HAWKE’S BAY REGIONAL COUNCIL

Wednesday 28 November 2018

Subject: Kahutia – Ngati

Kahungunu Iwi Incorporated Carbon Credit Proposal

Purpose

of Report

1. This paper

reports back to Council on the proposed agreement with Kahutia Limited

Partnership (Kahutia LP) for a ten year loan of up to 100,000 of the

Council’s carbon units (NZUs) and seeks a Council decision to proceed

with a loan with conditions.

Staff Recommendations

2. It is

recommended that Council considers and discusses the options for the

Council’s safe carbon portfolio and provide staff with direction on

whether it would like to proceed with a loan to Kahutia LP of 100,000 NZUs or a

lesser amount, or to undertake an RFP process for loans of some or all of the

Council’s safe carbon portfolio, or a combination of both.

3. It is not

recommended that the Council either do nothing, as this will not assist with

the Council’s strategic objective for accelerating afforestation within

the region, nor sell its safe carbon portfolio at this time as the future value

of the NZUs is likely to appreciate at a rate greater than equivalent funds

invested in the Council’s managed funds portfolio.

Background

4. On 3 October

2018 the Corporate and Strategic Committee resolved:

4.1. endorses the

Chief Executive negotiating a lease of New Zealand Units to Kahutia Limited

consistent with the proposal as detailed

4.2. requests that

the Chief Executive provides a draft contract and appropriate legal and

financial advice to Council on 24 October 2018 to enable consideration of a

decision, as being recommended following, to approve a lease agreement with

Kahutia Limited

4.3. recommends

that Council approves a lease of up to 100,000 New Zealand Units of the

Council’s safe carbon portfolio to Kahutia Limited.

5. The strategic

context for this initiative is that the Council has identified. In its

2017-2021 Strategic Plan the Council stated it would “Incentivise

afforestation of erosion-prone land” and set the following targets:

5.1 By 2030,

all farms in critical source areas have phosphorus management plans being

implemented, with at least 50% of highly erodible land treated with soil

conservation plantings.

5.2 By 2050,

all highly erodible land is under tree cover.

6. On 25 July 2018

the Council resolved to sign a memorandum of understanding with Ngati Kahungunu

Iwi Incorporated (NKII) for the Kahutia Accord with a stated intention of the

Council and NKII to co-invest, both jointly and in aligned investment, in a

programme of regional afforestation.

7. This proposal

to loan NZUs to Kahutia LP is consistent with the Council’s current

strategic direction and is complementary to the Council’s current works

with the Erosion Control Scheme and the Right Tree Right Place study underway.

The proposal is also consistent with the stated intention of the Council in its

MoU with NKII under the Kahutia Accord.

8. The principal

benefit of the proposal is that it utilises a current asset of Council to

support further afforestation, while generating a modest return for Council,

and does not require the permanent alienation of an asset which has an expected

longer term valuation uplift. As long as the contract contains

appropriate safeguards, the risks to the Council are low and considered to be

outweighed by the benefits.

9. The

Council’s current NZU portfolio consists of 105,640 ‘post-89’

NZUs and 14,907 ‘pre-1990’ NZUs. By 2033 the total gross NZUs

accrued by the Council’s forests will peak at 275,094 NZUs, of which an

estimated ~110,000 units is deemed to be ‘safe’ in that they do not

have to retained or surrendered for future harvest liabilities. The exact

quantum of future harvest liabilities will depend upon the timing of future

harvests and future field-based carbon measurements. The looming harvest

liabilities arising from the harvest of the Council’s forest at Tutira

can be accommodated within the current and expected Council holdings of NZUs at

the end of the 2023 Emissions Trading Scheme reporting period, even with

100,000 NZUs on loan to a third party or parties.

