Meeting of the Corporate and Strategic Committee

Date: Wednesday 19 May 2021

Time: 10.30am

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

Item Title Page

1. Welcome/Notices/Apologies

2. Conflict

of Interest Declarations

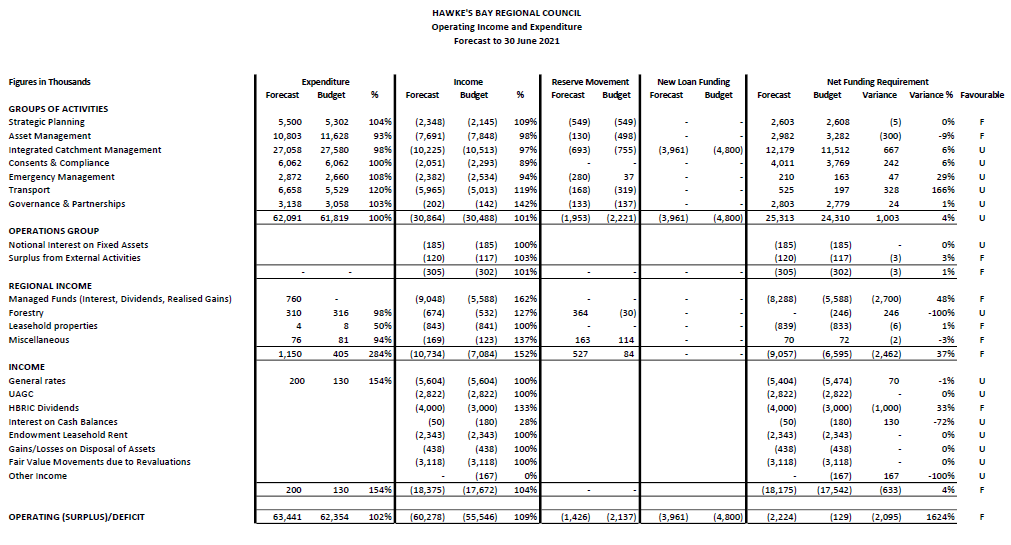

3. Confirmation of Minutes of the Corporate and Strategic Committee

held on 3 March 2021

4. Follow-ups from

Previous Corporate and Strategic Committee Meetings 3

5. Call for Minor

Items not on the Agenda 7

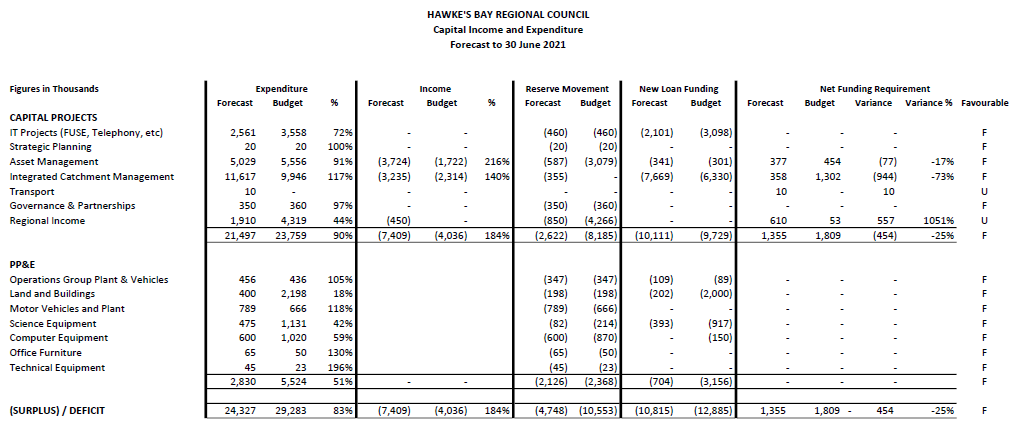

Decision Items

6. Report &

Recommendations from the 5 May 2021 Finance Audit and Risk Sub-committee

Meeting 7

7. Appointment of an

Independent Member to the Finance, Audit and Risk Sub-committee 35

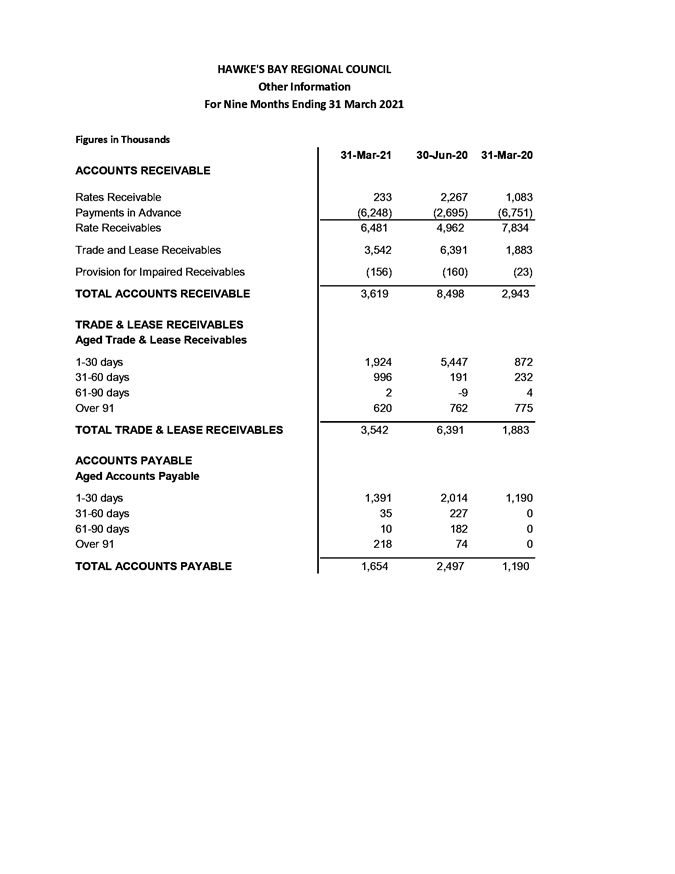

8. HBRC Investment

Strategy and Treasury Policy 39

Information or Performance Monitoring

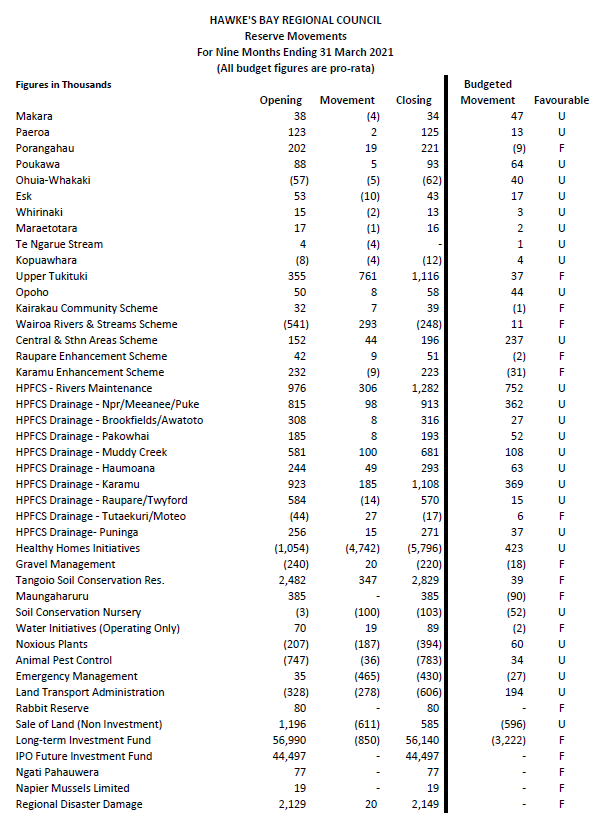

9. 2020-21 Quarter 3

(1 January - 31 March 2021) Financial Report 43

10. Organisational Performance

Report for period 1 January to 31 March 2021 57

11. LTP IT Work Programme Delivery 59

12. HBRIC Quarterly Update 65

13. Hawke's Bay Tourism

Six-monthly Update 77

14. Discussion of Minor Matters

Not on the Agenda 97

Decision Items (Public Excluded)

15. Confirmation of Public

Excluded Minutes 99

HAWKE’S

BAY REGIONAL COUNCIL

Corporate and

Strategic Committee

Wednesday 19 May 2021

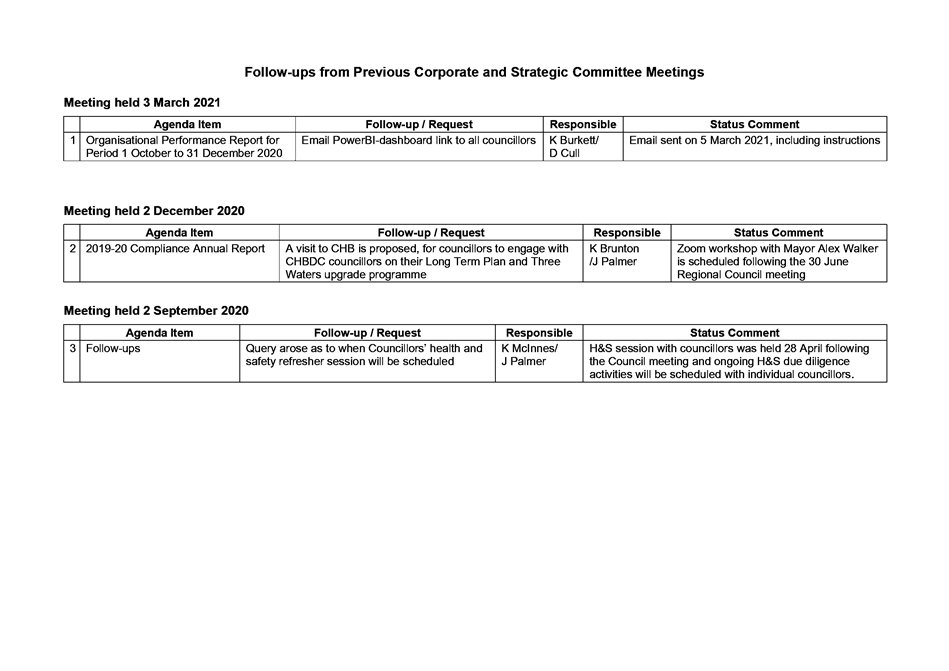

Subject: Follow-ups from

Previous Corporate and Strategic Committee Meetings

Reason

for Report

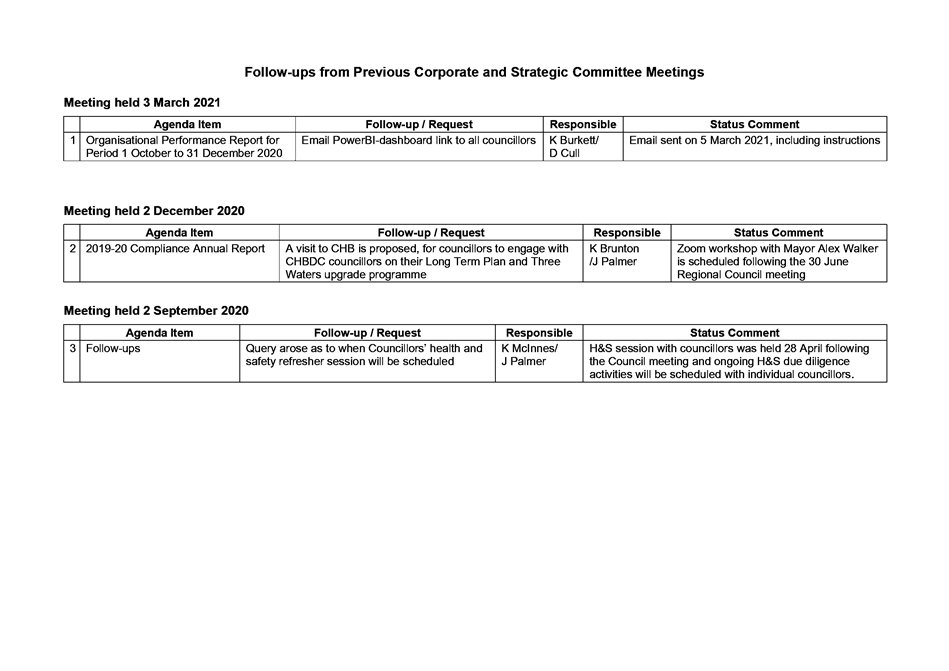

1. On the list attached are items raised at previous Corporate and

Strategic Committee meetings that staff have followed up on. All items indicate

who is responsible for follow up, and a brief status comment. Once the items

have been reported to the Committee they will be removed from the list.

Decision

Making Process

2. Staff have assessed the requirements of the Local Government Act

2002 in relation to this item and have concluded that, as this report is for

information only, the decision-making provisions do not apply.

Recommendation

That the Corporate and Strategic Committee receives and

notes the “Follow-up Items from Previous Meetings”.

Authored by:

|

Leeanne

Hooper

Team Leader Governance

|

|

Approved by:

|

Desiree Cull

Strategy and Governance Manager

|

|

Attachment/s

|

1⇩

|

Followups

from Previous Corporate and Strategic Committee meetings

|

|

|

|

Followups

from Previous Corporate and Strategic Committee meetings

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate and

Strategic Committee

Wednesday 19 May 2021

Subject: Call for Minor Items

not on the Agenda

Reason for Report

1. This item provides the means for councillors to raise minor matters

they wish to bring to the attention of the meeting.

2. Hawke’s Bay Regional Council standing order 9.13

states:

2.1 “A meeting may discuss an item that is not on the agenda only if it

is a minor matter relating to the general business of the meeting and the

Chairperson explains at the beginning of the public part of the meeting that

the item will be discussed. However, the meeting may not make a resolution,

decision or recommendation about the item, except to refer it to a subsequent

meeting for further discussion.”

Decision Making Process

3. Staff have

assessed the requirements of the Local Government Act 2002 in relation to this

item and have concluded that, as this report is for information only, the

decision-making provisions do not apply.

Recommendation

That the Corporate and Strategic Committee accepts the

following “Minor Items Not on the Agenda” for discussion as Item

14.

Authored by:

|

Leeanne

Hooper

Team Leader Governance

|

|

Approved by:

|

Desiree Cull

Strategy and Governance Manager

|

|

Attachment/s

There are no attachments

for this report.

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 19 May 2021

Subject: Report &

Recommendations from the 5 May 2021 Finance Audit and Risk Sub-committee

Meeting

Reason

for Report

1. The following

matters were considered by the Finance Audit and Risk Sub-committee (FARS)

meeting on 5 May 2021 and are now presented for the Committee’s

consideration alongside any additional commentary the

Sub-committee Chair wishes to offer.

2. The purpose of

the Finance, Audit and Risk Sub-committee, in accordance with its Terms of

Reference, is to report to the Corporate and Strategic Committee to fulfil its

responsibilities for:

2.1. The provision

of appropriate controls to safeguard the Council’s financial and

non-financial assets, the integrity of internal and external reporting and

accountability arrangements

2.2. The review of

Council’s revenue and expenditure policies and the effectiveness of those

policies

2.3. The

independence and adequacy of internal and external audit functions

2.4. The

robustness of risk management systems, processes and practices

2.5. Compliance

with applicable laws, regulations, standards and best practice guidelines

2.6. Monitor the performance of Council’s investment portfolio.

Agenda items

3. The Independent

Member Resignation item formally received the

resignation of Rebekah Dinwoodie. A separate agenda item has been

prepared to provide the means for the Corporate and Strategic Committee

(C&S) to act on the Sub-committee’s recommendation that:

3.1. the C&S

determines and recommends to Hawke’s Bay Regional Council an appropriate

recruitment and appointment process to replace the Independent Member of the

Finance, Audit and Risk Sub-committee.

4. The Risk Maturity Update item updated the Sub-committee on the implementation of

Council’s maturing risk management system, including

that Risk Appetite Workshops with the Executive

Leadership Team (ELT) and councillors have taken place and a draft Risk Appetite Statement will be presented to the August FARS meeting

for adoption. The Sub-committee resolved:

4.1. Confirms that

the management actions undertaken and planned adequately respond to the Risk

Management Maturity Roadmap as endorsed by Hawke’s Bay Regional Council

on 24 June 2020

4.2. Reports to

the Corporate and Strategic Committee, the Sub-committee’s satisfaction

that adequate evidence has been provided of progress to implement the maturing

risk management system

5. The Internal Audit Work Programme Update item

updated the Sub-committee on the work programme including the dashboard of corrective actions taken. In response to a

query made at the Sub-committee meeting in relation to Health & Safety and

the induction of Contractors, staff advise that although there are appropriate processes in place via SiteWise and the HBRC’s

2017 Contractors’ H&S Guidelines and Workbook, these are currently

under review in order to address inadequacies identified by the Audit, and

staff are also working to create a dashboard to enhance the tracking and

reporting of how contractors are meeting their H&S obligations. The Sub-committee resolved:

5.1. Confirms that management actions undertaken or planned for the

future adequately respond to the findings and recommendations of the internal

audits

5.2. Reports that the Committee can be assured that the H&S of

contractors whilst working for the HBRC onsite or off have the appropriate

processes in place via SiteWise or the HBRC’s 2017 Contractors’

H&S Guidelines and Workbook (currently under review)

5.3. Confirms that

the dashboard reports provide adequate information on the progress of

corrective actions and the progress of the approved Annual Internal Audit

programme

5.4. Reports to

the Corporate and Strategic Committee, the Sub-committee’s satisfaction

that the Internal Audit Work Programme Update provides adequate evidence of the

adequacy of Council’s internal audit functions and management actions

undertaken or planned to respond to internal audit review findings and recommendations.

