Meeting of the Corporate and Strategic Committee

Date: Wednesday 3 March 2021

Time: 1.30pm

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

Item Title Page

1. Welcome/Karakia

/Notices/Apologies

2. Conflict

of Interest Declarations

3. Confirmation of

Minutes of the Corporate and Strategic Committee meeting held on 2 December

2020

4. Follow-ups from

Previous Corporate & Strategic Committee Meetings 3

5. Call for Minor

Items Not on the Agenda 7

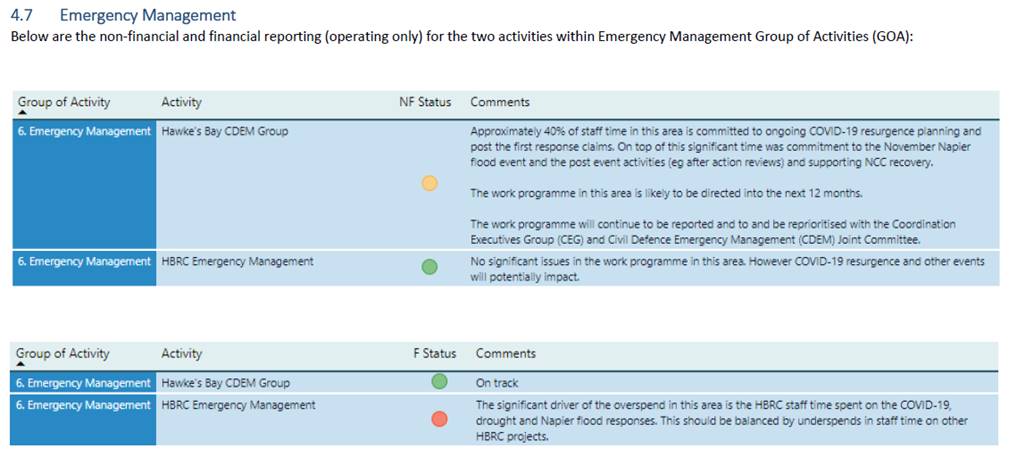

Decision Items

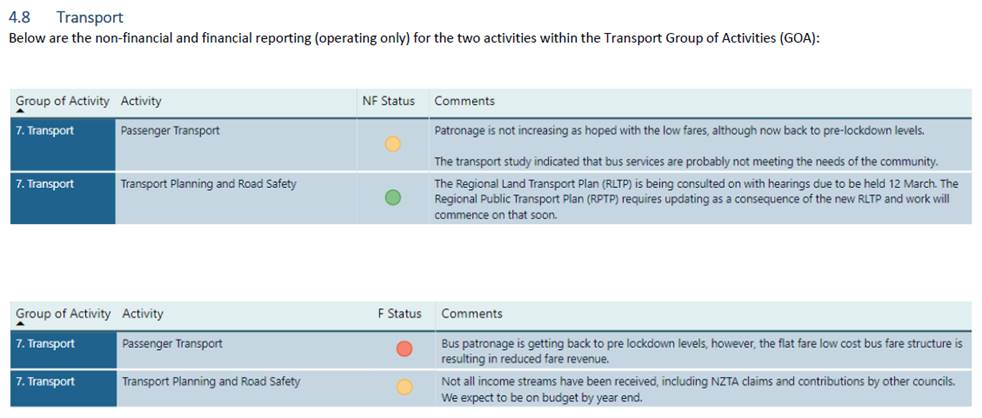

6. Recovery Fund

Projects 9

7. Report from the 17

March 2021 Finance Audit and Risk Sub-committee Meeting 17

Information or Performance Monitoring

8. 2020-21 Quarter 2

(1 October - 31 December 2020) Financial Report 21

9. Organisational

Performance Report for period 1 October to 31 December 2020 27

10. Discussion of Minor Matters

Not on the Agenda 57

Decision Items (Public Excluded)

11. HBRIC Ltd Quarterly Update (to

31 December 2020) 59

12. HBRIC Ltd Draft 2021-22

Statement of Intent 61

13. Wellington Leasehold Property

Offer 63

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 03 March 2021

Subject: Follow-ups from

Previous Corporate & Strategic Committee Meetings

Reason for Report

1. On the

list attached are items raised at previous Corporate & Strategic Committee

meetings that staff have followed up on. All items indicate who is responsible

for follow up, and a brief status comment. Once the items have been reported to

the Committee they will be removed from the list.

Decision Making Process

2. Staff

have assessed the requirements of the Local Government Act 2002 in relation to

this item and have concluded that, as this report is for information only, the

decision making provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee

receives and notes the “Follow-up Items from Previous Meetings”.

|

Authored by:

|

Leeanne

Hooper

Team Leader Governance

|

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

|

⇩1

|

Follow-ups

from Previous Corporate and Strategic Committee Meetings

|

|

|

|

Follow-ups

from Previous Corporate and Strategic Committee Meetings

|

Attachment 1

|

Follow-ups

from Previous Corporate and Strategic Committee Meetings

Meeting held 2 December 2020

|

|

Agenda Item

|

Follow-up / Request

|

Responsible

|

Status Comment

|

|

1

|

2019-20

Compliance Annual Report

|

Focused

quarterly reporting on Enforcement/ Prosecutions to be resumed

|

K Brunton

|

To be actioned to

enable reporting to May Corporate & Strategic Committee meeting. Content

will be subject to issues of confidentiality during and throughout

enforcement processes. Reports will also include completed enforcement

action.

|

|

2

|

2019-20

Compliance Annual Report

|

Request for

workshop with councillors about decisions made under the Enforcement Policy,

within statutory boundaries, in order to assess the policy’s

effectiveness and understand Council officers’ decision making

considerations

|

K Brunton

/J Palmer

|

Still to be scheduled

– likely July/August 2021, once new Compliance Manager is on deck.

|

|

3

|

2019-20

Compliance Annual Report

|

Municipal 3

waters compliance to be separated into its own section of the Compliance

report.

|

K Brunton

/J Blunden

|

Yes, the 2020-21

Annual Compliance Report will reflect this change.

|

|

4

|

2019-20

Compliance Annual Report

|

A visit to

CHB is proposed for the new year, for councillors to engage with CHBDC

councillors on their Long Term Plan and their 3 waters upgrade programme

|

K Brunton

/J Palmer

|

Not yet actioned. To

be confirmed post LTP adoption.

|

Meeting held 2 September 2020

|

|

Agenda Item

|

Follow-up / Request

|

Responsible

|

Status Comment

|

|

|

Follow-ups

|

Query arose as to when

Councillors’ health and safety refresher session will be scheduled

|

K McInnes/

J Palmer

|

Refresher H&S

session for councillors is scheduled 28 April following the Council

meeting.

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 03 March 2021

Subject: Call for Minor Items

Not on the Agenda

Reason

for Report

1. This item provides the means for committee members to raise minor

matters they wish to bring to the attention of the meeting.

2. Hawke’s Bay Regional Council standing order 9.13 states:

2.1. “A

meeting may discuss an item that is not on the agenda only if it is a minor

matter relating to the general business of the meeting and the Chairperson

explains at the beginning of the public part of the meeting that the item will

be discussed. However, the meeting may not make a resolution, decision or

recommendation about the item, except to refer it to a subsequent meeting for

further discussion.”

Recommendations

3. That the Corporate and Strategic Committee accepts the following

“Minor Items Not on the

Agenda” for discussion as Item 10.

|

Leeanne Hooper

TEAM LEADER GOVERNANCE

|

James Palmer

CHIEF EXECUTIVE

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 03 March 2021

Subject: Recovery Fund Projects

Reason for Report

1. This item seeks the Corporate & Strategic Committee’s

recommendation to Council to commit $400,000, of the remaining $700,000

Recovery Fund, established through the 2020-21 Annual Plan towards two

projects; a Jobs for Nature Private Land Biodiversity Fund application and the

development of a constructed wetland in the Tukipo catchment.

Officers’ Recommendation(s)

2. Council

officers recommend that the Committee supports the funding of $400,000 and puts

forward a recommendation to the 24 March 2021 Regional Council meeting for

confirmation.

Executive Summary

3. This item seeks

funding for two projects:

3.1 An

application to the Department of Conservation Jobs for

Nature Private Land Fund (PLBF) to protect 15 Ecosystem Prioritisation

sites. The total application value is $1,957,309 of which Council is requesting

$1m from the PLBF (maximum request allowable). The balance comprises of

$611,080 HBRC and $346,229 private land occupier/QEII contribution.

Contributions towards the project include external costs and in-kind time. For

this application to be successful, $300k is required from the HBRC Recovery

fund to leverage funding from the PLBF.

3.2 Council

is working in partnership with NIWA, Fonterra and the Tukipo Catchment Care

Group on a research and development project to build a 1.6ha constructed

wetland. This project will be included in a national monitoring program by NIWA

to show the effectiveness of constructed wetlands to reduce DIN levels on a

catchment scale. To date the project has been exclusively funded by Fonterra

($250k). Due to the impacts of COVID-19 lockdown estimated construction costs

now exceed the available budget to complete the project within timeframe

required for NIWA. To take the greatest advantage of this collaborative

opportunity we are requesting $100k from Councils Recovery Fund to complete

delivery of this project.

4. The $1million

Recovery Fund is part of the HBRC Climate. Smart. Recovery. Programme to ensure

our recovery from the COVID-19 crisis is sustainable and our environment

enhanced.

5. Both projects

will fund operational activity that has intergenerational benefit and as such

can appropriately be funded by borrowing.

Background: Recovery Fund

6. In July 2020,

Council resolved to proceed with its proposal through the 2020-21 Annual Plan

to establish a $1m Recovery Fund.

7. The purpose of

the Recovery Fund is to enable Council to act quickly and with some flexibility

to leverage potential government co-funding into planned Council related capital

projects that promote employment, encourage economic activity and accelerate

positive environmental change and therefore support the Hawke’s Bay

economy back to its fastest recovery.

8. The $1m for

this fund was reallocated from a budget tagged for additional office space and

updated facilities for field staff. New opportunities arising from COVID-19

have enabled the Council to revisit needs for additional office space and delay

the timing for this project.

9. A draft

Recovery Fund Policy was presented to Council at the time the Annual Plan was

adopted to give confidence to submitters to the Annual Plan and ratepayers that

there is rigour around the spending of the funding. The Policy is a

non-statutory policy that sets out the decision-making process, including

criteria that will be used to assess proposals.

10. On 15 September 2020,

Regional Council committed $700k of the Recovery Fund to two Freshwater

Improvement Fund applications: Ahuriri Catchment project ($400k) and Porangahau

Catchment Group ($300k). The Porangahau Catchment Group project was successful,

but our Ahuriri Catchment project was not.

11. Currently we have $700k

remaining within the Recovery Fund.

12. This paper requests $400k

of the Recovery Fund, (i.e. $300,000 Jobs for Nature Private Land Biodiversity

Fund application and $100,000 Tukipo constructed wetland) to be considered for

projects that are a good fit with the funds objectives and score highly when

assessed against the Climate. Smart. Recovery criteria in the draft Policy.

13. At this stage no other

projects have been identified and scored against the Climate. Smart. Recovery

criteria, but staff have earmarked the remaining $300k to support the Mahia and

Ruakituri catchment Freshwater Improvement Fund proposals that were recently

presented to the EICC (subject to successful applications to the next round of

the Freshwater Improvement Fund and final council approval).

14. As noted in the draft

Policy, staff recommend these projects to Council for consideration.

Project one: Jobs for Nature Private

Land Fund (PLBF) application ($300k)

15. On 14 January 2021, a Jobs for Nature Private Land Biodiversity Fund round was

announced as part of the $1.3 billion Jobs for Nature programme. It is a

one-off fund of $18 million, available for biodiversity restoration work on

private land to create nature-based employment. Grants range from $300,000 to

$1 million (in total), for organisations with projects working with private

landowners that create temporary employment for up to three years.

16. Hawke’s Bay Regional

Council are well placed to leverage from this fund through accelerating its

Ecosystem Prioritisation (EP) programme whilst creating employment

opportunities. The EP programme builds on the Zonation process undertaken by

the Council, which is a tool (software) that prioritised ecosystem or habitat

sites based on their representation, connectivity, and condition. Resources are

stretched for biodiversity protection in Hawke's Bay; therefore, this framework

plays an integral part in prioritising sites for protection. These

sites/segments represent a full range of ecosystem types that are present in

the region.

