Meeting of the Finance Audit & Risk Sub-committee

Date: Wednesday 5 May 2021

Time: 9.00am

|

Venue:

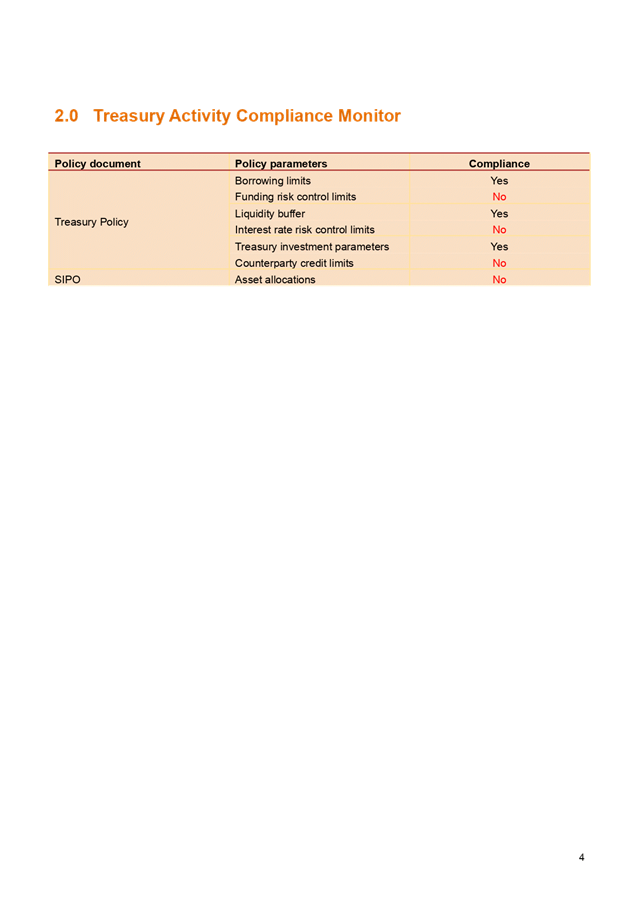

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

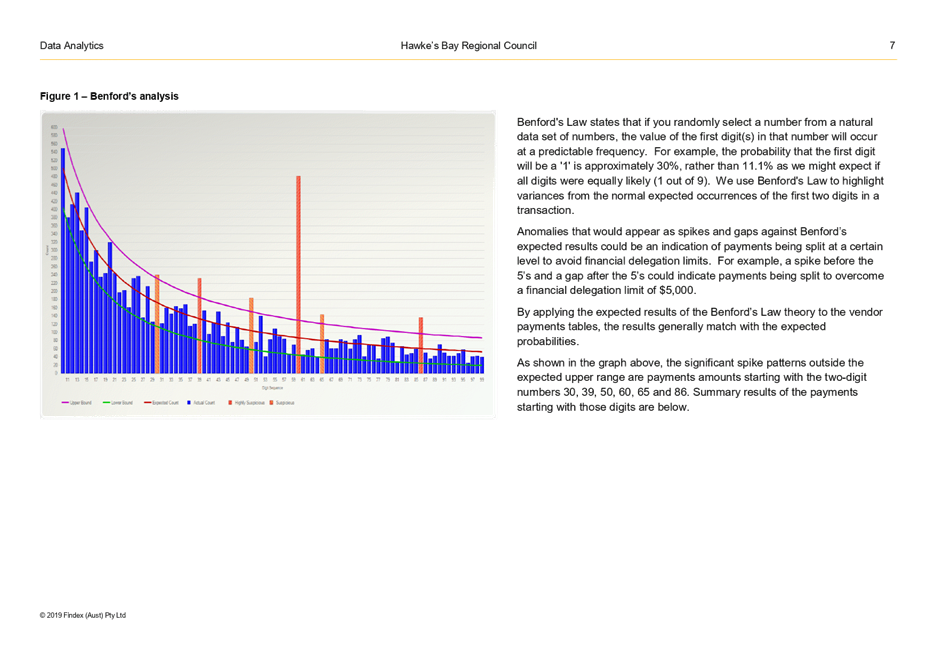

Agenda

Item Title Page

1. Welcome/Notices/Apologies

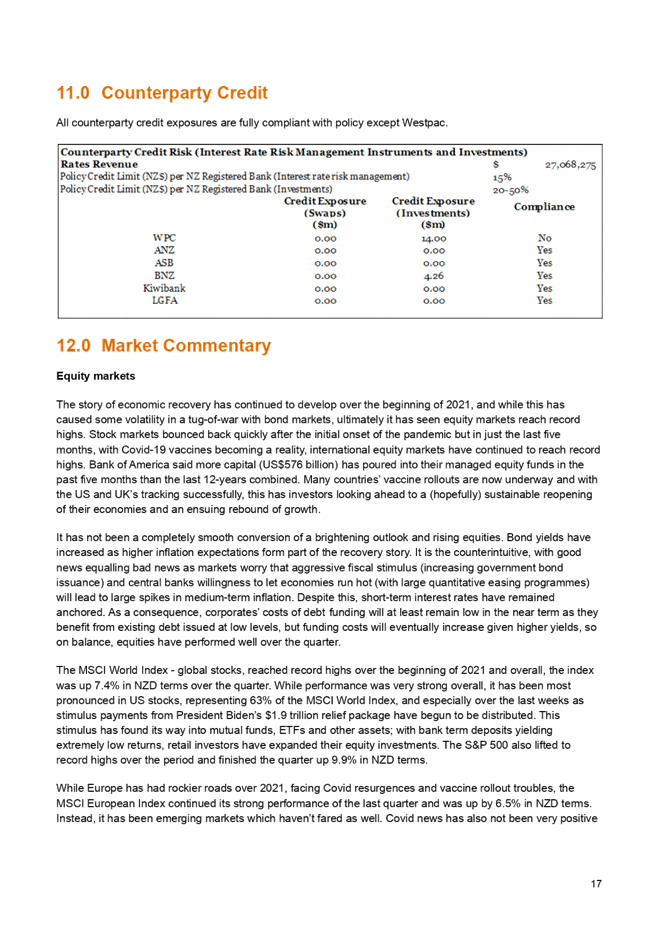

2. Conflict

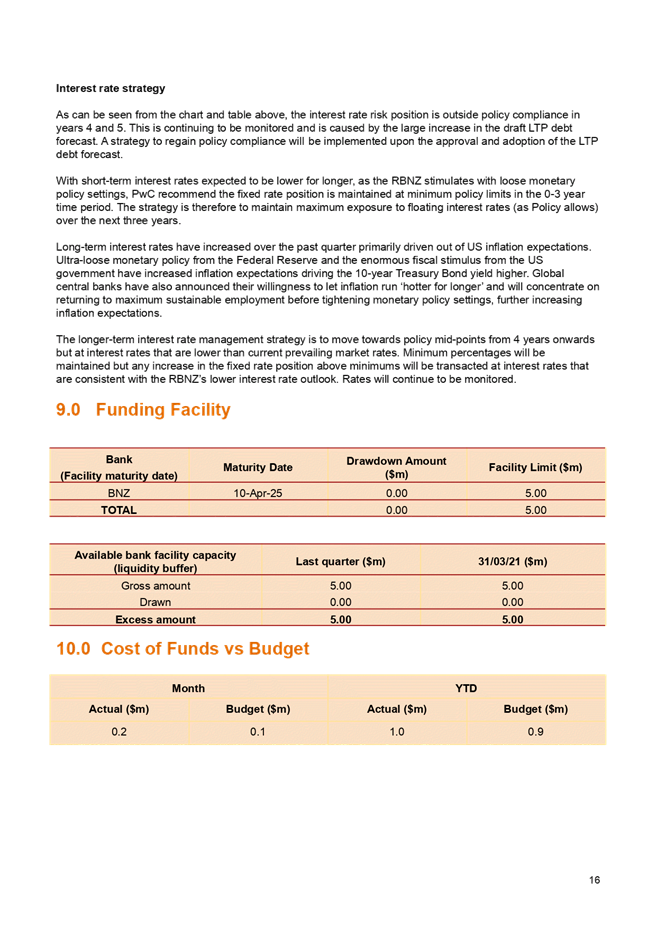

of Interest Declarations

3. Confirmation of Minutes of the Finance Audit & Risk

Sub-committee held on 17 February 2021

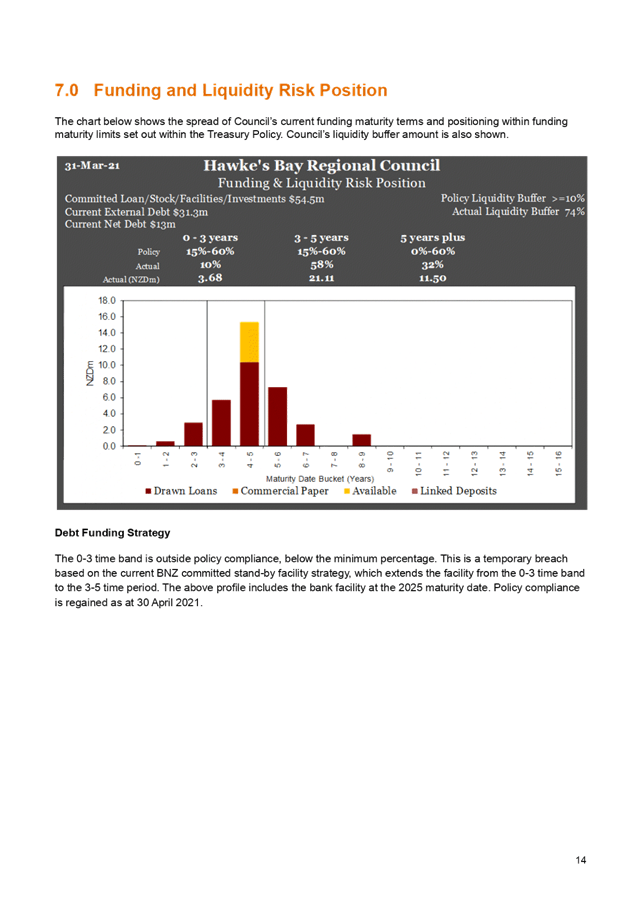

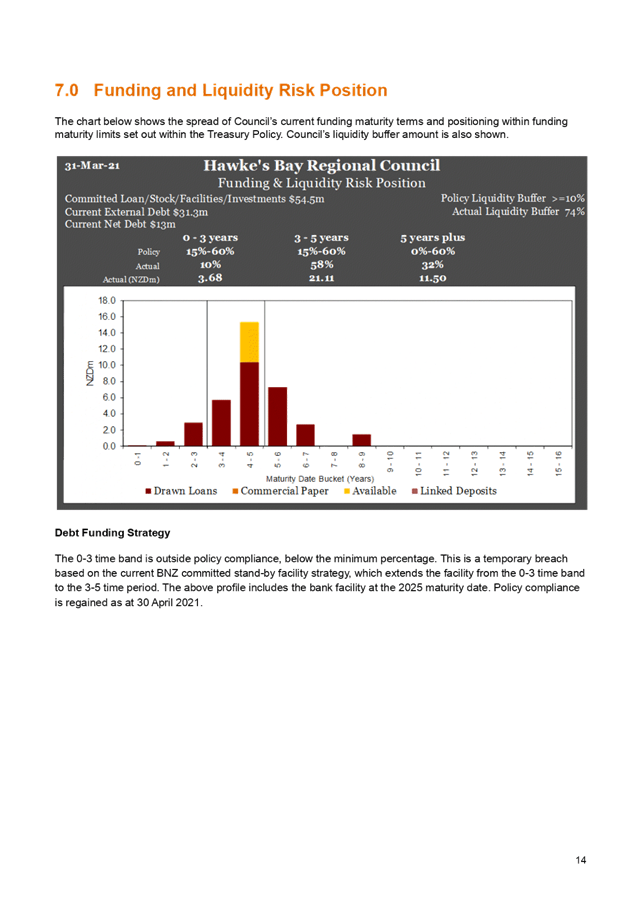

4. Independent Member

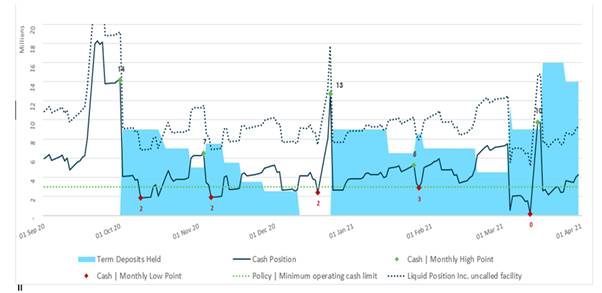

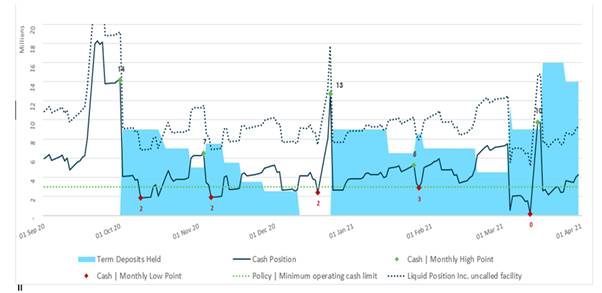

Resignation 3

5. Risk Maturity

Update 5

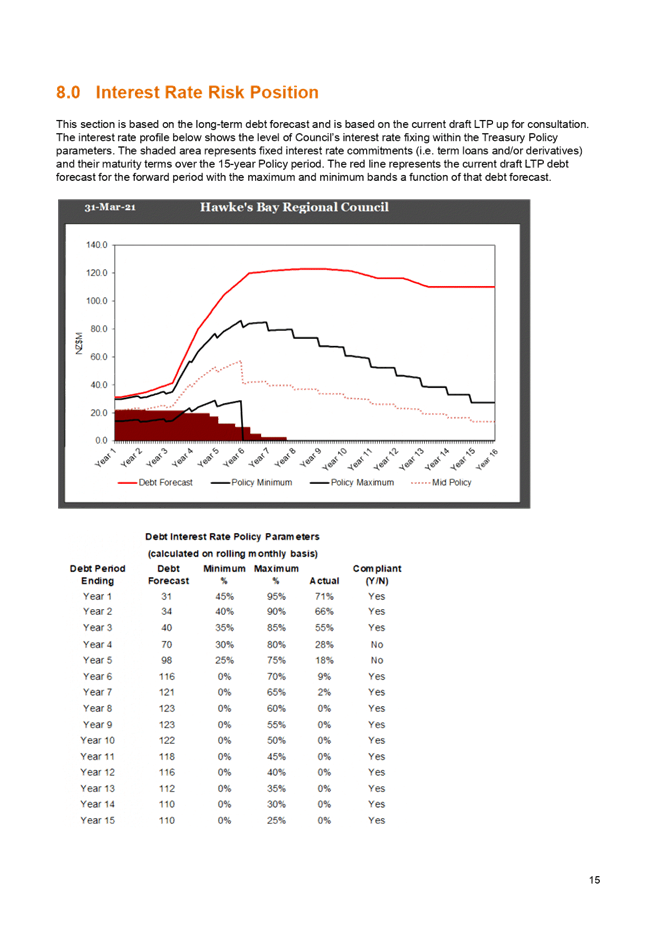

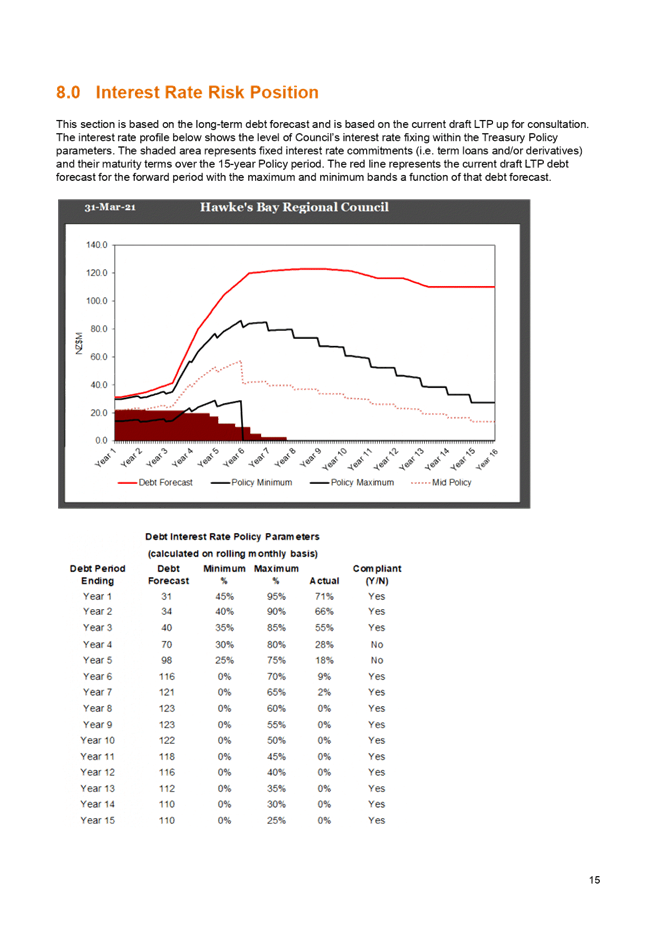

6. Internal Audit

Work Programme Update 7

7. Internal Assurance

Framework 25

8. Data Analytics

Internal Audit Report 51

9. Quarterly Treasury

Report for 1 January - 31 March 2021 69

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

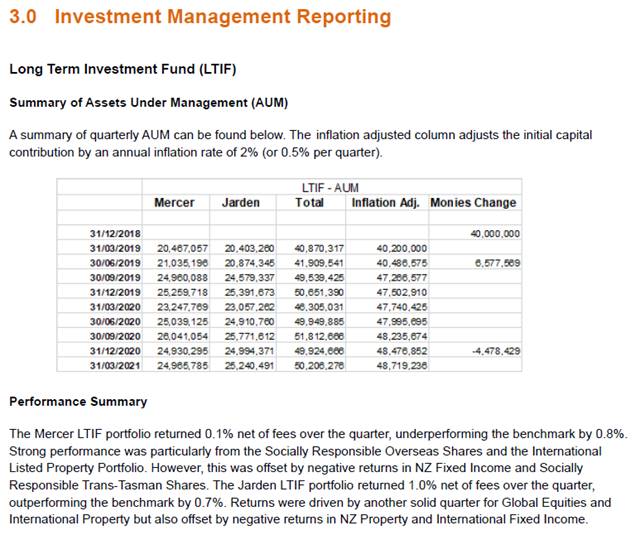

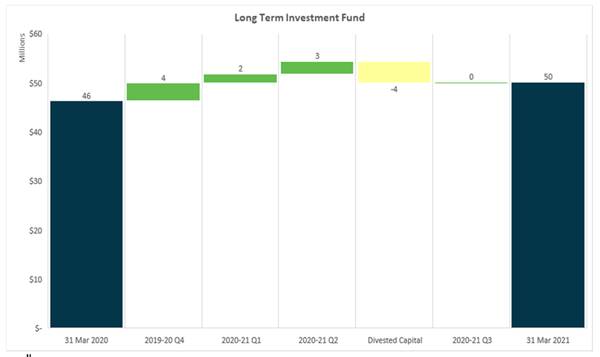

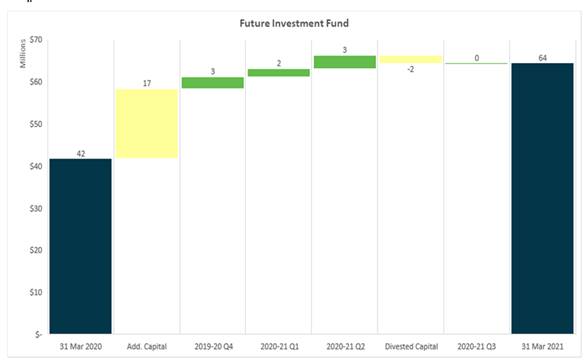

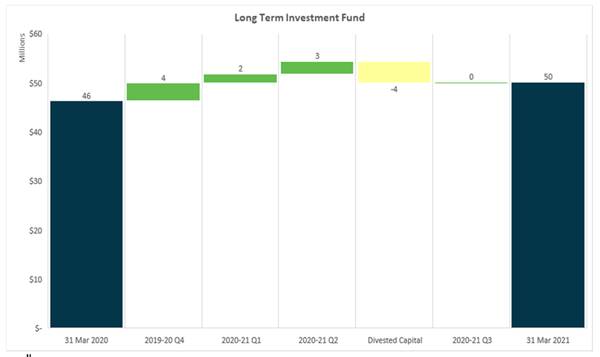

Wednesday 05 May 2021

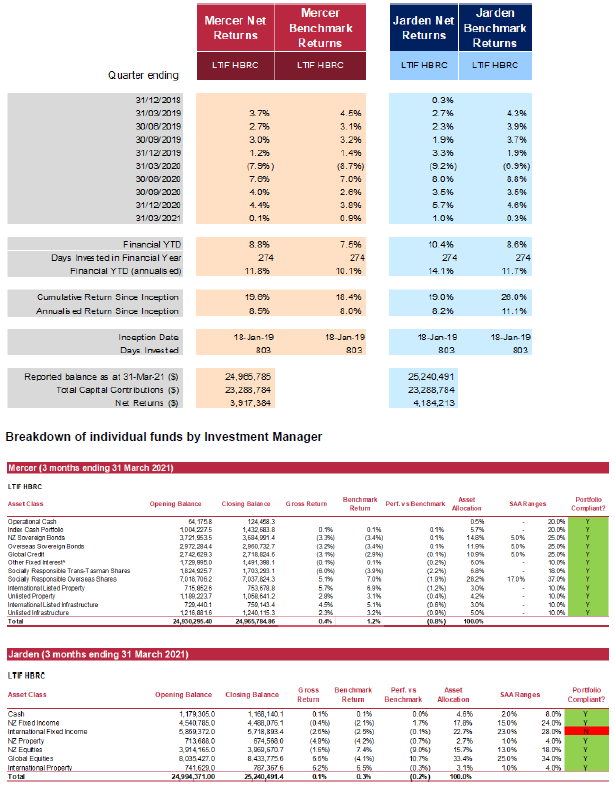

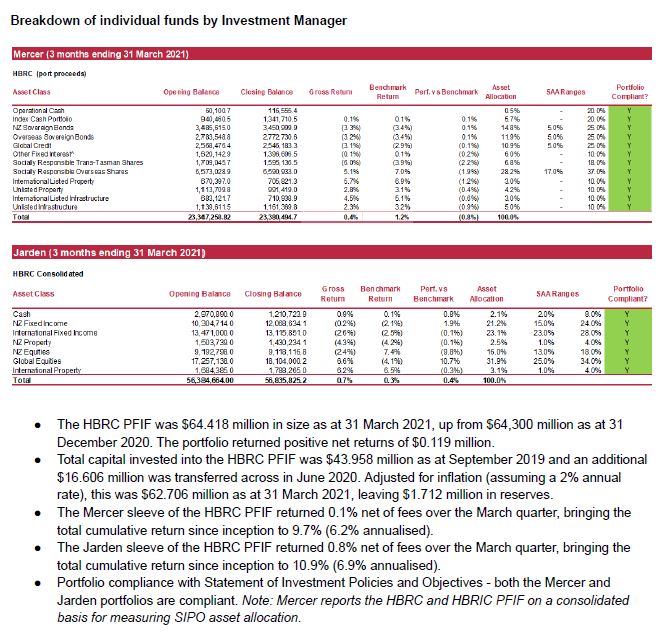

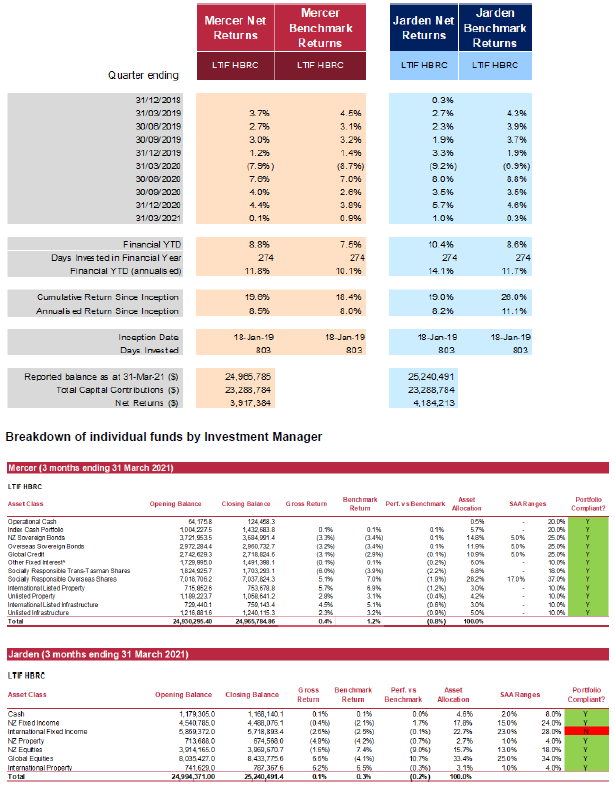

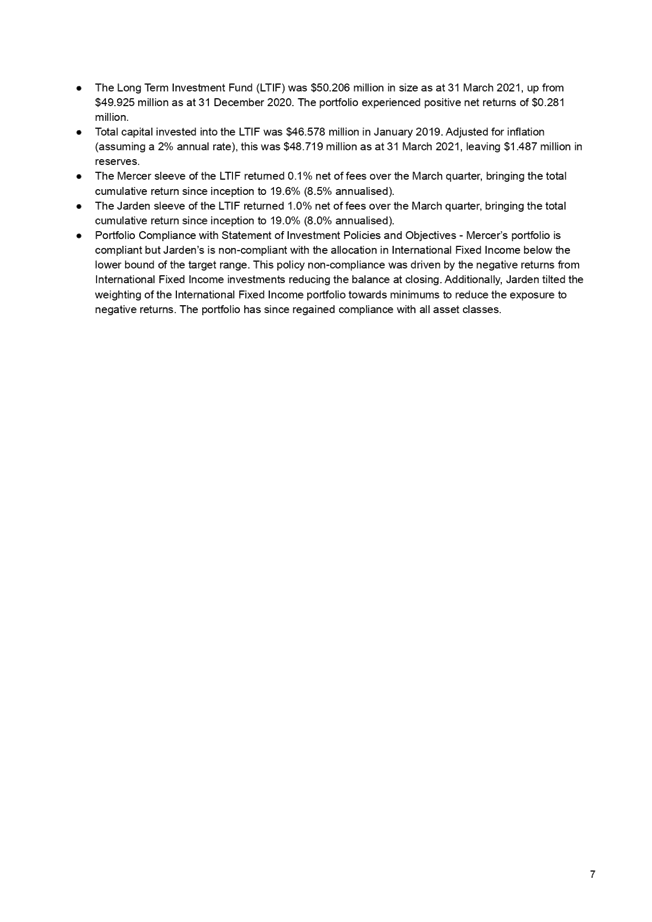

Subject: Independent Member Resignation

Reason for Report

1. This item

formally advises the resignation of Rebekah Dinwoodie as the independent member

of the Finance, Audit and Risk Sub-committee (FARS).

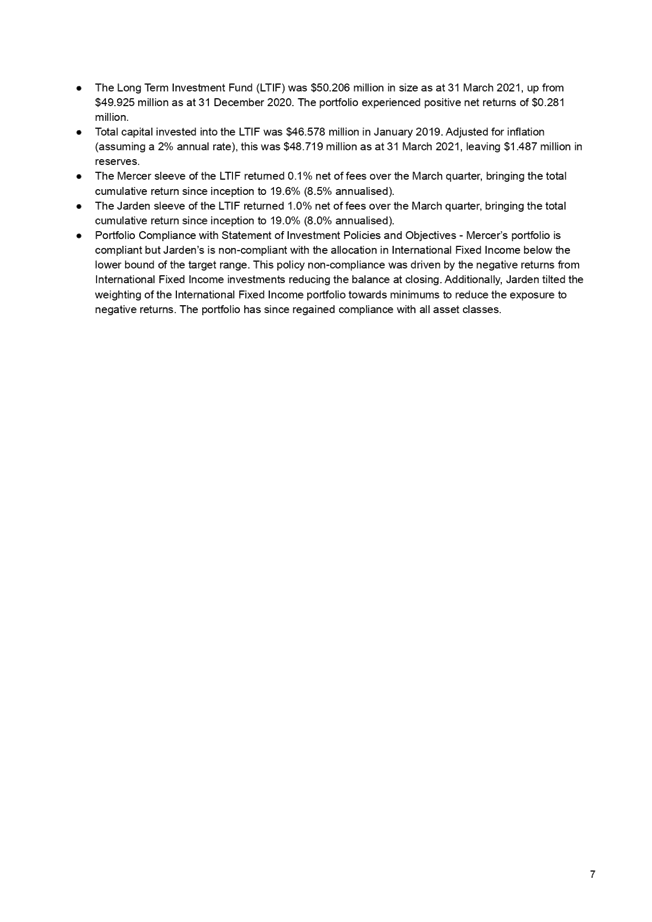

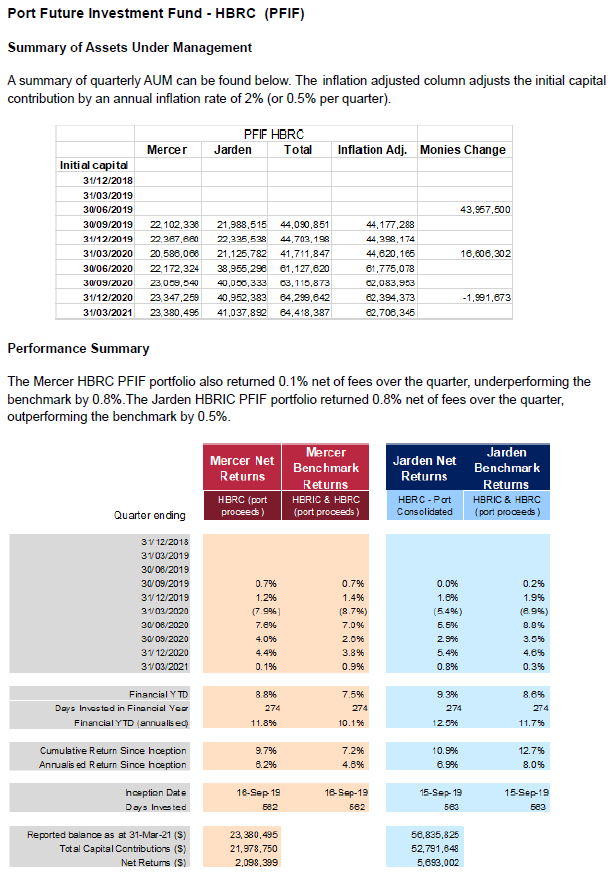

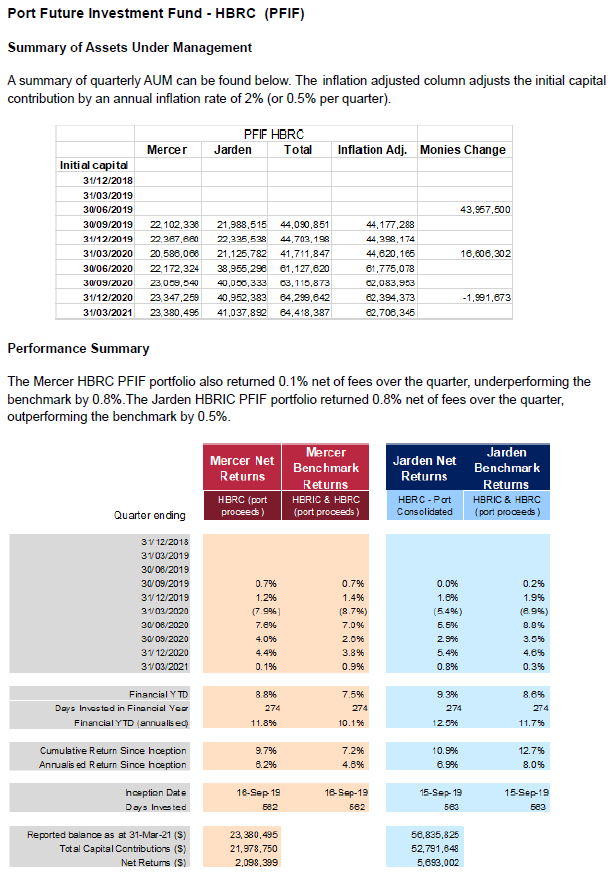

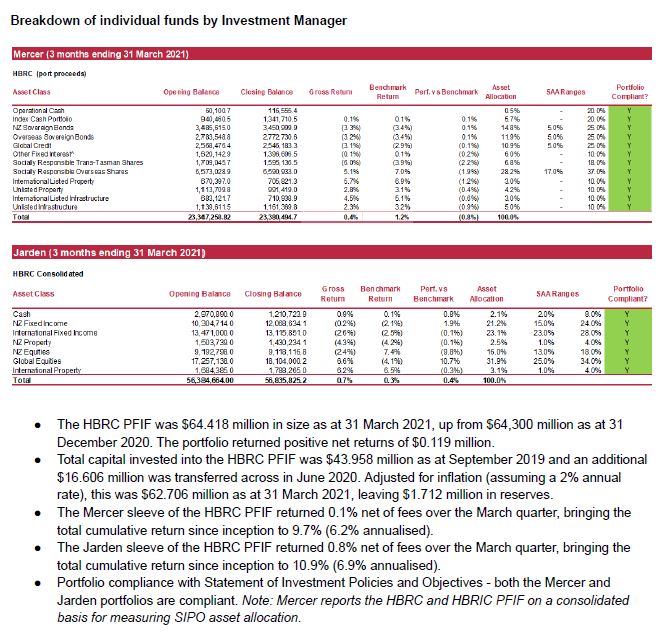

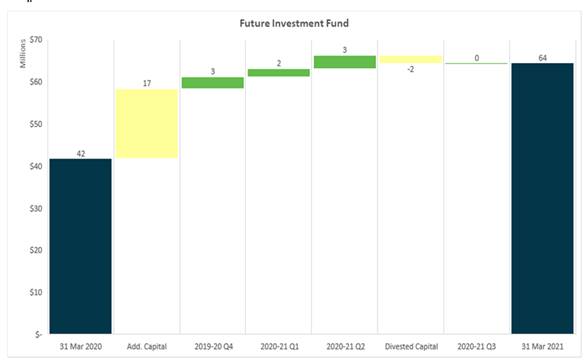

Background

2. Rebekah

Dinwoodie formally resigned from her position as Independent member of the FARS

on 24 February 2021 following her appointment to the position of Group Manager:

Community Wellbeing and Services at Hastings District Council.

Discussion

3. The FARS

membership comprises up to 4 members of Council and an external appointee in

accordance with the Terms of Reference adopted by the Regional Council upon

establishment of the Sub-committee on 6 November 2019 and confirmed by the

Corporate and Strategic Committee by resolution on 11 March 2020.

4. Ensuring

‘Independence’ a key principle and is deemed good practice by the

Office of the Auditor General.

5. The FARS helps

the organisation manage its risk, test and challenge new ideas as well as

monitoring business-as-usual operations to ensure that the entity is improving,

as well as meeting Audit and Risk Management expectations.

6. By applying

external, independent perspectives to the risks, issues, and challenges facing

the Regional Council, the independent member can help the organisation to manage

the variability of its delivery of outputs, impacts, and outcomes.

7. Officers

recommend commencing a formal process to recruit and appoint an appropriately

qualified independent member to the FARS.

Next

Steps

8. A

recommendation from this meeting will be made to the 19 May 2021 Corporate and

Strategic Committee meeting, to consider and recommend the recruitment and

appointment process to be undertaken to the 26 May Regional Council meeting.

9. The

recommendation from the C&S will be considered by Council at its 26 May

2021 meeting and the appointment process agreed including any associated

instructions to staff required to enable the process.

10. It is anticipated that the

agreed appointment process will include the FARS shortlisting and interviewing

candidates in the period leading up to the August FARS meeting to enable that

meeting to make a recommendation for appointment of the preferred candidate to

the 18 August C&S meeting for confirmation and subsequent appointment by

the Regional Council on 25 August.

Financial and Resource

Implications

11. The independent member is

currently remunerated $8,000 per annum plus reimbursement of expenses such as

accommodation and mileage costs incurred for meeting attendance.

Decision Making

Process

12. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that:

12.1. The decision does not

significantly alter the service provision or affect a strategic asset, nor is

it inconsistent with an existing policy or plan.

12.2. The use of the special

consultative procedure is not prescribed by legislation.

