Meeting of the

Finance Audit & Risk Sub-committee

Date: 10 August 2022

Time: 1.00pm

|

Venue:

|

Council

Chamber

Hawke's

Bay Regional Council

159

Dalton Street

NAPIER

|

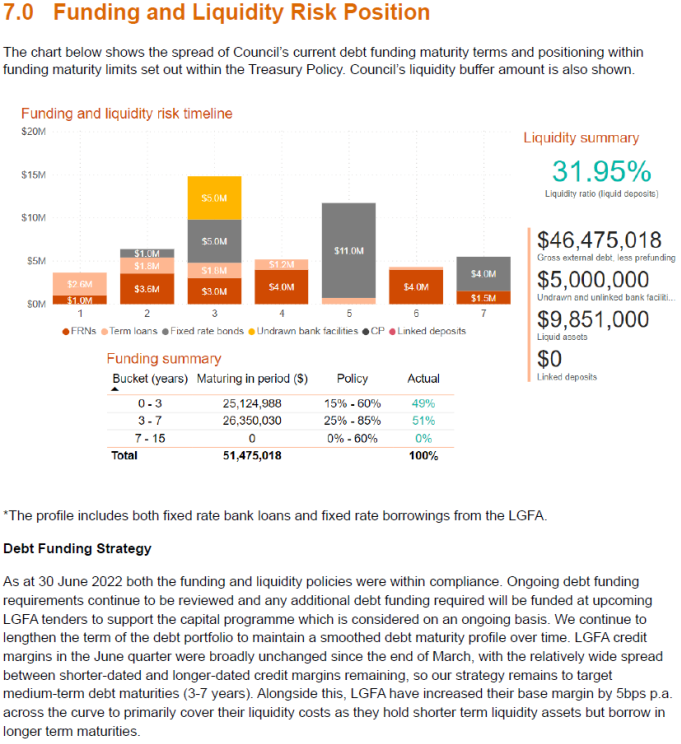

Agenda

Item Title Page

1. Welcome/Notices/Apologies

2. Conflict

of Interest Declarations

3. Confirmation of Minutes of

the Finance Audit & Risk Sub-committee meeting held on 4 May 2022

4. Follow-ups

from previous meetings 3

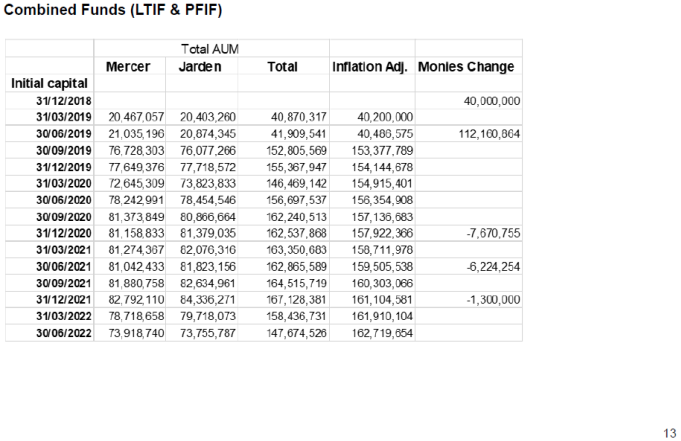

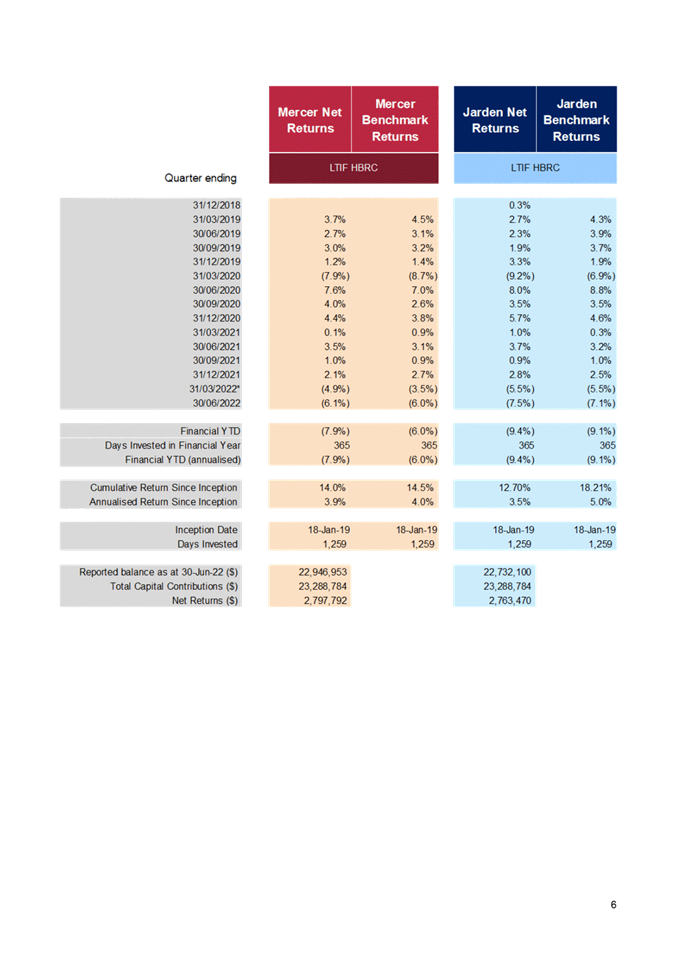

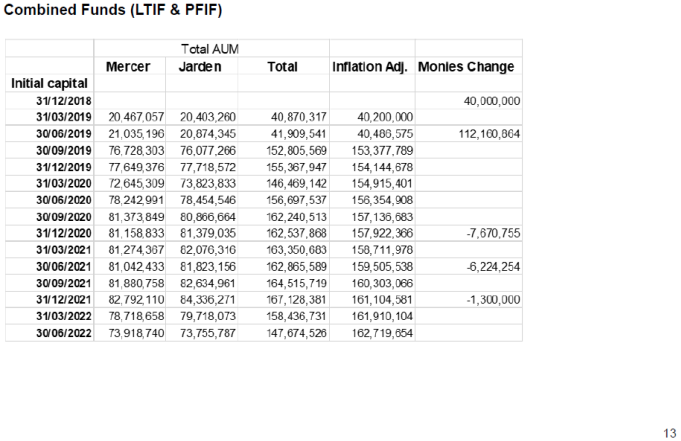

Decision

Items

5. Quarterly

Treasury Report for the period 1 April - 30 June 2022 7

6. Asset

Management Group review 37

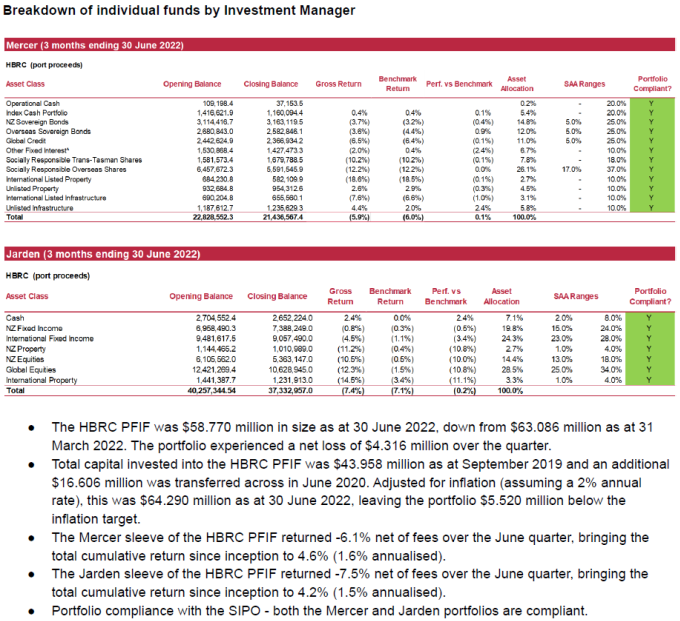

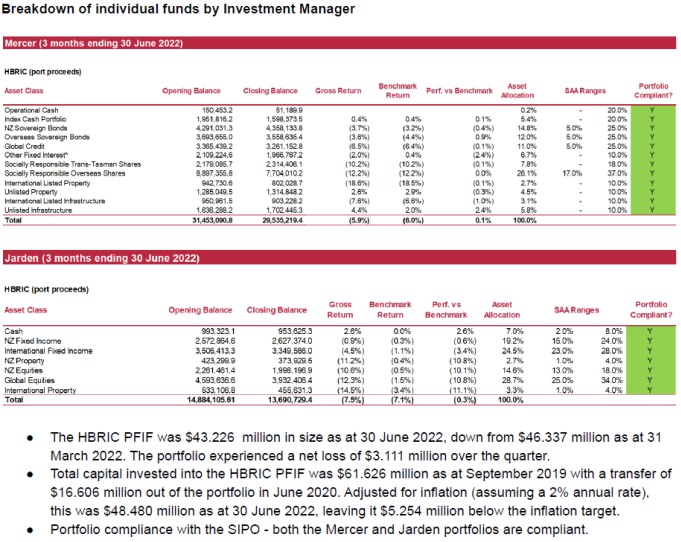

7. 2022-2023

Enterprise Internal Audit Plan 39

8. Data

Analytics audit report 45

9. 2021-2022

Enterprise Internal Audit plan status update 63

10. Audit

Plan for the 2021-2022 Annual Report 65

Decision

Items (Public Excluded)

11. Internal

Assurance corrective actions update 67

12. Six-monthly

Enterprise Risk Report 69

13. Confirmation

of Public Excluded Minutes

Hawke’s Bay Regional

Council

Finance

Audit & Risk Sub-committee

10 August

2022

Subject: Follow-ups from previous

meetings

Reason for Report

1. On the list attached are

items raised at previous Finance, Audit and Risk Sub-committee meetings that

staff have followed up on. All items indicate who is responsible for follow up,

and a brief status comment. Once the items have been reported to the

Sub-committee they will be removed from the list.

Decision Making Process

2. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That the Finance, Audit

and Risk Sub-committee receives and notes the Follow-ups from previous

meetings.

Authored by:

|

Leeanne Hooper

Team Leader Governance

