Meeting of the

Corporate and Strategic Committee

Date: Wednesday 20 September 2023

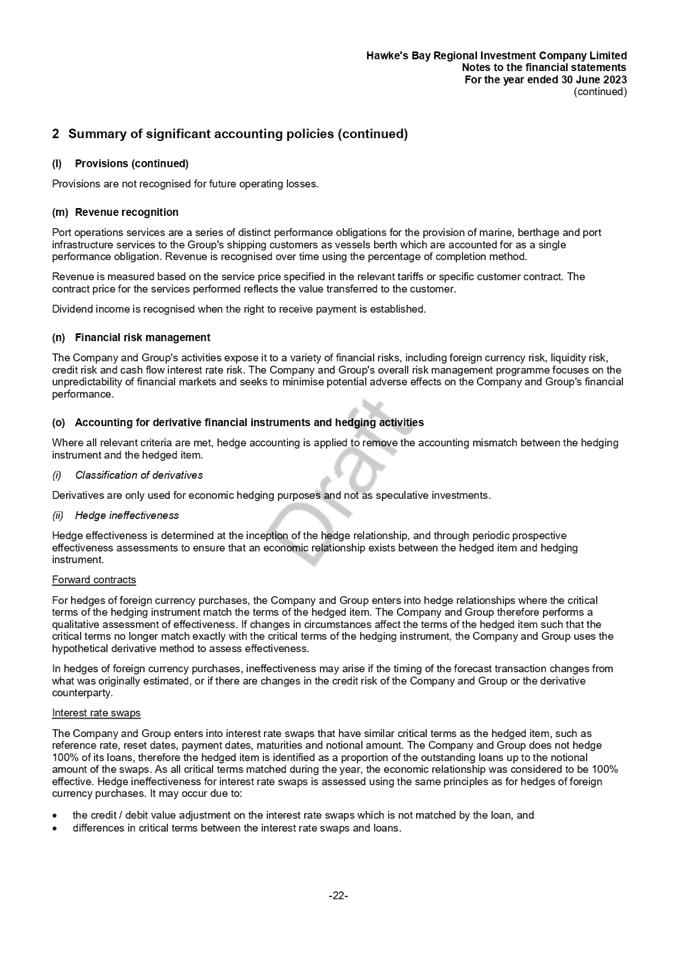

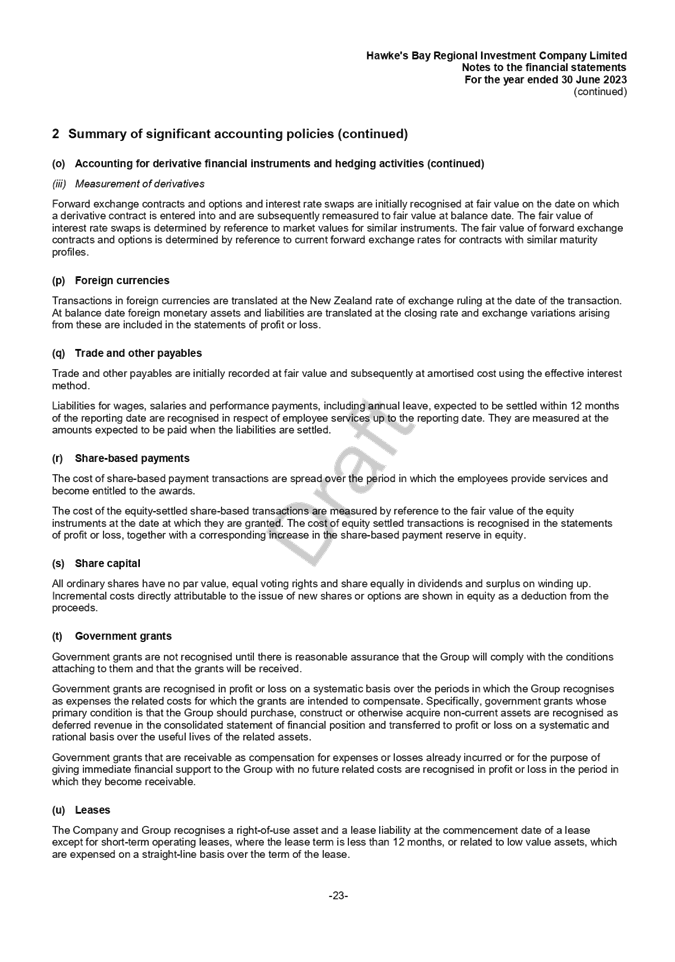

Time: 1.00pm

|

Venue:

|

Council

Chamber

Hawke's

Bay Regional Council

159

Dalton Street

NAPIER

|

Agenda

Item Title Page

1. Welcome/Karakia/Notices/Apologies

2. Conflict

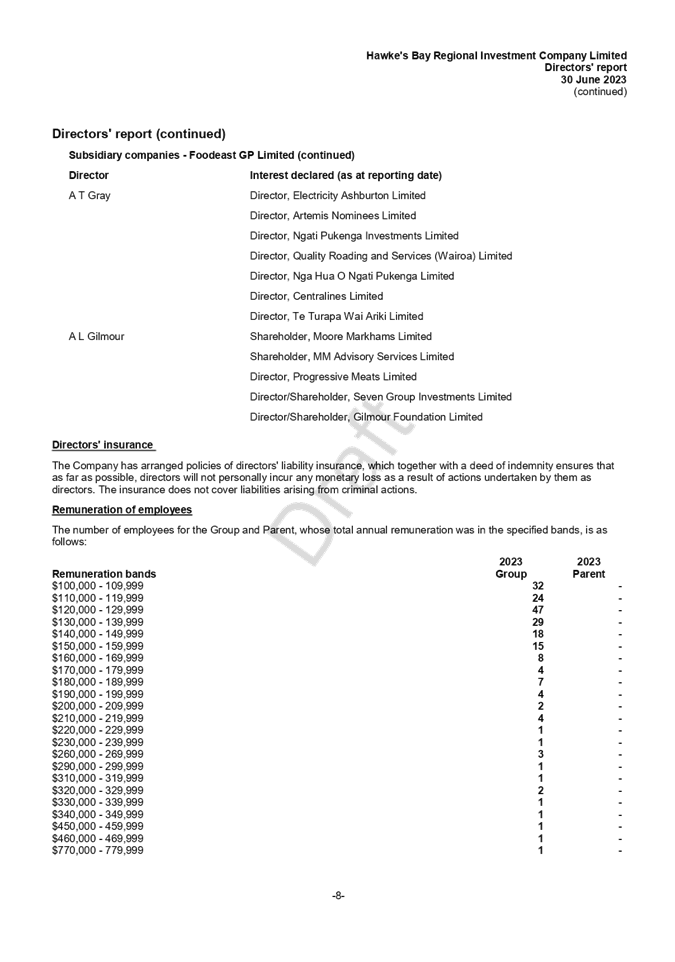

of Interest Declarations

3. Confirmation of Minutes of

the Corporate and Strategic Committee held on 14 June 2023

Decision

Items

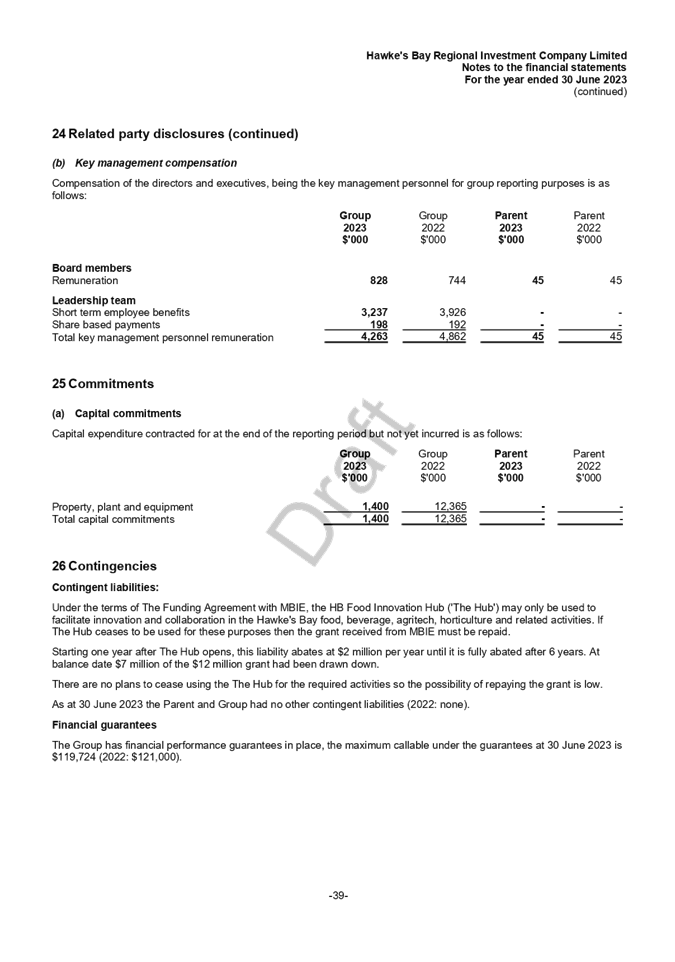

4. 2023

Navigation Safety Bylaw approval for consultation 3

5. 2022-2023

Carry forwards 7

6. Debt

drawdown 17

Information

or Performance Monitoring

7. Annual

Report 2022-2023 – Interim non-financial results 19

8. Organisational

Performance report for the period 1 April – 30 June 2023 53

9. Hawke's

Bay Tourism Annual report 97

10. HBRIC

Ltd Quarterly update 119

Decision

Items (Public Excluded)

11. HBRIC

Chairperson appointment 181

12. Cyclone

financials update 185

HAWKE’S BAY REGIONAL COUNCIL

Corporate and Strategic Committee

Wednesday

20 September 2023

Subject: 2023 Navigation Safety Bylaw approval for consultation

Reason

for Report

1. The 2018 Navigation Safety Bylaw needs

to be updated in 2023 in accordance with the Maritime Transport Act (1994) and

the Local Government Act (2002). Committee approval is sought to take the

attached draft 2023 Bylaw to public submission stage prior to its return to

Council for approval and adoption.

Officers’

Recommendation(s)

2. Council officers recommend that the

Corporate and Strategic Committee adopts the proposed 2023 Navigation Bylaw for

public consultation 29 September to 29 October 2023.

Background

/Discussion

3. In April of this year a project team

was formed to undertake the process of updating the 2018 Navigation Bylaw.

Pre-engagement feedback from key stakeholders alongside the identification of

known navigational issues in the region was the starting point for the drafting

process. A further key consideration was the need to simplify and refine the

document to make it more readable and relevant to a wider variety of

recreational water users.

4. Overall, it was felt that the existing

Bylaw was working well but changes were needed to address the increased

popularity and patronage of some mixed-use areas coupled with the advent of new

water recreation technologies.

5. The Hardinge Rd waterfront in Napier

is one such mixed-use area that is becoming increasingly popular with ocean

swimmers, surfers and paddle boarders, foil-boarders, recreational boaties and

jet-skiers. The area is relatively confined and gets very busy over the summer

months. Navigational risk occurs in such areas where high-speed powered vessels

are in close proximity to passive recreational water users. Similar

navigational risks are present at Napier Pandora Pond and the Pourerere lagoon

reserve areas.

6. Inflatable jet-boat use is also

increasing in popularity. These vessels are used to explore and access remote

river systems and have high-speed capability. While no incidents have yet been

reported, near misses and nuisance behaviour have been. Anecdotal evidence

increasingly suggests safety awareness, adherence to the five-knot rule and

user education need better promotion. We are seeking feedback from the public

on this issue as part of the consultation process.

Project

Timeline

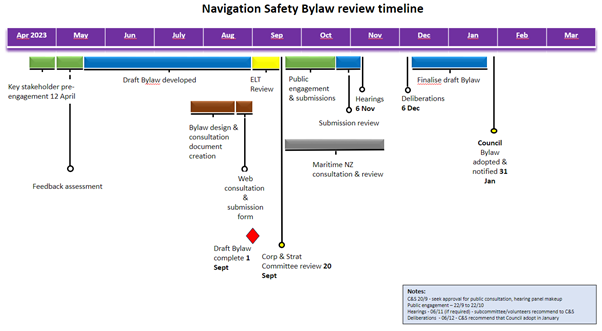

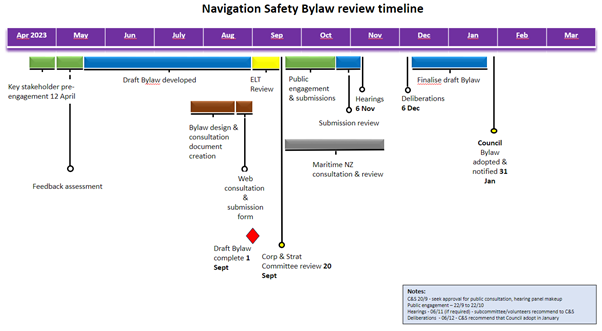

7. Pre-engagement with key contacts was

undertaken in mid-April to help inform a starting point for the drafting

process.

8. Taking into account this feedback,

drafting began in May with attention also given to overall document refinement

and further navigational risk identification.

9. By the end of August a supporting

consultation document and communications plan was created to contribute to the

public consultation process. Although not itemised on the workplan, a Statement

of Proposal has also been drafted; this is required by the Local Government Act

when proposing a Bylaw.

10. Public consultation will run from 29

September to 29 October 2023 with submissions, hearings in the event that

individuals wish their submissions to be heard in person and deliberations to

follow if necessary.

11. Alongside Council’s own internal

processes, and to ensure consistency with national maritime regulations, the

draft Bylaw is also required to be submitted for approval to Maritime NZ.

12. Subject to final Maritime NZ and

Council approval, the updated Bylaw will come into effect in late January 2024.

Updated

Bylaw – what’s changed?

13. A number of proposed changes are

suggested for the 2023 Bylaw review. These changes, intended to be tested with

the public, are incorporated into the draft document and have been summarised

into the following table for consideration.

|

Changes to current

Bylaw

|

Reason(s) for the

change

|

Draft (2023) Bylaw

reference

|

|

Bylaw section

re-ordering, refining, and reducing document size. Material from the Maritime

Transport Act and Maritime Rules is now referenced rather than

included in the Bylaw where possible.

|

To streamline the Bylaw

and make more readable and relevant to water users.

|

Various

|

|

New or strengthened

provisions regarding:

• the seaworthiness of

ships

• speed to reference

restrictions in reserved areas and mooring zones.

|

To mitigate navigational

risk and the potential for harm caused by unseaworthy vessels as well as

excessive speed in reserved areas and mooring zones.

|

Pages 14-15

|

|

Removed redundant

clauses regarding:

• licensing of hire

vessels

• tanker operations.

|

Regulations,

certifications or safety protocols exist in other forms.

|

N/A

|

|

Refined section on

rocket launching.

|

To help promote public

safety and awareness and also include flexibility on public notice

provisions.

|

Page 11

|

|

Removed Te Paerahi Beach

from schedule.

|

Schedule (and associated

regulations) deemed unnecessary.

|

N/A

|

|

Increased regulation in

these spatial areas:

• Napier Hardinge Road

beach

• Pourerere Beach lagoon

• Napier Pandora Pond

• Mohaka River.

|

To mitigate collision

risk in mixed use areas.

|

Schedules 1.3, 1.4, 1.5,

2.2

|

|

Decreased regulation in

these spatial areas:

• Whangawehi Beach

• Kairakau Beach

• Waikokopu Beach.

|

Variable seasonal

coastal conditions mean attempting to demarcate some areas is impractical.

Water users are instead advised to exercise caution. These areas are

identified and scheduled as ‘cautionary zones’ with

‘advisory notes’ included within the proposed Bylaw.

|

Schedules 1.7, 1.8, 1.9

|

|

Include new schedule for

Pourerere Beach.

|

To advise water users to

exercise caution.

|

Schedule 1.10

|

Significance

and Engagement Policy assessment

14. Council and its committees are

required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

14.1. The decision does not significantly alter the service

provision or affect a strategic asset, nor is it inconsistent with an existing

policy or plan.

14.2. The decision is not significant under the criteria

contained in Council’s adopted Significance and Engagement Policy.

14.3. Given the nature and significance of

the issue to be considered and decided, and the persons likely to be affected

by, or have an interest in the decisions made, the Committee can exercise its

discretion and make a decision without consulting directly with the community

or others having an

interest in the decision.

Considerations

of Tangata Whenua

15. Key Treaty partners were approached

for feedback at the project’s inception. However, this was not able to be

effectively obtained at the time due to cyclone recovery efforts taking

priority across many entities. At the time HBRC indicated that a further

opportunity for participation would be available later in the year. Mana whenua

will be approached directly for further feedback pending the Committee’s

approval to move to the consultation phase.

Financial

and Resource Implications

16. All project costs have been budgeted.

The project is on time and within budget.

Decision

Making Process

17. Council and its committees

are required to make every decision in accordance with the requirements of the Local

Government Act 2002 (the Act). Staff have assessed the requirements in relation

to this item and have concluded:

17.1. The decision does not significantly

alter the service provision or affect a strategic asset, nor is it inconsistent

with an existing policy or plan.

17.2. The use of the special consultative

procedure is prescribed by legislation. The Council must consult directly with

the community or others

having an interest in the decision.

17.3. The decision is not significant under

the criteria contained in Council’s adopted Significance and Engagement

Policy.

17.4. The persons affected by this decision

are all persons with an interest in the region’s waterbodies that are

used for navigation and recreation.

Recommendations

1. That the Corporate and

Strategic Committee receives and considers the 2023 Navigation Safety Bylaw

approval for consultation staff report.

2. The Corporate and

Strategic Committee recommends that Hawke’ Bay Regional Council:

2.1 Delegate authority to

the Group Manager Policy and Regulation to make any required minor amendments

or edits to the document prior to publication and the start of engagement.

2.2 Adopts the proposed

2023 Navigation Bylaw for public consultation 29 September to 29 October 2023.

Authored by:

|

Jason Doyle

Project

Manager Policy & Planning

|

Martin Moore

Harbourmaster

|

Approved by:

|

Katrina Brunton

Group

Manager Policy & Regulation

|

|

Attachment/s

|

1⇨

|

Navigation Safety Bylaws 2018

|

|

Under Separate Cover

|

|

2⇨

|

Statement of Proposal Document 2023

|

|

Under Separate Cover

|

|

3⇨

|

Draft Navigation Safety Bylaws 2023

|

|

Under Separate Cover

|

|

4⇨

|

Navigation Safety Bylaws

Consultation Document 2023

|

|

Under Separate Cover

|

HAWKE’S

BAY REGIONAL COUNCIL

Corporate and Strategic Committee

Wednesday

20 September 2023

Subject: 2022-2023 Carry forwards

Reason

for Report

1. This item seeks approval from the Corporate

and Strategic Committee to carry forward expenditure budgets from 2022-2023 to

2023-2024.

Executive

Summary

2. During 2022-2023 a number of work

programmes experienced delays and were unable to be completed as originally

planned. Where this work cannot be reprioritised from within the

2023-2024 Annual Plan budget, unspent expenditure budgets are requested to be

carried forward to cover the expected costs of completion.

3. A total of $9.043m unspent opex and

$3.805m unspent capex is requested to be carried forward into the 2023-2024

Annual Plan budget.

4. The source of funds required

($12.849m) for the total carry forward request is split as following:

4.1 $3.535m debt funding,

4.2 $5.811m reserve funds,

4.3 $0.863m external funds, and

4.4 $2.640m general funds.

5. The interim financial results

presented to Council on 30 August, indicated that Council will have an

operating deficit for the 2022-2023 financial year. Even after allocating

cyclone expenditure to the Emergency Management and Regional Disaster Damage

Reserves this will still result in a deficit to general funds for the year due

to the reduced investment income.

6. Any carry over of general funds into

the 2023/24 year would therefore require a drawdown from accumulated funds (i.e.:

from general fund surpluses accumulated over previous financial years) and

should be considered in this context.

7. The opening balance of accumulated

funds as at 1 July 2022 was $275 million (excluding $46m of internal

loans). The movements for the 2022/23 financial year are still being

finalised.

8. Debt and reserve funded carry forwards

have no immediate impact on Council’s financial position as they are just

a timing difference of when funding is drawn or recognised.

Background

9. Carry forwards is a common practice

within councils and allows for unspent funds against projects to be moved

forward so that projects can be completed. These include the funding of final

costs of projects, contracts that were unable to be completed by the financial

year end, and the carry forward of external income received for specific

projects.

10. The funding types are categorised as:

7.1 General funding is from General Rates

which includes investment income.

7.2 Reserve funding is from targeted rates

that have flowed through to Reserves or from specific reserves (eg: asset

replacement reserve).

7.3 External is external funding received

for specific projects.

7.4 Debt is for debt funding not drawn

down this year and is covered by interest and principal repayments that are

already included in the LTP and/or Annual Plan.

11. Officers informed the Corporate &

Strategic Committee on 14 June 2023 that, based on the full year forecast at

that time, the indicative carry forwards from 2022-2023 would be $6.0m opex and

$9.6m capex, and that final carry forward requests would be presented at the

conclusion of the financial year once the draft financial results had been

analysed.

12. The interim financial results

presented to Council on 30 August, indicated that HBRC will have an operating

deficit for the 2022-2023 financial year, and any carry forward of general

funding will impact the general funds deficit further.

13. The carry forward decision this year

is significantly impacted by Cyclone Gabrielle response and recovery

activities.

13.1. It has been a key driver for delays to originally planned

activities, thus causing many of the requests for carry forwards.

13.2. It has also had significant adverse impact on

Council’s financial situation, limiting our capacity to fund planned

activities.

14. Unplanned expenditure for the response

to Cyclone Gabrielle will be charged to the Emergency Management and Regional

Disaster Damage Reserves. A significant proportion of this shortfall is

anticipated to be repaid via NEMA, and insurance and other claims over the

coming 12 months.

15. It should be noted that the deficits

in the Emergency Management and Regional Disaster Damage Reserves will need to

be addressed as part of the Long-Term Plan 2024-2034.

Operating

expenditure carry forward requests

|

Activity / Project

|

Amount Requested

|

Source of funds

|

|

General

|

Reserve

|

External

|

Debt

|

|

Integrated Catchment Management (ICM)

|

|

|

|

|

|

|

1

|

Biodiversity

|

$429,000

|

|

|

$229,000

|

$200,000

|

|

2

|

Predator Free Hawkes Bay

|

$423,000

|

|

|

$423,000

|

|

|

3

|

Land for life

|

$277,000

|

|

$277,000

|

|

|

|

4

|

Environm’l Science data models

|

$502,000

|

|

|

|

$502,000

|

|

5

|

Environm’l Enhancement Prog

|

$320,000

|

$208,000

|

|

$112,000

|

|

|

6

|

Land research & investigations

|

$99,500

|

|

|

$99,500

|

|

|

Asset Management

|

|

|

|

|

|

|

7

|

Central & Southern Rivers – flood protection

|

$30,000

|

$ 3,750

|

$26,250

|

|

|

|

8

|

Regional Water Security

|

$3,500,000

|

|

$3,500,000

|

|

|

|

Governance & Partnerships

|

|

|

|

|

|

|

9

|

Tangata Whenua Partnerships

|

$700,000

|

$700,000

|

|

|

|

|

Policy & Regulation

|

|

|

|

|

|

|

10

|

Kotahi (policy & planning)

|

$1,500,000

|

$1,500,000

|

|

|

|

|

Transport

|

|

|

|

|

|

|

11

|

Passenger Transport

|

$763,000

|

|

$763,000

|

|

|

|

Corporate Services

|

|

|

|

|

|

|

12

|

Software-as-a-service dvlpt

|

$500,000

|

|

|

|

$500,000

|

|

Total

|

$9,043,500

|

$2,411,750

|

$4,566,250

|

$863,500

|

$1,202,000

|

Biodiversity - (opex – 1)

16. Integrated Catchment Management (ICM)

seeks to carry forward a total of $429k to cover various biodiversity projects

supported by external funding agreements with the Department of Conservation

(DOC) and the Ministry for the Environment (MFE).

16.1. $200k of the Covid Recovery fund approved in 2020/21

(debt funding at $100k per project) for the Department of Conservation Jobs for

nature fencing project, and the Porangahau catchment group Freshwater

improvement fund project;

16.2. $194k is required to complete fencing projects supported

by the DoC Jobs for Nature funding.

16.3. $35k is required to continue the support of the

Porangahau catchment group Freshwater Improvement fund project.

17. Financial Assessment: The $200k loan

funding was not drawn in 22/23, but repayment and interest costs have been

accounted for in the 23/24 annual plan as if it had been. $229k of

the unspent funds was received from external parties under Deeds of Funding

agreements.

18. Recommendation: That Council approves

the carry forward of $200k of debt funding, and $229k of external funding in

external funds from the general reserve.

Predator Free Hawkes Bay - (opex – 2)

19. ICM seeks to carry forward $423k to

cover the final milestones for the Predator Free Hawkes Bay project in Mahia,

as supported by a new funding agreement with Predator Free NZ 2050 Ltd.

20. Financial Assessment: $423k of

external funding was not spent in 2022-23.

21. Recommendation: That Council approves

the carry forward of $423k in external funding from revenue received in

advance.

Land

for life - (opex – 3)

22. ICM seeks to carry forward $277k for

the Land for Life project for implementation planning and scale up to support

primary sector recovery subject to due diligence on the business case.

23. Financial Assessment: The $277k

reserve funding was not drawn in 22/23, due to the impacts of the Cyclone and

the subsequent repositioning of the project.

24. Recommendation: That Council approves

the carry forward of $277k from the long-term investment fund reserve.

Environmental

Science Data models - (opex – 4)

25. ICM seeks to carry forward $502k for

environmental science data model projects that were unable to progress as

intended due to science staff turnover, difficulty securing contractors and

Cyclone Gabrielle impacts. Each of these multi-year projects provide a critical

role in the science decision support for PC6 and Kotahi, and have contractual

commitments now delayed into the 23/24 financial year.

25.1. $147k for the LiDAR tools project (data modelling for the

completed LiDAR mapping project)

25.2. $240k for the final milestones of the 3D Aquifer project

25.3. $115k for the Ruataniwha Groundwater modelling

26. Financial Assessment: The $502k loan

funding was not drawn in 22/23, but repayment and interest costs have been

accounted for in the 23/24 annual plan as if it had been.

27. Recommendation: That Council approves

the carry forward of $502k in loan funding.

Environmental Enhancement

Programme - (opex – 5)

28. ICM seeks to carry forward a total of

$320k to cover:

23.1 $208k for the final year of the Whakaki

Environment Enhancement project which is a multi-year project which has

suffered accumulated delays in deliverables due to extended community

consultation, covid-19 impacts and adverse weather. This project is co-funded

by MfE via the Freshwater Improvement fund.

23.2 $112k for the Fonterra sponsored

wetland construction at Tukipo as this was delayed due to restricted access due

to adverse weather conditions.

29. Financial Assessment: $208k for

Whakaki is general rate funded as part of the wider Enviro Enhancement

Programme, which had an underspend of $811k in 2022/23. $112k is external

funds received from Fonterra, which were note spent in 2022/23.

30. Recommendation: That Council approves

the carry forward of $112k external funds and $208k from the general

reserve.

Land

Research Investigations - (opex – 6)

31. ICM seeks to carry forward a total of

$99.5k for the completion of landslide mapping work with delivery of the

contractual commitments delayed into 23/24.

32. Financial Assessment: $114k external

funds were received from Ministry of Primary Industries (MPI) to support this

work, and $99.5k has not been spent.

33. Recommendation: That Council approves the

carry forward of $99.5k external funds from the general reserve.

Central & Southern

rivers flood protection - (opex – 7)

34. Asset Management seeks to carry

forward a total of $30k for flood protection work in the Central & Southern

rivers, which was originally programmed to commence in Autumn 2023, but was

unable to begin due to the Cyclone.

35. Financial Assessment: The Central

& Southern rivers flood protection workstream was underspent in 22/23 by

$52k.

36. Recommendation: That Council approves the

carry forward of $3.750k from the general reserve and $26.250k from the Central

& Southern rivers scheme reserve (representing the unspent targeted rates

collected in 22/23).

Regional Water Security Programme - (opex – 8)

37. Asset Management seeks to carry

forward a total of $3.5m for the continuation of the multi-year Regional Water

Security Programme, including the Water Demand Study as planned in the LTP, and

the Te Tua and CHB water storage and reticulation infrastructure (the latter of

which is expected to begin construction in 2023-24).

38. Financial Assessment: The Regional

Water Security Programme was underspent in 22/23 by $3.5m.

39. Recommendation: That Council approves

the carry forward of $3.5m from the long-term investment reserve.

Kotahi and Tangata Whenua Partnerships - (opex – 9 & 10)

40. Policy & Regulation and Governance

& Partnerships seek to carry forward a total of $2.2m, for tangata whenua

engagement regarding te mana o te wai, which stalled due to the inability to

progress discussions 'at place' for visions and values (for Kotahi) and set up

contracts with tāngata whenua. This was due to a change to the work

programme direction from All Governors and exacerbated by the inability to meet

at place because of Cyclone Gabrielle.

41. The visions and values work programmed

for 22/23 is still required as per the NPSFM. The budget was established

for Kotahi not on a year on year spend but an anticipated total amount for the

3 years of the LTP to enable this work to be undertaken. Visions and

values is one piece of the work which needs to be progressed and

contracted. The next stage which will require funding is attributes,

limits, targets and matauranga maori, and this stage will fully utilise the

existing budget allocated to Kotahi in the 23/24 annual plan.

42. Financial assessment: Tangata Whenua

Partnerships were underspent by $783k and the Kotahi external expenses budget

was underspent by $1.5m.

43. Recommendation: That Council approves

the carry forward of $2.2m from the general reserve.

Passenger Transport - (opex – 11)

44. Policy & Regulation seek to carry

forward the $763k shortfall funding received from NZTA to contribute towards

increased operational costs. The additional operational costs will impact

in the 23/24 financial year as indexation costs on the GoBus contract are

applied.

45. Financial Assessment: The passenger

transport cost centre had a $947k surplus in the 22/23 financial year.

Note a carry forward of surplus only addresses cost pressures for one financial

year, and ongoing cost pressures will need to be addressed in the 2024 LTP.

46. Recommendation: That Council approves

the carry forward of $763k from the transport reserve.

Software-as-a-service ICT

- (opex – 12)

47. ICT seeks to carry forward $500k for

the digital transformational work programme, which was not progressed due to

the suspension or slowing of work on the Finance and Biodiversity systems,

caused by unavailability of business teams to assist with scoping due to staff

turnover, and reprioritisation to work on the cyclone response.

48. Financial Assessment: The $500k loan

funding was not drawn in 22/23, but repayment and interest costs have been

accounted for in the 23/24 annual plan as if it had been.

49. Recommendation: That Council approves

the carry forward of $500k in loan funding.

Capital

expenditure carry forward requests

|

Activity / Project

|

Amount Requested

|

Type of

funding

|

|

General Funds

|

Reserve

|

Debt

|

|

Integrated Catchment Management (ICM)

|

|

|

|

|

|

1

|

SOE ground water monitoring drilling

|

$275,000

|

|

$208,000

|

$67,000

|

|

2

|

Enviro info technical equipment

|

$102,000

|

|

$102,000

|

|

|

Asset Management

|

|

|

|

|

|

3

|

Flood protection schemes

|

$397,000

|

|

$397,000

|

|

|

4

|

Flood risk assessment & warning

|

$113,000

|

$113,000

|

|

|

|

5

|

Forestry

|

$45,000

|

|

$45,000

|

|

|

6

|

Regional cycleways

|

$115,000

|

$115,000

|

|

|

|

7

|

Regional Parks

|

$707,000

|

|

|

$707,000

|

|

8

|

IRG – HPFCS and gravel extraction

|

$1,101,000

|

|

$212,000

|

$889,000

|

|

Corporate Services

|

|

|

|

|

|

9

|

Office renovations (including furniture & fittings)

|

$730,000

|

|

$164,000

|

$566,000

|

|

10

|

Radio network

|

$44,000

|

|

$44,000

|

|

|

11

|

ICT network & equipment

|

$72,500

|

|

$72,500

|

|

|

12

|

Aerial Imagery (GIS)

|

$104,000

|

|

|

$104,000

|

|

Total

|

$3,805,500

|

$228,000

|

$1,244,500

|

$2,333,000

|

SOE Ground water monitoring drilling - (capex – 1)

50. ICM seeks to carry forward $275k to

cover the contractually committed drilling programme delayed into 2023/24.

Resource capacity of drilling companies continues to be a limiting factor to

achieving the annual programme of work in line with the financial year, and

this was exasperated in 2022/23 by the cyclone disruptions.

51. Financial Assessment: The groundwater

monitoring drilling workstream was underspent by $275k.

52. Recommendation: That Council approves

the carry forward of $67k loan funding and $208k of asset replacement reserve

funding.

Environmental monitoring equipment replacements - (capex –

2)

53. ICM seeks to carry forward $102k for

scheduled equipment replacements postponed due to staff capacity redirected to

repair and replacement of equipment damaged in the cyclone.

54. Financial Assessment: The

environmental monitoring equipment cost centres were underspent by $102k.

55. Recommendation: That Council approves

the carry forward of $102k of asset replacement reserve funding.

Flood protection schemes - (capex – 3)

56. Asset Management seeks to carry

forward a total of $397k for cyclone-disrupted projects as follows:

56.1. Wairoa River and streams scheme – $120k for the

extension of the rock wall bank protection of the true right of the Wairoa

River upstream of the mouth.

56.2. Ohuia- Whakaki – $277k for renewal works including

pump installations, power supply and pump station screens.

57. Financial Assessment: The Wairoa

scheme opex budget was underspent by $120k, and it is this budget that is

requested to be carried forward and converted to capex. The Ohuia-Whakaki

workstream was underspent by the amount of carry forward requested above.

58. Recommendation: That Council approves

the carry forward of $120k from the Wairoa river and streams scheme reserve

(representing the unspent targeted rates collected in 22/23) and $277k from the

asset replacement reserve.

Flood risk assessment & warning - (capex – 4)

59. Asset Management seeks to carry

forward $113k for software developments for flood forecasting, where the

project was not started due to reprioritisation of staff capacity for the

cyclone response.

60. Financial Assessment: The flood risk

assessment and flood forecasting workstreams were underspent by the amount of

carry forward requested above. There is no budget for this work in the

23/24 annual plan.

61. Recommendation: That Council approves

the carry forward of $113k from the general reserve.

Forestry - (capex – 5)

62. Asset Management seeks to carry

forward $45k for the development of roading and access for three blocks around

the Devil’s Elbow due to be harvested, which were unable to be accessed

due to closures of SH2 following the cyclone.

63. Financial Assessment: The forestry

capex workstream was underspent by the amount of the carryfoward requested.

64. Recommendation: That Council approves

the carry forward of $45k from the long-term investment fund reserve.

Regional cycleways - (capex – 6)

65. Asset Management seeks to carry

forward a total of $115k for the extension of the Ngaruroro explorer cycleway,

which will be progressed once repairs on the cyclone-damaged section of the

trail are completed. This project has co-funding contributions from MBIE

and Hastings District Council.

66. Financial Assessment: The regional

cycleways capex budget was not spent in 2022/23.

67. Recommendation: That Council approves

the carry forward of $115k from the general reserve.

Regional Parks - (capex – 7)

68. Asset Management seeks to carry

forward a total of $707k for Regional Park developments unable to be

progressed:

68.1. Hawea Historical Park and Waitangi Park (toilet block)

– $605k

68.2. Ahuriri Regional Park, – establishment of project

manager for planning work – $102k

69. Financial Assessment: The $707k loan

funding was not drawn in 22/23, but repayment and interest costs have been

accounted for in the 23/24 annual plan as if it had been.

70. Recommendation: That Council approves

the carry forward of $707k of loan funding.

IRG – Heretaunga Plains Flood Control Scheme (HPFCS) and

gravel extraction - (capex – 8)

71. Asset Management seeks to carry

forward a total of $1.101m for the planned programme of works for HPFCS

improvements and Upper Tukituki gravel extraction, which was significantly

impacted by the cyclone. This multi-year programme of work is co-funded

by Kanoa/MBIE, and an extension to the funding deadline will be sought.

72. Financial Assessment: The $889k loan

funding was not drawn in 22/23, but repayment and interest costs have been

accounted for in the 23/24 annual plan as if it had been.

73. Recommendation: That Council approves

the carry forward of $889k of loan funding and $212k of HPFCS scheme reserves

funding.

Office renovations (including furniture & fittings) - (capex

– 9)

74. Corporate Services seeks to carry

forward a total of $730k for the accommodation refurbishment project postponed

due to consent and engineering report delays.

75. Financial Assessment: The

accommodation and furniture & fitting workstreams were underspent by the

value of the carry forward request above. The $566k loan funding was not drawn

in 22/23, but repayment and interest costs have been accounted for in the 23/24

annual plan as if it had been.

76. Recommendation: That Council approves

the carry forward of $566k of loan funding and $164k of asset replacement

reserves funding.

Radio network - (capex – 10)

77. Corporate Services seeks to carry

forward a total of $44k for the final deliverables of Project

Tarsier.

78. Financial Assessment: The RT Network

capex workstream was underspent by $234k in 22/23.

79. Recommendation: That Council approves

the carry forward of $44k asset replacement reserves funding.

ICT network & equipment - (capex – 11)

80. Corporate Services seeks to carry

forward a total of $72.5k for the purchase of extended hardware warranty

support. This will improve the resilience of the ageing parts of our ICT

infrastructure.

81. Financial Assessment: The Servers

& Storage capex workstream was underspent in 22/23 by the amount requested

to be carried forward.

82. Recommendation: That Council approves

the carry forward of $72.5k asset replacement reserves funding.

Aerial imagery - (capex – 12)

83. Corporate Services seeks to carry

forward a total of $104k for the acquisition of aerial imagery. This will be

necessary to develop models and storage systems to support the increased volume

of datasets collected following Cyclone Gabrielle.

84. Financial Assessment: The $104k loan

funding was not drawn in 22/23, but repayment and interest costs have been

accounted for in the 23/24 annual plan as if it had been.

85. Recommendation: That Council approves

the carry forward of $104k loan funding.

Options

Assessment

86. Option 1: Council approves the carry forwards

as proposed from 2022-2023 to 2023-2024 to enable all the projects to be

completed, service levels to be achieved, commitments to external organisations

to be fulfilled and the future work to be funded), acknowledging this would

require a drawdown of accumulated funds to fund the general and external funded

expenditure.

87. Option 2: Council approves the carry forward

of reserve, debt and externally funded expenditure only, leaving the

general-funded carry forward expenditure requests to be reprioritised through

2023-24 annual plan budgets.

88. Option 3: Council does not approve the carry

forwards as proposed and provides officers with guidance on which carry

forwards, if any, should be approved.

Financial

and Resource Implications

89. Debt funded expenditure can be carried

forward with no impact to the ratepayer in future years as the repayment of

these funds have already been included in the LTP and Annual Plan.

90. Funding from reserves can be carried

forward with no impact, as the expenditure has not been drawn from the reserve

and is therefore available to be drawn in 2023-24 instead.

91. Funding from targeted rates will be

automatically carried forward through the associated reserve to enable the

funds to be drawn down to complete the work in subsequent years.

92. The carry forward of $2.640m in

general funding and $0.863m in external funding from 2022-2023 to 2023-2024,

will impact the general reserve as there is not expected to be a surplus of

general funds for the 2022-23 financial year. The actual quantum of the

general fund deficit will be confirmed once the final funding and reserve

movements have been completed for the Annual Report.

93. Approved general funded and external

funded carry forward requests would be funded from the general reserve in

2023/24, drawing from accumulated funds.

Decision Making Process

94. Staff have assessed the requirements

of the Local Government Act 2002 in relation to this item and have concluded:

121.1 The decision does not

significantly alter the service provision or affect a strategic asset, nor is

it inconsistent with an existing policy or plan.

121.2 The use of the special

consultative procedure is not prescribed by legislation.

121.3 The decision is not

significant under the criteria contained in Council’s adopted Significance

and Engagement Policy.

121.4 The persons affected by this decision

are Council’s ratepayers.

95. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by, or have an interest in the decisions made, Council

can exercise its discretion and make a decision without consulting directly

with the community or others

having an interest in the decision.

