Meeting of the Finance Audit & Risk Sub-committee

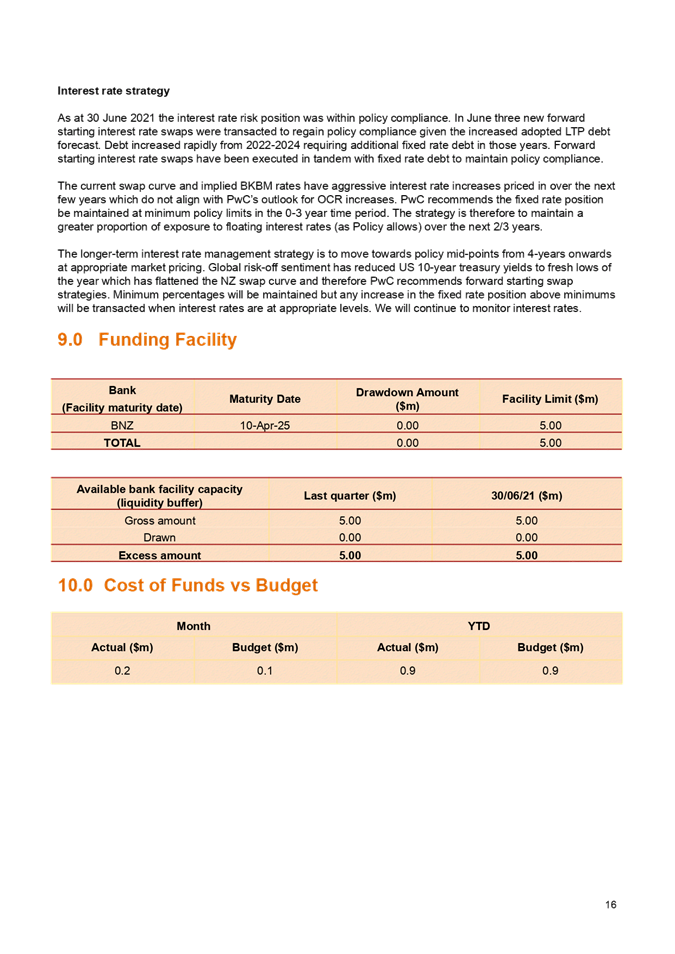

Date: 04 Aug 2021

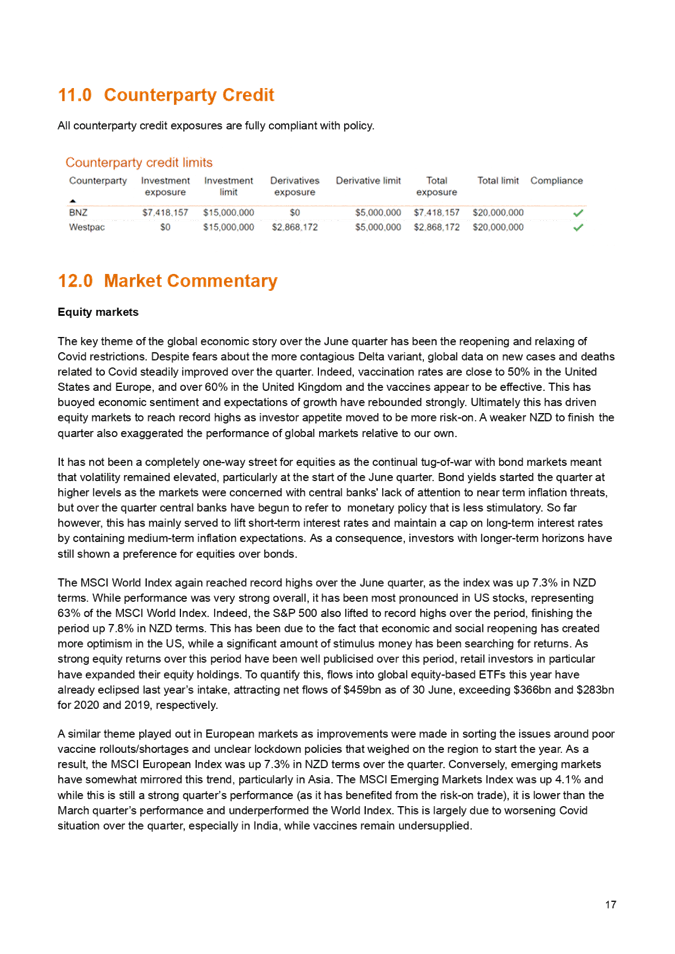

Time: 12.30pm

|

Venue:

|

Council Chamber

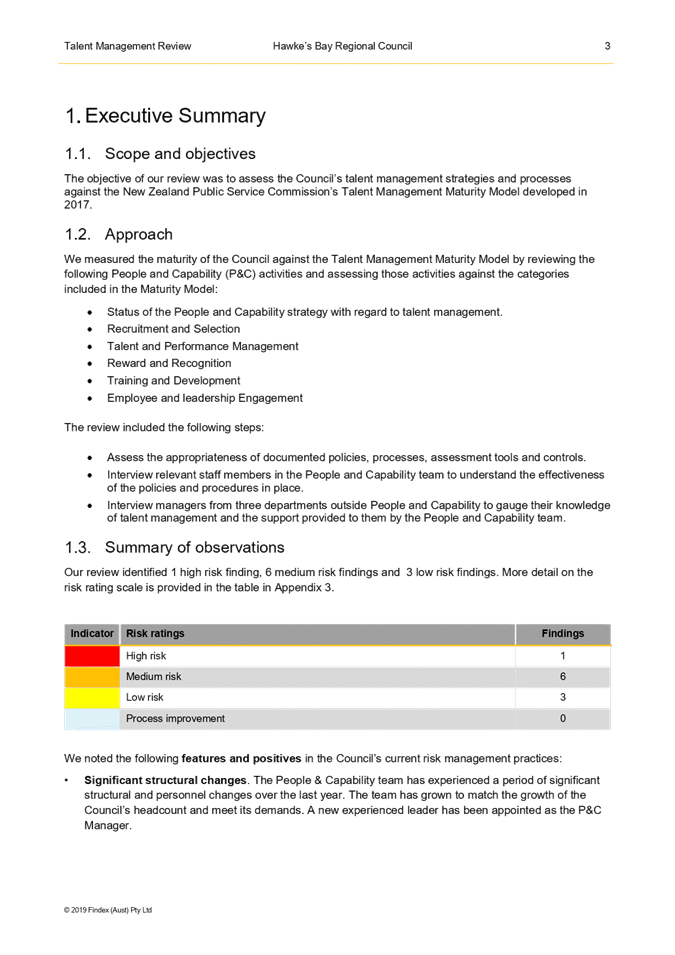

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

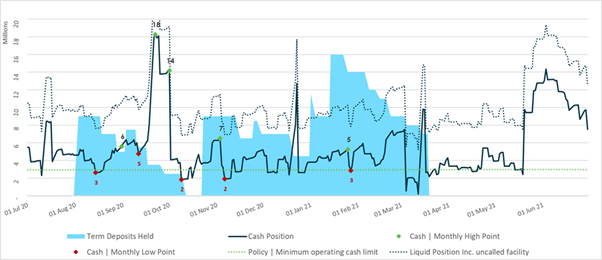

Agenda

Item Title Page

1. Welcome/Notices/Apologies

2. Conflict

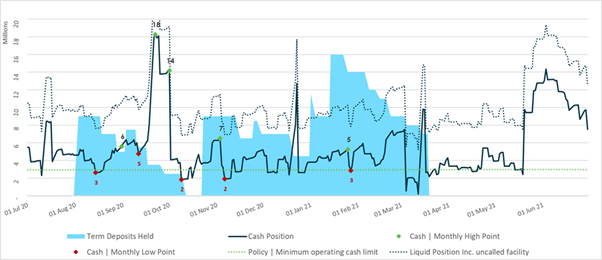

of Interest Declarations

3. Confirmation of Minutes of the Finance Audit & Risk

Sub-committee held on 5 May 2021

4. Risk Management

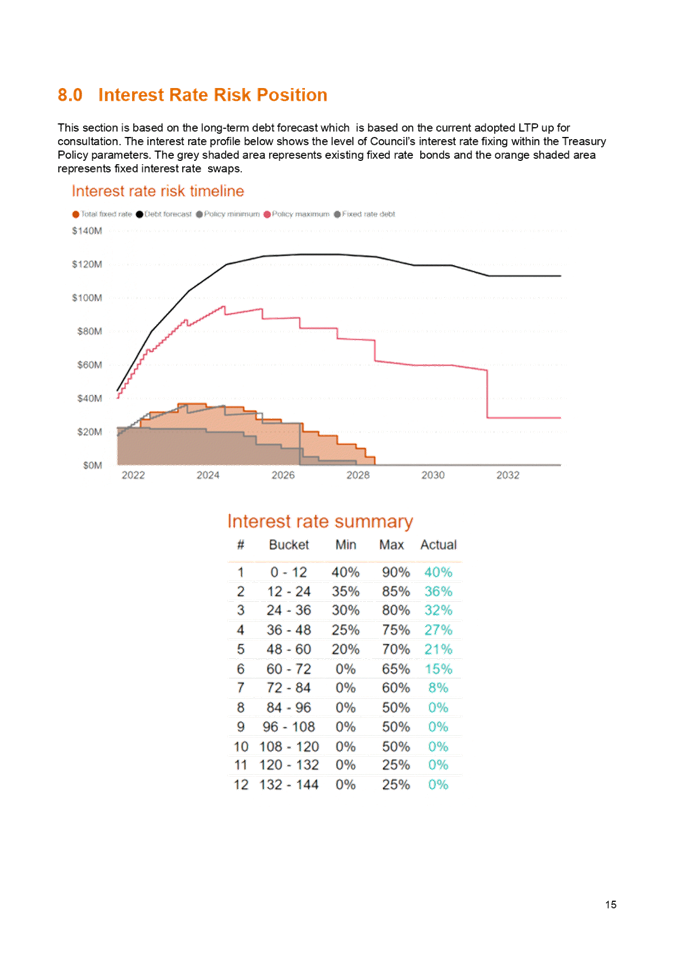

Maturity Update 3

5. Internal Assurance

Programme 9

6. Internal Audit

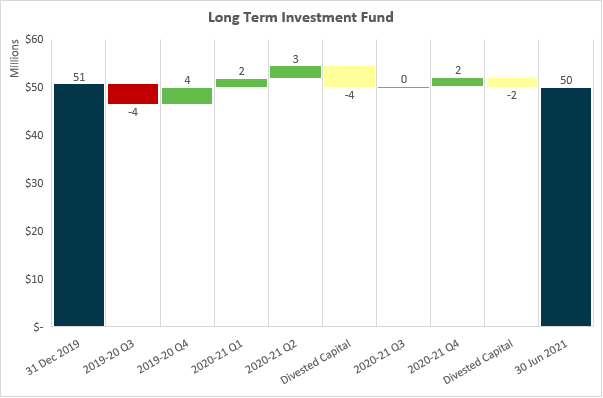

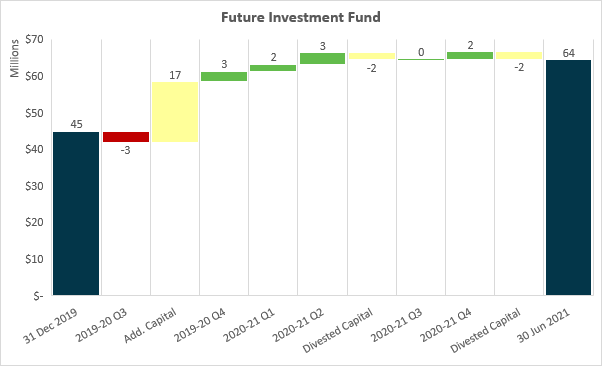

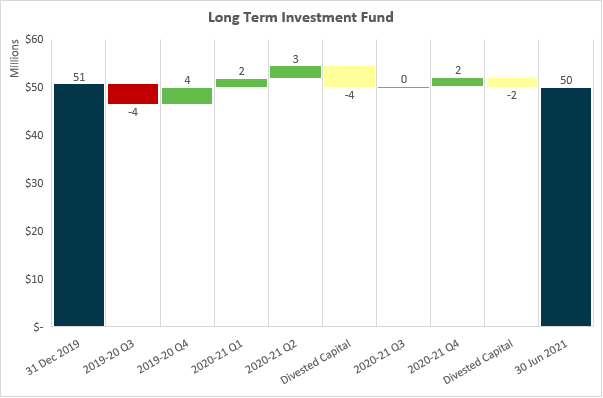

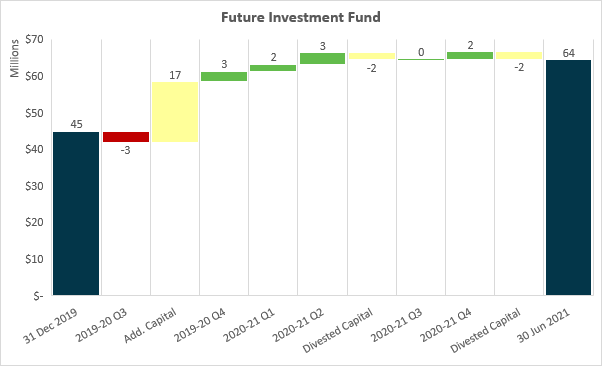

Report – Talent Management 21

7. 2020-21 Annual

Report Audit Plan 45

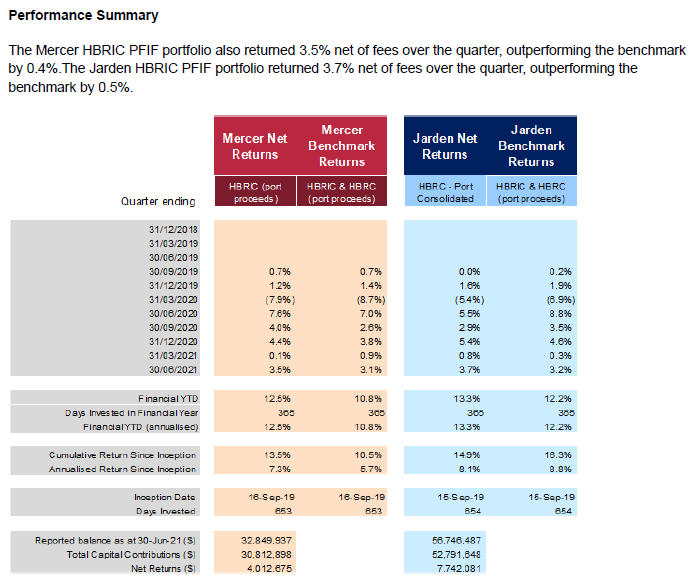

8. 2020-21 Annual Treasury

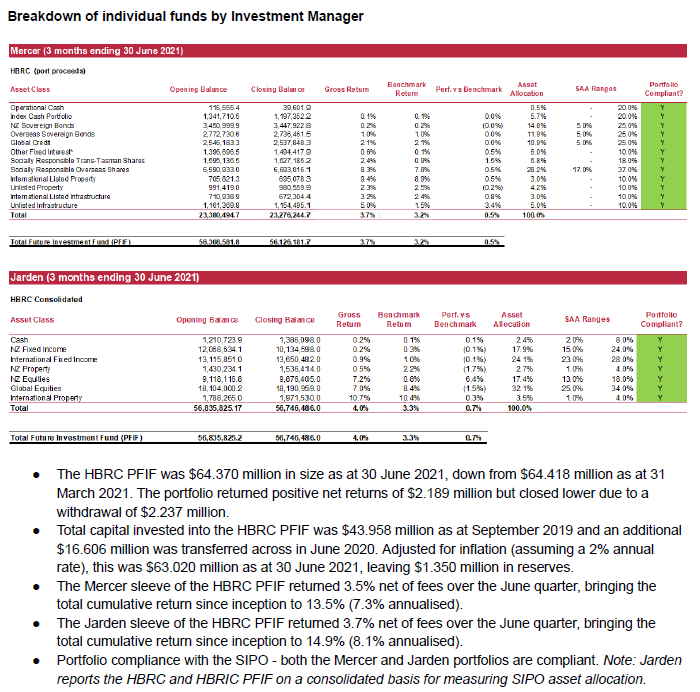

Report 47

Public Excluded

9. Six Monthly

Enterprise Risk Report 77

HAWKE’S BAY REGIONAL COUNCIL

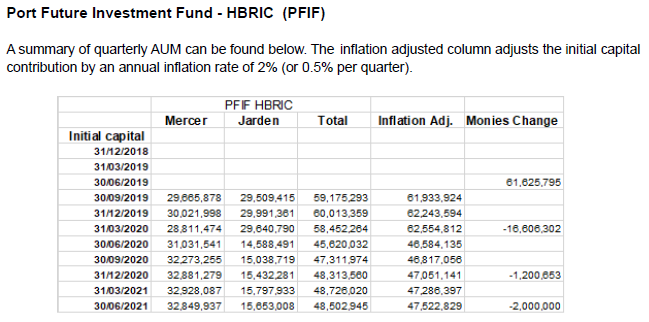

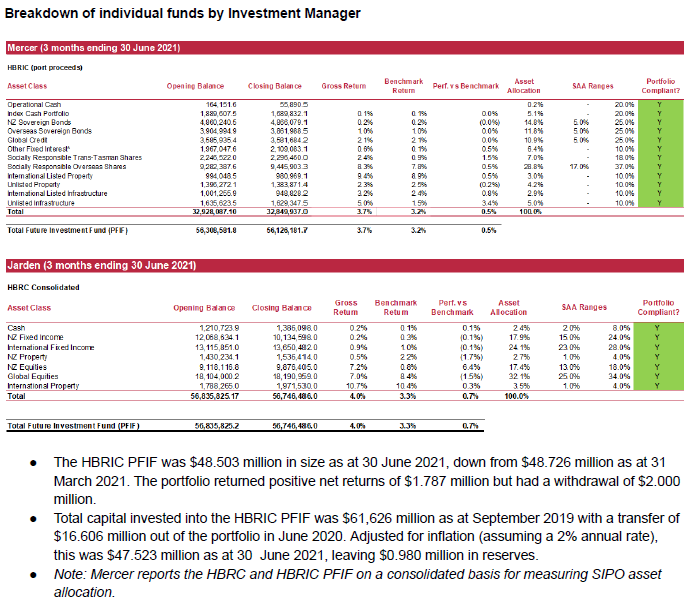

Finance

Audit & Risk Sub-committee

04 August 2021

Subject: Risk Management

Maturity Update

Reason for Report

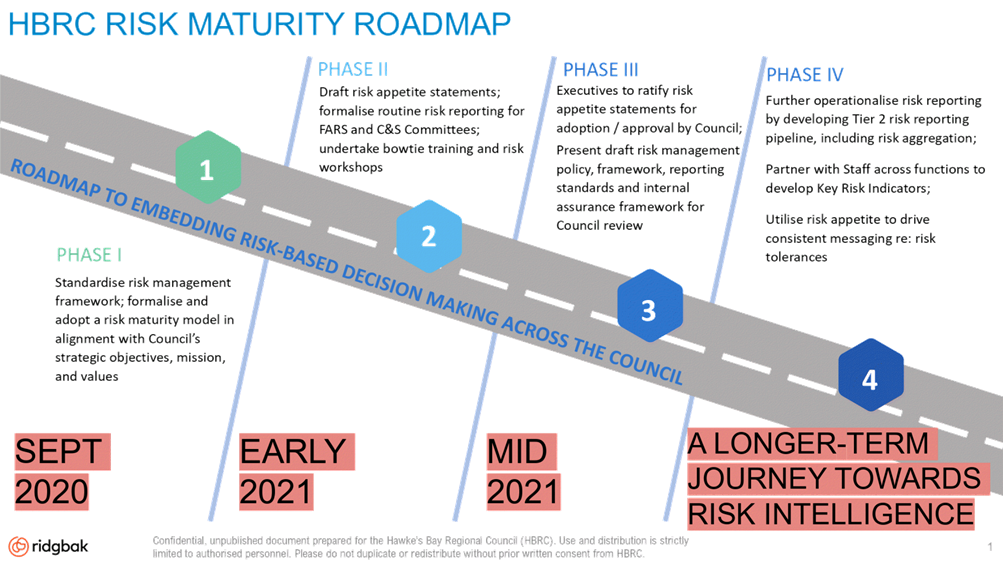

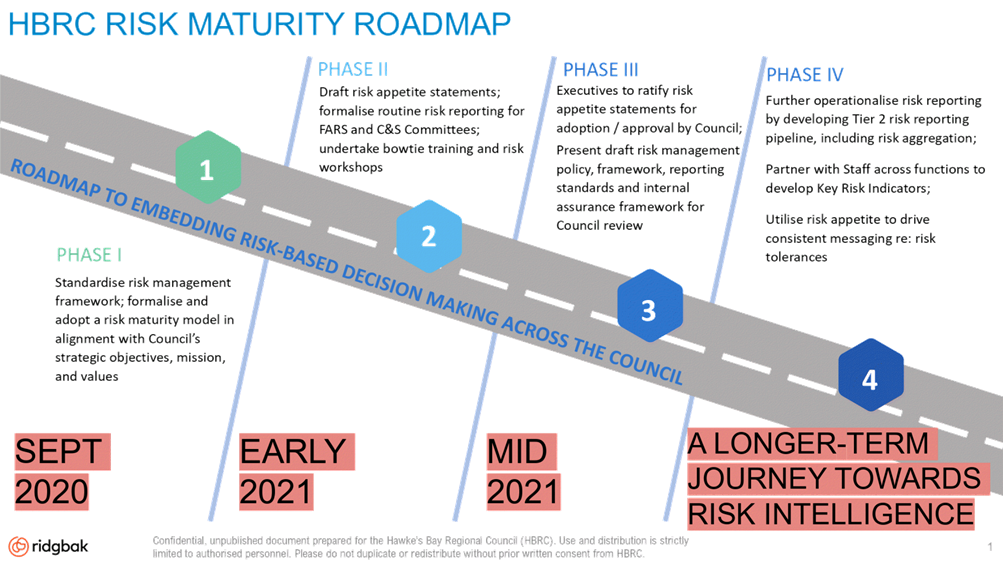

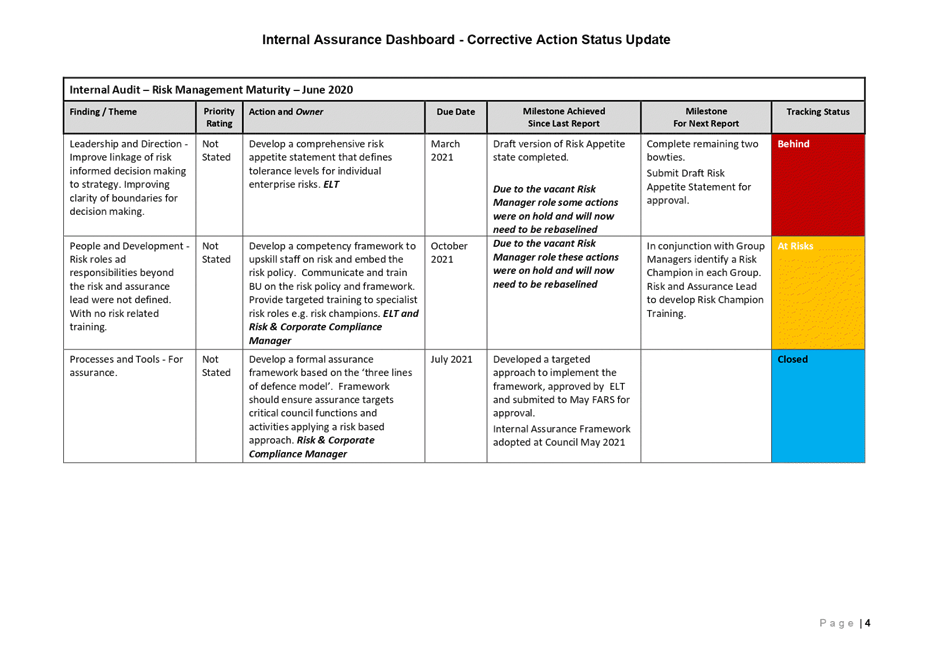

1. This item provides the Sub-committee with an update on

Council’s Risk Management Maturity.

