Meeting of the Risk

& Audit Sub-committee

Date: 10 May 2023

Time: 9.00am

|

Venue:

|

Council

Chamber

Hawke's

Bay Regional Council

159

Dalton Street

NAPIER

|

Agenda

Item Title Page

1. Welcome/Karakia/Notices/Apologies

2. Conflict

of Interest Declarations

Decision

Items

3. Confirmation

of the Risk & Audit Sub-committee Terms of Reference 3

4. 2022-2023

Enterprise Internal Audit Plan update and proposed 2023-2024 plan 7

5. Treasury

Compliance Report for the period 1 January - 31 March 2023 13

6. Organisational

Change Consolidation and Prioritisation Internal Audit findings 17

Information

or Performance Monitoring

7. Audit

Plan for the 2022-2023 Annual Report 33

Decision

Items (Public Excluded)

8. Enterprise

Risk Report 35

9. Internal

Assurance corrective actions update 37

10. Privacy

event 39

Hawke’s Bay Regional

Council

Risk

& Audit Sub-committee

10 May

2023

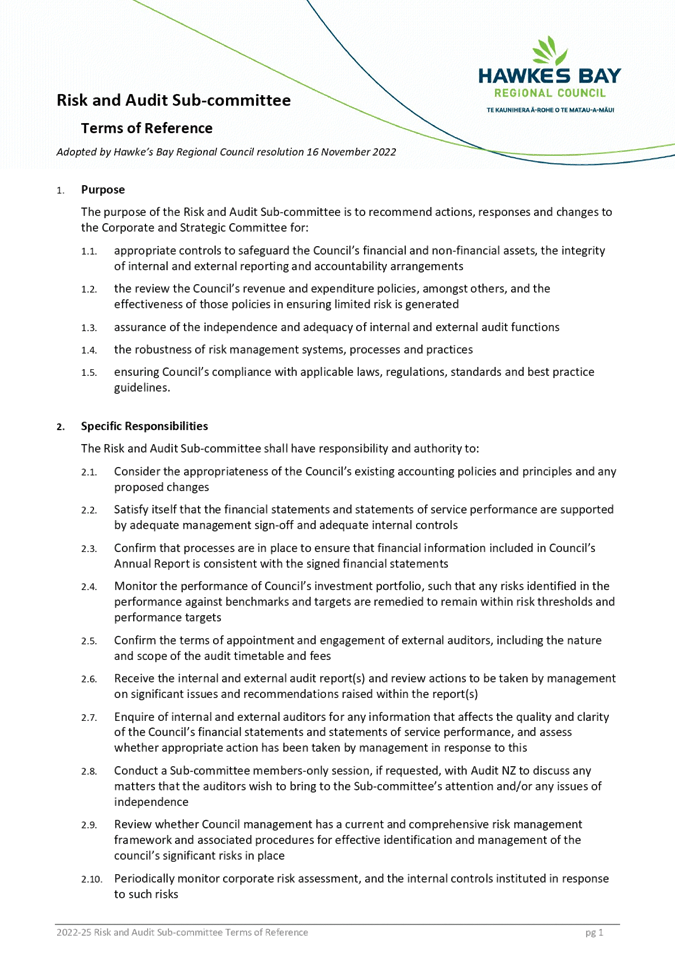

Subject: Confirmation of the Risk

& Audit Sub-committee Terms of Reference

Reason for Report

1. This item provides the

means for the Risk and Audit Sub-committee (RAS) to confirm its Terms of

Reference.

Officers’

Recommendations

2. Council officers recommend

that the RAS confirms the Terms of Reference as proposed and adopted by the

Regional Council on 16 November 2022, for the remainder of this term of

Council.

Background

/Discussion

3. For the 2019-22 term of

Council, the Finance, Audit and Risk Sub-committee was established as a

sub-committee of Corporate and Strategic Committee (C&S), with meetings

held quarterly to enable recommendations through to the C&S and then on to

the Regional Council.

4. This term it was proposed

that the Audit and Risk Committee (ARC) be established to report directly to

Council and with a reduced meeting cycle of six monthly to reflect the auditing

and risk management reporting cycles. By making this a sub-committee of Council

instead of C&S, it was intended to streamline decision-making and address

the issues items being considered three times, with the final decision being

twice removed from the meeting at which the detailed information was presented

and considered.

5. The proposed Terms of

Reference presented today were amended, from the 2019 version, to clarify the

different functions of the RAS and C&S. The C&S will review

ongoing financial performance and financial decisions and the role of RAS to

manage financial risk, i.e. investment/treasury related risk measures within

the Treasury and Investment policies. As well, the RAS will continue to oversee

the scope and outcomes of the external audit review of the Annual Report and

its findings.

Options

Assessment

6. The sub-committee has the

options to either confirm the Terms of Reference as adopted by the Regional

Council on 16 November 2022 or to agree amendments for recommending an updated

Terms of Reference to the Council for adoption.

Decision Making Process

7. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

7.1. Councils are required to (LGA

sch.7 cl.19(1)) hold the meetings that are necessary for the good governance of

their district or region.

7.2. Councils may appoint (LGA sch.7 cl. 30(1)(a)) the committees,

subcommittees, and other subordinate decision-making bodies that they consider appropriate,

including joint committees.

7.3. Given the provisions above,

the Risk and Audit Sub-committee can exercise its discretion and make these

decisions without consulting with the community.

Recommendations

That the Risk and Audit Sub-committee:

1. Receives and considers the Confirmation

of the Risk & Audit Sub-committee Terms of Reference staff report.

2. Agrees that the decisions

to be made are not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy, and that the Sub-committee can

exercise its discretion and make the relevant decisions without conferring with

the community.

3. Recommends that Hawke’s Bay Regional

Council adopts the Terms of Reference for the Risk and Audit Sub-committee as

amended as agreed today, 10 May 2023.

Or

4. Reports to the Hawke’s Bay Regional

Council that the Terms of Reference for the Risk and Audit Sub-committee was

confirmed today, 10 May 2023, as adopted on 16 November 2022.

