HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 11 November 2020

Subject: 2019-20 Annual Treasury

Report

Reason for Report

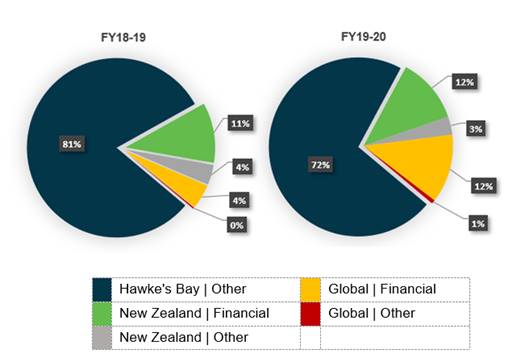

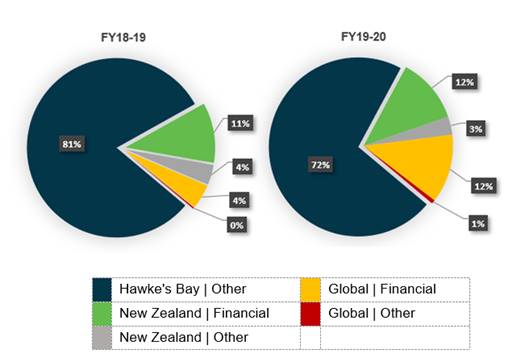

1. This item provides an annual update of the

Councils investment activity and reports the performance of the Council’s

investment portfolio for the year ending 30 June 2020.

Background

2. The Investment management reporting requirements, outlined

within Council’s Treasury Policy, requires Office to report to the

Financial Audit & Risk Sub-Committee (FARS) on the Council’s

investment allocation and investment

performance.

3. As stated within the Policy, all Treasury investments are

required to be reported on quarterly, with other defined investments reported

annually. A general outline of the reporting requirements is listed below.

|

Minimum update to FARS

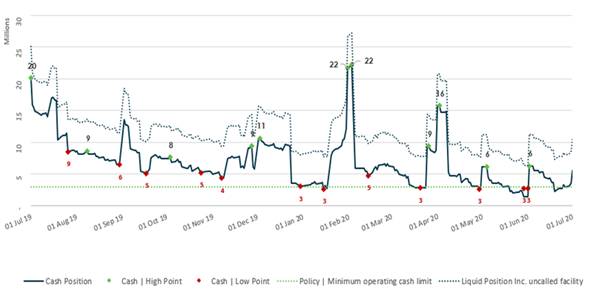

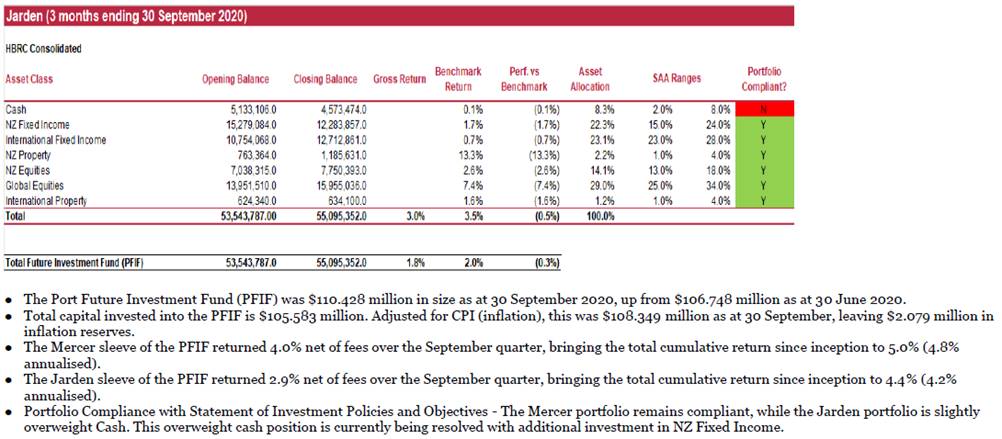

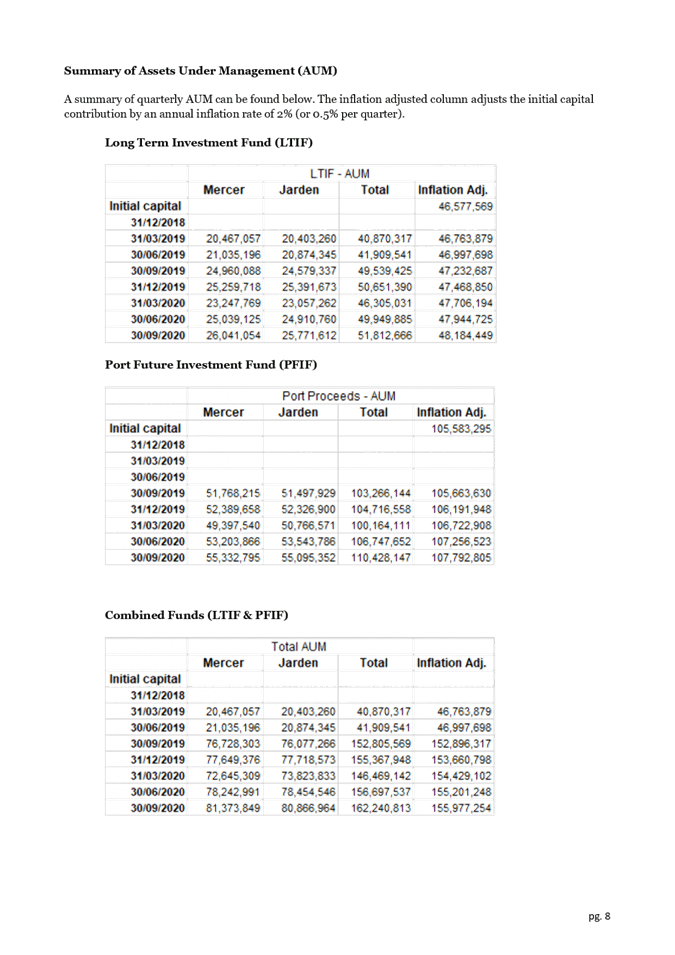

|

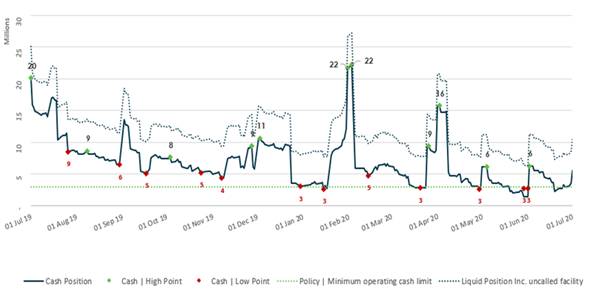

|

Quarterly

|

Annually

|

|

Liquidity

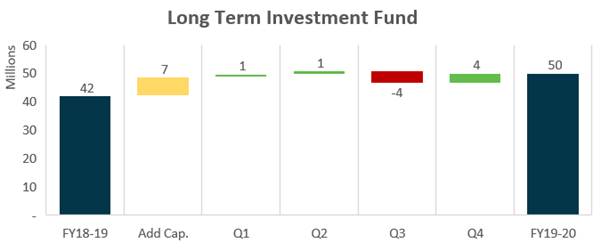

|

Investment property

|

|

Financial assets

|

Forestry assets

|

|

CCTO - HBRIC

|

Intangible assets

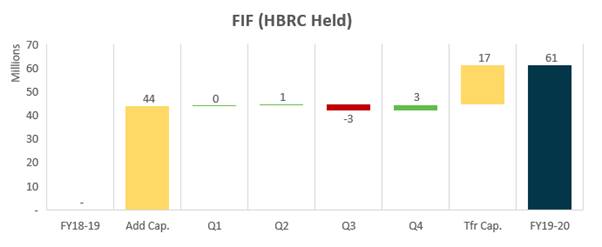

|

|

|

Napier / Gisborne Rail

|

4. Officers continue to welcome feedback from FARS to improve

and further develop the reporting process and to highlight any specific gaps of

information they would benefit from.

