Meeting of the

Corporate and Strategic Committee

Date: 5 April 2023

Time: 11.30am

|

Venue:

|

Council

Chamber

Hawke's

Bay Regional Council

159

Dalton Street

NAPIER

|

Agenda

Item Title Page

1. Welcome/Karakia/Apologies

2. Conflict

of Interest Declarations

3. Call for minor items not on

the Agenda 3

Decision

Items

4. Corporate

and Strategic Committee Terms of Reference and membership 5

Information

or Performance Monitoring

5. Quarterly

Treasury report for the period 30 September - 31 December 2022 9

6. Financial

Report for the period 1 July - 31 December 2022 13

7. Organisational

Performance report for the period 1 October - 31 December 2022 19

8. Audit

Plan for the 2022-2023 Annual Report 21

9. Discussion

of minor items not on the Agenda

Hawke’s Bay Regional

Council

Corporate

and Strategic Committee

5 April

2023

Subject: Call for minor items not on the Agenda

Reason

for Report

1. This item provides the

means for councillors to raise minor matters they wish to bring to the attention

of the meeting.

2. Hawke’s Bay Regional

Council standing order 9.13

states:

2.1. “A meeting may discuss an

item that is not on the agenda only if it is a minor matter relating to the

general business of the meeting and the Chairperson explains at the beginning

of the public part of the meeting that the item will be discussed. However, the

meeting may not make a resolution, decision or recommendation about the item,

except to refer it to a subsequent meeting for further discussion.”

Recommendations

3. That the Corporate and

Strategic Committee accepts the following minor items not on the agenda

for discussion as item 9.

Hawke’s Bay Regional

Council

Corporate

and Strategic Committee

5 April

2023

Subject: Corporate and Strategic Committee

Terms of Reference and membership

Reason for Report

1. This item provides an

opportunity for the Committee to review and confirm or amend its Terms of

Reference adopted by the Regional Council on 16 November 2022 and confirm the

appointment of tangata whenua representatives.

Decision Making Process

2. Councils and their

committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

2.1. Councils are required to

(LGA sch.7 cl.19(1)) hold the meetings that are necessary for the good

governance of their district or region.

2.2. Councils may appoint (LGA sch.7 cl. 30(1)(a)) the committees,

subcommittees, and other subordinate decision-making bodies that they consider

appropriate, including joint committees.

2.3. Given the provisions above,

the Committee can exercise its discretion and make these decisions without

consulting with the community or others having an interest in the decision.

Recommendations

That the Corporate and Strategic

Committee:

1. Receives and considers the Corporate

and Strategic Committee Terms of Reference and membership staff report.

2. Agrees that the decisions

to be made are not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy, and that the Committee can exercise

its discretion and make decisions on this issue without conferring with the

community.

3. Confirms the Terms of

Reference for the Committee as adopted by the Regional Council on 16 November

2022.

4. Confirms the appointment of

Peter Eden representing HBRC Māori Committee and Keri Ropiha representing

Regional Planning Committee.

Authored

by:

|

Desiree Cull

Strategy & Governance Manager

|

Leeanne Hooper

Team Leader Governance

|

Approved by:

|

Katrina Brunton

Group Manager Policy &

Regulation

|

Susie Young

Group Manager Corporate Services

|

Attachment/s

|

1⇩

|

2022-25

Corporate and Strategic Committee ToR adopted 16 November 2022

|

|

|

|

2022-25 Corporate and Strategic Committee

ToR adopted 16 November 2022

|

Attachment

1

|

Hawke’s Bay Regional

Council

Corporate

and Strategic Committee

5 April

2023

Subject: Quarterly Treasury Report for the

period 30 September - 31 December 2022

Reason for Report

1. This item provides

compliance monitoring of Hawke’s Bay Regional Council (HBRC) treasury

activity and reports the performance of Council’s investment portfolio for

the quarter ended 31 December 2022.

Overview of the Quarter – ending 31 December 2022

2. At the end of the quarter

to 31 December 2022, HBRC was compliant with all measures in its Treasury

policy.

3. Investment Fund portfolios

had total capital contributed initially of $152.2m; adjusted for inflation,

this equates to $164.4m, meaning the portfolio value at 31 December 2022 was

$16.6m below the inflation-adjusted contribution target. Annual inflation rate

of 2% (0.5% per quarter) has been used.