Officers’

Recommendations

2. Council Officers recommend that the Sub-committee notes that:

2.1. The status of the Regional Council’s risk management maturity

deliverables as reported through the ‘Corrective Actions Status

Update’ dashboard is stated as either ‘behind’ or ‘at

risk’. However, when deliverables are compared to the risk maturity

roadmap that was endorsed by the Hawke’s Bay Regional Council on

24 June 2020 risk maturity progress remains largely ‘on

track’.

2.2. The focus for quarter one FY2022 is to ensure the Regional Council

endorsed risk maturity roadmap remains ‘on track’, including:

2.2.1. Finalising the ‘draft’ risk appetite statement with

Council

2.2.2. Finishing remaining enterprise risk bowties through risk workshops,

and

2.2.3. Completing workshops to identify the critical controls for all

enterprise risks.

2.3. The baseline deliverable dates for reporting progress of the

Regional Council’s risk maturity through the ‘Corrective Actions

Status Update’ dashboard will be reset by:

2.3.1. Considering the period that the Risk and Corporate Compliance

Manager role was vacant

2.3.2. Considering other high priority corrective or strategic actions that

need to be embedded into the organisation, and

2.3.3. Aligning the corrective action deliverables and milestones to the

phases and dates outlined in the risk maturity roadmap.

Background/Discussion

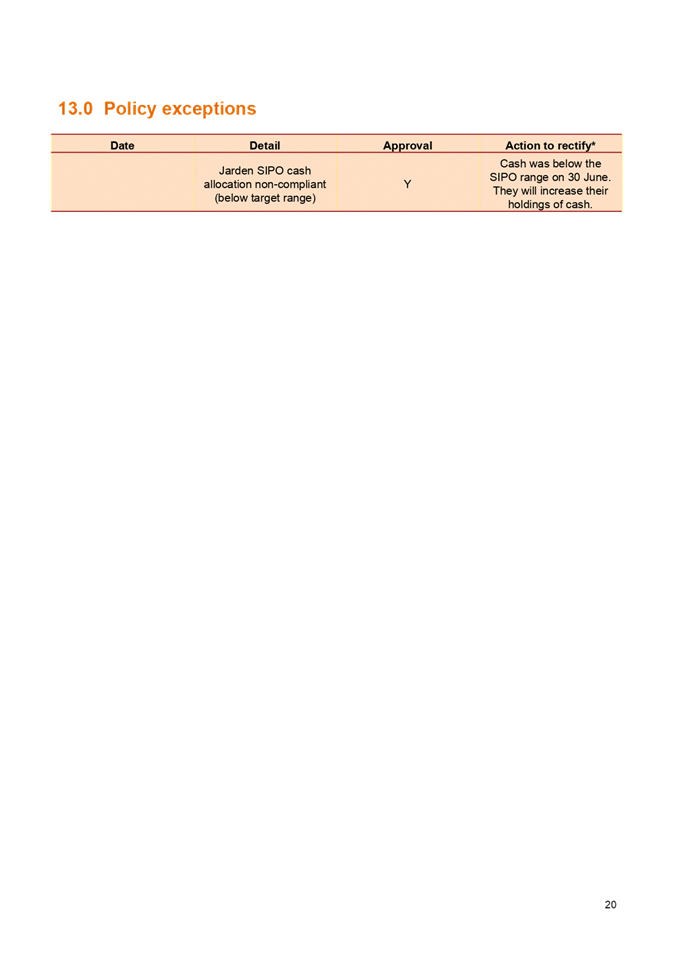

3. At the Hawke’s Bay Regional Council meeting on 24 June 2020,

on recommendation from the Corporate and Strategic Committee, the Regional

Council endorsed the risk maturity roadmap. At the Corporate and

Strategic Committee (C&S) meeting held on 10 June 2020 where the risk

maturity roadmap was scrutinised the Committee requested that the FARS oversee

progress of the risk maturity roadmap. Oversight by the FARS was to

ensure that the maturing risk management system remained on track and was

providing value to the organisation. Therefore, this item provides an update to

the FARS on progress of the risk management maturity against the risk maturity

roadmap.

4. The status of key milestones for the Regional Council’s risk

management maturity initiative is reported through the ‘Corrective

Actions Status Update’ dashboard. The dashboard is included as a

separate agenda item for this meeting.

5. The overall status of the risk management maturity corrective

actions reported in the dashboard are noted as either ‘behind’ or

‘at risk’. The actions’ due dates and milestones

reported in the dashboard are informed by the risk management maturity project

plan that was developed to implement the Regional Council approved risk

maturity roadmap. However, the risk management maturity project plan

contained ‘bold’ deliverables when compared to the risk maturity

roadmap. When risk maturity milestones delivered to date are compared to the

key deliverable dates outlined for each phase of Council’s risk maturity

roadmap the overall status remains largely ‘on track’.

6. Key areas for focus over quarter one of FY2022 to ensure that risk

maturity actions continue to deliver on the risk maturity roadmap phases,

include:

6.1. Progressing the risk appetite statement so that final sign-off can

be obtained from the Regional Council

6.2. Finalising the risk bowties for each enterprise risk, including:

5.2.1 Undertaking risk bowtie workshops for the following enterprise

risks; risk 1a strategic - decision, risk 1b strategic – implementation

and delivered, risk 6 core ICT services, risk 7 legal compliance, and risk 13

third parties/ contractors, and

5.2.2 Using each enterprise risk bowtie to undertake further workshops to

systematically identify the critical controls.

6 The risk management maturity project plan developed to implement the

risk maturity roadmap was bold. Since the risk management maturity update to

the FARS in February 2021 the Risk and Corporate Compliance Manager role has

been vacant for approximately four months. Over that same period some key

organisational activities that included the Long Term Plan (LTP) and TechOne

implementation needed prioritisation. Therefore, implementation of risk

management maturity milestones as outlined in the bold project plan was difficult.

It is also acknowledged that to now speed up actions to bring the project plan

back on track is difficult to achieve without additional resources and costs.

7 The preferred approach is therefore to reassess and reset the

baseline for the risk management maturity project and provide the updated

project plan and milestones to the FARS at the next meeting for endorsement.

The reset of the risk management maturity baseline will also include adjusting

the ‘due dates’ that are being reported to the FARS through the

‘Corrective Actions Status Update’ dashboard. Reset of the delivery

dates in the risk maturity project plan will consider:

7.2 The time the Risk and Corporate Compliance Mangere role was vacant

7.3 Delivery timeframes as per the phases outlined in the risk maturity

roadmap, and

7.4 The significance and focus of other high priority corrective actions

or key strategic actions that will impact staff across the organisation.

Strategic Fit

8 Maturity of the Regional Council’s risk management system

contributes towards achieving all strategic goals/vision by protecting the

organisation. A mature risk system provides consistent risk intelligent

decision making enabling the efficient prioritisation of finite organisational

resources to deliver on strategy.

Financial and Resource Implications

9 Maturity of the risk management system is phased to minimise

budgetary implications. Some facilitated workshops will be required over

quarter one of FY2022 to finalise the enterprise risk bowties. Later in the

financial year it is likely risk training workshops will need to be provided to

targeted staff to ensure risk intelligent decision making is consistently and effectively

embed across the organisation.

Next Steps

10 The

next steps for maturity of the Regional Council’s risk management system

is to ensure that momentum continues on risk maturity activities that align to

the Regional Council endorsed risk maturity roadmap. The focus for

quarter one FY2022 includes:

10.2 Finalising

the ‘draft’ risk appetite statement with Council

10.3 Finishing

the remaining enterprise risk bowties through risk workshops

10.4 Completing

workshops to identify the critical controls for all enterprise risk, and

10.5 Resetting

the baseline of the risk management maturity project plan then seeking

endorsement from the FARS to update the due dates in the ‘Corrective

Actions Status Update’ dashboard.

Decision Making

Process

11 Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

11.2 The

decision does not significantly alter the service provision or affect a

strategic asset, nor is it inconsistent with an existing policy or plan.

11.3 The

use of the special consultative procedure is not prescribed by legislation.

11.4 The

decision is not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy.

11.5 The

decision of the sub-committee is in accordance with the Terms of Reference and

decision-making delegations adopted by Hawke’s Bay Regional Council

25 March 2020, specifically the Finance, Audit and Risk Sub-committee

shall have responsibility and authority to:

11.5.1 Review

whether Council management has a current and comprehensive risk management

framework and associated procedures for effective identification and management

of the council’s significant risks in place.

11.5.2 Undertake

periodic monitoring of corporate risk assessment, and the internal controls

instituted in response to such risks.

11.5.3 report

on the robustness of risk management systems, processes and practices to the

Corporate and Strategic Committee to fulfil its responsibilities.

Recommendations

That the

Finance, Audit and Risk Sub-committee:

1. Receives and considers the “Risk

Management Maturity Update” staff report.

2. Confirms that the management actions undertaken and planned

adequately respond to the risk management maturity roadmap as endorsed by

Hawke’s Bay Regional Council on 24 June 2020.

3. Supports the reset of the baseline for the risk management maturity

project with the new deliverable dates of the reset plan being provided to the

FARS at the next meeting for endorsement.

4. Reports to the Corporate and Strategic Committee, the Sub-committee’s

satisfaction that adequate evidence has been provided of progress to implement

the maturing risk management system in accordance with the risk maturity

roadmap

5. Seeks the Corporate and Strategic Committee’s agreement to

reset the baseline of the supporting risk management maturity project plan to

implement the roadmap as proposed.

Authored by: Approved

by:

|

Helen Marsden

Risk and Corporate Compliance Manager

|

Tom Skerman

Acting

Corporate Services Group Manager

|

Attachment/s 1 Updated Risk Maturity Roadmap

|

Updated

Risk Maturity Roadmap

|

Attachment 1

|

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

04 August 2021

Subject: Internal Assurance

Programme

Reason for Report

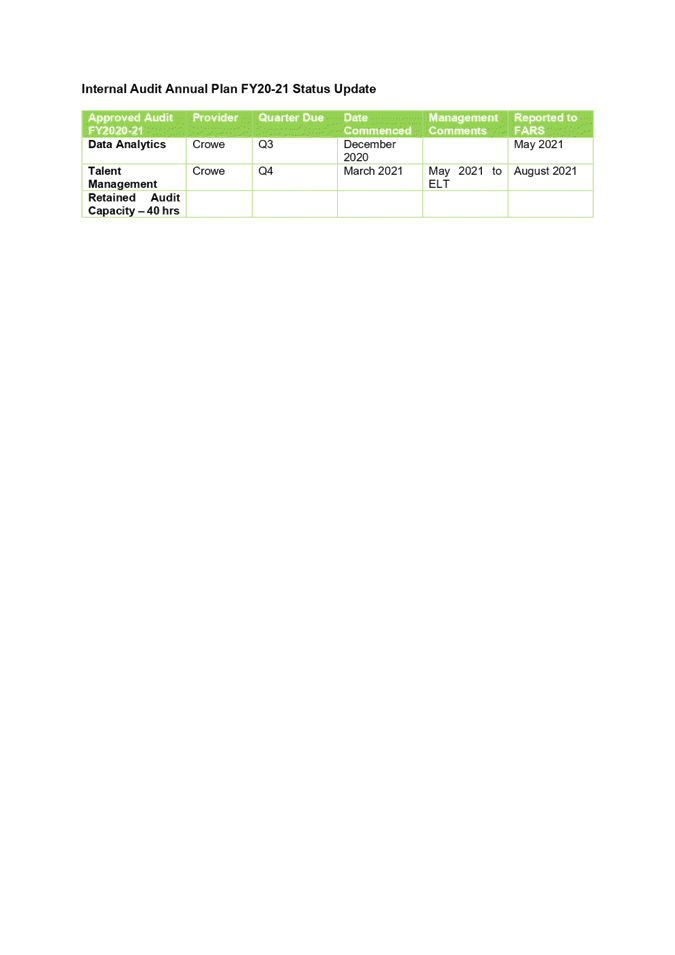

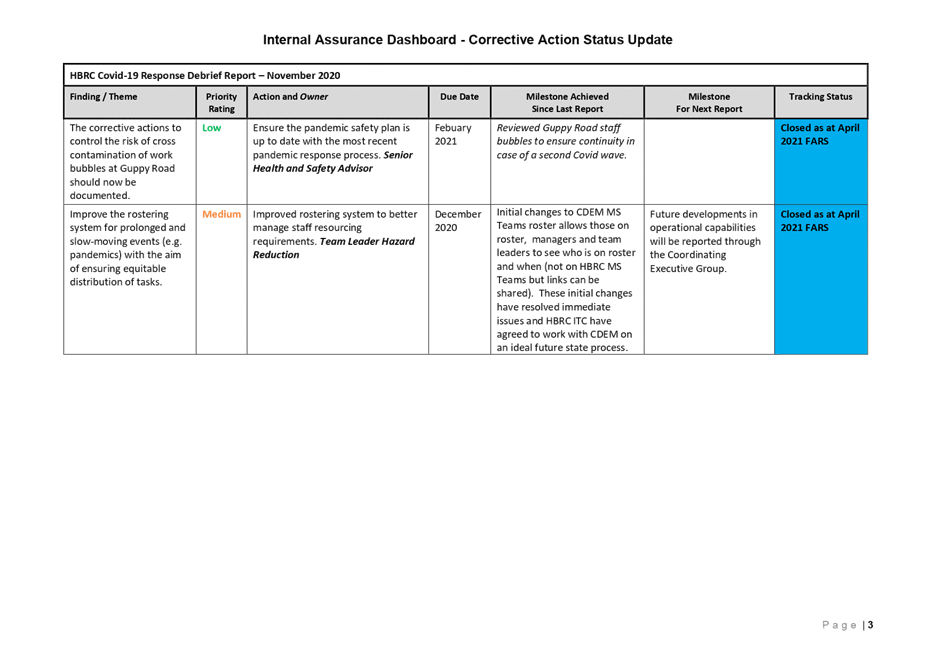

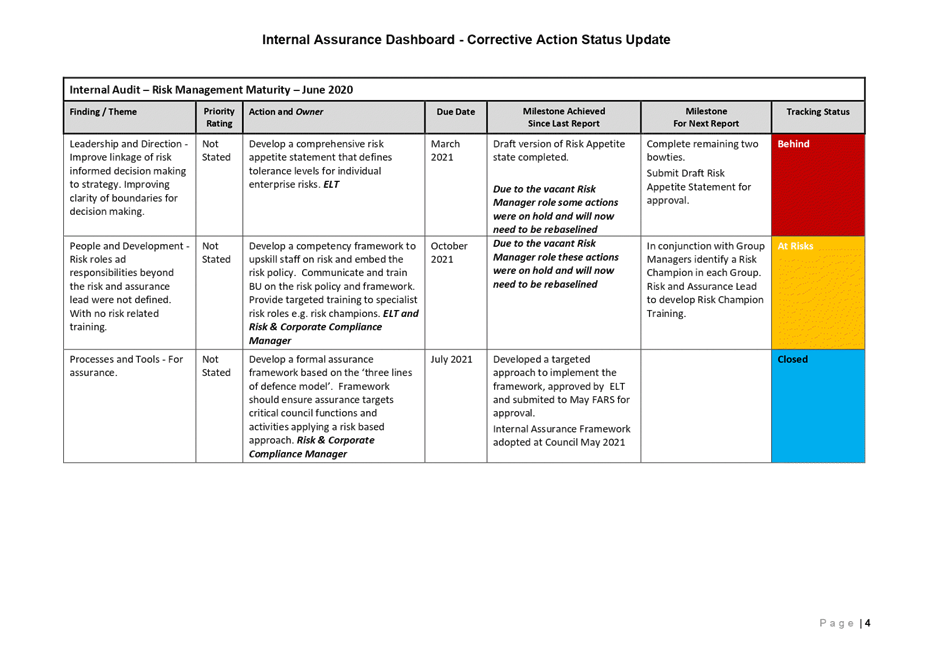

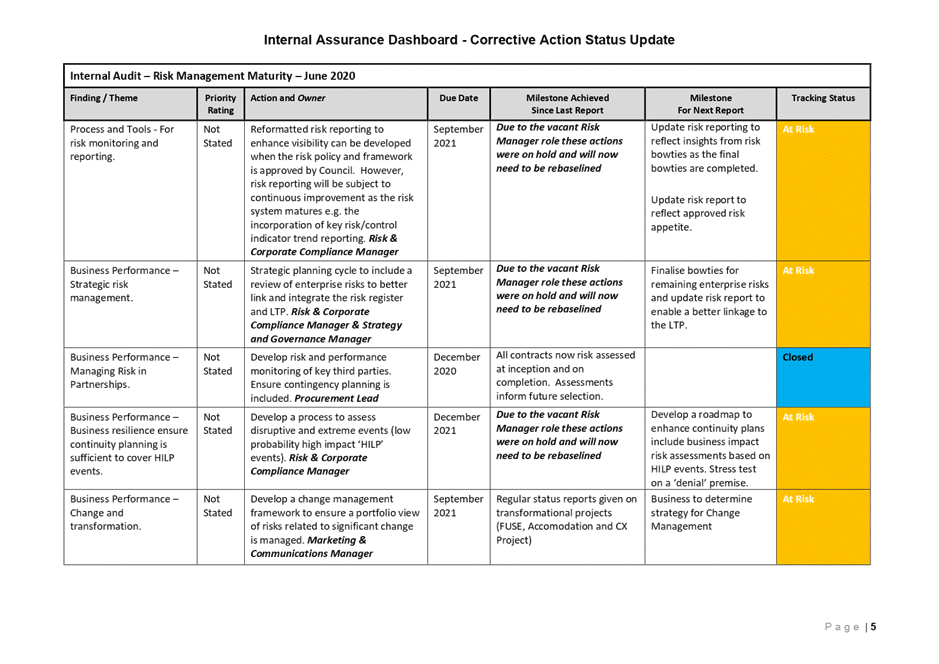

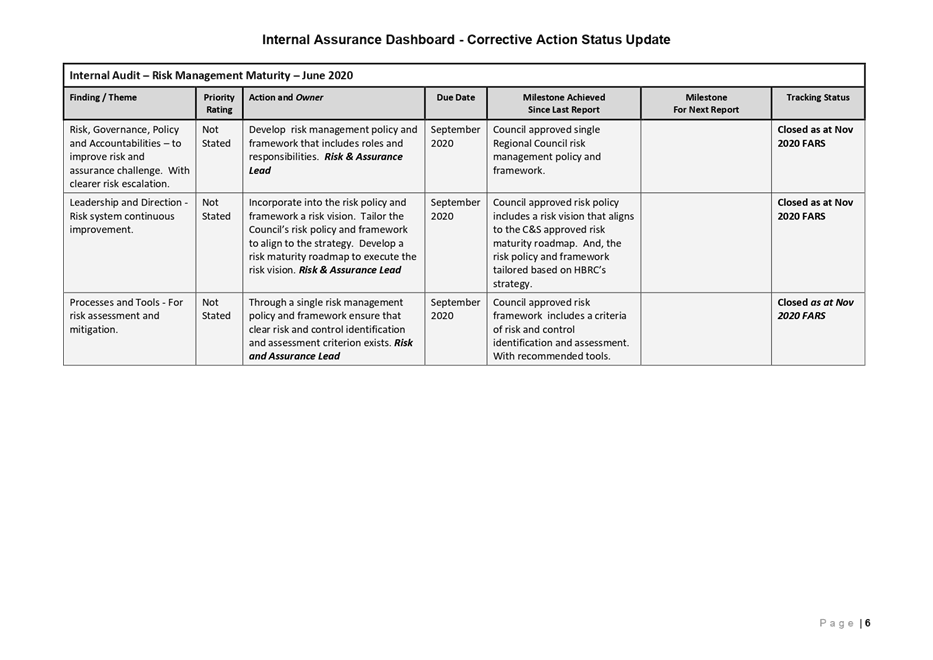

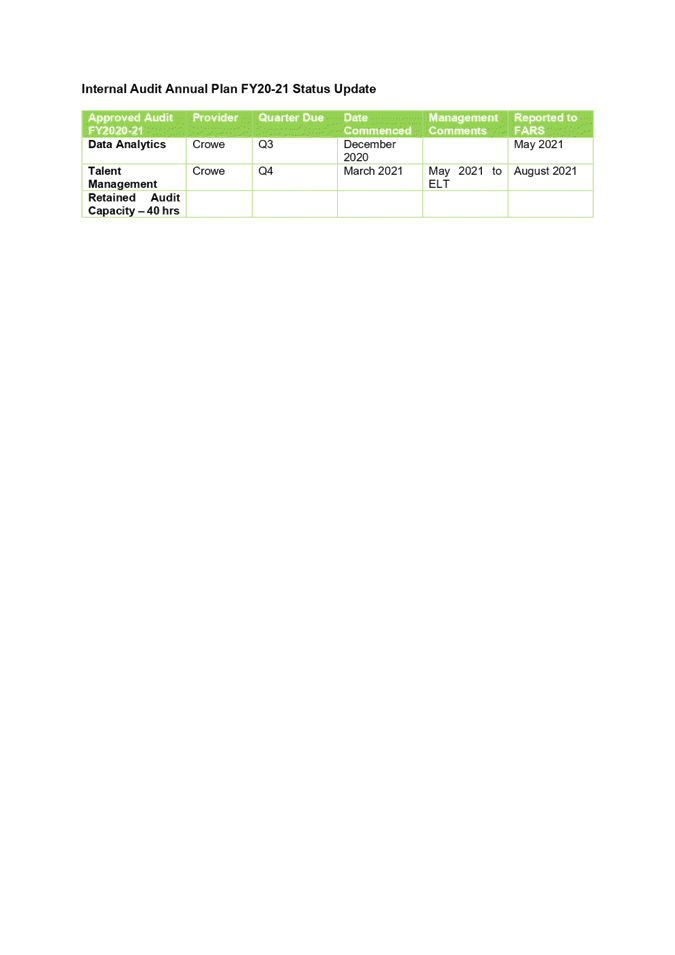

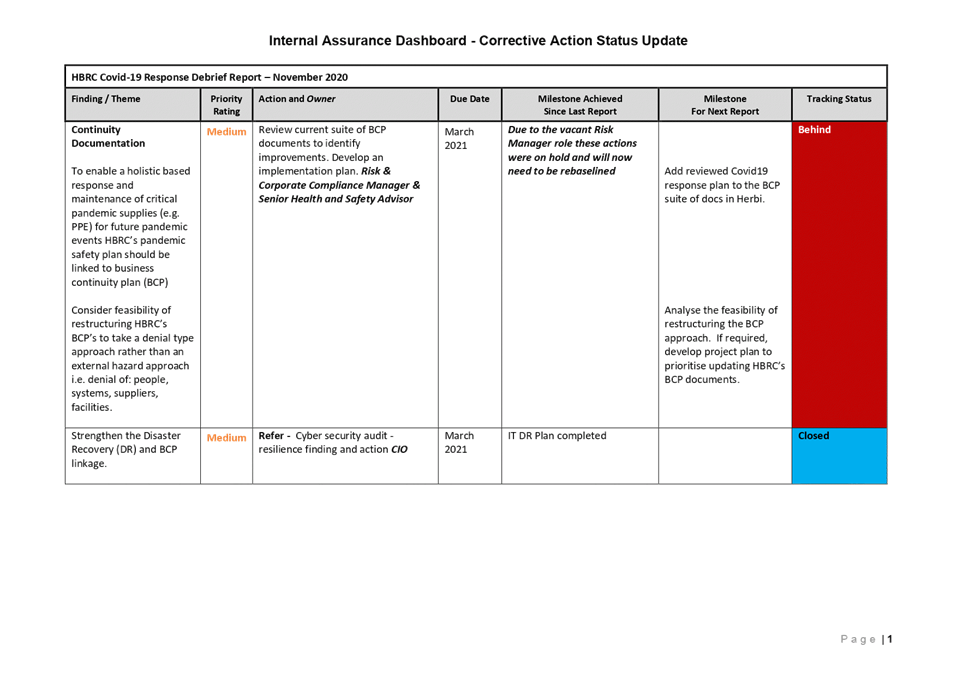

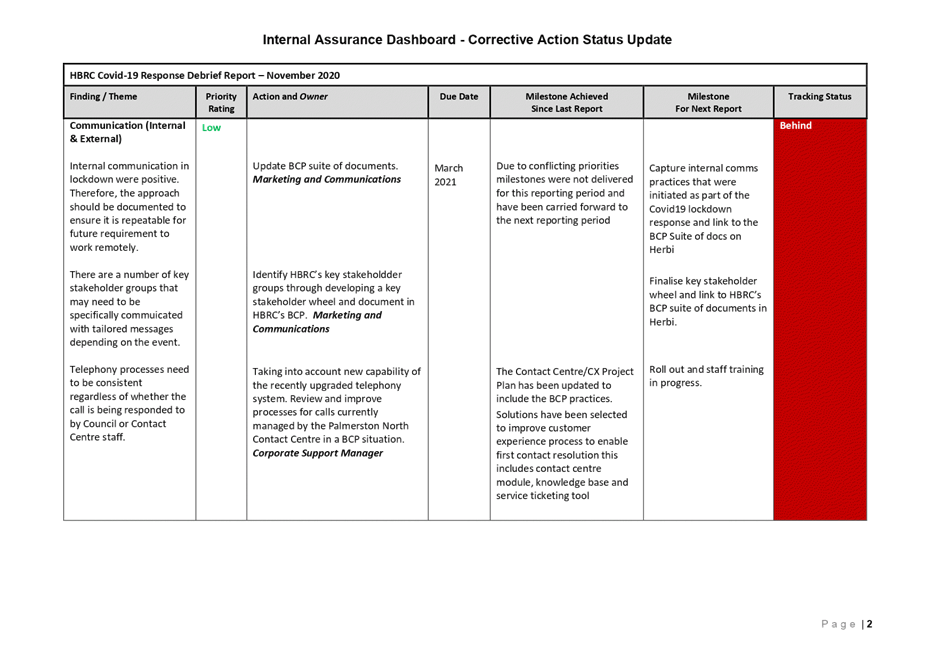

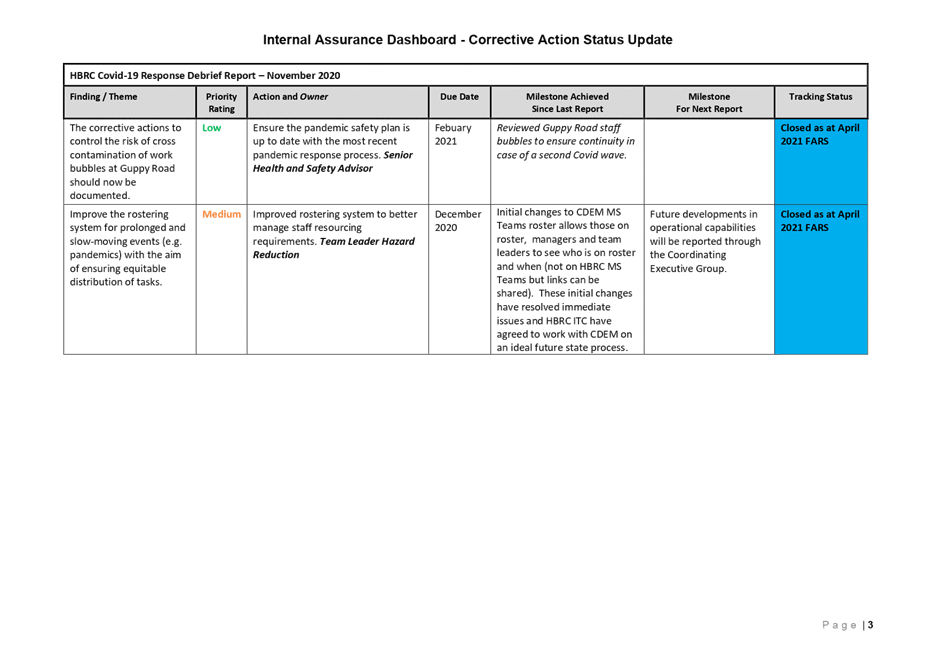

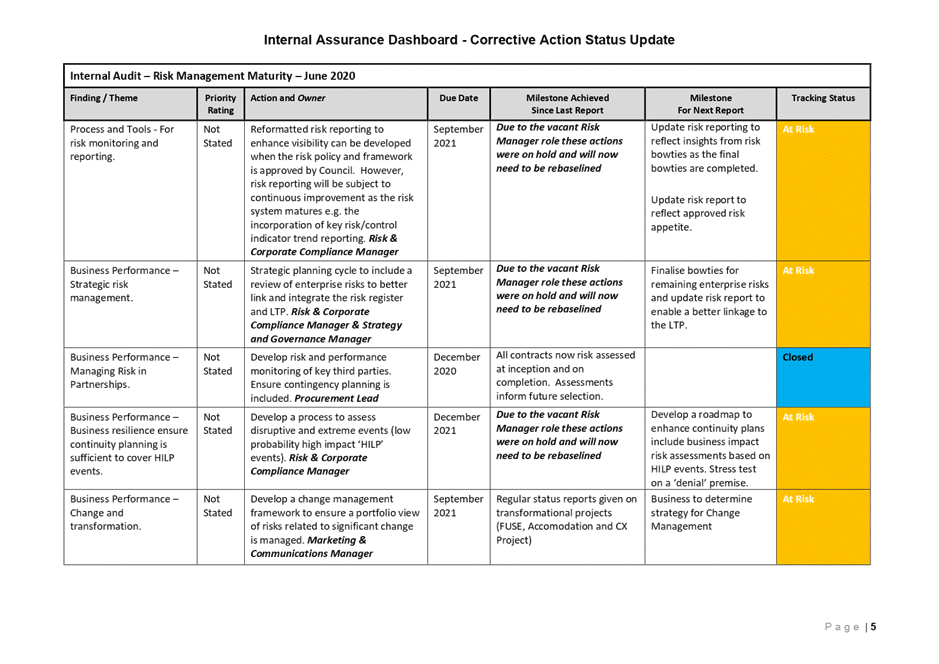

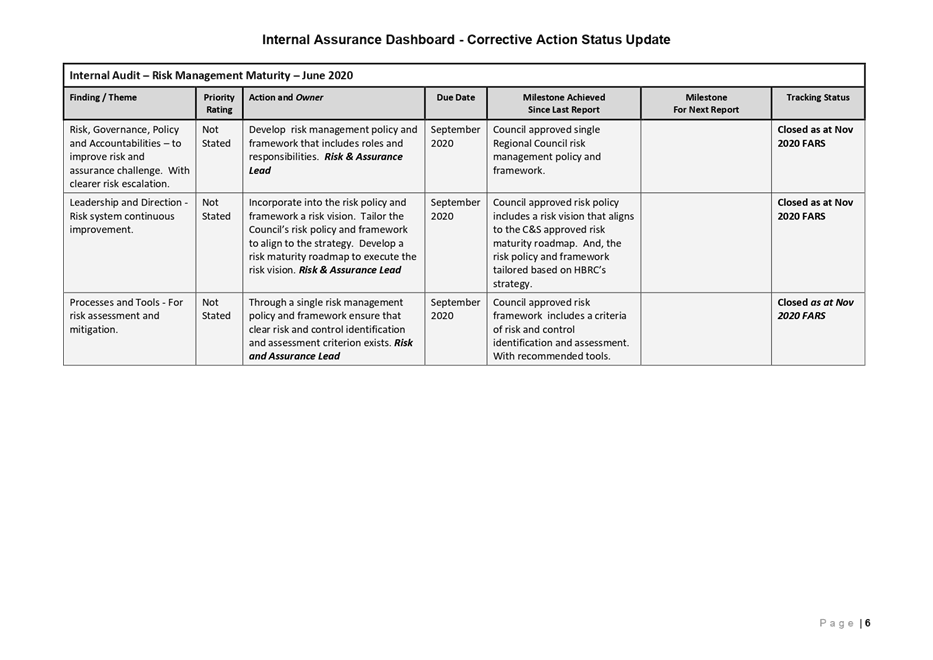

1. This agenda item provides the Finance Audit and Risk Sub-committee

(FARS) with two internal assurance dashboards that update the Sub-committee on progress

to deliver:

1.1. Previously reported internal audit ‘corrective actions’,

and

1.2. The FY21 annual internal audit plan.

Officers’

Recommendations

2. Council officers recommend that the FARS members consider and note

the internal assurance dashboards that update the status of progress with

corrective actions, and delivery of the FY2021 internal audit plan.

Background/Discussion

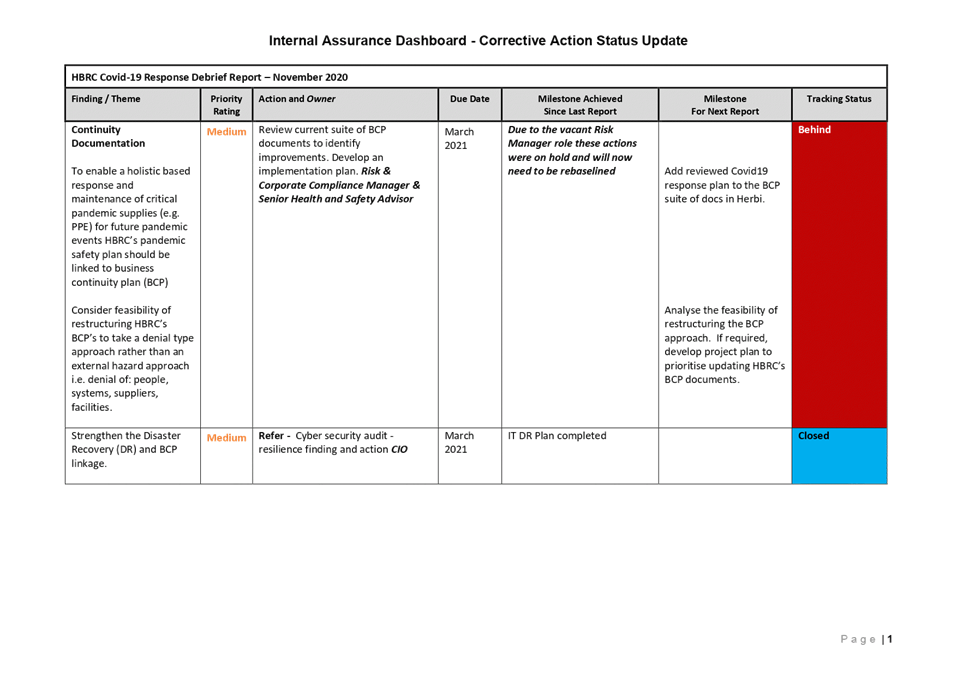

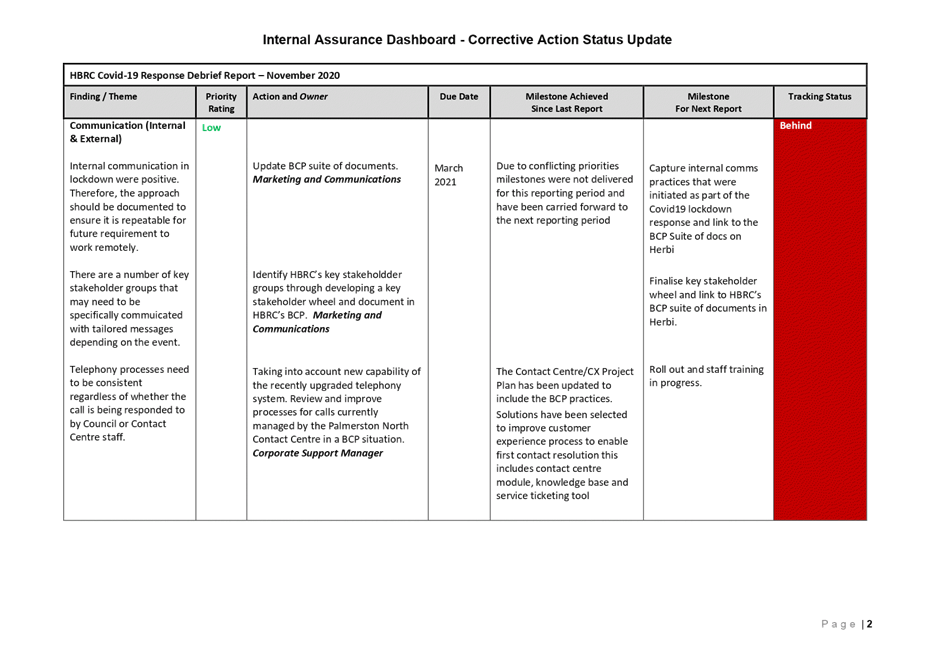

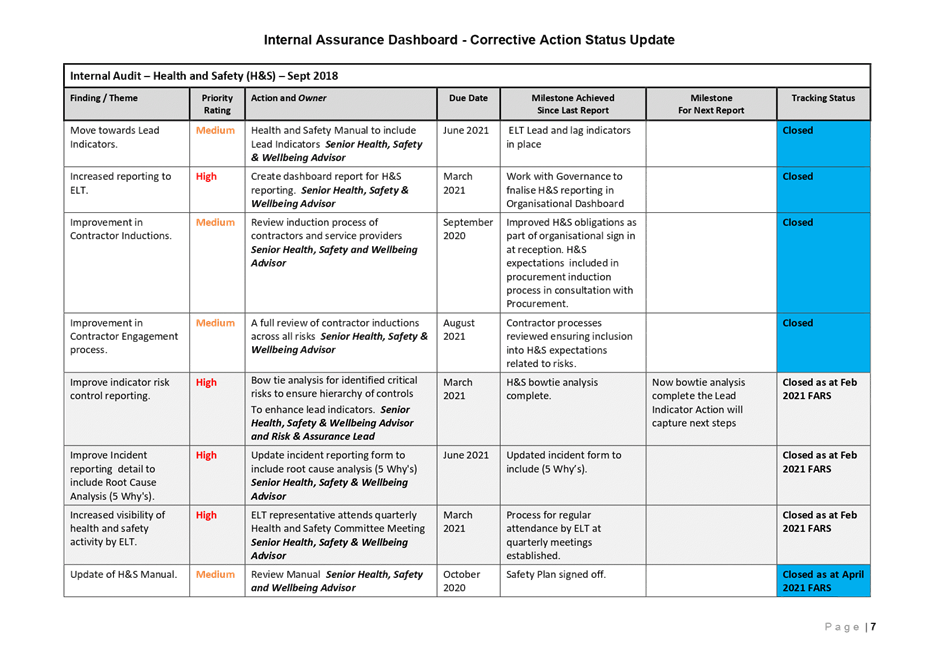

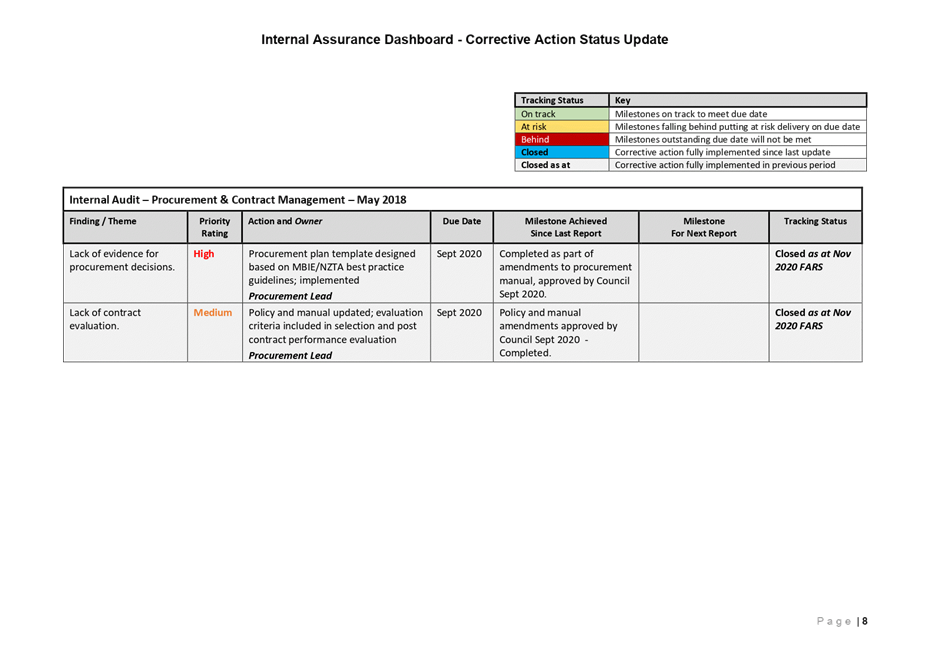

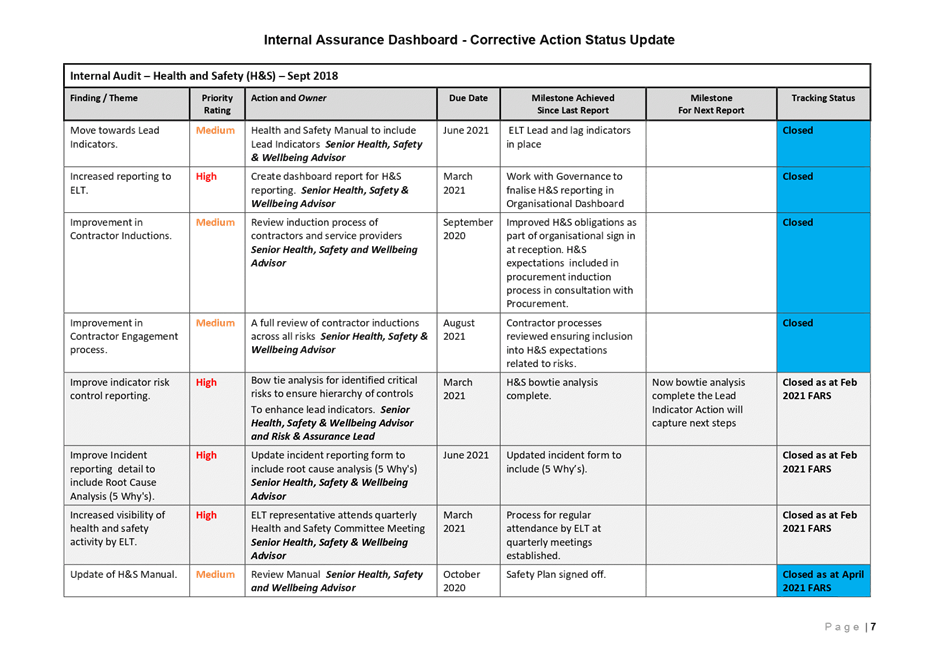

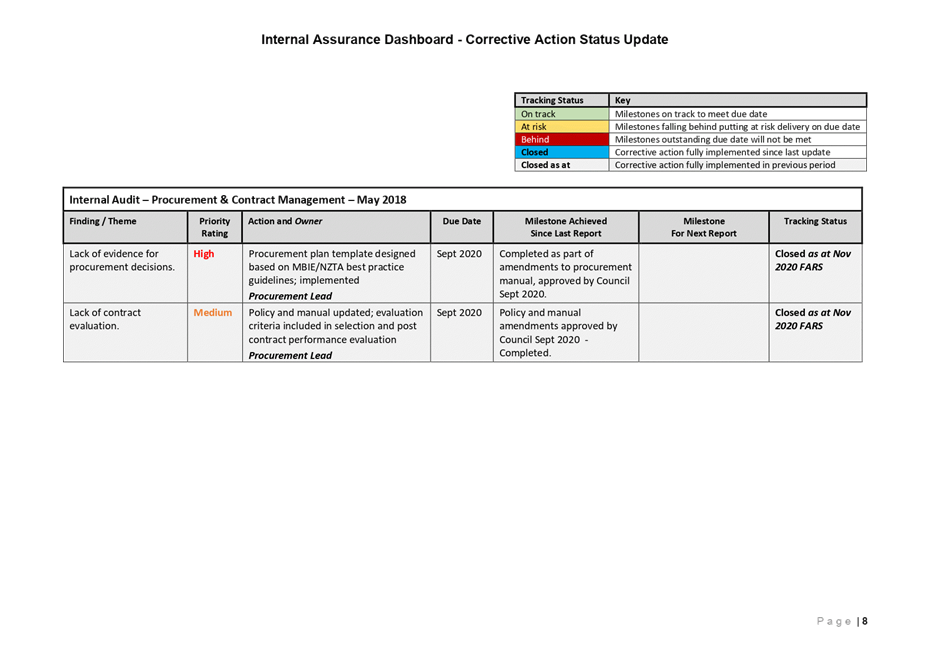

3. The purpose of the corrective action status update is to provide

oversight to the FARS on open internal audit findings from previously reported

internal audits. The dashboard tracks progress of the corrective actions

against agreed milestones, until the action is closed. Key points to note

from the dashboard includes:

3.1. All actions are now completed for the Health and Safety Review form

September 2018, and

3.2. A discrete agenda item has been prepared for this meeting to update

the Sub-committee separately on the Risk Management Maturity due to the number

of individual actions reported as ‘at risk’.