Discussion

5. The Annual Treasury report is written as at 30 June 2020,

and reports on:

5.1. Investment

Portfolio Summary

5.2. FY19-20

Performance Summary

5.2.1. Napier Port (PONL) IPO

5.2.2. Other

5.3. Liquidity

5.3.1. Cash & Cash Equivalents

5.3.2. Debt

5.4. Financial

Assets

5.5. Investment

Property

5.6. Forestry

Assets value

5.7. Intangible

Assets (Carbon Credits)

5.8. Napier /

Gisborne Rail

5.9. CCTO –

HBRIC

Investment Portfolio Summary

6. The below table

is an extract from HBRC Balance sheet, which shows the complete list of HBRC

assets as at 30 June 2020:

|

|

Asset

|

FY18-19

|

FY19-20

|

Change

|

|

|

|

$000

|

%

|

$000

|

%

|

$000

|

|

|

Cash &

cash equivalents

|

28,436

|

4.0

|

6,522

|

0.7

|

(21,914)

|

|

*

|

Trade &

other receivables

|

10,063

|

1.4

|

11,327

|

1.3

|

1,264

|

|

*

|

Inventories

|

113

|

0.0

|

452

|

0.1

|

339

|

|

|

Advances to

CCO

|

6,500

|

0.9

|

-

|

0.0

|

(6,500)

|

|

|

Other

financial assets

|

55,700

|

7.8

|

124,366

|

13.9

|

68,665

|

|

|

Management

Funds

|

41,910

|

75.2

|

111,073

|

89.3

|

69,163

|

|

*

|

Other

|

13,791

|

28.5

|

13,293

|

10.7

|

(498)

|

|

|

Investment

property

|

48,393

|

6.8

|

57,855

|

6.5

|

9,462

|

|

*

|

Forestry

assets

|

11,482

|

1.6

|

11,087

|

1.2

|

(395)

|

|

|

Intangible

assets

|

7,347

|

1.0

|

10,096

|

1.1

|

2,749

|

|

|

Napier /

Gisborne Rail

|

236

|

0.0

|

1,486

|

0.2

|

1,250

|

|

|

Investment

in HBRIC

|

340,396

|

47.9

|

457,260

|

51.0

|

116,864

|

|

*

|

Property,

plant & equipment

|

27,473

|

3.9

|

28,574

|

3.2

|

1,101

|

|

*

|

Infrastructure

assets

|

174,709

|

24.6

|

187,387

|

20.9

|

12,678

|

|

|

Total Assets

|

710,848

|

100.0

|

896,412

|

100.0

|

185,564

|

|

*

-

|

These assets aren’t considered

‘Investment Assets’ and are excluded from this report. They

will however be reported on as part of Council’s Annual Report.

Note amounts listed above are

subject to Audit sign off.

|

7. The graphs

below illustrate geographically, where Councils investments are located.

8. The percentages

equate to the percentage of total Council investment portfolio.

9. The graphs demonstrate

the response to HBRC Long-Term Plan (LTP 2018-28) strategy, which pursued the

strategy of diversifying the Council’s investment base, thereby

de-risking reliance on the Hawke’s Bay region and/or income derived from

any one asset class.

10. The diversification of the

investments base is less than anticipated over the past 12 months as a result

of the extraordinary value increase realised in PONL; where in spite of Council

divesting 45% of its ownership, the investment value increased by $71M. As at 30

June 2020, PONL still accounts for ~60% of the total investment portfolio.

FY19-20

Performance Summary

11. The tables below show

Actuals against the Annual Plan’s income and funding derived by Councils

investments.

|

|

Income

|

FY19-20

Annual Plan

|

FY19-20

Actuals

|

Variance

Actual v.

Plan

|

|

|

|

$000

|

%

|

$000

|

%

|

$000

|

%

|

|

|

Other

financial assets

|

7,727

|

8

|

3,422

|

3

|

(4,305)

|

44

|

|

|

Management

Funds

|

6,650

|

86

|

2,530

|

74

|

(4,120)

|

38

|

|

|

Interest

|

1,077

|

14

|

892

|

26

|

(185)

|

78

|

|

|

Investment

property

|

2,284

|

2

|

2,343

|

2

|

59

|

103

|

|

|

Endowment

leasehold land

|

1,443

|

63

|

1,500

|

64

|

57

|

104

|

|

|

Wellington

Leasehold land

|

841

|

37

|

843

|

36

|

2

|

100

|

|

|

Napier /

Gisborne Rail

|

-

|

-

|

-

|

-

|

-

|

-

|

|

|

Investment

in HBRIC

|

90,900

|

90

|

109,583

|

95

|

18,683

|

121

|

|

|

PONL

Dividend

|

7,900

|

9

|

2,500

|

2

|

(5,400)

|

32

|

|

|

IPO

‘special’ Dividend

|

83,000

|

91

|

107,083

|

98

|

24,083

|

129

|

|

|

Income

Total

|

100,911

|

100

|

115,348

|

100

|

14,437

|

114

|

12. The FY19-20 income result

reflects six months from the first reports of Covid-19 in China, and the global

the impact from it thereafter.

12.1. Other Financial

Assets: namely the two Managed Funds, preformed albeit as expected up to

Q2, took a significant hit in Q3 and with support from equally significant

global fiscal support packages, made a rebound in Q4.

12.2. As a result of the

numerous global fiscal packages, equity ‘valuations’, when compared

to low interest rates will now more appealing.

12.3. Investment Property:

Endowment land property has out-performed expectations, with the market value

of the land increasing by ~$9M in FY19/20. However, a prior Council decision

[ACC] limits the benefit to Council, and therefore both land areas performed as

expected.

12.4. Investment in HBRIC:

The success of the PONL listing is detailed below but is as expected, the

success of FY19-20.

13. The overall FY19-20

performance saw a $14.4M or 14% favourable variance in regard to income

generation.

PONL IPO

Summary

14. On 20 August 2019, Council

successfully listed the minority share of PONL on the NZX; resulting in HBRIC

receiving $107M cash proceeds in exchange for 45% of capital.

15. As part of the LTP 2018-28

consultation, funds received through the capital liquidation were to establish

a ‘ring fenced’ ‘Future Investment Fund’ (FIF). As a

consequence of being ‘ring fenced’, Council cannot reinvest the

107M received for the capital without initial community consultation.

16. As a result of an

unfavourable IRD binding tax ruling, $35M of the $107M received was financially

impractical to transfer as planned from HBRIC to HBRC. Transferring the

additional amount would have created onerous tax consequences. Furthermore, the

IPO raised an additional $27M compared to the LTP expectations. Any capital

achieved over and above the forecasted $83M would initially remain in HBRIC due

to Tax consequences.