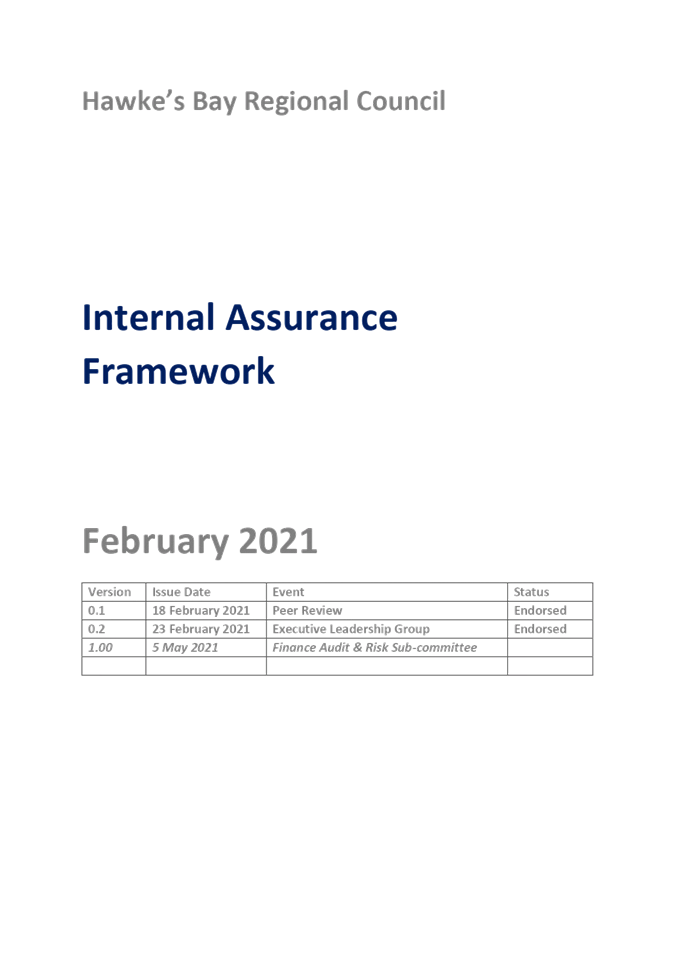

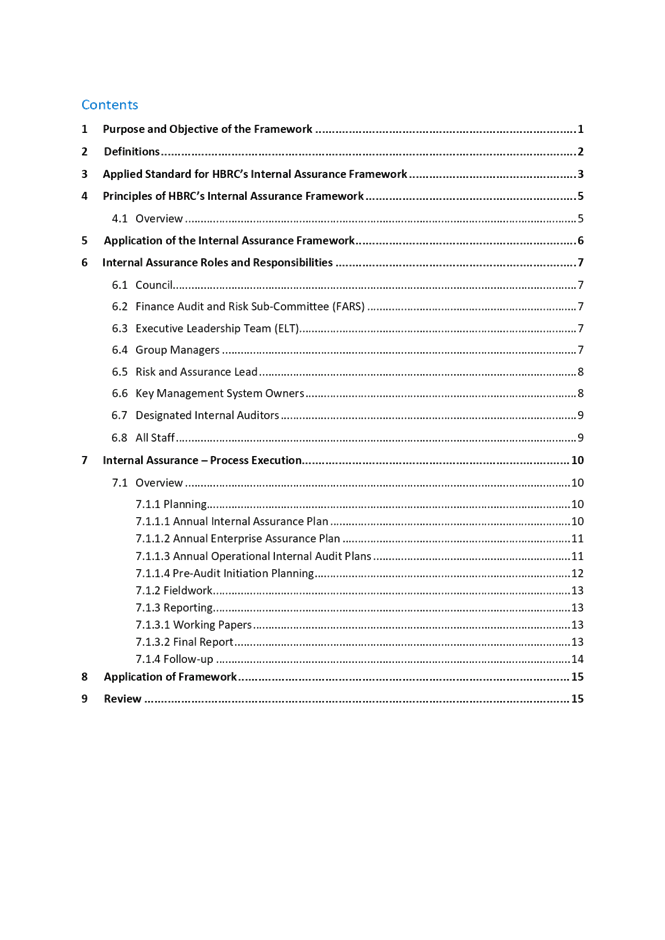

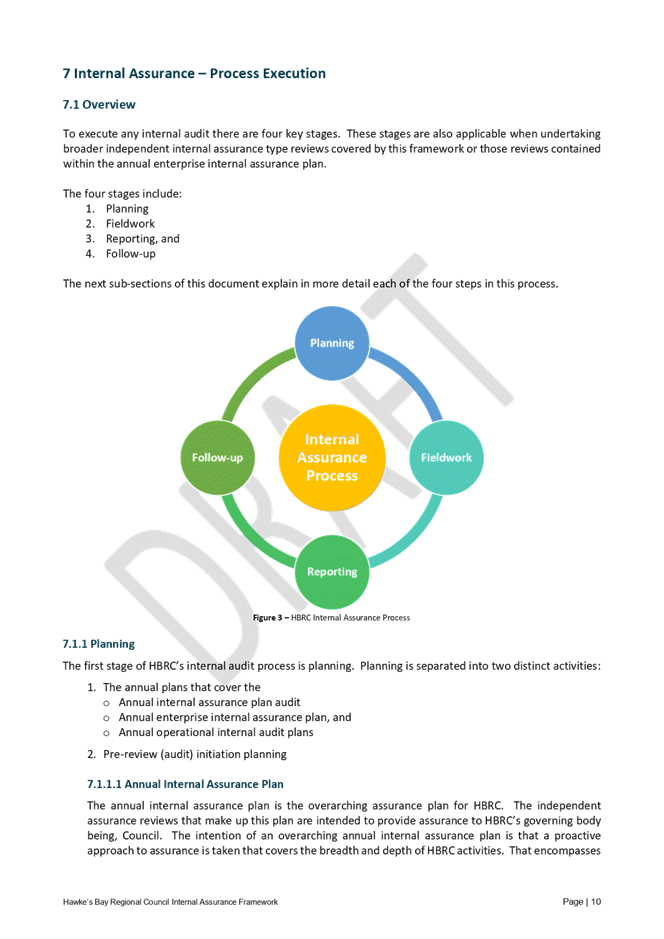

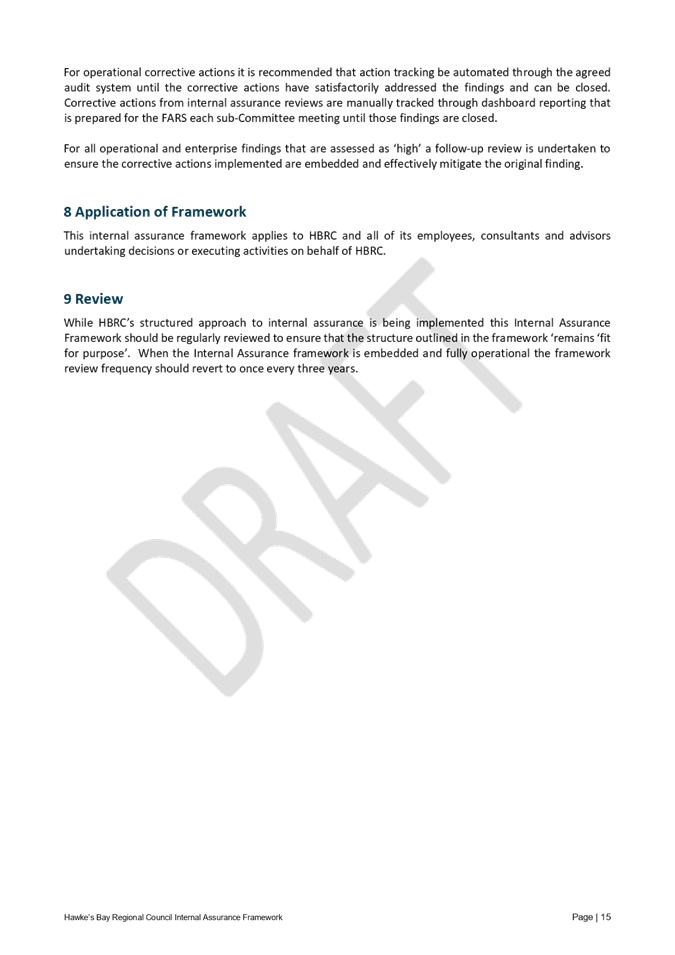

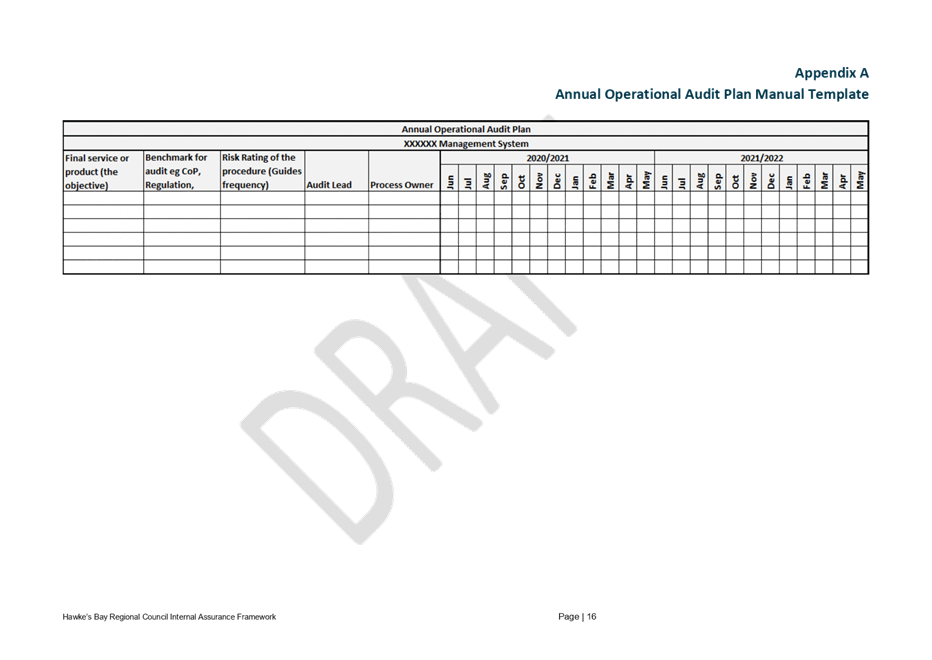

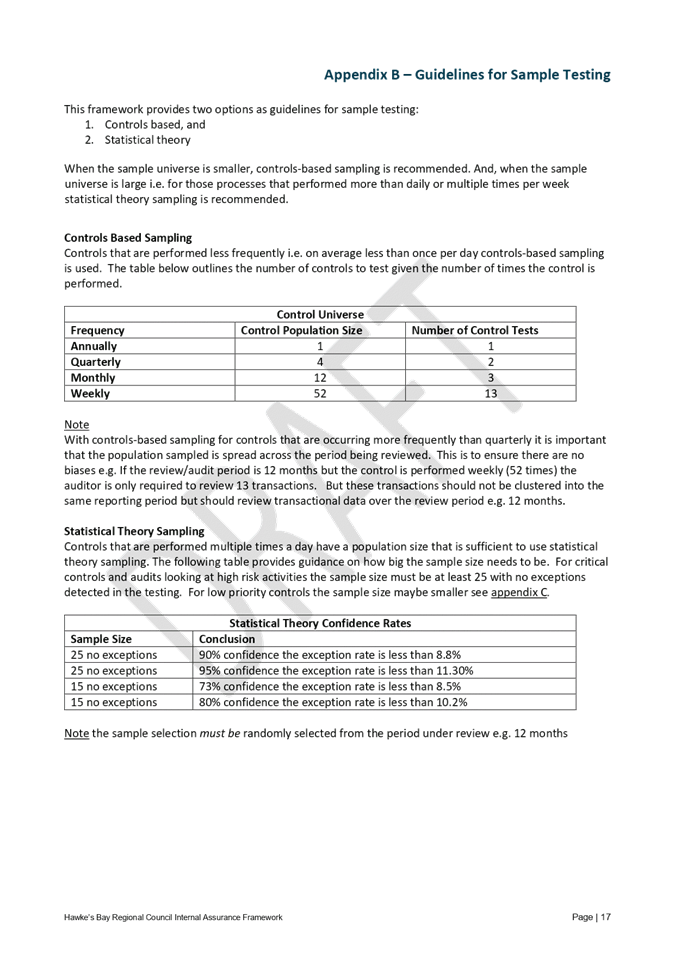

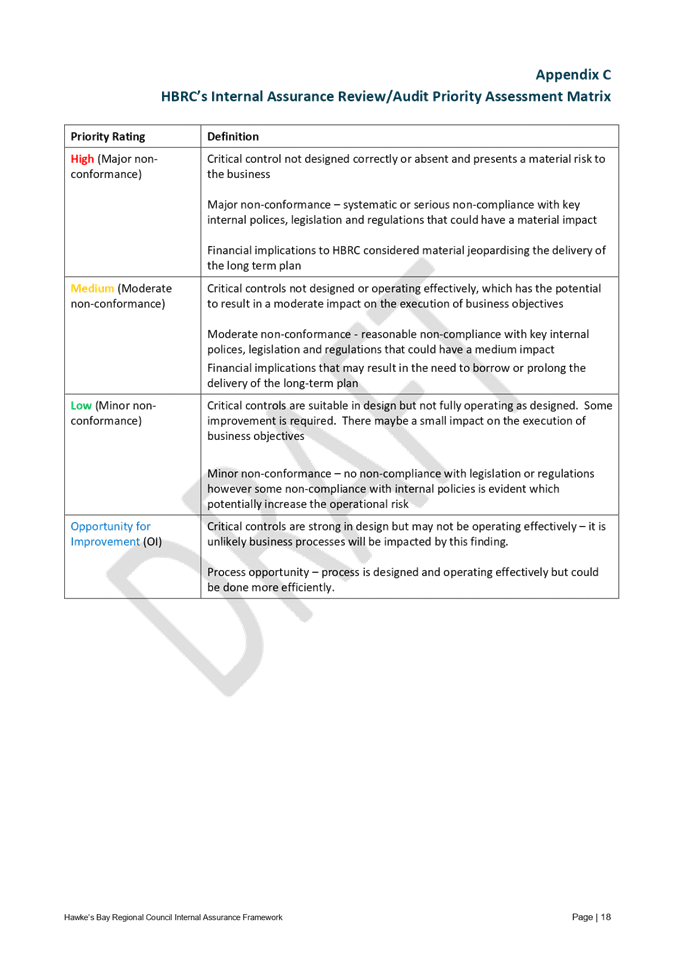

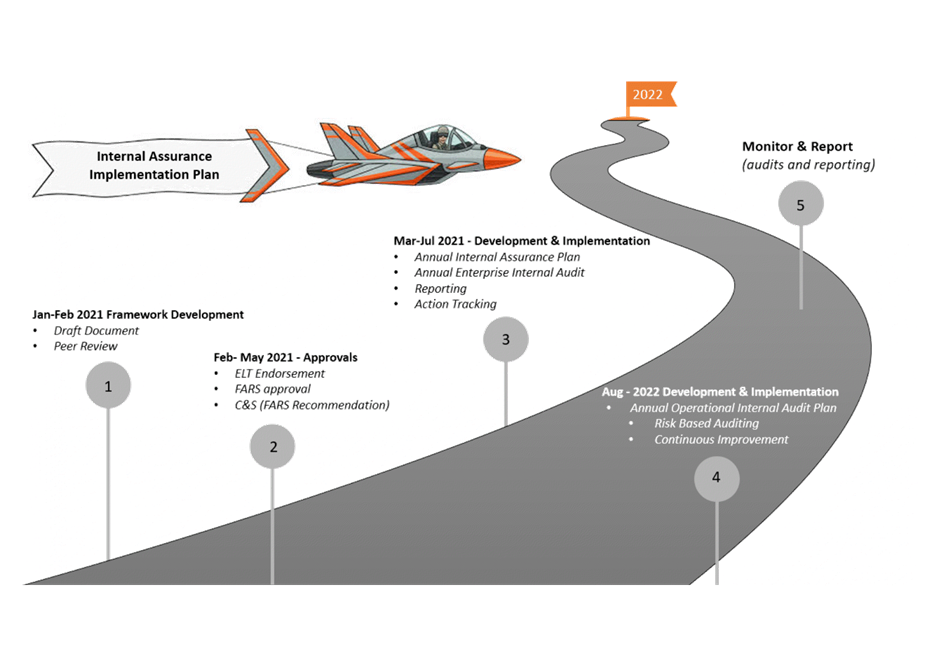

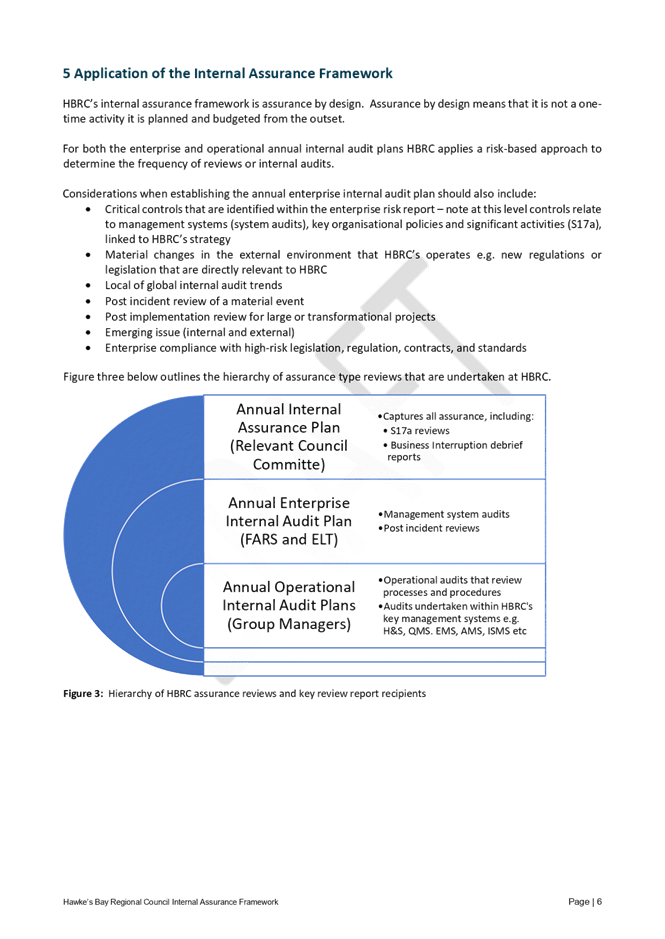

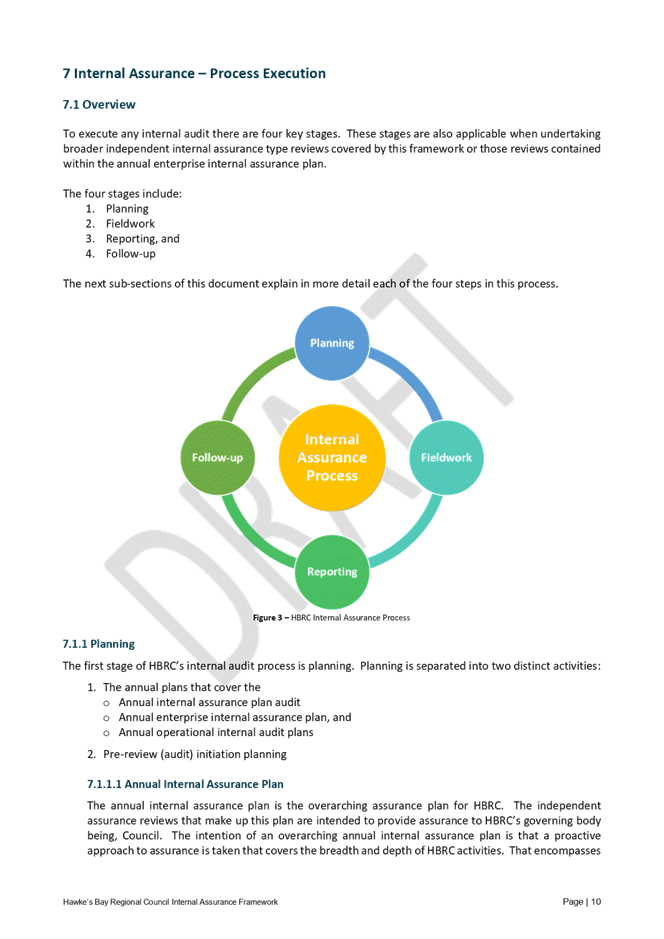

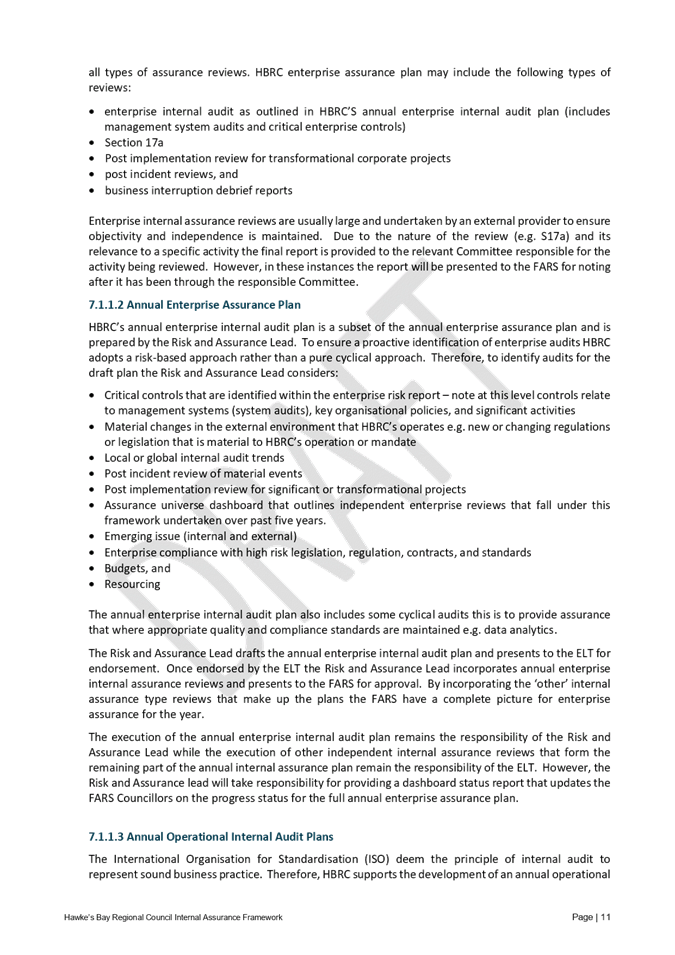

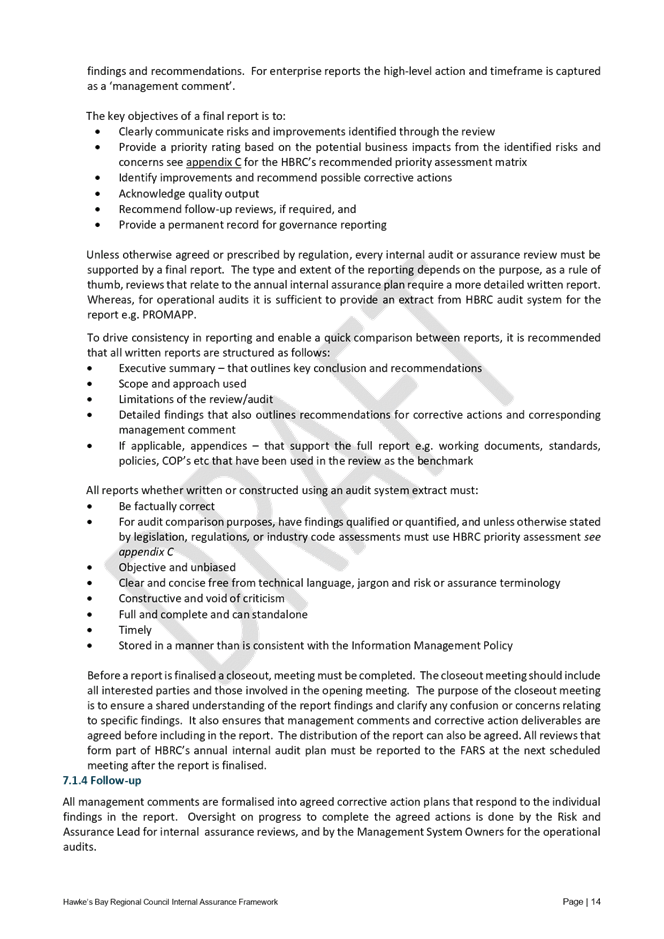

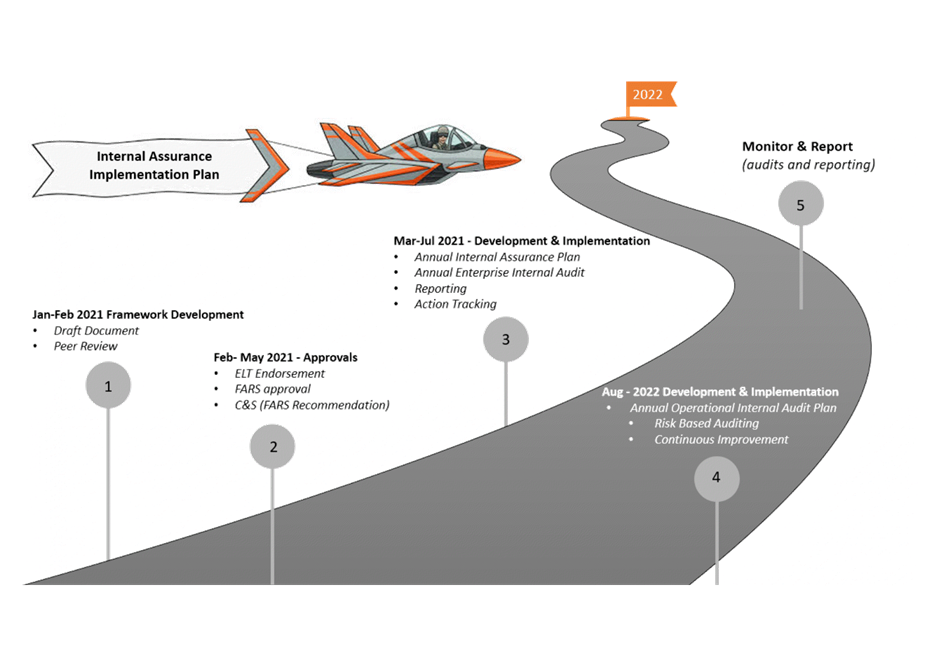

6. The Internal

Assurance Framework item provided the draft

Internal Assurance Framework and the Internal

Assurance Implementation Plan (attached) for the Sub-committee’s

endorsement and recommendation to the C&S to further recommend to Council

for adoption.

