HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 17 February 2021

Subject: 2019-20 Annual Report

Adoption Delay

Reason for Report

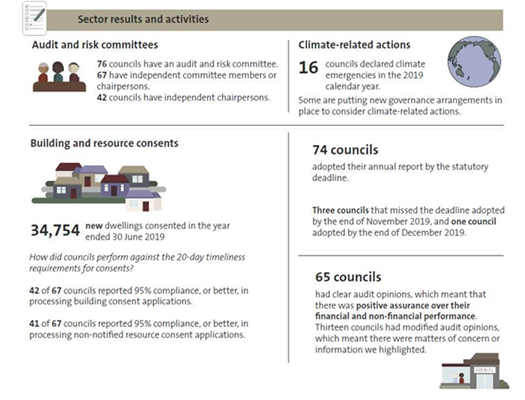

1. This item

updates the Finance, Audit and Risk Committee on the delay in the adoption of

the 2019-20 Annual Report including the implications of adoption of the report

outside of statutory timeframes.

Background

2. On

15 December 2020, Finance Audit and Risk Committee meet to review the 2019-20

Annual Report and recommended to Council that the Annual Report be adopted

subject to final Audit clearance.

3. Following the

meeting, officers were advised by Audit NZ on 21 December that a technical

accounting policy issue had been identified during the peer review. There is a

difference in the method between the value used for Council Land and Buildings

and HBRIC Group Accounts that have the Port Land and Buildings consolidated

into them.

4. The discrepancy

arises as Council values Land and Buildings at fair value and the Port Land and

Buildings are valued at cost and presenting them in the same asset classes does

not comply with PBE IPSAS 17 Property Plant & Equipment.

5. This resulted

in Council delaying the adoption of the 2019-20 Annual Report to resolve the

issue.

6. This is the

only issue raised by Audit with the 2019-20 Annual Report following the

recommendation by the FARS committee to Council. Following the resolution of

this issue the Annual Report audit opinion can be issued.

7. This has resulted

in Council being outside the statutory deadline of 31 December 2020 for

adoption of the 2019-20 Annual Report.

