HAWKE’S BAY REGIONAL COUNCIL

Wednesday 27 May 2020

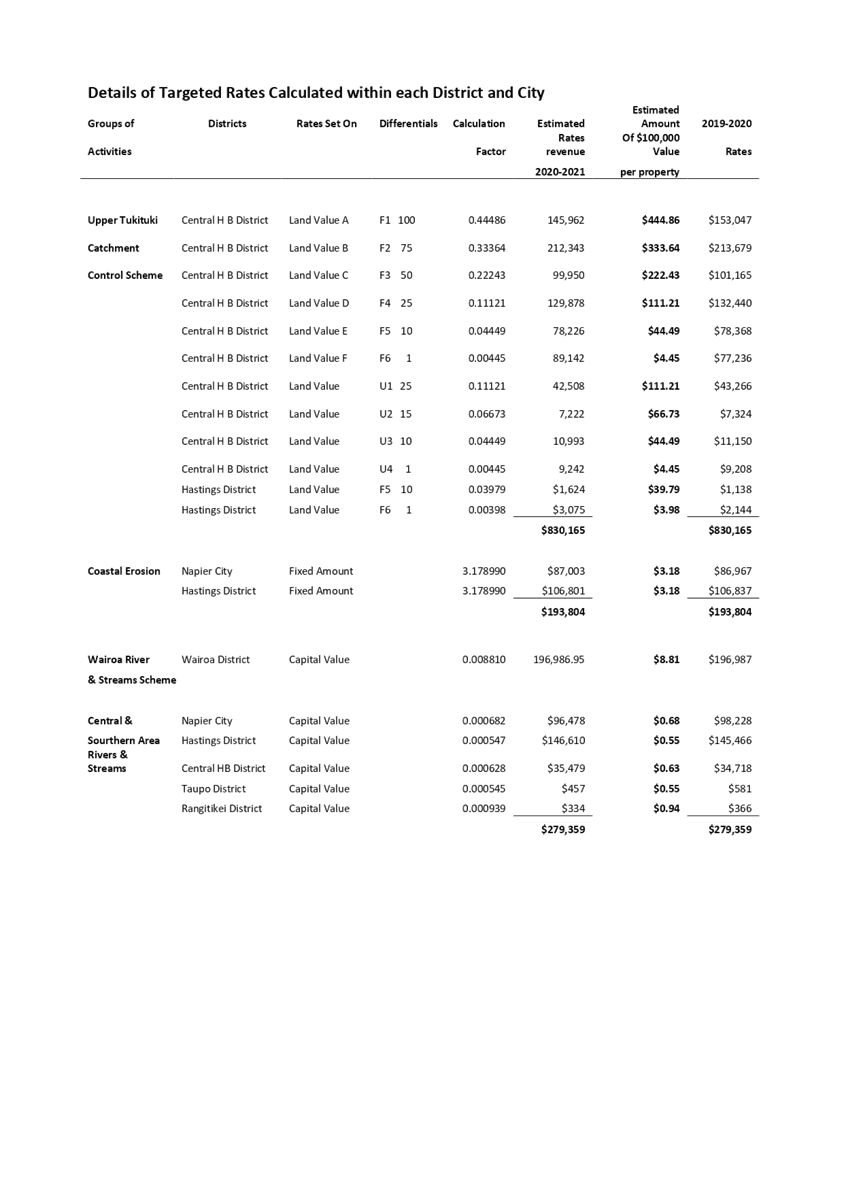

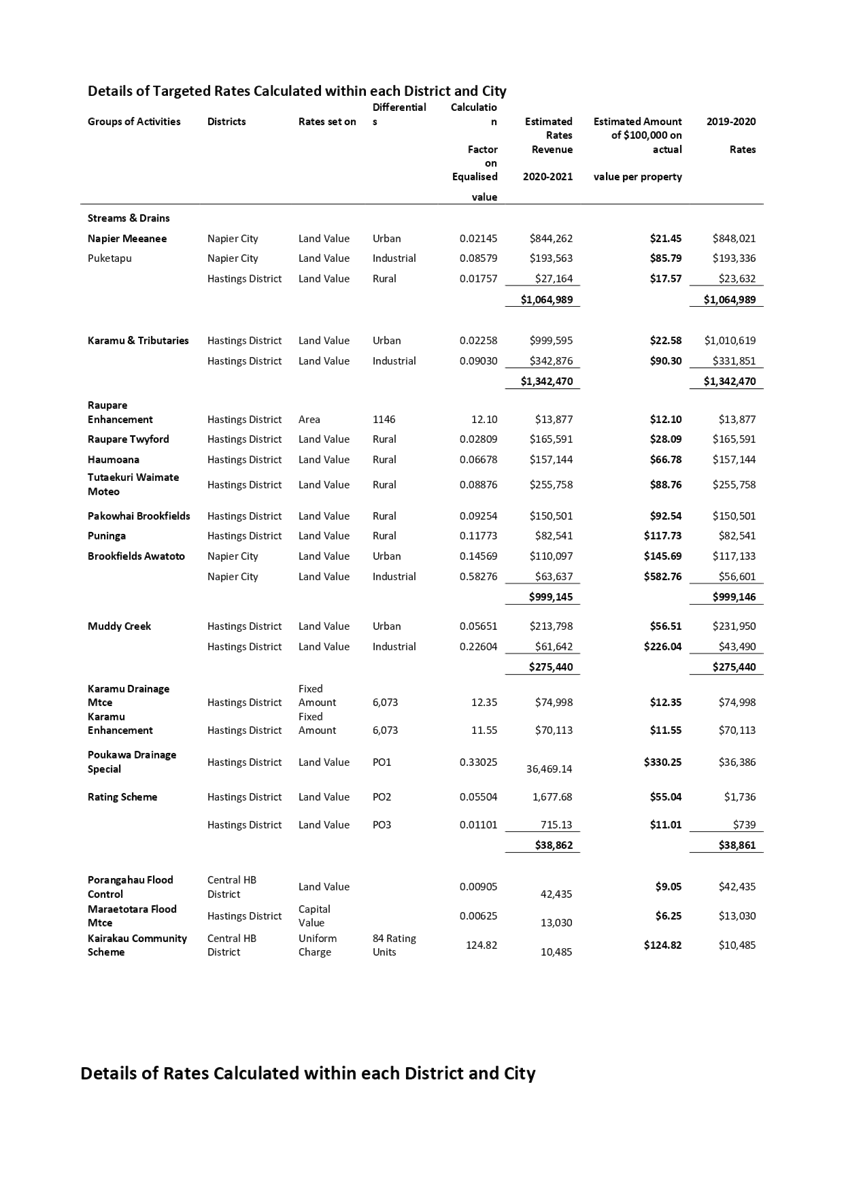

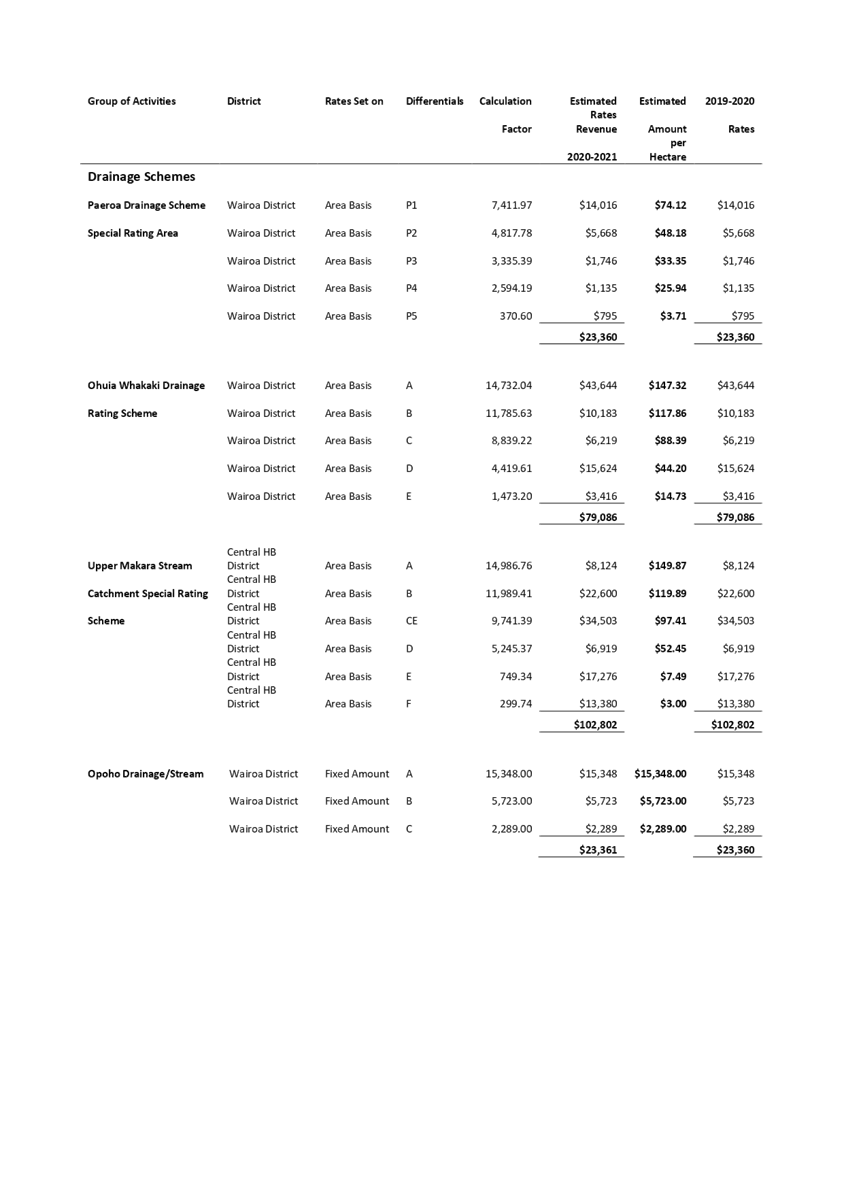

