Meeting of the

Corporate and Strategic Committee

Date: 1 June 2022

Time: 11.30am

|

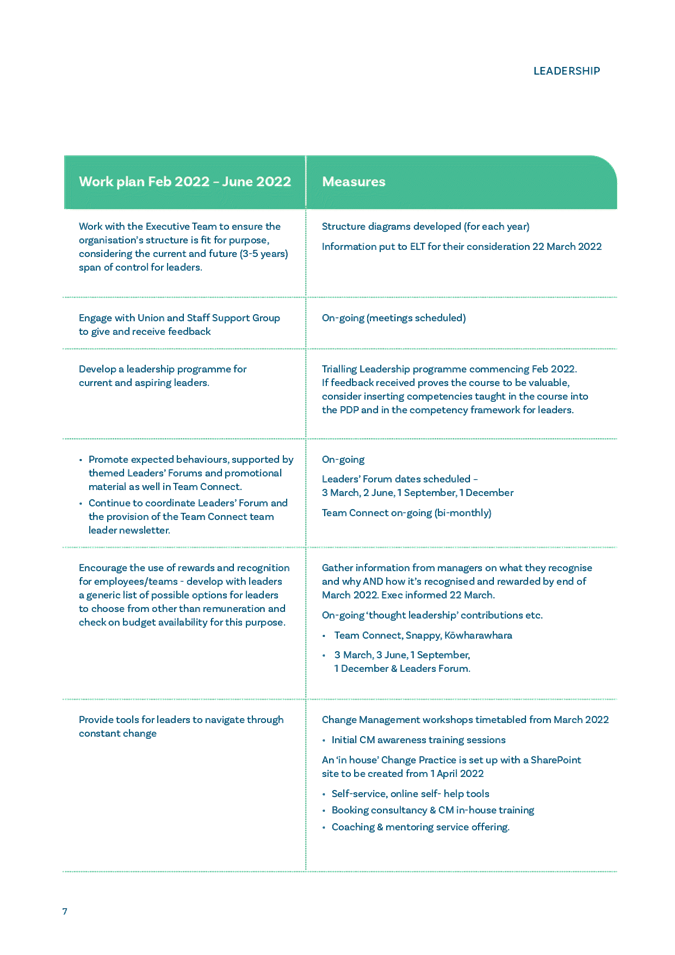

Venue:

|

Council

Chamber

Hawke's

Bay Regional Council

159

Dalton Street

NAPIER

|

Agenda

Item Title Page

1. Welcome/Karakia

/Notices/Apologies

2. Conflict

of Interest Declarations

3. Confirmation of Minutes of

the Corporate and Strategic Committee meeting held on 16 March 2022

4. Follow-ups

from Previous Corporate and Strategic Committee Meetings 3

5. Call

for minor items not on the Agenda 7

Decision

Items

6. Annual

Plan 2022-2023 for adoption 9

7. Regional

Sector Shared Services Council Controlled Organisation 13

Information

or Performance Monitoring

8. Organisational

Performance Report for the period 1 January – 31 March 2022 17

9. Financial

report for the period to 31 March 2022 19

10. HBRIC

Ltd Quarterly Update 27

11. Report

from the Finance Audit and Risk Sub-committee meeting 35

12. HBRC

People Plan 41

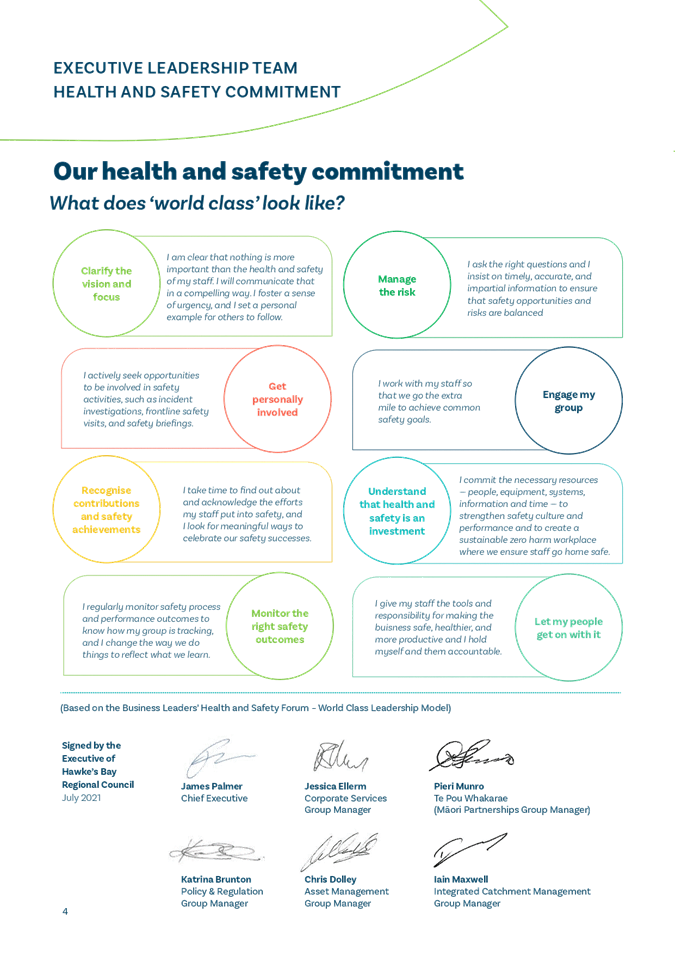

13. Health,

safety and wellbeing Strategic plan 57

14. HBRC

Forestry 71

15. Discussion

of Minor Items not on the Agenda 97

Decision

Items (Public Excluded)

16. Confirmation

of 16 March 2022 Public Excluded Minutes 99

Hawke’s Bay Regional

Council

Corporate

and Strategic Committee

1 June

2022

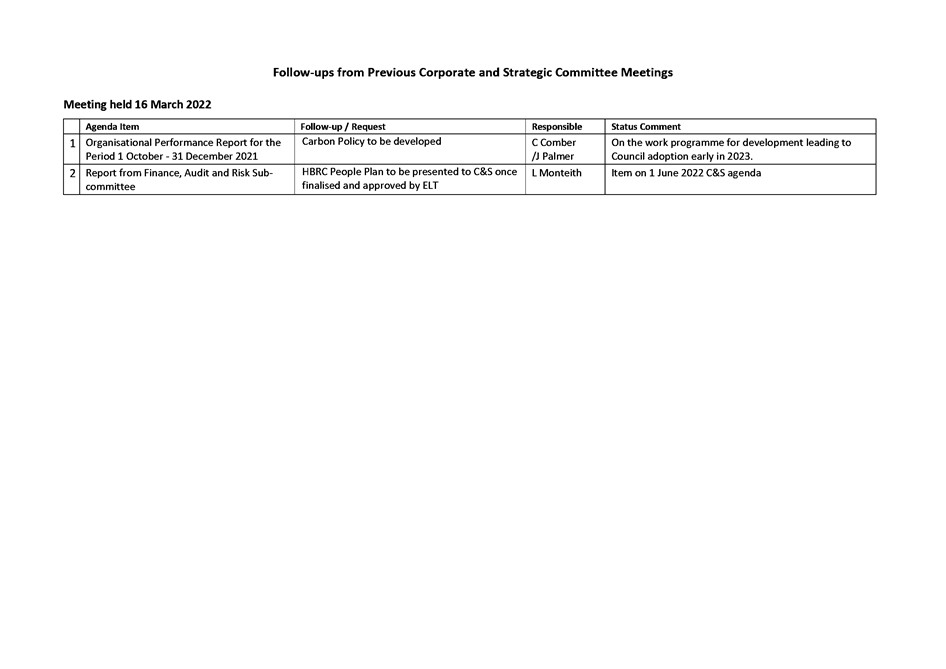

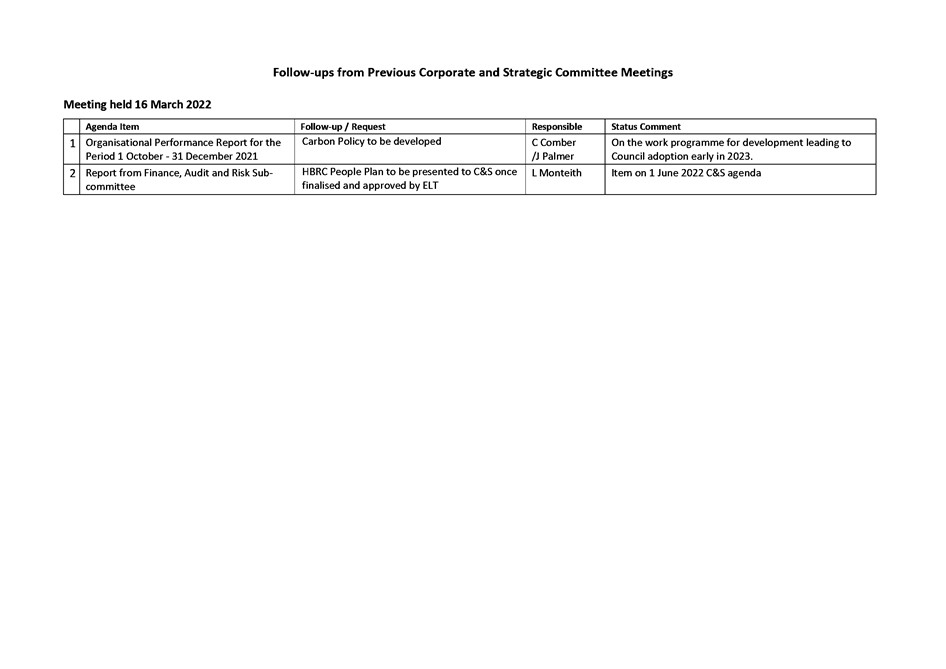

Subject: Follow-ups from previous Corporate and Strategic Committee meetings

Reason for

Report

1. On the list attached are

items raised at previous Corporate and Strategic Committee meetings that staff

have followed up on. All items indicate who is responsible for follow up, and a

brief status comment. Once the items have been reported to the Committee they

will be removed from the list.

Decision Making Process

2. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That the Corporate and

Strategic Committee receives and notes the Follow-ups from previous

Corporate and Strategic Committee meetings.

Authored by:

|

Leeanne Hooper

Team Leader Governance

|

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

|

1⇩

|

Followups from previous meetings

|

|

|

|

Followups from previous meetings

|

Attachment

1

|

Hawke’s

Bay Regional Council

Corporate

and Strategic Committee

1 June

2022

Subject: Call for minor items not on the Agenda

Reason for Report

1. This item provides the

means for committee members to raise minor matters relating to the general business of

the meeting

they wish to bring to the attention of the meeting.

2. Hawke’s Bay Regional

Council standing order 9.13

states:

2.1. “A meeting may discuss an

item that is not on the agenda only if it is a minor matter relating to the

general business of the meeting and the Chairperson explains at the beginning

of the public part of the meeting that the item will be discussed. However, the

meeting may not make a resolution, decision or recommendation about the item,

except to refer it to a subsequent meeting for further discussion.”

Recommendations

3. That the Corporate and

Strategic Committee accepts the following minor items not on the Agenda for

discussion as Item 15.

|

Leeanne

Hooper

Governance

Team Leader

|

James

Palmer

Chief

Executive

|

Hawke’s Bay Regional

Council

Corporate

and Strategic Committee

1 June

2022

Subject: Annual Plan 2022-2023

for adoption

Reason for Report

1. This item seeks a

recommendation to Council to adopt the Annual Plan 2022-2023. Council needs to

adopt the Annual Plan in accordance with the Local Government Act 2002 before

it can set the rates for the 2022-2023 financial year.

Officers’

Recommendation

2. Staff recommend that the

Committee reviews the information provided and resolves a recommendation that

Council adopts the Annual Plan 2022-2023 as

presented.

Background

3. Annual plans are prepared

and adopted under section 95 of the Local Government Act 2002 (LGA). Council is

required to produce an annual plan in the years between long term plans. Long

term plans are reviewed and adopted every three years. The Annual Plan 2022-2023

is Year 2 of the Long Term Plan 2021-2031 (LTP). The LGA requires that an

annual plan be adopted before the commencement of the year to which it relates.