17. Following the unfavourable

binding ruling decision, HBRIC continued to explore options to transfer the IPO

funds in a tax efficient manner to HBRC. Upon consultation with PwC a decision

was made in June 2020 by Council and the HBRIC board to transfer/ sell circa

16M of Jarden held domestic investments to HBRC in return for an interest

bearing loan. This arrangement transferred all risks and rewards of ownership

of the funds to HBRC and enabled HBRC to benefit from future earnings and

capital gains of the investments transferred.

18. The remaining $45M is invested

by HBRIC and governed by the HBRC SPIO.

18.1. As part of the

Investment Strategy of the LTP 2021-31, the SIPO of HBRIC will be considered to

take advantage of the benefits a CCTO has over Local Government.

|

PONL IPO

Proceeds breakdown summary:

|

|

|

|

|

|

IPO

|

>

|

HBRIC

|

HBRC

|

|

|

$000

|

|

$000

|

$000

|

|

Gross

IPO Proceeds

|

108

|

|

|

|

|

Net

IPO Proceeds * Ring Fenced Amount

|

107

|

>

|

|

|

|

Fully

Imputed Dividend Paid to HBRC

|

|

|

|

44

|

|

FIF

still held in HBRIC

|

|

|

35

|

|

|

FIF

HBRIC

|

|

|

27

|

|

|

Internal

Loans

|

|

|

(17)

|

17

|

|

Total

|

107

|

>

|

45

|

61

|

Liquidity - Cash & Cash Equivalents

|

|

Asset

|

FY19-20

|

|

|

|

$000

|

%

|

%

|

|

|

Cash

|

4,022

|

|

61.7

|

|

*

|

HBRC Held

Cash

|

3,553

|

88.3

|

|

|

|

Works

Group

|

138

|

3.4

|

|

|

|

Other

– managed trusts

|

330

|

8.3

|

|

|

|

Short-term

bank deposits

|

2,500

|

|

38.3

|

|

-

|

Cash &

and cash equivalents

|

6,522

|

|

100

|

* $650k is marked to rebalance the disaster

damage reserve referenced in the report.

- The remaining Term Deposit was invested for 84 days

& returned 1.65%.

19. With the Reserve Bank of

New Zealand (RBNZ) currently setting unprecedented monetary policy easing, the

forecast for returns from Cash and Cash Equivalents type investments is to

remain low, when compared to Pre Covid-19 levels.

20. This is unfavourable for

Council’s FY20-21 Annual Plan forecast interest earned from Cash and Cash

Equivalents. Returns from cash was forecast at 4.5% as per the

significant assumptions used in the 2018-28 LTP. However,

lower cash rates will have favourable financial implications through reduced

borrowing costs etc.

21. Cash and cash equivalents

are used purely for working capital to enable the organisation to meet its

requirements.

21.1. The following graph

displays HBRC daily closing cash position for the FY19-20.

22. As per the Treasury

policy, a minimum $3M liquidity should be accessible at all times.

23. The low material points

seen in January/February are a result of rates being due in February 2020. The

low points in May/June are loans yet to be drawn for debt funded activities,

such as Sustainable Homes and The Erosion Control Scheme. These loans wear

drawn in July 2020.

24. The Treasury Accountant

reports weekly to the CFO on HBRC short term cash position (up to 13 weeks).

Debt

Management

25. HBRC Loans drawn as at 30

June 2020:

|

|

Loan

Id

|

Bank

|

Loan Type

|

Interest Rate

|

Amount drawn

|

Execution

|

Maturity

|

|

|

|

|

|

%

|

$000

|

|

|

|

|

1062

|

BNZ

|

Fixed

|

6.4600

|

500

|

07 Jul ‘11

|

30 Jun ‘21

|

|

|

R0423LF63

|

LGFA

|

Floating

|

1.5875

|

1,000

|

10 May ‘19

|

15 Apr ‘23

|

|

|

1068

|

BNZ

|

Fixed

|

5.7500

|

1,000

|

22 Jun ‘12

|

22 Jun ‘22

|

|

|

1072

|

BNZ

|

Fixed

|

6.4500

|

2,450

|

09 Dec ‘03

|

09 Dec ‘23

|

|

|

1076

|

BNZ

|

Fixed

|

5.7400

|

2,925

|

18 Dec ‘14

|

18 Dec ‘24

|

|

|

1078

|

BNZ

|

Fixed

|

4.8500

|

2,600

|

16 Dec ‘16

|

15 Dec ‘26

|

|

|

92

|

Westpac

|

Fixed

|

5.0950

|

2,750

|

14 Dec ‘15

|

18 Dec ‘25

|

|

|

93

|

Westpac

|

Fixed

|

4.5500

|

3,000

|

14 Dec ‘17

|

15 Dec ‘27

|

|

|

R0429LF63

|

LGFA

|

Floating

|

1.2875

|

1,500

|

10 May ‘19

|

15 Apr ‘29

|

|

|

Average

|

|

|

4.5986

|

17,725

|

|

|

|

|

Repayments

|

|

|

|

Principal

|

Interest

|

Total

|

|

|

FY

Year

|

$000

|

$000

|

$000

|

|

|

FY21

|

3,650

|

896

|

4,546

|

|

|

FY22

|

3,150

|

532

|

3,682

|

|

|

FY23

|

3,650

|

374

|

4,024

|

|

|

FY24

|

2,300

|

230

|

2,530

|

|

|

FY25

|

1,625

|

135

|

1,760

|

|

|

FY26

|

1,050

|

75

|

1,125

|

|

|

FY27

|

600

|

39

|

639

|

|

|

FY28

|

200

|

23

|

223

|

|

|

FY29

|

1,500

|

15

|

1,515

|

|

|

Total

|

17,725

|

2,319

|

20,044

|

26. Officers have considered

refinancing the higher interest rate loans with the BNZ and Westpac Banks with

a lower interest rate with the LGFA. Unfortunately, as detailed below, the

penalties associated with the early repayment, and with the LGFA Principals

only being repayable at loan maturity – results in a $324k unfavourable

option.

27. Prior to the 2018-28

Treasury Policy, exposure to fixed / floating interest rates was not prescribed

through policy and therefore a more conservative approach was taken to borrow

at fixed rates. Unfortunately, in the current environment this has seen Council

commit longer to higher the fixed amounts. To mitigate this exposure, new

borrowing considers hedging interest risk with a combined of floating/fix rate

exposure.

|

|

Consideration

to Refinance

|

Interest

|

Total

|

|

|

|

$000

|

$000

|

|

|

BNZ early

break fee

|

(735)

|

|

|

|

Westpac

early break fee

|

(528)

|

|

|

|

LFGA

Interest Charged at 1.1804% for 6.75 years

|

(1,169)

|

|

|

|

Total

Refinancing Costs

|

|

(2,432)

|

|

|

Westpac

& BNZ Interest on current loans held

|

2,108

|

|

|

|

Remain as is

|

|

2,108

|

|

|

Savings /

(costs)

|

|

(324)

|

|

*

|

The

opening balance differs to the $17.2M above as calculations where preformed

in FY20-21 Q1.

|

Borrowing Limits

|

|

Ratio

|

HBRC

|

LGFA

|

Actual

|

|

|

|

|

%

|

|

%

|

%

|

|

|

Net external

debt as a % of total revenue

|

<

|

150

|

<

|

175

|

19.6

|

|

|

Net interest

on external debt as a % of total revenue

|

<

|

15

|

<

|

20

|

1.2

|

|

|

Net interest

on external debt as a % of annual rates income

|

<

|

20

|

<

|

25

|

4.2

|

|

|

Liquidity

buffer amount comprising liquid assets and available committed debt facility

amounts relative to existing total external debt

|

>

|

10

|

>

|

10

|

65.9

|

28. The ratios mentioned above

are self-imposed for HBRC and are covenant requirements for LGFA. HBRC

will be reviewed as part of the Treasury policy review for the 2021-31 LTP.