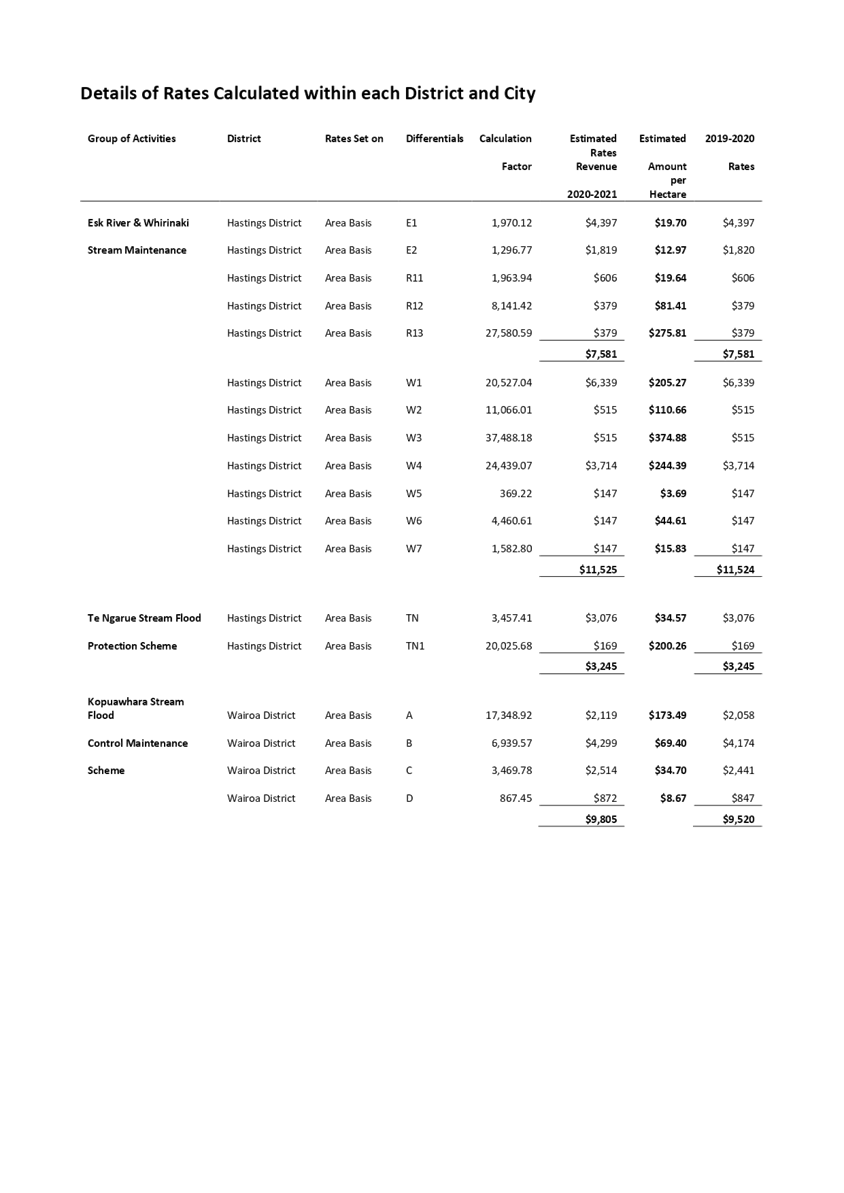

Subject: Adoption of 2020-21

Annual Plan Consultation Document and Supporting Information

Reason for Report

1. This item

provides the information necessary to enable Council to adopt the 2020-21

Annual Plan consultation document and supporting information in accordance with

the relevant provisions of the Local Government Act 2002 (LGA 2002).

