Meeting of the

Corporate and Strategic Committee

Date: 14 June 2023

Time: 11.30am

|

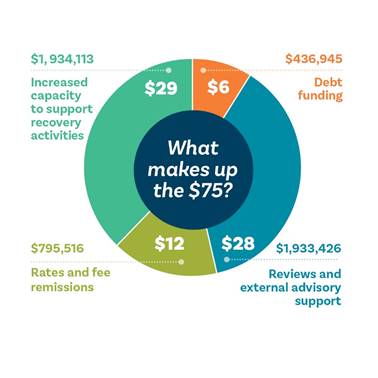

Venue:

|

Council

Chamber

Hawke's

Bay Regional Council

159

Dalton Street

NAPIER

|

Agenda

Item Title Page

1. Welcome/Karakia/Notices/Apologies

2. Conflict

of Interest Declarations

3. Confirmation of Minutes of

the Corporate and Strategic Committee held on 5 April 2023

4. Call

for minor items not on the Agenda 3

Decision

Items

5. 2023-2024

Annual Plan engagement 5

6. Annual

Compliance, Monitoring, and Enforcement Report 2021-2022 9

7. Policy

for the treatment of enforcement revenue 13

8. Investment

Strategy Review phase 2 approach 19

Information

or Performance Monitoring

9. HBRIC

Ltd Quarterly update 25

10. Financial

summary for the period to 31 March 2023 35

11. Organisational

Performance report for the period 1 January – 31 March 2023 43

12. HBRC

Cyclone Gabrielle impacts recognition and disclosure update 47

13. Hawke's

Bay Regional Economic Development Agency - 1-year update 55

14. Hawke's

Bay Tourism update 71

15. Discussion

of minor items not on the Agenda

Decision

Items (Public Excluded)

16. Port

of Napier 2022-2023 Half Year results 73

Hawke’s Bay Regional

Council

Corporate

and Strategic Committee

14 June

2023

Subject: Call for minor items not on

the Agenda

Reason for report

1. This item provides the

means for councillors to raise minor matters relating to the general business of

the meeting

they wish to bring to the attention of the meeting.

2. Hawke’s Bay Regional

Council standing order 9.13

states:

2.1. A meeting may discuss an

item that is not on the agenda only if it is a minor matter relating to

the general business of the meeting and the Chairperson explains at the

beginning of the public part of the meeting that the item will be discussed.

However, the meeting may not make a resolution, decision or recommendation

about the item, except to refer it to a subsequent meeting for further

discussion.

Recommendations

3. That Corporate and

Strategic Committee accepts the following Minor items not on the Agenda

for discussion as Item 15.

|

Leeanne

Hooper

Governance

Team Leader

|

Desiree

Cull

Strategy

& Governance Manager

|

Hawke’s Bay Regional Council

Corporate

and Strategic Committee

14 June

2023

Subject:

2023-2024 Annual Plan engagement

Reason for Report

1. This item presents the

engagement document Introducing our Annual Plan 2023-2024 –

Supporting the region’s recovery for Committee adoption.

Officers’

Recommendation

2. Staff recommend that the

Corporate and Strategic Committee reviews the document provided and resolves to

adopt it, on behalf on Hawke’s Bay Regional Council (HBRC), ahead of the

engagement process starting on Friday 16 June 2023.

Executive

Summary

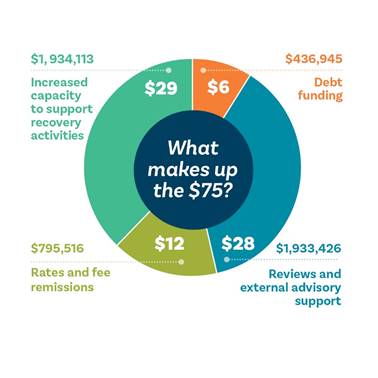

3. As a result of Cyclone

Gabrielle, HBRC has faced substantial new unplanned costs and we have taken on

new responsibilities across a large geographical area. To date, HBRC has

incurred unplanned costs of $9 million for the CDEM (Civil Defence Emergency

Management) response, and a further $42 million for HBRC in response to the

cyclone. While we expect a large portion of this to be reimbursed from National

Emergency Management Authority (NEMA) and our insurers, inevitably there will

be a shortfall in reimbursable activities and insurance.

4. Staff have taken a

hard-line approach to the proposed Annual Plan, such that we propose a 6%

average rate rise, instead of the forecast 14.5% in our Long Term Plan

2021-2031.

5. We have ring-fenced

additional costs being incurred as a result of the cyclone and propose a flat

charge of $75 per SUIP (separately used or inhabited part of a rating unit) for

the 2023-2024 financial year that will generate income to pay for these additional

costs.

6. While we do not intend

consult on any specific decision to be made, we will be engaging with our

community and informing them of the changes to our work programme, including

the additional activities we are undertaking. This includes being the

administrator for the Hawke’s Bay Regional Recovery Agency and

administrator for funding agreements with the Department of Internal Affairs

for programmes such as silt. We will be iterating there will be no cost

to ratepayers for us taking on this work.

Development

of the Annual Plan 2023-2024

7. Budgeting and planning for

2023-2024 was well underway when Cyclone Gabrielle struck. Like many others, we

were already facing challenges with increased insurance premiums, rising rate

increases, and inflation. We were managing our budget to contain the average

rate increase to near what we have forecast in our Long Term Plan 2021-2031.

8. Cyclone Gabrielle struck in

mid-February and we faced substantial new unplanned costs and also took on new

responsibilities.

9. Staff and Councillors had a

hard look at costs and spending and reprioritised our previously planned work

programmes. We have had to make some hard decisions so we could reduce the

planned average rates increase yet also be able to undertake unplanned cyclone

work.

10. This tightening of belts

means we have been able to substantially reduce our forecast average rate

increase from 14.5% down to 6%. We have a no-frills budget for 2023-2024 that

focuses on our core business and supporting the region’s recovery.

11. In addition to the rates

increase, Council is introducing a cyclone recovery charge of $75 per SUIP (separately used or inhabited part of a rating unit).

This will raise $5.1 million and help with additional costs and responsibilities

that we have undertaken or have planned in response to Cyclone Gabrielle.

12. It is important to note, there is still

a lot of uncertainty as we work through insurance and NEMA (National Emergency

Management Agency) claims and determine levels of central government financial

support. This is a best endeavours Annual Plan as we try and position

ourselves to support the region’s recovery.

13. We have

emphasised this uncertainty in the engagement document and signalled that costs

may change.

Community

Engagement

14. The attached document Introducing

our Annual Plan 2023-2024 – Supporting the region’s recovery

supports our planned feedback process. The purpose is to inform and engage our

community outlining the impact Cyclone Gabrielle has had on our organisation

and how we are supporting recovery in Hawke’s Bay, including our support

for the Hawke’s Bay Regional Recovery Agency.

15. We are seeking

feedback on:

15.1. what is

important to people in the region’s recovery from Cyclone Gabrielle, and

15.2. our proposed

Annual Plan generally.

16. Feedback will

be sought over a two-week period, from Friday 16 June to Sunday 2 July 2023, primarily online through a

feedback form or downloadable pdf. Promotional activity will include digital

and print media, and we will be holding one drop-in session and flyer drops in

Wairoa.

Strategic Fit

17. The Annual Plan’s

focus on core business and supporting the region’s recovery strongly

supports HBRC’s Strategic Plan 2020-2025. In particular, the goals of:

17.1. Climate-smart and

sustainable land use.

17.2. Sustainable and

climate-resilient services and infrastructure.

Significance

and Engagement Policy Assessment

18. Staff have assessed this

feedback process with the Regional Council’s Significance and Engagement

Policy and are working to the Inform and Consult levels of engagement.

Climate

Change Considerations

19. Climate change is a focus

in all Council’s planning and decision-making. The focus on supporting

the region’s recovery acknowledges climate change is increasing the

likelihood and severity of extreme weather events such as Cyclone Gabrielle.

Financial

and Resource Implications

20. This engagement process

will incur external costs of around $15,000 with the majority of that for

advertising.

Next

steps

21. Following the close of the

submission process on 2 July 2023, staff will collate feedback and provide some

high-level analysis for Council to consider and deliberate on at its meeting 19 July 2023.

22. The Annual Plan

2023-2024 will be provided to Council for adoption on 26 July 2023.

Decision Making Process

23. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

23.1. The decision to embark on

community engagement does not significantly alter the service provision or

affect a strategic asset, nor is it inconsistent with an existing policy or

plan.

23.2. Public

engagement will be carried out in accordance with LGA section 82.

23.3. The decision to

initiate engagement is not significant under the criteria contained in

Council’s adopted Significance and Engagement Policy.

23.4. The persons affected by

this decision are all ratepayers in the region.

Recommendations

That the Corporate and Strategic

Committee:

1. Receives and considers the 2023-2024

Annual Plan engagement staff report.

2. Decides to exercise its

delegated powers to make a decision that will have the same effect as the

Regional Council could itself have exercised or performed and that the decision

deserves urgency and the decision is carried unanimously.

3. Adopts the Annual Plan

2023-2024 – Supporting the region’s recovery for community

engagement.

4. Delegates to the Group

Manager Corporate Services authority to make any required minor amendments or

edits to the document prior to publication and the start of engagement.

5. Agrees to the public

engagement and feedback period being 16 June to 2 July 2023.

Authored by:

|

Desiree Cull

Executive Officer to CE

|

Mandy Sharpe

Senior Strategy & Corporate

Planner

|

|

Amy Allan

Senior Business Partner

|

Sarah Bell

Acting Strategy & Governance

Manager

|

|

Chris Comber

Chief Financial Officer

|

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

Bill Bayfield

Interim Chief Executive

|

Attachment/s

|

1

|

Supporting our region's recovery -

Annual Plan 2023-2024

|

|

Under Separate Cover

|

Hawke’s

Bay Regional Council

Corporate

and Strategic Committee

14 June

2023

Subject:

Annual Compliance, Monitoring, and Enforcement Report 2021-2022

Reason for Report

1. This item presents the Hawke’s

Bay Regional Council’s (HBRC) 2021-2022 Compliance Annual Report for

discussion and then recommendation to Council for adoption.

Executive

Summary

2. The attached report on

HBRC’s Compliance Monitoring and Enforcement (CME) activities provides

transparency to our communities and those regulated by HBRC.

3. The attached report summarises

HBRC’s compliance monitoring and enforcement functions undertaken under

the RMA. It

details compliance with consent conditions, breaches of the Resource Management Act

1991 (RMA) and Regional Resource Management Plan interventions. It also covers the

breadth of monitoring undertaken, the levels of compliance reported, and a

summary of enforcement action taken during the year.

4. Detailed information can be

found in the report with staff presenting highlights to the committee and

available to answer any questions.

Background

5. For the Committee’s

information, reporting on monitoring and enforcement occurs through the

following mechanisms to Council or Committee:

5.1. Compliance Annual Report

5.2. HBRC Annual Report –

results are presented through the Regulation Group of Activities within the

Annual Report document

5.3. Active investigations or

issues are reported to Council through the Significant Activities item on the

monthly Council agenda.

6. Internally a weekly

incident report is prepared for the Group Manager of Policy and Regulation

which details complaints, incidents and the associated outcomes.

7. Staff have also established

an approach whereby a media release will be issued at the conclusion of any

prosecution carried out by HBRC, regardless of the outcome of the prosecution.

Strategic Fit

8. Undertaking compliance

monitoring and enforcement where necessary helps us to:

8.1. Protect aquatic ecosystems

and ensure water use is sustainable (Priority Area: Water)

8.2. Ensure sustainable land use

(Priority Area: Land)

8.3. Maintain a healthy and

functioning biodiversity (Priority Area: Biodiversity).

Significance and Engagement Policy assessment

9. Although the matters

discussed in this report are of interest to the community they do not directly

impact or affect the community. There are no financial or levels of service

implications associated with deciding to adopt this report and, as such, this

report is of low significance.

Considerations

of Tangata Whenua

10. The attached report sets

out ways we have improved our engagement with tangata whenua on compliance

matters. This includes:

10.1. Keeping tangata whenua and

iwi representatives informed in relation to high level enforcement action.

