Meeting of the

Corporate and Strategic Committee

Date: 16 March 2022

Time: 9.00am

|

Venue:

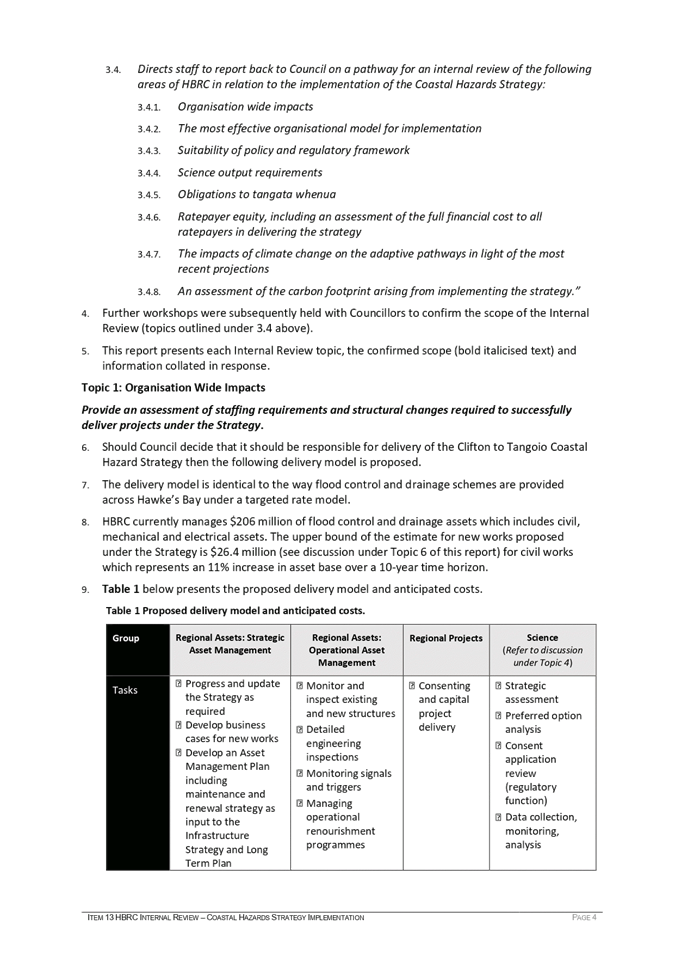

|

Council

Chamber

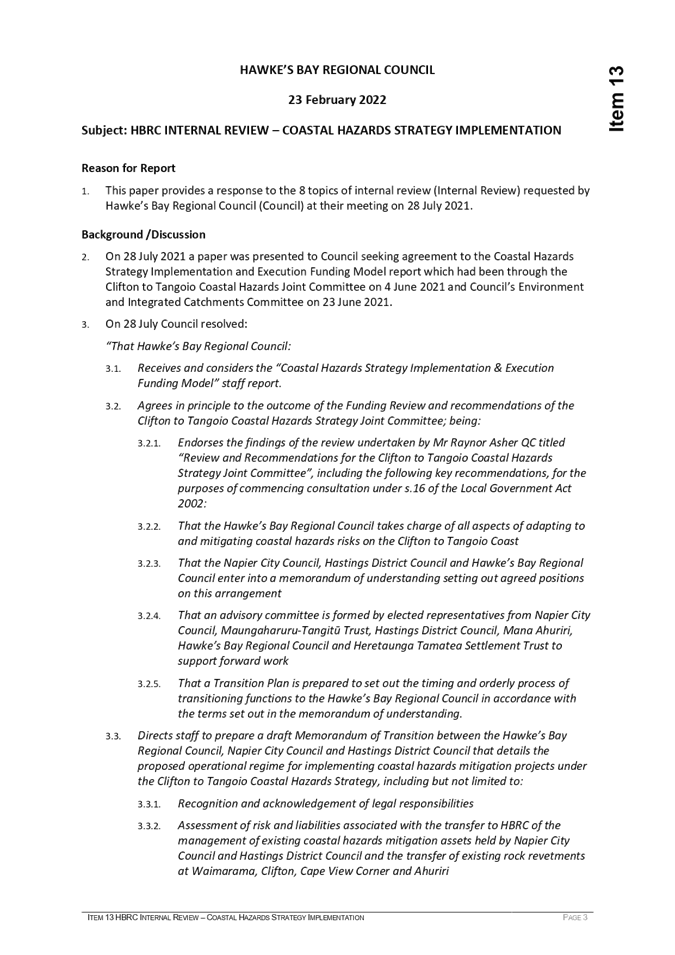

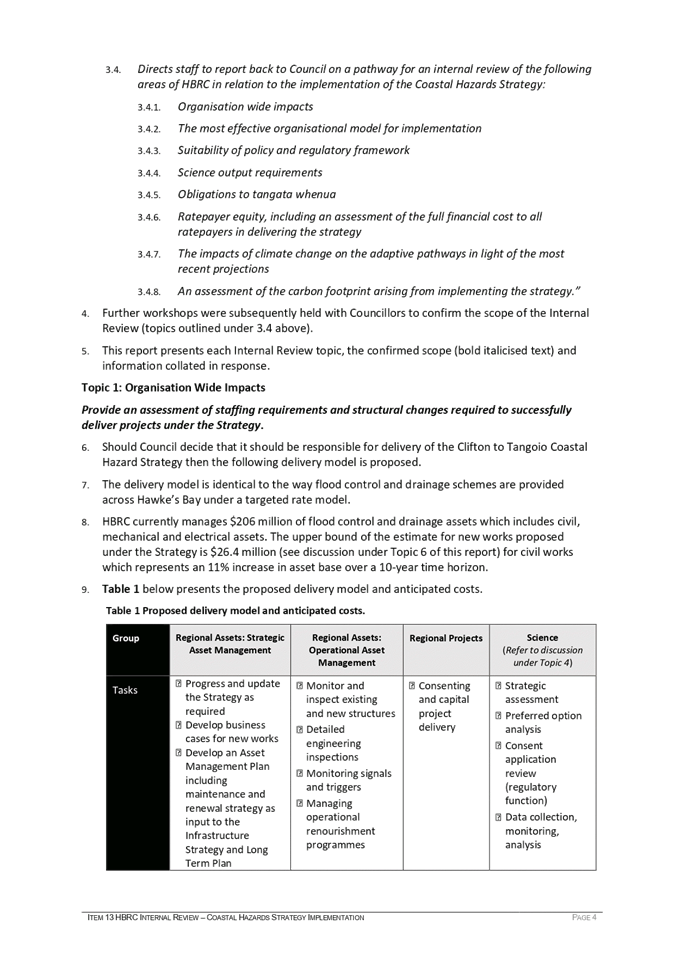

Hawke's

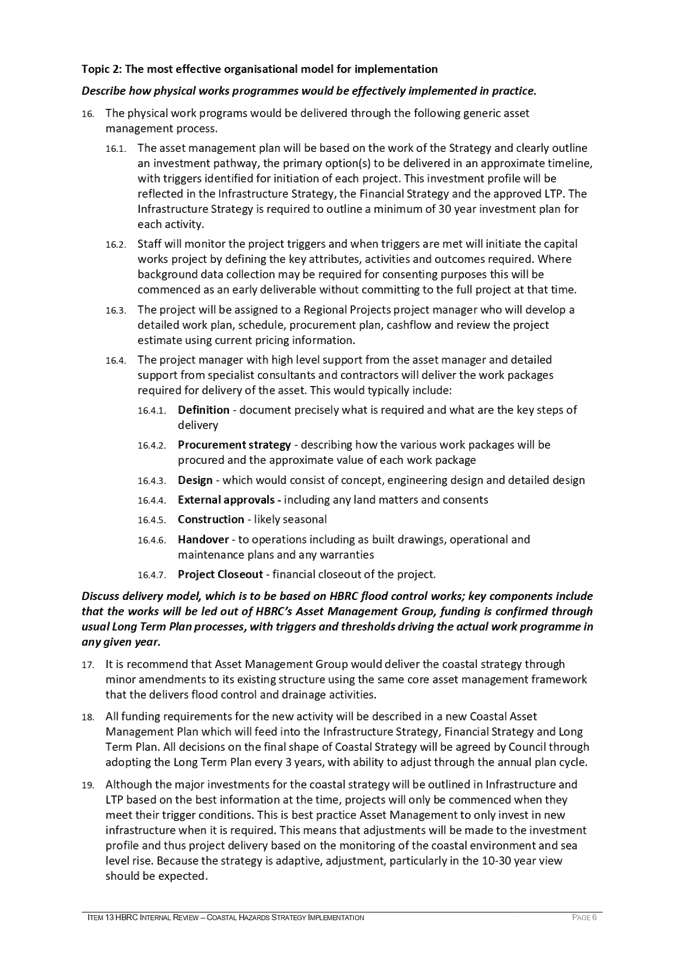

Bay Regional Council

159

Dalton Street, Napier

|

Agenda

Item Title Page

1. Welcome/Karakia/Notices/Apologies

2. Conflict

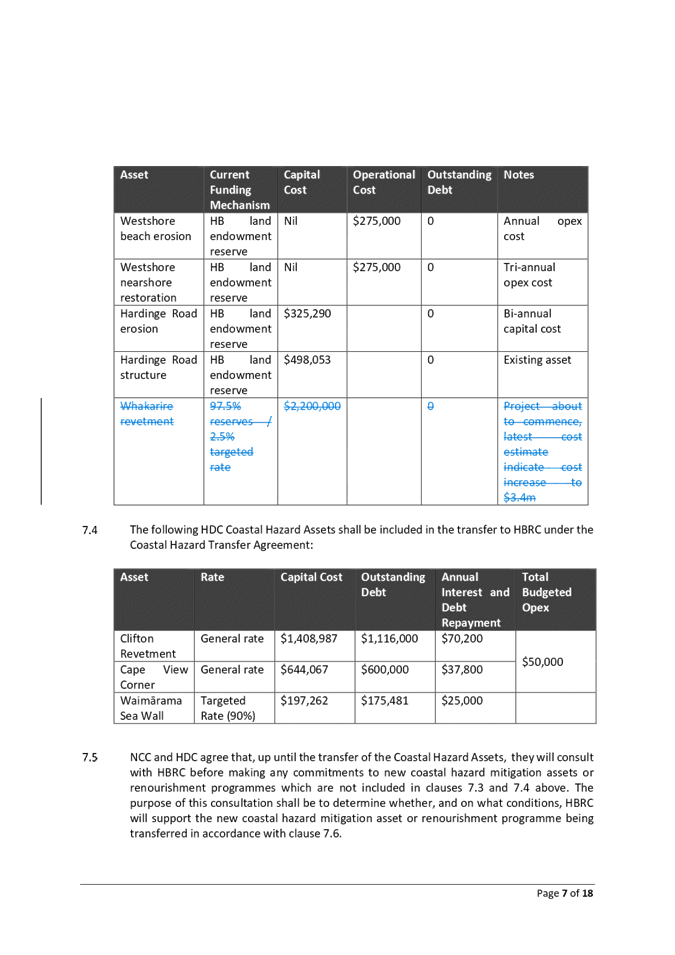

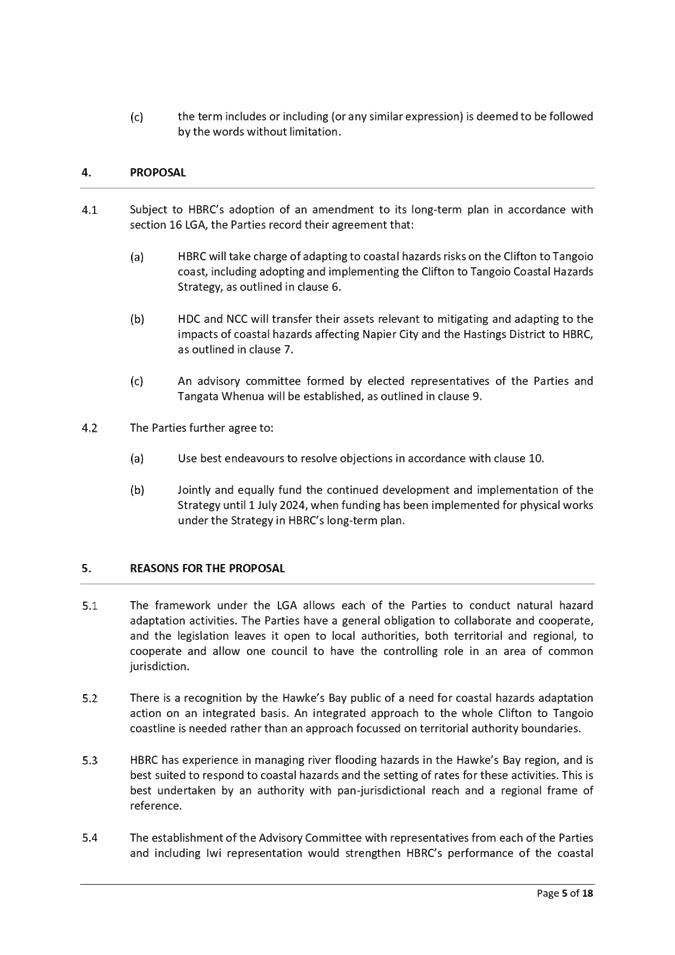

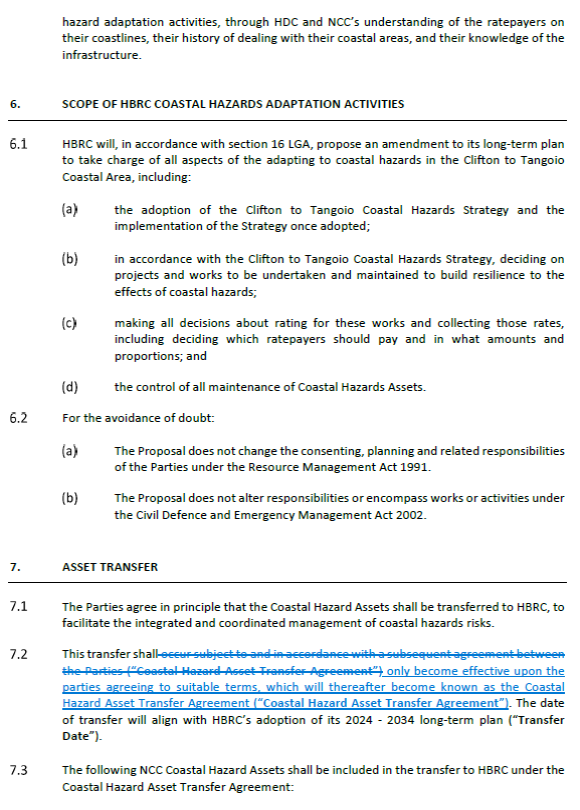

of Interest Declarations

3. Confirmation of Minutes of

the Corporate and Strategic Committee held on 17 November 2021

4. Follow-ups

from Previous Corporate and Strategic Committee Meetings 3

5. Call

for Minor Items Not on the Agenda 7

Decision

Items

6. Clifton

to Tangoio Coastal Hazards Strategy - Memorandum of Transition 9

7. Order

of Candidates Names on Voting Documents 57

8. Proposal

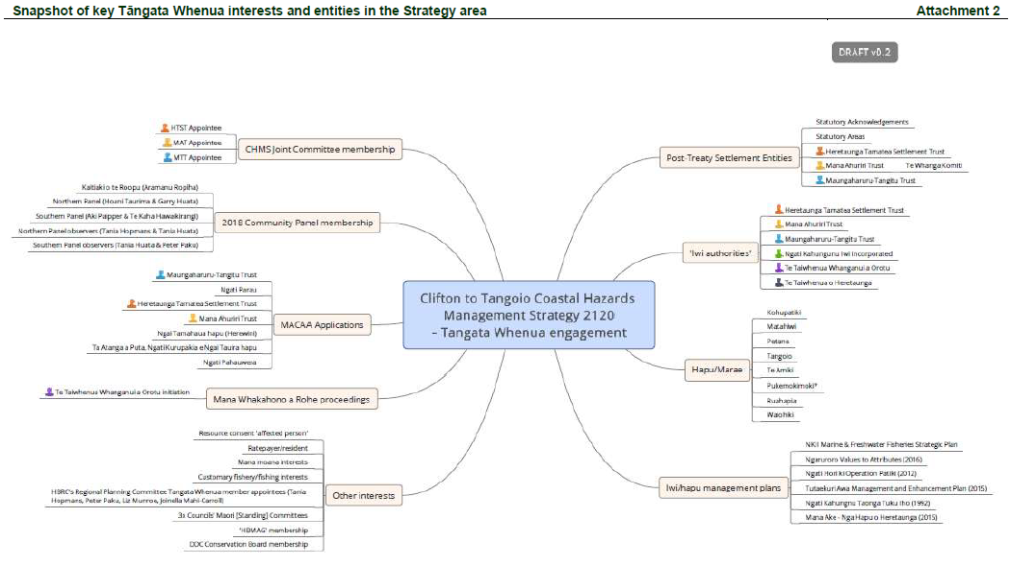

to Participate in Regional Sector Council-Controlled Organisation 61

9. Updated

HBRC Appointment and Remuneration of Directors Policy 81

10. HBRIC

and Foodeast Draft Statements of Intent 89

Information

or Performance Monitoring

11. HBRIC

Quarterly Update 117

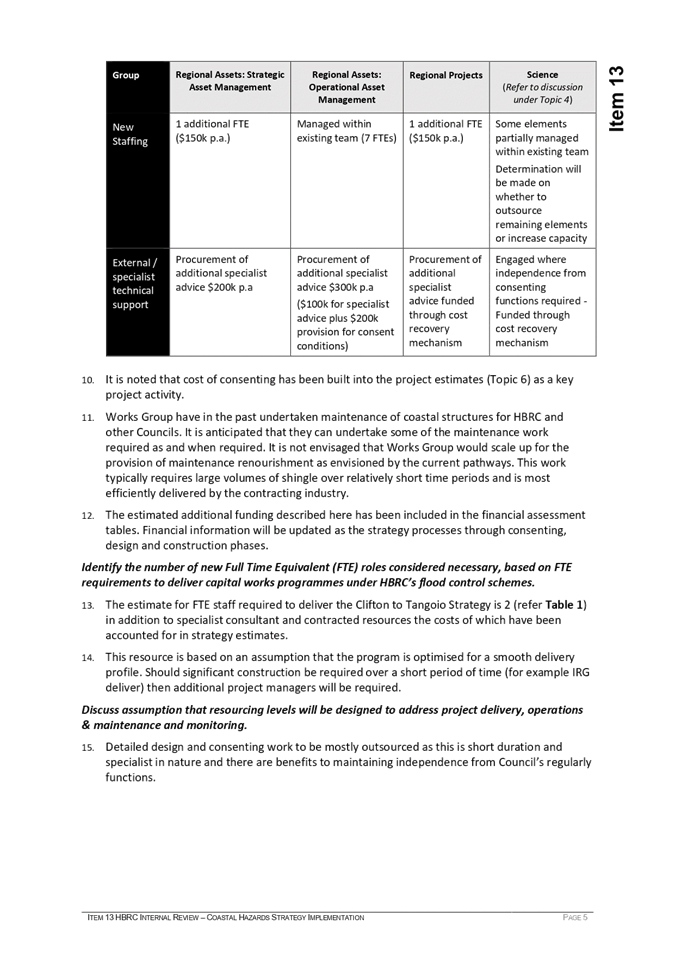

12. Report

from the Finance Audit and Risk Sub-committee Meeting 127

13. Financial

Report for the Period 1 July - 31 Dec 2021 133

14. Organisational

Performance Report for the Period 1 October - 31 December 2021 141

15. Corporate

Plan Implementation 169

16. Discussion

of Minor Items not on the Agenda 179

Decision

Items (Public Excluded)

