HAWKE’S BAY REGIONAL COUNCIL

Finance

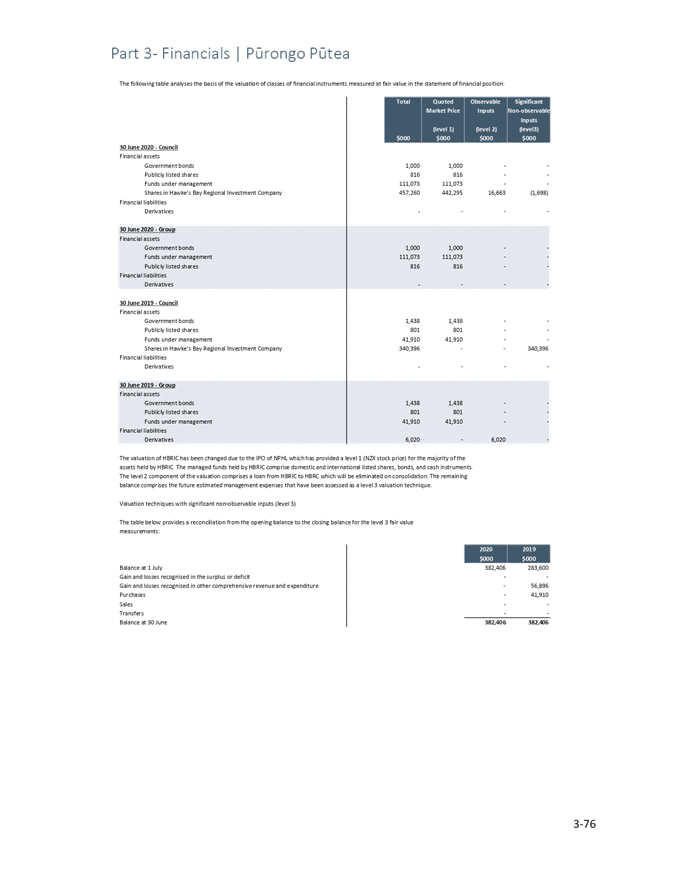

Audit & Risk Sub-committee

Tuesday 15 December 2020

Subject: 2019-20 Annual Report

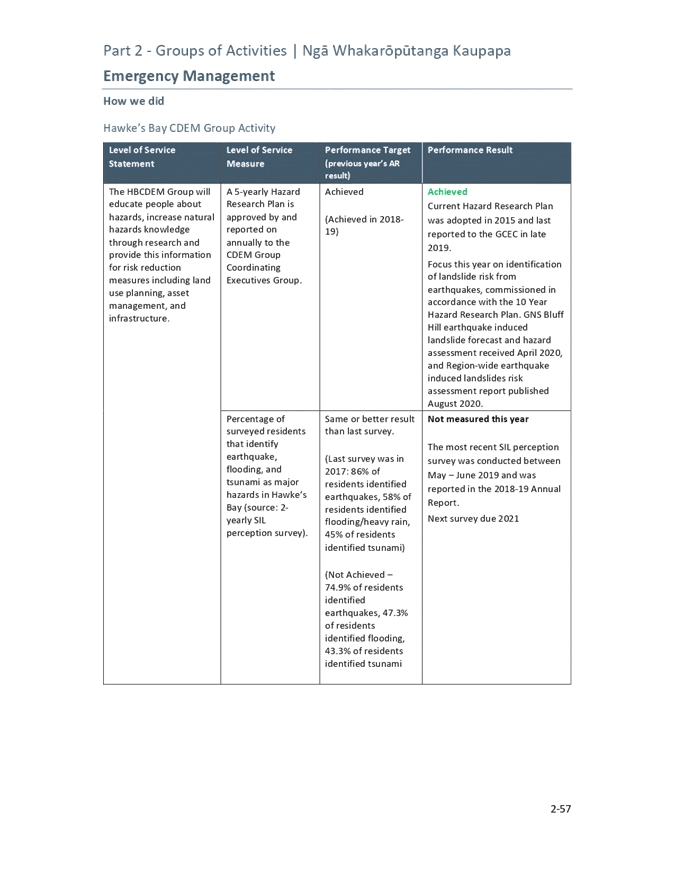

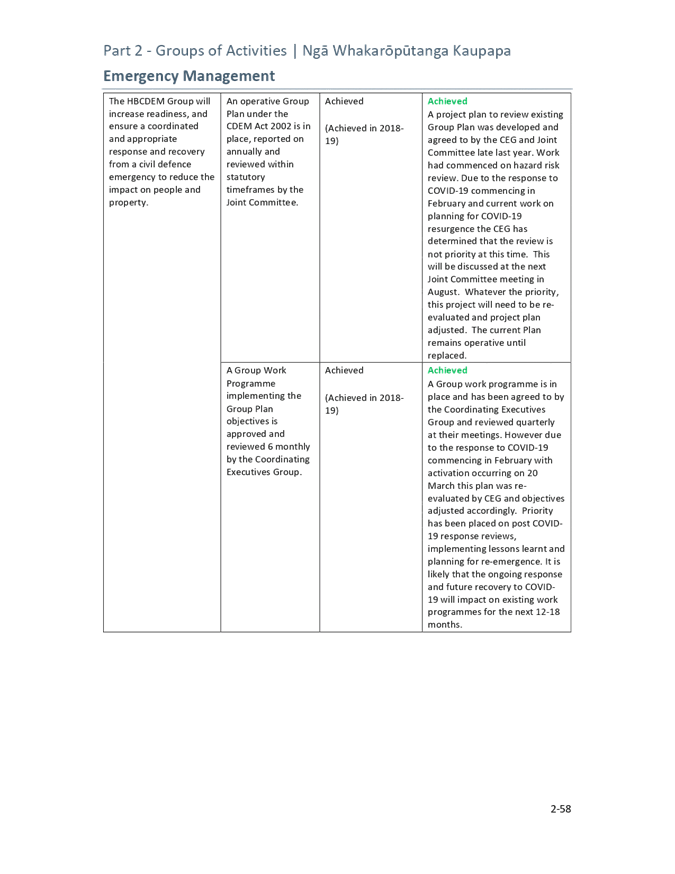

for Adoption

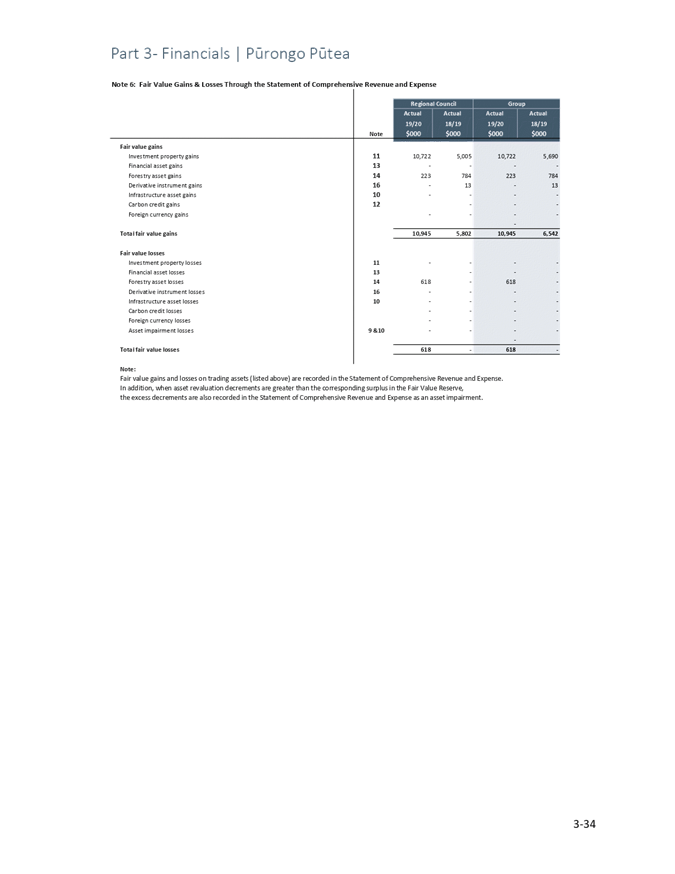

Reason for Report

1. This item

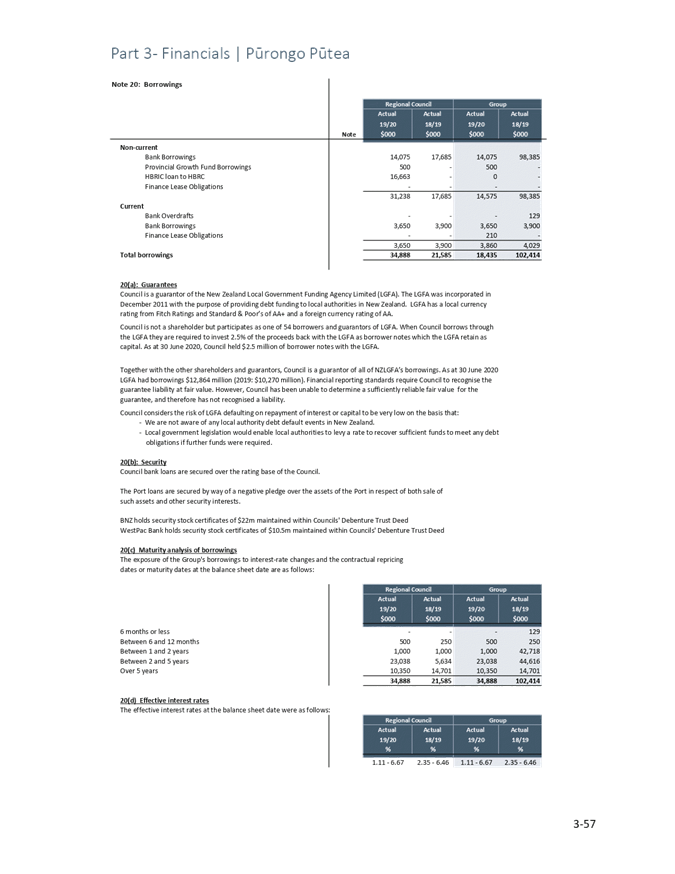

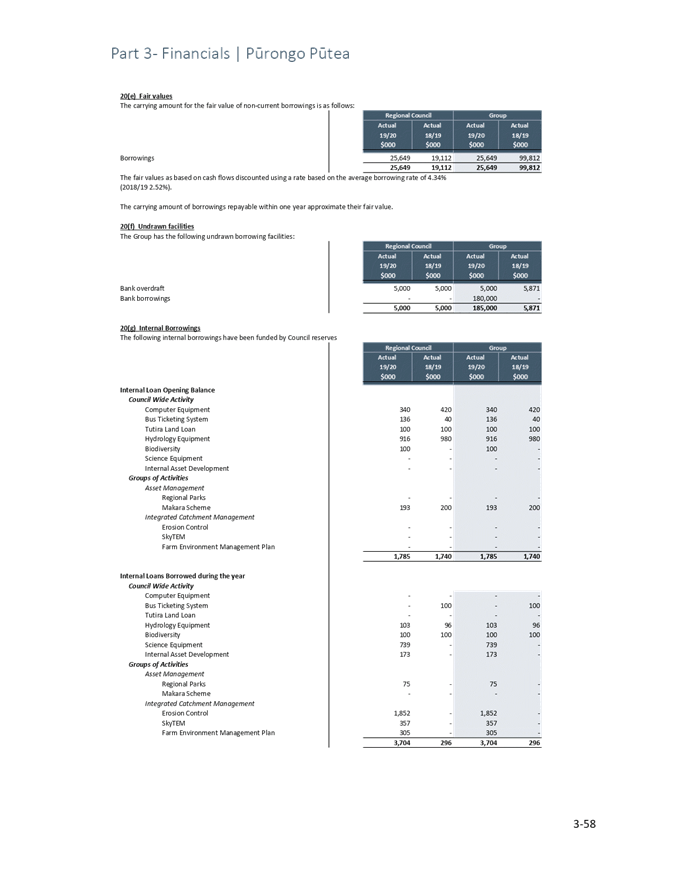

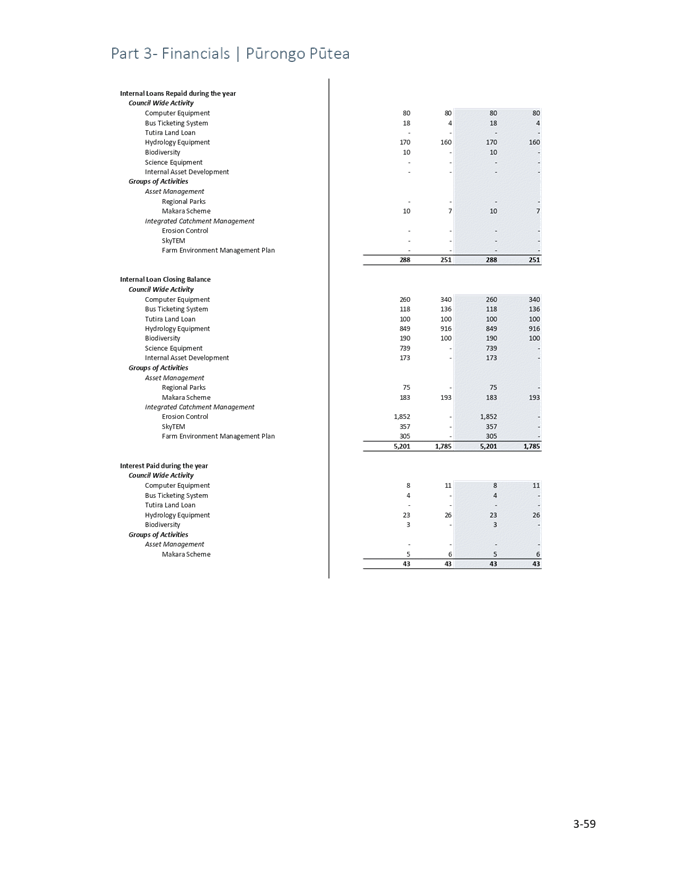

presents the Annual Report for the 2019-20 financial year to 30 June 2020.

