Meeting of the Finance Audit & Risk Sub-committee

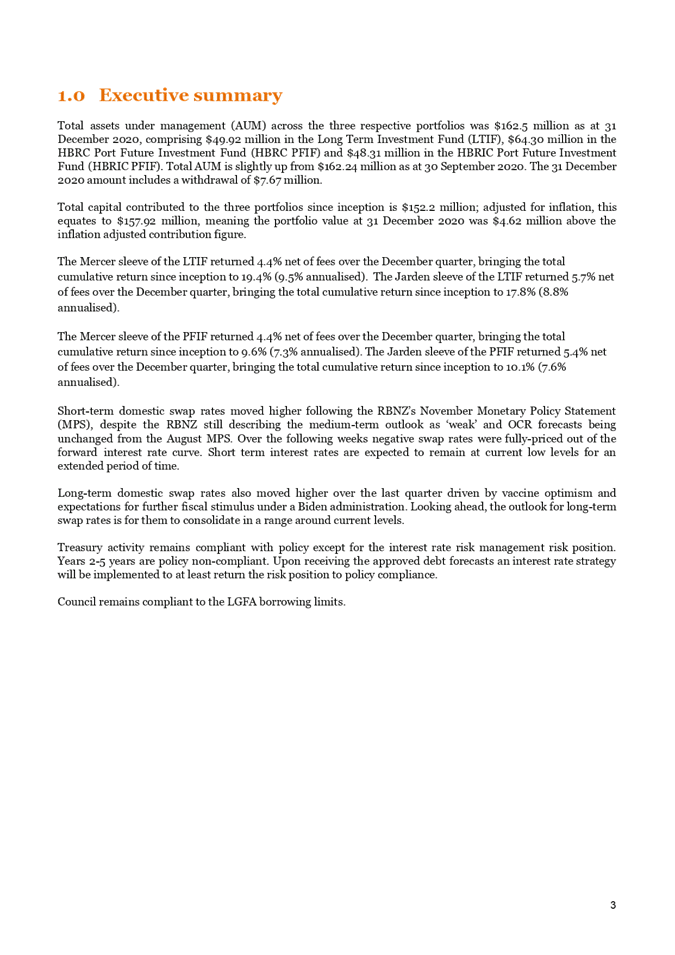

Date: Wednesday 17 February 2021

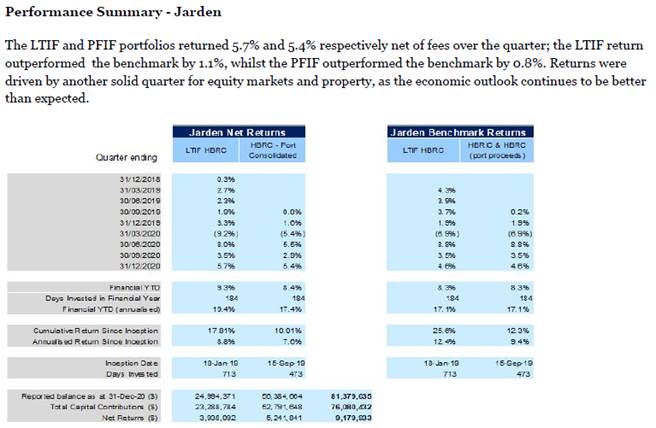

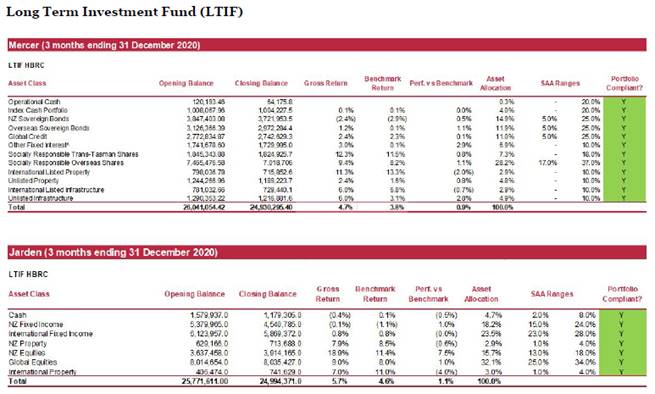

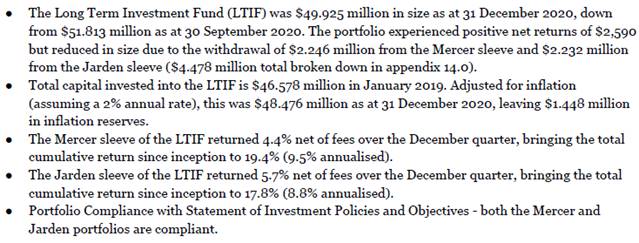

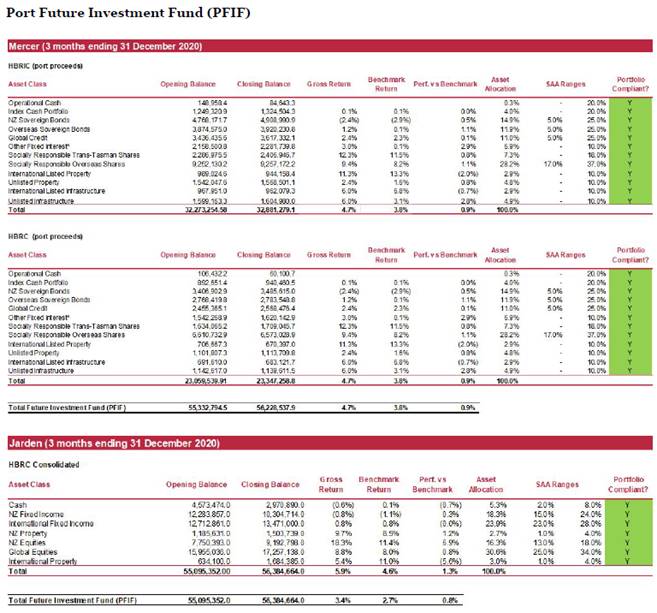

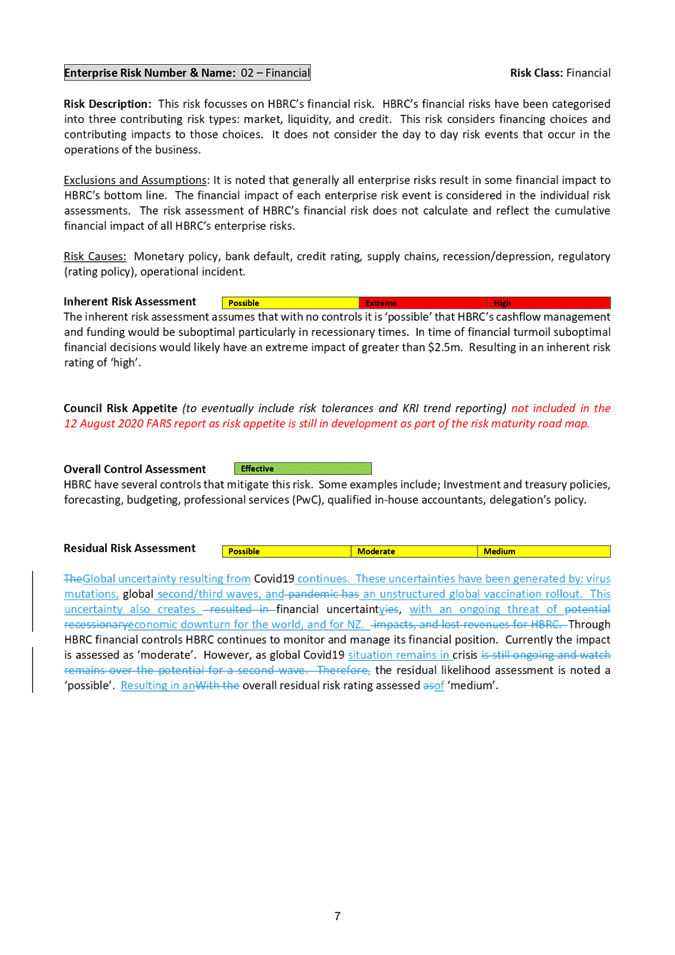

Time: 9.00am

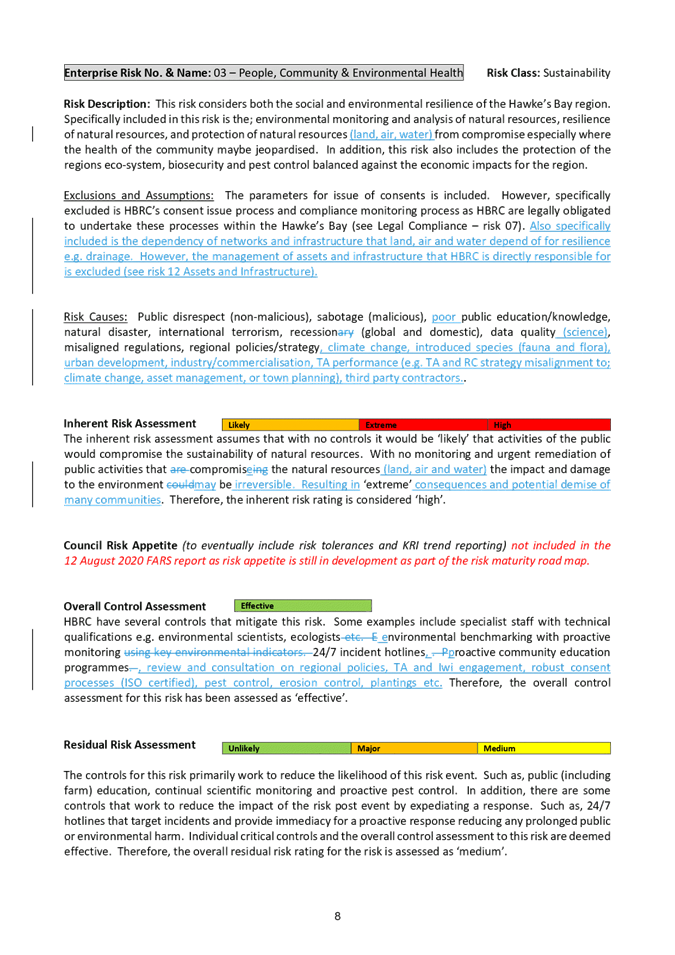

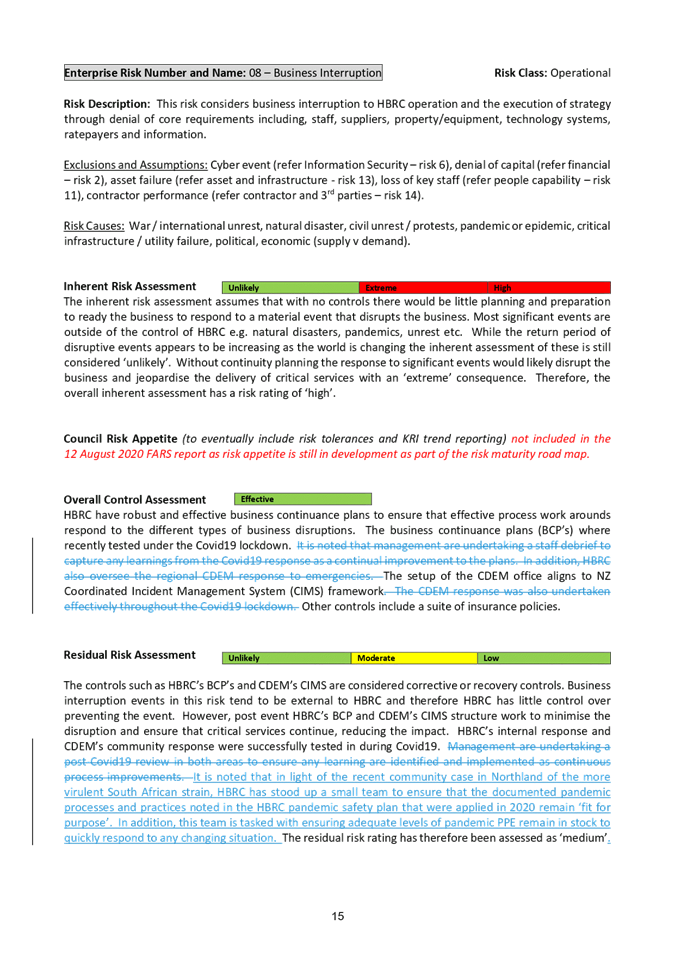

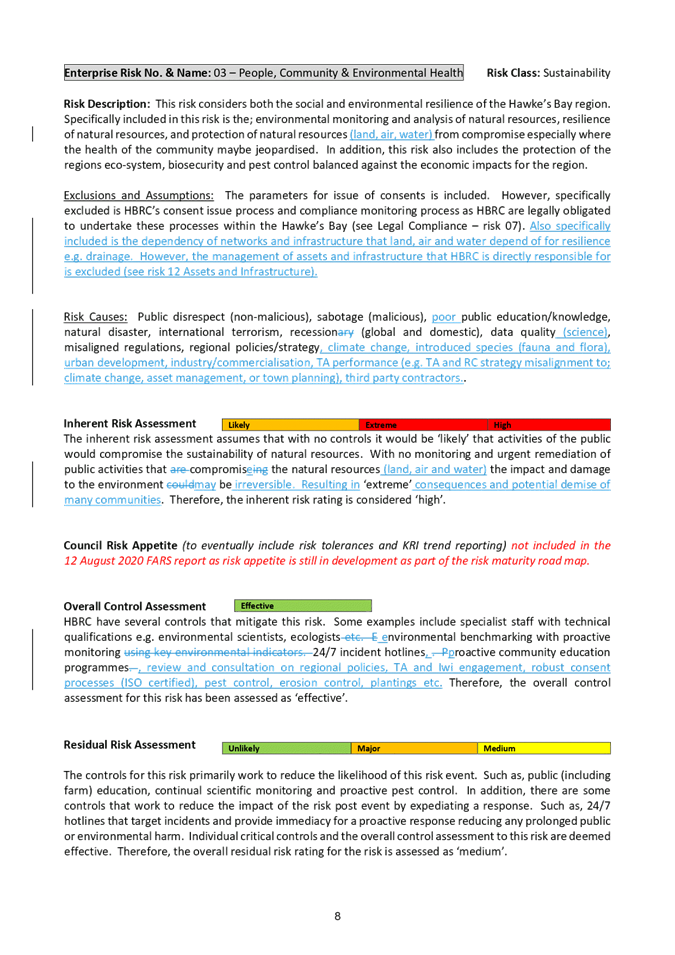

|

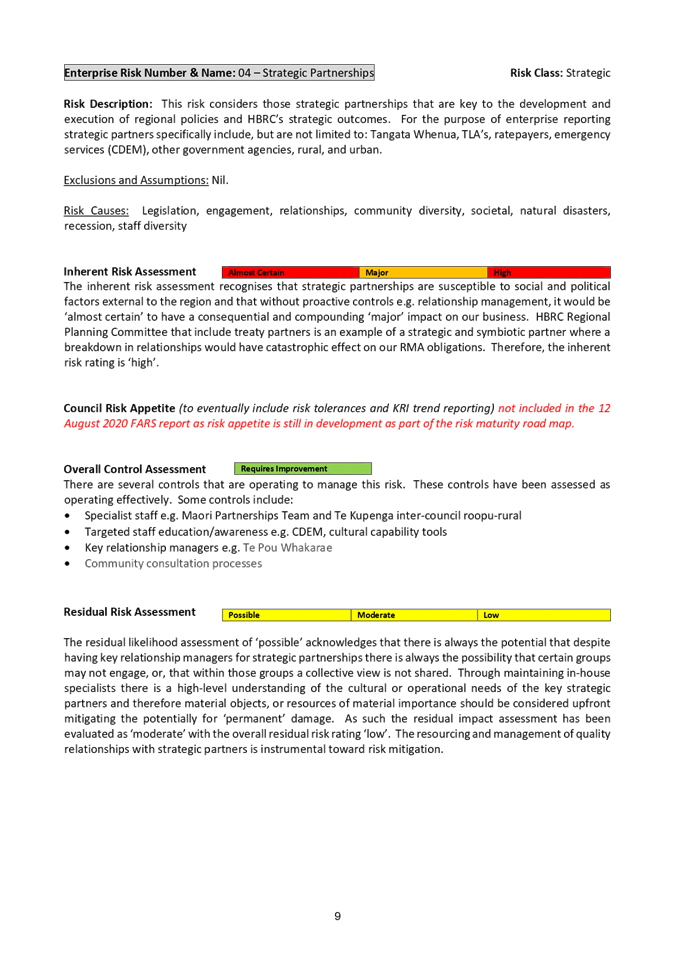

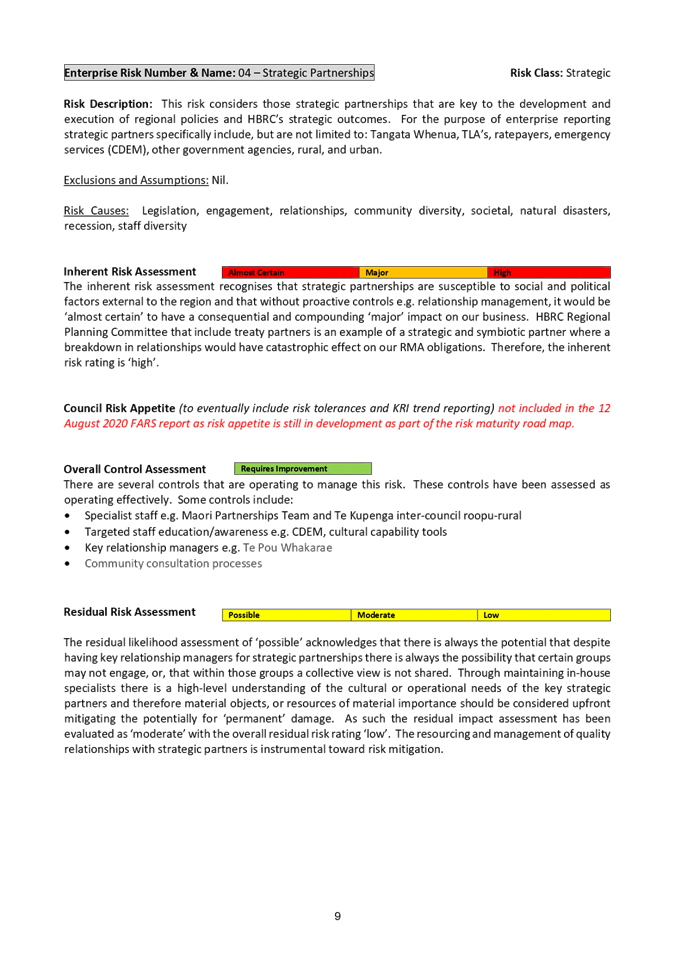

Venue:

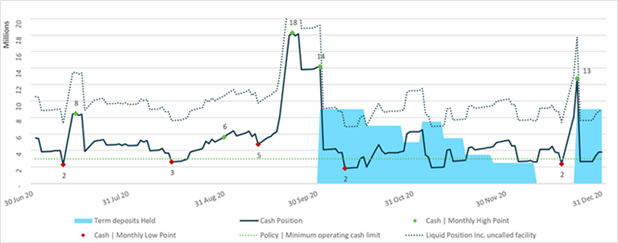

|

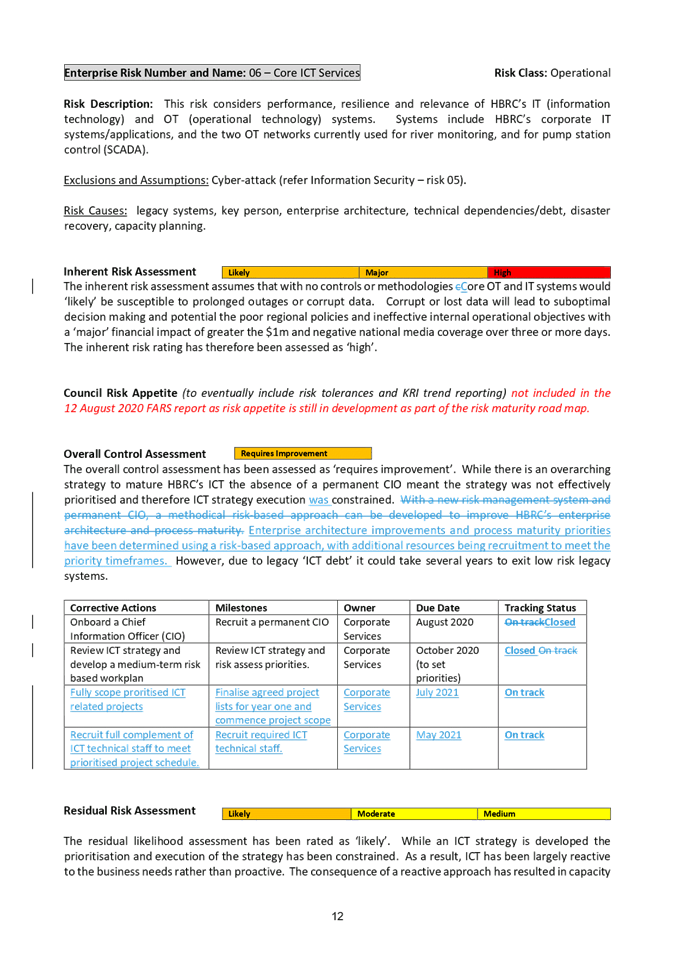

Council Chamber

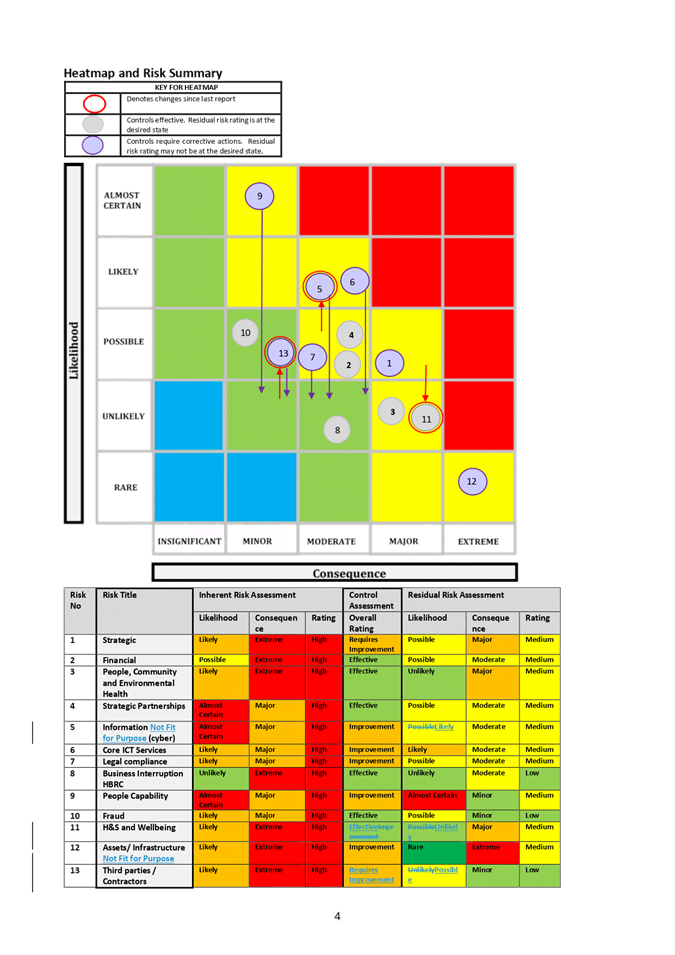

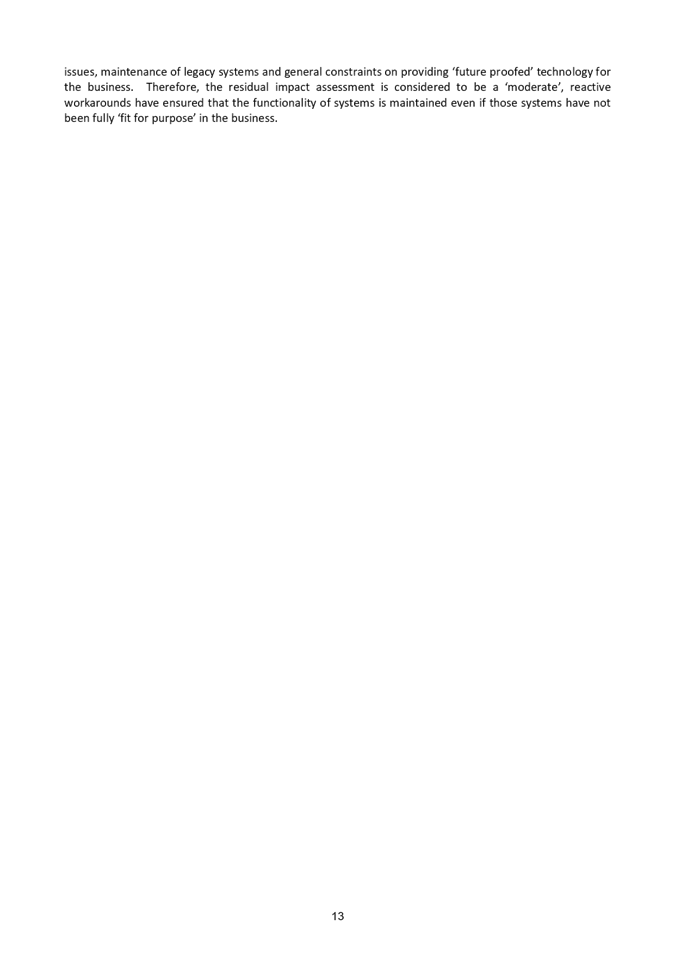

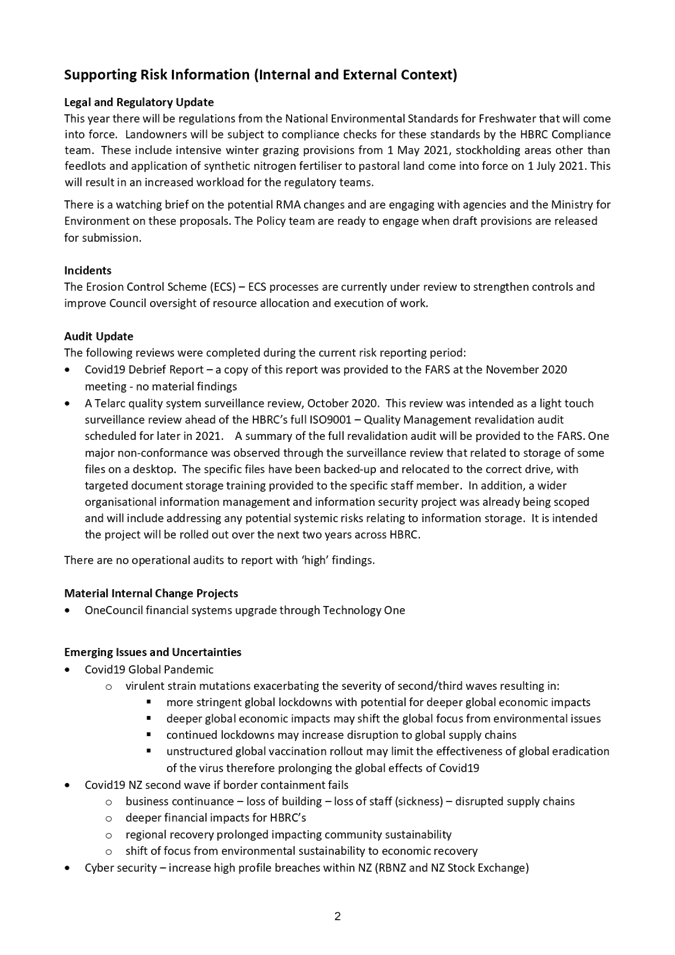

Hawke's Bay Regional Council

159 Dalton Street

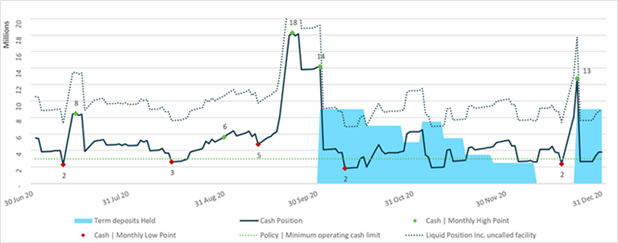

NAPIER

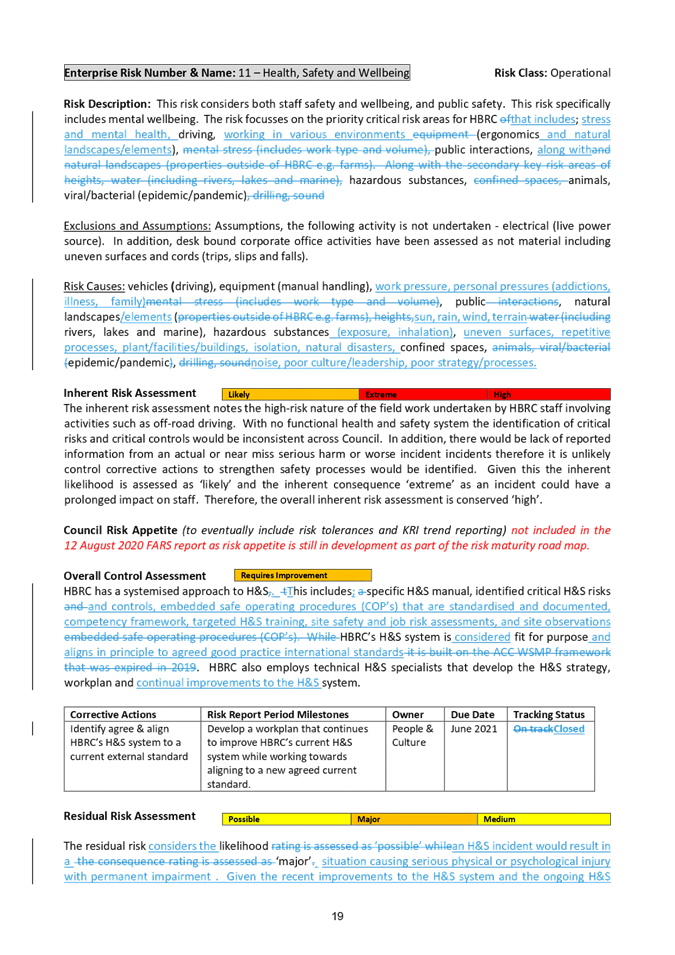

|

Agenda

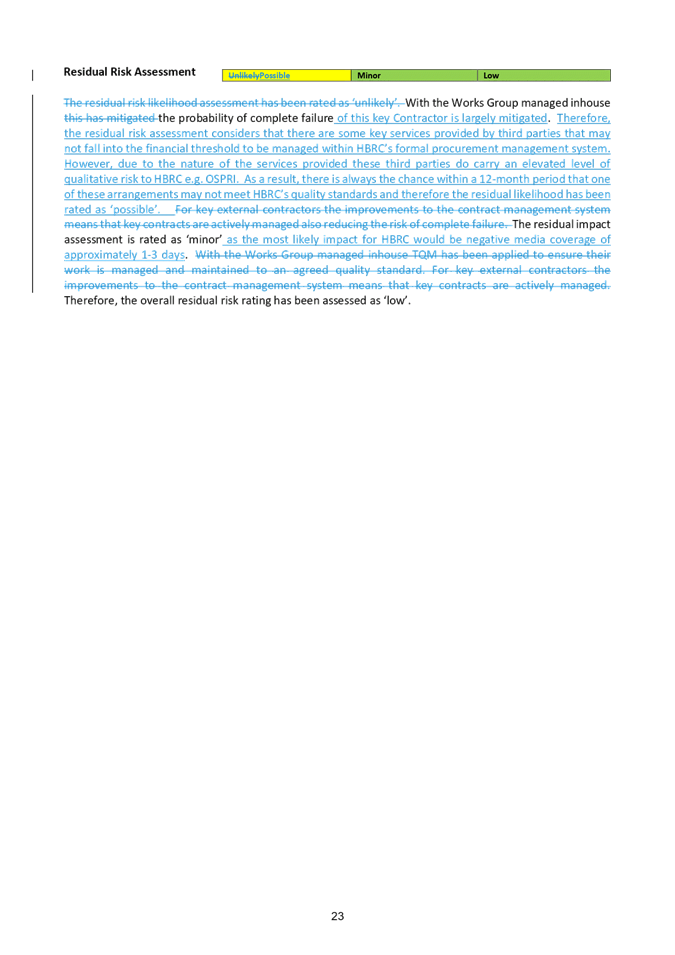

Item Title Page

1. Karakia

/Welcome/ Apologies

2. Conflict

of Interest Declarations

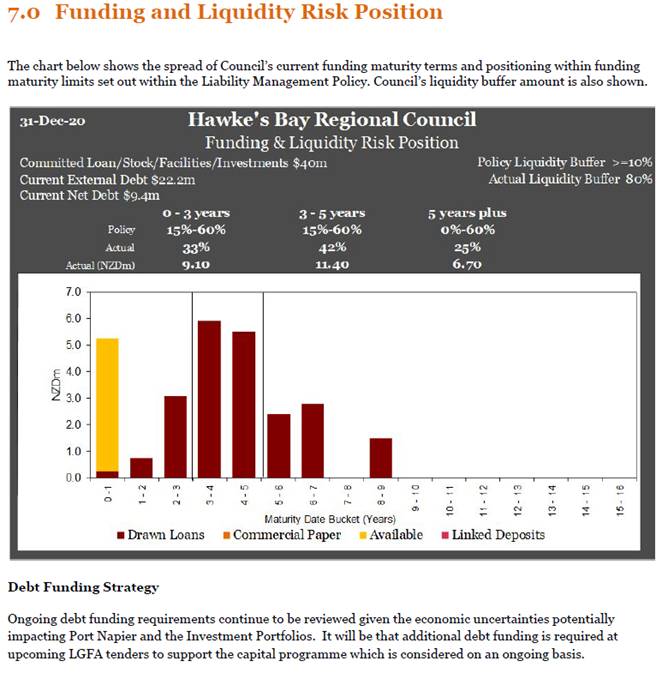

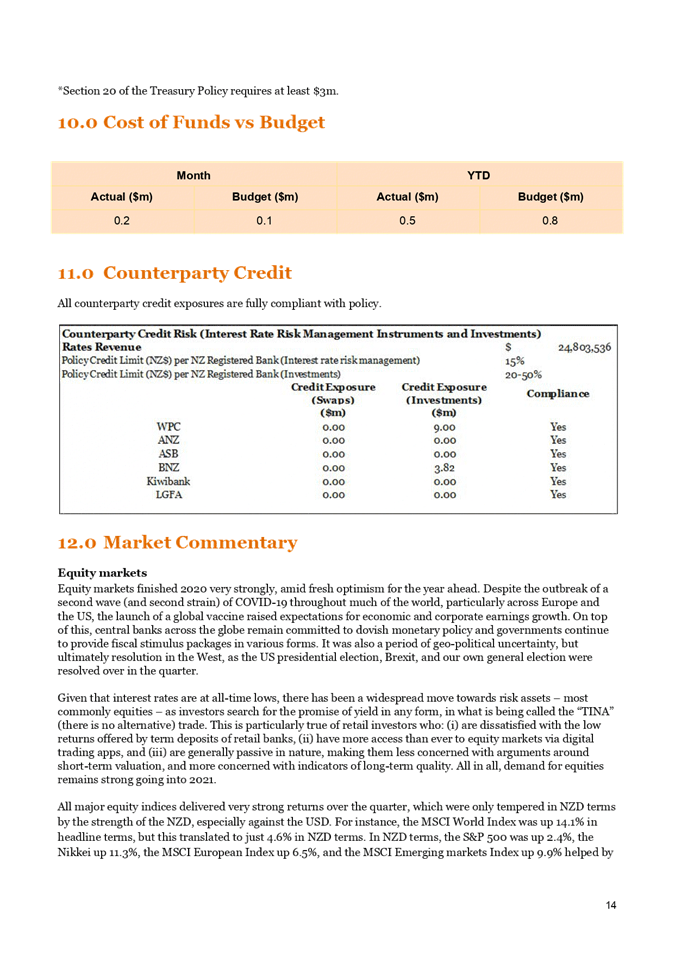

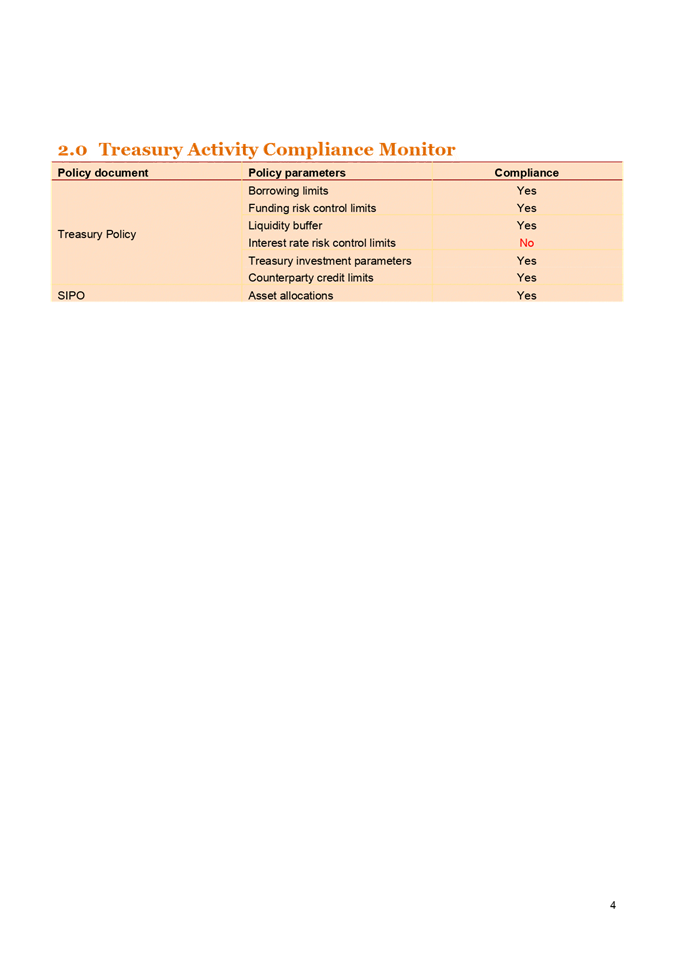

3. Confirmation of

Minutes of the Extraordinary Finance Audit & Risk Sub-committee meeting held

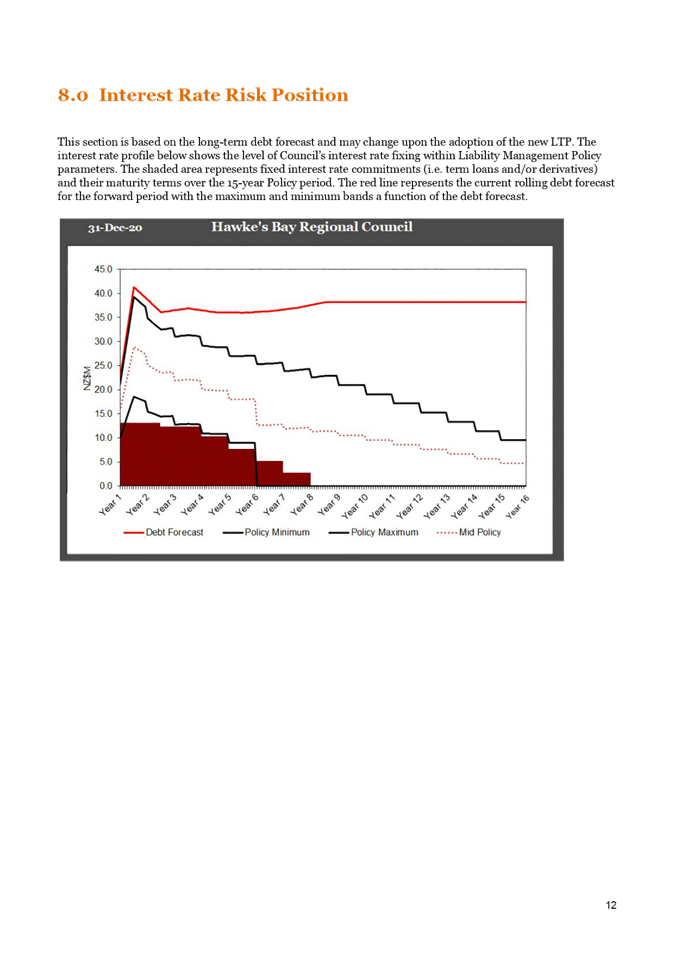

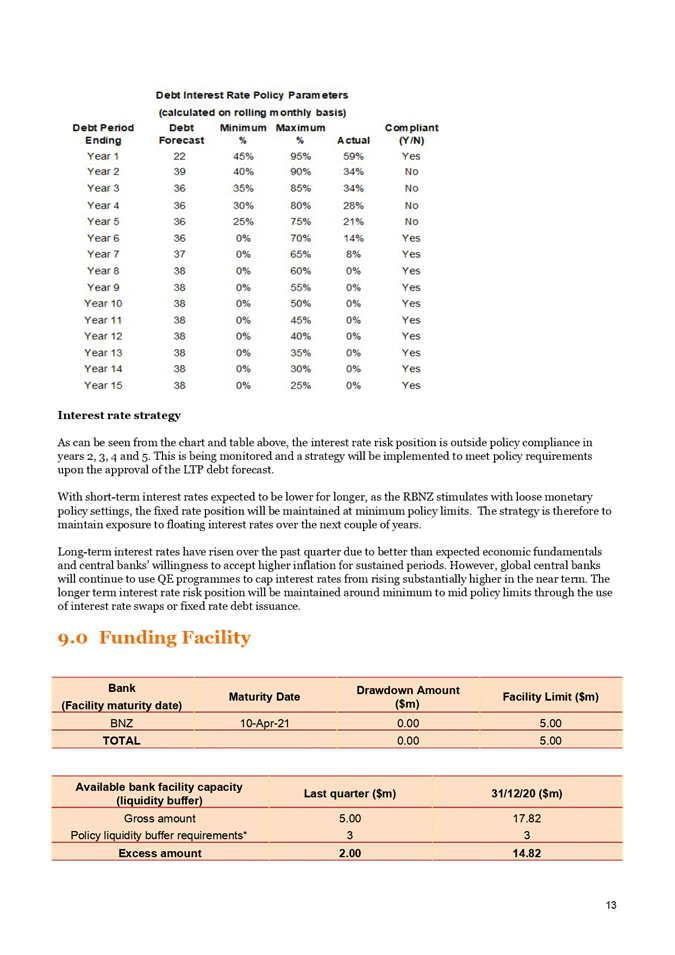

on 15 December 2020

4. Six Monthly Risk

Report and Risk Maturity Update 3

5. Internal Audit

Work Programme Update 37

6. Assurance Framework

Relevant to S17a Reviews 53

7. Quarterly Treasury

Report for 1 October - 31 December 2020 55

8. HBRC

2019-20 Annual Report Adoption (late item to

come)

