Extraordinary Meeting of the Hawke's Bay Regional

Council

Date: Wednesday 9 October 2019

Time: 10.00am

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

Item Subject Page

1. Welcome/Apologies/Notices

2. Conflict

of Interest Declarations

3. Confirmation of

Minutes of the Regional Council Meeting held on 25 September 2019

4. Call for Minor Items

of Business Not on the Agenda 3

Decision Items

5. Report and

Recommendations from the Regional Planning Committee 5

6. Amendment to

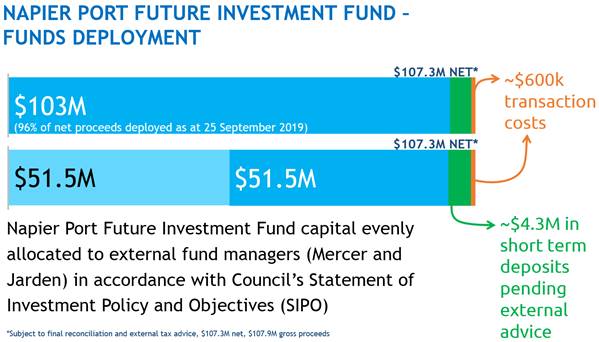

Significance and Engagement Policy to Ring Fence Napier Port IPO Proceeds 9

7. Appointment of

Hearing Panel for Wairoa District Council Wastewater Discharge Consent 19

Information or Performance Monitoring

8. 2018-19 Annual

Report and Summary 21

9. Discussion of

Minor Items Not on the Agenda 25

Decision Items (Public Excluded)

10. Confirmation of the Public

Excluded Minutes from 25 September 2019 Regional Council Meeting 27

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 09 October 2019

Subject: Call for Minor Items of

Business Not on the Agenda

Reason

for Report

1. Hawke’s Bay Regional Council standing order 9.13

allows:

1.1. “A meeting may discuss an

item that is not on the agenda only if it is a minor matter relating to the

general business of the meeting and the Chairperson explains at the beginning

of the public part of the meeting that the item will be discussed. However, the

meeting may not make a resolution, decision or recommendation about the item,

except to refer it to a subsequent meeting for further discussion.”

Recommendations

2. That Council accepts the following “Minor Items of Business Not on the Agenda” for discussion as Item 9:

|

Item

|

Topic

|

Raised

by

|

|

1.

|

|

|

|

2.

|

|

|

|

Leeanne Hooper

PRINCIPAL ADVISOR GOVERNANCE

|

James Palmer

CHIEF EXECUTIVE

|

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 09 October 2019

Subject: Report and

Recommendations from the Regional Planning Committee

Reason for Report

1. This item presents the recommendations arising from the 25 September

2019 extraordinary Regional Planning Committee meeting for Council’s

consideration and approval.

Agenda Items

2. In the agenda published for the Regional Planning Committee meeting

on 18 September 2019, there were four decision items of which, due to the

quorum being lost, three were not resolved. As a result, an extraordinary

meeting of the RPC was called for the morning of 25 September for resolution of

two of the outstanding decision items, being:

2.1. The TANK Plan Change 9 Options for Notification and Beyond decision item (7) sought the

Committee’s guidance on a preferred plan change track for notification,

submissions through to decision-making.

2.2. The Hawke's Bay Regional Planning Committee Terms of Reference

decision item (8) presented an interim annotated version of

the revised Terms of Reference (TOR), incorporating relatively minor amendments

to align the TOR with the Hawke’s Bay Regional Planning Committee Act

2015 for the Committee’s agreement and subsequent referral to the

Appointers for their agreement.

3. In relation to the TANK Plan Change 9 Options for Notification

and Beyond decision item,

the Committee was unable to reach agreement on a recommendation to the Council.

