Meeting of the

Finance Audit & Risk Sub-committee

Date: 4 May 2022

Time: 9.00am

|

Venue:

|

Council

Chamber

Hawke's

Bay Regional Council

159

Dalton Street

NAPIER

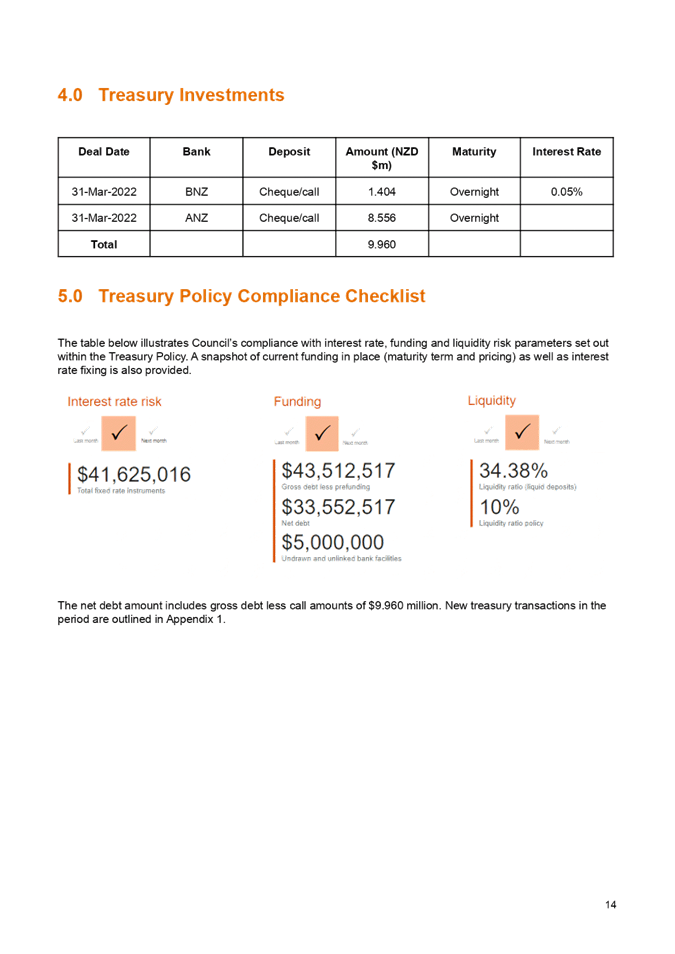

|

Agenda

Item Title Page

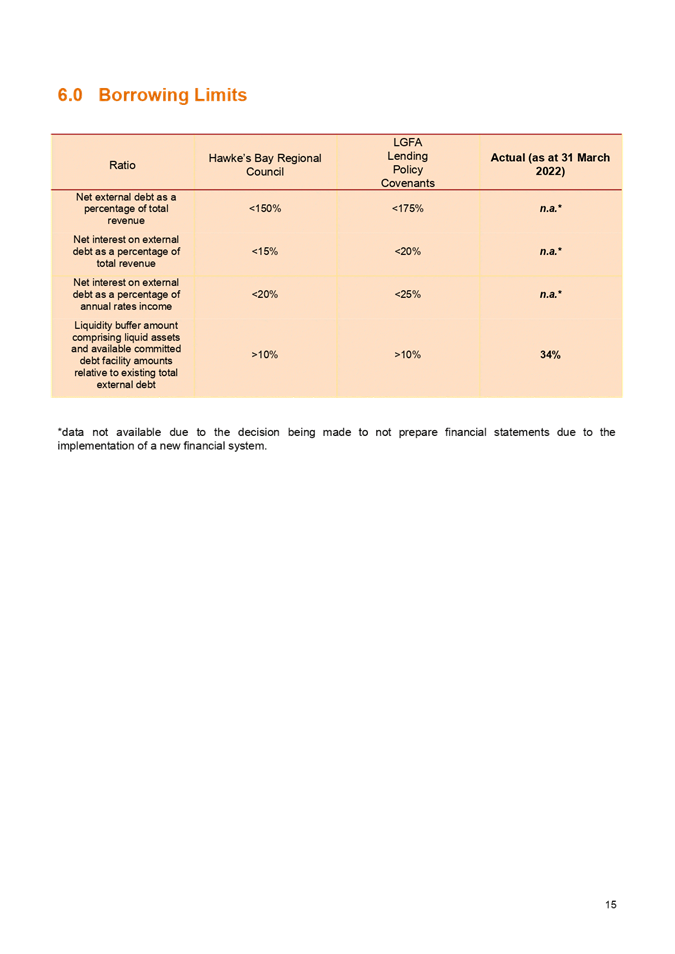

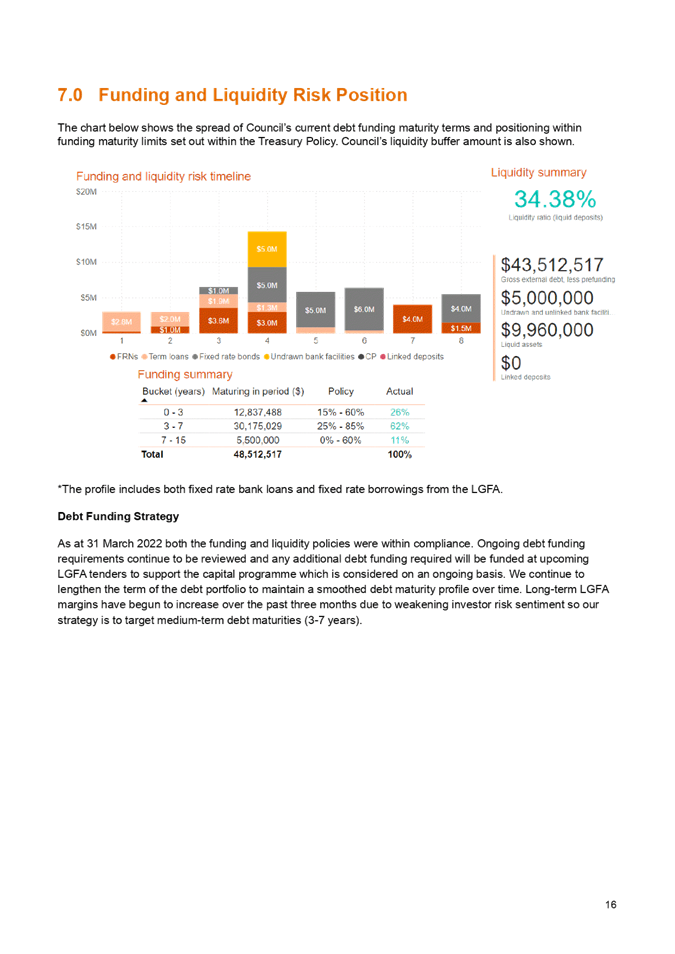

1. Welcome/Notices/Apologies

2. Conflict

of Interest Declarations

3. Confirmation of Minutes of

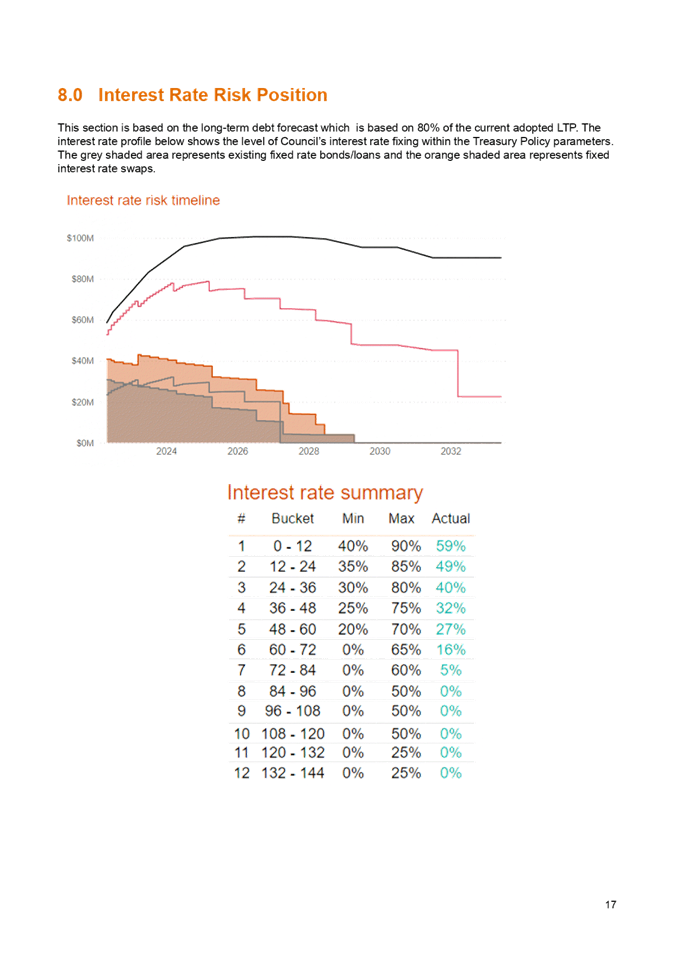

the Finance Audit & Risk Sub-committee meeting held on 2 March 2022

4. Annual

Internal Audit Plan 2022-2023 for adoption 3

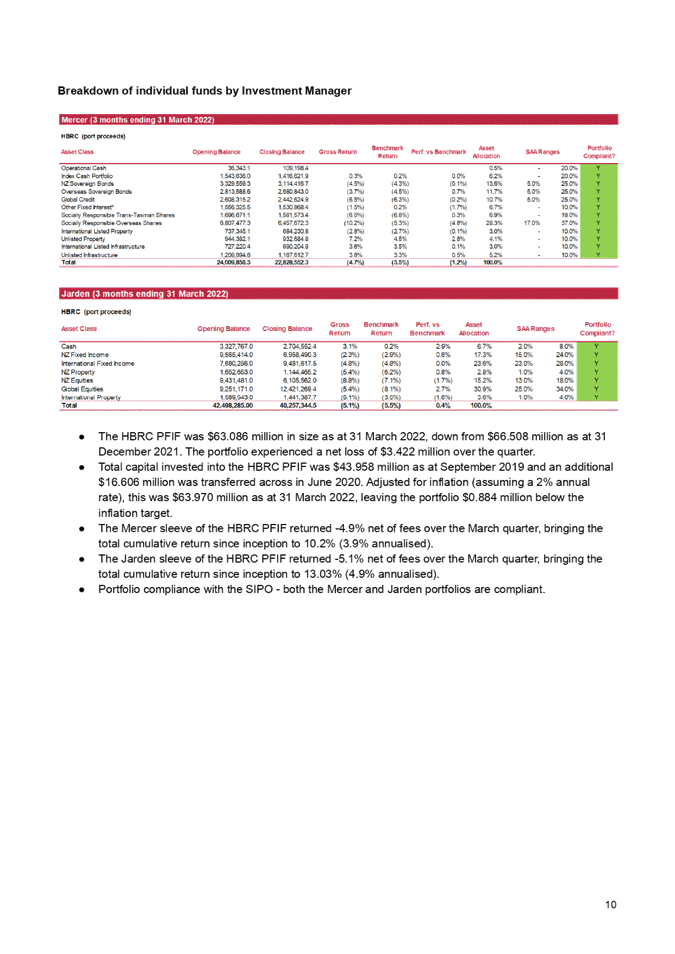

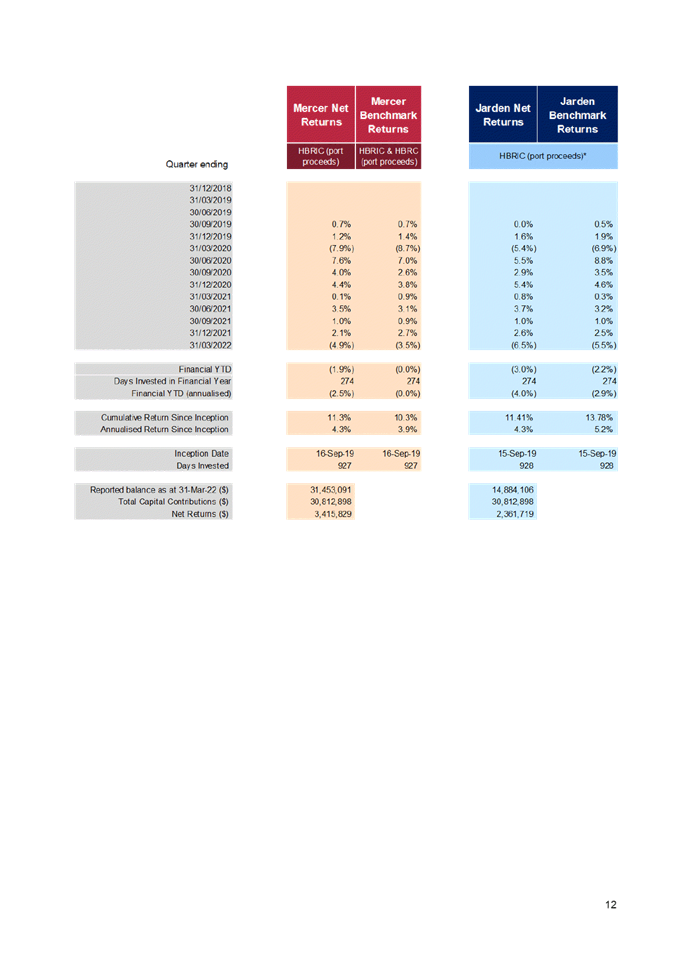

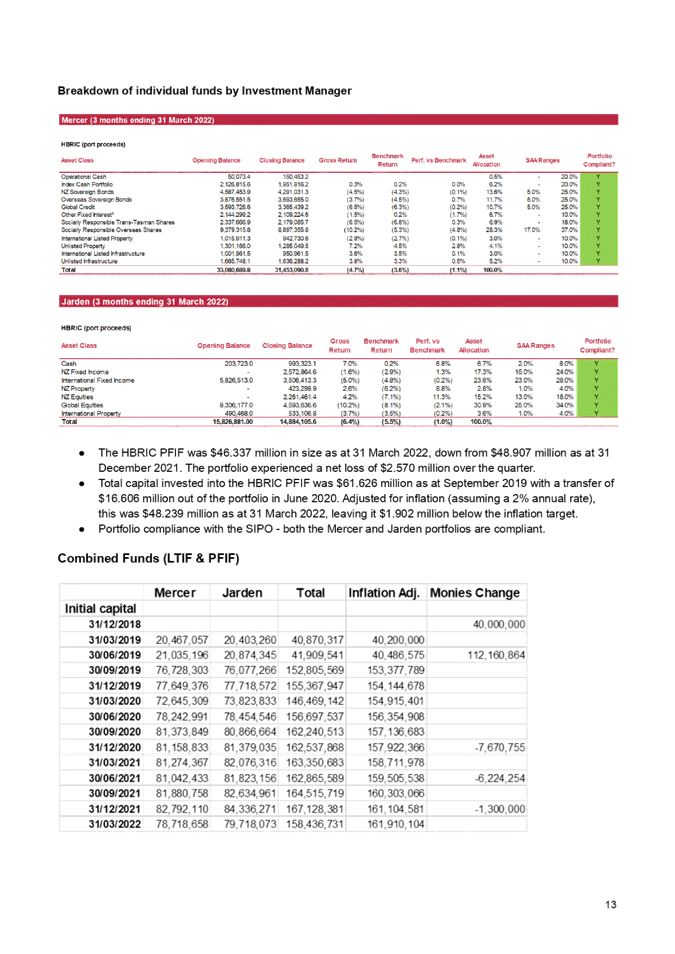

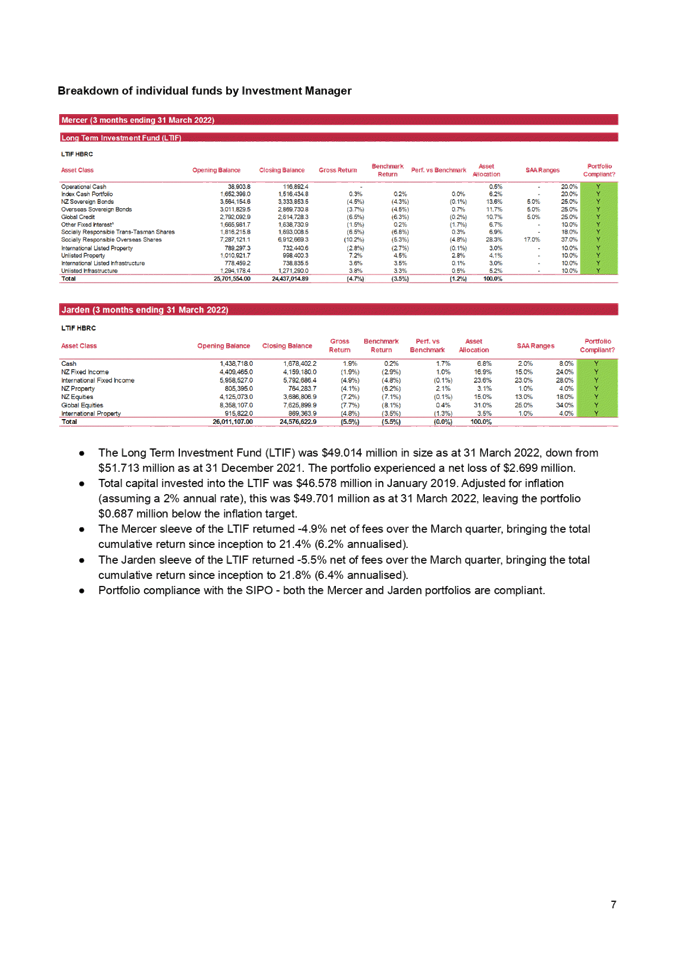

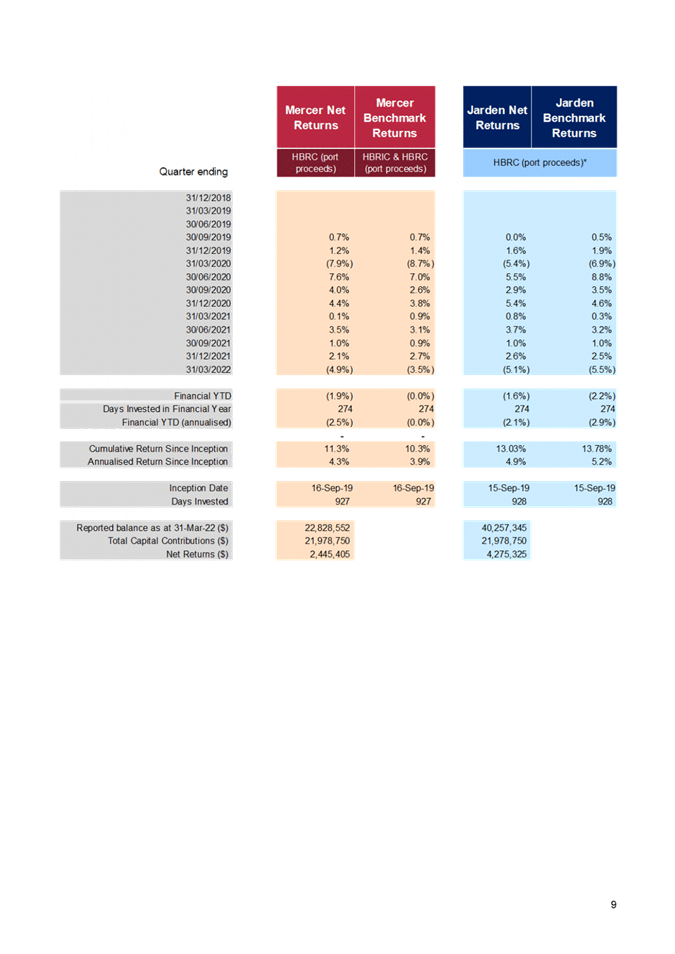

5. Fraud

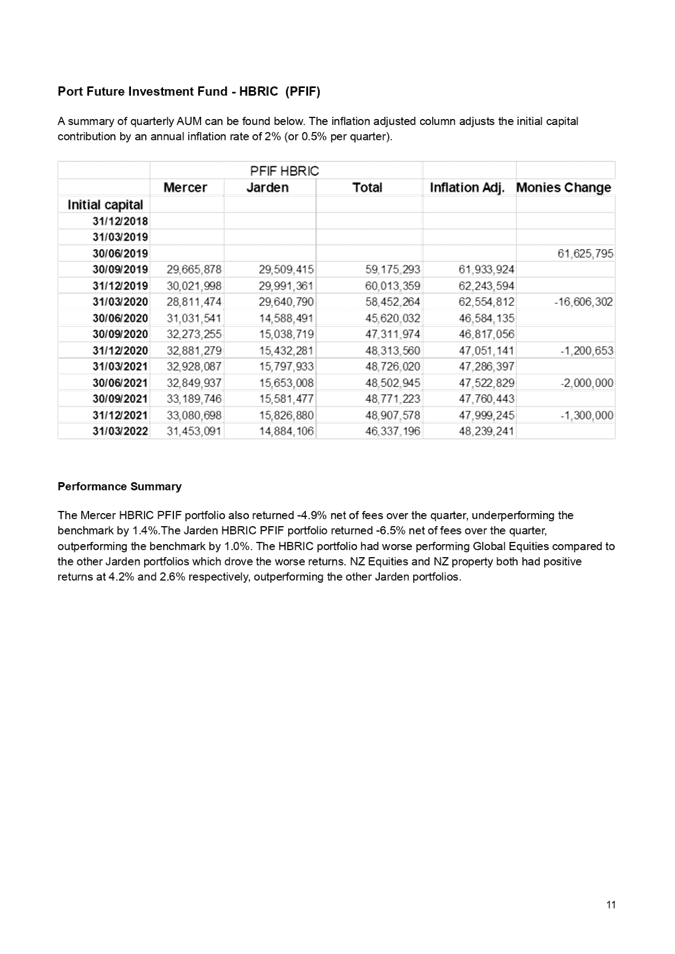

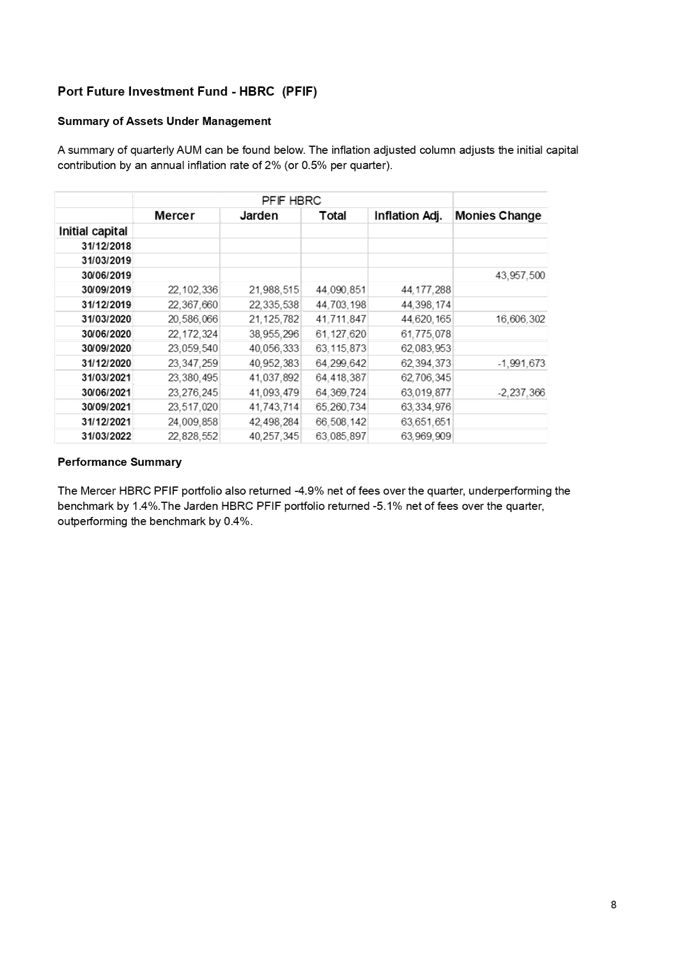

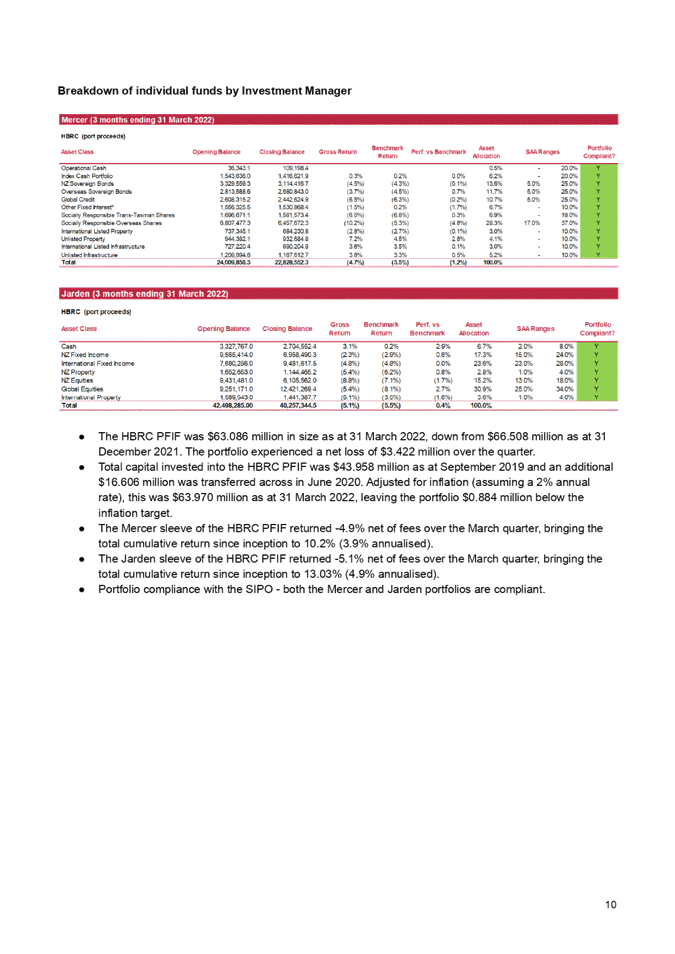

Internal Audit report 17

6. Annual

Internal Audit Plan 2021-2022 status update 49

7. Road

Safety s17a Review outcomes 51

8. 2020-2021

Annual Report adoption update 89

9. Quarterly

Treasury Report for the period 1 January - 31 March 2022 93

10. Risk

maturity update 123

11. Corrective

Actions dashboard 127

Public

Excluded Items

12. Corrective

Actions dashboard - Cyber security 139

13. Cyber

incident reports 141

14. Confirmation

of 2 March 2022 Public Excluded minutes 143

HAWKE’S BAY REGIONAL

COUNCIL

Finance Audit & Risk Sub-committee

4 May 2022

Subject: Annual Internal Audit Plan 2022-2023 for adoption

Reason for Report

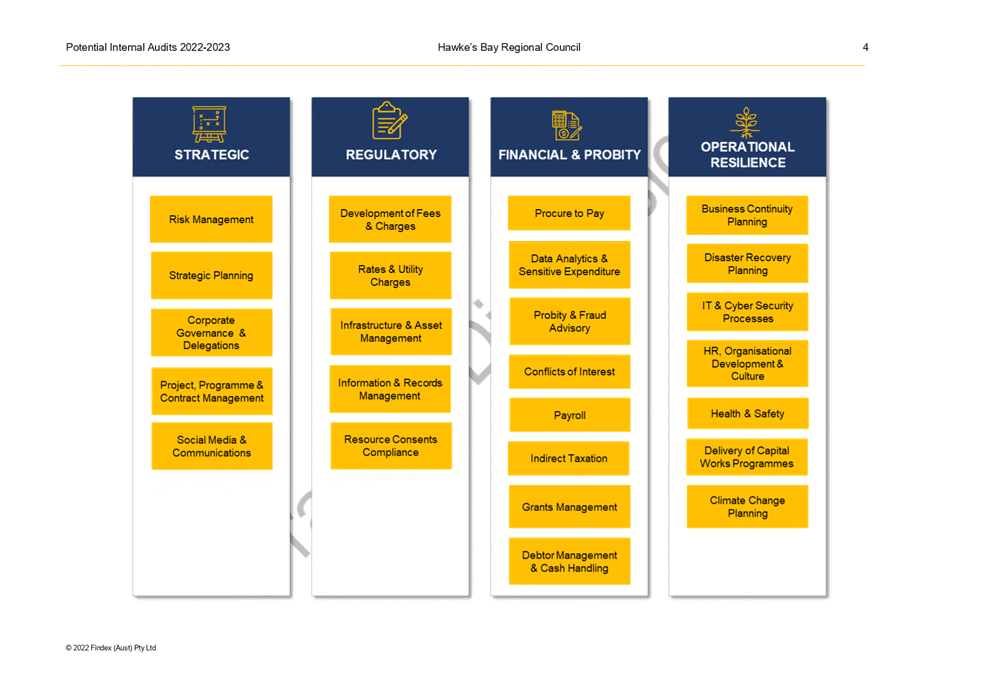

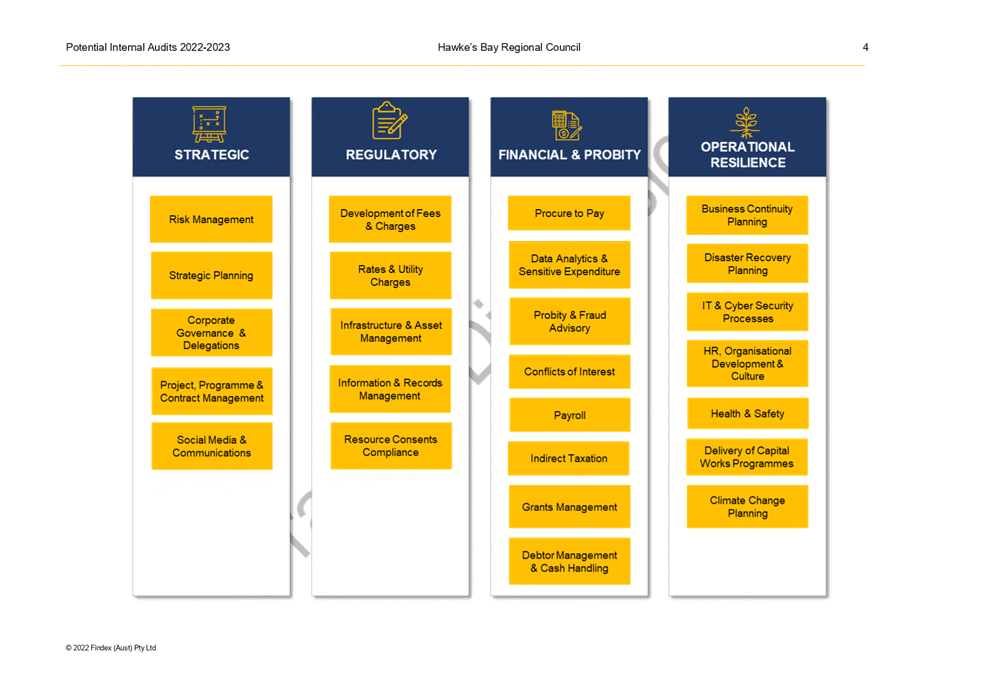

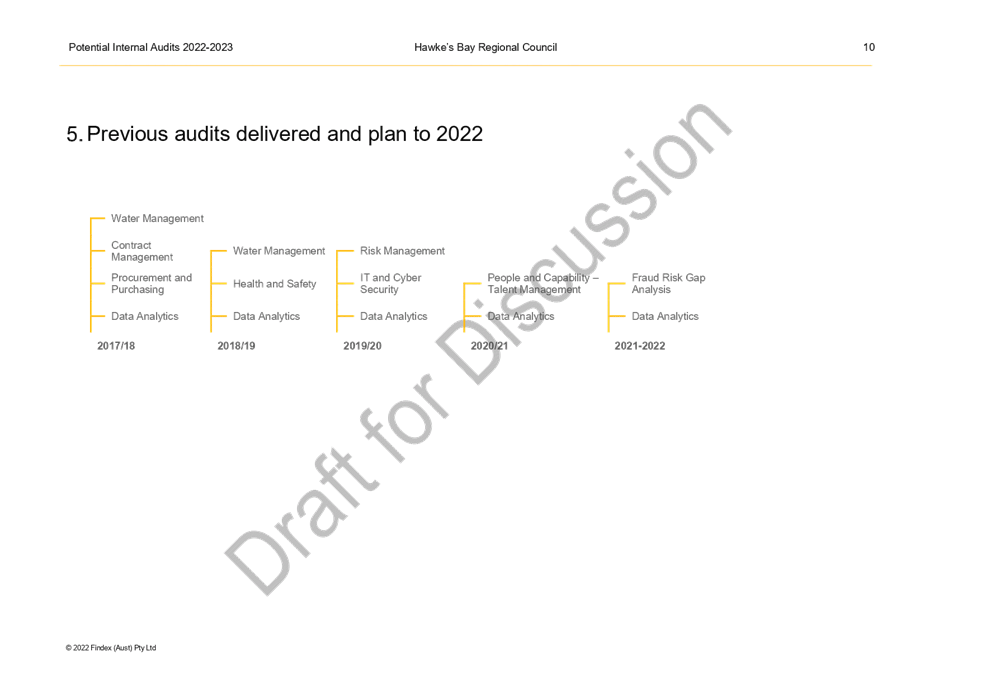

1. This item provides the

Finance Audit and Risk Sub-committee (FARS) with a potential Annual Internal

Audit Plan 2022-2023 for consideration and adoption.