4. In December 2022 HBRC

received a dividend of $5m from HBRIC following their receipt of the Napier

Port Dividend of $5.17m. Remaining funds were retained in HBRIC to provision

for general operating costs.

5. No divestments have been

made from managed funds this quarter. Based on results to date and the value of

the protected amount of funds, funds held are not sufficient to deliver the

returns required to meet Council’s requirement.

6. Financial markets for the

December quarter continue to be volatile and we continue to advise a

watch and wait approach until a greater investment strategy review is complete.

7. Cash balances remain

healthy and borrowing requirements remain unchanged with the exception of

expected debt repayments made since September quarter.

Background

8. Council’s Treasury

Policy requires a quarterly Treasury Report to be presented to the Audit and

Risk Sub-committee. The policy states that the Treasury Report is to include:

8.1. Treasury Exceptions report

8.2. Policy compliance

8.3. Borrowing Limit report

8.4. Funding and liquidity

report

8.5. Debt maturity profile

Interest rate report

8.6. Investment management

report

8.7. Treasury investments*

8.8. Cost of funds report Cash

flow and debt forecast report

8.9. Debt and interest rate strategy

and commentary

8.10. Counterparty credit report

8.11. Loan advances.

9. The Investment Management

report has specific requirements outlined in the Treasury Policy. This requires

quarterly reporting on all treasury investments plus annual reporting on all

equities and property investments.

10. In addition to the Treasury

Policy, Council has a Statement of Investment Policy and Objectives (SIPO)

document setting out the parameters required for funds under management for the

HBRC Long Term Investment Fund.

11. Since 2018, HBRC has

procured treasury advice and services from PriceWaterhouseCoopers (PwC) and

their quarterly Treasury Report containing the reports noted in paragraph 8 is

attached.

Discussion

12. This report gives a

high-level summary of the data in the PwC report.

Liquidity

13. To ensure HBRC has the

ability to adequately fund its operations, current policy requires HBRC to

maintain a liquid balance of “greater than 10% of existing total

external debt”. Current liquidity ratio is 47.24% and therefore meets

policy.

14. The following table reports

the cash and cash equivalents on 31 December 2022.

|

31

December 2022

|

$000

|

|

Cash

on Call

|

18,265

|

|

Short-term

bank deposits

|

1,000

|

|

Total

Cash & and Deposits

|

19,265

|

15. Council’s balance of

cash and deposits compares with the December 2021 balance of $15.9m.

16. To manage HBRC liquidity

risk, HBRC retains a Standby Facility with BNZ. This

facility provides HBRC with a same day draw down option, to any amount between

$0.3-$5.0m and with a 7 day minimum draw period.

Debt

Management

17. On 31 December 2022 the

current external debt for the Council group was $50.25m (includes $1m of

pre-funded debt ($69.1m including the loan from HBRIC).

18. Since the September quarter

no further borrowings were made.

19. The following summarises

the Year-to-date movements in Council’s debt position.

Summary

of HBRC Debt

|

|

HBRC

only

$000

|

HBRC

Group

$000

|

|

Opening Debt – 1 July 2021 – excl HBRIC

Loan

|

46,725

|

46,725,018

|

|

New Loans raised

|

8,450

|

8,450

|

|

Less amounts repaid

|

(4,925)

|

(4,925)

|

|

Closing Debt 31 December 2022 (excluding

HBRIC loan)

|

50,250*

|

50,250

|

|

Plus opening balance - loan from HBRIC

|

16,663

|

-

|

|

Total Borrowing as at 31 December 2022

|

66,913

|

50,250

|

*Includes pre-funding

debt of $1m

Managed

Funds

20. The LTP budgets an annual

return of 5.16% from managed funds. Of this 3.16% is used to fund activities

with 2.0% retained to grow the capital base to enable the future earnings to

protect the capital base for future generations. (Page 33 of LTP –

Part 3 – Financial Strategy)

21. Council budgets separately

for revenue from directly held managed funds and those held by HBRIC. HBRIC is

required to deliver an overall portfolio return by way of an agreed annual

dividend agreed through an annual Statement of Intent. The composition (between

revenues from managed funds and other sources such as port dividends is up to

the HBRIC board). Council has budgeted to receive $10.5m in dividends from

HBRIC within the FY 2022-2023.