4. The staff

report recommended that the Committee recommend the modified streamlined

planning process (SPP) for notification and post-notification stages of the

proposed TANK plan change (PC9) to Council. The modified SPP proposed by staff

would feature an extended submission period, plus a round of further

submissions and a hearing by a panel of accredited commissioners – all

optional extras to more closely mimic the submissions phase of a standard

Schedule 1 process. An application to use a modified SPP would require

approval from the Minister for the Environment prior to public notification of

PC9. The staff rationale for recommending the modified SPP rested on weighing

the retention of submitters’ substantive appeal rights against the depth

of community engagement for TANK to date, alignment with the Government’s

proposed freshwater planning process in a Bill currently before a Select

Committee, and the overall implications on HBRC’s policy and planning

work programme through to 2025.

5. At the

Committee meeting a motion to use a modified SPP was lost. An alternative

motion to use the RMA’s standard Schedule 1 Part 1 process was also lost.

Consequently, there are no recommendations from the Committee to the Council on

this item nor is there a clear direction under the Committee’s Terms of

Reference for the item to be referred back to the Committee.

6. In relation to the Hawke's Bay Regional Planning Committee Terms

of Reference decision item, the Committee received and accepted the

recommendations as presented in the staff report. Consequently, the

Committee’s recommendations are now presented to the Council for its

consideration.

Decision

Making Process

7. These items were specifically considered at the Committee level.

|

Recommendations

That Hawke’s Bay Regional Council:

1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that Council can exercise its discretion and make decisions on

this issue without conferring directly with the community and persons likely

to be affected by or to have an interest in the decision.

2. Notes that the Committee has not provided Council with a direction

in respect of the two notification pathway options available under the

Resource Management Act 1991.

3. Receives

and accepts the Report and resolutions from the

Regional Planning Committee, those resolutions being:

That the Regional

Planning Committee:

3.1. Receives and notes the “Hawke’s Bay Regional

Planning Committee Terms of Reference” staff report.

3.2. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that Council can exercise its discretion and make decisions on

this issue without conferring directly with the community and persons likely

to be affected by or to have an interest in the decision.

3.3. Agrees that the preferred approach is to agree on amendments to

the RPC’s February 2014 version of Terms of Reference that:

3.3.1. incorporates minor corrections, editorial improvements, and

various other uncontentious amendments that improve alignment with the

Hawke’s Bay Regional Planning Committee Act 2015

3.3.2. sets aside the following matters (which were within scope of the

first statutory review of performance of the RPC):

3.3.2.1. Voting

and Quorum

3.3.2.2. The

process by which the number of Council members eligible for voting will be

reduced to ensure equal numbers of appointed tāngata whenua

representatives

3.3.2.3. The

setting of the Quorum

3.3.2.4. Consensus

decision making and the 80% voting threshold.

3.3.2.5. The

presumption that the current Standing Orders of Council apply to the

operation of the committee unless amended by the committee.

3.3.2.6. Confirmation

of functions and powers of the committee (noting the legal advice that the

broader scope in draft terms of reference is not inconsistent with the

specified legislation).

3.3.2.7. Refer

back provisions and clarification of the options available to Council in the

event that no recommendation is received from the Committee. This issue

relates in particular to section 12(4) of the Act which provides that

“In the event of an inconsistency between the obligations of Council

under the terms of reference and its obligations under the specified

legislation, the specified legislation prevails.

3.3.3. Agrees to use best endeavours to seek resolution and agreement on

those matters in recommendation 2.3.2 above, and then when agreement has been

reached, thereafter agree that the RPC’s terms of Reference be approved

and referred to the Appointers (or their nominated delegate) for their

written agreement.

3.3.4. Recommends that Hawke’s Bay Regional Council:

3.3.4.1. writes to each of the RPC Appointers inviting them to consider and

agree to the amended Terms of Reference for the RPC as proposed; and

3.3.4.2. as an Appointer itself, Council agrees to the amended Terms of

Reference for the RPC as proposed.

