approves

the carry forward of $707k of loan funding.

IRG – Heretaunga Plains Flood Control Scheme (HPFCS) and

gravel extraction - (capex – 8)

74. Asset Management seeks to carry

forward a total of $1.101m for the planned programme of works for HPFCS

improvements and Upper Tukituki gravel extraction, which was significantly

impacted by the cyclone. This multi-year programme of work is co-funded

by Kanoa/MBIE, and an extension to the funding deadline will be sought.

75. Financial Assessment: The $889k loan

funding was not drawn in 2022-2023, but repayment and interest costs have been

accounted for in the 2023-2024 annual plan as if it had been.

76. Recommendation: That Council approves

the carry forward of $889k of loan funding and $212k of HPFCS scheme reserves

funding.

Office renovations (including furniture & fittings) - (capex

– 9)

77. Corporate Services seeks to carry

forward a total of $730k for the accommodation refurbishment project postponed

due to consent and engineering report delays.

78. Financial Assessment: The

accommodation and furniture & fitting workstreams were underspent by the

value of the carry forward request above. The $566k loan funding was not drawn

in 2022-2023, but repayment and interest costs have been accounted for in the

2023-2024 annual plan as if it had been.

79. Recommendation: That Council approves

the carry forward of $566k of loan funding and $164k of asset replacement

reserves funding.

Radio network - (capex – 10)

80. Corporate Services seeks to carry

forward a total of $44k for the final deliverables of Project

Tarsier.

81. Financial Assessment: The RT Network

capex workstream was underspent by $234k in 2022-2023.

82. Recommendation: That Council approves

the carry forward of $44k asset replacement reserves funding.

ICT network & equipment - (capex – 11)

83. Corporate Services seeks to carry

forward a total of $72.5k for the purchase of extended hardware warranty

support. This will improve the resilience of the ageing parts of our ICT

infrastructure.

84. Financial Assessment: The Servers

& Storage capex workstream was underspent in 2022-2023 by the amount

requested to be carried forward.

85. Recommendation: That Council approves

the carry forward of $72.5k asset replacement reserves funding.

Aerial imagery - (capex – 12)

86. Corporate Services seeks to carry

forward a total of $104k for the acquisition of aerial imagery. This will be

necessary to develop models and storage systems to support the increased volume

of datasets collected following Cyclone Gabrielle.

87. Financial Assessment: The $104k loan

funding was not drawn in 2022-2023, but repayment and interest costs have been

accounted for in the 2023-2024 annual plan as if it had been.

88. Recommendation: That Council approves

the carry forward of $104k loan funding.

Options

Assessment

89. Option 1: Council approves the carry forwards

as proposed from 2022-2023 to 2023-2024 to enable all the projects to be

completed, service levels to be achieved, commitments to external organisations

to be fulfilled and the future work to be funded), acknowledging this would

require a drawdown of accumulated funds to fund the general and external funded

expenditure.

90. Option 2: Council approves the carry forward

of reserve, debt and externally funded expenditure only, leaving the general-funded

carry forward expenditure requests to be reprioritised through 2023-2024 annual

plan budgets.

91. Option 3: Council does not approve the carry

forwards as proposed and provides officers with guidance on which carry

forwards, if any, should be approved.

Financial

and Resource Implications

92. Debt funded expenditure can be carried

forward with no impact to the ratepayer in future years as the repayment of

these funds have already been included in the LTP and Annual Plan.

93. Funding from reserves can be carried

forward with no impact, as the expenditure has not been drawn from the reserve

and is therefore available to be drawn in 2023-2024 instead.

94. Funding from targeted rates will be

automatically carried forward through the associated reserve to enable the

funds to be drawn down to complete the work in subsequent years.

95. The carry forward of $2.640m in

general funding and $0.863m in external funding from 2022-2023 to 2023-2024,

will impact the general reserve as there is not expected to be a surplus of

general funds for the 2022-23 financial year. The actual quantum of the

general fund deficit will be confirmed once the final funding and reserve

movements have been completed for the Annual Report.

96. Approved general funded and external

funded carry forward requests would be funded from the general reserve in

2023-2024, drawing from accumulated funds.

Decision Making Process

97. Staff have assessed the requirements

of the Local Government Act 2002 in relation to this item and have concluded:

121.1 The decision does not

significantly alter the service provision or affect a strategic asset, nor is

it inconsistent with an existing policy or plan.

121.2 The use of the special

consultative procedure is not prescribed by legislation.