|

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

|

1⇩

|

Follow-ups from previous meetings

|

|

|

|

Follow-ups from previous meetings

|

Attachment

1

|

Hawke’s

Bay Regional Council

Finance

Audit & Risk Sub-committee

10 August

2022

Subject: Quarterly Treasury Report for

the period 1 April - 30 June 2022

Reason for Report

1. This item provides

compliance monitoring of Hawke’s Bay Regional Council (HBRC) treasury

activity and reports the performance of Council’s investment portfolio

for the quarter ended 30 June 2022.

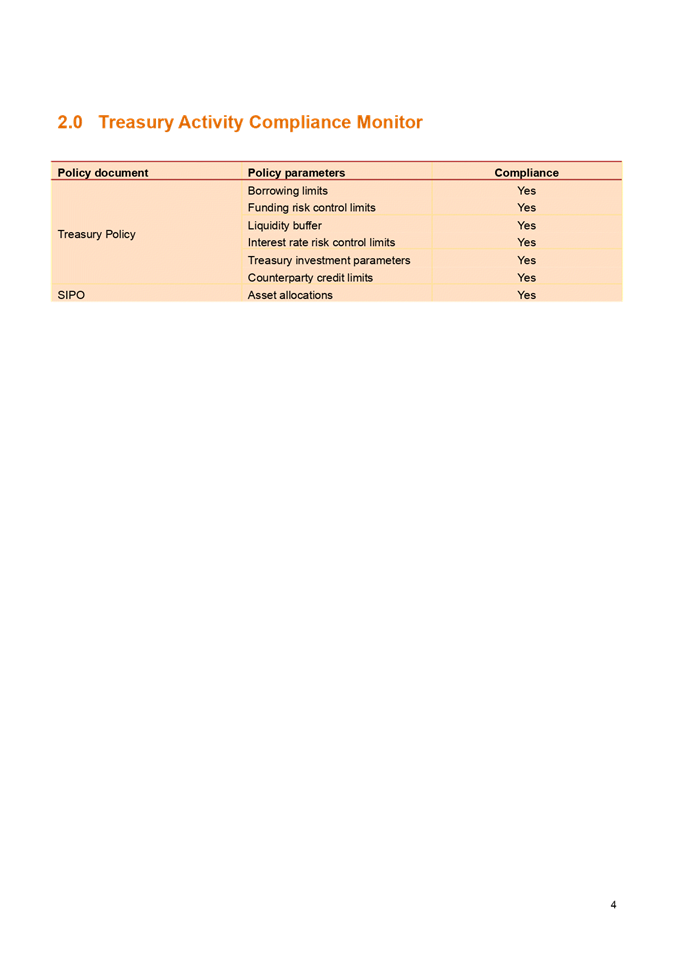

Overview of the Quarter – ending 30 June 2022

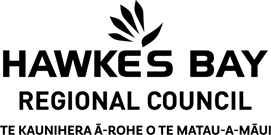

2. At the end of the quarter

to 30 June 2022, HBRC was compliant with all measures in its Treasury policy.

3. Investment returns are

below budget due to a significant financial market decline since January 2022.

The LTP budget had forecasted an annual growth of 2% ($2.3m) for capital

protection and returns of an additional 3.16% ($3.685m) to subsidise rates

income. However due to the decline in fund value, no withdrawals have

been made by Council this financial year. The lack of investment returns

has not required any additional debt due to the shortfall in Council

expenditure compared to budget.

4. Financial markets,

particularly international markets, continue to move around considerably given

the high economic uncertainty. Staff advice is to watch and wait at this point

in time, corrective action is not required, and the portfolio is well balanced

for the long term.

5. Cash balances are good and

borrowing requirements have remained relatively low.

Background

6. Council’s Treasury

Policy requires a quarterly Treasury Report to be presented to the Finance

Audit and Risk Sub-committee. The policy states that the Treasury Report is to

include:

6.1. Treasury Exceptions report

6.2. Policy compliance

6.3. Borrowing limit report

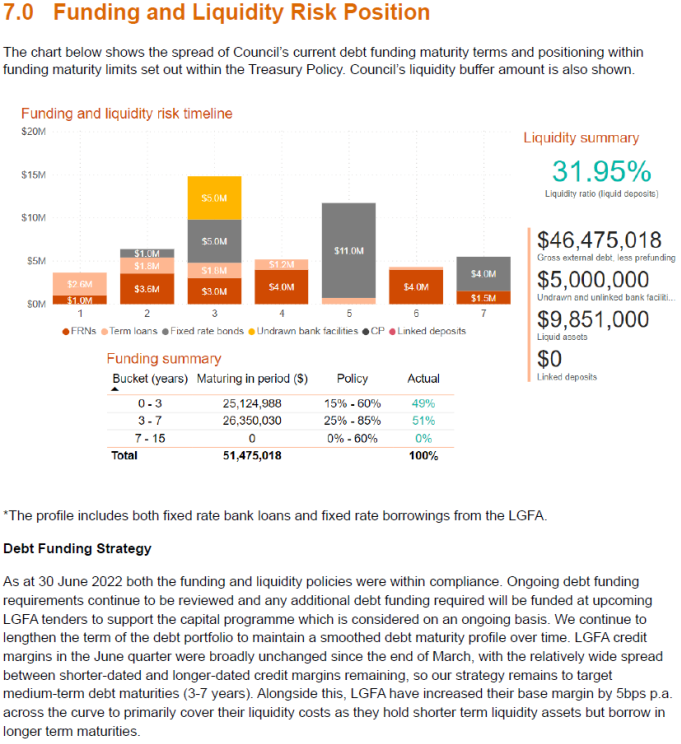

6.4. Funding and liquidity

report

6.5. Debt maturity profile

interest rate report

6.6. Investment management report

6.7. Treasury investments

6.8. Cost of funds report cash

flow and debt forecast report

6.9. Debt and interest rate

strategy and commentary

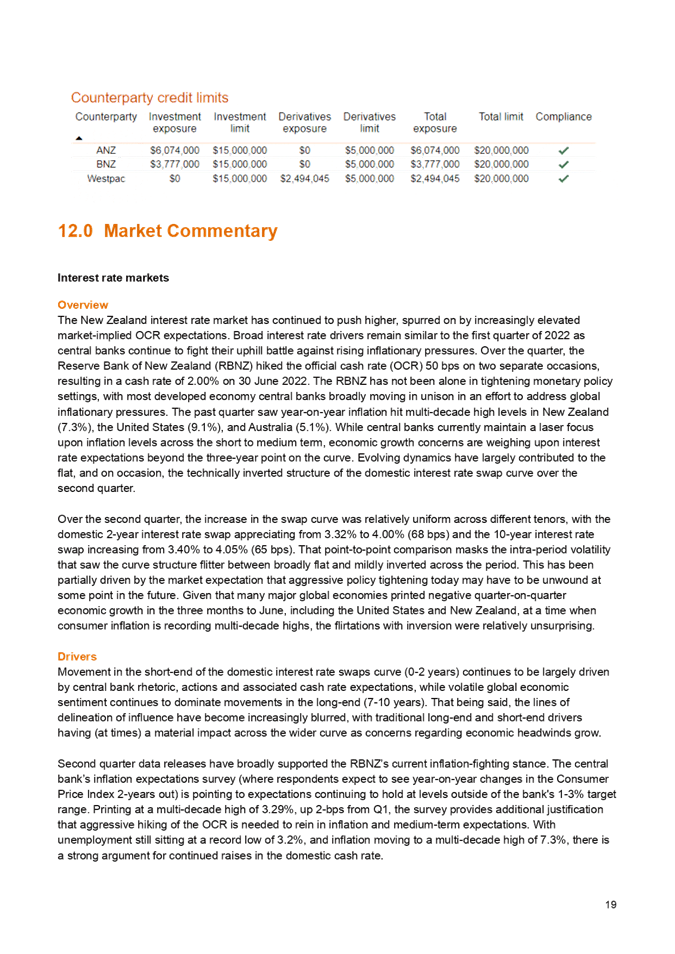

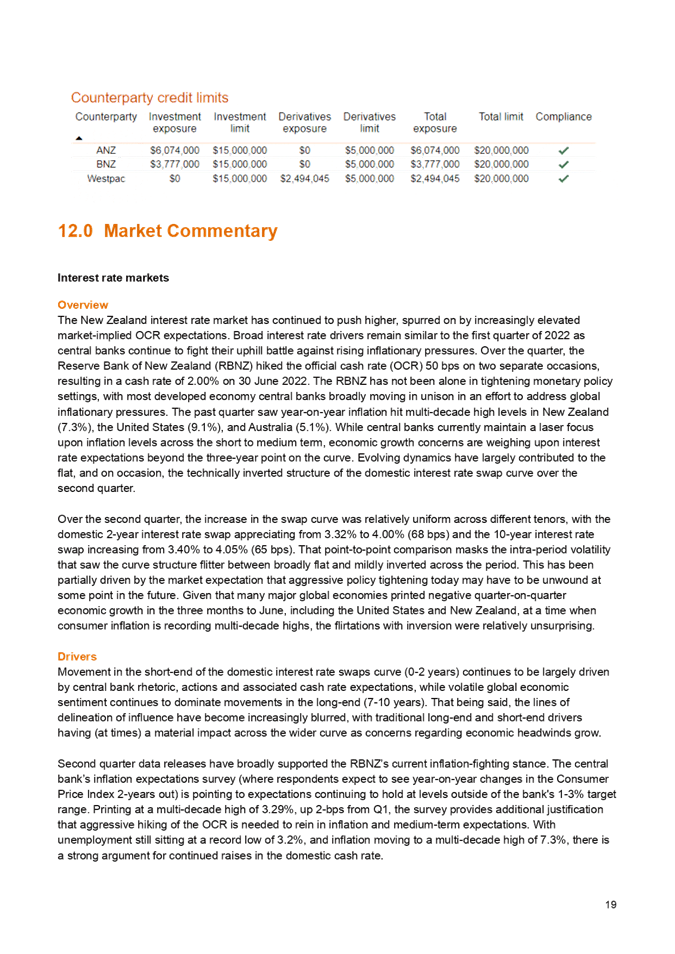

6.10. Counterparty credit report

6.11. Loan advances.

7. The Investment

Management report has specific requirements outlined in the Treasury

Policy. This requires quarterly reporting on all treasury investments plus

annual reporting on all equities and property investments.

8. In addition to the Treasury

Policy, Council has a Statement of Investment Policy and Objectives (SIPO)

document setting out the parameters required for funds under management for the

HBRC Long Term Investment Fund.

9. Treasury Investments to be

reported on consist of:

9.1. Liquidity

9.1.1. Cash and Cash Equivalents

9.1.2. Debt Management.

9.2. Externally Managed

Investment Funds

9.2.1. Long-Term Investment Fund

(LTIF)

9.2.2. Future Investment Fund

(FIF).

9.3. Investment properties

9.4. HBRIC Ltd

9.5. 2021-22 Performance

Summary.

Discussion

10. A separate treasury report

is prepared by Council’s advisors, PwC, to report on compliance with the

policy parameters and investment performance. The PwC report is attached. This

report gives a high-level summary of the data in the PwC report.

Liquidity

11. To ensure HBRC has the

ability to adequately fund its operations, current policy requires HBRC to

maintain a liquid balance of $3.0m.

12. The following table reports

the cash and cash equivalents on 30 June 2022.

|

30 June 2022

|

$000

|

|

Cash on Call

|

9,851

|

|

Short-term bank deposits

|

-

|

|

Total Cash & Deposits

|

9,851

|

13. Council’s balance of

cash and deposits compares with the June 2021 balance of $8.1m.

14. To manage HBRC liquidity

risk, HBRC also retains a Standby Facility with BNZ.

This facility provides HBRC with a same day draw down option, to any amount

between $0.3-$5.0m, and with a 7-day minimum draw period.

Debt

Management

15. On 30 June 2022 the current

external debt for the Council group was $46.725m ($63.388m including the loan

from HBRIC).

16. Since the March quarter

additional funds of $4.0m were borrowed from LGFA. Total new debt for 2021-22

was $19.0m against a plan of $36.5m.

17. We anticipate that further

borrowing will be required in the first quarter of the new financial year as

expenditure of flood recovery activities and Council’s capital programme

ramps up.

18. The following summarises

the year-to-date movements in Council’s debt position

Summary of HBRC Debt

|

|

HBRC only

|

HBRC Group

|

|

Opening Debt – 1 July 2021 – excl HBRIC

Loan

|

30,875,014

|

30,875,014

|

|

New Loans raised

|

19,000,000

|

19,000,000

|

|

Less amounts repaid

|

(3,149,996)

|

(3,149,996)

|

|

Closing Debt 30 June 2022 (excluding HBRIC

loan)

|

46,725,018

|

46,725,018

|

|

Plus opening balance - loan from HBRIC

|

16,663,036

|

-

|

|

Total Borrowing as at 30 June

|

63,338,054

|

46,725,018

|

Managed

Funds

19. The LTP budgets an annual

return of 5.16% from managed funds. Of this 3.16% is used to fund activities

with 2.0% retained to grow the capital base to enable the future earnings to

protect the capital base for future generations.

20. Council budgets separately

for revenue from directly-held managed funds and those held by HBRIC. HBRIC is

required to deliver an overall portfolio return by way of an agreed annual

dividend, agreed through an annual Statement of Intent. The composition (between

revenues from managed funds and other sources such as port dividends is up to

the HBRIC Board). Council has received the budgeted $10.1m in dividends from

HBRIC within the FY21-22.

21. The FY21-22 budget

expectation for managed funds to be withdrawn to support Council operations is

$3.7m. Based on the June funds result and the value above the protected amount,

the funds held are not sufficient to deliver the returns required to meet

Council’s requirements. Borrowing will be required to cover the revenue

shortfall.