17. Unfortunately, all

remaining terrestrial ecosystems in lowland Hawke's Bay are either acutely or

chronically threatened. Of this, most are small in size and sit on private

land. The sites proposed for protection in the PLBF application have been

assessed by a Biodiversity Advisor and confirmed as high biodiversity value,

generally being diverse old growth remnants. The sites were also assessed for

condition, including threats e.g. pest plants and animals, to make sure

biodiversity outcomes are achievable.

18. If successful, this

application will result in an additional 15 Ecosystem Prioritisation sites

(433ha) being deer fenced (42km fencing) and receiving pest plant and animal

control ($264k). This will fast-track the EP programme by approximately six

years.

19. It is expected this

application will create work for approximately 18 people over three years,

primarily in pest management and fencing.

20. Other Jobs for Nature

funds, such as the Freshwater Improvement Fund (FIF), require a 50/50

co-funding arrangement. Although the PLBF fund does not require this, it is

likely applications with an approximate 50/50 co-funding arrangement will be

marked favourably due to creating more jobs.

21. The

Council have worked closely with QEII and private land occupiers to reach a 50%

funding contribution of $957K to match the maximum grant available through the

PLBF ($1m). A contribution of $300k to this application from the Recovery Fund

is required to meet this approximate 50/50 co-funding arrangement.

Proposed funding by year

|

Financial Years

|

Existing HBRC

Budgets

|

Landowner/QEII

contribution

|

Request from

Recovery Fund

|

PLBF match

funding

|

|

Staff time

(In-kind)

|

External Costs

|

|

Year 1 - FY21/22

|

$61,360

|

$17,500

|

$117,501

|

$100,000

|

$325,000

|

|

Year

2 - FY 22/23

|

$61,360

|

$53,500

|

$50,088

|

$100,000

|

$300,000

|

|

Year

3 - FY 23/24

|

$61,360

|

$56,000

|

$178,640

|

$100,000

|

$375,000

|

|

TOTAL

|

$184,080

|

$127,000

|

$346,229

|

$300,000

|

$1,000,000

|

|

TOTAL

PROJECT

|

$1,957,309

|

Strategic

Fit: Assessment Criteria

22. This

project has been assessed to determine their fit with the draft criteria from

the HBRC Recovery Fund.

|

|

Score

|

Reasoning

|

|

Climate action

|

4

|

Protecting Ecosystem Prioritisation sites will increase

their carbon absorption and ensure they continue storing carbon in

perpetuity. Indigenous ecosystems are living carbon sinks and sequesters,

thus protecting them means continued carbon sequestration, and retaining

carbon and nitrogen (gas) which would otherwise be released to atmosphere. A

group of scientist recently called for urgent solutions to global climate

change, identifying the protection of existing forest as the number 1

priority (Di Dacco et al 2020). Old-growth forest not only continues to

sequester the carbon but are 2.5 times more effective than exotic species at

storing carbon in the soil. Old-growth and existing forest also has

substantial advantage over new-plantings as new plantings will take over 100

years to provide the same functions as the old-growth forest. Ultimately,

they will provide habitat for wildlife and assist in climate action whist

allowing farmers to continue farming the sustainable areas of their farms.

|

|

Strategic Alignment

|

5

|

The recovery fund portion of this project will protect

and enhance healthy functioning and climate resilient biodiversity,

contribute to achieving water quality and ecosystem health of waterbodies,

and climate-smart sustainable land use outcomes.

|

|

Core Competencies

|

5

|

HBRC is already delivering the Ecosystem Prioritisation

program and is only limited by funding. It is a core competency of the

council.

|

|

Ease of implementation

|

5

|

This project will use the current structure in place to

deliver the EP programme, in partnership with QEII. Year one and two projects

are already lined up ready to go. The Ecosystem Prioritisation team have

delivered similar sized projects in the past.

|

|

Leverage

|

4

|

This funding, alongside existing HBRC funds and

contributions from private land occupiers and QEII will be used as leverage

for an approximate 50:50 funding from the Jobs for Nature Private Land

Biodiversity Fund. HBRC’s contribution is approximately 30% of total

project costs.

|

|

Impact

|

4

|

The HBRC Ecosystem Prioritisation Programme focusses on

protecting HB's acutely and chronically threatened ecosystems. With current

budgets, it will take an approximate 150-year timeframe to secure these sites

which is poor and will not meet the Strategic Plan objective of completing

this by 2050. The current programme is oversubscribed. This change proposal

will accelerate the Ecosystem Prioritisation programme by approximately six

years. This will have significant regional Biodiversity gains through

securing approximately 15 threatened ecosystems. It will create fencing work

immediately and will create pest plant and animal work into the future.

Without this funding it is highly likely nine of these sites will not be

protected from biodiversity threats within the next six years.

|

|

Recovery

|

3

|

Local growth and investment will be supported by the EP

site projects directly related to this.

|

Project two: Tukipo Constructed

Wetland ($100k)

23. Ambitious nitrogen targets

have been set in the Tukituki Plan, and in some cases require instream DIN

levels to be more than halved.

24. Ongoing research has

proven the effectiveness of constructed wetlands and confirms that a strategic

network of constructed wetlands, in combination with on farm improvements

around nutrient management, may help achieve the ambitious nitrogen reduction

targets.

25. Fonterra included the

Tukipo catchment to be part of their Sustainable Catchments programme, due in

large part to proactive work being led by the Tukipo Catchment Care Group

(TCCG). The Tukipo subcatchment is currently sitting at 2.32 mg/l, which is

almost 3 times over the 0.8 mg/l DIN target and means a 66% reduction in

instream DIN levels are required.

26. When

Fonterra provided HBRC and the TCCG funding to undertake a scoping exercise to

identify willing landowners who had suitable sites to build a constructed

wetland to achieve DIN reduction on a catchment scale ($30k). A further $226k

was then provided to design and construct a wetland on the most promising site.

27. Over

this same time period, NIWA obtained funding from MPI’s Sustainable Land Management and Climate

Change: Freshwater Mitigation Fund to comprehensively monitor 5

constructed wetlands to collect high quality data to refine our understanding

on wetland performance and help improve the wetland modules available in

Overseer. The two projects aligned and so NIWA designed the Tukipo wetland so

that it could be used in their national project.

28. NIWA will be committing

their expertise and the equipment required to continuously monitor flow,

nitrate, turbidity and floods, alongside covering the laboratory costs for

monthly monitoring at the wetland inflow and outflow.

29. The Council Tukituki

implementation team think that constructed wetlands may form a key part of the

strategic Tukituki response, and are very supportive of the constructed wetland

initiative. It is hoped that the outcomes from this project will provide a

model that is transferable to other properties in Hawke’s Bay.

30. The Hawke’s Bay

region has a paucity of functioning wetlands and the establishment of any new wetland,

including man made systems, will be of significant value to the region for both

biodiversity and water quality outcomes.

31. Following completion of

the scoping exercise a preferred location was selected that had full support

from the landowner to construct a 1.6ha wetland that will capture and treat

water from a 180ha catchment.

32. To

fit in with project timelines and due to COVID-19 lockdown preventing site

visits, the wetland design work had to be completed remotely and was based off

LiDAR (remote sensing using pulse lasers to measure elevation) which gave the

most accurate data set available at the time.

33. Prior to construction the design was

double checked with a surveyor building a 3D model for machinery to run off.

However, this process revealed that the LiDAR data underestimated the volume of

earth that needs to be moved, and so the costs of construction are expected to

exceed budget.

34. The

initial estimated pricing for earthworks, based off the LiDAR design, was

$100k, this has now been raised to $180k, which has used the remaining budget

set aside for planting and initial maintenance of the wetland.

35. A

decision was made to proceed with the construction as to meet project

timeframes. This means

the wetland will be constructed, but the site will not be planted with the

correct wetland plants needed to ensure a highly functioning constructed

wetland in time to be part of the NIWA monitoring project until additional

funding becomes available in the future.

36. Currently the constructed wetland

project has been exclusively funded by Fonterra ($250k), with Council only

committing a small amount of staff time.

37. If $100k, for this

financial year, could be committed from Councils $1m Recovery Fund, it would

allow for the complete delivery of this project to meet the timeframes for

inclusion into the NIWA national monitoring programme.

38. Councils investment would

provide an opportunity to further collaborate with national organisations to

lead and deliver an exciting research and development project. The results of

which could provide a model that would add significant value to how we target

nitrogen reduction throughout the region and provide a more holistic

understanding of the water quality benefits derived from wetlands.

Strategic Fit: Assessment Criteria

39. This

project has been assessed to determine their fit with the draft criteria from

the Council’s Recovery Fund.

|

|

Score

|

Reasoning

|

|

Climate action

|

4

|

This project aims to develop a model for constructed

wetlands that will protect and improve our rivers from the challenges posed

by climate change while allowing the farmers to continue farming the

sustainably.

|

|

Strategic Alignment

|

5

|

This project aligns with our strategic outcomes. It is

targeting DIN reduction on a catchment scale to improve water quality and

river health. While the planting will promote biodiversity outcomes.

|

|

Core Competencies

|

5

|

HBRC is already collaborating on this project, while

the outcomes will provide increased knowledge and skill to multiple teams

including the catchment management, water quality and Tukituki implementation

teams.

|

|

Ease of implementation

|

5

|

This project is already underway with full landowner

support and resource consent obtained. The recovery funding portion is an

extension of this and will help facilitate the complete delivery of this

project within the timeframe to be included in the NIWA national monitoring

program.

|

|

Leverage

|

3

|

This funding will not be used to leverage additional

external funding. However, we have already been successful in leveraging

$250k from Fonterra to deliver the project with NIWA also committing

significant resources for the ongoing monitoring.

|

|

Impact

|

4

|

The project can have a significant impact across

several fronts in particular water quality, by providing landowners another

tool to help address high nitrogen levels on a catchment scale.

|

|

Recovery

|

3

|

Local growth and investment will be supported by future

projects directly related to the outcomes of this project.

|

Project Funding

40. The

proposed PLBF application is an expansion of the current council Ecosystem

Prioritisation programme, leveraging off established processes, existing

budgets, and staff resources. This programme is funded by general rates.

41. The Tukipo Constructed

Wetland project has been exclusively funded by Fonterra with Council only

committing a small amount of staff time.

42. The

Recovery Fund established as part of the 20/21 Annual Plan is to be funded via

a 10-year external loan. A total of $400k is requested from this fund, to be

used towards the PLBF application and the Tukipo constructed wetland, as

outlined in this paper.

43. As

the PLBF application is a multi-year project, the contribution requested from

the Recovery Fund would not all be required in 20/21. If the request for

funding from the Recovery Fund is approved and we are successful in obtaining

the PLBF funding, there would be a requirement to phase the loan drawdown over

three years.

44. The

two projects requesting contribution from the Recovery Fund are not building

Council owned assets, but they are creating community assets that will benefit

future generations. As such, the use of the Recovery Fund loan funding is in

alignment with the intergenerational equity principle.

45. If

a contribution from the Recovery Fund is approved for both projects, a budget

would need to be added to these projects for the loan financing costs. This

would not be an increase above existing funding, but rather a re-allocation

from the original building project, which the Recovery Fund was created from.

46. Council should note that

the PLBF fund is a contestable process and as an applicant we have no greater

chance of successfully obtaining funding than any other applicant. If

unsuccessful, the funds in the Recovery Fund would then be potentially

available to fund other projects as they are identified. The funding would be

treated as ‘committed’ until such time as we are notified either

way about our application, by approximately mid-March.

|

Projects

(across 4 Financial

years)

|

HBRC

Existing Budgets

|

Landowner/

QEII

contribution

|

Request

from Recovery Fund (HBRC)

|

PLBF

application (funding match from MfE)

|

Total

Project $

|

|

Staff

Time

(In-kind)

|

External

costs

|

|

PLBF

|

$184,080

|

$127,000

|

$346,229

|

$300,000

|

$1,000,000

|

$1,957,309

|

|

Tukipo constructed

wetland

|

$0

|

$0

|

$0

|

$100,000

|

$0

|

$100,000

|

|

Total

|

$184,080

|

$127,000

|

$346,229

|

$400,000

|

$1,000,000

|

$2,057,309

|

Decision Making

Process

47. Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

47.1. The

decision does not significantly alter the service provision or affect a

strategic asset, nor is it inconsistent with an existing policy or plan.