Executive Summary

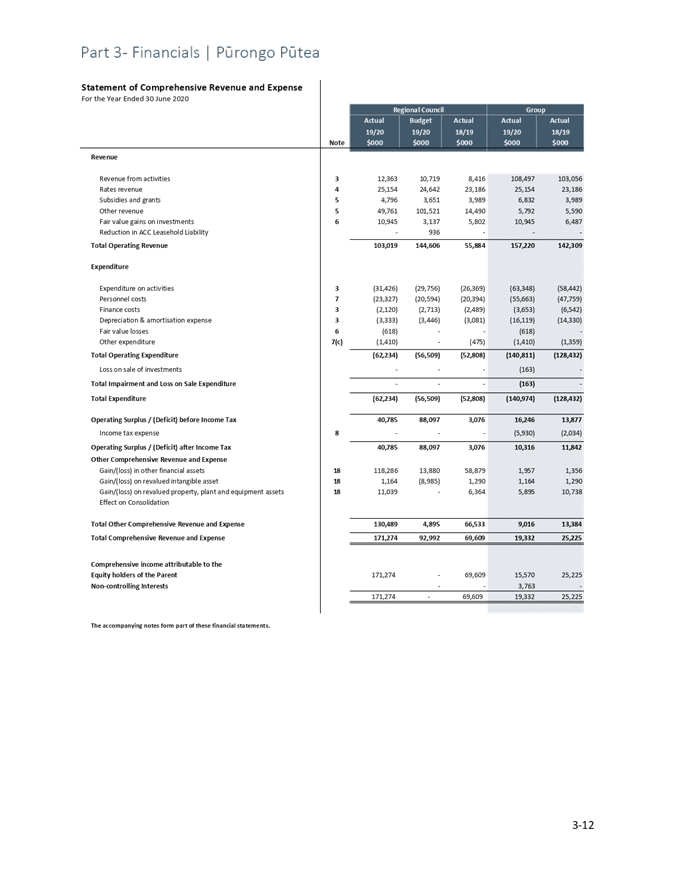

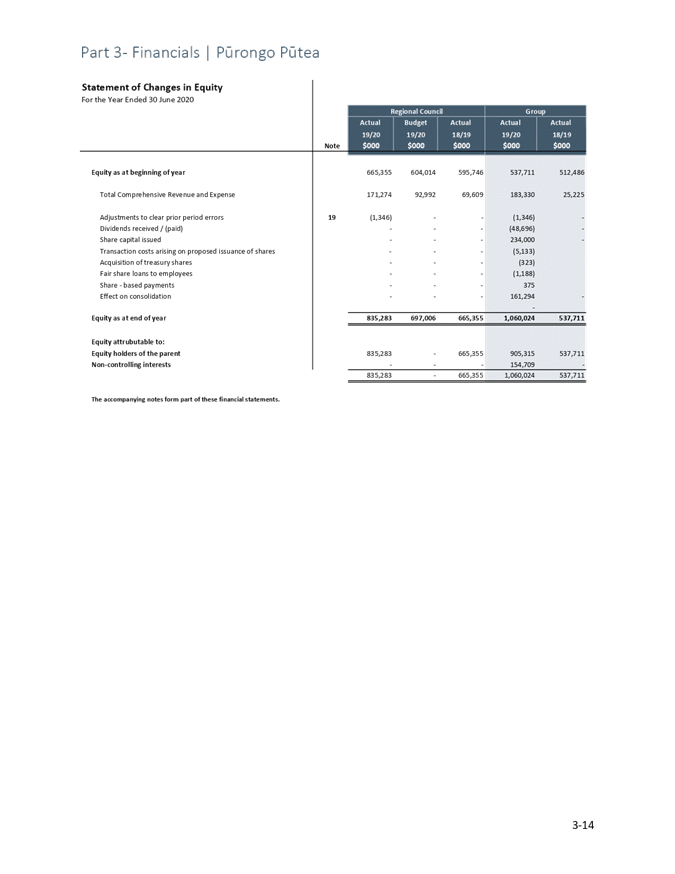

2. Operating

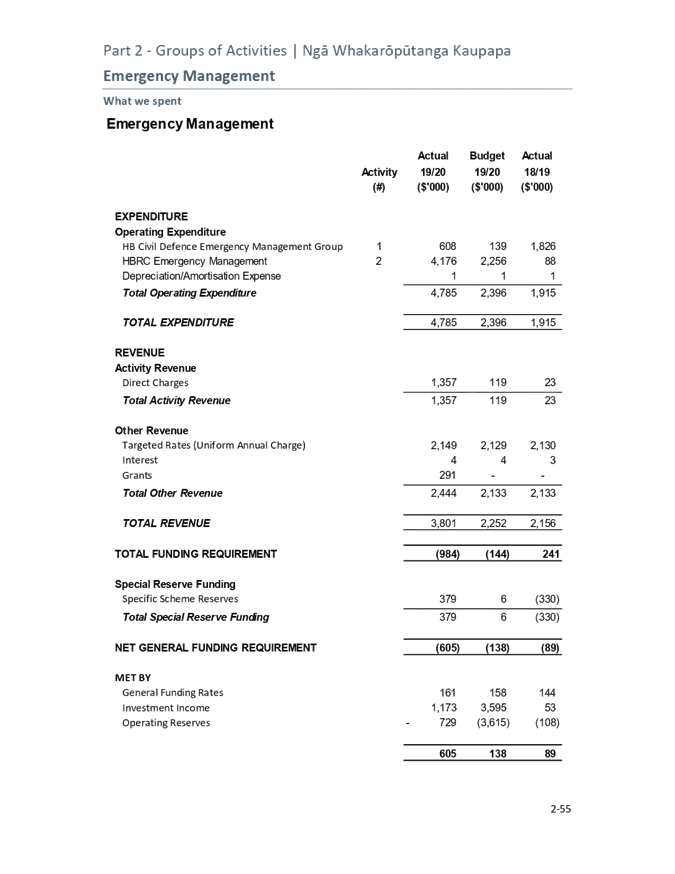

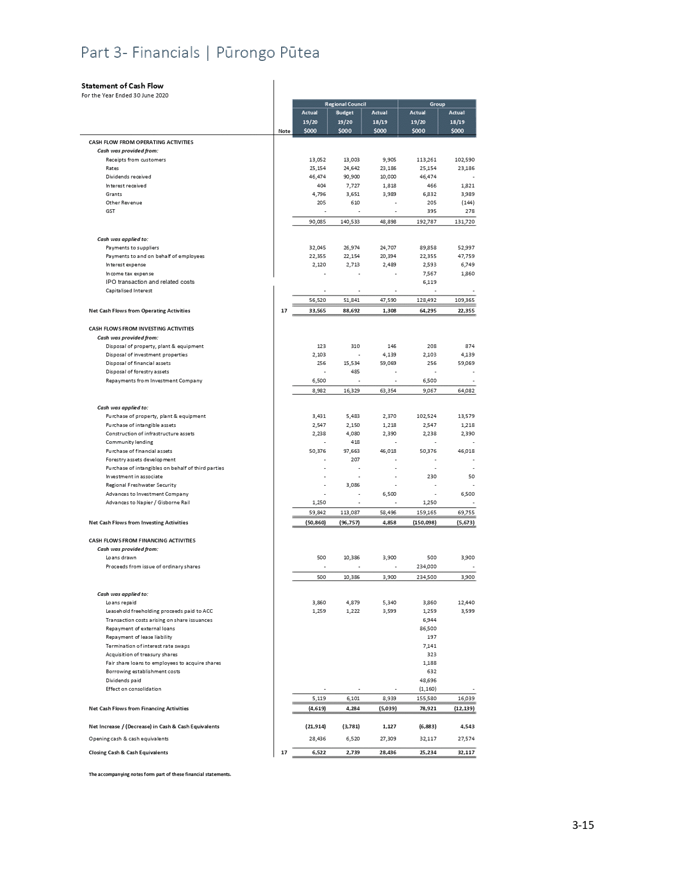

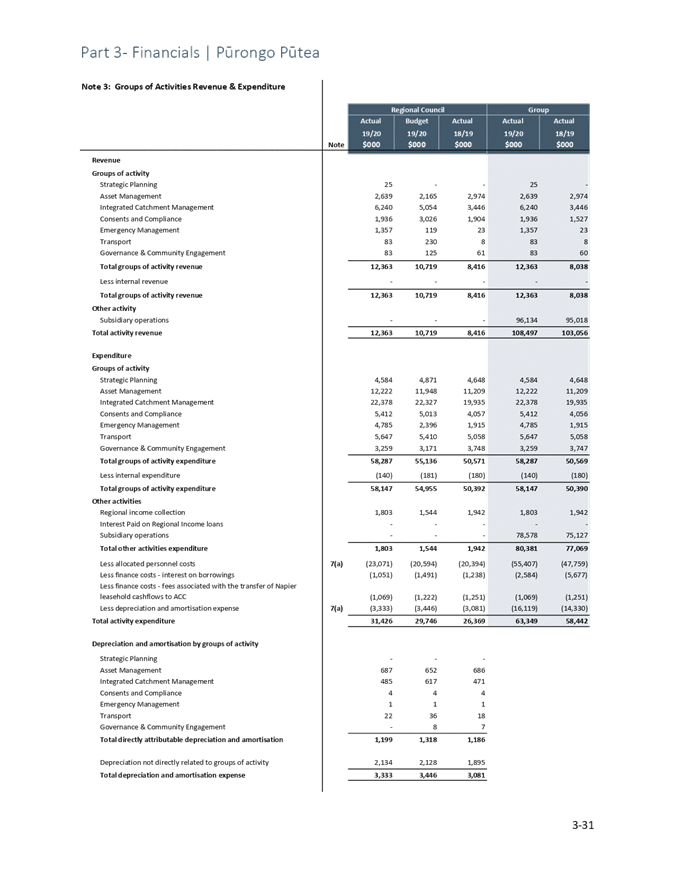

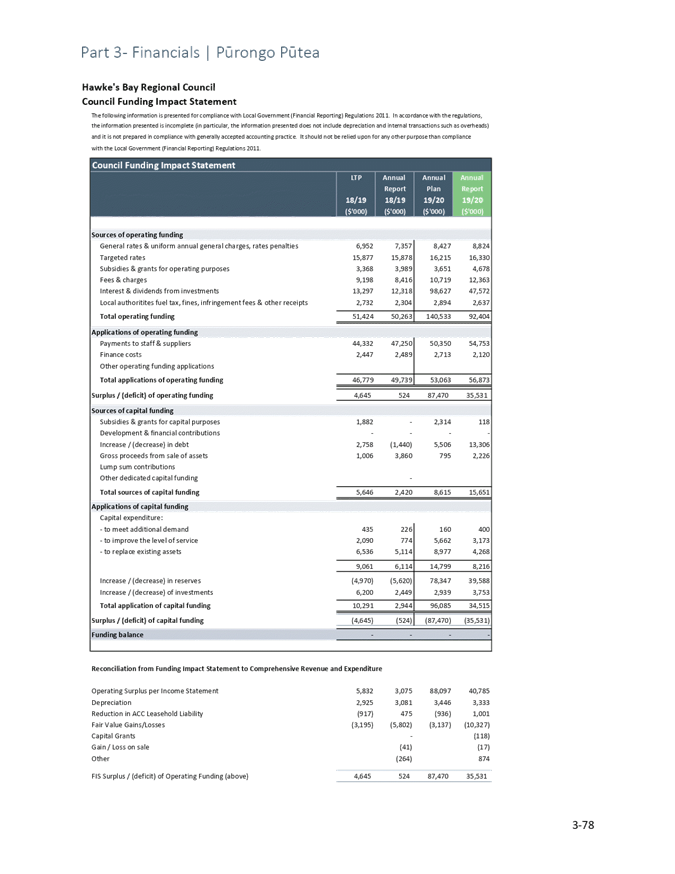

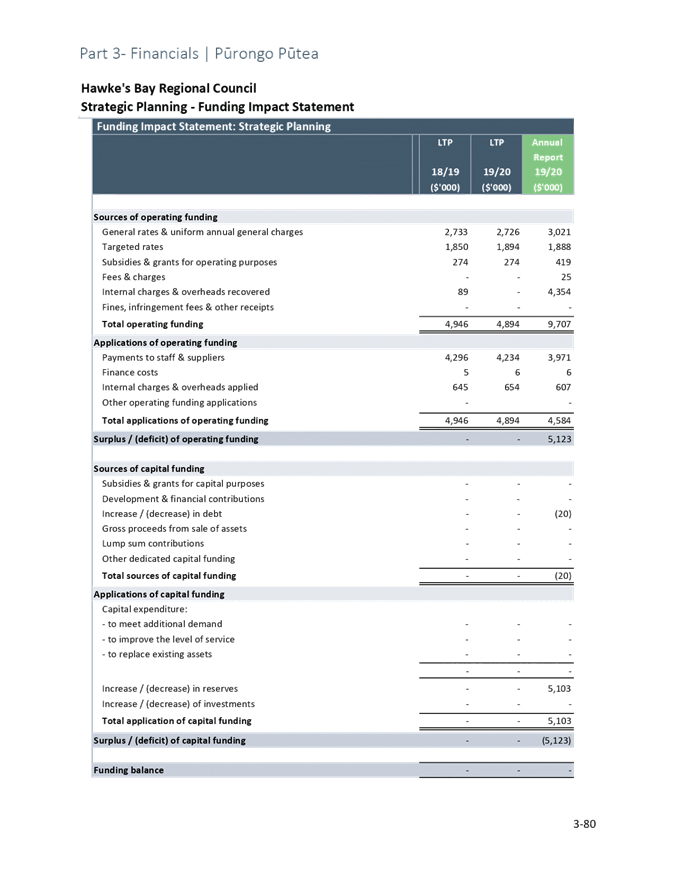

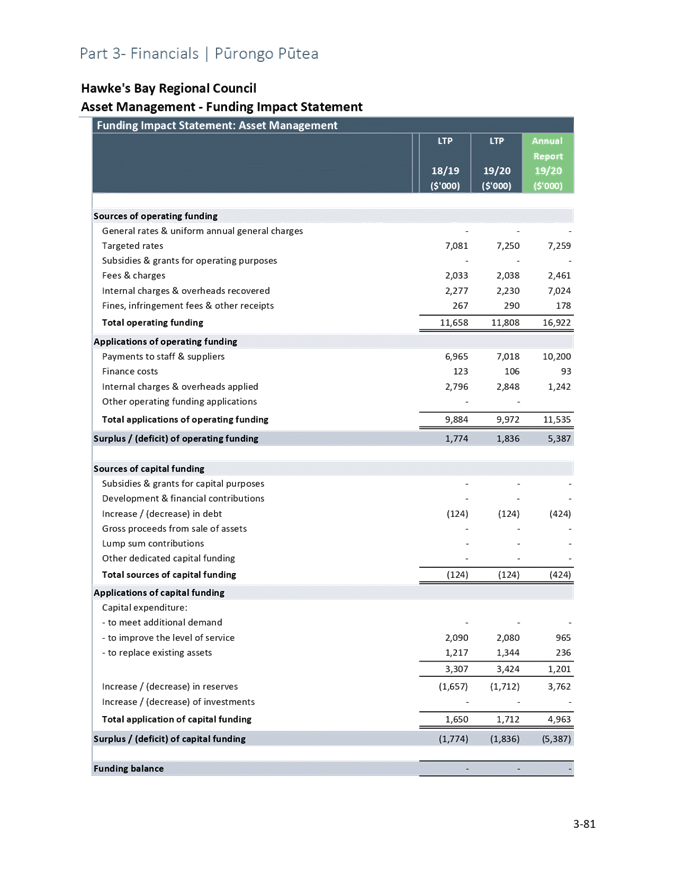

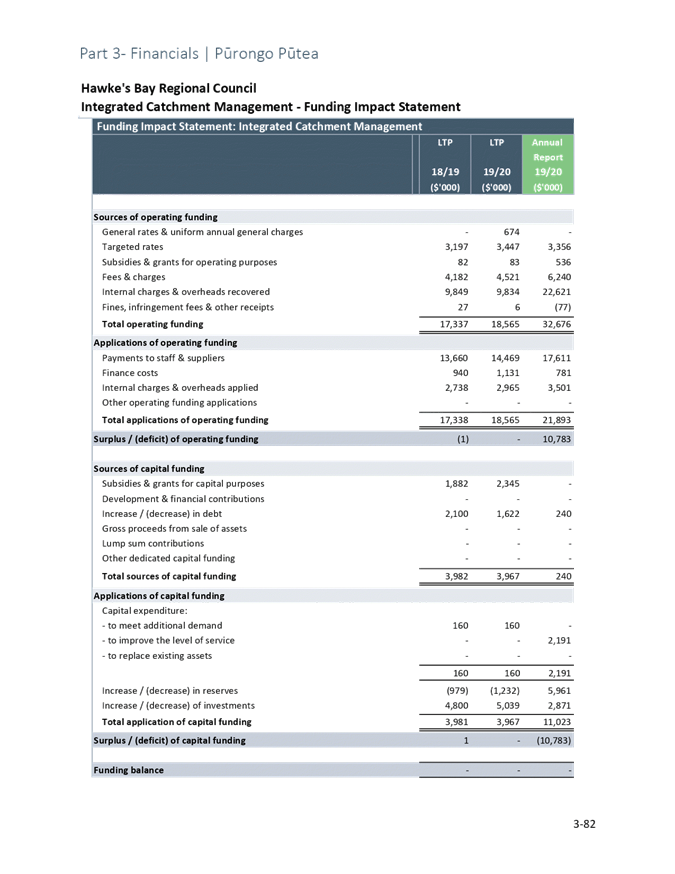

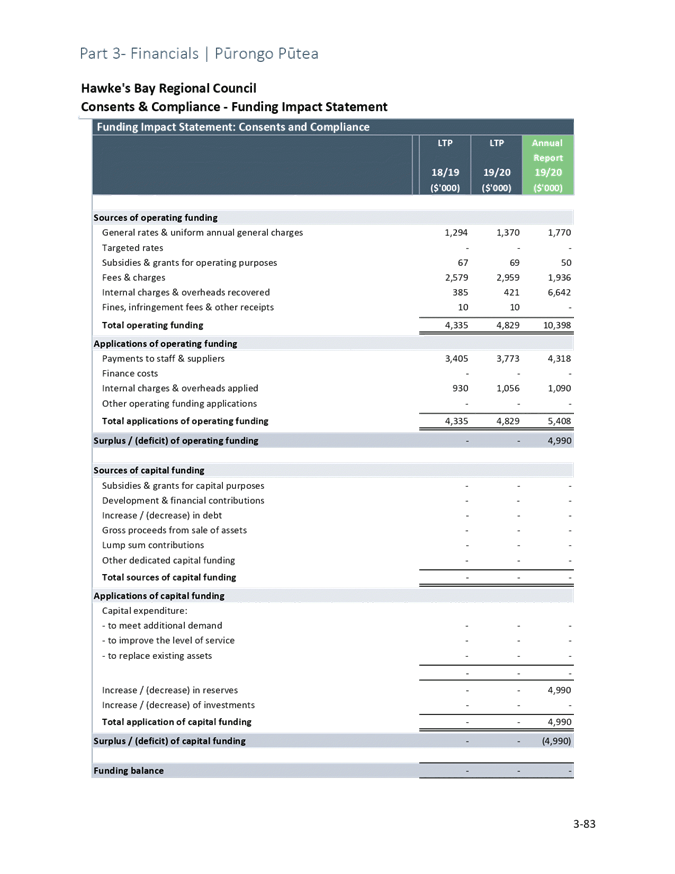