Authored by:

|

Leeanne Hooper

Team Leader Governance

|

|

Approved by:

|

Desiree Cull

Strategy & Governance Manager

|

Susie Young

Group Manager Corporate Services

|

Attachment/s

|

1⇩

|

2022-25 Risk and Audit Sub-committee

Terms of Reference adopted 16 November 2022

|

|

|

|

2022-25 Risk and Audit Sub-committee

Terms of Reference adopted 16 November 2022

|

Attachment

1

|

Hawke’s Bay Regional

Council

Risk

& Audit Sub-committee

10 May

2023

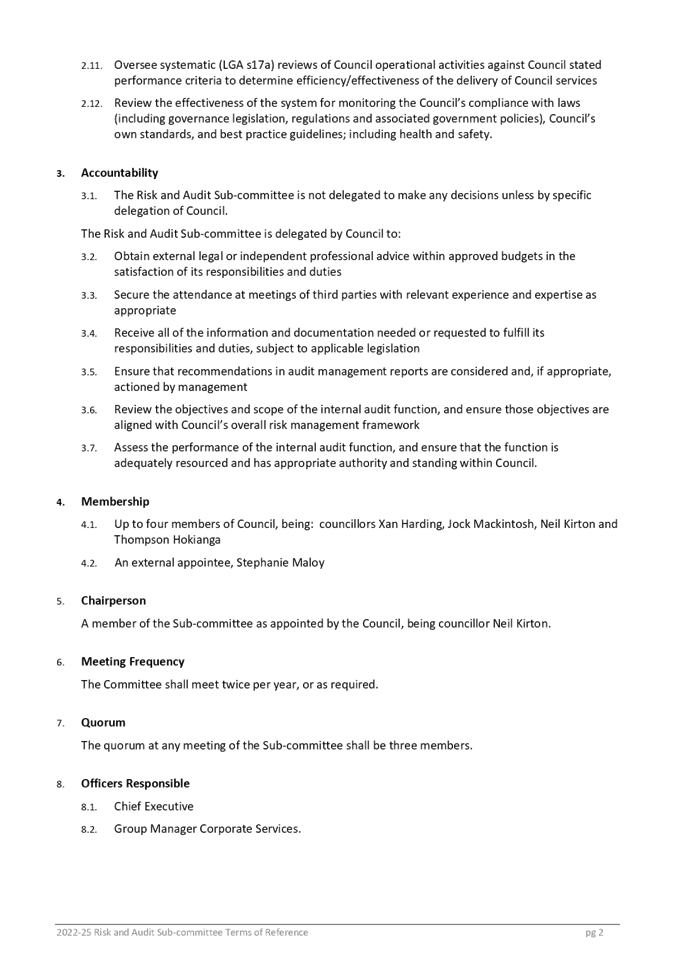

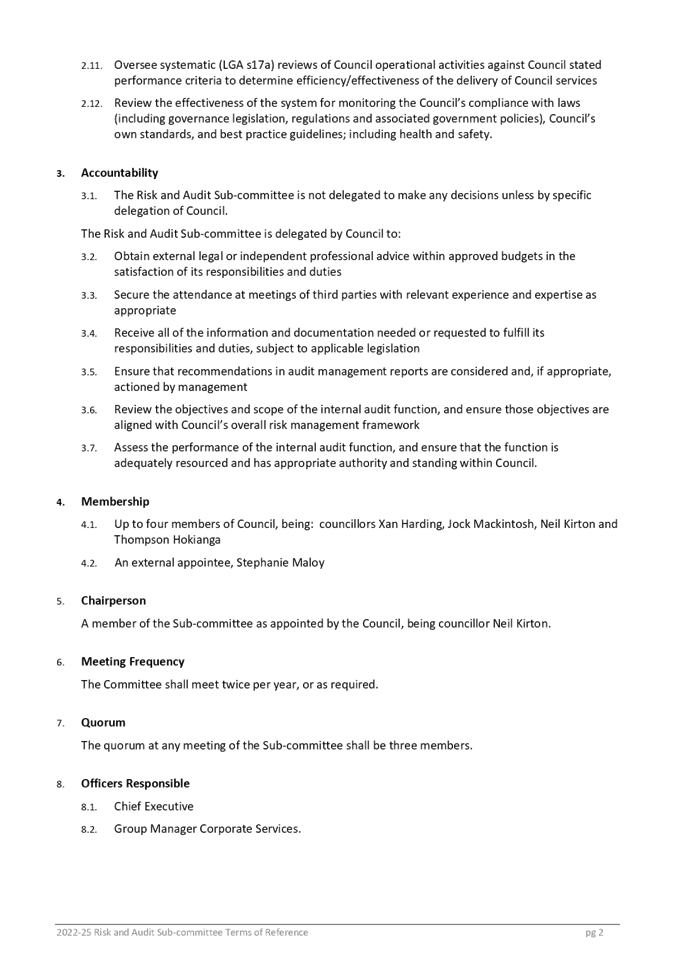

Subject: 2022-2023 Enterprise Internal

Audit Plan update and proposed 2023-2024 plan

Reason for Report

1. This item provides the Risk

and Audit Sub-committee (RAS) with an update on the 2022-2023 Enterprise

Internal Audit Plan and a proposed 2023-2024 Internal Audit Plan.

Background

2. The Internal Audit

Framework requires that an Annual Enterprise Internal Audit Plan be adopted by

RAS each year for the following financial year.

3. The adopted plan for the

2022-2023 financial year includes:

3.1. Organisational Change

Consolidation and Prioritisation internal audit

3.2. Data Analytics internal

audit.

4. The Organisational Change

Consolidation and Prioritisation internal audit has been completed by the

Council’s Internal Auditor Crowe and the audit report is the subject of

an item on today’s RAS agenda.

5. The Data Analytics internal

audit will commence in July 2023 to enable a full twelve-month analysis.

These findings will be presented to the October 2023 RAS.

6. In light of Cyclone

Gabrielle, the Executive Leadership Team (ELT) is recommending (ELT meeting of

21 April 2023) that RAS approves the adoption of the Data Analytics Internal

Audit for the 2023-2024 Internal Audit Programme along with the additional reviews

outlined below:

6.1. Independent review of HBRC

Flood Protection and Drainage Schemes performance during Cyclone Gabrielle

6.2. Heretaunga Plains Flood

Control Scheme

6.3. Cyclone Gabrielle Flood

Report

6.4. HBRC Internal Review

– Timeline of Events

6.5. Telemetry Resilience Review

6.6. Hydrometric Review.

7. Council’s Assurance

Universe is attached. The Assurance Universe links enterprise reviews

or audits undertaken over the past four years to an enterprise risk.

Reviews and audits in the Assurance Universe include external audits,

enterprise internal audits, business reviews with an enterprise focus, and

section 17a reviews.

Financial

and Resource Implications

8. The internal audits will be

undertaken, as per the approved plan, within the 2023-2024 budgets allocated.