17. Report

from the Public Excluded Finance, Audit and Risk Sub-committee Meeting 181

18. Possible

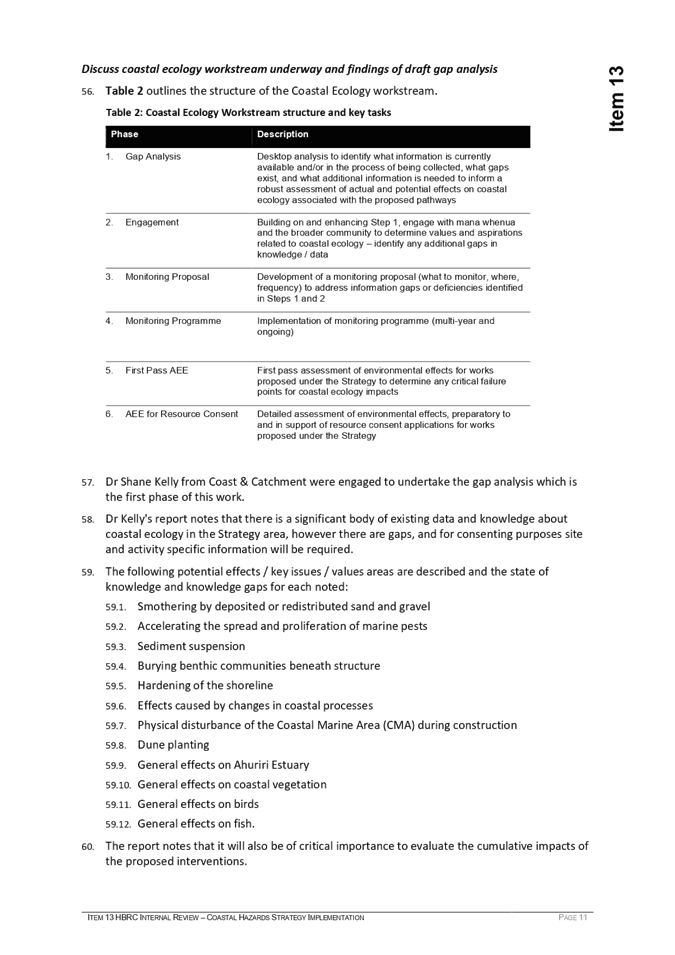

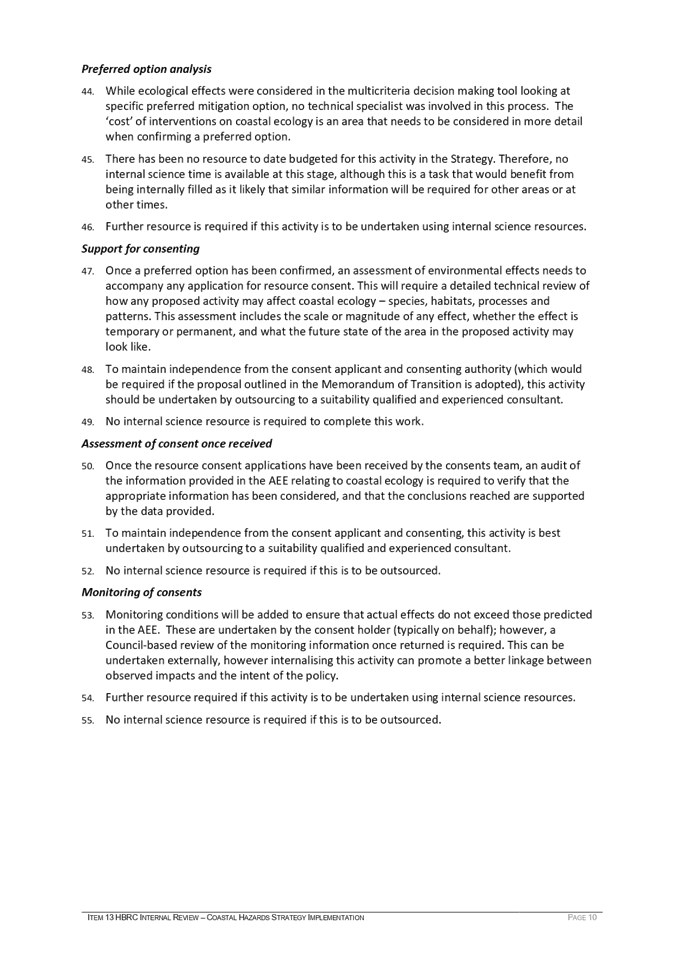

Sale of Wellington Leasehold Property 182

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

16 March

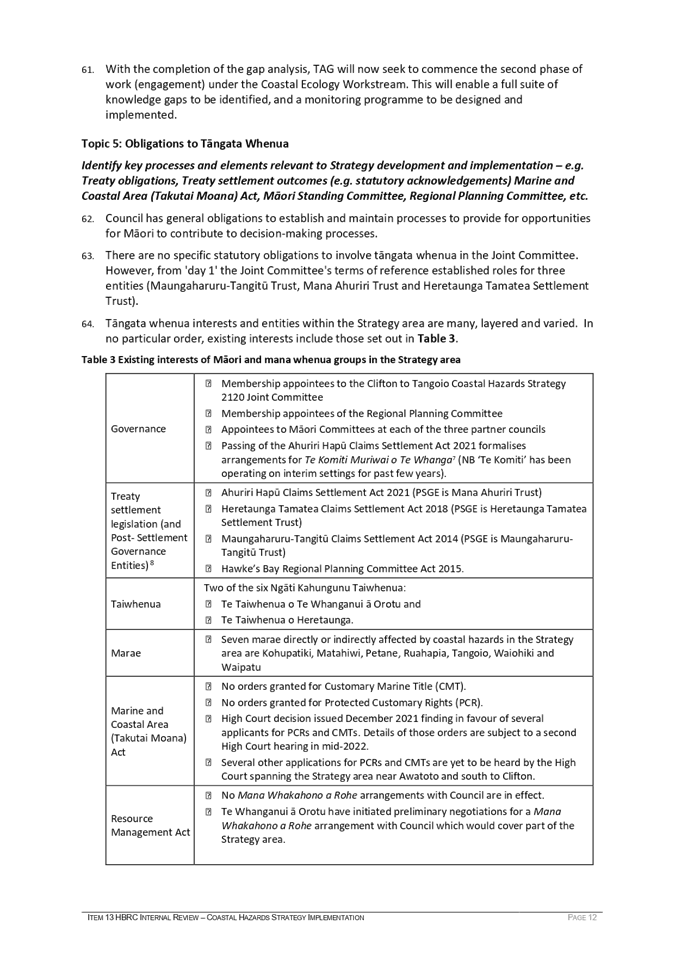

2022

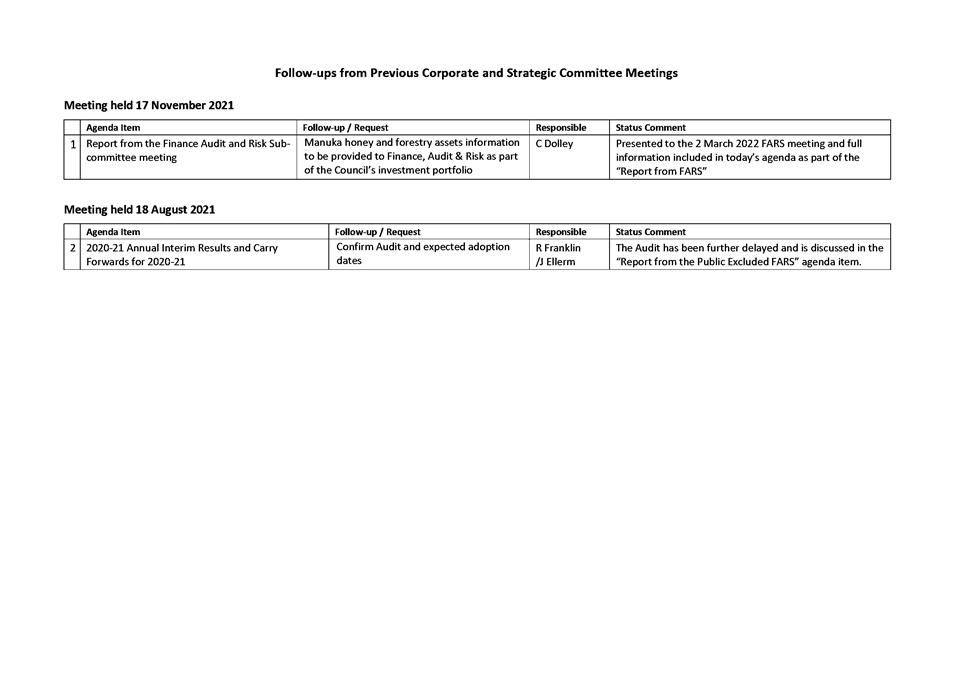

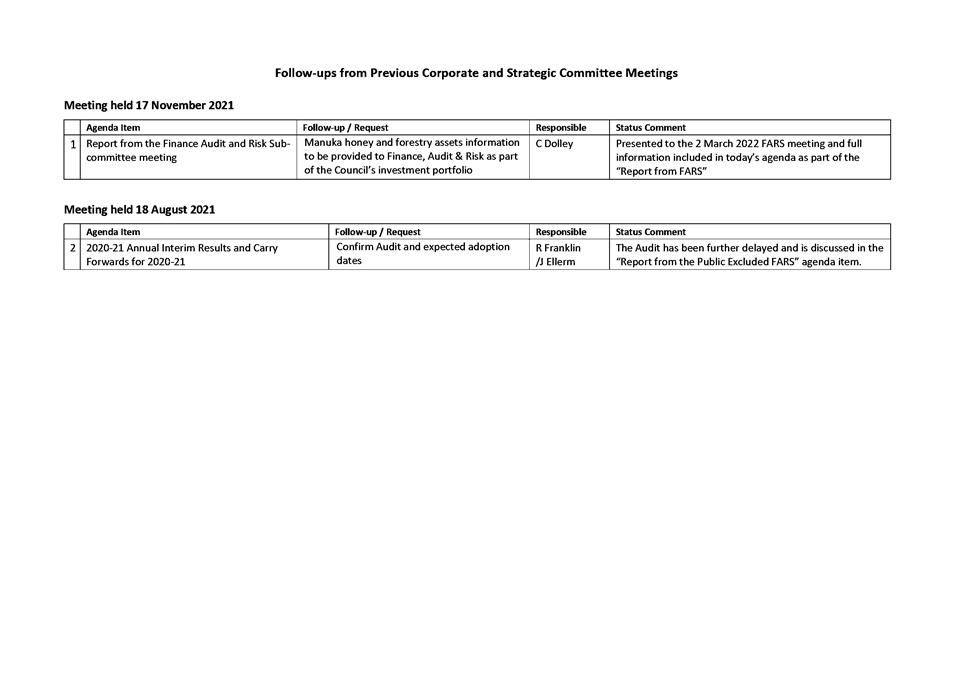

Subject: Follow-ups from Previous

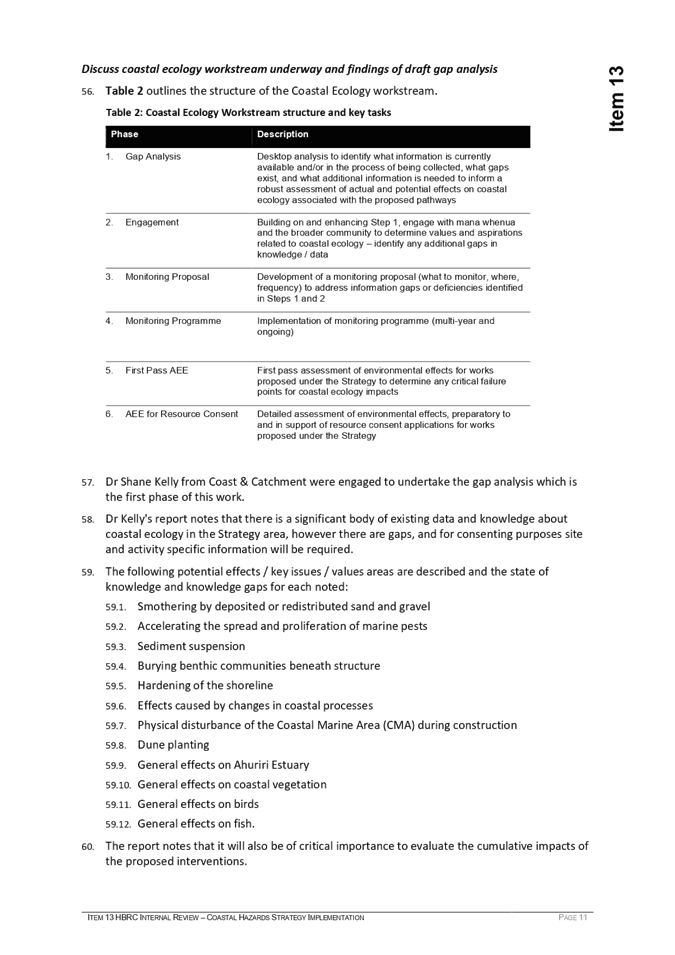

Corporate and Strategic Committee Meetings

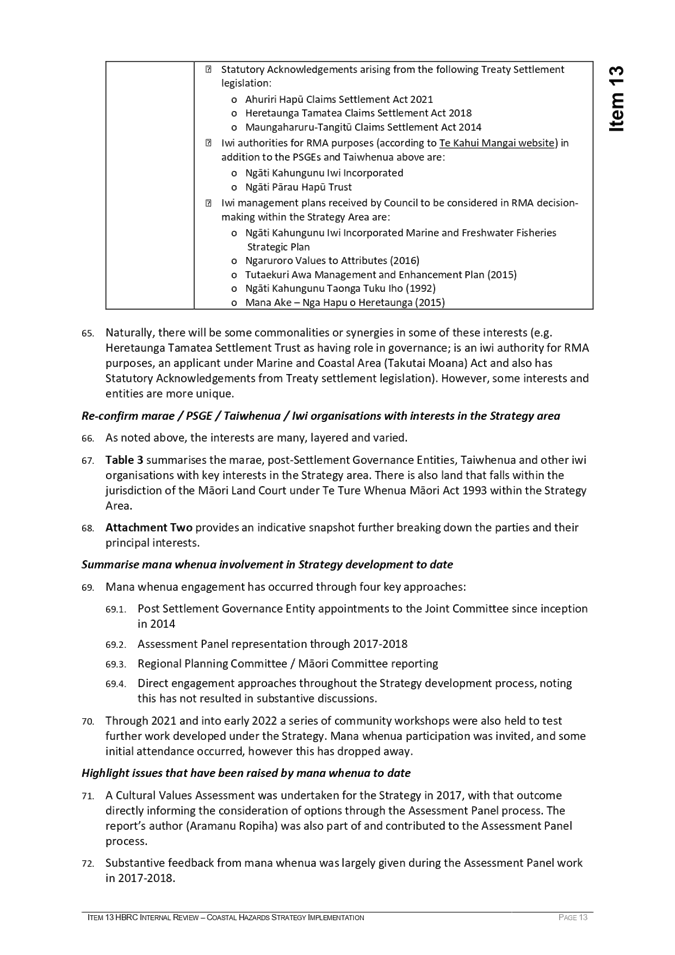

Reason for Report

1. On the attached list are

items raised at previous Corporate and Strategic Committee meetings that staff

have followed up on. All items indicate who is responsible for follow up, and a

brief status comment. Once the items have been reported to the committee they

will be removed from the list.

Decision Making Process

2. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That the Corporate and

Strategic Committee receives and notes the attached Follow-up Items from

Previous Meetings.

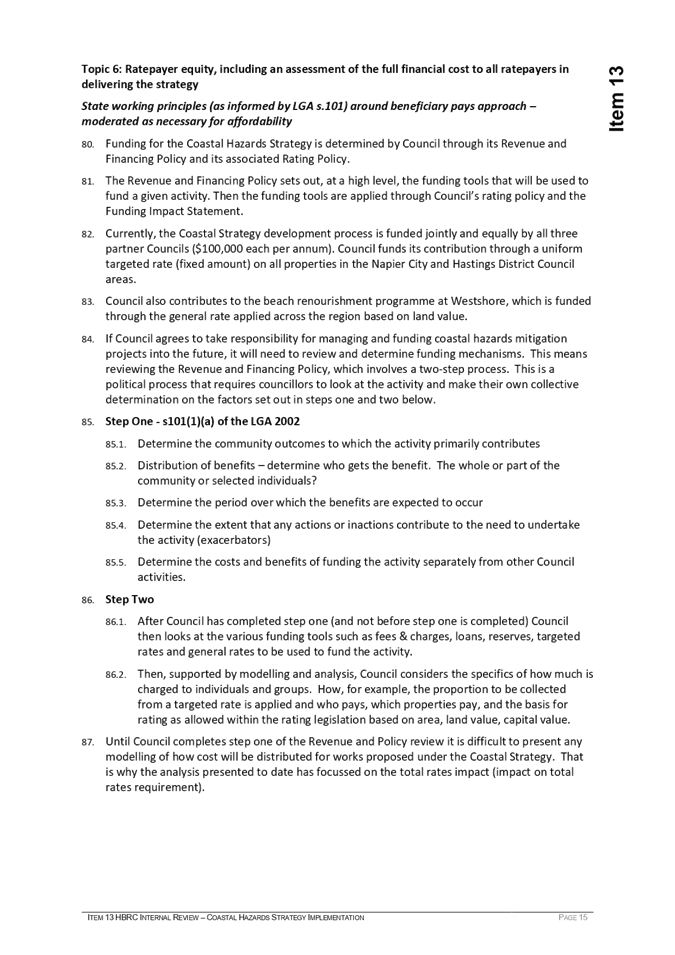

Authored by:

|

Leeanne Hooper

Team Leader Governance

|

|

Approved by:

