Meeting of the Finance Audit & Risk Sub-committee

Date: Wednesday 22 May 2019

Time: 9.00am

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

Item Subject Page

1. Welcome/Notices/Apologies

2. Conflict

of Interest Declarations

3. Confirmation of

Minutes of the Finance Audit & Risk Sub-committee held on 12 February 2019

4. Follow-ups from

Previous Finance Audit & Risk Sub-committee Meetings 3

Decision Items

5. Rating Invoice

– Proposed Issue, Due and Penalty Date Changes 7

6. Proposed Schedule

of 2019-2020 Internal Audits 21

Information or Performance Monitoring

7. Water Management

Follow-up Internal Audit Report 45

8. Draft 2019-20

Annual Plan 69

9. Living Wage Update 71

10. Procurement and Contract

Management Update 75

11. May 2019 Sub-committee Work

Programme Update 79

13. Treasury

Report (late item to come)

Decision Items (Public Excluded)

12. Proposed 2019-20 Council

Insurance Programme 81

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 22 May 2019

SUBJECT: Follow-ups from Previous Finance

Audit & Risk Sub-committee Meetings

Reason for Report

1. In order to track items raised at previous meetings that require

follow-up, a list of outstanding items is prepared for each meeting. All

follow-up items indicate who is responsible for each, when it is expected to be

completed and a brief status comment. Once the items have been completed and

reported to the Committee they will be removed from the list.

Decision

Making Process

2. Council is required to make every decision in

accordance with the Local Government Act 2002 (the Act). Staff have assessed

the in relation to this item and have concluded that as this report is for

information only and no decision is required, the decision making procedures

set out in the Act do not apply.

|

Recommendation

That the Finance, Audit and Risk Sub-committee receives

and notes the report “Follow-ups from Previous Finance Audit and

Risk Sub-committee Meetings”.

|

Authored by:

|

Leeanne

Hooper

Principal Advisor Governance

|

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

|

⇩1

|

Follow-ups

from Previous FARS Meetings

|

|

|

|

Follow-ups

from Previous FARS Meetings

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 22 May 2019

Subject: Rating Invoice –

Proposed Issue, Due and Penalty Date Changes

Reason for Report

1. This report

proposes a change to the date Hawke’s Bay Regional Council’s rate

invoices are sent out and the date payment is due with the objective of

improving Council’s cash flow and removing the payment pressure on

ratepayers over the Christmas period.

2. It provides the

Finance, Audit and Risk Sub-committee (FARS) the opportunity to review the

proposal and if supportive, make a recommendation to the Corporate and

Strategic Committee.

Background

3. An opportunity

has been identified to improve HBRC’s cash flow through adjustments to

the date rates assessment/invoices are sent out and the date payment is due.

4. Currently rates

invoices are sent out mid-September and due 1 October each year, however HBRC

allows ratepayers until 31 January to pay before a penalty is applied.

5. Rates are the

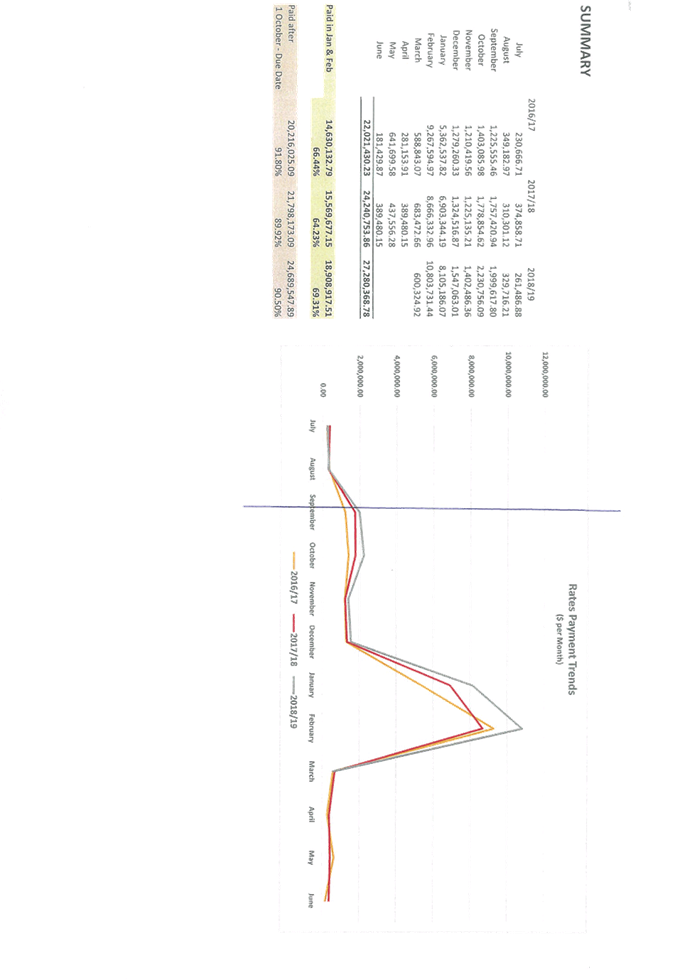

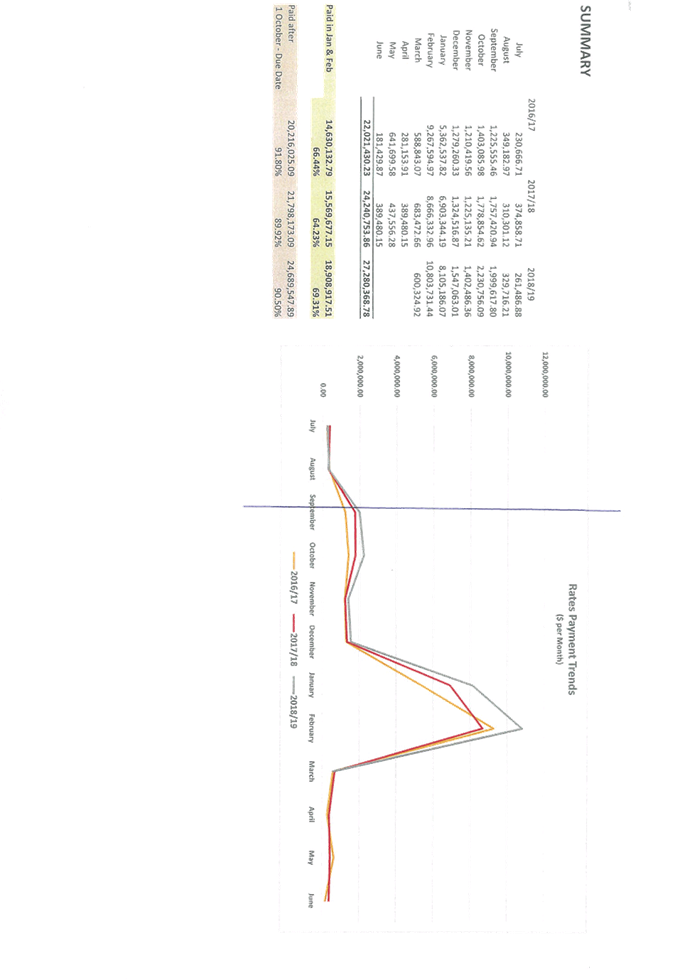

main direct source of income for Council. Typically Council receives

approximately 6-8% of rates revenue in October, with approximately 70% of the

rates revenue collected in January and February - seven to eight months into

the financial year. (Please see Attachment 1 for the rates payment trends for

the past three years.)

6. HBRC’s

history of having a due date (1 October) and then a final date for payment

(31 January) for rates is understood to have come from the time when HBRC

was a County Council. The Council at that time extended the timeframe for

payment to accommodate the rural sector who needed to wait for their wool

payments which arrived in January.

Proposal

7. This paper is

proposing Council send out rates invoices earlier and bring the date forward

for when payment is required. (Please see Table 8.1 below for the current dates

and proposed changes.) It is also proposed to have one payment date only

– so the due date and final date for payment is the same. Having

one due date is in line with how Territorial Local Authorities apply their

invoices.

Table

8.1: Current dates and proposed changes

|

|

Current dates

|

Proposed dates for 2020-21

|

|

Date rating

information is sent to NZ Post, Christchurch

|

31 August

|

Last week of

July

|

|

Date rates

invoices are sent out

|

Mid-September

|

Early to

mid-August

|

|

Rate

assessment/invoice date

|

1 October

|

20 September

|

|

Date invoice

payments are due

|

1 October

|

20 September

|

|

Date for

final payment

|

31 January

|

20 September

|

|

Date for

applying penalties

|

1 February

|

21 September

|

8. The

intention is for ratepayers to receive their invoice four to six weeks before

it is due to be paid (currently ratepayers have 17 weeks). Legislation requires

the ratepayer to receive the invoice 14 days before the due date.

9. The idea of

moving the date invoices are sent out and the date payment is due has

previously been discussed at a Council Long Term Plan (LTP) workshop on 11

October 2017 where potential efficiencies across the business were presented to

Councillors.

10. Also introduced at this

workshop was the option of adding a second penalty of 10% on total rates

outstanding (including penalties) as allowed as per the local Government

(Rating) Act 2002.

11. In the 2018-28 LTP Council

stated we would investigate the rating date changes and implement the

additional penalty. The following are extracts from the 2018-28 LTP.

Rate invoicing period change

It is proposed that during the 2018-28

LTP period HBRC will investigate changing the date that rate invoices are sent

out and the final due date each year.

Additional penalties to be added from July 2019

All outstanding rates including

previous penalties as at 1 July each year will now have a penalty of 10% added

to those rates. This penalty will be added on the first working day after 1

July each year.

12. A 10% penalty is being

implemented from 1 July 2019. This has also been notified on the current

years’ invoice.

Aim of changing the

dates

13. The main aim of changing

the date rate invoices are sent out and the payment date is to improve

Council’s cash flow.

14. The aim is to also shorten

the payment period and eliminate the final date for payment. This means

ratepayers would have one due date for payment (20 September).

15. It is hoped the new issue

and payment dates can be implemented for the 2020-21 year with promotion of the

new dates starting this year. This means the dates for next year’s

rates for 2019-20 will remain the same.

16. The intention is to also

redesign HBRC’s rate invoice to reflect Council’s new branding and

provide a cleaner invoice, while still meeting the legislative requirements.

Benefits of

changing the dates

17. Improved cash flow - by

moving the due date and having just one payment date, we are hoping to receive

the 70% of rates revenue several months earlier than we currently do.

17.1. As shown in Attachment

1, Council invoiced a total of $24,240,753 in rates for the 2017-18 financial

year and received approximately 70% ($15,569,677) in January/February. In the

current financial year (2018-19) $27,280,369 was invoiced and $18,908,917 was

received this January/February.

17.2. The earlier Council

collects the rates revenue, the earlier it can be invested or used to fund

operational expenses.

18. Less debt funding –

if required to cover cash flow shortfall periods.

19. Less penalty and simpler

payment for ratepayers.

19.1. While the proposed

changes might be viewed negatively by some, the change may be welcomed as

helping ease the frustration of some ratepayers. Every year the rates team gets

frustrated ratepayers calling once the penalty has been applied to their

invoice to say they forgot to pay their rates because of the long time span

between the issue and final due date.

19.2. The intention is to

provide ratepayers with a 12-month direct debit payment option which may assist

the ratepayer with better budgeting. Currently ratepayers have a three-month

direct debit option and a once-yearly option on 31 January. Some ratepayers

choose to pay through automatic payments. Ratepayers who pay by direct debit

will not be charged any penalty.

20. Better timing for

ratepayers.

20.1. Ratepayers tell Council

staff the timing of the final payment date, 31 January, is not ideal;

citing Christmas, holidays and expenses relating to the start of the new school

year. Although suggested that they can pay the rates earlier many prefer to pay

on the last possible date.

21. Will reduce staff time

spent taking phone calls from ratepayers checking to see if they have paid

their rates, and re-printing and sending out invoices on request due to the

long timespan between receiving the invoice and the final date for payment.

22. Provides Finance and

Rating staff the opportunity to take more leave during the school holidays and

Christmas period.

Risks/Issues of Changing the Dates

23. Public Perception

23.1. Ratepayers, for

budgeting purposes, will be receiving two rate invoices in one calendar

year – although the invoices cross over two financial years. It is vital

that the changes, if approved by Council, are communicated early and clearly

both internally and externally. A communications plan will be developed and

implementation will start the day Councillors adopt the proposal (if they

choose to adopt) to allow a good lead in time for the ratepayers.

24. Election Year

24.1. Due to it being it an

election year it may be that Councillors are not keen to approve the proposed

date changes. Should this be the case, the intention would be to implement the

changes for 2021-22, following approval from Council.

25. Transition Period

25.1. It is acknowledged it

may take two years before we receive the full targeted 70% earlier. People who

are currently on payment plans may take a longer period to adjust.

25.2. More penalties may need

to be remitted in the first year of implementation due to an unbudgeted change

for ratepayers. Council currently has a remission policy of one penalty

remittance allowed every three years. If this proposal is approved,

Council will develop a one-off additional penalty remission policy to take place

in the first year of implementing the new dates. This will enable previously

remitted ratepayers not to be financially punished while this change is being

implemented.

Consultation

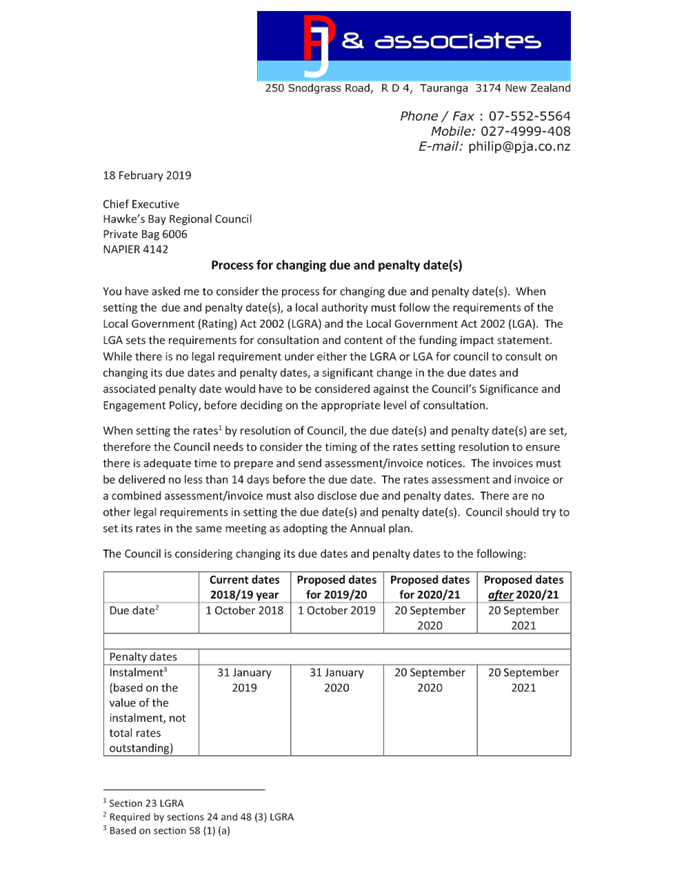

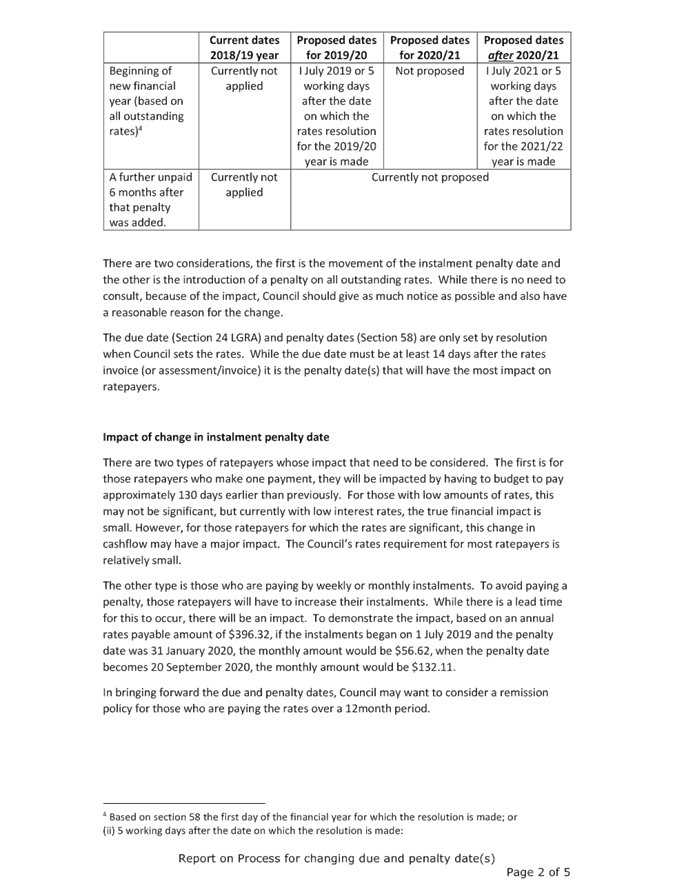

26. External advice has been

sought in regards to determining the need for community consultation in

changing the collection and penalty dates.