4. An annual plan provides an

opportunity for small adjustments or variances from the long term plan to

reflect changes since the plan was adopted.

5. Under the LGA, consultation

is only required if there is a “significant or material difference from

the content of the long term plan” for that financial year. In other

words, as long as budget adjustments do not significantly change total rates,

rating impacts or levels of service then no consultation is required.

6. Council’s

Significance and Engagement Policy is the primary tool to determine the

significance of Regional Council decisions and give clarity on when to engage.

As outlined in the policy, significant means that the issue, proposal, decision

or other matter is judged by Council to have a high degree of importance. This

is typically when the impact on the regional community or a large portion of

the community, or where the financial consequences of a decision, are

substantial.

Annual

Plan 2022-2023 Approach

7. Councillors have been

involved in several workshops around the development of this Annual Plan and

were advised of the challenges and financial pressures faced.

8. Council made a resolution

to adopt a no-consultation approach to the Annual Plan 2022-2023 at its meeting

on 30 March 2022. Budgets have been worked hard to ensure the financial

pressures within existing budgets have been accommodated within the 15% rates

increase forecast for Year 2 of the LTP. Staff have assessed that there

is no significant rating or levels of service impacts from proposed budget

adjustments that would trigger the need to consult.

9. Every financial lever

available has been pulled to remain within the total average rates increase of

15%. Ratepayers will be impacted differently based on the mix of general and

targeted rates they pay.

10. Some adjustments of scale

have been incorporated into the Annual Plan. These adjustments are not

significant in terms of financial impact, nor do they alter levels of service.

Some of these key adjustments are:

10.1. Economic Development

– funding the new Economic Development Agency within the Regional

Development Rate.

10.2. Possum Control –

$300k p.a. for additional monitoring is reallocated from the existing Predator

Free Hawke’s Bay budget. This is the proposed transitional approach to

implement large-scale contracts for possum control on 1 July 2024, following

consultation on the Long Term Plan 2024-2034.

10.3. Acceleration of the Right

Tree Right Place Pilot.

10.4. Implementation of weed boat

harvesting in the Karamū.

10.5. Ahuriri Regional Park

– funding for project management brought forward to Year 2.

10.6. Decrease in Tūtira

logging revenue forecast.

10.7. Increase in insurance

premiums.

11. The community were informed

of the Council’s approach to this Annual Plan with a media release issued

on 20 March 2022.

12. Following Council adoption

on 29 June 2022, another media release will be issued. This will be posted to

social media and the Council website.

13. A two-page summary of the

Annual Plan is also being prepared for publication in Hawke’s Bay Today.

14. There will be further

coverage of the Annual Plan in the monthly Our Environment

printed/digital community newsletter.

2022-2023

Annual Plan Budget

15. The impact of the changes

included in the 2022-2023 Annual Plan budgets has resulted in:

15.1. A reduction in the

2022-2023 operating surplus of $3.2m (down from $7.5m to $4.3m) as a result of:

15.1.1. Council’s budgeted

revenues are $0.5m higher at $81.7m (LTP $81.2m).

15.1.2. Council’s budgeted

expenditure of $77.4m (LTP $73.7m) is $3.7m higher. A substantial portion of

this is due to an accounting change in the way $1.4m of expenditure on

information systems improvements are treated. New accounting standards

require software costs, which were previously capitalised, to be treated as

operating expenditure each year. The balance of the change is driven by the need

to accommodate additional cost pressures within the budget.

15.1.3. Council will need to borrow

more to fund operations, however, the total forecast debt at 30 June 2023

is similar to that forecast in the LTP ($104.1m in LTP vs $103.8m in AP) due to

a lower opening debt figure.

16. Council is managing

increasing cost pressures, including higher inflation, interest rates and a

competitive employment and constrained contracting market. Council management

will continue to actively work with budget holders during the year to ensure

levels of service outlined in the LTP are delivered.

Financial

Strategy as per 2021-31 LTP

17. The 2022-2023 Annual Plan

is a continuation of the 2021-2031 LTP’s Financial Strategy. Council is

borrowing to fund operational costs in the early years so that rate increases

can be kept at a manageable and affordable level, while urgent environmental

protection and enhancement work with inter-generational benefits is progressed.

18. As outlined in the LTP,

Council considers this approach to be financially prudent as it balances the

Council’s funding needs with the need to keep the level of rates

affordable for ratepayers. As noted in the LTP, borrowing to fund operations in

the first 5 years will require higher rate increase in future years (years 6 to

10 of the LTP).

19. Council continues to meet

or exceed all benchmarks as set out in the LTP.

Fees

and Charges

20. For each Annual Plan, fees

and charges are updated to meet the required revenue budget for the new year.

It is proposed to present the fees and charges for 2022-2023 in a single

schedule separate to the Annual Plan document, but referred to within, and to

make this available on the HBRC website. The draft Fees and Charges Schedule

2022-2023 is attached to this paper.

21. The policy for fees and

charges is unchanged from what was set in the Long Term Plan 2021-2031.

The fees and charges set for each activity are unchanged from 2021-2022 (year 1

of the Long Term Plan), with the exception of:

21.1. Hourly charge-out rates for

staff involved in consent application and compliance monitoring activities,

have been increased slightly based on modelling the fees required to meet the

revenue target for income. The other staff charge-out rates have been updated

based on benchmarking against the consent and compliance rates for similar

roles, while taking internal costs and corporate overhead into

consideration. A minimum charge-out rate has been set at $95 per hour.

21.2. The jet ski registration

fee has been simplified to a single charge of $70 including GST for each

registration, which includes the registration sticker.

21.3. The annual freshwater

science charges have a slight increase of ~1% for discharge to land/water

consents, and ~2-5% for watertake consents. This is based on modelling of

the charges required to meet the 2022-2023 revenue target for Section 36 RMA

income for water quality and quantity science and monitoring, and reflects the

general inflationary cost lift in the budget for these activities.

Significance

and Engagement Policy Assessment

22. Staff assessed the changes

from what was proposed for Year 2 of the Long Term Plan 2021-2031 and advised

Council there were no significant rating or levels of service impacts that

would trigger the need to consult.

23. Council made a resolution

to adopt a no-consultation approach at its meeting on 30 March 2022.

Climate

Change Considerations

24. This year’s Annual

Plan continues the step-change approach we set in motion in our 2018-2028 Long

Term Plan Facing our Future, with an increased focus on climate change.

25. A number of our key

strategic projects are working to help urgently meet the climate change

challenge. These include Right Tree Right Place, the Regional Water Security

Programme, future water use, reviewing and upgrading flood protection assets

across the Tūtaekurī, Ngaruroro, Lower Tukituki and Clive rivers,

gravel extraction in the Upper Tukituki Flood Control Scheme, on-demand public

transport pilot, and the Erosion Control Scheme.

Decision Making Process

26. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

26.1. The decision does not

significantly alter the service provision or affect a strategic asset, nor is

it inconsistent with an existing policy or plan.

26.2. The use of the special

consultative procedure is not prescribed by legislation.

26.3. The decision is not significant

under the criteria contained in Council’s adopted Significance and

Engagement Policy.

26.4. The persons affected by

this decision are ratepayers in the Hawke’s Bay region.

26.5. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by or have an interest in the decisions made, Council can

exercise its discretion and make a decision without consulting directly with the

community or others

having an interest in the decision.

Recommendations

1. That the Corporate and

Strategic Committee receives and considers the Annual Plan 2022-2023 for

adoption staff report.

2. The Corporate and Strategic

Committee recommends the Hawke’s Bay Regional Council:

2.1. Agrees that the decisions

to be made are not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without conferring directly with

the community or persons likely to have an interest in the decision.

2.2. Adopts the Annual Plan

2022-2023 in accordance with the Local Government Act 2002, subject to any

amendments agreed by the Corporate and Strategic Committee at its meeting on 1

June 2022.

2.3. Delegates to the Chief

Financial Officer authority to make any required minor amendments or edits to

the Annual Plan 2022-2023 prior to publishing.

Authored by:

|

Mandy Sharpe

Project Manager

|

Sarah Bell

Team Leader Strategy &

Performance

|

|

Tim Chaplin

Senior Group Accountant

|

Desiree Cull

Strategy & Governance Manager

|

|

Amy Allan

Management Accountant

|

Ross Franklin

Finance Consultant

|

Approved by:

|

Chris Comber

Chief Financial Officer

|

James Palmer

Chief Executive

|

Attachment/s

|

1

|

2022-2023 Annual Plan

|

|

Under Separate Cover

|

|

2

|

HBRC Draft Fees and Charges Schedule

2022-2023

|

|

Under Separate Cover

|

Hawke’s

Bay Regional Council

Corporate

and Strategic Committee

1 June

2022

Subject: Regional Sector Shared Services Council Controlled

Organisation

Reason for Report

1. This deliberations report

provides the Corporate and Strategic Committee with information to assist it to

make an informed decision on whether to recommend that Council participates in

a Regional Sector Shared Services Council Controlled Organisation (RSSSCCO).

Officers’

Recommendations

2. Council officers recommend

that Councillors consider the view expressed by the submission received in

conjunction with the information in this report in making a decision on whether

to recommend whether or not the Council participates in the proposed RSSSCCO.

Background

3. At the meeting of the

Regional Council on 27 April 2022, Council agreed to consult with the public on

participating in a Council Controlled Organisation (CCO) to support shared

services and collaborative activities in the regional sector.

4. The Council:

4.1. agreed that the decisions

to be made are in accordance with section 56 and 82 of the Local Government Act

4.2. agreed to participate in a

Regional Sector Shared Services Council Controlled Organisation subject to

consultation

4.3. agreed to the

‘streamlined’ public consultation process proposed.

Scope

of the decision

5. Only two options were

proposed during consultation, being:

5.1. To support Hawke’s

Bay Regional Council participating in a regional sector shared services CCO.

5.2. To not support

Hawke’s Bay Regional Council participating in a regional sector shared

services CCO.

6. Council can only decide in

favour of one of the two options as consulted on without requiring further

consultation.

Consultation

7. Staff are confident that

the consultation undertaken is compliant with the requirements under the Local

Government Act 2002.

8. The consultation period,

from 29 April to 15 May 2022 was supported by public notice in the newspaper,

media release, social media, an email targeted to relevant organisations and

content on the Regional Council’s website.

9. Submissions were invited

through our online submission form and a downloadable form was also available

on the Regional Council website.

10. HBRC’s Facebook

social media channel sent 3 posts concerning this consultation, resulting in:

10.1. Individuals reached: 1,858

10.2. Post engagements: 43

10.3. Links clicked: 19.

11. The question asked was:

“Do you support Hawke’s Bay Regional Council participating in a

regional sector shared services council-controlled organisation?”

Submissions received

12. One submission was received

giving a response of ‘don’t know’ to the proposal.

13. The online submission

stated:

13.1. “Yet again a

consultation document about the creation of a CCO has been put out for comment

without a full explanation of what the CCO is intended to do. What 'shared

services' are you intending to have delivered under the umbrella of this CCO?

What 'projects' are you intending to have delivered under the umbrella of this

CCO? Whilst I think I understand the intent of what you are trying to achieve,

without knowing what 'shared services' and 'projects' that the proposed CCO

will be tasked with it is difficult to agree or disagree with your proposal.

Personally I have been advised that the implementation of IRIS is proving to be

a dogs breakfast. Therefore, I have to wonder what other projects or services

can be better provided by sharing them between the Regional Council sector when

each council has their own way of doing things to reach the same outcomes. I

find it ironic that our local Territorial Authorities arguing against the

governments Three Waters proposal due to loss of community of interest yet it appears

that HBRC is willing to do the same thing for yet undefined 'shared services'

and 'projects'. Much like the comments I made around the Food East proposal

this another fail for the content of your consultation document. I expect

better.”

14. The submitter, Paul Bailey

wished to be heard, and presented his submission to the 25 May 2022 Regional

Council meeting.