surplus is $40.8m, up from $3.08m in prior year but $47.3m below budget as a

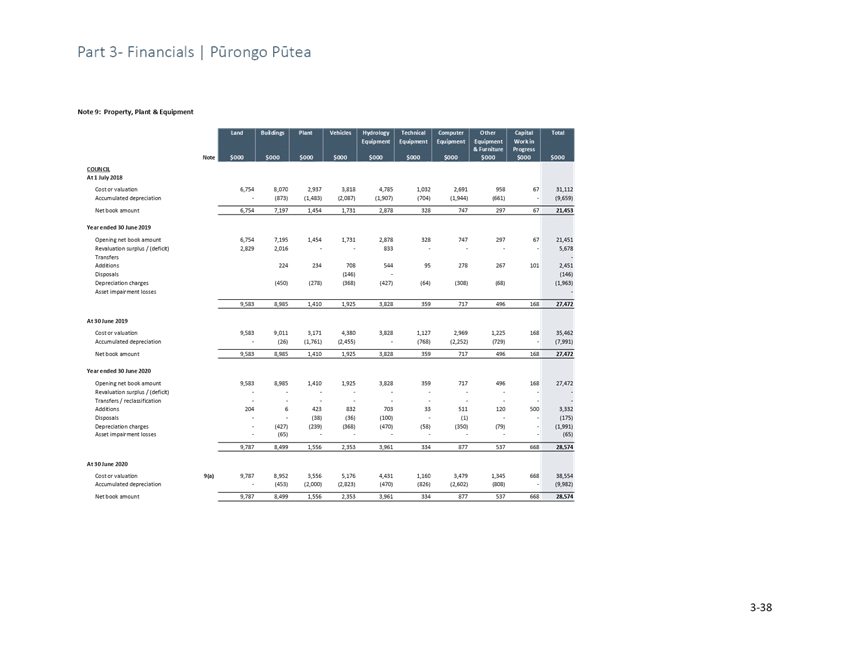

result of stranded Napier Port IPO funds retained within Hawke’s Bay

Regional Investment Company (HBRIC).

3. Excluding the

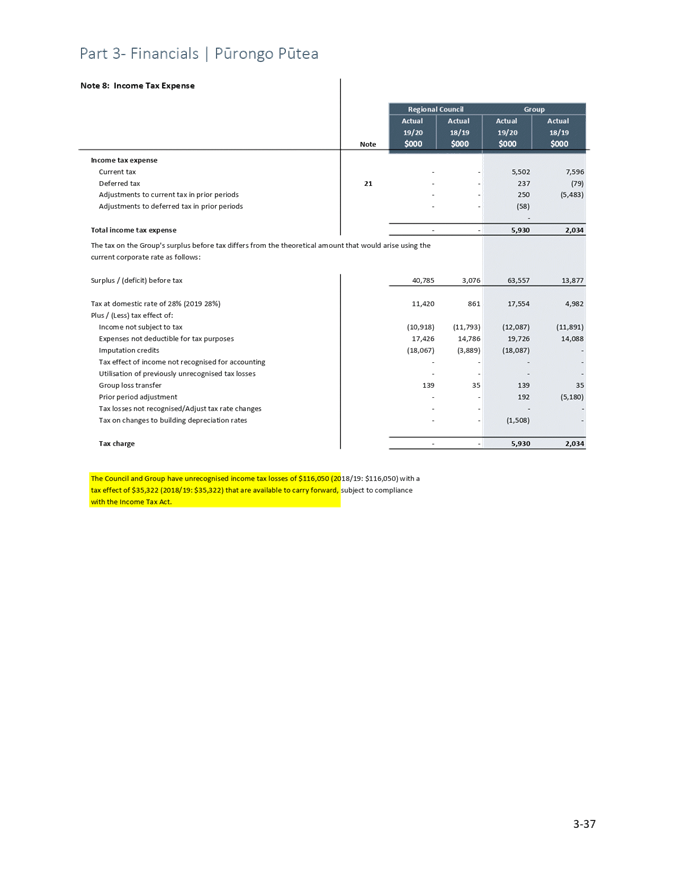

one-off Port IPO dividend, the year delivers a $3.2m deficit for the year

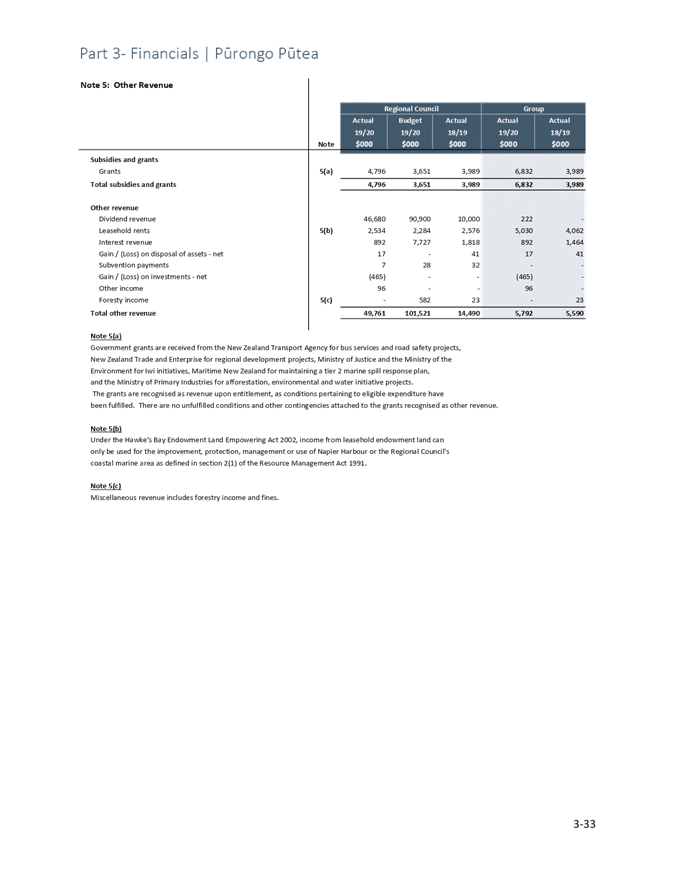

against a budget surplus of $7m.