Discussion

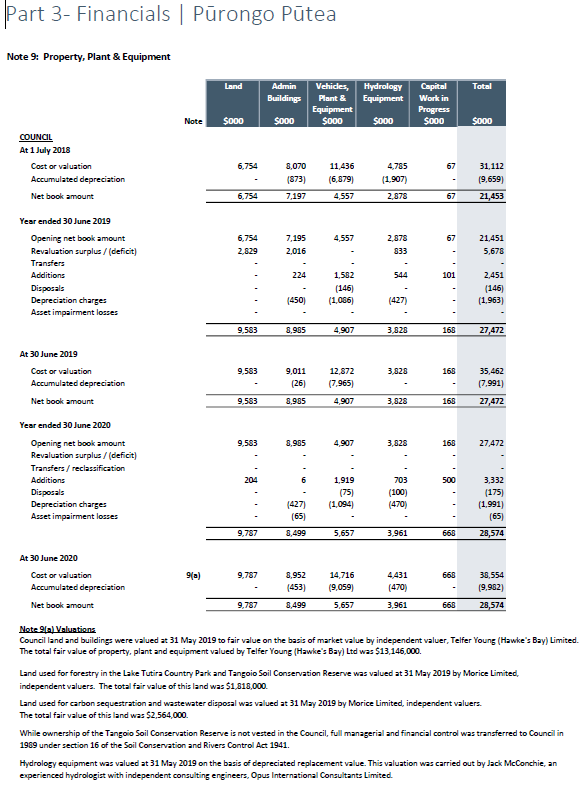

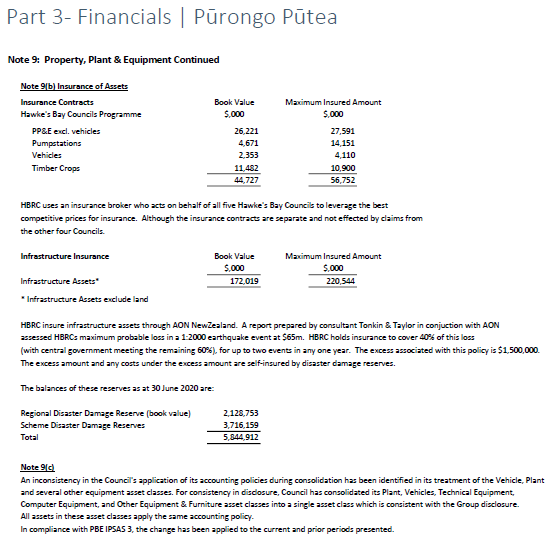

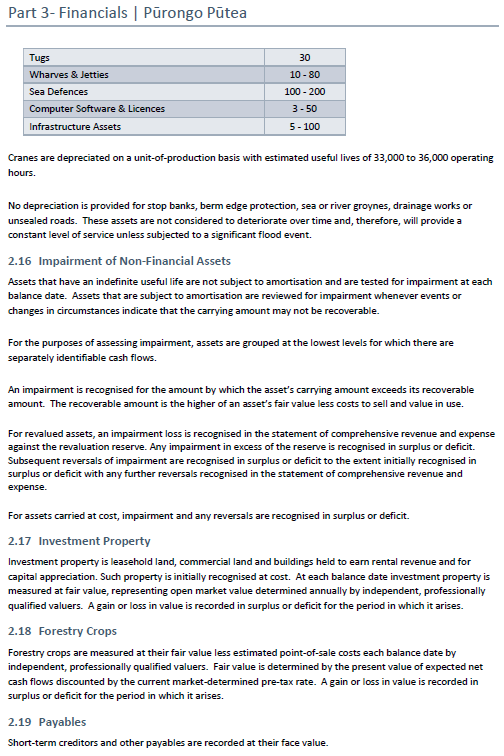

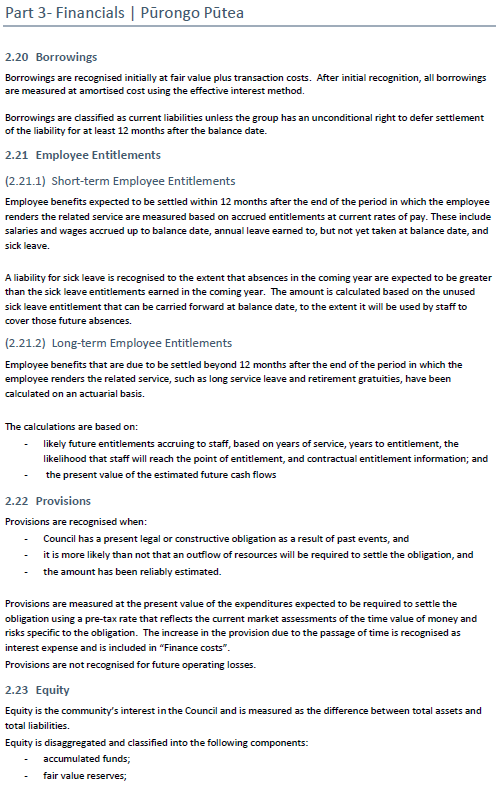

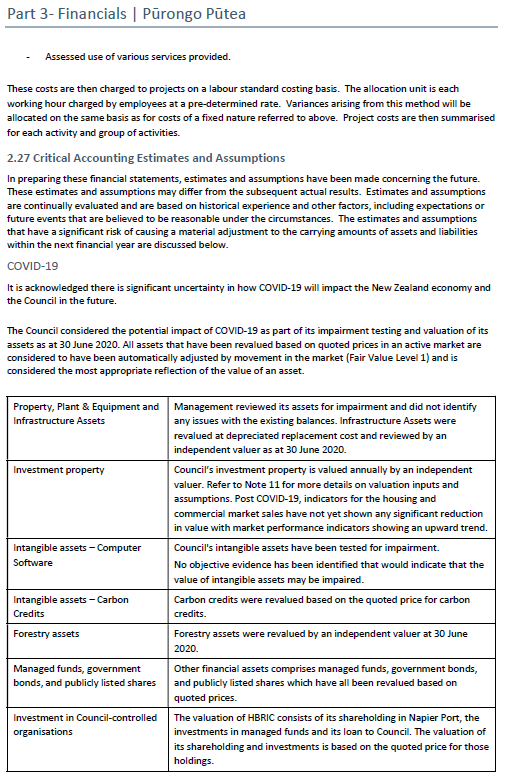

Property Plant and Equipment issue

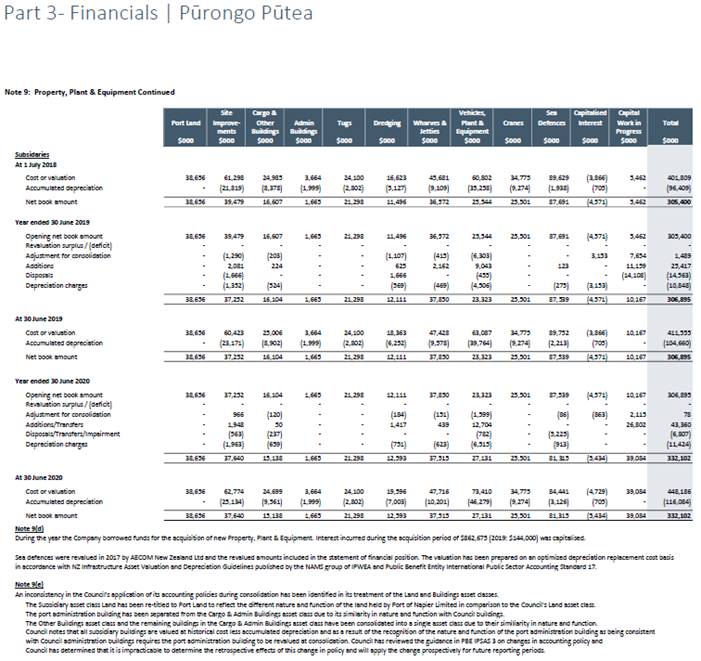

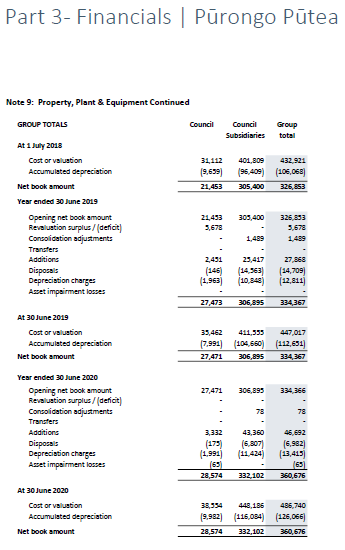

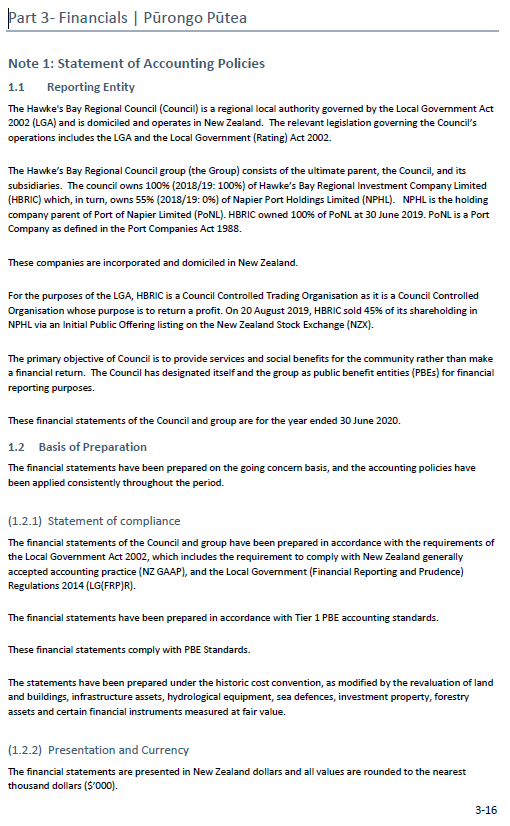