Decision Making Process

9. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

9.1. This agenda item is in

accordance with the Sub-committee’s Terms of Reference, specifically:

9.1.1. The purpose of the Risk and

Audit Sub-committee is to report to the Corporate and Strategic Committee to

fulfil its responsibilities for:

(1.3) the independence and adequacy of internal and external audit functions

9.1.2. The Risk and Audit

Sub-committee shall have responsibility and authority to:

(2.5) Confirm the terms of appointment and engagement of external auditors, including

the nature and scope of the audit timetable and fees; (2.6) Receive the

internal and external audit report(s) and review actions to be taken by

management on significant issues and recommendations raised within the

report(s); and (2.11) Oversee systematic (LGA s17a) reviews of Council

operational activities against Council stated performance criteria to determine

efficiency/effectiveness of the delivery of Council services

9.1.3. The Risk and Audit

Sub-committee is delegated by Council to:

(3.6) Review the objectives and scope of the internal audit function, and

ensure those objectives are aligned with Council’s overall risk

management framework; and (3.7) assess the performance of the internal audit

function and ensure that the function is adequately resourced and has

appropriate authority and standing within Council.

Recommendations

That the Risk and Audit Sub-committee:

1. Receives and considers the 2022-2023 Enterprise

Internal Audit Plan update and proposed 2023-2024 plan staff report.

2. Confirms the internal audit

plan for the 2022-2023 financial year includes:

2.1. data analytics (as resolved 4 May 2022)

2.2. Organisational Change

Consolidation and Prioritisation (as resolved 4 May 2022).

3. Confirms the proposed

internal audit plan for the 2023-2024 financial year includes:

3.1. Data Analytics Internal

Audit

3.2. Independent review of HBRC

Flood Protection and Drainage Schemes’ performance during Cyclone

Gabrielle

3.3. Heretaunga Plains Flood

Control Scheme

3.4. Cyclone Gabrielle Flood

Report

3.5. HBRC Internal Review

– Timeline of Events

3.6. Telemetry Resilience Review

3.7. Hydrometric Review.

Authored by:

|

Olivia Giraud-Burrell

Quality & Assurance Advisor

|

Helen Marsden

Risk & Corporate Compliance

Manager

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s 1 Assurance Universe as at 1

May 2023

|

Assurance

Universe as at 1 May 2023

|

Attachment

1

|

Hawke’s

Bay Regional Council

Risk

& Audit Sub-committee

10 May

2023

Subject: Treasury Compliance Report

for the period 1 January - 31 March 2023

Reason for Report

1. This item provides

compliance monitoring of Hawke’s Bay Regional Council (HBRC) Treasury

activity and reports the performance of Council’s investment portfolio

for the quarter ended 31 March 2023.

Overview of the Quarter – ending 31 March 2023

2. At the end of the quarter

to 31 March 2023, HBRC was compliant with all measures in its Treasury

policy except for the interest rate risk control limits.

3. As at 31 March 2023 the

interest rate risk position was outside policy compliance. We had previously

been reporting compliance against the 80% scenario of the current adopted LTP

debt forecast for interest rate management purposes. This is due to debt levels

being below LTP forecast.

4. Given the sharp increase in

debt requirements post-Cyclone Gabrielle, we are now looking to confirm a new

debt forecast so that we can update our debt funding strategy and therefore

redesign our interest rate strategy accordingly.

5. Cash balances remain

adequate and borrowing requirements to date have remained relatively low.

Background

6. Council’s Treasury

Policy requires a Treasury Compliance report to be presented quarterly to the

Risk and Audit Sub-committee. The policy states that the Treasury Compliance

report is to include:

6.1. Treasury exceptions report

6.2. Policy compliance

6.3. Borrowing limit report

6.4. Funding and liquidity

report

6.5. Debt maturity profile

Interest rate report

6.6. Investment management

report

6.7. Treasury investments

6.8. Cost of funds report cash

flow and debt forecast report

6.9. Debt and interest rate

strategy and commentary

6.10. Counterparty credit report

6.11. Loan advances.

7. The Investment Management

report has specific requirements outlined in the Treasury Policy. This requires

quarterly reporting on all treasury investments plus annual reporting on all

equities and property investments.

8. In addition to the Treasury

Policy, Council has a Statement of Investment Policy and Objectives (SIPO)

document setting out the parameters required for funds under management for the

HBRC Long Term Investment Fund.

9. Since 2018, HBRC has

procured treasury advice and services from PriceWaterhouseCoopers (PwC) and

their quarterly Treasury Report is attached.

Treasury

exceptions report & policy compliance

10. As at 31 March 2023 the

interest rate policy parameters did not meet the Treasury policy requirements.

Specifically this is due to a higher debt forecast from increased capital

expenditure on repairs from cyclone Gabriel. When a new debt forecast is

confirmed (incorporating expected debt levels post cyclone) with the debt

funding strategy, an interest rate strategy will be designed.

11. Our action to rectify this

is to confirm a new debt forecast and transact new interest rate swaps to bring

this back in line with the policy.

12. All other metrics remain

compliant.

Funding

& Liquidity

13. To ensure HBRC has the

ability to adequately fund its operations, current policy requires HBRC to

maintain a liquid balance of “greater than 10% of existing total

external debt”. Current liquidity ratio is 31.83% and therefore meets

policy.

14. The following table reports

the cash and cash equivalents on 31 March 2023.

|

31 March 2023

|

$000

|

|

Cash

on Call

|

8,790

|

|

Short-term

bank deposits

|

0

|

|

Total

Cash & and Deposits

|

8,790

|

15. To manage HBRC liquidity

risk, HBRC retains a Standby Facility with BNZ. This

facility provides HBRC with a same day draw-down option, to any amount between

$0.3m-$10.0m, and with a seven day minimum draw period.

Debt

Management & Interest Rate Report

16. On 31 March 2023 the

external debt for the Council was $60.025m (includes $1m of pre-funded debt)

and $75.688m including the loan from HBRIC.

17. Since the December 2022

quarter, $10m of short term borrowings were made to assist with the increased

cash requirements following Cyclone Gabrielle.

18. The following summarises

the year-to-date movements in Council’s debt position.

Summary

of HBRC Debt

|

|

HBRC only

|

HBRC Group

|

|

Opening Debt – 1 July 2022 – excl HBRIC

Loan

|

46,725

|

46,725

|

|

New Loans raised

|

18,450

|

18,450

|

|

Less amounts repaid

|

(5.150)

|

(5.150)

|

|

Less pre-funded debt

|

(1,000)

|

(1,000)

|

|

Closing Debt 31 March 2023 (excluding

HBRIC loan)

|

59,025

|

59,025

|

|

Plus opening balance - loan from HBRIC

|

16,663

|

-

|

|

Total Borrowing as at 31 March 2023

|

75,688

|

59,025

|

19. Council debt maturity

profile remains compliant, however, any further short term drawdowns will push

the policy limit in the 0-3 year bucket. We intend to look at borrowing a

tranche over a 4 year term to alleviate this position while we confirm the

updated debt forecast.