4. The impact of

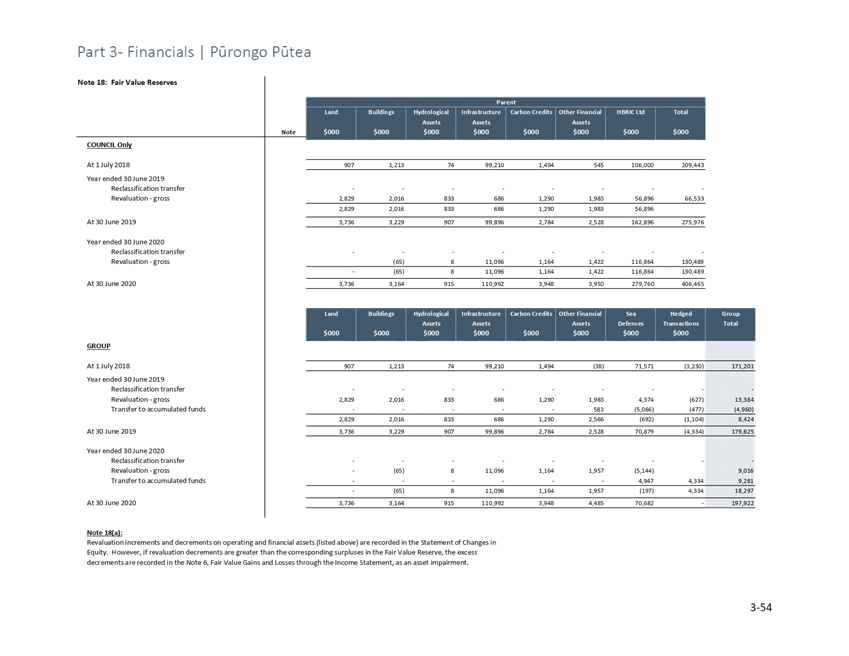

the pandemic on the financial markets and subsequent investment returns reduced

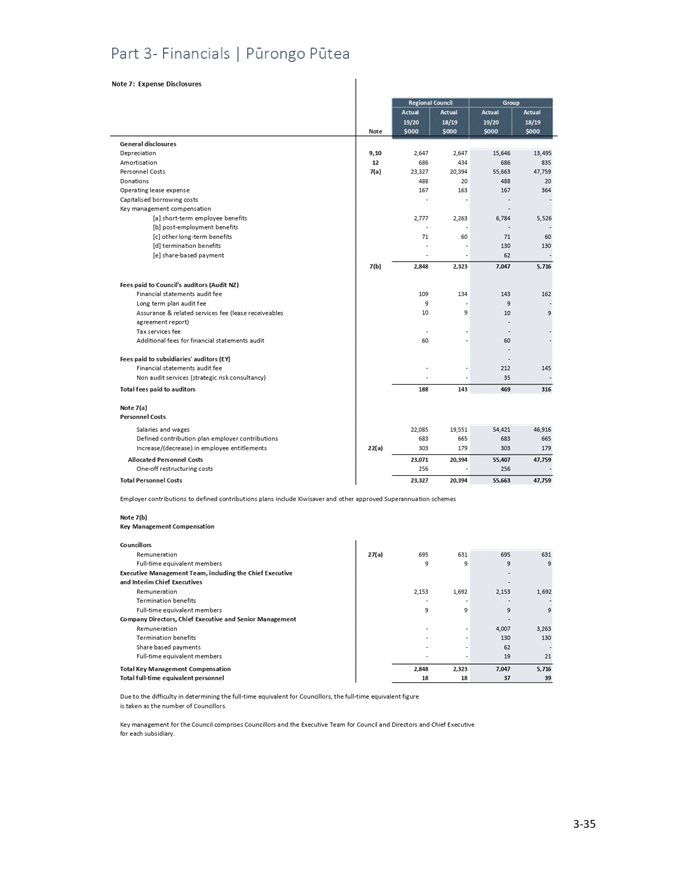

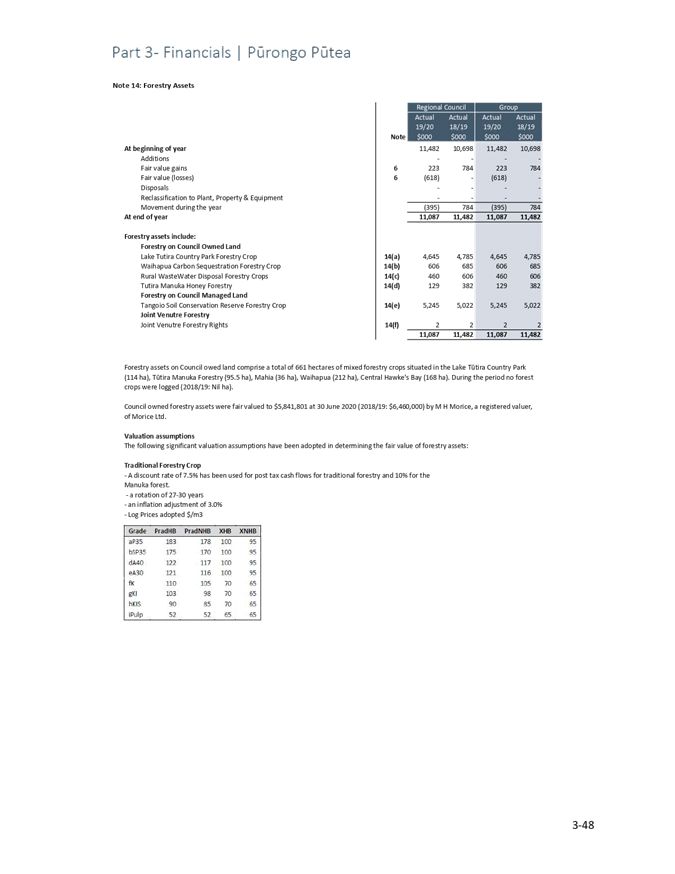

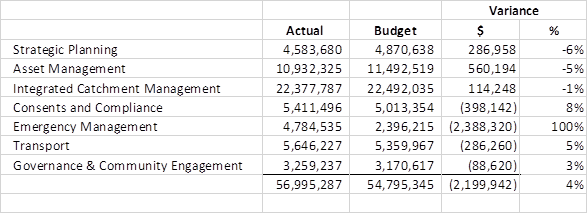

actual investment income from managed funds and other financial deposits to

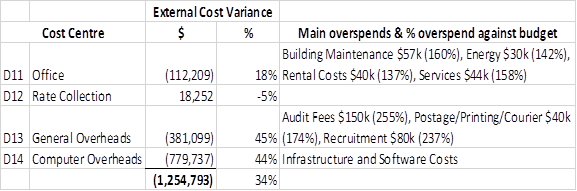

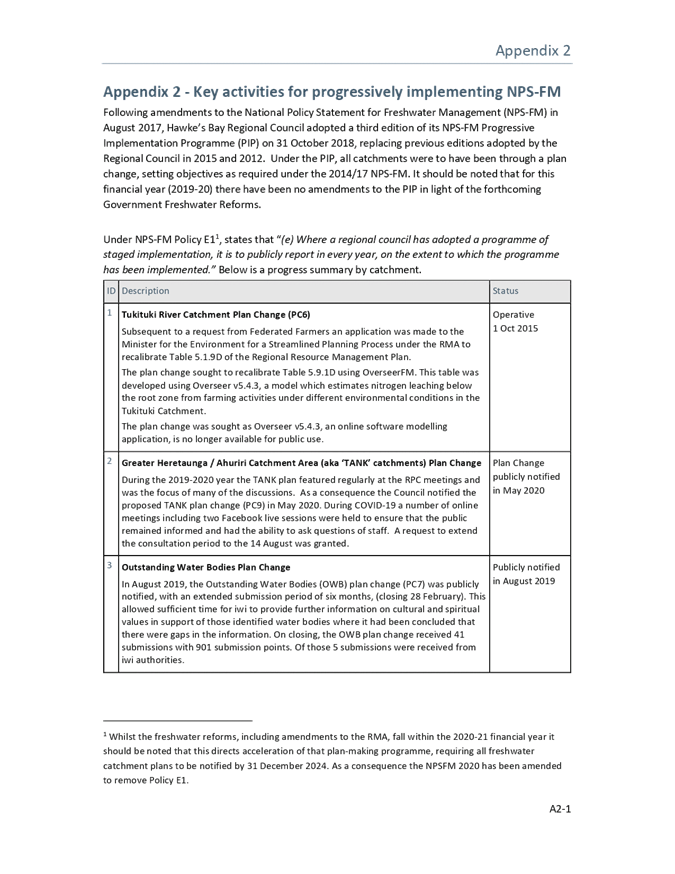

$0.43m ($0.892 revenue less $0.465m losses), $7.3m short of an expected $7.7m.

5. The pandemic

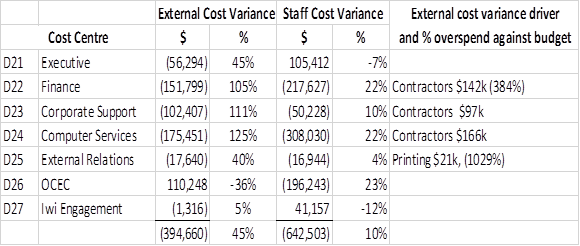

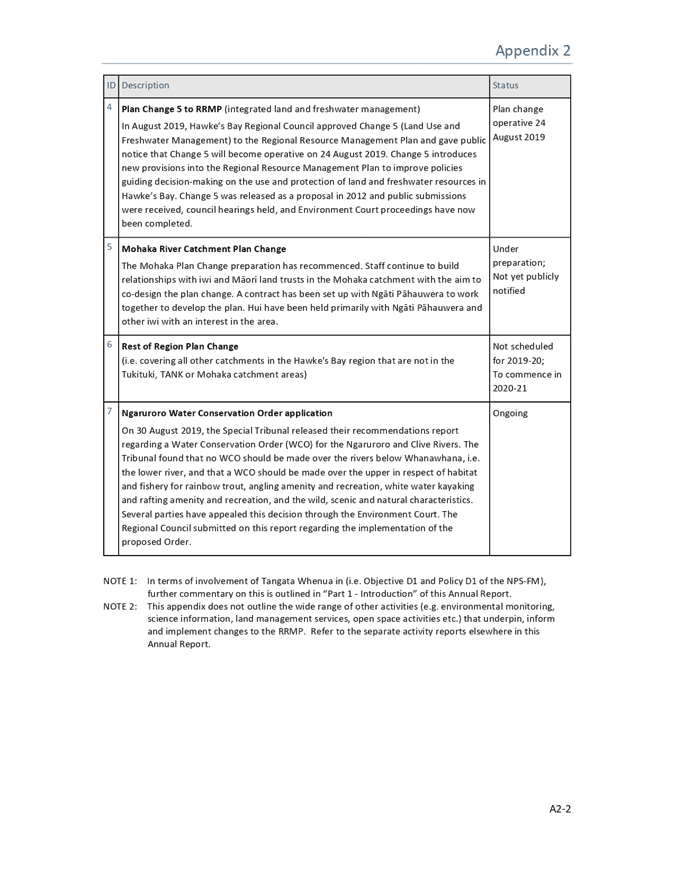

delayed some projects and increased some costs particularly those relating to

Emergency Management to support Council’s pandemic response.

