Meeting of the

Finance Audit & Risk Sub-committee

Date: 15 December 2021

Time: 1.30pm

|

Venue:

|

Council

Chamber

Hawke's

Bay Regional Council

159

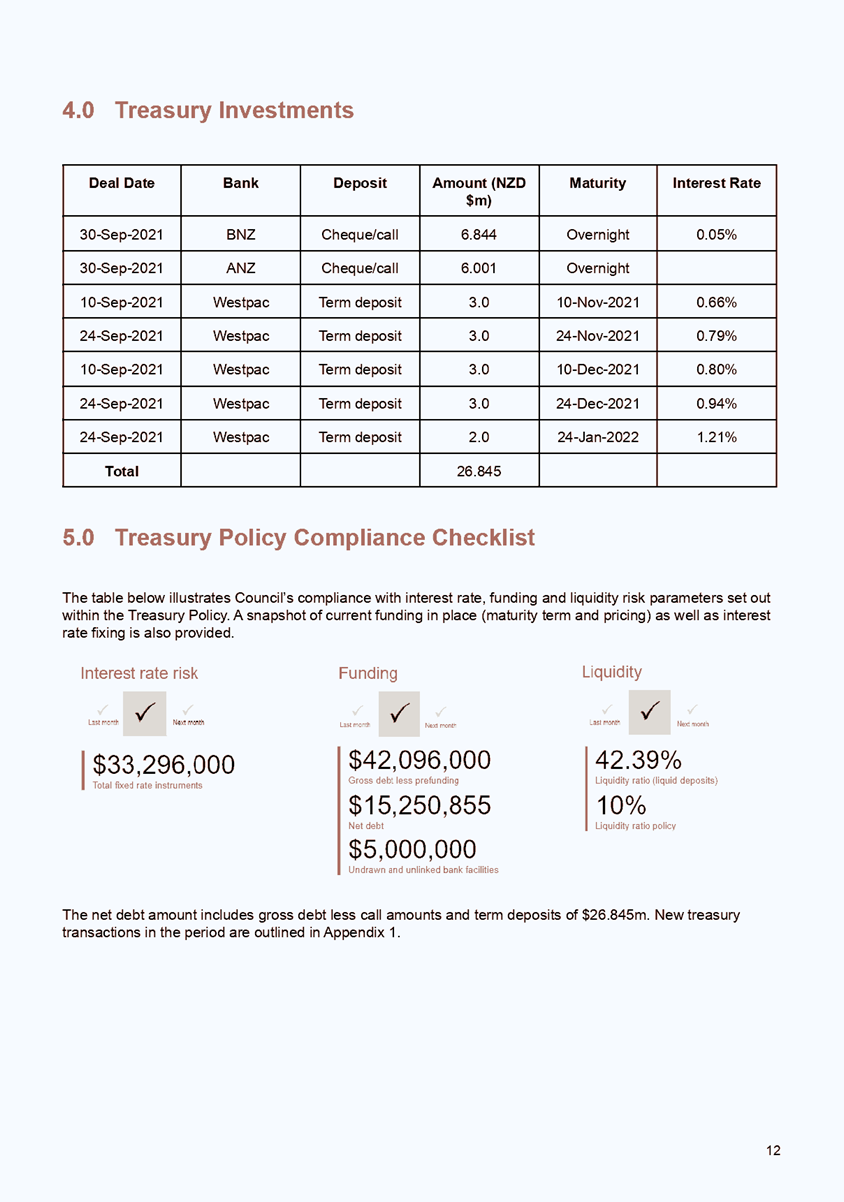

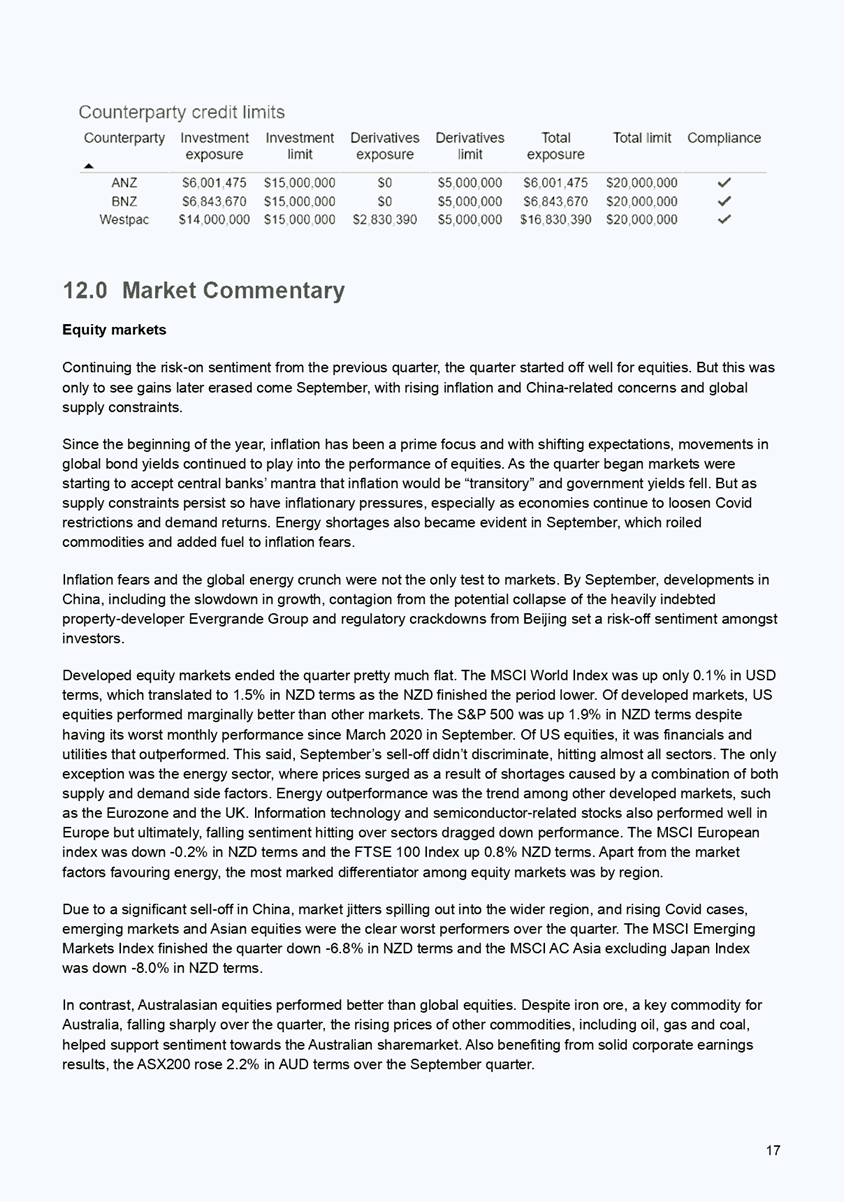

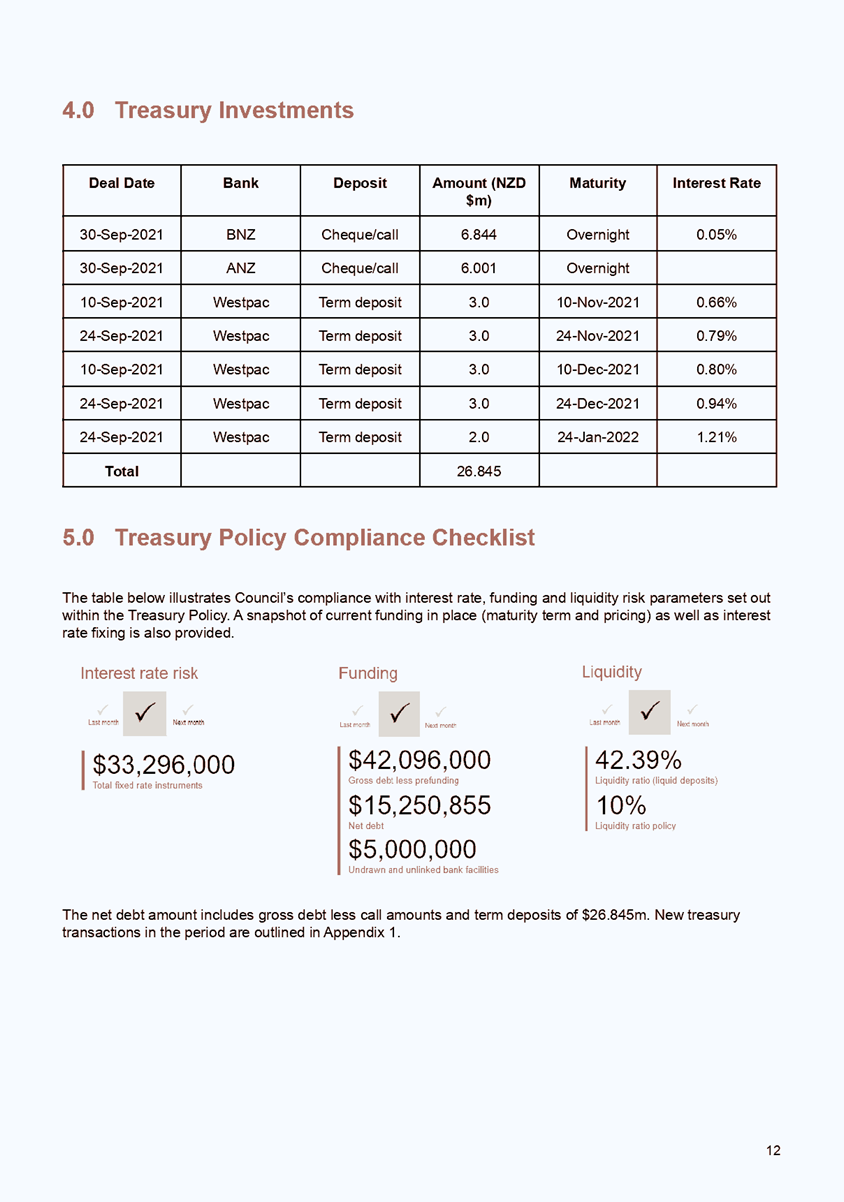

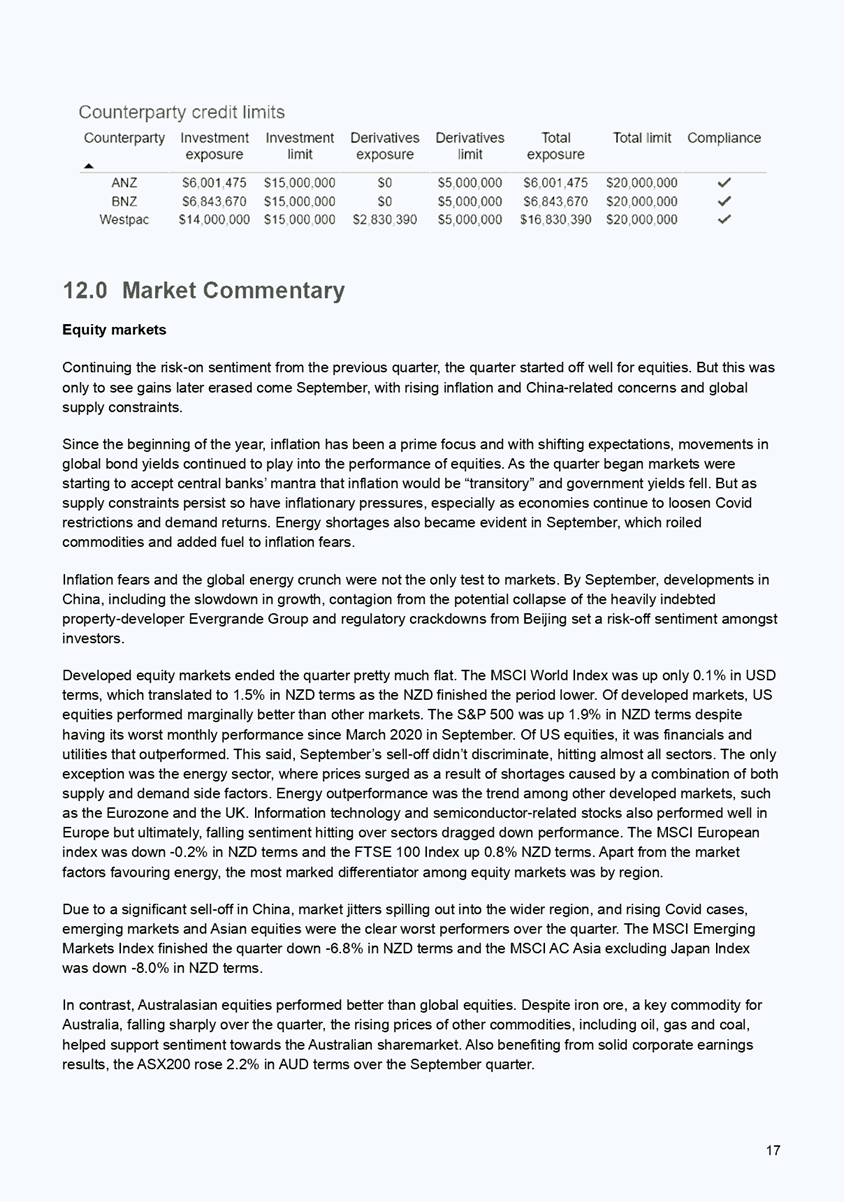

Dalton Street

NAPIER

|

Agenda

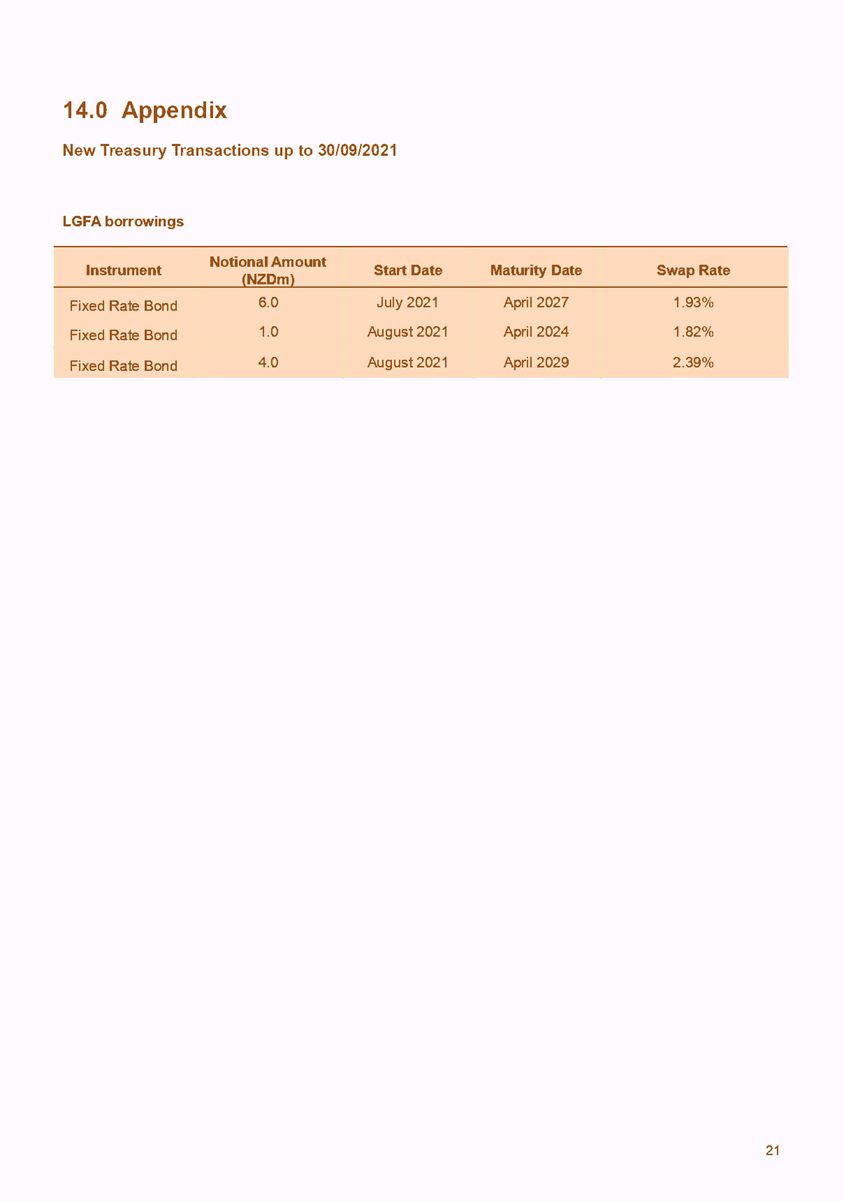

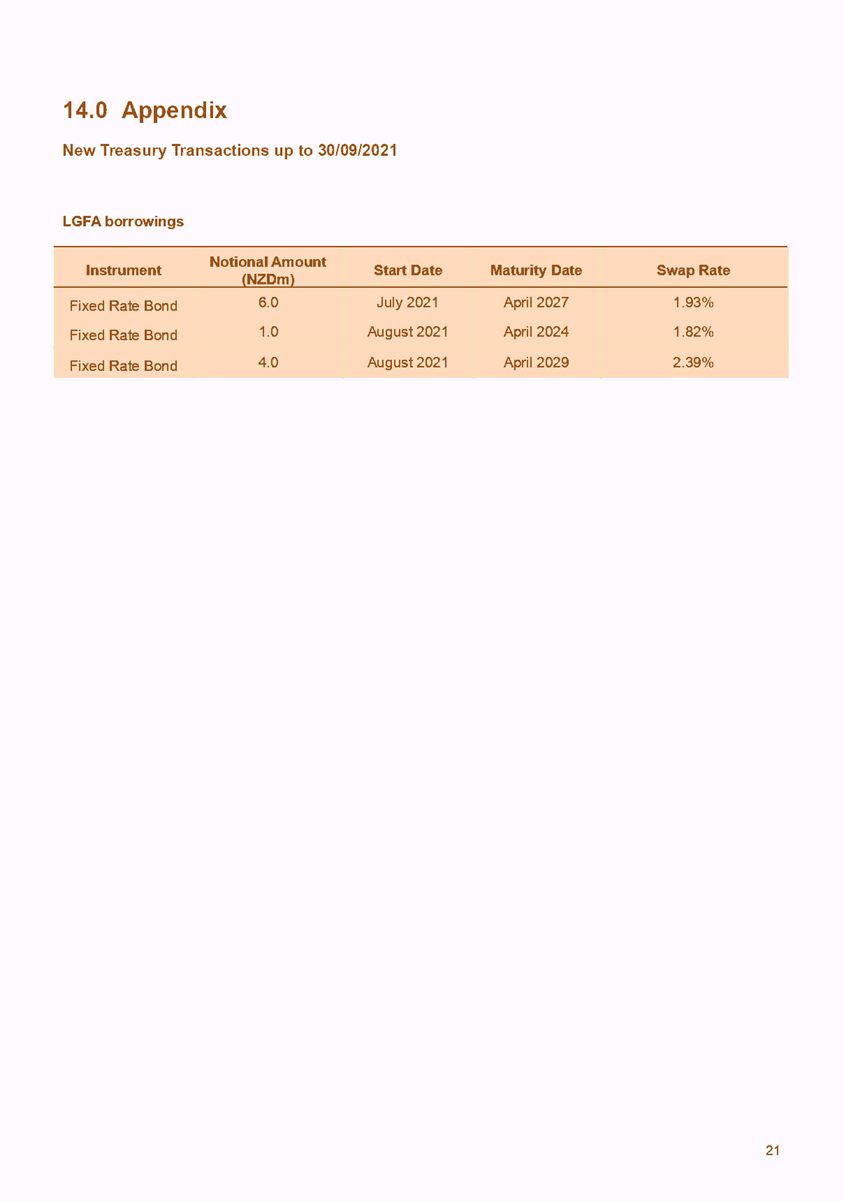

Item Title Page

1. Welcome/Karakia/Notices/Apologies

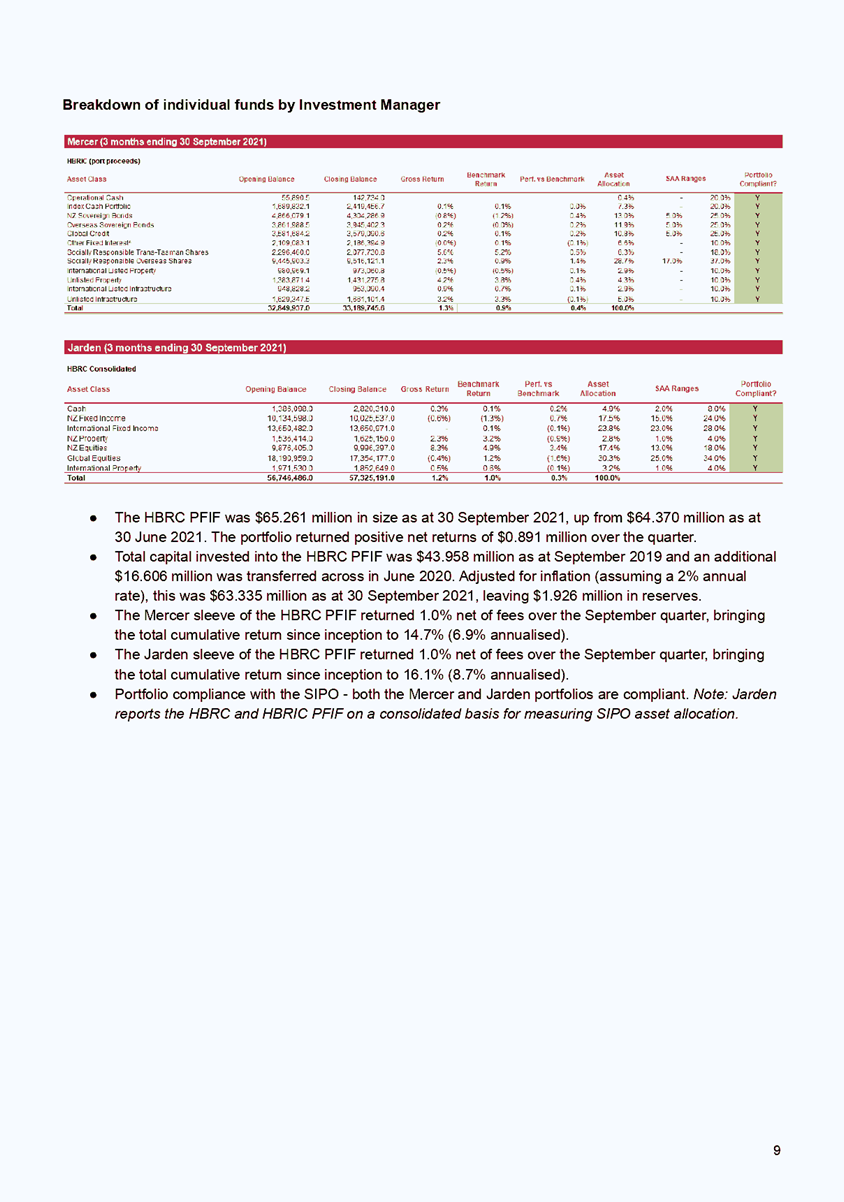