7. The intent of

the Internal Assurance Framework is to take an organisational and proactive

risk-based approach to assurance that covers the breadth and depth of Council.

This should provide greater confidence to governors and to management that the organisation

is well run with the ‘right’ activities being delivered in the

‘right’ way.

8. It is also

intended that the Framework will provide a catalyst to promote a culture of

transparency across the organisation. Key points in the draft Internal Assurance

Framework include:

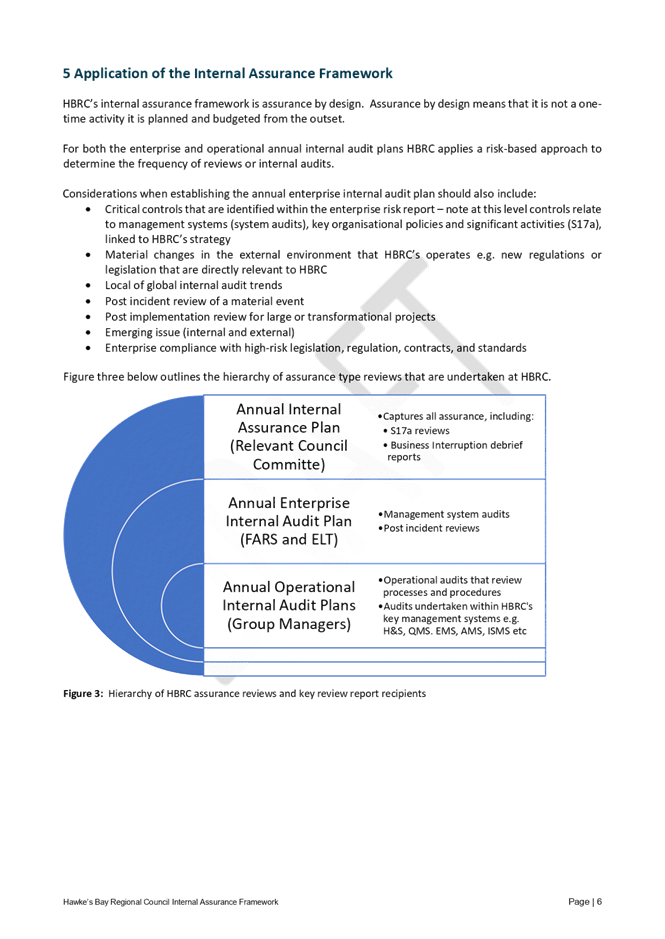

8.1. Adoption of

internal audit principles as defined by the International Institute of Internal

Auditors.

8.2. Adoption of

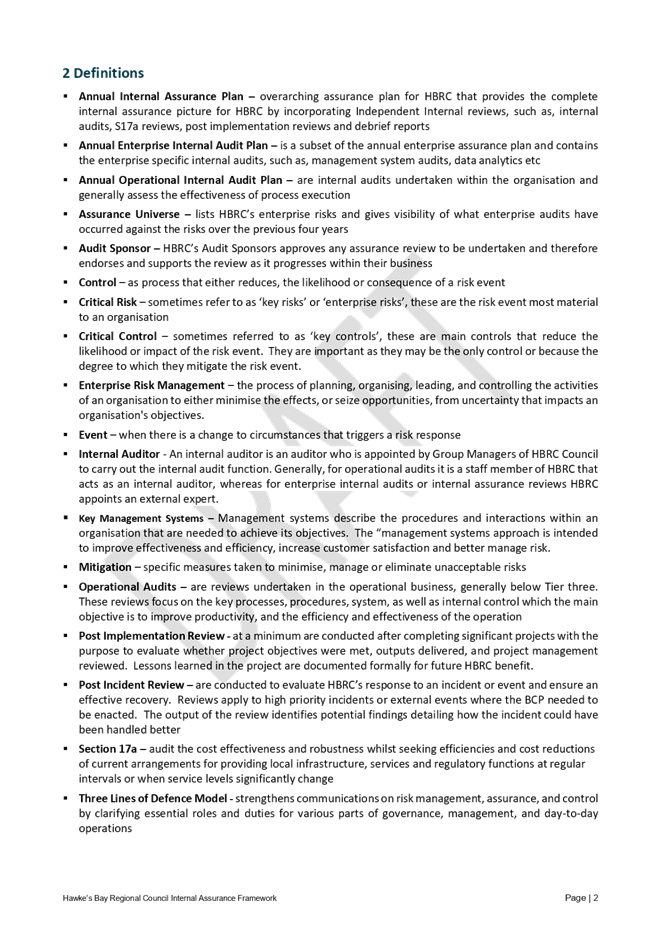

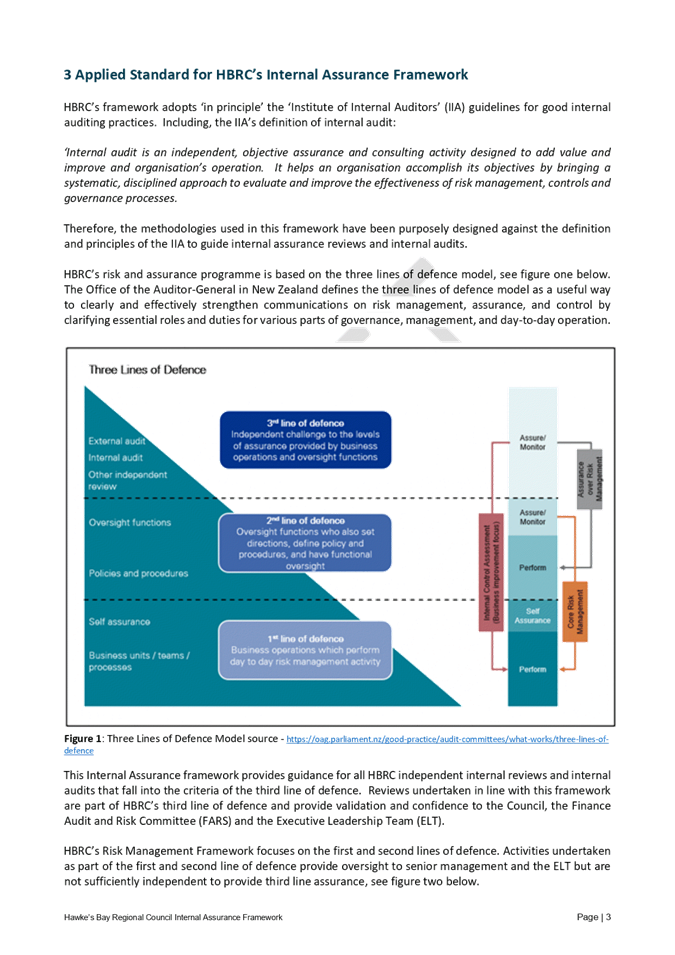

the three lines of defence model which is an assurance model that has been

endorsed by the Office of the Auditor General. The Office of the Auditor

General notes that this model allows for scalability of an assurance programme

based on the: criticality of the activity being reviewed, type of assurance

being undertaken, and level within the organisation requiring assurance.

8.3. Assurance

review classification based on the type of review being undertaken and the

recipient of the assurance. The three types of review classifications,

classification review examples, and the intended recipients are:

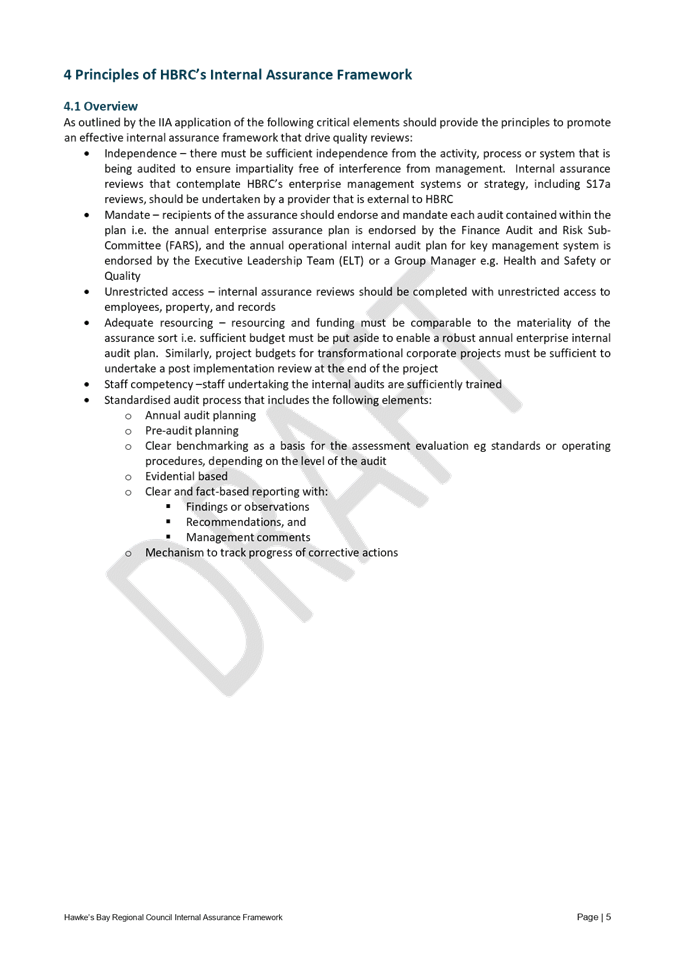

8.3.1. Internal assurance,

e.g. S17a – Council Committee and management that is responsible for the

activity being reviewed

8.3.2. Enterprise

Internal audit, e.g. management system audits – the FARS

8.3.3. Operational

internal audits, e.g. review of ‘Codes of Practice’ (COP) –

Council’s Management and ELT.

8.4. The Framework will be measured by its

ability to drive positive change and improvement throughout Council.

9. The Sub-committee resolved its endorsement of the Framework

and support for the Implementation Plan as well as recommending that C&S

further recommend both to Council for adoption, noting that the framework

itself does not deliver outcomes.

10. The Data Analytics

Internal Audit Report item provided the report on the fourth consecutive

annual Data Analytics Audit of payables, payroll and transactional data for the

financial year conducted by Crowe. No significant issues were raised by the

Audit and it is proposed that the Data Analytics internal audit be carried out

in the first year of TechOne being implemented and then extended to a 2-yearly

cycle.

10.1. That the Finance, Audit

and Risk Sub-committee receives and notes the “Data Analytics Internal

Audit Report”.

11. The Quarterly

Treasury Report for 1 January - 31 March 2021 item provided an

update on the performance of Council’s investment portfolio for the third

quarter of the 2020-21 financial year, highlighting an

expectation that returns will continue to equalise over the next quarter

and that full year performance will be around $8.0m ahead of budget. The

following resolution was then passed.

11.1. That

the Finance, Audit and Risk Sub-committee receives and notes the

“Quarterly Treasury Report for 1 January - 31 March 2021” and

confirms that the performance of Council’s investment portfolio has been

reported to the Sub-committee’s satisfaction.

Decision

Making Process

12. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as all items were specifically considered at

the Sub-committee level this item is for information only and the LGA

decision making provisions do not apply.

|

Recommendations

1. That the Corporate and Strategic Committee receives and notes the

report and recommendations from the 5 May 2021 Finance, Audit and Risk

Sub-committee, including the FARS resolutions:

Risk Maturity Update

1.1. Confirms that the management actions undertaken and planned

adequately respond to the Risk Management Maturity Roadmap as endorsed by

Hawke’s Bay Regional Council on 24 June 2020

1.2. Reports the Sub-committee’s satisfaction that adequate

evidence has been provided of progress to implement the maturing risk management

system.

Internal Audit Work Programme Update

1.3. Confirms that management actions undertaken or planned for the

future adequately respond to the findings and recommendations of the internal

audits.

1.4. Confirms that the dashboard reports provide adequate information

on the progress of corrective actions and the progress of the approved Annual

Internal Audit programme.

1.5. Reports the Sub-committee’s satisfaction that the Internal

Audit Work Programme Update provides adequate evidence of the adequacy of

Council’s internal audit functions and management actions undertaken or

planned to respond to internal audit review findings and recommendations.

Data Analytics

Internal Audit Report

1.6. Receives and notes the “Data

Analytics Internal Audit Report”.

Quarterly Treasury

Report for 1 October - 31 December 2020

1.7. Receives and notes the “Quarterly Treasury Report for 1

October - 31 December 2020” and confirms that the performance of

Council’s investment portfolio has been reported to the Sub-committee’s

satisfaction.

2. The Finance, Audit and Risk Sub-committee recommends that the

Corporate and Strategic Committee:

2.1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that the Committee can exercise its discretion and make decisions

on this issue without conferring directly with the community or persons

likely to have an interest in the decision.

Independent Member

Resignation

2.2. Determines and recommends to Hawke’s Bay Regional Council an

appropriate recruitment and appointment process to replace the Independent

Member of the Finance, Audit and Risk Sub-committee.

Internal Assurance

Framework

2.3. Approves the draft Internal

Assurance Framework and the Internal

Assurance Implementation Plan as proposed and recommends the adoption of both

to the Hawke’s Bay Regional Council.

|

Authored by:

|

Olivia

Giraud-Burrell

Business Analyst

|

Leeanne

Hooper

Team Leader Governance

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

Draft

Internal Assurance Framework Feb21

|

|

|

|

2⇩

|

Internal

Assurance Framework Implementation Plan

|

|

|

|

Draft

Internal Assurance Framework Feb21

|

Attachment 1

|

|

Internal Assurance

Framework Implementation Plan

|

Attachment 2

|

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 19 May 2021

Subject: Appointment of an

Independent Member to the Finance, Audit and Risk Sub-committee

Reason for Report

1. This item

enables the initiation of a process to appoint an independent member of the

Finance, Audit and Risk Sub-committee (FA&R) to replace Rebekah Dinwoodie,

who has tendered her resignation from the role.

Background

2. The Terms of

Reference for the FARS, adopted by Council on 6 November 2019, state that

membership of the sub-committee is up to four members of Council and an

external appointee.

3. At the time

(November 2019) Council adopted its governance structure, including

committees’ Terms of Reference and membership, there were discussions

around:

3.1. The necessity

(or otherwise) for an external, independent member of the FARS

3.2. Whether the

FARS should be a ‘standing committee of the whole’ with delegations

to make recommendations directly to Council rather than through the Corporate

& Strategic Committee as a sub-committee of that body.

Options Assessment

4. Council could

amend the FARS Terms of Reference to remove the membership requirement for an external

(independent) appointee on the sub-committee. However, as this would be

contrary to best practice guidelines, staff do not recommend this option.

5. The Committee

can agree the process to replace the Independent Appointee on the FARS and

recommend to Council that the process be initiated.

6. If it is of a

mind to, the Committee might base the process to appoint a new independent

member on the one previously undertaken, being:

6.1. Requests that

the Chief Executive seeks Expressions of Interest from suitably qualified

applicants for the role of independent member of the Finance, Audit and Risk

Sub-committee

6.2. Determines

the process for the appointment of the independent member of the sub-committee;

being:

6.2.1. Candidates

short-listed for interview by the Sub-committee

6.2.2. Sub-committee

interviews shortlisted candidates

6.2.3. Sub-committee

recommends appointment of preferred candidate to the Corporate and Strategic

Committee.

Financial and Resource Implications

7. The

remuneration, including expenses, for the independent member has been included

in Council’s governance budgets and is currently set at $8,000 per annum.

Decision

Making Process

8. Council is required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

8.1. The decision does not significantly alter the service provision or

affect a strategic asset.

8.2. The use of the special consultative procedure is not prescribed by

legislation.

8.3. The decision does not fall within the definition of Council’s

policy on significance.

8.4. The persons

affected by this decision are councillor members of the Finance, Audit and Risk

Sub-committee and potential candidates for independent member of that body.

8.5. The decision is not inconsistent with an existing policy or plan.

8.6. Given the nature and significance of the issue to be considered and

decided, and also the persons likely to be affected by, or have an interest in

the decisions made, Council can exercise its discretion and make a decision

without consulting directly with the community or others having an

interest in the decision.

Timeline

9. Proposed

timeline for appointment of Independent Member to Finance, Audit and Risk

Sub-Committee.

|

Week

24 - 28 May

|

Week

14 - 18 June

|

Week

21 - 25 June

|

Late June

|

Thursday 29 July

|

4

August

|

|

SEEK advert

|

Shortlisting

|

Interviewing

|

Reference Checking

|

FARS Final Agenda

|

FARS Meeting

|

|

HBRC to advertise

Approx 2 weeks

|

Chair of FARS

GM Corporate Services

|

Chair of FARS

GM Corporate Services

|

People & Capability

|

Recommendation/s

for final agenda

|

Rec to C&S

|

|

Recommendations

1. That the Corporate and Strategic Committee receives and considers

the “Appointment of an Independent Member to the Finance, Audit and

Risk Sub-committee” staff report.

2. The Corporate and Strategic Committee recommends that

Hawke’s Bay Regional Council:

2.1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that Council can exercise its discretion and make decisions on

this issue without conferring directly with the community or persons likely

to have an interest in the decision.

2.2. Initiates the process following for the recruitment and

appointment of an Independent member of the Finance, Audit and Risk

Sub-committee

2.2.1. Chief Executive to seek expressions of interest from suitably

qualified candidates

2.2.2. FARS councillor members to assess Expressions of Interest received

and determine a shortlist of candidates for interview

2.2.3. FARS Chair and GM Corporate Services undertake interviews of the

shortlisted candidates, after which the FARS recommends the appointment of

the preferred candidate to Council.

|

Authored by:

|

Leone Andrews

EA to Group Manager – Corporate

Services

|

Leeanne

Hooper

Team Leader Governance

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

There are no attachments

for this report.