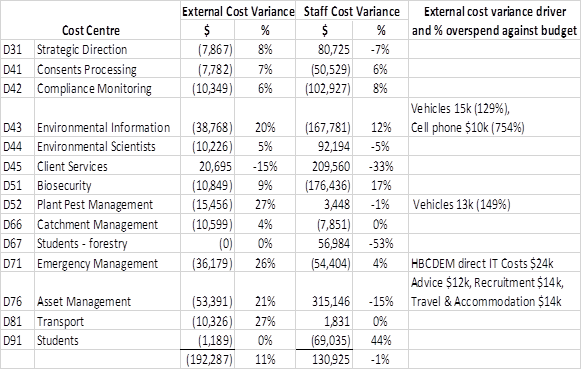

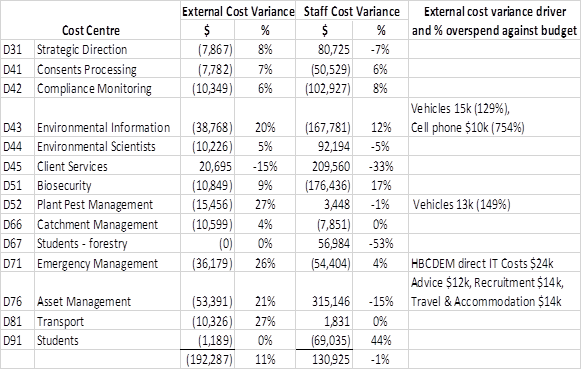

However, despite the pandemic, the levels of services were largely delivered as

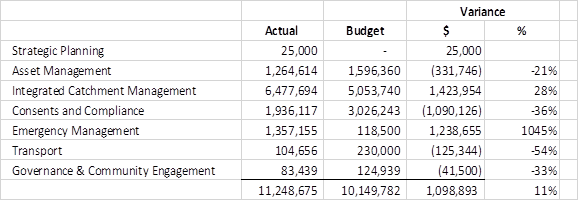

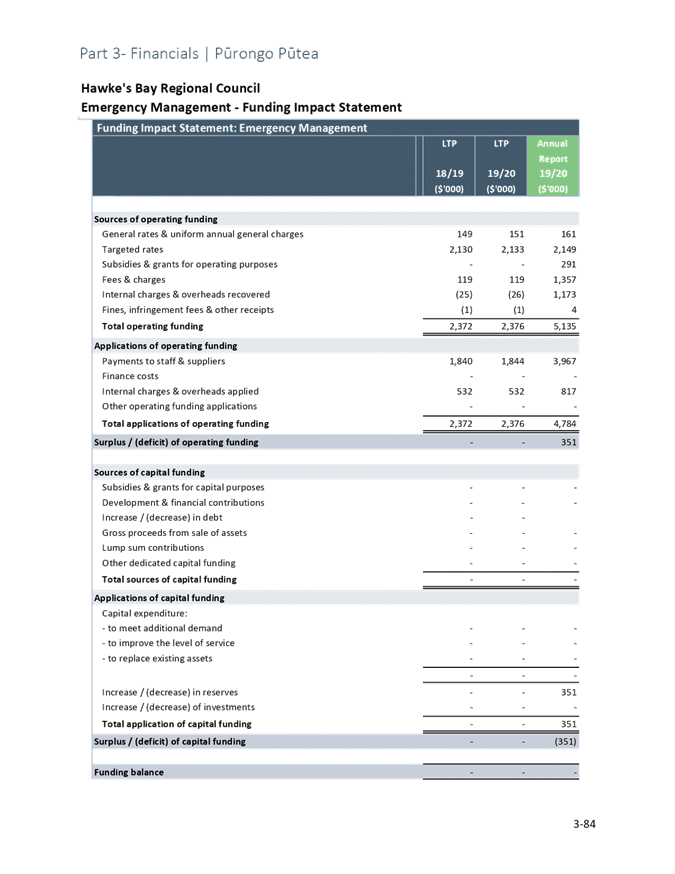

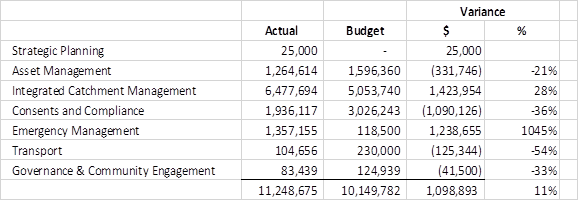

per the Annual Plan.