10.2. Working closely with iwi

and iwi trusts to seek victim impact statements for prosecution offences,

facilitated by our Māori Partnerships team.

10.3. Ensuring consent conditions

that require consultation and engagement with iwi are met by the consent

holder.

10.4. Building cultural

competency within the compliance team with internal training.

11. It is becoming increasingly

common for resource consents to include more complex conditions that better

recognise Te Ao Māori; for example, conditions requiring development of

cultural monitoring plans in consultation with iwi/ marae/ hapū and treaty

groups.

12. Future areas of focus are:

12.1. Improving how we report

incidents, particularly discharges to water, to tangata whenua and kaitiaki so

we can inform their decision-making, and so their observations and involvement

can inform cultural assessments.

13. Establishing regular

meetings and workshops with tangata whenua across the region to further

strengthen communication and relationships, build trust and increase

accountability.

Financial

and Resource Implications

14. There are currently no

financial and funding implications associated with adopting the report.

Decision Making Process

15. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

15.1. The decision does not

significantly alter the service provision or affect a strategic asset, nor is

it significant under the criteria contained in Council’s adopted

Significance and Engagement Policy.

15.2. Given the nature and

significance of the issue to be considered and decided, Council can exercise

its discretion and make a decision without consulting with the community or others having an interest

in the decision.

Recommendations

That the Corporate and Strategic

Committee:

1. Receives and considers the Annual

Compliance, Monitoring, and Enforcement Report 2021-2022.

2. Recommends that

Hawke’s Bay Regional Council:

2.1. Agrees that the decisions

to be made are not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without consulting the community or

persons with an interest in the decision.

2.2. Adopts the Annual Compliance,

Monitoring, and Enforcement Report 2021-2022 for publication (or) as

amended as agreed by the Corporate and Strategic Committee on 5 April 2023.

Authored by:

|

Rob Hogan

Manager Compliance

|

Simon Moffitt

Team Leader Compliance – Rural

|

|

Nichola Nicholson

Team Leader Policy & Planning

|

|

Approved by:

|

Katrina Brunton

Group Manager Policy &

Regulation

|

|

Attachment/s

|

1

|

Annual Compliance, Monitoring, and

Enforcement Report 2021-2022

|

|

Under Separate Cover for councillors

only

|

Hawke’s

Bay Regional Council

Corporate

and Strategic Committee

14 June

2023

Subject:

Policy for the treatment of enforcement revenue

Reason for report

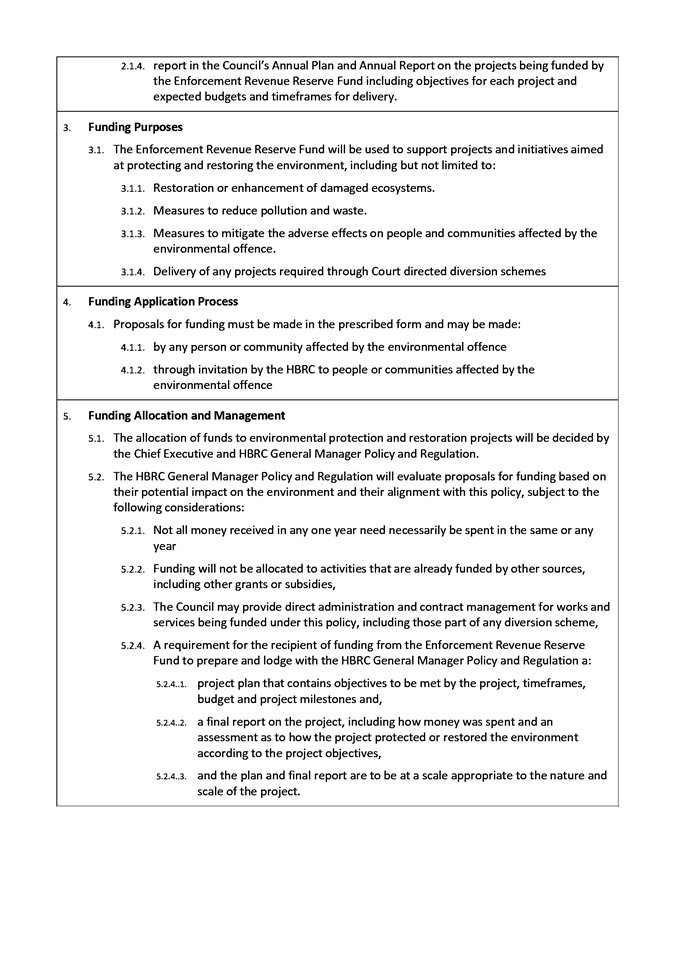

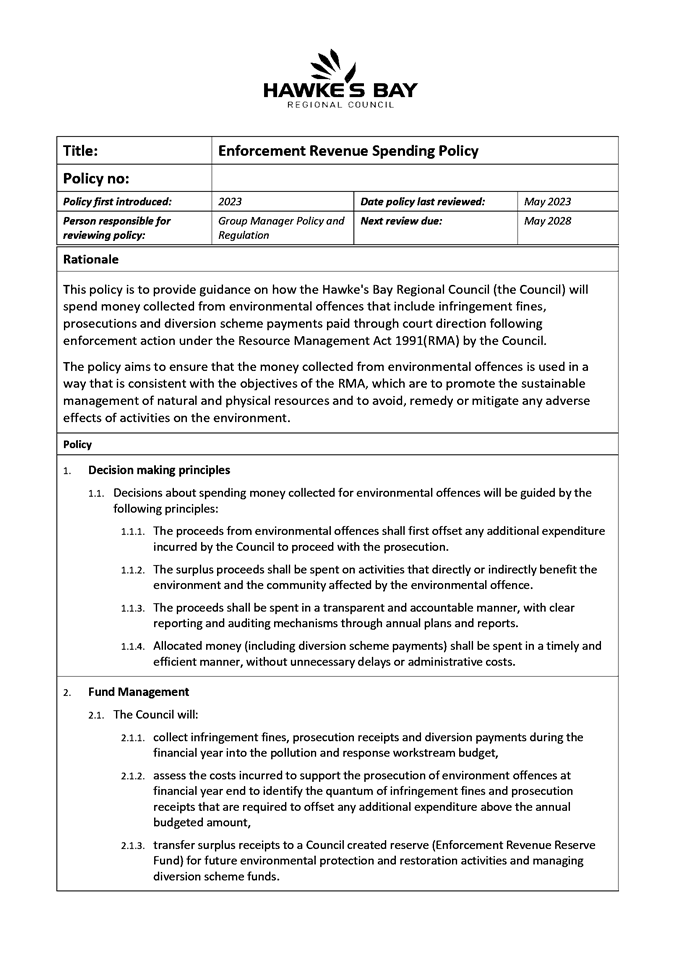

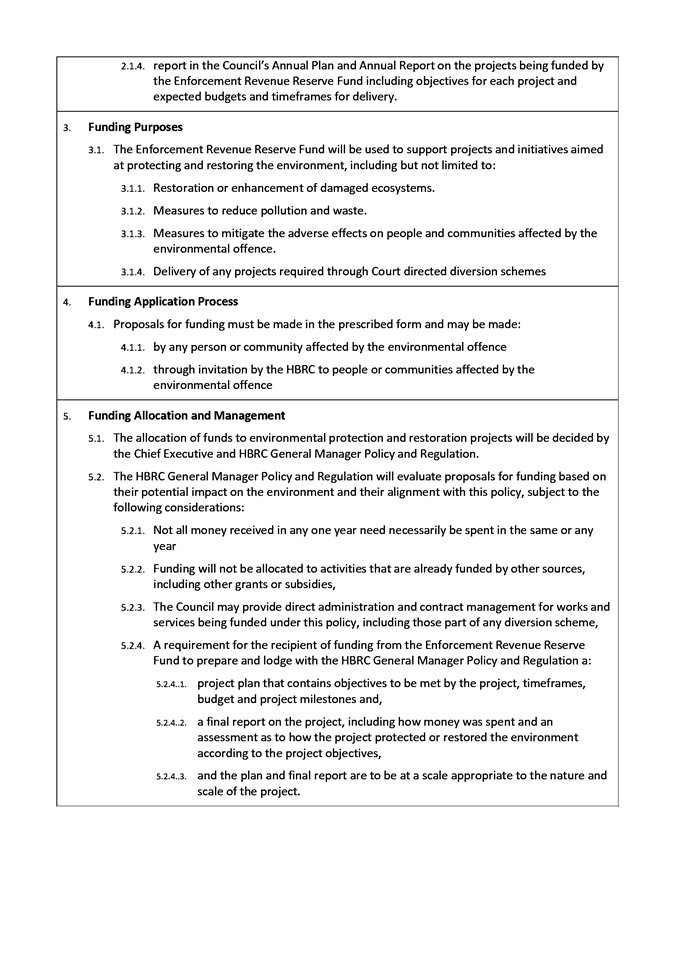

1. This report seeks the

Committee’s adoption of an Enforcement Revenue Spending Policy and the

creation of a new financial reserve to manage the spending of surplus

enforcement revenue.

Officers’

recommendations

2. Enforcement revenue funds

received from fines and prosecutions are not budgeted income, and where

proceeds are surplus to the actual costs of prosecution they are currently held

as part of general income and not targeted for any specific purpose.

3. Council officers recommend

the Committee accepts the Enforcement Revenue Spending Policy (attached)

to guide decisions for the expenditure of this revenue, the management of funds

received as part of Court directed diversion schemes, and the creation of a new

financial reserve to ringfence these funds for use across financial years.

Executive

Summary

4. The Council receives funds

from enforcement action under the Resource Management Act (1991) through

infringement fines issued by Hawke’s Bay Regional Council or through

prosecutions imposed by the Court for environmental offences. The Court

may also direct money be paid to Council to fund diversion schemes for some

environmental offences.

5. The recommended Enforcement

Revenue Spending Policy proposes that, having first offset any additional

expenditure incurred by the Council to proceed with prosecutions in that year,

any surplus proceeds it receives in any one year:

5.1. are transferred to a

Council-created reserve (Enforcement Revenue Reserve Fund) for future

environmental protection and restoration activities, and

5.2. are used to fund activities

that directly benefit the environment and the community affected by the

environmental offence.

Discussion

6. The Council allocates an

annual budgeted amount to cover the costs of prosecutions for environmental offences

(Annual Plan 2022-2023 budget was $104k for legal fees). Prosecutions

imposed by the Court and infringement fines will usually cover the costs of

prosecution on an annual basis.

7. The Council currently only

budgets for a minimal amount of infringement/enforcement income (Annual Plan

2022-2023 budget was $36k).

8. The Council does not

currently provide specific direction for the expenditure of funds received

through its enforcement actions, above what is included in the annual plan

budgets. Traditionally, these funds received have offset any additional

operational expenses incurred for Compliance and Enforcement activities, and

any surplus remaining has fallen to the general operating reserve.

9. Over the past two years,

due to increasing enforcement actions in years past and present and a catch up

on collection of enforcement proceeds, these funds have accumulated. In

the 2021-2022 financial year, a surplus of $244k was approved to carry forward into

the current financial year for use on activities that directly benefit the

environment, though this budget has not yet been spent. The enforcement

proceeds surplus for 2022/23 is currently at $211k above budget, bringing a

combined total surplus of $455k in the current financial year.

10. Where a local authority

lays a charge and there is a conviction with the Court imposing a fine, then

the fine is paid to the local authority. This excludes a deduction of 10% which

is credited to the Crown Bank account. However, the Court can order that the

whole fine be paid to the local authority. Nothing prevents a local

authority from redirecting part of those funds to a specific environmental

purpose, as compensation to the community at large.

11. There are a number of

council and community environmental enhancement projects that are unable to be

funded through our Annual Plan or by community groups that would benefit from

this additional funding, and as this surplus has grown there is pressure to

spend it for a wide range of council projects.

12. A financial reserve must

first be established to enable funds to be set aside from the enforcement

operating work programme for future funding of projects or activities.