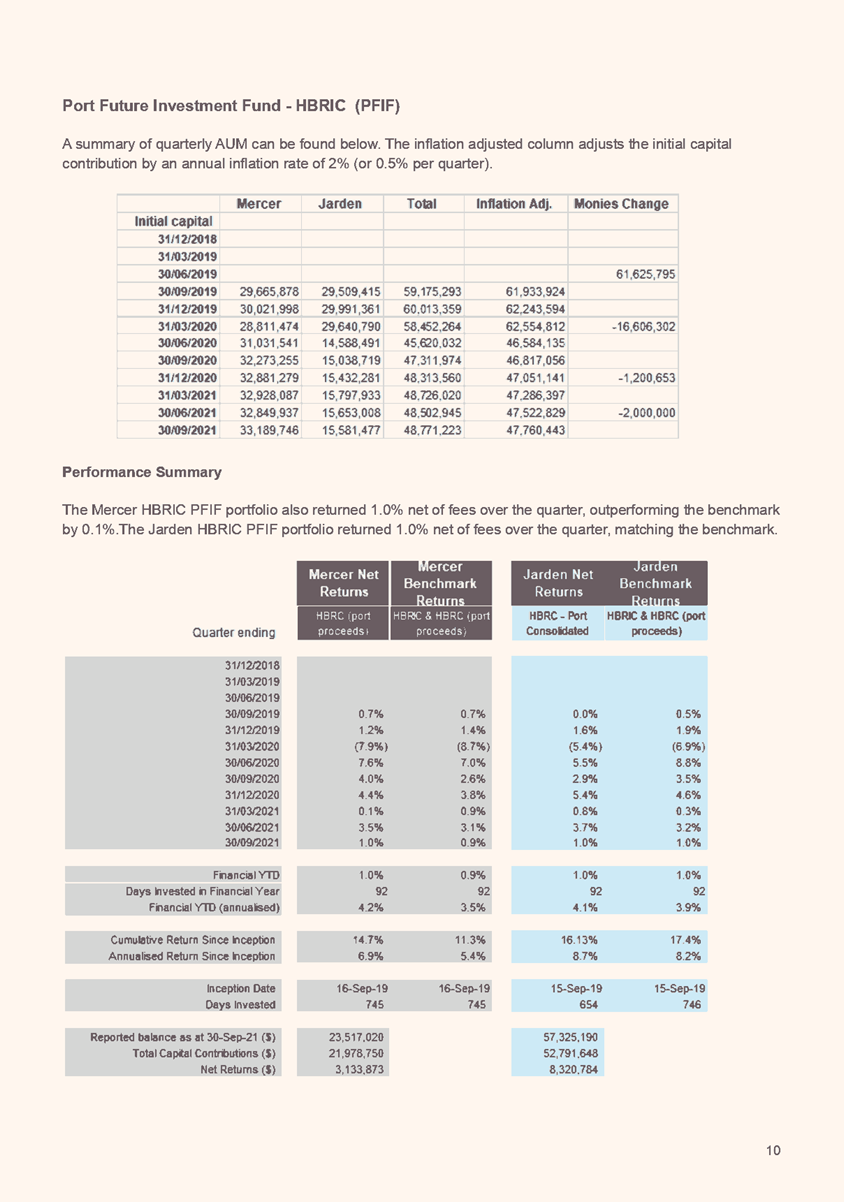

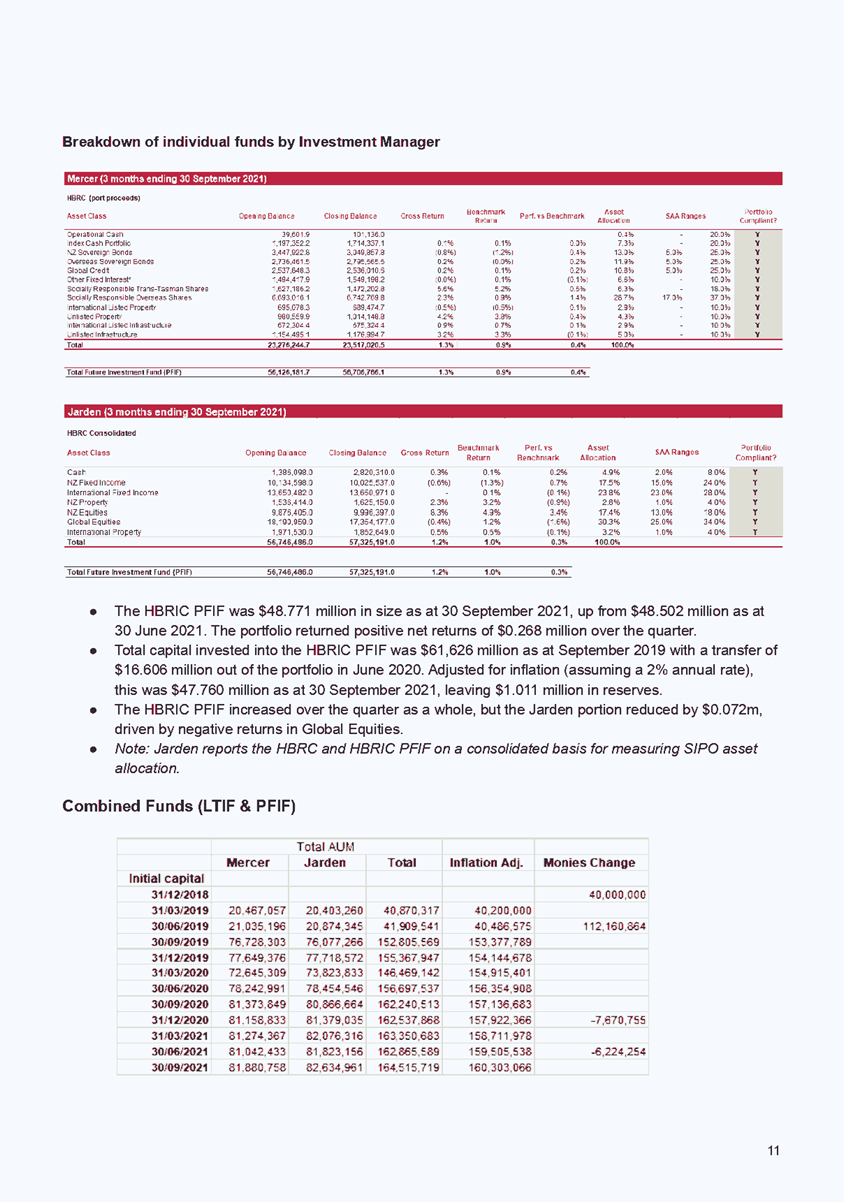

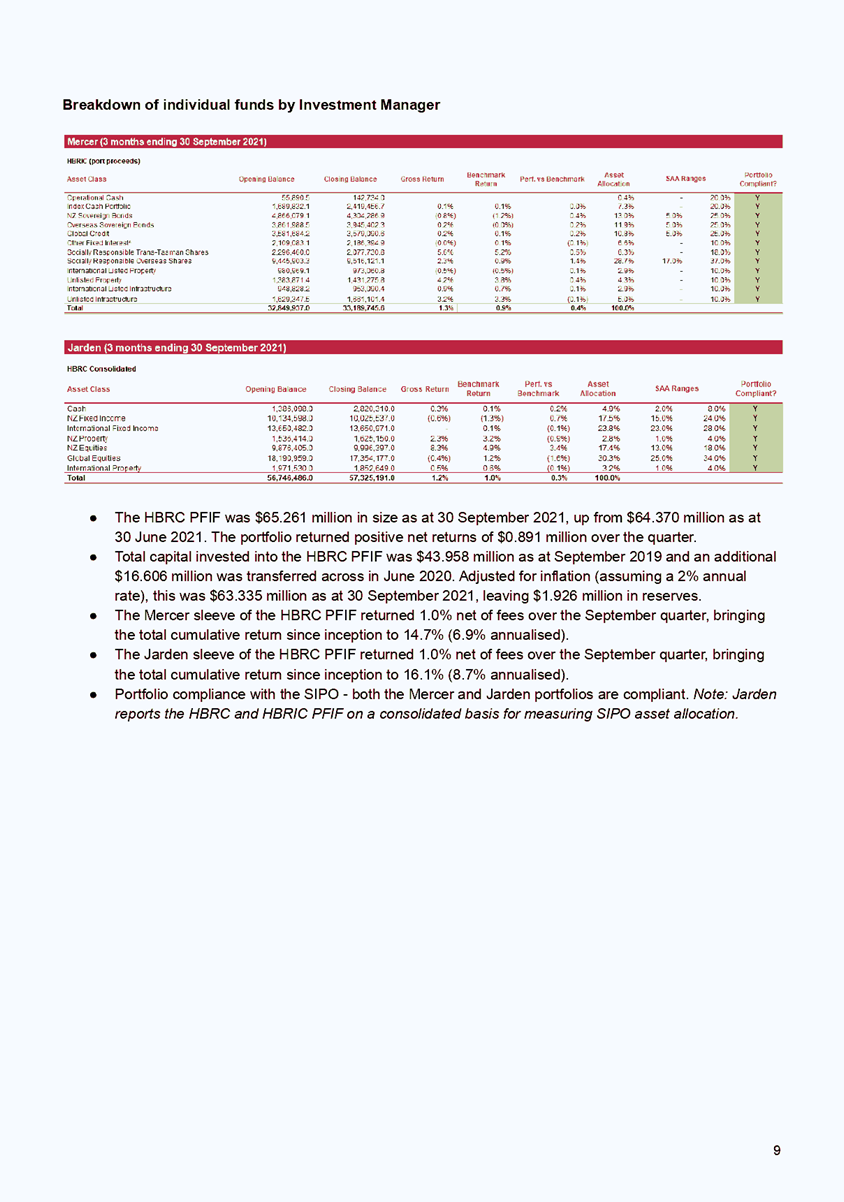

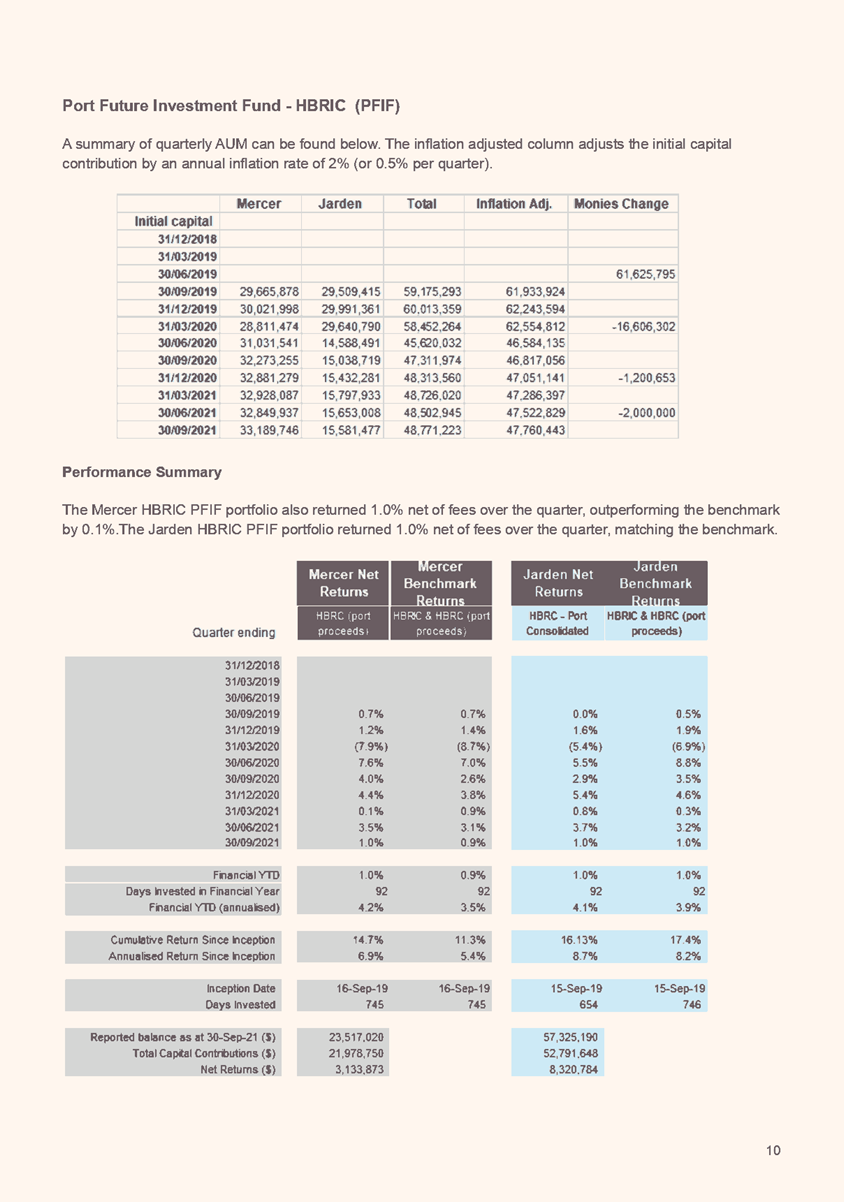

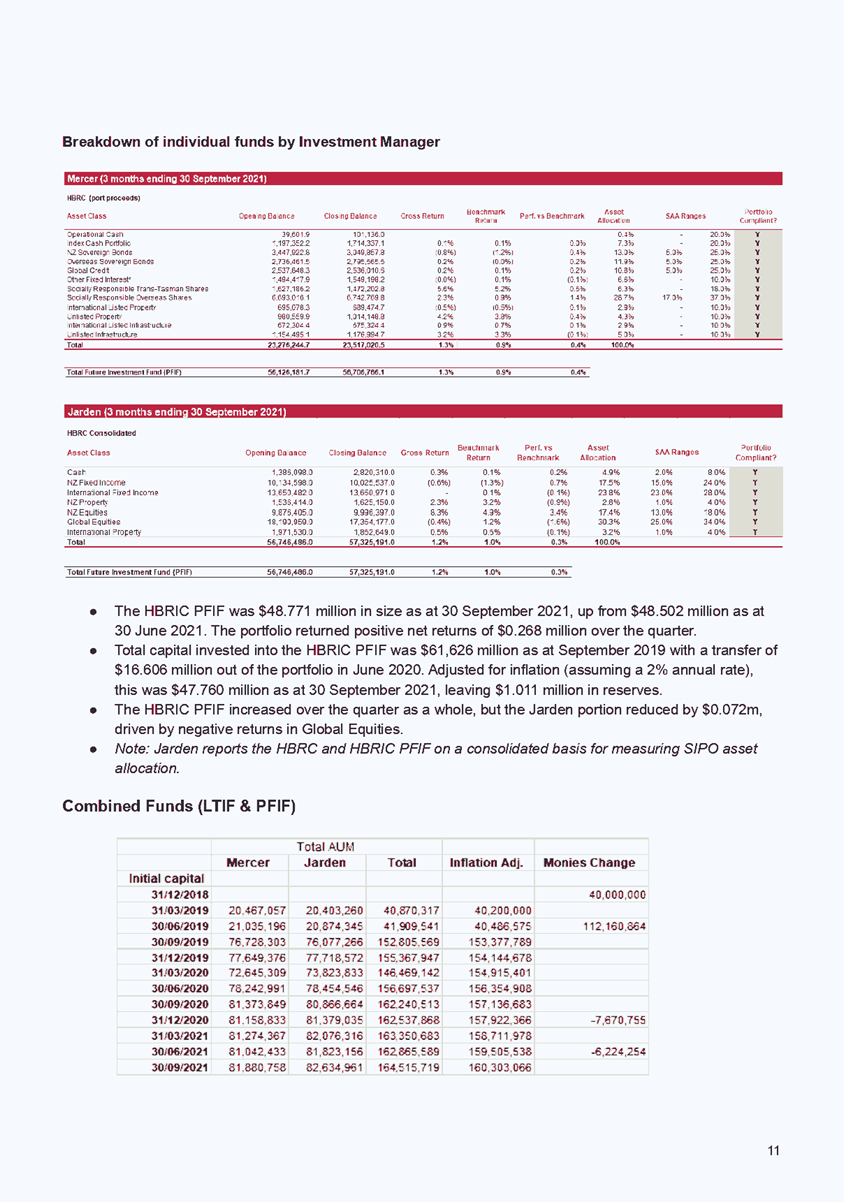

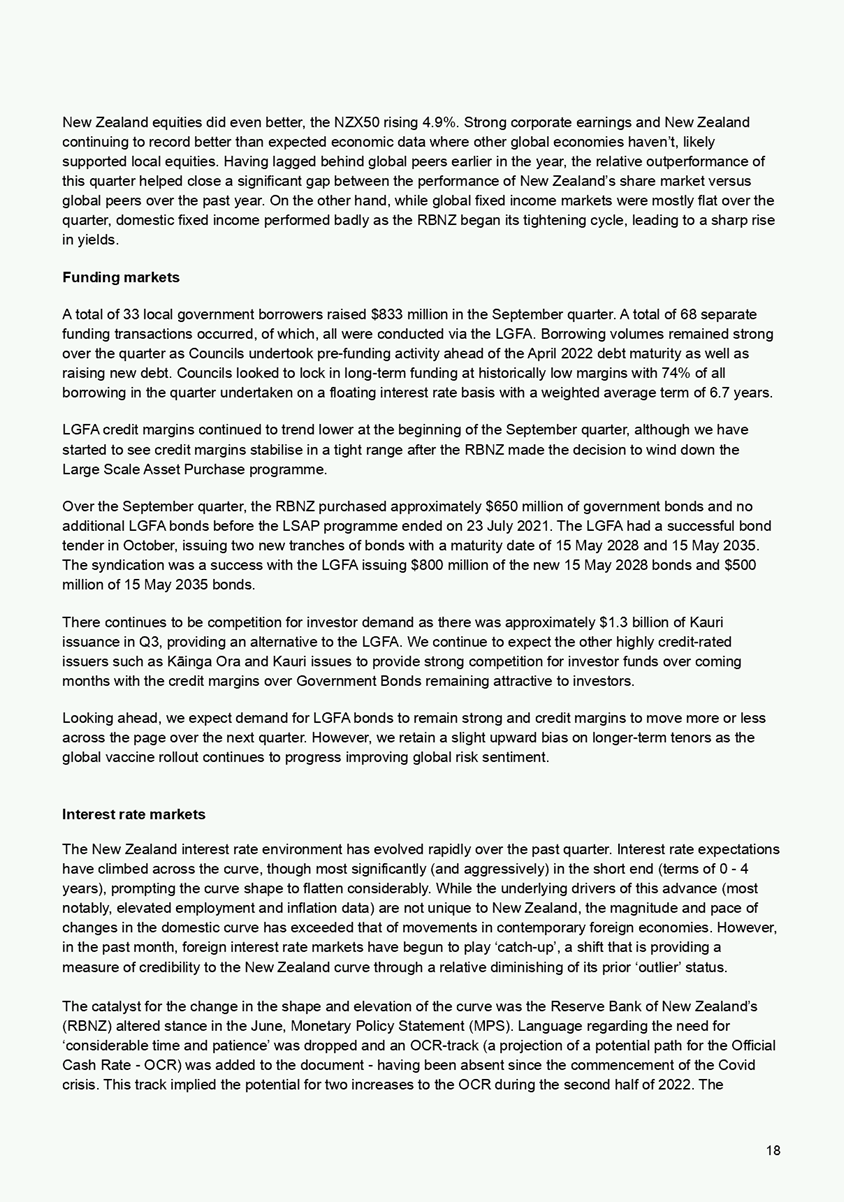

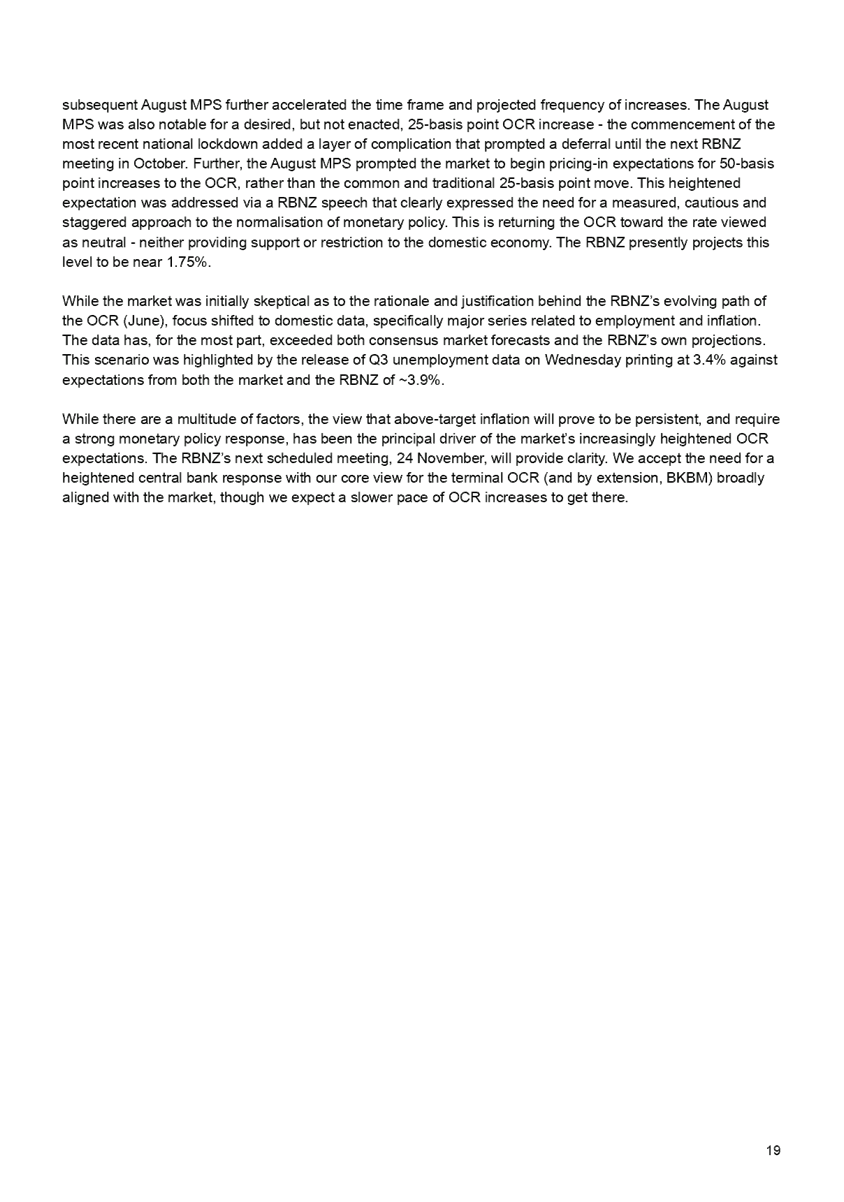

2. Conflict

of Interest Declarations

3. Confirmation of Minutes of

the Finance Audit & Risk Sub-committee held on 13 October 2021

Decision

Items

4. 2020-2021

Annual Report and Summary 3

Information

or Performance Monitoring

5. Quarterly

Treasury Report for 1 July - 30 September 2021 7

Decision

Items (Public Excluded)

6. Confirmation

of Public Excluded Minutes of the Finance, Audit and Risk Sub-committee meeting

held on 13 October 2021 33

HAWKE’S BAY REGIONAL COUNCIL

Finance Audit & Risk Sub-committee

15

December 2021

Subject: 2020-2021 Annual Report and Summary

Reason for report

1. This item presents the Hawke’s

Bay Regional Council Annual Report for the 2020-2021 financial year for the

Sub-committee’s review and recommendation to the Regional Council for

adoption.