Recommendations

1. That

the Corporate and Strategic Committee receives and notes the 2022-2023

Carry forwards staff report.

2. The Corporate and Strategic Committee

recommends that Hawke’ Bay Regional Council:

2.1. Agrees that the decisions to be made

are not significant under the criteria contained in Council’s adopted Significance

and Engagement Policy, and that Council can exercise its discretion and make

decisions on this issue without conferring directly with the community or

persons likely to have an interest in the decision.

2.2. Approves the carry forward of all expenditure

requests from the 2022-2023 to the 2023-2024 budget, being:

Operating

expenditure carry forward requests

|

Activity / Project

|

Amount Requested

|

Source of funds

|

|

General

|

Reserve

|

External

|

Debt

|

|

Integrated Catchment Management (ICM)

|

|

|

|

|

|

|

1

|

Biodiversity

|

$429,000

|

|

|

$229,000

|

$200,000

|

|

2

|

Predator Free Hawkes Bay

|

$423,000

|

|

|

$423,000

|

|

|

3

|

Land for life

|

$277,000

|

|

$277,000

|

|

|

|

4

|

Environmental Science data models

|

$502,000

|

|

|

|

$502,000

|

|

5

|

Environmental Enhancement Programme

|

$320,000

|

$208,000

|

|

$112,000

|

|

|

6

|

Land research & investigations

|

$99,500

|

|

|

$99,500

|

|

|

Asset Management

|

|

|

|

|

|

|

7

|

Central & Southern Rivers – flood protection

|

$30,000

|

$ 3,750

|

$26,250

|

|

|

|

8

|

Regional Water Security

|

$3,500,000

|

|

$3,500,000

|

|

|

|

Governance & Partnerships

|

|

|

|

|

|

|

9

|

Tangata Whenua Partnerships

|

$700,000

|

$700,000

|

|

|

|

|

Policy & Regulation

|

|

|

|

|

|

|

10

|

Kotahi (policy & planning)

|

$1,500,000

|

$1,500,000

|

|

|

|

|

Transport

|

|

|

|

|

|

|

11

|

Passenger Transport

|

$763,000

|

|

$763,000

|

|

|

|

Corporate services

|

|

|

|

|

|

|

12

|

Software-as-a-service development

|

$500,000

|

$500,000

|

|

|

|

|

Total

|

$9,043,500

|

$2,411,750

|

$4,566,250

|

$863,500

|

$1,202,000

|

Capital expenditure carry forward requests

|

Activity / Project

|

Amount Requested

|

Type of funding

|

|

General

|

Reserve

|

Debt

|

|

Integrated Catchment Management (ICM)

|

|

|

|

|

|

1

|

SOE Ground water monitoring drilling

|

$275,000

|

|

$208,000

|

$67,000

|

|

2

|

Enviro info technical equipment

|

$102,000

|

|

$102,000

|

|

|

Asset Management

|

|

|

|

|

|

3

|

Flood protection schemes

|

$397,000

|

|

$397,000

|

|

|

4

|

Flood risk assessment & warning

|

$113,000

|

$113,000

|

|

|

|

5

|

Forestry

|

$45,000

|

|

$45,000

|

|

|

6

|

Regional cycleways

|

$115,000

|

$115,000

|

|

|

|

7

|

Regional Parks

|

$707,000

|

|

|

$707,000

|

|

8

|

IRG – HPFCS and gravel extraction

|

$1,101,000

|

|

$212,000

|

$889,000

|

|

Corporate Services

|

|

|

|

|

|

9

|

Office renovations (including furniture & fittings)

|

$730,000

|

|

$164,000

|

$566,000

|

|

10

|

Radio network

|

$44,000

|

|

$44,000

|

|

|

11

|

ICT network & equipment

|

$72,500

|

|

$72,500

|

|

|

12

|

Aerial Imagery (GIS)

|

$104,000

|

|

|

$104,000

|

|

Total

|

$3,805,500

|

$228,000

|

$1,244,500

|

$2,333,000

|

Authored by:

|

Amy Allan

Senior

Business Partner

|

Chris Comber

Chief

Financial Officer

|

Approved by:

|

Andrew Siddles

Acting

Group Manager Corporate Services

|

Susie Young

Executive

Officer Recovery

|

|

Nic Peet

Chief

Executive

|

|

Attachment/s

There are no attachments for this

report.

HAWKE’S

BAY REGIONAL COUNCIL

Corporate and Strategic Committee

Wednesday

20 September 2023

Subject: Debt drawdown

Reason for Report

1. The purpose of this paper is to obtain

the necessary delegations to authorise the borrowing of new debt to the Chief

Executive (CE) and Group Manager Corporate Services (GMCS) under the Treasury

Policy.

2. Previously at the 29 March 2023

Council meeting, Council resolved to delegate borrowing up to the 2022-2023

Annual Plan total debt amount of $104m (new debt of +$44m) to the Hawke’s

Bay Regional Council Chief Executive and Group Manager Corporate Services,

noting that further delegation over and above this level, if required, will be

a Council decision.

3. The Treasury Policy requires specific

delegation by Council for any new borrowings, in particular the delegation of

authority and authority limits on page 252 of the Council’s 2021-31 Long

Term Plan (LTP).

Officers’

Recommendations

4. Council officers recommend that

Council delegates borrowing up to the annual plan total debt amount of $134.6m

to the CE and GMCS, noting that further delegation over and above this level,

if required, will be a Council decision.

Background

5. The Annual Plan 2023-2024 provisioned

for new debt of $36.081m with a total debt totalling $134.6m. Our current total

borrowing is $97.625m which includes $30m of short term debt as a result of the

cyclone that we currently believe will be recovered via insurance and NEMA

claims. Please note this excludes $10m of undrawn overdraft (OD) facility that

we are required to hold for liquidity purposes.

|

External Debt

|

Running

Total

|

|

Existing

debt

|

$97,625,000

|

|

BNZ

Committed Cash Advance Facility (undrawn)

|

$10,000,000

|

|

Total

Debt Facilities

|

$107,625,000

|

Decision

Making Process

6. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

6.1. The decision does not

significantly alter the service provision or affect a strategic asset, nor is

it inconsistent with an existing policy or plan.

6.2. The use of the special

consultative procedure is not prescribed by legislation.

6.3. The decision is necessary

for the financial delegations to be compliant with Council’s current Treasury

Policy.

Recommendations

1. That the Corporate and Strategic

Committee Receives and considers the Debt drawdown staff report.

2. That

the Corporate and Strategic Committee recommends that Hawke’s Bay

Regional Council:

2.1 Agrees that the decisions to be made

are not significant under the criteria contained in Council’s adopted

Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without conferring directly with

the community or persons likely to have an interest in the decision.

2.2 Delegates borrowing up to the

2023-2024 Annual Plan total debt amount of $134.6m to the Hawke’s Bay

Regional Council Chief Executive and Group Manager Corporate Services, noting

that further delegation over and above this level, if required, will be a

Council decision.

Authored by:

|

Jess Bennett

Senior

Manager - Finance Recovery

|

|

Approved by:

|

Susie Young

Executive

Officer Recovery

|

Nic Peet

Chief

Executive

|

Attachment/s

There are no attachments for this

report.

HAWKE’S BAY REGIONAL COUNCIL

Corporate and Strategic Committee

Wednesday

20 September 2023

Subject: Annual Report 2022-2023 – Interim non-financial results

Reason

for Report

1. This item provides the Corporate and

Strategic Committee with the interim non-financial results for inclusion in the

Annual Report 2022-2023. Feedback from the Committee can be incorporated into

the final results.

Background

Levels of

Service

2. The purpose of the non-financial

performance measures, as specified in the Local Government Act 2002, is to

enable the public to assess the actual versus intended levels of service

achieved for major aspects of groups of activities. In other words, to demonstrate

we have done what we said we would do.

3. There are 58 performance measures in

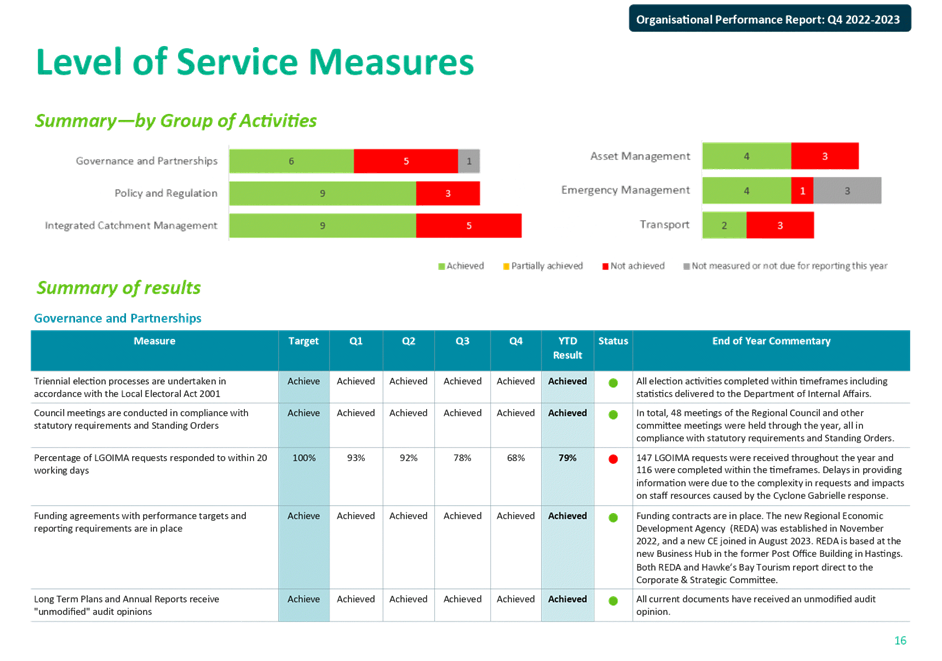

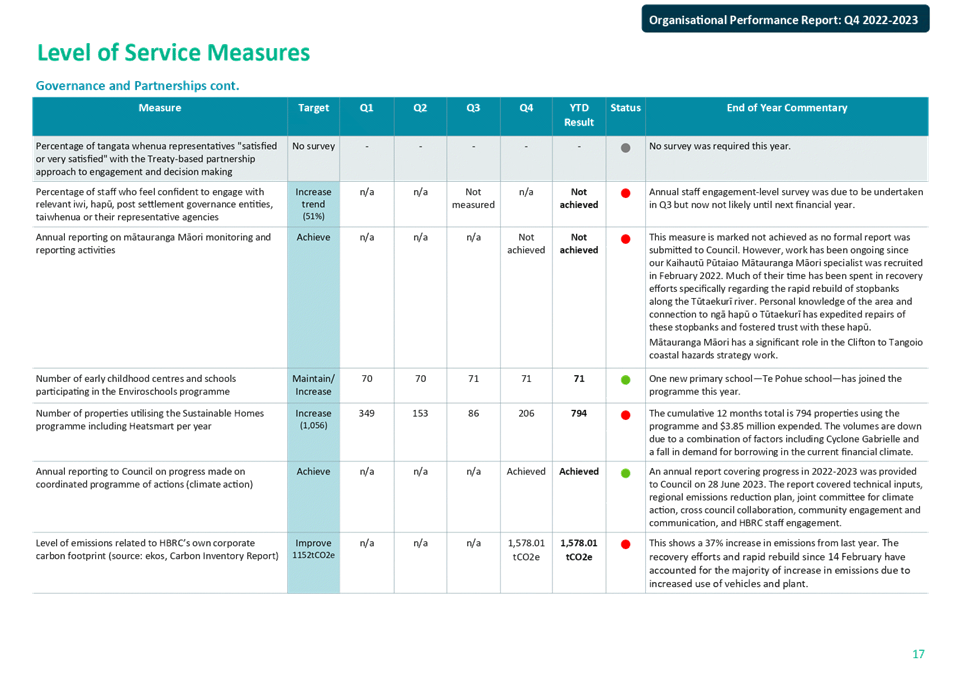

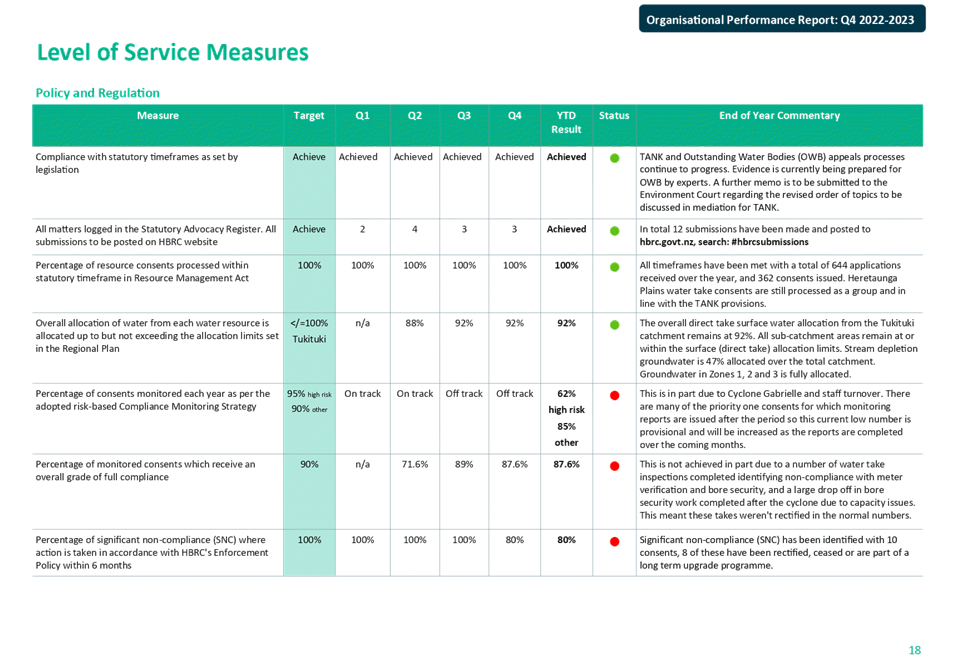

total across six groups of activities as per the Long Term Plan

2021-2031.

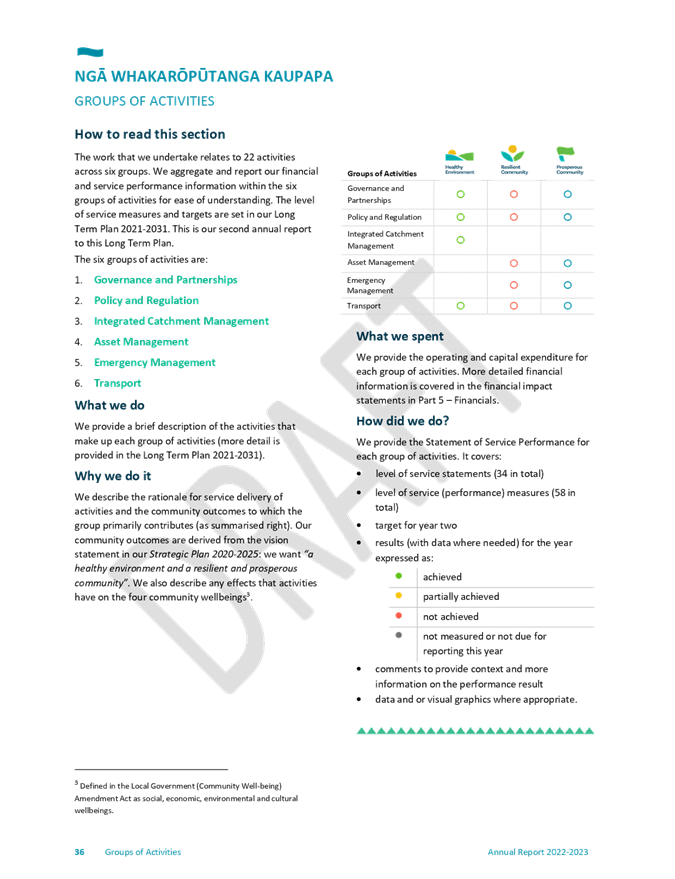

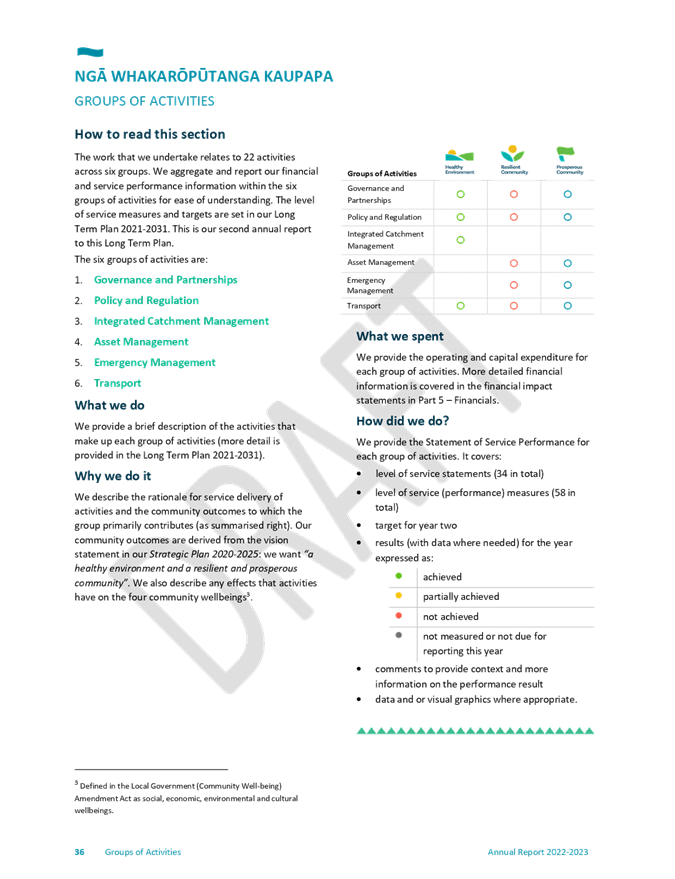

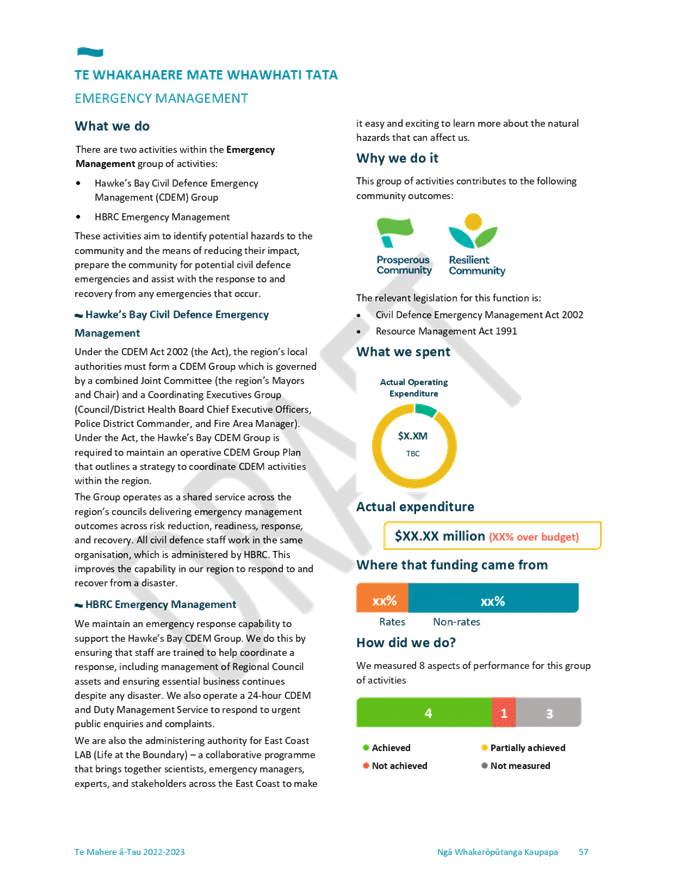

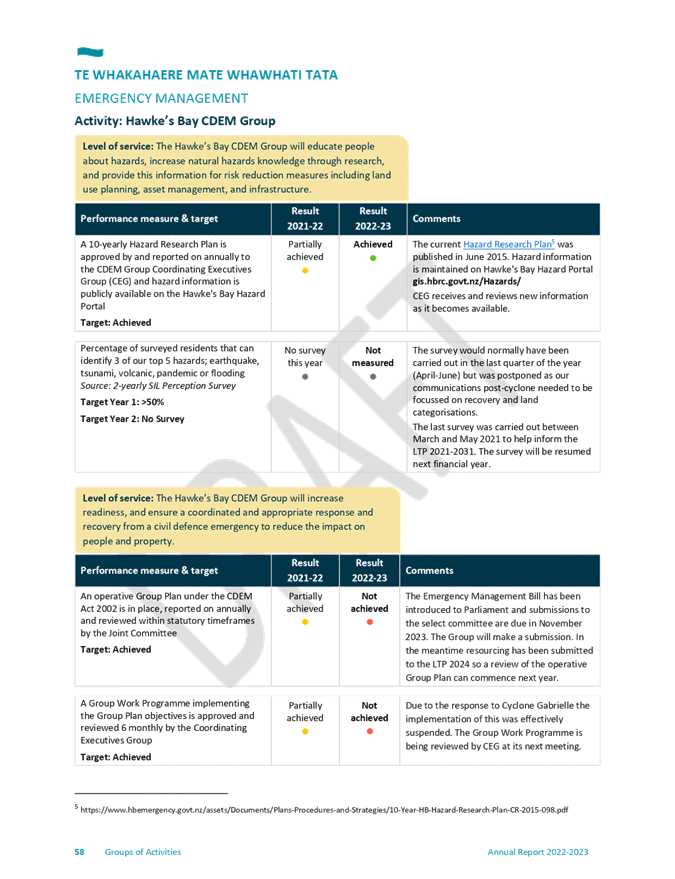

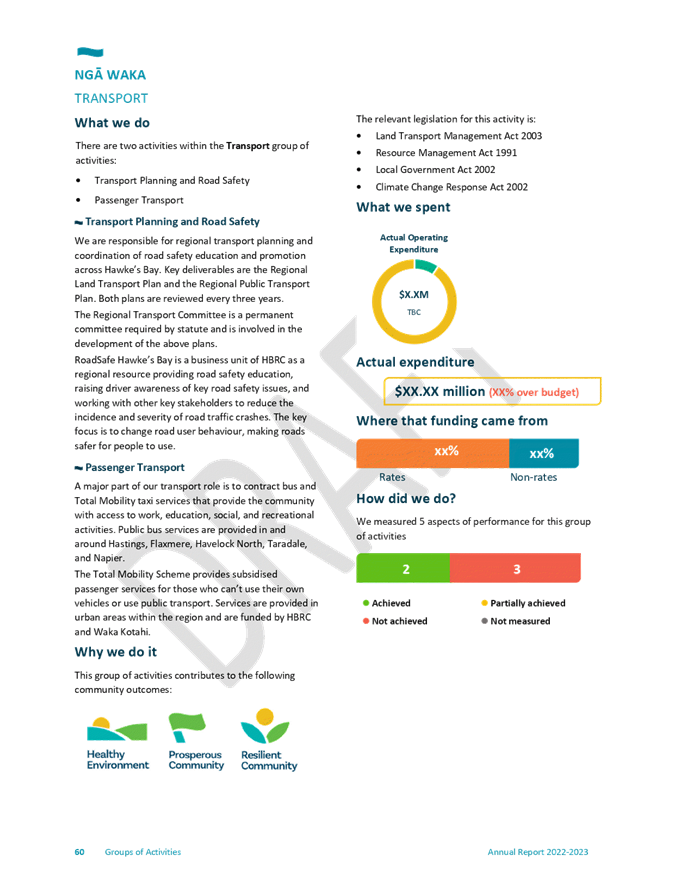

4. The groups of activities are:

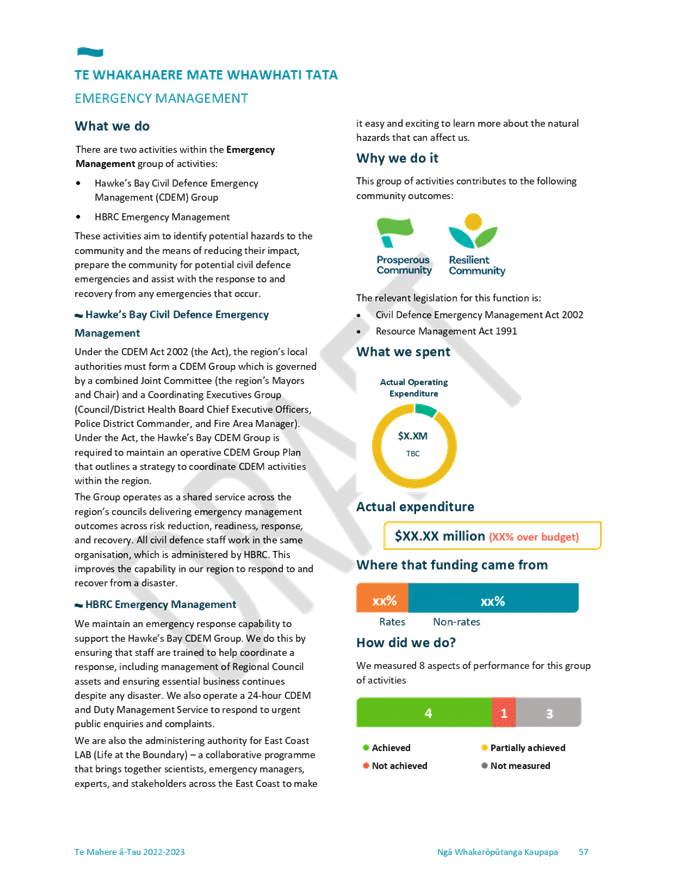

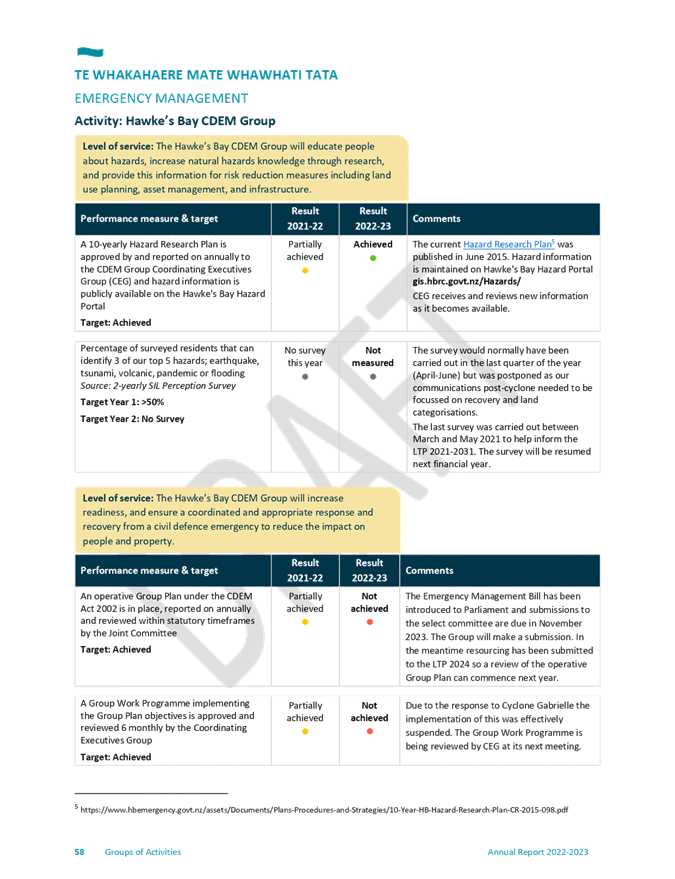

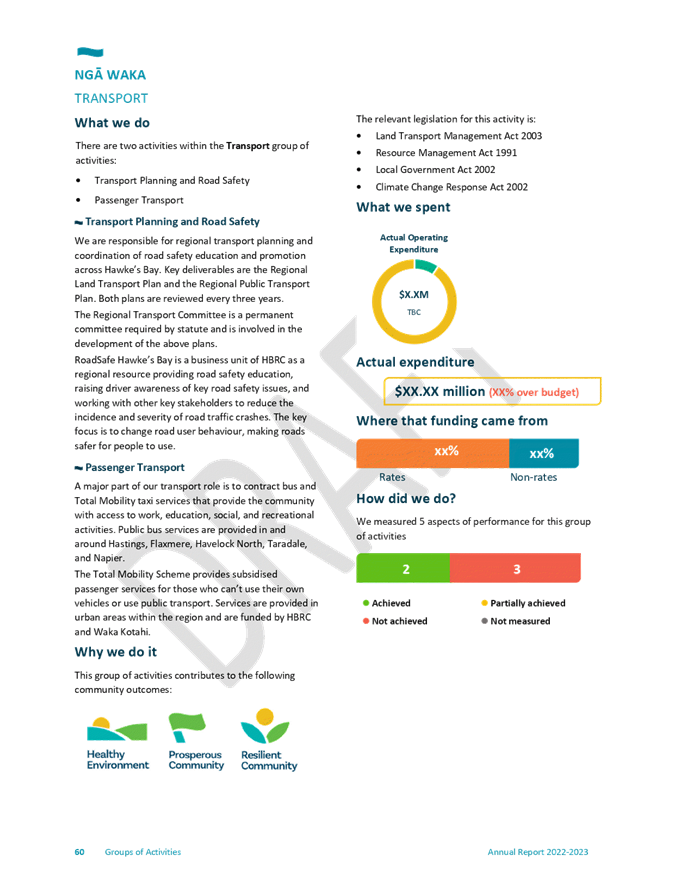

4.1. Governance and Partnerships

4.2. Policy and Regulation

4.3. Integrated Catchment Management

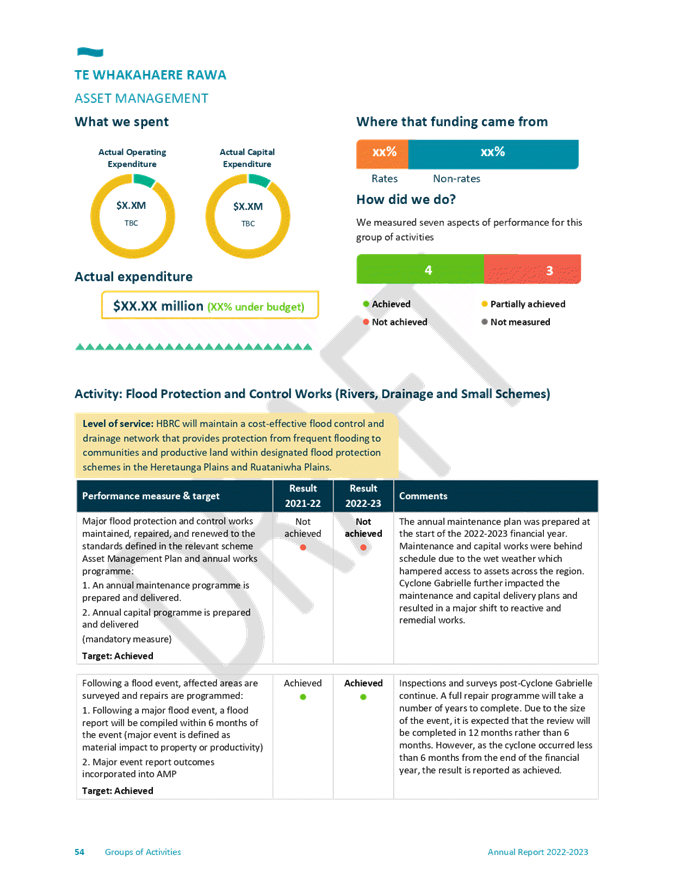

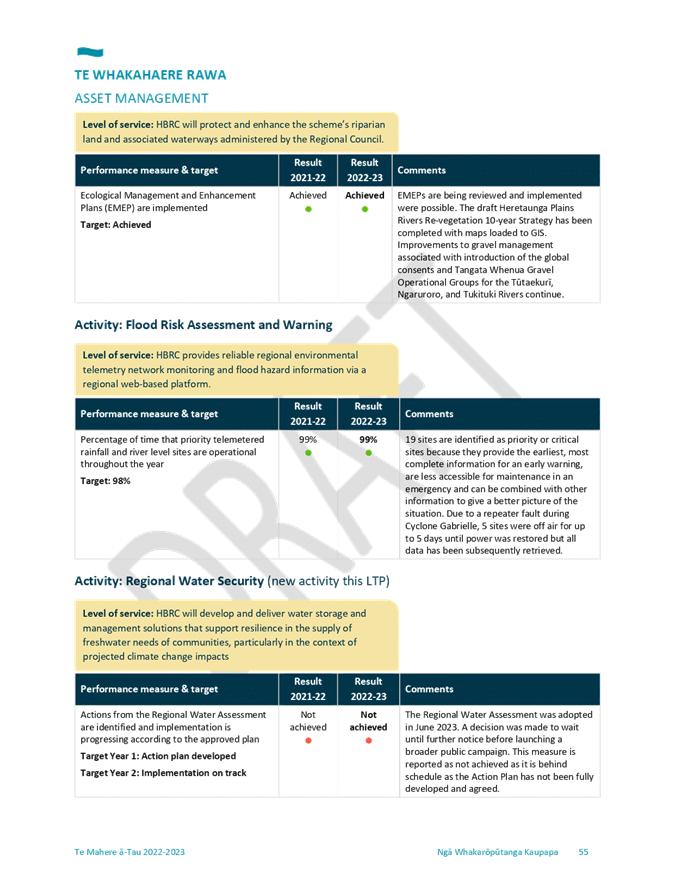

4.4. Asset Management

4.5. Emergency Management

4.6. Transport.

5. We report on actual performance

against targets set for the corresponding year in the Long Term Plan. We have

traditionally used the following format to report performance. However, based

on feedback from our auditors last year, we have avoided using ‘partially

achieved’ and have kept to ‘achieved’ and ‘not

achieved’ in this year’s reporting.

6. The 2022-2023 financial year is the

second year of the current Long Term Plan.

Other non-financial sections – to be completed

7. The non-financial sections of the full

Annual Report document will also include:

7.1. forewords by the Regional Council

chair, Chief Execute and Co-Chairs of the Māori Committee

7.2. a statement around Māori

participation in decision-making

7.3. measurement undertaken during the year

of progress towards the achievement of community outcomes

7.4. highlights by geographical area to

describe what we did during the year in more detail.

