Meeting of the Hawke's Bay Regional Council

Date: Wednesday 15 July 2020

Time: 9.00am

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

Item Title Page

1. Karakia

/Welcome/Apologies

2. Conflict

of Interest Declarations

3. Submissions

on the HBRC 2020-21 Annual Plan 3

4. 2020-21

Annual Plan Submissions Hearing Process 5

5. Deliberation

Report on the Rates Approach for 2020-21 9

6. Deliberation

Report on the Recovery Fund for 2020-21 33

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 15 July 2020

SUBJECT Submissions on the HBRC 2020-21 Annual

Plan

Reason for Report

1. This item

provides the submissions and feedback, as attached, received

during consultation on the Regional Council’s 2020-21 Annual Plan for

Councillors to read in advance of the Hearing and Deliberations on 15 July

2020, as well as an outline of the consultation process undertaken.

Background

2. The focus of

this year’s Annual Plan is: Climate. Smart. Recovery. - due to COVID-19,

its effect on Hawke’s Bay people, and the significant ongoing impacts of

the drought in Central HB and Heretaunga.

3. Consultation on

the 2020-21 Annual Plan ran over three weeks, from Monday 8 June until Sunday

28 June.

4. The channels

used to inform the public of this consultation included the Regional

Council’s website, radio, newspapers, digital (Stuff, hbtoday.co.nz and

nzherald.co.nz in Hawke’s Bay), social media (Facebook posts and two

Facebook Live virtual public meetings), a ratepayer postcard mail-out, media

reporting, email, at libraries and Regional Council offices.

5. All information

relating to this consultation was available online via hbrc.govt.nz and

consultations.nz/hbrc, and physically at Regional Council offices and libraries

throughout the region.

6. Due to the

recent lifting of COVID-19 social restrictions, this consultation was weighted

to digital engagement over physical engagement, but used a number of

traditional channels to ensure the opportunity to give feedback reached the

target audience, including a new option of submissions by phone message.

|

Channel

|

Reach or Frequency

|

|

Newspaper advertising

|

2 adverts each in HB

Today, CHB Mail, Napier Courier, Hastings Leader and Wairoa Star; 1 public

notice in HB Today, between 6-25 June

|

|

Radio advertising

|

A total of 195

x30-second adverts on HB Coast, HB Hits and HB ZB from 10-26 June

|

|

Facebook posts

|

24 Facebook posts with

a total of 53,602 views; 11,740 total video views; total post engagement of

960, Reaction/ Comments/ Shares = 227

|

|

Ratepayer postcard

mail-out

|

54,449 households, 173

‘Returned to Sender’ (0.32%)

|

|

Digital impressions

|

100,004 impressions,

338 clicks for a click-through rate of 0.34% - more than 4 times the average

NZ click-through rate

|

|

Totals

Submissions: 118

|

Online:

95

Physical: 3

Email: 16

Phone messages: 2

Text messages: 1

Social

media: 1

|

Next Steps

7. Submission Hearings are scheduled to begin at 9.00am on 15 July, and

the timetable will be confirmed and provided with the agenda.

8. Deliberations will follow the verbal submissions. The deliberation

reports will be distributed as part of the agenda for the 15 July meeting, and

councillors will make recommendations for adoption of the Annual Plan at

Council’s 29 July meeting.

Decision Making

Process

9. Staff have assessed the requirements of the Local Government Act

2002 in relation to this item and have concluded that, as this report is for

information only, the decision making provisions do not apply.

|

1. Recommendations

That

Hawke’s Bay Regional Council receives the

“Submissions on the HBRC 2020-21 Annual Plan” staff report.

|

Authored by:

|

Drew Broadley

Community Engagement and Communications

Manager

|

Mandy Sharpe

Project Manager

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

⇨1

|

All

Submissions Received to 2020-21 Annual Plan

|

|

Under

Separate Cover

|

|

⇨2

|

Social Media

Feedback on 2020-21 Annual Plan

|

|

Under

Separate Cover

|

HAWKE’S BAY REGIONAL

COUNCIL

Wednesday 15 July 2020

SUBJECT 2020-21 Annual Plan Submissions

Hearing Process

Reason for Report

1. This report outlines the process to be undertaken to hear and

consider submissions received on the 2020-21 Annual Plan.

Background

2. The focus of this year’s Annual Plan is Climate. Smart.

Recovery. – it responds to the effects of COVID-19 on Hawke’s Bay

people and the significant ongoing impacts of the drought in Central

Hawke’s Bay and Heretaunga.

3. Consultation on the 2020-21 Annual Plan ran over three weeks from

Monday 8 June until Sunday 28 June, on the two topics of:

3.1. Rates

Approach for 2020-21

3.2. Recovery Fund

for 2020-21

4. On 3 July Councillors received all submissions and Facebook posts in

their entirety. On 10 July these were made available online and at reception.

Verbal Submissions

5. The submissions hearing is scheduled to begin at 9am. All submitters

are allocated ten minutes to present, including questions and answers. Submitters may be an individual or a group and may be representing

an organisation.

6. The timetable is attached.

Deliberations and Decision Making

7. After all

verbal submissions have been heard Councillors will move into deliberations and

decision making.

8. Councillors

will be asked to receive and consider the two deliberation staff reports in

order to arrive at decisions on:

8.1. Council’s

rates approach for 2020-21

8.2. Whether to

establish a $1 million Recovery Fund for 2020-21.

9. Attached to the

reports are the submissions related to the consultation topic sorted by the

option chosen.

Topics and Issues Raised Not Related

to Consultation Topics

10. The two

deliberation reports focus on community feedback provided on the two

consultation topics only as these are the focus of decisions to be made by

Councillors for the upcoming financial year.

11. It is not intended to

provide specific responses to submitters who have provided feedback on matters

outside of the consultation topics, unless requested by Councillors. All

submitters have received acknowledgement of their submissions.

Adoption

12. Subsequent

to Council’s decisions on 15 July, the 2020-21 Annual Plan will be

finalised, incorporating any amendments necessitated by the decisions made, for

adoption on 29 July 2020.

Post-adoption

13. Following

the adoption of the Annual Plan on 29 July, each submitter will be provided

with Council’s resolutions (decisions) in regards to the two consultation

topics.

14. The

Annual Plan will then be made available to the public within one month of the

date of adoption as required under Section 95 of the Local Government Act 2002.

Decision Making

Process

15. The

Council is required to make a decision in accordance with Part 6 Sub-Part 1, of

the Local Government Act 2002 (the Act). Staff have assessed the

requirements contained within this section of the Act in relation to this item

and have concluded the following:

15.1. Council has a

statutory obligation to adopt an Annual Plan under Section 95 of the Act.

15.2. The persons

affected by the Annual Plan have been consulted and today’s meeting will

consider the issues raised by those members of the community that have

submitted to Council on the Annual Plan.

|

Recommendations

That Hawke’s Bay Regional Council receives and considers the

verbal and written submissions received in response to the Climate. Smart.