2. The item also presents the 2020-2021

Annual Report Summary for information. The Summary does not require Council

adoption but is instead authorised by the Chief Executive.

Officers’

recommendations

3. Staff recommend that the Sub-committee

considers the 2020-2021 Annual Report as presented, noting that the final audit

report has not yet been received and adjustments may be required before Council

adoption.

Audit

clearance

4. Under the Local Government Act 2020

(the Act), the annual report and summary are statutory requirements and

required to be audited by an independent auditor.

5. Legislation[1] was passed in July 2021 to

extend the statutory deadline for adoption of both the 2020-2021 and 2021-2022

Annual Reports (with 30 June balance dates) by two months due to a severe

shortage of Auditors. That means that those annual reports must be

adopted no later than 31 December in their respective year.

6. At the time of writing, Audit NZ was

still resolving queries with their technical team, therefore there is

uncertainty around when the final audit report will be received. Due to this uncertainty

the plan is now for Council to adopt in January 2022.

7. Staff are expecting an unmodified

audit opinion. We could however expect to see some adjustments to the

financial statements due to the amount of work still to be completed by the

auditors. Should these be minor, staff consider it is not necessary to

bring them before the Sub-committee again for further review. Should

those amendments be significant in nature, revised financial statements will be

brought back to the Sub-committee before Council adoption.

8. Auditing of Hawke’s Bay Regional

Investment Company Ltd’s (HBRIC) accounts has been completed and received

an unmodified audit opinion.

9. A late adoption requires the inclusion

of a note in the Annual Report. It does not affect our Level of Service

Measure related to a clear audited opinion. Interim non-financial and

financial results, prior to being audited, have been in the public arena multiple

times via committee agendas. (See section “Information already

presented to Council’ for more details).

Background

10. The purposes of the annual report are

to:

10.1. compare actual financial and service

performance against intended performance as set out in Year 3 of the Long Term

Plan 2018-2028

10.2. promote accountability to the

community for the decisions made throughout the year by the Regional Council.

11. Schedule 10 of the Act prescribes what

must be included in the annual report.

12. The summary must represent, fairly and

consistently, the information regarding the major matters dealt with in the

annual report. It must not include any new information (not included in the

full document) but does offer the opportunity to engage more effectively with

the community.

Information

already presented to Council

13. Interim financial results for the

2020-2021 financial year to 30 June 2021 (prior to audit) and requests to carry

forward expenditure budgets from 2020-2021 to 2021-2022 were presented to the

Corporate and Strategic Committee on 18 August 2021, noting that year-end

financial results were likely to change as staff refine information as part of

the audit process. Some draft non-financial results (Community Outcomes and

Groups of Activities) were also presented at that meeting.

14. Council approved the budget carry

forward requests at its meeting on 25 August 2021.

15. Feedback from the Corporate and

Strategic Committee on the draft non-financial results was incorporated and

then presented to the Finance, Audit and Risk Sub-committee on 13 October 2021,

along with the Introduction and Regional Highlights sections.

Discussion

points

16. The production of the 2020-2021 Annual

Report financial information has been a challenging process for staff as the

implementation of a new finance system for the whole organisation has taken

place at the same time.

17. The 2020-2021 Annual Report includes a

significant prior year adjustment. In December 2013, Council signed a contract

with the Accident Compensation Corporation (ACC) to provide immediate

investment funds in exchange for the future rental income from the Napier

endowment leasehold properties for the 50-year term of the contract. Council

has recognised a provision for the payment of the future rental income in the

financial statements since the year ending 30 June 2014.

18. The contract includes an obligation

that Council pays ACC two-thirds of the gain from the sale of the leasehold

over and above the future rental income due on that property. In the early

years of the contract, the portion of the gain paid to ACC was immaterial but

this has evolved over time as a large number of properties have been freeholded

and the value of the remaining properties has increased significantly.

19. Council has now assessed the potential

liability based on the valuation of the Napier property portfolio and the

remaining rental provision and has determined that a provision of $21.7 million

is required to correctly state the liability to ACC from the probable sale of

the remaining leasehold properties.

20. Council has determined that this

adjustment should be recognised in prior periods to meet accounting standards

and has restated the 2019-2020 figures accordingly resulting in a

$6.3 million reduction in the 2019-2020 surplus and a $2.9 million expense

in the current year.

Next

steps

21. Following Council adoption, and in

line with section 98 of the Local Government Act 2002, both the 2020-2021

Annual Report and the 2020-2021 Annual Report Summary will be made publicly

available within one month. Both will be published on Council’s website

and a limited number of the Summary Annual Report will be printed.

Decision Making Process

22. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002. Staff have assessed the requirements in relation to

this item and have concluded:

22.1. The decision does not

significantly alter the service provision or affect a strategic asset, nor is it

inconsistent with an existing policy or plan.

22.2. The use of the special

consultative procedure is not prescribed by legislation.

22.3. The decision is not

significant under the criteria contained in Council’s adopted

Significance and Engagement Policy.

22.4. The decision is in accordance with the

Finance, Audit and Risk Sub-committee Terms of Reference, specifically to:

22.4.1. Satisfy itself that the financial

statements and statements of service performance are supported by adequate

management signoff and adequate internal controls and recommend adoption of the

Annual Report by Council.

22.5. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by, or have an interest in the decisions made, Council

can exercise its discretion and make a decision without consulting directly

with the community or others

having an interest in the decision.

Recommendations

That the Finance, Audit and Risk

Sub-committee:

1. Receives and considers the “Hawke’s

Bay Regional Council 2020-2021 Annual Report and Summary” staff report.

2. Recommends that

Hawke’s Bay Regional Council adopts the 2020-2021 Annual Report, pending receipt of Audit New

Zealand’s final audit report and subject to any minor adjustments resulting from

the audit.

Authored by:

|

Sarah Bell

Team Leader

Strategy & Performance

|

Mandy Sharpe

Project

Manager

|

|

Desiree Cull

Strategy

& Governance Manager

|

|

Approved by:

|

Jessica Ellerm

Group

Manager Corporate Services

|

|

Attachment/s

|

1⇨

|

2020-2021 HBRC Annual Report

|

|

Under Separate Cover

|

|

2⇨

|

2020-2021 Annual Report Summary

|

|

Under Separate Cover

|

HAWKE’S BAY REGIONAL

COUNCIL

Finance Audit & Risk Sub-committee

15

December 2021

Subject: Quarterly Treasury Report for 1 July - 30 September 2021

Reason for Report

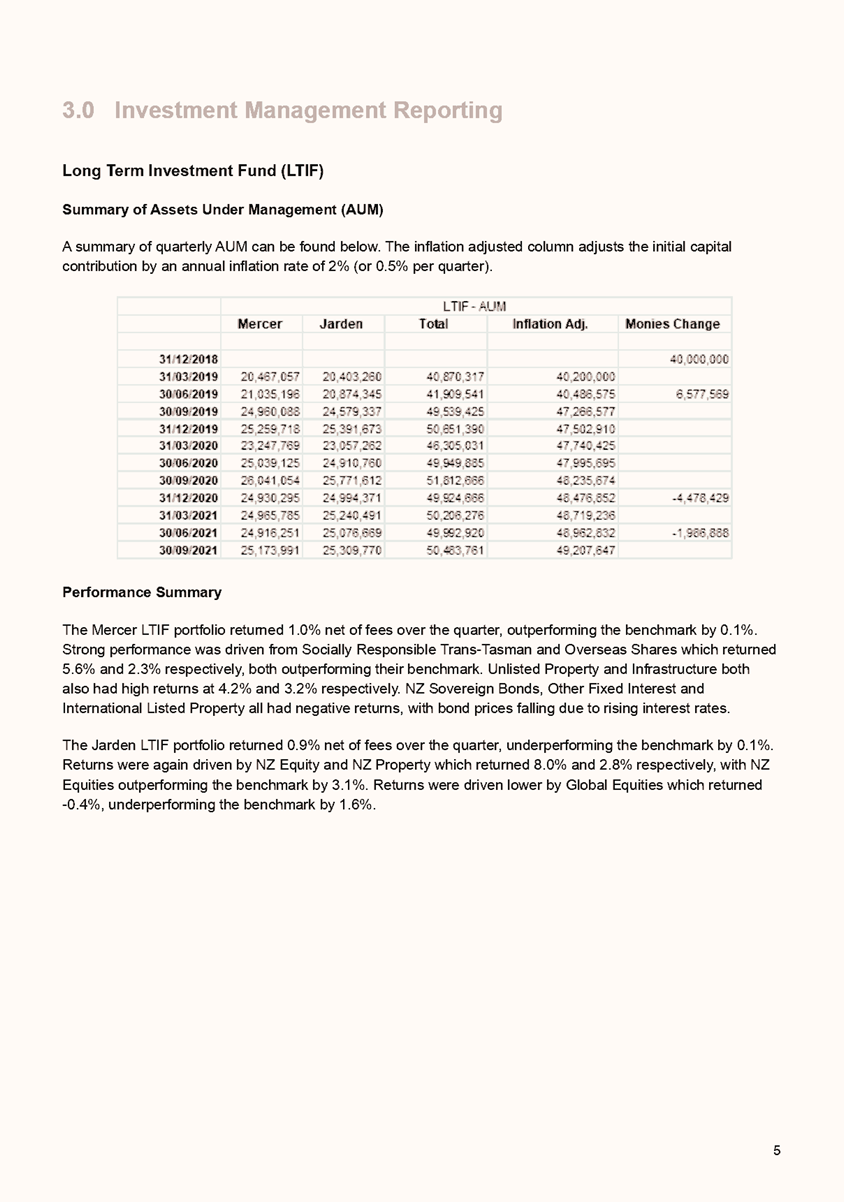

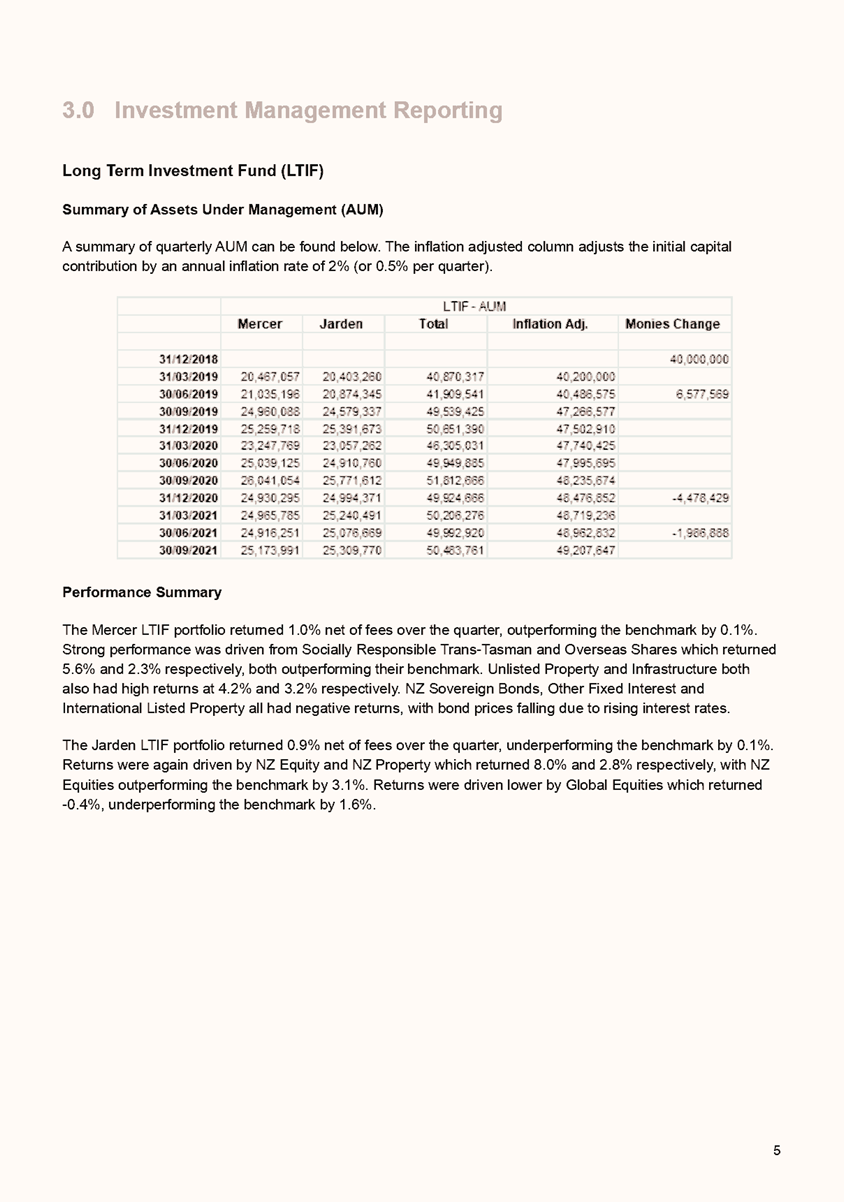

1. This item provides

compliance monitoring of Hawke’s Bay Regional Council (HBRC) treasury

activity and reports the performance of Council’s investment portfolio

for the quarter ended 30 September 2021.