47.2. The use

of the special consultative procedure is not prescribed by legislation.

47.3. The

decision is not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy.

47.4. Given

the nature and significance of the issue to be considered and decided, and also

the persons likely to be affected by, or have an interest in the decisions

made, Council can exercise its discretion and make a decision without

consulting directly with the community or others having an interest in

the decision.

|

Recommendations

That

Hawke’s Bay Regional Council:

1. Receives and considers the “Recovery Fund Projects”

staff report.

2. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that Council can exercise its discretion and make decisions on

this issue without conferring directly with the community or persons likely

to have an interest in the decision.

3. Notes the opportunity to utilise the Recovery Fund for leveraging

funding from the Jobs for Nature Private Land Biodiversity Fund, through an

application made by Hawke’s Bay Regional Council, and Tukipo

constructed wetland, and agrees to support the funding of both these

projects.

|

Authored by:

|

Thomas Petrie

Programme Manager Protection &

Enhancement Projects

|

Mark Mitchell

Acting Manager Catchment Services

|

Approved by:

|

Iain Maxwell

Group Manager Integrated Catchment

Management

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 03 March 2021

Subject: Report from the 17

March 2021 Finance Audit and Risk Sub-committee Meeting

Reason

for Report

1. The following

matters were considered by the Finance Audit and Risk Sub-committee (FARS) meeting

on 17 March 2021 and are now presented for the Committee’s consideration

alongside any additional commentary the Sub-committee Chair

wishes to offer.

2. The purpose of

the Finance, Audit and Risk Sub-committee, in accordance with its Terms of

Reference, is to report to the Corporate and Strategic Committee to fulfil its

responsibilities for:

2.1. The provision

of appropriate controls to safeguard the Council’s financial and

non-financial assets, the integrity of internal and external reporting and accountability

arrangements

2.2. The review of

Council’s revenue and expenditure policies and the effectiveness of those

policies

2.3. The

independence and adequacy of internal and external audit functions

2.4. The

robustness of risk management systems, processes and practices

2.5. Compliance

with applicable laws, regulations, standards and best practice guidelines

2.6. Monitor the performance of Council’s investment portfolio.

Agenda items

3. The Six Monthly Risk Report and Risk Maturity Update item updated the Sub-committee on implementation of

Council’s maturing risk management system as well as introducing

Karen Walters, Information Management Advisor, who presented about the risks

associated with information and the project plan to mitigate those risks.

The Sub-committee resolved:

3.1. Confirms that

the management actions undertaken and planned, as detailed in the February 2021

Enterprise Risk Report, adequately respond to the Risk Management Maturity

Roadmap as endorsed by Hawke’s Bay Regional Council on 24 June 2020.

3.2. Reports to

the Corporate and Strategic Committee, the Sub-committee’s satisfaction

that the Six Monthly Risk Report and Risk Maturity Update provides adequate

evidence of the robustness of Council’s risk management policy and

framework and progress to implement the maturing risk management system.

4. The Internal Audit Work Programme Update item

updated the Sub-committee on the internal audit work programme and a dashboard update on corrective actions taken, with

discussions also covering the potential for an audit of Third

party contractual agreements and MoUs; how those are negotiated, managed and

monitored as well as assessed for risk. The Sub-committee resolved:

4.1. Confirms that

management actions undertaken or planned for the future adequately respond to

the findings and recommendations of previously reported internal assurance

reviews.

4.2. Reports to

the Corporate and Strategic Committee, the Sub-committee’s satisfaction

that the Internal Audit Work Programme Update provides adequate evidence of the

adequacy of Council’s internal assurance functions and management actions

undertaken or planned to respond to internal assurance review findings and

recommendations.

5. The Assurance Framework Relevant to S17a Reviews item provided an update on the development of

Council’s Assurance Framework and where s17a reviews will fit within

it. It highlighted that the proposed assurance framework

has three levels, with S17a reviews sitting at the organisational level with

elevation to FARS where there is significant non-compliance or material issues

identified. The Sub-committee resolved:

5.1. reports to

the Corporate and Strategic Committee, the Sub-committee’s satisfaction

with progress made to draft a Regional Council Internal Assurance Framework.

6. The Quarterly Treasury Report for 1 October - 31 December 2020 item

provided an update on the performance of Council’s investment portfolio

for the second quarter of the 2020-21 financial year, highlighting

some upside in returns against Annual Plan budgets resulting in reduced

requirement for Council to borrow. The following resolution was then

passed.

6.1. That the Finance, Audit and Risk Sub-committee receives and notes

the “Quarterly Treasury Report for 1 October - 31 December 2020”

and confirms that the performance of Council’s investment portfolio has

been reported to the Sub-committee’s satisfaction.

7. As part of

today’s meeting, representatives of Jarden will provide an update on the

funds they manage for Council.

8. The 2019-20 Annual Report Adoption Delay provided

an update on progress toward adoption of the Annual Report by Council on 24

February. It explained the issues that caused the delays, including the valuation of the Napier Port administration building as a result

of different accounting policies.

Decision Making Process

9. Staff have

assessed the requirements of the Local Government Act 2002 in relation to this

item and have concluded that, as all items were specifically

considered at the Sub-committee level this item is for information only

and the LGA decision making provisions do not apply.

|

Recommendations

1. That the Corporate

and Strategic Committee receives and notes the report from the 17 March

2021 Finance, Audit and Risk Sub-committee, including the following

resolutions of the Sub-committee.

Six Monthly Risk Report and Risk

Maturity Update

1.1. Reports to the Corporate and

Strategic Committee, the Sub-committee’s satisfaction that the Six

Monthly Risk Report and Risk Maturity Update provides adequate evidence of

the robustness of Council’s risk management policy and framework and

progress to implement the maturing risk management system.

Internal Audit Work Programme Update

1.2. Reports to the Corporate and

Strategic Committee, the Sub-committee’s satisfaction that the Internal

Audit Work Programme Update provides adequate evidence of the adequacy of

Council’s internal assurance functions and management actions

undertaken or planned to respond to internal assurance review findings and

recommendations.

Assurance Framework Relevant to S17a

Reviews

1.3. reports to the Corporate and

Strategic Committee, the Sub-committee’s satisfaction with progress

made to draft a Regional Council Internal Assurance Framework.

Quarterly Treasury Report for 1

October - 31 December 2020

1.4. receives and notes the

“Quarterly Treasury Report for 1 October - 31 December 2020”

and confirms that the performance of Council’s investment portfolio has

been reported to the Sub-committee’s satisfaction

|

Authored by:

|

Leeanne

Hooper

Team Leader Governance

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 03 March 2021

Subject: 2020-21 Quarter 2 (1

October - 31 December 2020) Financial Report

Reason for Report

1. This item provides the Committee with financial results for the

first half of the 2020-21 financial year.

YTD Summary to 30 December

2020

2. Council has an operating surplus of $1m compared to a

forecast deficit of $2.3m based on the pro-rata budget.

3. Operating expenditure is on budget, income is ahead due to

the higher than forecast returns from the managed funds and HBRIC dividends.

4. Capital expenditure is running at 72% of budget overall,

additional capital income is due to receiving PGF funding for Heretaunga Plains

Flood Control, Upper Tukituki and Wairoa work. In addition, higher

repayments have been received from Sustainable Homes (both early repayments and

higher repayments from the increased uptake in the programme).

Summary – Full Year

Forecast

5. The forecast year end operating position is favourable to

plan by $2.4m.

6. Full year operating expenditure will include Council

approved $2.45m accelerated funding for the Erosion Control Scheme. This

is debt funded operational expenditure.

7. Full year income is expected to exceed plan due to better

than expected investment income; dividends and managed fund returns.

8. Full year capital expenditure is expected to be $800k under

budget but income (Sustainable Homes repayments and grants) is expected to be

over budget by $3.3m.

Background to the Financial

Summary

9. Many of the variances in the financial report to 31

December are the result of:

9.1. no seasonal phasing of budgets.

9.2. timing of the work programme delivery.

10. The FY20-21 annual plan

budget was revised in response to the Covid-19 Pandemic. It includes

conservative forecasting for investment income in-particular the uncertainly

around the economy and financial markets at the time of preparation and

adoption.

11. The budgets presented

include the carry forwards from FY19-20 approved by Council.

12. For reporting purposes,

the annual budget is divided evenly across the year without phasing. Annual

spend has considerable seasonality, particularly planting activity, which will

occur towards the end of the Financial Year. Future year reporting, from

the new finance system will be phased across the year accounting for

seasonality.

13. New loan funding is

generally drawn down at the end of the financial year when the actual required

funding is known.

14. All revenue and

expenditure accrued (carried forward) at the end of the FY19-20 financial year

has been recognised in the Q2 FY20-21 actuals.

15. The pro-rata budgets do

not include additional expenditure and funding agreed after the annual plan was

adopted (e.g. PGF funding for Heretaunga Plains Flood

Control).

Overheads

16. Employee

costs are on track at 31 December, the cost of the deferred mid-year pay review

will impact the second half of the year but will be partially offset by savings

derived from carrying vacancies.

17. Rental

costs are exceeding budget by $130k due to the office expansion in Station St

for new accommodation to support the increased headcount. This is due to

the originally planned approach to long term accommodation being a capital

funded project. This is offset by an underspend in capital.

18. Computer

software costs are over budget at 31 December by $300k due to the pro-rata

budgeting but these costs are expected to finish the year close to budget.

Operating Expenditure

19. Across the Council,

operating expenditure is 99% of the pro-rata budget.

20. Strategic

Planning expenditure is at 93% of the pro-rata budget at the midpoint of the

year. It is likely that the Response to Climate Change project will be

overspent at year end as additional costs will be incurred to obtain a baseline

understanding of greenhouse gas emissions as a prerequisite to Kotahi

discussions with tāngata whenua, Regional Planning Committee and the

community. Statutory Advocacy costs are likely to be higher than budget as the

Water Conservation Order and Marine and Coastal Area Act hearings are scheduled

to commence 9 February. The legal fees associated with both processes are

extensive. HBRC are also committed to funding a third of the fees for

Barker and Associates to undertake the Housing and Business Development

Capacity Assessment for Heretaunga Plains Urban Development Strategy.

21. Expenditure

by Asset Management is below budget, at 88% of the year-to-date total.

Westshore coastal works have been completed under budget and the bulk of the

work on flood protection and control will take place later in the year. Work on

the regional park network is more than budget and this perennial issue is being

addressed in the 2021-31 LTP.

22. ICM expenditure is at 94%

of the pro-rata budget. Science and Biodiversity budgets have large seasonal

components during Q3 and Q4 and expect expenditure to match the budget by year

end.

23. Consents and Compliance is

operating slightly over budget. Maritime safety expenditure is slightly over

budget due to some unexpected repairs on navigation aids in Mahia and

Onepoto. Further, additional time has been spent by the compliance team

on enforcement activities resulting in increased legal costs.

24. Emergency management

expenditure is higher than budget due to approximately 40% of staff time

continuing to be spent on Covid-19 response and resurgence planning plus the

costs of the Napier flood event. It is expected that some of these costs will

be recoverable from central government and this group expects to have a small

surplus by year end.

25. Transport is over budget

due to the increased work on the Regional Land Transport Plan with hearings due

in March. The overspend will be recovered when the other councils are charged

their share of the costs. The bus service costs are over budget but this

increase will be offset by grants from NZTA.

26. Governance

and partnerships expenditure is higher than budget due to external consultancy

costs to inform the updated investment strategy for the LTP and the $100k

donation to the NCC Mayoral Flood Relief Fund funded from the council disaster

damage reserve.

Operating Income

27. Across

the Council, operating income is at 111% of the pro-rata budget.

28. Strategic

planning is favorable due to receipt of additional funding for the Regional

Business Partner programme to support the Covid recovery.

29. Asset management is reporting as under budget; this is due to

budgeted interest income on reserves. This income is not assessed until

year end but should be lower than expected due to the historically low interest

rates received on deposits.