22. The Fund performances for

this year have been lower than we have experienced for some time. Financial

markets have not performed as strongly as the FY2020-2021. The December quarter

saw a slight positive return, however, these have not clawed back the six

months of significant losses to 30 June last year.

23. Given the nature of the

investments some volatility is to be expected. However, the performance of the

managed funds since placement demonstrate market recovery can occur within

relatively short timeframes, and a watch and wait approach is prudent. The

portfolio construct is intentionally conservatively balanced for the long-term.

24. The following table summarises the fund balances at the

end of each quarter.

|

|

30 Jun 2022

|

30 Sept 2022

|

31 Dec 2022

|

|

Fund Balances HBRC

|

$000

|

$000

|

|

|

Fund Balance HBRC

|

104,449

|

103,121

|

104,421

|

|

Capital Protected Amount HBRC (2% compounded)

|

114,239

|

114,810

|

115,384

|

|

Current HBRC value above protected amount

|

(9,790)

|

(11,689)

|

(10,963)

|

|

Funds Balances (Group + HBRIC)

|

|

Long-Term Investment Fund (HBRC)

|

45,679

|

45,101

|

45,713

|

|

Future Investment Fund (HBRC)

|

58,770

|

58,020

|

58,708

|

|

Total HBRC

|

104,449

|

103,121

|

104,421

|

|

Plus HBRIC

|

43,226

|

42,609

|

43,315

|

|

Total Group Managed Funds

|

147,675

|

145,730

|

147,736

|

|

Capital Protected Amount (2% compound inflation)

|

162,720

|

163,533

|

164,350

|

|

Current group value above/(below) protected

amount

|

(15,045)

|

(17,803)

|

(16,614)

|

HBRIC

Ltd

25. In accordance with Council

Policy, HBRIC provides separate quarterly updates to the Corporate and

Strategic Committee. However, given the missed meeting due to the Cyclone the

December 2022 quarterly update was provided to Council on 29 March 2023.

Decision-making

process

26. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

the Corporate

and Strategic Committee receives and notes the Quarterly Treasury report for

the period 30 September - 31 December 2022.

Authored by:

|

Jess Bennett

Treasury & Investments

Accountant

|

Chris Comber

Chief Financial Officer

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

|

1⇨

|

PWC HBRC Treasury Reporting 31

December 2022

|

|

Under Separate Cover

|

Hawke’s

Bay Regional Council

Corporate

and Strategic Committee

5 April

2023

Subject: Financial Report for the period 1 July

- 31 December 2022

Reason for Report

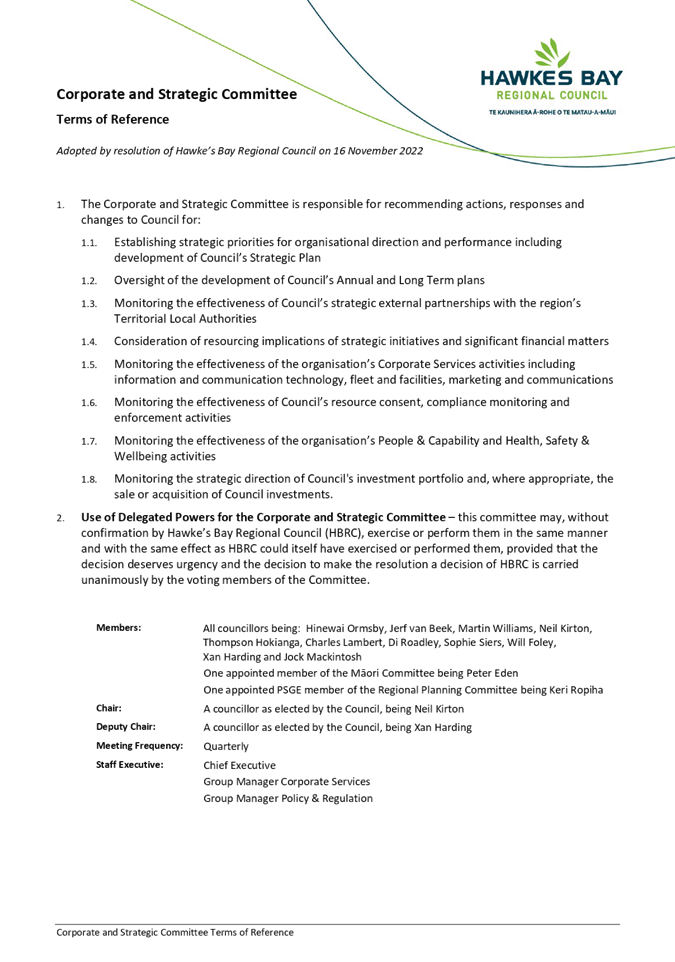

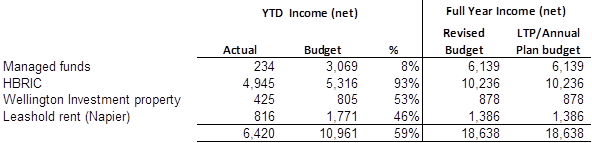

1. This item presents the

Committee with financial results for the first half of the 2022-2023 financial

year.

Executive Summary

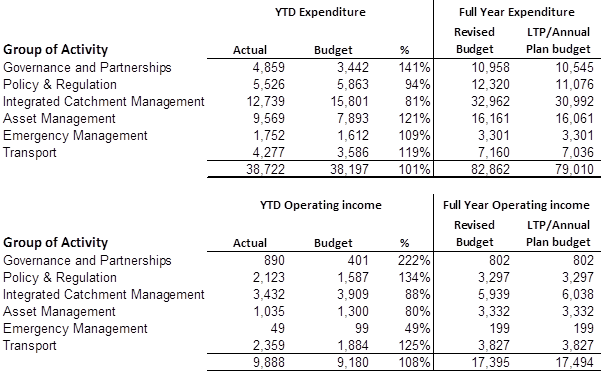

2. The operating position for

the council for the first six months of the financial year was adverse to

budget by $3.5m. This is principally driven by lower than budgeted returns from

our managed funds.

3. Operating expenditure for

the Groups of Activities for the six months to 31 December 2022 was $38.7m,

$0.5m below budget (1%). Overspends occurred in Asset Management due to

Regional Water Security project spend being reclassified as opex, in Transport

due to Go Bus contract indexation costs of 26% being well above budget and in

Governance & Partnerships due to sustainable homes loan repayment

phasing. The major underspends were in Integrated Catchment Management

with Erosion Control Scheme spend to falling in the later part of the year

rather than evenly across the year and in Land for Life, which will likely be

under budget at year end due to changes in funding methods as the pilots are

delivered.

4. The operating income from

activities was $9.9m, $0.7m ahead of budget (8%), mostly related to additional

consent activities and environmental infringement/enforcement proceeds.

Enforcement proceeds may be transferred to a reserve to ensure that they are

used for specific activities as detailed in prosecutions. Note operating income

excludes rates, loan and reserve funding.

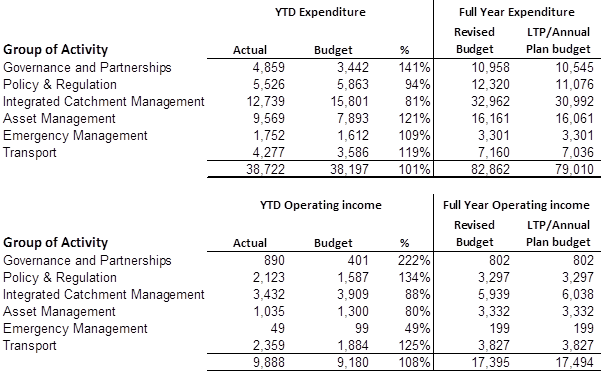

5. Capital expenditure net of

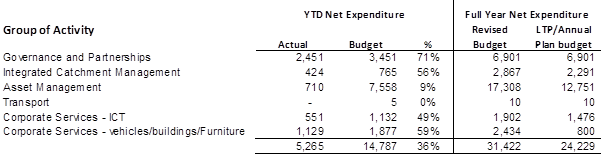

capital grants was $5.3m, $9.5m behind budget (64%), with the largest variances

in asset management infrastructure projects ($6.8m) mostly related to wet

weather delays, $1m in sustainable homes due to a decline in applications and

$1m underspend in the accommodation refurbishment project due to contractor

availability and consenting timeframes being extended, both of which have

slowed progress.