4. The purpose of the annual internal audit plan status update

dashboard is to provide the FARS with oversight and progress of individual

internal audits that form part of the Corporate and Strategic Committee

(C&S) approved annual internal audit plan. The completion and presentation

of the Talent Management internal audit to the FARS closes out the FY2021

internal audit plan. A separate paper has been prepared for this meeting to

report to the FARS the findings from the Talent Management internal

audit.

Financial and Resource Implications

5. There are no financial implications or additional resource

requirements resulting from this internal assurance programme update.

Decision Making

Process

6. Council and its committees are required to make every decision in

accordance with the requirements of the Local Government Act 2002 (the Act).

Staff have assessed the requirements in relation to this item and have

concluded:

6.1. The agenda item is in accordance with the Sub-committee’s

Terms of Reference, specifically:

6.1.1. The purpose of the Finance, Audit and Risk Sub-committee is to

report to the Corporate and Strategic Committee to fulfil its responsibilities

for (1.3) the independence and adequacy of internal and external audit

functions

6.1.2. The Finance, Audit and Risk Sub-committee shall have responsibility

and authority to (2.6) receive the internal and external audit report(s) and

review actions to be taken by management on significant issues and

recommendations raised within the report(s)

6.1.3. The Finance, Audit and Risk Sub-committee is delegated by Council to

(3.6) review the objectives and scope of the internal audit function, and

ensure those objectives are aligned with Council’s overall risk

management framework; and (3.7) assess the performance of the internal audit

function,and ensure that the function is adequately resourced and has

appropriate authority and standing within Council.

Recommendations

That the

Finance, Audit and Risk Sub-committee:

1. Receives and considers the “Internal

Assurance Programme” staff report.

2. Reports to the Corporate and Strategic Committee, the

Sub-committee’s satisfaction that the Internal Assurance Programme Update

provides adequate evidence of the adequacy of Council’s internal

assurance functions and management actions undertaken or planned respond to

findings and recommendations from completed internal audits.

Authored by:

|

Helen Marsden

Risk and Corporate Compliance Manager

|

|

Approved by:

|

Tom Skerman

Regional Water Security Programme Director

|

|

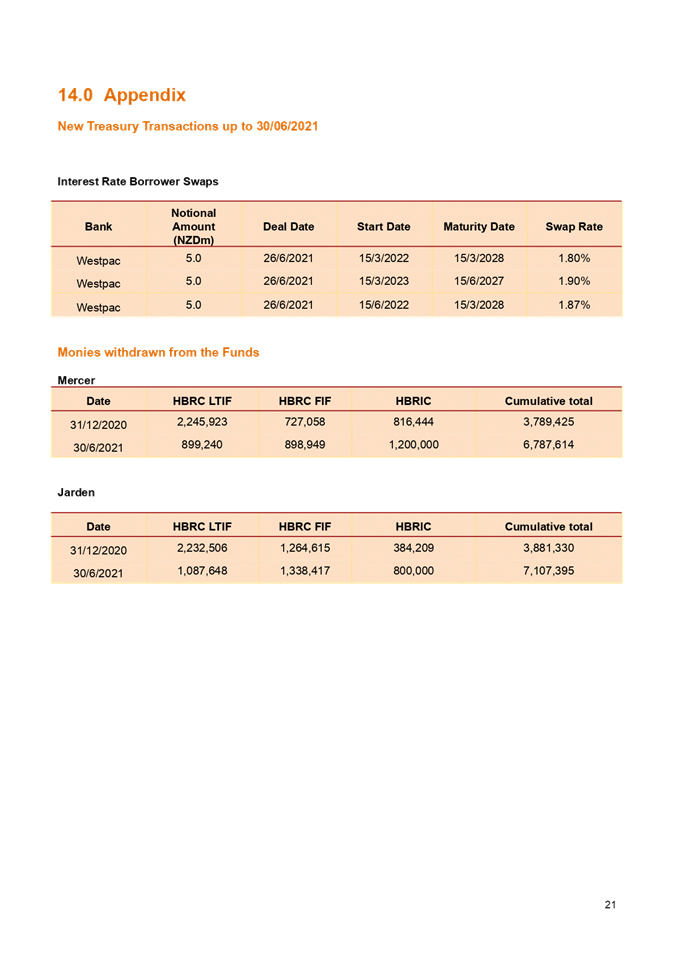

Attachment/s

|

1⇩

|

Internal

Audit Annual Plan FY2020-21 Status Update

|

|

|

|

2⇩

|

Internal

Assurance Dashboard - Corrective Action Status Update

|

|

|

|

Internal

Audit Annual Plan FY2020-21 Status Update

|

Attachment 1

|

|

Internal

Assurance Dashboard - Corrective Action Status Update

|

Attachment 2

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

04 August 2021

Subject: Internal Audit Report

– Talent Management

Reason for Report

1. This item provides the Finance

Audit and Risk Sub-committee (FARS) with the report

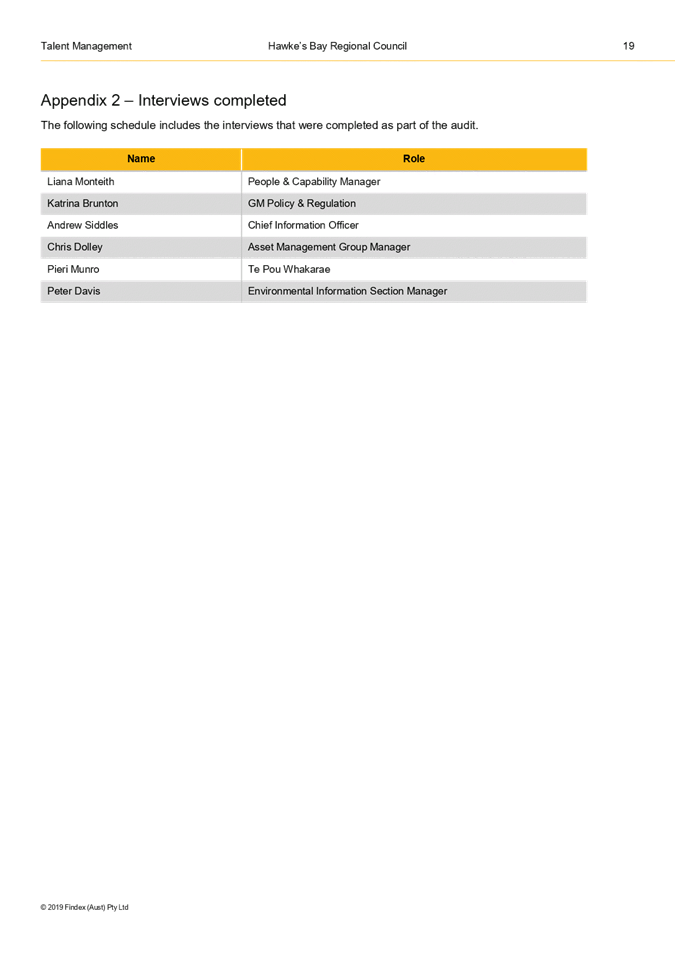

on the Talent Management internal audit undertaken by Crowe Horwath.

Officers’

Recommendations

2. Staff recommend that the FARS note the attached Talent Management

report prepared by Crowe Horwath (Crowe), and consider the adequacy of the key

management actions noted in the report and outlined following.

Background

/Discussion

3. The FARS agreed at its meeting on 12 August 2020, as part of the

internal audit work programme, to engage Crowe to conduct an internal audit of

the Council’s Talent Management system.

4. The objective of the Audit was to evaluate the talent management

strategies and processes against the New Zealand Public Service

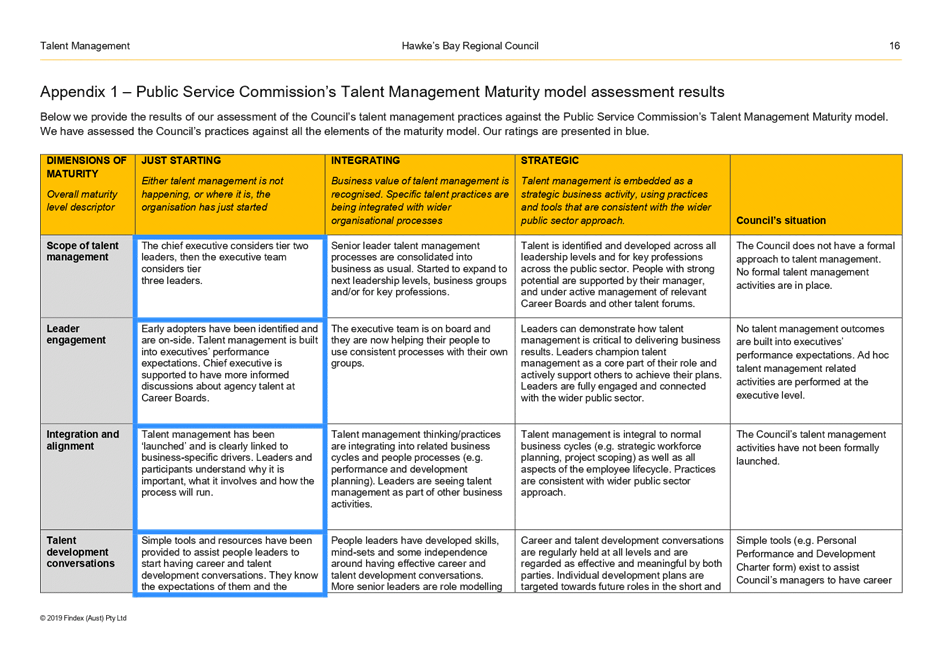

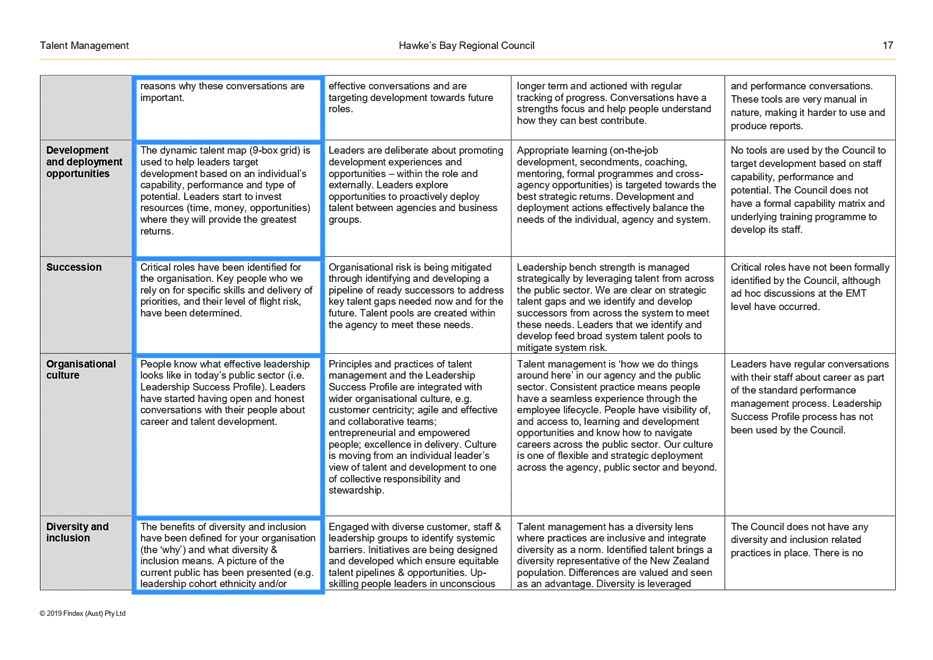

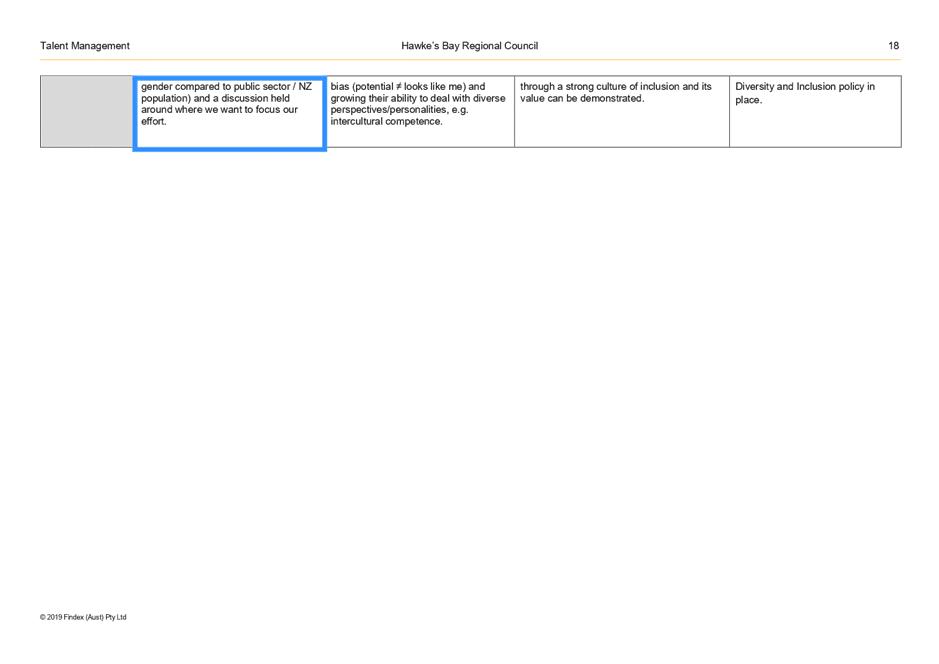

Commission’s Talent Management Maturity Model.

Report Analysis

5. Findings and recommendations contained within the Crowe report were

reviewed by the People and Capability Manager. The recommendations were

accepted and timeframes for implementing the recommendations were inserted into

the report as ‘Management Comments’. The final report was

also presented to the Executive Leadership Team (ELT) for information.

6. Each management action from the Talent Management internal audit

report will be tracked and reported to the FARS at future meetings through the Internal

Audit Dashboard – Corrective Actions Status Update, until such time

that the management action is closed.