Background/Discussion

2. The Internal Audit

Framework was adopted by Council on 26 May 2021. This framework requires that

an Annual Internal Audit Plan be adopted by FARS each year, for the following

financial year.

3. Council’s current

internal auditors, Crowe, have provided a potential FY22-23 Annual Internal

Audit Plan (attached) and will attend the FARS meeting to respond to questions

and provide additional information as required.

4. The following, from the

list of potential internal audits provided by Crowe, are recommended by the

Executive Leadership Team (ELT meeting of 11 April 2022). In making the

recommendation the ELT considered emerging risks, coverage of enterprise risks

from previous years audits, resource availability, and budgets. Recommended

audits include:

4.1. Data and Analysis –

currently this audit is a 12-monthly cyclical review (consideration could be

given to reduce this to once every two years when TechOne has been fully

embedded) that covers payroll and accounts payables master and transactional data

to identify potentially suspicious relationships, trends and transactions for

the year.

4.2. Three yearly Health and

Safety Review – this reviews health and safety reporting processes and

mechanisms in place at the Council to assess their effectiveness in informing

management of events and in developing appropriate actions (e.g.,

identification of trends, training needs, control improvements, etc).

4.3. Organisational Change

Consolidation and Prioritisation – this audit is to ensure that decisions on

‘how’ to execute and programme our strategic organisational change

initiatives effectively consider organisational impacts, risks, resource

constraints and process/system integration. The aim is to look at opportunities

to strengthen decision making to execute organisational change in order to

expedite the creation of value while protecting the organisation from undue

risk, e.g. impact on people, compliance, etc. The strategic

decision-making process on each individual organisational change initiative and

project management process is out of scope.

Financial

and Resource Implications

5. The internal audits will be

undertaken, as per the approved plan, within the 2022-2023 budgets allocated.

Decision Making Process

6. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

6.1. This agenda item is in

accordance with the Sub-committee’s Terms of Reference, specifically:

6.1.1. The purpose of the Finance,

Audit and Risk Sub-committee is to report to the Corporate and Strategic

Committee to fulfil its responsibilities for (1.3) the independence and

adequacy of internal and external audit functions

6.1.2. The Finance, Audit and Risk

Sub-committee is delegated by Council to (3.6) review the objectives and scope

of the internal audit function, and ensure those objectives are aligned with

Council’s overall risk management framework; and (3.7) assess the performance

of the internal audit function and ensure that the function is adequately

resourced and has appropriate authority and standing within Council.

Recommendations

That the Finance, Audit and Risk

Sub-committee:

1. Receives and considers the Annual Internal Audit Plan

2022-2023

for adoption staff

report

2. Adopts the internal audit

plan for the 2022-2023 financial year, which includes:

2.1. data analytics

2.2. health and safety system

2.3. organisational change

consolidation and prioritisation.

Authored by:

|

Olivia Giraud-Burrell

Quality & Assurance Advisor

|

Helen Marsden

Risk & Corporate Compliance

Manager

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

|

1⇩

|

Crowe - Potential HBRC Internal

Audits 2022-2023

|

|

|

|

Crowe - Potential HBRC Internal Audits

2022-2023

|

Attachment

1

|

HAWKE’S

BAY REGIONAL COUNCIL

Finance Audit & Risk Sub-committee

4 May 2022

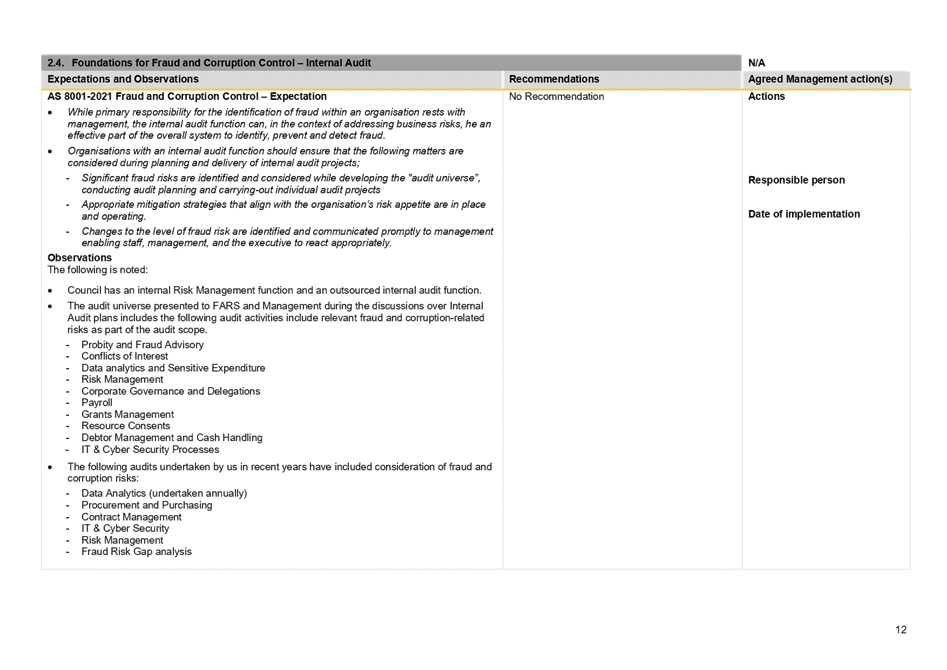

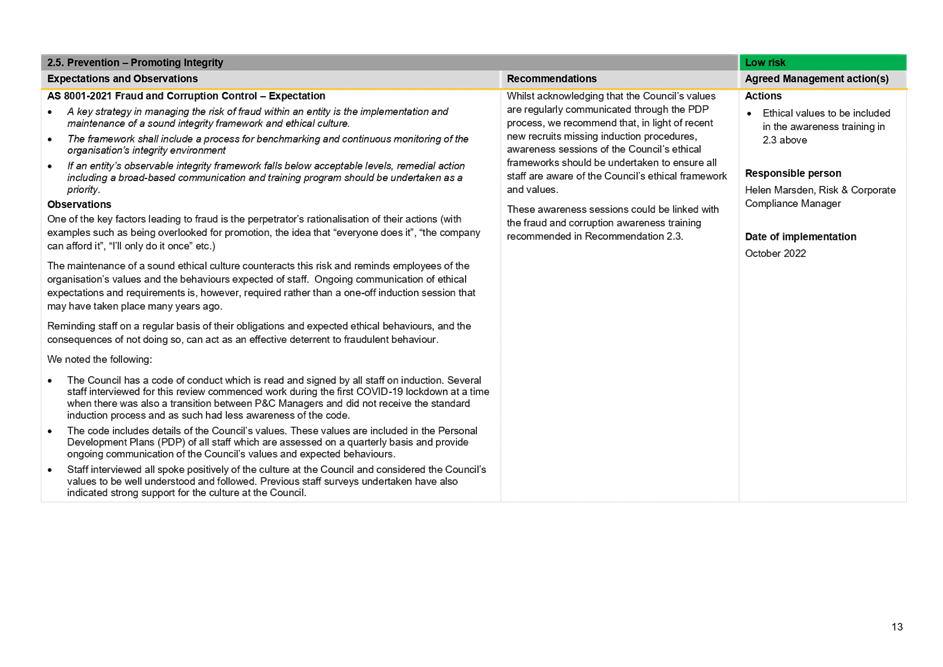

Subject: Fraud Internal Audit report

Reason for Report

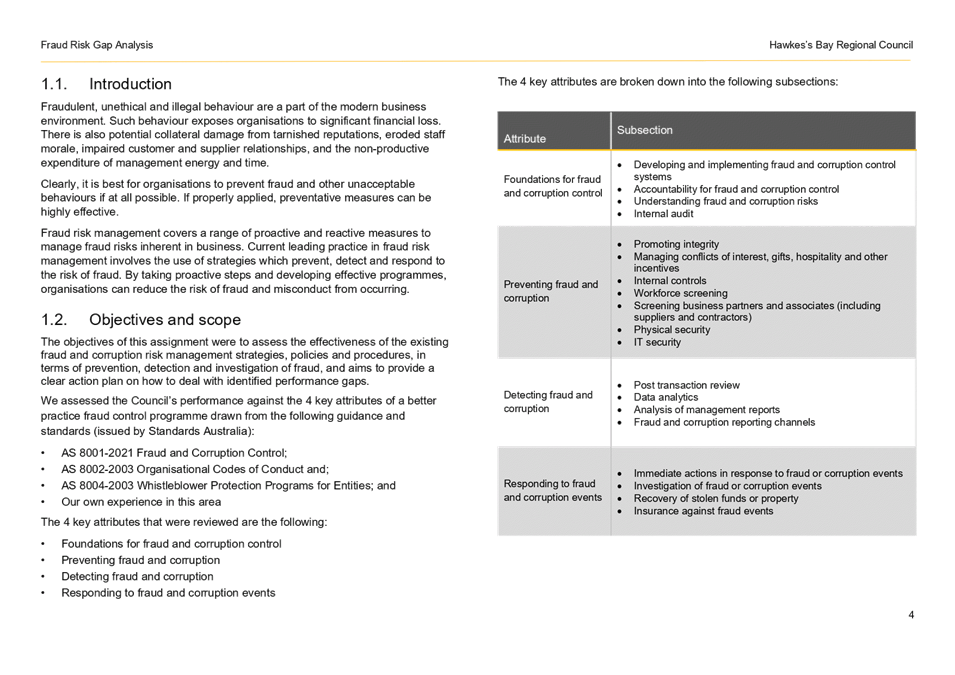

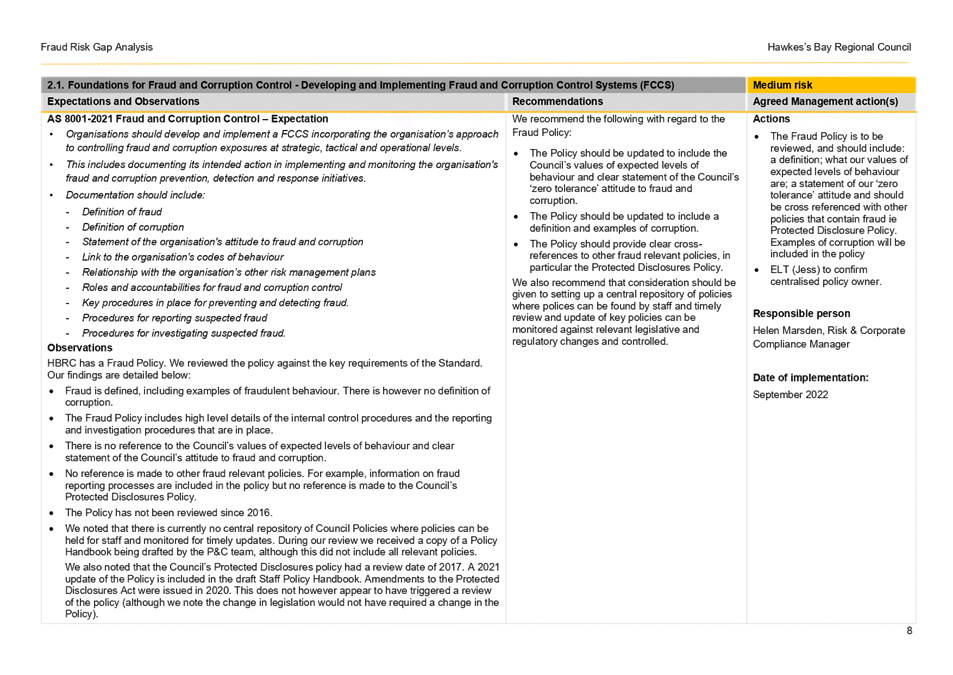

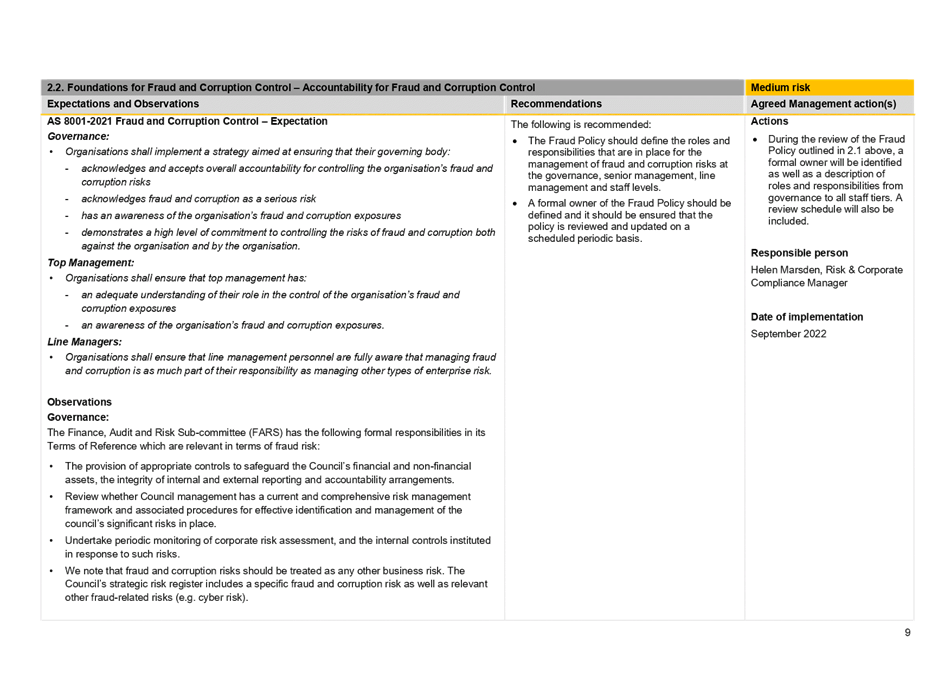

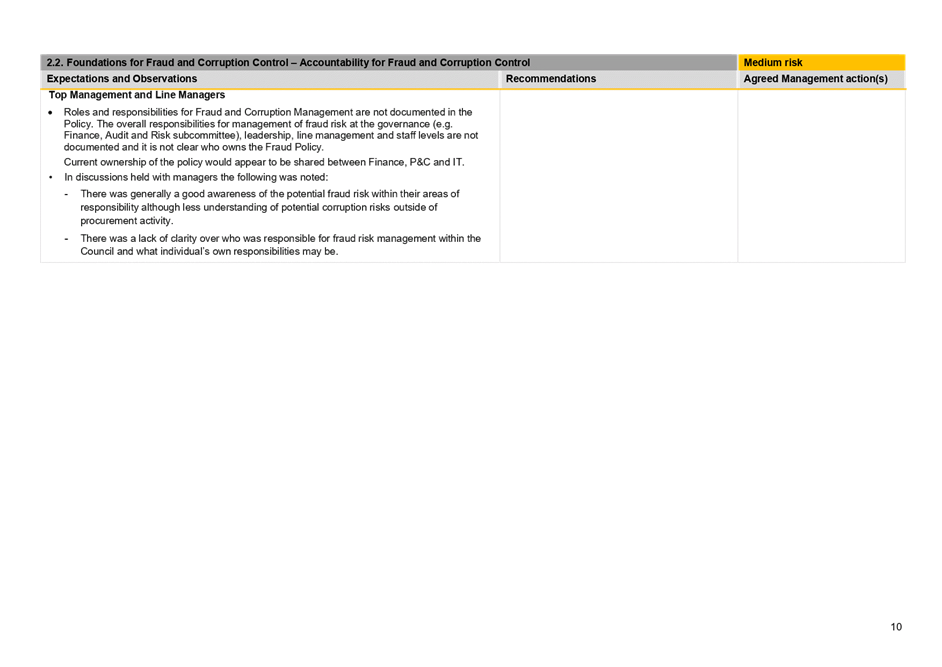

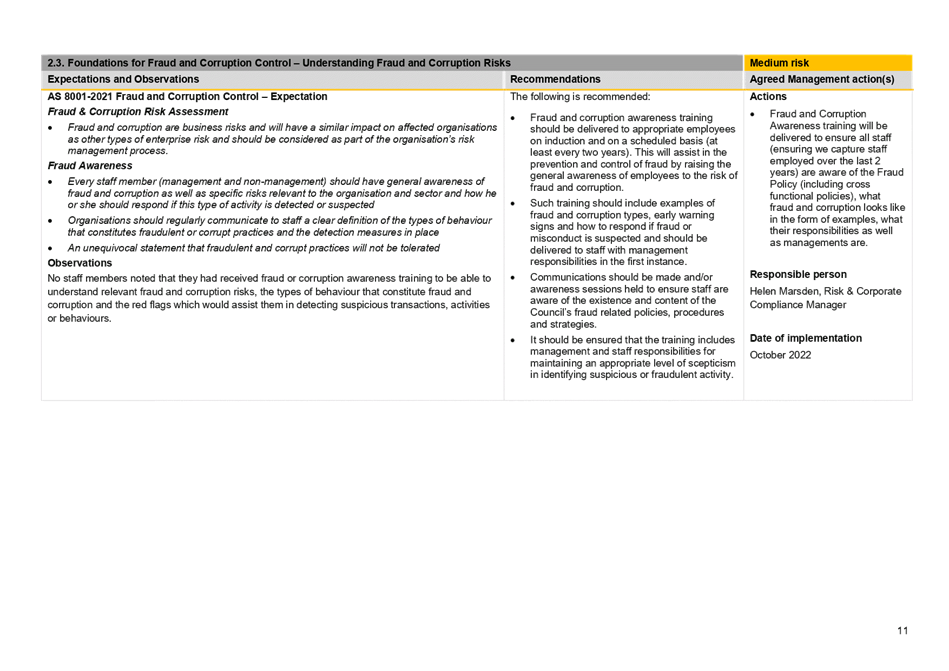

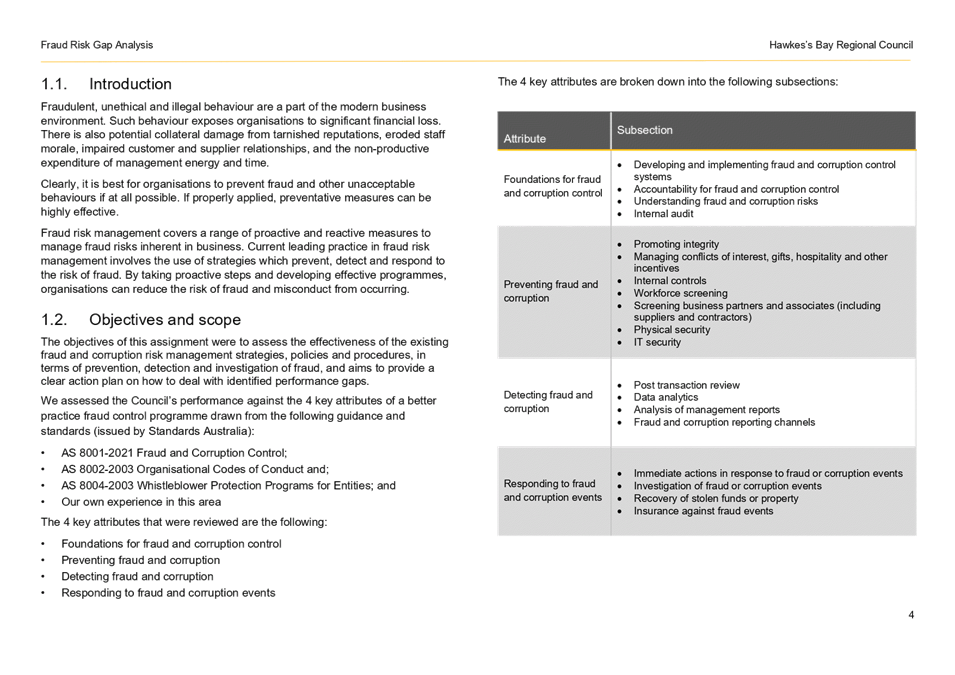

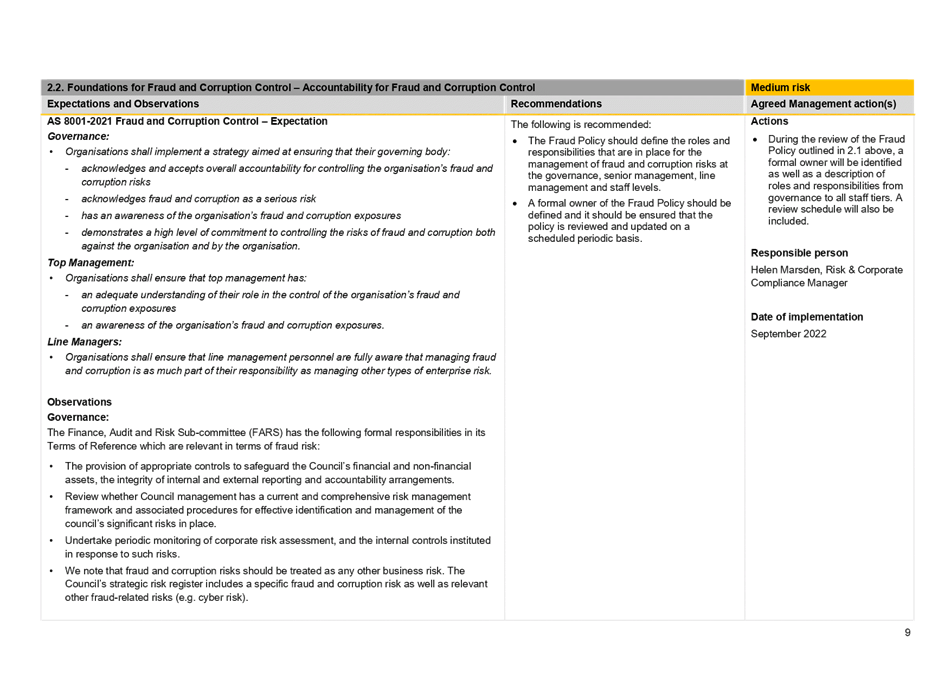

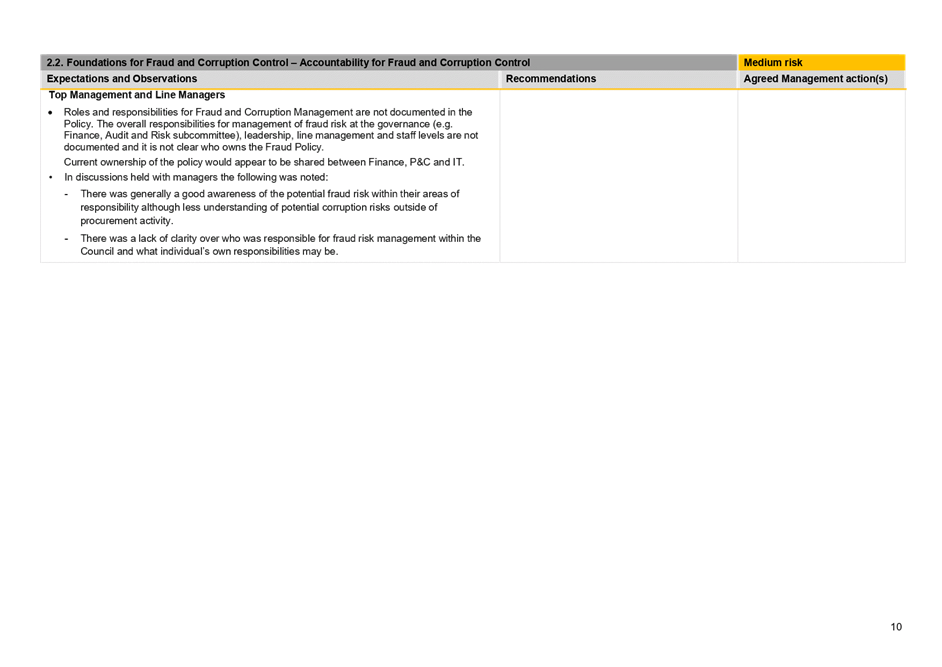

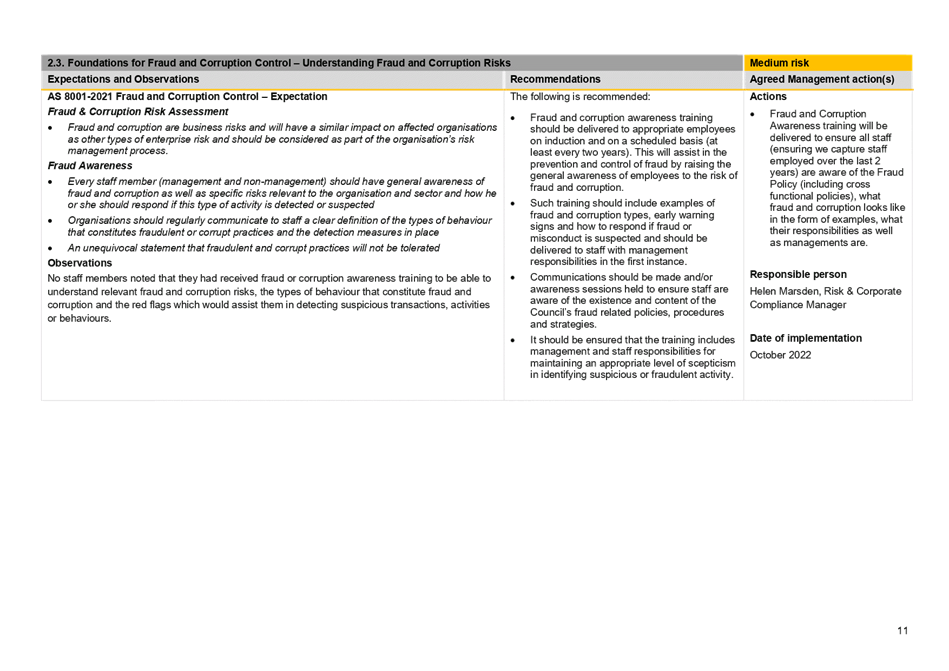

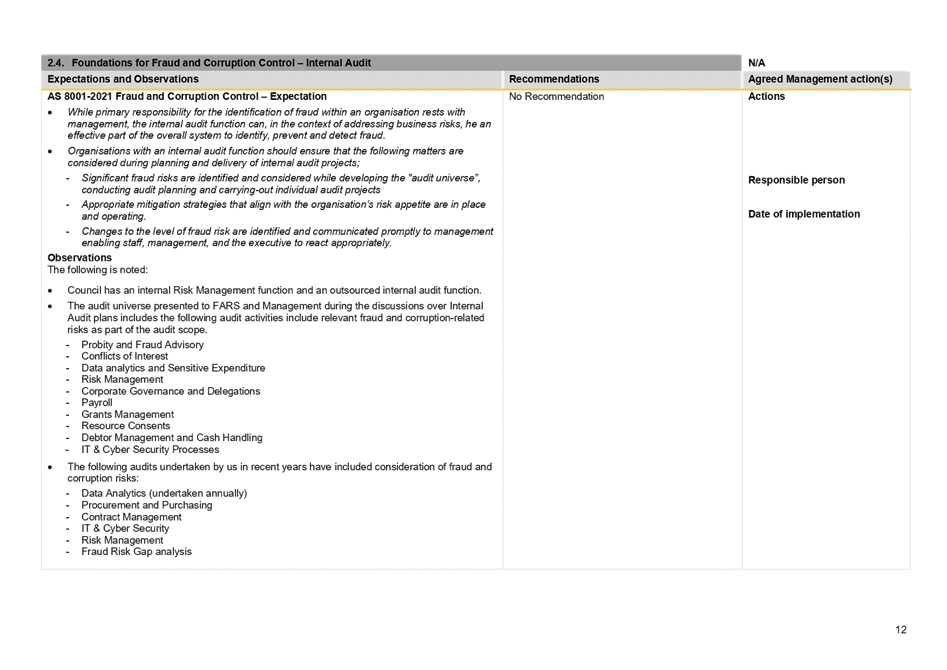

1. This item provides the

Finance Audit and Risk Sub-committee (FARS) with the internal audit report on

Fraud Risk Management undertaken by Crowe.