HAWKE’S BAY REGIONAL COUNCIL

Corporate and

Strategic Committee

Wednesday 19 May 2021

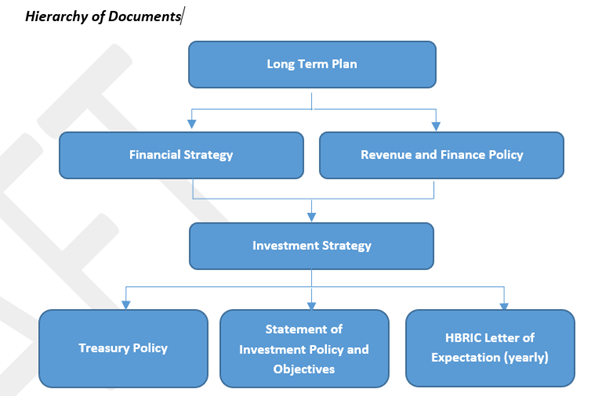

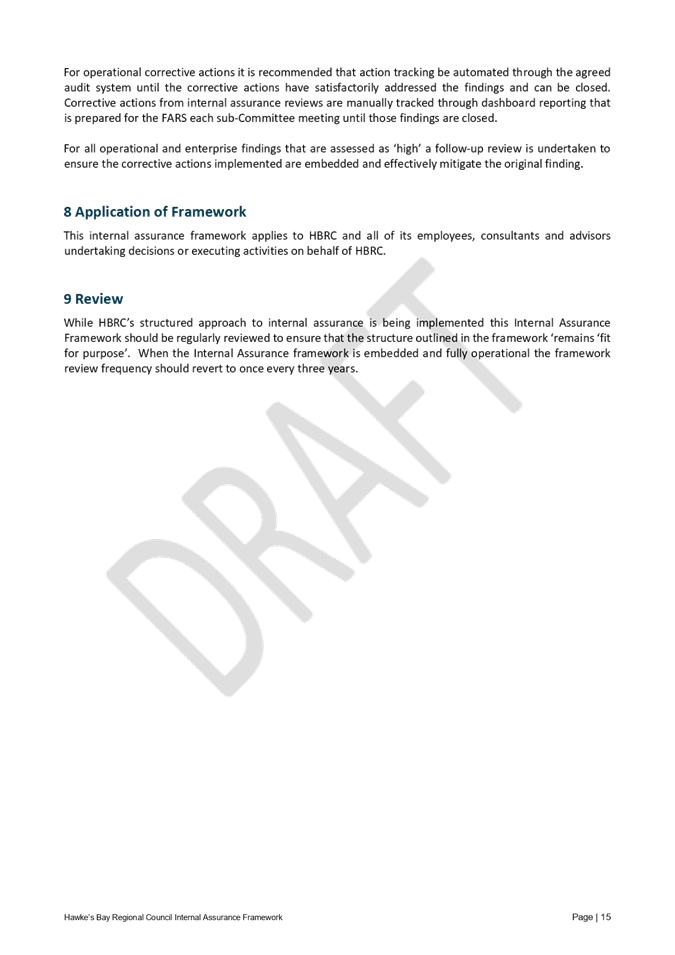

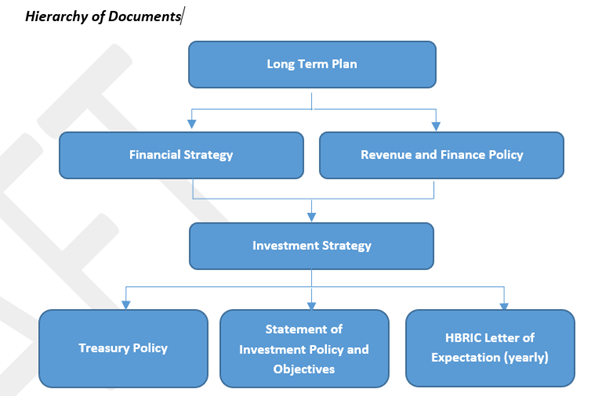

Subject: HBRC Investment

Strategy and Treasury Policy

Reason for Report

1. The

Investment Strategy outlines Council’s approach to managing its

investment assets. It reflects the principles agreed upon with Councillors as

part of the development of the financial strategy for the 2021-31 Long Term

Plan (LTP). It builds on this work by providing detail regarding the

operational elements required to implement the Investment Strategy. The

draft Investment Strategy for the 2021-31 LTP is attached for feedback.

2. The

Treasury Policy further operationalises the financial strategy of the LTP and

Annual Plan. It sets the limits and parameters to manage all external

borrowing, investments and incidental financial arrangements (e.g. use of

interest rate risk management instruments). It ensures requirements of

the Local Government Act 2002 are met and incorporates the Liability Management

Policy and Investment Policy. The amended (marked up) Treasury Policy is

attached for feedback.

Officers’ Recommendation(s)

3. Officers

recommend the Committee considers both documents and provides feedback on

whether the documents adequately and appropriately deliver operationalising the

key principals agreed through the development of the 2021-31 LTP in order to

recommend to Council for adoption.

Background /Discussion

4. The Financial Strategy outlines the Council’s overall

approach to managing its finances. The

objective of the Financial Strategy is to:

4.1. manage the

collection, investment and expenditure of rate-sourced, grant-sourced and

user-pays-sourced funds

4.2. set

guidelines and limits so that the community has assurance that HBRC’s

revenue and expenditure remains within known and agreed limits and provides for

the investment in infrastructure and the achievement of goals that the

community is aware of and has agreed to.

5. Officers have

developed an Investment Strategy and updated the Treasury Policy to support

delivery of and reflect key changes made to the 2021-31 Financial Strategy,

including:

5.1. Increase in

debt limit from Net Debt / Total Revenue 150% to 175% in line with LGFA policy

covenants

5.2. Increase in

Rates as a percentage of Revenue, from 50% to 60% to reduce reliance on

investment income

5.3. Build an

investment equalisation reserve of $10m by the end of the 2021-31 LTP

5.4. Borrowing to

fund operational costs to balance the rating impact in order to fund an

accelerated work programme

5.5. HBRIC

mandated to grow its investment portfolio.

Next Steps

6. Feedback

received on the draft documents attached to this report will be incorporated

and presented to Council for formal adoption on 30 June 2021 with the

Investment Strategy becoming effective from 1 July 2021 and the Treasury Policy

from 30 June 2021.

7. Review of the

Statement of Investment Policy and Objectives will follow the finalisation of

the Investment Strategy and Treasury Policy.

8. The HBRIC

Statement of Intent was presented in draft to the Corporate and Strategic

Committee on 3 March and the Regional Council on 24 March 2021. Council

feedback has been given to the HBRIC board and the revised document will be

presented back to Council for adoption on 30 June 2021.

Decision Making Process

9. Council and its committees are required to make every decision in

accordance with the requirements of the Local Government Act 2002 (the Act).

Staff have assessed the requirements in relation to this item and have

concluded:

9.1. The decision does not significantly alter the service provision or

affect a strategic asset, nor is it inconsistent with an existing policy or

plan.

9.2. The use of the special consultative procedure is not prescribed by

legislation.

9.3. The decision is not significant under the criteria contained in

Council’s adopted Significance and Engagement Policy.

9.4. Given the nature and significance of the issue to be considered and

decided, Council can exercise its discretion and make a decision without

consulting directly with the community or others having an interest in

the decision.

Recommendations

1. That the

Corporate and Strategic Committee receives and considers the “HBRC

Investment Strategy and Treasury Policy” staff report.

2. The Corporate

and Strategic Committee recommends that Hawke’s Bay Regional Council:

2.1. Agrees that

the decision to be made is not significant under the criteria contained in

Council’s adopted Significance and Engagement Policy, and that Council

can exercise its discretion and make the decisions on this issue without

conferring directly with the community or persons likely to have an interest in

the decision.

2.2. Adopts the

HBRC Investment Strategy and Treasury Policy as proposed.

Or

2.3. Adopts the

HBRC Investment Strategy and Treasury Policy as amended to incorporate the

amendments agreed by the Corporate and Strategic Committee, being:

2.3.1. …

2.3.2. …

Authored by:

|

Geoff Howes

Treasury & Funding Accountant

|

Bronda Smith

Chief Financial Officer

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

James Palmer

Chief Executive

|

Attachment/s

|

1⇨

|

Draft

Investment Strategy

|

|

Under

Separate Cover

|

|

2⇨

|

Updated Draft

Treasury Policy

|

|

Under

Separate Cover

|

HAWKE’S BAY REGIONAL COUNCIL

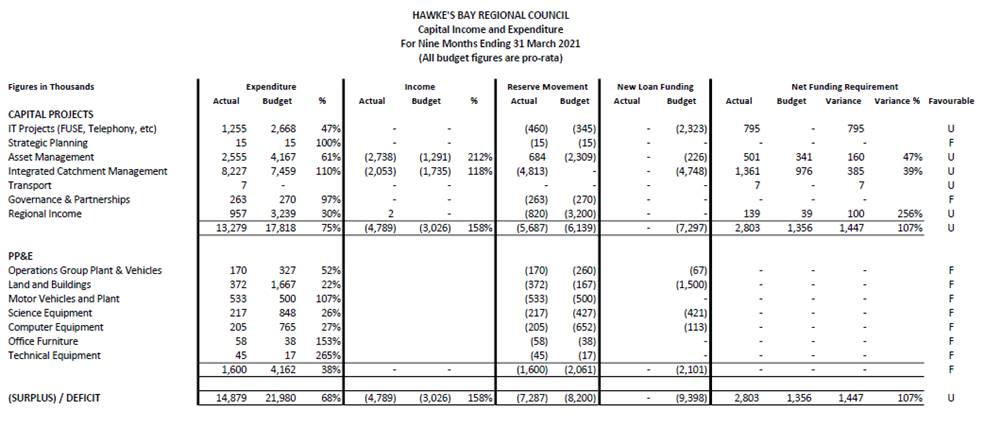

Corporate

and Strategic Committee

Wednesday 19 May 2021

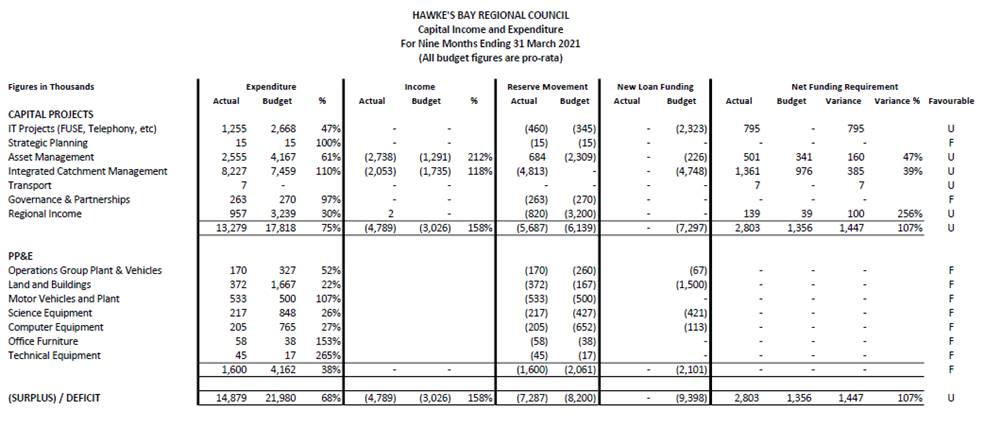

Subject: 2020-21 Quarter 3 (1

January - 31 March 2021) Financial Report

Reason for Report

1. This item provides the Committee with financial results for the 2020-21

financial year for the 9 months to 31 March 2021.

YTD Summary to 31 March

2021

2. Councils operating position has improved by $2.4m, with a

YTD deficit of $2.7m compared to a forecast deficit of $5.1m based on the

pro-rata budget.

3. Operating income is $500k favourable to budget and

expenditure to date is almost $2m less than budget.

4. Capital expenditure overall is running at 68% of the

pro-rata budget ($7m lower than planned) and capital income is 58%

($1.75m) exceeding budget due to receiving PGF funding for shovel-ready

projects (Heretaunga Plains Flood Control Schemes, Upper Tukituki and Wairoa

work). In addition, repayments received from the Sustainable Homes

programme have exceeded budget (both early repayments and higher repayments from

the increased uptake in the programme).

Summary – Full Year

Forecast

5. A $3.6m improvement in the forecast year end operating

position. The forecast year end operating position is an operating deficit of

$3.2m compared to a budgeted deficit of $6.8m.

6. Full year operating income is expected to exceed the budget

by 9% ($4.7m) due to favourable investment income expectations including

dividends from HBRIC and the returns from Managed Funds.

7. Full year operating expenditure is expected to exceed the

budget by 2% ($1.1m) due to $760k of fees charged by the Managed Fund providers

as a result of the additional revenue received as noted above.

8. Full year capital expenditure is expected to be 17% ($5m)

underspent with an additional $3.4m income expected from government funding for

the shovel-ready projects across Asset Management and Integrated Catchment

Management.

9. The combined capital and operating carry forward requests

are expected to exceed $10m including $150k of shovel ready funding.

Background to the Financial

Summary

10. Many of the variances in the financial report to 31 March

are the result of:

10.1. no seasonal phasing of budgets.

10.2. timing of the work programme delivery.

11. The FY20-21 annual plan

budget was revised in response to the Covid-19 Pandemic. It includes

conservative forecasting for investment income in-particular the uncertainly

around the economy and financial markets at the time of preparation and

adoption.

12. The budgets presented

include the carry forwards from FY19-20 approved by Council.

13. For reporting purposes,

the annual budget is divided evenly across the year without phasing. Annual

spend has considerable seasonality, particularly planting activity, which will

occur towards the end of the Financial Year. Future year reporting, from

the new finance system will be phased across the year accounting for

seasonality.

14. New loan funding is

generally drawn down at the end of the financial year when the actual required

funding is known.

15. All revenue and

expenditure accrued (carried forward) at the end of the FY19-20 financial year

has been recognised in the FY20-21 actuals.

Operating Income and

Expenditure to 31 March

Groups of Activities

16. Overall

Expenditure is at 94% ($2.6m less) than pro-rata budget across all activities.

16.1. Asset Management and

Integrated Catchment Management expenditure is less than budget by $1m and $2m

respectively but both areas are subject to seasonal variations with significant

additional expenditure occurring in the last quarter of the year.

16.2. Transport is 13% ($500k)

over budget due to the increased costs associated with the operation of the bus

service.

17. Income is

4% ($1m) favourable to budget at 31 March.

17.1. Emergency

Management is $200k below budget. This is a reflection of budget phasing as

partners are invoiced at year end when expenditure for the year is known and

the income will be recognised.

17.2. Consents

and Compliance income recovery is $200k less than budget due to more time spent

on unrecoverable activities and enforcement actions. However, through

prosecutions significant income has been awarded via court fines which has not

yet been accounted for in these financial statements.

Regional and Other Income

18. Income

from Managed Funds is 56% ($2.35m) ahead of budget reflecting returns exceeding

the conservative, Covid19 adjusted plan.

19. HBRIC

Dividends for FY20-21 were received in December.

20. Endowment

Leasehold Rent is $1.9m below budget due to the timing of the leaseholder

invoicing and the payments to ACC but will be adjusted at year end to reflect

the revenue received.

21. Fair

Value Movements due to Revaluations will be calculated at year end.

Capital Expenditure to 31

March

22. Overall

Capital Expenditure is at 75% of the planned YTD position due to:

22.1. IT

projects $1.4m variance due to delays in recruiting appropriately qualified

resources to gather requirements and manage projects.

22.2. Asset

management $1.6m variance due to delays in projects (Clive River dredging

awaiting consents etc) and the timing of work as plant purchase and planting is

carried out in the winter season. Asset Management income is ahead of budget by

$1.2m through funds received for the shovel-ready projects.

22.3. Integrated Catchment

Management expenditure is 10% ($600k) ahead of budget due to the continued

success of the Sustainable Homes programme which is $2.6m ahead of its budget

offsetting limited expenditure in the Ruataniwha Groundwater Modelling, 3D

Aquifer Mapping (SkyTEM) and LiDAR mapping projects caused by delays and

unavailability of resource.

22.4. Regional

Income capital expenditure is behind budget by $2.3m. This includes the

Regional Water Security Scheme which has been impacted by delays in contract

agreements with PGF deferring the entire project timeline.

22.5. Property, Plant and

Equipment purchasing is at 38% of budget ($2.5m less). $1.3m variance relates

to the timing of the accommodation project. Building work is about to

begin and the $2m allocated to this project is expected to be spent by the end

of the calendar year, but will be somewhat dependant on the availability of

architects and builders.

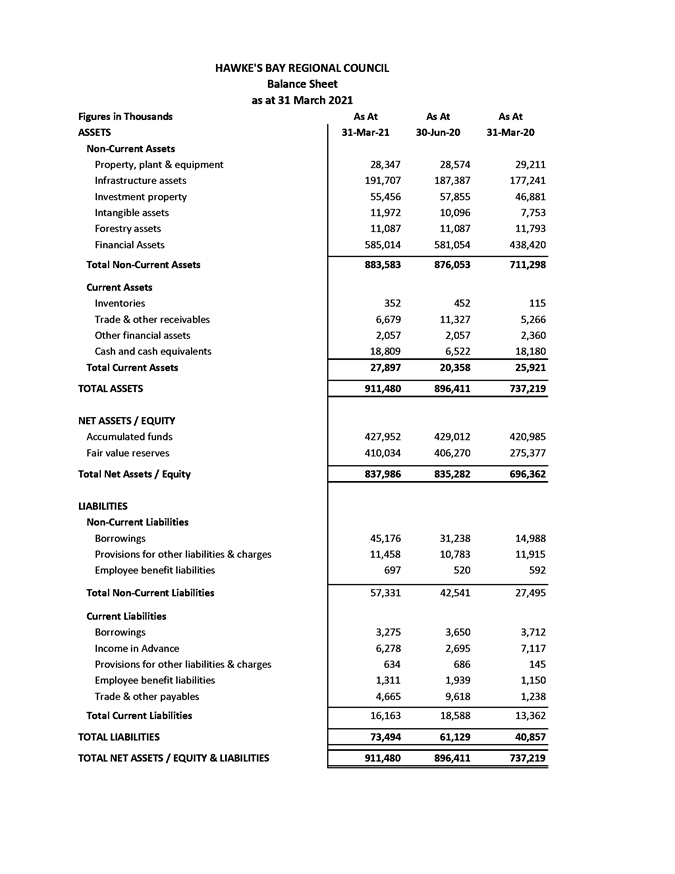

Balance Sheet

23. Non-Current

Assets have increased by $7.5m overall since year end. This comprises increases

in Infrastructure Assets and Intangible Assets as a result of the capital work

programme, increases in Financial Assets due to the continued growth in the

managed funds, offset by $2.4m reduction in the Investment Property value from

the sales of leasehold properties.

24. Current

Assets are consistent with the same period in FY19-20 with the increase in

Trade Receivables being the result of invoicing to MBIE of $1.4m for PGF funds

for work completed and forestry harvesting revenue from Pan Pac.

25. Fair

value reserves have increased by $7m over the last quarter from unrealized

gains in the managed funds.

26. Non-current

Liabilities have increased following the further drawdown of $10m in March 2021

to meet cash flow requirements in addition to the original drawdown of $6.3m in

July 20 for debt funded project work in FY19-20.

27. Current

liabilities have increased in comparison to FY19-20 due to an increase in trade

and other payables. This consists of the payroll accrual for the end of March

and the underlying growth in trade payables which is the result of the

significant increase in the work programme.

Other Information

28. Rates receivables are down

by $800k compared to 31 March 2020 reflecting the overall improvement in rates

payment through the early collection and increased use of direct debit.

29. Trade and Lease

Receivables are up $1.7m compared to 31 March 2020 with longer collection

periods. Analysis shows the increase is primarily due to the growth in invoices

to central government for approved funding which can take months to be verified

and processed.

30. Accounts Payable has

increased compared to the same period prior year due to the growth in the work

programme and the additional costs from the external contractors.

Reserves

31. Reserve movements are as

expected based on the operating and capital income and expenditure to date.

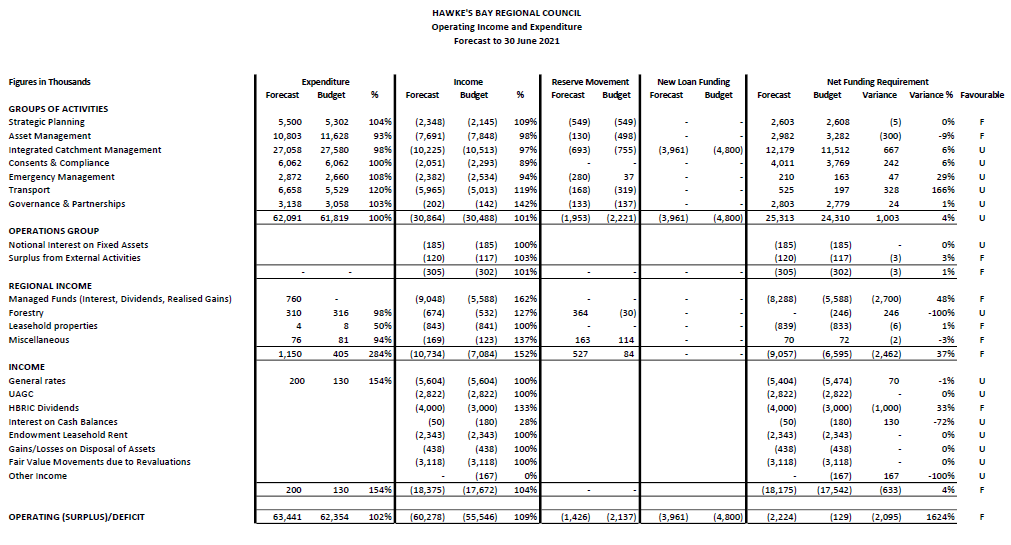

Forecast to 30 June 2021

32. The

full forecast year end position is a $3.6m improvement on budget, expecting an operating

deficit of $3.2m compared to a budgeted deficit of $6.8m and a net funding

requirement improving from a surplus of $129k to $2.2m.