12.3. The decision is not

significant under the criteria contained in Council’s adopted

Significance and Engagement Policy.

|

Recommendations

That the Finance, Audit and Risk Sub-committee:

1. Formally

receives and accepts the resignation of Rebekah Dinwoodie as independent

member, dated 24 February 2021.

2. Recommends

that the Corporate and Strategic Committee determines and recommends to

Hawke’s Bay Regional Council an appropriate recruitment and appointment

process to replace the Independent Member of the Finance, Audit and Risk

Sub-committee.

|

Authored by:

|

Leeanne

Hooper

Team Leader Governance

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 05 May 2021

Subject: Risk Maturity Update

Reason for Report

1. This item

provides the Sub-committee with oversight and details of progress to date with

implementation of Council’s enterprise risk maturity roadmap.

Background & Discussion

2. The risk maturity roadmap as adopted by the Regional Council in 2020

provides for the FARS to oversee, and report to the Corporate and Strategic

Committee (C&S), progress on the implementation of the risk maturity

roadmap to ensure that the evolving risk management system is on track and

providing value to the organisation.

3. Since the last report to the FARS in February 2021 the following

progress has been made.

3.1. Risk Appetite

Workshops with the Executive Leadership Team (ELT) and the Council have taken

place and a draft risk appetite statement, populated with ELT and Councillors’ views on the risk

appetite of Council for each of the 13 key enterprise risks, has been developed.

3.2. Eleven of the

thirteen Risk Bowties have commenced and are at varying stages.

3.2.1. Business Interruption -

Completed

3.2.2. Health and Safety - Completed

3.2.3. Third parties and contractors

- Draft

3.2.4. People, Community,

Environmental Health - Draft

3.2.5. Strategic Partnerships -

Completed

3.2.6. Fraud - Completed

3.2.7. People - Completed

3.2.8. Technology - Draft

3.2.9. Information Security - Draft

3.2.10. Assets and Infrastructure - Completed

3.2.11. Financial – Draft.

Next Steps

4. Over the coming

quarter, Council officers will progress:

4.1. Completion of

the risk appetite statement for Finance, Audit and Risk Sub-committee adoption

on 4 August 2021.

4.2. Completion of

the final two bowties, Legal Compliance Breach and Strategic, for inclusion

into the enterprise risk report to ensure we capture the revised risk scope.

Strategic Fit

5. Maturity of HBRC’s risk management system contributes towards

achieving all strategic goals/vision by protecting the organisation. A

mature risk system provides consistent risk intelligent decision making

enabling the efficient prioritisation of finite organisational resources to

deliver on strategy.

Decision Making

Process

6. Council and its committees are required to make every decision in

accordance with the requirements of the Local Government Act 2002 (the

Act). Staff have assessed the requirements in relation to this item and

have concluded:

6.1. The decision does not significantly alter the service provision or

affect a strategic asset, nor is it inconsistent with an existing policy or

plan.

6.2. The use of the special consultative procedure is not prescribed by

legislation.

6.3. The decision is not significant under the criteria contained in

Council’s adopted Significance and Engagement Policy.

6.4. The decision of the sub-committee is in accordance with the Terms of

Reference and decision-making delegations adopted by Hawke’s Bay Regional

Council 25 March 2020, specifically the Finance, Audit and Risk

Sub-committee shall have responsibility and authority to:

6.4.1. Review

whether Council management has a current and comprehensive risk management framework

and associated procedures for effective identification and management of the

council’s significant risks in place.

6.4.2. Undertake

periodic monitoring of corporate risk assessment, and the internal controls

instituted in response to such risks.

6.4.3. report on

the robustness of risk management systems, processes and practices to the

Corporate and Strategic Committee to fulfil its responsibilities.

|

Recommendations

That the Finance, Audit and Risk Sub-committee:

1. Receives and considers the “Risk Maturity Update” staff report.

2. Confirms that the management actions undertaken and planned

adequately respond to the Risk Management Maturity Roadmap as endorsed by

Hawke’s Bay Regional Council on 24 June 2020.