Hawke’s

Bay Regional Planning Committee Terms of Reference

4. Writes to each of the Regional Planning Committee Appointers

inviting them to consider and agree to the amended Terms of Reference for the

RPC as proposed; and

5. As an Appointer itself, Council agrees to the amended Terms of

Reference for the Regional Planning Committee as proposed.

|

Authored by:

|

Ceri Edmonds

Manager Policy and Planning

|

Gavin Ide

Principal Advisor Strategic Planning

|

Approved by:

|

Tom Skerman

Group Manager Strategic Planning

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Wednesday 09 October 2019

Subject: Amendment to

Significance and Engagement Policy to Ring Fence Napier Port IPO Proceeds

Reason for Report

1. This item

provides an update to Council regarding the proceeds from the Napier Port

Initial Public Offering (IPO) and suggests amendments to Council’s

Significance and Engagement Policy to qualify ‘Napier Port Future

Investment Fund’ as a strategic asset.

Background: Napier Port Initial Public

Offering (IPO) transaction

2. On 19 August

2019, the Napier Port IPO transacted in line with agreed transaction proceeds

agreements. This resulted in the Hawke’s Bay Regional Investment Company

Limited (HBRIC) receiving $107,858,750 ($107.9m) in cash proceeds,

significantly greater than anticipated during the community consultation on

options to fund the development of Napier Port.

3. After deduction

of approximately $600,000 ($0.6m) of IPO associated transactions costs, the net

proceeds from the IPO available for re-investment equates to approximately

$107.3m (subject to final reconciliation).

4. A commitment

was made through the community consultation to establish a ‘future

investment fund’ in which this capital is ‘ring fenced’ and

the investment proceeds from it would, subject to market conditions, more than

match the current dividend flow from the Port.

5. In order to

begin achieving operating returns from the proceeds immediately, as resolved

previously with Council, the net proceeds would be transferred to

Council’s designated investment fund managers for deployment.

6. The funds have

been deployed in accordance with the Council’s existing Statement of

Investment Policy and Objectives (SIPO) which dictates, defines and mandates

the parameters within which the investments and their ongoing management and

reporting are to operate.

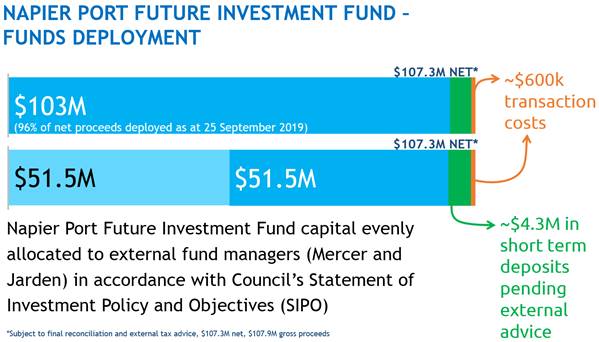

7. As at 25

September 2019, $103m or 96% of the net proceeds from the transaction (subject

to final reconciliation) have already been transferred to Council’s fund

managers.

8. The remaining

$4.3m is in short term deposit pending final reconciliation and definitive tax

advice on dividend disbursements.

9. Staff believe

the existing SIPO provides an appropriate and robust governance framework for

the Napier Port Future Investment Fund. The SIPO is a dynamic document and is

reviewed annually or sooner if market conditions warrant.

10. All numbers used in this

report have been rounded to the nearest $100,000.

Background: Council’s

Statement of Investment Policy and Objectives (SIPO)

11. Effective as at 1 July

2018, the purpose of SIPO is to assist Councillors, Council staff and external

Investment Managers in effectively supervising, monitoring and evaluating the

management of all externally managed funds.

12. The SIPO outlines and

encourages use of methodologies and processes that reflect industry best

practice, encompass the principles of good governance, and reflect

Council’s vision and risk tolerances.