Discussion

Aggregated

results for levels of service performance measures

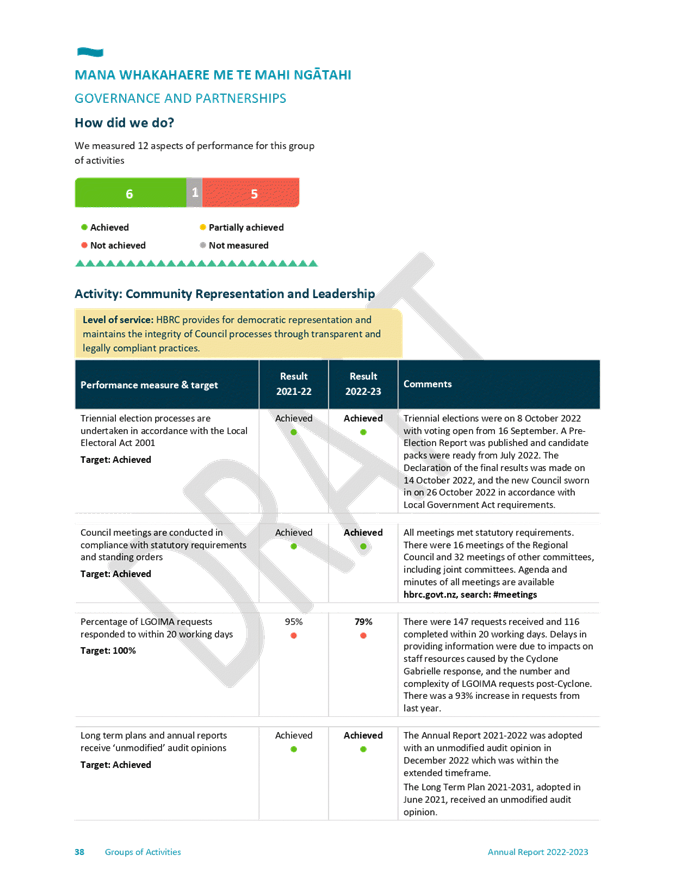

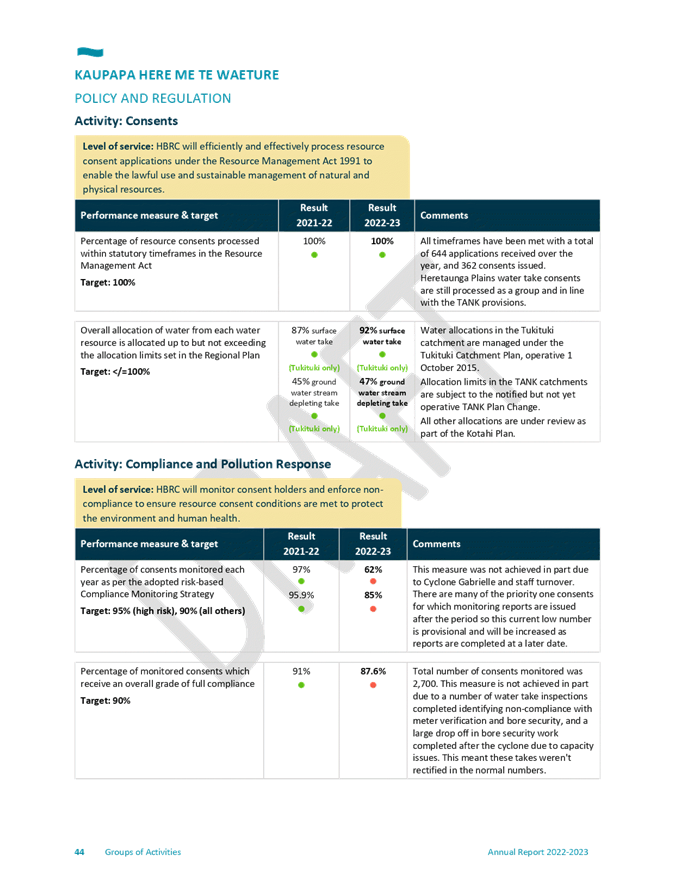

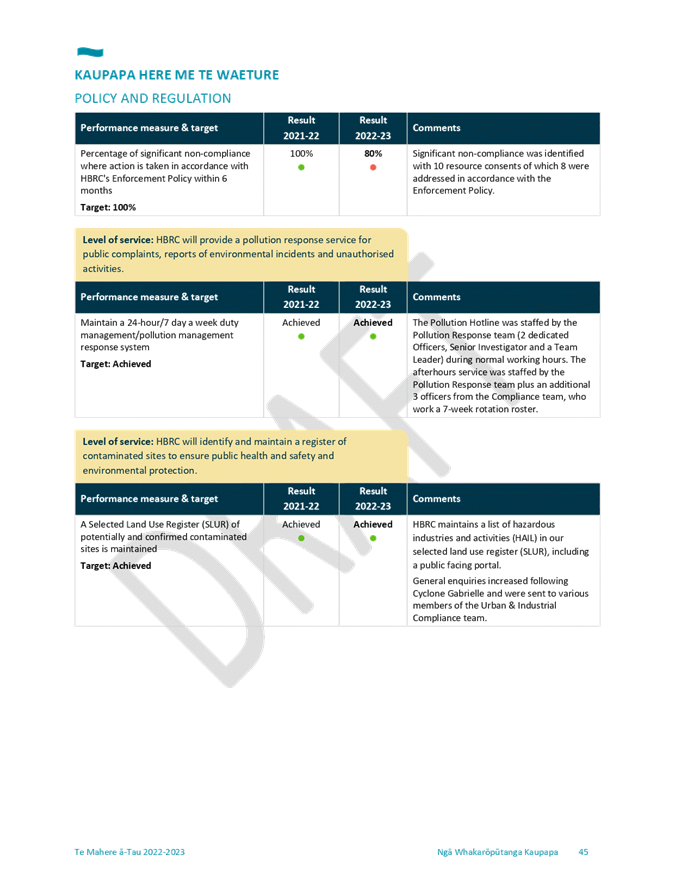

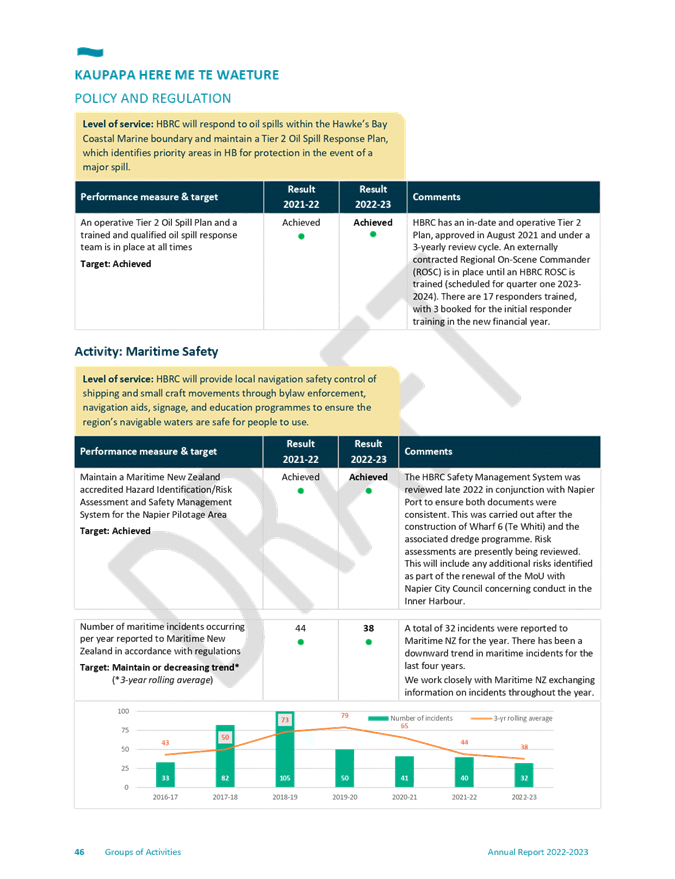

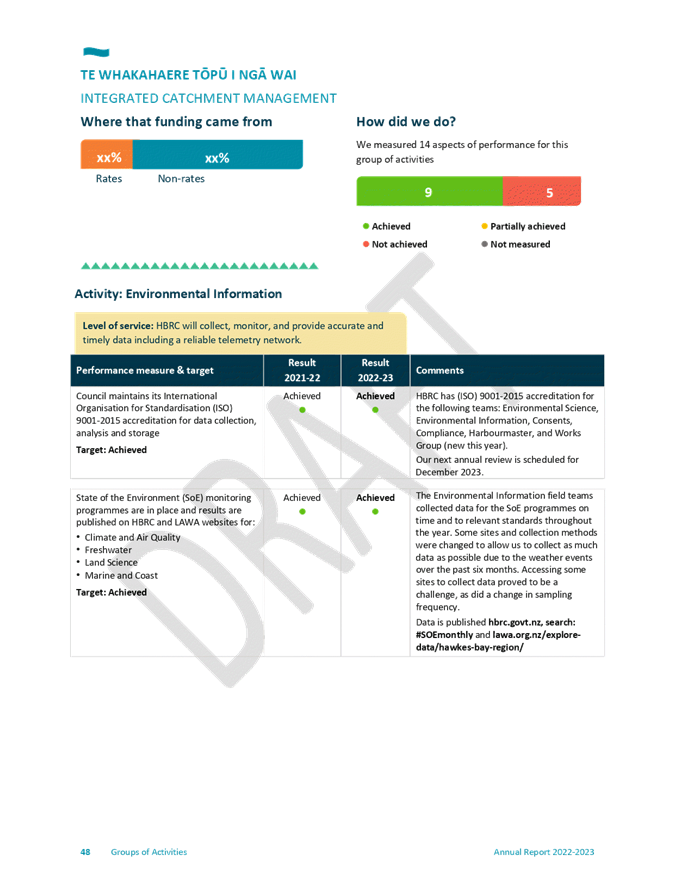

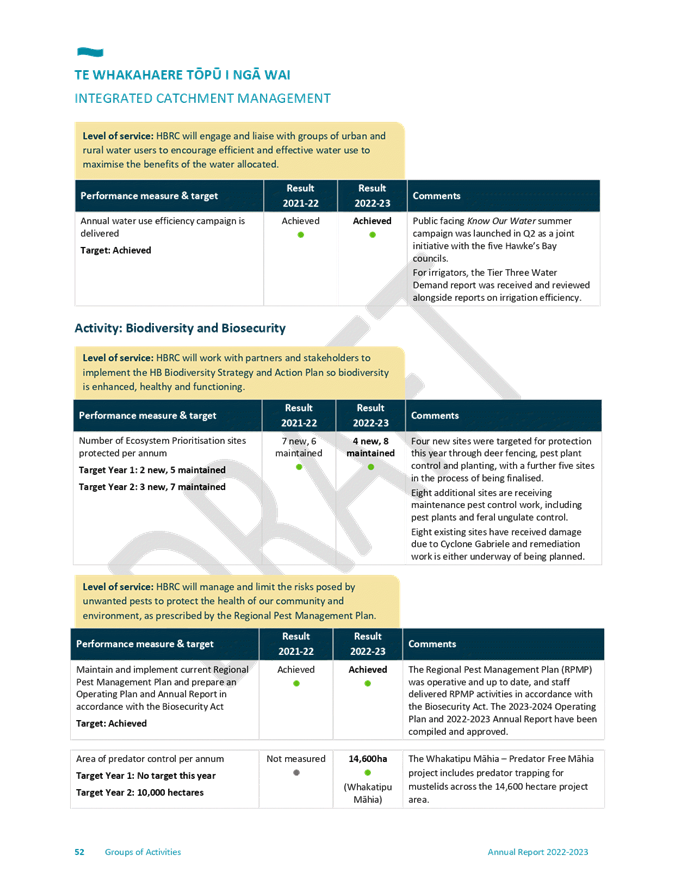

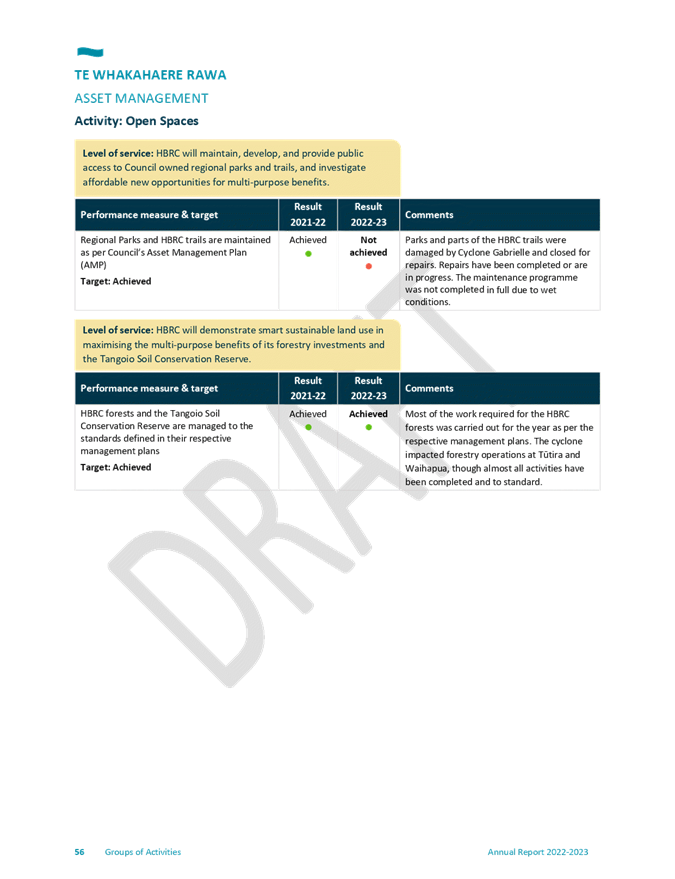

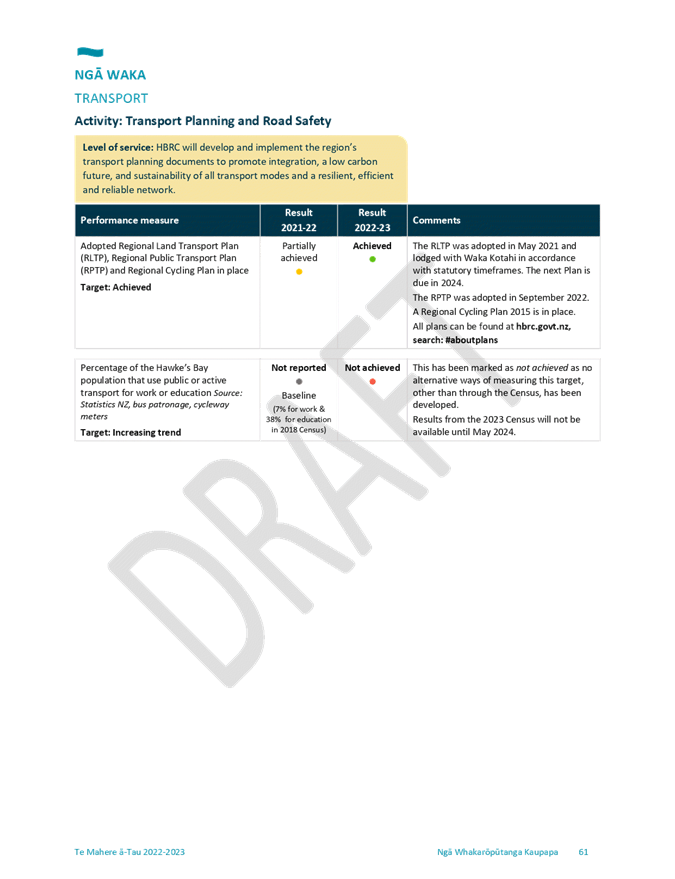

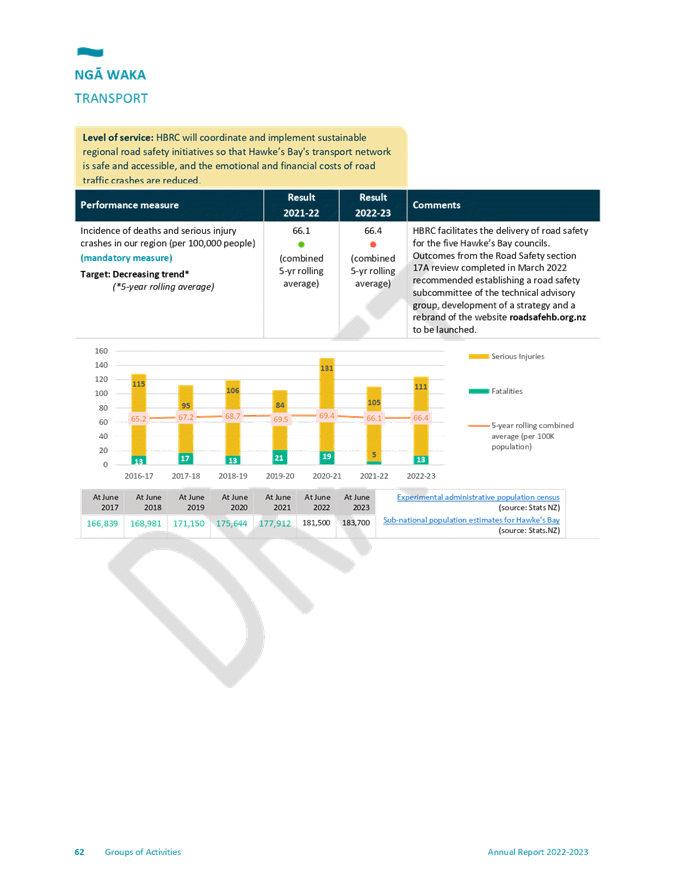

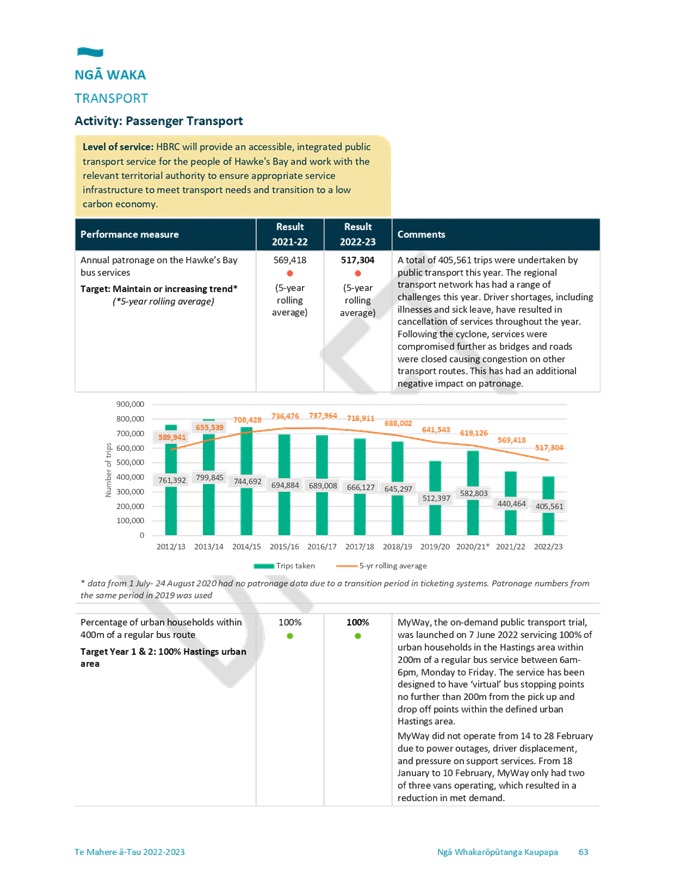

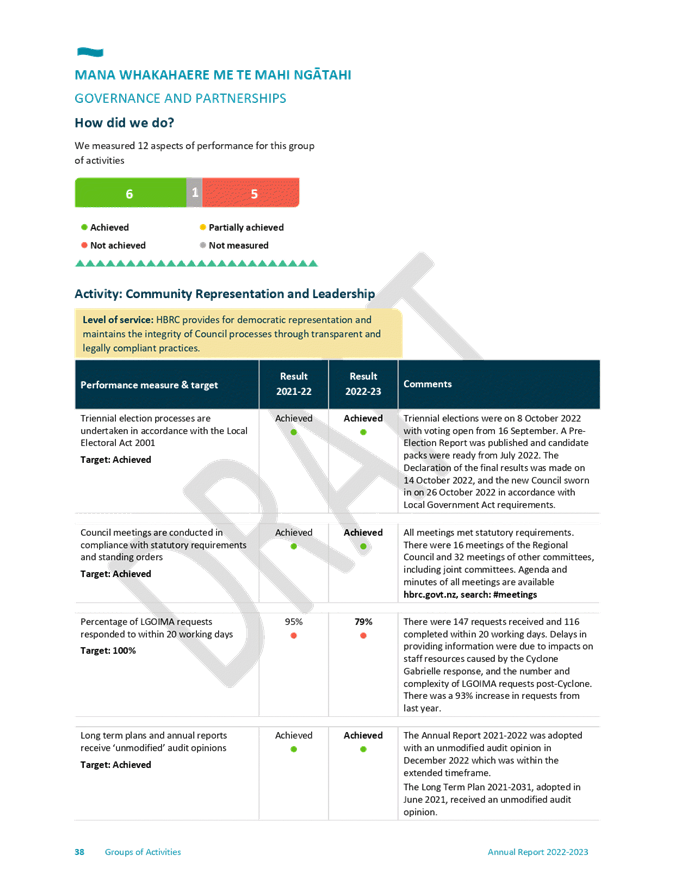

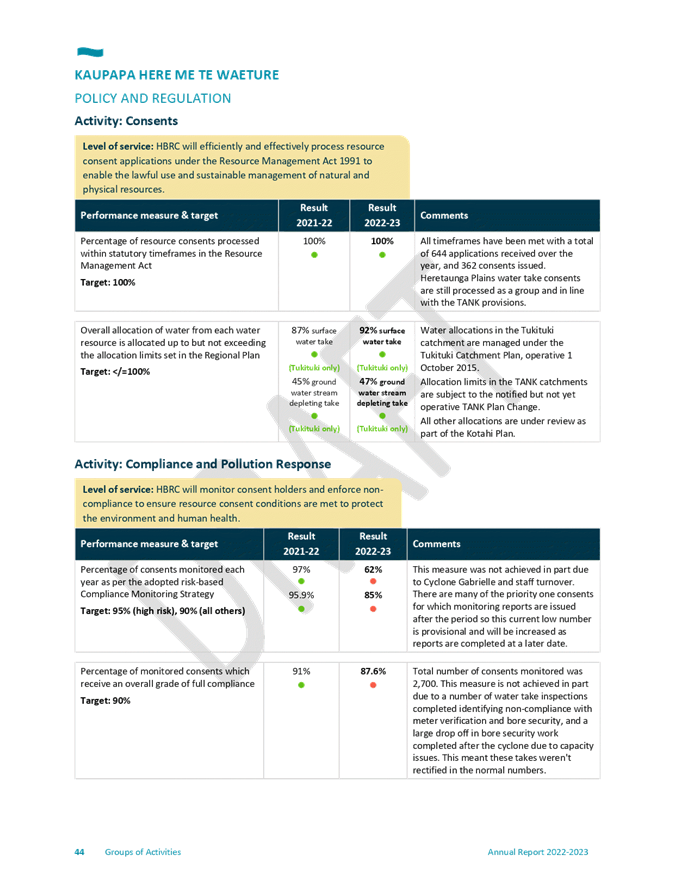

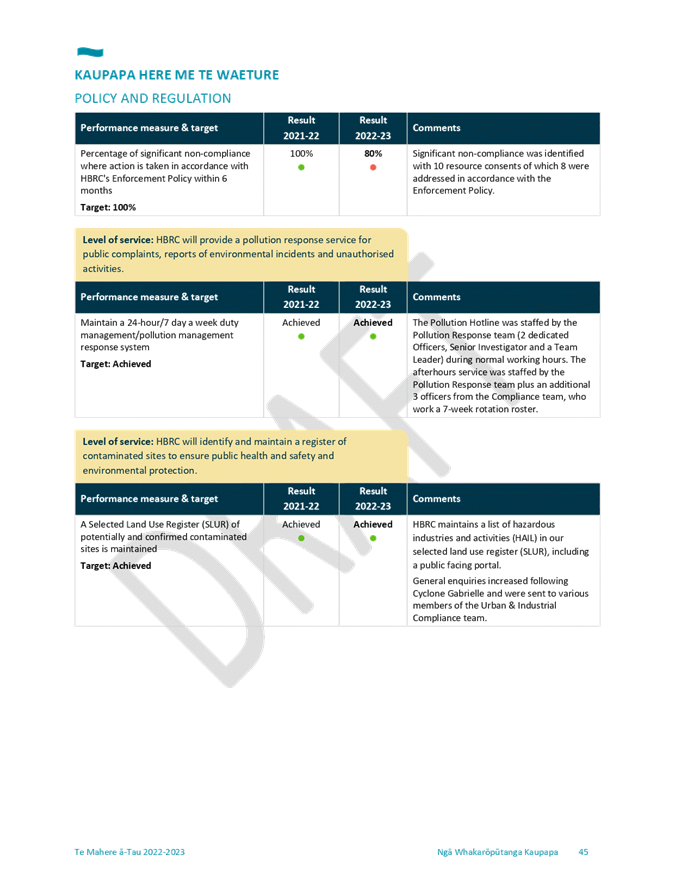

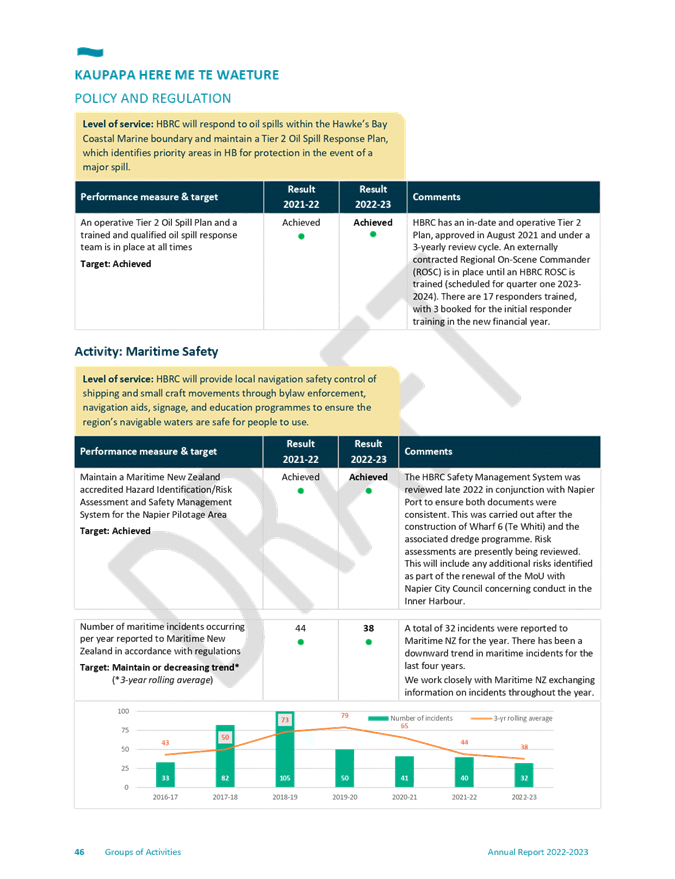

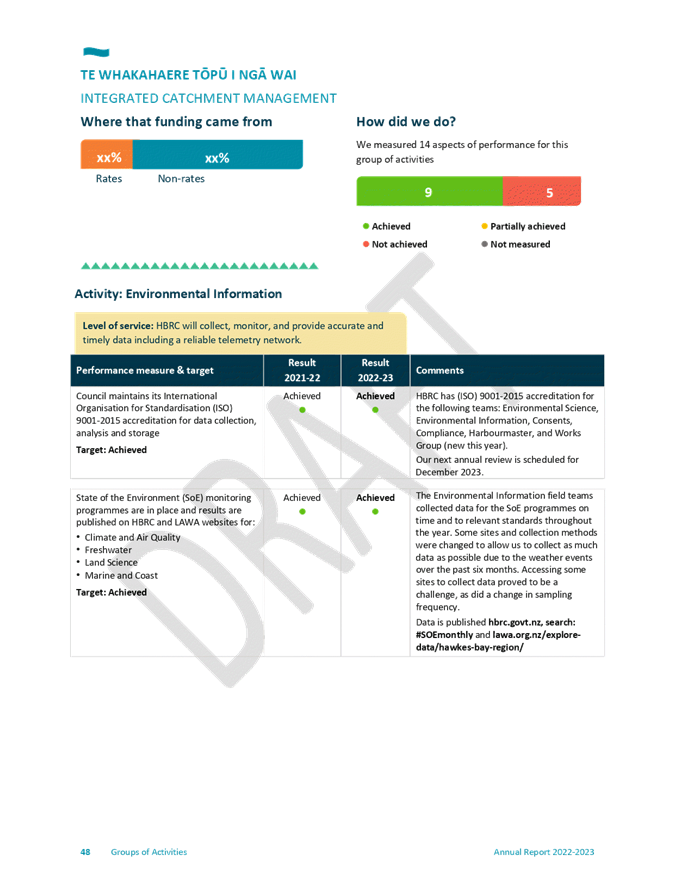

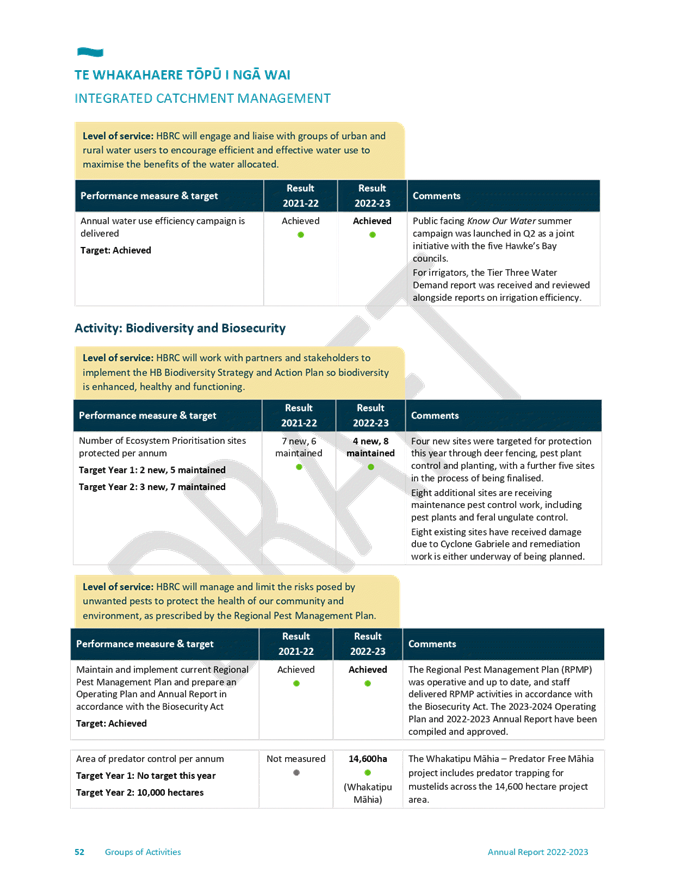

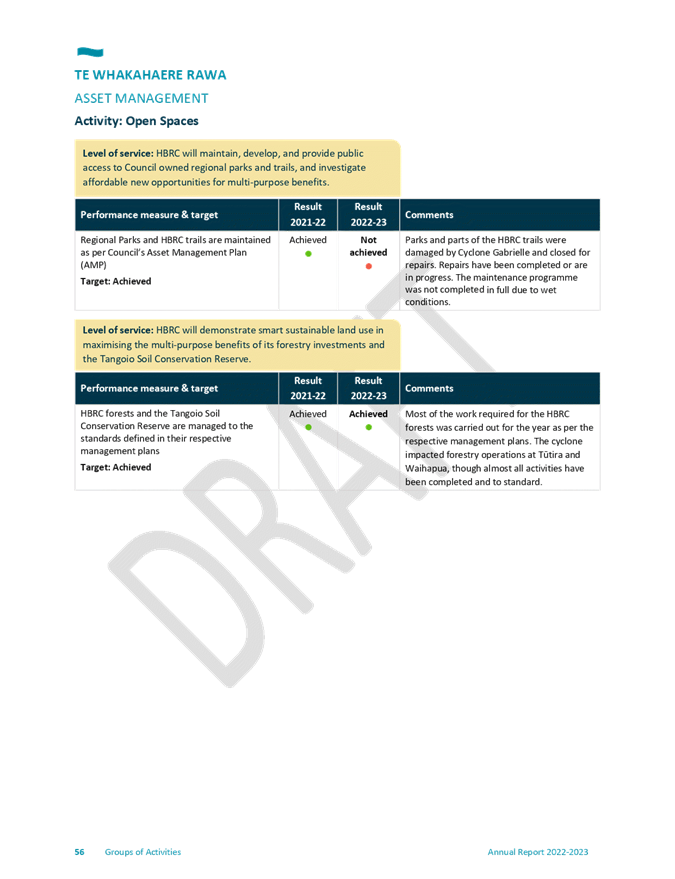

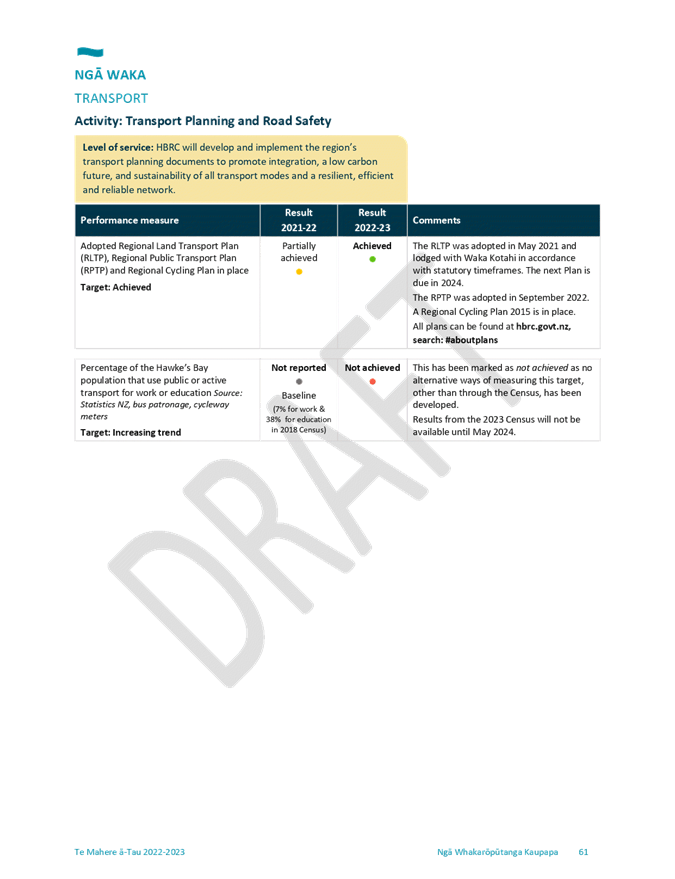

8. Of the 58 measures, 33 were achieved,

21 were not achieved and 4 were not measured or not due for reporting this

year. This compares with last year’s results when 38 were achieved, 4

were partially achieved, 11 were not achieved and 5 were not measured.

9. Staff analysis suggests the reasons

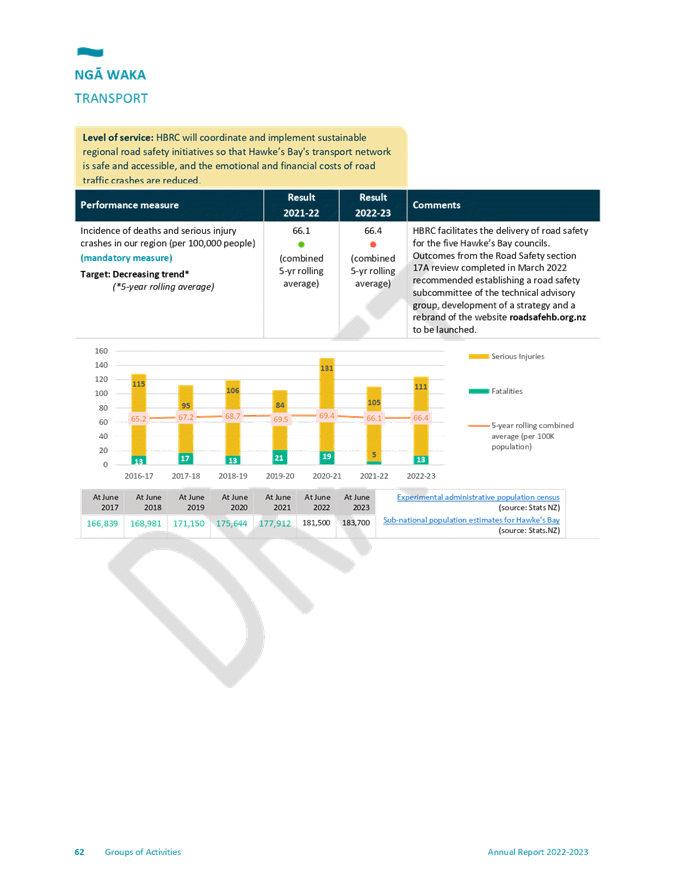

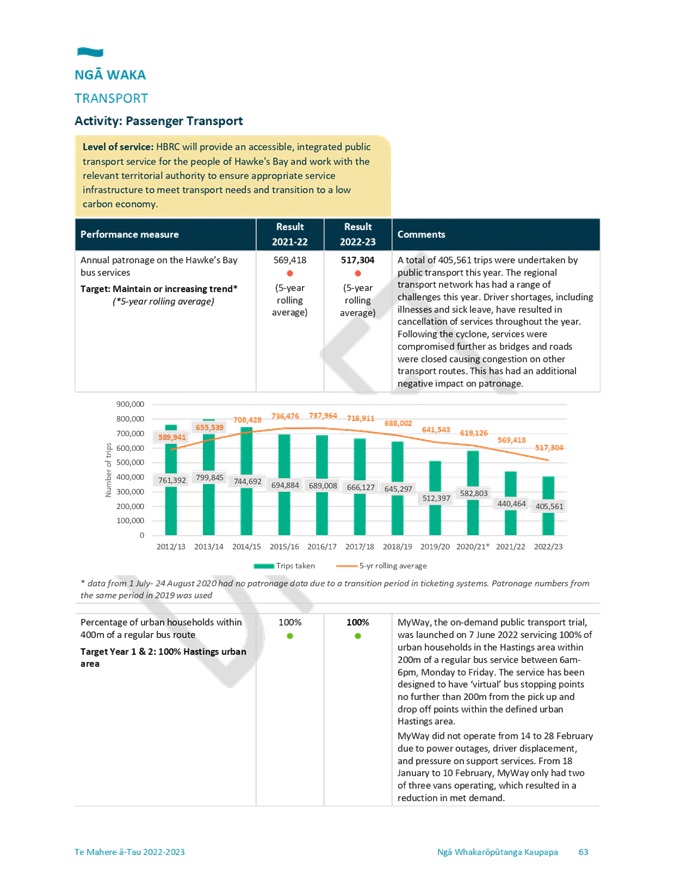

for not achieving the targets generally fall into the following areas:

9.1. Cyclone Gabrielle that had a

significant impact on our levels of service as staff were involved in the

response, and/or deployed to other roles in recovery. To do this, regular work

programmes were disrupted in many cases for at least part of the year.

9.2. other external forces impacting

staff’s ability to do their work and hampering work progress included

wetter than usual weather throughout the year, recruitment and vacancies of key

roles

9.3. results outside our direct control,

for example road crashes, bus driver shortages and cancelled bus routes

9.4. continuation of a downward trend, for

example public transport passenger numbers.

10. Commentary has been added to the

quantitative results to provide context and, in particular, explain why

measures have not been achieved. These are completed with care to meet the PBE

FRS 48 Service Performance Reporting requirements.

11. Where data allows, graphs illustrating

trends have been included to give visual context.

Next

Steps

12. The full Annual Report is due to go to

Ernst & Young (EY) for auditing between 16 September and 13 October. This

will include the financial statements and other components.

13. Draft financial statements and

community outcomes will be available for review by Council at a briefing

session on 11 October.

14. Our auditors, EY will present its

Preliminary Audit Findings report to the Risk and Audit Committee on 18

October.

15. The final Annual Report 2022-2023 will

be presented to Council on 25 October for adoption.

16. The Annual Report Summary will be

produced and audited by 25 November. This does not need to be adopted by

Council.

Decision

Making Process

17. Staff have assessed the requirements

of the Local Government Act 2002 in relation to this item and have concluded

that, as this report is for information only, the decision-making provisions do

not apply.

Recommendation

That

the Corporate and

Strategic Committee receives and notes the Annual Report 2022-2023 –

Interim non-financial results staff report.

