Meeting of the Corporate and Strategic Committee

Date: Wednesday 2 December 2020

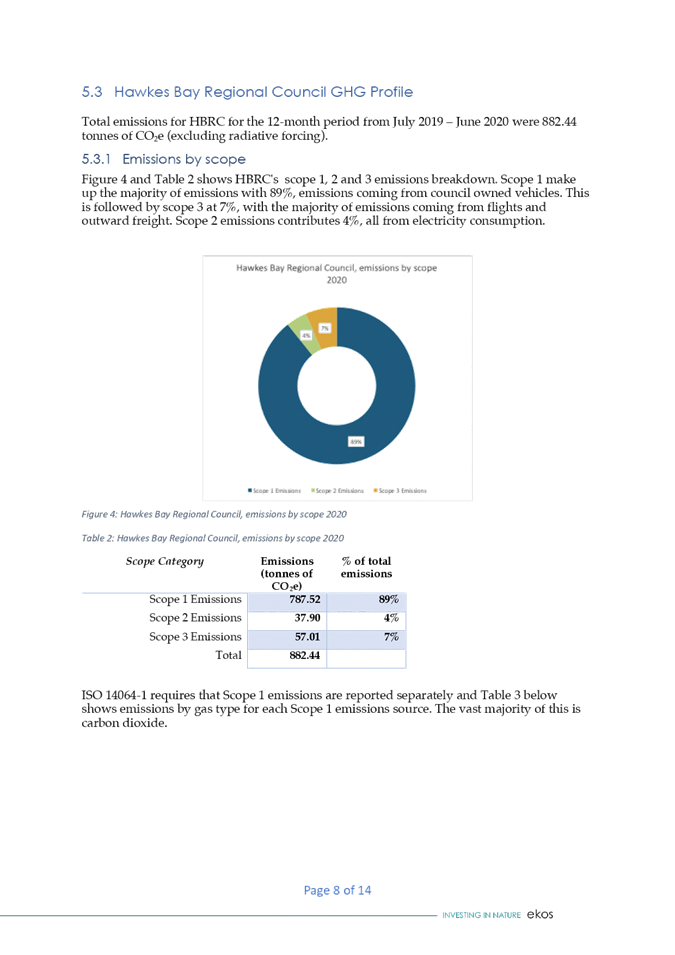

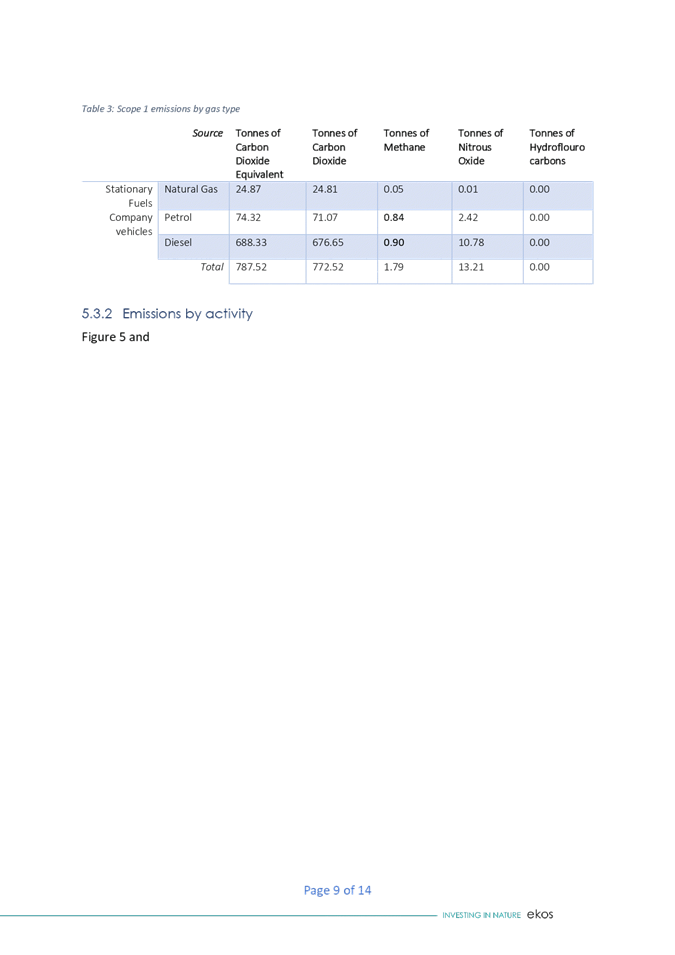

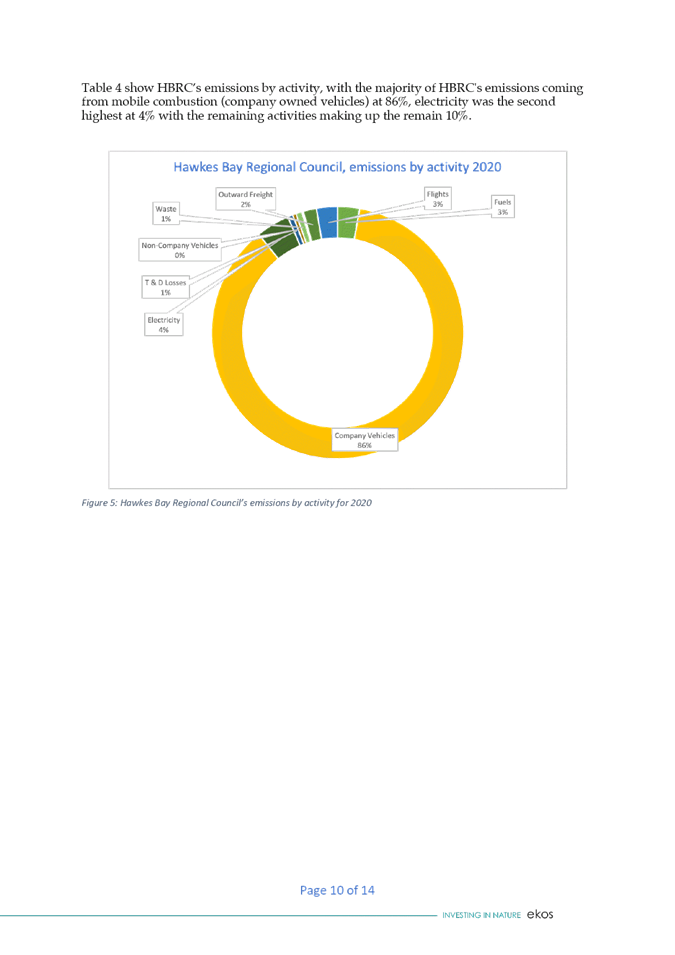

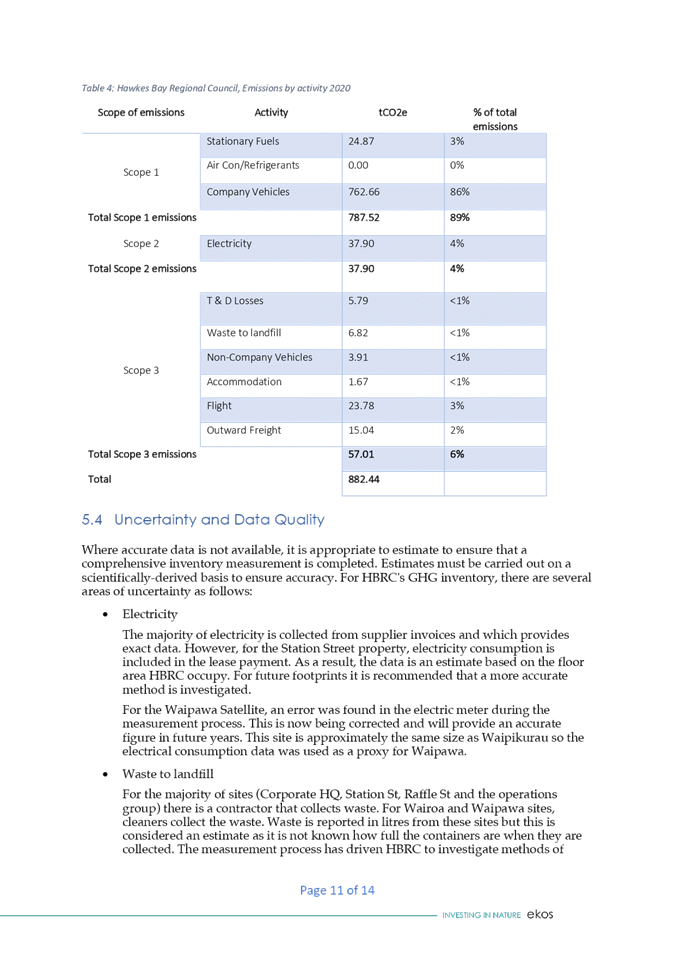

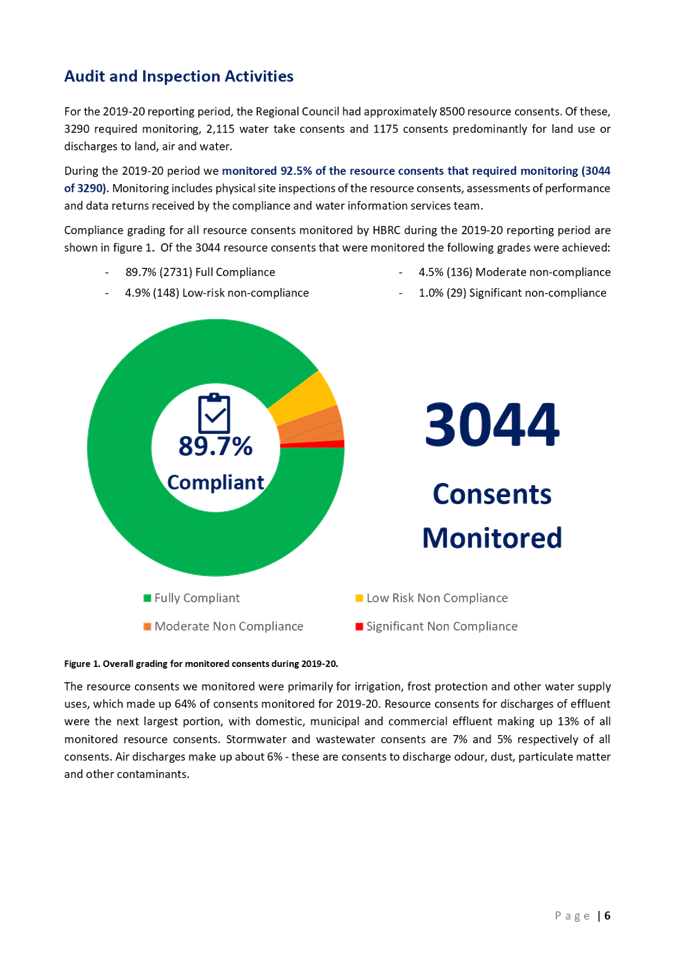

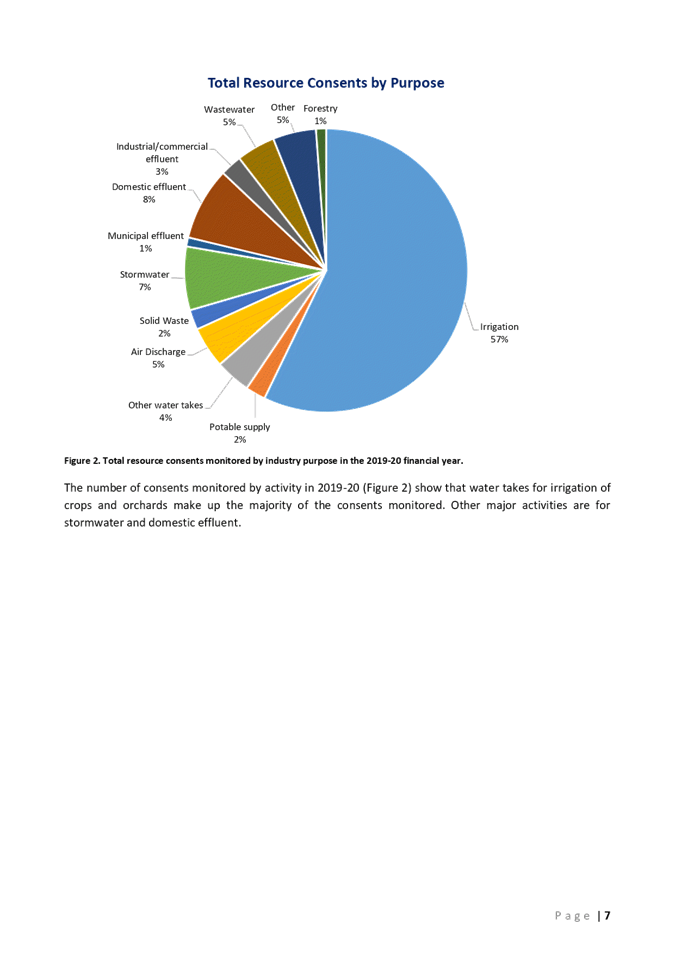

Time: 9.00am

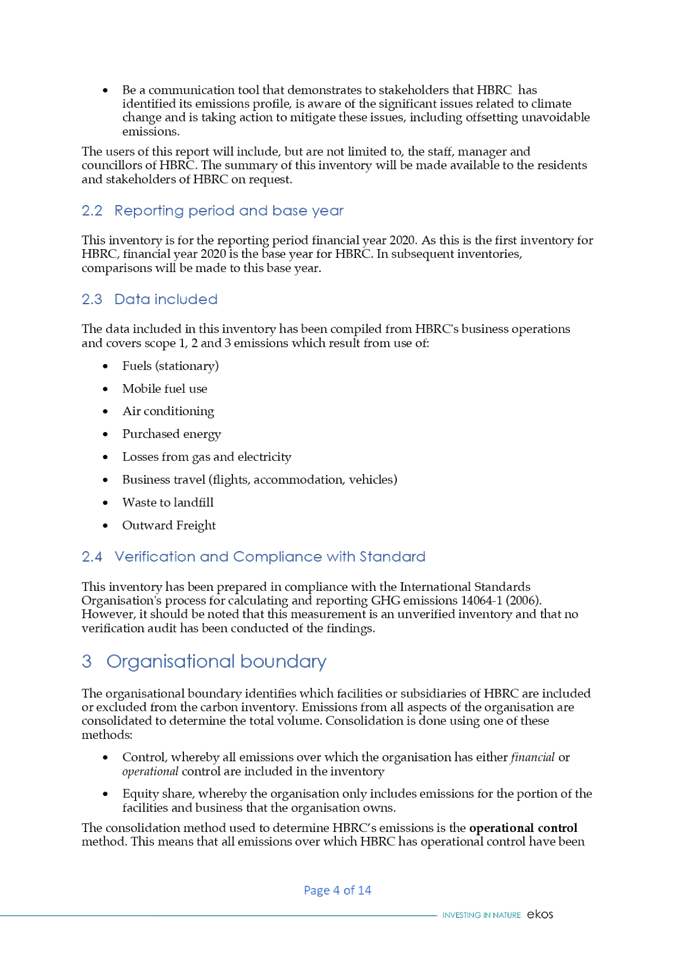

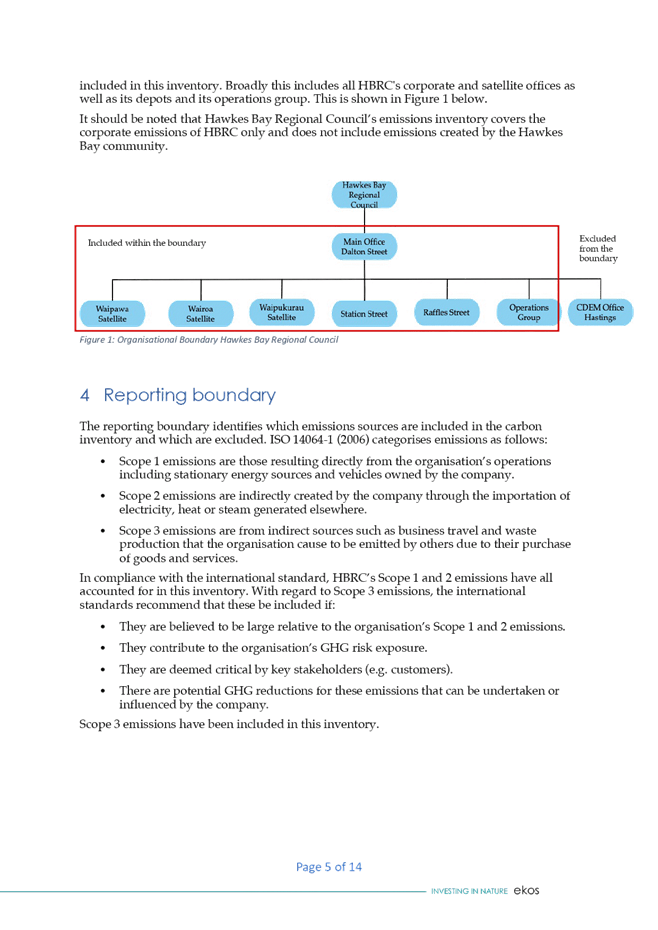

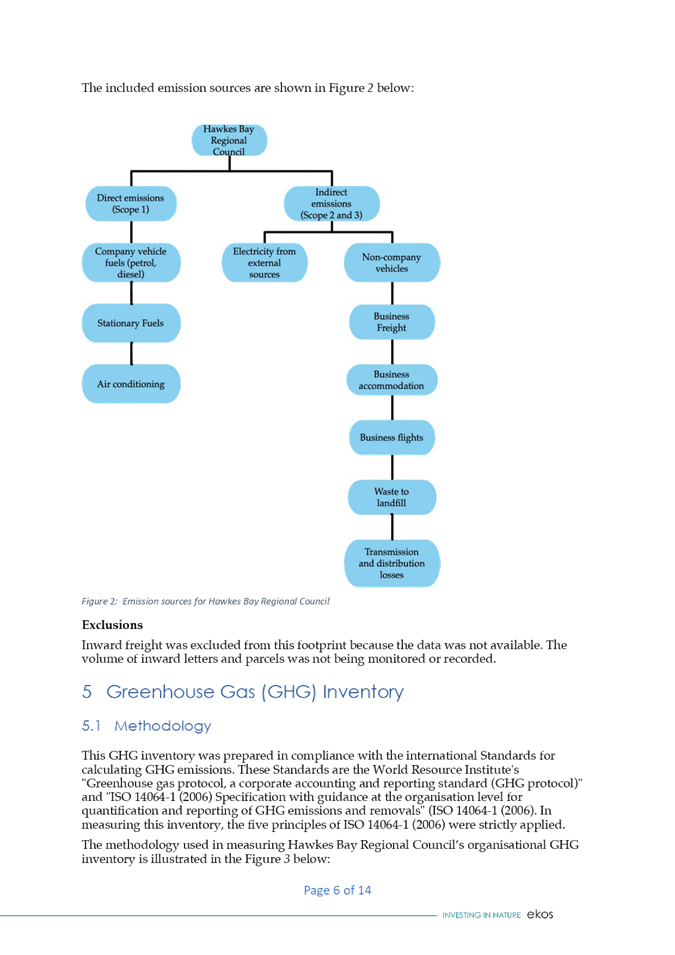

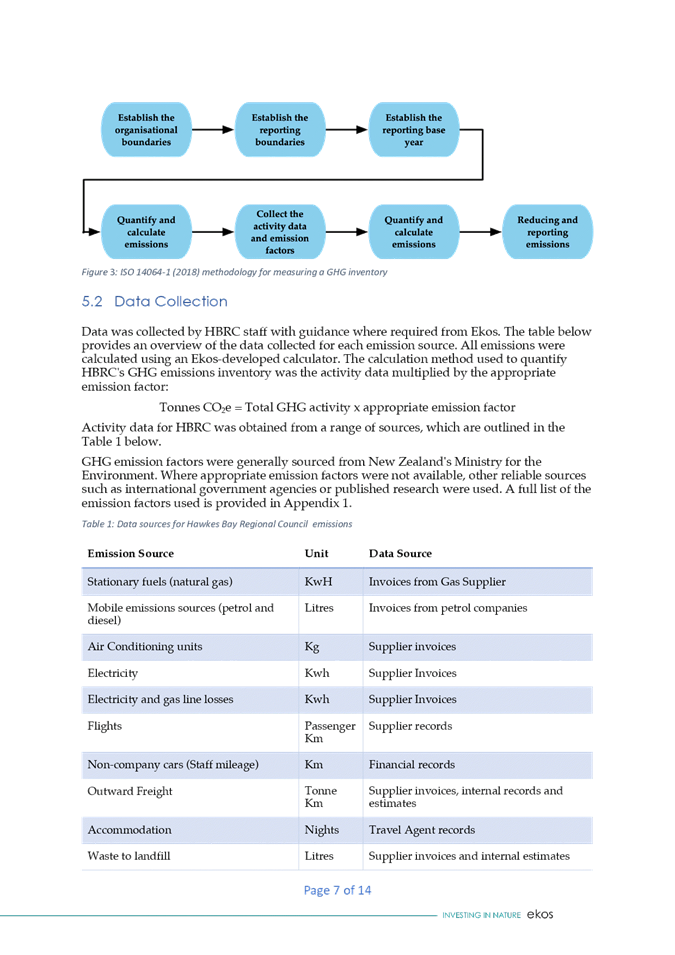

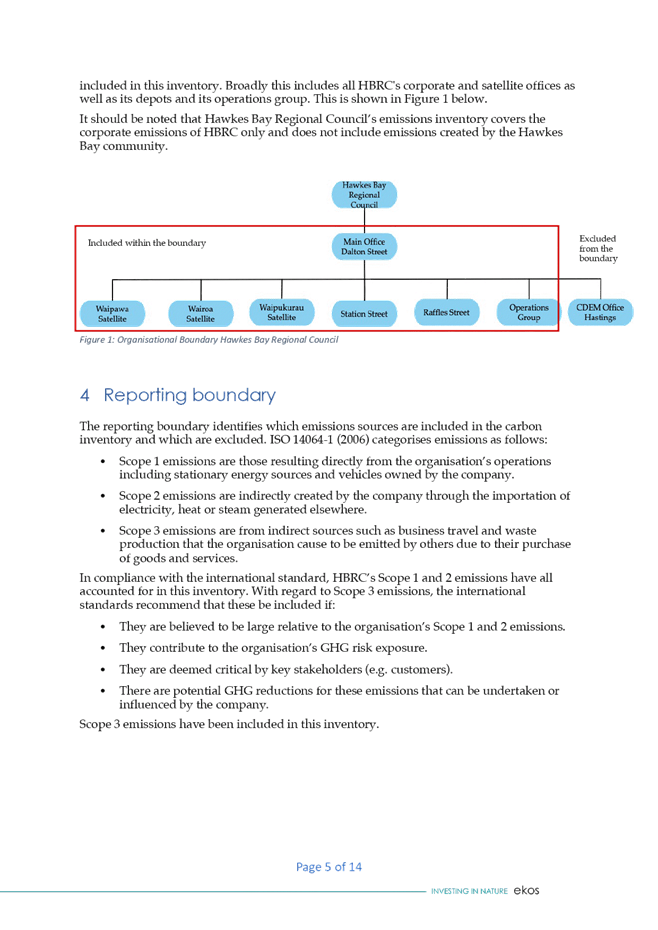

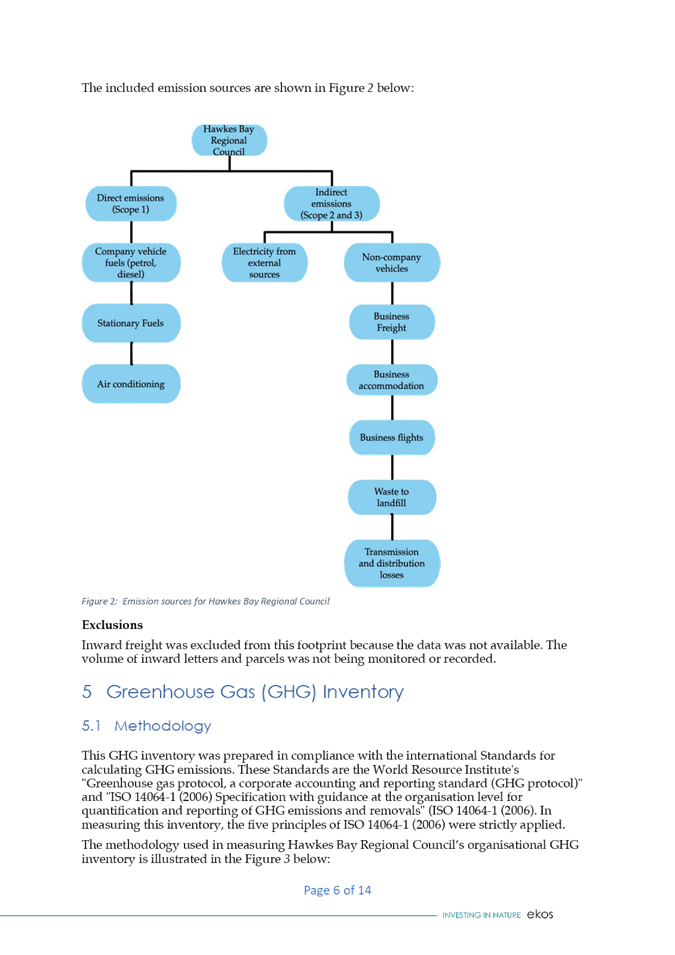

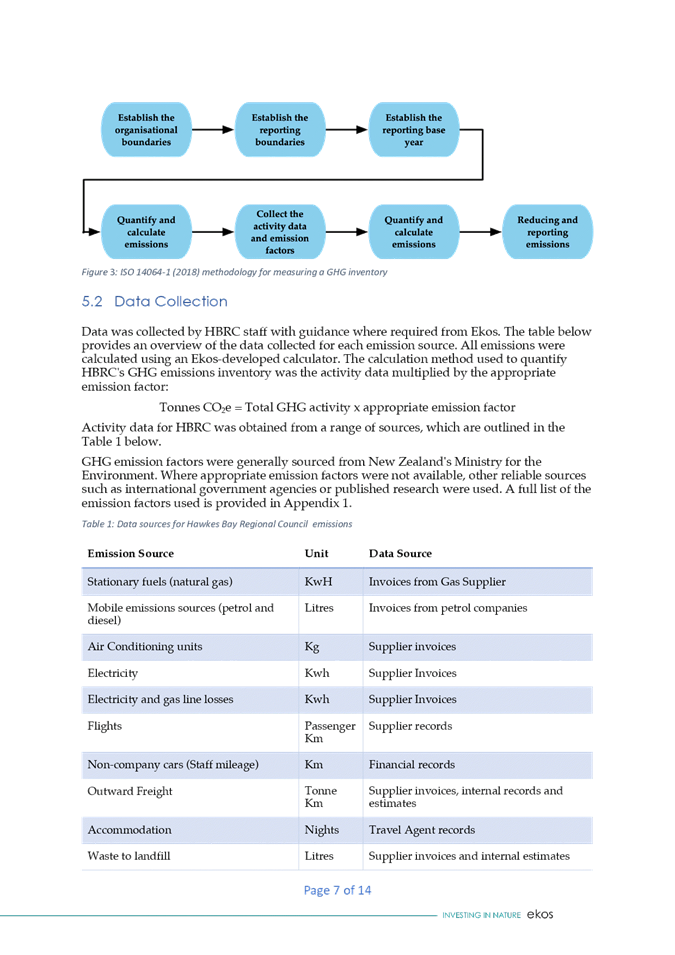

|

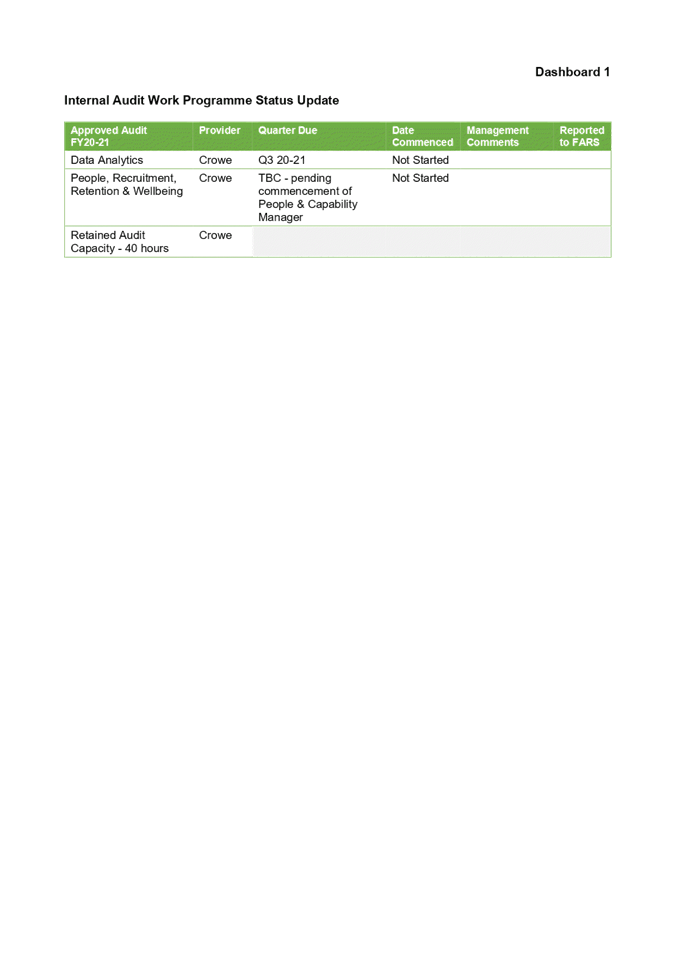

Venue:

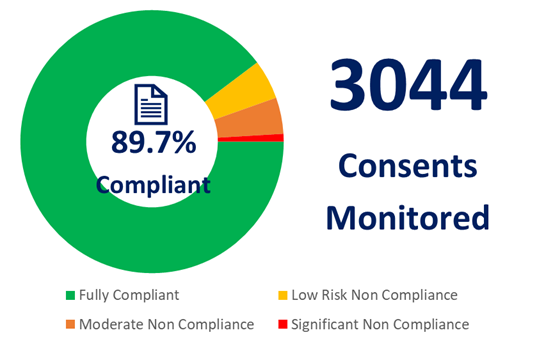

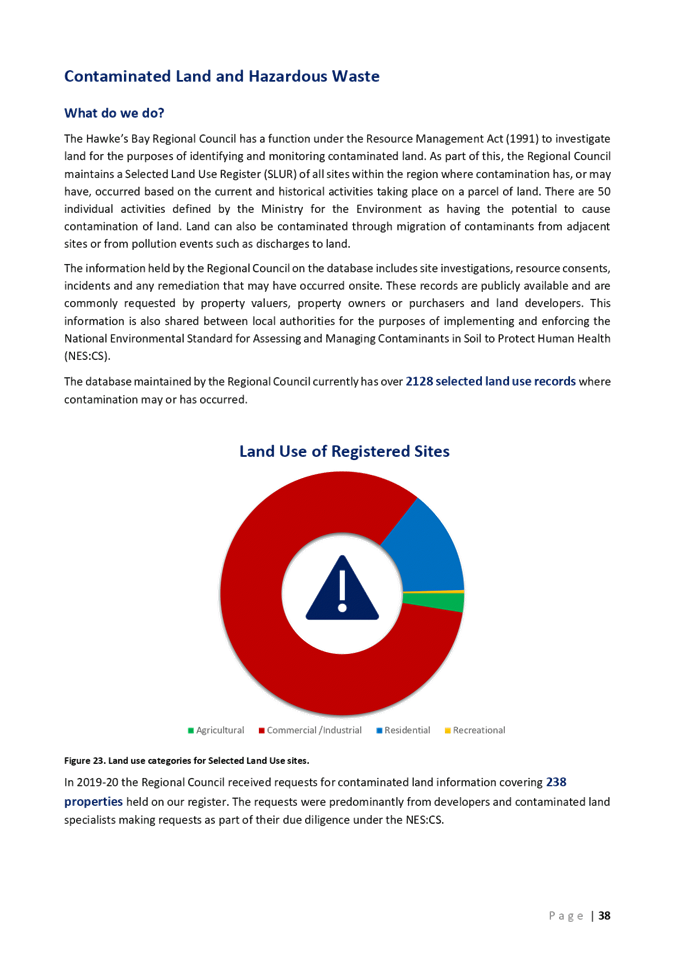

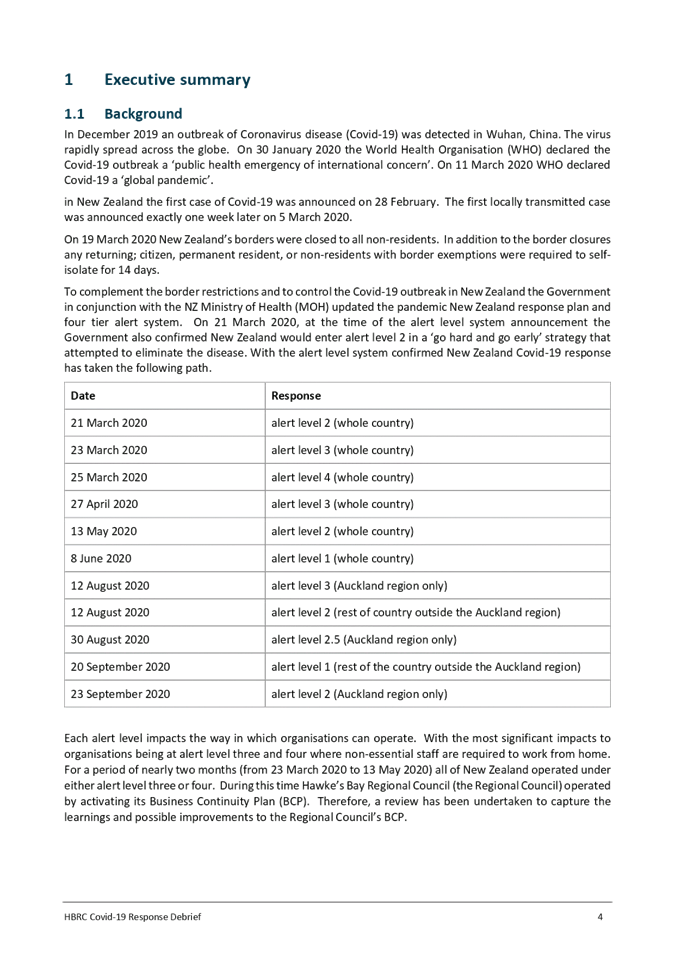

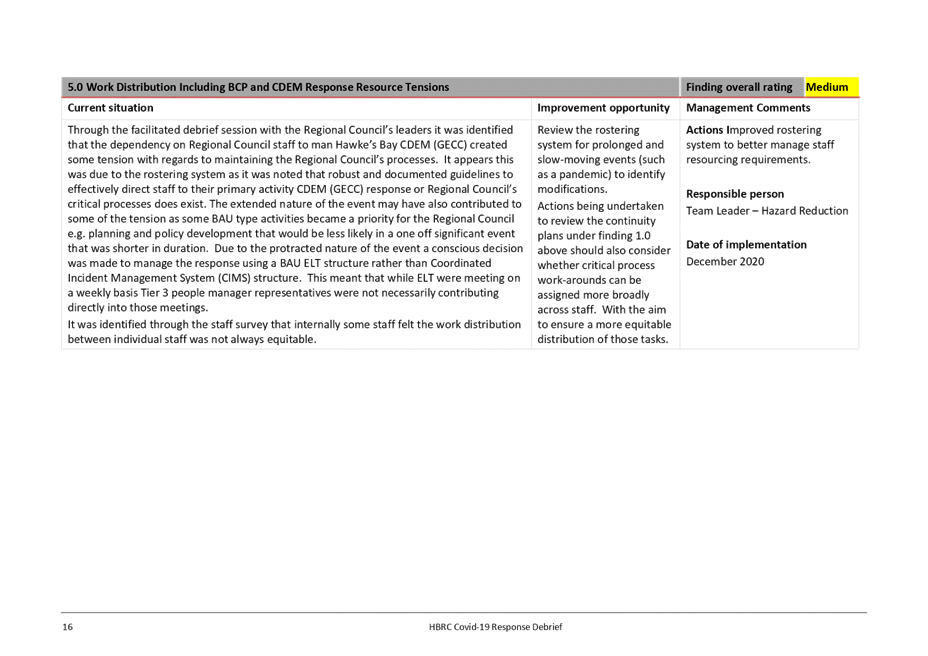

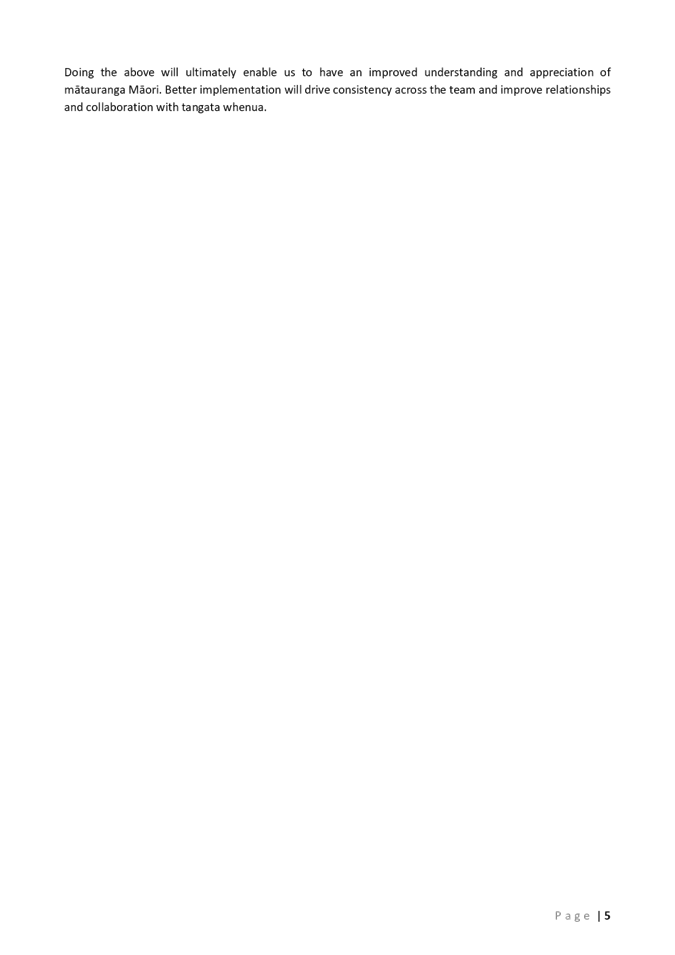

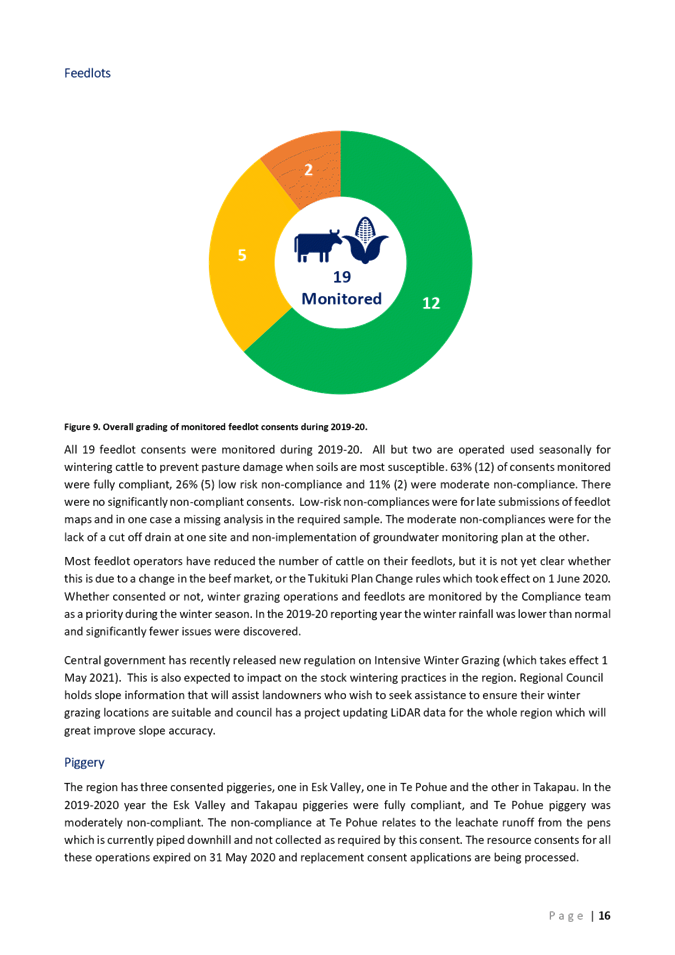

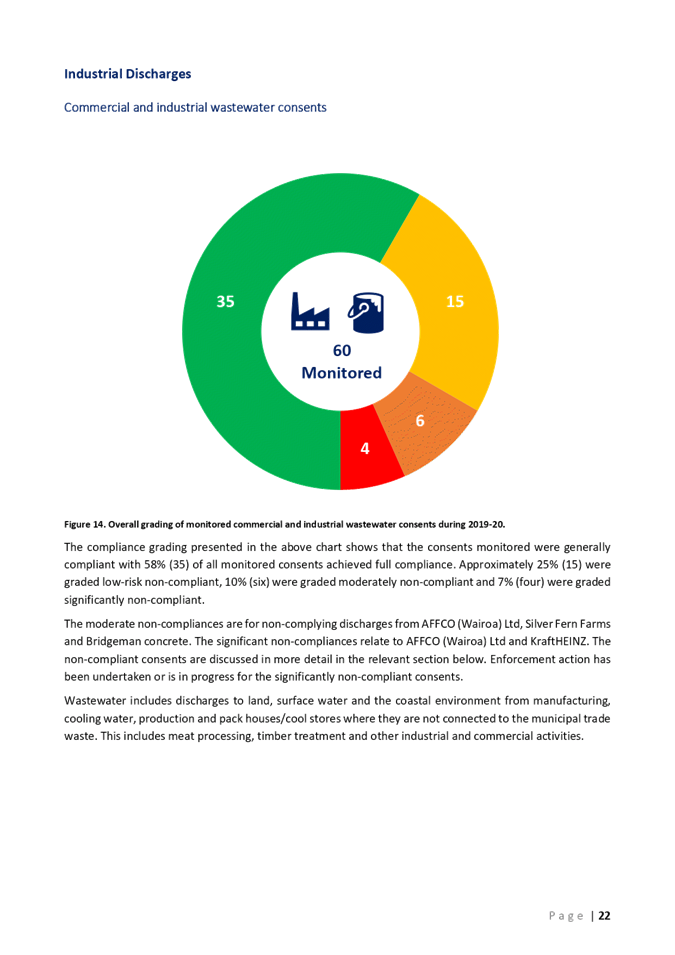

|

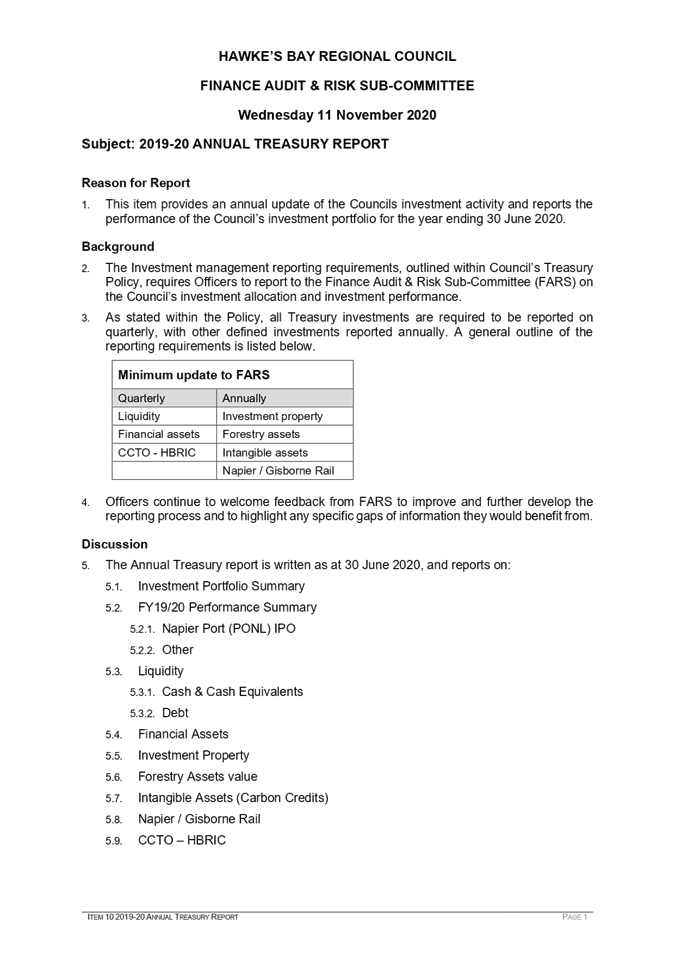

Council Chamber

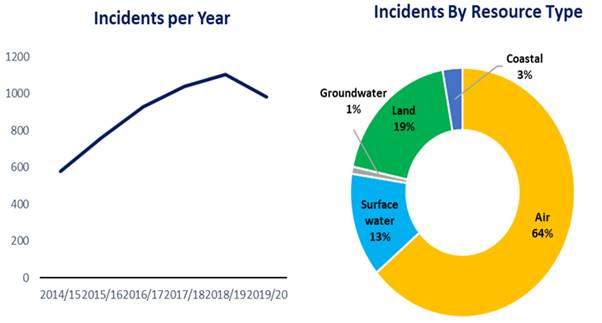

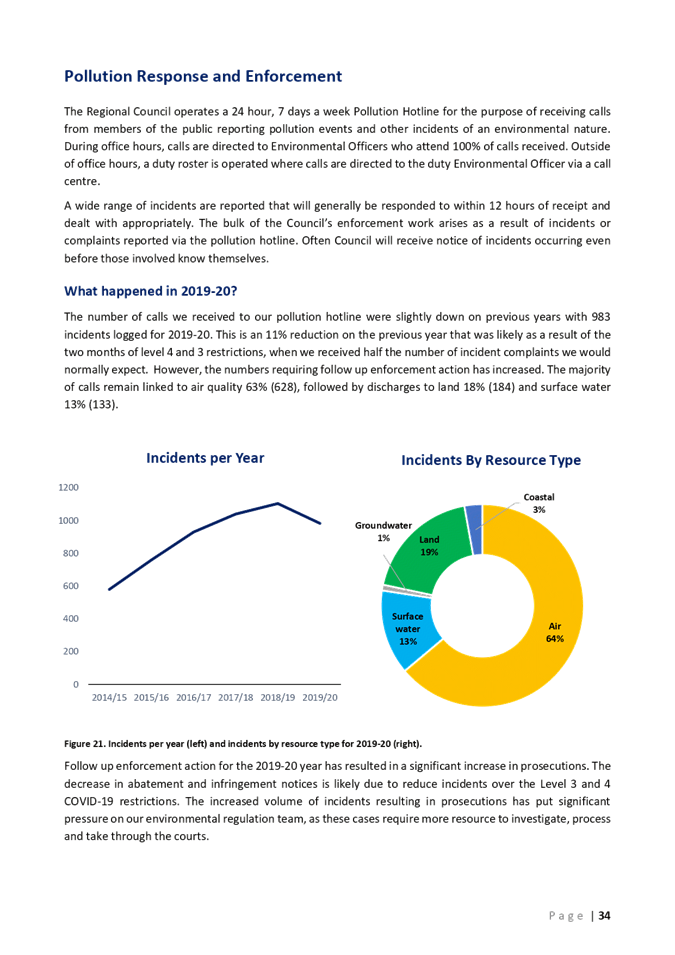

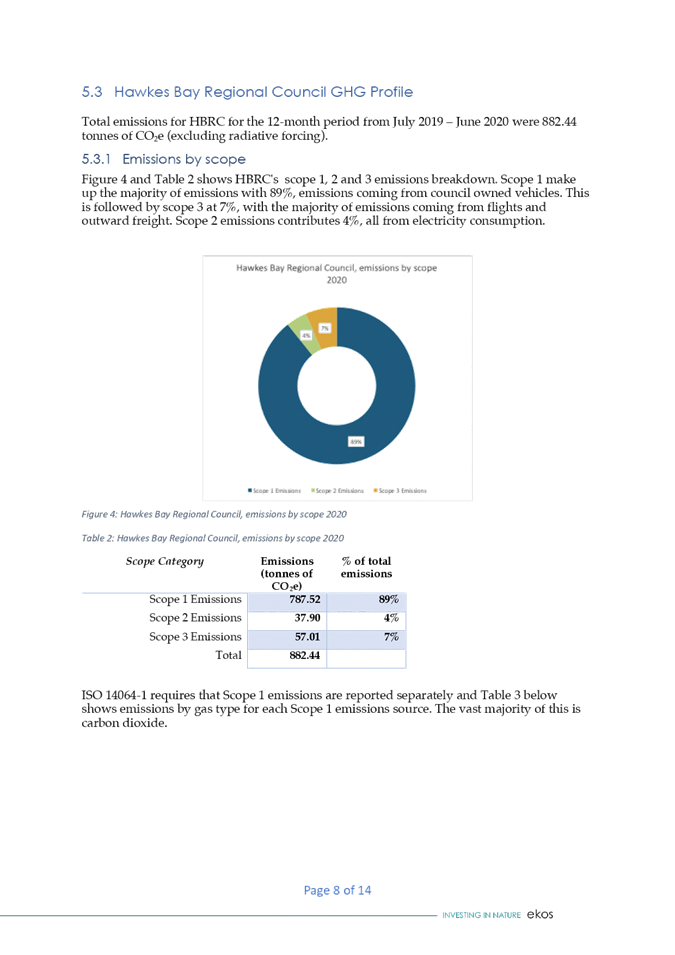

Hawke's Bay Regional Council

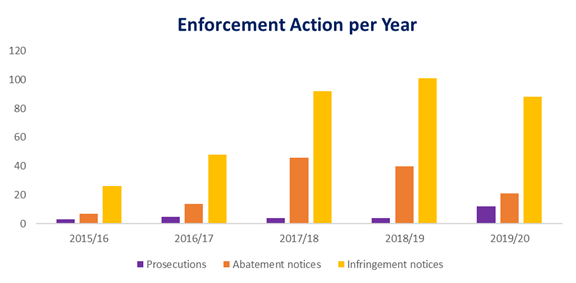

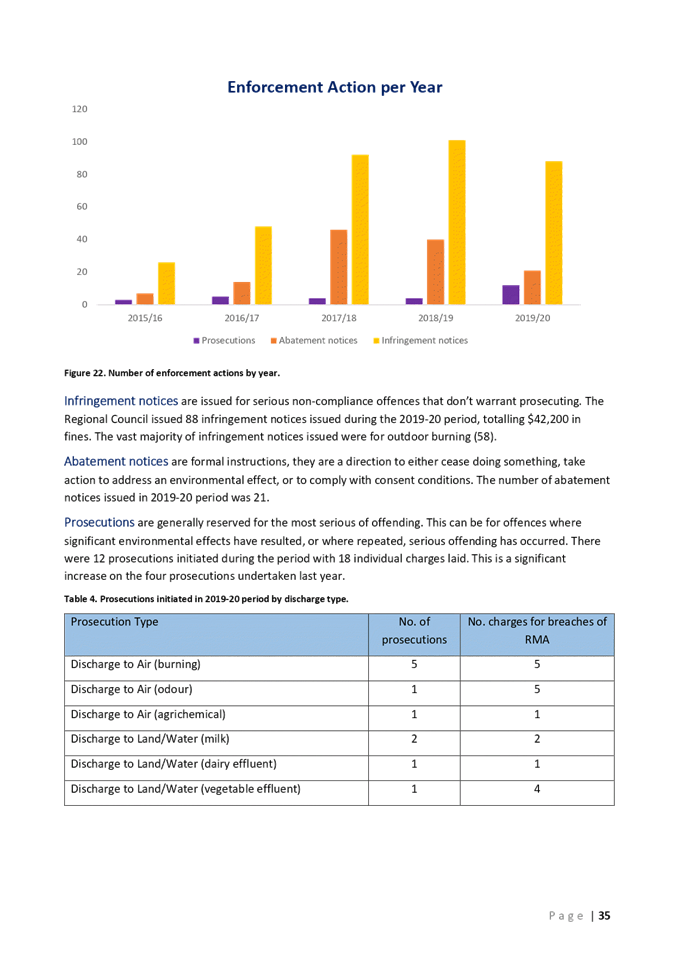

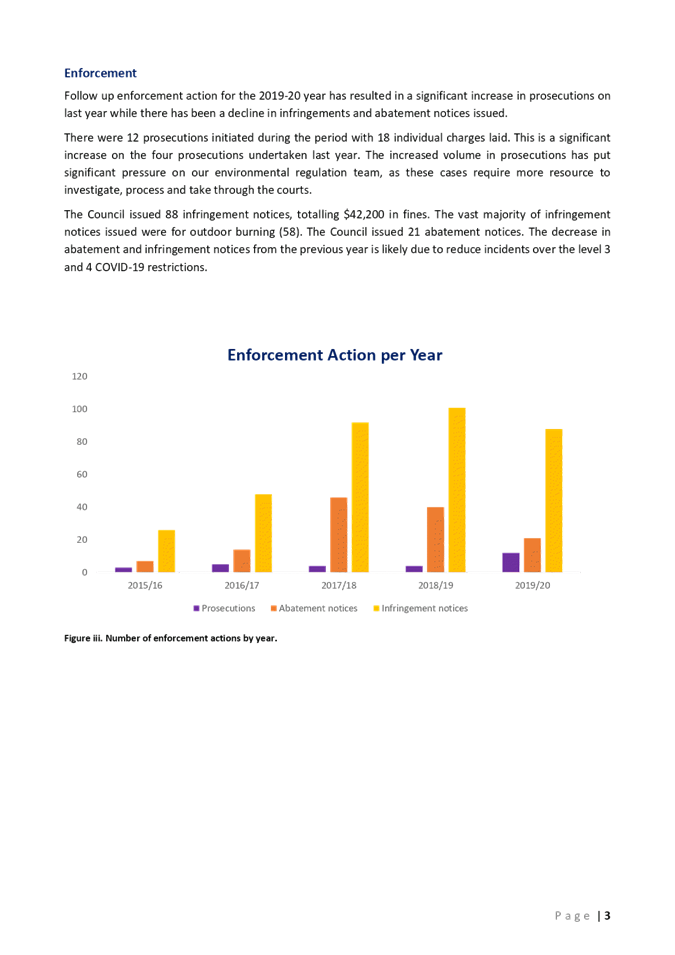

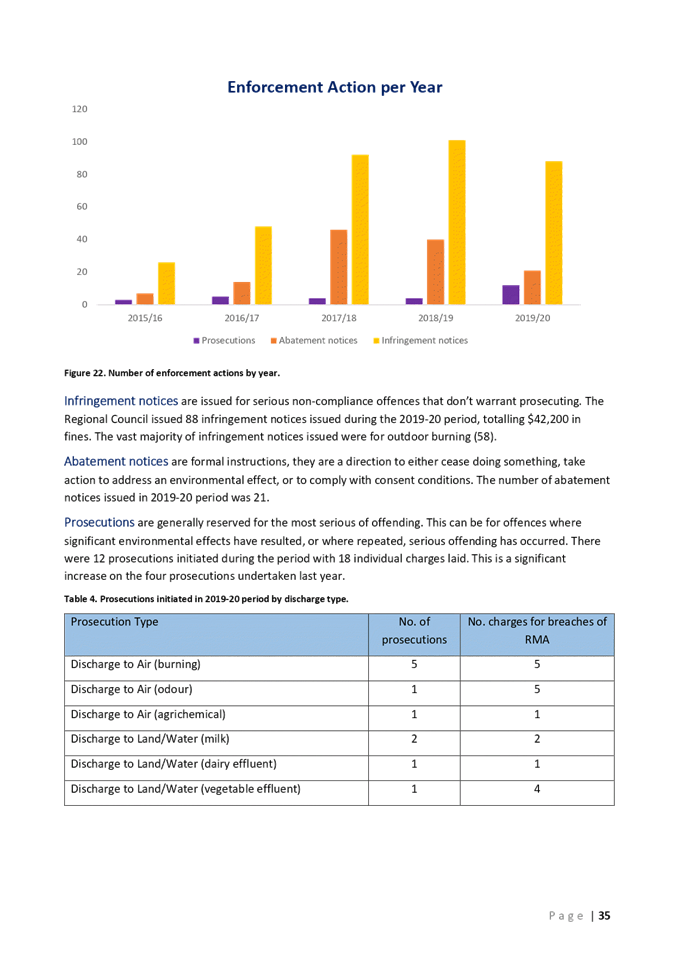

159 Dalton Street

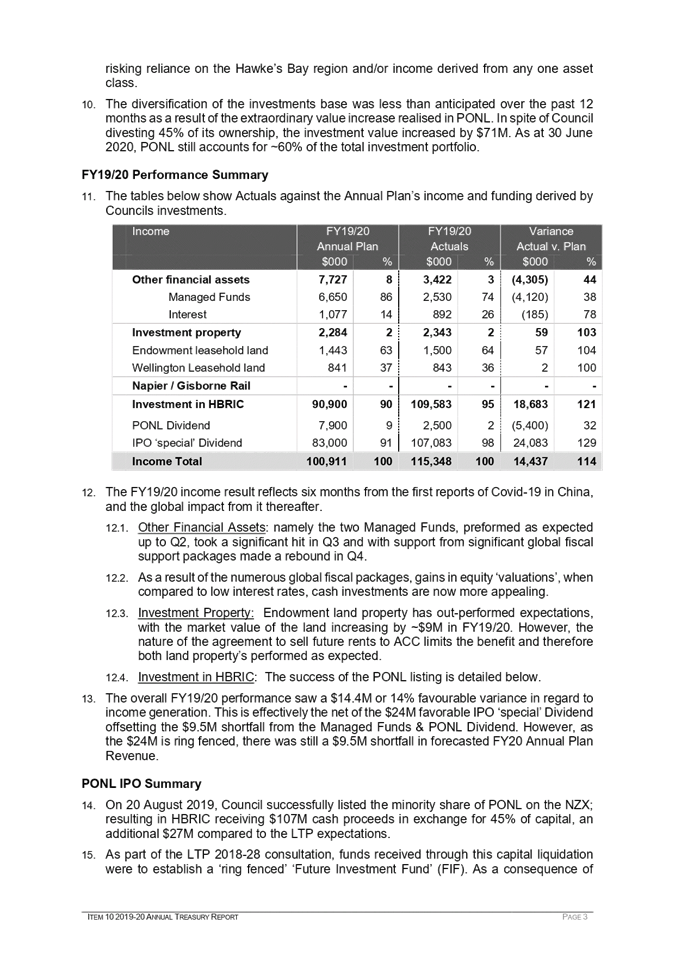

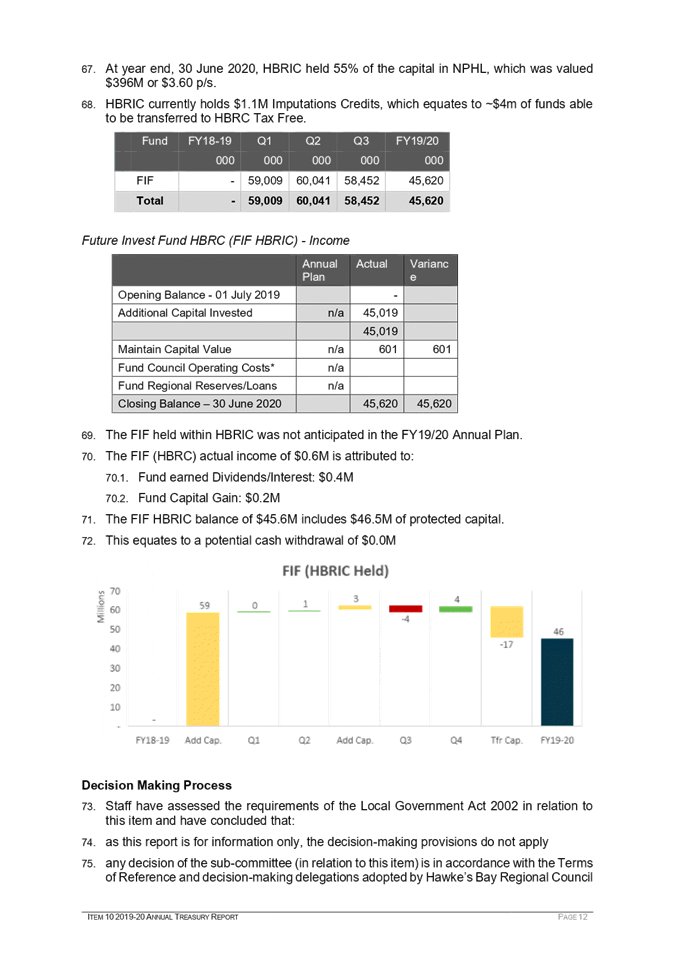

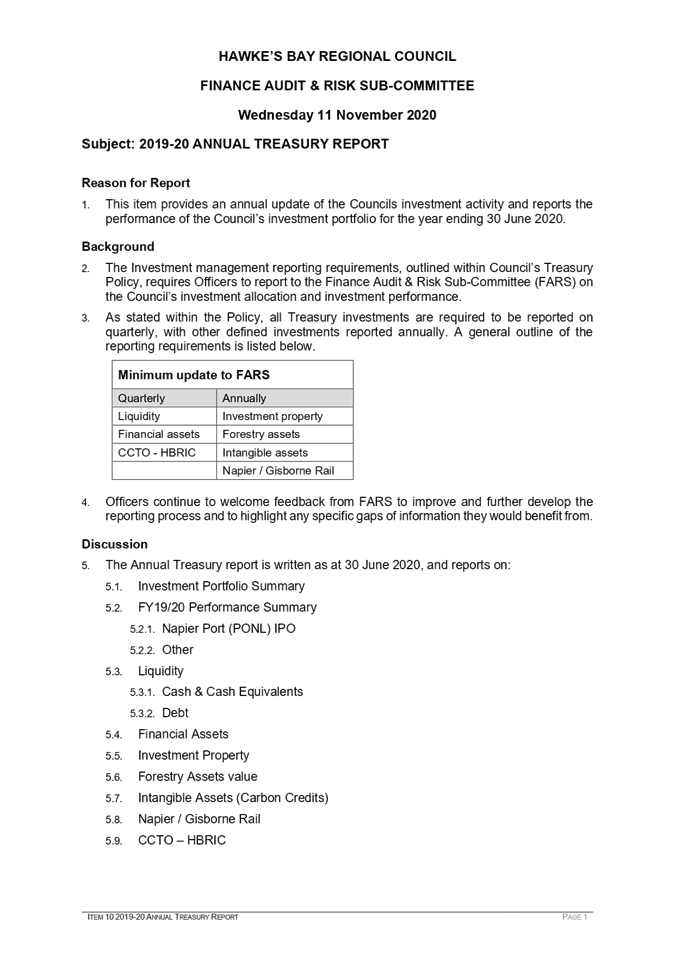

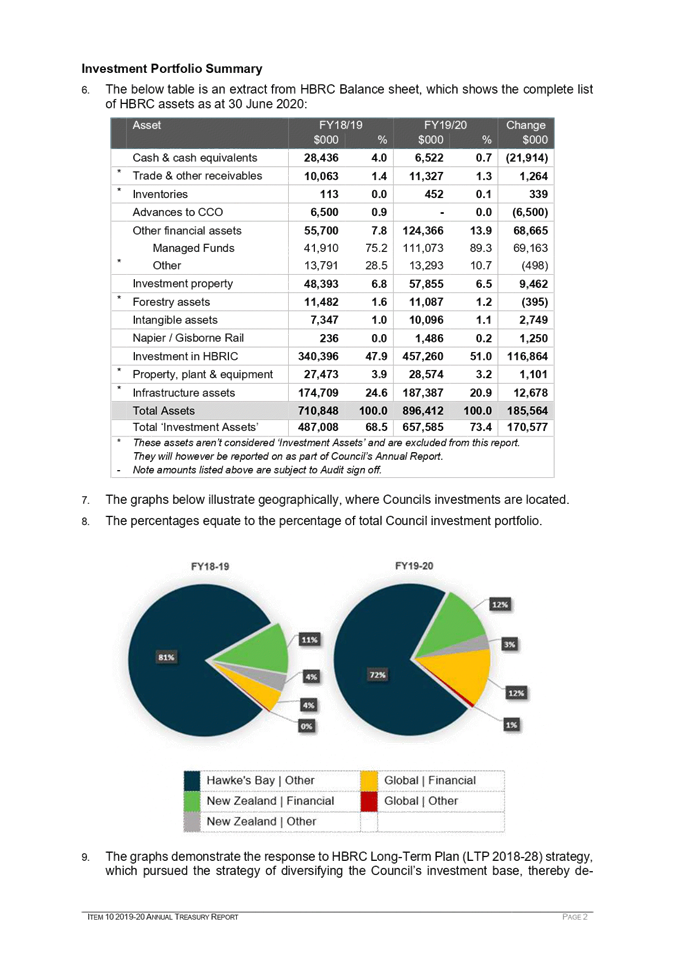

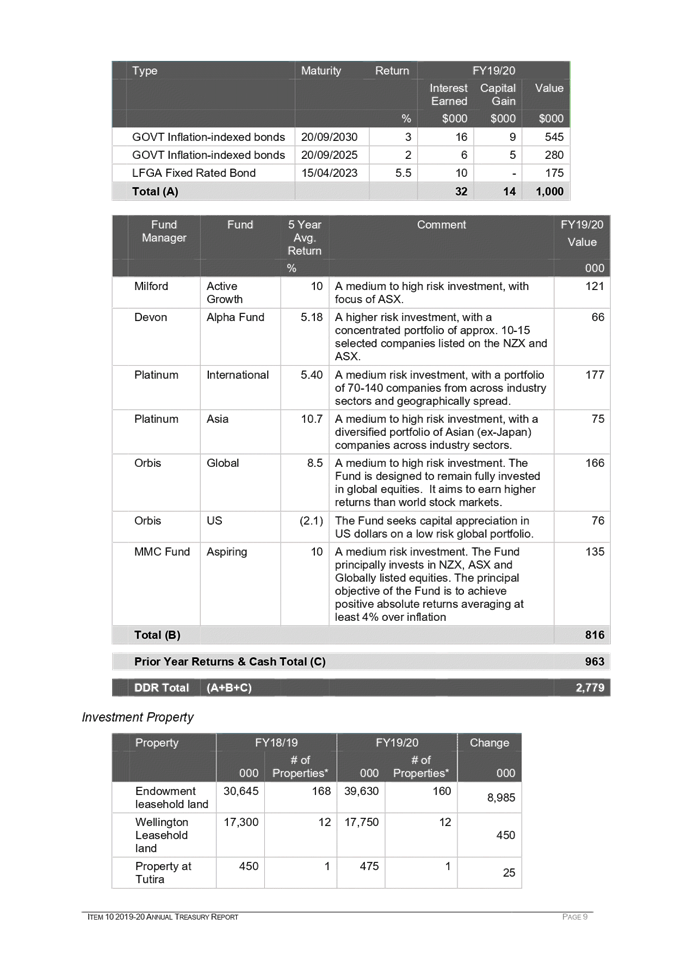

NAPIER

|

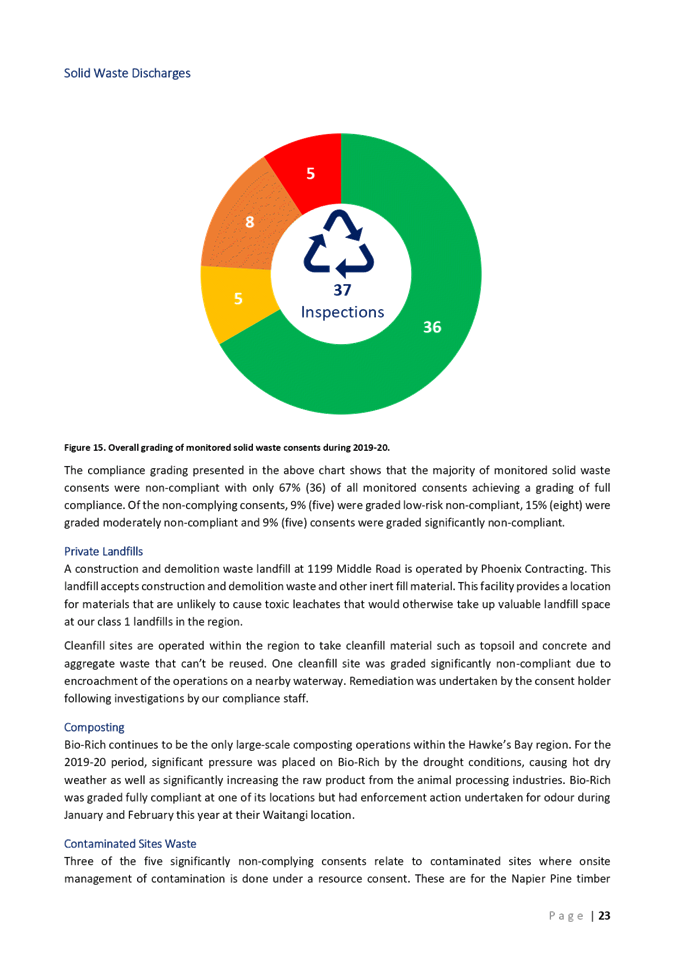

Agenda

Item Title Page

1. Welcome/Notices/Apologies

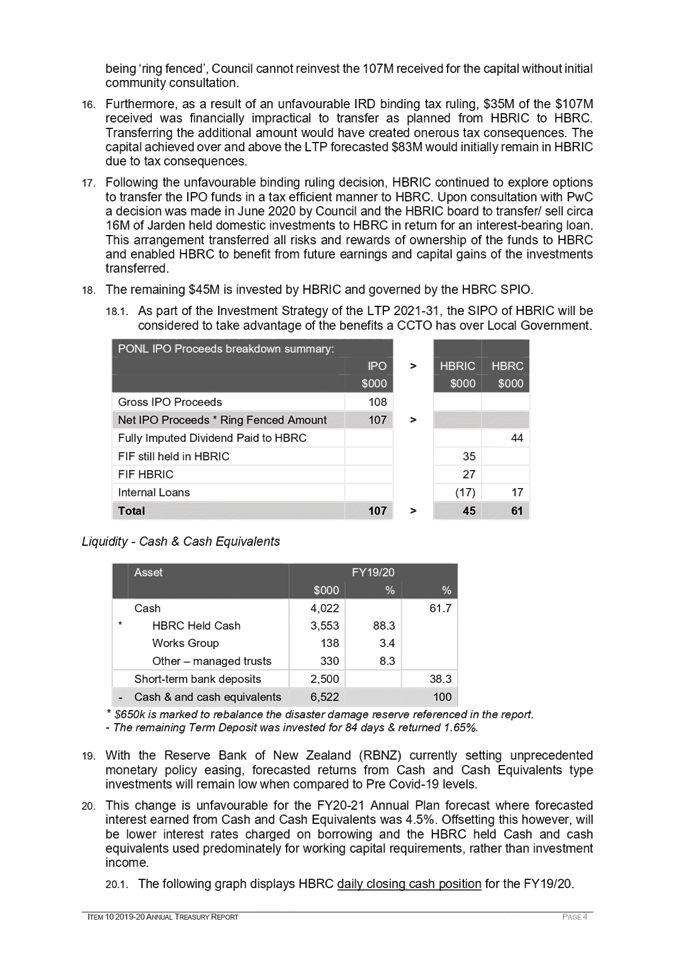

2. Conflict

of Interest Declarations

3. Confirmation of

Minutes of the Corporate and Strategic Committee held on 2 September 2020

4. Follow-ups from

Previous Corporate & Strategic Committee Meetings 3

5. Call for Minor

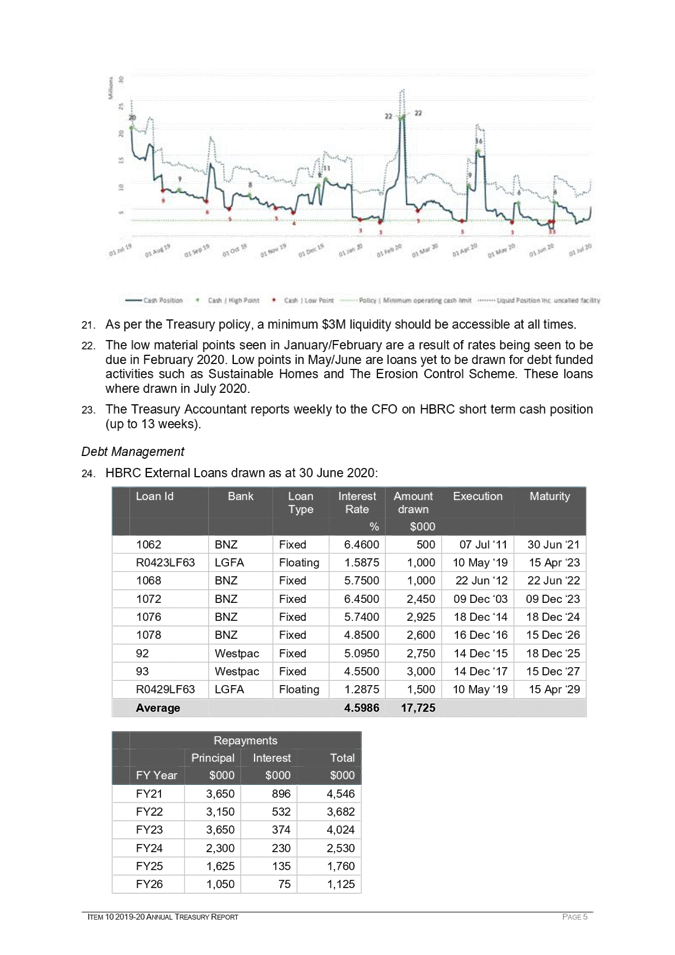

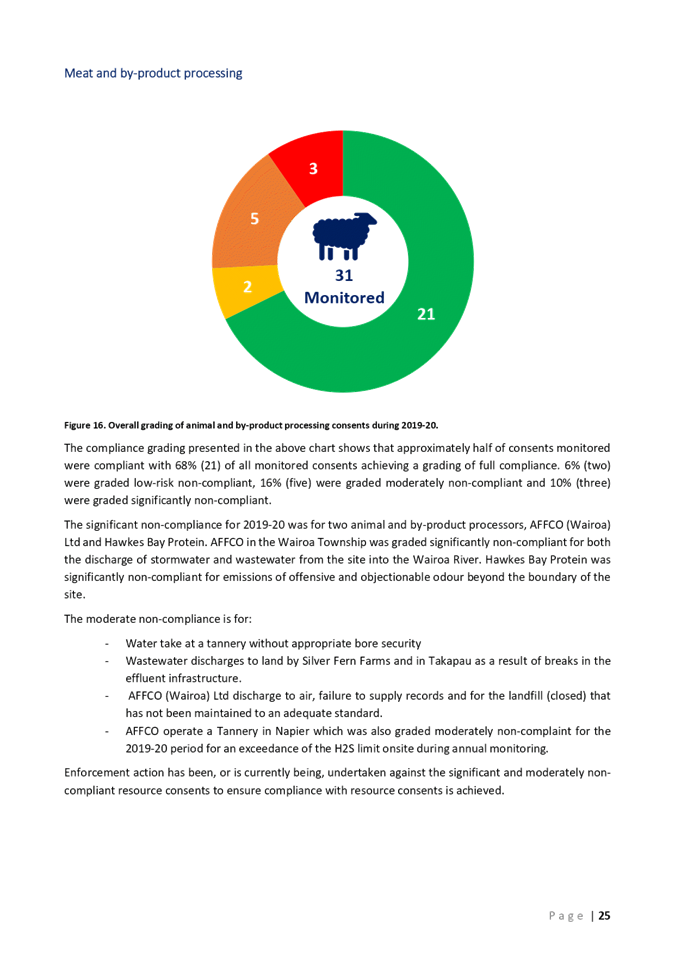

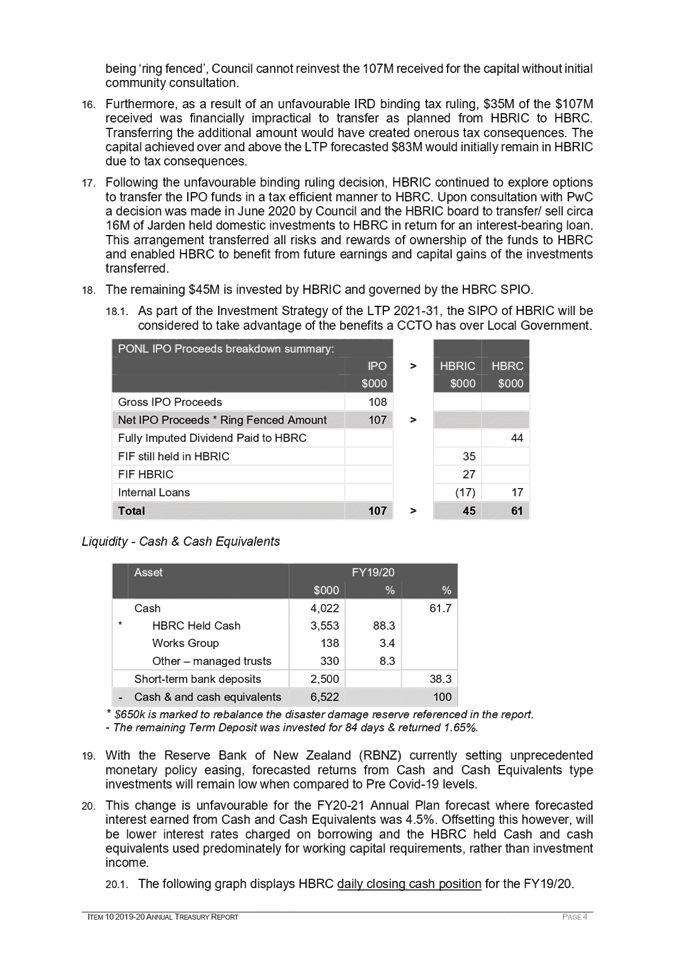

Items Not on the Agenda 7

Decision Items

6. Pettigrew Green

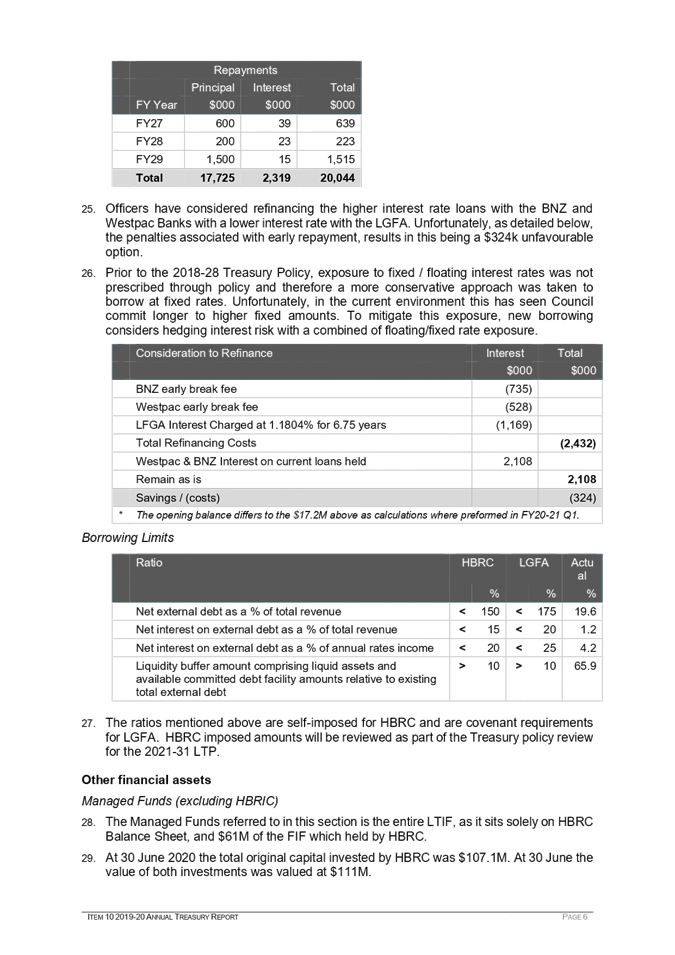

Arena Car Park 9

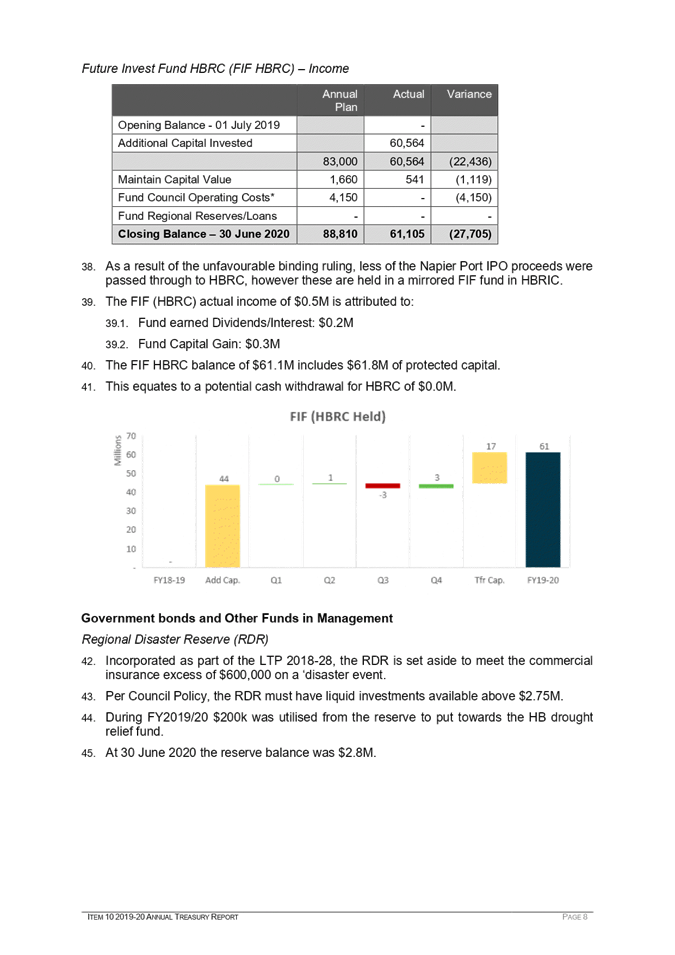

7. 2019-20 Compliance

Annual Report 23

Information or Performance Monitoring

8. Report from the 11

November 2020 Finance Audit and Risk Sub-committee Meeting 77

9. Harbourmaster

Functions 117

10. HB Tourism Six-monthly Update 119

11. Organisational Performance

Report for period 1 July to 30 September 2020 139

12. 2020-21 Quarter 1 (1 July

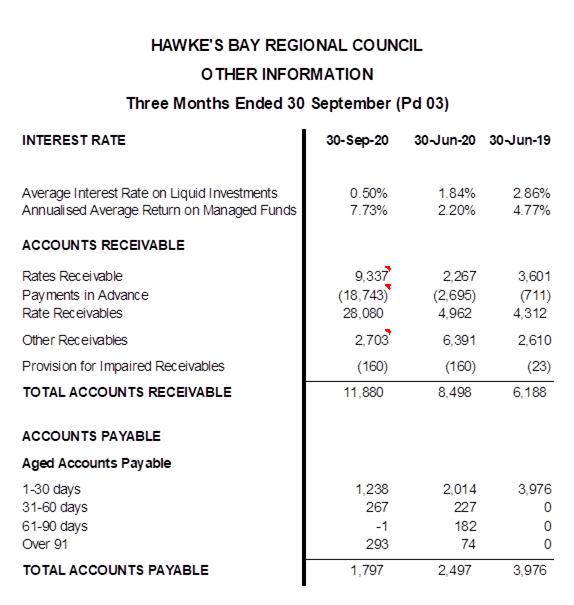

– 30 September 2020) Financial Report 229

13. The Regional Council’s

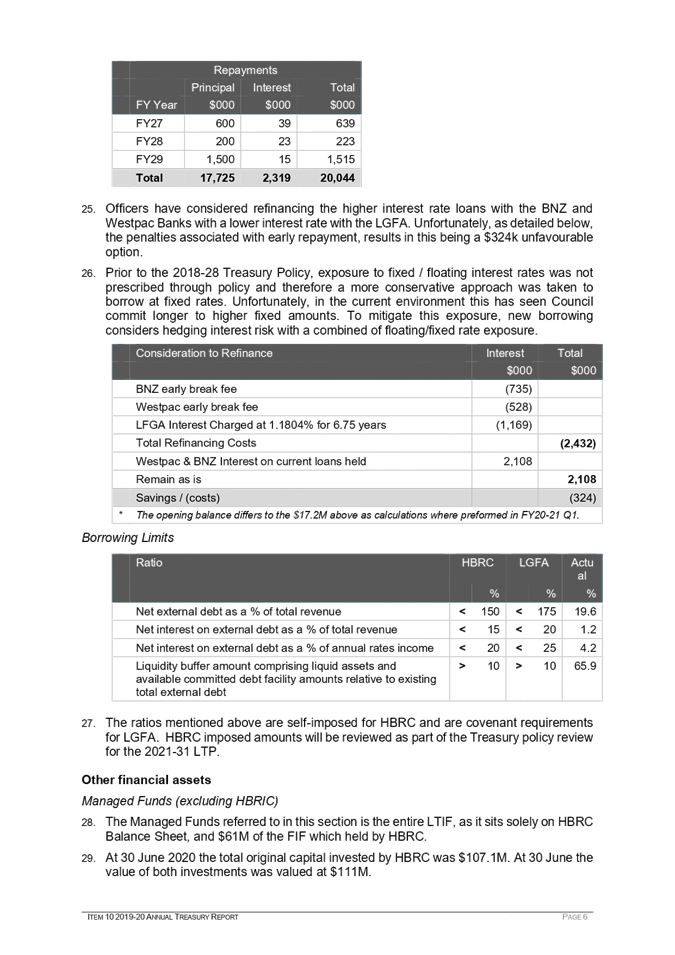

Corporate Carbon Footprint 239

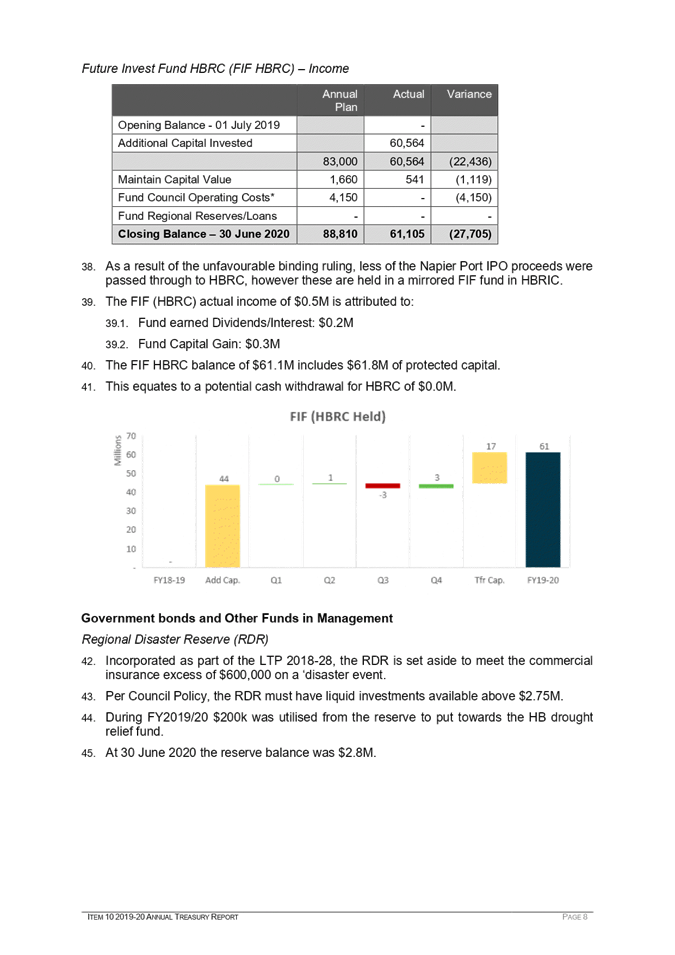

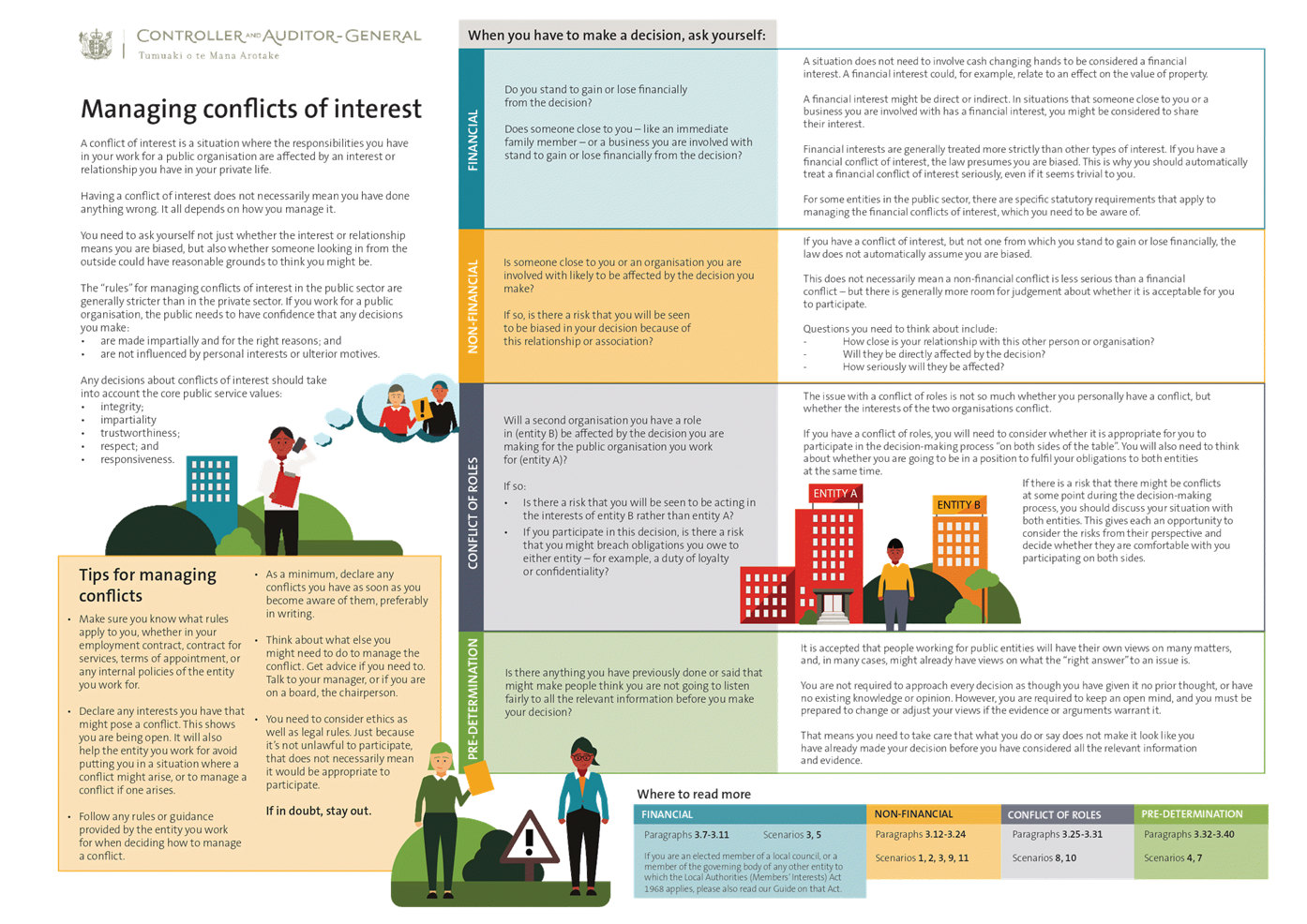

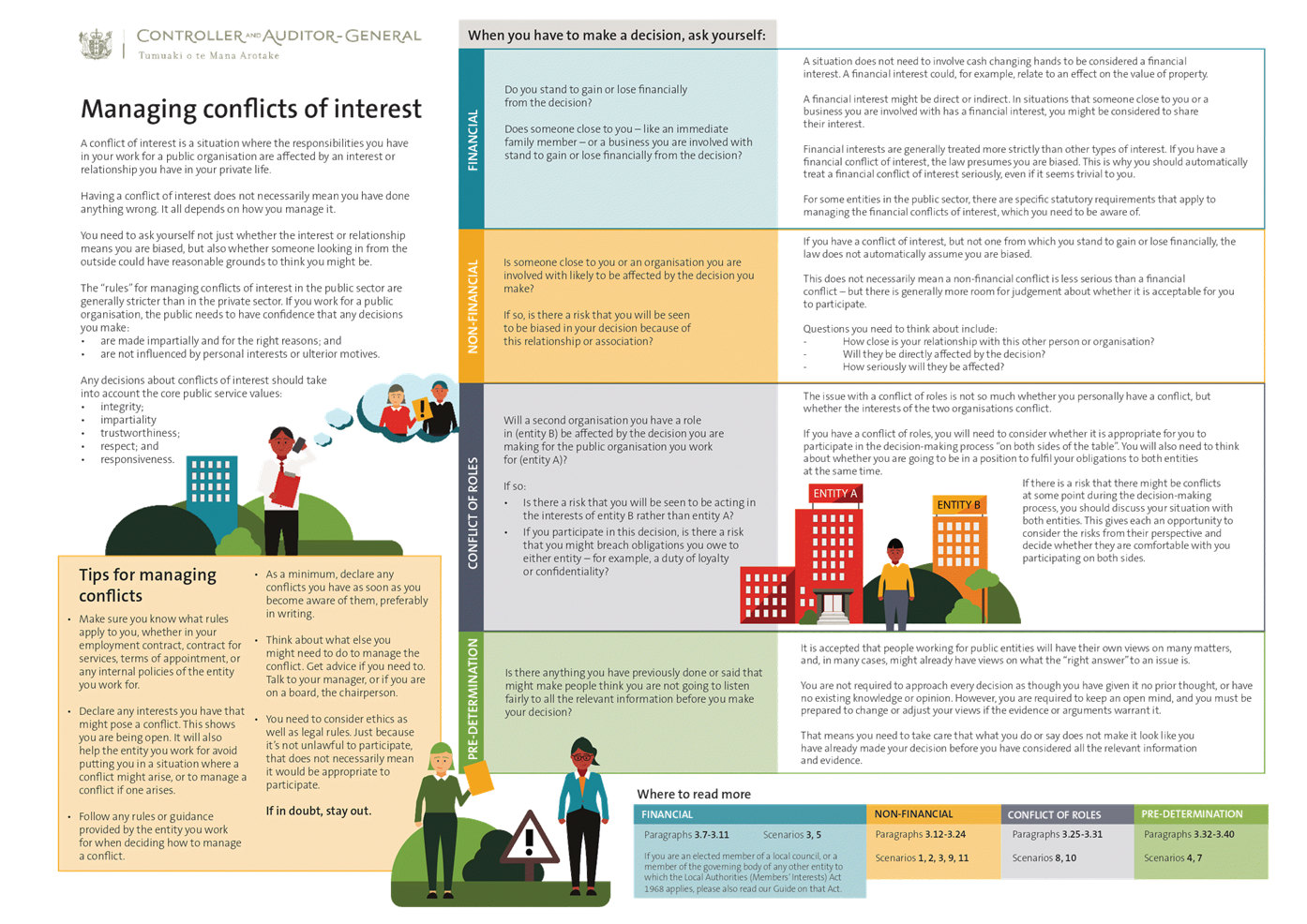

14. Controller and Auditor General

2020 Managing Conflicts of Interest Guidance 259

15. Discussion of Minor Matters

Not on the Agenda 315

Decision Items (Public Excluded)

16. HBRIC Ltd Quarterly Update 317

HAWKE’S BAY REGIONAL COUNCIL

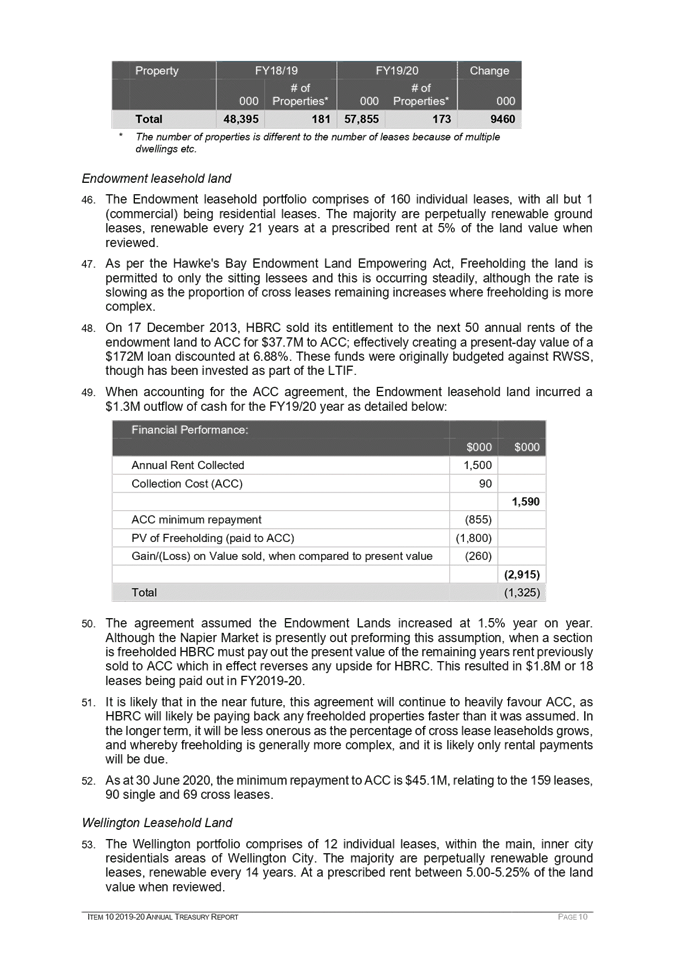

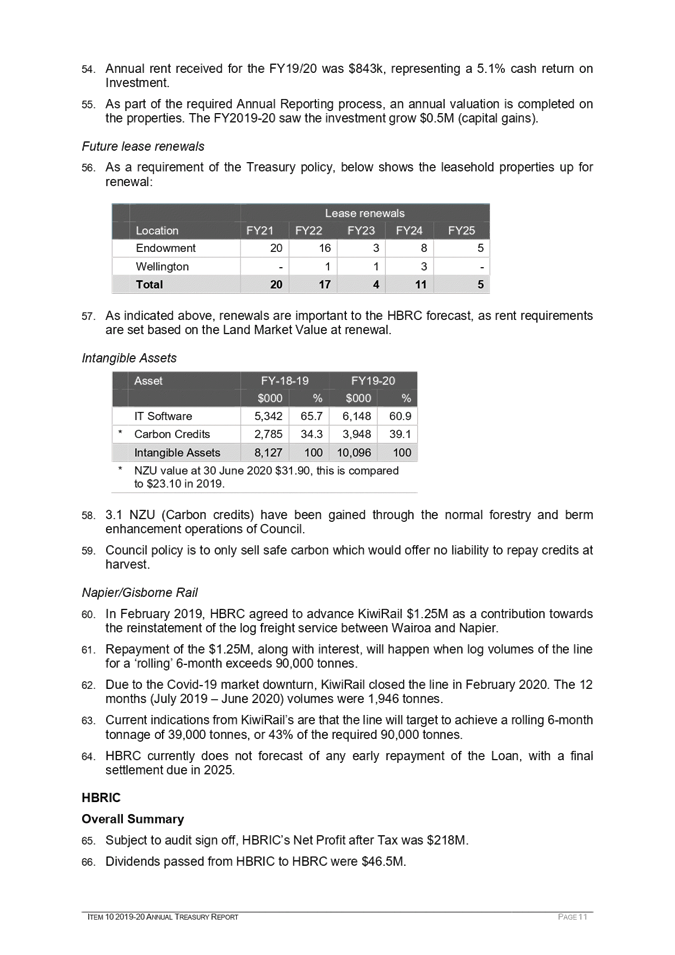

Corporate

and Strategic Committee

Wednesday 02 December 2020

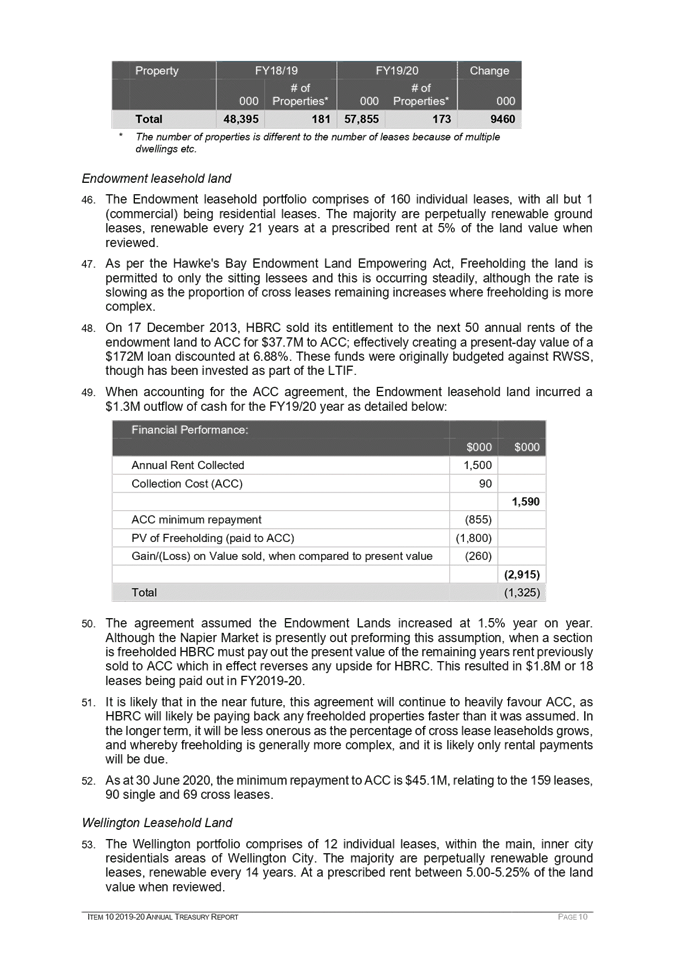

Subject: Follow-ups from

Previous Corporate & Strategic Committee Meetings

Reason for Report

1. On the

list attached are items raised at previous Corporate & Strategic Committee

meetings that staff have followed up on. All items indicate who is responsible

for follow up, and a brief status comment. Once the items have been reported to