13. The policy directs that

enforcement revenue will only be added into the proposed reserve when there is

a surplus in any financial year. That is, the costs of taking the enforcement

action has been met and there is surplus thereafter.

14. Where there is a deficit

because we have had to take more enforcement action than anticipated –

resulting in more legal spend, in accordance with the revenue and financing

policy – that would fall to the general rate funding. Funds will not be

taken out of the proposed reserve to offset a deficit in the operational work

programme of enforcement.

15. The recommended policy

provides a process and decision-making guidance for spending surplus money

received from environmental compliance and directly links it back to the

reasons for imposing the sanctions for an environmental offence in the first

instance.

Options assessment

16. The alternative to a

ringfencing policy is to remain with the status quo, where surplus funds

received through enforcement action are left to fall to the general operating

reserve.

17. No other more relevant

purpose could be identified as all Council projects generally seek to deliver

sustainable environmental outcomes. If the surplus funds become part of a

council’s general reserve, it loses its connection to where environmental

infringements have caused adverse effects.

Strategic Fit

18. The recommended Enforcement

Revenue Spending Policy is relevant across all of the Council’s strategic

goals, albeit by way of recompense for environmental offences. Decisions

about funding for specific projects depends on the types of environmental harm

caused and the options for directly benefit the environment and community

impacted by that offence. Projects might thus be relevant across all four

focus areas.

Significance and Engagement Policy

assessment

19. The significance of this

decision is very low and does not require engagement with the wider community

Financial and resource implications

20. The Enforcement Revenue

Spending Policy does not have budget implications except to help reduce

shortfalls where the budgeted amount for Council’s prosecution action is

not recovered through infringement fines and Court imposed prosecutions.

Consultation

21. This matter was discussed

during the Corporate and Strategic meeting on 24 August 2022 when adopting the

carry forward expenditure budgets from 2021-2022 to 2022-2023. Council

resolved to carry forward the surplus income on the basis that these funds were

spent on environmental enhancement and protection works in the 2022-2023

financial year. Subsequent to that, advice was provided by the finance

team that a financial reserve was the appropriate mechanism to provide for the

ringfencing of enforcement revenue on an on-going basis. In accordance with the

establishment of a Council-created reserve, a policy is required for how that

reserve will be used.

Other Considerations

22. The policy will need to be

supported by a change to the delegations register to expressly provide the HBRC

Chief Executive and the Group Manager Policy and Regulation with the financial

delegation to evaluate proposals and allocate funding from the Enforcement

Revenue Reserve Fund. It is recommended that the financial delegation for

this fund is included in the HBRC Delegations Policy (Policy CD0021) for the

Chief Executive and the Group Manager Policy and Regulation.

23. Decisions about expenditure

of a new fund, will need to be made and the proposed policy provides for the

HBRC Chief Executive and the Group Manager Policy and Regulation to be given

the decision-making role. It is appropriate that the Group Manager is

delegated with this authority as compliance action is undertaken by this Group.

There is intended to be a high level of connection between the enforcement

action and the projects that are intended to benefit the environment in these

situations.

Decision Making Process

24. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

24.1. The decision does not

significantly alter the service provision or affect a strategic asset, nor is

it inconsistent with an existing policy or plan.

24.2. The use of the special

consultative procedure is not prescribed by legislation.

24.3. The decision is not

significant under the criteria contained in Council’s adopted

Significance and Engagement Policy.

24.4. The persons affected by

this decision are unable to be directly identified as this policy guides future

decisions where enforcement actions are yet to be made and projects that enable

environmental benefits to be delivered have yet to be identified.

24.5. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by, or have an interest in the decisions made, Council

can exercise its discretion and make a decision without consulting directly

with the community or others

having an interest in the decision.

Recommendations

That the Corporate and Strategic Committee:

1. Receives and considers the Policy

for the treatment of Enforcement Revenue staff report.

2. Agrees that the decisions

to be made are not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without conferring directly with

the community or persons likely to have an interest in the decision.

3. Recommends the

establishment of a financial reserve for the purpose of receiving funds set

aside from the enforcement operating work programme for future funding of

environmental protection and restoration activities.

4. Recommends that

Hawke’s Bay Regional Council adopts the Policy for the treatment of

Enforcement Revenue as proposed (or) as amended as agreed by

the Committee today as follows.

Authored by:

|

Mary-Anne Baker

Team Leader Policy & Planning

|

Rob Hogan

Manager Compliance

|

Approved by:

|

Katrina Brunton

Group Manager Policy &

Regulation

|

|

Attachment/s

|

1⇩

|

Enforcement Revenue Spending Policy

May 2023

|

|

|

|

Enforcement Revenue Spending Policy May

2023

|

Attachment

1

|

Hawke’s Bay Regional

Council

Corporate

and Strategic Committee

14 June 2023

Subject:

Investment Strategy Review phase 2 approach

Reason for Report

1. This paper outlines

proposed steps that are being taken to address phase 2 work of the Investment

Strategy review of HBRC and HBRIC entities, to ultimately ensure that intent

and purpose of how and what investments continue to be undertaken in what entity

are operating with maximum efficiency and outcome for our rate payers.

2. In a follow up meeting with

HBRIC directors we have been tasked with providing an updated paper and

presentation to the Corporate and Strategic Committee (C&S) on 14 June with

recommendations through to full Council on 28 June.

Executive

Summary

3. HBRIC officers continue to

review the Investment Strategy of HBRC and HBRIC to ensure that settings and

management of our investments is returning maximum benefit to our ratepayers.

4. Director Scott Hamilton, ex

Quayside, has worked with officers to propose recommendations on how to enable

investment growth and better returns based on experience in establishing in

navigating a similar entity.

5. A number of proposals are now

being worked through as outlined within this paper specifically expanding the

role that HBRIC plays in managing investments (both HBRC and HBRIC in

totality), resetting HBRIC objectives and operating structure, and baselining

LTP assumptions.

Background

/Discussion

6. On 29 March 2023 (at a

workshop arranged prior to the cyclone) Council received a presentation from

former Quayside Holdings Chief Executive Scott Hamilton who provided an

overview of the establishment, development and performance of Quayside Holdings

and the subsequent outcomes and opportunities for Bay of Plenty Regional

Council, Port of Tauranga, and the wider community.

7. Subsequently, in Public

Excluded Council formally received the outcome of two commissioned pieces of

work from PricewaterhouseCoopers (PWC) being:

7.1. A review of fund manager

performance given ongoing concerns raised through the Finance, Audit and Risk

Committee in 2022, and

7.2. A stocktake of HBRC’s

overall investment strategy (thereby incorporating HBRC’s wholly owned

subsidiary HBRIC Ltd).

8. The Council paper at that

time also addressed the potential financial impacts of Cyclone Gabrielle on

HBRC’s P&L and Balance Sheet, and the likely pressures that will be

paced on the HBRC-group investment portfolio, both in terms of dividend demands

to support HBRC operational expenditure, and the temptation to liquidate

investment assets to support cyclone-recovery efforts.

9. Council agreed that the

investment portfolio was intergenerational in nature and should not be

‘deployed’ for recovery projects, unless there is a compelling

commercial investment return available.

10. Council acknowledged that

HBRIC’s current portfolio mix and dividend payment requirements made

meeting its ‘top-down’ performance targets difficult.

11. Council

confirmed the objective/vision of the HBRIC Investment Strategy to deliver

higher capital and dividend growth.

12. Council unanimously

supported efforts for HBRC to seek to replicate the BOPRC model consistent with

a vision for HBRC’s long term financial resilience and to support

strategic regional growth initiatives. This included a direction for staff to

report back to HBRC’s Corporate and Strategic Investment Committee with

recommendations on rebalancing the group’s investment portfolio in a way

that supports HBRC’s long term investment objectives.

Phase

2 – preliminary recommendations to support growth

13. It is widely recognised by

Council Officers that HBRIC has been constrained in its ability to grow, given

the labelling of strategic assets to all investments held by both HBRC and

HBRIC. Labelling of such assets were attributable to past decisions and

processes put in place to ‘over protect’ the investment endowment,

particularly following the Port IPO process and RWSS water consents.

14. Despite this, In the 10

years through to 30 June 2022 financial year HBRIC’s net assets have

increased from $177m to $369m. Through that period dividend payments of

approximately $118m have been paid to Council.

15. While at the time, taking a

risk adverse position was deemed appropriate to set expectation of

“protection”, these settings have now created in environment where

stated returns expectations (e.g. 6% for HBRIC) are not being, and are unlikely

to be, met.

16. Specifically:

16.1. Inability of HBRIC to

retain a portion of dividend/income to support investment growth.

16.2. Strategic Assets have been

locked down with a perception that they cannot be touched, liquidated or

changed due to their particular importance.

16.3. The SIPO is considered

simple, off the shelf with 50/50 growth/income assets. This SIPO operates

across both the HBRC and HBRIC portfolios even though there are considerable

differences between the outcomes required. (commercial and non-commercial

returns)

16.4. As a result of the SIPO and

reporting it is difficult to get clarity on how and who is actually actively

monitoring and managing Investment funds and where returns are being made to

which entity.

16.5. Lack of clarity and

consistency in managing allowing years with excess to be used rather than

income equalized for future years.

17. The following work has been

undertaken to take steps in addressing gaps and misalignments in the

overarching investment settings across both HBRC and HBRIC of which will ultimately

propose changes to the Investment Policy Council currently adheres and

administers.

The

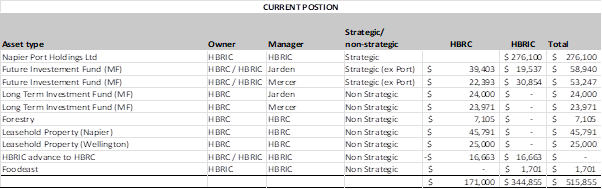

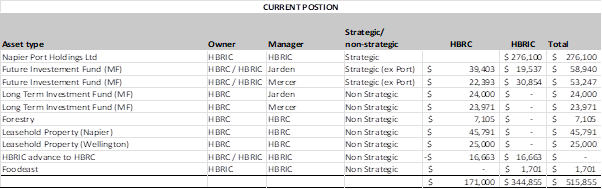

HBRC Group Investment Assets

18. In referring to the

Investment Assets of the HBRC Group, we are referring to the investment assets

held in the name of HBRC and HBRIC.

19. Not all investment assets

are today yielding a commercial return.

20. The assets are a mix of

Strategic and Non-Strategic Assets.

21. The assets of the HRBC

Group are:

Expanding

the HBRIC Role

About HBRIC

22. HBRIC Ltd is a council-controlled

trading organisation (CCTO) for the purposes of the Local Government Act 2002.

It is 100% owned by Hawke’s Bay Regional Council. HBRIC’s mission

is to optimise the financial and strategic returns to Council from its allocated

investment portfolio to assist Council achieve its vision of “a healthy

environment, and a resilient and prosperous community”.

Steps

Already Taken

23. Council workshops in March

2023 reaffirmed the mission of HBRIC, its intergenerational investment

timeframes, and the opportunity for it to provide significantly more resilience

capacity to HBRC’s operational budget.

24. Council has supported this

mission through the search for additional Independent Directors with a view to

further building HBRIC’s investment capability and capacity.

Growing

Scale and Capability

25. HBRIC is currently staffed

by Council and Contractors.

26. HBRIC should be a Centre of

Investment Excellence for Council in managing the Commercial Interest and

Investment Assets of the Council Group.

27. To be a Centre of

Investment Excellence, HBRIC needs to have its own staff supported by an

experienced Board. Council has commenced this process via board

appointments.

28. HBRIC can achieve economies

of scale by managing on behalf of the wider Council Group both HBRC and HBRIC

investment assets.