Proposed Loan Agreement

10. Following the October

meeting of the Corporate and Strategic Committee, Kahutia LP provided a revised

contract, which is attached and while it requires finalising, the key elements

are contained within. This newer version differs substantially in two

particular respects. The original contract had been expressed as a lease

but is now expressed as a loan. This better reflects the fact that the

NZUs to be returned to the Council are not the same NZUs as that initially

provided but have equivalent surrender value. This works in the same way

a monetary loan will be repaid with equivalent cash but it may well be money

acquired from another source.

11. The second significant

change to the terms of the loan is that interest is now repayable from the end

of year one and it is no longer proposed that this be capitalised for the first

four years.

12. There has also been the

introduction of an interest penalty to apply to non-performance by the

borrower. It is recommended that this be set at 5% per annum, not 2%

expressed in the draft contract, and apply to both interest and principal

payment due at the end of each year that is not repaid on time. It is

proposed that this interest be calculated on a daily basis pro rata to the

total annual sum due.

13. As previously advised the

Council has been invited by the directors of Kahutia LP to co-invest in the

company up to, and including, as a 50% joint venture shareholder. If the

Council was to take up this option at a 50% shareholding the company would be

deemed to be a Council Controlled Organisation and a decision to invest would

require a special consultation under the Local Government Act. Any decision to

invest substantial capital into the company may also trigger the significance

policy and necessitate special consultation as well. It is proposed that the question

of whether to invest in Kahutia LP be considered in 2019 once the ‘Right

Tree Right Place’ forestry investment case has been completed.

Legal Advice

14. The draft loan contract

has been reviewed by Sainsbury Logan and Williams (SLW) on the Council’s

behalf. This legal advice is attached.

15. SLW note that while the

contract expresses an intent that Kahungunu Asset Holding Company (KAHC)

provide security for the loan, we do not have a confirmation of this directly

from KAHC at this time. Representatives from NKII attending the Council

meeting may be able to confirm that this security has been formally agreed by

the board of KAHC. It is recommended that any agreement to loan NZUs to

Kahutia LP be done so on the condition that KAHC become a party to the loan

agreement and expressly guarantee the necessary security to the satisfaction of

the Council’s solicitor.

16. SLW recommended that

Council seek comfort from Kahutia LP on the afforestation plans to ensure the

level of carbon intended to be sequestered will be sufficient to meet the

obligations under the loan agreement. Discussions with Kahutia LP have

indicated that the company has expressions of interest and a desire to afforest

1600 hectares of land within the region. Representatives from NKII attending

the Council meeting will give a presentation to Council on the land that is

intended for afforestation and the mix of intended species and area to be

planted. It is recommended that the contract require Kahutia LP to report

annually to Council on its achievements in terms of forest area and species

planted, forest establishment success and volumes of carbon sequestered.

Financial Advice

17. The primary cost to the

Council from this proposal is the administration and oversight of the contract

with Kahutia LP. The cost of transferring NZUs between the Council and

Kahutia LP on the NZTES Registry is minor. The principal costs related to

NZU registration arise from registering new land for NZUs and the costs in this

situation have already been borne by the Council with respect to its own

forests and the cost of registering units against land planted by Kahutia LP

will be funded by the borrower.

18. The value of the NZUs in

question presently reside on the Council’s balance sheet as assets and

this will remain the case as the loan to Kahutia LP will also be an asset,

albeit a non-current one until the loan is repaid.

19. The loan agreement

proposes that a 2% per annum interest rate applies to the loan balance. A

repayment schedule has not been finally negotiated with Kahutia but if this is

set at interest only for the first four years and then 16% per annum repayment

of the principal thereafter then interest income to the Council would be 2000

NZUs at a current market value of approximately $50,000 at the end of year

one. In year ten, the interest payable would be 400 NZUs with a value of

$5000. Over the life of the loan, under this repayment schedule, the total NZUs

payable as interest would be 14,982 with a current market value of

approximately $375,000. Given the forward price path for NZUs it can be

expected that expected returns will actually be higher.