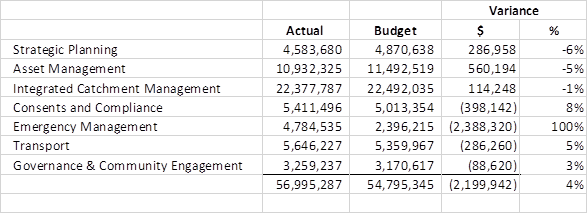

6. The annual

revaluation of the Napier and Wellington investment property portfolios

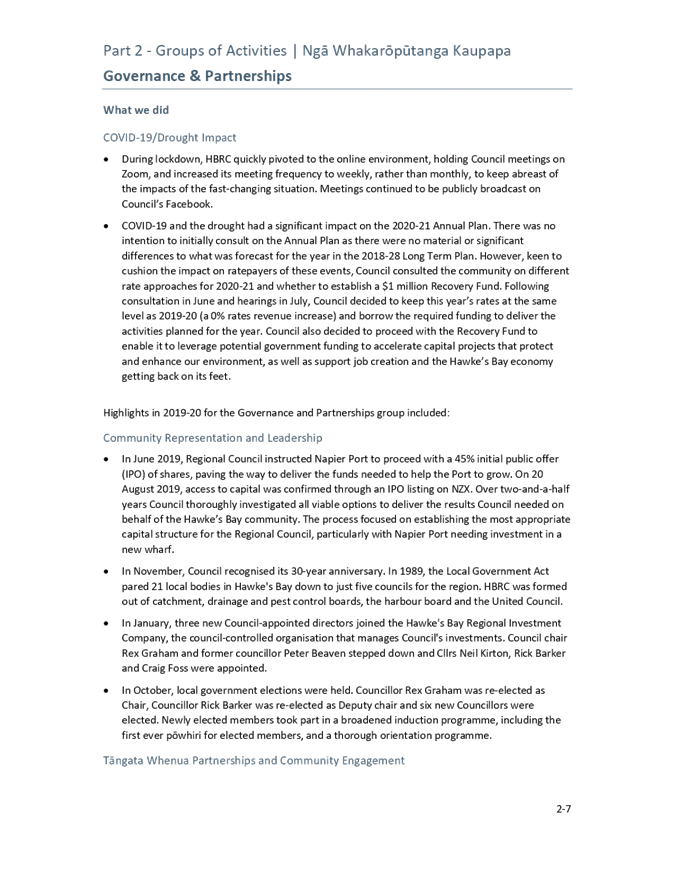

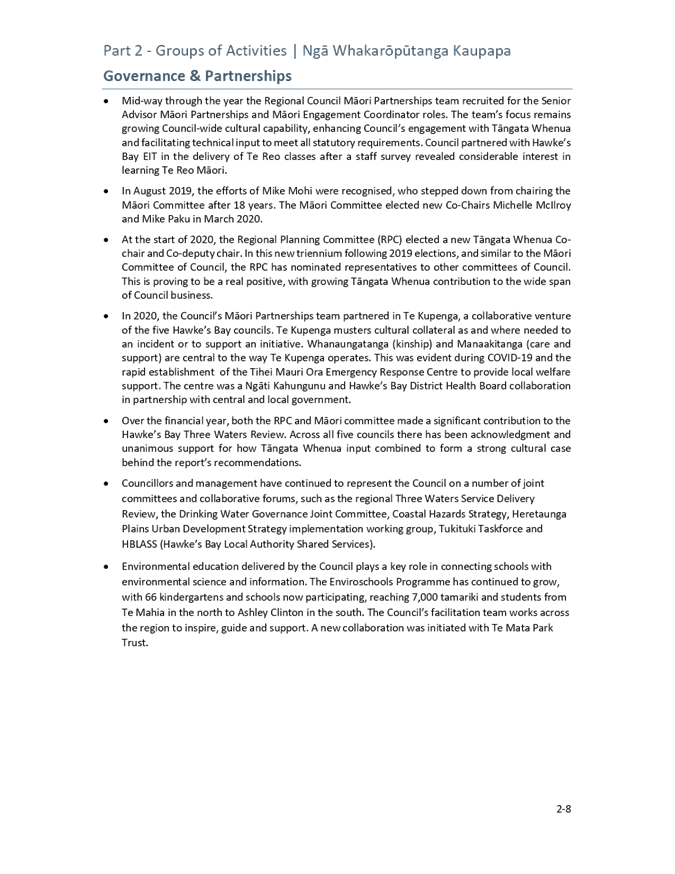

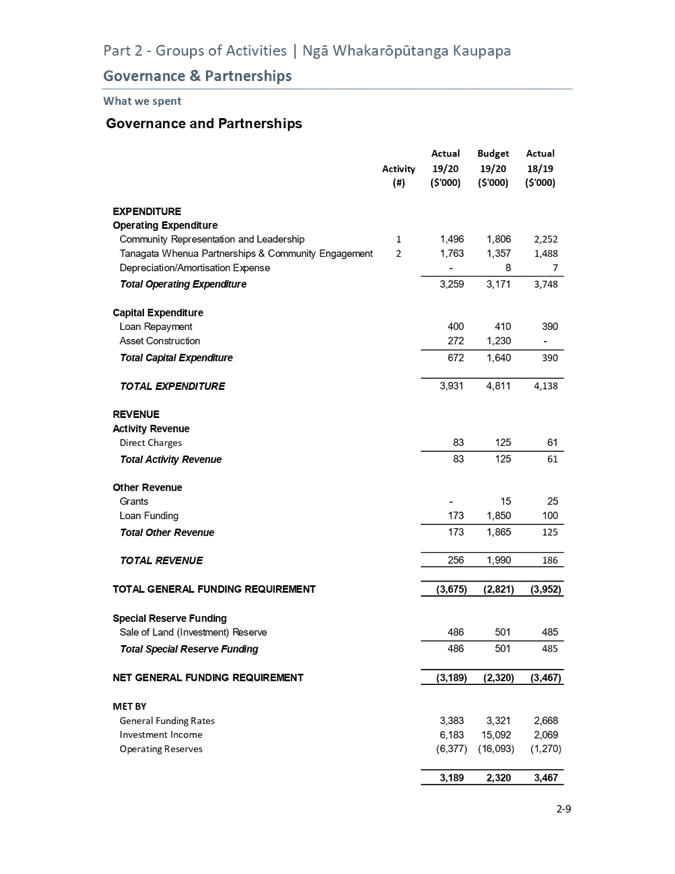

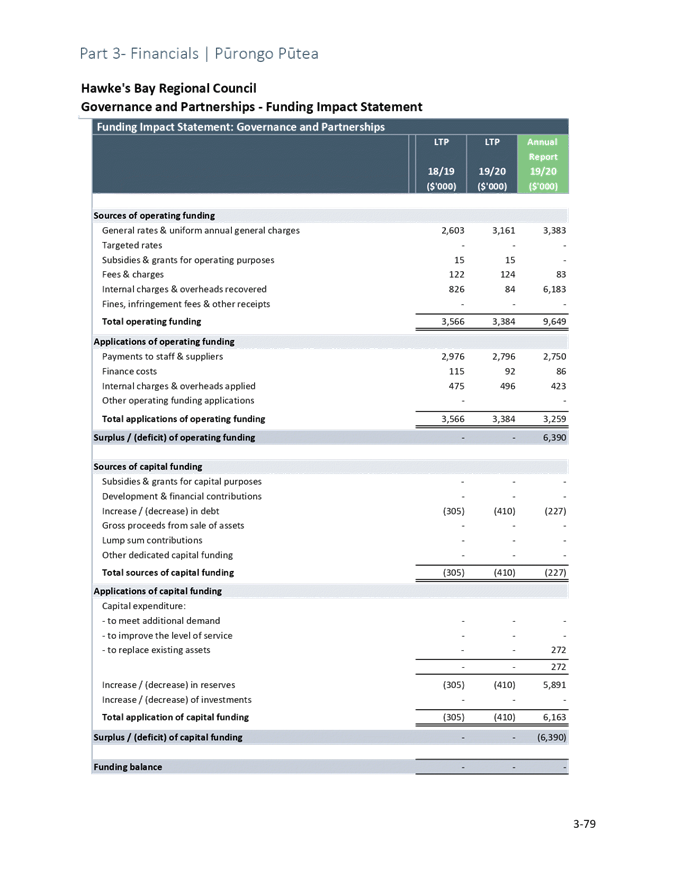

provided a further $11.5m of unrealised revaluation gains towards the operating

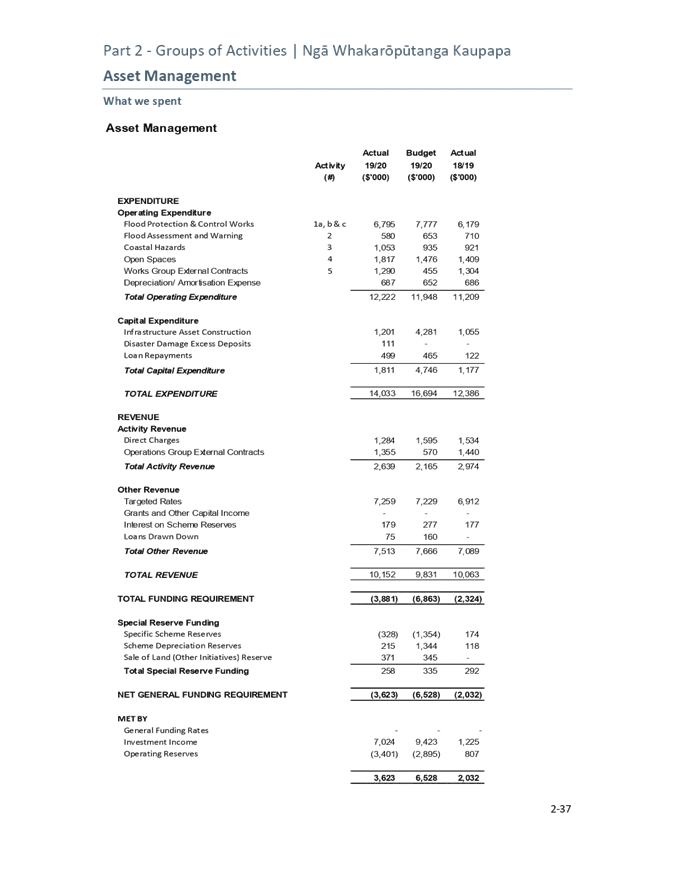

surplus.

7. Total Other

Comprehensive Revenue is $130.5m, up from $66.5m in prior year and above budget

by $125m, mostly due to the revaluation of HBRIC/Napier Port.