15. The key themes in his

submission have been summarised as:

15.1. Lack of information - on which to base support

or not for joining

15.2. Past performance/results - issues with the

implementation of IRIS

15.3. Unique ways of doing things - councils each do things

differently so shared solutions may not be better

15.4. Loss of community interest.

Officer’s

response to themes raised in submission

Lack of information

16. Current labour market

challenges are requiring us to look at new ways of getting things done.

17. The initial scope of

activities for the CCO are the collaborations that are already in progress

across the Regional Sector / Te Uru Kahika.

18. Current collaborations are

Environmental Monitoring and Reporting (EMaR), Land Air Water Aotearoa (LAWA),

ReCoCo and Integrated Regional Information Systems (IRIS) programmes

19. It is anticipated that the

CCO will be a useful vehicle to enable a joined-up response to new initiatives

that are passed down to the sector from central government.

Past

Performance / Results

20. The original IRIS project

won a Taituarā (then SOLGM) Excellence Award and an ALGIM

collaboration award.

21. The shared service approach

to IRIS has delivered the following benefits to the regional sector:

21.1. Affordability – the

development and implementation of the system would have created affordability

issues if procured separately by each of the seven participating regional

councils.

21.2. Risk reduction –

predictability of cost, resilience for personnel changes, continuity of supply.

21.3. Alignment – there is

significant interaction among domain experts and practitioners that is driving

best practice through standardisation.

Unique

ways of doing things

22. There is significant

interaction among domain experts and practitioners that is driving best

practice through standardisation.

23. Sector working groups are

currently developing standards that will be included in the IRIS software and

deployment.

Loss of community interest

24. Each participating Regional

Council will have shareholder voting rights in the CCO.

25. Regional Council’s

retain the right to choose whether to participate in each of the shared service

projects.

Financial and Resource Implications

26. Involvement in the CCO will

not require any additional funding initially, the operating costs will be

covered by existing ReCoCo subscription fees that are paid by all regional

councils and already built into the current LTP. Additional costs are incurred when

each Council decides to participate in and contribute funding towards a work

programme. However, these are costs that we are likely to have incurred as

regional collaborations are usually aimed at reducing the cost of required

work.

Key

obligations of Council in making its decision

27. In making its decision,

Council is required by the Local Government Act 2002 to:

27.1. consider the advantages and

disadvantages of the reasonably practicable options identified in this report.

27.2. consider the views and

preferences of all persons likely to be interested in or affected by the matter

(as expressed through consultation). This means:

27.2.1. giving due consideration

and having regard to all views and preferences, and

27.2.2. giving due consideration

and having regard to such views and preferences with an open mind (i.e. not

having a predetermined view).

Decision Making Process

28. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

28.1. The decision does not

significantly alter the service provision or affect a strategic asset, nor is

it inconsistent with an existing policy or plan.

28.2. The use of a special

consultative procedure is not prescribed by legislation.

28.3. The decision is significant

under the criteria contained in Council’s adopted Significance and

Engagement Policy and so has been the subject of a two-week public consultation

process and hearing of submissions.

Recommendations

1. That the Corporate and

Strategic Committee receives and considers the Regional Sector Shared

Services Council Controlled Organisation staff report in conjunction with

the submission presented to Council on 25 May 2022.

2. The Corporate and Strategic

Committee recommends that Hawke’s Bay Regional Council:

2.1. Agrees that the decisions

to be made have been the subject of community consultation.

And either

2.2. Agrees to participate in a Regional

Sector Shared Services Council Controlled Organisation

Or

2.3. Does not agree to participate in a Regional

Sector Shared Services Council Controlled Organisation.

Authored by:

|

Sarah Bell

Team Leader Strategy &

Performance

|

Chris Comber

Chief Financial Officer

|

|

Desiree Cull

Strategy & Governance Manager

|

Andrew Siddles

Chief Information Officer

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

There are no attachments for this report.

Hawke’s Bay Regional

Council

Corporate

and Strategic Committee

1 June

2022

Subject: Organisational Performance Report for the period 1 January

– 31 March 2022

Reason for Report

1. This item provides the

Organisational Performance Report for the third quarter of the 2021-2022

financial year which is the period 1 January to 31 March 2022.

Content of the Report

2. The report contains four

parts:

2.1. Executive Summary with highlights and lowlights

for the quarter.

2.2. Corporate Service Metrics that focus on how well we

are performing across a number of corporate-wide measures such as health and

safety incidents and response to customer feedback.

2.3. Level of Service Measures (LOSM) by group of

activities with adopted targets, traffic light status and commentary by

exception (measures flagged amber and red only).

2.4. Activity

Reporting by group of activities with non-financial traffic light status and commentary.

3. This is the 14th

Organisational Performance Report to be presented. The status and commentary

reporting are rolled up from cost centre to activity level. Commentary by cost centre

is still available to committee members via the PowerBI dashboard.

4. As with the previous report,

this

quarter does not include financial information due to the implementation of the

new financial system.

5. Staff complete their

reporting in a software tool called Opal3. For LOSM and Activity reporting,

staff select the status (red, amber, green) of non-financial results and

provide commentary on what they did in the quarter.

Points

of Interest

6. NEW for the dashboard this

quarter is the Strategic Projects report with traffic light status for Risk,

Schedule and Budget, and a status commentary for the month of April. This is

the same content as in the Significant Activities Report that is received at

Council each month. This will be updated monthly in the dashboard.

7. NEW for the report are a sample

of measures from the new Customer Experience software (Zendesk). See page 10 of

the report.

8. In response to committee

member feedback, both LOSM and Activity reporting have been centrally reviewed

more closely to ensure consistency between traffic light status and commentary

and more accurately reflect known issues with for example, Covid-19 disruption.

As a result, there has been a shift from green to amber across both sections of

the report when compared to last quarter.

LOSM and Activity Reporting

9. Level of service measures

from the Long Term Plan 2021-2031 are reported. There are 35 measures that are

green (compared with 40 in Q2), 15 amber (9 in Q2), 2 red (1 in Q2) and 6 not

measured/recorded (8 in Q2).

10. Activities from the Long

Term Plan 2021-2031 are also reported. There are 12 Activities that are green

(compared with 19 in Q2) and 10 that are amber (3 in Q2).

Carbon

footprint

11. Commentary on

carbon credits and HBRC’s carbon portfolio is included.

12. Since Q1 2021-22,

electricity use at Guppy Road, Wairoa and Raffles Street offices has been included in the report in addition

to the main office at Dalton Street.

13. Since Q2, fuel use by all HBRC

vehicles, including Works Group equipment/plant has been included.

Dashboard

14. The dashboard is produced

using PowerBI to give a visual representation of the results over time. The

Organisational Performance Report document is produced from the dashboard.

15. The dashboard also provides

committee members with the ability to delve deeper into activities of interest

(via cost centres) and all level of service measures results (not just by

exception).

15.1. To access the dashboard,

please open your PowerBI app on your iPad. The dashboard will be on your

homepage.

16. Annual community outcome

results (which are the same as the 24 strategic goals from the Strategic Plan

2020-2025) are reported on at the end of the financial year only.

17. We are continuously

improving the dashboard and improving the data reliability across all areas,

and would appreciate any feedback you have.

Future developments

18. Financial reporting will be

re-introduced to the report as soon as we are able.

19. Metrics from

the new Customer Experience software are being developed for PowerBI and will

be incorporated into the dashboard when completed.

20. Further

improvements, particularly around the Corporate Metrics, will be incorporated

when data can be tested and reported with confidence to provide additional

information.

Decision Making Process

21. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That the Corporate and Strategic Committee

receives and notes the Organisational Performance Report for the period 1

January – 31 March 2022 staff report.

Authored by: Approved

by:

|

Sarah Bell

Team Leader Strategy &

Performance

|

Desiree Cull

Strategy

& Governance Manager

|

Attachment/s

|

1

|

Organisation Performance Report

Quarter 3, 1 January to 31 March 2022

|

|

Under Separate Cover

|

Hawke’s

Bay Regional Council

Corporate

And Strategic Committee

1 June

2022

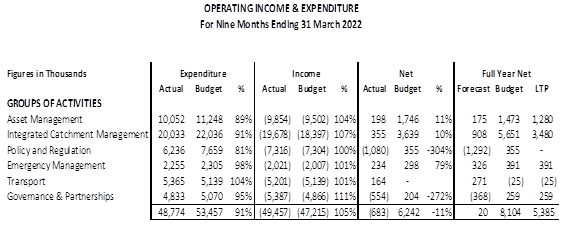

Subject: Financial report for the period to 31 march 2022

Reason for report

1. This item provides the

Committee with financial results for three quarters of the 2021-2022 financial

year.

2. It also provides a

high-level full year forecast for the year-end financial position, including

commentary about possible requests to carry forward budget to the next

financial year.

Executive Summary

3. The daily impacts of

Covid-19 continue to disrupt delivery and planning. While delivery for

most levels of service is on track to be achieved, some significant impacts to

large scale projects will not be recoverable this financial year.

4. The Long Term Plan (LTP)

capital work programme will require re-profiling across the remaining 8 years

of the 10-year plan horizon to account for changes to project scoping, building

internal capability and shifts in the external operating environment.

Within

the Quarter 1 Jan – 31 March 2022

5. Q3 operating expenditure is

slightly ahead of budget, $17.7m vs $17.2m contributing towards a small

correction in the year-to-date operating spend to budget.

6. As anticipated, borrowing

for capital expenditure continued to fall behind budget $5.3m against the

quarter budget of $10.7m.

Year

to Date to 31 March 2022

7. For the Group of Activities

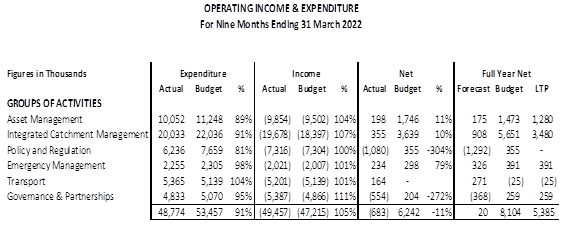

for the nine months to 31 March 2022:

7.1. Operating Expenditure

$48.8m, $4.7m (9%) below budget

7.2. Operating income for the

same period was $49.5m, $2.2m (5%) above budget

7.3. Operating surplus of $0.7m

vs planned budget deficit of $6.2m

7.4. There is a planned budget

deficit because the current financial year has operating costs which were

planned to be funded through borrowing.

8. The YTD operating

expenditure includes 3 specific areas of underspend, being:

8.1. Asset Management $1.2m due

to vacancies, contractor delays and Covid-19 impacts on outdoor workforces in

flood control, coastal hazards and open spaces

8.2. Integrated Catchment

Management (ICM) $2m across environment enhancement and erosion control, and

8.3. Policy & Regulation

$1.4m mainly in the Kotahi plan change project.

9. Capital expenditure YTD is

$17m (53%) below budget and income is $2m (17%) behind budget. Asset Management

is $13m behind budget, ICM $1.6m, Information Communication Technology (ICT)

$1.9m and vehicles and building works are $1m behind budget. The underspends

are due to a range of reasons including delays in consents and assessments,

supply chain delays and other Covid-19 impacts explained in detail within the

report.

10. Staff and overhead cost

centres consolidated are close to budget, being $200k favourable. Within

cost centres there are variances to budget, explained within this report.

Full

Year Forecast

11. The indicative full year

forecast is under budget by $8m (nett) in Opex, and $18m (nett) in Capex, with

the largest impacts coming from Kotahi, IRG flood and river control

improvements, regional water security, Clive River dredging and Erosion Control

Scheme.

12. These projects remain a

high priority and will require budget carry forward to complete delivery.

Officers will conduct a review of the phasing of the carry-forward expenditure,

and final carry-forward requests will only reflect funds required in addition

to the 2022-2023 Annual Plan budget. The remaining rephasing of work programmes

will be addressed as part of the 2023-2024 Annual Plan process.

13. The world-wide economic and

political uncertainty partially due to the pandemic but also through the

Russia-Ukraine situation have been and will continue to affect costs, with

inflation rates significantly above budget.