20. Please note the total in

the infographic above includes our $10m BNZ overdraft in total debt.

21. We currently are

forecasting that a further $30m is likely to be required in borrowings through

to 30 June 2023.

22. Council interest rate risk

position has previously been reported on against the 80% scenario of the debt

forecast of the current adopted LTP. Given the increased debt requirements post

cyclone Gabrielle this is now assessed against the full LTP forecast until a

new debt forecast is confirmed.

23. Due to the movement in how

we were assessing the interest rate risk, this has temporarily pushed the lower

term buckets out of policy parameters.

24. Our action to rectify this

is to confirm our new debt forecast and the transact new interest rate swaps

which are currently at favourable levels below 4%.

Managed

Funds

25. The LTP budgets an annual

return of 5.16% from managed funds. Of this, 3.16% is used to fund activities

with 2.0% retained to grow the capital base to enable the future earnings to

protect the capital base for future generations (page 33 of LTP – Part

3 – Financial Strategy).

26. Council budgets separately

for revenue from directly-held managed funds and those held by HBRIC. HBRIC is

required to deliver an overall portfolio return by way of an agreed annual

dividend agreed through an annual Statement of Intent. The composition (between

revenues from managed funds and other sources such as port dividends is up to

the HBRIC board). Council has budgeted to receive $10.5m in dividends from

HBRIC within the FY 2022-2023.

27. The Fund performances have

improved this quarter with the three portfolios combined gaining $5.53m after

fees.

28. The following table summarises the fund balances at the

end of this quarter compared with FY22.

|

|

31 March 2022

|

31 March 2023

|

|

Fund Balances HBRC

|

$000

|

$000

|

|

Fund Balance HBRC

|

104,449

|

108,451

|

|

Capital Protected Amount HBRC (2% compounded)

|

114,239

|

115,961

|

|

Current HBRC value below protected amount

|

(9,790)

|

(7,510)

|

|

|

|

Funds Balances (Group + HBRIC)

|

|

Long-Term Investment Fund (HBRC)

|

45,679

|

47,409

|

|

Future Investment Fund (HBRC)

|

58,770

|

61,041

|

|

Total HBRC

|

104,449

|

108,451

|

|

Plus HBRIC

|

43,226

|

44,815

|

|

Total Group Managed Funds

|

147,675

|

153,266

|

|

Capital Protected Amount (2% compound inflation)

|

162,720

|

165,173

|

|

Current group value below protected amount

|

(15,045)

|

(11,907)

|

Cost

of funds

29. The last 12 months to 31

March 2023, Gross Cost of Funds (COF) was 3% and Net COF was 2.79%.

HBRIC

Ltd

30. In accordance with Council

Policy, HBRIC Ltd provides separate quarterly updates to the Corporate and Strategic

Committee.

Decision Making Process

31. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

the Risk and Audit Sub-committee receives and notes the Treasury Compliance Report for

the period 1 January – 31 March 2023.

Authored by:

|

Jess Bennett

Senior Manager - Finance Recovery

|

Chris Comber

Chief Financial Officer

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1

|

PWC Treasury Compliance Report 31

March 2023

|

|

Confidential

Under Separate Cover

|

Hawke’s

Bay Regional Council

Risk

& Audit Sub-committee

10 May

2023

Subject: Organisational Change

Consolidation and Prioritisation Internal Audit findings

Reason for Report

1. This item provides the Risk

and Audit Sub-committee (RAS) with the draft internal audit report on the

Organisational Change Consolidation and Prioritisation audit undertaken by

Crowe.

Officers’

Recommendations

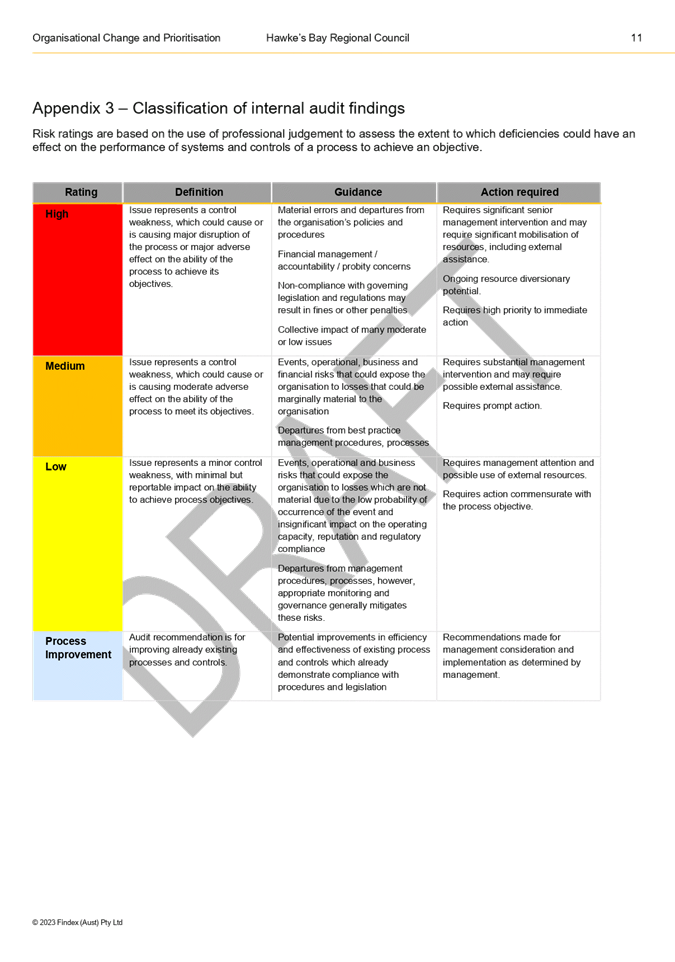

2. Council officers recommend

that the sub-committee considers the planned actions to address the

recommendations of the draft Audit report and agrees the medium findings that

will be monitored and tracked as corrective actions via the Corrective Actions

Dashboard.