13. The SIPO clearly defines

Council’s investment structure for all externally managed funds. This

structure includes various asset classes, investment management style(s), asset

allocations and acceptable investment ranges that, in total, are expected to

produce an appropriate level of diversification and total return over the

investment time horizon.

14. As a responsible public

authority, Council is a risk averse entity. The SIPO dictates that Council

investments must be prudent and the associated risks and returns balanced

against the key aim of capital preservation. Council’s investment

framework is supportive of its intergenerational responsibilities to current

and future ratepayers. The primary focus is capital protection, followed by an

appropriate return and acceptable liquidity.

Isolating, Preserving and Protecting (ring

fencing) Napier Port IPO Proceeds

15. Recognising the need and

fulfilling the commitment to the community to protect net IPO proceeds (subject

to final reconciliation), staff recommend the creation of an indefinite

“Napier Port Future Investment Fund” providing a source of

intergenerational capital reserves to support Council operating activities

while maintaining a SIPO-mandated level of diversification and total return

over the investment time horizon.

16. Staff also recommend that

Council’s Significance and Engagement Policy (attached) is amended to

specifically include “Napier Port Future Investment Fund” as a

strategic asset, listed as:

16.1. Napier Port Future

Investment Fund (inflation adjusted capital base retention of net proceeds from

partial sell down of 45% ownership in Port of Napier Limited following Initial

Public Offering).

17. This amendment is aimed to

protect the inflation adjusted capital base of the “Napier Port Future

Investment Fund” by requiring that any decision to expend or reduce any

portion of the capital base would require community engagement or a formal

special consultative process in accordance with LGA s83 provisions. It should

be noted that a subsequent Council resolution may nullify this policy change,

however staff believe this provides an immediate and necessary level of

protection consistent with feedback from the Napier Port IPO consultation

process.

Current State: Napier Port IPO Proceeds

18. In August 2019, HBRIC

received a total of $107.3m in net cash proceeds (subject to final

reconciliation) from the Napier Port IPO after deduction of approximately $0.6m

of associated IPO transactions costs

19. This was paid as $63.3m in

proceeds from the sale of its 45% shareholding in Napier Port, along with a

fully imputed special dividend of $44m - to substantially utilise all of Port

of Napier Limited’s imputation credit balance which would have otherwise

been lost due to change in ownership following the IPO.

20. As at 25 September 2019,

$103m (or 96%) of net proceeds from the Napier Port IPO transaction have been

transferred to the aforementioned two external investment managers.

20.1. Jarden (formerly First

New Zealand Capital) and Mercer manage $22m each as part of the “Napier

Port Future Investment Fund” on behalf of the Council.

20.2. Jarden (formerly First

New Zealand Capital) and Mercer manage $29.5m as part of the “Napier Port

Future Investment Fund” on behalf of HBRIC.

21. The remaining $4.3m is in

short term deposit pending final reconciliation and definitive tax advice on

dividend disbursements.

22. Upon final reconciliation

and definitive tax advice, this remaining $4.3m will be issued evenly to the

external fund managers for deployment in the Napier Port Future Investment Fund

in accordance with Council’s SIPO bringing the total funds under

management for the Napier Port Future Investment Fund to $107.3m.

23. In order to fulfil the

commitment to the community to ‘ring fence’ the capital base from

IPO proceeds, a component of the Napier Port Future Investment Fund is likely

to remain on HBRIC’s balance sheet in order to maximise tax efficiencies.

24. All externally managed

funds are subject to Council’s SIPO and associated investment mandates

regardless of whether the funds are managed on behalf of the Council or HBRIC.

25. The diagram below provides

a visual depiction of current state of “Napier Port Future Investment

Fund” deployment amongst the investment managers as well as current state

of future tax-efficient dividends to the Council from HBRIC (subject to final

reconciliation).

Future State: Napier Port IPO Proceeds

26. Staff continue to evaluate

tax-efficient and tax-neutral options to further return subscribed capital

and/or dividend from HBRIC to Council subject to ongoing discussions with

external tax advisor(s).