the Committee they will be removed from the list.

Decision Making Process

2. Staff

have assess the requirements of the Local Government Act 2002 in relation to

this item and have concluded that, as this report is for information only, the

decision making provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee

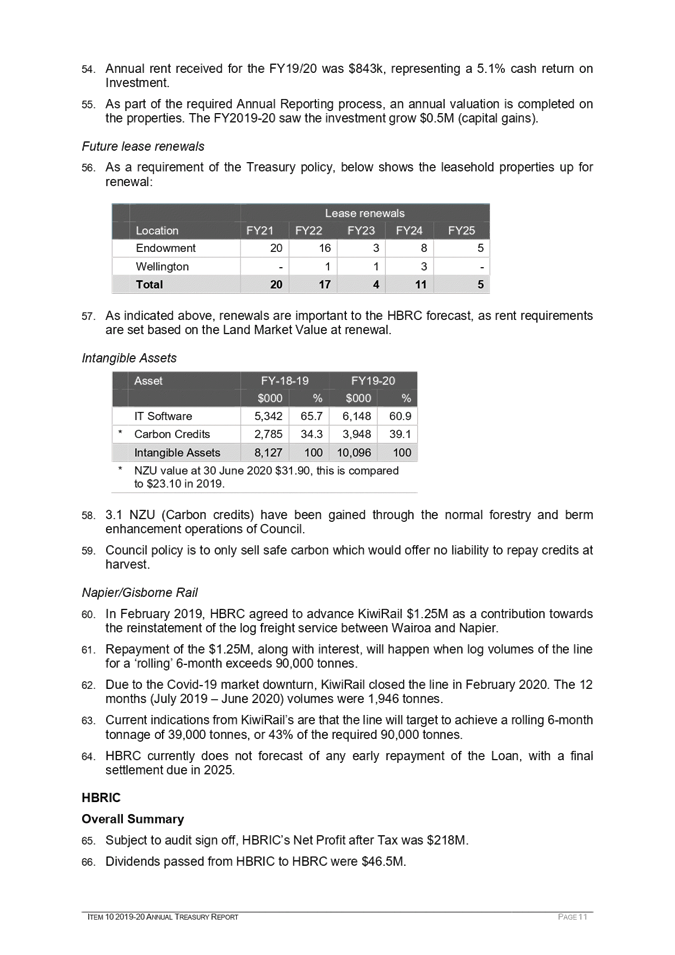

receives and notes the “Follow-up Items from Previous Meetings”.

|

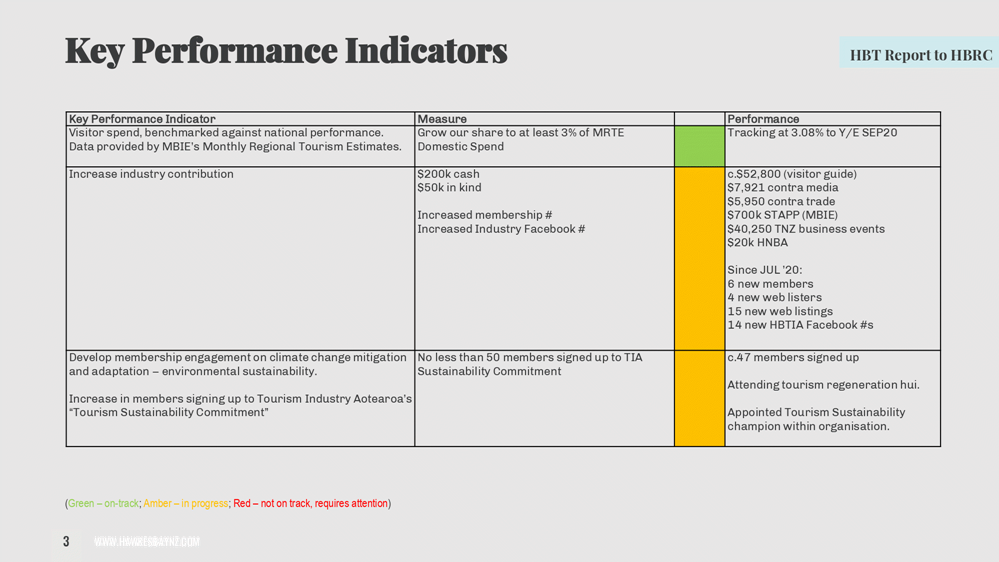

Authored by:

|

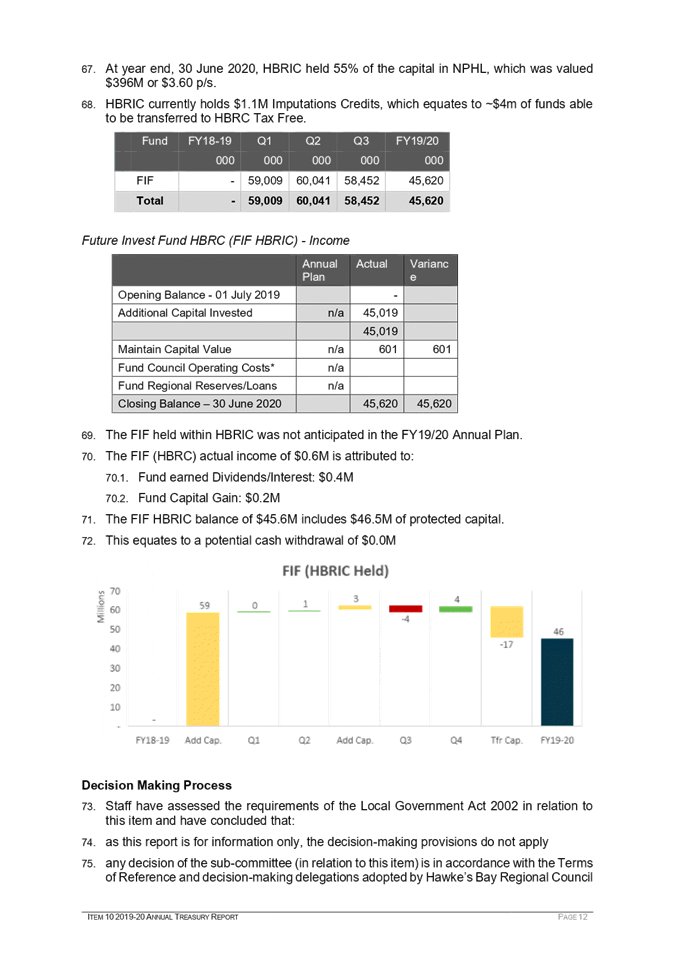

Leeanne

Hooper

Team Leader Governance

|

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

|

⇩1

|

Followups for

December 2020 Corporate and Strategic meeting

|

|

|

|

Followups

for December 2020 Corporate and Strategic meeting

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 02 December 2020

Subject: Call for Minor Items

Not on the Agenda

Reason

for Report

1. This item provides the means for committee members to raise minor

matters they wish to bring to the attention of the meeting.

2. Hawke’s Bay Regional Council standing order 9.13

states:

2.1. “A

meeting may discuss an item that is not on the agenda only if it is a minor

matter relating to the general business of the meeting and the Chairperson

explains at the beginning of the public part of the meeting that the item will

be discussed. However, the meeting may not make a resolution, decision or

recommendation about the item, except to refer it to a subsequent meeting for

further discussion.”

Recommendations

3. That the Corporate and Strategic Committee accepts the following

“Minor Items Not on the

Agenda” for discussion as Item 15:

|

Leeanne Hooper

TEAM LEADER GOVERNANCE

|

James Palmer

CHIEF EXECUTIVE

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 02 December 2020

Subject: Pettigrew Green Arena

Car Park

Reason for Report

1. This report

provides information to inform inter-Council decisions around the preferred

location of the car-parking for the Pettigrew Green Arena expansion.

Officers’ Recommendations

2. Council

officers recommend that the Committee considers the three options provided and

recommends that Council commences discussions with Napier City Council to

provide direction to Pettigrew Green Arena on a preference for the car-parking

site.

Executive Summary

3. The Pettigrew

Arena is in receipt of PGF funding to develop additional indoor court space for

Napier/ Hastings.

4. As part of the

development of the site, a location is required for approximately 400 carparks.

During the day these carparks can be utilised by EIT.

5. There are two

identified locations for the carpark. The first located behind the existing

Pettigrew Arena building and carpark on NCC Reserve and the second located on

adjacent Tūtaekurῑ river berm on the river side of the stopbank

managed by HBRC. There is a third hybrid option also presented in the paper.