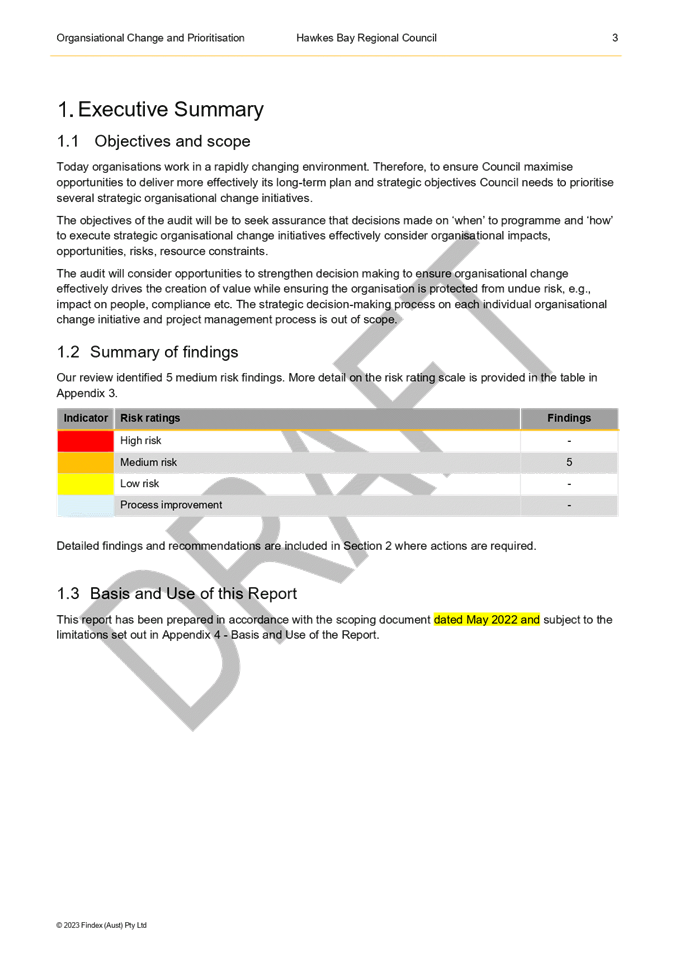

Executive Summary

3. The previous Finance, Audit

and Risk Sub-committee (now RAS) agreed the Enterprise Internal Audit Plan for

2022-2023 on 10 August 2022, which included this audit.

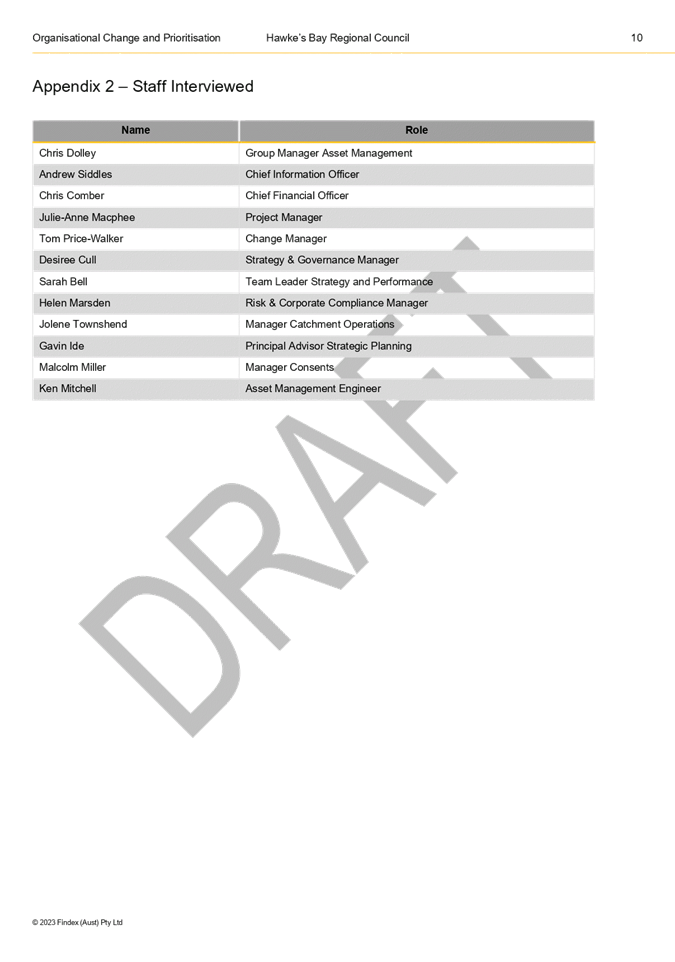

4. The audit was carried out

by Crowe, our Internal Auditor, during the period 31 January –

10 February, interviewing a range of staff, and the draft report was

delivered in March 2023.

5. The audit scope covered:

5.1. Opportunities to strengthen

decision making to ensure organisational change effectively drives the creation

of value while ensuring the organisation is protected from undue risk, e.g.

impact on people, compliance, etc, which is sometimes referred to as

‘risk in change’.

5.2. The audit did not cover the

strategic decision-making process on each individual organisational change

initiative and project management process as that was out of scope.

6. The Executive Leadership

Team (ELT) has not reviewed the draft report at this time and it is anticipated

that the Strategy & Governance team will be consulted (due to the majority

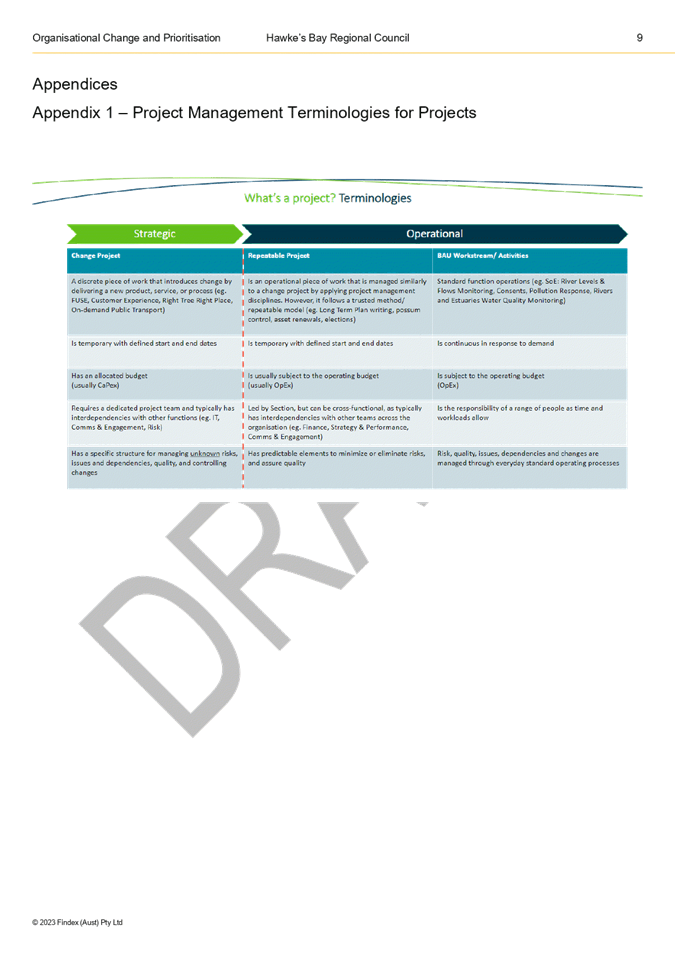

of actions being for the Project Management Office) in the first instance on

the findings, recommendations and actions.

