Meeting of the

Corporate and Strategic Committee

Date: Wednesday 24 August 2022

Time: 1.00pm

|

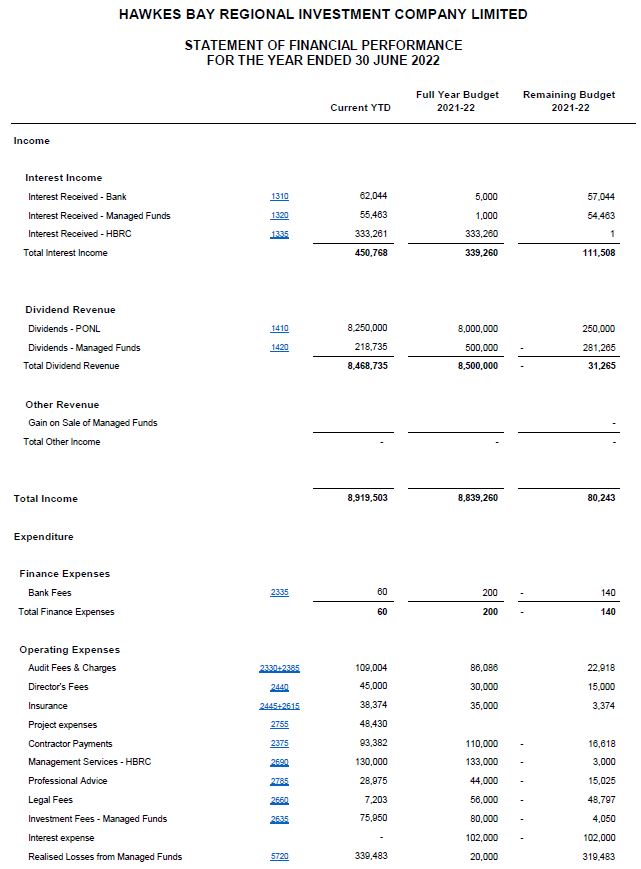

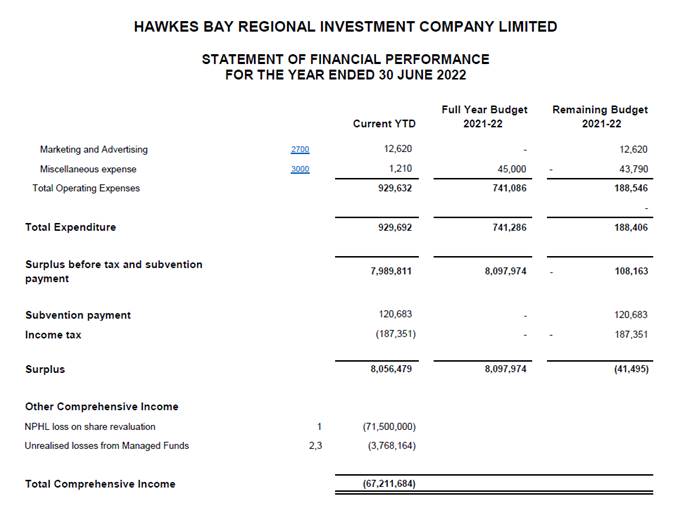

Venue:

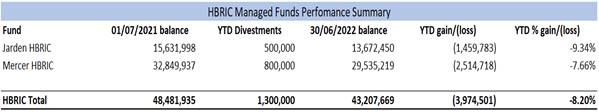

|

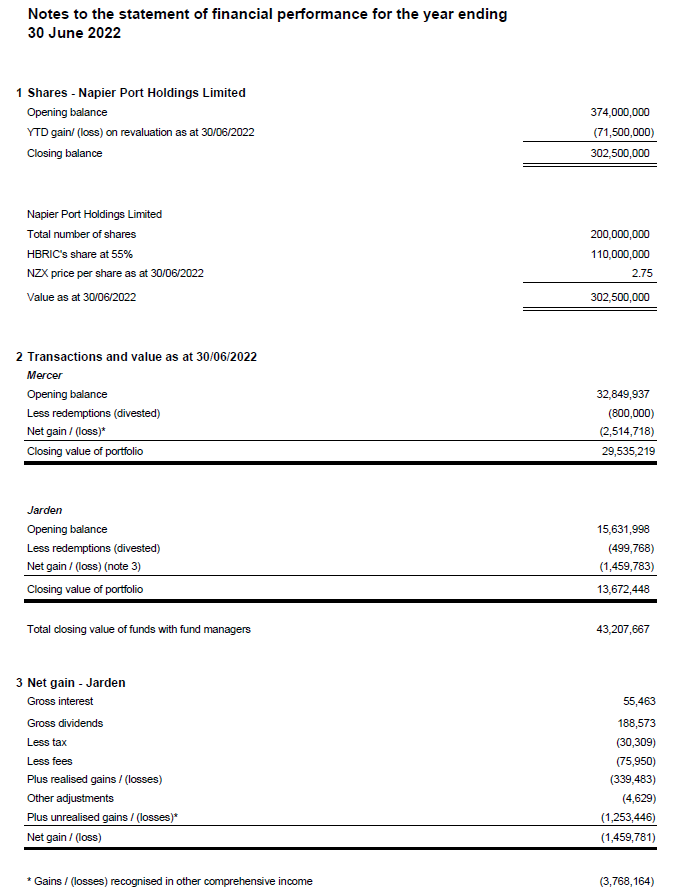

Council

Chamber

Hawke's

Bay Regional Council

159

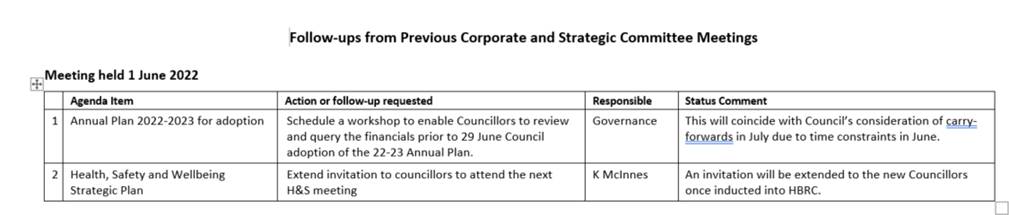

Dalton Street

NAPIER

|

Agenda

Item Title Page

1. Welcome/Karakia/Notices/Apologies

2. Conflict

of Interest Declarations

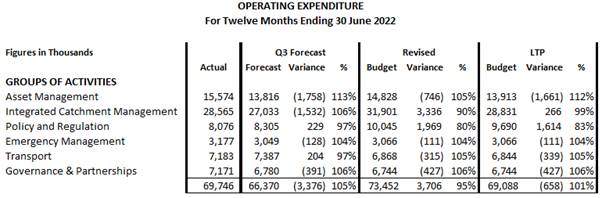

3. Confirmation of Minutes of

the Corporate and Strategic Committee held on 1 June 2022

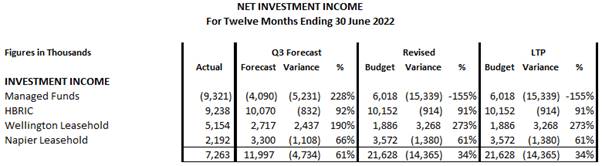

4. Follow-ups

from previous meetings 3

5. Call

for minor items not on the Agenda 7

Decision

Items

6. Hawke's

Bay Regional Council shareholding in the Regional Sector Shared Services Organisation

(RSSSO) 9

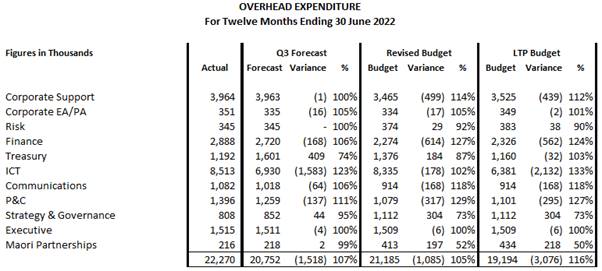

7. 2021-2022

Carry forwards 13

Information

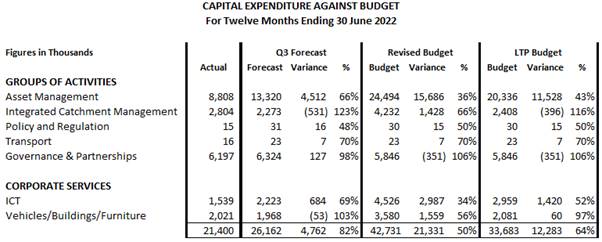

or Performance Monitoring

8. 1

April – 30 June 2022 Financial Report 25

9. HBRIC

Quarterly Update 33

10. Organisational

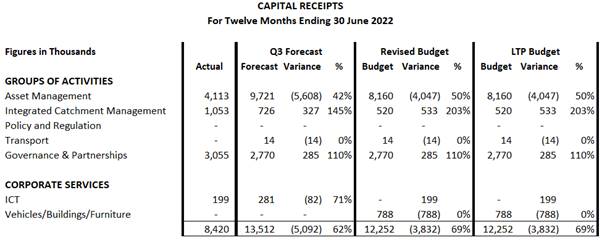

Performance Report for the period 31 March – 30 June 2022 43

11. 2021-2022

Annual Report – Interim Non-Financial Results 45

12. Hawke's

Bay Tourism Six-Monthly Update 49

13. Report

from the Finance Audit and Risk Sub-committee meeting 61

14. Discussion

of Minor Items not on the Agenda 65

Decision

Items (Public Excluded)

15. Section

36 charges for Water Holdings HB 67

HAWKE’S BAY REGIONAL COUNCIL

Corporate and Strategic Committee

Wednesday

24 August 2022

Subject: Follow-ups from previous meetings

Reason for Report

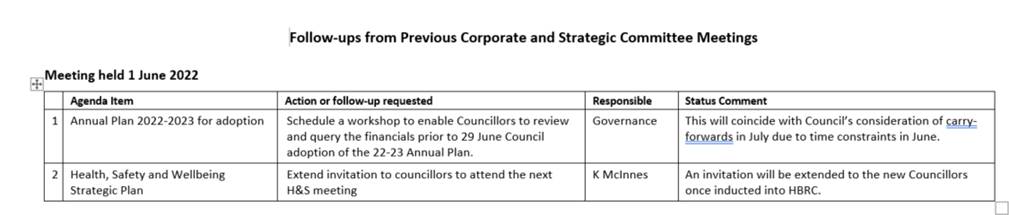

1. On the list attached are

items raised at previous Corporate and Strategic Committee meetings that staff

have followed up on. All items indicate who is responsible for follow up, and a

brief status comment. Once the items have been reported to the Committee they

will be removed from the list.

Decision Making Process

2. Staff have assessed the requirements

of the Local Government Act 2002 in relation to this item and have concluded

that, as this report is for information only, the decision-making provisions do

not apply.

Recommendation

That the

Corporate and Strategic Committee receives and notes the Follow-up items

from previous meetings.