Recovery. 2020-21 Annual Plan consultation document.

|

Authored by:

|

Leeanne

Hooper

Governance Lead

|

Mandy Sharpe

Project Manager

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

⇩1

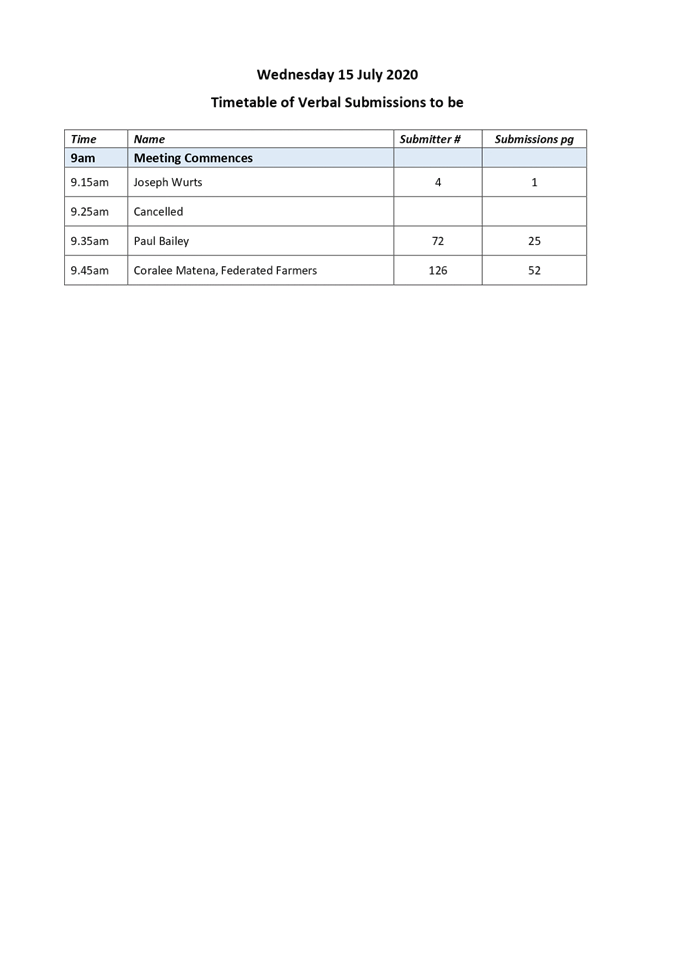

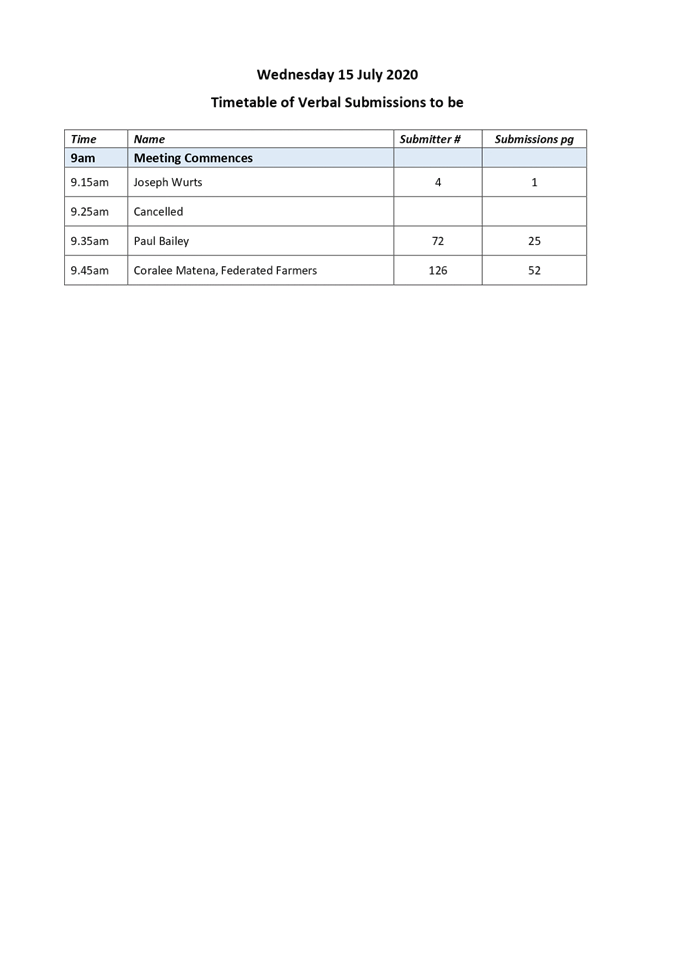

|

15 July 2020

Verbal Submissions Timetable

|

|

|

|

15

July 2020 Verbal Submissions Timetable

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 15 July 2020

Subject: Deliberation Report on

the Rates Approach for 2020-21

Reason for Report

1. This

report provides Council with officers’ analysis of the feedback received

from the community for options on Council’s rate approach for 2020-21 as

part of the 2020-21 Annual Plan consultation document. Community consultation

was held from 8-28 June 2020.

2. The

report identifies and considers key themes, comments and suggestions raised in

order to assist Council in its decision making regarding the Rates Approach.

Officers’ Recommendation

3. Council

staff recommend that, having considered all submissions and the officers’

analysis of submissions, that Council chooses its preferred option for the

rates approach for 2020-21.

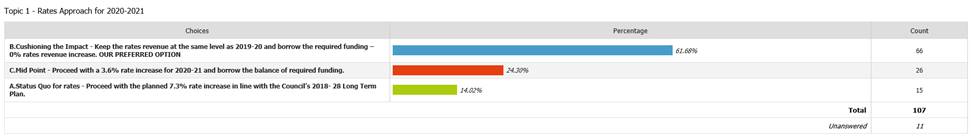

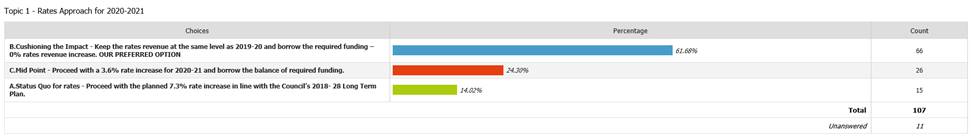

Options Analysis

– Topic 1: Rates Approach for 2020-21

4. Three

options were provided on Council’s rates approach for 2020-21, submitters

were asked to indicate which option they supported.

5. The

options selected by submitters were:

|

OPTIONS

|

Number that chose this option

|

% that chose this option

|

|

Option A

Status Quo for rates – proceed with the planned 7.3% rate

increase in line with the Council’s 2018-28 Long Term Plan.

|

15

|

14% *

|

|

Option B

Cushioning the Impact – Keep the rates revenue at the same

level as 2019-20 and borrow the required funding – a 0% rates revenue

increase.

|

66

|

62% *

|

|

Option C

Mid-Point – Proceed with a 3.6% rate increase for 2020-21 and

borrow the balance of required funding.

