Meeting of the Corporate and Strategic Committee

Date: Wednesday 6 March 2019

Time: 9.00am

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

Item Subject Page

1. Welcome/Notices/Apologies

2. Conflict

of Interest Declarations

3. Confirmation of

Minutes of the Corporate and Strategic Committee held on 12 December 2018

4. Follow-ups from

Previous Corporate and Strategic Committee meetings 3

5. Call for Minor

Items of Business Not on the Agenda 7

Decision Items

6. Report and

Recommendations from the Finance Audit and Risk Sub-committee 9

7. 2019 Local

Governance Statement Update 13

8. Financial

Delegations 33

Information or Performance Monitoring

9. HB Tourism Update 37

10. Matters Arising from Audit NZ

2018-28 Long Term Plan Audits 49

11. Organisational performance

update for the period 1 July 2018 to 31 January 2019 65

12. Health and Safety Work

Programme 103

13. Discussion of Minor Items Not

on the Agenda 121

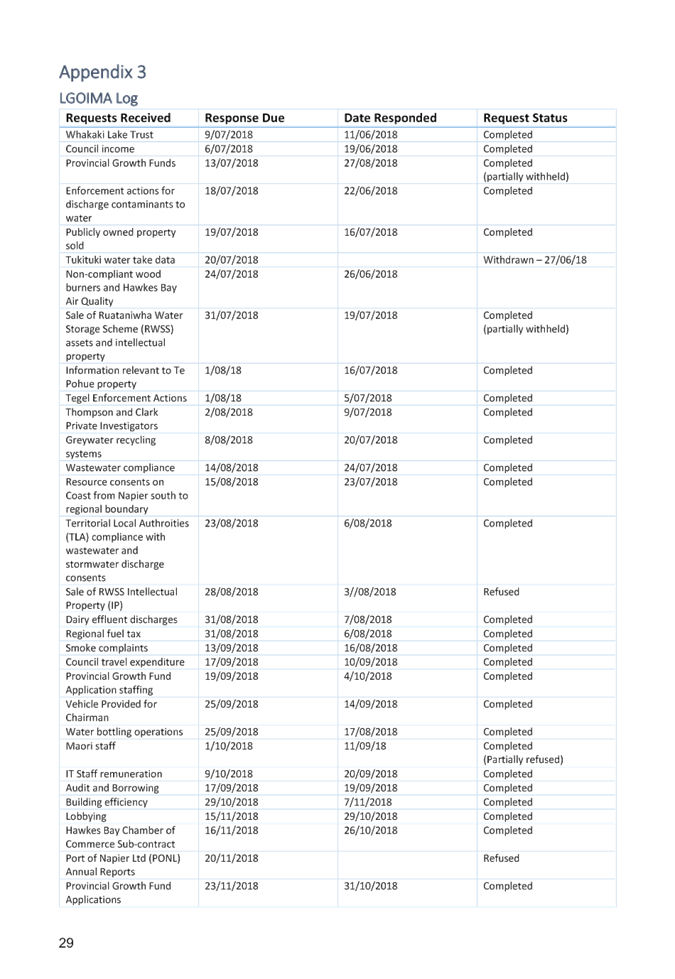

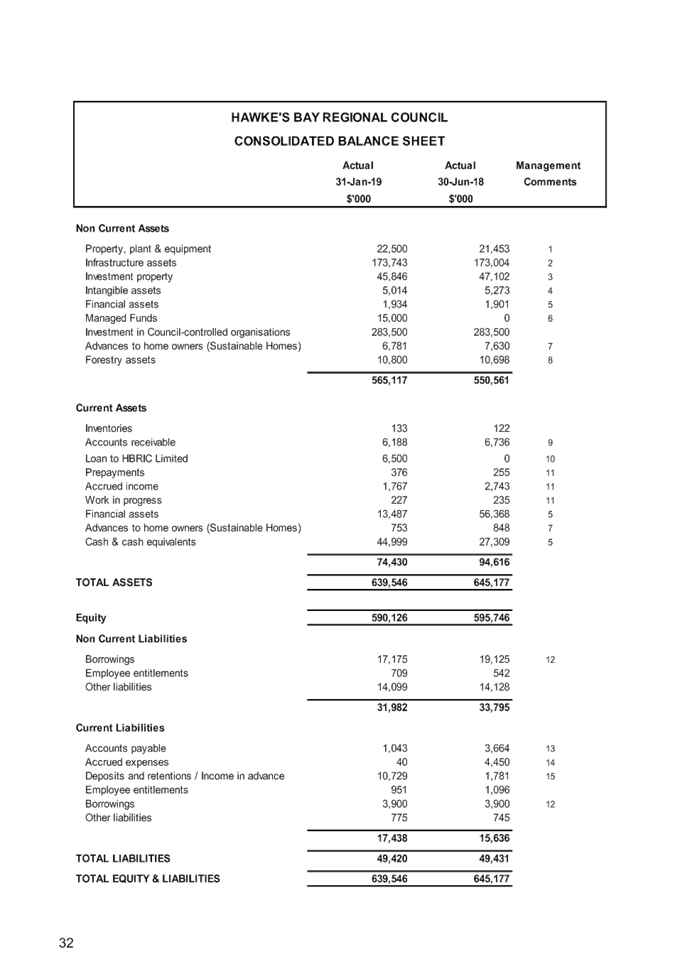

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 06 March 2019

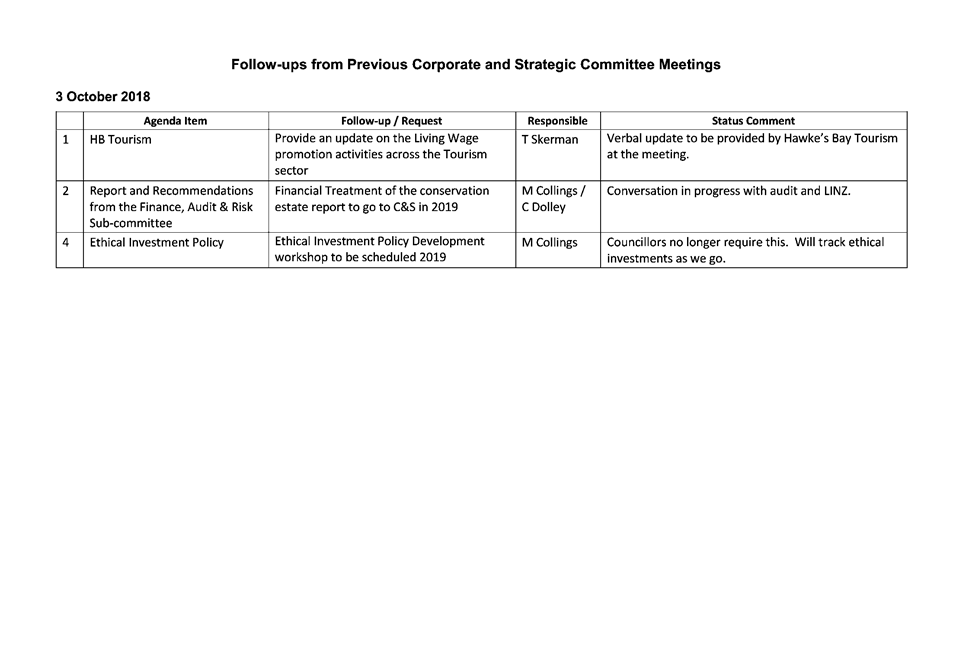

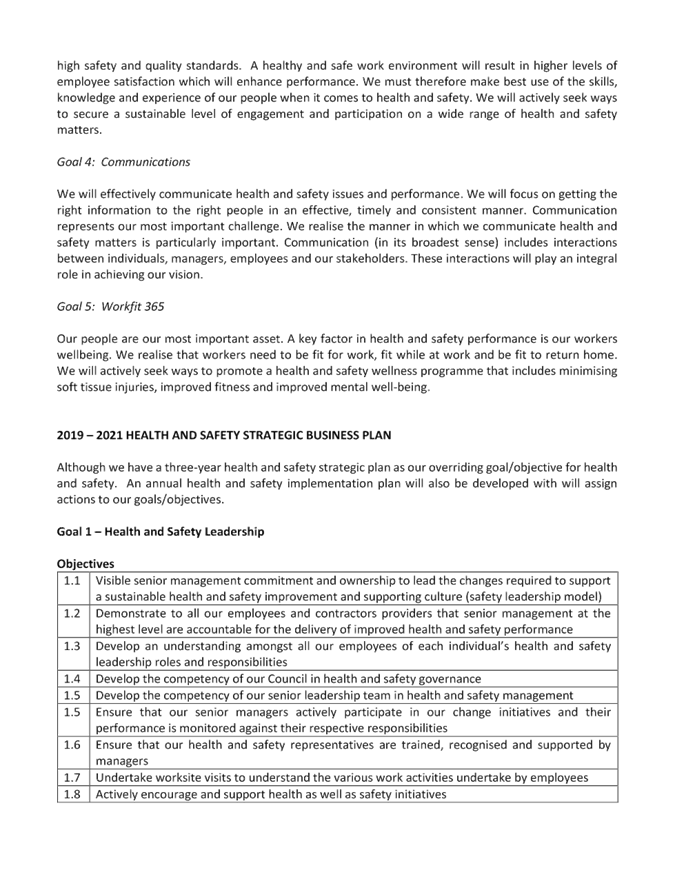

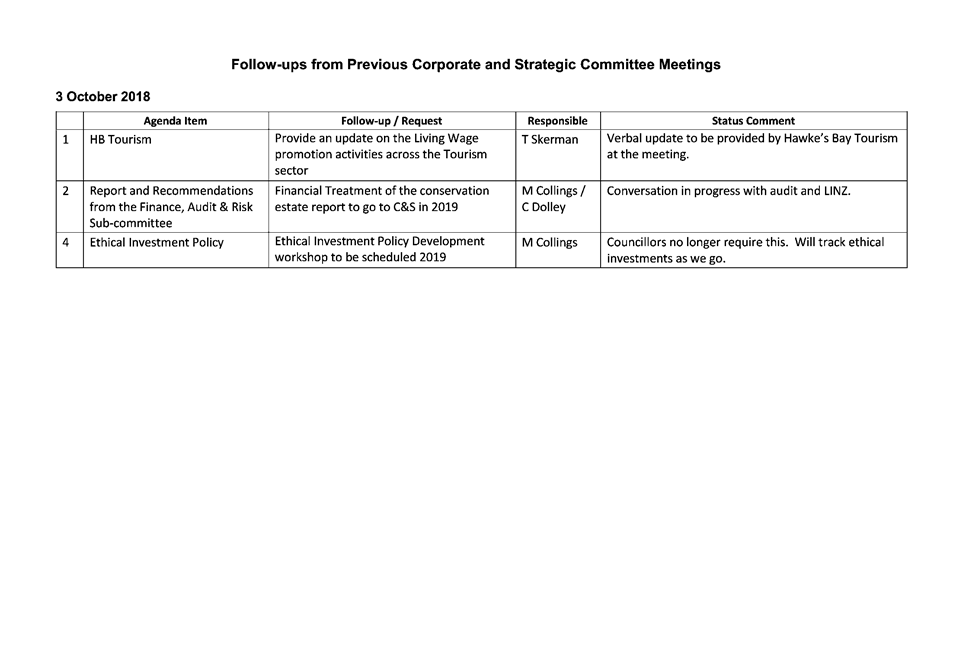

SUBJECT: Follow-ups from Previous Corporate

and Strategic Committee meetings

Reason for Report

1. In order to track items raised at previous meetings that require

follow-up, a list of outstanding items is prepared for each meeting. All

follow-up items indicate who is responsible for each, when it is expected to be

completed and a brief status comment.

2. Once the items have been completed and reported

to the Committee they will be removed from the list.

Decision

Making Process

3. Staff have assessed the requirements of the Local Government Act

2002 in relation to this item and have concluded that, as this report is for

information only, the decision making provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee receives and

notes the “Follow-ups from Previous Corporate and Strategic

Committee Meetings” report.

|

Authored by:

|

Leeanne

Hooper

Principal Advisor Governance

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

⇩1

|

Follow-ups

for March 2019 Corporate and Strategic meeting

|

|

|

|

Follow-ups

for March 2019 Corporate and Strategic meeting

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 06 March 2019

Subject: Call for Minor Items of

Business Not on the Agenda

Reason

for Report

1. Standing order 9.13 allows

“A meeting may discuss an item

that is not on the agenda only if it is a minor matter relating to the general

business of the meeting and the Chairperson explains at the beginning of the

public part of the meeting that the item will be discussed. However, the

meeting may not make a resolution, decision or recommendation about the item,

except to refer it to a subsequent meeting for further discussion.”

Please note that nothing in this standing order removes

the requirement to meet the provisions of Part 6, LGA 2002 with regard to

consultation and decision making.”

Recommendations

That the Corporate and Strategic Committee accepts the following

“Minor Items of Business Not on the Agenda” for discussion as Item

13:

|

Leeanne Hooper

PRINCIPAL ADVISOR GOVERNANCE

|

James Palmer

CHIEF EXECUTIVE

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 06 March 2019

Subject: Report and

Recommendations from the Finance Audit and Risk Sub-committee

Reason

for Report

1. The following

matters were considered by the Finance Audit and Risk Sub-committee meeting on

12 February 2019 and are now presented for the Committee’s consideration.

Agenda Items

Six Monthly Report on Risk Assessment

and Management

2. This item provided the sub-committee with the

key changes to internal processes and to the register itself, with discussions

at the meeting covering:

2.1. attracting and retaining appropriately qualified staff

2.2. the level of detail provided in the reports to the sub-committee and

whether the reporting provides sufficient awareness of the underlying detail

contained within the risk management software

2.3. Wider societal risks and whether those risks that are currently

considered at a national level should be noted or included in Council’s

risk register and framework in some way

2.4. whether Civil Defence risks are adequately addressed and

sufficiently detailed in the Council’s risk register

2.5. considerations to be taken into account through the Risk Assessment

and Management review scheduled for the 2019-20 financial year.

3. The

sub-committee resolved:

3.1. confirms the

Sub-committee’s confidence that Council management has a current and

comprehensive risk management framework and associated procedures for effective

identification and management of the Council’s significant risks

3.2. recommends

that the Corporate and Strategic Committee receives and notes the resolutions

of the sub-committee, confirming the robustness of Council’s risk

management systems, processes and practices

3.3. notes that a

review of the Risk Assessment and Management framework will be undertaken in

the 2019-20 financial year.

Proposed Scope for

Follow-up Water Management Internal Audit

4. This item proposed the scope for an internal audit to review

Council’s progress of implementing and maintaining agreed action points

that were stated as a response to the original audit report. The scope proposed

by Crowe Horwath was accepted without change, and the sub-committee resolved:

4.1. Receives and notes the “Proposed Scope for the Follow-up

Water Management Internal Audit” staff report.

4.2. Confirms the proposed Scope for the Follow-up Water Management

Internal Audit.

Data Analytics Internal

Audit Report

5. This item provided the Crowe Horwath report on the Council’s

financial data analytics internal audit, essentially following up on the

previous internal audit. This second audit demonstrated

progress has been made to improve internal controls and process through a

significant reduction of the number of duplicate payments made and a decrease

in the number of duplicate vendors contained in Council’s accounts

payable system. The Sub-committee resolved:

5.1. receives and

notes the “Data Analytics Internal Audit Report”

5.2. confirms its

confidence that appropriate action has been taken by management in response to

the Data Analytics Internal Audit recommendations

5.3. recommends

that the Corporate and Strategic Committee receives and notes the resolutions

of the sub-committee, confirming that appropriate action has been taken by

management in response to the Data Analytics Internal Audit recommendations.

Financial Delegations

6. Separate paper

brought to the Corporate and Strategic Committee.

2017-18 Audit NZ

Management Report

7. This item

provided the Audit NZ “Report to the Council on the

Audit of Hawke’s Bay Regional Council for the year ended 30 June

2018” to the sub-committee for review and discussion, with discussions on

the day covering:

7.1. Qualified

Audit issued due to insufficient evidence provided by HBRIC to determine the tax effects of losses on the sale of Ruataniwha assets

7.2. HBRIC tax write-off has received a binding ruling from IRD

subsequent to Audit having been completed

7.3. Napier Port

valuations and tax/financial treatment of sea defences

7.4. Inconsistencies identified in relation to the way staff apply

contract management policies and processes

7.5. Flow of

information required for the Audit process from Napier Port (via special

purposes financial statements) and HBRIC Ltd to HBRC to proactively deal with

any issues that may be influenced by the IPO transaction process and October

elections.

8. The resolutions

of the sub-committee were:

8.1. That the Finance, Audit and Risk Sub-committee receives and notes

the “2017-18 Audit NZ Management Report”.

8.2. The Finance, Audit and Risk Sub-committee recommends that the

Corporate and Strategic Committee:

8.2.1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that the Committee can exercise its discretion and make decisions

on this issue without conferring directly with the community or persons likely

to be affected by or have an interest in the decision.

8.2.2. Confirms the Finance, Audit and Risk Sub-committee’s

satisfaction that the “2017-18 Audit NZ Management Report”

is sufficient and that there are no outstanding issues of concern.

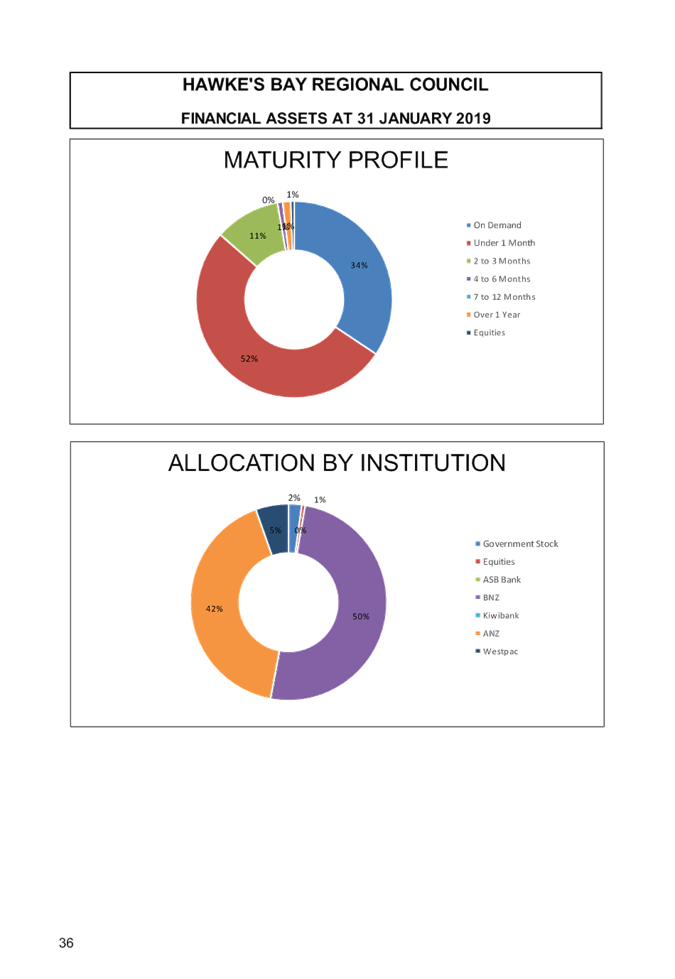

Treasury Report

9. This report was

essentially an update on the processes associated with transferring funds to

the Investment managers, with the funds to be fully allocated by 22 February,

and Council’s accession to the Local Government Funding

Agency (LGFA) as an unrated guaranteeing Local Authority, which should be

complete by the end of March.

Resource Management

Information System (IRIS) Implementation Update

10. This update on progress

with the implementation of IRIS advised:

10.1. Phase 1 of the project

is on schedule and will finish on 31 March 2019

10.2. the Incidents and

Enforcements modules ‘went live’ on 11 February 2019

10.3. the Water Information

Services module has been deferred to Phase 2

10.4. learnings from a lessons

learnt workshop in mid-February will be used in the planning and implementation

of Phase 2

10.5. Phase 2 of the project

will be initiated shortly, with scoping, planning and

budgeting under way to deliver modules for Biosecurity, Integrated

Catchment Management and Water Information Services.

February 2019

Sub-Committee Work Programme Update

11. This standing item

provides the sub-committee with an update on the status of the work programme

and schedule of internal audits. Of note at this meeting, was advice that staff are currently undertaking a review of supplier contracts and a survey of suppliers to gather data for

undertaking an exercise to quantify the financial impact of enforcing a Council

procurement policy which requires suppliers to pay the Living Wage.

Decision

Making Process

12. These matters have all

been specifically considered at the Committee level except where specifically

noted.

|

Recommendations

The Finance,

Audit and Risk Sub-committee recommends that the Corporate and Strategic

Committee:

1. Receives and

notes the “Report and Recommendations from the 12 February

2019 Finance, Audit and Risk Sub-committee Meeting”

2. Agrees that the

decisions to be made are not significant under the criteria contained in

Council’s adopted Significance and Engagement Policy, and that the

Committee can exercise its discretion and make decisions on this issue

without conferring directly with the community or persons likely to be

affected by or have an interest in the decision.

Six Monthly Report on Risk

Assessment and Management

3. Receives and notes

the resolutions of the sub-committee, confirming the robustness of Council’s

risk management systems, processes and practices

4. Notes that a review

of the Risk Assessment and Management framework will be undertaken in the

2019-20 financial year.

Data Analytics Internal Audit

Report

5. Receives and notes

the resolutions of the sub-committee, confirming that

appropriate action has been taken by management in

response to the Data Analytics Internal Audit recommendations.

Financial Delegations

6. Reviews and

considers the proposed Financial Delegations and provides feedback for

recommendations to Council for decision.

2017-18 Audit NZ Management Report

7. Confirms the

Finance, Audit and Risk Sub-committee’s satisfaction that the “2017-18

Audit NZ Management Report” is sufficient and that there are no

outstanding issues of concern.

Reports

Received

8. Notes

that the following reports were provided to the Finance Audit and Risk

Sub-committee.

8.1. Proposed Scope for Follow-up

Water Management Internal Audit (resolved: Confirms the proposed Scope for the

Follow-up Water Management Internal Audit)

8.2. Treasury Report

8.3. Resource Management

Information System (IRIS) Implementation Update

8.4. February 2019 Sub-Committee

Work Programme Update.

|

Authored by:

|

Leeanne

Hooper

Principal Advisor Governance

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

James Palmer

Chief Executive

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 06 March 2019

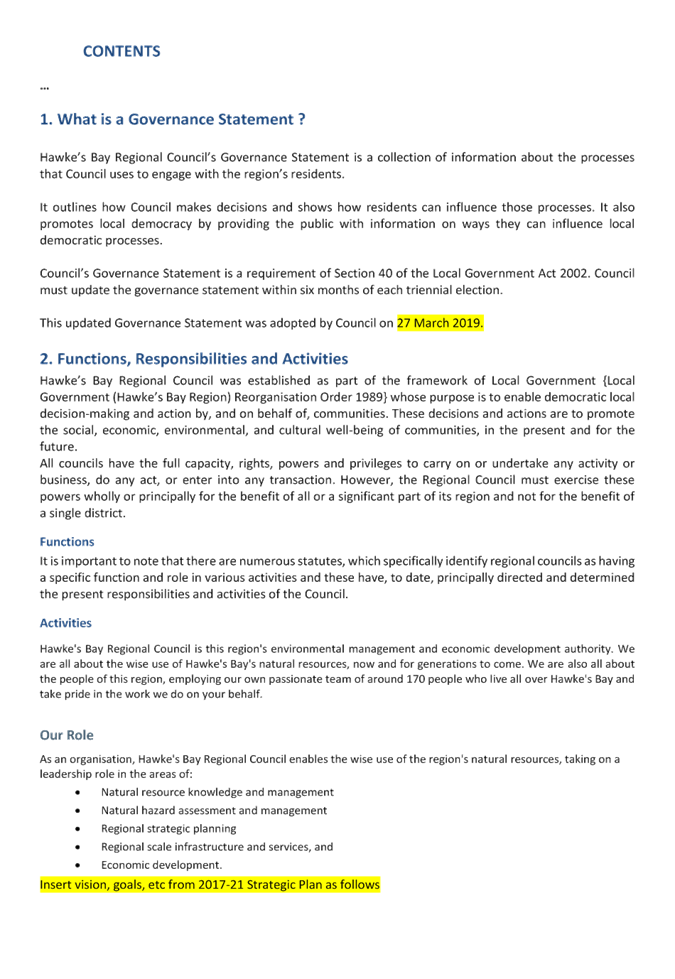

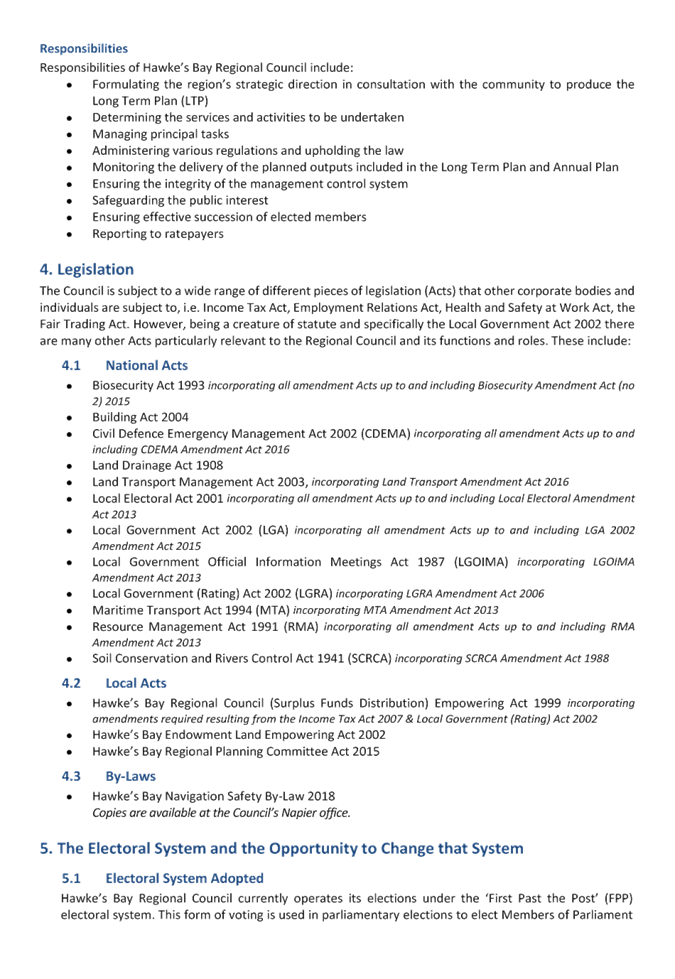

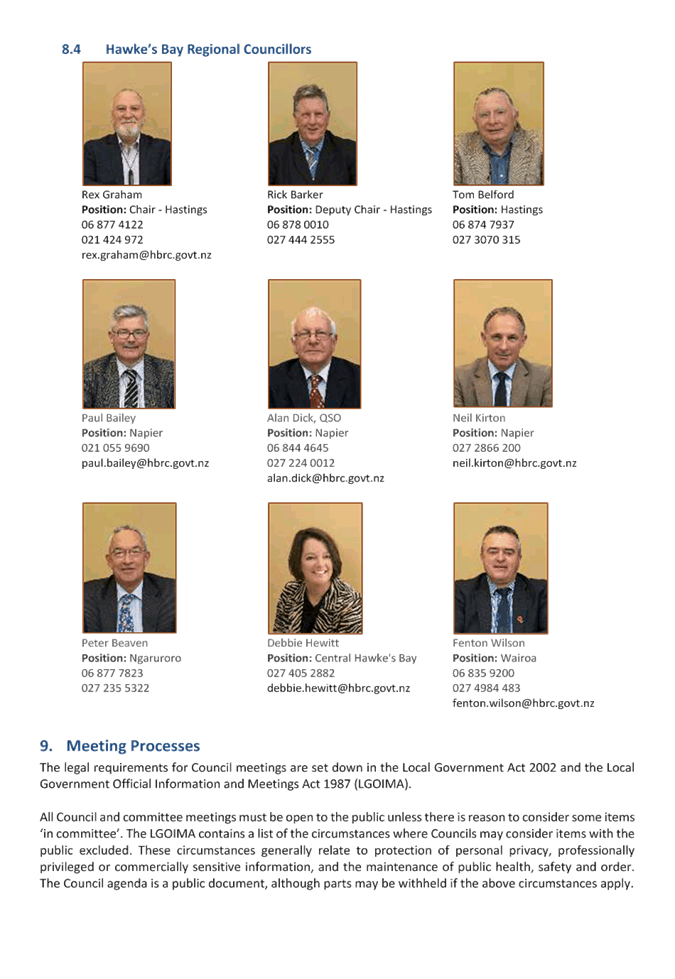

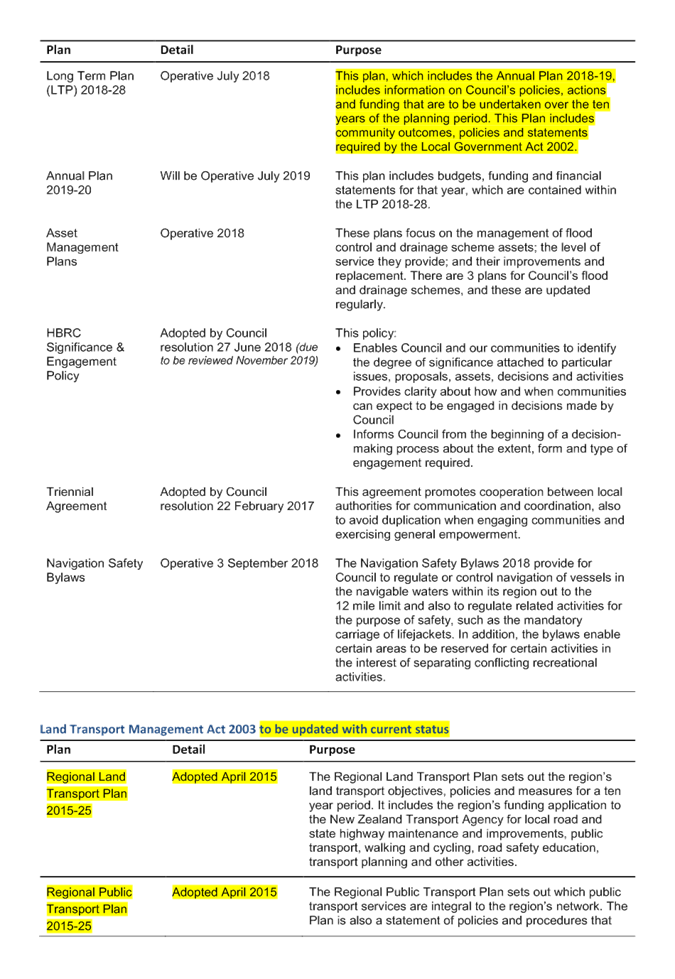

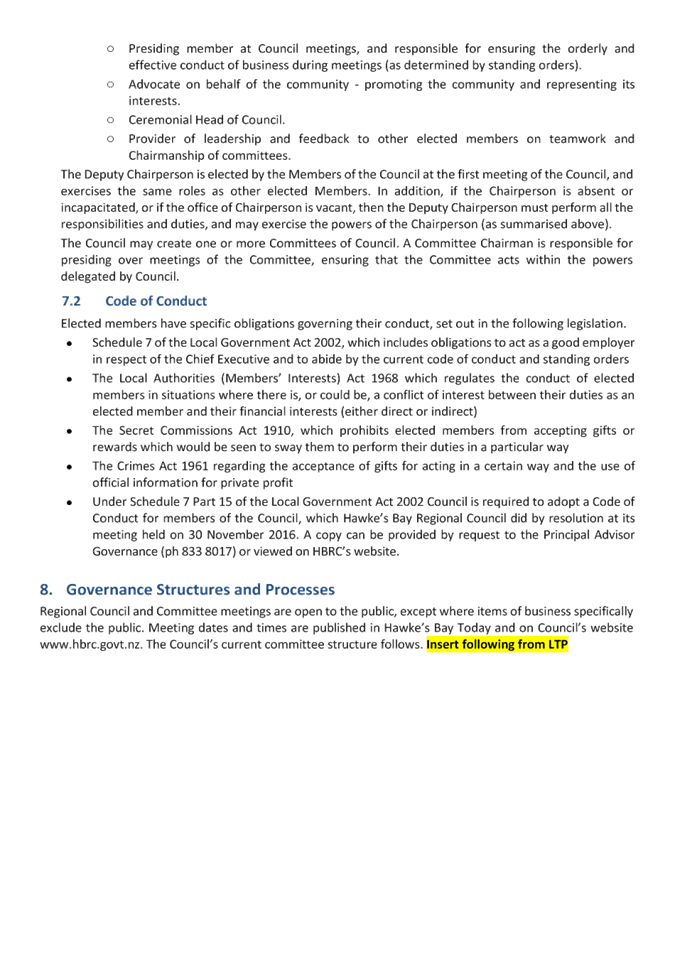

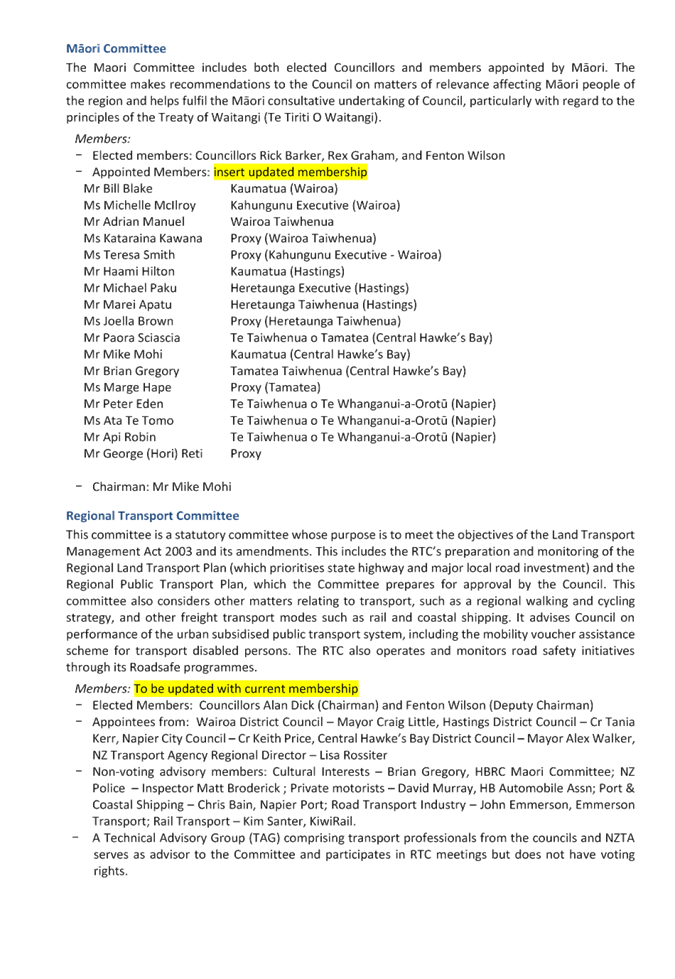

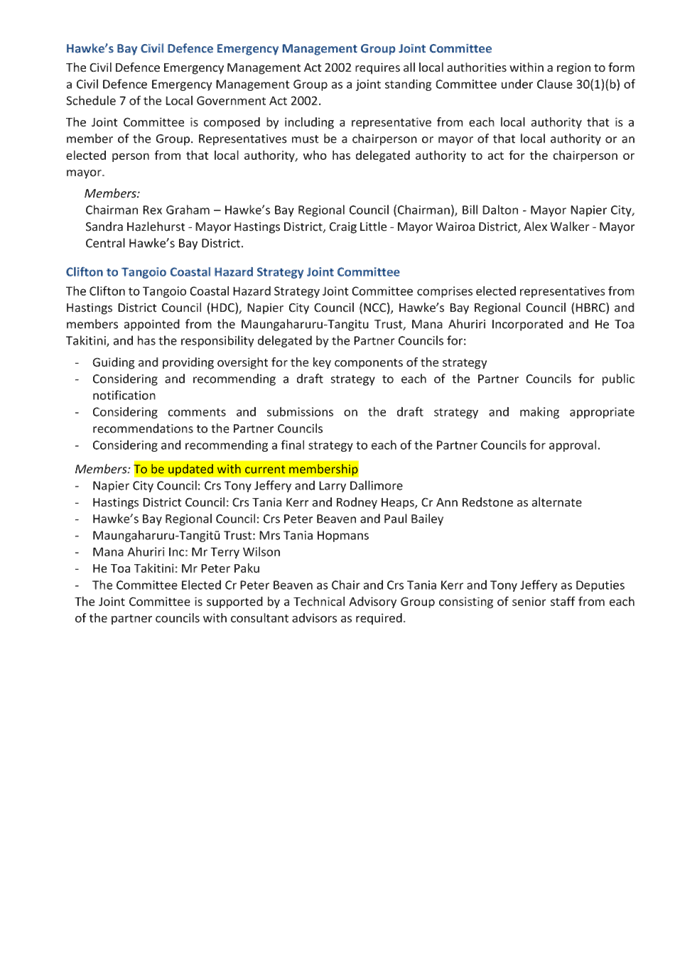

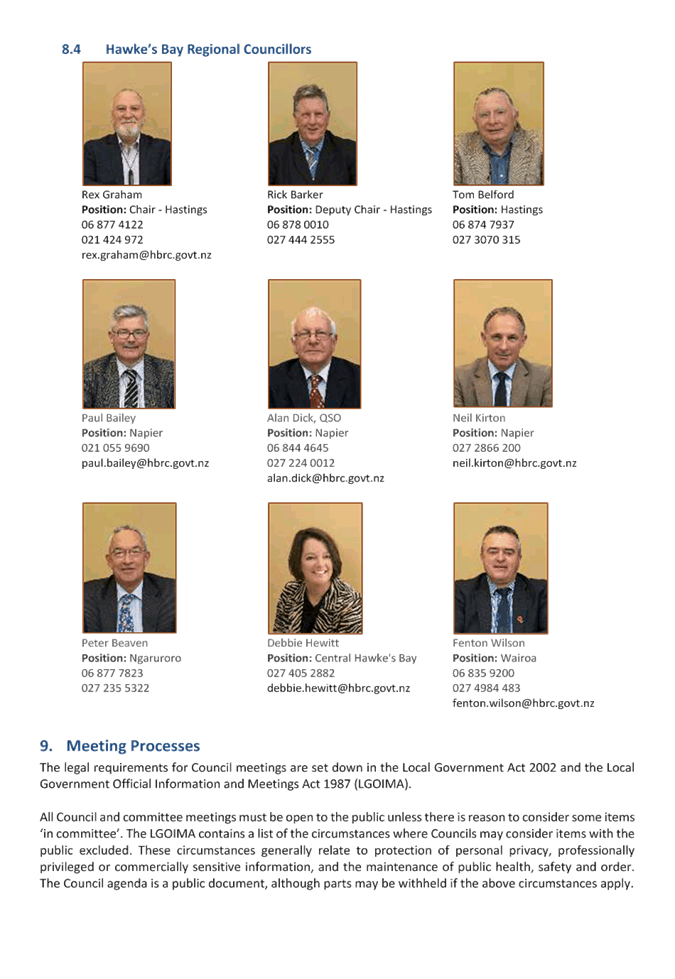

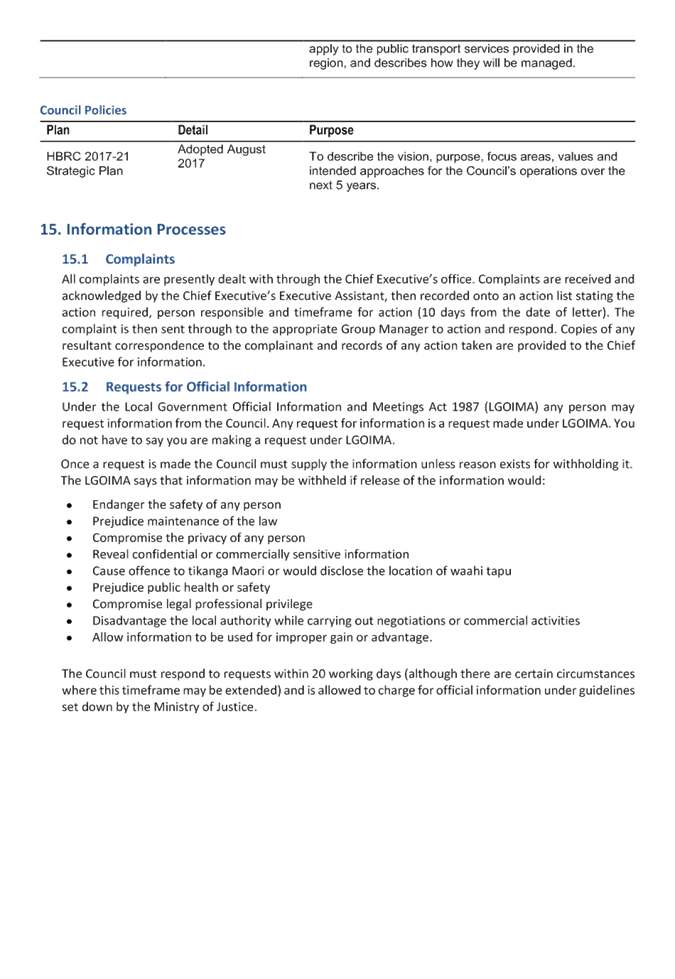

Subject: 2019 Local Governance

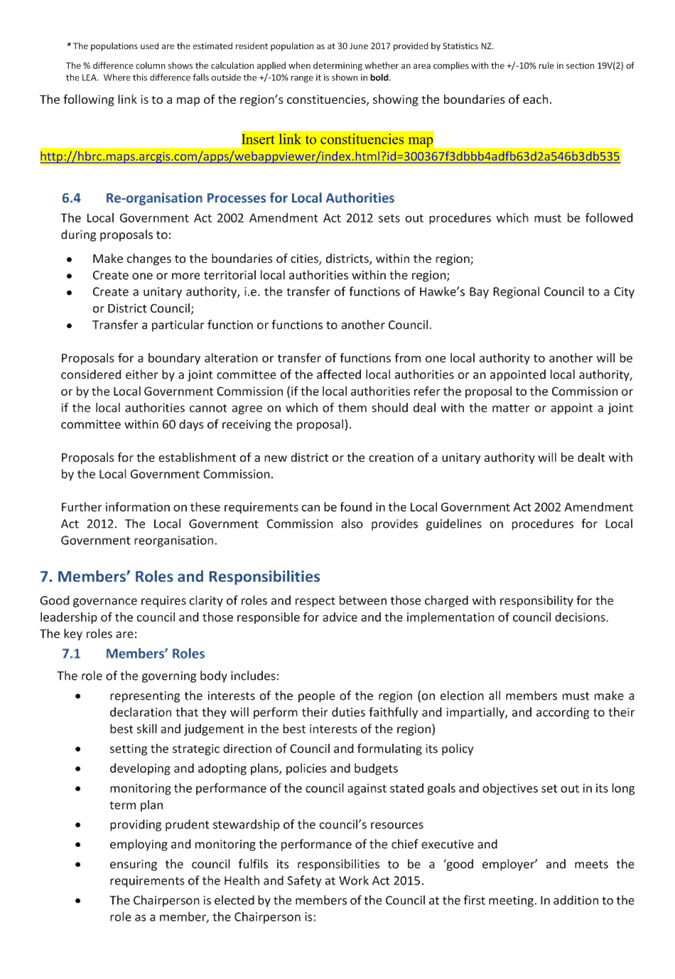

Statement Update

Reason for Report

1. This item

proposes an updated Local Governance Statement for consideration and

recommendation to Council for adoption and publication to the HBRC website.

Background

2. Within 6 months after each triennial general election,

the Local Government Act (section 40) requires that each Council prepares and

makes publicly available a “Local Governance Statement” that

includes (but is not limited to) information on the functions,

responsibilities, and activities of the local authority, any legislation that

confers powers on the local authority, representation arrangements, including

the option of establishing Māori wards or constituencies, and the

opportunity to change them, members’ roles and conduct (with specific

reference to the applicable statutory requirements and code of conduct) and key

approved planning and policy documents and the process for their development

and review.

Options Assessment

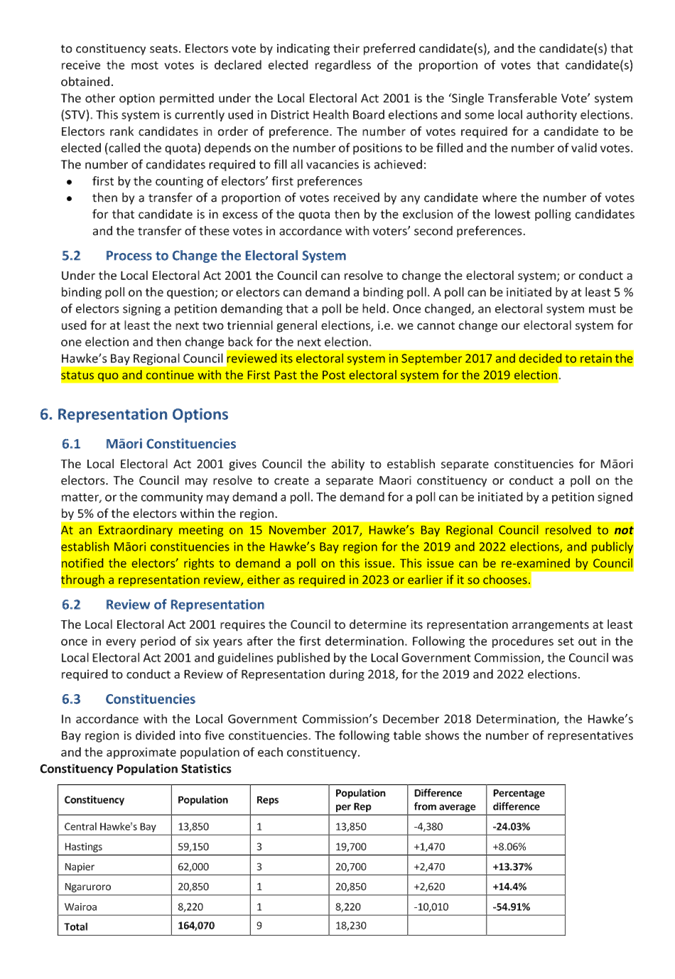

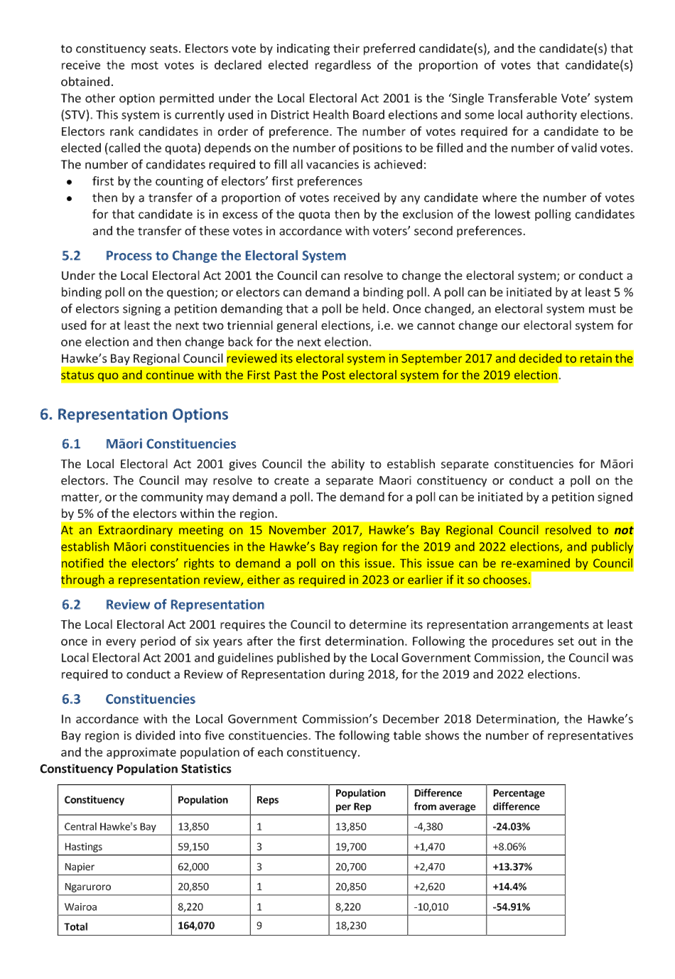

3. Several changes

over the past few months suggest to staff that it is appropriate to update the

statement now, to reflect:

3.1. Establishment

of the Hawke’s Bay Drinking Water Governance Joint Committee in October

2017

3.2. Adoption of

new 2018 Navigation Safety Bylaw (replacing 2012 Bylaw)

3.3. Confirmation

of the electoral system (First Past the Post) to be used for the 2019 elections

3.4. LGC determination

issued December 2018 that changes the constituency boundaries of the Hastings

and Ngaruroro constituencies.

4. Council could

choose to leave the update until after the election, when the LGA requires

preparation of a new Local Governance Statement, however staff recommend that

an update is published prior to the upcoming elections so that candidates and

voters have access to the most up to date information about Council that is

available.

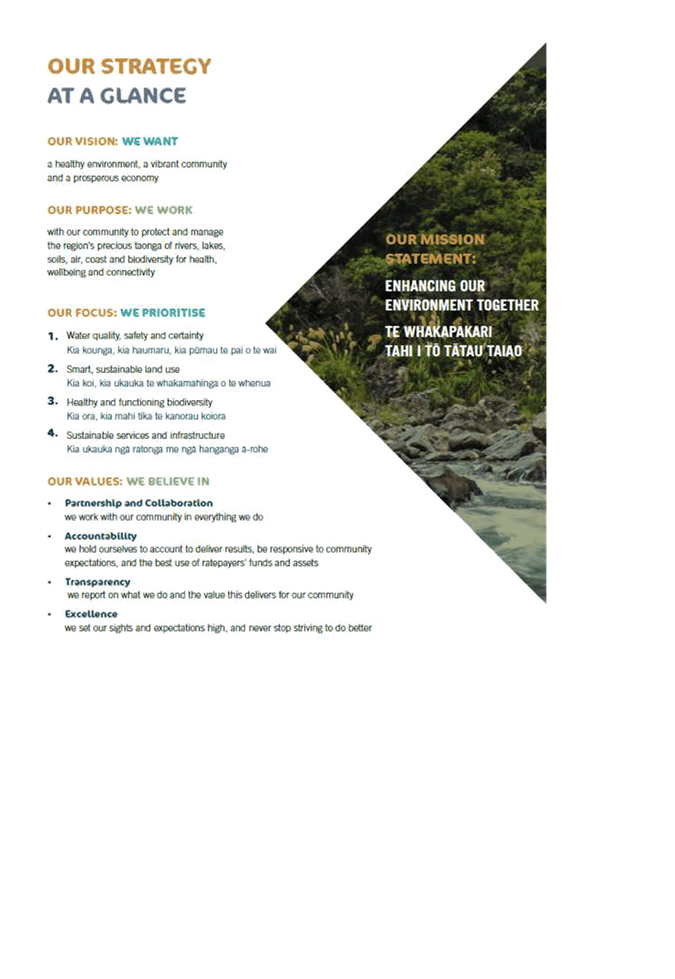

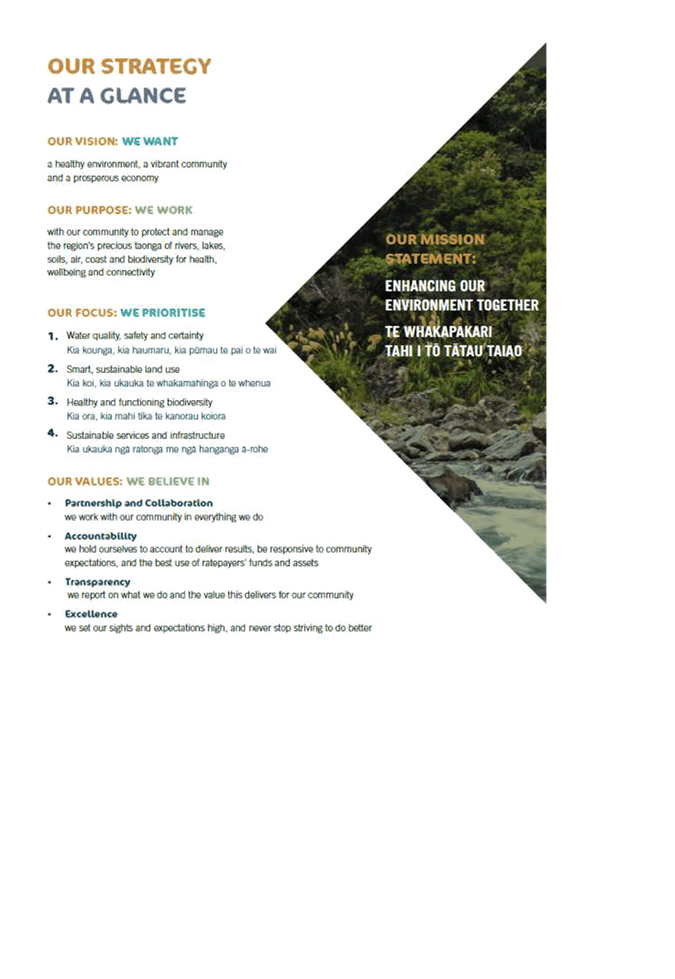

Strategic Fit

5. In addition to

governance and organisational structure changes, Council adopted a new

“2017 Strategic Plan” and it is timely for this to be incorporated

in an updated Local Governance Statement.