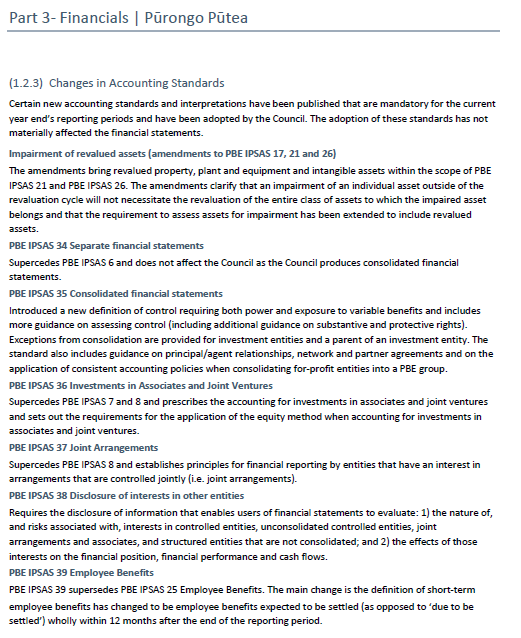

8. The issue

raised by Audit NZ is a technical accounting policy difference. PBE IPSAS 17

Property Plant & Equipment requires the valuation of assets within a class

to be the same. Council’s accounting policy for Land and Buildings states

that assets are included at fair valuation. The accounting policy of the Port

states that Land and Buildings are valued at cost.