2. The item

comprises two parts.

2.1. Part 1:

Background and Previous Workshop Discussions provides some background and a

public summary of the information presented to Council at the 29 April workshop

on 2020-21 Annual Plan Financials, and the subsequent discussion that took

place.

2.2. Part 2:

Discussion for 27 May 2020 Meeting provides information to assist Council

in its decision making in regards to adopting the 2020-21 Annual Plan

consultation document and supporting information.

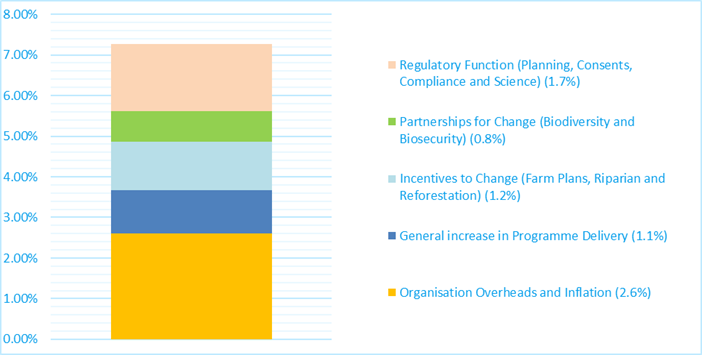

Executive Summary

3. At a workshop

on 11 March 2020, Council received information outlining the budget

requirements for the 2020-21 Annual Plan year, with a 7.3% rate increase.

Council had previously signalled an intention not to formally consult the

community on the 2020-21 Annual Plan. Despite challenging cost pressures

on overheads, specifically in the areas of people costs and IT, there were no

material differences to year 3 of the Long Term Plan.

4. The local

economy has since been impacted by the effects of both COVID-19 and the

drought.