Authored by:

|

Sarah Bell

Team Leader

Strategy and Performance

|

|

Approved by:

|

Desiree Cull

Strategy

and Governance Manager

|

|

Attachment/s

|

1⇩

|

INTERIM 2022-23 Annual Report

Performance Measures

|

|

|

|

NTERIM 2022-23 Annual Report Performance

Measures

|

Attachment

1

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate and Strategic Committee

Wednesday

20 September 2023

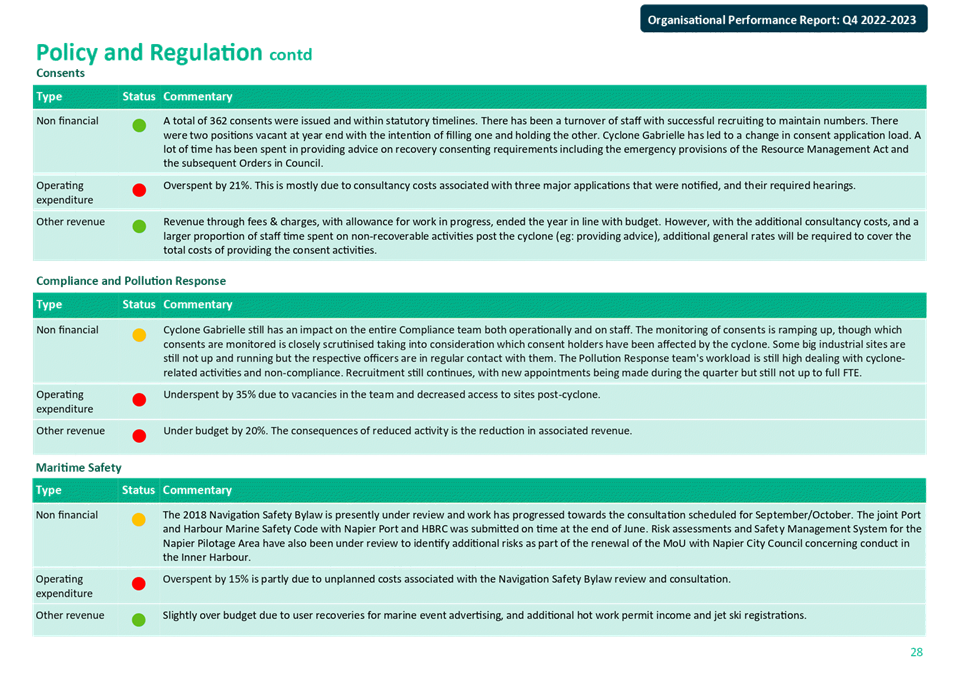

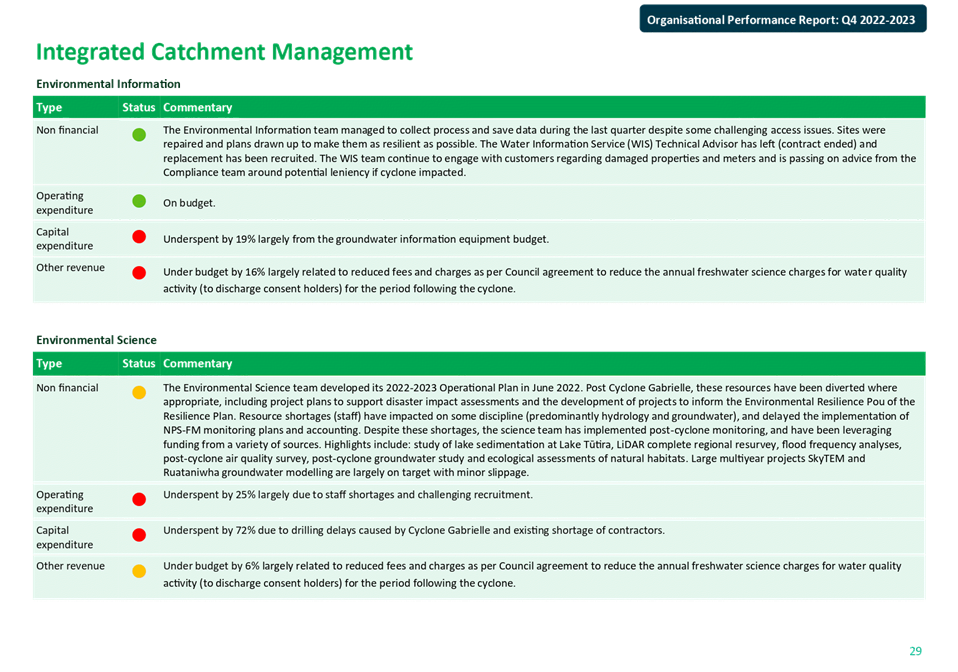

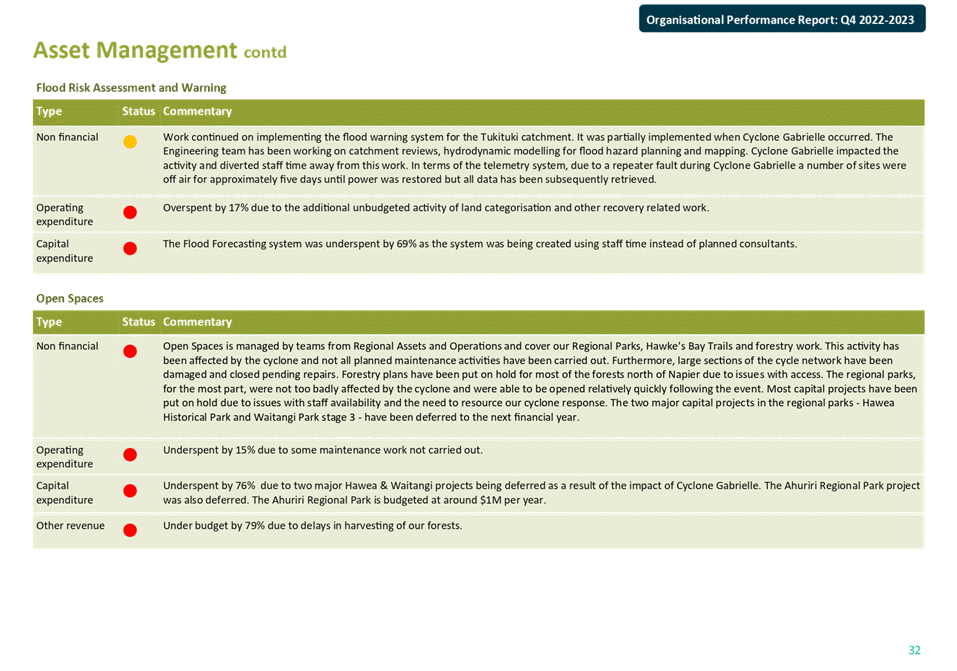

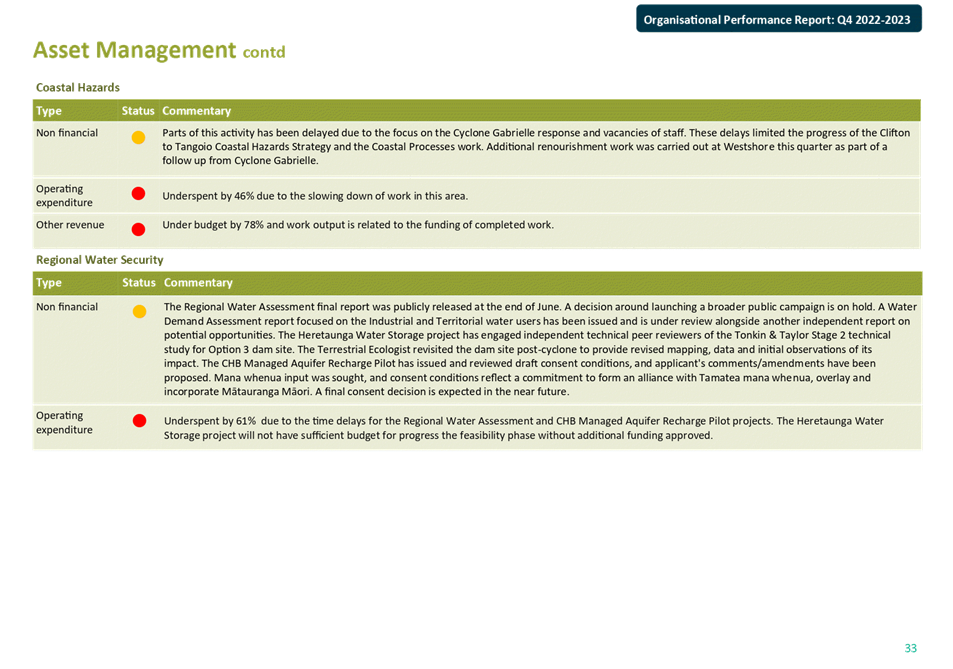

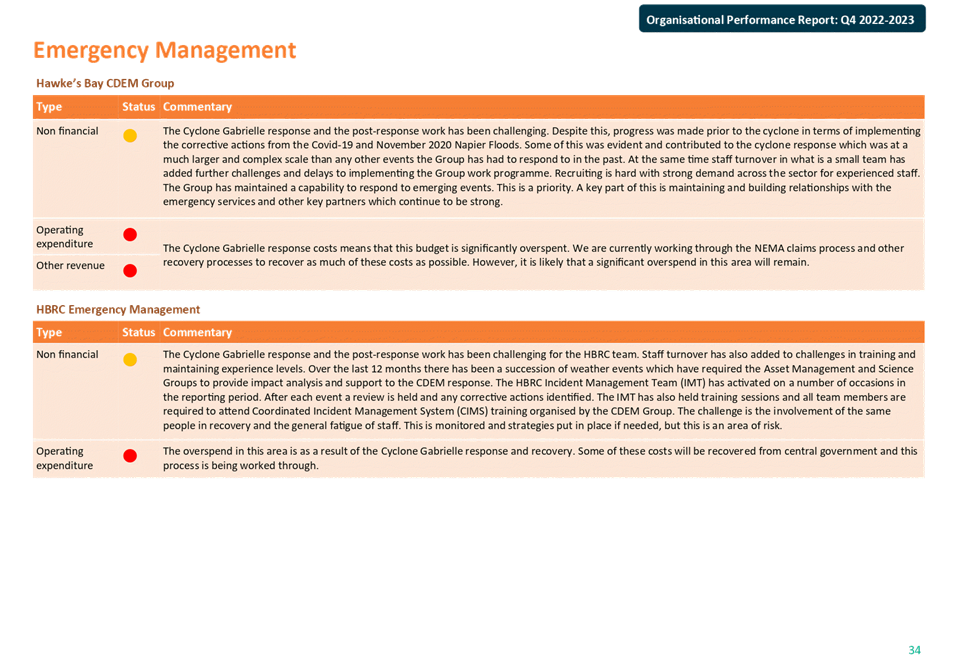

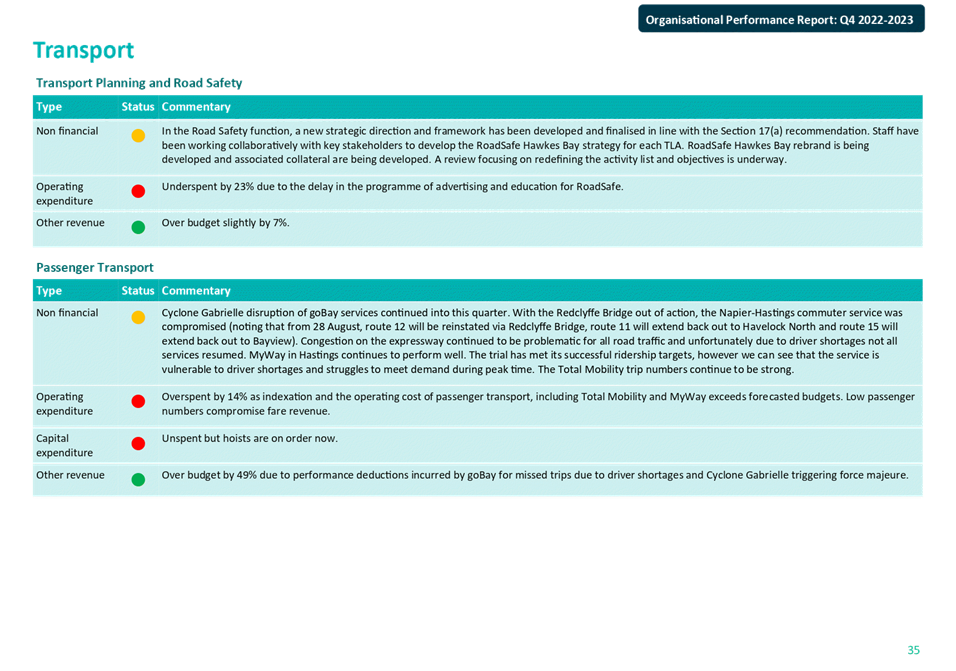

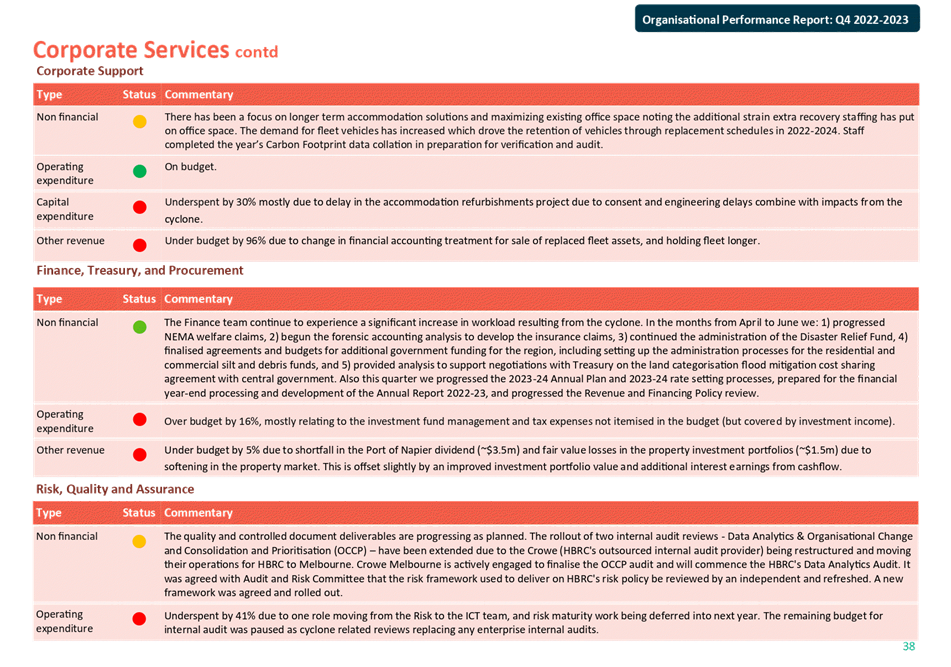

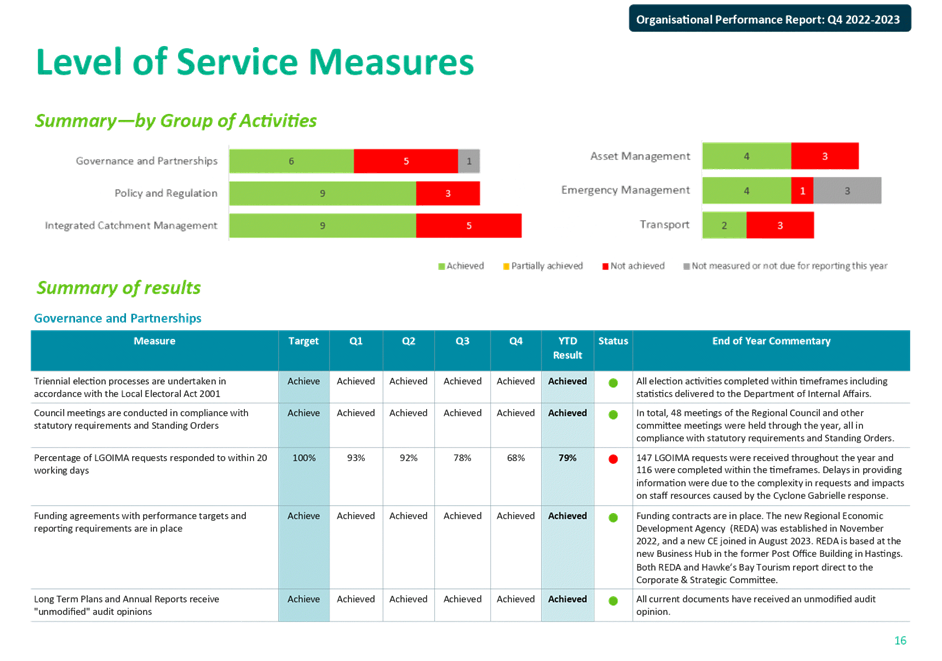

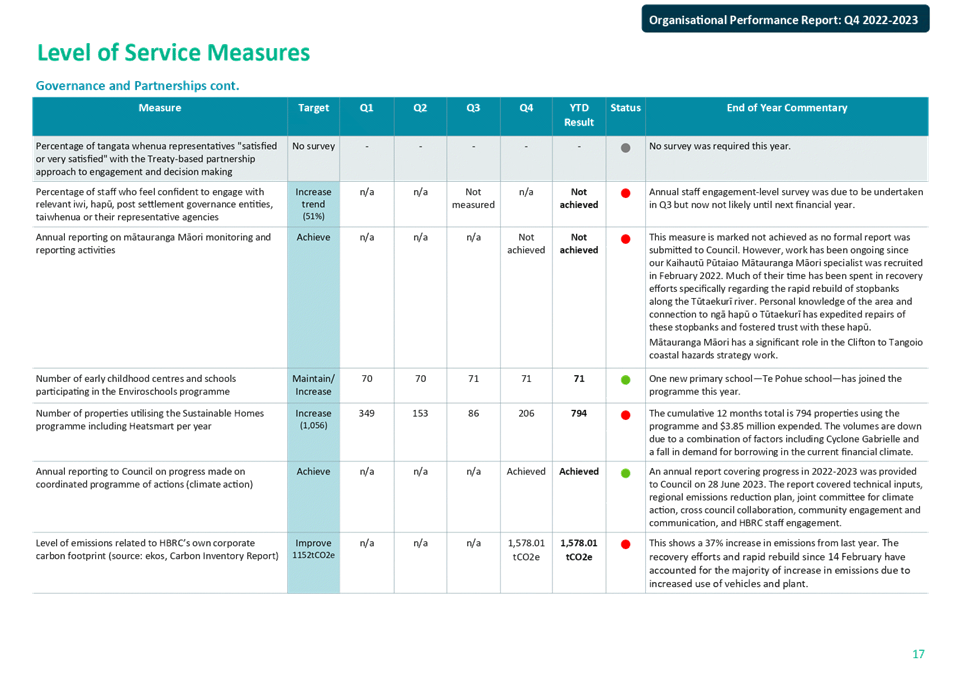

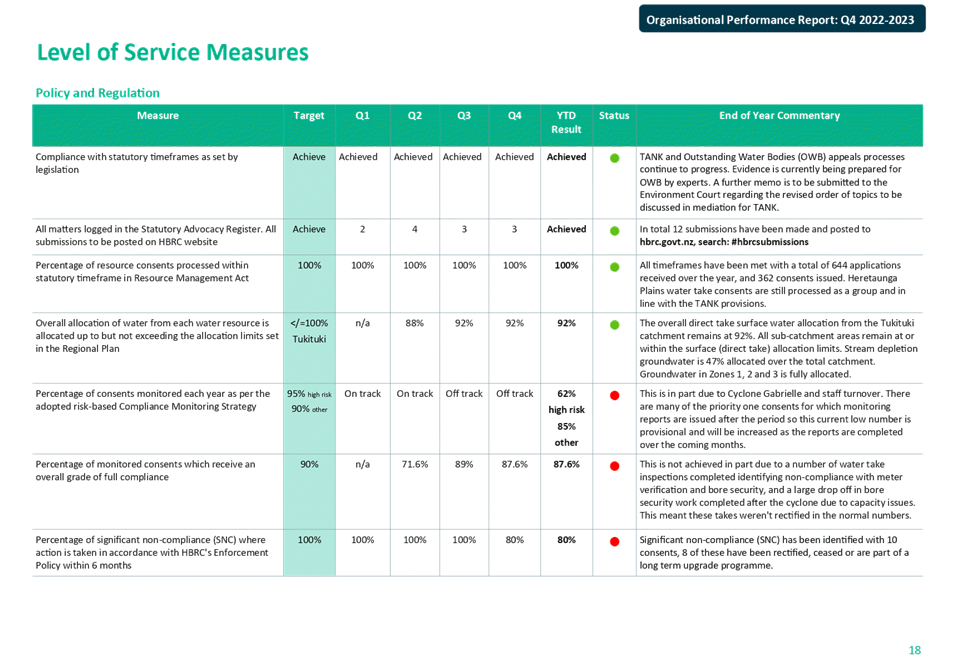

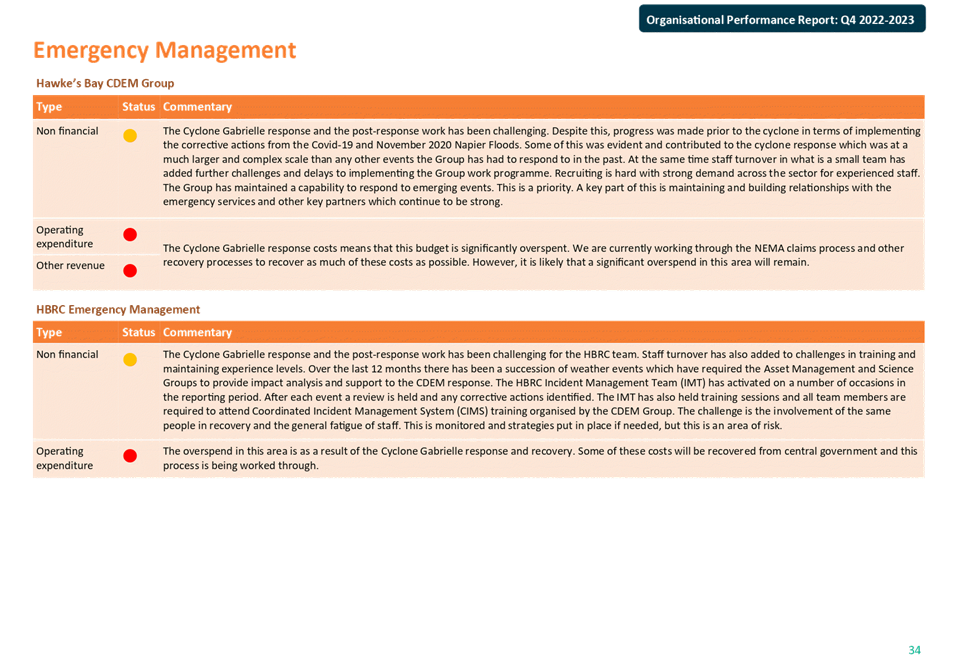

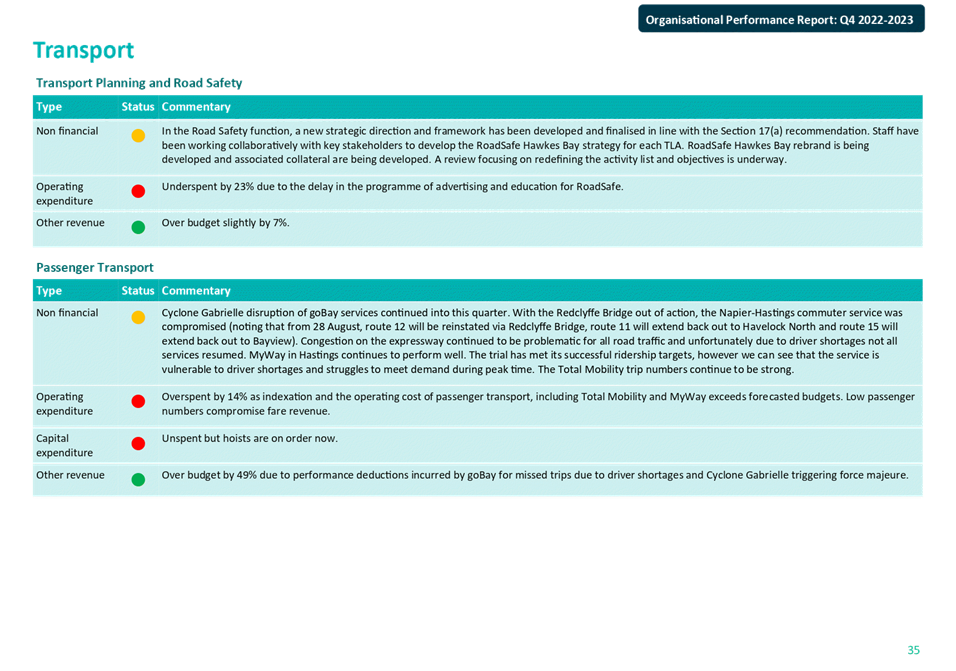

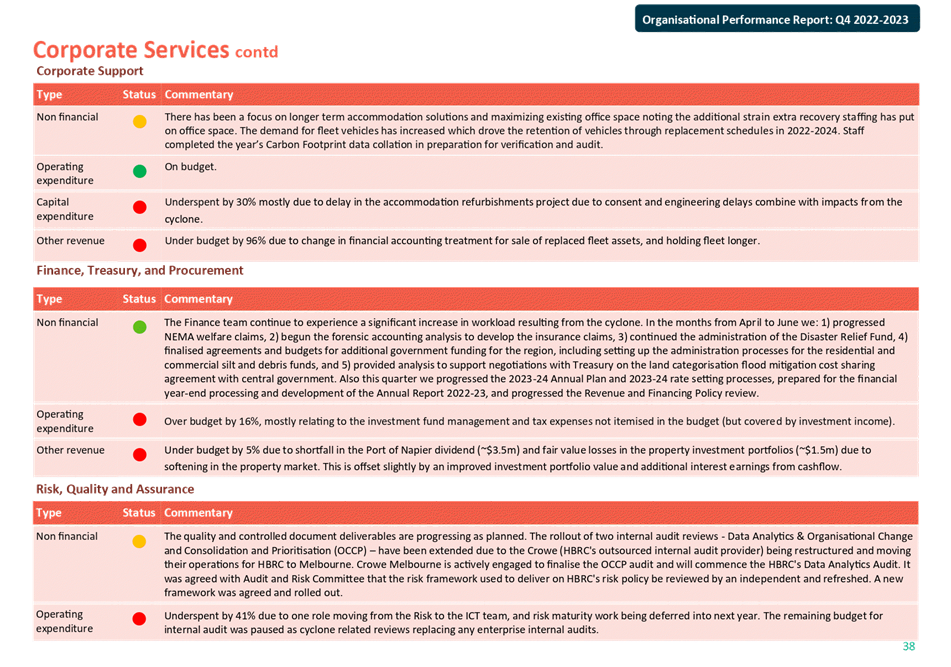

Subject: Organisational Performance report for the period 1 April –

30 June 2023

Reason

for Report

1. This item presents the Organisational

Performance Report for the period 1 April – 30 June 2023.

Content

of the Report

2. The report contains four parts:

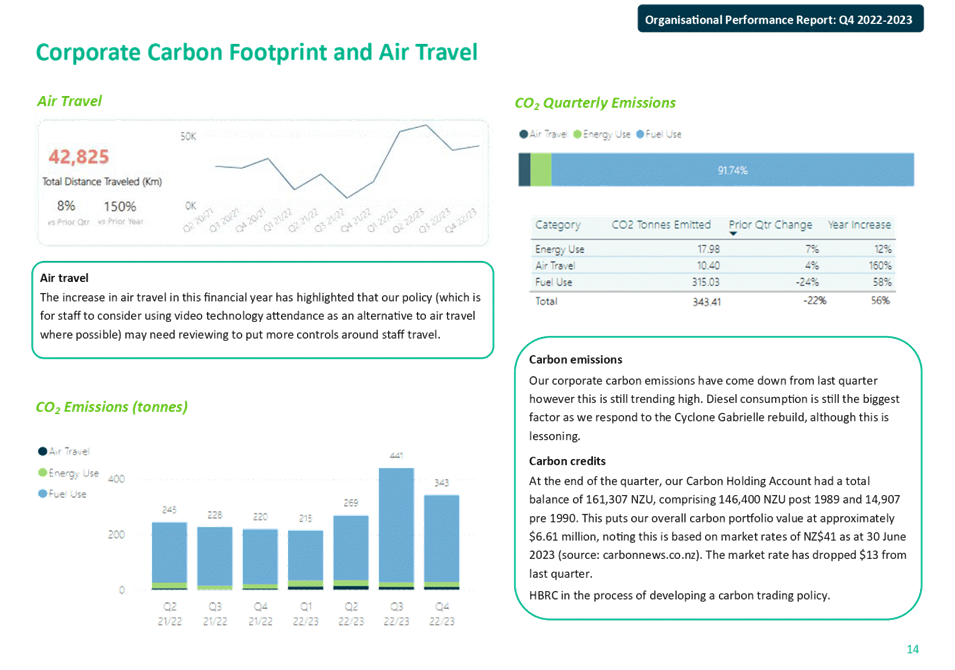

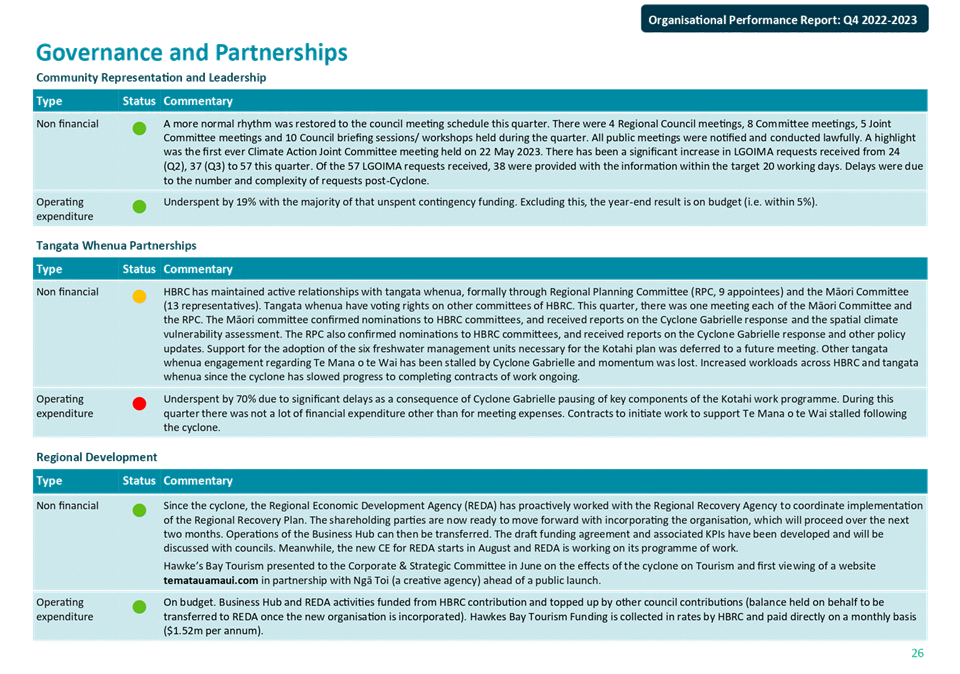

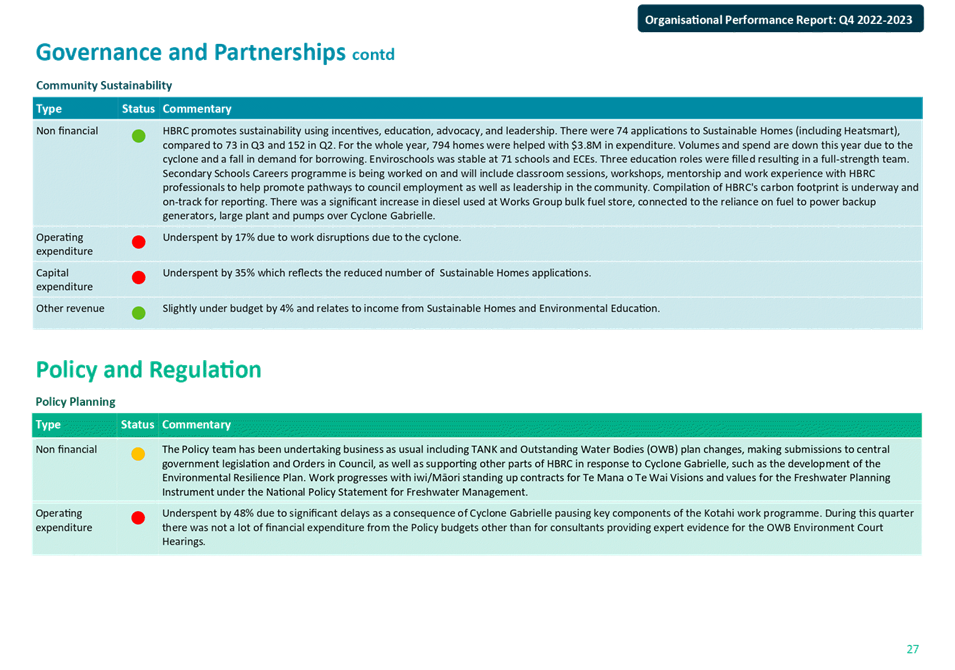

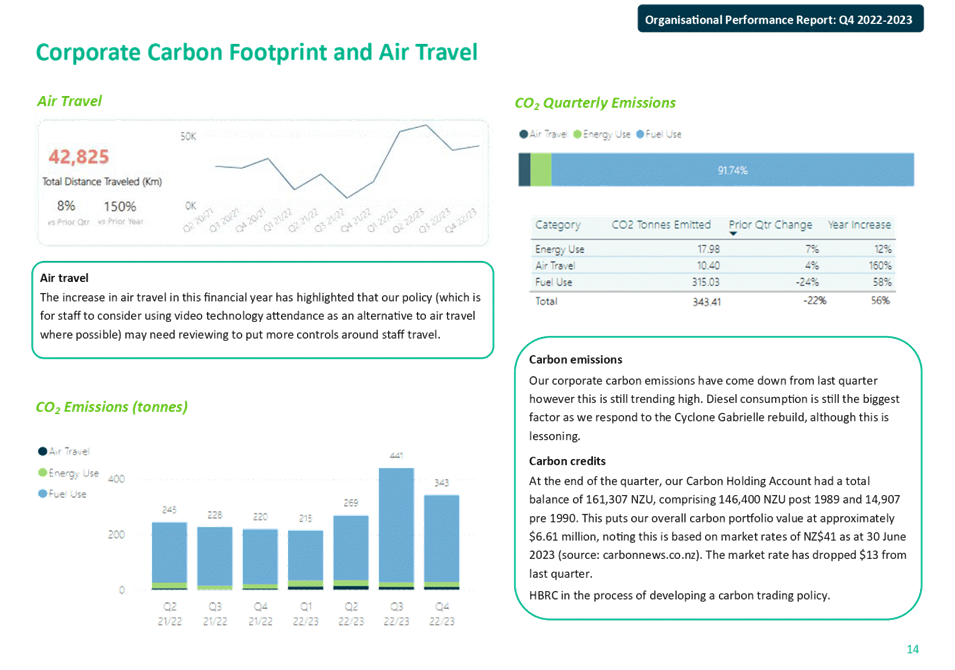

2.1. Executive Summary continues to have a focus on our

region’s response (pp4-7)

2.2. Corporate Metrics that focus on how well we are

performing across a number of corporate-wide measures such as employee turnover

and corporate carbon footprint (pp 8-14)