|

26

|

24% *

|

|

No option chosen

|

11

|

|

|

TOTAL

|

118

|

|

*

excluding those that did not choose an option

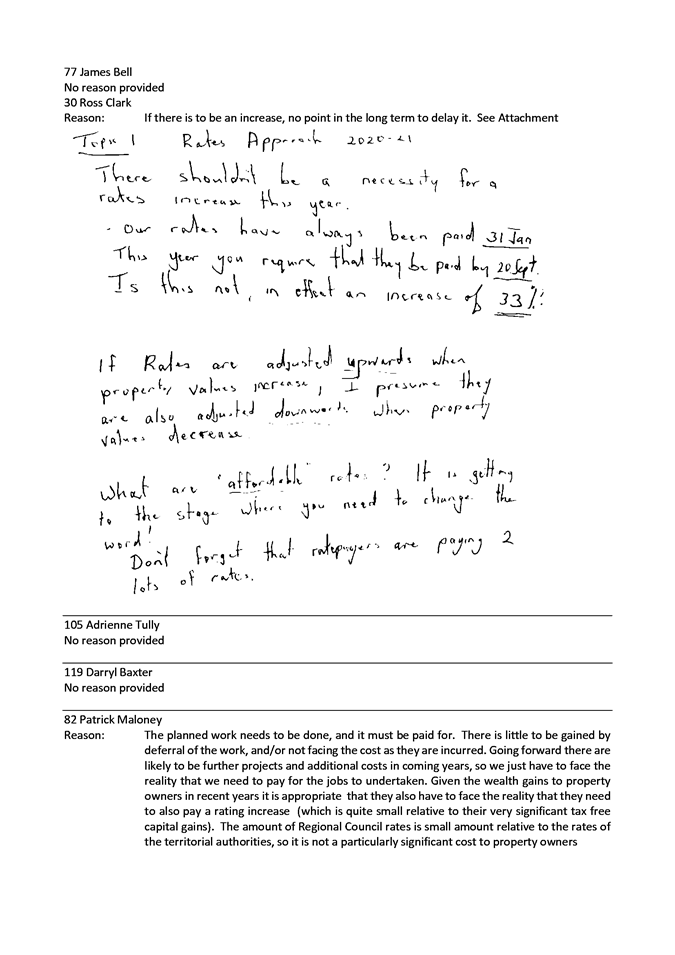

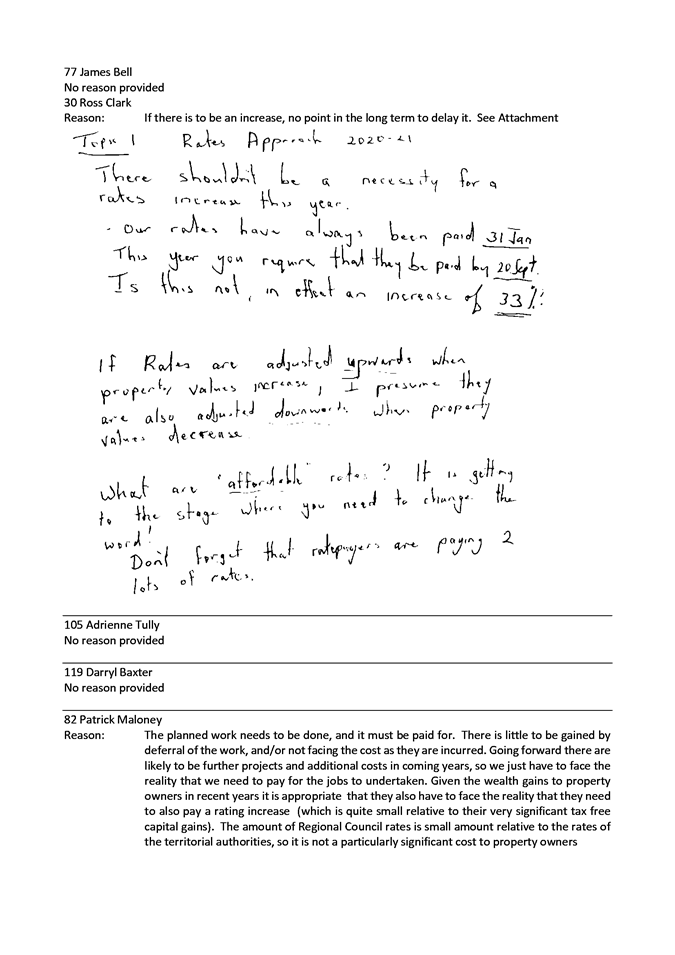

6. Attached

to this report is the data above represented as a bar graph.

7. This

report provides analysis of the responses by each option. Related comments made

by submitters who did not select an option are also included in the analysis,

which covers:

7.1. Key

themes

7.2. Analysis

of themes

7.3. Direct

quotes from submitters (extracts only)

7.4. Officers’

response.

OPTION A: STATUS

QUO FOR RATES

Key themes

8. Fifteen

submitters selected this option. The following key themes were identified.

8.1. Essential

work that needs to be done

8.2. Concern

about borrowing

8.3. Affordable

for most

8.4. Target

those in need

Analysis of

themes

9. There

was sentiment that proceeding with the 7.3% rate increase as planned in the

2018-28 Long Term Plan will enable the work to be done, and that the planned

projects are essential.

10. Other

submitters commented that rates are affordable for most and the work should be

paid for now, rather than borrowing for it and affecting future rate

levels.

11. Targeting

those in need was also suggested, by building in assistance or offering

targeted rebates.

Direct quotes

from submitters (extracts only)

12. “…Proceed

with 2018-28 projects outlined in the long term plan to benefit the citizens of

Hawke's Bay now and for the younger generations in the future. We need more

development now to make HB a preferred region to live and work in so to

increase regional population and economic growth.” (sub #18)

13. “…

It doesn't seem to me to be a very good idea to put us in debt given the Covid

19 situation…” (sub #6)

14. “…You

could instead offer targeted rebates aimed at low income households…”

(sub #44)

Officers’ response to the key themes expressed in Option

A

15. Officers

agree that the work programme for the 2020-21 year should proceed in line with

the proposed levels of service consulted on in the 2018-28 LTP. The work is

essential, and the organisation has an important role to play in supporting the

regional economy through its work and expenditure.

16. Officers

acknowledge that while it is deemed necessary to continue to maintain existing

levels of service, cost efficiencies should and will be sought to reduce the

borrowing requirement and burden on future rate-payers.

17. Whilst

acknowledging submitters’ concerns about borrowing, officers consider the

cost of borrowing to be extremely low. It is planned to be repaid over 10

years, which has a relatively low cost impact on servicing costs.

18. While

many in the community may have not been financially impacted as a result of

current events, many have been, and borrowing to fund a zero percent rates

increase will provide some financial relief in the coming year particularly to

large landholders.

OPTION B:

CUSHIONING THE IMPACT

Key themes

19. Sixty-six

66 submitters selected this option. The following key themes were identified.

19.1. Affordability

19.2. Live

within your means

19.3. Need

another option

Analysis of

themes

20. Affordability

was a strong theme for why people chose Option B. Some submitters stated

they are already seriously affected financially by COVID-19, and others, while

not themselves affected, felt others already are, or will feel the financial

impacts.

21. Comments

were also made about high or rising rates, which are compounded by

central government charges

22. Whilst

not choosing a preferred option, general comments made by Federated Farmers

included concern “…about the impact that this debt will have on

rural rates, both now and in future years. Rural rates have been increasingly significantly

year by year, albeit without any increase in farmer/rural rate payer ability to

pay…..” They are also concerned about Council opting to borrow the

entire forecasted shortfall (income gap from drop in investment income).

23. Strong

sentiment was expressed that Council should work within its existing budgets

just like other people have had to, rather than increase rates.

24. Several

submitters encouraged Council to review spending. Tangible suggestions

included:

24.1. Focus

solely on core district infrastructure

24.2. Reallocate

the budget tagged to additional office space and updated facilities for field

staff to general rates and/or the Uniform Annual General Charge to offset the

amount needed to pay or borrow for rates

24.3. Every

Council should have a plan for when their financial plan falls apart

24.4. Droughts

are common in H.B if there isn't a plan already in place for situations like

this then why not!?

24.5. Stick to

the basics, stop overspending, and those earning over $100,000 should take a

pay cut.

25. Four

submitters were keen to see a different approach for rates that wasn’t

provided for in consultation. Three submitters were keen to have a 0% rates

increase (as per the first part of option B) but do not want Council to borrow

(the required funding). Suggestions instead included; cut back on projects, cut

back on spending, defer capital expenditure, and a pay cut for those earning

over $100,000. The fourth submitter didn’t explicitly articulate the rate

level they preferred but was also of the similar sentiment in terms of how to

implement it – keep expenditure at the current level, or at best cap it

(at either inflation of the local GDP factor).

26. Similar

sentiments were provided by another submitter who chose a different rates

approach (Option C - Mid Point) – that submitter wanted to see rates

revenue kept at the same level as 2019-20 and reduced costs to match.

27. One

submitter added they wanted Council to consider adding additional options to

future consultations, and commented that the options provided may have the

unintended consequence of the Council believing that rate payers are happy to

borrow the funds to cover the shortfall.

Direct quotes

from submitters (mostly extracts only)

Affordability

28. “…

Some rural ratepayers are not only facing the economic consequences of Covid 19

and the worst drought in "113 years". They are also dealing with the

costs of the governments National Freshwater policies, the MPI Mycoplasma bovis

eradication programme, environmental development work and their FEMPs. Some

of these new costs for our businesses are being incurred voluntarily as we are

all invested in improving environmental outcomes. They are however still new

expenses for our businesses to manage. All these issues are combining to be a

tsunami of extra expenses for a district that is already one of the most

expensive areas in the world to produce food…” (sub #115)

29. “It

is good to see that the preferred option on rates is a zero rise in the 2020-21

year. People on limited financial income who own their own homes cannot afford

rates rises. It's hard enough to pay power/phone plus food without additional

expenses being added…” (sub #59)

30. “It

is time council recognise household incomes do not rise inline with council

rating expectations. Many households will suffer a decline in income this year.