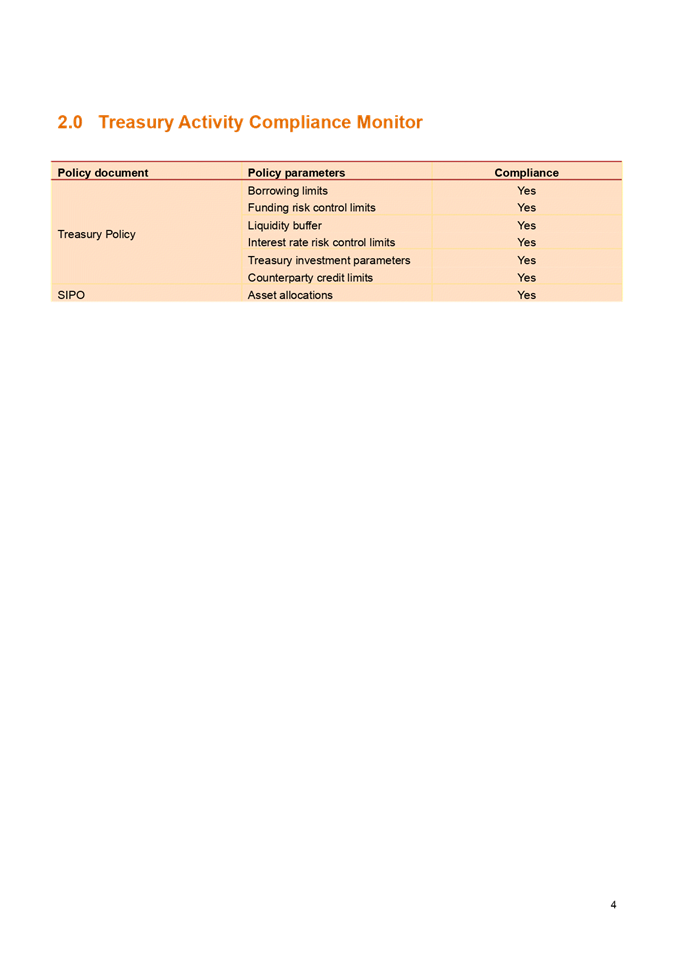

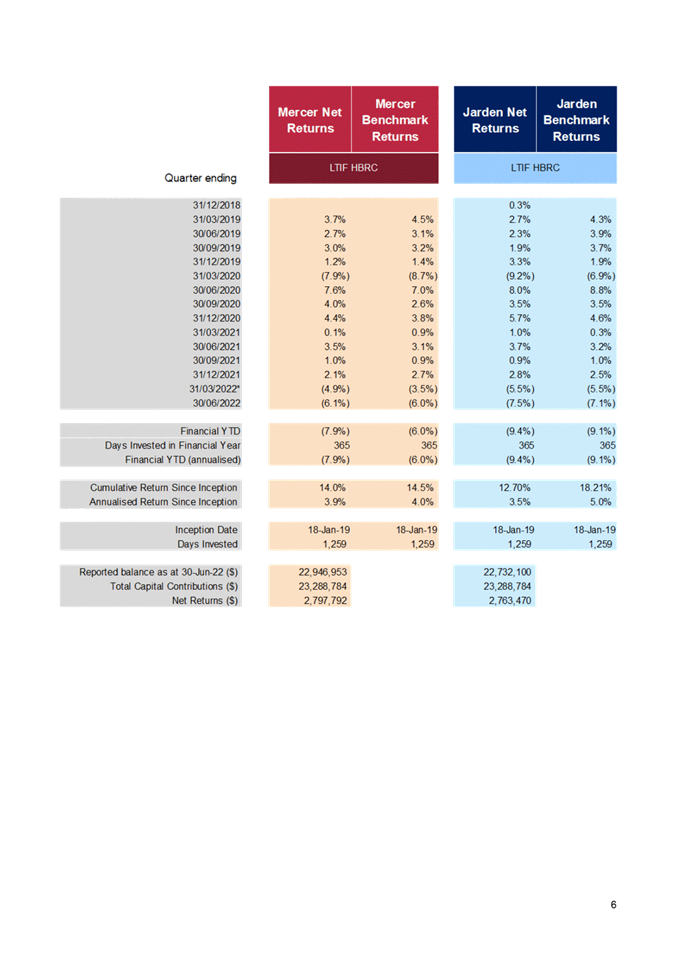

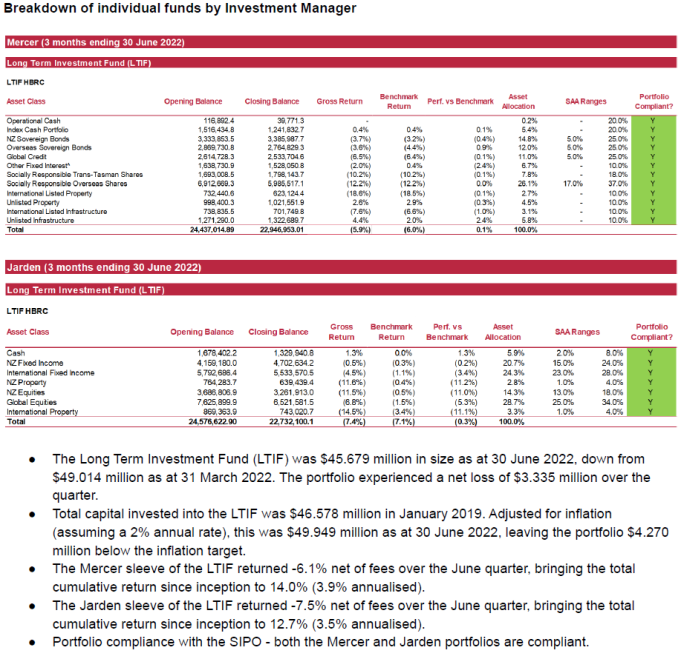

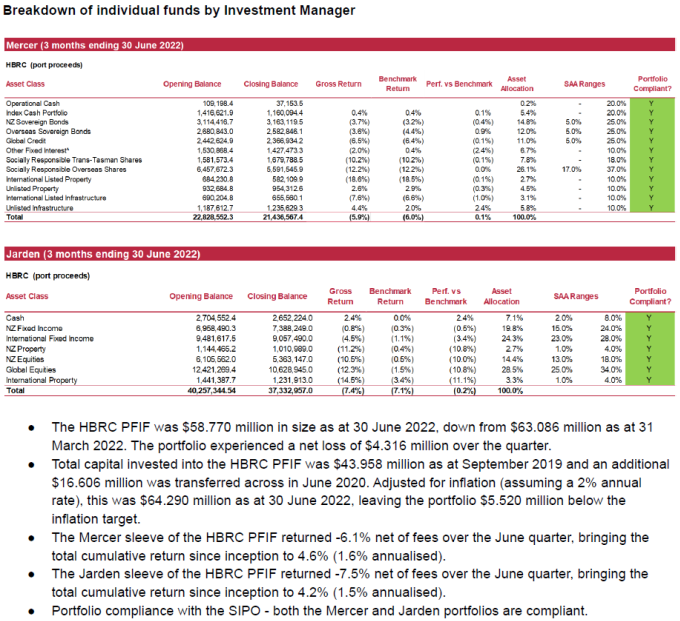

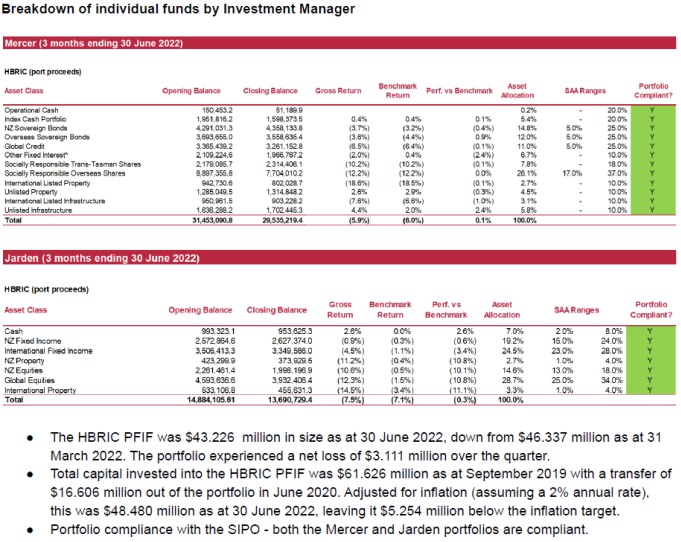

22. The Fund performances for

this year have been lower than we have experienced for some time. Financial

markets have not performed as strongly as the FY20-21 with the June quarter

2022 bringing further significant losses to the funds.