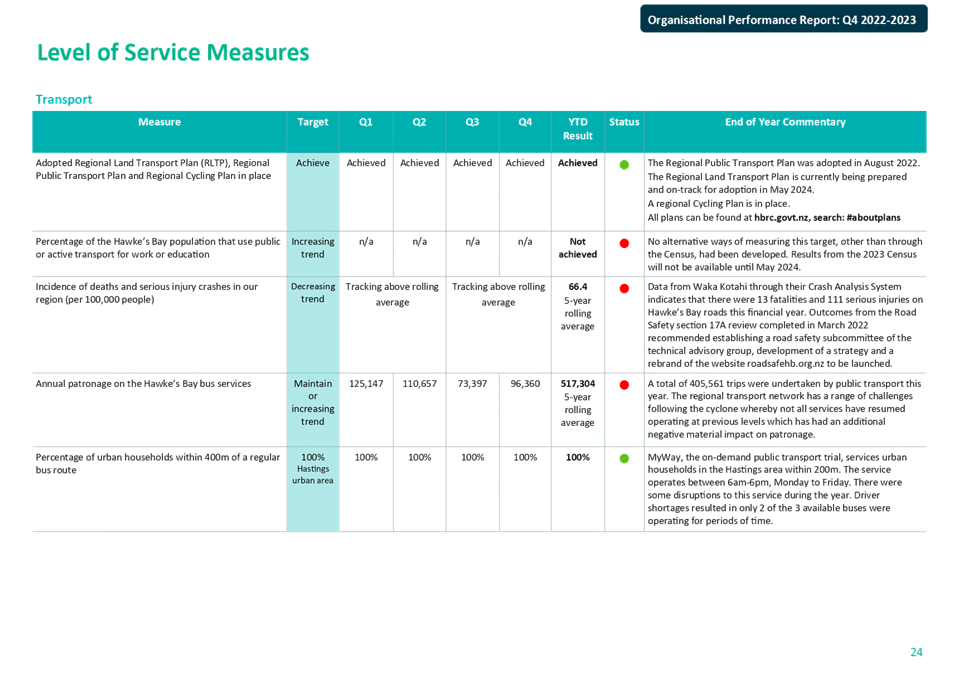

2.3. Level of Service Measures (LOSM) by group of activities with

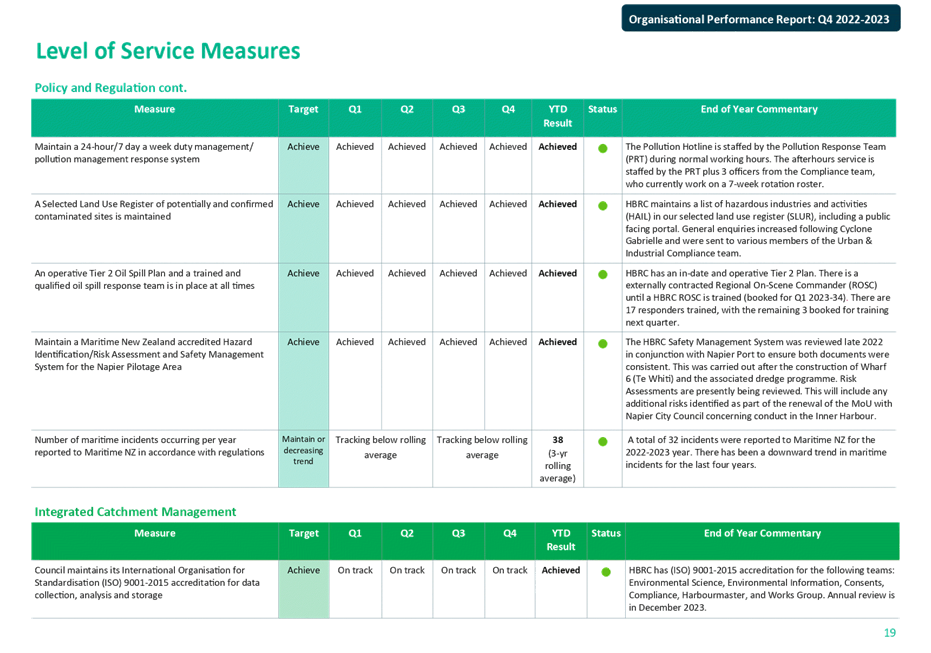

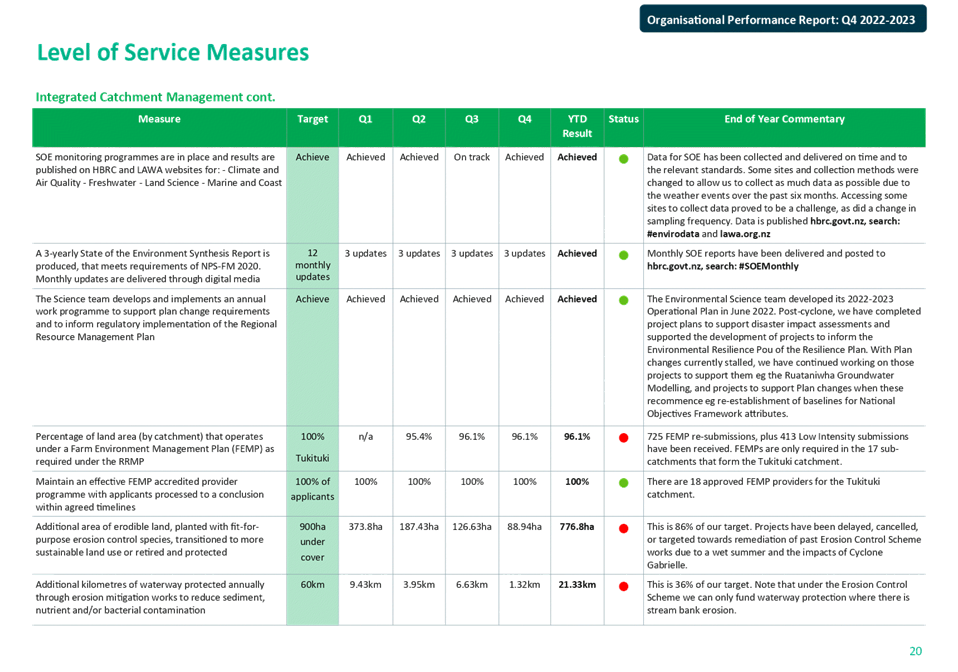

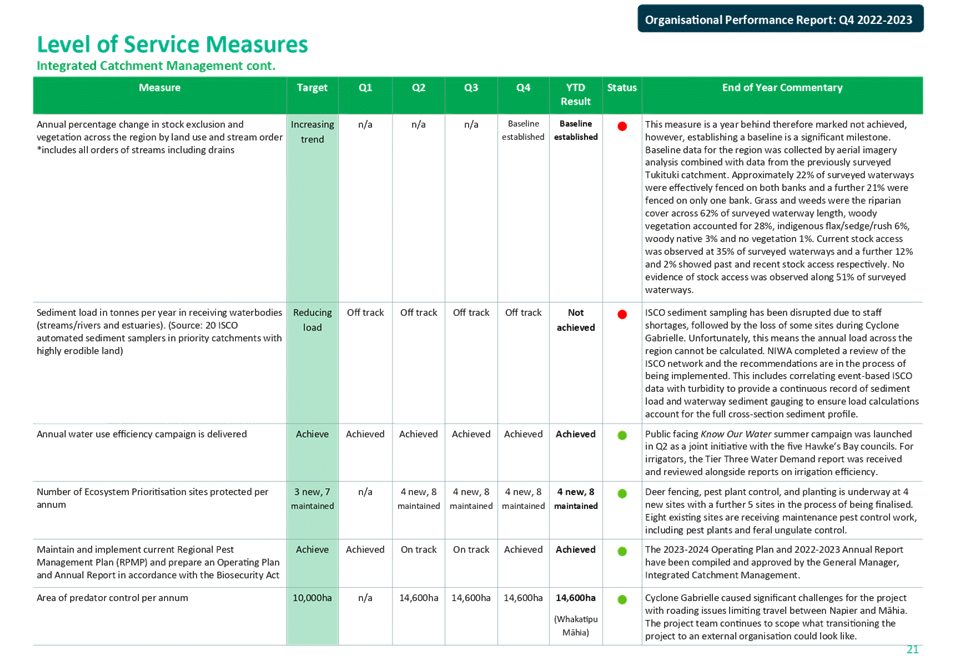

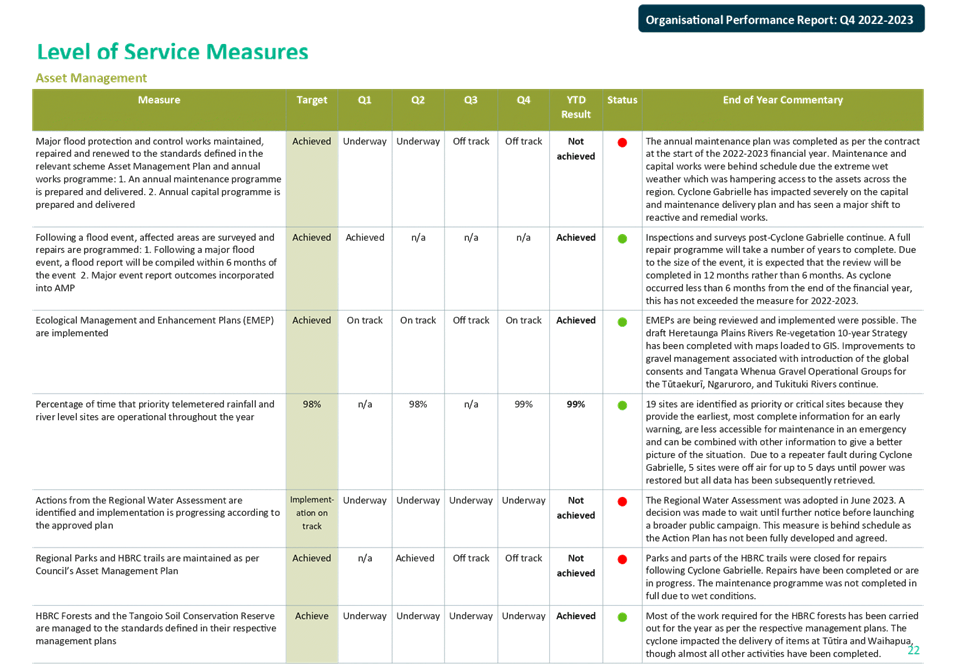

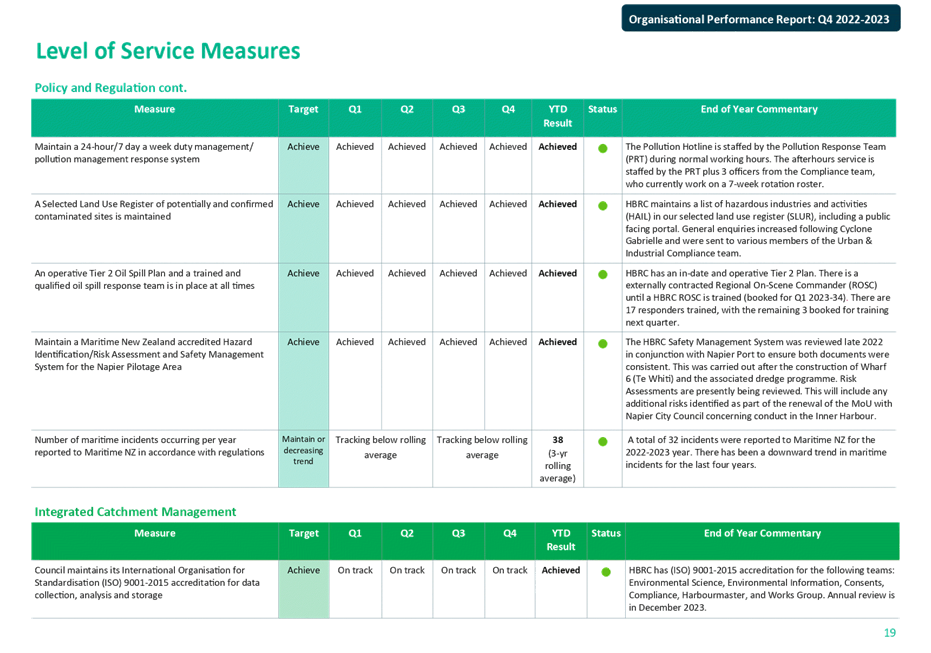

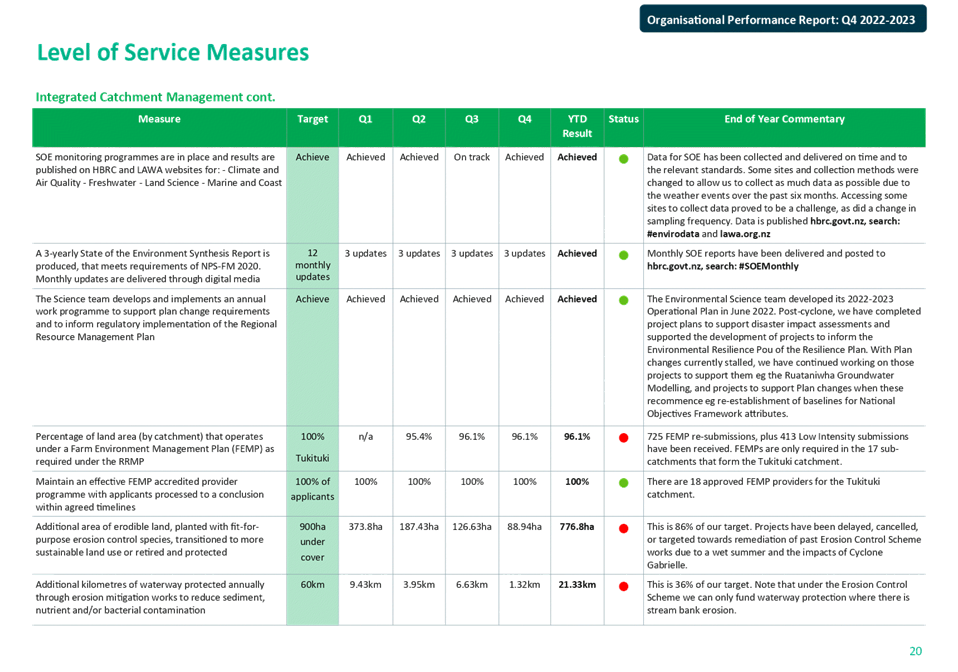

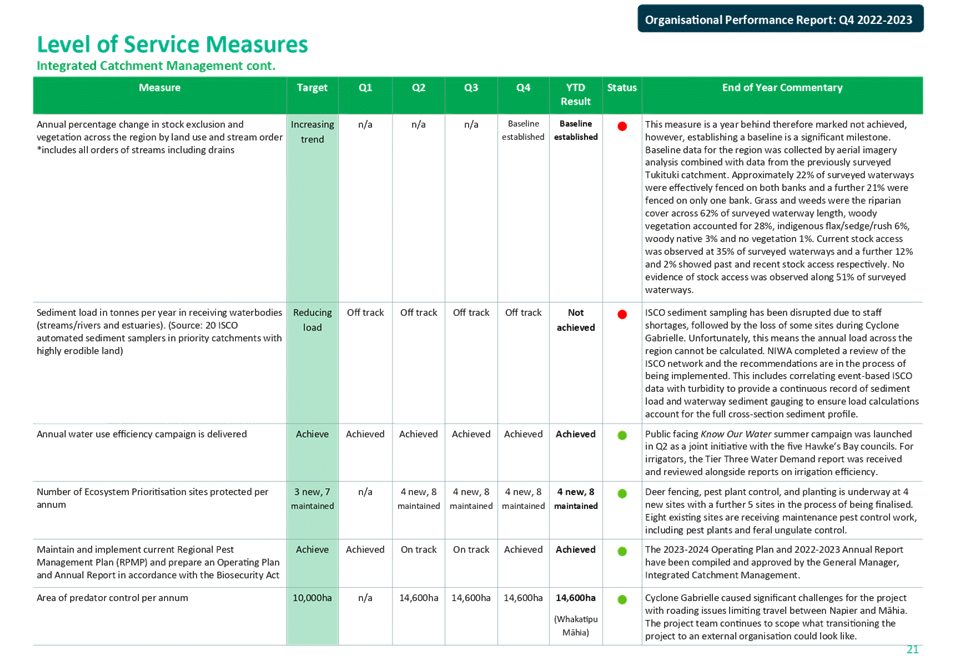

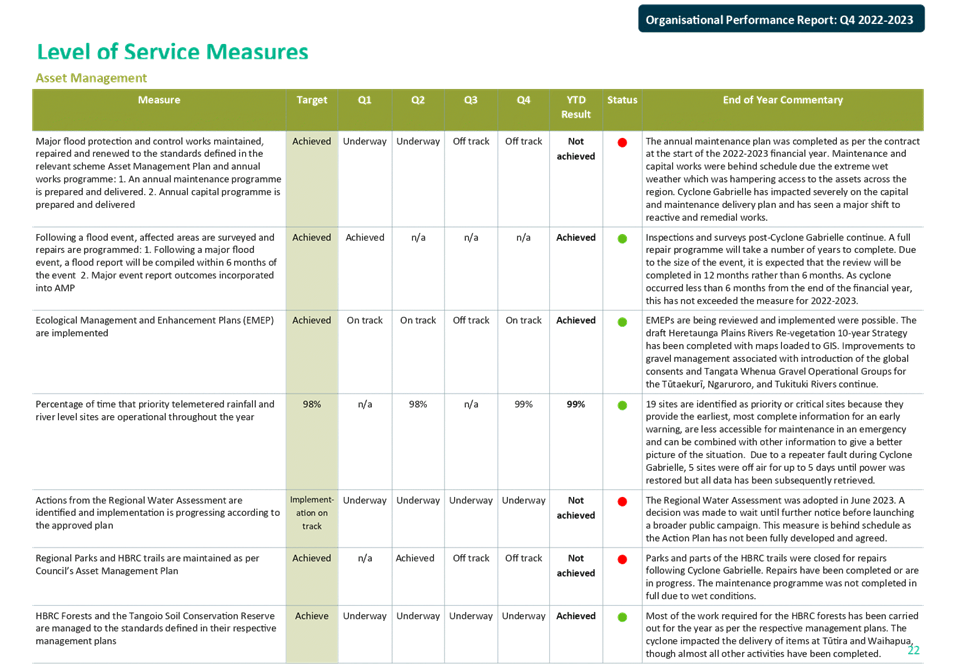

adopted targets, traffic light status and commentary (pp 15-24)

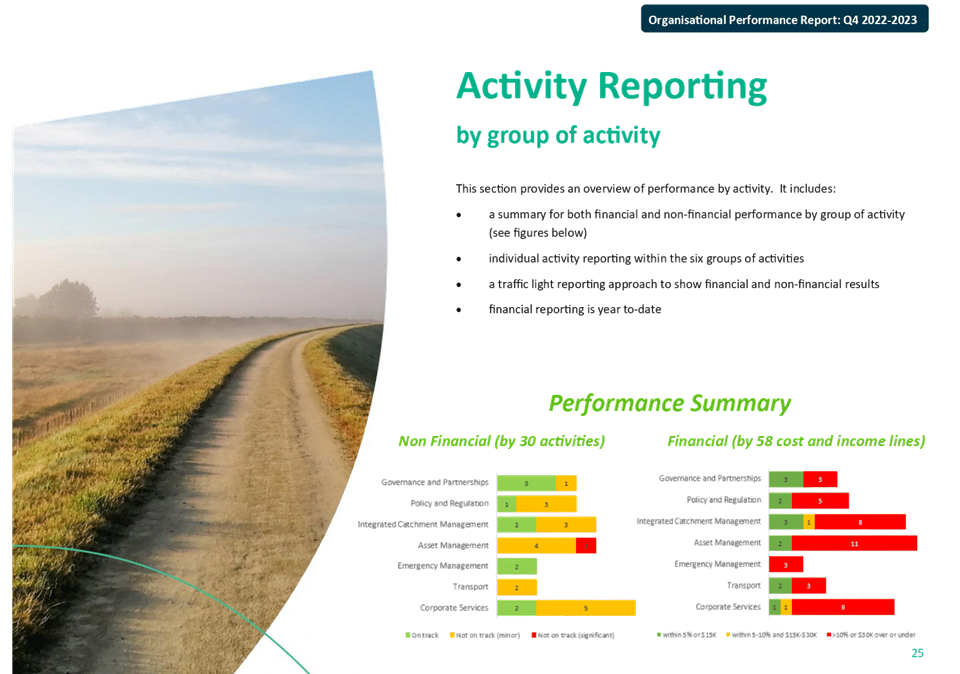

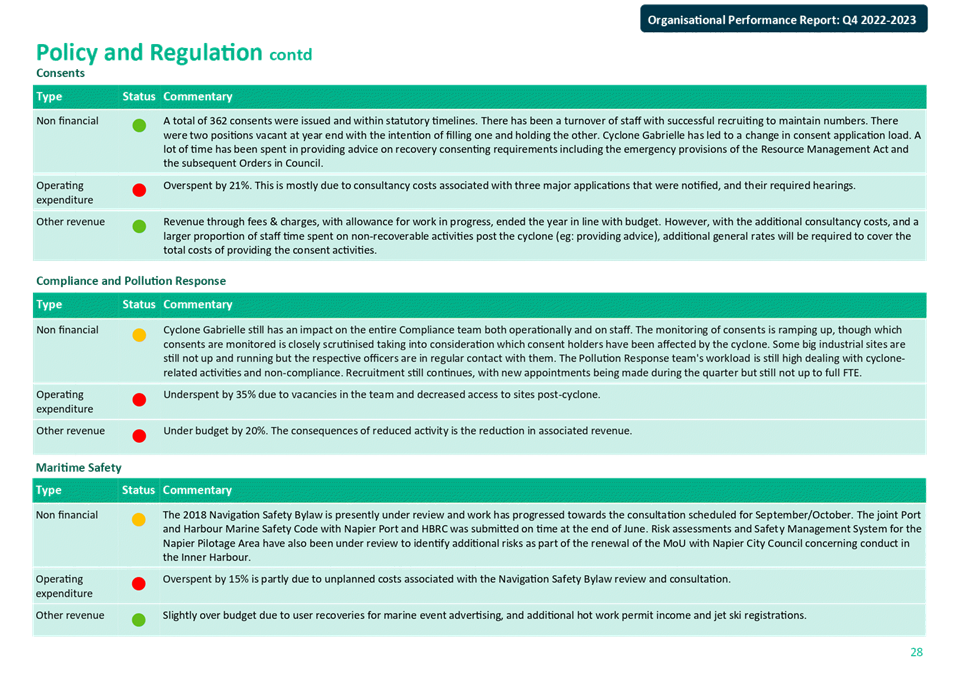

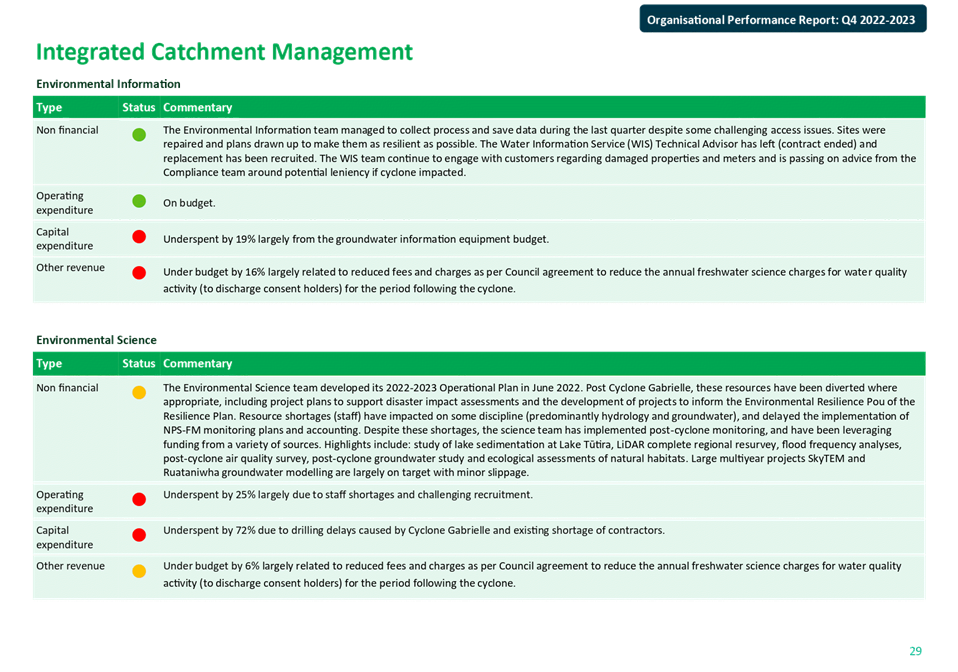

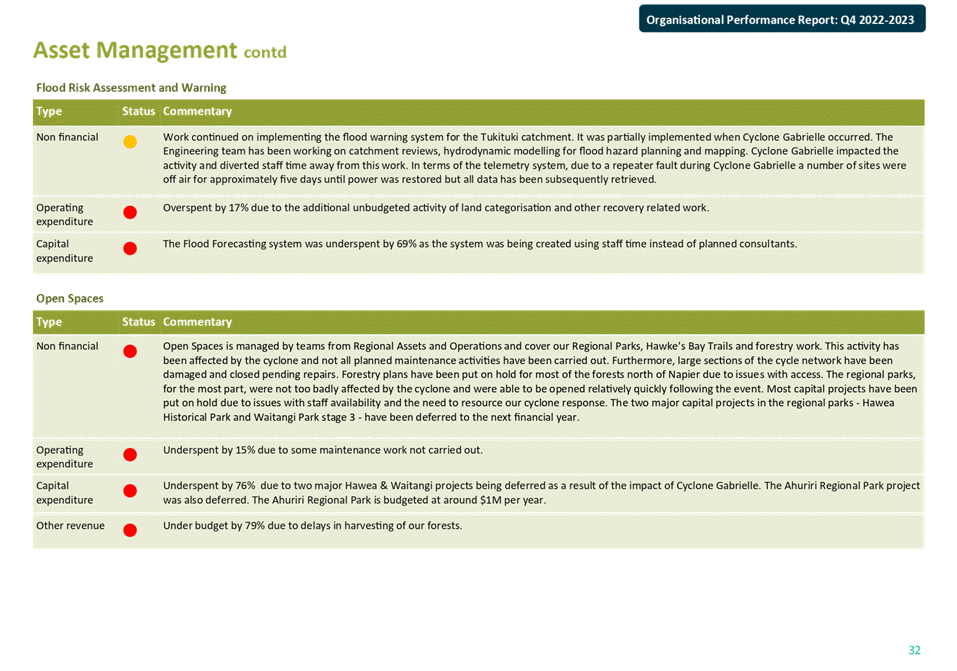

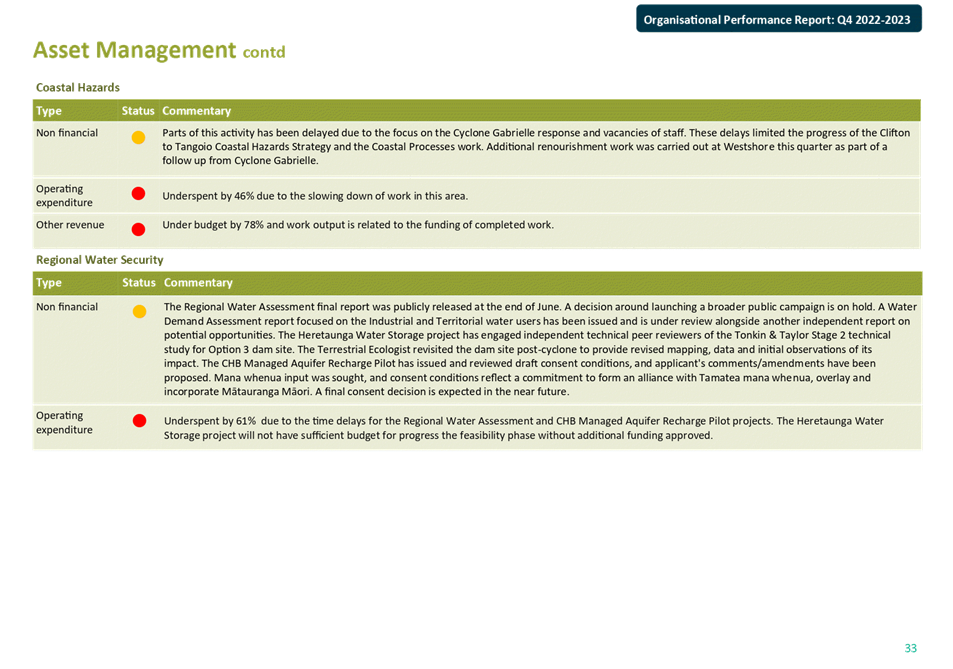

2.4. Activity Reporting by group of activities with non-financial and financial traffic light status and commentary

(pp 25-38).

3. Organisational Performance reports

were established in 2018. The status and commentary reporting are rolled up

from cost centre to activity level. Commentary

by cost centre is still available to committee members via the PowerBI

dashboard (see points 10-14 below).

4. Staff complete their reporting in a

software tool called Opal3. For LOSM and activity reporting, staff select the

status (red, amber, green) of non-financial results and provide commentary on

what they did in the quarter against their annual work plans. Traffic light

status of financial commentary is selected on predetermined parameters with

commentary provided by staff.

5. The financial ‘lines’ are

broken down (where applicable) to:

5.1. operating expenditure (opex) which

includes external costs, internal time and personnel costs

5.2. capital expenditure (capex) which

includes external costs and internal time

5.3. other revenue which includes fees

& charges, grants and proceeds from other income – both opex and capex.

Points of

Interest

6. Corporate metrics (pp 8-14)

6.1. LGOIMA requests jumped to 57 this

quarter compared with 37 last quarter. Over the course of the year, we

experienced a 93% increase on last year. Requests have been more complex and

require more staff resources to complete.

6.2. There are three new graphs from our

Customer Experience team around daily feedback sentiment and response time for

customer enquiries.

6.3. The quarterly employee turnover has

trended downwards this quarter, with the rolling 12-month turnover down to

19.8% from 21.5% last quarter.

7. Levels of service measures

(pp 15-24)

7.1. These signal the end of

year results that will be included in the Annual Report 2022-2023, subject to

audit.

7.2. The end of year results

are 33 achieved (57%), 21 not achieved (36%) and 4 not measured or not due for

reporting this year.

7.3. The results are spread

evenly across the groups as the cyclone has had a significant impact on our

levels of service and budgets across the organisation.

8. Activity reporting (pp 25-38)

8.1. Staff have reported 19 activities as

‘off track’ from their usual workplans. This is up from 10 last

quarter. This has been as a result of deploying staff and resources to support

the response and recovery, and pauses to business as usual.

8.2. Financial reporting largely shows

underspend due to paused activity also resulting from the altered work

programmes following the cyclone.

8.3. Recovery costs are captured elsewhere

and reported to directly to Council.

9. The Reporting Dashboard (PowerBI) has

additional commentary not included in this report, which is edited for

readability.

Reporting

Dashboard (PowerBI)

10. The dashboard is produced using

PowerBI to give a visual representation of the results over time. The

Organisational Performance Report document is produced from the dashboard.

11. The dashboard also provides committee

members with the ability to delve deeper into activities of interest (via cost

centres) particularly under Work Programmes. There is often more commentary in

the dashboard than on the published report.

12. To access the dashboard, please open

your PowerBI app on your iPad. The link to the dashboard is https://shorturl.at/csEQY. Staff from the Strategy and

Performance team are available to go over the dashboard with councillors who

would like to review its content.

13. Strategic projects commentary and

status by schedule, risk, and budget are updated on a monthly basis on the

dashboard. They are also included in the Strategic Projects Report that is

presented to Council monthly. Note that the last month of updates was July

2023.

14. We are continuously improving the

dashboard and improving the data reliability across all areas and would appreciate

any feedback you have.

Decision

Making Process

15. Staff have assessed the requirements

of the Local Government Act 2002 in relation to this item and have concluded

that, as this report is for information only, the decision-making provisions do

not apply.

Recommendation

That

Hawke’s Bay Regional Council

receives and notes the Organisational Performance Report for the period

1 April – 30 June 2023.

Authored by:

|

Hariza Adlan

Performance

& Data Analyst

|

Sarah Bell

Team Leader

Strategy and Performance

|

Approved by:

|

Desiree Cull

Strategy

and Governance Manager

|

|

Attachment/s

|

1⇩

|

Organisational Performance Report

Quater 4: 1 April to 30 June 2023

|

|

|

|

Organisational Performance Report Quater

4: 1 April to 30 June 2023

|

Attachment

1

|

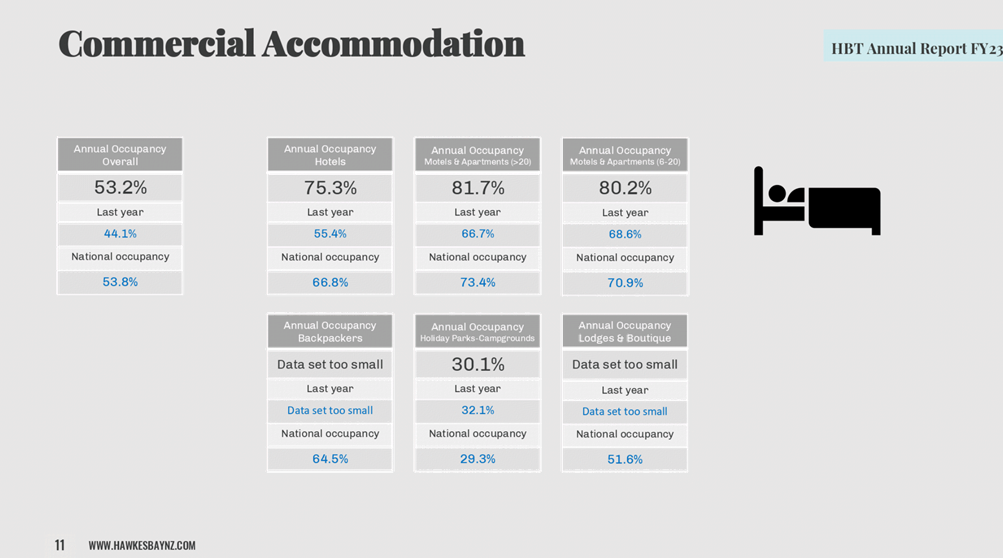

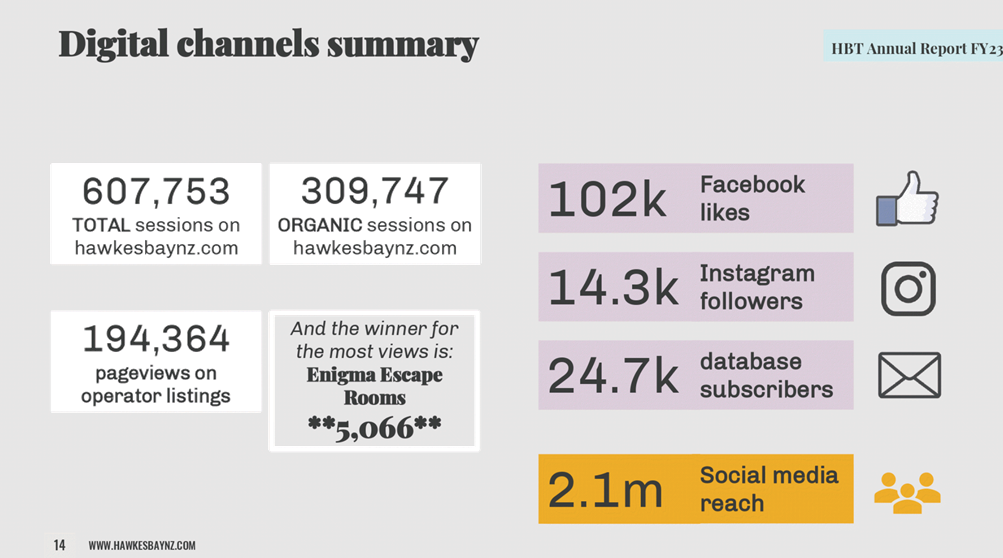

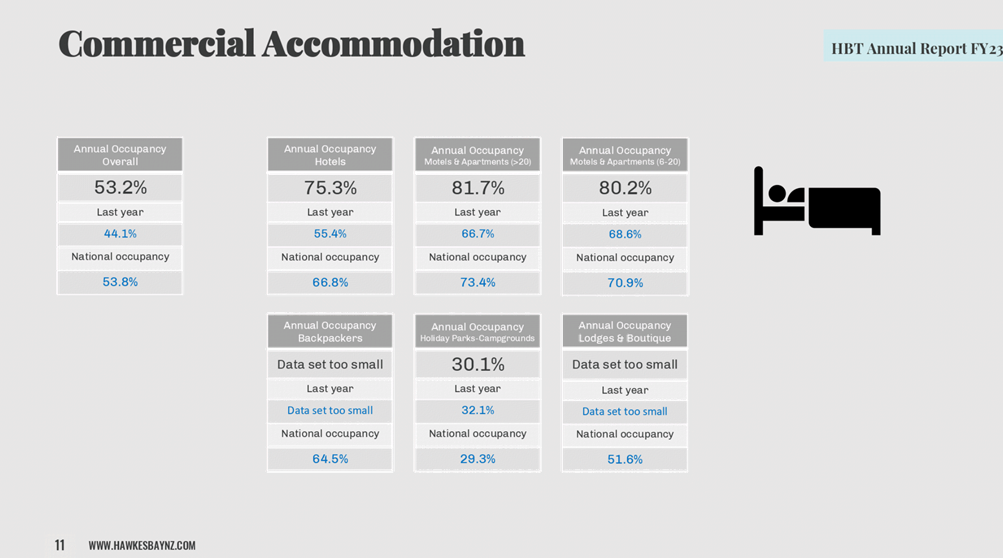

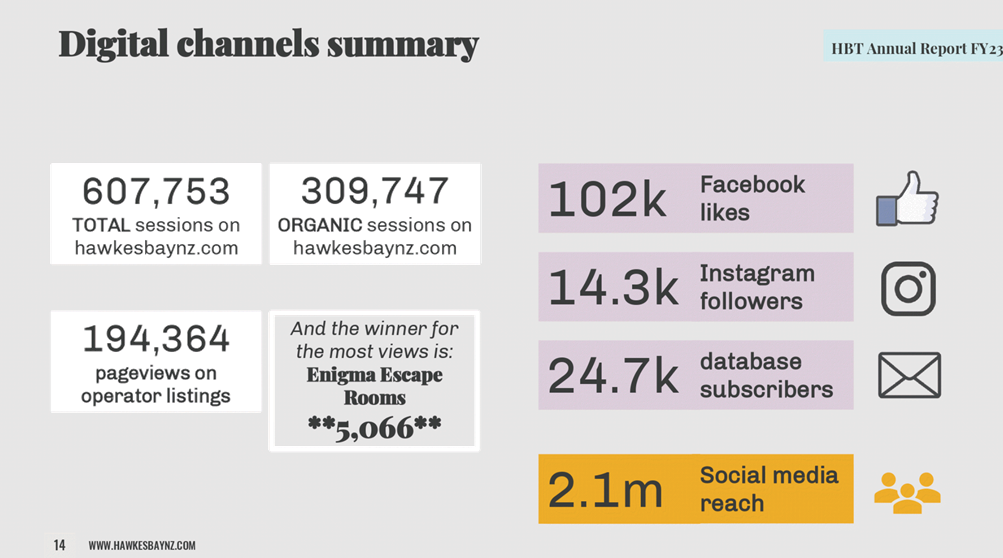

HAWKE’S BAY REGIONAL

COUNCIL

Corporate and Strategic Committee

Wednesday

20 September 2023

Subject: Hawke's Bay Tourism Annual report

Reason for Report

1. This item

provides an outline of HB Tourism’s Annual report (attached), and an

overview of activities and funding sources, and of performance against key

indicators.

Background

2. Hawke’s Bay

Tourism is reliant upon funding via two primary means – Hawke’s Bay

Regional Council, and membership fees and investment/support from tourism

businesses who belong to the Hawke’s Bay Tourism Industry

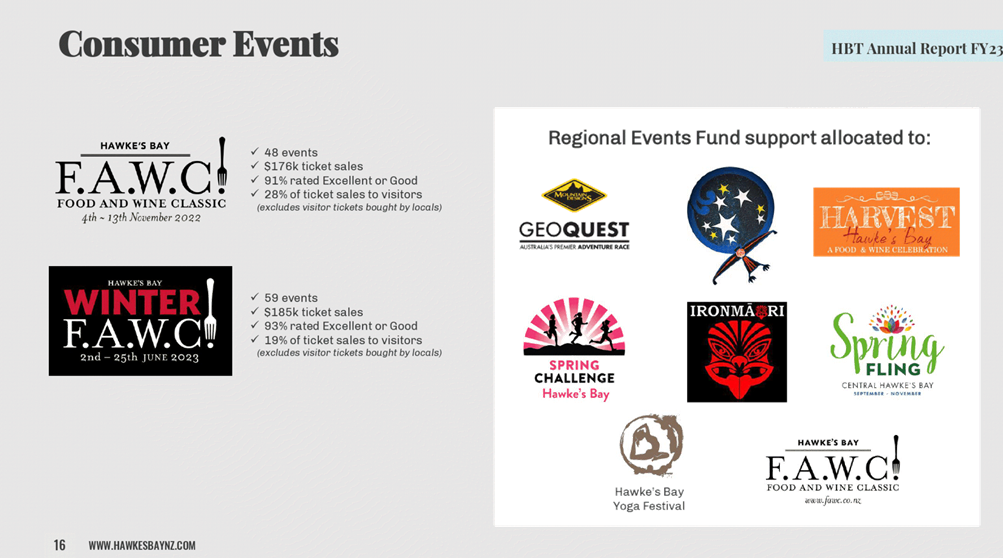

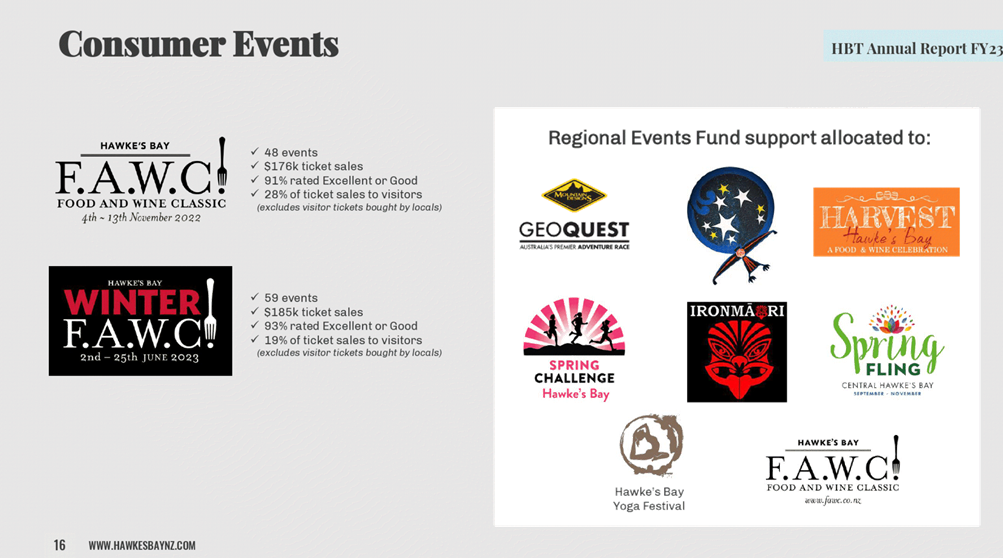

Association. Additional turnover is generated by the summer and winter

F.A.W.C! series and additional marketing/industry initiatives.

3. Hawke’s Bay

Tourism is a limited liability company owned by its shareholders, the

Hawke’s Bay Tourism Industry Association.

4. It has an

independent board of 6 directors, including a representative from Hawke’s

Bay Regional Council (Cr Sophie Siers).

Key

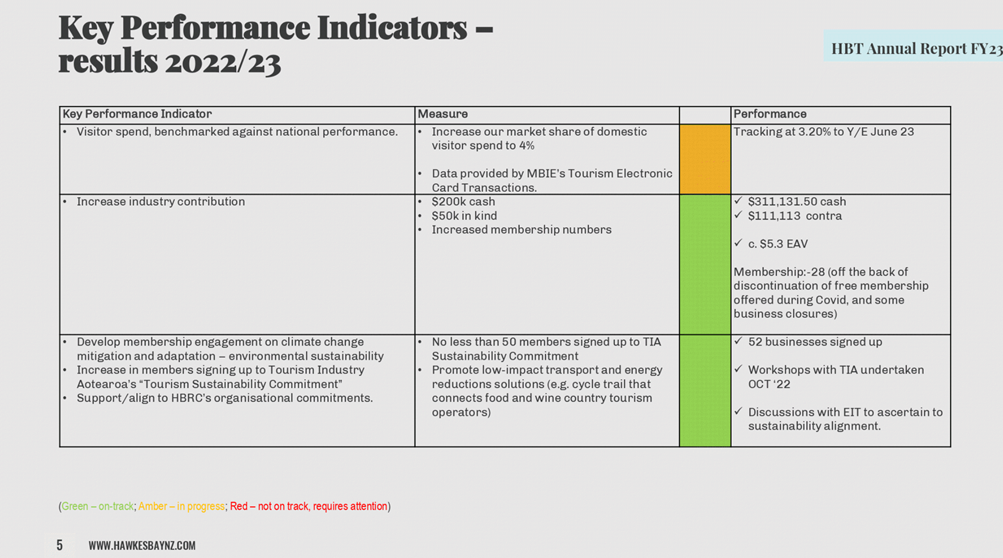

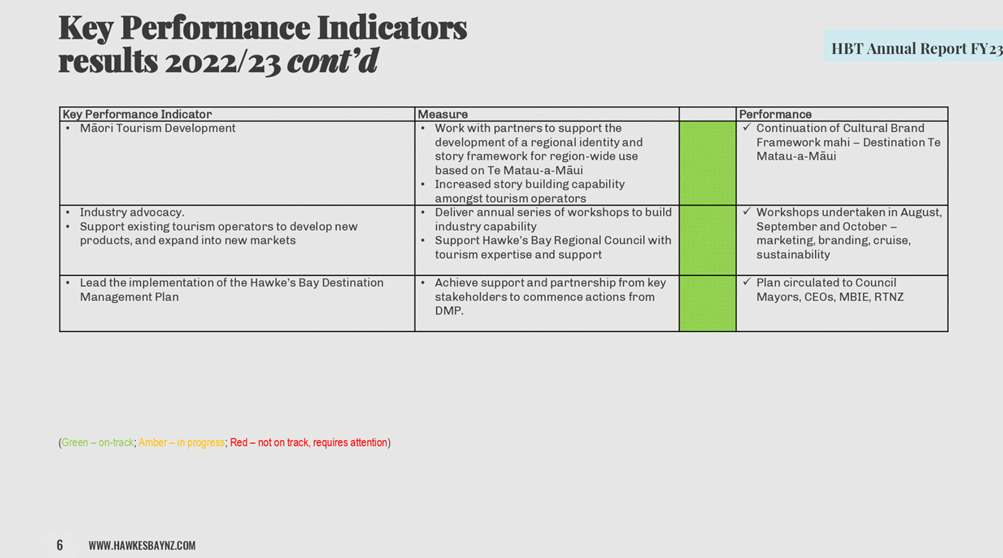

Performance Indicators

5. The ‘Funding

Agreement for the Operation of a Regional Tourism Organisation’ (the

Agreement) between Hawke’s Bay Regional Council (HBRC) and HB Tourism

requires HBTL to deliver KPIs in accordance with the Agreement and current

accepted best practices applicable to the tourism industry and tourism

promotion.

Market share

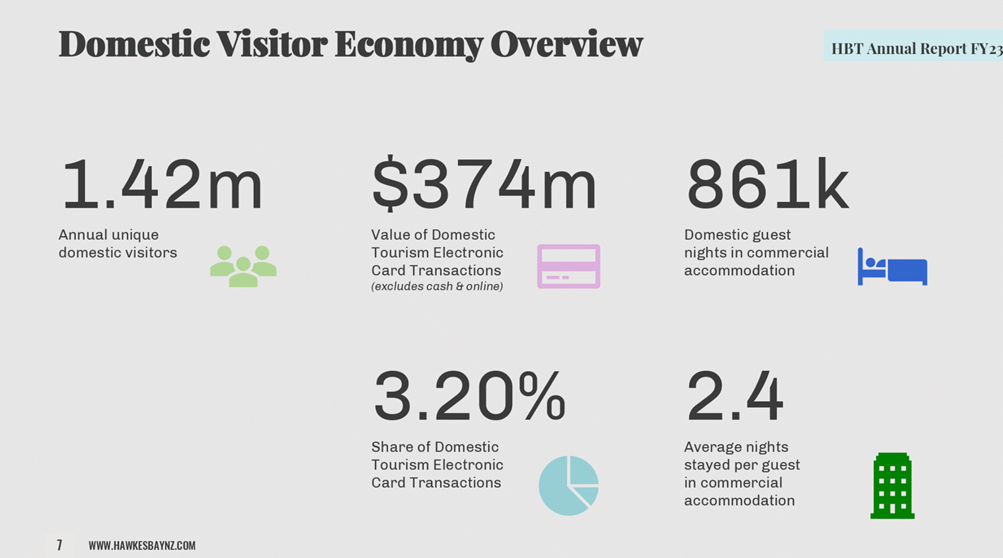

6. HBT set an ambitious

target for 23/24 – aiming to achieve 4% market share of domestic visitor

spend. This was, effectively, setting ourselves an increase of 14.3% from

the previous year’s target.

7. Due to international

borders reopening, an increase in visitation to Auckland (Auckland had suffered

during Covid with a series of specific city lockdowns), and the resulting Cyclones

Hale and Gabrielle, market share achieved was, understandably, lower than

targeted and our result was 3.2% market share.

Industry Contribution

8. The tourism sector

continues to support Hawke’s Bay Tourism and invest in joint marketing

initiatives.