It would be irresponsible for there to be an increase…” (sub #52)

31. “Rates

should not increase at all!! Reduce all your burocratic overheads first, get

back to dealing with core issues, pest management, vegetation control etc. Far

too many managers and people who produce nothing. Rates have increased

threefold in last 5 years, services provided dropped to minimal. Council

should be looking to reduce rates and cut the deadwood out from Dalton St. NO

INCREASE!!!!” (sub #53)

32. “…In

just five years, the regional council rates on our property has increased by

over 100%. This is a highly unsustainable rate of

increase…” (sub #4)

33. “…Given

the acute state of the New Zealand economy as a whole currently, it would be

remiss of the HBRC to entertain pursuing a raft of activity that is "nice

to have yet not necessary" during the next 2 years; particularly where

such activity mostly relies on rates as the main funding source. Instead, I

suggest that only "essential" work (i.e. "core business")

should be undertaken by the HBRC to ensure that no increase in rates is

required for at least the next 2 years…” (sub #74)

Live within

your means

34. “Year

on year rate increases have to stop. Councils have to learn to live within

their budgets…” (sub #32)

35. “The

Council needs to be operated as private business and must work within current

funding levels. In private enterprise you would stop any essential spending and

staff numbers must be greatly reduced to reduce spending on wages…”

(sub #84)

36. “…What

happened to all of the proceeds of selling the port? Why is the council

asking for so much more money after so significantly raising rates in the past

few years as well as selling essential assets? The HBRC needs to learn

fiscal prudence…” (sub #4)

Need another

option

37. “Option

D: Keep the rate revenue the same and DO NOT BORROW extra funding. Cut

back on projects. Debt is bad money management whatever way you look at

it.” (sub #67)

38. “I

submit that the rate increases should be 0%.I would like the council to

consider adding additional options to future consultations. The above options

may have the unintended consequence of the council believing that rate payers

are happy to borrow the funds to cover the shortfall. I have selected B

since it is the best option out of those listed above. However I would

prefer the council instead cut back on spending and defer capital expenditure

in order to accommodate the 0% rate increase.” (Sub #79)

Officers’

response to the key themes expressed in Option B

39. We’re

proposing to work with ratepayers on a case by case basis, and as noted in the

consultation document – our rating team will operate with greater

flexibility (i.e via Rates Remission and Postponement Policy). HBRC recognises

the rural community’s ability to pay is greatly affected and that specific

consideration will be given to rural ratepayers facing the double whammy of

COVID and the drought.

40. In

response to submitters who queried the apparent lack of a contingency plan for

such situations, Council did establish a Reserve Fund using the ring fenced

capital released from the Napier Port Initial Public Offering, but it has not

had sufficient time to provide for operating returns. Over time this will build

a Reserve Fund to protect the Council from the fluctuation / impact of

financial markets.

41. Council

is also undertaking a review of its Financial Strategy with the intent to

reduce our reliance on investment income to subsidise operating costs to

provide greater resilience to respond to extraordinary events.

42. Staff

consider that a case for debt funding is appropriate as the beneficiaries for

much of Council’s work are future generations (in exceptional

circumstances).

43. In

relation to the theme of “live within your means” it is noted that

prior to COVID-19 budgets had been reviewed and tightened to remain within the

planned 7.3% rate increase for 2020-21, as forecast in Council’s Long

Term Plan 2018-18. Organisational costs and spending continue to be under tight

scrutiny, in particular travel and training for staff. We will also be

revisiting our needs for additional office space, with our experiences during

the lock down providing new opportunities for working. A flexible working

policy is currently being finalised. Vacancies are being tightly managed and

only replaced if considered essential.

44. As a final

point it is worth noting that Council can not introduce new options that we

haven’t consulted on as we are constrained by the provisions in the Local

Government Act 2002.

OPTION C: MID

POINT

Key themes

45. Twenty-six

submitters selected this option. Most of the feedback provided could be

categorised into the following two themes.

45.1. A

balanced approach

45.2. Concern

about borrowing.

Analysis of key

themes

46. The

submitters that chose this option saw it as a considered approach that responds

to the immediate hardship felt by the community post COVID and the drought, but

with the least ongoing financial impact related to paying back the interest

costs on borrowing. Some noted that the full impacts of COVID are yet to be

felt so this was a sensible mid -way point given the uncertainty.

47. Comments

reflected that people chose this mid-point option as they weren’t keen on

the costs associated with a higher level of borrowing and could live with a

more modest 3.6% rates increase.

Direct quotes

from submitters (mostly extracts only)

A

Balanced Approach

48. “Cushion

the financial impacts but not fully absorb them so they become a future

problem.” (sub #64)

49. “The

financial impact of Covid is relatively unknown but unlikely businesses will

have recovered for two or three years. to add funding cost to projected rates

increase next year, resulting in an increase close to 10% Criminal. This

will push many business owners out of business, especially tourism businesses.

Yes it is only a few dollars, but combined with all the other increases, it adds

up.” (sub # 75)

50. “…In

considering Option 3 however, is there any magic about the 3.6% or could it

just as easily be 2.5% (and bearing in mind interest rates are now at historically

low levels)?...” (sub #71)

51. “Recognize

thing have changed, but no overreation.” (sub #112)

Concern about borrowing

52. “Prefer

not to pay for costs incurred today by fully loan funding - discounts / relief

could be provided to those who need it.” (sub #93)

53. “Despite

the financial impacts post COVID on organisations and individuals, a modest

3.6% increase on quite a reasonable annual rates bill rather than relying

totally on debt funding seems more reasonable.” (sub #65)

Officers’ response to the key themes expressed in

Option C

54. As this a

combination of mid point of Options A and B the officers’ points are

covered above.

Decision Making

Process

55. Section 95 of the Local Government Act 2002 prescribes the statutory

requirements in relation to annual plans, including that Council must consult in a manner that gives effect to the requirements

of the section 82 principles of consultation. The consultation process has been undertaken and reflects the high

degree of significance associated with adopting the 2020-21 Annual Plan to

specifically respond to the impacts of the Covid-19 pandemic and the drought.

|

Recommendations

That

Hawke’s Bay Regional Council:

1. Receives and considers the “Deliberation

Report on the Rates Approach for 2020-21”,

including the officers’ analysis and responses

to submission points.

2. Agrees its preferred option for 2020-21 is to

2.1. (Option A) proceed with the planned 7.3% rate increase in line

with the Council’s 2018-28 Long Term Plan

Or

2.2. (Option B) keep the rates revenue at the same level as 2019-20 and

borrow the required funding

Or

2.3. (Option C) proceed with a 3.6% rate increase for 2020-21 and

borrow the balance of required funding.

|

Authored by:

|

Leeanne

Hooper

Governance Lead

|

Mandy Sharpe

Project Manager

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

⇩1

|

Topic 1

Options Results Table

|

|

|

|

⇩2

|

Topic 1

Submissions by Option Chosen

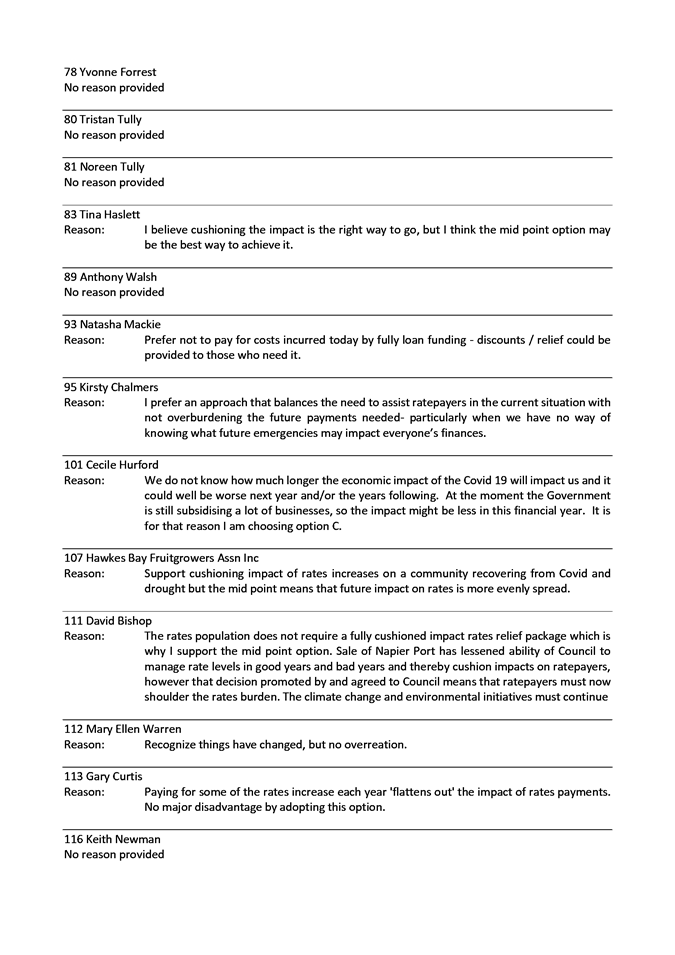

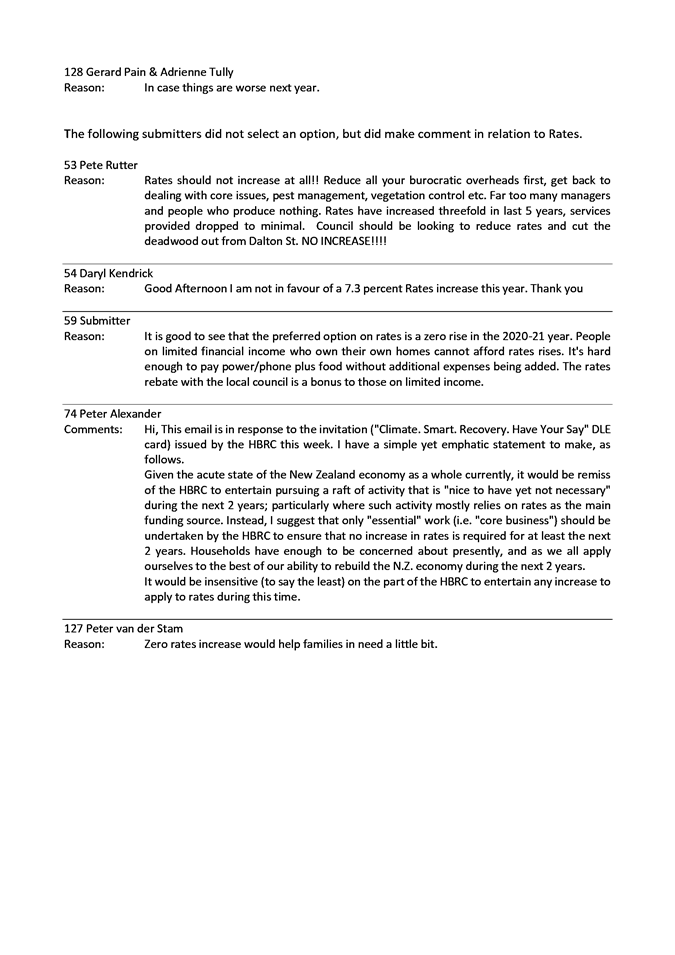

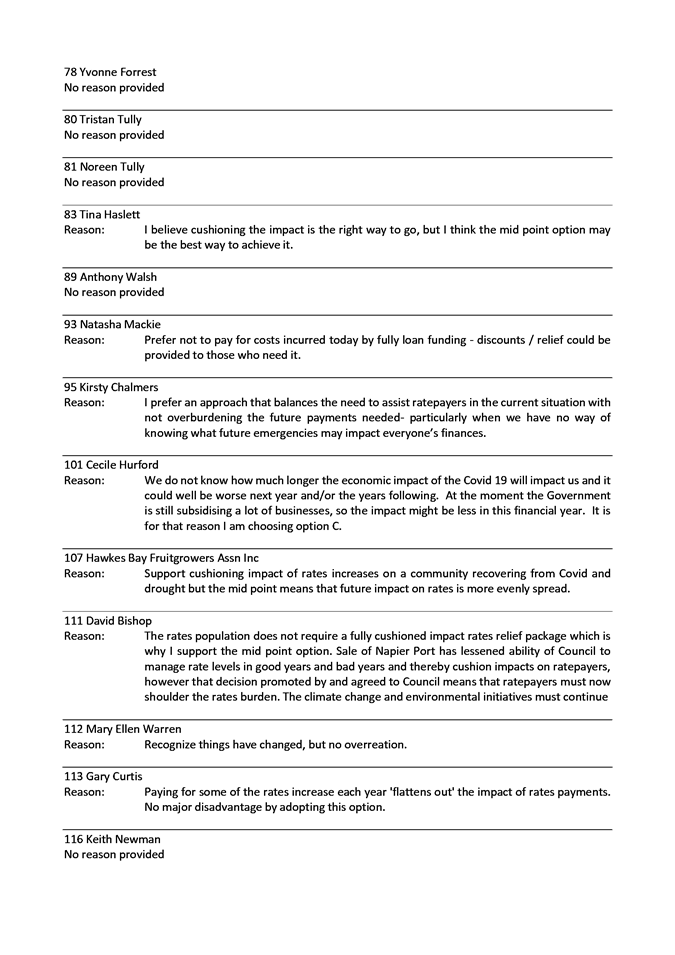

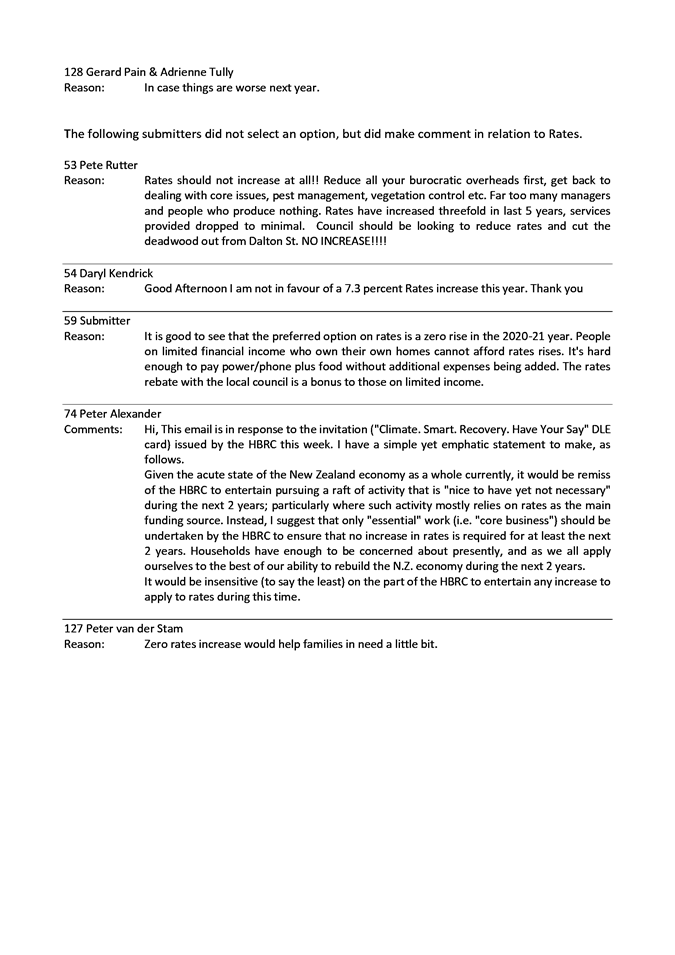

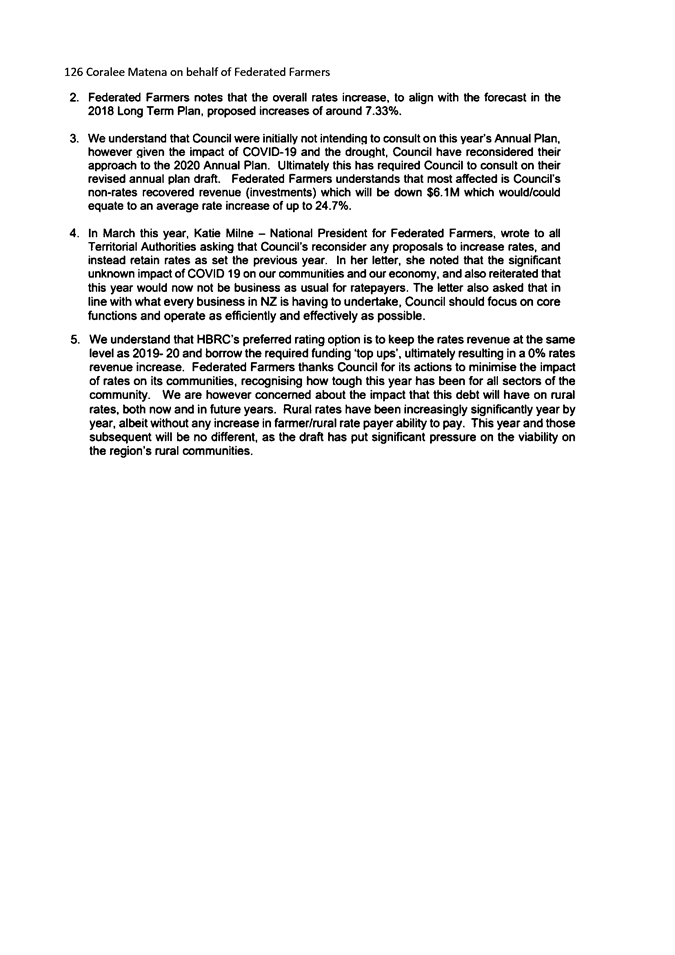

|

|

|

|

Topic

1 Options Results Table

|

Attachment 1

|

|

Topic 1 Submissions by

Option Chosen

|

Attachment 2

|

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 15 July 2020

Subject: Deliberation Report on

the Recovery Fund for 2020-21

Reason for Report

1. This report

provides Council with officers’ analysis of the feedback received from

the community on the proposal to establish a recovery fund as part of the

2020-21 Annual Plan Consultation Document. Community consultation was held from

8-28 June 2020.

2. The report

identifies and considers key themes, comments and suggestions raised in order

to assist Council to make a decision on which option to progress.

Officers’ Recommendation

3. That Council,

having considered all submissions and the officers’ analysis of submissions,