Suggested Changes

6. The changes

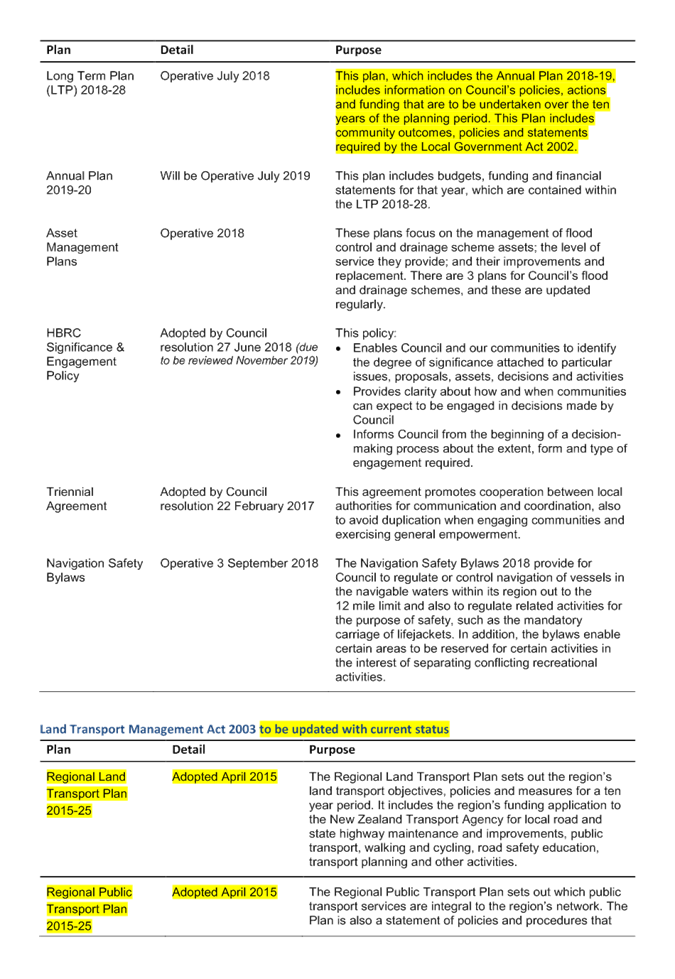

suggested (as attached) are to:

6.1. Include the

updated committee structure with the HB Drinking Water Governance Joint

Committee and updated membership as appropriate

6.2. Include the

updated organisational structure

6.3. Update date

references for Navigation Safety Bylaw, Regional Pest Management Plan,

transport plans, LTP, annual plans, etc as appropriate

6.4. Include

updated vision, goals, etc from 2017-21 Strategic Plan

6.5. Include updated population statistics and constituencies map from

December 2018 Local Government Commission determination of HBRC representation

arrangements

6.6. Include updated Significance and Engagement Policy as per 2018-28

LTP.

Decision Making

Process

7. Council is required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

7.1. The decision does not significantly alter the service provision or

affect a strategic asset.

7.2. The use of the special consultative procedure is not prescribed by

legislation.

7.3. The decision does not fall within the definition of Council’s

policy on significance.

7.4. The decision is not inconsistent with an existing policy or plan.

|

Recommendations

1. That the Corporate and Strategic Committee receives and notes the

“2019 Local Governance Statement Update” staff report.

2. The Corporate and Strategic Committee recommends that

Hawke’s Bay Regional Council:

2.1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that Council can exercise its discretion and make this decision

without conferring directly with the community.

2.2. Accepts the “2019 Local Governance Statement”

incorporating amendments as agreed by the Corporate and Strategic Committee

on 6 March 2019, for publication to the Hawke’s Bay Regional Council

website.

|

Authored by:

|

Leeanne

Hooper

Principal Advisor Governance

|

|

Approved by:

|

Joanne

Lawrence

Group Manager Office of the Chief Executive

and Chair

|

|

Attachment/s

|

⇩1

|

Proposed Updated

2019 Local Governance Statement

|

|

|

|

Proposed

Updated 2019 Local Governance Statement

|

Attachment 1

|

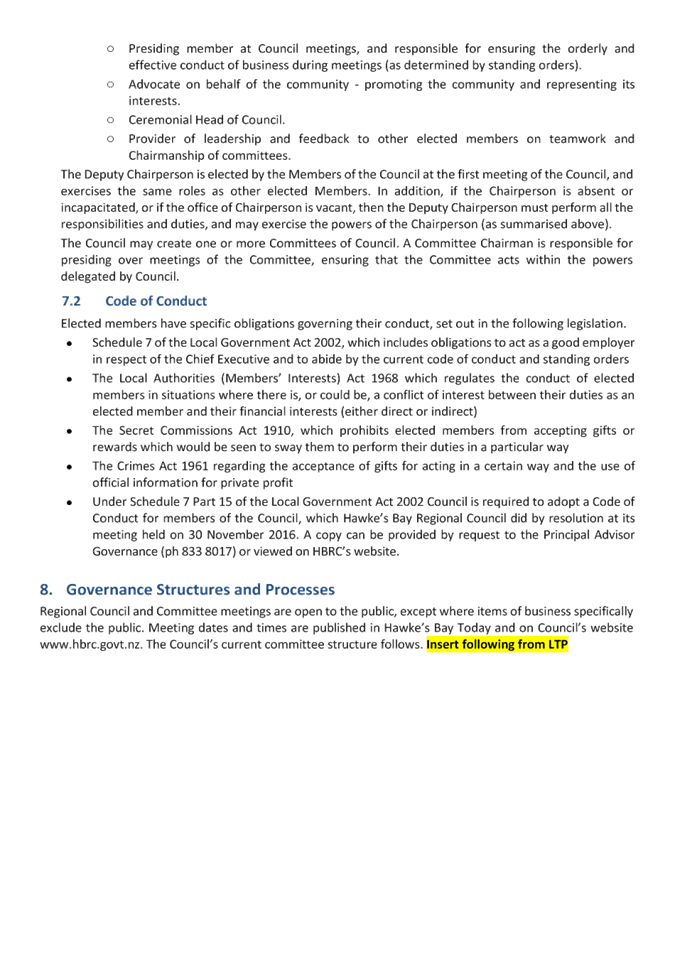

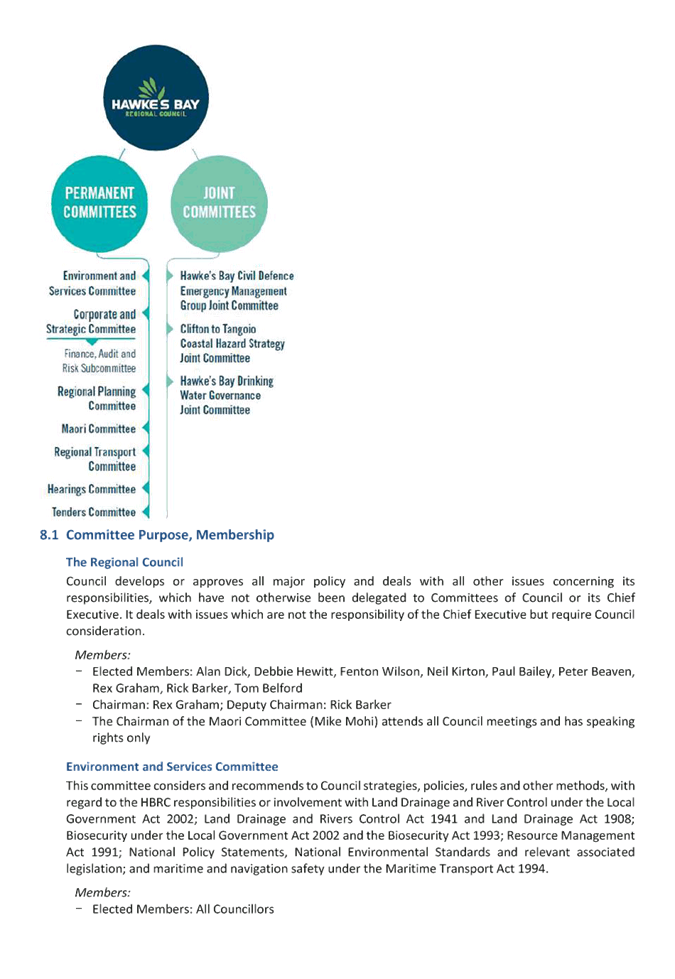

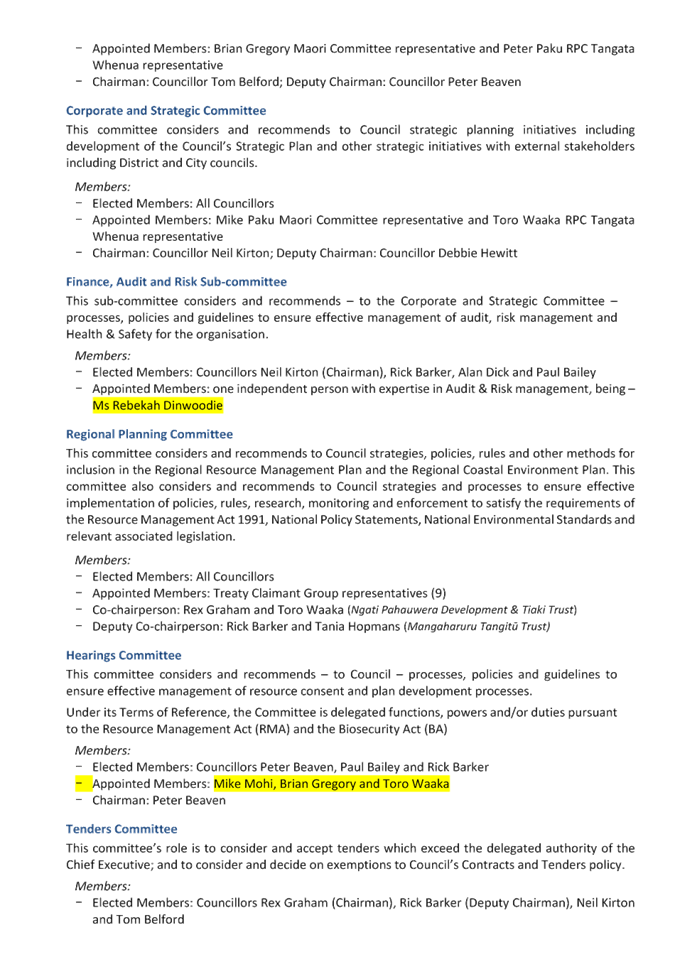

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 06 March 2019

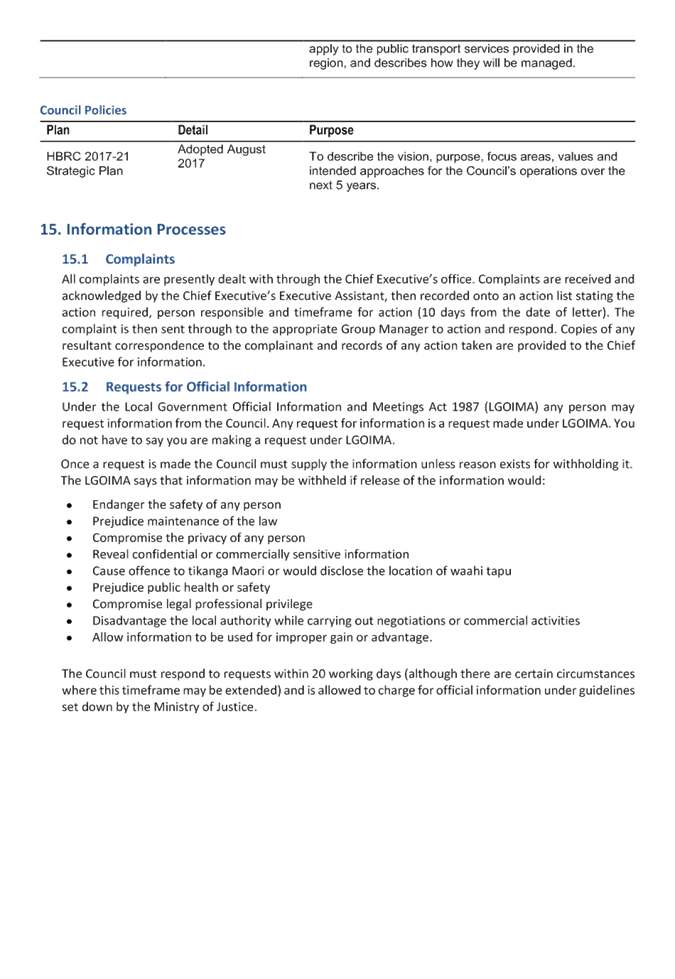

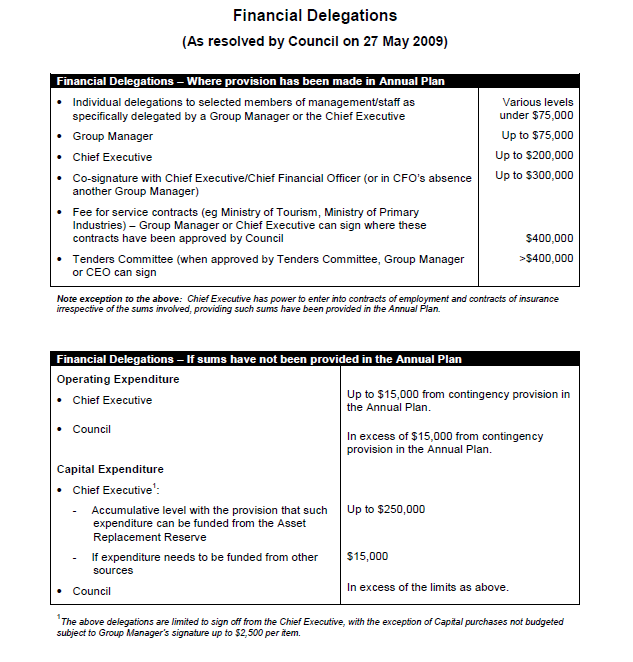

Subject: Financial Delegations

Reason for Report

1. To provide the

Corporate and Strategic Committee with the opportunity to discuss the current

financial delegations for the Chief Executive (CE) and Group Managers.

2. Any changes to

financial delegations need to be approved by Council, so this item enables

debate thought the Corporate and Strategic Committee and then recommendations

to Council.

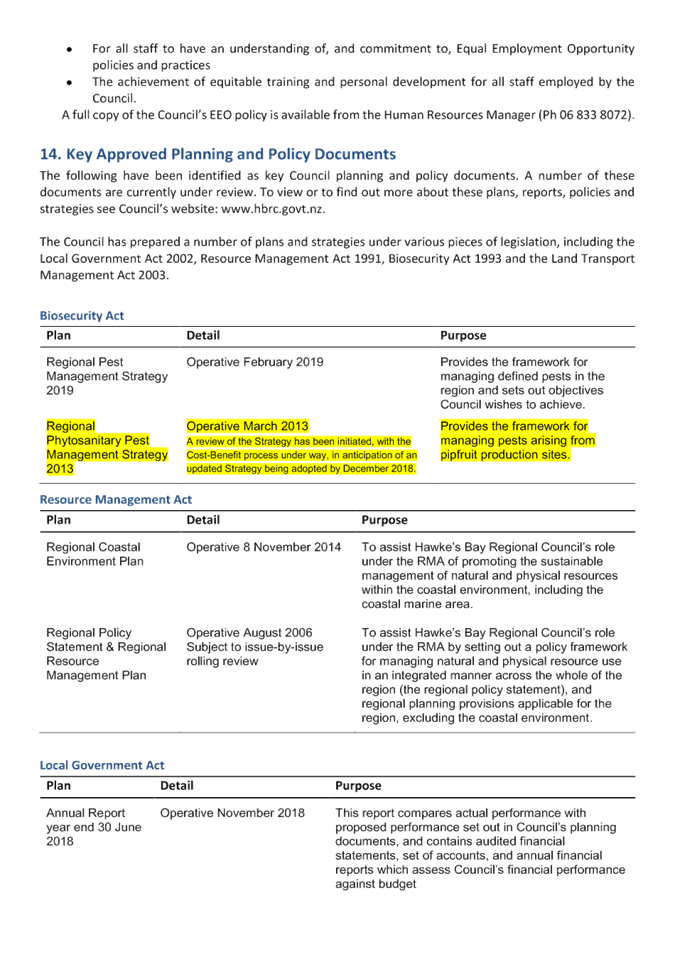

Background

3. Council last

changed the financial delegations for the CE and Group Managers in 2009, and

the levels decided then are still current as below.

4. Since 2009

Council’s annual expenditure has increased from $32 million to $45

million but the delegation limits have remained the same. Staff believe that an

update of the financial delegations is well overdue and should be updated to

allow for efficient operation, especially to implement the ambitious workload

of the 2018-28 long term plan.

5. Staff have

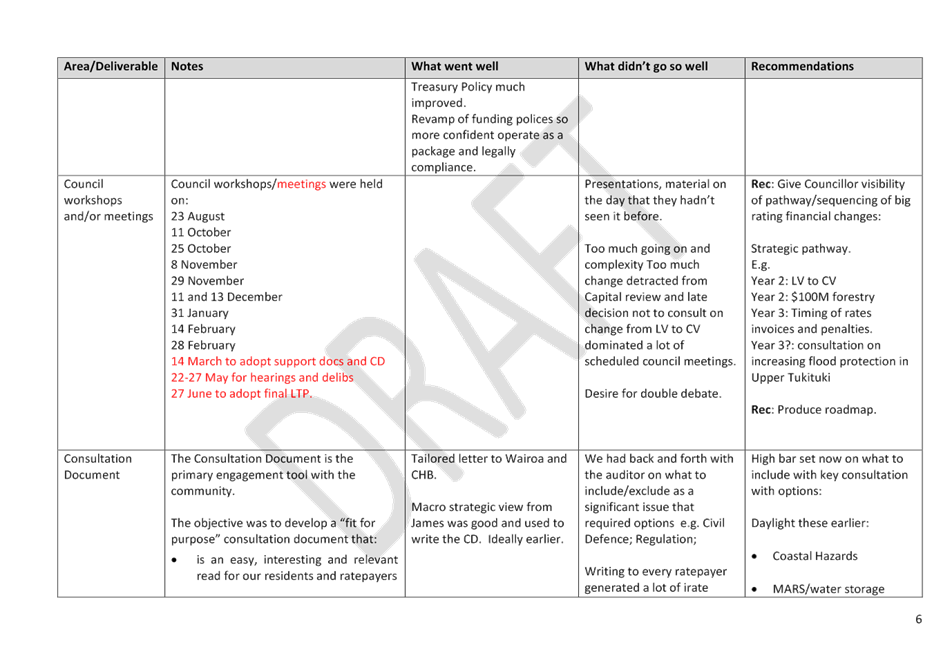

investigated the delegation limits of other regional councils whose delegations

were online, with the results shown below.

|

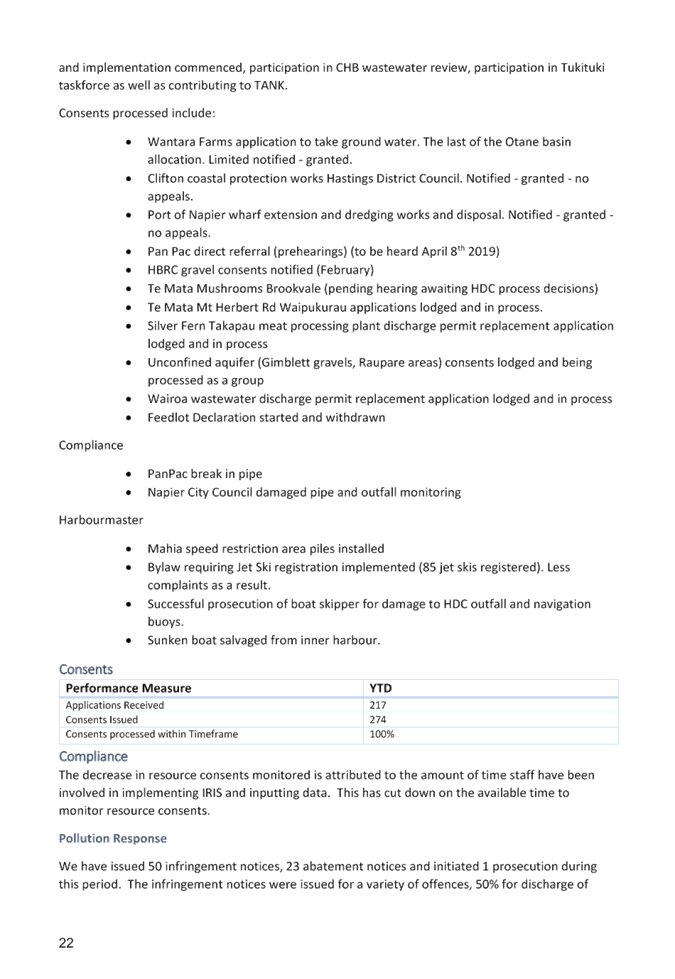

Council

|

Role

|

Delegation

|

|

Greater Wellington

|

CE

|

Authority to implement the Annual Plan

|

|

Group Managers

|

$200,000

|

|

Environment Canterbury

|

CE & Group Manager (Jointly)

|

Authority to implement the Annual Plan

|

|

CE

|

$250,000

|

|

Group Manager

|

$250,000

|

|

Bay of Plenty

|

CE

|

$2,000,000

|

|

Group Manager

|

Delegated by CE

|

Proposal

6. Staff propose

that the financial delegation levels for the CE and Group Managers be increased

to levels that reflect the organisational growth over the last 10 years, align

more closely to other regional councils and allow for the organisation to operate

efficiently.

7. The following

recommendations are based on simplifying the current system and allowing for

practical governance.

|

Financial Delegations – Where

provision is made in the LTP / Annual Plan

|

|

CE

|

Authority to implement the LTP/Annual Plan as

approved by Council

|

|

Group Manager - Office of the Chair and Chief

Executive

|

Up to $200,000 for any one commitment

|

|

Other Group Managers

|

Up to $150,000 for any one commitment

|

|

Emergency Management – Group and Local

Controllers

|

Up to $100,000 for any one commitment

|

|

Staff

|

Delegations provided by their Group Manager up to a

level of $100,000 for any one commitment

|

Financial Delegations – Where no

provision is made in the LTP / Annual Plan

|

|

Operating Expenditure

|

|

Council

|

In excess of $50,000 for any one commitment from

contingency provision

|

|

CE

|

Up to $50,000 for any one commitment from

contingency provision

|

|

Capital Expenditure

|

|

Council

|

In excess of the limits below

|

|

CE

|

Up to $50,000 per asset if funded via asset

replacement reserve

Up to $20,000 if funded elsewhere

|

|

Group Managers

|

Up to $20,000 per asset if funded via asset

replacement reserve

Up to $5,000 if funded elsewhere

|

8. The Tenders

Committee is only used for competitive procurement processes over $400,000.

Decision Making

Process

9. Council and its

committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

9.1. The decision

does not significantly alter the service provision or affect a strategic asset,

and is not inconsistent with an existing policy or plan.

9.2. The use of

the special consultative procedure is not prescribed by legislation.

9.3. The decision

does not fall within the definition of Council’s policy on significance.

9.4. The decision

of the sub-committee is in accordance with the Terms of Reference and decision

making delegations adopted by Hawke’s Bay Regional Council

9 November 2016, specifically:

9.4.1. The purpose of the Audit and Risk Sub-committee is to report to the

Corporate and Strategic Committee to fulfil its responsibilities for the

provision of appropriate controls to safeguard the Council’s financial

and non-financial assets, the integrity of internal and external reporting and

accountability arrangements.

9.5. The decision is not inconsistent with an existing policy or plan.

9.6. Given the nature and significance of the issue to be considered and

decided, and also the persons likely to be affected by, or have an interest in

the decisions made, Council can exercise its discretion and make a decision

without consulting directly with the community or others having an

interest in the decision.

|

Recommendations

That :

1. That the Corporate and Strategic Committee receives and notes the “Financial

Delegations” staff report.

2. That the Corporate and Strategic Committee provides feedback on

the “Financial Delegations” levels proposed.

3. The Corporate and Strategic Committee recommends that Council:

3.1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that the Committee can exercise its discretion and make decisions

on this issue without conferring directly with the community or persons

likely to be affected by or have an interest in the decision.

3.2. Reviews and considers the proposed Financial

Delegations and provides feedback for recommendations to Council for

decision.

|

Authored by:

|

Manton

Collings

Chief Financial Officer

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

There are no

attachments for this report.