Other financial assets

Managed Funds

(excluding HBRIC)

29. The Managed Funds referred

to in this section the entire LTIF because this sits solely on HBRC Balance Sheet,

and $61M of the FIF held by HBRC.

30. At 30 June 2020 the total

original capital invested by HBRC was $107.1M. At 30 June the value of both

investments was valued at $111M.

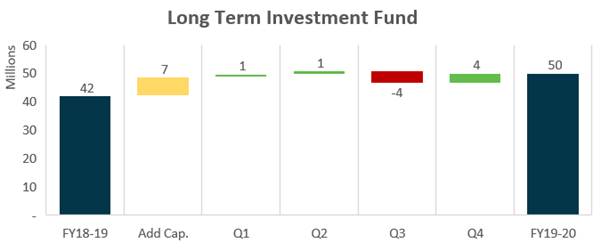

Quarter ending Fund balances.

|

|

Fund

|

FY18-19

|

Q1

|

Q2

|

Q3

|

Q4

|

|

|

|

$000

|

$000

|

$000

|

$000

|

$000

|

|

|

LTIF

|

41,926

|

49,539

|

50,674

|

46,305

|

49,922

|

|

|

FIF

|

-

|

43,967

|

44,724

|

41,712

|

61,105

|

|

|

Total

|

41,926

|

93,506

|

95,398

|

88,017

|

111,027

|

31. The table above,

highlights the volatility seen throughout FY19-20, by outlining the investment

balance at the start/end of each quarter. While this market volatility can

create uncertainly, the downs (and ups) will occur from time to time. The

strategy of diversifying an asset base is by far the best way of safeguarding

any investment; achieved through exposing the investment to the full spectrum

of any global market movements.

32. The investment strategy

aims to provide capital protection for intergenerational benefit, meaning these

managed funds should always be considered with a long-term view. Reacting

to short term shifts in the market can have a significant financial impact in

the longer term.

33. As part of the investment

strategy discussion for the 2021-31 LTP the Treasury and SIPO policy settings

will be reviewed and recommendations made to ensure any changes to the strategy

are reflected in the policy and direction given via the SIPO to the fund

managers.

Long Term Investment Fund (LTIF) -

Income

|

|

Annual Plan

|

Actual

|

Variance

|

|

Opening

Balance - 01 July 2019

|

|

41,926

|

|

|

Additional

Capital Invested

|

|

6,578

|

|

|

|

50,000

|

48,504

|

(1,496)

|

|

Maintain

Capital Value

|

1,667

|

1,418

|

(249)

|

|

Fund

Council Operating Costs*

|

2,500

|

-

|

(2,500)

|

|

Fund

Regional Reserves/Loans

|

833

|

-

|

(833)

|

|

Closing

Balance – 30 June 2020

|

55,000

|

49,922

|

(5,078)

|

34. The LTIF actual income of

$1.4M is attributed to:

34.1. Fund earned

Dividends/Interest: $0.4M

34.2. Fund Capital Gain: $1.0M

35. Direct investment into the

LTIF is $46.6M.

36. Adjusted for CPI, $48M is

protected capital.

37. This equates to a

potential cash withdrawal for HBRC of up to $1.9M.

38. It should be noted that

the $1.9M is a life to date amount, not a FY19-20 amount.

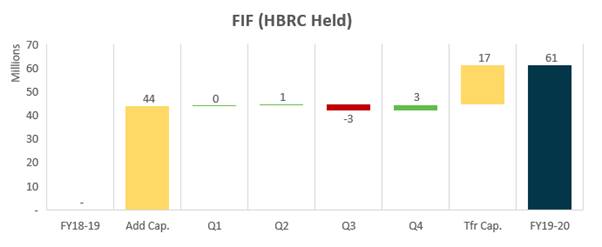

Future Invest Fund HBRC (FIF HBRC)

– Income

|

|

Annual Plan

|

Actual

|

Variance

|

|

Opening

Balance - 01 July 2019

|

|

-

|

|

|

Additional

Capital Invested

|

|

60,564

|

|

|

|

83,000

|

60,564

|

(22,436)

|

|

Maintain

Capital Value

|

1,660

|

541

|

(1,119)

|

|

Fund

Council Operating Costs*

|

4,150

|

-

|

(4,150)

|

|

Fund

Regional Reserves/Loans

|

-

|

-

|

-

|

|

Closing

Balance – 30 June 2020

|

88,810

|

61,105

|

(27,705)

|

41. As a result of the

unfavourable binding ruling, less of the Napier Port IPO proceeds were passed

through to HBRC, however these are held in a mirrored FIF fund in HBRIC.

42. The FIF (HBRC) actual

income of $0.5M is attributed to:

42.1. Fund earned

Dividends/Interest: $0.2M

42.2. Fund Capital Gain: $0.3M

43. The FIF HBRC balance of

$61.1M includes $60.9M of protected capital.

44. This equates to a

potential cash withdrawal for HBRC of up to $0.2M.

Government

bonds and Other Funds in Management

Regional

Disaster Reserve (RDR)

45. Incorporated as part of

the LTP 2018-28, the RDR is set aside to meet the commercial insurance excess

of $600,000 on a ‘disaster event.

46. Per Council Policy, the

RDR must have liquid investments available above $2.75M.

47. During FY2018-19 $200k was

utilised from the reserve and put towards the HB draught relief fund.

48. At 30 June 2020 the

reserve balance was $2.8M.

|

|

Type

|

Maturity

|

Return

|

FY19-20

|

|

|

|

|

|

Interest Earned

|

Capital Gain

|

Value

|

|

|

|

|

%

|

$000

|

$000

|

$000

|

|

|

GOVT

Inflation-indexed bonds

|

20/09/2030

|

3

|

16

|

9

|

545

|

|

|

GOVT

Inflation-indexed bonds

|

20/09/2025

|

2

|

6

|

5

|

280

|

|

|

LFGA Fixed

Rated Bond

|

15/04/2023

|

5.5

|

10

|

-

|

175

|

|

|

Total

|

|

|

32

|

14

|

1,000

|

|

Fund Manager

|

Fund

|

5 Year Avg. Return

|

Comment

|

FY19-20

Value

|

|

|

|

|

%

|

|

000

|

|

|

Milford

|

Active

Growth

|

10

|

A medium to

high risk investment, with focus of ASX.

|

121

|

|

|

Devon

|

Alpha Fund

|

5.18

|

A higher

risk investment, with a concentrated portfolio of approx. 10-15 selected

companies listed on the NZX and ASX.

|

66

|

|

|

Platinum

|

International

|

5.40

|

A medium

risk investment, with a portfolio of 70-140 companies from across industry sectors

and geographically spread.

|

177

|

|

|

Platinum

|

Asia

|

10.7

|

A medium to

high risk investment, with a diversified portfolio of Asian (ex-Japan)

companies across industry sectors.

|

75

|

|

|

Orbis

|

Global

|

8.5

|

A medium to

high risk investment. The Fund is designed to remain fully invested in global

equities. It aims to earn higher returns than world stock markets.

|

166

|

|

|

Orbis

|

US

|

(2.1)

|

The Fund

seeks capital appreciation in US dollars on a low risk global portfolio.