chooses its preferred option in regards to establishing a recovery fund for

2020-21.

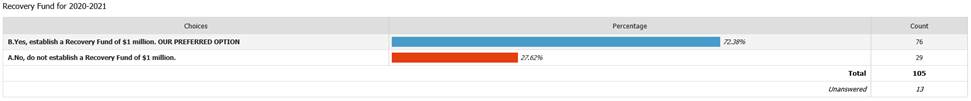

Options Analysis – Topic 2:

Recovery Fund for 2020-21

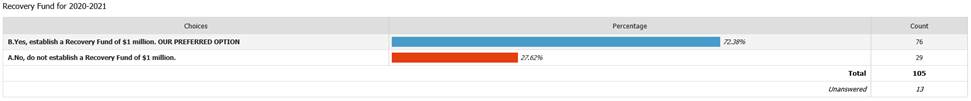

4. Submitters were

provided with two options on Council’s proposal to establish a recovery

fund for 2020-21, and asked to indicate which option they supported.

5. The options

selected by submitters were:

|

OPTIONS

|

Number that chose this option

|

% that chose this option

|

|

Option A

No, do not establish a

Recovery Fund of $1 million.

|

29

|

28%*

|

|

Option B

Yes, establish a

Recovery Fund of $1 million.

|

76

|

72%*

|

|

No

option chosen

|

13

|

|

|

TOTAL

|

118

|

|

*Excluding

those that did not choose an option.

6. Attached to

this report is the data above represented as a bar graph.

7. This report

provides analysis of the responses by each option. Related comments made by

submitters who did not select a preferred option are also included in the

analysis, which includes:

7.1. Key themes

7.2. Analysis of

themes

7.3. Direct quotes

from submitters (extracts only)

7.4. Officers’

response.