Audit

findings

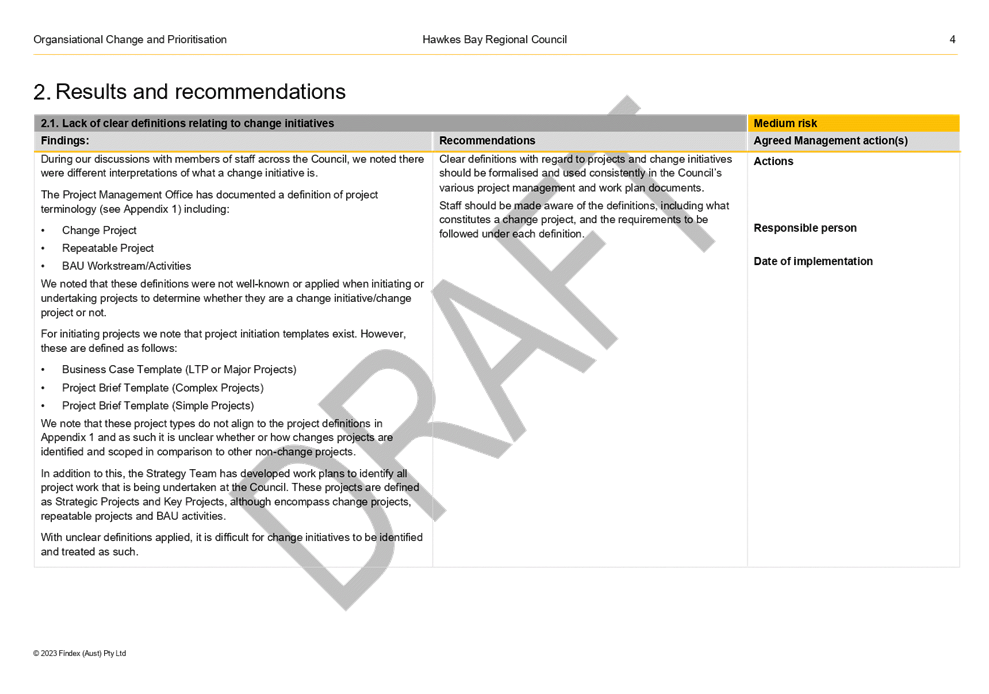

7. There were no high priority

findings observed. The report noted staff members interviewed had differing

interpretations of what a change initiative is. In addition, the

organisation has the correct tools to enable good project management going

forward. The main themes of the findings for corrective action and

improvement, included:

7.1. A Lack of clear definitions

relating to change initiatives

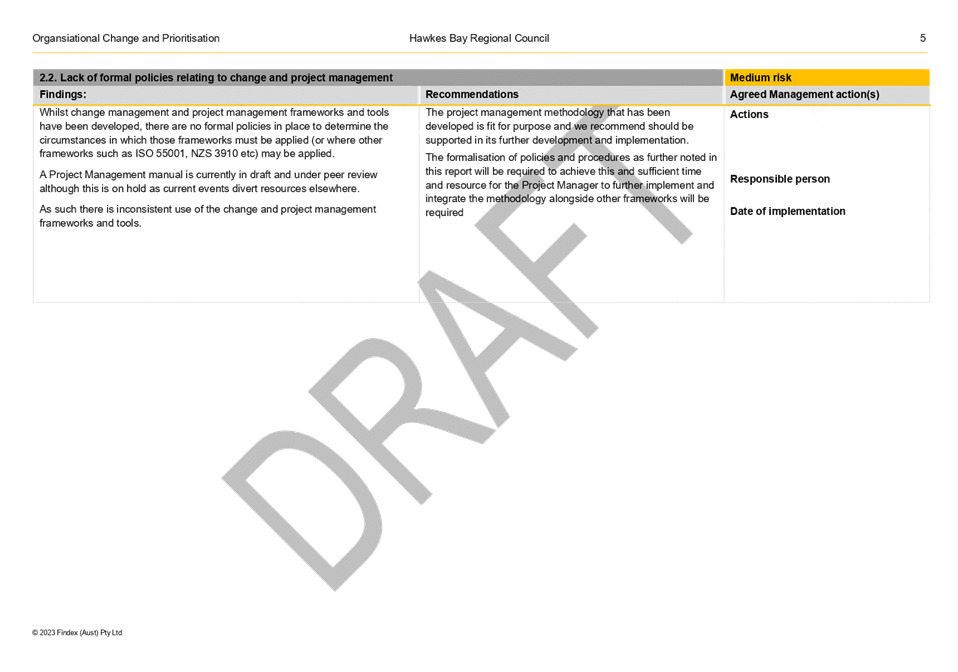

7.2. Lack of formal policies

relating to change and project management

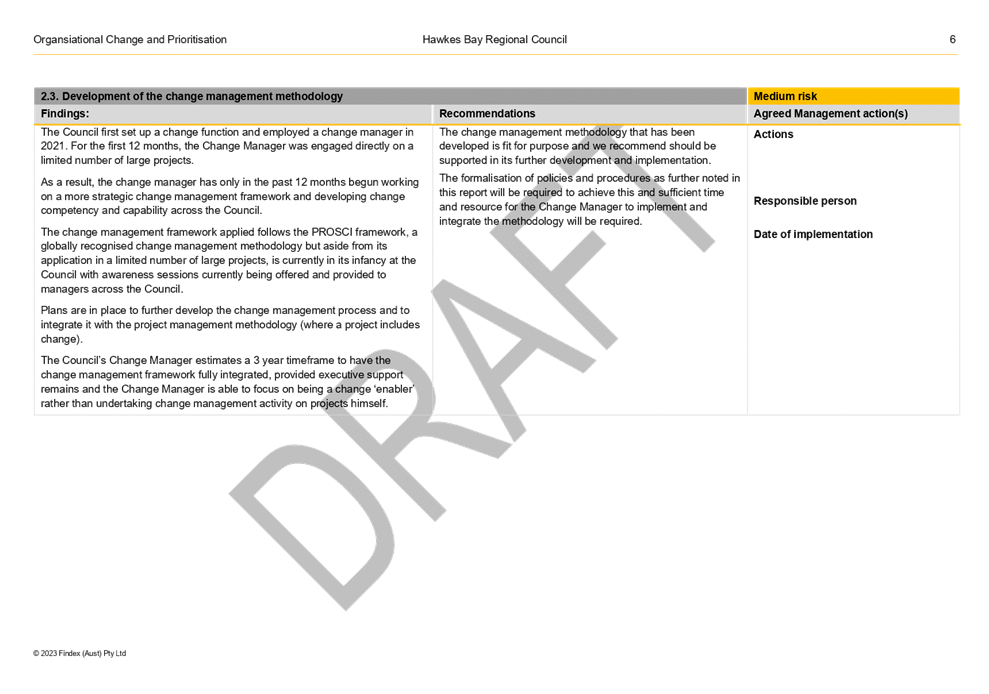

7.3. Development of a change

management methodology

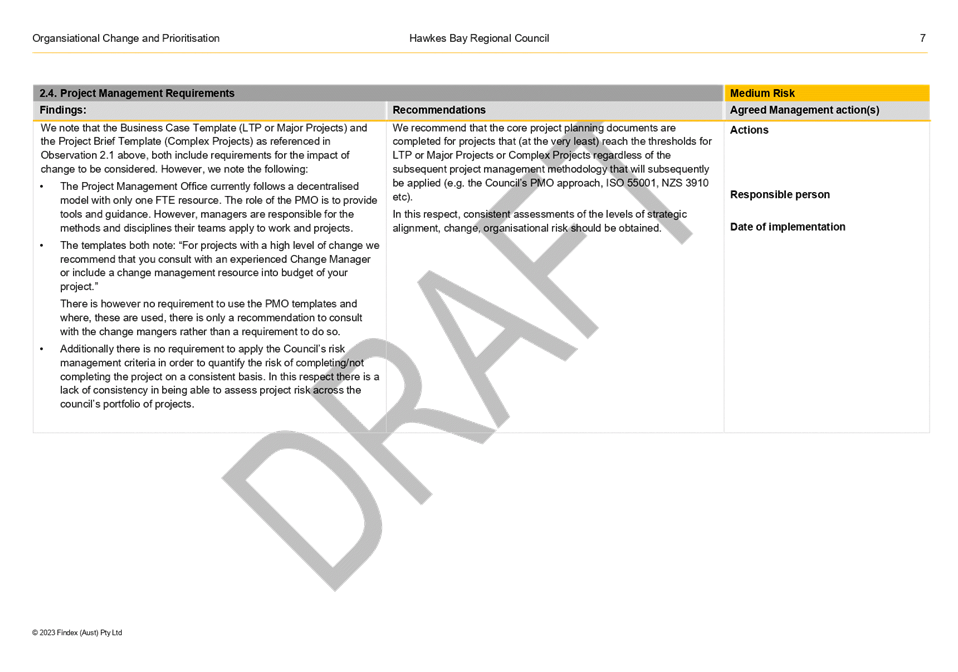

7.4. Project management

requirements

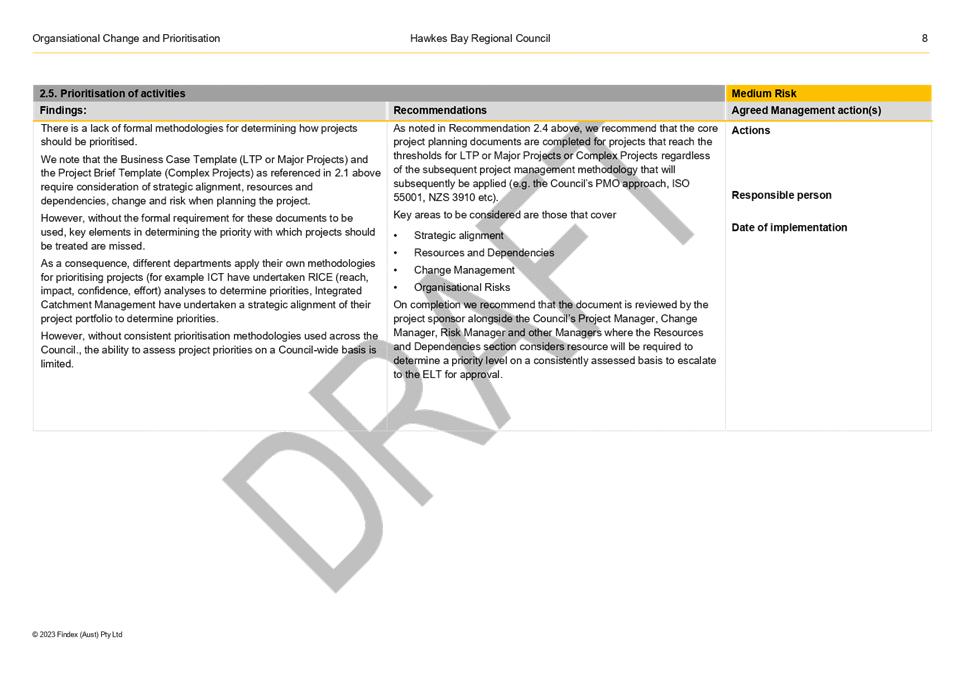

7.5. Prioritisation of

activities.

Decision Making Process

8. Council and its Committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

8.1. The decisions associated

with this agenda item are in accordance with the Sub-committee’s Terms of

Reference, specifically:

8.1.1. The purpose of the Risk and

Audit Sub-committee is to report to the Corporate and Strategic Committee to

fulfil its responsibilities for (1.3) the independence and adequacy of internal

and external audit functions

8.1.2. The Risk and Audit

Sub-committee shall have responsibility and authority to (2.6) receive the

internal and external audit report(s) and review actions to be taken by

management on significant issues and recommendations raised within the

report(s)

8.1.3. The Risk and Audit

Sub-committee is delegated by Council to (3.5) ensure

that recommendations in audit management reports are considered and, if

appropriate, actioned by management.

Recommendation

That the Risk and Audit Sub-committee:

1. Receives and notes the Organisational

Change Consolidation and Prioritisation Internal Audit findings staff

report.