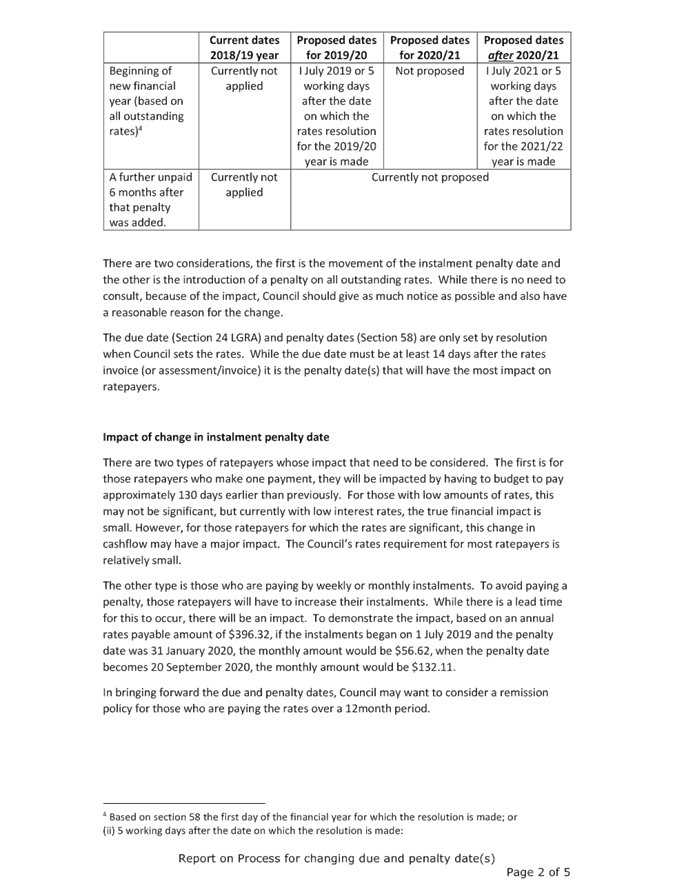

27. Philip Jones of PJ and

Associates[1]

has advised (please see Attachment 2) there is no legal requirement under

either the Local Government (Rating) Act 2002 (LGRA) or the Local Government

Act 2002 (LGA) for Council to consult on changing the due or penalty dates

(When setting the due and penalty date a local authority must follow the

requirements of both these acts.)

28. As noted in point 11 it

was stated in Council’s 2018-28 LTP HBRC will investigate changing the

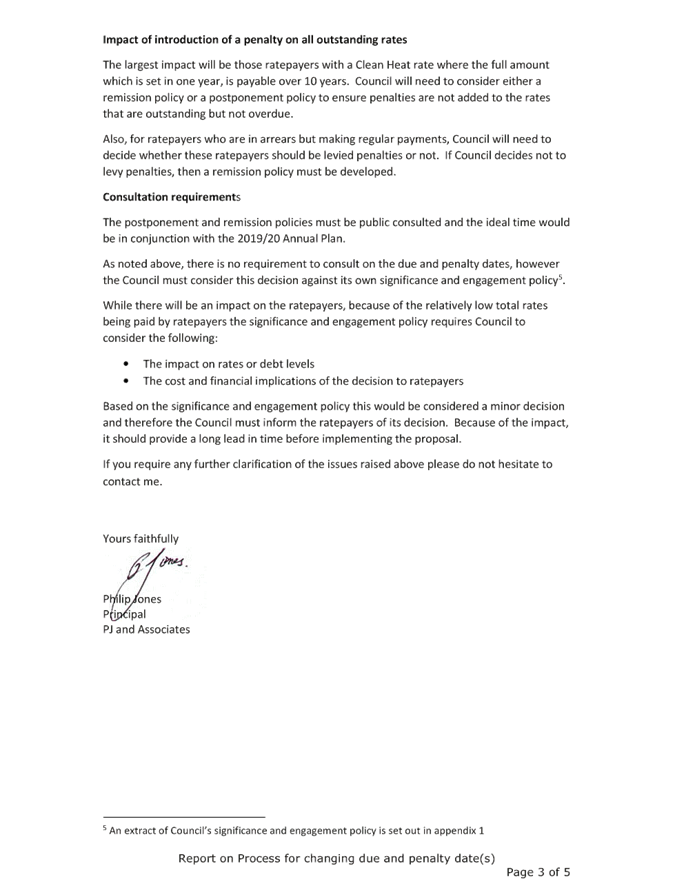

date that rate invoices are sent out and the final due date each year.

29. Philip Jones advises that

a significant change in the due dates and associated penalty date would have to

be considered against the Council’s Significance and Engagement Policy.

He advises the proposed changes would be considered a minor decision and

therefore does not require further consultation via public meetings. However,

because of the ratepayer’s impact, Council should provide a long lead in

time before implementing the proposal.

30. Staff have also considered

Council’s Criteria for Significance, in particular:

30.1. The likely impact or

consequences for affected individuals and groups in the region

30.2. The impact on rates or

debt levels

30.3. The cost and financial

implications of the decision to ratepayers

31. Is it acknowledged there

will be some ratepayers who be significantly impacted by the earlier payment

due date. The intention is to identify the 200 highest ratepayers in each

district and contact them personally in writing to explain the changes, outline

payment options, and potential remission of penalties for the implementation

year.

Financial and Resource Implications

32. A project team has been

established with Project Manager Mandy Sharpe (from the Project Management

Office) and Principal Accountant Rates and Revenue Trudy Kilkolly leading the

project. Within this team are staff from Communications, Rates, Finance and

ICT.

33. Regular meetings/workshops

will be held to ensure the process is rolled out as smoothly as possible,

identifying and managing any issues.

34. Estimated costs that this

project will incur include:

34.1. Implementation of a

communication/advertising campaign - $15,000.

34.2. Software changes (@

$205.00/ hr) to allow the development of a new rates invoice template and to

enable the 12-month direct debit facility to be added to our system. It

is not known at this stage how long this will take.

34.3. Consultant fees for peer

review and development of remission policy - $5,000.

34.4. Re-design of new invoice

- $5000-$7000.

34.5. Increased staffing

levels for short fixed term period to deal with ratepayers queries in relation

to the change in payment times and/or payment structure $10,000-$15,000

34.6. Possible increase in

penalty remissions for the first year of implementation. (Last year 9,992

ratepayers received a penalty with 14% written off).

Decision Making

Process

35. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

35.1. The decision does not

significantly alter the service provision or affect a strategic asset, and is

not inconsistent with an existing policy or plan.

35.2. The use of the special

consultative procedure is not prescribed by legislation.

35.3. The decision does not

fall within the definition of Council’s policy on significance.

35.4. The decision of the

sub-committee is in accordance with the Terms of Reference and decision making

delegations adopted by Hawke’s Bay Regional Council 9 November 2016,

specifically:

35.4.1. The purpose of the Audit and

Risk Sub-committee is to report to the Corporate and Strategic Committee to

fulfil its responsibilities for the provision of appropriate controls to

safeguard the Council’s financial and non-financial assets, the integrity

of internal and external reporting and accountability arrangements.

|

Recommendations

1. That the Finance, Audit and Risk Sub-committee receives and notes

the “Rating Invoice – Proposed Issue, Due and Penalty Date

Changes” staff report.

2. The Finance, Audit and Risk Sub-committee recommends that the

Corporate and Strategic Committee:

2.1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that the Committee can exercise its discretion and make decisions

on this issue without conferring directly with the community.

2.2. Recommends that Hawke’s Bay Regional Council approves the

proposed rates issue, due and penalty dates following, for implementation 1

July 2020.

2.2.1. Invoices sent out – early to mid-August

2.2.2. Rate assessment/invoice date – 20 September

2.2.3. Payment due date – 20 September

2.2.4. Penalty date – 21 September

|

Authored by:

|

Trudy

Kilkolly

Principal Accountant Rates and Revenue

|

Mandy Sharpe

Project Manager

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

⇩1

|

Rate Payment

Trends

|

|

|

|

⇩2

|

Letter from

PJ & Associates

|

|

|

|

Rate

Payment Trends

|

Attachment 1

|

|

Letter from PJ &

Associates

|

Attachment 2

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 22 May 2019

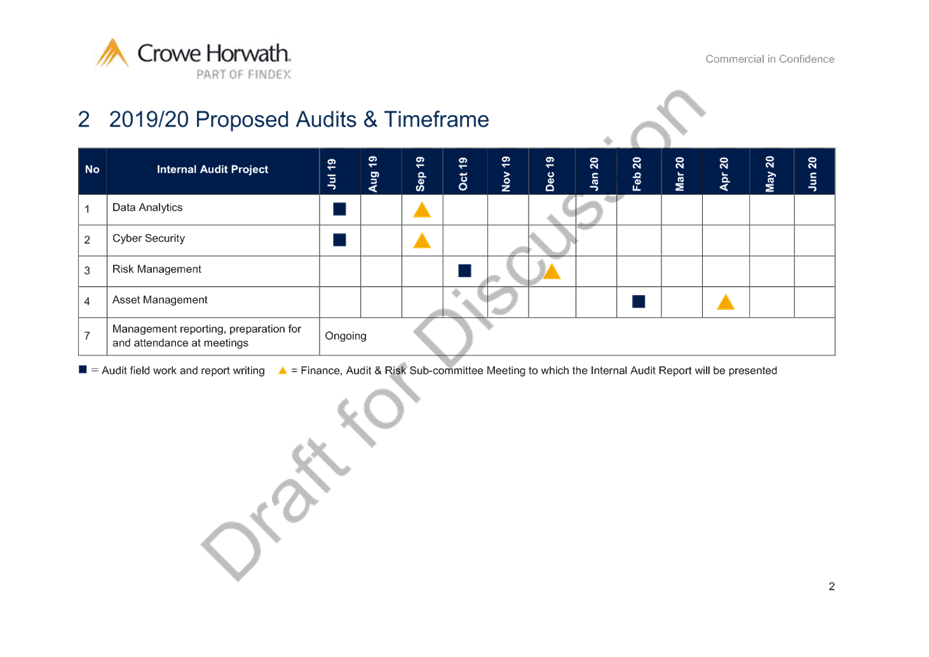

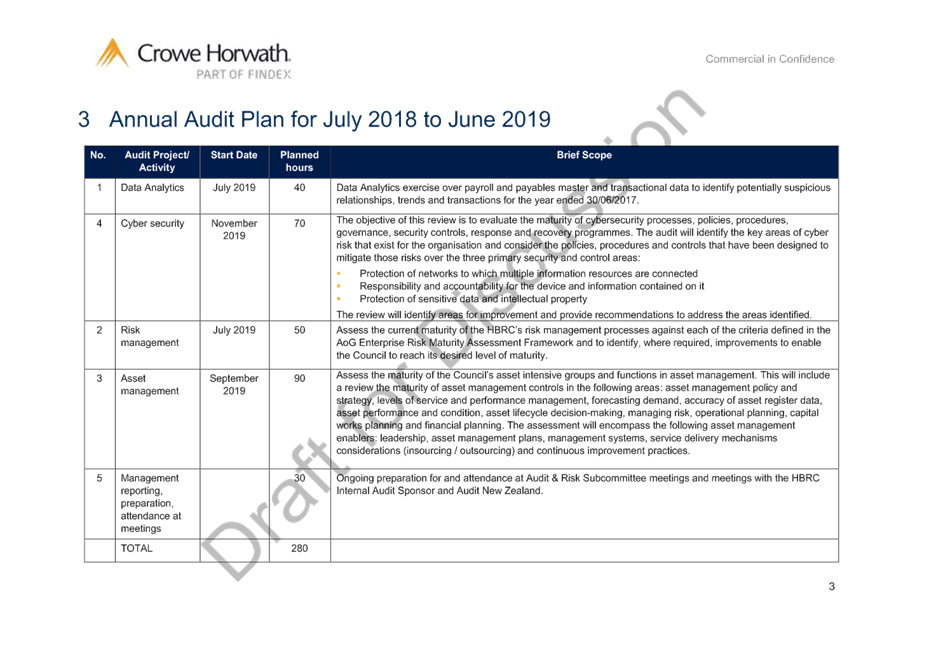

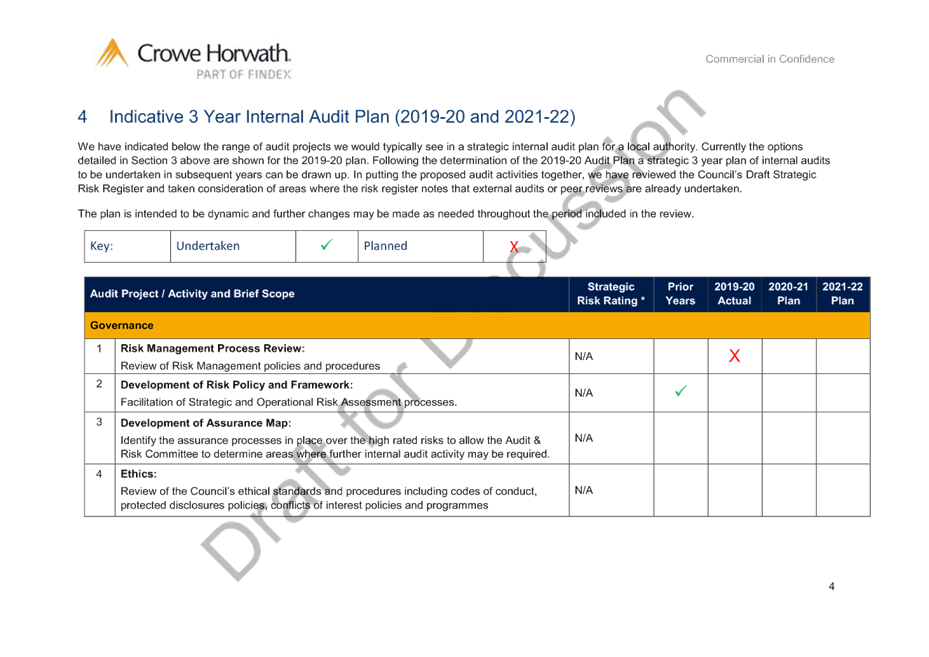

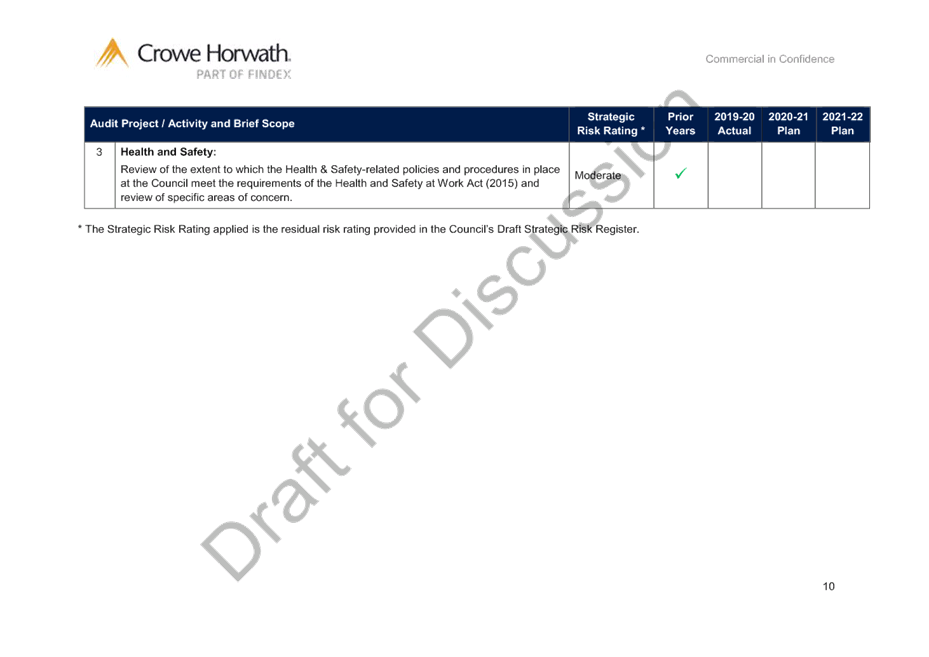

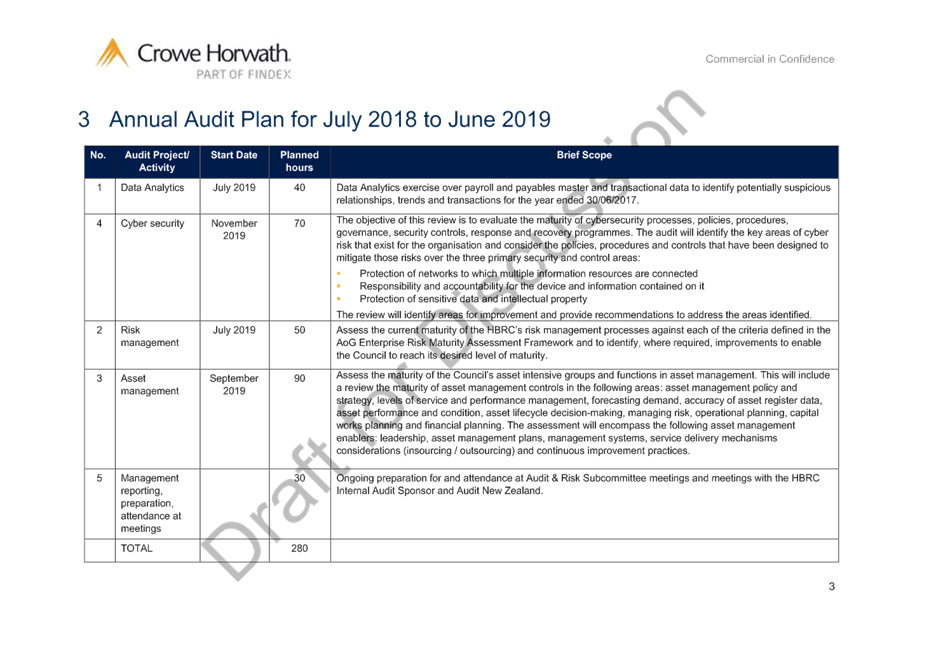

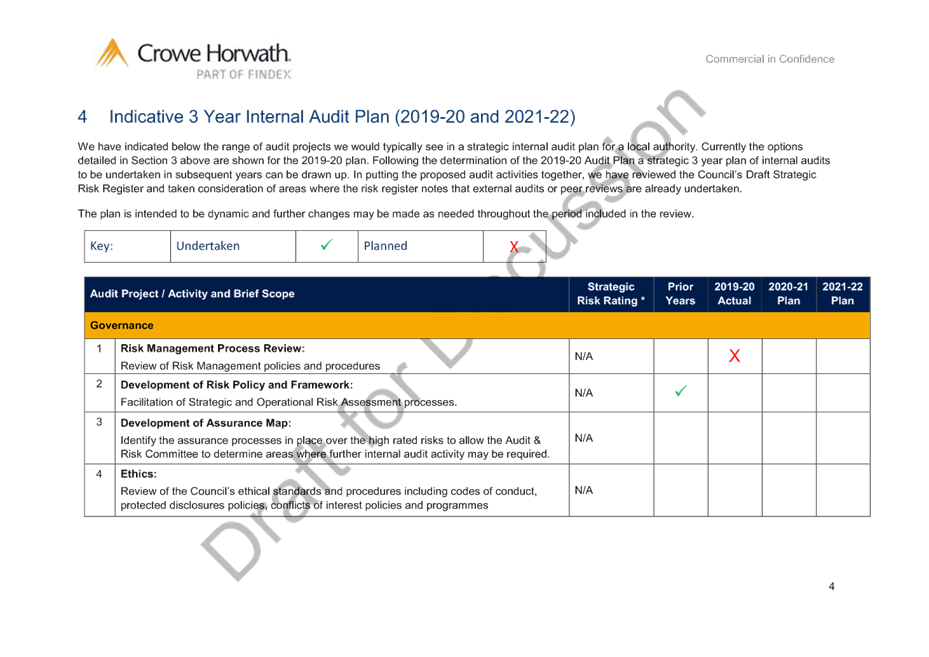

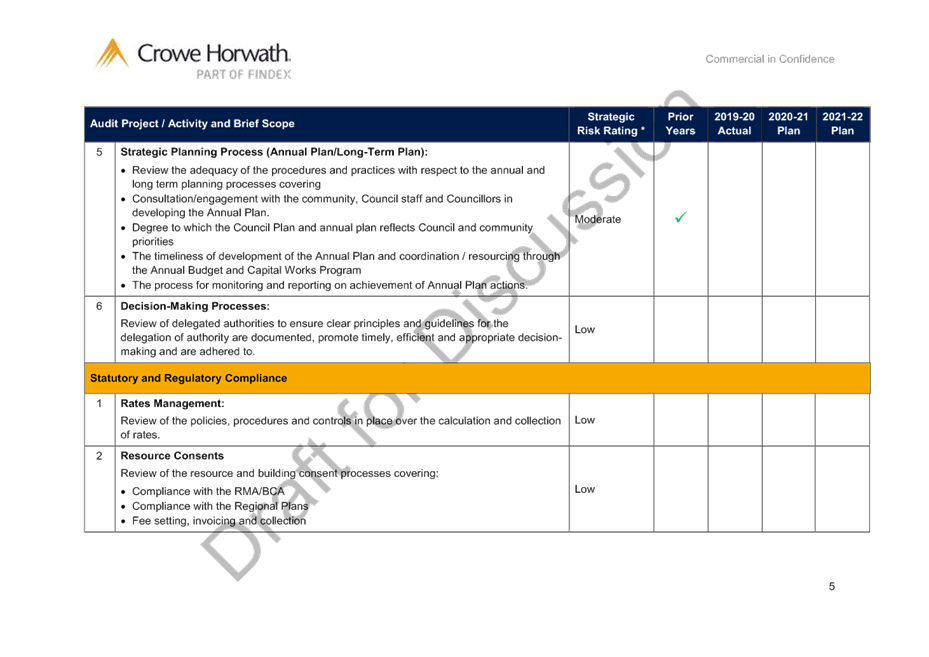

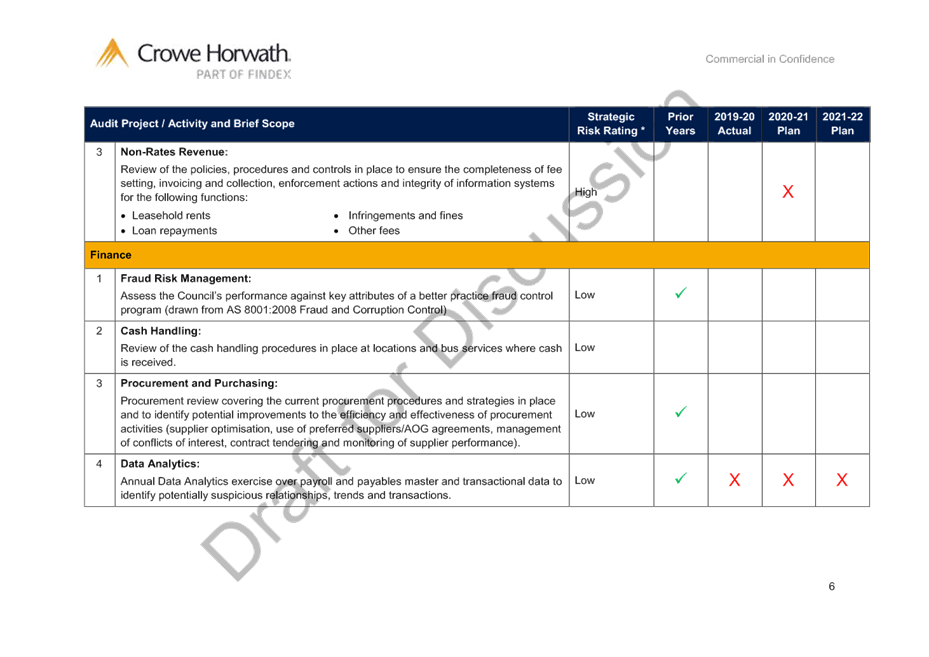

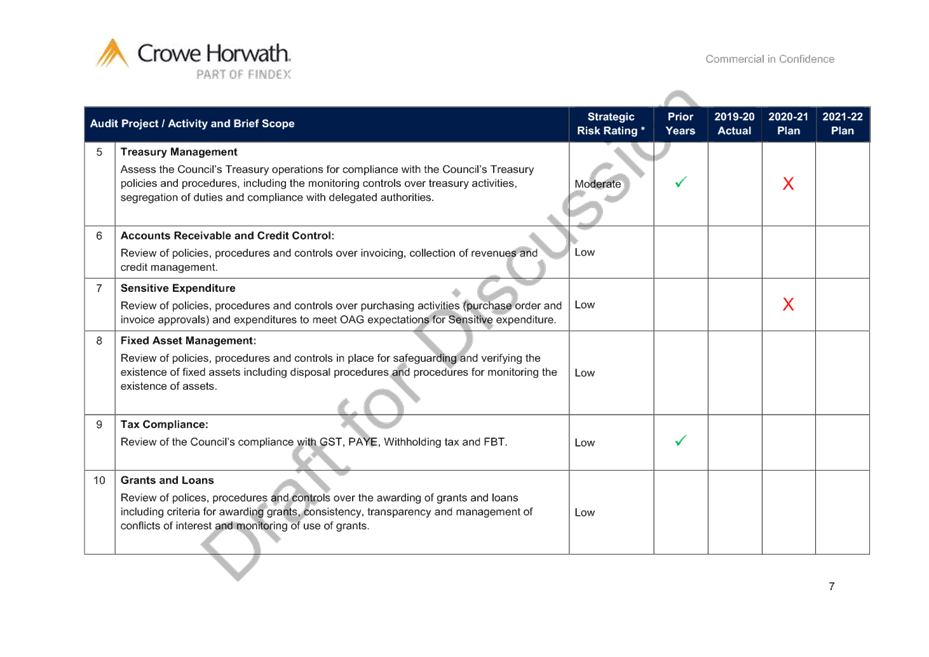

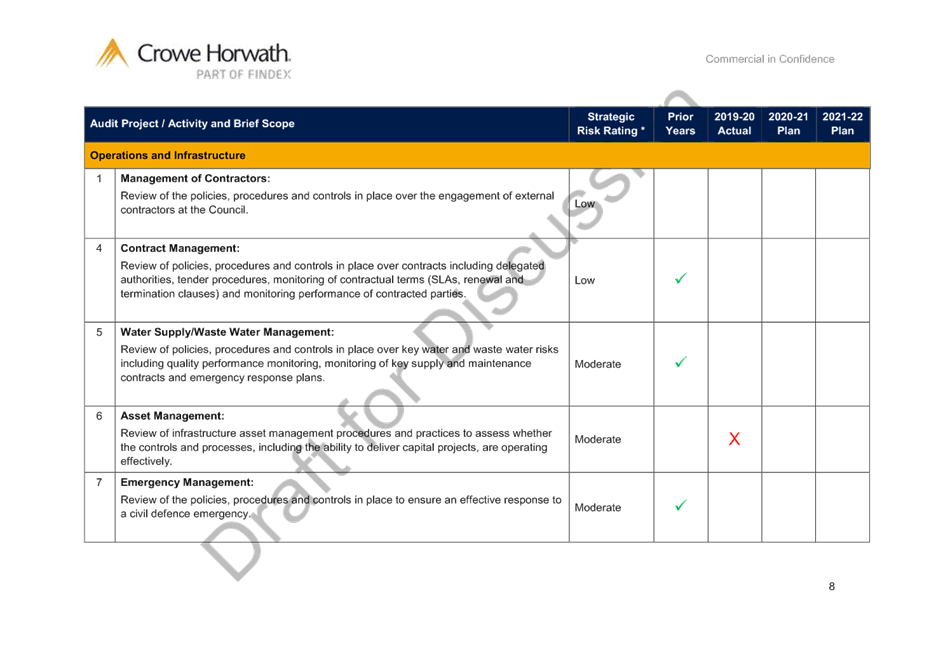

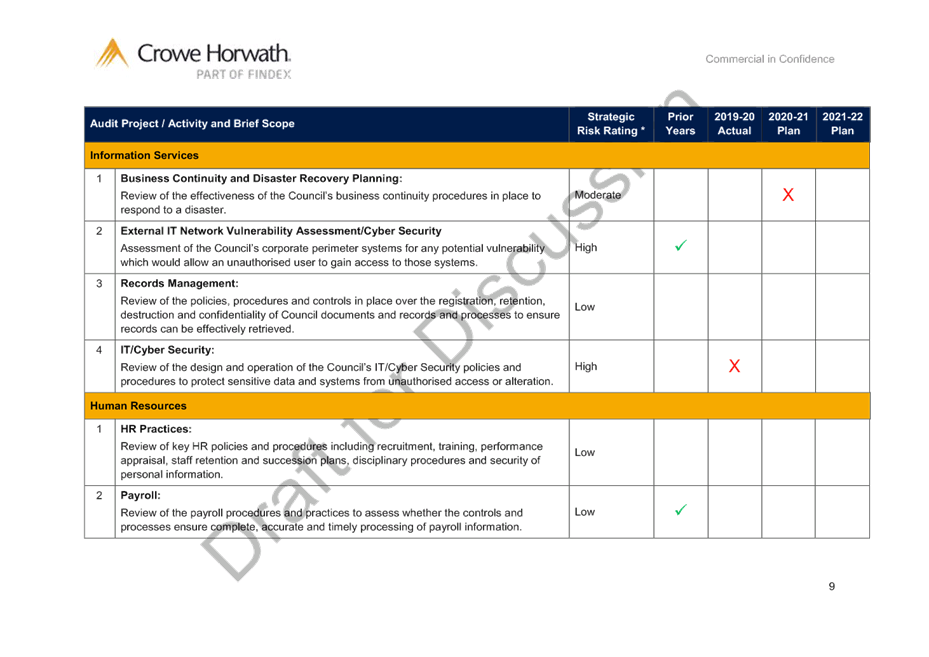

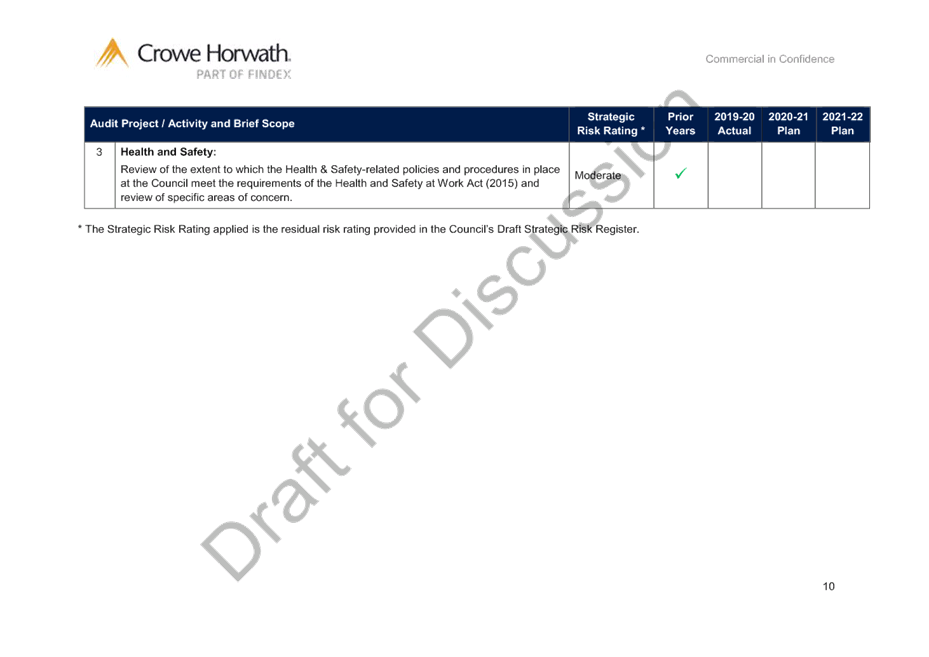

Subject: Proposed Schedule of

2019-2020 Internal Audits

Reason for Report

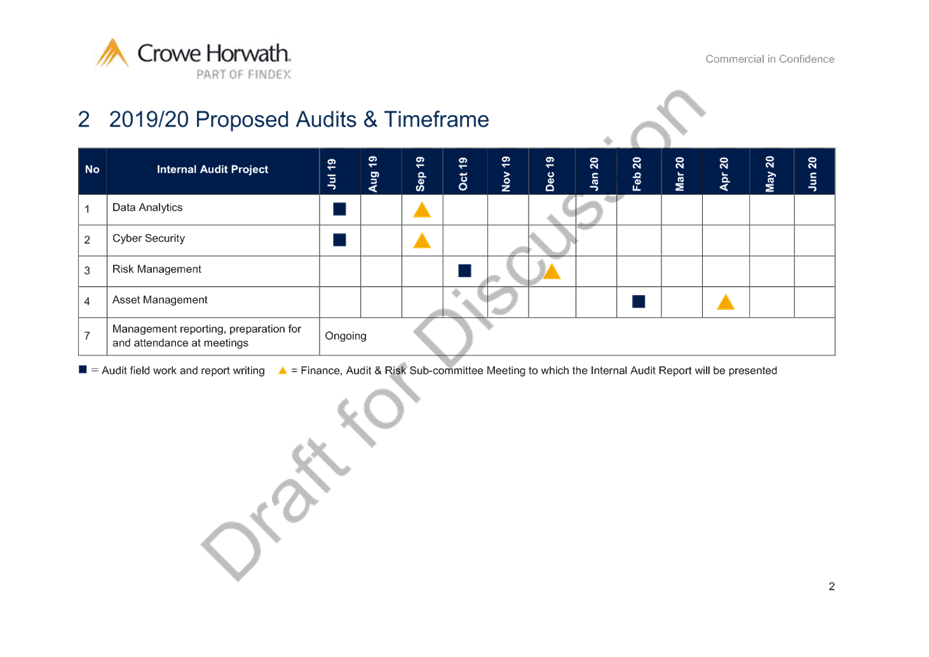

1. To propose an

internal audit programme for the 2019-20 financial year for agreement of the

Sub-committee.

Background

2. During the

current financial year HBRC’s internal auditors, Crowe Horwath, have

conducted a series of internal audits including:

2.1. Data

Analytics

2.2. Health &

Safety

2.3. Water

Management Follow-up.

Options Assessment

3. In consultation

with Crowe Horwath, and based on HBRC’s risk register, staff recommend

the following internal audit programme for the 2019-20 financial year.

3.1. IT Security

3.2. Data

Analytics

3.3. Risk

Management

3.4. Asset

Management.

4. A detailed work

programme which provides an outline of the above proposed and previously

conducted audits is attached.

5. IT security has

been proposed due to the benefit of independent advice over how effective HBRC’s

IT controls are. While HBRC believes its controls are effective, IT and cyber

security is an increasingly high risk area for organisations. The review would

include an evaluation of processes, policies, procedures, security controls and

response and recovery programmes. This would also tie in well with a

cyber-security/penetration testing assignment currently underway as part of an

overall IT security review. As this is the first proposed audit in the

programme, a scope is attached for the Sub-committee to review and

approve.

6. Data Analytics

is proposed to be repeated due to the useful information it has provided in its

previous two audits. This also provides the opportunity to benchmark

improvements made to processes since prior audits. As this audit has been

performed previously, the cost and staff time involved will be reduced.

7. Risk Management