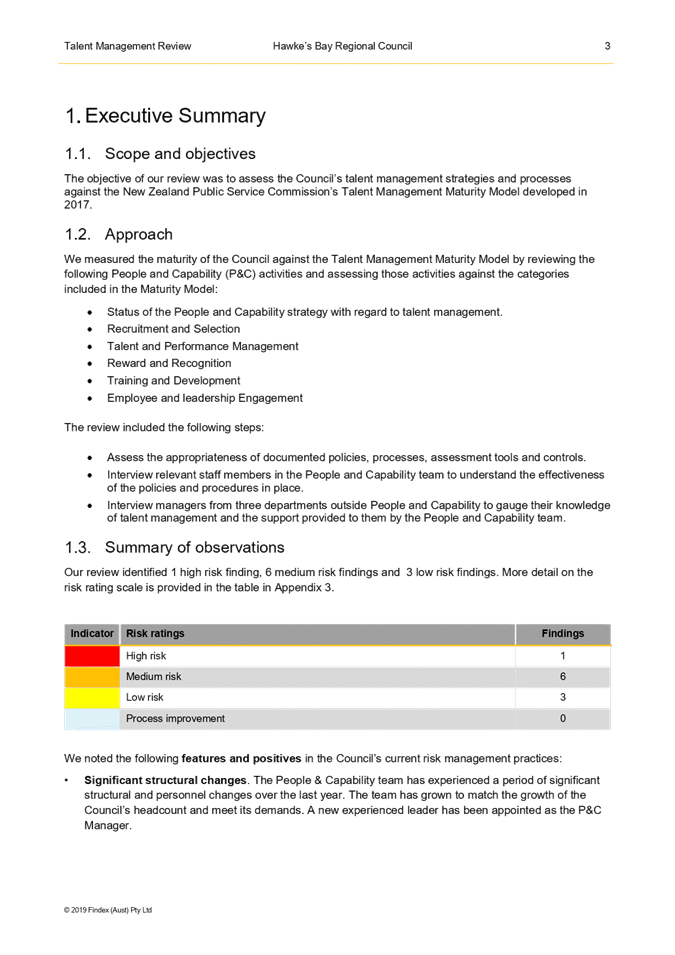

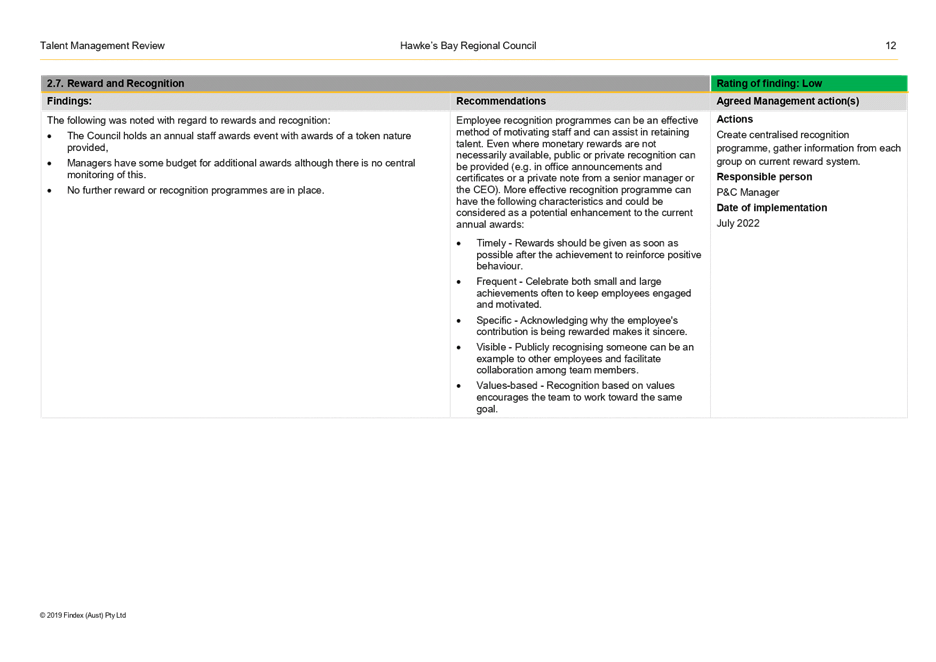

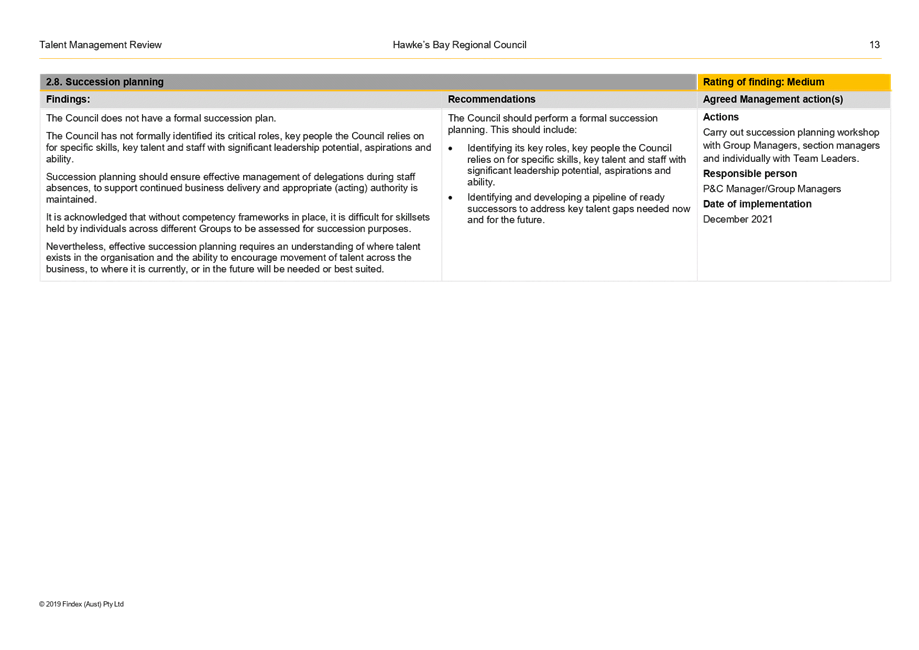

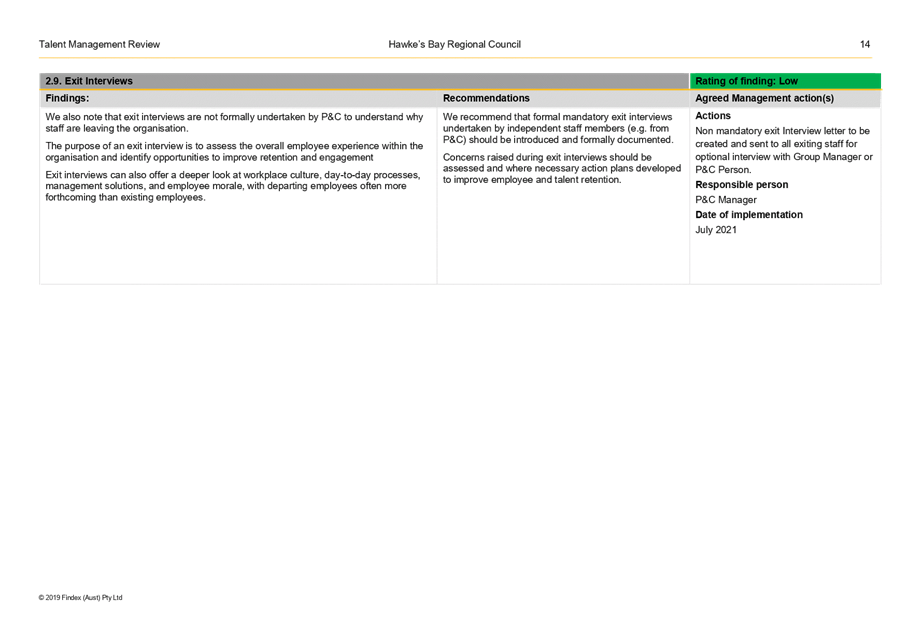

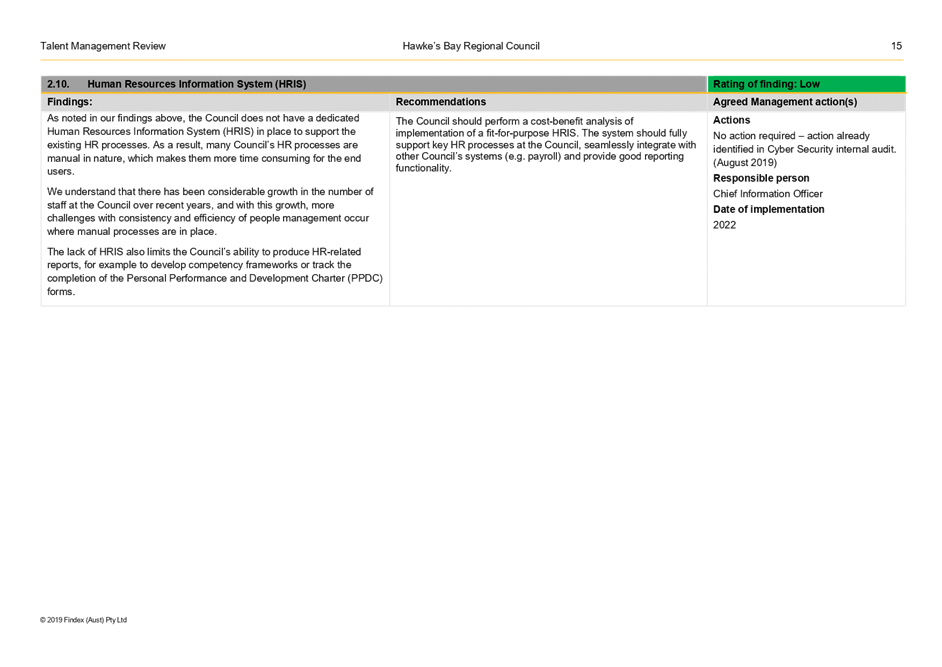

7. The Audit identified one high, six medium, and three low risk

findings.

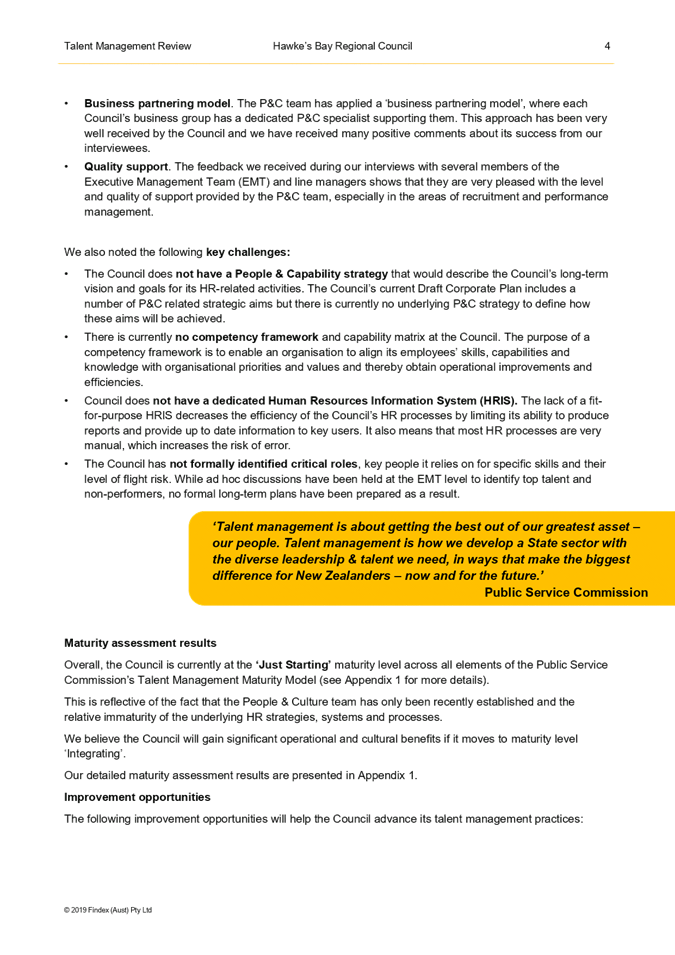

Maturity Assessment

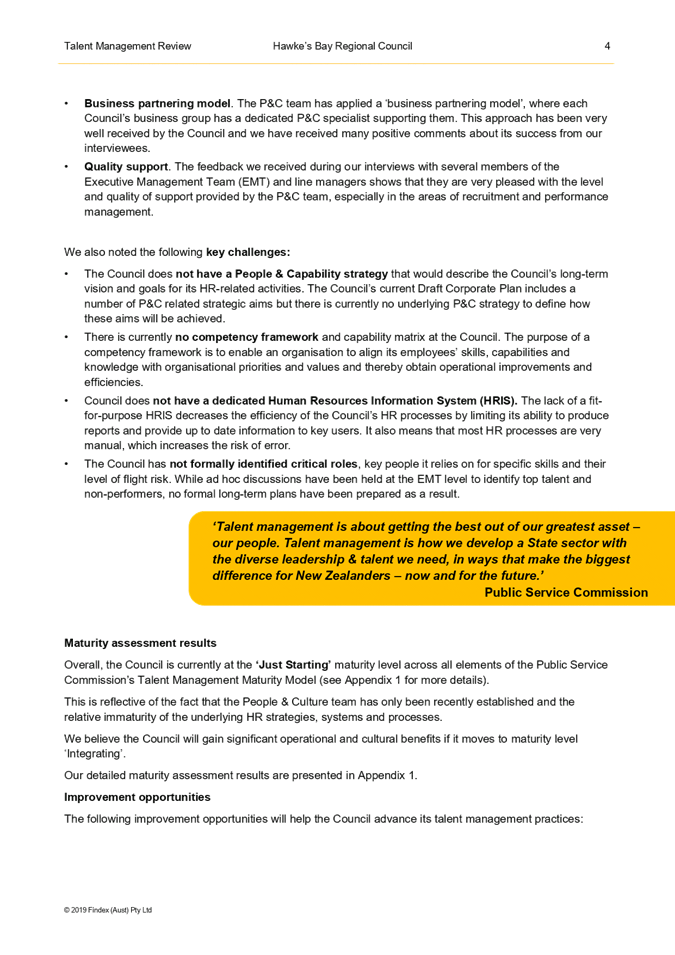

8. The report assessed the Council’s maturity status as being

‘Just Starting’ when benchmarked against the current Public Service

Commission’s Talent Management Maturity model. Management comments

noted within the report, and outlined below, are intended to progress the

Council’s Talent Management maturity level to at least an

‘integrating’ status. The key management action themes

include:

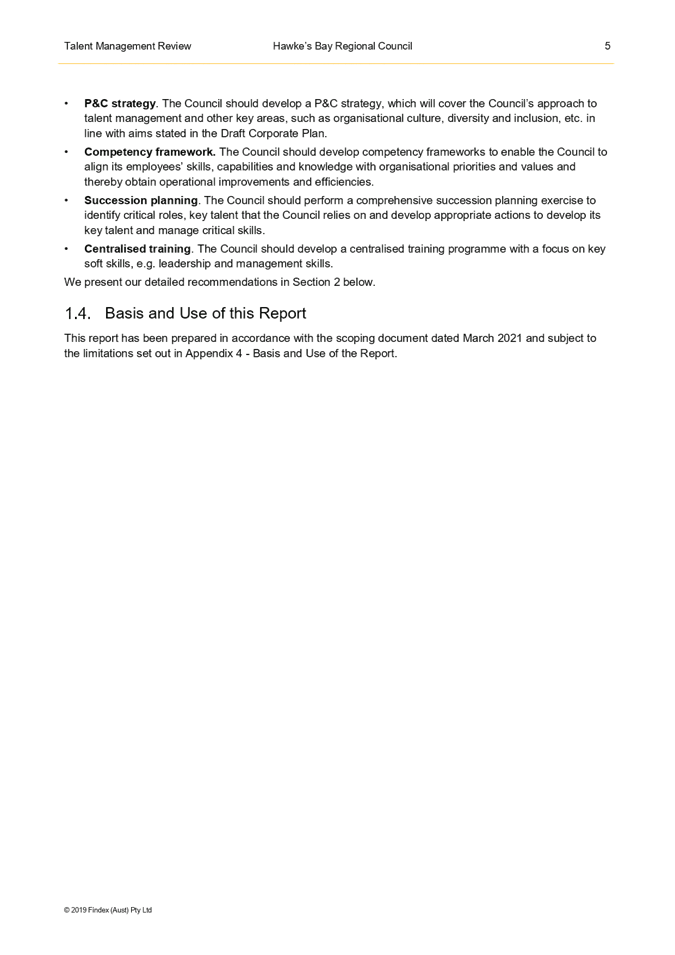

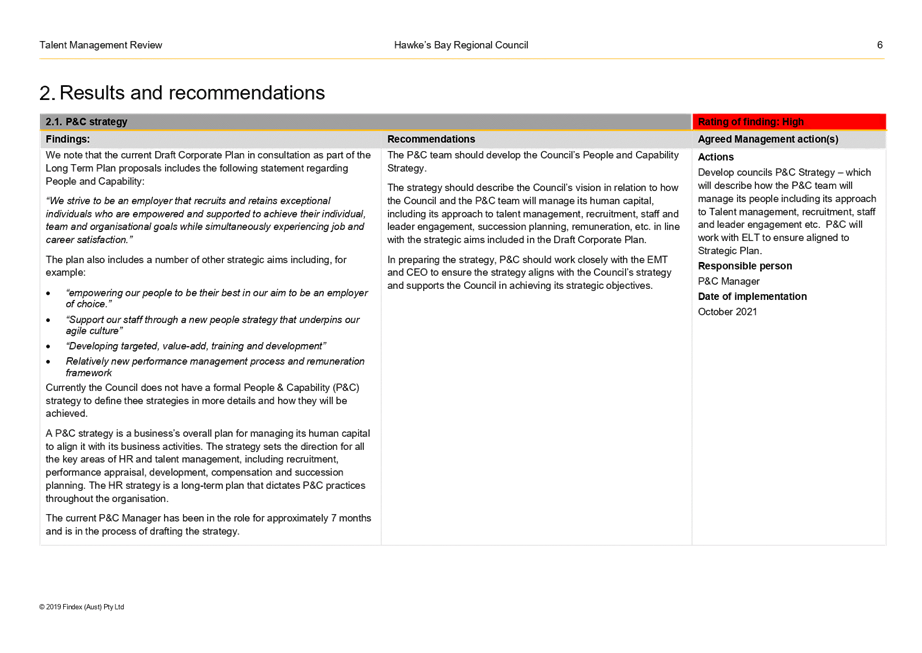

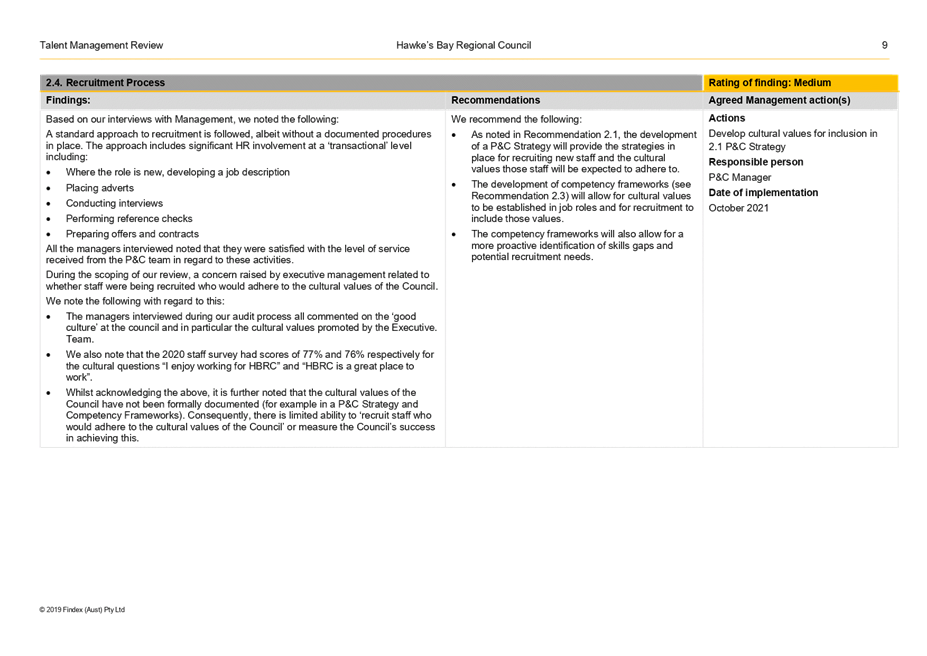

Develop a People

and Capability(P&C) Strategy

9. The People and Capability Manager will develop a People and

Capability Strategy which will include how the Council will manage its human

capital including for example, its approach to talent management, recruitment,

leader engagement, succession planning, and remuneration

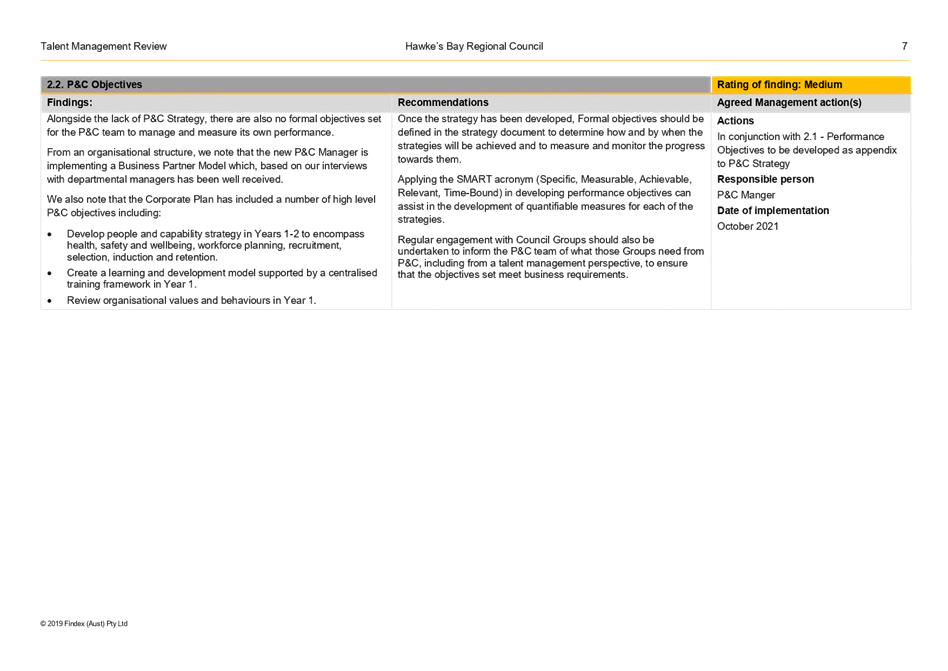

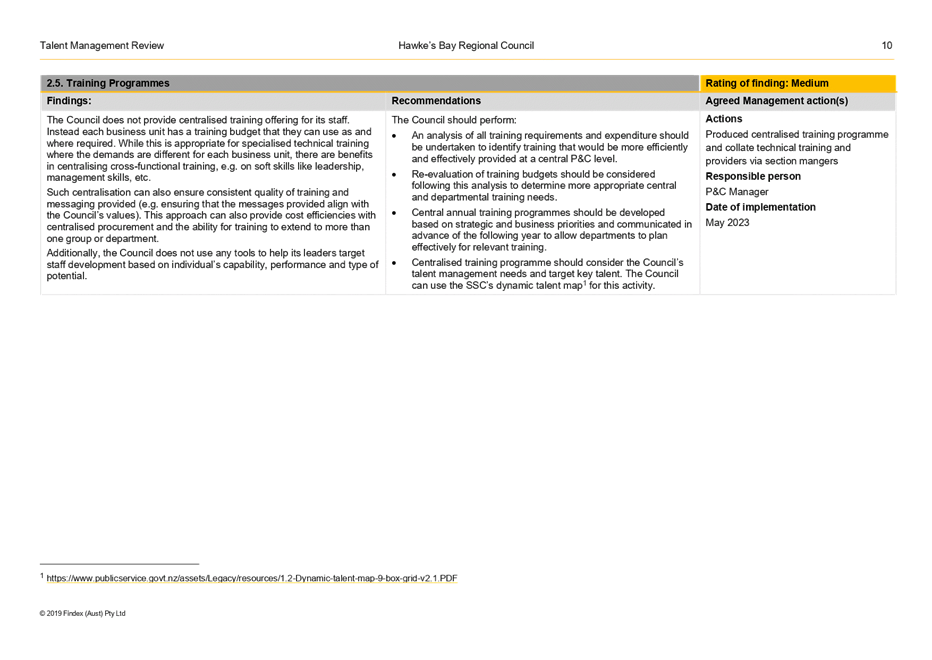

Develop a Competency

Framework

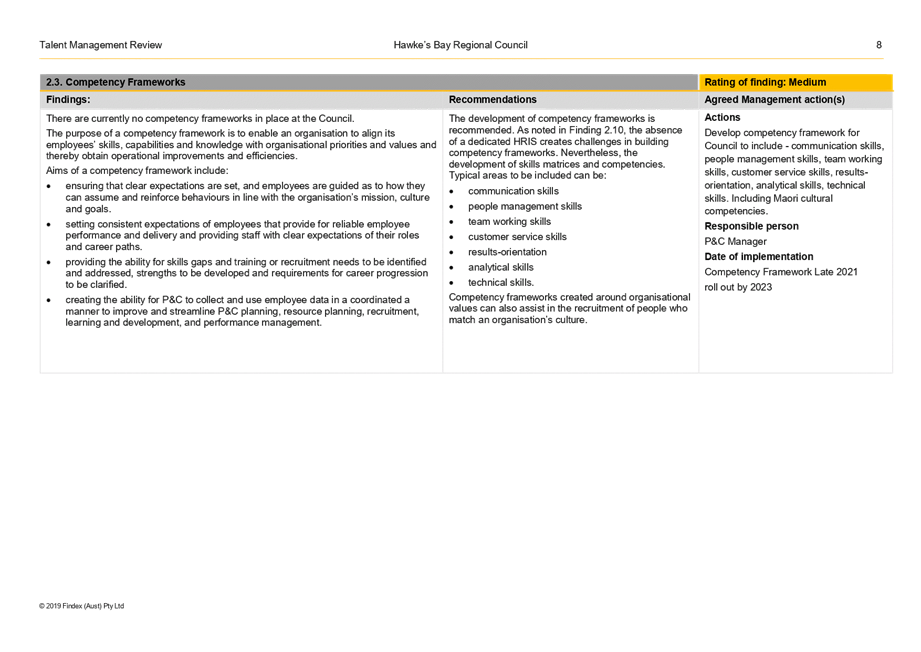

10. A

Competency Framework is to be developed to enable the Council to align its

employee’s skills, capabilities and knowledge with its priorities and

values with the aim to achieve operational improvements and efficiencies.

This includes setting expectations regarding behaviours and performance and

identifying and addressing skill gaps. The competency

framework will provide information to support recruitment decisions

Performance

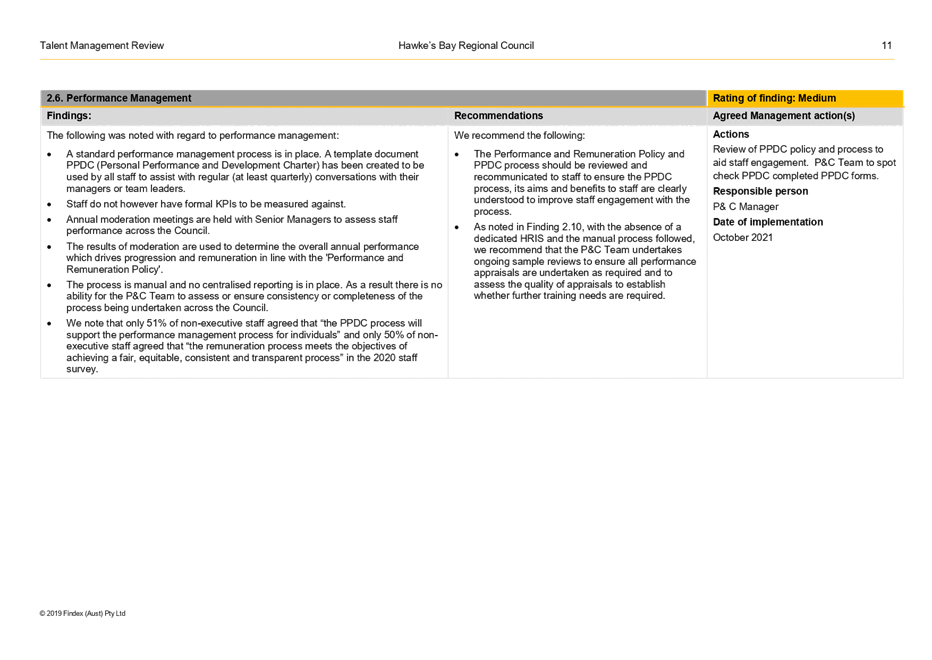

Management

11. The

People and Capability Team have reviewed the current Personal Development Plan

(PDP) and Guidelines in order to streamline the process and make it easier to

employees and their managers to work with. There will be more of a focus

on behaviour going forward.