Officers’

Recommendations

2. Council officers recommend

that the Sub-committee considers the planned actions to address the

recommendations of the Fraud Risk Management Internal Audit report and agree

the medium findings to be monitored and tracked as corrective actions via the

Correction Actions Dashboard.

Executive

Summary

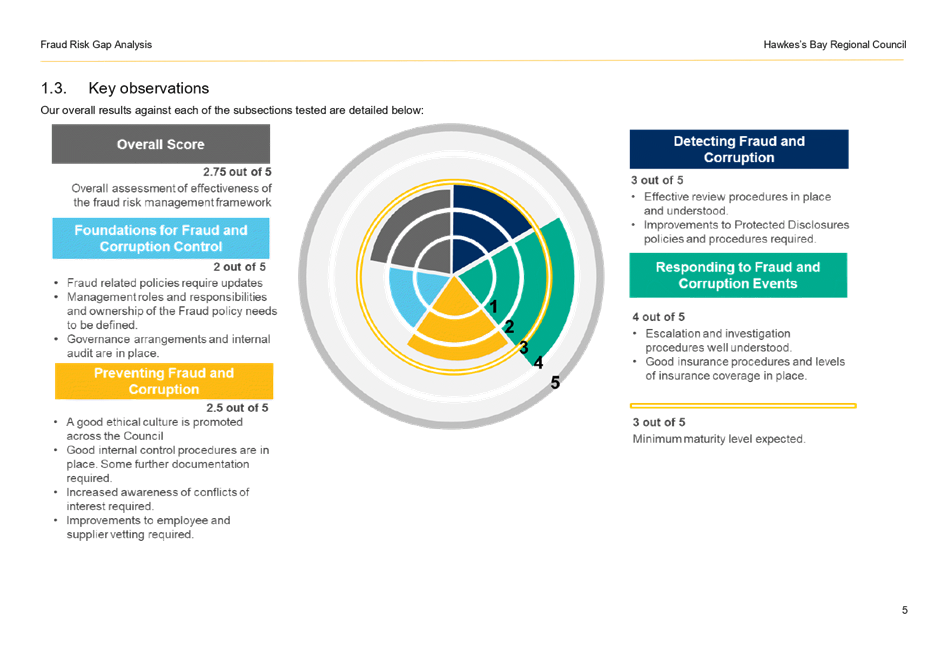

3. The FARS agreed on 13

October 2021, as part of the Annual Internal Assurance Plan FY 2022-21 to

engage Crowe to conduct an internal audit of the Council’s Fraud Risk

Management system.

4. The Fraud Internal Audit

was carried out in February 2022 in accordance with the 2021-2022 Internal

Audit Plan. The scope of the audit was to establish the effectiveness of

the current fraud and corruption policies and procedures, and to establish

actions to reduce the risk of fraud or misconduct from occurring.

5. The Executive Leadership

Team reviewed and agreed the findings at its meeting of 11 April following

recommendations by the Fraud Risk Management Audit report.

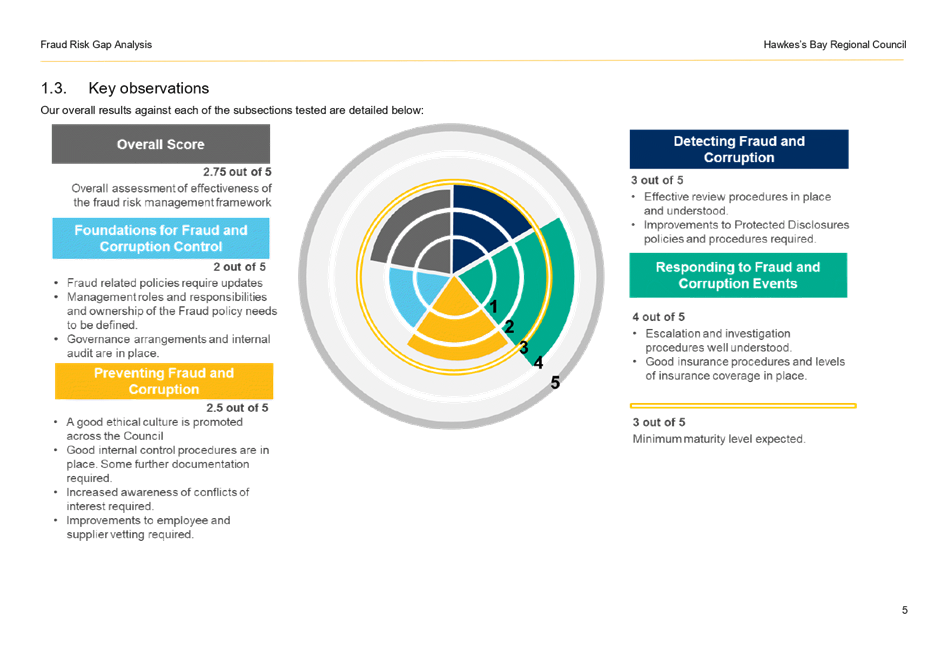

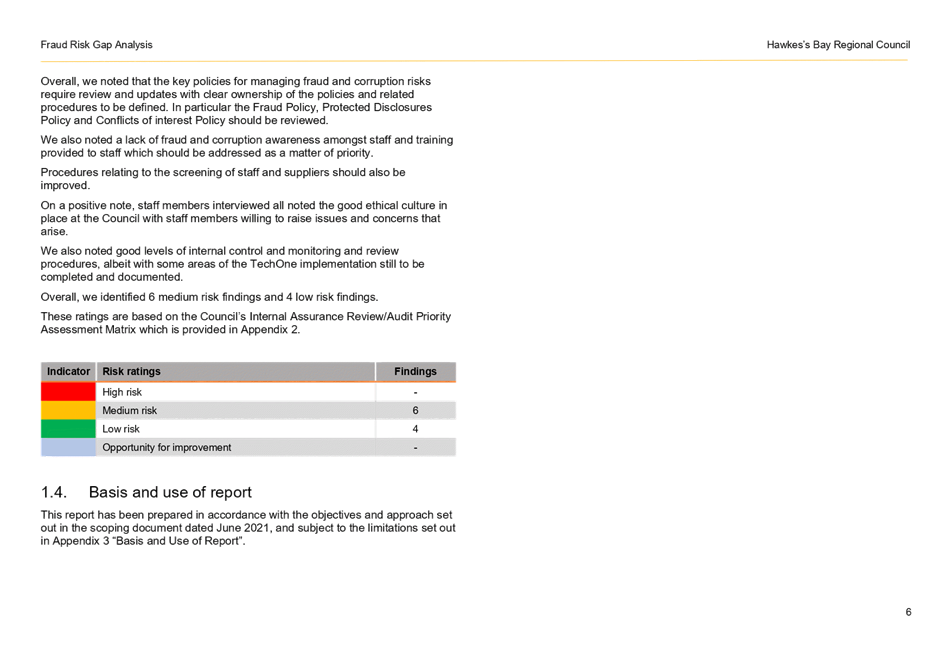

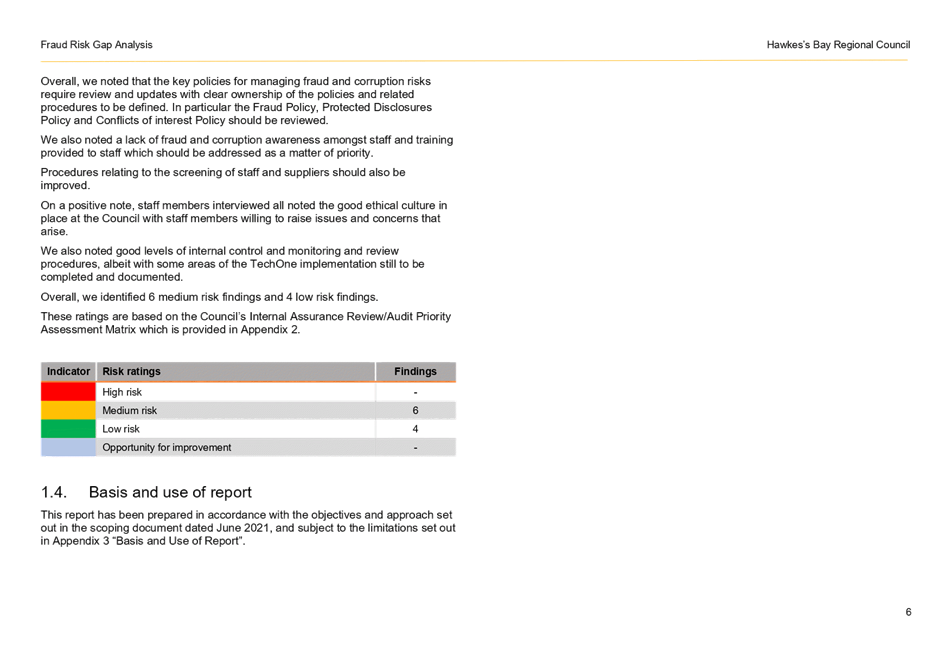

6. There were no high priority

findings observed. The report noted staff members interviewed all noted a good

ethical culture where staff have a willingness to raise issues and concerns

when they arise. In addition, good levels of internal control, monitoring and

reviewing of procedures were noted. The main themes of the findings for corrective action and

improvement, included:

6.1. a lack of awareness of

fraud and corruption amongst staff

6.2. key fraud policies require

reviewing, updating and ownership

6.3. procedures on staff and

supplier screening requires improvement.

Decision Making Process

7. Council and its Committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

7.1. The agenda item is in

accordance with the Sub-committee’s Terms of Reference, specifically:

7.1.1. The purpose of the Finance,

Audit and Risk Sub-committee is to report to the Corporate and Strategic

Committee to fulfil its responsibilities for (1.3) the independence and

adequacy of internal and external audit functions

7.1.2. The Finance, Audit and Risk

Sub-committee shall have responsibility and authority to (2.6) receive the

internal and external audit report(s) and review actions to be taken by

management on significant issues and recommendations raised within the

report(s)

7.1.3. The Finance, Audit and Risk

Sub-committee is delegated by Council to (3.5) ensure

that recommendations in audit management reports are considered and, if

appropriate, actioned by management.

7.2. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by or have an interest in the decisions made, the

Sub-committee can exercise its discretion and make a decision without

consulting directly with the community or others having an interest in the

decision.

Recommendations

That the Finance, Audit and Risk

Sub-committee:

1. Receives and considers the Fraud

Internal Audit Report.

2. Agrees that the decisions

to be made are not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy, and that the Sub-committee can

exercise its discretion and make decisions on this issue in accordance with its

Terms of Reference.

3. Agrees that the corrective

actions and due dates following, for medium risk findings from the Crowe HBRC

Fraud Risk Gap Analysis Report February 2022, are considered adequate to

address the report’s findings and recommendations, with progress to be

monitored and reported to the Sub-committee using the Corrective Actions

Dashboard.

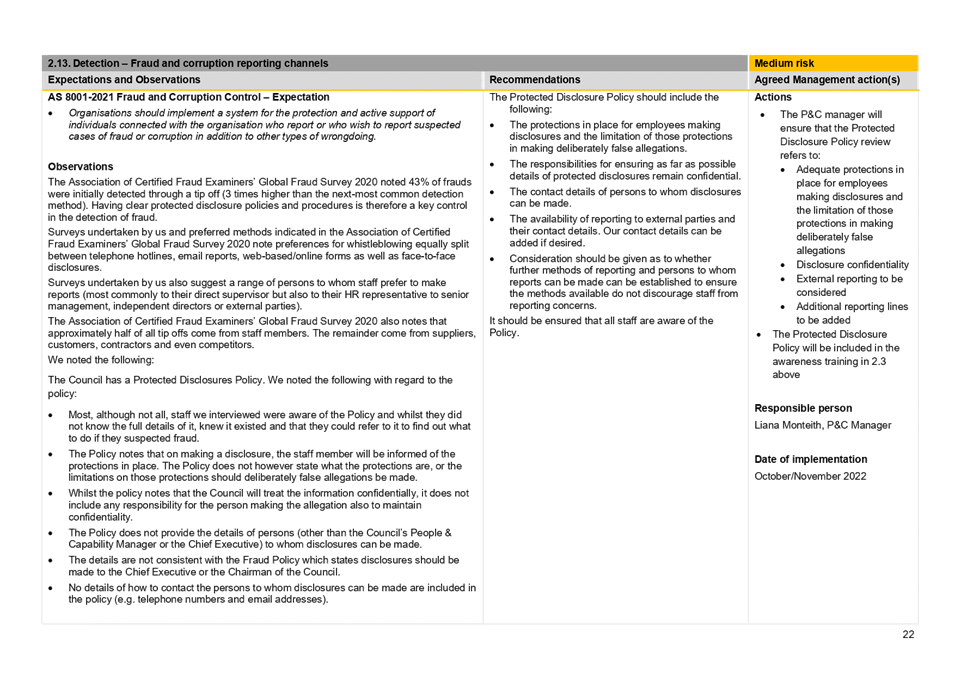

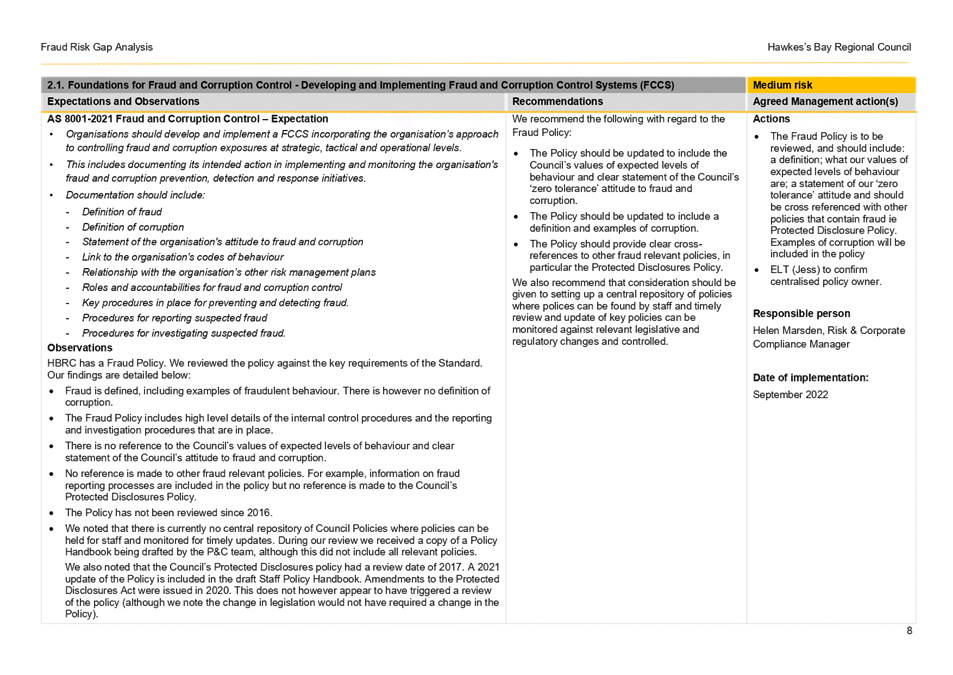

3.1. The Fraud Policy is to be

reviewed – implementation September 2022.

3.2. The formal owner of the

Fraud Policy is to be identified – implementation September 2022.

3.3. Fraud and Corruption

Awareness training will be delivered to all staff – implementation

October 2022.

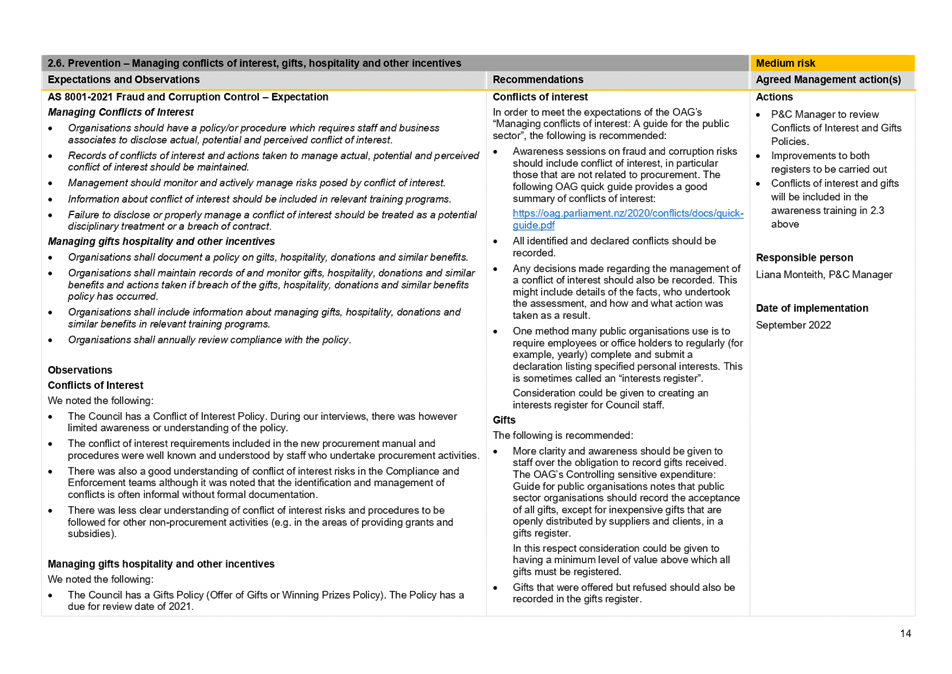

3.4. Conflicts of

Interest and Gifts policies are to be reviewed– implementation September

2022.

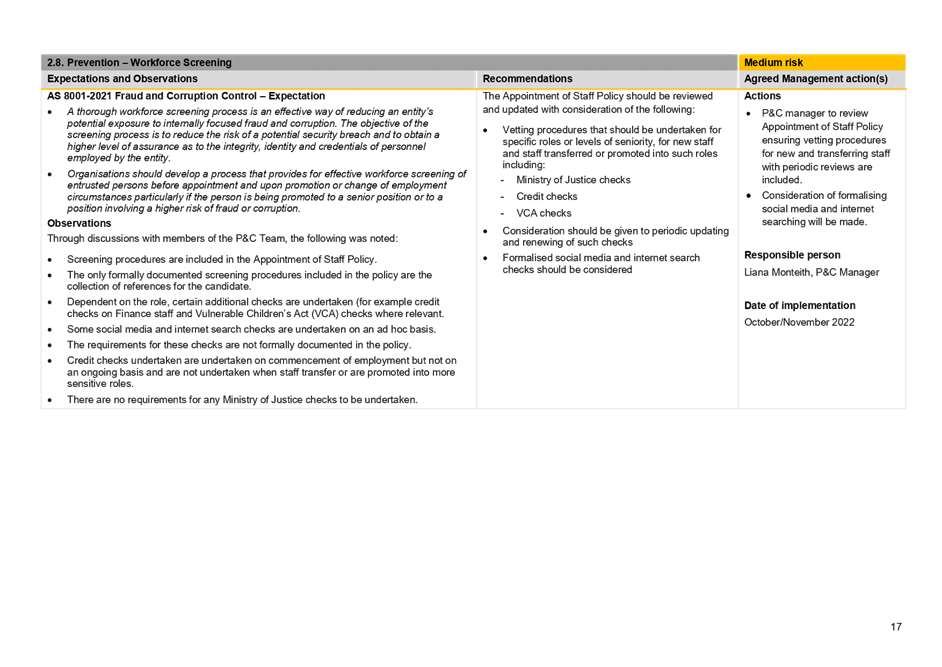

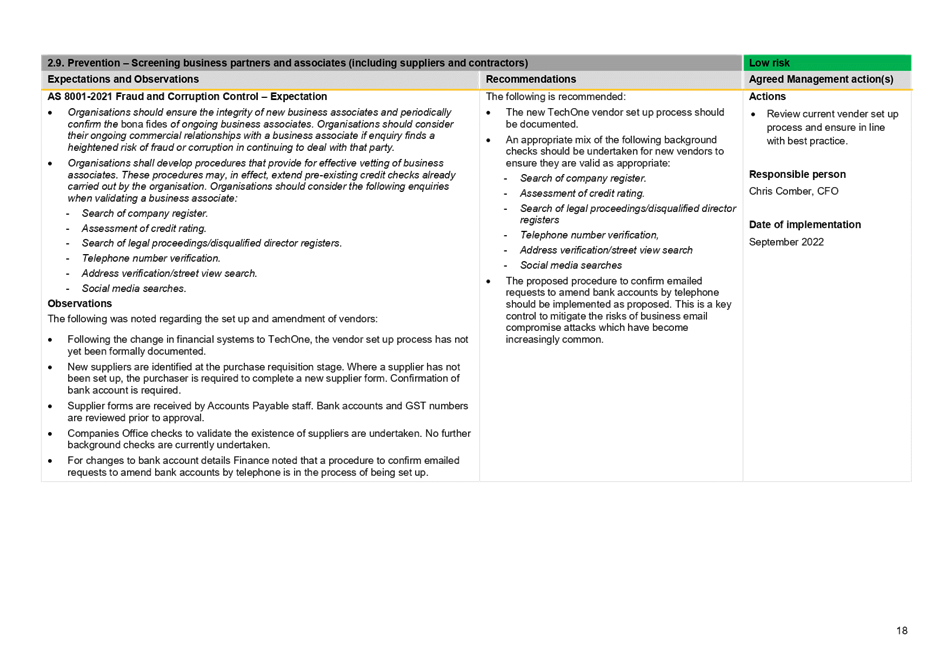

3.5. The Appointment

of Staff Policy is to be reviewed – implementation October/November 2022.

3.6. The Protected

Disclosures Policy is to be reviewed – implementation October/November

2022.

Authored by:

|

Olivia Giraud-Burrell

Quality & Assurance Advisor

|

Helen Marsden

Risk & Corporate Compliance

Manager

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

|

1⇩

|

Crowe HBRC Fraud Risk Gap Analysis

Report February 2022

|

|

|

|

Crowe HBRC Fraud Risk Gap Analysis Report

February 2022

|

Attachment

1

|

HAWKE’S BAY REGIONAL

COUNCIL

Finance Audit & Risk Sub-committee

4 May 2022

Subject: Annual Internal Audit Plan 2021-2022 status update

Reason for Report

1. This item provides the

Finance Audit and Risk Sub-committee (FARS) with the Annual Internal Audit Plan FY21-22 status update.

Officers’

Recommendations

2. Council officers recommend

that the FARS members consider and notes the Annual Internal Audit Plan FY21-22

status update below.

|

Approved Audit FY2021-22

|

Provider

|

Quarter Due

|

Date Commenced

|

Management Comments

|

Reported to FARS

|

|

Fraud Management

|

Crowe

|

Q3

|

February 2022

|

Approved by ELT 11 April 2022

|

May 2022*

|

|

Data Analytics

|

Crowe

|

Q4

|

|

Commencing May 2022

|

|

|

Retained Audit Capacity – 40 hrs

|

|

|

|

|

|

*The Fraud Management Audit report is a separate item to this FARS

meeting agenda.

3. The purpose of this status

update dashboard is to provide the FARS with oversight and progress of

individual internal audits that form part of the Corporate and Strategic

Committee (C&S) approved Annual Internal Audit Plan.

Financial and Resource Implications

4. The internal audits

undertaken as per the approved plan have been managed within the approved

budgets.

Decision Making Process

5. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

5.1. This agenda item is in

accordance with the Sub-committee’s Terms of Reference, specifically:

5.1.1. The purpose of the Finance,

Audit and Risk Sub-committee is to report to the Corporate and Strategic

Committee to fulfil its responsibilities for (1.3) the independence and

adequacy of internal and external audit functions

5.1.2. The Finance, Audit and Risk

Sub-committee shall have responsibility and authority to (2.5) confirm the terms of appointment and engagement of external

auditors, including the nature and scope of the audit, timetable, and fees;

(2.6) receive the internal and external audit report(s) and review actions to

be taken by management on significant issues and recommendations raised within

the report(s)

5.1.3. The Finance, Audit and Risk

Sub-committee is delegated by Council to (3.6) review the objectives and scope

of the internal audit function, and ensure those objectives are aligned with

Council’s overall risk management framework; and (3.7) assess the

performance of the internal audit function, and ensure that the function is

adequately resourced and has appropriate authority and standing within Council.

5.1.4. As this item is for

information only, the decision making provisions do not apply.

Recommendations

That

the Finance, Audit and Risk Sub-committee receives and notes the Annual Internal Audit Plan

2021-2022

status update staff

report.

Authored by:

|

Olivia Giraud-Burrell

Quality & Assurance Advisor

|

Helen Marsden

Risk & Corporate Compliance

Manager

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

There are no attachments for this

report.