6. This paper

presents an analysis of all three options of which the staff assessment shows a

narrow margin for the NCC reserve. This paper asks the Corporate and Strategic

Committee to form a position on the optimal location of the carpark.

7. A similar paper

and process is being presented to Napier City Council.

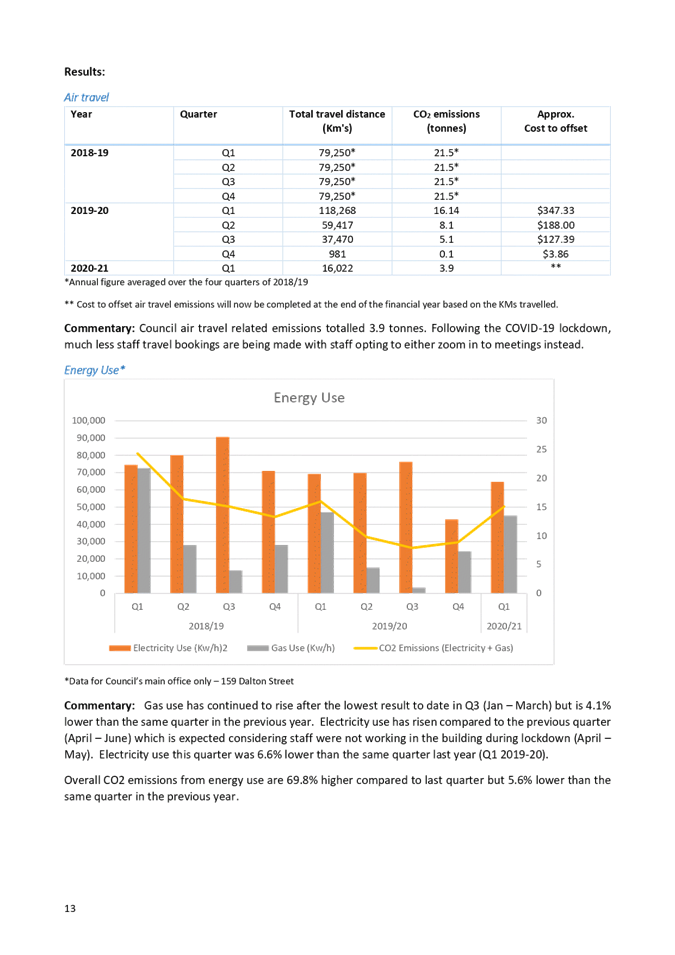

8. Once each

Council has formed a view, advice can be provided to the Regional Indoor Sport

and Events Centre Trust.

Background /Discussion

9. The Regional

Indoor Sport and Events Centre Trust (RISEC) is the charitable trust that

operates the Pettigrew Green Arena in Taradale. Since the decision not to

proceed with the Multi-Use Sports Facility in 2018, the Trust has been

developing options to progress its own facility expansion through providing additional

indoor courts. A business case, feasibility study and proposal have been

completed.

10. The facility is situated

on NCC reserve land (Riverside Reserve). The reserve is broken into two

parts with separate designations under the Reserves Act 1977. The area of

the reserve in which the existing facility is located is designated as a local

purpose community holding reserve, where the rear of the reserve that is

currently green space, playground and dog agility area is a recreational

reserve. The local purpose community holding reserve designation enables

more commercial activity with the leased office space, gym and food provider

within the facility.

11. The proposed extension is

to construct a new building at the rear of the existing Pettigrew Green Arena

(PGA) in Taradale over the car park and a small section of EIT land next

door. It is proposed to include a wooden floor that can accommodate six

full size futsal courts. The carpark area that has made way for the

expanded building will need to replaced and added to close by.

12. The new facility will be

available for use by a large number of sporting codes, so the floor space will

be able to be configured for the following sports:

12.1. Basketball

12.2. Futsal

12.3. Volleyball

12.4. Netball

12.5. Badminton

12.6. Indoor bowls

13. The new facility is

estimated to cost in the region of $14 million (definitive budget still to be

completed), with one third of the funding to be sought from corporate

sponsorship, philanthropic trusts, government funding and public donations.

14. Construction of the

proposed facility is to take approximately one year, and the project will have

the ability to be scaled back if the funding targets are not achieved.

15. The need for the expanded

facility has been supported by a number of documents and reports that have

indicated a high level of unmet demand for indoor court space in Hawke’s

Bay driven by structured indoor sports.

16. These documents and

reports have consistently indicated a need of between two and six additional

courts across Hawke’s Bay. Given the age of these reports and for

some the dependence on the National Facilities Strategy for Indoor Sports

(2013), these court demand projections do not account for the rapid growth of

primarily basketball, but also futsal and volleyball, and the larger than

projected growth in the population of Hawke’s Bay.

17. To support RISEC with its

expansion project, in April 2020 NCC approved the formation of an Indoor Sports

Working Group comprising NCC councillors and officers, PGA, Sport HB and EIT

representatives.

18. In August 2020 Government

announced that the PGA expansion project has been granted $6.4 million from the

Government's Covid Response and Recovery Fund. This investment combined

with $4.1 million from NCC and approximately $2 million of existing RISEC

funding will comprise the bulk of the project’s construction

budget. The primary driver for the national government investment is to

stimulate economic activity for the local economy. This impetus creates a

haste to get the building underway.

19. The site plan for the

expanded facility (attached) shows the new 5 futsal court facility sited where

at the rear of the existing facility and over the current carpark. In

addition to replacing the carpark that is planned to be built over, there is a

need to create car parking capacity to cater for the additional visitors to the

facility.

20. The HBRC land assessed for

a carpark is in part held for the Improvement and Protection of the Tūtaekurῑ

River and in accordance with the purposes of the Soil Conservation and Rivers

Control Act 1941 (SCRCA). The objectives set out in Section 10 of the SCRCA

included:

20.1. The promotion of soil

conservation

20.2. The prevention and

mitigation of soil erosion

20.3. The prevention of damage

by floods

20.4. The utilisation of lands

in such manner as will tend towards the attainment of the above objectives

21. Part of the land is also

held as a Hydro Parcel surveyed prior to 1918. Further analysis is required on

this land tenure with regards to the rights for HBRC to establish a carpark

over this area. HBRC’s relationship to this land is as the responsible

authority for the waterway in accordance with the Resource Management Act 1991

(RMA). Section 30(1)(g) of the RMA which is relevance to the Hydro parcel sets

out the function of HBRC with similar responsibilities to the SCRCA.

Options Assessment

22. Pettigrew Green Arena has

an existing arrangement with the Eastern Institute of Technology in which PGA

parking can be used by EIT students during weekdays, with PGA having access to

EIT parking for events when overflow car parking is required.

23. The council reserve is

bordered by the EIT Student Village to the north, and Hawke’s Bay

Regional Council land to the south (the stopbank, cycle paths and riverbank

land). To enable the land required to construct the expanded facility and

provide a service access lane around the facility a small sliver of EIT land is

required.

24. These site constraints and

different landowners pose a challenge to locating car parking in a way that

best services the need of the facility and EIT.

25. There are three options

for the location of the car park:

25.1. Option 1 is locating the

car–parking on the NCC-owned Riverside Reserve to the east of the

proposed extension

25.2. Option 2 is locating the

car parking over the stopbank on HBRC

managed land

25.3. Option 3 is a hybrid of

the two options – part located in the NCC reserve and part across the

stopbank on HBRC land.

26. To inform subsequent

discussions between NCC and HBRC, this paper includes an assessment of these

three options.

Criteria

27. In order to develop a

rounded assessment of the three options a criteria including the following

aspects was developed:

27.1. Strategic fit –

the impact that the options have on the strategic intent of NCC and HBRC

27.2. Site efficiency –

how effectively the positioning of the car-park services the Pettigrew Green

Arena

27.3. Whole of life costs

– the capital and operating costs of each option

27.4. Existing utility –

what community utility value will be given up for each option to construct a

car-park

27.5. Environmental/ecological

impact – the impact of each option on the natural environment

27.6. Risks – the risk

levels associated with each option

27.7. Acoustics – the

acoustic impact on neighbouring residents

27.8. Visual impact –

Mitigating the car-park aesthetics and blending into its surroundings

27.9. Future-proofing –

the impact of the options on potential future PGA expansion

28. The criteria and ratings have

been developed and agreed between officers from Napier City Council and

Hawke’s Bay Regional Council.

Limitations

29. The options assessment is

a high-level officer assessment to inform council decisions as to the way

forward. It provides a qualitative assessment to assess the three options

using relevant criteria to identify the positive and negative aspects and

separate the options. The assessment is not intended to make the

decision, but to inform deliberations between councils to provide direction to

PGA/RISEC.

30. Every criteria has been

given equal weighting. It is possible that council considers that some

criteria should be given increased or decreased weightings and this should be

considered during deliberations.

Assessment results

31. Three options assessed

against this criteria, with the intention of providing an objective and

relative option comparison to assist with the decision making of NCC and

HBRC.

32. The following rating scale

was used to assess the options and help to differentiate based on the criteria:

32.1. 1 – Little to no

impact

32.2. 3 – Medium impact

32.3. 5 – Significant

impact

33. The assessment scoring of

the three options is as follows:

|

Option

|

Total score

|

Ranking

|

|

1 – Riverside Park Reserve (NCC land)

|

44

|

1 (preferred)

|

|

2 – Over the stopbank (HBRC land)

|

50

|

2

|

|

3 – Hybrid options (both NCC and HBRC land)

|

52

|

3 (least preferred)

|

Summary of options

34. Option 1: Riverside Park

Reserve

34.1. Pros

34.1.1. Better car-parking security and

accessibility

34.1.2. No need to have traffic cross the bike

path

34.1.3. Car park not constructed in flood hazard

zone – reducing risks and operating costs

34.2. Cons

34.2.1. Closer to neighbouring residences

meaning that noise and disturbances from car park users will be more

significant

34.2.2. Is further from EIT for students,

potentially meaning students may choose to park on the road rather than the

designated car park

34.2.3. Will remove green space used by the

community

34.2.4. Will require the relocation of

infrastructure including public toilets, dog-agility park and playground.

35. Option 2: Over the

stopbank

35.1. Pros

35.1.1. Closer proximity for EIT students

35.1.2. Advantages to managing noise,

disturbances and visual impact

35.2. Cons

35.2.1. Increased risks to carpark infrastructure

and private vehicles due to flooding from a 1 in 5 year flood event

35.2.2. Increased operational costs for the

carpark owner from clean up and damage caused by potential flood damage

35.2.3. Will remove greenspace used by the

community

35.2.4. Will require relocation of the Taradale

pump/ jumps cycle track

36. Option 3: Hybrid option

36.1. Pros

36.1.1. No advantages over the 2 other options

36.2. Cons

36.2.1. Higher capital costs from cross the

stopbank twice

36.2.2. Greater disruption to cycle path from

the two crossings

36.3. The full option

evaluation matrix is included in the attached documents.

Mitigations through design

37. Design, engineering and

construction methods can mitigate the negative impacts of the stopbank

option. Plantings, choice of materials and engineering to help to

mitigate the impact of flood waters in a flood event are all considerations for

detailed design.

38. It may also be possible to

use the car park to provide improved access for people to the river to support

other recreational opportunities.

39. The summary identifies the

key tension between the options.

40. While the stopbank option

(option 2) is considered optimal by the proponent as the best situation for

servicing the arena itself, as well as better servicing EIT students, it

carries a much greater risk of flooding, potentially causing loss or damage to

parked vehicles, damage to the car park itself and increased operational costs

through clean up after flood events.

41. Pettigrew Green Arena has

undertaken to be responsible for asset repair costs, operational costs and

risks should the car park be situated over the stopbank, so these costs will

not be borne by HBRC or NCC.

Impact of Climate Change

42. The impact of climate

change to Hawke’s Bay was recently presented at the 4 November 2020

Environment and Integrated Catchment Committee.

43. This paper noted:

43.1. The changes in rainfall

are expected to impact river flows. Annual average discharge decreases

(by approximately 20% by 2090 under the high emissions pathway). Mean

annual low flows (MALF) largely decrease over time, exceeding 20% in some areas

by 2090 under the high emissions pathway, but an increase in summer rainfall in

coastal locations may mean an increase in some catchments by 2040 under the mid-range

emissions pathway. Mean Annual Flood increases by up to 50% for

many of the region’s rivers by the end of the century under a high

emissions pathway.

44. The key point of this

analysis is that flood events are likely to become more frequent and so over time

the current flood impact assessment of 1:5 to the proposed carpark will become

more frequent. At this stage it is a trend only and no detailed analysis has

been undertaken.

45. HBRC is currently working

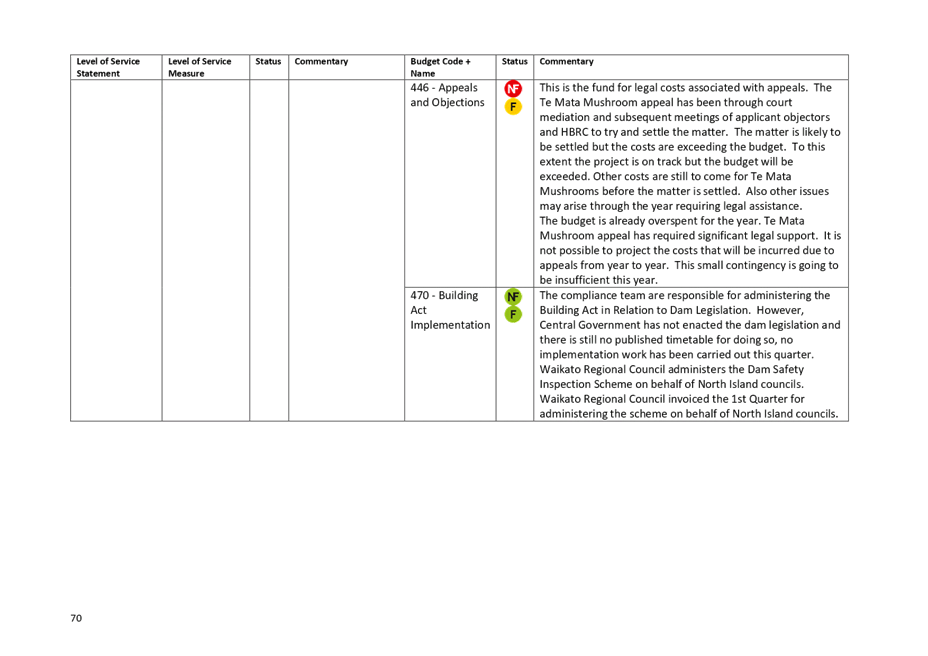

with NIWA to develop robust methods to introduce climate change scenarios into

our river modelling.

The EIT perspective

46. EIT has formally expressed

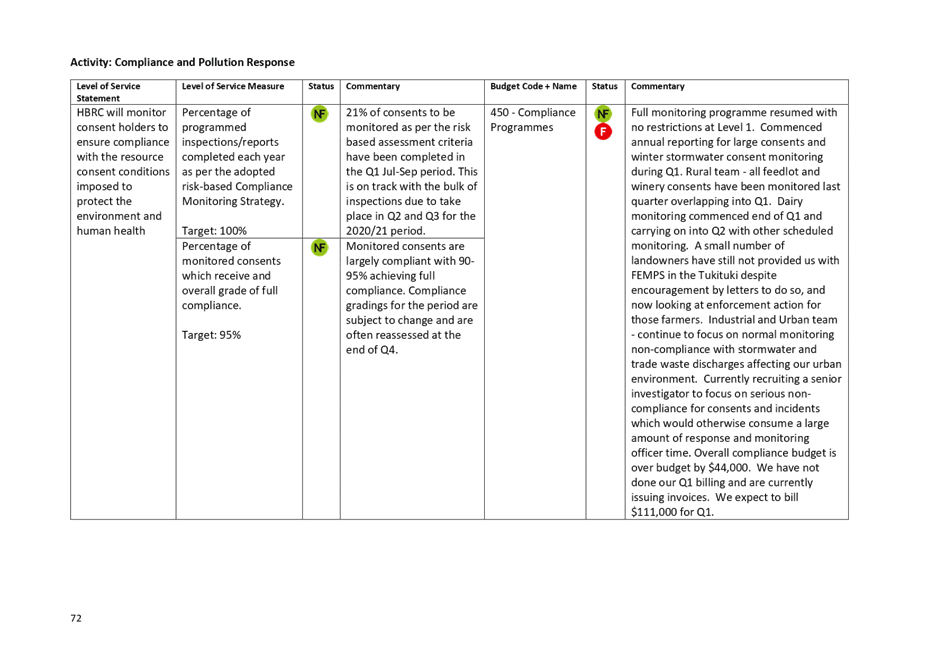

its firm preference to have the car-parking located over the stopbank.

This is primarily driven by concerns over the proximity of the parking to EIT,

and concerns that with the additional distance that the students will not use

the park and prefer to park on the street.

47. The project requires that

EIT provide a small section of its land to the north of the proposed site to

enable vehicle access around the facility. EIT has indicated that unless

the car-parking is situated in the preferred location for its students, then

the granting of this land to enable construction as per the current designs may

be withheld. This is a potential ‘show-stopper’ for the

construction of the expanded facility.

Recommendation

48. The recommendation is to:

48.1. Remove the hybrid option

from consideration

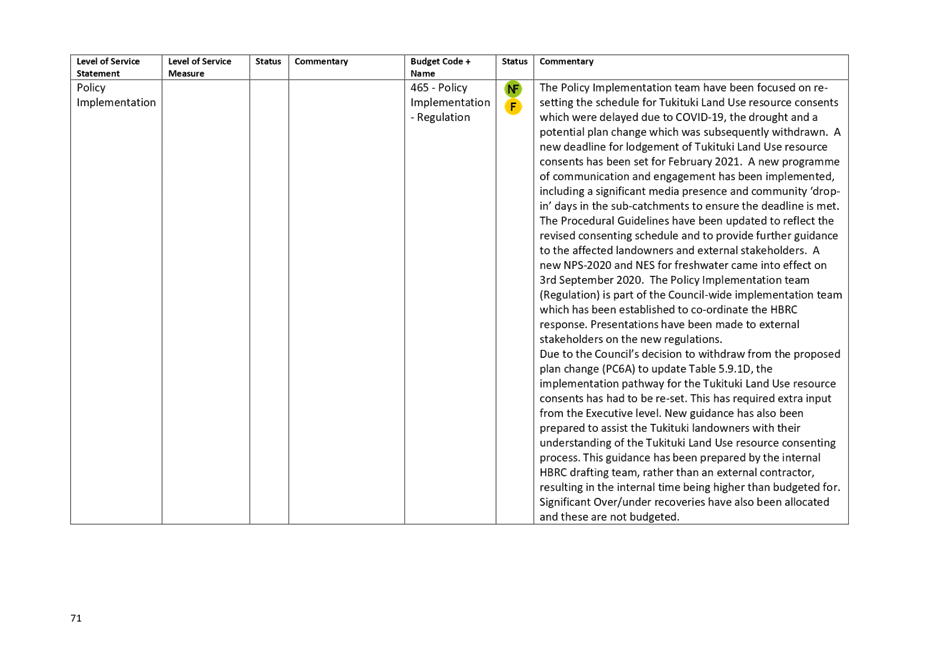

48.2. Consider the pros and

cons of the two remaining options (Riverside Park Reserve and over the

stopbank) and develop a position.

48.3. Agree this position with

Napier City Council

48.4. Provide direction to

Pettigrew Green Arena as to the location of the car park.

Issues

49. HBRC have scheduled work

during this financial year to reinforce (widen) the Taradale stopbank. This

work is funded by the IRG funding as part of the Governments Covid-19 Recovery

response. Further work may be scheduled in years 2 (2021-22) and 3(2022/23) of

the program which is currently under development.

50. This section of stopbank

has been accessed by HBRC as a critical component of the Heretaunga Plains

Flood Control Scheme due to the high consequence of failure on the Taradale

area.

51. Though this work does not

directly impact the determination of a preferred option, the amended dimensions

and the construction period itself will need to be considered through design

and construction.

Significance and Engagement

52. Community engagement is to

be considered through the resource consent process and through the proposed

Napier City Council Spatial and Connectivity Plan.

Risk

53. The potential that EIT

will not provide the small section of land required for the project to commence

if the carpark is not located on HBRC land.

54. The HBRC carpark option

knowingly places third party infrastructure and private property in a flood

hazard zone where lower risk options exist.

Financial and

Resource Implications

55. Delays with this decision

may result in the project not meeting key deadlines for Government funding and

result in the return of the committed investment. At the time of writing this

report clarity on the deadlines or consequences on progress with PGF funding

were not available.

56. HBRC is not funding any

part of the project, nor will not own or maintain the third party

infrastructure and will not be responsible in any way for damage or destruction

of third party or private property through flood or other event.

Consultation

57. HBRC has not undertaken

any consultation with any group on the proposal to utilise Taradale river berm

as a significant carpark. This paper has been presented to facilitate urgent

direction to RISEC.

Decision Making Process

58. Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

58.1. The

decision does not significantly alter the service provision or affect a

strategic asset, nor is it inconsistent with an existing policy or plan.

58.2. The use

of the special consultative procedure is not prescribed by legislation.

58.3. The

decision is not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy.

58.4. The persons affected by

this decision are a students and staff of EIT, patrons of the Pettigrew Green

Arena and residents who live and recreate close by.

58.5. Given

the nature and significance of the issue to be considered and decided, and also

the persons likely to be affected by, or have an interest in the decisions

made, Council can exercise its discretion and make a decision without

consulting directly with the community or others having an interest in

the decision.

|

Recommendations

1. That the Corporate and Strategic Committee receives and considers

the “Pettigrew Green Arena Car Park” staff report.

2. That Corporate and Strategic Committee form a view to either

support NCC carpark location or HBRC carpark location

3. Commit to work with NCC to provide direction to RISEC on suitable

location of carpark.

4. The Corporate and Strategic Committee recommends that

Hawke’s Bay Regional Council:

4.1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that Council can exercise its discretion and make decisions on

this issue without conferring directly with the community or persons likely

to have an interest in the decision.

|

Authored and

Approved by:

|

Chris Dolley

Group Manager Asset Management

|

|

Attachment/s

|

⇩1

|

PGA Car Parking

Options Assessment Matrix

|

|

|

|

⇩2

|

PGA Extension

Site Plan with Car Park Adjustments

|

|

|

|

PGA

Car Parking Options Assessment Matrix

|

Attachment 1

|

|

PGA Extension Site Plan

with Car Park Adjustments

|

Attachment 2

|

|

PGA

Extension Site Plan with Car Park Adjustments

|

Attachment 2

|

|

PGA

Extension Site Plan with Car Park Adjustments

|

Attachment 2

|

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 02 December 2020

Subject: 2019-20 Compliance

Annual Report

Reason for Report

1. This item

provides the 2019-20 Hawke’s Bay Regional Council’s (HBRC)

Compliance Annual Report for councillors’ information and adoption.

2. A comprehensive

report on HBRC’s Compliance Monitoring and Enforcement (CME) activities

provides transparency to our communities and those regulated by us.

Reporting the level of compliance in our region and interventions undertaken

where breaches of the Resource Management Act 1991 (RMA) have occurred, allows

trends to be tracked and council’s performance be open to public

scrutiny.

Officers’ Recommendation(s)

3. The reporting

officer recommends that the Corporate and Strategic Committee receives the

report and recommends that Council adopts the report for publication on the

Council’s website.

Executive Summary

4. The attached

annual report summarises HBRC’s CME functions undertaken under the RMA. It

details the breadth of monitoring undertaken, the levels of compliance

reported, and a summary of enforcement action taken during the year.

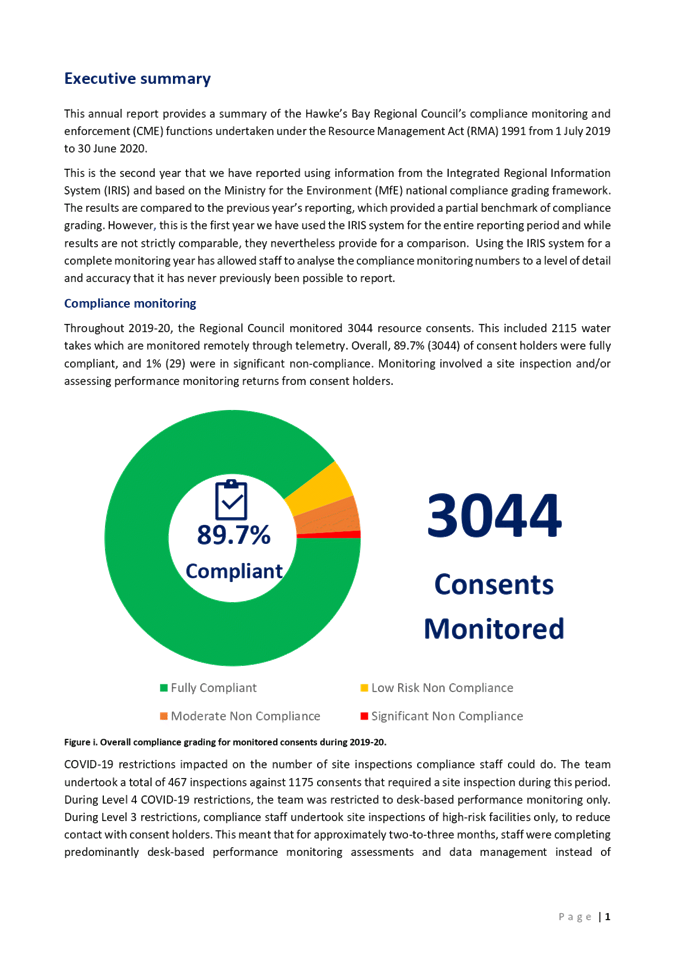

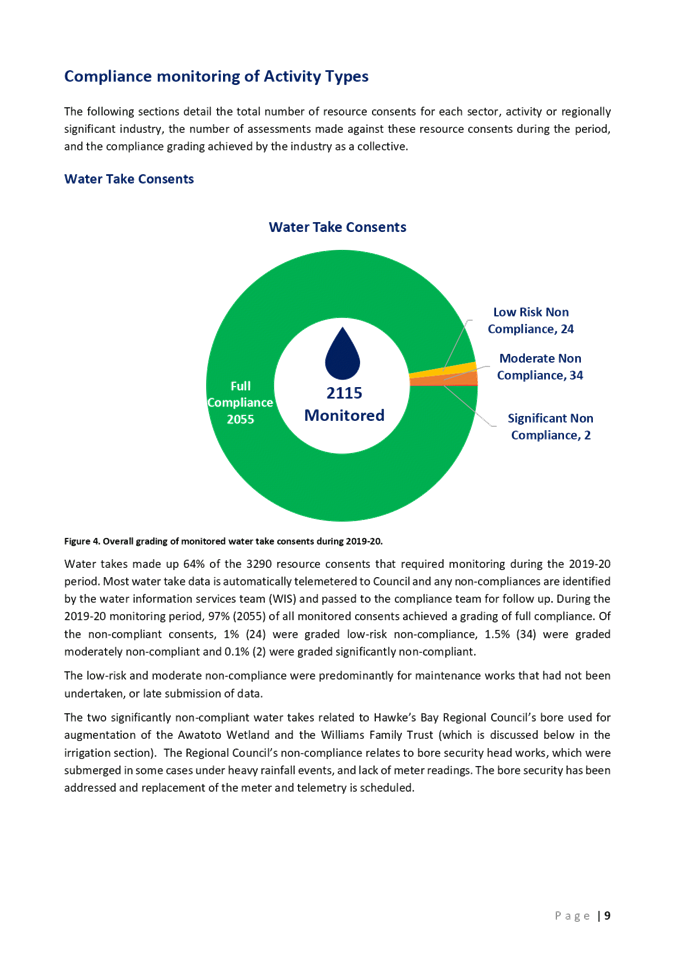

5.

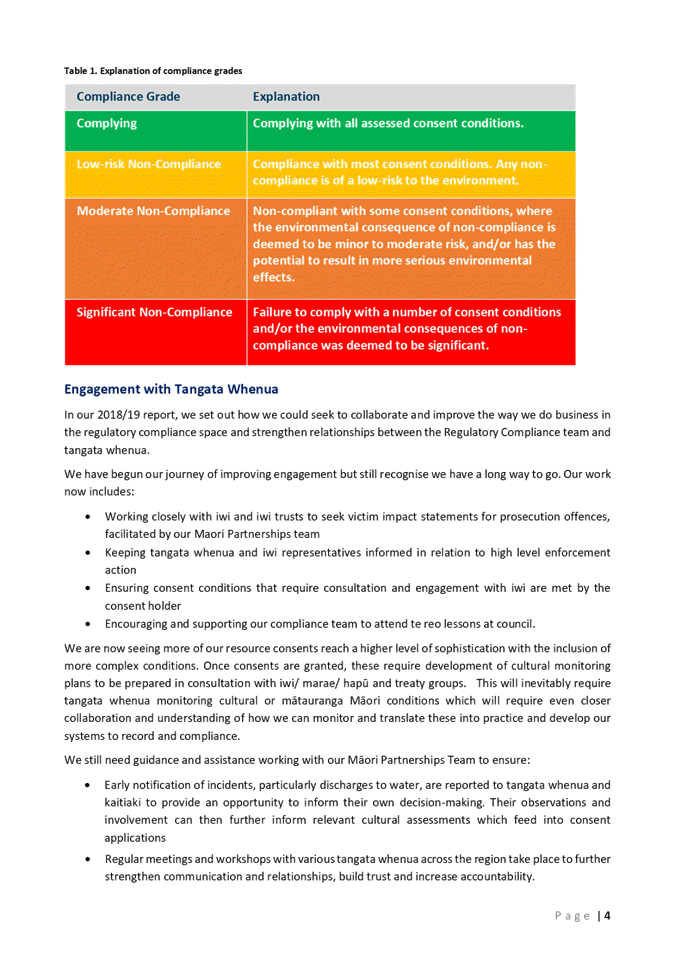

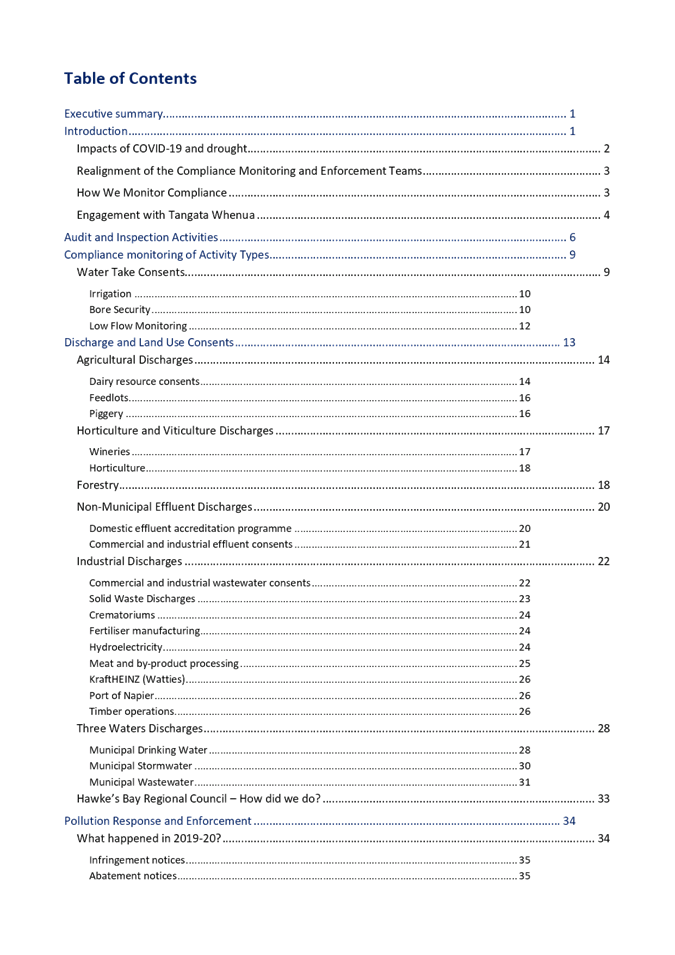

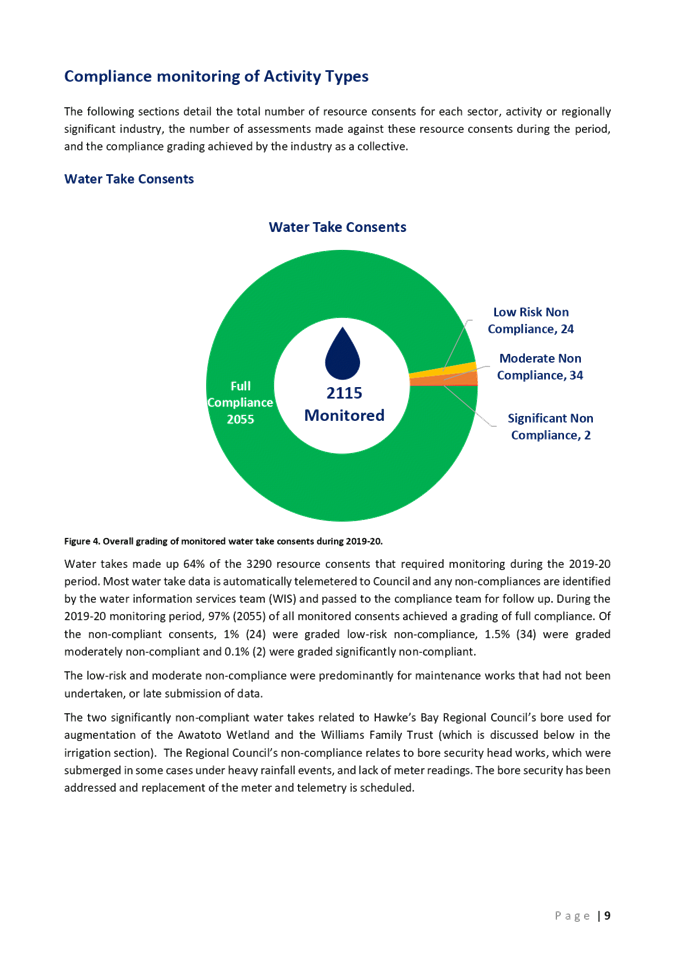

Compliance monitoring - staff monitored 3044 resource consents,

including 2115 water takes monitored remotely through telemetry. Overall, 3044

(89.7%) of consent holders were fully compliant, and 29 (1%) were in

significant non-compliance.