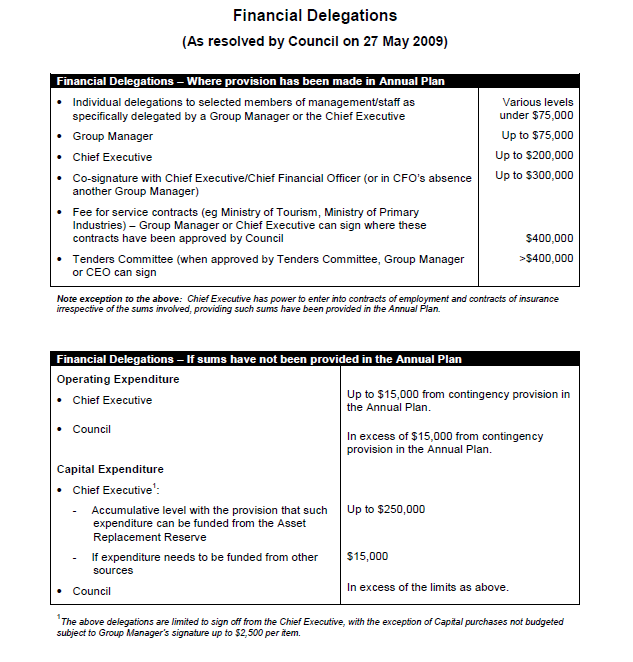

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 06 March 2019

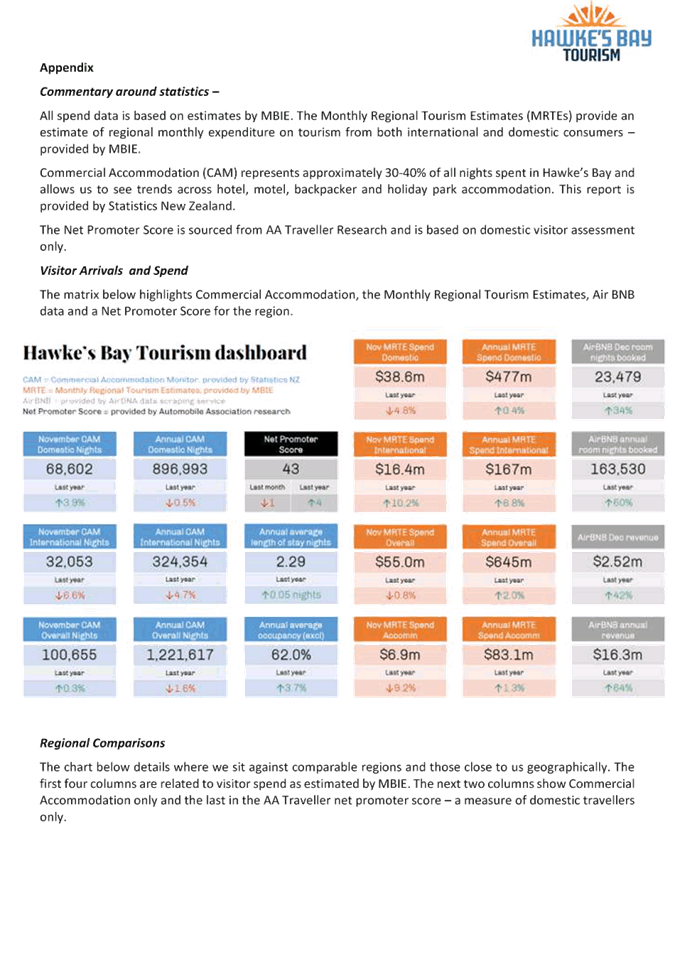

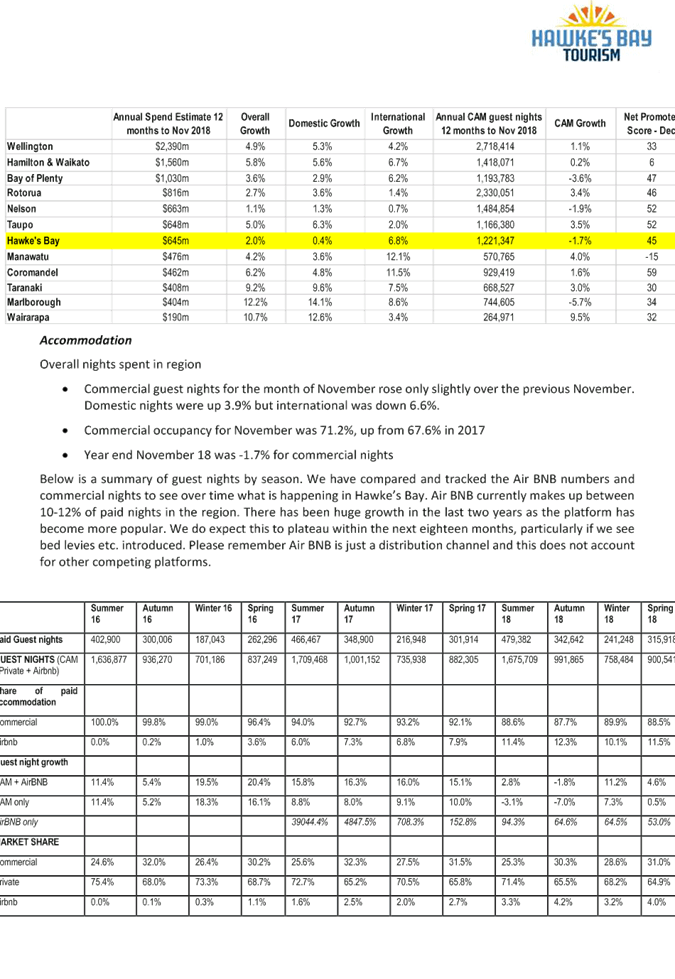

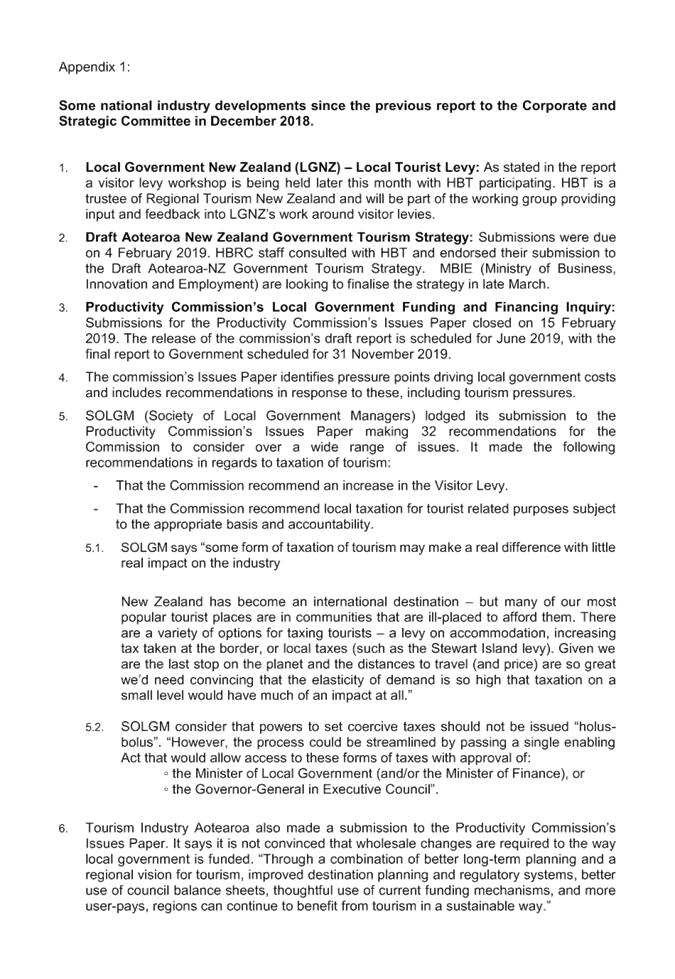

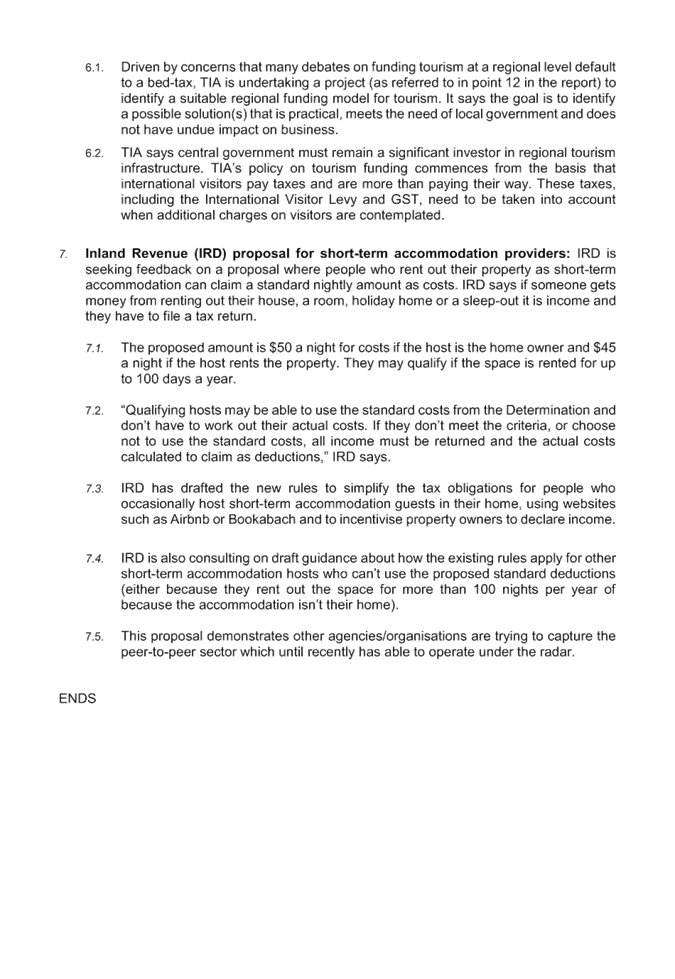

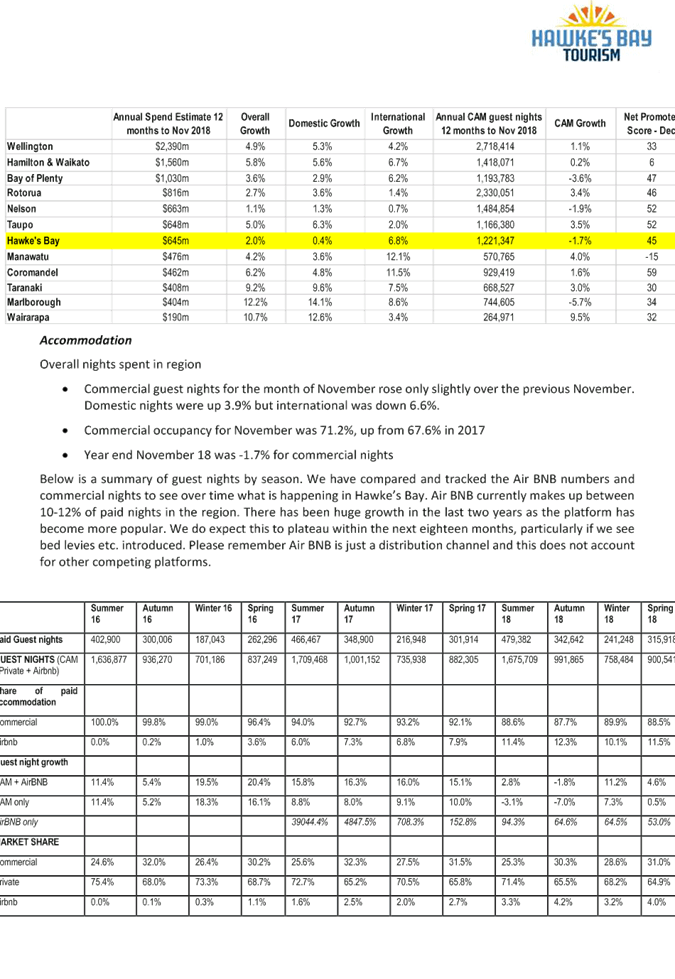

Subject: HB Tourism Update

Reason

for Report

1. This information paper provides the Corporate and Strategic

Committee with:

1.1. An update on the joint funding review of Hawke’s Bay Tourism

(HBT).

1.2. An update on some national industry developments (provided as

Appendix 1).

1.3. Hawke’s Bay Tourism update report for March 2019 is attached

hereto.

Executive Summary

2. The regional review of HBT’s funding model is taking place in

the wider context of a national debate about tourism funding. This debate

is investigating at the national level some funding solutions, including a

visitor levy and/or bed tax, that HBRC was investigating at a regional level.

3. On 25 February 2019 the Regional Leader’s Forum endorsed the

development of a targeted Regional Visitor Strategy to develop a funding

framework that addresses how a new national funding model would be sensibly

allocated in Hawke’s Bay between organisations charged with marketing,

infrastructure and event attraction.

4. Notwithstanding these initiatives, staff will continue to progress

analysis of changes to HBT’s targeted rate formula to ensure that those

who benefit commercially from tourism contribute more to the promotion and

marketing of the region as a tourism destination in the next LTP in the event

that these issues are not resolved through the review.

Background

5. Following

consultation on the 2018 - 2028 Long Term Plan (LTP) Council decided to support

HBT at a rate of $1.52 million (M) per annum, for three years, with subsequent

funding levels to be reviewed through the 2021 - 2031 LTP process. HBRC also

agreed to adjust the economic development rating split (where funding for HBT

comes from) to become more weighted to the commercial sector, as consulted on.

6. Council also requested that:

6.1. Hawke’s Bay Tourism examine levels of accommodation in private

homes achieved through hosting websites to recommend to HBRC possible

differentiated rating levels for accommodation providers based on occupancy

rates.

6.2. HBRC staff work with Hawke’s Bay Tourism to investigate the

possibility of introducing a bed tax via enabling legislation to support the

activities of HB Tourism.

7. Council staff and Hawke’s Bay Tourism (HBT) are working

together on this funding review. The objectives being:

7.1. To develop a

long-term sustainable funding model for Hawke’s Bay Tourism that ensures

those who benefit commercially from tourism contribute to the promotion and

marketing of the region.

7.2. To lessen the

burden on the Hawke’s Bay ratepayer.

8. A joint HBRC

and HBT item was provided to the Corporate and Strategic Committee on 12

December 2018. This identified:

8.1. The issue of

tourism funding, for both infrastructure and tourism promotion, is a national

issue and one for which there are multiple national and regional initiatives

under active consideration and review.

8.2. While the

current funding model can be improved to ensure better linkages between HBT

funding and the beneficiaries and/or users of tourism activities, the

complexities, and transaction costs of more targeted funding models,

particularly at a regional level, should not be underestimated and perhaps

point to the need to retain a degree of core community funding via the economic

development rate.

8.3. There is no

one-size fits all approach. A review of international case studies of

peer-to-peer accommodation and how some councils in New Zealand treat

peer-to-peer accommodation by HBT and council staff has confirmed the

complexity of the issues.

8.4. The

introduction of a local bed tax/visitor levy would require legislation meaning

change could be slow. Discussions with the region’s Mayors and Chair

indicated strong support for an all-of region approach to the development of a

sustainable funding model and strategy that encompasses not only visitor

attraction but also tourism infrastructure and event management.

9. The December

report outlined HBT’s objective is to raise $2M per

annum to fund the promotion of Hawke’s Bay and ensure a long-term

sustainable approach to marketing of the region. This is in-line with

HBT’s current revenue from all sources.

Funding

Review Developments

10. Regional Visitor

Strategy: In anticipation of the introduction of a visitor

tax/bed levy either at a national or local level, HBT is recommending

the development of a targeted Regional Visitor Strategy to inform the development

of a sustainable multi-agency funding model and strategy that encompasses not

only visitor attraction but also tourism infrastructure and event management.

The Hawke’s Bay Local Government Leaders’

Forum formally endorsed the development of the strategy at its meeting on 25

February 2019 and agreed that Councils and HBT would contribute financially to

the cost of engaging a consultant for the development of the strategy.

11. Note that the scope of

this initiative falls short of a fully-fledged Regional Tourism Strategy. While

HBT envisages the strategy will be developed in conjunction with iwi, all

Councils and the wider tourism industry the primary engagement will rest with

the principle organisations involved in regional visitor attraction, the provision

of tourism infrastructure and regional event management.

12. Tourism Industry

Aotearoa (TIA) - Regional Funding Project: Of note, is the selection of

HBT’s General Manager Annie Dundas to join a national group for a project

run by TIA to identify preferred regional funding models to support long-term

local government funding and investment. The group is meeting in mid-March for

five days with the work to be considered be the Productivity Commission ahead

of releasing its draft report of its inquiry into Local Government Funding and

Financing.

13. Local

Government New Zealand (LGNZ): HBT is also participating in a visitor levy

workshop LGNZ is holding later this month. HBT has advised LGNZ intends to

undertake economic work to understand the costs and benefits of a visitor

tax/levy up and down the delivery chain. HBT is a trustee of Regional Tourism

New Zealand and will be part of the working group providing input and feedback

on this work.

Next Steps

14. Hawkes’ Bay Tourism

to develop Terms of Reference and Request for Proposal for the development of a

Regional Visitor Strategy, and get a costing for this work.

15. HBT and HBRC to identify, if necessary, further potential funding

opportunities for the development of the strategy.

16. Hawkes Bay Tourism to

provide feedback on TIA’s regional funding model work and LGNZ’s

visitor levy workshop.

17. HBRC

staff to continue to progress analysis of changes to HBT’s targeted rate

formula to ensure that those who benefit commercially from tourism contribute more

to the promotion and marketing of the region as a tourism destination in the

next LTP in the event that issues are not resolved through the review.

18. Continue to closely track

industry developments and report back to the Corporate and Strategic Committee

when new information comes to light.

Decision

Making Process

19. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision making

provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee

Meeting receives the “HB Tourism Update” report.

|

Authored by:

|

Mandy Sharpe

Project Manager

|

|

Approved by:

|

Tom Skerman

Group Manager Strategic Planning

|

|

Attachment/s

|

⇩1

|

HBT -

Appendix 1

|

|

|

|

⇩2

|

Hawkes Bay

Tourism Report - March 2019

|

|

|

|

HBT

- Appendix 1

|

Attachment 1

|

|

Hawkes Bay Tourism Report -

March 2019

|

Attachment 2

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 06 March 2019

Subject: Matters Arising from

Audit NZ 2018-28 Long Term Plan Audits

Reason

for Report

1. This item provides the opportunity for the Committee to consider and

discuss the Auditor General’s report on Matter arising from our audits

of the 2018-28 long-term plans.

Background

2. The Office of the Auditor General (OAG) has released a 91-page

report on common themes from the 2018 long term plans. The OAG publish such a

report after each LTP of which there have been five audited LTPs completed to

date. The OAG is required to present this report to the House of

Representatives under the Public Audit Act 2001.

Headline points

3. Three key points noted in the report include:

3.1. Rising capital expenditure;

3.2. Increased debt to fund it based on the principle of

intergenerational equity; and

3.3. Uncertainty and cost of addressing the effects of climate change.

4. The 2018-28 LTPs show significant forecast capital expenditure

compared with previous LTPs. This was in response to unprecedented levels of

growth (particularly 11 “high-growth” councils, none of which are

in Hawke’s Bay), increased levels of service to meet growing community

expectations, and historical underinvestment.

5. Like the national trend, HBRC’s long-term plan included

significant new capital expenditure for projects with intergenerational

benefits, such as the erosion control scheme, funded through debt with total

new borrowing of $71 million over the ten years. HBRC forecasts a debt balance

of $38 million by the end of the plan after repayments.

6. Unlike some “high-growth” councils,

even at the height of its borrowing, HBRC will remain conservatively under the

debt limit it has set itself which is net external debt not exceeding 150% of

total revenue. Regional Council staff highlighted throughout the 2018-28

Long term plan development and consultation that its balance sheet will very

likely be called upon heavily in future long term plans as the region begins to

future proof its infrastructure in response to climate change.

7. For the 2021-31 LTP, the OAG consider that there

is a need for a comprehensive discussion about resilience and climate change

issues with the community, and that it makes little sense for all councils to

individually think about how to improve reporting on these particular issues.

8. We expect climate change to feature strongly in

the next iteration of HBRC’s Strategic Plan and to form the basis of

early engagement with the community and a call to action leading up to the next

LTP.

Specific

mention of HBRC

9. HBRC is specifically mentioned twice in the

report. On p12 it is noted that HBRC disclosed 23 specific outcomes

measures. This is referred to as a good example of how to demonstrate

achievement of, or progress towards, the outcomes that council seek.

10. On page 44, it is noted that HBRC referred in

its Infrastructure Strategy to the work it is doing to implement the Clifton

to Tangoio Coastal Hazards Strategy 2120. This is used as a good example of

a council disclosing risk and how it plans to address it.

Non-standard

audit reports

11. Only once council received a modified audit

opinion, being Westland District Council because the auditors believed the

council did not have reliable information about the condition of its three

water assets.

12. Nine councils received unmodified opinions with

“emphasis of matter” paragraphs, including Central Hawke’s

Bay (CHBDC) and Wairoa District Councils.

13. The auditors drew attention to disclosures in

the Central Hawke’s Bay District Councils LTP about the resource consent

breach for the Waipukurau and Waipawa wastewater treatment plants. It noted that

more investigative work is required to find a viable solution before remedial

work can be carried out that will meet resource consent requirements and that

the cost of this work is uncertain and could be significant. These costs will

be in addition to those included in the financial forecasts in the plan. As a

result, the Council expects to carry out formal consultation with the community

once viable options have been identified and funding options determined.

14. Wairoa District Council’s audit report drew

attention to its failure to adopt the plan before 1 July 2018, which is a

breach of section 93 of the Local Government Act.