23. Given the nature of the

investments some volatility is to be expected. However, the performance of the

managed funds since placement demonstrates that market recovery can occur

within relatively short timeframes, and a watch and wait approach is prudent. The

portfolio construct is intentionally conservatively balanced for the long-term.

24. The following table summarises the fund balances at the

end of each quarter.

25. The view for the quarters

has been expanded to show the total group balance of managed funds (including

HBRIC) and the amount by which the current funds balance exceeds/(under) the

capital protected amount.

|

|

30 Jun 2021

|

30 Sep 2021

|

31 Dec 2021

|

31 Mar 2022

|

30 Jun 2022

|

|

|

$000

|

$000

|

$000

|

$000

|

$000

|

|

Total funds before withdrawals

|

118,563

|

115,745

|

118,221

|

112,099

|

104,449

|

|

Funds withdrawn

|

(4,200)

|

|

|

|

|

|

Fund balance HBRC

|

114,363

|

115,745

|

118,221

|

112,099

|

104,449

|

|

Capital Protected Amount HBRC (2% compounded)

|

111,983

|

112,543

|

113,105

|

113,671

|

114,239

|

|

Current HBRC value above protected amount

|

2,380

|

3,202

|

5,116

|

(1,572)

|

(9,790)

|

|

|

30 Jun 2021

|

30 Sep 2021

|

31 Dec 2021

|

31 Mar 2022

|

30 Jun 2022

|

|

|

$000

|

$000

|

$000

|

$000

|

$000

|

|

Funds Balances (Group + HBRIC)

|

|

Long-Term Investment Fund

|

49,883*

|

50,484

|

51,712

|

49,013

|

45,679

|

|

Future Investment Fund

|

64,370*

|

65,261

|

66,508

|

63,086

|

58,770

|

|

Total HBRC

|

114,363*

|

115,745

|

118,220

|

112,099

|

104,449

|

|

Plus HBRIC

|

48,503

|

48,771

|

48,907**

|

46,337

|

43,226

|

|

Total Group Managed Funds

|

162,866

|

164,516

|

167,127

|

158,436

|

147,675

|

|

Capital Protected Amount (2% compound inflation)

|

159,506

|

160,303

|

161,104

|

161,910

|

162,720

|

|

Current group value above protected amount

|

3,360

|

4,213

|

6,023

|

(3,474)

|

(15,045)

|

25.1. * Additional funds totalling

$4.2m (LTIF $2.0m & FIF $2.2m) were withdrawn from the funds during the

June 2021 quarter

25.2. ** HBRIC withdrew $1.3m

during the December quarter.

Investment

Property – Napier Leasehold Portfolio

26. Napier leasehold properties

represent the balance of ex-Harbour Board residential leasehold properties. The

HBRC returns from this portfolio are limited as following the sale of future

revenues in 2013 to ACC, HBRC retains one third of any excess rentals and one

third of any surplus when a property is freeholded.

27. HBRC provides a detailed

report to ACC every 6 months and a 6 monthly payment is made for rents owing

and for properties freeholded.

28. During the year, ten Napier

Endowment Leasehold Properties were freehold totalling $2.02m. The HBRC share

of $348,554 is paid into the sale of land reserve. The balance of the funds

received are paid to ACC to meet Council’s obligations under the contract.

29. The HBRC share of net

rentals received for the year, after payments to ACC was $118,386.

Investment

Property – Wellington Leasehold Portfolio

30. The Wellington leasehold

portfolio comprises 12 properties in central Wellington. The lessees are a mix of

commercial and residential entities.

31. Most of the properties (11)

have the rental reviewed every 14 years and one has a 7-year review period. No

rent reviews were conducted over the first 9 months and one property is

currently in the process of having its review completed.

32. As previously reported the

portfolio value has grown considerably from the initial cost of $6.5m in 2002

to $20.8m at 30 June 2021. Valuation advice is that we can expect another

significant increase in the portfolio value when it is revalued as at 30 June

2022.

33. Council budgets to utilise

the annual rentals of $841k to offset rates each year.

HBRIC

Ltd

34. In accordance with Council

Policy, HBRIC provides separate quarterly updates to the Corporate and

Strategic Committee.

Decision Making Process

35. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

35.1. This agenda item is in

accordance with the Finance, Audit and Risk Sub-committee Terms of Reference,

specifically “The Finance, Audit and Risk

Sub-committee shall have responsibility and authority to (2.4) monitor the performance of Council’s investment

portfolio”.

35.2. As this report is for

information only, the decision-making provisions do not apply.

Recommendations

That the Finance, Audit and Risk

Sub-committee:

1. Receives and notes the Quarterly Treasury Report

for the period 1 April – 30 June 2022.

2. Confirms that the

performance of Council’s investment portfolio has been reported to the

sub-committee’s satisfaction.

Authored by:

|

Jess Bennett

Commercial Accountant

|

Chris Comber

Chief Financial Officer

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

James Palmer

Chief Executive

|

Attachment/s

|

1⇩

|

Treasury Reporting as at 30 June

2022

|

|

|

|

Treasury Reporting as at 30 June 2022

|

Attachment

1

|

Hawke’s Bay Regional

Council

Finance

Audit & Risk Sub-committee

10 August

2022

Subject: Asset Management Group review

Reason for Report

1. This item presents a

summary of management reviews of the Asset Management function undertaken since

2018 to assist in decision-making on the timing of an Asset Management internal

audit proposed through the 2022-2023 internal audit plan.

Executive Summary

2. The draft 2022-2023

enterprise internal audit plan identified an opportunity to audit the Asset

Management function.

3. Management reviews of the

Asset Management Group, s17a Review of Works Group, Asset Management Framework

and Asset Management plans were conducted in the preparation of the 2021-2031

LTP.

4. The Group Manager of the

Asset Management Group will provide a presentation to the sub-committee,

outlining the previous management reviews and their findings.

5. The recommendation of the

Group Manager Asset Management is to defer the audit, to allow time for the

identified improvements from previous reviews to be implemented.

Background

6. A number of management

reviews have been undertaken since 2018 to assist in the improvement of both

service delivery and Asset Management processes/frameworks. These include:

6.1. A review of structure in

2018 and creation of a capital delivery team with the sole focus on delivering

the capital works programme and improving capital delivery processes.

6.2. A Section 17A review of

Works Group undertaken by Morrison Low in 2020 and presented to Finance Audit

and Risk Sub-committee on 11 November 2020.

6.3. A review of our Asset

Management framework (processes) undertaken by Waugh Infrastructure in March

2020.

6.4. A review of our Asset

Management plans by Waugh Infrastructure providing feedback to improve Asset

Management plans for the 2021-2031 LTP.

6.5. A review of the Asset

Management Group structure in 2022 which separated the operations function from

the strategic asset management function to assist in the management of change

for the Asset Management framework.

7. Many of the process

improvements are still to be delivered through the Enterprise Asset Management

ICT project, which is a significant activity with regular reporting to Council.

The Enterprise Asset Management ICT project is only just commencing, with an

expected duration of 24 months. The solution is fully integrated with the new

finance system.

Next Steps

8. It is proposed to improve

the visibility of the various Asset Management improvement actions to Council

by the creation of a master Improvement Register to track execution of

agreed actions and report on a regular basis.

9. Defer the proposed 2022-23

audit to 2024-2025 to allow time for the improvements from previous reviews to be

implemented.

Decision Making Process

10. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

10.1. This agenda item is in

accordance with the Sub-committee’s Terms of Reference, specifically:

10.1.1. The purpose of the Finance,

Audit and Risk Sub-committee is to report to the Corporate and Strategic

Committee to fulfil its responsibilities for the independence and adequacy

of internal and external audit functions

10.2. The Finance, Audit and Risk

Sub-committee is delegated by Council to (3.6) review the objectives and scope

of the internal audit function, and ensure those objectives are aligned with

Council’s overall risk management framework; and (3.7) assess the

performance of the internal audit function and ensure that the function is

adequately resourced and has appropriate authority and standing within Council.

10.3. As this agenda item is for

information only, the decision-making provisions do not apply.