3. Reports to the Corporate and Strategic Committee, the

Sub-committee’s satisfaction that adequate evidence has been provided

of progress to implement the maturing risk management system.

|

Authored by:

|

Olivia

Giraud-Burrell

Business Analyst

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 05 May 2021

Subject: Internal Audit Work

Programme Update

Reason for Report

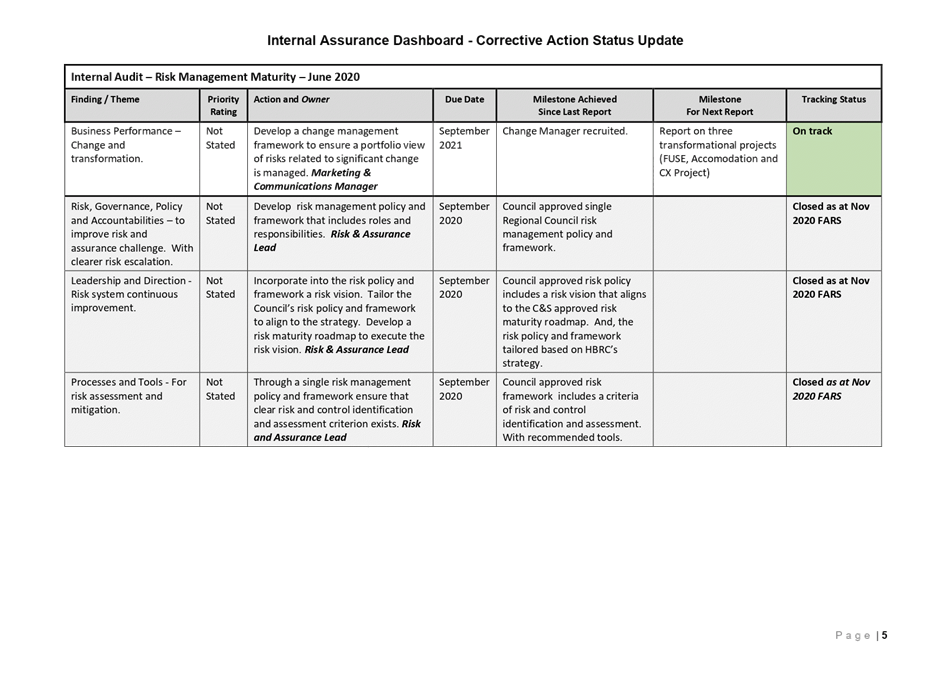

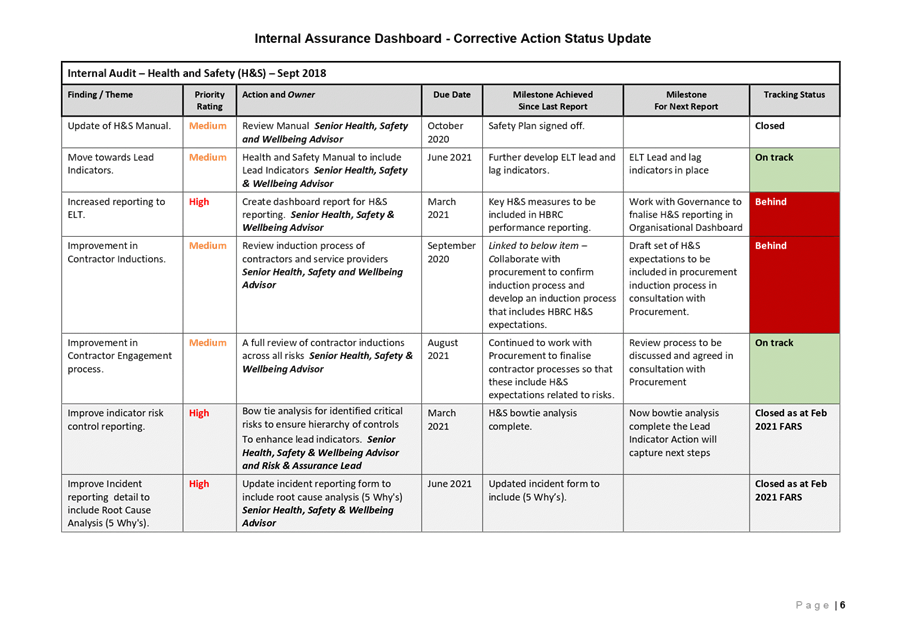

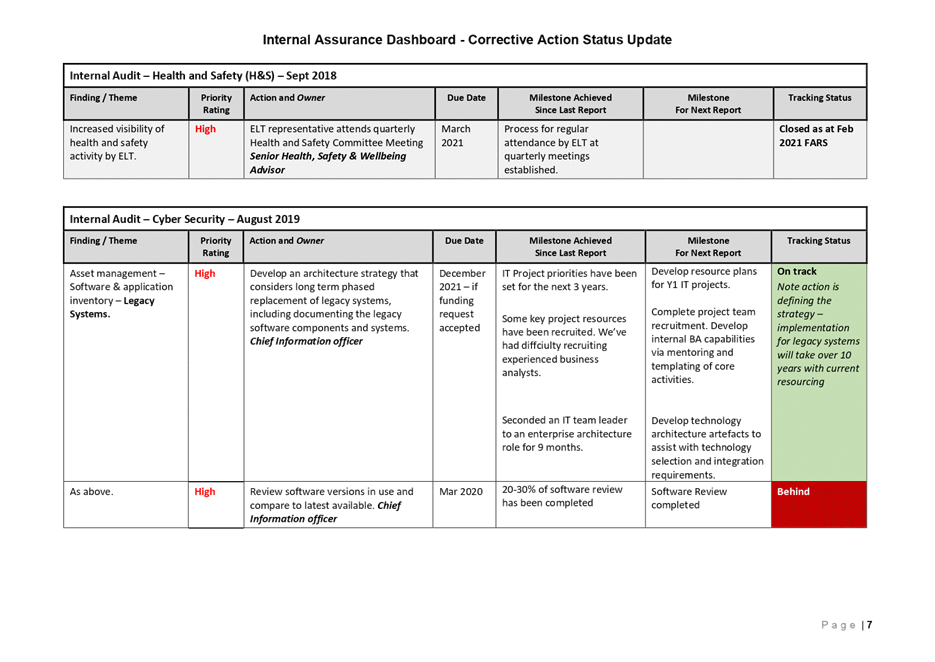

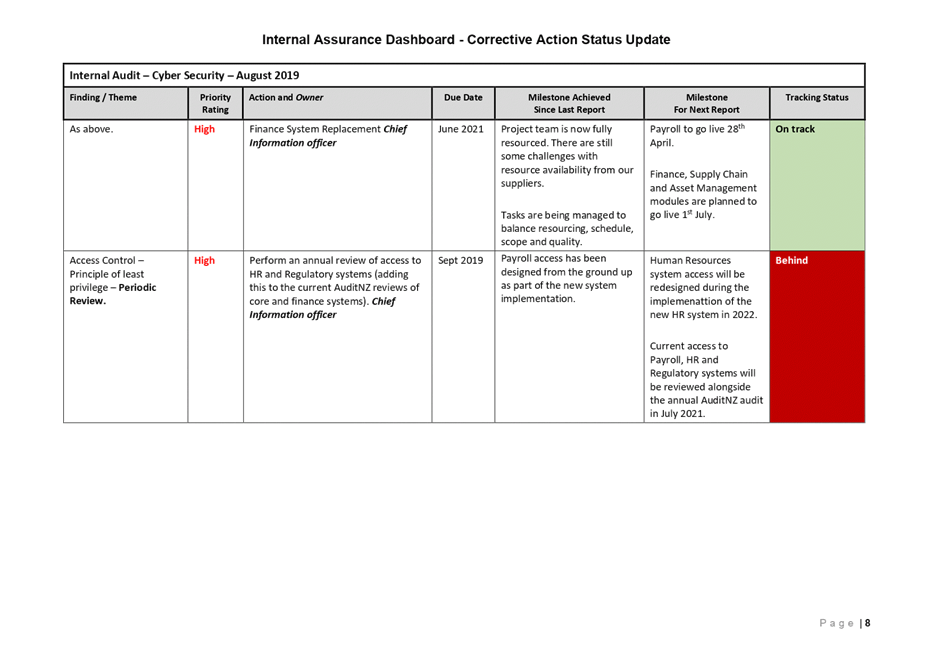

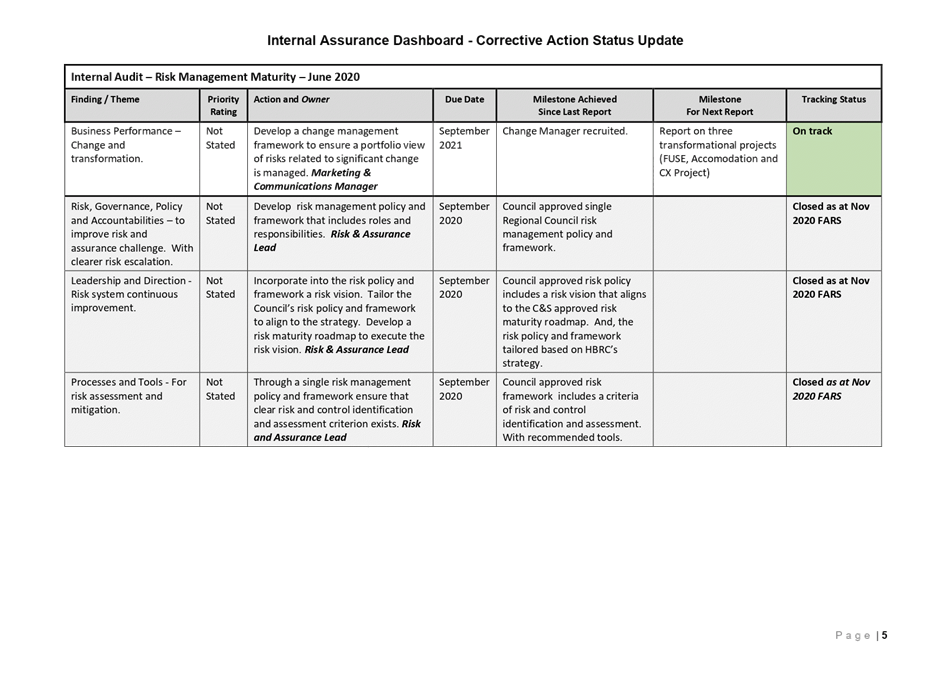

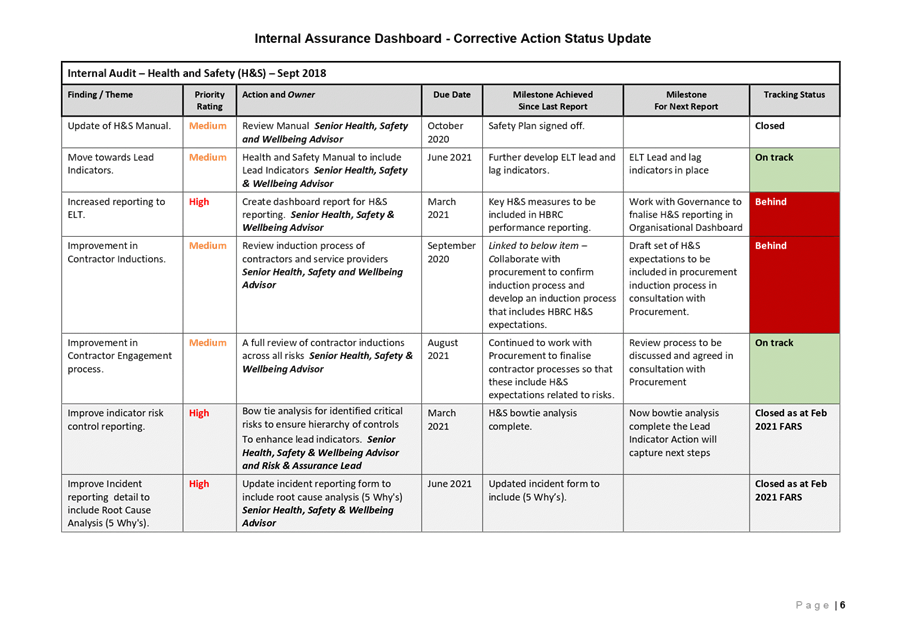

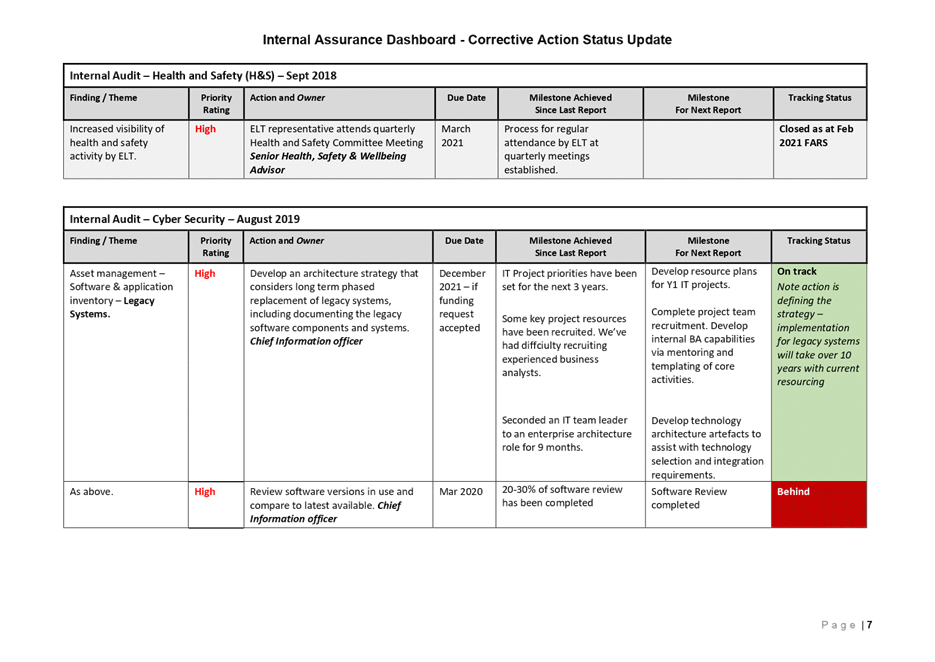

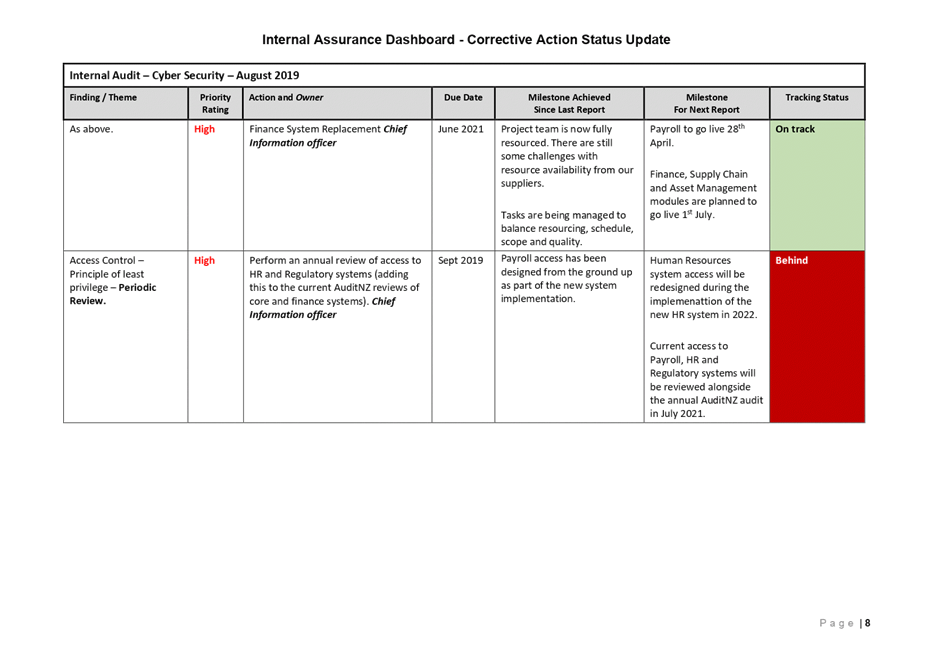

1. This item updates the Finance, Audit and Risk Sub-committee (FARS)

on the progress carrying out corrective actions that respond to internal audit

findings as previously reported to the FARS, along with a status update on the

current Annual Enterprise Internal Assurance plan approved by FARS in August

2020.

Officers’ Recommendation

2. Council officers recommend that the FARS members consider and note

the internal assurance dashboard and corrective action status update, and the

internal assurance plan status update with a view to confirming the adequacy of

corrective actions undertaken and reporting as such to the Corporate &

Strategic Committee (C&S).