20. The Council presently

holds insurance cover on its forestry estate but this cover does not extend to

the NZUs attributed to them. In the event of material fire, wind or pest

damage the Council is liable for surrendering NZUs to the extent of the damage.

As the Council’s forests are geographically spread and have a mix of

species the portfolio provides a natural hedge against this risk and enables the

Council to self-insure. If the Council is loan its NZUs to Kahutia LP or

any other party staff recommend insurance is obtained to ensure any liabilities

arising from material damage to the Council’s forests can be covered

while the NZUs are effectively on loan to other parties.

21. Staff have obtained a

quotation for cover from its current insurer for the Council’s full NZU

portfolio, which has a current market value of approximately $3m, with an

annual premium payable of $3,753 ex GST. The Council’s Chief

Executive has determined that this cover should be obtained - regardless of the

whether NZUs are leased or not - as the value of NZUs is now at a level that

the Council’s overall portfolio is a valuable asset and warrants

protection, and represents a liability to the Council in the event of material

damage.

Options

22. As alternatives to the

proposal from Kahutia LP, the Council could proceed with any of the following

instead.

23. Do nothing – this would

involve the Council retaining all of its NZUs at this time. The Council

would continue to benefit from the expected increased value of these assets

(although this is not guaranteed) but would receive no income from them until

such time as the Council decides to sell. This option would not result in

any additional trees being established as a result of the Council’s NZU

portfolio.

24. Sell the safe carbon NZUs –

the Council could sell all or some of its current safe carbon portfolio for up

to $2.6-2.8m and direct these funds toward Council operations, such as

supplementary funding for the Erosion Control Scheme, or set aside the funds

for future commercial forestry investment, or add the funds to the

Council’s managed funds portfolio for financial returns. Under this

option the Council could ensure additional tree planting occurs within the

region but this is unlikely to be practicable for the 2019 planting year and

would not leverage the work already undertaken with landowners by Kahutia

LP. If the Council was to use the realised funds for the Erosion Control

Scheme they would cease to be a balance sheet asset for the Council as this is

a grant-based scheme.

25. Call for a Request for Proposals (RFP) – the Council could undertake an RFP process to determine whether

there are other parties who wish to borrow some or all of the Council’s

safe carbon portfolio. In the same way that Kahutia LP have approached

this opportunity other parties may wish to borrow NZUs from the Council in

order to fund afforestation activity and use their future carbon allocations to

repay the loan and any interest. Council could run a competitive process

and seek to maximize the level of afforestation achieved for the allocation or

seek higher interest/returns on the loan. Kahutia LP could submit their

proposal into this process. The benefit of this approach is that the

Council may achieve a better rate of return or greater levels of afforestation

than proposed by Kahutia LP. However, to date the Council has not

received any expressions of interest from other parties for the use of its

carbon portfolio. Furthermore, in signing the Kahutia Accord the Council

has expressed an intention to work collaboratively with Ngati Kahungnunu Iwi

Incorporated, as the regional iwi authority, to undertake afforestation

activities and choosing other parties over Kahutia LP may be seen as a breach

of the good faith provisions the Council sought for inclusion with the Kahutia

Accord.

26. Undertake a combined RFP and loan to Kahutia LP – the Council could run a RFP for part of the safe

carbon portfolio (for example 50% or 50,000 NZUs) and loan the remainder to

Kahutia LP under the current proposed terms or similar. Kahutia LP could also

compete within the RFP process for the other half of the portfolio. This

approach may balance the risks and benefits of the approach outlined above.

Implications

for Tangata Whenua

27. A loan of this nature to

Kahutia Limited Partnership is an avenue for the Council to exercise

partnership with regional iwi and assist in the development of afforestation on

erosion prone Maori land. The Kahutia LP is owned by Ngati Kahungunu Iwi

Incorporated, which has 31,241 members, and so working in partnership with

Kahutia LP gives the Council the maximum indirect partnership with regional

tangata whenua. However, it should be noted that Treaty Settlement Entities

within the region may also wish to enter into similar arrangements with the

Council and maybe critical if the loan is made exclusively with Ngati Kahungunu

Iwi Incorporated via Kahutia LP and an RFP process is not followed.