Recommendation

That the Finance, Audit and Risk Sub-committee

receives and notes the Asset Management Group review staff report.

Authored & Approved by:

|

Chris Dolley

Group Manager Asset Management

|

|

Attachment/s

There are no attachments for this

report.

Hawke’s

Bay Regional Council

Finance

Audit & Risk Sub-committee

10 August

2022

Subject: 2022-2023

Enterprise Internal Audit Plan

Reason for Report

1. This item provides the

Finance Audit and Risk Sub-committee (FARS) with an update on the proposed

2022-2023 Enterprise Internal Audit Plan for consideration and confirmation.

Background

2. The Internal Audit

Framework requires that an Annual Enterprise Internal Audit Plan be adopted by

FARS each year for the following financial year.

3. Council’s internal

auditors, Crowe, provided a potential plan to the May 2022 FARS meeting. After

discussions it was agreed that further information would be provided to the

August 2022 FARS meeting to enable to the sub-committee to confirm the schedule

of audits in relation to the:

3.1. Asset Management Group

review

3.2. Health & Safety review.

Discussion

4. An update on

Council’s Asset Management Framework is being provided to FARS as a

separate agenda item. Maturity of Council’s Asset Management

Framework is making good progress. As the framework maturity is not fully

implemented it is considered too soon for an internal audit to provide full

assurance that the updated Asset Management Framework is effective both

operationally and in design. Therefore, staff propose that the Asset

Management Framework enterprise internal audit be deferred to 2023-2024.

5. Council’s Health and

System Management Framework is benchmarked to a standard that is no longer

being maintained – ACC’s Workplace Safety Management Practices

(WSMP). Therefore, Council’s Health and Safety Management Framework

is under review to align to a new Health and Safety Management external

standard that is recognised by Worksafe. Undertaking a Health and Safety

internal audit in FY23 is timely and will provide two purposes:

5.1. assurance that the maturity

of Council’s current Health and Safety Management Framework remains

‘fit for purpose’, with no immediate operational areas of concern,

and

5.2. as a gap analysis to the

new Health and Safety Management external standard allowing the Health and

Safety Team to prioritise key focusses areas for updating Council’s

current Health and Safety Management Framework.

6. Therefore, proposed audits

for the FY23 Annual Enterprise Internal Audit Plan include Council’s

Health and Safety Management Framework and the two audits agreed at the May 2022

FARS meeting, being Data Analytics and Organisational Change Consolidation and

Prioritisation. The high-level scope of the proposed enterprise internal

audits for FY23 are as follows.

6.1. Data Analytics – a

12-monthly cyclical review to interrogate transactions and master data within

Council’s payroll and financial system to identify potentially suspicious

relationships, trends, or transactions.

6.2. Organisational Change

Consolidation and Prioritisation – seeking assurance that decisions on

‘when’ to programme and ‘how’ to execute our strategic

organisational change initiatives effectively consider organisational impacts,

risks, resource constraints and process/system integration. The audit will

consider opportunities to strengthen decision making to ensure organisational

change effectively drives the creation of value while ensuring the organisation

is protected from undue risk, e.g., impact on people, compliance, etc, which is

sometimes referred to as ‘risk in change’. The strategic

decision-making process on each individual organisational change initiative and

project management process is out of scope.

6.3. Health and Safety –

to seek assurance that the structure of Council’s Health and Safety

Management Framework adequately aligns to a Worksafe recognised Health and

Safety Management external standard, and to provide the gap analysis against

the new external standard to assist the Health and Safety Team with

prioritising the Health and Safety workplan. In addition, the audit will

review how effectively of Health and Safety processes and procedures are

embedded into the operational business that ensures compliance with

Council’s Health and Safety Management Policy.

7. Council’s Assurance

Universe is attached to this paper. The Assurance Universe links

enterprise reviews or audits undertaken over the past four years at Council to

an enterprise risk. Reviews and audits in the Assurance Universe include

external audits, enterprise internal audits, business reviews with an

enterprise focus, and section 17a reviews.

Financial

and Resource Implications

8. The internal audits will be

undertaken, as per the approved plan, within the 2022-2023 budgets allocated.

Decision Making Process

9. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

9.1. This agenda item is in

accordance with the Sub-committee’s Terms of Reference, specifically:

9.1.1. The purpose of the Finance,

Audit and Risk Sub-committee is to report to the Corporate and Strategic

Committee to fulfil its responsibilities for (1.3) the independence and

adequacy of internal and external audit functions

9.1.2. The Finance, Audit and Risk

Sub-committee is delegated by Council to (3.6) review the objectives and scope

of the internal audit function, and ensure those objectives are aligned with

Council’s overall risk management framework; and (3.7) assess the performance

of the internal audit function and ensure that the function is adequately

resourced and has appropriate authority and standing within Council.

Recommendations

That the Finance, Audit and Risk

Sub-committee:

1. Receives and considers the 2022-23 Enterprise Internal

Audit Plan

staff

report

2. Confirms the internal audit

plan for the 2022-2023 financial year, will include:

2.1. data analytics (as resolved 4 May 2022)

2.2. organisational change

consolidation and prioritisation (as resolved 4 May 2022)

2.3. Health & Safety

management framework.

Authored

by:

|

Helen Marsden

Risk & Corporate Compliance

Manager

|

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

James Palmer

Chief Executive

|

Attachment/s

|

1⇩

|

Assurance Universe as at 6 July 2022

|

|

|

|

Assurance Universe as at 6 July 2022

|

Attachment

1

|

Hawke’s

Bay Regional Council

Finance

Audit & Risk Sub-committee

10 August

2022

Subject:

Data Analytics audit report

Reason for Report

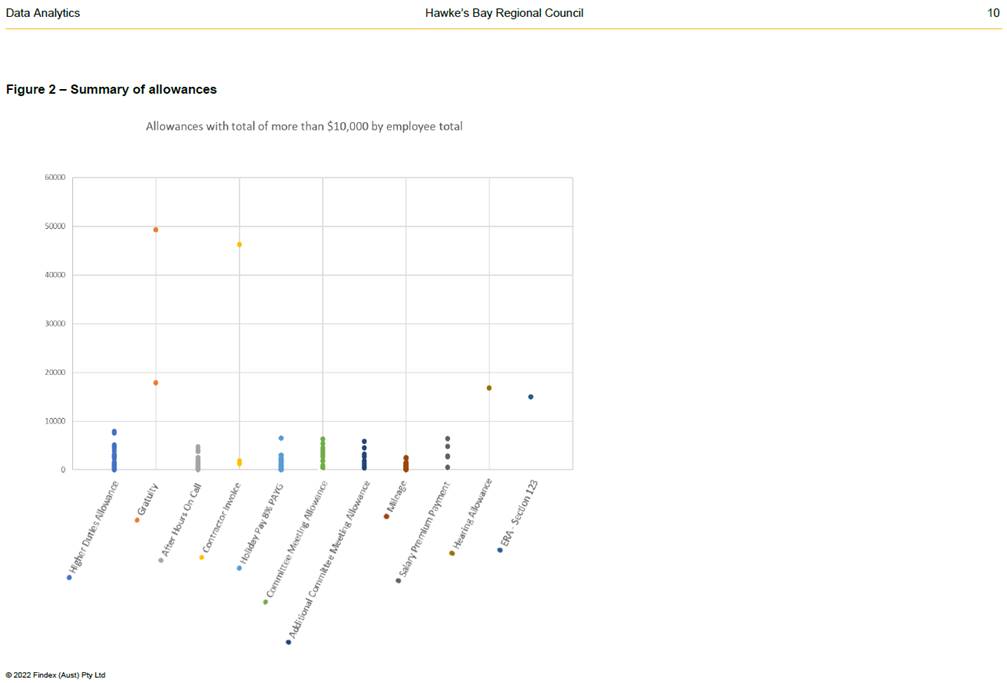

1. This item presents the

internal audit report (attached) for the Data Analytics audit undertaken by

Crowe in July 2022.

Executive

Summary

2. The Finance, Audit and Risk

Sub-committee (FARS) agreed at its meeting on 13 October 2021, as part of the

internal audit work programme, to engage Crowe to conduct an internal audit of

Council’s Data Analytics.