Authored by:

|

Annelie Roets

Governance

Advisor

|

|

Approved by:

|

James Palmer

Chief

Executive

|

|

Attachment/s

|

1⇩

|

Followups for August 2022 Corporate

and Strategic meeting

|

|

|

|

Followups for August 2022 Corporate and

Strategic meeting

|

Attachment

1

|

HAWKE’S

BAY REGIONAL COUNCIL

Corporate and Strategic Committee

Wednesday

24 August 2022

Subject: Call for minor items not on the Agenda

Reason for Report

1. This item provides the

means for committee members to raise minor matters relating to the general business of

the meeting

they wish to bring to the attention of the meeting.

2. Hawke’s Bay Regional

Council standing order 9.13

states:

2.1. “A meeting may discuss an item that is

not on the agenda only if it is a minor matter relating to the general business

of the meeting and the Chairperson explains at the beginning of the public part

of the meeting that the item will be discussed. However, the meeting may not

make a resolution, decision or recommendation about the item, except to refer

it to a subsequent meeting for further discussion.”

Recommendations

3. That the Corporate and Strategic

Committee accepts the following minor items not on the Agenda for

discussion as Item 14:

|

Annelie

Roets

Governance

Advisor

|

James

Palmer

Chief

Executive

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate and Strategic Committee

Wednesday

24 August 2022

Subject: Hawke's Bay Regional Council shareholding in the Regional Sector

Shared Services Organisation (RSSSO)

Reason

for Report

1. This report sets out the

background and steps required, for Council to become a shareholder of the

Regional Sectors Shared Services Organisation, as previously resolved by

Council.

Officers’

Recommendation(s)

2. Council officers recommend that the

Council formally sign into the Council Shareholding in the Regional Sector

Shared Services Organisation (RSSSO) by delegating authority to the CEO to sign

the Shareholders’ Agreement - Deed of Accession on behalf of the Council.

Executive

Summary

3. Council consulted on and

subsequently resolved to participate in RSSSO/RSHL in April/May 2022 and June

2022 respectively.

4. Regional Software Holdings

Limited (RSHL) is being transitioned into the Regional Sector Shared Services

Organisation (RSSSO) to consolidate existing collaboration programmes and to

put in place a fit-for-purpose structure that will enable the sector to respond

more quickly to shared issues and opportunities, while reducing individual

council cost and resource use.

5. RSSSO will have up to eight

directors and Hawke’s Bay Regional Council will have equal nomination,

selection and voting rights alongside all other Class A shareholding councils.

6. Once the current

shareholders sign the new Shareholders’ Agreement, the Council can sign

the Deed of Accession (as appended to the Shareholders’ Agreement), be

issued a single, fully paid Class A share and become a shareholder of RSSSO.

7. The share price is $1 for 1 Class A

Share.

8. Involvement in the Council Controlled

Organisation (CCO) won’t initially require any funding. Operational costs

will be covered by the existing ReCoCo subscription fees paid by all regional

councils.

9. Additional costs are incurred when

each council decides to participate in and contribute funding towards a

programme eg. IRIS.

Background

/Discussion

10. The sector already has several

resource sharing and collaboration programmes in place including: the Special

Interest Group (SIG) Network, EMAR / LAWA, Essential Freshwater Implementation

Programme, the Regional Sector Office, ReCoCo Programmes, the Sector Financial

Management System and IRIS.

11. On 3 August 2021, the Regional Chief

Executive Officers (RCEO) Group approved a business case for the development of

a Regional Sector Shared Services Organisation.

12. The business case set out that the

next evolutionary step is to consolidate existing collaboration programmes and

to put in place a fit-for-purpose structure that will enable the sector to

respond more quickly to shared issues and opportunities, while reducing

individual council cost and resource use. Ultimately, doing more with

less.

13. It was agreed to transition Regional

Software Holdings Limited (RSHL) into the Regional Sector Shared Services

Organisation (RSSSO) and a cross-council project team and steering group were

stood up to run the transition.

14. Regional Software Holding Limited

(RSHL) is a not-for-profit Council Controlled Organisation (CCO) that has been

operating for 10 years and delivering an increasing number of innovative,

collaborative solutions to the regional and unitary sector.

15. Regional Software Holdings Limited

(RSHL) has six founding shareholders who will sign a new Shareholders’

Agreement and a Shareholders’ Resolution in order to transition the

company into the Regional Sector Shared Services Organisation.

16. The following objectives were sought

through the transition, to:

16.1. Equalise the shareholding and control

rights for each shareholder of RSSSO

16.2. Achieve consistent treatment of

founding and new shareholders

16.3. Enable shareholders to retain rights

and ownership over the assets that they funded

16.4. Minimise the impact of the transition

on founding shareholders.

17. Hawke’s Bay Regional Council

consulted with the community on 29 April 2022 – 15 May 2022 and

subsequently resolved to join RSSSO as a shareholder on 29 June 2022 as

recommended by the Corporate and Strategic Committee.

18. Once the founding shareholders have

signed the Shareholders’ Agreement and Shareholders’ Resolution,

Council can sign the Shareholder’s Agreement - Deed of Accession to

become a shareholder.

Approach

to shareholding

19. To achieve the above objectives, the

structure of the new company separates the ownership and control of the

company, from the ownership and control of the significant assets developed by

the company, such as IRIS classic.

19.1. The Shareholders’ Agreement,

Constitution and Shareholders’ Resolution propose that:

19.1.1. All founding and future

shareholders receive a single fully paid, Class A share that holds the rights

of ownership and control of the company.

19.1.2. The company issues a

separate class of shares for all significant capital developments. These

separate class shares will hold the rights of ownership and control over the

specific assets.

19.1.3. The company issue Class B

shares that will hold the rights of ownership and control over IRIS classic.

19.1.4. The company transfer the founding

shareholders current shareholding into Class B shares enabling the founding

shareholders to maintain their ownership of IRIS classic, resulting in minimal

impact on the founding shareholders as a result of the transition.

Approach

to Director Appointment

20. The Shareholders’

Agreement and Constitution propose the following key aspects:

20.1. That there be a maximum of

eight directors

20.2. That while the company has

less than six directors, at least one must be an independent director, and

while the company has six or more directors, at least two must be independent

directors

20.3. Only the independent

directors are entitled to receive directors’ fees

20.4. The directors will be

appointed by ordinary resolution, voted on by all Class A shareholders

20.5. At the next annual meeting

(Nov 2022) the current Board will retire and, if they so choose, offer

themselves for re-election

20.6. The Class A shareholders

will then select the full Board at this annual meeting

20.7. In subsequent years, the

Board will operate a retirement by rotation approach whereby a minimum of two

vacancies will be created and shareholders can nominate candidates (which may

include any directors retiring by rotation) to be reviewed, selected and appointed

to the vacancies.

21. This approach is intended to balance

the retention of experience with the need to refresh the Board for upcoming

issues and opportunities.

22. The Shareholders’ Agreement,

Constitution and Shareholders’ Resolution have been drafted to give

effect to the above.

Decision

Making Process

23. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

23.1. The decision does not significantly

alter the service provision or affect a strategic asset, nor is it inconsistent

with an existing policy or plan.

23.2. The use of the special consultative

procedure is not prescribed by legislation, but consultation is required under

section 56 of the Act prior to becoming a shareholder of a CCO. The substantial

decision to participate in RSSSO has been previously consulted on.

23.3. The decision to delegate authority to the CEO to sign the

Shareholder’s Agreement - Deed of Accession on behalf of the Council to

formally join the RSSSO is

not significant under the criteria contained in Council’s adopted

Significance and Engagement Policy.

23.4. The persons affected by this decision

are all ratepayers in the region and have been previously consulted.

23.5. Given the nature and significance of

the issue to be considered and decided, and also the persons likely to be

affected by, or have an interest in the decisions made, Council can exercise

its discretion and make a decision without consulting directly with the

community or others

having an interest in the decision.

Recommendations

That

Hawke’s Bay Regional Council:

1. Receives and considers the Hawke's

Bay Regional Council shareholding in the Regional Sector Shared Services

Organisation (RSSSO) staff report.

2. Agrees that the decisions to be made

are not significant under the criteria contained in Council’s adopted Significance

and Engagement Policy, and that Council can exercise its discretion and make

decisions on this issue without conferring directly with the community or

persons likely to have an interest in the decision.

3. Notes the approach to shareholding and

appointments of directors related to establishing the Regional Sector Shared

Services Organisation, and as incorporated into the Shareholders’

Agreement and Constitution.

4. Delegates authority to the CEO to sign

the Shareholder’s Agreement - Deed of Accession on behalf of the Council.

Authored by:

|

Susie Young

Group

Manager Corporate Services

|

|

Approved by:

|

James Palmer

Chief

Executive

|

|

Attachment/s

|

1⇨

|

RSHL Shareholders Agreement

|

|

Under Separate Cover

|

|

2⇨

|

RSHL Constitution

|

|

Under Separate Cover

|

HAWKE’S

BAY REGIONAL COUNCIL

Corporate and Strategic Committee

Wednesday

24 August 2022

Subject: 2021-2022 Carry forwards

Reason

for Report

1. This item seeks approval from the

Corporate and Strategic Committee to carry forward expenditure budgets from

2021-2022 to 2022-2023

Executive

Summary

2. During 2021-2022 a number of work

programmes experienced delays and were unable to be completed. Where this

work cannot be reprioritised from within the Annual Plan 2022-2023 budget,

unspent expenditure budgets are requested to be carried forward to cover the

expected costs that are likely to be incurred.

3. A total of $4.032m unspent opex and

$9.319m unspent capex is requested to be carried forward into the 2022-2023

budget.

4. The source of funds required

($13.351m) for the combined opex and capex carry forward request is

4.1 $4.860m debt funding

4.2 $5.316m reserve funds

4.3 $0.713m external funds and

4.4 $2.461m general funds.

5. A further $2.190m of unspent opex and

$5.713m unspent capex is still required, but the re-phasing of this expenditure

will be reviewed as part of the 2023-2024 Annual Plan.

Background

6. Carry forwards is a common practice

within Councils and allows for unspent funds against projects to be moved

forward so that projects can be completed. These include the funding of final

costs of projects and contracts that were unable to be completed by the

financial year end and the carry forward of external income received for

specific projects.

7. The funding types are categorized

below:

7.1 General funding is from General Rates

which includes investment income

7.2 Reserve funding is from targeted rates

that have flowed through to Reserves and funding from Reserves

7.3 External is external funding received

for specific projects

7.4 Debt is for debt funding not drawn

down this year and is covered by interest and principal repayments that are

already included in the LTP.

8. Officers informed the Corporate &

Strategic Committee on 1 June 2022, based on the full year forecast at that

time, the indicative carry forwards from 2021-2022 would be $4.7m opex and

$17.17m capex, and final carry forward requests would be presented at the

conclusion of the financial year once the draft financial results had been

analysed.

Phasing of

carry forwards

9. Many work programmes experienced

significant delays in 2021-2022, due to Covid-19 disruptions, staff turnover,

weather events such heavy rain and flooding, contractor availability and supply

shortages.