Discussion

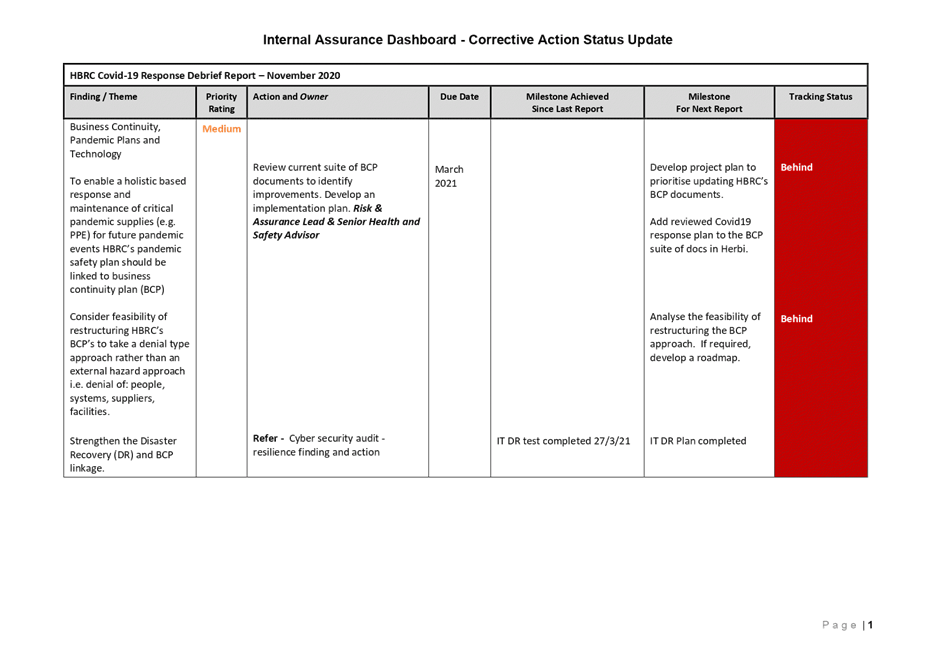

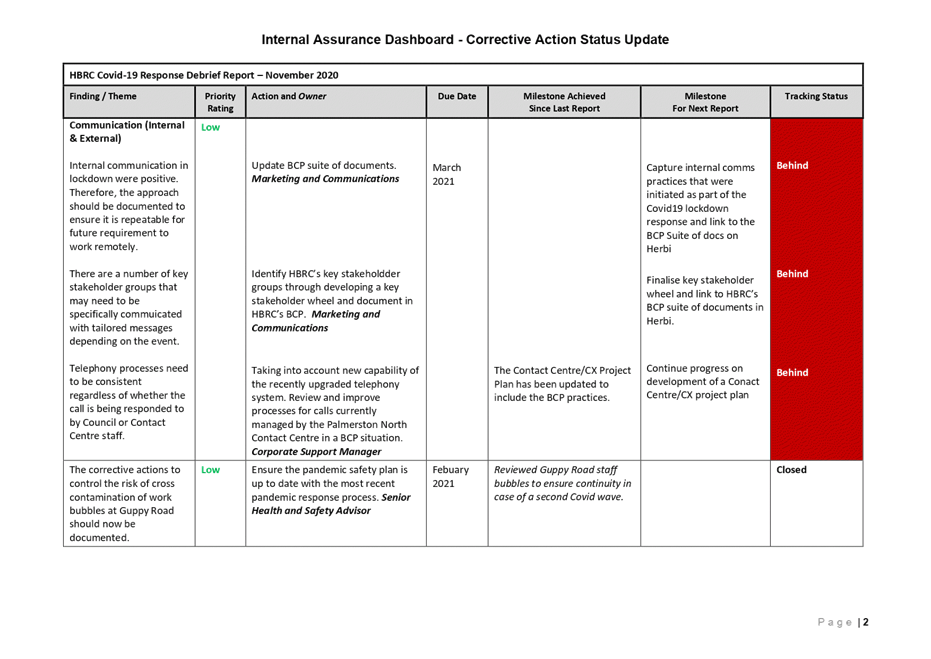

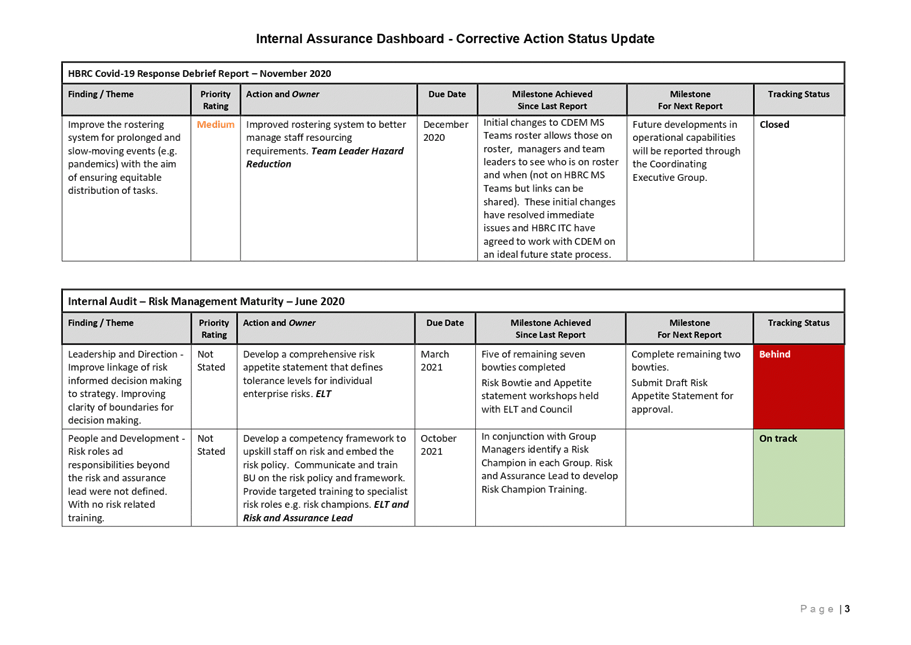

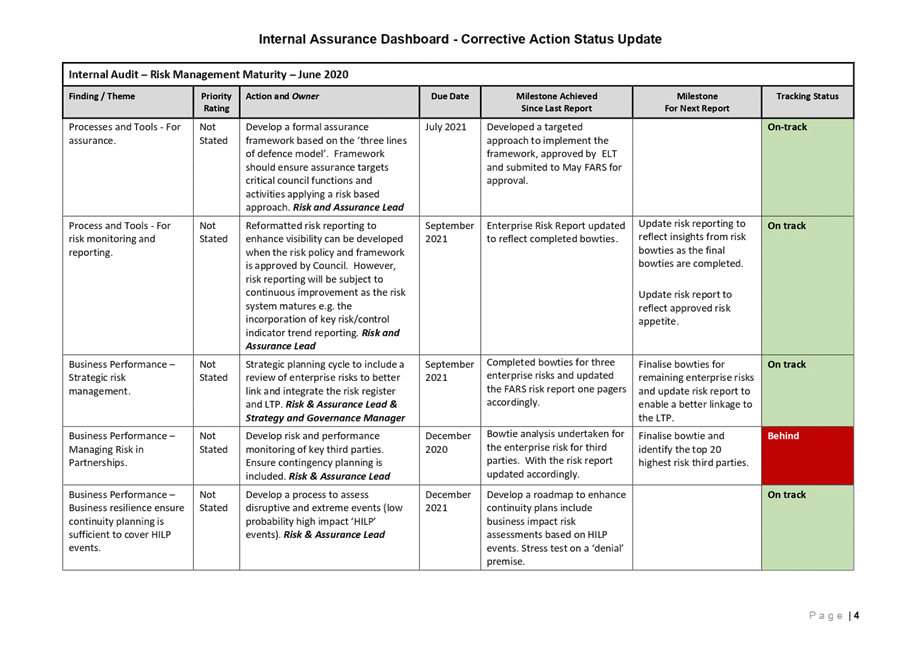

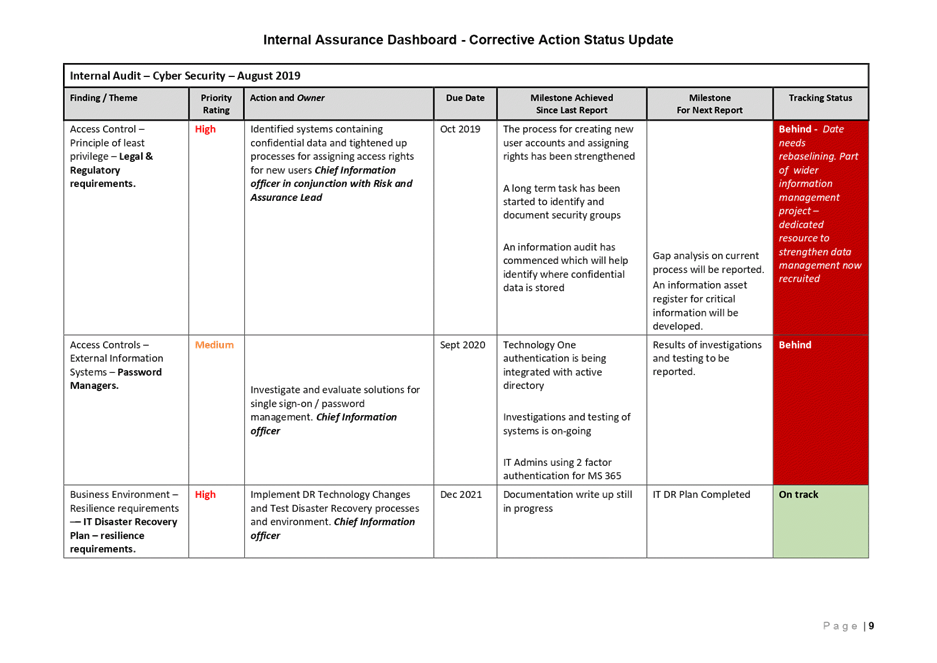

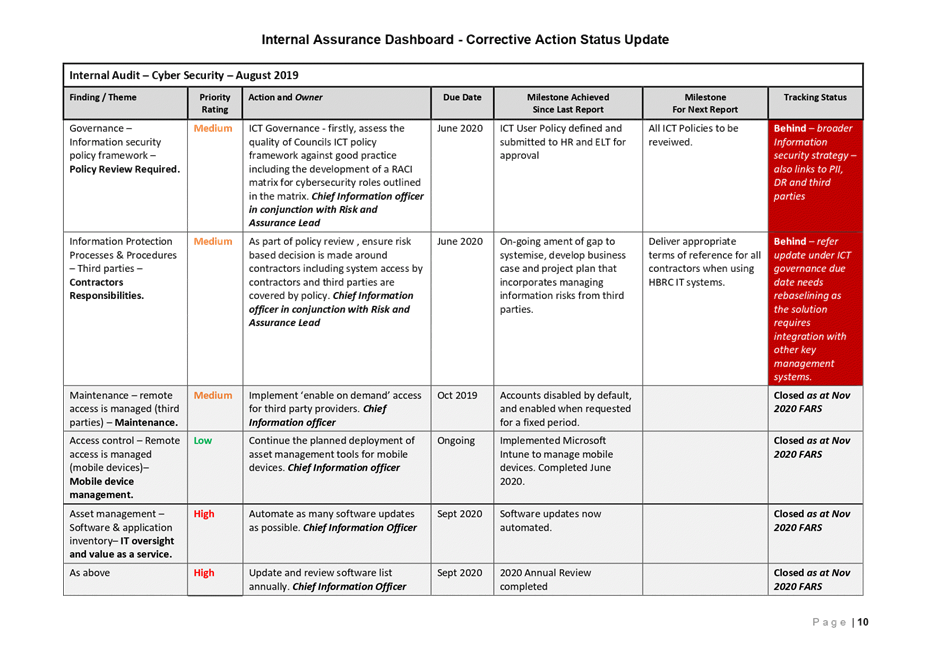

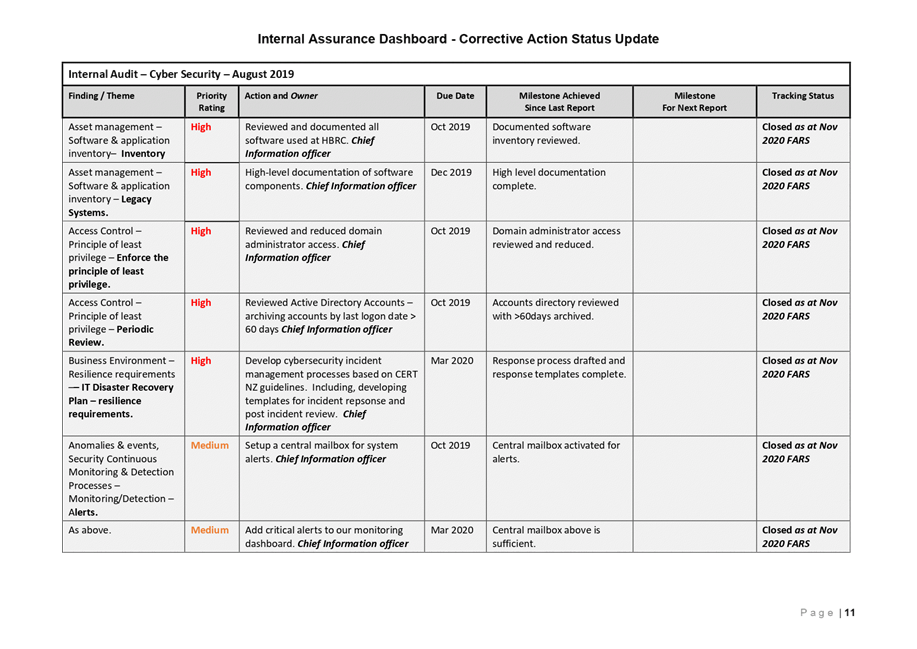

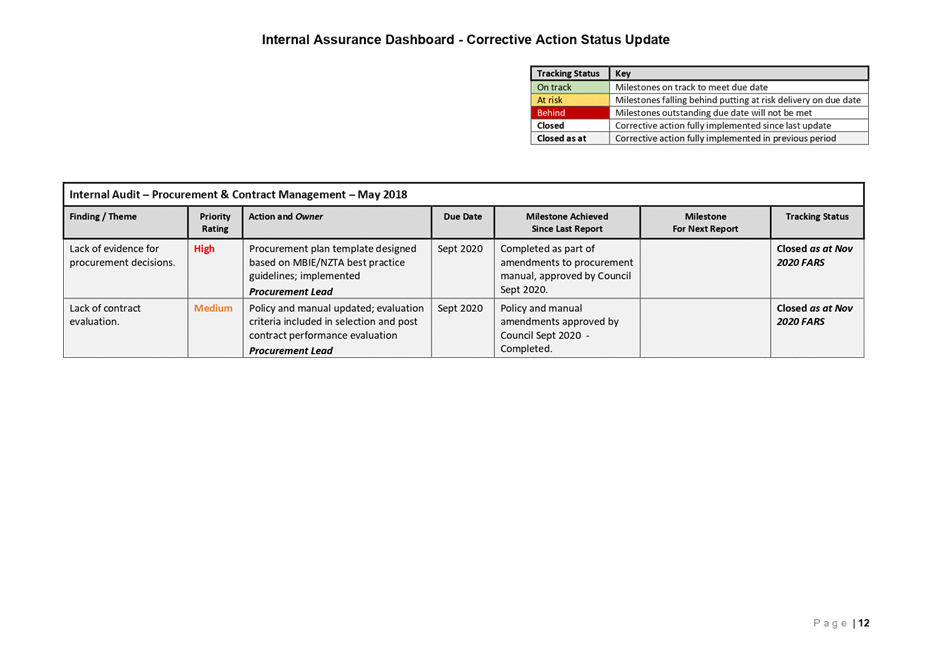

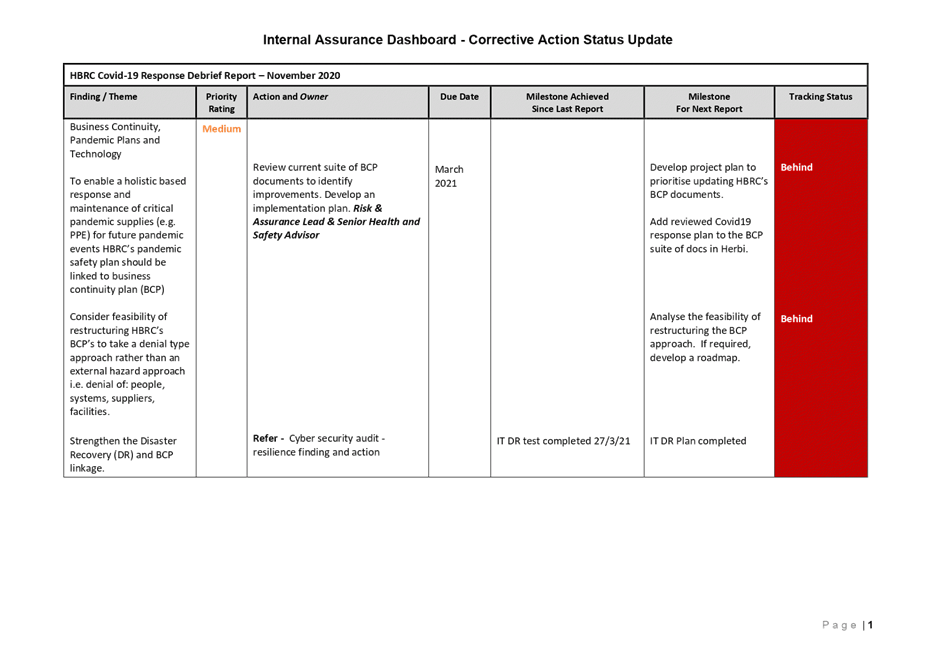

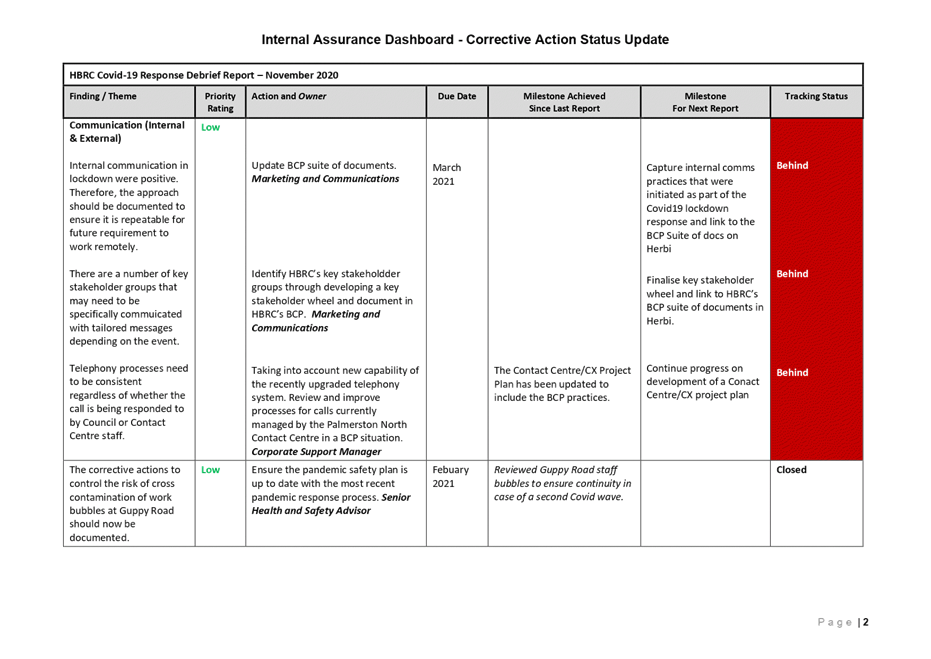

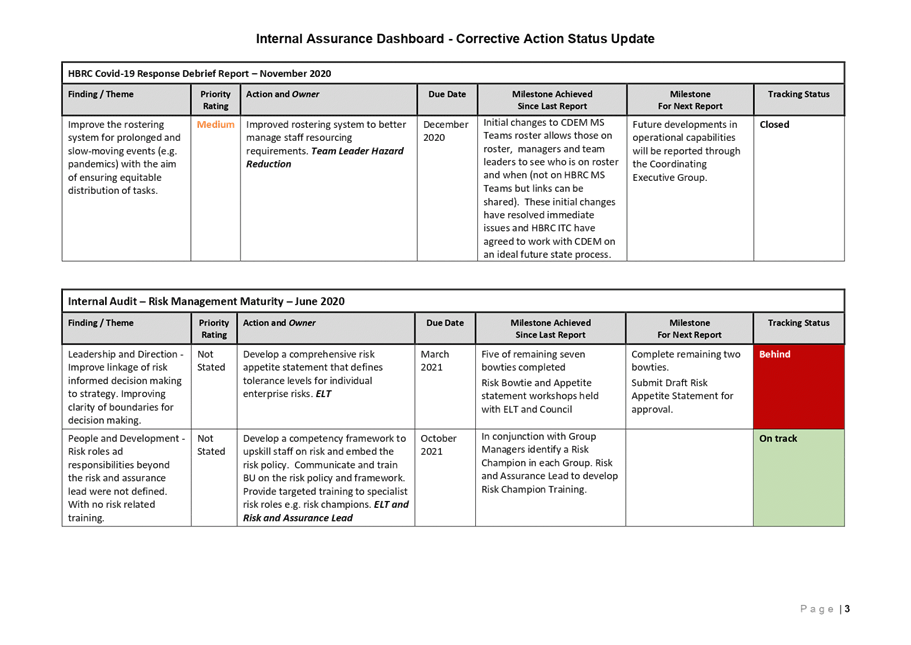

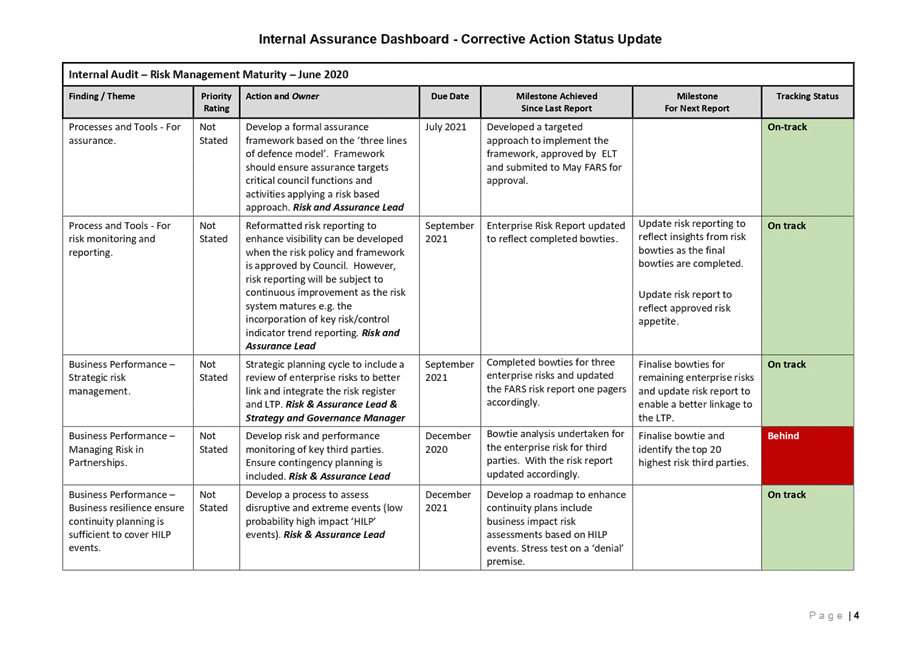

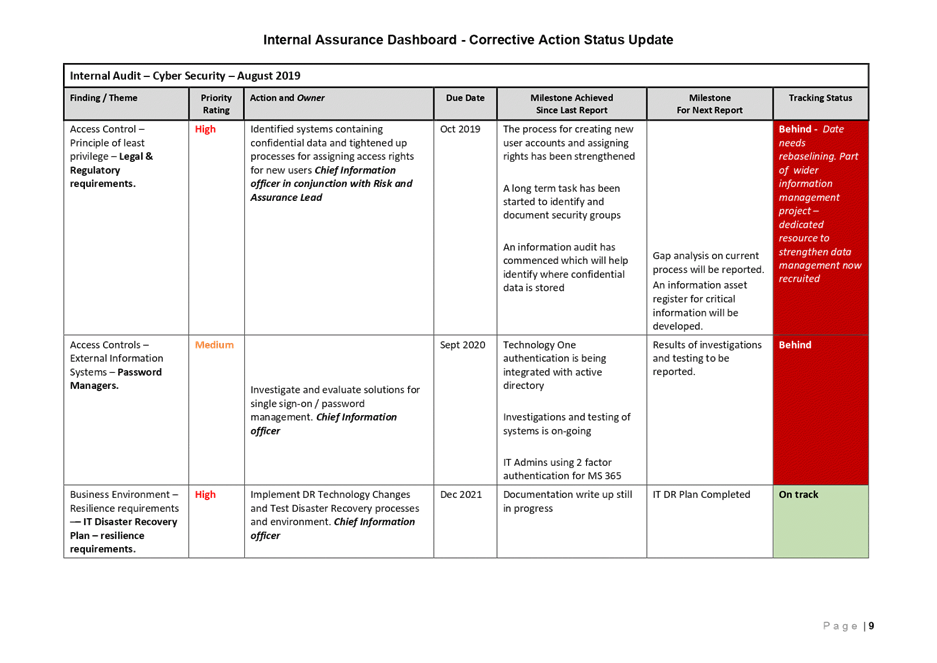

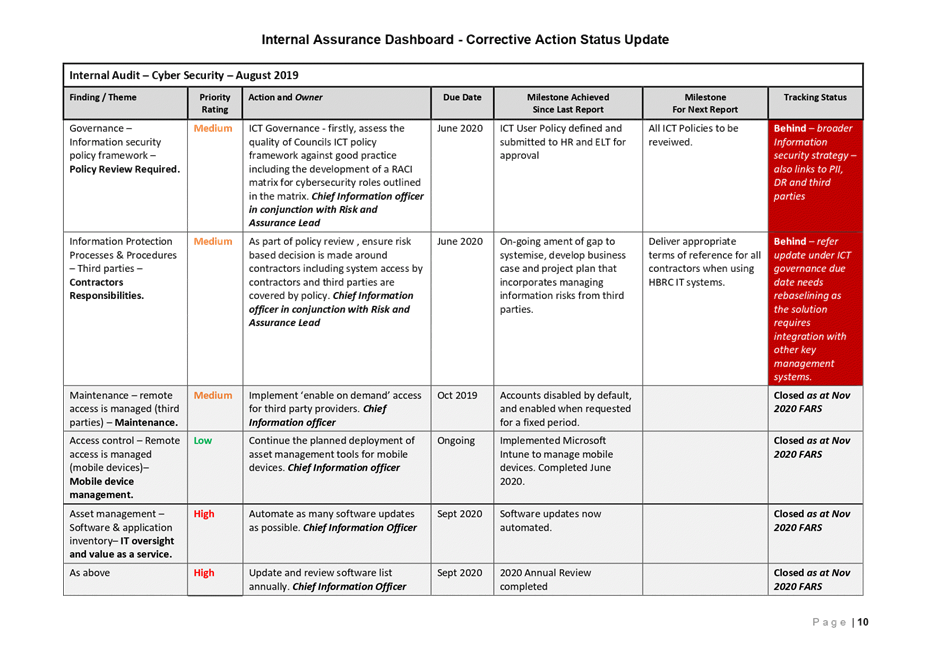

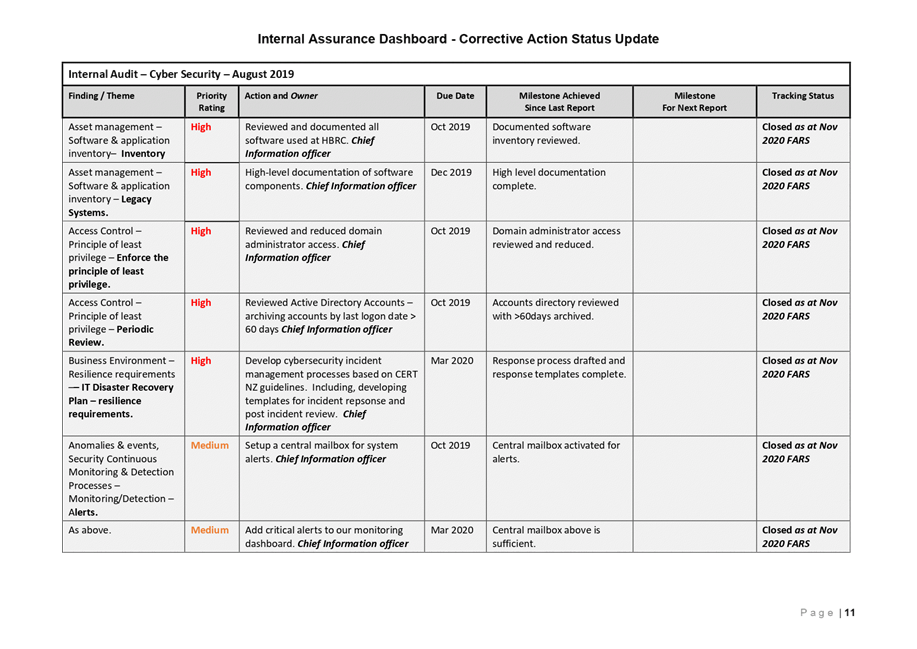

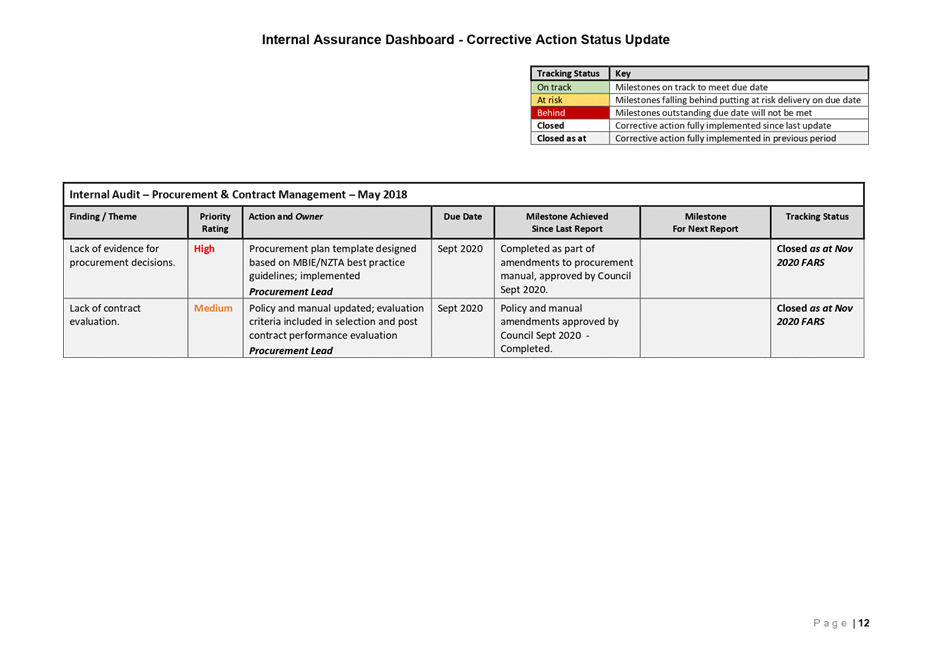

3. The purpose of the corrective action status update is to provide

oversight to the FARS of open internal assurance findings from previously

reported internal assurance reviews. The dashboard tracks progress of the

corrective actions against agreed milestones, until the action is closed.

At a Glance, as at April 2021:

|

|

Carried out

|

Total no of actions

|

Closed

|

On track

|

At Risk

|

Behind

|

|

HBRC

Covid-19 Response Debrief Report

|

Nov 2020

|

7

|

2

|

0

|

0

|

5

|

|

Internal

Audit – Risk Management Maturity

|

June

2020

|

11

|

4

|

5

|

1

|

1

|

|

Internal

Audit – Procurement & Contract Management

|

May

2018

|

2

|

2

|

0

|

0

|

0

|

|

Internal

Audit – Health and Safety

|

Sept

2018

|

8

|

4

|

2

|

0

|

2

|

|

Internal

Audit – Cyber Security

|

August

2019

|

20

|

11

|

3

|

0

|

5

|

4. Members should

note that, as a consequence of the departure of the Risk and Assurance Lead,

progression of risk maturity actions were prioritised over the Business

Continuity Plan (BCP) actions over Quarter 3. The BCP actions relating to

the HBRC Covid-19 Response Debrief report will be prioritised for progression

during Quarter 4.

5. While a number

of actions are reported above as behind for Internal Audit – Cyber

Security, management is comfortable with the progress that has been and

continues to be made, and the subsequent level of risk being carried by the

organisation. Prioritisation of effort continues, focusing limited

resources on the highest risk areas raised in the audit, being the 11 closed

items and the 3 on track items:

5.1. Finance system replacement

5.2. Disaster recovery planning

5.3. IT architecture & planning

to replace legacy systems

6. Phase one

(Information stocktake) of the Information Management Programme is

progressing. Workshops have been held to gather information required to

develop a gap analysis and critical information asset register which will

identify confidential/sensitive information. Several areas of risk have been

identified for immediate intervention.

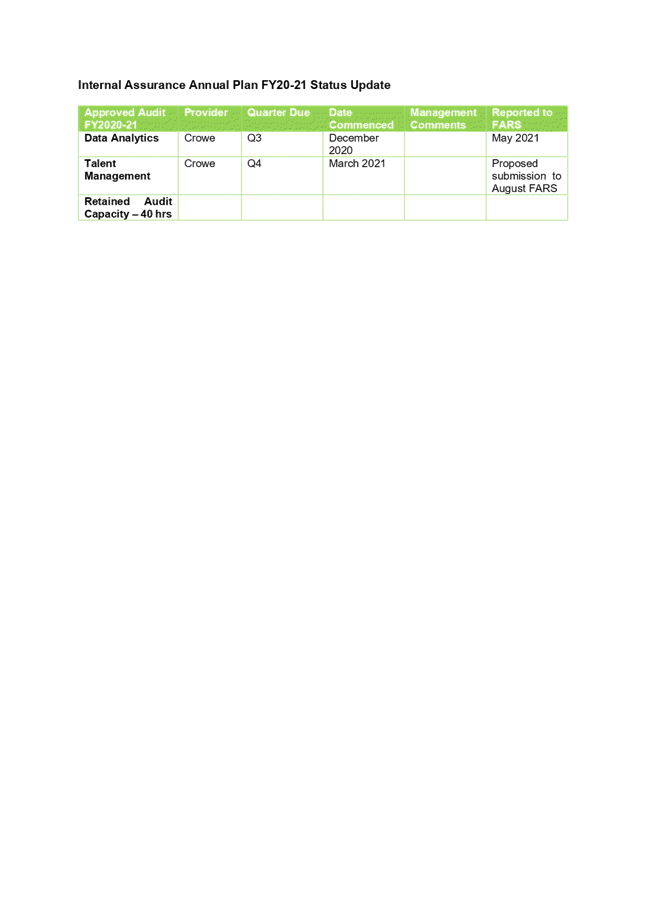

7. The purpose of the Annual Enterprise Internal Assurance plan status

update is to provide the FARS with oversight of progress on individual internal

assurance reviews that were approved by the Committee as part of the Annual

Enterprise Internal Assurance plan.

8. Both internal assurance dashboards have been updated as at April

2021 and are attached.

Financial

and Resource Implications

9. There are no

financial implications or additional resource requirements resulting from this

internal audit programme update.

Decision

Making Process