|

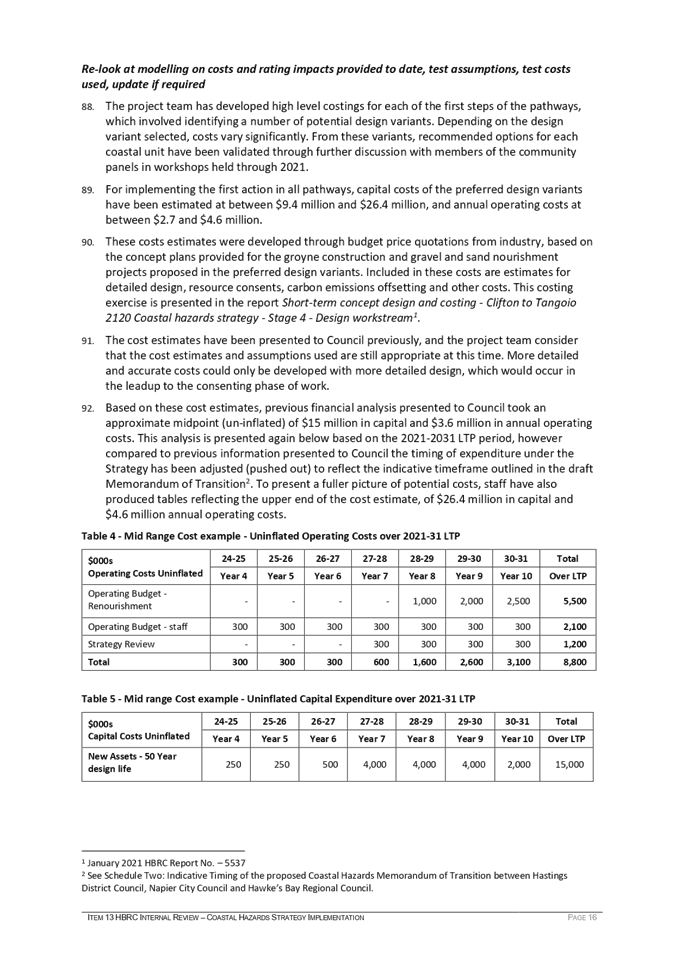

Jessica Ellerm

Group Manager Corporate Services

|

|

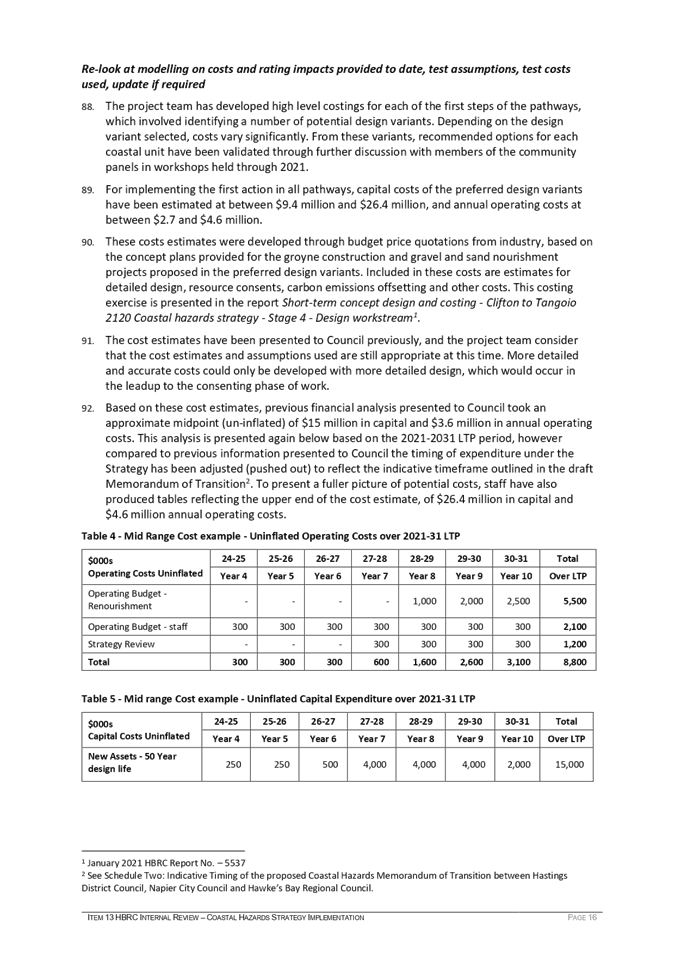

Attachment/s

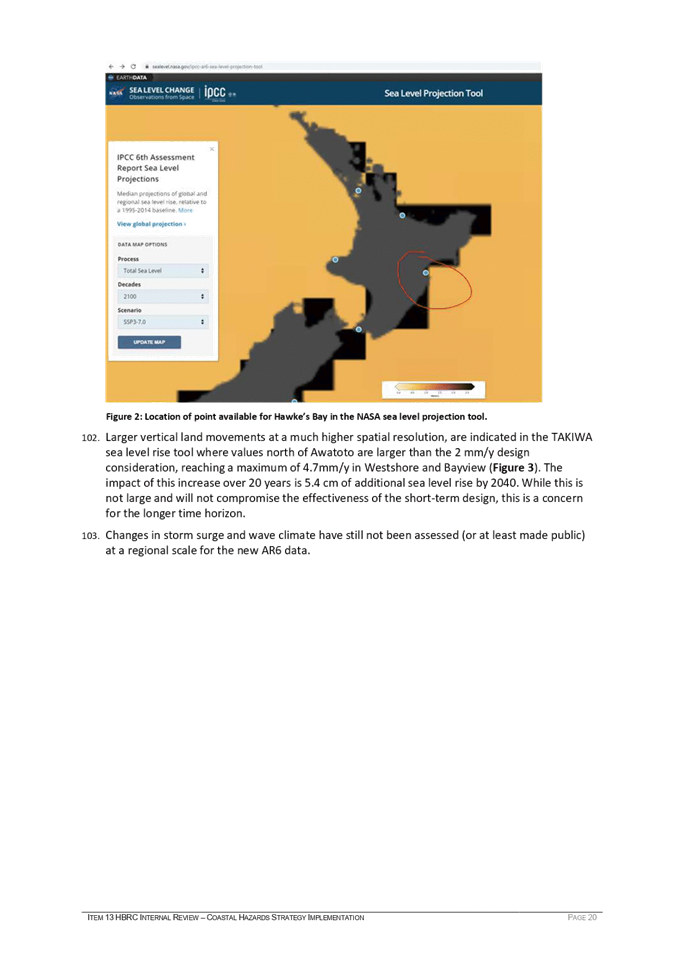

|

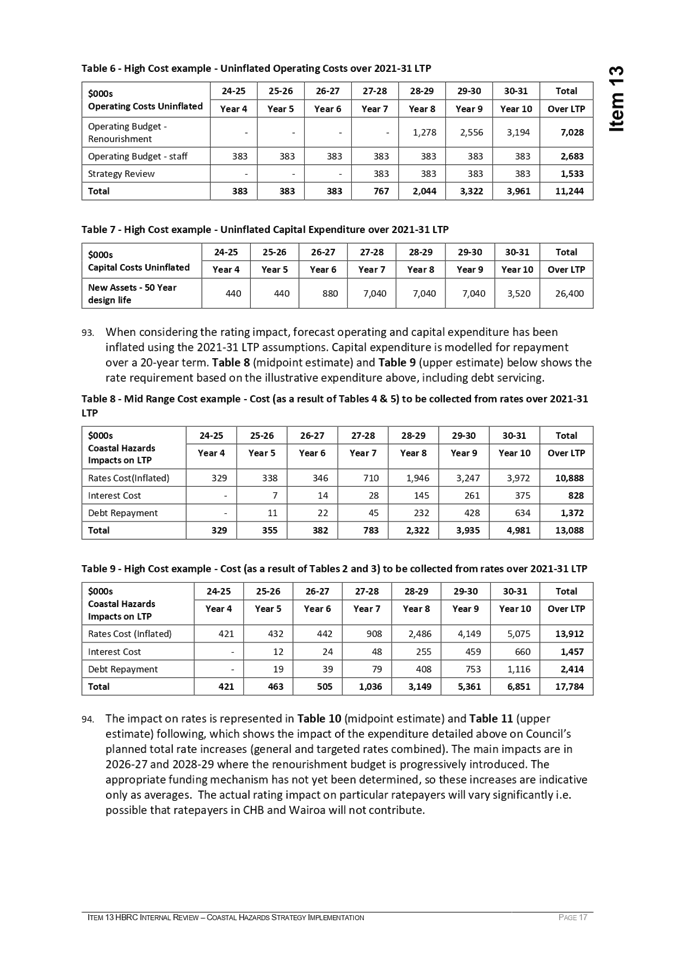

1⇩

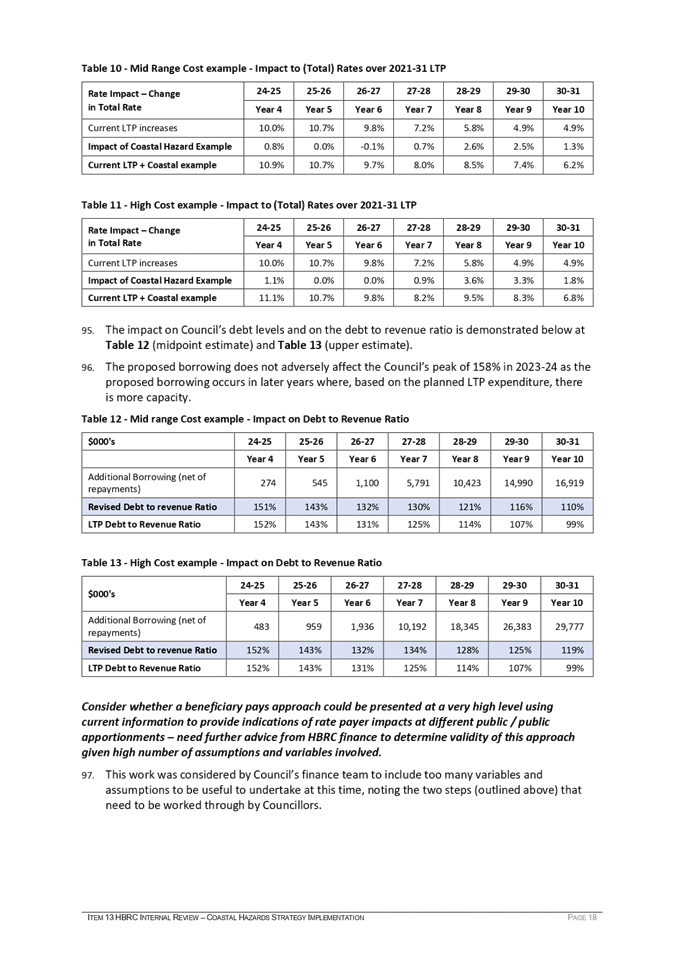

|

Follow-ups from Previous Meetings

|

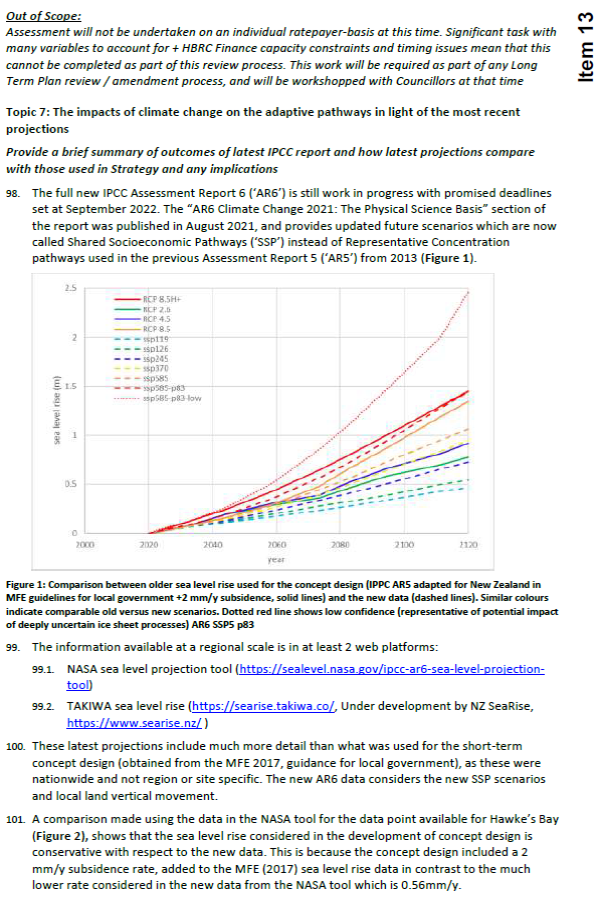

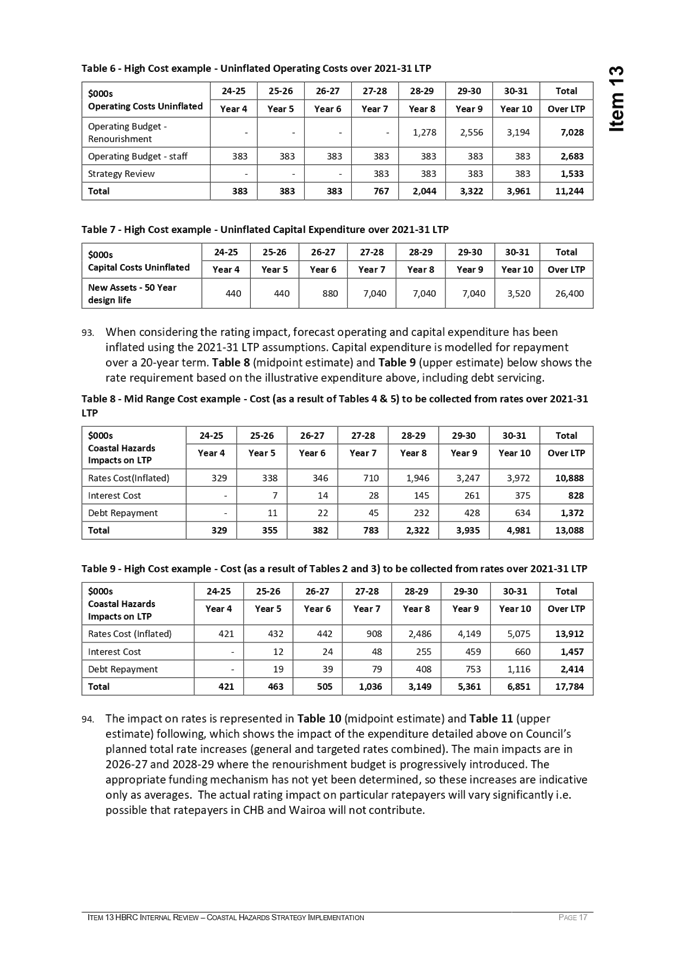

|

|

|

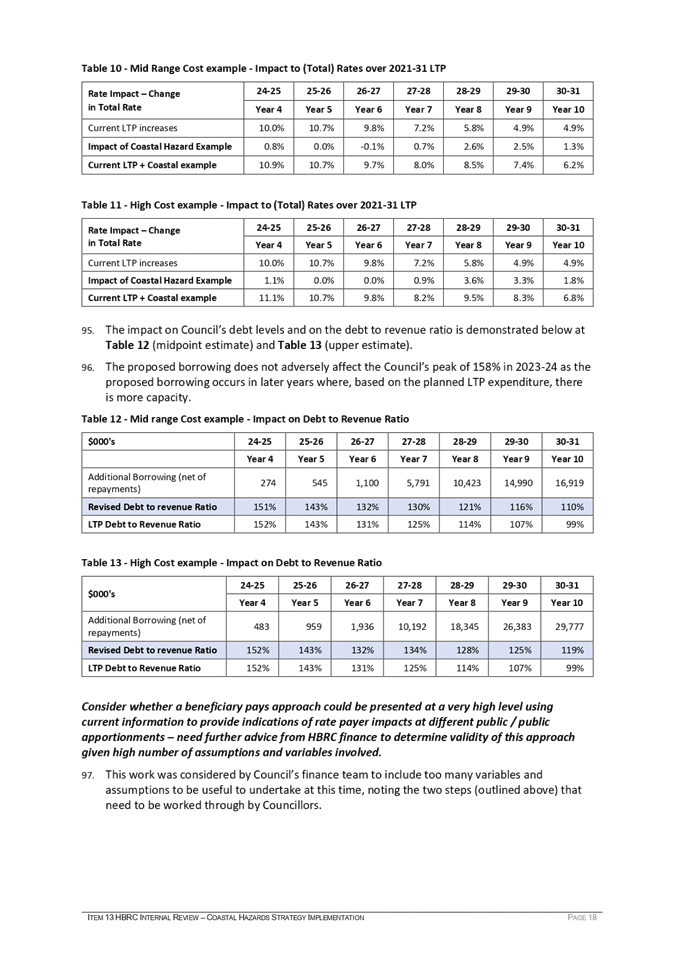

Follow-ups from Previous Meetings

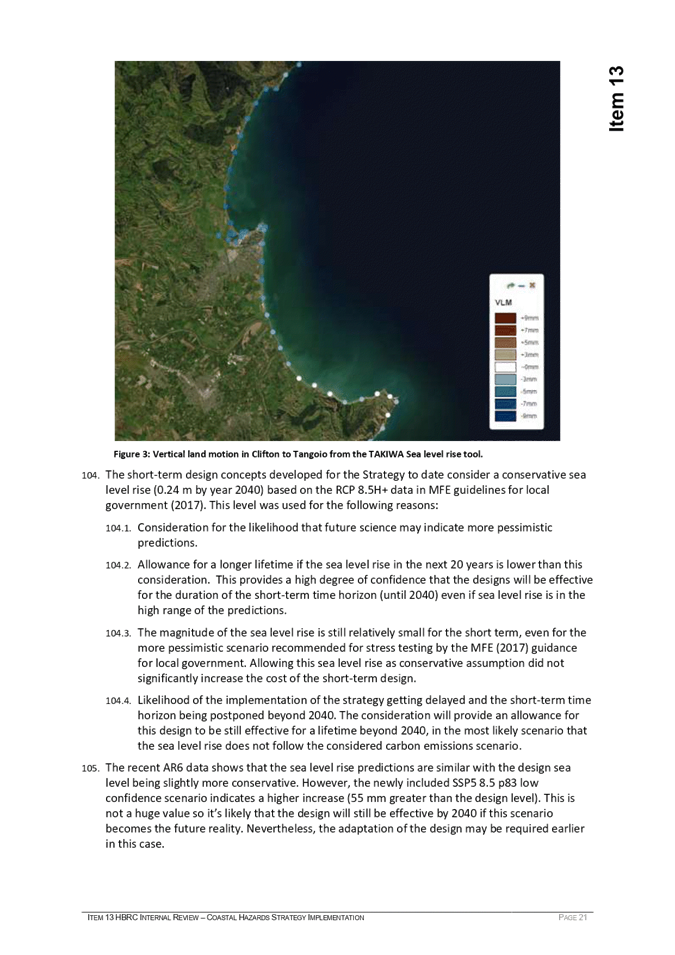

|

Attachment

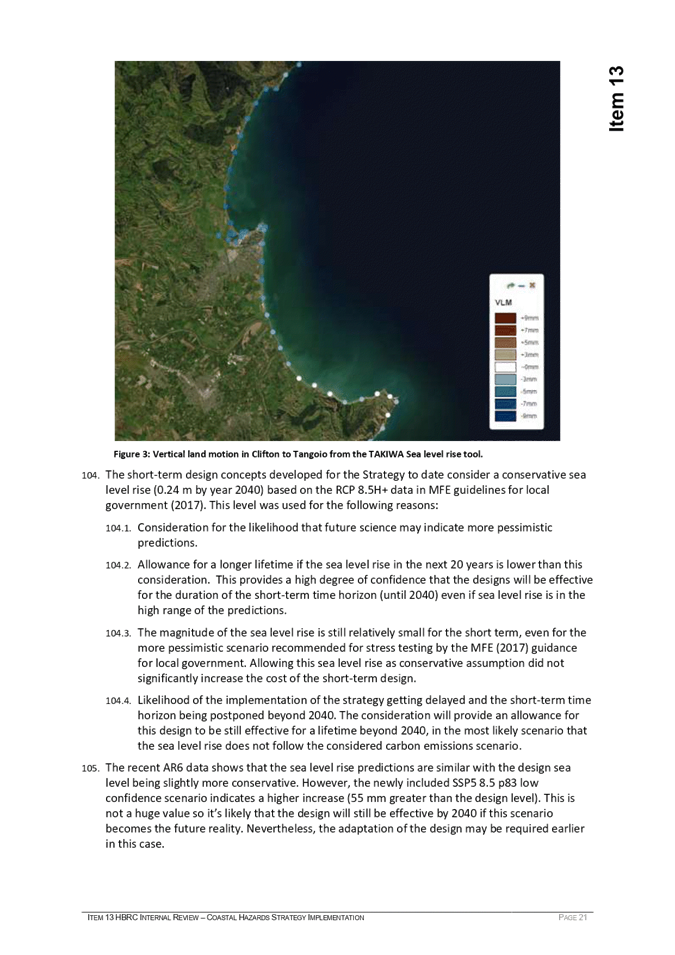

1

|

HAWKE’S

BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

16 March

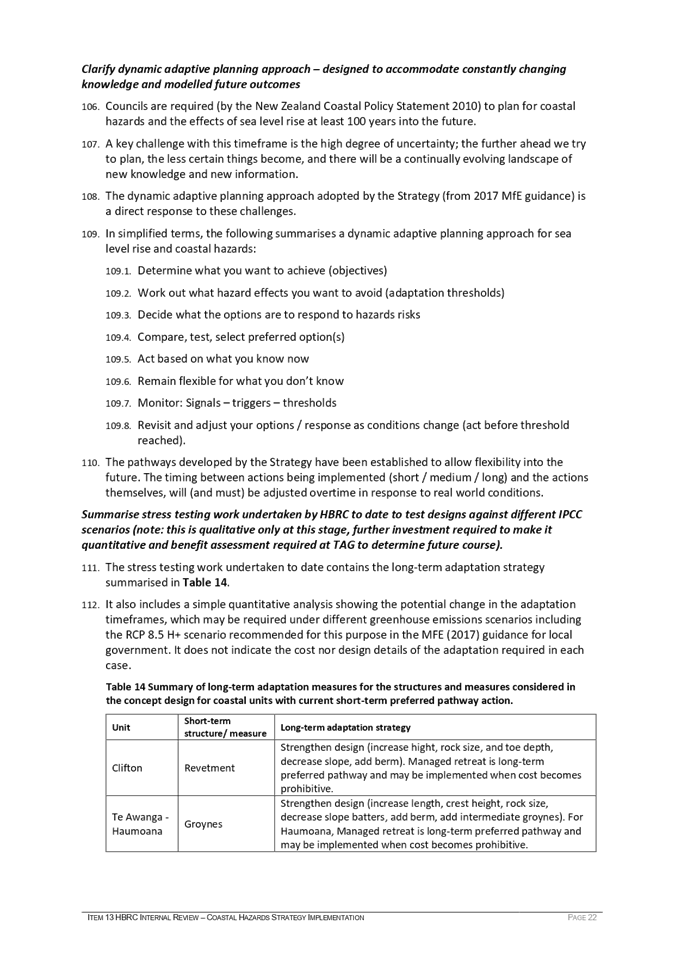

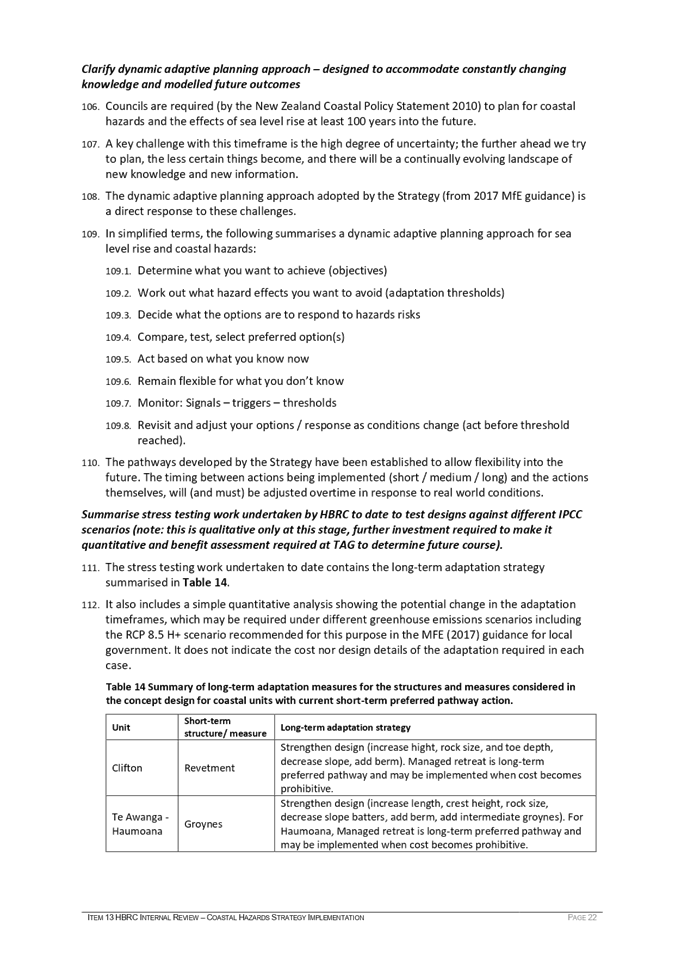

2022

Subject: Call for Minor Items Not on

the Agenda

Reason

for Report

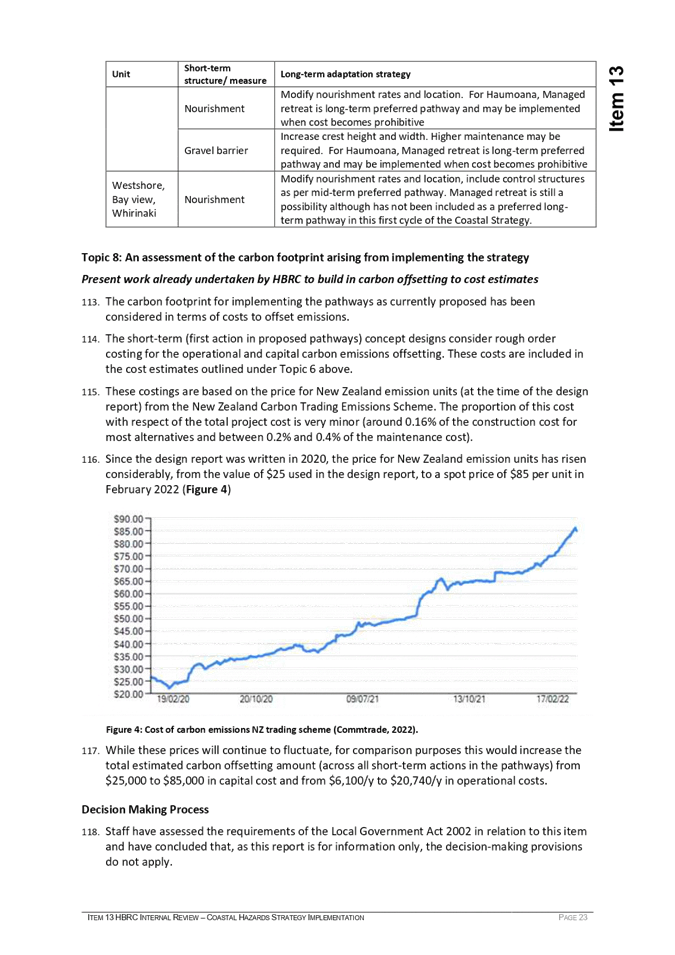

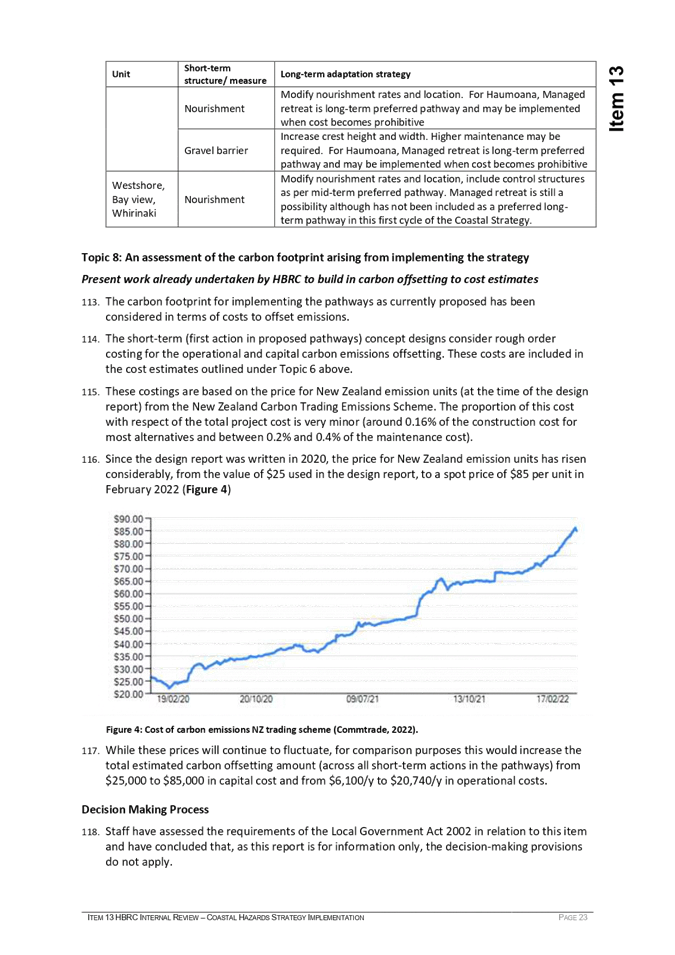

1. This item provides the

means for committee members to raise minor matters relating to the general business of

the meeting

they wish to bring to the attention of the committee.

2. Hawke’s Bay Regional

Council standing order 9.13

states:

2.1. “A meeting may discuss an

item that is not on the agenda only if it is a minor matter relating to the

general business of the meeting and the Chairperson explains at the beginning

of the public part of the meeting that the item will be discussed. However, the

meeting may not make a resolution, decision or recommendation about the item,

except to refer it to a subsequent meeting for further discussion.”

Recommendations

3. That the Corporate and

Strategic Committee accepts the following Minor Items Not on the Agenda for discussion

as Item 16.

|

Leeanne

Hooper

GOVERNANCE

TEAM LEADER

|

James

Palmer

CHIEF

EXECUTIVE

|

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

16 March

2022

Subject: Clifton to Tangoio Coastal

Hazards Strategy - Memorandum of Transition

Reason for Report

1. This item presents a

proposed Memorandum of Transition (MoT) to confirm Council roles and

responsibilities for the implementation of the Clifton to Tangoio Coastal

Hazards Strategy (Strategy).

Officers’

Recommendations

2. Staff recommend that the

Committee endorses the Memorandum of Transition as proposed, for Council

adoption and execution by the Chief Executive.

Executive

Summary

3. A proposed MoT has been

developed to give effect to the outcome of the Funding Review, led by Raynor

Asher, QC.

4. The MoT has been endorsed

by Napier City Council (NCC) and Hastings District Council (HDC).

5. Hawke’s Bay Regional

Council (HBRC) has received further advice to assist in its consideration of

the MoT, and a decision is now being sought.

6. If HBRC endorses the MoT, a

public consultation process will follow in the form of a proposal by HBRC under

s.16 of the Local Government Act.

Background

7. All Partner Councils have

agreed in principle to the outcomes of the funding review led by Raynor Asher,

QC.

8. As the first phase of

implementing the funding review outcomes, the Technical Advisory Group (TAG)

has prepared a draft MoT.

9. The purpose of the MoT is

to provide a mechanism for HBRC, HDC and NCC to confirm the agreed arrangements

for implementing the Strategy and the associated transfer of assets recommended

by the funding review.

10. These implementation

arrangements, if confirmed, would be actioned through a proposal by HBRC to

amend its Long Term Plan by proposing to undertake a significant new activity

under s.16 of the Local Government Act.

11. The MOT will also provide

the means for HBRC to complete the s.16 process without objection from territorial

authorities in the region (including Wairoa District Council and Central

Hawke’s Bay District Council).

12. Associated with the MoT, an

advisory committee was recommended by Mr Asher to support HBRC’s

functions as the lead agency for implementing the Strategy. This advisory

committee will in effect replace the Clifton to Tangoio Coastal Hazards

Strategy Joint Committee and provide for an ongoing forum for collaboration

between tāngata whenua and the councils.

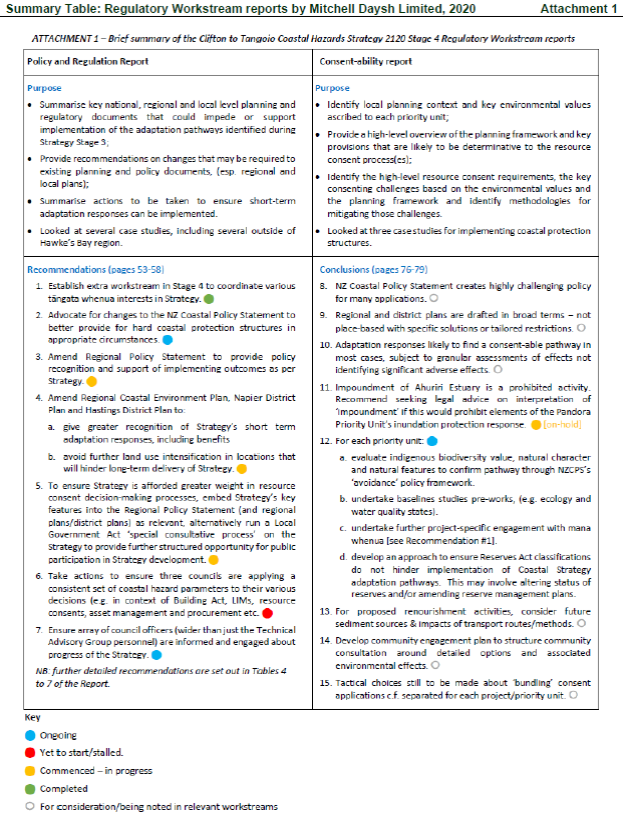

13. The MoT is provided as Attachment

1 to this paper.

14. A draft terms of reference

for the proposed advisory committee is included as Schedule One to the MoT.

15. In December 2021, the MoT

was endorsed by HDC and NCC. Both Councils have delegated authority to their

Chief Executives to execute the MOT on their behalf.

16. HBRC considered the MoT in

workshop in December 2021, however, it deferred a decision to endorse the MoT

pending receipt of further advice and analysis.

17. This advice and analysis

was presented in workshop and in the Council meeting on 23 February 2022. As a

result of advice received, Councillors sought minor amendments to the MoT and

instructed staff to discuss these proposed changes with HDC and NCC.

18. The amendments sought by HBRC

are shown as tracked changes in Attachment 1. Amendments are proposed to

Clause 7.2 and a new proposed clause 7.10 has been inserted. For completeness,

TAG has also proposed that the Whakarire Avenue revetment is removed from the

MoT at this stage, as the works are consented but not yet constructed. This

change is also shown as tracked.

19. Staff have consulted with

HDC and NCC on the changes proposed by HBRC. Both councils have confirmed their

agreement to the proposed changes through their Chief Executives.

Options

Assessment

20. The MoT is a key next step

in confirming the outcome of the funding review led by Raynor Asher.

21. HDC and NCC have confirmed

their agreement to the MoT, and have subsequently accepted changes proposed by

HBRC from their meeting on 23 February 2022.

22. HBRC is now asked to

consider and endorse the final MoT. Staff consider that this presents HBRC with

two options, as follows.

Option

One (Recommended Option)

23. Council endorses the MoT,

as attached, and instructs the Chief Executive to execute this on behalf of

Hawke’s Bay Regional Council following satisfaction of consultation

requirements under Clause 7 of the Hawke’s Bay Region’s Triennial

Agreement for the Triennium October 2019 – 2022.

Advantages

23.1. Council has previously

agreed in principle to the outcome of the funding review, and has considered

the proposal, as outlined in the MoT, in some detail along with further advice

and analysis.

23.2. Mr Asher has set out, in

his advice, detailed reasons for his recommendation that that the Regional

Council is the organisation best placed to take charge of all aspects of

adapting to coastal hazards in the Clifton to Tangoio Coastal area.

23.3. The process of confirming

roles and responsibilities for strategy implementation between councils has

raised important and significant questions, and has taken some time to work

through. More significant work lies ahead, including determining how to fairly

apportion costs between ratepayers for coastal hazards mitigation. Endorsing

the MoT will clear the way for this next important phase of work to commence.

Disadvantages

23.4. The MoT proposes that HBRC

take on a significant new activity. This will result in increased costs for the

organisation, and increased resourcing and capability requirements.

Option

Two – Status Quo

24. Council does not endorse

Memorandum of Transition and instructs officers to revisit Funding Review

outcomes.

Advantages

24.1. HBRC would not be exposed

to the cost and resource implications associated with leading strategy

implementation.

Disadvantages

24.2. This option is not

supported by officers. As noted above, Mr Asher has outlined with sound

reasoning why HBRC is best placed to lead strategy implementation. The draft

MOT has had significant input from the strategy’s Technical Advisory

Group, has had legal input from Simpson Grierson, and has been endorsed by the

Joint Committee which includes representatives from HBRC, HDC and NCC. The MoT

has also been formally endorsed by HDC and NCC.

24.3. HBRC has been presented

with, and had the opportunity to further consider, advice relative to the

potential liabilities, costs and resourcing implications associated with its

endorsement of the MoT.

24.4. If the MoT is not endorsed

by HBRC, the Strategy itself has no agreed mechanism for implementation. Other

options, which were assessed by Mr Asher but were found to be far less

effective and desirable, would need to be considered.

Strategic Fit

25. Climate Change is at the

heart of everything we do.

The coastal strategy aims to provide coastal communities, businesses and

critical infrastructure from Clifton to Tangoio are resilient to the effects of

coastal hazards. Climate change and the corresponding sea level rise is the

primary hazard being mitigated through this strategy.

26. The strategy would sit

under the sustainable and climate-resilient services and infrastructure HBRC

Strategic Objective.

Why

the Strategy is a Priority

27. High performing regional

infrastructure enables the region’s natural and human resources to

deliver goods and services that underpin the prosperity and wellbeing of the

Hawke’s Bay community.

Climate

Change Impacts

28. The climate assumptions that

underpin our infrastructure investments and decisions are changing

rapidly. We must ensure our assets and services are future proofed for

climate change impacts, which supports the leading edge adaptive pathways

approach of the strategy.

Strategic

Outcome

29. The region has resilient

physical, community and business infrastructure to unlock potential growth and

prosperity from our natural resource base, which aligns with the coastal

strategy’s vision.

Significance

and Engagement Policy Assessment

30. If endorsed by HBRC, the

MoT will be actioned through a proposal by HBRC under s.16 of the Local

Government Act. This requires full community consultation. HBRC would make a

final decision following the outcome of that consultation process.

31. Further to the s.16

process, more detail on the delivery model, programme and funding will be

developed for consultation through the 2024-2034 Long Term Plan.

Considerations

of Tāngata Whenua

32. The MoT has been endorsed

by the Strategy’s Joint Committee, which includes representation from the

Maungaharuru-Tangitū Trust, Mana Ahuriri Trust and Heretaunga Tamatea

Settlement Trust (although the Joint Committee is waiting to confirm new

representatives for Mana Ahuriri Trust and Heretaunga Tamatea Settlement

Trust).

33. A Mana Whenua Engagement

Strategy has also been activated as part of work under the Strategy and this

work is ongoing.

34. As noted, if HBRC endorse

the MoT, a s.16 consultation process will follow, providing further opportunity

for input from tāngata whenua. The Mana Whenua Engagement Strategy has

been designed to support and facilitate this input.

Financial

and Resource Implications

35. Staff presented financial

analysis in the report to Council on 23 February 2022, HBRC Internal Review

– Coastal Hazards Strategy Implementation.

36. This analysis included an

assessment of indicative potential costs and rating impacts for the 2021-2031

LTP 10 year period should HBRC agree to implement the strategy.

37. Rather than repeat this

analysis here, this report is provided as Attachment 2.

38. Full financials and rating

methodology will be developed for consultation as part of the proposed

2024-2034 LTP (refer Table 1).

Next Steps

39. Staff propose to take the

MoT and the recommendations of this Committee to full Council on 30 March

2022.

40. Should HBRC agree to

endorse the MoT, the following sequential steps will occur:

40.1. Agreement will be sought

from Wairoa District Council and Central Hawke’s Bay District Council

that they do not object to the MoT, and the s.16 proposal that will follow from

it.

40.2. Hastings District Council

will consult with ratepayers who may be affected by the proposed transfer of

the Waimarama seawall.

40.3. The Chief Executives of

HBRC, NCC and HDC will be invited to execute the MoT, in accordance with the

resolutions passed by each Council.

40.4. The Minister of Local

Government will be informed of the proposal and the reasons for it, in

accordance with the requirements of s.16(2) of the Local Government Act

40.5. HBRC will notify the

proposal under s.16 of the Local Government Act (this is targeted to occur in

May 2022).

41. Further decision-making

steps are outlined below in Table 1.