has been proposed due to its evolution and development over the past two years

to ascertain how effective risk management processes are, along with areas for

improvement.

8. Asset

management has been proposed as there hasn’t been an audit of this

activity in recent years. The audit would include areas such as a review of the

maturity of asset management controls in areas such as asset management policy

and strategy, accuracy of data, asset lifecycle decision making, and asset

performance and condition. Areas such as leadership, planning and continuous

improvement would also be assessed.

9. All of these

areas are recommendations at this stage and staff will take any guidance from

the Sub-committee for additional or reprioritising topics, as well as refining

of scope.

Financial

and Resource Implications

10. Staff confirm that the

schedule of internal audits as proposed is accommodated within existing budgets

as set by the 2018-28 Long Term Plan, however if the sub-committee wishes to

consider additional work in this area budget allocations may require

reconsideration.

Decision Making

Process

11. Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

11.1. The decision

does not significantly alter the service provision or affect a strategic asset,

and is not inconsistent with an existing policy or plan.

11.2. The use of

the special consultative procedure is not prescribed by legislation.

11.3. The decision

does not fall within the definition of Council’s policy on significance.

11.4. The decision of

the sub-committee is in accordance with the Terms of Reference and decision

making delegations adopted by Hawke’s Bay Regional Council

9 November 2016, specifically:

11.4.1. The purpose

of the Audit and Risk Sub-committee is to report to the Corporate and Strategic

Committee to fulfil its responsibilities for the independence and adequacy of

internal and external audit functions.

11.4.2. The

Finance, Audit and Risk Sub-committee shall have responsibility and authority

to confirm the terms of appointment and engagement of external auditors,

including the nature and scope of the audit, timetable, and fees.

|

Recommendations

1. That the Finance, Audit and Risk Sub-committee:

1.1. receives and considers the “Proposed

Schedule of 2019-2020 Internal Audits” staff

report.

1.2. Agrees to the 2019-20 schedule of Internal Audits, including

associated budget allocations, being:

1.2.1. IT

Security

1.2.2. Data

Analytics

1.2.3. Risk

Management

1.2.4. Asset

Management.

2. The Finance,

Audit and Risk Sub-committee recommends that the Corporate and Strategic

Committee takes note of the agreed 2019-20 schedule of Internal Audits within

associated budget allocations.

|

Authored by: Approved

by:

|

Melissa des

Landes

Acting Chief Financial Officer

|

Jessica

Ellerm

Group

Manager Corporate Services

|

Attachment/s

|

⇩1

|

Draft

Proposed 2019-20 Internal Audit Plan

|

|

|

|

⇩2

|

2020 Cyber

Security Planning Memo - Draft for discussion

|

|

|

|

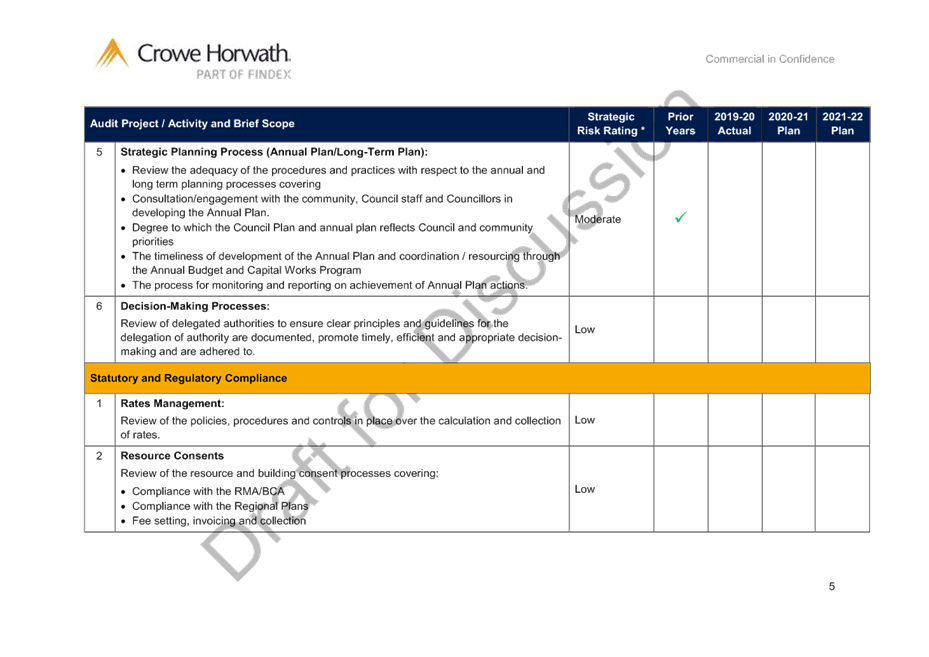

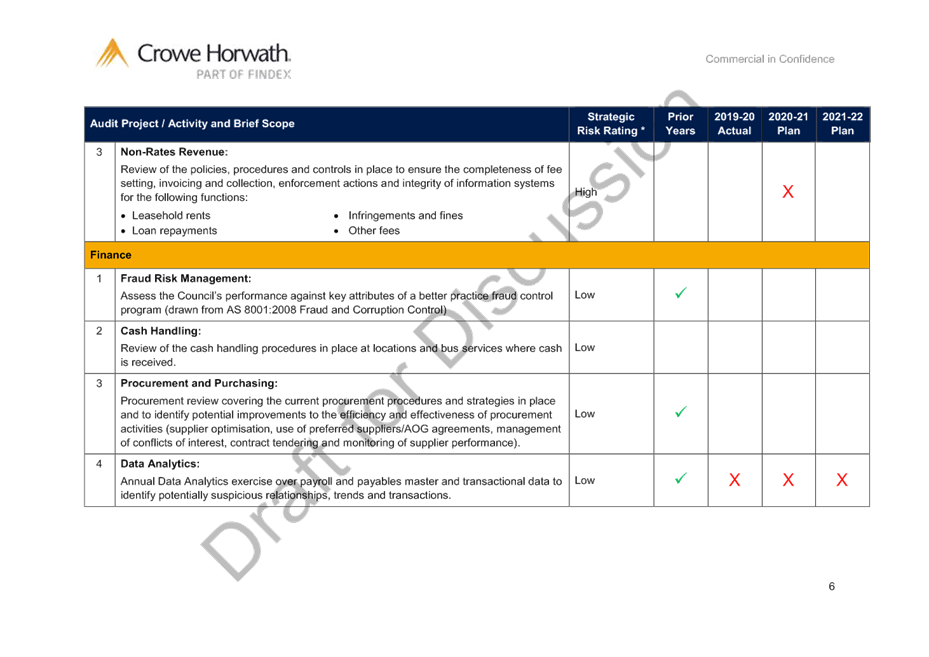

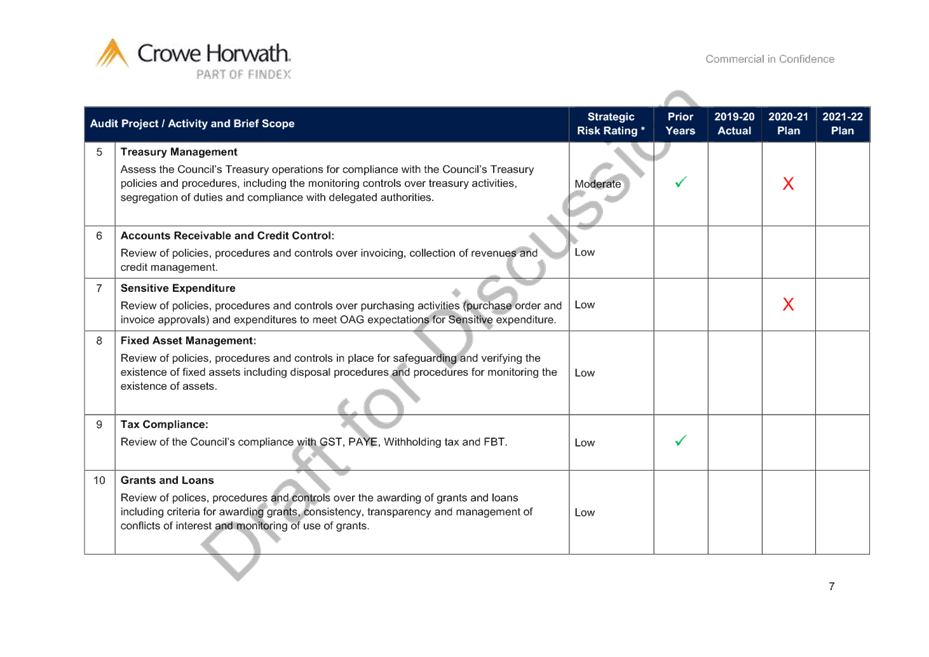

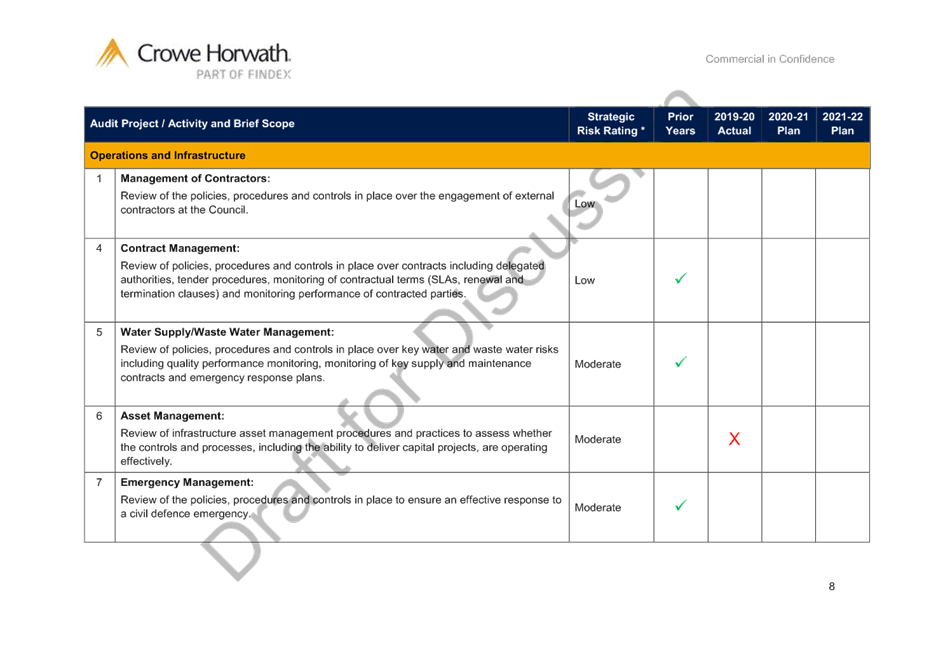

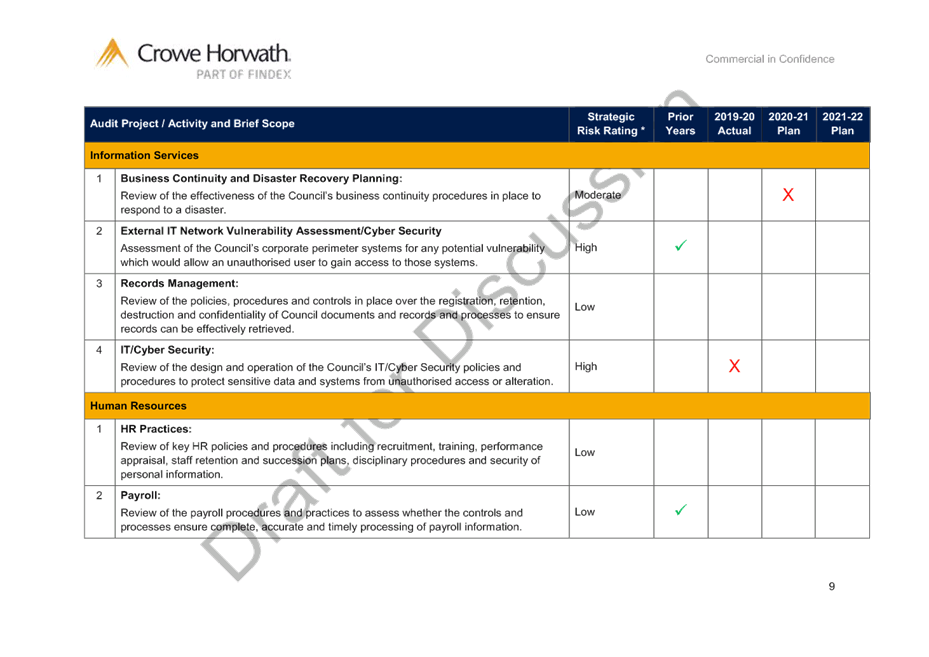

Draft

Proposed 2019-20 Internal Audit Plan

|

Attachment 1

|

|

Draft

Proposed 2019-20 Internal Audit Plan

|

Attachment 1

|

|

Draft

Proposed 2019-20 Internal Audit Plan

|

Attachment 1

|

|

2020

Cyber Security Planning Memo - Draft for discussion

|

Attachment 2

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 22 May 2019

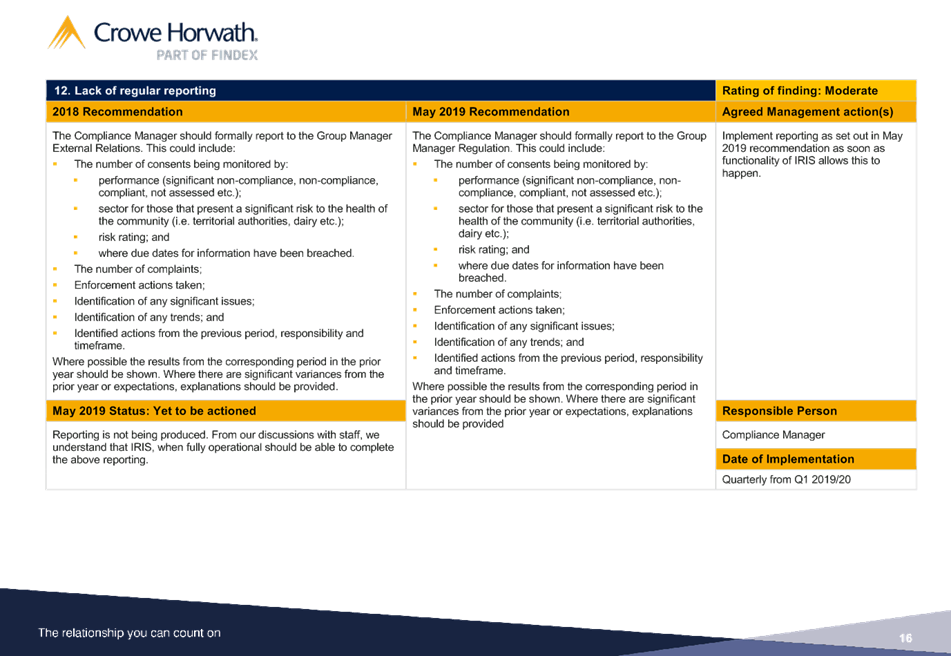

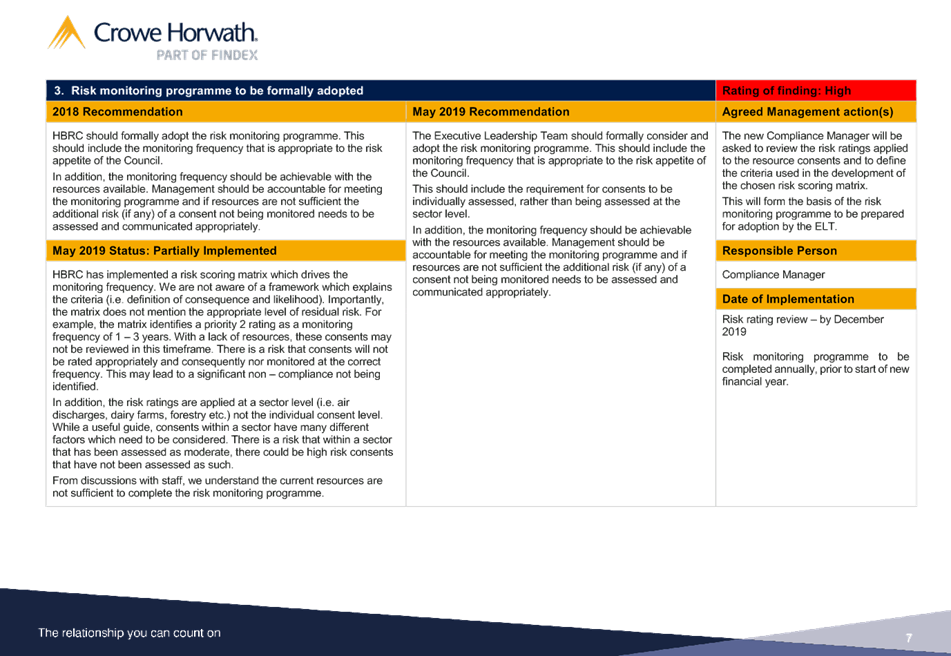

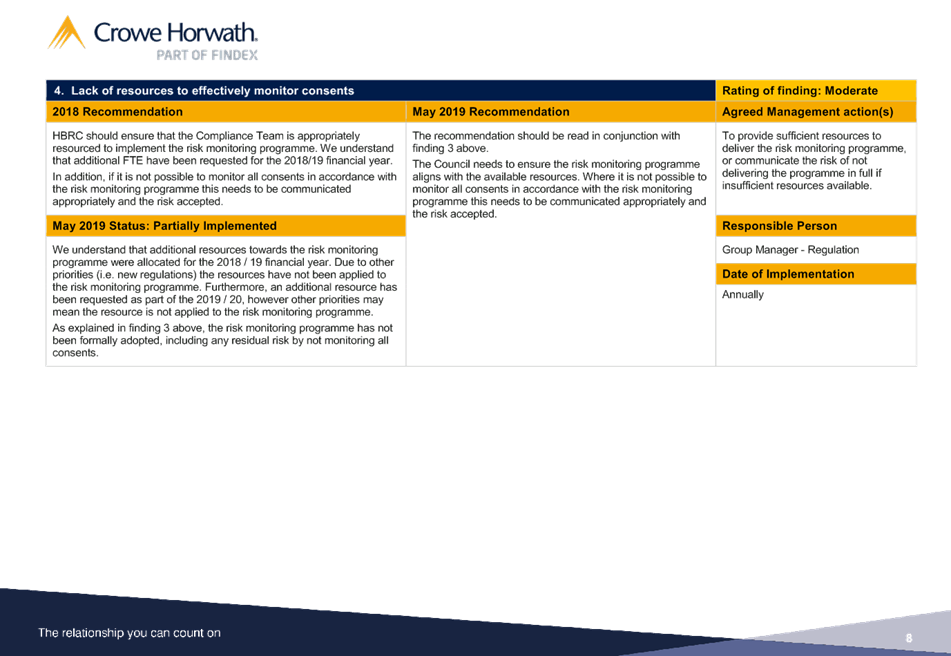

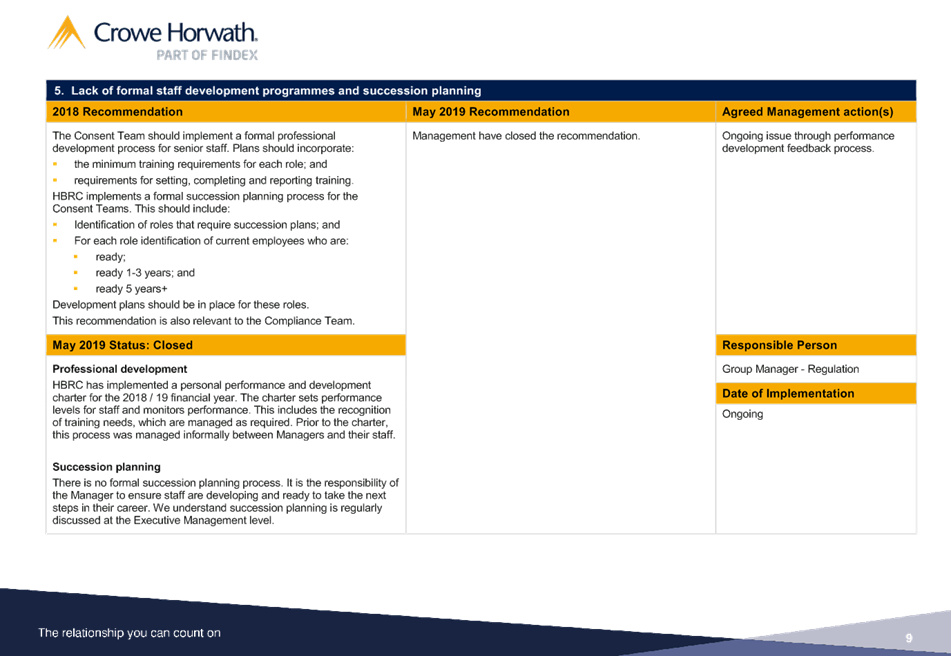

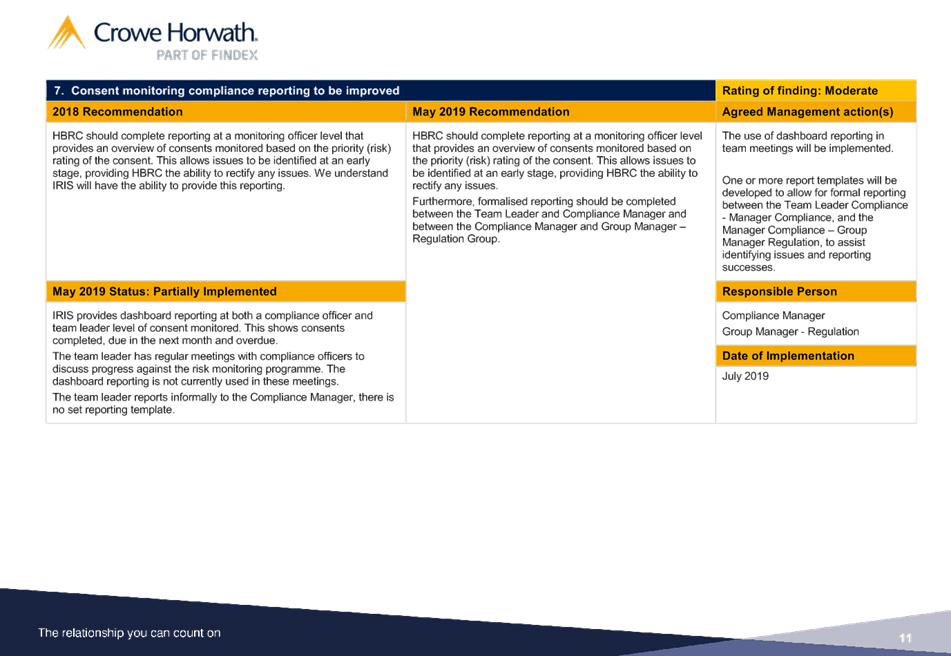

Subject: Water Management

Follow-up Internal Audit Report

Reason for Report

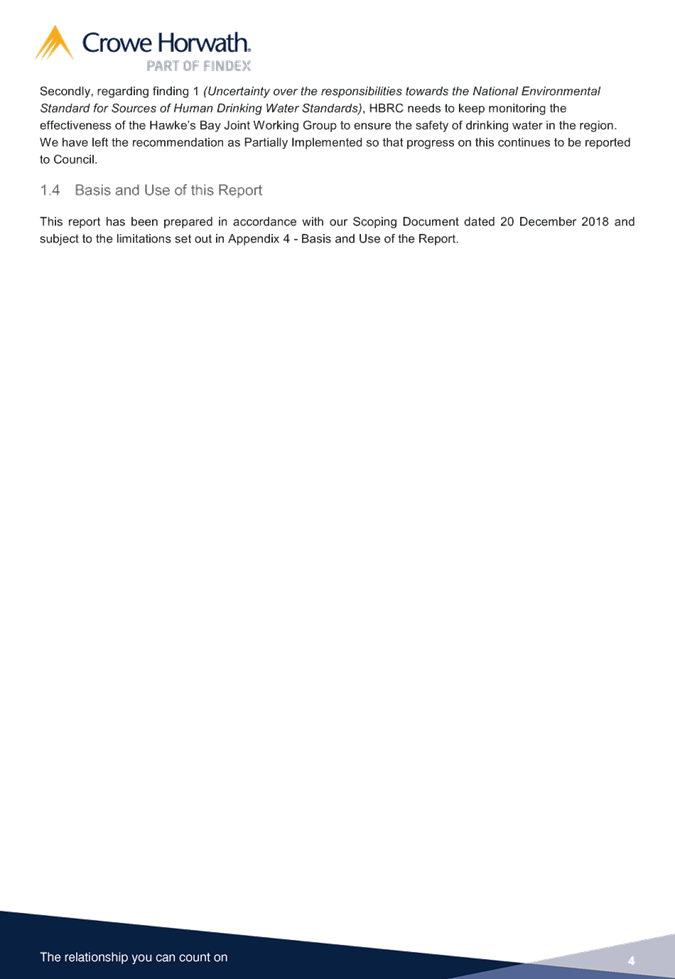

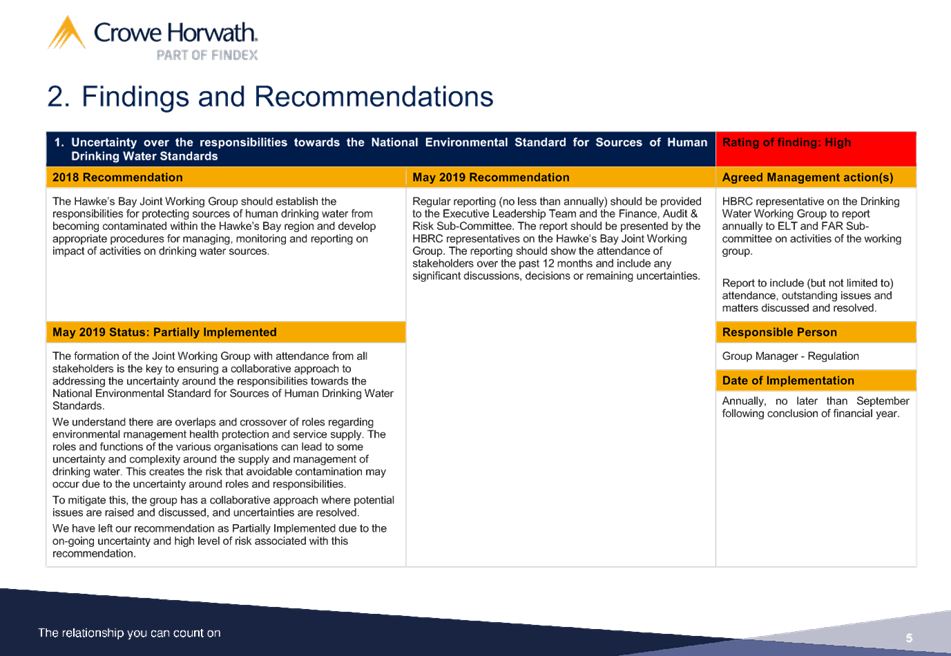

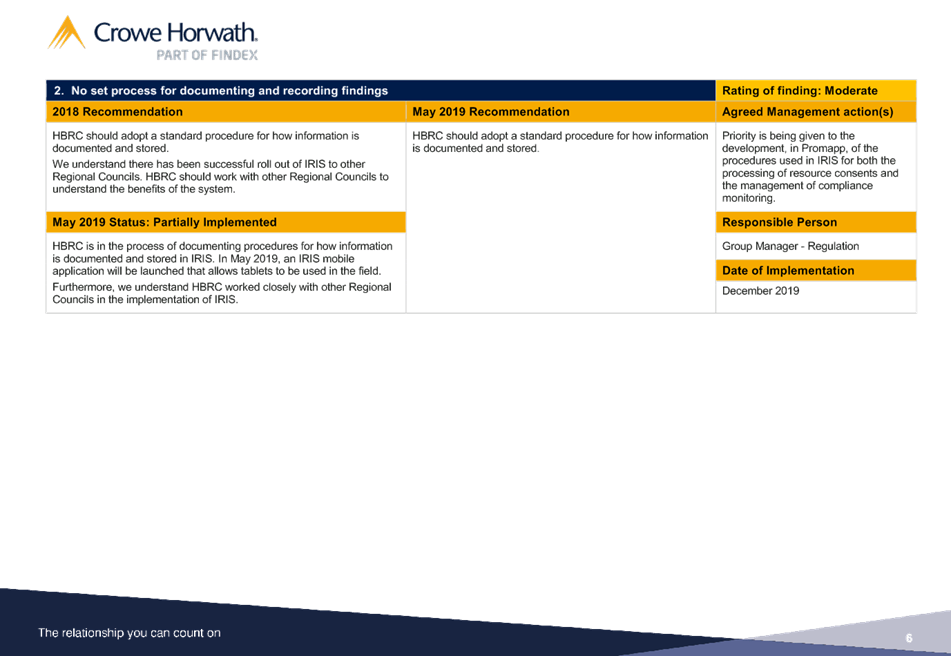

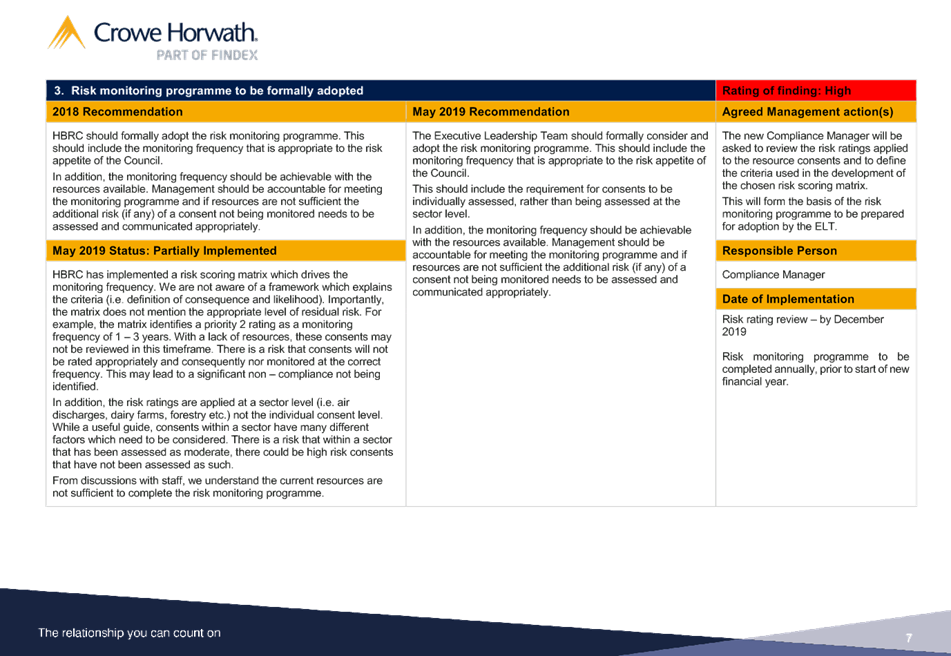

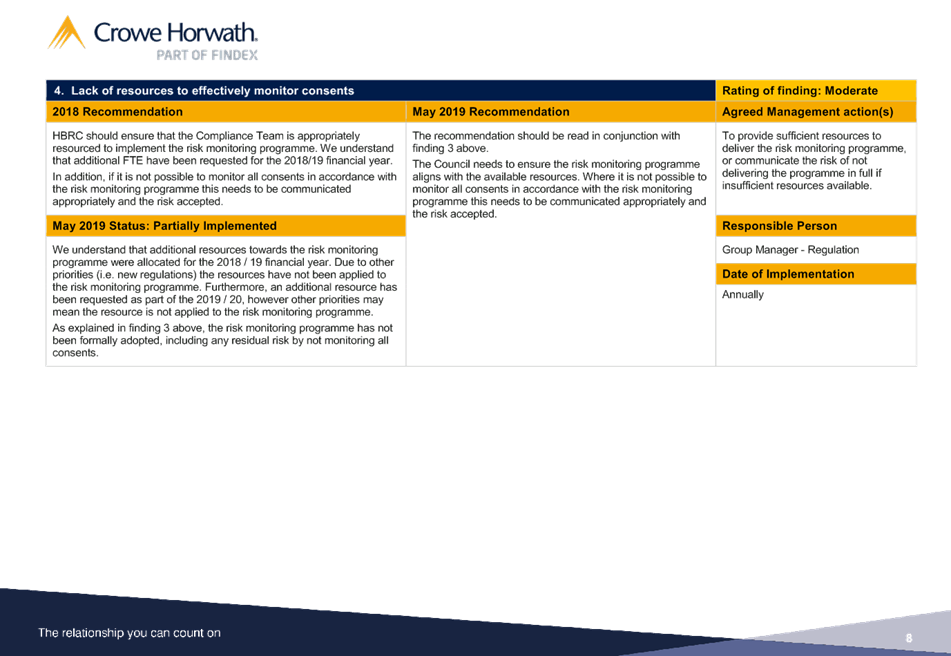

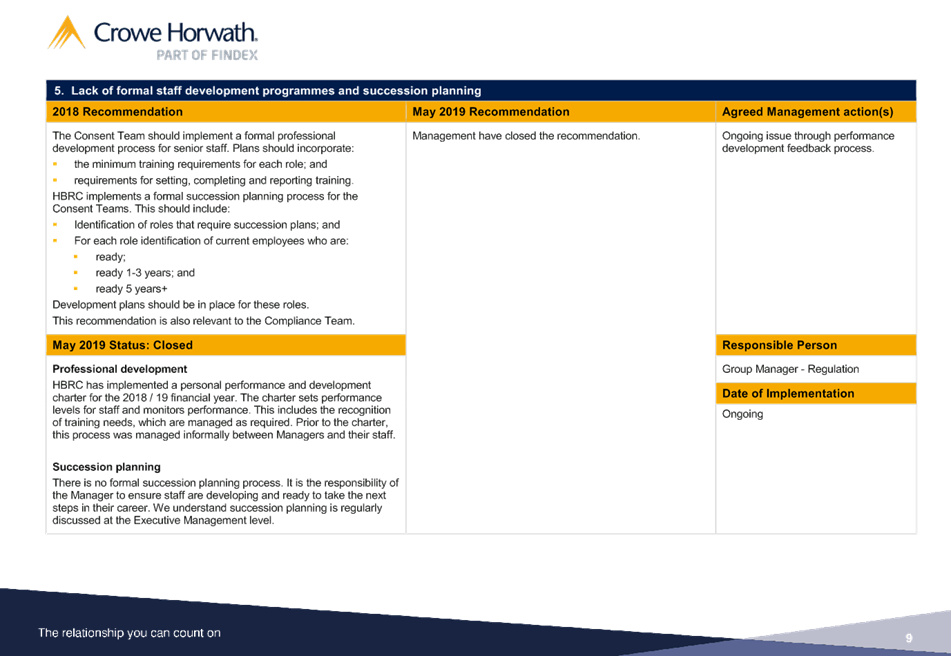

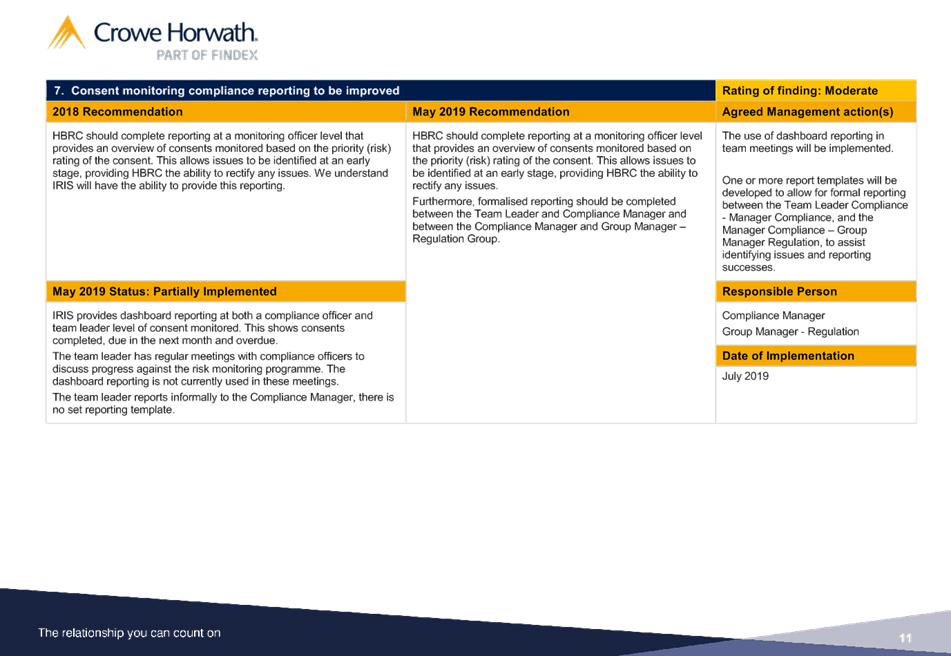

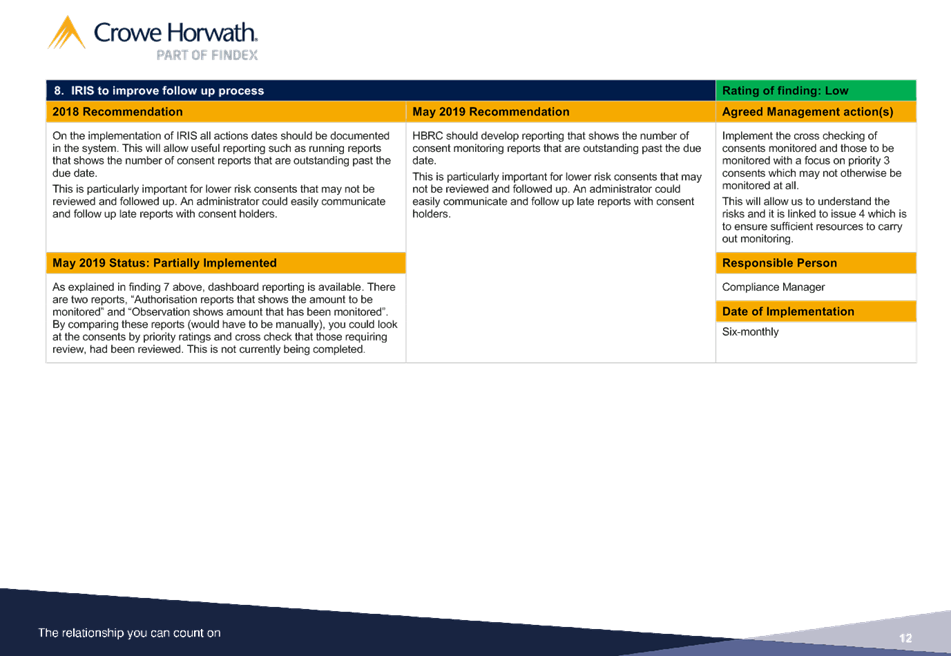

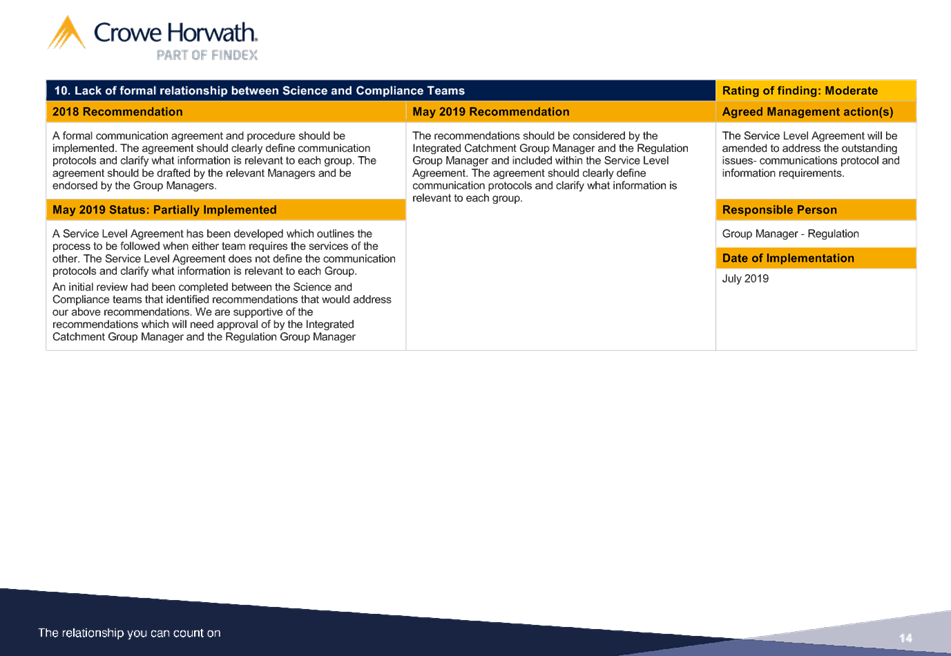

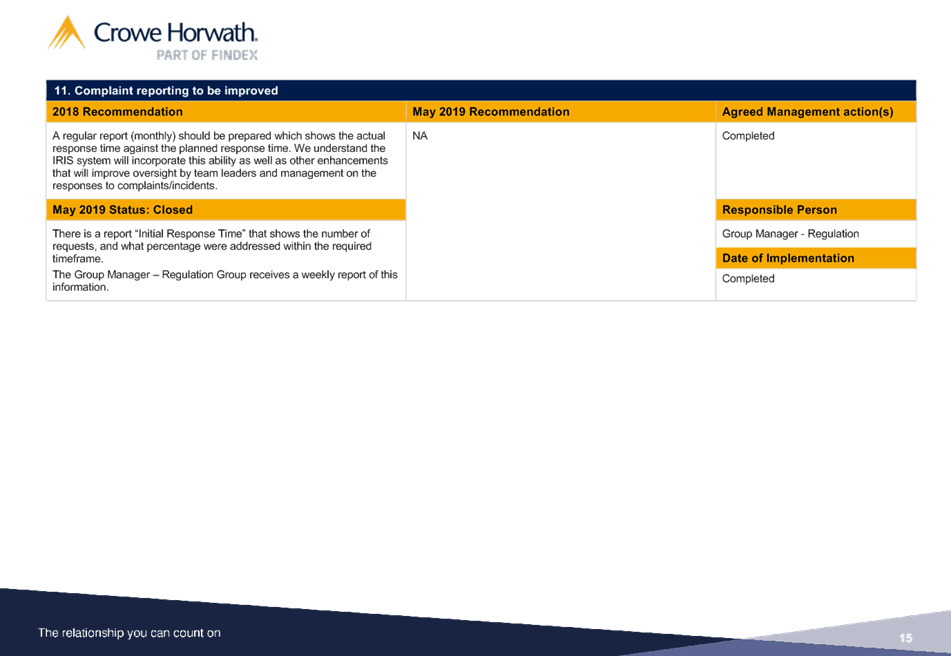

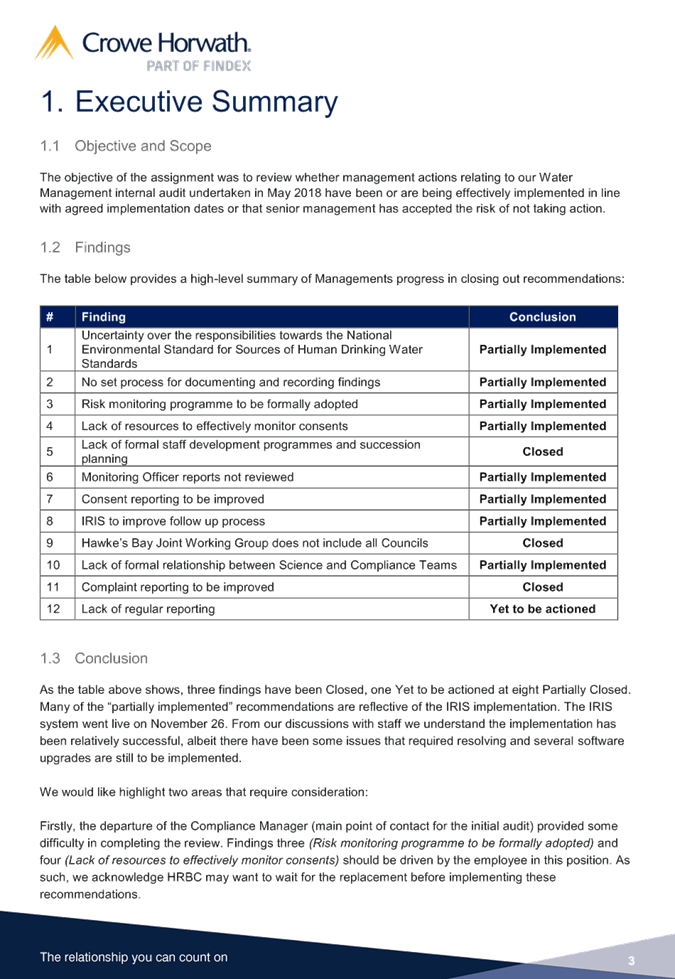

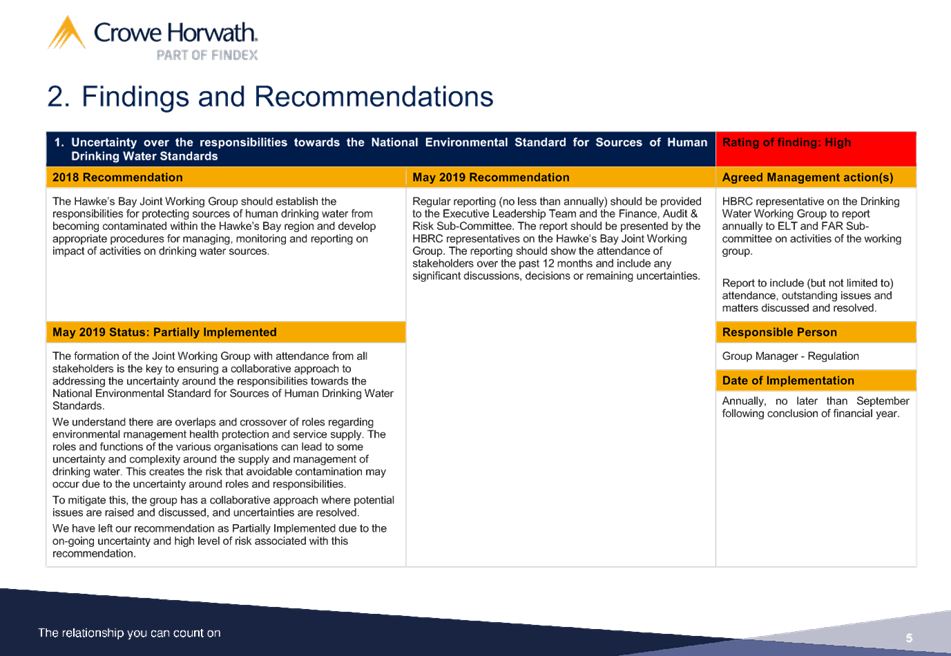

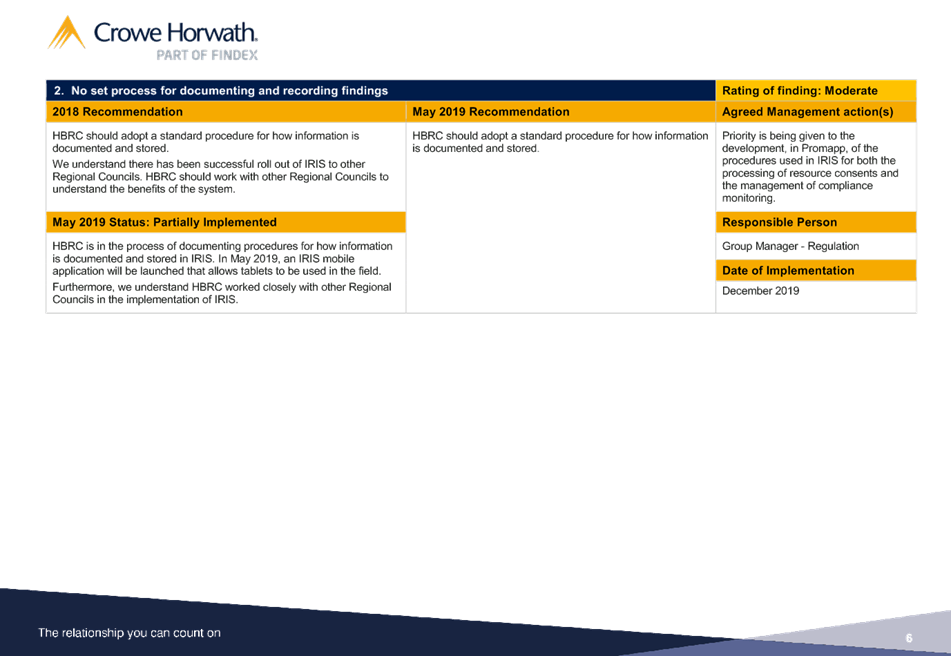

1. To provide the sub-committee with the results of the follow-up Water

Management internal audit undertaken by Crowe Horwath.

Background

2. The Finance,

Audit and Risk sub-committee agreed at its meeting on 9 September 2017 to

include Water Management as part of the internal audit work programme. After a

series of iterations, the scope was agreed at the Regional Council meeting on

31 January 2018.

3. The initial Water Management Audit was presented to the Finance,

Audit and Risk Sub-Committee in June 2018

4. As part of its internal audit programme a review has now been

undertaken by Crowe Horwath and the findings presented as attached for the sub-committee’s

consideration.

Decision Making

Process

5. Staff have

assessed the requirements of the Local Government Act 2002 in relation to this

item and have concluded that, as this report is for information only, the

decision making provisions do not apply.

|

Recommendation

That the Finance, Audit and Risk

Sub-committee receives and notes the “Water

Management Follow-up Internal Audit Report”

staff report.

|

Authored by:

|

Malcolm

Miller

Manager Consents

|

|

Approved by:

|

Liz Lambert

Group Manager Regulation

|

|

Attachment/s

|

⇩1

|

Crowe Horwath

