Meeting of the Corporate and Strategic Committee

Date: Wednesday 17 November 2021

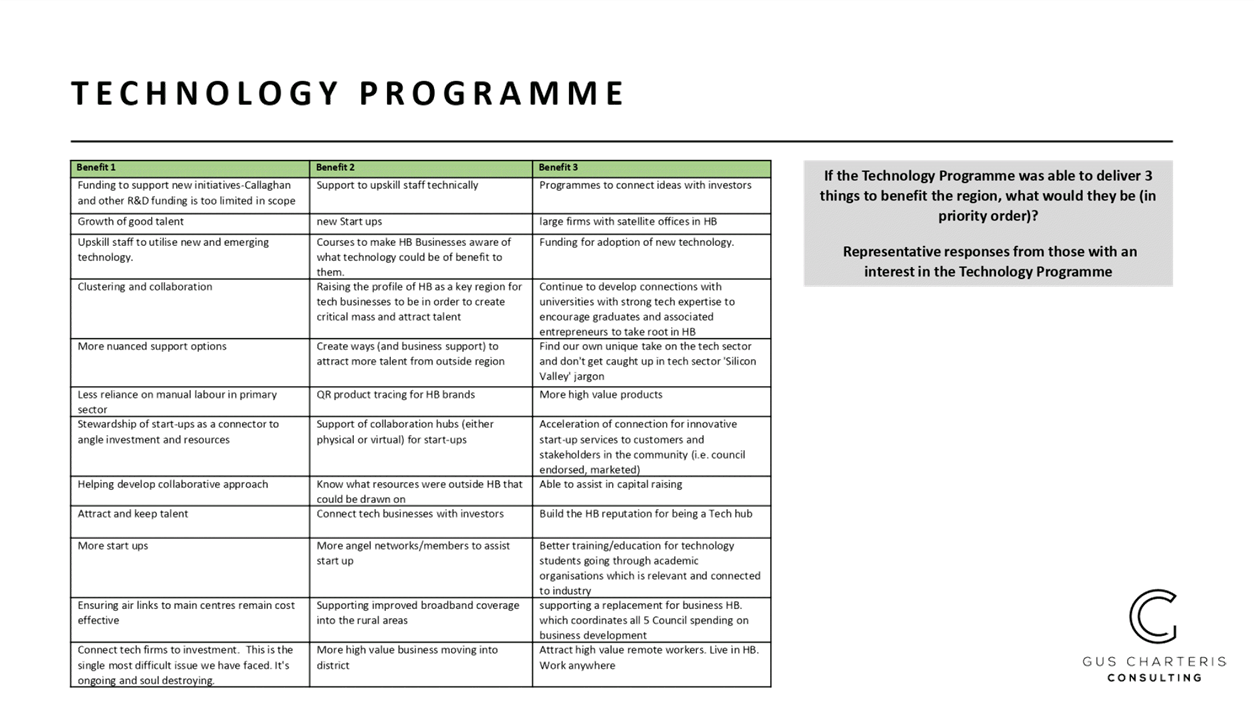

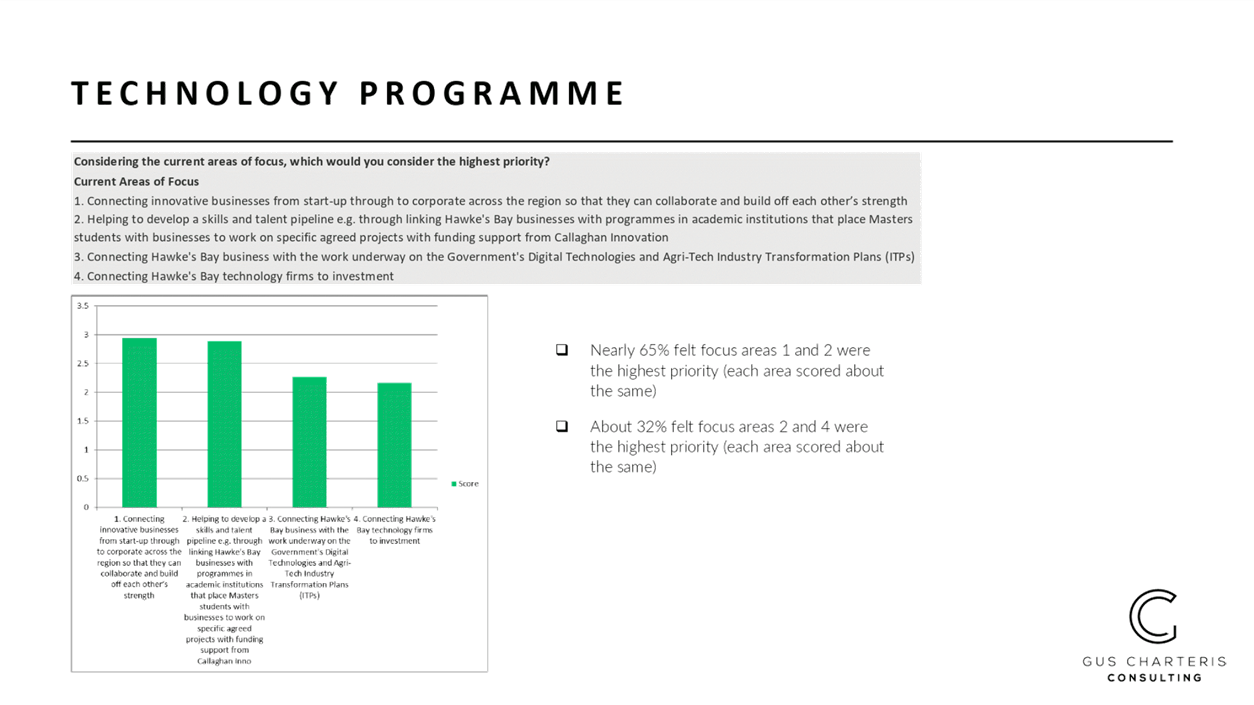

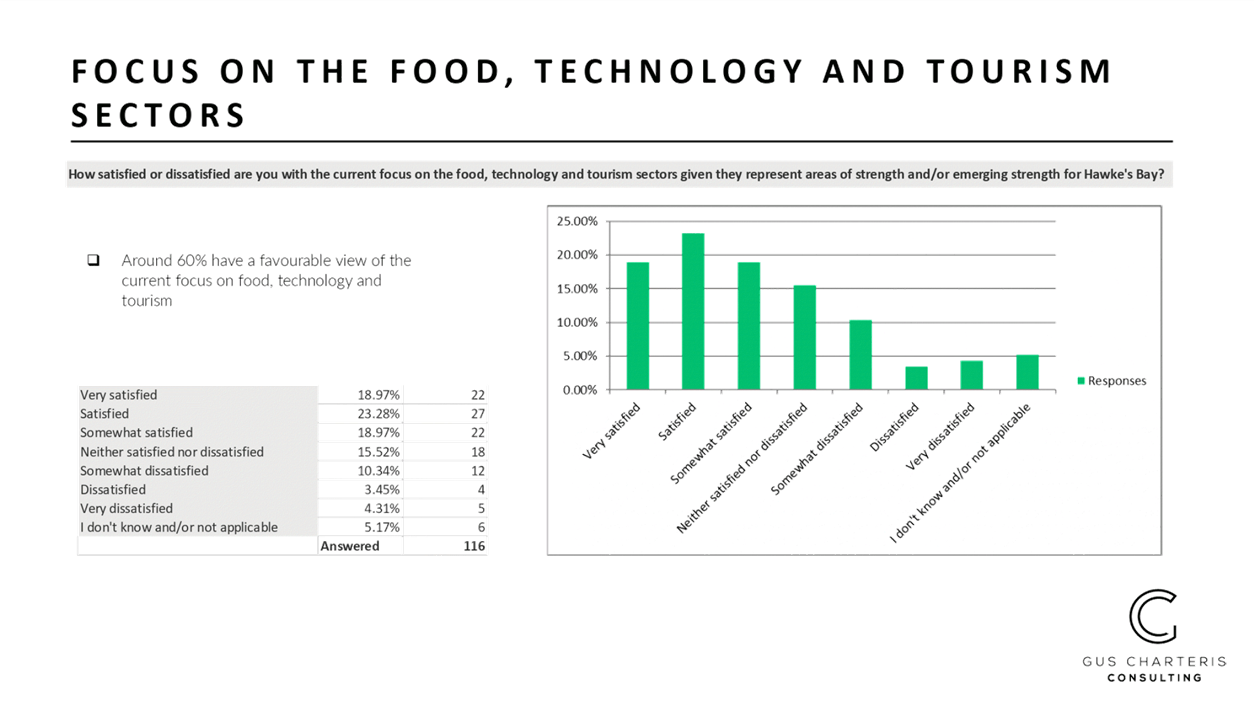

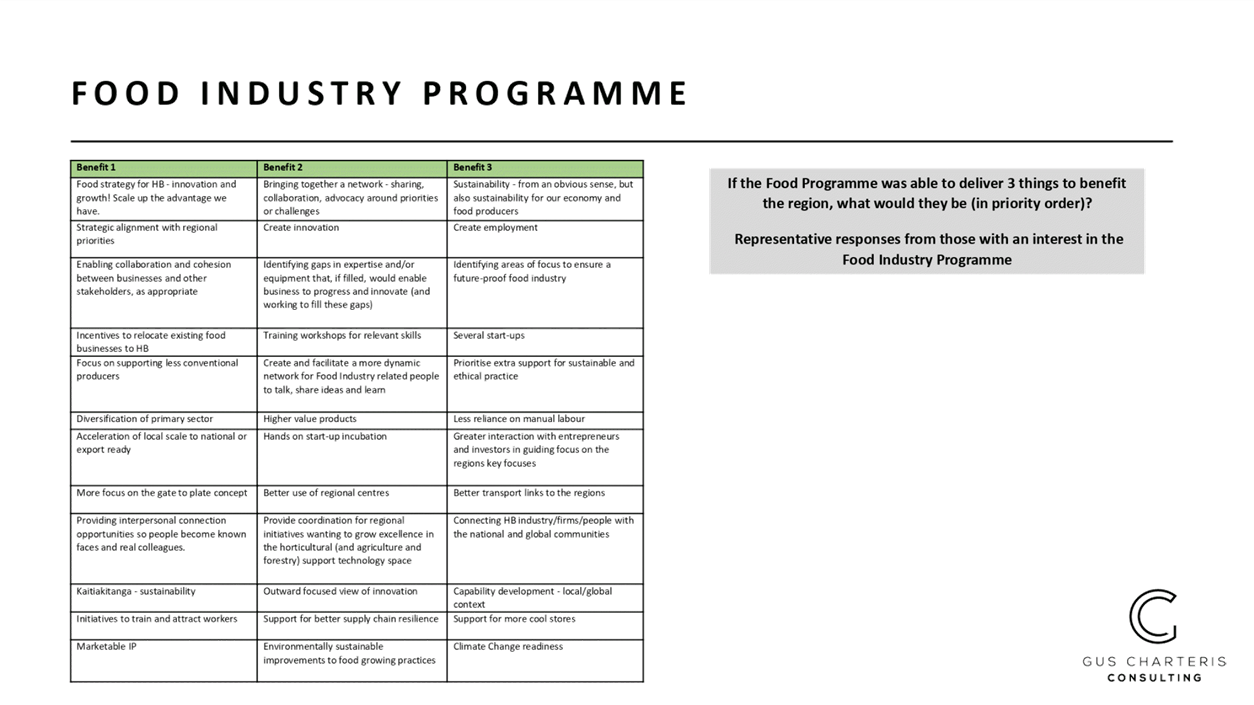

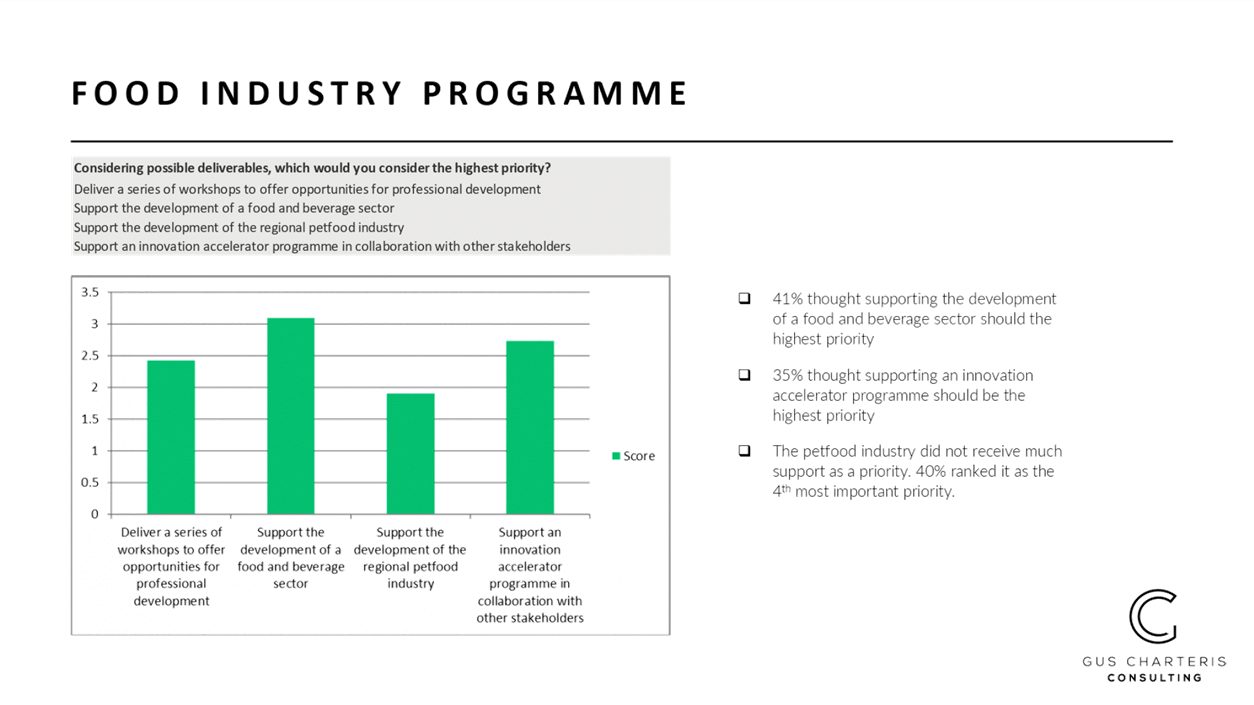

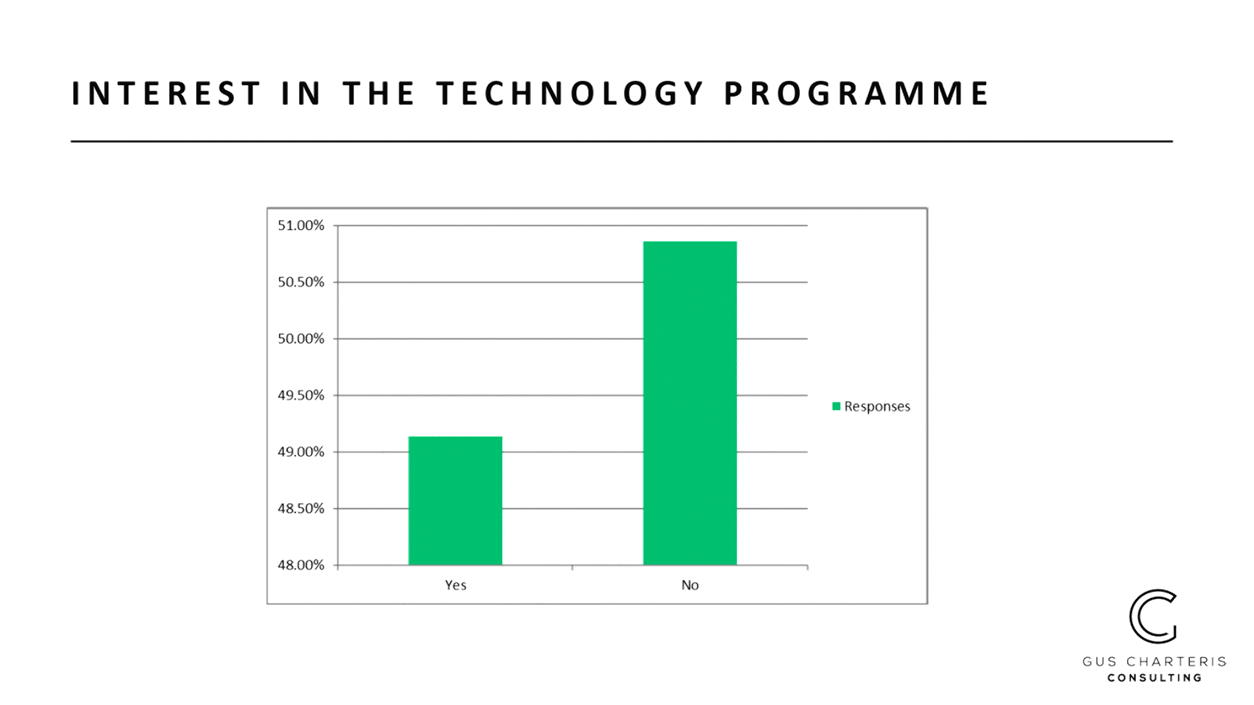

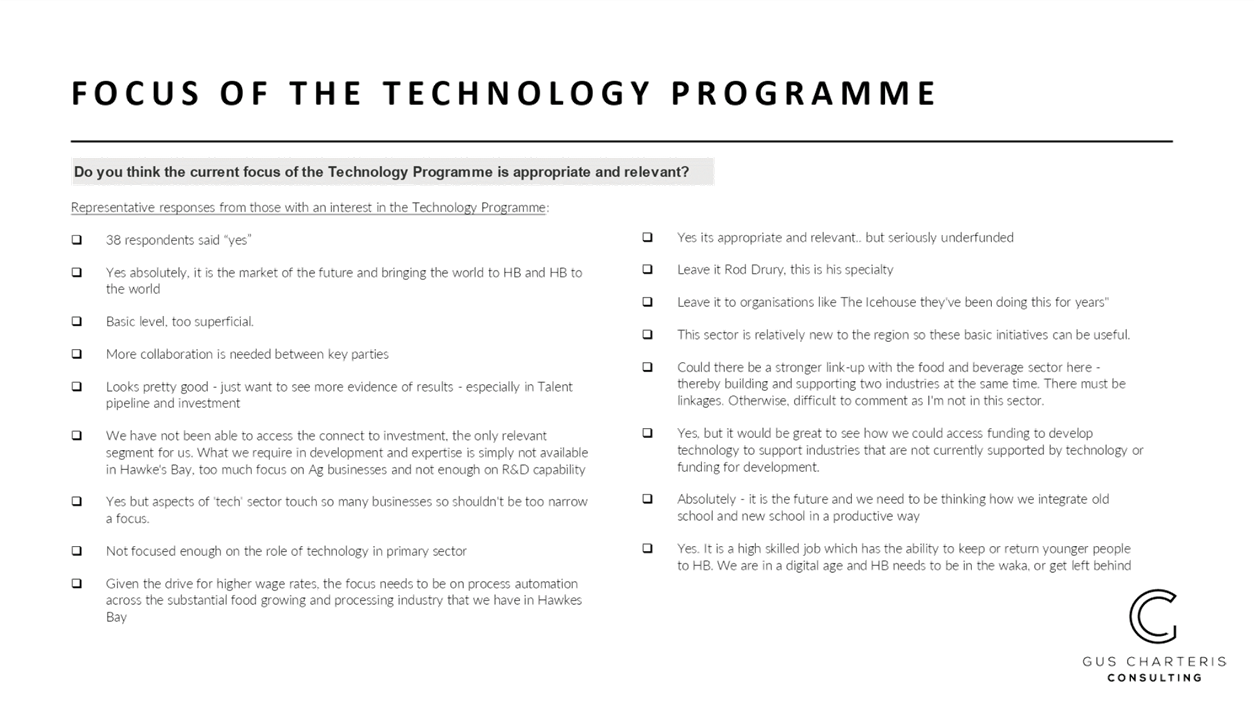

Time: 9.00am

|

Venue:

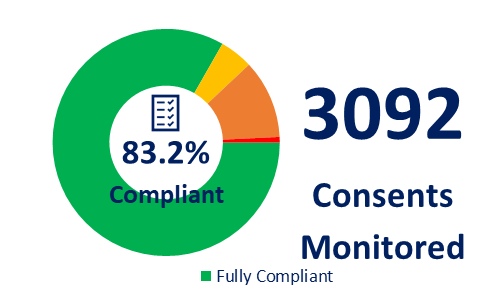

|

Council Chamber

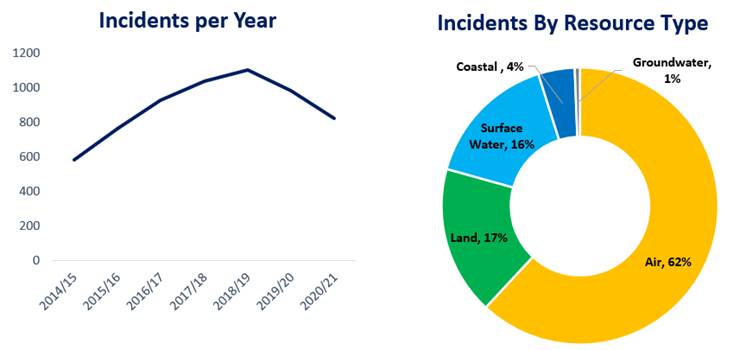

Hawke's Bay Regional Council

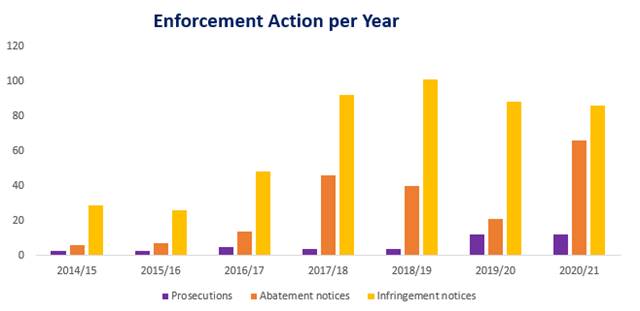

159 Dalton Street

NAPIER

|

Agenda

Item Title Page

1. Welcome/Karakia/Notices/Apologies

2. Conflict

of Interest Declarations

3. Confirmation of Minutes of the Corporate and Strategic Committee

held on 18 August 2021

4. Follow-ups from

Previous Corporate and Strategic Committee Meetings 3

5. Call for Minor

Items Not on the Agenda 7

Decision Items

6. Hawke's Bay

Economic Development Review 9

7. 2020-21 Compliance

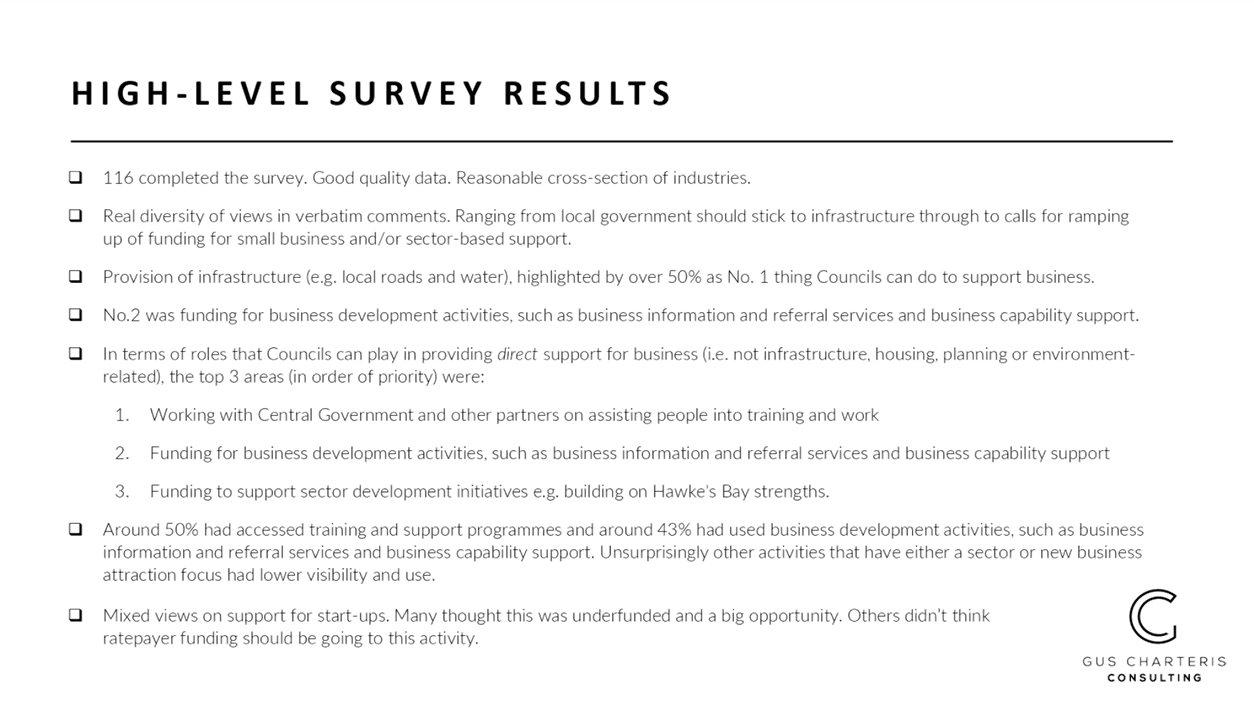

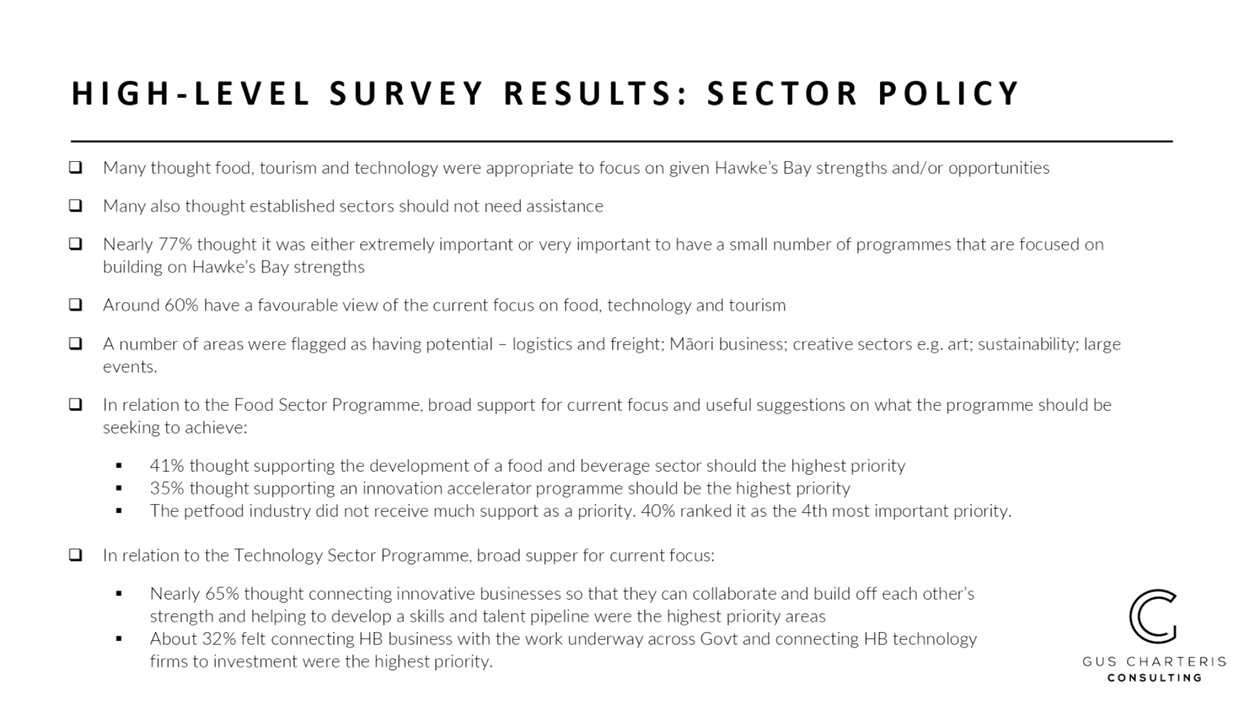

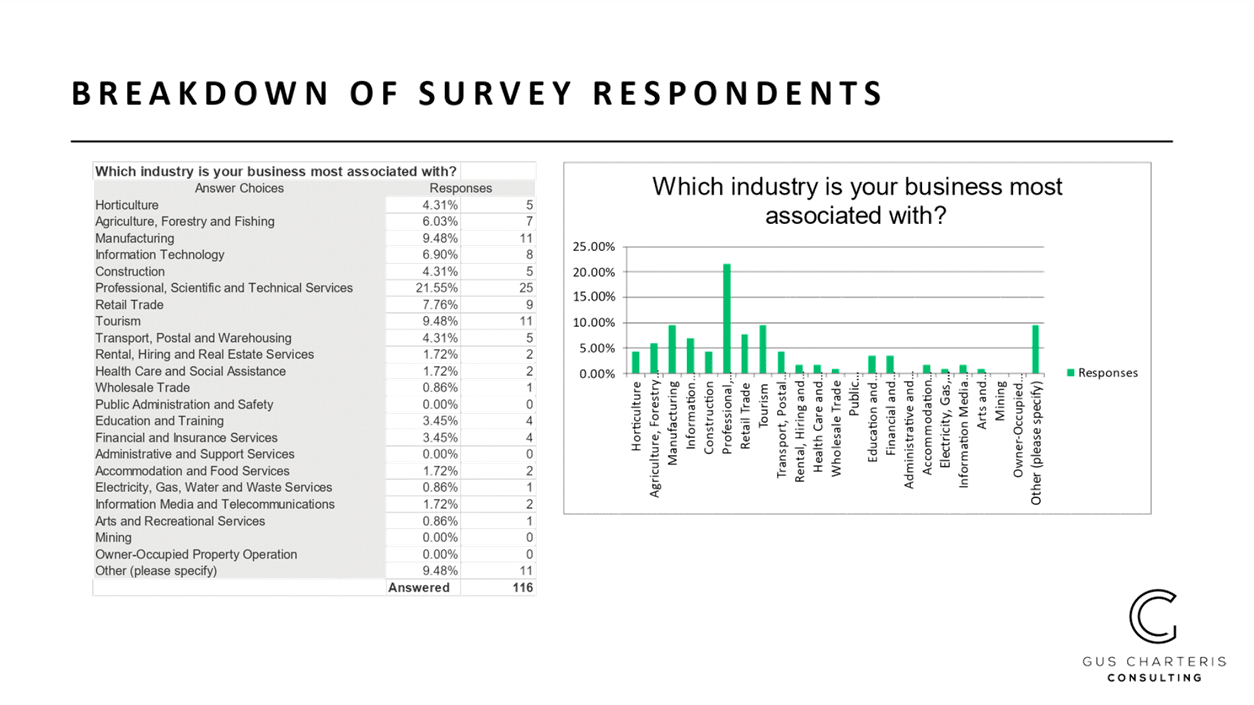

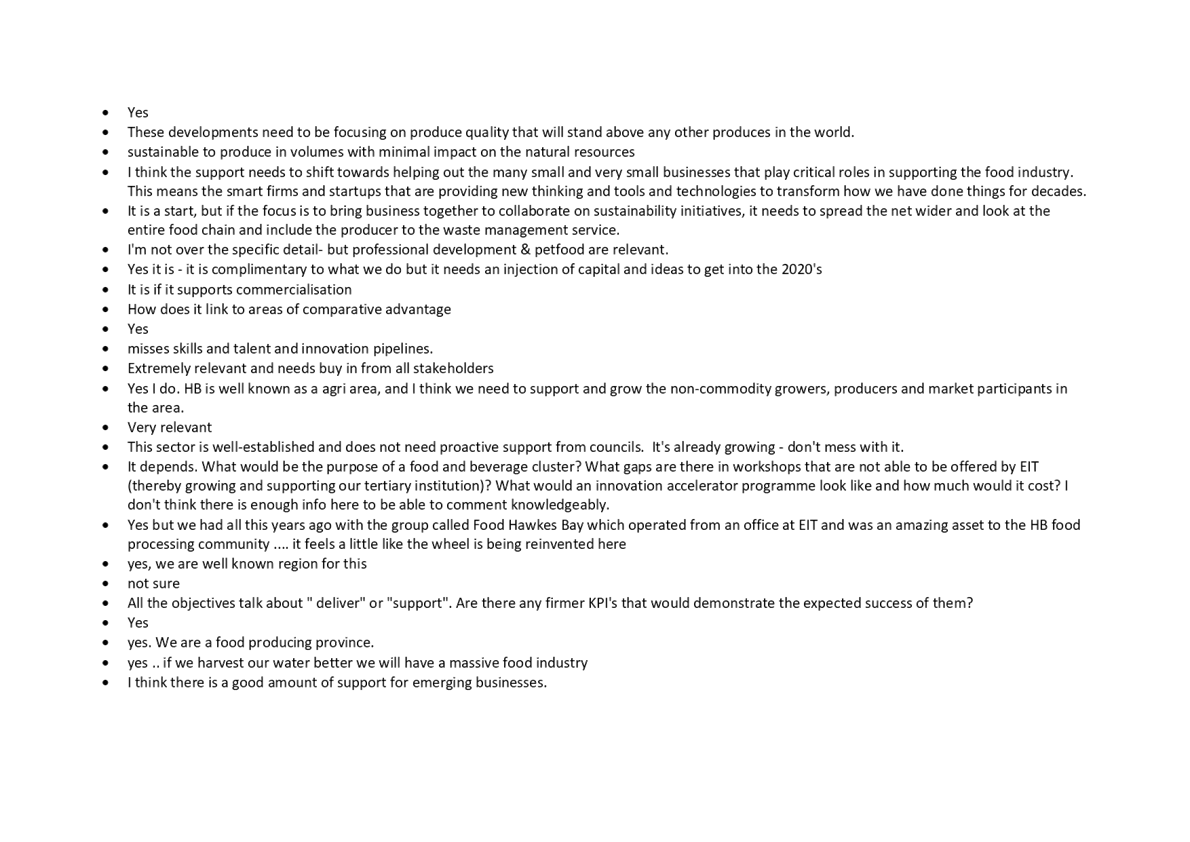

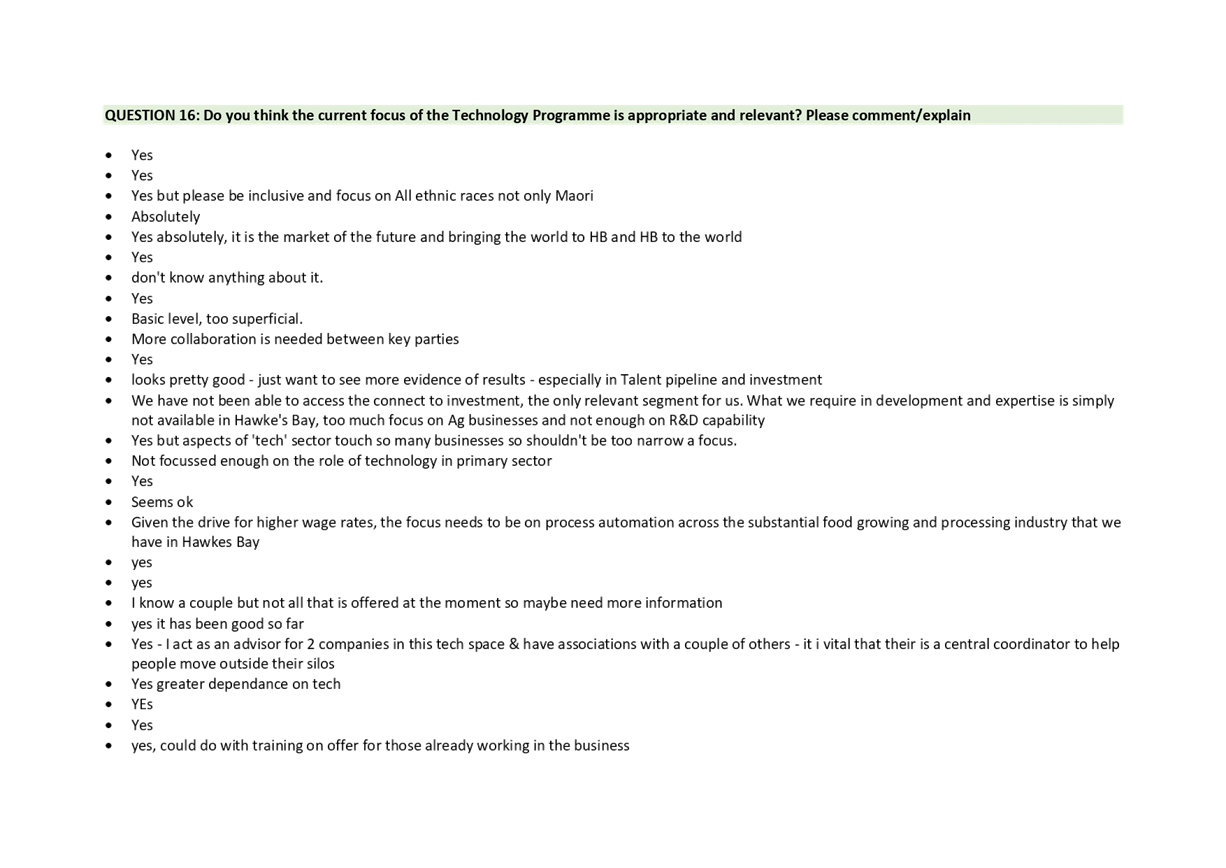

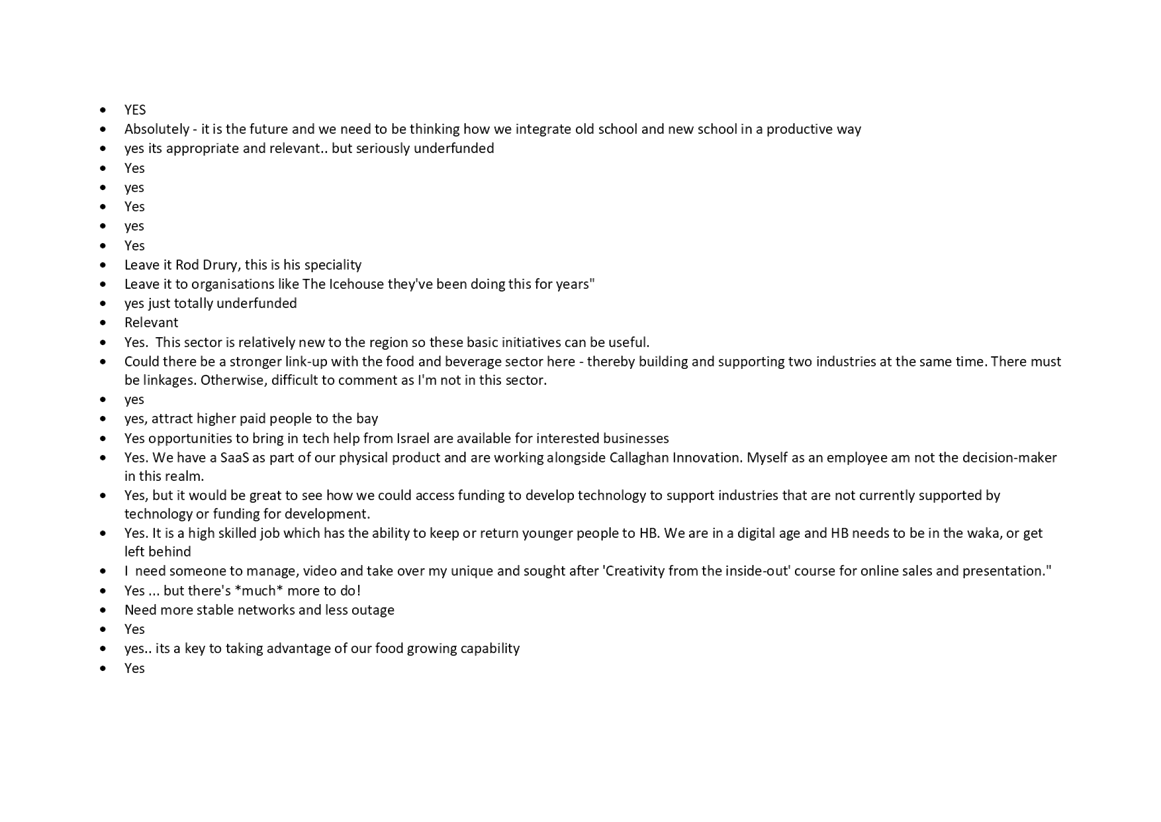

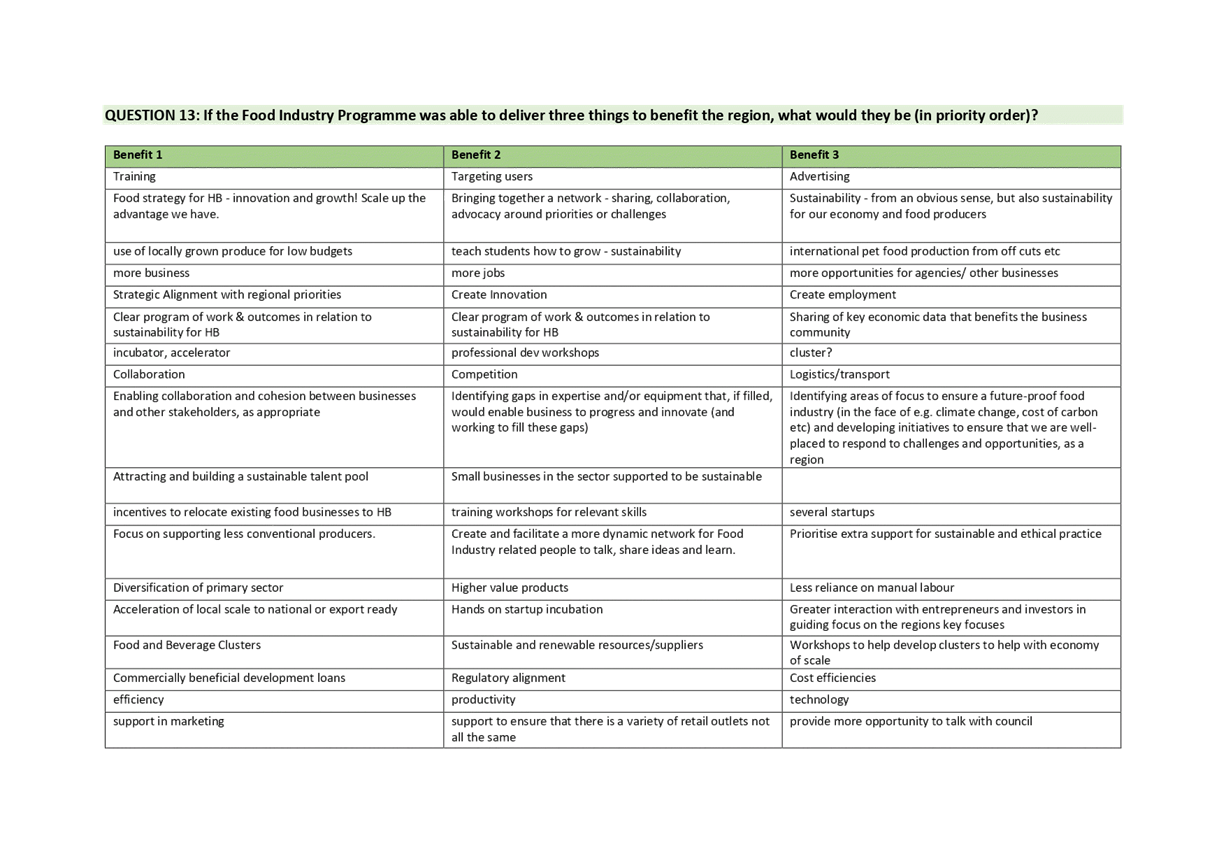

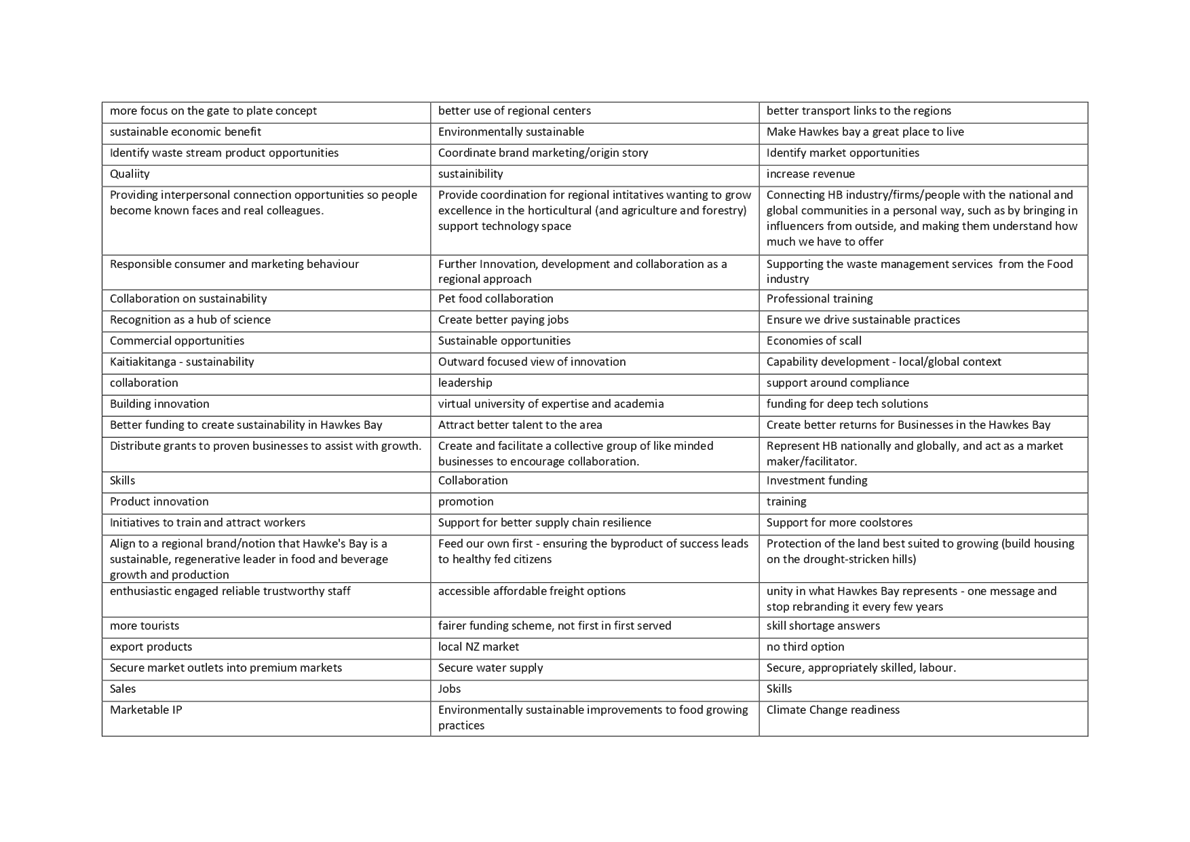

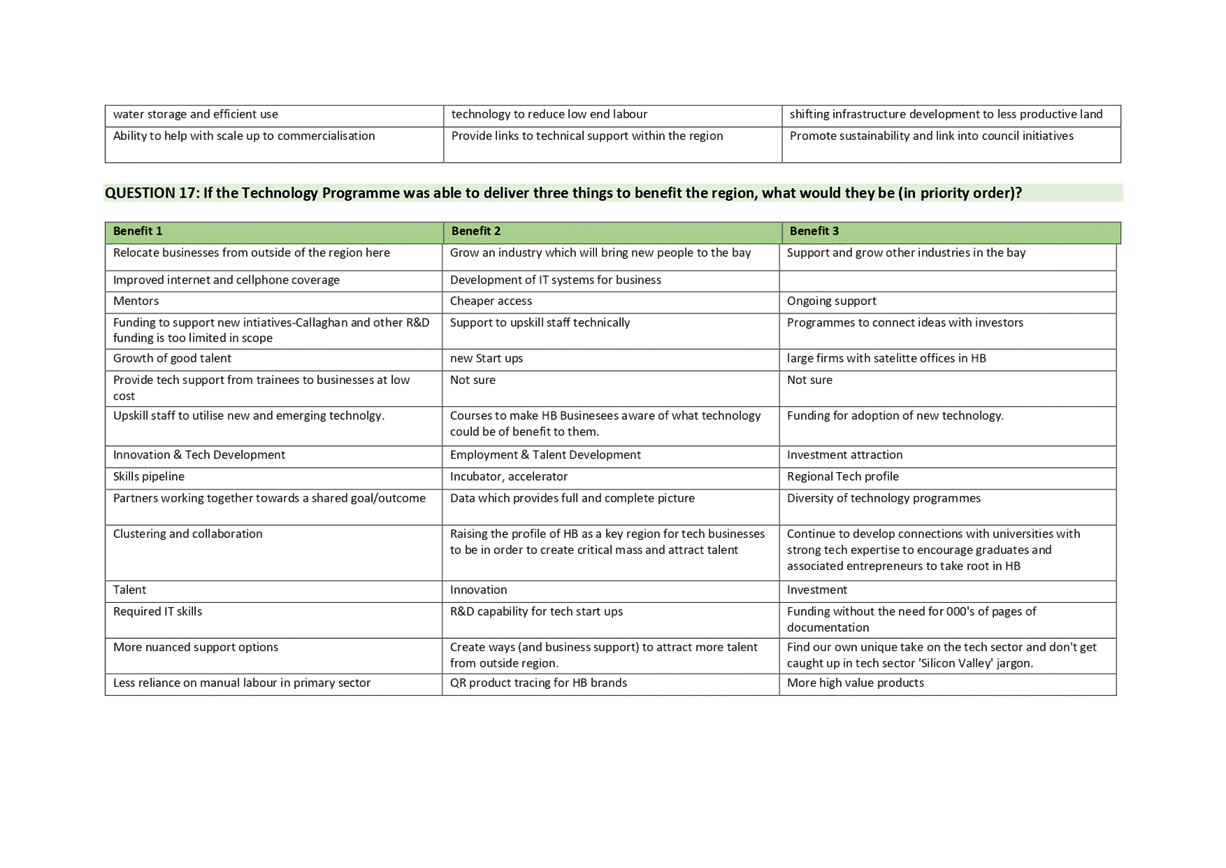

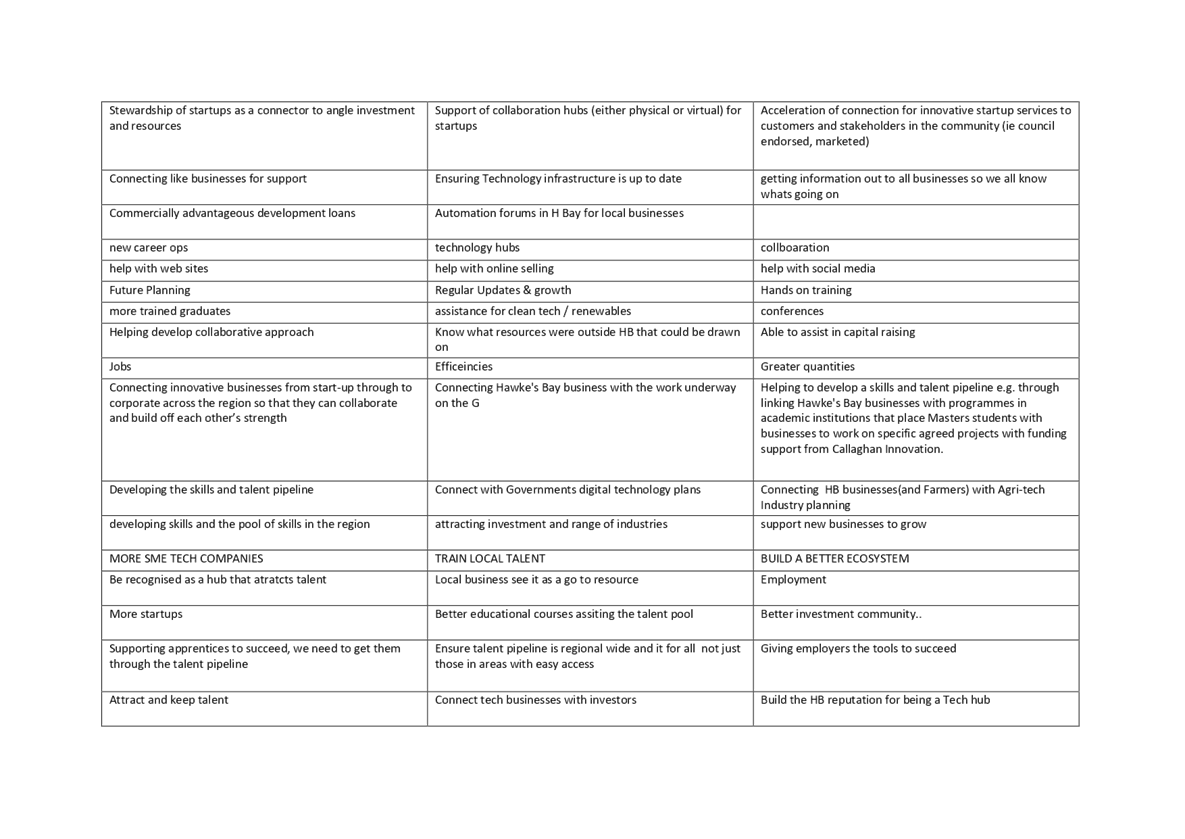

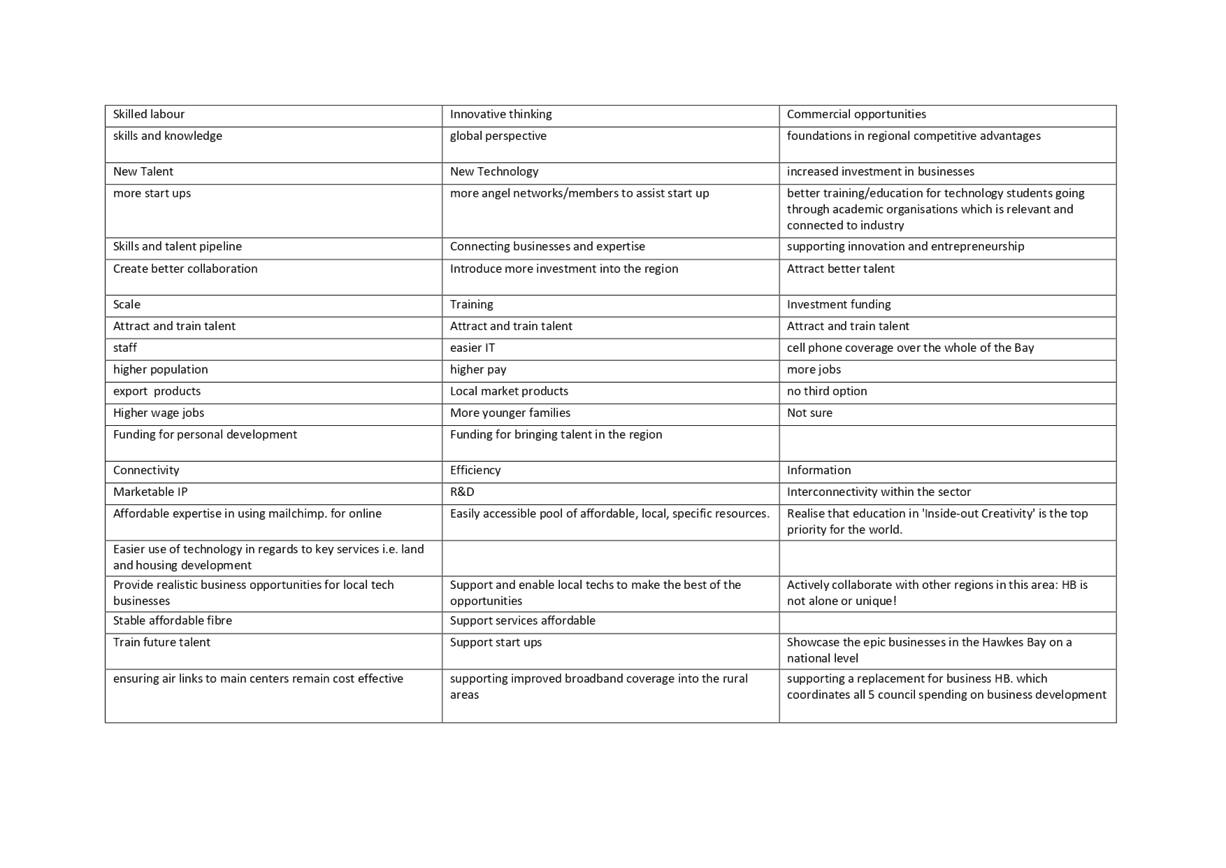

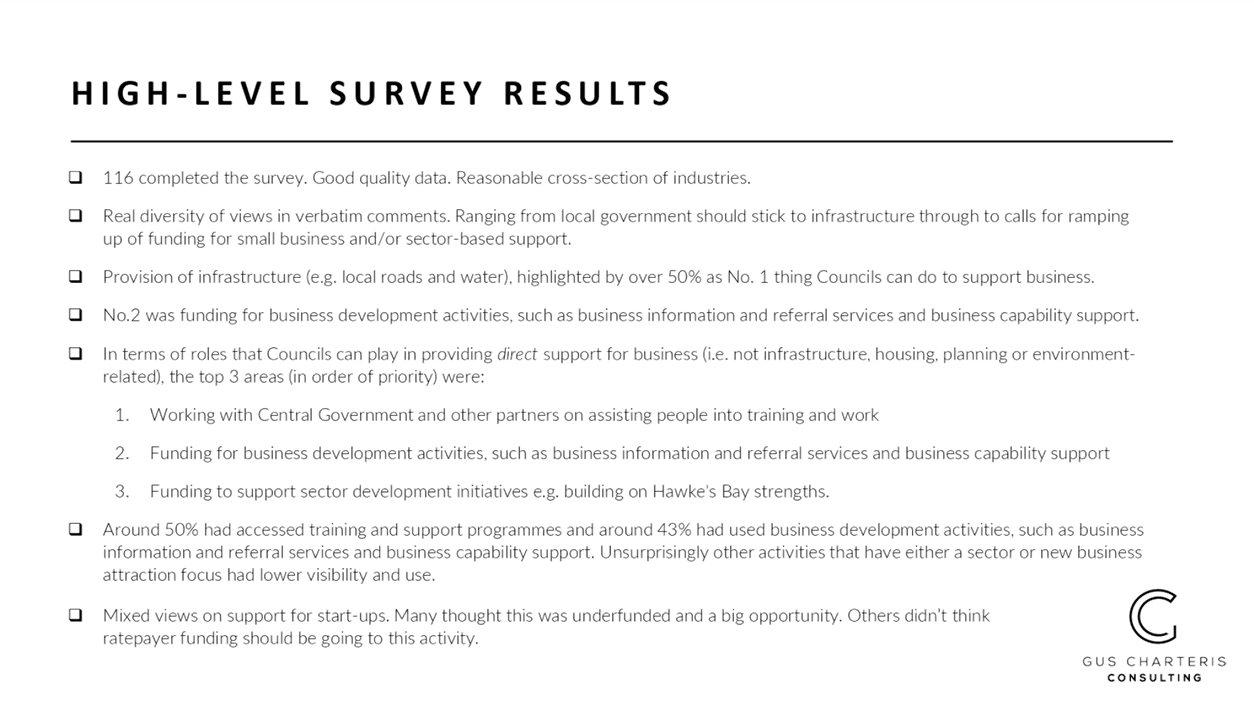

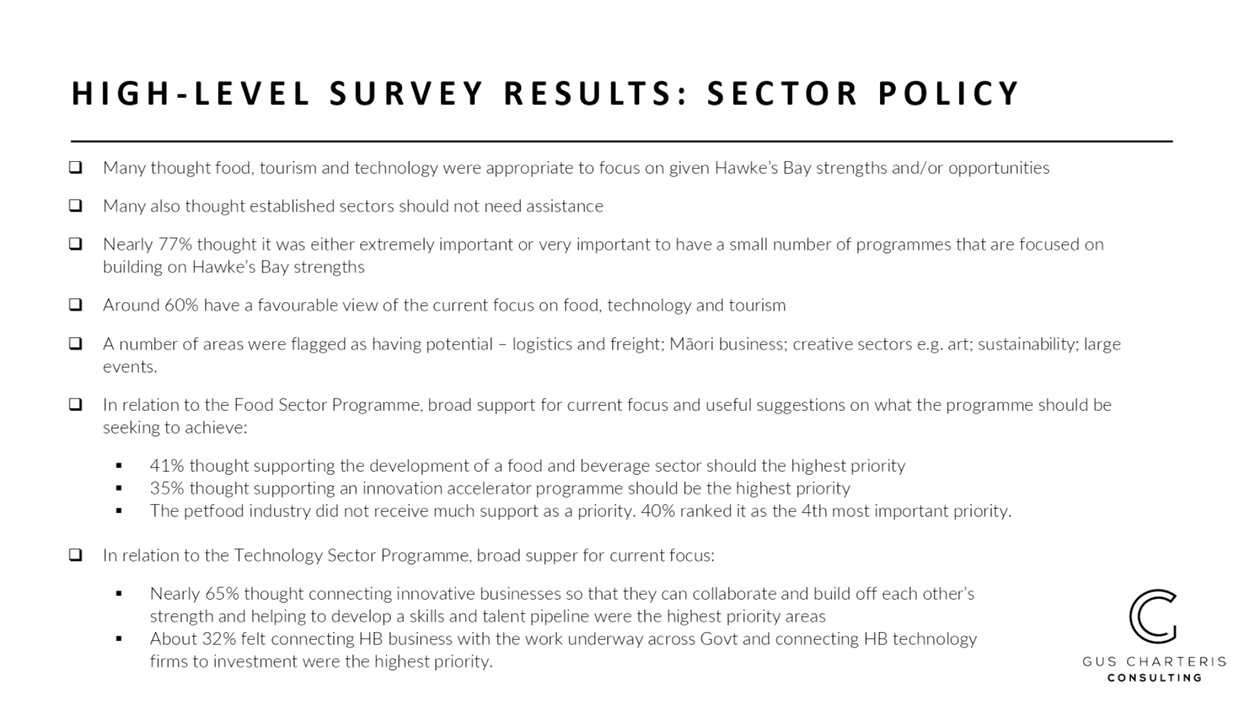

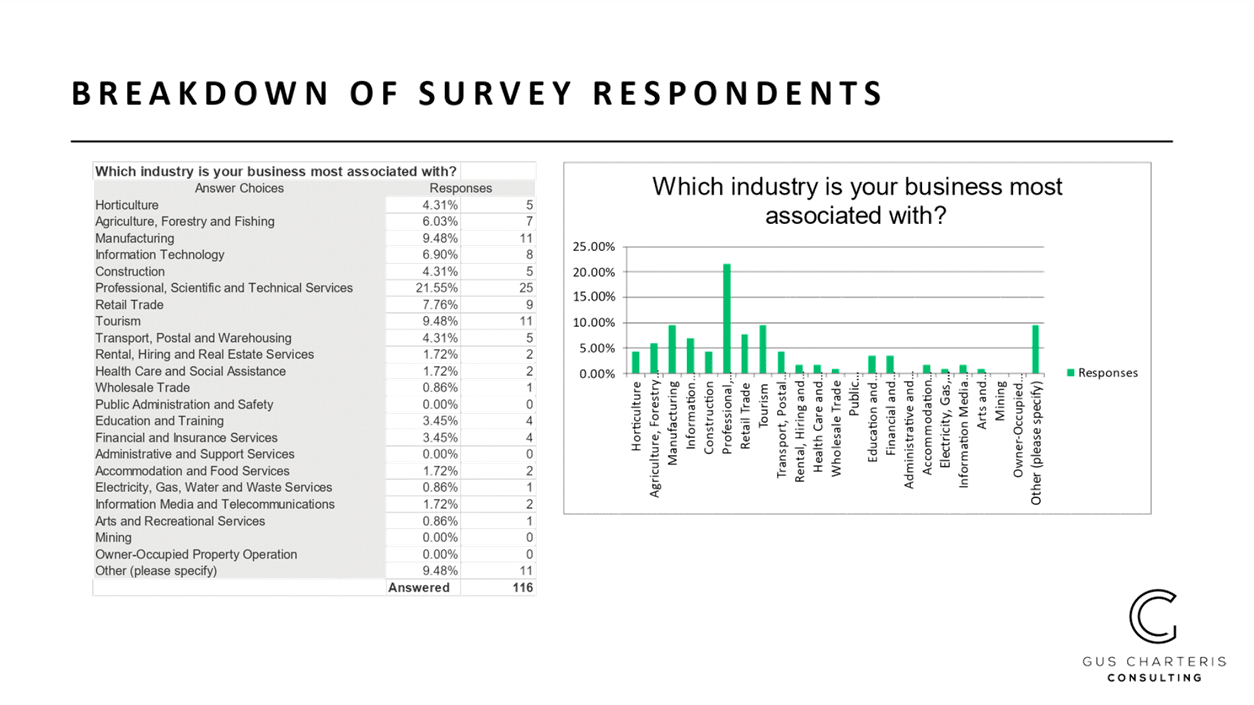

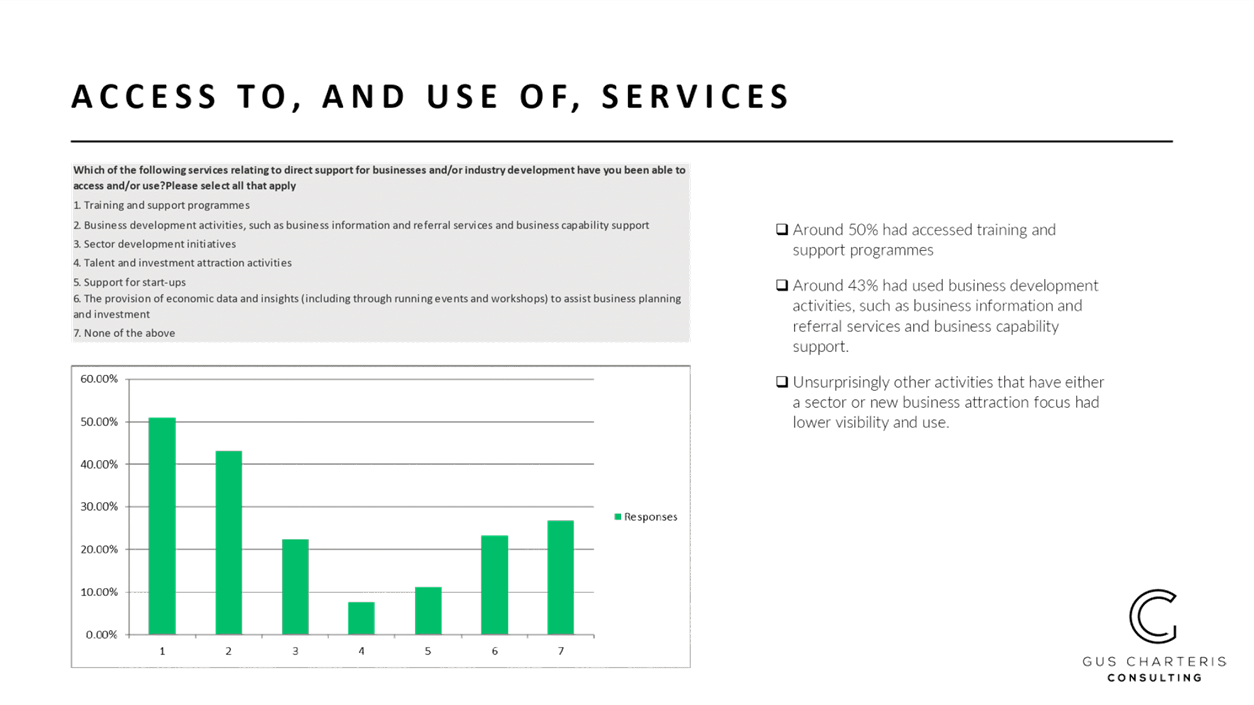

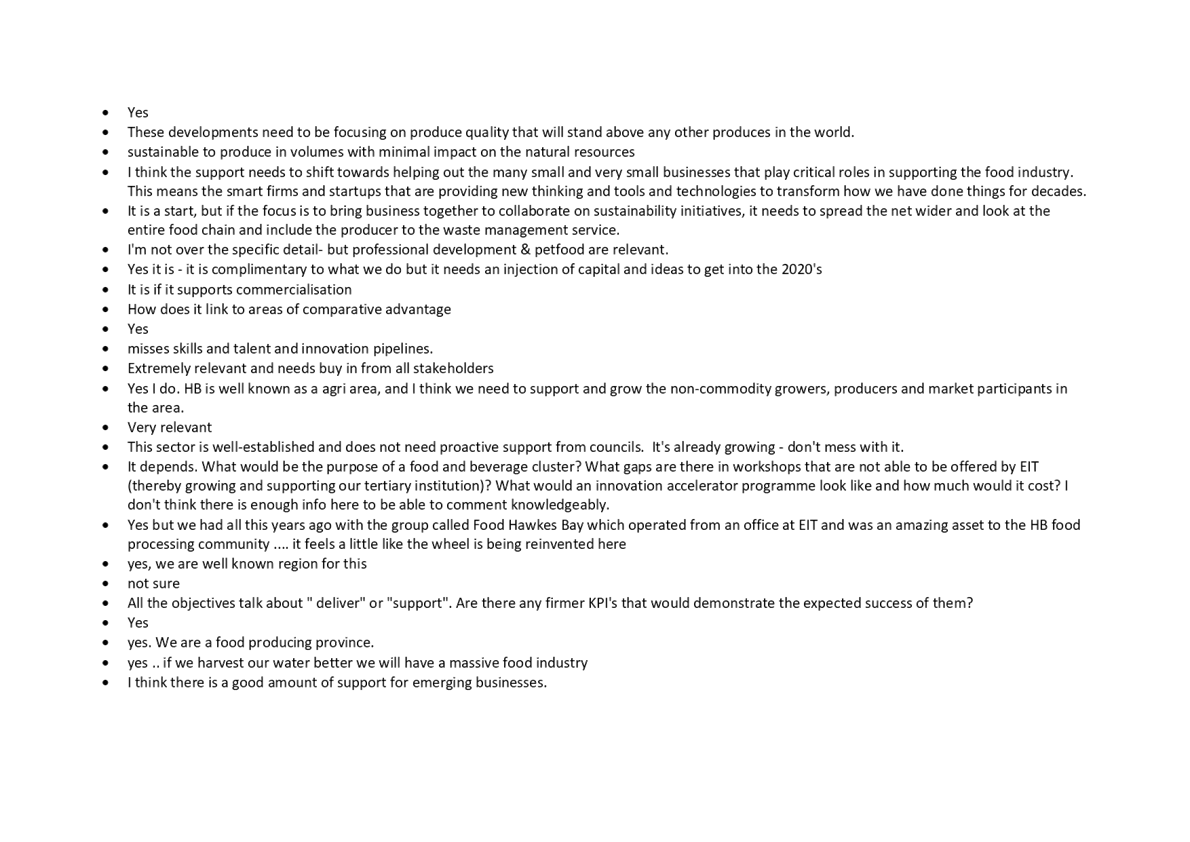

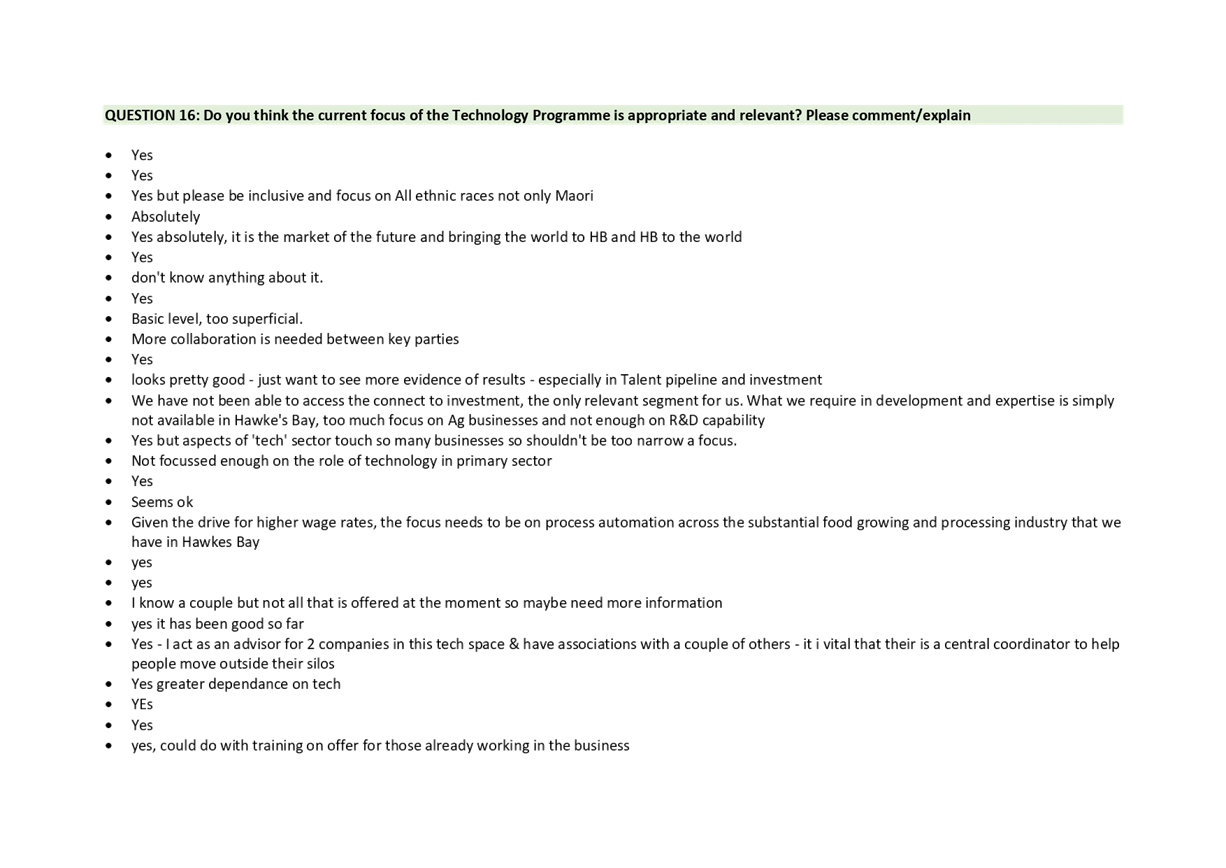

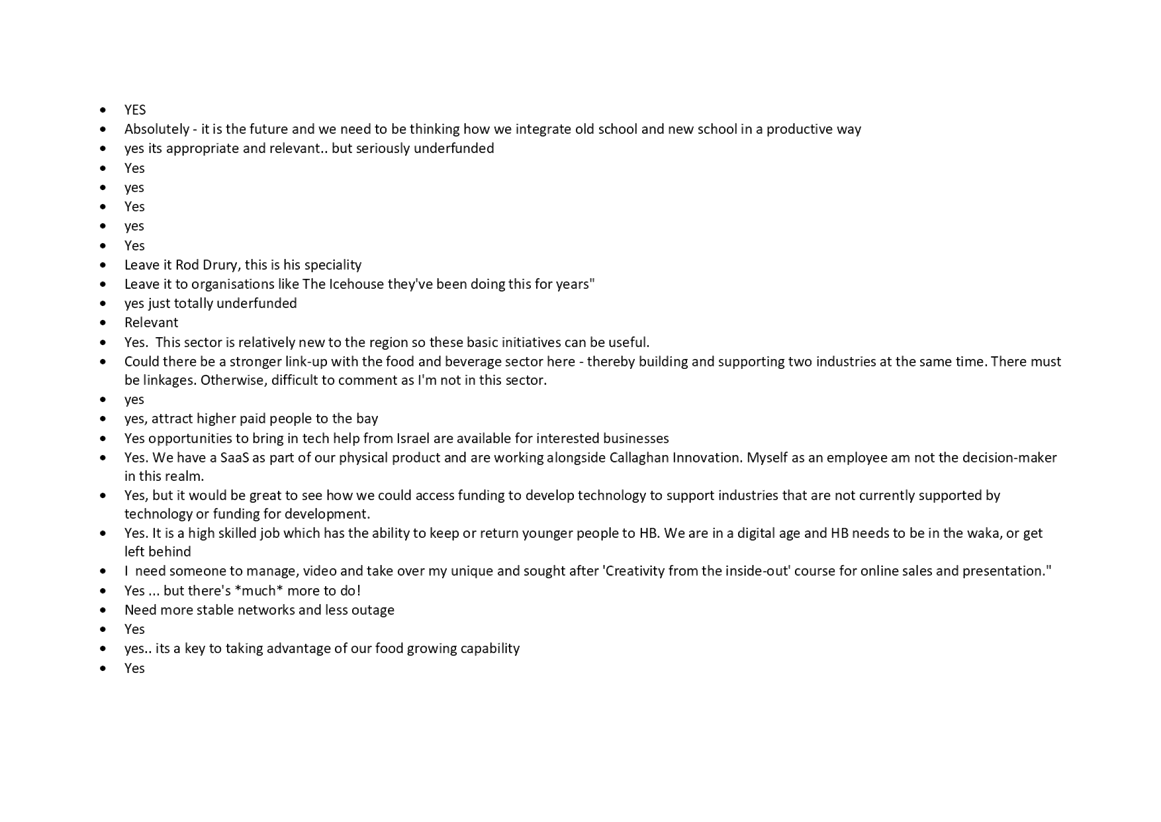

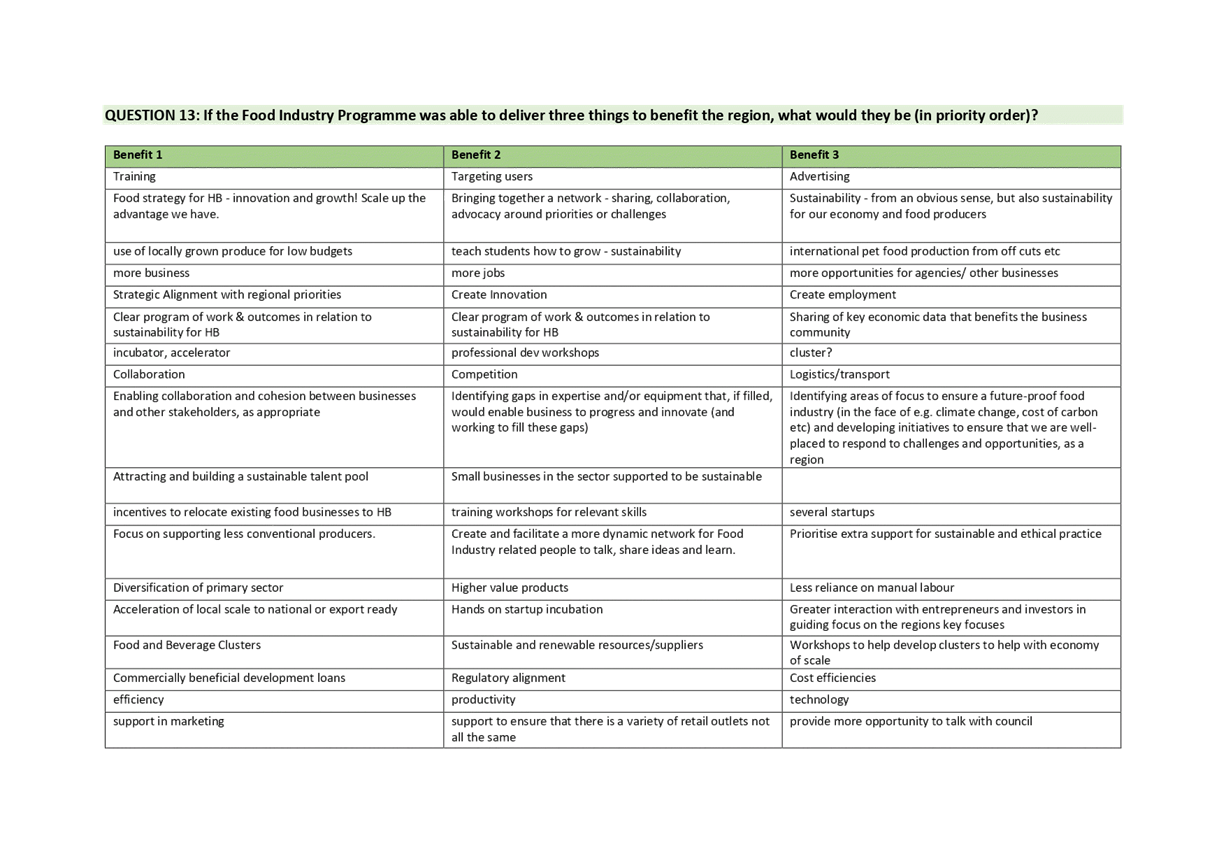

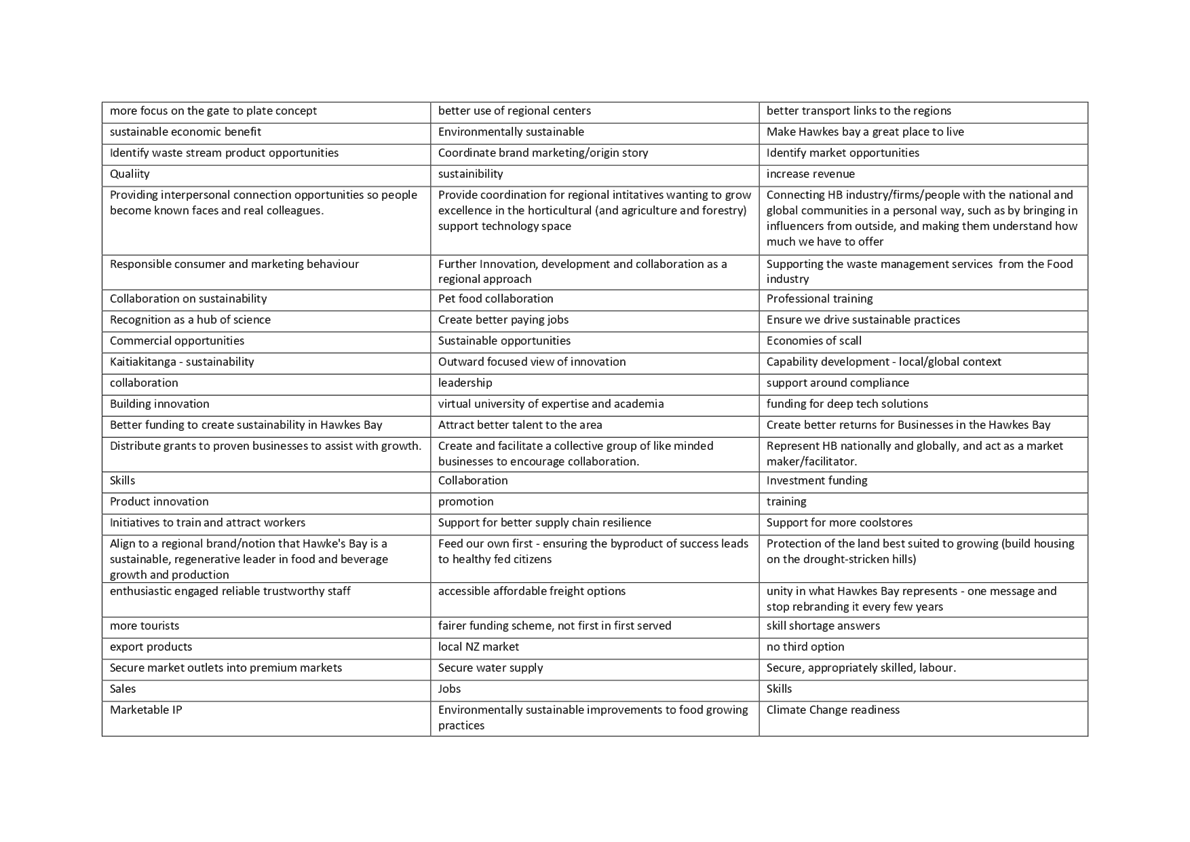

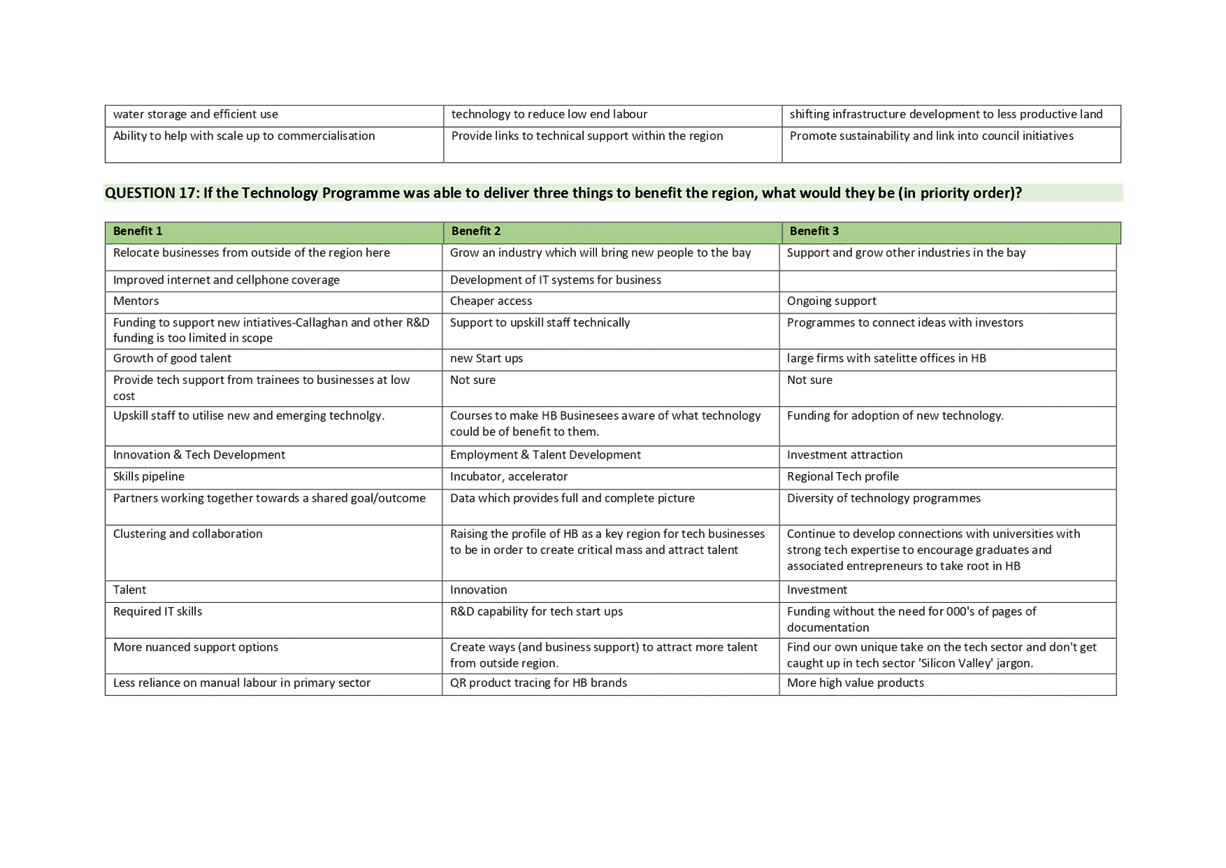

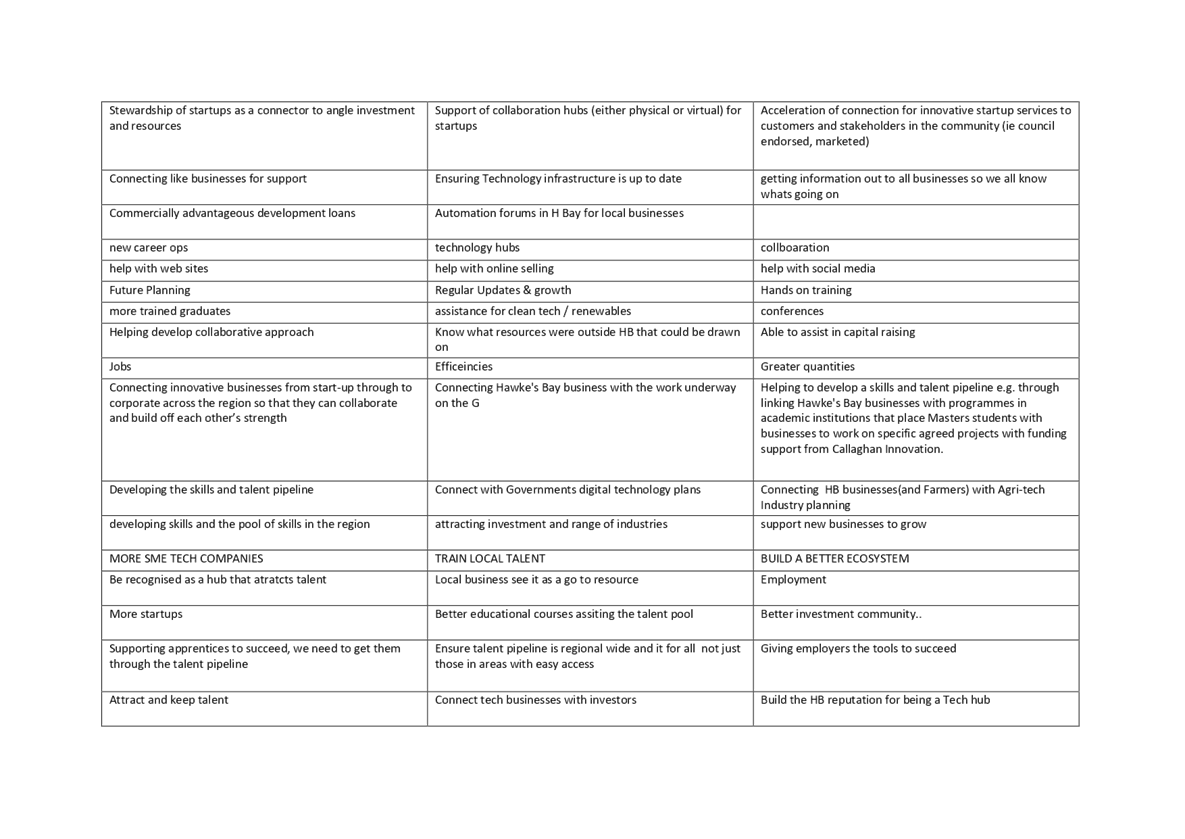

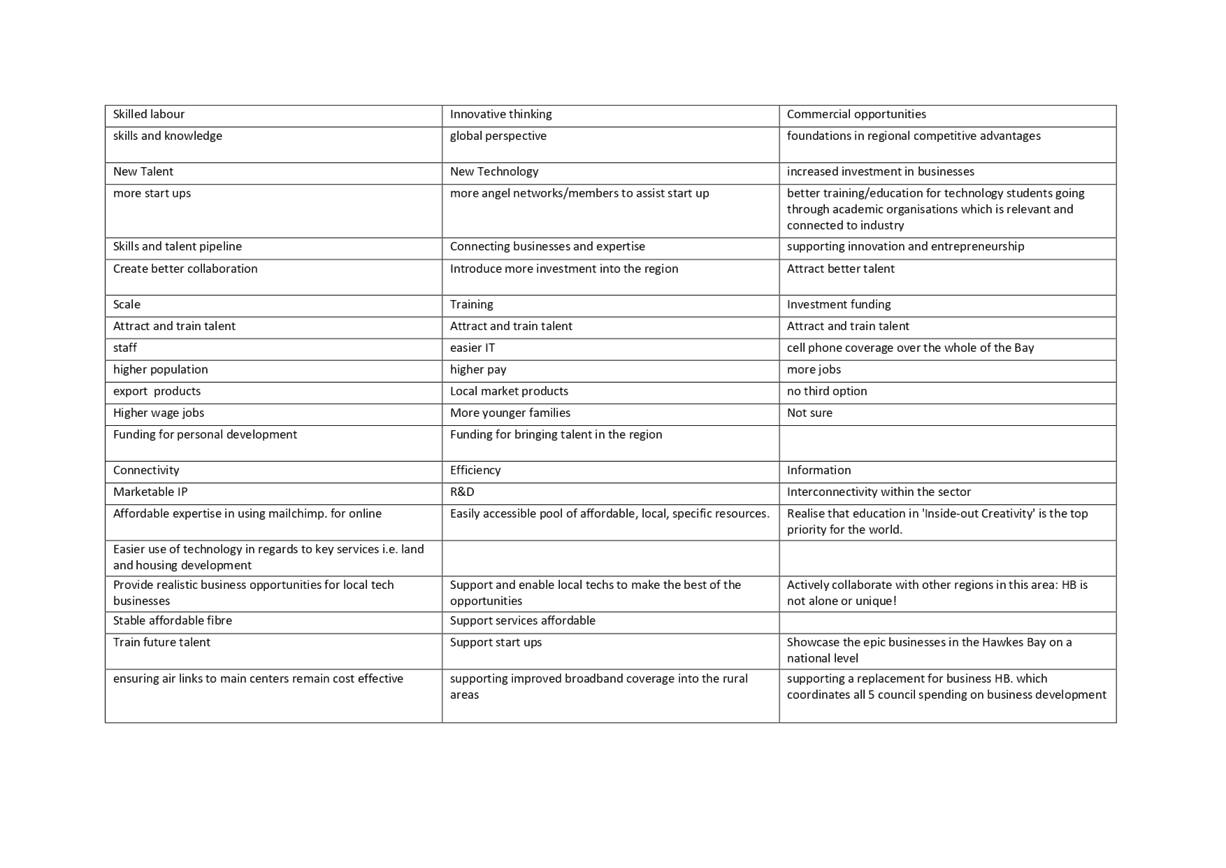

Annual Report 67

8. Possum Control

Area - Partial Regional Pest Management Plan Review 71

9. Proxy for the

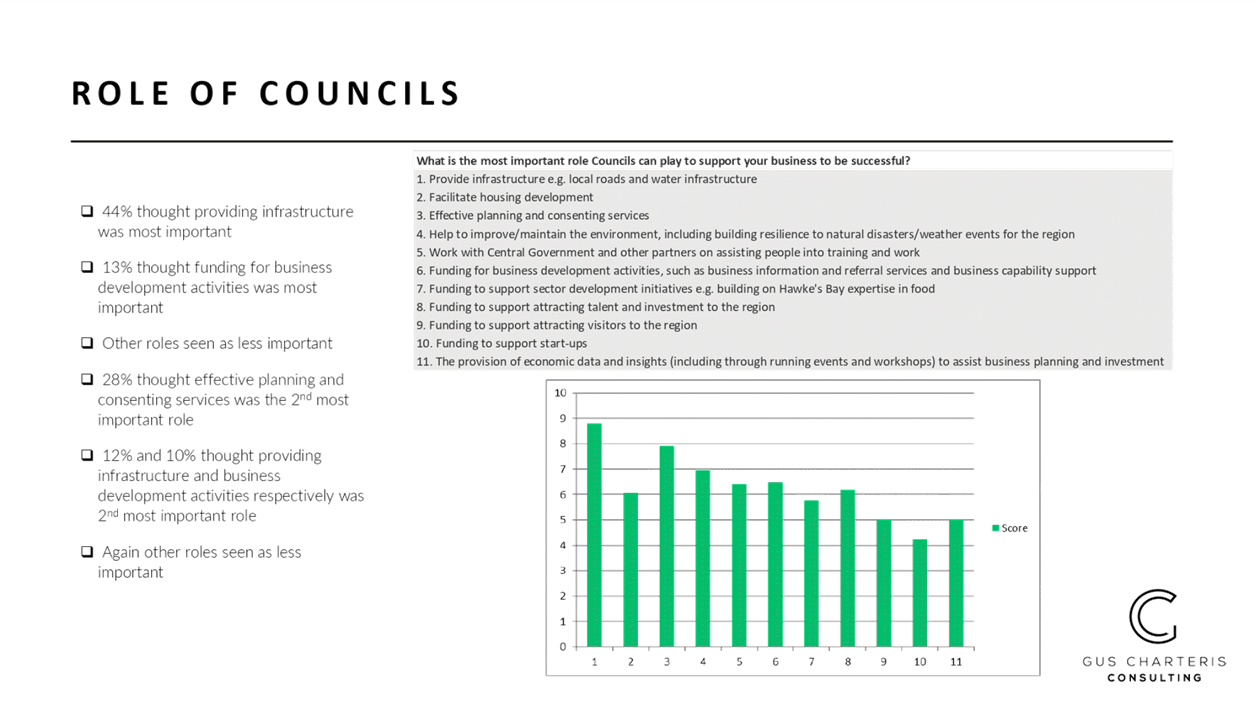

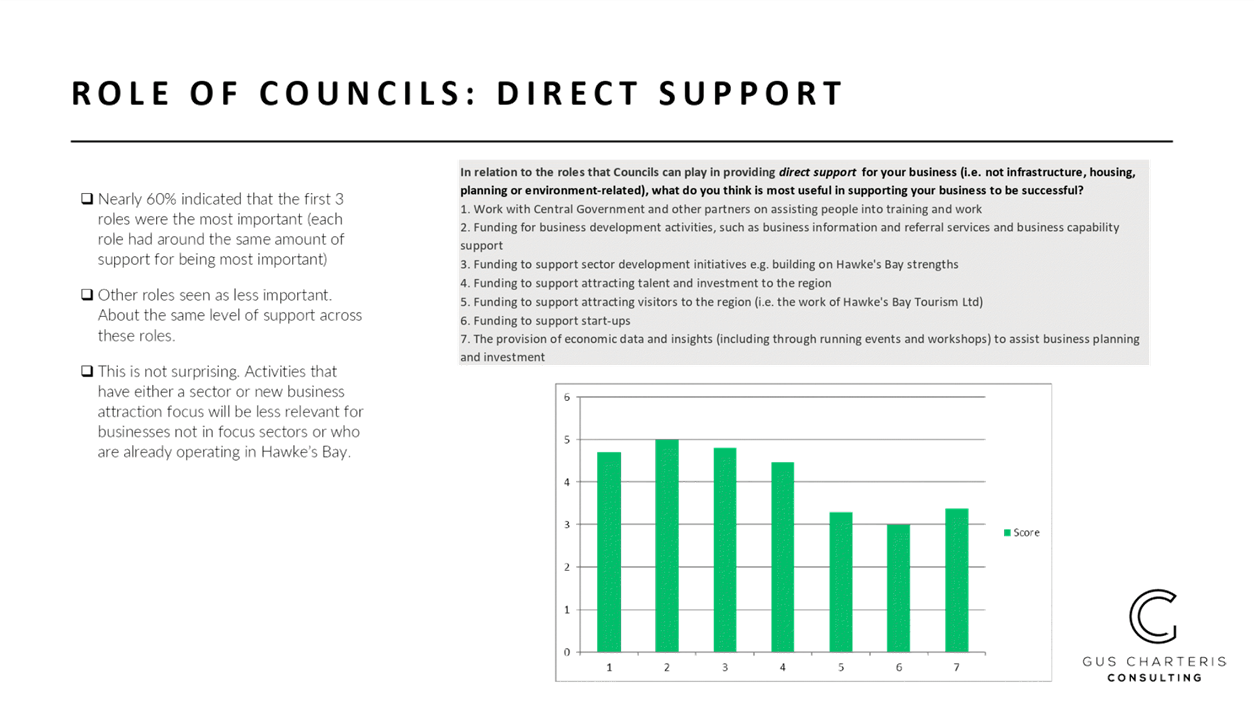

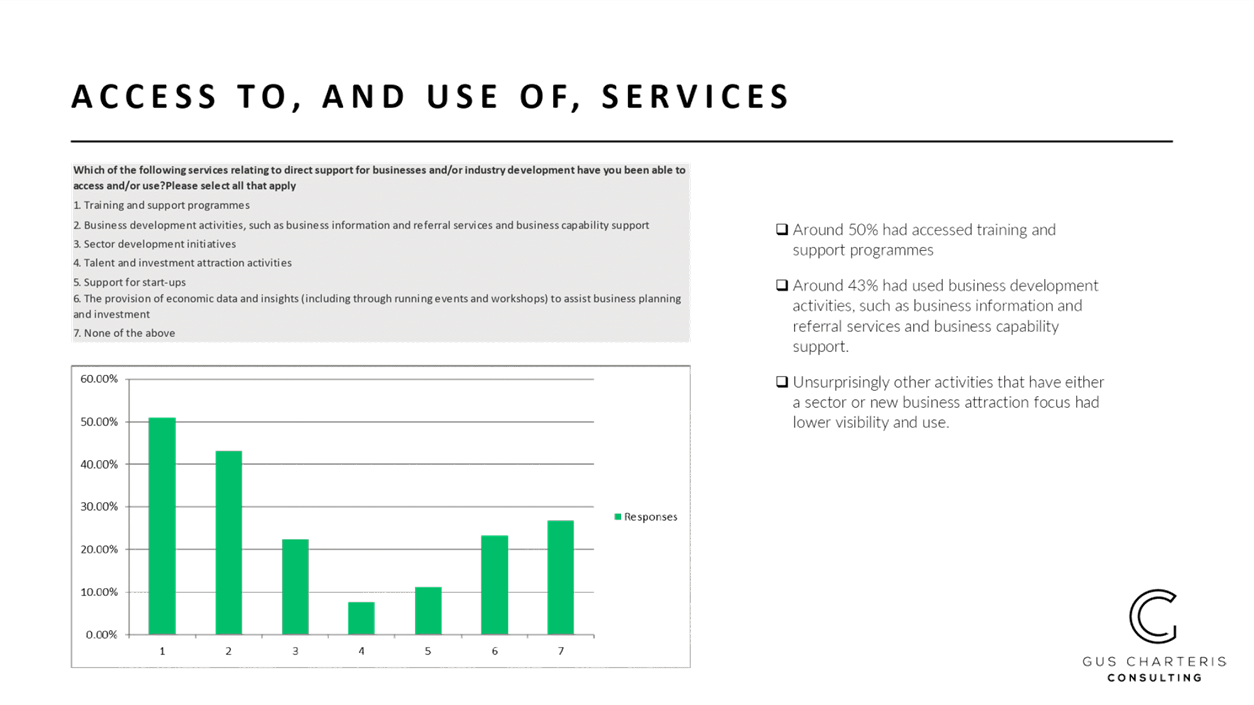

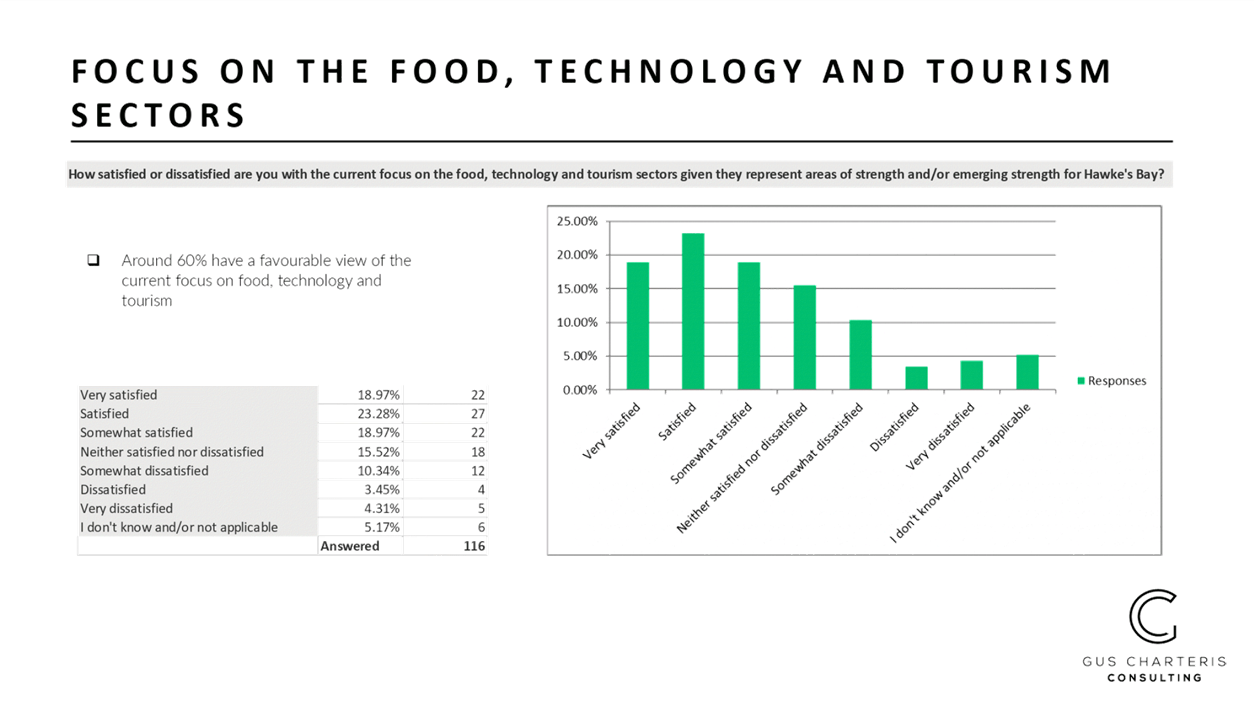

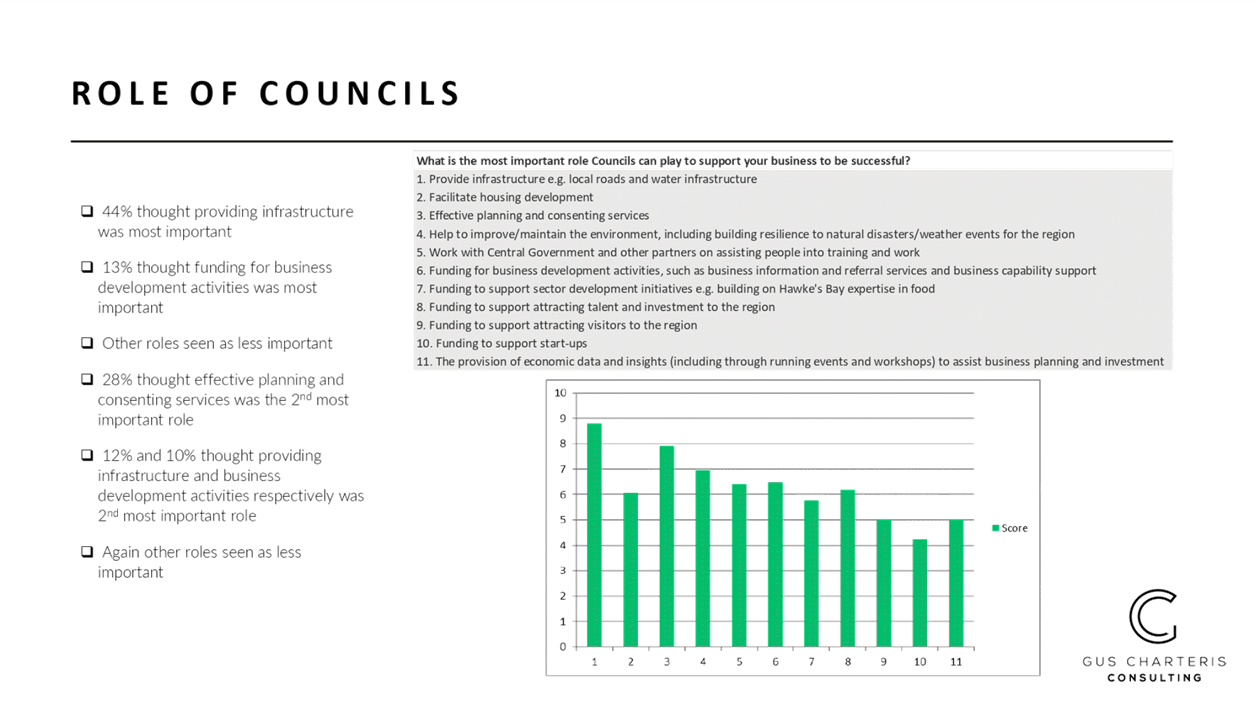

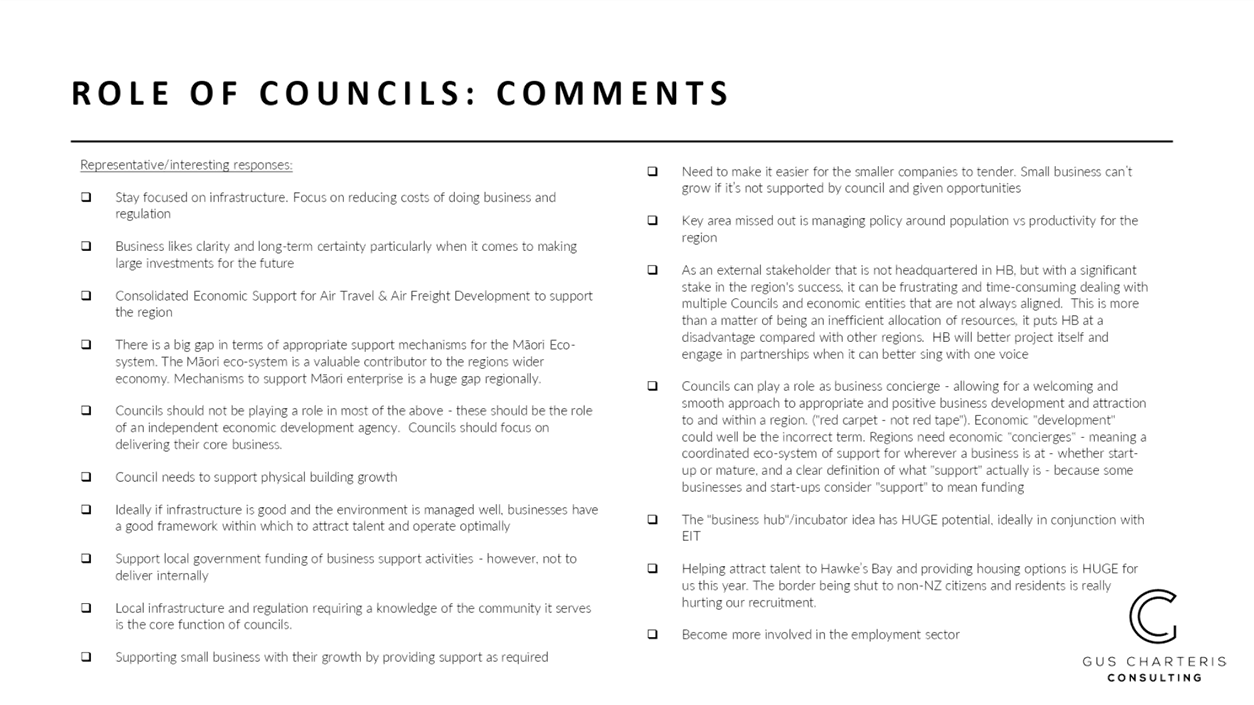

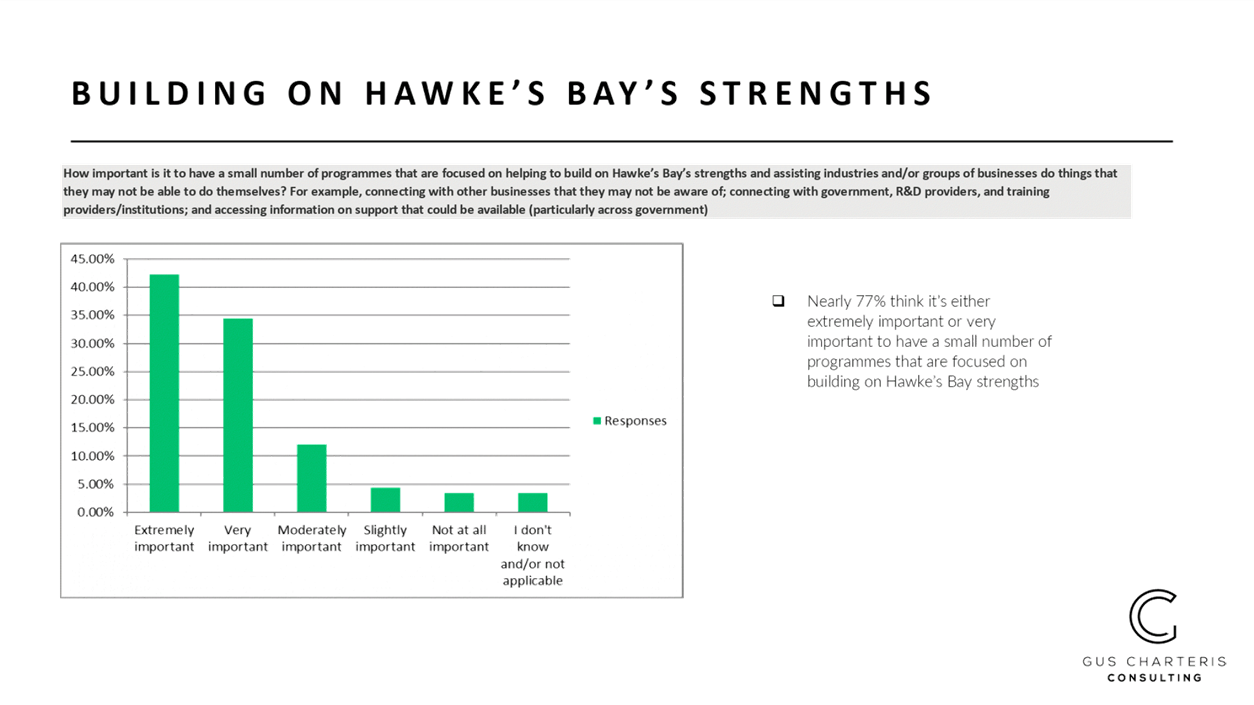

HBRIC Ltd Annual General Meeting 91

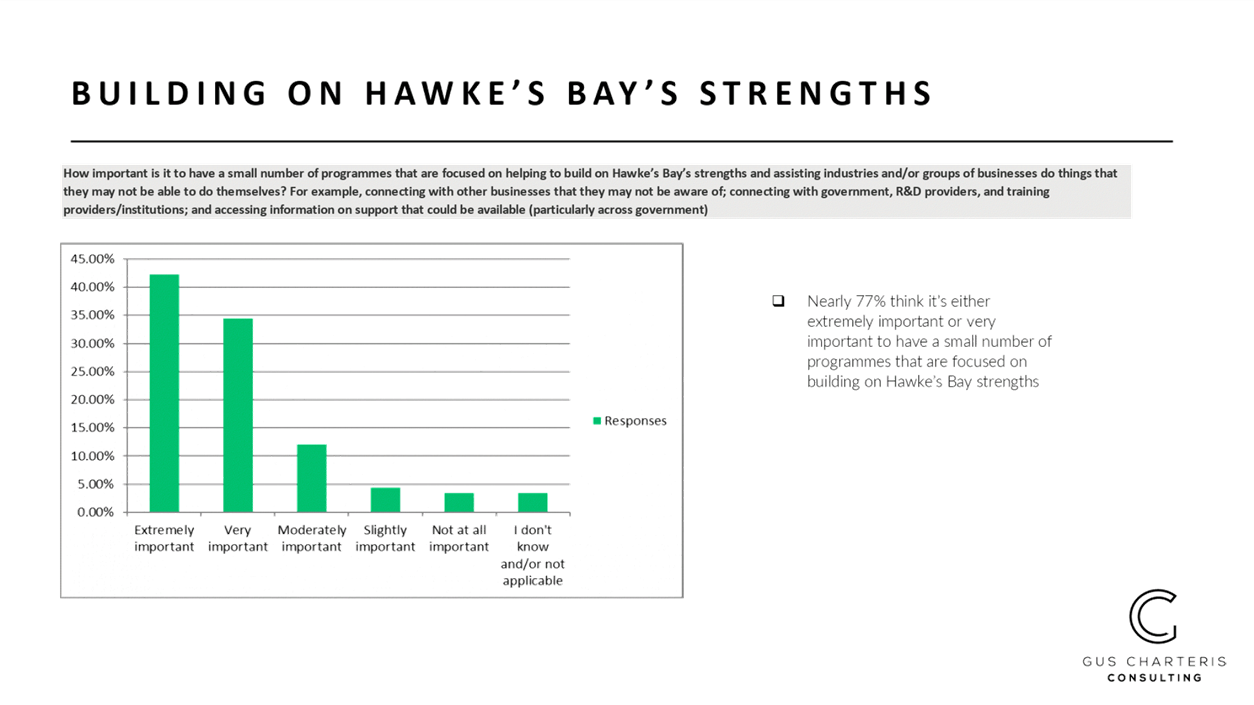

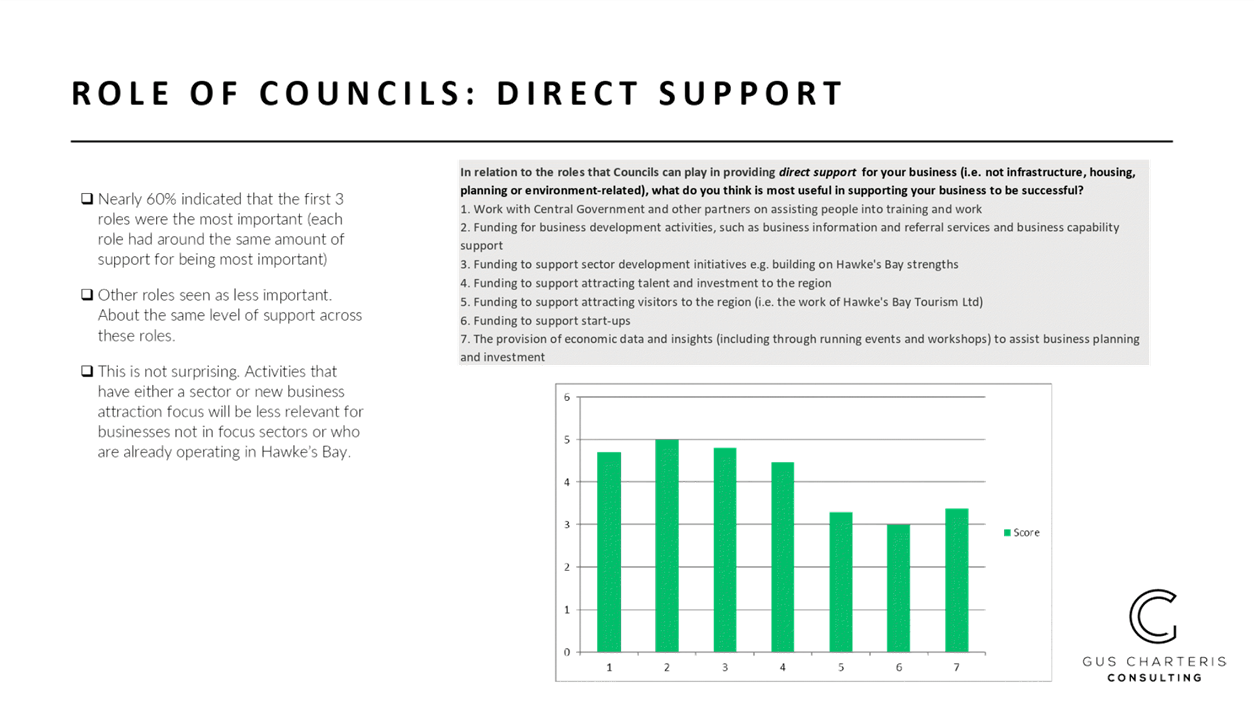

Information or Performance Monitoring

10. HBRIC Ltd Quarterly Update 95

11. Report from the Finance Audit

and Risk Sub-committee Meeting 107

12. National Policy Statement on

Urban Development - Napier-Hastings Housing Assessment 113

13. Organisational Performance

Report for the Period 1 July - 30 September 2021 127

14. Hawke's Bay Tourism

Six-monthly Update 129

15. Discussion of Minor Items not

on the Agenda 149

Decision Items (Public Excluded)

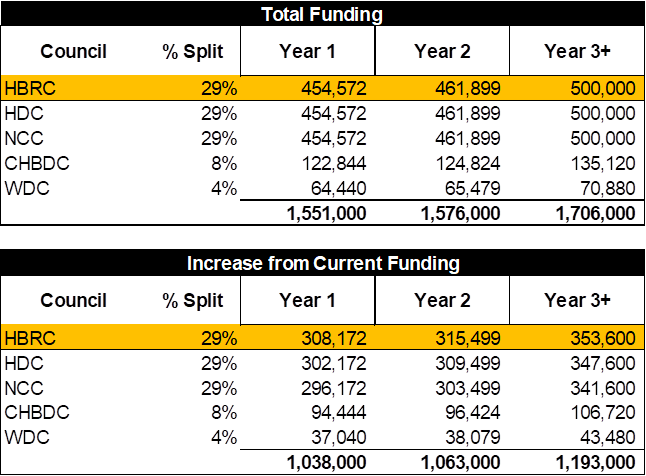

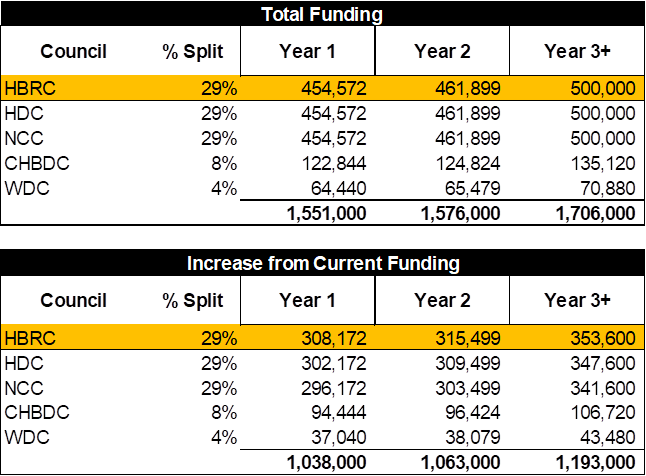

16. Confirmation of Public

Excluded Minutes of the Corporate & Strategic Committee meeting held on 18

August 2021 151

HAWKE’S

BAY REGIONAL COUNCIL

Corporate and

Strategic Committee

17 November 2021

Subject: Follow-ups from

Previous Corporate and Strategic Committee Meetings

Reason

for Report

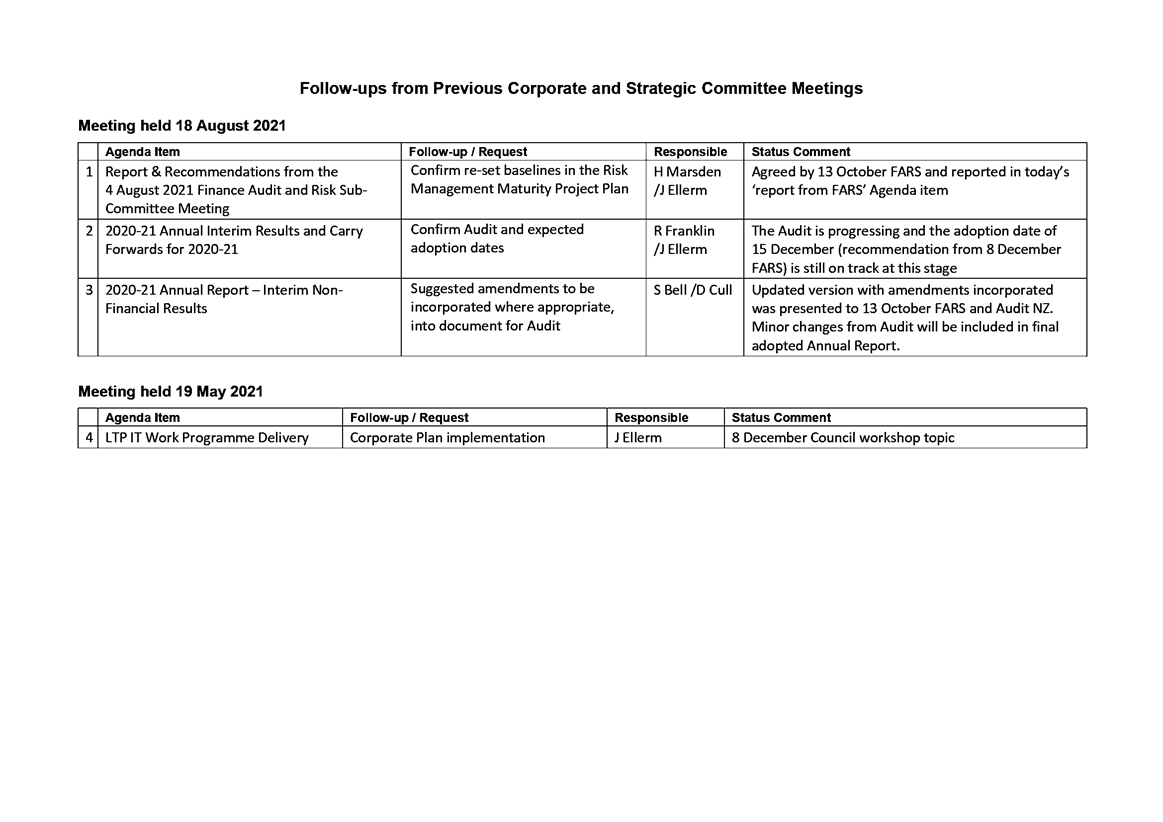

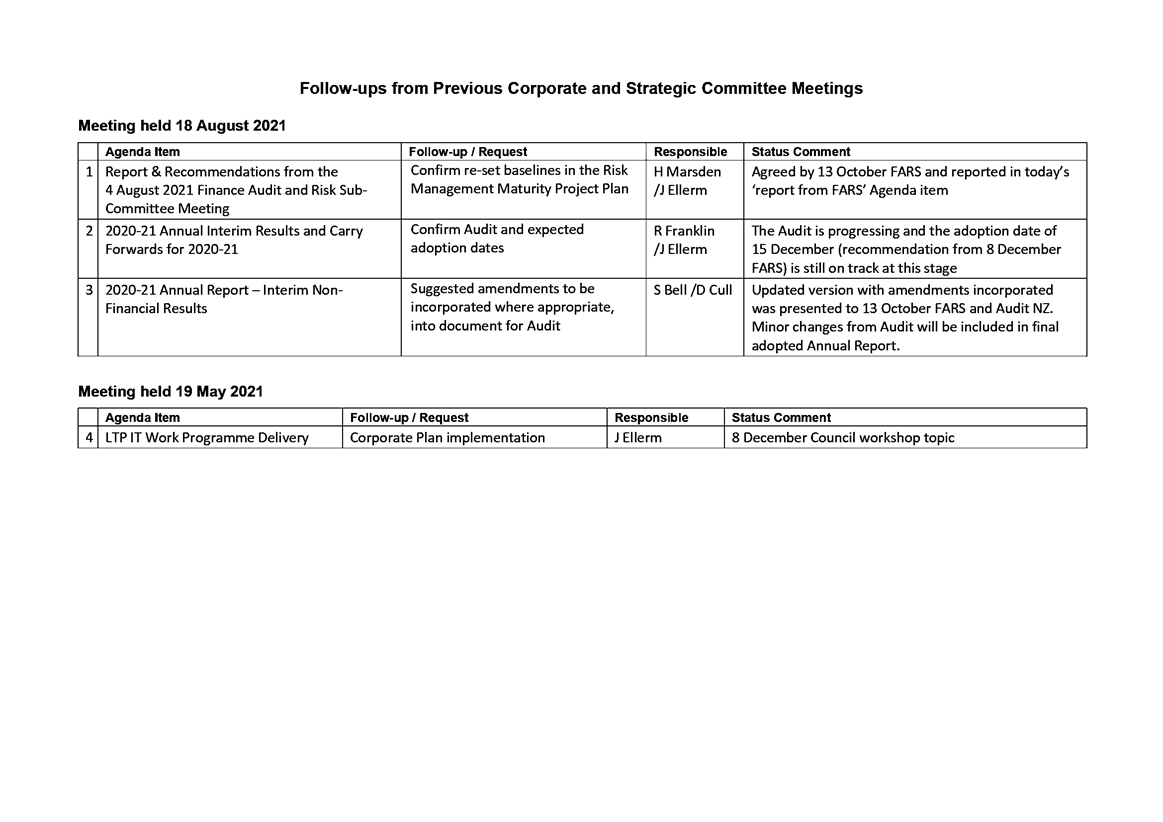

1. On the list attached are items raised at previous Corporate and

Strategic Committee meetings that staff have followed up on. All items indicate

who is responsible for follow up, and a brief status comment. Once the items

have been reported to the Committee they will be removed from the list.

Decision

Making Process

2. Staff have assessed the requirements of the Local Government Act

2002 in relation to this item and have concluded that, as this report is for

information only, the decision-making provisions do not apply.

Recommendation

That the Corporate and Strategic Committee receives and

notes the “Follow-up Items from Previous Meetings”.

Authored by:

|

Leeanne

Hooper

Team Leader Governance

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

Follow-ups

from Previous Meetings

|

|

|

|

Follow-ups

from Previous Meetings

|

Attachment 1

|

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

17 November 2021

Subject: Call for Minor Items

Not on the Agenda

Reason

for Report

1. This item provides the means for committee members to raise minor

matters relating to the general business of the meeting they wish to bring to the attention of the meeting.

2. Hawke’s Bay Regional Council standing order 9.13

states:

2.1. “A

meeting may discuss an item that is not on the agenda only if it is a minor

matter relating to the general business of the meeting and the Chairperson

explains at the beginning of the public part of the meeting that the item will

be discussed. However, the meeting may not make a resolution, decision or

recommendation about the item, except to refer it to a subsequent meeting for

further discussion.”

Recommendations

3. That the Corporate and Strategic Committee accepts the following

“Minor Items Not on the

Agenda” for discussion as Item15:

|

Leeanne Hooper

GOVERNANCE TEAM LEADER

|

James Palmer

CHIEF EXECUTIVE

|

HAWKE’S

BAY REGIONAL COUNCIL

Corporate and

Strategic Committee

17 November 2021

Subject: Hawke's Bay Economic

Development Review

Reason for Report

1. This report

presents the findings and recommendations of the Stage 2 Review of

Investment in Business & Industry Support across the Hawke’s Bay

Region undertaken by Gus Charteris Consulting for the five Hawke’s

Bay councils.

2. This report

also presents subsequent joint ‘next steps’ recommendations with

respect to the preferred option, structure and funding.

3. A briefing on

the draft report was provided to Council in a workshop on 27 October 2021. This

is the first time the public have received the information, therefore the key

findings and recommendations have also been included in this report.

Officers’ Recommendations

4. Council

officers recommend that the Committee notes and considers the findings of the

review and recommends that Council support the establishment of an independent

regional development entity in Hawke’s Bay.

5. Formal

decisions of Council would be subject to the other four councils joint support

and endorsement.

Executive Summary

6. In August 2020

the five Hawke’s Bay councils commissioned a review of business and

industry support across the region.

7. The review

presented a clear case for change – highlighting a range of

inefficiencies and missed opportunities with current ratepayer-funded activities

and services.

8. Councils

endorsed participation in a second stage review process to further investigate

recommendations and focus on what priority activities and services should be

funded, what the best option for delivering this in Hawke’s Bay would be,

and the required cost of investment.

9. Key

recommendations from the second stage review (based on engagement with

iwi/hapū and business) were:

9.1. Focus

ratepayer investment in areas where there are gaps or at a ‘macro’

level (e.g. working with groups of companies or sectors and developing regional

strategies to help marshal and direct scarce resources to areas of agreed

regional priority)

9.2. Support other

organisations to lead on ‘micro’ level activities and services

(given this space is crowded and competitive).

9.3. Support a

‘by Māori for Māori’ approach to regional economic

development given this is an area where Hawke’s Bay has not delivered on

well in the past.

9.4. Continue to

support the HB Business Hub and Matariki Regional Development Strategy.

9.5. Develop

programmes and an area of focus for industry and sector development; investment

and talent attraction; HB brand strategy and activation; coordination of skills

and employment initiatives.

9.6. Consider

funding the establishment of a regional development entity with the appropriate

scale and mandate.

9.7. If the

preferred option is not accepted, at minimum consider funding the establishment