121.3 The decision is not

significant under the criteria contained in Council’s adopted

Significance and Engagement Policy.

121.4 The persons affected by this decision

are Council’s ratepayers.

98. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by, or have an interest in the decisions made, Council

can exercise its discretion and make a decision without consulting directly

with the community or others

having an interest in the decision.

Recommendations

1. That the Council

receives and notes the 2022-2023 Carry forwards staff report.

2. The Hawke’s Bay Regional

Council:

2.1. Agrees that the decisions to be made

are not significant under the criteria contained in Council’s adopted

Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without conferring directly with

the community or persons likely to have an interest in the decision.

2.2. Approves the carry forward of all

expenditure requests from the 2022-2023 to the 2023-2024 budget, being:

Operating

expenditure carry forward requests

|

Activity / Project

|

Amount Requested

|

Source of funds

|

|

General

|

Reserve

|

External

|

Debt

|

|

Integrated Catchment Management (ICM)

|

|

|

|

|

|

|

1

|

Biodiversity

|

$429,000

|

|

|

$229,000

|

$200,000

|

|

2

|

Predator Free Hawkes Bay

|

$423,000

|

|

|

$423,000

|

|

|

3

|

Land for life

|

$277,000

|

|

$277,000

|

|

|

|

4

|

Environmental Science data models

|

$502,000

|

|

|

|

$502,000

|

|

5

|

Environmental Enhancement Programme

|

$320,000

|

$208,000

|

|

$112,000

|

|

|

6

|

Land research & investigations

|

$99,500

|

|

|

$99,500

|

|

|

Asset Management

|

|

|

|

|

|

|

7

|

Central & Southern Rivers – flood protection

|

$30,000

|

$ 3,750

|

$26,250

|

|

|

|

8

|

Regional Water Security

|

$3,500,000

|

|

$3,500,000

|

|

|

|

Governance & Partnerships

|

|

|

|

|

|

|

9

|

Tangata Whenua Partnerships

|

$450,000

|

$450,000

|

|

|

|

|

Policy & Regulation

|

|

|

|

|

|

|

10

|

Kotahi (policy & planning)

|

$1,050,000

|

$1,050,000

|

|

|

|

|

Transport

|

|

|

|

|

|

|

11

|

Passenger Transport

|

$763,000

|

|

|

$763,000

|

|

|

Corporate services

|

|

|

|

|

|

|

12

|

Software-as-a-service development

|

$500,000

|

|

|

|

$500,000

|

|

Total

|

$8,343,500

|

$1,711,750

|

$3,803,250

|

$1,626,500

|

$1,202,000

|

Capital expenditure carry forward requests

|

Activity / Project

|

Amount Requested

|

Type of funding

|

|

General

|

Reserve

|

Debt

|

|

Integrated Catchment Management (ICM)

|

|

|

|

|

|

1

|

SOE Ground water monitoring drilling

|

$275,000

|

|

$208,000

|

$67,000

|

|

2

|

Enviro info technical equipment

|

$102,000

|

|

$102,000

|

|

|

Asset Management

|

|

|

|

|

|

3

|

Flood protection schemes

|

$397,000

|

|

$397,000

|

|

|

4

|

Flood risk assessment & warning

|

$113,000

|

$113,000

|

|

|

|

5

|

Forestry

|

$45,000

|

|

$45,000

|

|

|

6

|

Regional cycleways

|

$115,000

|

$115,000

|

|

|

|

7

|

Regional Parks

|

$707,000

|

|

|

$707,000

|

|

8

|

IRG – HPFCS and gravel extraction

|

$1,101,000

|

|

$212,000

|

$889,000

|

|

Corporate Services

|

|

|

|

|

|

9

|

Office renovations (including furniture & fittings)

|

$730,000

|

|

$164,000

|

$566,000

|

|

10

|

Radio network

|

$44,000

|

|

$44,000

|

|

|

11

|

ICT network & equipment

|

$72,500

|

|

$72,500

|

|

|

12

|

Aerial Imagery (GIS)

|

$104,000

|

|

|

$104,000

|

|

Total

|

$3,805,500

|

$228,000

|

$1,244,500

|

$2,333,000

|

2.3. Notes that officers may come back to

Council to approve bringing forward some LTP funding if required to maintain

momentum in the delivery of tangata whenua engagement regarding te mana o te

wai.

Authored by:

|

Amy Allan

Senior

Business Partner

|

Chris Comber

Chief

Financial Officer

|

Approved by:

Attachment/s

There are no attachments for this

report.