33. The

forecast Operating Expenditure across the group of activities is expected to be

close to budget Transport is expecting to be 20% over budget due to cost

increases in operating the bus service.

34. The

forecast Operating Income across the group of activities is expected to be

close to budget Transport is expecting to be 20% over budget with the

additional funding from NZTA offsetting the reduced direct income from the

public from the flat rate fees.

35. Under

Regional Income. further gains are expected from the Managed Funds with the

year end forecast indicating returns 62% ($3.5m).over the budget of $5.5m and

HBRIC Dividends remaining at the higher than expected $4m, $1m over the full

year budget.

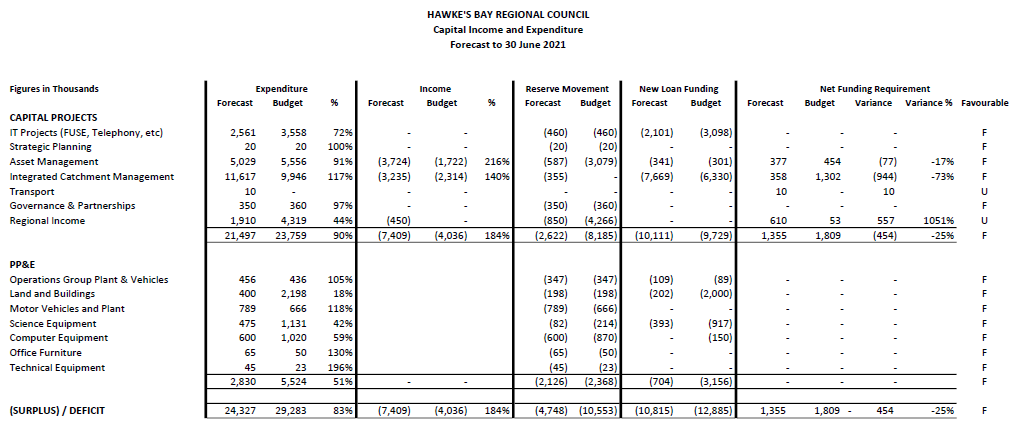

36. The Capital forecast shows:

36.1. IT

projects finishing $1m below budget in this year, but projects on track to

utilise full budgets.

36.2. Asset

Management finishing $500k below budget. This is a combination of $1m unspent

through continued delays in the Clive river dredging project moving the work to

21/22 plus underspends on other scheme expenditure totaling $2.3m. This

shortfall has been offset by the $2.825m in additional work expected to be

completed through the shovel ready projects.

36.3. Integrated

Catchment Management expects to complete the year $1.7m over budget due to the

Sustainable Homes programme which is fully debt funded.

36.4. Regional

Income includes Water Security and HBRC Forestry and forecasts $2.4m shortfall

in expenditure. Water Security expects to be $3m under budget at year end while

$600k has been spent in Forestry on new roading and bridges to support improved

access and facilitate the harvest.

37. The

2020-21 annual plan included a forecast $7.5m debt requirement to cover the

impact of Covid-19 on the budget (zero rates increase, reduced returns on

managed funds and HBRIC dividends). The higher than expected returns from the

managed funds and dividends indicate that this debt requirement will be reduced

by $4.5m.

Carry Forwards for 2021-22

38. Several

capital and operating projects will be requesting a carry forward of funding

into the next financial year based on their forecast expenditure for the year:

38.1. ICM

expect to request to carry forward $1.4m of their operating expenditure

including $800k for the Erosion Control Scheme and $380k of third party funding

for Biodiversity from Te Uru Rakau 1BT. Also, $1.8m of their capital

expenditure including $650k for 3D Aquifer Mapping (SkyTEM), $400k for the

Ruataniwha Groundwater Modelling and $370k for the drilling required as part of

the Ruataniwha groundwater monitoring programme.

38.2. IT is

expecting to request to carry forward $1m from the IT projects budget due to

delays in recruiting staff to initiate, gather requirements and oversee

projects and $400k from the Computer Equipment budget including $300k for

aerial mapping. The regional aerial mapping project has incurred delays from

HDC in progressing the procurement process. The tender should be issued before

30 June with the work now expected in 21-22.

38.3. Asset

Management is expecting to carry forward $1m on the Clive River Dredging

project with the amount dependent on the timing of consent and capability of

the contractor to start work. Other Scheme Capital Expenditure is expected to

be carried forward with a review before year end to assess the requirement

based on the LTP. The shovel ready projects expect to carry forward $150k of

IRG funding to spend in 21-22.

38.4. Corporate

support expects to request a carry forward of $1.7m to continue the work on the

Raffles Street, Station Street and Dalton Street buildings for completion within

the calendar year.

38.5. The

Water Security project expects to request a capital expenditure carry forward

of $4.1m.

38.6. Strategic

Planning expect to request an operating expenditure carry forward of $250k for

continued work on the regional coastal plan, TANK and the OWB hearings.

Decision Making

Process

39. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee

receives and notes the “2020-21 Quarter 3 (1 January - 31 March

2021) Financial Report”.

|

Authored by:

|

Tim Chaplin

Senior Group Accountant

|

Bronda Smith

Chief Financial Officer

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

Q3 2020-21

Financial Statements

|

|

|

|

2⇩

|

Forecast

Financials to 30 June 2021

|

|

|

|

Q3

2020-21 Financial Statements

|

Attachment 1

|

|

Forecast Financials to 30

June 2021

|

Attachment 2

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 19 May 2021

Subject: Organisational

Performance Report for period 1 January to 31 March 2021

Reason for Report

1. This item provides the organisational performance for the period 1

January – 31 March 2021.

Content of the

Report

2. The attached Report contains four parts plus an Executive Summary

with highlights and lowlights for the quarter.

2.1. Part 1: Significant Events or

Programmes impacting this quarter. These tend to be cross-council so

sit outside the groups of activities section.

2.2. Part 2: Business Improvement

Measures focus on how well we are performing across a number of

corporate-wide measures such as health and safety incidents and response to

customer feedback.

2.3. Part 3: Level of Service

Measures by Group of Activities with traffic light status and commentary by

exception.

2.4. Part 4: Activity

Reporting by Group of Activities with non-financial

and financial (operating only) traffic light status and

commentary.

3. This is the tenth Organisational Performance Report to be presented.

As per last quarter the status and commentary reporting has been rolled up from

3-digit code to activity level. Status and commentary

by 3-digit code is still available to Councillors via the dashboard.

4. Following feedback from Councillors at the last committee meeting we

have included the targets for the Level of Service Measures that were adopted

in the 2018-28 Long Term Plan.

5. As a reminder, staff complete their reporting in a software tool

called Opal3 once actual financial results for the quarter are loaded on the 20th

of the month following the end of the quarter. Staff select the status

(red, amber, green) of non-financial results, but it is fixed against agreed

criteria for financial results. For example, red is set at >$30,000 or

>10% over or under budget. Staff are then required to provide

commentary on what they did in the quarter in terms of actual non-financial

performance and to explain any variations to budgets.

6. It should also be noted that many of the variances shown as red in

the activity financial reporting are the result of the current financial

systems’ inability to phase budgets through the year. The current

budget has been spread evenly across the 12 months which does not reflect the

actual timing of work programme delivery. The new financial system due to

be implemented from 1 July 2021 will address this.

7. Next quarter we plan to increase visibility over our Internal

Activities with both non- financial and financial reporting.

Dashboard

8. We are

continuously improving the new dashboard and improving the data reliability

across all areas – we would appreciate any feedback you have. New this

quarter are timeseries graphs for the Level of Service Measures to give context

for the quarter result.

Decision Making Process

9. Staff have

assessed the requirements of the Local Government Act 2002 in relation to this

item and have concluded that, as this report is for information only, the

decision-making provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee receives and notes the “Organisational Performance Report for period 1 January

to 31 March 2021”.

|

Authored by:

|

Kelly Burkett

Business Analyst

|

Desiree Cull

Strategy and Governance Manager

|

Approved by:

|

Desiree Cull

Strategy and Governance Manager

|

|

Attachment/s

|

1⇨

|

Q3

January-March 2021 Organisational Performance Report

|

|

Under

Separate Cover

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate and

Strategic Committee

Wednesday 19 May 2021

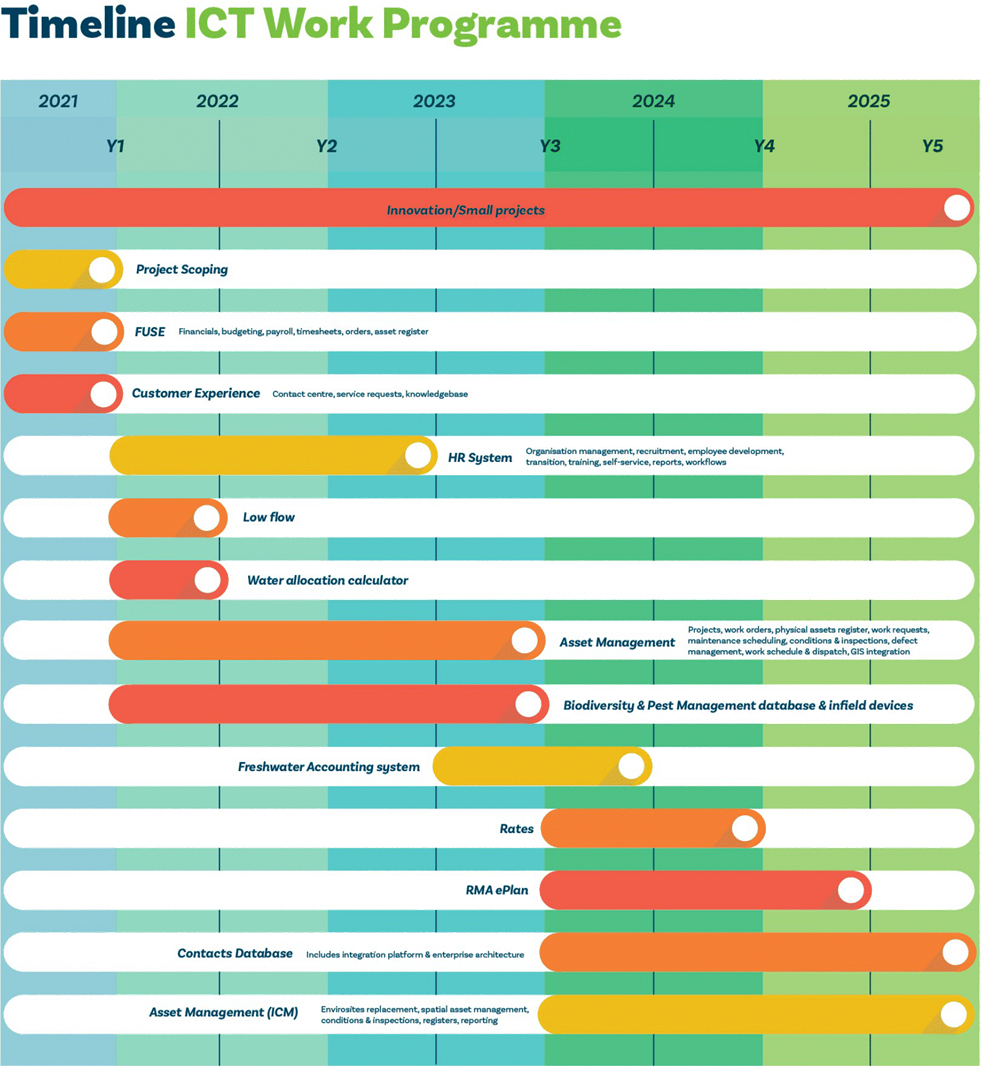

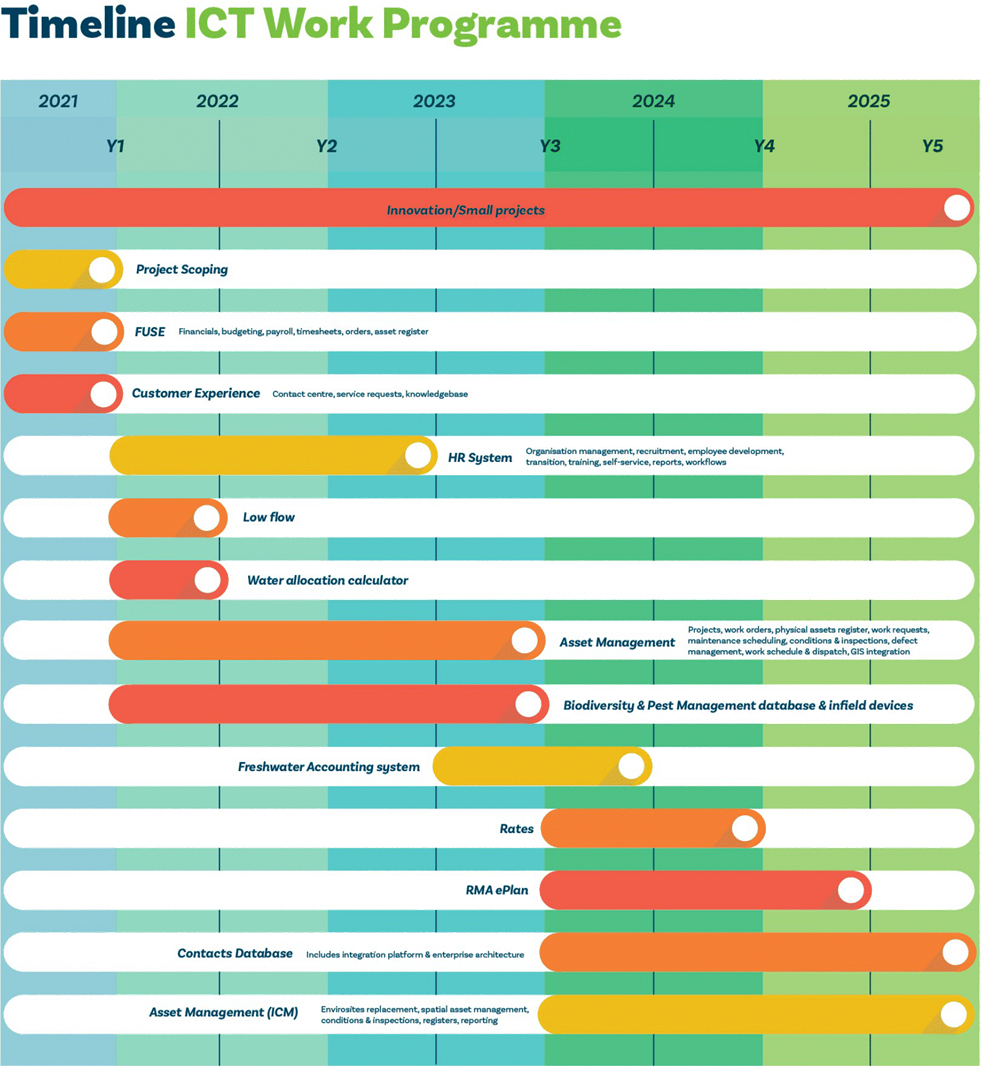

Subject: LTP IT Work Programme

Delivery

Reason for Report

1. This item

highlights key initiatives in progress to improve Council’s digital

systems as well providing an update on the planned programme for delivery,

including $30m capital spend, funded within the 2021-31 Long Term Plan (LTP)

draft budgets.

2. It provides the

context for a presentation to be made to the Committee by Andrew Siddles, Chief

Information Officer.

Background

3. One certainty

in today’s business environment is that most organisations could not

survive for very long without their digital systems. In the public sector, good

digital systems are the ‘table stakes’ to meet the expectations of

customers, partners, suppliers, staff and other stakeholders. Above these

necessities, there are also opportunities for digital systems to enable

different ways of doing our work and collaborating with our stakeholders.

4. Council has a

diverse range of digital systems that enable the capture, analysis, storage and

presentation of data. But there are key gaps in the application portfolio and

obsolescence issues with many of our technology platforms. Expectations

for integrated systems and reporting are also challenging within current

application architectures and datasets.

5. In response to

the huge demand for improvements to digital systems across many business units,

Council has approved $30m capital spend, within the 2021-31 Long Term Plan

(LTP) draft budgets for the implementation of new digital systems.

6. As part of the

Corporate Plan, we’ve committed to develop an implementation plan for the

IT capital work programme.

Implementation Plan for the

IT Capital Work Programme

7. The IT

implementation plan will deliver the capital work programme at a fast pace,

while also ensuring that numerous new and upgraded systems are delivered as a

cohesive and integrated digital platform.

8. Although $30m

is a significant investment, it is still not enough to meet all of the requests

that have been put forward by staff, customers and stakeholders. We have

therefore needed to prioritise efforts and investments.

9. The

prioritisation process was as follows:

9.1. Requests for business

proposals (60 project requests were received)

9.2. Workshopped

proposals to clarify the desired outcomes, estimated size, cost and risk

profile

9.3. Reviewed data

from previous and current digital system implementations to improve

understanding of our capacity to deliver

9.4. The Executive

leadership team then prioritised activities for the first 3 years of the LTP,

taking account of business needs, risks and capacity to deliver

10. The digital system

implementations that have been prioritised are illustrated and are attached.

11. This work programme is

very ambitious, it will consume most of the resources of the ICT section, as

well as many other staff from impacted business units. The implications of this

are that there won’t be residual capacity to respond to ad-hoc requests

for new systems, or system enhancements. To mitigate this, we:

11.1. have

reserved 12-15% of project resources for medium sized / innovation projects

11.2. will review

internal processes and resources associated with the continuous improvement of

existing digital systems.

Strategic Fit

12. The IT work programme is a

subset of the Corporate Plan, which underpins many of the desired outcomes and

actions in HBRC Strategic Plan 2020-2025.

13. Two of the pillars within

HBRC Strategic Plan 2020-2025 are specifically targeted for support and

enablement through digital system implementations:

13.1. Sustainable and

climate-resilient services and infrastructure.

13.1.1. Enterprise Asset Management System

13.2. Healthy, functioning and

climate-resilient biodiversity

13.2.1. Improved systems for Biodiversity and

Pest Management teams

Next Steps

14. The IT work programme will

be monitored and reported on as part of the broader Corporate Plan.

15. Individual project

progress will be reported via the Project Management Office.

16. The IT work programme will

have impacts on the wider Council organisation

16.1. There will be an

opportunity to review and re-design work processes in areas targeted for

digital system implementations

16.2. Process redesign and

system implementation will have an impact on resourcing within customer

business units. This impact is intended to be mitigated by funding backfill

resources from project budgets.

17. IT project priorities will

be reviewed annually, alongside the annual plan process. At this time, we will

review the assumptions we’ve made about project sizing, capacity to

deliver

Decision Making Process

18. Staff have

assessed the requirements of the Local Government Act 2002 in relation to this

item and have concluded that, as this report is for information only, the

decision making provisions do not apply.

Recommendation

That the Corporate &

Strategic Committee receives and notes the “LTP IT Work Programme

Delivery” staff report.