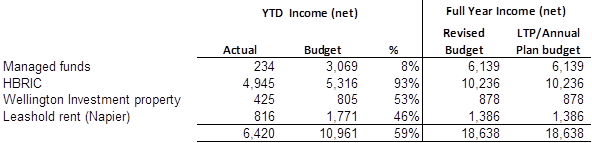

6. Investment income net of

investment expenditure was $6.4m, $4.5m behind budget YTD (41%), predominantly

driven by lower-than-expected returns in the managed fund portfolio –

consistent with global markets.

7. Rates income is ahead of

budget, in part due to rates penalty income significantly above what was

assumed in the Annual Plan ($0.6m).

8. Overhead cost centres were

$1.2m above budget YTD (11%), mostly in relation to increased interest charges

for borrowing, insurance charges incurred to date ($0.7m over budget), and

recruitment costs. These costs are included as part of the overhead

allocation in the above operating expenditure results.

Background

9. All revenue and expenditure

carried forward at the end of the FY2021-22 financial year has been recognised

in the FY2022-23 budgets. This is the difference between the LTP/Annual

plan budgets presented and the “Revised Budget”.

10. Property, plant and

equipment fixed assets were imported into TechONE in January 2023, and the

system driven depreciation for these assets is now included in the financial

results.

11. Rates funding allocations,

reserve movements and loan funding have not been included in this report as

these are calculated at year end.

12. With the introduction of

Enterprise Budgeting in TechOne some of the FY2021-2022 budgets are now phased

to recognise the seasonality of the expenditure, particularly planting

activity. However, phasing will continue to be improved over future budget

iterations to further ensure that phasing variances are minimised.

13. Groups of activities (GOA)

expenditure include each activity’s external expenditure, internal staff

time, finance costs (interest and debt repayments), depreciation/amortisation

and a share of overheads. The operating income presented for each GOA,

includes fees and charges, user charges and recoveries and grants, and excludes

rates, loans or investment income (which are allocated to activities at year

end).

14. The nine-month financials

to March 2023, will be presented to the 14 June 2023 Corporate & Strategic

Committee, and will include full year forecasts, funding impact requirements

and proposed carry forwards.

Operating

Income and Expenditure

15. Figures presented in the

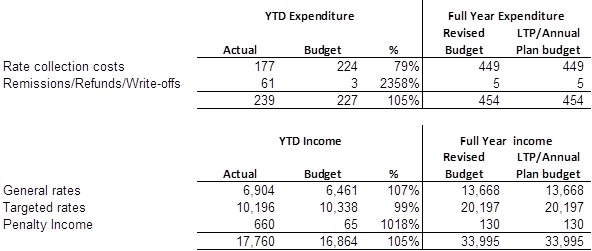

tables above are in thousands.

16. Governance and Partnerships

is $1.4m over in expenditure, due to phasing of loan repayments for sustainable

homes. Income is $0.5m overachieved, which mostly relates to additional

interest earnings from the sustainable homes programme following the increase

in interest rate last year from 4% to 6%.

17. Policy and Regulation

expenditure is mostly on track YTD, and income is $0.5m ahead of budget due to

increased consent activities, and receipt of enforcement proceeds which were

not budgeted.

18. Integrated Catchment

Management is $3.1m underspent, and $0.5m behind budget in operating income.

18.1. Environmental science is

$1.4m underspent, which is due to unfilled staff vacancies, reduction in

depreciation budget requirement due to audit direction to not capitalise data

models, and various phasing variances across a number of contracted work

programmes (largest being LiDAR Mapping $0.3m).

18.2. Catchment

management is $2.1m underspent, which is mostly phasing variances in the

Erosion Control Scheme (ECS) grants ($1.4m), environmental enhancement

programme ($0.4m) and Land for Life ($0.2m).

18.3. Environmental information

is $0.5m overspent, which is mostly related to depreciation budgets to be

transferred from environmental science ($0.3m).

18.4. The operating income

variance is mostly related to phasing of grants for the Whakaki environmental

enhancement work programme, but this is offset by reduced expenditure.

19. Asset Management is $1.7m

ahead of budget operational spend, and $0.3m behind in operational income.

19.1. Regional Water Security

projects are underway, but still at the research/assessment phase, and costs

are classified as opex rather than capex as budgeted ($1.4m opex overspend

offsets $1.3m underspend in capex).