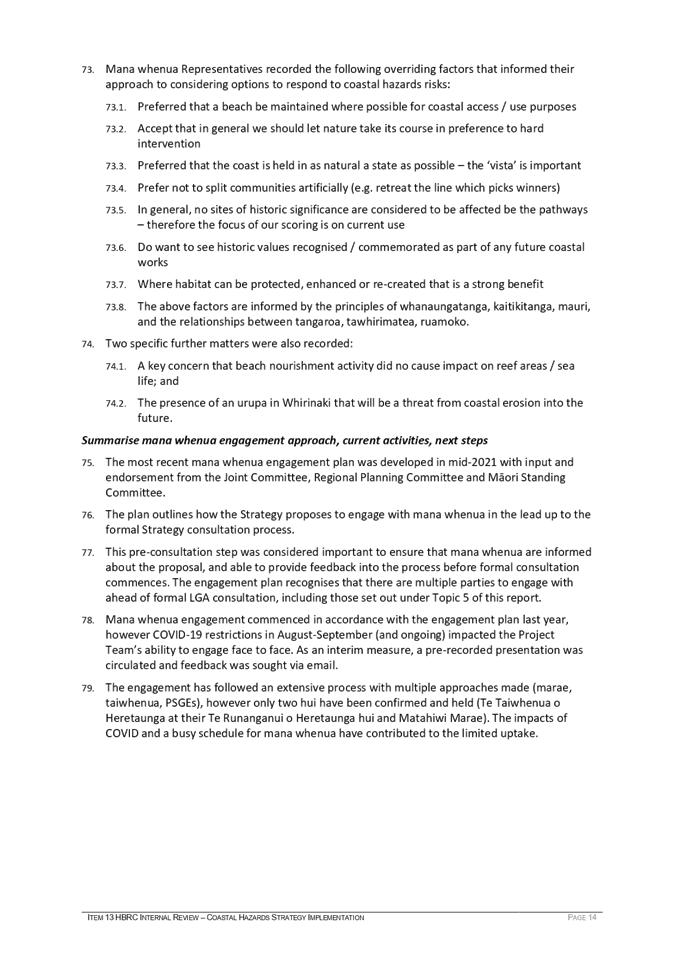

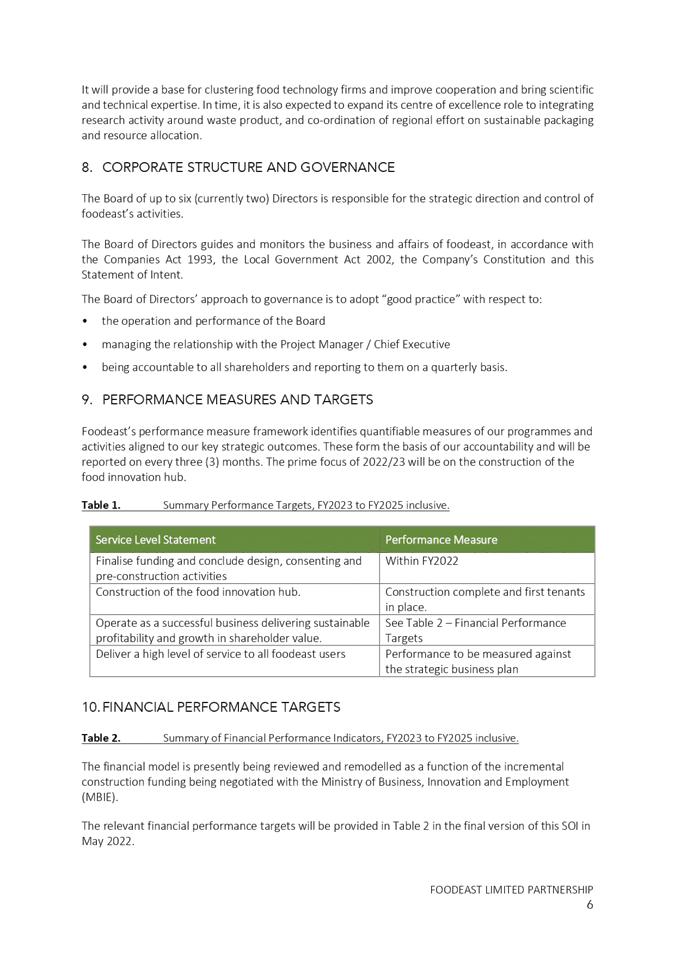

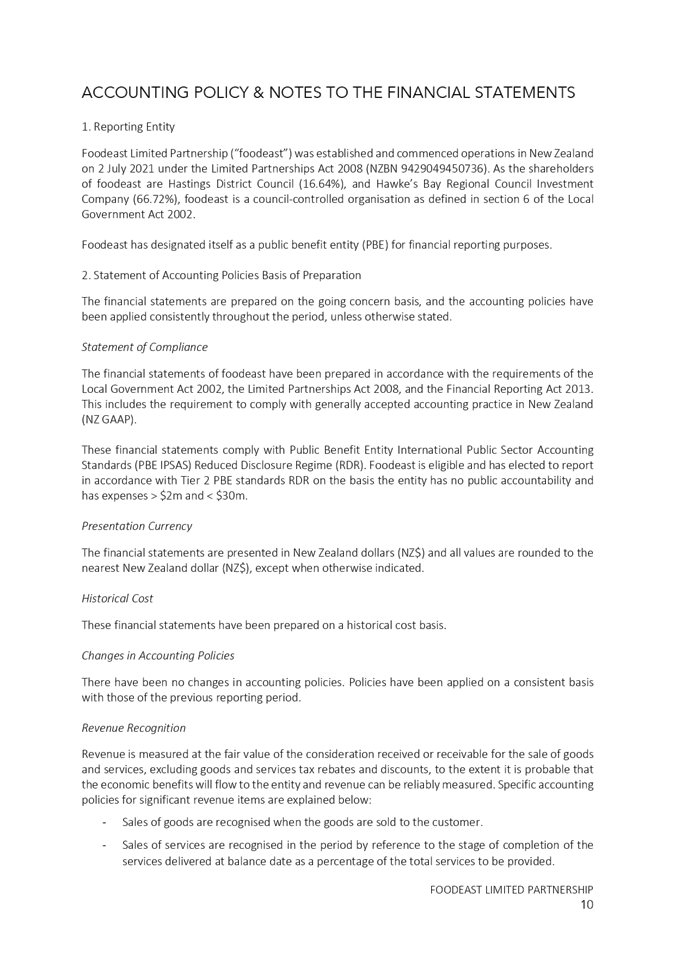

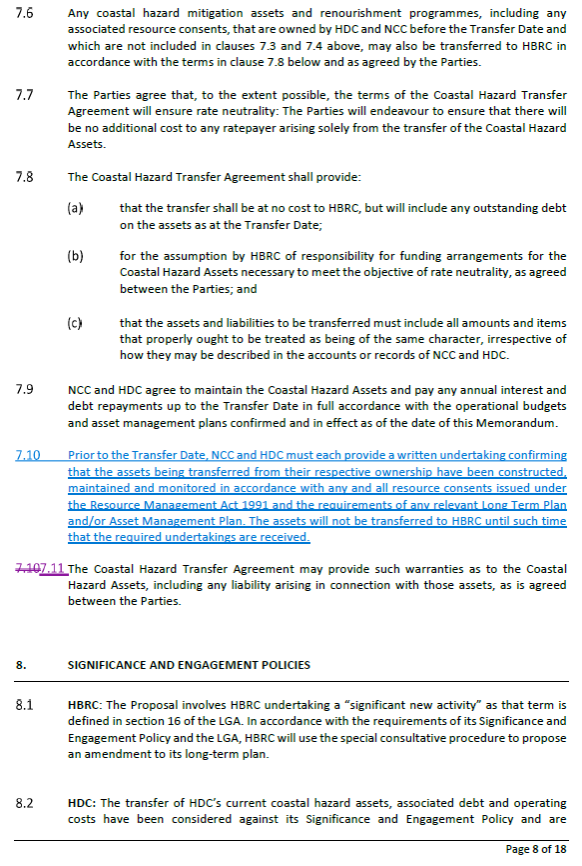

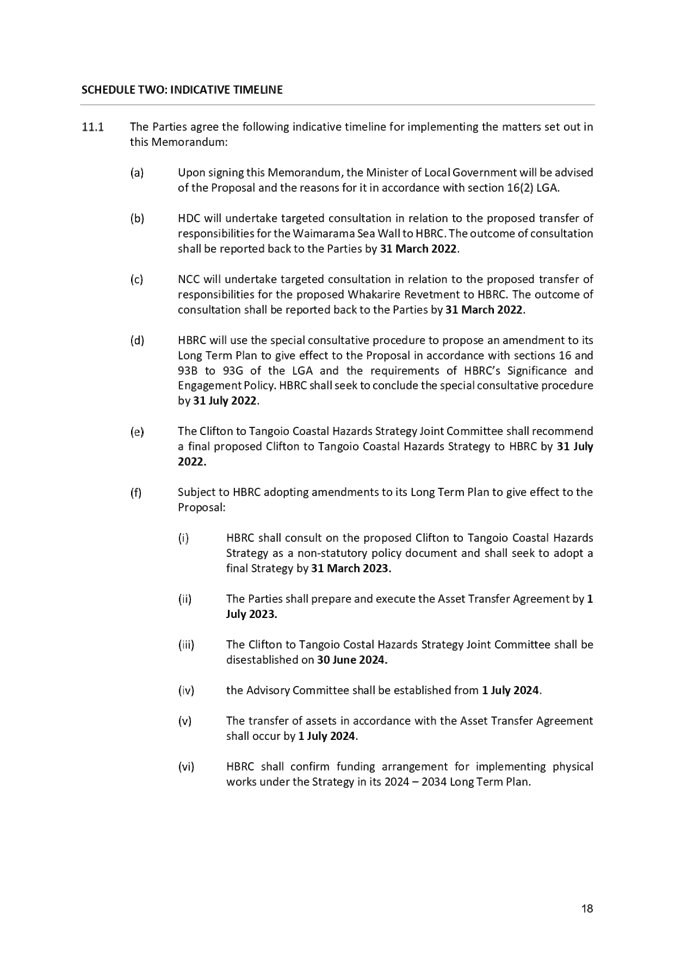

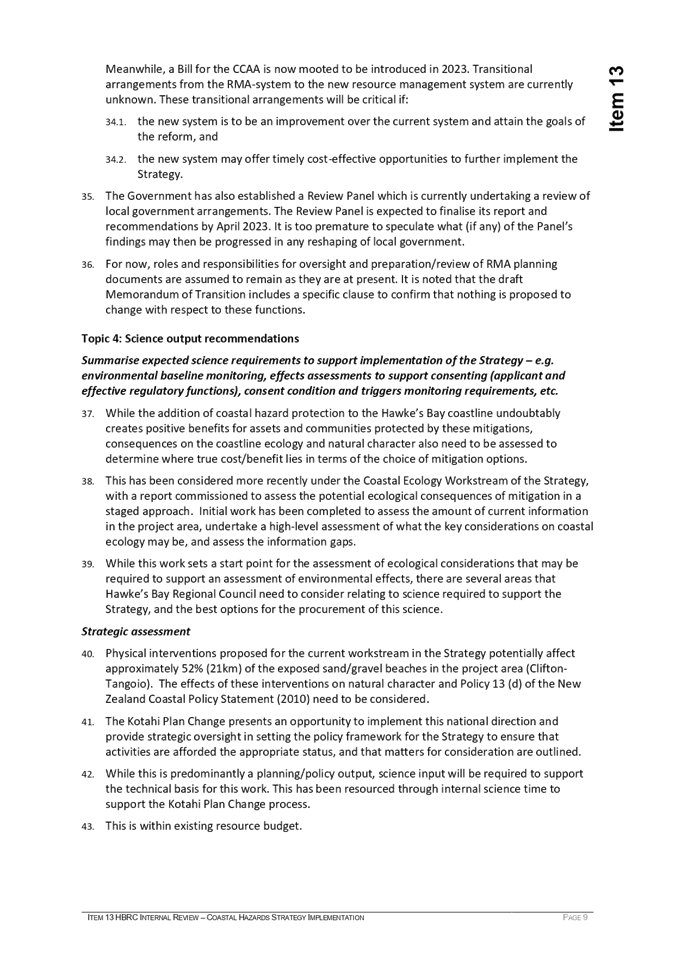

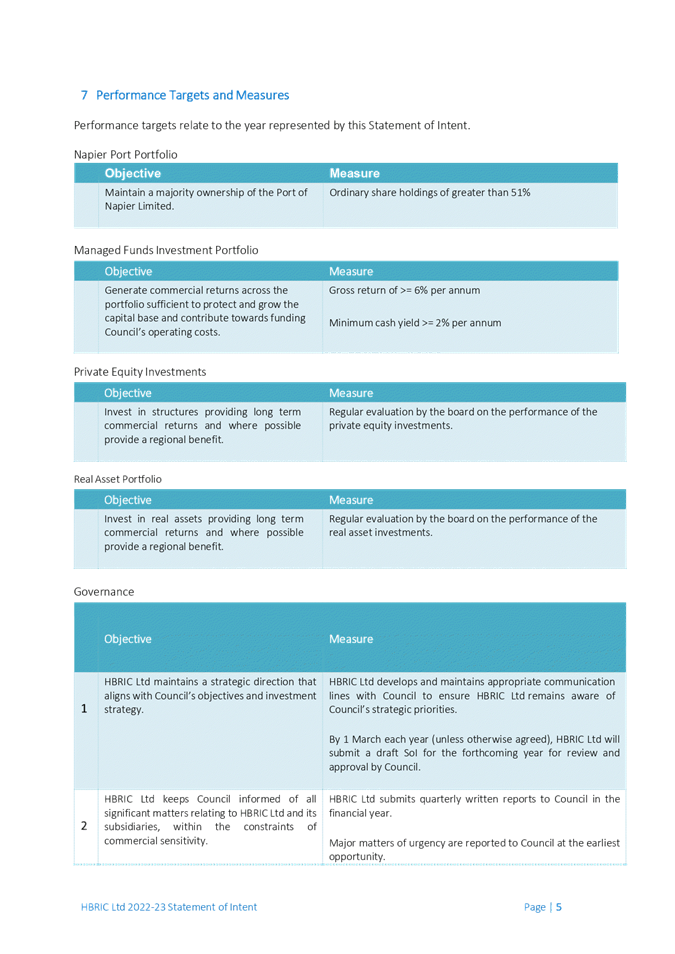

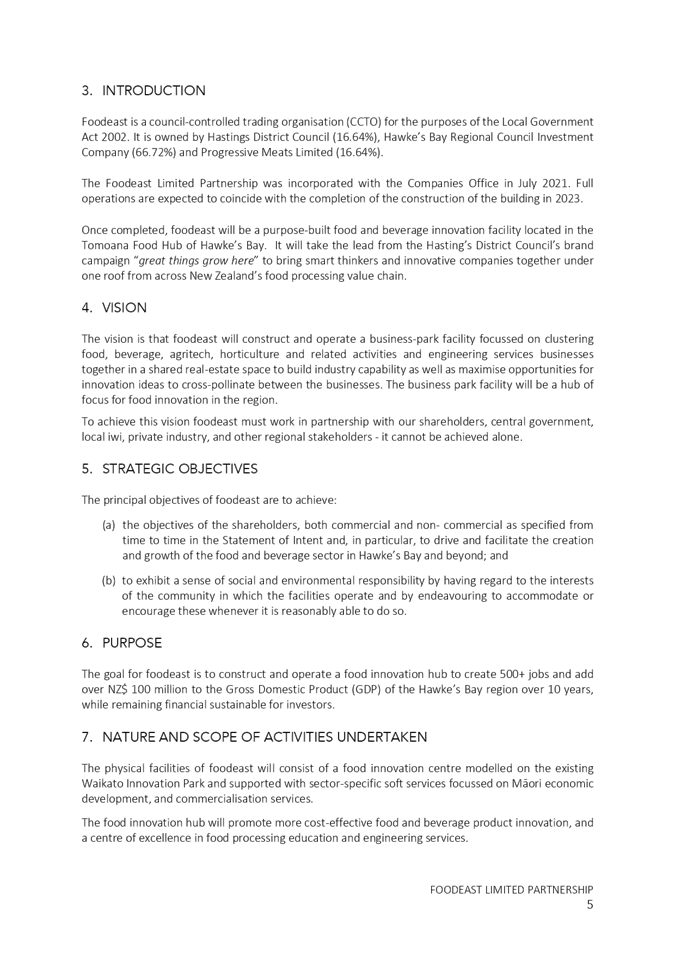

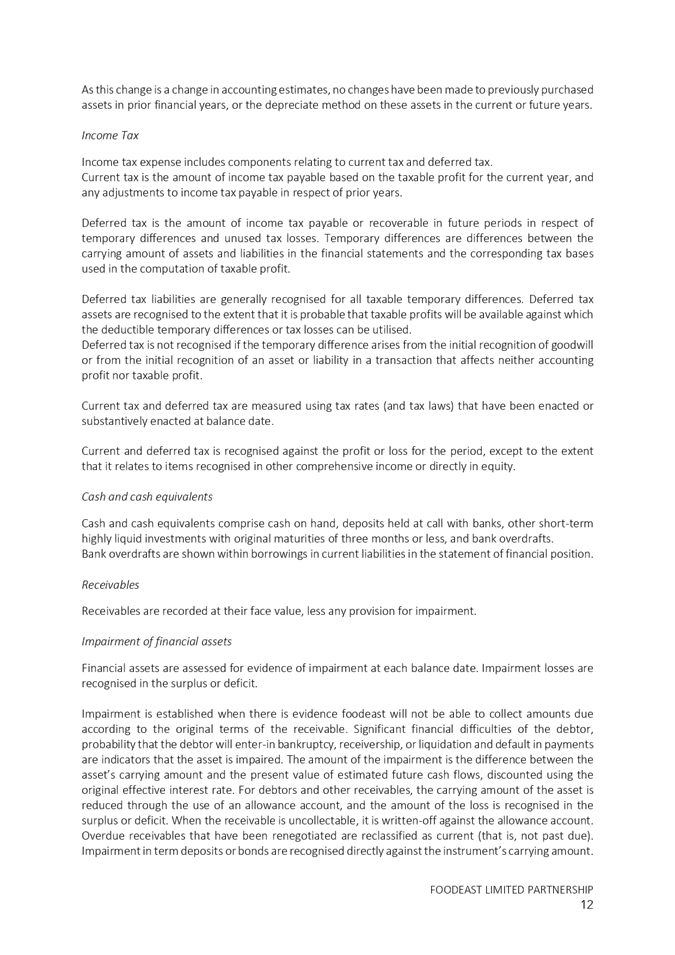

Table 1: Strategy Consultation and Implementation Timeframes

|

Timing

|

Critical Tasks + Decision Gateways

|

|

To

end of Feb 2022

|

- Pre-consultation

Mana whenua engagement, community workshops, community engagement

|

|

Decision Gateway 1: Memorandum of Transition

|

|

Oct

2021 – May 2022

|

- Memorandum of Transition

development and approval

- LTP Amendment preparation

Councillor workshops / consultation material preparation

|

|

Timing

|

Critical Tasks + Decision Gateways

|

|

Decision Gateway 2: Notification of LTP Amendment

|

|

May-June

2022

|

- Consultation

LTP Amendment notified as s.16 proposal (significant new activity for

HBRC)

|

|

July-August

2022

|

- Hearings / deliberations

/ decisions

|

|

Decision Gateway 3: Adoption of LTP Amendment & Strategy

|

|

August

2022

|

- Consenting process

commences for physical works (est. 2 years)

|

|

October

2022

|

- Local Body Elections

|

|

March

2024

|

- Triennial LTP review to

include funding for physical works

|

|

Decision Gateway 4: Adoption of LTP including funding provisions

|

|

July

2024

|

- Strategy implementation

rating commences

|

|

September

2024 (est.)

|

- Construction phase

commences

|

Decision Making Process

42. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

42.1. The decision does not

significantly alter the service provision or affect a strategic asset, nor is

it inconsistent with an existing policy or plan.

42.2. The use of the special

consultative procedure is proposed to occur in accordance with s.16 of the

Local Government Act, in order to give effect to the proposal as set out in the

MoT.

42.3. The decision to endorse the

MoT is not itself significant under the criteria contained in Council’s

adopted Significance and Engagement Policy.

42.4. The persons affected by

this decision are the ratepayers of the Napier and Hastings Districts, and they

will be provided with the opportunity to participate as part of the s.16

consultation process.

43. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by, or have an interest in, the decisions made, Council

can exercise its discretion and make a decision to endorse the MoT without

consulting directly with the community or others having an interest in the

decision. It is noted that this decision will lead to the development of a

proposal under s.16 of the Local Government Act that will be the subject of a

public consultation process.

Recommendations

1. That the Corporate and

Strategic Committee receives and notes the Clifton to Tangoio Coastal

Hazards Strategy - Memorandum of Transition staff report.

2. The Corporate and Strategic

Committee recommends that Hawke’s Bay Regional Council:

2.1. Agrees that the decisions

to be made are not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without conferring directly with

the community or persons likely to have an interest in the decision.

2.2. Endorses the Memorandum of

Transition as proposed.

2.3. Instructs the Chief

Executive to execute the Memorandum of Transition on behalf of the

Hawke’s Bay Regional Council following satisfaction of consultation

requirements under Clause 7 of the Hawke’s Bay Region’s Triennial

Agreement for the Triennium October 2019 – 2022.

2.4. Delegates to the Chief

Executive authority to approve changes to the Memorandum of Transition should

they be required by the Hastings District Council and Napier City Council in

consultation with the Hawke’s Bay Regional Council members of the Clifton

to Tangoio Coastal Hazards Strategy Joint Committee.

Authored by:

|

Simon Bendall

Coastal Hazards Strategy Project Manager

|

|

Approved by:

|

Chris Dolley

Group Manager Asset Management

|

|

Attachment/s

|

1⇩

|

Memorandum of Transition

|

|

|

|

2⇩

|

Report: HBRC Internal Review –

Coastal Hazards Strategy Implementation, 23 February 2022

|

|

|

|

Memorandum of Transition

|

Attachment

1

|

|

Report: HBRC Internal Review – Coastal Hazards Strategy

Implementation, 23 February 2022

|

Attachment

2

|

HAWKE’S

BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

16 March

2022

Subject: Order of Candidates Names on

Voting Documents

Reason for Report

1. This item seeks a decision

on the order of candidates’ names on voting documents for the next (2022)

local body elections.

Officers’

Recommendations

2. Staff recommend that the

Council chooses to list candidates names in random order on the 2022 local body

election voting documents. Staff consider that is the fairest order as it

removes name order bias and is increasingly adopted by councils in local body

elections.

Background

3. Regulation 31 of the Local

Electoral Regulations 2001 provides the opportunity for Council to choose the

order of candidate names appearing on the voting documents from three options -

alphabetical, pseudo-random (names drawn out of a hat with all voting documents

printed in this order) or random order (names randomly drawn by computer with

each voting document different).

4. Council has used

alphabetical order for all previous elections.

5. The decision on the order

of candidate names must be made in early 2022 to enable printing of voting

documents. If no decision is made, the order of names defaults to alphabetical.

Options

Alphabetical Order

6. Alphabetical order is

simply listing candidate names alphabetically and is the order traditionally

used in local authority and parliamentary elections.

Pseudo-random

Order

7. Under this arrangement, the

candidates’ names for each issue (election) are placed in a hat (or

similar receptacle), mixed together, and then drawn out of the receptacle, with

candidates’ names being placed for all voting documents for that

issue in the order they are drawn.

8. The regulations provide

that if a council has determined that pseudo-random order is to be used, the

Electoral Officer must state, in the public notice required to be given, the

date, time and place in which the order of the candidates’ names will be

arranged. Any person is then entitled to attend while the draw is in progress.

Random

Order

9. Under this arrangement, the

names of the candidates for each issue (election) are shown in a different

order on each and every voting document, utilising software which enables the

names of candidates to be printed in a different order on each paper.

Advantages and disadvantages of the

options

10. The advantage of

alphabetical order is that it is familiar and easier to understand for voters.

Where there is a large number of candidates competing for a position, it is

easier for a voter to find a candidate they wish to vote for if the names are

listed alphabetically.

11. It is also easier for a

voter if the order of names on the voting document follows the order of names

in the directory of candidate profile statements accompanying the voting

document.

12. Random order (both random

and pseudo-random) removes the potential for name order bias, but the

pseudo-random order of names simply substitutes a different order for an

alphabetical order. Any first-name bias will transfer to the name at the top of

the pseudo-random list. Therefore the only effective alternative to

alphabetical order is random order.

13. A disadvantage for both the

random options is voter confusion as it is not possible for the supporting

documents such as the candidate profile statement booklets to follow the order

of a random voting paper. Making voting more difficult carries the risk of

deterring the voter from taking part.

Research

on name order bias

14. Research on voting patterns

has indicated that candidates with a surname starting at the top end of the

alphabet may have a slight advantage over others with a lower alphabetical

ranking.

14.1. Delbert

A. Taebel showed that not only did candidates listed first enjoy a favourable advantage,

but that this advantage was greater in contests further down the ballot. This

advantage did not, however, hold when voters had high recognition of candidate

names. This suggests that presidential elections, where there is generally much

higher name recognition than in primary and off-year elections, are less likely

to be influenced by name-order effects. The flip side of this was that in this

study, low name recognition meant that voters were less likely to make any

choice at all for those unknown candidates. The Effect of Ballot Position on

Electoral Success Delbert A. Taebel American

Journal of Political Science Vol. 19, No. 3 (Aug., 1975), pp.

519-526 (8 pages) Published by: Midwest Political Science Association.

14.2. More

recently, Jonathan G. Koppell and Jennifer A. Steen studied an actual election in which the names were rotated on the ballots by

precincts. In 71 of 79 New York City Democratic Primary

contests, candidates received a greater proportion of votes when they were

listed first compared to any other position they were listed in. For 7 of the

71 contests where this was the case, the advantage of first position exceeded

the winner’s margin, “suggesting that the ballot position would

have determined the election’s outcomes if one candidate had held the top

spot in all precincts.” The Effects of Ballot Position on Election Outcomes The Journal of

Politics Vol. 66, No. 1 (Feb., 2004), pp. 267-281 (15 pages) Published by: The University of Chicago Press on behalf of the Southern Political Science Association.

14.3. A study by Nuri Kim, Jon

Krosnick and Daniel Casasanto found, in an experiment embedded in a

large (USA) national Internet survey, participants read about the issue

positions of two hypothetical candidates and voted for one of them in a

simulated election in which candidate name order was varied. The expected

effect of position appeared and was strongest (1) when participants had less

information about the candidates on which to base their choices, (2) when

participants felt more ambivalent about their choices, (3) among participants

with more limited cognitive skills, and (4) among participants who devoted less

effort to the candidate evaluation process. The name-order effect was greater

among left-handed people when the candidate names were arrayed horizontally,

but there was no difference between left- and right-handed people when the

names were arrayed vertically. These results reinforce some broad theoretical

accounts of the cognitive process that yield name-order effects in elections. Political

Psychology Vol. 36, No. 5 (OCTOBER 2015), pp. 525-542, published by International Society of Political

Psychology.

National

and local context

14.4. A Government response to

the Report of the Justice and Electoral Committee on its Inquiry into the

2013 local authority elections stopped short of recommending that the order

on all ballot papers in local authority elections be completely

randomised, but did encourage councils to consider adopting the randomisation

of names under the existing provision.

14.5. Random order for voting

papers has been increasingly adopted by local councils. For the 2019 elections

all of the region’s councils except Wairoa District and Hawke’s Bay

Regional councils resolved to use random order.

Financial

and Resource Implications

15. Technological developments

for the printing of voting papers is such that there is no difference in either

cost or quality for the printing of alphabetical or randomised voting papers.

Costs are provided for in existing budgets.

Decision Making Process

16. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

16.1. The decision is provided

for under Regulation

31 of the Local Electoral Regulations 2001

16.2. The persons affected by

this decision are candidates and voters in the local body elections.

16.3. Given the nature of the

issue to be considered and decided Council can exercise its discretion and make

the relevant decisions without consulting directly with the community or others having an interest

in the decision.

Recommendations

1. That the Corporate and

Strategic Committee receives and considers the Order of Candidates Names on

Voting Documents staff report.

2. The Corporate and Strategic

Committee recommends that Hawke’s Bay Regional Council:

2.1. Agrees that the decisions

to be made are not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without conferring directly with

the community or persons likely to have an interest in the decision.

2.2. Resolves that the names of

candidates at the 2022 Hawke’s Bay Regional Council elections and any

intervening by-elections be arranged in random order.

Authored

by:

|

Leeanne Hooper

Team Leader Governance

|

|

Approved by:

|

Desiree Cull

Strategy & Governance Manager

|

|

Attachment/s

There are no attachments for this

report.