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

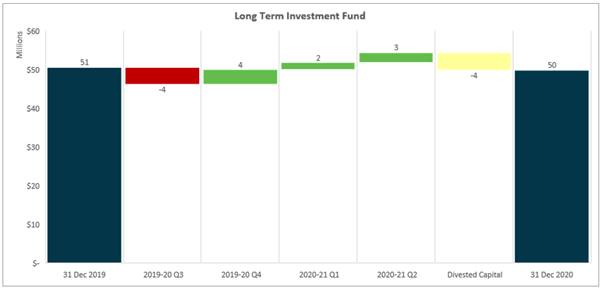

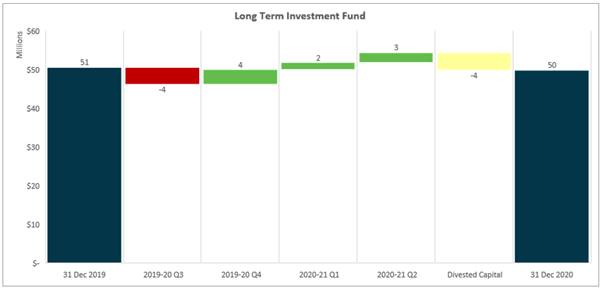

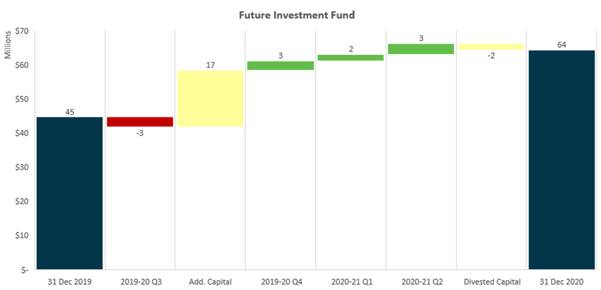

Wednesday 17 February 2021

Subject: Six Monthly Risk Report

and Risk Maturity Update

Reason for Report

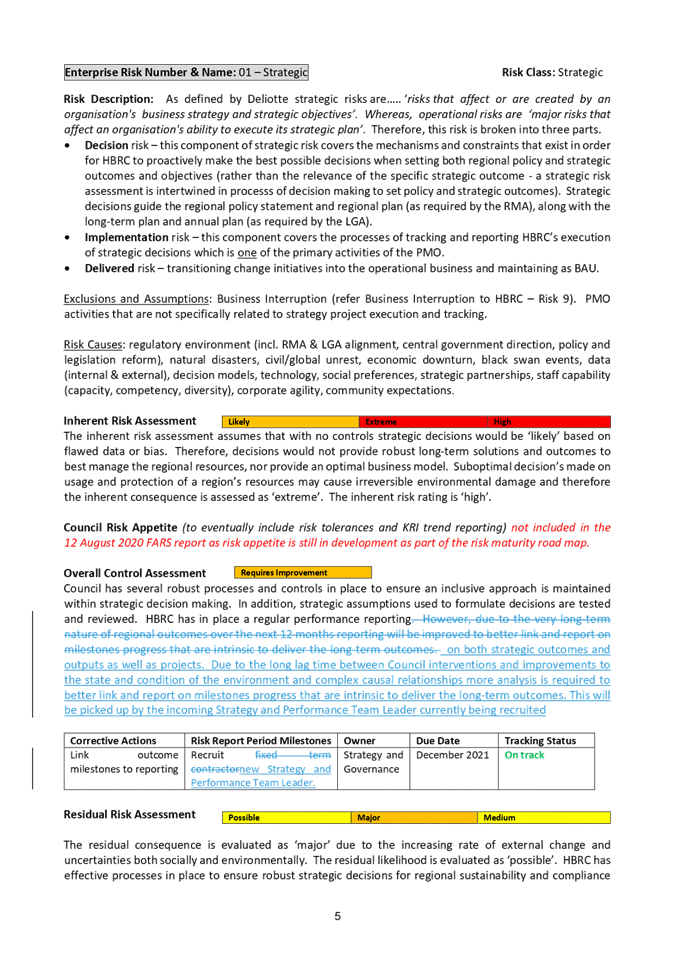

1. This item and

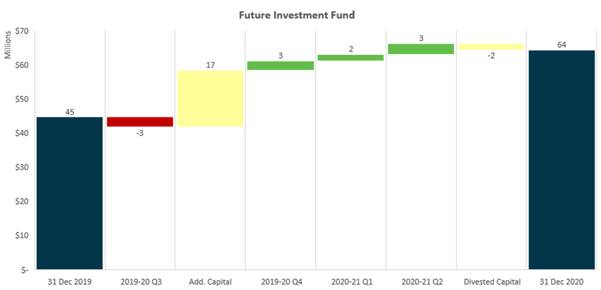

accompanying presentation present the Regional Council’s (Council)

six-monthly enterprise risk report as well as an update on progress towards

risk maturity.

Background

2. At the

Corporate and Strategic Committee meeting held on 10 June 2020 the Committee

endorsed the risk maturity roadmap for Council. At that meeting it was

agreed that the FARS would oversee implementation of the maturing risk

management system. With the focus on ensuring the evolving risk system is

progressively delivering value to the organisation, and that the roadmap

deliverables remain on track. Oversight of Council’s risk maturity by

FARS can be evidenced through improvements to governance risk reporting.

Therefore, the risk maturity update and Council’s six-monthly risk report

have been combined into one agenda item.

Discussion

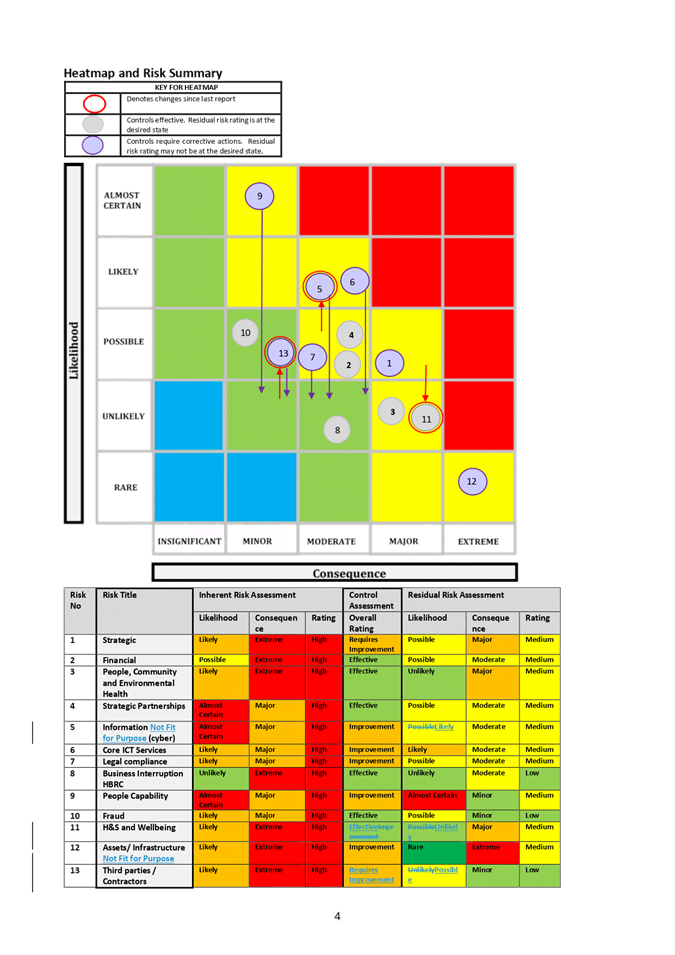

3. As part of the

risk management maturity roadmap both a risk management policy and framework

were developed and approved by Council. By applying the risk methodologies

outlined in the risk framework a ‘new look’ risk report with

refreshed enterprise risks was presented to, and endorsed by, the FARS at the

August 2020 meeting. The August 2020 enterprise risk report and the

accompanying enterprise risks have now formed the baseline for presenting

changes to the Council’s risk profile. All updates between risk reports

are denoted as tracked changes or red text.

4. At the August

2020 meeting it was noted that due to timing of the meeting each enterprise

risk had not been subject to bowtie analysis as required in the

framework. Therefore, some changes noted from the August 2020 report to

this current risk report reflect Council’s continual risk maturity and

improved risk synthesisation resulting from undertaking the bowtie analysis,

rather than reflecting a change to Council’s risk profile.

5. At the November

2020 FARS meeting and as a milestone for risk maturity it was agreed over the

proceeding risk reporting period to February 2021 at least six enterprise risk

would have bowtie analysis applied. And, the bowtie analysis output to be

reflected in the enterprise risk report. Bowtie analysis was subsequently

undertaken for the following risks with the enterprise risk report updated

accordingly:

5.1. Information

Management and Security Not Fit for Purpose (incl. cyber)

5.2. Business

Interruption

5.3. People

Capability

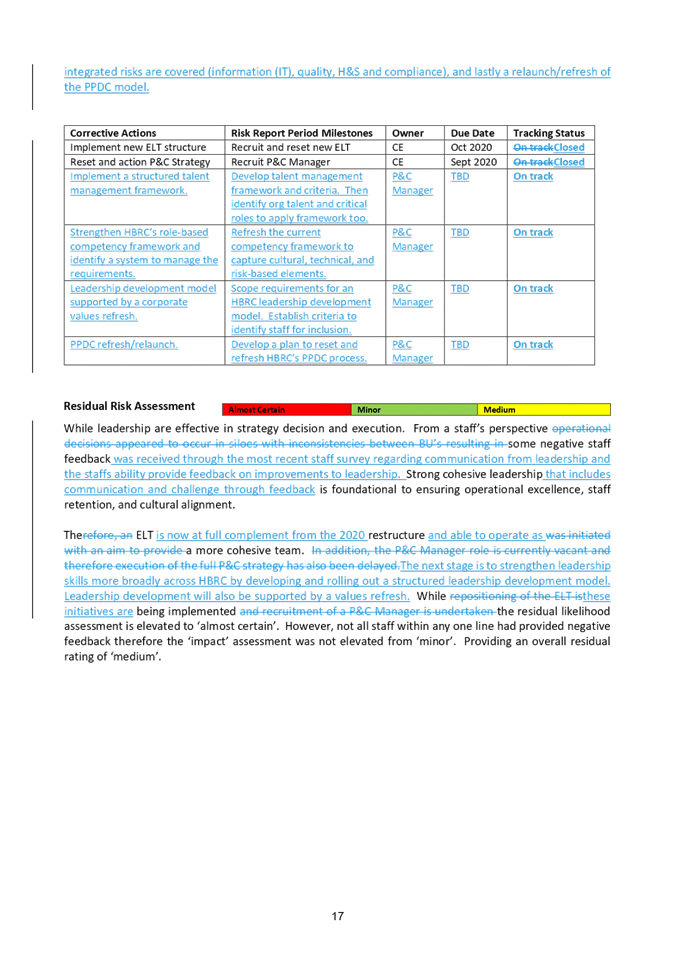

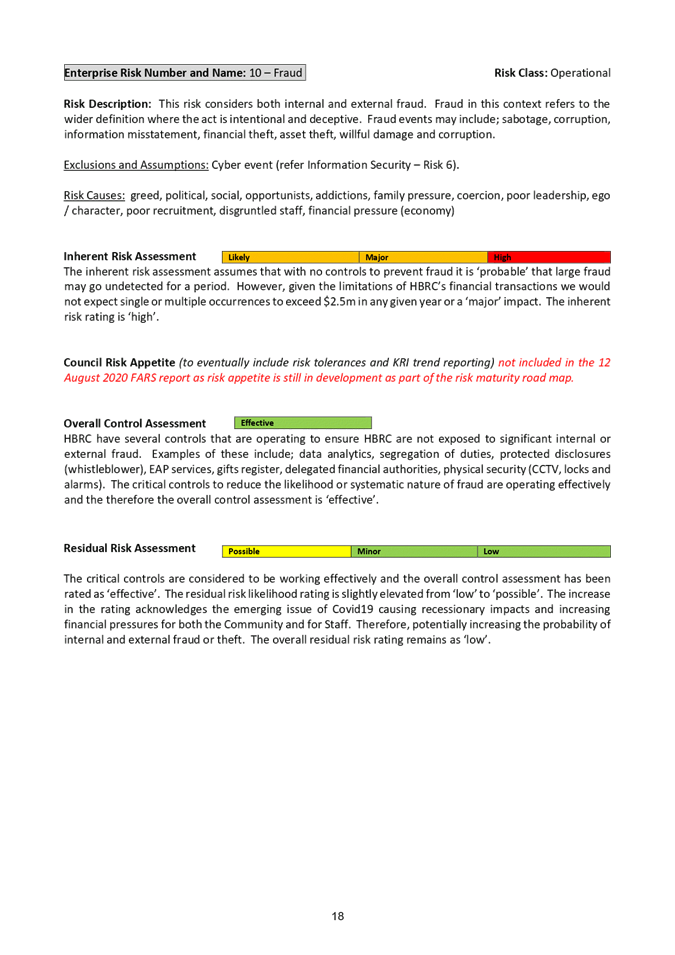

5.4. Fraud

5.5. Heath, Safety

and Wellbeing

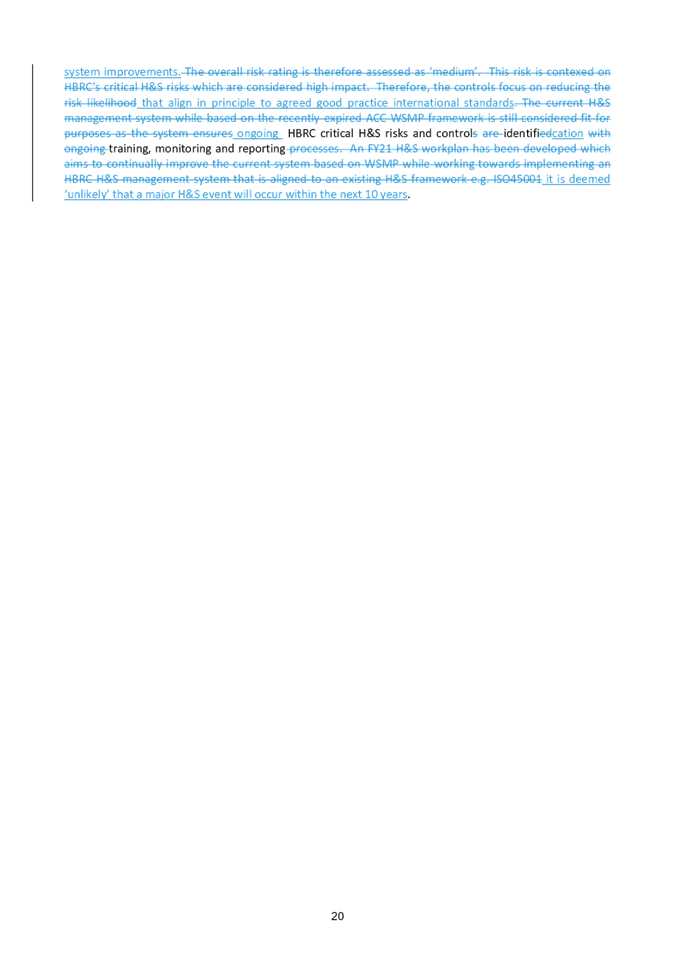

5.6. Infrastructure and Asset Management Not Fit for Purpose.

6. As per the agreed risk maturity roadmap the remaining enterprise

risks will have bowtie analysis undertaken over the next risk reporting period

to April 2021. Completion of bowties by April 2021 is in preparation for

meeting the target date of setting the Council’s risk appetite within the

first half of 2021.

Summary of Risk

Reporting Changes

7. The following

material changes are noted in the current enterprise risk report compared to

the August 2020 report.