Decision

Making Process

28. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that the decisions sought in this paper are not significant in terms

of the Council’s Significance and Engagement Policy. This

assessment is based on the fact that the level of community interest and the

impact on individuals or groups is likely to considered low. The proposal

does not impact upon levels of service, rates or debts in the current Long Term

Plan, and the costs and financial implications for ratepayers are minor. The

Council’s carbon portfolio is not a strategic asset.

|

Recommendation

That Hawke’s Bay Regional Council:

1. Receives and notes the “Kahutia – Ngati

Kahungunu Iwi Incorporated Carbon Credit Proposal” staff

report.

2. Authorises the Chief Executive to finalise the terms of a loan to

Kahutia Limited Partnership for a ten year loan of XXX,000 NZUs consistent

with the other terms in the attached draft contract and within this paper,

and including an appropriate repayment schedule.

3. Agrees that the loan only be authorised subject to Kahungunu Asset

Holding Company becoming a party to the loan agreement and providing security

for the loan to the satisfaction of the Council’s solicitor.

And/or

4. Directs staff to undertake a Request for Proposals for loans of

NZUs from the Council’s carbon portfolio for XXX,000 NZUs.

|

Authored &

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

|

⇩1

|

HBRC and

Kahutia LP Carbon Loan Agreement

|

|

|

|

⇩2

|

Memo from Jonathan

Norman re Kahutia

|

|

|

|

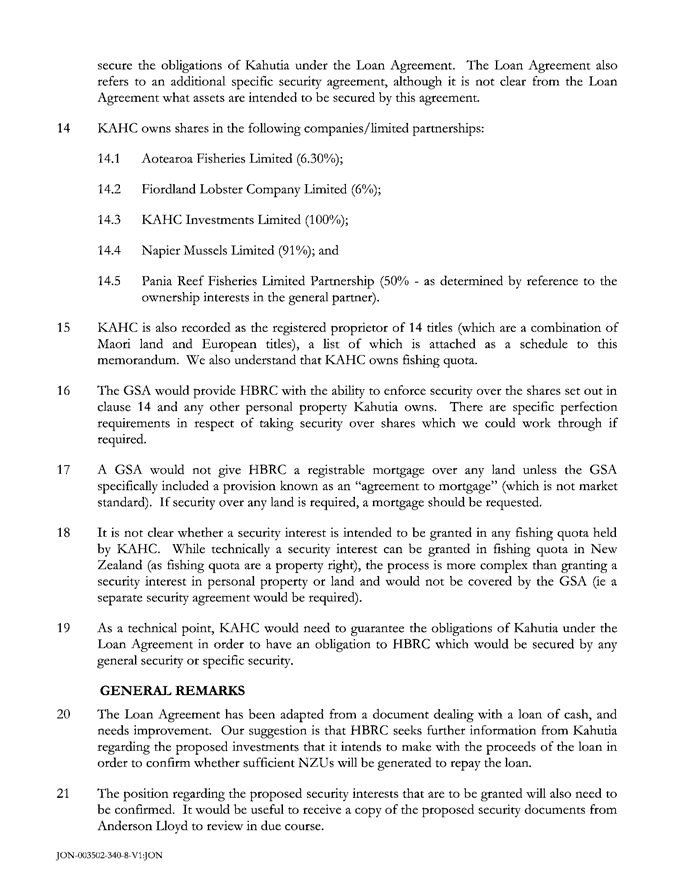

⇩3

|

List of

Titles owned by Kahungunu Asset Holding Co

|

|

|

|

⇩4

|

Previously

Public Excluded 28 November 2018 Meeting Minutes

|

|

|