30. ICM is at

85% of its pro-rata budget. Science is less than budget due to delays in

claiming refunds from MPI under the ECS booster scheme and to the territorial

authorities for their contribution to LiDAR. Invoicing of third parties can

only take place after the work is completed, this incurs a delay between the

receipt and recognition of external costs and staff time, and being able to

invoice.

31. Consents

and Compliance income is under budget. Consents income is ahead of budget but

Compliance income is 50% of the pro-rata budget due to under recovery of

compliance monitoring charges (due to delayed invoicing). In future, we

intend to accrue the income where possible to provide a more balanced picture.

32. Emergency

management income is under budget reflecting a drop in expenditure and

consequent funding for the operation of the East Coast Lab.

33. Transport

income is over-budget across all activities with the bulk of the increase being

funding from NZTA which offsets and moves in line with the increased operating

costs of the bus network.

34. Works

group income from external contracts is ahead of budget by $59k and meeting

full-year expectations.

35. The

growth in the managed funds has exceeded expectations, with $6.4m divested to

recognize gains in December 2020. The performance has exceeded the full

year budget. Should performance continue to be strong, further divestment

and recognition of gains is achievable within the financial year.

36. Forestry

income will be received in the second half of the year. There were delays

to the start of harvesting due the time taken to establish the infrastructure

and procure harvest managers. This will slightly reduce the volume harvested by

the end of 2020-21 but the end of year forecast is in line with expected

revenue.

37. Leasehold

revenue is on track for the year.

38. $4m

Dividend from HBRIC was received in December and exceeded the forecast by

$1m. Any subsequent dividend would provide further upside in the current

financial year.

Capital Expenditure

39. IT

expenditure is under budget primarily due to the difficulties recruiting staff

in a very competitive market to deliver projects, this has resulted in several

delays. The telephony system upgrade has been completed slightly under budget;

water information system completed under budget; Finance system is expected to

run ahead of the original budget due to higher than budgeted internal costs and

having to introduce alternative resourcing solutions in order to complete the

project on time.

40. Asset

management is underspent on most projects however this reflects actual timing

against budget phasing and more time spent on design work in the early stages.

41. ICM

capital expenditure is over budget due to the continued success of the

Sustainable Homes project which has spent $4.9m of its annual $5.6m budget by

31 December with repayments higher than expected due to the increased take up

of the programme. This is a cost recoverable programme.

42. Regional

Income capital expenditure includes the water security project. This project is

underspent due to ongoing delays in project delivery resulting from COVID-19

events through the middle of 2020. Further, timing of two significant capital

projects scheduled for the second half of 20/21 financial year. The project

team has now concluded an RFP for technical investigations for Heretaunga

Storage and is about to confirm a preferred site for the Central Hawkes Bay

Managed Aquifer Recharge pilot. With these now concluded the project team

expects to initiate these two significant work streams shortly.

43. The Land

and Buildings budget includes $2m for the progression of a long-term

accommodation solution. Work is underway to fit-out the new Station St

accommodation, repurpose the Raffles St building and renovate the Dalton Street

ground floor. This capital underspend is offset by increased

operational costs leasing additional space for the short – medium term.

44. Motor

vehicle expenditure is ahead of budget due to timing of the purchases.

45. Science

have several large purchases planned for the second half of the year and expect

to meet full year budget.

Balance Sheet

46. Non-Current

Assets have increased by $2.7m, PP&E, Infrastructure Assets and Intangible

Assets has increased due to the ongoing capital expenditure noted above.

Investment Property has decreased as Napier Endowment Leasehold properties are

freehold and Financial Assets have decreased following the withdrawal of $6.47m

of growth from the managed funds.

47. Current

Assets have increased by $5m reflecting the continued reduction in outstanding

rates offset by the receipt of cash from the managed funds.

48. Fair

value reserves have decreased as unrealized gains in the managed funds have

been realized as the underlying assets have been sold facilitate the withdrawal

of $6.47m in cash.

49. Non-current

Liabilities have increased due to a new $6.3m loan drawn down in July as

delayed funding for the Sustainable Homes and Erosion Control projects offset

by the principal repayments in the 1st half of FY20-21.

50. Current

liabilities are consistent with the same period in FY19-20.

Other Information

51. Accounts

receivables shows the increased $15.1m in rates revenue received in comparison

to the same period in FY19-20. The increased “Over 91” days

receivable primarily consists of government debtors and does not indicate an

increased risk of default from leaseholders or consent holders.

52. Rates

receivables continues to reflect the improved level of payments. This is

further evidenced through the issuing of two thousand fewer penalty notices at

31 January 2021 compared to prior year.

Reserves

53. Reserve movements are as

expected based on the operating and capital income and expenditure to date.

Forecast to 30 June 2021

54. The

Operating forecast shows a decrease in the net funding requirement of $2.1m

across the groups of activities.

55. The most

significant variance to full year budget will be the approved acceleration of

expenditure for the Erosion Control Scheme within the year, and the continued

success of Sustainable Homes as part of Integrated Catchment Management.

56. In the second

half of the year, managed fund growth has been estimated based on the average

long-term growth of 5.16%. This is a conservative view based on the continued

impact of Covid-19 and uncertainty in world-wide economies and financial

markets. This growth, $2.93m, has been split and $1m recognized as realised

gains and included in operating income with the balance being recognized as

fair value gains on the balance sheet.

57. The Capital forecast shows less than planned expenditure on IT

Projects (ability to recruit suitable contract staff) and Regional Income

(result of delays in the Water Security project noted above) offset by

increased expenditure in Integrated Catchment Management (Sustainable Homes)

and Asset Management (PGF/IRG funded projects no included in the 2020-21 Annual

Plan).

58. The

2020-21 annual plan included a forecast $7.5m debt requirement to cover the

impact of Covid-19 on the budget (zero rates increase, reduced returns on

managed funds and HBRIC dividends). The higher than expected returns from the

managed funds and dividends indicate that this debt requirement will be reduced

by $2.5m to $5m.

Carry Forwards for 2021-22

59. Several

capital projects are likely to request a carry forward of funding into the next

financial year based on their forecast expenditure for the year:

59.1. ICM

expect to carry forward $600k for the SkyTEM 3D Aquifer work due to delays in

the programme caused by the pandemic.

59.2. IT is

expecting to carry forward $1.1m due to delays in recruiting staff to initiate

and oversee projects.

59.3. Asset

Management is expecting to carry forward between $500k to $750k on the Clive

River Dredging project with the amount dependent on the timing of consent and

capability of the contractor to start work.

59.4. Corporate

support expects to carry forward $1.5m to complete the work on the Raffles

Street and Dalton Street buildings as work continues on the architecture,

design and planning prior to construction.

59.5. The

Water Security project expects to carry forward $1m due to the time to complete

the RFP process and gain landowner agreement prior to commencing the pilot.

Decision Making

Process

60. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee

receives and notes the “2020-21 Quarter 2 (1 October - 31 December

2020) Financial Report”.

|

Authored by:

|

Tim Chaplin

Senior Group Accountant

|

Bronda Smith

Chief Financial Officer

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 03 March 2021

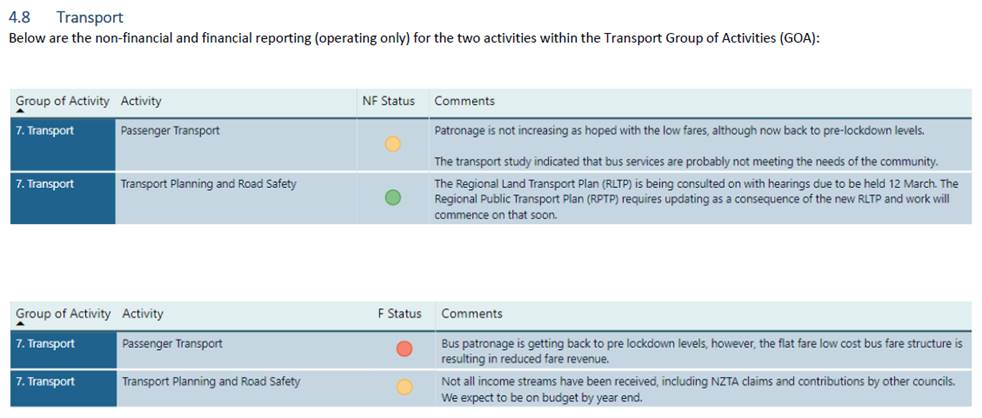

Subject: Organisational

Performance Report for period 1 October to 31 December 2020

Reason for Report

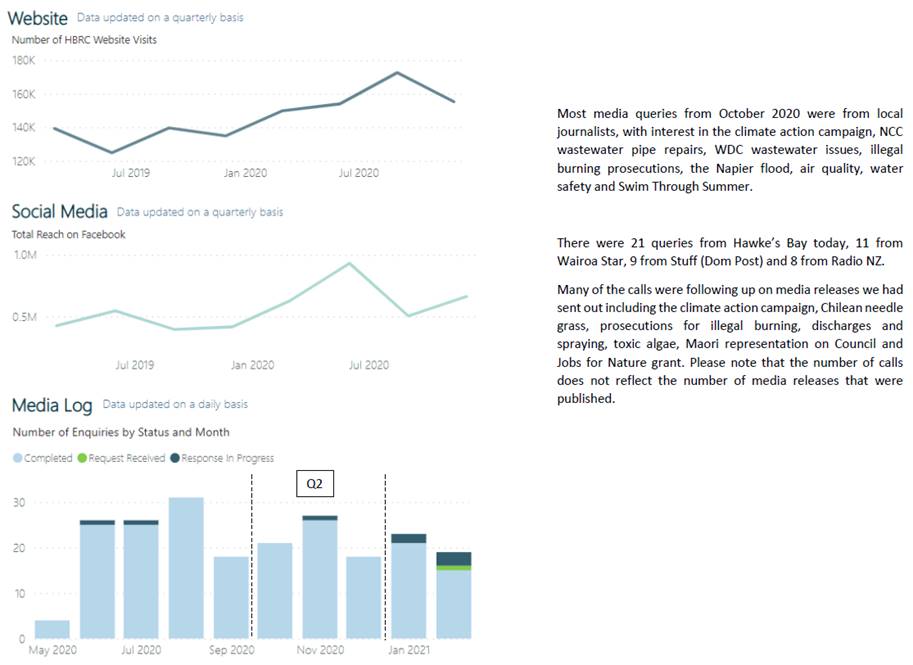

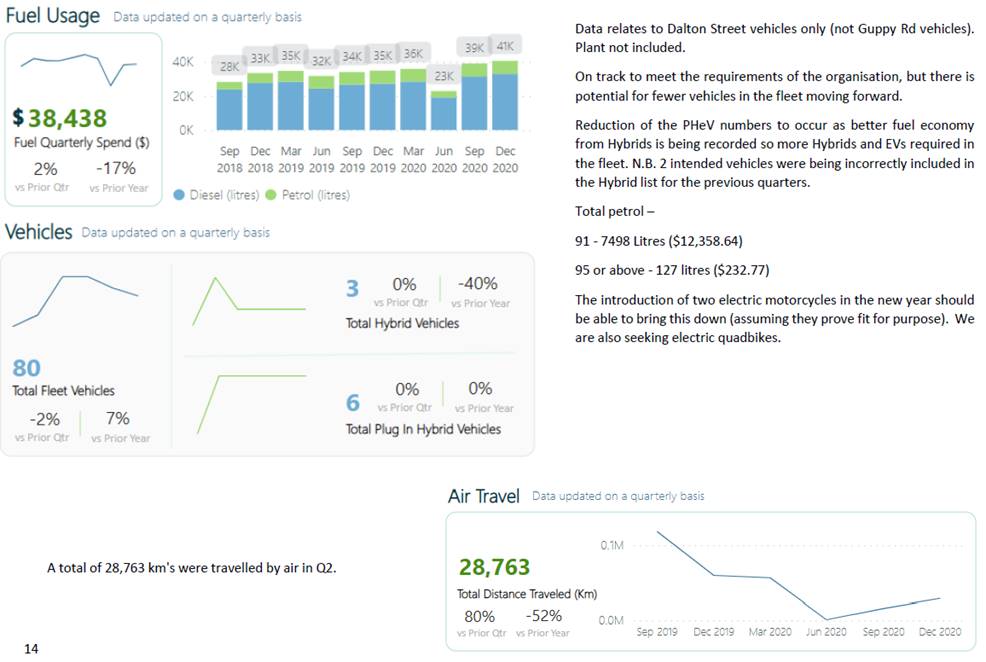

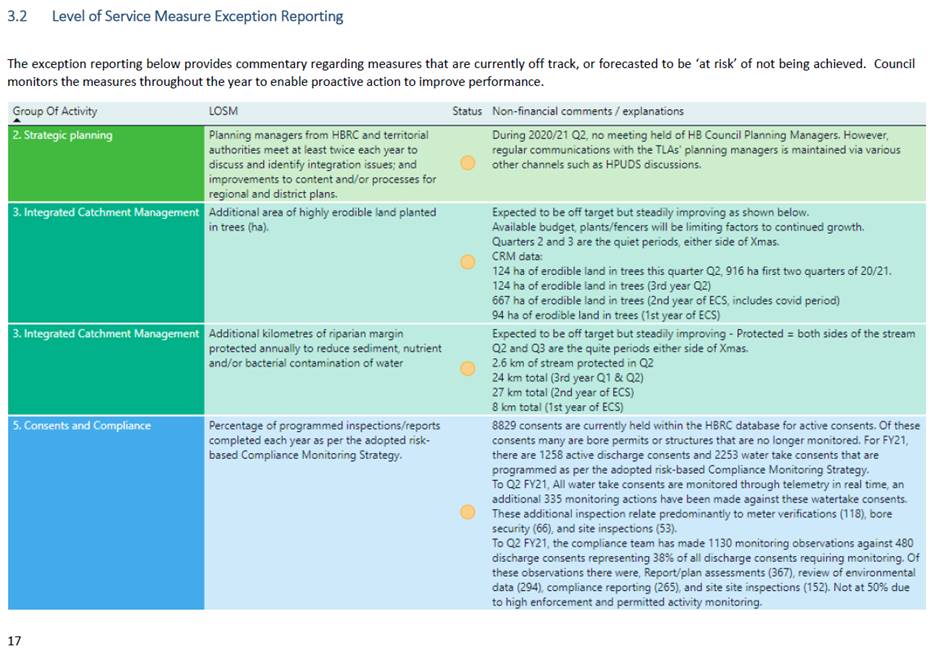

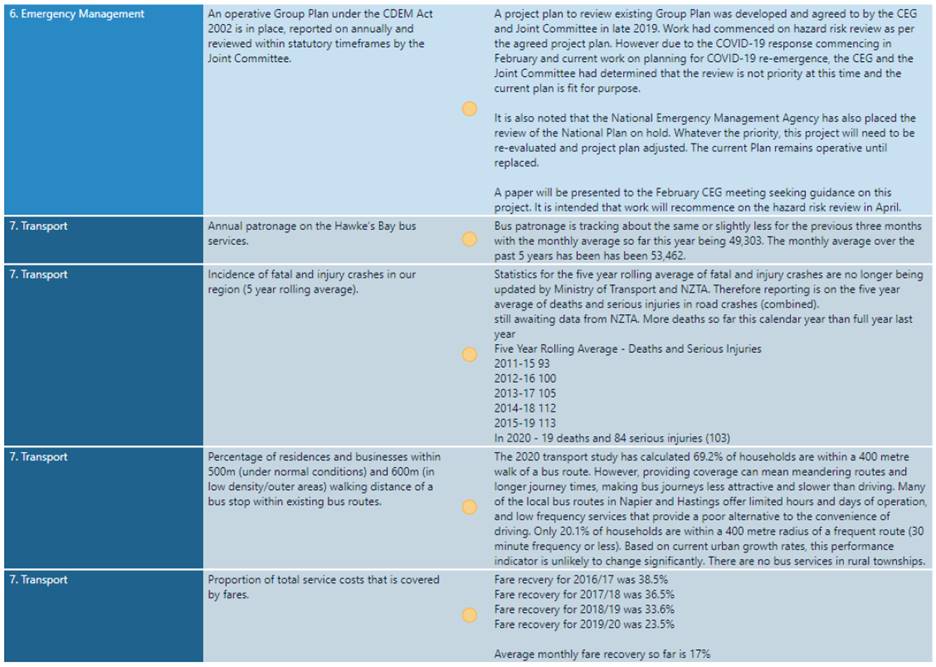

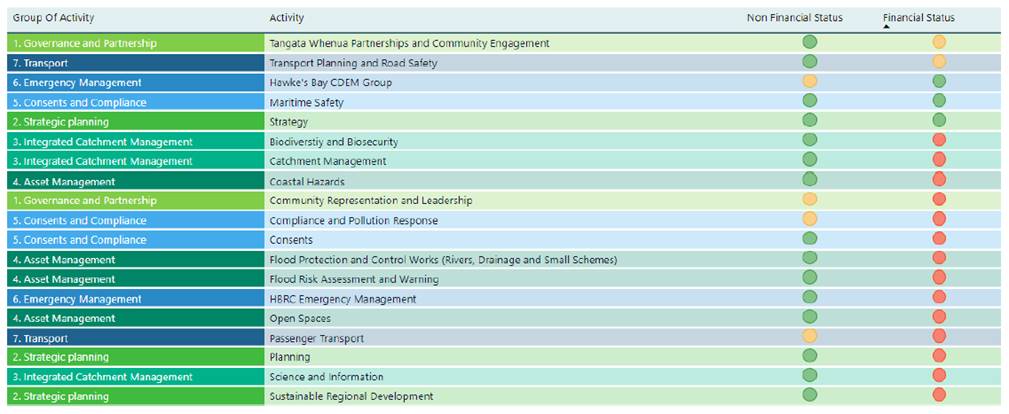

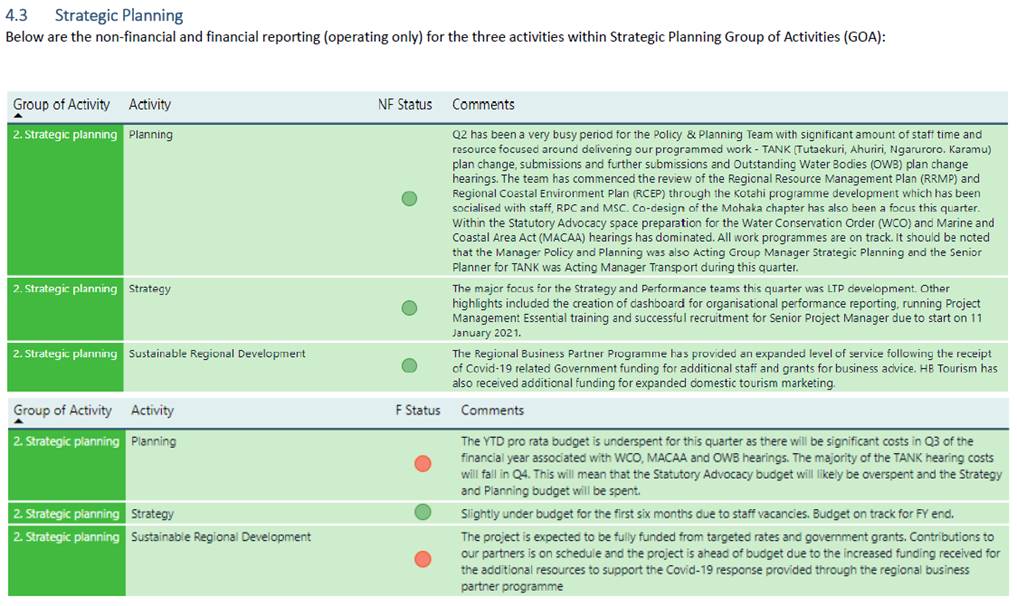

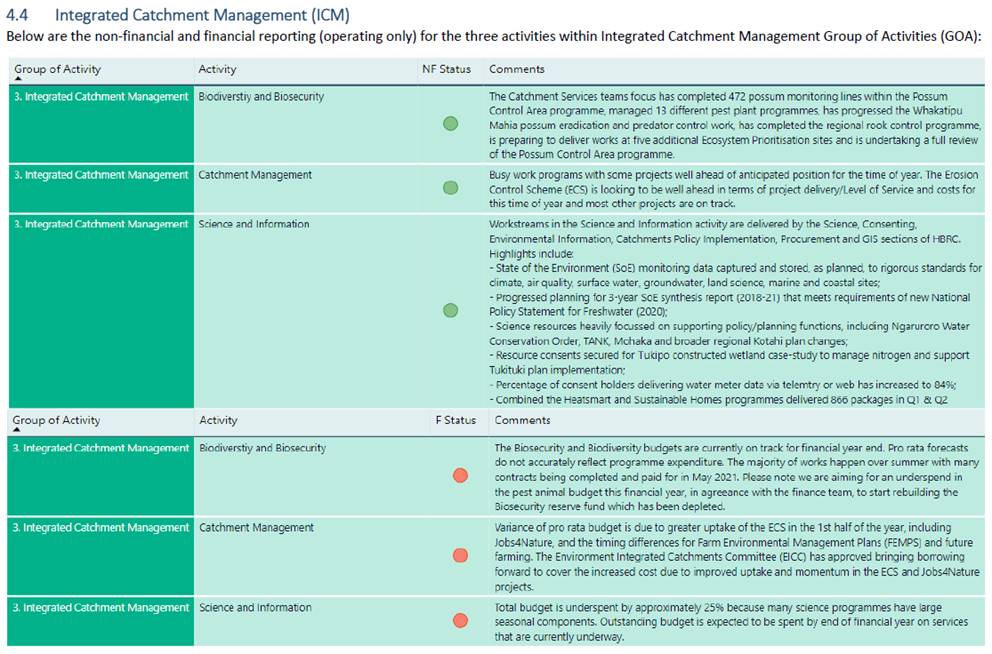

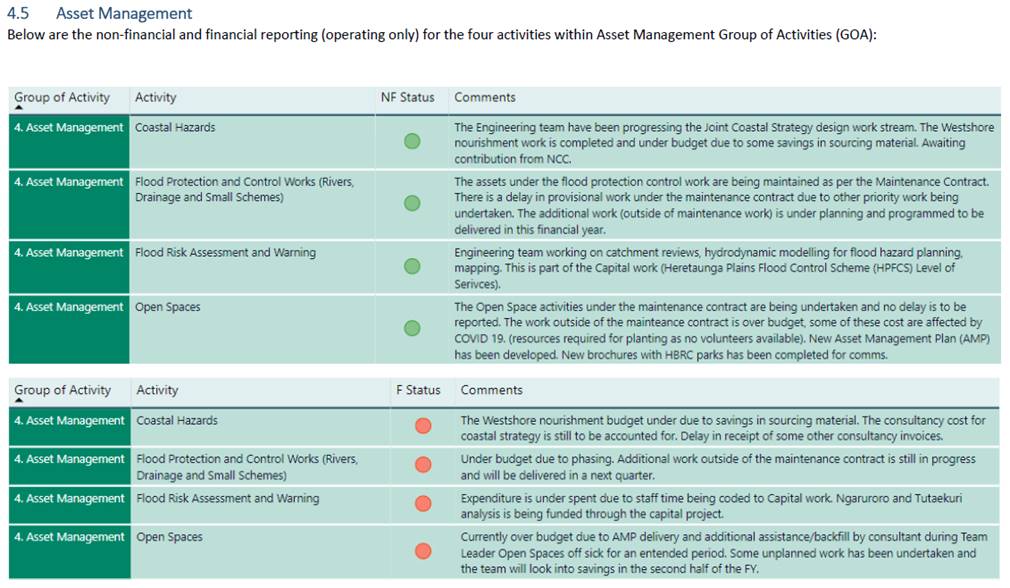

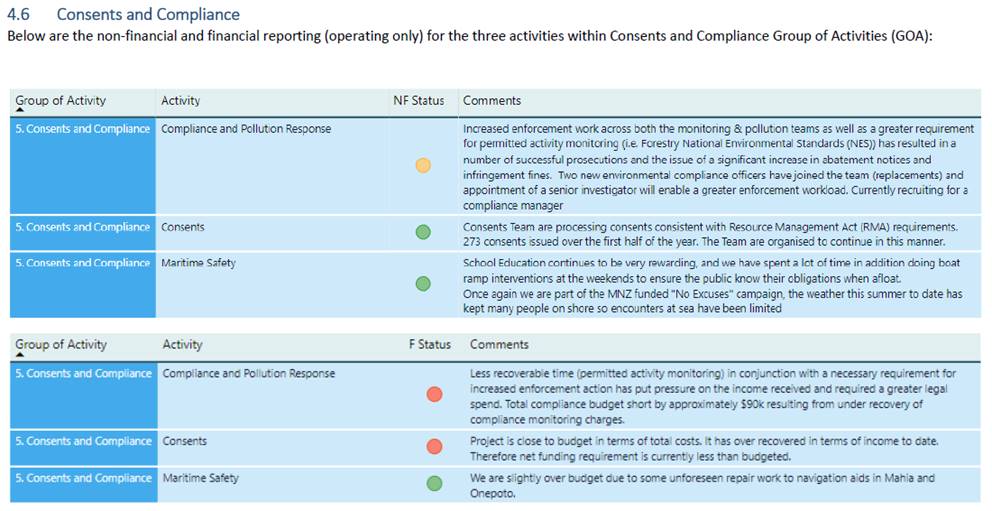

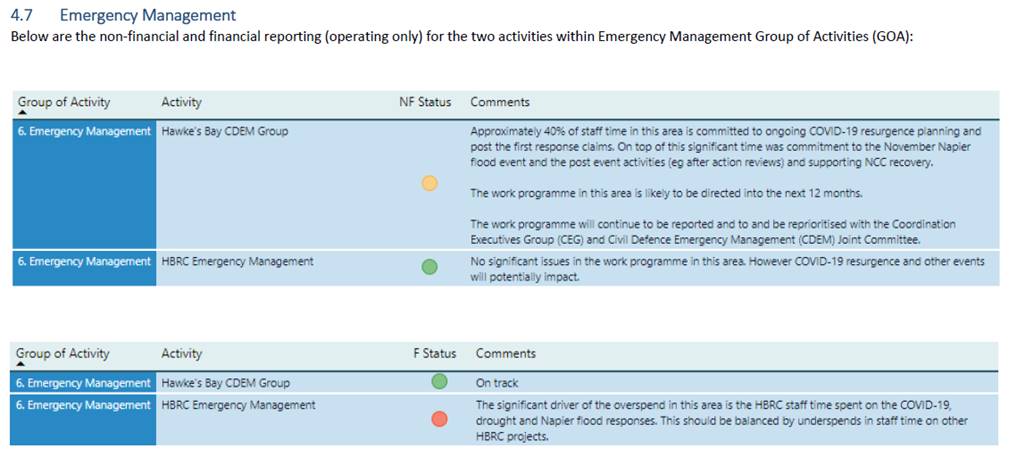