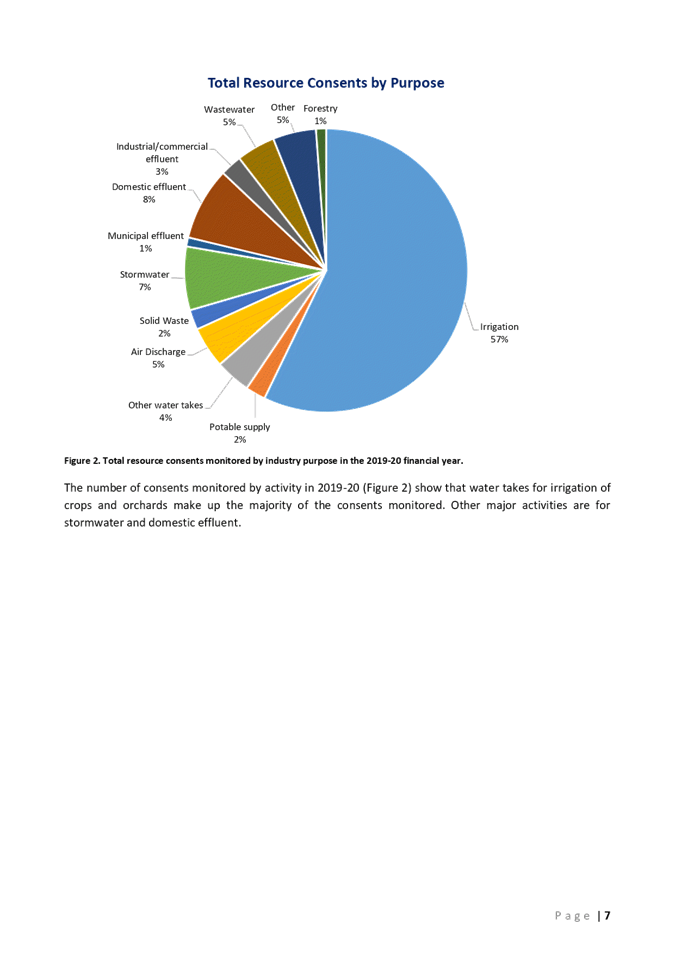

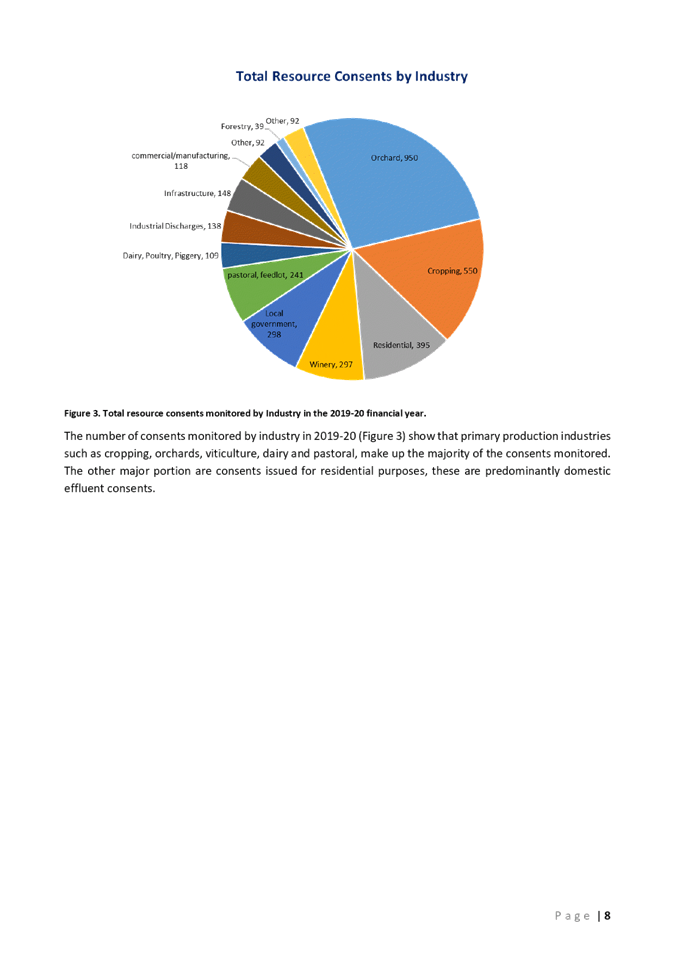

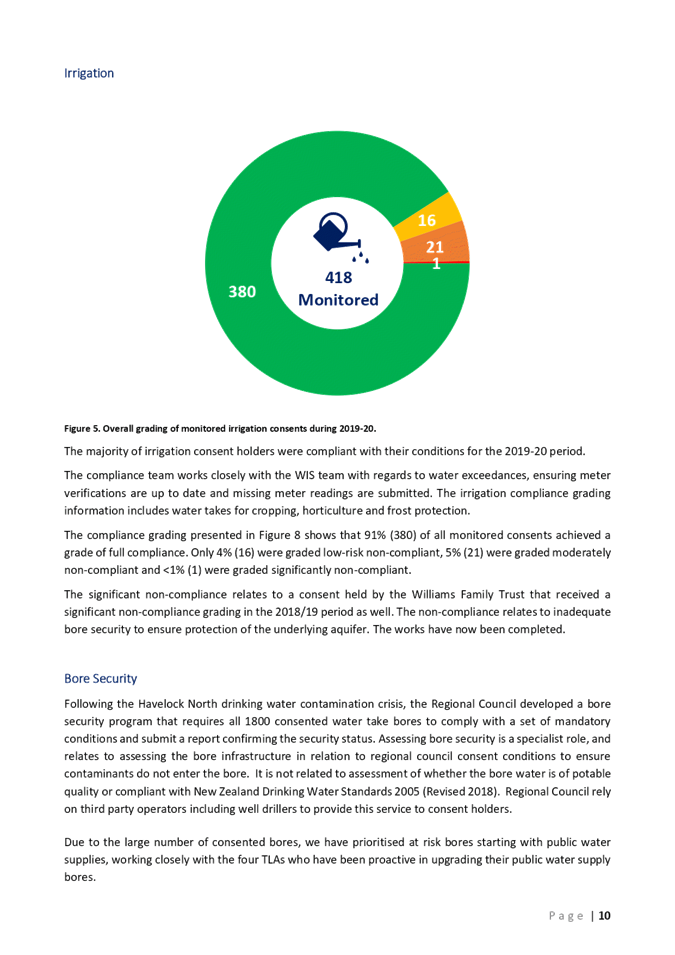

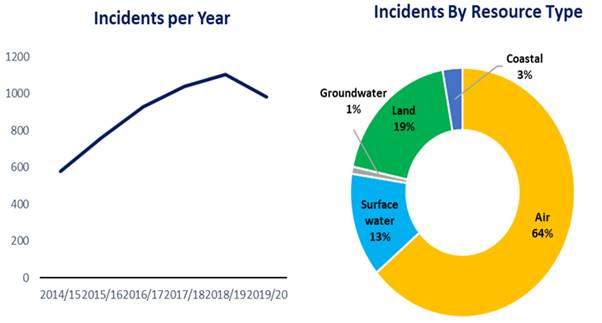

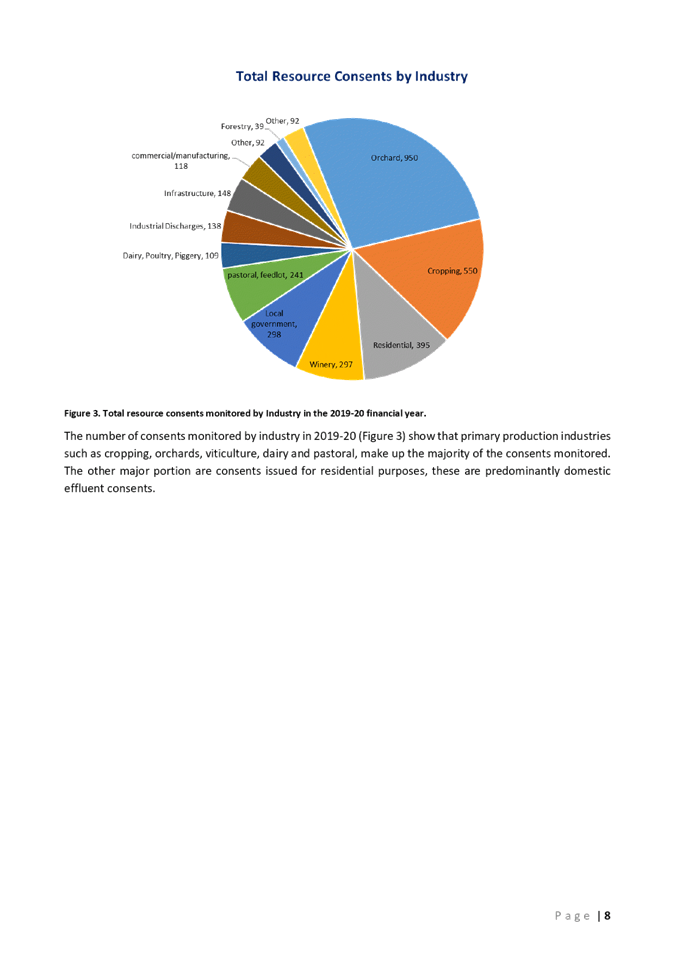

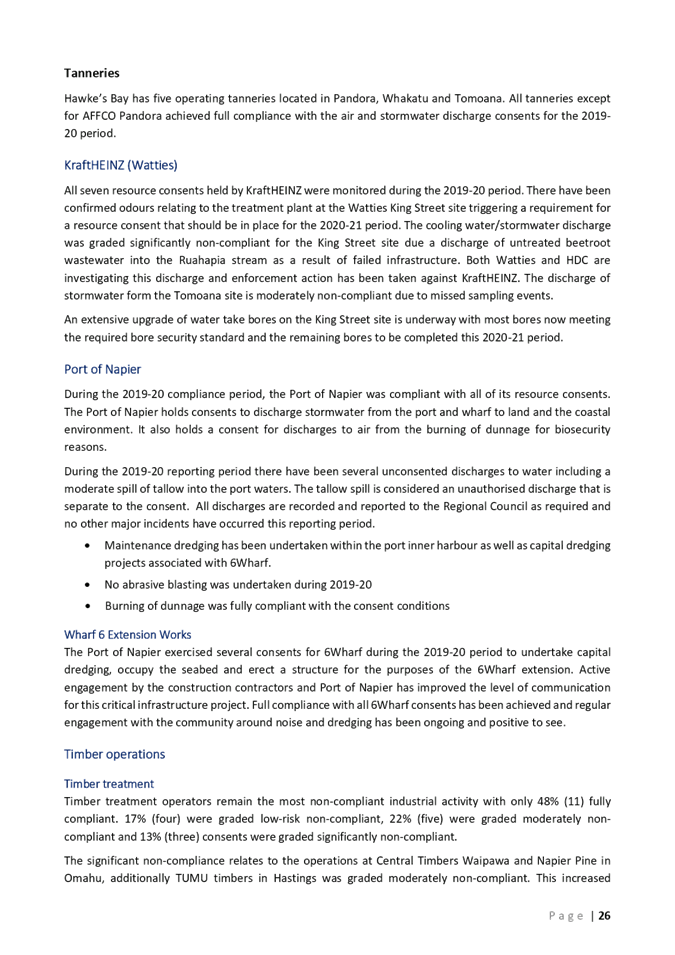

Figure 1. Consents monitored

6. Monitoring

involved a site inspection, assessing performance monitoring returns from

consent holders or both.

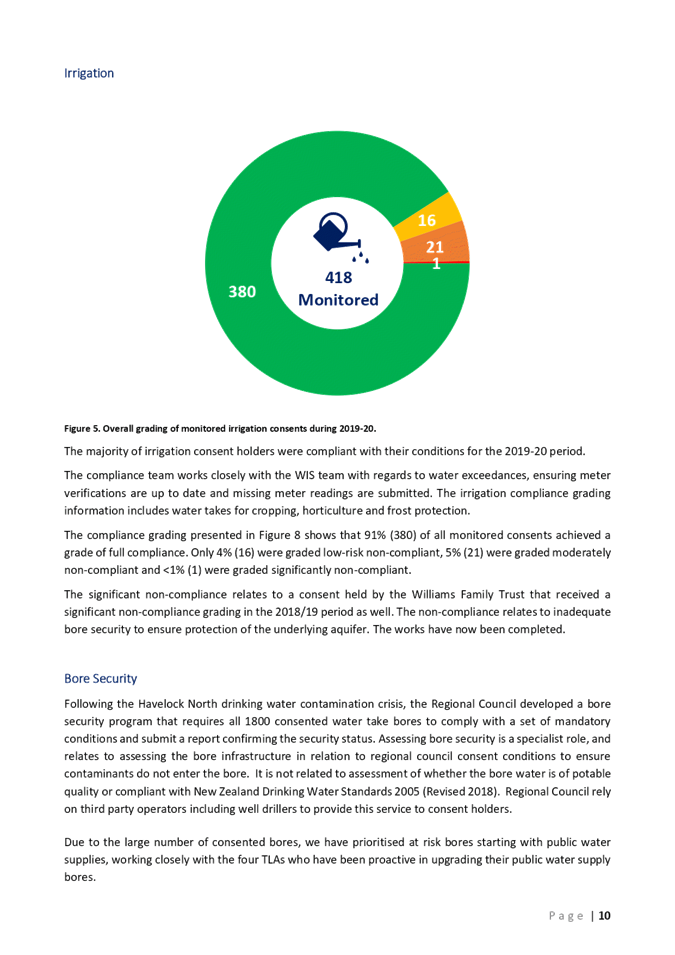

7. Pollution

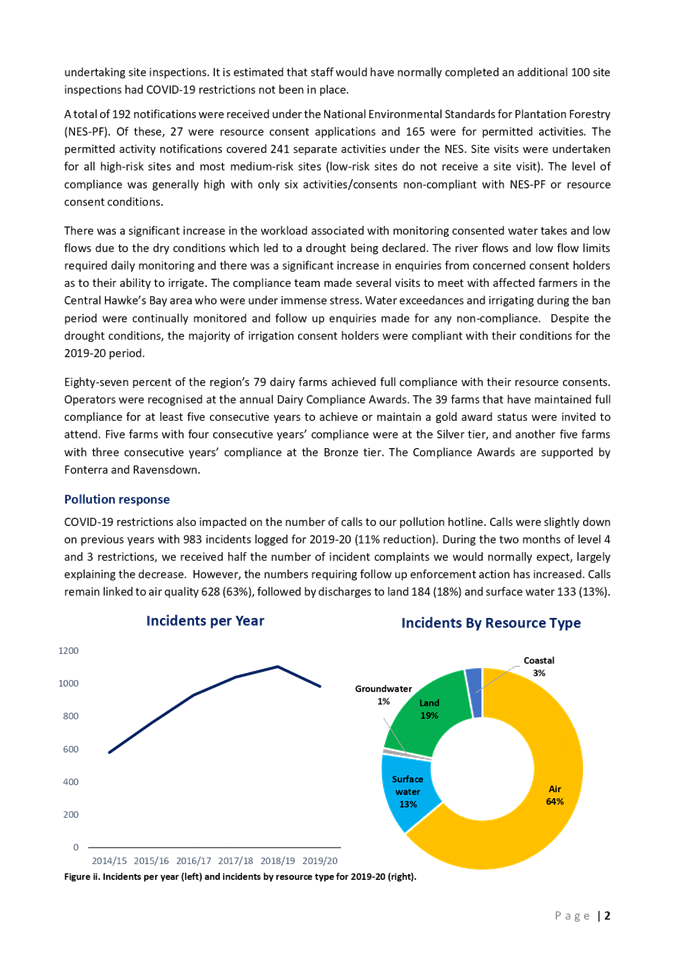

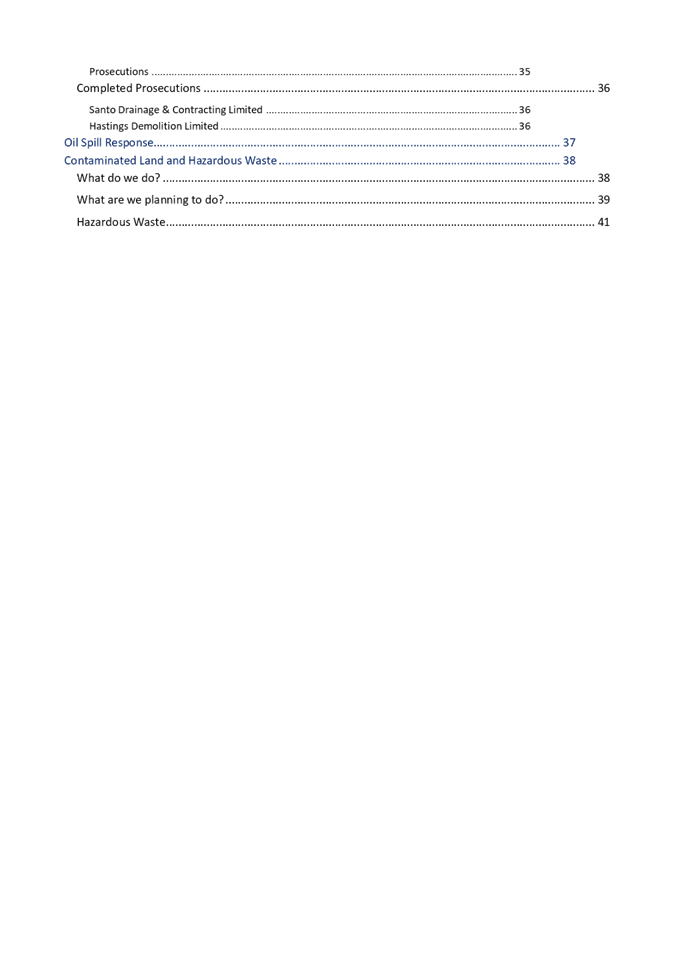

response - calls received to our hotline were slightly down on previous

years with 983 incidents logged for 2019-20 (11% reduction). During COVID-19

level 4 and 3 restrictions, we received half the number of incident complaints

we would normally expect, largely explaining the decrease. However, the

numbers requiring follow up enforcement action has increased. The majority of

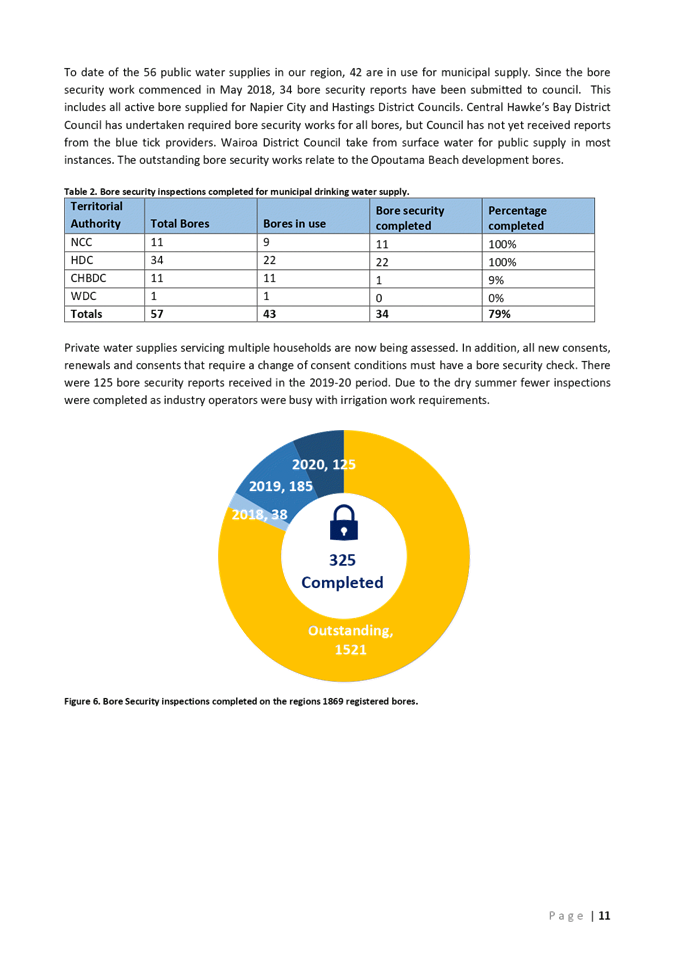

calls remain linked to air quality 628 (63%), followed by discharges to land

184 (18%) and surface water 133 (13%).

Figure

2. Incidents per year (left) and incidents by resource type for 2019-20

8. Enforcement

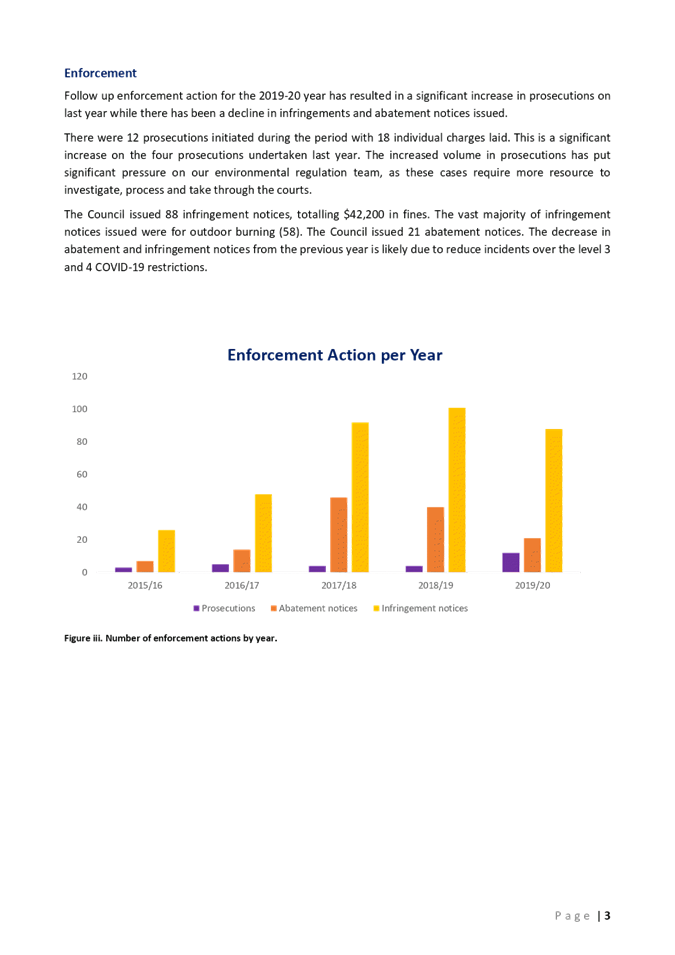

– follow-up enforcement action for the 2019-20 year has resulted in a

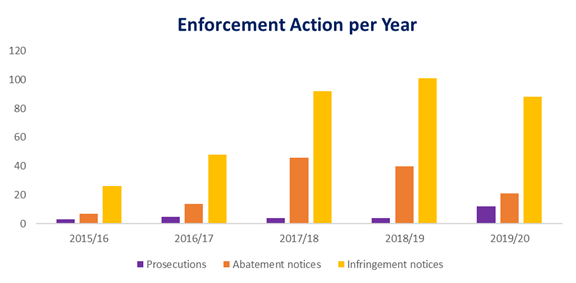

significant increase in prosecutions on last year while there has been a

decline in infringements and abatement notices issued.

9. Twelve

prosecutions were initiated during the period with 18 individual charges laid.

This is a significant increase on the four prosecutions taken last year. The

increased volume in prosecutions has put significant pressure on our

environmental regulation team, as these cases require more resource to

investigate, process and take through the courts.

10. Eight-eight infringement

notices were issued, totalling $42,200 in fines. The vast majority were for

outdoor burning (58). Twenty-one abatement notices were

issued. The decrease in abatement and infringement notices from the

previous year is likely due to reduced incidents over the level 3 and 4

COVID-19 restrictions.

Figure

3: Number of enforcement actions by year.

11. Detailed information is

contained within the report attached to this agenda item.

12. Staff will make a

presentation to Committee at the meeting based on the written report and at the

conclusion of questions Council will be asked to receive and adopt the report

for publication.

Background /Discussion

13. For the Committee’s

information reporting back occurs through the following mechanisms to Council

or Committee:

13.1. Compliance Annual Report

(2018-19 report herein).

13.2. HBRC Annual Report

– results are presented through the Regulation Group of Activities within

the Annual Report document.

13.3. Active investigations or

issues are reported to Council through the Significant Activities item on the

monthly Council agenda.

14. Internally, a weekly

incident report is prepared for the Group Manager which details complaints and

incidents and the outcomes or progress towards the outcomes.

15. Staff have also

established an approach whereby a media release will be issued at the

conclusion of any prosecution carried out by HBRC, regardless of the outcome of

the prosecution.

Options Assessment

16. The committee can choose

to adopt, or not adopt, the attached report.

17. Adopting the report and

making it readily available to the community via the Council website increases

transparency and Council’s accountability to the community. Compliance

activities are partly funded by rates, and it is important that the public

knows how their money is being spent. The MfE Best Practice Guidelines for

Compliance, Monitoring and Enforcement under the Resource Management Act 1991

state that it is good practice to provide annual reports to the public on CME

activities.

18. There are no material

risks associated with adopting the report.

Strategic Fit

19. Undertaking compliance

monitoring (and enforcement where necessary) helps us to:

19.1. Protect aquatic

ecosystems and ensure water use is sustainable (Priority Area: Water)

19.2. Ensure sustainable land

use (Priority Area: Land)

19.3. Maintain a healthy and

functioning biodiversity (Priority Area: Biodiversity).

Significance and Engagement Policy

Assessment

20. Whilst the matters

discussed in this report are of interest to the community they do not directly

impact or affect the community. There are no financial or levels of service

implications associated with deciding to adopt this report. Accordingly, this

report is of low significance.

Climate Change Considerations

21. The matters discussed in

this report do not contribute towards climate change mitigation or adaptation

response, either directly or indirectly. The RMA has only recently been amended

to allow the effects of activities on greenhouse emissions to be considered

during the consenting process. None of the consents monitored in the 2018-19

year contained conditions relating to greenhouse gas emissions.

Considerations of Tangata Whenua

22. The attached report sets

out ways we have improved our engagement with tangata whenua on compliance

matters. This includes:

22.1. Working closely with iwi

and iwi trusts to seek victim impact statements for prosecution offences,

facilitated by our Maori Partnerships team.

22.2. Keeping tangata whenua

and iwi representatives informed in relation to high level enforcement action.

22.3. Ensuring consent

conditions that require consultation and engagement with iwi are met by the

consent holder.

22.4. Building Māori

responsiveness capability within the compliance team to attend Te reo lessons

at council.

23. It is becoming

increasingly common for resource consents to include more complex conditions

that better recognise Te ao Maori. For example, conditions requiring

development of cultural monitoring plans in consultation with iwi/ marae/

hapū and treaty groups. Monitoring such conditions will even closer

collaboration with tangata whenua.

24. Future areas of focus are:

24.1. Improving how we report

incidents, particularly discharges to water, to tangata whenua and kaitiaki so

we can inform their decision-making and their observations and involvement can

inform cultural assessments.

24.2. Establishing regular

meetings and workshops with tangata whenua across the region to further

strengthen communication and relationships, build trust and increase

accountability.

Financial and Resource Implications

25. There are no financial and

funding implications associated with adopting the report.

Decision Making Process

26. Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

26.1. The

decision does not significantly alter the service provision or affect a

strategic asset, nor is it inconsistent with an existing policy or plan.

26.2. The use

of the special consultative procedure is not prescribed by legislation.

26.3. The

decision is not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy.

26.4. There are no persons

directly affected by this decision, although all those persons with an interest

in management of the region’s natural and physical resources may have an

interest in the report’s content.

26.5. Given

the nature and significance of the issue to be considered and decided, and also

the persons likely to be affected by, or have an interest in the decisions

made, Council can exercise its discretion and make a decision without

consulting directly with the community or others having an interest in

the decision.

|

Recommendations

1. That the Corporate and Strategic Committee receives the report and

recommends to Council to adopt the “2019-20 Compliance Annual

Report” staff report for publication on the Hawke’s Bay Regional

Council website.

2. The Corporate and Strategic Committee recommends that

Hawke’s Bay Regional Council:

2.1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that Council can exercise its discretion and make decisions on

this issue without conferring directly with the community or persons likely

to have an interest in the decision.

|

Authored by:

|

Nick Zaman

Manager Compliance

|

|

Approved by:

|

Liz Lambert

Group Manager Regulation

|

|

Attachment/s

|

⇩1

|

HBRC Annual

Compliance Report 2019-20

|

|

|

|

HBRC

Annual Compliance Report 2019-20

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 02 December 2020

Subject: Report from the 11

November 2020 Finance Audit and Risk Sub-committee Meeting

Reason

for Report

1. The following

matters were considered by the Finance Audit and Risk Sub-committee (FARS)

meeting on 11 November 2020 and are now presented for the Committee’s

consideration alongside any additional commentary the

Sub-committee Chair wishes to offer.

2. The purpose of the

Finance, Audit and Risk Sub-committee, in accordance with its Terms of

Reference, is to report to the Corporate and Strategic Committee to fulfil its

responsibilities for:

2.1. The provision

of appropriate controls to safeguard the Council’s financial and

non-financial assets, the integrity of internal and external reporting and

accountability arrangements

2.2. The review of

Council’s revenue and expenditure policies and the effectiveness of those

policies

2.3. The

independence and adequacy of internal and external audit functions

2.4. The

robustness of risk management systems, processes and practices

2.5. Compliance

with applicable laws, regulations, standards and best practice guidelines

2.6. Monitor the performance of Council’s investment portfolio.

Agenda items

3. The Risk Maturity Roadmap item

accompanied a bowtie analysis demonstration and updated the Sub-committee on

the Regional Council’s implementation of the risk maturity roadmap

activities, with the Sub-committee resolving:

3.1. Confirms that

management actions undertaken and planned for the future adequately respond to

the risk maturity roadmap that was approved by the Corporate and Strategic

Committee on 10 June 2020.

3.2. Confirms that

the bowtie analysis is an appropriate tool to drive risk maturity as defined by

the risk maturity road map.

3.3. Requests that

issues external to HBRC, such as joint ownership and responsibilities for

assets that have an impact on HBRC are considered as part of the Risk Maturity

Roadmap.

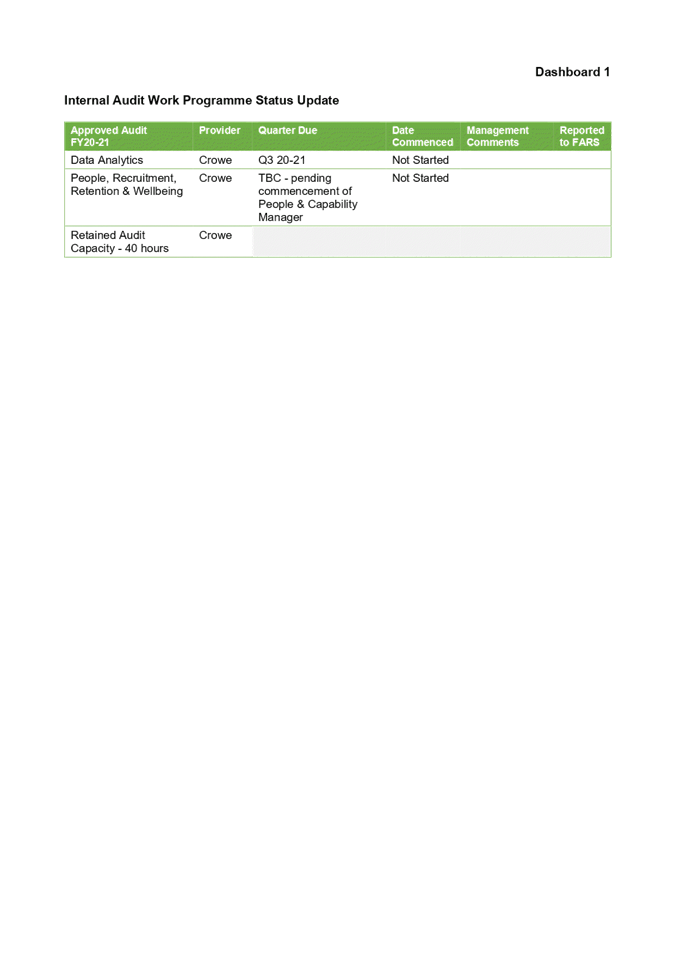

4. The Internal

Audit Work Programme Update item updated the Sub-committee on the internal

audit work programme and sought feedback on the newly developed reporting

dashboards (attached), with the Sub-committee resolving:

4.1. Receives and

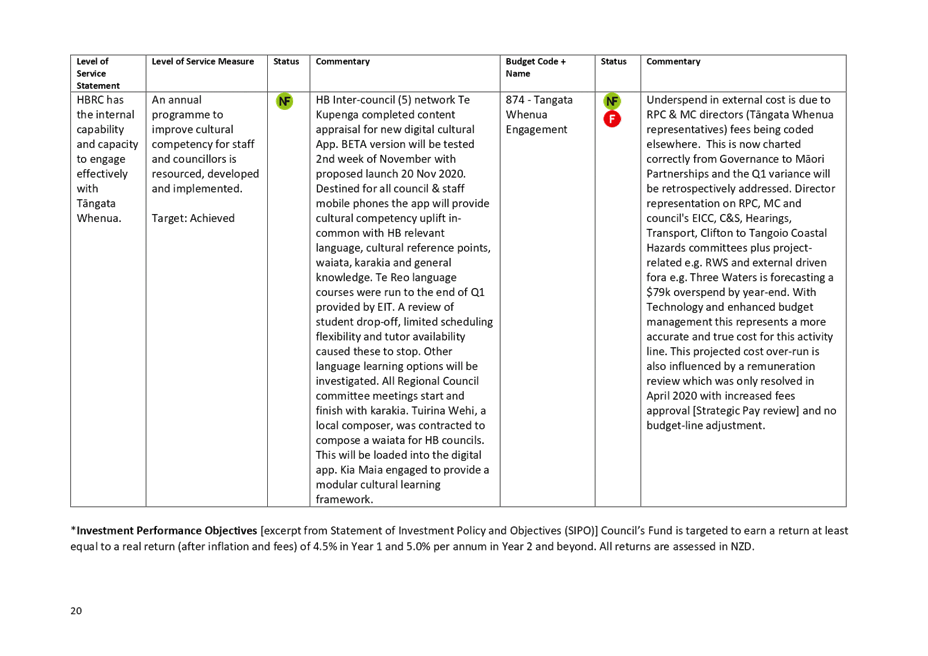

notes the ‘Internal Audit Work Programme Update’ staff report and

accompanying dashboards.

4.2. Confirms that management actions undertaken or planned for the

future adequately respond to the findings and recommendations of the internal

audits.

4.3. Confirms that

the dashboard reports provide adequate information on the progress of

corrective actions and the progress of the approved annual internal audit

programme.

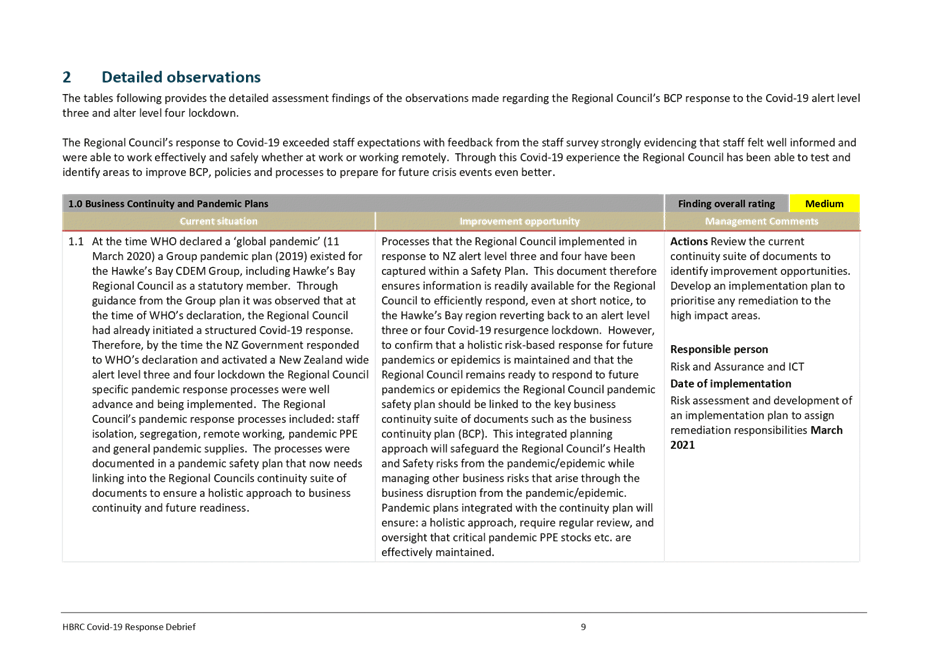

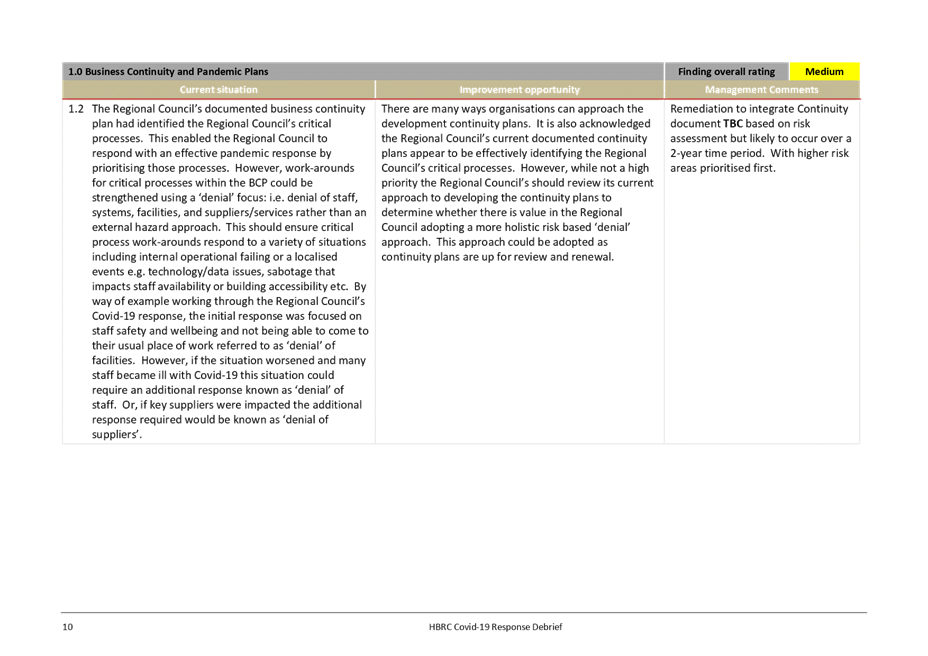

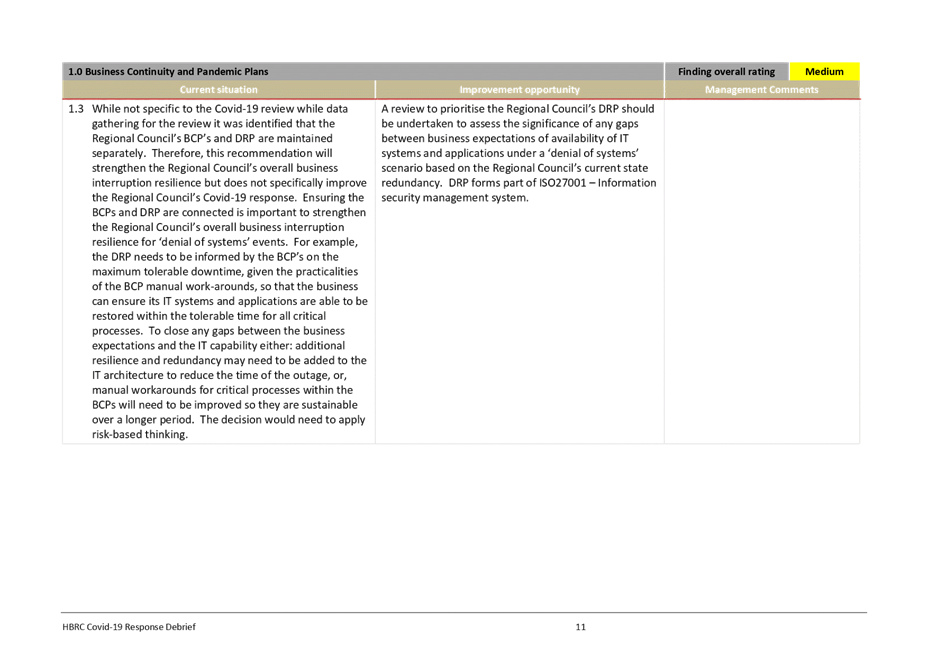

5. The HBRC

Covid-19 Response Review Report item provided learnings and findings from

the internal review of the Regional Council’s organisational response to

the Covid-19 pandemic, with the Sub-committee resolving:

5.1. receives and

considers the “HBRC Covid-19 Response Debrief and Learnings

Report”.