HBRIC

Expanded Role

29. HBRIC as HBRC’s

Investment Manager will:

29.1. Be an Investment Manager

for and to Council, with an experienced team and board capable of managing and administrating

both HBRIC and HBRC’s Investment Assets, and

29.2. Manage the Groups

Investment Assets that currently including a mix of strategic and non-strategic

assets including Port of Napier shares, Managed Funds (LTIF and FIF),

Investment Property (Wellington and Napier leasehold, FoodEast), and Forestry,

and

29.3. Through a Letter of

Expectation has a mandate to grow and diversify its investment portfolio to

meet key objectives (To be determined and outlined in a Letter of

Expectations), and

29.4. Through a Management

Agreement, has the mandate to manage and transact on HBRC investment assets to

achieve key objectives (Management Agreement to be drafted, Objectives are set

through the Letter of Expectation). Council will pay HBRIC for this service,

and

29.5. Through a Loan Agreement

(or similar), has through HBRC access to debt funding through the LGFA where

such funding is not being utilised by HBRC. – An initial agreement is

already in place.

30. Does Council agree with

this as the role for HBRIC?

Setting

HBRIC Objectives

31. The Local Government Act

Section 64B allows councils to set Statements of Expectations for CCO and CCTO

subsidiaries.

32. It is recommended that a

Statement of Expectations be defined for HBRIC to clearly state their

objectives towards Council and the community.

33. Other investment entities

such as Quayside Holdings Limited (under Bay of Plenty Regional Council) and

Christchurch City Holdings Limited (under Christchurch City Council) have

existing Statement or Letters of Expectation.

34. This Statement or Letter

will form the basis of consideration in any future HBRIC Draft Statement of

Intent.

35. Draft HBRIC Potential

Letter of Expectation objectives

35.1. Be the HBRC Commercial

Entity as a Council Controlled Trading Organisation (CCTO), focused primarily

on commercial returns in accordance with the Local Government Act, and

35.2. Retain a majority ownership

of the Port of Napier as a Strategic Asset, and

35.3. Work with Port of Napier to

ensure ongoing growth in return for the benefit of the region, and

35.4. For Non-Port Investment

Assets: Achieve growth and return targets against a rolling five-year

objectives, and

35.5. Achieve an annual,

consistently growing cash income target for Council (as interest and dividend

from HBRIC), and

35.6. Grow a reserve portfolio

(over ten years) from retained profits to risk mitigate the Council from

volatility in the Port income, and

35.7. Create key partnerships for

growth with other regional investment entities, including iwi.

36. What other objectives does

Council wish be considered for HBRIC?

Strategic

Investment Assets

37. Both HBRC and HBRIC own

portions of Council’s investment assets, some of which are tagged as

‘Strategic’.

38. As per the HBRC investment

Policy, a strategic asset is an asset Council owns which is considered to have

particular importance to the community and/or Council’s ability to

promote outcomes within the community.

39. More importantly, the

Significance and Engagement Policy must be applied to any Council consideration

to change a strategic asset.

40. Strategic assets appear to

be a legacy of previous decisions made by Council, due to commercial

implications meant some of the proceeds from the Napier Port IPO have remained

with HBRIC and been invested.

41. The earlier table detailed

the investment assets covered by the Investment Strategy and whom they are

owned by. It also indicates whether the investment holding is strategic or not.

42. These distinctions are

important because it has implications regarding return expectations and any

realisation of capital gains and treatment of capital losses.

43. Any recommendations on

changes to Strategic Assets to allow the HBRC Group to better utilise its

Investment Assets will be brought forward to the first LTP workshop. This

may include how the current Long Term Investment Fund is defined to allow assets

to be better managed while still retaining the purpose of the proceeds as an

intergenerational asset.

Next

Steps

44. To support the above, the

following items will be bought to Council or the HBRIC Board:

44.1. A draft Letter of

Expectation.

44.2. Assess impact of Cyclone

Gabrielle has impacted the income stream from the Port of Napier.

44.3. A Forecast of distributions

and income to Council from the Group assets over the LTP.

44.4. A Management Services

Agreement.

44.5. Rebalance the portfolio

HBRC and HBRIC will target moving more volatile assets to HBRIC, with income

assets at HBRC.

44.6. Model the future ownership

of Group assets based on functional / legal obligation, volatility of the asset

returns, tax efficiency, and complexity to change. This may involve

settling or partially settling the loan between HBRIC and HBRC.

44.7. Model the impact of holding

of one year’s future reserves (equivalent to the annual Port dividend)

will have on HBRIC assets and its distribution.

44.8. Establish a draft budget

for the expanded HBRIC team and functions (staff, board, accommodation, due

diligence). This will be partially offset by savings inside Council.

44.9. Create a dividend policy to

allow both feed into 2024 LTP and achieve Letter of Expectation and Reserving

objectives.

44.10. HBRIC to create a SIPO to achieve the

objectives of the HBRC/HBRIC Group

44.11. Bring a recommendation on Strategic

Assets to the Long Term Plan meetings.

Decision Making Process

45. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

45.1. The decision does not significantly

alter the service provision or affect a strategic asset, nor is it inconsistent

with an existing policy or plan.

45.2. The use of the special

consultative procedure is not prescribed by legislation.

45.3. The decision is not

significant under the criteria contained in Council’s adopted

Significance and Engagement Policy.

45.4. No-one is directly affected

by this decision.

45.5. Given the nature and

significance of the issue to be considered and decided, Council can exercise

its discretion and make a decision without consulting directly with the

community or others

having an interest in the decision.

Recommendations

That the Corporate and

Strategic Committee:

1. Receives and considers the Investment

Strategy review phase 2 approach staff report.

2. Recommends that

Hawke’s Bay Regional Council:

2.1. Agrees that the decisions

to be made are not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without conferring directly with

the community.

2.2. Supports recommendations

that:

2.2.1. HBRIC has a broader role in

managing all investments on behalf of the Group,

2.2.2. HBRIC Board considers

appropriate staffing to enable success,

2.2.3. Investigate opportunities

to better utilise or manage strategic assets that can be put forward to the

next Long Term Plan.

Authored by:

|

Scott Hamilton

Rautaki

|

Tom Skerman

HBRIC Commercial Manager

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

There are no attachments for this

report.

Hawke’s Bay Regional

Council

Corporate

and Strategic Committee

14 June

2023

Subject:

HBRIC Ltd Quarterly update

Reason for Report

1. This item presents the

HBRIC quarterly update.

2. Note that Napier Port

Holdings will be presenting to today’s committee meeting as well.