9. The target of $200,000

cash investment was surpassed by 57% - $313,113.50. The target of $50,000

of in-kind support was surpassed by 122% - $111,113.

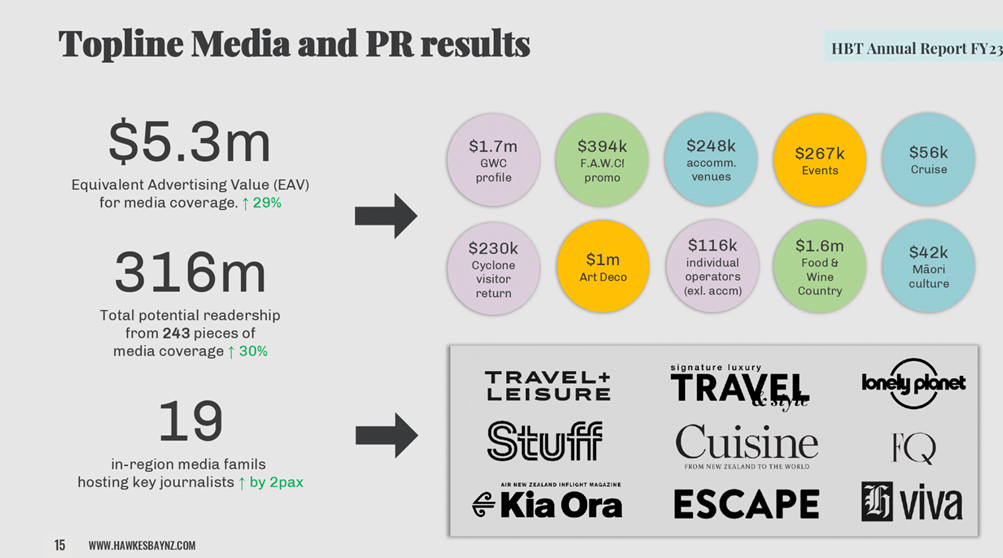

10. Our efforts in generating public

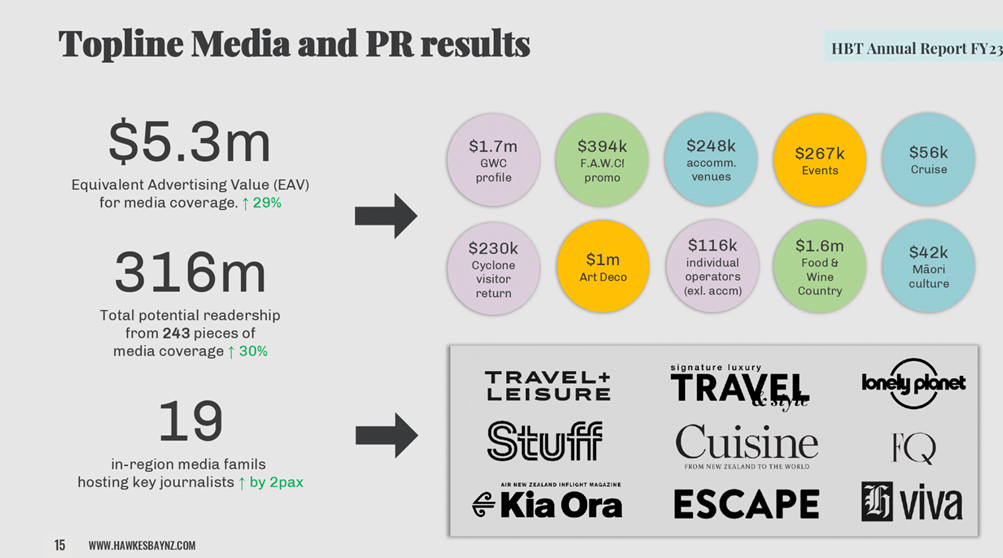

relations exposure resulted in an equivalent advertising value of $5.3m EAV.

11. In 2020 Hawke’s Bay Tourism

offered businesses free membership as a means of bringing the sector together

for purposes of capability and communications throughout the Covid-19

period. Paid membership was reintroduced from 22/23 and as a result we

saw a reduction in membership (with the majority being businesses that either

closed or sold).

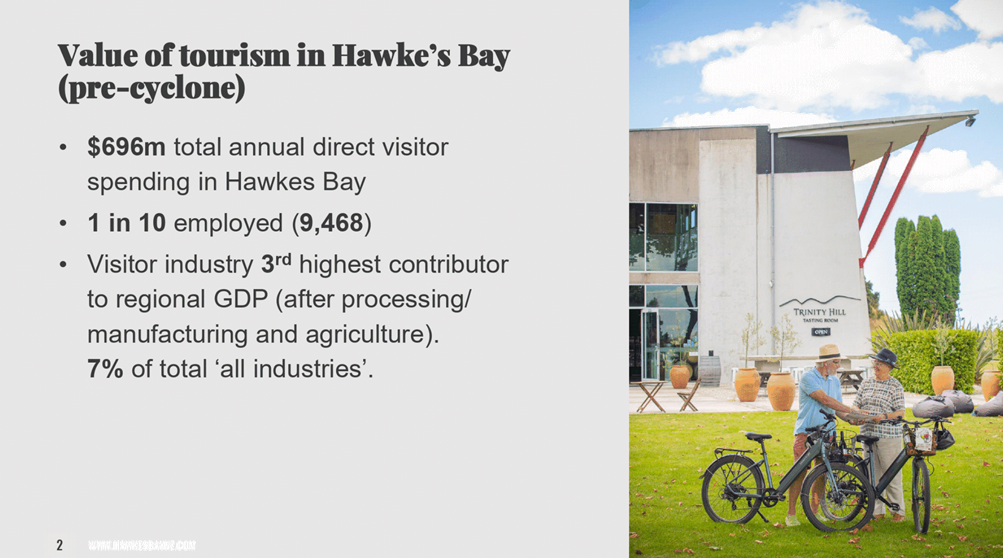

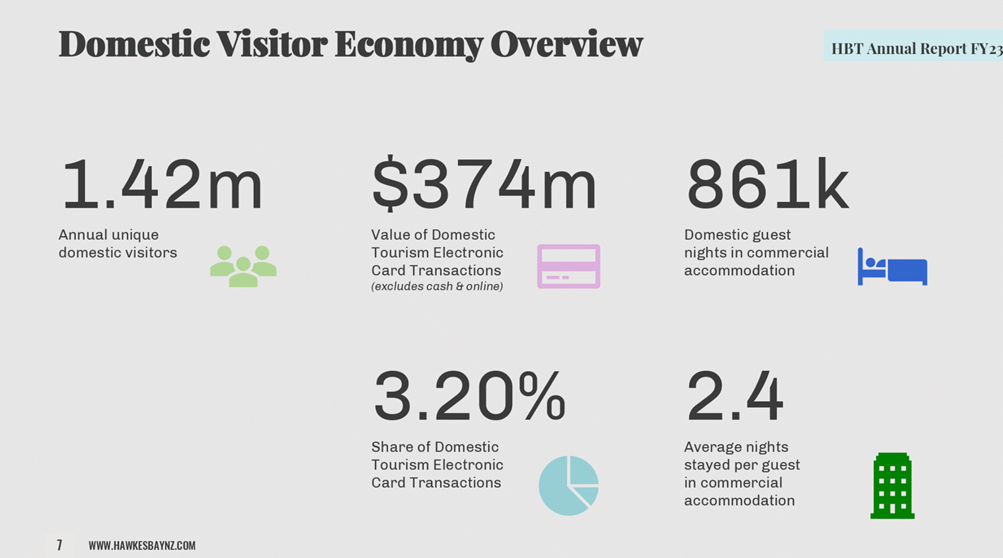

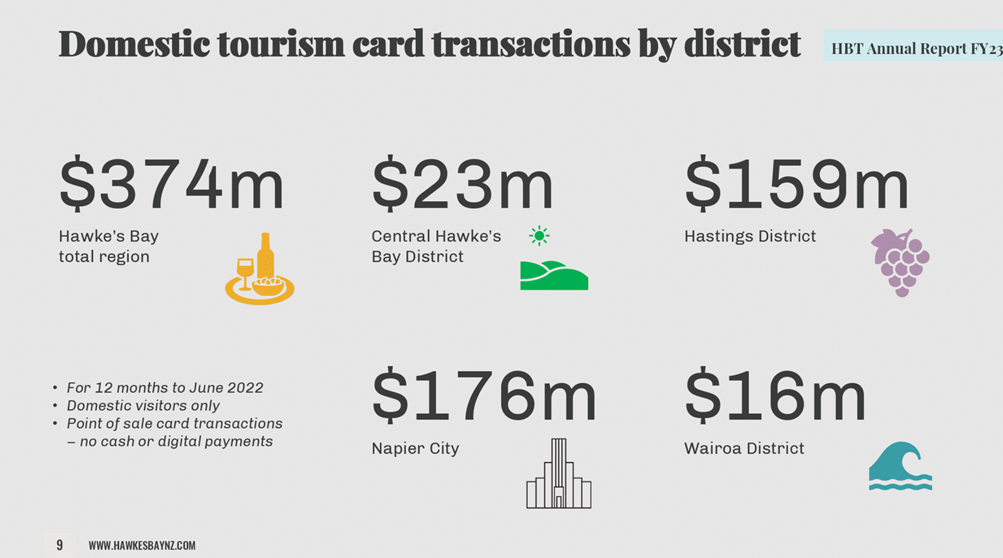

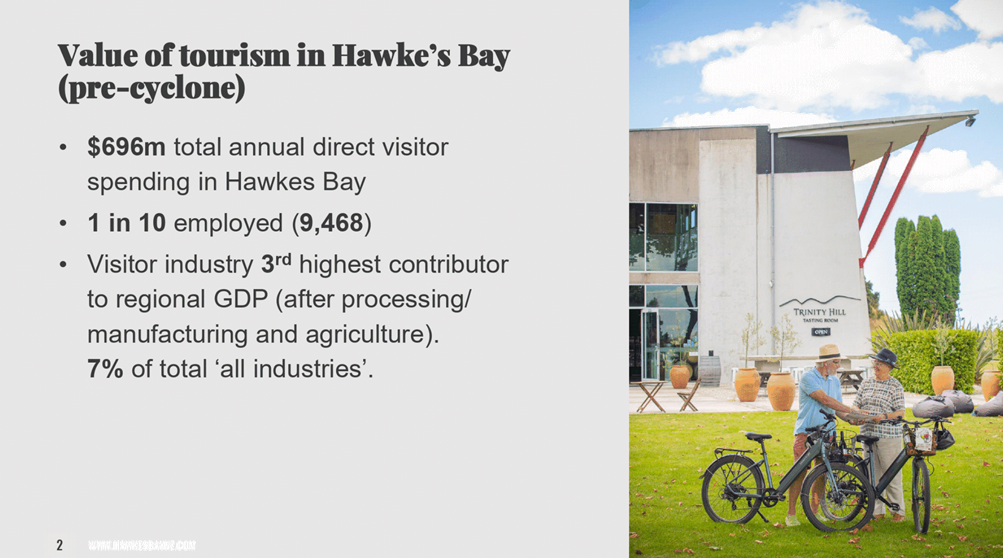

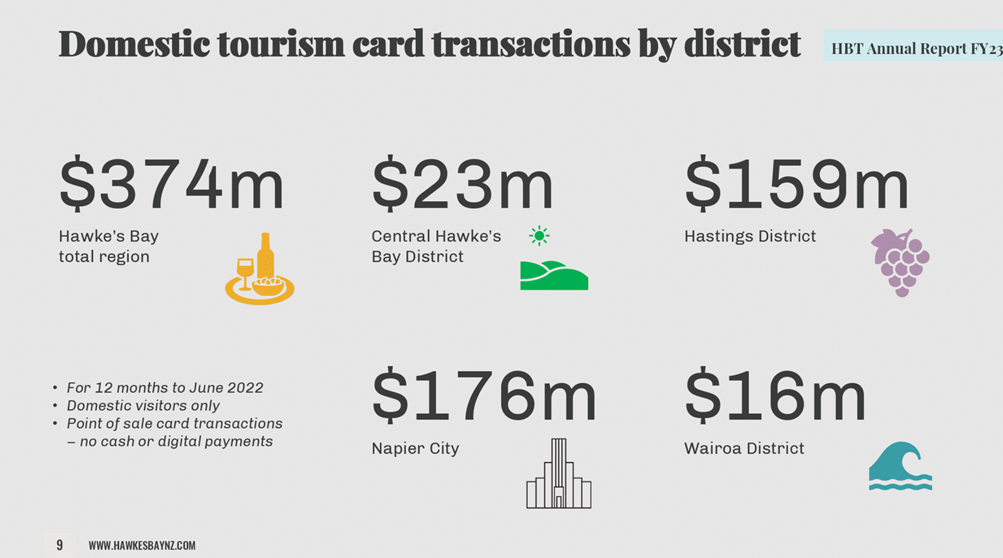

Value of Tourism for Hawke’s Bay Economy

12. An analysis undertaken by

specialist economic impact modelling agency Hughes Economics, Auckland (January

'23) indicates that the total direct visitor spending in Hawke’s Bay over

the year ended October 2022, of $696 million, has a total direct plus flow-on

or multiplied GDP or economic activity impact within the region of $666.31

million and a total flow-on employment impact in the area of 9,468

full/part-time employees.

13. The total GDP impact for the

visitor spending in 2022 represents an approximate 7% of total ‘all

industries’ regional GDP and ranks the visitor industry 3rd (after

processing/manufacturing and agriculture) amongst the different industry

sectors in the region.

14. Total visitor industry GDP in the

region grew at an estimated annual average rate of 5-6% over the 2012-2022

interval, compared to the ‘all industries’ growth figure of 4.7%.

15. The employment impact of

the Hawke’s Bay visitor industry is estimated to represent 9-10% of total

employment in the region.

16. Examples of the results of

HBT’s work over the past decade have included: the now pivotal role for

the agency in the growth and development of the region’s visitor

industry; overall significant visitor spending growth (especially in the

domestic sector); increased visitor duration in the region and share of

national commercial accommodation night-stays; significantly increased business

numbers and new building investment activity within visitor industry-related

industries; development of an annual programme of major events catering for

both Hawkes Bay residents and visitors; and major upgrading and development of

new Local Government and other organisation community/visitor facilities and amenities.

17. Analysis undertaken by ESL

indicates that HBRC annual grant figures of $1.85 million (2019), $1.88 million

(2020), $1.94 million (2021) and $2.08 million (2022), compared to the actual

grant for these years of $1.52 million would have resulted in at least a stable

annual Council grant allocation in real or inflation-adjusted terms, during the

above period.

18. Over 2012-2022, HBT’s total

expenditure grew at an annual average 6.8%, similar to the growth in total

revenue. Over the period, the agency’s operating expenses have comprised

40% of its total expenditure and marketing/events/industry partner expenditure

the balance of 60%. Staff remuneration has comprised approximately 70% of total

operating expenses.

Funding

19. HBRC funding for HBT has

largely remained a flat-line base of $1,520,000 since 2016 (with the one-year

exception 2017/18), without CPI adjustment.

|

|

Hawke’s

Bay Regional Council investment

|

Annual

NZ CPI

(y/e

JUN)

|

|

2015/16

|

$1,220,000

|

|

|

2016/17

|

$1,520,000

|

1.7%

|

|

2017/18

|

$1,820,000

|

1.5%

|

|

2018/19

|

$1,520,000

(decrease)

|

1.7%

|

|

2019/20

|

$1,520,000

(no increase)

|

1.5%

|

|

2020/21

|

$1,520,000

(no increase)

|

3.3%

|

|

2021/22

|

$1,520,000

(no increase)

|

7.3%

|

|

2022/23

|

$1,520,000

(no increase)

|

6%

|

|

2023/24

|

$1,520,000

(no increase)

|

|

20. MBIE recognised the

importance of tourism to New Zealand, and provided one-off additional

investment funds to regional tourism organisations to revitalise and maintain

tourism demand throughout Covid. As such, Hawke’s Bay Tourism

received:

a. 2020/21 $750,000

(Strategic Tourism Asset Protection Programme – STAPP)

b. 2021/22 $1,000,000

(Tourism Communities: Support, Recovery and Re-Set Plan)

c. 2021/25 $603,000

(Regional Events Fund)

21. Excluding a small budgeted

amount attributed to the Regional Events Fund for the 23/24 and 24/25 years,

the other funds are exhausted.

22. MBIE funding was made

available to RTOs that could demonstrate a commitment to retaining RTO

investment from local government e.g. Government funding is not a substitution

for local government funding.

23. Hawke’s Bay Tourism is

grateful for the support of Hawke’s Bay Regional Council as we achieved

laudable results during unprecedented and impactful events.

Decision Making Process

24. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision- making

provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee

receives and notes the HB

Tourism Annual report

report.

|

Authored by:

|

Andrew Siddles

Acting

Group Manager Corporate Services

|

|

Approved by:

|

Andrew Siddles

Acting

Group Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

Hawke's Bay Tourism Annual Report

2023

|

|

|

|

Hawke's Bay Tourism Annual Report 2023

|

Attachment

1

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate and Strategic Committee

Wednesday

20 September 2023

Subject: HBRIC Ltd Quarterly update

Reason for Report

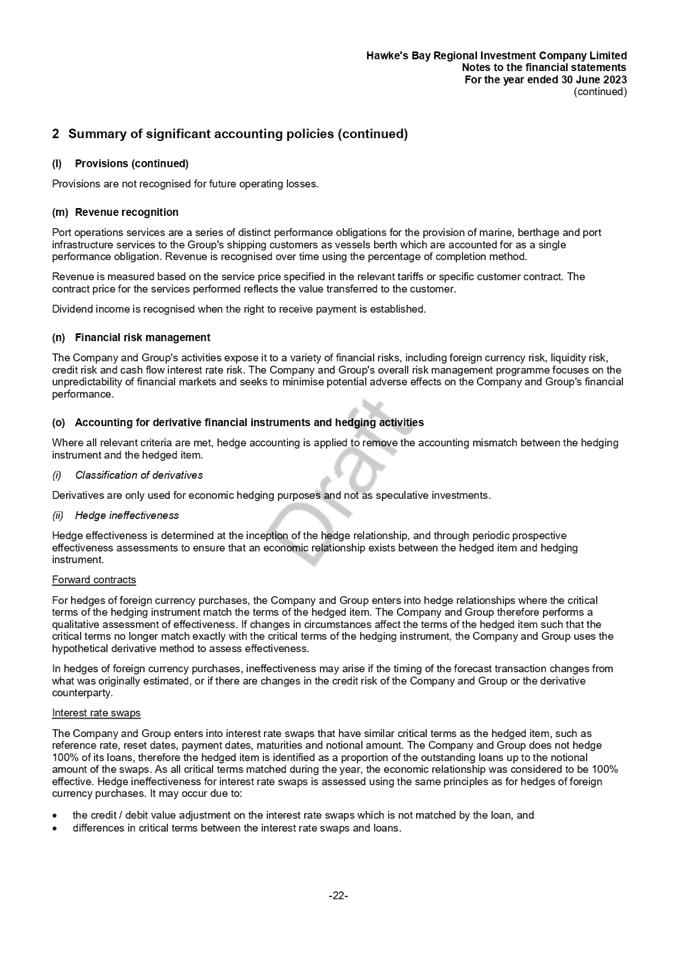

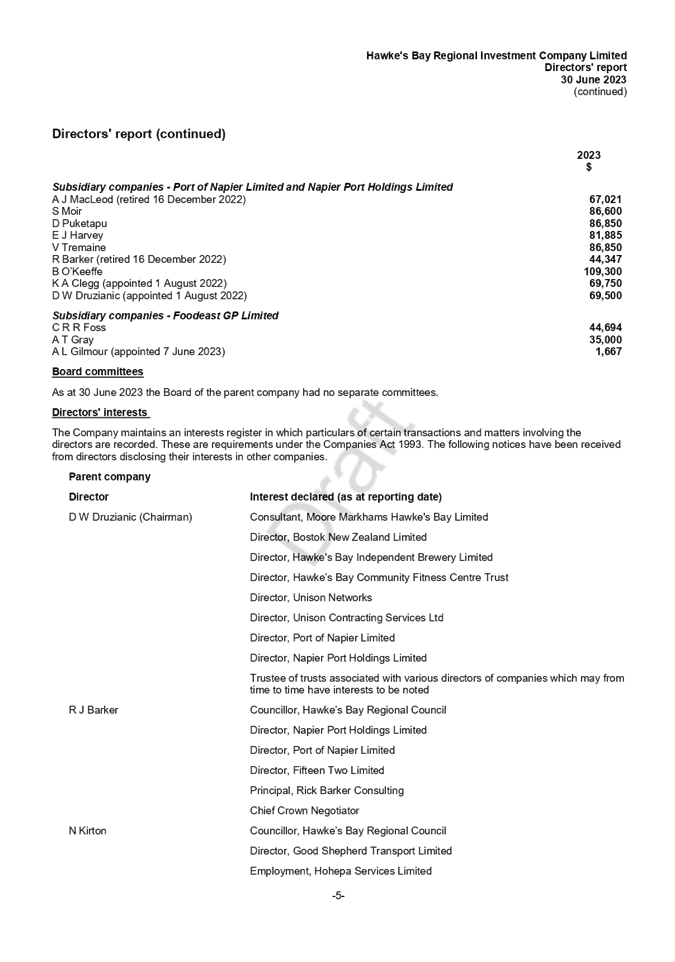

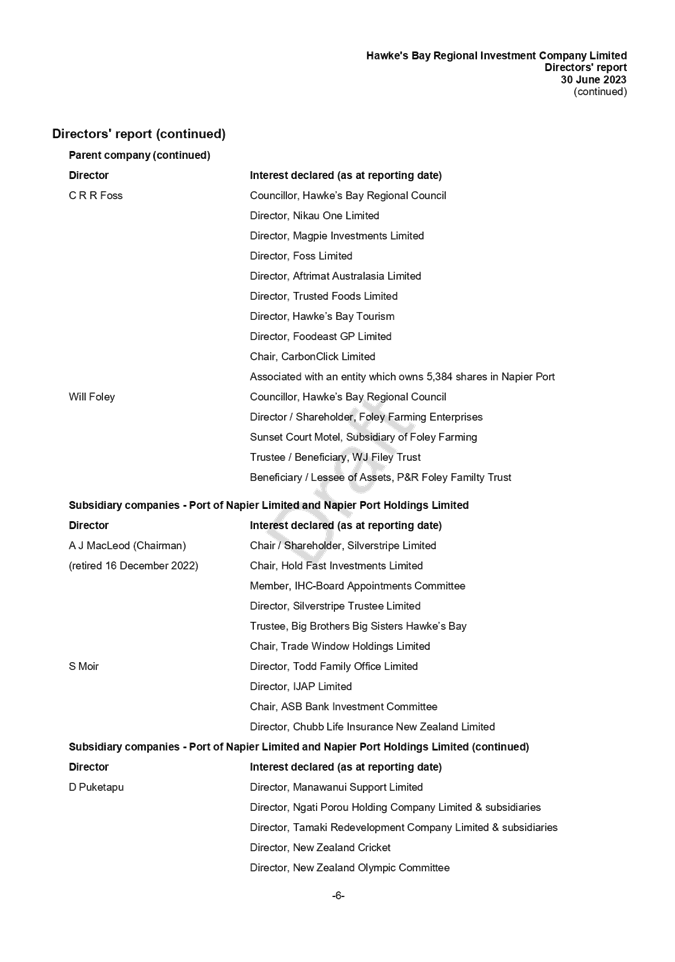

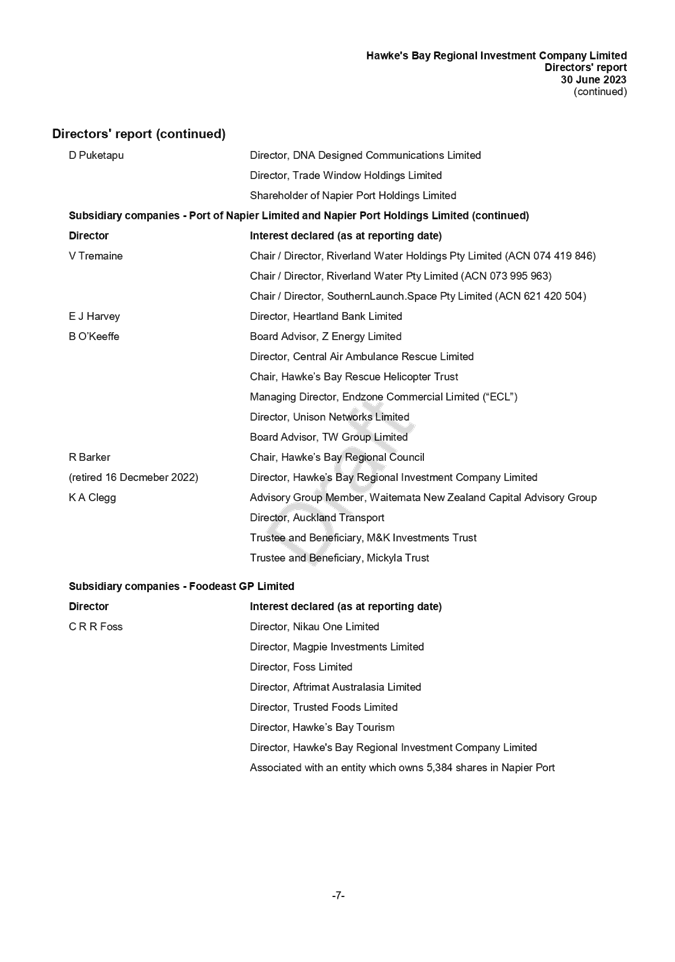

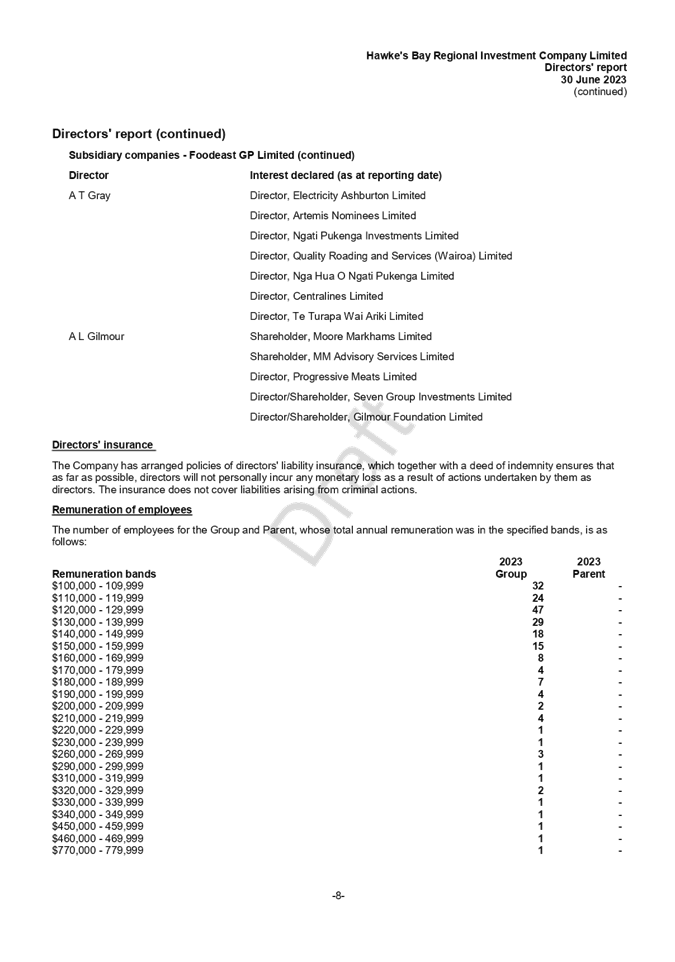

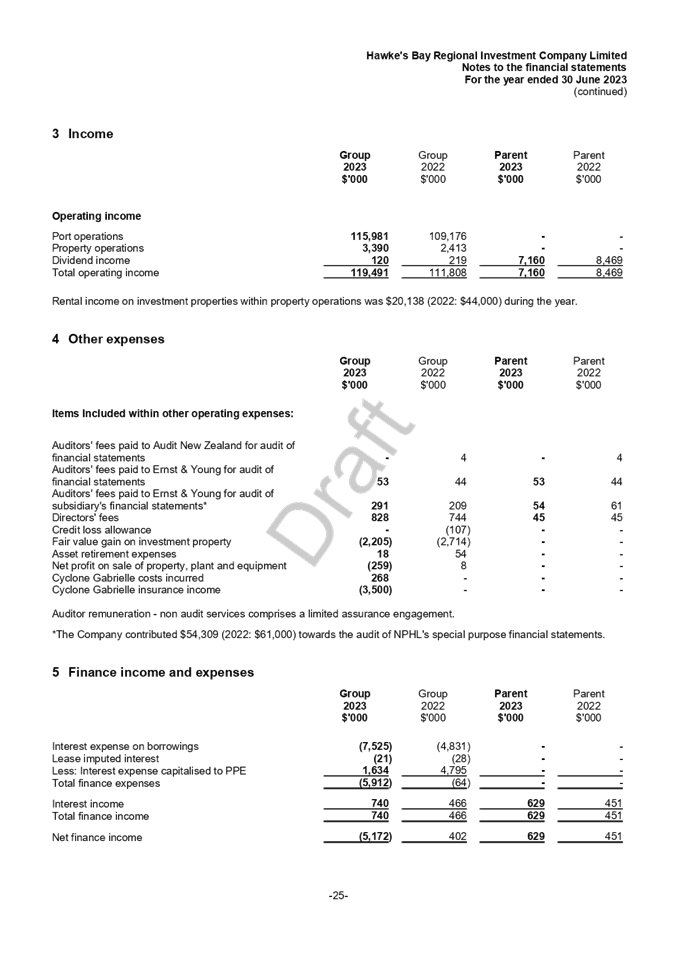

1. This item presents the HBRIC quarterly

update.