14. Further ongoing impacts

include supply chain issues, increased costs of borrowing and the financial

markets incurring major losses. The most significant impact will likely be the

loss of investment income from the managed funds this financial year.

Background

15. In the following tables the

full year net budgets presented are:

15.1. Forecast – forecast

net result for the year end

15.2. Budget – operating

budget for FY2021-2022 including carry forwards from FY2020-2021

15.3. LTP – long-term plan

budget for FY2021-2022.

16. Reserve movements and

internal loan funding have not been included as these are calculated at year

end.

17. Groups of activities income

and expenditure include each activity’s share of overheads, general

rates, UAGCs, targeted rates and investment income as per the FY2021-2022

budget.

Operating

Income and Expenditure

18. Operating Expenditure is

$4.7m below budget YTD, and this underspend is expected to increase by year

end, although at a lesser rate than previous quarters.

19. Asset Management

expenditure is $1.2m below budget YTD, though this underspend will decrease

slightly by year end.

19.1. Flood Protection and

Control Works is below budget by $800k with variances spread across all the

schemes, and the recent rain events impacting the ability to complete all the

tasks scheduled.

19.2. Coastal Hazards is $250k

behind budget but more monitoring and research work is expected in the final

quarter.

20. Integrated Catchment Management

expenditure is $2m below budget YTD, and this underspend is expected to

increase by year end.

20.1. Depreciation on ICM assets

is $500k below budget YTD due to delays in the main ICM Science capital

projects including LiDAR, 3D Aquifer Mapping (SkyTEM), Ruataniwha ground water

modelling, monitoring drilling and equipment purchasing. This underspend

will remain by year end.

20.2. Catchment Management is $1m

below budget YTD, which is primarily due to budget phasing and variations in

the multi-year funding agreements for the Enhancement & Protection

Programme and Hill Country Erosion Fund/ECS Booster schemes.

20.3. The full year underspend

forecast is mainly in the Erosion Control Scheme, due to reduced uptake/demand

for grants this year, and a number of projects delayed into 2022-2023 due to

wet weather and resource shortages (see further discussion in the indicative

carry forwards section); and in Biodiversity, where Council has been successful

in applications for external funding support for biodiversity projects, but the

deliverables will not be complete until later in 2022.

21. Policy and Regulation

expenditure is $1.4m below budget YTD and this will remain by year end.

21.1. Most of the shortfall in

expenditure ($1.1m) is in Strategy & Planning, due to significant delays in

the Kotahi project. Covid-19 is impacting the ability to progress iwi

engagement, and Governance is still working through partnership arrangements.

22. Transport expenditure is

$200k above budget YTD, and this overspend is anticipated to remain by year

end.

22.1. The overspend is primarily

due to the inflationary impact on the cost of operating the subsidised

passenger transport, though some costs may be able to be recouped due to

services not provided by the operator.

23. Governance &

Partnerships expenditure is $250k below budget YTD and this will remain by year

end.

23.1. Delays in the recruitment

of the climate change ambassador have impacted the climate change engagement

work, and Tangata Whenua Partnerships are under budget due to the slower roll

out of Kotahi than anticipated.

24. Emergency Management is

close to budget.

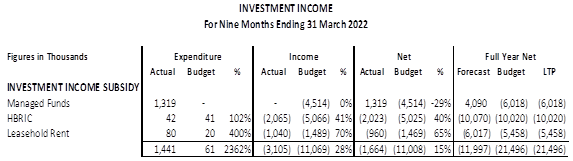

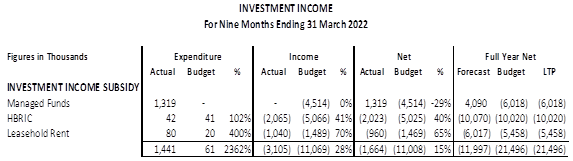

Investment

Income

25. Managed Funds returned a

YTD deficit of $1.3m at 31 March. Global events since the start of 2022 have

resulted in a $5.6m decrease in value since 31 December 2021. The current

forecast is a $10m income deficit by year end. This forecast is based on the

current deficit at the time of writing, but world economic markets may decline

further or show some recovery by year end. The forecast operating and capital

expenditure and leeway in our treasury requirements enable any shortfall to be

met by borrowing. Ongoing conversations about asset allocation and performance

continue with our fund managers.

26. In consultation with HBRC,

HBRIC has delivered a dividend of $2 million in the nine months to 31 March

2022, while retaining cash received from Port dividends to fund investments

that were being considered. The YTD budgeted amount of $7.6m has been allocated

to the Groups of Activity as investment income subsidy.

27. HBRIC are expecting to

return the full dividend for the year (subject to the Napier Port dividend) and

the YTD shortfall is just a timing difference.

28. Leasehold rent received net

revenue of $1m from the Napier and Wellington leasehold portfolios in the nine

months to 31 March 2022. The full year budgets presented include the fair value

increase of the properties at revaluation on 30 June 2022.

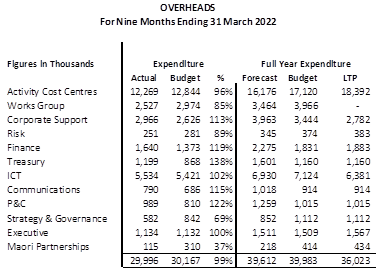

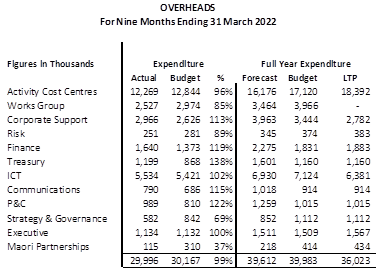

Overheads

29. Overhead costs are in-line

with budget, however, within cost centres there is some variance.

29.1. Activity cost centres hold

the staff related costs for teams that work directly on Council activities.

These are $0.6m behind budget with recruitment and retention issues affecting

many cost centres.

29.2. Works Group detailed

budgets were not included in the LTP. Works Group overhead costs

(accommodation, energy, insurance, etc) are included in the revised budgets but

these costs have not been recharged from corporate support YTD. This will

be corrected for year end.

29.3. Corporate Support is $300k

ahead of budget due to job re-gradings, increased accommodation costs as

Council has increased staff levels and Works Group overhead costs being

included in corporate overheads and not recharged.

29.4. Finance is $270k above

budget reflecting the increased staffing levels to support the TechOne

implementation.

29.5. Treasury is $300k above

budget following higher interest rates.

29.6. People and Capability

(P&C) is above budget due to additional consultancy costs to support the

Covid-19 vaccination policy, high up take of workplace support services, and

increased health and safety training.

29.7. Strategy and Governance is

below budget following delays recruiting the climate change ambassador and

reduced costs for the Annual Plan due to the no consultation approach.

29.8. Māori Partnerships is

below budget due to vacant positions in the first half of the financial year.

30. Overheads are forecast to

be close to budget at year end.

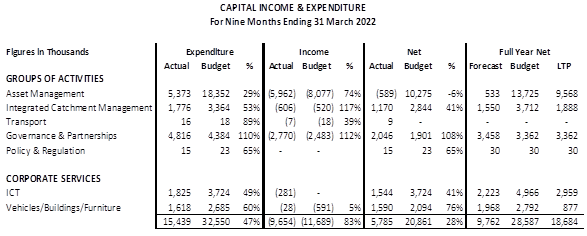

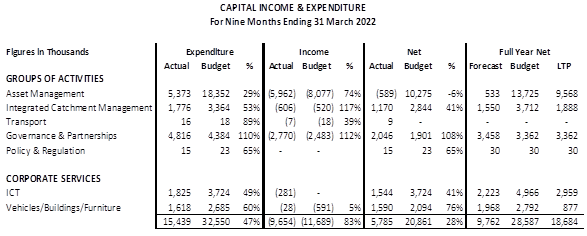

Capital

Income and Expenditure

31. Capital expenditure is $17m

below budget YTD, and this underspend is expected to remain at year end.

The Senior Business Partner is working with the leadership team to re-profile

the LTP capital borrowing programme across the remaining 8-year

timeframe. Management is confident the strategies such as the Asset

Management Strategy that underpin these borrowing requirements are still

relevant, however large-scale capital delivery projects are fluid across

multiple financial periods. Increasing external challenges, such as

supply and resourcing, mean it is increasingly challenging to phase with any

accuracy when the majority of spend or borrowing will occur.

32. Asset Management

expenditure is $13m below budget YTD with vacancies (including Manager Regional

Projects), contractor availability, Covid-19 and weather being factors

alongside the original cashflow for the Crown-funded projects needing to be

reforecast to reflect realistic delivery. It is anticipated this underspend

will decrease slightly by year end.

33. The majority of the YTD

underspend is in flood protection and control works ($8.5m).

33.1. Infrastructure Reference

Group (IRG) expenditure is $7.1m below budget mostly due to weather-related

construction delays, although noting that the LTP split the budget equally

across years but 2022-23 will be significantly higher.

33.2. Consent for the Clive River

dredging has been notified and requires a hearing, leading to further delays in

commencing work and a shortfall in expenditure of $800k YTD.

33.3. Regional Water Security is

$4m below budget YTD and this underspend will continue to year end. CHB Water

Security is $1.3m behind budget. The Cultural Impact Assessment is still in

progress.

33.4. Te Tua Water Security is

$530k behind budget, with no progress this year.

33.5. The overall project has not

begun to spend the $2.8m carried forward from the previous year ($2.1m to 31

March 2022).

34. Integrated Catchment

Management expenditure is $1.6m below budget YTD, and this underspend will

remain at year end.

34.1. The largest single

shortfall ($450k) is in the 3D Aquifer Mapping project. GNS staff resourcing

has been impacted significantly by Covid-19 as they typically recruit

internationally and have also been losing international staff returning home.

34.2. The technical equipment

replacement project is behind schedule due to supply chain issues ($275k).

There is no risk to critical functions yet, just a slower pace of replacements.

34.3. No capital expenditure is

anticipated to be incurred this financial year for Right Tree Right Place

($507k). Commercial and legal advice on farm planting plans is progressing

before the pilot farm work begins, to ensure HBRC risk in relation to carbon

revenues and security is properly assessed.

35. Governance and Partnerships

capital activity comprises the Sustainable Homes programme and is $500k ahead

of budget YTD due to the continued popularity of this low-cost home improvement

opportunity.

36. ICT expenditure is $1.9m

below budget YTD, and this underspend will remain at year end.

36.1. ICT hardware renewal

projects are $200k underspent with the network and server upgrades delayed due

to re-focusing on end-user hardware as part of the Covid-19 response.

36.2. ICT system implementation

projects are $1.7m behind budget due to resourcing challenges.

36.3. Income is received from the

other Hawke’s Bay councils and Land Information NZ who share in the costs

of the aerial survey work for GIS.

37. Vehicles/Buildings/Furniture

expenditure is $1m behind budget YTD, and this underspend will remain at year

end.

37.1. Expenditure on new and

replacement vehicles is $240k below budget. Vehicles totalling $808k are on

order or pending order when the correct model becomes available, with expected

delivery of all these vehicles in the next financial year.

37.2. The accommodation

refurbishments are experiencing delays due to the supply of contractors and

workers with a potential carry forward of $0.9m.

37.3. The Raffles Street building

refurbishment ($500k) is on hold following the structural report concluding

that the building was earthquake prone.

37.4. Work on upgrading the Radio

Telephone network and equipment has started with most of the work expected to

be completed before year end.

Debt

38. New debt of $15m has been

drawn down and an additional $4m is forecast for this financial year. The LTP

new debt forecast was $36.5m. The reduced debt requirement is due to the below

budget capital and operating expenditure.

39. Debt principal repayments

are on schedule with repayments of $2.36m completed by 31 March 2022 with total

repayments for the year being $3.15m.

Accounting for ICT projects

40. In March 2021, the IFRS

Interpretation Committee issued further guidance on the accounting treatment of

cloud-based software implementations.

41. This guidance has now been

reviewed by the Finance team.