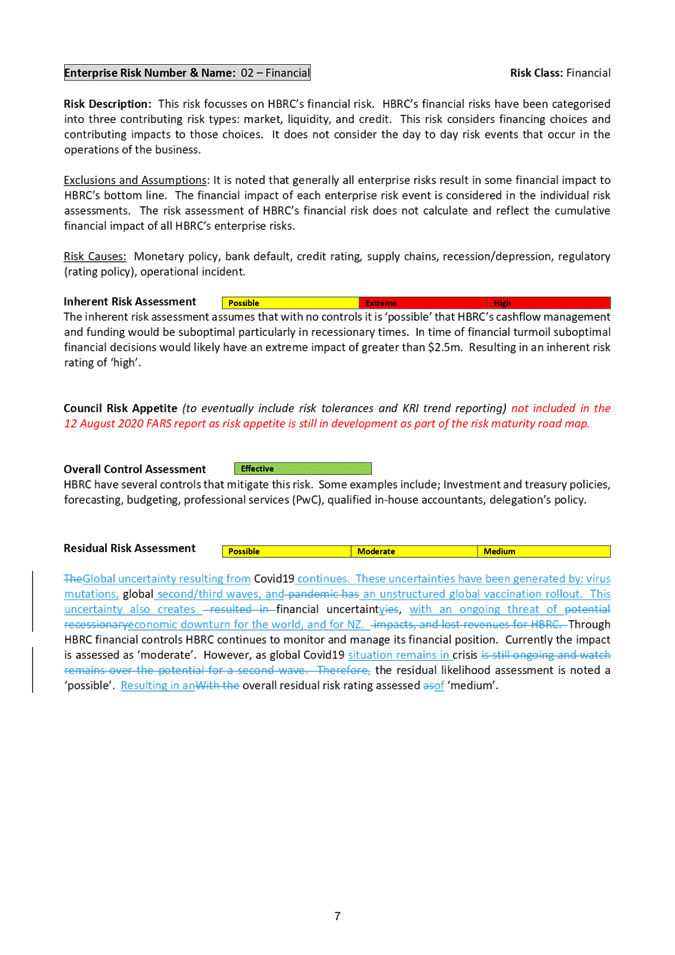

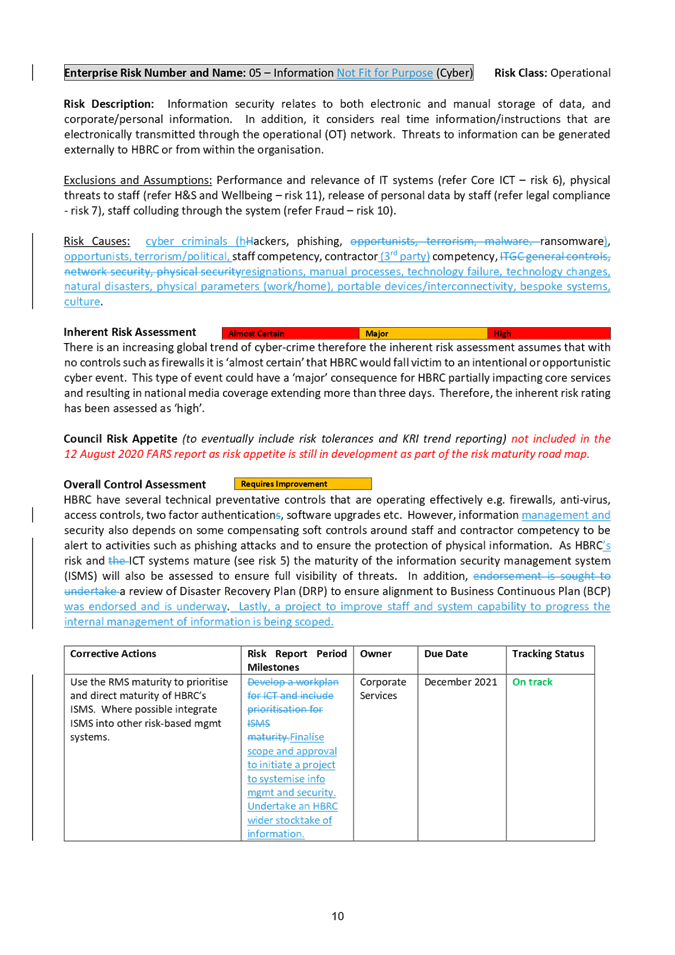

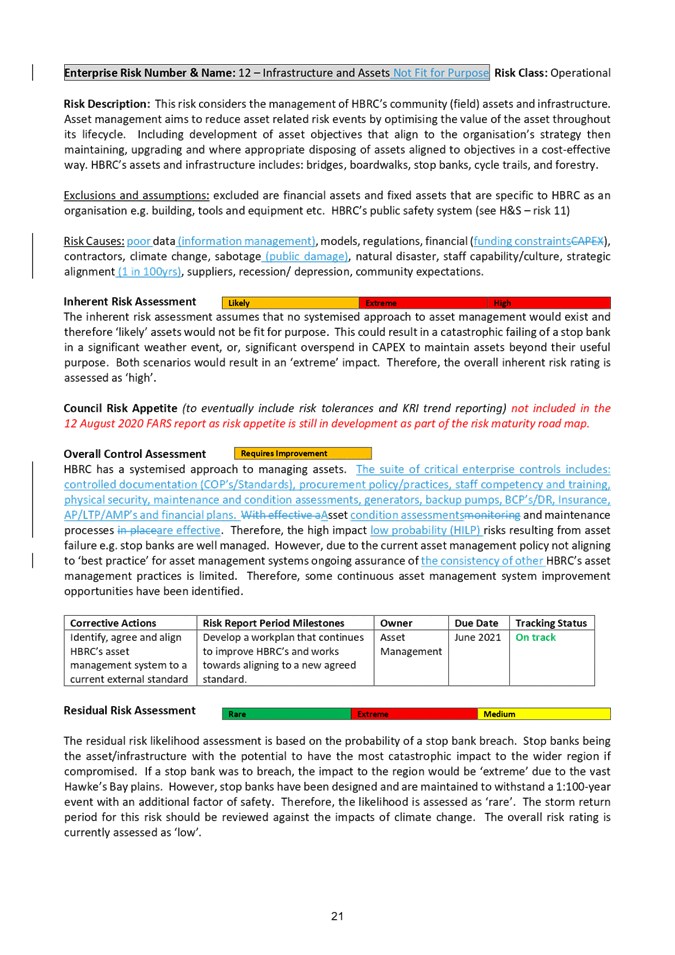

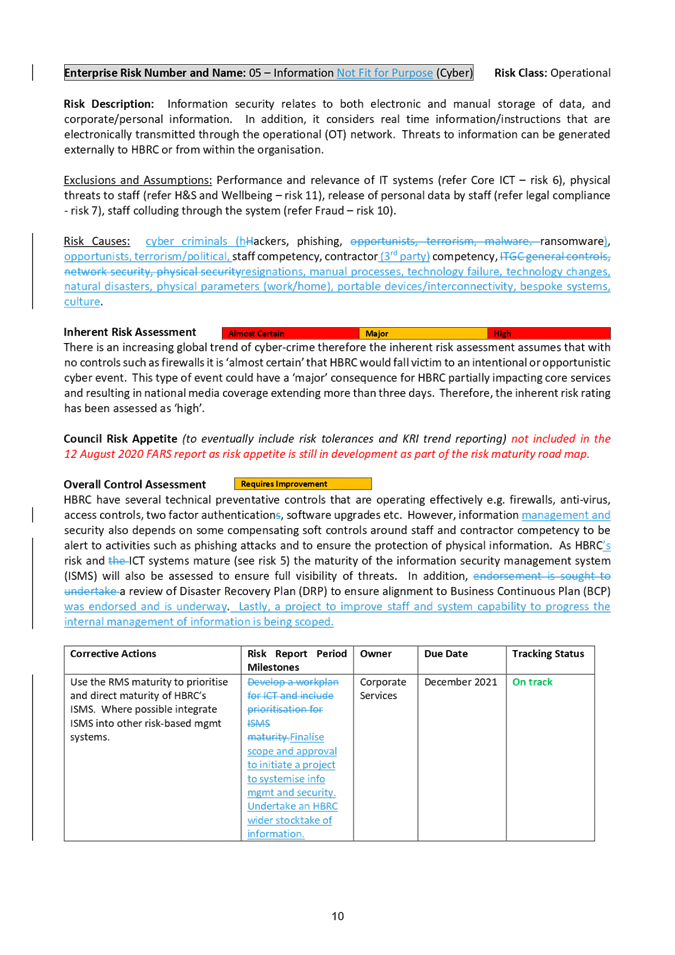

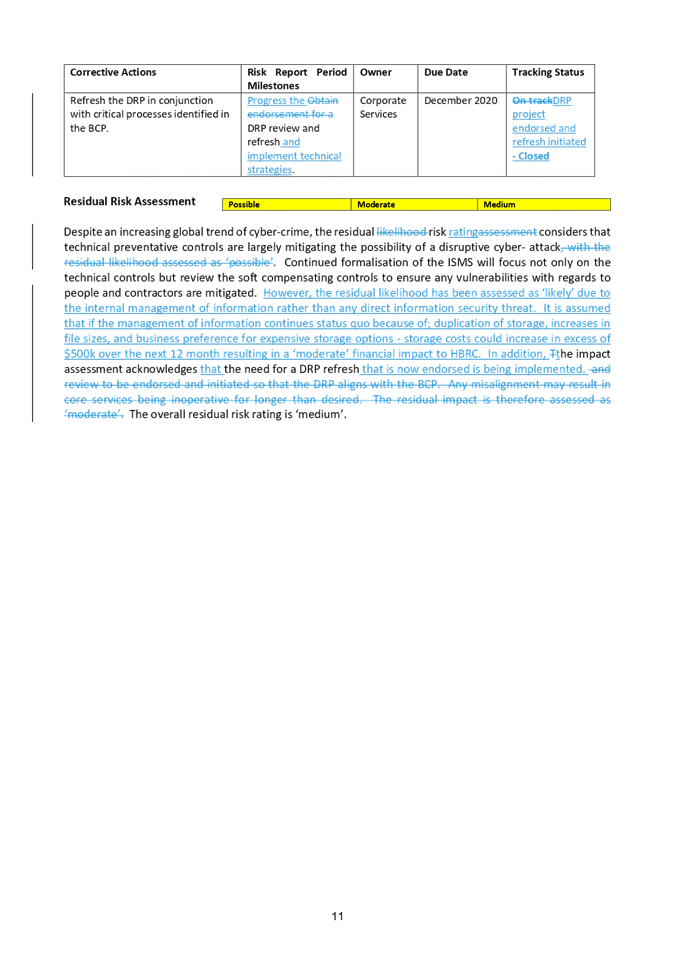

8. Risk 5 -

Information Not Fit for Purpose (incl. Cyber) formally titled Information

Security (Cyber)

8.1. Through the

bowtie analysis it is clearer that this risk has two distinct components,

being:

8.1.1. information

management, and

8.1.2. information

security.

8.2. Analysis of

information management has determined that without implementing additional

controls to improve information storage over the next 12 months it is

‘likely’ that increased storage costs will exceed $500k.

Therefore, the residual likelihood risk assessment has been elevated from

‘possible’ to ‘likely’. There was no resulting change

to the risk rating. It is noted that without changing information management

processes and staff behaviours storage cost increases will likely be

exponential and not linear over proceeding years. A deeper dive into this

risk and proposed corrective action initiatives will be presented to the FARS

at the meeting.

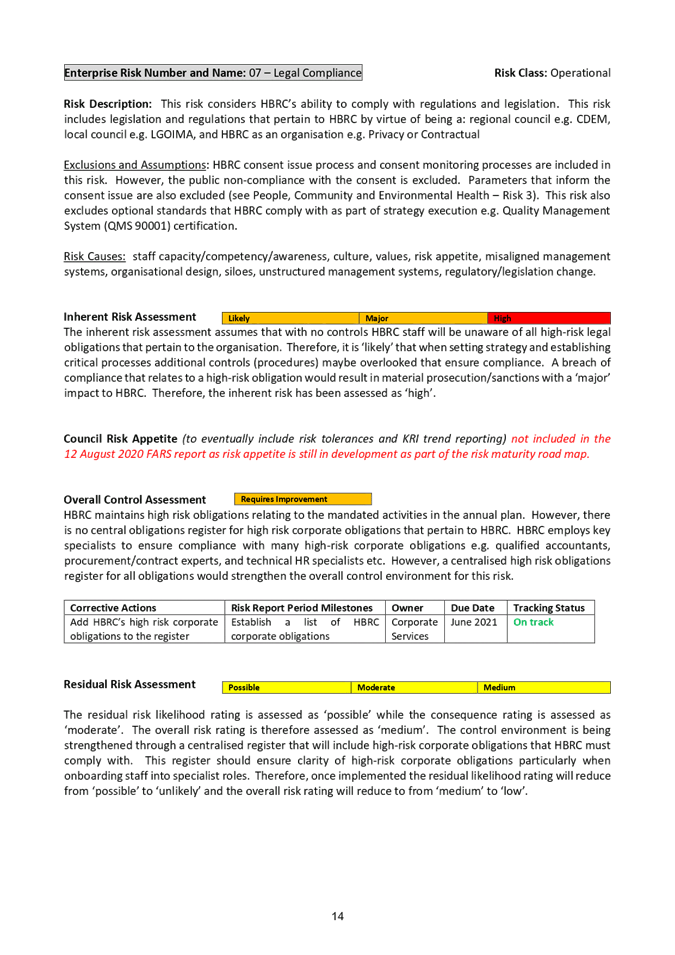

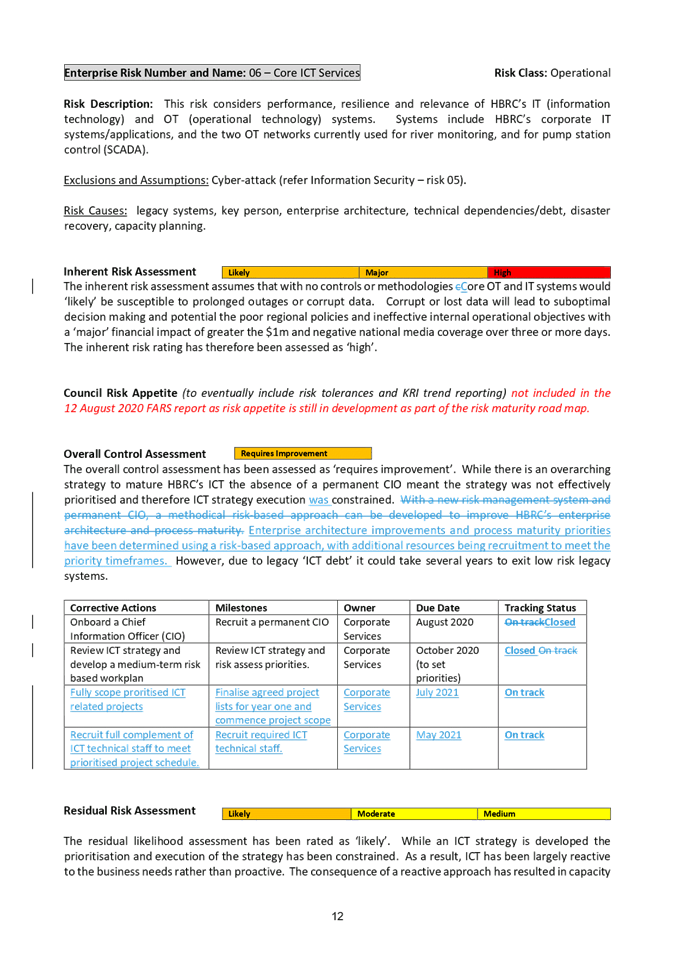

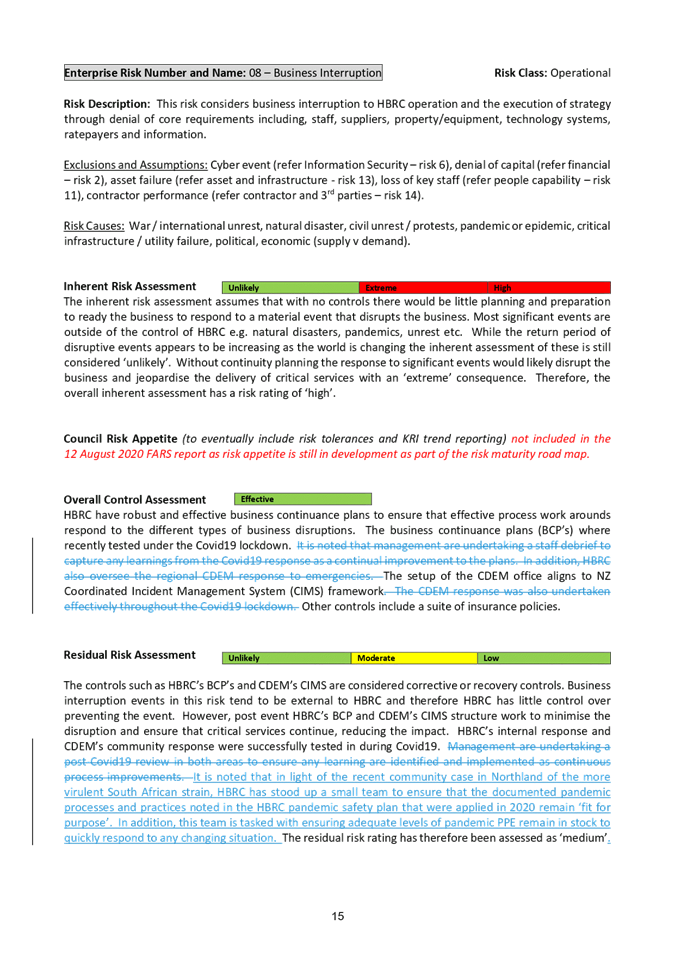

9. Risk 8 –

Business Interruption

9.1. There has

been no change to the risk or overall control rating for Business Interruption.

However, the risk has been updated to reflect structured activities that

Council has initiated to ensure the pandemic safety response plan remains

relevant for the more virulent mutations of Covid19. Especially as the

more virulent strains are now being detected at New Zealand’s border.

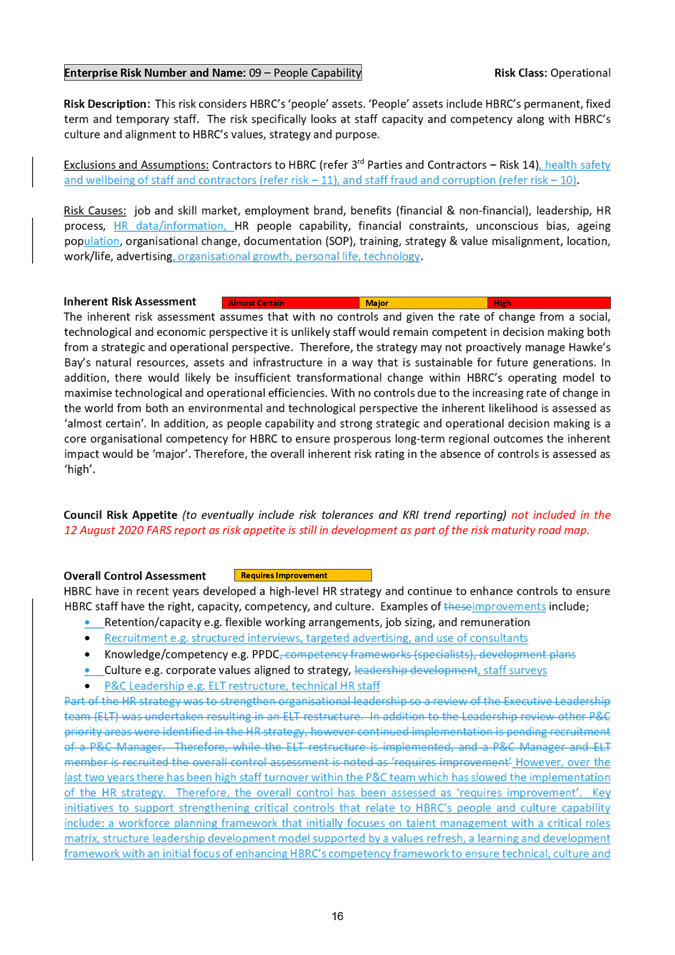

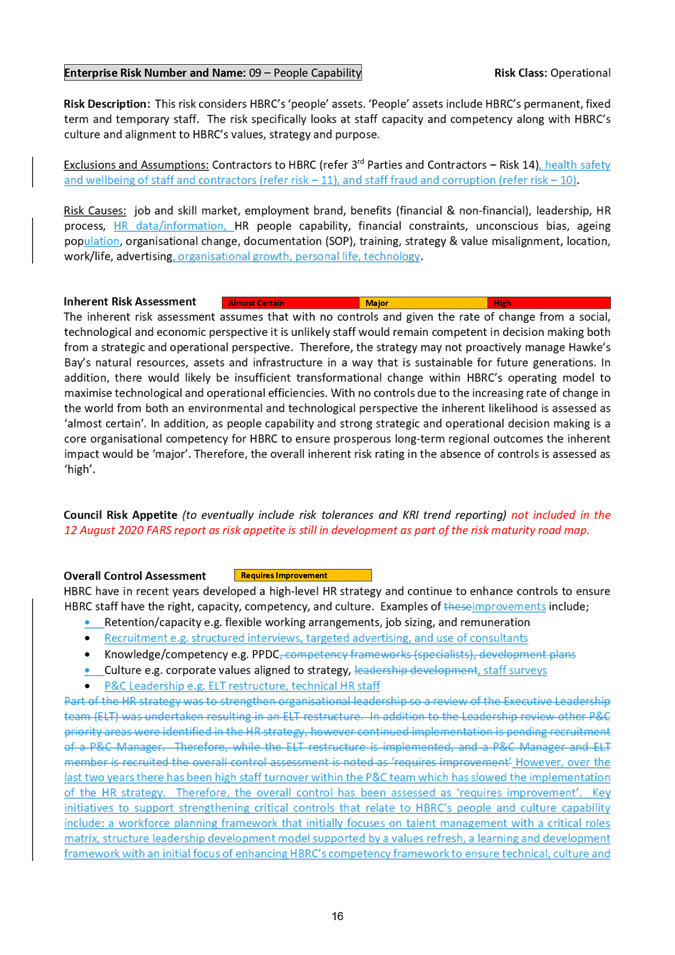

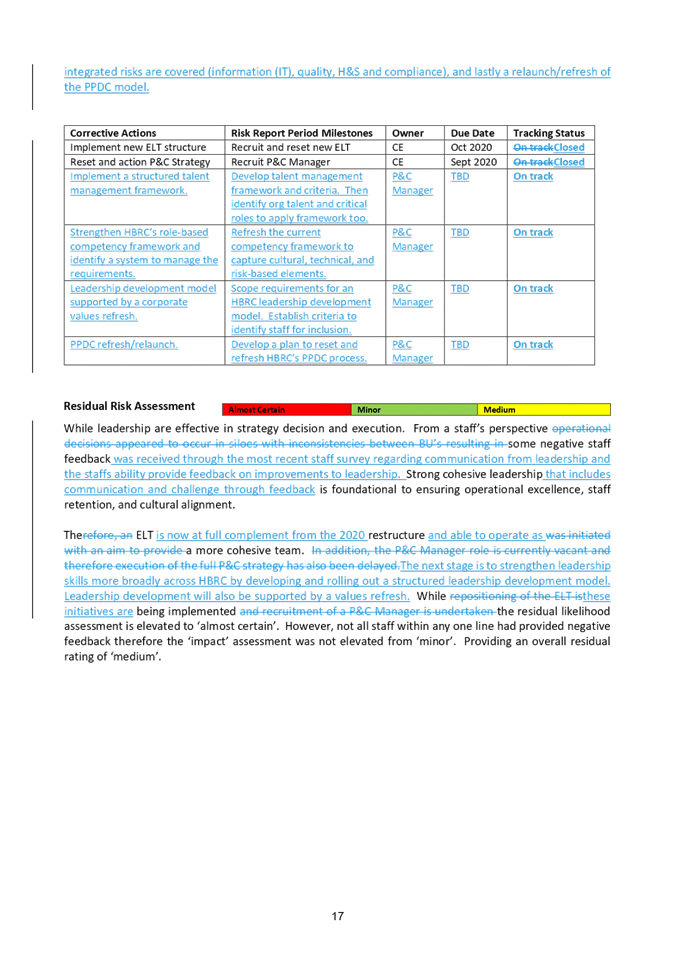

10. Risk 9 - People Capability

10.1. There has been no change

to the risk or overall control rating for People Capability. However, bowtie

analysis undertaken has helped reinforce that the People and Culture (P&C)

strategy is successfully targeting improvements to ‘People

Capability’ by focussing on core P&C activities and critical P&C

controls. Therefore, the residual risk commentary and control corrective action

plan has been updated to better reflect the current state.