HAWKE’S

BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

16 March

2022

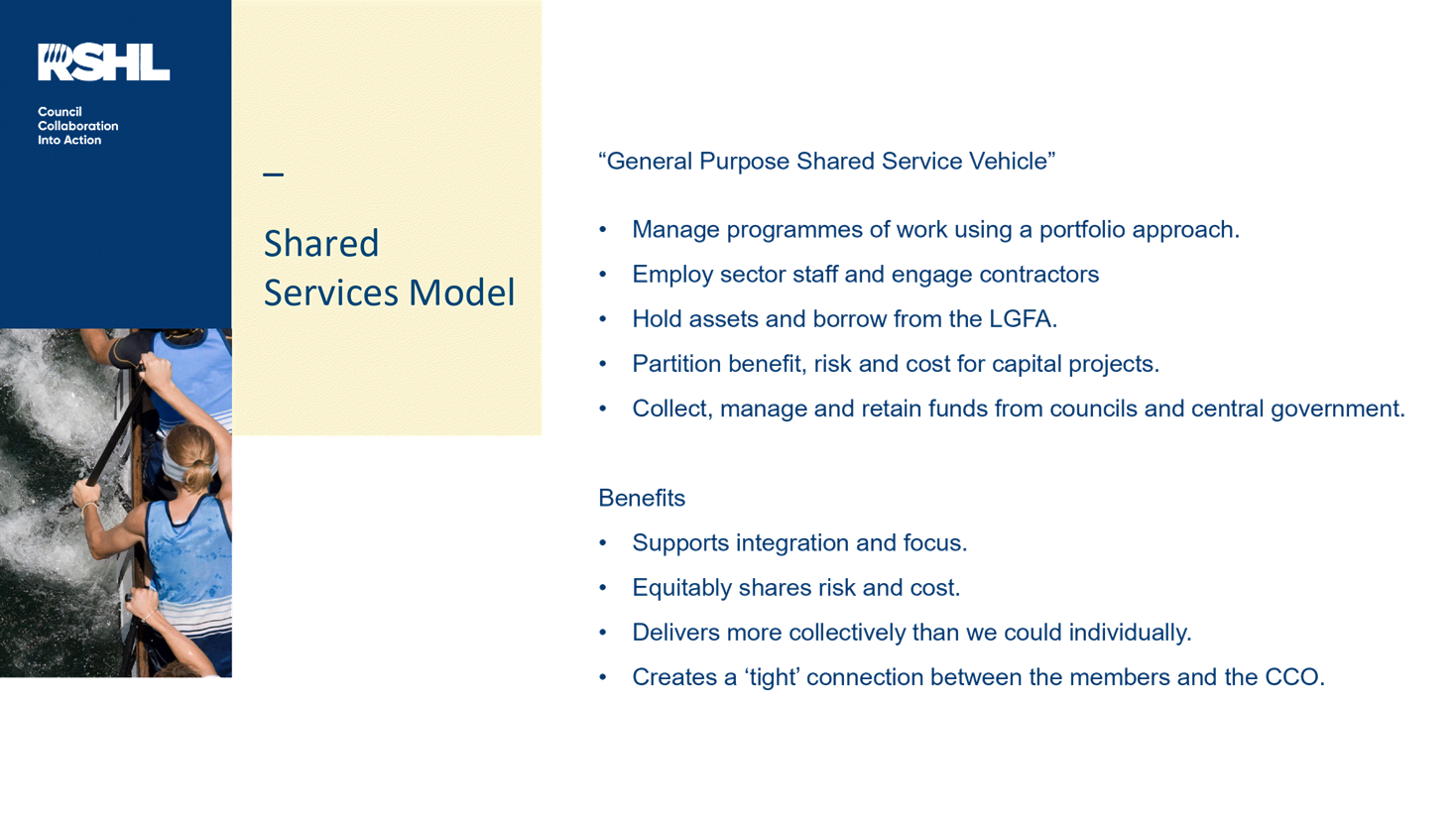

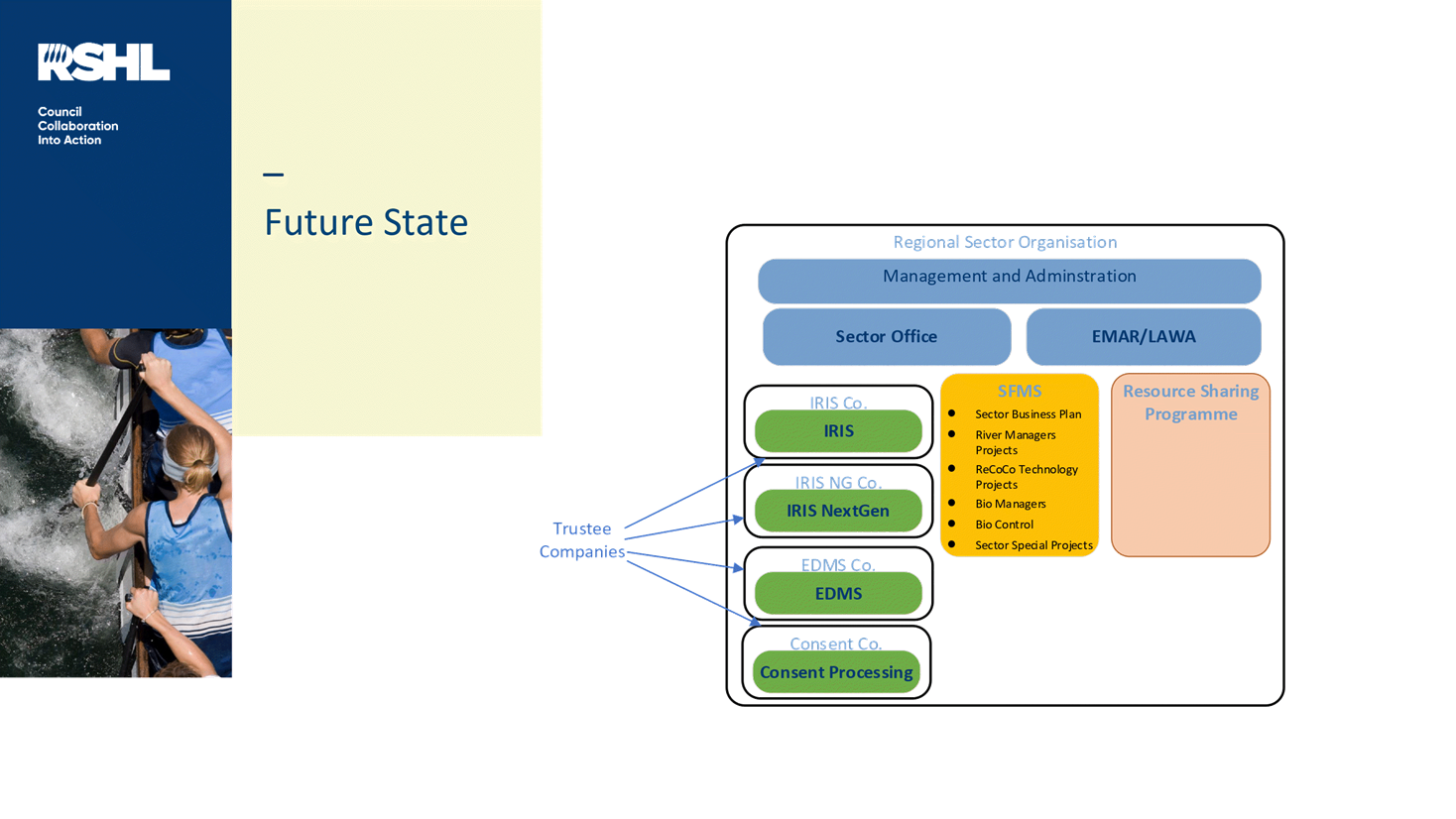

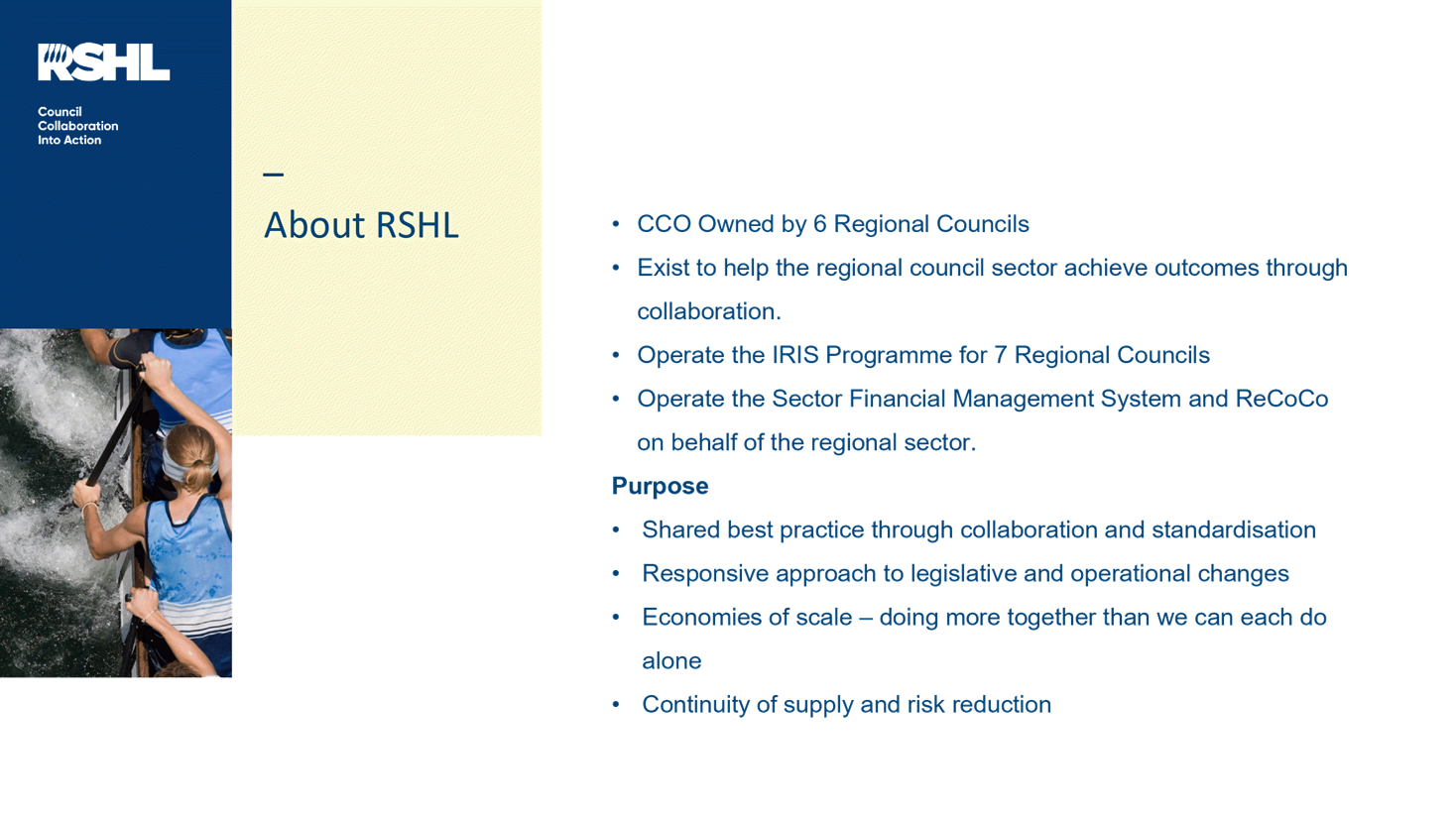

Subject: Proposal to Participate in

Regional Sector Council-Controlled Organisation

Reason for Report

1. This report asks the

Committee to recommend participation in a Regional Sector Shared Services Council

Controlled Organisation, subject to consultation.

2. The Council is required

under section 56 of the Local Government Act 2002 (LGA) to undertake

consultation before establishing or becoming a shareholder in a CCO. This

paper asks the Committee to recommend a streamlined consultation approach as

detailed below.

3. Mark Donnelly the General

Manager of RSHL (Regional Software Holdings Limited) will be in attendance via

Zoom to answer questions.

Background

4. The 16 Regional Councils

and Unitary Authorities in Aotearoa New Zealand work together on areas of

shared interest, but now wish to take this arrangement a step further through

the creation of a shared services company. This is in response to:

4.1. Increased demands from

Central Government to deliver a broad range of reform packages.

4.2. Capacity and capability

challenges and competition between councils to attract and retain talent.

4.3. Expectations from our

communities for councils to do more with less.

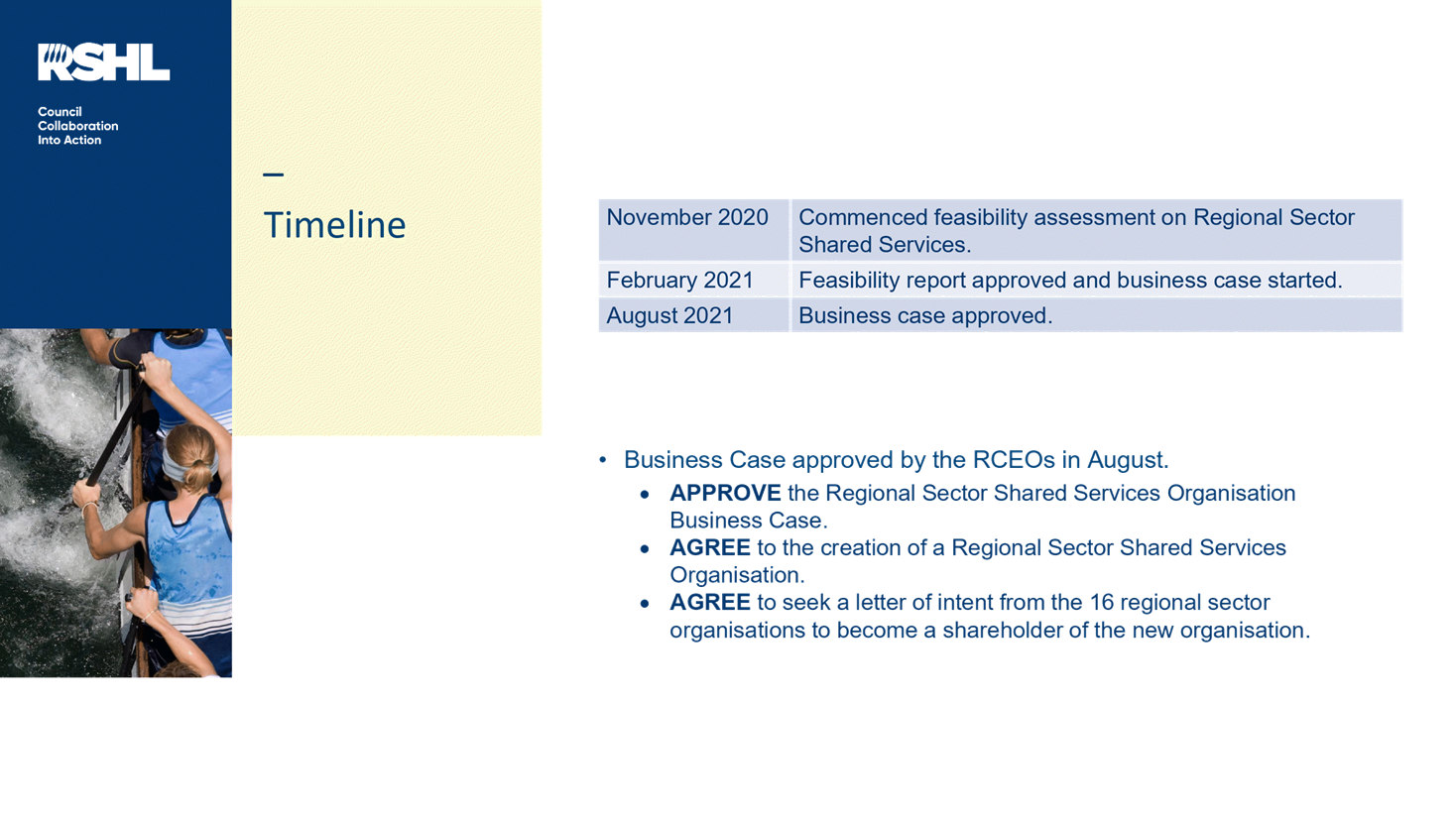

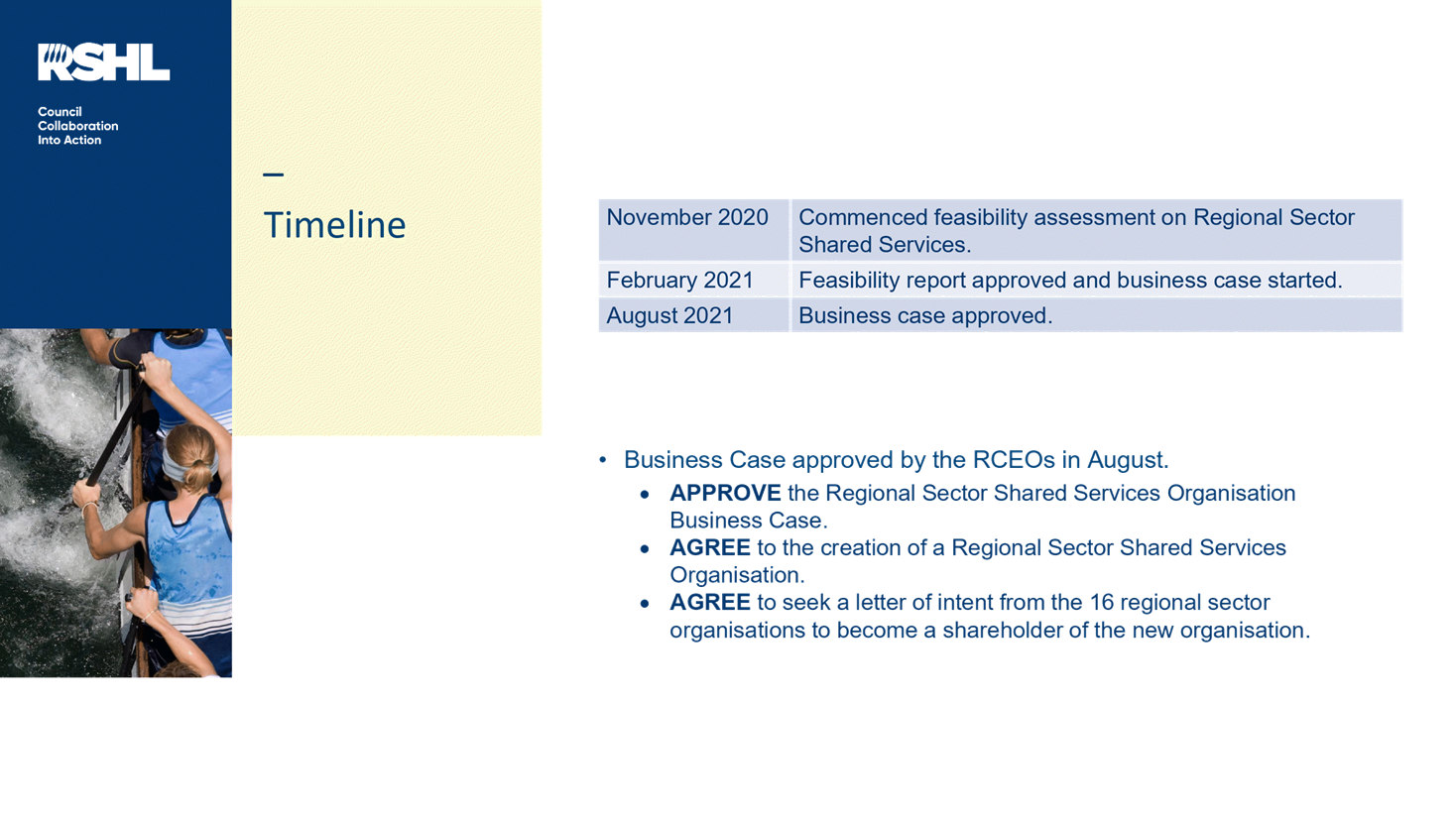

5. At the Regional Chief

Executives Group meeting on 3 August 2021, the business case for the creation

of a Regional Sector Shared Services Organisation was tabled for approval. The

creation of a Regional Sector Shared Services Organisation was considered as a

step forward for the sector, and an important foundational building block for

future collaboration and delivery of shared services and initiatives.

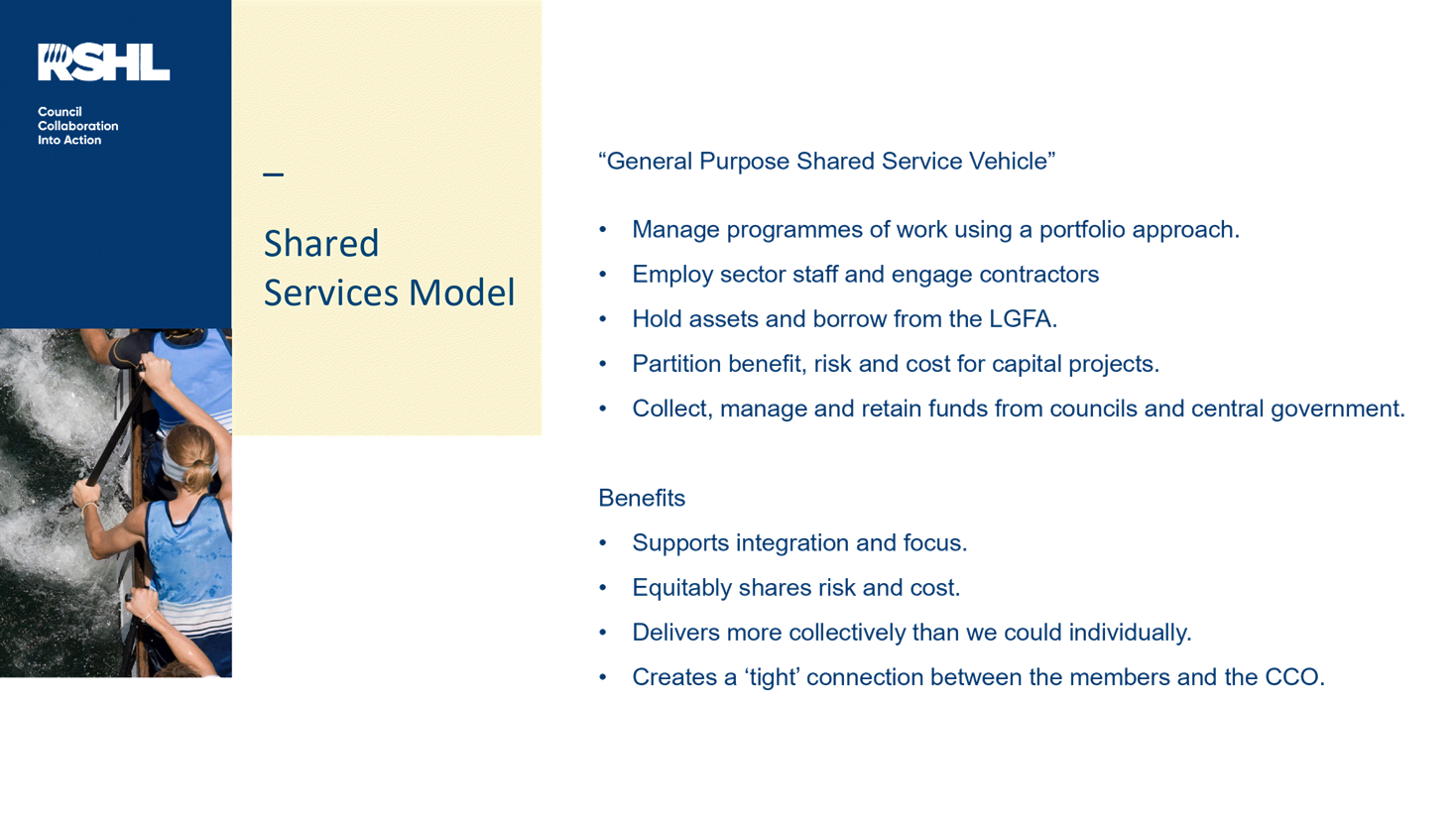

6. The business case

recommended the creation of an organisation that all regional councils and

unitary authorities will invest in, fairly sharing the benefits, costs, and

risks of the investment. This change will enable improved outcomes from

investment into national programmes of work. It will also improve access to

specialist and expensive resource, reducing costs and sharing risk.

Structure

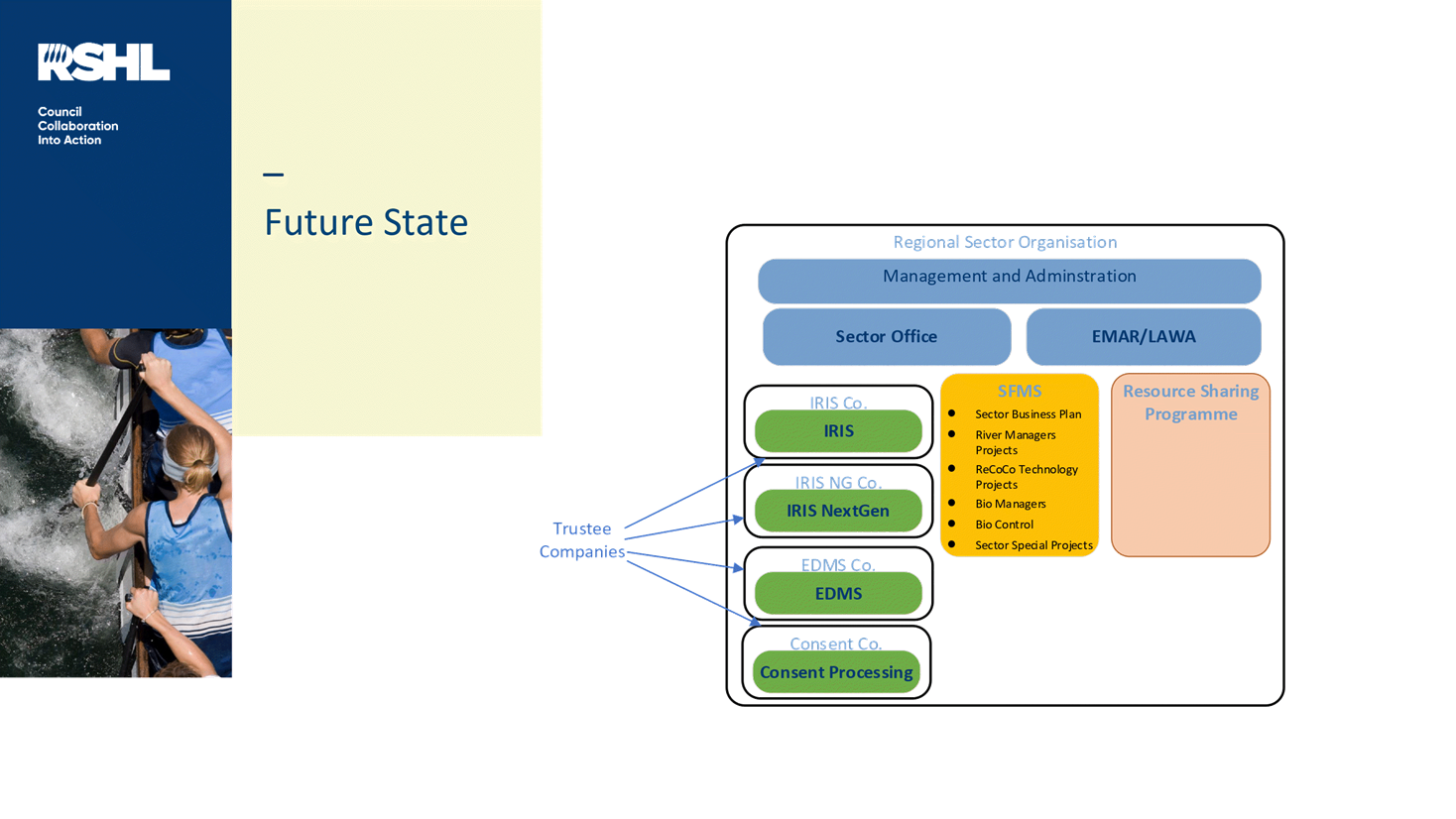

7. The company will be created

by restructuring RSHL (Regional Software Holdings Limited), a pre-existing

Council Controlled Organisation (CCO) created by six regional councils for this

purpose. The six existing shareholders do not need to consult.

8. A council-controlled

organisation can be a company, partnership, trust, arrangement for the sharing

of profits, union of interest, co-operation, joint venture or other similar

arrangement in which one or more local authorities, directly or indirectly,

controls the organisation.

9. It is intended that the

Regional Sector Shared Services organisation will be a company, with up to 16

shareholders, being the 16 regional councils and unitary authorities in New

Zealand.

10. The table below shows each

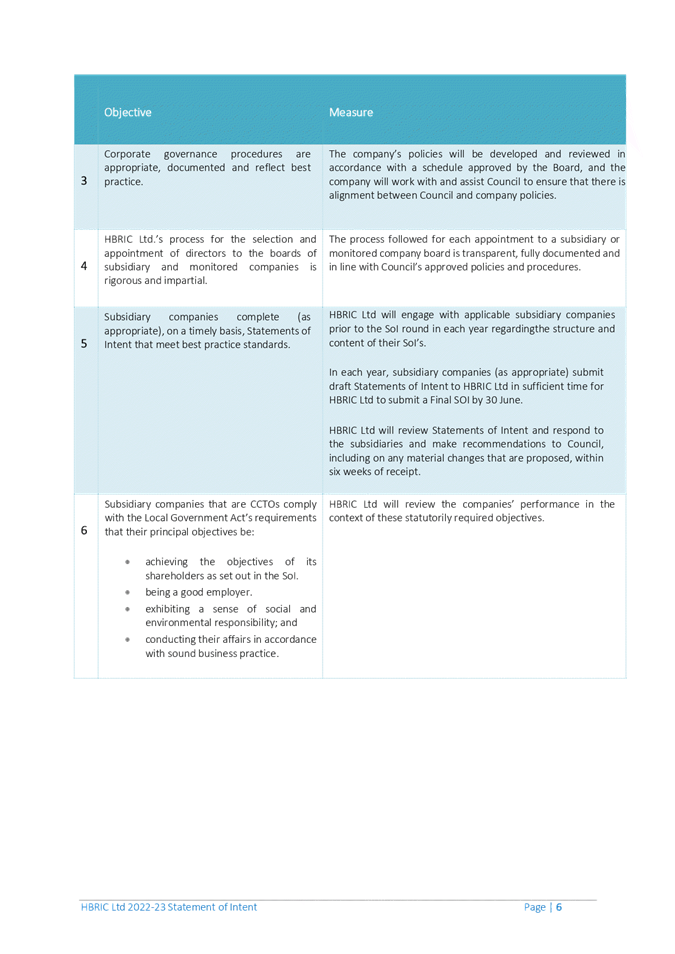

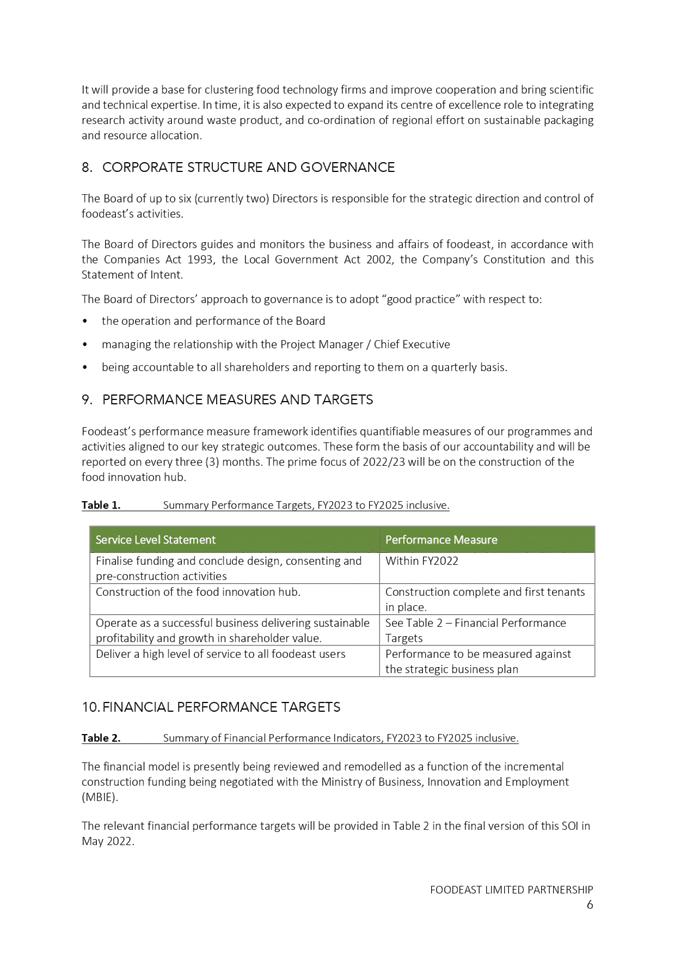

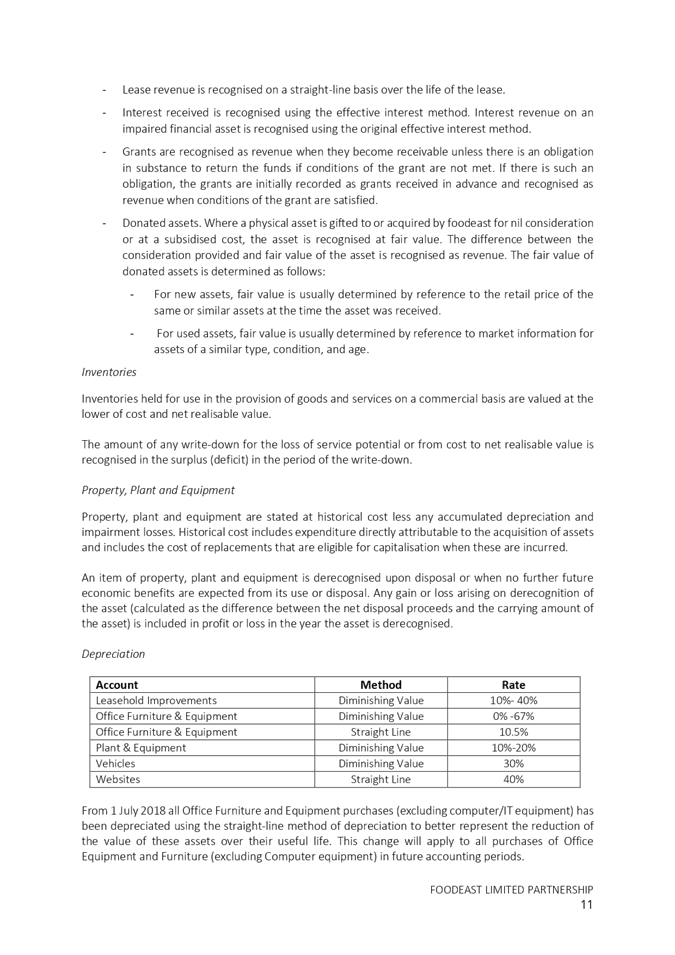

Council’s intention as at 28 January 2022.

|

Council

|

Intend

to join

|

|

Environment

Southland

|

Yes

(existing RSHL shareholder)

|

|

Horizons

Regional Council

|

Yes

(existing RSHL shareholder)

|

|

Northland

Regional Council

|

Yes

(existing RSHL shareholder)

|

|

Taranaki

Regional Council

|

Yes

(existing RSHL shareholder)

|

|

West

Coast Regional Council

|

Yes

(existing RSHL shareholder)

|

|

Waikato

Regional Council

|

Yes

(existing RSHL shareholder)

|

|

Otago

Regional Council

|

Yes

|

|

Bay

of Plenty Regional Council

|

Yes

|

|

Gisborne

District Council

|

Yes

|

|

Greater

Wellington Regional Council

|

Maybe

|

|

Environment

Canterbury

|

Maybe

|

|

Tasman

District Council

|

Maybe

in 2023

|

|

Marlborough

District Council

|

Talking

to Council

|

|

Nelson

City Council

|

Talking

to Council

|

|

Auckland

Council

|

No

|

11. Depending on the final

adopted structure of the council-controlled organisation, the Council may hold

shares or some other form of ownership. The Council will contribute to the

operating costs of the council-controlled organisation, these contributions

will replace existing contributions to national programmes, and will be at a

similar level.