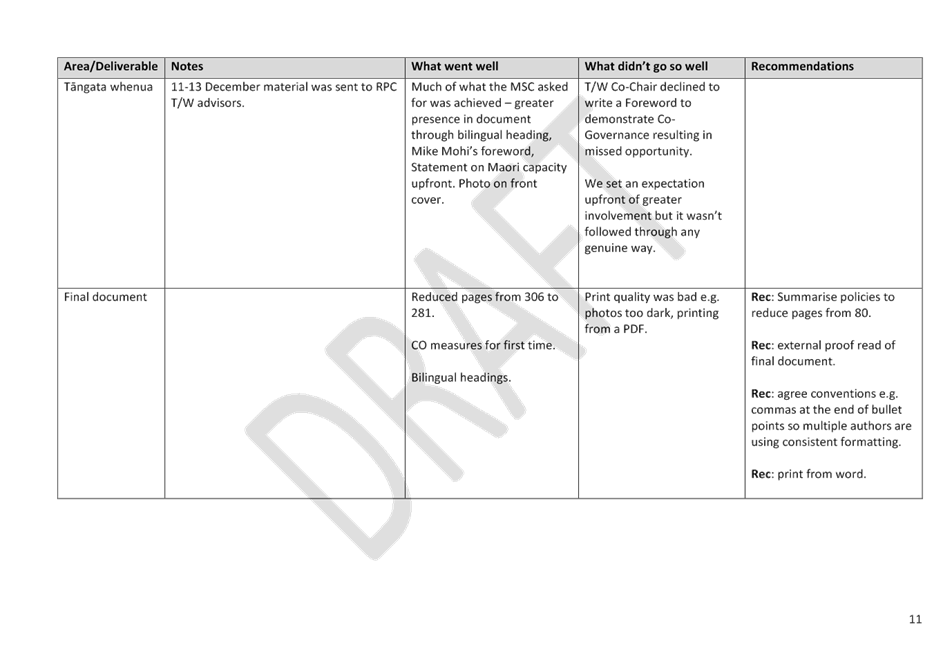

Areas

for improvement for HBRC

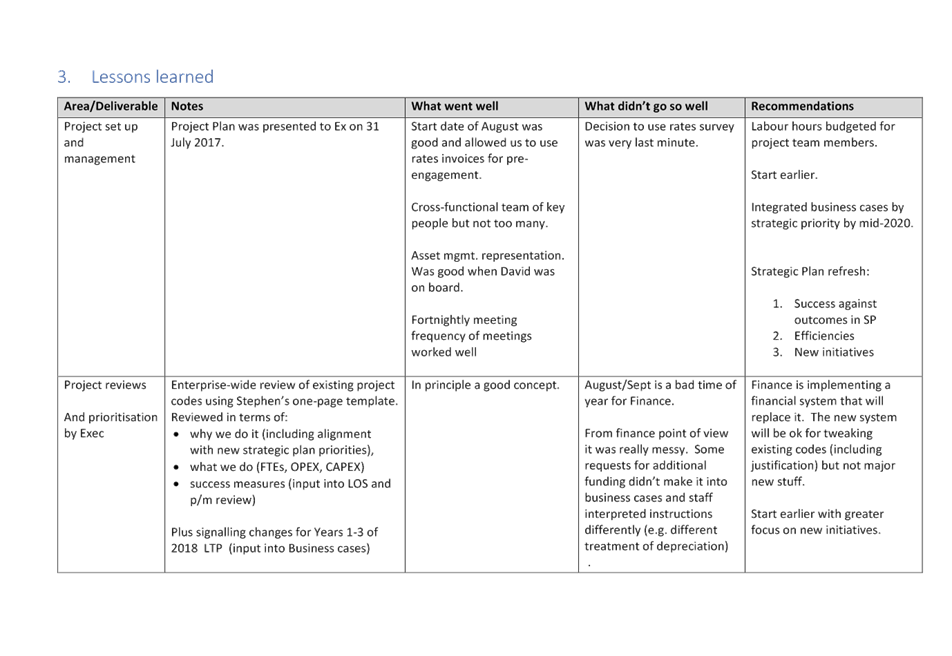

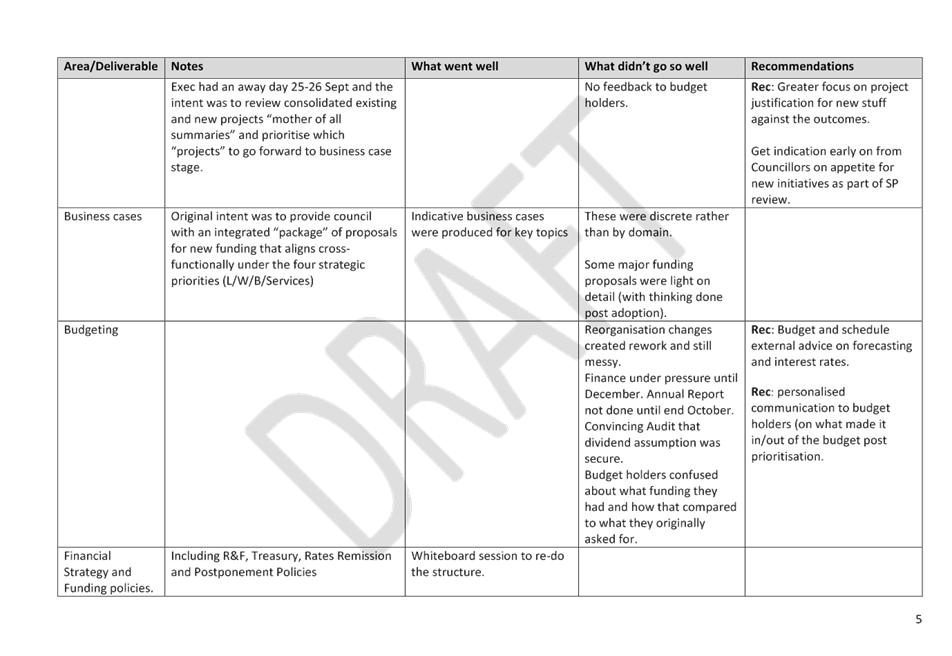

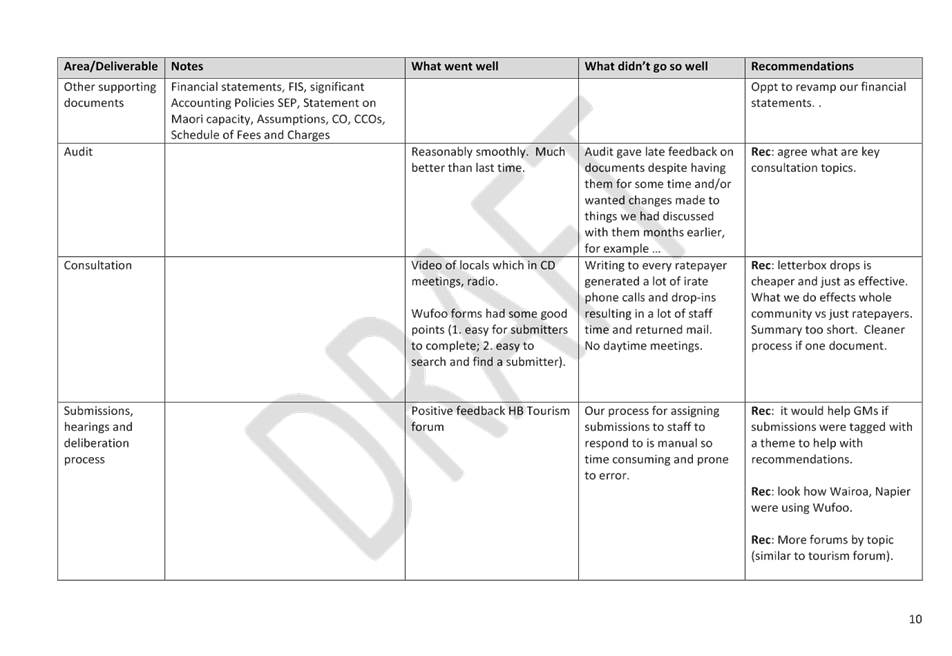

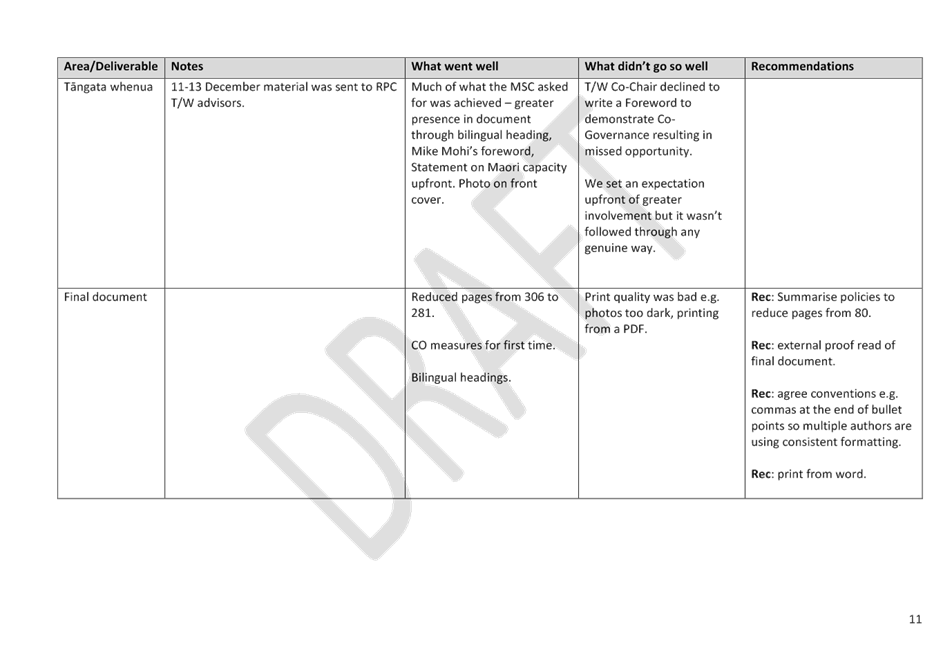

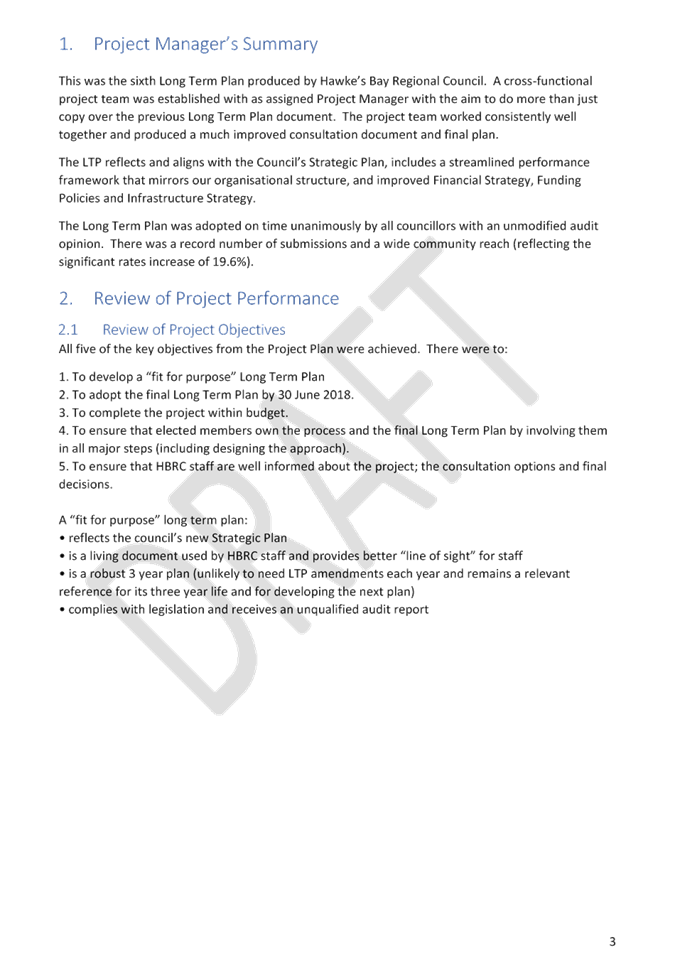

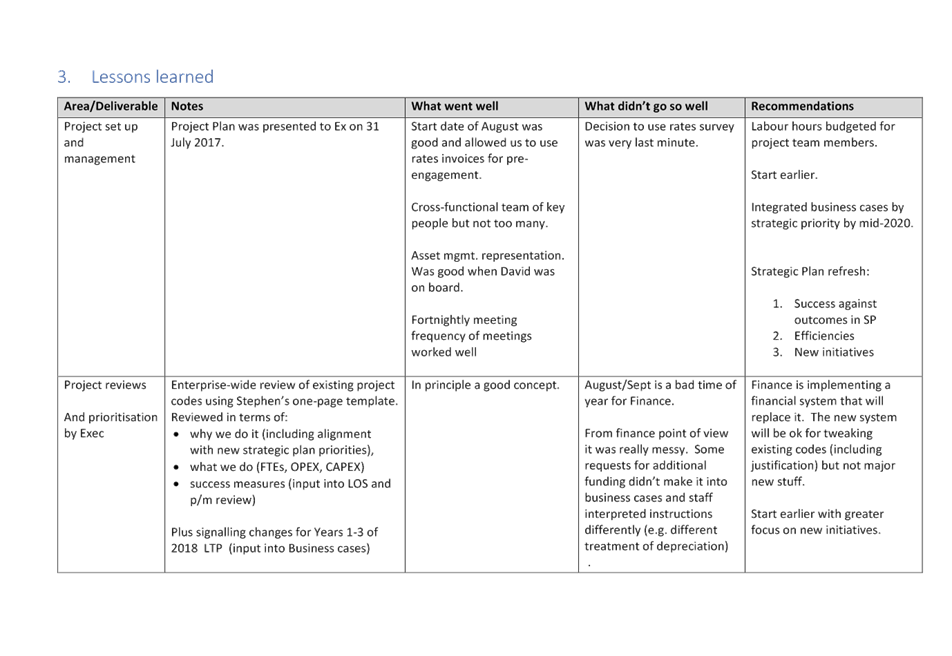

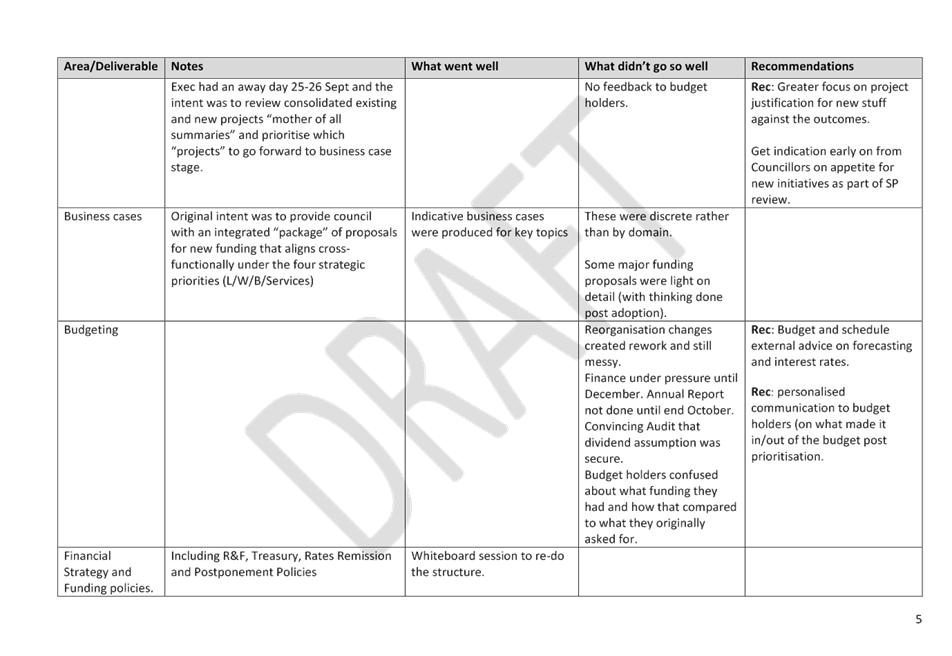

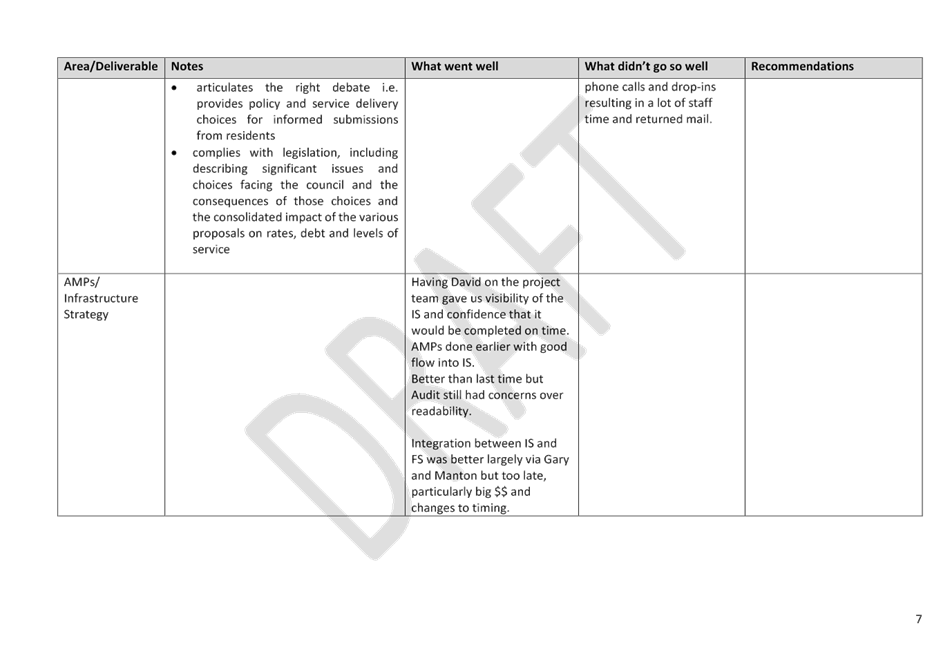

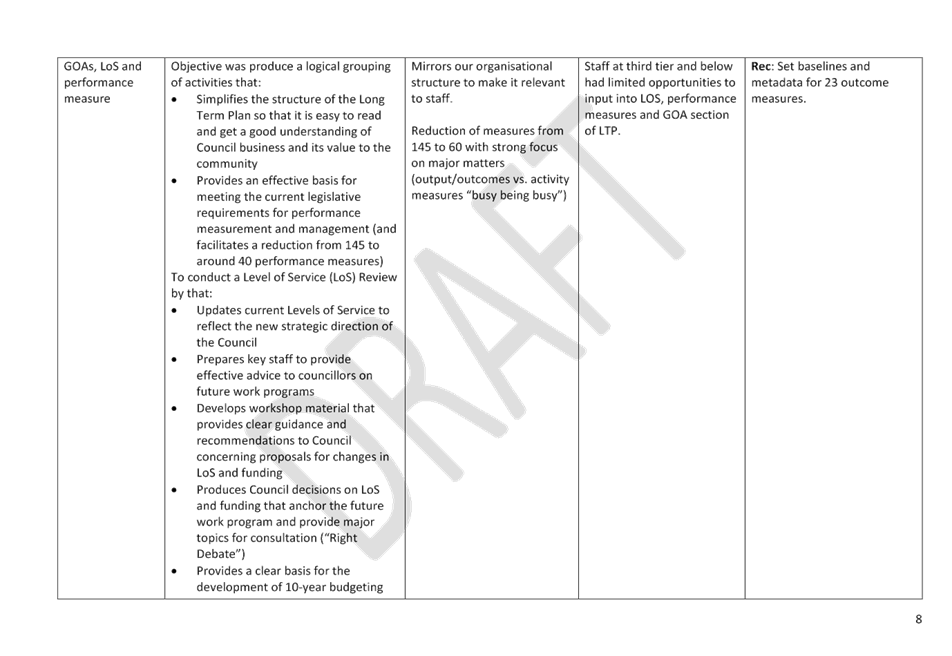

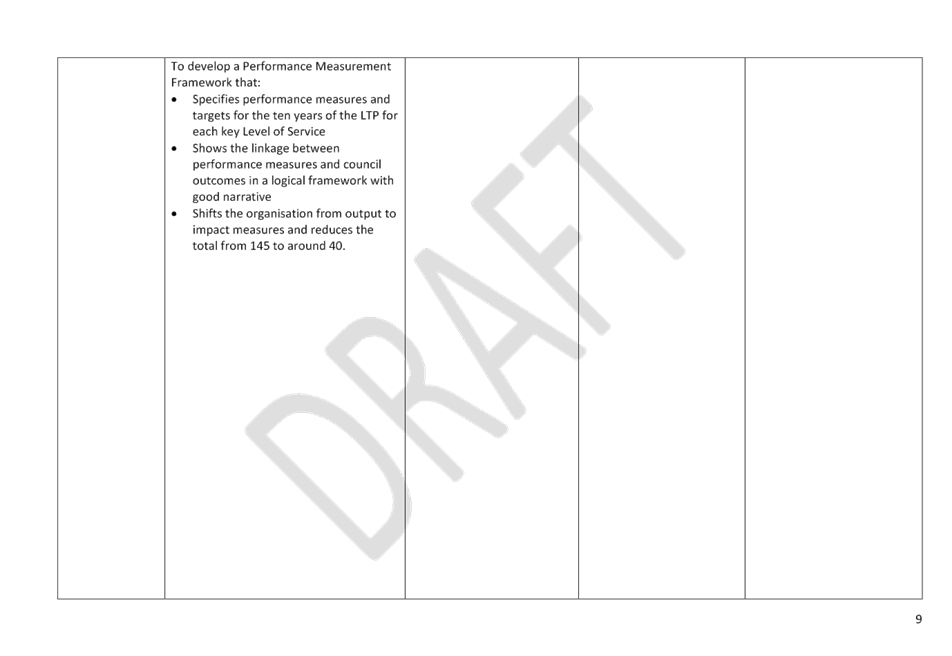

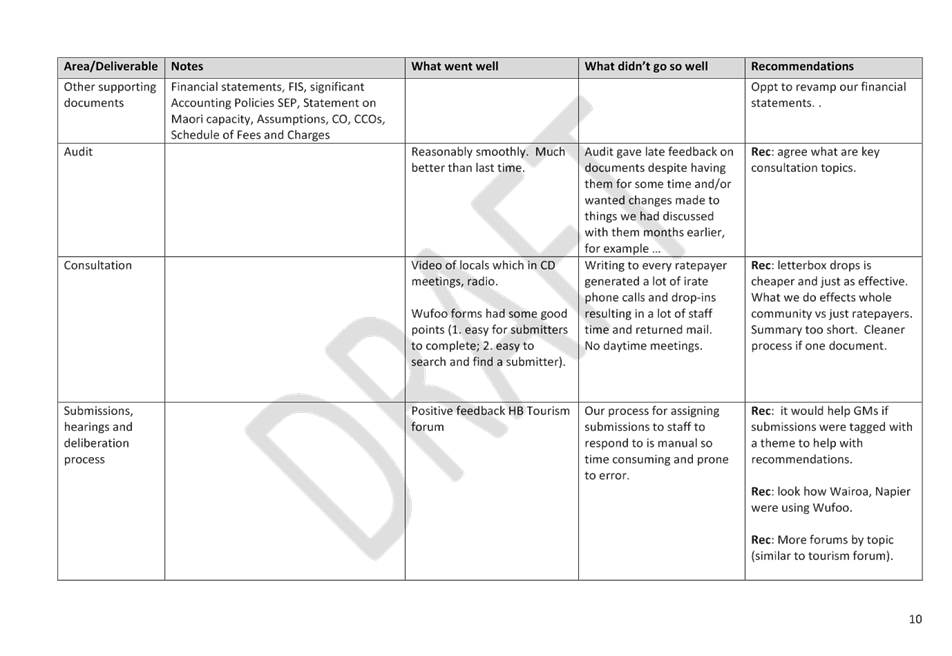

15. Staff completed a project review or lessons

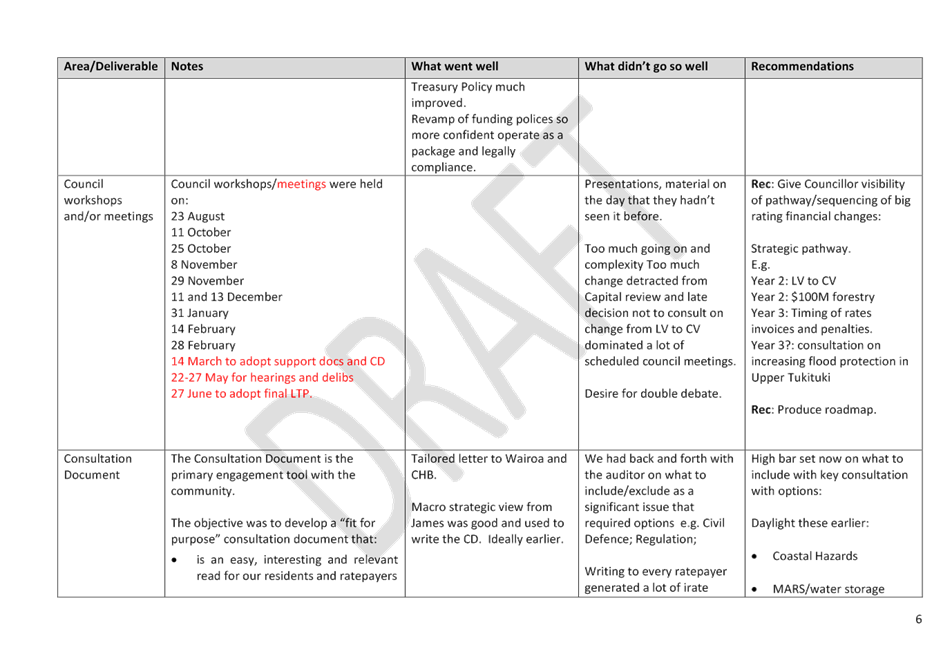

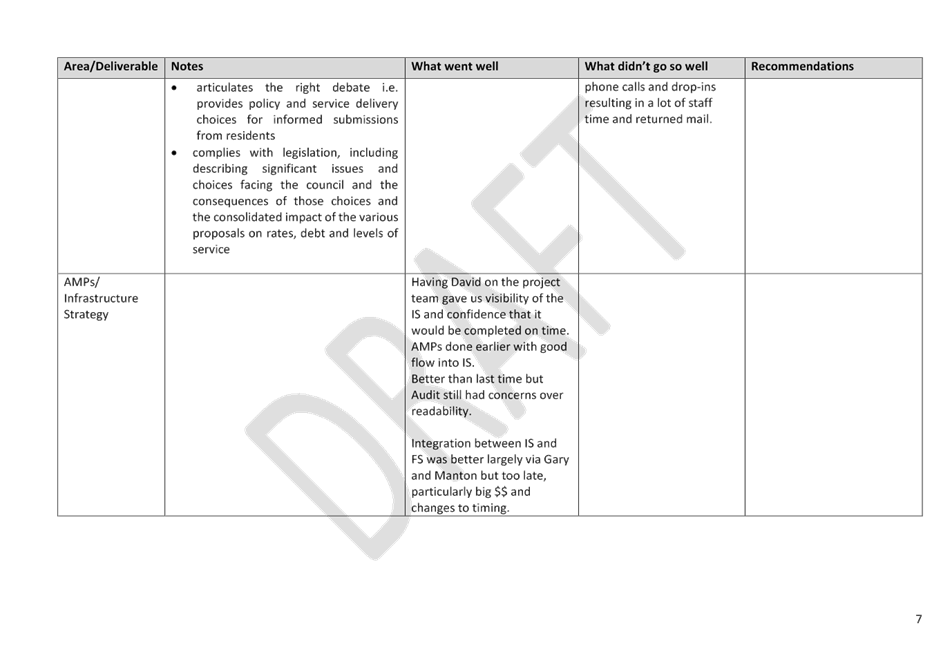

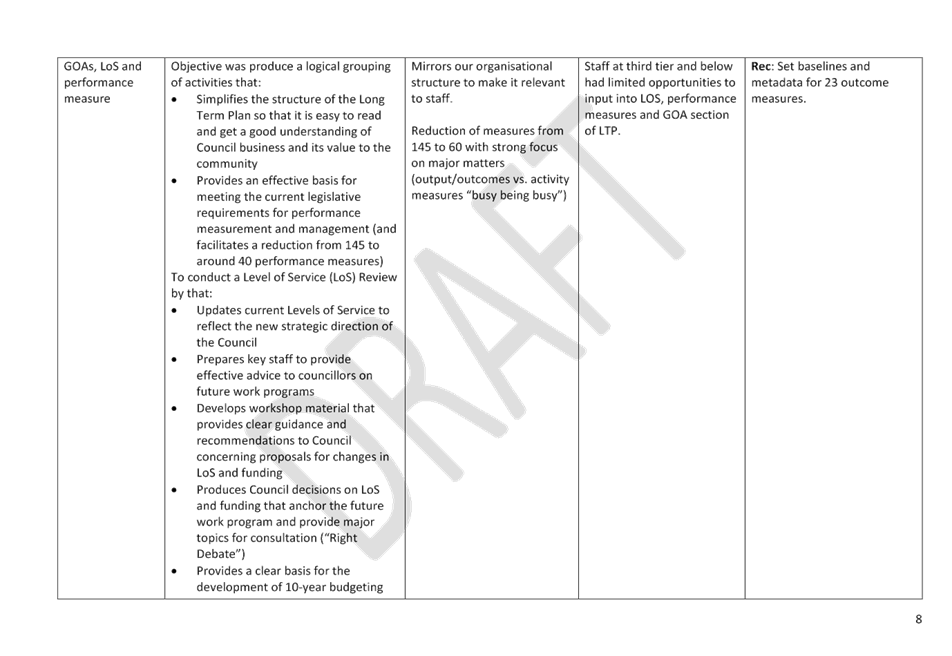

learnt exercise shortly after the LTP was adopted. This covered what went

well, what didn’t and areas for improvement. The lessons learnt

session was split by deliverables including:

15.1. Project management

15.2. Reviews of existing project/workstreams,

business cases for new projects and budgeting

15.3. Council workshops and meetings

15.4. Consultation document

15.5. Financial Strategy and Funding Policies

15.6. Infrastructure Strategy

15.7. Performance framework (Groups of Activities,

levels of service and measures)

15.8. Stakeholder management and consultation,

submissions and hearings

15.9. Audit process

15.10. Final document

16. The findings from this OAG report will be

combined with the lessons learnt exercise to improve the approach for the 2021

LTP. In particular, staff have noted the increasing use of spatial

planning highlighted in the OAG report as a means to better communicate

information to the public (e.g. in Infrastructure Strategies) and the challenge

set by the Auditor-General to prepare a financial strategy in up to five pages

(our current Financial Strategy is 13 pages).