19.2. Flood Protection and

Control Works is overspent by $0.3m, due to unbudgeted expenditure on scheme

reviews, consent applications associated with pump stations, EMEP for code of

practice on rivers and the Joint City-wide Waterway monitoring Project with

Napier City Council. Some of this overspend is offset by delayed works on a

number of the river and drainage schemes due to wet weather events and less

access to waterways.

19.3. The income underachievement

is due to phasing related to Coastal Hazards contributions from Territorial

Local Authorities ($0.5m), offset by additional external contracting income by

the Works Group ($0.2m).

20. Emergency management

expenditure is mostly on track YTD, but behind in operating income due to

phasing variances of East Coast Lab grant funding.

21. Transport is $0.7m

overspent YTD mostly due to indexation costs on the GoBus contract. This

is partially offset by increased bus service funding from NZTA for increased

activity for on demand transport and total mobility (Transport income ahead YTD

$0.5m).

Capital

Expenditure (net of capital grants)

22. The expenditure figures

presented in the tables above are in thousands, net of any capital grant

income.

23. Governance &

Partnerships is $1m behind budget due to an ongoing decline in the number of

sustainable homes grant applications received, and a rise in early repayment of

existing loans. This is expected to result in a permanent underspend this

financial year.

24. ICM is $0.3m behind budget,

due to phasing variances in monitoring equipment replacements.

25. Asset Management

expenditure was $3.9m, with grants received of $3.2m. The net expenditure

is $6.8m behind budget (29%).

25.1. In general, many of the

capex projects were delayed due to wet weather and were planning to progress in

quarter 3. However, this is expected to be deferred in order to

prioritise the Cyclone Gabrielle rebuild work.

25.2. The major underspends were

in flood protection and control works ($4.7m) and open spaces ($0.7m).

26. ICT expenditure is behind

$0.6m, due to most of the business computing development work being classified

as opex so far this year (i.e., software-as-a-service solutions).

27. Vehicles/Buildings/Furniture

expenditure is $0.8m behind budget YTD.

27.1. Expenditure on new and replacement

vehicles is over by $0.4m, due to increased cost in vehicles, partly related to

requirements to select the eco cleanest vehicle fit for purpose.

28. The accommodation

refurbishments are $1m behind budget due to delays in sourcing contractors, and

developments in design plans requiring additional consents.

Investment

Income

29. The income figures

presented in the table above are in thousands, and are presented net of

investment expenses, and exclude property fair value gains (not yet assessed).

30. Managed funds income is

significantly down in line with the global market in December. The

treasury report provides more detail of the managed funds performance.

31. HBRIC income includes the

dividend issued on the back on the Napier Port dividend. In December

Napier Port announced and paid an interim dividend of $5.2m to HBRIC, of which

$5.0m was paid across to HBRC.

32. Wellington investment

property income is generally on track, and leasehold rent income is slightly

behind budget, and expected to be behind budget at year end, given the small

decrease in the number of properties in the portfolio.

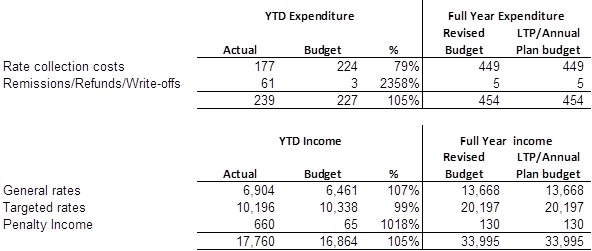

Rates collection

33. Rate collection costs are

in line with budget. Rates penalty income is above budget and above the

amount in the last financial year. The increase is due to a number of factors

including returning to the standard due dates for imposing penalties and the increase

in the rates charged.

34. Rates arrears decreased

this quarter from $517k to $313k due to active management and collecting

processes from our Debt Management team.

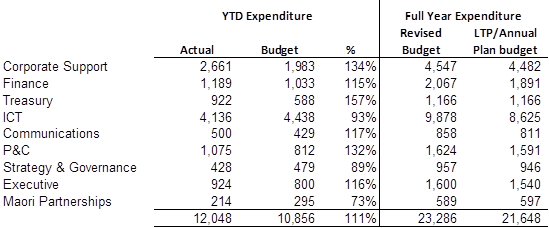

Overheads

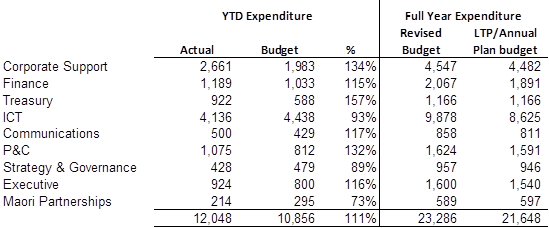

35. Overhead costs overall are

slightly ahead of budget, however within cost centres there are some larger

variances.