12. The Council will maintain

its ownership of the CCO as long as it continues to operate and the Council

continues to utilise the services provided by the council-controlled

organisation.

Operation

13. Once established, the CCO

will prepare a statement of intent. This statement of intent will form the

basis of key performance targets and other measures by which the performance of

the company may be judged.

Nature

and scope of activities

14. RSHL will provide a

framework for collaboration between the shareholders and across the regional

sector. It will support the procurement or development of shared solutions in a

manner that provides greater consistency in how council operate their core

processes. RSHL will provide a more cost-effective alternative than individual

councils can achieve on their own.

15. The company will operate by

facilitating collaborative initiatives between councils and through managed

contractual arrangements.

16. The initial scope of

activities for the company is limited to pre-existing shared services

programmes.

17. A business case will be

developed for any additional service that is not part of the original company.

The business case will be approved by the shareholders prior to any new service

proceeding. The investigation of any new services will be fully funded by

councils that wish to promote that service.

Council policies and objectives

relating to CCOs

18. Council does not have any

significant policies or objectives about ownership and control of a company as

a vehicle for shared services. Council has a policy on the appointment and

remuneration of directors, which is currently under review and available on

request. The constitution of any company structure set up for this project will

have the principles according to which the company will be operated and

governed. This includes shareholders’ rights and the appointment of

directors. The annual statement of intent identifies the activities and

intentions of the company for the year and the objectives to which those

activities will contribute.

Performance targets

19. Performance targets relate

to the level of services that the company will achieve to deliver on its stated

outcomes. It is envisaged that these targets will change as new services are

developed.

19.1. Customers will be surveyed

annually to ensure that there is at least 75 per cent satisfaction with the services

provided.

19.2. Expenditure shall not

exceed that budgeted by more than 5 per cent unless prior approval is obtained

from the shareholders.

19.3. The organisation will

demonstrate material benefit to the regional sector and shareholders.

Benefits of joining

20. The CCO is intended to be

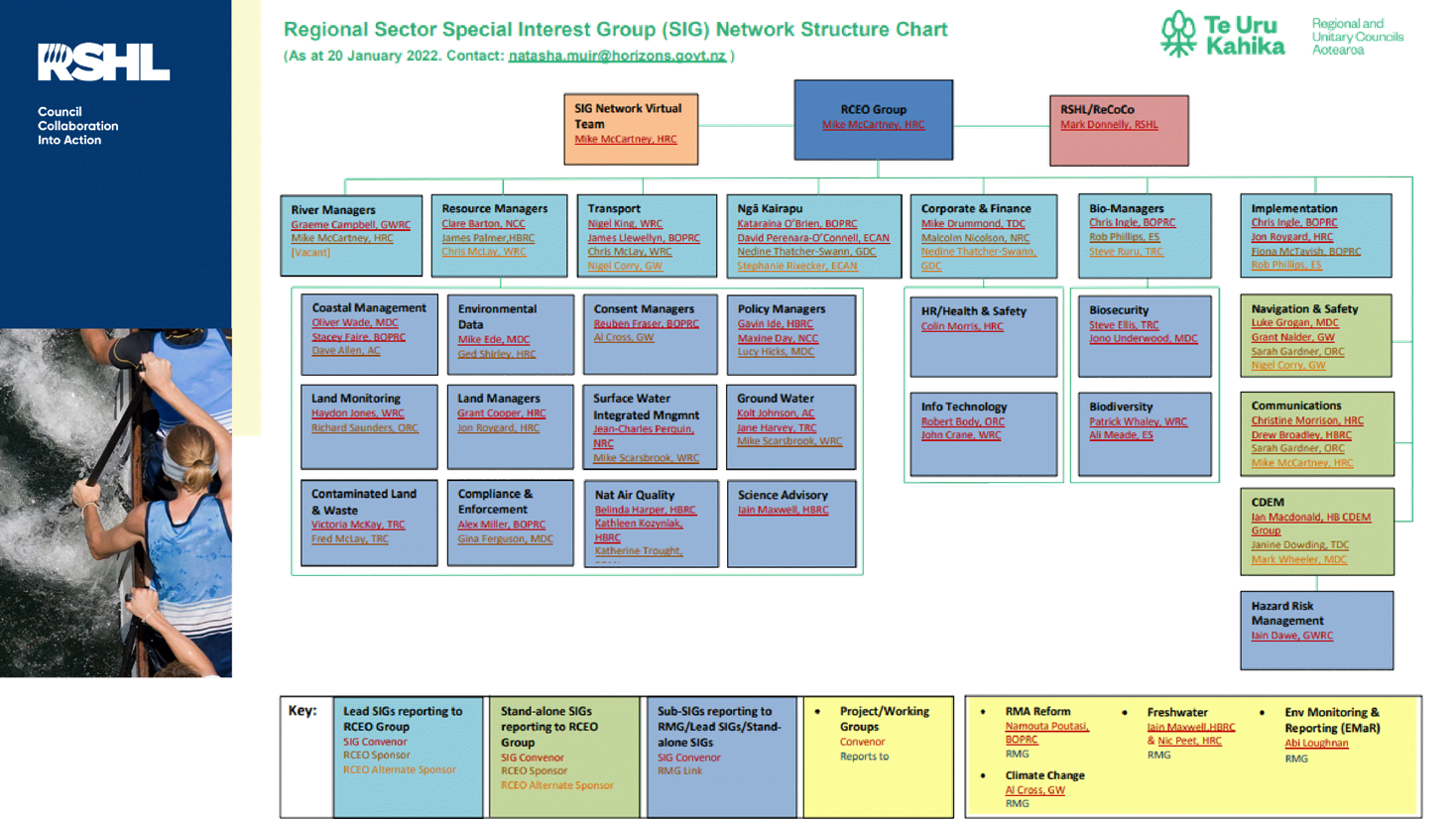

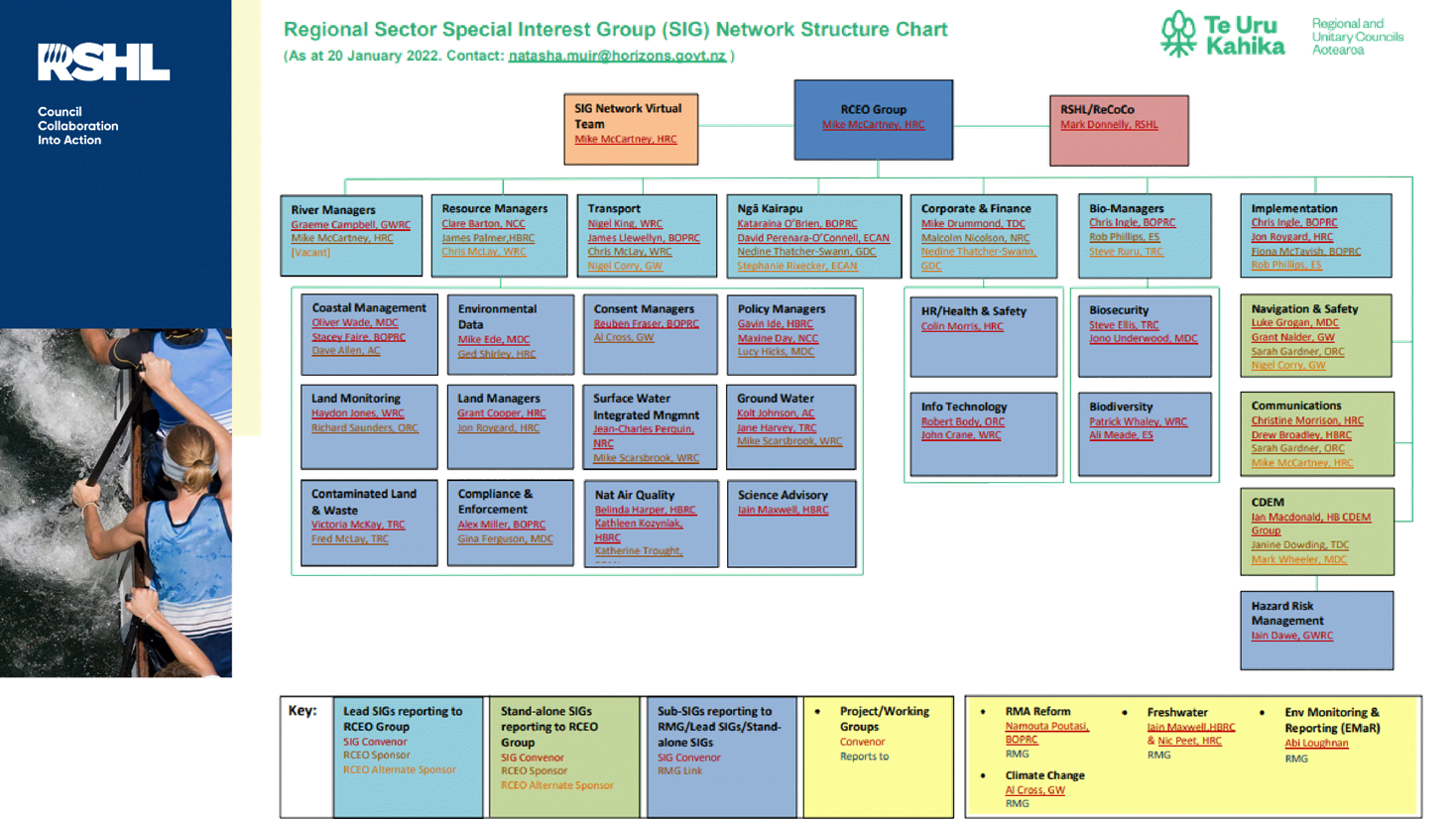

the delivery mechanism for the projects that are identified by the regional

sector special interest groups (SIGs) and prioritised by the regional sector

CEOs through the ReCoCo (Regional Council Collaboration) programme. RSHL is

well placed to deliver this:

20.1. RSHL is already responsible

for the management and delivery of sector programmes with an annual budget of

$2.5-$3m.

20.2. RSHL also has a good track

record of delivering technology projects, such as the original design and build

of the IRIS regulatory software.

21. Involvement in the CCO

won’t require any additional funding initially, the operating costs will

be covered by existing ReCoCo subscription fees that are paid by all regional

councils. Additional costs are incurred when each Council decides to

participate in and contribute funding towards a work programme.

22. Council has a long standing

relationship with RSHL, which has delivered benefits through access to:

22.1. cost-effective solutions

that are specifically designed for the unique functions of a regional council

22.2. a sector-wide body of

knowledge of Council business processes in the IT, regulatory, biodiversity and

land management functions of a regional council.

23. The CCO proposal is an appropriate

next step in the evolution of our long-standing relationship with RSHL.

Becoming a shareholder moves us from being a customer, into a more influential

role as a stakeholder. This role will enable us to actively contribute to the

design of processes and solutions that drive the sector alignment and

efficiencies that the shared services work programme is intended to deliver.

IRIS Next Generation Work Programme

24. The first CCO work

programme of significance to Council is the IRIS Next Generation programme.

This programme is intended to deliver sector alignment through consistent good

practice business processes that are embedded in modern extensible software.

The scope of the programme covers the regulatory, land management and

biodiversity functions of regional councils. All three of these functions are

on Council’s roadmap for system improvements and have been budgeted for

in the current LTP IT capital work programme.

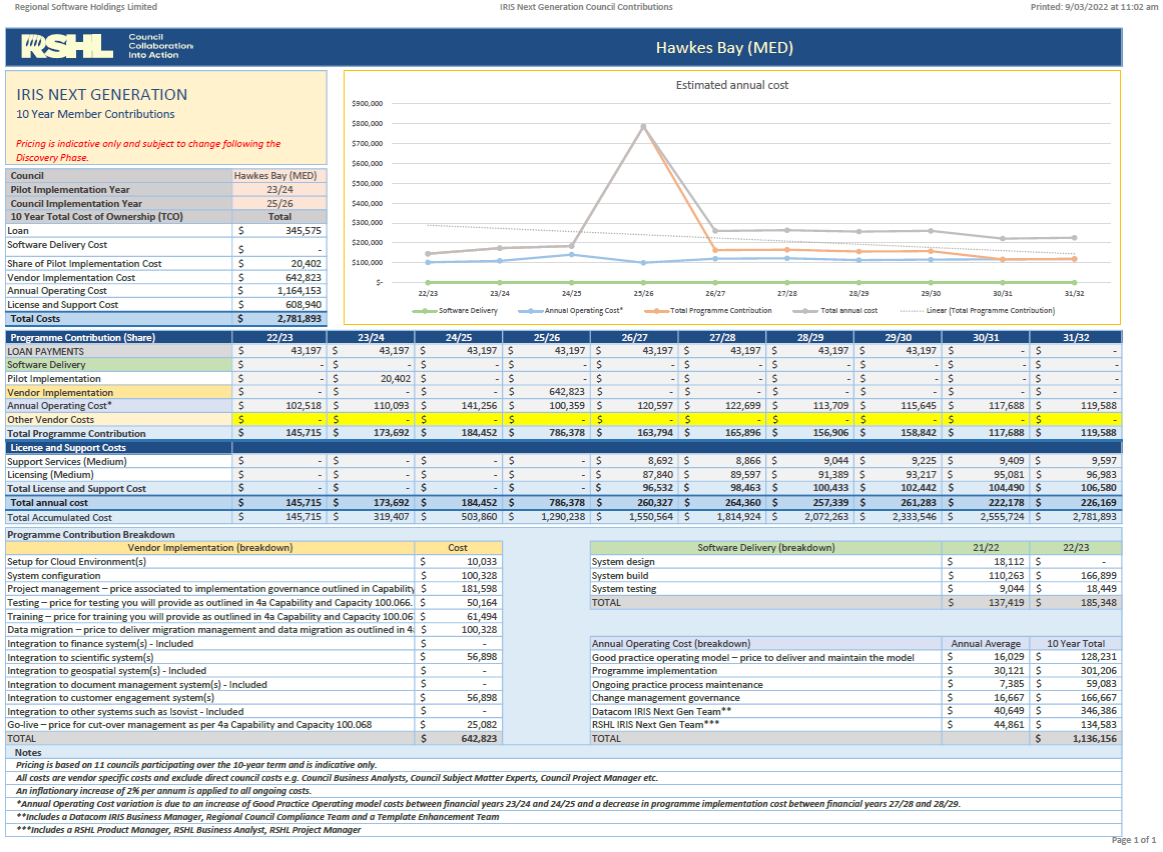

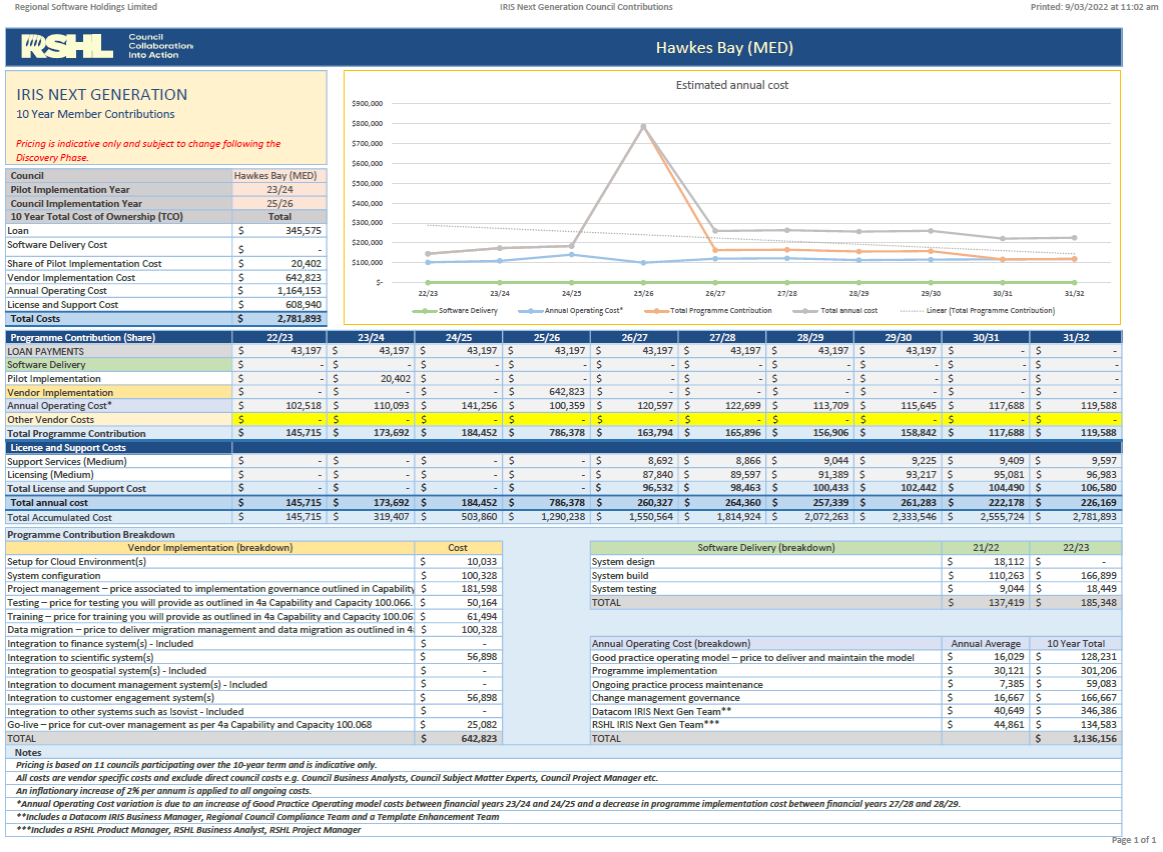

25. The ten year cost to HBRC

for participating in the IRIS Next Generation programme is $2.78m (details

attached). This is not the full cost of the implementation, but the cost

compares favourably when benchmarked against the external costs of our recent

system implementations. Partnering with RSHL for these implementations will

enable Council to leverage the collective capabilities of all councils, which

will help mitigate current project delivery risks that are driven by talent

shortages.

Consultation Process

26. As noted above, the Council

must consult prior to becoming a shareholder of a CCO. In accordance with

section 82 Principles of Consultation, the Council has discretion to decide the

form the consultation takes.

27. Staff consider that this is

a relatively procedural matter and therefore a streamlined consultation is

sufficient to comply with Local Government Act 2002 consultation requirements.

28. It is proposed that the

Council invites submissions and feedback over a period of two weeks in early

May to avoid Easter and the school holidays. Submissions will then be collated,

heard if required, and the final decision to join the CCO made in time for the

new financial year - from 1 July 2022.

29. Consultation channels will

include:

29.1. Hawke’s Bay Regional

Council’s website

29.2. Hawke’s Bay Today

29.3. Direct engagement with our

Territorial Authorities, and

29.4. Email to interested and

affected parties via the Council’s ‘Stakeholder Update’.

Next steps

30. If the Committee supports

participating in the new CCO, provisionally named ‘Regional Sector Shared

Services’, a Statement of Proposal (SOP) for consultation will be brought

to the 30 March Council meeting for adoption. A similar SOP is intended to

be used by all participating councils who are required to consult.

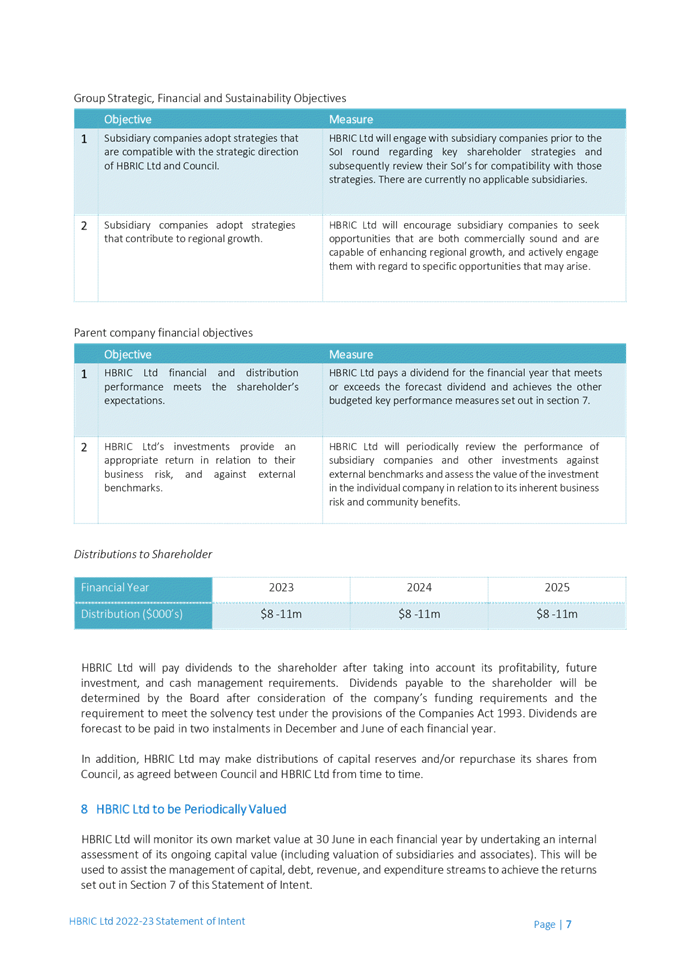

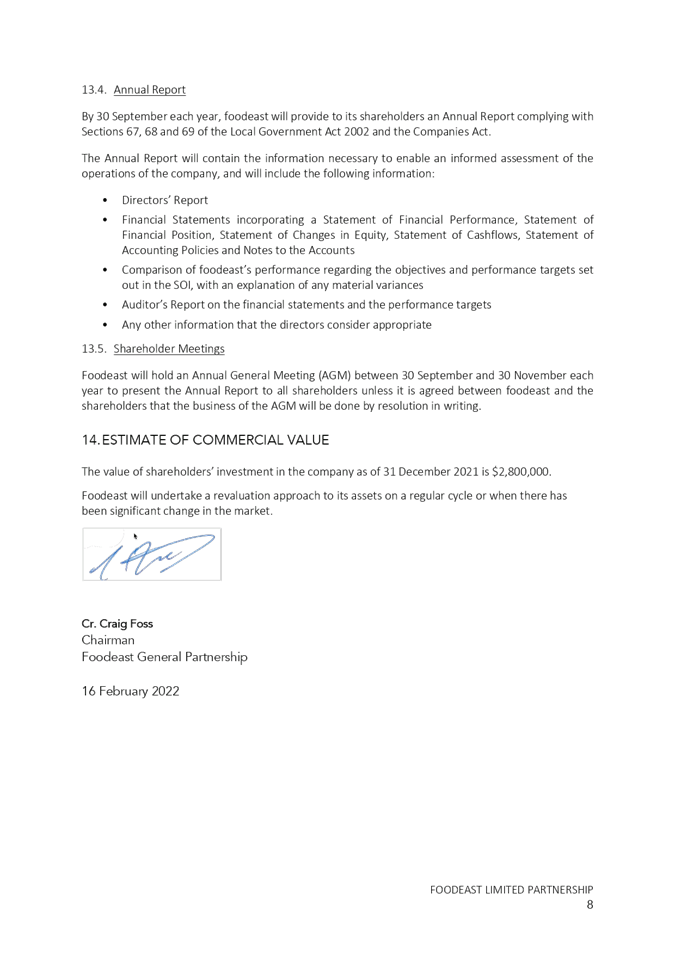

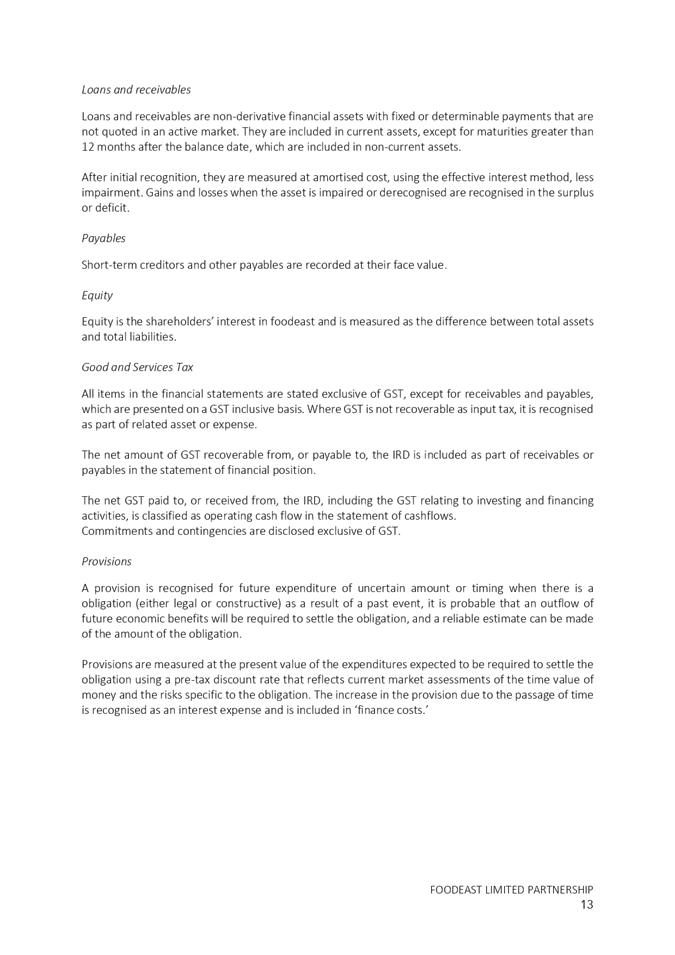

31. Key dates include:

|

16

March 2022

|

C&S

Committee decision to recommend to Regional Council

|

|

30

March 2022

|

Council

adopts Statement of Proposal for consultation

|

|

1

May 2022

|

Consultation

opens

|

|

15

May 2022

|

Consultation

closes

|

|

1

June 2022

|

Hearings

at C&S Committee meeting (if required)

|

|

29

June 2022

|

Council

decision

|

Decision Making Process

32. Council is required to make

every decision in accordance with the requirements of the Local Government Act

2002 (the LGA). Staff have assessed the requirements in relation to this item

and have concluded:

32.1. The decision does not

significantly alter the service provision or affect a strategic asset.