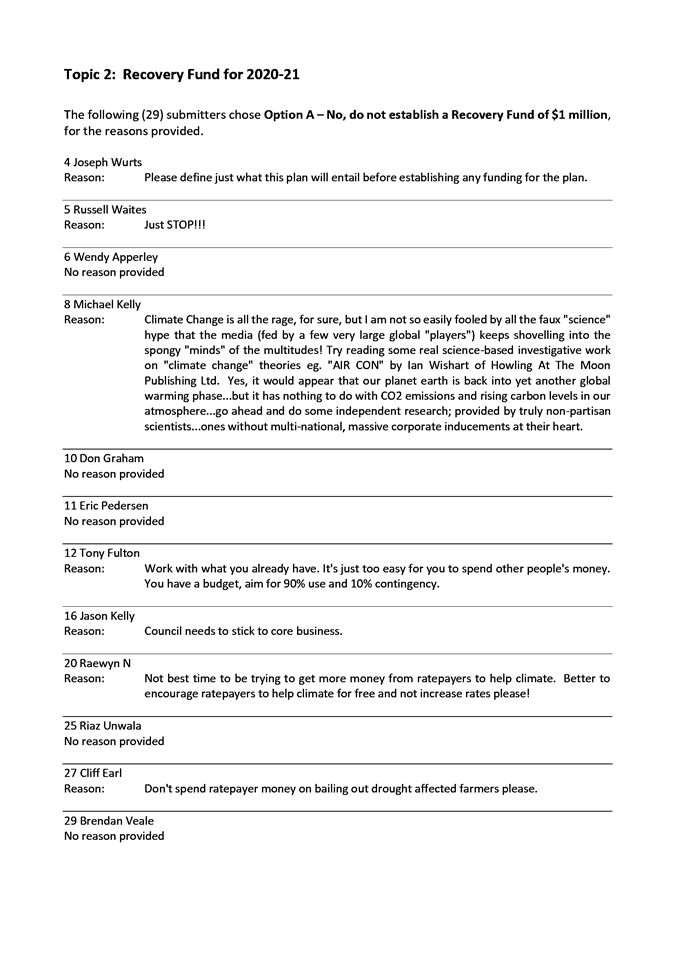

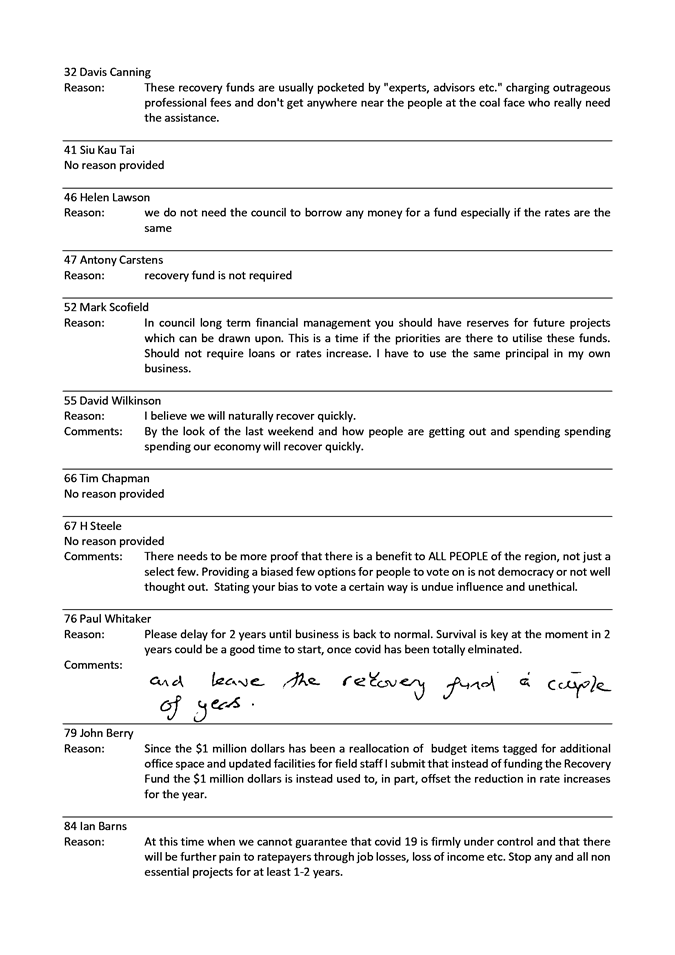

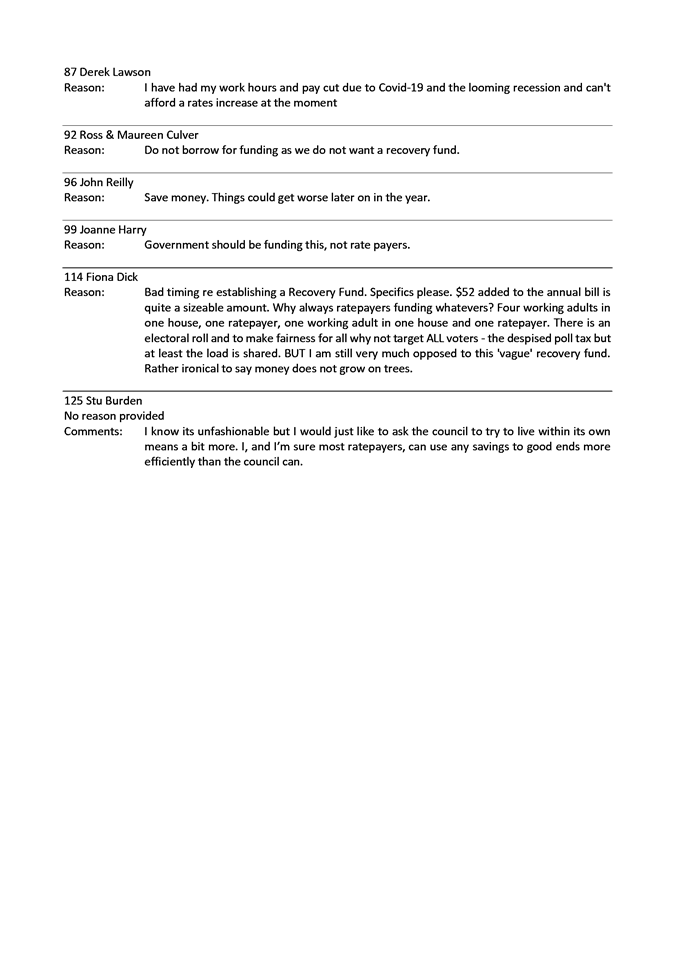

OPTION A: No, do not establish a Recovery Fund of $1 million

Key themes

8. 29 submitters

selected this option. A range of reasons and comments were given as to why

submitters do not support the establishment of a recovery fund. These

included:

8.1. Affordability

8.2. More

information needed

8.3. Work with

what you already have

8.4. Delay setting

up the fund

8.5. Fund is not

needed

8.6. Concern

around who benefits.

Analysis of themes

9. There appears

to be some confusion around the recovery fund, including how it will be funded

and the work it would support. Some submitters were concerned

establishing this fund would increase rates or borrowing, which would impact

rates affordability. One submitter believed “Council needs to stick to

core business”. This is despite the consultation document outlining that

the proposed $1 million would be reallocated from the budget tagged for

additional office space and would be focusing on accelerating Council capital

projects.

10. Specific details were

requested, including what projects would be initiated. This was a sentiment

expressed by those that both did and did not support establishment of a fund.

11. There is a sentiment of

“work with what you already have”, including that Council should

have reserves to draw on for future projects.

12. Sentiment was also

expressed that Council should delay setting up the fund, until COVID-19 was in

control or eliminated, and to “…Stop any and all non essential

projects for at least 1-2 years.” Survival was key and there is no

guarantee that there will be further financial impact on people. This sentiment

was echoed by another submitter who suggested that only “essential”

work be undertaken in the next two years, to ensure rates would not increase in

that time. “…Given the acute state of the New Zealand

economy…”

13. Sentiment was also

expressed that the fund was not needed, with one submitter inferring the impact

of COVID-19 will not be as severe as expected.

14. There was some concern

expressed about who the fund would benefit, one submitter not wanting ratepayer

money spent “…on bailing out drought affected farmers please”

and another saying there needed to be proof that all people benefit.

15. One submitter suggested

that the $1 million instead be used to, in part, offset the reduction in rate

increases. This sentiment was also made by another submitter, who caveated

their preference for establishing a recovery fund on the $1 million be

reallocated to general rates/and or Uniform Annual General Charge to offset the

amount needed to borrow if rates are kept at the 2019-2020 level.

Direct quotes from submitters

(mostly extracts only)

Affordability

16. “Not best time to be

trying to get more money from ratepayers to help climate…” (sub

#20)

17. “Bad timing re

establishing a Recovery Fund. Specifics please. $52 added to the annual bill is

quite a sizeable amount…” (sub #114)

18. “… and can't

afford a rates increase at the moment.” (sub # 87)

More information needed

19. “Please define just

what this plan will entail before establishing any funding for the

plan.”(sub #4)

Work with what you already have

20. “Work with what you

already have. It's just too easy for you to spend other people's

money…” (sub #12)

21. “In council long

term financial management you should have reserves for future projects which

can be drawn upon. This is a time if the priorities are there to utilise these

funds…” (sub #52)

Delay setting up the fund

22. “Please delay for 2

years until business is back to normal. Survival is key at the moment in 2

years could be a good time to start…”(sub #76)

23. “…Stop any and

all non essential projects for at least 1-2 years.” (sub #84)

Fund is not

needed

24. “I believe we will

naturally recover quickly.” (sub #55)

Concern around who benefits

25. “There needs to be

more proof that there is a benefit to ALL PEOPLE of the region, not just a

select few…” (sub #67)

Officers’

response to the key themes in Option A

26. The funding of the

proposed recovery fund does not have any impact on the 20-21 financials as the

capital spend is a redeployment from an existing project, this therefore has no

impact on rates. The original funding, and the subsequent recovery fund

was planned to be debt funded and capitalised which means it wouldn’t be

able to offset operational and rates funded expenditure.

27. Further, the fund is

proposed to be used to accelerate existing work, and / or leverage external

third party funding. Any use of the fund will be for work that is

Council’s core business.

28. In response to a request

for more detail, a policy for governance of the fund is being developed and

will be complete for adoption alongside the Annual Plan on 29 July 2020.

29. Officers believe there is

a benefit to the community to create this fund for use in the 2020-21 year, a

key aspect of the fund will be to create and support jobs in the region.

The economic effects of Covid-19 will continue to impact Hawke’s Bay

particularly as the government’s wage subsidy programme comes to an end.

30. In response to Forest

& Bird’s submission, officers agree that climate change will mean

that weather events will become more common in the future, and Council’s

existing, and 2021-31 work programme must continue to address the medium to

long-term issues experienced in the region.

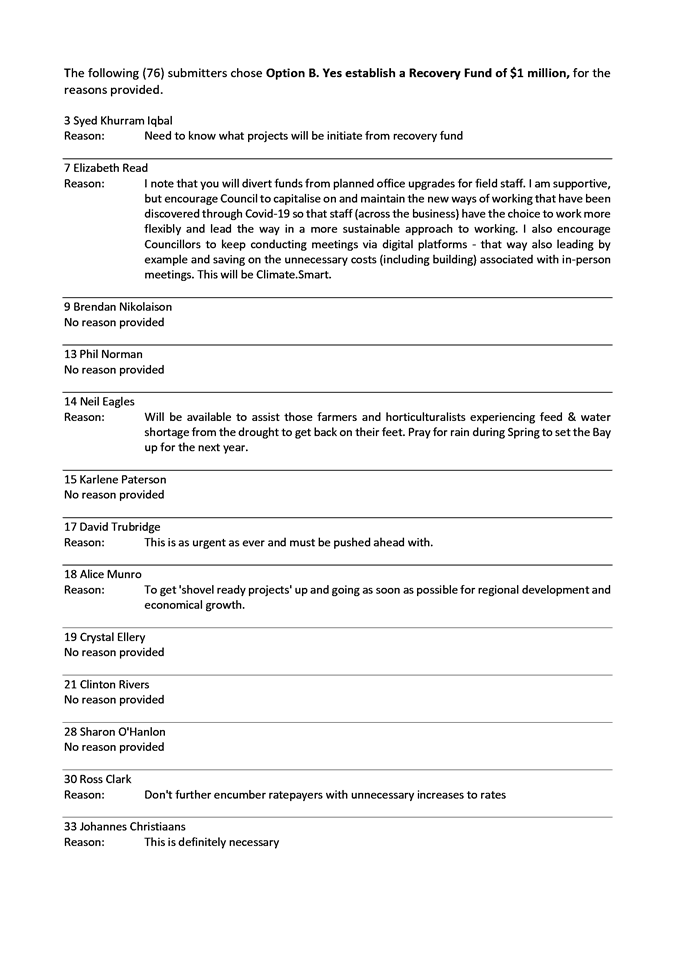

OPTION B: Yes, establish a Recovery Fund of $1 million

Key themes

31. 76 submitters selected

this option. The following key themes were identified.