Decision

Making Process

17. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision making

provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee

receives and notes the “Matters Arising from Audit NZ 2018-28

Long Term Plan Audits” staff report and the Auditor

General’s report titled “Matters arising from our audits of

the 2018-28 long-term plans”.

|

Authored by:

|

Manton

Collings

Chief Financial Officer

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

⇨1

|

Auditor

General Matters arising from 2018-28 LTP audits Report

|

|

Under

Separate Cover

|

|

⇩2

|

HBRC Project

Review and Closure template

|

|

|

|

HBRC

Project Review and Closure template

|

Attachment 2

|

|

HBRC

Project Review and Closure template

|

Attachment 2

|

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 06 March 2019

Subject: Organisational

performance update for the period 1 July 2018 to 31 January 2019

Reason for Report

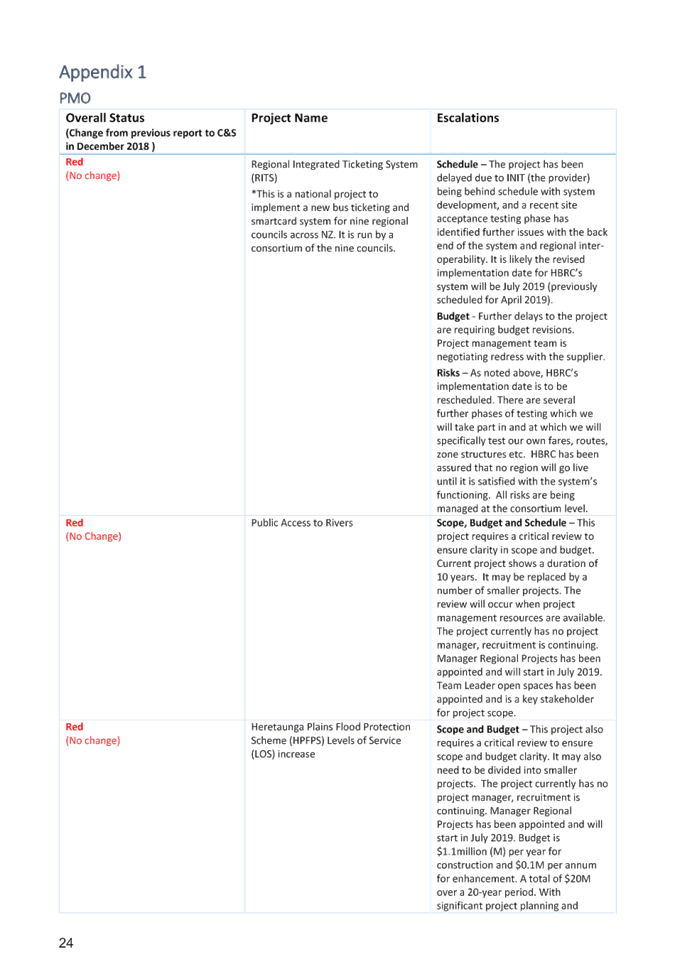

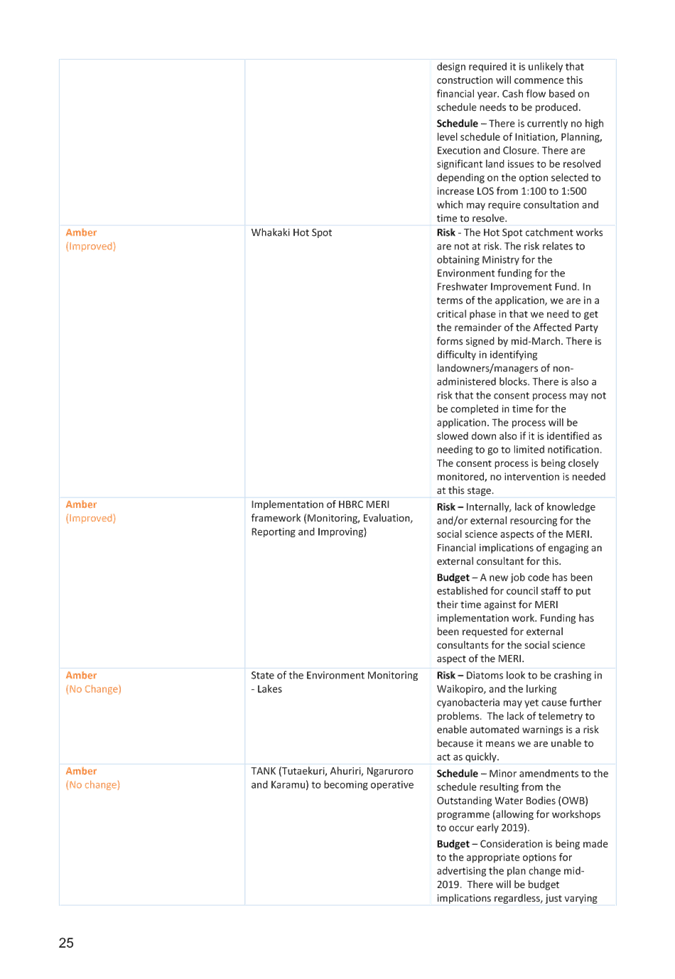

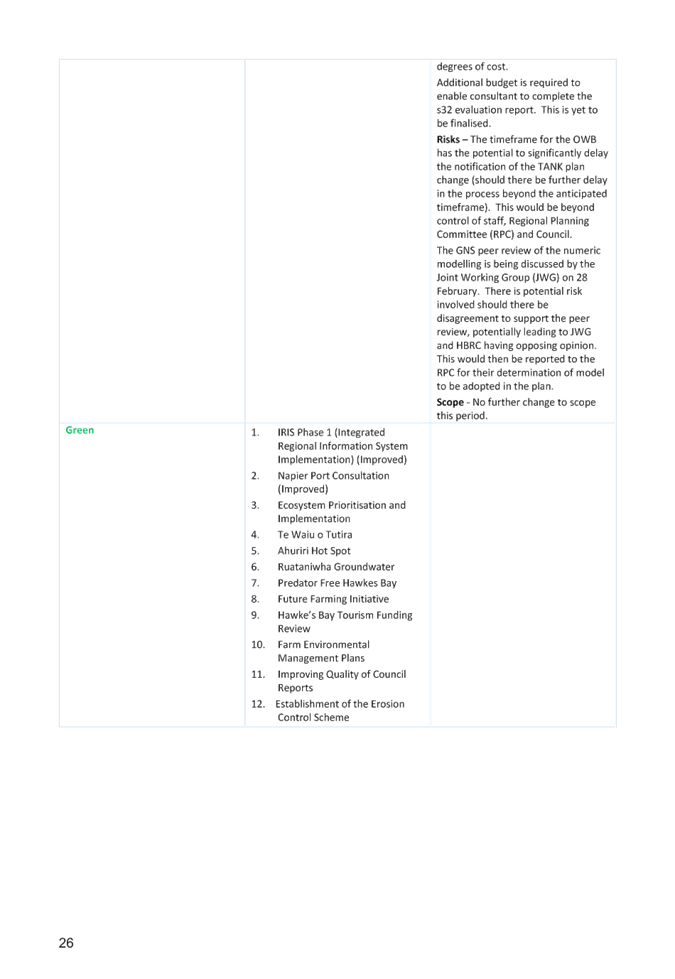

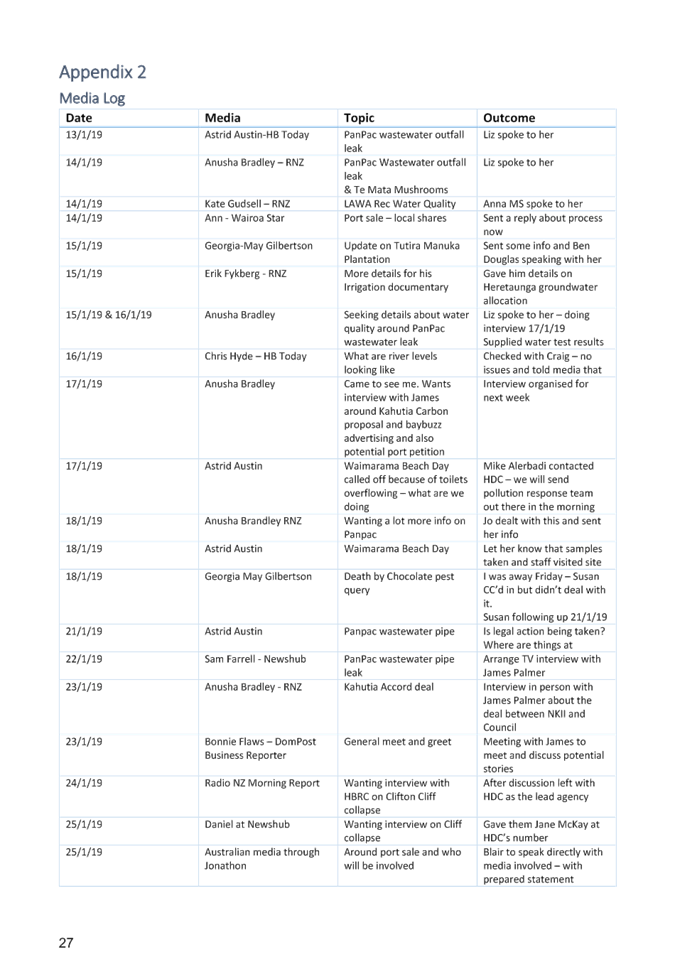

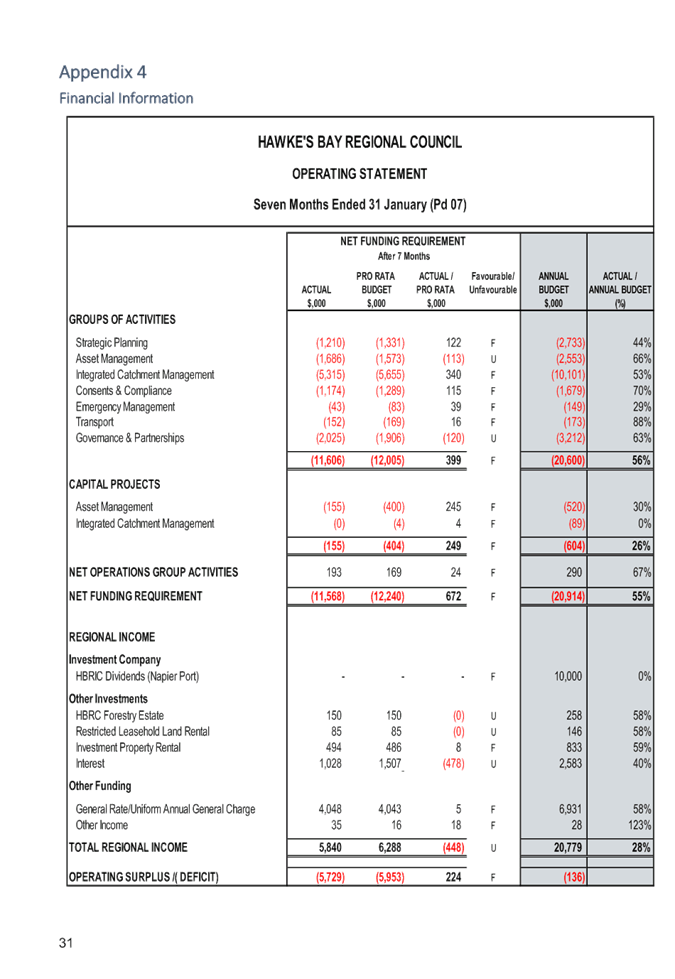

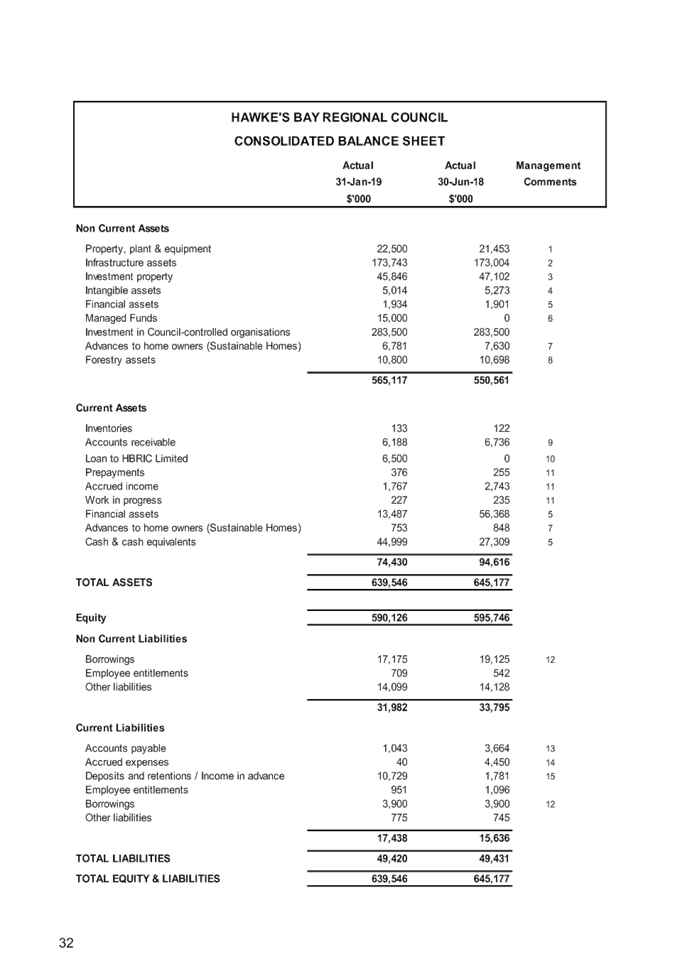

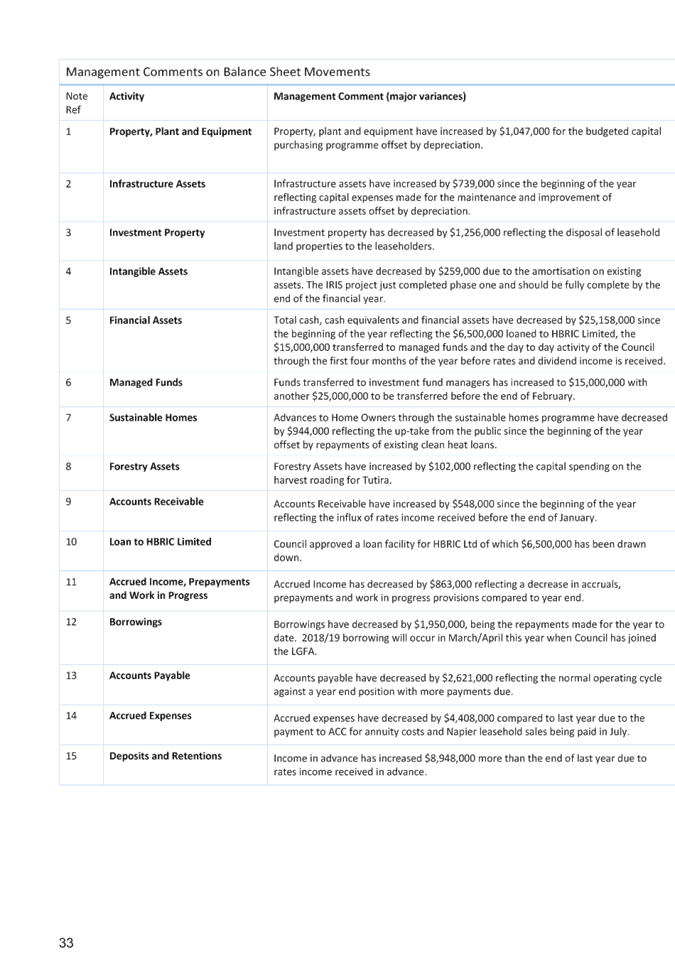

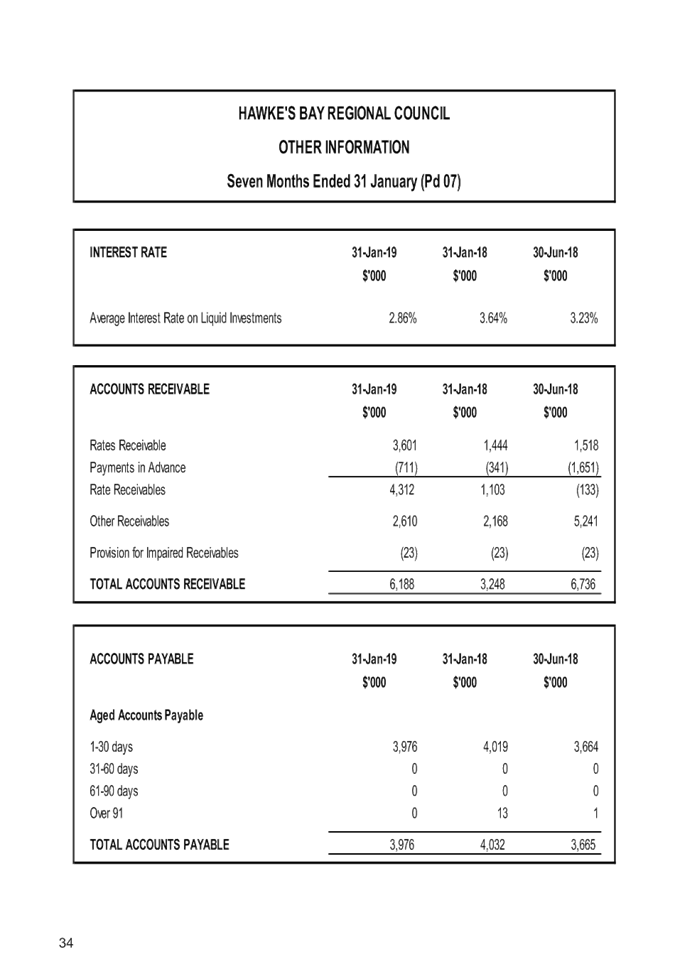