Authored by: Approved

by:

|

Andrew

Siddles

Chief Information Officer

|

Jessica

Ellerm

Group

Manager Corporate Services

|

Attachment/s

|

1⇩

|

ICT Work

Programme Timeline

|

|

|

|

ICT

Work Programme Timeline

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate and

Strategic Committee

Wednesday 19 May 2021

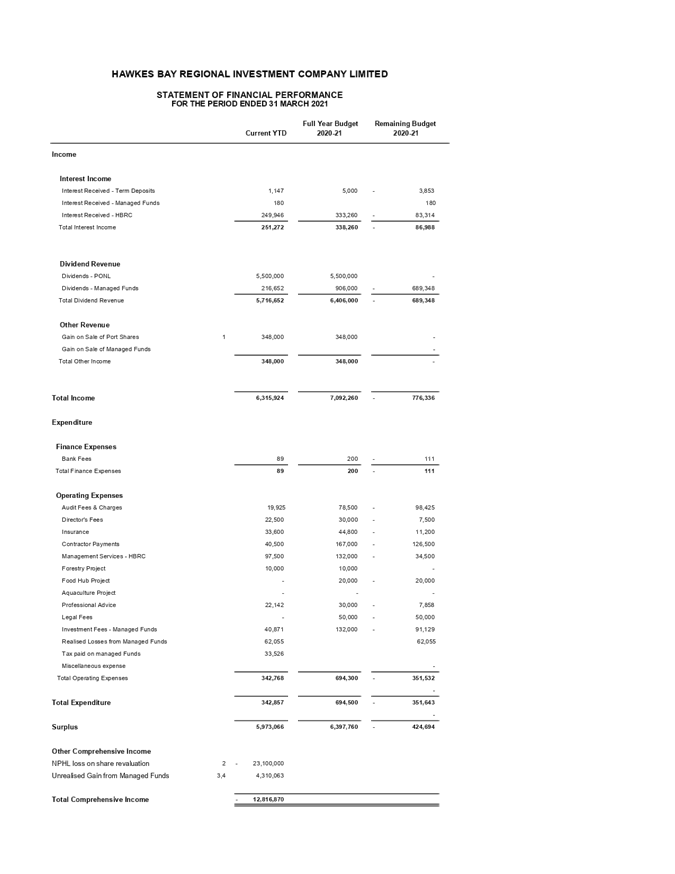

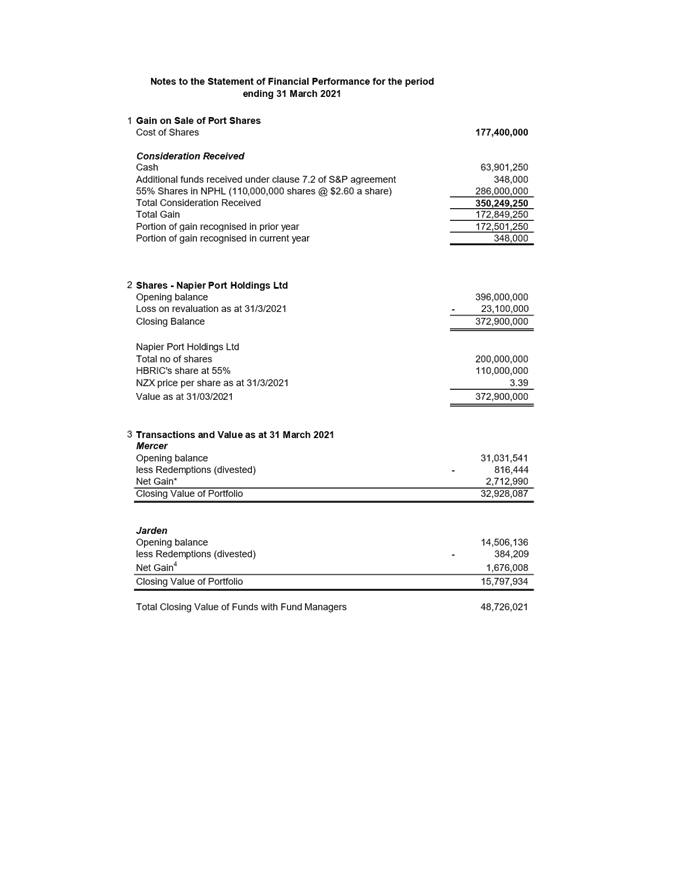

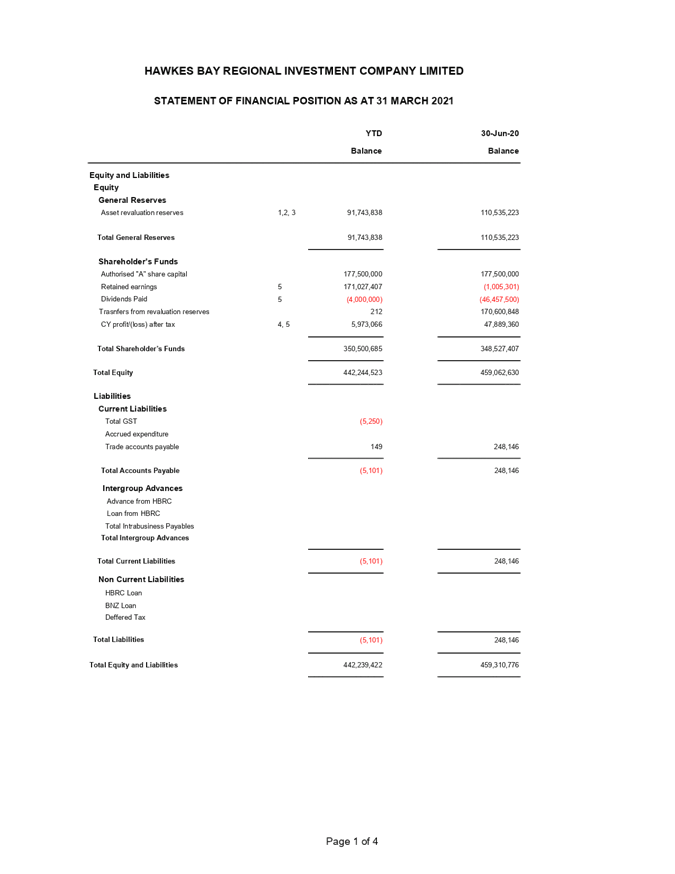

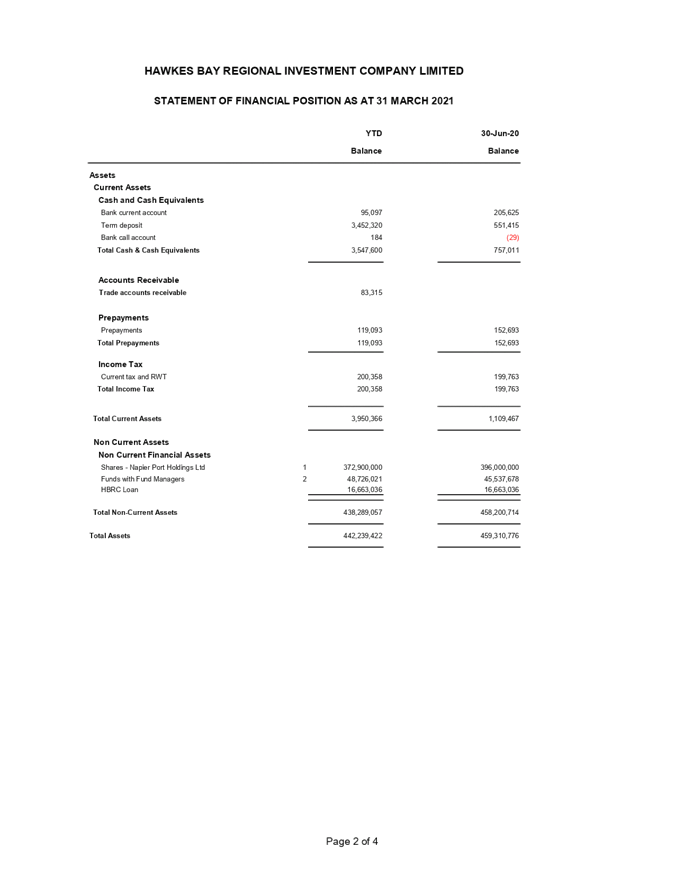

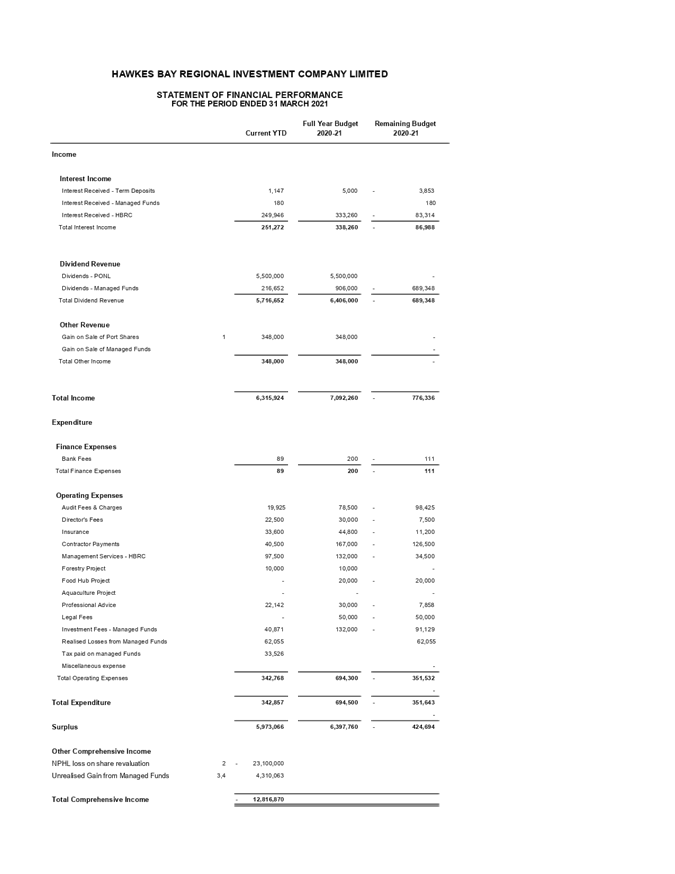

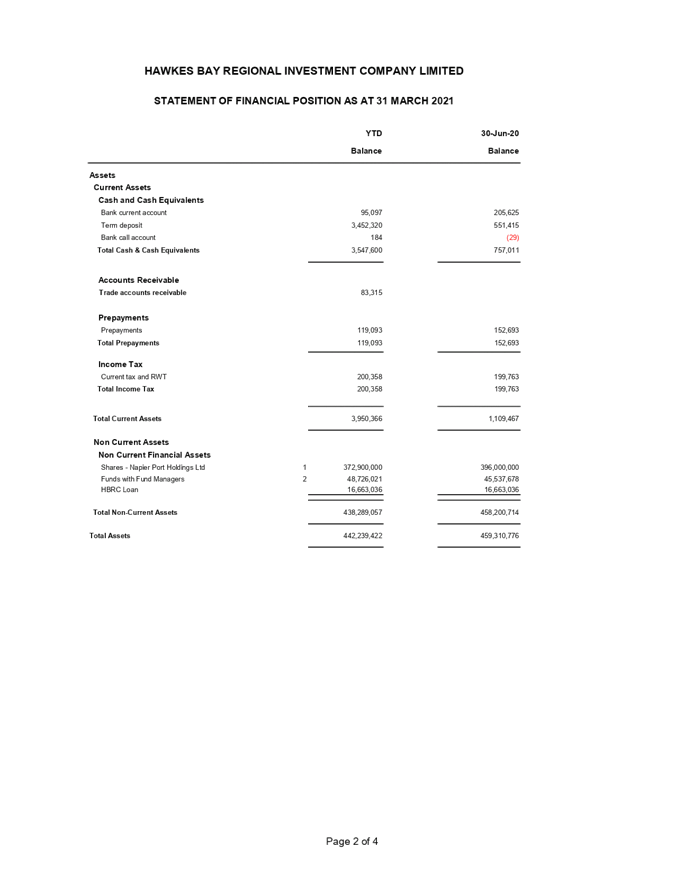

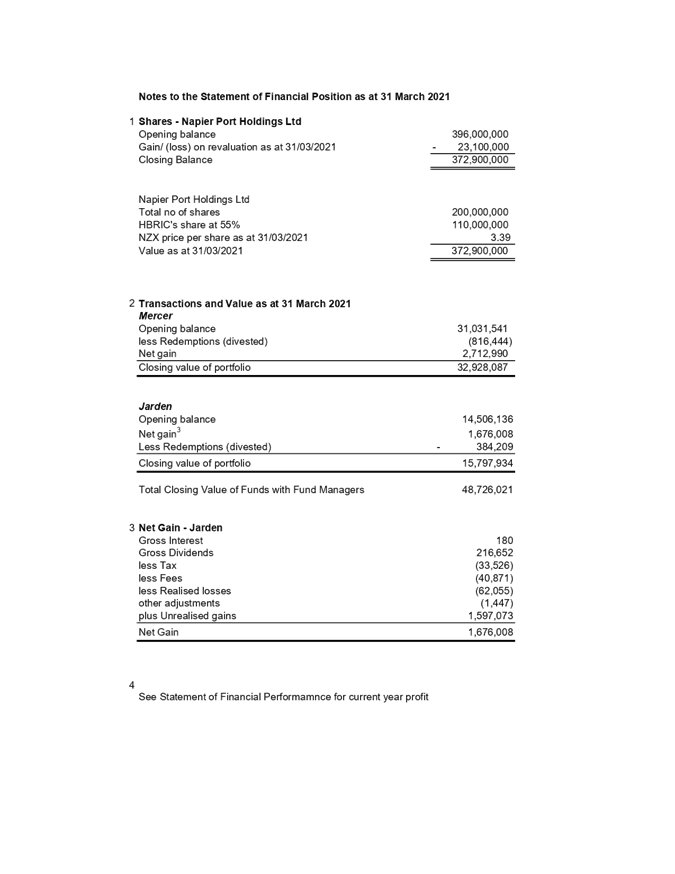

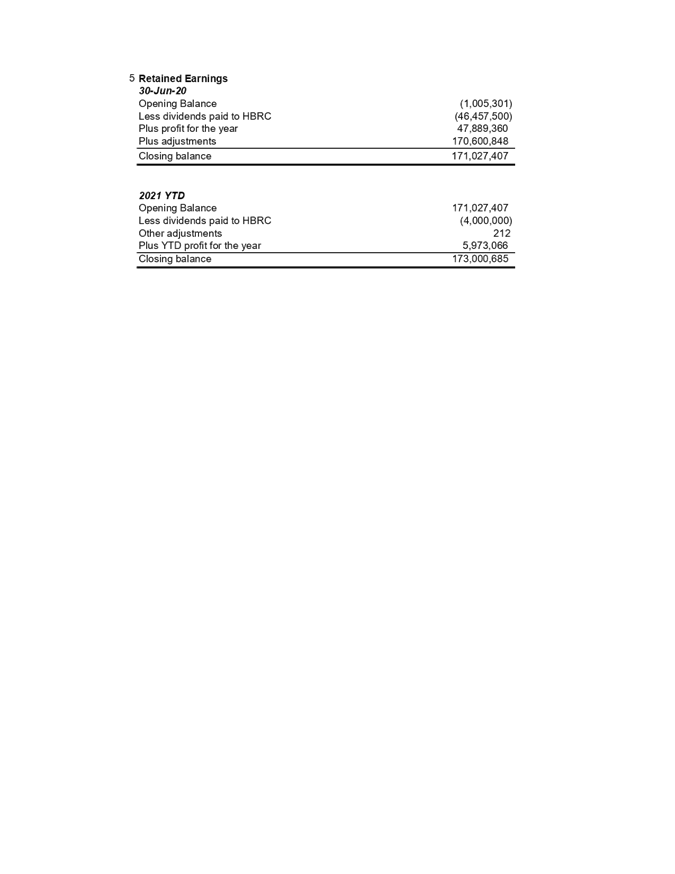

Subject: HBRIC Quarterly Update

Reason for Report

1. This

item provides Council with a quarterly update on the affairs of Hawke’s

Bay Regional Investment Company (HBRIC) for the March 2021

quarter.