27. Staff expect to provide an

update to the Council on this matter within the first or second quarter of FY

2019-20 noting that this is an indicative estimate subject to change.

Future State: Napier Port IPO Proceeds

under HBRIC’s management

28. Pending

finalised transaction costs, a conclusive review of tax-efficient options of

returning additional capital to the Council, it is estimated that HBRIC will

continue to manage an investment portfolio of a yet to be determined amount of

IPO proceeds as a result of its inability to fully repatriate IPO proceeds

without negative tax consequences.

29. As indicated

above, all IPO proceeds, including those managed by external fund managers on

behalf of HBRIC are mandated to comply with Council’s SIPO.

30. Staff intend to evaluate the tax implications of any

investment income derived from the “Napier Port Future Investment

Fund” on behalf of HBRIC impacting Council’s ability to enhance its

operating activities.

31. HBRIC will

also continue to own a 55% share in Napier Port, currently valued at

approximately $340m at time of this report.

Decision

Making Process

32. Council

is required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

32.1. The use of

the special consultative procedure is not prescribed by legislation.

32.2. The decision

is not inconsistent with an existing policy or plan.

32.3. Given

the nature and significance of the issue to be considered and decided, and also

the persons likely to be affected by, or have an interest in the decisions

made, Council can exercise its discretion and make a decision without

consulting directly with the community or others having an interest in

the decision.

|

Recommendations

That Hawke’s Bay Regional Council:

1. Receives and

notes the “Amendment to Significance and Engagement Policy to Ring

Fence Napier Port IPO Proceeds” staff report.

2. Establishes

and maintains a dedicated ‘Napier Port Future Investment Fund’

comprised of:

2.1. Net

proceeds of the IPO transaction (approximately $107.3m subject to final

reconciliation) plus retention of investment income equivalent to the annual

rate of inflation in order to maintain the real value of the IPO proceeds.

3. Amends the

Significance and Engagement Policy to include Napier Port Future Investment

Fund as a Strategic Asset.

|

Authored by:

|

Shash

Davé

Chief Financial Officer

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

⇩1

|

Proposed

edits - Significance and Engagement Policy for 2018 - 2028 Long Term Plan

|

|

|

|

Proposed

edits - Significance and Engagement Policy for 2018 - 2028 Long Term Plan

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 09 October 2019

Subject: Appointment of Hearing

Panel for Wairoa District Council Wastewater Discharge Consent

Reason

for Report

1. To provide

information relating to the upcoming resource consent hearing for Wairoa

District Council and to enable the appointment of commissioners to the Hearing

Panel.

2. The application

is APP-123774 – Wairoa District Council – Activities and discharges associated with the receipt,

treatment, storage and general management of wastewater received at the Wairoa

Wastewater Treatment Plant

3. This

application is to replace the expired resource consents for the Wairoa waste

water treatment plant discharge.

4. The application

was publicly notified in August 2019 and 22 submissions were received.

5. A pre-hearing

meeting with submitters will take place on 17 October 2019. Provisional dates

for the hearing are 5 and 6 December 2019 and these dates will be confirmed or

amended following the pre-hearing meeting.

6. Three Hearing Panel members are proposed for this hearing.

7. The following

people are recommended as commissioners for this hearing: Mr Bill Wasley

(chair), Rauru Kirikiri and Dr Jim Cooke. Mr Wasley has chaired a number of resource

consent hearings for the Regional Council recently. Rauru Kirikiri was on the

Port of Napier consent hearing panel. Dr Jim Cooke has specialised experience

in  water, wastewater discharges,

and water quality.

water, wastewater discharges,

and water quality.

8. All the

recommended commissioners are accredited RMA decision makers.