10. Officers have analysed the unspent

expenditure budgets still required to complete the planned activities, and

identified the budget required to meet the immediate commitments in

2022-2023. The carry forwards requested in this paper are for expenditure

in the 2022-2023 year on top of the existing Annual Plan budget. The

remainder of the unspent funds still required will be incorporated into the

2023-2024 Annual Plan process for confirmation. A high-level summary of

the anticipated phasing of the unspent budgets still required is provided in

the table below.

|

Figures

in Thousands ($,000)

|

Opex

|

Capex

|

|

Interim Net Variance

|

Carry forward request to

22-23

|

Required in outyears

|

Interim Net Variance

|

Carry forward request to

22-23

|

Required in outyears

|

|

Groups

of Activities

|

|

|

|

|

|

|

|

Asset

management

|

$26

|

$100

|

$52

|

$11,639

|

$4,556

|

$5,505

|

|

Integrated

Catchment Management

|

$4,037

|

$1,422

|

$2,138

|

$1,961

|

$1,623

|

$208

|

|

Policy

& Regulation

|

$1,969

|

$1,244

|

-

|

$15

|

-

|

-

|

|

Emergency

Management

|

$57

|

-

|

-

|

-

|

-

|

-

|

|

Transport

|

($103)

|

$124

|

-

|

($7)

|

-

|

-

|

|

Governance

& Partnerships

|

$236

|

$413

|

-

|

($66)

|

-

|

-

|

|

Corporate

Services/Other

|

|

|

|

|

|

|

|

ICT

|

|

-

|

-

|

$3,186

|

$1,506

|

-

|

|

Fleet/Buildings/Radio

|

|

-

|

-

|

$771

|

$1,634

|

-

|

|

Staff

renumeration

|

|

$729

|

-

|

|

-

|

-

|

|

Total

|

$6,222

|

$4,032

|

$2,190

|

$17,499

|

$9,319

|

$5,713

|

|

Source of funds:

|

|

|

|

|

|

|

|

General funds

|

|

$2,383

|

$8

|

|

-

|

-

|

|

Reserve funds

|

|

$333

|

$43

|

|

$4,983

|

$4,910

|

|

External funds

|

|

$713

|

-

|

|

-

|

-

|

|

Debt funding

|

|

$524

|

$2,139

|

|

$4,336

|

$803

|

|

Total

|

|

$3,953

|

$2,190

|

|

$9,319

|

$5,713

|

11. The operating interim net variance

result for Asset Management and Transport is less than the value of carry

forward requested, though the budget for the specific activity required to be

carried forward is underspent. At a total level, the overall net variance

result indicates sufficient underspend to cover the total requested amount.

Operating

expenditure carry forward requests

|

Activity / Project

|

Amount Requested

|

Source of funds

|

|

General

|

Reserve

|

External

|

Debt

|

|

Integrated Catchment Management (ICM)

|

|

|

|

|

|

|

1

|

Biodiversity

|

$712,566

|

|

|

$512,566

|

$200,000

|

|

2

|

Erosion Control Scheme grants

|

$324,000

|

|

|

|

$324,000

|

|

3

|

Predator Free Hawkes Bay

|

$82,000

|

$18,224

|

$42,522

|

$21,255

|

|

|

4

|

Environmental Enhancement Programme

|

$293,000

|

$113,543

|

|

$179,457

|

|

|

5

|

Air quality science

|

$10,000

|

$10,000

|

|

|

|

|

Asset Management

|

|

|

|

|

|

|

6

|

Makara Dam

|

$100,000

|

$14,099

|

$85,901

|

|

|

|

Governance & Partnerships

|

|

|

|

|

|

|

7

|

Climate change engagement

|

$80,000

|

|

$80,000

|

|

|

|

8

|

Tangata Whenua Partnerships

|

$300,000

|

$300,000

|

|

|

|

|

9

|

Corporate sustainability

|

$33,000

|

$33,000

|

|

|

|

|

Policy & Regulation

|

|

|

|

|

|

|

10

|

Kotahi (policy & planning)

|

$1,000,000

|

$1,000,000

|

|

|

|

|

11

|

Enforcement proceeds

|

$244,000

|

$244,000

|

|

|

|

|

Transport

|

|

|

|

|

|

|

12

|

On Demand/My way

|

$124,388

|

|

$124,388

|

|

|

|

Other

|

|

|

|

|

|

|

13

|

Staff remuneration

|

$729,000

|

$729,000

|

|

|

|

|

Total

|

$4,031,954

|

$2,461,866

|

$332,811

|

$713,278

|

$524,000

|

Biodiversity (opex – 1)

12. Financial Assessment: The Biodiversity

workstream was underspent by $1.016m (excluding overhead allocations which are

overspent due to additional corporate services costs).

13. Integrated Catchment Management (ICM)

seeks to carry forward a total of $712k to cover various biodiversity projects

supported by external funding agreements.

13.1 $403k is required for landowner grants

received from Te Uru Rakau 1BT for planting projects taking place in July to

September, and

13.2 $109k is required to complete the

Pakuratahi bush fencing supported by the DoC Jobs for Nature

funding.

14. The HBRC contributions for year 2 of

the Porangahau Freshwater Improvement Fund project, and the DoC jobs for Nature

Private Land Biodiversity fund is also required to be carried forward ($100k

each, funded from the recovery fund approved in 2020/21).

15. Recommendation: That Council approves

the carry forward of $200k of debt funding, and $512k of external funding.

Erosion Control Scheme Grants (opex – 2)

16. Financial Assessment: The ECS grants

workstream was underspent by $2.2m (all debt funded).

17. ICM seeks to carry forward $324k to

cover the grant costs for Erosion Control Scheme (ECS) contracts, where project

completion has been delayed due to various external factors including flooding,

extended periods of wet weather, and fencing contractor shortages.

18. Recommendation: That Council approves

the carry forward of $324k of debt funding.

Predator

Free Hawkes Bay (opex – 3)

19. Financial Assessment: The Predator

Free Hawkes Bay workstream was underspent by $21k and the possum control

workstream was underspent by $72k (excluding overhead allocations which are

overspent due to additional corporate services costs).

20. ICM seeks to carry forward $82k to

cover the final milestones for the Predator Free Hawkes Bay project in Mahia,

which were delayed due to flooding, extended periods of wet weather and staff

turnover.

21. Recommendation: That Council approves

the carry forward of $82k in external funding.

Environmental Enhancement & Protection Programme (opex –

4)

22. Financial Assessment: The

Environmental Enhancement & Protection Programme was underspent by $949k.

23. ICM seeks to carry forward a total of

$293k to cover:

23.1 $200k for the completion of the

Whakaki Weir construction which was delayed whilst the Geotech was reviewed,

and the design amended. As the construction of the Weir requires a capex

budget, this request includes the conversion of $200k opex to capex.

23.2 $88k for the Fonterra sponsored

wetland construction at Tukipo as this was delayed due to wet weather

preventing machinery on site.

23.3 $5k is required to be carried forward

in relation to enforcement proceeds received late in June, for the purpose of

planting restoration of the Ahuriri Lagoon.

24. Recommendation: That Council approves

the carry forward of $179k external funding and $113k of general funds, and

that this be treated in the 2022-2023 budget as $200k capex and $93k

opex.

Air

quality science (opex – 5)

25. Financial Assessment: The Air Quality

Science workstream was overspent, but the wider Environmental Science activity

was underspent by $1.3m.

26. ICM seeks to carry forward $10k to

cover GNS contractual commitments for an elemental analysis of air pollution,

where the contract milestones have been delayed because of Covid-19 related

disruptions.

27. Recommendation: That Council approves

the carry forward of $10k in general funding.

Makara Dam (opex – 6)

28. Financial Assessment: The Makara Dam

workstream was underspent by $187k.

29. Asset Management seeks to carry

forward $100k for the completion of desilting works and erosion control.

30. Recommendation: That Council approves

the carry forward of $14k from general funds and $86k from reserves.

Climate change engagement (opex – 7)

31. Financial Assessment: The Climate

Change Engagement workstream was underspent by $320k.

32. Strategy & Governance seeks to

carry forward $30k for the remaining climate fresk workshops and to meet the

contractual commitment on the Community Carbon footprint report which was

unable to be delivered by year end due to contractor capacity

constraints. Another $50k is requested to be carried forward from unspent

funds to be provided to the Hawke’s Bay Environment Centre as a one-off

grant to support their forced relocation.

33. Recommendation: That Council approves

the carry forward of $80k funding from carbon credit reserves.

Tāngata Whenua Partnerships (opex – 8)

34. Financial Assessment: The Tāngata

Whenua Partnerships cost centre was underspent by $430k.

35. Governance & Partnerships seeks to

carry forward $300k of unspent general funds to help meet the cost demands of

the Kotahi project once efforts advance in the new financial year, including

unbudgeted cost for Tāngata whenua representation as part of ‘All of

Governors’ approach to Kotahi.

36. Recommendation: That Council approves

the carry forward of $300k in general funding.

Corporate sustainability (opex – 9)

37. Financial Assessment: The corporate

sustainability workstream was underspent by $46k.

38. Governance & Partnerships seeks to

carry forward $33k to cover the contractual commitments of the corporate carbon

footprint assessment, which took longer than anticipated.

39. Recommendation: That Council approves

the carry forward of $33k in general funding.

Kotahi (opex – 10)

40. Financial Assessment: The Planning

cost centre was underspent by $1.3m.

41. Policy & Regulation seeks to carry

forward $1m to resource Tāngata Whenua and community groups to engage with

HBRC on Kotahi. This investment is required to catch up community

engagement activities not progressed in 2021-2022 due to the delays in

determining governance arrangements for the project, as well as ongoing

disruption from the Covid-19 pandemic.

42. Recommendation: That Council approves

the carry forward of $1m in general funding.

Enforcement proceeds (opex

– 11)

43. Financial Assessment: The

Environmental Incident Response workstream was underspent by $376k.

44. Policy & Regulation seeks to carry

forward $244k of surplus proceeds from environmental infringement and

prosecution activities carried out under the RMA. In 2021-2022, HBRC

received a significant boost in prosecution fines, due to the efforts of the

Compliance Manager working with the Ministry of Justice court bailiff to chase

up fines owed. Council’s approval is requested to spend these funds

on environmental enhancement and protection works in the 2022-2023 financial

year. The specific work programme will be identified and signed off by

the Executive Management Team.

45. Recommendation: That Council approves

the carry forward of $244k in general funding.

On Demand/My way (opex – 12)

46. Financial Assessment: The subsidised

passenger transport cost centre was underspent by $481k.

47. Transport seeks to carry forward $124k

to cover the outstanding set up costs for the My way trial.

48. Recommendation: That Council approves

the carry forward of $124k in reserve funds.

Staff remuneration (opex – 13)

49. The Executive Management

Team seeks to carry forward $729k of unspent general funds, to supplement both

proposed staff performance remuneration outcomes for the FY22 year, and to

bring forward the recruitment of an additional comms advisor (originally

planned for year 3 of the LTP) to assist in responding to the recommendations

of the Communications Review.