31.1. We need this now

31.2. Supportive – with

a caveat

31.3. Leverage government

funding

31.4. Suggestions

Analysis of themes

32. There appears to be a

strong sense of urgency and need to establish the recovery fund amongst several

submitters. It was felt it was important to get such projects underway as soon

as possible to address climate change, with the sentiment this was a very real

and serious issue, and to help with the economic recovery of the region

following the COVID-19 restrictions.

33. Several supported the

establishment of a recovery fund, but outlined caveat/s for this. These

included:

33.1. If the fund can be

established without borrowing.

33.2. If the capital projects

have a positive environment effect and are carbon negative.

33.3. If employment

opportunities are created.

33.4. If the fund can be

justified (ahead of - and even at the expense of) other Council spending.

33.5. As long as it is used to

leverage central government funding.

33.6. Assuming that the extra

borrowing is agreed on a fixed-rate basis.

33.7. Only if the budget

tagged for additional office space and updated facilities for field staff was

reallocated to general rates and/or the Uniform Annual General Charge (UAGC) to

offset the amount needed to borrow (if rates are kept at the same level as

20190-2020).

34. There was a keenness and

encouragement to make use of and leverage central government funding for the

shovel-ready projects.

35. Some suggestions were made

for the recovery fund, including that it would be better to fund it by taking a

loan out of Napier Port rather than ratepayers having to pay for it, and that

erosion control/flood mitigation projects shouldn’t be delayed.

36. Whilst not choosing a

preferred option, Forest & Bird expressed strong opinions on the type of

projects to be considered for Council’s Climate.Smart.Recovery

“…it will be important to ensure that the way in which

interventions respond to climate change are progressive, sustainable and

genuinely transformational. We strongly oppose approaches to drought resilience

such as building dams that will simply perpetuate environmentally unsound land

use, or enable intensification of water needs in a region where that is

inappropriate…”

37. While not choosing a

preferred option, it is noted that Federated Farmers would like to work closely

with Council on the scope and detail of the projects to be implemented though a

recovery fund, to ensure they align with rural HB activities and realities.

Direct quotes from submitters

(mostly extracts only)

We need this now

38. “Time is of essence

with our climate change and environmental issues…” (sub #118)

39. “While we have a

downturn due to Covid 19 we also have a serious climate emergency and for the

sake of refurbishment of offices, not to proceed wit that, would be unwise in

my view…” (sub #101)

40. “we are already so

late adapting to climate emergency. we need far stronger action and far sooner

than existing plans dictate…it makes absolute sense to put money into

smart climate saving projects that happen to stimulate the economy at same

time.” (sub #73)

Supportive – with a

caveat

41. “If the Fund can be

justified, ahead of - and even at the expense of - other Council spending then

it should proceed on its merits.” (sub #45)

42. “As long as it is

used to leverage central government funding - otherwise $1million won't go a

long way.” (sub #93)

Leverage government funding

43. “…Whilst

central government is loosening it’s purse strings we should try and take

advantage of that.” (sub #72)

Suggestions

44. “The erosion

control/flood mitigation etc projects shouldn't be delayed. We could end up

paying much more in future for trying to save money now by halting these

projects.” (sub #70)

Officers’ response to the key themes

in Option B

45. Officers recommend further

detail of the intended use and objectives of the recovery fund be outlined

within the policy under development, proposed for adoption alongside the Annual

Plan on 29 July.

46. The objectives within the

policy confirm the Council’s intention to leverage government funding as

much as possible, use the fund to progress Council’s core environmental

works which achieve not only environmental outcomes but which also respond to

Climate Change. Another key objective of the fund is to support the

regional recovery and the creation of jobs.

47. Officers recommend

borrowing is a suitable funding mechanism for this fund given the

intergenerational nature of the proposed use of the fund.

48. Regarding the repurposing

of the accommodation project funding, officers believe this is reasonable given

the review currently being undertaken intends to incorporate and respond to

employees desire to have more flexible working arrangements. Further,

alternative accommodation options may now be available and more suitable given

the current economic conditions. Officers believe the remaining $1mil in the

accommodation project funding is enough to progress the project through to a preferred

option within the 2020-21 financial year.

Decision Making Process

49. Section 95 of the Local Government Act 2002 prescribes the statutory

requirements in relation to annual plans, including that Council must consult

in a manner that gives effect to the requirements of the section 82 principles

of consultation. The consultation process has been undertaken and reflects the

high degree of significance associated with adopting the 2020-21 Annual Plan to

specifically respond to the impacts of the Covid-19 pandemic and the drought.

|

Recommendations

That

Hawke’s Bay Regional Council:

1. Receives and considers the “Deliberation

Report on the Recovery Fund for 2020-21”

staff report, including the officers’ analysis

and response to submission points.

2. Agrees to

2.1. (Option A) not establish a Recovery Fund of $1 million for 2020-21

Or

2.2. (Option B) establish a Recovery Fund of $1 million for 2020-21.

|

Authored by:

|

Leeanne

Hooper

Governance Lead

|

Mandy Sharpe

Project Manager

|

Approved by:

|

Jessica

Ellerm

Group Manager

Corporate Services

|

|

Attachment/s

|

⇩1

|

Topic 2

Options Results Table

|

|

|

|

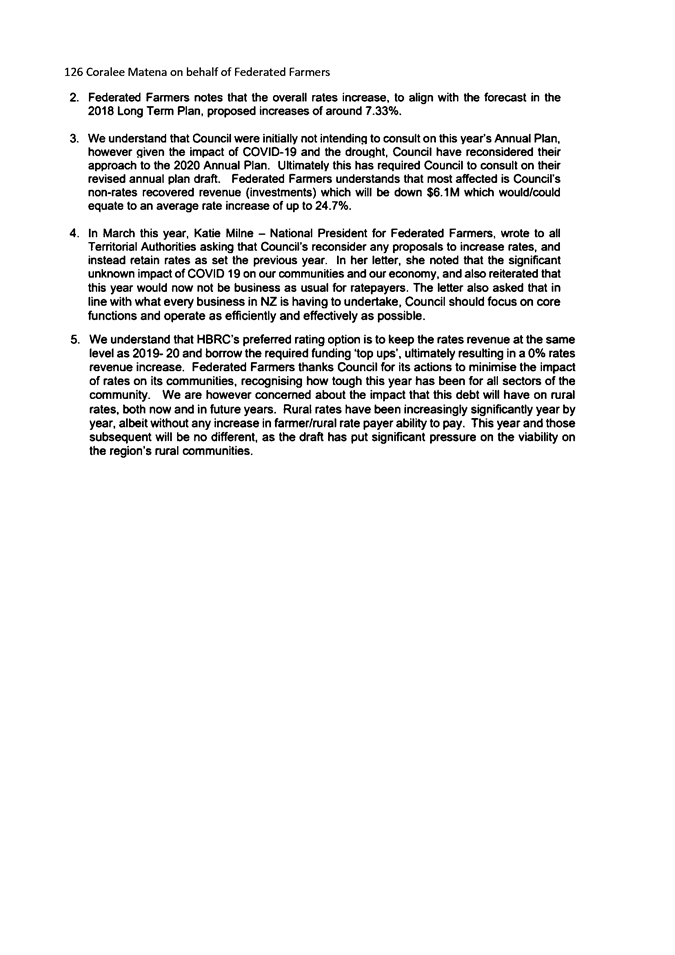

⇩2

|

Topic 2

Submissions by Option Chosen

|

|

|

|

Topic

2 Options Results Table

|

Attachment 1

|

|

Topic 2 Submissions by

Option Chosen

|

Attachment 2

|