10. Council and its committees are required to make every decision in accordance

with the requirements of the Local Government Act 2002 (the Act). Staff have

assessed the requirements in relation to this item and have concluded:

10.1. The decision does not

significantly alter the service provision or affect a strategic asset, nor is

it inconsistent with an existing policy or plan.

10.2. The use of the special

consultative procedure is not prescribed by legislation.

10.3. The decision is not

significant under the criteria contained in Council’s adopted Significance

and Engagement Policy.

10.4. The decision is in

accordance with the Finance, Audit and Risk Sub-committee Terms of Reference,

specifically to report to the Corporate and Strategic Committee to fulfil its

responsibilities for:

10.4.1. receiving the internal and

external audit report(s) and review actions to be taken by management on

significant issues and recommendations raised within the report(s).

10.4.2. Ensuring that

recommendations in audit management reports are considered and, if appropriate,

actioned by management.

10.4.3. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by, or have an interest in the decisions made, Council

can exercise its discretion and make a decision without consulting directly

with the community or others having an interest in the decision.

|

Recommendations

That the

Finance, Audit and Risk Sub-committee:

1. Receives and

notes the ‘Internal Audit Work Programme Update’ staff report and

accompanying dashboards.

2. Confirms that management actions undertaken or planned for the

future adequately respond to the findings and recommendations of the internal

audits.

3. Confirms that the dashboard reports provide adequate information

on the progress of corrective actions and the progress of the approved Annual

Internal Audit programme.

4. Reports to the Corporate and Strategic Committee, the

Sub-committee’s satisfaction that the Internal Audit Work Programme

Update provides adequate evidence of the adequacy of Council’s internal

assurance functions and management actions undertaken or planned to respond

to internal assurance review findings and recommendations.

|

Authored by:

|

Olivia

Giraud-Burrell

Business Analyst

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

Internal

Assurance Dashboard – Corrective Action Status Update

|

|

|

|

2⇩

|

Internal

Assurance Annual Plan FY20-21 Status Update

|

|

|

|

Internal

Assurance Dashboard – Corrective Action Status Update

|

Attachment 1

|

|

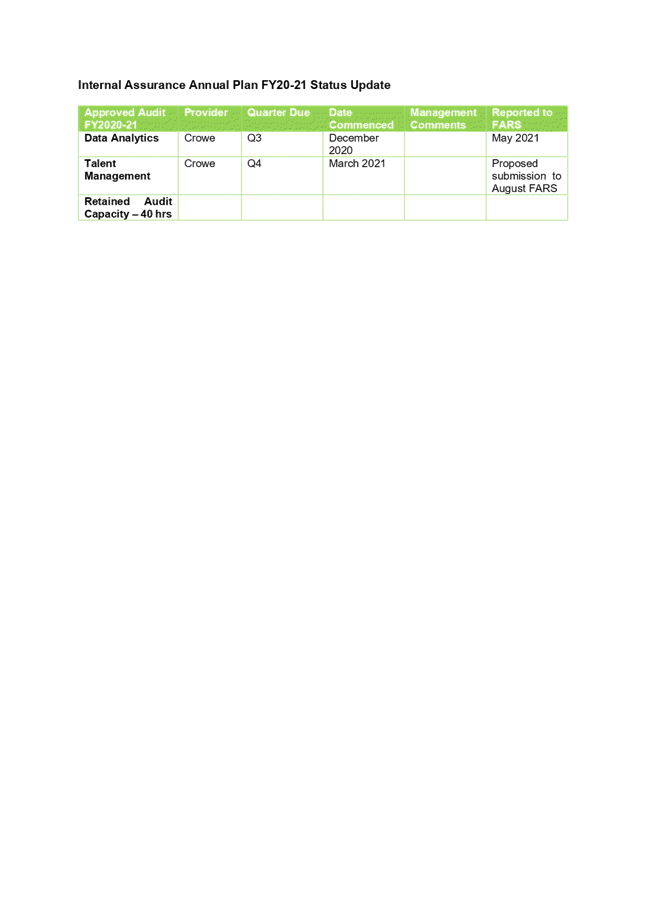

Internal Assurance Annual

Plan FY20-21 Status Update

|

Attachment 2

|

HAWKE’S BAY REGIONAL COUNCIL

Finance Audit

& Risk Sub-committee

Wednesday 05 May 2021

Subject: Internal Assurance

Framework

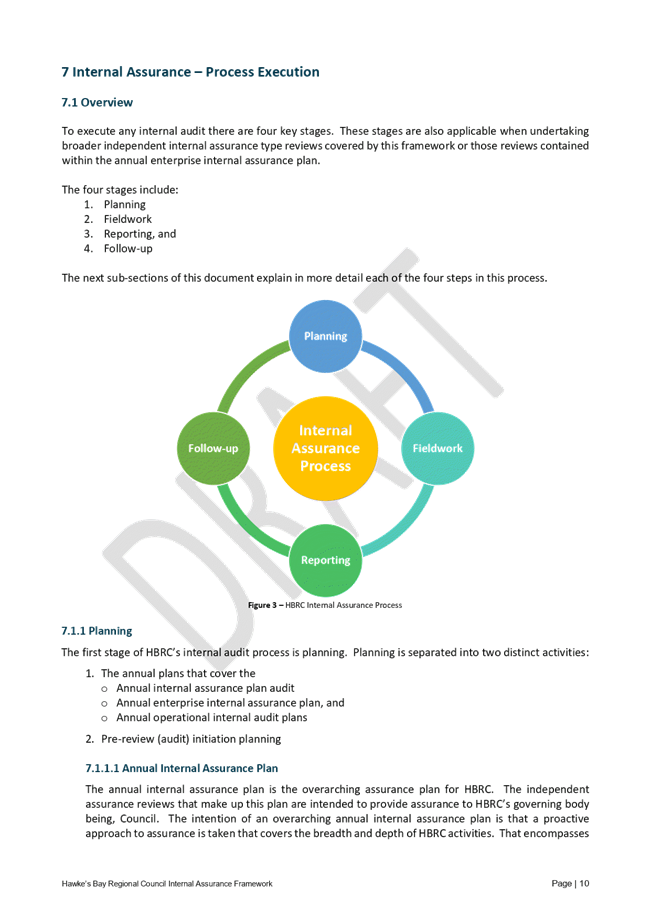

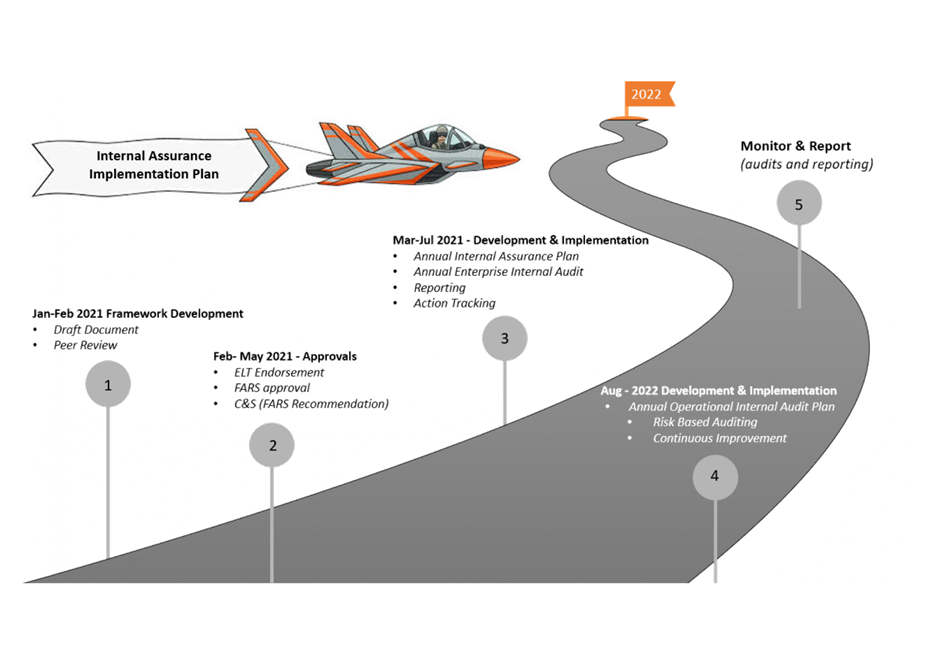

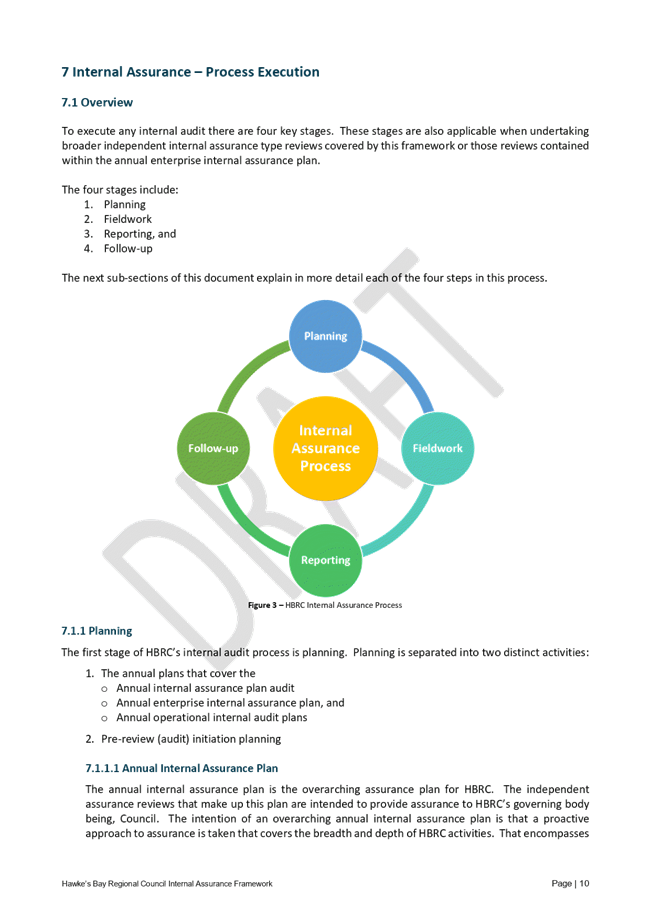

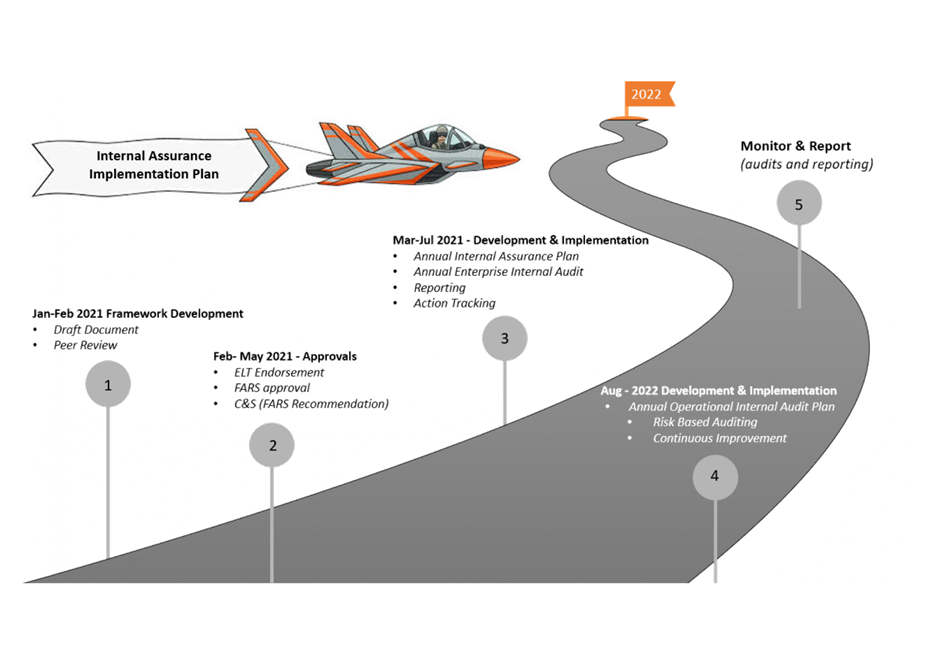

Reason for Report

1. This item seeks

the Finance Audit & Risk Sub-committee’s (FARS) endorsement of the

draft Internal Assurance Framework as endorsed by the Executive Leadership Team

(ELT) on 23 February 2021.

Officers’ Recommendation(s)

2. Council

officers recommend that the FARS members endorse the draft Internal Assurance

Plan and support the Internal Assurance Implementation Plan as proposed.