HAWKE’S

BAY REGIONAL COUNCIL

Finance Audit & Risk Sub-committee

4 May 2022

Subject: Road Safety s17a Review

outcomes

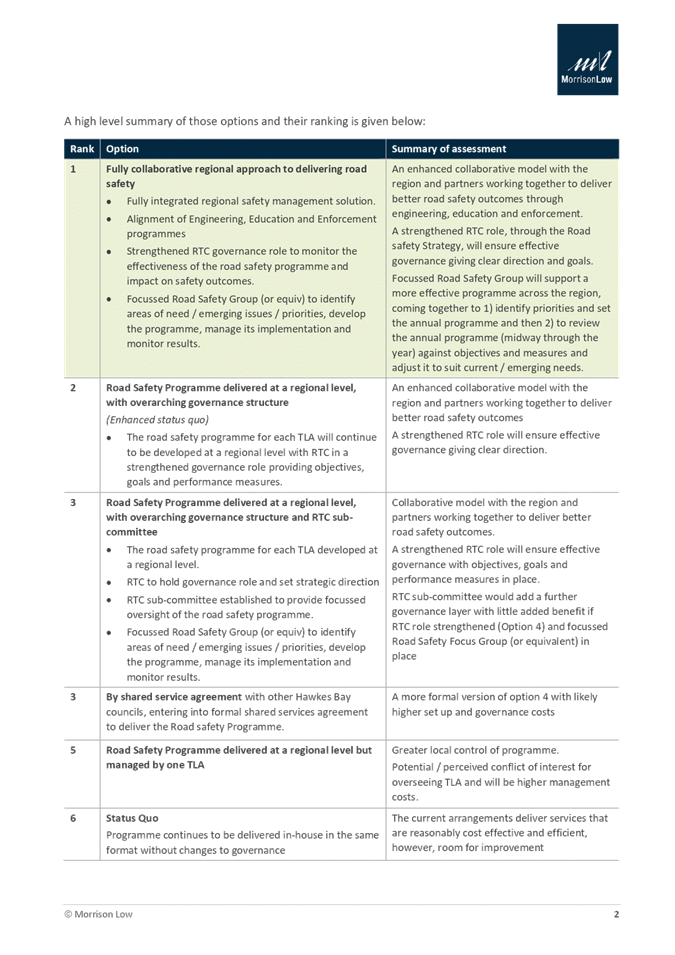

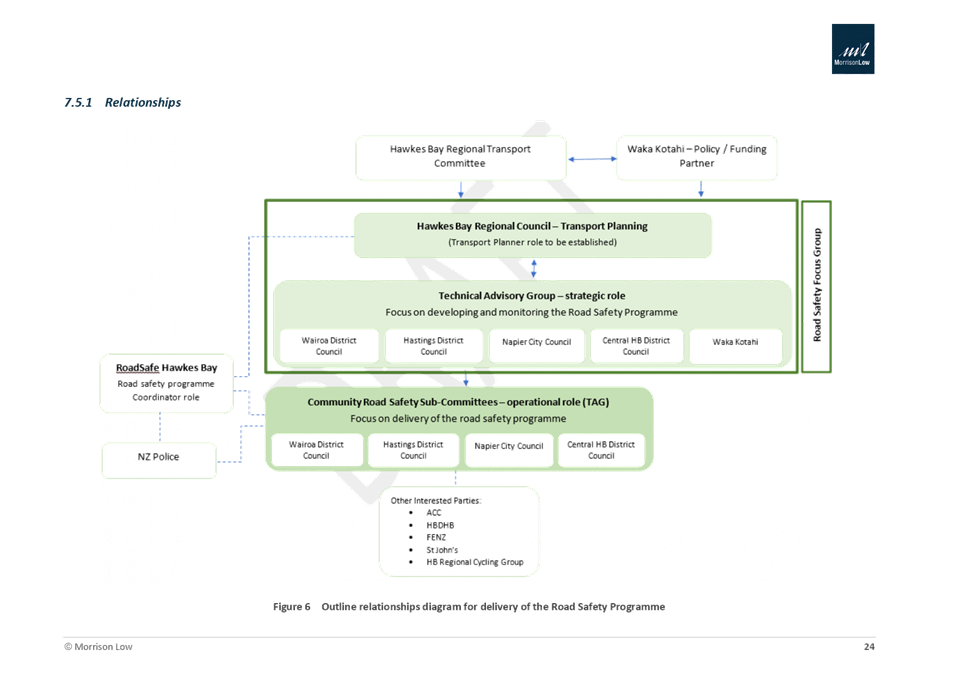

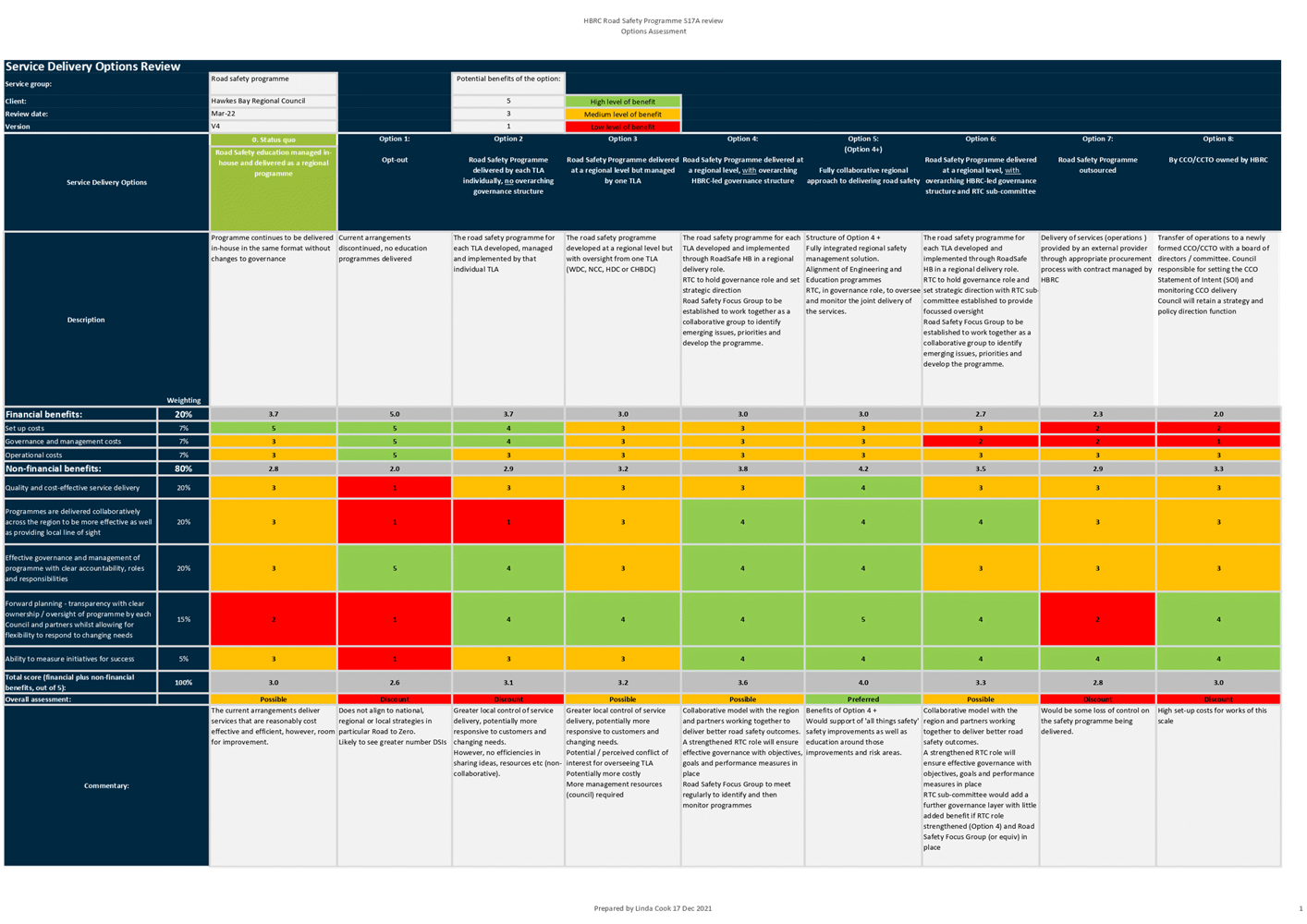

Reason for report

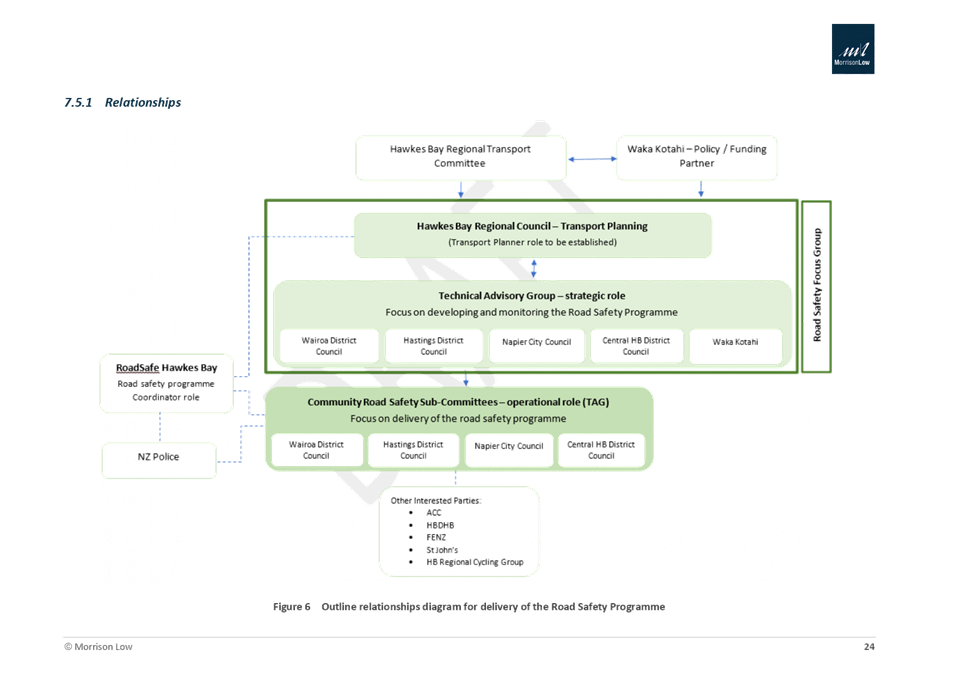

1. This item presents the Local Government Act

section 17a Service Delivery review of HB Roadsafe functions and seeks approval from the

Finance Audit and Risk Sub-committee to progress the proposed outcome resulting

from the review.

Officers’

recommendations

2. Staff recommend that the

committee approves the proposed delivery outcome that resulted from Morrison

Low’s Service Delivery Review of the Hawke’s Bay Regional

Council’s Road Safety function and has been agreed by the Regional

Transport Committee.

Executive

Summary

3. This report introduces the

Morrison Low report, attached, which covers the feedback, findings, evaluation,

and recommendations of the delivery of Hawke’s Bay’s Road Safety

programme.

Background/Discussion

4. At its 11 December 2020

meeting, the Regional Transport Committee (RTC) sought advice in relation to

their oversight and governance of Hawke’s Bay’s Road Safety programme (RSP). The

Committee also sought further advice about the effective delivery of their

governance obligations for Road Safety.

5. In response to the request

for oversight and governance of the Road Safety Programme, a workshop was held

on 12 March 2021. The workshop provided an opportunity to discuss the options

and preferred approach for the involvement of the Committee in the Road Safety

Programme.

6. The outcome from that

workshop was agreement that direction setting, oversight and accountability for

the RoadSafe programme should sit with the RTC at the Governance level.

7. Following that decision,

the RTC agreed to a service delivery review in accordance with the requirements

of Section 17a of the Local Government Act 2002.

8. Morrison Low undertook the

Section 17a review of the delivery of the Road Safety programme with all

stakeholders and the findings and recommendations from that review are

attached.

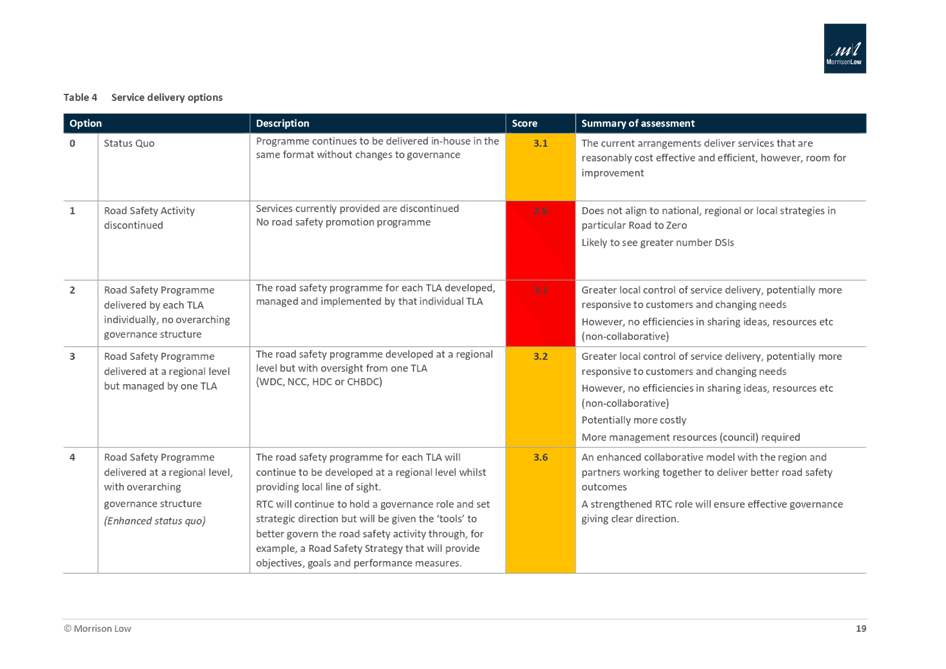

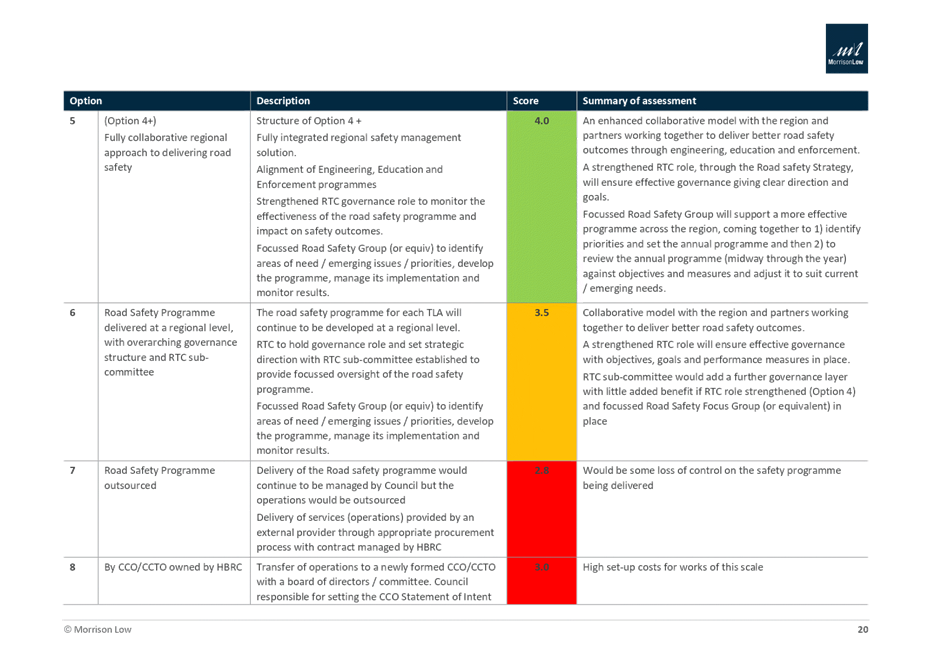

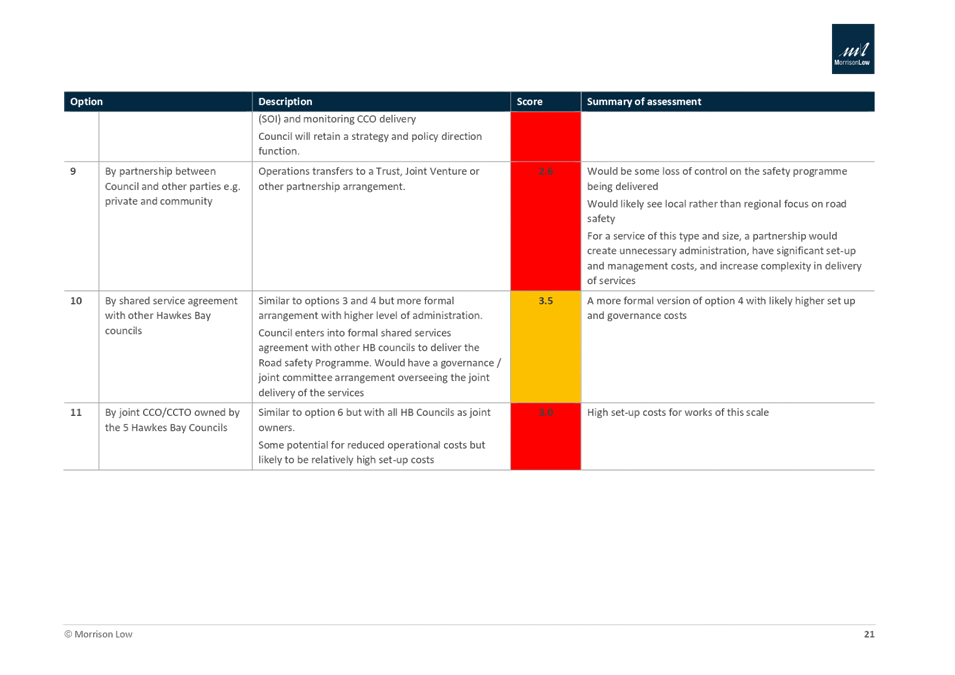

Options

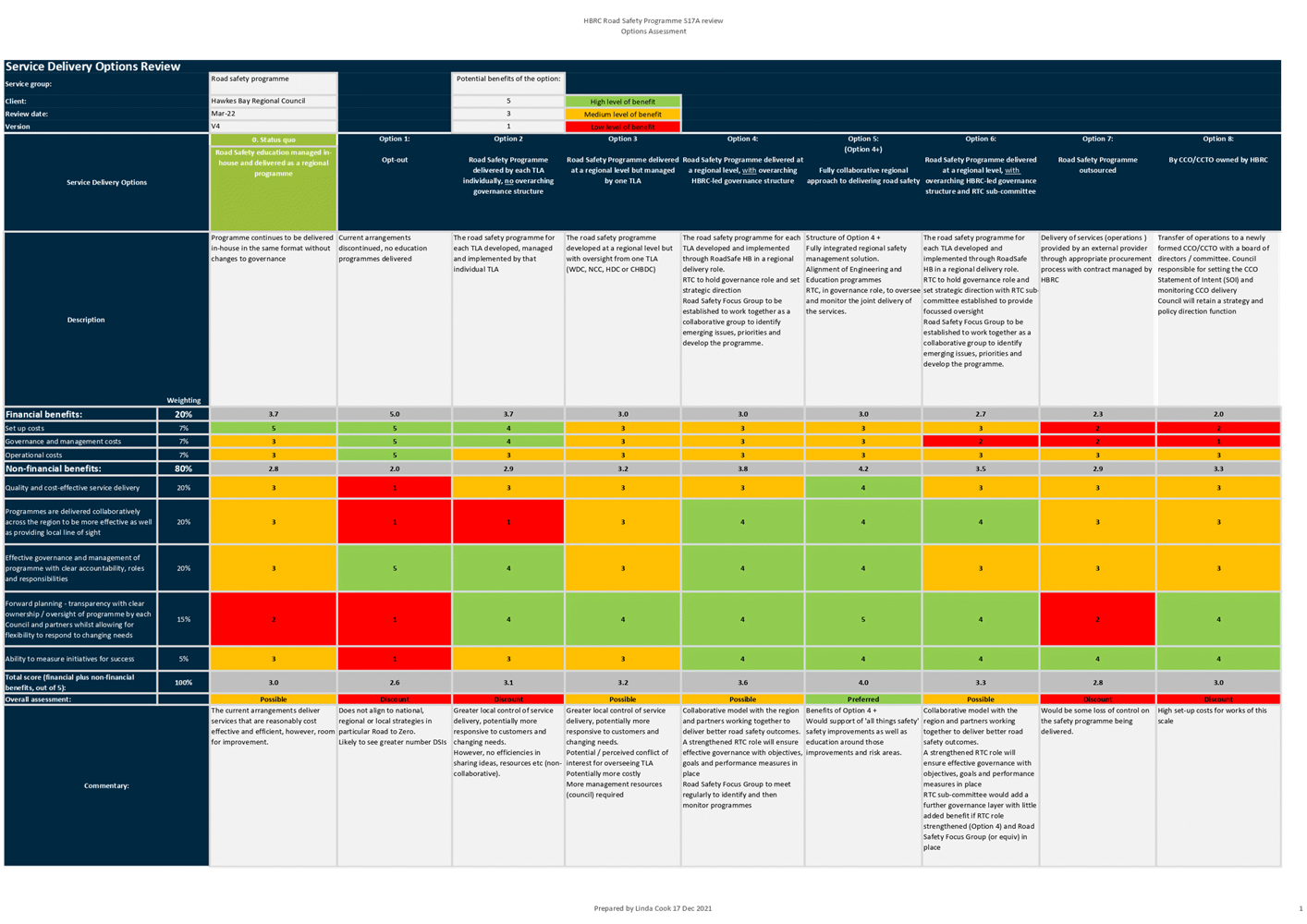

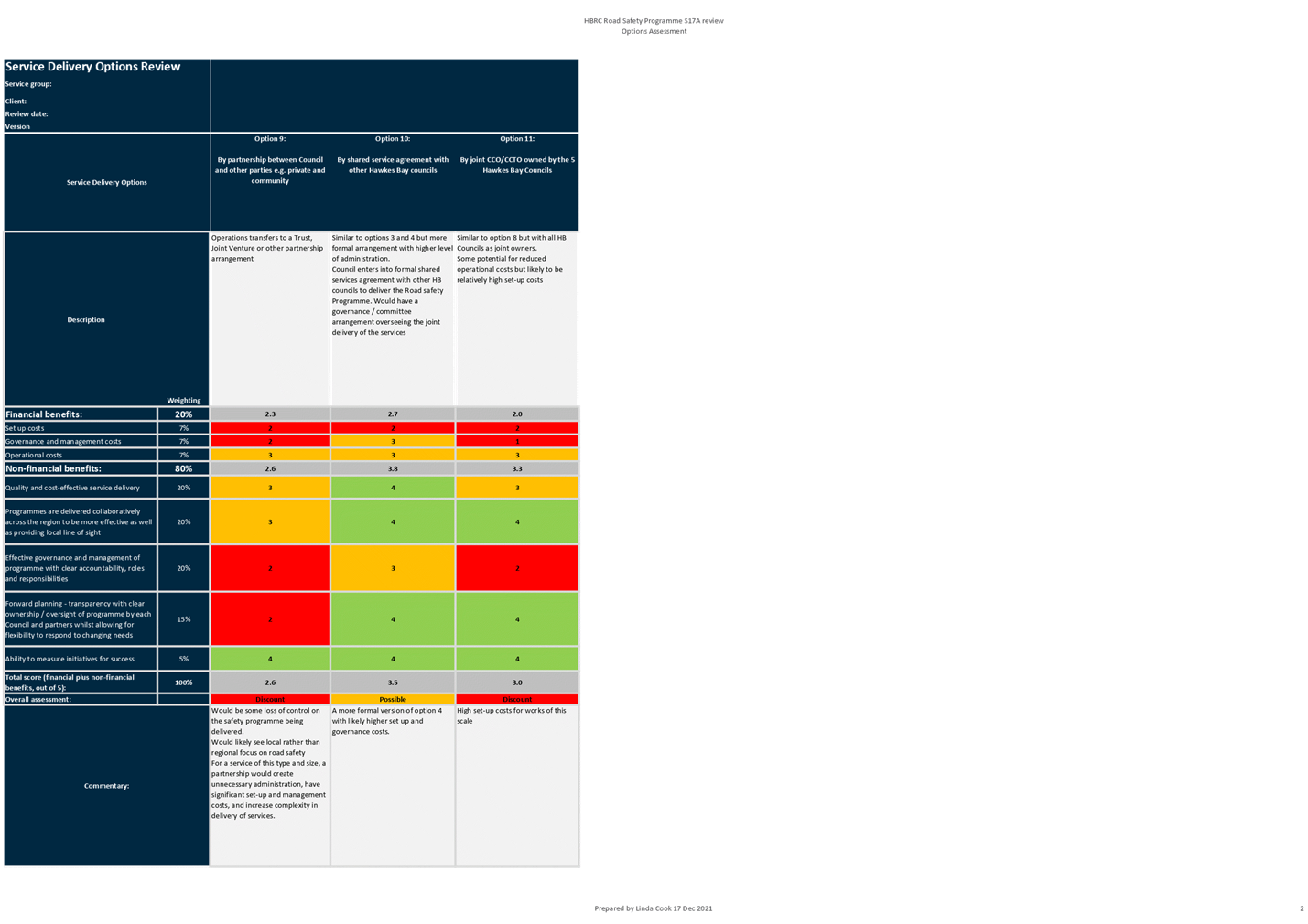

assessment

9. Road Safety delivery

options are discussed in the attached Morrison Low report.

Financial

and resource implications

10. Financial and resource

implications are outlined in the attached Morrison Low report.

Consultation

11. Consultation undertaken

with stakeholders is outlined in the attached report.

Considerations

of tangata whenua

12. There are no social,

cultural, or economic effects on tangata whenua as a result of this review, but

consultation was undertaken with key stakeholders, some of which have a primary

focus on the social, cultural and economic wellbeing of tangata whenua in

regard to road safety.

Decision making process

13. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

13.1. This agenda item is in

accordance with the Sub-committee’s Terms of Reference, specifically:

13.1.1. The purpose of the Finance,

Audit and Risk Sub-committee is to report to the Corporate and Strategic

Committee to fulfil its responsibilities for (1.3) the independence and

adequacy of internal and external audit functions

13.1.2. The Finance, Audit and Risk

Sub-committee shall have responsibility and authority to (2.6) receive the

internal and external audit report(s) and review actions to be taken by

management on significant issues and recommendations raised within the report(s);

(2.11) undertake systematic reviews of Council

operational activities against Council stated performance criteria to determine

efficiency/effectiveness of delivery of Council services

13.1.3. The Finance, Audit and Risk

Sub-committee is delegated by Council to (3.5.)

ensure that recommendations in audit management reports are considered and, if

appropriate, actioned by management.

13.2. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by, or have an interest in the decisions made, the

Sub-committee can exercise its discretion and make a decision without

consulting directly with the community or others having an interest in the

decision.

Recommendations

That the Finance, Audit and Risk

Sub-committee:

1. Receives and considers the Road Safety s17a Review

outcomes

staff report.

2. Agrees that the decisions

to be made are not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy, and that the Sub-committee can

exercise its discretion and make decisions on this issue in accordance with its

Terms of Reference.

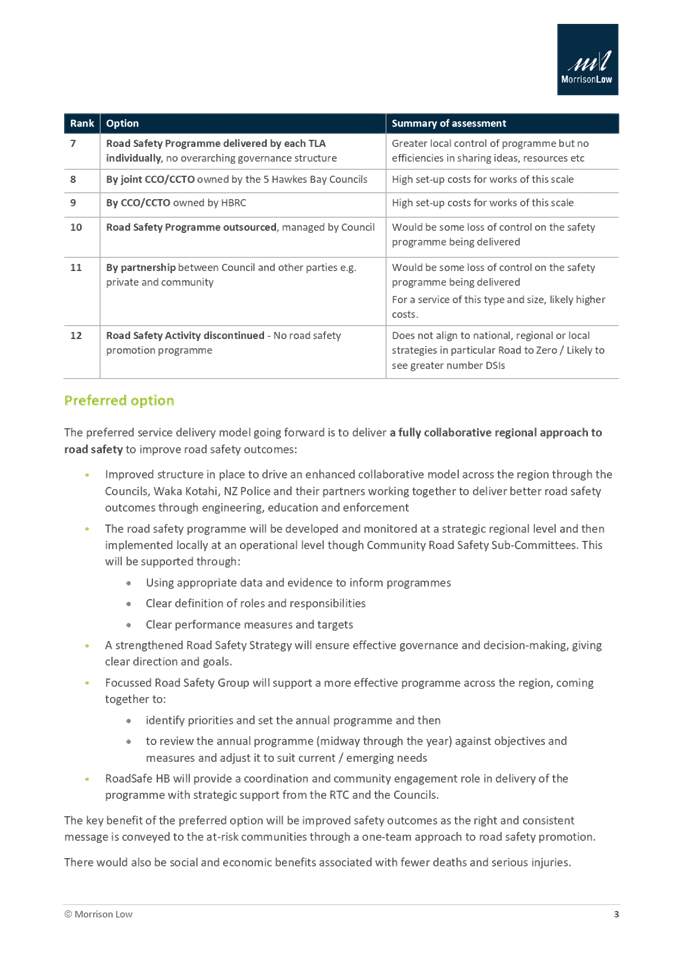

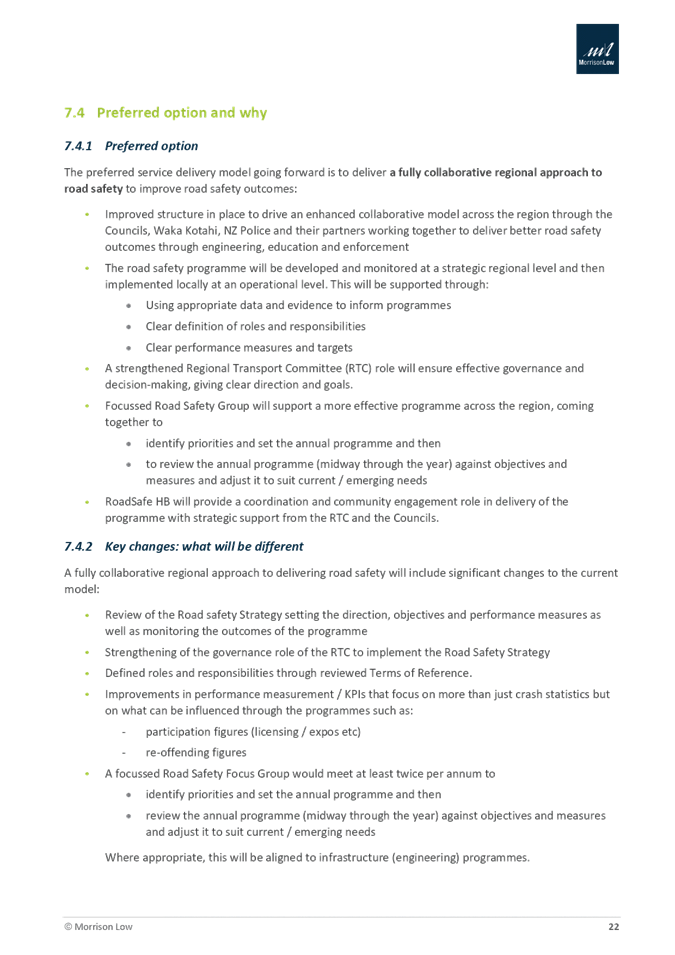

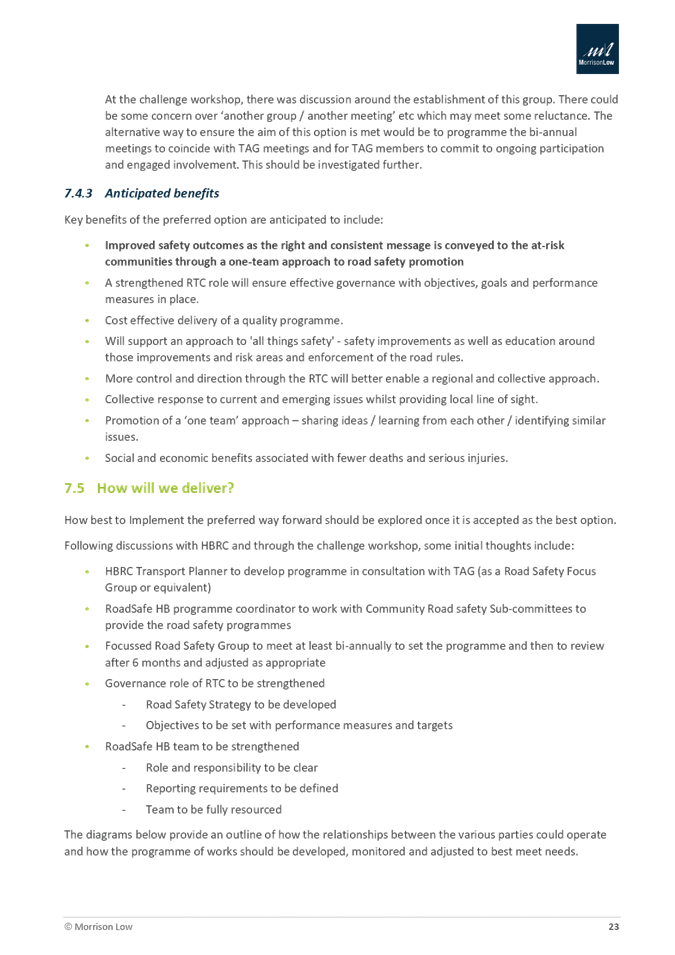

3. Endorses the preferred service delivery model, as

approved by way of a resolution of the Regional Transport Committee on 11 March

2022, of a fully collaborative regional approach to road safety including:

3.1. The revised structure will drive an

enhanced collaborative model across the region through the Napier City,

Hastings District, Central Hawke’s Bay District, Wairoa District and

Hawke’s Bay Regional councils, Waka Kotahi, NZ Police and their partners

working together to deliver better road safety outcomes through engineering,

education and enforcement.