32.2. The use of the special

consultative procedure is not prescribed by legislation but consultation is

required under section 56 of the LGA.

32.3. The decision is not

inconsistent with an existing policy or plan.

|

Recommendations

1. That the Corporate and

Strategic Committee receives and notes the Proposal to Participate in

Regional Sector Council-Controlled Organisation staff report.

2. The Corporate and

Strategic Committee recommends that Hawke’s Bay Regional Council:

2.1. Agrees that the decisions

to be made are in accordance with section 56 and 82 of the Local Government Act.

2.2. Agrees to participate in

a Regional Sector Shared Services Council Controlled Organisation subject to

consultation.

2.3. Agrees to the

‘streamlined’ public consultation process proposed.

|

Authored by:

|

Andrew Siddles

Chief Information Officer

|

Desiree Cull

Strategy & Governance Manager

|

Approved by:

|

Jessica Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

Shared Services Briefing

|

|

|

|

2⇩

|

HBRC Proportion of Member

Contributions to Shared Services CCO

|

|

|

|

Shared Services Briefing

|

Attachment

1

|

|

HBRC Proportion of Member

Contributions to Shared Services CCO

|

Attachment 2

|

HAWKE’S

BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

16 March

2022

Subject: Updated HBRC Appointment and

Remuneration of Directors Policy

Reason for Report

1. This paper seeks committee

recommendations to Council for amendments to the Policy on the appointment and

remuneration of directors to the Council’s investment company, the

Hawke’s Bay Regional Investment Company (HBRIC), and its subsidiaries, in

order to support changes to the investment mandate of the company made in the

Investment Policy contained within the 2021-2031 Long Term Plan.

Officers’

Recommendations

2. Council officers recommend

a series of amendments to the Appointment and Remuneration of Directors Policy

to clarify the roles of councillors and independent appointees as directors of

HBRIC and its subsidiaries, and thereby ensure that Council’s more active

investment objectives are appropriately governed to support optimum investment

performance, while maintaining appropriate oversight and accountability by

Council.

Executive

Summary

3. The 2021-31 Long Term Plan

included a revised Investment Strategy enabling HBRIC, to grow its investment

portfolio by up to $100m over the next decade. It is therefore likely

HBRIC will expand the number of entities in which it has a shareholding

interest, necessitating decisions on governance representation.

4. HBRIC should continue to be

governed by a blend of commercial and council affiliated directors to support

integrated objectives setting and strategic alignment with Council, while

ensuring the perspectives and expertise of independent commercial directors

complement that of councillor directors. It is recommended that the Policy

states a preference for the Chair of HBRIC to be an independent director.

5. It is recommended that

board fees be payable to councillor directors of HBRIC only in the event they

are until that point remunerated at the base councillor salary rate, and that

remuneration for HBRIC director duties be equivalent to the difference between

the base councillor salary and that of a Council committee chair.

6. HBRIC acts as a holding

company for Council’s investment assets. To maintain separation between

active commercial investment activity and the role of councillors as community

representatives overseeing this activity, it is recommended that the Policy

state that councillors should not be eligible for appointment as directors to

subsidiaries of HBRIC.

7. Transitional arrangements

for Councillors serving on the

boards of two HBRIC subsidiaries, Napier Port and HBRIC CCO FoodEast are

recommended to manage the transition to the new arrangements to minimise

disruption to the relevant commercial entity.

8. It is recommended that the

Policy provide for the appointment of Council executives from time to time to

the board of a CCO to represent its interests in a apolitical manner, where

this provides for particular skills and expertise, or development opportunities

for executives.

9. Following the decisions of

the Corporate and Strategic Committee, council officers will prepare a revised

draft policy to be considered by Council alongside the recommendations of the

committee on 30 March 2022.

Background

/Discussion

10. An Appointment and

Remuneration of Directors Policy (the Policy) is a statutory requirement

regarding the appointment and remuneration of directors to all Council

organisations. Under section 57 of the Local Government Act 2002 (the LG Act),

the Council must adopt a policy that sets out an objective and transparent

process for:

10.1. the identification and

consideration of the skills, knowledge, and experience required of directors of

a council organisation (including consideration of whether knowledge of tikanga

Māori is relevant to

its governance);

and

10.2. the appointment of

directors to a council organisation; and

10.3. the remuneration of

directors of a council organisation.

11. The current policy on Appointment

and Remuneration of Directors was last reviewed and adopted on 22 February

2017, with specific matters related to Napier Port updated in 2019 as part of

the Initial Public Offering.

12. Historically Council was

required to only make appointments of directors to its sole Council Controlled

Trading Organisation HBRIC (which in turn made appointments to its sole

subsidiary Napier Port). Appointments to HBRIC have typically been a mix of

councillor and independent directors.

13. However, the 2021-31 Long

Term Plan (LTP) has enabled HBRIC to grow its investment portfolio and it is

therefore likely that HBRIC will expand the number of entities in which it has

shareholding interest (including the formation of Council Controlled Trading

Organisations, where shareholding interest exceeds or is equal to 50%)

necessitating decisions on governance representation.

14. Following the adoption of

the Investment Strategy in the 2021-31 LTP it was considered timely to review

the governance and remuneration structure for HBRIC and its subsidiaries,

including Council’s policy position around Councillor appointments to

external board / directorship positions and their remuneration.

15. Within the Investment

Strategy Council decided its commercial interests are generally best managed by

its investment company, HBRIC, unless there are good reasons, such as tax

treatment to manage such interests in an alternative manner.

16. Council officers presented

options for amending the Policy to Council workshops on 17 November 2021 and 23

February 2023. In preparation of advice for the workshops reference was made to

industry advice and Office of the Auditor-General (OAG) best practice where

applicable. The recommendations in this paper reflect the direction provided to

officers on amendments to the Policy arising from the workshops.

Options

Assessment

Councillor Directors

17. Council has, until now,

appointed councillors to the board of HBRIC to ensure the company pursues the

strategic investment objectives of Council and undertakes its activities in a

many that is in the best interests of Council and its ratepayers. It is

recommended that Council continues to appoint councillor directors to the board

of HBRIC and the Policy reflects this.

18. At the Council workshops

councillors expressed a preference for HBRIC to continue to be governed by a

blend of commercial and council affiliated directors to support integrated

objectives setting and strategic alignment with Council, while ensuring the

perspectives and expertise of independent commercial directors complement that

of councillor directors HBRIC. This reduces risks to Council by improving the

quality of governance and decision making at the HBRIC board table. Rather than

a balanced board, with equal numbers of councillor and independent directors,

councillors have expressed a preference for flexibility in the composition of

the board of HBRIC. Council officers recommend that the Policy requires a minimum

of two independent directors within an overall maximum of up to 8

directors overall for the board of HBRIC.

19. HBRIC acts as a holding

company for Council’s investment assets, active commercial activity is

undertaken via subsidiaries or funds management, and HBRIC not itself directly engaged in

commercial trading activity.

Councillors have expressed a preference that HBRIC not appoint councillor

directors to HBRIC subsidiaries and CCO’s in the future. This would

maintain separation between active commercial investment activity and the role

of councillors as community representatives overseeing this activity, and

thereby enable the governance of these active investments to be entirely

commercially focussed, with councillors remaining able to hold the investment

entities accountable for their performance without being conflicted. It is

therefore recommended that the Policy state that councillors should not be

eligible for appointment as directors to subsidiaries of HBRIC.

20. Council may make exceptions

to the Policy by formal resolution of Council and there may be special

circumstances in which the appointment of councillors to a HBRIC subsidiary is

deemed necessary or desirable. In the event that Council does suspend the

Policy to enable councillors to be considered for appointment by HBRIC to a subsidiary

company, by resolution in response to special circumstances, it is recommended

that the Policy state that the appointment is to be made by independent

directors of HBRIC. This will ensure councillors being appointed to commercial

entities attracting market-based fees are only appointed following an objective

and apolitical assessment of the suitability of their skills for the role.

21. For reasons of efficiency

and consistent with the purpose of HBRIC, Councillors have indicated that HBRIC

should be delegated the authority to appoint directors to its subsidiaries, in

consultation with Council, and it is recommended that the Policy reflect this.

Skills

22. To maximise the performance

of commercial CCOs, it is essential that CCOs have a skills-based board,

constituted of directors with the relevant industry experience and knowledge,

governance and commercial skills. It is therefore recommended the Policy state

that relevant skills are the most important criteria for all director

appointments

to HBRIC subsidiaries and CCOs.

Independence & Chair

23. Councillor tenure by the

nature of the triennial election process, presents continuity uncertainty that

can be disruptive to a CCO, particularly to a commercial entity. To mitigate

this uncertainty, it is recommended that the Policy states a preference for the

Chair of HBRIC to be an independent director.

24. In the event Council

resolves to appoint a Councillor director to the chair of HBRIC, including on

an interim basis, it is recommended that the Councillor be eligible for

remuneration at the same rate as the independent chair.

Diversity & Transparency

25. It is recommended that the

Policy explicitly states that Council values and supports the benefits that

diversity of thought, experience and skills brought to CCO boards. This

recognises that increasing diversity and fostering inclusive board culture is an

important element in supporting high performing boards, driving long-term

success and delivering better outcomes.

26. It is further recommended

that Council commits to supporting and initiatives that lead to an inclusive

recruitment and selection process for board appointments, which are open and

transparent, uphold Council’s commitments to Equal Employment

Opportunities, and achieve diversity and inclusion.

Councillor Remuneration

27. The OAG recommends as

standard practice that councillor directors receive directors' remuneration in

addition to their remuneration as councillors. A CCO director is responsible

for the governance of the CCO. The position, if discharged properly, involves

work, so remuneration is appropriate.

28. Board members’ fees

will typically compensate board members for their normal contribution to the

board, including attending board and Committee meetings, meeting preparation,

stakeholder management and any other agreed tasks. However, with publicly owned

entities the OAG advises that board members’ fees may reflect the element

of public service in serving on the board of a CCO and be set at or below the

average for comparable private sector entities.

29. In the case of HBRIC,

councillor directors have not received board members’ fees to date, on

the premise that participation in this board has been an extension of the role

of councillors, with HBRIC operating as a supervisory arm of Council. This has

been deemed appropriate with HBRIC acting as a holding company for the Council’s

portfolio of investments, that is not itself directly engaged in commercial

trading activity. However, board duties for HBRIC directors still involve a

regular attendance at board meetings, a substantial volume of board papers and

periodic decision making which can be expected to increase with the more active

investment mandate for HBRIC.

30. At present all HBRIC

councillor directors hold other Council committee chair responsibilities that

attract a higher level of remuneration than the base salary of councillors, as

determined by the Remuneration Authority. Councillors have indicated that they

believe this higher level of remuneration compensates for additional duties,

including directors’ duties on the board of HBRIC. It is therefore

recommended that board fees be payable to councillor directors only in the

event they are until that point remunerated at the base councillor salary rate,

and that remuneration for HBRIC director duties be equivalent to the difference

between the base councillor salary and that of a Council committee chair.

Council Executive Director

Appointments

31. Council may from time to

time wish to appoint a Council executive to the board of a CCO to represent its

interests in a non-political manner, where this provides for particular skills

and expertise, or development opportunities for executives. Council chief

executives are routinely appointed to CCOs around New Zealand to represent

Council interests in a non-political and electorally stable manner. For

example, the Chief Executive of the Bay of Plenty Regional Council is a

director of Quayside Holdings Ltd.

32. It is recommended that the

Policy provide for the appointment of executive directors to HBRIC subsidiaries

and CCOs, and that any directors’ fees such an appointment may attract

should be paid by the subsidiary or CCO to the parent company, unless otherwise

agreed as part of a modified remuneration package for the executive that

reflects adjusted responsibilities and accountabilities.

Transitional arrangements

33. Council is presently

represented by councillors on the boards of two HBRIC subsidiaries, Napier Port

and HBRIC CCO FoodEast, which reflects historic circumstances related to the

Initial Public Offering of shares in Napier Port and the establishment of the FoodEast

entity in partnership with the Crown, Hastings District Council and Progressive

Meats.

34. In light it is recommended

that the councillor director on the Port of Napier board serves the remainder

of this term to the Annual General Meeting of Napier Port in December 2022 to

enable an orderly transition to a new non-councillor director. With respect to

FoodEast, it is recommended that the councillor director continue their board

role until completion of the establishment stage and a decision is made to

commence construction of the FoodEast facility.

35. Both councillor directors

of these CCTOs have undertaken significant work in addition to their councillor

duties, as well as taking on significant commercial and legal responsibilities,

in their HBRIC subsidiary board roles. It is therefore recommended that they be

eligible for payment of full board fees as determined by their respective

boards for work undertaken to date and for the remainder of their terms.

Port of Napier

36. Prior to the Initial Public

Offering (IPO) of shares in Napier Port directors of the company were appointed

by HBRIC, in consultation with Council. As part of the IPO process

Council resolved to maintain board representation of the strategic interests of

the region and regional ratepayer as the majority shareholder. Council resolved

to nominate two directors for appointment by the shareholder of the company at

the applicable Annual General Meeting.

37. To ensure Council

visibility of the board’s decision making and governance of the Port

through the transition to a public company Council nominated a Councillor and a

council affiliated commercial director in 2019.

38. It is recommended that the

Policy be amended to state that Council will nominate two directors to the

board of Napier Port for as long as a majority shareholding is held by Council

via HBRIC.

Strategic Fit

39. Leveraging the

Council’s balance sheet and taking a more active approach to

Council’s investment activity is an important element of the

Council’s overall financial strategy to fund more activity to achieve

greater impact in the Council’s strategic outcome areas. This paper

supports these objectives.

Significance

and Engagement Policy Assessment

40. Council officers have

assessed the significance of the decisions in this report as being low and

therefore not requiring community engagement.

Climate

Change Considerations

41. There are no specific

climate change considerations related to the policy proposed for amendment in

this paper. However, the Council has specific climate change related objectives

within its investment strategy and the maintenance of councillor director

influence on the board of HBRIC assists in ensuring the Council’s

strategic objectives in this regard are achieved.

Considerations

of Tangata Whenua

42. There are no direct

considerations for tangata whenua arising from this paper. The recommended

inclusions in the Policy, with respect to diversity and transparency, are

intended to create opportunities for Te Ao Maori perspectives to be brought to

the governance of HBRIC and its subsidiaries.

Financial

and Resource Implications

43. There are no direct

financial implications arising from this report. Director remuneration is

provided via revenue generated from the investment activity that is governed by

the directors. A high standard of governance arrangements assists in managing

risks to the Council’s investment portfolio and protecting asset values

and revenues.

Consultation

44. Consultation is not

required for the decisions in this paper as they relate to administrative

arrangements to facilitate the more substantive matter of Council’s

investment strategy that was consulted upon as part of the 2021-2031 Long Term

Plan.

Decision Making Process

45. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

45.1. The decision does not

significantly alter the service provision or affect a strategic asset, nor is

it inconsistent with an existing policy or plan.

45.2. The use of the special

consultative procedure is not prescribed by legislation.

45.3. The decision is not

significant under the criteria contained in Council’s adopted

Significance and Engagement Policy.

45.4. The persons affected by

this decision are all ratepayers and residents as beneficiaries of the

Council’s investment portfolio.

45.5. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by, or have an interest in the decisions made, Council

can exercise its discretion and make a decision without consulting directly

with the community or others

having an interest in the decision.

Recommendations

1. That the Corporate and

Strategic Committee:

1.1. receives and considers the Updated HBRC Appointment and Remuneration of Directors

Policy staff report.

1.2. Agrees the Appointment and

Remuneration of Directors Policy be amended to reflect the following

preferences.

1.2.1. HBRIC should continue to be

governed by a blend of commercial and councillor directors to support

integrated objectives setting and strategic alignment between Council and

HBRIC, while incorporating independent perspectives and commercial skills, with

a minimum of two independent directors within an overall maximum of eight

directors.

1.2.2. Councillor directors are to

be paid for their director duties on the board of HBRIC only if they are not

already remunerated for higher duties as Council committee chairs or Council

Chair or Deputy, and in such event are to be paid the difference between a base

councillor salary and that of a Council committee chair.

1.2.3. In the event a Councillor

director is appointed Chair of HBRIC, remuneration should be equivalent to that

which would be paid to an Independent Chair.

1.2.4. HBRIC’s commercial

subsidiaries should be run for commercial objectives by independent directors only,

in order to maintain separation between active commercial investment activity

and the role of councillors as community representatives overseeing this

activity via HBRIC and Council, enabling councillors to hold the investment

entities accountable for their performance without being conflicted.

1.2.5. In the event that Council,

by resolution, suspends the Policy in respect of 1.2.4 above and enables

councillors to be considered for appointment by HBRIC to a subsidiary company

in response to special circumstances, the appointment is to be made by

independent directors of HBRIC to ensure councillors being appointed to

commercial entities attracting market-based fees are only appointed following

an objective and apolitical assessment of the suitability of their skills for

the role.

1.2.6. Commercial subsidiaries and

CCOs must have skills-based boards, constituted of directors with the relevant

industry experience and knowledge, governance and commercial skills.

1.2.7. All boards of entities for

which HBRIC holds significant shareholdings are required to consider how they

support diversity and inclusion, with open and transparent appointment processes.

1.2.8. HBRIC is delegated the

authority to appoint directors to its subsidiaries in consultation with Council.

1.2.9. The Chair of HBRIC should

be an Independent Director.

1.2.10. Board fees should be paid

for all non-councillor Director positions, and that Council supports payment of

market-based fees.

1.2.11. Existing councillor

directors on HBRIC subsidiaries should stand down from their roles in a managed

transition that minimises disruption to the commercial interests of their

entities, and Council with board fees paid for all work to that point.

1.2.12. In consultation with

Council, HBRIC may appoint executive directors to HBRIC subsidiaries with

directors’ fees paid by the subsidiary or CCO to the parent company,

unless otherwise agreed as part of a modified remuneration package for the

executive that reflects adjusted responsibilities and accountabilities.

1.2.13. Council will nominate two

directors for the board of Napier Port for as long as a majority shareholding

is held by Council via HBRIC.

1.3. Instructs Council officers

to provide a revised Appointment

and Remuneration of Directors Policy to the Council meeting on 30 March 2022

that incorporates the amendments resolved in 1.2.1 through 1.2.13 above.

2. The Corporate and Strategic

Committee recommends that Hawke’s Bay Regional Council:

2.1. Agrees that the decisions

to be made are not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without conferring directly with

the community or persons likely to have an interest in the decision.

2.2. Adopts the Appointment and

Remuneration of Directors Policy as amended to incorporate the Corporate and

Strategic Committee’s preferences resolved by resolutions 1.2.1 through

1.2.13 above.

Authored by:

|

Desiree Cull

Strategy & Governance Manager

|

Kishan Premadasa

Management Accountant

|

Approved by:

|

Jessica Ellerm

Group Manager Corporate Services

|

James Palmer

Chief Executive

|

Attachment/s

There are no attachments for this

report.

HAWKE’S

BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

16 March

2022

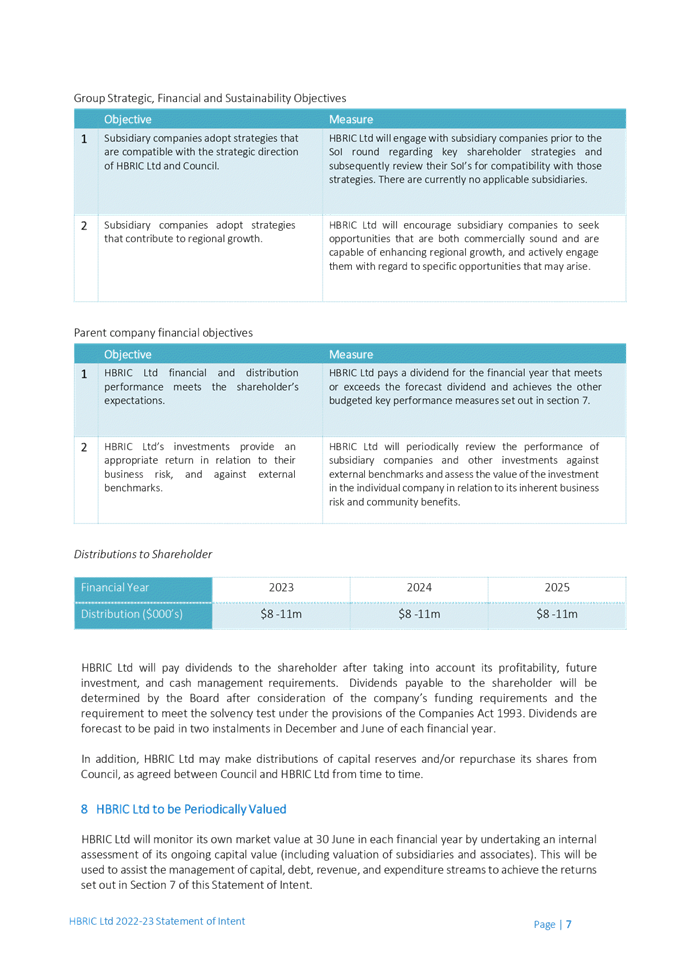

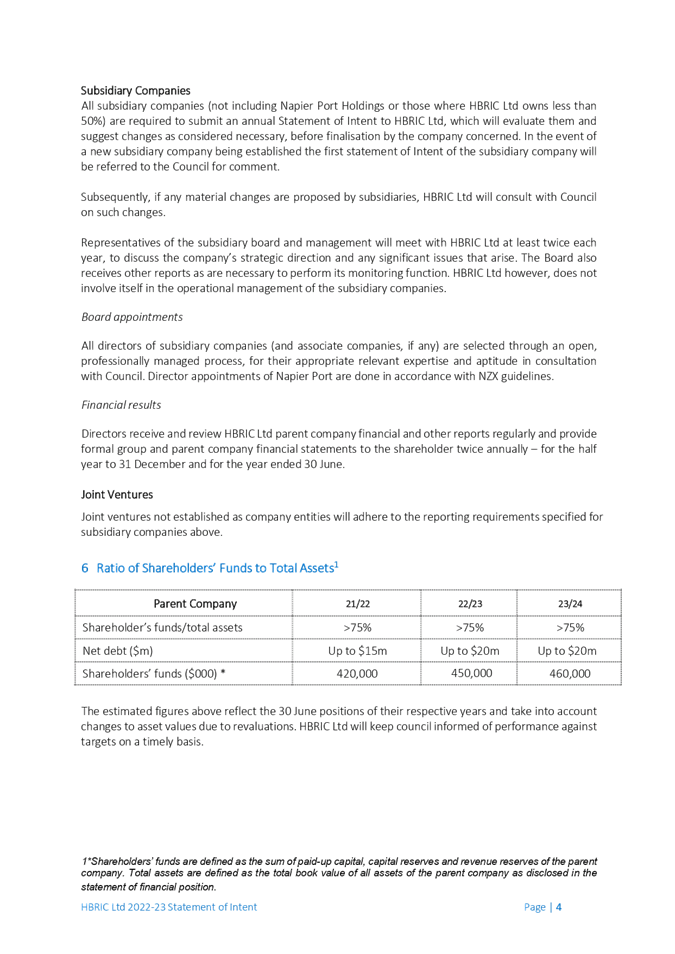

Subject: HBRIC and Foodeast Draft

Statements of Intent

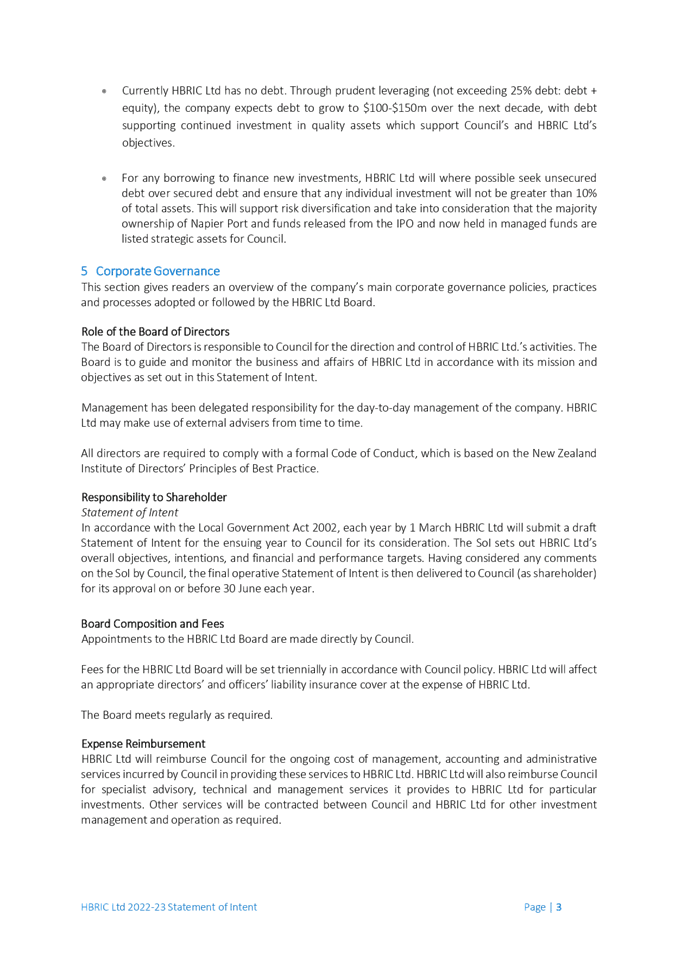

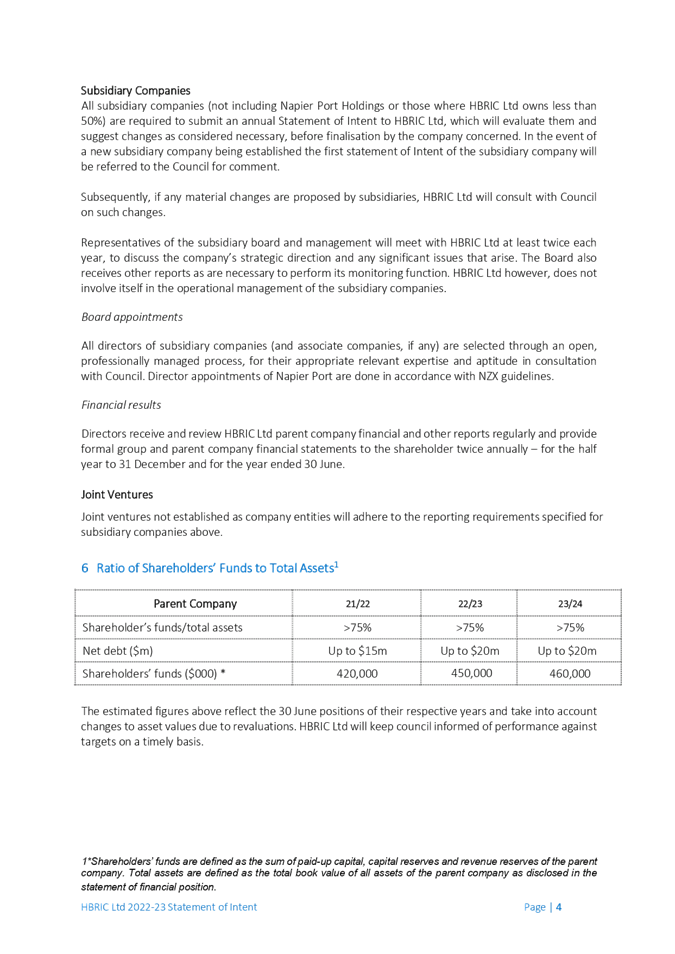

Reason for Report

1. This item presents the

draft Statement of Intent for Hawke’s Bay Regional Investment Company

(HBRIC) and Foodeast Limited Partnership (Foodeast) for the Committee’s

feedback.