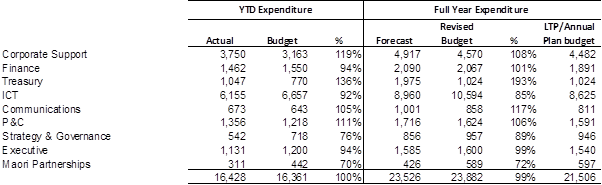

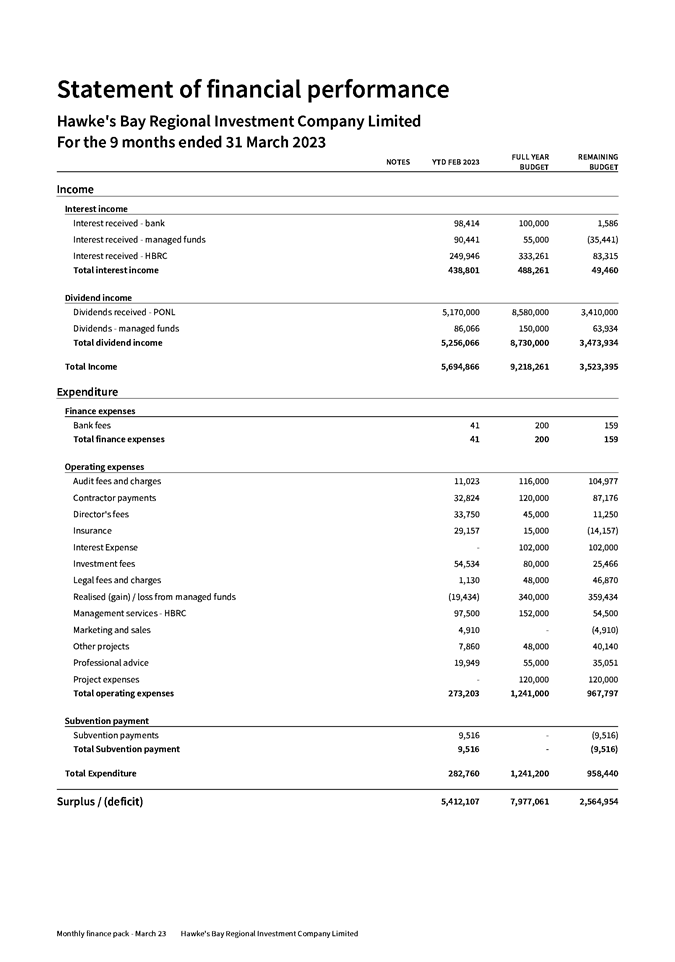

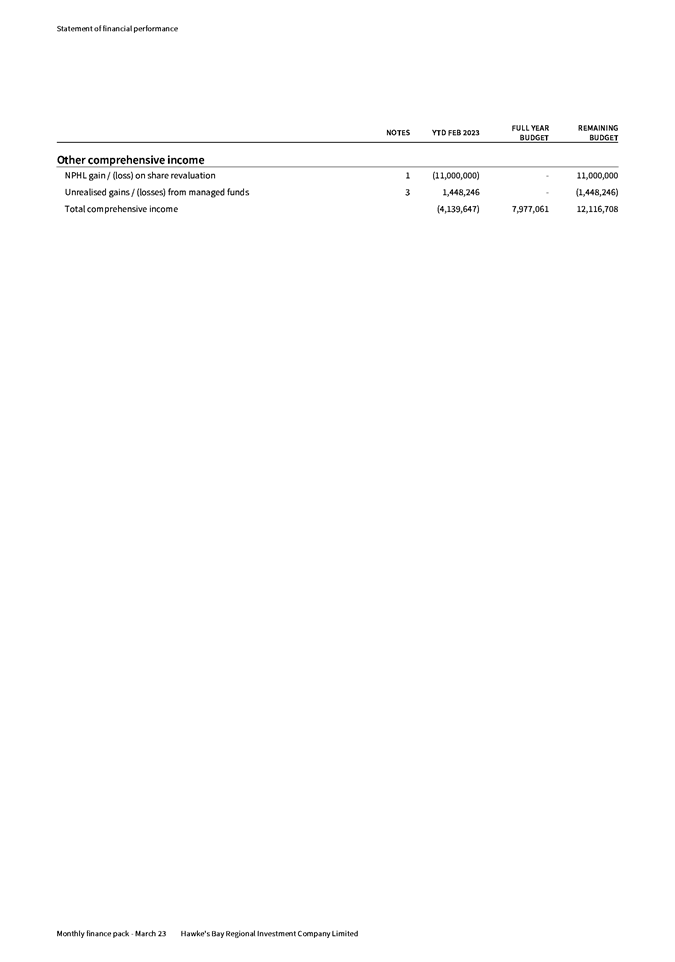

Financial Reporting

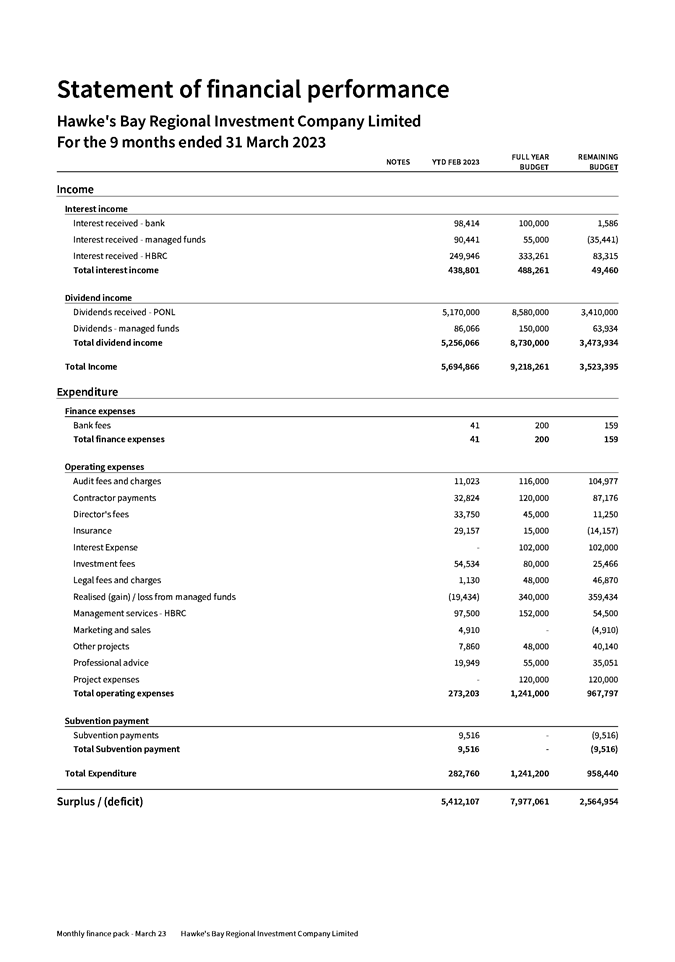

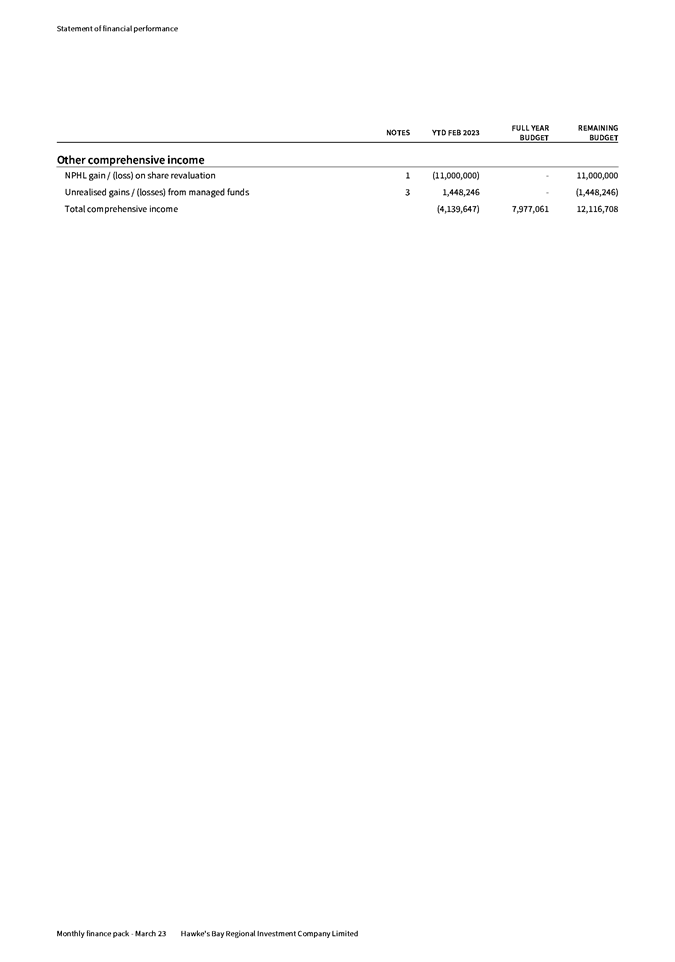

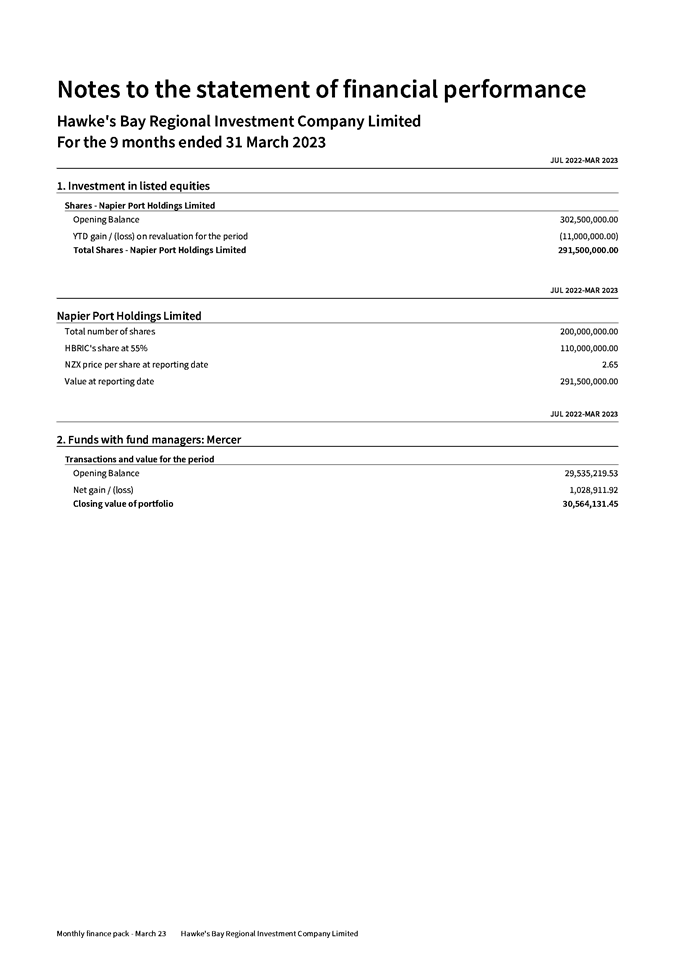

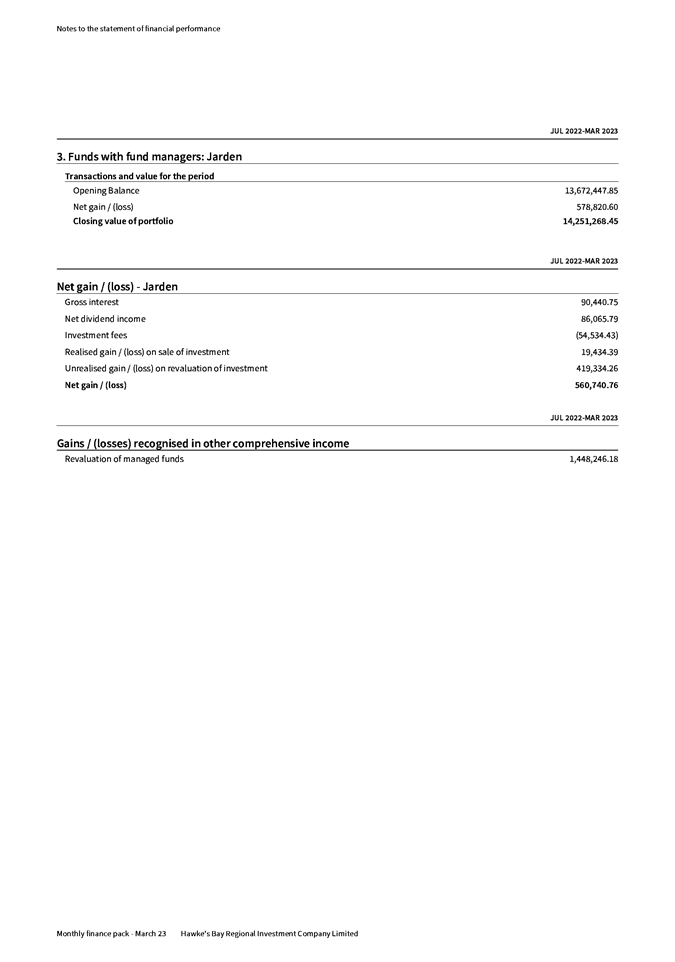

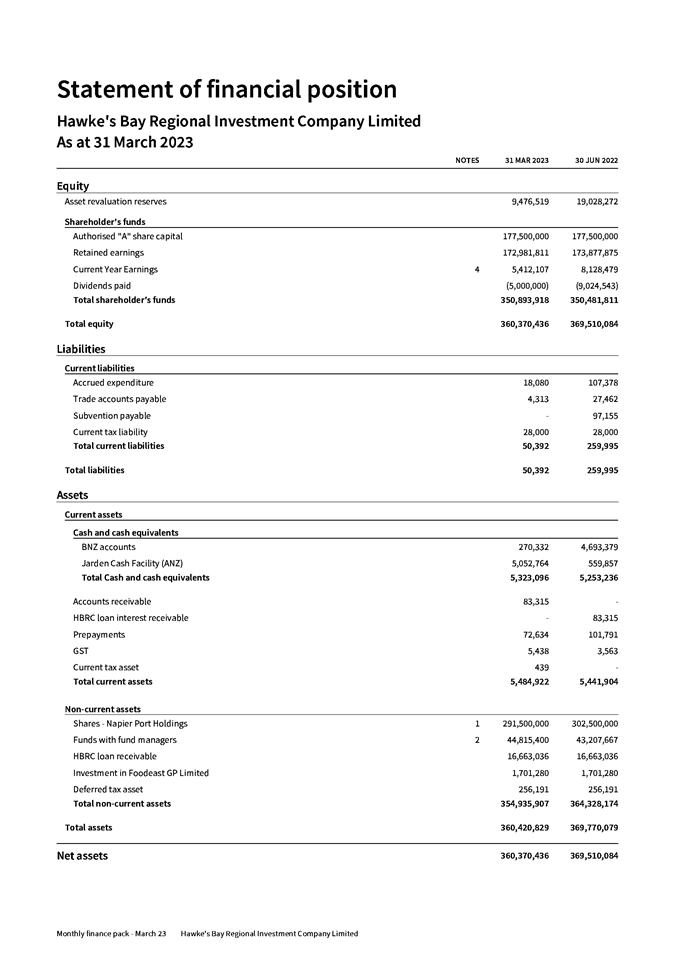

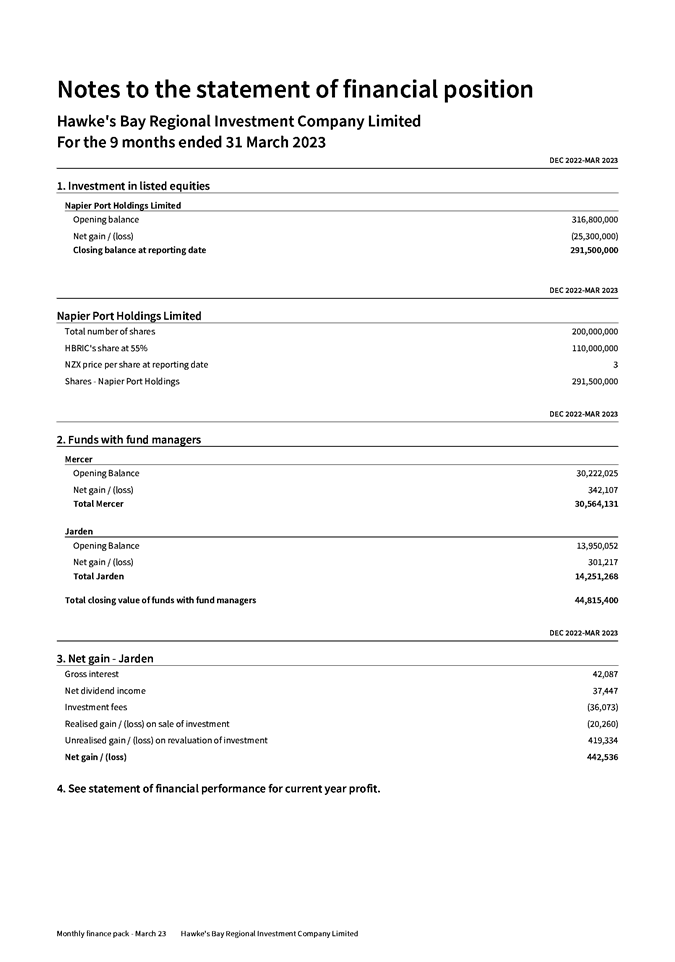

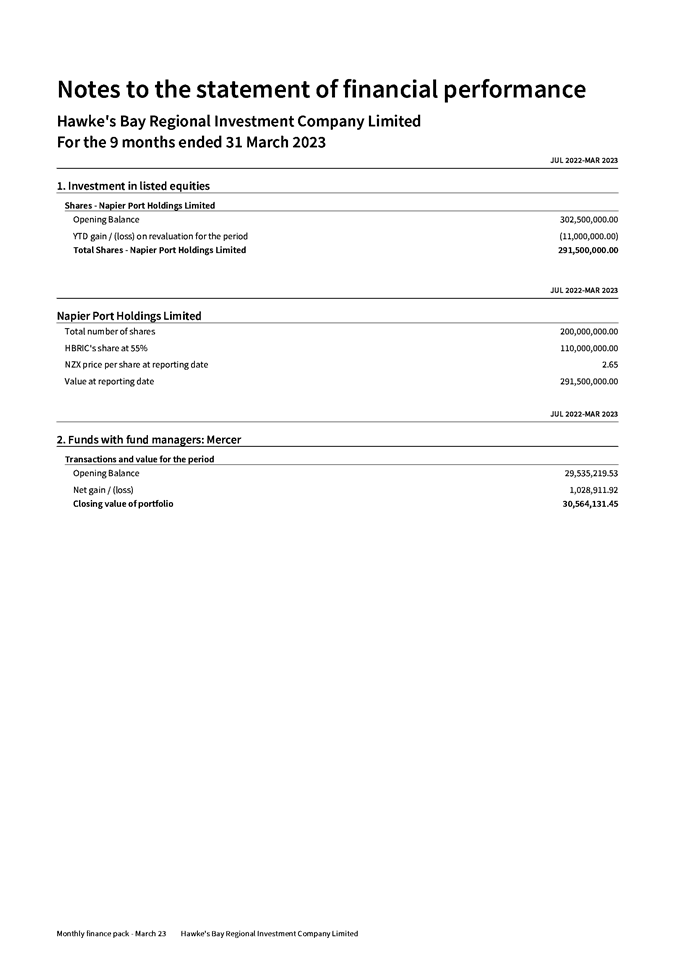

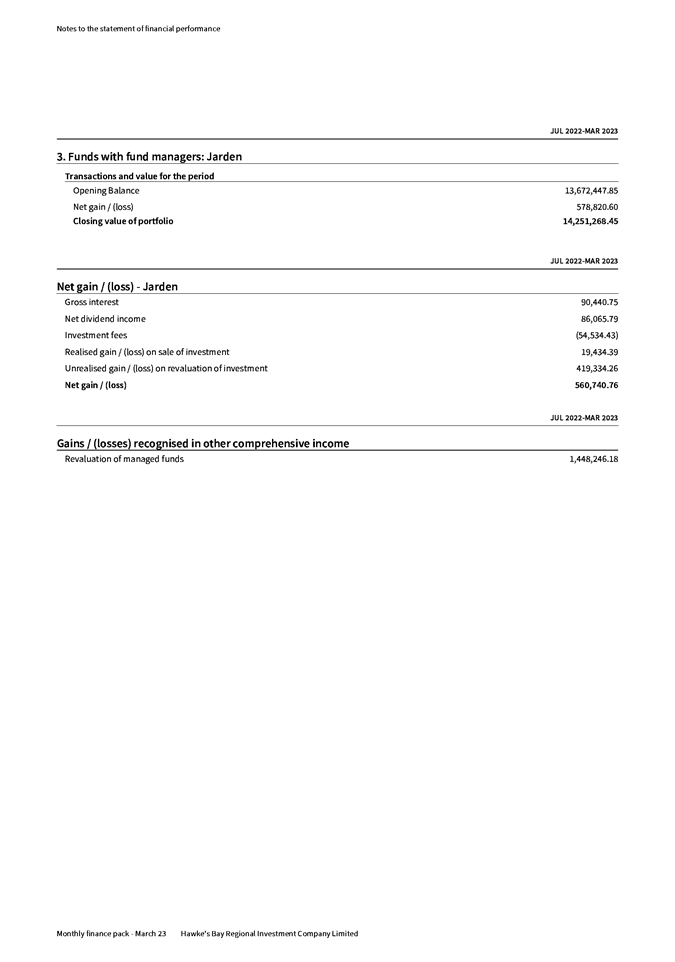

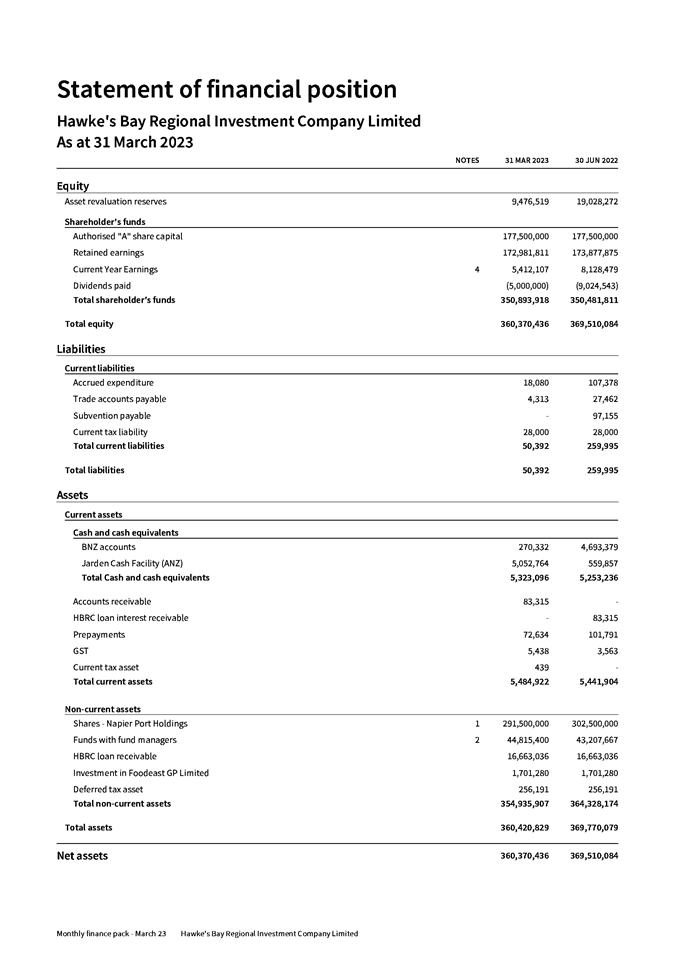

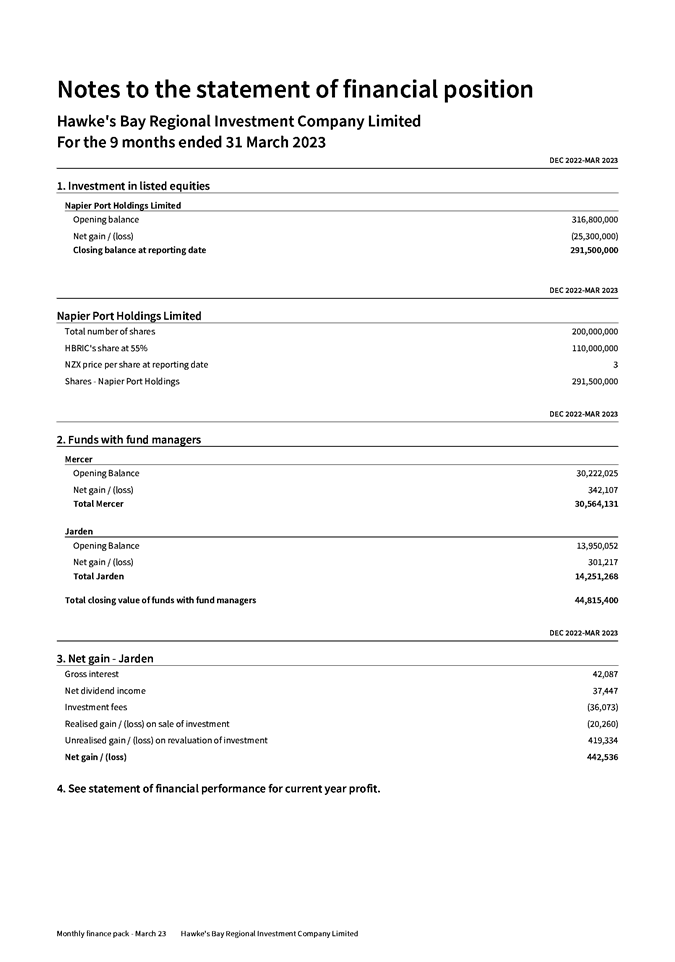

3. HBRIC’s YTD Financial

Statements as at 31 March 2023 are attached to this report.

4. Key Items to note.

4.1. Statement of Financial

Performance

4.1.1. YTD surplus of $5.4M (excluding

fair value movements through other comprehensive income)

4.1.2. $5.17M of dividend revenue

received from Napier Port Holdings Limited (NPHL) in December, next dividend

due June 2023 $1.87M

4.1.3. YTD $439K interest income

4.2. Statement of Financial

Position

4.2.1. Decrease in net assets of

$9.14M YTD to $360m as at 31 March 2023

4.2.2. NPHL share price has

decreased 3.64% YTD from $2.75 to $2.65 – total decrease is $11m

4.2.3. Increase in managed funds

value $1.6M to $44.8M

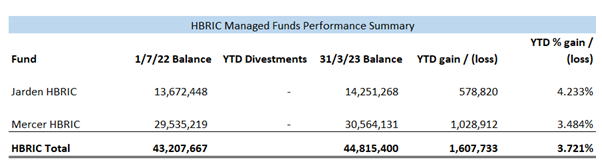

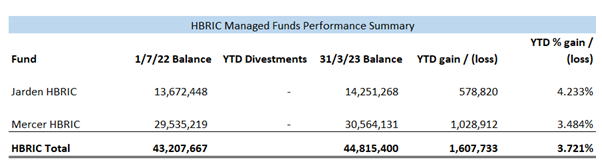

Managed Funds

5. The funds remain under

management in compliance with Council’s SIPO.

6. The value of managed funds

with HBRIC as at 31 March 2023 amounted to $44.8M a movement of approximately

$1.60M (3.721%) year to date.

FoodEast

7. The following summary is

drawn from the Foodeast

Haumako

(FoodEast) Q3 report to Limited Partners.

7.1. The primary activity during

the past quarter has been the awarding of tenders for Building A, along with

completing siteworks and initiating construction of Building B.

7.2. In early May FoodEast

received the consent for Building A from HDC and executed a signed contract

variation to include Building A with the existing contractor for building B,

with the contract cost being within the QS estimate and budget parameters.

7.3. Building A is scheduled to

start in May 2023. Completion of Building B is scheduled for completion