Overview of the Quarter – ending 30 September 2021

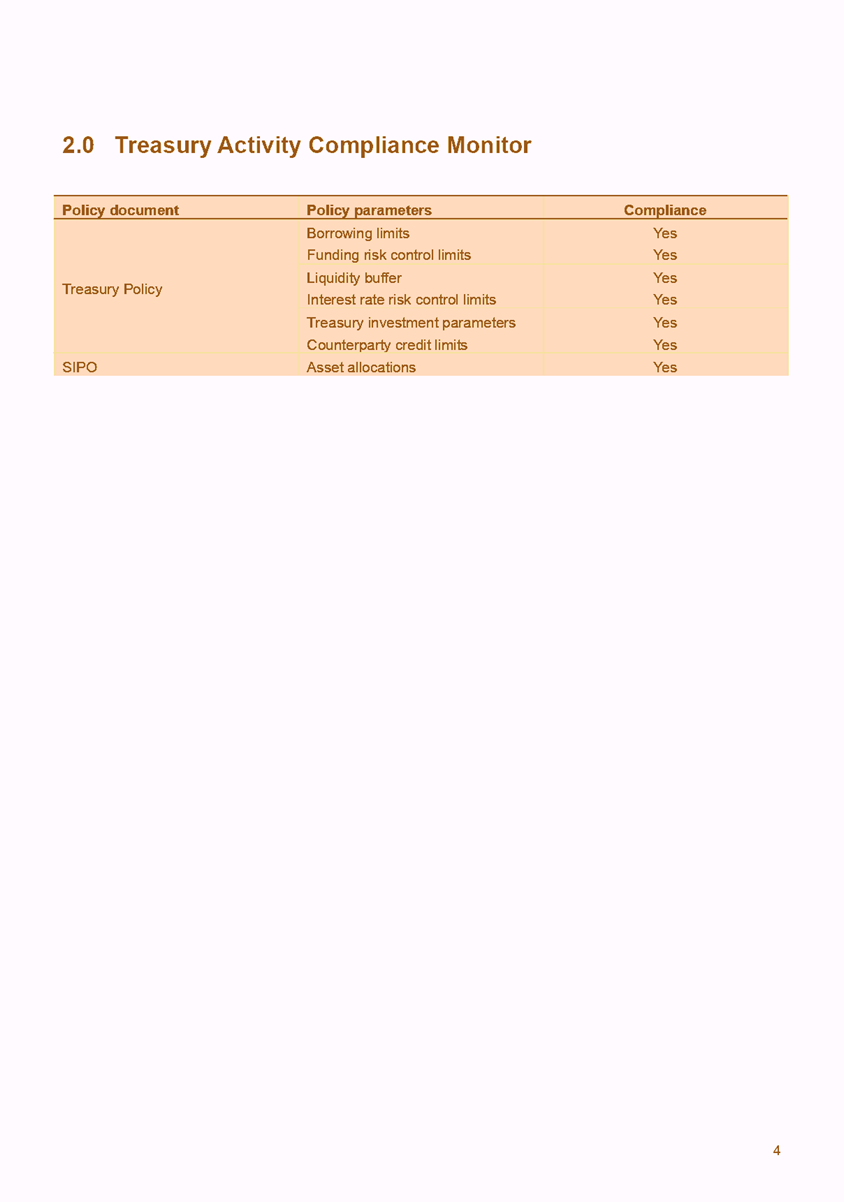

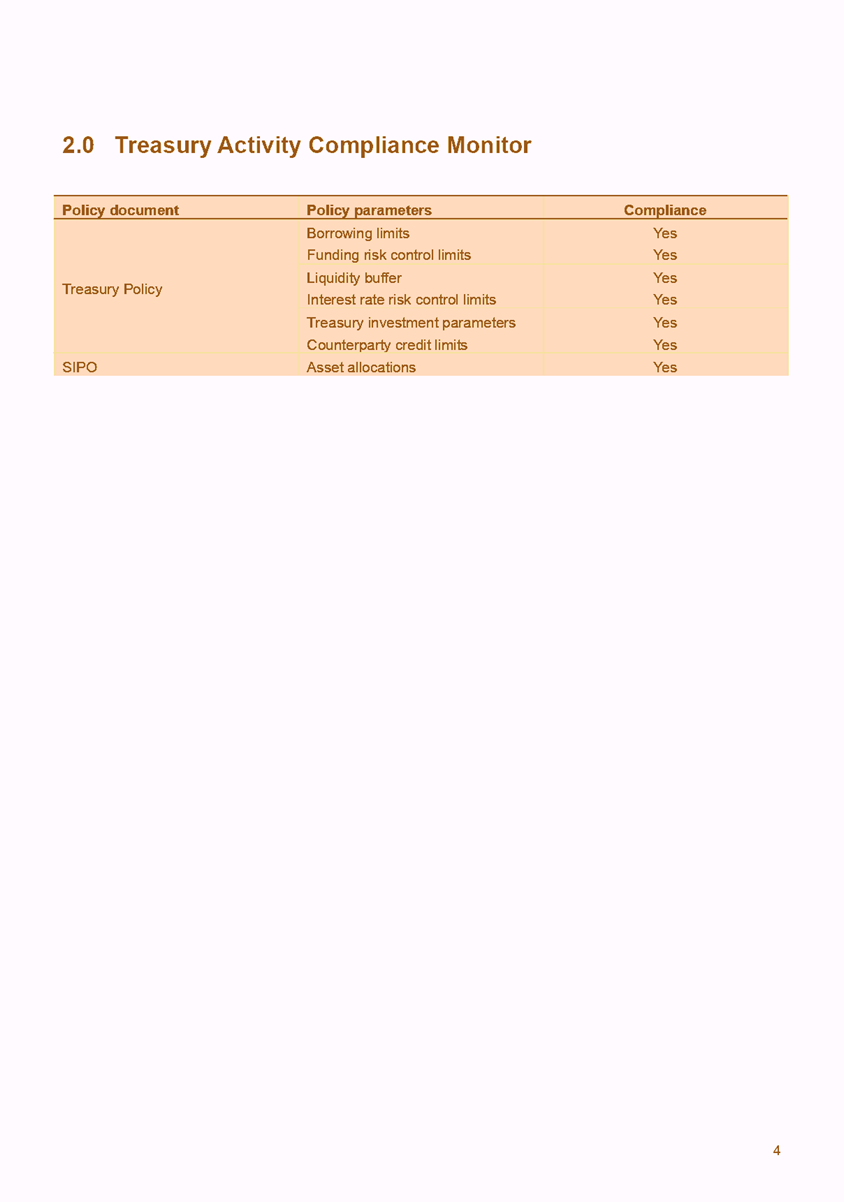

2. At the end of the quarter

to 30 September 2021, HBRC was compliant with all of the measures in its

Treasury policy.

3. Our investment returns for

the first 3 months are below expectations at this stage, however, it is too

early to predict the returns for the rest of the year.

4. Our cash balances are good

and borrowing requirements low for the first 3 months. As Council progresses

further into the financial year additional borrowing will be required.

Background

5. Council’s Treasury

Policy requires a quarterly Treasury Report to be presented to the Finance

Audit and Risk Sub-committee. The policy states that the Treasury Report

is to include:

5.1. Treasury Exceptions report

5.2. Policy compliance

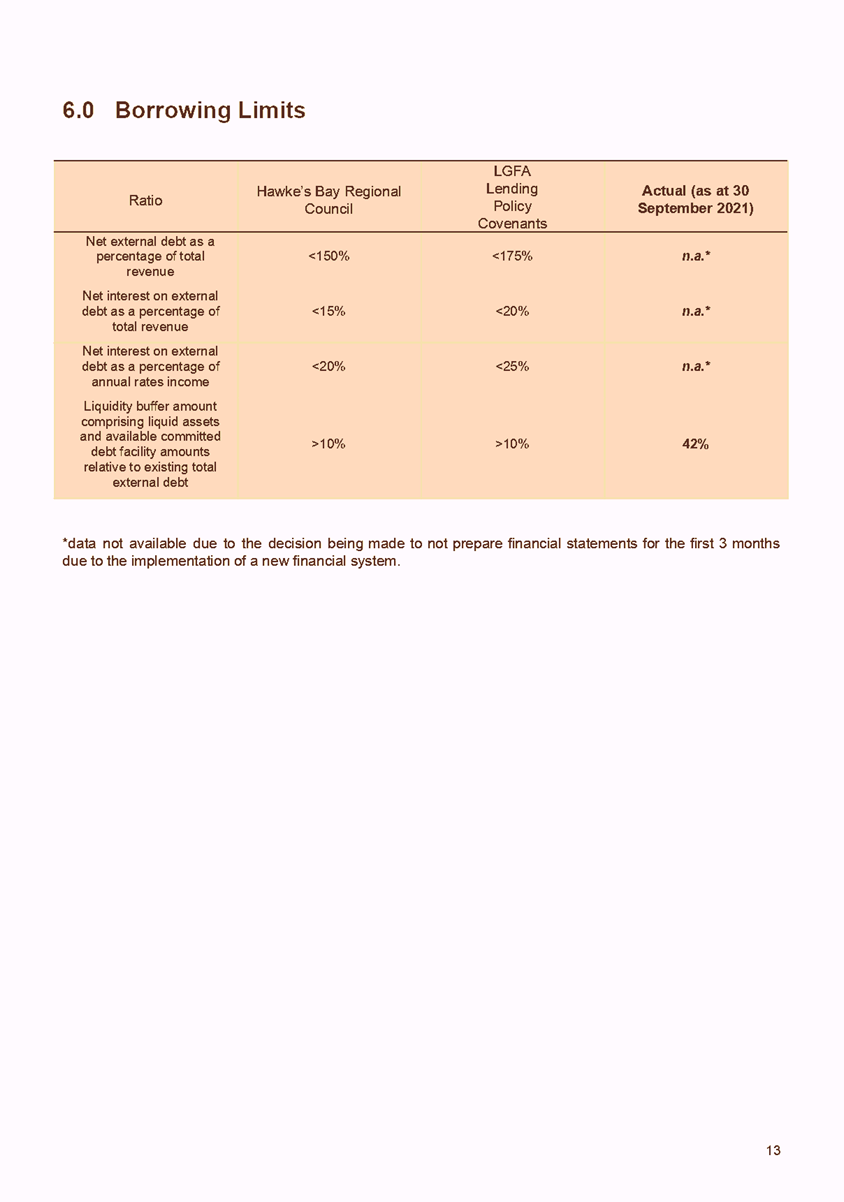

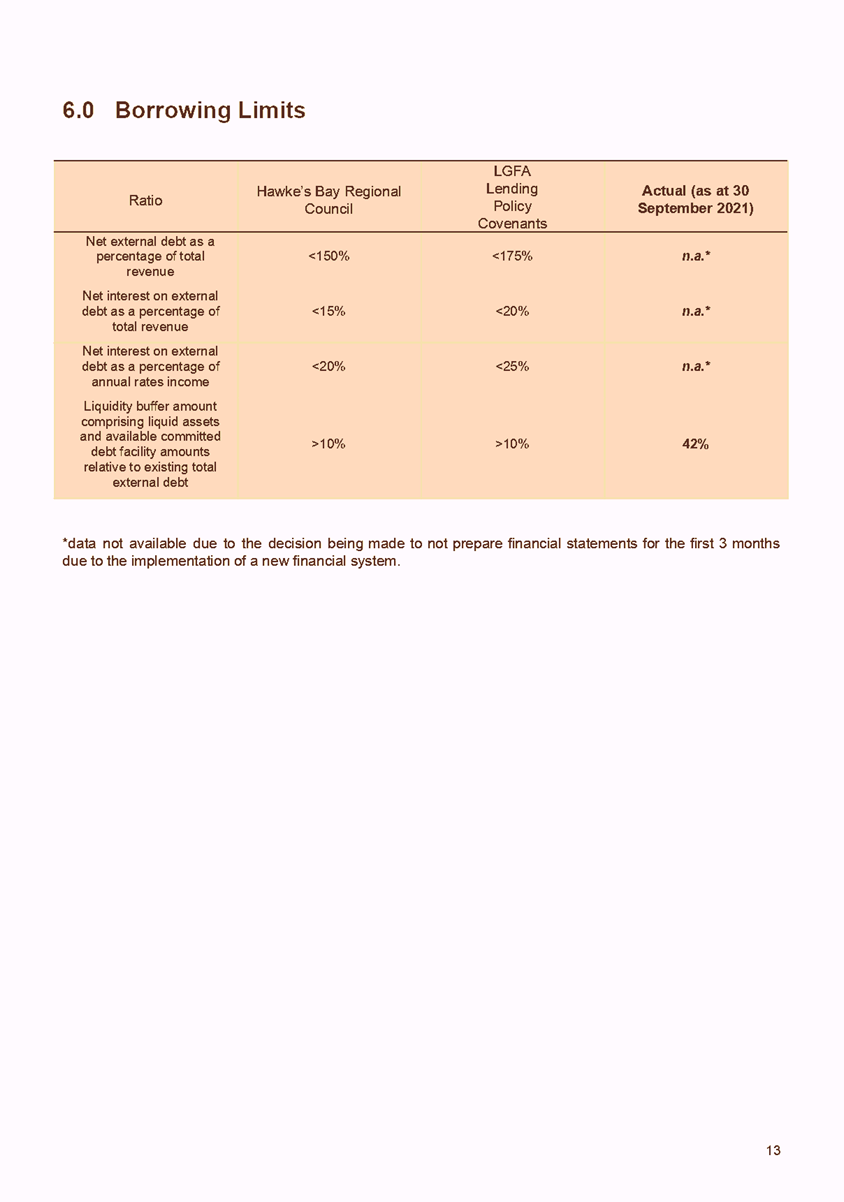

5.3. Borrowing Limit report

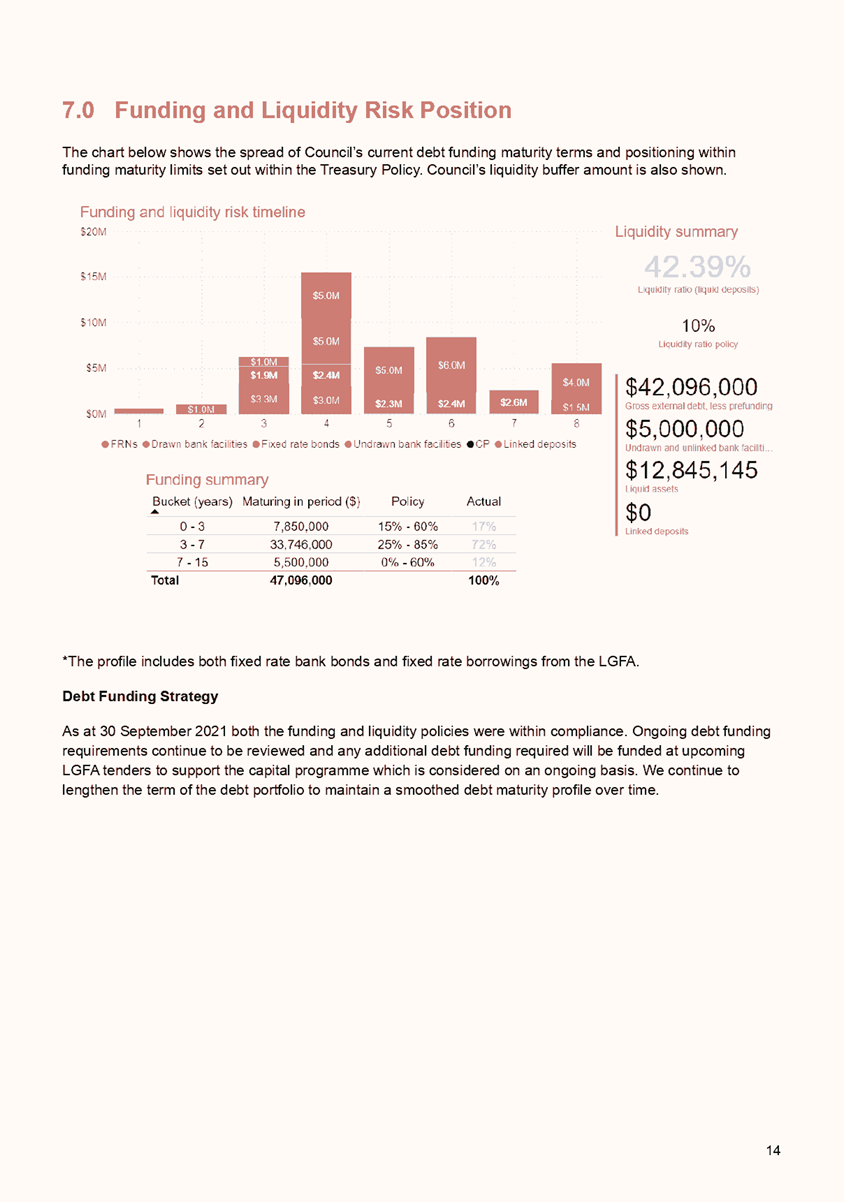

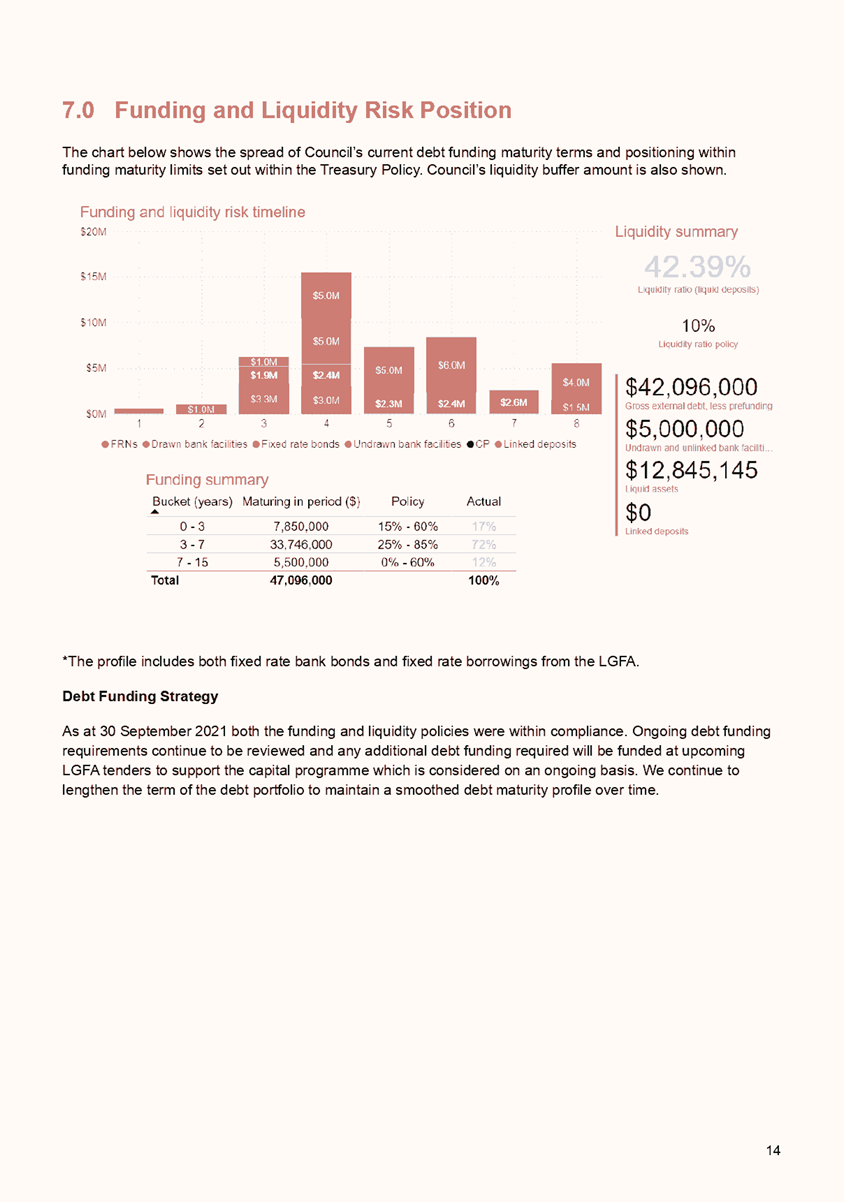

5.4. Funding and liquidity report

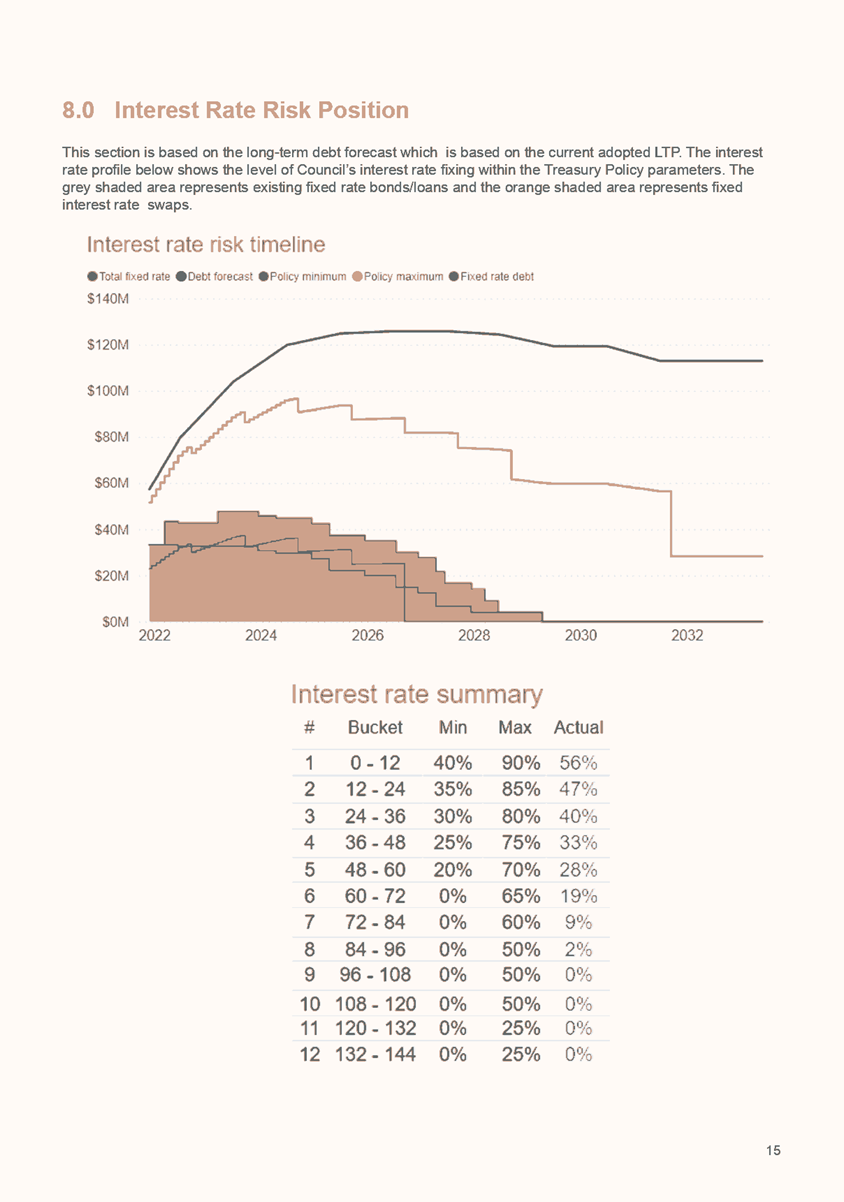

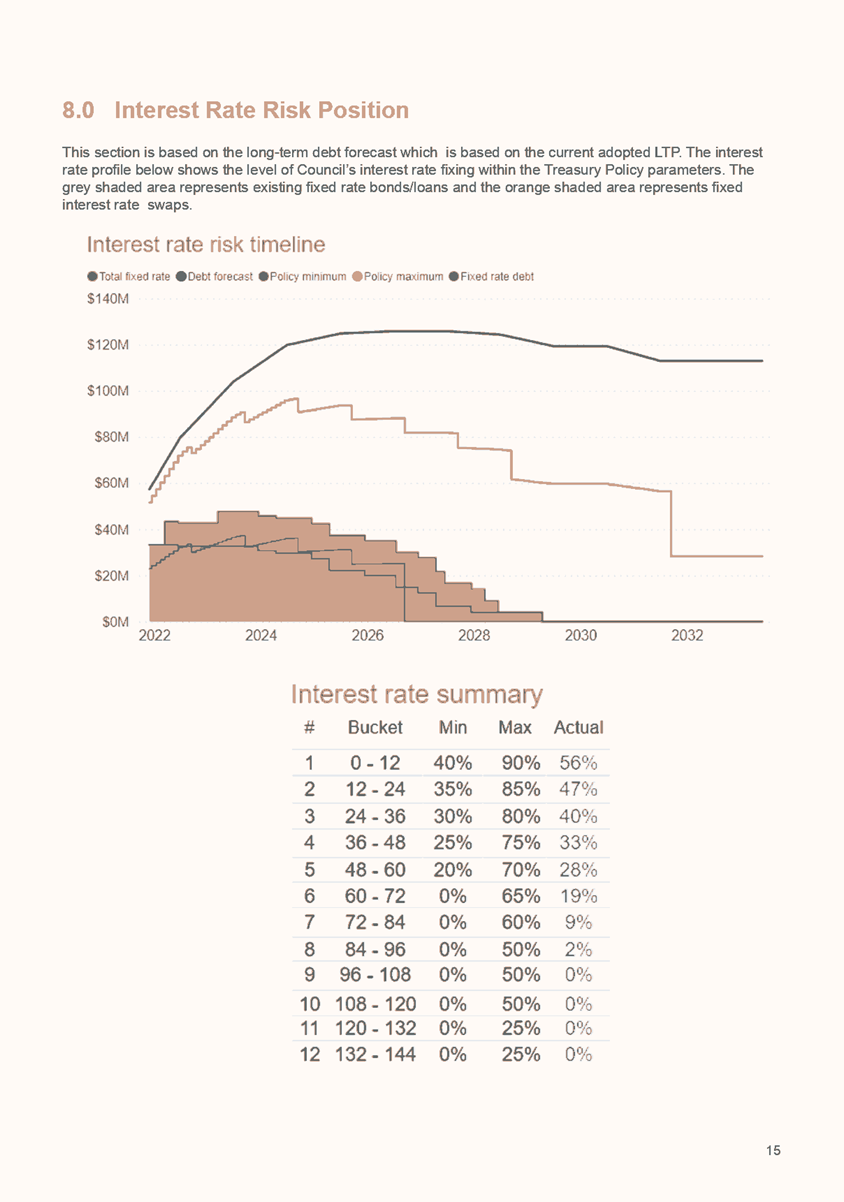

5.5. Debt maturity profile Interest rate report

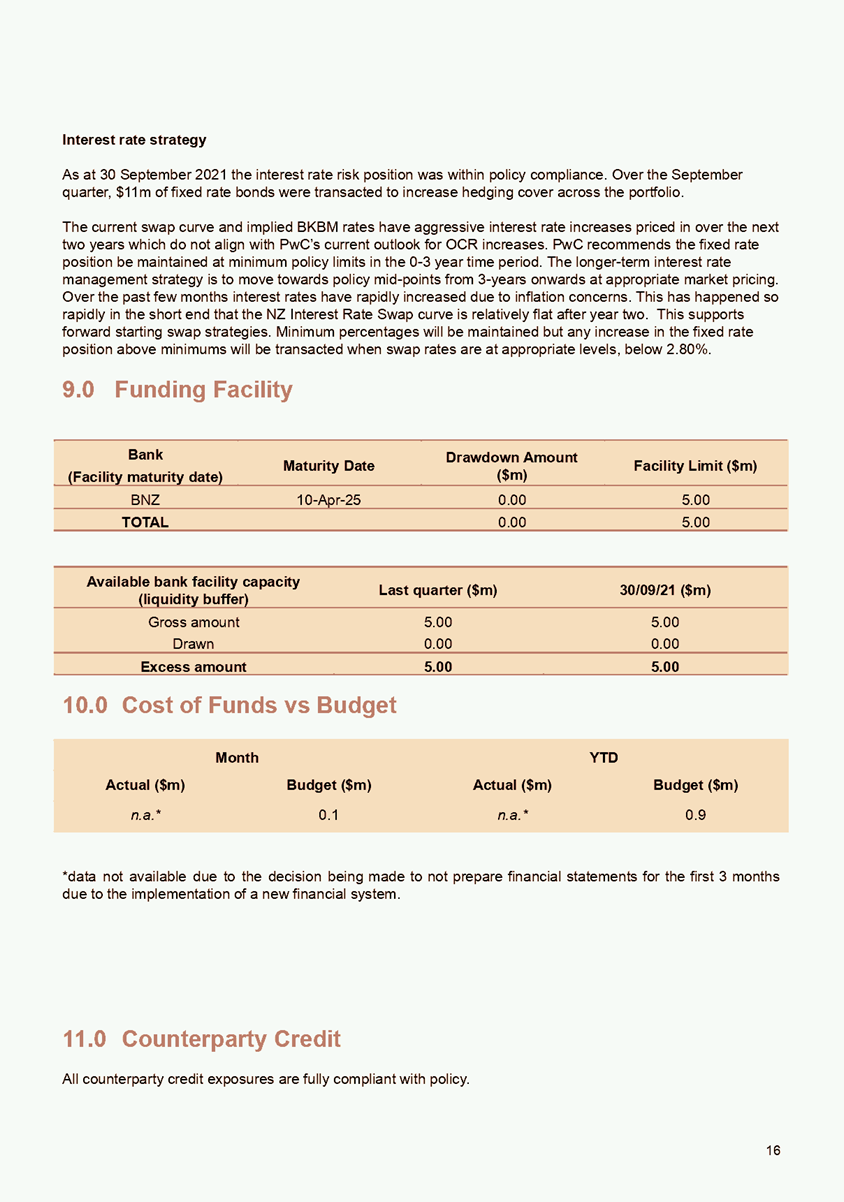

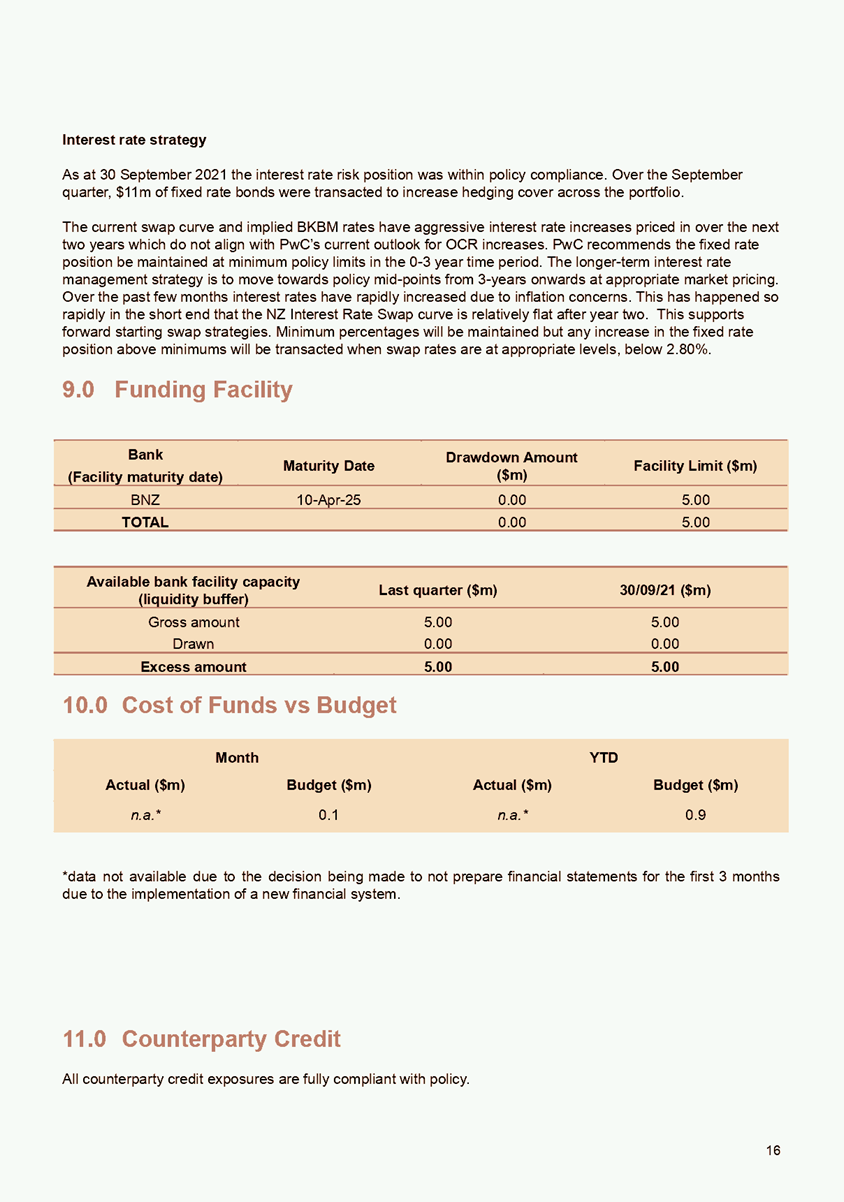

5.6. Investment management report **

5.7. Treasury investments

5.8. Cost of funds report Cash flow and

debt forecast report

5.9. Debt and interest rate strategy and

commentary

5.10. Counterparty credit report

5.11. Loan advances.

6. The Investment Management report** has

specific requirements outlined in the Treasury Policy. This requires quarterly

reporting on all treasury investments plus annual reporting on all equities and

property investments.

7. In addition to the Treasury Policy,

Council has a Statement of Investment Policy and Objectives (SIPO) document

setting out the parameters required for funds under management for the HBRC

Long Term Investment Fund.

8. Treasury Investments to be

reported on consist of:

8.1. Liquidity

8.1.1. Cash and Cash Equivalents

8.1.2. Debt Management

8.2. Externally Managed Investment Funds

8.2.1. Long-Term Investment Fund (LTIF)

8.2.2. Future Investment Fund (FIF)

8.3. Investment properties

8.4. HBRIC Ltd

8.5. 2020-21 Performance Summary.

9. Since 2018, HBRC has

procured treasury advice and services from PriceWaterhouseCoopers (PwC) and

their quarterly compliance report is attached.

Discussion

10. A separate treasury report is prepared