Background

/Discussion

2. To meet Local Government

Act 2002 (LGA) legislative timeframes, HBRIC and Foodeast are required to

submit their Draft Statement of Intent (SoI) to Council (as shareholder and

local authority with indirect control). The Draft SoIs, which outline the

CCO’s role, strategic direction and objectives for the year ahead, were

approved by the respective Boards in February (Attachments 1 & 2).

3. The Committee is asked to

provide feedback to HBRIC and Foodeast on amendments to be considered for

incorporation into the final Statement of Intent.

4. In accordance with the LGA,

HBRIC and Foodeast are required to consider any comments received from Council

prior to submitting the final SoI for Council’s approval by 30 June each

year.

HBRIC

SoI

5. There have been no

significant changes to the SoI from the 2021-2022 year.

6. The HBRIC Board recently

approved the company’s investment framework and strategy and will present

this to Council in the near future.

7. The Board is focused on

growing and diversifying investment returns in the coming years.

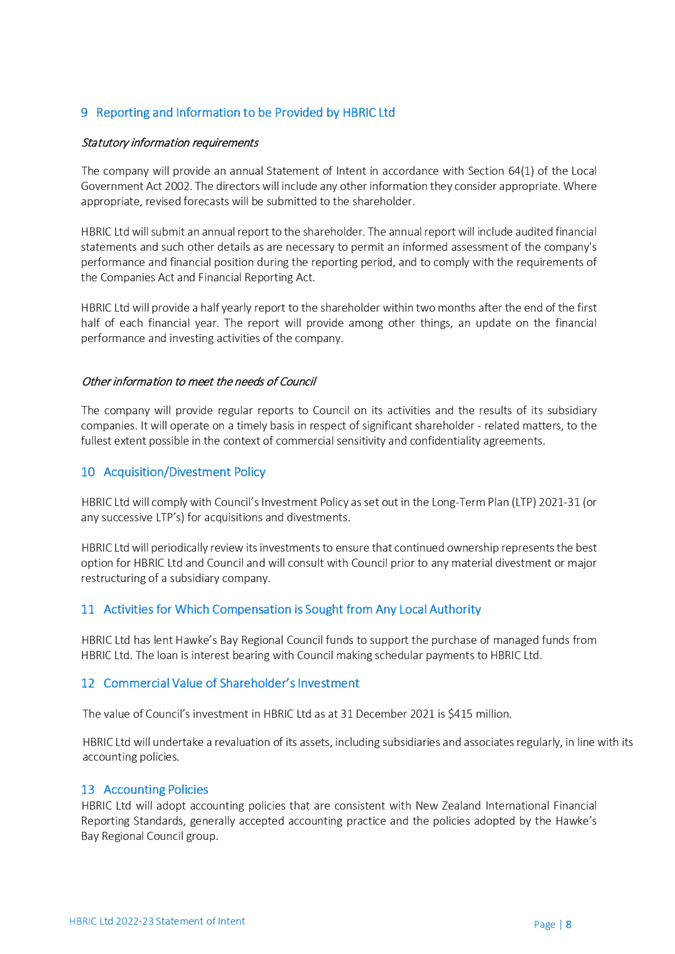

8. Distributions to

Shareholder have been presented as a range ($8-11m). The HBRIC Board is

confident of delivering dividends within these target ranges, noting that

dividend payments to Council are dependent on future market and trading

conditions that Napier Port Holdings Ltd may encounter.

9. Council’s Annual Plan

dividend expectation from HBRIC for the FY2022-23 year is $10.5m which is

within the SoI range, albeit the upper end.

10. HBRIC’s Chairman will

be present to answer questions.

Foodeast

SoI

11. Following a review of the

Foodeast SoI, the Directors of HBRIC intend to provide the below feedback to

Foodeast. It is recommended that the Committee provides any additional feedback

on the Foodeast SoI to HBRIC, so that it can be included with HBRIC’s

feedback to Foodeast.

11.1. Page 5, section 4, Vision:

recommend adding “to create 500+ jobs and add over $100m to the Gross

Domestic Product (GDP) for the Hawke’s Bay region”

11.2. Page 5, section 6, Purpose:

recommend shortening the purpose to be “To construct and operate a food

innovation hub, whilst making a commercial return consistent with the

requirements of its shareholders and as outlined in Foodeast’s Limited

Partnership Agreement”

11.3. Page 6-7, Financial

Performance Targets: recommend adding a target to generate commercial returns

equalling a minimum of 6% per annum (capital gains and income) over time, consistent

with the requirements of the majority shareholder Hawke’s Bay Regional

Investment Company

11.4. We note the project is

working through the impact of cost inflation associated with the construction

sector, which has delayed the development. Please provide an update on the

status of construction planning and any impact on shareholders associated with

the development as part of the final SOI.

Decision Making Process

12. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

12.1. The Statements of Intent

for HBRIC Ltd and Foodeast are required to be prepared under section 64 of the

Local Government Act 2002. This is a statutory requirement and is not subject

to consultation under the provisions of the Act.

12.2. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by, or have an interest in the decisions made, Council

can exercise its discretion and make a decision without consulting directly

with the community or others

having an interest in the decision.

Recommendations

1. That the Corporate and

Strategic Committee receives and considers the HBRIC and Foodeast Draft

Statements of Intent staff report, with agreed feedback to the HBRIC Board of Directors

for potential incorporation into the final 2022-2023 Statement of Intent.

If

required

2. Agreed feedback being:

2.1. That the HBRIC Statement of

Intent is edited to include …

2.2. That the Foodeast Statement

of Intent is edited to include …

3. The Corporate and Strategic

Committee recommends that Hawke’s Bay Regional Council:

3.1. Agrees that the decisions

to be made are not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without conferring directly with

the community or persons likely to have an interest in the decision.

3.2. Further considers the HBRIC

Ltd 2022-2023 draft Statement of Intent (SoI) and undertakes to provide any

additional feedback on the Draft SoI to HBRIC Ltd by 1 May 2022 (LGA Sch8 cl3)

to enable delivery of the completed Statement of Intent to Council on or before

30 June 2022 for adoption.

Authored

by: Approved

by:

|

Kishan Premadasa

Management Accountant

|

Jessica Ellerm

Group

Manager Corporate Services

|

Attachment/s

|

1⇩

|

HBRIC Draft Statement of Intent

2022-2023

|

|

|

|

2⇩

|

Foodeast

Draft Statement of Intent 2022-2023

|

|

|

|

HBRIC Draft Statement of Intent 2022-2023

|

Attachment

1

|

|

Foodeast Draft Statement of Intent 2022-2023

|

Attachment

2

|

HAWKE’S

BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

16 March

2022

Subject: HBRIC Quarterly Update

Reason for Report

1. This item provides Council

with a quarterly update on the activities of Hawke’s Bay Regional

Investment Company (HBRIC) for the second quarter of

the FY2021-22 financial year.

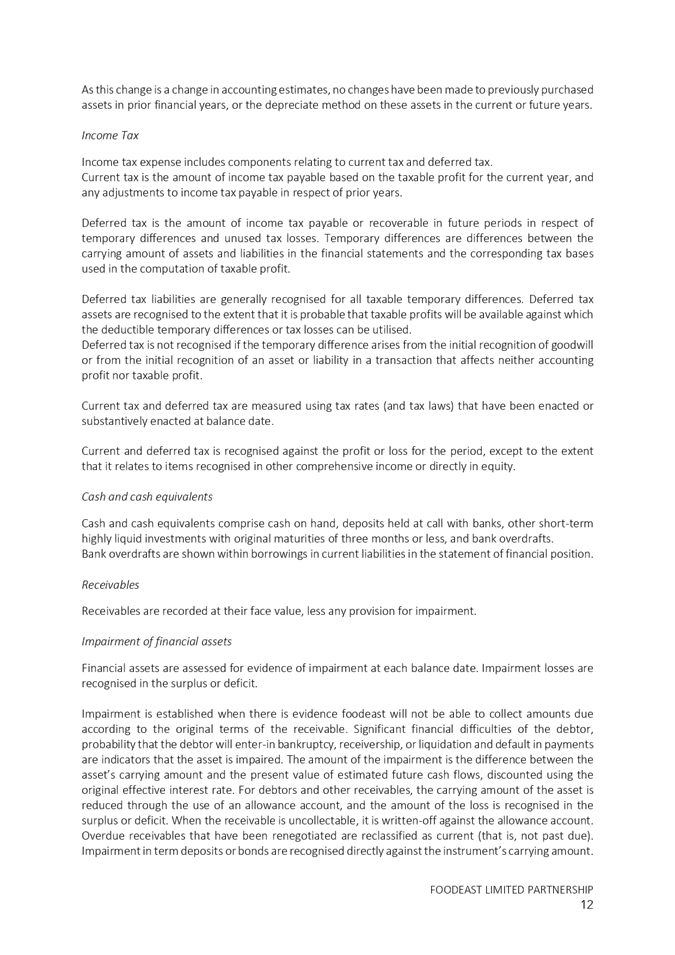

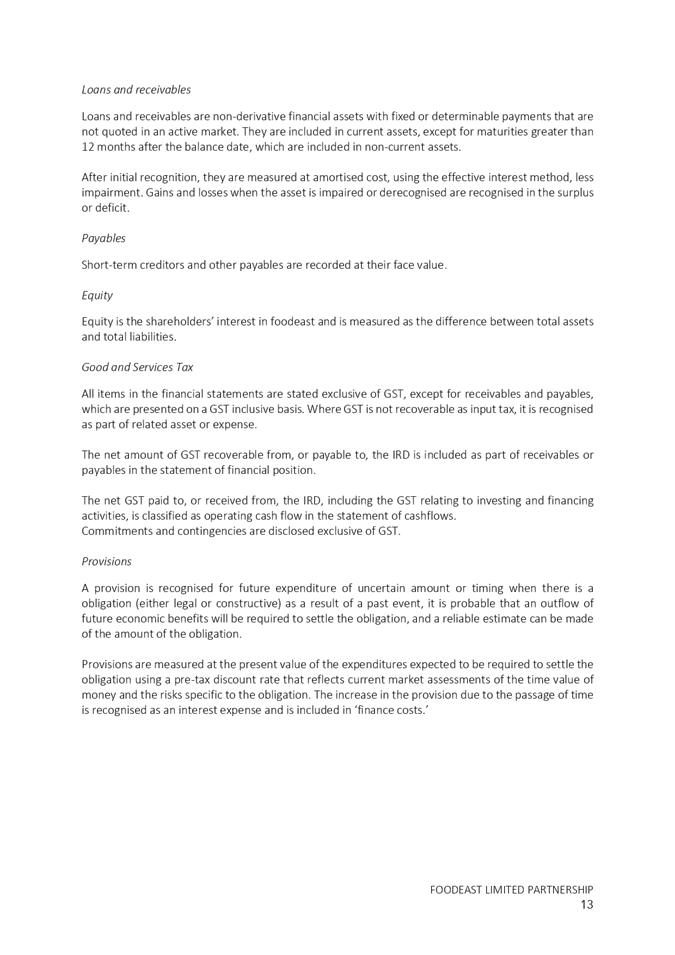

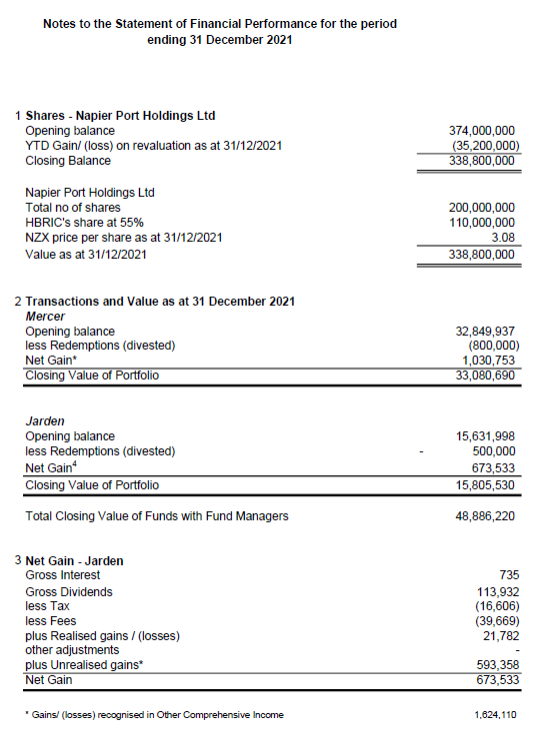

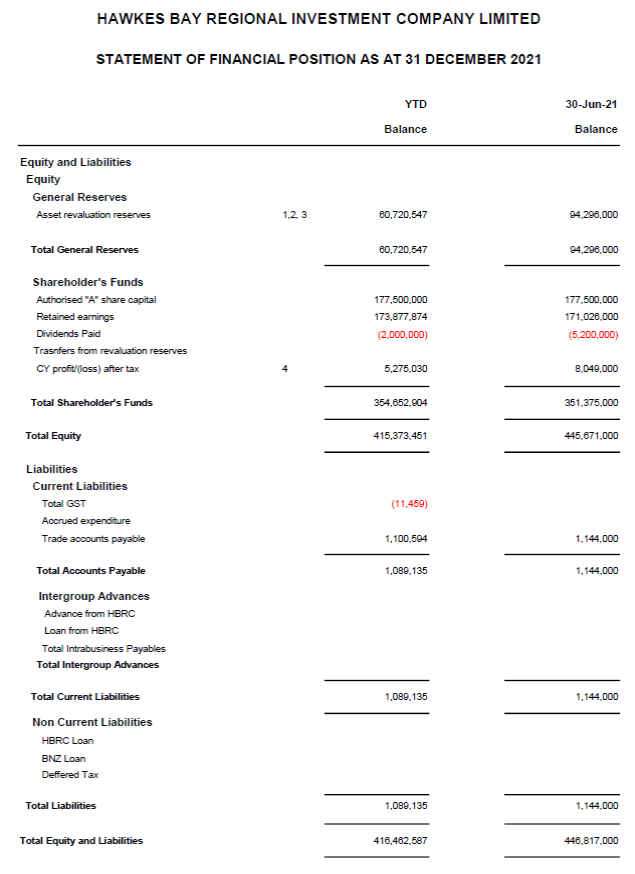

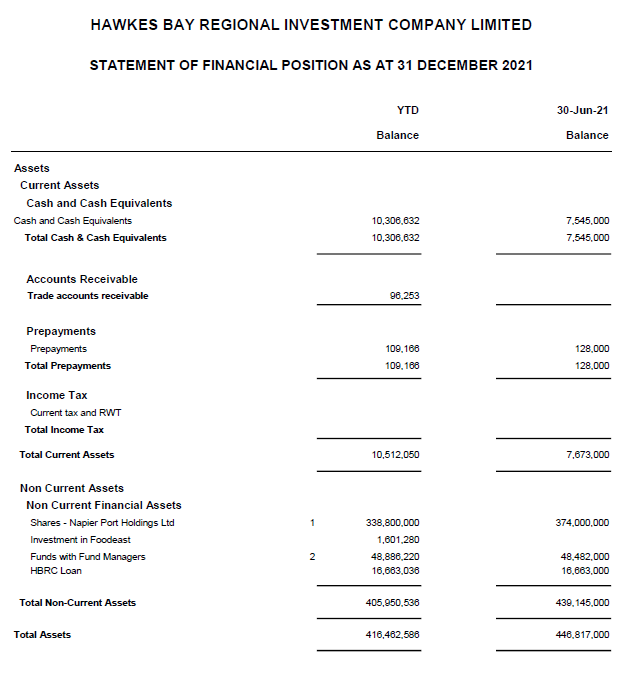

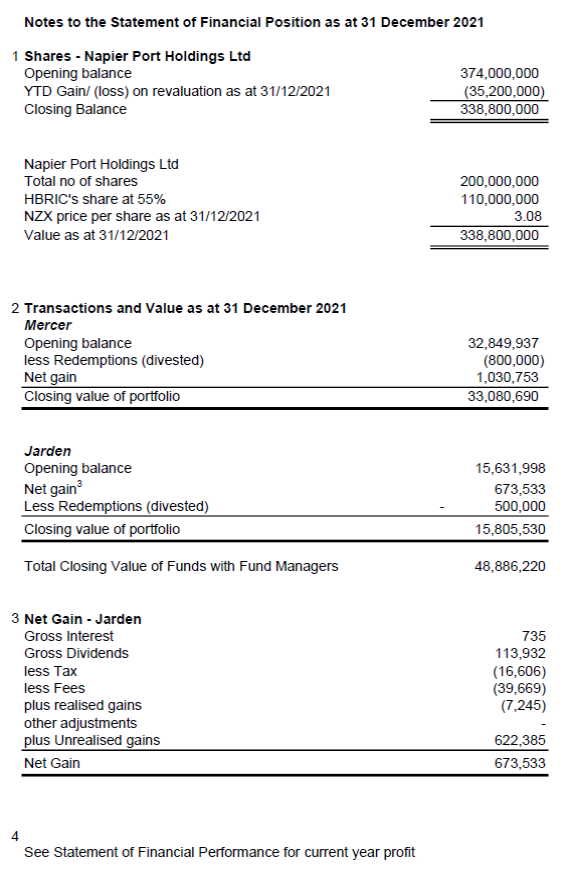

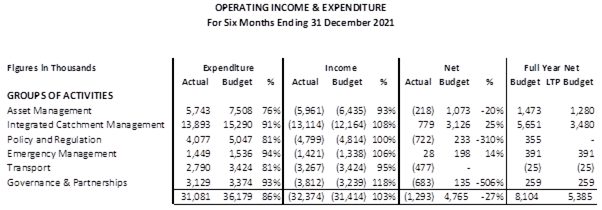

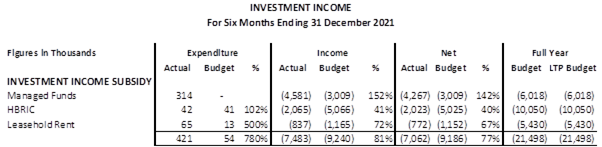

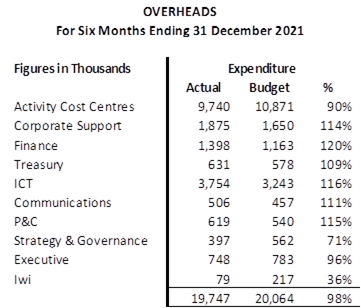

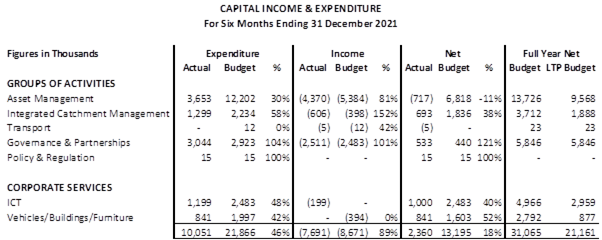

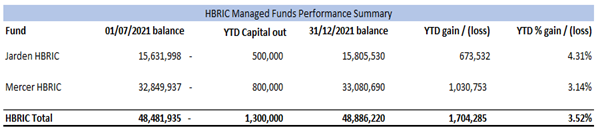

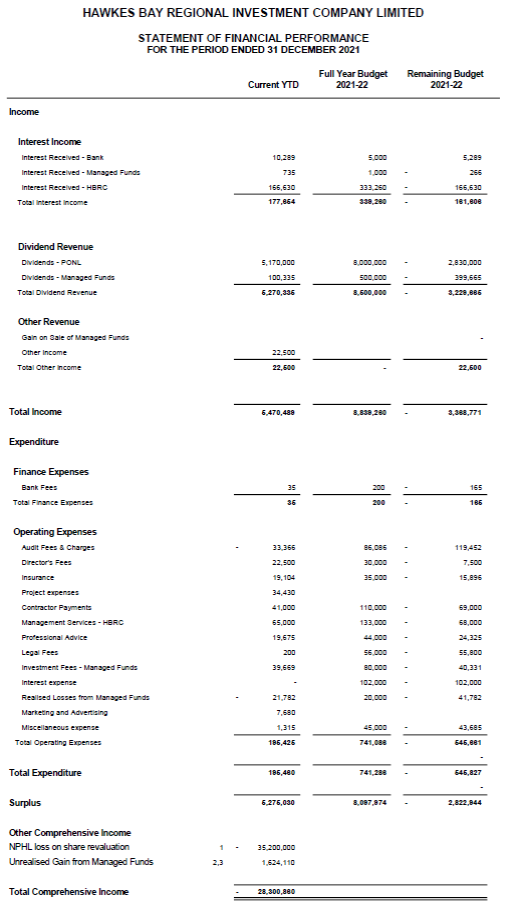

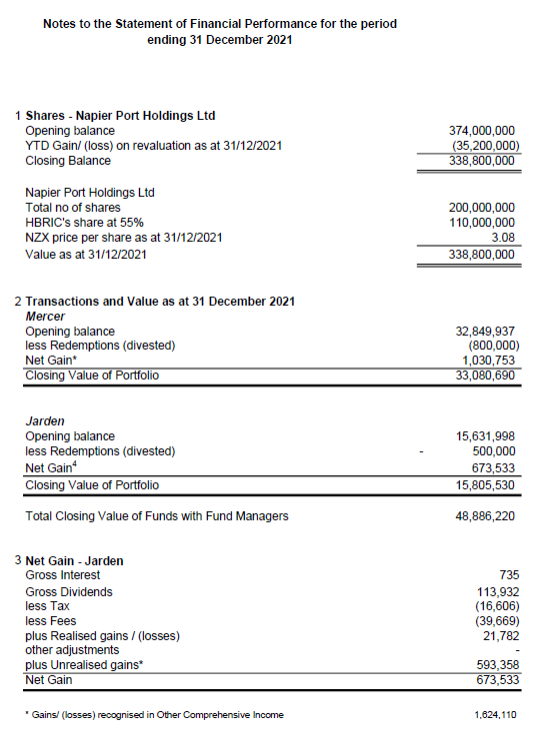

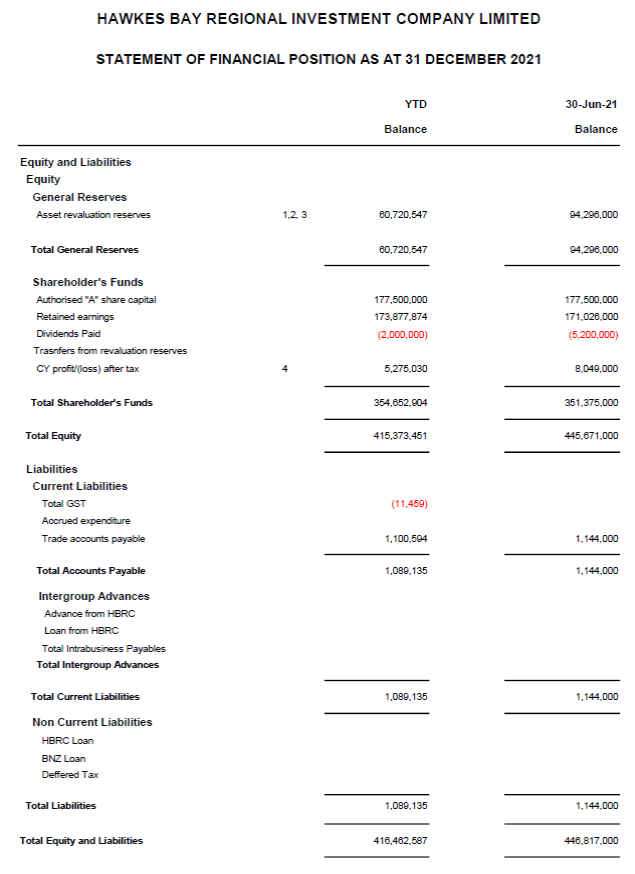

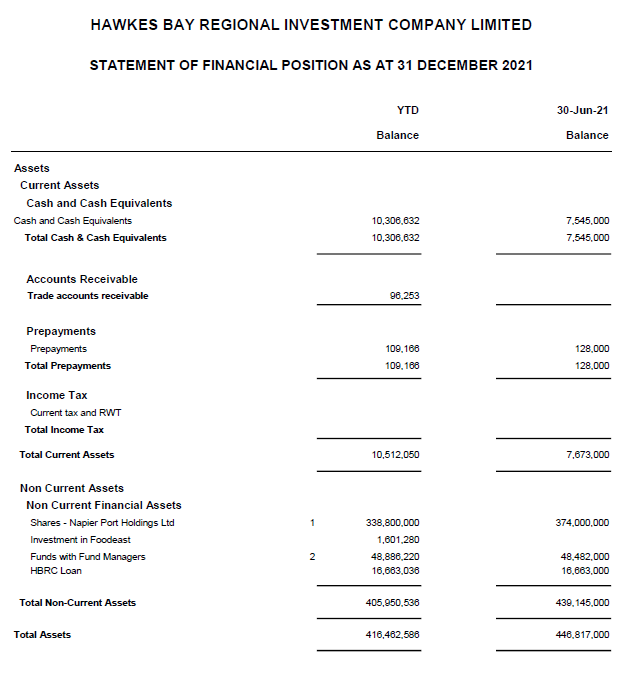

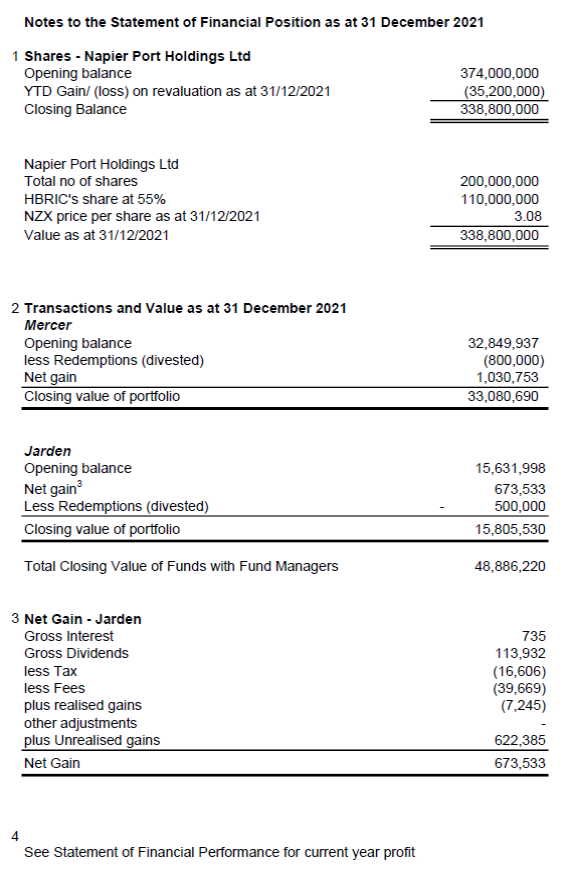

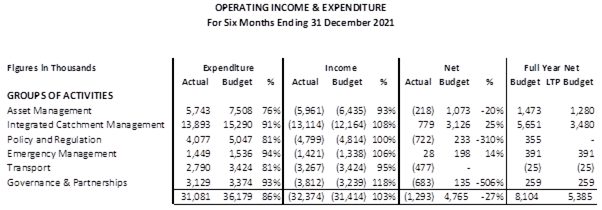

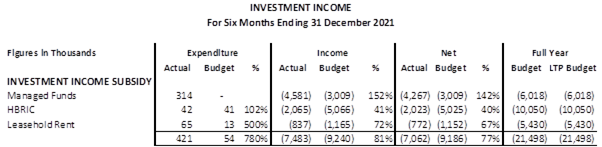

Financial Reporting

2. HBRIC’s Financial