of a regional economic development team that would be hosted by the councils.

10. Prior to the second stage

of the review being finalised, the key findings and recommendations were

workshopped with all five councils, and feedback sought from iwi/hapū and

business.

11. Based on the second stage

review findings and feedback from councils, iwi/hapū and business -

councils are jointly recommending the preferred option of establishing an

independent regional development entity. This would take the form of a non-CCO

and the governance structure would represent an equal co-governance model /

tripartite partnership between business, iwi/hapū and local government.

12. This was the only fully

supported option across councils, iwi/hapū and business.

13. Preference for this model

over other options is based on the substantive and widespread view that if we

are going to do this, we need to do it properly - and a minimum viable option

would not deliver to meet the needs or potential of the Hawke’s Bay

economy. It has also been based on the degree to which this option is most

able to create an enduring platform that provides Hawke’s Bay with the

appropriate scale and mandate to:

13.1. Better guide and direct

activity to priority areas/issues

13.2. Support a culture of

sharing, connection and collaboration, and

13.3. Support Hawke’s

Bay to be greater than the sum of its parts (e.g. by presenting a strong and

united voice and vision to external investors, talent and Central Government),

and by helping to attracting the resources of others.

14. A similar paper and

process is being presented to all five councils over the next four weeks.

Background /Discussion

15. In August 2020 the five

Hawke’s Bay councils commissioned a review (Stage 1 Review) in business

and industry support across the Hawke’s Bay region, stemming from a Local

Government Act (2002) s.17A requirement to review the cost effectiveness of

council arrangements for delivering services on a periodic basis.

16. Key reasoning for commissioning

the review was the request for additional funding by Business Hawke’s Bay

(BHB) – the region’s business development agency, and recognising

the opportunities to improve regional coherence of economic development

investments funded by ratepayers. Councils wanted a clearer picture of funding

commitments to inform Long Term Plan processes starting from late 2020.

17. The focus of the Stage 1

Review was activities undertaken and services provided by BHB, Hawke’s

Bay Tourism (HBTL) and individual councils. Insights developed in relation to

Hawke’s Bay’s Regional Development Strategy (Matariki RDS) were

also incorporated, however not reviewed in detail.

18. The Stage 1 Review

presented a clear case for change - highlighting a range of inefficiencies and

missed opportunities with current ratepayer-funded activities and services and

found there was an opportunity to do something that better met the

region’s needs and potential. The exception to this was HBTL, being

widely supported by its main stakeholders and acknowledged to be doing a

successful job in leveraging ratepayer investment into real value for the

Hawke’s Bay economy.

19. During this review period

BHB made the decision to wind down with formal closure taking effect on 30 June

2021.

20. Councils received and

considered the Stage 1 Review in early 2021. Key recommendations included the

establishment of a new regional economic development agency to lead non-tourism

economic development activities, embedding a partnership with Māori,

retaining the Hawke’s Bay Business Hub (Business Hub), investing in a

clear impact framework for Matariki RDS and better understanding the impact of

Great Things Grow Here (GTGH) in attracting investor/talent attention.

21. All councils endorsed

participation in a second stage review process (Stage 2) to further investigate

recommendations and explore options in relation to effective delivery of

business and industry support for Hawke’s Bay.

22. As a result of BHB’s

wind down councils also endorsed re-directing the joint economic development

funding for a 12 month period to support the Business Hub remaining operational

and continuation of two sector development initiatives (food & fibre and

hi-tech & agri-tech) at a scaled back level. These activities were

considered at minimum necessary to retain an important regional asset and

momentum in two areas of economic development focus for the region while the

Stage 2 Review progressed.

23. The Business Hub

operations and staff and industry programme contractors were formally

transitioned to Hawke’s Bay Regional Council (HBRC) oversight on 1 July

2021 on behalf of the five councils. This arrangement and associated

operations/agreements are in place to 30 June 2022.

Discussion

Stage 2 Review - Process

24. The Stage 2 Review

involved both engagement and desktop analysis, focusing on three key areas:

24.1. The priority

activities/services for ratepayer investment

24.2. Options for the most

effective way to deliver these for Hawke’s Bay

24.3. The estimated cost of

investment.

25. Methodology continued the

frameworks and approach used in Stage 1 – incorporating the needs of both

current and future businesses facing the current Hawke’s Bay economy, but

primarily focused on the appropriate role for local government investment. The

rationale for support is based on this investment being focused to fill some

sort of gap in provision of an activity or service (where there was a market

failure to some degree), and/or seeking to add value that was

additional to what could be achieved otherwise.

26. Engagement has focused on:

26.1. Hawke’s Bay

iwi/hapū through Te Kāhui Ōhanga o Takitimu collective (TKO).

TKO was formed to represent Māori economic interests in Hawke’s Bay

and to help implement Matariki RDS

26.2. Hawke’s Bay

businesses via a survey (see Annex C in the draft report and separate Annex D

attachments) and a small number of group discussions

26.3. Leading providers or

funders of support for small business in Hawke’s Bay, via small

workshops.

27. Insights developed through

this process have been used alongside the following sources of information:

27.1. The survey conducted as

part of the first stage of the review

27.2. A survey Hastings

District Council ran in mid-2020 on interest in, and the focus of, the Hastings

Business Hub

27.3. Hawke’s Bay

business and industry insights from COVID-19 resurgence check-in process led by

Hawke’s Bay councils

27.4. Consultant’s own

knowledge from working with a range of Hawke’s Bay companies, sector

groups and iwi interests.

Stage 2 Review – Key Findings and Insights

28. The detailed review

findings, and insights from engagement with iwi/hapū and wider businesses

are detailed in the final report attached.

29. Summary insights from

engagement with iwi/hapū are:

29.1. Delivering effectively

for Māori will require a new approach or approaches.

29.2. Cultural differences,

familiarity and trust will constrain the reach of mainstream providers and

services. This means there needs to be more opportunity for Māori to

inform, design, support and deliver activities and services.

29.3. Greater effort is

required in helping whānau understand and navigate what is perceived as a

cluttered and complex space. This requires effective regional networks and

requires going to where Māori are, rather than expecting them to seek

things out from central delivery points. Online is not enough.

29.4. Access to capital is

more likely to constrain Māori business – both those starting out

through to Post-Settlement Governance Entities (PSGEs).

29.5. Councils could use their