50. Executive Management are requesting an

increase in Salary/Wage expense of $1,287k in FY22/23 reflecting a ~4.5% on

average across all staff.

51. 2.2% of this increase ($700k) is

expected through assumed staff turnover savings across the coming year, with

2.2% ($729k) asked through carry forward.

52. The average increase across the board

is both an outcome of i) the Labour Cost Index for Local Government (which

measures the changes in wages and salaries within the Local Government Sector)

is at 3.4%, ii) management ensuring parity amongst like graded roles (such as

44% of our staff will sit between 98-102% of a band – previously this was

39%), and iii) HBRC has also been experiencing higher than usual levels of

staff turnover and is having to offer competitive remuneration to secure new

recruits. To remain competitive, particularly within our own sector, HBRC

needs to be able to increase our salary budget.

53. Financial Assessment: The interim net

operating variance indicates sufficient underspend to allow this carry forward,

however, the general funds surplus is still to be confirmed once reserve

movements have been finalised. If the general funds surplus is not

sufficient to cover the carry forward for the salary remuneration, the

difference may be covered using debt funding.

54. Recommendation: That Council approves

the carry forward of $729k (average increase 4.65%) in general funding and note

that the ongoing salary budget pressure will be addressed as part of the Annual

Plan 2023-2024.

Capital

expenditure carry forward requests

|

Activity / Project

|

Amount Requested

|

Type of funding

|

|

Reserve

|

Debt

|

|

Integrated Catchment Management (ICM)

|

|

|

|

|

1

|

3D Aquifer mapping

|

$294,931

|

|

$294,931

|

|

2

|

Hydrodynamic modelling

|

$25,000

|

|

$25,000

|

|

3

|

SOE Ground water monitoring drilling

|

$176,903

|

|

$176,903

|

|

4

|

Right Tree Right Place (RTRP)

|

$507,000

|

$507,000

|

|

|

5

|

Ruataniwha ground water model

|

$325,877

|

|

$325,877

|

|

6

|

LiDAR Mapping

|

$187,956

|

|

$187,956

|

|

7

|

Enviro info technical equipment

|

$105,000

|

$105,000

|

|

|

Asset Management

|

|

|

|

|

8

|

Clive river dredging

|

$100,000

|

$100,000

|

|

|

9

|

Flood warning system (Mt Misery)

|

$50,000

|

|

$50,000

|

|

10

|

Forestry (Tangoio)

|

$30,388

|

$30,388

|

|

|

11

|

Hawkes Bay Trails/cycleways

|

$100,000

|

|

$100,000

|

|

12

|

Heretaunga Plains flood control scheme (HPFCS)

|

$698,687

|

$546,437

|

$152,250

|

|

13

|

IRG HPFCS

|

$1,583,578

|

$1,583,578

|

|

|

14

|

Regional Parks

|

$247,854

|

|

$247,854

|

|

15

|

Water Security

|

$1,745,825

|

$1,745,825

|

|

|

Corporate Services

|

|

|

|

|

16

|

Office renovations

|

$1,375,025

|

$70,944

|

$1,304,081

|

|

17

|

Fleet

|

$55,448

|

$55,448

|

|

|

18

|

Radio network

|

$203,686

|

$203,686

|

|

|

19

|

ICT network & equipment

|

$306,340

|

$34,670

|

$271,670

|

|

20

|

ICT projects

|

$1,200,000

|

|

$1,200,000

|

|

Total

|

$9,319,498

|

$4,982,976

|

$4,336,522

|

3D Aquifer mapping (capex - 1)

55. Financial Assessment: The 3D Aquifer

mapping capex workstream was underspent by $304k.

56. ICM seeks to carry forward $294k to

cover 3D Aquifer mapping project milestones delayed due to difficulty accessing

specialist contractors from the international market (via GNS) with the ongoing

Covid-19 pandemic. This multi-year project is now due to complete in July

2023.

57. Recommendation: That Council approves

the carry forward of $294k debt funding.

Hydrodynamic modelling (capex - 2)

58. Financial Assessment: The Coastal

Water Quality capex workstream was underspent by $25k, which could be carried

forward

59. ICM seeks to carry forward $25k to

cover the final payment for the University of Waikato PhD project on the

Hydrodynamic modelling of Hawkes Bay with coupled sediment delivery, which has

been delayed into the 2022-2023 financial year.

60. Recommendation: That Council approves

the carry forward of $25k debt funding.

SOE Groundwater monitoring drilling (capex - 3)

61. Financial Assessment: The ground water

monitoring drilling capex workstream was underspent by $177k.

62. ICM seeks to carry forward $177k to

cover the contractually committed drilling programme. Resource capacity of

drilling companies was a limiting factor to achieving the annual programme of

work in line with the financial year.

63. Recommendation: That Council approves

the carry forward of $177k debt funding.

Right Tree Right Place (capex - 4)

64. Financial Assessment: The full capex

budget of $507k for RTRP was unspent.

65. ICM seeks to carry forward $507k to

cover the costs of the initial RTRP pilot farm works, which were delayed while

a full risk assessment was completed around carbon revenues and security.

66. Recommendation: That Council approves

the carry forward of $507k from reserves.

Ruataniwha ground water model (capex - 5)

67. Financial Assessment: The Ruataniwha

ground water model capex workstream was underspent by $326k.

68. ICM seeks to carry forward $326k for

the Ruataniwha ground water model, which is a critical part of the science

decision support for PC6 and Kotahi. This work was unable to progress as

intended during 2021-2022 due to science staff turnover, and difficulty

securing contractors.

69. Recommendation: That Council approves

the carry forward of $326k debt funding.

LiDAR Mapping (capex - 6)

70. Financial Assessment: The LiDAR

mapping capex workstream was underspent by $188k.

71. ICM seeks to carry forward $188k for

the LiDAR mapping project, where data production delays have meant the final

project milestones were delayed into 2022-2023. This had a flow on impact

to the LiDAR data modelling project, which was not able to progress as

planned. The data modelling work is now contracted for delivery over the

next two financial years.

72. Recommendation: That Council approves

the carry forward of $188k of debt funding.

Enviro Info monitoring equipment (capex - 7)

73. Financial Assessment: The

Environmental information equipment capex workstreams were underspent by $187k.

74. ICM seeks to carry forward $105k for

replacements of various minor hydrology and water quality monitoring equipment,

which were delayed due to supply shortages.

75. Recommendation: That Council approves

the carry forward of $105k from the asset replacement reserve.

Clive River Dredging (capex - 8)

76. Financial Assessment: The Clive River

dredging capex workstream was underspent by $1.063m.

77. Asset Management seeks to carry

forward $100k for Clive River dredging, which did not progress as planned due

to not being able to obtain a resource consent. The overall phasing for

this work programme will be addressed as part of the Annual Plan 2023-2024.

78. Recommendation: That Council approves

the carry forward of $100k from reserve funds.

Flood warning system (Mt Misery) (capex - 9)

79. Financial Assessment: The Flood

warning system capex budget was not spent ($50k).

80. Asset Management seeks to carry

forward $50k for the relocation of the Mt Misery flood warning repeater

site. The access arrangements for the current site are not ideal, and

radio coverage could be improved. Relocation has been delayed until after the

new digital radio network is tested and the best positioning option is

confirmed.

81. Recommendation: That Council approves

the carry forward of $50k of debt funding.

Forestry (Tangoio) (capex - 10)

82. Financial Assessment: The Forestry

cost centre was overspent by $281k (opex and capex), but the budget for Tangoio

soil conservation reserve was underspent by $30k.

83. Asset Management seeks to carry

forward $30k for replanting the Tangoio soil conservation reserve, which was

delayed due to contractor availability. Pre-spraying and other site preparation

has been completed, but the planting contractors were unable to plant by year

end.

84. Recommendation: That Council approves

the carry forward of $30k of reserve funding.

Trails/Cycleways (capex - 11)

85. Financial Assessment: The Hawke Bay

Trails new capital workstream was underspent by $309k.

86. Asset Management seeks to carry

forward $100k to progress the Ngaruroro explorer work programme. The

Whirinaki link project has been suspended due to stalled land negotiations

between Napier City Council and landowners.

87. Recommendation: That Council approves

the carry forward of $100k of debt funding.

Heretaunga Plains Flood Control Schemes (capex - 12)

88. Financial Assessment: Cost

Centres underspent by $1.512m.

89. Asset Management seeks to carry

forward $699k, for delays in planned pump replacements at Plantation, Haumoana,

Karamu, Farndon, Opoho and Ohuia/Whakaki, due to various factors including

staff resource constraints, planning delays and parts availability.

90. Recommendation: That Council approves

the carry forward of $546k of reserve funds and $152k of debt funding.

IRG Flood and river control (capex - 13)

91. Financial Assessment: The HPFCS flood

and river control cost centre were underspent by $1.583m.

92. Asset Management seeks to carry

forward $1.583m, for the Heretaunga Plains flood and river control works

delayed by wet weather and industry capacity to develop the Moteo package for

tender (now programmed for 2022/23).

93. Recommendation: That Council approves

the carry forward of $1.583m of reserve funds.

Regional Parks (capex - 14)

94. Financial Assessment: The Regional

Parks workstream was underspent by $481k.

95. Asset Management seeks to carry

forward

94.1 $240k for the Waitangi Regional Park

site development, and

94.2 $7k for Tutira park fencing that was

delayed due to contractor availability and poor weather restricting access.

96. Recommendation: That Council approves

the carry forward of $247k of debt funding.

Regional water security (capex - 15)

97. Financial Assessment: The Water

security cost centre underspent by $5.584m.

98. Asset Management seeks to carry

forward $1.745m, for the regional water security scheme, which has been

impacted by delays in contract agreements with PGF deferring the entire project

timeline.

99. Recommendation: That Council approves

the carry forward of $1.745m of reserve funds.

Office renovations (capex -16)

100. Financial Assessment: The office complex cost centre was

underspent by $1.367m, and the pole nursery capex budget was underspent by

$63k.

101. Corporate Services seeks to carry forward $1.367m to

cover the Dalton St office renovations (including furniture & fittings),

which have been significantly delayed due to supply and contractor

availability. Another $8k is also required to be carried forward for the

completion of the pole nursery office.

102. Recommendation: That Council approves the carry forward

of $1.304m of debt funding, and $71k of reserve funds.

Fleet (capex -17)

103. Financial Assessment: The fleet cost centre was

underspent by $55k.

104. Corporate Services seeks to carry forward $55k for the

vehicle replacement programme, which was impacted by limited supply

availability.

105. Recommendation: That Council approves the carry forward

of $55k reserve funding.

Radio Network (capex - 18)

106. Financial Assessment: The radio network cost centre was

underspent by $204k.

107. Corporate Services seeks to carry forward $203k for

project Tarsier, where supply and installation delays have hindered progress.

108. Recommendation: That Council approves the carry forward

of $203k reserve funding.