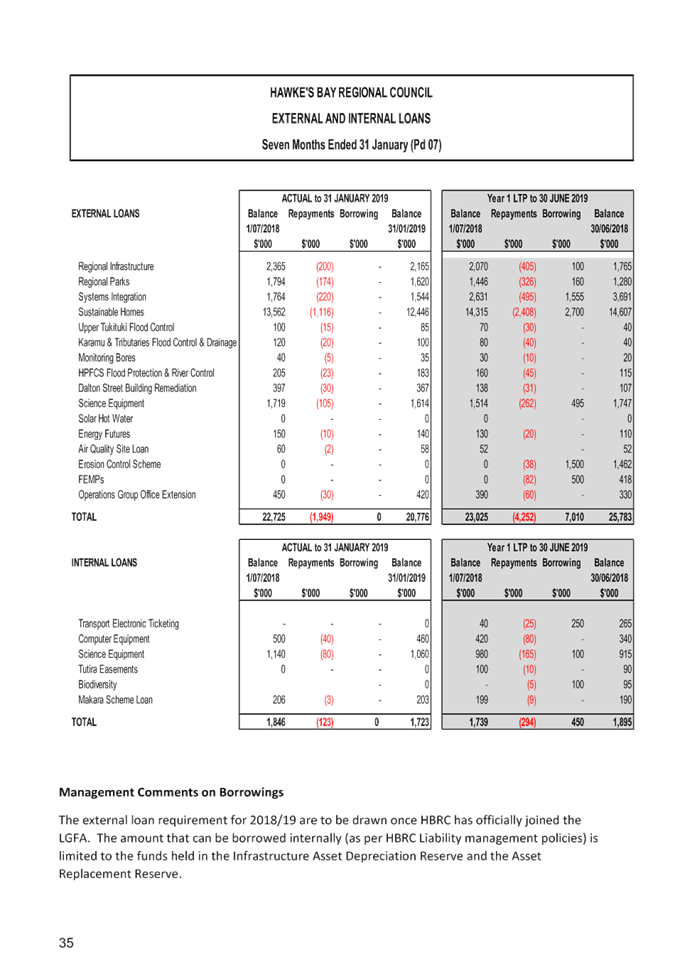

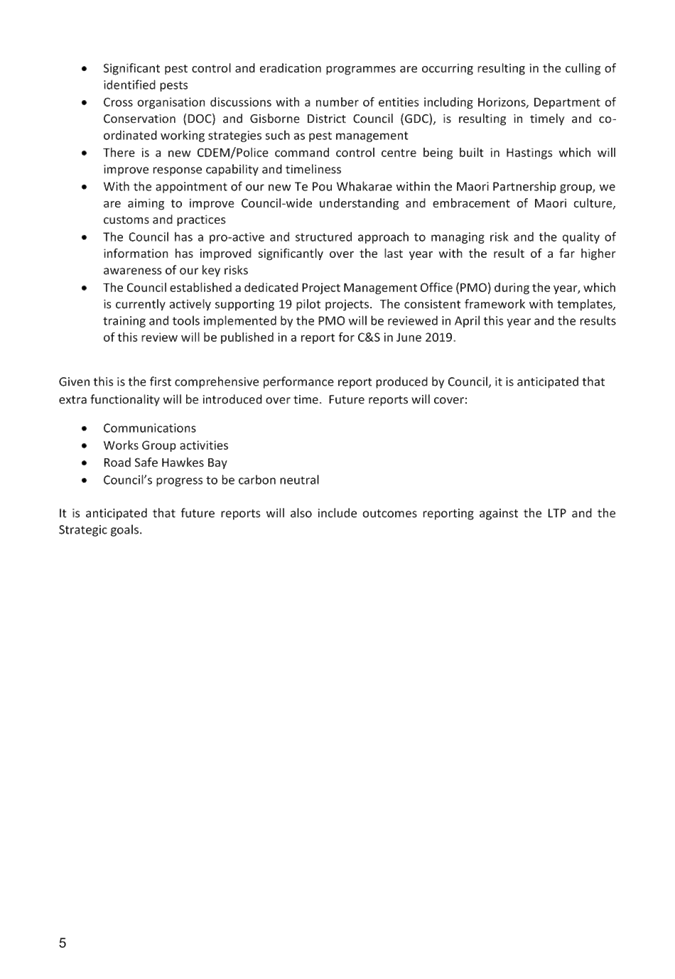

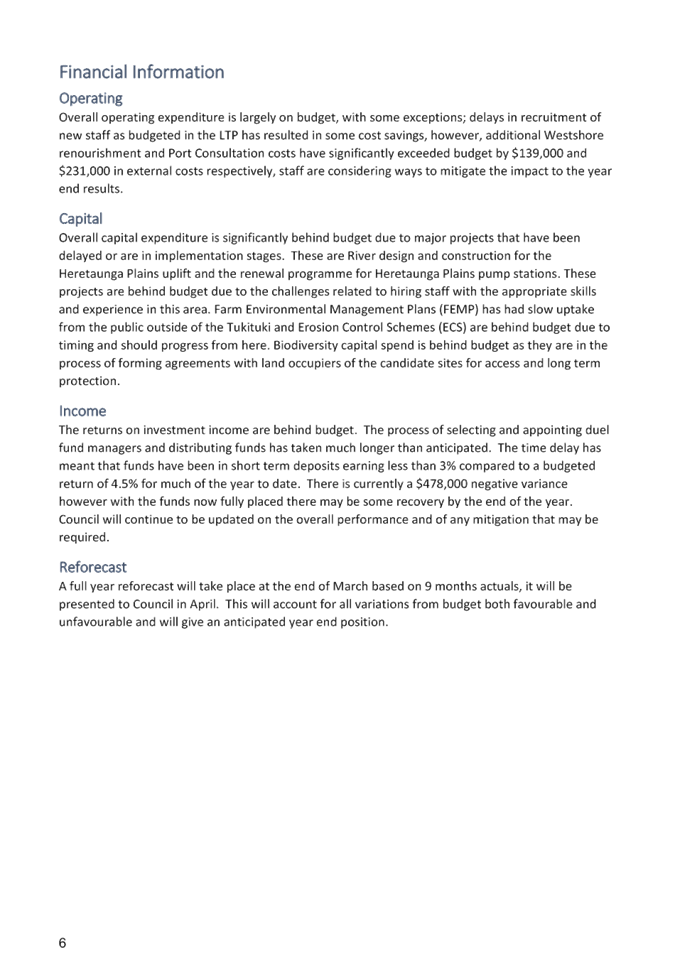

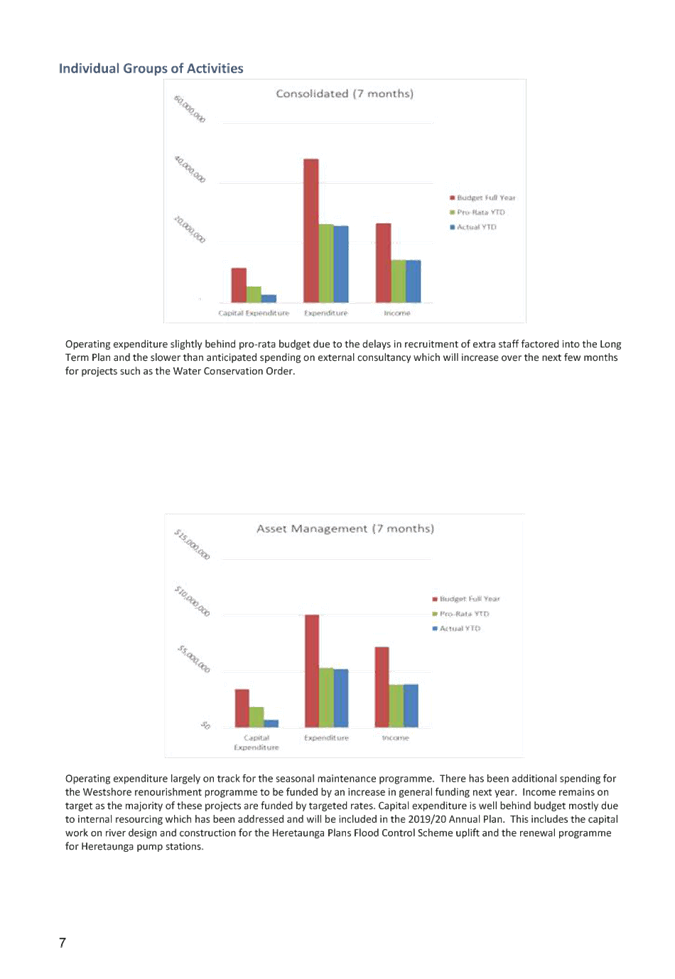

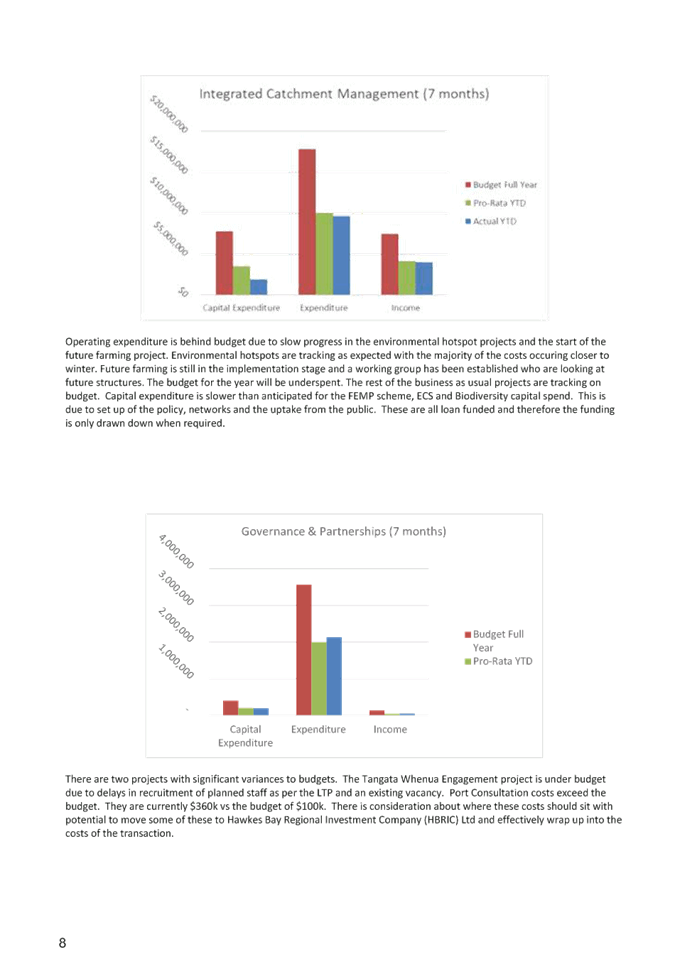

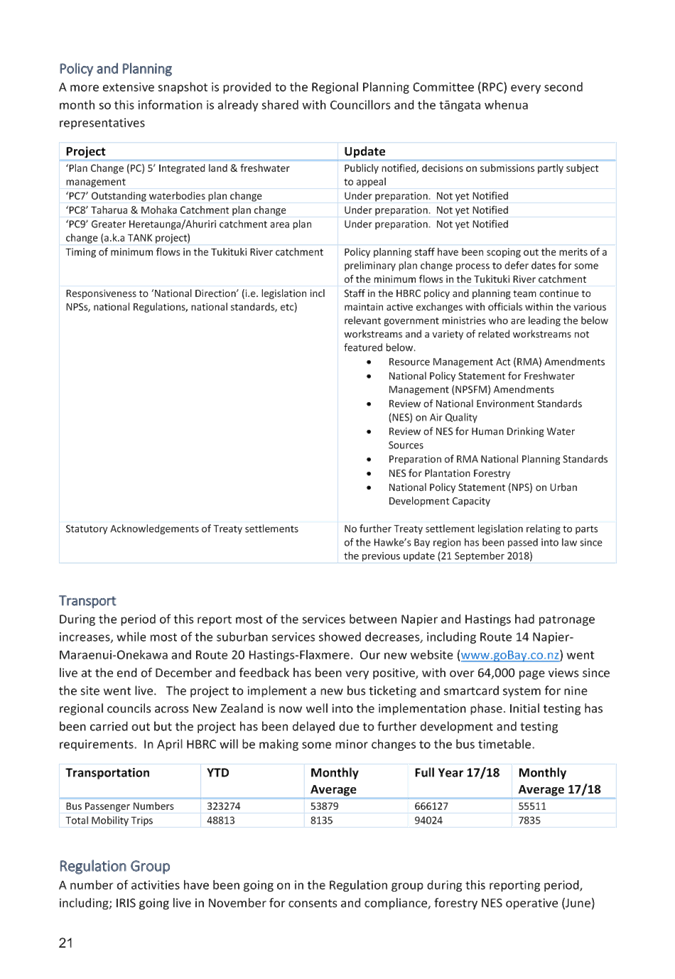

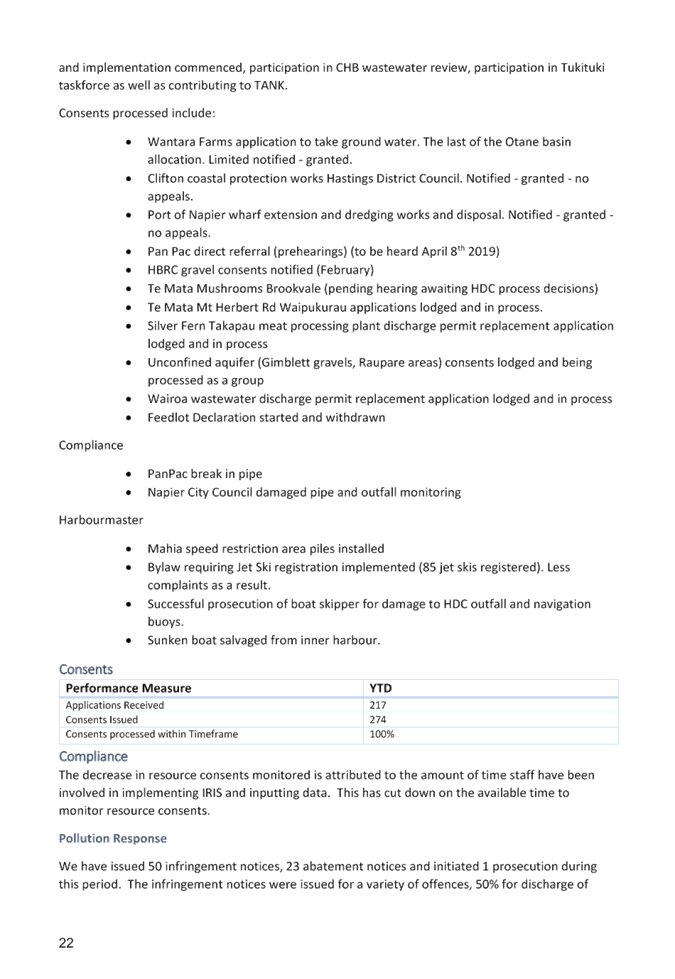

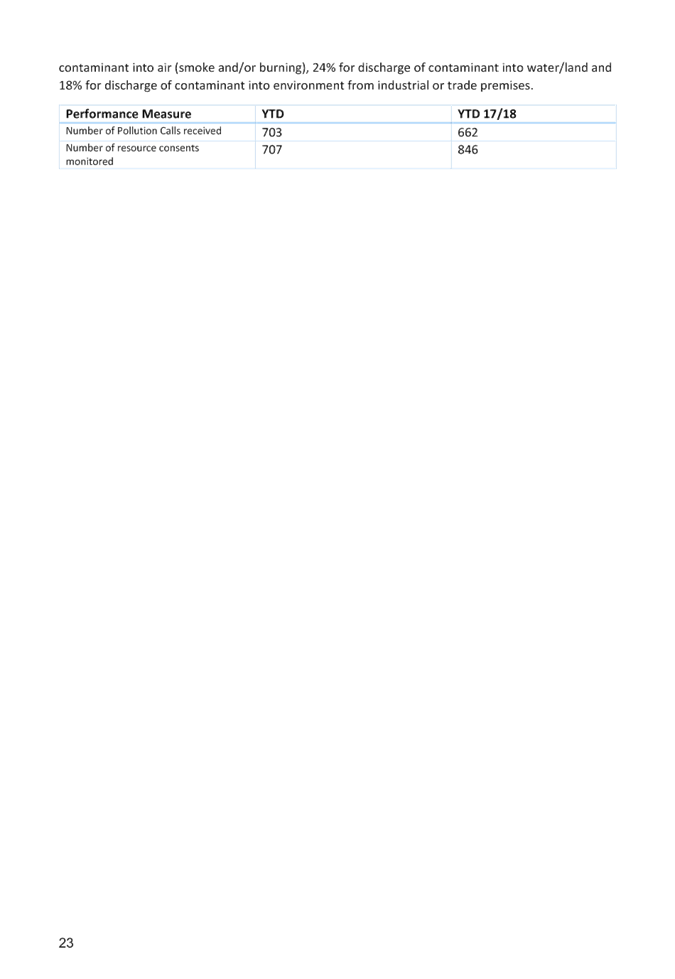

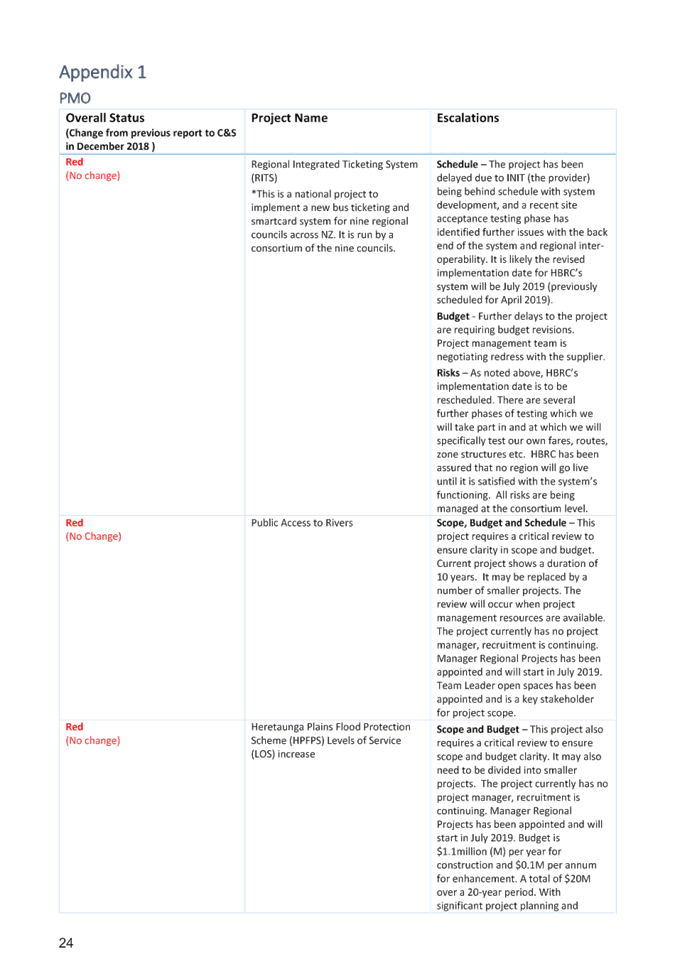

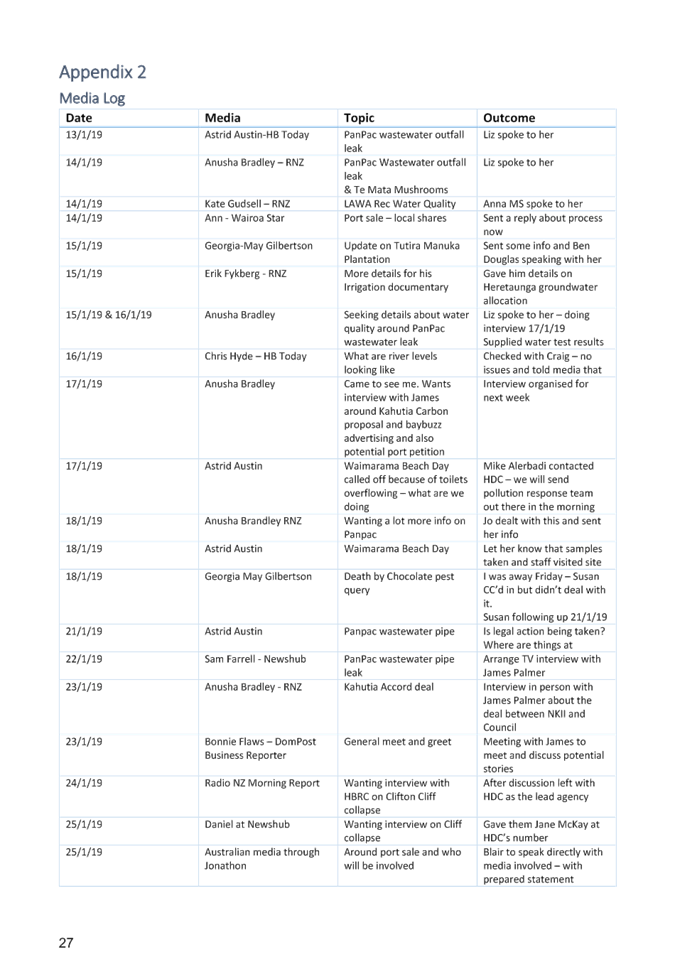

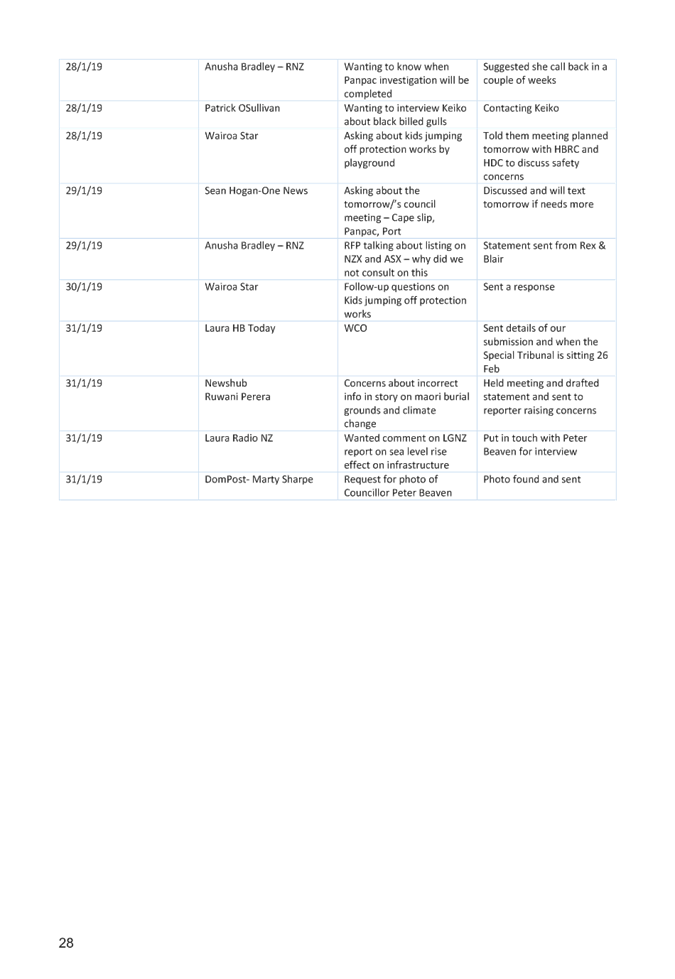

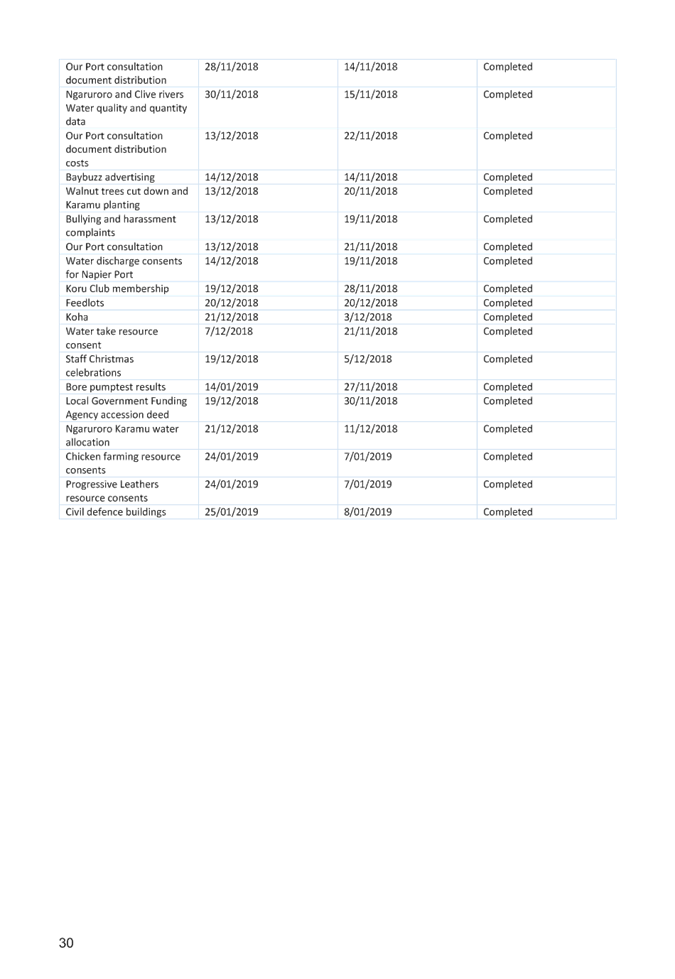

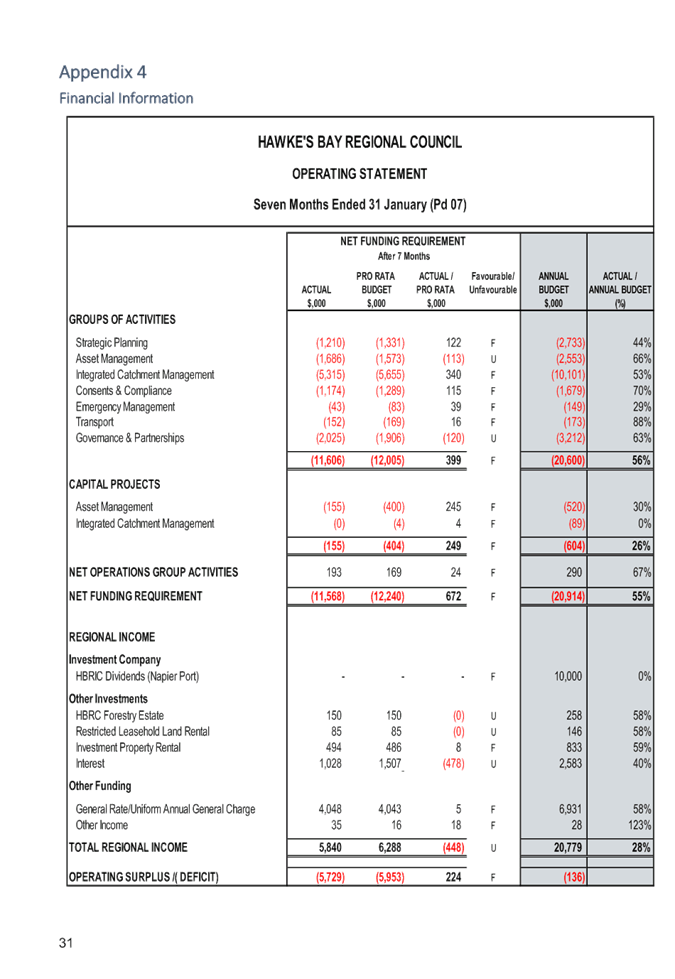

1. This report provides an update on operational activities and

performance (financial and non-financial) for the first seven months of the

2018-19 financial year to 31 January 2019.

Decision Making Process

2. Staff have

assessed the requirements of the Local Government Act 2002 in relation to this

item and have concluded that, as this report is for information only, the

decision making provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee receives and notes of the “Operational Update for Seven Months Ending 31

January 2019” and provides feedback to Council staff.

|

Authored by:

|

Kelly Burkett

Business Analyst

|

Manton

Collings

Chief Financial Officer

|

|

Peter

Wallwork

Principal Advisor - Organisational

Performance

|

|

Approved by:

|

James Palmer

Chief Executive

|

Jessica

Ellerm

Group Manager Corporate Services

|

Attachment/s

|

⇩1

|

Organisational

Performance Report 1 July 2018 - 31 Jan 2019

|

|

|

|

Organisational

Performance Report 1 July 2018 - 31 Jan 2019

|

Attachment 1

|

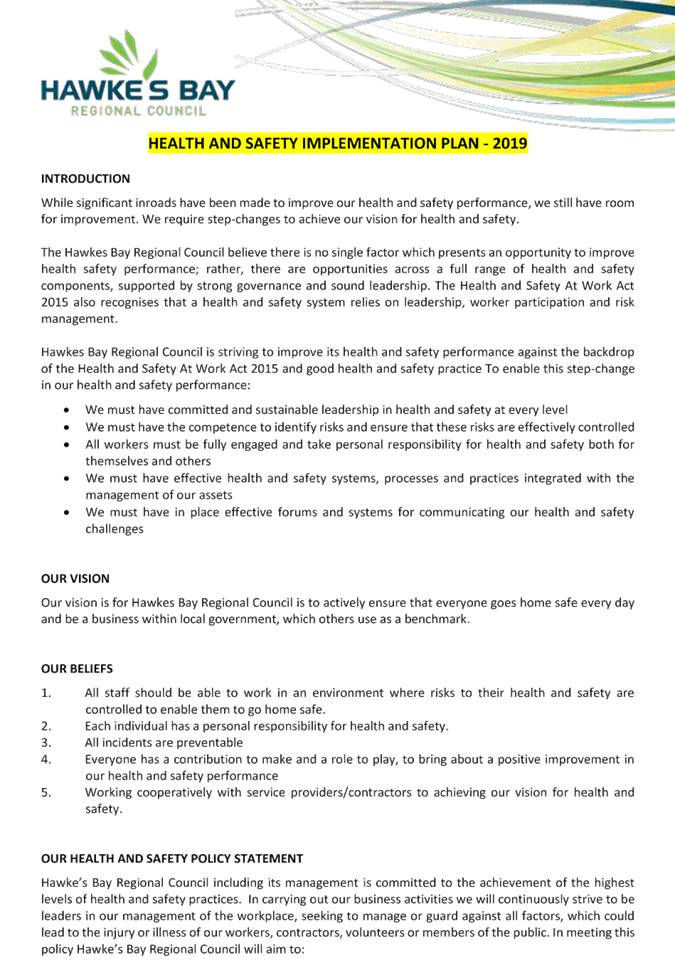

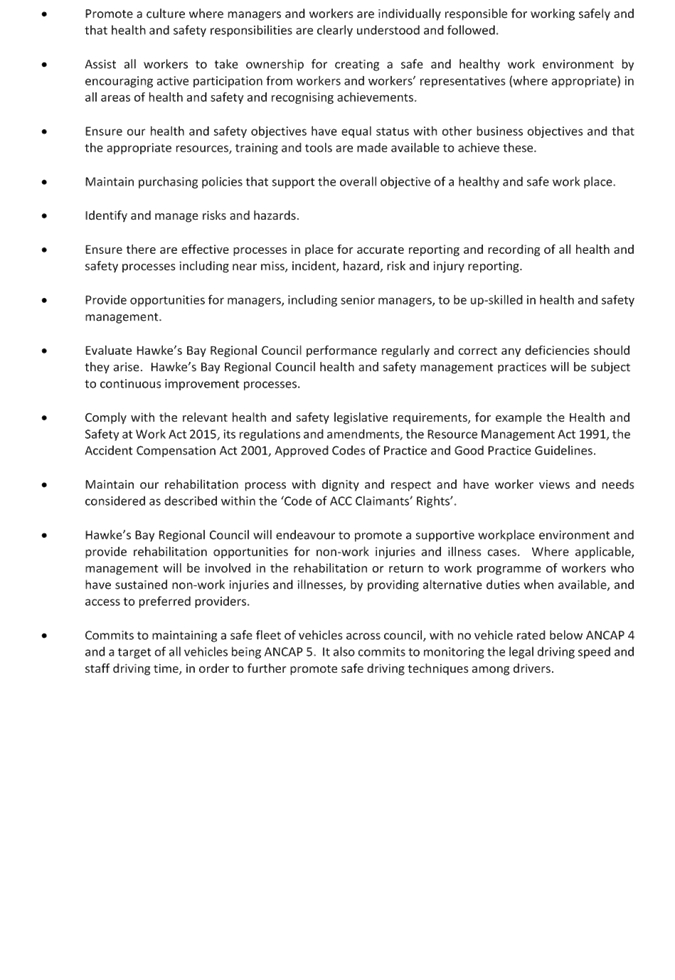

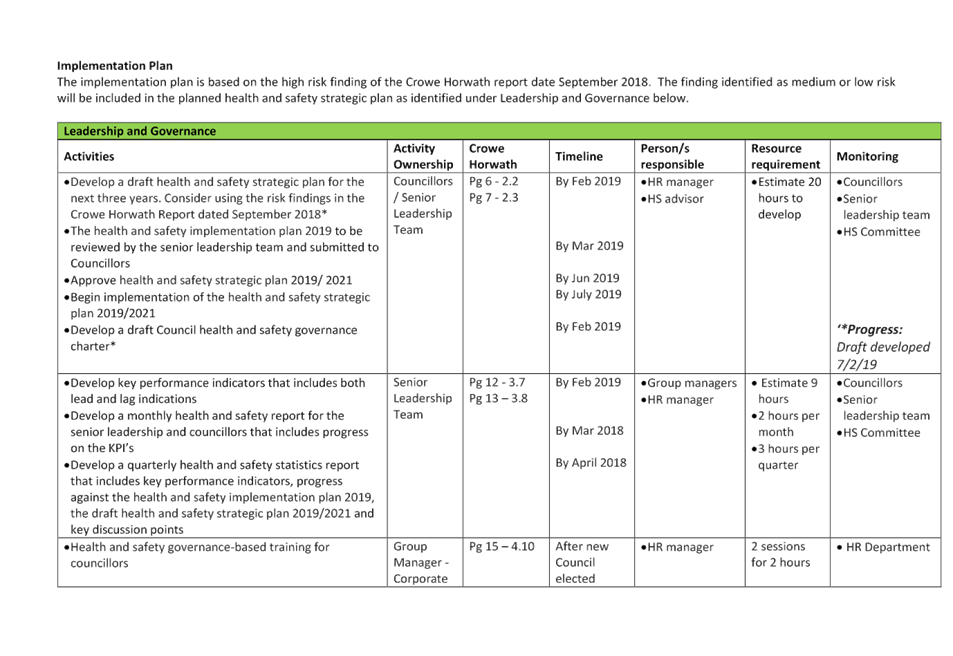

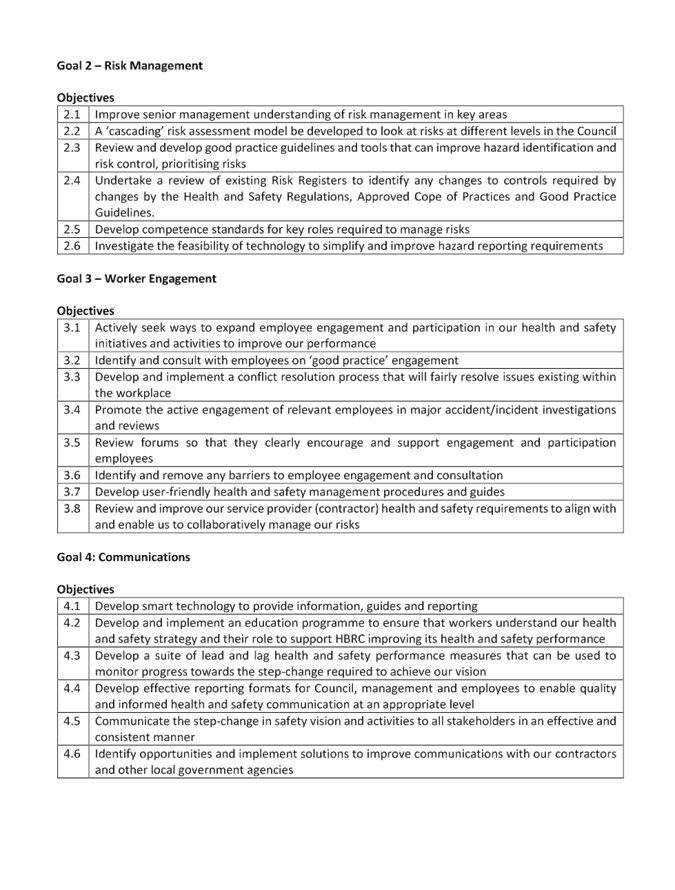

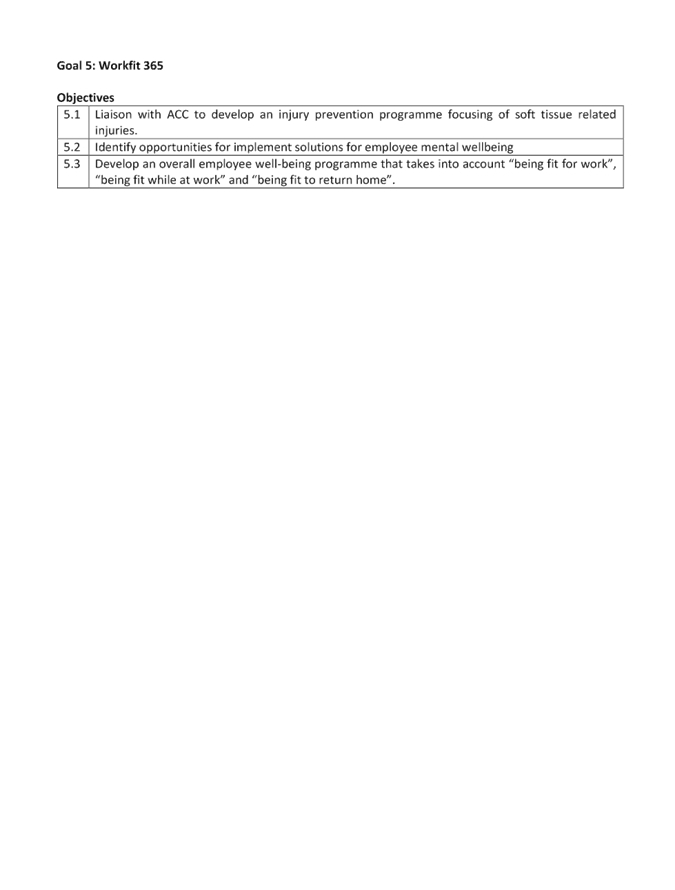

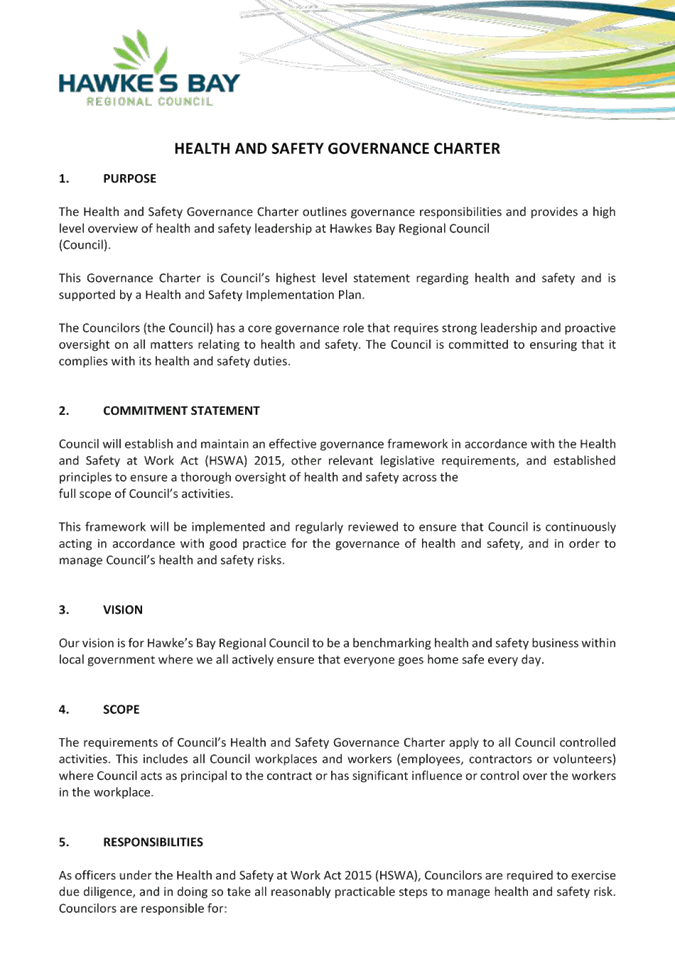

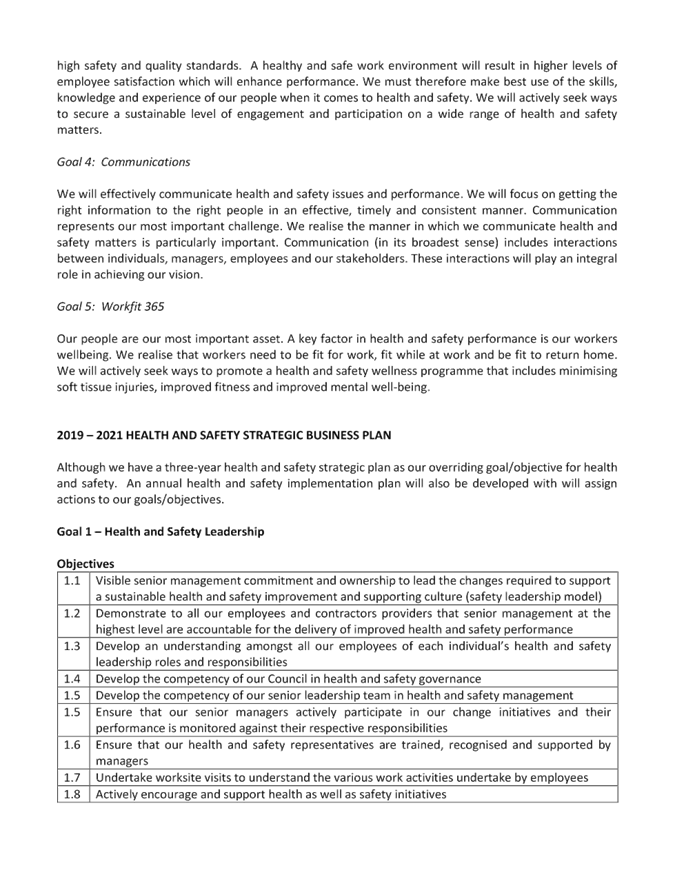

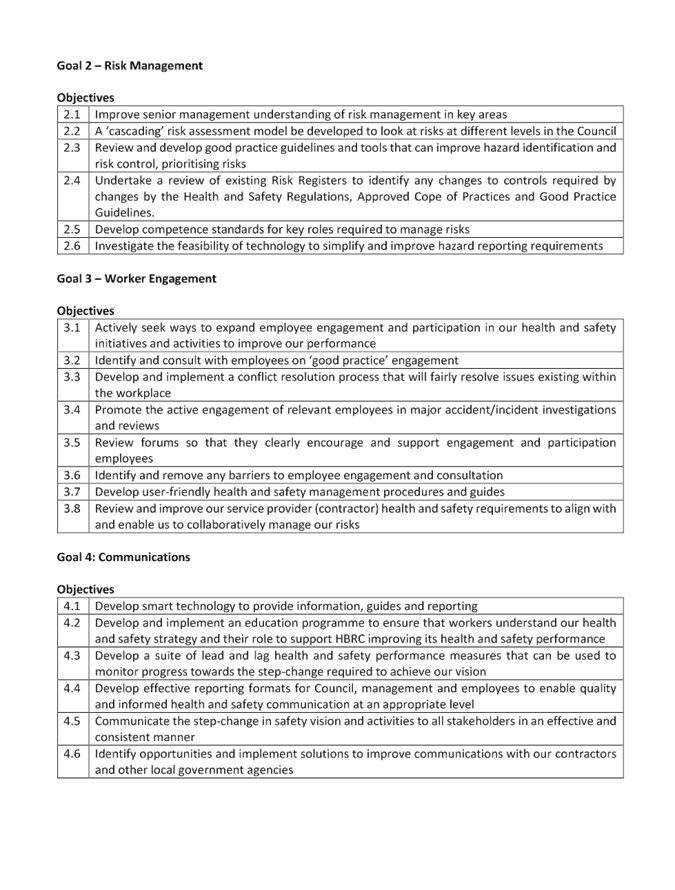

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 06 March 2019

Subject: Health and Safety Work

Programme

Reason

for Report

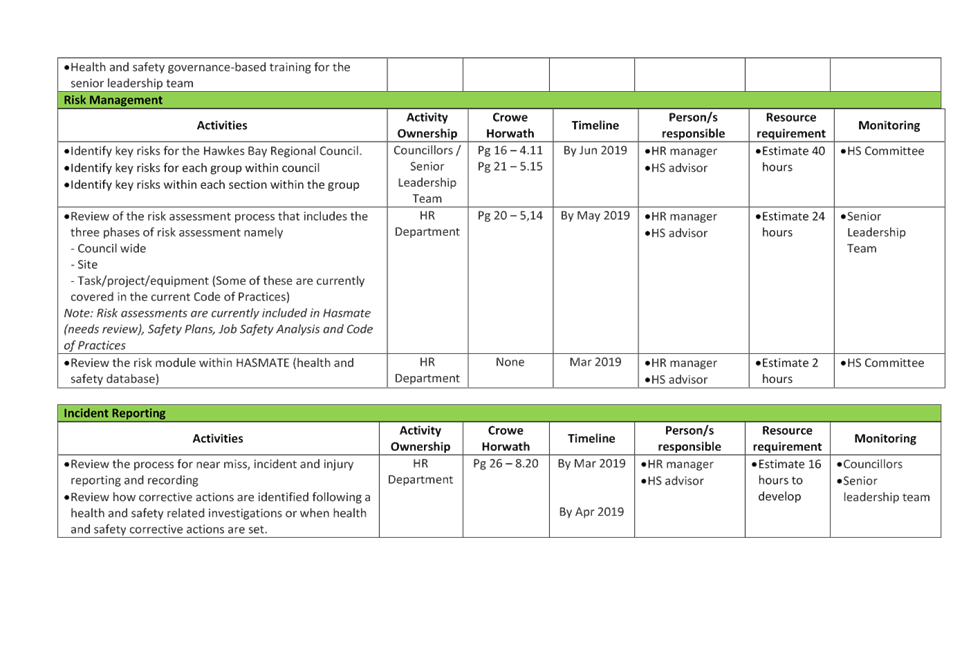

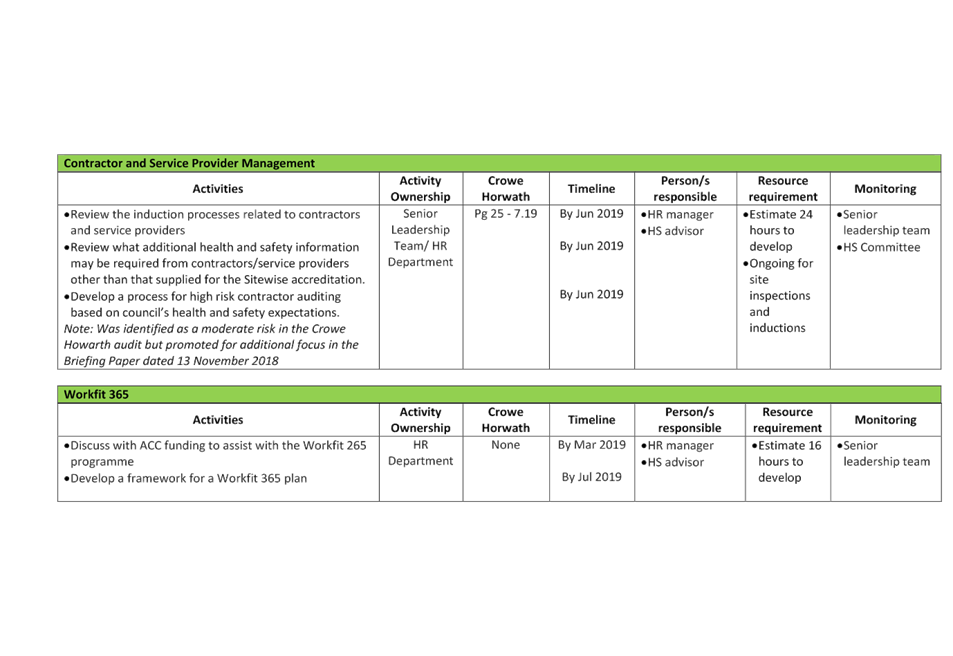

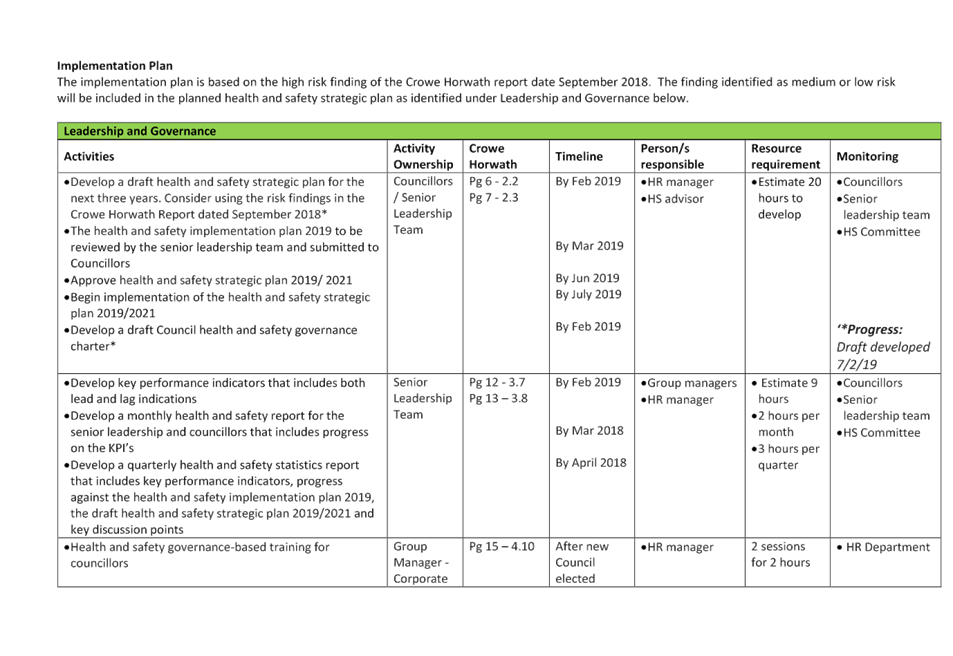

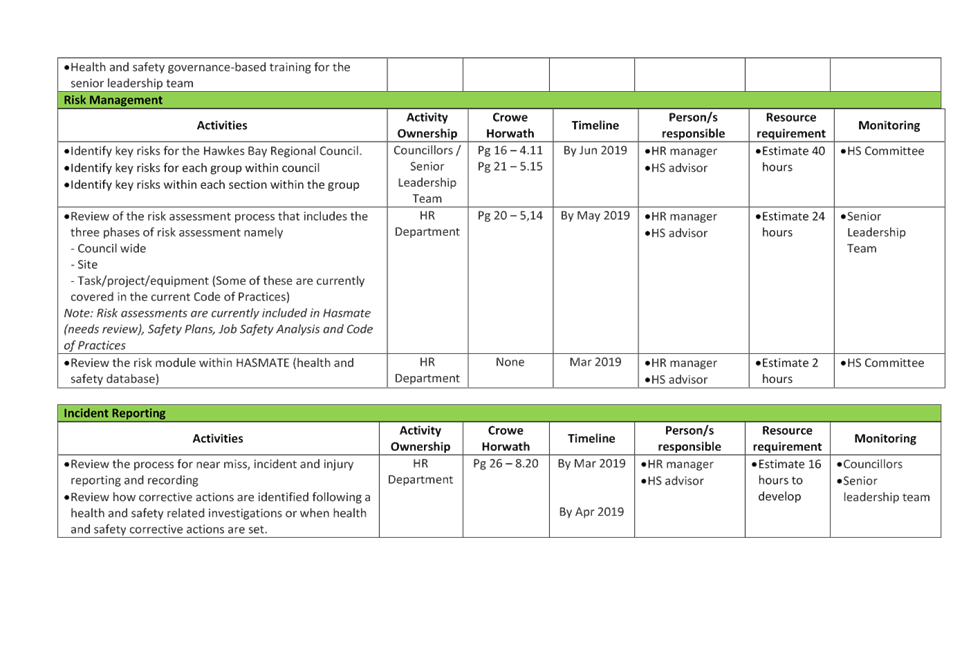

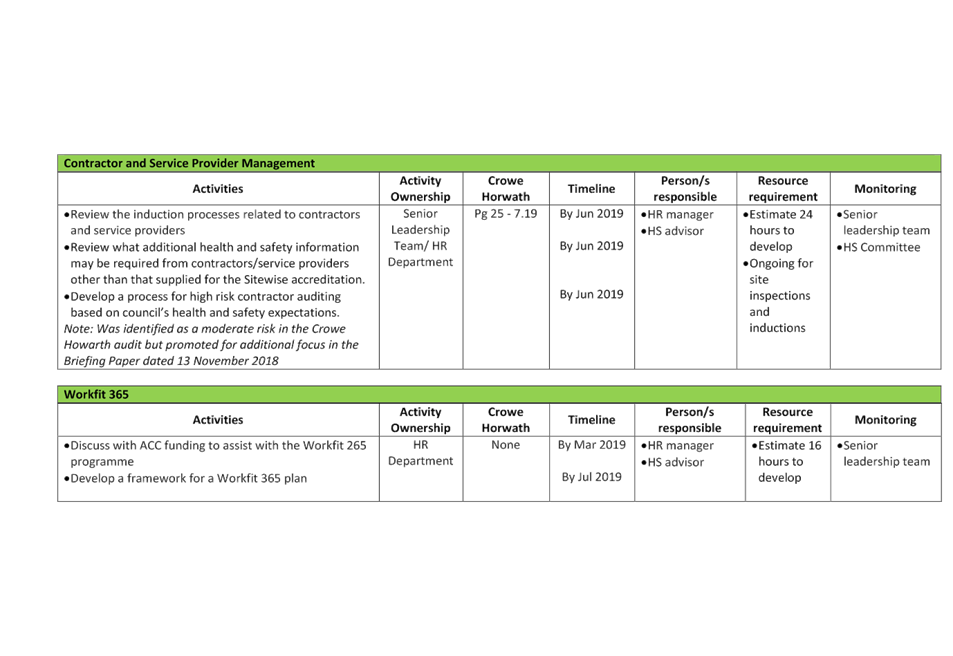

1. This item updates the Committee on progress with activities on the

Health & Safety (H&S) work programme in response to the 2018 internal

audit of Council’s H&S processes.

Background

2. The Finance, Audit and Risk Sub-committee (FARS) were presented with

a report on 21 November 2018 which was completed by Crowe Horwath

resulting from their audit of health and safety practices and processes in

Council.

3. The audit did not include any ‘field’ monitoring.

4. The audit noted, “It is important to note that our findings

are written on an exception basis, there were many examples of good practice

within Council” and further, “Throughout our review, it is

clear that staff were engaged in health and safety and truly understood its

importance”.

5. This report focuses on progress against the audit

recommendations. Health and Safety metrics are recorded separately in the

overall Council performance report.

6. The following documents have been prepared in draft form:

6.1. An Implementation Plan has been prepared to address the high risk

issues and recommendations identified in the Crowe Horwath audit report

(Attached).

6.2. A draft Health and Safety Charter for councilors has been created to

meet one of the recommendations from the audit for councilors to consider and

‘sign off’ (Attached).

6.3. A draft Strategic Plan has been developed which is linked to the

government’s Health and Safety at Work Strategy 2018-2028 and draws on

strategic health and safety planning guidelines in the Business Leaders’

Health and Safety Forum Strategic Plan. It provides some high level targets and

will be focused, in the first 12 to 18 months, on the objectives set in the

Implementation Plan (Attached).

7. Work has commenced on reviewing risks across the organisation with a

view to identifying Council wide risks, Group risks and section risks and

associated controls at each level. This ‘cascading’ approach

should encourage strong discussion at each level and ensure improved focus on

relevant risks in the workplace.

8. The classification of risks required in Hasmate, (Council’s

health and safety software tool), to ensure they are classified in terms of

significance, will commence shortly.

9. In relation to the recommendation that Executive members should

undertake ‘regular’ monitoring visits to work sites with higher

level risks, it is proposed to have the executive assistants schedule

appropriate times for these visits to occur when the work visits are relevant

and appropriate e.g. high risk site or operation. They will be scheduled

when the group manager is available and staff from a relevant section are

visiting a relevant site. This will need some flexibility to arrange.

10. Another

part of this recommendation was to have councilors visit various work sites to

ensure they have an improved understanding of the risks staff face and their

role in governance responsibilities under health and safety requirements.

In the past, councilors would undertake a day or two ‘tour’ of

various activities and workplaces which would go a significant way to meeting

the recommendation for health and safety awareness reasons. Councilors’

feedback on how best to implement the requirements of this recommendation will

help determine a course of action.

Decision

Making Process

11. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision making

provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee

receives and notes the “Health and Safety Work Programme”

staff report.

|

Authored by:

|

Viv Moule

Human Resources Manager

|

Joanne

Lawrence

Group Manager Office of the Chief Executive

and Chair

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

|

⇩1

|

Health and

Safety Implementation Plan 2019

|

|

|

|

⇩2

|

HBRC

Governance Charter

|

|

|

|

⇩3

|

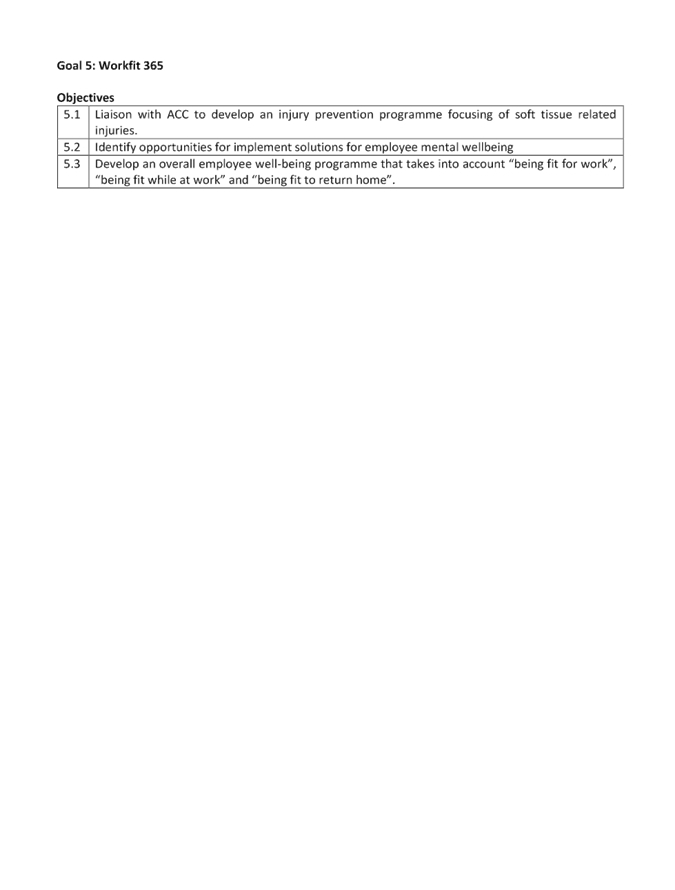

Health and

Safety Strategic Plan 2019

|

|

|

|

Health

and Safety Implementation Plan 2019

|

Attachment 1

|

|

Health

and Safety Implementation Plan 2019

|

Attachment 1

|

|

HBRC

Governance Charter

|

Attachment 2

|

|

Health and Safety Strategic

Plan 2019

|

Attachment 3

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 06 March 2019

Subject: Discussion of Minor

Items Not on the Agenda

Reason for Report

This document has been prepared to assist Committee Members

to note the Minor Items of Business Not on the Agenda to be discussed as determined earlier in Agenda Item

5.

|

Item

|

Topic

|

Raised

by

|

|

1.

|

|

|

|

2.

|

|

|

|

3.

|

|

|

|

4.

|

|

|

|

5.

|

|

|