|

76

|

|

|

MMC Fund

|

Aspiring

|

10

|

A medium

risk investment. The Fund principally invests in NZX, ASX and Globally listed

equities. The principal objective of the Fund is to achieve positive absolute

returns averaging at least 4% over inflation

|

135

|

|

|

Total

|

|

|

|

|

816

|

|

|

|

|

|

|

|

|

|

|

Prior

Year Returns & cash

|

|

|

963

|

|

|

|

|

|

|

|

|

|

|

DDR Total

|

|

|

|

|

2,779

|

Investment Property

|

|

Property

|

FY18-19

|

FY19-20

|

Change

|

|

|

|

000

|

# of Properties*

|

000

|

# of Properties*

|

000

|

|

|

Endowment

leasehold land

|

30,645

|

168

|

39,630

|

160

|

8,985

|

|

|

Wellington

Leasehold land

|

17,300

|

12

|

17,750

|

12

|

450

|

|

|

Property at

Tutira

|

450

|

1

|

475

|

1

|

25

|

|

|

Total

|

48,395

|

181

|

57,855

|

173

|

9460

|

|

*

|

The number

of properties is different to the number of leases because of multiple

dwellings etc.

|

Endowment

leasehold land

49. The Endowment leasehold

portfolio comprises of 160 individual leases, with all but 1 (commercial) being

residential leases. The majority are perpetually renewable ground leases,

renewable every 21 years at a prescribed rent at 5% of the land value when

reviewed.

50. As per the Hawke's Bay

Endowment Land Empowering Act, Freeholding the land is permitted to only the

sitting lessees and this is occurring steadily, although the rate is slowing as

the proportion of cross leases remaining increases where freeholding is more

complex.

51. On 17 December 2013, HBRC

sold its entitlement to the next 50 annual rents of the endowment land to ACC

for $37.7M to ACC; effectively creating a present-day value of a $172M loan

discounted at 6.88%. These funds were originally budgeted against RWSS, however

has been invested as part of the LTIF.

52. When accounting for the

ACC agreement, the Endowment leasehold land incurred a $1.3M outflow of cash

for the FY19-20 year as detailed below.

|

|

Financial

Performance:

|

|

|

|

|

|

$000

|

$000

|

|

|

Annual Rent

Collected

|

1,500

|

|

|

|

Collection

Cost (ACC)

|

90

|

|

|

|

|

|

1,590

|

|

|

ACC minimum

repayment

|

(855)

|

|

|

|

PV of

Freeholding (paid to ACC)

|

(1,800)

|

|

|

|

Gain/(Loss)

on Value sold, when compared to present value

|

(260)

|

|

|

|

|

|

(2,915)

|

|

|

Total

|

|

(1,325)

|

53. The agreement assumed the

Endowment Lands increased at 1.5% year on year. Although the Napier Market is

presently out preforming this assumption, when a section is freeholded HBRC

must pay out the present value of the remaining years rent previously sold to

ACC which in effect reverses any upside for HBRC. This resulted in $1.8M or 18

leases being paid out in FY2019-20.

54. It is likely that in the

near future, this agreement will continue to heavily favour ACC, as HBRC will

likely be paying back any freeholded properties faster than it was assumed. In

the longer term, it will be less onerous as the percentage of cross lease

leaseholds grows, and whereby freeholding is generally more complex, and it is likely only rental payments will be due.

55. As at 30 June 2020, the

minimum repayment to ACC is $45.1M, relating to the 159 leases, 90 single and

69 cross leases.

Wellington Leasehold Land

56. The Wellington portfolio

comprises of 12 individual leases, within the main, inner city residentials

areas of Wellington City. The majority are perpetually renewable ground leases,

renewable every 14 years. At a prescribed rent between 5.00-5.25% of the land

value when reviewed.

57. Annual rent received for

the FY19-20 was $843k, representing a 5.1% cash return on Investment.

58. As part of the required

Annual Reporting process, an annual valuation is completed on the properties.

The FY2019-20 saw the investment grow $0.5M (capital gains).

Future lease renewals

59. As a

requirement of the Treasury policy, below shows the leasehold properties up for

renewal:

|

|

|

Lease renewals

|

|

|

Location

|

FY21

|

FY22

|

FY23

|

FY24

|

FY25

|

|

|

Endowment

|

20

|

16

|

3

|

8

|

5

|

|

|

Wellington

|

-

|

1

|

1

|

3

|

-

|

|

|

Total

|

20

|

17

|

4

|

11

|

5

|

60. As indicated above,

renewals are important to the HBRC forecast, as rent requirements are set based

on the Land Market Value at renewal.

Intangible

Assets

|

|

Asset

|

FY-18-19

|

FY19-20

|

|

|

|

$000

|

%

|

$000

|

%

|

|

|

IT Software

|

5,342

|

65.7

|

6,148

|

60.9

|

|

*

|

Carbon

Credits

|

2,785

|

34.3

|

3,948

|

39.1

|

|

|

Intangible

Assets

|

8,127

|

100

|

10,096

|

100

|

|

*

|

NZU value at

30 June 2020 $31.90, this is compared to $23.10 in 2019.

|

61. 3.12 NZU (Carbon credits)

have been gained from the normal forestry and berm enhancement operations of

Council.

62. Council policy is to only

sell safe carbon which would offer no liability to repay credits at harvest

Napier/Gisborne Rail

63. In February 2019, HBRC

agreed to advance KiwiRail $1.25M as a contribution towards the reinstatement

of the log freight service between Wairoa and Napier.

64. Repayment of the $1.25M,

along with interest, will happen when log volumes of the line for a

‘rolling’ 6-month exceeds 90,000 tonnes.

65. Due to the Covid-19 market

downturn, KiwiRail closed the line in February 2020. The 12 months (July 2019

– June 2020) volumes were 1,946 tonnes.

66. Current indications from

KiwiRail’s are that the line will target to achieve a rolling 6-month

tonnage of 39,000 tonnes, or 43% of the required 90,000 tonnes.

67. HBRC currently does not

forecast of any repayment.

HBRIC

Overall

Summary

68. Subject to audit sign off,

HBRIC’s Net Profit after Tax was $218M.

69. Dividends passed from

HBRIC to HBRC were $46.5M.

70. At year end, 30 June 2020,

HBRIC held 55% of the capital in NPHL, which was valued $396M or $3.60 p/s.