ICT network & equipment (capex - 19)

109. Financial Assessment: The ICT end user hardware cost

centre was underspent by $277k, and the ICT network & server cost centre

was underspent by $35k.

110. Corporate Services seeks to carry forward $306k for

delayed replacements/upgrades of meeting room technology, aerial photography

hardware, and network and server upgrades, where priority has been given

instead to satisfying end user hardware requirements as part of the Covid-19

response.

111. Recommendation: That Council approves the carry forward

of $271k debt funding and $35k reserve funds.

ICT projects (capex - 20)

112. Financial Assessment: The ICT business computing capex

budget was underspent by $3.075m.

113. Corporate Services seeks to carry forward $1.2m for

business systems implementations delayed due to staff resourcing challenges.

This carry forward request includes the conversion of capex budget to opex, in

line with the new accounting treatment for “software-as-a-service”

projects.

114. Recommendation: That Council approves the carry forward

of $1.2m debt funding, and that this be treated in the 2022-2023 budget as

$1.080m opex and $0.12m capex.

Options

Assessment

115. Option 1:

Council approves the carry forwards from 2021-2022 to 2022-2023 to enable all

the projects to be completed, service levels to be achieved, commitments to

external organisations to be fulfilled and the future work to be funded.

116. Option 2:

Council approves the carry forward of all non-general funded expenditure (i.e.

reserve, debt, and externally funded expenditure) with the general funded carry

forward expenditure met through additional debt funding in 2022-2023.

117. Option 3:

Council does not approve the carry forwards as proposed and provides officers

with guidance on which carry forwards, if any, should be approved.

Financial

and Resource Implications

118. The interim financial results indicate that HBRC has a

net underspend in opex of $6.222m and a net underspend in capex of $17.499m,

which is sufficient underspend to cover the carry forward amounts requested for

2022-2023.

119. Reserve and debt funded expenditure can be carried

forward with no impact to general funding as this has been included in the LTP.

120. Funding from targeted rates will be automatically carried

forward through the associated reserve to enable the funds to be drawn down to complete

the work in subsequent years.

121. The carry forward of $2.382m in general funding and

$0.713m in external funding from 2021-2022 to 2022-2023, will impact the

general funds surplus. The quantum of the general fund’s surplus will be

confirmed once the reserve movements have been finalised. If the general

funds balance is not sufficient to cover the carry forwards, the difference may

be covered by additional debt funding.

Decision Making Process

122. Staff have assessed the requirements of the Local

Government Act 2002 in relation to this item and have concluded:

121.1 The decision does not

significantly alter the service provision or affect a strategic asset, nor is

it inconsistent with an existing policy or plan

121.2 The use of the special consultative

procedure is not prescribed by legislation.

121.3 The decision is not

significant under the criteria contained in Council’s adopted

Significance and Engagement Policy.

121.4 The persons affected by this decision

are Council’s ratepayers.

123. Given the nature and significance of

the issue to be considered and decided, and also the persons likely to be

affected by, or have an interest in the decisions made, Council can exercise

its discretion and make a decision without consulting directly with the

community or others

having an interest in the decision.

Recommendations

1. That

the Corporate and Strategic Committee receives and notes the 2021-2022

Carry Forwards staff report.

2. The Corporate and Strategic Committee

recommends that Hawke’ Bay Regional Council:

2.1. Agrees that the decisions to be made

are not significant under the criteria contained in Council’s adopted

Significance and Engagement Policy, and that Council can exercise its

discretion and make decisions on this issue without conferring directly with

the community or persons likely to have an interest in the decision.

2.2. Approves the carry forward of all

expenditure requests from the 2021-2022 to the 2022-2023 budget, being:

Operating

expenditure carry forward requests

|

Activity / Project

|

Amount Requested

|

Source of funds

|

|

General

|

Reserve

|

External

|

Debt

|

|

Integrated Catchment Management (ICM)

|

|

|

|

|

|

|

1

|

Biodiversity

|

$712,566

|

|

|

$512,566

|

$200,000

|

|

2

|

Erosion Control Scheme grants

|

$324,000

|

|

|

|

$324,000

|

|

3

|

Predator Free Hawkes Bay

|

$82,000

|

$18,224

|

$42,522

|

$21,255

|

|

|

4

|

Environmental Enhancement Programme

|

$293,000

|

$113,543

|

|

$179,457

|

|

|

5

|

Air quality science

|

$10,000

|

$10,000

|

|

|

|

|

Asset Management

|

|

|

|

|

|

|

6

|

Makara Dam

|

$100,000

|

$14,099

|

$85,901

|

|

|

|

Governance & Partnerships

|

|

|

|

|

|

|

7

|

Climate change engagement

|

$80,000

|

|

$80,000

|

|

|

|

8

|

Tangata Whenua Partnerships

|

$300,000

|

$300,000

|

|

|

|

|

9

|

Corporate sustainability

|

$33,000

|

$33,000

|

|

|

|

|

Policy & Regulation

|

|

|

|

|

|

|

10

|

Kotahi (policy & planning)

|

$1,000,000

|

$1,000,000

|

|

|

|

|

11

|

Enforcement proceeds

|

$244,000

|

$244,000

|

|

|

|

|

Transport

|

|

|

|

|

|

|

12

|

On Demand/My way

|

$124,388

|

|

$124,388

|

|

|

|

Other

|

|

|

|

|

|

|

13

|

Staff remuneration

|

$729,000

|

$729,000

|

|

|

|

|

Total

|

$4,031,954

|

$2,461,866

|

$332,811

|

$713,278

|

$524,000

|

Capital expenditure carry forward requests

|

Activity / Project

|

Amount Requested

|

Type of funding

|

|

Reserve

|

Debt

|

|

Integrated Catchment Management (ICM)

|

|

|

|

|

1

|

3D Aquifer mapping

|

$294,931

|

|

$294,931

|

|

2

|

Hydrodynamic modelling

|

$25,000

|

|

$25,000

|

|

3

|

SOE Ground water monitoring drilling

|

$176,903

|

|

$176,903

|

|

4

|

Right Tree Right Place (RTRP)

|

$507,000

|

$507,000

|

|

|

5

|

Ruataniwha ground water model

|

$325,877

|

|

$325,877

|

|

6

|

LiDAR Mapping

|

$187,956

|

|

$187,956

|

|

7

|

Enviro info technical equipment

|

$105,000

|

$105,000

|

|

|

Asset Management

|

|

|

|

|

8

|

Clive river dredging

|

$100,000

|

$100,000

|

|

|

9

|

Flood warning system (Mt Misery)

|

$50,000

|

|

$50,000

|

|

10

|

Forestry (Tangoio)

|

$30,388

|

$30,388

|

|

|

11

|

Hawkes Bay Trails/cycleways

|

$100,000

|

|

$100,000

|

|

12

|

Heretaunga Plains flood control scheme (HPFCS)

|

$698,687

|

$546,437

|

$152,250

|

|

13

|

IRG HPFCS

|

$1,583,578

|

$1,583,578

|

|

|

14

|

Regional Parks

|

$247,854

|

|

$247,854

|

|

15

|

Water Security

|

$1,745,825

|

$1,745,825

|

|

|

Corporate Services

|

|

|

|

|

16

|

Office renovations

|

$1,375,025

|

$70,944

|

$1,304,081

|

|

17

|

Fleet

|

$55,448

|

$55,448

|

|

|

18

|

Radio network

|

$203,686

|

$203,686

|

|

|

19

|

ICT network & equipment

|

$306,340

|

$34,670

|

$271,670

|

|

20

|

ICT projects

|

$1,200,000

|

|

$1,200,000

|

|

Total

|

$9,319,498

|

$4,982,976

|

$4,336,522

|

Authored by:

|

Amy Allan

Management

Accountant

|

Tim Chaplin

Senior

Group Accountant

|

|

Desiree Cull

Strategy

& Governance Manager

|

Chris Comber

Chief

Financial Officer

|

Approved by:

|

Katrina Brunton

Group

Manager Policy & Regulation

|

Chris Dolley

Group

Manager Asset Management

|

|

Iain Maxwell

Group

Manager Integrated Catchment Management

|

Susie Young

Group

Manager Corporate Services

|

|

James Palmer

Chief

Executive

|

|

Attachment/s

There are no attachments for this

report.

HAWKE’S BAY REGIONAL COUNCIL

Corporate and Strategic Committee

Wednesday

24 August 2022

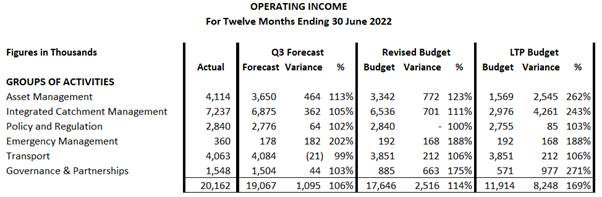

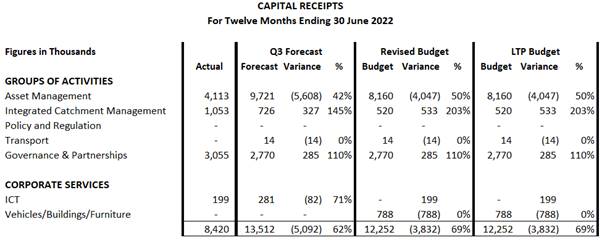

Subject: 1 April - 30 June 2022 Financial Report

Reason

for Report

1. This item provides the Committee with

draft financial results for the 2021-2022 financial year.

Executive

Summary

2. HBRC continues to see and experience

the impacts of Covid-19 to planning and delivery. While delivery for most

levels of service is on track to be achieved there are impacts to our larger

projects.

3. In addition, the world-wide economic

and political uncertainty, due partially to the pandemic but also through the

Russia-Ukraine situation, have continued to affect costs (supply chain,

increased cost of borrowing, financial impacts to investments), with inflation

rates significantly above budget.

4. The Long Term Plan (LTP) capital work

programme will require re-profiling across the remaining 8 years of the 10-year

plan horizon to account for changes to project scoping, building internal

capability and shifts in the external operating environment.

Within the

Quarter 1 Apr – 30 June 2022

5. Q4 Groups of Activities operating

expenditure was $21m (30% annual opex) and exceeded the Q3 year-end forecast by

$3.4m.

6. Q4 Corporate and Groups of Activities

capital expenditure was $6m (27.9% of annual capital expenditure). This was

$4.7m below the Q3 year-end forecast. This reflects ongoing delays across the

capital work programme.

Year to 30

June 2022

7. Preliminary results indicate an

operating deficit of $2.8m compared to a budget operating surplus of $4m.