3. The agreed scope and

purpose of the audit was to review payables and payroll, and master and

transactional data for the financial year ended 30 June 2021. Due to the

change in financial system from 1 July 2021, the scope was changed to use

transaction data from 1 July 2021 to 30 April 2022 and master data

extracted on 24 May 2022. This data was then analysed independently by Crowe

for any potential anomalies or suspicious transactions.

4. The report was then

provided to staff, along with separate spreadsheets listing the transactions

that required review. These spreadsheets were initially analysed by the

Payroll Officer and the Team Leader Finance and then reviewed by the Chief

Financial Officer to identify any findings requiring further investigation.

5. This is the fifth

consecutive annual Data Analytics audit conducted by Crowe. Previous

reporting of the findings of the 2019-20 audit was presented to the

sub-committee on 5 May 2021. A comparison to previous findings is also provided

in this paper.

6. It is important to note

that, when a transaction is identified, it does not necessarily indicate that

there is anything suspicious. There are often legitimate business reasons

for a transaction being identified, such as different types of payments to a Council

(rates credits versus payment for services). These types of transactions may

display in areas such as ‘duplicate address’, ‘GST/non-GST

transactions’, or ‘duplicate IRD number’.

7. In addition, some

transactions are listed purely for review purposes due to their deemed higher

risk nature, such as ‘top 50 vendors by amount’ as an example.

This, in itself, allows staff to easily assess whether vendors are in line with

expectations and would highlight any vendors that may appear erroneous.

8. Given the small size of

Hawke’s Bay, there are times when an employee may share the same address

as a vendor, usually a spouse. Transactional processing staff ensure that

employee approvals are not allowed where any known conflicts exist between an

employee and a vendor.

Audit

Findings

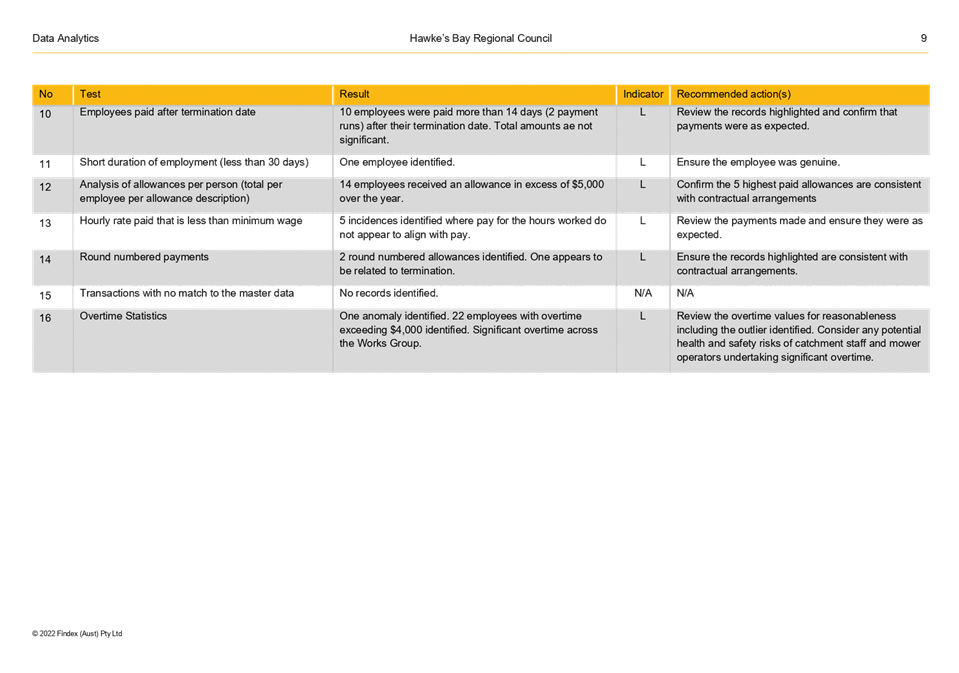

9. The report includes three

high risk results pertaining to:

9.1. Vendors with multiple

purchase orders on same day that would exceed approver's delegation, e.g. 33

cases were identified where a purchase order for the same supplier was approved

on the same day by the same individual and the total value exceeds delegated authority.

9.2. Invoices approved by

persons over or on their delegated authorities – 40 cases identified

where Purchase Order approval appeared to exceed delegated authority. We note

that in 26 cases the PO was approved after the invoice date.

9.3. Payments to Vendors with an

employee master data match approved by the employee – one record was

identified where the purchase requisition approver is linked to the vendor. A

Companies Office search confirmed the employee who approved the purchase requisition

is a director and shareholder of the vendor. The transaction value is $1,710

excluding GST.

10. All of the cases where a

purchase order for the same supplier was approved on the same day by the same

individual and the total value exceeds delegated authority relate to either

sustainable homes or vehicle purchases, where requisitions are for specific

individual items and a number can be put through on the same day. No unusual

items were noted.

11. On review of the cases

identified where Purchase Order approval appeared to exceed delegated authority

it was noted that 35 cases were approved by the correct person with the correct

financial delegation at the requisition stage. The remaining five cases were

for staff that had been given higher financial delegation due to covering

management roles. With regard to purchase orders being raised after invoice

date, this is a known issue which we will be addressing through increased

training.

12. The one record identified

where the purchase requisition approver is linked to the vendor was a valid

payment. Staff will be reminded to ensure that one-up approval is obtained for

any transactions where a conflict of interest may be perceived.

13. All other findings have

been reviewed in detail, and no unusual or unexpected transactions were

identified.

Comparison

to the Last (2020) Audit

14. The number of duplicate

bank accounts, vendor names and addresses in the supplier master file decreased

from 184 last audit to 74.

15. Last year there were eight

possible duplicate payments identified while this year none were identified.

16. Overall, the number of

errors arising from internal processes is better than the prior year, with

internal checks continuing to keep the number of flagged or highlighted

transactions arising within the review to a low percentage of the overall

transactions. Staff recognise that there is a need to maintain appropriate

process to reduce errors and to ensure correct internal controls are used to

reduce the risk of fraud or misappropriation.

Actions to Address Findings

17. While reviewing the

findings of the audit, corrective action has been taken where needed to remove

duplicates and complete any missing details. Staff have also streamlined some

vendor accounts where multiple sub-accounts were causing problems.

18. Staff have also been

requested to update their contact details in the system, which most have now

done.

19. Finance continues to train

users on processes with the new financial system, especially the raising of

requisitions and purchase orders before goods and services are received. The

Council is also preparing some fraud training, which will include reminders

about ensuring any situations where a conflict of interest may be perceived are

appropriately managed.

Decision Making Process

20. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

20.1. As this report is for information

only, the decision-making provisions do not apply.

20.2. Any decision of the

sub-committee is in accordance with the Terms of Reference and decision-making

delegations adopted by Hawke’s Bay Regional Council 25 March 2020,

specifically the Finance, Audit and Risk Sub-committee shall have

responsibility and authority to:

20.2.1. Receive the internal and

external audit report(s) and review actions to be taken by management on

significant issues and recommendations raised within the report(s)

20.2.2. Ensure that recommendations

in audit management reports are considered and, if appropriate, actioned by

management.

Recommendations

That

the Finance, Audit and Risk Sub-committee receives and considers the Data

Analytics audit report staff report.

Authored by:

|

Chris Comber

Chief Financial Officer

|

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

|

1⇩

|

Crowe 2022 HBRC Data Analytics

Report

|

|

|

|

Crowe 2022 HBRC Data Analytics Report

|

Attachment

1

|

Hawke’s Bay Regional

Council

Finance

Audit & Risk Sub-committee

10 August

2022

Subject: 2021-2022 Enterprise Internal

Audit plan status update

Reason for Report

1. This item provides the

Finance Audit and Risk Sub-committee (FARS) with the Internal

Audit Annual Plan FY21-22 status update.

Discussion

2. The intention of this

update is to provide the FARS with oversight and progress of individual internal

audits that form part of the approved annual internal audit plan.

3. The Data Analytics audit

carried out by Crowe commenced in mid-May, and the full report is being

presented to the FARS by the Chief Financial Officer in this meeting.