procurement of services to more effectively support Māori business.

29.6. PSGEs are using their

own procurement to support local and Māori capability. They see themselves

as part of a social and economic eco-system and are building capability to

provide wrap-around support for skill and business development.

30. Summary insights from

engagement with business are:

30.1. There is no single

business perspective. Different businesses will need different things based on

their size and the sector in which they operate.

30.2. There are a wide range

of views on the appropriate role of local government. Some think that local

government should stick to infrastructure and getting the broad regulatory

settings right and some believe councils can play a greater role in increasing

funding for small business and/or sector-based support.

30.3. Smaller businesses are

more likely to be looking for assistance with professional development and

access to business support programmes. There are a range of existing barriers

including awareness, cost, location, and cultural familiarity.

30.4. Beyond infrastructure

and regulatory settings, larger businesses are likely to be looking for

partnerships (with each other and with local government), to do things they

might not be able to do alone. This is often because it requires decisions

and/or investments in other areas that they do not have control over.

30.5. Bigger businesses and

industry organisations are also more likely to be playing a role in helping to

support the region’s strategic economic development priorities e.g.

building on our regional strengths in food and the eco-system of sophisticated

products and services that have grown to support this industry. This means they

are more likely to want to understand how the region is setting and executing

its regional economic development priorities and how they fit into the bigger

picture.

30.6. Bigger businesses in

Hawke’s Bay are frustrated that there is no ongoing and coordinated

engagement, or clear point of contact/one unified voice on economic development

issues. They are seeing opportunities that can only be taken forward as a

region and there is a view that Hawke’s Bay is missing an opportunity to

leverage our strengths and recover strongly from COVID-19.

30.7. There is acknowledgment

that governance and organisational structures can either support or constrain

collaboration and there is a view that Hawke’s Bay has not yet got this

right.

30.8. There is a perception

that there are still unhelpful and competitive behaviours in the system and

that this is constraining more effective collaboration. As the 2020 Review

found, this is feeding a perception in the business community that the economic

development system in Hawke’s Bay is fragmented and not particularly

transparent.

31. Summary findings for the

priority activities/services for ratepayer investment are:

31.1. It is useful to think

about funding for business and industry support in terms of more direct or

‘micro’ support (direct support for business e.g. training for

business owners and employees), versus less direct or more ‘macro’

support for business (e.g. working with groups of companies or sectors and

developing regional strategies to help marshal and direct scarce resources to

areas of agreed regional priority).

31.2. The main gap in service

delivery relates to more ‘macro’ support for business – broad

types of activities include facilitation and connection, promotion, information

provision and addressing collective action issues.

31.3. Given the existing

providers of services to small to medium enterprises (SMEs) there is a less

compelling case for local government investment in more ‘micro’

support for business. That said, engagement with providers and Central

Government funders of these services note that demand is currently outstripping

available supply of funded places. Additional funding could assist with this

and involve partnerships between providers, iwi/hapū, and local and

central government. Any local government funding assistance to provide these

activities would want to target areas where there was a clear gap in service

provision or the ability to add value.

31.4. One area that requires

further consideration is support for start-ups. To be fully effective an

economic development support system will have appropriate interventions along

the spectrum of business needs from start-up through to mature. There appears

to be unmet demand in the start-up area and a lack of funding to support

existing providers of services. A regional economic development team or entity

could help guide investment in this area i.e. develop the strategy in

collaboration with partners, but outsource the delivery (with funding) to

existing providers of services to SMEs.

32. Summary analysis for the

most effective way to deliver these for Hawke’s Bay is:

32.1. The preferred regional

economic development delivery platform for Hawke’s Bay is still a

regional entity that has an appropriate mandate and appropriate resourcing. It

can’t be set up to fail by not giving it a clear purpose and mandate and

inadequate resources.

32.2. A regional entity with

the appropriate scale and mandate could guide and direct activity to priority

areas/issues; support a culture of sharing, connection and collaboration; and

support Hawke’s Bay to be greater than the sum of its parts (e.g. by

presenting a strong and united voice and vision to external investors, talent

and Central Government; and by helping to attracting the resources of others).

32.3. This could take the form

of an independent Trust, Incorporated Society or Company - or a Council

Controlled Organisation (CCO). An independent form that is not a CCO is more

likely to be accepted by iwi/hapū and wider business. Specialist legal and

tax advice would be recommended before deciding the preferred legal form.

32.4. All structures would

offer an opportunity to embed a tripartite governance partnership between local

government, iwi/hapū, and wider business. An independent Board could be

made up of 2 representatives from local government, iwi/hapū, and wider

business respectively. An independent Chair could complete a 7-person Board.

32.5. This entity would need

to be supported by an effective measurement and reporting framework which helps

track the relationship between activities, outputs and outcomes i.e. whether

ratepayers’ money is being invested and used effectively.

32.6. Hawke’s Bay may

not be able to do this in one step. There is a legacy of mistrust that

investment in regional economic development activities yield meaningful results

and ratepayer funding is constrained. Trust may need to be earned and value

delivered in order to motivate additional funding over time.

Stage 2 Review – Recommendations

33. The Stage 2 Review

recommends that the priority activities/services for ratepayer investment

should:

33.1. Focus in areas where

there is a gap in provision of an activity or service. This will look like

working with groups of companies or sectors and developing regional strategies

to help marshal and direct scarce resources to areas of agreed regional

priority.

33.2. Support other

organisations to lead on support for SMEs and start-ups - this does not need to

sit with a regional economic development entity. To assist with ‘lane

clarity’ and to help support regional collaboration rather than

competition, consideration should be given to supporting the HB Chamber of

Commerce to take on the Regional Business Partner (RBP) contract. Separate

funding could also be made available to an agreed Māori economic

development nominee subject to developing an agreed approach and focus for the

funding.