Follow-up Water Management Audit report

|

|

|

|

Crowe

Horwath Follow-up Water Management Audit report

|

Attachment 1

|

|

Crowe

Horwath Follow-up Water Management Audit report

|

Attachment 1

|

|

Crowe

Horwath Follow-up Water Management Audit report

|

Attachment 1

|

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 22 May 2019

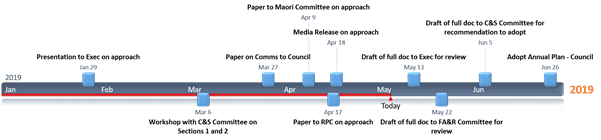

Subject: Draft 2019-20 Annual Plan

Reason for Report

1. The Annual Plan for 2019-20 is attached for review and

feedback. It will then go to the Corporate and Strategic Committee on 05

June for final adoption by Council for 26 June 2019.

Background

2. The Annual Plan 2019-20 represents year 2 of the Long Term Plan

(LTP) and as the forecasted rates increase of 7.9% has not changed, nor were

there any material or significant differences to what was forecast, the Council

has decided not to consult.

3. The Annual Plan document has three sections:

3.1. Section 1: Introduction

3.2. Section 2: Highlights

3.3. Section 3: Financial information

4. A draft of sections 1 and 2 were presented to Council in a workshop

early March. A media release on 18 April signified our non-consultation

approach and provided a high level overview to the public.

5. A detailed two page spread of key highlights will be published

(through newspapers and social media) in early June to inform the community.

6. A timeline of events for the Annual Plan is below.

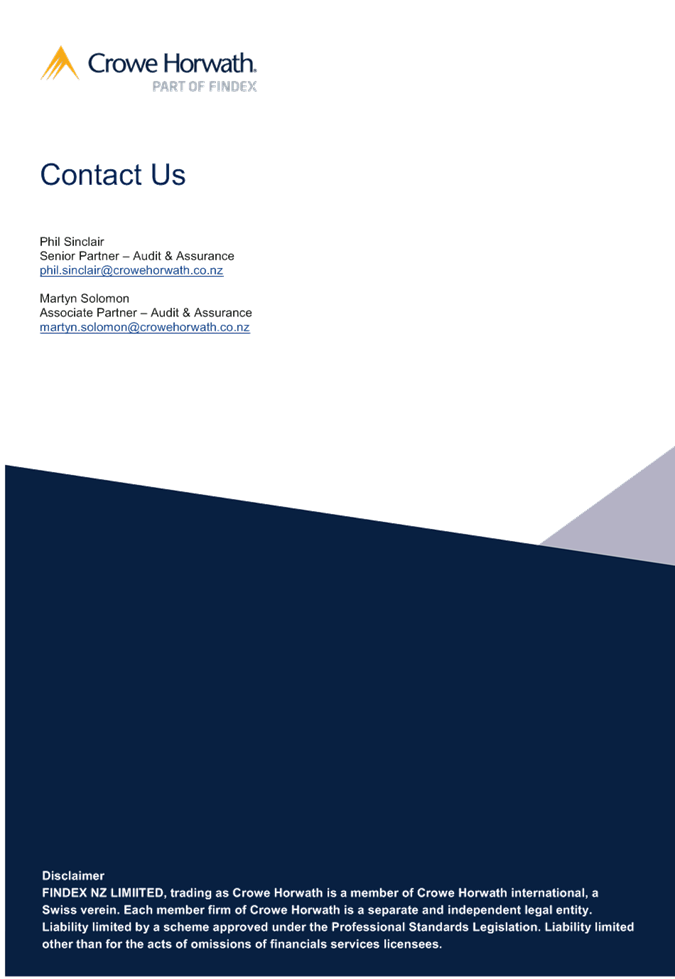

Decision Making

Process

7. Staff have

assessed the requirements of the Local Government Act 2002 in relation to this

item and have concluded that, as this report is for information only, the

decision making provisions do not apply.

|

Recommendation

That the Finance, Audit and Risk

Sub-committee receives and considers the Draft

2019-20 Annual Plan and provides feedback to staff.

|

Authored by:

|

Karina

Campbell

Senior Project Manager

|

Melissa des

Landes

Acting Chief Financial Officer

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

⇨1

|

First Draft

2019-20 Annual Plan

|

|

Provided to FARS members only

|

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 22 May 2019

Subject: Living Wage Update

Reason for Report

1. To provide the Sub-committee with a report that breaks down the type

and value of suppliers used by Council for review and consideration. This is

provided in conjunction with any other relevant Living Wage updates since

previous meetings.

Background

2. A procurement internal audit was completed and presented to FARS 6

June 2018, which included an extension to consider the implications behind

implementing a Living Wage requirement. This Living Wage memorandum traversed

the key issues behind implementation of a living wage, such as legal and

financial challenges. The memorandum also noted the benefits of implementing a