8. Investment income for the year totals

$7.2m compared to a budget of $21.6m, 64% below budget. This is primarily

drive by our managed funds returning a $9.3m deficit for the year, an adverse

variance of $15.3m when compared to the expected $6m return. Refer to para

34

9. Other material variances to note

occurred in:

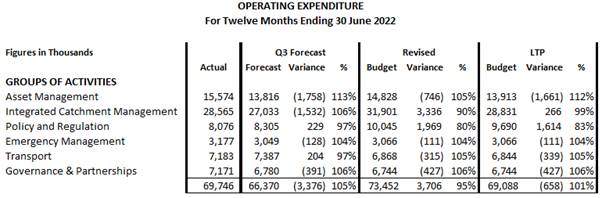

9.1. Operating expenditure of $69.75m which

was $3.7m (5%) below budget.

9.2. 2 specific areas of underspend, being

Integrated Catchment Management (ICM) $3.3m across environment enhancement and

erosion control, and Policy & Regulation $2m mainly in the Kotahi plan

change project.

9.3. Staff and overhead cost centres

consolidated which are $1.1m (5%) above budget- refer para 47.

9.4. Operating income (excluding rates and

investment income) which was $20m, $2.5m (14%) above budget – refer to

para 23/24).

9.5. Capital expenditure which is $21.4m

(50%) below budget and income $3.8m (31%) below budget. The underspends are due

to a range of reasons including delays in consents and assessments, supply chain

delays and other Covid-19 impacts explained in detail within the report. The

main underspend is $15.7m in Asset Management with the remainder spread across

ICM ($1.4m), ICT ($3m) and building works ($1.5m).

10. Debt was planned to increase by $30.8m

but only $15.8m of additional debt was required leaving headroom of $53m within

policy – refer para 0. No additional debt is required due to the indicated

operating deficit.

11. Many projects remain a high priority

and will require budget carry forward to complete delivery. Officers have

conducted a review of the phasing of the carry-forward expenditure, and final

carry-forward requests reflect the expenditure and funds required in addition

to the 2022-2023 Annual Plan budget. The remaining rephasing of work programmes

will be addressed as part of the 2023-2024 Annual Plan process.

Background

12. In the following tables the figures

presented are:

12.1. Actual – full year income or

expenditure

12.2. Q3 Forecast – forecast result

for the year end provided in the Q3 paper presented in June

12.3. Revised – operating budget for

FY2021-2022 including carry forwards from FY2020-2021

12.4. LTP – long-term plan budget for

FY2021-2022.

13. Reserve movements and internal loan

funding will be calculated for the Annual Report.

14. Groups of Activities operating

expenditure includes the allocation of overheads.

Groups of

Activities Operating Expenditure

15. Operating Expenditure is $3.7m below

budget.

16. Asset Management expenditure is $0.75m

over the full year budget.

16.1. Flood Protection and Control Works is

above budget by $0.4m comprising

16.1.1. Gravel management being over budget by $0.6m due to the

need for increasing the depth of the rivers and natural events, like floods

during the year has resulted in high contractor and consultancy costs. This has

been offset by higher income.

16.1.2. Makara dam being below budget by $0.2m following delays

from the community consultation process.

17. Integrated Catchment Management

expenditure is $3.3m below budget.

17.1. Catchment Management is $2.9m below

budget, which is primarily due to budget phasing and variations in the

multi-year funding agreements for the Enhancement & Protection Programme

and Hill Country Erosion Fund/ECS Booster schemes and various external factors

including flooding, extended periods of wet weather, and fencing contractor

shortages.

17.2. Environmental Science, Environmental

Information and Biodiversity & Biosecurity provide a net $0.4m below budget

driven by long-term vacancies in the scientist positions and reduced

depreciation due to delays in the capital programme.

18. Policy and Regulation expenditure is

$2m below budget.

18.1. Most of the shortfall in expenditure

($1.6m) is in Policy Planning and Implementation, due to significant delays in

the Kotahi project. Covid-19 is impacting the ability to progress iwi

engagement, and Governance is still working through partnership arrangements.

In addition, Compliance and Pollution Response are $0.8m below budget due to

staff vacancies and reduced external legal and consulting costs resulting from

the new investigator roles.

19. Transport expenditure is $0.3m above

budget primarily due to the inflationary impact on the cost of operating the

subsidised passenger transport, though some costs may be able to be recouped

due to services not provided by the operator.

Groups

of Activities Operating Income

20. Operating income includes fees &

charges, grants & subsidies, cost recoveries etc as per the FY2021-2022

budget but excludes rates and investment income subsidy. This reflects the

income that staff control.

21. Operating Income excludes all general

funding (i.e. rates & investment income) and is $2.5m ahead of budget for

the year.

21.1. Asset Management income is $0.77m

ahead of budget primarily due to Gravel management $0.95m ahead of budget due

to high demand and the need for increased extraction for river management. The

additional revenue offsets the increase in expenditure on this activity.

21.2. Integrated Catchment Management income

is $0.7m above budget with some minor below budget returns offset by plant and

Animal Pest Control recovered costs of $0.2m from their partners, Predator Free

Hawke’s Bay funding agreement changed providing an extra $0.2m and new

external funding agreements for Biodiversity added $0.4m.

21.3. Governance & Partnerships income

is $0.66k above budget due to Regional Developments $0.5m above budget due to

the Business Hub income and grants from other Councils. This offsets the

additional operating expenditure.

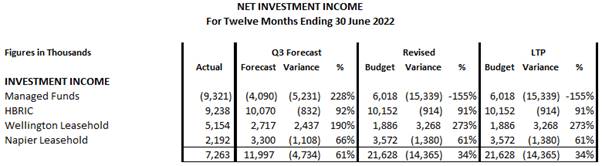

Investment

Income

22. Managed funds returned a $9.3m deficit

for the year delivering an adverse variance of $15.3m when compared to the

expected $6m return. The full-year result shows an additional $5m decline

during the final quarter of the financial year reflecting the continued

volatility in the World economic markets.

23. The Managed Funds returns comprise:

23.1. $0.4m interest income

23.2. $0.9m dividend income

23.3. $0.5m losses on the sale of

investments

23.4. $9.4m of unrealised losses i.e.

decline in capital value

23.5. $0.8m of fees and taxes plus interest

expense paid to HBRIC.

24. The Managed Funds budget of $6m included

investment returns of $3.7m to subsidise rates with the remaining $2.3m being

capital growth to protect the fund value (all classified as Interest in the

LTP/Annual Plan).

25. No cash has been withdrawn from the

funds to maintain the capital and maximise future returns. No impact is

expected due to the shortfall in expenditure throughout the year.

26. HBRIC paid $9m in dividends to Council

compared to a budget of $10m. At the start of the year, HBRIC and Council

agreed that the $1.1m subvention payment for the 20-21 tax year would be

counted towards the $10m budget. The subvention payment was recorded as income

from HBRIC in the 2020-21 financial statements resulting in HBRIC exceeding its

due payments for that year. The forecast $132k subvention payment for the

2021-22 tax year is included in the $9.321m income.

27. Wellington Leasehold received net

rental income of $0.8m plus fair value gain of $4.3m from the 30 June 2022

revaluation of the portfolio compared to a budgeted growth of $1m.

28. Napier Leasehold received net rental

income of $0.9m plus the fair value gain of $1.3m from the 30 June 2022

revaluation of the portfolio compared to a budgeted gain of $2.2m. The fair

value gain on the portfolio was $4m but two-thirds of the gain will be expensed

as an adjustment to the ACC future payments liability under the lease

receivables agreement. 10 leaseholders purchased the freehold during the year

for $2m with Council retaining $0.35m.

Forestry and

Carbon Credits

29. The fair value of the tree crops at 30

June 2022 showed a decrease of $0.9m to $13.3m compared to a budgeted decrease

of $1.4m.

30. The market price of carbon credits

increased from $43.45 per unit on 30 June 2021 to $75.95 at year end resulting

in a balance sheet gain of $3.8m.

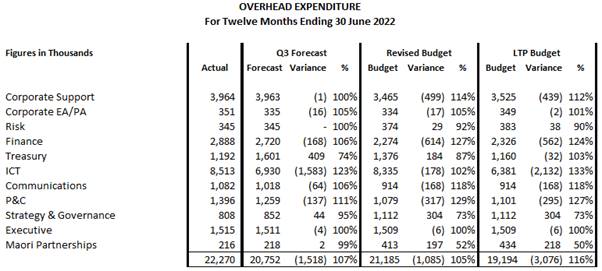

Overhead

Expenditure

31. Overhead expenditure has been included

in the Groups of Activities Operating Expenditure results.

32. Overhead costs are above budget by

$1.1m with similar rationale for increases across the board noted as increased

recruitment costs for staff turnover, position re-gradings, and additional head

count required to support critical programmes such as TechOne implementation

and/or IT capital programme.

33. Any below budget lines (Strategy and

Governance, Māori Partnerships) is due to vacant positions held or

recruitment delays.

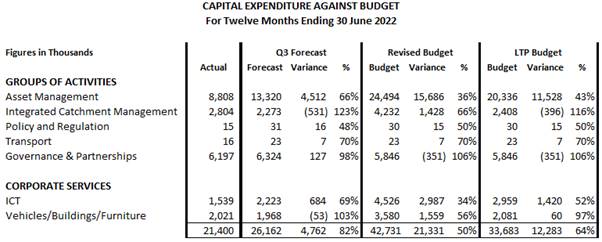

Capital

Expenditure

34. Capital expenditure is $21.3m below

budget.

35. The Senior Business Partner is working

with the leadership team to re-profile the LTP capital borrowing programme

across the remaining 8-year timeframe. Management is confident the

strategies such as the Asset Management Strategy that underpin these borrowing

requirements are still relevant, however, large-scale capital delivery projects

are fluid across multiple financial periods. Increasing external

challenges, such as supply and resourcing, mean it is increasingly challenging

to phase with any accuracy when the majority of spend or borrowing will occur.

36. Asset Management expenditure is $15.7m

below budget.

36.1. Vacancies (including Manager Regional

Projects), contractor availability, Covid-19 and weather are factors in the

performance, alongside the original cashflow for the Crown-funded projects

needing to be reforecast to reflect realistic delivery.

36.2. Most of the underspend is in flood

protection and control works ($9.5m).

36.2.1. Infrastructure Reference Group (IRG) expenditure is $7.8m

below budget, mostly due to weather-related construction delays, although

noting that the LTP split the budget equally across years but 2022-23 will be

significantly higher.

36.2.2. Consent for the Clive River dredging has been notified

and requires a hearing, leading to further delays in commencing work and a

shortfall in expenditure of $1.1m.

36.3. Open Spaces expenditure is $0.65m

below budget with work planned for Q4 not taking place.

36.4. Regional Water Security is $5.5m below

budget.

36.4.1. CHB Managed Aquifer Recharge is $1.7m behind budget. The

Cultural Impact Assessment is still in progress.

36.4.2. Heretaunga Water Security is slightly below budget by

$0.3m but progressing through to geotechnical work.

36.4.3. Te Tua Water Security is $0.7m behind budget, with no

progress this year.

36.4.4. The overall project has not begun to spend the $2.8m

carried forward from the previous year.

37. Integrated Catchment Management

expenditure is $1.4m below budget.