Financial and Resource Implications

12. There are no immediate budget implications not already

identified in Council’s Long Term Plan or budgets.

Decision Making

Process

13. Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

13.1. As this

report is for information only, the decision-making provisions do not apply.

13.2. Any

decision of the sub-committee is in accordance with the Terms of Reference and

decision-making delegations adopted by Hawke’s Bay Regional Council

25 March 2020, specifically the Finance, Audit and Risk Sub-committee

shall have responsibility and authority to:

13.3. Receive

the internal and external audit report(s) and review actions to be taken by

management on significant issues and recommendations raised within the reports

13.4. Ensure

that recommendations in audit management reports are considered and, if

appropriate, actioned by management.

Recommendations

That the

Finance, Audit and Risk Sub-committee receives and considers Crowe’s

“Internal Audit Report – Talent Management”, including the key management actions added by Staff in

response to the report’s recommendations.

Authored by:

|

Liana

Monteith

Manager People and Capability

|

Helen Marsden

Risk and Corporate Compliance Manager

|

Approved by:

|

Tom Skerman

Regional Water Security Programme Director

|

|

Attachment/s

|

1⇩

|

2021 Internal

Audit Report - HBRC Talent Management

|

|

|

|

2021

Internal Audit Report - HBRC Talent Management

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

04 August 2021

Subject: 2020-21 Annual Report

Audit Plan

Reason for Report

1. This item provides an update on the likely timing for the Audit of

Council’s 2020-21 Annual Report.

Executive Summary

2. Legislation has been passed to extend the statutory deadlines for

the completion of the audited 2020-21 Annual Report by 2 months due to the

continued impacts of Covid-19 on the resourcing for the audits.

3. The statutory deadline for the adoption of the HBRC Annual Report is

now 31 December 2021 and the deadline for the adoption of the HBRIC annual

report is 30 November 2021.

4. Staff have been given 11 October (6 weeks later than previously

scheduled) as the revised date for the commencement of the audit process. This

will require the scheduling of an additional meeting of the Finance Audit and

Risk Sub-committee in early December to review the draft annual report prior to

its submission to Council for adoption.

Background

/Discussion

5. The audit and adoption of the annual report follows timelines set

out in the Local Government Act 2002. This Act has been amended to extend

the timeframes for the 2020-21 and 2021-22 Annual Reports.

5.1. Section 98 (7) now states that the annual report of a Council must

be adopted no later than 31 December (31 December 2021 for the 2020-21 Annual

Report).

5.2. Section 67 (5) now states that the annual report of a Council

Controlled Organisation must be adopted no later than 30 November (30 November

2021 for the 2020-21 Annual Report).

6. Officers have had initial discussions with our auditors about audit

timing and have received an indicative audit start date of 11 October. It

is likely that this may change as our auditors refine their work plans and

resourcing.

7. Officers are comfortable with the revised timing as it is

preferrable to have certainty now rather than be faced with delays and changes

during the audit process.

Financial and Resource Implications

8. The delays in the Audit proframme are not expected to impact on the

cost of the audit for 2020-21.

Decision Making

Process

9. Council and its committees are required to make every decision in

accordance with the requirements of the Local Government Act 2002 (the Act).

Staff have assessed the requirements in relation to this item and have

concluded:

9.1. as this report is for information only, the decision-making

provisions do not apply.

9.2. any decision of the sub-committee (in relation to this item) is in

accordance with the Terms of Reference and decision-making delegations adopted

by Hawke’s Bay Regional Council 25 March 2020, specifically the

Finance, Audit and Risk Sub-committee shall have responsibility and authority

to:

9.2.1. Satisfy itself that the financial statements and statements of

service performance are supported by adequate management signoff and adequate

internal controls and recommend adoption of the Annual Report by Council

9.2.2. Confirm that processes are in place to ensure that financial

information included in Council’s Annual Report is consistent with the

signed financial statements

9.3. Confirm the terms of appointment and engagement of external

auditors, including the nature and scope of the audit, timetable, and fees.

Recommendations

That the

Finance, Audit and Risk Sub-committee receives and considers the “2020-21

Annual Report Audit Plan”

staff report:

Authored by:

|

Tim Chaplin

Senior Group Accountant

|

|

Approved by:

|

Ross Franklin

Acting Chief Financial Officer

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

04 August 2021

Subject: 2020-21 Annual Treasury

Report

Reason for Report

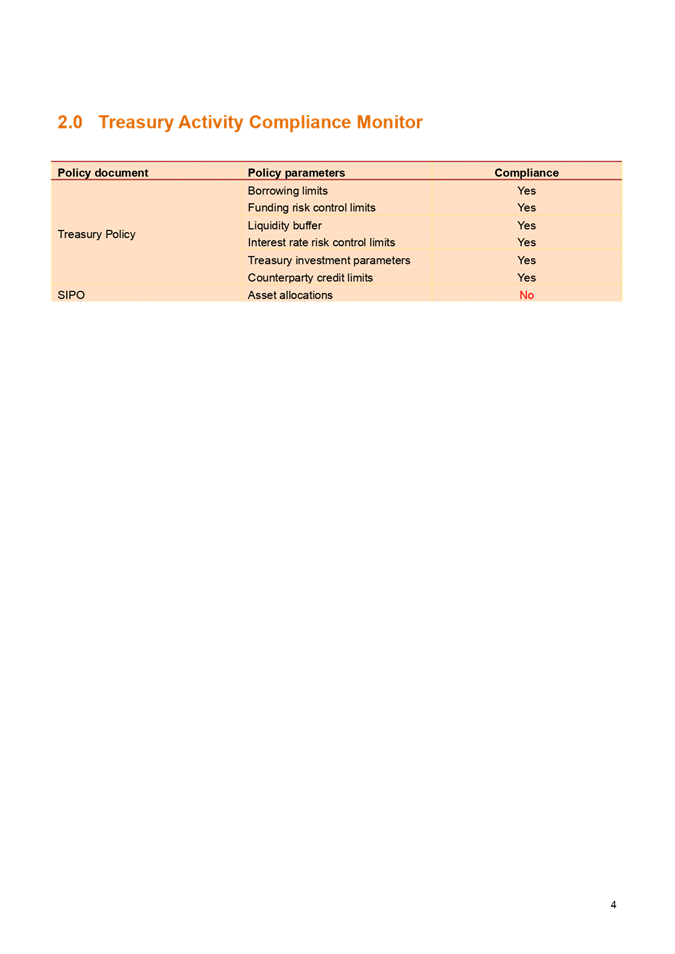

1. This item provides compliance monitoring of Hawkes Bay Regional

Council (HBRC) treasury

activity and reports the performance of Council’s investment portfolio

for the year ended 30 June 2021.

Executive

Summary

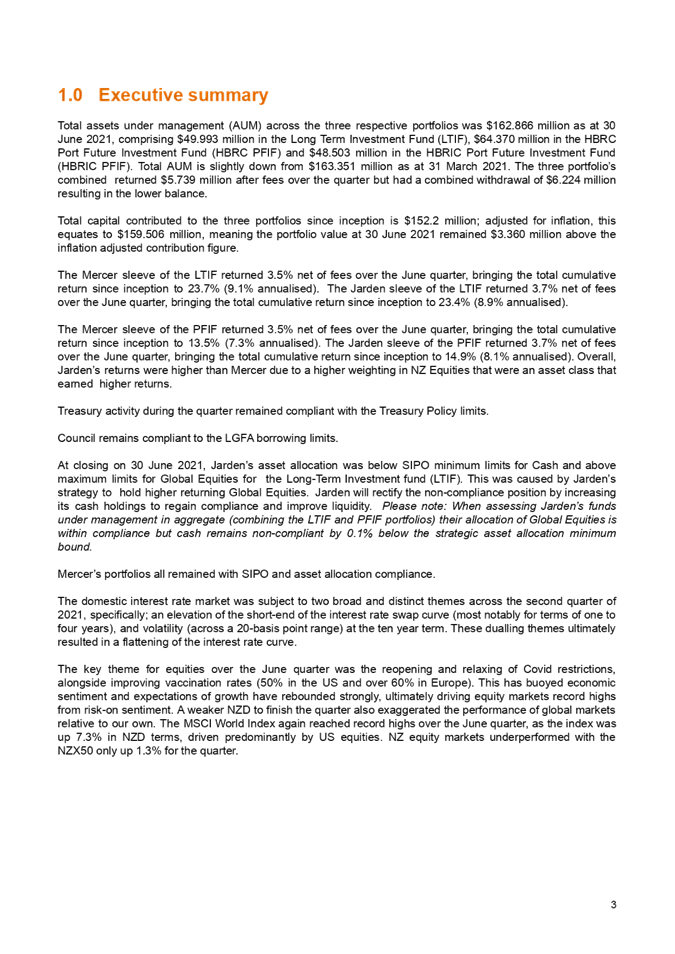

2. For the year ended 30 June 2021 Council’s investment returns

have exceeded expectations with a strong performance for managed funds.

In addition, the dividends received of $5.2m, while lower than the pre-covid

expectations, exceeded the revised budget by $2.2m. Due to the improved returns

the planned borrowing to supplement an expected investment revenue shortfall of

$4.6m was not required.

3. Apart from a variance in the Jarden’s fund allocations against

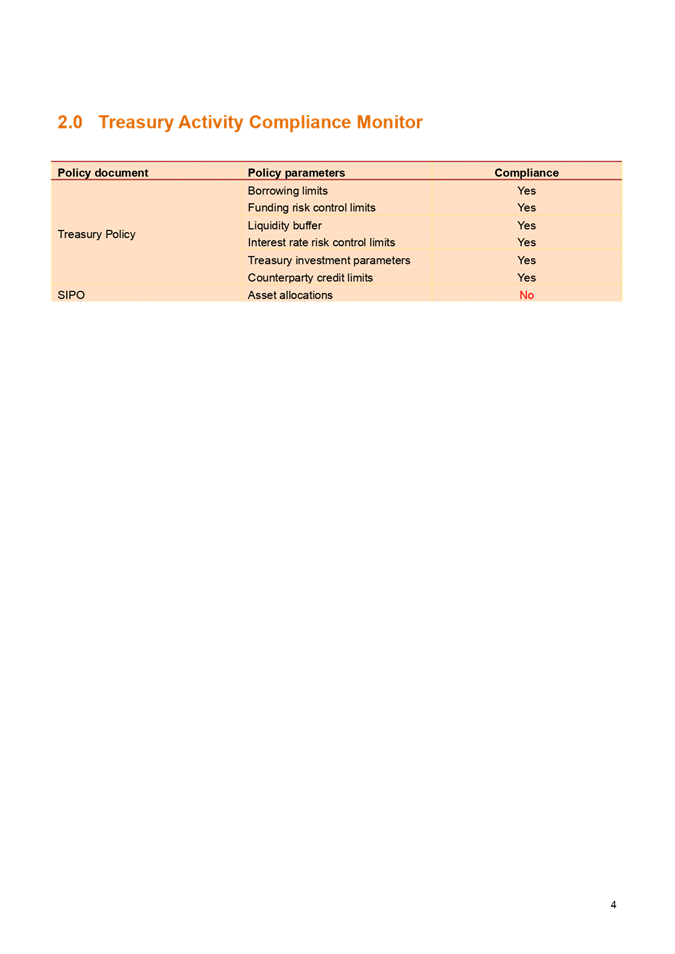

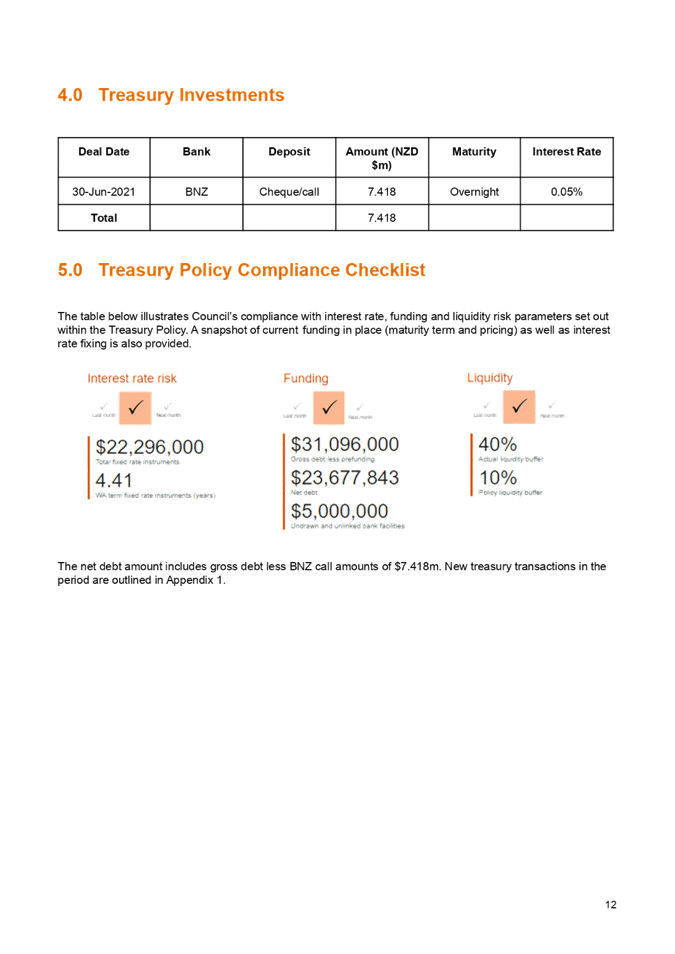

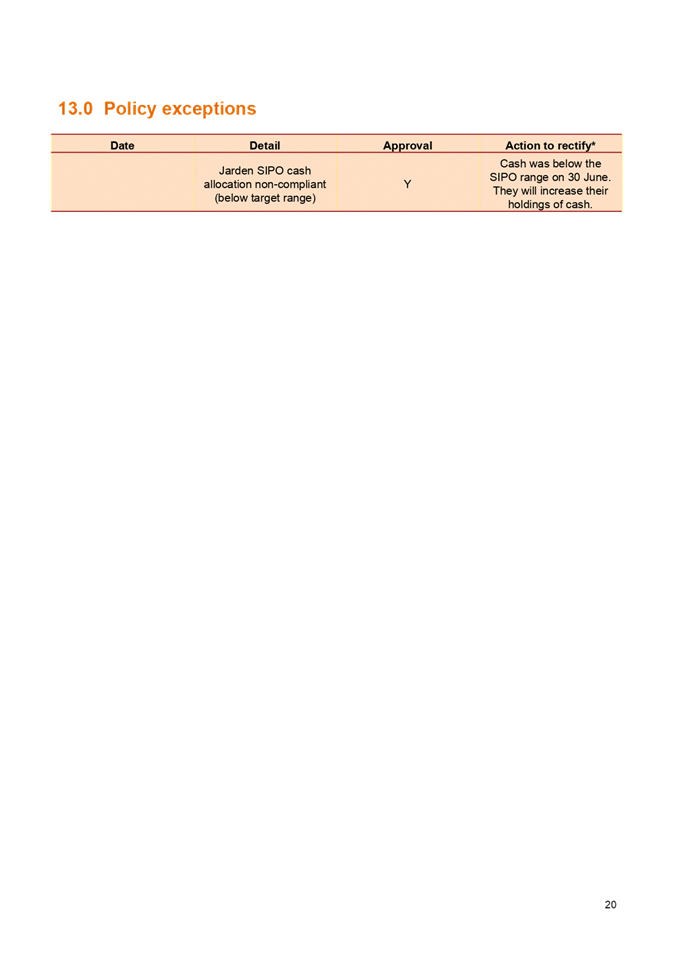

the SIPO Council is compliant with all policy parameters as at 30 June 2021.

4. Based on an initial view of the end year position Council’s

borrowing requirement for the year is $9.5m lower than projected at

$16.5m. Of this $10m was raised during the year with a further $6m raised

in July. The final requirement will be updated when the annual report and

result is finalised.

Background

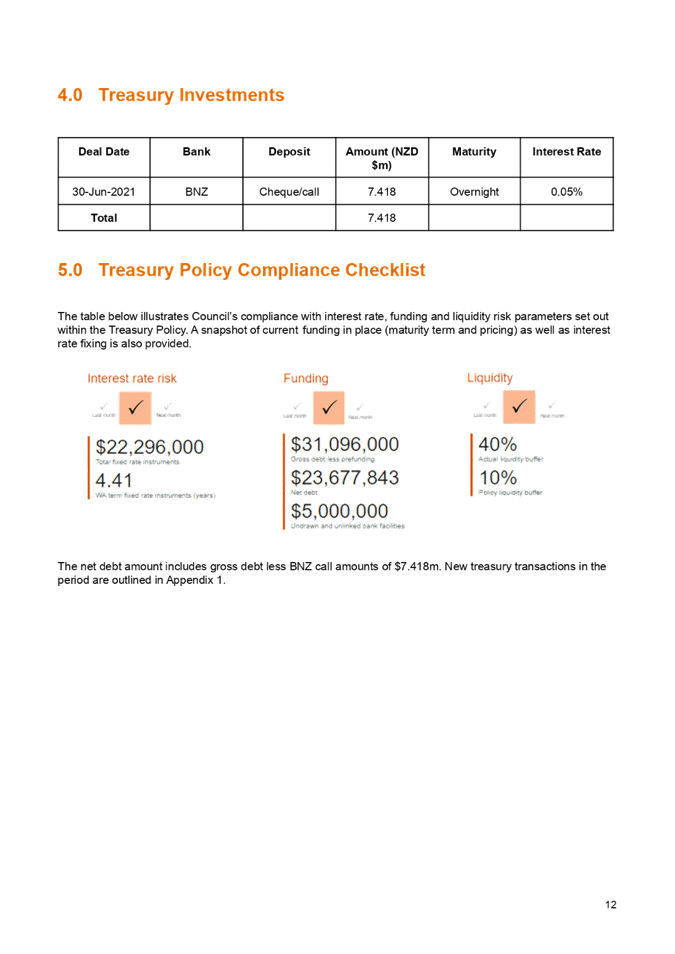

5. Council’s Treasury Policy requires a quarterly Treasury Report

to be presented to the Finance Audit & Risk Sub-Committee. The policy

states that the Treasury Report includes:

5.1. Treasury Exceptions report

5.2. Policy compliance

5.3. Borrowing Limit report

5.4. Funding and liquidity report

5.5. Debt maturity profile Interest rate report

5.6. Investment management report **

5.7. Treasury investments

5.8. Cost of funds report Cash flow and debt forecast report

5.9. Debt and interest rate strategy and commentary

5.10. Counterparty

credit report

5.11. Loan

advances.

6. The Investment management report** has specific requirements

outlined in the Treasury Policy. This requires quarterly reporting on all

treasury investments plus annual reporting on all equities and property

investments.

7. In addition to the Treasury Policy Council has a Statement of

Investment Policy and Objectives (SIPO) document setting out the parameters

required for funds under management for the HBRC Long Term Investment Fund.

8. At 30 June 2021, Treasury Investments to be reported on consist of:

8.1. Liquidity

8.1.1. Cash and Cash Equivalents

8.1.2. Debt Management

8.2. Externally Managed Investment Funds

8.2.1. Long-Term Investment Fund (LTIF)

8.2.2. Future Investment Fund (FIF)

8.3. Investment properties

8.4. HBRIC Ltd

8.5. 2020-21 Performance Summary.

9. Since 2018, HBRC has procured treasury advice and services from PwC

and their quarterly compliance report is attached.

Discussion

10. A

separate treasury report is prepared by Council’s advisors, PwC, to

report on compliance with the policy parameters and investment

performance. The PwC Quarterly Treasury Report is attached. The

body of this report highlights some of the key components of the PwC report and

adds additional information on cashflows and on property investments.

Liquidity

11. To ensure

HBRC has the ability to adequately fund its operations, current policy requires

HBRC to maintain a liquid balance of $3.0m.

12. The

following table reports the cash and cash equivalents as at 30 June 2021.

|

30 June

2021

|

$000

|

|

Cash

|

8,963

|

|

HBRC Held

Cash

|

7,438

|

|

Works

Group

|

222

|

|

Other

– managed trusts

|

1,303

|

|

Short-term

bank deposits

|

0

|

|

Cash

& and cash equivalents

|

8,963

|

13. HBRC

liquidity throughout Q4 benefited from the strong YTD cash position at the end

of Q3.

14. To manage

HBRC liquidity risk, HBRC retains a Standby Facility with

BNZ. This facility provides HBRC with a same day draw down option, to any

amount between $0.3-$5.0m, and with a 7-day minimum draw period.

15. The graph

following shows the daily closing cash position and Term Deposits held

throughout Q4.