by Council’s advisors, PwC to report on compliance with the policy

parameters and investment performance. The PwC report is attached. This

report gives a high-level summary of the data in the PwC report.

Liquidity

11. To ensure HBRC has the

ability to adequately fund its operations, current policy requires HBRC to

maintain a liquid balance of $3.0m.

12. The following table reports

the cash and cash equivalents on 30 September 2021.

|

30

September 2021

|

$000

|

|

Cash

on Call

|

12,845

|

|

Short-term

bank deposits

|

14,000

|

|

Total

Cash & and Deposits

|

26,845

|

13. Council’s balance of

cash and deposits compares favorably with the September 2020 balance of $15.2m.

The main reason for the variance to last year is that the due date for the

payment of rates was 20 September 2021 so a large portion of rates revenue had

been received, while last year ratepayers were given additional time to pay.

14. To manage HBRC liquidity

risk, HBRC also retains a Standby Facility with BNZ.

This facility provides HBRC with a same day draw down option, to any amount

between $0.3-$5.0m, and with a 7-day minimum draw period.

Debt Management

15. On 30 September 2021,

current external debt was $42.096m.

16. $6m was raised form LGFA in

July and a further $5m was raised from LGFA in August. The funds were

raised for terms of 3,6 and 8 years with effective interest rates ranging from

1.82% to 2.39%. Details of the funds raised are show in Appendix 14 of the PwC

report.

17. Further borrowing will be

required in the second half of the financial year (first half of 2022) as the

requirements of the proposed 2021-22 borrowing programme of $27.5m ramps up.