2. Reports to the Corporate

and Strategic Committee that the medium priority findings from the Organisational

Change Consolidation and Prioritisation Internal Audit report that will be

monitored and tracked as corrective actions and reported to the RAS via the

Corrective Actions Dashboard are:

2.1. …

2.2. …

2.3. …

Authored by:

|

Olivia Giraud-Burrell

Quality & Assurance Advisor

|

Helen Marsden

Risk & Corporate Compliance

Manager

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

Organisational Change Consolidation

and Prioritisation draft Internal Audit report

|

|

|

|

Organisational Change Consolidation and

Prioritisation draft Internal Audit report

|

Attachment

1

|

Hawke’s

Bay Regional Council

Risk

& Audit Sub-committee

10 May

2023

Subject:

Audit Plan for the 2022-2023 Annual Report

Reason for Report

1. This item provides an

update on the timing for the audit of HBRC’s 2022-2023 Annual Report.

Executive

Summary

2. The statutory deadline for

the adoption of the HBRC Annual Report is 31 October 2023.

3. Our auditors, Ernst &

Young (EY), will undertake an interim visit during the week beginning

8 May and will begin the audit in the week beginning 18 September 2023.

4. The Audit Planning Report

from EY will follow as a late attachment to the agenda, and representatives

from EY will attend the RAS meeting to present their Audit Plan and take

questions.

Background

/Discussion

5. The audit and adoption of

the Annual Report follows timelines set out in the Local Government Act 2002.

5.1. Section 98 (3) states that

the annual report of a Council “must be completed and adopted, by resolution, within 4 months after the

end of the financial year to which it relates”.

6. Officers have had

discussions with our auditors, EY, about audit timing (see table below). This may

change as our auditors refine their work plans and resourcing.

|

Dates

|

Description

|

|

w/b

8 May to

w/b

15 May 2023

|

Audit

interim visit will be conducted (4 people onsite for 2 weeks to complete the

interim work for HBRC, HBRIC and FoodEast)

|

|

w/b 4 Sep to

w/b 11 Sep 2023

|

Audit of HBRIC and FoodEast (2 weeks)

|

|

w/b

18 Sep to

w/b

16 Oct 2023

|

Audit

of the

annual report (2 weeks onsite, remainder from Wellington)

|

7. Staff have a level of

uncertainty that the timing of the audit and the proposed date for adoption can be achieved.

8. A draft Annual Report

2022-2023 will be presented to the Corporate and Strategic Committee on 20

September for review.

Timeline

of Annual Report and Summary project management

Financial

and Resource Implications

9. Staff do not expect the

cost of the audit for 2022-2023 to exceed the budget allocated for the audit

programme.

Decision Making Process

10. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

the Risk and

Audit Sub-Committee receives and notes the Audit Plan for the 2022-2023

Annual Report.

Authored by:

|

Sarah Bell

Team Leader Strategy &

Performance

|

Chelsea Spencer

Senior Group Accountant

|

Approved by:

|

Chris Comber

Chief Financial Officer

|

Susie Young

Group Manager Corporate Services

|

Attachment/s

There are no attachments for this

report.

Hawke’s Bay Regional

Council

Audit

& Risk Sub-committee

10 May

2023

Subject: Enterprise Risk Report

That the Risk

and Audit Sub-committee excludes the public from this section of the meeting,

being Agenda Item 8 Enterprise Risk Report with the general subject of

the item to be considered while the public is excluded. The reasons for passing

the resolution and the specific grounds under Section 48 (1) of the Local

Government Official Information and Meetings Act 1987 for the passing of this

resolution are:

|

General

subject of the item to be considered

|

Reason

for passing this resolution

|

Grounds

under section 48(1) for the passing of the resolution

|

|

Enterprise Risk Report

|

s7(2)(f)(ii) The

withholding of the information is necessary to maintain the effective conduct

of public affairs through the protection of such members, officers,

employees, and persons from improper pressure or harassment.

s7(2)(j) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to prevent

the disclosure or use of official information for improper gain or improper

advantage.

|

The Council is specified,

in the First Schedule to this Act, as a body to which the Act applies.

|

Authored by:

|

Helen Marsden

Risk & Corporate Compliance

Manager

|

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Hawke’s

Bay Regional Council

Risk

& Audit Sub-committee

10 May

2023

Subject: Internal Assurance corrective

actions update

That

the Risk and Audit Sub-committee excludes the public from this section of the

meeting, being Agenda Item 9 Internal Assurance corrective actions update with

the general subject of the item to be considered while the public is excluded;

the reasons for passing the resolution and the specific grounds under Section

48 (1) of the Local Government Official Information and Meetings Act 1987 for

the passing of this resolution being:

|

General

subject of the item to be considered

|

Reason

for passing this resolution

|

Grounds

under section 48(1) for the passing of the resolution

|

|

Internal Assurance

corrective actions update

|

7(2)(f)(ii) The

withholding of the information is necessary to maintain the effective conduct

of public affairs through the protection of such members, officers,

employees, and persons from improper pressure or harassment.

s7(2)(e) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to avoid

prejudice to measures that prevent or mitigate loss to members of the public.

s7(2)(j) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to prevent

the disclosure or use of official information for improper gain or improper

advantage.

|

The Council is specified,

in the First Schedule to this Act, as a body to which the Act applies.

|

Authored by:

|

Olivia Giraud-Burrell

Quality & Assurance Advisor

|

Helen Marsden

Risk & Corporate Compliance

Manager

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

HAWKE’S

BAY REGIONAL COUNCIL

Risk

& Audit Sub-committee

10 May

2023

Subject: Privacy event

That

the Risk and Audit Sub-committee excludes the public from this section of the

meeting, being Agenda Item 10 Privacy event with the general subject of the item to be considered while the

public is excluded. The reasons for passing the resolution and the specific

grounds under Section 48 (1) of the Local Government Official Information and

Meetings Act 1987 for the passing of this resolution are:

|

General

subject of the item to be considered

|

Reason

for passing this resolution

|

Grounds

under section 48(1) for the passing of the resolution

|

|

Privacy event

|

7(2)(f)(ii) The

withholding of the information is necessary to maintain the effective conduct

of public affairs through the protection of such members, officers,

employees, and persons from improper pressure or harassment.

s7(2)(e) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to avoid

prejudice to measures that prevent or mitigate loss to members of the public.

s7(2)(j) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to prevent

the disclosure or use of official information for improper gain or improper

advantage.

|

The Council is specified,

in the First Schedule to this Act, as a body to which the Act applies.

|

Authored by:

|

Helen Marsden

Risk & Corporate Compliance

Manager

|

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|