3.2. The road safety programme will be

developed and monitored at a strategic regional level and then implemented

locally at an operational level.

3.3. A strengthened Regional Transport

Committee role will ensure effective governance and decision-making, giving

clear direction and goals.

3.4. A focused Road Safety Group will

support a more effective programme across the region, coming together to

identify priorities and set the annual programme and then to review the annual

programme (midway through the year) against objectives and measures and adjust

it to suit current / emerging needs.

3.5. RoadSafe HB will provide a

coordination and community engagement role in delivery of the programme with

strategic support from the Regional Transport Committee and the Napier City,

Hastings District, Central Hawke’s Bay District, Wairoa District and

Hawke’s Bay Regional councils.

Authored by:

|

Katie Nimon

Transport Manager

|

|

Approved by:

|

Katrina Brunton

Group Manager Policy &

Regulation

|

James Palmer

Chief Executive

|

Attachment/s

|

1⇩

|

Morrison Low Hawke's Bay Road Safety

s17A Review report

|

|

|

|

Morrison Low Hawke's Bay Road Safety s17A

Review report

|

Attachment

1

|

HAWKE’S BAY REGIONAL

COUNCIL

Finance Audit & Risk Sub-committee

4 May 2022

Subject: 2020-2021 Annual Report adoption update

Reason for report

1. This item provides the

sub-committee with an update on the late adoption of the FY20-21 Annual Report,

specifically the outcome of the auditor’s deliberations on the accounting

treatment of the significant prior year adjustment regarding the Accident

Compensation Corporation (ACC) Contract.

Background

2. The purposes of the Annual

Report are to:

2.1. compare actual financial

and service performance against intended performance as set out in year 3 of

the Long-Term Plan 2018-2028

2.2. promote accountability to

the community for the decisions made throughout the year by the Regional

Council.

3. Schedule 10 of the Act

prescribes what must be included in the Annual Report.

4. The production of the

Annual Report 2020-2021 financial information has been a challenging process

for staff because the implementation of a new finance system for the whole

organisation has taken place at the same time.

5. The Annual Report 2020-2021

includes a significant prior year adjustment. In December 2013, Council signed

a contract with ACC to provide immediate investment funds in exchange for the

future rental income from the Napier endowment leasehold properties for the

50-year term of the contract. Council has recognised a provision for the

payment of the future rental income in the financial statements since the year

ending 30 June 2014.

6. The contract includes an

obligation that Council pays ACC two-thirds of the gain from the sale of the

leasehold over and above the future rental income due on that property. In the

early years of the contract, the portion of the gain paid to ACC was

immaterial, but this has evolved over time as the freehold has been sold on a

large number of properties and the value of the remaining properties has

increased significantly.

7. Council has now assessed

the potential liability based on the valuation of the Napier property portfolio

and the remaining rental provision and has determined that a provision of $21.7

million is required to correctly state the liability to ACC from the probable

sale of the remaining leasehold properties.

8. Council has determined that

this adjustment should be recognised in prior periods to meet accounting

standards and has restated the 2019-2020 figures accordingly resulting in a $6.3 million

reduction in the 2019-2020 surplus and a $2.9 million expense in the current

year.

9. At the March sub-committee

meeting. Karen Young of Audit NZ explained that their technical team were

reviewing the ACC contract and its associated accounting treatment.

Update

10. Audit NZ has recommended we

receive an unqualified audit opinion.

11. Audit NZ, after further

delay, has completed their technical assessment of the ACC contract and

provided Council with their recommendations:

11.1. Council should have treated

the payment of the future rental income included in the contract as a financial

liability not a provision, and must change the headings to reflect the correct

classification.

11.2. Council should have

recognised two embedded derivatives (such as financial liabilities) being

payment of two-thirds of any excess rental received and two-thirds of the

profit from sales.

11.3. Council’s decision to

recognise a prior period error and restate the financial statements is correct.

11.4. Audit NZ proposed options

for the treatment of the future rental income and embedded derivatives.

11.5. Staff have chosen to

present the future rental income liability as previously calculated and the

derivatives as a single liability shown at fair value.

11.6. Audit NZ considered that

the Council’s draft calculation of $21.7 million for the fair value of

the derivatives was reasonable.

12. Staff have made the

following changes to the Annual Report presented to the sub-committee in

December 2021.

12.1. Changed the headings in the

Statement of Financial Position and Notes to ‘ACC Leasehold Financing

Liability’.

12.2. Changed the movements in

the sales liability from an expense to fair value through surplus/deficit.

12.3. Updated the notes to

reference the correct classification of the liabilities and movements.

13. Because the changes to the

Annual Report 2020-2021 presented to the sub-committee in December 2021 are not

considered significant nor material, staff will present the updated Annual

Report 2020-2021 and Annual Report Summary direct to the Regional Council for

adoption on 25 May 2022.

Decision Making Process

14. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendations

That

the Finance, Audit and Risk Sub-committee receives and notes the Hawke’s

Bay Regional Council 2020-2021 Annual Report adoption update staff report.

Authored by:

|

Sarah Bell

Team Leader Strategy &

Performance

|

Tim Chaplin

Senior Group Accountant

|

|

Chris Comber

Chief Financial Officer

|

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

There are no attachments for this

report.

HAWKE’S

BAY REGIONAL COUNCIL

Finance Audit & Risk Sub-committee

4 May 2022

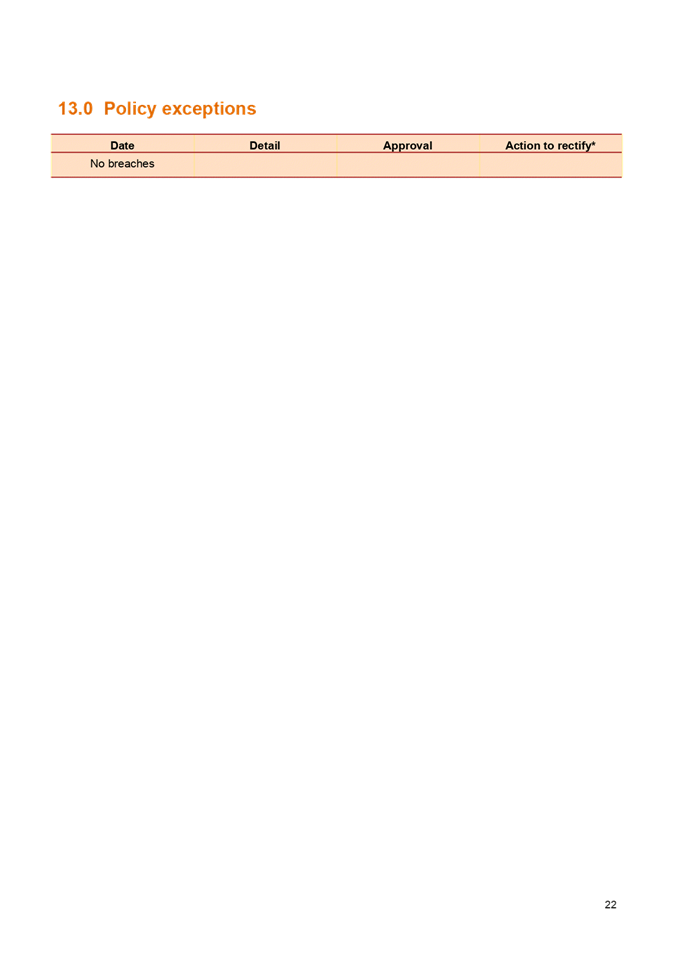

Subject: Quarterly Treasury Report for the period 1 January - 31 March 2022

Reason for Report

1. This item provides

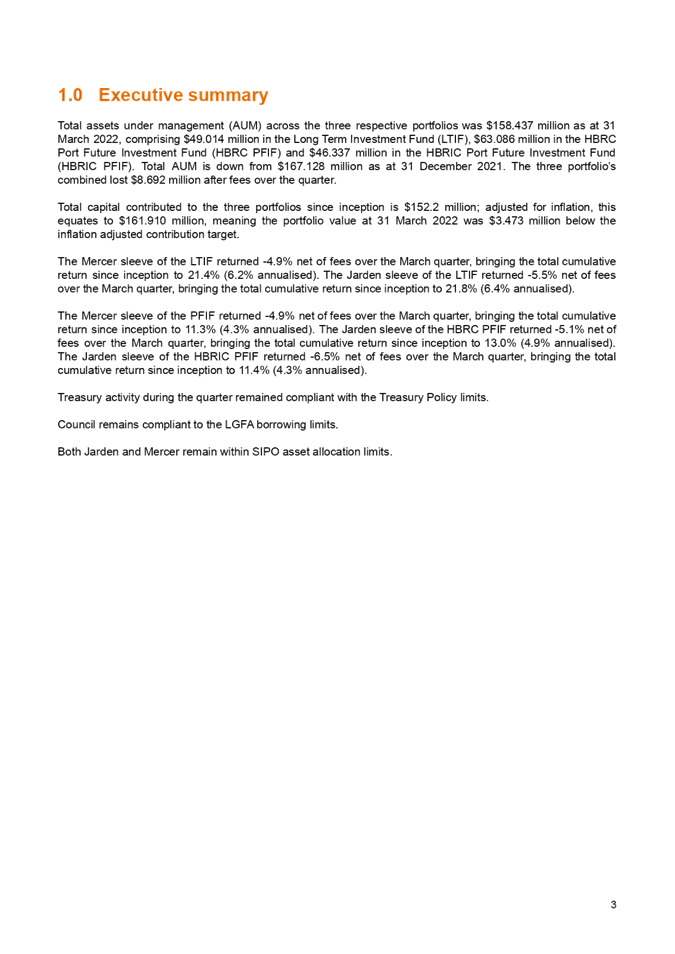

compliance monitoring of Hawke’s Bay Regional Council (HBRC) treasury

activity and reports the performance of Council’s investment portfolio

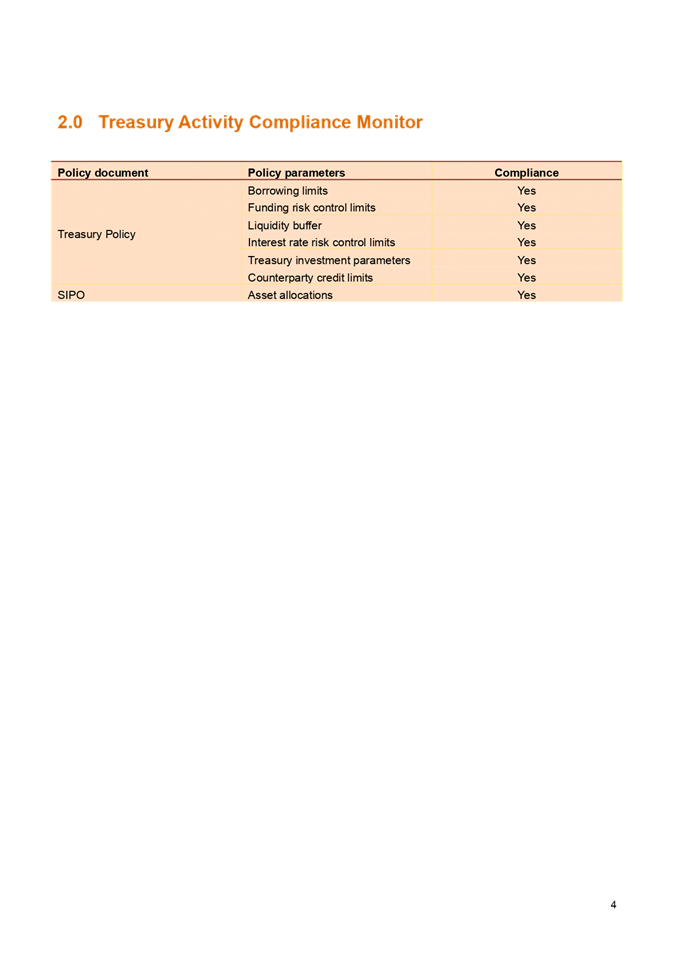

for the quarter ended 31 March 2022.

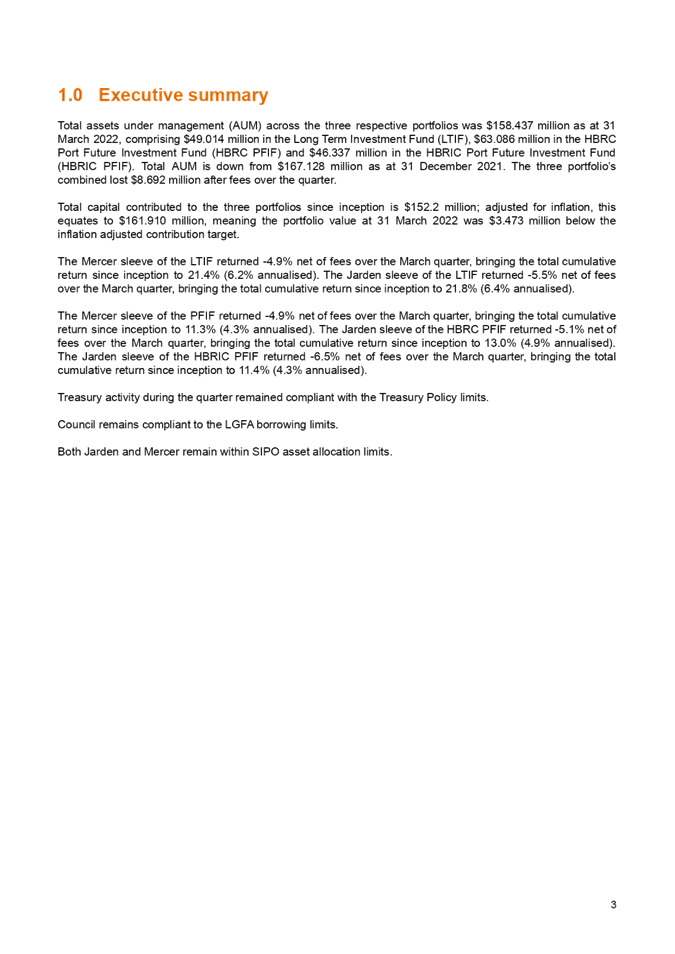

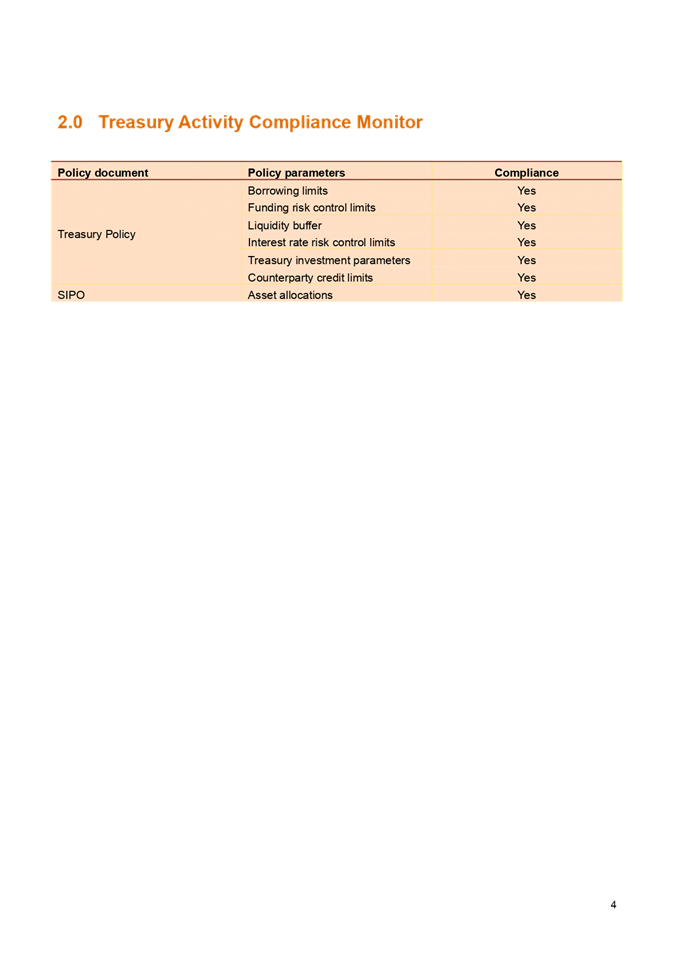

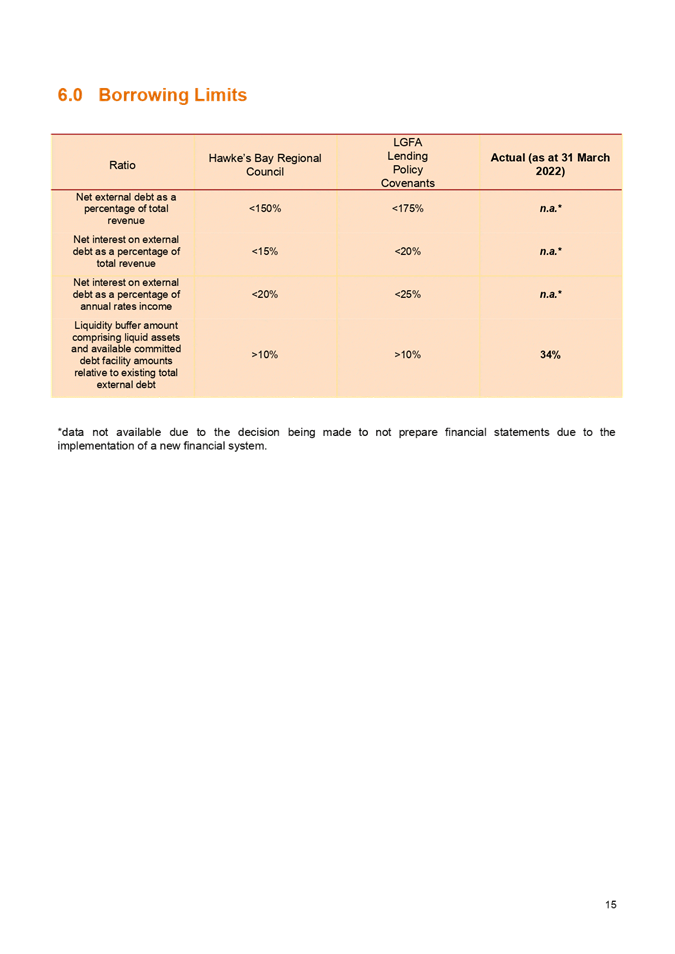

Overview of the Quarter – ending 31 March 2022

2. At the end of the quarter

to 31 March 2022, HBRC was compliant with all measures in its Treasury policy.

3. Investment returns for

managed funds, are now ($3.7m) below budget for the first 9 months due to a

significant financial market adjustment in January 2022. Another

significant market correction is now needed to deliver the required cash

returns to support the 2021-22 budget requirements.

4. Further growth of $1.5m is required

to achieve 2% capital growth on managed funds for the year, before any funding

of Council activities can be considered.

5. It is now anticipated there

will be a shortfall to the planned current financial year investment

income. However, the market is variable and staff advice in consultation

with investment managers is that the portfolio remains balanced for the long

term.

6. Cash balances are good and

actual year to date borrowing is $15m. Potentially, $15m is the full borrowing

requirement for activities for the year, which was planned at $36.5m. The

variance is due to some delay in timing of capital work programme delivery and

the impacts of Covid-19. As a result, and the additional debt to revenue

headroom, staff are comfortable with the ability to fund the anticipated

shortfall in investment income this financial year through borrowing based on

current financial performance and position.

Background

7. Council’s Treasury

Policy requires a quarterly Treasury Report to be presented to the Finance

Audit and Risk Sub-committee. The policy states that the Treasury Report is to

include:

7.1. Treasury Exceptions report

7.2. Policy compliance

7.3. Borrowing Limit report

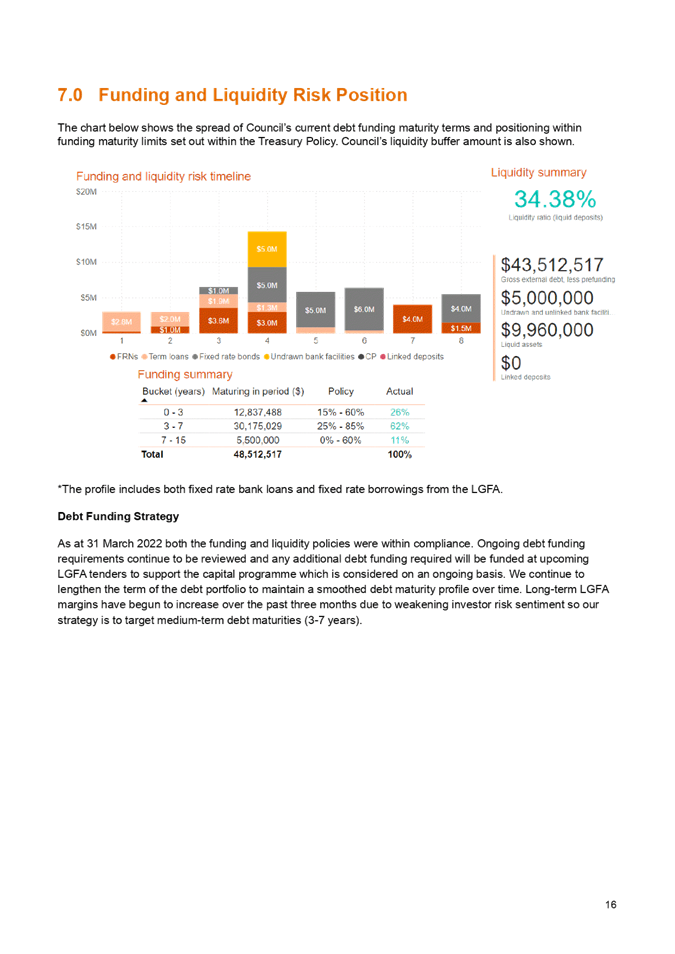

7.4. Funding and liquidity

report

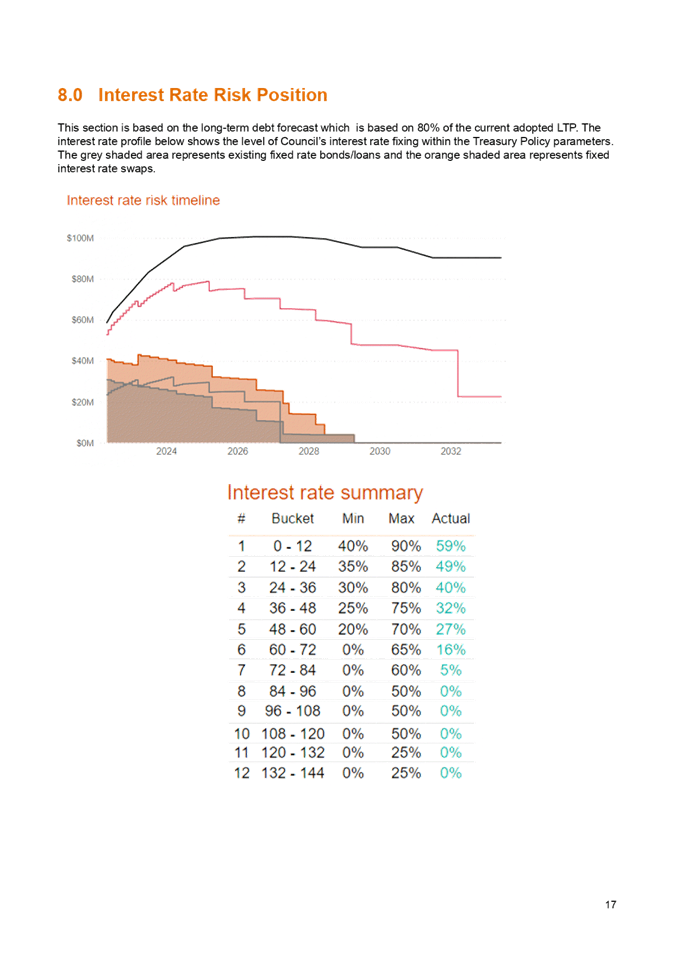

7.5. Debt maturity profile

Interest rate report

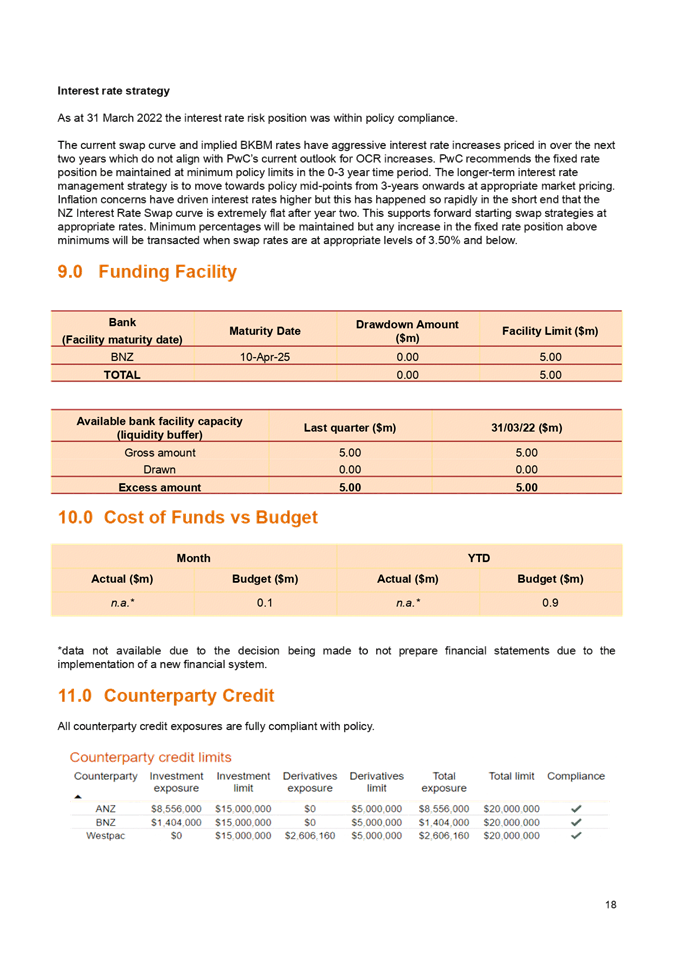

7.6. Investment management

report**

7.7. Treasury investments

7.8. Cost of funds report Cash

flow and debt forecast report

7.9. Debt and interest rate

strategy and commentary

7.10. Counterparty credit report

7.11. Loan advances.

8. The Investment Management

report** has specific requirements outlined in the Treasury Policy. This

requires quarterly reporting on all treasury investments plus annual reporting

on all equities and property investments.

9. In addition to the Treasury

Policy, Council has a Statement of Investment Policy and Objectives (SIPO)

document setting out the parameters required for funds under management for the

HBRC Long Term Investment Fund.

10. Treasury Investments to be

reported on consist of:

10.1. Liquidity

10.1.1. Cash and Cash Equivalents

10.1.2. Debt Management

10.2. Externally Managed

Investment Funds

10.2.1. Long-Term Investment Fund

(LTIF)

10.2.2. Future Investment Fund

(FIF)

10.3. Investment properties

10.4. HBRIC Ltd

10.5. 2021-22 Performance

Summary.

11. Since 2018, HBRC has

procured treasury advice and services from PriceWaterhouseCoopers (PwC).

Discussion

12. A separate treasury report

is prepared by Council’s advisors, PwC, to report on compliance with the

policy parameters and investment performance. The PwC report is attached. A

high-level summary of the data in the PwC report is provided following.