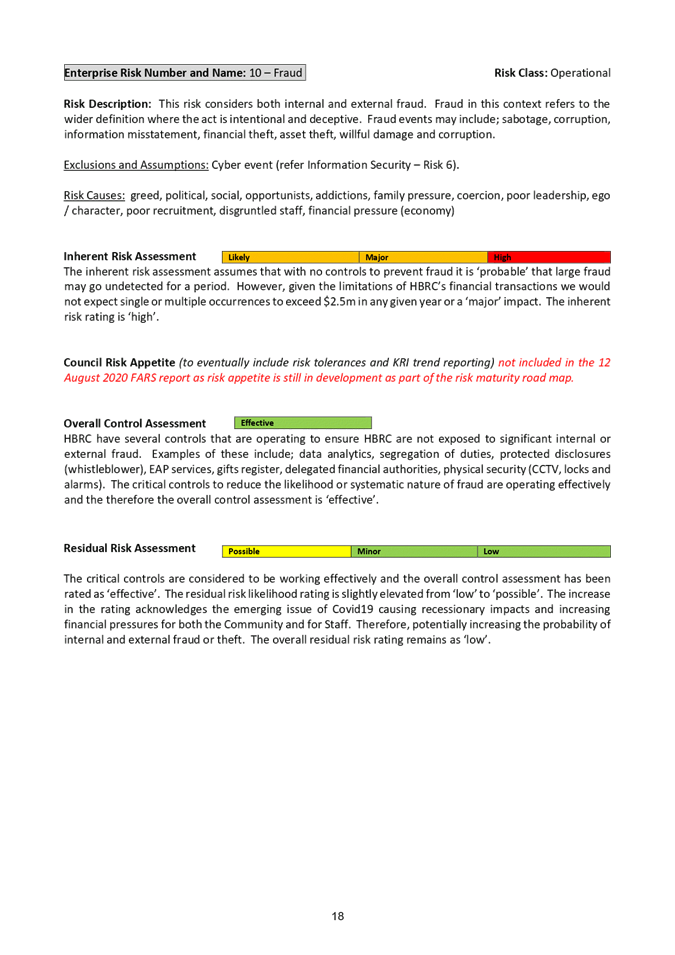

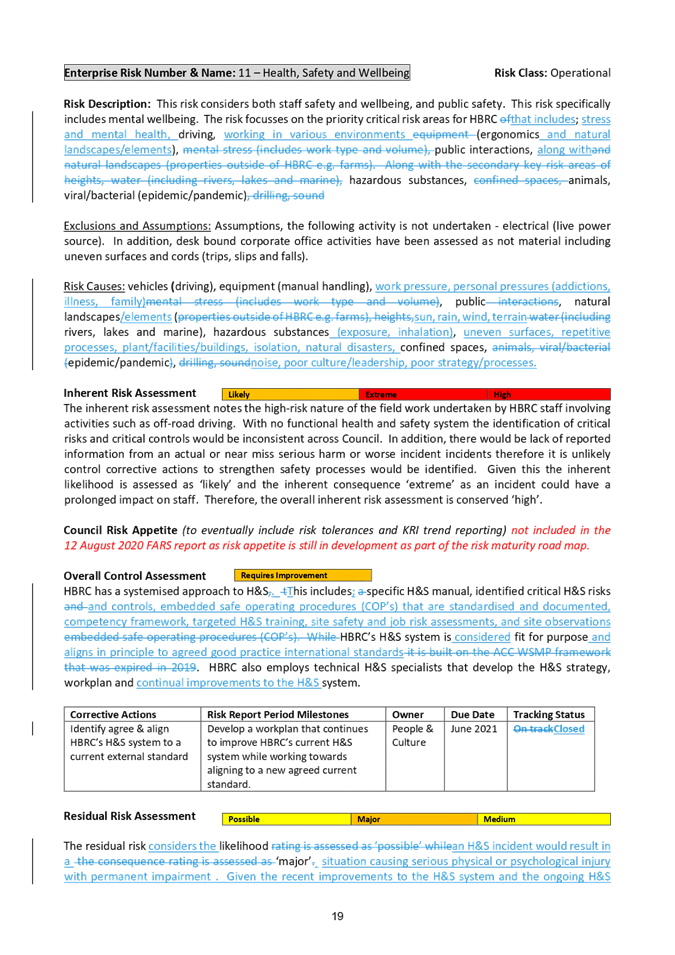

11. Risk 11 - Health, Safety

and Wellbeing

11.1. Over the last six months

several improvements have been implemented to Council’s Health and Safety

System. While continual improvement to Council’s Health and Safety

System will endure, the overall control assessment has improved from

‘requires improvement’ to ‘effective’. Resulting

in the residual likelihood assessment changing from ‘possible’ to

‘unlikely’. The change in the residual likelihood reflects

the focus for control corrective actions being on reducing the likelihood for a

‘major’ health and safety incident. There was no resulting change

to the residual risk rating.

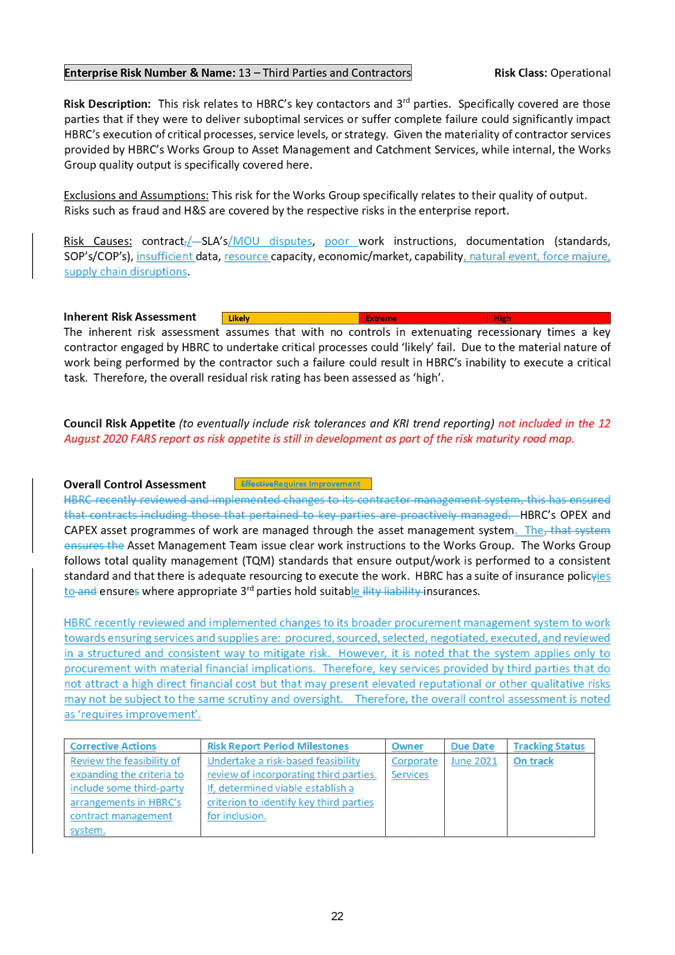

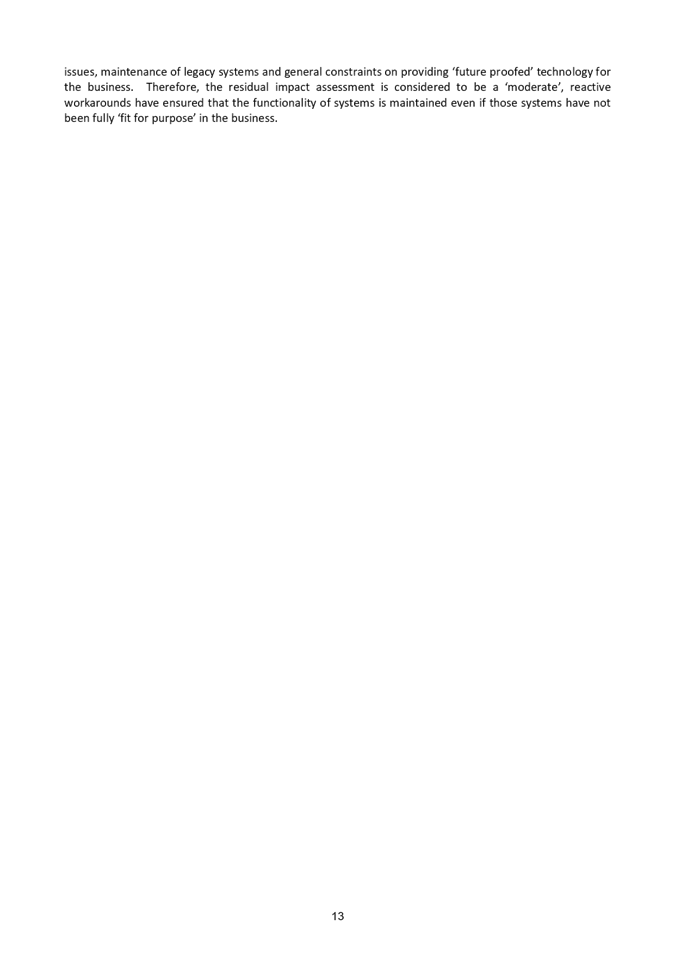

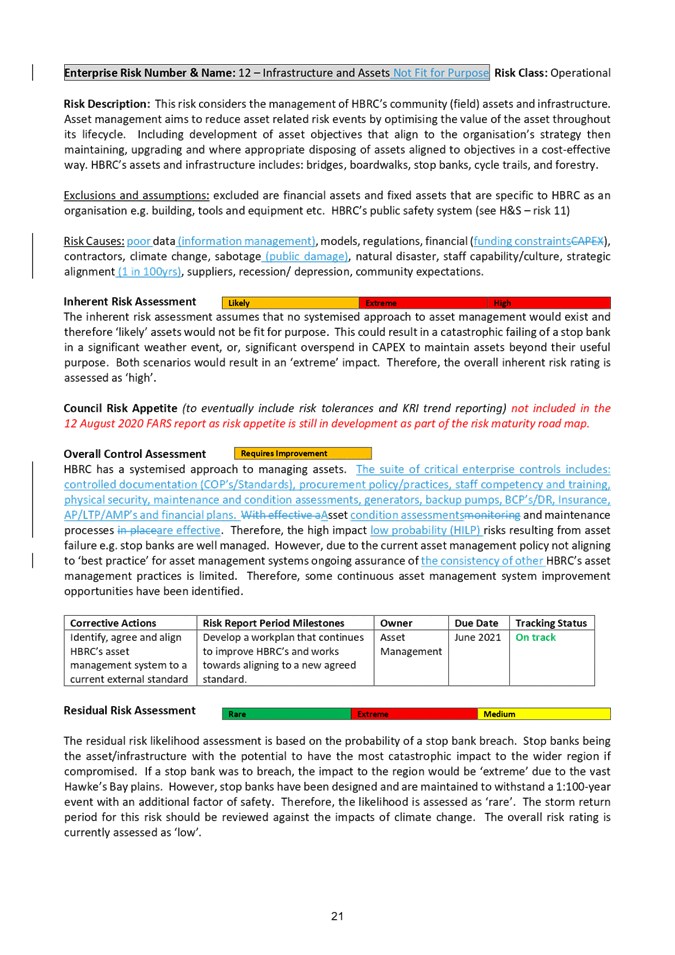

12. Risk 13 - Third Parties

and Contractors

12.1. Critical contracts such

as Council’s Work’s Group and other key contracts that expose

Council’s to direct material financial risks are well managed.

These contracts follow structured procurement practices from initiation to

ongoing performance monitoring. However, services or supply arrangements that

do not attract high direct financial risks are not explicitly included in the

formalised procurement management system. Some contracts or MOU’s

arrangements while not attracting significant direct financial risk could

present elevated qualitative risks to Council e.g. reputation. Therefore, a

feasibility review on incorporating such arrangements into the procurement

management system is being considered. For this reason, the overall control

assessment has changed from ‘effective’ to ‘requires

improvement’ and the residual likelihood assessment has been elevated

from ‘unlikely’ to ‘possible’. There was no

resulting change to the residual risk rating.

13. The remainder of changes

noted within the enterprise risk report relate to minor updates due to new

information contained within the supporting risk information. Or, because

of risk clarification due to bowtie analysis having been undertaken.

Strategic Fit

14. The

six-monthly risk report facilitates discussions to ensure that any emerging

matters within Council’s internal or external environment are being

managed. And, therefore unlikely to impinge of Council’s ability to

deliver on its strategy. In addition, the maturity of Council’s

risk management system contributes towards achieving excellence in execution of

strategy. A mature risk system provides consistent risk intelligent

decision making enabling the efficient prioritisation of finite organisational

resources to deliver on strategy.

Financial and

Resource Implications

15. Maturity

of the risk management system is phased to minimise budgetary

implications. Some facilitated workshops will be required to establish

the risk appetite with Council.

Next Steps

16. Implementation of the risk

management maturity roadmap continues. Scheduled actions for the next quarter

include:

16.1. Finalising the bowtie

analysis for all remaining enterprise risks

16.2. Analysing the

feasibility of continuing with the scheduled risk appetite workshop between the

ELT and Council due to ongoing border closures and the inability to get the

preferred workshop facilitator in person

16.3. Identification of Risk

Champions within each Group

16.4. Training of those Risk

Champions on Regional Council’s risk management policy, framework and

practices, and finally

16.5. Approval of the draft

Regional Council internal assurance framework

17. The FARS should note that

while these activities are targeted for the next quarter, there is some

dependency on the speed at which a replacement Risk and Assurance Lead can be

appointed.

Decision Making Process

18. Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

18.1. The

decision of the Sub-committee is in accordance with the Terms of Reference and

decision-making delegations adopted by Hawke’s Bay Regional Council on

25 March 2020, specifically the Finance, Audit and Risk Sub-committee

shall have responsibility and authority to:

18.1.1. Review whether Council

management has a current and comprehensive risk management framework and

associated procedures for effective identification and management of the

council’s significant risks in place

18.1.2. Undertake periodic

monitoring of corporate risk assessment, and the internal controls instituted

in response to such risks

18.1.3. report on the robustness of

risk management systems, processes and practices to the Corporate and Strategic

Committee to fulfil its responsibilities.

|

Recommendations

That the Finance, Audit and Risk Sub-committee:

1. Receives and considers the “Six Monthly Risk Report and Risk Maturity Update” staff report, specifically noting the changes in the February 2021 Enterprise Risk Report.

2. Confirms that the management actions undertaken and planned, as

detailed in the February 2021 Enterprise Risk Report, adequately

respond to the Risk Management Maturity Roadmap as

endorsed by Hawke’s Bay Regional Council on 24 June 2020.

3. Reports to the Corporate and Strategic

Committee, the Sub-committee’s satisfaction that the Six Monthly Risk Report and Risk

Maturity Update provides adequate evidence of the

robustness of Council’s risk management policy and framework and

progress to implement the maturing risk management system.

|

Authored by:

|

Helen Marsden

Risk and Assurance Lead

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

⇩1

|

February 2021

Enterprise Risk Report

|

|

|

|

February

2021 Enterprise Risk Report

|

Attachment 1

|

|

February

2021 Enterprise Risk Report

|

Attachment 1

|

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 17 February 2021

Subject: Internal Audit Work

Programme Update

Reason for Report

1. This item

updates the Finance Audit and Risk Sub-Committee (FARS) on the progress of

corrective actions that respond to internal assurance review findings that have

previously been reported to the FARS, along with a status update on the current

annual enterprise internal assurance plan. The plan was approved by FARS

at the meeting in August 2020.

Officers’ Recommendation

2. Council officers recommend that the FARS members consider and note

the internal assurance dashboard and corrective action

status update, and the internal assurance plan status update.

Discussion

3. At

the November 2020 FARS meeting the Sub-committee endorsed two ‘new

look’ internal assurance dashboards, being the:

3.1. corrective actions status update, and

3.2. annual enterprise internal assurance plan status update.

4. The purpose of

the corrective action status update is to provide oversight to the FARS of open

internal assurance findings from previously reported internal assurance

reviews. The dashboard tracks progress of the corrective actions against

agreed milestones, until the action is closed.

5. The purpose of

the annual enterprise internal assurance plan status update is to provide the

FARS with oversight of progress of individual internal assurance reviews that

were approved by the Committee as part of the annual enterprise internal

assurance plan.

6. Both internal

assurance dashboards have been updated as at February 2021, and are attached.

Financial

and Resource Implications

7. There are no financial implications or additional resource requirements

resulting from this internal audit programme update.

Decision

Making Process

8. Council and its committees are required to make every decision in

accordance with the requirements of the Local Government Act 2002 (the Act).

Staff have assessed the requirements in relation to this item and have

concluded:

8.1. The agenda

item is in accordance with the Sub-committee’s Terms of Reference,

specifically:

8.1.1. The purpose of the Finance, Audit and Risk Sub-committee is

to report to the Corporate and Strategic Committee to fulfil its

responsibilities for (1.3) the independence and adequacy of internal and

external audit functions

8.1.2. The Finance, Audit and Risk Sub-committee shall have

responsibility and authority to (2.6) receive the internal and external audit

report(s) and review actions to be taken by management on significant issues

and recommendations raised within the report(s)

8.1.3. The Finance, Audit and Risk Sub-committee is delegated by

Council to (3.6) review the objectives and scope of the internal audit

function, and ensure those objectives are aligned with Council’s overall

risk management framework; and (3.7) assess the performance of the internal

audit function, and ensure that the function is adequately resourced and has

appropriate authority and standing within Council.

8.2. As this report is for information only, the decision making

provisions do not apply.

|

Recommendations

That the

Finance, Audit and Risk Sub-committee:

1. receives and

notes the ‘Internal Audit Work Programme Update’ staff

report and accompanying dashboards.

2. Confirms that management actions undertaken or planned for the

future adequately respond to the findings and recommendations of previously

reported internal assurance reviews.

3. Reports to the Corporate and Strategic Committee, the

Sub-committee’s satisfaction that the Internal Audit Work

Programme Update provides adequate evidence of the

adequacy of Council’s internal assurance functions and management

actions undertaken or planned to respond to internal assurance review

findings and recommendations.

|

Authored by:

|

Helen Marsden

Risk and Assurance Lead

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

⇩1

|

Dashboard 1 -

Internal Assurance Dashboard - Corrective Action Status Update

|

|

|

|

⇩2

|

Dashboard 2 -

Internal Assurance Annual Plan FY20-21 Status Update

|

|

|

|

HBRC Covid-19 Response Debrief Report

– November 2020

|

|

Finding / Theme

|

Priority

Rating

|

Action and Owner

|

Due Date

|

Milestone Achieved

Since Last Report

|

Milestone

For Next Report

|

Tracking Status

|

|

Business

Continuity, Pandemic Plans and Technology

To

enable a holistic based response and maintenance of critical pandemic

supplies (e.g. PPE) for future pandemic events HBRC’s pandemic safety

plan should be linked to business continuity plan (BCP)

Consider

feasibility of restructuring HBRC’s BCP’s to take a denial type

approach rather than an external hazard approach i.e. denial of: people,

systems, suppliers, facilities.

Strengthen the Disaster Recovery (DR) and BCP linkage.

|

Medium

|

Review

current suite of BCP documents to identify improvements. Develop an

implementation plan. Risk & Assurance Lead & Senior Health and

Safety Advisor

Refer - Cyber

security audit - resilience finding and action

|

March 2021

|

Reviewed

current Covid response plan to reflect MOH updates.

IT DR test scheduled for March 27th 2021.

|

Develop

project plan to prioritise updating HBRC’s BCP documents.

Add

reviewed Covid19 response plan to the BCP suite of docs in Herbi.

Analyse

the feasibility of restructuring the BCP approach. If required, develop

a roadmap.

IT DR test to be executed. Review lessons learnt

from DR test and allocate resourcing to quick wins / high risks.

|

On track

On track

|

|

Communication (Internal & External)

Internal

communication in lockdown were positive. Therefore, the approach should

be documented to ensure it is repeatable for future requirement to work

remotely.

There

are a number of key stakeholder groups that may need to be specifically

commuicated with tailored messages depending on the event.

Telephony

processes need to be consistent regardless of whether the call is being

responded to by Council or Contact Centre staff.

|

Low

|

Update

BCP suite of documents. Marketing and Communications

Identify

HBRC’s key stakeholdder groups through developing a key stakeholder

wheel and document in HBRC’s BCP. Marketing and

Communications

Taking into account new capability of the recently

upgraded telephony system. Review and improve processes for calls currently

managed by the Palmerston North Contact Centre in a BCP situation. Corporate

Support Manager

|

March

2021

|

|

Capture

internal comms practices that were initiated as part of the Covid19 lockdown

response and link to the BCP Suite iof docs on Herbi

Finalise

key stakeholder wheel and link to HBRC’s BCP suite of documents in

Herbi.