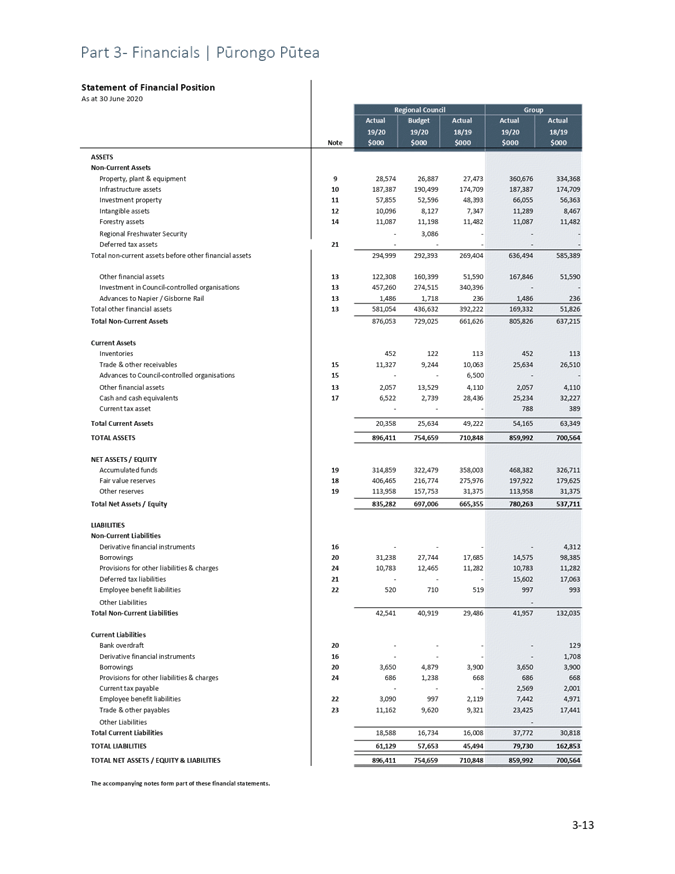

8. On the balance

sheet, the main movements reflect the revaluations and the Port/HBRIC

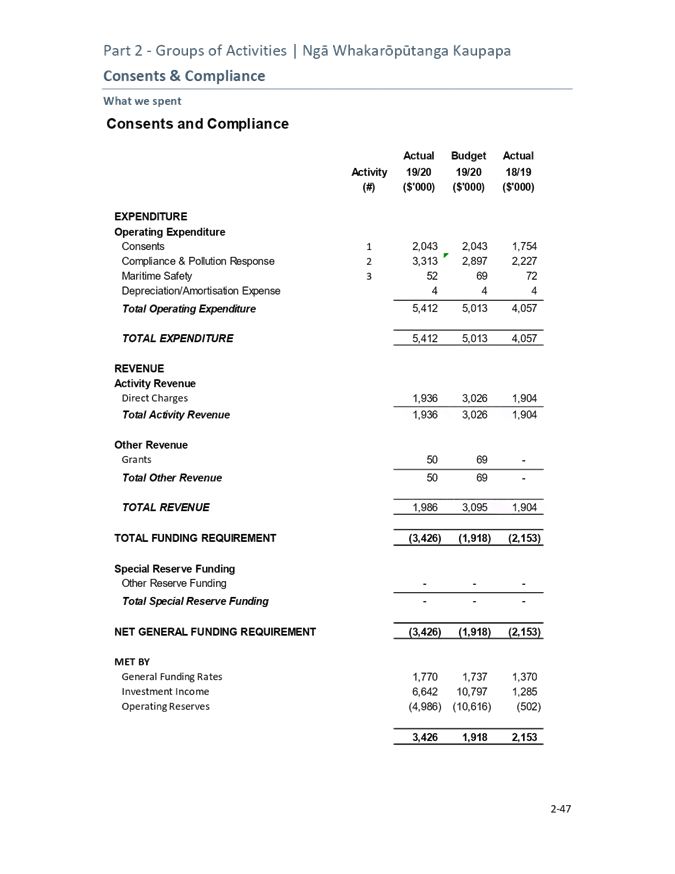

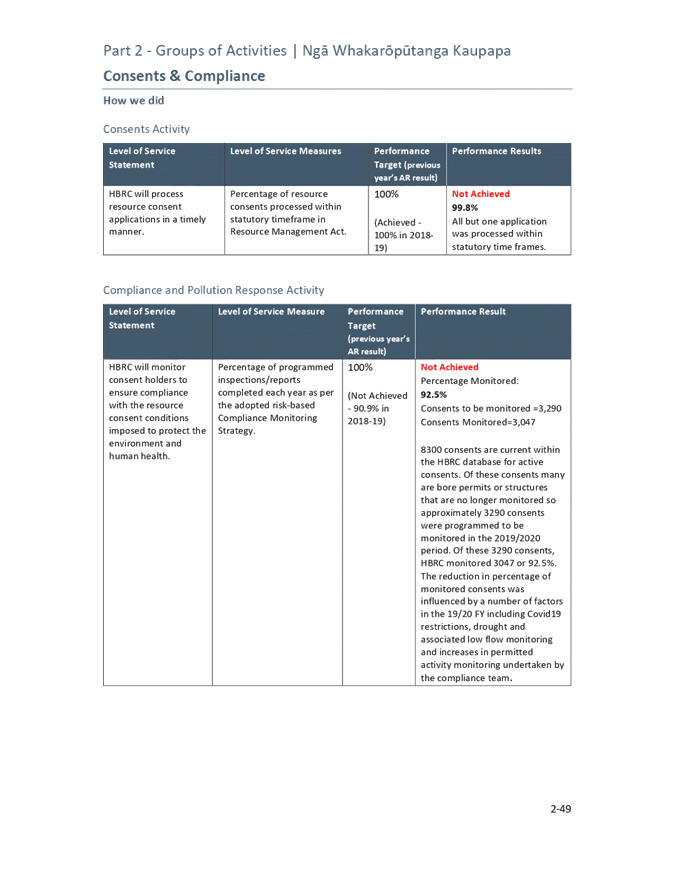

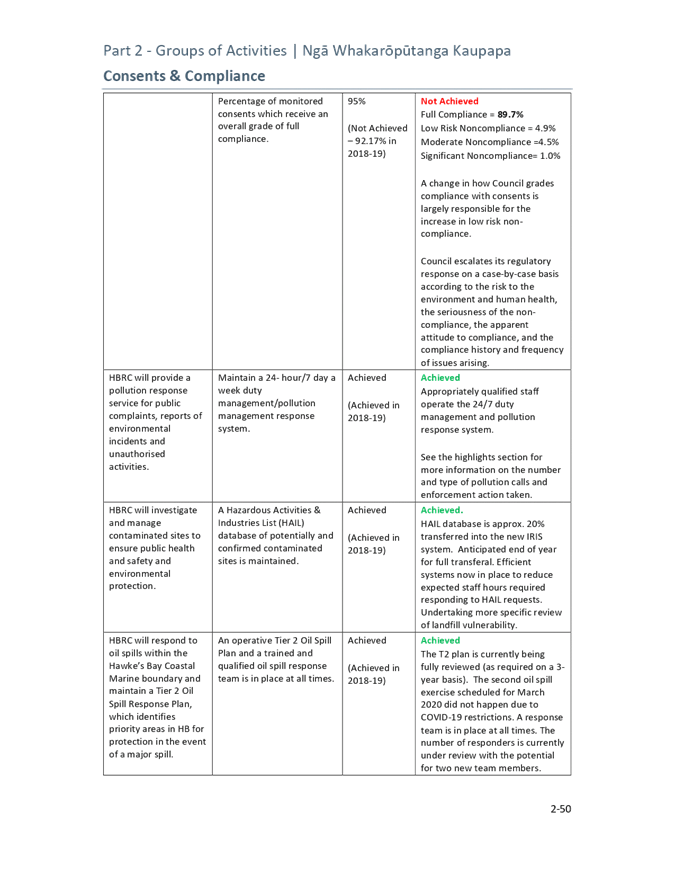

transactions with non-current borrowings increasing by $14m to reflect the loan

from HBRIC to the Council ($16m loan increase offset by

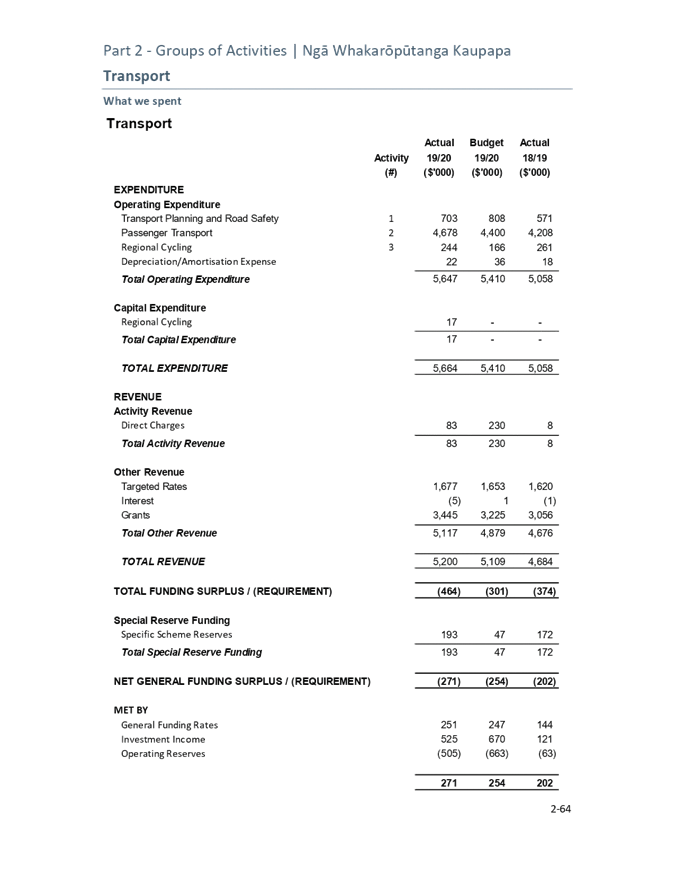

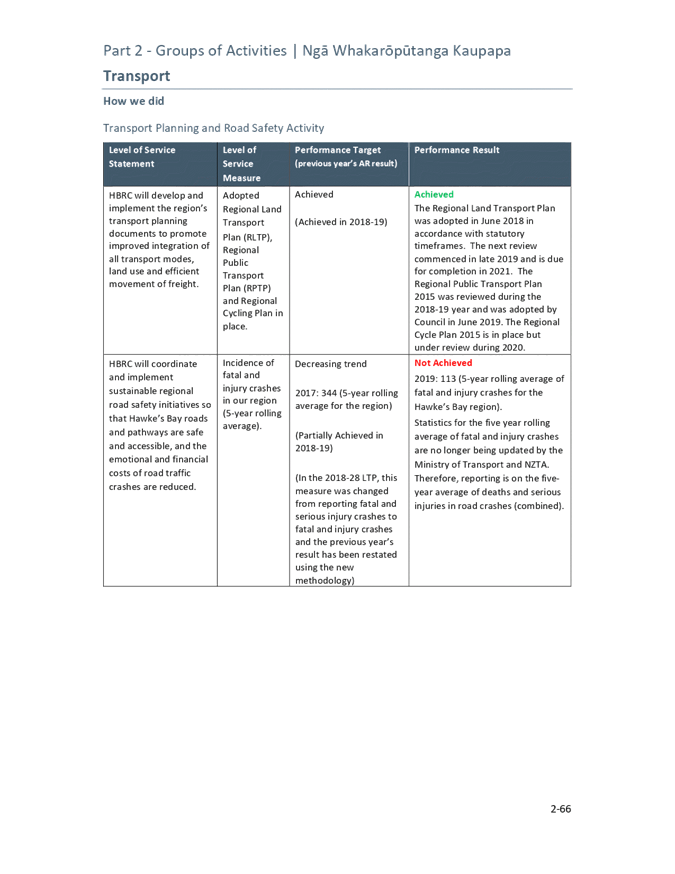

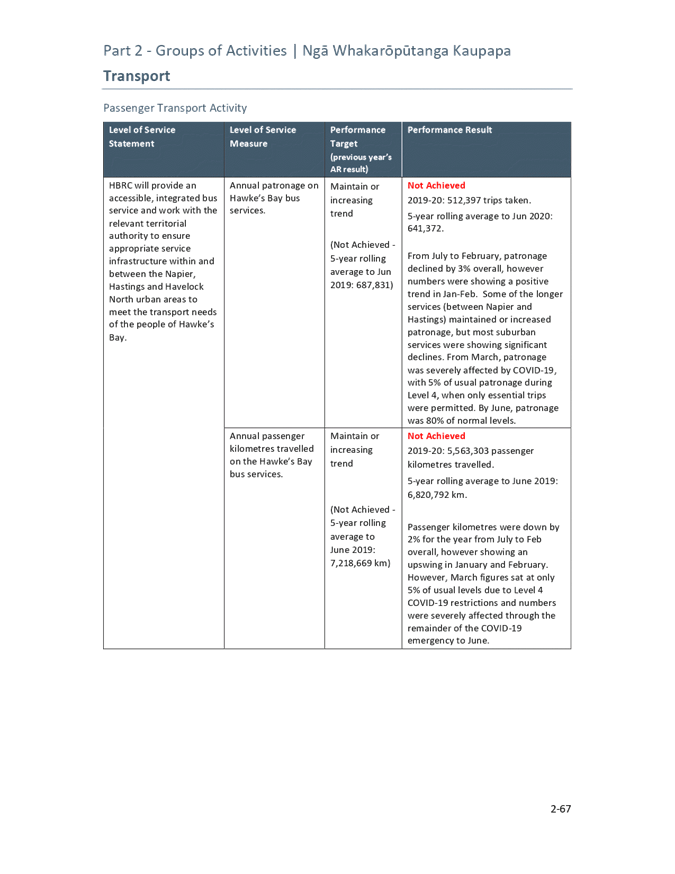

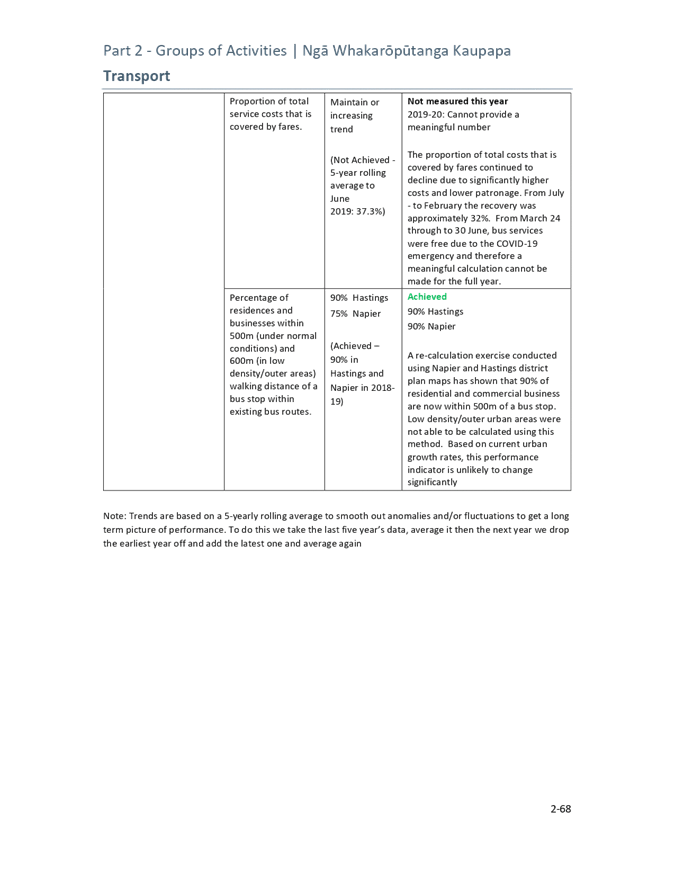

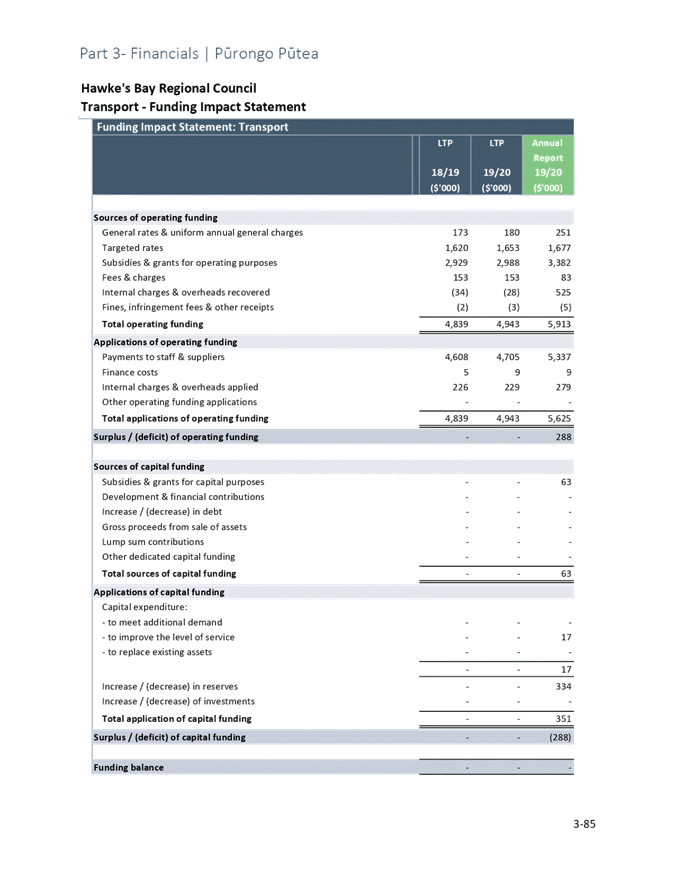

debt repayments through the year).

9. From the cost

centre perspective, direct employee costs including restructuring costs were up

on cost centre budgets overall by $750k (3%)

this is due to additional headcount and implementation of the remuneration

review to better align staff to market, address historic under-remuneration of

some roles and the introduction of a formal performance pay mechanism.

The cost of this was approximately 4% of salary compared to the 2% budgeted for

increases.

9.1. Note that the

actual personnel costs in the financial statements include Works Group

salaries, wages and allowances etc. which are not included in the annual plan

budgets. The annual plan budget includes the net profit from Works Group

external contracts only. This is being addressed as part of the Long Term

Plan budgeting process.

10. External costs were over

budget by $1.8m (31%).

Specifically, general overheads (including accommodation and IT

infrastructure) was $1.25m (34%) overspent and the support services cost

centres were $395k (45%) overspent. Some of this overspend is the result of

increased headcount (rent for additional accommodation, energy costs for more

staff, services (cleaning etc for more accommodation), recruitment fees, IT

licenses, etc), some overspend is due to additional costs caused by the

pandemic (increased cleaning, sanitiser, protective screens, IT infrastructure

to support remote working, etc), additional audit fees for the 18/19 audit, and

the general increase in IT costs have not been adequately budgeted.

11. The net funding

requirement for 2019-20 for Operating and Capital is over budget by $0.8m

(3.5%). Asset Management was $2.9m underspent mainly offset by the

overspending in Consents and Compliance ($1.508m), Governance ($869k), and

Emergency Management ($467k).

|

|

Net Funding

Requirement

|

|

Group of Activities

|

Actual

|

Budget

|

Variance

$

|

Variance

%

|

|

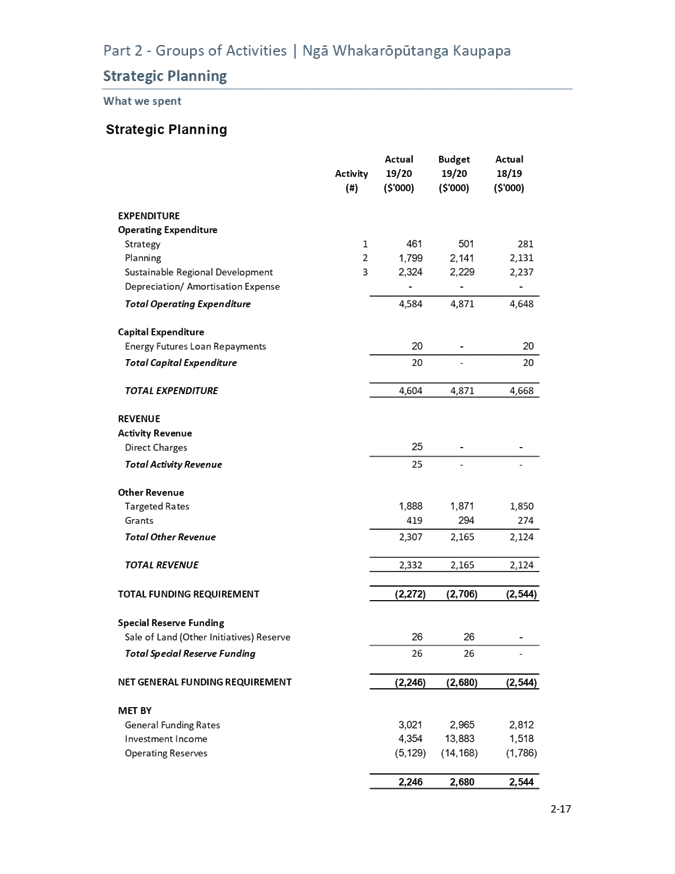

Strategic Planning

|

$2.246m

|

$2.680m

|

$0.434m

|

84%

|

|

Asset Management

|

$3.623m

|

$6.528m

|

$2.905m

|

55%

|

|

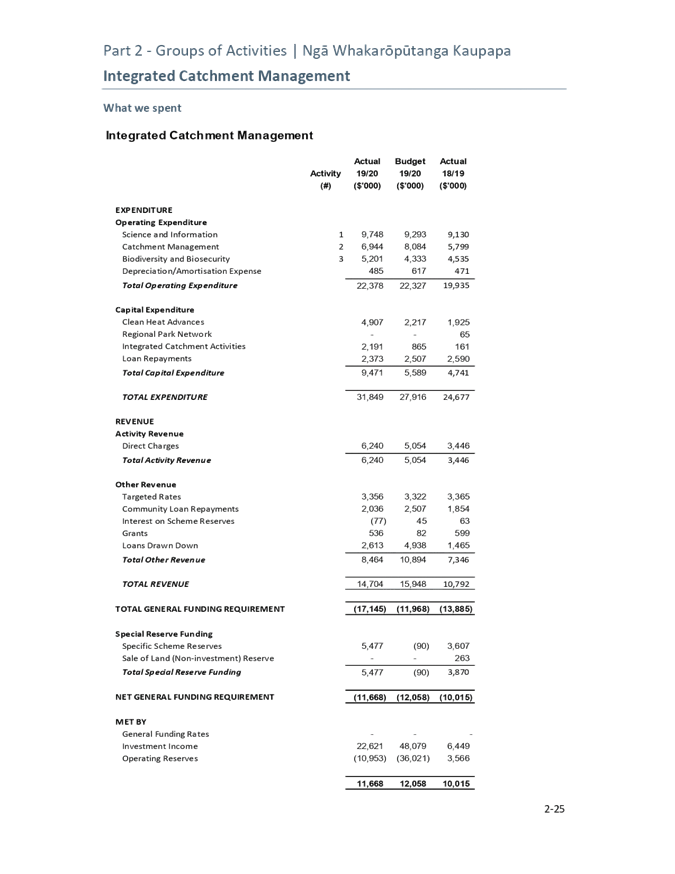

ICM

|

$11.668m

|

$12.058m

|

$0.390m

|

97%

|

|

Consents & Compliance

|

$3.426m

|

$1.918m

|

$(1.508m)

|

178%

|

|

Emergency Management

|

$0.605m

|

$0.138m

|

$(0.467m)

|

438%

|

|

Transport

|

$0.271m

|

$0.254m

|

$(0.017m)

|

107%

|

|

Governance & Community Engagement

|

$3.189m

|

$2.320m

|

$(0.869m)

|

137%

|

|

Total

|

$25.03m

|

$25.9m

|

$(0.868m)

|

97%

|

12. Capital expenditure across

the Groups of Activities was $3m (18%) below budget and asset purchases (new

vehicles, computers, furniture, etc) was $1.6m (39%) below budget.