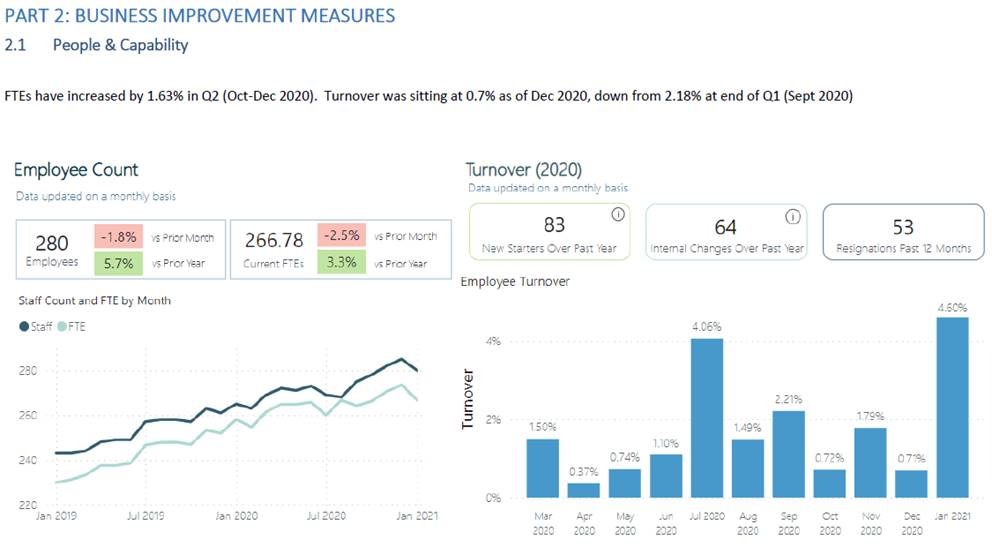

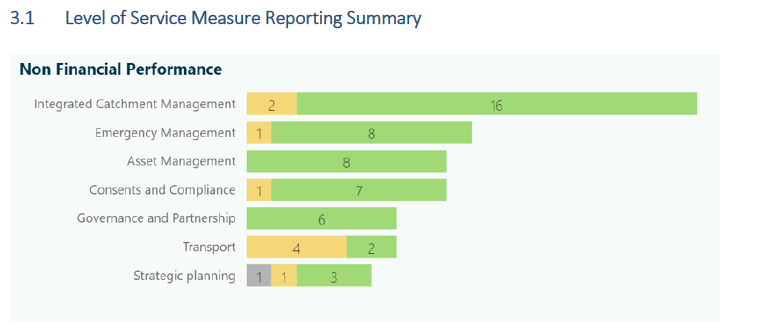

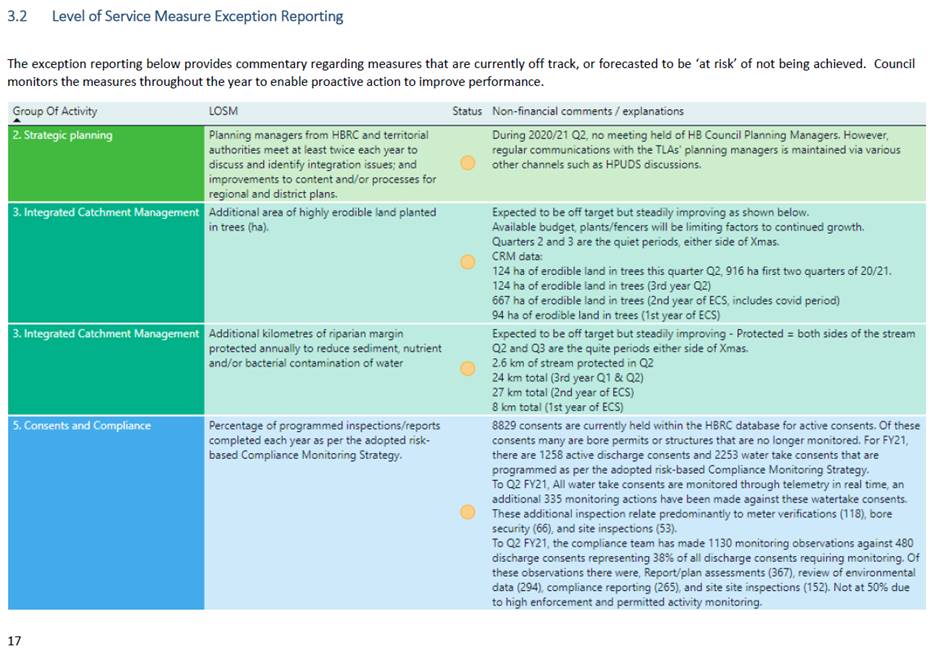

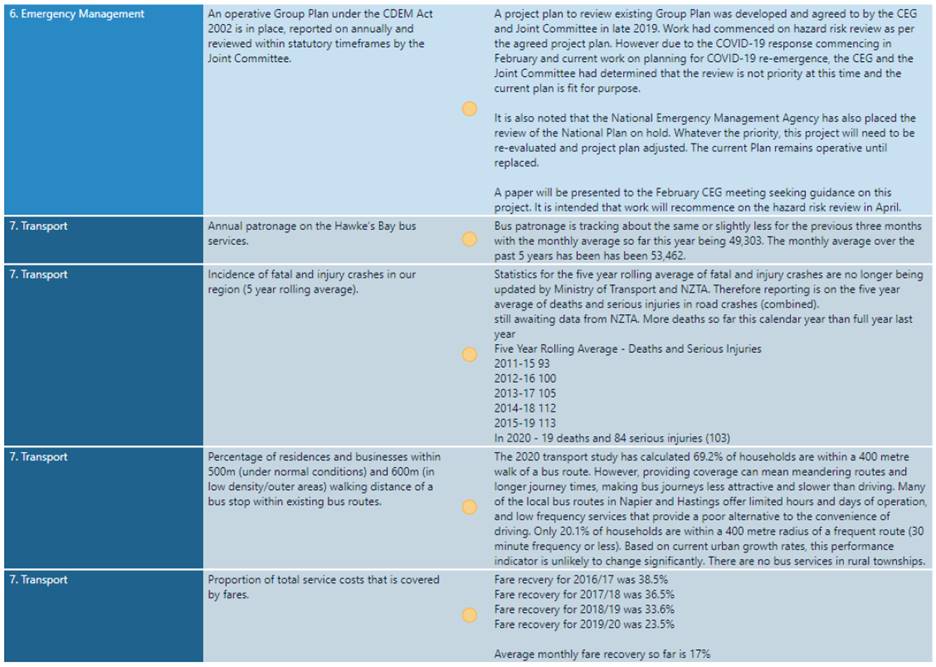

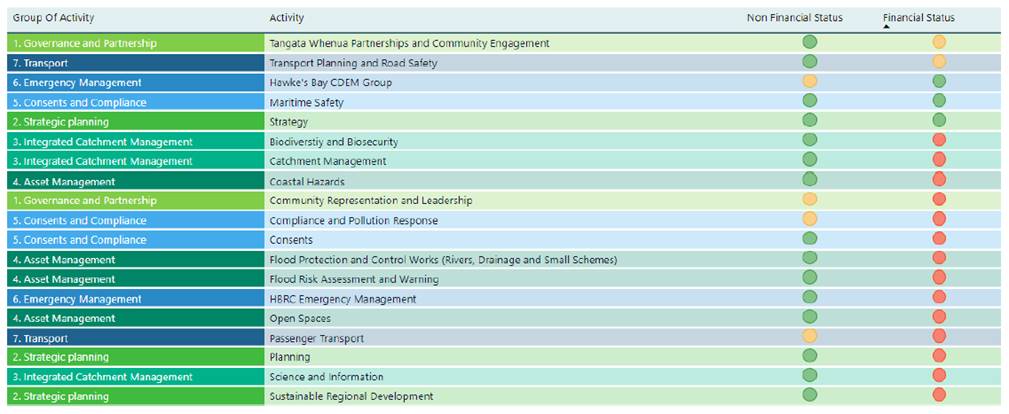

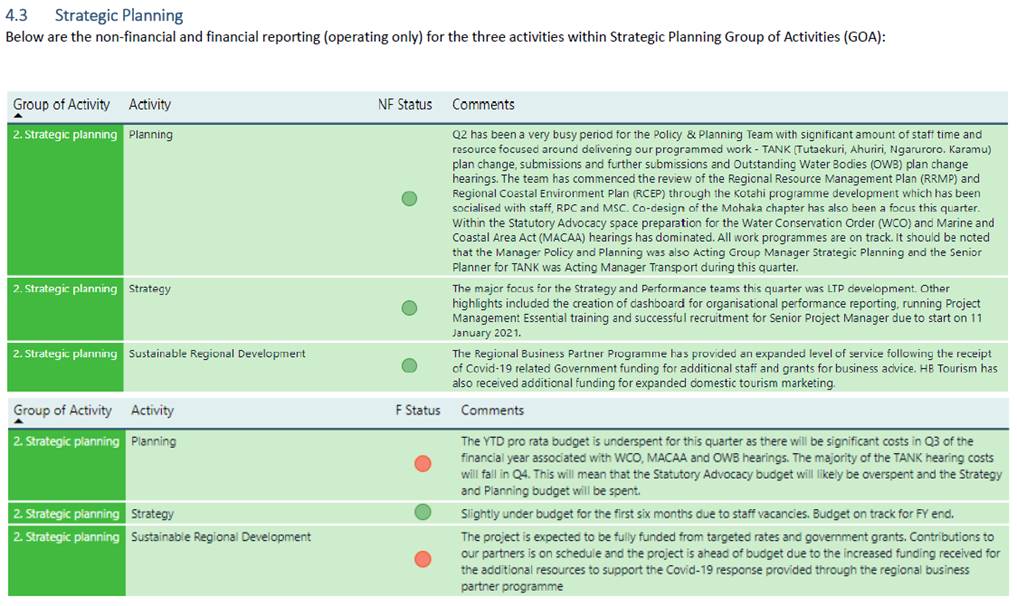

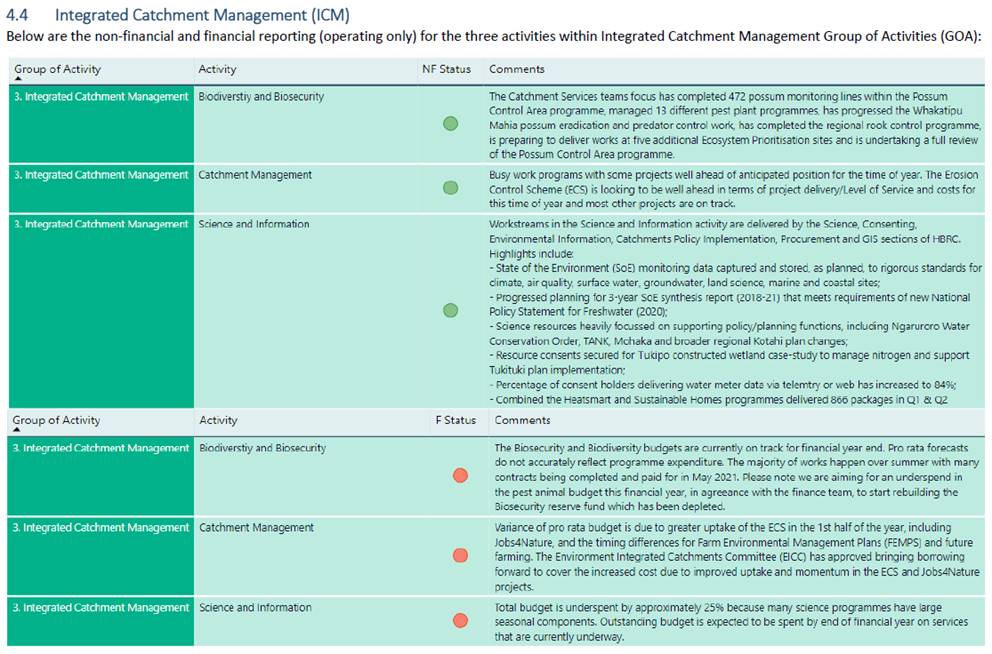

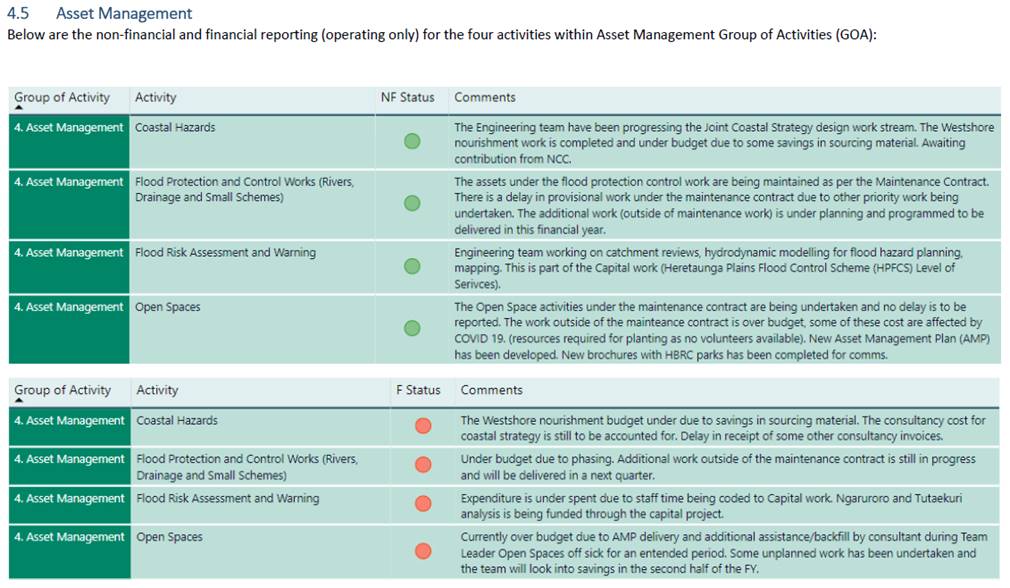

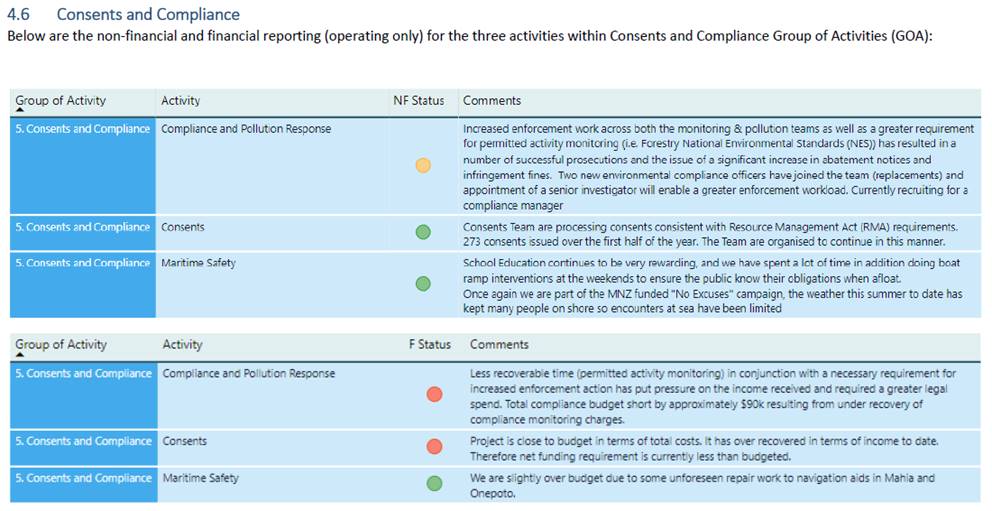

1. Attached to this cover report is the Organisational Performance

Report for Quarter 2: 1 October to 31 December 2020. The

Organisational Performance Report provides governors with situation-specific

factors affecting the organisation’s ability to deliver on its agreed

levels of service, activities and budgets. It holds staff to account for

non-financial and financial performance and signals through traffic light status

reporting, issues that may require intervention.

2. The Report is supplemented with a new dashboard which provides

Councillors with the ability to drill down and filter by area of interest.

Instructions on how to log-in and navigate the PowerBI dashboard are attached.

All Councillors have PowerBI licenses. A demonstration will also be

provided on the day.

3. Year-to-date financials and full year expectations are reported

through a separate paper on the agenda. The financial information in the

separate report is at a more aggregated level than the financial commentary in

the Organisational Performance Report.