33.3. Prioritise the following

activities/services:

33.3.1. HB Business Hub

33.3.2. Programme Management

support for Matariki RDS

33.3.3. Industry and sector

development programmes

33.3.4. Investment and talent

attraction

33.3.5. Hawke’s Bay

brand strategy and activation

33.3.6. Coordination of skills

and employment initiatives – focused on connecting businesses with people

and training organisations

33.3.7. Provision of funding

to support a ‘by Māori for Māori’ approach to regional

economic development (delegated to TKO and/or an agreed nominee)

33.3.8. Additional funding for

SME and start-up support - if funding allows and a clear gap or need is

identified, but delivered by other providers.

34. The Stage 2 Review

recommends that councils consider funding the establishment of a regional

development entity with the appropriate scale and mandate, that would be

responsible for the priority activities and services above (see above).

35. If the preferred option is

not accepted, the review recommends that at a minimum councils should consider

funding the establishment of a regional economic development team that would be

hosted by the Councils and would be responsible for:

35.1. The HB Business Hub

35.2. Programme Management

support for Matariki RDS

35.3. Current industry and

sector development programmes

35.4. Provision of funding to

support a ‘by Māori for Māori’ approach to regional

economic development (delegated to TKO and/or an agreed nominee).

Stage 2 Review – Consultation and Feedback

36. Prior to the Stage 2

Review being finalised, the key findings and recommendations were workshopped

with all five councils. In addition, TKO were formally sent the draft report to

provide feedback as our iwi/hapū partner in this process and a number of

businesses engaged with to ensure they were on board and supportive of the

planned direction.

37. Feedback summary –

councils:

37.1. General

support for direction of travel and recommendations. Understanding of rationale of focusing investment where gaps needed

to be filled and a future platform ‘swimming in the appropriate

lane’.

37.2. An

acknowledgement of tumultuous history with Hawke’s Bay economic

development agencies and historic under-funding and unclear purpose/mandate.

The plan forward needs to be sustainable and enduring - if

we’re going to do it, we need to do it well.

37.3. An

acknowledgment that good metrics and outcome/reporting frameworks would need to

be developed in the establishment phase to guide activities and hold the entity

to account for delivery for the region (and individual districts).

37.4. A

desire to understand business feedback and ensure they are on board –

this is not about councils, it is about business.

37.5. Both

communications and Hawke’s Bay branding, and skills and talent growth

were seen as critical areas of focus. This leant to more support for the

preferred option rather than a minimum viable option for Hawke’s Bay.

37.6. Best

mechanism for delivery of funding for Māori economic development will need

further consultation with Hawke’s Bay iwi/hapū.

37.7. Funding constraints and

the need to prioritise are very real challenges for councils to consider. Any

additional funding will likely significantly impact Annual Plans.

38. Feedback summary –

iwi/hapū (via TKO):

38.1. Acknowledgement that

there is merit across the options presented.

38.2. Raised the importance of

an outcomes or performance framework that references to the current

Hawke’s Bay Strategy – Matariki RDS.

38.3. Desire to further

understand what a Māori partnership/co-governance model would look like.

38.4. General support for

direction and seeking in summary:

38.4.1. Commitment

to a partnered approach

38.4.2. A

co-governance model and active involvement in the strategic leadership

38.4.3. A

co-managed operational model

38.4.4. By

Māori for Māori regional economic development approach (delegated to

TKO or nominee).

39. Feedback summary –

business:

39.1. Widespread endorsement

and support for the preferred option recommendation – a fully funded

regional development entity. Pleasantly surprised where this had landed and see

this a big step forward for Hawke’s Bay.

39.2. Noted that the proposal

would only be supported if councils commit to getting in behind the entity and

not running parallel strategies or undermining it.

39.3. Acknowledged

the critical need for Hawke’s Bay to speak with one voice nationally

– be unified and seen to be unified.

39.4. Agreement that the new

entity should stay out of the business advice space and focus on the big

transformational opportunities. Noted the need for any entity to focus effort

very tightly and avoid taking on all the region’s problems and achieving

nothing.

39.5. Agreement to keep

Hawke’s Bay Tourism separate but explore co-location to share overheads

and maximise synergistic collaboration in the future.

39.6. Acknowledged

the importance of Matariki RDS and thinking about economic development from an

‘every whānau and every household’ perspective – however

noted that it needs a refresh and refocus.

39.7. A desire to ensure

governance is light touch, with clusters of industry participants working

together on specific programmes.

39.8. Supportive of tripartite

governance model and independent non-CCO entity.

39.9. Some larger businesses

were favourably disposed toward financial or in-kind contributions in the

future.

39.10. Concern raised with a July 2022

start date – we don’t want to lose momentum and energy, or

opportunities to secure Central Government funding for key sector programmes.

Options Assessment

40. The Stage 2 Review

considers 5 main options for delivery. These are detailed in the attached

report. Options were analysed and rated against key criteria with the

assessment resulting in the best option for Hawke’s Bay being a regional

development entity.

41. Preference for this model

over other options is based on the degree to which this option is most able to

create an enduring platform that provides Hawke’s Bay with the

appropriate scale and mandate to:

41.1. Better guide and direct

activity to priority areas/issues

41.2. Support a culture of

sharing, connection and collaboration, and

41.3. Support Hawke’s

Bay to be greater than the sum of its parts (e.g. by presenting a strong and

united voice and vision to external investors, talent and Central Government),

and by helping to attracting the resources of others.

42. If this option is not

accepted, the review recommends that at a minimum councils should consider

funding the establishment of a regional economic development team that would be

hosted by the councils.

43. Both the preferred option

(a regional development entity) and the minimum option (a regional development

team), were presented to councils, iwi/hapū and business during feedback

sessions and workshops.

Regional Cost of Investment

44. The Preferred Option -

Option 3: A Regional Development Entity represents:

44.1. Estimated cost of

investment per annum of $1.706m

44.2. One-off investment in

CAPEX of $50,000

44.3. Representing an

operational increase of $1.193m per annum on the existing investment of

$513,000 across the five councils (excluding internal economic development

investment within councils)

45. The Minimum Option -

Option 2: A Regional Development Team represents:

45.1. Estimated cost of

investment per annum of $1.05m

45.2. One-off investment in

CAPEX of $50,000

45.3. Representing an

operational increase of $537,000 per annum on the existing investment of

$513,000 across the five councils (excluding internal economic development

investment within councils).

46. Central Government funding

has been secured to support Matariki RDS programme management for 2022 and

2023. This totals $155,000 (year 1) and $130,000 (year 2). This would therefore

decrease the total funding requirement for either option over these two years,

given Matariki RDS programme management support has been built into the overall

budget.

Preferred Option Recommendation

47. Based on the Stage 2

Review findings and feedback from councils, iwi/hapū and business,

councils are jointly recommending:

47.1. The Preferred Option

– Option 3 – A Regional Development Entity. This option

equates to an increase of 200%+ and $1.2M on the current joint investment of

$513,000.

47.2. This was the only fully

supported option across all five councils, iwi/hapū and business.

47.3. Preference for this model

over other options is based on the substantive and widespread view that if we

are going to do this, we need to do it properly - and a minimum viable option

would not deliver to meet the needs or potential of the Hawke’s Bay

economy. It has also been based on the degree to which this option is most able

to create an enduring platform that provides Hawke’s Bay with the

appropriate scale and mandate to better guide and direct activity to priority

areas/issues; support a culture of sharing, connection and collaboration; and

support Hawke’s Bay to be greater than the sum of its parts (e.g. by

presenting a strong and united voice and vision to external investors, talent

and Central Government), and by helping to attracting the resources of others.

47.4. The following regional

funding split is agreed

|

Council

|

% Split

|

|

Hawke's Bay Regional Council

(HBRC)

|

29%

|

|

Hastings District Council (HDC)

|

29%

|

|

Napier City Council (NCC)

|

29%

|

|

Central Hawke's Bay District

Council (CHBDC)

|

8%

|

|

Wairoa District Council (WDC)

|

4%

|

47.5. A non-CCO independent

entity with the legal form (i.e. Trust, Incorporated Society or Company) to be

confirmed upon legal and tax advice

47.6. An appropriate

governance structure with an independent chair that incorporates equal

co-governance across business, iwi/hapū and local government.

48. Whatever legal form is

chosen, councils could influence priorities through yearly Statement of Intent

and Service Level Agreement (SLA)/Contract for Service (CfS) setting

discussions. This entity would also need to be supported by an effective

measurement and reporting framework which helps track the relationship between

activities, outputs, and outcomes. This would help to provide greater

transparency and accountability around whether ratepayers’ money is being

invested and used effectively.

Strategic Fit

49. Most of what Council does

and is focussed on under its 2020-2025 Strategic Plan is critical for the

region’s economic wellbeing – particularly the management of the

region’s natural resources and hazards. HBRC plays a broad role by ensuring

the natural resource platform upon which both the economy and community relies

on is managed to meet the reasonably foreseeable needs of future generations.

Equally, a strong regional economy is essential to fund Council’s

projects and key activity through rates and investment returns.

50. Support for the

development of individual businesses, industries or sectors however is not a

focus area or strategic priority. Council’s focus is typically related to

areas of core competence, such as water security or flood control.

51. Funding for HBTL and BHB

have historically occurred as a consequence of the Council’s ability to

raise rating revenue across the entire region. It is proposed that the economic

development rate continue to be collected by Council (70% from the commercial

sector) and that this be applied to continuing to fund HBTL and a percentage of

a future economic development entity.

Significance and Engagement Policy Assessment

52. Staff have assessed the

significance of the decisions in this report and have concluded that they are

not significant and therefore do not require community consultation before

these decisions are taken. The assessment considered the “criteria for

significance” from the Council’s adopted Significance and

Engagement Policy, summarised in the table below.

|

Criteria

|

Assessment

|

|

Community interest

|

Low

to Medium

|

|

Impact for affected individuals of

groups

|

Low

to Medium

|

|

Impact on rights and Interests of

Tāngata Whenua

|

Low

|

|

How much promotes community

outcomes or other council priorities

|

Low

|

|

Impact on existing levels of

service

|

Low

|

|

Impact on rates or debt

|

Low

|

|

Cost and financial implications to

ratepayers

|

Low

to Medium

|

|

Involvement of strategic asset

|

No

|

|

Conclusion

|

Not

significant

|

Climate Change Considerations

53. Climate change is expected

to create barriers and opportunities for future economic development within the

region and it will be important that any new delivery model for the region is

responsive to these change drivers. Water security has been an existing pillar

of Matariki RDS as one component of ensuring there is climate resilience to

support the future wellbeing of the regional economy. As the regional lead

agency on climate change Council staff will ensure that any new model that

emerges is informed about these barriers and opportunities in due course.

Considerations of Tangata Whenua

54. Tangata whenua have a

significant stake in the regional economy and are key partners for regional

economic development support activity. Councils have partnered with TKO (on

behalf of Hawke’s Bay iwi/hapū) throughout this review process. TKO

have endorsed the key findings and recommendations subject to ongoing

partnership and co-design around future service delivery.

55. A commitment has been made

to a partnered approach and it is intended that collaboration will continue to

occur as the next phase progresses.

56. The proposed governance

model in the preferred option includes equal co-governance across

iwi/hapū, business and local government.

Financial and Resource Implications

57. The financial impact of

the recommended option – a regional development entity, for the five

councils is set out in the table following. This takes into account the Central

Government funding secured for Matariki RDS. Also highlighted is the increase from

Council’s current direct funding in this space (total investment required

less the previous BHB funding and other direct economic development

expenditure).

58. It is proposed that the

increased investment ($308K - $354K) is funded by reallocation within the existing

regional development budget as discussed at the 27 October workshop. This is

primarily achieved by reallocating the non-committed economic development

consultancy budget, and the reapportionment of some corporate overheads within

the budget model. Because this funding is derived from a targeted rate for the

purposes of economic development it is not available for reallocation to other

Council functions or priorities.

59. The proposed approach will

still absorb corporate overheads to a level which is deemed appropriate for the

new activity given less activity will be delivered by Council directly under

this proposal. Initial modelling has been completed and the CFO is comfortable

that the impact of the reallocation is not significant.

Consultation and Next Steps

60. In undertaking both the

Stage 1 and Stage 2 reviews, the Consultant has surveyed and interviewed key

stakeholders involved in economic development across the region. Feedback was

also sought on key findings, recommendations and the proposed way forward.

61. The recommended option and

funding mechanism will not trigger consultation requirements under the Local

Government Act 2002 or Council’s Significance and Engagement Policy with

respect to form/structure, increased investment or delivery model.

62. Council will inform and

communicate any agreed changes to the community as part of the 2022-23 Annual

Plan, however it will not be a separate consultation topic.

63. The Committee will be

provided an update at the next Corporate and Strategic Committee meeting.

Decision Making Process

64. Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

64.1. The

decision does not significantly alter the service provision or affect a

strategic asset, nor is it inconsistent with an existing policy or plan.

64.2. The use

of the special consultative procedure is not prescribed by legislation for this

decision but is for consequential decisions.

64.3. This

decision is not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy, however consequential decisions

will be informed by 2022-23 Annual Plan consultation with the community.

64.4. The persons affected by

this decision are all regional ratepayers and residents who benefit directly or

indirectly from the Council’s economic development activities.

64.5. Given

the nature and significance of the issue to be considered and decided, and also

the persons likely to be affected by, or have an interest in the decisions

made, Council can exercise its discretion and make a decision without

consulting directly with the community or others having an interest in

this decision.

Recommendations

1. That the

Corporate and Strategic Committee receives and considers the “Hawke's Bay

Economic Development Review” staff report.

2. The Corporate

and Strategic Committee recommends that Hawke’s Bay Regional Council:

2.1. Agrees that

the decisions to be made are not significant under the criteria contained in

Council’s adopted Significance and Engagement Policy, and that Council

can exercise its discretion and make decisions on this issue without conferring

directly with the community or persons likely to have an interest in the

decision.

2.2. Supports the

Stage 2 Review recommendations for priority activities/services and the focus

for ratepayer investment in business and industry support.

2.3. Supports the

establishment of a regional development entity in Hawke’s Bay.

2.4. Supports the

recommended funding split and notes the financial implications for the Regional

Council.

2.5. Endorses

councils’ partnership approach with Hawke’s Bay iwi/hapū

2.6. Agrees to accommodate

the Regional Council’s funding contribution for the new entity from

reprioritisation within the targeted rate funded regional development budget in

the 2022/23 Annual Plan.

Authored by:

|

Sarah Tully

Regional Recovery Manager

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

James Palmer

Chief Executive

|

Attachment/s

|

1⇨

|

Stage 2

Review of Investment in Business Industry Support in HB

|

|

Under

Separate Cover

|

|

2⇩

|

Summary of

survey responses

|

|

|

|

3⇩

|

Survey

Responses - verbatim comments

|

|

|

|

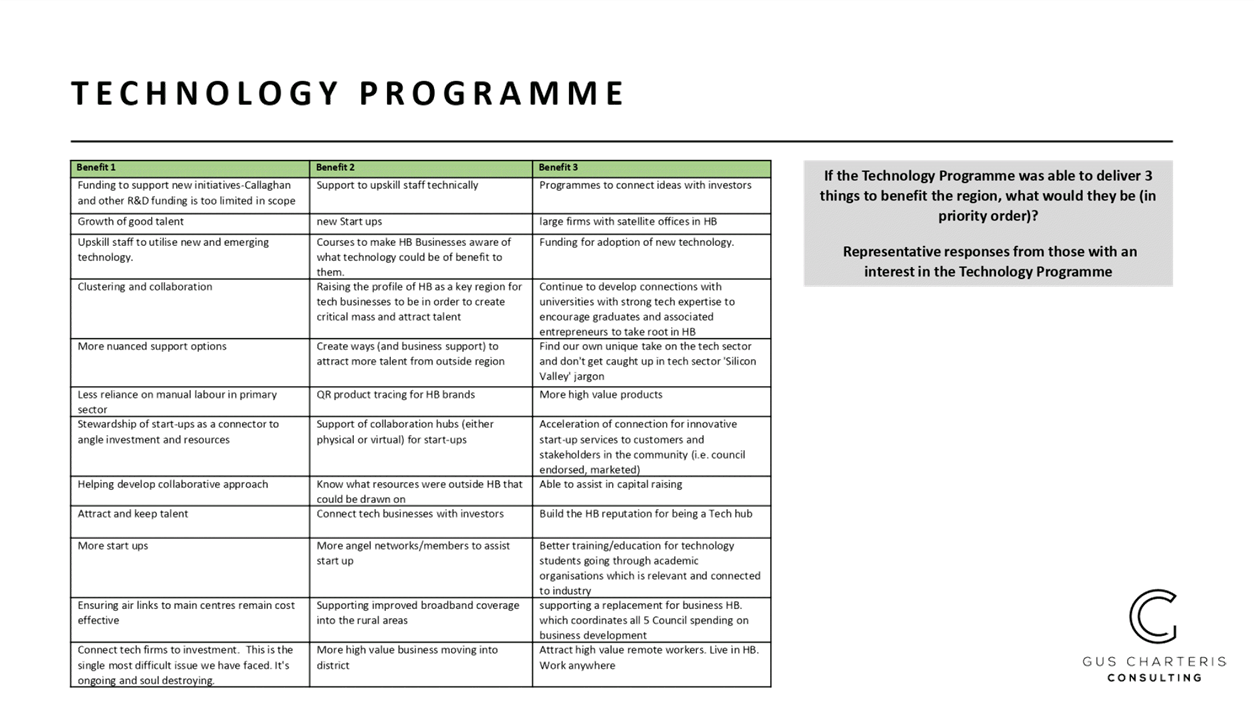

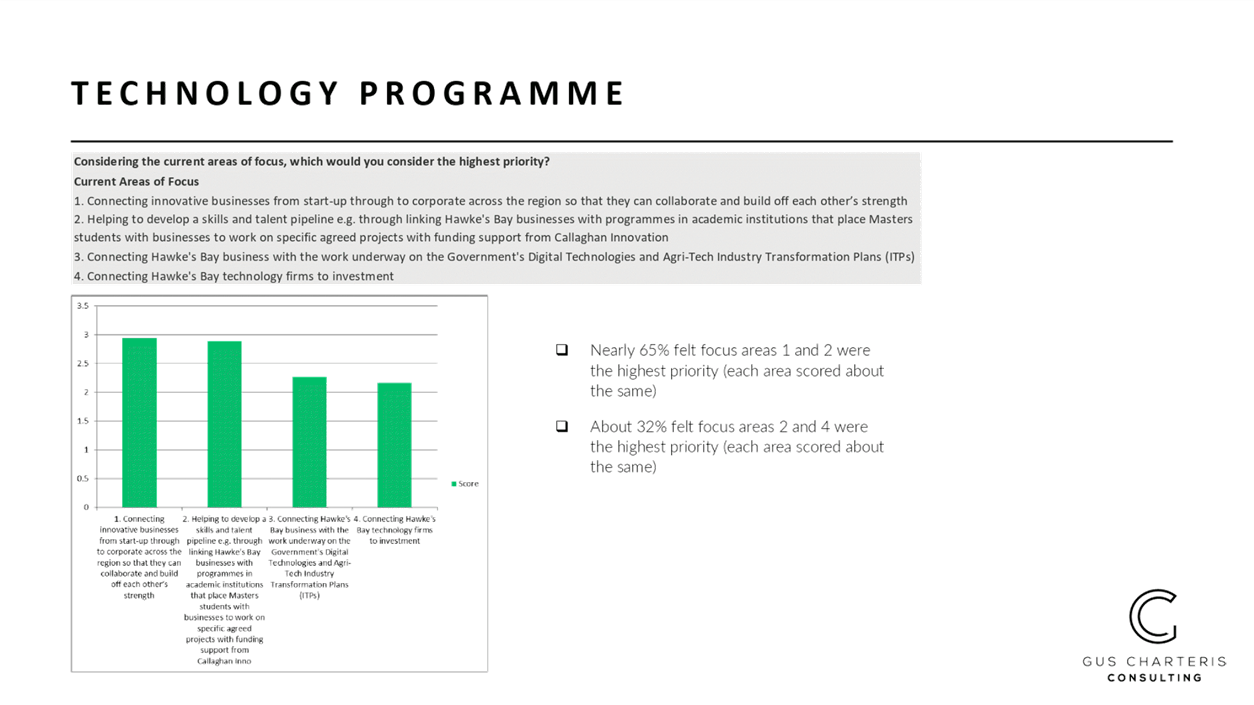

Summary

of survey responses

|

Attachment 2

|

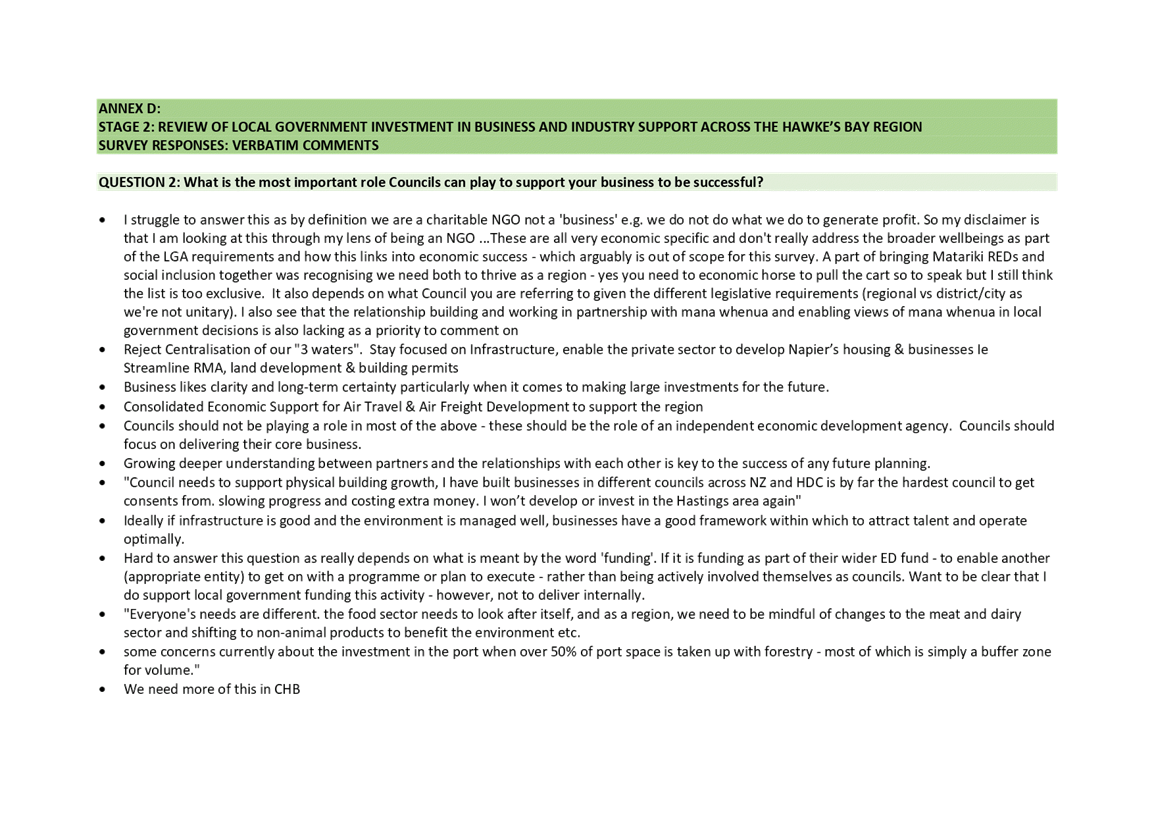

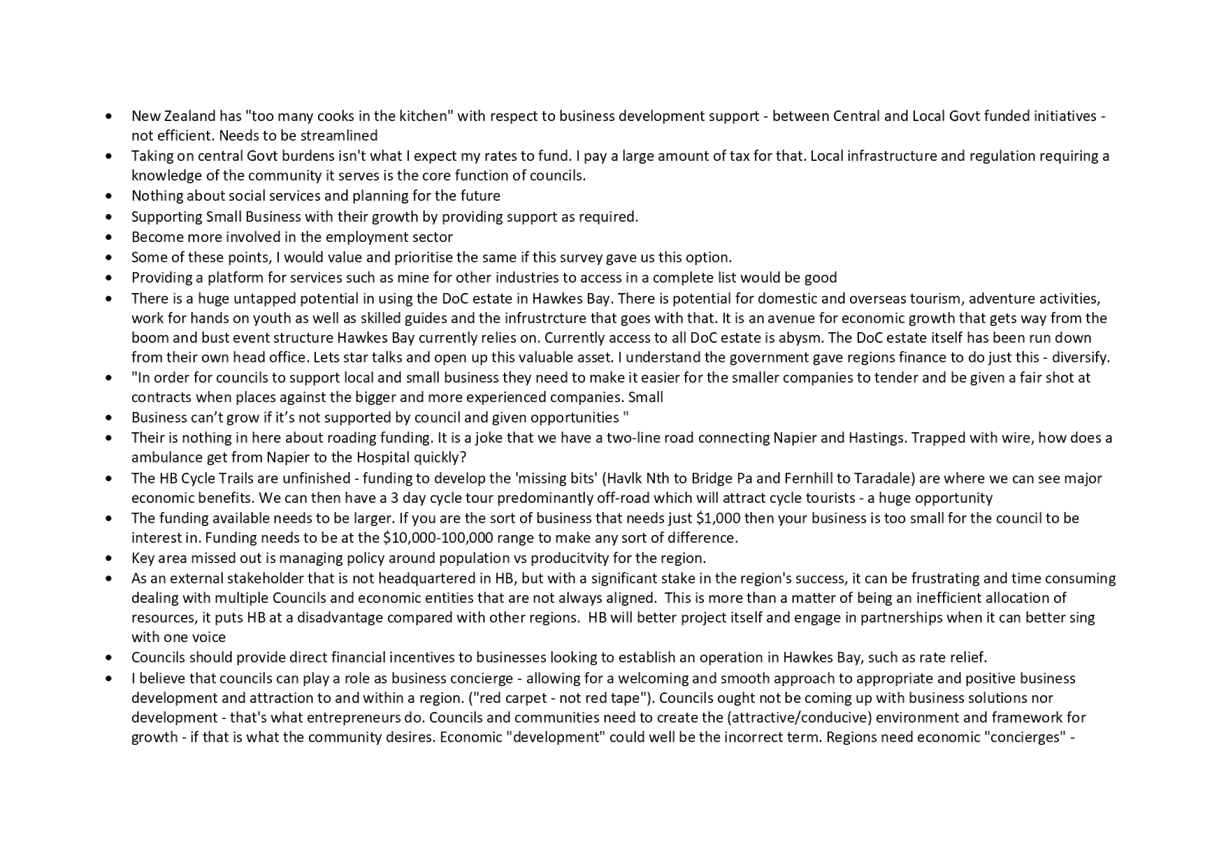

|

Survey Responses - verbatim

comments

|

Attachment 3

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

17 November 2021

Subject: 2020-21 Compliance

Annual Report

Reason for Report

1. This item

provides the 2020-21 Hawke’s Bay Regional Council’s (HBRC)

Compliance Annual Report for the Committee’s information and

recommendation to Council for adoption.

2. A comprehensive

report on HBRC’s Compliance Monitoring and Enforcement (CME) activities

provides transparency to our communities and those regulated by us.

Reporting the level of compliance with consent conditions, breaches of the Resource

Management Act 1991 (RMA) and Regional Resource Management Plan and

interventions undertaken, allows trends to be tracked and council’s

performance be open to public scrutiny.

Officers’ Recommendations

3. The reporting

officer recommends that the Corporate and Strategic Committee receives the

report and recommends that Council adopts the report for publication on the

Council’s website.

Executive Summary

4. The attached

annual report summarises HBRC’s Compliance Monitoring and Enforcement

functions undertaken under the RMA. It details the breadth of monitoring

undertaken, the levels of compliance reported, and a summary of enforcement

action taken during the year.

5. Compliance

monitoring - staff monitored a total of 3092 (93.8%) resource consents out

of a total 3297 to be monitored. This included 2029 water takes monitored

remotely through telemetry, and 1063 discharge and land use consents monitored

through inspections and data returns. Overall, 2574 (83.2%) of consent holders

were fully compliant, and only 22 (0.8%) were in significant non-compliance.

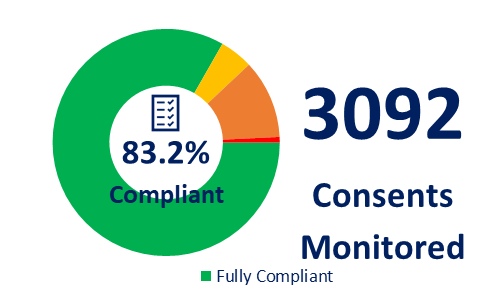

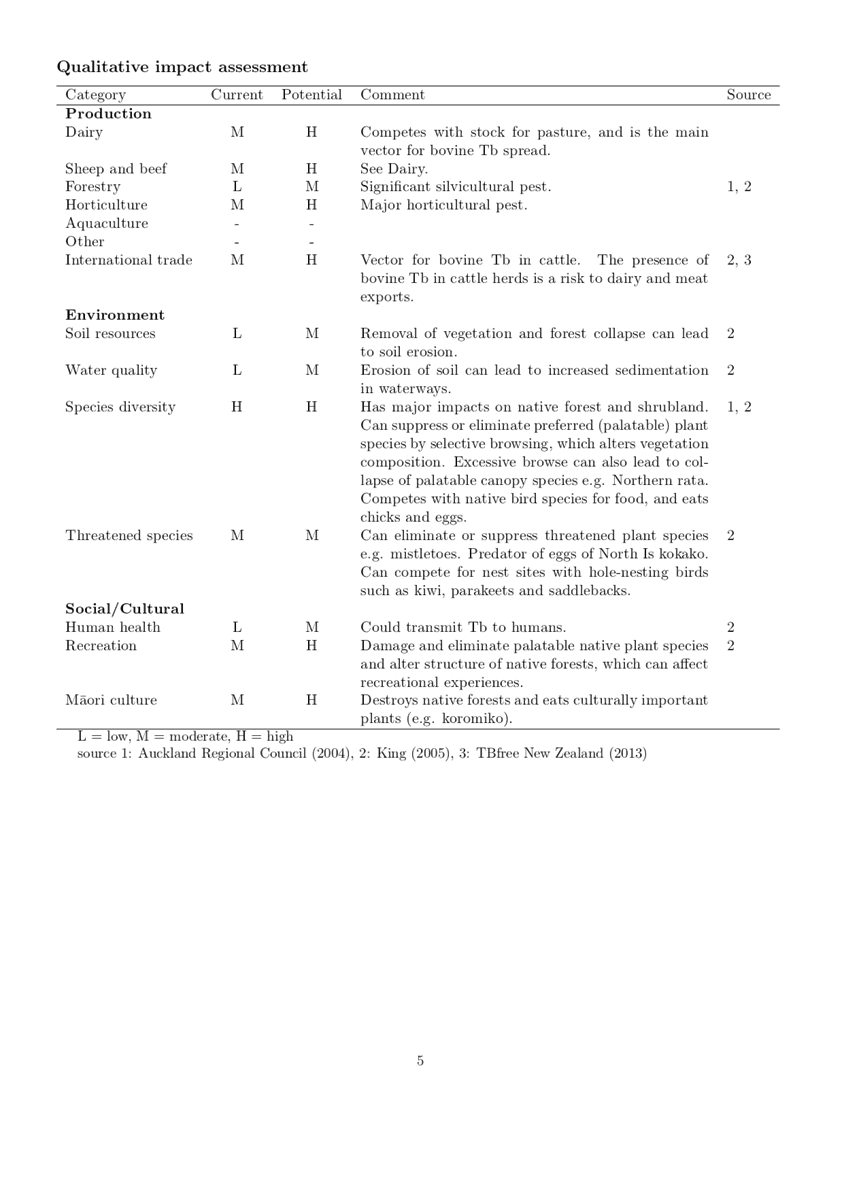

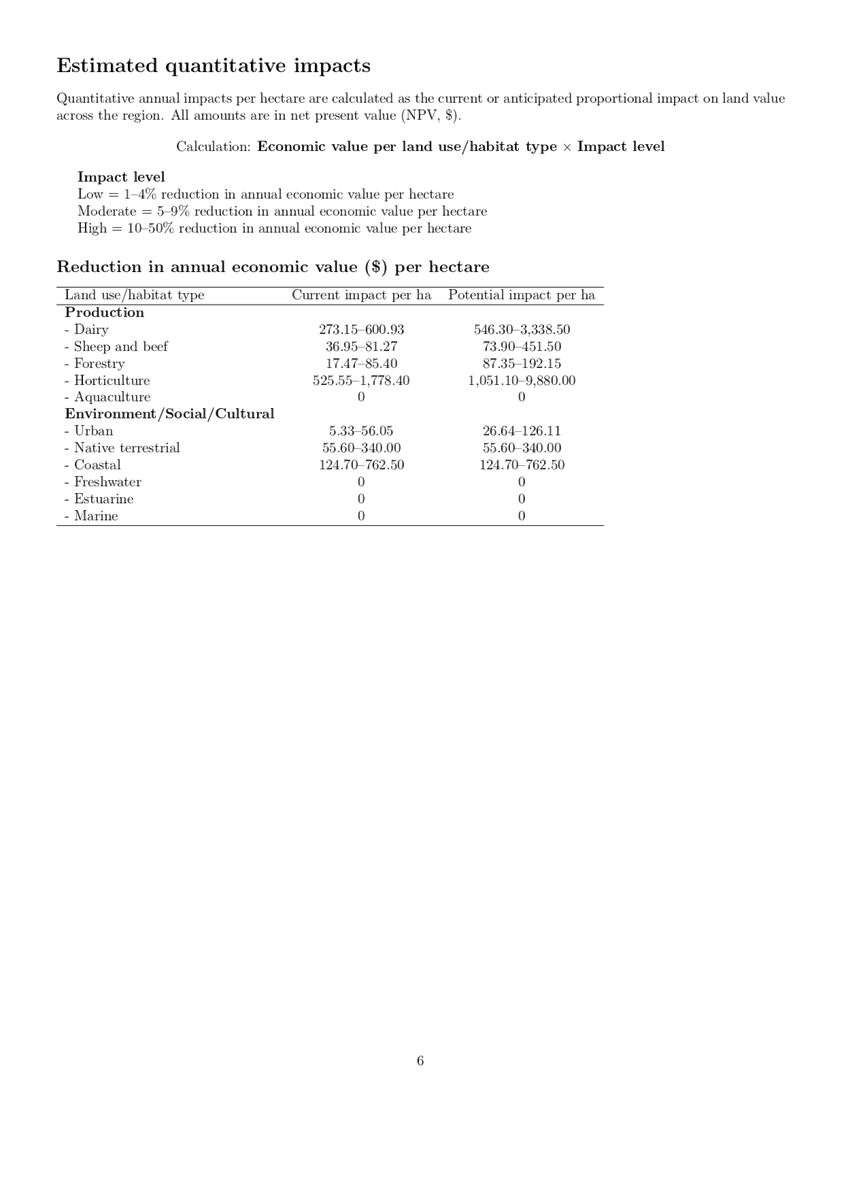

Figure 1. Consents monitored

6. Monitoring

involved a site inspection, desktop assessments, assessing performance

monitoring returns from consent holders or a combination.