13. The presentation of the

Annual Report to the Council for adoption has been delayed due to staffing

issues at Audit New Zealand and the additional audit work that has been

required to assess the impact of the Covid-19 pandemic on organisations that

has been mandated by the Auditor General.

14. Karen Young, Director,

Audit NZ will attend the meeting to answer any questions and allow for auditor

only time with the committee as per the Term of References.

Discussion

15. The main driver for the

financial surplus for 2019-20 is the IPO of Napier Port with the sale of 45% of

the group’s holdings in the port generating $107m in one-off revenue for

the group. The net proceeds from the sale exceeded expectations by $24m.

15.1. The 2019-20 budget for

HBRC was based on all proceeds from the Port IPO being available to HBRC but

tax implications have resulted in a split with $63m remaining with HBRIC.

15.2. $44m of the IPO receipts

reverted to HBRC with all receipts being invested in managed funds. Prior to

year-end, an asset/loan swap between the Council and HBRIC placed a further

$16m of managed funds under direct Council control.

16. Expected dividends

received from HBRIC were down from $10m to $2.5m due to the deferral of the

anticipated interim Napier Port dividend. The Port dividend is based on free

cash flow which has been affected by the uncertain trading conditions and the

Port commencing work on the new wharf.

17. Expected capital growth,

dividends and interest from the managed funds was significantly impacted by the

financial market and share price fluctuations but recovered at the end of the

year resulting in small growth for the year of 1%.

18. The increase in Total

Other Comprehensive Revenue is due to the:

18.1. Revaluation of HBRIC

based on the value of its Port shareholdings resulting in an increase of $117m

18.2. Revaluation increases in

carbon credits of $1.2m

18.3. Unrealised growth in the

managed funds of $1.4m

19. Operating expenditure was

up $9.4m from prior year and $5.7m (10%) over budget. This relates to $2.25m of

cost centre overspend, depreciation $600k above budget and fair value losses on

some of the forestry offset by reduced finance costs.

20. The general overhead cost

centres were overspent by $1.25m (34%) compared to budget:

21. Audit fees were

particularly high due to the inclusion of cost over-runs for the 2018-19 audit

and fully accruing for the 2019-20 audit.

22. The support cost centres

were overspent by $643k (10%) compared to budget on staff costs and $395k (45%)

overspent on external costs. The external costs below have been adjusted to

exclude overhead allocations. Additional resource was required, and cost

incurred in the finance team due to significant turnover, and a need to add

both capacity and capability to the team as a result of the organisations

growth and increased complexity. Contractors were required during

the recruitment of new staff. This team is now right-sized and providing

a professional service to the organisation.

23. Computer overheads are

significantly over budget due to the increased headcount and the associated

licence costs, additional software to support staff working remotely during the

pandemic, and previous under-budgeting of IT costs through not adequately

budgeting for the increase in costs of IT services and not accounting for the

increase in use of IT services (e.g. storage costs are increasing

exponentially). The increased IT costs in the new LTP have recognised this

deficiency.

24. Across all activity cost

centres, the results were close to budget with an overspend in external costs

$192k (11%) offset by an underspend on staff costs of $131k (1%) when allocated

overheads are excluded.

25. The User Charges and cost

recovery revenue across the groups of activities showed significant variance

but was $1.6m (15%) more than budget. The increased revenue for Emergency

Management is due to the expected cost recoveries from government for the

welfare costs incurred, ICM obtained un-budgeted external funding for two

projects (SkyTEM, LiDAR) that had been included in the operating budget, and

the under budget revenue of Consents and Compliance was comparable to prior

year. The Consents and Compliance result is an expected outcome based on the

LTP cost recovery expectations for S36 charges.

26. Operating expenditure

across all activities for each group of activities was within 10% of budget

except for Emergency Management which was 100% over budget due to the pandemic

response costs.

27. Strategic Planning

underspent operating expenditure over the year by $287k (6%) due to delays in

projects 191 Regional Coastal Plan and 192 Strategy and Planning offset by an

overspend in 196 Statutory Advocacy.

27.1. Regional Coastal Plan

work was delayed due to the team being under-staffed and staff being

prioritised to other resource management planning projects.

27.2. Strategy and Planning

work was delayed due to TANK notification and an extended submission period

resulted in the budget being off-track and associated costs (communications,

IT, staff input etc) will be pushed into 2020/21. Hearings have also been

delayed in TANK (RPC decision making and Covid-19) and OWB (6-month consultation)

resulting in significant costs rollover to 2020/21 (est. $800,000). A new

submissions database was purchased to support accurate management of public

submissions on plans. The Senior planner vacancy was not filled until

April. The Covid-19 pandemic response delayed this workstream as all members of

the Planning Team were deployed to assist for some time in the CDEM Group

Covid-19/drought response event.

27.3. Statutory Advocacy work

was overspent due to additional external expenses that are primarily due to the

commissioning of evidence from HBRC's experts on Environment Court proceedings

for the Ngaruroro/Clive Rivers Water Conservation Order (WCO), plus associated

legal services in same proceedings. Environment Court WCO proceedings

have encountered delays due to Covid-19. Legal expenses were also incurred for

the unbudgeted work to prepare evidence for first tranche of High Court

proceedings on Marine & Coastal Area (Takutai Moana) Act applications.

28. Governance and Community

Engagement was 3% overspent in operating expenditure where a $300k underspend

in Community Partnerships was offset by a $400k overspend in 840 Community

Representation. The overspend was mainly attributed to additional Executive,

Governance and Project Management resources required to support meetings and

Long Term/Annual plan development processes.

29. Asset Management had a

$600k (5%) underspend in operating expenditure and $2.7m (67%) underspend on

capital works. The capital expenditure shortfall included:

29.1. $800k underspend on the

planned Clive River dredging due to delays in land purchase.

29.2. $700k on HPFCS Flood and

River Control as work has been focused on hydrological modelling, planning and

communication (internal staff or consultant). No physical work or land

acquisition has been progressed any further.

30. Works Group returned a

surplus of $65k from external contracts.

31. ICM was close to budget

overall (1% overspend) in operating expenditure but had a $3.9m overspend on

capital expenditure.

32. There were variances across

the ICM operating projects but this reflected work carried out under

complementary projects with costs attributed to one project but budgeted under

the alternative project (e.g. 312 Regional Surface Water Ecology underspent and

315 Surface Water Quality being overspent by a similar margin).

33. The ICM capital

expenditure did not include the SkyTEM and LiDAR work which had been classified

as operating expenditure in the LTP and annual plan. The SkyTEM and LiDAR

capital costs have effectively been offset by external funding.

34. The Sustainable homes

programme has been very successful leading to a $2.4m overspend compared to

budget. The cost of installation (and the debt repayments by the rate payers)

is classified as capital expenditure due to the loan asset created as a

result. The additional expenditure will be recouped over the next 10

years through the voluntary targeted rate applied in each case.

35. Overall Consents and

Compliance was overspent by $400k (8%) on expenditure and income was $1.1m below

budget due to an under recovery in fees and charges of $300k for 402 Resource

Consent Processing and $800k in 450 Compliance programmes.

36. Emergency Management was

overspent by $2.4m (100%) due to the pandemic and drought responses. This was

partially offset by an extra $1.5m in revenue being mainly cost recovered from

the government.

37. Transport overall was

overspent by $240k (4%) predominantly on 790 Subsidised Transport where the

cost of the bus contract has increased substantially due to increased

indexation rates and payment of drivers for a ten-minute break every 2 hours

worsened by lower revenues through declining patronage.

38. The systems integration

projects were underspent by $1.9m. This was due to a lack of organisational

readiness (vacancies in Finance and People & Capability delaying the start

of the Finance and HR implementations), a focus on using existing capabilities

to deliver solutions to ICM and other teams, and re-prioritising the work

programme based on risk resulting in the work on FUSE, Telephony and customer

experience solutions being prioritised.

Decision

Making Process

39. Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

39.1. The

decision does not significantly alter the service provision or affect a

strategic asset, nor is it inconsistent with an existing policy or plan.

39.2. The use

of the special consultative procedure is not prescribed by legislation.

39.3. The

decision is not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy.

39.4. The

decision is in accordance with the Finance, Audit and Risk Sub-committee Terms

of Reference, specifically:

39.4.1. The

Finance, Audit and Risk Sub-committee is to satisfy itself that the financial

statements and statements of service performance are supported by adequate

management signoff and adequate internal controls and recommend adoption of the

Annual Report by Council.

39.5. Given

the nature and significance of the issue to be considered and decided, and also

the persons likely to be affected by, or have an interest in the decisions

made, Council can exercise its discretion and make a decision without

consulting directly with the community or others having an interest in

the decision.

|

Recommendations

1. That the

Finance, Audit and Risk Sub-committee receives and notes the “2019-20

Annual Report”.

2. The Finance,

Audit and Risk Sub-committee, after receiving the Draft Annual Report and

hearing from Audit NZ, recommends that Hawke’s Bay Regional Council

adopts the 2019-20 Annual Report.

|

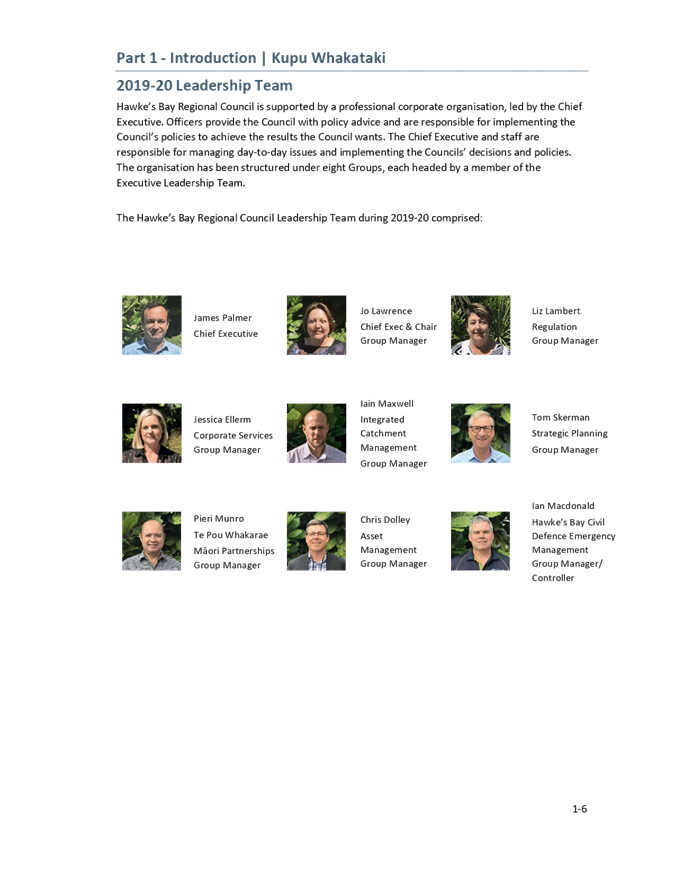

Authored by:

|

Tim Chaplin

Senior Group Accountant

|

Ross Franklin

Contractor, Finance

|

|

Geoff Howes

Treasury & Funding Accountant

|

Bronda Smith

Chief Financial Officer

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

⇩1

|

DRAFT 2019-20

Annual Report

|

|

|