Living Wage, such as the recognition of the dignity of work and ability to earn

a living.

3. The Finance, Audit and Risk Sub-committee (FARS) requested at its

meeting on 21 November 2018 that staff prepare further analysis of the

types of suppliers (direct and indirect) Council engages with in the

procurement of its goods and services. This analysis would attempt to quantify

the cost of implementing or preferencing living wage suppliers and how it could

be implemented by way of policy.

4. Finally there was also an analysis of other Councils’ stances

on the living wage, whereby the overarching theme was that most Council’s

elected to only pay the living wage under certain criteria, such as to direct

staff only.

5. This report was then presented to the 12 December 2018 Corporate and

Strategic Committee meeting, where after extensive discussion it was agreed to

await the results of a national review of the Public Transport Operating Model

(PTOM) which is currently underway.

6. The above report was presented in conjunction with other work that

Council has previously provided to FARS in relation to GoBus and staff and a

further update on this and other relevant updates is provided at this meeting.

7. Over the last quarter, staff have conducted a survey of a sample of

direct suppliers to determine likely impacts on requiring them to pay the

Living Wage. The volume of feedback received was disappointing, a full analysis

of the feedback that was received is provided in separate section following.

Council Supplier Analysis

8. Over the past quarter, staff have conducted an analysis of the top

100 suppliers by spend over a 12 month period. From this list a distinction was

made between direct and in-direct suppliers, with direct suppliers being

determined as those whom Council engages on a direct level. For example, a

cleaner who provides their services on site and in person would be deemed

direct, as opposed to a stationary provider who would be deemed indirect.

9. Once this distinction was determined, a total of 65 suppliers from

the top 100 were determined to be direct. A survey was then emailed out

utilising the online survey tool “Survey Monkey” to the direct

suppliers. The disclaimer for the survey stated that Council is reviewing its

procurement policy and was using any responses for information only at this

stage.

10. The

survey was kept brief but included key questions such as whether or not

suppliers pay their staff the living wage. A further question was posed that if

the requirement for suppliers to pay their staff the Living Wage was made a

compulsory, whether that supplier could absorb the costs or if they would need

to pass them on (or a combination thereof). Finally, a question was asked if

this was made a requirement, whether they would still be interested in

continuing business with Council, with room for optional free text comments.