Liquidity

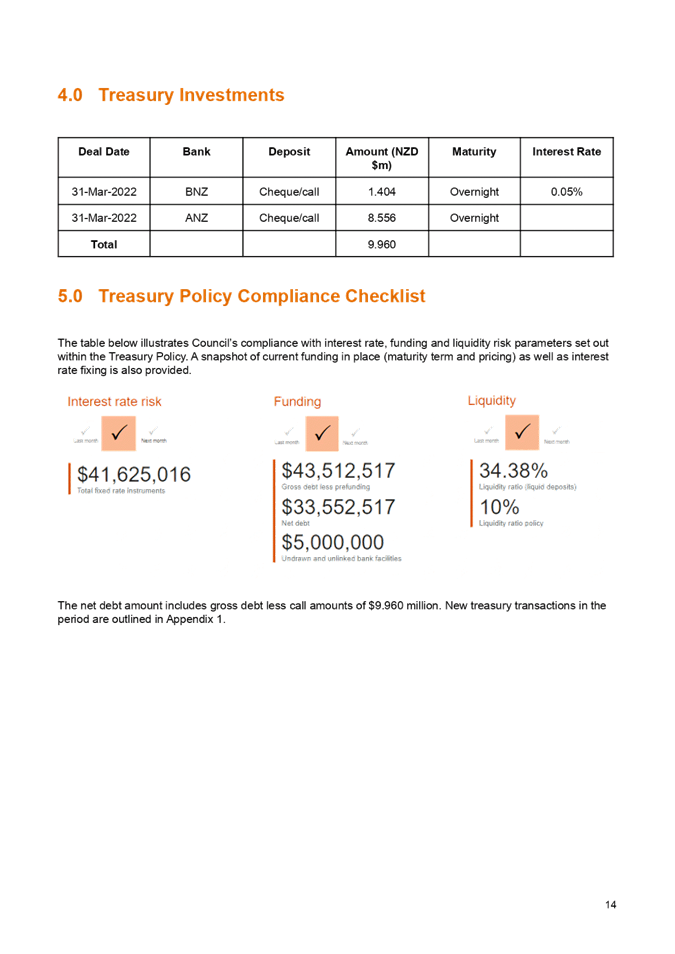

13. To ensure HBRC has the

ability to adequately fund its operations, current policy requires HBRC to

maintain a liquid balance of a minimum of $3.0m.

14. The following table reports

the cash and cash equivalents on 31 March 2022.

|

31 March 2022

|

$000

|

|

Cash on Call

|

9,960

|

|

Short-term bank deposits

|

-

|

|

Total Cash & and Deposits

|

9,960

|

15. Council’s balance of

cash and deposits compares with the March 2021 balance of $18.94m (in March

2021 Council raised $10m from the LGFA).

16. To manage HBRC liquidity

risk, HBRC also retains a Standby Facility with BNZ.

This facility provides HBRC with a same day draw down option, to any amount

between $0.3-$5.0m, and with a 7-day minimum draw period.

Debt

Management

17. On 31 March 2022 the

current external debt for the Council group was $43.5m ($60.175m including the

loan from HBRIC).

18. Since the December quarter

additional funds of $4m were borrowed from LGFA.

19. Further borrowing is

anticipated in the last quarter of the financial year as capital programmes

increase and to offset anticipated shortfalls in investment income.

20. The following summarises

the Year-to-date movements in Council’s debt position.

Summary of HBRC Debt

|

|

HBRC only

|

HBRC Group

|

|

Opening Debt – 1 July 2021 – excl HBRIC

Loan

|

30,875,014

|

30,875,014

|

|

New Loans raised

|

15,000,000

|

15,000,000

|

|

Less amounts repaid

|

(2,362,497)

|

(2,362,497)

|

|

Closing Debt 31 March 2022 (excluding HBRIC

loan)

|

43,512,517

|

43,512,517

|

|

Plus opening balance - loan from HBRIC

|

16,663,036

|

-

|

|

Total Borrowing as at 31 March

|

60,175,553

|

43,512,517

|

Managed

Funds

21. The LTP budgets an annual

return of 5.16% from managed funds. Of this 3.16% is used to fund activities

with 2.0% retained to grow and protect the capital base for future generations.

22. Council budgets separately

for revenue from directly held managed funds and those held by HBRIC. HBRIC is

required to deliver an overall portfolio return by way of an annual dividend

agreed through an annual Statement of Intent. The composition (between revenues

from managed funds and other sources such as port dividends is up to the HBRIC

board). Council has budgeted to receive $10.1 in dividends from HBRIC within

the FY21-22.

23. The FY21-22 budget

expectation for managed funds to be withdrawn to support Council operations is

$3.7m. Based on the March funds result and the value above the protected

amount, the funds held are not sufficient to deliver the returns required to

meet Council’s requirements. A recovery of the market is now required to

deliver on budget expectations.

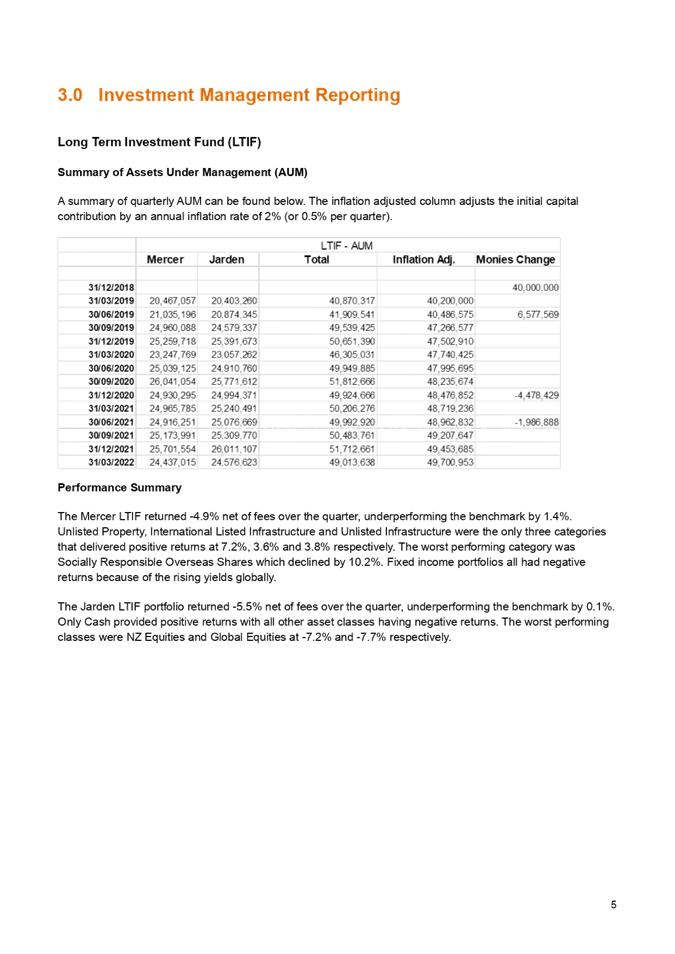

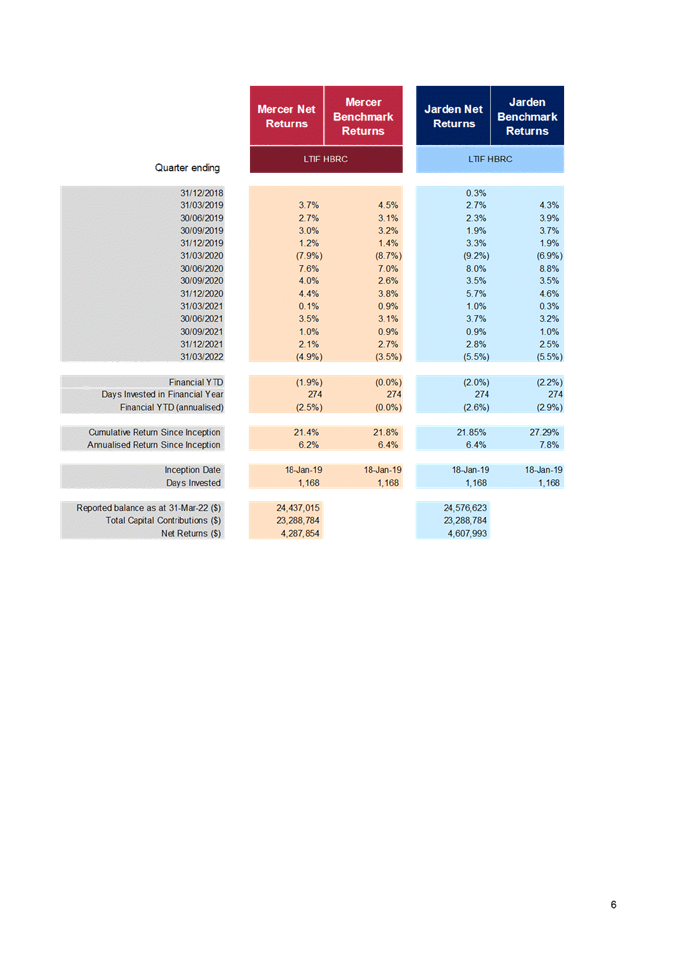

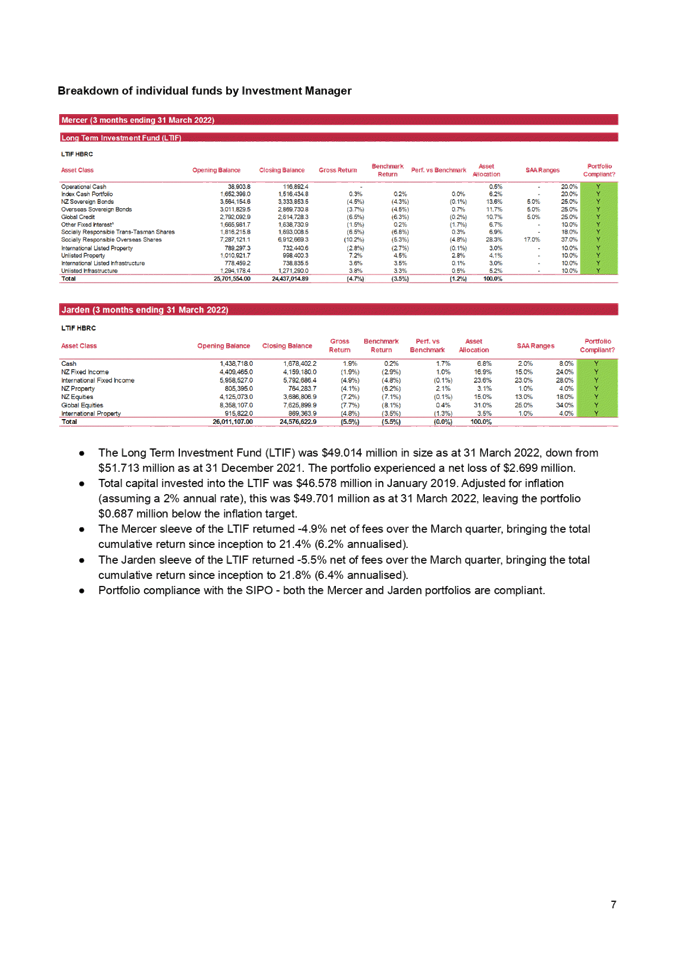

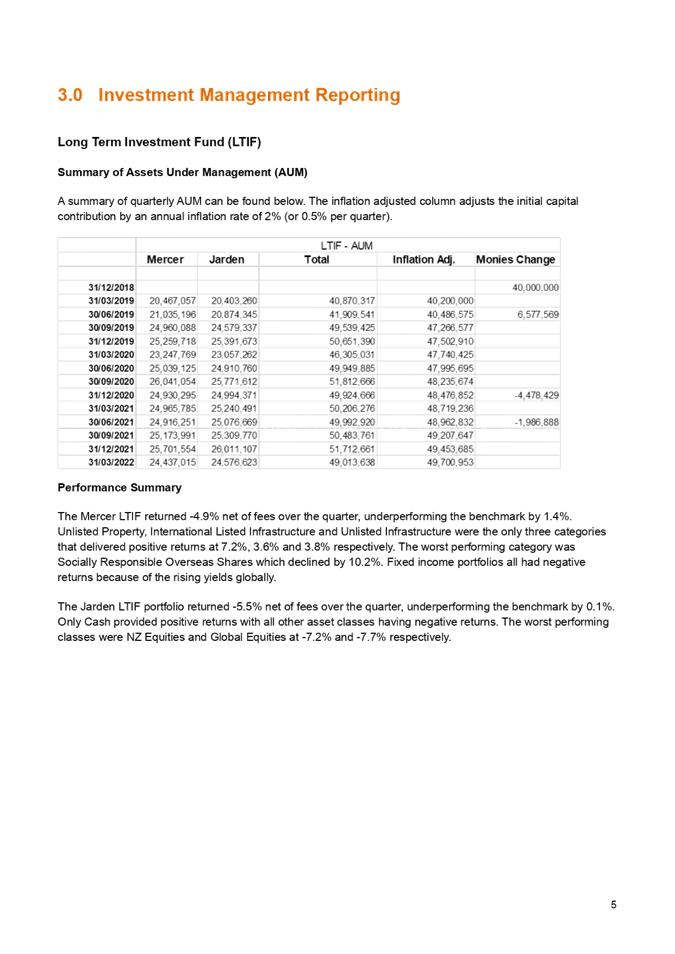

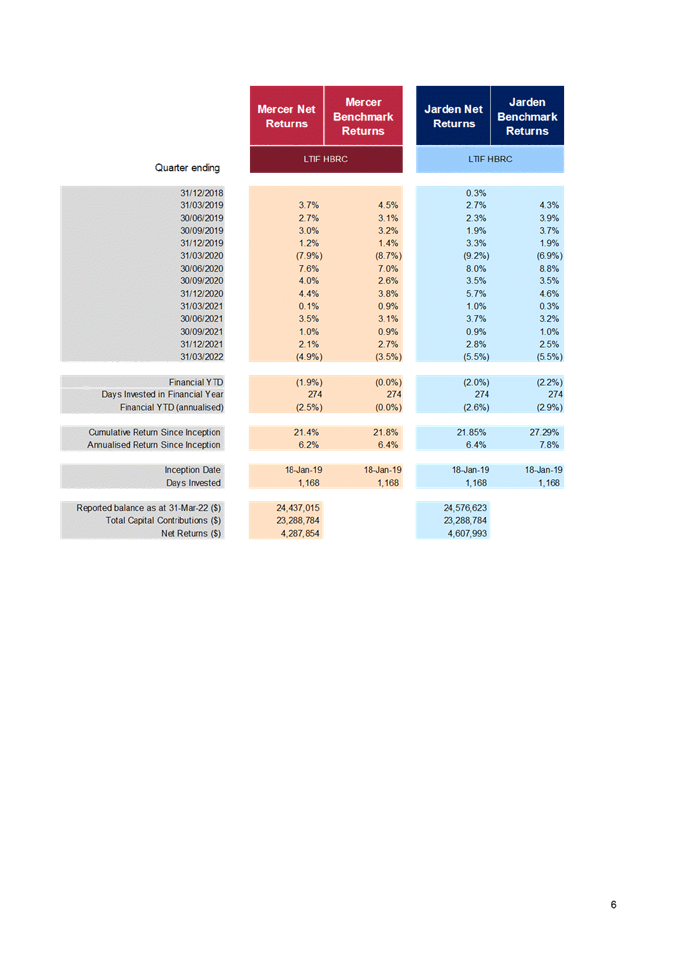

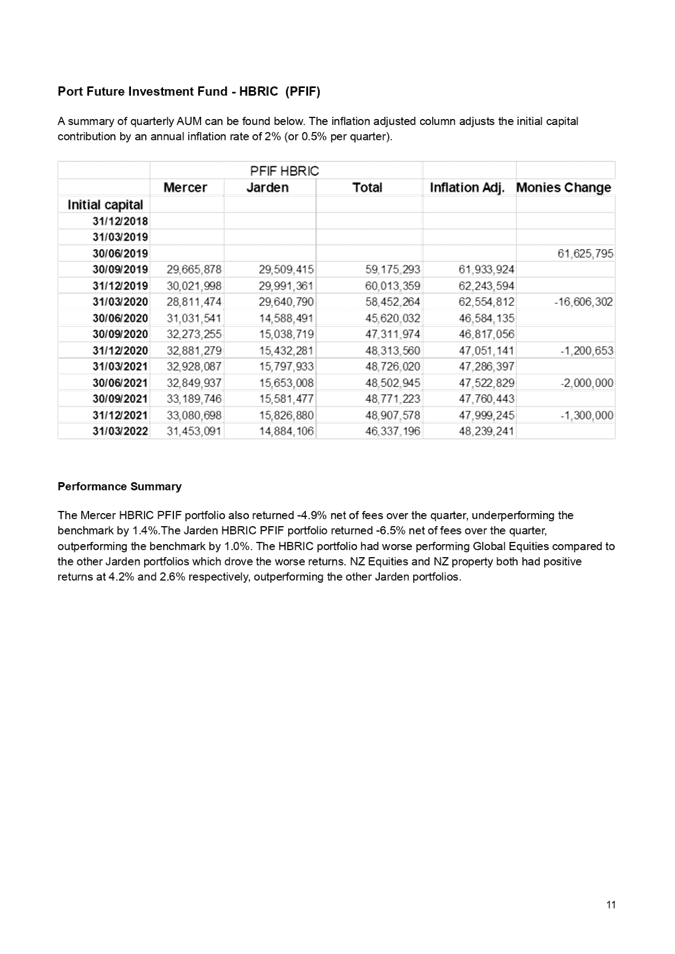

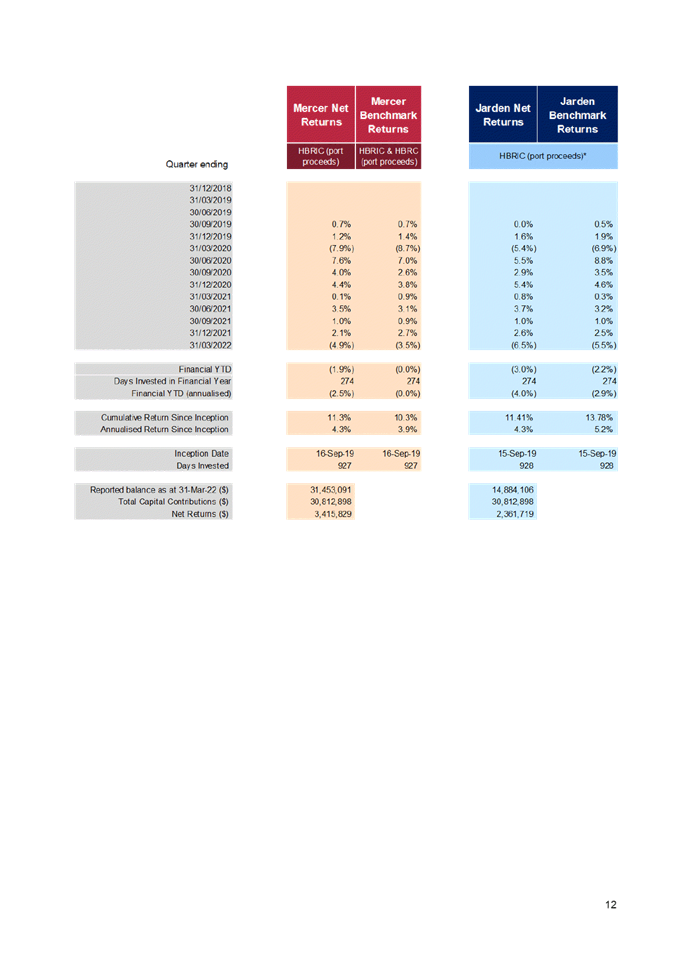

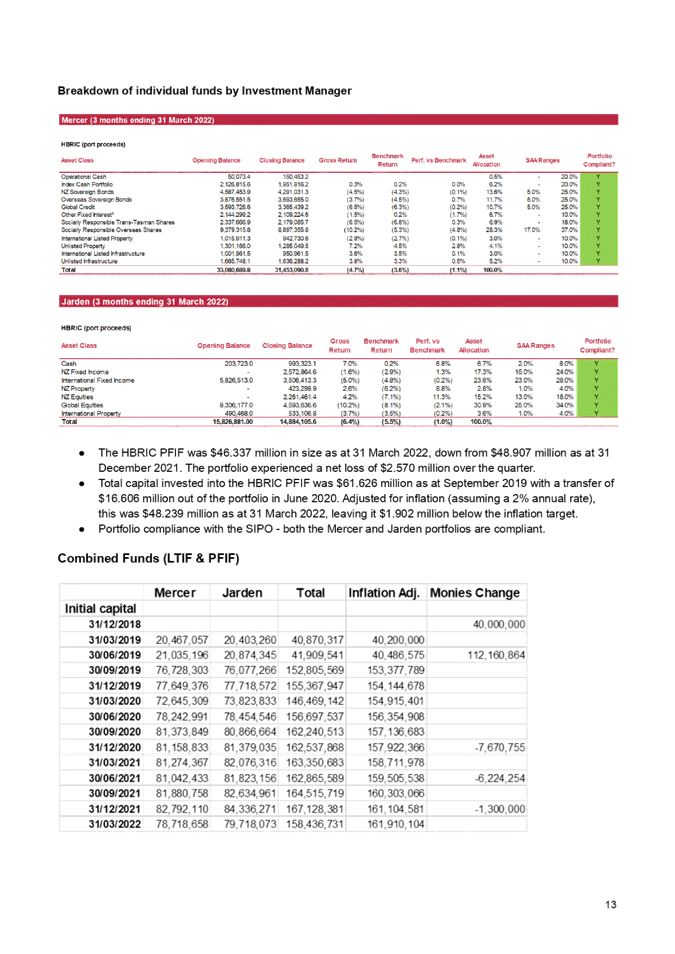

24. Over the March quarter, the

Mercer and Jarden LTIF portfolios returned -4.9% and -5.5% net of fees

respectively. The annualised cumulative return since inception for the Mercer

and Jarden LTIF portfolios was 6.2% and 6.4% respectively.

25. Over the March quarter, the

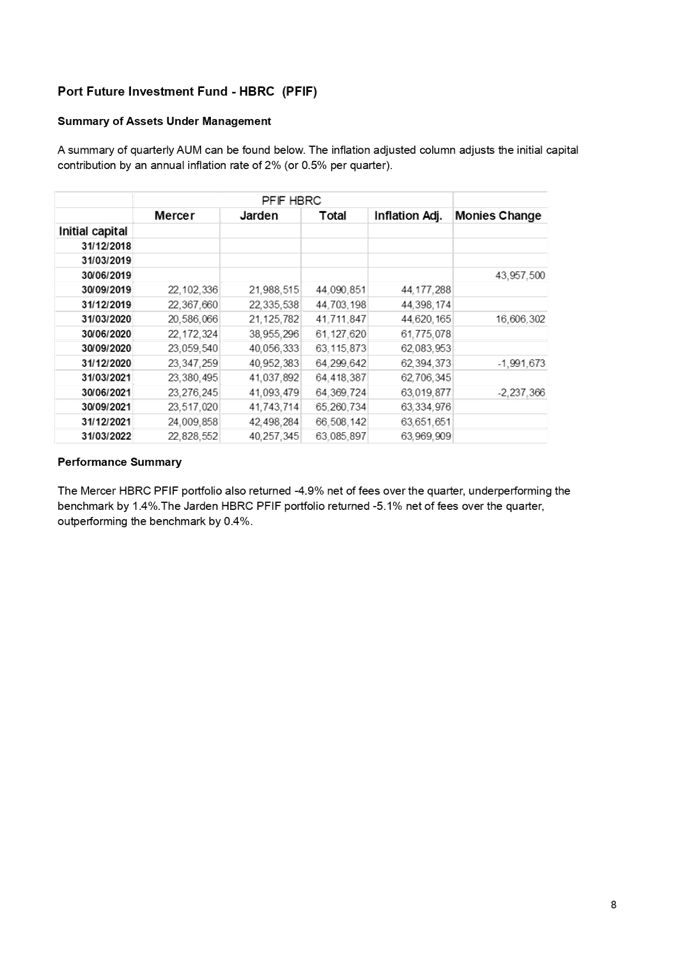

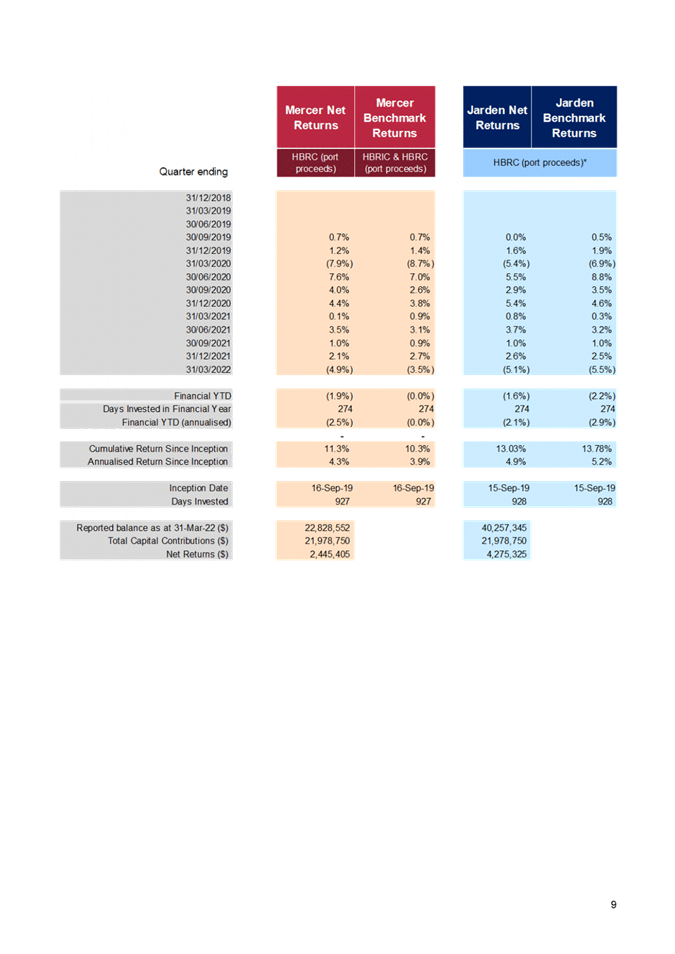

Mercer and Jarden FIF portfolios returned -4.9% and -5.1% net of fees

respectively. The annualised cumulative return since inception for the Mercer

and Jarden FIF portfolios was 4.3% and 4.9% respectively.

26. The volatility experienced

in markets in recent times make it hard to predict the likely returns for the

full year. However, if the final quarter delivers similar results as the March

quarter, the annualised return would be approximately -5% against an LTP budget

of 5.16% p.a. This means there would be no funds available to fund

activities in the current financial year.

27. However, the performance of

the managed funds since placement demonstrate market recovery can occur within

relatively short timeframes, and a watch and wait approach is prudent. The

portfolio construct is intentionally conservatively balanced for the long-term.

28. The presentation of table

below has been changed from previous reports to show the combined view of funds

and the value available above the capital protected sum. As at March 2022 the

funds are $1.5m below the expected capital protected amount due to the downward

trend in markets in recent times. Because there are no funds available at

31 March over and above capital protection of the funds, there is currently no

income from managed funds available this financial year to fund council

activities. Any shortfall in investment income will be reflected as an

operating deficit and / or borrowed to fund council activities.

29. The following table summarises the fund balances at the

end of each quarter.

30. The view for the June,

September, December and latest March 2022 quarters has been expanded to show

the total group balance of managed funds (including HBRIC) and the amount by which

the current funds balance exceeds the capital protected amount.

|

|

31 Mar 2021

|

30 Jun 2021

|

30 Sep 2021

|

31 Dec 2021

|

31 Mar 2022

|

|

|

$000

|

$000

|

$000

|

$000

|

$000

|

|

Total funds before withdrawals

|

114,625

|

118,563

|

115,745

|

118,221

|

112,100

|

|

Funds withdrawn

|

|

(4,200)

|

|

|

|

|

Fund Balance HBRC

|

114,625

|

114,363

|

115,745

|

118,221

|

112,100

|

|

Capital Protected Amount HBRC (2% compounded)

|

|

111,983

|

112,543

|

113,105

|

113,671

|

|

Current HBRC value above protected amount

|

|

2,380

|

3,202

|

5,116

|

(1,571)

|

|

|

|

Funds Balances (Group + HBRIC)

|

|

Long-Term Investment Fund

|

50,206

|

49,883*

|

50,484

|

51,712

|

49,014

|

|

Future Investment Fund

|

64,418

|

64,370*

|

65,261

|

66,508

|

63,086

|

|

Total HBRC

|

114,625

|

114,363*

|

115,745

|

118,220

|

112,100

|

|

Plus HBRIC

|

|

48,503

|

48,771

|

48,907**

|

46,337

|

|

Total Group Managed Funds

|

|

162,866

|

164,516

|

167,127

|

158,437

|

|

Capital Protected Amount (2% compound inflation)

|

|

159,506

|

160,303

|

161,104

|

161,910

|

|

Current group value above protected amount

|

|

3,360

|

4,213

|

6,023

|

(3,473)

|

30.1. * Additional

funds totalling $4.2m (LTIF $2.0m & FIF $2.2m) were withdrawn from the

funds during the June 2021 quarter

30.2. ** HBRIC

withdrew $1.3m during the December quarter. The Capital Protected amount

of HBRIC on 31 December is $47.999m. ($0.907m available).

Investment

Property – Napier Leasehold Portfolio

31. Napier Leasehold properties

represent the balance of ex Harbour Board residential leasehold properties. The

HBRC returns from this portfolio are limited as following the sale of future

revenues in 2013 to ACC, HBRC retains one third of any excess rentals and one

third of any surplus when a property is freeholded.

32. HBRC provides a detailed

report to ACC every 6 months and a 6 monthly payment is made for rents owing

and for properties freeholded.

33. In the first 9 months,

eight Napier Endowment Leasehold Properties were freeholded totalling $1.4m.

The HBRC share of $226,800 for the first 9 months is paid into the sale of land

reserve. The balance of funds received are paid to ACC to meet Council’s

obligations under the contract.

Investment

Property – Wellington Leasehold Portfolio

34. The Wellington leasehold

portfolio comprises 12 properties in central Wellington. The lessees are a mix

of commercial and residential entities.