42. The review has shown that

most of the existing and forecast expenditure in the LTP relating to ICT projects

will need to be classified as operating expense.

43. Finance and ICT will assess

the classification of $2m+ work-in-progress from 2019-2020 and 2020-2021 and an

additional $1m spent this financial year. Re-classifications to historical

work-in-progress will be treated as prior year adjustments and will not affect

the 2021-2022 results.

44. The 2022-2023 Annual Plan

has been adjusted to reflect this guidance based on an estimated 60% of ICT

capital expenditure in the LTP being re-classified as operating expenditure.

45. The CFO is satisfied that

borrowing for projects of this nature is still appropriate, given the

benefits. The Corporate plan and ICT digital work programme do not

require revisiting as a result of these changes. The accounting treatment has

no impact on cashflow or funding requirements.

Covid-19 Impact

46. Since the Q2 financial

update, Council has continued to experience impacts from Covid-19 in terms of

increasing unit costs, supply chain and recruitment issues, volatility in

inflation and investment returns and the direct impact on our teams through

uncertainty and changing working conditions. Some activities have started to

pick up, but the delay on our large-scale projects such as Kotahi, IRG flood

protection and improvements, and regional water security, will not be recovered

this financial year.

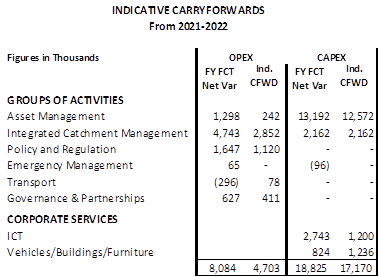

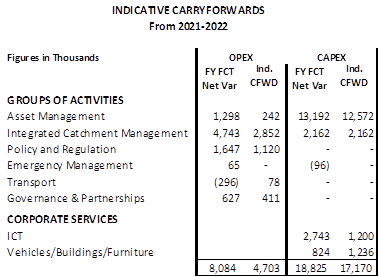

Indicative Carry forwards

47. The indicative full year

forecast net position is an underspend of $8m Opex and $18.8m Capex. This

reflects the major disruption experienced this financial year from Covid-19 and

staff recruitment and retention.

48. Indicative carryforwards of

$4.7m Opex relates mostly to Kotahi, externally-funded Biodiversity projects

and the Erosion Control Scheme (loan funded). Staff are clarifying what funding

from the 2021-2022 year is committed to ECS projects to be carried into the

2022-2023 year. Any unspent budget will be relinquished and not carried

forward. Staff intend to engage Council in a discussion through the LTP

development to extend the life of the ECS beyond the original 30 year

timeframe.

49. Indicative carryforwards of

$17.17m for Capex relates mostly to IRG flood and river control improvements,

Regional Water Security, Clive River Dredging, ICT projects and office

alterations. The majority of this work is funded via reserves or external

loans.

50. Activities identified for

carryforward are in progress and funding is still required. However,

before requesting final carryforwards at the conclusion of this financial year,

staff will undertake a review of the phasing. Only funds that are

required on top of the Annual Plan 2022-2023 budget will be put forward for

carryforward from 2021-2022. Any remaining budget amount still required

will be addressed as part of the Annual Plan 2023-2024 process.

51. Staff remain confident that

the LTP budget quantum is reliable, however, phasing of the expenditure on an

annual basis will need to be readdressed given the disruptions experienced in

the current year. It is difficult to phase the large capital programmes

with any real certainty in the current environment and the proposed 2022-23

Annual Plan remains our best estimate for the next financial year.

Decision Making Process

52. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

the Corporate

and Strategic Committee receives and notes the Financial report for the

period to 31 March 2022.

Authored by:

|

Amy Allan

Management Accountant

|

Tim Chaplin

Senior Group Accountant

|

|

Jessica Ellerm

Programme Director

|

|

Approved by:

|

Chris Comber

Chief Financial Officer

|

James Palmer

Chief Executive

|

Attachment/s

There are no attachments for this

report.

Hawke’s

Bay Regional Council

Corporate

and Strategic Committee

1 June

2022

Subject: HBRIC Ltd quarterly

update

Reason for report

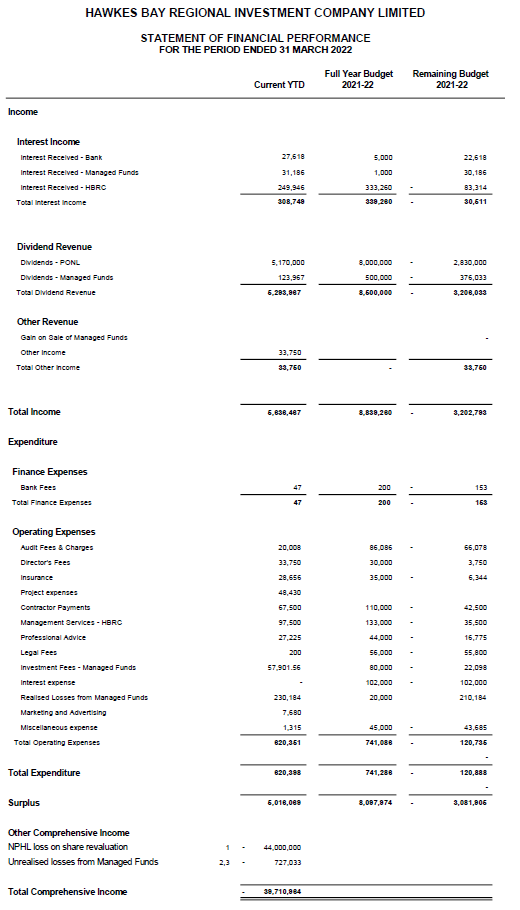

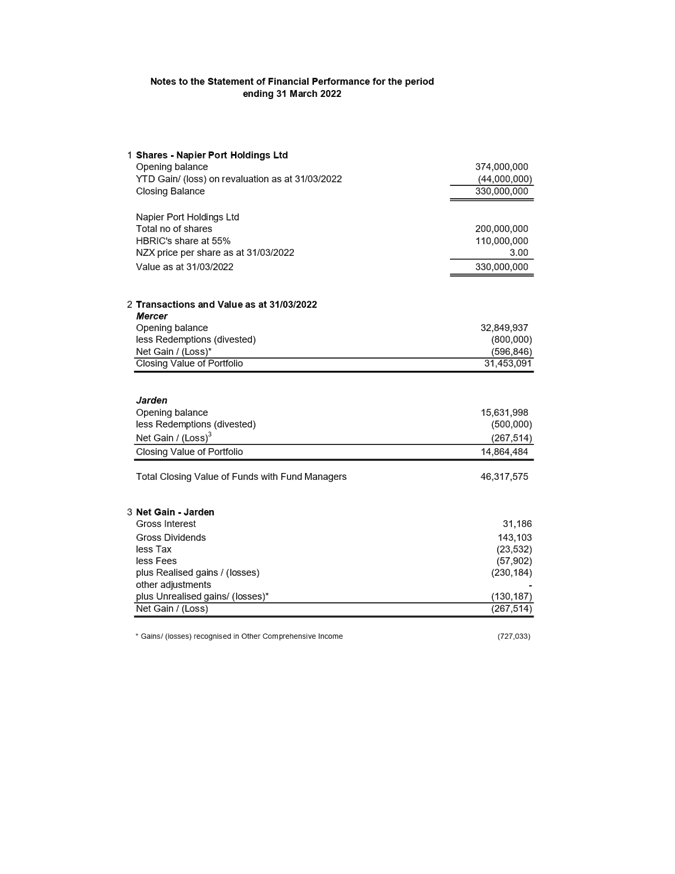

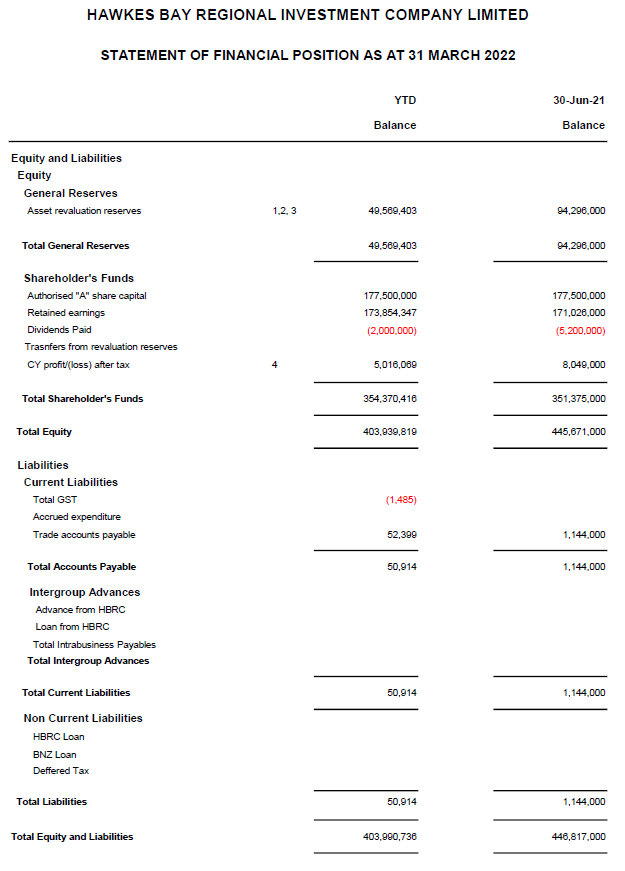

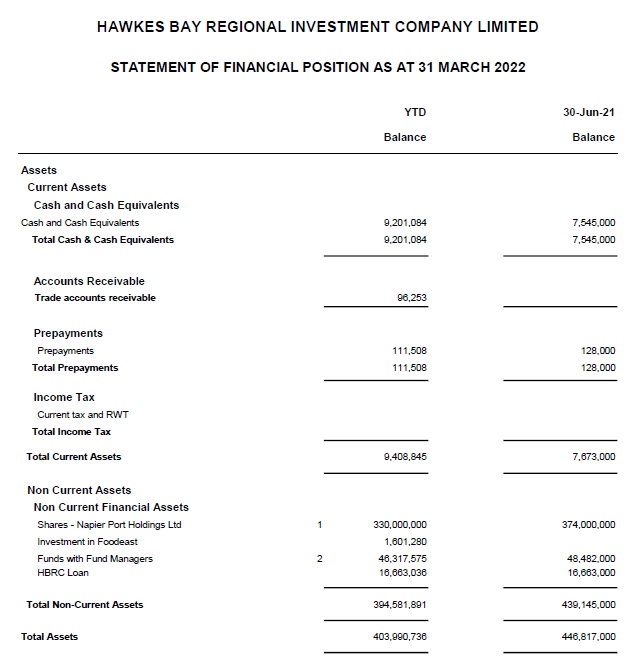

1. This item provides the

Committee with a quarterly update on the activities of Hawke’s Bay

Regional Investment Company (HBRIC) for the third quarter of

the 2021-2022 financial year.