Review current telephony BCP practices to identify

improvements. Develop a project plan for implementation

|

On track

On track

On track

|

|

The corrective actions to control the risk of cross

contamination of work bubbles at Guppy Road should now be documented.

|

Low

|

Ensure the pandemic safety plan is up to date with the

most recent pandemic response process. Senior Health and Safety Advisor

|

Febuary 2021

|

|

Review underway for Guppy Road staff bubbles to ensure

continuity in case of a second Covid wave.

|

On track

|

|

Improve the rostering system for prolonged and

slow-moving events (e.g. pandemics) with the aim of ensuring equitable

distribution of tasks.

|

Medium

|

Improved rostering system to better manage staff

resourcing requirements. Team Leader Hazard Reduction

|

December 2020

|

Worked

with HBRC ICT to present draft proposal October 2020 to HBCDEM using

rostering app.

|

Obtain approval from HBCDEM of proposed rostering app.

|

Behind – due to

Napier Flood and HBCDEM staff departures.

|

Internal

Audit – Risk Management Maturity – June 2020

|

|

Finding / Theme

|

Priority

Rating

|

Action and Owner

|

Due Date

|

Milestone Achieved

Since Last Report

|

Milestone

For Next Report

|

Tracking Status

|

|

Risk, Governance, Policy and Accountabilities - to

improve risk and assurance challenge. With clearer risk escalation.

|

Not Stated

|

Develop risk management policy and framework that

includes roles and responsibilities. Risk & Assurance Lead

|

September 2020

|

Council approved single Regional Council risk

management policy and framework.

|

|

Closed as at Nov 2020 FARS

|

|

Leadership and Direction - Improve linkage of

risk informed decision making to strategy. Improving clarity of boundaries for

decision making.

|

Not Stated

|

Develop a comprehensive risk appetite statement that

defines tolerance levels for individual enterprise risks. ELT

|

March 2021

|

Bowties for six enterprise risks completed and update

the FARS risk report one pagers..

|

Finalise bowties for remaining enterprise risks and run

risk appetite workshop. Subject to accessibility of facilitator.

|

At risk – borders

may limit access to trainer / facilitator. Viability of Zoom v delay

will be analysed

|

|

Leadership and Direction - Risk system continuous

improvement.

|

Not Stated

|

Incorporate into the risk policy and framework a risk

vision. Tailor the Council’s risk policy and framework to align

to the strategy. Develop a risk maturity roadmap to execute the risk

vision. Risk & Assurance Lead

|

September 2020

|

Council approved risk policy includes a risk vision

that aligns to the C&S approved risk maturity roadmap. And, the

risk policy and framework tailored based on HBRC’s strategy.

|

|

Closed as at Nov 2020 FARS

|

|

People and

Development - Risk roles ad responsibilities beyond the risk and

assurance lead were not defined. With no risk related training.

|

Not Stated

|

Develop a competency framework to upskill staff on risk

and embed the risk policy. Communicate and train BU on the risk policy

and framework. Provide targeted training to specialist risk roles e.g.

risk champions. ELT and Risk and Assurance Lead

|

October 2021

|

|

In conjunction with Group Managers identify a Risk

Champion in each Group. Risk and Assurance Lead to develop Risk Champion

Training..

|

On track

|

|

Processes and Tools - For risk assessment and

mitigation.

|

Not Stated

|

Through a single risk management policy and framework

ensure that clear risk and control identification and assessment criterion

exists. Risk and Assurance Lead

|

September 2020

|

Council approved risk framework includes a

criteria of risk and control identification and assessment. With

recommended tools.

|

|

Closed as at Nov 2020 FARS

|

|

Processes and Tools - For assurance.

|

Not Stated

|

Develop a formal assurance framework based on the

‘three lines of defence model’. Framework should ensure

assurance targets critical council functions and activities applying a risk

based approach. Risk and Assurance Lead

|

July 2021

|

Regional Council assurance framework drafted and

awaiting ELT approval.

|

Develop a targeted approach to implement the framework

subject to ELT and FARS approval.

|

On track

|

|

Process and Tools - For risk monitoring and reporting.

|

Not Stated

|

Reformatted risk reporting to enhance visibility can be

developed when the risk policy and framework is approved by Council.

However, risk reporting will be subject to continuous improvement as the risk

system matures e.g. the incorporation of key risk/control indicator trend

reporting. Risk and Assurance Lead

|

September 2021

|

Enterprise risk report updated to reflect completed

bowties.

|

Update

risk reporting to reflect insights from risk bowties as thes final bowties

are completed.

Update risk report to reflect approved risk appetite.

|

On track

|

|

Business Performance – Strategic risk management.

|

Not Stated

|

Strategic planning cycle to include a review of

enterprise risks to better link and integrate the risk register and LTP.

Risk & Assurance Lead & Strategy and Governance Manager

|

September 2021

|

Complete

bowties for six enterprise risks and update the FARS risk report one pagers

accordingly.

|

Finalise bowties for remaining enterprise risks

and update risk report to enable a better linkage to the LTP.

|

On track

|

|

Business Performance – Managing Risk in

Partnerships.

|

Not Stated

|

Develop risk and performance monitoring of key third

parties. Ensure contingency planning is included. Risk &

Assurance Lead

|

December 2020

|

Bowtie

analysis undertaken for the enterprise risk for third parties. With the

risk report updated accordingly.

|

Finalise bowtie and identify the top 20 highest

risk third parties.

|

At risk – this

enterprise risk is not prioritised for bowtie pre Xmas

|

|

Business Performance – Business resilience ensure

continuity planning is sufficient to cover HILP events.

|

Not Stated

|

Develop a process to assess disruptive and extreme

events (low probability high impact ‘HILP’ events). Risk

& Assurance Lead

|

December 2021

|

|

Develop a roadmap to enhance continuity plans include

business impact risk assessments based on HILP events. Stress test on a

‘denial’ premise.

|

On track

|

|

Business Performance – Change and transformation.

|

Not Stated

|

Develop a change management framework to ensure a

portfolio view of risks related to significant change is managed. Marketing

& Communications Manager

|

September 2021

|

Recruited fixed term Change Management Resource to

focus on corporate maturity / readiness that can develop a change management

framework and strategy while managing current change projects. Has been

recruited. It is expected to transition the role into a permanent position

through the LTP.

|

The new Change Manager to draft a change management

framework for approval.

|

On track

|

|

Internal

Audit – Procurement & Contract Management – May 2018

|

|

Finding / Theme

|

Priority

Rating

|

Action and Owner

|

Due Date

|

Milestone Achieved

Since Last Report

|

Milestone

For Next Report

|

Tracking Status

|

|

Lack of evidence for procurement decisions.

|

High

|

Procurement plan template designed based on MBIE/NZTA

best practice guidelines; implemented

Procurement Lead

|

Sept 2020

|

Completed as part of amendments to procurement manual,

approved by Council Sept 2020.

|

|

Closed as at Nov 2020 FARS

|

|

Lack of contract evaluation.

|

Medium

|

Policy and manual updated; evaluation criteria included

in selection and post contract performance evaluation

Procurement Lead

|

Sept 2020

|

Policy and manual amendments approved by Council Sept

2020 - Completed.

|

|

Closed as at Nov 2020 FARS

|

|

|

|

|

|

|

|

|

|

Internal

Audit – Health and Safety – Sept 2018

|

|

Finding / Theme

|

Priority

Rating

|

Action and Owner

|

Due Date

|

Milestone Achieved

Since Last Report

|

Milestone

For Next Report

|

Tracking Status

|

|

Improve indicator risk control reporting.

|

High

|

Bow

tie analysis for identified critical risks to ensure hierarchy of controls

To enhance lead indicators. Senior Health,

Safety & Wellbeing Advisor and Risk & Assurance Lead

|

March 2021

|

H&S bowtie analysis complete.

|

Now bowtie analysis complete the Lead Indicator Action

below captures next steps

|

Closed

|

|

Update of Health and Safety Manual.

|

Medium

|

Review Manual Senior Health, Safety and

Wellbeing Advisor

|

October 2020

|

Health and Safety Manual scheduled for Executive

Leadership Team final sign off February 2021.

|

Safety Plan to be signed off.

|

Behind –

Bowtie analysis now complete and awaiting Safety Plan

sign off.

|

|

Move towards Lead Indicators.

|

Medium

|

Health and Safety Manual to include Lead

Indicators Senior Health, Safety & Wellbeing Advisor

|

June 2021

|

Key lag/lead indicators now reported as part of ELT

Organisational Performance reporting.

|

Further develop ELT lead and lag indicators.

|

On track

|

|

Improve Incident reporting detail to include Root

Cause Analysis (5 Why's).

|

High

|

Update incident reporting form to include root cause

analysis (5 Why's) Senior Health, Safety & Wellbeing Advisor

|

June 2021

|

Updated incident formto include (5 Why’s).

|

|

Closed

|

|

Increased reporting to ELT.

|

High

|

Create dashboard report for health and safety

reporting. Senior Health, Safety & Wellbeing Advisor

|

March 2021

|

Agreement with Organisational Performance to

specifically include health and safety as part of performance reporting.

|

Finalise key H&S measures to include in HBRC

performance reporting.

|

On track

|

|

Increased visibility of health and safety activity by

ELT.

|

High

|

ELT representative attends quarterly Health and Safety

Committee Meeting Senior Health, Safety & Wellbeing Advisor

|

March 2021

|

Process for regular attendance by ELT at quarterly

meetings established.

|

|

Closed

|

|

Improvement in Contractor Inductions.

|

Medium

|

Review induction process of contractors and

service providers Senior Health, Safety and Wellbeing Advisor

|

September 2020

|

Review of induction process via survey to be developed,

delivered and corrective outcomes identified.

|

Linked to below item – collaborate with

procurement to confirm induction process and complile list of contractors

that require corrective actions. Establish timetable for corrective actions.

|

Behind

|

|

Improvement in Contractor Engagement process.

|

Medium

|

A full review of contractor inductions across all

risks Senior Health, Safety & Wellbeing Advisor

|

August 2021

|

Procurement have endorsed working with H&S to

oversee that H&S inductions and risk assessments. That occur as part of

the wider procurement management system.

|

Continue

to work with Procurement to finalise contractor processes so that these

include H&S risks.

|

On track

|

|

Internal

Audit – Cyber Security – August 2019

|

|

Finding / Theme

|

Priority

Rating

|

Action and Owner

|

Due Date

|

Milestone Achieved

Since Last Report

|

Milestone

For Next Report

|

Tracking Status

|

|

Asset management

– Software & application inventory– IT oversight and value

as a service.

|

High

|

Automate as many software updates as possible. Chief

Information Officer

|

Sept 2020

|

Software updates now automated.

|

|

Closed as at Nov 2020 FARS

|

|

As above

|

High

|

Update and review software list annually. Chief

Information Officer

|

Sept 2020

|

2020 Annual Review completed

|

|

Closed as at Nov 2020 FARS

|

|

Asset management – Software & application

inventory – Legacy Systems.

|

High

|

Develop an architecture strategy that considers long

term phased replacement of legacy systems, including documenting the legacy

software components and systems. Chief Information officer

|

December 2021 – if funding request accepted

|

IT Projects have been identified and described in 1

page briefs.

|

Projects

are prioritised by exec team.

Resourcing

is recruited to begin scoping and delivery of prioritised projects.

Resourcing

is recruited to develop enterprise architecture artefacts.

|

On track

Note action is defining the strategy

– implementation for legacy systems will take over 10 years with

current resourcing

|

|

Asset management – Software & application

inventory– Inventory

|

High

|

Reviewed and documented all software used at HBRC. Chief

Information officer

|

Oct 2019

|

Documented software inventory reviewed.

|

|

Closed as at Nov 2020 FARS

|

|

Asset management – Software & application

inventory – Legacy Systems.

|

High

|

High-level documentation of software components. Chief

Information officer

|

Dec 2019

|

High level documentation complete.

|

|

Closed as at Nov 2020 FARS

|

|

As above.

|

High

|

Review software versions in use and compare to latest

available. Chief Information officer

|

Mar 2020

|

IT

Support team reviewed the list of active software, and updated old versions

– starting with areas of highest risk.

|

Our current approach to this has been adhoc.

Reporting will be provided on the size of this issue, progress to date and

target state.

|

Behind

|

|

As above.

|

High

|

Finance System Replacement Chief Information

officer

|

June 2021

|

Enterprise

Budgeting is live.

|

FMIS planned to go live 1/7/21. Payroll to go

live 14/4/21

|

On track

|

|

Access Control – Principle of least privilege

– Periodic Review.

|

High

|

Perform an annual review of access to HR and Regulatory

systems (adding this to the current AuditNZ reviews of core and finance

systems). Chief Information officer

|

Sept 2019

|

Reviewed access of HR and Regulatory systems.

Request for new HR system in LTP. This included HR access review.

|

If HRIS is prioritised – access review will be

included as part of the project. If not, a thorough access review will be

performed on the current system.

|

Behind

|

|

Access Control – Principle of least privilege

– Enforce the principle of least privilege.

|

High

|

Reviewed and reduced domain administrator access. Chief

Information officer

|

Oct 2019

|

Domain administrator access reviewed and reduced.

|

|

Closed as at Nov 2020 FARS

|

|

Access Control

– Principle of least privilege – Legal & Regulatory

requirements.

|

High

|

Identified systems containing confidential data and

tightened up processes for assigning access rights for new users Chief

Information officer in conjunction with Risk and Assurance Lead

|

Oct 2019

|

Information Management Advisor recruited- due to

commence in role on 30 November 2020.

|

Stocktake with business to assess what information and

records are held and where including PII.

With Information re-baseline due date based on scope of

remediation and linkage to ICT Governance below.

|

Behind - Date

needs rebaselining. Part of wider information management project

– dedicated resource to strengthen data management now recruited

|

|

Access Control – Principle of least privilege

– Periodic Review.

|

High

|

Reviewed Active Directory Accounts – archiving

accounts by last logon date > 60 days Chief Information officer

|

Oct 2019

|

Accounts directory reviewed with >60days archived.

|

|

Closed as at Nov 2020 FARS

|

|

Access Controls – External Information Systems

– Password Managers.

|

Medium

|

Investigate and evaluate solutions for single sign-on /

password management. Chief Information officer

|

Sept 2020

|

Requested resourcing to evaluate solutions for

implementation.

|

|

Behind

|

|

Business Environment – Resilience requirements ––

IT

Disaster Recovery Plan – resilience requirements.

|

High

|

Implement DR Technology Changes and Test Disaster

Recovery processes and environment. Chief Information officer

|

Dec 2021

|

Scoped and designed a Disaster Recovery solution for

when funding is available.

|

IT DR test scheduled for March 27th 2021.

Scenario - simulating the loss of the Dalton St building

|

On track

|

|

As above.

|

High

|

Develop cybersecurity incident management processes

based on CERT NZ guidelines. Including, developing templates for

incident repsonse and post incident review. Chief Information

officer

|

Mar 2020

|

Response process drafted and response templates

complete.

|

|

Closed as at Nov 2020 FARS

|

|

Governance – Information security policy

framework – Policy Review Required.

|

Medium

|

ICT Governance - firstly, assess the quality

of Councils ICT policy framework against good practice including the

development of a RACI matrix for cybersecurity roles outlined in the matrix. Chief

Information officer in conjunction with Risk and Assurance Lead

|

June 2020

|

|

Define Council's risk appetite for enterprise risk 5

‘information security’. Assess gap to systemise, develop

business case and project plan that incorporates updating ICT governance

documentation.

|

Behind – broader

Information security strategy – also links to PII, DR and third parties

|

|

Anomalies & events, Security Continuous Monitoring

& Detection Processes – Monitoring/Detection – Alerts.

|

Medium

|

Setup a central mailbox for system alerts. Chief

Information officer

|

Oct 2019

|

Central mailbox activated for alerts.

|

|

Closed as at Nov 2020 FARS

|

|

As above.

|

Medium

|

Add critical alerts to our monitoring dashboard. Chief

Information officer

|

Mar 2020

|

Central mailbox above is sufficient.

|

|

Closed as at

Nov 2020 FARS

|

|

Information Protection Processes & Procedures

– Third parties – Contractors Responsibilities.

|

Medium

|

As part of policy review , ensure

risk based decision is made around contractors including system access by

contractors and third parties are covered by policy. Chief Information

officer in conjunction with Risk and Assurance Lead

|

June 2020

|

|

Define Council's risk appetite for enterprise risk 5

‘information security’. Assess gap to systemise, develop

business case and project plan that incorporates managing information risks

from third parties.

|

Behind – refer

update under ICT governance due date needs rebaselining as the solution

requires integration with other key management systems.

|

|

Maintenance – remote access is managed (third

parties) – Maintenance.

|

Medium

|

Implement ‘enable on demand’ access for

third party providers. Chief Information officer

|

Oct 2019

|

Accounts disabled by default, and enabled when

requested for a fixed period.

|

|

Closed as at Nov 2020 FARS

|

|

Access control – Remote access is managed (mobile

devices)– Mobile device management.

|

Low

|

Continue the planned deployment of asset management

tools for mobile devices. Chief Information officer

|

Ongoing

|

Implemented Microsoft Intune to manage mobile devices.

Completed June 2020.

|

|

Closed as at Nov 2020 FARS

|

|

|

|

|

|

|

|

|

|

|

Tracking Status

|

Key

|

|

On track

|

Milestones on track

to meet due date

|

|

At risk

|

Milestones falling

behind putting at risk delivery on due date

|

|

Behind

|

Milestones

outstanding due date will not be met

|

|

Closed

|

Corrective action

fully implemented since last update

|

|

Closed

|

Corrective action

fully implemented in previous period

|

|

Dashboard 2 - Internal

Assurance Annual Plan FY20-21 Status Update

|

Attachment 2

|

Dashboard 2

Internal

Assurance Annual Plan FY20-21 Status Update

|

Approved

Audit FY20-21

|

Provider

|

Quarter

Due

|

Date

Commenced

|

Management

Comments

|

Reported

to FARS

|

|

Data

Analytics

|

Crowe

|

Q3

|

December 2020

|

|

|

|

People,

Recruitment, Retention and Wellbeing

|

Crowe

|

Q4

|

IA scope and LOE

being finalised with Crowe

|

|

|

|

Retained

Audit Capacity - 40 hours

|

Crowe

|

|

|

|

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 17 February 2021

Subject: Assurance Framework

Relevant to S17a Reviews

Reason for Report

1. This item

updates the Finance Audit and Risk Sub-committee (FARS) on progress made with

the drafting of a Regional Council (Council) Internal Assurance Framework, and

key next steps.

2. A specific

focus of this update is how, within the draft framework, it is proposed

requirements of S17a will be met and then operate in practice.

Background

3. At the Corporate and Strategic Committee meeting held on 10 June

2020 the Committee endorsed the risk maturity roadmap for Council. At that

meeting it was decided the FARS would oversee implementation of the maturing

risk management system. A key element of risk maturity is assurance.

4. Through the risk roadmap it was agreed that by mid-2021 Council

would focus on embedding a structured and consistent approach to assurance.

Therefore, the first step requires the development of an overarching assurance

framework for Council.

Discussion

5. The intent of the assurance framework is to bring together the many

different assurance review types that are undertaken across the business and

apply a systematic and structured approach, therefore, improving oversight to

Councillors and to the Executive Leadership Team (ELT). Examples of the

different types of assurance reviews include internal audits, post incident

debrief, post implementation review, and S17a.

6. The first draft of the assurance framework is complete and currently

being prepared for presenting to the Executive Leadership Team (ELT) for

endorsement on 23 February 2021. Once endorsed by the ELT the framework will

then be presented to the FARS for recommending to C&S for Council adoption.

7. With the application of a structured and systematic approach to

assurance output between reviews can be easily compared and analysed improving

the prioritisation of resources. In addition, Councillors and ELT are provided

with a reasonable level of comfort that the spread of assurance reviews

provides a good breadth and depth across council’s activities, strategy

and risks. Opportunities sought for efficiencies and cost reduction are a key

element of S17a.

8. The framework outlines that the FARS is responsible for identifying

reviews that are contained in the enterprise annual internal audit plan.

Internal audits are one of the main review types that make up the internal

assurance programme. With an improved understanding of the breadth and

depth of reviews a proactive risk-based approach can be applied to identify

future internal audits.

9. While the framework encourages a proactive and risk-based approach

to identifying future reviews it is noted that identification of S17a reviews

are prescribed in legislation. S17a reviews prescribes the following.

9.1. A local authority must review the cost-effectiveness of current

arrangements for meeting the needs of communities within its district or region

for good-quality local infrastructure, local public services, and performance

of regulatory functions. A review must be undertaken (a) in conjunction

with consideration of any significant change to relevant service levels; and

(b) within 2 years before the expiry of any contract or other binding agreement

relating to the delivery of that infrastructure, service, or regulatory

function; and (c) at such other times as the local authority considers

desirable, but not later than 6 years following the last review.

10. The S17a

exception to identifying reviews is noted in the framework. Therefore,

while the FARS will be updated on the S17a reviews being undertaken the

identification of these reviews will come from other channels.

11. All final

reports for reviews that are undertaken as part of the annual enterprise

internal audit plan are first reported to the FARS. However, for other

assurance reviews that are not necessarily under the remit of internal audit

e.g. S17a the final may first be provided to the appropriate oversight

Committee for accepting. However, in these cases the final report will also

subsequently be made available to the FARS Committee for noting.

Next

Steps

12. Present

the draft internal assurance framework to ELT for endorsement.

13. On ELT

endorsement the internal assurance framework will be presented to the next

scheduled FARS meeting for recommendation to Council for approval.