Decision

Making Process

9. Pursuant to

Section 34(1) of the Resource Management Act (RMA) the Hawke's Bay Regional

Council has delegated the following functions, powers and/or duties under the

RMA[1]:

9.1. The appointment of Hearings Committee members or independent

commissioners to a Hearing Panel to undertake the functions pursuant to s 34A

RMA and the appointment of the Chairperson of the Hearing Panel.

|

Recommendations

That the Hearings Committee

1. Receives and notes the “Appointment

of Hearing Panel for Wairoa District Council Wastewater Discharge Consent” staff report.

2. Makes the following appointments in accordance with its delegation

to do so: Mr Bill Wasley (chair), Rauru Kirikiri and

Dr Jim Cooke to act as commissioners to hear and decide resource consent

applications (APP-123774) by Wairoa District Council to discharge waste water

to the Wairoa River.

|

Authored by:

|

Malcolm

Miller

Manager Consents

|

|

Approved by:

|

Liz Lambert

Group Manager Regulation

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 09 October 2019

Subject: 2018-19 Annual

Report and Summary

Reason for Report

1. To provide the Council with the 2018-19 Annual Report and Summary

for review to enable adoption post audit clearance on 16 October 2019.

Background

1. The proposed timeframes for development and adoption of the 2018-19

Annual Report were considered by Council on 31 July 2019. That item noted that

the process was complicated this year by the Napier Port IPO Transaction

which affected the Group Financials and the Local Elections.

2. Council’s Auditor, Stephen Lucy from Audit New Zealand,

attended the 11 September 2019 Corporate and Strategic Committee meeting to

provide the Councillors with an opportunity to ask questions related to the

audit. The 60 non-financial performance measures were also included on the

Committee agenda for review and discussion prior to the completion of the

audit.

3. Due

to a number of contributing factors we do not believe audit clearance will be

received before the Council meeting takes place on 9 October to enable the

adoption of the 2018-19 Annual report. The Annual Report however, is largely

complete and is attached, including your feedback on the non-financial

performance measures, for your review.

4. Audit Director

Stephen Lucy has recommended the existing Council meet on 16 October before the

election results are officially declared to formally adopt the Annual

Report. The same situation occurred in 2016, and while it’s not

ideal, it is preferred that the existing Council adopt the Annual Report given

their understanding of the work which has been performed throughout the year

and the substantial post balance date event being the Napier Port Initial

Public Offer.

5. The statutory deadline for the adoption of the Annual Report is four

months after balance date, being 30 October 2019.

6. Subsequent to Council approval and adoption, and in line with

Section 98 of the Local Government Act, the 2018-19 Annual Report will be

printed for distribution and published on the Council’s website.

7. A summary document of the information contained in the Annual Report

is also required under Section 98 of the Act. This summary is audited to ensure

that it fairly and consistently represents the information regarding the major

matters in the full Annual Report. The summary must be published on the

Council’s website no later than one month from adoption of the full

Annual Report. This is being graphically designed and will be provided under a

separate cover and in hard copy to Councillors only as soon as it’s

available.

8. The final Annual Report is provided under a separate cover.

The final audit report has yet to be received from Audit NZ, and will be tabled

at the Council meeting on 16 October 2019.

Financial Performance

9. Year one of the

2018-28 Long Term Plan signalled a step change in activity particularly in the

areas of land and water to achieve real results on-the-ground at pace and at

scale.

10. This was in response to

the challenge set by the Council’s 2017-2021 Strategic Plan, which set

ambitious timeframes to achieve strategic goals in the focus areas:

10.1. Water quality, safety

and certainty

10.2. Smart, sustainable land

use

10.3. Healthy and functioning

biodiversity

10.4. Sustainable services and

infrastructure.

11. This is the first year of

the new Financial Strategy set out in the 2018-28 Long Term Plan. The Financial

Strategy aims to accelerate and scale up activity to influence behavioural

change to achieve outcomes by front loading activity to have a greater impact

sooner.