5.2. notes the

extended timeframe required to enhance the Regional Council’s suite of

business continuity and recovery documents.

5.3. agrees

support for the improvements proposed by staff.

6. Section 17a

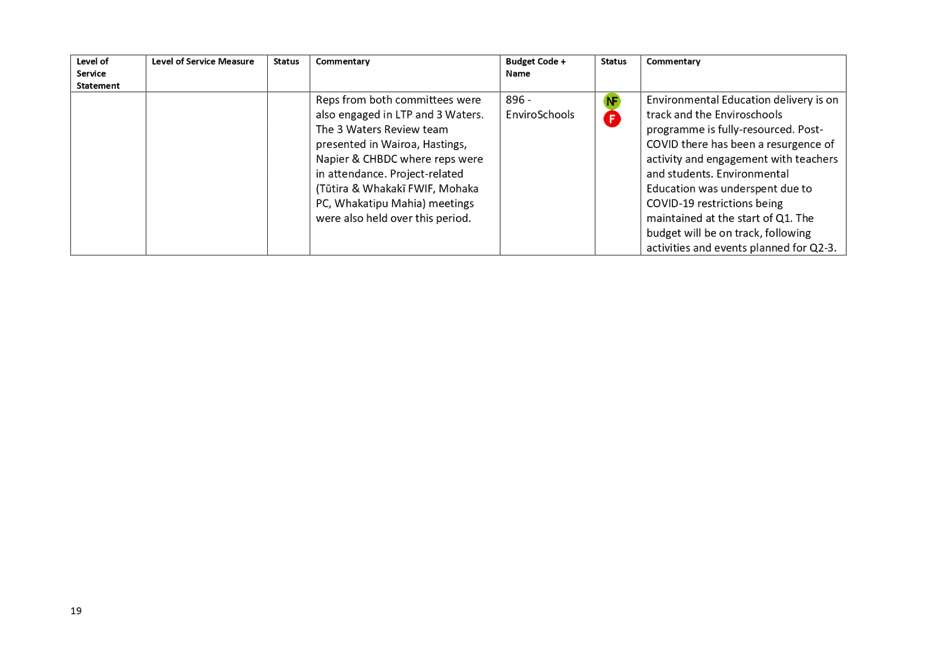

Review of the HBRC Works Group discussed in Public Excluded informed the

Sub-committee of the outcomes of the recent Section 17A Review of Works Group

undertaken by Morrison Low, agreeing to increase the size and scale of the

Works Groups, and to introduce processes and tools to enable this, with the

Sub-committee resolving:

6.1. receives and

notes the Morrison Low “Section 17A Review of Works Group” report

6.2. agrees the

associated implementation actions proposed by staff

7. The Verbal

FUSE Project Update provided the Sub-committee with an update on the

progress made to date implementing the new financial system (FUSE) as well as a

rundown of the project’s benefits.

8. The Sub-committee

Work Programme November 2020 Update provided an update on the overall work

programme progress to date and advised that a report covering Council’s

overall assurance framework will be prepared for the February 2021 FARS

meeting, focussing and informing S17a effectiveness and efficiency

conversations.

9. The 2019-20

Annual Treasury Report item provided an annual update of the

Council’s investment activity and reported on the performance of the

Council’s investment portfolio for the year ending 30 June 2020 and is

attached in full.

10. The Q1 2020-21 (1 July

– 30 September 2020) Treasury Report provided an update on treasury

activity and reported on the performance of Council’s investment

portfolio for the first quarter of the 2020-21 financial year.

Decision

Making Process

11. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as all items were specifically considered at

the Sub-committee level this item is for information only and the LGA

decision making provisions do not apply.

|

Recommendations

That the

Corporate and Strategic Committee receives and notes the report from the

Finance, Audit and Risk Sub-committee.

|

Authored by:

|

Annelie Roets

Governance Administration Assistant

|

Leeanne

Hooper

Team Leader Governance

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

⇩1

|

Internal

Audit Work Programme Status Update Dashboard

|

|

|

|

⇩2

|

Internal

Audit Dashboard

|

|

|

|

⇩3

|

HBRC Covid-19

Response Debrief Report

|

|

|

|

⇩4

|

FARS Annual

Treasury Report

|

|

|

|

Internal

Audit Work Programme Status Update Dashboard

|

Attachment 1

|

|

Internal

Audit – Risk Management Maturity – June 2020

|

|

Finding / Theme

|

Priority

Rating

|

Action and Owner

|

Due Date

|

Milestone Achieved

Since Last Report

|

Milestone

For Next Report

|

Tracking Status

|

|

Risk, Governance, Policy and Accountabilities - to

improve risk and assurance challenge. With clearer risk escalation.

|

Not Stated

|

Develop risk management policy and framework that

includes roles and responsibilities. Risk & Assurance Lead

|

September 2020

|

Council approved single Regional Council risk

management policy and framework.

|

|

Closed

|

|

Leadership and Direction - Improve linkage of

risk informed decision making to strategy. Improving clarity of boundaries

for decision making.

|

Not Stated

|

Develop a comprehensive risk appetite statement that

defines tolerance levels for individual enterprise risks. ELT

|

March 2021

|

Redefine Regional Councils enterprise risks context to

the new risk policy and framework.

|

Complete bowties for six enterprise risks and update

the FARS risk report one pagers accordingly.

|

At risk – borders

may limit access to trainer / facilitator. Viability of Zoom v delay

will be analysed

|

|

Leadership and Direction - Risk system continuous

improvement.

|

Not Stated

|

Incorporate into the risk policy and framework a risk

vision. Tailor the Council’s risk policy and framework to align

to the strategy. Develop a risk maturity roadmap to execute the risk

vision. Risk & Assurance Lead

|

September 2020

|

Council approved risk policy includes a risk vision

that aligns to the C&S approved risk maturity roadmap. And, the

risk policy and framework tailored based on HBRC’s strategy.

|

|

Closed

|

|

People and

Development - Risk roles ad responsibilities beyond the risk and

assurance lead were not defined. With no risk related training.

|

Not Stated

|

Develop a competency framework to upskill staff on risk

and embed the risk policy. Communicate and train BU on the risk policy

and framework. Provide targeted training to specialist risk roles e.g.

risk champions. ELT and Risk and Assurance Lead

|

October 2021

|

|

In conjunction with Group Managers identify a Risk

Champion in each Group.

|

On track

|

|

Tracking Status

|

Key

|

|

On track

|

Milestones on track

to meet due date

|

|

At risk

|

Milestones falling

behind putting at risk delivery on due date

|

|

Behind

|

Milestones

outstanding due date will not be met

|

|

Closed

|

Corrective action

fully implemented

|

|

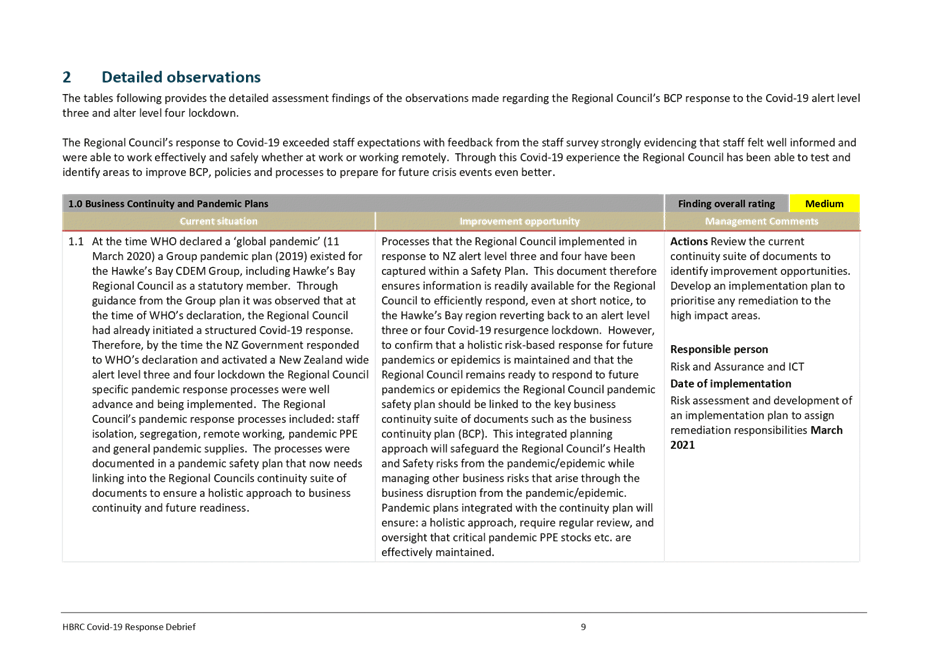

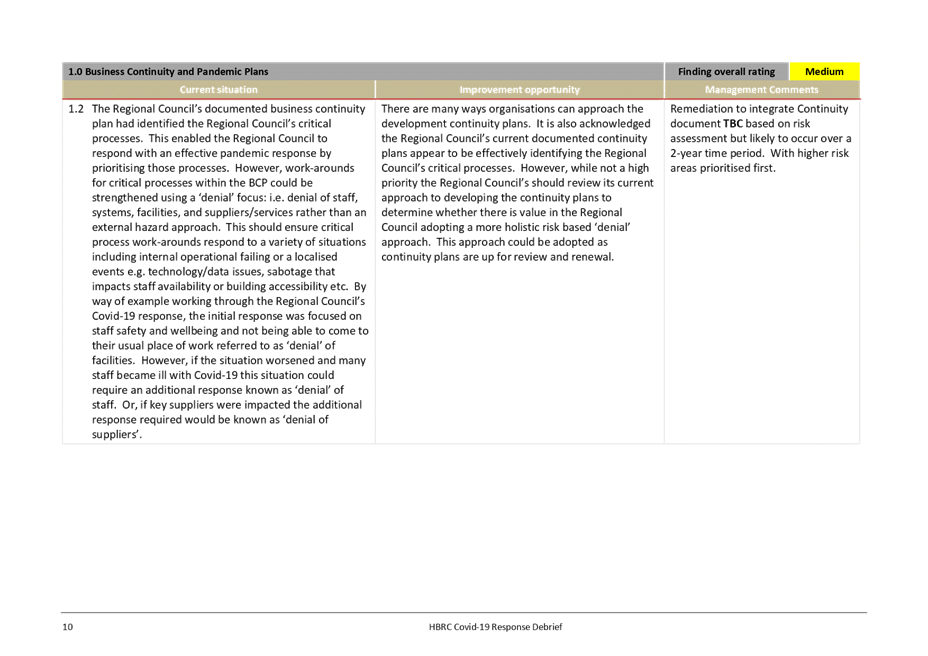

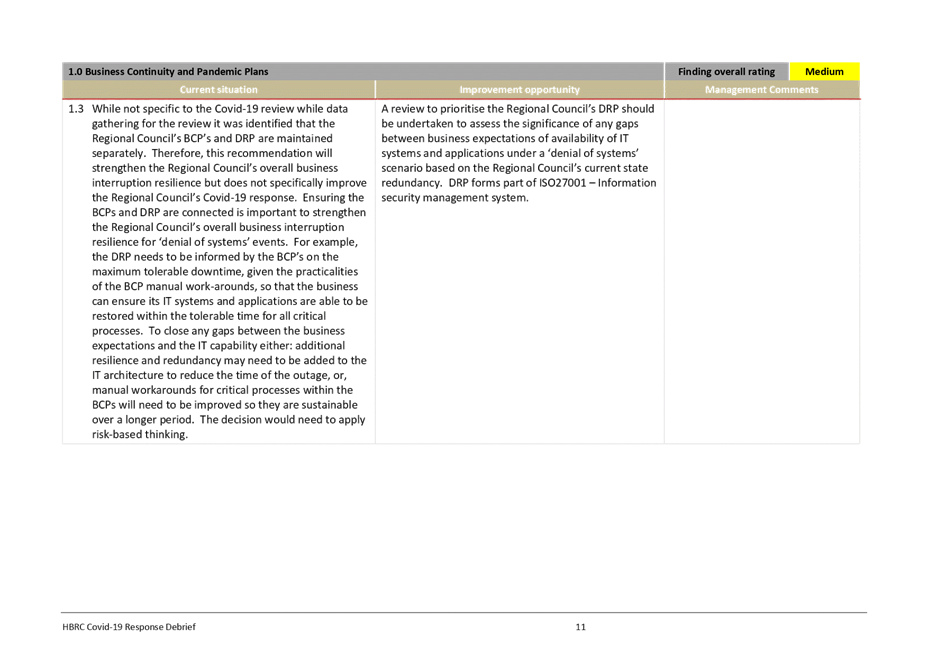

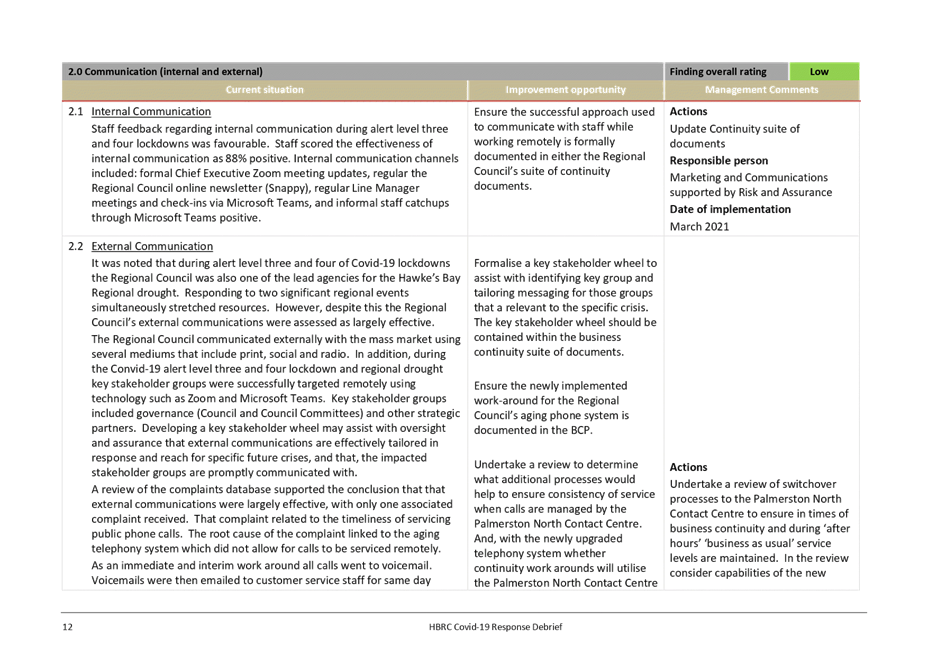

HBRC Covid-19 Response

Debrief Report

|

Attachment 3

|

|

HBRC

Covid-19 Response Debrief Report

|

Attachment 3

|

|

HBRC

Covid-19 Response Debrief Report

|

Attachment 3

|

|

FARS

Annual Treasury Report

|

Attachment 4

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 02 December 2020

Subject: Harbourmaster Functions

Reason for Report

1. This item provides the Committee with an introduction to and

information about the role and functions of the Harbourmaster.

Background

2. Captain Martin Moore is currently HBRC’s Harbourmaster.

Captain Moore started in the role in April 2016, taking over from Captain Phil

Norman.

Discussion

3. The role of Harbourmaster covers safe navigation in the Napier

Pilotage Area, through administration of the Navigation Safety Bylaws as well

as navigation safety education around the region.

4. A presentation to the Committee will cover the various aspects of

the Harbourmaster’s role and responsibilities.

Decision Making

Process

5. Staff have

assessed the requirements of the Local Government Act 2002 in relation to this

item and have concluded that, as this report is for information only, the

decision making provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee

receives and notes the “Harbourmaster Functions” staff report.

|

Authored by:

|

Martin Moore

Harbourmaster

|

|

Approved by:

|

Liz Lambert

Group Manager Regulation

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 02 December 2020

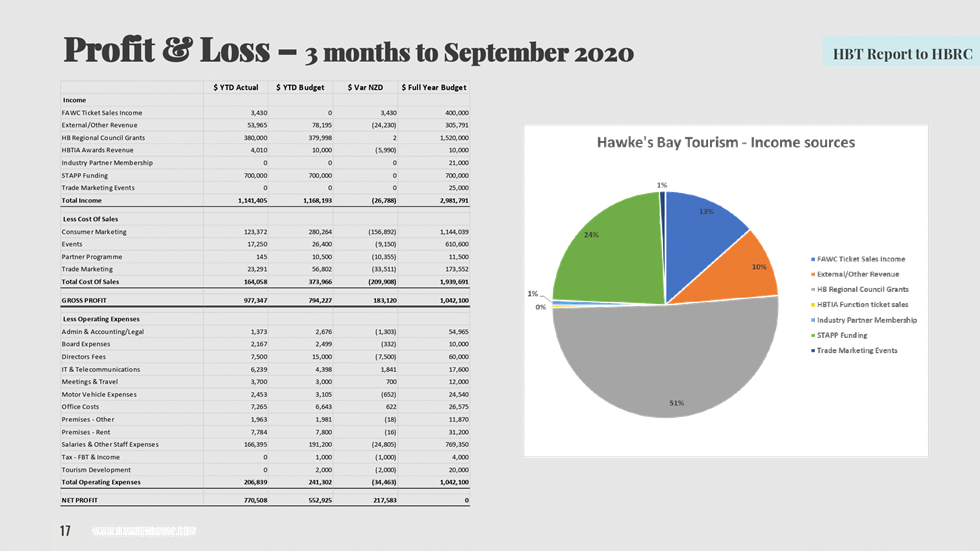

Subject: HB Tourism Six-monthly

Update

Reason for Report

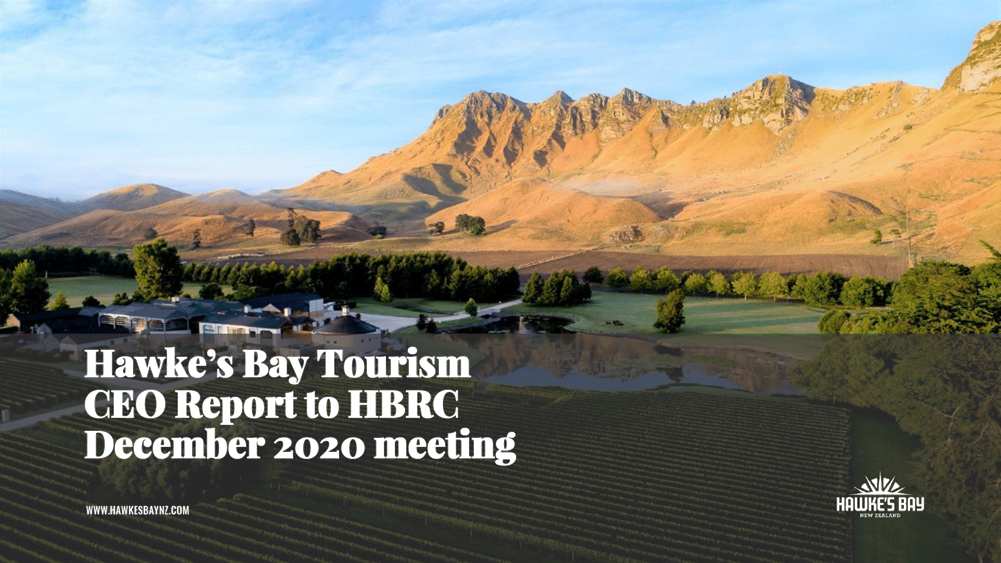

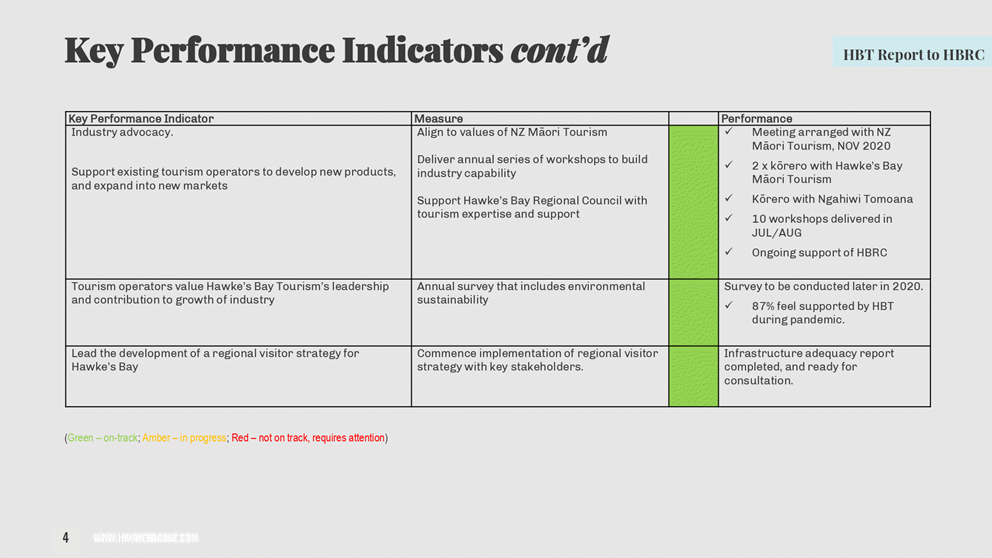

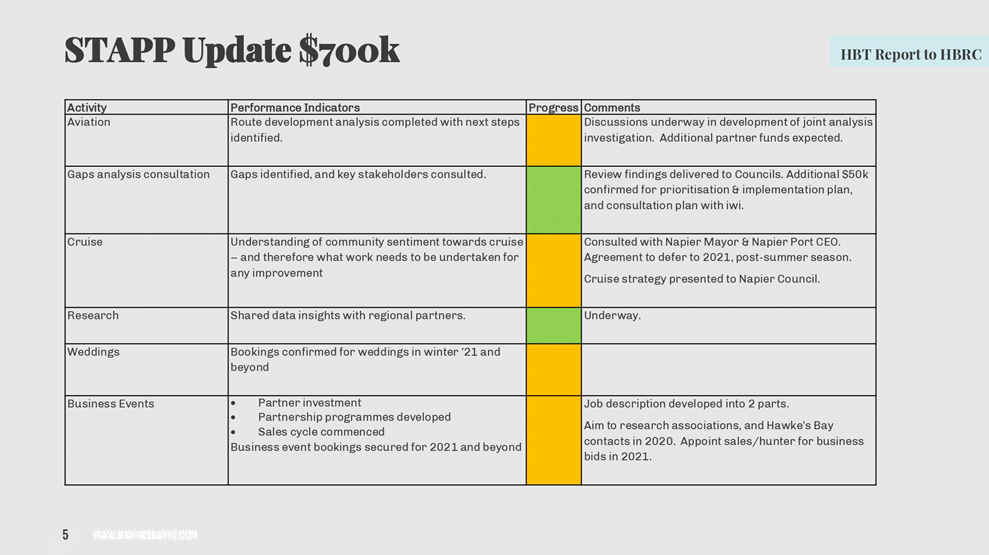

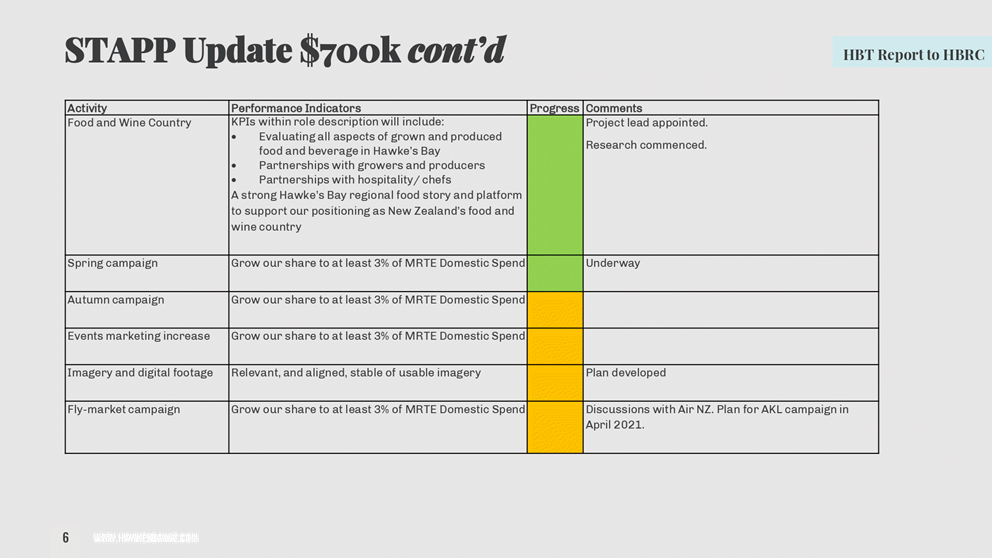

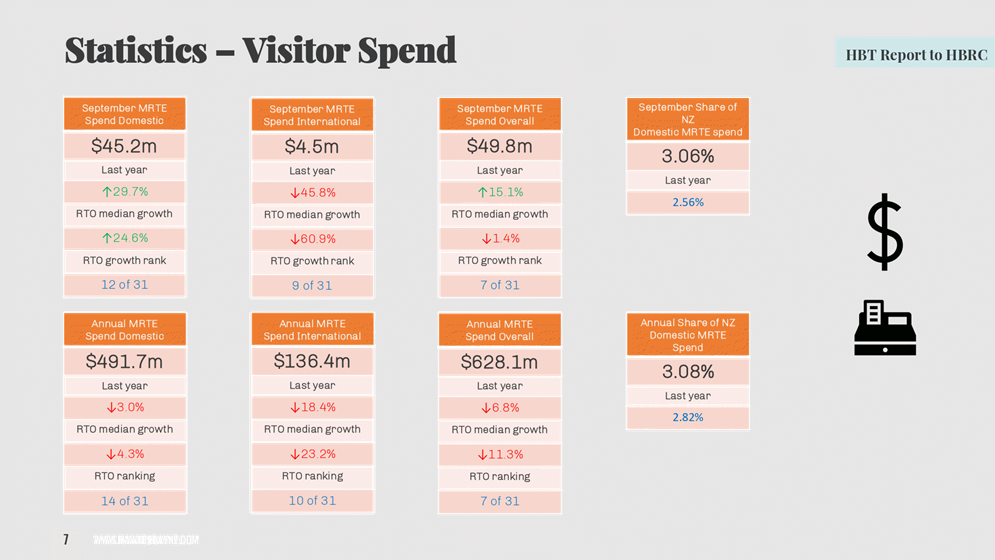

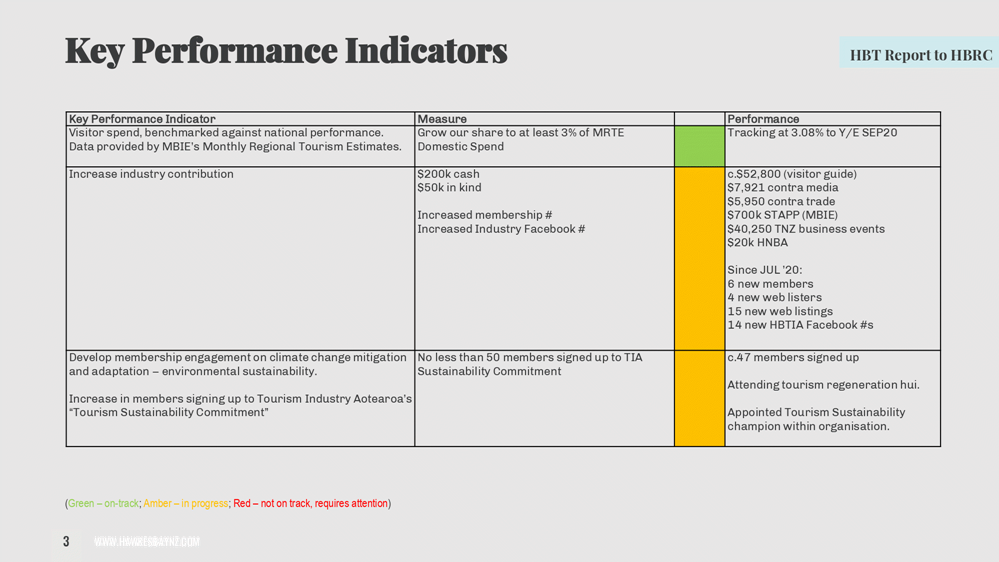

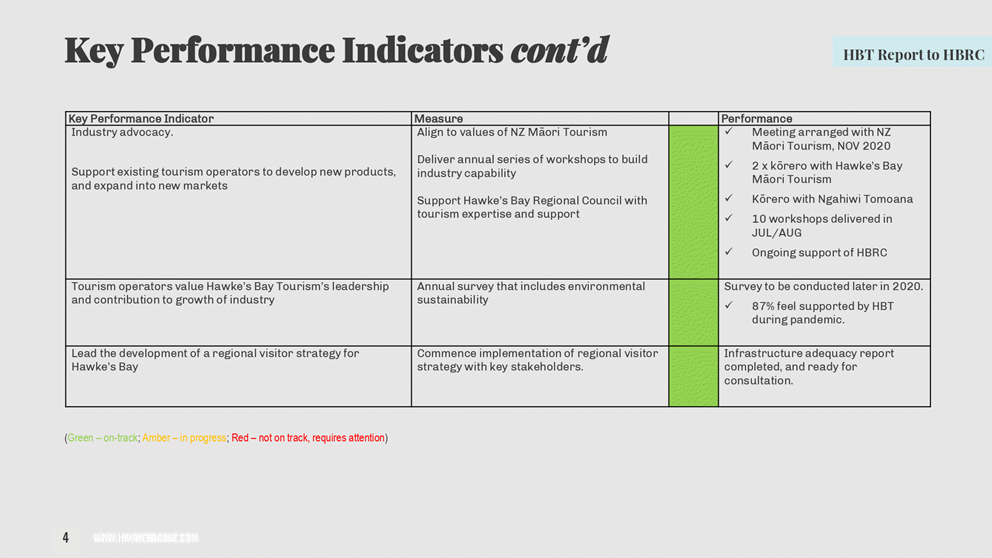

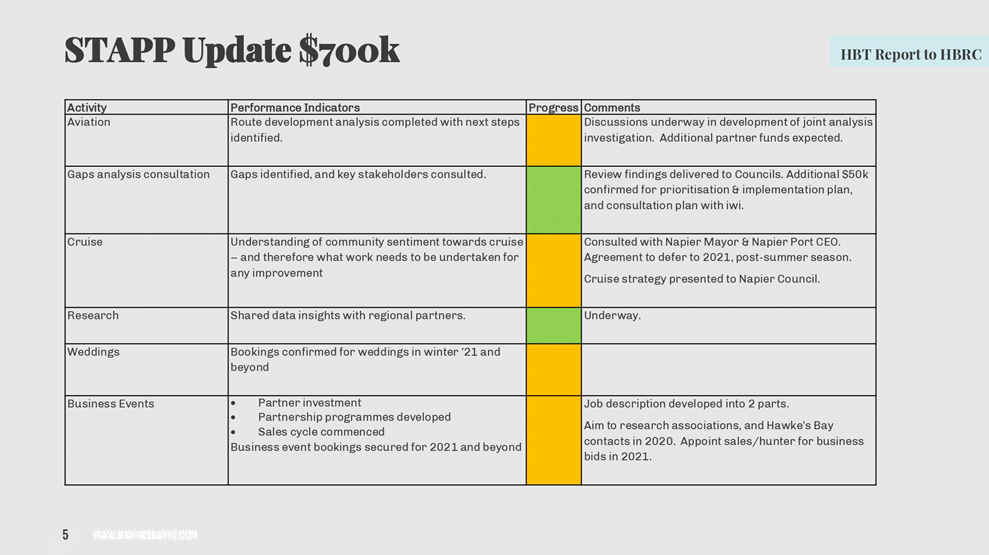

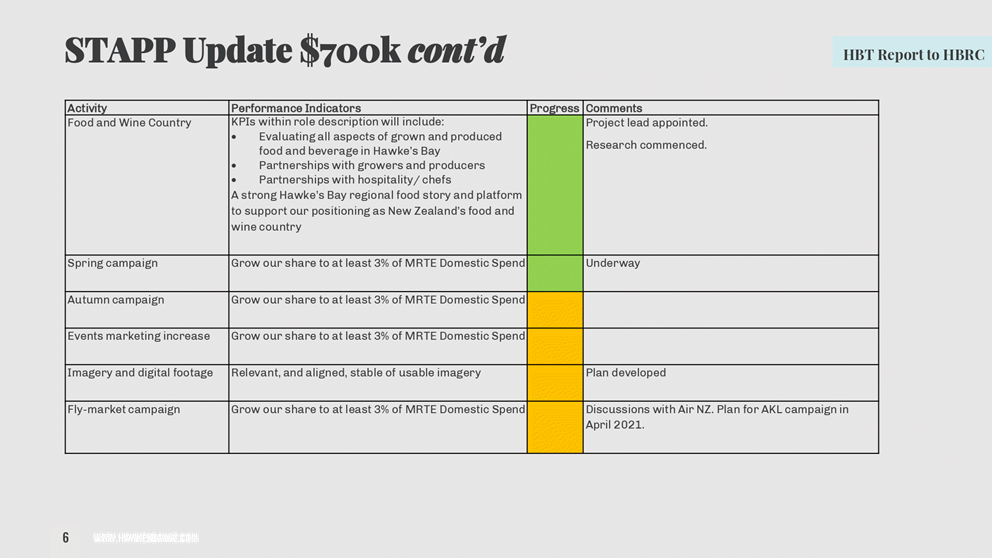

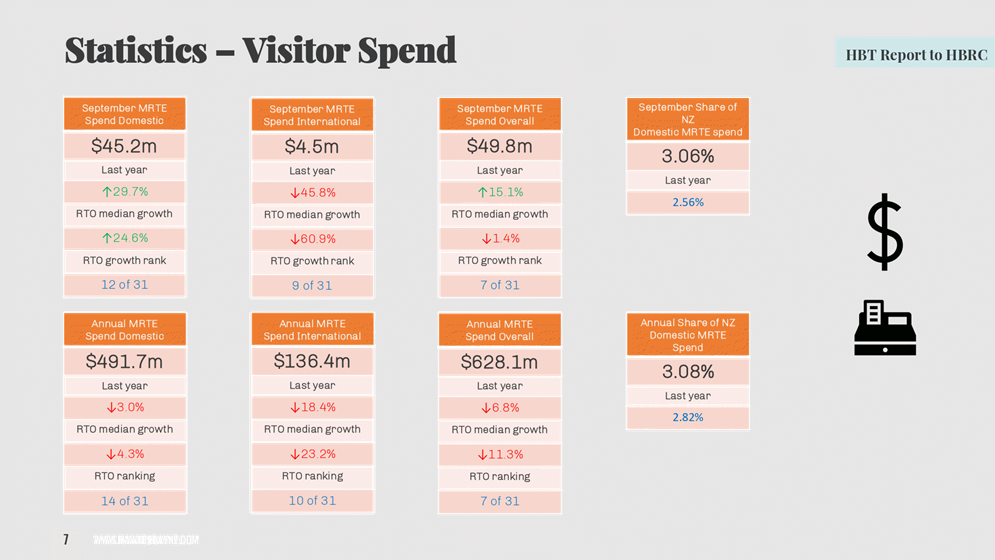

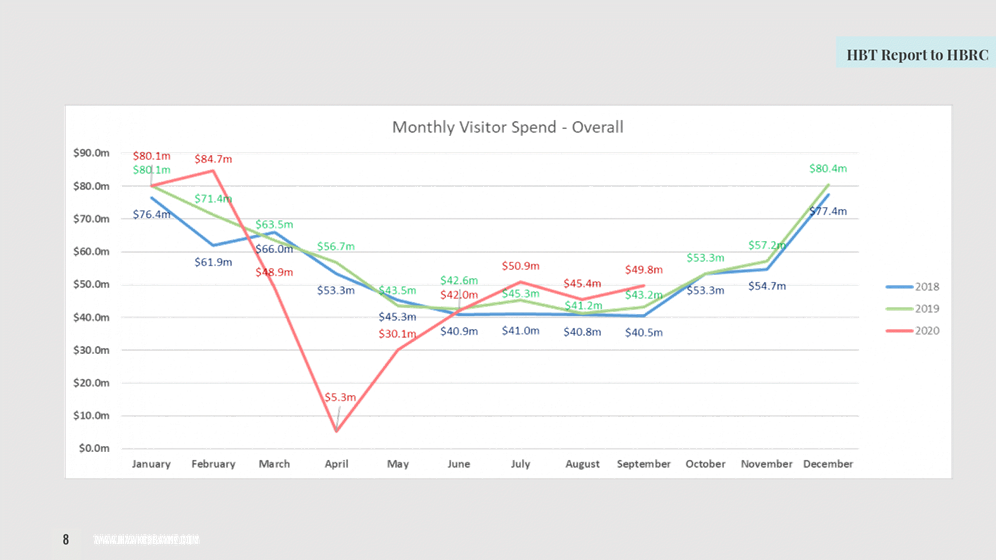

1. This item provides HB Tourism’s update (attached) on

achievements against key performance indicators as required by their Funding

Agreement with Hawke’s Bay Regional Council.