71. HBRIC currently holds

$1.1M Imputations Credits, which equates to ~$4m of funds able to be

transferred to HBRC Tax Free.

|

|

Fund

|

FY18-19

|

Q1

|

Q2

|

Q3

|

FY19-20

|

|

|

|

000

|

000

|

000

|

000

|

000

|

|

|

FIF

|

-

|

59,009

|

60,041

|

58,452

|

45,620

|

|

|

Total

|

-

|

59,009

|

60,041

|

58,452

|

45,620

|

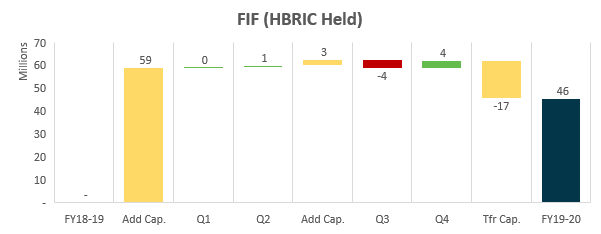

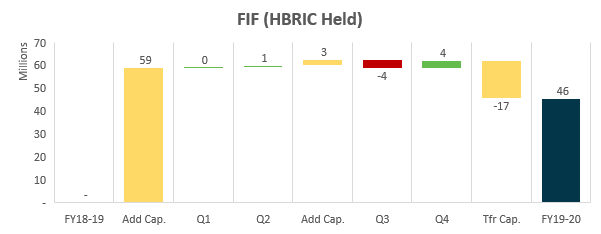

Future Invest Fund HBRC (FIF HBRIC) -

Income

|

|

Annual Plan

|

Actual

|

Variance

|

|

Opening

Balance - 01 July 2019

|

|

-

|

|

|

Additional

Capital Invested

|

n/a

|

45,019

|

|

|

|

|

45,019

|

|

|

Maintain

Capital Value

|

n/a

|

601

|

601

|

|

Fund

Council Operating Costs*

|

n/a

|

|

|

|

Fund

Regional Reserves/Loans

|

n/a

|

|

|

|

Closing

Balance – 30 June 2020

|

|

45,620

|

45,620

|

72. The FIF held within HBRIC

was not anticipated in the FY19-20 Annual Plan.

73. The FIF (HBRC) actual

income of $0.6M is attributed to:

73.1. Fund earned

Dividends/Interest: $0.4M

73.2. Fund Capital Gain: $0.2M

74. The FIF HBRIC balance of

$45.6M includes $45.0M of protected capital.

75. This equates to a

potential cash withdrawal for HBRC of up to $0.6M

Decision Making

Process

76. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that:

77. as this report is for

information only, the decision-making provisions do not apply

78. any decision of the

sub-committee (in relation to this item) is in accordance with the Terms of

Reference and decision-making delegations adopted by Hawke’s Bay Regional

Council 25 March 2020, specifically the Finance, Audit and Risk Sub-committee shall

have responsibility and authority to:

78.1. Monitor the performance

of Council’s investment portfolio.

|

Recommendations

That the Finance, Audit and Risk Sub-committee receives and notes the “2019-20 Annual Treasury Report”.

|

Authored by:

|

Geoff Howes

Treasury & Funding Accountant

|

Bronda Smith

Chief Financial Officer

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 11 November 2020

Subject: Quarterly Treasury

Report for 1 July - 30 September 2020

Reason for Report

1. This item provides an update of compliance monitoring of treasury

activity and reports the performance of Council’s investment portfolio

for the quarter to 30 September 2020.

Background

2. The Investment management reporting requirements, outlined within

Council’s Treasury Policy, requires Office to inform to the Financial

Audit & Risk Sub-Committee (FARS) on the Council’s current investment

allocation and investment performance.

3. As stated within the Policy, all Treasury investments are required

to be reported on quarterly. As at Q1, 30 September 2020, the Treasury

Investments to be reported on consist of:

3.1. Liquidity

3.1.1. Cash and

Cash Equivalents

3.1.2. Rates

3.1.3. New debt

3.1.4. Negative

Interest Rates

3.2. Externally Managed Investment Funds

3.2.1. Long-Term

Investment Fund (LTIF)

3.2.2. Future

Investment Fund (FIF)

3.3. CCTO - HBRIC

4. Since 2018, HBRC has procured treasury advice and services from PwC.

Their quarterly compliance report has been attached to this report.

Discussion

FY20-21 Performance

5. The table below shows the income to date against the FY20-21 Annual

Plan.

|

|

Income

|

Annual Plan

|

YTD

Annual Plan

|

YTD

Actuals

|

|

|

|

$000

|

%1

|

$000

|

%2

|

$000

|

%3

|

|

|

Other financial assets

|

5,644

|

51

|

1,411

|

71

|

5,056

|

358

|

|

|

Management

Funds

|

5,263

|

93

|

1,316

|

93

|

5,056

|

384

|

|

|

Interest

|

381

|

7

|

95

|

7

|

-

|

-

|

|

|

Investment property

|

2,343

|

21

|

586

|

29

|

443

|

76

|

|

|

Endowment leasehold land

|

1,502

|

64

|

376

|

64

|

229

|

61

|

|

|

Wellington Leasehold land

|

841

|

36

|

210

|

26

|

214

|

100

|

|

|

PONL Dividend

|

3,000

|

27

|

-

|

-

|

-

|

|

|

|

Total

|

10,987

|

|

1,997

|

|

5,499

|

275

|

|

%1

|

Annual plan - Asset income vs. Total Income

|

|

%2

|

YTD planned asset income vs. Total Income

|

|

%3

|

YTD asset income vs. YTD planned asset income

|

|

|

|

|

|

|

|

|

|

Key observations

6. The YTD income of $5.1M YTD equates to gross income the [LTIF &

FIF] funds have increased by since 30 June 2020.

7. Of the $5.1M, $300K is what the funds have earned by way of

interest, dividends & selling shares at a gain. Alternatively, $4.8M is by

way of ‘market’ equity growth.

Liquidity - Cash & Cash

Equivalents

8. Cash and cash equivalents:

|

|

Asset

|

30 Sep 2020

|

|

|

|

|

$000

|

%

|

%

|

|

|

|

Cash

|

15,223

|

|

100.0

|

|

|

|

HBRC Held Cash

|

14,149

|

92.9

|

|

|

|

|

Works Group

|

502

|

3.3

|

|

|

|

|

Other –

managed trusts

|

572

|

3.8

|

|

|

|

|

Short-term bank deposits

|

-

|

|

-

|

|

|

|

Cash & and cash equivalents

|

6,522

|

|

100

|

|

|

*

|

$9m was placed in Term Deposits on 2 October 2020, ranging

for a period between 17-56 days and returning on average 0.64%.

|

9. FY20-21 will see historical low interest rates continue throughout

the year, which will limit Council’ earning additional income via Term

Deposits from surplus liquidity.

10. To

highlight these low market rates, when placing the $9M in Term Deposits

recently, the Retail Term Deposits before investment were:

|

Term

|

BNZ

|

ASB

|

Kiwi

Bank

|

ANZ

|

Westpac

|

|

up

to:

|

Interest Rate %

|

|

30

|

.15

|

.15

|

.25

|

-

|

.33

|

|

60

|

.25

|

.21

|

.25

|

-

|

.68

|

|

90

|

.40

|

.30

|

.65

|

-

|

.79

|

11. It is

expected that low interest rates will remain for

a sustained period. The budgeted interest earned amount in the FY20-21 Annual

Plan, was 4.5% or $0.4M for the period. Further analysis has since been

completed on this significant assumption set in the 2018-28 LTP, and a 1.5%

return or $0.2M, would be used as a deposit rate assumption going forward. It

is expected the shortfall can mostly be mitigated through the daily management

of the Council working capital via the earlier collection of rates and later

borrowing based on this.

Rates and Rates Collection

12. Last year

Council decided to change the due date for Rates Invoices from 1 October to 20

September and to apply the penalties on 21 September for any outstanding rates

rather than 31 January which had become the pseudo due date. During the Annual

Plan process it was decided to leave the penalty date as 31 January to allow

those experiencing hardship to pay the rates without penalty however the due

date remained as 20 September. This has seen 80% of all Rates revenue, $28.7M,

now collected, compared to 23%, $6.5M at the same point last year.