35.1. Corporate Support is above

budget due to additional temps required for the customer service team

(resulting from ongoing staff turnover), additional fleet running costs from

fuel and maintenance price pressure and an increase in fleet numbers to meet

increased vehicle requirements, and increased insurance premiums.

35.2. Finance, Executive and

Communications are above budget due to staffing changes specifically external

recruitment for Director Comms and Engagement, bringing forward additional

resource from Y3 of the LTP to assist in Communications and further resource

and support complexities related to the finance system implementation.

35.3. Treasury is $0.3m ahead of

budget due to higher interest rates on external loans.

35.4. People and Capability (P&C)

is above budget due to increase in salary protection insurance costs, and

increased recruitment expenditure due to continued staff turnover.

35.5. Māori Partnerships

(Iwi) is below budget due to delays in recruitment.

35.6. ICT and Strategy & Governance

expenditure is on track.

Decision-making Process

36. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

the Corporate

and Strategic Committee receives and notes the Financial Report for the

Period 1 July - 31 December 2022.

Authored by:

|

Amy Allan

Senior Business Partner

|

Chris Comber

Chief Financial Officer

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

Attachment/s

There are no attachments for this

report.

Hawke’s

Bay Regional Council

Corporate

and Strategic Committee

5 April

2023

Subject: Organisational Performance Report for the period 1 October

- 31 December 2022

Reason for Report

1. This item presents the

Organisational Performance report for Quarter Two which is the period

1 October – 31 December 2022.

Content of the Report

2. The report contains four

parts:

2.1. Executive Summary with highlights and lowlights

for the quarter (pp 4-5).

2.2. Corporate Metrics that focus on how well we

are performing across a number of corporate-wide measures such as employee

turnover and corporate carbon footprint (pp 6-12)

2.3. Level of Service Measures (LOSM) by group of

activities with adopted targets, traffic light status and commentary (pp 13-21)

2.4. Activity

Reporting by group of activities with non-financial and financial traffic light status and commentary

(pp 22-35).

3. This is the 18th

Organisational Performance report to be presented. The status and commentary

reporting are rolled up from cost centre to activity level. Commentary by cost centre

is still available to committee members via the PowerBI dashboard (see points

9-11 below).

4. Staff complete their

reporting in a software tool called Opal3. For LOSM and activity reporting,

staff select the status (red, amber, green) of non-financial results and

provide commentary on what they did in the quarter. Traffic light status of

financial commentary is selected on predetermined parameters with commentary

provided by staff.

Points

of Interest

5. Traffic light status and

commentary for the financial results of the 31 activities have been included

for the first time in 18 months, following implementation of a new financial

system.

6. The financial

‘lines’ are broken down (where applicable) to:

6.1. Operating expenditure

(OPEX) which includes external costs, internal time and personnel costs

6.2. Capital expenditure (CAPEX)

which includes external costs and internal time

6.3. Other revenue which

includes fees & charges, grants and proceeds from other income – both

OPEX and CAPEX.

7. Level of Service Measures

(LOSM) by group of activities are presented in full, rather than by exception.

In the past, commentary was only provided for LOSMs that were not on track.

This is to familiarise the new council with the 58 LOSMs in the current Long

Term Plan.

8. Gaps in

activity reporting are due to staff being deployed into response roles following

Cyclone Gabrielle during the reporting period.

Reporting Dashboard (PowerBI)

9. The dashboard is produced

using PowerBI to give a visual representation of the results over time. The

Organisational Performance Report document is produced from the dashboard.

10. The dashboard also provides

committee members with the ability to delve deeper into activities of interest

(via cost centres).

11. To access the dashboard,

please open your PowerBI app on your iPad. The dashboard will be on your

homepage. Staff from the Strategy and Performance team are available to go over

the dashboard with councillors who would like to review its content.