Discussion

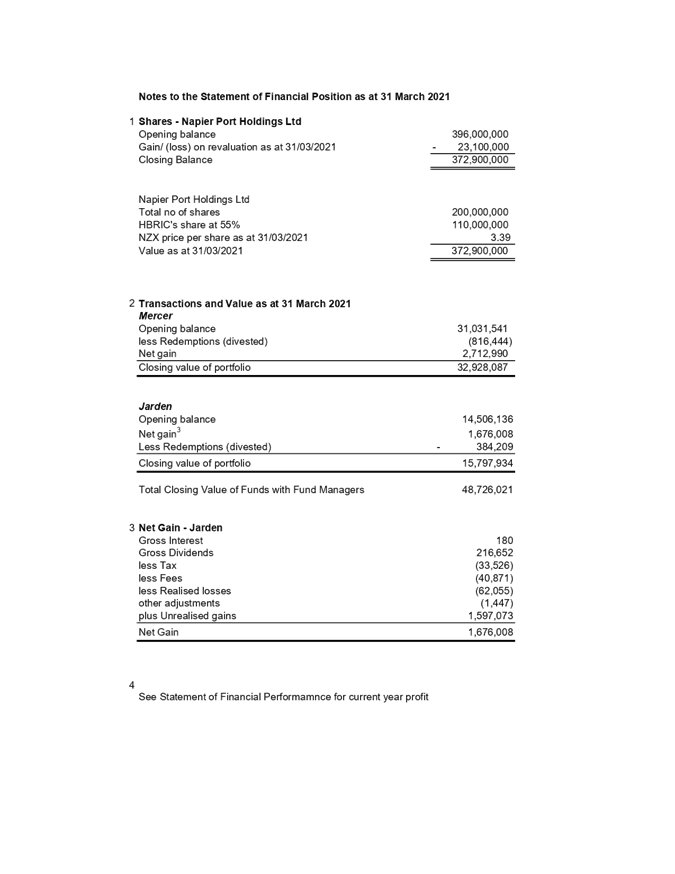

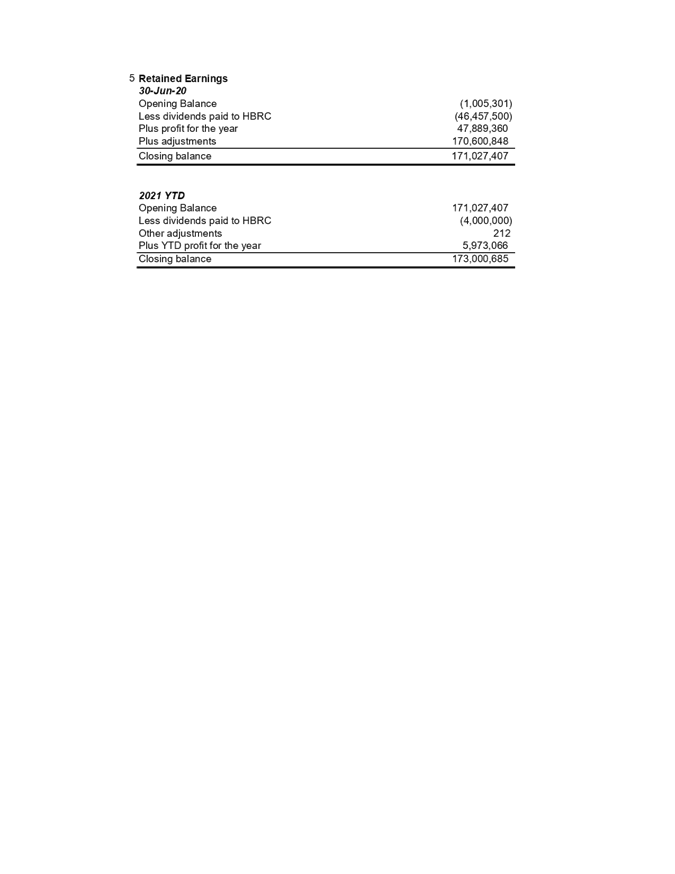

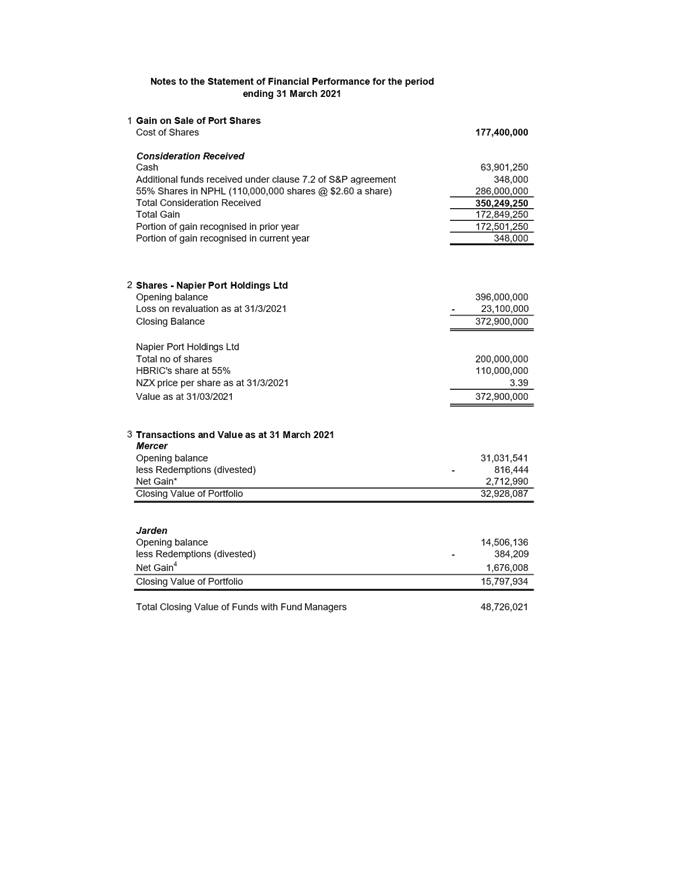

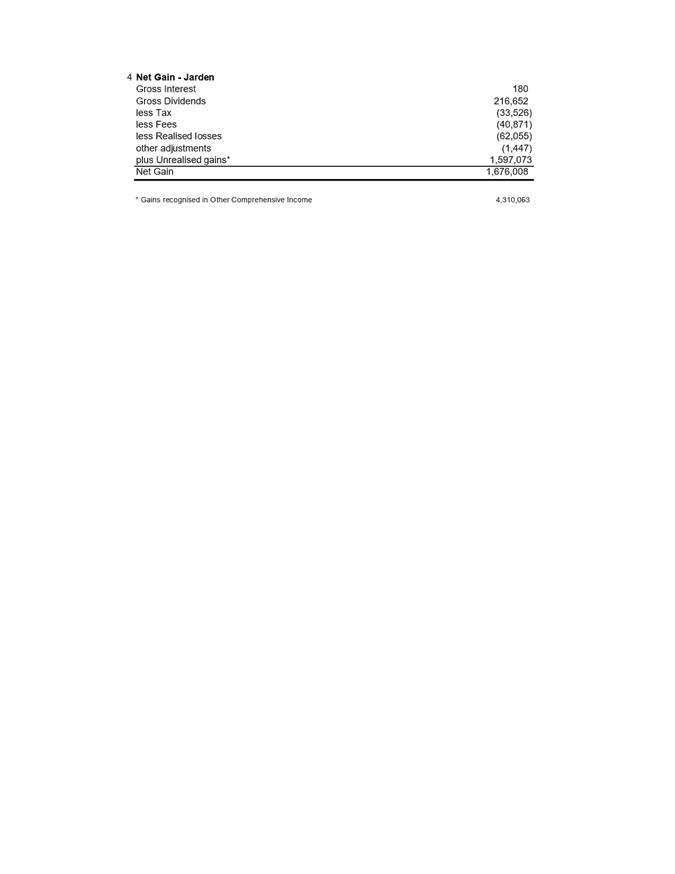

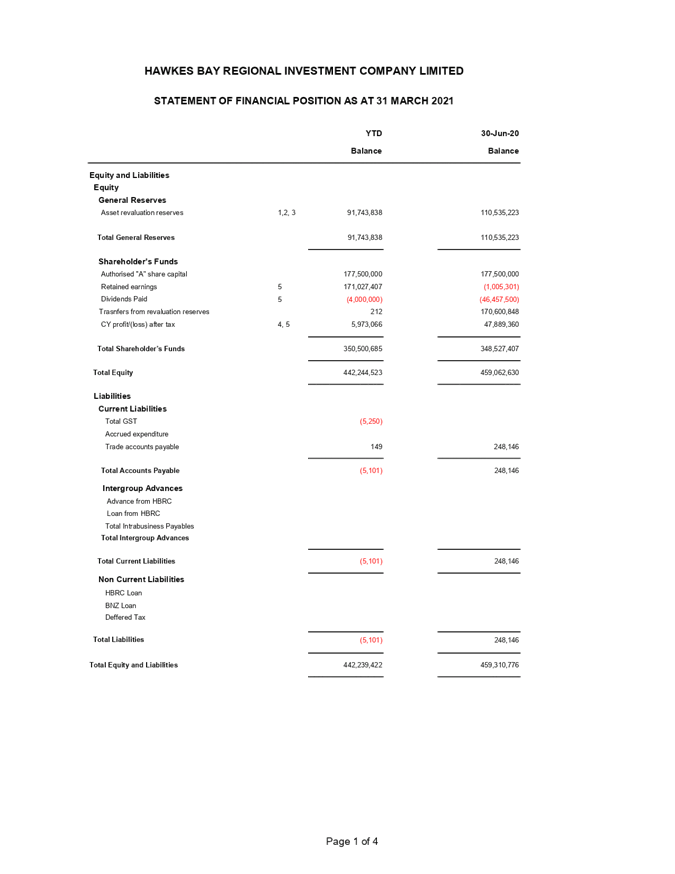

2. Attached to this report are the HBRIC financial statements for the 9 months to

31 March 2021.

3. Key Items to note:

3.1. Reported

$348k gain on sale of Port shares is due to a credit on advisor fees confirmed at final

washup of IPO costs

3.2. $5.5mil of Port Dividend

revenue recognised in December 2020

3.3. $4mil dividend

paid by HBRIC to HBRC in December

2020

3.4. $249K

of interest received from HBRC relating to interest on a loan from HBRIC to

HBRC related to managed funds transferred to Council

3.5. $23mil YTD loss

on revaluation of Napier Port shares

3.6. $4.3mil YTD gains

on managed fund investments (realised

and unrealised) of which

$1.2mil was divested in December 2020

3.7. YTD

surplus - $5.9mil

3.8. Net

Assets - $442mil.

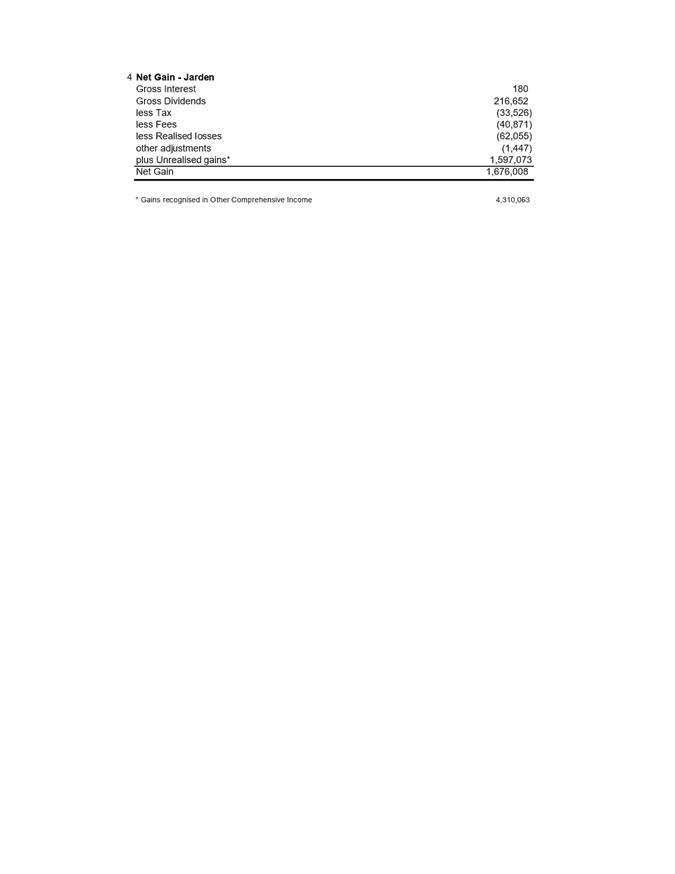

Managed Funds

4. Full

reporting on the HBRIC managed funds is provided via the Council treasury

process.

5. The funds remain under management

in compliance with Council’s SIPO.

6. In

December 2020, mirroring Council’s approach, HBRIC liquidated circa

$1.2mil of funds after protecting the real

capital value of the funds.

7. The

value of managed funds with HBRIC as at

31 March 2021 amounted to $48.7mil,

a movement of approximately + $3.1mil (post divestment) since 30 June 2020.

HBRIC Capital Structure

8. The Board of HBRIC has commenced the development of a clearer

capital structure and investment mandate to support the growth of the company,

as agreed with Council. When this is finalised, it will be shared with

Council.

9. To

support the required planning, the Board of HBRIC and Council Chair undertook a

field trip to meet with similar entities and also entities involved in

investment activities of interest. Visits included:

9.1. Tainui

Holdings - review of corporate investment model and inland port project

9.2. Waikato

Innovation Park – review of the hub’s business model, which was

used as a template for FoodEast

9.3. Quayside

Holdings – review of corporate investment model, corporate structure and

investment categories

9.4. Whakatohea

Mussels – review of mussel industry and business model.

FoodEast

10. At

Council’s request, HBRIC has been working with Hastings District Council

and Progressive Meats to develop a viable business case for the development of

a Food Innovation Hub in Hawke’s Bay (to be named FoodEast).

11. Council

and HBRIC agreed to commit up to $200k to support the feasibility stage, with

the option to invest further. Initial funding has been limited to $100k,

with further investment subject to further due diligence and a business case.

12. The

business case was approved by the HBRIC Board in February and endorsed by

Council at the February Council meeting. Council noted HBRIC will now

finalise the investment quantum and terms under its delegated authorities.

13. At

the February meeting, Council also agreed to consult on the creation of two new

Council Controlled Organisations (CCO’s) to enable FoodEast to be created.

This has now been completed and approved by HBRC. HDC is completing its

parallel CCO formation consultation process in the coming days.

14. Due

diligence and final preparation for financial close is now well advanced with

financial close targeted for the end of May/early June.

1.

15. Due diligence and final preparation for financial close is now well

advanced with financial close targeted for the end of May/early June.

2.

The investment structure is now being finalised,

including:

2.1. HBRIC’s majority share

2.2. Director appointments and governance structure during the start-up

and construction phase

2.3. Phasing of the capital investment.

16. The current schedule, subject to all of HBRIC’s

conditions being met on time (e.g. confirmation of Crown funding, finalisation

of all documentation) will see the HBRIC Board make a final investment decision

by 21 May 2021. At this time a decision is also required on the

appointment of a director to FoodEast. This appointment requires Council

approval and will need to be brought to the 26 May 2021 Council meeting in a

public excluded session.

17. Aquaculture – There has been no further work on this item.

Film studios and TV show

investment

18. There

has been no further work on this item, with any next steps resting with the

interested third parties providing sufficient information and an investment

case.

Whakatu Inland Port

19. HBRIC is

working with the Crown and Napier Port to develop a viable model. A

further update will be provided once this is developed further.

Napier Port

20. In April,

Napier Port announced an earnings upgrade on the back of solid trade

performance, increasing its

earnings guidance from $34m - $38m to $39m - $42m.

21. The upgrade has largely offset the loss of cruise trade and

has been supported by stable container trade and strong growth in bulk trades,

largely logs.

22. Construction of 6 Wharf remains on budget and on track for

completion late 2022.

23. A copy

of Napier Port’s half year trade results to March release is available

at: https://www.napierport.co.nz/investor-centre/.

24. During

the quarter Napier Port also officially launched its industry leading marine

cultural health programme. Further information can be found at: https://marineculturalhealth.co.nz.

Decision Making Process

25. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision making

provisions do not apply.

Recommendation

That the Corporate and Strategic Committee receives and notes the

“HBRIC Ltd Quarterly Update”.

Authored by:

|

Kishan

Premadasa

Management Accountant

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

HBRIC

Statement of Financial Performance March 2021

|

|

|

|

2⇩

|

HBRIC

Statement of Financial Position March 2021

|

|

|

|

HBRIC

Statement of Financial Performance March 2021

|

Attachment 1

|

|

HBRIC Statement of

Financial Position March 2021

|

Attachment 2

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 19 May 2021

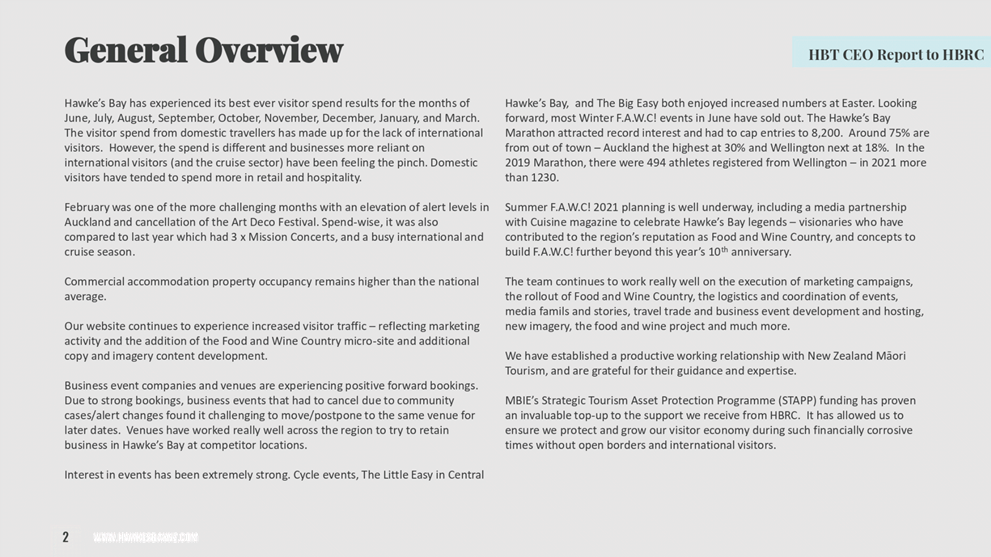

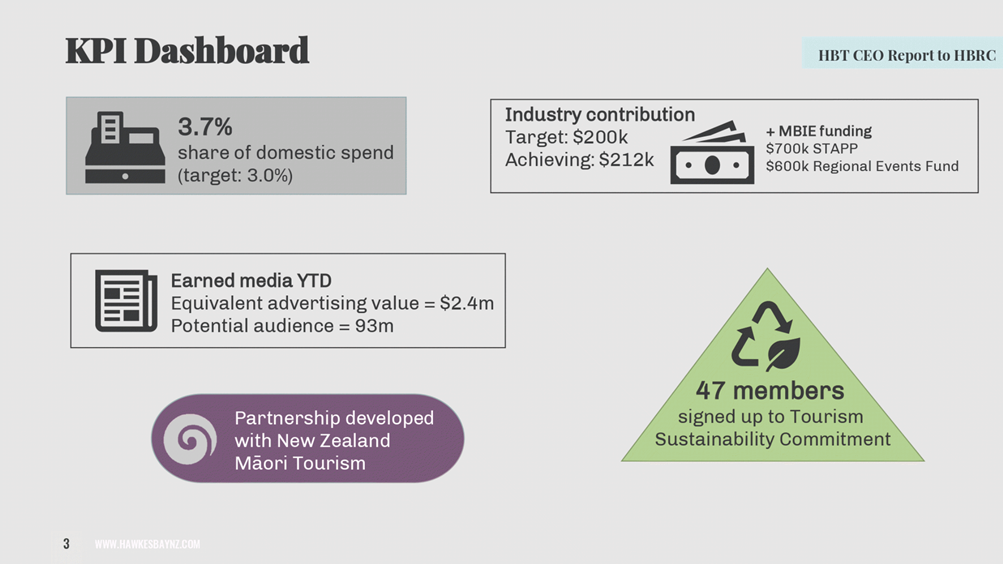

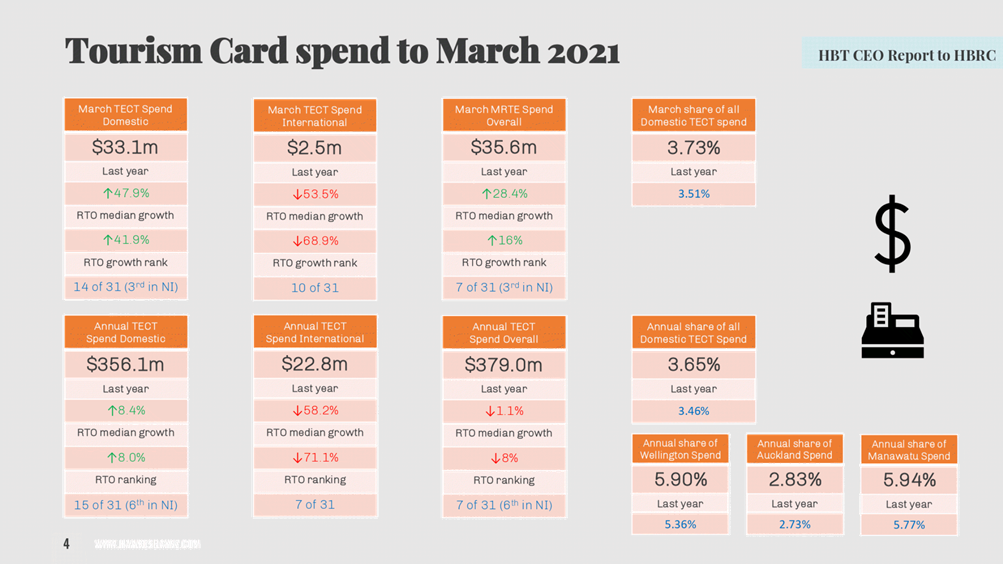

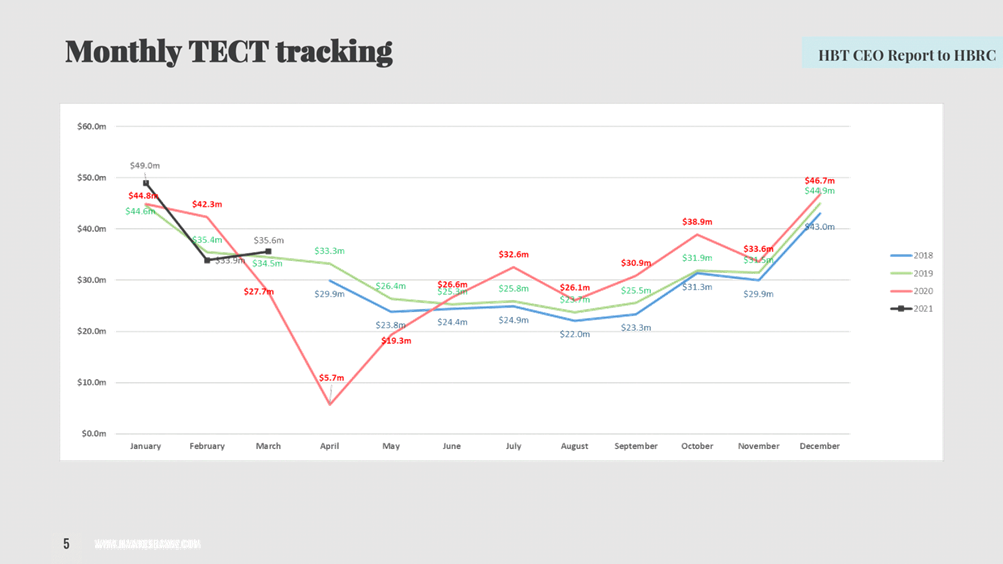

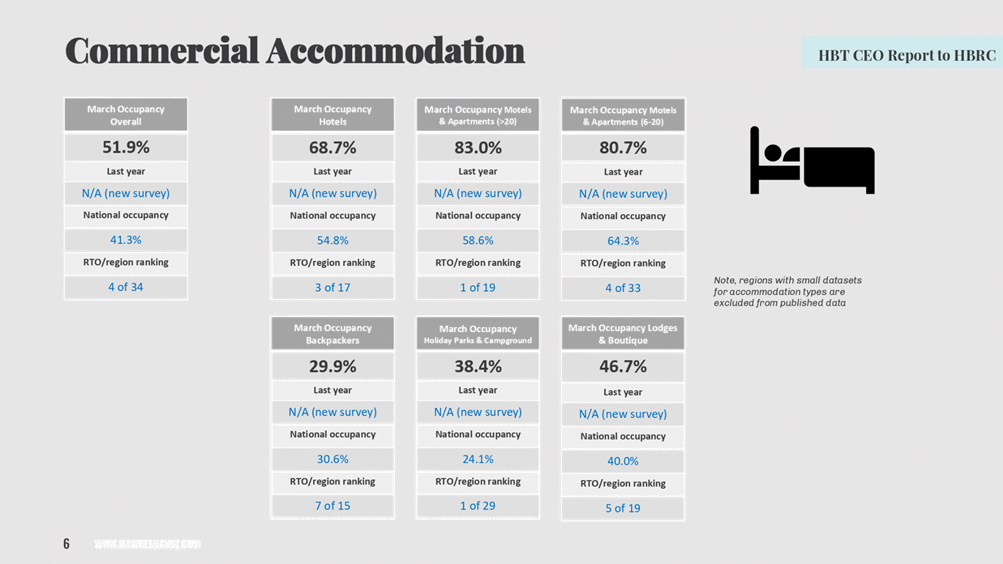

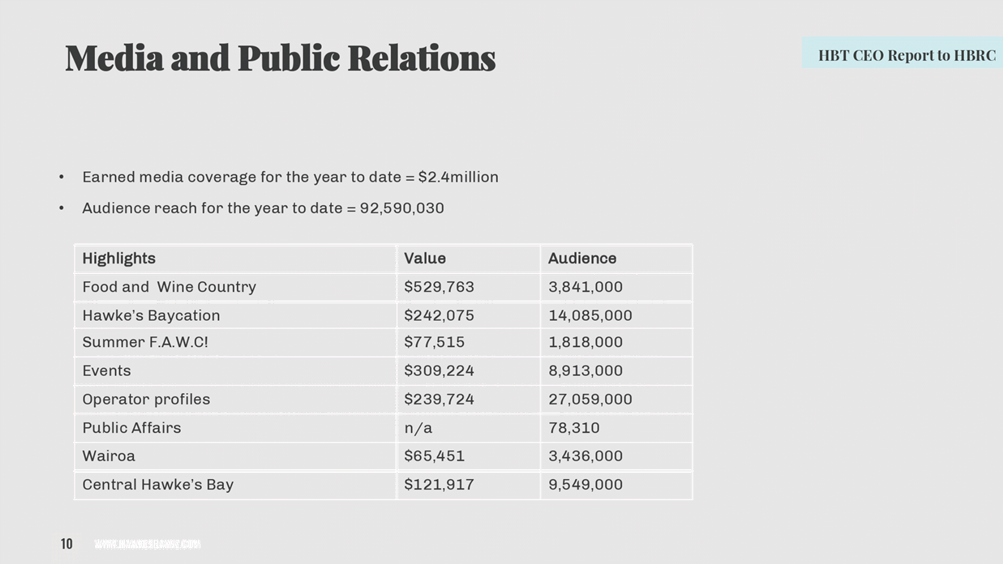

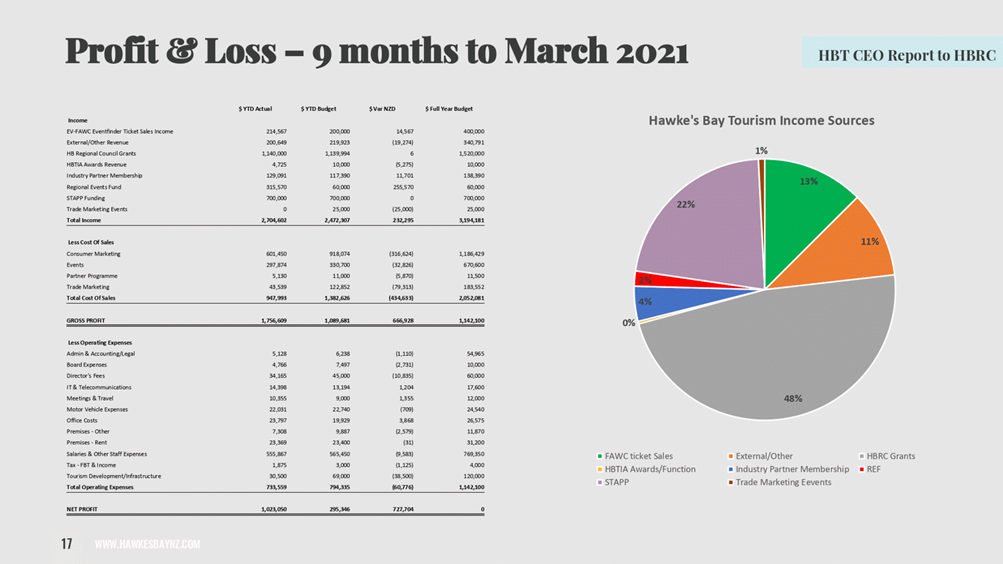

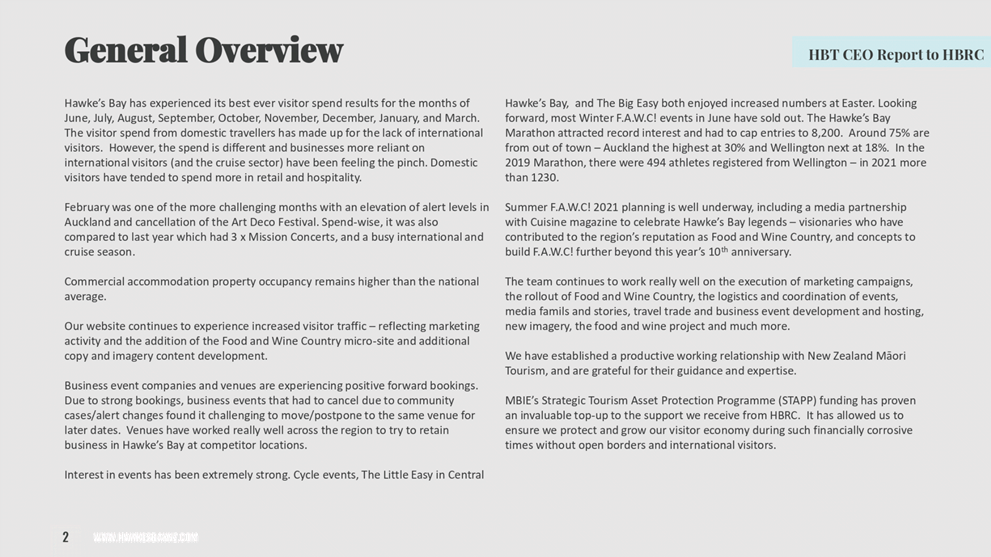

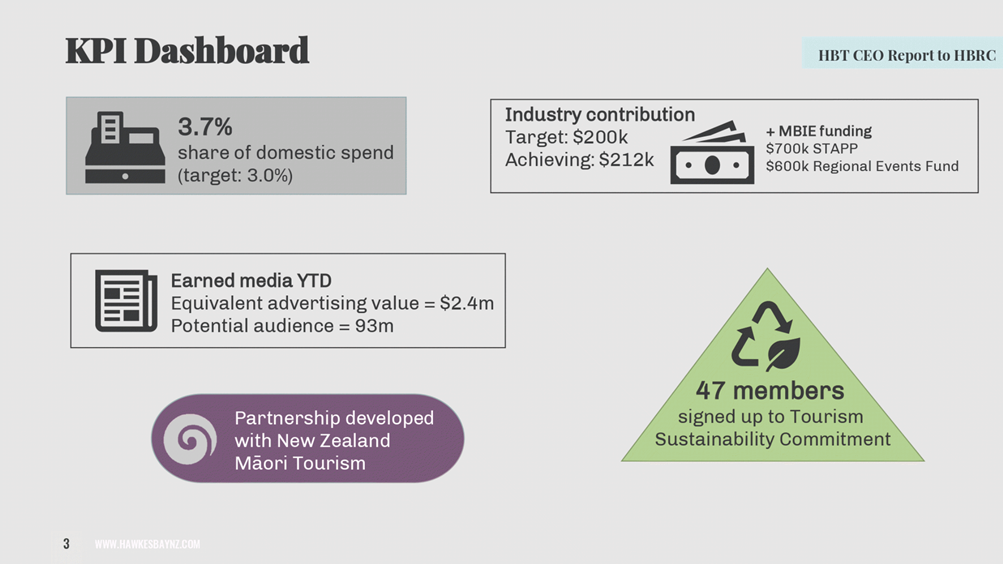

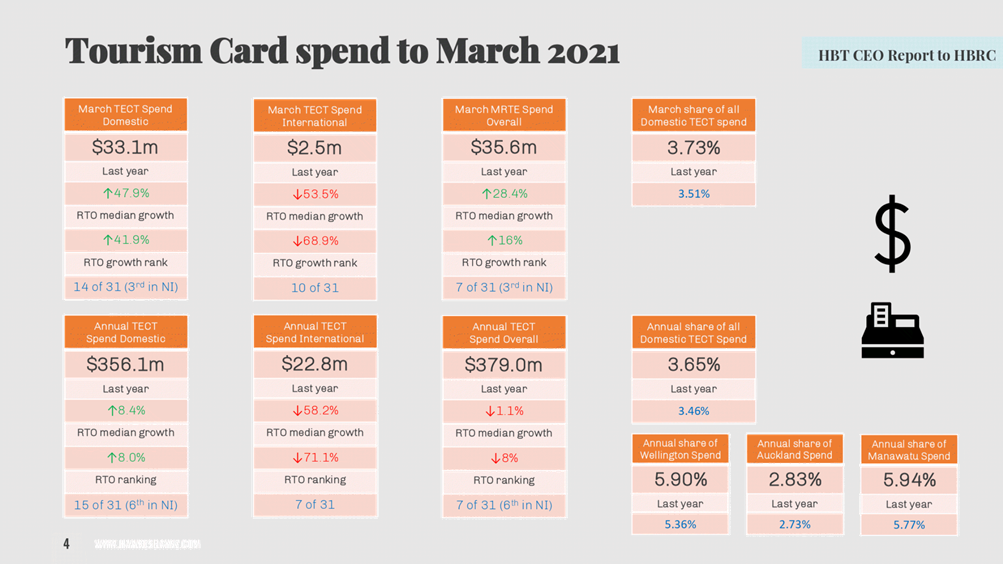

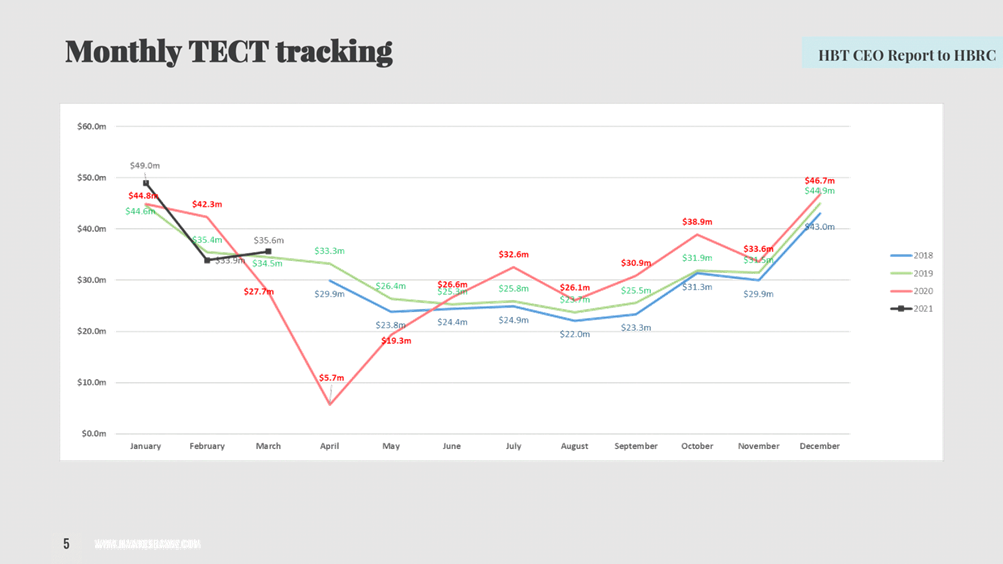

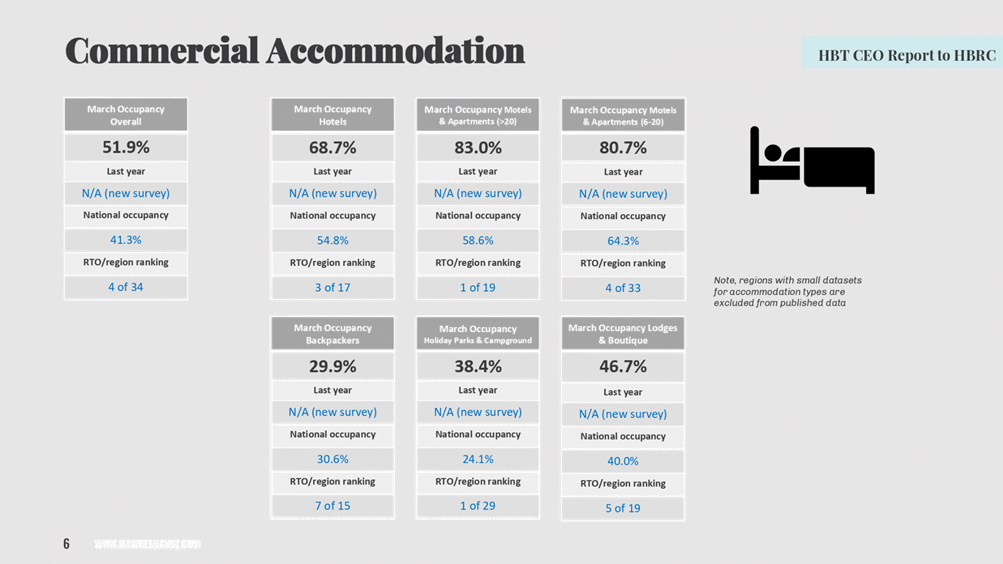

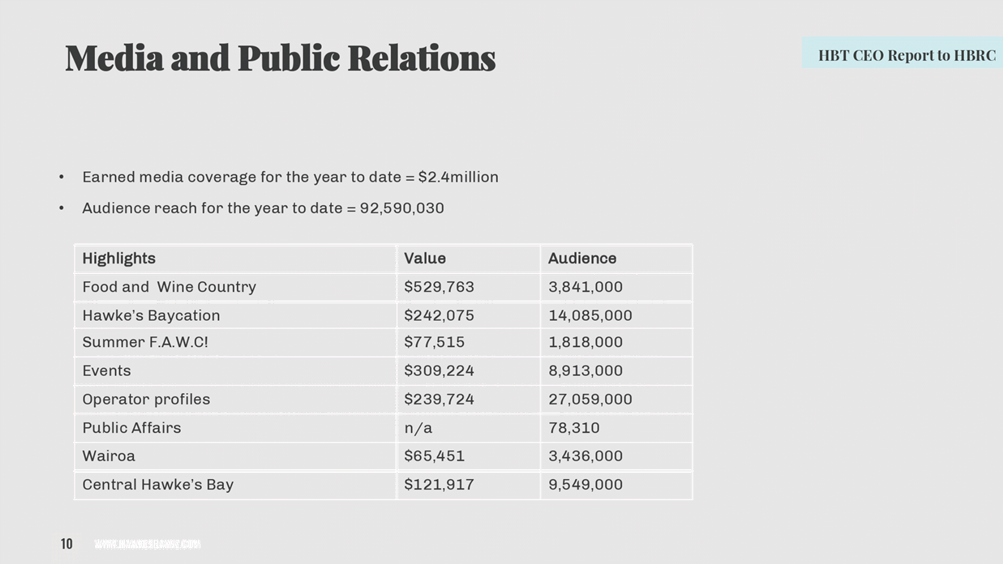

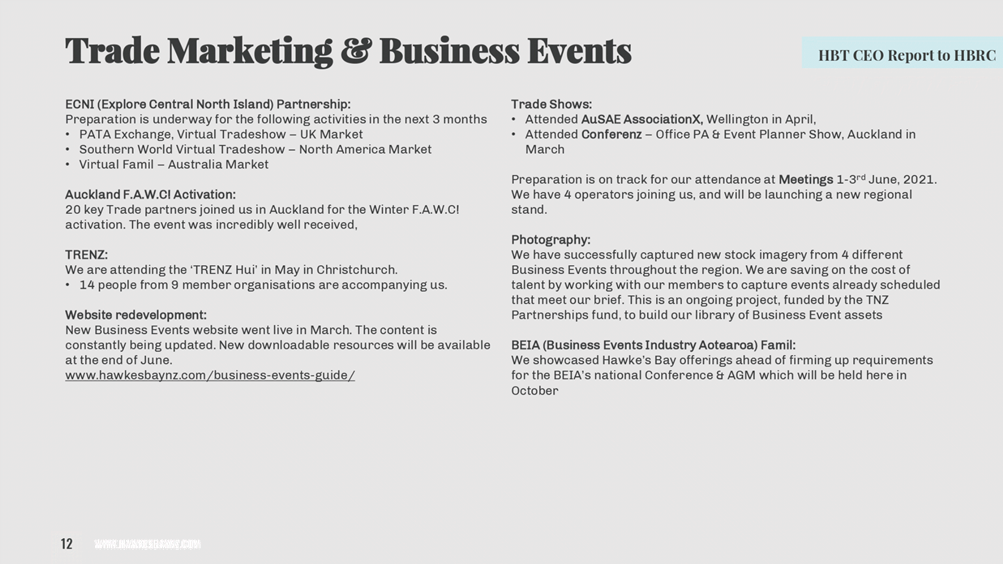

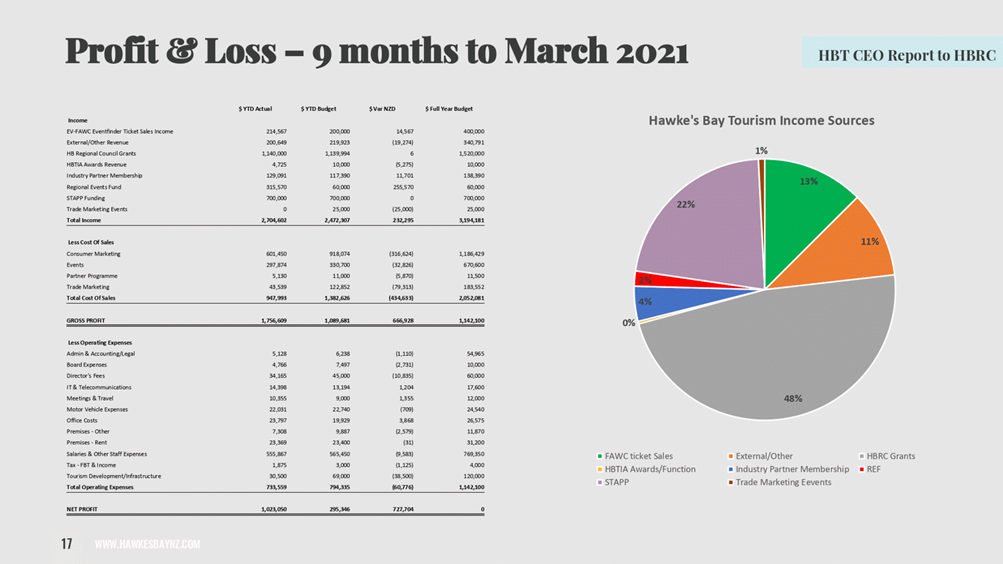

Subject: Hawke's Bay Tourism

Six-monthly Update

Reason for Report

1. This item provides HB Tourism’s update (attached) on

achievements against key performance indicators as required by their Funding

Agreement with Hawke’s Bay Regional Council.

2. Hamish Saxton, HB Tourism CEO, will be in attendance to present the

report.

Decision Making

Process

3. Staff have

assessed the requirements of the Local Government Act 2002 in relation to this

item and have concluded that, as this report is for information only, the

decision- making provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee

receives and notes the “HB Tourism Six-monthly

Update” report.

|

Authored &

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

1⇩

|

Hawke's Bay

Tourism CEO Report

|

|

|

|

Hawke's

Bay Tourism CEO Report

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 19 May 2021

Subject: Discussion of Minor

Matters Not on the Agenda

Reason for Report

1. This document has been prepared to assist

Committee members note the Minor Items Not on the

Agenda to be discussed as determined earlier in Agenda

Item 5.

|

Item

|

Topic

|

Raised

by

|

|

1.

|

|

|

|

2.

|

|

|

|

3.

|

|

|

HAWKE’S

BAY REGIONAL COUNCIL

Corporate and

Strategic Committee

Wednesday 19 May 2021

Subject: Confirmation

of Public Excluded Minutes of the Corporate and Strategic Committeemeeting held

on 3 March 2021

That the Corporate and Strategic Committee

excludes the public from this section of the meeting being Confirmation of

Public Excluded Minutes Agenda Item 15 with

the general subject of the item to be considered while the public is excluded;

the reasons for passing the resolution and the specific grounds under Section

48 (1) of the Local Government Official Information and Meetings Act 1987 for

the passing of this resolution being:

|

GENERAL SUBJECT OF THE ITEM TO BE CONSIDERED

|

REASON FOR PASSING THIS RESOLUTION

|

GROUNDS UNDER SECTION 48(1) FOR THE PASSING OF THE RESOLUTION

|

|

HBRIC Ltd Quarterly Update (to 31 December 2020)

|

s7(2)(b)(ii) That the public conduct of this agenda item would

be likely to result in the disclosure of information where the withholding of

that information is necessary to protect information which otherwise would be

likely unreasonably to prejudice the commercial position of the person who

supplied or who is the subject of the information

|

The Council is specified, in the First Schedule to this Act, as

a body to which the Act applies.

|

|

HBRIC Ltd Draft 2021-22 Statement of Intent

|

s7(2)(h) That the public conduct of this agenda item would be

likely to result in the disclosure of information where the withholding of

the information is necessary to enable the local authority holding the

information to carry out, without prejudice or disadvantage, commercial

activities

|

The Council is specified, in the First Schedule to this Act, as

a body to which the Act applies.

|

|

Wellington Leasehold Property Offer

|

s7(2)(i) That the public conduct of this agenda item would be

likely to result in the disclosure of information where the withholding of

the information is necessary to enable the local authority holding the

information to carry out, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

The Council is specified, in the First Schedule to this Act, as

a body to which the Act applies.

|

Authored by:

|

Leeanne

Hooper

Team Leader Governance

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|