Managed

Funds

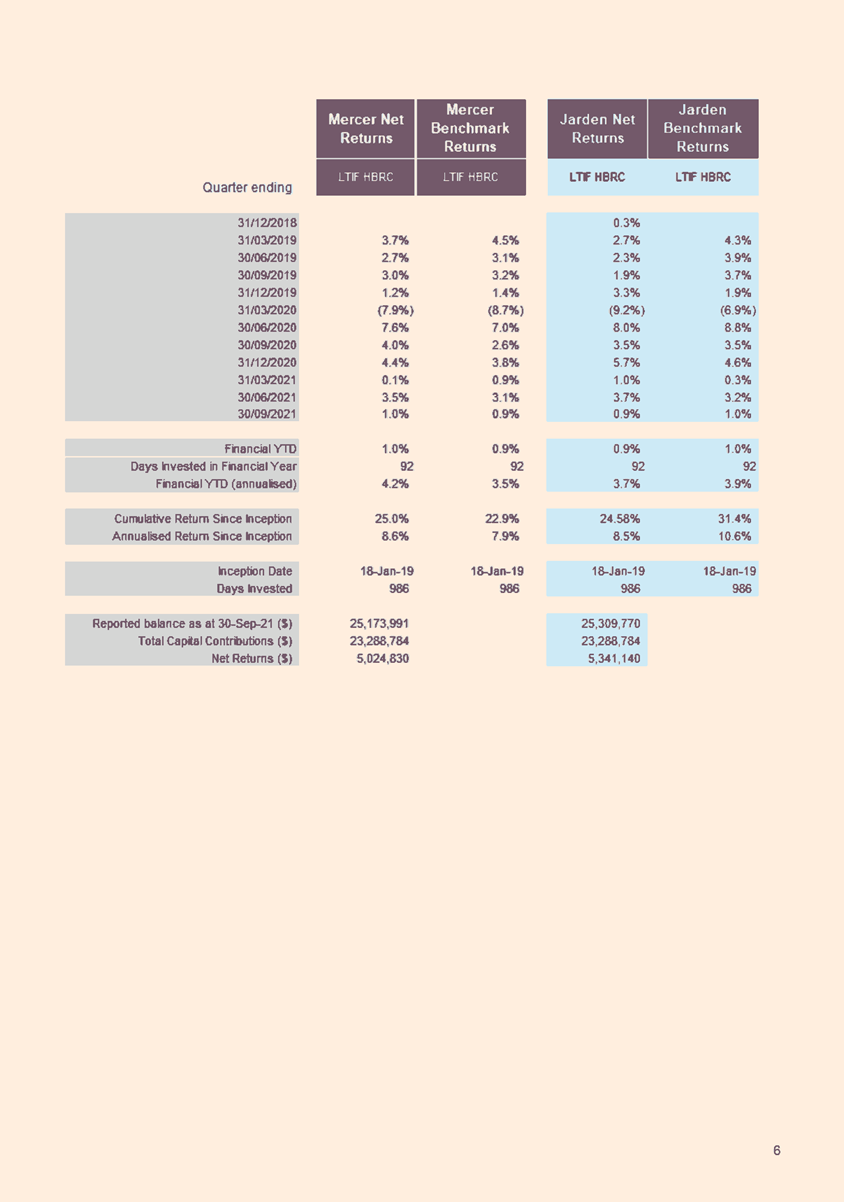

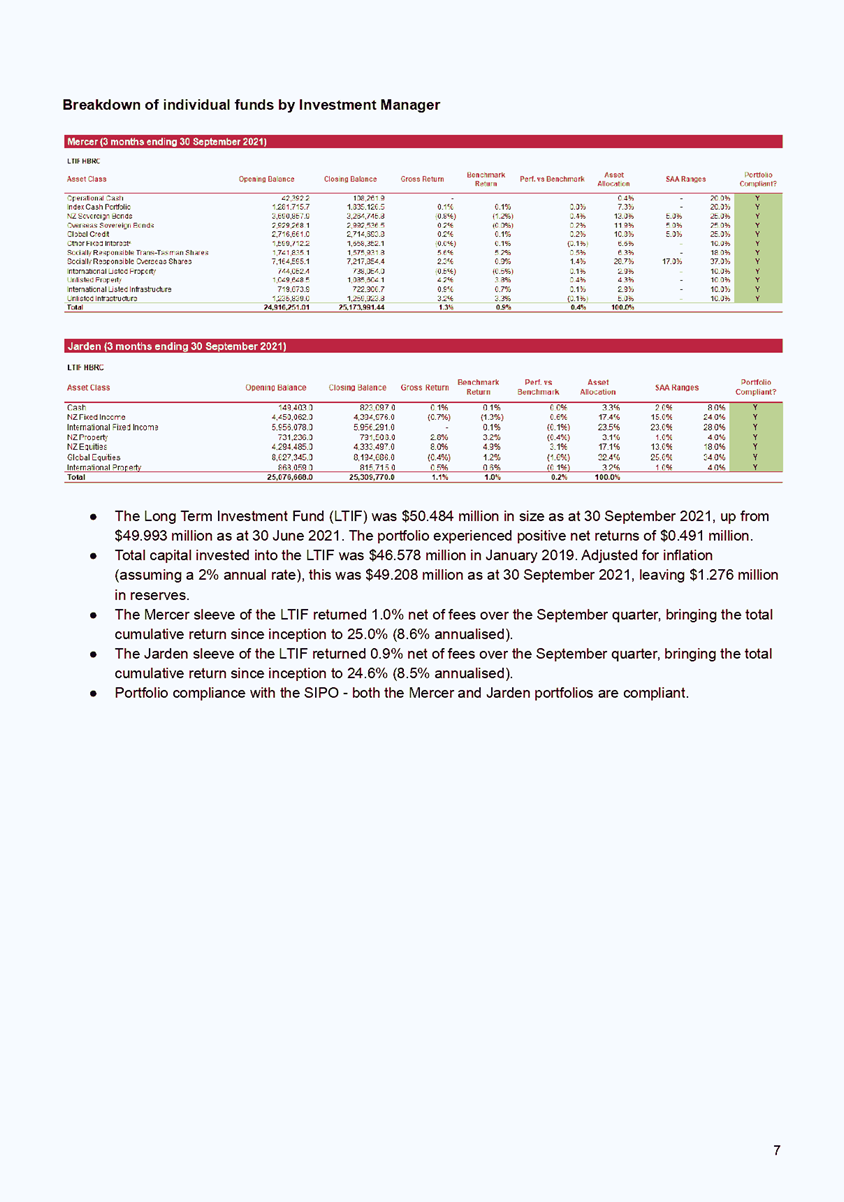

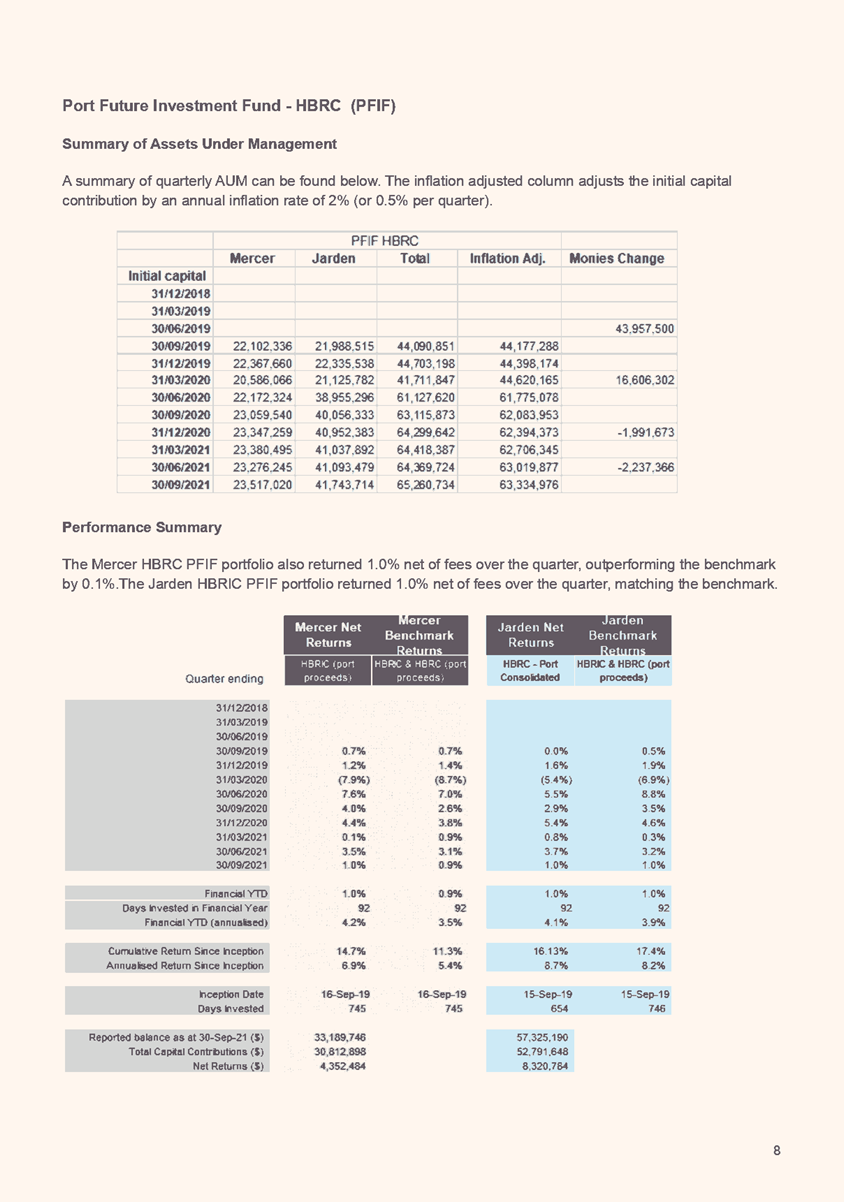

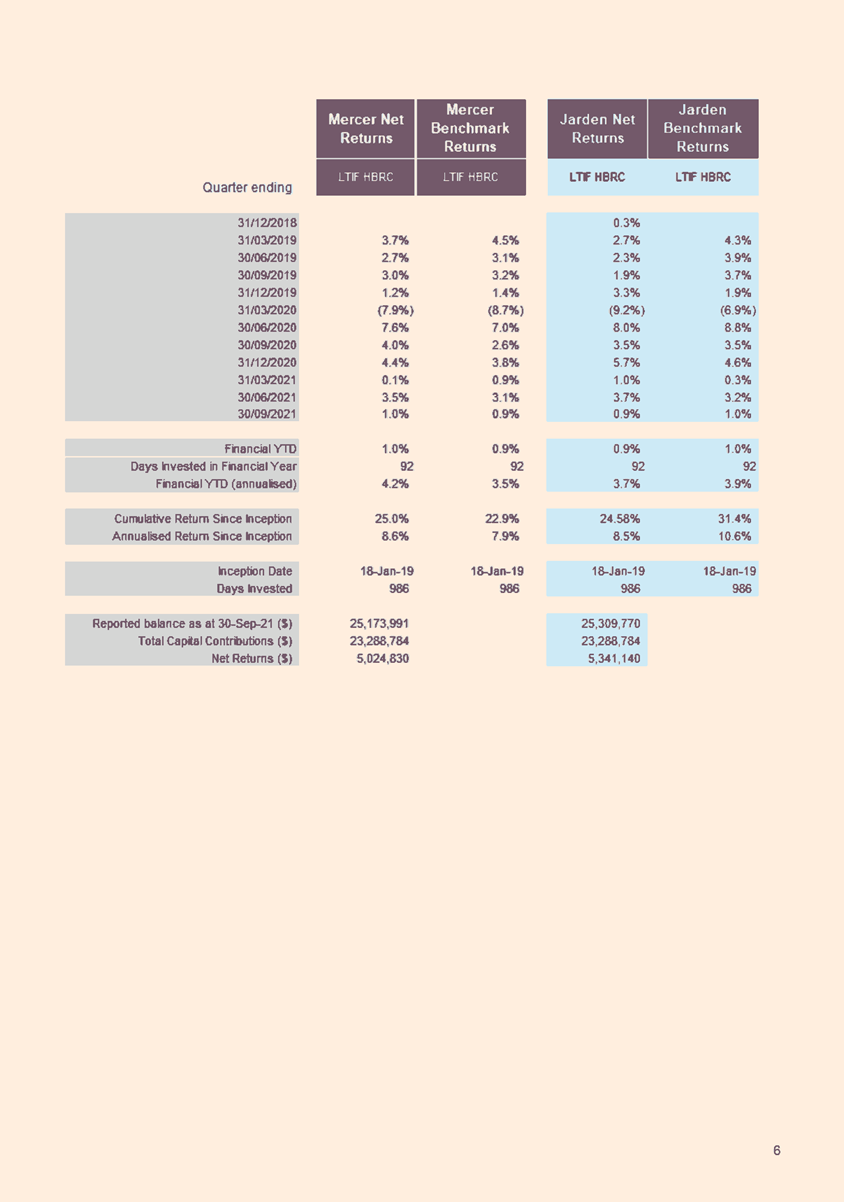

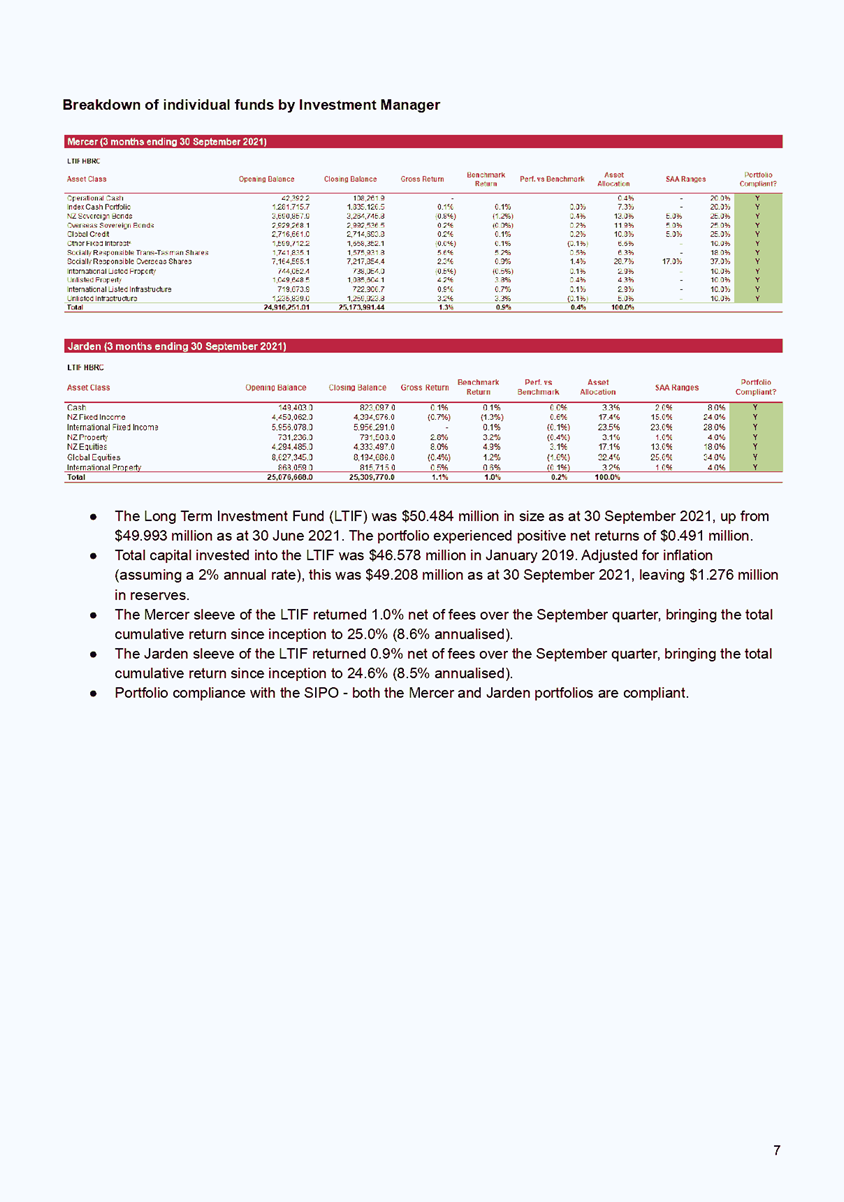

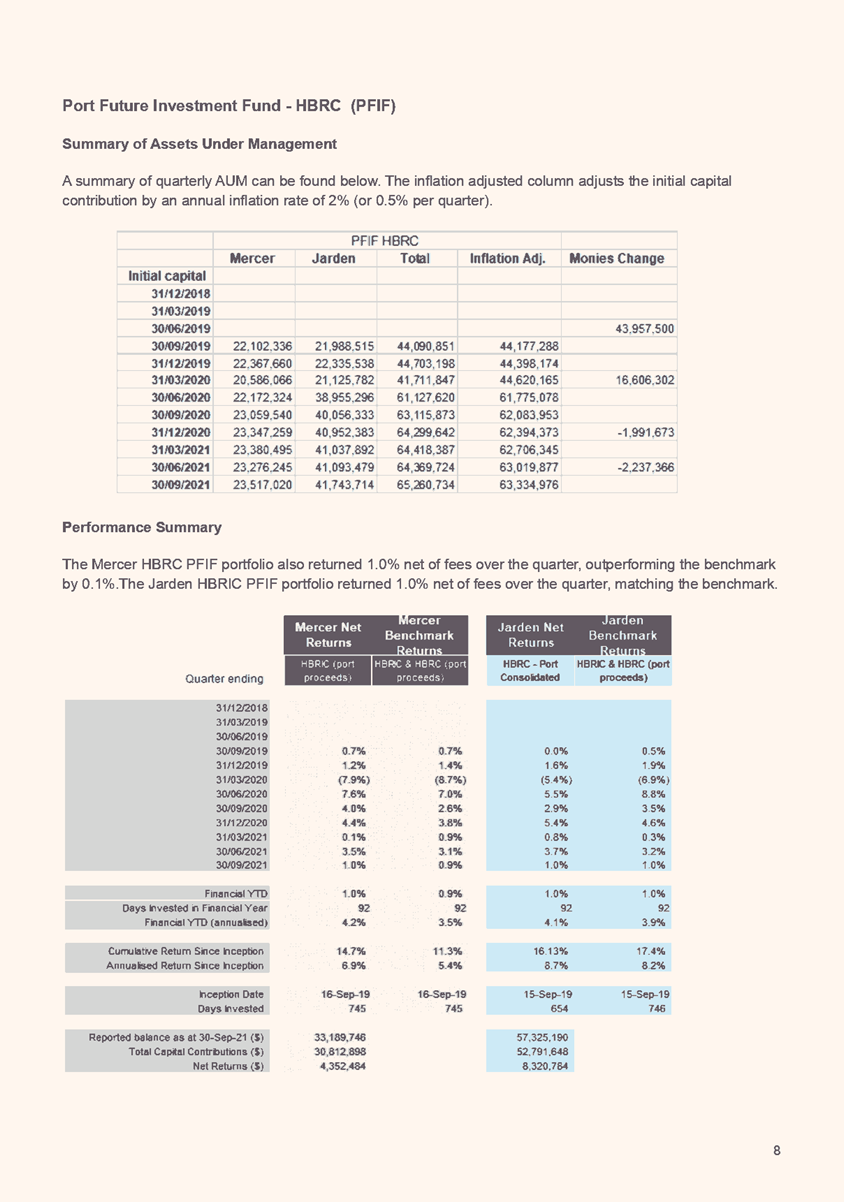

18. The Fund performances for

the first 3 months have been lower than we have experienced recently. Markets

have not performed as strongly as last year with the YTP results for the two

providers being 0.9% and 1% so far. This follows on from annualized returns of

12.5% and 14.5% for the 2020-21 financial year.

19. Given the nature of the

investments some volatility is to be expected. It is too early to predict

likely returns for the full year, however, if the remaining quarters deliver

similar results the annualized return would be approximately 4% which is below

the LTP budget of 5.16% p.a.

20. The presentation of table

below has been changed from previous reports to show the combined view of funds

and the value available above the capital protected sum. As at June 2021

Council had an additional $3.36m available due to the stronger investment

returns in 2020-2021. Some of this could be used to supplement any shortfall if

the current lower returns continue to the end of the financial year.

21. The following table summarises the fund balances at the

end of each quarter.

22. The view for the June 2021

and September 2021 has been expanded to show the total group balance of managed

funds (including HBRIC) and the amount by which the current funds balance

exceeds the capital protected amount.

|

|

30 Sep 2020

|

31 Dec 2020

|

31 Mar 2021

|

30 Jun 2021

|

30 Sep 2021

|

|

|

$000

|

$000

|

$000

|

$000

|

$000

|

|

Total funds before withdrawals

|

111,078

|

121,404

|

114,625

|

118,563

|

115,745

|

|

Funds withdrawn

|

|

(6,500)

|

|

(4,200)

|

|

|

Fund Balance HBRC

|

111,078

|

114,904

|

114,625

|

114,363

|

115,745

|

|

|

|

Funds Balances (HBRC & Group)

|

|

Long-Term Investment Fund

|

51,810

|

49,925 *

|

50,206

|

49,883**

|

50,484

|

|

Future Investment Fund

|

63,094

|

64,300 *

|

64,418

|

64,370**

|

65,261

|

|

Total HBRC

|

111,078

|

114,904

|

114,625

|

114,363**

|

115,745

|

|

Plus HBRIC

|

|

|

|

48,503

|

48,771

|

|

Total Group Managed Funds

|

|

|

|

162,866

|

164,516

|

|

Capital Protected Amount (2% compound inflation)

|

|

|

|

159,506

|

160,303

|

|

Current value above protected amount

|

|

|

|

3,360

|

4,213

|

22.1. * December 2020 saw $6.5m

(LTIF $4.5m & FIF $2.0m) Funds being divested for the first time, which

explains the reduced fund balance.

22.2. ** Additional funds totaling

$4.2m (LTIF $2.0m & FIF $2.2m) were withdrawn from the funds during the

June quarter.

Investment

Property

23. In the first quarter, two

Napier Endowment Leasehold Properties were been freeholded totaling $0.35m.

$0.27m of this has been subsequently paid to ACC as settlement for the

remaining 42 years rent for these properties.

24. The income from leasehold

sales is recognised in the current financial

year. Most of this goes into offsetting the movement in the ACC

liability. HBRC receives one third of any surplus after paying out the

remaining ACC liability. The HBRC share of proceeds to date ($42,000) are

placed in the Sale of Land Reserve.

25. Since 30 September a

further 4 properties have been freeholded and another two will be settled in

the near future.

HBRIC

26. In accordance with Council

Policy, HBRIC provides separate quarterly updates to the Corporate and

Strategic Committee.

Decision Making Process

27. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

27.1. The agenda item is in accordance with

the Finance, Audit and Risk Sub-committee Terms of Reference, specifically

“The Finance, Audit and Risk Sub-committee

shall have responsibility and authority to (2.4) monitor the performance of Council’s investment portfolio”.

27.2. As this report is for information

only, the decision making provisions do not apply.

|

Recommendation

That the Finance, Audit

and Risk Sub-committee receives and notes the “Quarterly Treasury

Report for 1 July – September 2021” and confirms that the

performance of Council’s investment portfolio has been reported to the

Sub-committee’s satisfaction.

|

Authored by:

|

Ross Franklin

Acting

Chief Financial Officer

|

|

Approved by:

|

Jessica Ellerm

Group

Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

PWC Quarterly Treasury Report to 30

September 2021

|

|

|

|

PWC

Quarterly Treasury Report to 30 September 2021

|

Attachment 1

|

HAWKE’S

BAY REGIONAL COUNCIL

Finance Audit & Risk Sub-committee

15

December 2021

Subject: confirmation

of public excluded minutes

That

Hawke’s Bay Regional Council excludes the public from this section of the

meeting being Confirmation of Public Excluded Minutes Agenda Item 6 with the

general subject of the item to be considered while the public is excluded; the

reasons for passing the resolution and the specific grounds under Section 48

(1) of the Local Government Official Information and Meetings Act 1987 for the

passing of this resolution being:

|

GENERAL SUBJECT OF THE ITEM TO

BE CONSIDERED

|

REASON FOR PASSING THIS

RESOLUTION

|

GROUNDS UNDER SECTION 48(1) FOR

THE PASSING OF THE RESOLUTION

|

|

Internal Assurance Dashboard -

Cyber Security Corrective Actions Status Update

|

7(2)(f)(ii)

The withholding of the information is necessary to maintain the effective

conduct of public affairs through the protection of such members, officers,

employees, and persons from improper pressure or harassment

s7(2)(j)

That the public conduct of this agenda item would be likely to result in the

disclosure of information where the withholding of the information is

necessary to prevent the disclosure or use of official information for

improper gain or improper advantage

|

The Council is specified, in

the First Schedule to this Act, as a body to which the Act applies.

|

Authored by:

|

Leeanne Hooper

Team Leader

Governance

|

|

Approved by:

|

Desiree Cull

Strategy

& Governance Manager

|

|