November 2023, and the completion of building A is now scheduled for March

2024.

7.4. Dr Nicky Solomon continues

to work with FoodEast in an adjunct advisory role, advising FoodEast from both

her perspective as leader of the Hawke’s Bay Regional Food Programme and

her role within the New Zealand Food Innovation Network.

7.5. FoodEast has had strong

interest from three potential tenants, and there are possible additional

revenue streams associated with more bespoke fitout of some spaces. The

Directors are investigating a vehicle for funding the fitout to meet specific

tenant requirements.

7.6. With the awarding of

consent for building A, the project moves into a new phase with a greater focus

on building the FoodEast business model and commercialising the business.

8. HBRIC is conducting a

recruitment process to appoint up to three additional directors to the FoodEast

Board. The governance skill set must be aligned with the business needs to

ensure that directors are developing the appropriate resource model to lead the

commercialisation and the development of the business in addition to oversee

the construction activity as we progress through the 2023 calendar year.

Napier Port

9. On 24 May Napier Port

released positive trade volumes for the six months to 31 March 2023, on the

back of higher container volumes (14.5% increase) and the return of cruise

vessels (62 calls compared to 1 in the previous year). Overall revenue

increased 22.8%

10. While the trade impact of

Cyclone Gabriel on full year trade volumes remains uncertain as the region

recovers, it is anticipated the port’s long-term strategies and

additional berth availability will deliver growth

11. Napier Port representatives

are attending the Corporate and Strategic Committee meeting to present the half

yearly results.

Other

12. HBRIC continues to support

HBRC’s Investment Strategy review. While this process was initiated

several months prior to February’s flooding events, Cyclone Gabrielle has

reinforced the strategic importance of a strongly performing, intergenerationally

focussed, arms-length, regional investment company.