35. Most of the properties (11)

have the rental reviewed every 14 years and one has a 7-year review period. No

rent reviews were conducted over the first 9 months and one property is due for

a review in June 2022.

36. As previously reported the

portfolio value has grown considerably from the initial cost of $6.5m in 2002

to $20.8m at 30 June 2021. Valuation advice is that we can expect another

significant increase in the portfolio value when it is revalued as at 30 June

2022.

37. Council budgets to utilise

the annual rentals of $841k to offset rates each year.

HBRIC

Ltd

38. In accordance with Council

Policy, HBRIC Ltd provides separate quarterly updates to the Corporate and

Strategic Committee.

Decision Making Process

39. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

39.1. This agenda item is in

accordance with the Sub-committee’s Terms of Reference, specifically:

39.1.1. The purpose of the Finance,

Audit and Risk Sub-committee is to report to the Corporate and Strategic

Committee to fulfil its responsibilities for (1.1) the

provision of appropriate controls to safeguard the Council’s financial

and non-financial assets, the integrity of internal and external reporting and

accountability arrangements

39.1.2. The Finance, Audit and Risk

Sub-committee shall have responsibility and authority to (2.4) monitor the performance of Council’s investment

portfolio.

39.2. As this item is for

information only, the decision making provisions do not apply.

Recommendations

That the Finance, Audit and Risk

Sub-committee:

1. Receives and notes the Quarterly Treasury Report

for the period 1 January - 31 March 2022.

2. Confirms that the

performance of Council’s investment portfolio has been reported to the

Sub-committee’s satisfaction.

Authored by:

|

Ross Franklin

Finance Consultant

|

Kishan Premadasa

Commercial Accountant

|

|

Chris Comber

Chief Financial Officer

|

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

|

1⇩

|

HBRC Treasury Report for period to

31 March 2022

|

|

|

|

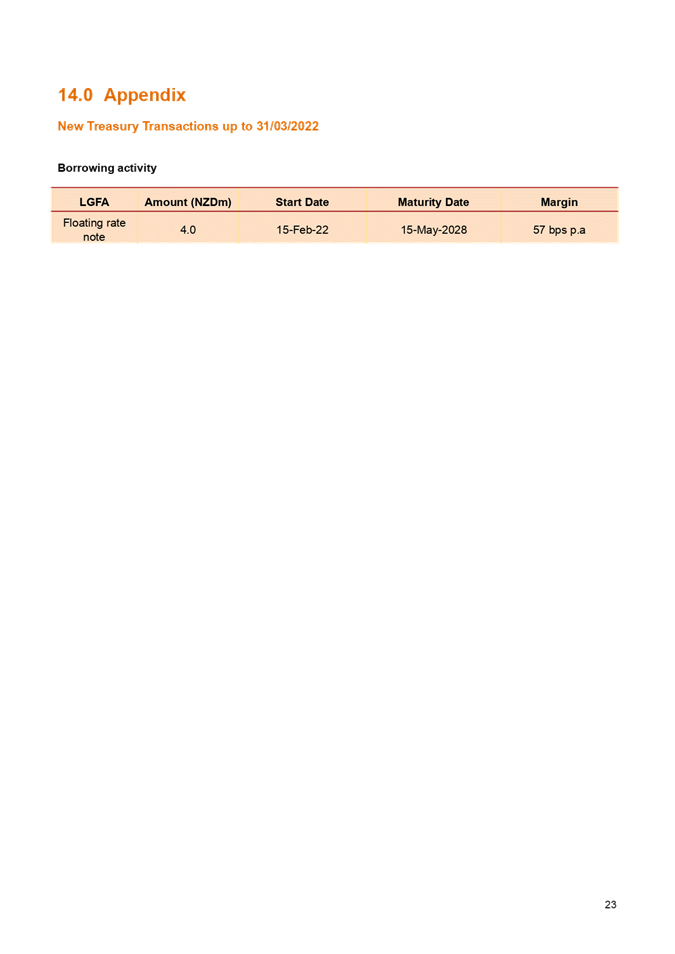

HBRC Treasury Report for period to 31

March 2022

|

Attachment

1

|

HAWKE’S BAY REGIONAL

COUNCIL

Finance Audit & Risk Sub-committee

4 May 2022

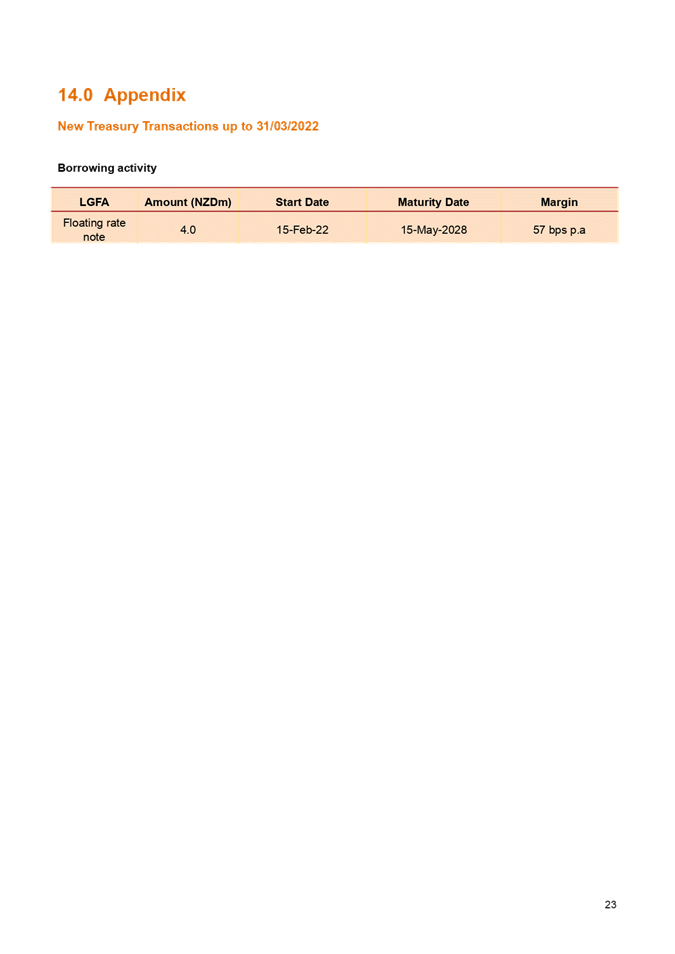

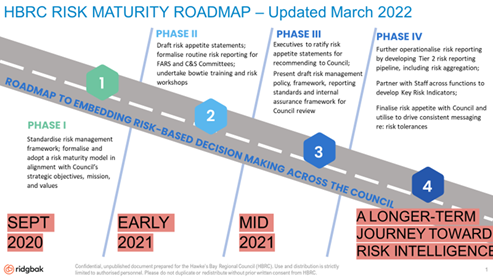

Subject: Risk maturity update

Reason for Report

1. This item provides the

Finance Audit and Risk Sub-committee (FARS) with an update on the Risk maturity

programme of work.

Executive

Summary

2. The Executive Leadership

Team (ELT) on 11 April noted the status of implementation of phase IV of the

risk maturity roadmap as ‘well behind’ plan. They also noted

that the disruption to the delivery of phase IV of the risk maturity roadmap

was primarily attributable to work from home (WFH) Covid-19 response and staff

turnover. It was recommended to, and supported by, ELT that phase IV of

the risk maturity roadmap formally be put ‘on-hold’ until Covid disruptions, including the WFH response, ease.

Background

3. At the Corporate and

Strategic (C&S) Committee meeting on 10 June 2020 Council’s risk

maturity roadmap was endorsed. At that meeting it was agreed that the

FARS would take responsibility for overseeing the implementation of the risk

maturity roadmap. Therefore, this paper provides the latest update which

was presented to the ELT at the meeting on 11 April 2022.

Discussion

4. Subsequent to the Corporate

and Strategic (C&S) Committee endorsing the risk maturity roadmap at its

meeting on 10 June 2020, phases I-III of the risk maturity roadmap were

delivered. Phases I-III focussed on creating risk content and challenging

risk thinking at an enterprise level with the ELT and Governance.

5. However, since rollout of

phase IV of the roadmap, Council has been faced with significant business

disruption due to the Covid-19 WFH response and higher than historic levels of

staff turnover. As a result, progress on delivery of phase IV of the

roadmap stalled. The rollout of phase IV targets embedding risk management

practices and risk-based thinking into the business, and therefore is dependent

on staff time and, in some cases, interactive risk sessions with staff.

6. Therefore, at the ELT

meeting on 11 April the Executive Team noted the status of implementation of

phase IV of the risk maturity roadmap as ‘well behind’ plan.

It was recommended to, and supported by, ELT that phase IV of the risk maturity

initiative formally be put ‘on-hold’ until Covid disruptions

including the WFH response eases. This also allows the operational

business to focus on service delivery during the current period of elevated

business disruption.

7. The following table

outlines the status of key milestones within phase IV of the roadmap that were

targeted to be delivered before July 2022.

|

Risk Maturity Milestone

|

% Progress and Owners

|

Status

|

Reason for Delay

|

|

Formal training of Risk Champions

|

2%

Risk Champions/Risk Manager

|

On hold

|

Loss of Risk Champions due to resignations and

secondments.

|

|

Development of Group risk profiles linked to SMART

Group objectives

|

0%

Risk Champions / Group Managers / Group LT

|

On hold

|

Some Risk Champion roles are now vacant, or Champions

are yet to be trained. Covid19 WFH response limits the effectiveness of

interactive sessions with Group LT.

|

|

Development of critical controls within the completed

enterprise bowties

|

5%

Risk Champions / Group Managers / Group LT

|

On hold: There is a possibility that Group Managers could populate

critical controls into the completed enterprise bowties

|

Covid19 WFH status limits the ability for interactive

sessions to identify critical controls.

|

|

Formalisation of risk aggregation sessions

|

10%

|

On hold

|

No Group profiles and Covid19 WFH status limits the

effectiveness of interactive risk sessions. This limits the ability for risk

system processes to effectively elevate risks from the operational business

that link to our service deliverables.

|

|

Formulation of KPIs / KRIs

|

1%

|

Delayed

|

Internal staff transfer.

|

|

Formalisation of CDEM policy/framework

|

5%

|

Delayed

|

HB/Wairoa floods and the flood response.

|

|

External validation on the completeness and accuracy of

the enterprise bowties

|

50%

Risk Manager and Protecht

|

Progressing

|

|

|

General risk awareness roadshow

|

0%

Risk Manager

|

On hold

|

Covid19 WFH status limits the ability for interactive

sessions.

|

|

Engage ICT to source options for an integrated risk

management system to enable improved FARS dashboard reporting. And to

provide a single source of truth for H&S, ISMS, EMS, Compliance (incident

management, issues and actions, internal audits, and corporate compliance)

|

0%

Risk Manager and ICT BA

(Liaison with H&S, QMS, EMS, ISMS, AMS)

|

Option to bring forward

– pending ICT resource availability

|

TBC – pending ICT resource availability.

|

|

Review of risk appetite statement, RM policy and RM

framework

|

75%

Risk Manager, ELT, Council

|

On hold

|

Awaiting election and new FARS.

|

8. Based on the status of

milestones and ongoing business disruption due to Covid19 response and staff

turnover it is recommended that the FARS notes that the phase IV of the risk

maturity roadmap is formally ‘on hold’ with that status regularly

being reviewed by staff and the ELT.

Financial and Resource Implications

9. The maturity of the risk

management system is phased to minimise budgetary implications. Some

facilitated risk training workshops may need to be provided to targeted staff

but financed within current budgets. The 0.1 Risk Champion FTE from each Group

will be managed through current resourcing.

Decision Making Process

10. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

10.1. This agenda item is in accordance

with the Sub-committee’s Terms of Reference adopted by Hawke’s Bay Regional

Council 25 March 2020, specifically:

10.1.1. The purpose of the Finance,

Audit and Risk Sub-committee is to report to the Corporate and Strategic

Committee to fulfil its responsibilities for (1.4) the robustness of risk

management systems, processes and practices

10.1.2. The Finance, Audit and Risk

Sub-committee shall have responsibility and authority to (2.9) review whether Council management has a current and

comprehensive risk management framework and associated procedures for effective

identification and management of the council’s significant risks in

place; and (2.10) undertake periodic monitoring of corporate risk assessment,

and the internal controls instituted in response to such risks.

10.2. As this item is for

information only, the decision-making provisions do not apply.

Recommendation

That

the Finance, Audit and Risk Sub-committee receives the Risk maturity update

staff report, and notes that phase IV of the risk maturity roadmap is

temporarily ‘on hold’ while the business prioritises resourcing to

respond to current levels of business disruption.

Authored by:

|

Olivia Giraud-Burrell

Quality & Assurance Advisor

|

Helen Marsden

Risk & Corporate Compliance

Manager

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

There are no attachments for this

report.