4. As shown on the following

dashboard, the internal audits for FY21-22 have now been completed and reported

to FARS.

|

Approved Audit FY2021-22

|

Provider

|

Quarter Due

|

Date Commenced

|

Management Comments

|

Reported to FARS

|

|

Fraud Management

|

Crowe

|

Q3

|

February 2022

|

|

May 2022

|

|

Data Analytics

|

Crowe

|

Q4

|

May 2022

|

|

August 2022

|

|

Retained Audit Capacity – 40 hrs

|

|

|

|

|

|

Decision Making Process

5. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

5.1. This agenda item is in

accordance with the Sub-committee’s Terms of Reference, specifically:

5.1.1. The purpose of the Finance,

Audit and Risk Sub-committee is to report to the Corporate and Strategic

Committee to fulfil its responsibilities for (1.3) the independence and

adequacy of internal and external audit functions

5.1.2. The Finance, Audit and Risk

Sub-committee shall have responsibility and authority to (2.6) receive the

internal and external audit report(s) and review actions to be taken by

management on significant issues and recommendations raised within the

report(s)

5.1.3. The Finance, Audit and Risk

Sub-committee is delegated by Council to (3.6) review the objectives and scope

of the internal audit function, and ensure those objectives are aligned with

Council’s overall risk management framework; and (3.7) assess the

performance of the internal audit function, and ensure that the function is

adequately resourced and has appropriate authority and standing within Council.

Recommendations

That the Finance, Audit and Risk

Sub-committee:

1. Receives and considers the 2021-22 enterprise Internal Audit plan status update

staff report.

2. Reports to the Corporate

and Strategic Committee, the Sub-committee’s satisfaction that the 2021-22

Enterprise Internal Audit plan has been completed.

Authored by:

|

Olivia Giraud-Burrell

Quality & Assurance Advisor

|

Helen Marsden

Risk & Corporate Compliance

Manager

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

James Palmer

Chief Executive

|

Attachment/s

There are no attachments for this

report.

Hawke’s

Bay Regional Council

Finance

Audit & Risk Sub-committee

10 August

2022

Subject: Audit Plan for the 2021-2022

Annual Report

Reason for Report

1. This item provides an

update on the timing for the Audit of Council’s 2021-22 Annual Report.

Executive

Summary

2. Legislation has been passed

to extend the statutory deadlines for the completion of the audited 2021-2022

Annual Report by 2 months due to the continued impacts of Covid-19 on the

resourcing for the audits.

3. The statutory deadline for

the adoption of the HBRC Annual Report is now 31 December 2022.

4. Staff have been given 3

October 2022 as the date for the commencement of the audit process. This will

require the scheduling of a meeting of the Finance Audit and Risk Sub-committee

in early December to review the draft Annual Report prior to its submission to

Council for adoption.

Background

/Discussion

5. The audit and adoption of

the Annual Report follows timelines set out in the Local Government Act

2002. This Act has been amended to extend the timeframes for the

2020-2021 and 2021-2022 Annual Reports.

5.1. Section 98 (7) now states

that the annual report of a Council must be adopted no later than 31 December

(31 December 2022 for the 2021-2022 Annual Report).

6. Officers have had

discussions with our new auditors, Ernst & Young (EY), about audit timing

(see table below) and have received an audit start date of 3 October 2022. This

may change as our auditors refine their work plans and resourcing.

|

3

– 28 October 2022

|

Audit

field work will be conducted (3 weeks onsite and 1 week remotely)

|

|

w/b

24 October 2022

|

Audit

of the debenture trust deed

|

|

w/b

24 October 2022

|

Audit

of the

summary annual report

|

|

w/b

24 October 2022

|

ACC

contract Agreed Upon Procedures

|

|

w/b

31 October

|

Wrap-up

of annual report review

|

|

8

November 2022

|

EY

issue draft audit closing report, report on control findings and representation

letters for management review

|

|

16

November 2022

|

EY

clear the annual report, summary annual report, debenture trust deed

reporting and AUP

|

7. Given the timing of the

appointment of the new auditors, officers have not requested the production of

an audit planning report for FARS from Ernst & Young.

8. Officers are comfortable

with the timing of the audit process.

Financial and Resource Implications

9. Staff do not expect the

cost of the audit for 2021-2022 to exceed the budget allocated for the audit

programme.

Decision Making Process

10. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

10.1. as this report is for

information only, the decision-making provisions do not apply.

10.2. any decision of the sub-committee

(in relation to this item) is in accordance with the Terms of Reference and

decision-making delegations adopted by Hawke’s Bay Regional Council

25 March 2020, specifically the Finance, Audit and Risk Sub-committee

shall have responsibility and authority to:

10.2.1. Satisfy itself that the

financial statements and statements of service performance are supported by

adequate management signoff and adequate internal controls and recommend

adoption of the Annual Report by Council

10.2.2. Confirm that processes are

in place to ensure that financial information included in Council’s

Annual Report is consistent with the signed financial statements

10.3. Confirm the terms of

appointment and engagement of external auditors, including the nature and scope

of the audit, timetable, and fees.

Recommendations

That

the Finance, Audit and Risk Sub-committee receives and considers the Audit

Plan for the 2021-2022 Annual Report.

Authored by:

|

Tim Chaplin

Senior Group Accountant

|

Sarah Bell

Team Leader Strategy &

Performance

|

Approved by:

|

Chris Comber

Chief Financial Officer

|

Susie Young

Group Manager Corporate Services

|

Attachment/s

There are no attachments for this

report.

Hawke’s Bay Regional

Council

Finance

Audit & Risk Sub-committee

10 August

2022

Subject: Internal Assurance corrective

actions update

That the

Finance, Audit and Risk Sub-committee excludes the public from this section of

the meeting, being Agenda Item 11 Internal Assurance corrective actions

update with the general subject of the item to be considered while the

public is excluded; the reasons for passing the resolution and the specific

grounds under Section 48 (1) of the Local Government Official Information and

Meetings Act 1987 for the passing of this resolution being:

|

General

subject of the item to be considered

|

Reason

for passing this resolution

|

Grounds

under section 48(1) for the passing of the resolution

|

|

Internal Assurance

corrective actions update

|

s7(2)(f)(ii) The

withholding of the information is necessary to maintain the effective conduct

of public affairs through the protection of such members, officers,

employees, and persons from improper pressure or harassment.

s7(2)(e) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to avoid

prejudice to measures that prevent or mitigate loss to members of the public.

s7(2)(j) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to prevent

the disclosure or use of official information for improper gain or improper

advantage.

|

The Council is specified,

in the First Schedule to this Act, as a body to which the Act applies.

|

Authored by:

|

Olivia Giraud-Burrell

Quality & Assurance Advisor

|

Helen Marsden

Risk & Corporate Compliance

Manager

|

|

Andrew Siddles

Chief Information Officer

|

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

James Palmer

Chief Executive

|

Hawke’s

Bay Regional Council

Finance

Audit & Risk Sub-committee

10 August

2022

Subject: Six-monthly Enterprise Risk

Report

That

the Finance, Audit and Risk Sub-committee excludes the public from this section

of the meeting, being Agenda Item 12 Six-monthly Enterprise Risk Report

with the general subject of the item to be considered while the public is

excluded. The reasons for passing the resolution and the specific grounds under

Section 48 (1) of the Local Government Official Information and Meetings Act

1987 for the passing of this resolution are:

|

General

subject of the item to be considered

|

Reason

for passing this resolution

|

Grounds

under section 48(1) for the passing of the resolution

|

|

Six-monthly Enterprise

Risk Report

|

s7(2)(f)(ii) The

withholding of the information is necessary to maintain the effective conduct

of public affairs through the protection of such members, officers,

employees, and persons from improper pressure or harassment.

s7(2)(e) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to avoid

prejudice to measures that prevent or mitigate loss to members of the public.

s7(2)(j) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to prevent

the disclosure or use of official information for improper gain or improper

advantage.

|

The Council is specified,

in the First Schedule to this Act, as a body to which the Act applies.

|

Authored by:

|

Helen Marsden

Risk & Corporate Compliance

Manager

|

|

Approved by:

|

Susie Young

Group Manager Corporate Services

|

James Palmer

Chief Executive

|