Decision Making Process

14. Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

14.1. This agenda item is in

accordance with the Finance, Audit and Risk Sub-committee Terms of Reference,

specifically:

14.1.1. “The purpose of the Finance, Audit and Risk Sub-committee is

to report to the Corporate and Strategic Committee to fulfil its

responsibilities for (1.3) the independence and adequacy of internal and

external audit functions” and

14.1.2. “The Finance, Audit and Risk Sub-committee is

delegated by Council to (3.6) review the objectives and scope of the internal

audit function, and ensure those objectives are aligned with Council’s

overall risk management framework; and (3.7) assess the performance of the

internal audit function, and ensure that the function is adequately resourced

and has appropriate authority and standing within Council.”

14.2. As this report is for information only, the decision making

provisions do not apply.

|

Recommendation

That the Finance, Audit and Risk

Sub-committee:

1. receives and notes the “Assurance Framework Relevant to

S17a Reviews” staff report

2. reports

to the Corporate and Strategic Committee, the Sub-committee’s

satisfaction with progress made to draft a Regional Council Internal

Assurance Framework.

|

Authored by:

|

Olivia

Giraud-Burrell

Business Analyst

|

Helen Marsden

Risk and Assurance Lead

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 17 February 2021

Subject: Quarterly Treasury

Report for 1 October - 31 December 2020

Reason for Report

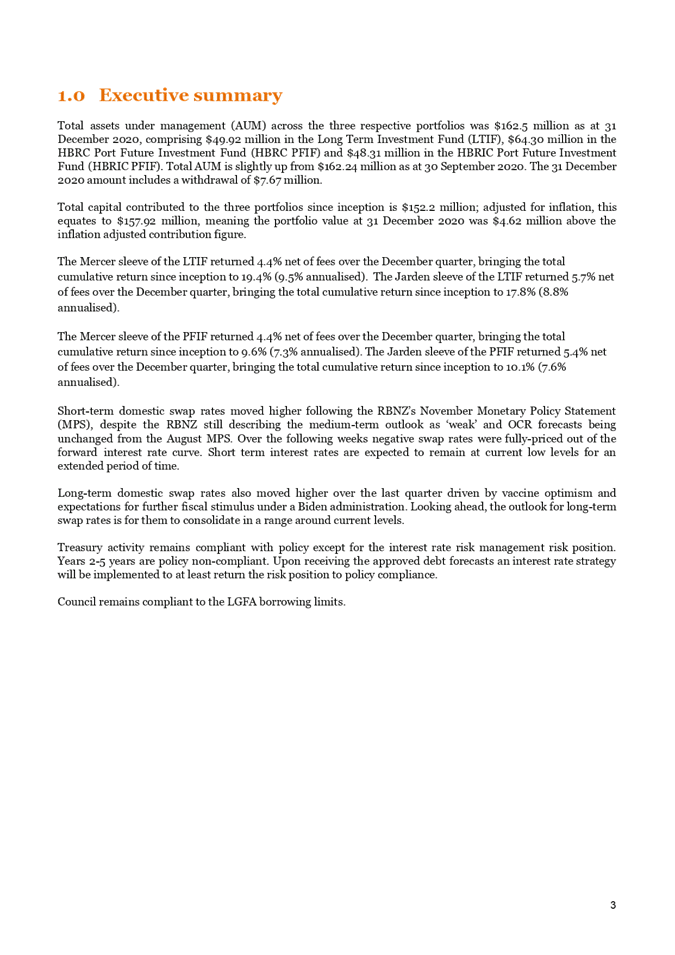

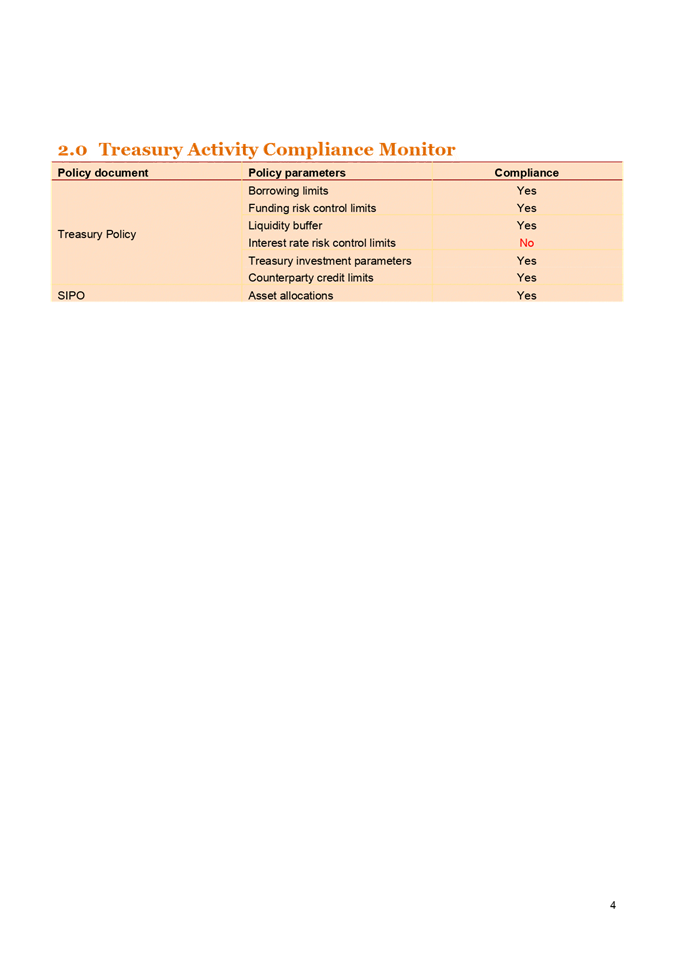

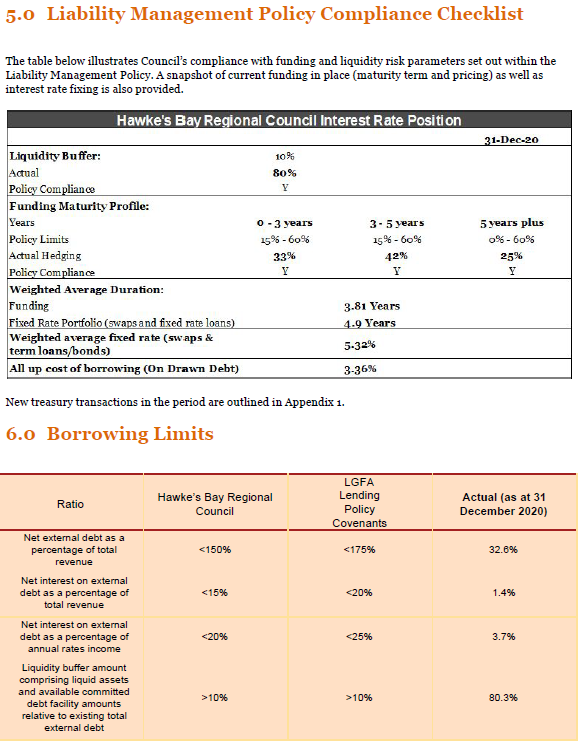

1. This item provides compliance monitoring of Hawkes Bay Regional

Council (HBRC) treasury activity and reports the performance of Council’s

investment portfolio for the quarter ended 31 December

2020.

Overview of the Quarter - ending 31 December 2020

2. The investment portfolio continued its strong performance with the

global economy seemingly continuing its recovery from the lows seen in Q3

2019-20.

3. Managed Funds have provided a year-to-date gross income net of fees

of ~9%, enabling a combined (Council and HBRIC) divestment of $7.7m. This

ensures that previous gains are now realised, and a $2.6m reduction of the

Covid-19 Impact Loan.

4. Napier Port paid a final dividend to HBRIC of $5.5m, of which HBRIC

passed through dividend of $4.0m; $1.0m greater than the budgeted $3.0m in the

Covid-19 impacted 2020-21 Annual Plan.

5. Earlier collection of rates resulted in a strong liquidity position

right throughout the quarter.

Background

6. The Investment management reporting requirements, outlined within

Council’s Treasury Policy, requires quarterly reporting to the Financial

Audit & Risk Sub-Committee (FARS) of current investment allocation and

investment performance.

7. All Treasury investments are to be reported on quarterly. As at 31

December 2020, Treasury Investments to be reported on consist of:

7.1. Liquidity

7.1.1. Cash and Cash Equivalents

7.1.2. Debt Management

7.2. Externally Managed Investment Funds

7.2.1. Long-Term Investment Fund (LTIF)

7.2.2. Future Investment Fund (FIF)

7.3. Investment properties

7.4. HBRIC Ltd

7.5. 2020-21 Year to Date Performance Summary.

8. Since 2018, HBRC has procured treasury advice and services from PwC.

Their quarterly compliance report is attached.

Discussion

Liquidity - Cash

& Cash Equivalents

9. To ensure HBRC has the ability to adequately fund its operations,

current policy requires HBRC to maintain a liquid balance of $3.0m.

10. The

following table reports the cash and cash equivalents as at 31 December 2020.

|

31

December 2020

|

$000

|

|

Cash

|

4,534

|

|

HBRC Held

Cash

|

3,817

|

|

Works

Group

|

432

|

|

Other

– managed trusts

|

286

|

|

Short-term

bank deposits

|

9,000

|

|

Cash

& and cash equivalents

|

13,534

|

11. HBRC

liquidity throughout Q2 benefited from the early collection of rates (~$18.0m),

HBRIC Dividend ($4.0m), and divestment of returns achieved from the LTIF and

FIF managed funds ($6.5m).

12. Any cash

surplus to operating requirements is placed on term deposit. For 81 of

the possible 91 days in the quarter an average of $5.5m was held in term

deposits, returning an average of 0.36% or $4.3k for the period.

13. To

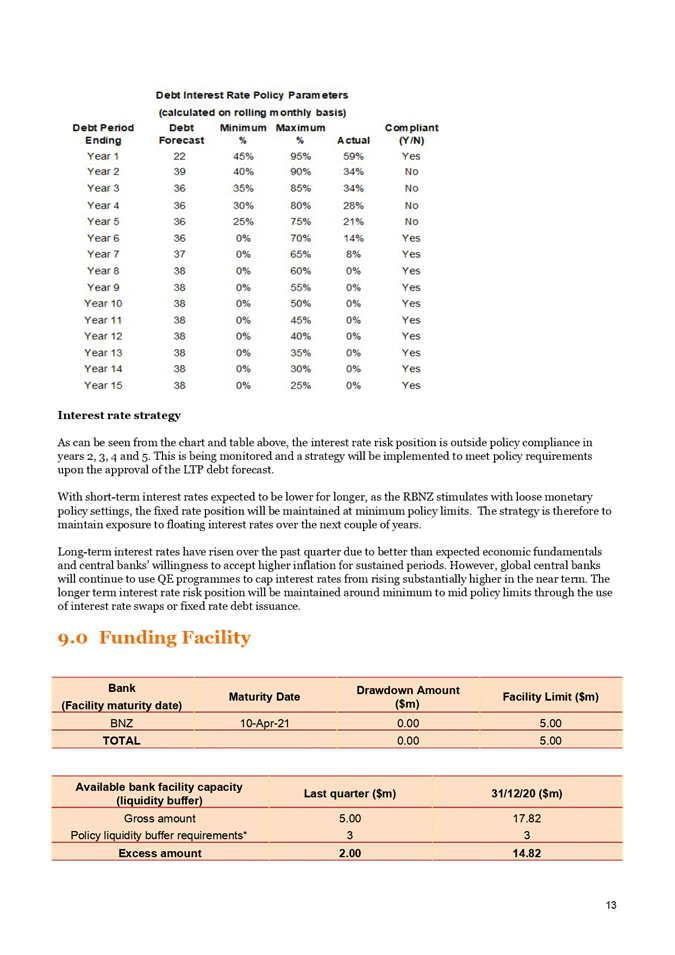

further manage its liquidity risk, HBRC currently retains a Standby Facility with BNZ. This facility provides HBRC with a

same day draw down option, to any amount between $0.3-$5.0m, and with no

minimum draw period. The cost of the current facility is an annual line

fee 0.30% ($15,000) + a margin above BKBM of 1.1% on any borrowings.

14. This

facility is due to expire in April 2021 and Officers are currently pursuing

options to extend this Facility for a further 3 years.

14.1. Currently

BNZ 3-year indicative cost is an Annual Line Fee 0.35% ($17,500) and a margin

above BKBM of 1.3%. This pricing remains competitive when compared to the

15-month Standby Facility being offered by the LGFA whom price the Annual Line

fee of 0.20% ($10,000) + a margin above BKBM of 0.90%. Additionally, the LGFA

requires a business days’ notice, a minimum draw down of $1.0m and a 30

day minimum draw period.

15. The graph

below shows the daily closing cash position and Term Deposits held throughout

Q2.

16. Low

interest rates are expected to remain throughout the remainder of the financial

year impacting the 2020-21 budgeted income received from cash deposits -

budgeted at $0.4m or 4.5%. A recent revised forecast based on current interest

rates is $0.2m or 1.5%. The $0.2m shortfall will be offset by lower than

budgeted borrowing rates.

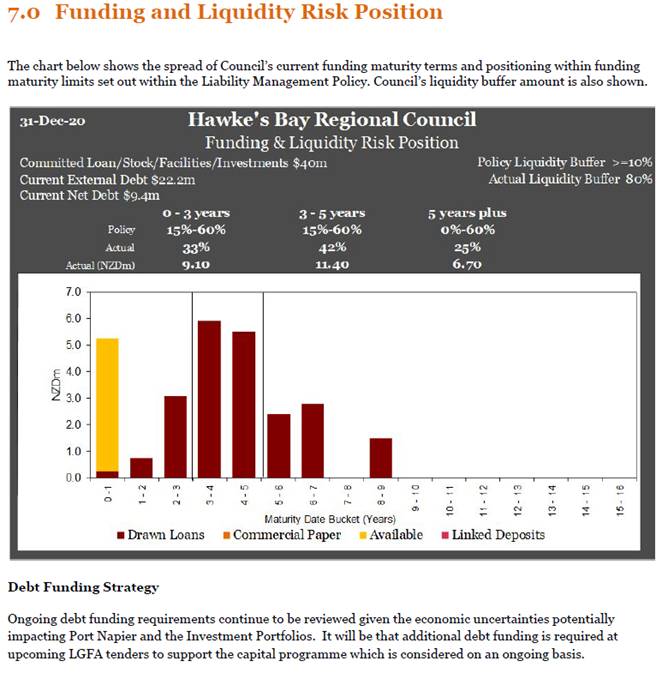

Debt Management

17. As at 31

December 2020, current external debt was $22.2m, $38.9m when taking into

consideration the internal $16.7m HBRIC Loan. All financial covenant ratios are

currently at least 4 times under any internal or external limit. The financial

covenant ratios can be seen in the attached PwC report.

18. The year

end position is forecast at $38.1m. Accounting for the existing $22.2m

plus forecast $15.9m requirement detailed below. This is slightly above that

forecast in the 2018-28 LTP, which forecast borrowing to be $35.5m at the end

of the 2020-21 year.

19. As the

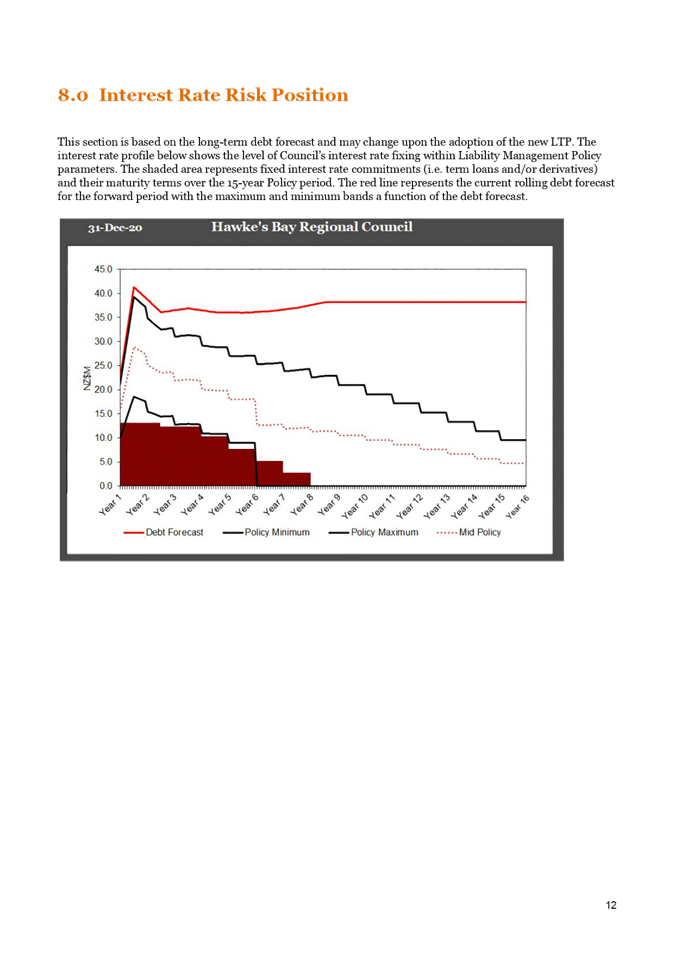

current debt profile continues to mature, and the 2020-21 forecast borrowing is

not required yet, HBRC is currently outside its interest rate risk management

policy. The policy is written

to minimize any adverse movements in interest rates which could affect future

Council Cash Flows. As per the Policy, Officers now have 90 days to correct the

interest profile before it becomes a policy breach.

20. The

borrowing discussed below will be raised with the LGFA via the scheduled March

2021 tender. Officers will work with PwC to ensure that HBRC realigns to

its Interest Rate Risk Policy by the end of the next quarter.

21. The table

below details forecast debt requirements compared to the 2020-21 Annual Plan.

|

Loan Requirements

|

2020-21

Annual Plan

|

2020-21 Debt Requirement

|

Variance

|

|

|

$000

|

$000

|

$000

|

|

Sustainable Homes

|

3,527

|

3,527

|

-

|

|

Systems Integration

|

1,913

|

1,275

|

(638)

|

|

Building Accommodation

|

2,000

|

500

|

(1,500)

|

|

HBRC Recovery Fund

|

1,000

|

100

|

(900)

|

|

Integrated Catchment

|

2,250

|

4,700

|

2,450

|

|

Covid-19 Budget Impacts

|

7,584

|

5,000

|

(2,584)

|

|

Other

|

755

|

755

|

-

|

|

Total

|

19,029

|

15,857

|

(3,172)

|

22. 2020-21

borrowing is forecast at $15.9m, $3.2m lower than planned.

23. As at 31

December 2020, the borrowing forecast of $15.9m is based on the expected full

year expenditure for 2020-21. The adjusted forecast requirements for

“Systems Integration” and “Building Accommodation” is

due to the timing of expenditure and request to carry forward this borrowing

into 2021-22 is expected.

24. Borrowing

required for the Covid-19 related reduction in investment income is subject to

change. Any upside in investment income, from either an additional HBRIC

dividend or managed fund returns, will reduce the current requirement.

25. The

Recovery Fund has committed spend of $300k, $200k in outer years.

Managed Funds

26. For the

purposes of this report, the following terms have been referred to and have the

following meaning.

|

Term

|

Meaning

|

|

Gross Income

Net of Fees

|

The full

amount the fund has returned for the period, net of any fees paid to the fund

managers. This amount remains in the funds unless divested.

|

|

Capital

Protection

|

The amount

the fund must earn in relation to the rate of inflation to retain its real

purchasing power.

|

|

Funding

Council Operating Costs

|

The amount

the fund must earn to fund Council operating costs (offsetting rating

requirements).

|

|

Divested

Capital

|

Unrealised

Gross Income Net of Fees less Capital Protection and have now been withdrawn

from the funds.

|

|

Undivested

Funds Available

|

Unrealised

Gross Income Net of Fees less Capital Protection that are still invested

within the funds.

|

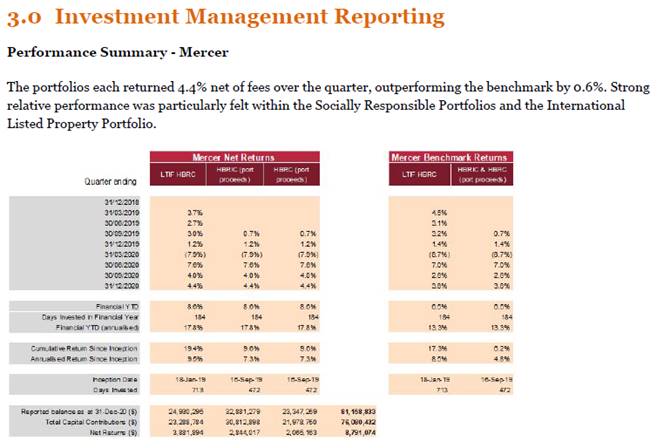

27. The first

six months of 2020-21 saw better than expected results achieved with an average

gross income net of fees of 9% (annualised 17%) compared to the Post Covid-19

2020-21 Annual Plan of 3% (6% annualised).

28. This

performance aligns with general market expectation given the results of the US

election and the announcement of a successful COVID-19 vaccine trial. Both

events reduce uncertainty either by reducing a tariff-inspired manufacturing

recession or a clearer pathway out of the pandemic.