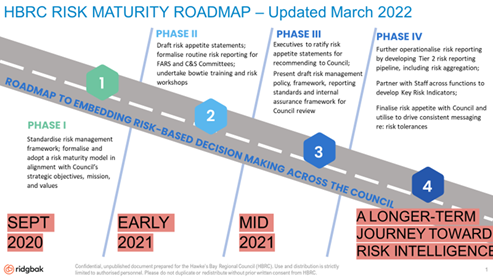

HAWKE’S

BAY REGIONAL COUNCIL

Finance Audit & Risk Sub-committee

4 May 2022

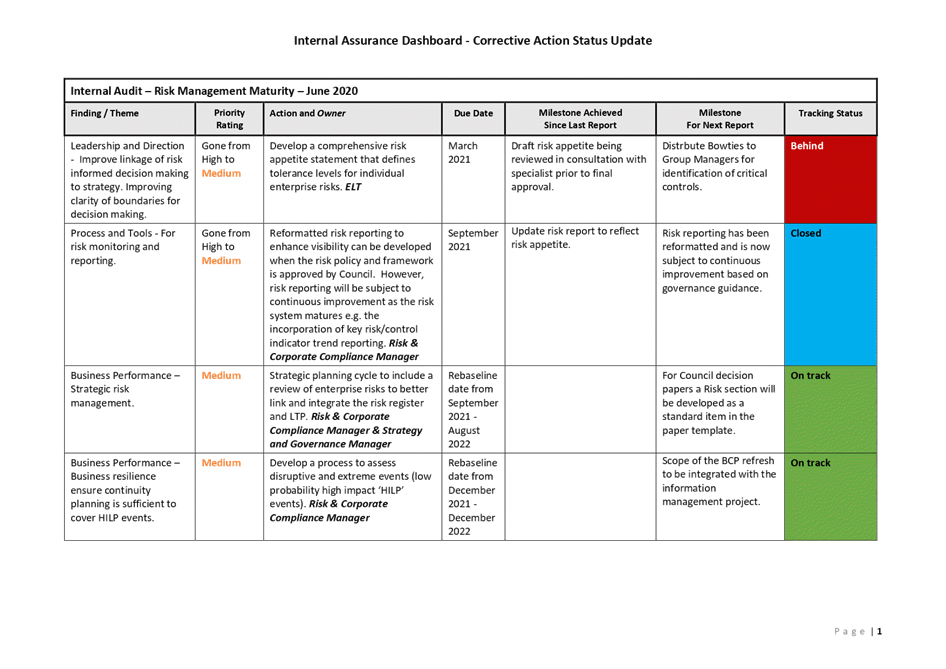

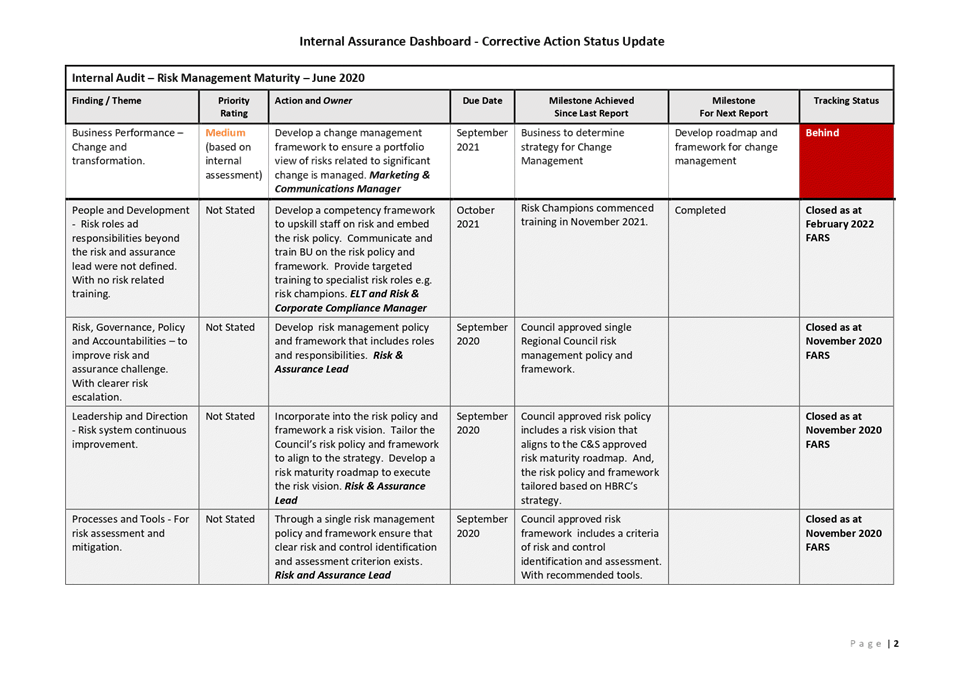

Subject: Corrective Actions dashboard

Reason for Report

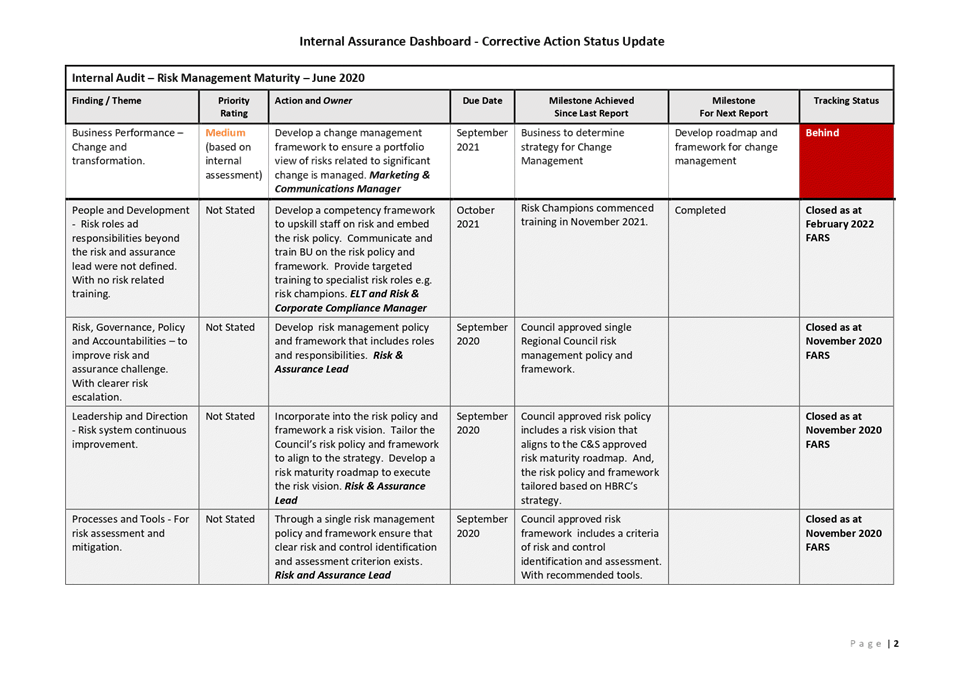

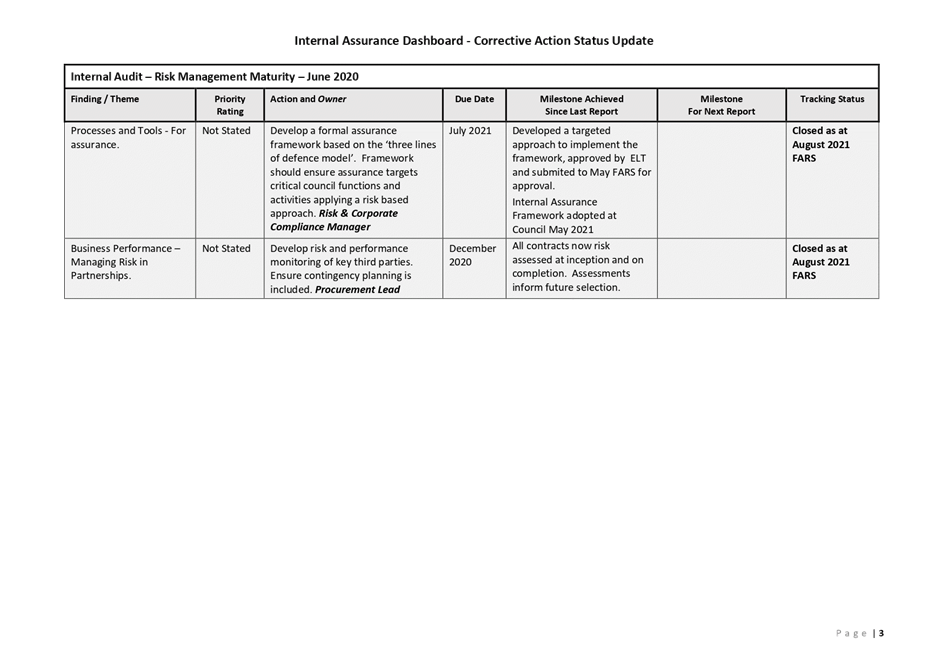

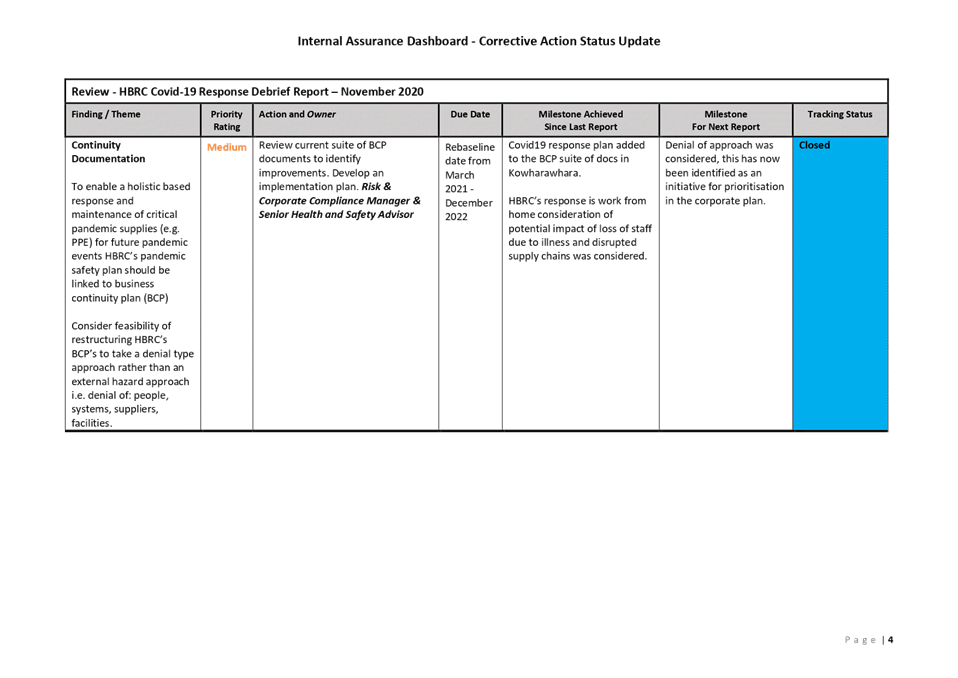

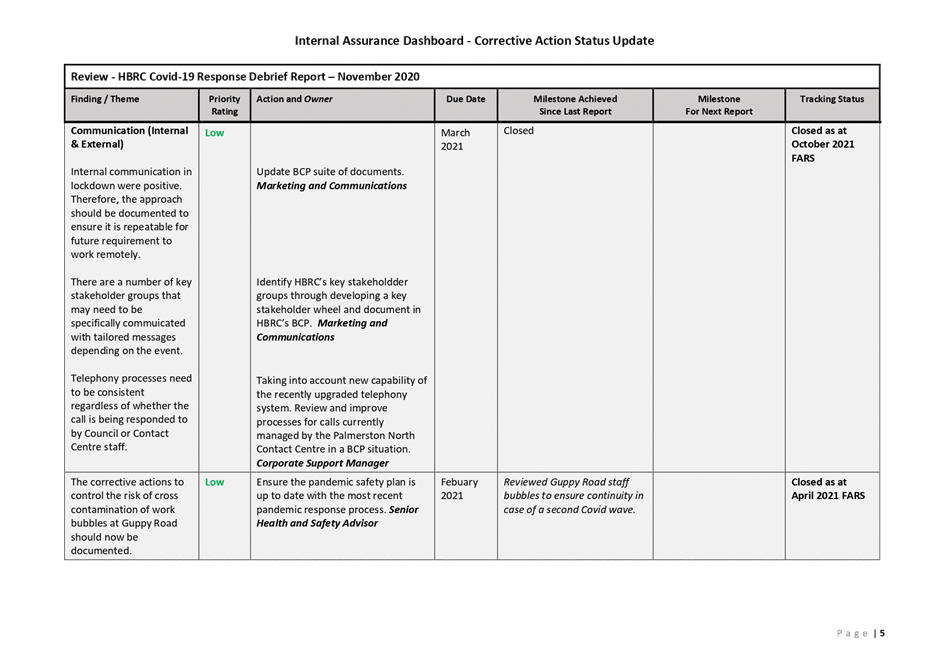

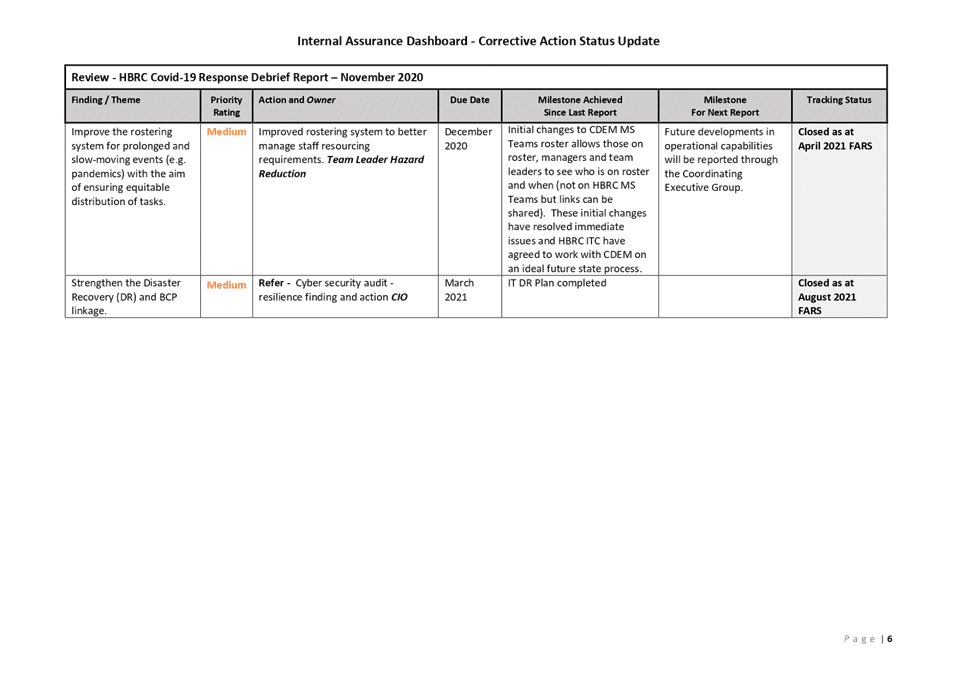

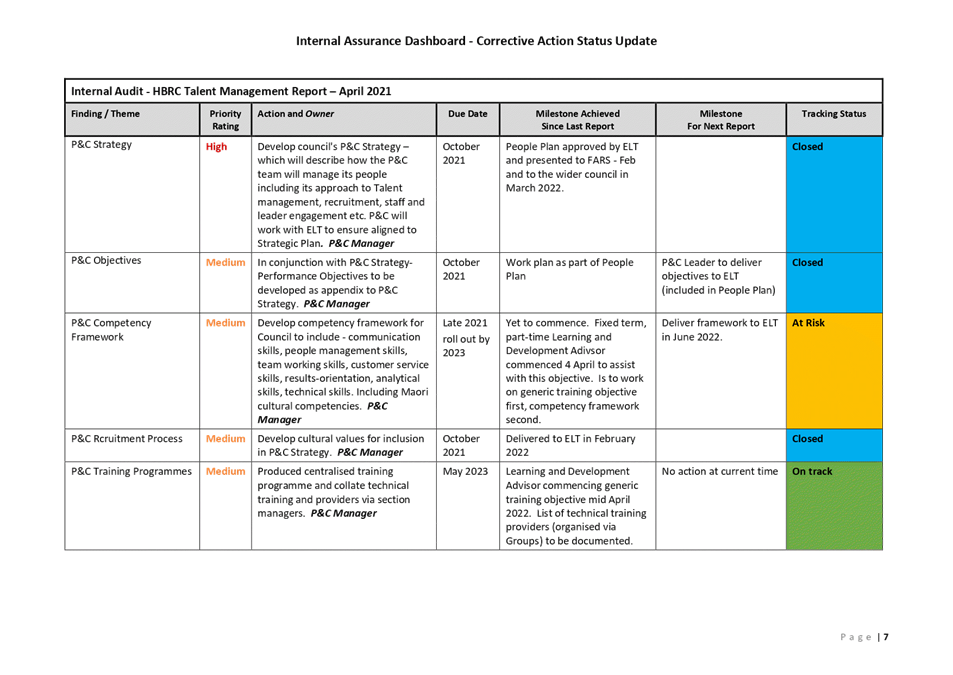

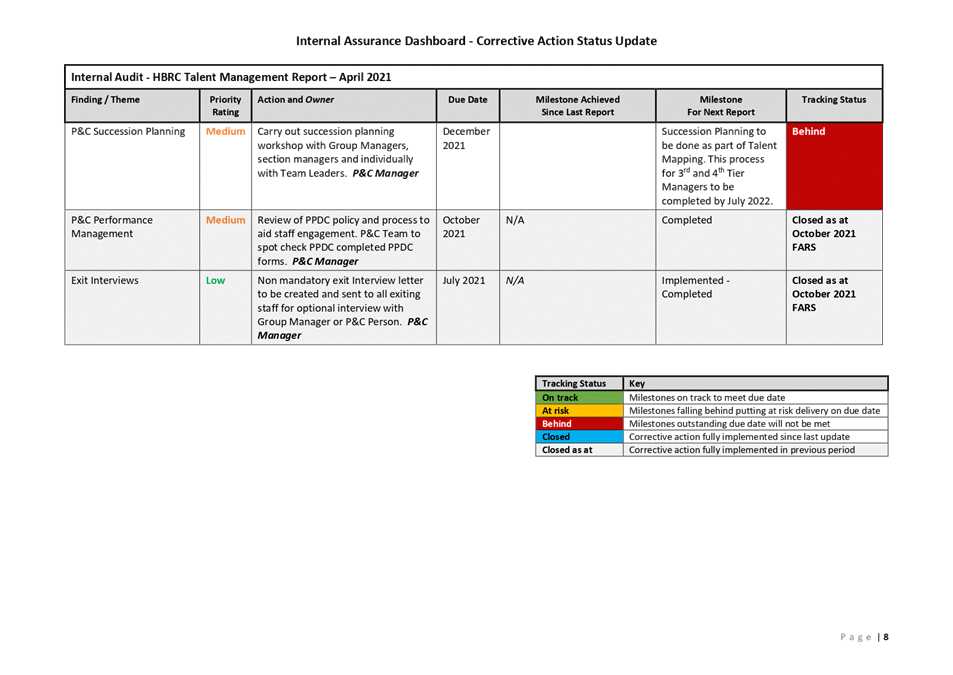

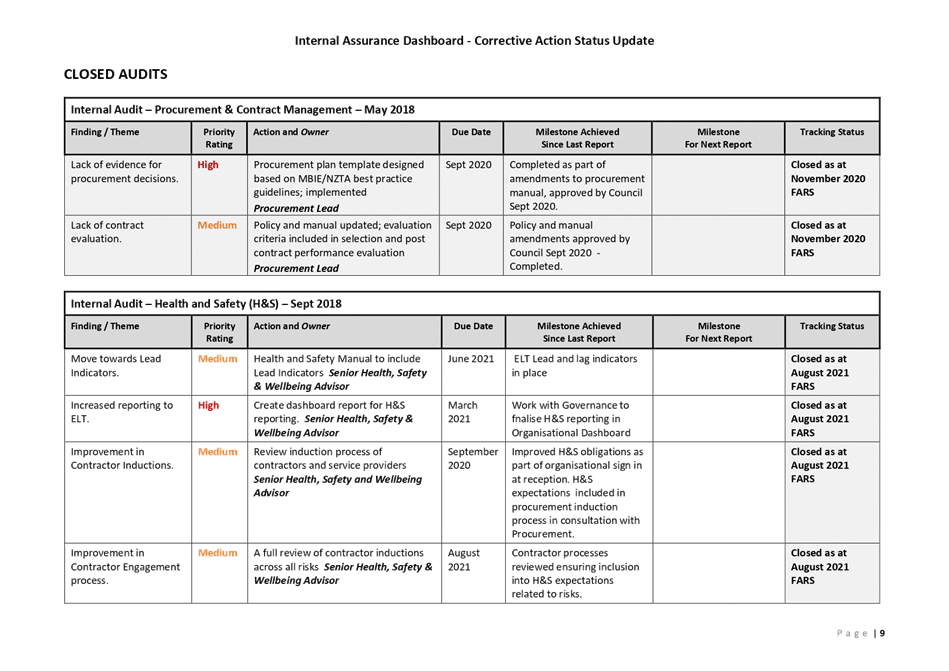

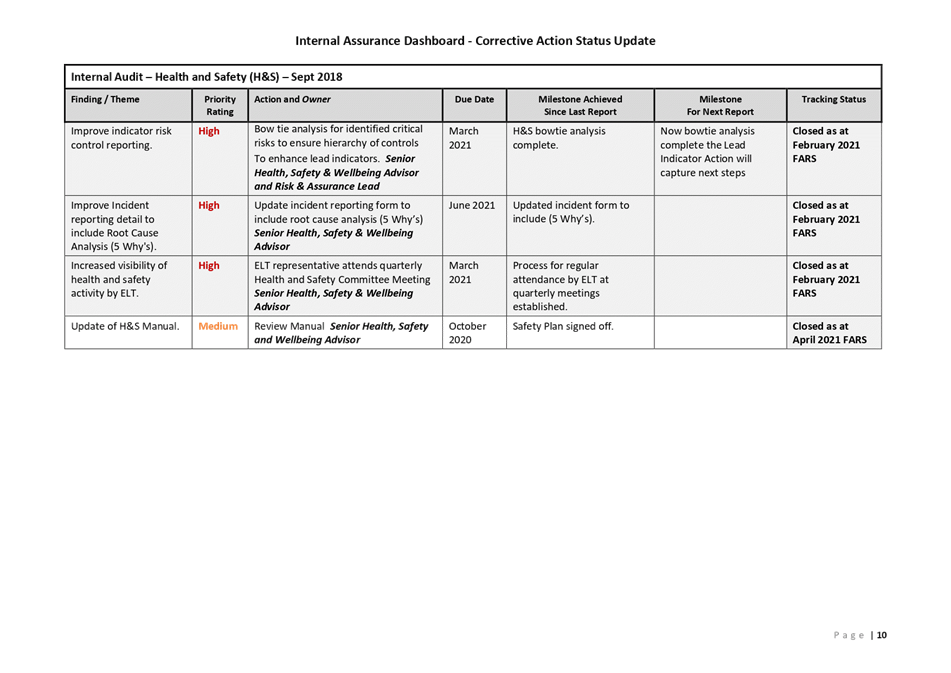

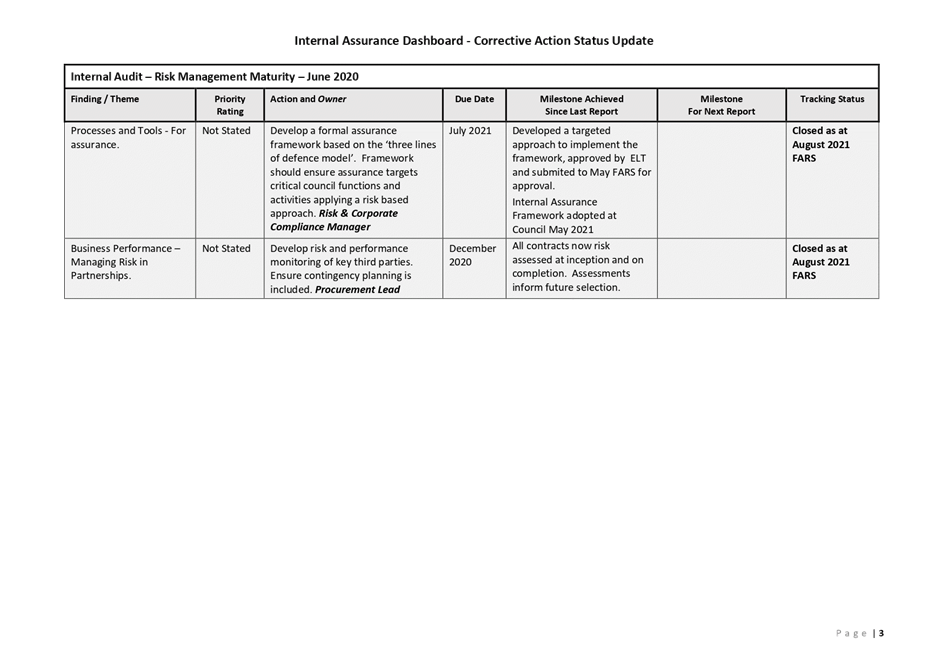

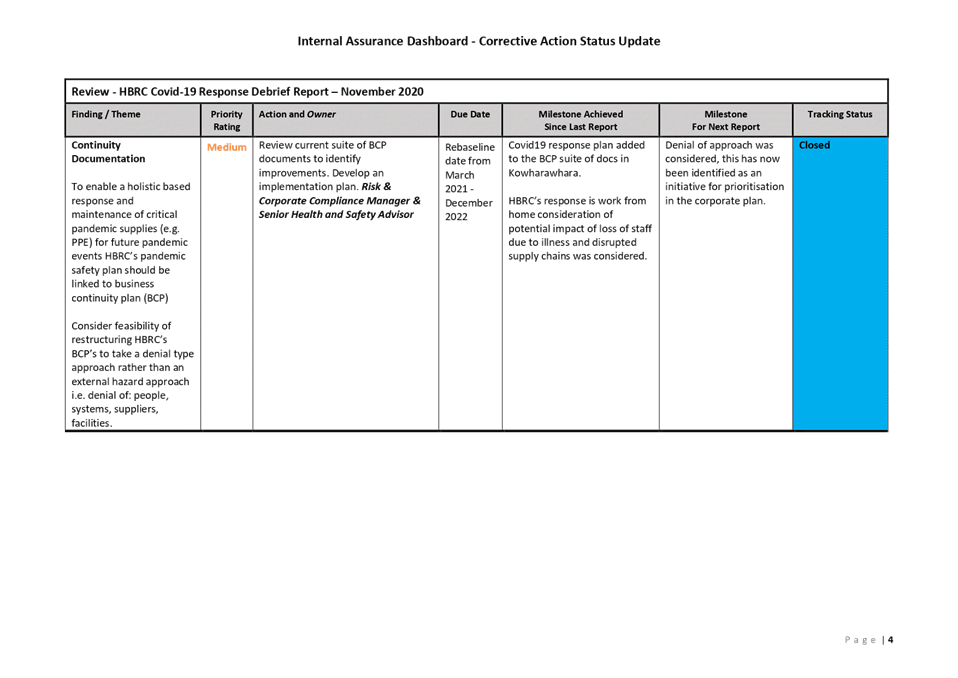

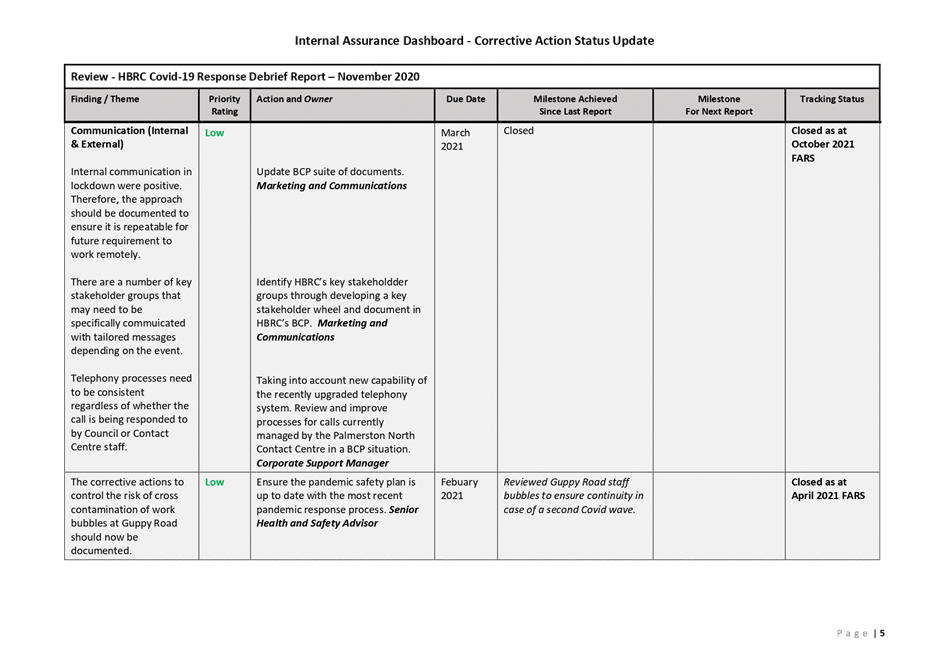

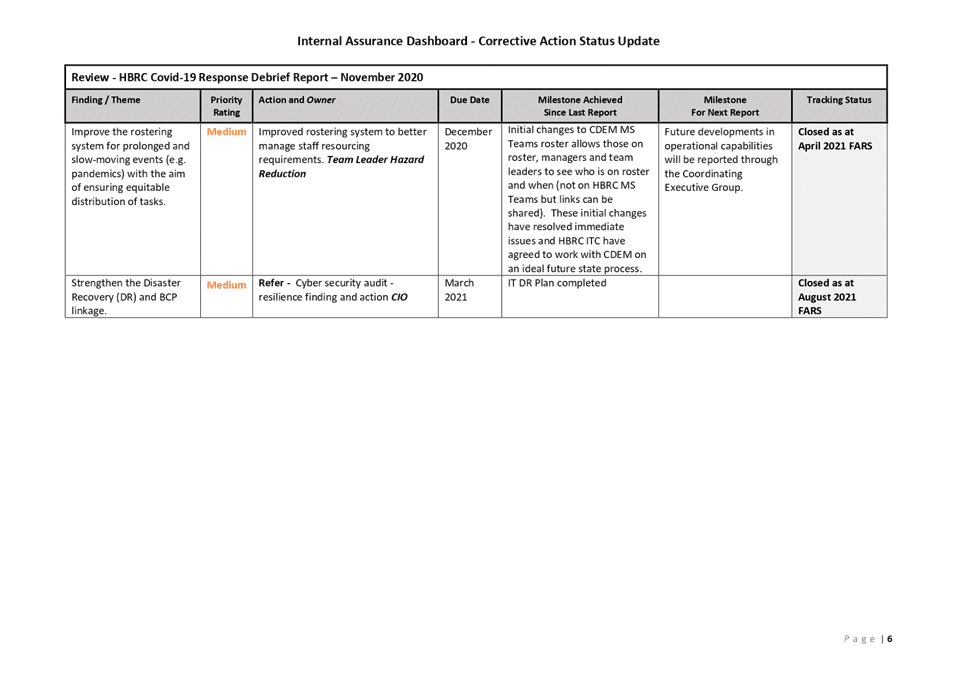

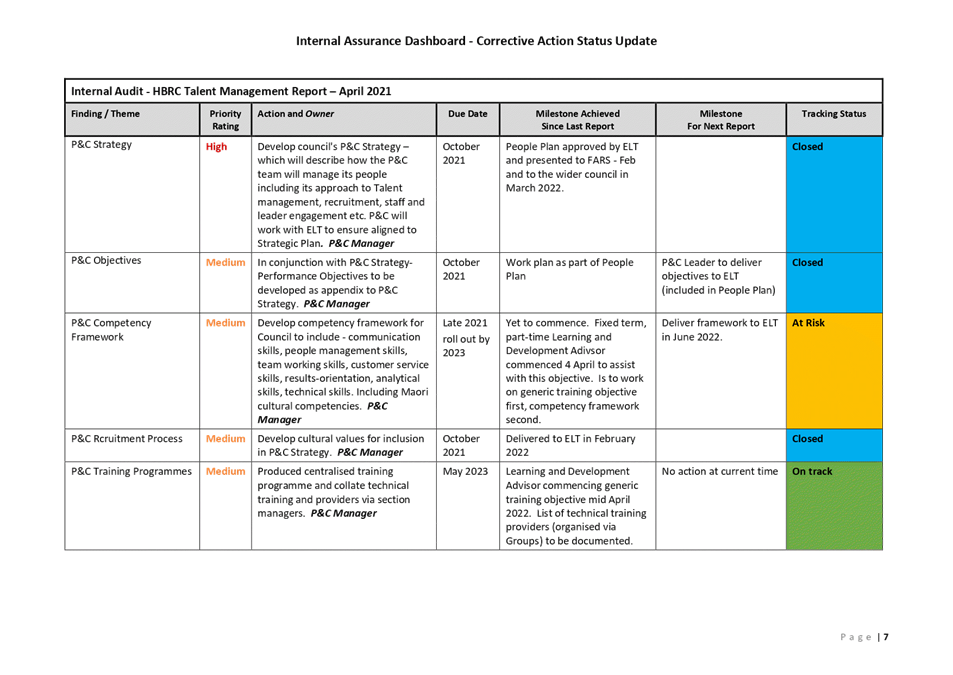

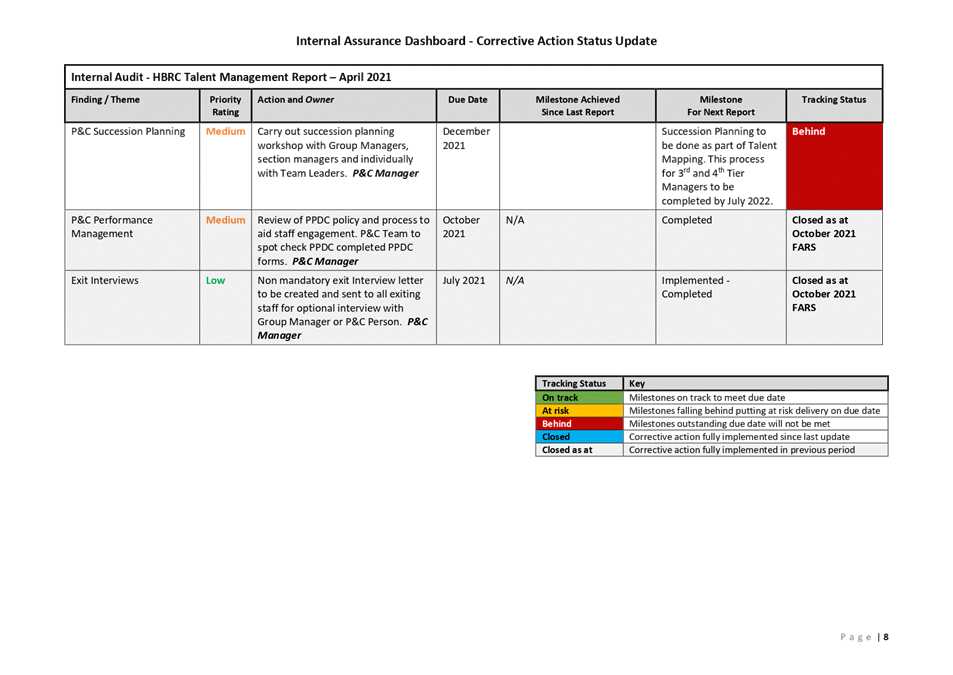

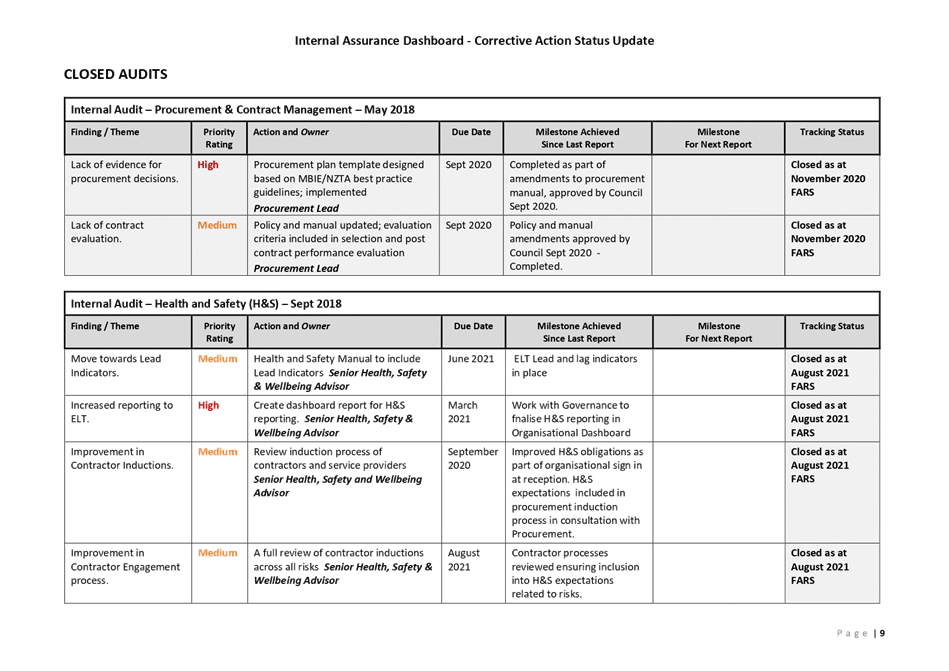

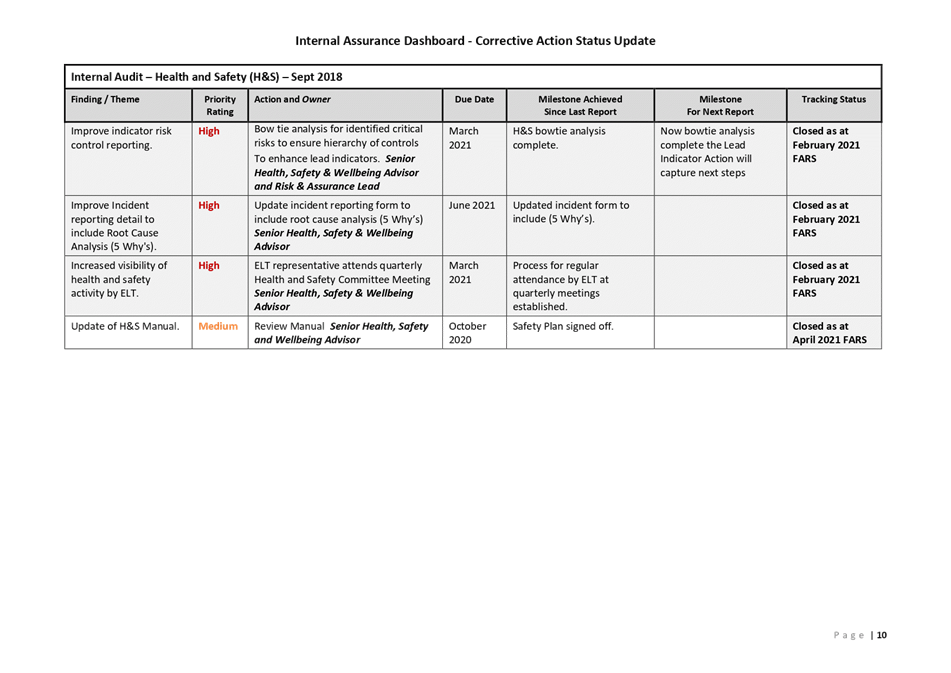

1. This item updates the

Finance, Audit and Risk Sub-committee (FARS) on the progress carrying out

corrective actions that respond to internal audit findings as previously

reported to the FARS.

Officers’

Recommendation

2. Council officers recommend

that the sub-committee considers and notes the internal assurance dashboard

corrective action status update, with a view to confirming the adequacy of

corrective actions undertaken and reporting as such to the Corporate &

Strategic Committee (C&S).

Discussion

3. The purpose of the

corrective action status update is to provide oversight to the FARS on the

progress of actions taken to address open internal assurance findings.

The dashboard gives visibility of:

3.1. open findings of the

tracking status milestones plus milestones completed since last reported

3.2. milestones to be completed

by the next FARS report

3.3. summary of closed actions

since the last FARS report

3.4. summary of the overall

progress to close out the full audit review through the reporting of all

previous closed actions.

Financial and Resource Implications

4. The actions undertaken, as

per the plan approved by Council’s Executive Leadership Team, have been

managed within existing approved budgets.

Decision Making Process

5. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

5.1. This agenda item is in

accordance with the Sub-committee’s Terms of Reference, specifically:

5.1.1. The purpose of the Finance,

Audit and Risk Sub-committee is to report to the Corporate and Strategic

Committee to fulfil its responsibilities for (1.1) the provision of appropriate

controls to safeguard the Council’s financial and non-financial assets,

the integrity of internal and external reporting and accountability

arrangements, and (1.3) the independence and adequacy of internal and external

audit functions

5.1.2. The Finance, Audit and Risk

Sub-committee shall have responsibility and authority to (2.6) receive the

internal and external audit report(s) and review actions to be taken by

management on significant issues and recommendations raised within the

report(s), and (2.11) undertake systematic reviews of Council operational

activities against Council stated performance criteria to determine efficiency/

effectiveness of delivery of Council services

5.1.3. The Finance, Audit and Risk

Sub-committee is delegated by Council to (3.5) ensure that recommendations in

audit management reports are considered and, if appropriate, actioned by

management

5.2. As this item is for

information only, the decision making provisions do not apply.

Recommendations

That the Finance, Audit and Risk Sub-committee:

1. Receives and notes the Corrective

actions dashboard staff report.

2. Confirms that the

corrective actions undertaken and/or planned for the future adequately respond

to the findings and recommendations of the internal audits.

3. Confirms that the dashboard

reports include adequate information on the status of the corrective actions.

4. Reports to the Corporate

and Strategic Committee, the Sub-committee’s satisfaction that the Corrective

actions dashboard report provides adequate evidence of the management

actions undertaken or planned respond to findings and recommendations from

completed internal audits.

Authored by:

|

Olivia Giraud-Burrell

Quality & Assurance Advisor

|

Helen Marsden

Risk & Corporate Compliance

Manager

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

|

1⇩

|

Internal Assurance Dashboard April

2022

|

|

|

|

Internal Assurance Dashboard April 2022

|

Attachment

1

|

HAWKE’S

BAY REGIONAL COUNCIL

Finance Audit & Risk Sub-committee

4 May 2022

Subject: Corrective Actions dashboard - Cyber security

That

the Finance, Audit and Risk Sub-committee excludes the public from this section

of the meeting, being Agenda Item 12 Corrective Actions dashboard - Cyber

security with the general subject of the item to be considered while the public

is excluded; the reasons for passing the resolution and the specific grounds

under Section 48 (1) of the Local Government Official Information and Meetings

Act 1987 for the passing of this resolution being:

|

General

subject of the item to be considered

|

Reason

for passing this resolution

|

Grounds

under section 48(1) for the passing of the resolution

|

|

Corrective Actions

dashboard - Cyber security

|

7(2)(f)(ii) The

withholding of the information is necessary to maintain the effective conduct

of public affairs through the protection of such members, officers,

employees, and persons from improper pressure or harassment.

s7(2)(e) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to avoid

prejudice to measures that prevent or mitigate loss to members of the public.

s7(2)(j) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to prevent

the disclosure or use of official information for improper gain or improper

advantage.

|

The Council is specified,

in the First Schedule to this Act, as a body to which the Act applies.

|

Authored by:

|

Olivia Giraud-Burrell

Quality & Assurance Advisor

|

|

Approved by:

|

Andrew Siddles

Chief Information Officer

|

James Palmer

Chief Executive

|

HAWKE’S

BAY REGIONAL COUNCIL

Finance Audit & Risk Sub-committee

4 May 2022

Subject: Cyber Incident Rreports

That

the Finance, Audit and Risk Sub-committee excludes the public from this section

of the meeting, being Agenda Item 13 Cyber incident reports with the

general subject of the item to be considered while the public is excluded. The

reasons for passing the resolution and the specific grounds under Section 48

(1) of the Local Government Official Information and Meetings Act 1987 for the

passing of this resolution are:

|

General

subject of the item to be considered

|

Reason

for passing this resolution

|

Grounds

under section 48(1) for the passing of the resolution

|

|

Cyber incident reports

|

7(2)(f)(ii) The

withholding of the information is necessary to maintain the effective conduct

of public affairs through the protection of such members, officers,

employees, and persons from improper pressure or harassment.

s7(2)(e) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to avoid

prejudice to measures that prevent or mitigate loss to members of the public.

s7(2)(j) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to prevent

the disclosure or use of official information for improper gain or improper

advantage.

|

The Council is specified,

in the First Schedule to this Act, as a body to which the Act applies.

|

Authored by:

|

Andrew Siddles

Chief Information Officer

|

|

Approved by:

|

James Palmer

Chief Executive

|

|

HAWKE’S

BAY REGIONAL COUNCIL

Finance Audit & Risk Sub-committee

4 May 2022

Subject: Confirmation of Public

Excluded Minutes

That

the Finance, Audit and Risk Sub-committee excludes the public from this section

of the meeting being Confirmation of Public Excluded Minutes Agenda Item 14 with the general subject

of the item to be considered while the public is excluded; the reasons for

passing the resolution and the specific grounds under Section 48 (1) of the

Local Government Official Information and Meetings Act 1987 for the passing of

this resolution being:

|

General

subject of the item to be considered

|

Reason

for passing this resolution

|

Grounds

under section 48(1) for the passing of the resolution

|

|

Internal Assurance

Dashboard - Cyber Security Corrective Actions Status Update

|

7(2)(f)(ii) The withholding

of the information is necessary to maintain the effective conduct of public

affairs through the protection of such members, officers, employees, and

persons from improper pressure or harassment

s7(2)(j) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to prevent

the disclosure or use of official information for improper gain or improper

advantage

|

The Council is specified,

in the First Schedule to this Act, as a body to which the Act applies.

|

Authored by:

|

Leeanne Hooper

Team Leader Governance

|

|

Approved by:

|

Desiree Cull

Strategy & Governance Manager

|

|