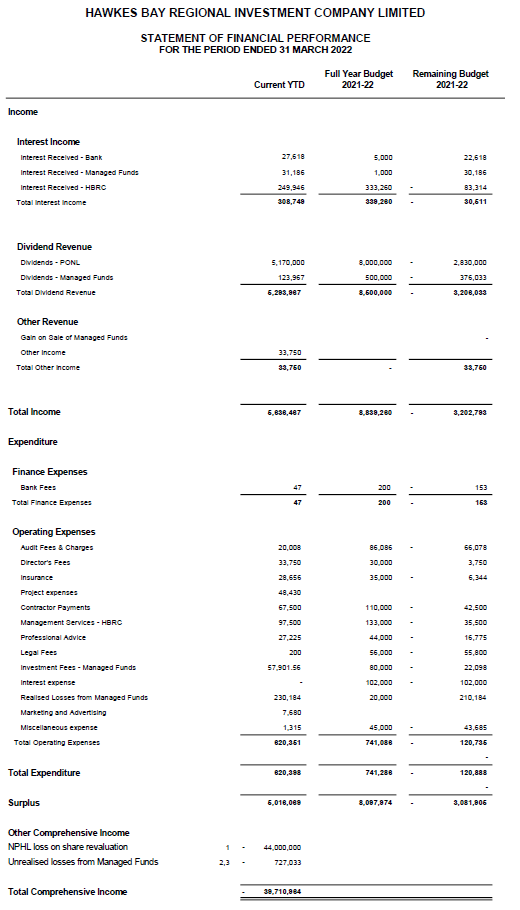

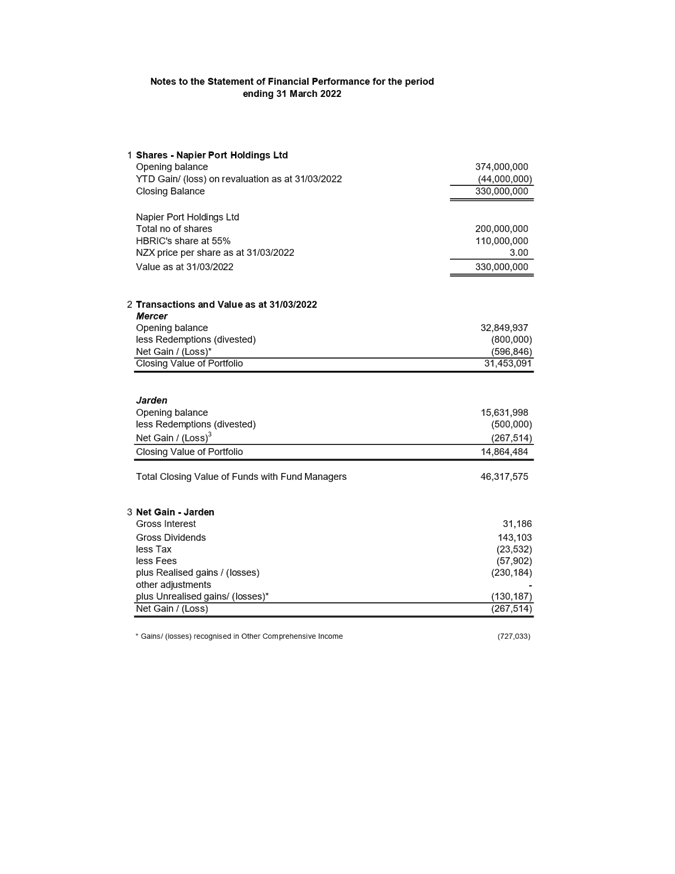

Financial Reporting

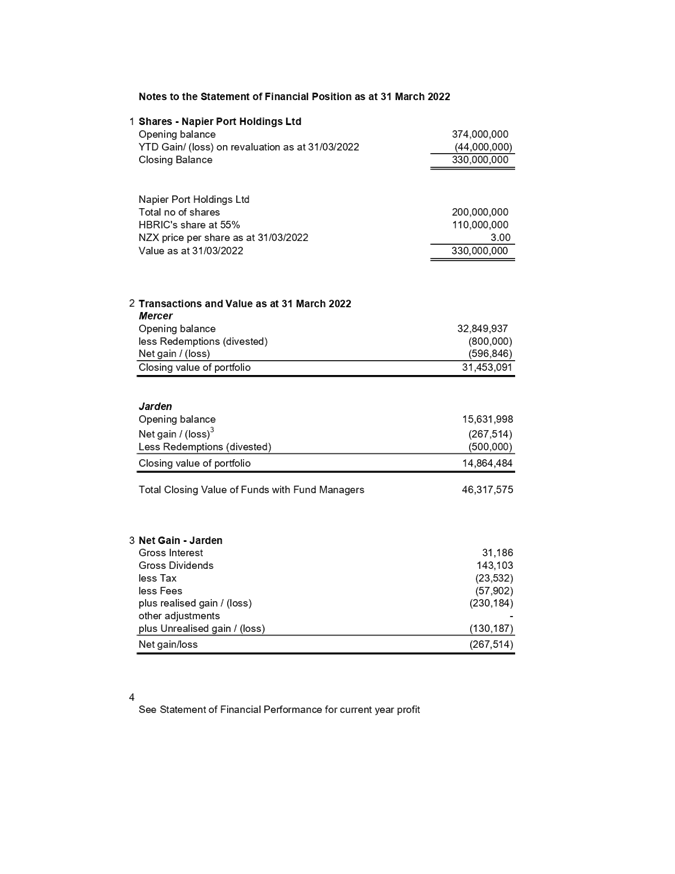

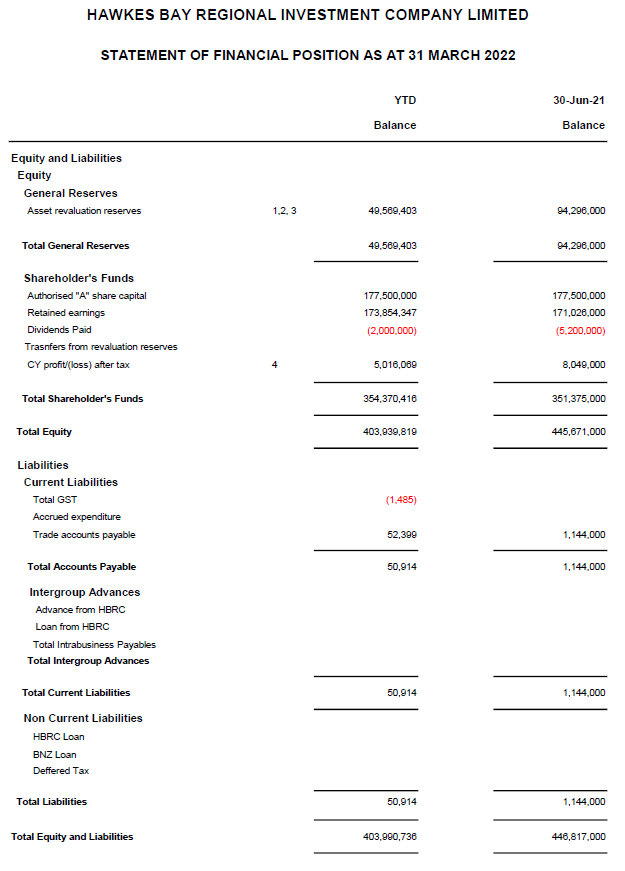

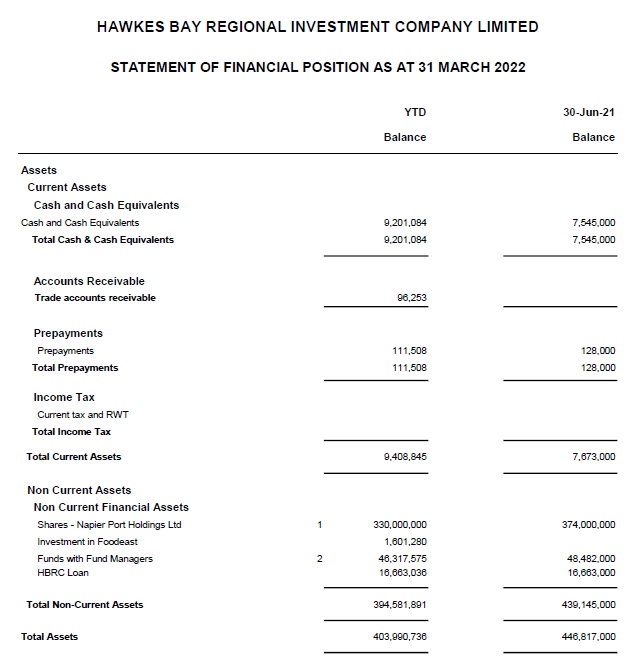

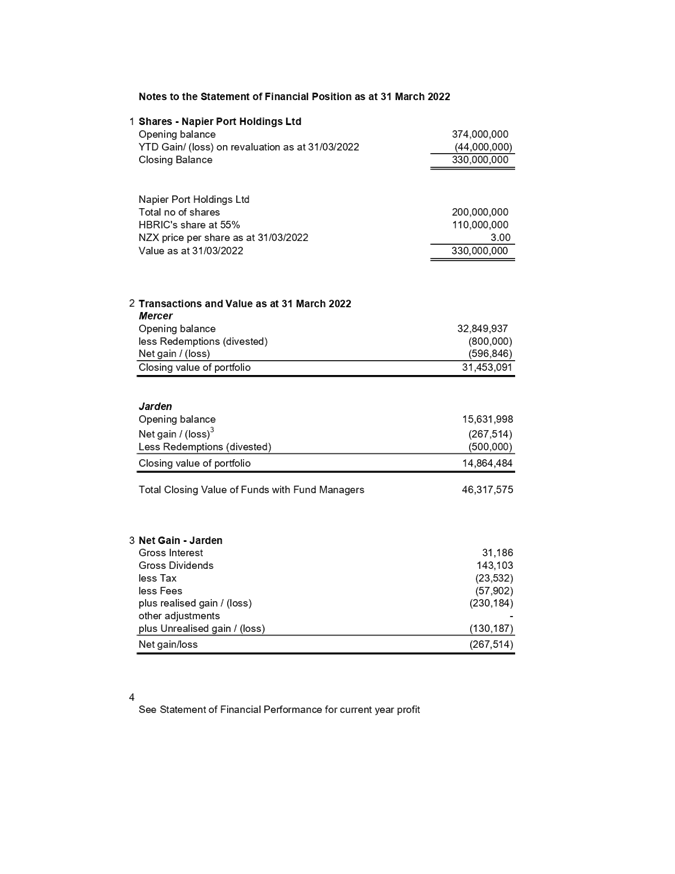

2. HBRIC’s Year to Date

(YTD) Financial Statements as at 31 March 2022 are attached to this report.

3. Key Items to note:

3.1. Statement of Financial

Performance – YTD Surplus of $5 million (excluding fair value movements

through other comprehensive income).

3.2. Statement of Financial

Performance – $5.1 million of dividend revenue received from Napier Port

Holdings Limited (NPHL) in December 2021.

3.3. Statement of Financial

Performance – YTD $308K Interest Income.

3.4. Other Comprehensive Income

– YTD Loss of $44 million, driven by a drop in the NPHL share price (loss

on revaluation) and unrealised losses on managed funds.

3.5. Statement of Financial

Position - A reduction in net assets of $42 million YTD due to the drop in NPHL

share price and losses from managed funds.

3.6. NPHL share price has

dropped 11.76% YTD from $3.4 to $3.0. This is comparable to the movement in the

share price of Port or Tauranga, which has dropped 11.71% YTD from $7.00 to

$6.18.

3.7. Net Assets of $403 million

as at 31 March 2022.

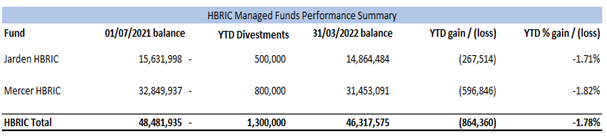

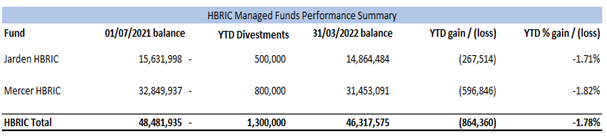

Managed

Funds

4. The funds remain under management

in compliance with Council’s SIPO.

5. The value of managed funds

with HBRIC after divestments as at 31 March 2022 amounted to $46.3 million, a

movement of approximately -$864K (-1.8%) year to date.

6. In December 2021, HBRIC

divested $1.3 million from the managed funds after protecting its capital

value.

FoodEast

7. Following the construction

cost escalation experience, the directors have worked with the limited partners

and MBIE to reset the project with a view to having re-design completed and

contractor appointed by 31 October 2022, construction commencement between

December 2022 and March 2023, with completion scheduled 12-18 months post

commencement.

Napier

Port

8. In January NPH released its

first quarter 2022 trade volumes.

9. Compared to the same period

in the prior year, trade volumes increased 3.4% for bulk cargo led by increased

log exports. Containerised cargo volume decreased by 7.7% principally due to

less container repositioning activity and continued container shipping schedule

disruption.