9. Officers have

been discussing options available with Audit NZ since the 21 December to

identify how the issue may be resolved.

10. This included:

10.1. Require Napier Port to

provide fair value valuations for all land and buildings for the 2018-19 and

2019-20 to enable the adjustments to be made to the Group Accounts. This was

not practically able to be carried out and was discounted as an option by Audit

NZ and officers.

10.2. Continue with the

adoption of the 2019-20 Annual Report with an audit qualification regarding the

discrepancy with the Fixed Assets value and accounting policy. This was agreed

to be a final option if no other options were identified.

10.3. Review the accounting

policies and classification of assets against the requirements PBE IPSAS 17

Property Plant & Equipment to identify any available reclassification

options.

11. Officers have worked

through option 8.3 with Audit NZ and the following has been the outcome.

11.1. Council Land and Port

Land will be split into two classes on the basis the nature/function of the

Port land is sufficiently different to other land within the Group. Port Land

will continue to be valued at cost and Council Land will continue to be valued

at fair value.

11.2. Port Cargo buildings

will be separated into a different class due to a different use to other

buildings within the Group and will be valued at cost.

11.3. Port Admin Buildings

will be included within the Council Buildings class and will be required to be

valued at fair value. Audit NZ will note in the management report to Council

that Council is outside its accounting policy for 2019-20 Annual Report and

will require the 2020-21 Annual Report to have the Port Admin Building valued

at fair value. This will not result in a qualified audit opinion.

11.4. Consolidation of the

asset classes for Vehicles, Plant and Equipment will be required to bring the

Council assets and Group assets into line.

12. Officers have worked

through the required policy and presentation adjustments with Audit NZ and the

adjusted Note for Fixed Assets and Accounting Policy are attached for

reference.

13. Officers have received

notification by Audit NZ that Council can adopt the 2019-20 Annual Report at

the Council Meeting on 24 February 2021.

14. A copy of the updated

Annual Report and draft audit opinion will be tabled at the Finance, Audit and

Risk Committee meeting.

15. Therefore the Finance,

Audit and Risk Committee is not required to amend its recommendation to Council

to adopt the Annual Plan from the 15 December 2020 meeting.

Late Adoption

16. Under Section 98 of the

Local Government Act 2002, Council is required to adopt the annual report

within 4 months after the end of the financial year.

17. As a result of the

Covid-19 pandemic, parliament passed legislation on 5 August 2020 to extend the

statutory reporting time frames by up to two months in order to ensure that

there is no reduction in the quality of the financial reporting and the audit

of the annual report. Therefor Council was required to adopt the 2019-20 Annual

Report by 31 December 2020.

18. Due to the late

identification of this issue, Council will adopt the Annual Report outside of

the statutory deadline for adoption of the annual report and below are the

consequences as a result.

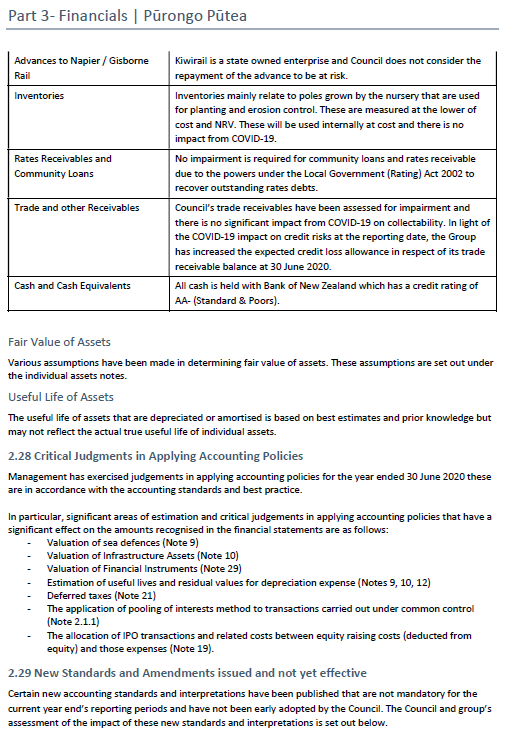

18.1. Council must include a

disclose that we are outside the statutory deadline and the reasons behind the

non-compliance. As Council is self-disclosing there is no audit opinion

implications.