Debt Management

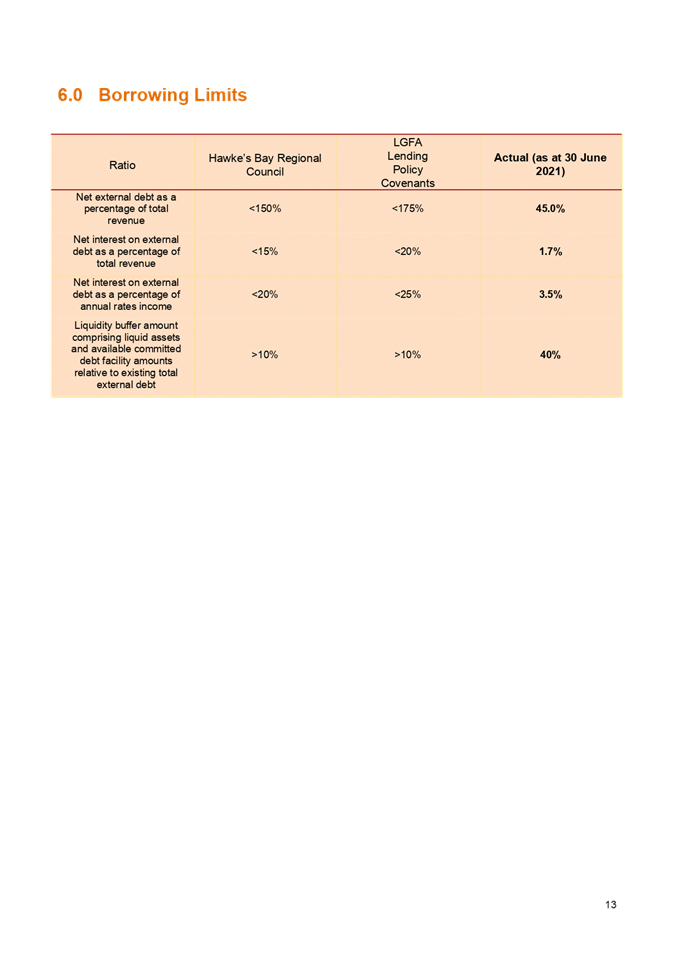

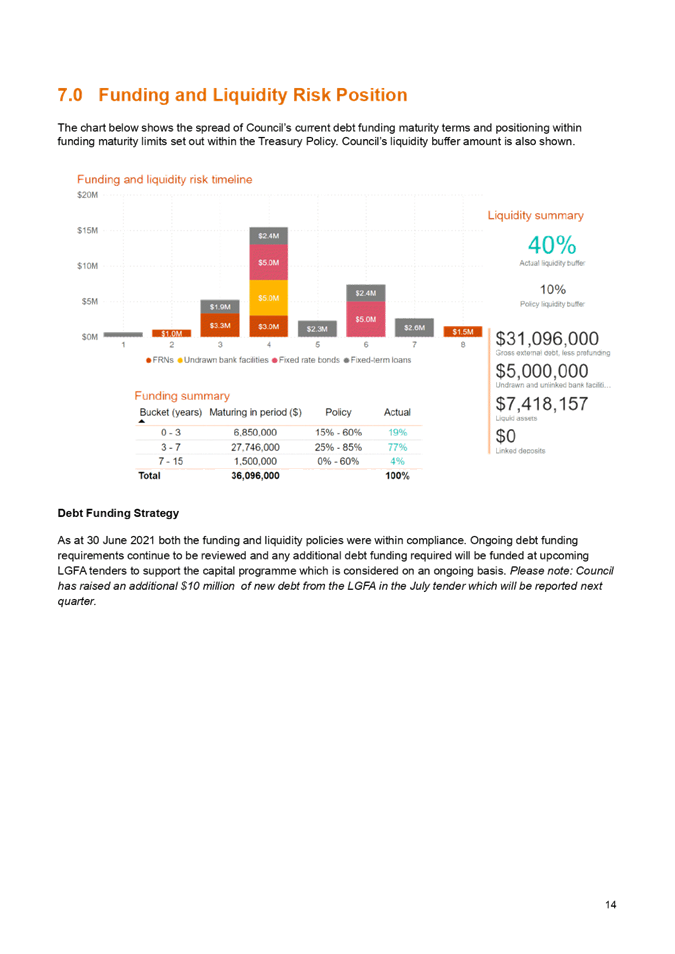

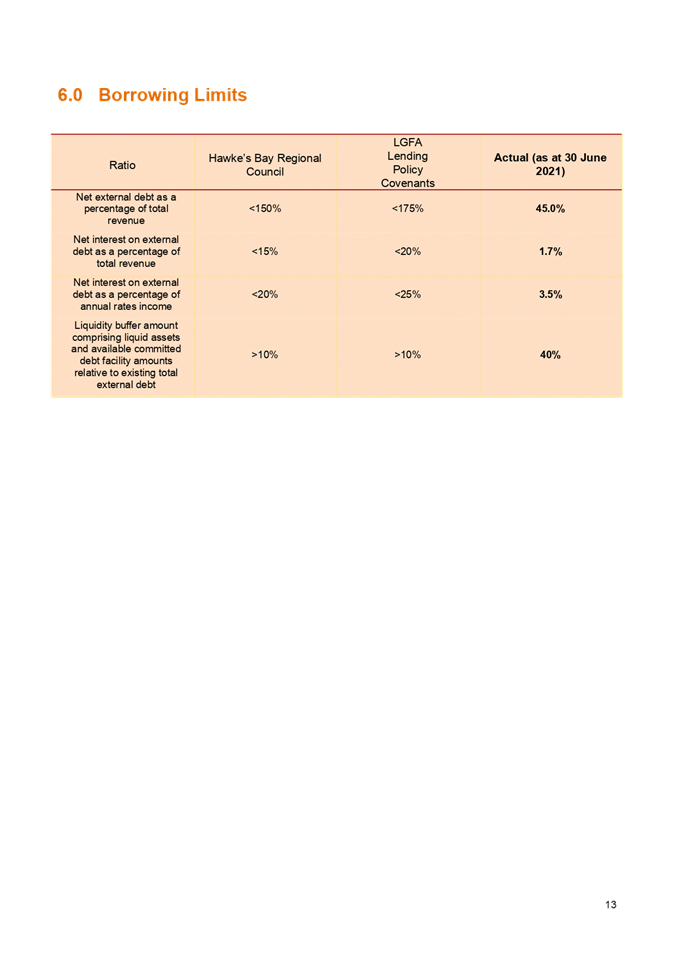

16. As at 30 June 2021, the HBRC external debt was $31.1m, $47.8m when taking into consideration

the internal $16.7m HBRIC loan All

financial covenant ratios are currently at least 4 times under any internal or

external limit. The financial covenant ratios can be seen in the attached

PwC report.

17. The

end-year accounts have not yet been prepared so a final year-end debt figure is

not yet available. No further external borrowing took place however since

30 June Council has drawn down $6m in funding from LGFA. The interim

year-end debt position is forecast to be $31.1m, which is below the 2020-21

Covid-19 Adjusted Annual Plan of $41.3m.

|

18. Loan Requirements

|

2020-21

Annual Plan

|

Approved Additional Funds

|

Approved Carry Forward Debt Funding

|

Total Approved Requirement

|

2020-21 Debt Forecast*1

|

Variance to Approved Requirement

More (less)

|

|

|

$000

|

$000

|

$000

|

$000

|

$000

|

$000

|

|

Sustainable

Homes

|

3,527

|

-

|

-

|

3,527

|

6,523

|

2,996

|

|

Systems

Integration

|

1,913

|

-

|

1,578

|

3,491

|

1,668

|

(1,823)

|

|

Building

Accommodation

|

2,000

|

-

|

|

2,000

|

136

|

(1,864)

|

|

HBRC Recovery

Fund

|

1,000

|

-

|

|

700

|

100

|

(600)

|

|

Porangahau

Catchment

|

|

|

|

300

|

0

|

(300)

|

|

Integrated

Catchment

|

2,250

|

2,450

|

|

4,700

|

3,334

|

(1,366)

|

|

Covid-19

Budget Impacts

|

7,584

|

-

|

|

7,584

|

3,000

|

(4,584)

|

|

Other

|

755

|

-

|

2,901

|

3,656

|

1,700

|

(1,956)

|

|

Total

|

19,029

|

2,450

|

4,479

|

25,958

|

16,461

|

(9,497)

|

|

*1

Council’s year end balances are still being determined so the final

debt requirement will be reported when Council receives the year-end report

As at 30

June 2021, only $10m of the total 2020-21 requirement has been raised. $6m

was raised in July 2021.

|

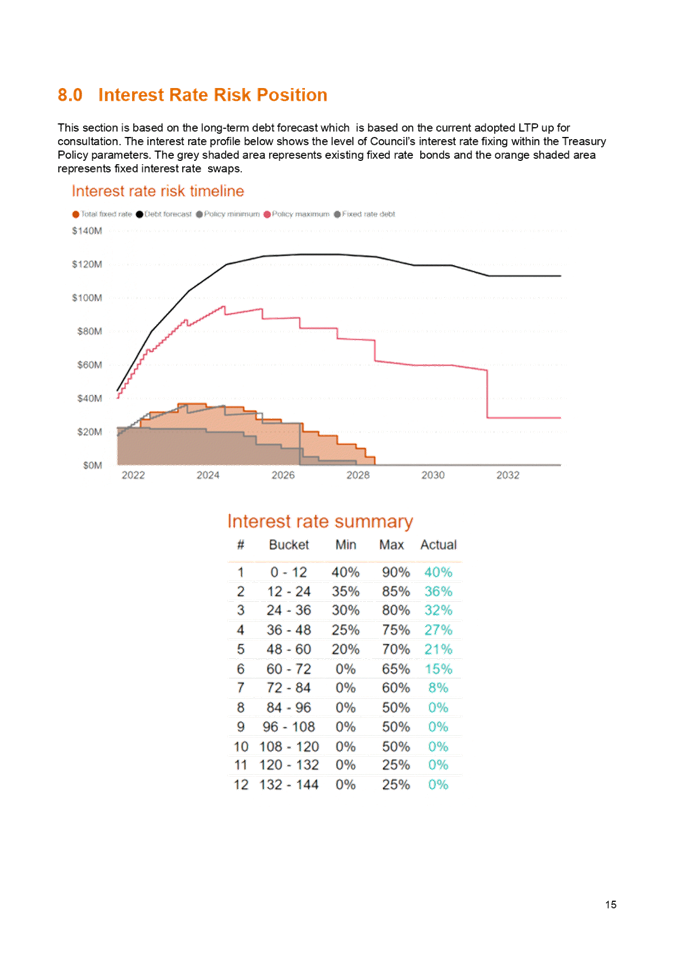

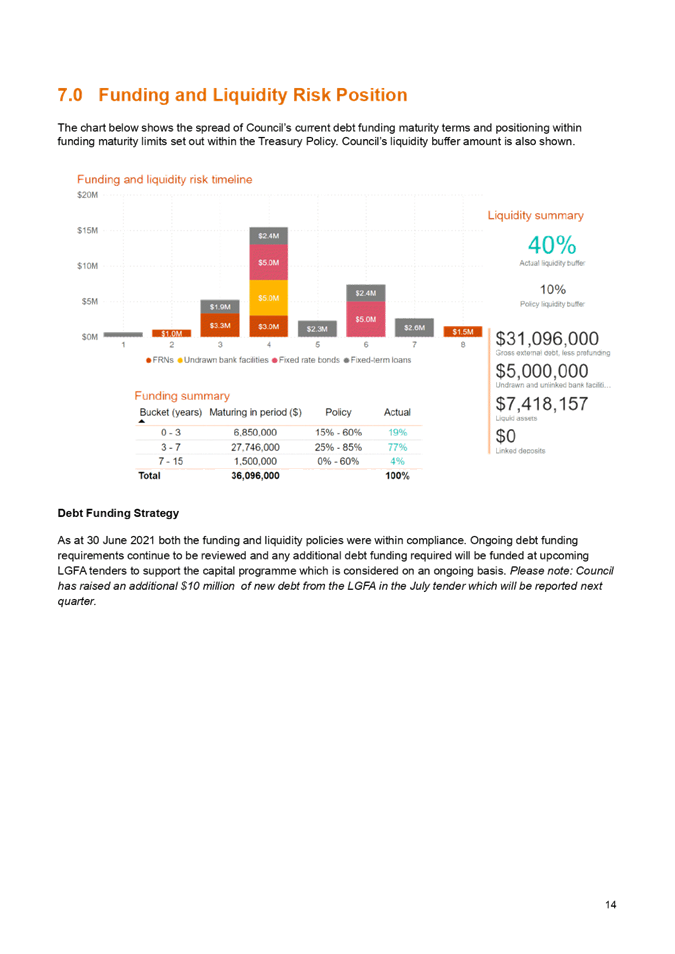

19. Council

was in compliance with its policy parameters for interest rate risk position as

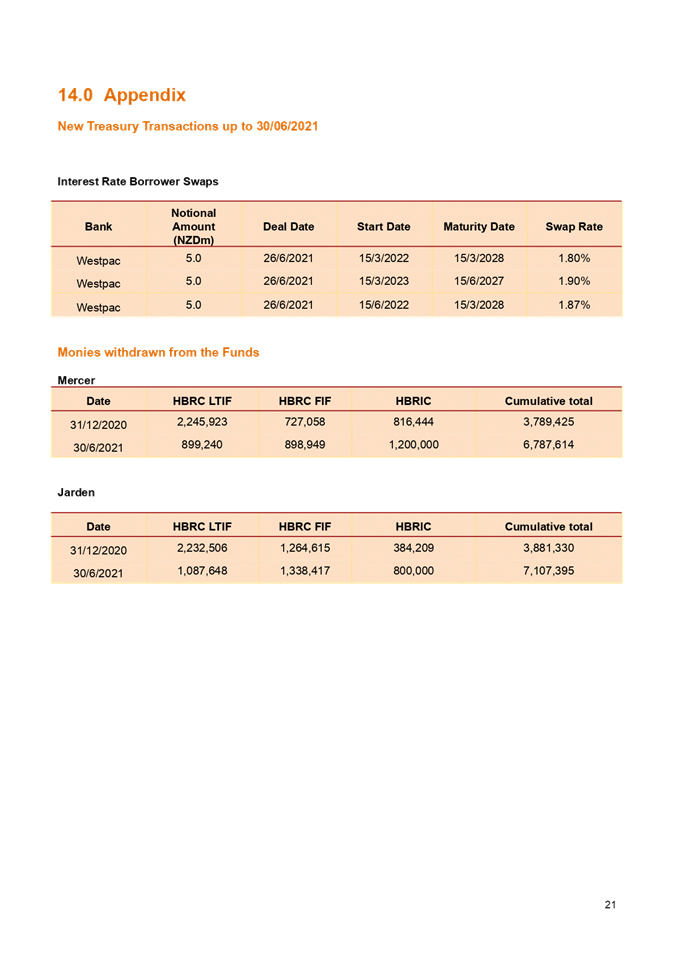

at 30 June. This was achieved through the execution of 3 interest rate swaps

prior to 30 June. These swaps fix the interest rate on a total of

$15m worth of future borrowings with start dates of June 2022 and March

2023. Details of these swaps are on page 21 (section 14 Appendix) of the

PWC report.

Managed Funds

20. For the

purposes of this report, the below terms have been referred to and have the following

meaning.

|

Term

|

Meaning

|

|

Gross Income

Net of Fees

|

The full

amount the fund has returned for the period, net of any fees paid to the fund

managers. This amount remains in the funds unless divested.

|

|

Capital

Protection

|

The amount

the fund must earn in relation to the rate of inflation to retain its real

purchasing power.

|

|

Funding

Council Operating Costs

|

The amount

the fund must earn to fund Council operating costs (offsetting rating

requirements).

|

|

Divested

Capital

|

Gross Income

Net of Fees less Capital Protection and have now been withdrawn from the

funds.

|

|

Undivested

Funds Available

|

Gross Income

Net of Fees less Capital Protection that are still invested within the funds.

|

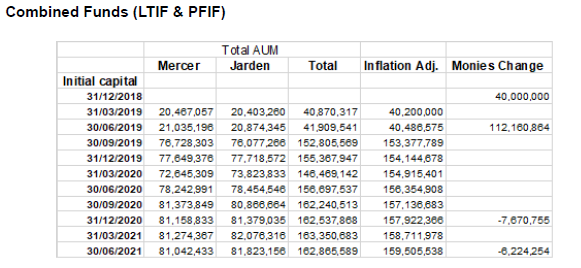

21. The Fund

performances have continued to be above expectations over the last

quarter. During the year a total of $10.694m was withdrawn from the

funds. These withdrawals were partly to cover cash not withdrawn in

2019-20 as well as to meet the 2020-21 funding requirement.

22. The total

earnings over the year were $13.979m which is a return of 12.58% on the opening

balance as at 30 June 2020.

23. The table

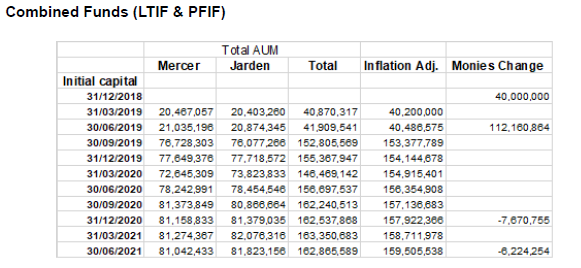

and graphs below summaries the quarter end fund balances over the last

12 months.

|

Fund

|

30 Jun 2020

|

30 Sep 2020

|

31 Dec 2020

|

31 Mar 2021

|

30 Jun 2021

|

|

|

$000

|

$000

|

$000

|

$000

|

$000

|

|

Long-Term

Investment Fund

|

49,950

|

51,810

|

49,925 *

|

50,206

|

49,993**

|

|

Future

Investment Fund

|

61,128

|

63,094

|

64,300 *

|

64,418

|

64,370**

|

|

Total

|

111,078

|

114,904

|

114,225*

|

114,624

|

114,363**

|

* December 2020 saw $6.5m (LTIF $4.5m & FIF $2.0m) Funds being

divested for the first time, which explains the reduced fund balance.

** Additional funds totalling $4.2m (LTIF $2.0m & FIF $2.2m) were

withdrawn from the funds during the June quarter.

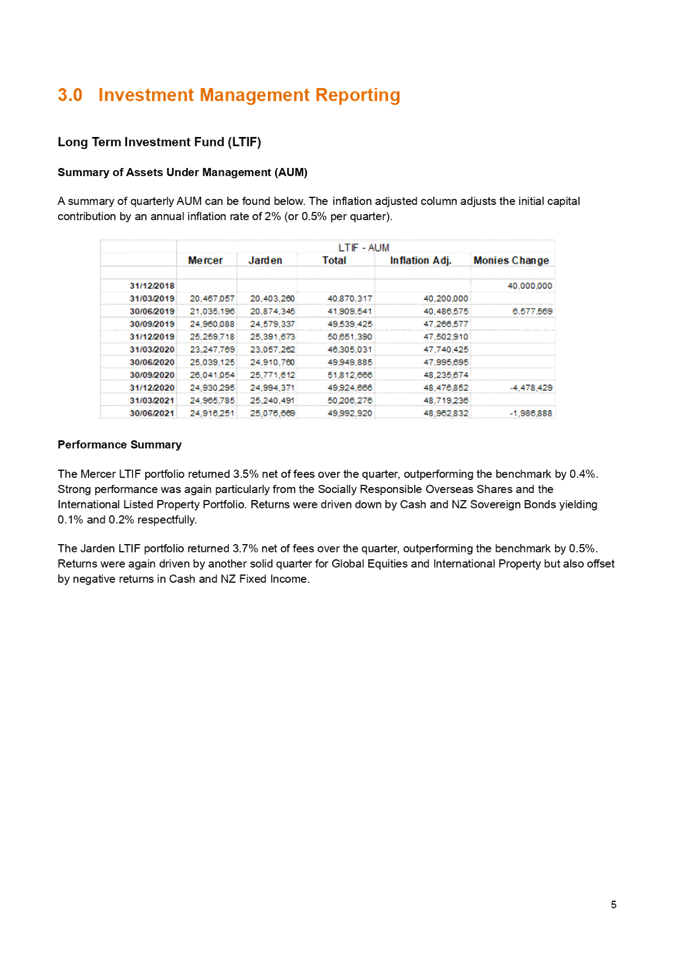

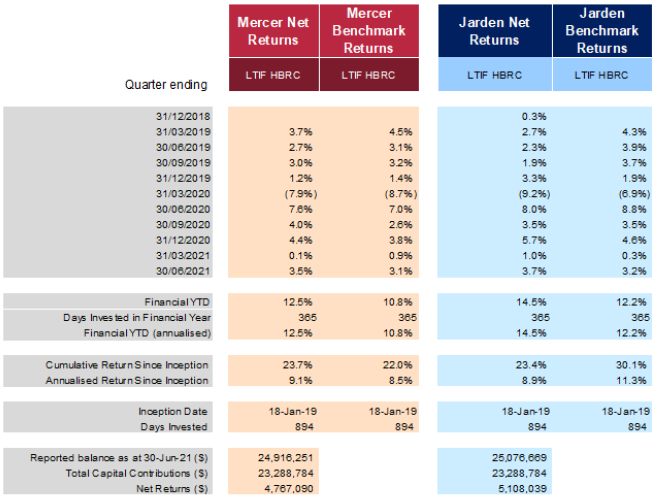

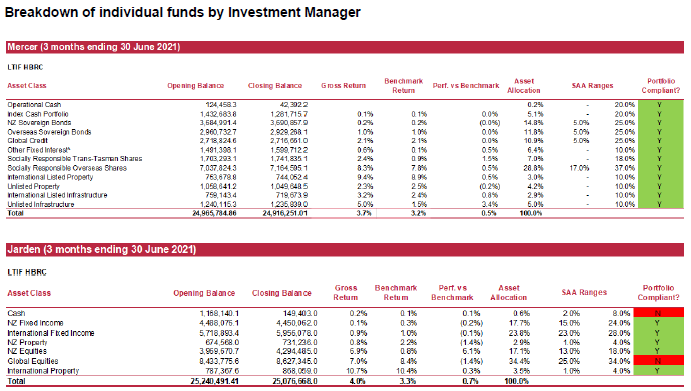

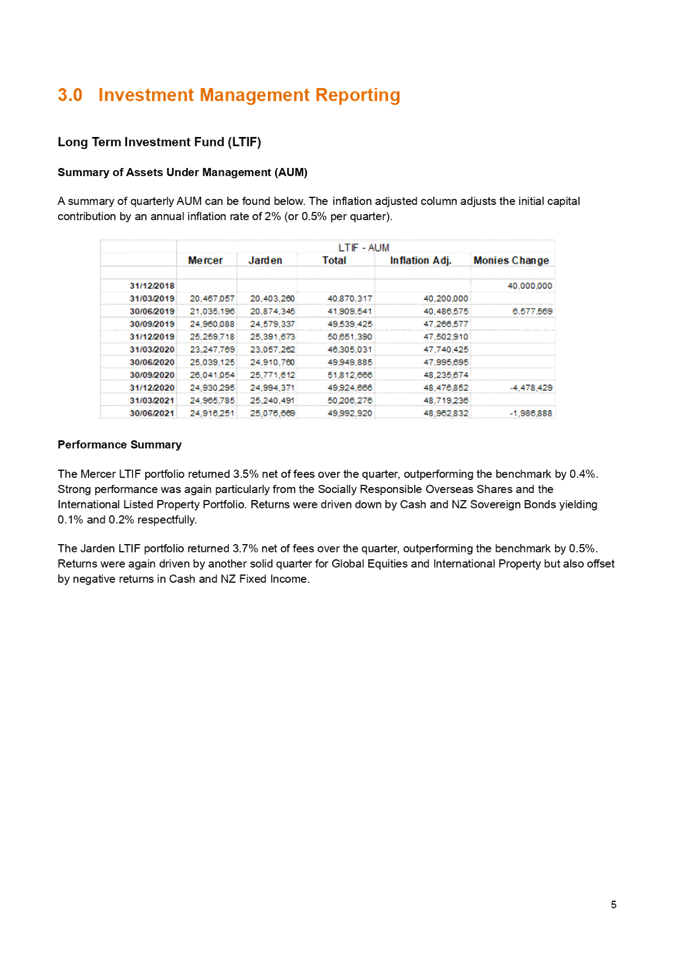

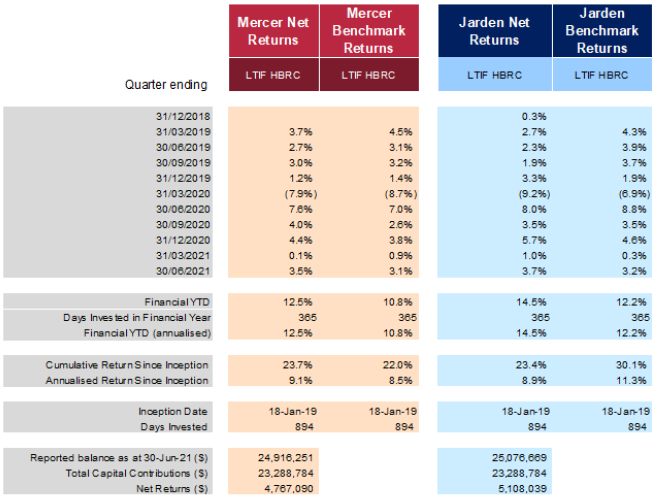

Long-term Investment Fund

24. Invested

since November 2018, the fund provides a return which, protects capital value

first and then funds Council’s operating costs.