2. Hamish Saxton, CEO HB Tourism will be in attendance to present the

report.

Decision Making

Process

3. Staff have

assessed the requirements of the Local Government Act 2002 in relation to this

item and have concluded that, as this report is for information only, the

decision- making provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee

receives and notes the “HB Tourism Six-monthly

Update” report.

|

Authored by:

|

Hamish Saxton

HB Tourism General Manager

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

⇩1

|

HB Tourism

December 2020 update

|

|

|

|

HB

Tourism December 2020 update

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 02 December 2020

Subject: Organisational

Performance Report for period 1 July to 30 September 2020

Reason

for Report

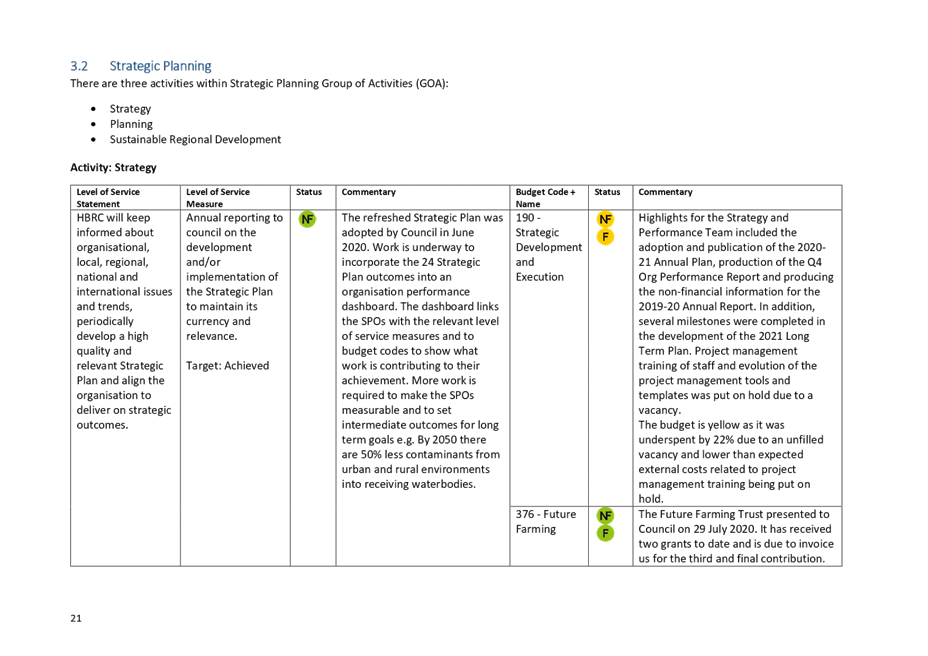

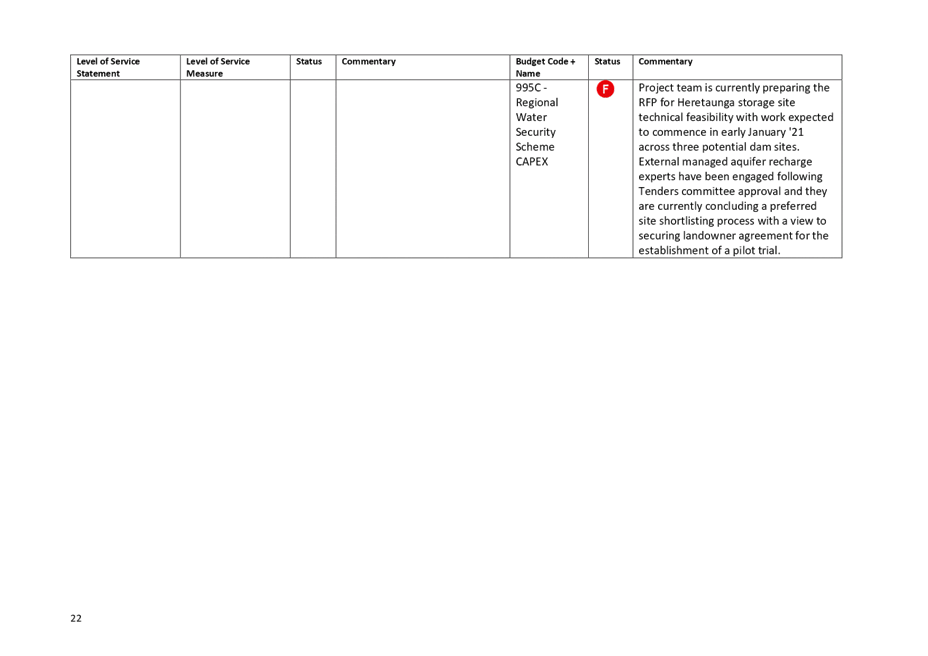

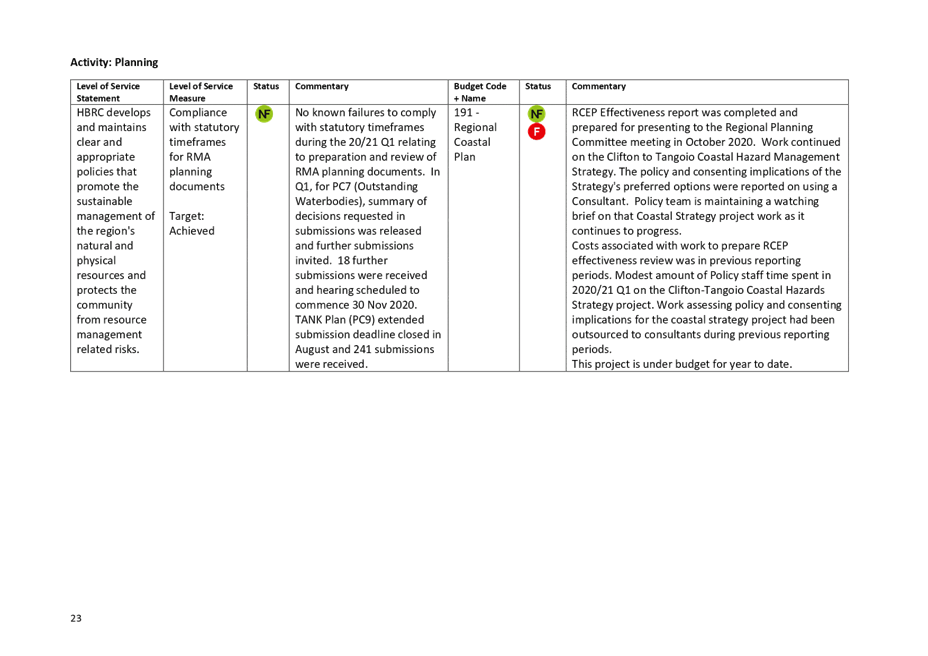

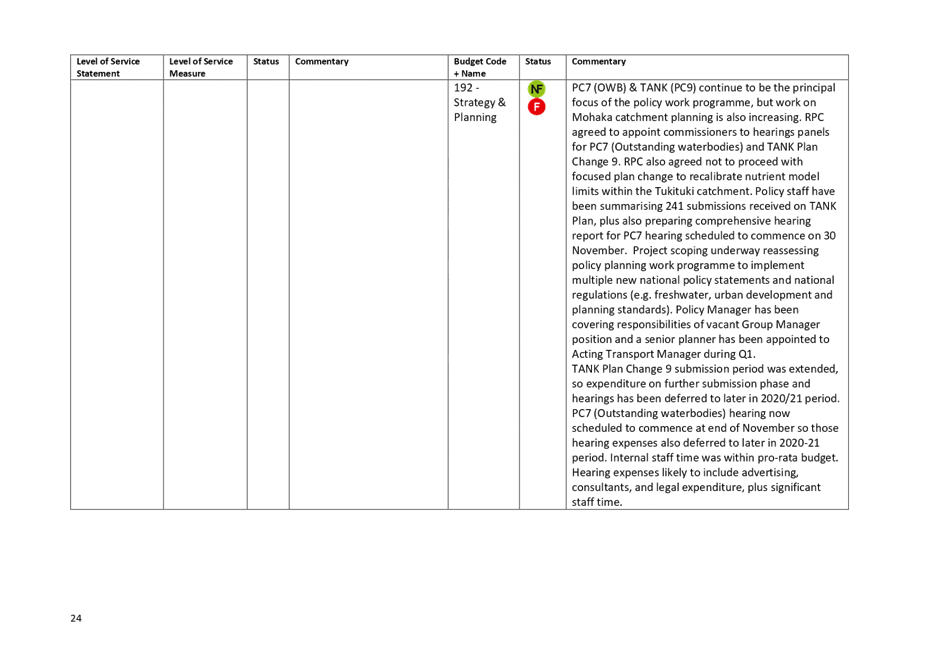

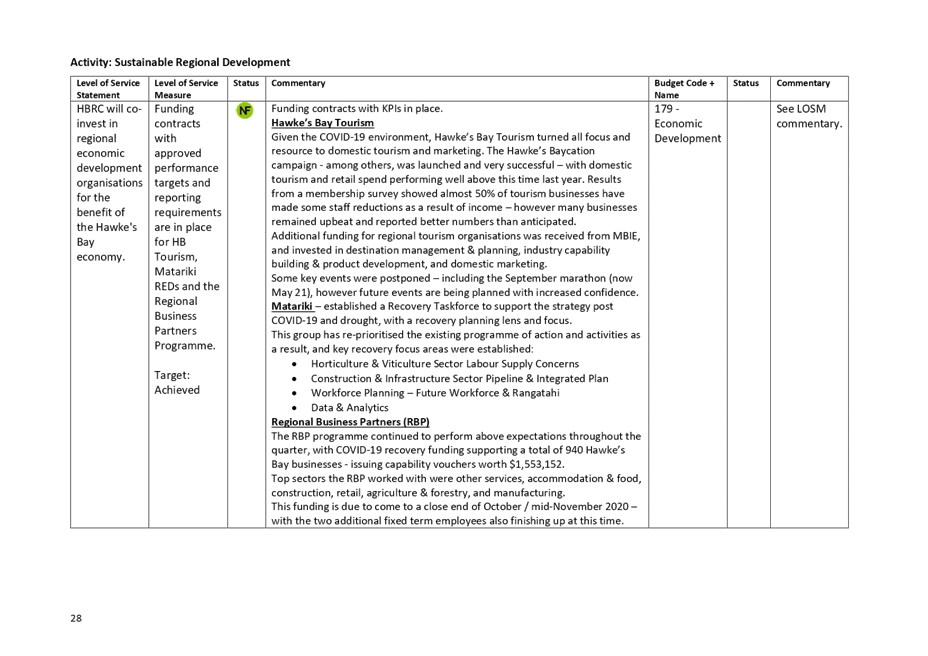

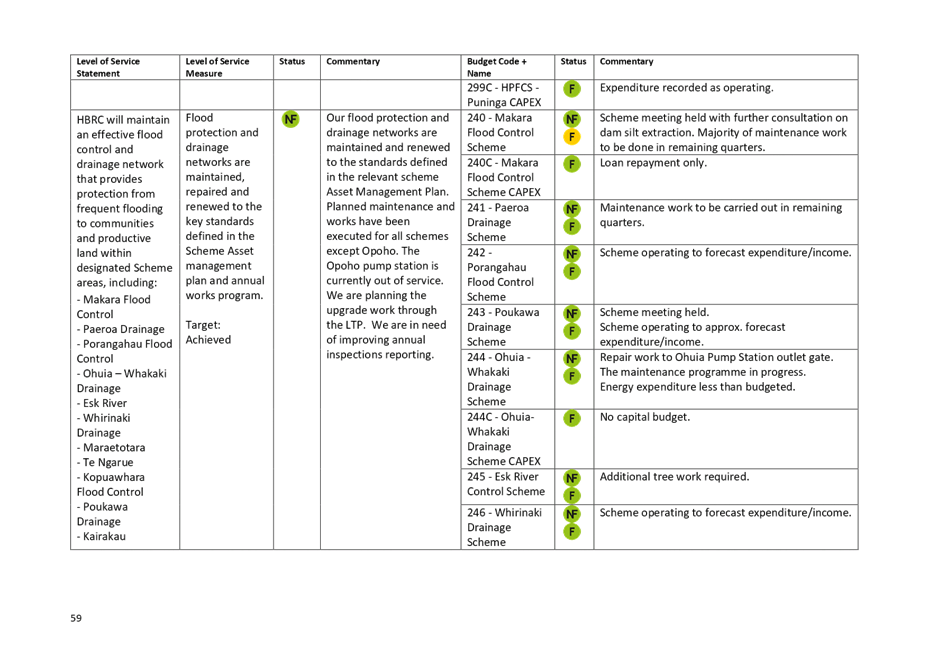

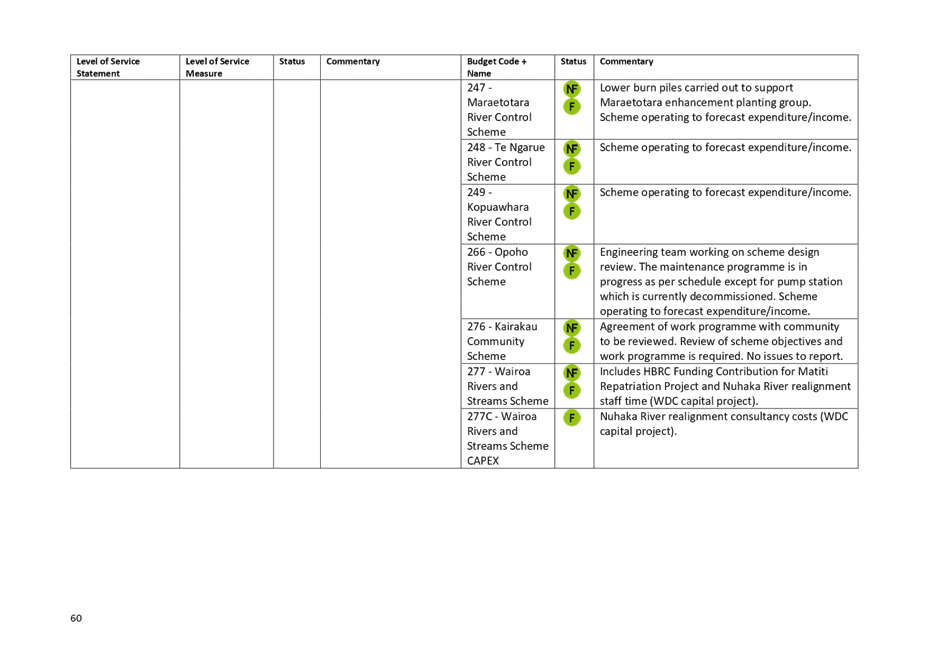

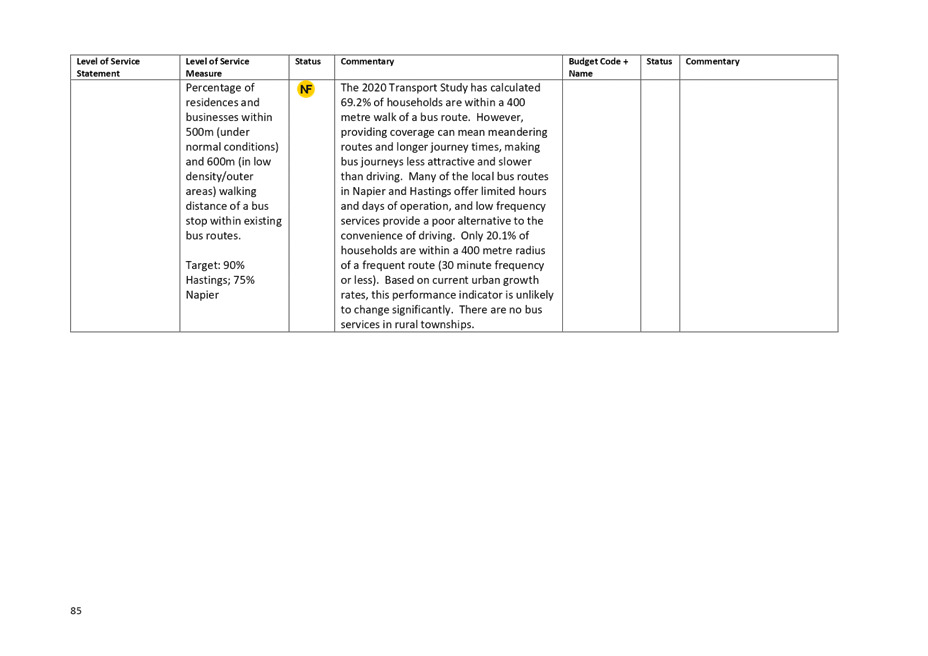

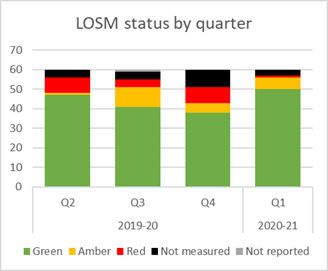

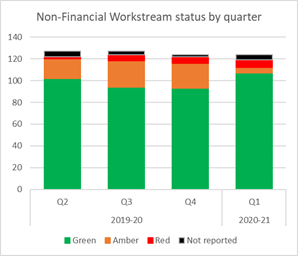

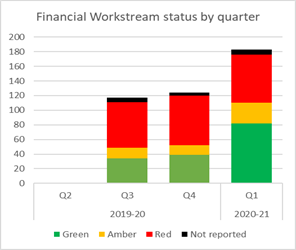

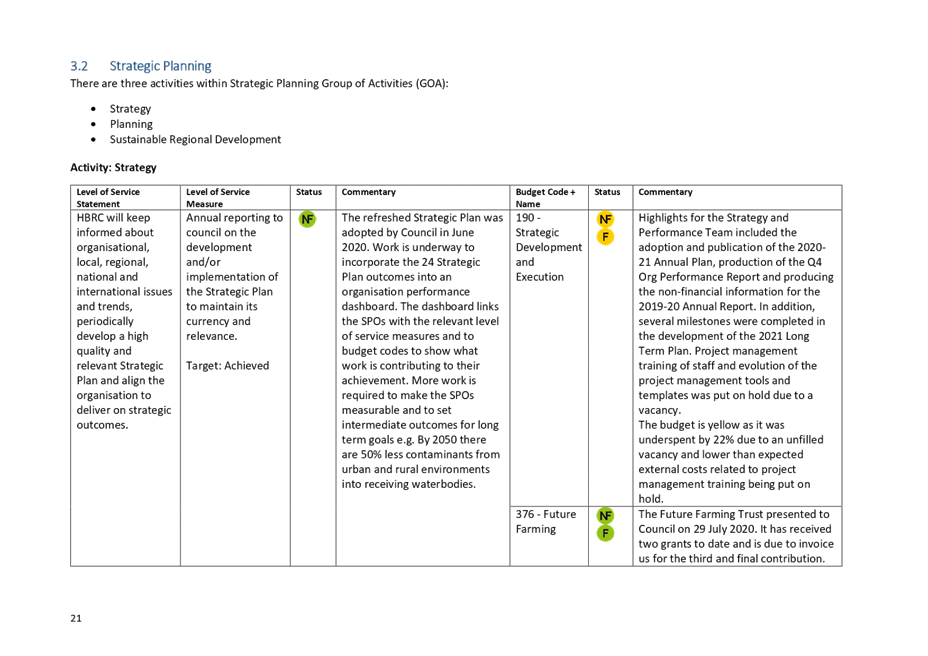

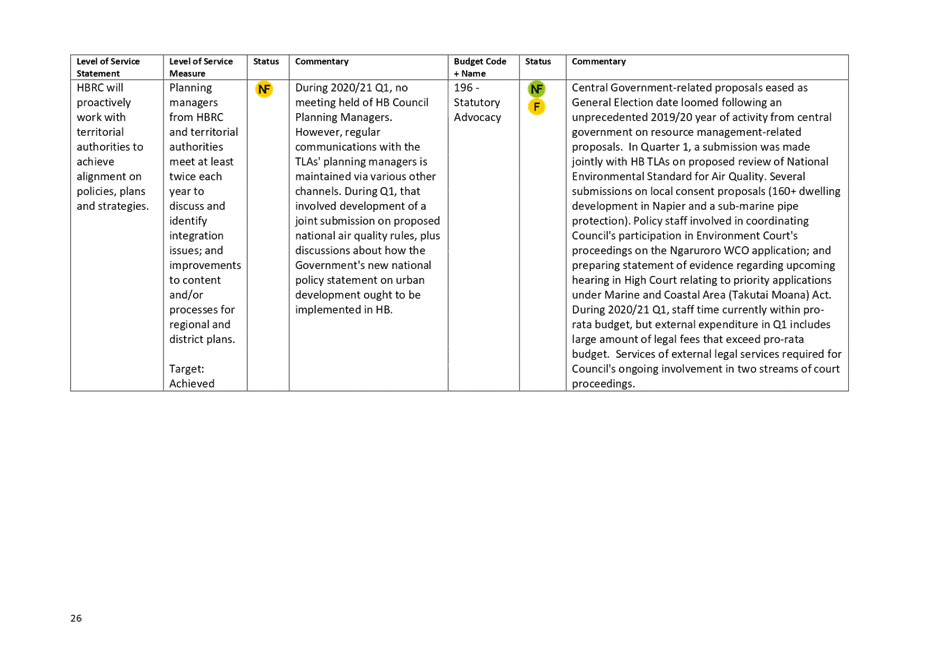

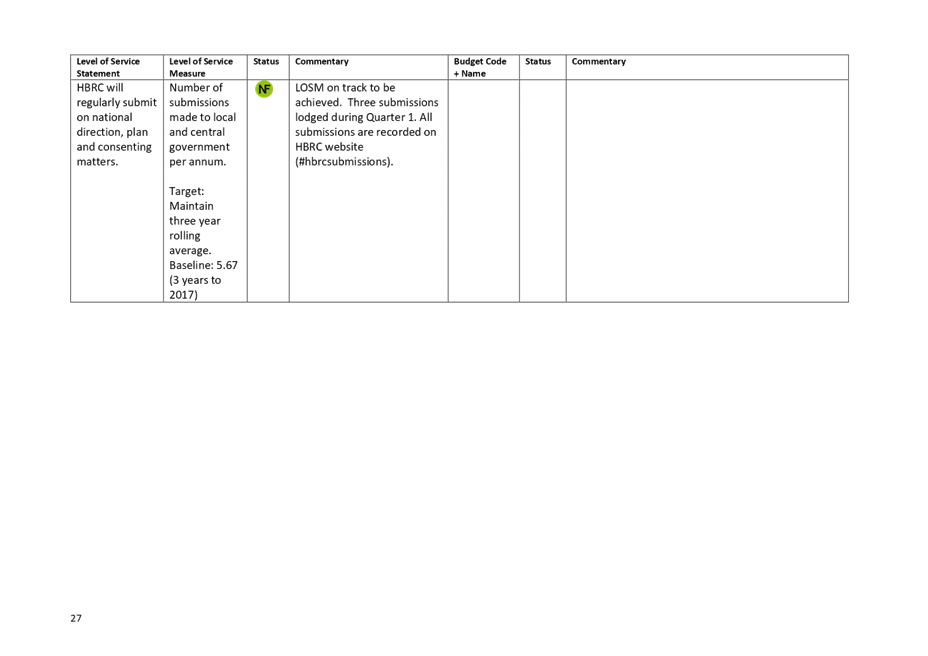

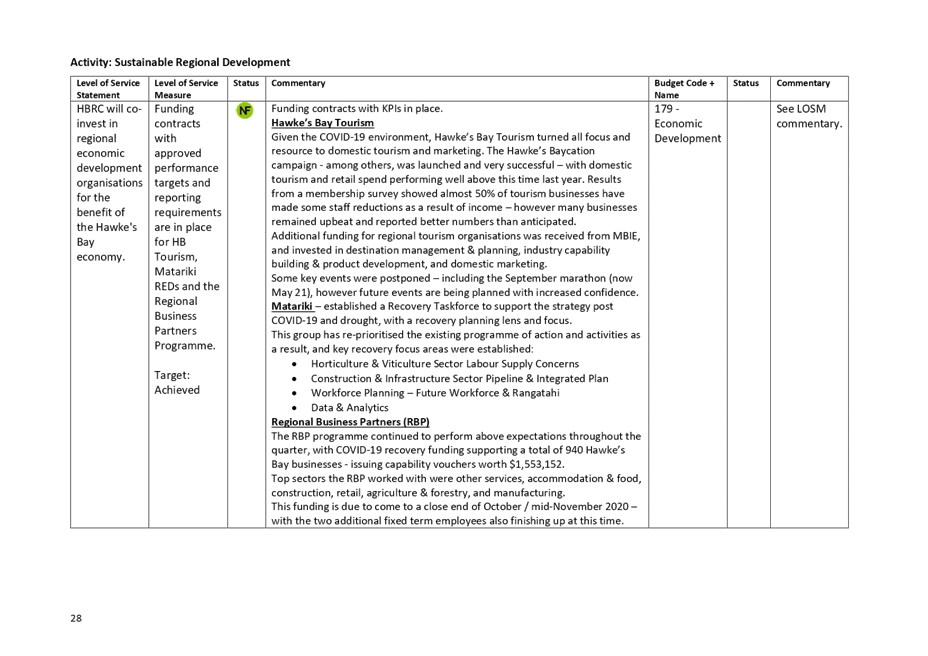

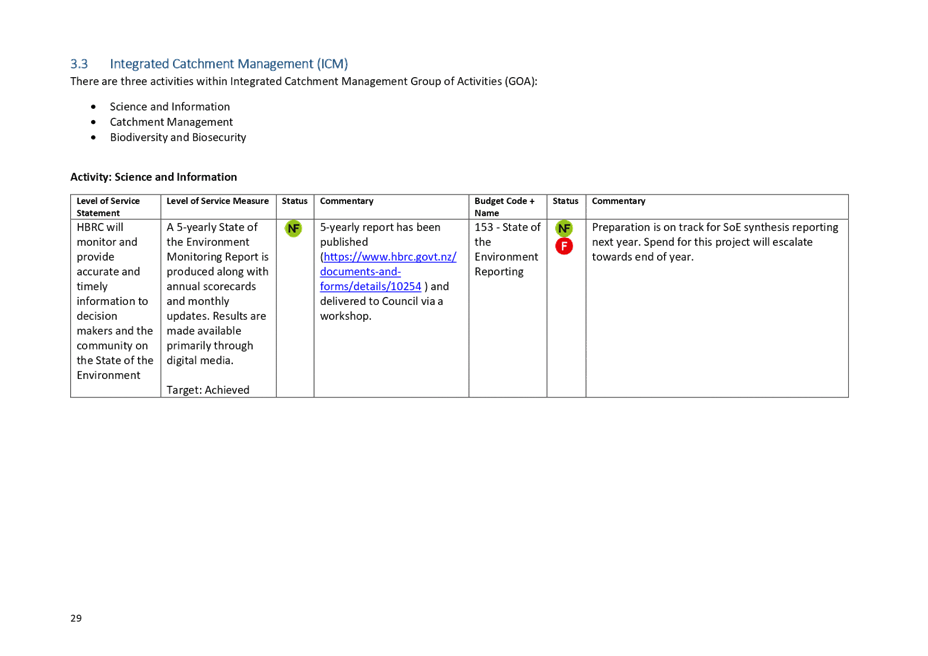

1. The attached Organisational Performance Report provides governors

with information to track performance against the level of service measures set

in the 2018 Long Term Plan. It describes situation-specific factors

affecting the organisation’s ability to deliver on what it said it

would. It also holds staff to account for non-financial and financial

performance signaling through traffic light status reporting issues that may

require management intervention.

2. At the meeting staff will present a prototype Organisation-wide

Performance Dashboard that is a visual representation of the Organisational

Performance Report. It presents the same information but in a much more user-friendly

manner and will provide users with the ability to drill down and filter by area

of interest. It is a work-in-progress so is not yet fully functional and the

data in some cases is illustrative only. The intention is to replace the 80+

page report with the dashboard.

Content of the Report

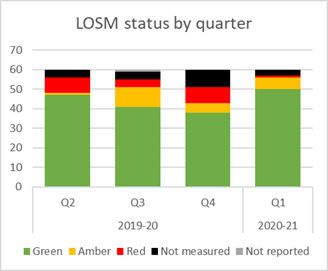

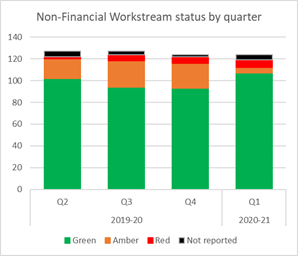

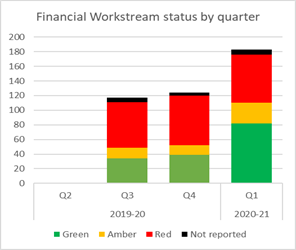

3. The Organisational Performance Report is for Quarter 1 of

2020-21. The quarter is the three months from 1 July to 30 September

2020. The report contains three parts plus an Executive Summary with

highlights and lowlights for the quarter.

3.1. Part 1: Significant

Events or Programmes impacting this quarter. These tend to be

cross-council so sit outside the groups of activities section

3.2. Part 2: Business

Improvement measures which focus on how well we are performing across a

number of corporate-wide measures such as health and safety incidents and

response to customer feedback

3.3. Part 3: Groups

of Activities with traffic light status and commentary on level of service

measures and related 3-digit code workstreams.

4. Like the previous quarter this Organisational

Performance Report includes wrap-up commentary on the impacts of COVID-19

lockdown on Council’s activities and related budgets, and to a lesser

extent the drought.

5. This quarterly report includes commentary on

capital expenditure for the first time. Improving the quality of this

reporting will be a focus for the next quarter.

Dashboard

6. The dashboard to be presented at the Committee meeting is based on

the information in the Organisational Performance Report. However, there is the

opportunity to tailor the dashboard for different audiences by turning off/on

different metrics.

7. For example, the Chair of the Environment and Infrastructure

Committee (EICC) has indicated her desire for a dashboard to track how major

environmental outcomes/projects are tracking and to see in one place the

breadth of contributing work. This is to address a concern that narrowly

focused papers to the Committee often feel adhoc and fail to give elected

members a sense of the bigger picture.

8. Staff are working with the Chair to develop a dashboard for EICC

early in the new year.

Background

9. This is the seventh Organisational Performance Report to be

presented. Improvements continue to be made to the content to ensure the

information is meaningful for governors and to the process for collating the

information to reduce reporting burden for staff.

10. Staff

complete their reporting in a software tool called Opal3 once actual financial

results for the quarter are loaded on the 20th of the month

following the end of the quarter. Staff choose the status (red, amber,

green) of non-financial results, but it is fixed against agreed criteria for

financial results. For example, red is set at >$30,000 or >10% over

or under budget. Staff are then required to provide commentary on what

they did in the quarter in terms of actual non-financial performance and to

explain any variations to budgets.

Change Between Quarters

11. The following graphs show change between quarters. The large

increase in financial workstreams reported on this quarter is due to capital

expenditure being included for the first time.

Next Steps

12. Further planned improvements to the Organisational Performance

Report include setting targets for the business improvements measures and

comparisons with industry benchmarks where possible. Work is underway in the

Corporate Service Group to set targets for its functions such as customers

experience and comms.

13. The dashboard will be finetuned and brought back to the Corporate

and Strategic Committee at its next meeting 3 March 2021.

Decision

Making Process

14. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee receives and notes the “Organisational Performance Report for period 1 July to 30

September 2020” staff report.

|

Authored by:

|

Kelly Burkett

Business Analyst

|

Desiree Cull

Strategy and Governance Manager

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

|

⇩1

|

Q1

Organisational Performance Report - July to September 2020

|

|

|

|

Q1

Organisational Performance Report - July to September 2020

|

Attachment 1

|

|

Q1

Organisational Performance Report - July to September 2020

|

Attachment 1

|

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 02 December 2020

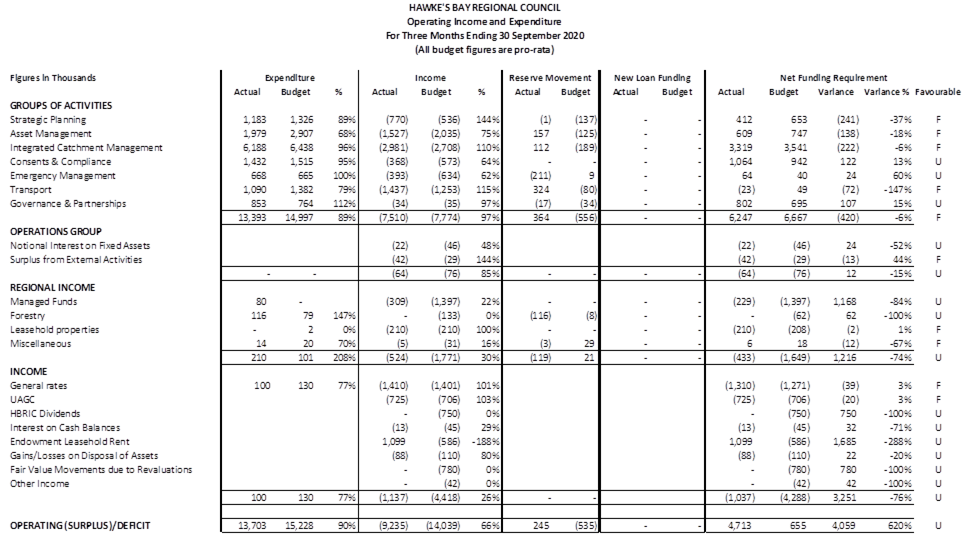

Subject: 2020-21 Quarter 1 (1

July – 30 September 2020) Financial Report

Reason for Report

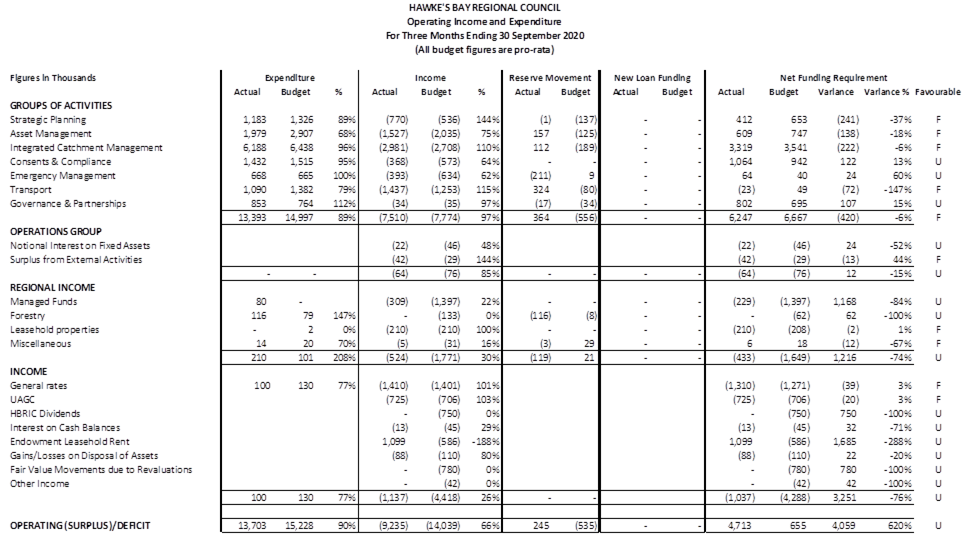

1. This item provides the Committee with financial results for the

first quarter of the 2020-21 financial year.

Summary

2. There have been no significant unbudgeted items or areas of

expenditure in the quarter.

3. Actual performance of investment income sources ie managed

fund and dividend forecast are currently favourable, however it is too early to

signal any full year expectations after one quarter.

4. Many of the variances in the financial report to 30

September are the result of; no phasing of budgets, timing of work programme

delivery and accounting treatment adjustments.

Background to

the Financial Summary

5. The FY20-21

annual plan budget was revised in response to the Covid-19 Pandemic. It

includes conservative forecasting for investment income in-particular given the

uncertainly around the economy and financial markets at the time of preparation

and adoption.

6. The budgets

presented have been updated to include the carry forwards from FY19-20 approved

by Council.

7. For reporting

purposes, the annual budget is divided evenly across the year with no phasing.

8. New loan

funding is generally drawn down at the end of the financial year when the

actual required funding is known.

9. All revenue and

expenditure accrued at the end of the FY19-20 financial year has been

recognised in the Q1 FY20-21 actuals.