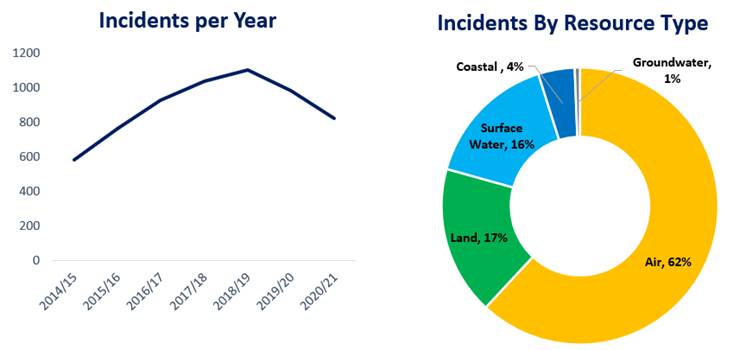

7. Pollution

response - calls received to our hotline continue the decreasing trend we

observed the previous year with 823 incidents logged for 2020-21 (11%

reduction). The continued reduction this period was driven by reduced

complaints about odours from Te Mata Mushrooms and fewer airshed burning

incidents during restricted seasons. As in previous years, the majority of

complaints are related to air quality 509 (62%) followed by discharges to land

143 (18%) and surface water 130 (16%).

Figure

2. Incidents per year (left) and incidents by resource type for 2020-21

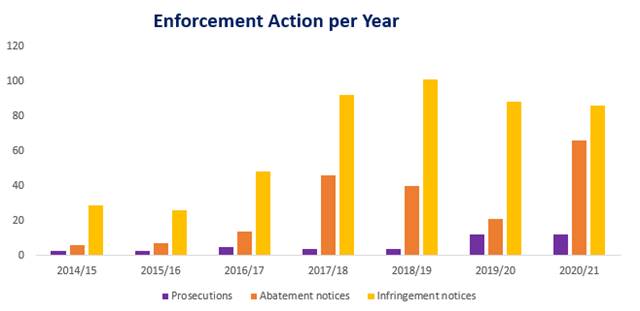

8. Enforcement

– for 2020-21 the enforcement team has continued to undertake a large

volume of enforcement work through formal actions with a high level of

prosecutions, infringement notices and abatement notices issued.

9. Twelve

prosecutions concluded and an additional five commenced with 12 individual

charges. The increased volume in prosecutions has put significant pressure on

our environmental regulation team, as these cases require more resource to

investigate, process and take through the courts. The establishment of a senior

investigator role to manage case files and prosecutions has helped to

streamline the process

10. The Council issued a

similar number of infringement notices to last year (86), totalling $43,800 in

fines. The number of infringement notices issued for winter burning continues

to decrease, with only 31 issued this period. There has been a

significant increase in the number of abatement notices issued this period (66)

compared to 2019-20 (21) and 2018-19 (40). This reflects an increase in more

serious offending as well as a tougher stance on controlling activities with a

high likelihood of environmental effects.

Figure

3: Number of enforcement actions by year.

11. Detailed information is

contained within the report attached to this agenda item.

12. Staff will make a

presentation to Committee at the meeting based on the written report.

Background /Discussion

13. For the Committee’s

information, reporting back occurs through the following mechanisms to Council

or Committee:

13.1. Compliance Annual Report

13.2. HBRC Annual Report

– results are presented through the Regulation Group of Activities within

the Annual Report document

13.3. Active investigations or

issues are reported to Council through the Significant Activities item on the

monthly Council agenda.

14. Internally, a weekly

incident report is prepared for the Group Manager which details complaints and

incidents and the outcomes or progress towards the outcomes.

15. Staff have also

established an approach whereby a media release will be issued at the

conclusion of any prosecution carried out by HBRC, regardless of the outcome of

the prosecution.

Strategic Fit

16. Undertaking compliance

monitoring (and enforcement where necessary) helps us to:

16.1. Protect aquatic ecosystems

and ensure water use is sustainable (Priority Area: Water)

16.2. Ensure sustainable land

use (Priority Area: Land)

16.3. Maintain a healthy and

functioning biodiversity (Priority Area: Biodiversity).

Significance and Engagement Policy Assessment

17. Whilst the matters

discussed in this report are of interest to the community they do not directly

impact or affect the community. There are no financial or levels of service

implications associated with deciding to adopt this report. Accordingly, this report

is of low significance.

Considerations of Tangata Whenua

18. The attached report sets

out ways we have improved our engagement with tangata whenua on compliance

matters. This includes:

18.1. Keeping tangata whenua

and iwi representatives informed in relation to high level enforcement action.

18.2. Working closely with iwi

and iwi trusts to seek victim impact statements for prosecution offences,

facilitated by our Maori Partnerships team.

18.3. Ensuring consent

conditions that require consultation and engagement with iwi are met by the

consent holder.

18.4. Building cultural

competency within the compliance team with internal training.

19. It is becoming

increasingly common for resource consents to include more complex conditions

that better recognise Te Ao Maori. For example, conditions requiring

development of cultural monitoring plans in consultation with iwi/ marae/

hapū and treaty groups.

19.1. In the next report we

hope to include analysis and reporting on findings from cultural health

monitoring undertaken in accordance with resource consents.

20. Future areas of focus are:

20.1. Improving how we report

incidents, particularly discharges to water, to tangata whenua and kaitiaki so

we can inform their decision-making and their observations and involvement can

inform cultural assessments.

20.2. Establishing regular

meetings and workshops with tangata whenua across the region to further

strengthen communication and relationships, build trust and increase

accountability.

Financial and Resource Implications

21. There are no financial and

funding implications associated with adopting the report.

Decision Making

Process

22. Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

22.1. The

decision does not significantly alter the service provision or affect a

strategic asset, nor is it inconsistent with an existing policy or plan.

22.2. The use

of the special consultative procedure is not prescribed by legislation.

22.3. The

decision is not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy.

22.4. There are no persons

directly affected by this decision.

22.5. Given

the nature and significance of the issue to be considered and decided, and also

the persons likely to be affected by, or have an interest in the decisions

made, Council can exercise its discretion and make a decision without

consulting directly with the community or others having an interest in

the decision.

|

Recommendations

1. That the Corporate and Strategic Committee receives and notes the

“2020-21 Compliance Annual Report” staff report.

2. Te Corporate and Strategic Committee recommends that Hawke’s

Bay Regional Council:

2.1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that Council can exercise its discretion and make decisions on

this issue without conferring directly with the community or persons likely

to have an interest in the decision

2.2. Adopts the HBRC Annual Compliance Report 2020-21 for

publication on the Hawke’s Bay Regional Council website.

|

Authored by:

|

Jack Blunden

Team Leader Compliance - Urban &

Industrial

|

Rob Hogan

Manager Compliance

|

Approved by:

|

Katrina

Brunton

Group Manager Policy & Regulation

|

|

Attachment/s

|

1⇨

|

HBRC Annual

Compliance Report 2020-21

|

|

Under

Separate Cover

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate and

Strategic Committee

Wednesday 17 November 2021

Subject: Possum Control Area - Partial

Regional Pest Management Plan Review

Reason for Report

1. This item updates the Committee on

the Partial Plan Review process for the Possum Control Area (PCA) programme

including a review of the Cost Benefit Analysis (CBA) and seeks decisions to

progress to the next stage of the process. The decisions sought are:

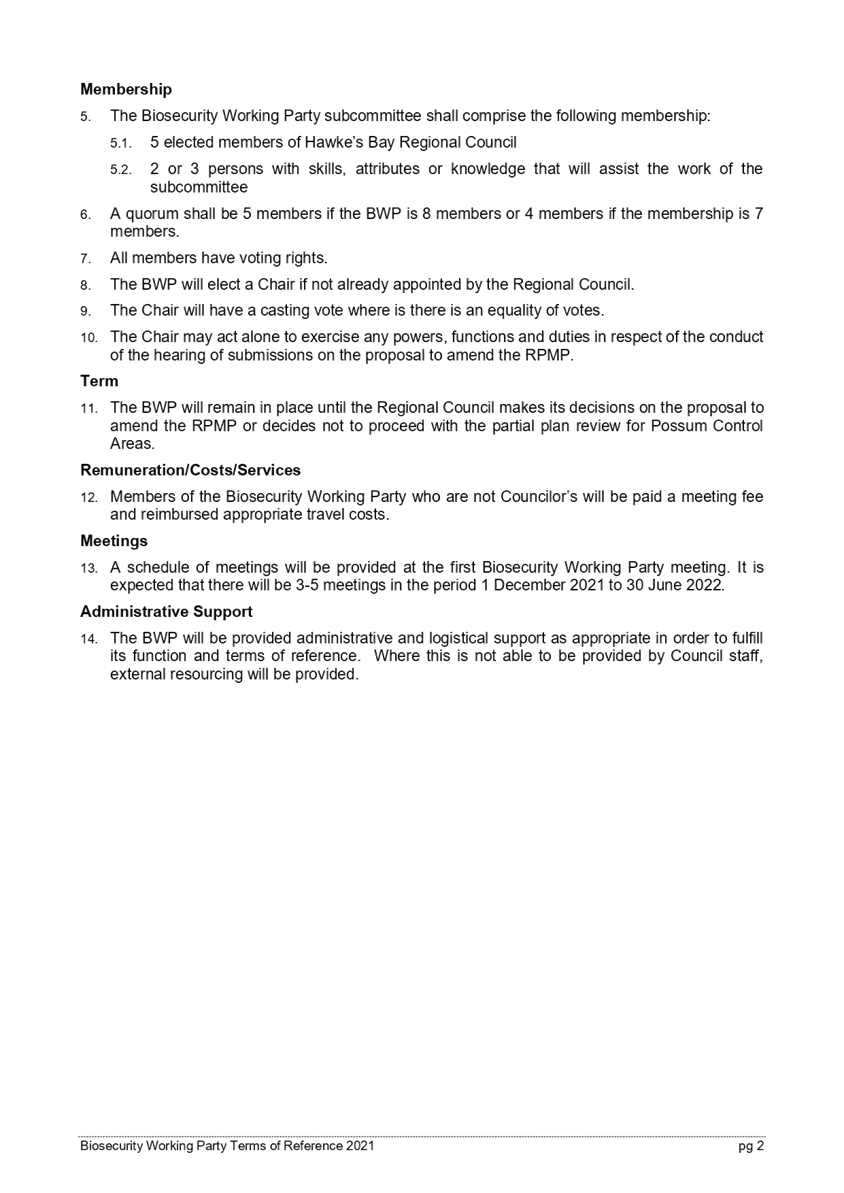

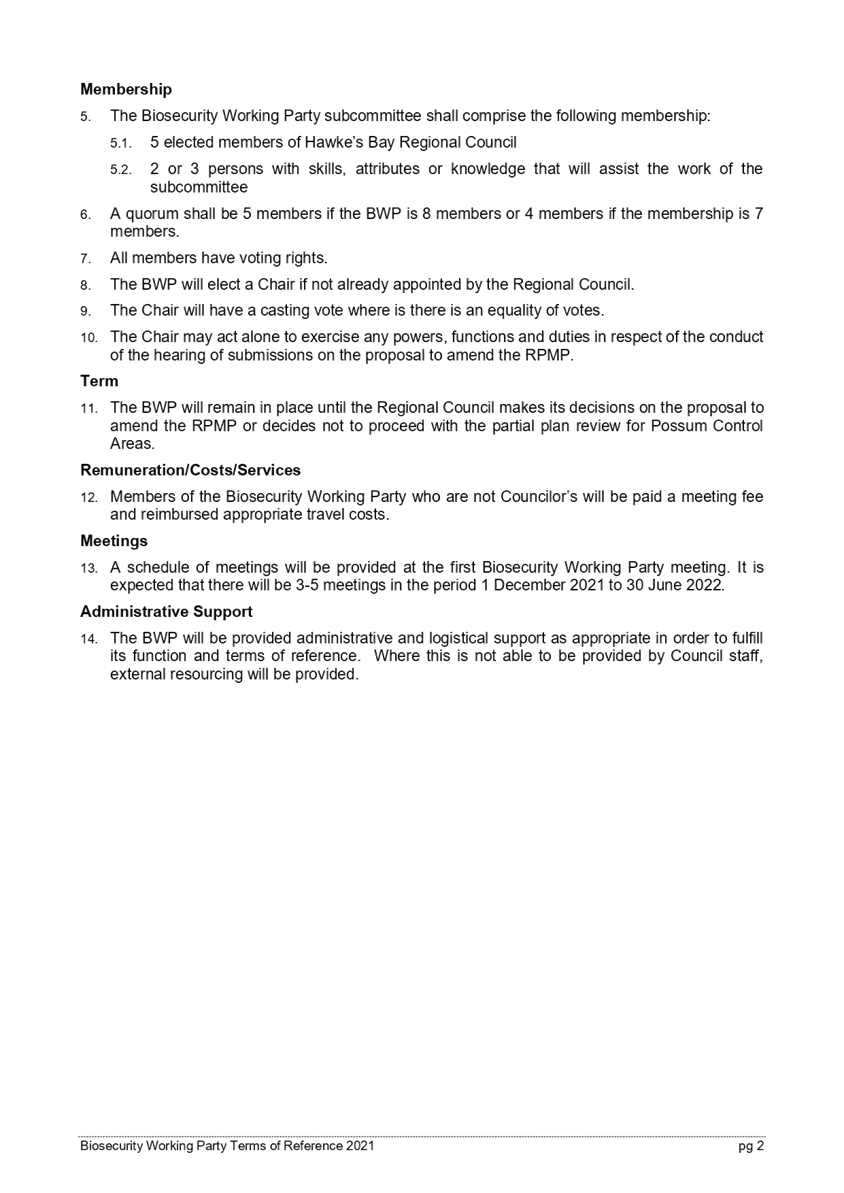

1.1. To establish a Biosecurity Working Party (BWP) which will

also serve as a Hearing Panel for the Partial Plan Review submission process

1.2. To delegate to the BWP the relevant powers and functions

under the Biosecurity Act necessary to deliver the Partial Plan Review of the

PCA programme.

1.3. To confirm the appointment of 5 councillors and 2 members

of the Hearings Committee to the BWP.

Officers’

Recommendation(s)

2. Council

officers recommend that the Committee establishes the BWP as proposed,

including the decision making delegations, and provides feedback on the

engagement plan.

Executive Summary

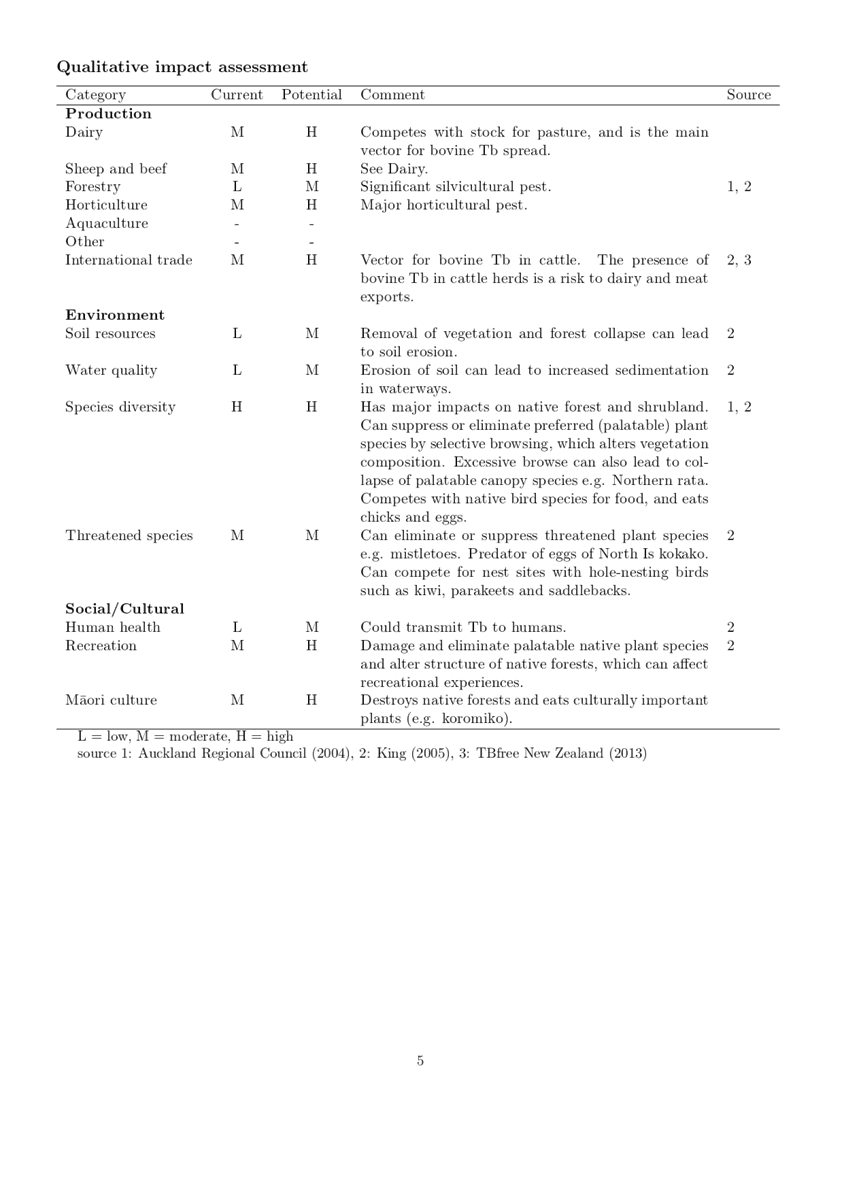

3. There are a

range of elements that need to be completed to meet the requirements of the

Biosecurity Act 1993 (the Act) in the PCA programme Partial Plan Review (PPR).

There are also process steps that need to be considered regarding the funding

of the programme and its potential implementation and management. These include:

3.1. A review of

the expected outcomes, who receives those benefits and how the programme might

be funded

3.2. the

completion of a cost benefit analysis

3.3. a proposal

for a change to the Regional Pest Management Plan (RPMP) that meets section

70-71 of the Act

3.4. the level of

resourcing required to deliver the outcomes

3.5. the

implementation speed and delivery options of any changed PCA operating model

3.6. establishment

of a Biosecurity Working Party to provide staff guidance on the Partial Plan Review

and hear submissions on the proposal if considered appropriate.

4. As part of the Partial Plan Review the Council is required

to consult on amending the Hawke’s Bay Regional Pest Management Plan. The

steps to ‘make’ an RPMP are clearly outlined within sections 70 to

77 and section 10D(5) of the Act. This includes preparation of a proposal in

accordance with the Act, public notification, receipt of submissions and

conducting a hearing process.

5. The 8 September

2021 EICC meeting discussed the establishment of a

Hearing Panel (BWP) to hear submissions, potentially with the delegated

authority to make certain decisions under the Act.

Background /Discussion

6. The Partial

Plan Review of the PCA programme signals a potentially substantial change in

how possum control is managed in the Hawkes Bay region. Broadly speaking this

change requires considering why we do possum control, the outcomes we expect to

get and the funding basis and rates impact of any change. Alongside this how

possum control is delivered and the speed of any change to possum management

has a direct bearing on when costs fall due. These are also key factors

in managing the risk that the current programme continues to be under resourced

and potentially fails at sufficient scale that the value of the investment over

the last 20 years is lost.

7. The proposal

for a change to the RPMP required under sections 70-71 of the Act, the

potential resourcing and the options for the implementation of change will be

discussed in more detail by the BWP who will make recommendations to Council.

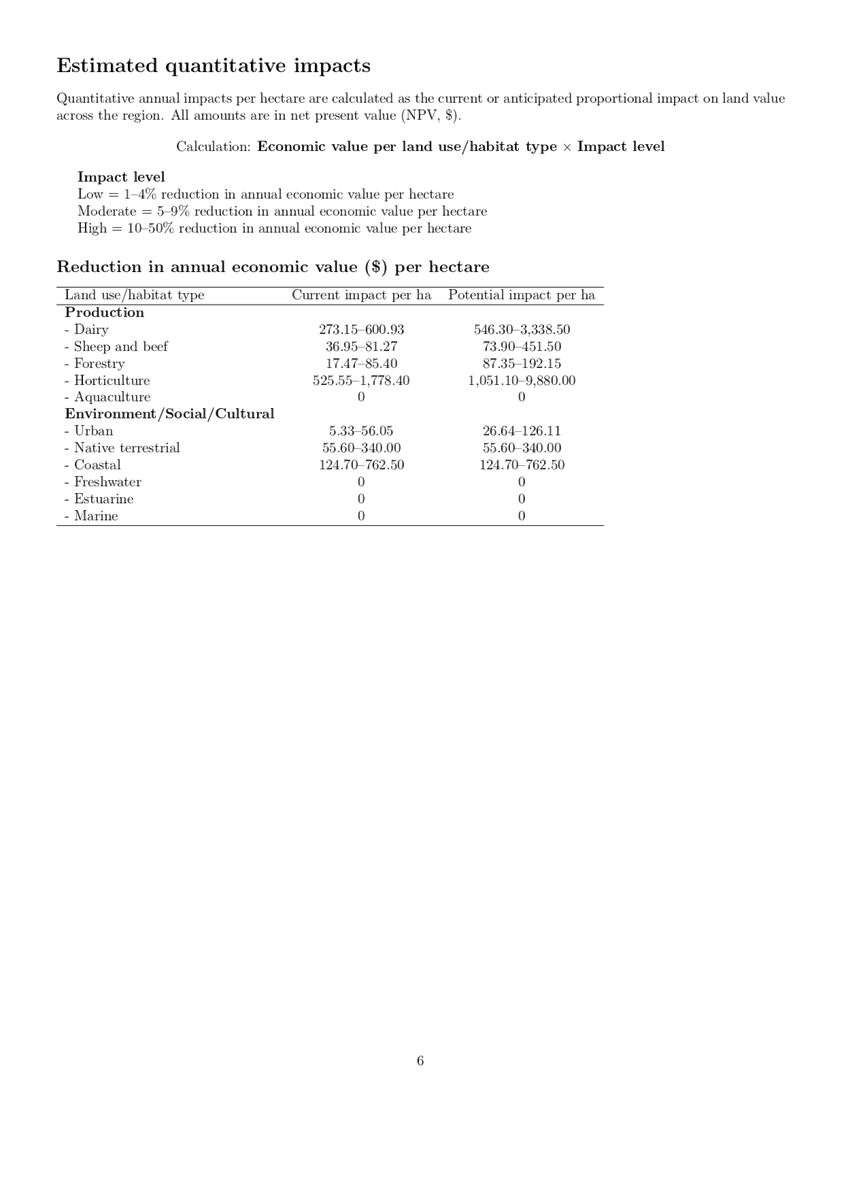

Cost Benefit Analysis

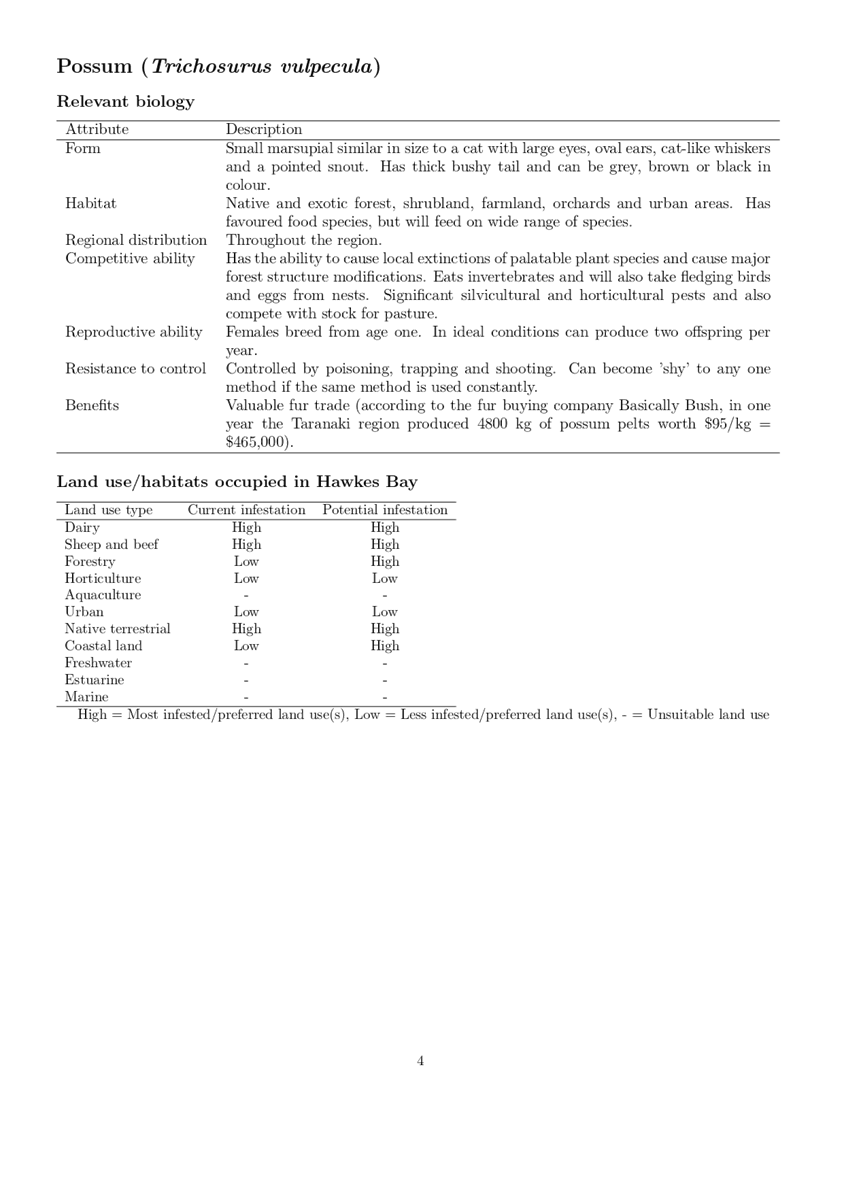

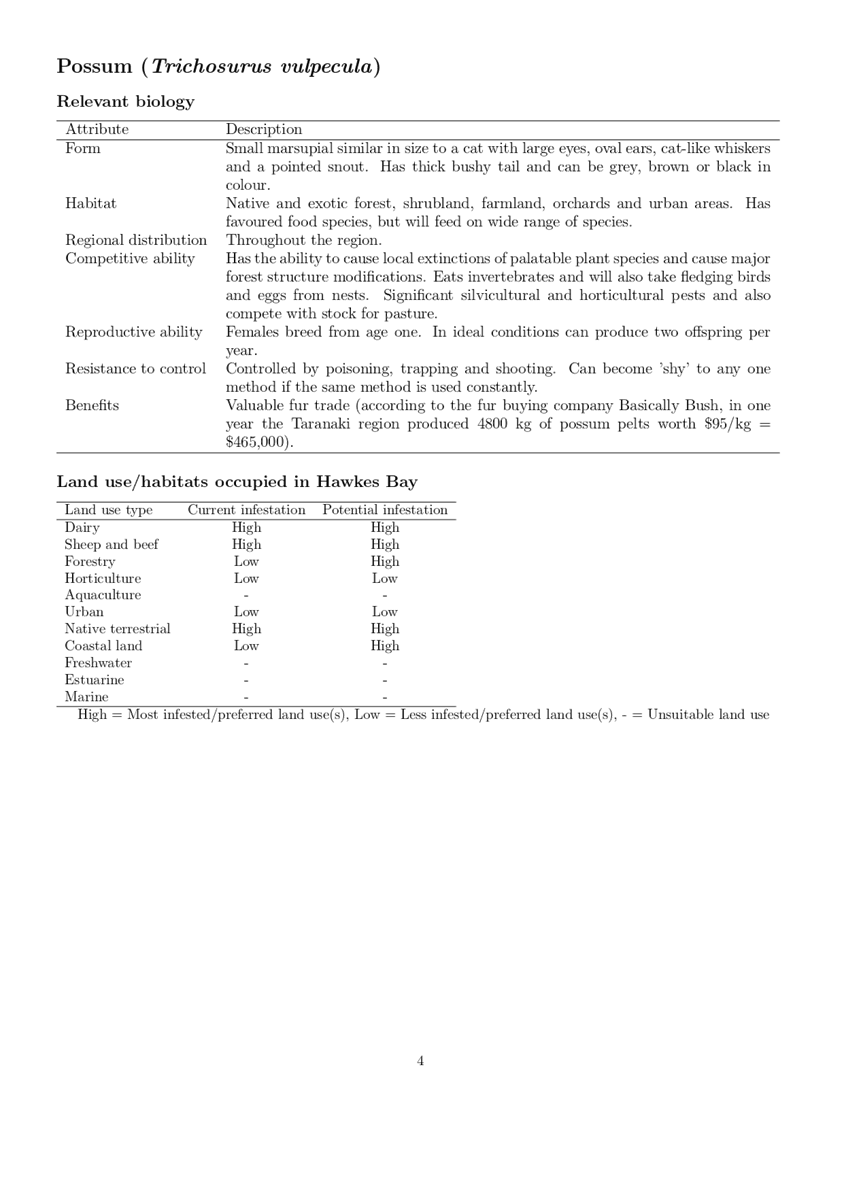

8. The cost

benefit analysis (CBA) is a key part of the Partial Plan Review process and has

been updated from the work undertaken in 2017-18 for the RPMP. This economic

analysis was undertaken by Jon Sullivan at Lincoln University, Melissa

Hutchison at Tenex consultants and Hawke’s Bay Regional Council staff and

is outlined in their draft report “Proposed Regional Pest Management Plan

possum control area Partial Plan Review Cost Benefit Analysis and Cost

Allocation Report”. This report is referred to below as the “CBA

Report” and is Attachment 1. Minor changes may still need to be made to

the CBA report.

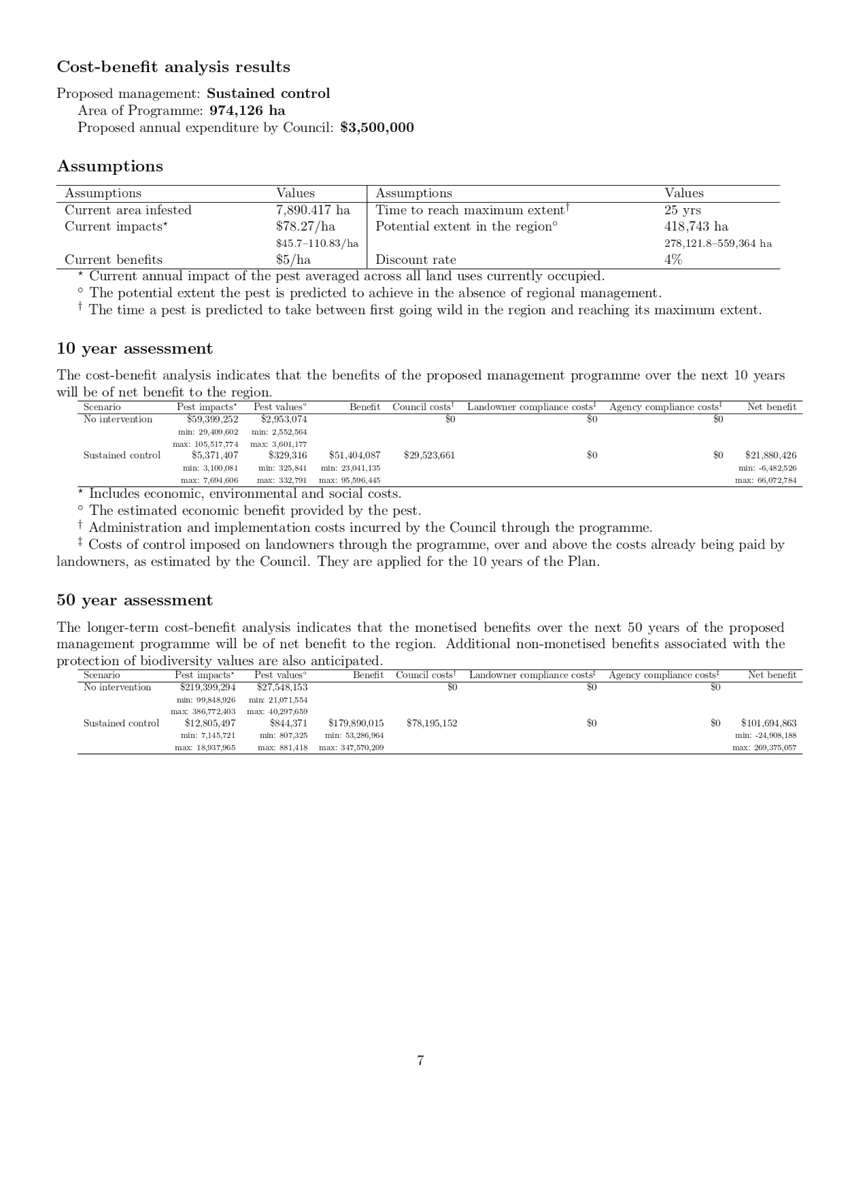

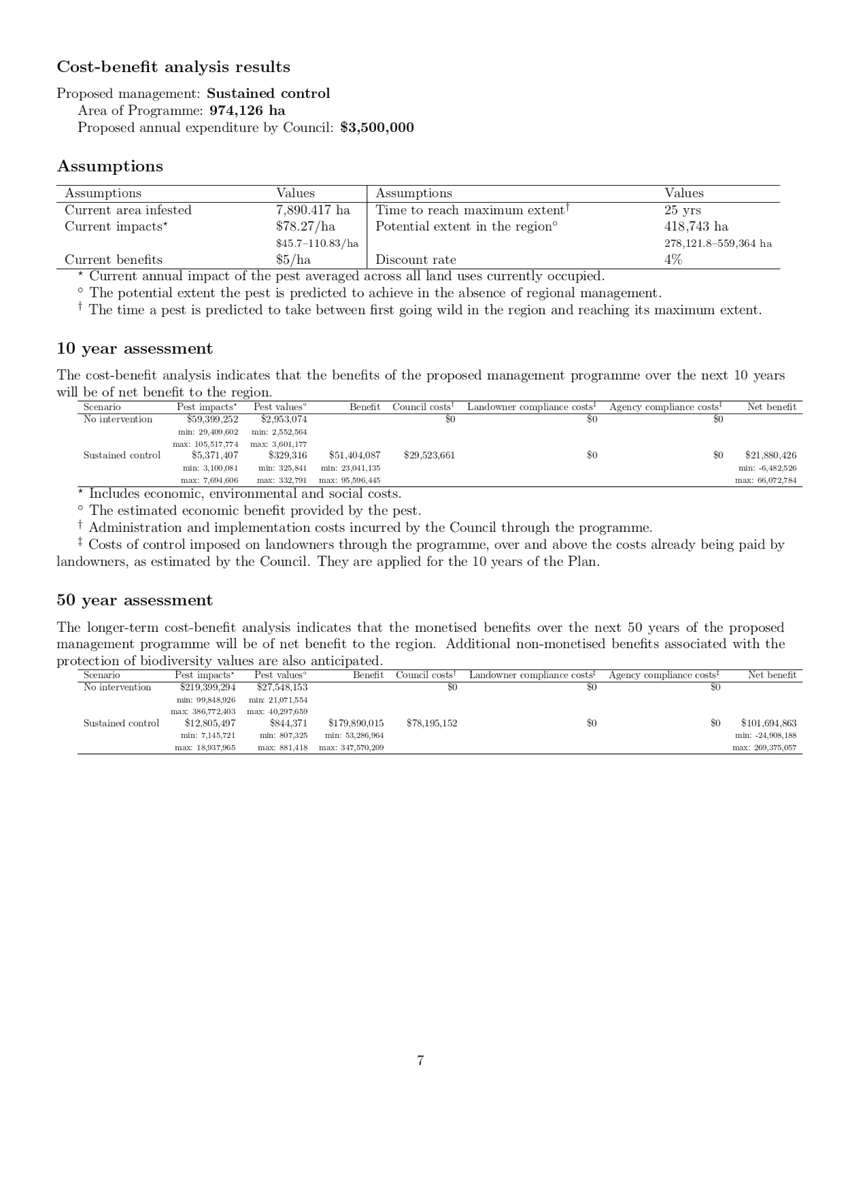

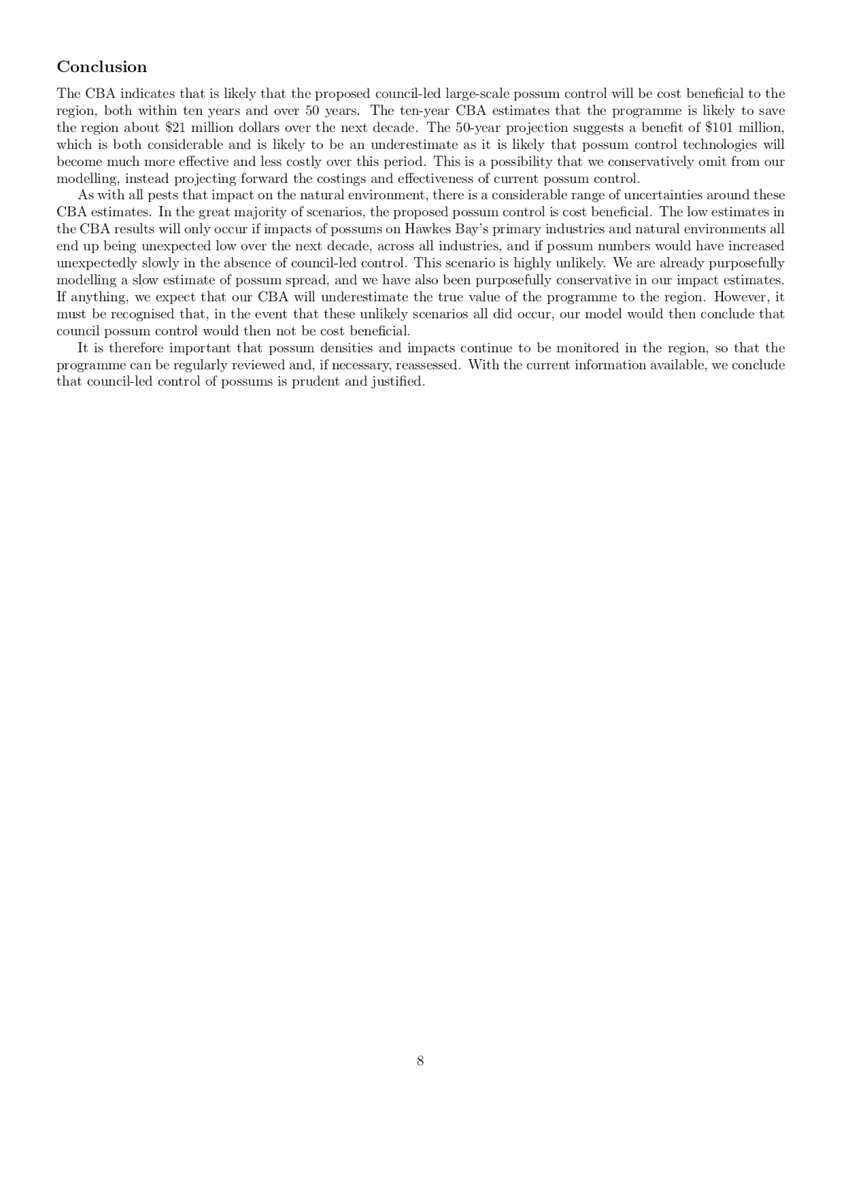

9. The CBA

indicates that the total benefit of the PCA programme is around $51m and at an

annual PCA programme cost of $3.5m the net benefit using discounted cashflow

analysis is $21m over a ten-year period. Net benefit exceeding cost is a key

test of the Act.