Background /Discussion

3. At

the Corporate and Strategic (C&S) Committee meeting held on 10 June 2020

the Committee endorsed a risk maturity roadmap for the ‘Regional

Council’ (Council). The Council’s risk maturity roadmap

targeted mid-2021 for the development of an internal assurance framework. The

draft Internal Assurance Framework that the FARS is asked to endorse and

recommend to the C&S is attached.

4. The FARS should

note that this framework has been peer reviewed by Council’s key

management system owners including Quality Management, Health and Safety

Management, Asset Management, Environmental Management, and Information

Management. These teams were identified as suitable peer reviewers as

usually when structured management systems are in place an internal operational

audit programme is required.

5. Throughout

Council several reviews and audits are undertaken each year. The reviews

and audits may provide assurance or identify opportunities for improvement to

Council’s management or governance. For the reviews and audits

currently being undertaken across Council there is no centralised assurance

view or assurance register. Therefore, at times this has resulted in more

than one review targeting a single area within Council, while other areas of

Council may not have been subject to any independent review.

6. Therefore, the

intent of this internal assurance framework is to take an organisational and

proactive risk-based approach to assurance that covers the breadth and depth of

Council. Which, in turn should provide greater confidence to governors

and to management that the organisation is well run with the

‘right’ things being delivered in the ‘right’

way. It is noted that assurance itself does not deliver outcomes.

7. A

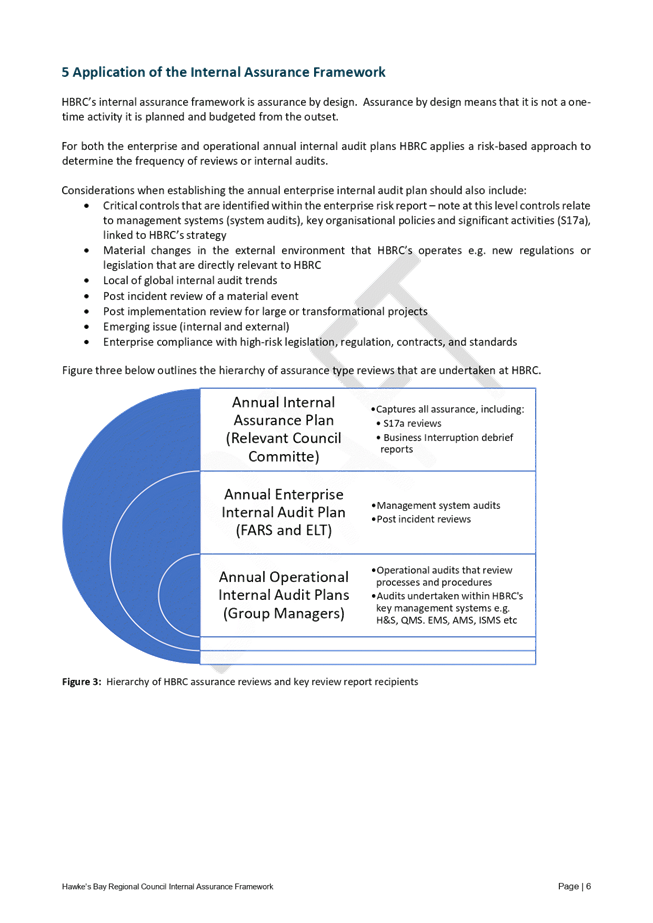

summary of key points in the draft Internal Assurance Framework includes:

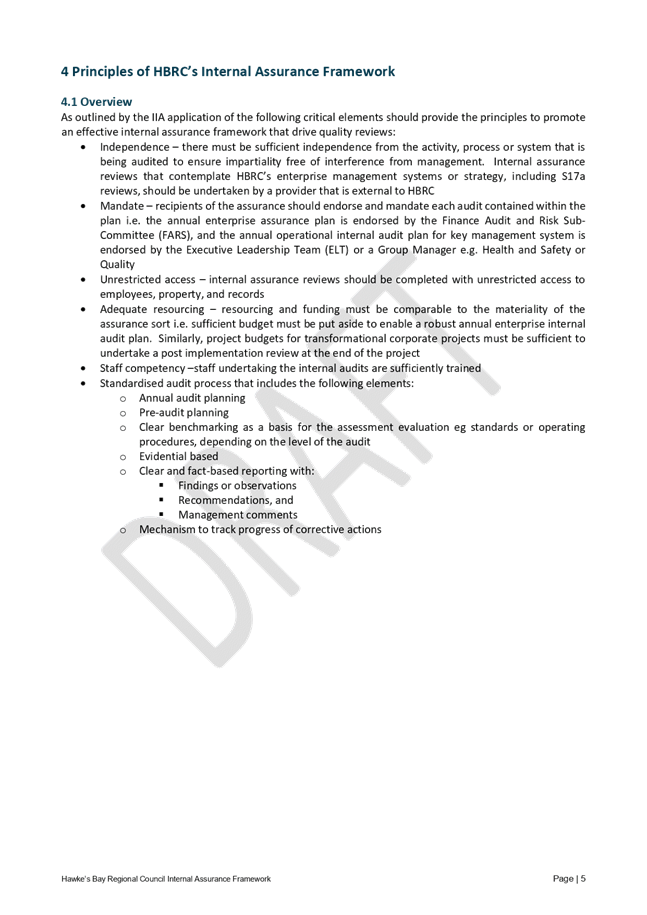

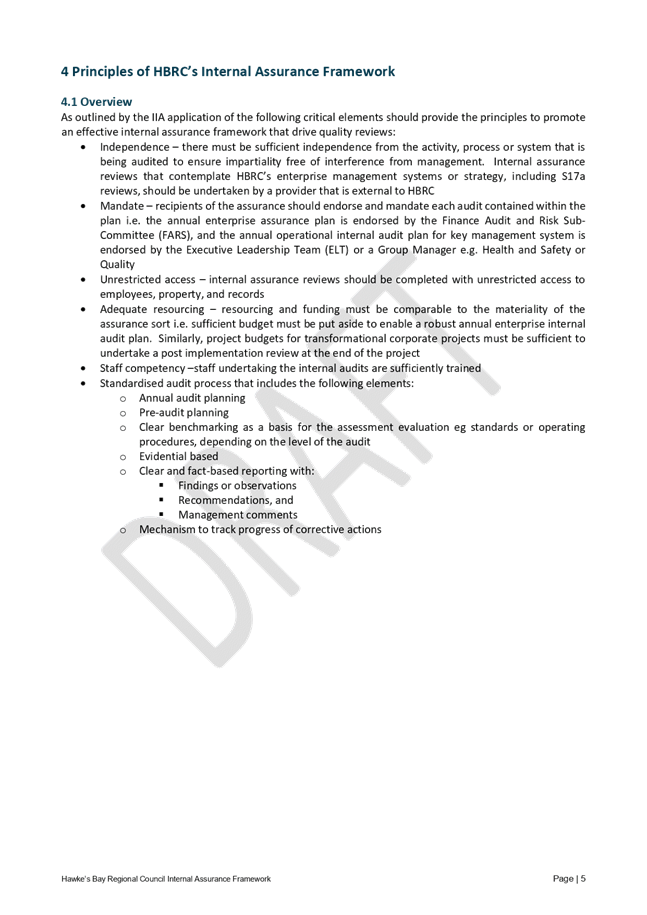

7.1. Adoption of

internal audit principles as defined by the International Institute of Internal

Auditors.

7.2. Adoption of

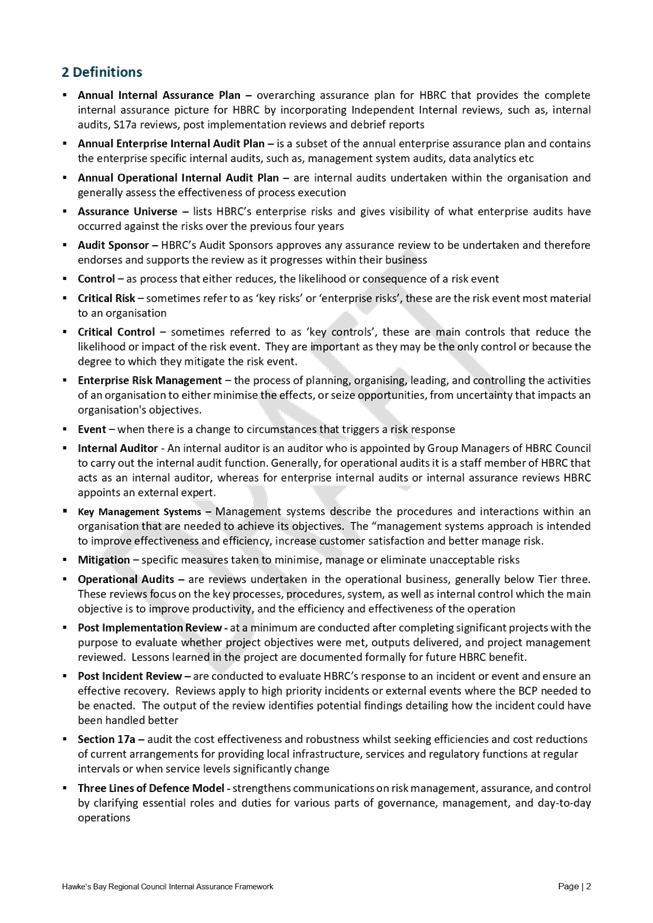

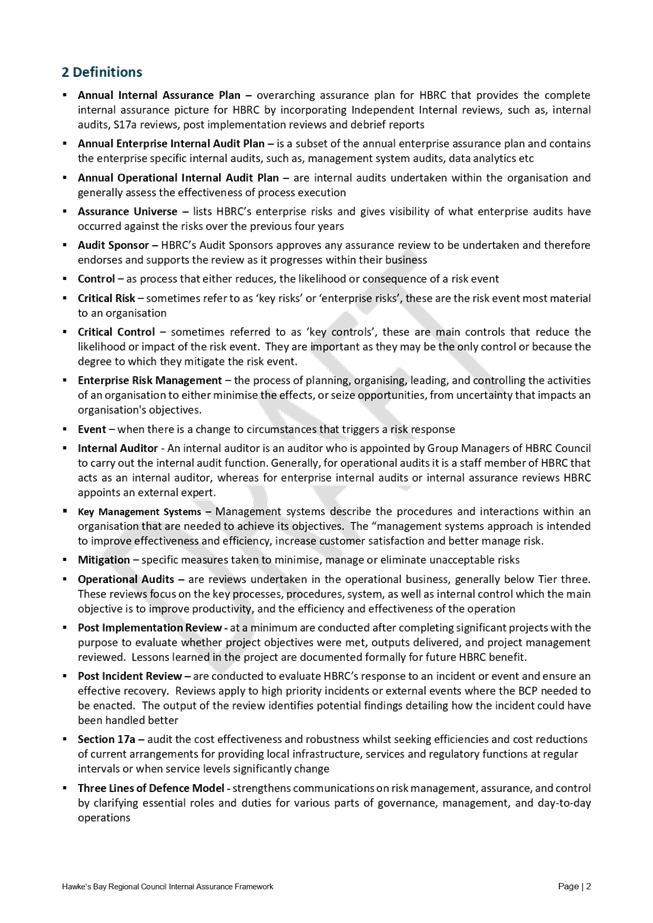

the three lines of defence model which is an assurance model that has been

endorsed by the Office of the Auditor General. The Office of the Auditor

General notes that this model allows for scalability of an assurance programme

based on the: criticality of the activity being reviewed, type of assurance

being undertaken, and level within the organisation requiring assurance

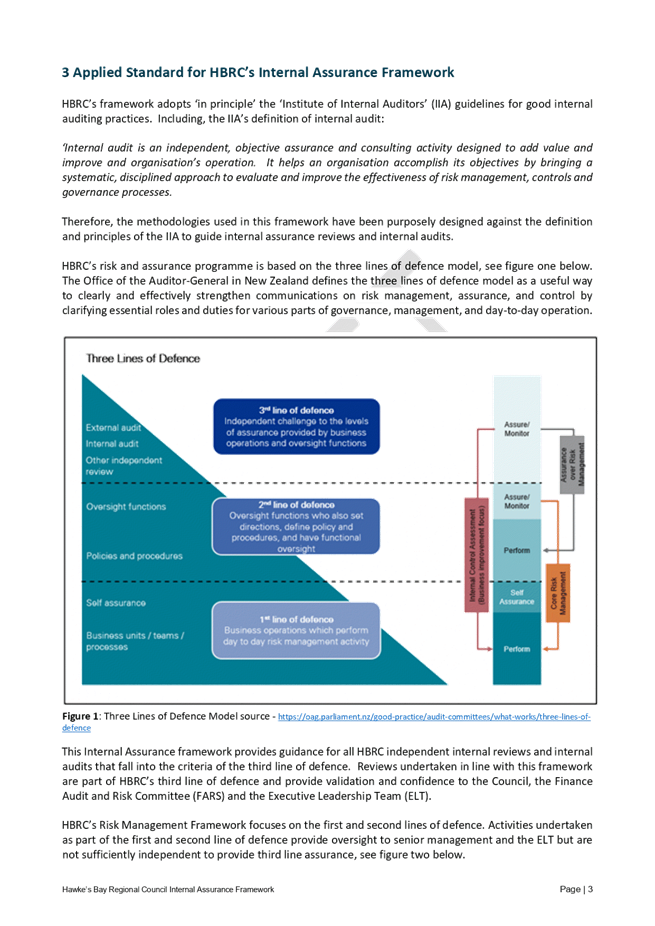

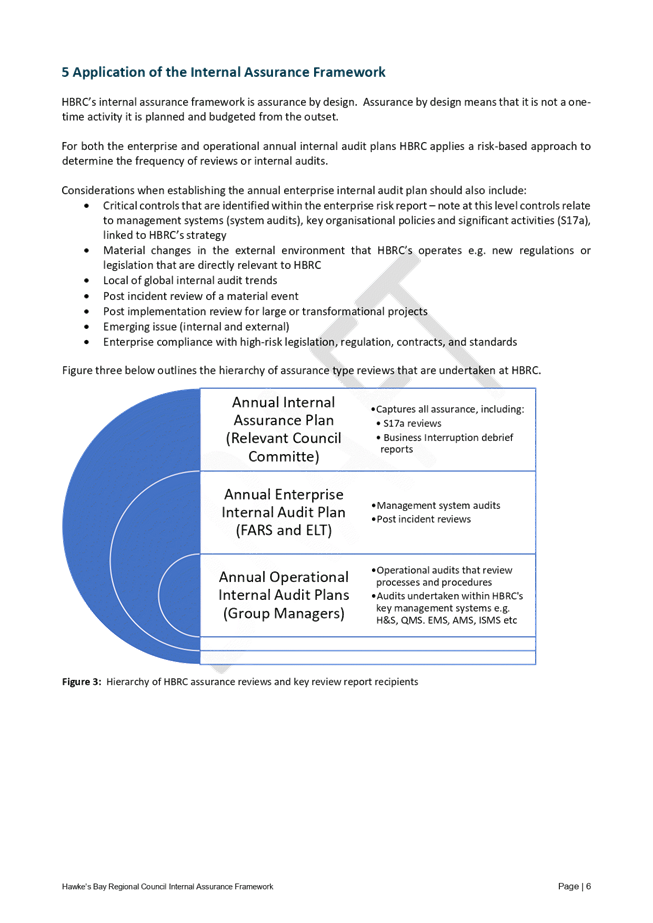

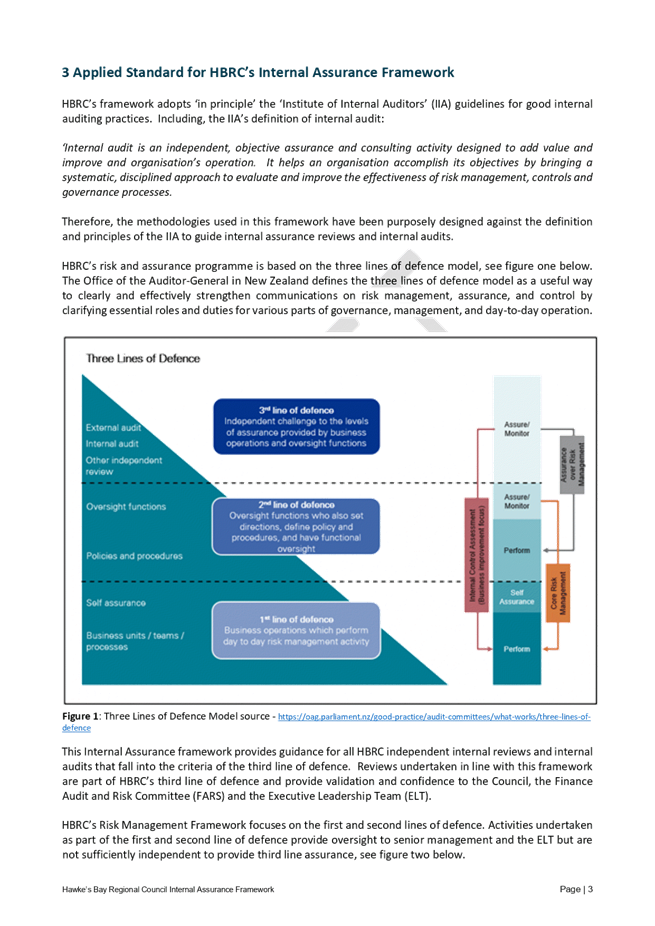

7.3. Assurance

review classification based on the type of review being undertaken and the

recipient of the assurance. The three types of review classifications,

classification review examples, and the intended recipients are:

7.3.1. Internal

assurance, e.g. S17a – Council Committee and management that is responsible

for the activity being reviewed

7.3.2. Enterprise

Internal audit, e.g. management system audits – the FARS

7.3.3. Operational

internal audits, e.g. review of ‘Codes of Practice’ (COP) –

Council’s Management and ELT.

7.4. Outline of

critical elements that must be evident in any assurance review, including:

7.4.1. Independence

from the process or activity being reviewed

7.4.2. Assurance

sponsor endorsement

7.4.3. Unrestricted

access

7.4.4. Adequate

resourcing

7.4.5. Competent

auditors

7.4.6. Standardised

assurance review processes, including:

7.4.6.1 The annual assurance

plan

7.4.6.2 The pre-assurance

planning

7.4.6.3 Fieldwork that uses

recognised techniques

7.4.6.4 Reports that have a

common format and have a standardised assessment criterion for findings to

enable comparison between individual reports and report findings for easier

prioritisation of resources for corrective actions, and

7.4.6.5 follow-up and tracking

of agreed corrective actions.

8. Lastly, the

framework outlines the key roles and role responsibilities applicable to

internal assurance at Council from Governance to all of Council Staff.

Strategic Fit

9. The Internal

Assurance Framework is a module of the Risk Management System which contributes

towards achieving all strategic goals/vision by protecting the organisation.

Financial

and Resource Implications

10. There are no financial

implications or additional resource requirements resulting from this Internal

Assurance Framework.

Decision Making Process

11. Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

11.1. The agenda item is in accordance

with the Sub-committee’s Terms of Reference, specifically:

11.1.1. The purpose of the Finance,

Audit and Risk Sub-committee is to report to the Corporate and Strategic

Committee to fulfil its responsibilities for (1.3) the independence and adequacy

of internal and external audit functions

11.1.2. The Finance, Audit and Risk

Sub-committee shall have responsibility and authority to (2.6) receive the

internal and external audit report(s) and review actions to be taken by

management on significant issues and recommendations raised within the

report(s)

11.1.3. The Finance,

Audit and Risk Sub-committee is delegated by Council to (3.6) review the

objectives and scope of the internal audit function, and ensure those

objectives are aligned with Council’s overall risk management framework;

and (3.7) assess the performance of the internal audit function, and ensure

that the function is adequately resourced and has appropriate authority and

standing within Council.

Recommendations

That the Finance, Audit and Risk

Sub-committee:

1. Receives and

considers the “Internal Assurance Framework” staff report.

2. Endorses the draft Internal Assurance Framework and supports the Internal Assurance Implementation

Plan as proposed.

3. Recommends that the Corporate and Strategic Committee

approves the draft Internal Assurance Framework

and the Internal Assurance Implementation Plan as proposed and

recommends the adoption of both to the Hawke’s Bay Regional Council.

Authored by:

|

Olivia

Giraud-Burrell

Business Analyst

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

Draft

Internal Assurance Framework

|

|

|

|

2⇩

|

Internal

Assurance Framework Implementation Plan

|

|

|

|

Draft

Internal Assurance Framework

|

Attachment 1

|

|

Internal Assurance

Framework Implementation Plan

|

Attachment 2

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 05 May 2021

Subject: Data Analytics Internal

Audit Report

Reason for Report

1. This item

presents the internal audit report (attached) for the Data Analytics audit

undertaken by Crowe in February 2021.

Background

2. The Finance,

Audit and Risk Sub-committee (FARS) agreed at its meeting on 12 August 2020, as

part of the internal audit work programme, to engage Crowe to conduct an

internal audit of Council’s Data Analytics.

3. The agreed

scope and purpose of the audit was to review payables and payroll, and master

and transactional data for the financial year ended 30 June 2020. This

data was then analysed independently by Crowe for any potential anomalies or

suspicious transactions.