12. Strategic projects

commentary and status by schedule, risk, and budget are updated on a monthly

basis on the dashboard. They are also included in the Strategic Projects Report

that is presented to Council monthly. Note that the last month of updates was

January 2023. Monthly reporting will resume in April 2023 with a revised list

of strategic projects.

13. We are continuously

improving the dashboard and improving the data reliability across all areas,

and would appreciate any feedback you have.

Decision Making Process

14. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

Hawke’s Bay Regional Council receives and notes the Organisational Performance

report for the period 1 October - 31 December 2022 staff report.

Authored by:

|

Hariza Adlan

Performance & Data Analyst

|

Sarah Bell

Team Leader Strategy &

Performance

|

Approved by:

|

Desiree Cull

Strategy & Governance Manager

|

|

Attachment/s

|

1⇨

|

2022-23 Q2 HBRC Organisational

Performance report

|

|

Under Separate Cover

|

Hawke’s

Bay Regional Council

Corporate

and Strategic Committee

5 April

2023

Subject: Audit Plan for the 2022-2023 Annual Report

Reason for Report

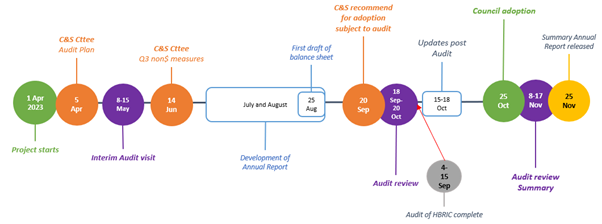

1. This item provides an

update on the timing for the Audit of HBRC’s 2022-2023 Annual Report.

Executive

Summary

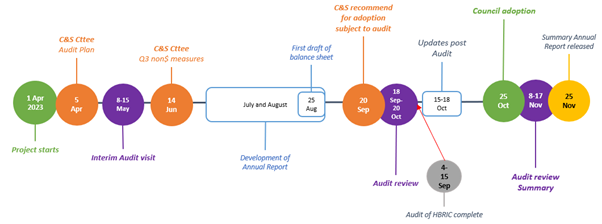

2. The statutory deadline for

the adoption of the HBRC Annual Report is 31 October 2023.

3. We are awaiting the outcome

of the Severe Weather Emergency Legislation Bill making its way through

Parliament, which may or may not extend the deadline for adoption of the Annual

Report.

4. Staff have been notified

that Ernst & Young (EY) will undertake an interim visit during the week

beginning 8 May and begin the audit in the week beginning 18 September 2023.

Background

/Discussion

5. The audit and adoption of

the Annual Report follows timelines set out in the Local Government Act 2002.

5.1. Section 98 (3) states that

the annual report of a Council “must be completed and adopted, by resolution, within 4 months after the

end of the financial year to which it relates”.

6. Officers have had discussions

with our auditors, EY, about audit timing (see table below). This may change as

our auditors refine their work plans and resourcing.

|

w/b

8 May to

w/b

15 May 2023

|

Audit

interim visit will be conducted (4 people onsite for 2 weeks to complete the

interim work for HBRC, HBRIC and FoodEast)

|

|

w/b 4 Sep to

w/b 11 Sep 2023

|

Audit of HBRIC and FoodEast (2 weeks)

|

|

w/b

18 Sep to

w/b

16 Oct 2023

|

Audit

of the

annual report (2 weeks onsite, remainder from Wellington)

|

7. An audit planning report

from EY will be forwarded to staff prior to their visit in May 2023.

8. Staff have a level of

uncertainty that the timing of the audit and the proposed date for adoption can be achieved.

9. The Annual Report 2022-2023

will be presented to the Corporate and Strategic Committee on 20 September to

recommend to the Regional Council for adoption subject to audit.

Timeline

of Annual Report and Summary project management

Financial

and Resource Implications

10. Staff do not expect the

cost of the audit for 2022-2023 to exceed the budget allocated for the audit

programme.

Decision Making Process

11. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

the Corporate

and Strategic Committee receives and notes the Audit Plan for the 2022-2023

Annual Report.

Authored by:

|

Sarah Bell

Team Leader Strategy &

Performance

|

Aaron Percival

Systems Accountant

|

Approved by:

|

Chris Comber

Chief Financial Officer

|

Susie Young

Group Manager Corporate Services

|

Attachment/s

There are no attachments for this

report.