Content of the Report

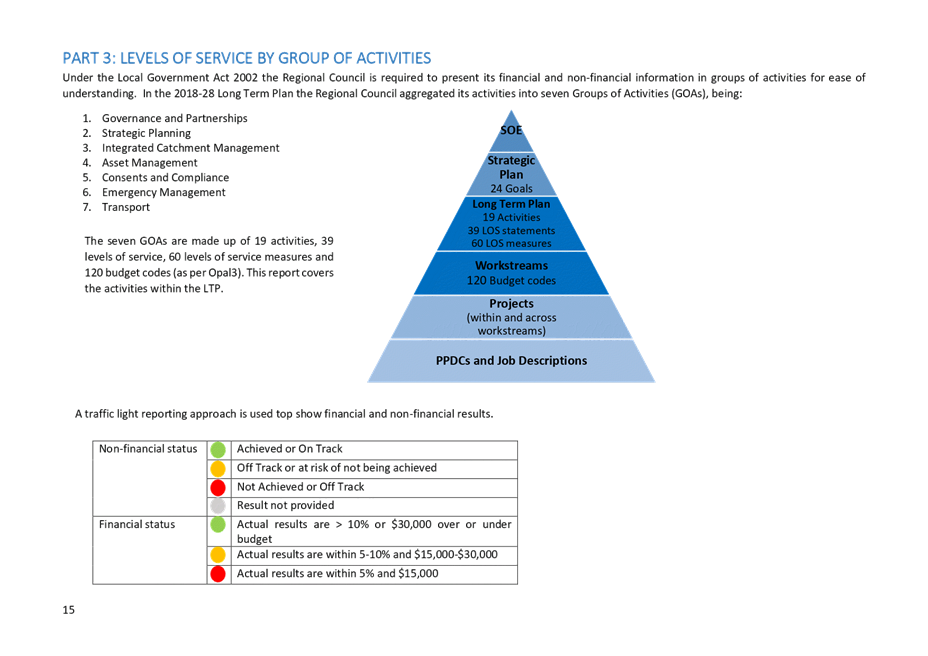

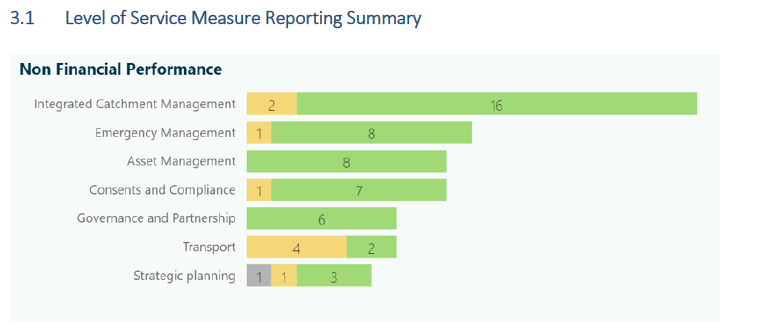

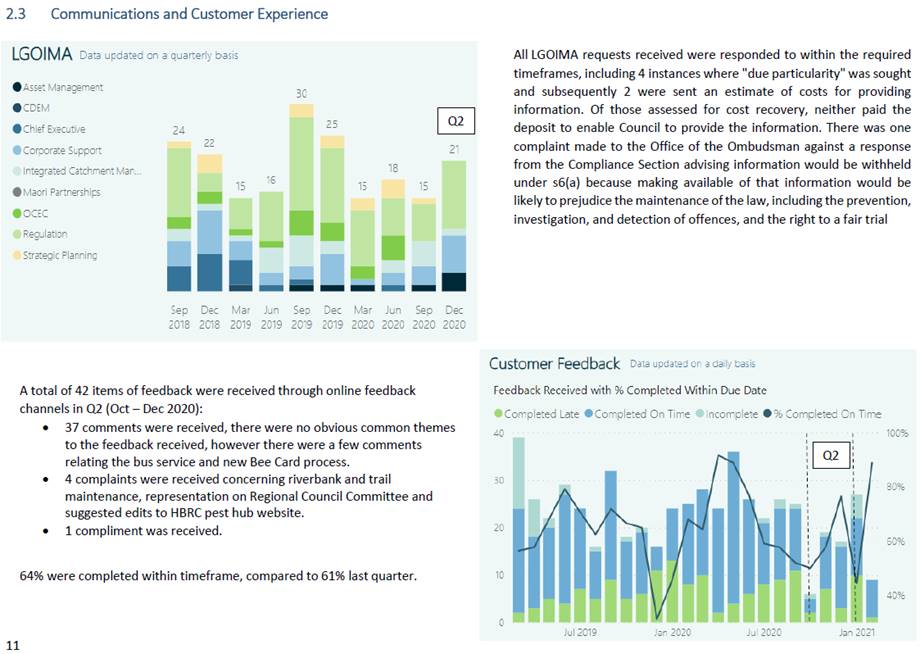

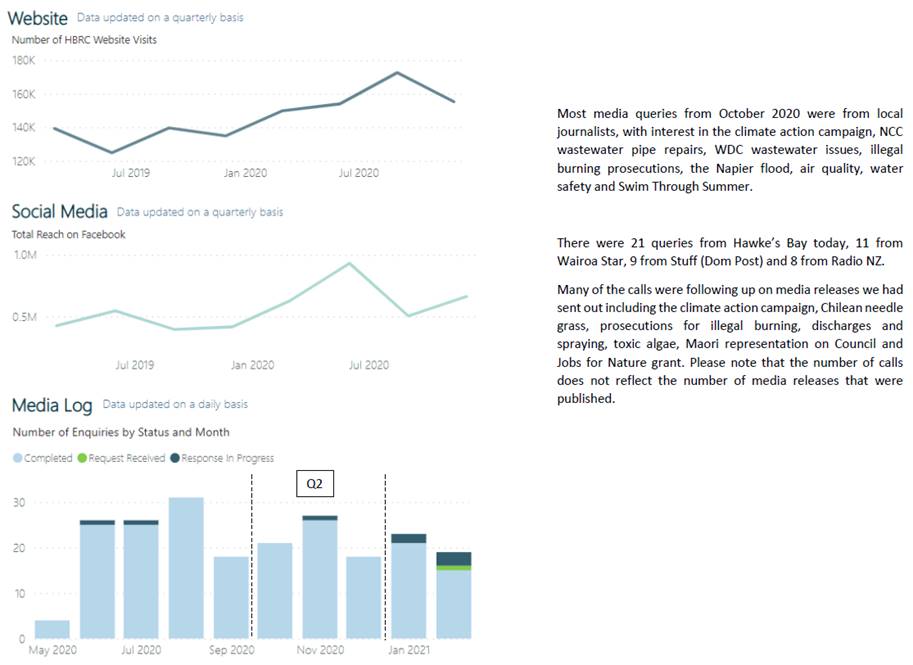

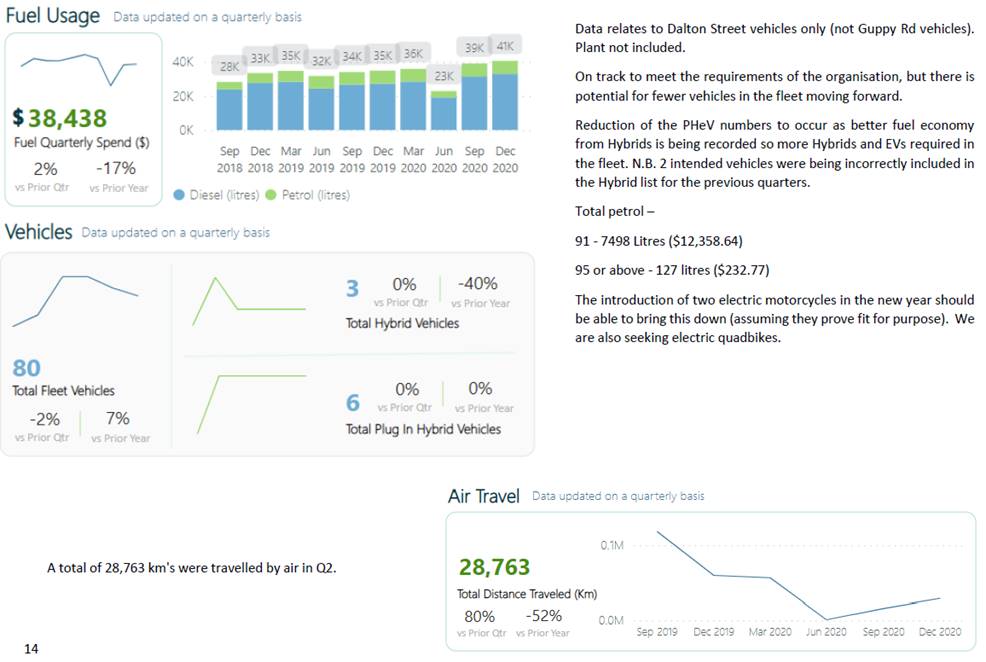

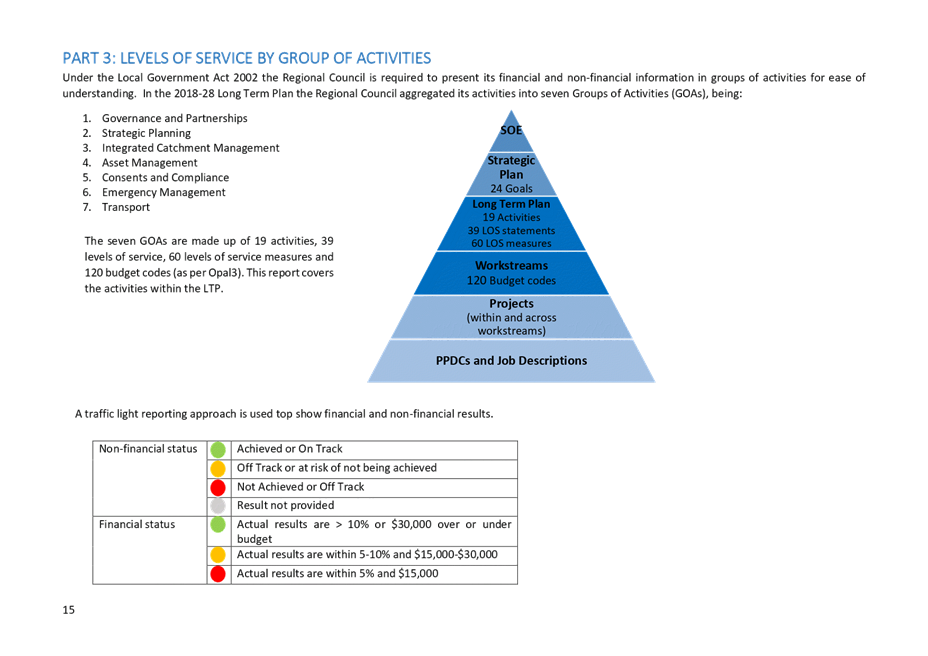

4. The attached Report contains four parts plus an Executive Summary

with highlights and lowlights for the quarter.

4.1. Part 1: Significant

Events or Programmes impacting this quarter. These tend to be

cross-council so sit outside the groups of activities section.

4.2. Part 2: Business

Improvement Measures focus on how well we are performing across a number of

corporate-wide measures such as health and safety incidents and response to

customer feedback.

4.3. Part 3: Level

of Service Measures by Group of Activities with traffic light status and

commentary by exception.

4.4. Part 4: Activity Reporting by Group of Activities with non-financial and financial (operating only) traffic light

status and commentary.

5. This is the eighth Organisational Performance Report to be

presented. It is much shorter than the previous versions (26 vs 80+ pages) as

the status and commentary reporting has been rolled up from 3-digit code to

activity level. Status and commentary by 3-digit

code is still available to Councillors via the dashboard.

6. As a reminder, staff complete their reporting in a software tool

called Opal3 once actual financial results for the quarter are loaded on the 20th

of the month following the end of the quarter. Staff select the status

(red, amber, green) of non-financial results, but it is fixed against agreed

criteria for financial results. For example, red is set at >$30,000 or

>10% over or under budget. Staff are then required to provide

commentary on what they did in the quarter in terms of actual non-financial

performance and to explain any variations to budgets.

7. It should also be noted that many of the variances shown as red in

the activity financial reporting are the result of the current financial

systems inability to phase budgets through the year. The current budget

has been spread evenly across the 12 months which does not reflect the actual

timing of work programme delivery. The new financial system due to be

implemented from 1 July 2021 will address this.

Dashboard

8. A prototype of

the dashboard was presented to the Corporate and Strategic Committee at its previous meeting in December 2020. Since then we have

made improvements to the content and design, however, data checking/cleansing

is ongoing and some areas is still under development. The dashboard will be

updated every quarter, ready for the Corporate and Strategic Committee Agenda.

9. We are continuously

improving the new dashboard, and improving the data reliability across all

areas – we would appreciate any feedback you have.

Decision Making

Process

10. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee receives and notes the “Organisational Performance Report for period 1 October to

31 December 2020” staff report.

|

Authored by:

|

Kelly Burkett

Business Analyst

|

Desiree Cull

Strategy and Governance Manager

|

Approved by:

|

Desiree Cull

Strategy and Governance Manager

|

|

Attachment/s

|

⇩1

|

HBRC

Organisation Performance Report Q2 1 October to 31 December 2020

|

|

|

|

HBRC

Organisation Performance Report Q2 1 October to 31 December 2020

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 03 March 2021

Subject: Discussion of Minor

Matters Not on the Agenda

Reason for Report

1. This document has been prepared to assist

Committee members note the Minor Items Not on the

Agenda to be discussed as determined earlier in Agenda

Item 5.

|

Item

|

Topic

|

Raised

by

|

|

1.

|

|

|

|

2.

|

|

|

|

3.

|

|

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 03 March 2021

Subject: HBRIC Ltd Quarterly

Update (to 31 December 2020)

That Hawke’s Bay Regional

Council excludes the public from this section of the meeting, being Agenda Item

11 HBRIC Ltd Quarterly Update (to 31 December 2020) with the general subject of

the item to be considered while the public is excluded; the reasons for passing

the resolution and the specific grounds under Section 48 (1) of the Local

Government Official Information and Meetings Act 1987 for the passing of this

resolution being:

|

GENERAL SUBJECT OF THE ITEM TO BE

CONSIDERED

|

REASON FOR PASSING THIS RESOLUTION

|

GROUNDS UNDER SECTION 48(1) FOR THE

PASSING OF THE RESOLUTION

|

|

HBRIC Ltd Quarterly Update (to 31 December 2020)

|

s7(2)(b)(ii) That the public conduct of this agenda item

would be likely to result in the disclosure of information where the

withholding of that information is necessary to protect information which

otherwise would be likely unreasonably to prejudice the commercial position

of the person who supplied or who is the subject of the information.

|

The Council is specified, in the First Schedule to this

Act, as a body to which the Act applies.

|

Authored by:

|

Kishan

Premadasa

Management Accountant

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 03 March 2021

Subject: HBRIC Ltd Draft 2021-22

Statement of Intent

That Hawke’s Bay Regional

Council excludes the public from this section of the meeting, being Agenda Item

12 HBRIC Ltd Draft 2021-22 Statement of Intent with the general subject of the

item to be considered while the public is excluded; the reasons for passing the

resolution and the specific grounds under Section 48 (1) of the Local

Government Official Information and Meetings Act 1987 for the passing of this

resolution being:

|

GENERAL SUBJECT OF THE ITEM TO BE

CONSIDERED

|

REASON FOR PASSING THIS RESOLUTION

|

GROUNDS UNDER SECTION 48(1) FOR THE

PASSING OF THE RESOLUTION

|

|

HBRIC Ltd Draft 2021-22 Statement of Intent

|

s7(2)(h) That the public conduct of this agenda item would

be likely to result in the disclosure of information where the withholding of

the information is necessary to enable the local authority holding the

information to carry out, without prejudice or disadvantage, commercial

activities.

|

The Council is specified, in the First Schedule to this

Act, as a body to which the Act applies.

|

Authored by:

|

Kishan

Premadasa

Management Accountant

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 03 March 2021

Subject: Wellington Leasehold

Property Offer

That Council excludes the public

from this section of the meeting, being Agenda Item 13 Wellington Leasehold

Property Offer with the general subject of the item to be considered while the

public is excluded; the reasons for passing the resolution and the specific

grounds under Section 48 (1) of the Local Government Official Information and

Meetings Act 1987 for the passing of this resolution being:

|

GENERAL SUBJECT OF THE ITEM TO BE

CONSIDERED

|

REASON FOR PASSING THIS RESOLUTION

|

GROUNDS UNDER SECTION 48(1) FOR THE

PASSING OF THE RESOLUTION

|

|

Wellington Leasehold Property Offer

|

s7(2)(i) That the public conduct of this agenda item would

be likely to result in the disclosure of information where the withholding of

the information is necessary to enable the local authority holding the

information to carry out, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations).

|

The Council is specified, in the First Schedule to this

Act, as a body to which the Act applies.

|

Authored by:

|

Geoff Howes

Treasury & Funding Accountant

|

Bronda Smith

Chief Financial Officer

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|