4. The report was

then provided to staff, along with a separate spreadsheet listing the

transactions that required review. These spreadsheets were initially

analysed by the Payroll Officer and the Team Leader Finance and then reviewed

by the Chief Financial Officer to identify any findings requiring further

investigation.

5. This is the

fourth consecutive annual Data Analytics audit conducted by Crowe.

Previous reporting of the findings of the 2018-19 audit was presented to the

sub-committee on 12 August 2020. A comparison to previous findings is also

provided following.

6. It is important

to note that when a transaction is identified; it does not necessarily indicate

that there is anything suspicious. There are often legitimate business

reasons for a transaction being identified, such as different types of payments

to a Council (rates credits versus payment for services) by way of pure

example. These types of transactions may display in areas such as

“duplicate address”, “GST/non-GST transactions”, or

“duplicate IRD number” for example.

7. In addition,

some transactions are listed purely for review purposes due to their deemed

higher risk nature, such as “review of top 50 vendors” as an

example. This in itself allows staff to easily assess whether vendors are in

line with expectations and would highlight any vendors that may appear

erroneous.

8. Given the small

size of Hawke’s Bay, there are often times when an employee may share the

same address as a vendor, usually a spouse. Transactional processing

staff ensure that employee approvals are not allowed where any known conflicts

exist between an employee and a vendor.

Discussion

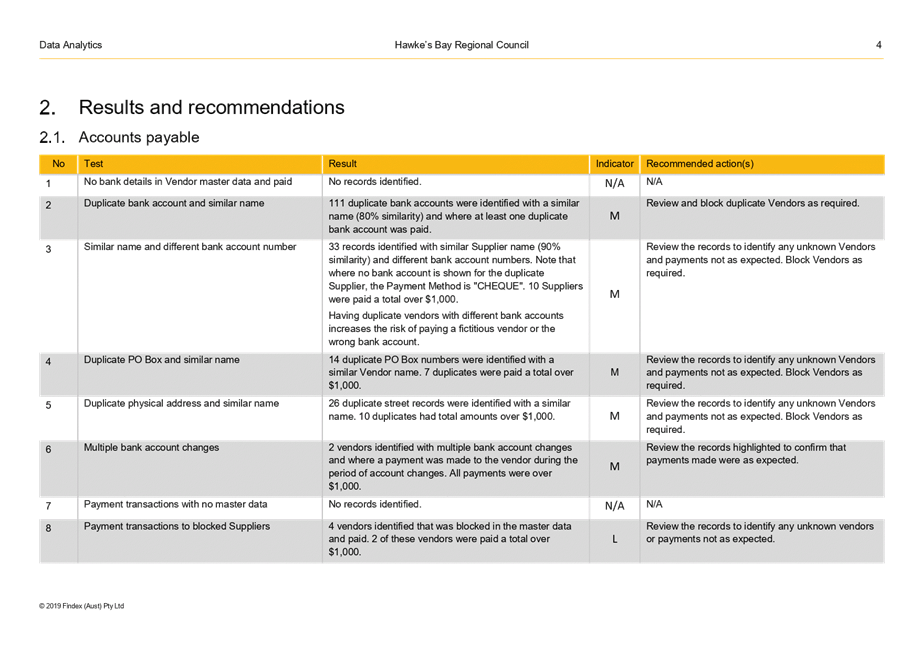

9. There were 111

duplicate bank accounts with similar Vendor names where one of the vendors

received a payment. These were reviewed and where required vendors were

blocked. Of these 111, 77 were duplicates which were blocked following

the review. The primary reason is for a change in master data such as GST

number changes or changes to the trading name of the entity. An

additional process will be added to ensure that the old accounts are blocked as

part of the establishment of the new account. The remaining 34 duplicates

are valid. These are instances when a vendor has more than one business

function or GST/Non-GST accounts i.e. Hastings District Council. There were no

incorrect payments within the above transactions.

10. There were 8 possible

duplicate payments identified with 3 payments being genuine payments.

Five invoices totalling $11,210.88 were paid twice and have been refunded. Four

were identified prior to the audit . One was identified as a result of the audit

totalling $38.96 and has since been refunded. The invoice processing errors

occurred during the invoice scanning and were incorrectly scanned with

different invoice numbers for example: !NV-0332 & INV-0332. Officers

continue working with the scanning software provider to reduce the errors and

also systemically review the scanning results for any errors as part of the

scanning process.

11. In terms of the cross

matching of data between payroll and accounts payable all records were reviewed

with no issues to note.

12. For the payroll data, all

data was reviewed with no issues noted.

2018-19 Comparison

13. The list of duplicates

within the supplier master file, i.e. supplier account information has

increased from 34 to 111. Previously the criteria was based on supplier

accounts where at least one of the accounts had a payment over $5000.

This year’s criteria is based on any payment from one of the duplicate

accounts.

14. The number of possible

duplicate payments increased from 4 to 8 with 5 being actual double payments in

comparison with none last year.

15. Overall the number of

errors arising from internal processes is comparable to prior year, with

internal checks continuing to keep the number of flagged or highlighted

transactions arising within the review to a low percentage of the overall

transactions. Staff recognize that there is a need to maintain appropriate

process to reduce errors and to ensure correct internal controls are used to

reduce the risk of fraud or misappropriation.

New Finance System Process Changes

16. The implementation of the

new finance system will reduce the opportunity for the following issues.

16.1. Duplication of supplier

accounts will be reduced as GST/Non-GST triggers can be controlled by the GL

account they are posted as well as at supplier account level.

16.2. The introduction of

purchase orders will reduce duplicate payments as invoices will need to be

matched to purchase orders with values.

Next

Steps

17. Staff are seeking feedback

as to whether this Sub-committee would like to see another data analytics

assignment be conducted for 2020-21, as Auditors recommend completing a data

analytics audit every year. With the low rate of issues, the Data Analytics

audit could be delayed a year.

18. A Data Analytics audit is

recommended for the 2021-22 year as this will be the first year of processing

transactions in TechOne One Council.

Decision Making Process

19. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that:

19.1. as this report is for

information only, the decision-making provisions do not apply.

19.2. any decision of the

sub-committee is in accordance with the Terms of Reference and decision-making

delegations adopted by Hawke’s Bay Regional Council 25 March 2020,

specifically the Finance, Audit and Risk Sub-committee shall have

responsibility and authority to:

19.2.1. Receive the internal and

external audit report(s) and review actions to be taken by management on

significant issues and recommendations raised within the report(s)

19.2.2. Ensure that recommendations

in audit management reports are considered and, if appropriate, actioned by

management.

|

Recommendation

That the

Finance, Audit and Risk Sub-committee receives and notes the “Data

Analytics Internal Audit Report”.

|

Authored by:

|

Bronda Smith

Chief Financial Officer

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

Internal Audit

Data Analytics report

|

|

|

|

Internal

Audit Data Analytics report

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 05 May 2021

Subject: Quarterly Treasury

Report for 1 January - 31 March 2021

Reason for Report

1. This item provides compliance monitoring of Hawkes Bay Regional

Council (HBRC) treasury

activity and reports the performance of Council’s investment portfolio

for the quarter ended 31 March 2021.

Overview of the

Quarter - ending 31 March 2021

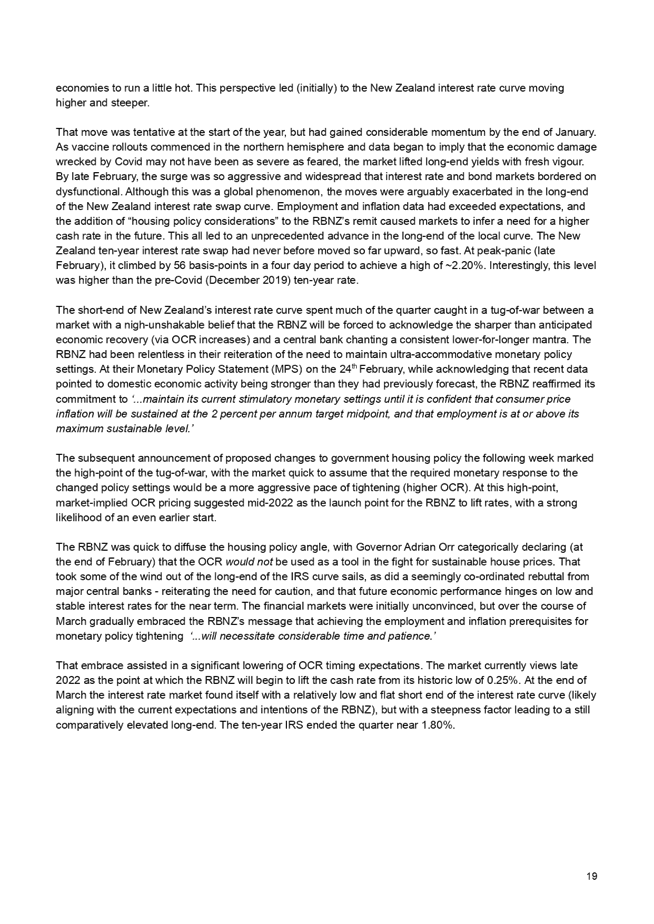

2. Borrowing totalling $10m was raised with the LGFA. Two

forecast $5m loans were raised. Both raised at fixed rates of 1.6% (4

years) and 1.97% (5 years) respectively.

3. Managed Funds have provided a year-to-date gross income net of fees

of 6.6%. The funds continue to perform better than the Covid-19 Adjusted

2020-21 Annual Plan.

4. The C&S Committee declined an offer by the building owner to

purchase one of HBRCs Wellington leasehold properties.

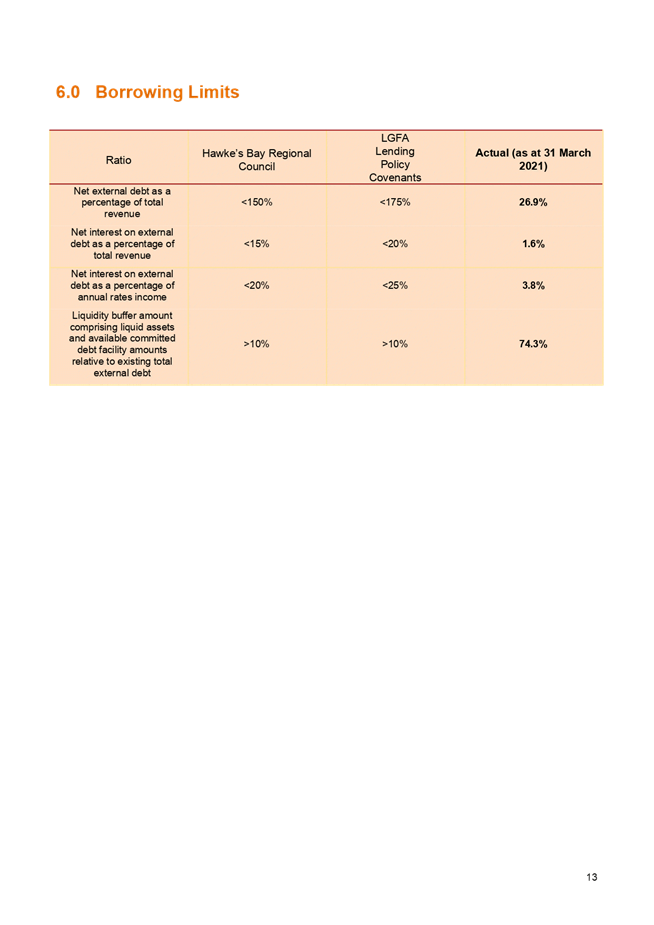

5. As at 31 March 2021 closing, HBRC was non-compliant with its

Treasury policy in the following 4 parameters:

5.1. Funding Risk Control

5.2. Interest Rate Risk

5.3. Counterparty Credit Limits (now within policy limits)

5.4. Asset Allocations (now within policy limits).

6. All breaches, and proposed actions to rectify, are discussed in

detail in this report.

Background

7. The Investment management reporting requirements, outlined within

Council’s Treasury Policy, requires quarterly reporting to the Financial

Audit & Risk Sub-Committee (FARS) of current investment allocation and investment

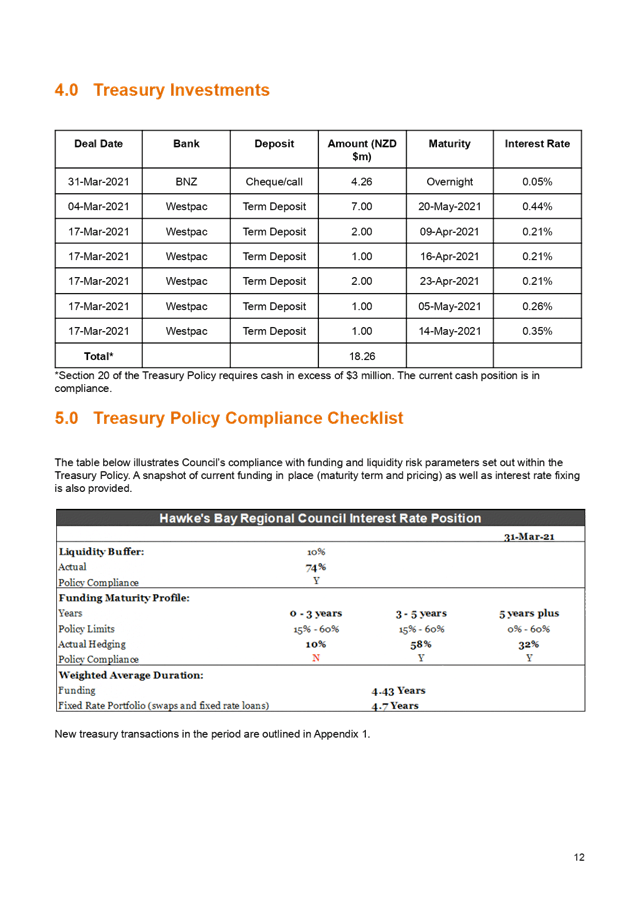

performance.

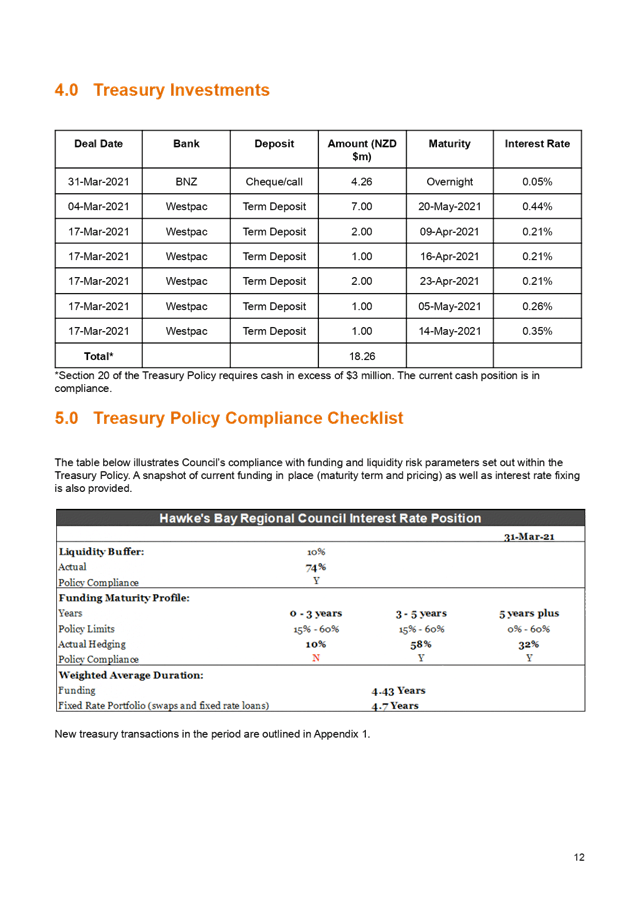

8. All Treasury investments are to be reported on quarterly. As at 31

March 2021, Treasury Investments to be reported on consist of:

8.1. Liquidity

8.1.1. Cash and Cash Equivalents

8.1.2. Debt Management

8.2. Externally Managed Investment Funds

8.2.1. Long-Term Investment Fund (LTIF)

8.2.2. Future Investment Fund (FIF)

8.3. Investment properties

8.4. HBRIC Ltd

8.5. 2020-21 Year to Date Performance Summary.

9. Since 2018, HBRC has procured treasury advice and services from PwC

and their quarterly compliance report is attached.

Discussion

Liquidity

– Cash & Cash Equivalents

10. To ensure

HBRC has the ability to adequately fund its operations, current policy requires

HBRC to maintain a liquid balance of $3.0m.

11. The following table reports the cash and cash equivalents as at 31

March 2020.

|

31 March

2021

|

$000

|

|

Cash

|

4,943

|

|

HBRC Held

Cash

|

4,279

|

|

Works

Group

|

325

|

|

Other

– managed trusts

|

339

|

|

Short-term

bank deposits

|

14,000

|

|

Cash

& and cash equivalents

|

18,943

|

12. HBRC

liquidity throughout Q3 benefited from the strong YTD cash position at the end

of Q2 and the loans raised with the LGFA on 15 March

2021 ($10m). - The $10m in loans raised with the LGFA reflects HBRC cash

requirement through to approximately June/July 2021.

13. Any cash

surplus to operating requirements is placed on term deposit. All of the

possible 90 days in the quarter had an average of $8.6m held in term deposits;

returning an average of 0.25% or $6.1k for the period.

14. At 31

March 2021 closing, HBRC had placed all its short- term bank deposits ($14m)

with Westpac Bank with the intention to maximize the interest being

earned. This resulted in HBRC not being compliant to current counterparty

policy limits. Counterparty policy risk is the risk of any loss arising

from a counterparty defaulting. Current policy limits officers to place a

maximum of 50% of Rates Revenue placed in 1 RBNZ Registered Bank. HBRC

was over this limit by ~$500k for a total 23 days. The timing of already

held term deposit maturating and the materiality of separating $500k, would

have negated any gains having the full $14m placed with Westpac. The

proposed Treasury Policy within the 2021-31 LTP, sees the Counterparty limit

increase to $15m.

15. To manage

HBRC liquidity risk, HBRC retains a Standby Facility with

BNZ. This facility provides HBRC with a same day draw down option, to any

amount between $0.3-$5.0m, and with a 7-day minimum draw period. The cost

of the renewed current facility is an establishment fee ($10,000), an annual

line fee 0.37% ($18,500) + a margin above BKBM of 1.45% on any borrowings.

16. With

advice from PwC, this facility has recently been renewed with BNZ, in favor of

the LFGA due it its minimum draw period and the 4-year facility term. The

current LGFA facility would frustrate HBRC liquidity policy requirements with

its rolling 15 month term, i.e. not having a secured liquidity beyond 15

months.

17. As new

debt is drawn in line with the proposed 2021-31 LTP, consideration will be

given to a mix of LGFA and BNZ facilities.

18. The

renewal of this facility briefly placed HBRC outside current policy compliance

to its funding & liquidity risk positions. Funding & liquidity

risk positions are set to avoid the occurrence of Council needing to refinance

a substantial proportion of debt at the same time and being exposed to

unfavorable pricing. By renewing the Standby Facility, at 31 March,

10% of HBRC debt profile maturated within 3 years. The current

policy’s minimum requirement is 15%. This breach was only temporary and

is now compliant.

19. The following

graph shows the daily closing cash position and Term Deposits held throughout

Q3.

Debt Management

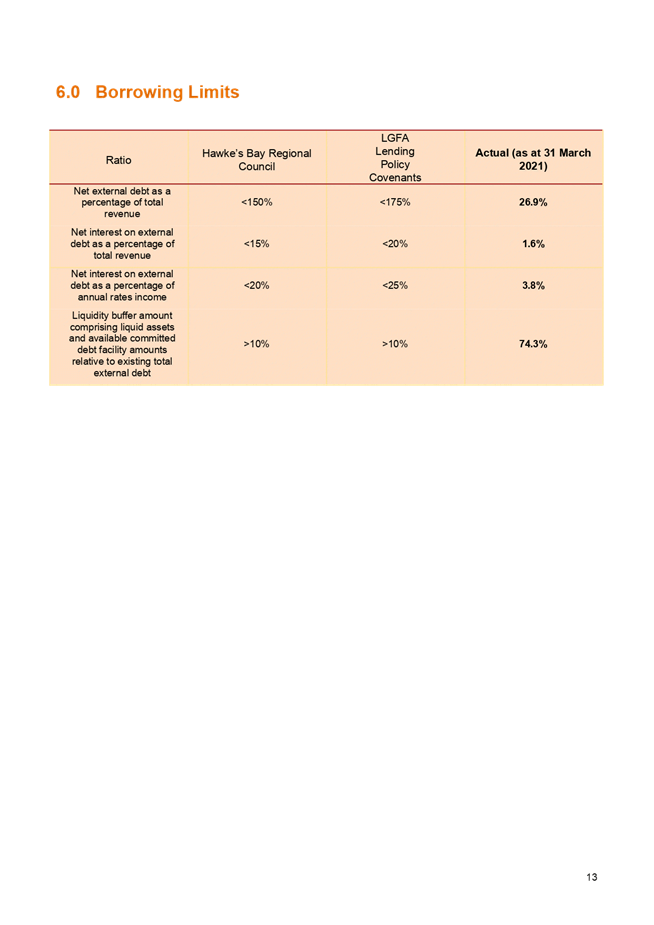

20. As at 31

March 2021, current external debt was $31.3m, $48.0m when taking into

consideration the internal $16.7m HBRIC loan All financial covenant ratios are

currently at least 4 times under any internal or external limit. The

financial covenant ratios can be seen in the attached PwC report.