11. There

were only nine responses after the initial email which staff concluded

wasn’t a large enough sample to refelct a fair view. A decision was made

to contact other direct suppliers who Council recognises would traditionally be

the type of service who may traditionally be paid on the lower end of the wage

scale. This included suppliers who Council engages frequently, such as cleaners

and caterers who were not in the preliminary selection.

12. This

direct approach also resulted in a disappointing response rate, with only an

additional four responses, or 13 in total. This poor response may highlight the

reluctance of suppliers to provide sensitive salary information, despite a

clear disclaimer being provided as to how this information would be used.

13. Results

from respondents are as follows:

13.1. Just

over 75% of respondents already pay their staff the Living Wage.

13.2. 100% of

respondents who answered stated that they would continue to provide services to

Council if it was made a requirement for suppliers to pay the Living Wage.

13.3. There

were a mixture of those suppliers who would be able to absorb the costs (29%)

versus those who would need to pass on the cost (43%), with the remainder

stating they would need to pass on a portion of the costs.

13.4. The

cost of the increase in terms of the value of the contract with Council was:

13.4.1. less than

10% (43%)

13.4.2. 10-20%

(57%)

13.4.3. no

suppliers stated that this would cost more than 20%. Note that the survey only

asked for a percentage, as opposed to total costs in order not to make the

survey too cumbersome for respondents.

14. The

optional comments section at the conclusion of the survey provided some

supportive, albeit minimal feedback, with all comments provided being in

positive support of the Living Wage concept and encouraged Council for

conducting a review on this. The following comments were made. “Make the

change to Living Wage,” “I do think this is a necessary step. I

fully support a living wage,” “We totally support the Living Wage

goal, good on you for highlighting this.”

15. Note the

comments above were from suppliers who already pay their staff the Living Wage.

No additional feedback was received from those suppliers that don’t.

16. Overall,

the feedback shows the majority of respondents already pay their staff the

living wage, with around 70% of those that don’t indicating a need to

pass on either a portion, or the entire cost to their customers in order to

operate their business.

17. Given the

relatively small sample size, and the assumption that those suppliers already

paying the living wage could have been more inclined to complete the survey,

the results of the survey are not conclusive enough to make assumptions or

estimates accurate enough to inform decision making. However, based on the

results, staff reviewed the budget for the provision of building maintenance

services, which includes services such as cleaning and catering as noted above

as being types of serviced traditionally in the lower quartile of the wage

bracket. At present, Council currently spends approximately $300k per annum on

such services. A 20% increase on this budget item would cost Council an

additional $60k per annum.

GoBus/PTOM Update

18. At FARS

meeting 21 November, Councillors were advised that staff had been participating

in the national PTOM review which the GoBus contract falls under. Staff were

expecting to have viewed the initial report by this date however Transport

Minister Phil Twyford had indicated that further detailed work would be

required for the report to be more useful and as a result the report is not yet

available.

19. Latest

update from the review is that unions were engaged in November/December 2018,

with research approach agreed in late December. Work on additional research was

launched earlier this year, with report expected to follow. Staff will continue

to provide updates to FARS at each meeting.

National Local Authority Update

20. Council

is currently working with all five local authorities to progress a discussion

on the living wage for internal staff. Councils have agreed to engage an economic

consultant to review this from a Hawke’s Bay perspective.

21. At the

time of writing this report this is still being finalised however initial

indication suggests that every region adopting a common national living wage is

not necessarily an adequate reflection of regional living costs and as such the

report may identify a more appropriate, Hawke’s Bay living wage. This is

similar to an exercise conducted by Palmerston North City Council that

identified a living wage which better reflects regional economies.

22. Council

currently pays all of its permanent staff the living wage or higher.

Central Government Steps

23. Central

Government has recently lifted the minimum wage in New Zealand significantly

which now sits at $17.70 per hour as at 1 April 2019. This is an increase of

$1.20 on previous minimum wage. This increase is the biggest boost to the

minimum wage in recent New Zealand history.

24. In

addition to this increase, Central Government has also promised to increase the

minimum wage further annually for it to reach $20 per hour by 2021.

25. Workplace

Relations and Safety Minister Iain Lees-Galloway has stated that the reasoning

behind this increase is “the Government is determined to improve the

wellbeing and living standards of all New Zealanders as we build a productive,

sustainable and inclusive economy”.

26. At the

time of writing this paper, the Living Wage is currently $20.55 and has been

signalled to increase to $21.15 - with a 1 September 2019 implementation date.

27. The

Living Wage website doesn’t appear to have any commentary on the recent

minimum wage increases at the time of writing this paper.

28. As a

reminder at FARS meeting 6 June 2018, a Living Wage Implications Memorandum was

presented and noted Palmerston North City Council (PNCC) conducted an exercise

to determine a Palmerston North living wage. This was in light of the fact that

the cost of living in this centre was considerably less than the cost of living

in major centres. This determination was set at $17.50.

29. As minimum

wage ($17.70) has now increased beyond the Palmerston North living wage

($17.50), PNCC has elected to drop its local living wage and options to

reassess it further, in recognition of the minimum wage increases.

30. Some PNCC

Councillors noted within their decision making that the increase in the minimum

wage is setting out what the living wage originally planned to do, being

increase the wellbeing and living standards of New Zealanders.

Procurement Options

31. Given the difficulty Council has faced in extracting

supplier wage information, it is hard to determine the real cost impact of the

requirement to include a Living Wage as a minimum requirement as part of

Council’s procurement policy.

32. Staff note that an option may be to encourage

the payment of a living wage within its procurement policy, as opposed to

making it a minimum requirement.

33. The payment of a Living Wage could be given a

weighting however should be weighed up alongside other important factors, such

as buying local, environmental impacts, and good health and safety practices.

For example, a supplier may pay the Living Wage but they may be from a larger

centre. As a result, a local business may miss out on Council’s

business. Due to this staff are not recommending a set weighting and

believe that each contract should be considered on a case by case basis.

Decision Making

Process

34. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision making

provisions do not apply.

|

Recommendation

1. That the Finance, Audit and Risk

Sub-committee:

1.1. Receives and notes the “Living Wage Update”

staff report

1.2. Notes that considerations of living wage related procurement

policy decisions are addressed in a separate “Procurement and

Contract Management” item.

1.3. Continues to await the feedback of the Public Transport Operating

Model report.

2. The Finance, Audit and Risk Sub-committee

recommends that the Corporate and Strategic Committee recommends that

Hawke’s Bay Regional Council:

2.1. Considers the addition of a statement in the Procurement Policy

that “Council encourages payment of the Living Wage”

2.2. Recommends that if the inclusion of a weighting for payment of the

Living Wage in a contract decision is to be considered, that decision will be

determined based on the type and value of the contract, and should also weigh

up other best business practices.

|

Authored by:

|

Melissa des

Landes

Acting Chief Financial Officer

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 22 May 2019

Subject: Procurement and

Contract Management Update

Reason for Report

1. This report provides an update on progress made in response to

recommendations made by the 2018 internal audit to review and amend the

Regional Council’s Procurement Policy and Procurement Manual.

Background

2. From a purely business perspective, the most obvious benefits of an

effective procurement process are financial, via upfront cost savings by

procuring items, services, and contracts at the best price available. Effective

procurement should also ensure that projects are delivered to time and budget,

with reduced exposure to commercial risk and by way of a consistent and

appropriate process which aligns with HBRC procurement principals.

3. The HBRC Procurement Policy was approved in 2015, the Procurement

Manual was approved in 2016, with the intent to review within three years.

4. In September 2018 The Office of the Auditor General (OAG) and

Ministry of Business Innovation and Employment (MBIE) made new recommendations

for best practice in procurement. HBRC commissioned a review in 2018 by Crowe

Horwath to evaluate our existing policy and make recommendations to align with

current best practice guidelines. This draft policy and the accompanying draft

procurement manual reflect HBRC progress to adopt those and other

recommendations to achieve best practice.

5. The attached revised policy and manual are consistent with national

procurement principles and guidelines and are compliant with relevant

legislation. The Policy details what HBRC is required to do to meet national

guidelines and the Manual details how to apply policy principles, to deliver

benefits of best practice procurement.

6. Key Audit findings from 2018 were:

6.1. Procurement policy (2015) is fit for purpose

6.2. HBRC would benefit from a central Procurement and Contract resource

6.3. There was a lack of evidence to support procurement decisions

(Procurement plans)

6.4. There are inconsistent templates and de-centralised systems for

contract management, with inherent risk.

6.5. Contract register was incomplete and contained expired contracts.

7. Audit recommendations and responses are tabled following.

|

Recommendation

|

Response

|

|

Procurement

structure should be centralised to ensure consistency in the application and

training for best practice

|

1. A procurement hub has now been established as a

central procurement management resource. Staff have created a replacement for

‘contract central’ an Electronic Document Record Management

System (EDRMS) and rather than just being a repository, the new contracts hub

will provide resources to manage the whole procurement life cycle from

planning to evaluation.

2. Specifically, for an organisation of HBRC’s

size and scale, MBIE have informally recommended 1 x procurement FTE to be at

Senior Leadership Team level. This is due to the level of work likely to be

involved, along with the requirement for that person to have sufficient

stature within the organisation to drive results. This role was not included

in the HBRC Long Term plan, but was proposed at the finance audit and risk

committee in June 2018, to be explored for 2020, existing resource being

utilized in the interim.

|

|

Regular

reporting to the Executive team should include high value, high risk or

complex procurement and notice of upcoming significant tenders.

|

A draft

template report will be implemented from June 2019

|

|

A

procurement planning template be included in the procurement manual

|

Plan

templates are included for simple and complex procurements

|

|

Training

should be provided to staff engaged in procurement practice and contract

management

|

Training

will be cascaded from the Hub to selected subject matter experts in each

executive team member group. Each group will include (where relevant)

training for existing staff and new staff as part of the induction process

|

|

Tools and

templates should be implemented to ensure policies and procedures are

followed

|

Procurement

NZ, OAG and MBIE templates are now being introduced as standard across all HB

councils, currently being led by HBRC and HDC. These are detailed in the

revised procurement manual.

|

Next Steps

8. As part of the centralisation of procurement, and in order to

promote a consistent approach, training will be cascaded through the

organisation for and to those with procurement responsibilities. The training

will be based on the manual and targeted to the needs of each service group.

The Executive Assistants for each group will be supported as ‘subject

matter experts’ for the group and training will be delivered to team

level. New staff will have training as part of their induction. Training videos

will be available for reference and ‘refresher’ presentations

delivered on request.

9. Contract reporting as provided monthly to the Executive team and the

Office of the Chief Executive will be provided to Finance Audit and Risk

sub-committee on a quarterly basis with effect from July 2019. This will

include: New contracts in the reporting period by value (over $50k) and

level of risk; details of sourcing – RFP/RFQ /Local interest; List of

expiring contracts in the next reporting period.

10. Crowe

Horwath (Findex) will be invited to review the revised policy and manual in

June 2020 to check adherence and completeness.

Decision Making

Process

11. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision making

provisions do not apply.

|

Recommendation

1. That

the Finance, Audit and Risk Sub-committee:

1.1. Receives and

considers the “Procurement and Contract

Management Update” staff report

1.2. Agrees

support for the proposed revised Hawke’s Bay Regional Council

Procurement Policy May 2019 and Procurement Manual.

|

Authored by:

|

Mark Heaney

Manager Client Services

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

⇨1

|

HBRC

Procurement Policy May 2019

|

|

Under

Separate Cover

|

|

⇨2

|

HBRC

Procurement Manual May 2019

|

|

Under

Separate Cover

|

|

⇨3

|

Contractor

registration

|

|

Under

Separate Cover

|

|

⇨4

|

Procurement

Plans

|

|

Under

Separate Cover

|

|

⇨5

|

Contract for

Provision of Services

|

|

Under

Separate Cover

|

|

⇨6

|

Contract

Evaluation Form

|

|

Under

Separate Cover

|

|

⇨7

|

Contract

monitoring template

|

|

Under

Separate Cover

|

|

⇨8

|

Other Policy

and Legislation

|

|

Under

Separate Cover

|

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 22 May 2019

Subject: May 2019 Sub-committee

Work Programme Update

Reason for Report

1. In order to ensure the sub-committee’s ability to effectively

and efficiently fulfill its role and responsibilities, an overall update on its

work programme is provided following.

|

Task

|

Item

|

Scheduled / Status

|

|

Internal

Audits

|

Health &

Safety

|

Presented to

21 November 2018 FARS meeting.

|

|

Data

Analytics

|

Presented to

12 February 2019 FARS meeting.

|

|

Business

Continuance

|

Deferred

|

|

Water

Management – Follow Up Review

|

Scope agreed

at 12 February 2019 FARS meeting with final report to be presented to 22 May

FARS meeting.

|

|

Risk

Assessment & Management

|

Reporting on risks

(6-monthly) affecting Council plus noting changes / improvements / areas that

require attention from last report (3-monthly).

|

Presented to

19 September 2018 and 12 February 2019 meeting.

Risk

management review proposed for 2019-20 financial year.

|

|

Insurance

|

Council’s

proposed 2018-19 Insurance programme.

|

Update to be

presented to 22 May FARS meeting.

|

|

Annual

Report

|

Discussion on Audit

Management Letter.

Discussion

on the major issues (if any) in the audit report on the Annual Report.

|

Audit

Director attended 21 November 2018 FARS meeting to discuss Annual Report

process.

|

|

S17a

Efficiency Reviews (Section 17a Local Government Act)

|

Update on progress and

findings of Section 17a Efficiency Reviews.

|

Staff

resourcing has been diverted to focus on the procurement and contract

management piece of work, with S17a to form part of this following.

|

|

Investment

Returns & Treasury Monitoring

|

Update on progress in

obtaining required level of dividend from PONL (Port of Napier Limited).

Update on Treasury function within Council.

|

Separate

Treasury paper prepared to be presented to 22 May FARS meeting.

Application

to join LGFA (Local Government Funding Agency) now complete.

|

|

Living Wage

|

Procurement and

Contract Management

|

Staff have

undertaken a survey of supplier contracts and findings of this will be

presented at 22 May FARS meeting, alongside an update on the PTOM (Public

Transport Operating Model) review.

|

Decision Making

Process

2. Staff have assessed the requirements of the Local Government Act

2002 in relation to this item and have concluded that, as this report is for

information only, the decision making provisions do not apply.

|

Recommendation

That the Finance, Audit and Risk

Sub-committee receives and notes the “May 2019 Sub-committee Work

Programme Update” staff report.

|

Authored by:

|

Melissa des

Landes

Acting Chief Financial Officer

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 22 May 2019

Subject: Proposed 2019-20

Council Insurance Programme

That Council excludes the public

from this section of the meeting, being Agenda Item 12 Proposed 2019-20 Council

Insurance Programme with the general subject of the item to be considered while

the public is excluded; the reasons for passing the resolution and the specific

grounds under Section 48 (1) of the Local Government Official Information and

Meetings Act 1987 for the passing of this resolution being:

|

GENERAL SUBJECT OF THE ITEM TO BE

CONSIDERED

|

REASON FOR PASSING THIS RESOLUTION

|

GROUNDS UNDER SECTION 48(1) FOR THE PASSING

OF THE RESOLUTION

|

|

Proposed 2019-20 Council Insurance Programme

|

7(2)(i) That the public conduct of this agenda item would

be likely to result in the disclosure of information where the withholding of

the information is necessary to enable the local authority holding the

information to carry out, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations).

|

The Council is specified, in the First Schedule to this

Act, as a body to which the Act applies.

|

Authored by:

|

Melissa des

Landes

Acting Chief Financial Officer

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|