13. To note:

Council’s decision on the recommendations of the committee appointed to

recruit additional independent directors for HBRIC is due before the deadline

of this paper, but these appointments will obviously align well with

opportunities for HBRIC that may arise as a result of HBRC’s investment

strategy review.

Decision-making Process

14. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendations

That

the Corporate and Strategic Committee receives and considers the HBRIC Ltd

quarterly update.

Authored by:

|

Jess Bennett

Senior Manager - Finance Recovery

|

|

Approved by:

|

Tom Skerman

HBRIC Commercial Manager

|

|

Attachment/s

|

1⇩

|

HBRIC financials March 2023

|

|

|

|

HBRIC financials March 2023

|

Attachment

1

|

Hawke’s Bay Regional

Council

Corporate

and Strategic Committee

14 June

2023

Subject:

Financial summary for the period to 31 March 2023

Reason for Report

1. This item presents the

Committee with a summary of financial results for the first three quarters of

the 2022-2023 financial year.

2. It also provides a

high-level full year forecast for the year-end financial position by activity,

including commentary about possible requests to carry forward unspent budget to

the next financial year.

Executive Summary

3. The operating position for

the council to 31 March 2023 was $16.6m adverse to budget, and the full year

forecast is tracking towards being $21.3m deficit. These adverse variances are

driven by Cyclone Gabrielle response expenditure and lower than expected

investment returns.

4. Operating expenditure for

the Groups of Activities for the 9 months to 31 March 2023 was $13.6m over

budget due to Cyclone Gabrielle response expenditure. Total forecast

operating expenditure on the Cyclone response is $40.8m, which when added to

the full year forecast for business-as-usual activities puts the forecast year

end position at $23.1m above budget.

5. The operating income from activities

was $0.8m above budget YTD and is forecast to be $4m above budget by year end,

due to grants and claim income related to Cyclone Gabrielle.

6. Capital expenditure net of

capital grants was on track YTD and forecast to be $2.7m above budget by year

end. The $21.6m Cyclone Gabrielle Response capex expenditure is mostly

offset by significant underspends in the business-as-usual budgets, however

many of the projects disrupted by the Cyclone will still need to be progressed

in the new financial year, and a carry forward of budgets will need to be

considered.

7. Investment income net of

investment expenditure was $4.7m behind budget YTD and forecast to be $3.2m

behind budget by year end, mostly due to a shortfall in HBRIC income, and lower

than expected returns on managed funds in the first half of the year.

8. Rates income is $0.8m ahead

of budget YTD and forecast at $1.0m ahead of the annual budget, mostly due to

rates penalty income significantly above what was assumed in the Annual Plan.

9. Overhead cost centres were

on track YTD and forecast to be within overall budget by year end, however this

is largely due to the underspend in ICT software-as-a-service development,

offsetting the increased treasury costs (interest charges for borrowing).

The overhead costs are included as part of the overhead allocation in the above

operating expenditure results.

10. While the operating

position for the Council is forecast to be in deficit, there are still

activities that were budgeted to occur this financial year but have not been

delivered due to disruption from the Cyclone. These commitments will

continue in the 2023-2024 financial year and will need budget. The

indicative quantum of carryforward budget that is likely to be needed is $15.6m

($6m opex and $9.6m capex), much of which is loan or reserve funded.

Finance staff will do a full analysis of budget carryforwards required once the

financial year end results are available and present this to Council for

consideration and approval in August.

Background

11. All revenue and expenditure

carried forward at the end of the 2021-2022 financial year has been recognised

in the 2022-2023 budgets. This is the difference between the LTP/Annual

plan budgets presented and the ‘Revised Budget’.

12. Groups of activities (GOA)

expenditure include each activity’s external expenditure, internal staff

time, finance costs (interest and debt repayments), depreciation/amortisation

and a share of overheads. The operating income presented for each GOA, includes

fees and charges, user charges and recoveries and grants, and excludes rates,

reserves or loan funding, which are allocated to activities at year end.

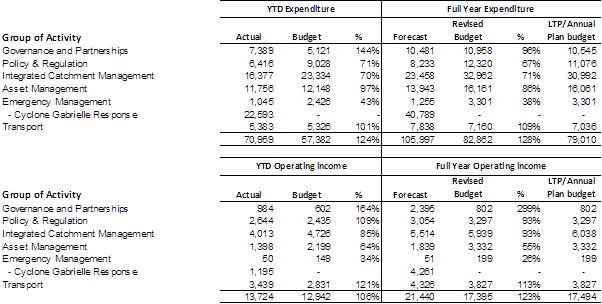

Operating

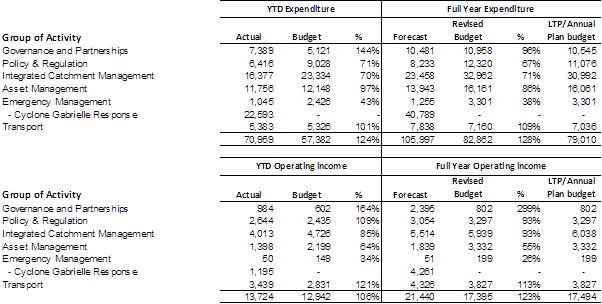

Income and Expenditure ($,000)

13. Governance and Partnerships

was overspent $2.2m YTD, and $0.3m ahead in operating income.

13.1. The YTD overspend is mostly

due to a timing variance in sustainable homes loan repayments but is forecast

to be in line with budget by year end. Full year forecast income is for

sustainable homes is $0.3m ahead of budget due to additional interest earnings

following the increase in interest rate last year from 4% to 6%.

13.2. Regional development is

forecast to be $1.1m overspent due to costs of establishing the Regional

Economic Development Authority (REDA) and new business hub in Hastings, though

this is offset by additional operating grants from other Councils.

13.3. Tangata whenua partnerships

is forecast to be underspent by $1m, due to unfilled staff vacancies and

cyclone disruptions.

14. Policy and Regulation is

underspent $2.6m YTD, and $0.2m ahead in operating income.

14.1. Compliance is behind budget

($1.1m) due to delays in recruitment, and this is further compounded by staff

time reprioritised to the Cyclone response.

14.2. Planning is behind budget ($1.6m)

mostly due to the pause of the Kotahi programme while staff resources have been

re-prioritised to the cyclone response and recovery activities, and a carry

forward of this budget may be required to support this activity next financial

year.

14.3. Consents is ahead $0.2m in

operating income YTD, which offsets additional expenditure above budget on

consent applications in progress ($0.3m).

15. Integrated Catchment

Management is underspent YTD $6.9m, and $0.7m behind budget in operating

income.

15.1. Environmental science is

$1.8m behind budget YTD, and this underspend is forecast to remain by year

end. The underspend is largely driven by unfilled staff vacancies,

reduction in depreciation budget requirement due to audit direction to not

capitalise data models, and delays across a number of contracted work

programmes.

15.2. Catchment

operations was $4.8m behind budget YTD, largely due to disruption caused by

Cyclone Gabrielle ($2m is in the Erosion Control scheme due to delays in

completion of landowner projects, meaning grants not yet paid out, $0.5m in

Land for life, $0.7m in the Environment Enhancement programme and $0.9m in

biodiversity/biosecurity activities). Full year forecast is tracking at $4.9m

underspend, and a carry forward of budget to complete committed works will

likely be required.

15.3. The operating income

variance was $0.7m behind YTD mostly related to phasing of grants for the

Whakaki environmental enhancement work programme, but this is offset by reduced

expenditure. The full year forecast is $0.4m behind budget and is mostly

driven by reduced annual freshwater science charges ($0.6m), offset by

additional grant income to support biodiversity and biosecurity projects ($1m)

(e.g. Predator Free Hawkes Bay in Mahia, and DOC jobs for nature

biodiversity fencing).

16. Asset Management was $0.4m

underspent YTD, and $0.8m behind in operating income.

16.1. Flood Protection and

Control Works was underspent YTD by $1.5m due to Cyclone Gabrielle response and

recovery work taking priority over planned maintenance activities.

16.2. Regional Water Security

projects are continuing to progress at the research/assessment phase, meaning

costs are classified as opex rather than capex as budgeted ($1.6m opex

overspend offsets $1.9m underspend in capex). The projects will continue into

the new financial year, and a carryforward of unspent budget will be requested.

16.3. The majority of the YTD

income underachievement relates to reduced Coastal Hazards contributions from

Territorial Local Authorities ($0.6m), which is offset by reduced

expenditure. Full year forecast is $1.5m behind budget, of which $0.9m is

due to significantly reduced forestry income, where harvest has been postponed

to next financial year due to a mix of wet weather conditions and an

unfavourable export log market.

17. Cyclone Gabrielle response

expenditure includes staff time reprioritised from business-as-usual

activities, as well as the external expenditure required for the CDEM welfare

response, the waste management response and set up of the Silt task force and

the disaster relief trust administration. The YTD operating income

includes the Government grant contribution to the disaster relief trust, and

the full year forecast includes anticipated claims for welfare costs from NEMA

this financial year. The forecast does not currently include business

interruption insurance proceeds or infrastructure recovery claim costs from

NEMA, as the quantity and timing of these funds is not yet certain.

18. Transport expenditure was

in line with budget YTD, largely due to the unbudgeted indexation costs on the

GoBus contract being offset by a reduced overhead allocation (where the Cyclone

response expenditure is drawing a larger proportion of the cost allocation),

and due to credits received for reduced schedules and cancelled services.

These offsets also impact the full year forecast, with the net operating

position only at $0.2m above budget.

Capital

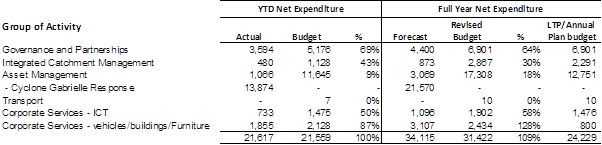

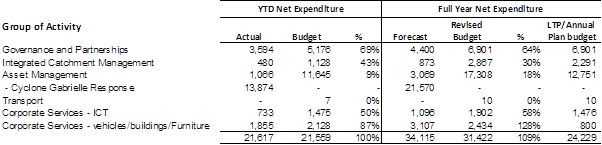

Expenditure (net of capital grants) ($,000)

19. Governance &

Partnerships was $1.6m behind budget YTD and anticipated to be $2.5m underspent

at year end, due to the ongoing decline in the number of sustainable homes

grant applications received.

20. ICM was $0.6m underspent

YTD due to delays in the Whakaki Weir construction, groundwater monitoring

drilling and environmental monitoring equipment replacements. The full

year forecast is an underspend mostly in the Land for life project ($1.5m),

where HBRC loan funding to farmers as originally envisaged has not eventuated

as yet.

21. Asset Management

expenditure was $10.6m behind budget, and this underspend is forecast to

increase to $14.2m by year end.

21.1. The majority of the YTD

underspend is in flood protection and control works ($7.6m), where weather

events delayed progress in the first half of the year, and then Cyclone

Gabrielle rabid rebuild projects have taken top priority since.

21.2. Regional Water security was

$2m behind budget YTD, as the expenditure is classified against opex for this

current phase of work.

22. The Cyclone Gabrielle

response expenditure includes the purchase of generators, stop bank and pump

station rapid rebuild projects, and the replacement of environmental monitoring

equipment lost or damaged in the flood. Assessments on how to treat these costs

at year end are currently being undertaken.

23. ICT expenditure was $0.7m

behind budget YTD and forecast to remain underspent at year end. Business

computing is forecast to be $1m underspent, due to

disruptions caused by Cyclone Gabrielle (staff re-prioritised to the response

and recovery activities), and due to the delay in scaling up resource capacity

as intended to accelerate the programme of work. The business computing

underspend is slightly offset by additional expenditure in hardware driven

largely by the increase in staff numbers.

24. Vehicles/Buildings/Furniture

expenditure was $0.3m behind budget YTD but forecast to be $0.7m overspent by

year end, in part due to a budget assumption of $0.8m gain on sale of vehicles,

which is not going to be achieved.