21. The

year-end debt position is forecast to be $36.9m, excluding the HBRIC loan and any

further distributions form Managed Funds. Accounting for the existing

$31.3m plus the forecasted $5.9m requirement detailed below. This is

slightly above that forecast in the 2018-28 LTP, which forecast borrowing to be

$35.5m at the end of the 2020-21 year, and below the 2020-21 Covid-19 Adjusted

Annual Plan of $41.3m.

22. With HBRC

current debt profile continuing to mature, along with the proposed “ramp

up” in borrowings forecasted within the 2021-31 LTP, HBRC remains outside

its interest rate risk management policy. The policy is written to minimize any adverse movements in interest

rates which could affect future cash flows.

23. Officers

continue to work with PwC to adhere to best practice on this

noncompliance. An option available to correct HBRC interest rate position

is utilising financial instruments such as swaps to effectively fix existing

floating rated loans. This option can have undesired effects however,

where future expected borrowings are delayed and HBRC is then required to

rebalance its interest rate position again.

24. It should

be noted that the forecast remaining debt requirement for 2020-21 would still

not allow HBRC to be operating within the current policy.

25. Upon

writing this report, Q3 reforecasts are still being completed. Full year

forecasts will be presented at the next Corporate & Strategic Committee

meeting. The table below details the current understood debt requirements

compared to the 2020-21 Annual Plan.

|

Loan Requirements

|

2020-21

Annual Plan

|

Approved Additional Funds

|

Total Approved Requirement

|

2020-21 Debt Forecast*1

|

Variance to Approved Requirement

|

|

|

$000

|

$000

|

$000

|

$000

|

$000

|

|

Sustainable Homes

|

3,527

|

-

|

3,527

|

3,527

|

-

|

|

Systems Integration

|

1,913

|

-

|

1,913

|

1,275

|

(638)

|

|

Building Accommodation

|

2,000

|

-

|

2,000

|

500

|

(1,500)

|

|

HBRC Recovery Fund

|

1,000

|

-

|

700

|

-

|

(700)

|

|

Porangahau Catchment

|

|

|

300

|

50

|

250

|

|

Integrated Catchment

|

2,250

|

2,450

|

4,700

|

3,900

|

(800)

|

|

Covid-19 Budget Impacts

|

7,584

|

-

|

7,584

|

5,000

|

(2,584)

|

|

Other

|

755

|

-

|

755

|

755

|

-

|

|

Total

|

19,029

|

2,450

|

21,479

|

15,857

|

(3,172)

|

|

*1 As at the

end of Q3, only $10m of 2020-21 requirement has been raised.

|

26. As at 31 March 2021, the borrowing forecast of $15.9m is based on

the expected full year expenditure for 2020-21. The adjusted forecast

requirements for “Systems Integration” and “Building

Accommodation” is due to the timing of expenditure and request to carry forward

this borrowing into 2021-22 is expected.

27. Borrowing

required for the Covid-19 related reduction in investment income is subject to

change. Any upside in investment income, from either an additional HBRIC

dividend or managed fund returns, will reduce the current requirement.

28. The

Recovery Fund has committed spend of $300k on the Porangahau Catchment, with $50k expected to be spent within 20-21,

$100k in 2021-22, $100k in 2022-23 and $150k in 2023-24.

Managed Funds

29. For the

purposes of this report, the below terms have been referred to and have the

following meaning.

|

Term

|

Meaning

|

|

Gross Income

Net of Fees

|

The full

amount the fund has returned for the period, net of any fees paid to the fund

managers. This amount remains in the funds unless divested.

|

|

Capital

Protection

|

The amount

the fund must earn in relation to the rate of inflation to retain its real

purchasing power.

|

|

Funding

Council Operating Costs

|

The amount

the fund must earn to fund Council operating costs (offsetting rating

requirements).

|

|

Divested

Capital

|

Gross Income

Net of Fees less Capital Protection and have now been withdrawn from the

funds.

|

|

Undivested

Funds Available

|

Gross Income

Net of Fees less Capital Protection that are still invested within the funds.

|

30. The Fund performances have slowed over the last quarter, however are

still performing ahead of forecast with a weighted average gross income net of

fees of 9.3% (annualised 12.6%) compared to the Post Covid-19 2020-21 Annual

Plan of 4% (6% annualised).

31. Officers

cautious approach of de-risking against short market fluctuations and divesting

$6.4m at the end of Q2 was seemingly a prudent decision.

32. Should

the current performance of the funds continue, Officers intend to divest from

the funds, further reducing the borrowing requirement arising from the Covid-19

adjusted 2020-21 Annual Plan.

33. The table

and graphs following summarise the quarter end fund balances over the last 12 months.

|

Fund

|

31 Mar 2020

|

30 Jun 2020

|

30 Sep 2020

|

31 Dec 2020

|

31 Mar 2021

|

|

|

$000

|

$000

|

$000

|

$000

|

$000

|

|

Long-Term

Investment Fund

|

46,305

|

49,950

|

51,810

|

49,925 *

|

50,206

|

|

Future

Investment Fund

|

41,712

|

61,128

|

63,094

|

64,300 *

|

64,418

|

|

Total

|

95,398

|

88,017

|

111,078

|

114,904

|

114,625

|

* December 2020 saw $6.5m (LTIF $4.5m & FIF $2.0m) Funds being

divested for the first time, which explains the reduced fund balance.

Long-term Investment Fund

34. Invested

since November 2018, the fund provides a return which, protects capital value

first and then funds Council’s operating costs.

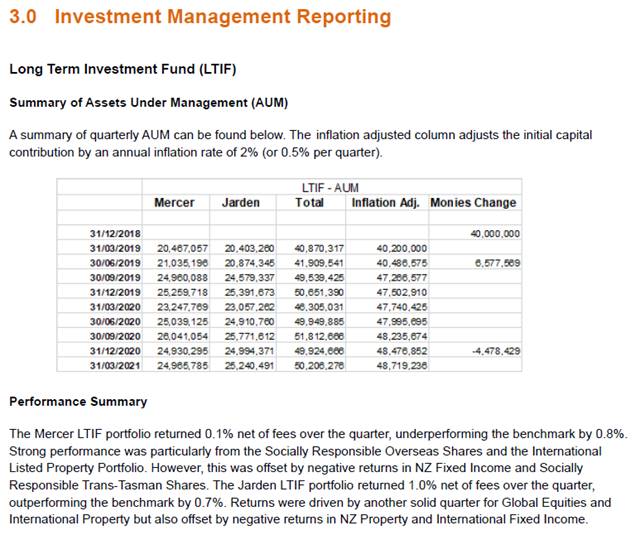

35. The table

below shows the LTIF income earned YTD against the 2020-21 Annual Plan.

|

Income

|

Full Year Annual Plan 2020-21

|

YTD Ann. Plan

|

YTD Q3 Actuals

|

Variance to YTD Ann. Plan

|

|

|

$000

|

%

|

$000

|

%

|

$000

|

%

|

$000

|

|

Capital Protection

|

838

|

2%

|

629

|

1%

|

718

|

1%

|

91

|

|

Fund Operating Costs

|

1,876

|

4%

|

1,407

|

3%

|

4015

|

8%

|

2,608

|

|

Gross

Income Net of Fees

|

2,715

|

6%

|

2,036

|

5%

|

4,735

|

9%

|

2,699

|

36. The table

below shows the key balances of the LTIF as at the end of Q3.

|

|

1 July 2020 – Opening Balances

|

31 March 2021 – Closing Balances

|

|

|

Capital Protected Balance

|

Undivested Funds Available

|

Total Fund Balance

|

Capital Protected Balance

|

Undivested Funds Available

|

Total Fund Balance

|

|

|

$000

|

$000

|

$000

|

$000

|

$000

|

$000

|

|

LTIF

|

47,996

|

1,954

|

49,950

|

48,719

|

1,487

|

50,206

|

37. The table above has been prepared as at 31 March 2021 (Q3). It

should be noted, that the LTIF needs to earn a further $240k to meet the

required annual capital protection of $980k. This amount is slightly

different to the 2020-21 Annual Plan, due to the budgeted numbers being set off

the Fund Balances in March 2020.

38. At

closing on 31 March 2021, Jarden’s asset allocation was below SIPO policy

minimum limits for International Fixed Income in the Long-Term Investment fund

(LTIF). This was caused by the asset classes negative return reducing the

value relative to the portfolio. The allocation returned to policy compliance

during April.

Future Investment Fund (FIF)

39. Invested

since September 2019, the fund provides a return which, protects capital value

first and then funds Council’s operating costs.

40. The table

below shows the FIF income earned YTD against the 2020-21 Annual Plan.

|

Income

|

Full year Annual Plan 2020-21

|

YTD Ann. Plan

|

Q3 YTD Actuals

|

Variance to YTD Ann. Plan

|

|

|

$000

|

%

|

$000

|

%

|

$000

|

%

|

$000

|

|

Capital Protection

|

974

|

2%

|

731

|

1%

|

927

|

1%

|

196

|

|

Fund Operating Costs

|

1,690

|

4%

|

1,268

|

2%

|

4,306

|

7%

|

3,038

|

|

Gross Income Net of

Fees

|

2,665

|

6%

|

1,999

|

3%

|

5,232

|

8%

|

3,234

|

41. The table

below shows the key balances of the FIF as at the end of Q3.

|

|

1 July 2020 – Opening Balances

|

31 March 2021 – Closing Balances

|

|

|

Capital Protected Balance

|

Undivested Funds

Available

|

Total Fund Balance

|

Capital Protected Balance

|

Undivested Funds

Available

|

Total Fund Balance

|

|

|

$000

|

$000

|

$000

|

$000

|

$000

|

$000

|

|

FIF

|

61,775

|

(647)

|

61,128

|

62,706

|

1,662

|

64,418

|

42. As mentioned previously, the previous table has been prepared as at

31 March 2021 (Q3). Similar to the LTIF, the FIF will need to earn a further

$305k to meet the required annual capital protection of $1,236k.

Investment Property

43. In the

current financial period, 2020-21, 16 Napier Endowment Leasehold Properties

have been freeholded totaling $2.4m. $2.1m of this has been subsequently paid

to ACC as settlement for the remaining 42 years rent for these properties.

44. The

income from leasehold sales is recognised in the current financial year.

Most of which goes into offsetting the movement in the ACC liability –

the additional proceeds are now being placed in the Sale of Land Reserve.

HBRIC

45. Per

Council Policy, HBRIC will separately provide a quarterly update to the Corporate

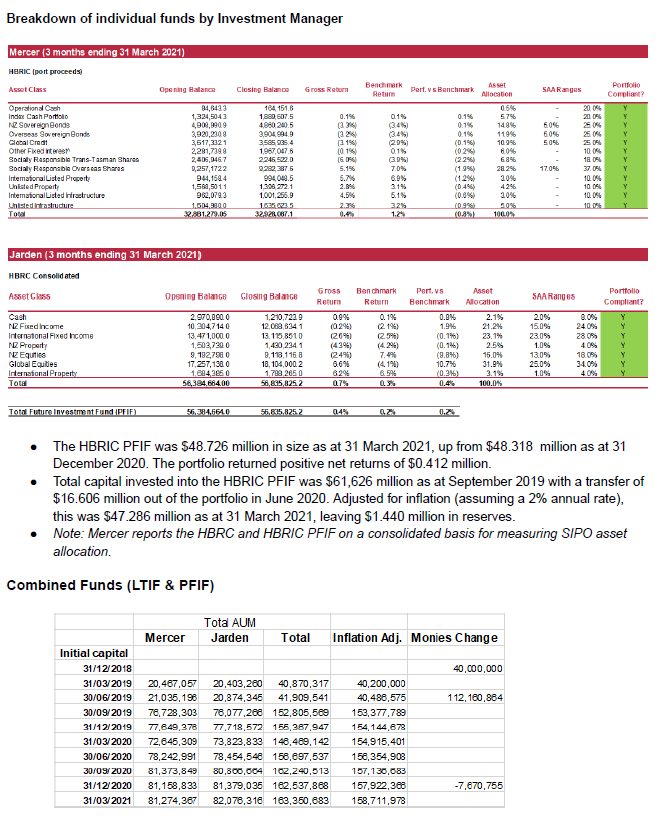

and Strategic Committee in May 2021. Main matters of relevance are:

45.1. Consultation

on establishing a new Council Controlled Trading Organisation has completed and

an update will made by HBRIC.

45.2. Potential

that the PONL will pay a final dividend in June 2021

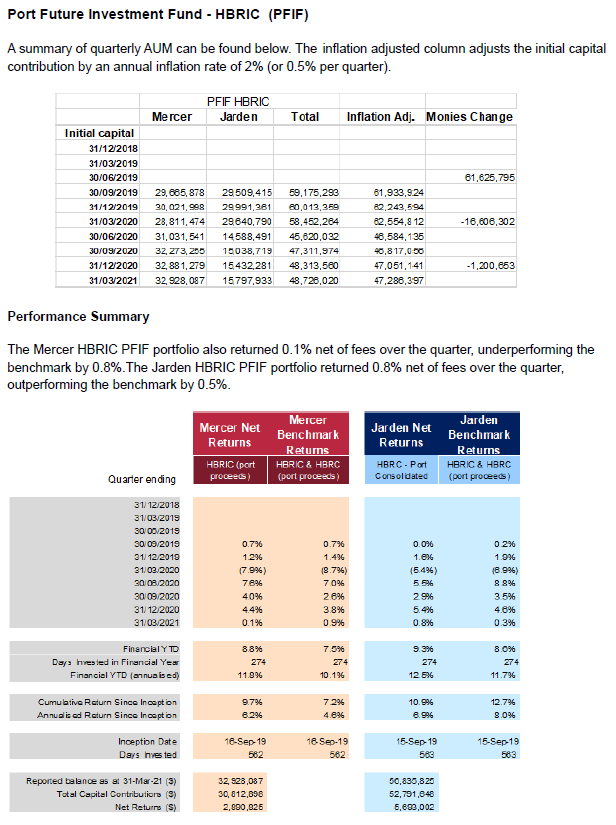

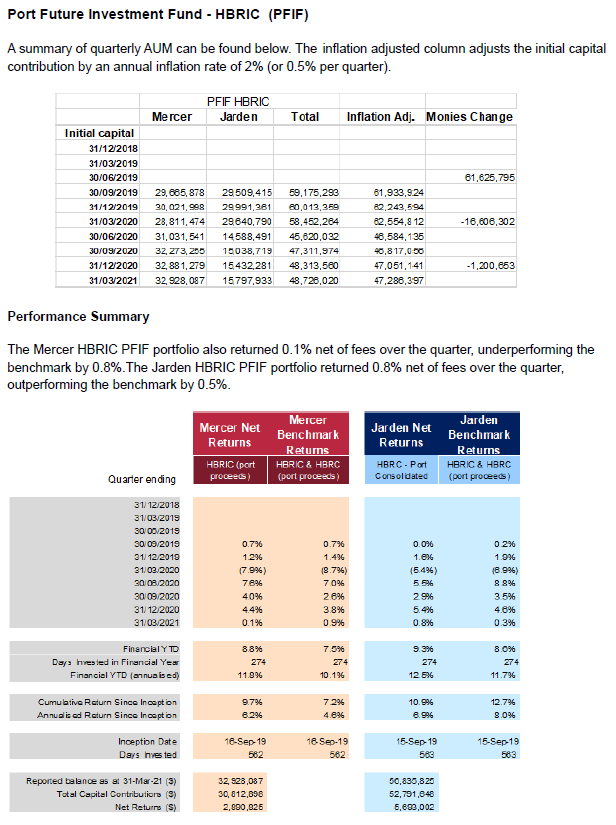

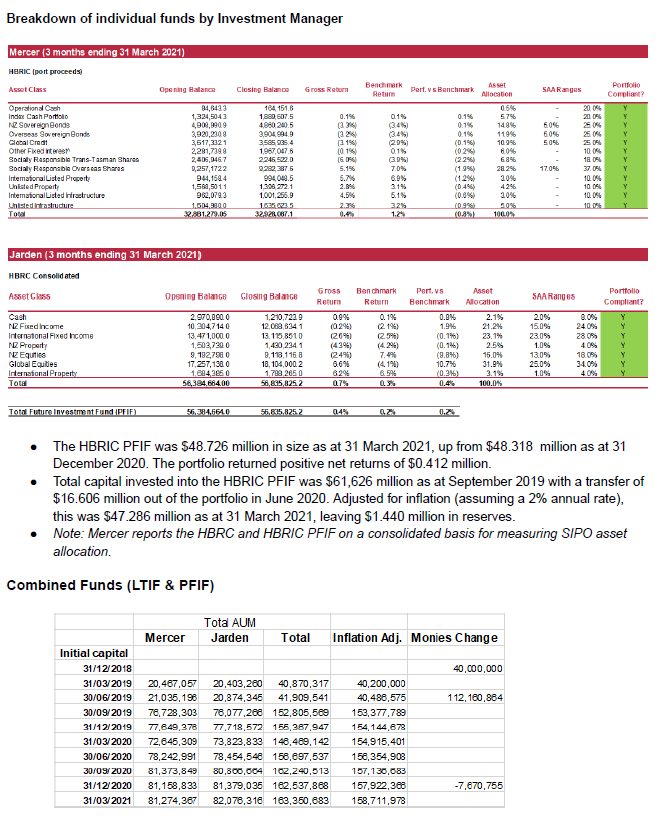

45.3. The table below shows the key balances of the FIF (HBRIC) as at the

end of Q3.

|

|

1 July 2020 – Opening Balances

|

31 March 2021 – Closing Balances

|

|

|

Capital Protected Balance

|

Undivested Funds

Available

|

Total Fund Balance

|

Capital Protected Balance

|

Undivested Funds

Available

|

Total Fund Balance

|

|

|

$000

|

$000

|

$000

|

$000

|

$000

|

$000

|

|

FIF

|

46,584

|

(964)

|

45,620

|

47,286

|

1,475

|

48,726

|

2020-21 Year to Date Performance

Summary

46. The following

table shows investment income to date against the 2020-21 Annual Plan.

|

Income

|

Annual Plan 2020-21

|

YTD Ann. Plan

|

YTD Q3 Actuals

|

Variance to YTD Ann. Plan

|

|

|

$000

|

$000

|

$000

|

$000

|

|

Other financial

assets

|

4,195

|

3,146

|

8,345

|

5,199

|

|

Managed Funds

|

3,567

|

2,675

|

8,321

|

5,646

|

|

Other Interest*

|

628

|

471

|

24

|

(447)

|

|

Investment property

|

2,343

|

1,757

|

1,487

|

(270)

|

|

Endowment leasehold

land

|

1,502

|

1,127

|

851

|

(276)

|

|

Wellington Leasehold

land

|

841

|

631

|

636

|

5

|

|

Dividends

|

5,369

|

4,777

|

9,158

|

4,381

|

|

PONL Dividend

|

3,000

|

3,000

|

5,500

|

2,500

|

|

Managed Fund

|

2,369

|

1,777

|

3,658

|

1,881

|

|

Total

|

11,907

|

9,680

|

16,729

|

9,310

|

* Includes Interest budgeted to be earnt on scheme reserves.

47. The $9.3m

favourable YTD performance should be considered cautiously. There is

still a significant ‘point in time’ factor that could potentially

reduce this variance significantly over the last quarter, particularly when

considering the performance of the managed funds. It would be prudent to

expect that the future returns will continue to equalise over the next

remaining quarter. If performance does equalise, it could be expected

that the full year performance will be ~$8.0m ahead of budget.

48. The other

material significant change which may arise is Napier Port paying HBRIC an

interim dividend in June 2021. For this to have a fiscal impact for

Council, HBRIC’s Board would need to consider its requirements and then

to agree to any funds being passed to Council. Unlike the managed funds,

this would continue to improve the actual performance when compared to the

2020-21 Annual Plan

Decision Making

Process

49. Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have

assessed the requirements in relation to this item and have concluded:

49.1. The agenda item is in

accordance with the Finance, Audit and Risk Sub-committee Terms of Reference,

specifically “The Finance, Audit and Risk

Sub-committee shall have responsibility and authority to (2.4) monitor the performance of Council’s investment

portfolio”.

49.2. As this

report is for information only, the decision making provisions do not apply.

|

Recommendation

That the Finance, Audit and Risk

Sub-committee receives and notes the “Quarterly Treasury Report for

1 January - 31 March 2021” and confirms that the performance of

Council’s investment portfolio has been reported to the

Sub-committee’s satisfaction.

|

Authored by:

|

Geoff Howes

Treasury & Funding Accountant

|

Bronda Smith

Chief Financial Officer

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

HBRC Treasury

Reporting - March 2021

|

|

|

|

HBRC

Treasury Reporting - March 2021

|

Attachment 1

|