Operating

Expenditure

10. Across the Groups of

Activities, expenditure is $1.6m below budget which is largely a reflection of

the pro-rata budget comparative to the actual planned expenditure. Annual

spend has considerable seasonality, particularly planting activity, which will

occur towards the end of the FY. Future year reporting, from the new

finance system will be phased across the year accounting for seasonality.

11. Strategic

Planning expenditure continues to be delayed due to the TANK Plan Change 9

submission period being extended and delays to the Plan Change 7 (Outstanding

Waterbodies) hearing.

12. Asset

Management are the most underspent because of the timing of when maintenance

takes place in the year, the seasonal nature of planting leading to more work

in quarter 2 and 4, scheduled work is due later in the financial year (e.g.

surveying is scheduled for the drier summer months).

13. Transport are underspent

by $300k primarily due to the timing of the September invoice from Go Bus

Transport for $287k which was processed into October.

Operating

Income

14. Across

all groups, income is $250k below budget.

15. Emergency

Management is showing a $241k shortfall. This is due to year end

accounting adjustment for the re-imbursement of the Covid-19 response welfare

costs from NEMS (the re-imbursement was accrued as revenue in 19/20 to offset

the cost in that year but the reversal of the accrual causes reduced income in

20/21 until the invoice is issued). The final invoice has not been issued as

approval from NEMS is pending.

16. Consents

and Compliance income is below budget, this is a result of the timing of

invoicing. Invoices were raised post the quarter end date for the Q1

period.

17. Asset

management income is $500k below budget, due to;

17.1. the

revenue from harvesting (Tangoio reserve) is not due till later in the year,

17.2. NCC

will be invoiced for its 50% share of the Westshore coastal works at the end of

the year when costs are known,

17.3. the

asset management team has stopped offering hydraulic modelling consultancy.

18. Regional

income from investments is below budget by $1.2m. This is due in part to the

timing of the forestry income from harvesting (Tutira) but mostly because of a

difference in the accounting treatment for the budgeting and reporting of the

managed funds.

19. The

budget for managed funds income includes all forecast gains for the year, but

actual income is split for accounting purposes.

20. Actual

revenue from interest, dividends and realised gains are reported in operating

revenue, with the remainder of the growth being in unrealised gains ($3.5m)

which are recognised on the balance sheet.

21. Overall,

the funds out-performed expectations, the combined growth of the managed funds

in the 1st quarter was $3.8m compared to the budget of $1.397m.

22. Income

was below budget by $3.3m, this is due to:

22.1. The

timing of dividends received from HBRIC not due to the end of the calendar year

22.2. the

Endowment Leasehold Rent affected by the timing of the 6-monthly payment to ACC

22.3. Fair

value movements are recognised at year-end.

23. Note that

a 5 cents per share dividend was announced by Napier Port Holdings on 18

November providing a dividend of $5.5m to HBRIC (the total budget was $3m for

the year) with HBRIC directors to determine the dividend paid to HBRC. (As in

prior years it is still expected that there will be an interim dividend paid in

June 2021).

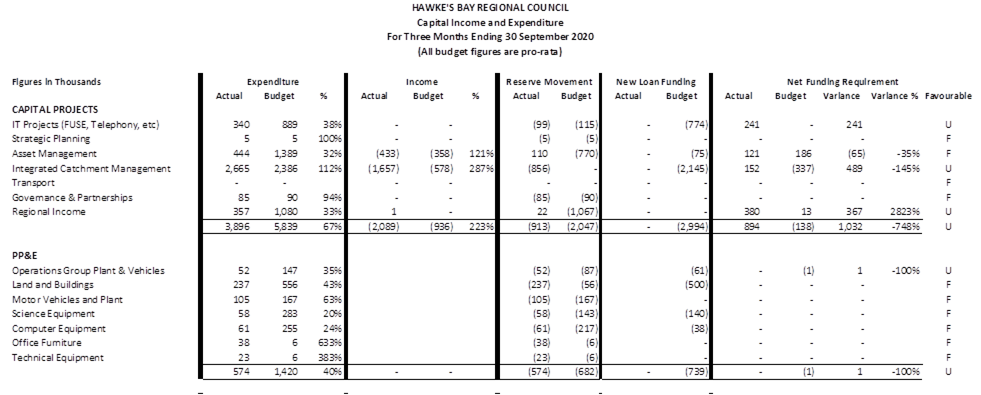

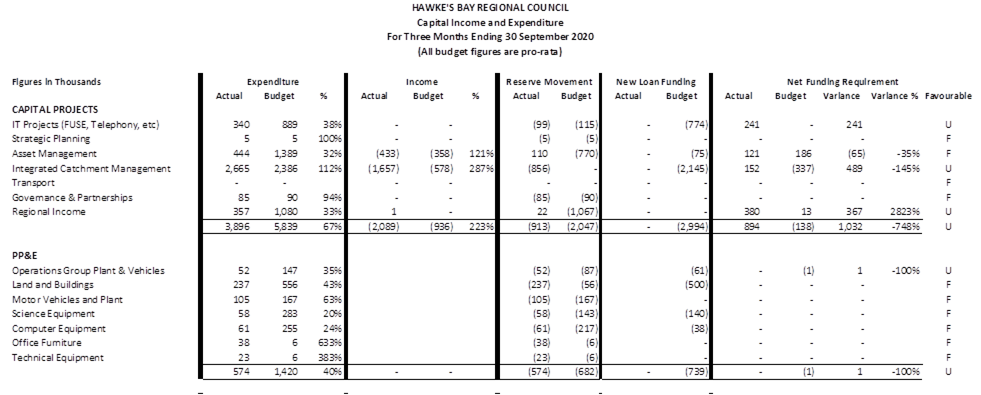

Capital Expenditure

24. IT

expenditure is below budget due to delays in the Water Information Project

caused by Covid-19. However, the FUSE (Finance System replacement) and

Telephony projects are on schedule for delivery with expenditure expected to

increase as the HR/Payroll, Finance, Supply Chain and Asset Management streams

of FUSE kick-off.

25. Asset

Management are performing some design reviews and expenditure is planned to

ramp up through the year.

26. ICM is

overbudget in income and expenditure due to the continued success of the

Sustainable Homes programme. The programme is running at 44% of expected annual

expenditure and 77% of expected annual income by the end of the 1st quarter.

27. Regional

Income includes the water investment project which is undergoing site selection

for a Heretaunga storage location with work commencing in the new calendar

year.

28. Property,

Plant and Equipment (PP&E) purchasing is under budget but is highly

dependent on the timing of placing of orders and invoicing.

29. The Land

and Buildings budget includes $2m for progression of a long term accommodation

solution. Alternatives to a new purpose built building are being explored

post Covid and the current preferred option is to compliment leasing more

office space by utilising the $2M to repurpose the Raffles St building and

renovate the Dalton Street ground floor.

Balance Sheet

30. Non-Current

Assets have increased by $2.8m, PP&E, Infrastructure Assets and Intangible

Assets has increased due to the ongoing capital expenditure noted above.

Investment Property has decreased as Napier Endowment Leasehold properties are

freehold and Financial Assets show the unrealised growth in the managed funds.

31. Current Assets

have increased by $11.5m reflecting the rates revenue received in August and

September resulting in a cash (& term deposit) increase of $9m with

outstanding receivables increase of $2.5m.

32. Equity

has decreased due to the current operating deficit offset by the unrealised

gains in the managed funds.

33. Non-current

Liabilities have increased due to a new $6.3m loan drawn down in July as

delayed funding for the Sustainable Homes and Erosion Control projects offset

by the principal repayments in the 1st quarter.

34. Current

liabilities have increased by $10m due to the increase in income in advance

from ratepayers ($16.2m) offset by decreases following the reversal of year-end

adjustments in employee benefit liabilities and trade payables.

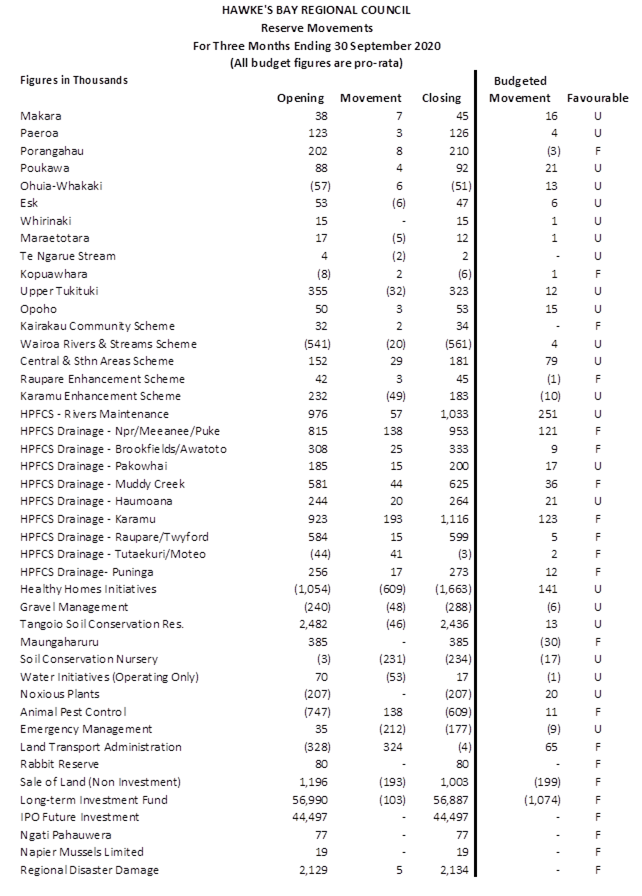

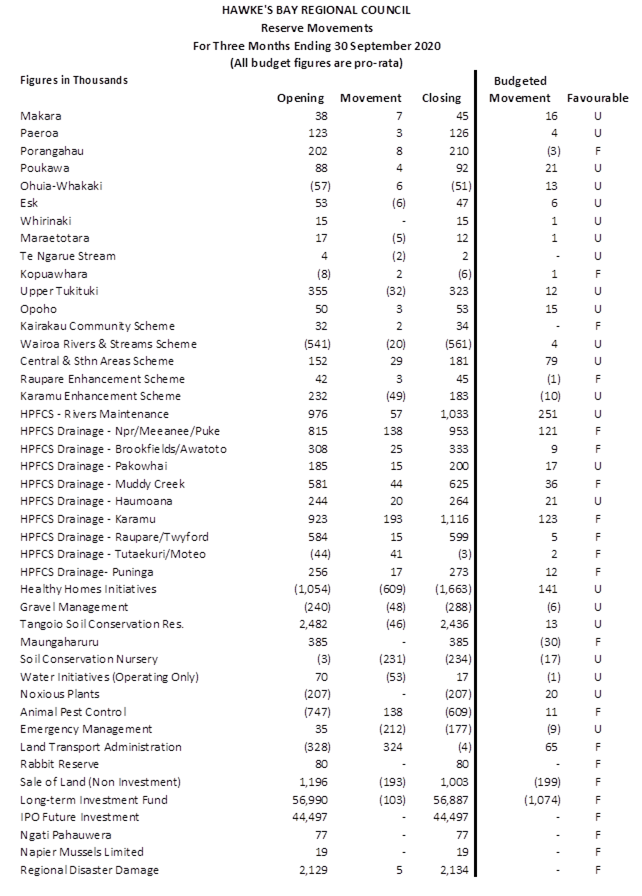

Reserves

35. Reserve movements are as

expected based on the operating and capital income and expenditure to date. The

deficit in the Healthy Homes Initiatives (Cleanheat/Sustainable Homes) reserve

continues to grow as operating costs exceed the revenue from interest charges.

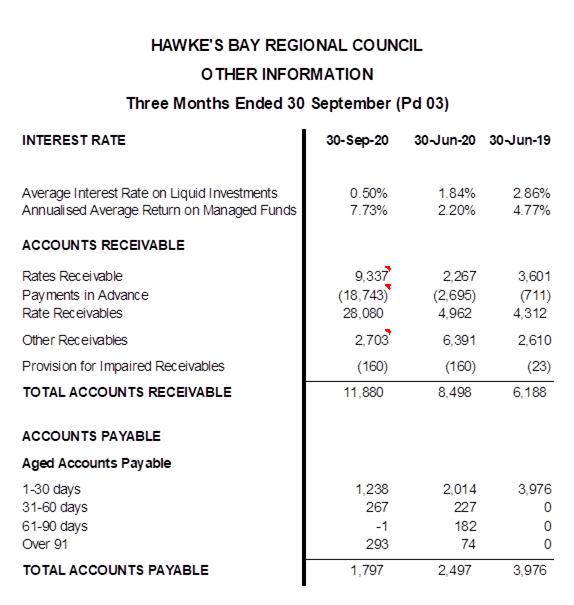

Other Information

36. Average

annualised interest rates show the low returns on cash and term deposit

holdings with an average 0.5% return while the managed funds have returned

7.73% when including realised and unrealised gains.

37. Accounts

receivables shows an increase of $3m since year end due to the issuing of rates

invoices. Payments in advance reflects the success of the updated rate

collection policy with $18.7m in rates revenue received in advance as at 30

September 2020 compared to $3.7m at the same time in 2019.

Decision Making

Process

38. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision making

provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee

receives and notes the “2020-21 Quarter 1 (1 July – 30

September 2020) Financial Report”.

|

Authored by:

|

Tim Chaplin

Senior Group Accountant

|

Bronda Smith

Chief Financial Officer

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

2020-21

Q1 Financials

|

Attachment 1

|

|

2020-21

Q1 Financials

|

Attachment 1

|

|

HAWKE'S BAY REGIONAL

COUNCIL

|

|

Balance Sheet

|

|

as at 30 September 2020

|

|

Figures in Thousands

|

As At

|

As At

|

|

|

ASSETS

|

30-Sep-20

|

30-Jun-20

|

|

|

Non-Current Assets

|

|

|

|

|

Property, plant & equipment

|

28,872

|

28,574

|

|

|

Infrastructure assets

|

188,112

|

187,387

|

|

|

Investment property

|

57,272

|

57,855

|

|

|

Intangible assets

|

10,374

|

10,096

|

|

|

Forestry assets

|

11,087

|

11,087

|

|

|

Financial Assets

|

585,004

|

581,054

|

|

|

|

|

|

|

|

Total Non-Current Assets

|

880,721

|

876,053

|

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

Inventories

|

36

|

452

|

|

|

Trade & other receivables

|

14,198

|

11,327

|

|

|

Other financial assets

|

2,057

|

2,057

|

|

|

Cash and cash equivalents

|

15,530

|

6,522

|

|

|

Total Current Assets

|

31,821

|

20,358

|

|

|

|

|

|

|

|

TOTAL

ASSETS

|

912,542

|

896,411

|

|

|

|

|

|

|

|

NET

ASSETS / EQUITY

|

|

|

|

|

Accumulated funds

|

426,789

|

428,817

|

|

|

Fair value reserves

|

408,160

|

406,465

|

|

|

|

|

|

|

|

Total

Net Assets / Equity

|

834,949

|

835,282

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

Non-Current Liabilities

|

|

|

|

|

Borrowings

|

36,751

|

31,238

|

|

|

Provisions for other liabilities &

charges

|

11,458

|

10,783

|

|

|

Employee benefit liabilities

|

676

|

520

|

|

|

|

|

|

|

|

Total Non-Current Liabilities

|

48,885

|

42,541

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

Borrowings

|

3,525

|

3,650

|

|

|

Income in Advance

|

18,901

|

2,695

|

|

|

Provisions for other liabilities &

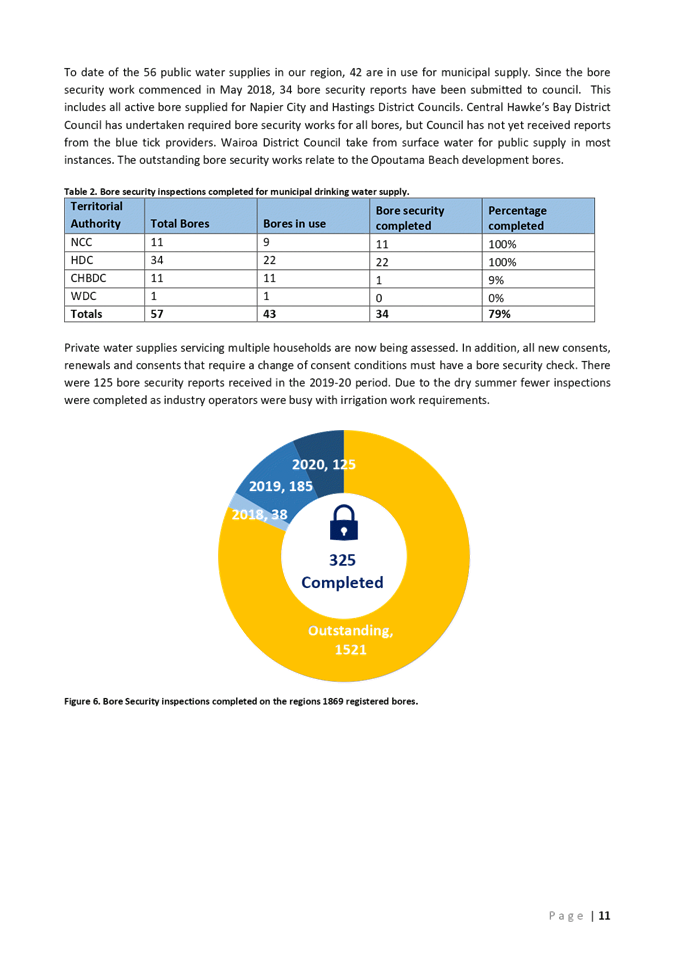

charges

|

276

|

686

|

|

|

Employee benefit liabilities

|

1,656

|

3,090

|

|

|

Trade & other payables

|

4,350

|

8,467

|

|

|

|

|

|

|

|

Total Current Liabilities

|

28,708

|

18,588

|

|

|

|

|

|

|

|

TOTAL

LIABILITIES

|

77,593

|

61,129

|

|

|

|

|

|

|

|

TOTAL

NET ASSETS / EQUITY & LIABILITIES

|

912,542

|

896,411

|

|

|

|

|

|

|

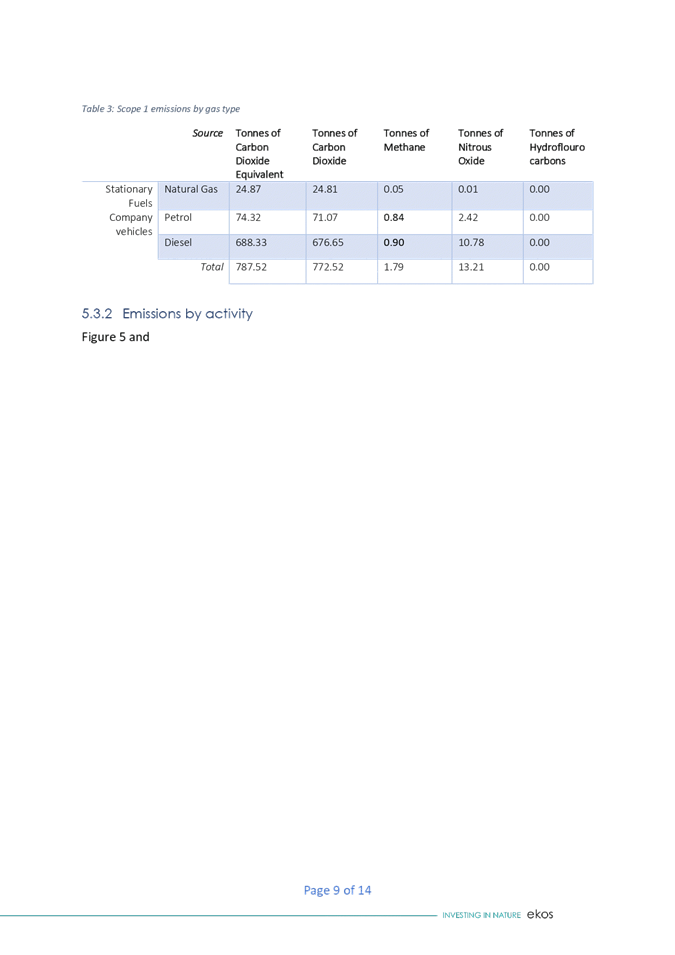

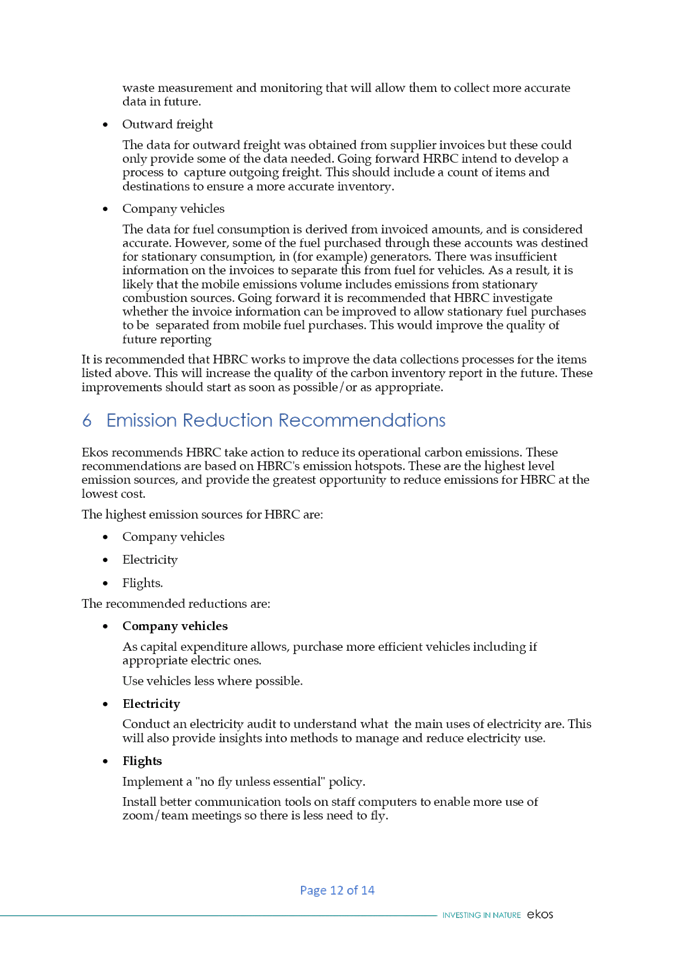

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 02 December 2020

Subject: The Regional

Council’s Corporate Carbon Footprint

Reason for Report

1. This item provides the findings identified in a study conducted to

establish Council’s carbon footprint relating to its corporate

operations.

Executive Summary

2. The response to climate change is at the heart of core Council

functions, and establishing a corporate emissions profile was a key first step

in understanding the environmental impacts of conducting Council business,

while looking for reduction opportunities.

Background

3. Following the FY19-20, staff undertook a process to establish

Council’s corporate emissions profile. The ‘footprint’ scope

and organisational boundary included the measurement of resources used to

undertake daily business operations at all Council offices. This required data

input across all office sites which included fuel use, travel and accommodation,

vehicle use, electricity and gas use, waste, and outward freight data. Refer to

page 3 of the EKOS Carbon inventory report attached.

4. A Senior Carbon Analyst from EKOS, Ian Challenger, undertook a peer

reviewed carbon footprint calculation and provided a report on findings and

carbon offsetting options.

5. Due to the disruption COVID19 had on Council operations we will a

fine-tuning of baseline data for FY20-21, however this exercise has built a

solid foundation that brings visibility to our environmental impacts, enabling

us to better monitor and bring maturity to our footprint data collation going

forward. All Council offices were closed for 1 month and took the

following months thereafter to get to full staff occupancy. The closure of

office facilities impacted energy use, waste, and freight and to some degree

vehicle use, leaving a gap in annual data. Travel requirements were majorly

impacted due to national COVID-19 restrictions and because of these impacts,

staff expect there may be slight increase to Council’s carbon footprint

profile next FY.

6. A stocktake of our emission sources gave perspective to

Council’s reliance on fuel, especially diesel, to undertake programmed

activities. With a goal of being carbon neutral by 2025, this study enables

progress in making a calculated effort to monitor and plan emission reduction

initiatives.

Discussion

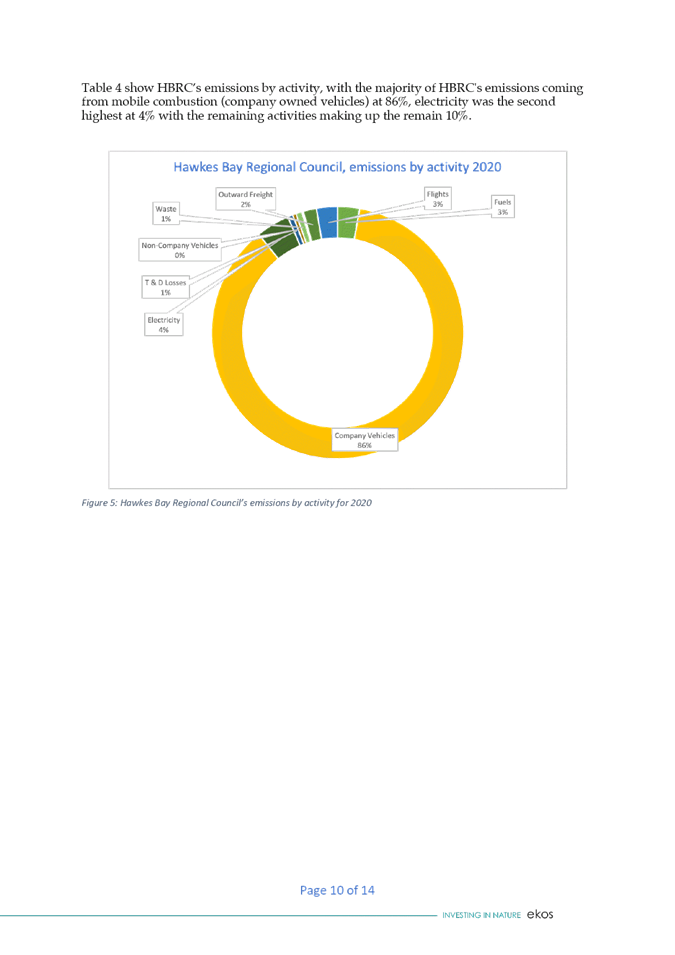

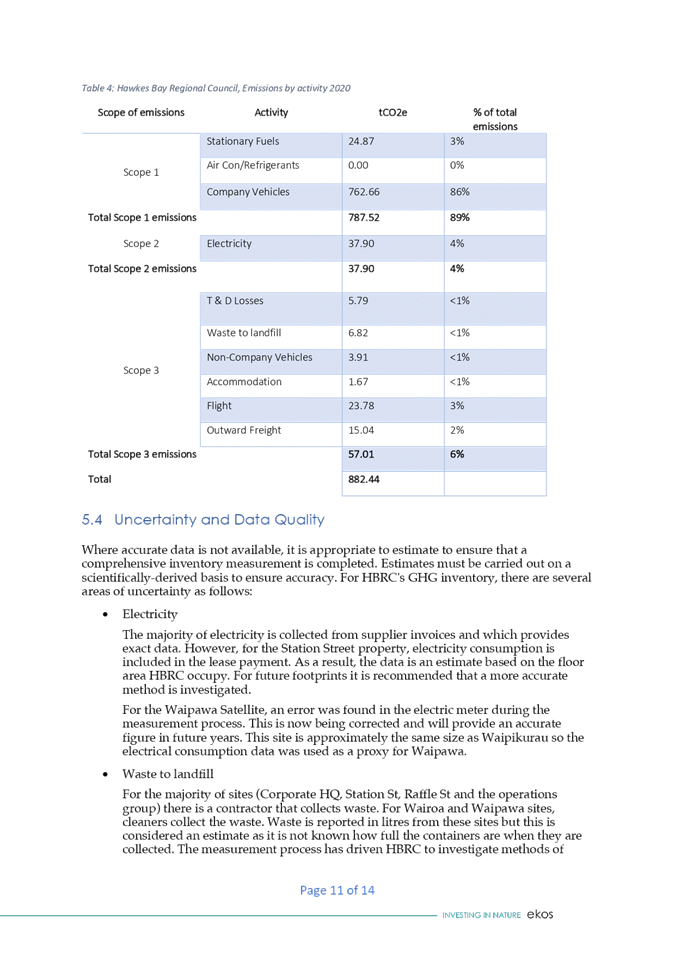

7. The combined Council carbon footprint relating to daily business

operations across all office sites totaled 884.44

tonnes CO2e in the FY19-20.

8. Additional findings of interest include:

8.1. 86% of Council emissions stem from fleet use. This included the use

of large plant such as diggers and mowers.

8.2. 4% of emissions relate to electricity use at Council offices.

8.3. The remaining 10% of emissions stem from flights (3%), gas (3%),

plus freight and waste

8.4. 136 nights accommodation were provided for work related travel.

8.5. Staff travelled a total of 183,000 km’s by air. The highest

sector flown was Napier/Wellington at 266 times, with the Napier/Auckland

sector flown 126 times.

8.6. The number of letters sent via post in the FY19-20 was 243,712.

8.7. Through the data collation process an issue was discovered with the

Waipawa office meter which impacted the usage data that was reported. The

Waipawa office is assumed to have had a similar consumption to the Waipukurau

site which has been added to footprint calculations. The electricity

consumption (kWh) of all Council offices is as outlined below.

|

Dalton St

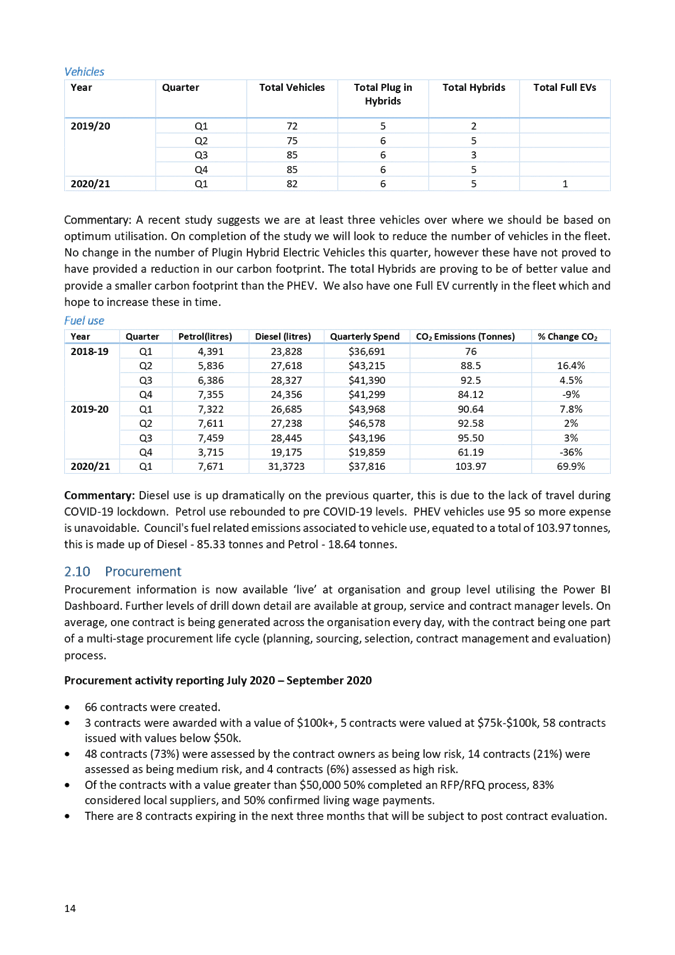

|

Guppy Rd

|

Station

St

|

Raffles

St

|

Wairoa

|

Waipukurau

|

|

258,147

|

59,983

|

24,723

|

16,789

|

10,108

|

9,097

|

8.8. Fuel data was collated from all three BP accounts. The

organisational fuel consumption profile is as below:

|

Source

|

Diesel

(l)

|

Petrol

(l)

|

|

Bulk Diesel

store – Guppy Rd

|

104,166

|

|

|

Works Group

|

50,293

|

3618

|

|

HBRC

|

101,055

|

26,693

|

Works Group

9. Through the data collection process, it was interesting to give

visibility to the volume of diesel used by our Works Group, specifically to

discover more diesel is consumed via the bulk fuel store when compared to the

entire HBRC diesel fleet.

10. Given the

community dependency on the Works Group emergency response function, the bulk

diesel store facility was implemented as a strategic asset to provide a fuel

supply contingency. The onsite bulk store provides efficient and convenient

diesel supply to power diggers, trucks, tractors, generators, and light

vehicles, on a daily basis.

11. Initial

consideration has been given to reducing the Works Group emissions profile by

committing to the implementation of tractors with higher emission control

ratings, targeting Tier 4 machinery (increased fuel efficiency) through renewal

schedules. Operating a modern fleet of tractors and mowers has increased

productivity overall resulting in reduced engine hours to complete annual work

programmes. The minor plant replacement schedule has also targeted equipment

with an increased fuel efficiency such as new technology ‘Stihl fuel

injected chainsaws’, and battery power tools where practical. In

addition, opportunities to introduce electric ATVs will be explored as

practical.

12. The

option to incorporate carbon offsetting costs into contracted work will be

considered going forward to assist with counteracting associated works group

emissions. A fleet evaluation will be programmed for next financial year to

investigate the prospects of balancing emission reduction opportunities while

maintaining existing levels of service.

Fuel use

13. Council’s

largest source of emissions relate to vehicle use. Electric vehicles are

introduced to the fleet through replacement schedules when fit for purpose.

Council currently runs a profile of fuel-efficient vehicles including 3

Hybrid’s, 6 Plug-in Hybrids, 2 Full electric vehicles and 2 electric

motorbikes which have replaced traditional fuel counterparts.

14. Following

this study, Council’s vehicle purchasing policy has been reviewed to

provide a greater emphasis on and commitment to ‘Electric First’

vehicle procurement guidelines. Installation of additional charging stations

have been programmed annually to facilitate electric vehicle uptake.

15. Through

any planned building alterations, additional bike parking and changing room

facilities will be catered for to encourage sustainable to and from work

travel. This works in tandem with staff wellness initiatives and indirectly

towards reducing the wider Council footprint.

16. The fuel

used by backup generators is currently lumped in with the wider vehicle fuel

consumption data. Reporting measures will be put in place to accurately record

the fuel used for generators, so vehicle and plant fuel use can be monitored

more accurately.

Travel

17. Travel

emissions were relatively low this year due to COVID-19 restrictions, however

as a result, COVID-19 became the catalyst to change the way meetings are

conducted and foster a level of comfort in staff use of video conferencing

facilities. Programmed updates to meeting room video conferencing facilities

are planned for next year to keep up the momentum towards utilising this

technology instead of travelling.

18. The travel

policy will be reviewed to show approval thresholds around staff travel

requirements and what is deemed essential and non-essential travel.

Waste

19. This

study highlighted the need to establish a better way of monitoring waste to

provide a baseline with increased accuracy. Waste data for the baseline

footprint was collated via invoices and weekly estimates from key staff and

cleaning contractors. Waste is currently measured in litres correlating to the

bins collected which can dramatically vary in weight. Staff are investigating

alternate waste collection opportunities where weight on collection data can be

provided for more accurate measurements going forward.

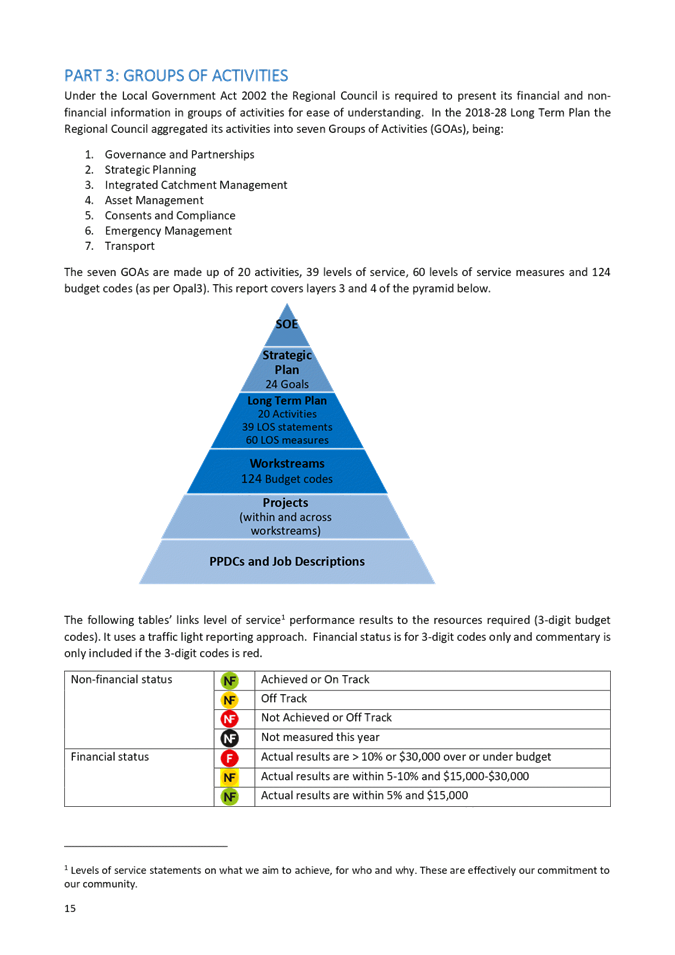

20. An