10. Container vessel calls were

down to 53 ships from 65 ships in the prior year due to continued shipping

service schedule disruptions largely caused by continued supply chain

congestion regionally and globally.

11. In April the company

reported that it now expects to report a result from operating activities for

the half year to 31 March 2022 of approximately $16.4 million, which is less

than the $21.3 million reported for the first half of the last financial year.

12. This provisional unaudited

operating result remains subject to further adjustments and the final result

will be reported in May.

13. Assuming a continuation of

the current market conditions, Napier Port now expects an underlying result

from operating activities for the year to 30 September 2022 to range between

$38 million and $42 million, which is less than the previously forecast

increase of approximately 10% on the result for 2021 of $43.8 million.

14. These results are

indicative of a number of factors including global container shipping schedule

disruption, Covid omicron outbreaks and pandemic-related port lockdowns in

China, the continuation of seasonal labour shortages in New Zealand’s

primary sector, and extreme weather conditions which contributed to delays in

cargo arriving on port and caused several port shipping closures in the second

quarter).

15. The company releases its

financial results for the half year to 31 March 2022 on the morning of Tuesday

24 May 2022.

Decision Making Process

16. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That the Corporate and Strategic Committee

Meeting receives and notes the HBRIC Quarterly Update staff report.

Authored

by: Approved

by:

|

Kishan Premadasa

Commercial Accountant

|

Tom Skerman

Hbric

Chief Executive

|

Attachment/s

|

1⇩

|

HBRIC Statement of financial

performance March 2022

|

|

|

|

2⇩

|

HBRIC Statement of financial

position March 2022

|

|

|

|

HBRIC Statement of financial performance

March 2022

|

Attachment

1

|

|

HBRIC Statement of financial position March 2022

|

Attachment

2

|

Hawke’s Bay Regional

Council

Corporate

and Strategic Committee

1 June

2022

Subject: Report from the Finance, Audit and Risk Sub-committee

meeting

Reason for Report

1. The following matters were

considered by the Finance, Audit and Risk Sub-committee (FARS) meeting on 4 May

2022 and are now presented for the Committee’s consideration alongside any additional commentary

the Sub-committee Chair wishes to offer.

Agenda

items

2. The Annual Internal Audit Plan

2022-2023 for adoption

item provided

the Finance

Audit and Risk Sub-committee (FARS) with a potential plan for internal audits

to be undertaken in the 2022-2023 financial year. The Sub-committee discussions covered:

2.1. Data Analytics and

Organisational Change Consolidation and Prioritisation internal audits were

approved to occur in the 2022-2023 financial year.

2.2. A Health & Safety deep

dive review, to ensure systems, processes and practices are compliant with

legislation, will be carried out by a Health & Safety external expert

instead of the internal audit on H&S reporting proposed in the 2022-2023

plan. It was suggested that either Cyber Security or Asset Management be

brought forward in place of Health & Safety.

2.3. The Chief Executive

suggested that a deep dive into the Asset Management systems and processes is

required, which would not be achieved by the suggested ‘internal

audit’. It was agreed that Chris Dolley will present work that has been

done in Asset Management around performance, internal processes/policies and

practices to the next FARS meeting to further inform a decision by the

sub-committee on the nature and scope as well as timing of an asset management

review.

3. The Fraud Internal Audit

report item provided the sub-committee with the findings and

recommendations from the Crowe internal audit. Discussions covered:

3.1. Key observations noted that

no high priority findings were observed.

3.2. Key policies for managing fraud

and corruption risks require review and updating including clear documentation

of ownership.

3.3. An apparent lack of fraud

and corruption policy awareness amongst staff will be addressed by training as

a matter of priority, and will cover conflict of interest management.

3.4. The sub-committee agreed

with the management actions recommended and resolved:

3.4.1. Agrees that the corrective

actions and due dates following, for medium risk findings from the Crowe HBRC

Fraud Risk Gap Analysis Report February 2022, are considered adequate to

address the report’s findings and recommendations, with progress to be

monitored and reported to the Sub-committee using the Corrective Actions

Dashboard.

3.4.1.1 The Fraud Policy is to be

reviewed – implementation September 2022

3.4.1.2 The formal owner of the

Fraud Policy is to be identified – implementation September 2022.

3.4.1.3 Fraud and Corruption

Awareness training will be delivered to all staff – implementation

October 2022.

3.4.1.4 Conflicts of

Interest and Gifts policies are to be reviewed – implementation September

2022.

3.4.1.5 The Appointment

of Staff Policy is to be reviewed – implementation October/November 2022.

3.4.1.6 The Protected

Disclosures Policy is to be reviewed – implementation October/November

2022.

4. The Annual Internal

Audit Plan 2021-2022 status update item highlighted:

4.1. Data is currently being

extracted from TechOne to generate the FY22 Data Analytics Audit, which is

currently conducted annually. If results of the FY22 audit are clean, with

limited exceptions, reducing the frequency to two-yearly will be considered.

5. The Road Safety s17a

Review outcomes item sought approval from the Sub-committee to progress the

preferred

service delivery model

from the review to:

5.1. Deliver Road Safety

collectively as a region, with support from HBRC staff including a new

transport planner.

5.2. Establish a Road Safety

sub-committee of the Technical Advisory Group (TAG) with a specific focus on

delivering regional road safety promotion, to support a more effective

programme with identified priorities and an annual work programme. This

sub-committee will also have responsibility for reviewing the Regional Road

Safety Strategy to provide strategic direction that is aligned with national

policy.

5.3. HBRC management of funding

the new delivery structure, with Territorial Authorities retaining their

funding to deliver their own community messaging.

6. The 2020-2021 Annual

Report adoption update item advised that Council will receive an unmodified

Audit and the Annual Report will be ready for adoption on 25 May 2022.

7. The Quarterly Treasury

Report for the period 1 January - 31 March 2022 item provided an update on

the performance of Council’s investment portfolio, and highlighted:

7.1. As of March 2022 the

managed funds are $1.5m below the expected capital projected amount due to

recent downward trends in markets.

7.2. Any shortfall in investment

income will be reflected as an operating deficit and/or borrowed to fund

Council activities.

8. The Risk Maturity Update

highlighted:

8.1. Phase IV of the risk

maturity roadmap is behind schedule and the Executive Leadership Team (ELT) has

supported putting it on hold until Covid disruptions ease.

8.2. Reviews of risk appetite

statements and the Risk Management policy and framework will continue to be

progressed in the meantime.

9. The Corrective Actions

Dashboard items updated on the progress carrying out corrective actions

that respond to internal audit findings, highlighting:

9.1. The good work done to

complete actions for Risk Management Maturity and Talent Management

9.2. The HBRC Covid-19 Response

debrief report has been completed.

Decision Making Process

10. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that:

10.1. All items were considered

at the Finance, Audit and Risk Sub-committee in accordance with the Terms of

Reference, specifically in relation to the 4 May 2022 meeting, its

responsibility and authority to:

10.1.1. Receive the internal and external audit reports and review

actions to be taken by management on significant issues and recommendations

raised within the reports (3. Fraud Internal Audit report, 5.

Road Safety s17a Review outcomes and 9. Corrective Actions dashboard)

10.1.2. Review whether Council

management has a current and comprehensive risk management framework and

associated procedures for effective identification and management of the

Council’s significant risks in place (8. Risk Maturity Update)

10.1.3. Undertake systematic

reviews of Council operational activities against Council stated performance

criteria to determine efficiency/effectiveness of delivery of Council services (5.

Roadsafe S17a Review)

10.2. The Finance, Audit and Risk

Sub-committee is delegated by Council, specifically in relation to the 4 May

2022 meeting, to:

10.2.1. Receive all of the

information and documentation needed or requested to fulfill its

responsibilities and duties, subject to applicable legislation

10.2.2. Ensure that recommendations

in audit management reports are considered and, if appropriate, actioned by

management (3. Fraud Internal Audit report, 5. Road

Safety s17a Review outcomes and 9. Corrective Actions dashboard)

10.2.3. Review the objectives and

scope of the internal audit function, and ensure those objectives are aligned

with Council’s overall risk management framework (2. Annual

Internal Audit Plan 2022-2023 for adoption and 4. Annual Internal Audit Plan

2021-2022 status update)

10.2.4. Assess the performance of

the internal audit function and ensure that the function is adequately

resourced and has appropriate authority and standing within Council (2. Annual

Internal Audit Plan 2022-2023 for adoption and 4. Annual Internal Audit Plan

2021-2022 status update).

10.3. This item is for reporting

purposes in accordance with the Finance, Audit and Risk Sub-committee Terms of

Reference, specifically to report to the Corporate and Strategic

Committee to fulfil its responsibilities for:

10.3.1. The provision of

appropriate controls to safeguard the Council’s financial and

non-financial assets, the integrity of internal and external reporting and

accountability arrangements

10.3.2. The independence and

adequacy of internal and external audit functions

10.3.3. The robustness of risk

management systems, processes and practices.

10.4. This item is for

information and noting only, there are no decisions required, and therefore the

LGA decision-making provisions do not apply.

|

Recommendations

1. That the Corporate and

Strategic Committee receives and notes the Report from the Finance, Audit

and Risk Sub-committee meeting, including the following resolutions.

The Annual Internal Audit

Plan 2022-2023 for adoption

1.1. Receives and considers

the Annual

Internal Audit Plan 2022-2023 for adoption staff report.

1.2. Adopts the Crowe internal

audit plan for the 2022-2023 financial year, which includes:

1.2.1. data analytics

1.2.2. organisational change

consolidation and prioritization.

1.3. Agrees to further

consider an Asset Management audit or review at the next sub-committee

meeting.

Fraud

Internal Audit report

1.4. Receives and considers

the Fraud Internal Audit Report.

1.5. Agrees that the following

corrective actions and due dates for medium-risk findings from the Crowe HBRC

Fraud Risk Gap Analysis Report February 2022 are considered adequate to

address the report’s findings and recommendations, with progress to be

monitored and reported to the Sub-committee using the Corrective Actions

Dashboard.

1.5.1. The Fraud Policy is to be

reviewed – implementation September 2022

1.5.2. The formal owner of the

Fraud Policy is to be identified – implementation September 2022

1.5.3. Fraud and Corruption

Awareness training will be delivered to all staff – implementation

October 2022

1.5.4. Conflicts of

Interest and Gifts policies are to be reviewed – implementation

September 2022

1.5.5. The

Appointment of Staff Policy is to be reviewed – implementation

October/November 2022

1.5.6. The Protected

Disclosures Policy is to be reviewed – implementation October/November

2022.

Annual Internal Audit Plan 2021-2022 status update

1.6. That the Finance, Audit

and Risk Sub-committee receives and notes the Annual Internal Audit Plan 2021-2022 status update staff report.

The Road Safety s17a Review outcomes

1.7. Receives and considers

the Road

Safety s17a Review outcomes staff report.

1.8. Agrees the preferred service

delivery model, as approved by way of a resolution of the Regional Transport

Committee on 11 March 2022, of a fully collaborative regional approach to

road safety including:

1.8.1. A revised structure that

will drive an enhanced collaborative model across the region through the

Napier City, Hastings District, Central Hawke’s Bay District, Wairoa

District and Hawke’s Bay Regional councils, Waka Kotahi, NZ Police and

their partners working together to deliver better road safety outcomes

through engineering, education and enforcement.

1.8.2. The road safety programme

will be developed and monitored at a strategic regional level and then

implemented locally at an operational level.

1.8.3. A strengthened Regional

Transport Committee role will ensure effective governance and

decision-making, giving clear direction and goals.

1.8.4. A focused Road Safety

Group will support a more effective programme across the region, coming

together to identify priorities and set the annual programme and then to

review the annual programme (midway through the year) against objectives and

measures and adjust it to suit current / emerging needs.

1.8.5. RoadSafe HB will provide

a coordination and community engagement role in delivery of the programme

with strategic support from the Regional Transport Committee and the Napier

City, Hastings District, Central Hawke’s Bay District, Wairoa District

and Hawke’s Bay Regional councils.