37.1. The 3D Aquifer Mapping Project is

$0.4m below budget. GNS staff resourcing has been impacted significantly by

Covid-19 as they typically recruit internationally and have also been losing

international staff returning home.

37.2. The capital programs for LiDAR data

modelling, monitoring drilling and Ruataniwha Groundwater modelling are behind

budget due to contractor delays and science staff turnover.

37.3. No capital expenditure is anticipated

to be incurred this financial year for Right Tree Right Place ($0.5m).

Commercial and legal advice on farm planting plans is progressing before the

pilot farm work begins, to ensure HBRC risk in relation to carbon revenues and

security is properly assessed.

38. Governance and Partnerships capital

activity comprises the Sustainable Homes programme and is $0.4m ahead of budget

due to the continued popularity of this low-cost home improvement opportunity.

38.1. ICT expenditure is $3m below budget

driven primarily by ICT system implementation projects are $2.6m behind budget

due to resourcing challenges.

39. Vehicles/Buildings/Furniture

expenditure is $1.6m behind budget.

39.1. Expenditure on new and replacement

vehicles ended the year slightly below budget.

39.2. The accommodation refurbishments are

experiencing delays due to the availability of contractors and workers with a

budget shortfall of $0.8m.

Capital

Receipts

40. Capital receipts includes fees &

charges, grants & subsidies, cost recoveries etc as per the FY2021-2022

budget but excludes targeted rates, reserve funding, debt funding and

investment income subsidy. This reflects the income that staff control.

41. Capital receipts are $3.8m below

budget primarily due to Asset Management receipts $4m below budget reflecting

the delays in the expenditure on the IRG co-funded projects.

External

Debt

42. New external debt of $19m has been

drawn down. The LTP new debt forecast was $36.5m. The reduced debt requirement

is due to the below budget debt funded expenditure.

43. Debt principal repayments are on

schedule with repayments of $3.15m completed by 30 June 2022.

44. Total external debt was $63.338m

compared to the budget of $79.831m, $16.5m below budget. Council’s debt

ceiling is $116.472m based on the treasury policy of 175% of total revenue

providing headroom of $53m.

Decision

Making Process

45. Staff have assessed the requirements

of the Local Government Act 2002 in relation to this item and have concluded

that, as this report is for information only, the decision making provisions do

not apply.

Recommendation

That

the Corporate and Strategic Committee receives and notes the 1 April - 30

June 2022 Financial Report.

Authored by:

|

Amy Allan

Management

Accountant

|

Tim Chaplin

Senior

Group Accountant

|

|

Chris Comber

Chief

Financial Officer

|

|

Approved by:

|

Susie Young

Group

Manager Corporate Services

|

James Palmer

Chief

Executive

|

Attachment/s

There are no attachments for this

report.