12. As a result, operating

expenditure in 2018-19 was $53m, an increase of $5.1m or 10% compared to the

previous year. External operating expenditure increased by $3.2m and personnel

costs increased by $2.8m or 16%. This demonstrates the significant

increase in capacity and capability required to carry out an ambitious work

programme.

13. Total capital expenditure

was budgeted at $15.4m for the year. However, $3.2m of this has been

carried forward to 2019-20. Despite an increase in staffing numbers and

cost, many vacancies were difficult to fill and were vacant for part or all of

the year. This was particularly apparent in Asset Management where a lack

of resource and capability resulted in an underspent in Infrastructure Asset

Construction of $2.2 million.

14. Another $1m of capital

carried forward represents IT project work or spend. Following a full

review of the approach to IT transformation, greater priority has been placed

on ensuring the organisation has the correct processes, resources and

disciplines in place to warrant or benefit from system implementation before

work begins. This should ensure that as projects are initiated, spend is

maximised due to the organisation being ready, and the up-take of solutions is

optimised.

15. We also saw longer than

anticipated set up phase for policy design and implementation for some of the

new initiatives. For the Catchment Management team, the design of the

Erosion Control Scheme dominated most of the year, and is reflected through

$600k of the budget being carried forward. In total, approximately $1m of

budgeted operating expenditure has been carried forward to the 2019-20 year for

a number of various work streams and as a result of resourcing challenges,

difficulty gaining access to land, reliance on partnership or external funding

or are reserve balances being carried over.

16. Overall, operating

expenditure exceeds budget due to the re-allocation or prioritisation of

internal work streams over debt fund capital projects which have been delayed

or deferred to the new financial year.

17. The increased level of

activity was funded through:

17.1. Rates –

Rates revenue makes up 50% or less of annual revenue. The 2018-19 year

saw an on average 19% increase in rates (including 5.3% related to the regional

collection of Civil Defence Emergency Management). Rates revenue for the

year was $23.2m, an increase of $3.7m from the previous year.

17.2. Recovery of user

charges via fees and charges – Fees and charges provide around 20% of

the annual funding requirement of the Regional Council. The 2018-19 year

included a greater user-pays approach. Both consents and compliance were 80%

chargeable to the consent holders (up from 60% and 70% respectively in previous

years). A total of $1.9m in revenue was collected from direct charges,

which was an increase of $520k from the previous year. This however was $600k

less than budget due to more time than anticipated spent responding to important

but non-recoverable activity such as the pollution hotline.

17.3. Investment income –

Total Investment income including $10m dividends was $13.7m. It included

leasehold income of $1.8m, forestry income of $23k, returns from managed funds

and cash on term deposit of $1.8m.

18. Our investment strategy

aims to maintain and grow investments for generating income, allowing general

rates to continue being subsidised by investment income. During this year

we received $10m in dividends from the 100% ownership of Napier Port via HBRIC

Ltd. Post balance date, ownership in this asset has been diluted to 55%

via an Initial Public Offering, which is outlined in the attached full

report. This post balance date event has already had a significant impact

on the valuation of the asset. HBRC valuation of assets has increased by

over $64m in the 2018-19 year including a revaluation of HBRIC.

19. Overall investment income

was $3.2m less than budget due to returns from managed funds being un-realised

(they are balance sheet gains) and a delay in expected Forestry income, which

will be recognised when the forests are harvested. During the course of

the 2018-19 year $40m of funds were placed into diversified investment

portfolios managed by two separate fund managers. Appointment of the fund

managers and subsequent establishment of the funds took longer administratively

than anticipated which has an impact on the timing of the placement of funds

(planned July 18, allocated in Nov 2018), however, the $40m placed achieved overall

gains of $1.88m or 4.7% including adjustment for inflation. Forecast

returns were 4.5% net of inflation which has resulted in a shortfall of

investment income for this year. Gain on invested funds is recognised in

the financial statements as an unrealised gain as the returns were not divested

in the year due to favourable cashflow position.