13. The

following table shows HBRC rolling monthly cash liquidity position. The impact

of Rates being collected early is highlighted in the September liquidity

position.

|

Cash

Position

|

Apr 20

|

May 20

|

Jun 20

|

Jul 20

|

Aug 20

|

Sep 20

|

|

Millions

(NZD)

|

Actual

|

Actual

|

Actual

|

Actual

|

Actual

|

Actual

|

|

Mean

|

6.5

|

3.3

|

4.1

|

6.5

|

3.3

|

9.7

|

|

High Point

|

15.8

|

6.2

|

6.3

|

15.8

|

6.2

|

18.3

|

|

Low Point

|

2.6

|

1.4

|

1.4

|

2.6

|

1.4

|

4.7

|

|

Available

facility*

|

5.0

|

5.0

|

5.0

|

5.0

|

5.0

|

5.0

|

|

*

facility available to HBRC is the BKBM + 1.1% margin. As at June 30, this

would cost 1.4% to call on.

|

Debt Funding

14. Council

raised $6.3M of funds through the LGFA tender on 8 July 2020, with principle

repayments due in 2024 and 2025. The debt was to fund FY19-20 spending on

Sustainable Homes and the Erosion Control Schemes.

15. New

borrowings expected for the FY20-21 include:

15.1. $7.6M

– due to % rates increase and expected reduction in Investment Returns

due to COVID-19

15.2. $3.5M -

Sustainable Homes

15.3. $2.3M -

Costal Erosions Schemes

15.4. The

drawn down of loans are based on cashflow requirements. As forecasting is still

manual and phasing of budgets is not done, the exact timing of loan drawn downs

is monitored on a weekly basis.

16. A

significant forecasted cash item is the Napier Port Dividend, forecasted for

December 2020 and will reduce the requirement to borrow to later in the year

depending on the level of dividend.

17. Contrary

to the interest earned rates mentioned earlier, the historical low OCR benefits

Council where loans are expected to be raised at ~1.15%, ~1.15 less than the ~3.3%

forecasted in the FY20-21 Annual Plan.

Negative Interest Rates

18. Recent

forecasts have indicated that in the foreseeable future, there is a likely

chance that the NZOCR will fall below 0% (currently 0.25%).

19. A

negative OCR will largely concern wholesale bank rates, as banks will be driven

into a position to lend money, rather than keep it and therefore paying

interest the funds.

20. As a

borrower, we can expect fixed rate loans will become highly competitive,

however as borrowing does attract a margin (2.1% average in 2019), it will be

unlikely that HBRC will be in a position where it’s being paid to borrow.

Managed Funds

21. The total

capital invested by HBRC & HBRIC across the two funds was $162.2M as

at 30 September 2020. This represents a YTD total income return of $5.1M (3%)

or $4.7m after capital protection of the investment (2% as per policy).

22. Both the

Long-Term Investment Fund (LTIF) and Future Investment Fund (FIF) have improved

significantly since the last reported positions as at 30 June 2020.

Fund Totals

|

Fund

|

30 Sep 2019

|

31 Dec 2020

|

31 Mar 2021

|

30 Jun 2020

|

30 Sep 2020

|

|

|

$000

|

$000

|

$000

|

$000

|

$000

|

|

LTIF

|

49,539

|

50,674

|

46,305

|

49,922

|

51,810

|

|

FIF (HBRC)

|

43,967

|

44,724

|

41,712

|

61,105

|

63,094

|

|

Total HBRC

|

93,506

|

95,398

|

88,017

|

111,027

|

114,904

|

|

FIF (HBRIC)

|

59,009

|

60,041

|

58,452

|

45,620

|

47,292

|

|

Total

|

152,515

|

155,439

|

146,469

|

156,647

|

162,196

|

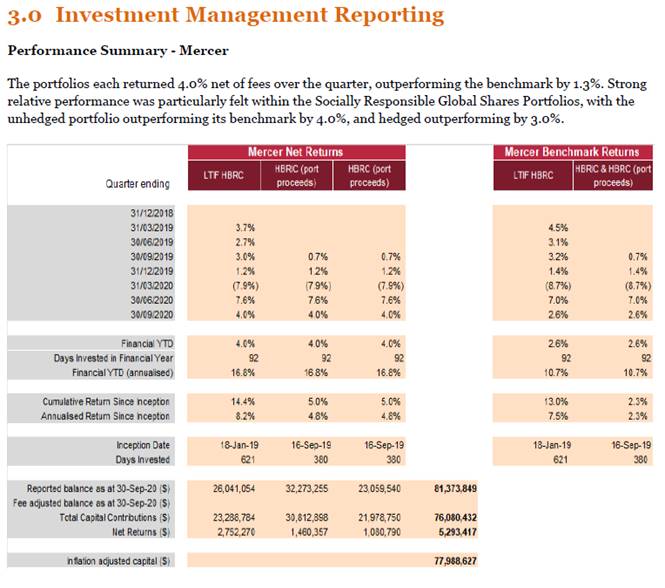

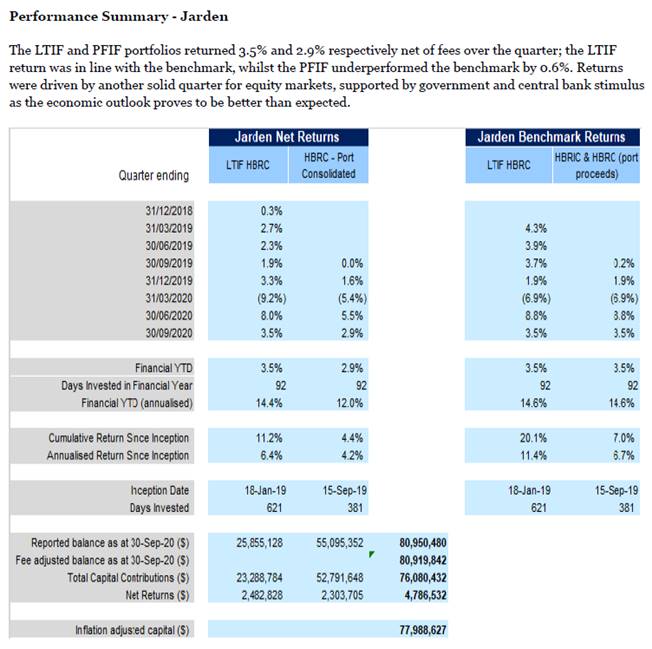

Performance Long Term Investment Fund (LTIF)

|

FY20-21 Q1

|

Annual

|

Annual P.

|

YTD

|

YTD

|

|

Return

|

Plan

|

YTD

|

Total

|

|

|

|

$000

|

$000

|

$000

|

%

|

|

Gross of Fees

|

|

|

1,900

|

3.8

|

|

Net of Fees

|

1,677

|

419

|

1,418

|

3.7

|

|

Capital

Protection (2% annualized)