HAWKE’S

BAY REGIONAL COUNCIL

Corporate and Strategic Committee

Wednesday

24 August 2022

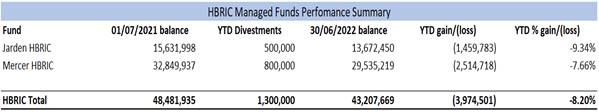

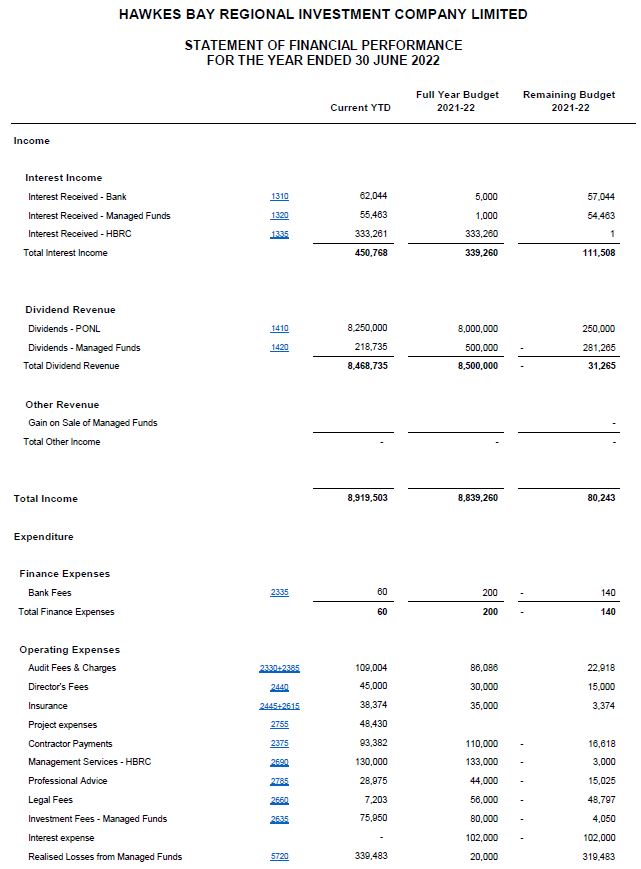

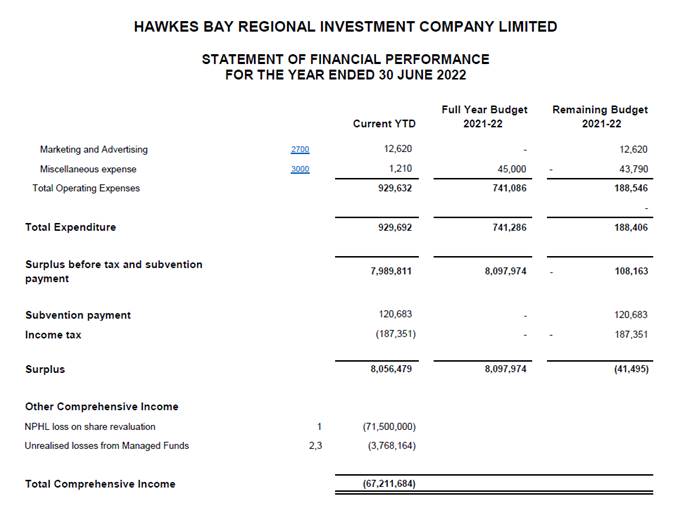

Subject: HBRIC Quarterly Update

Reason

for Report

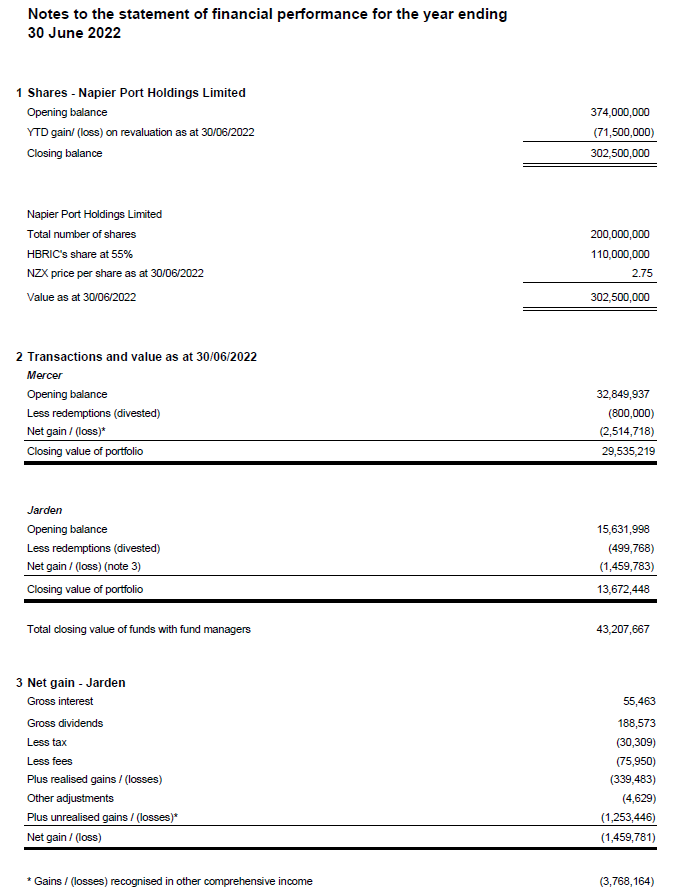

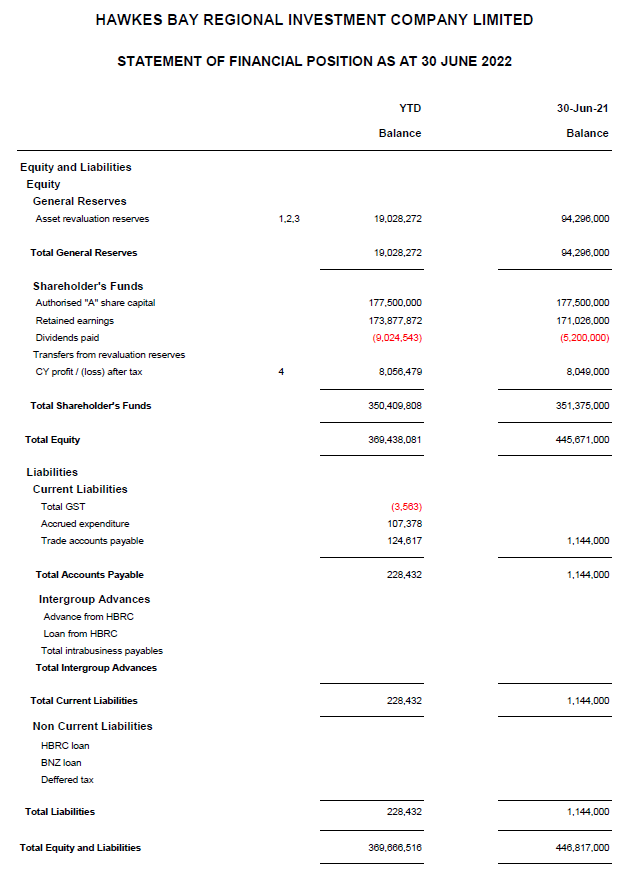

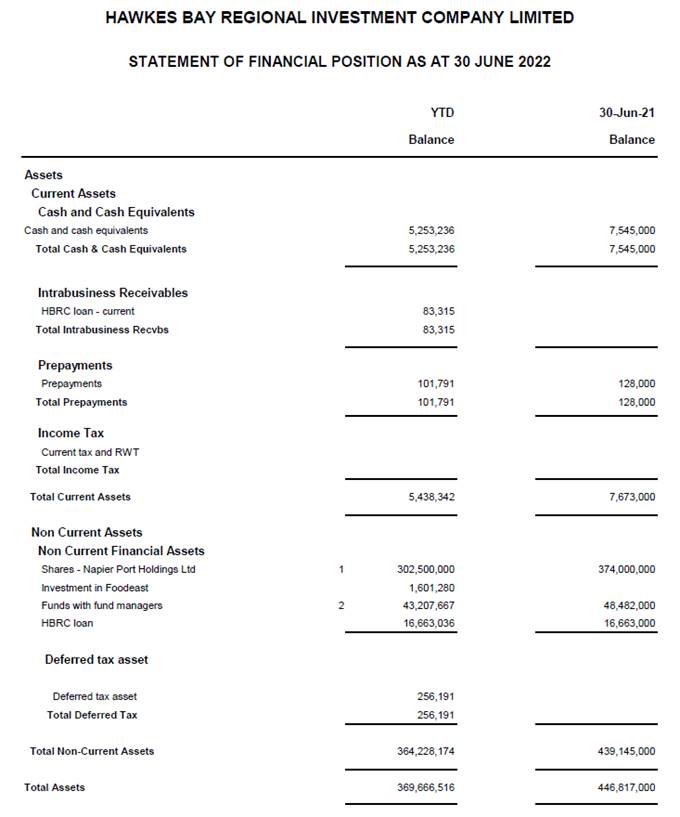

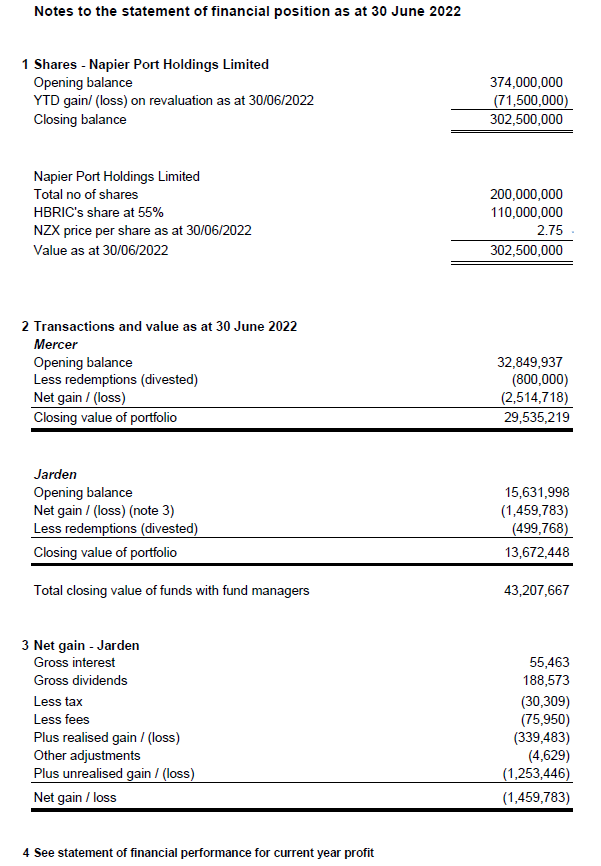

1. This item provides the Committee with

a quarterly update on the activities of Hawke’s Bay Regional Investment Company

(HBRIC) for the fourth quarter of the 2021-2022 financial

year and provides guidance on the outlook for the 2022-2023 financial year.

About HBRIC

2. HBRIC Ltd is a council-controlled

trading organisation (CCTO) for the purposes of the Local Government Act 2002.

It is 100% owned by Hawke’s Bay Regional Council. HBRIC

Ltd’s mission is to optimise the financial and strategic returns to

Council from its allocated investment portfolio to assist Council achieve its

vision of “a healthy environment, and a resilient and prosperous

community”.

3. In the 10 years through to

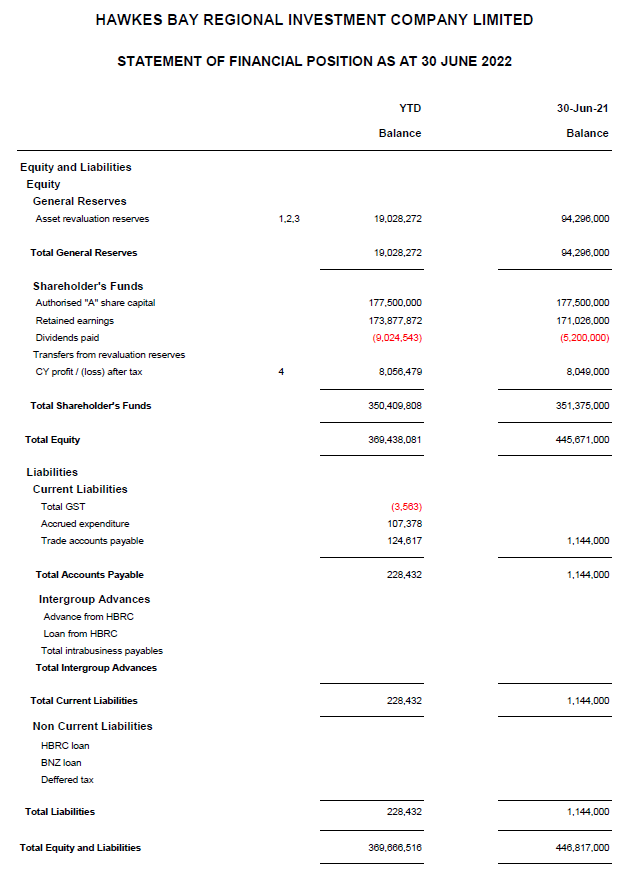

30 June 2022 financial year HBRIC’s net assets have increased from $177m

to $369m. Through that period dividend payments of approximately $118m have

been paid to Council.

Financial

Reporting

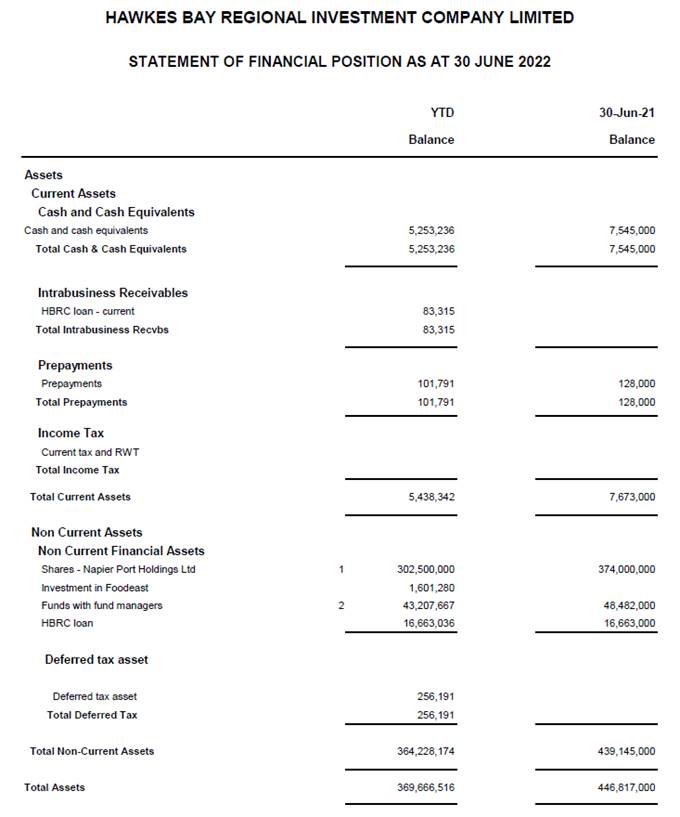

4. HBRIC’s YTD Financial Statements

as at 30 June 2022 are attached to this report.

5. Key Items to note:

5.1. Statement of Financial Performance

– YTD Surplus of $7.9 million (excluding fair value movements through

other comprehensive income)

5.2. Statement of Financial Performance

– $8.2 million of dividend revenue received from Napier Port Holdings

Limited (NPHL) in the year

5.3. Statement of Financial Performance

– YTD $442K Interest Income

5.4. Other Comprehensive Income – YTD

Loss of $67 million, driven by a drop in the NPHL share price (loss on

revaluation) and unrealised losses on managed funds

5.5. Statement of Financial Position - A

reduction in net assets of $76 million YTD due to the drop in NPHL share price

and losses from managed funds

5.6. NPHL share price had dropped 8.33% YTD

from $3 to $2.75

5.7. Net Assets of $369 million as at 30

June 2022.

Managed

Funds

6. The

funds remain under management

in compliance with Council’s SIPO.

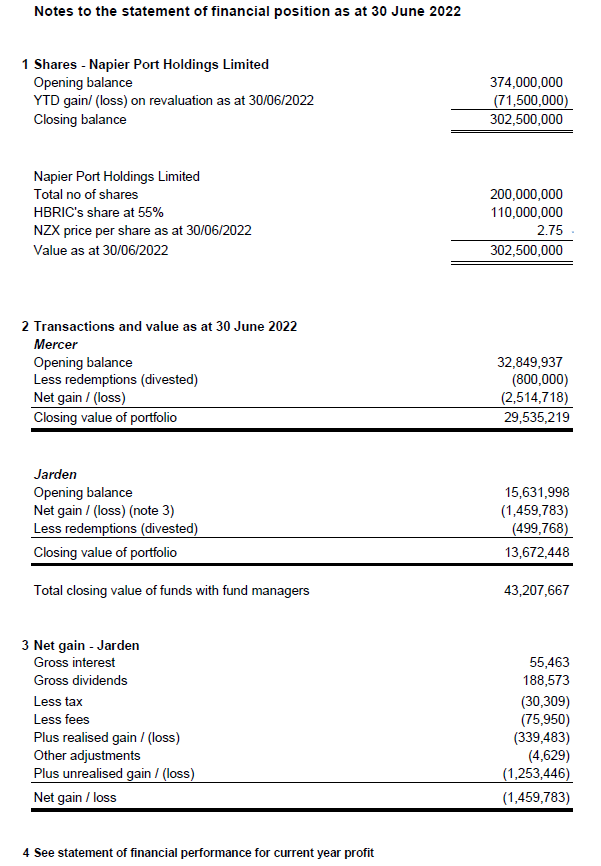

7. The value of managed funds with HBRIC

after divestments as at 30 June 2022 amounted to $43.2 million, a movement of

approximately -$5.3 million (-10.88%) year to date.

8. In December 2021, HBRIC divested $1.3

million from the managed funds after protecting its capital value.

FoodEast

9. Following the construction cost

escalations, the directors have worked with the limited partners and MBIE to

reset the project with a view to having the re-design completed and contractor

appointed by 31 October 2022, construction commencing between December 2022 and

March 2023, and completion scheduled within 12-18 months after commencing.

10. New layout and scheme plans have been

reviewed and approved, amended resource consents have

been submitted to Hastings District Council and the developed design is

underway ahead of an October decision to proceed to detailed design.

Napier Port

11. 6 Wharf – Te Whiti –

officially opened on 22 July 22. Market commentators note that this investment

will protect Napier Ports current trade and customer base, set the scene for

growth and will avoid considerable future issues with congestion that would worsen

over time as vessel sizes grow. The project was completed ahead of schedule and

within budget.

12. In its half year report released on 24

May Napier Port reported:

12.1. Revenue fell 3.6% to $50.7 million

from $52.6 million in the same period last year, with the fall reflecting lower

trade volumes and the reduction in vessel calls following supply chain and

Covid disruptions.

12.2. Result from operating activities

decreased 22.8% to $16.4 million from $21.3 million in the same period last

year, due to the reduction in revenue alongside an increase in operating

expenses.

12.3. Underlying net profit after tax