29. Officers

remain cautiously optimistic regarding the expected full year 2020-21

performance. In mid-December, Officers, with FARS endorsement divested $6.4M

from the Funds. Thereby ensuring prior gains are realised and available to fund

operating costs.

30. Council’s

current policy is silent on triggers which define at what point divestment from

the managed fund should occur. With global markets seemly at a high in December

2020 Officers made the prudent decision to divest $6.4m, de-risking the future

possibility of losing any of the unrealised gains.

31. At the

time of the divestment, $6.4m equaled the current policy limit of what could

have been withdrawn less the required capital protection for the remaining six

months of the 2020-21 year ($1.1M).

32. After the

December 2020 divestment, the Q2 actual closing position reflects that an

additional $3.4m could have been divested, or $2.2m whilst still protecting the

capital base until June 2021.

33. If the

current strong performance of the funds continues, there will be potential for

further divestment, reducing the forecast borrowing requirement arising from

the Covid-19 adjusted 2020-21 Annual Plan.

34. The table

and graphs below summarise the quarter end fund balances over the last 12

months.

|

Fund

|

31 Dec 2019

|

31 Mar 2020

|

30 Jun 2020

|

30 Sep 2020

|

31 Dec 2020

|

|

|

$000

|

$000

|

$000

|

$000

|

$000

|

|

Long-Term

Investment Fund

|

50,674

|

46,305

|

49,950

|

51,810

|

49,925 *

|

|

Future

Investment Fund

|

44,724

|

41,712

|

61,128

|

63,094

|

64,300 *

|

|

Total

|

95,398

|

88,017

|

111,078

|

114,904

|

114,224

|

* December 2020 saw Funds being divested for the first

time, which explains the reduced fund balance.

Long-term

Investment Fund

35. Invested

since November 2018, the fund provides a return which, protects capital value

first and then funds Council’s operating costs.

36. The table

below shows the LTIF income earned YTD against the 2020-21 Annual Plan.

|

Income

|

Full Year Annual Plan 2020-21

|

YTD Ann. Plan

|

YTD Q2 Actuals

|

Variance to YTD Ann. Plan

|

|

|

$000

|

%

|

$000

|

%

|

$000

|

%

|

$000

|

|

Capital Protection

|

838

|

2%

|

419

|

1%

|

480

|

1%

|

61

|

|

Fund Operating Costs

|

1,876

|

4%

|

938

|

2%

|

3,973

|

8%

|

3,035

|

|

Gross

Income Net of Fees

|

2,715

|

6%

|

1,357

|

3%

|

4,453

|

9%

|

3,096

|

37. The table

below shows the key balances of the LTIF as at the end of Q2.

|

|

1 July 2020 – Opening Balances

|

31 December 2020 – Closing Balances

|

|

|

Capital Protected Balance

|

Undivested Funds Available

|

Total Fund Balance

|

Capital Protected Balance

|

Undivested Funds Available

|

Total Fund Balance

|

|

|

$000

|

$000

|

$000

|

$000

|

$000

|

$000

|

|

LTIF

|

47,996

|

1,954

|

49,950

|

48,476

|

1,449

|

49,925

|

38. The table

above has been prepared as at 31 December 2020 (Q2), it should be noted, that

the LTIF needs to earn a further $480k, to meet the required annual capital

protection of $980k. This amount is slightly different to the 2020-21 Annual

Plan, due to the budgeted numbers being set off the Fund Balances in March

2020.

Future Investment

Fund (FIF)

39. Invested

since September 2019, the fund provides a return which, protects capital value

first and then funds Council’s operating costs.

40. The table

below shows the FIF income earned YTD against the 2020-21 Annual Plan.

|

Income

|

Full year Annual Plan 2020-21

|

YTD Ann. Plan

|

Q2 YTD Actuals

|

Variance to YTD Ann. Plan

|

|

|

$000

|

%

|

$000

|

%

|

$000

|

%

|

$000

|

|

Capital Protection

|

974

|

2%

|

487

|

1%

|

618

|

1%

|

131

|

|

Fund Operating Costs

|

1,690

|

4%

|

845

|

2%

|

4,496

|

7%

|

3,651

|

|

Gross Income Net of

Fees

|

2,665

|

6%

|

1,332

|

3%

|

5,114

|

8%

|

3,781

|

41. The table

below shows the key balances of the FIF as at the end of Q2.

|

|

1 July 2020 – Opening Balances

|

31 December 2020 – Closing Balances

|

|

|

Capital Protected Balance

|

Undivested Funds

Available

|

Total Fund Balance

|

Capital Protected Balance

|

Undivested Funds

Available

|

Total Fund Balance

|

|

|

$000

|

$000

|

$000

|

$000

|

$000

|

$000

|

|

FIF

|

61,775

|

(647)

|

61,128

|

62,394

|

1,906

|

64,300

|

42. As

mentioned previously, the table above has been prepared as at 31 December 2020

(Q2), similar to the LTIF, the FIF will need to earn a further $618k, to meet

the required annual capital protection of $1,236k.

Investment

Property

43. In the

current financial period, 2020-21, 5 Napier Endowment Leasehold Properties have

been freeholded totaling $776k. $693k of this has been subsequently paid to ACC

as settlement for the remaining 42 years rent for these properties.

44. HBRC has

recently been contacted by a Leasehold occupier in Wellington regarding the

Freeholding of the land. The Leasehold

offer and how this aligns to HBRC investment strategy will be presented at the

Corporate and Strategic Committee in March 2021 (publicly excluded).

HBRIC

45. On 18

December 2020, HBRC received a dividend payment of $4.0m from HBRIC, $1m

favourable to the $3.0m budgeted in the Covid-19 adjusted Annual Plan.

46. Per

Council Policy, HBRIC will separately provide a six-monthly update to Corporate

at Strategic committee in March 2021. Main matters of relevance are:

46.1. PONL

advised it would pay $0.05 per share as its interim dividend. HBRIC holds 110M

shares (55%) resulting in a $5.5m dividend

46.2. There

is potential in that the PONL will pay a final dividend in June 2021

46.3. The following

table shows the key balances of the FIF (HBRIC) as at the end of Q2.

|

|

1 July 2020 – Opening Balances

|

31 December 2020 – Closing Balances

|

|

|

Capital Protected Balance

|

Undivested Funds

Available

|

Total Fund Balance

|

Capital Protected Balance

|

Undivested Funds

Available

|

Total Fund Balance

|

|

|

$000

|

$000

|

$000

|

$000

|

$000

|

$000

|

|

FIF

|

46,584

|

(964)

|

45,620

|

47,000

|

1,314

|

48,314

|

2020-21 Year to

Date Performance Summary

47. The

following table shows investment income to date against the 2020-21 Annual

Plan.

|

Income

|

Annual Plan 2020-21

|

YTD Ann. Plan

|

Q2 Actuals

|

Variance to YTD Ann. Plan

|

|

|

$000

|

$000

|

$000

|

$000

|

|

Other financial

assets

|

4,195

|

2,097

|

7,387

|

5,290

|

|

Managed Funds

|

3,567

|

1,783

|

7,371

|

5,588

|

|

Other Interest*

|

628

|

314

|

16

|

(298)

|

|

Investment property

|

2,343

|

1,171

|

830

|

(131)

|

|

Endowment leasehold

land

|

1,502

|

751

|

620

|

(131)

|

|

Wellington Leasehold

land

|

841

|

420

|

420

|

-

|

|

Dividends

|

5,369

|

4,184

|

7,012

|

4,328

|

|

PONL Dividend

|

3,000

|

3,000

|

5,500

|

2,500

|

|

Managed Fund

|

2,369

|

1,184

|

3,012

|

1,828

|

|

Total

|

11,907

|

7,452

|

16,729

|

9,487

|

* Includes Interest budgeted to be earnt on

scheme reserves.

48. The $9.5m

favourable YTD performance should be considered cautiously. It is likely that

the majority of this performance will be a point in time variance and it

potentially will reduce significantly over the next 6 months, particularly when

considering the performance of the managed funds. 20-year historical data

suggests that an expected annual return for the funds should currently be

5.16%. With the funds returning an average six-month return of 8.64%, it would

be prudent to expect that the future returns will equalise over the next six

months and come more inline with a 5.16%. If performance does equalise, it

could be expected that the full year performance will be ~$2.0m ahead of

budget; not the current $7.4m.

49. The other

material significant change could arise via Napier Port paying HBRIC an interim

dividend in June 2021. Unlike the managed funds, this would continue to improve

the actual performance when compared to the 2020-21 Annual Plan

Decision Making Process

50. Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

50.1. The agenda item is in

accordance with the Finance, Audit and Risk Sub-committee Terms of Reference,

specifically “The Finance, Audit and Risk

Sub-committee shall have responsibility and authority to (2.4) monitor the performance of Council’s investment

portfolio”.

50.2. As this report is for information only, the decision making

provisions do not apply.

|

Recommendation

That the Finance, Audit and Risk

Sub-committee receives and notes the “Quarterly Treasury Report for

1 October - 31 December 2020” and confirms that the performance of

Council’s investment portfolio has been reported to the

Sub-committee’s satisfaction.

|

Authored by:

|

Geoff Howes

Treasury & Funding Accountant

|

Bronda Smith

Chief Financial Officer

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

⇩1

|

PWC HBRC

Treasury Reporting to 31 December 2020

|

|

|

|

PWC

HBRC Treasury Reporting to 31 December 2020

|

Attachment 1

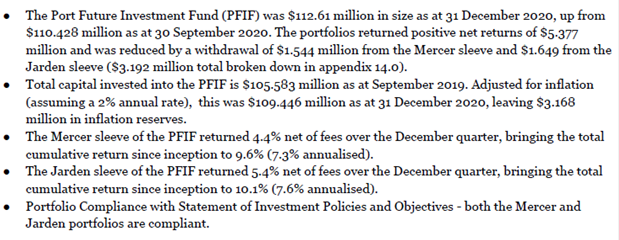

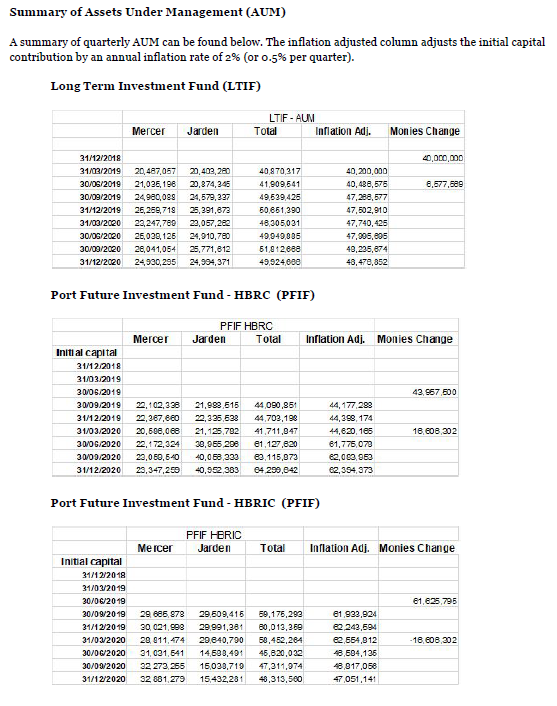

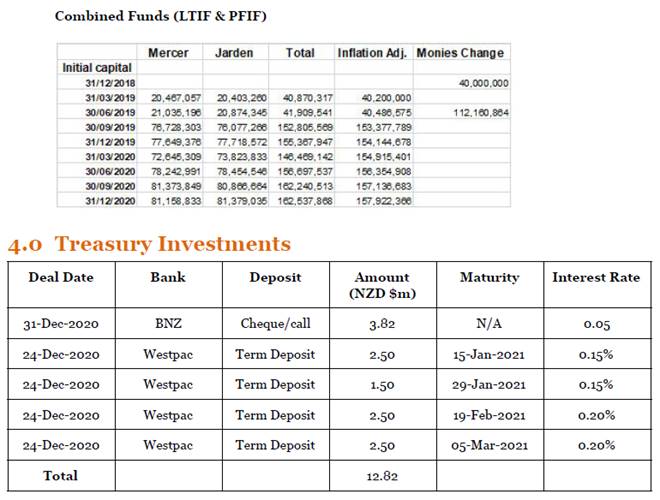

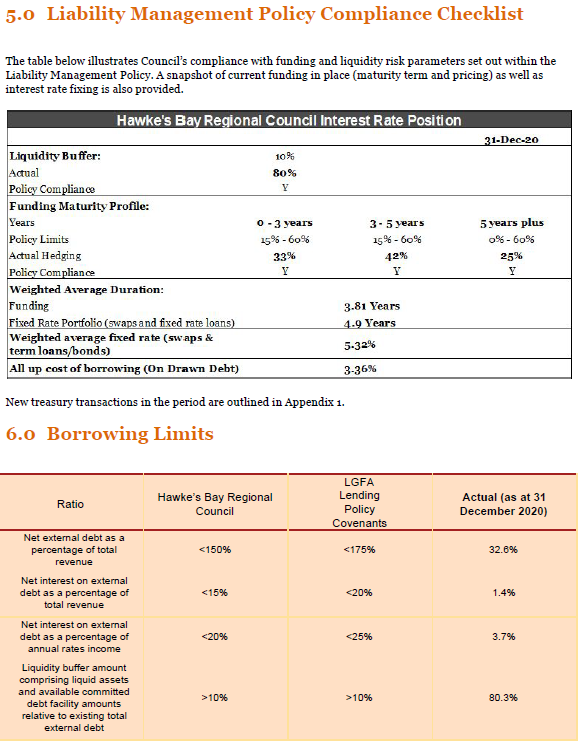

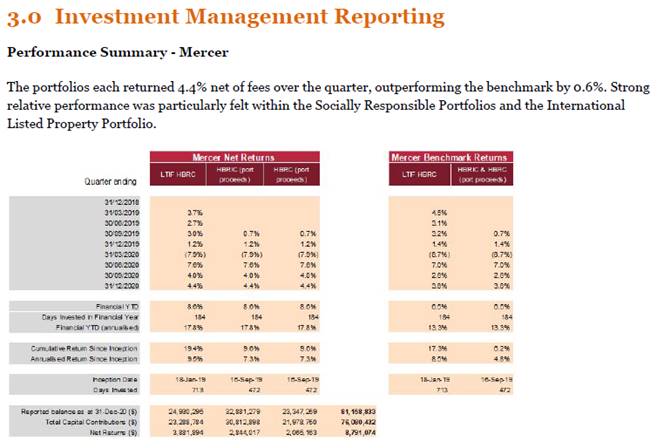

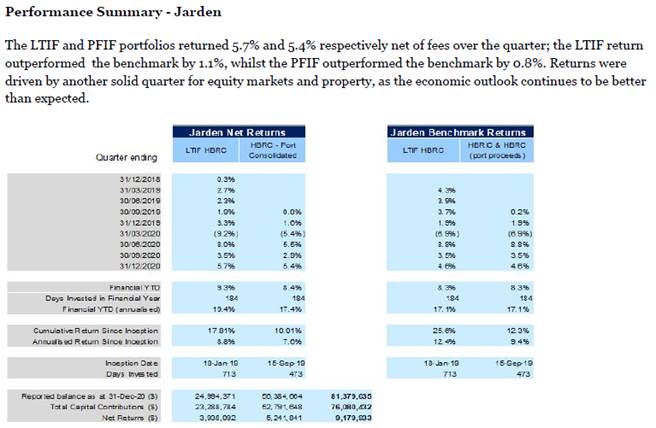

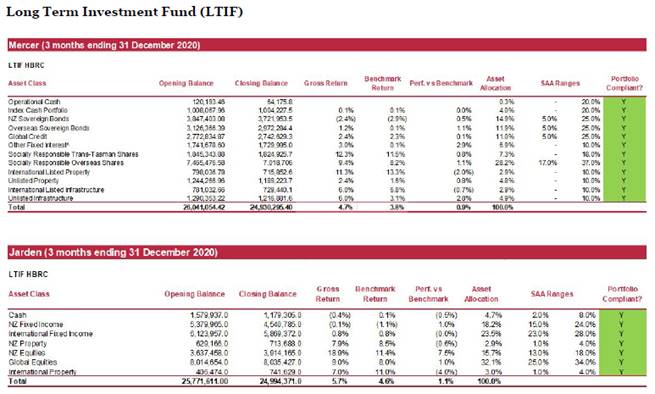

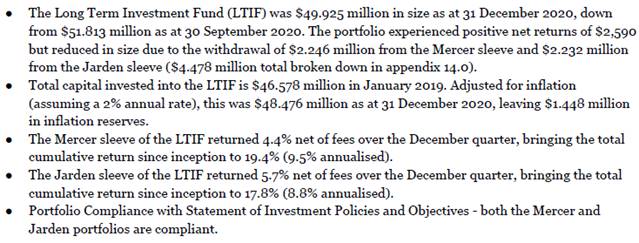

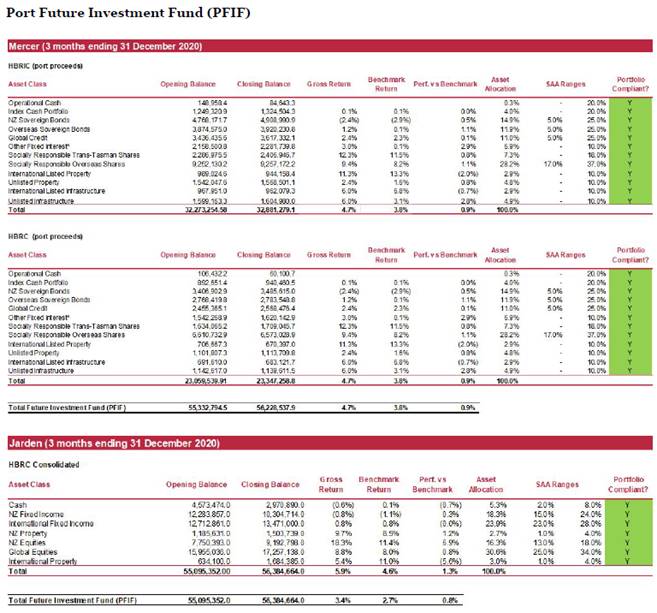

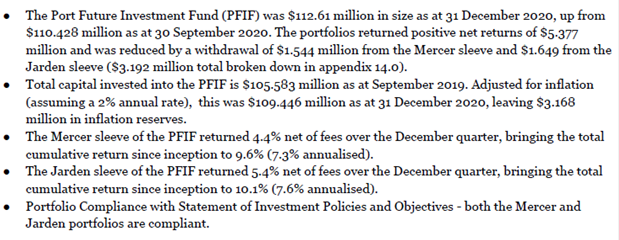

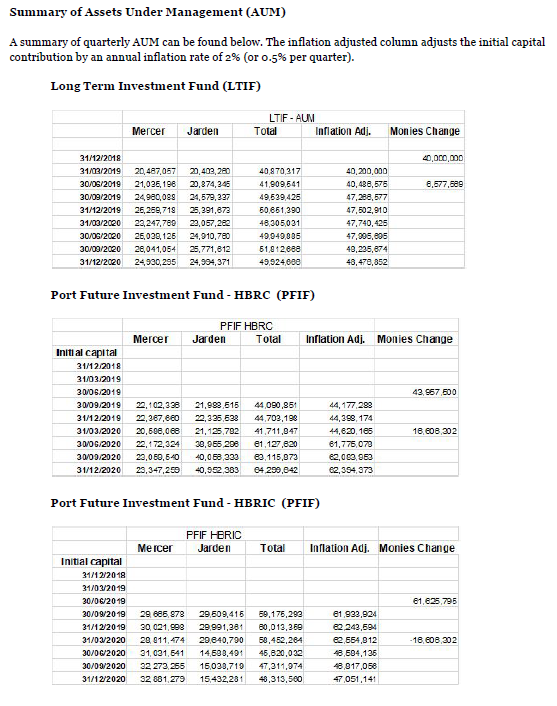

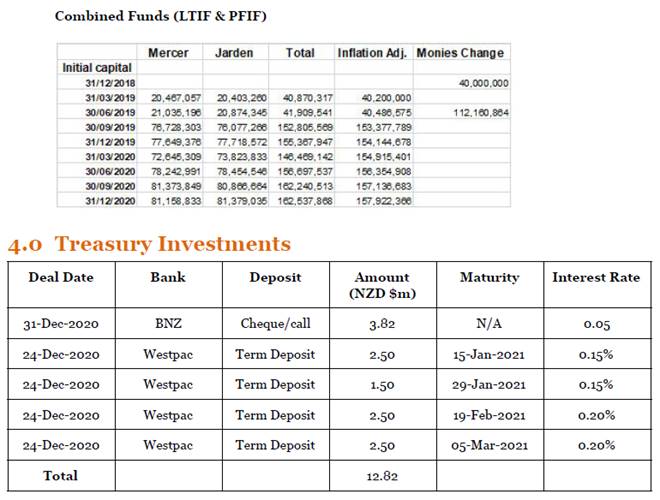

|