|

|

|

|

.05

|

|

Real net return

|

|

|

|

3.2

|

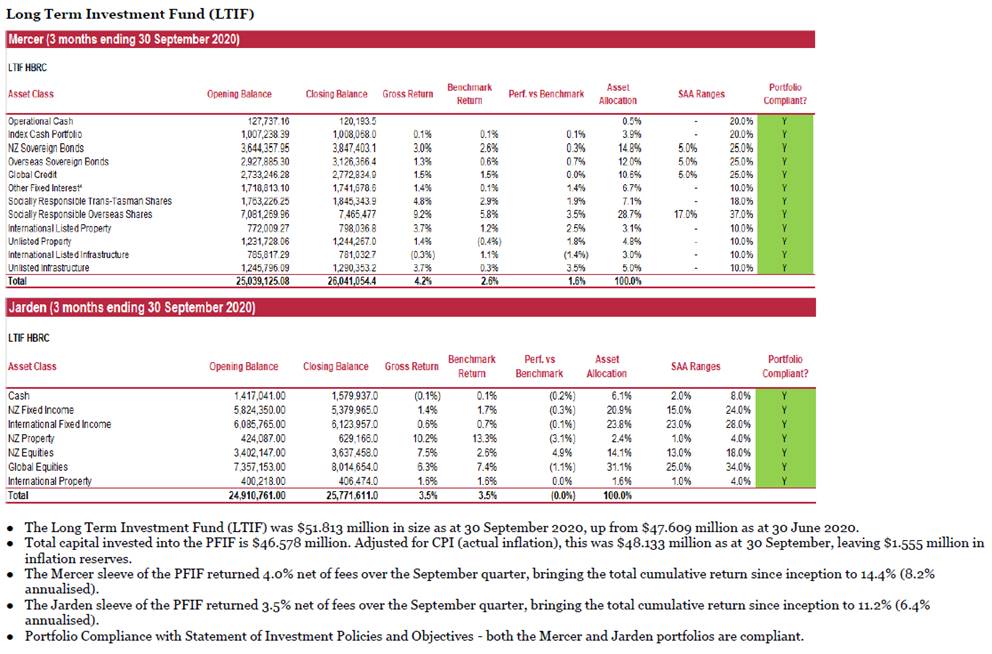

23. The LTIF

balance of $51.8M includes $48.2M of protected capital, which equates to a

potential cash withdrawal for HBRC of up to $3.6M. It should be noted that the

$3.6M is a life to date amount, not a FY20-21 amount.

24. The below

table reflects what the LTIF has achieved year to date, against the FY20-21

Annual Plan.

|

FY20-21 Q1

|

Annual

|

Annual P.

|

YTD

|

|

|

$000

|

$000

|

$000

|

|

Real Capital

Growth

|

1,118

|

280

|

280

|

|

Operational

Fund

|

1,667

|

419

|

419

|

|

Loan

Reduction

|

559

|

140

|

719

|

Performance Future Investment Fund (FIF HBRC)

|

FY20-21 Q1

|

Annual

|

Annual Plan

|

Actual YTD

|

YTD

|

|

|

Plan

|

YTD

|

Total

|

|

|

|

$000

|

$000

|

$000

|

%

|

|

Gross of Fees

|

|

|

1,984

|

3.3

|

|

Net of Fees

|

2,053

|

513

|

1,931

|

3.2

|

|

Capital

Protection (2% annualized)

|

|

|

|

.05

|

|

Real return

|

|

|

|

2.7

|

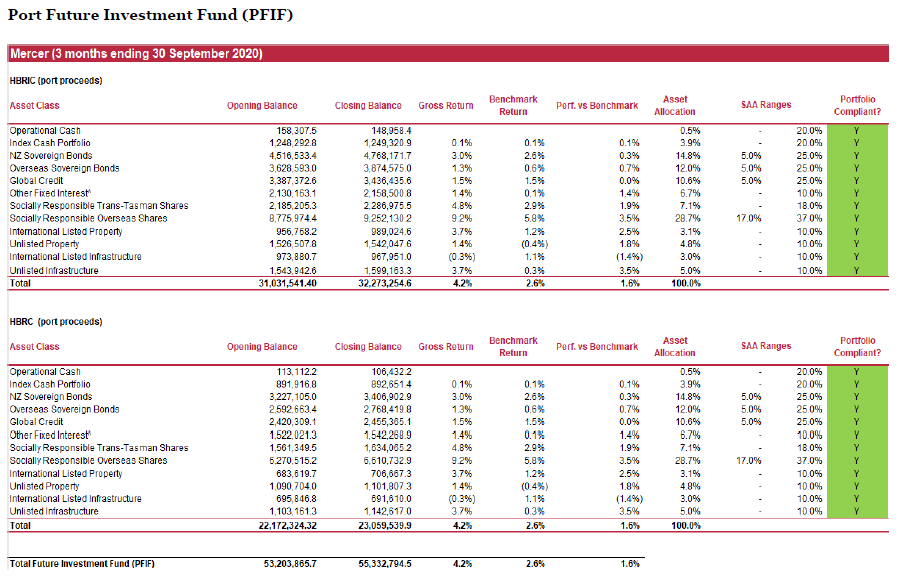

25. The FIF

balance of $63.1M includes $61.2M of protected capital, which equates to a

potential cash withdrawal for HBRC of up to $1.5M. It should be noted that the

$1.5M is a life to date amount, not a FY20-21 amount.

26. The following

table reflects what the FIF HBRC has achieved to date, against the FY20-21

Annual Plan.

|

FY20-21 Q1

|

Annual

|

Annual Plan YTD

|

Actual YTD

|

|

|

$000

|

$000

|

$000

|

|

Real Capital

Growth

|

1,369

|

342

|

342

|

|

Operational

Fund

|

2,053

|

513

|

513

|

|

Loan

Reduction

|

684

|

171

|

1076

|

Performance Future Investment Fund (FIF HBRIC)

|

FY20-21 Q1

|

Annual

|

Annual Plan

|

Actual

YTD

|

YTD

|

|

Return

|

Plan

|

YTD

|

Total

|

|

|

|

$000

|

$000

|

$000

|

%

|

|

Gross of Fees

|

|

|

1,769

|

3.9

|

|

Net of Fees

|

1,533

|

383

|

1,707

|

3.7

|

|

Capital Protection (2% annualized)

|

|

|

|

.05

|

|

Real net return

|

|

|

|

3.2

|

27. The FIF

HBRIC balance of $47.3M includes $46.3M of protected capital, which equates to

a potential cash withdrawal for HBRC of up to $1.0M. It should be noted that

the $1.0M is a life to date amount, not a FY20-21 amount.

28. The below

table reflects what the FIF HBRIC has achieved to date, against the FY20-21

Annual Plan.

|

FY20-21 Q1

|

Annual Plan

|

Annual Plan YTD

|

Actual YTD

|

|

|

$000

|

$000

|

$000

|

|

Capital

Protection

|

1,022

|

255

|

255

|

|

Available

for Dividend to HBRC

|

2,044

|

383

|

1,452

|

HBRIC

29. The

Adopted FY20-21 annual plan, forecast $3M in dividends to be received from

Napier Port Holdings Limited, via HBRIC.

30. Office’s

current forecast is the $3M will be received in December 2020.

31. There is

speculative potential upside to this forecast. Earlier in the year, when the

decision was made to cancel the interim dividend, the Napier Board did advise

they intended to review the full financial year result and outlook in November

2020 before deciding on a final dividend and ensuring they stay within their

dividend policy.

Decision Making

Process

32. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that:

32.1. as this item is for

information only, the decision-making provisions do not apply

32.2. Any

decision of the sub-committee is in accordance with the Terms of Reference and

decision-making delegations adopted by Hawke’s Bay Regional Council

25 March 2020, specifically the Finance, Audit and Risk Sub-committee shall

have responsibility and authority to monitor the performance of Council’s

investment portfolio.

|

Recommendation

That the Finance, Audit and Risk

Sub-committee receives and notes the “Treasury Report to 30 June

2020”.

|

Authored by:

|

Geoff Howes

Treasury & Funding Accountant

|

Bronda Smith

Chief Financial Officer

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

⇩1

|

HBRC Q1

2020-21 Treasury Report

|

|

|