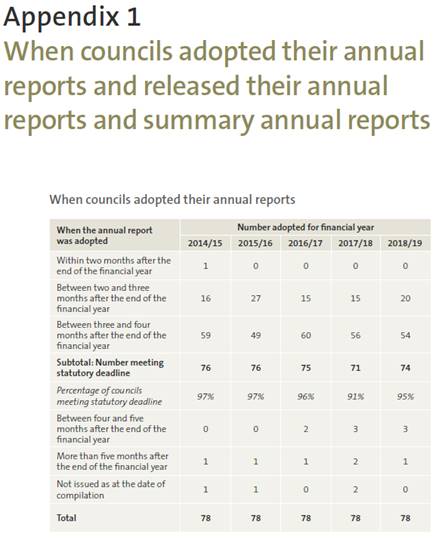

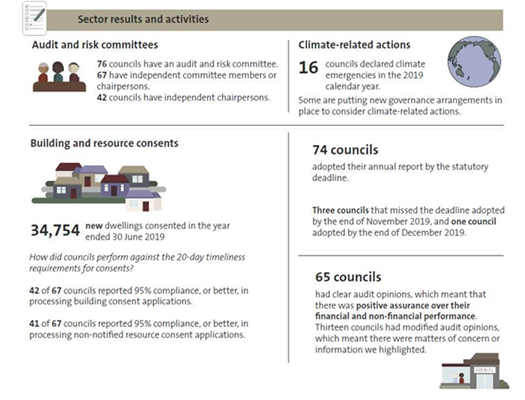

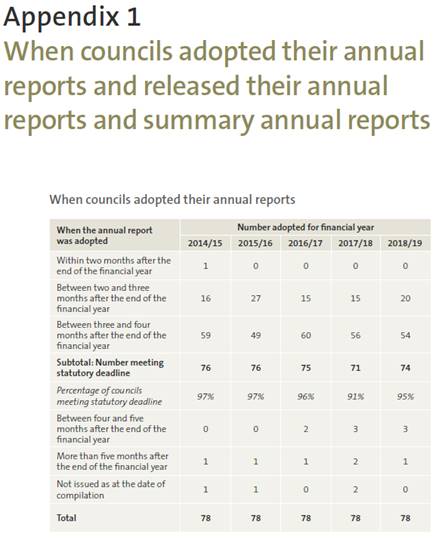

18.2. Each year the Office of

the Auditor General produces an annual review/insights document on local

government which includes statistics for Council that have not adopted the

annual report on time. Below is an extract from the 2019 publication.

Decision

Making Process

19. Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

19.1. The

decision does not significantly alter the service provision or affect a strategic

asset, nor is it inconsistent with an existing policy or plan.

19.2. The use

of the special consultative procedure is not prescribed by legislation.

19.3. The

decision is not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy.

19.4. The

decision is in accordance with the Finance, Audit and Risk Sub-committee Terms

of Reference, specifically:

19.4.1. The

Finance, Audit and Risk Sub-committee is to satisfy itself that the financial

statements and statements of service performance are supported by adequate

management signoff and adequate internal controls and recommend adoption of the

Annual Report by Council.

19.5. Given

the nature and significance of the issue to be considered and decided, and also

the persons likely to be affected by, or have an interest in the decisions

made, Council can exercise its discretion and make a decision without

consulting directly with the community or others having an interest in

the decision.

|

Recommendations

That the

Finance, Audit and Risk Sub-committee receives and notes the “2019-20

Annual Report Adoption Delay”.

|

Authored by:

|

Bronda Smith

Chief Financial Officer

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

⇩1

|

Note 9 -

Property Plant and Equipment

|

|

|

|

⇩2

|

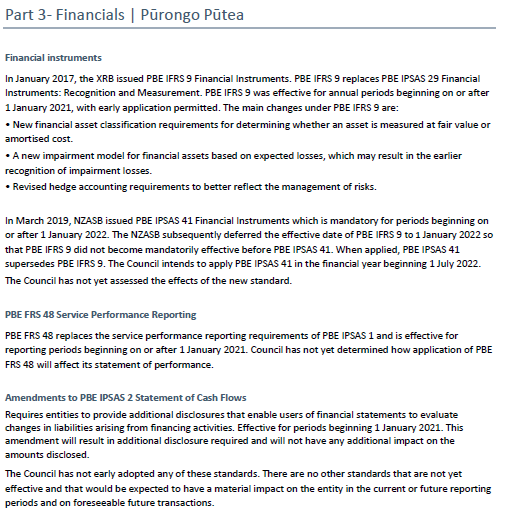

Draft 2019-20

Annual Report Part 3 - Financials

|

|

|