10. It is important to note

that the CBA is based on an indicative cost of $12/ha per annum for the first

year and $7/ha per annum for subsequent years possum control. HBRC’s

approved possum contractors have indicated that the initial years cost of

control to transition to HBRC managed contracts is between $8-12 per hectare.

Subsequent years of maintenance control would be in the range of $6-9/ha. This

assumes large-scale longer term performance-based output contracts with a mean

residual trap catch (RTC) of 4% and no individual monitoring line over three

possums.

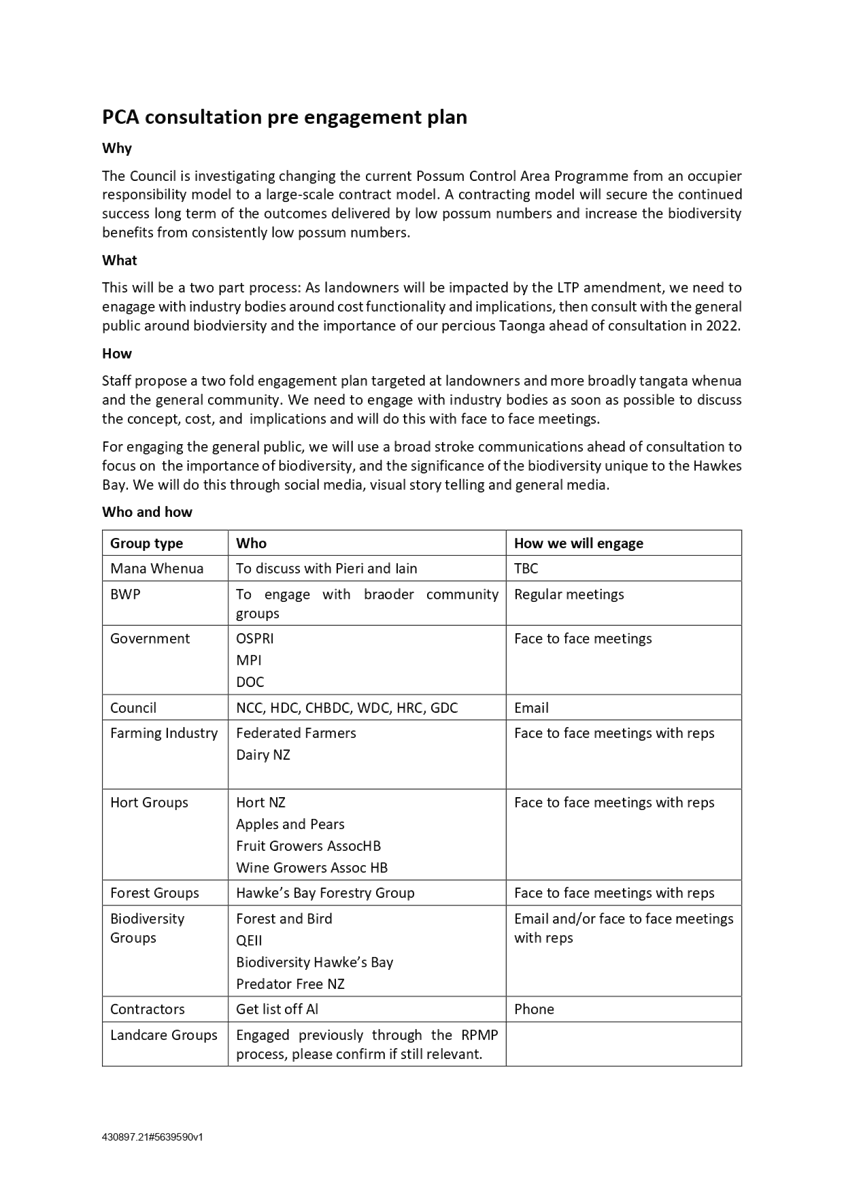

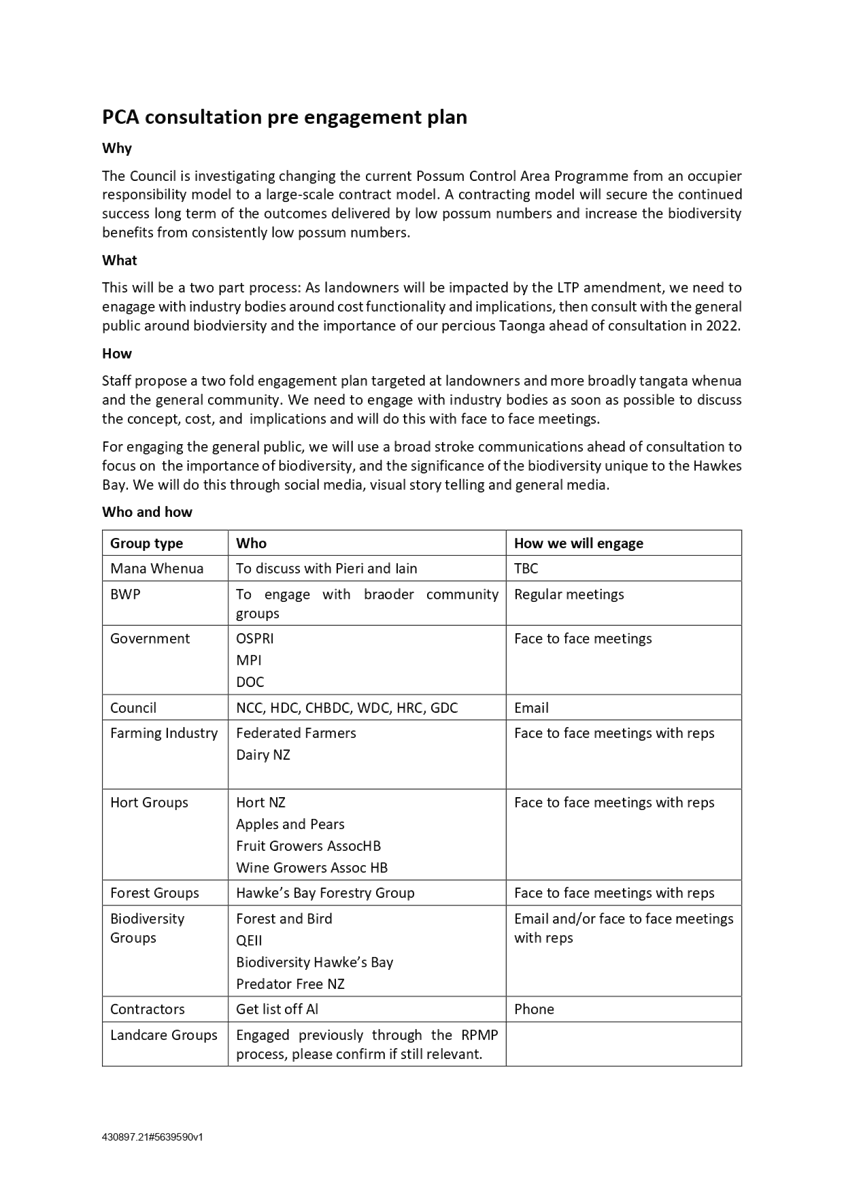

Engagement process

11. Engagement will be an

important part of the PCA programme Partial Plan Review. This will be

undertaken:

11.1. Individually with key

stakeholders

11.2. Broadly through social

media and other media platforms

11.3. As part of the Long-Term

Plan amendment / annual plan process.

12. A draft engagement process

associated with the Partial Plan Review process is set out in Attachment 2.

Outcomes delivered by possum control

13. For the last 20 years

possum control has been funded by HBRC on the basis that the primary benefits

have been to farming in terms of reducing possum impact on pastoral production

and reducing the risk of Bovine TB.

14. It is important to note

that OSPRI Ltd have responsibility for the National bovine TB strategy which is

levy funded by farmers to eliminate TB from New Zealand. While coordination

between HBRC and OSPRI is important, and mutually beneficial, the principal

outcomes HBRC seeks to deliver from possum control are biodiversity related.

15. There is evidence from

research over the last 20 years that possum control also provides significant

biodiversity benefits. “A review of biodiversity outcomes from

possum-focused pest control in New Zealand” is a meta-analysis of 47

research projects and one of the largest studies of quantitative data to date

on the biodiversity benefits of possum control. This report is attached at

attachment three. The key themes from the report are:

15.1. Eighty five percent of

studies reporting on the impacts of possum control on vegetation (canopy cover,

threatened plants, tree mortality, fruit /seed production) reported a positive

response of vegetation to possum- focused pest control.

15.2. Native birds benefit

from possum control with 80% of the relevant studies in the meta-analysis

showing improved nesting success and bird abundance after possum control.

15.3. Impacts of possum

control on invertebrates and frogs is more difficult to assess as it can be

linked with rat control and interactions between complex ecosystems. There

appears to be evidence that Weta and some frogs benefit from possum and rat

control.

16. Council has not reviewed

the funding of the biosecurity programme over the last two decades and the PCA Partial

Plan Review is an appropriate time to do so.

Biosecurity Working Party

17. As part of the consultation plan discussion at the 8 September

EICC meeting it was recommended that a Hearing Panel

be established to hear submissions. This Panel (the BWP) can also be delegated

the authority to make certain decisions under the Act.

18. The

decisions and recommendations that a Hearing Panel can be required to make with

delegated authority are:

18.1. To

determine whether the Proposal meets the requirements of sections 70 and 71 of

the BSA and make recommendations to council on that (refer https://www.legislation.govt.nz/act/public/1993/0095/latest/DLM315719.html)

18.2. Hear

submissions on the Proposal and receive and consider recommendation reports

from staff

18.3. Make

a recommendation to council (or a committee of council) on whether sufficient

consultation has been undertaken on the Proposal under section 72 of the BSA and

that the issues raised in consultation have been considered

18.4. Approve

the preparation of an amendment to the RPMP and which body is to be the

management agency

18.5. Consider

the amendment to the RPMP and determine that the requirements of sections 73

and 74 of the BSA have been met (refer https://www.legislation.govt.nz/act/public/1993/0095/latest/DLM315730.html)

18.6. Prepare a written report

under 75(1) of the BSA and make recommendations to Council as to its decision

on the amendment to the RPMP.

19. During

the 2019 - 2039 RPMP development, the BWP included one independent out of

region member, with both Biosecurity and hearings process experience, to sit on

the panel as a Biosecurity expert. This worked well and staff recommend this

takes place for the Partial Plan Review as well. Staff propose that this is

discussed at the first meeting of the BWP.

20. It

is proposed that:

20.1. The BWP is established

as a subcommittee under Schedule 7 of the Local Government Act 2002.

20.2. The

Chair of the BWP will be delegated the power to have a casting vote if a

majority decision is unable to be reached on any matter.

20.3. The Chairperson of the BWP is authorised to act alone to

exercise any powers, functions and duties delegated in respect of the conduct

of the Hearing. This allows the Chair to issue notices of hearing and minutes

before and during the hearing regarding procedural requirements for the hearing

without needing the signatures and approval of all the hearing panel members.

It does not authorise the Chair to act alone in relation to decisions or

recommendations on the Proposal.

20.4. Councillors Will Foley, Jerf Van Beek, Craig Foss,

Charles Lambert and Jacqueline Taylor are formally appointed as members of the

BWP.

20.5. Roger Maaka and Katarina

Kawana (two members of the Hearing Panel delegated by the Māori Committee)

are also formally appointed as members of the BWP.

Options Assessment

21. There is the option to

consider the Possum Control Area Partial Plan Review and hear submissions as

part of Regional Council meetings and the annual plan process (status quo).

However, given the range of broader, non-submission related matters to consider

and the prescriptive steps set out in the Biosecurity Act, staff do not

recommend this. The BWP will provide greater flexibility to discuss and

consider the PCA Partial Plan Review and then bring recommendations back to

Council or its committees.

22. Staff’s preferred

option is to establish the BWP subcommittee with the delegations detailed in

the recommendations section of this paper.

Strategic Fit

23. The PCA programme sits

within the RPMP. The RPMP plays an important role in achieving both the

Biodiversity and Land strategic outcomes and goals in the HBRC Strategic Pan

2020-25.

24. Pest management sits

within a biosecurity framework for the Hawke’s Bay region, which includes

the RPMP, the Hawke’s Bay Biodiversity Strategy and the HBRC Strategic

Plan. Neighbouring Regional Pest Management Plans and national legislation,

policy and initiatives have also influenced this Plan.

25. All programmes sitting

within an RPMP are required to have clear measurable outcomes, which are specified

within the monitoring section. This monitoring section is integrated into

the Biosecurity Annual Operational Plan, which goes to council for approval

prior to each financial year. The Operational Plan sets out the

operational delivery for each programme and the monitoring and reporting

requirements. Staff report to council annually (November) on the progress

of the Operational Plan.

26. Failing to achieve the

RPMP objective and council Level of Service Measures for the PCA programme

could affect achieving the strategic outcomes and goals in the HBRC Strategic

Pan 2020-25 for Biodiversity and Land.

Significance and Engagement Policy Assessment

27. The decisions in this

paper are of low significance. Council will be required through the PPR to

consult with the community as part of BSA requirements.

Financial and Resource Implications

28. The costs associated with

the BWP will be between $10-15,000 and will be met from existing Catchment

Services budgets set aside for the RPMP process.

Decision Making Process

29. Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (LGA). Staff have assessed the

requirements in relation to this item and have concluded:

29.1. The

decision does not significantly alter the service provision or affect a

strategic asset, nor is it inconsistent with an existing policy or plan.

29.2. The

Biosecurity Act requires amendments to be made to the RPMP if changes are to be

made to the Possum Control Area programme. The Biosecurity Act outlines

consultation and other requirements for amending the RPMP.

29.3. The

decision is not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy.

29.4. The persons affected by this

decision are all those with an interest in the region’s biosecurity. The

proposed establishment of a BWP to hear submissions and make recommendations on

the Partial Plan Review will enable those persons to be heard on any proposed

amendments to the RPMP.

29.5. Given

the nature and significance of the issue to be considered and decided, and also

the persons likely to be affected by, or have an interest in the decisions

made, Council can exercise its discretion and make these decisions without

consulting directly with the community.

Recommendations

1. That

the Corporate and Strategic Committee receives and considers the “Possum

Control Area - Partial Regional Pest Management Plan Review” staff

report.

2. The

Corporate and Strategic Committee recommends that Hawke’s Bay Regional

Council, acting under clause 32 of Schedule 7 of the Local Government Act 2002:

2.1. Establishes the

Biosecurity Working Party with the Terms of Reference proposed.

2.2. Appoints

councillors Will Foley, Jerf van Beek, Craig

Foss, Charles Lambert and Jacqueline Taylor,

Dr Roger Maaka and Katarina Kawana as members of the Biosecurity Working Party.

2.3. Delegates to the

Biosecurity Working Party the powers, functions and duties of the Council set

out in sections 71 to 74 (excluding sections 72(5)) and 100D(6)(b)) of the

Biosecurity Act 1993, in respect of the Proposed Regional Pest Management Plan

2018-2038 Possum Control Area Partial Plan Review.

2.4. Delegates to the

Biosecurity Working Party the powers functions and duties of the Council to

hear submissions and make recommendations on the proposal to amend the Regional

Pest Management Plan.

2.5. Delegates to the

Biosecurity Working Party the powers, functions and duties of the Council set

out in sections 75(1) and (2) of the Biosecurity Act 1993 to prepare a written

report on the Regional Pest Management Plan.

2.6. Directs that the

Biosecurity Working Party provides recommendations to Council as to

Council’s decision on the Regional Pest Management Plan.

2.7. Authorises the

Chair of the Biosecurity Working Party acting alone to exercise any powers,

functions and duties delegated in respect of the conduct of the Hearing.

2.8. Authorises the Chair of the Biosecurity Working Party to

have a casting vote when there is an equality of votes when exercising any of

the powers, functions and duties delegated.

Authored by:

|

Lauren

Simmonds

Project Manager - Biosecurity Review

|

Campbell

Leckie

Manager Catchment Services

|

Approved by:

|

Iain Maxwell

Group Manager Integrated Catchment

Management

|

|

Attachment/s

|

1⇩

|

Council led

Possum Control Cost Benefit Analysis

|

|

|

|

2⇩

|

PCA Review

Draft Pre-engagement Plan

|

|

|

|

3⇨

|

Byrom et al

2016 Biodiversity Outcomes from Possum Control

|

|

Under

Separate Cover

|

|

4⇩

|

Biosecurity

working Party Subcommittee TOR

|

|

|

|

Council

led Possum Control Cost Benefit Analysis

|

Attachment 1

|

|

PCA Review Draft

Pre-engagement Plan

|

Attachment 2

|

|

Biosecurity working Party

Subcommittee TOR

|

Attachment 4

|

HAWKE’S

BAY REGIONAL COUNCIL

Corporate and

Strategic Committee

17 November 2021

Subject: Proxy for the HBRIC Ltd

Annual General Meeting

Reason for Report

1. This item provides the means for Council to appoint a proxy and

alternate, to vote at the Annual General Meeting of Hawke’s Bay Regional

Investment Company Limited (HBRIC Ltd).

Executive Summary

2. HBRIC Ltd intends to hold its Annual General Meeting at 4:00pm on

Friday, 16 December 2021 at the Hawke’s Bay

Regional Council’s Station Street Office, 43 Station Street, Napier. The

Council (as the shareholder) is required to appoint a proxy and alternate to

attend this meeting and vote on the Council’s behalf at the meeting.

3. There are 2 items that require shareholder voting, being:

3.1. To receive

the company’s Financial Statements for the year ended 30 June 2021

3.2. To note the

appointment of Auditors.

4. All Councillors

are invited to the Annual General Meeting. A copy of

the Notice of the Annual General Meeting of HBRIC Ltd is attached.

5. With regards to

appointing a proxy to attend this meeting, it is recommended that the proxy be

given to the Deputy Chairman of the Council, with the alternate being the Chief

Executive of the Council.

Decision Making Process

6. Council and its committees are required to make every decision in

accordance with the requirements of the Local Government Act 2002 (the Act).

Staff have assessed the requirements in relation to this item and have

concluded:

6.1. The decision does not significantly alter the service provision or

affect a strategic asset, nor is it inconsistent with an existing policy or

plan.

6.2. The use of the special consultative procedure is not prescribed by

legislation.

6.3. The decision is not significant under the criteria contained in

Council’s adopted Significance and Engagement Policy.

6.4. The decisions in relation to the HBRIC Ltd Annual

General Meeting are required under the Companies Act 1993.

Recommendations

That the Corporate and Strategic

Committee:

1. Receives and

considers the “Proxy for the HBRIC Ltd Annual General Meeting”

staff report.

2. Recommends that

Hawke’s Bay Regional Council:

2.1. Agrees that

the decisions to be made are not significant under the criteria contained in

Council’s adopted Significance and Engagement Policy, and that Council

can exercise its discretion and make decisions on this issue without conferring

directly with the community or persons likely to have an interest in the

decision.

2.2. Notes the date of the Hawke’s Bay Regional Investment Company

Limited Annual General Meeting is 16 December 2021.

2.3. Appoints _________________ to act as Council’s proxy at the

Annual General Meeting of the Hawke’s Bay Regional Investment Company

Limited to be held at 4:00pm on Friday, 16 December 2021, and to vote as proxy

holder on behalf of the Council

2.4. Appoints _________________ to act as Council’s alternate.

Authored by:

|

Kishan

Premadasa

Management Accountant

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

HBRIC Notice

of 2021 AGM

|

|

|

|

HBRIC

Notice of 2021 AGM

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

17 November 2021

Subject: HBRIC Ltd Quarterly

Update

Reason for Report

1. This item provides Council with a quarterly update on the activities

of Hawke’s Bay Regional Investment Company (HBRIC).

Discussion

Financial

reporting

2. HBRIC’s annual report, including auditors report, for the year

ended 30 June 2021 is attached. The annual report was approved by the Directors

of HBRIC on 8 November 2021.