The

2020-2021 Annual Report adoption update

1.9. That the Finance, Audit

and Risk Sub-committee receives and notes the Hawke’s Bay Regional

Council 2020-2021 Annual Report adoption update staff report.

Quarterly

Treasury Report for the period 1 January - 31 March 2022

1.10. Receives and notes the Quarterly Treasury Report

for the period 1 January - 31 March 2022.

1.11. Confirms that the

performance of Council’s investment portfolio has been reported to the

Sub-committee’s satisfaction.

Risk

Maturity Update

1.12. That the Finance, Audit

and Risk Sub-committee receives the Risk Maturity Update staff report,

and notes that phase IV of the risk maturity roadmap is temporarily ‘on

hold’ while the business prioritises resourcing to respond to current

levels of business disruption.

Corrective

Active Dashboard

1.13. Receives and notes the Corrective

Actions Dashboard staff report.

1.14. Confirms that the

corrective actions undertaken and/or planned for the future adequately

respond to the findings and recommendations of the internal audits.

1.15. Confirms that the

dashboard reports include adequate information on the status of the

corrective actions.

1.16. Reports to the Corporate

and Strategic Committee, the Sub-committee’s satisfaction that the Corrective

actions dashboard report provides adequate evidence of the management

actions undertaken or planned to respond to findings and recommendations from

completed internal audits.

|

Authored by:

|

Olivia Giraud-Burrell

Quality & Assurance Advisor

|

Leeanne Hooper

Team Leader Governance

|

|

Helen Marsden

Risk & Corporate Compliance

Manager

|

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

There are no attachments for this

report.

Hawke’s

Bay Regional Council

Corporate

And Strategic Committee

1 June

2022

Subject: HBRC People Plan

Reason for Report

1. This item provides the

Committee with an overview and update on HBRC’s People Plan.

Background

2. Crowe undertook an Audit in

April 2021 to assess the Council’s talent management strategies and

processes against the NZ Public Service Commission’s Talent Management

Maturity Model, developed in 2017. To do this, they reviewed the following

People and Capability (P&C) activities and assessed those activities

against the categories included in the Maturity Model.

2.1. Status of the P&C

strategy with regard to talent management

2.2. Recruitment and selection

2.3. Reward and performance

2.4. Training and development

2.5. Employee and leadership

engagement.

Discussion

3. The Crowe Audit identified

that the P&C services to the organisation, in terms of maturity, are

largely at the ‘just starting’ point.

4. The People Plan has incorporated

the recommendations from the audit in addition to further pieces of work

determined by the P&C team.

5. The People Plan has three

key focus areas: Leadership, People Experience and Sustainable

Workforce.

5.1. The main focus of the

Leadership workstream is the development of people leaders, and working with

and through them to foster and promote the behaviours and cultural values they

have agreed to as a leadership group. Those leaders in the organisation

who have had no previous leadership development have now all attended their

first leadership development course. The feedback received to date has been

very positive and we will now be considering what further opportunities for

leaders we can provide in the next financial year.

5.2. People Experience aims to

improve the experience our people have throughout their time with HBRC.

We will be gathering data, analysing it and making improvements to the services

we provide staff. Included in the plan is the development of centrally coordinated

generic training which will be made available to staff throughout the year. To

date, training has been delivered for leaders and soon to follow will be time

management, climate change (for novices) and Microsoft Excel training.

Other training will be developed once generic competencies have been confirmed

by the organisation. The intention is to strengthen staff training and

development to improve performance and confidence, as well as job satisfaction.

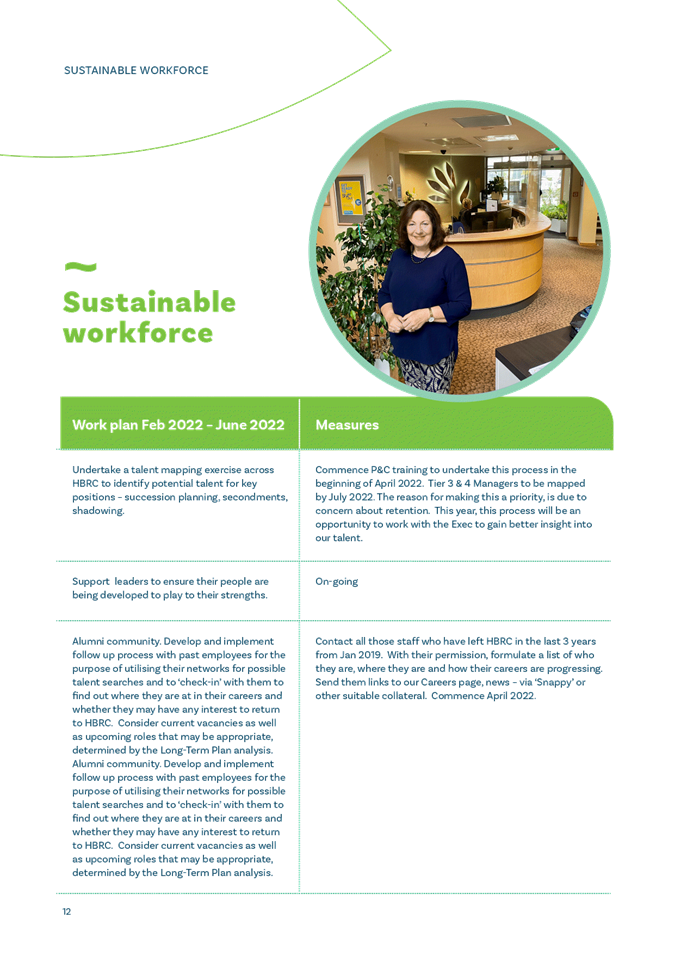

5.3. Sustainable Workforce

focuses on the development of a competency framework, undertaking a talent

mapping exercise and ensuring we employ the ‘right’ people.

There is also work to be done to align the competencies already defined in any

existing tools with any new solutions developed to ensure that all these

competencies are captured within the Competency Framework. This piece of

work commenced this week.

6. P&C will also be

gathering data and information so that we can better understand our current and

future workforce needs, and build further targeted initiatives and

interventions around critical skill dependencies, such as we have undertaken

for River engineers. We will also be focusing on students as a potential

permanent workforce and developing a Corporate Alumni to keep in touch with our

ex-employees who, along with current staff, are our ambassadors.

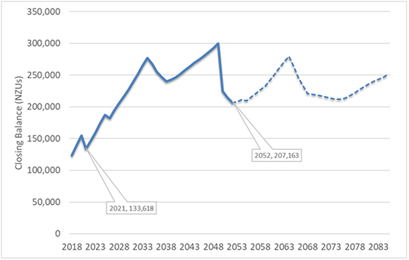

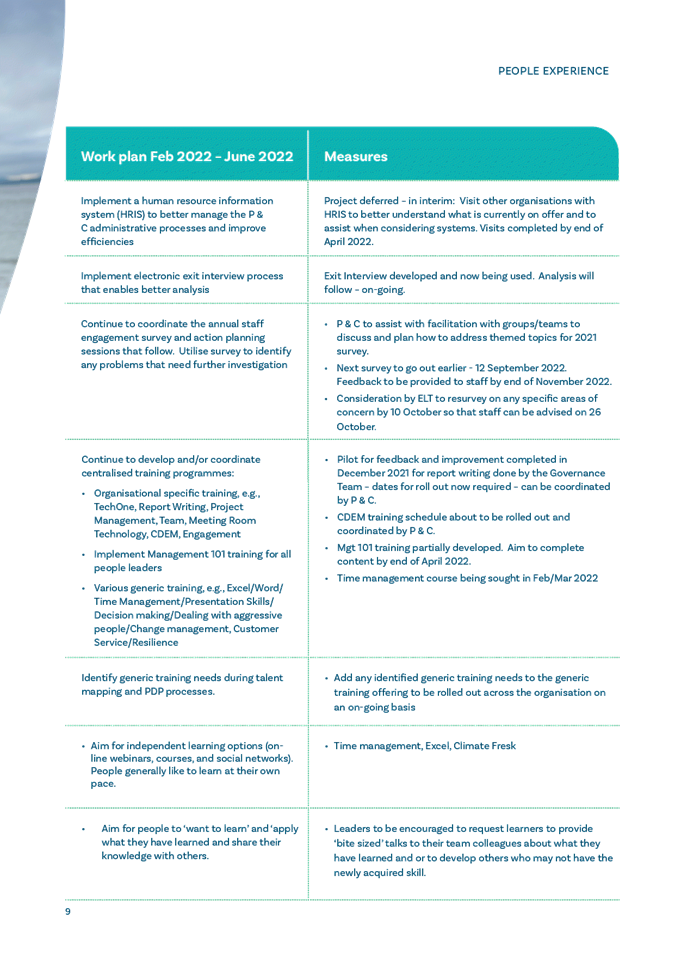

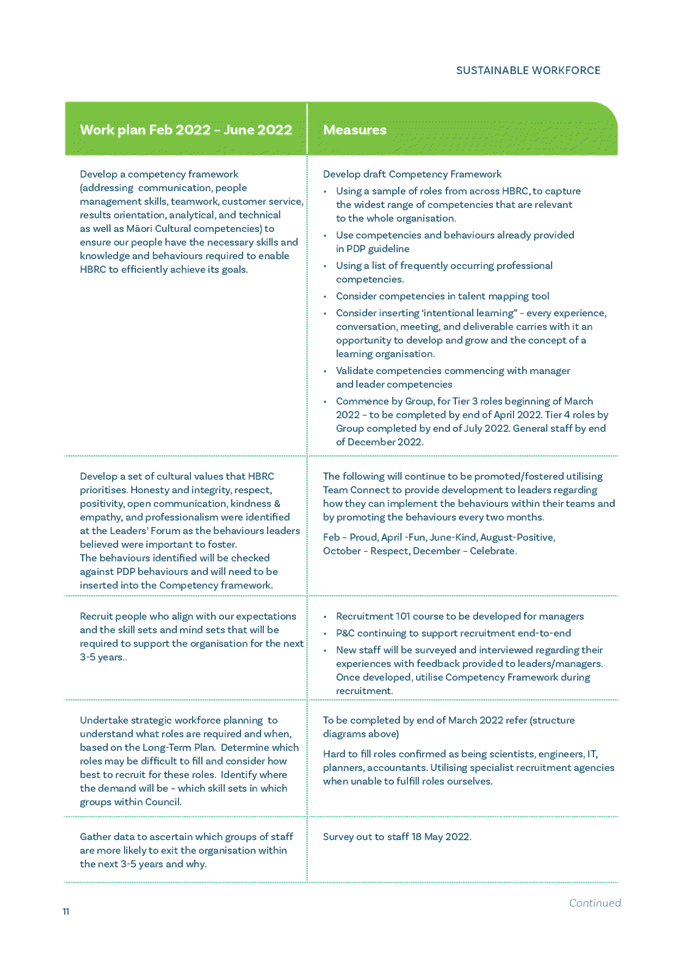

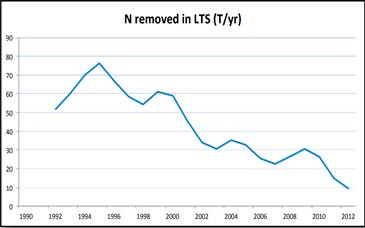

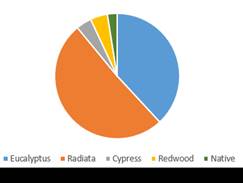

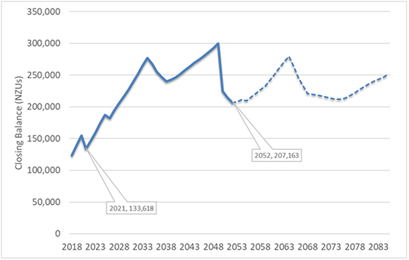

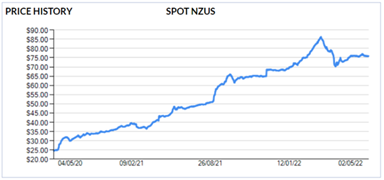

Ex-employees may wish to return to HBRC and bring back with them the skills and