Financial

Reporting

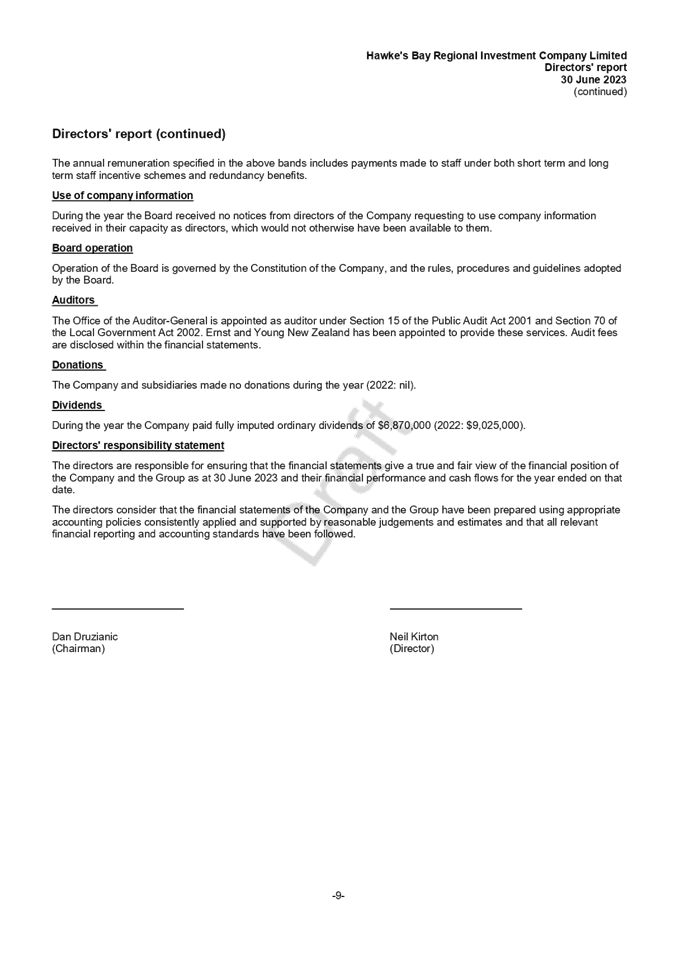

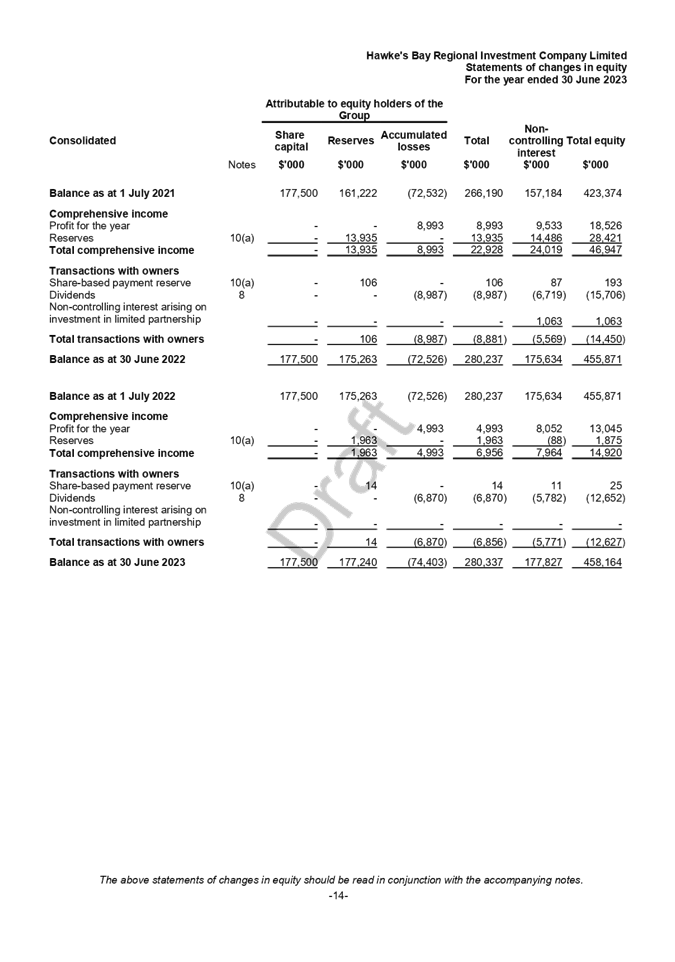

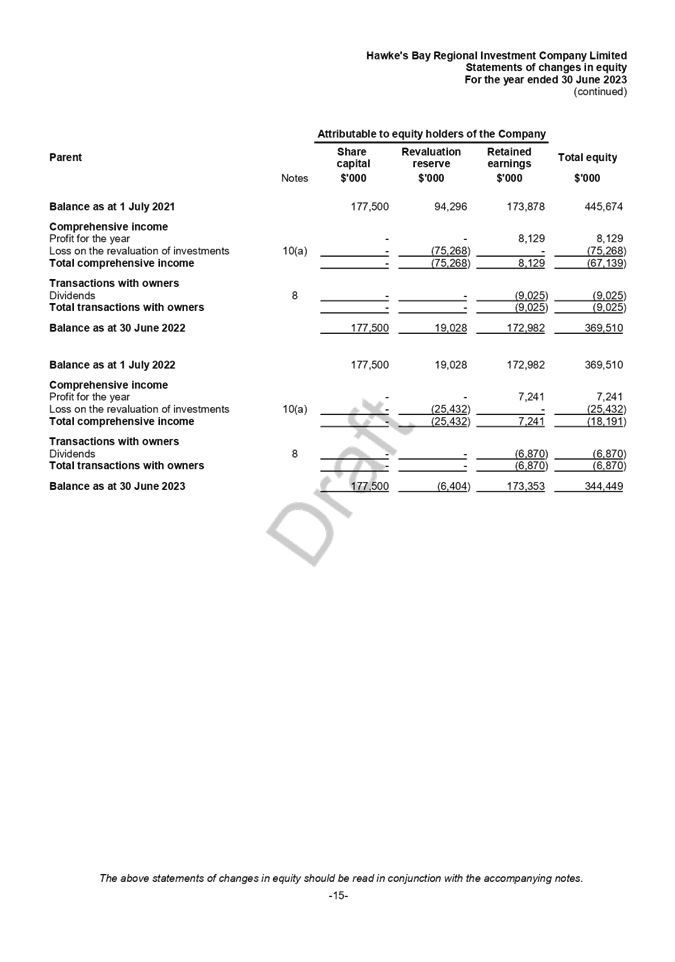

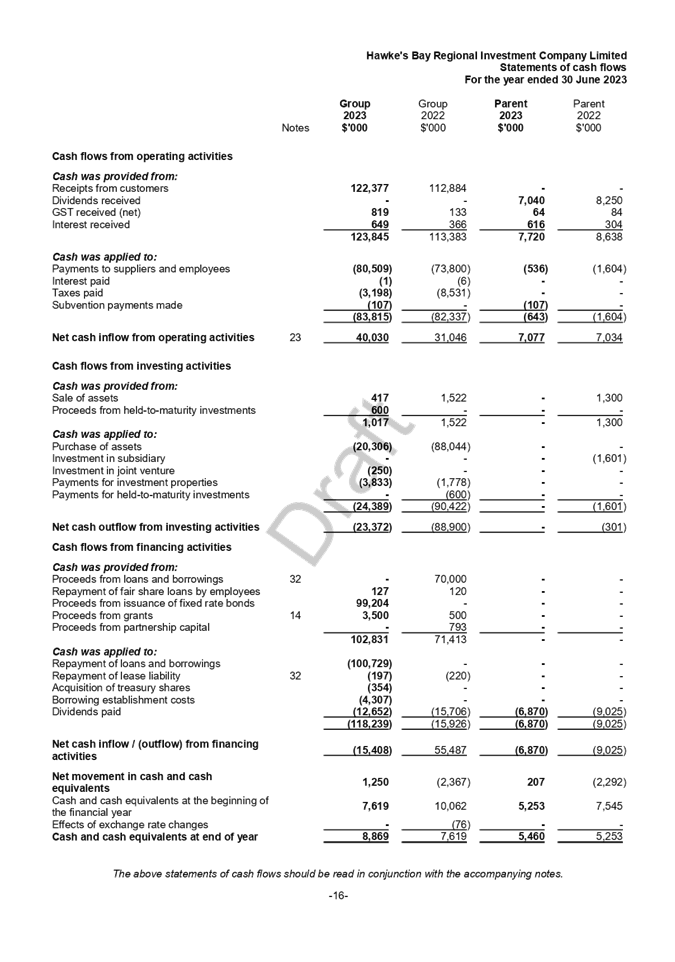

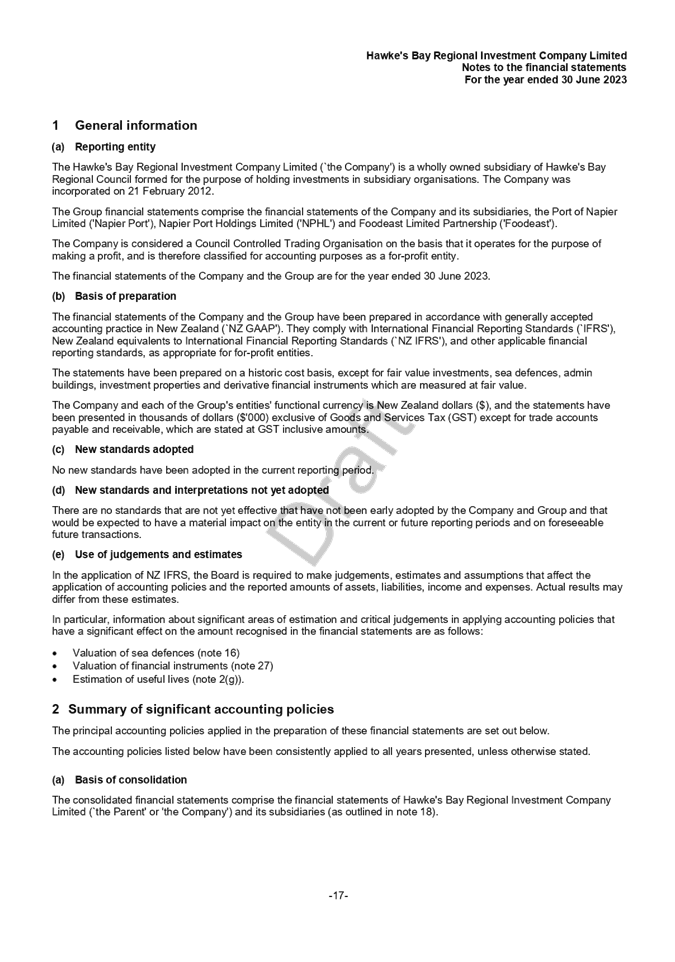

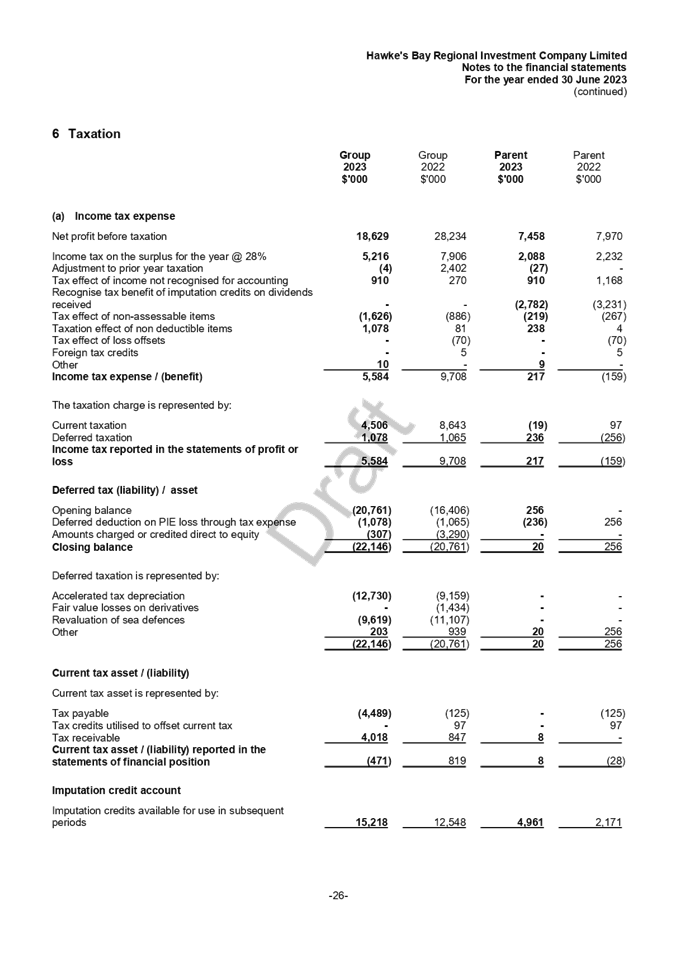

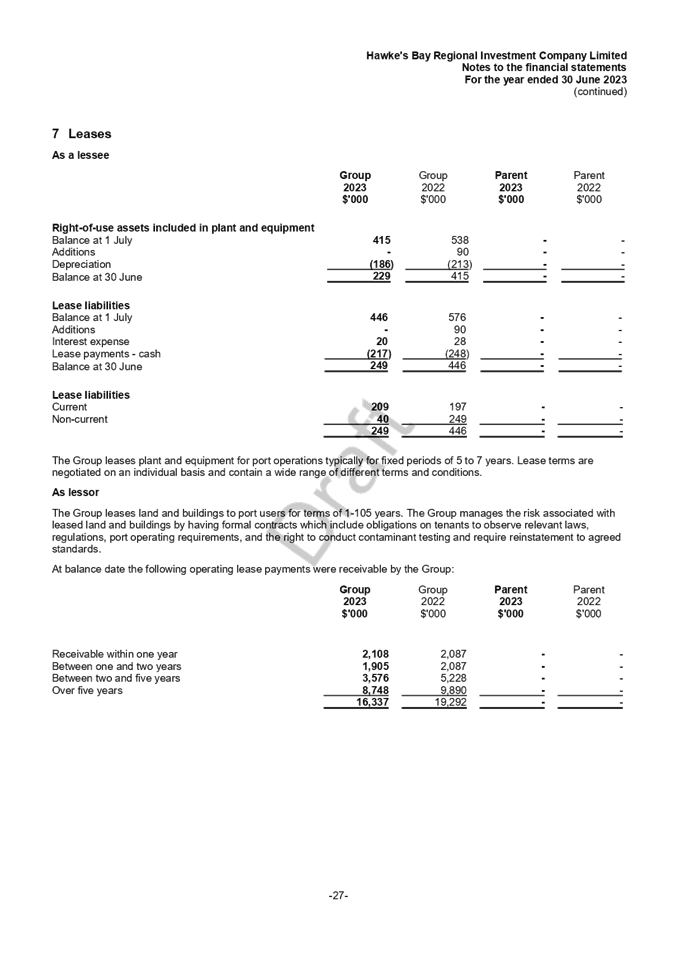

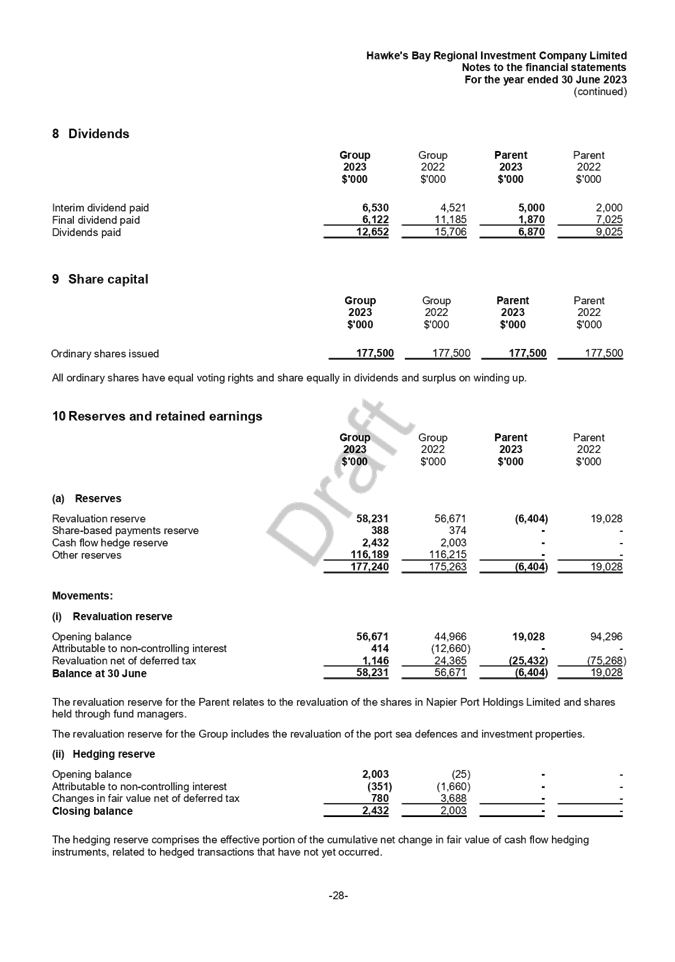

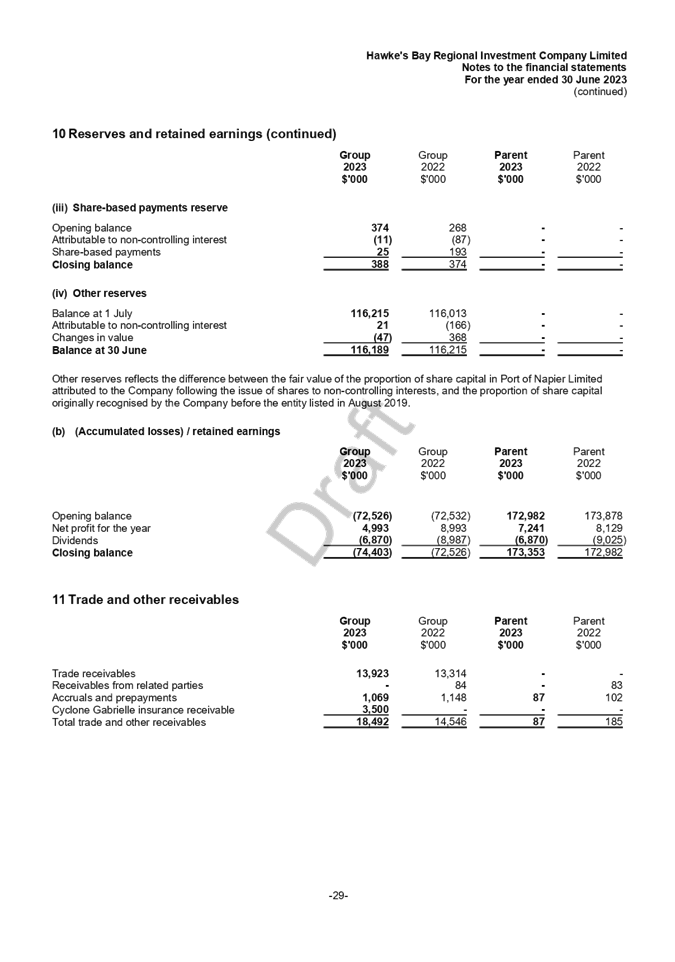

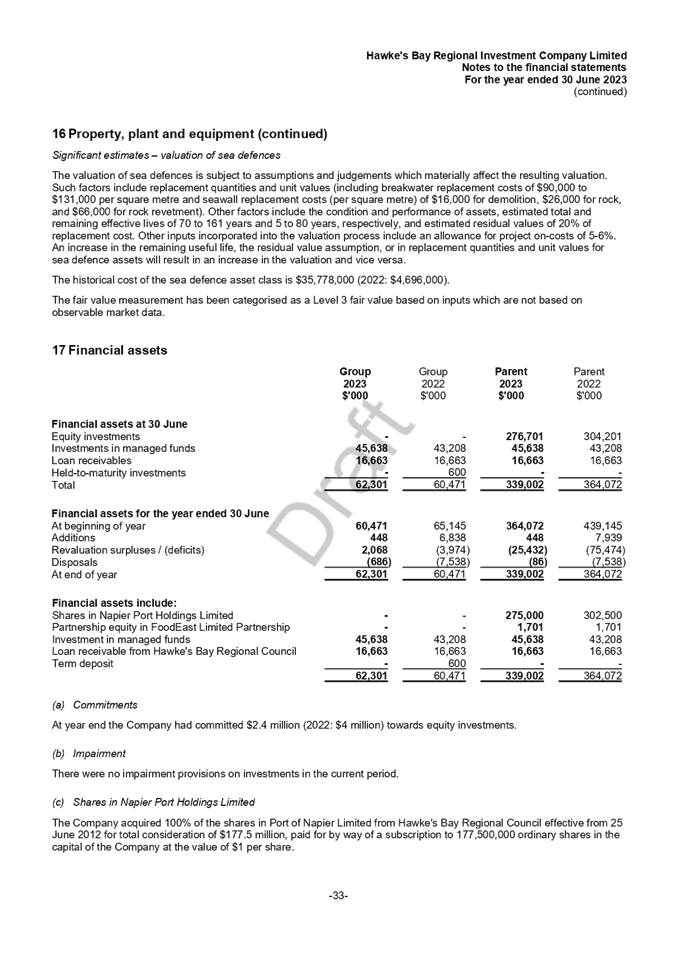

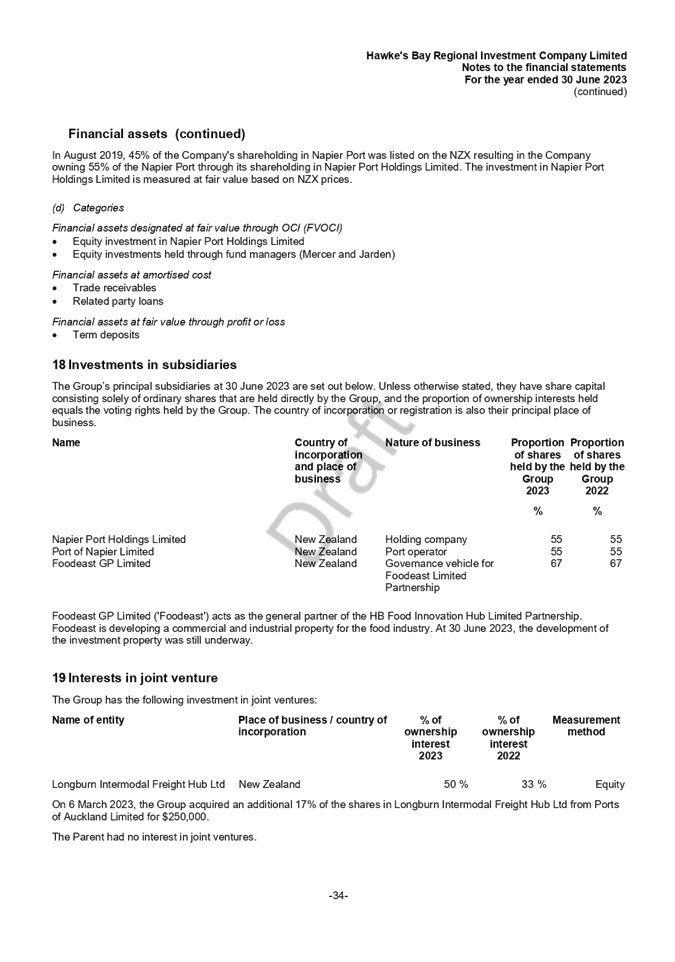

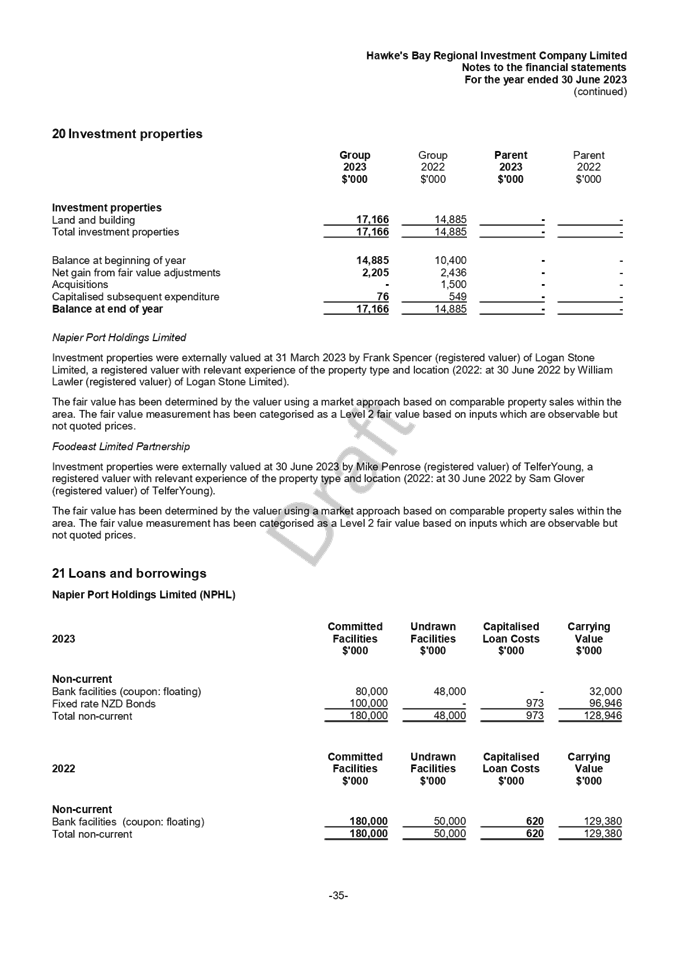

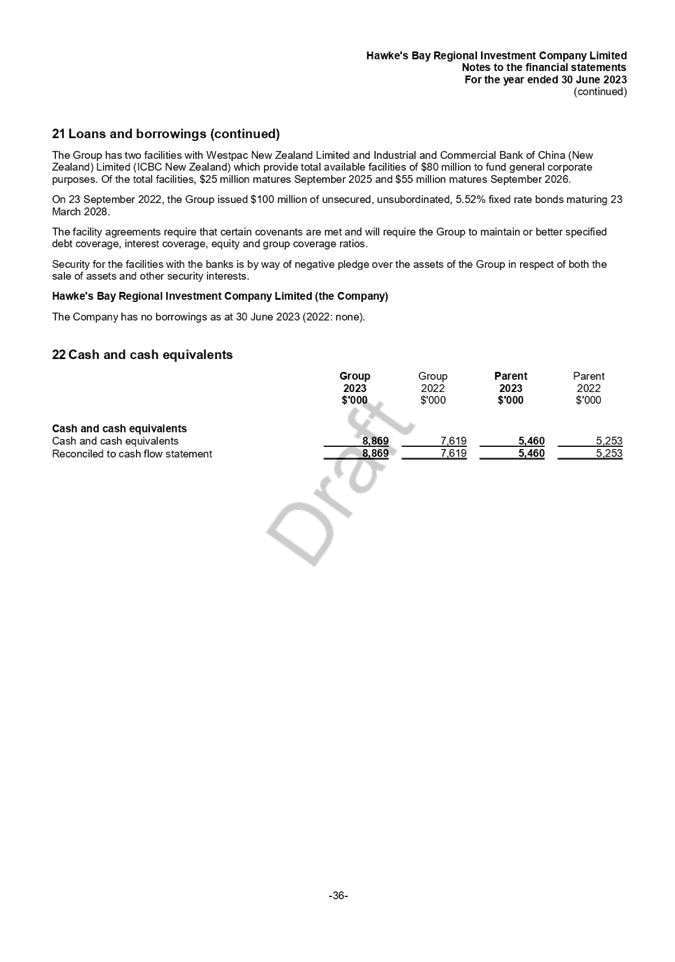

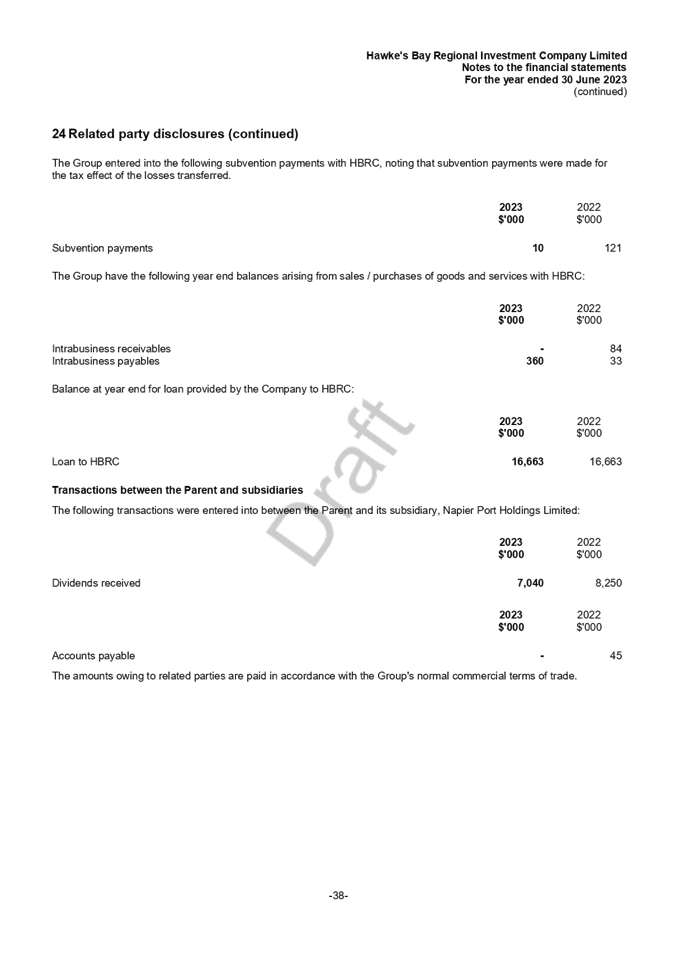

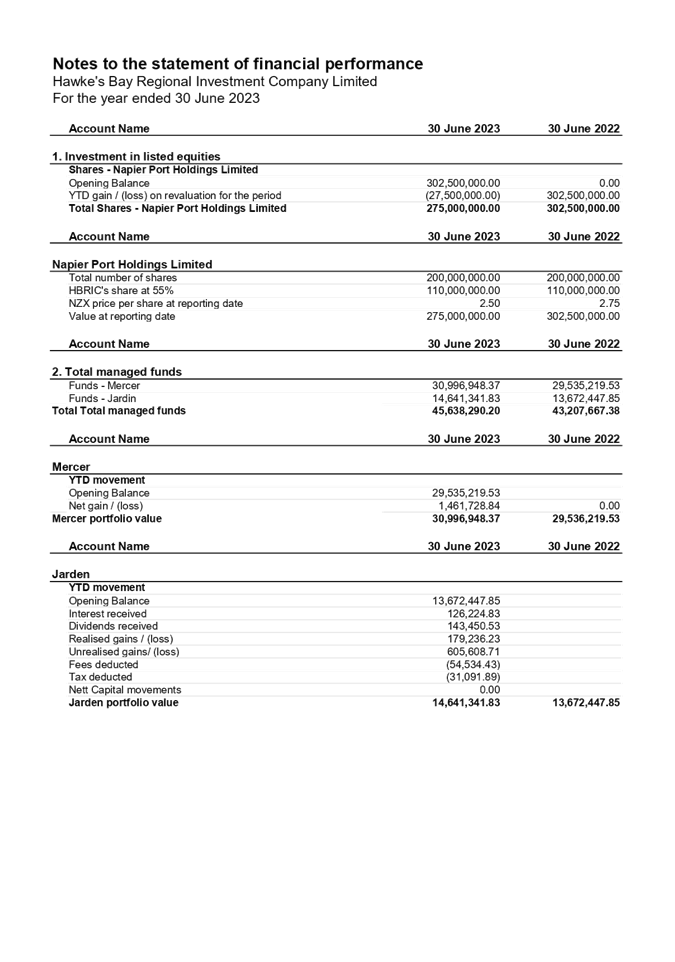

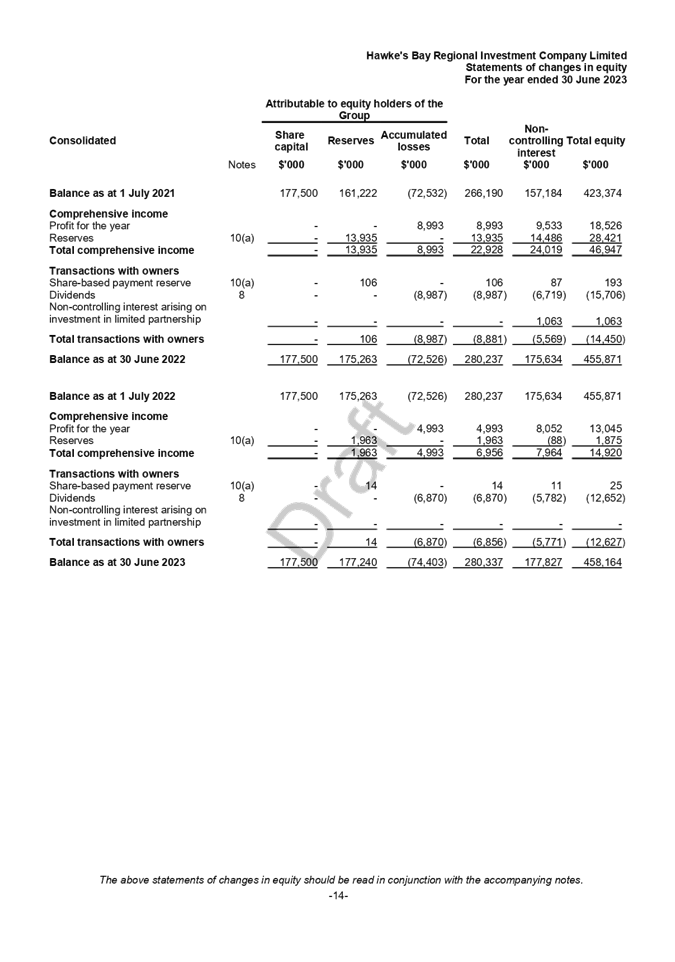

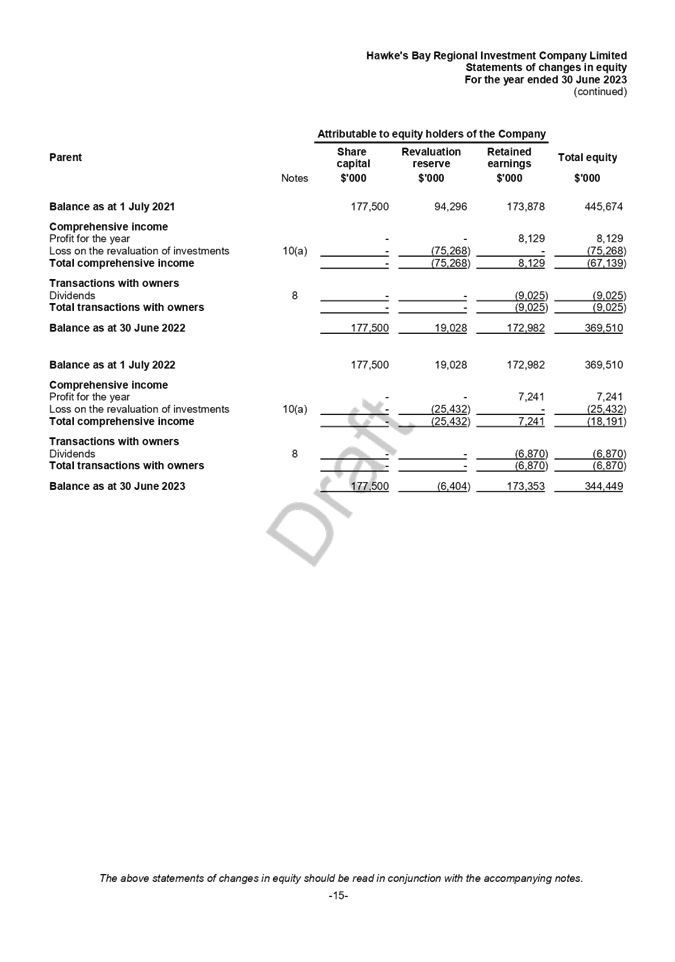

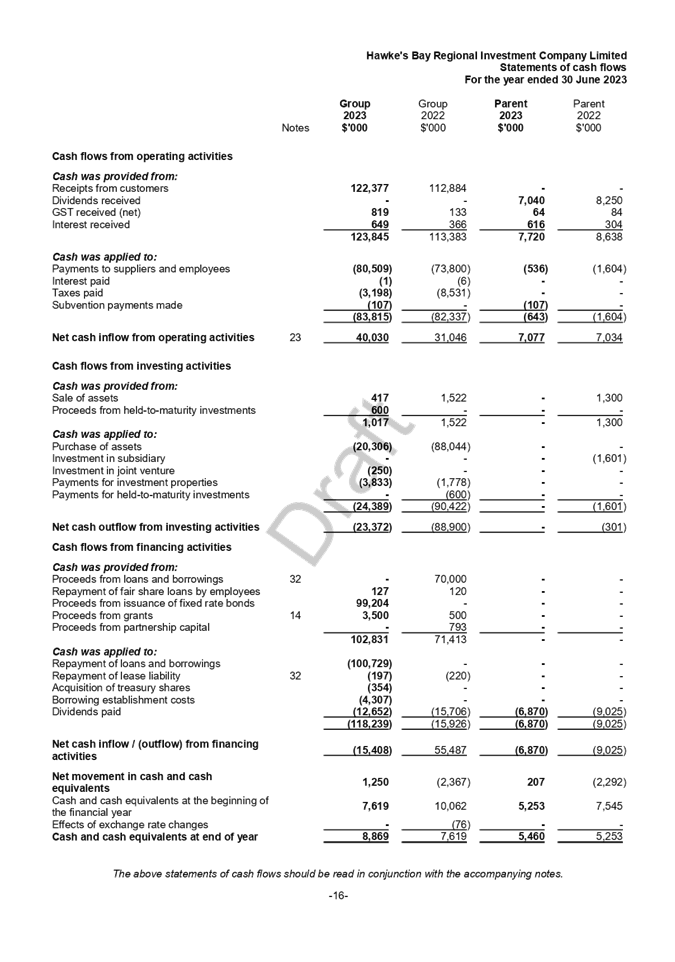

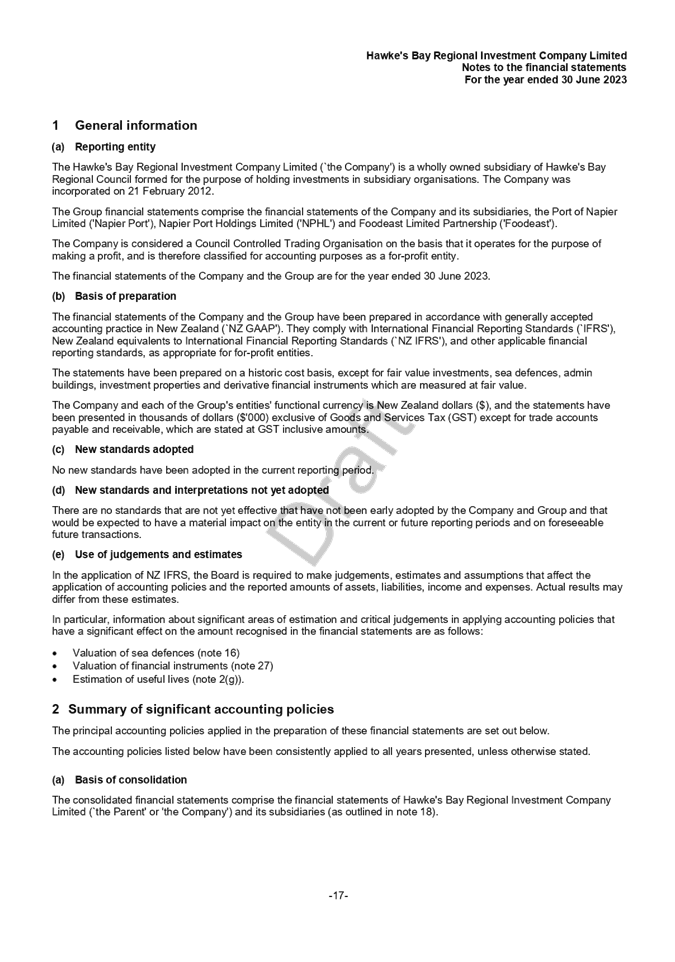

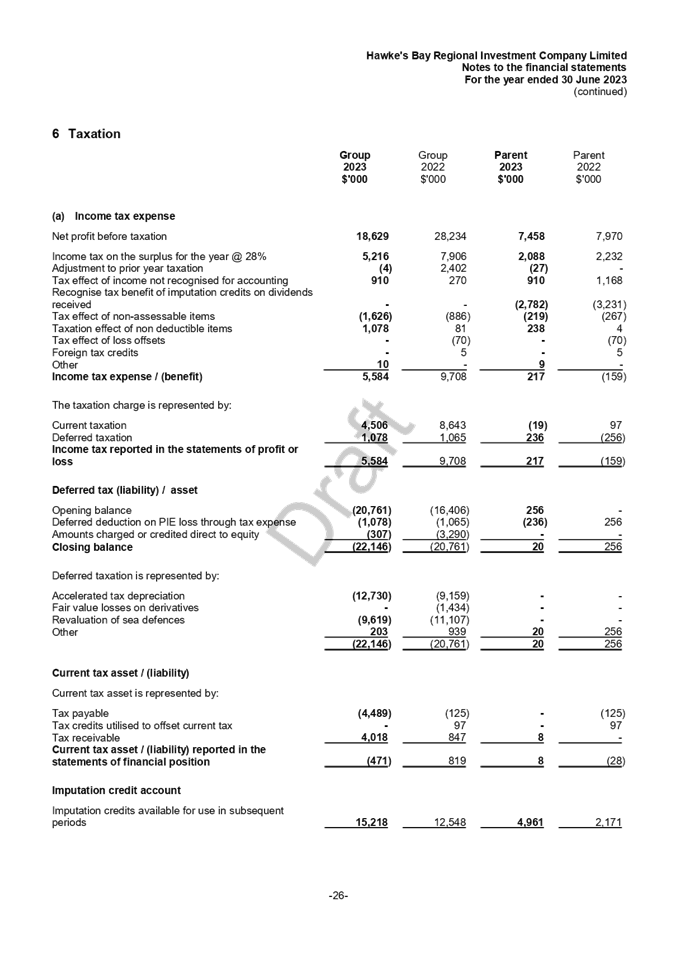

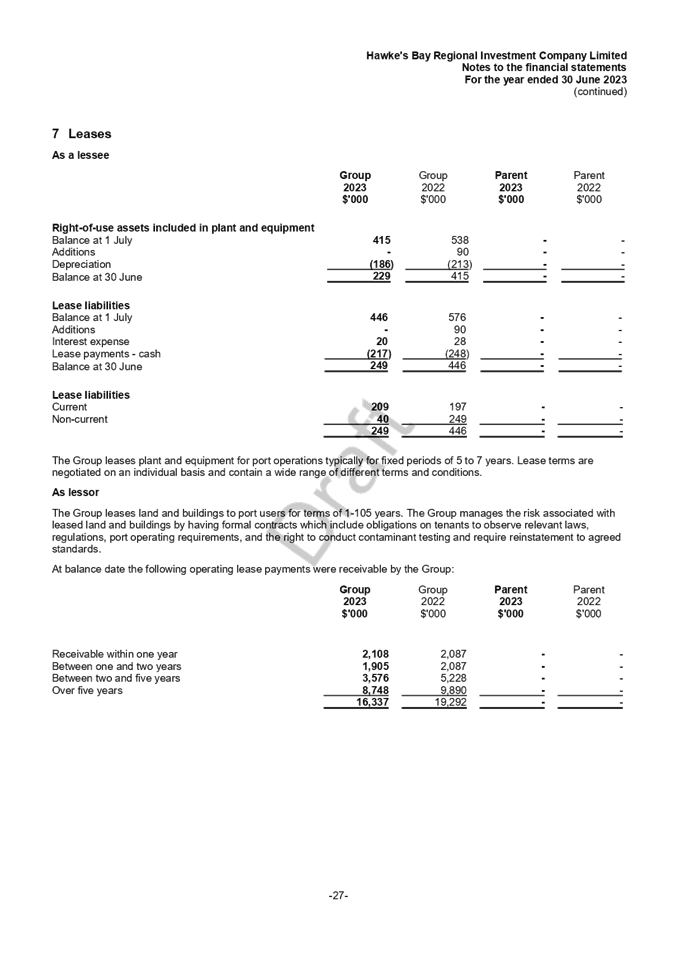

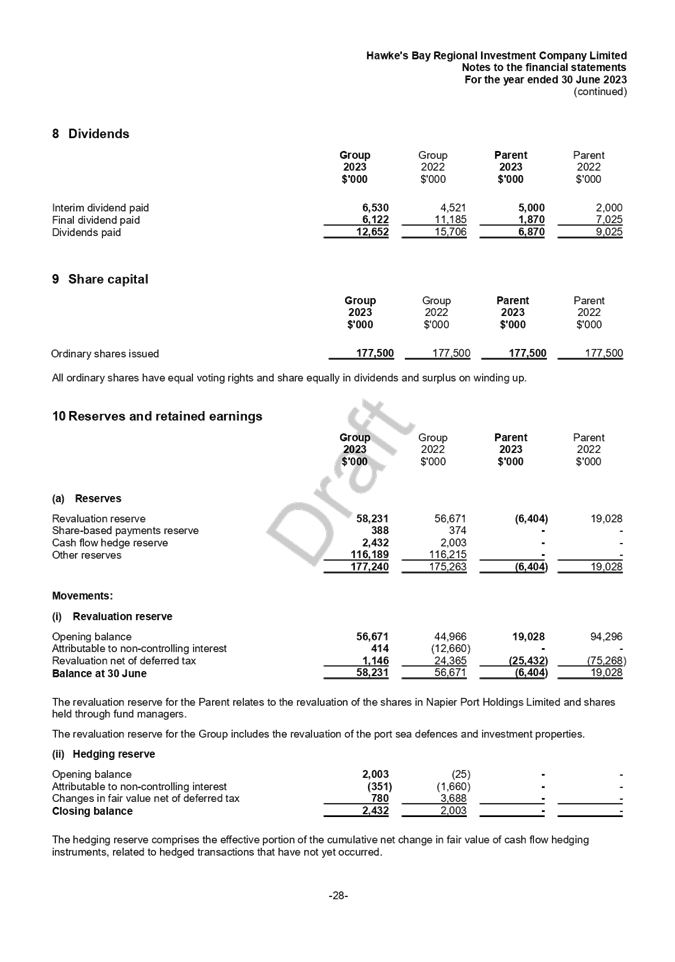

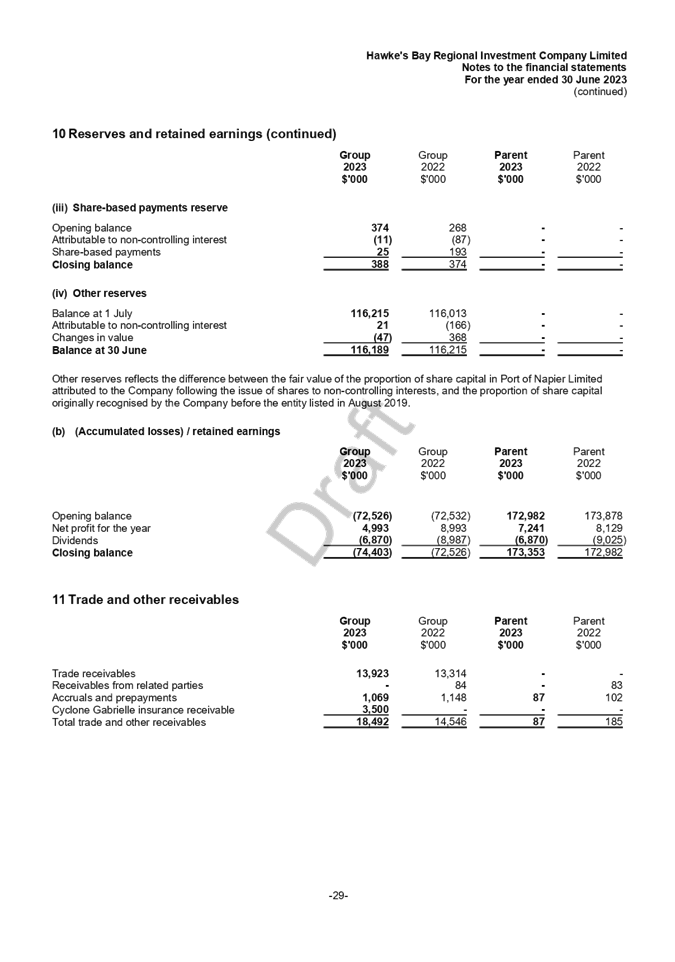

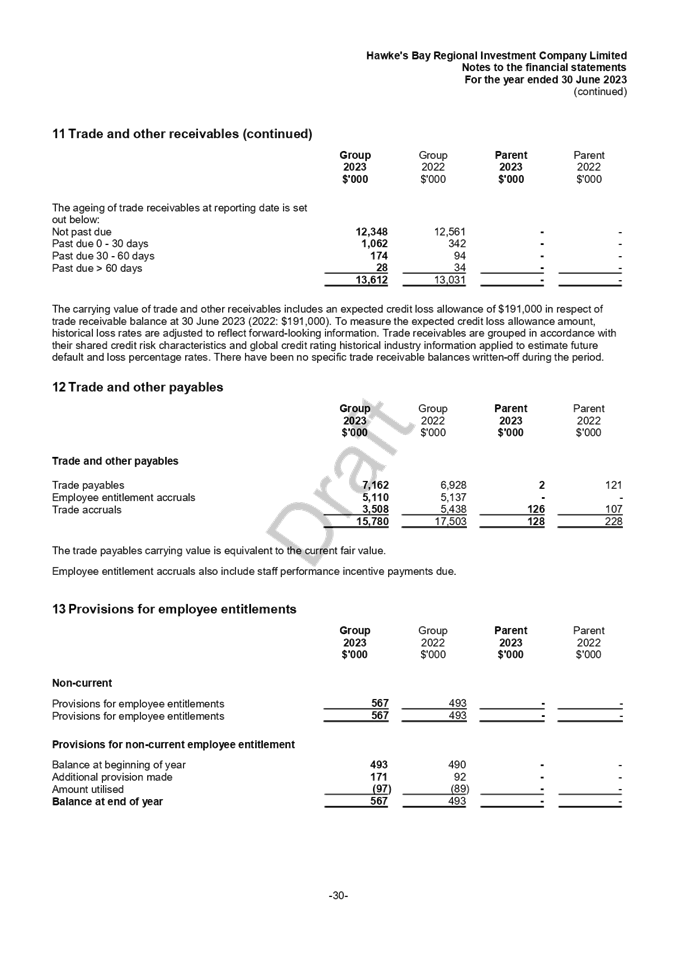

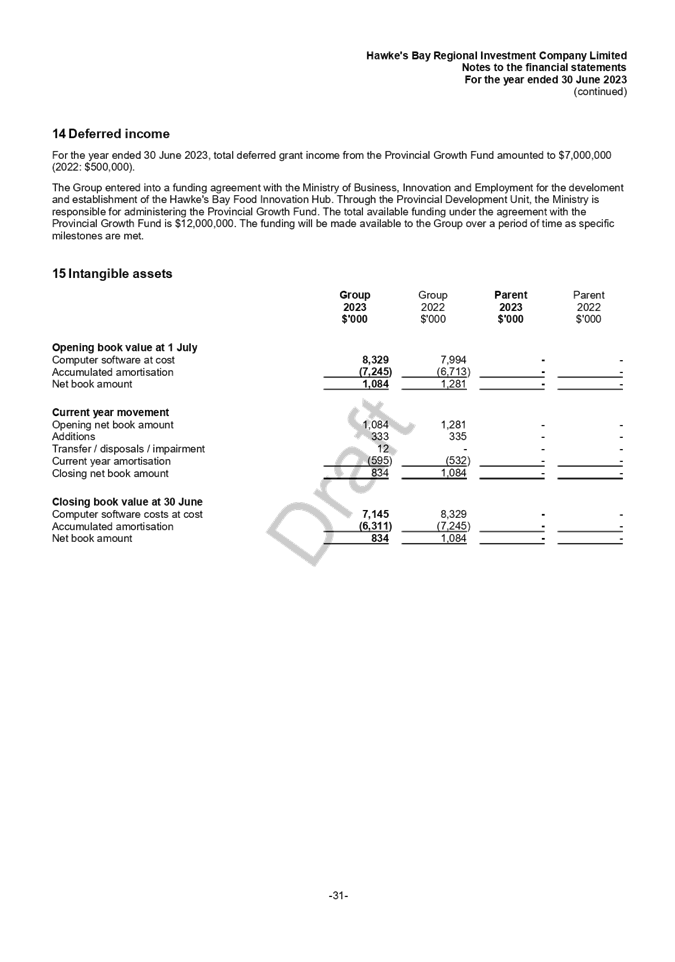

2. HBRIC’s consolidated annual

report for the year ended 30 June 2023 is in the audit process at the time of

distribution of this report. The unaudited Financial Report is attached

to this report for perusal.