25. The table

below shows the key balances of the LTIF as at the end of June 2021.

|

|

1 July 2020 – Opening Balances

|

30 June 2021 – Closing Balances

|

|

|

Capital Protected Balance

|

Undivested Funds Available

|

Total Fund Balance

|

Capital Protected Balance

|

Undivested Funds Available

|

Total Fund Balance

|

|

|

$000

|

$000

|

$000

|

$000

|

$000

|

$000

|

|

LTIF

|

47,996

|

1,954

|

49,950

|

48,963

|

1,030

|

49,993

|

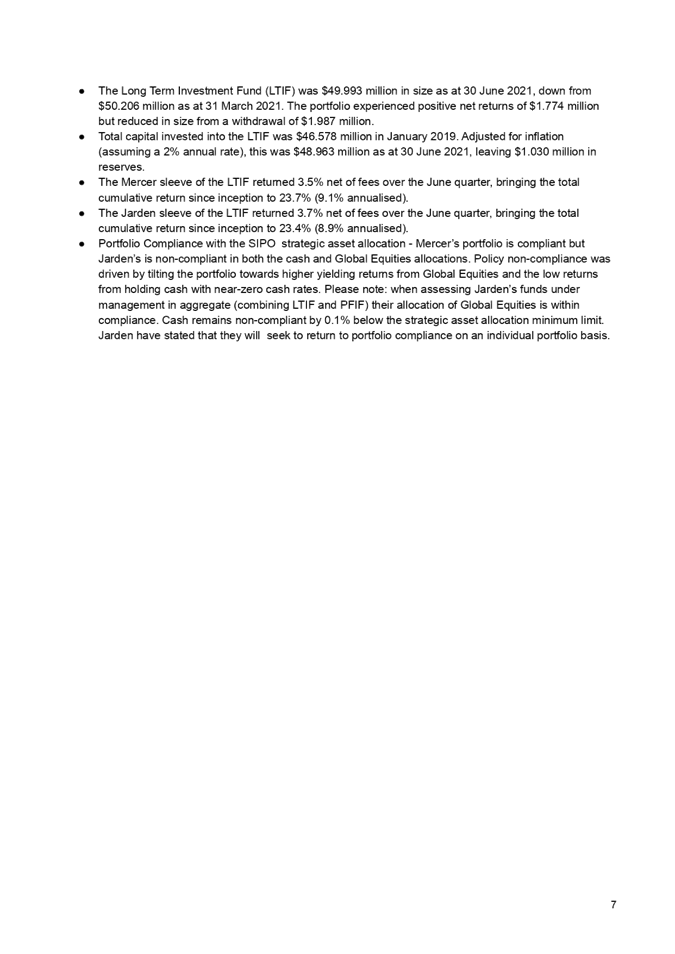

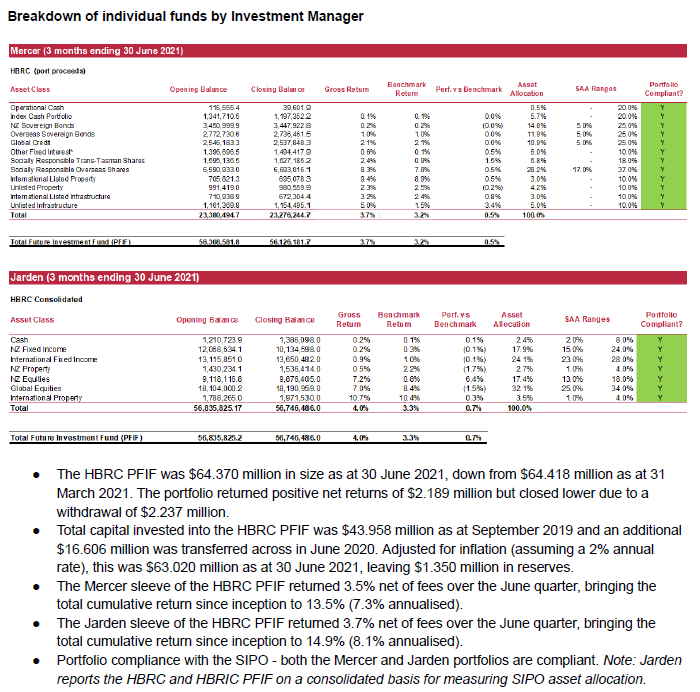

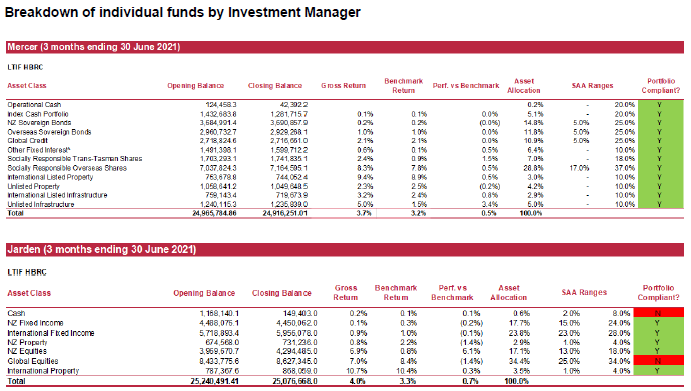

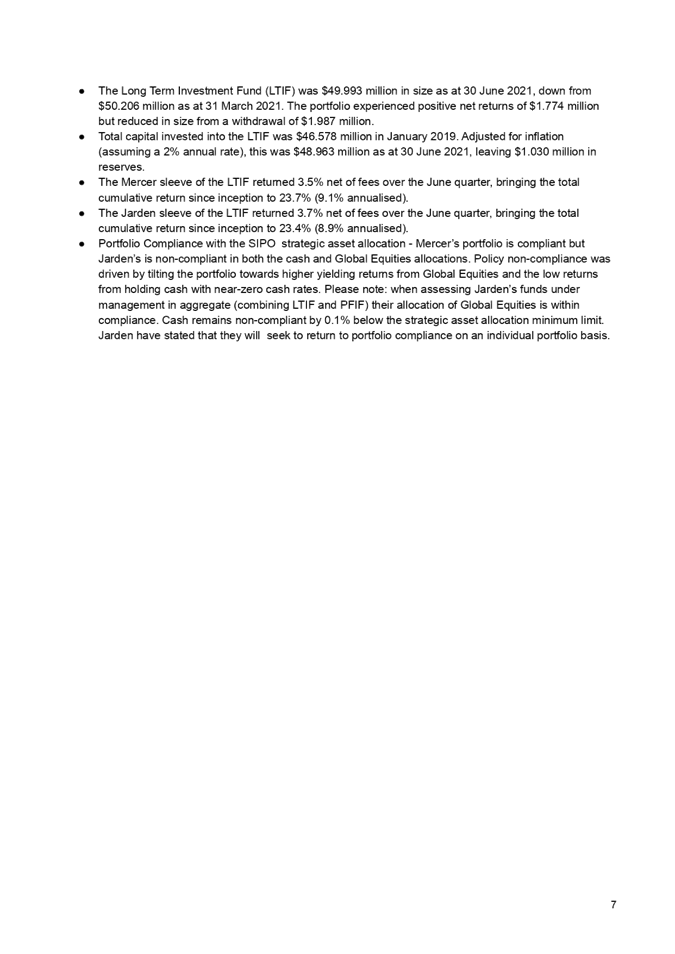

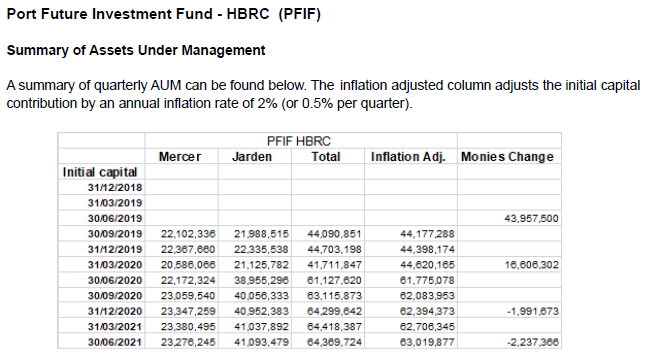

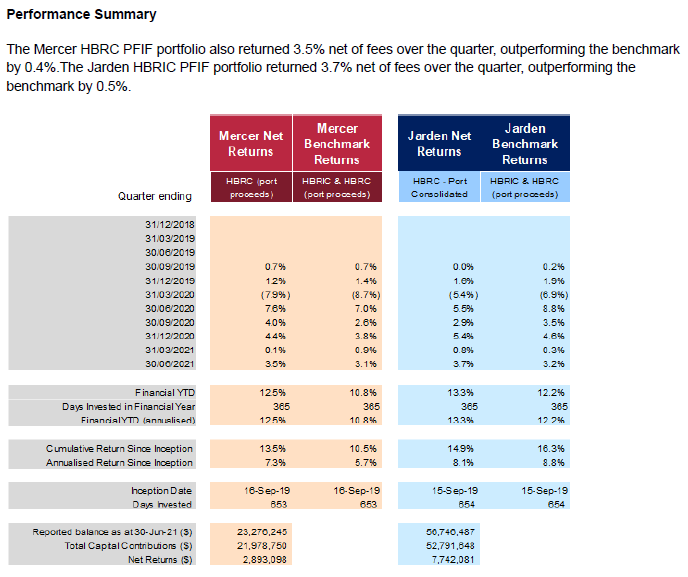

26. At

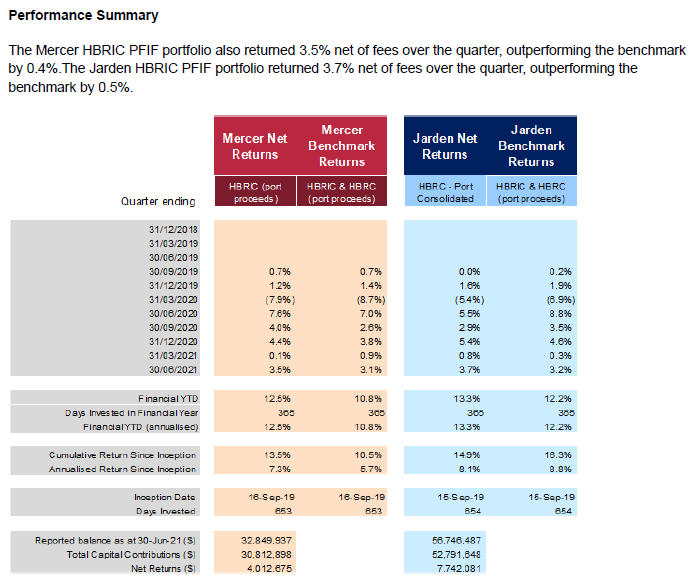

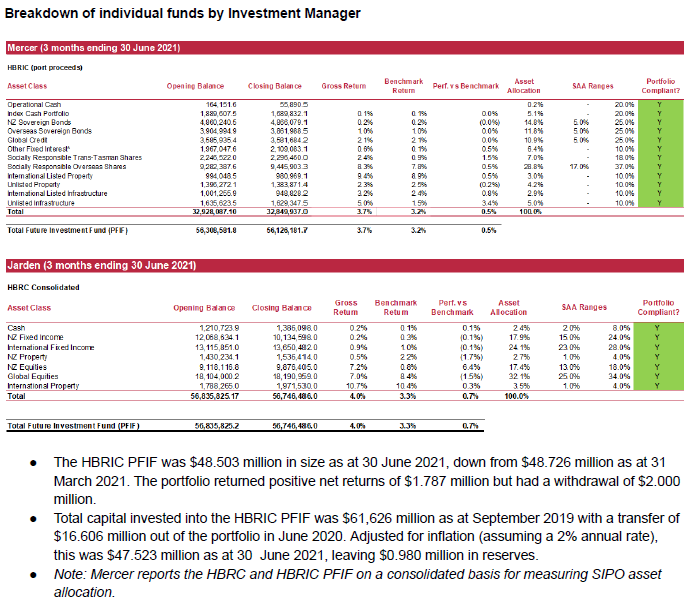

closing on 30 June 2021, Mercer’s portfolio is compliant, but

Jarden’s is non-compliant in both the cash and Global Equities

allocations (SIPO policy minimum limits). Policy non-compliance was driven by

tilting the portfolio towards higher yielding returns from Global Equities and

the low returns from holding cash with near zero cash rates. Note however that

when assessing Jarden’s funds under management in aggregate (combing LTIF

and PFIF) their allocation of Global Equities is within compliance. Cash

remains non-compliant by 0.1% below the strategic asset allocation minimum

limit. Jarden have stated that they will seek to return to portfolio compliance

on an individual portfolio basis.

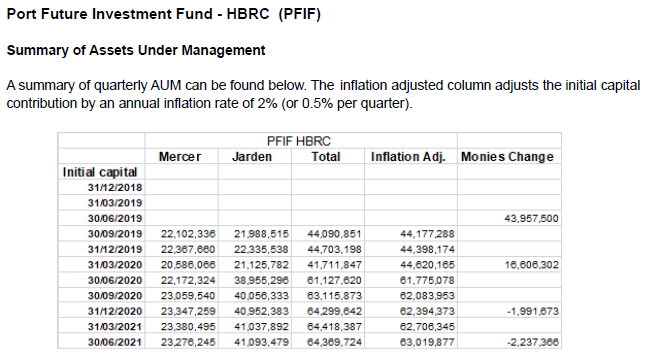

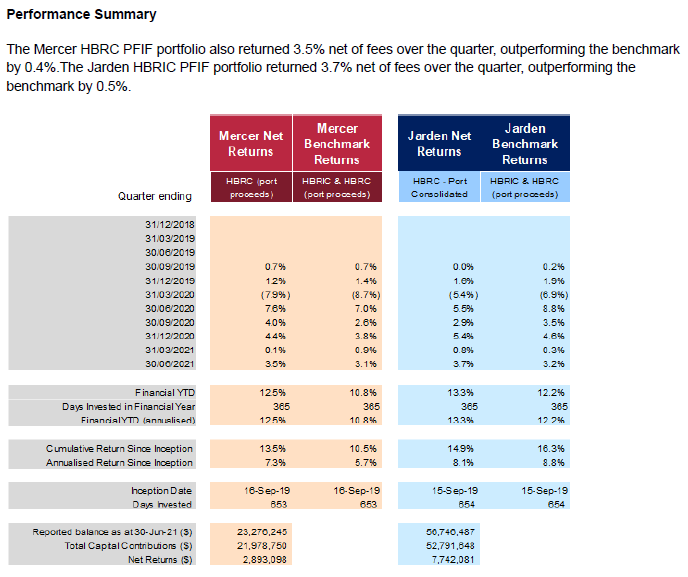

Future Investment Fund (FIF)

27. Invested

since September 2019, the fund provides a return which, protects capital value

first and then funds Council’s operating costs.

28. The table

below shows the key balances of the FIF as at 30 June 2021.

|

|

1 July 2020 – Opening Balances

|

30 June 2021 – Closing Balances

|

|

|

Capital Protected Balance

|

Undivested Funds

Available

|

Total Fund Balance

|

Capital Protected Balance

|

Undivested Funds

Available

|

Total Fund Balance

|

|

|

$000

|

$000

|

$000

|

$000

|

$000

|

$000

|

|

FIF

|

61,775

|

(647)

|

61,128

|

63,011

|

1,350

|

64,229

|

Investment Property

29. In the

current financial year, 2020-21, 18 Napier Endowment Leasehold Properties were

freeholded totalling $2.9m. $2.5m of this has been subsequently paid to ACC as

settlement for the remaining 42 years rent for these properties.

30. The

income from leasehold sales is recognised in the current financial year.

Most of which goes into offsetting the movement in the ACC liability –

the additional proceeds, net of payments to ACC, are transferred to Reserves.

HBRIC

31. Per

Council Policy, HBRIC will separately provide a quarterly update. The main

matters of relevance are:

31.1. Consultation

on establishing a new Council Controlled Trading Organisation has completed and

an update will made by HBRIC.

32. The table

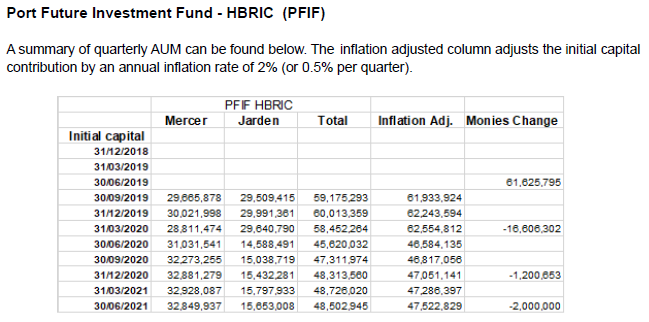

below shows the key balances of the FIF (HBRIC) as at the end of Q4.

|

|

1 July 2020 – Opening Balances

|

31 December 2020 – Closing Balances

|

|

|

Capital Protected Balance

|

Undivested Funds

Available

|

Total Fund Balance

|

Capital Protected Balance

|

Undivested Funds

Available

|

Total Fund Balance

|

|

|

$000

|

$000

|

$000

|

$000

|

$000

|

$000

|

|

FIF

|

46,584

|

(964)

|

45,620

|

47,523

|

980

|

48,503

|

Financial and Resource Implications

2020-21 Year to Date Performance Summary

33. The

following table shows investment income to date against the 2020-21 Annual

Plan.

|

Income

|

Annual Plan 2020-21

|

2020-21 Actuals

|

Variance to YTD Ann. Plan

|

|

|

$000

|

$000

|

$000

|

|

Other

financial assets

|

4,195

|

14,228

|

10,033

|

|

Managed

Funds

|

3,567

|

13,979

|

10,412

|

|

Other

Interest*

|

628

|

249

|

(379)

|

|

Investment

property

|

2,343

|

2,318

|

(270)

|

|

Endowment leasehold

land**

|

1,502

|

1,478

|

(24)

|

|

Wellington

Leasehold land

|

841

|

840

|

(1)

|

|

Dividends

(HBRIC

|

4,696

|

5,200

|

504

|

|

10,267PONL

Dividend

|

3,000

|

5,200

|

2,200

|

|

Managed

Fund

|

1,696

|

|

(1,696)

|

|

Total

|

11,234

|

21,746

|

10,267

|

* Includes Interest budgeted to be earnt on scheme reserves.

** Endowment leasehold rents are

paid to ACC under the 2013 agreement where future rents were sold in exchange

for a lump sum payment.

34. The

2020-21 Investment performance has exceeded expectations. In response to

covid-19 Council revised its investment revenue expectations downwards and

proposed to make up the shortfall by borrowing a part of the

expectations. $4.6m out of the proposed $7.6m was to cover an expected

reduction in investment revenues. This borrowing is not now required.

Decision Making

Process

35. Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

35.1. as this

report is for information only, the decision-making provisions do not apply

35.2. any

decision of the sub-committee (in relation to this item) is in accordance with

the Terms of Reference and decision-making delegations adopted by Hawke’s

Bay Regional Council 25 March 2020, specifically the Finance, Audit and

Risk Sub-committee shall have responsibility and authority to:

35.2.1. Monitor the

performance of Council’s investment portfolio.

Recommendation

That the Finance, Audit and Risk

Sub-committee receives and notes the “2020-21 Annual Treasury

Report”.

Authored &

Approved by:

|

Ross Franklin

Acting Chief Financial Officer

|

|

Attachment/s

|

1⇩

|

PWC Treasury

Reporting June 2021

|

|

|

|

PWC

Treasury Reporting June 2021

|

Attachment 1

|

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

04 August 2021

Subject: Six Monthly Enterprise

Risk Report

That Hawke’s Bay Regional

Council excludes the public from this section of the meeting, being Agenda Item

9 Six Monthly Enterprise Risk Report with the general subject of the item to be

considered while the public is excluded; the reasons for passing the resolution

and the specific grounds under Section 48 (1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution being:

|

GENERAL SUBJECT OF THE ITEM TO BE

CONSIDERED

|

REASON FOR PASSING THIS RESOLUTION

|

GROUNDS UNDER SECTION 48(1) FOR THE

PASSING OF THE RESOLUTION

|

|

Six Monthly Enterprise Risk Report

|

7(2)s7(2)(j) That the public

conduct of this agenda item would be likely to result in the disclosure of information

where the withholding of the information is necessary to prevent the

disclosure or use of official information for improper gain or improper

advantage.

|

The Council is specified, in the First Schedule to this

Act, as a body to which the Act applies.

|

Authored by:

|

Helen Marsden

Risk and Corporate Compliance Manager

|

|

Approved by:

|

Tom Skerman

Regional Water Security Programme Director

|

|