24.1. Expenditure on new and

replacement vehicles was $0.4m overspent YTD and forecast to be $0.6m overspent

by year end, due to additional unbudgeted vehicle requirements combined with an

increase in vehicle purchase prices (particularly for eco clean vehicles).

24.2. The accommodation

refurbishments project was underspent $0.9m YTD due to consent and engineering

delays, combined with impacts from the Cyclone. The reception

reconfiguration and ground floor upgrade will continue into the new financial

year, and a carry forward of unspent budget will be requested.

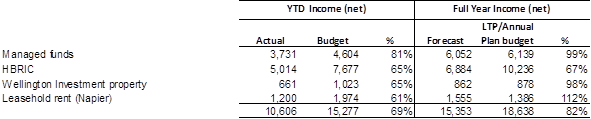

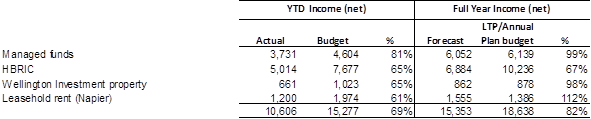

Investment

Income ($,000)

25. The income figures

presented in the table above are presented net of investment expenses and

exclude property fair value gains (not yet assessed).

26. Managed funds have seen a

$2m favourable variance within the third quarter, reflecting improved financial

markets.

27. HBRIC income reflects the

transfer of the interim dividend from Napier Port and the forecast

underachievement reflects the expectation that the final dividend will be

impacted by Cyclone Gabrielle.

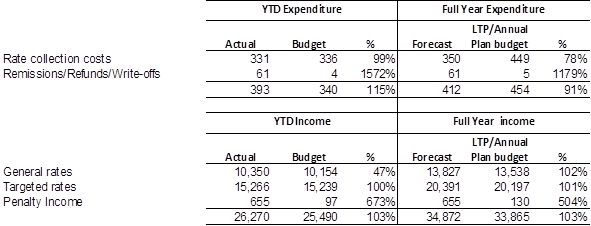

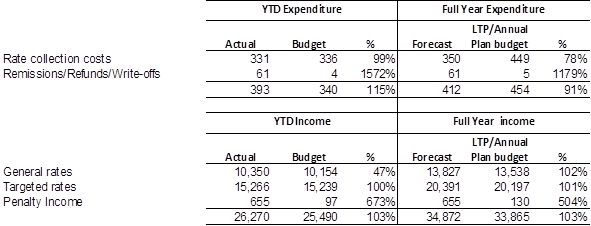

Rates collection ($,000)

28. Rate collection costs are

on track YTD but forecast to be $0.1m underspent by year end, mostly due to

reduced debt collection costs (a pause was placed on debt management activities

after the Cyclone).

29. Rates penalty income was

$0.5m above budget YTD and $0.2m above the amount in the last financial year.

The increase is due to a number of factors including returning to the standard

due dates for imposing penalties and the increase in the rates charged.

30. Rates arrears decreased

this quarter from $373k to $257k.

Overheads

($,000)

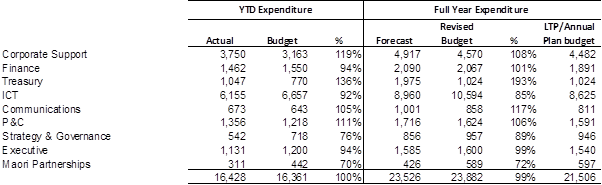

31. Overhead costs overall are

slightly ahead of budget YTD, and forecast to be finish within budget, however

within cost centres there are some larger variances.

31.1. Corporate Support was $0.6m

above budget YTD due to additional fleet running costs (from fuel price

pressure as well as increase in fleet numbers) and increase in depreciation and

finance costs for fleet and the accommodation project.

31.2. Treasury was on track YTD

but forecast to be overspent by year end due to the increased cost of borrowing

(interest rates).

31.3. ICT expenditure is forecast

to be $1.7m underspent at year end, relating to delays in the

software-as-a-service development programme due to staff being redeployed to

cyclone response and recovery activities ($0.9m), and lower storage costs than

anticipated in budget ($0.4m). The software-as-a-service development budget is

loan funded, therefore savings this financial year reduces our borrowing

requirements.

31.4. Communications is forecast

to be $0.1m above budget due to staffing changes, including bringing forward

additional resource from Y3 of the LTP to meet work demands.

31.5. People and Capability

(P&C) is forecast to be $0.1m above budget due to increase in salary

protection insurance costs, and increased recruitment expenditure and health

& safety training related to continued staff turnover.

31.6. Māori Partnerships and

Strategy & Governance are forecast to be below budget due to delays in

recruitment.

Indicative

Carry forwards

32. Excluding the additional

expenditure incurred because of the Cyclone Gabrielle response, the

‘business-as-usual’ activity budgets are forecast to be underspent

by $17.6m in opex, and $18.8m in capex. Some committed activities that are not

expected to be completed by 30 June 2023, will need to continue into the new

financial year. The table below provides a summary of the activities

which are forecast to be underspent and which are likely to require a carry

forward of budget to complete committed projects in the 2023-2024 financial

year.

|

Group

|

Activity

|

Opex/ Capex

|

Indicative funding

to be carried forward ($,000)

|

|

General Rates

|

Targeted rates/ Reserves

|

Loan funding

|

Third party revenue

|

Total

|

|

Asset Management

|

Flood protection schemes

|

Capex

|

19

|

966

|

882

|

-

|

1,868

|

|

Asset Management

|

Flood protection schemes

|

Opex

|

20

|

180

|

-

|

-

|

200

|

|

Asset Management

|

Open spaces

|

Capex

|

115

|

-

|

1,038

|

-

|

1,153

|

|

Asset Management

|

Regional Water Security

|

Opex

|

|

3,500

|

|

|

3,500

|

|

Integrated Catchment Management

|

Environmental Science (drilling)

|

Capex

|

-

|

-

|

277

|

-

|

277

|

|

Integrated Catchment Management

|

Environmental Science (models)

|

Opex

|

-

|

-

|

467

|

-

|

467

|

|

Integrated Catchment Management

|

Monitoring equipment

|

Capex

|

-

|

170

|

-

|

-

|

170

|

|

Integrated Catchment Management

|

Biodiversity/EnviroEnhancement

|

Opex

|

210

|

|

100

|

875

|

1,185

|

|

Integrated Catchment Management

|

Erosion Control Scheme

|

Opex

|

-

|

-

|

1,500

|

-

|

1,500

|

|

Integrated Catchment Management

|

Land for life

|

Capex

|

-

|

-

|

1,546

|

-

|

1,546

|

|

Integrated Catchment Management

|

Land for life

|

Opex

|

-

|

265

|

-

|

-

|

265

|

|

Policy & Regulation

|

Enforcement proceeds

|

Opex

|

-

|

-

|

-

|

493

|

493

|

|

Policy & Regulation

|

Kotahi

|

Opex

|

1,400

|

|

|

|

1,400

|

|

Corporate

|

Buildings/ furniture/ Radio Network

|

Capex

|

-

|

200

|

720

|

-

|

920

|

|

Corporate

|

ICT - infrastructure

|

Capex

|

-

|

65

|

140

|

-

|

205

|

|

Corporate

|

ICT – Software-as-a service

|

Opex

|

-

|

-

|

500

|

-

|

500

|

|

Total $,000

|

Capex

|

134

|

4,901

|

4,603

|

-

|

9,638

|

|

Total $,000

|

Opex

|

1,630

|

445

|

2,567

|

1,253

|

6,009

|

33. Final carry forward

requests will be presented to Council for approval in August, once the interim

financial year end results are available. Only funds that are required to

be spent during the 2023-2024 financial year will be put forward for carry forward

from 2022-2023, and any remaining unspent budget amount still required will be

addressed as part of the Long Term Plan 2024 process.

Decision-making Process

34. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

the Corporate

and Strategic Committee receives and notes the Financial summary for the

period to 31 March 2023.

Authored by:

|

Amy Allan

Senior Business Partner

|

Chris Comber

Chief Financial Officer

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

There are no attachments for this

report.

Hawke’s

Bay Regional Council

Corporate

and Strategic Committee

14 June

2023

Subject: Organisational Performance

report for the period 1 January – 31 March 2023

Reason for Report

1. This item presents the

Organisational Performance report for quarter three which is the period 1

January – 31 March 2023.

Content of the Report

2. The report contains four

parts:

2.1. Executive Summary with content dedicated to

Cyclone Gabrielle and the region’s response (pp 4-5).

2.2. Corporate Metrics that focus on how well we

are performing across a number of corporate-wide measures such as employee

turnover and corporate carbon footprint (pp 6-12)

2.3. Level of Service Measures (LOSM) by group of

activities with adopted targets, traffic light status and commentary (pp 13-22)

2.4. Activity

Reporting by group of activities with non-financial and financial traffic light status and commentary

(pp 23-36).

3. Organisational Performance

reports were established 2018. The status and commentary reporting are rolled

up from cost centre to activity level. Commentary by cost centre is still

available to committee members via the PowerBI dashboard (see points 10-14

below).

4. Staff complete their

reporting in a software tool called Opal3. For LOSM and activity reporting,

staff select the status (red, amber, green) of non-financial results and

provide commentary on what they did in the quarter against their annual work

plans. Traffic light status of financial commentary is selected on

predetermined parameters with commentary provided by staff.

5. The financial ‘lines’

are broken down (where applicable) to:

5.1. Operating expenditure

(OPEX) which includes external costs, internal time and personnel costs

5.2. Capital expenditure (CAPEX)

which includes external costs and internal time

5.3. Other revenue which

includes fees & charges, grants and proceeds from other income – both

OPEX and CAPEX.

Points

of Interest

6. Corporate metrics (pp 6-12)

6.1. Our LGOIMA requests have

reason sharply this quarter and there have been delays in providing required information.

This quarter, eight were not provided with the information requested within the

required 20 working days timeframe.

6.2. There was a very high fuel

spend ($521k) this quarter as a result of using private suppliers to keep

depots and 24/7 generators going. Their price is inclusive of delivery costs.

There was also an increase in kilometres travelled and use of plant (heavy

machinery) during the response. The cost of diesel also went up.

6.3. The quarterly employee

turnover has risen from 3% to 6.7% this quarter with 24 resignations. The

12-month rolling turnover dipped slightly to 21.5%.

6.4. There is additional

information on staff wellness and our Health, Safety and Wellbeing team’s

support around the cyclone response.

7. Levels of

service measures (pp 13-22)

7.1. There are 14

not on track and at risk of not reaching the end of year target, compared with

11 last quarter. Most of these are ICM and Asset Management activities.

7.2. There are 4 not

likely to reaching the end of year target, compared with 1 last quarter.

8. Activity reporting (pp

22-36)

8.1. Staff have reported ten

activities as ‘off track’ (amber) from their usual workplans. This

has been as a result of deploying staff and resources to support the response

and recovery.

8.2. Much of the financial

reporting remains greater than 10% ‘off track’ (red) however, most

of these are underspends in the budget due to wet weather (pre-cyclone) and/or

the cyclone itself delaying work programmes and spending.

9. The Reporting Dashboard

(PowerBI) has additional commentary not included in this report, which is

edited for readability.

Reporting Dashboard (PowerBI)

10. The dashboard is produced

using PowerBI to give a visual representation of the results over time. The

Organisational Performance Report document is produced from the dashboard.

11. The dashboard also provides

committee members with the ability to delve deeper into activities of interest

(via cost centres). There is often more commentary in the dashboard than on the

published report.

12. To access the dashboard,

please open your PowerBI app on your iPad. The dashboard will be on your

homepage. Staff from the Strategy and Performance team are available to go over

the dashboard with councillors who would like to review its content.

13. Strategic projects

commentary and status by schedule, risk, and budget are updated on a monthly

basis on the dashboard. They are also included in the Strategic Projects Report

that is presented to Council monthly. Note that the last month of updates was

April 2023.

14. We are continuously

improving the dashboard and improving the data reliability across all areas and

would appreciate any feedback you have.

Decision Making Process

15. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

Hawke’s Bay Regional Council receives and notes the Organisational Performance