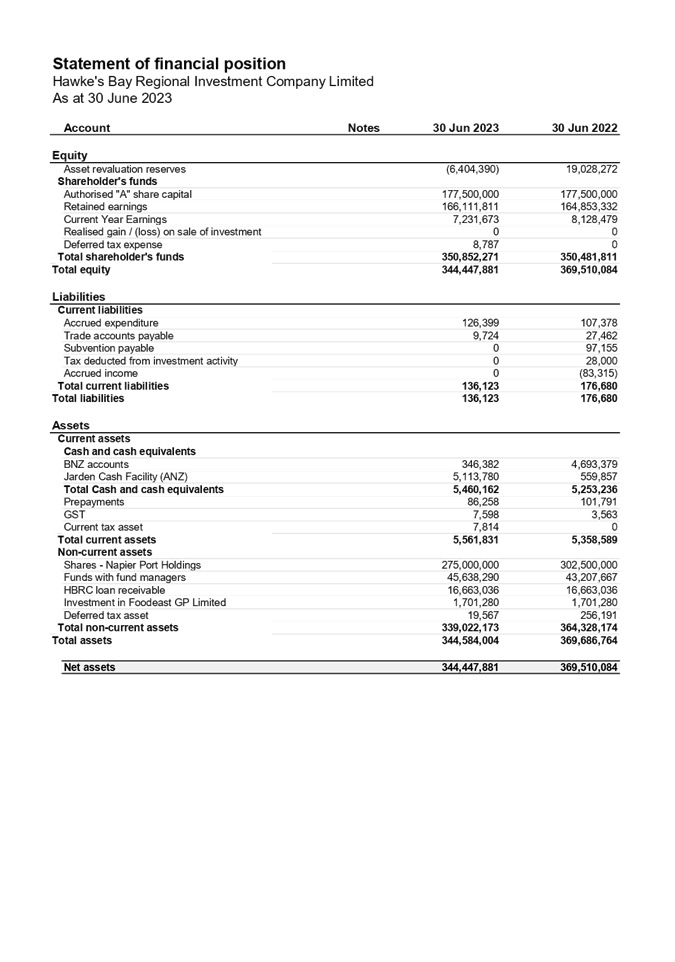

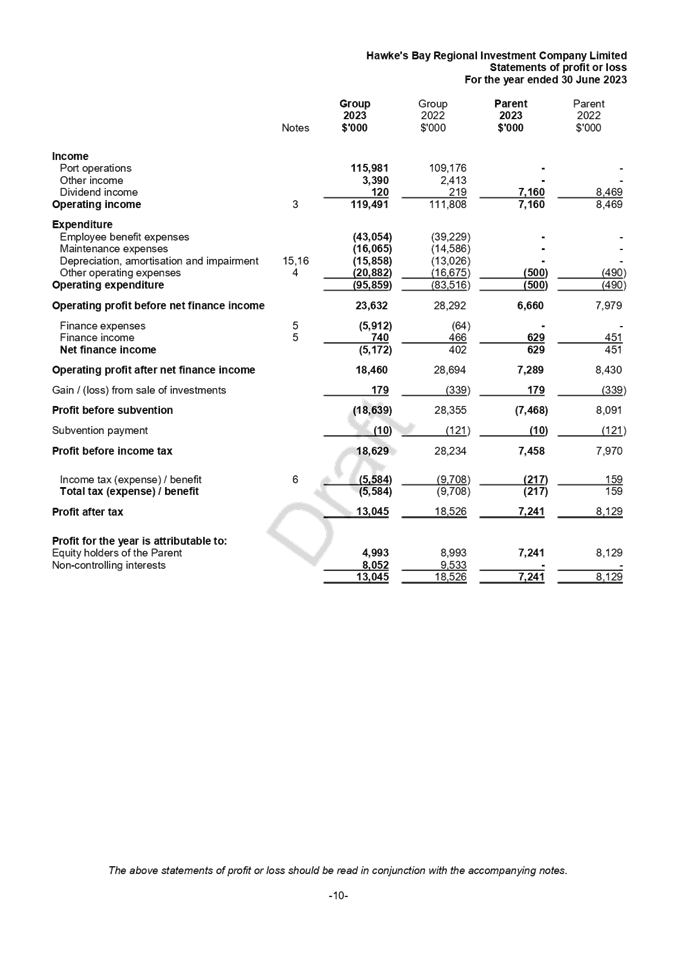

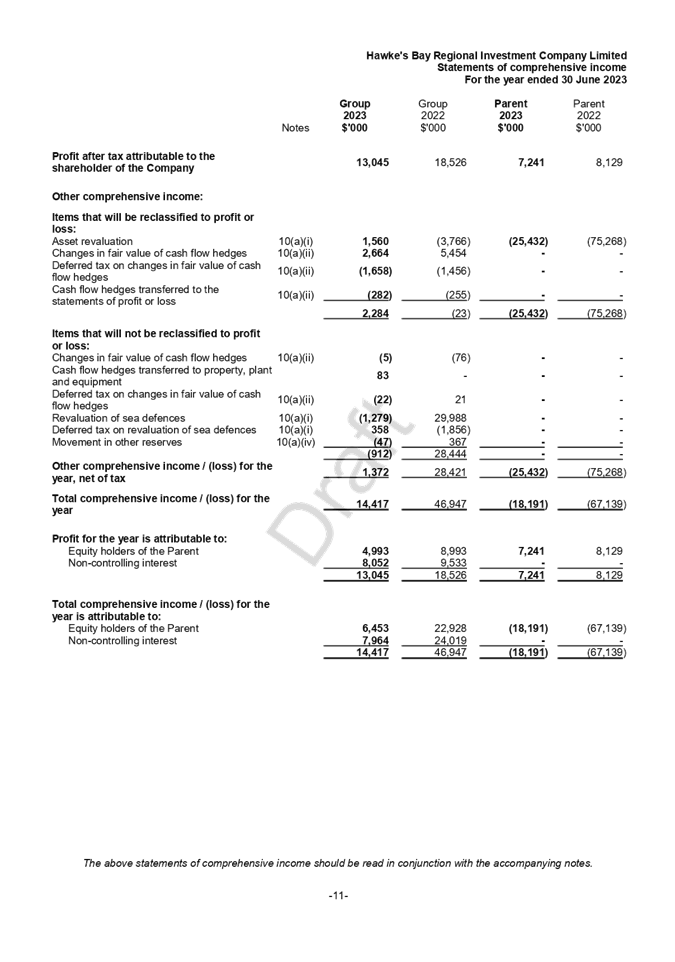

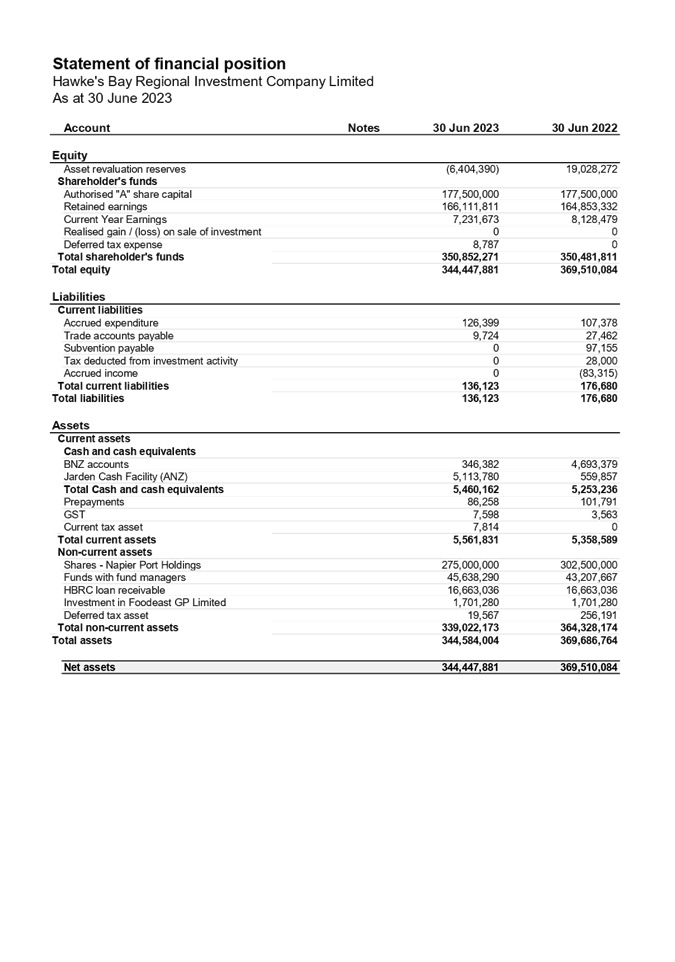

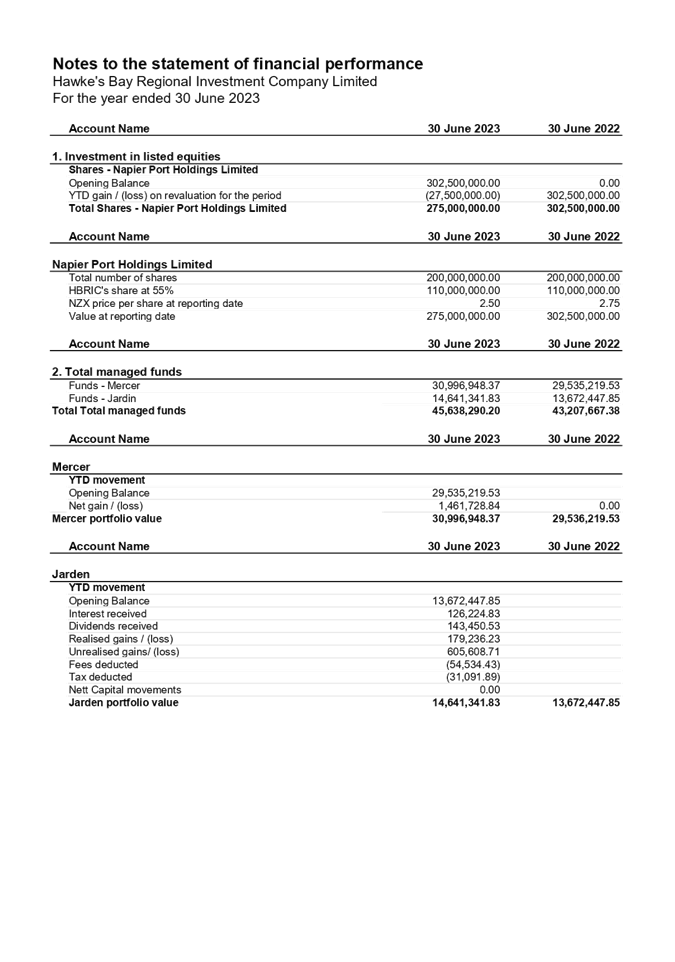

3. HBRIC’s YTD financial statements

as at 30 June 2023 are attached to this report.

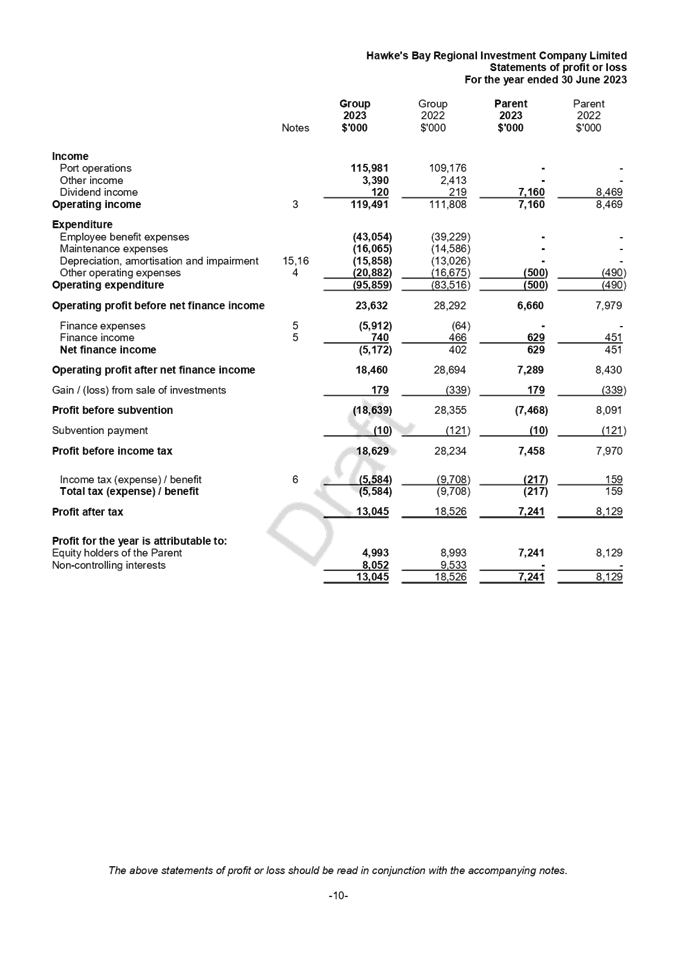

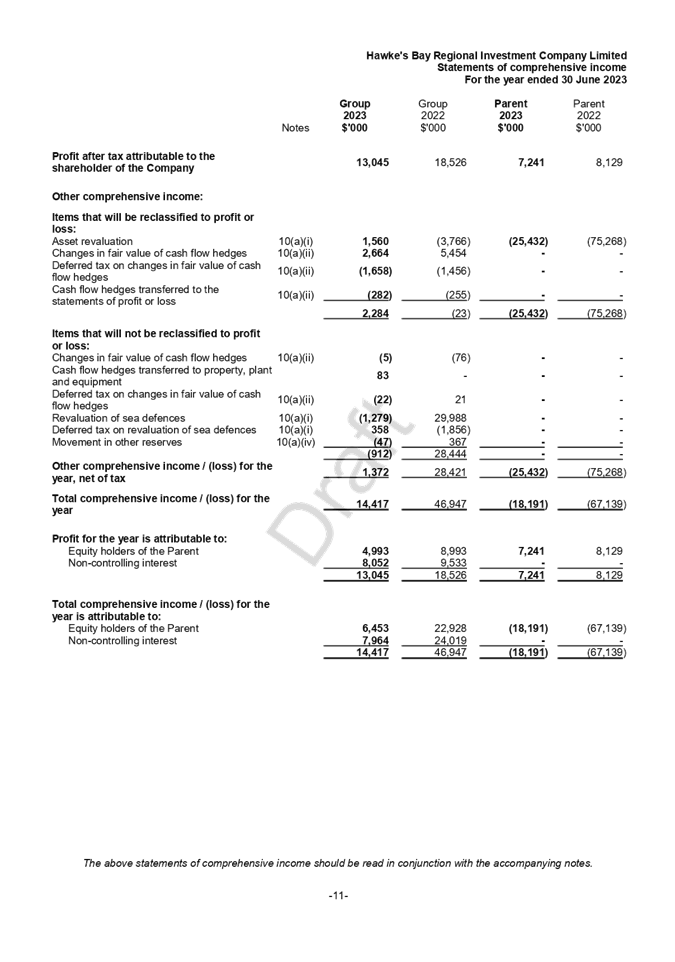

4. Key Items to note:

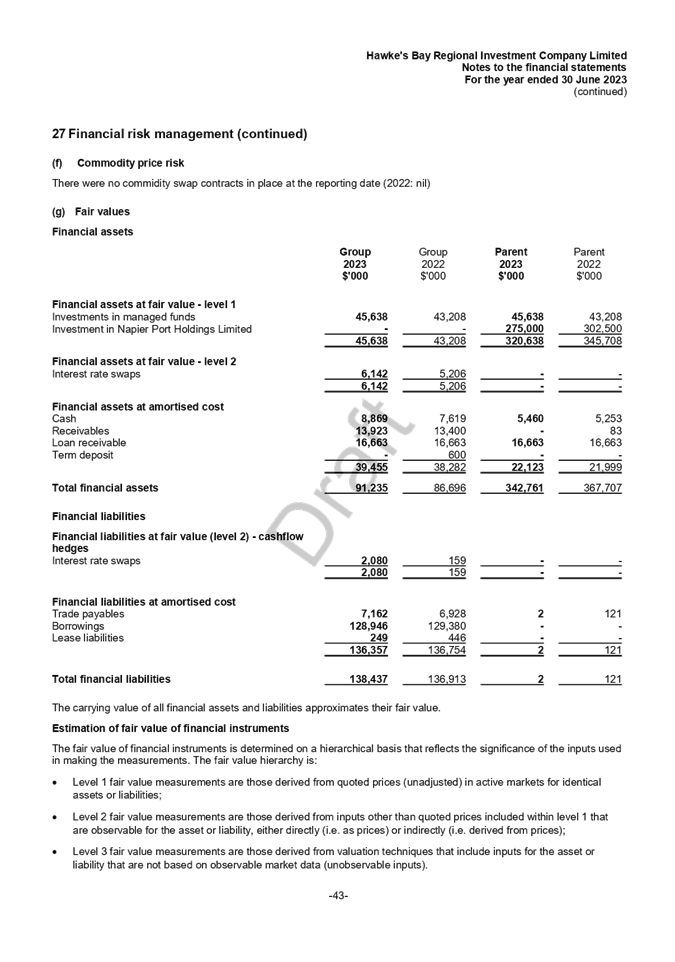

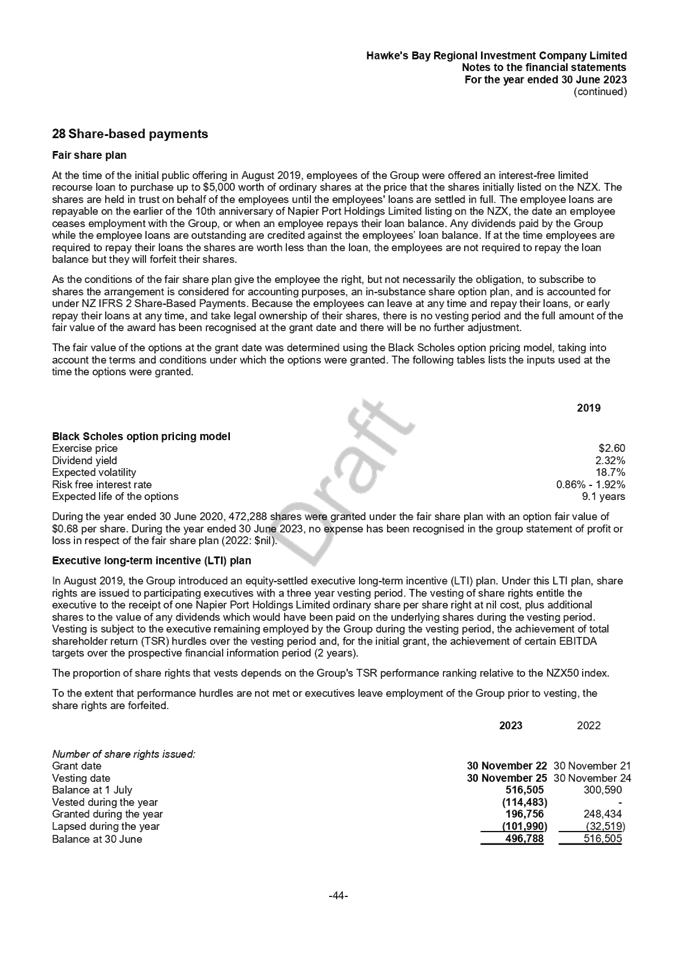

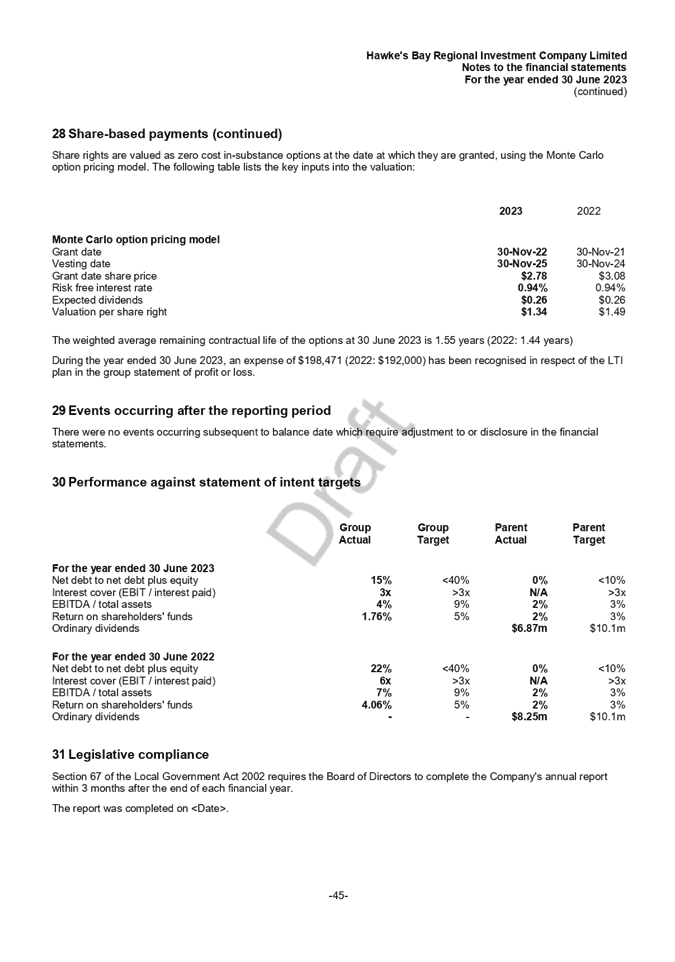

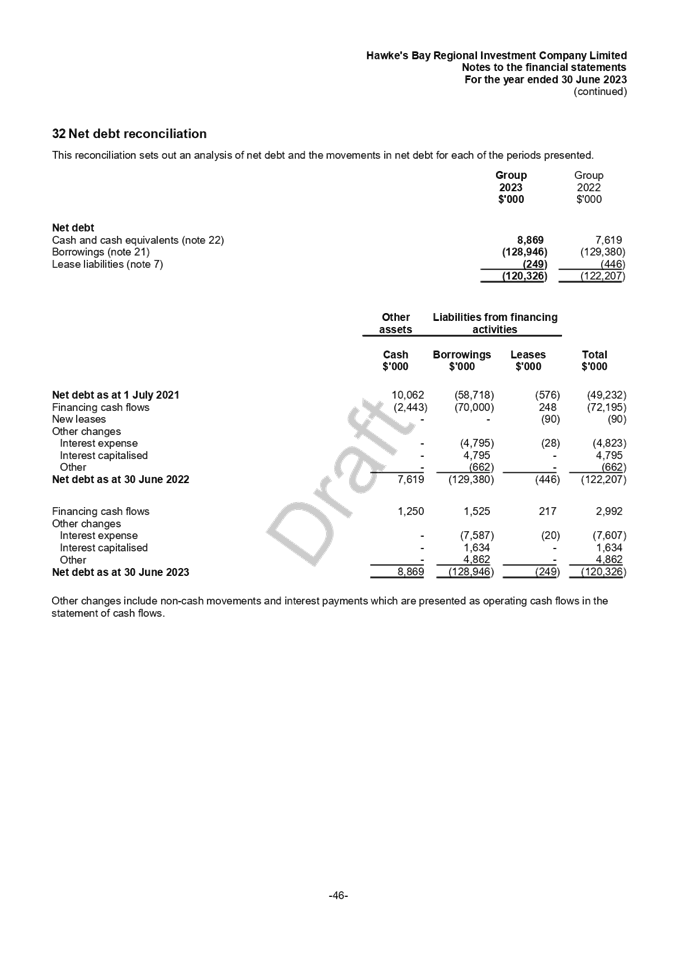

4.1. Statement of Financial Performance

4.1.1. Year-end surplus of $7.2 million (excluding fair value

movements through other comprehensive income)

4.1.2. Year-end $628k interest income

4.1.3. $7.04 million of dividend revenue received from Napier

Port Holdings Limited (NPHL) in the year, with $6.87 million paid to HBRC

4.2. Statement of Financial Position

4.2.1. Decrease in net assets of $25 million to $344 million for

the year to 30 June 2023.

4.2.2. NPHL share price had decreased during the year 9% from

$2.75 to $2.50 – total decrease is $ 27.5m

4.2.3. Increase in managed fund value $43.2m to $45.6m at

year-end 30 June 2023

Managed Funds

5. The funds remain under management in

compliance with Council’s SIPO.

6. The value of managed funds with HBRIC

after divestments as at 30 June 2023 amounted to $45.6 million, a movement of

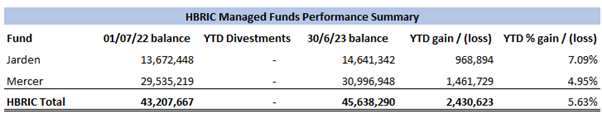

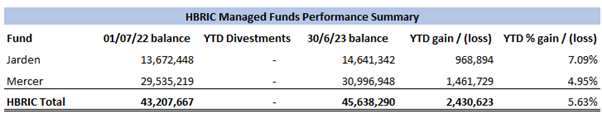

approximately +$2.43m (+5.63%) year to date

FoodEast

7. The following summary is drawn from

FoodEast Haumako (FoodEast) Q4 report to Limited Partners for the 3 months

ended 30 June 2023.

7.1. The key operational focus has been

construction, with Building B enclosed and scheduled for completion at the end

of the calendar year. The Building A slab has been laid with completion

scheduled for Q1 2024.

7.2. The FoodEast board is working through

a rental valuation to validated the rentals in the financial forecasts and

notes prospective tenant interest has increased now that construction is well

underway.

8. To date, HBRIC had only appointed one

director out of a total of its four possible appointees. In consultation with

the FoodEast board and the other limited partners HBRIC has now completed a

director recruitment process and is happy to report the appointment of three

new directors, all with deep food industry and food innovation experience:

8.1. Dr Nicky Solomon – Nicky holds a

Phd in Food Science and is a business development manager for the NZ Food

Innovation Network and the Manager of the HB Regional Food & Fibre

Programme.

8.2. Christie Campbell –

Christie’s experience spans multiple industries including FMCG, wine,

clothing retail, financial services and local government across all disciplines

including marketing, ecommerce, sales, finance, operations, business

development, legal and corporate governance.

8.3. Richard Shirtcliffe – Richard

brings deep executive and governance credentials to the table with an

impressive portfolio of experience and achievement, including Noho, Coffee

Supreme, Tuatara Brewing, phil&teds.

9. In addition, FoodEast has confirmed

the appointment of Michael Basset-Foss and interim CEO (six months).

10. These appointments mark a significant

change in the resourcing of the project as it transitions to an operational

footing. Following discussions with the HBRIC Board it has been agreed that

Craig Foss will step aside at the forthcoming AGM as a founding director and

Chair for the next phase of the project. HBRIC has acknowledged Mr Foss’s

contribution to the project over many years, with particular regard to the

challenges the project has faced in relation to cost pressures in the

construction sector generally.

Napier

Port

11. On 16th August Napier Port released

unaudited financial results for the nine months to 30 June 2023 with reduced

earnings for the 9 months as the impact of Cyclone Gabrielle weighed on exports

from the region. (Q3 net operating activities decreased 44.4% , reported net

profit after tax, with the benefit of insurance income of $3.5m decreased 40.2%

to $7.0m) It was expected earnings in the third quarter would be reduced,

however adverse weather in June and July further challenged the 9 month result.

The effects from the cyclone are anticipated to persist into the fourth

quarter, but the Port retains confidence of an increase in cargo in the new

financial year. The upcoming cruise season is showing strong forward

bookings suggesting it could be the busiest season yet and this along with high

interest from shipping lines creates a measure of confidence in Napier

Port’s long-term volume growth potential.

Other

12. HBRIC continues to support

HBRC’s Investment Strategy review currently underway, including

Council’s decision to recruit two new independent directors, Debbie Birch

and Jonathan Cameron, who have since been appointed to HBRIC’s board and

attended their first meeting in July.

Decision

Making Process

13. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, ass this report is for information only, the decision-making

provisions do not apply.

Recommendations

That the

Corporate and Strategic Committee receives and considers the HBRIC Ltd

quarterly update.

Authored by:

|

Jess Bennett

Senior

Manager - Finance Recovery

|

Tracey O'Shaughnessy

Treasury

& Investments Accountant

|

Approved by:

|

Tom Skerman

HBRIC Commercial

Manager

|

|

Attachment/s

|

1⇩

|

HBRIC unaudited consolidated annual

report to 30 June 202324

|

|

|

|

2⇩

|

HBRIC Finacials to June 2023

|

|

|

|

HBRIC unaudited consolidated annual

report to 30 June 202324

|

Attachment

1

|

|

HBRIC Finacials to June 2023

|

Attachment

2

|

Hawke’s

Bay Regional Council

Corporate and Strategic Committee

Wednesday

20 September 2023

Subject: HBRIC Chairperson appointment

That

Hawke’s Bay Regional Council excludes the public from this section of the

meeting, being Agenda Item 10 HBRIC Chairperson appointment with the general

subject of the item to be considered while the public is excluded. The reasons

for passing the resolution and the specific grounds under Section 48 (1) of the

Local Government Official Information and Meetings Act 1987 for the passing of

this resolution are:

|

General

subject of the item to be considered

|

Reason

for passing this resolution

|

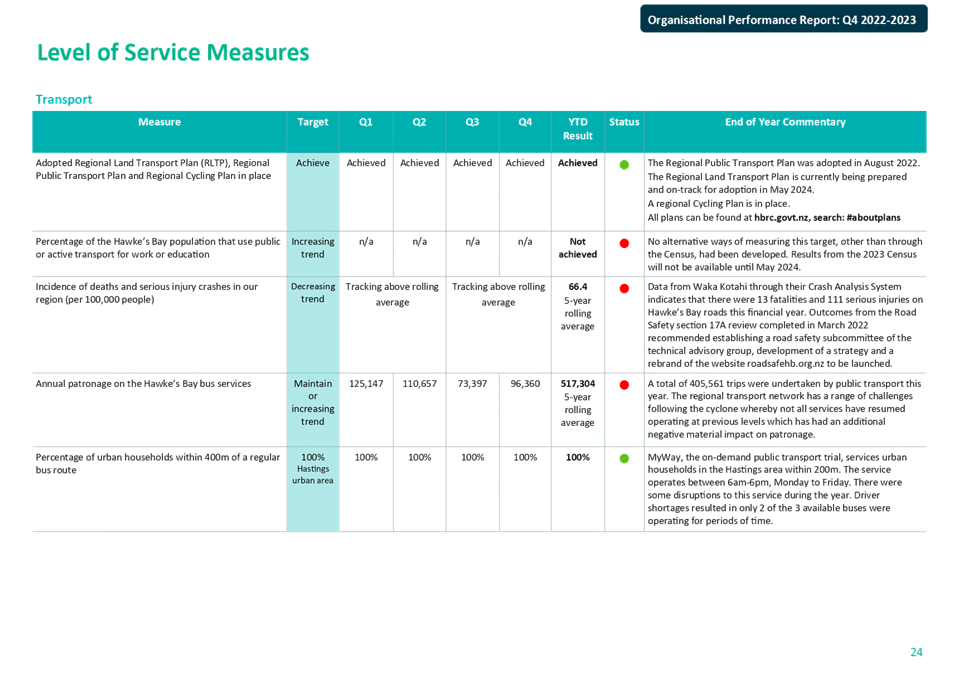

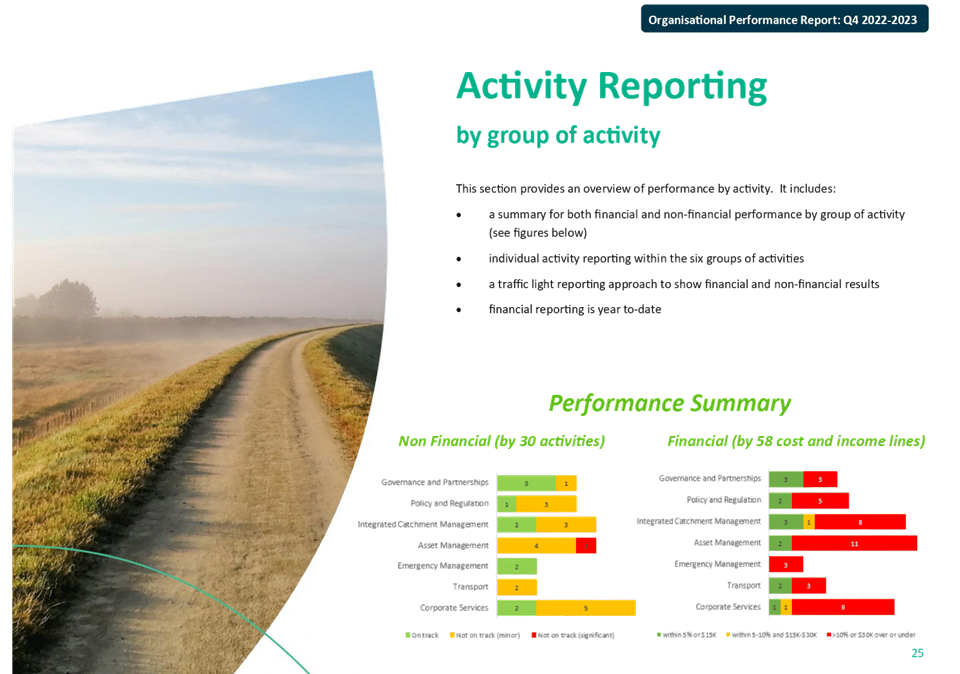

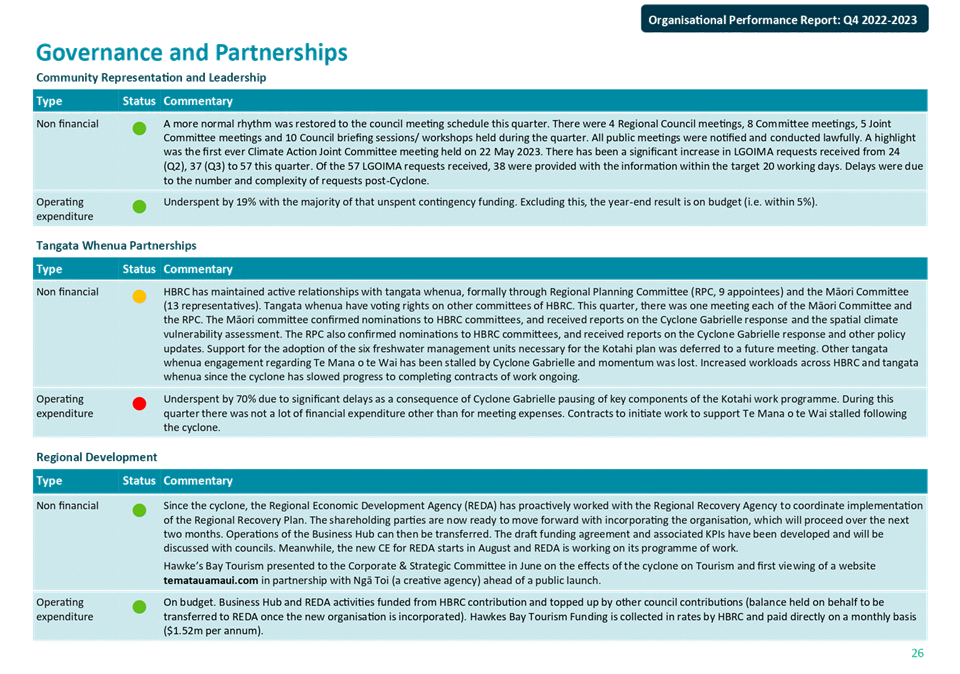

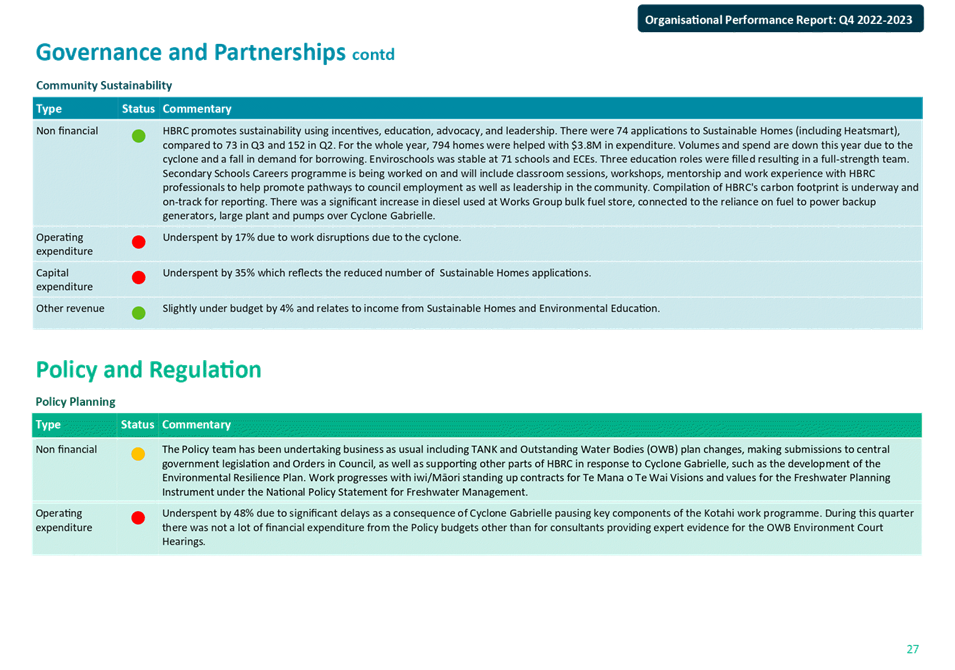

Grounds