3. Key items to note:

2020-21 2019-20

3.1. Group profit after tax - $23.9mil $16.6mil

3.2. Parent profit after tax -

$8mil $47.9mil

3.3. Group year-end equity - $423mil $406mil

3.4. Parent year-end equity - $446mil $459mil

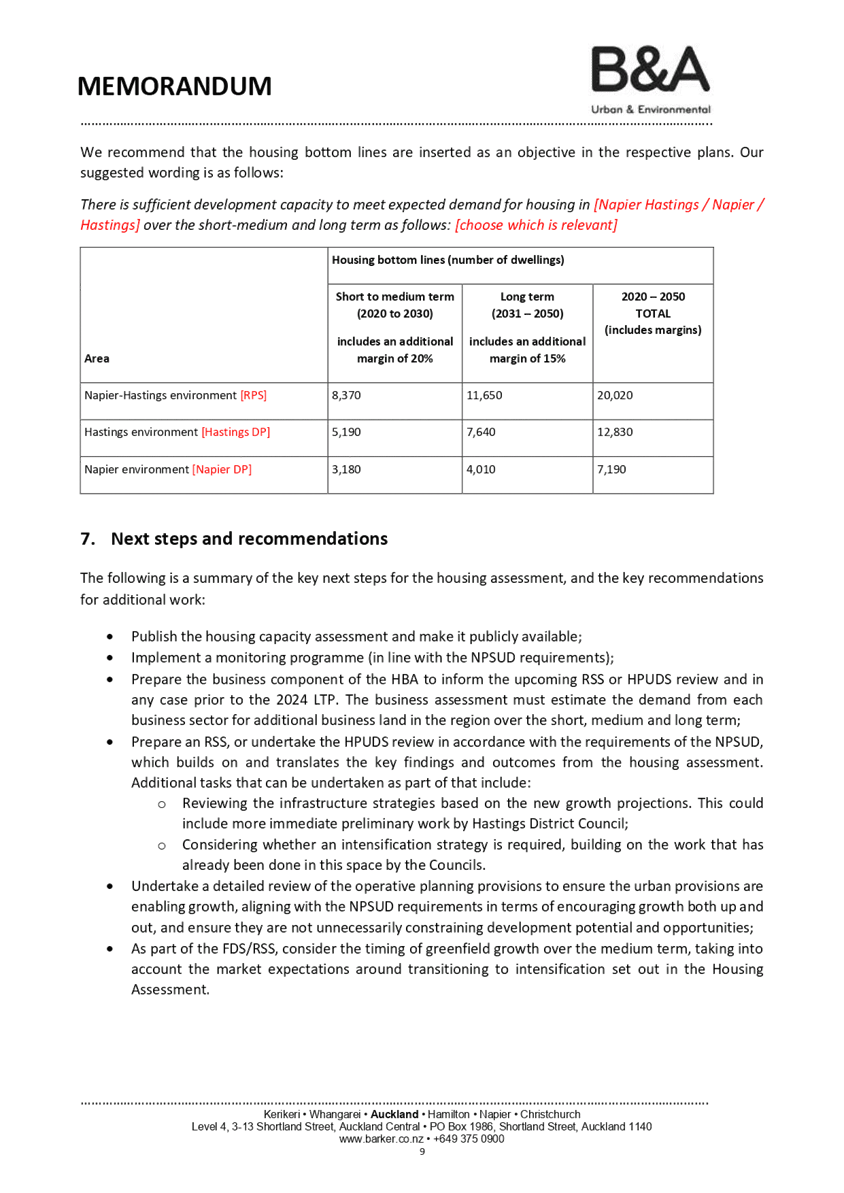

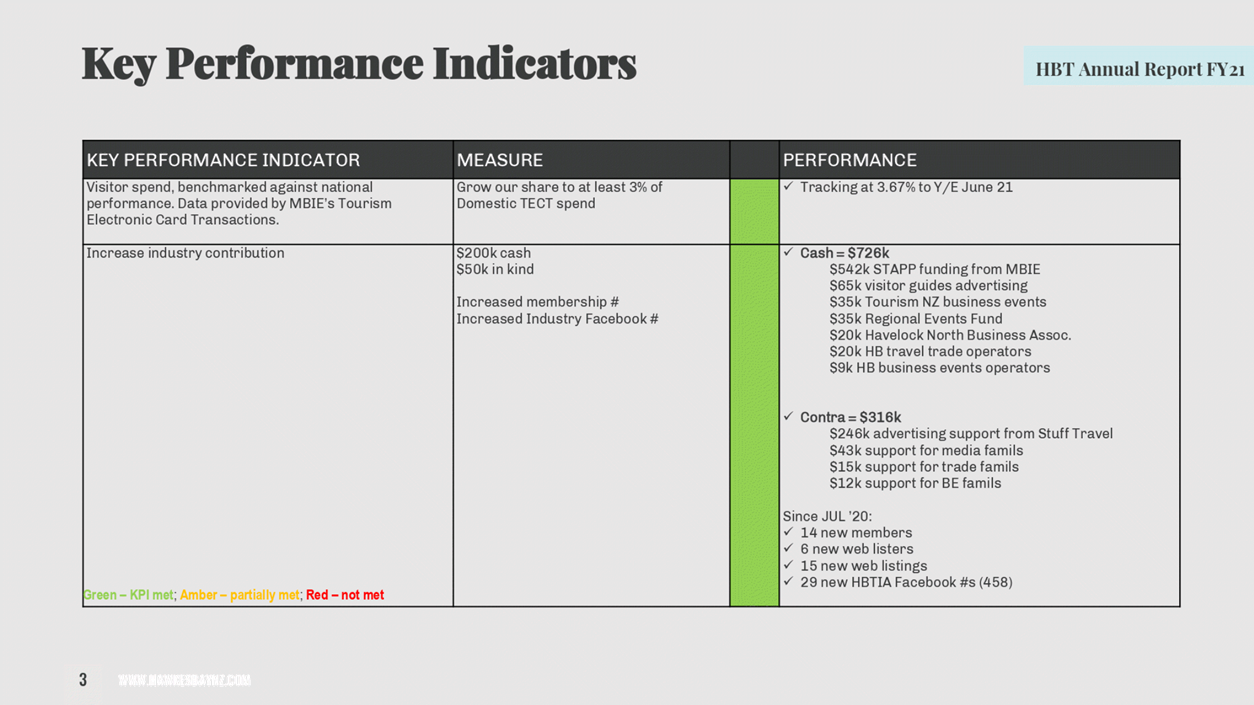

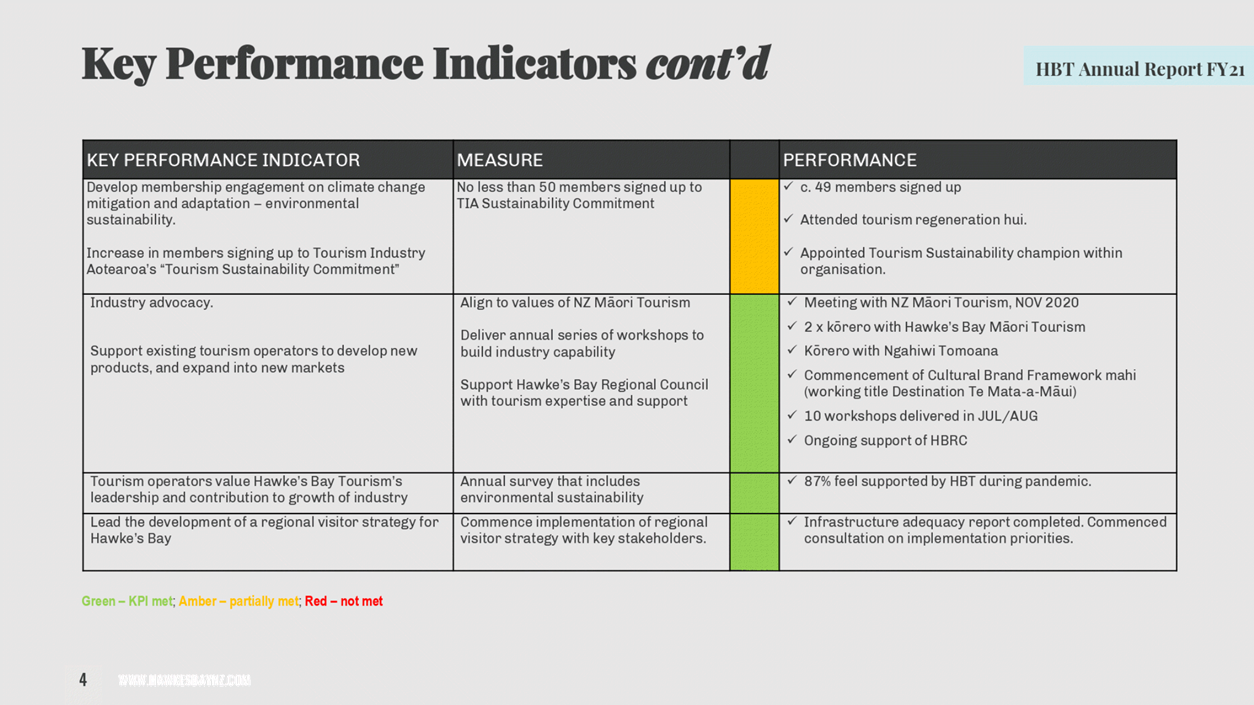

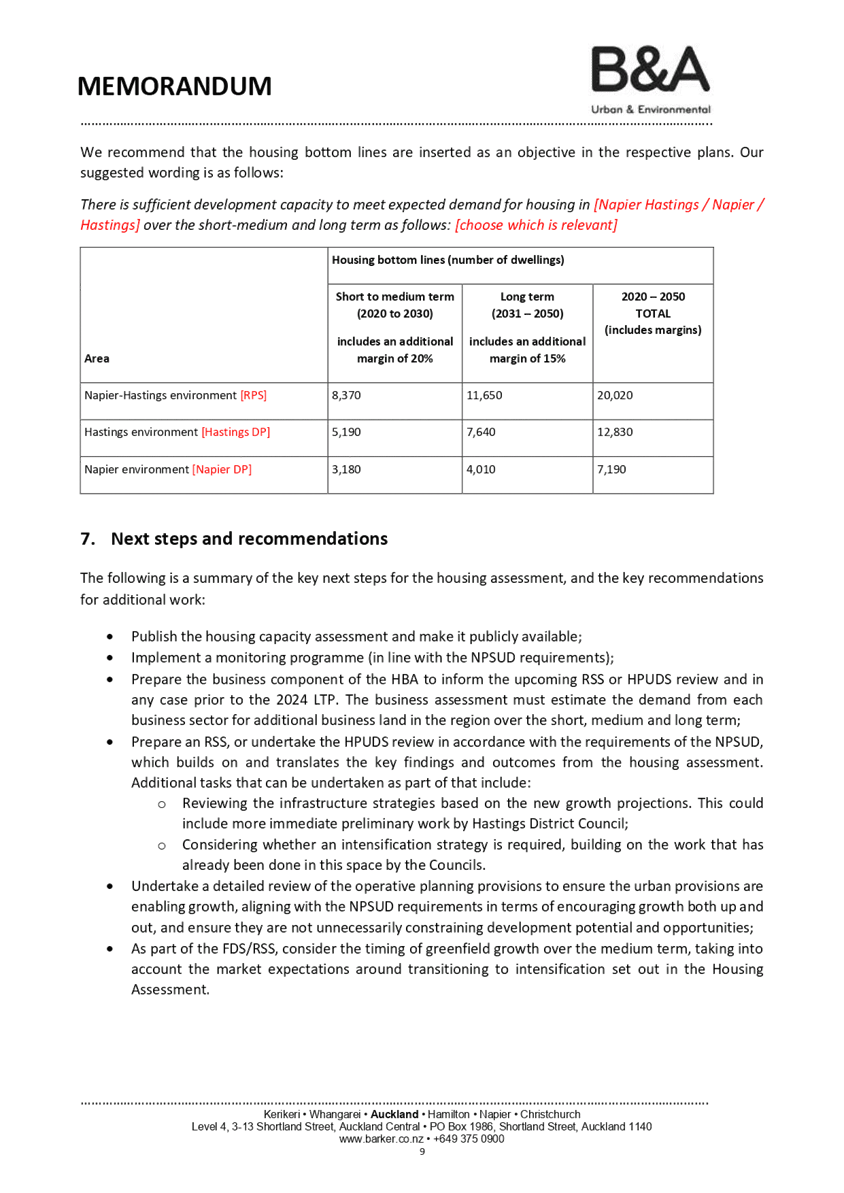

3.5. Group total assets -

$526mil $442mil

3.6. Parent total assets -

$446mil $459mil

3.7. Parent = HBRIC; Group = HBRIC + NPHL

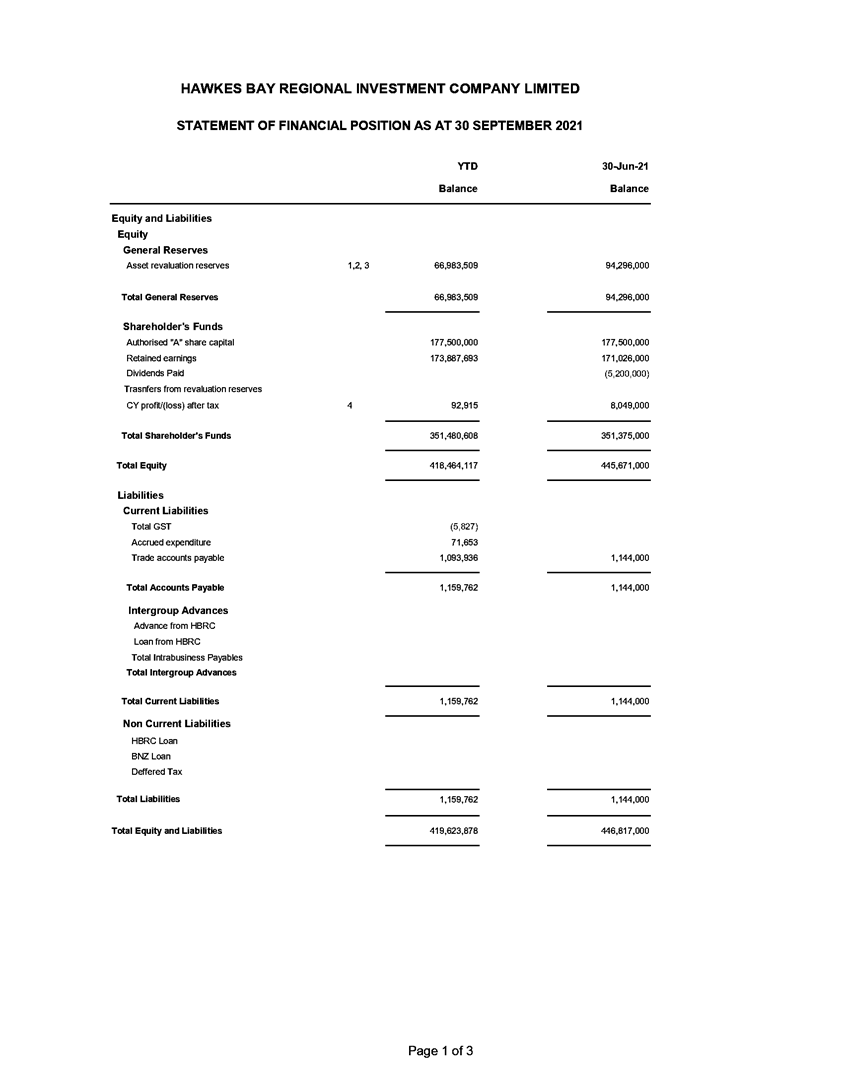

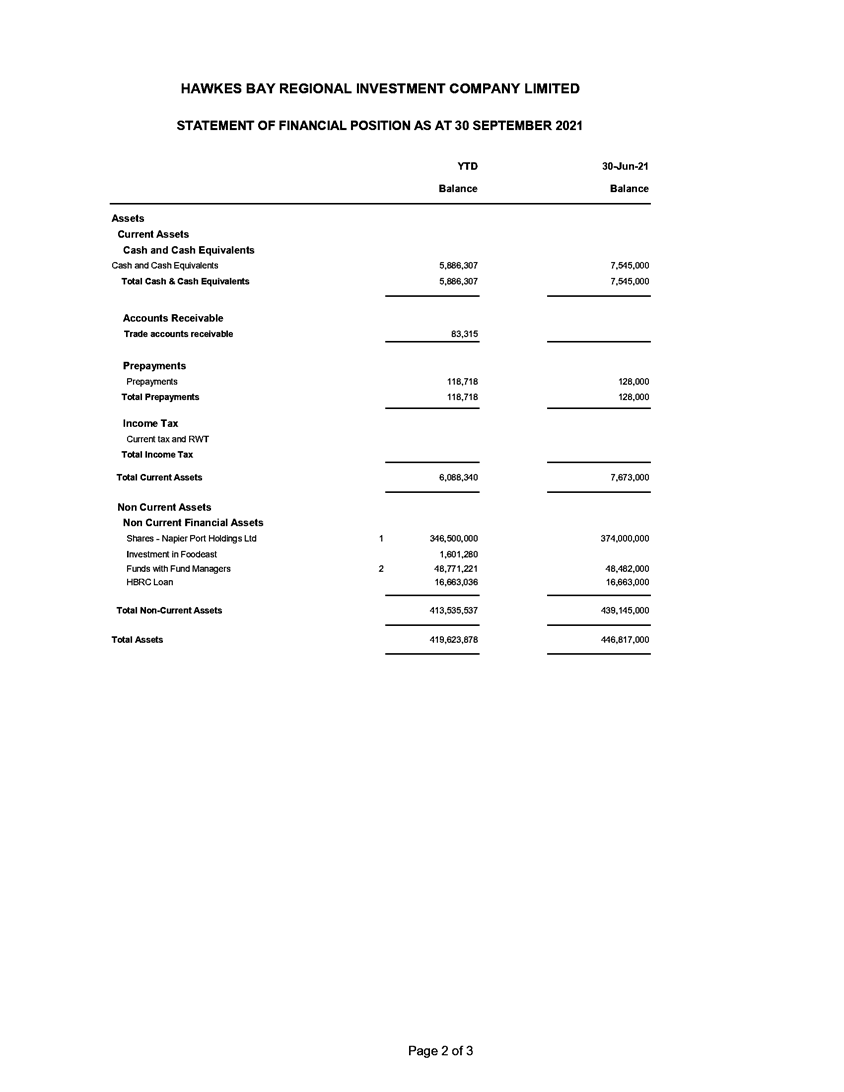

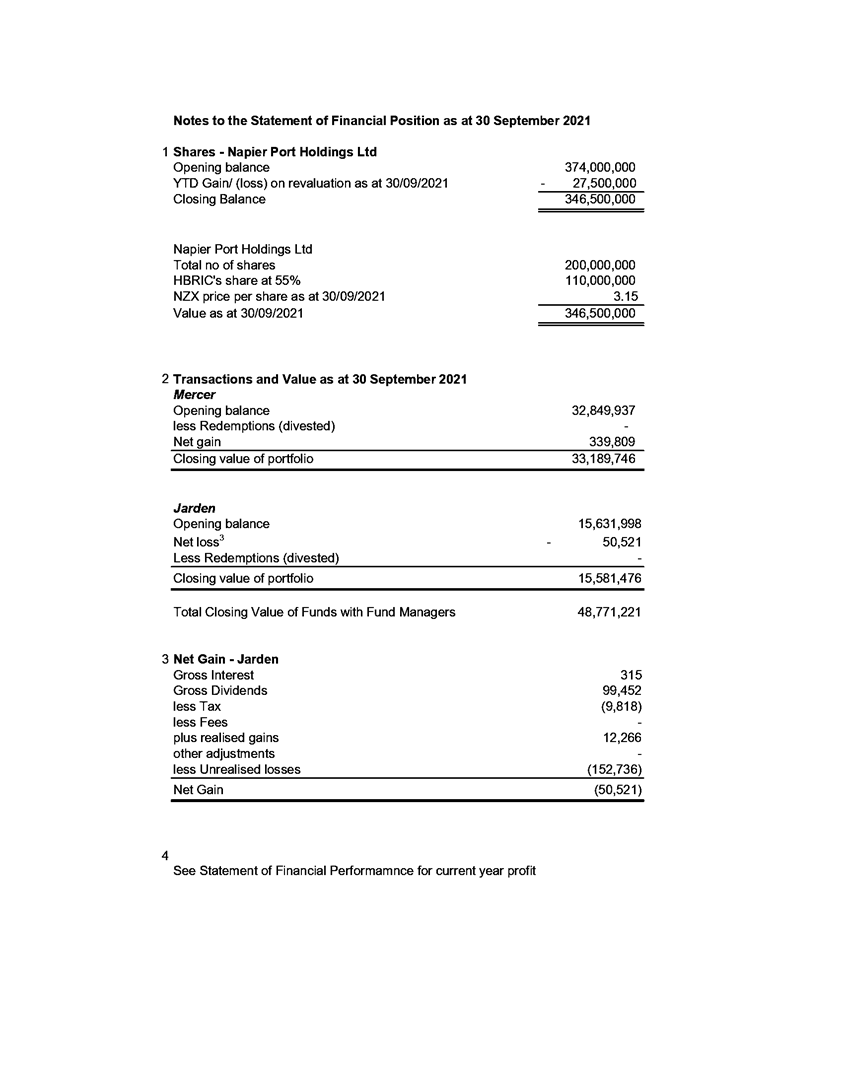

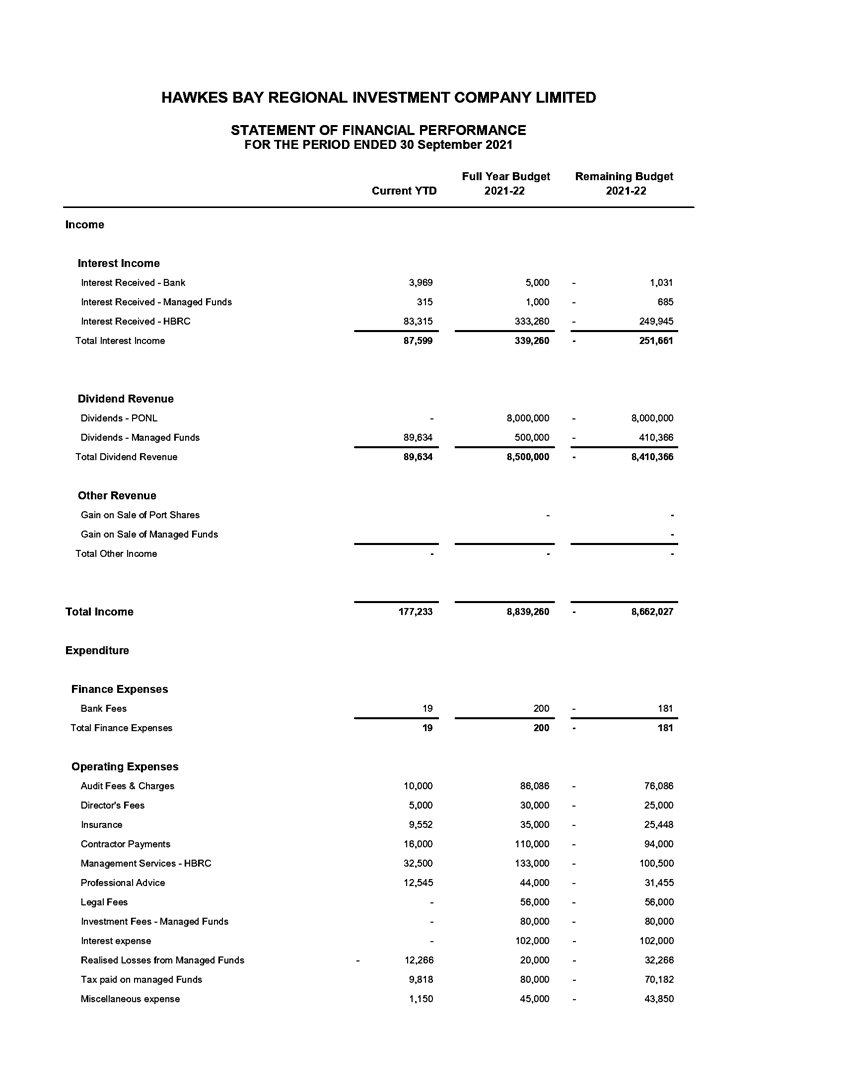

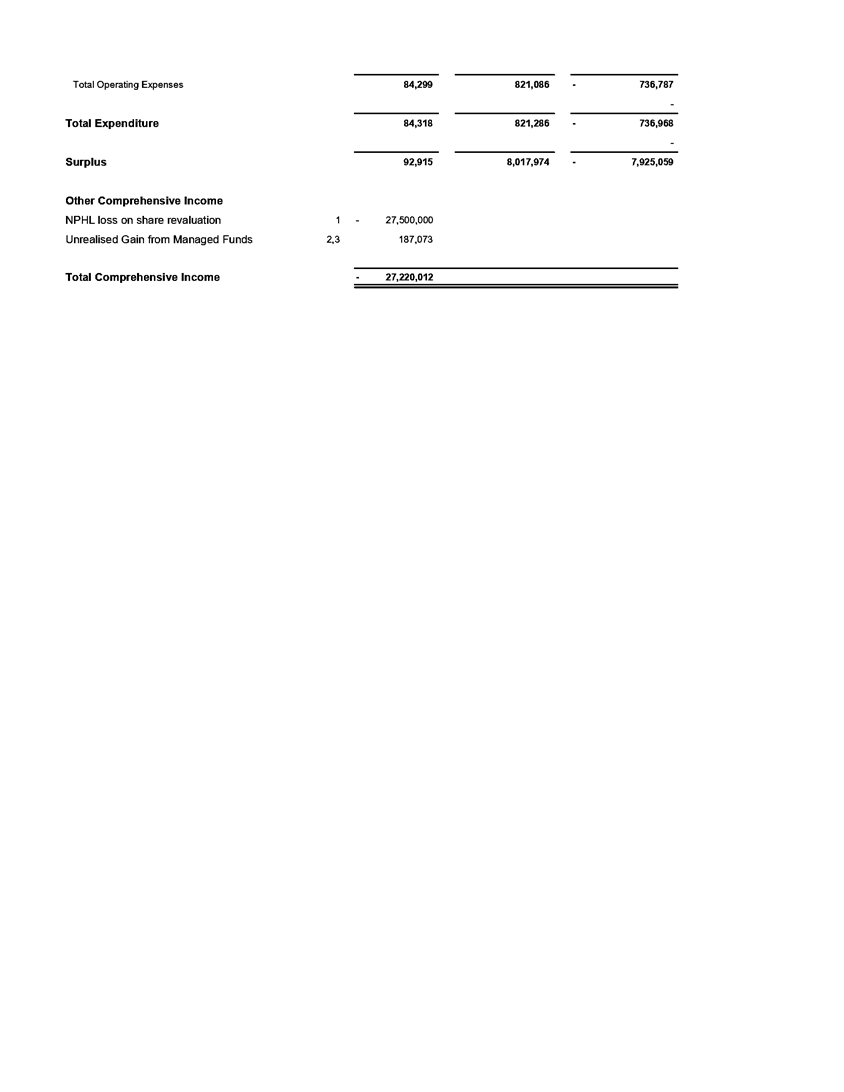

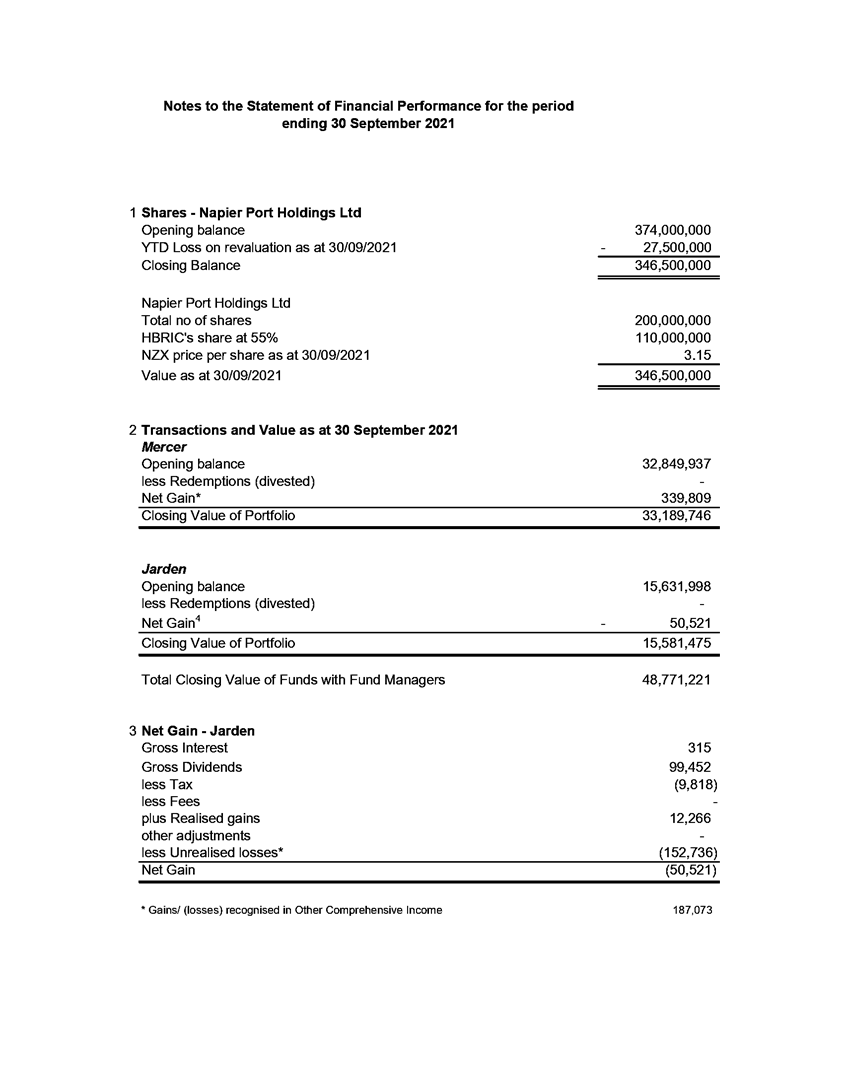

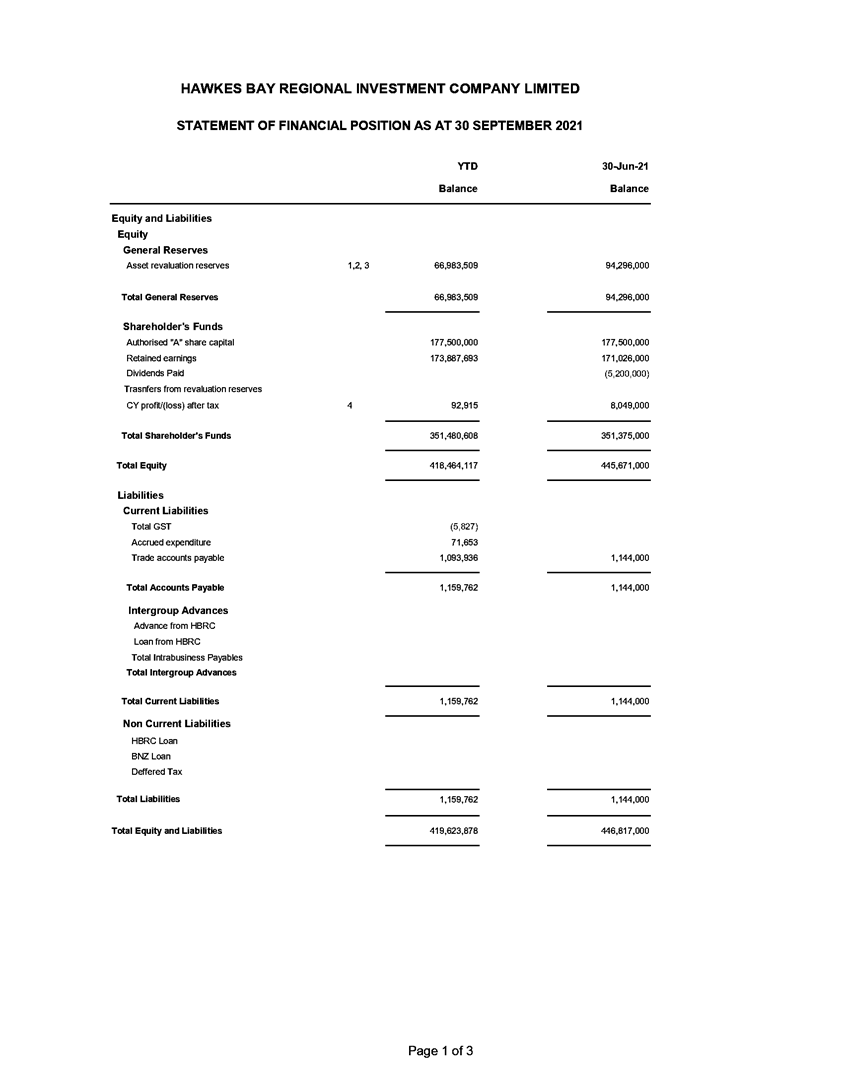

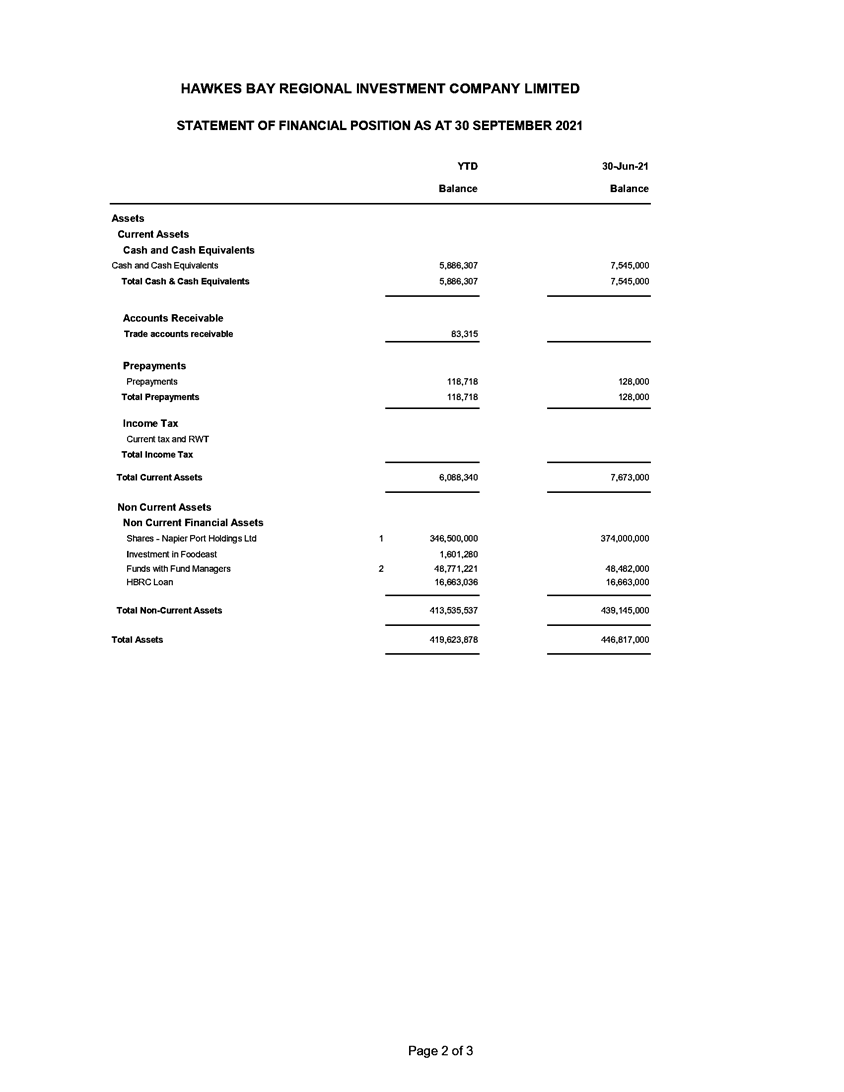

4. Financial Statements for the quarter ending 30 September 2021 are

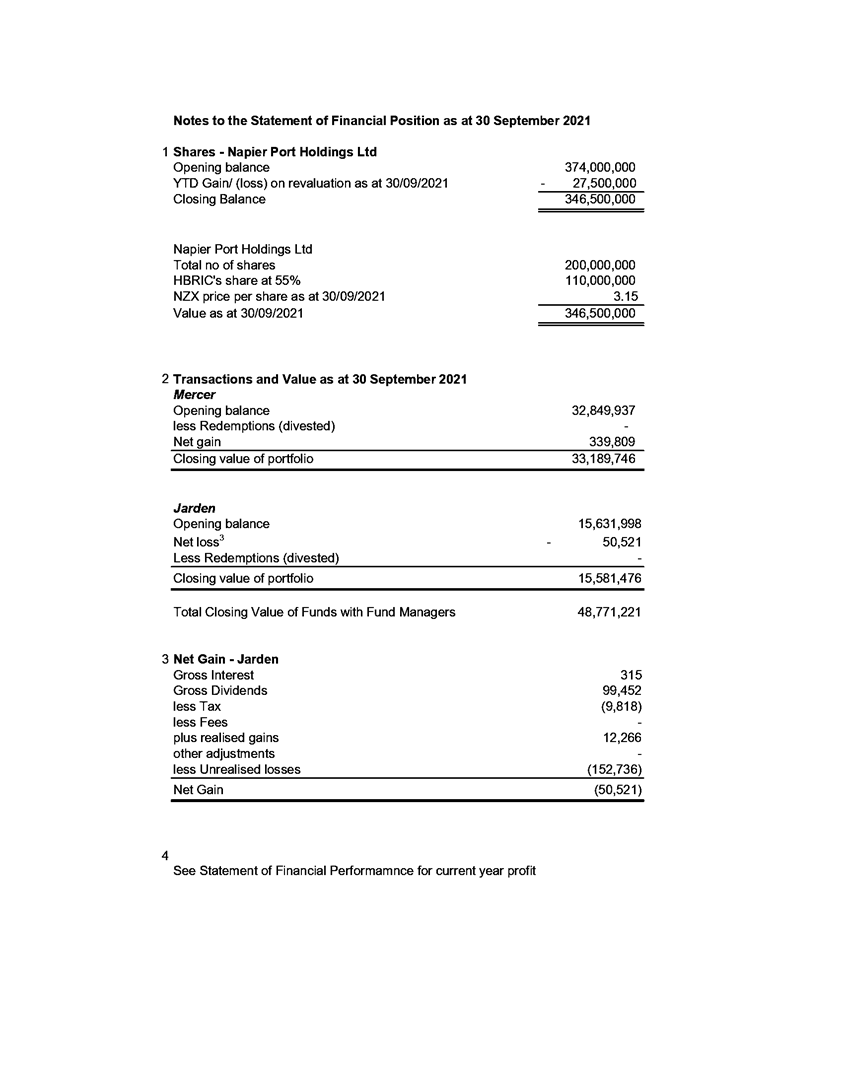

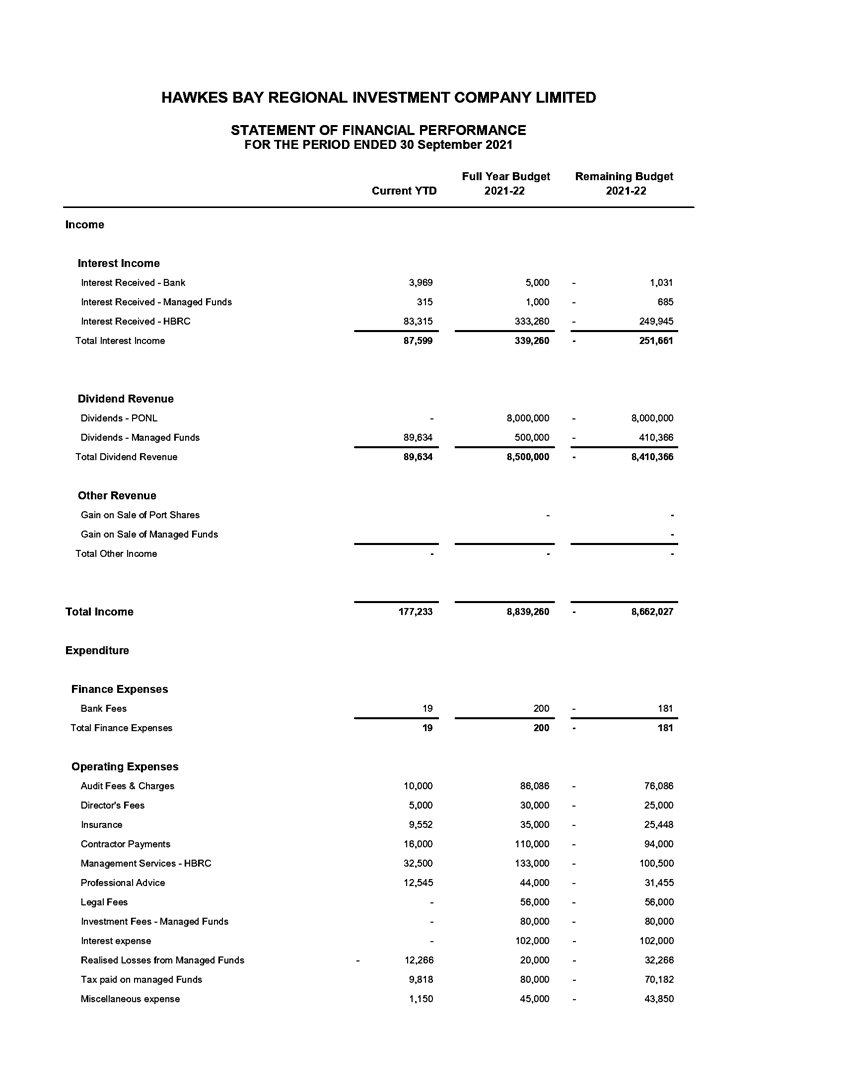

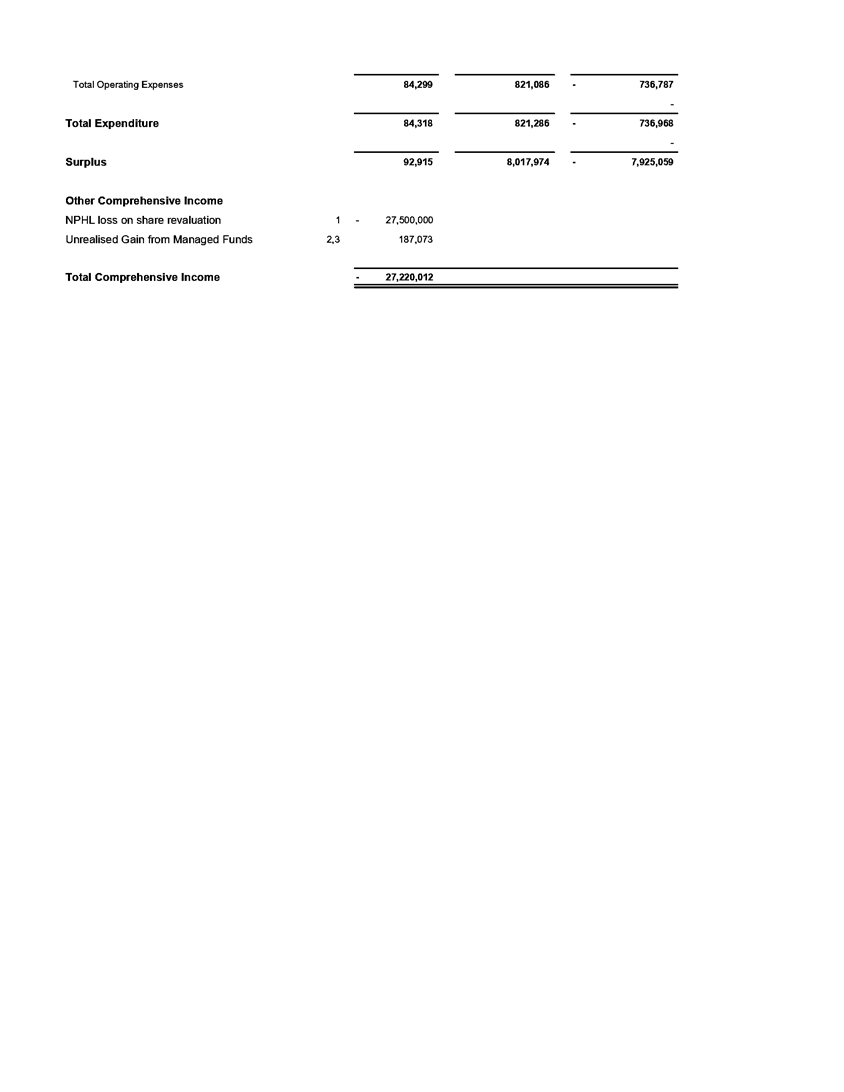

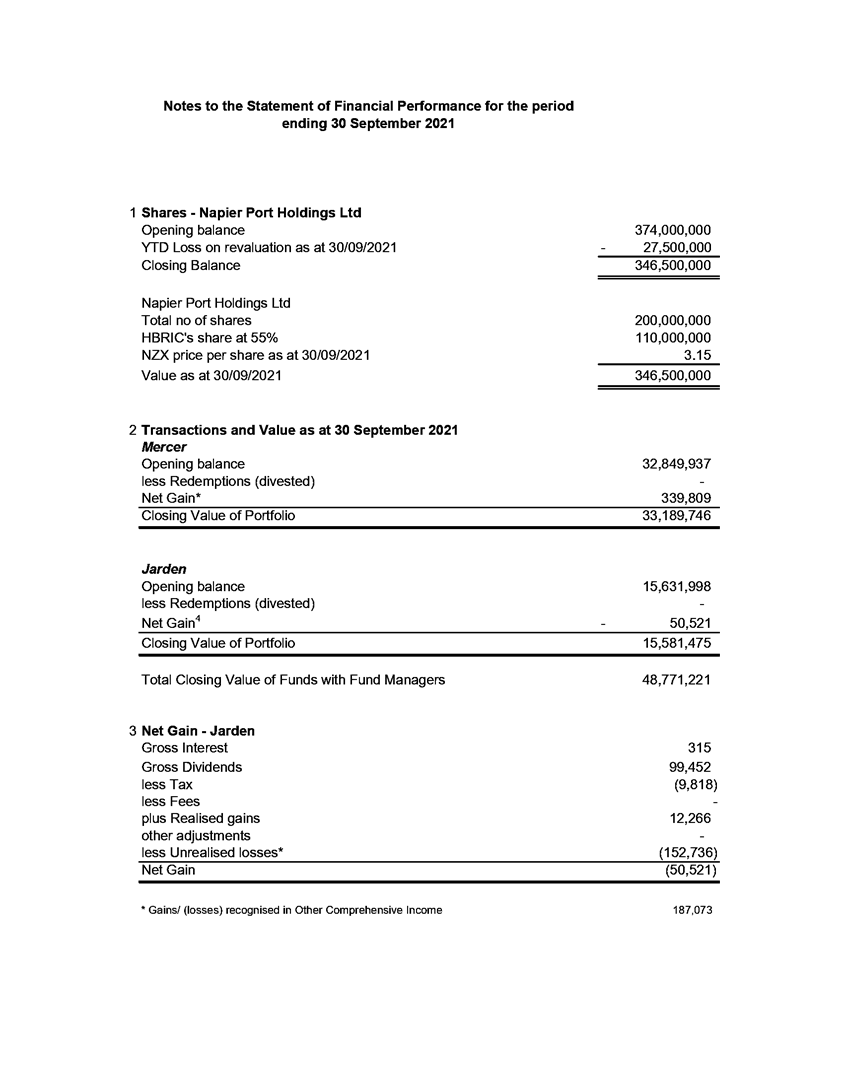

attached to this report.

5. Key items to note for the quarter:

5.1. Statement of Financial Performance - Surplus of $92k (excluding fair

value movements through other comprehensive income)

5.2. Other Comprehensive Income – Loss of $27mil driven by a drop

in the Napier Port Holdings Limited (NPHL) share price (loss on revaluation)

5.3. A reduction in net assets by $27mil due to the drop in NPHL share

price.

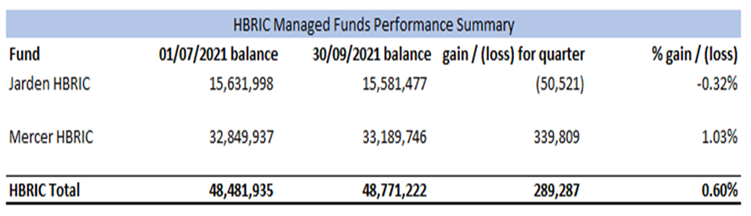

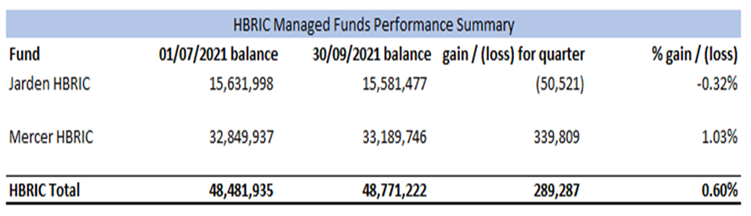

Managed Funds

6. The funds remain under management in compliance with Council’s

SIPO.