20. Debt – The

Long Term Plan outlines a preference for funding for intergenerational projects

through debt. In 2018-19, we borrowed $2.5m to fund regional infrastructure

projects, work on regional parks and open spaces, and research and development

projects.

21. External grant funding –

Government grants are received from the New Zealand Transport Agency for bus

services and road safety projects, New Zealand Trade and Enterprise for

regional development projects, Ministry of Justice and the Ministry of the

Environment for iwi initiatives, and the Ministry of Primary Industries for

afforestation, environmental and water initiative projects.

22. The closing financial

position for the year is an operating surplus of $2.6m compared to a planned

surplus of $5.8m. The total comprehensive revenue and expense position is

$68.6m which exceeds the planned $8.2m surplus. This significant increase

is due to unrealised revaluation gains across all asset classes, most

specifically a $58m increase in the valuation of HBRIC (reflecting the value of

ownership of Napier Port).

Hawke’s Bay Regional Investment

Company Ltd (HBRIC)

23. The HBRIC Ltd Board of

Directors approved the HBRIC 2018-19 annual report on 30 September 2019.

24. HBRIC Ltd has been issued

a qualified audit opinion, because the group financial statements include the

financial statements for the group’s subsidiary, Port of Napier Limited,

for the year end 31 March 2019 rather than for the year end 30 June 2019.

The HBRIC audit opinion is attached for reference.

25. This qualified option

flows through to the HBRC Group accounts as this incorporates the same

decisions made by the directors of HBRIC Ltd.

Decision Making

Process

26. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision making

provisions do not apply.

|

Recommendation

That Hawke’s Bay Regional Council receives and considers the

2018-19 Annual Report and Summary.

|

Authored by:

|

Drew Broadley

Community Engagement and Communications

Manager

|

Desiree Cull

Strategy and Projects Leader

|

|

Shash

Davé

Chief Financial Officer

|

Melissa des

Landes

Senior Group Accountant

|

|

Brylee

Finlayson

Financial Accountant

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

James Palmer

Chief Executive

|

Attachment/s

|

⇨1

|

Draft 2018-19

Annual Report

|

|

Under

Separate Cover

|

|

⇨2

|

2018-19

Annual Report Summary

|

|

Under

Separate Cover

|

|

⇨3

|

HBRIC 2018-19

Annual Report signed

|

|

Under

Separate Cover

|

HAWKE’S BAY REGIONAL

COUNCIL

Wednesday 09 October 2019

Subject: Discussion of Minor

Items Not on the Agenda

Reason for Report

1. This document has been prepared to assist

Councillors note the Minor Items of Business Not on the

Agenda to be discussed as determined earlier in Agenda

Item 5.

|

Item

|

Topic

|

Raised

by

|

|

1.

|

|

|

|

2.

|

|

|

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 09 October 2019

SUBJECT:

That the Council excludes the public

from this section of the meeting being Confirmation of Public Excluded Minutes

Agenda Item 10 with the general subject of the item to be considered while the public

is excluded; the reasons for passing the resolution and the specific grounds

under Section 48 (1) of the Local Government Official Information and Meetings

Act 1987 for the passing of this resolution being:

|

|

GENERAL SUBJECT OF THE ITEM TO BE

CONSIDERED

|

REASON FOR PASSING THIS RESOLUTION

|

GROUNDS UNDER SECTION 48(1) FOR THE PASSING

OF THE RESOLUTION

|

|

Napier Port IPO Proceeds Deployment

|

7(2)s7(2)(i) That the public conduct of

this agenda item would be likely to result in the disclosure of information

where the withholding of the information is necessary to enable the local

authority holding the information to carry out, without prejudice or

disadvantage, negotiations (including commercial and industrial

negotiations).

|

The Council is specified, in the First

Schedule to this Act, as a body to which the Act applies.

|

|

Authored by:

|

Leeanne

Hooper

Governance Lead

|

|

Approved by:

|

James Palmer

Chief Executive

|

|