5. In response to

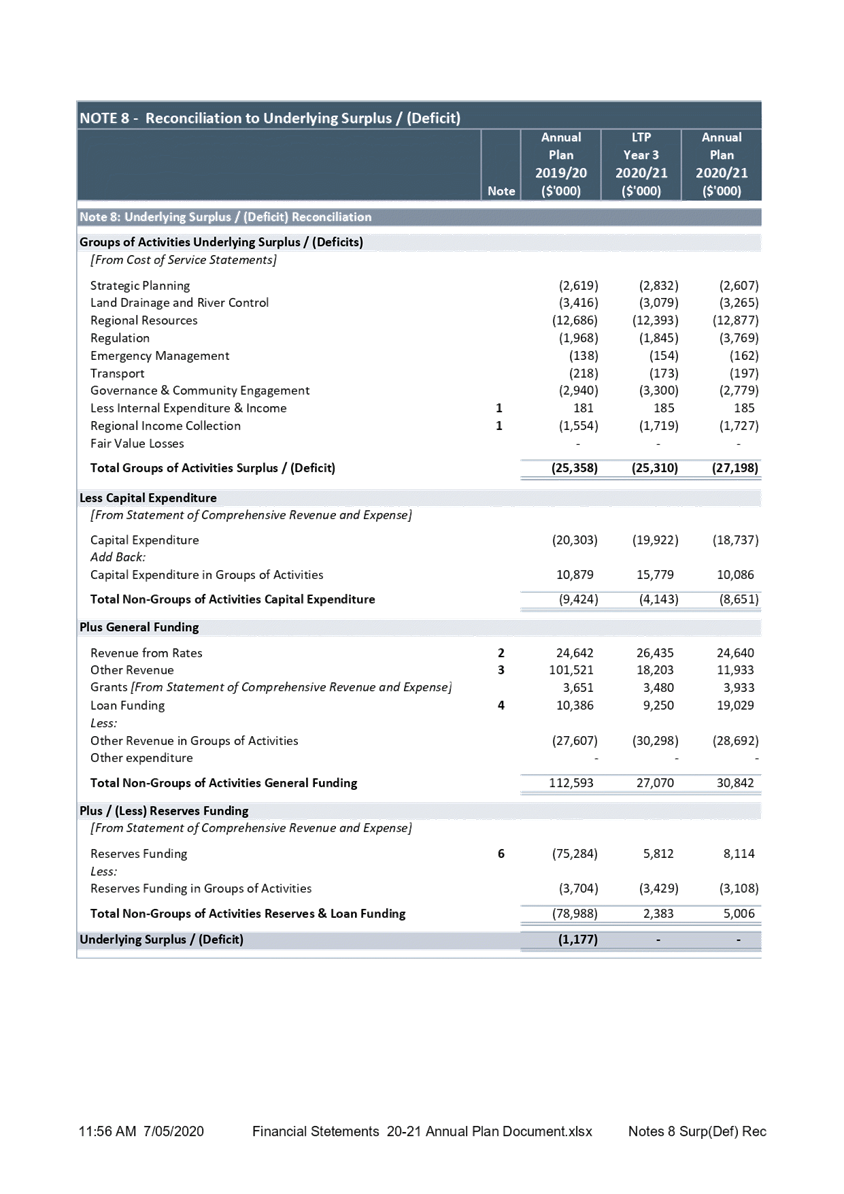

these events, Council asked officers to revisit the budget to update changes

to:

5.1. known revenue

assumptions

5.2. provide

options on how to deliver a 0% rate increase to ratepayers, and

5.3. include $1

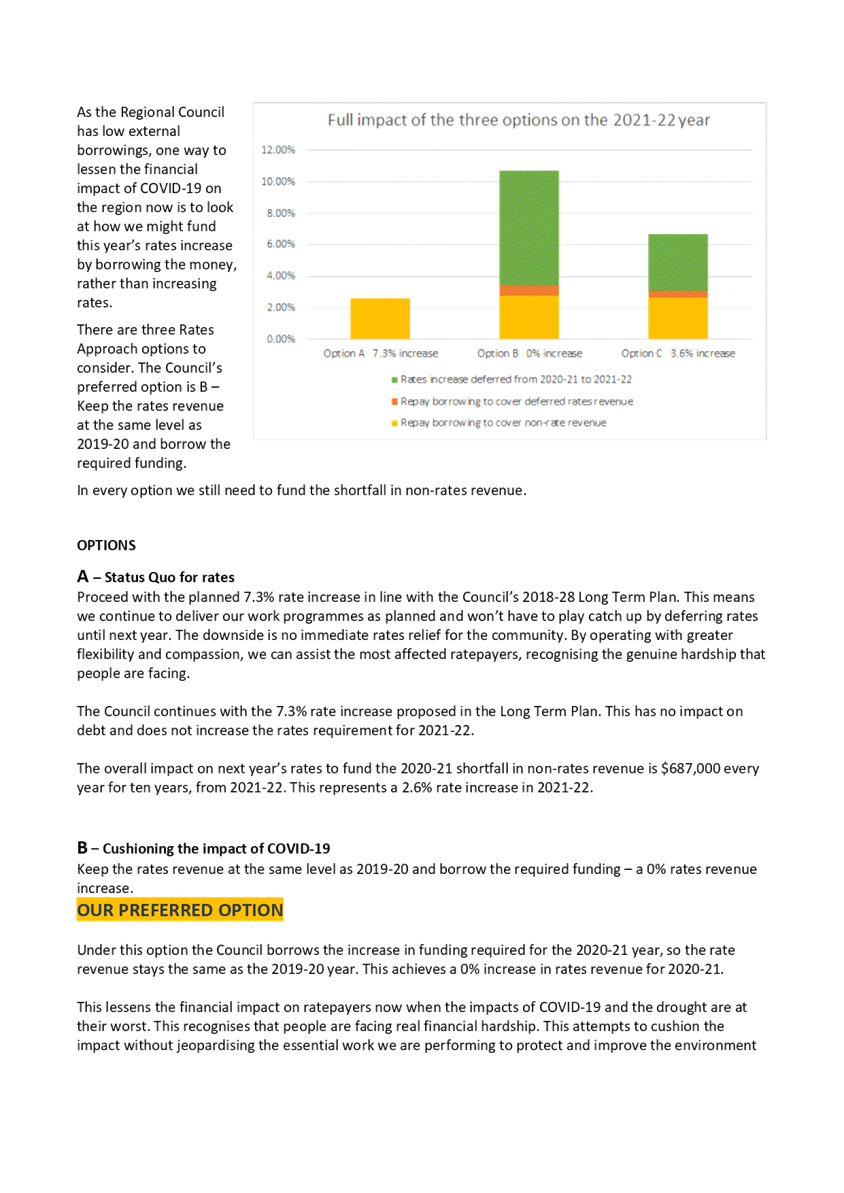

million (m) funding to leverage central government funding for ‘shovel

ready’ projects which would support economic recovery.

6. Council was

presented with four options to address the rate increase, at a meeting on 22

April, being:

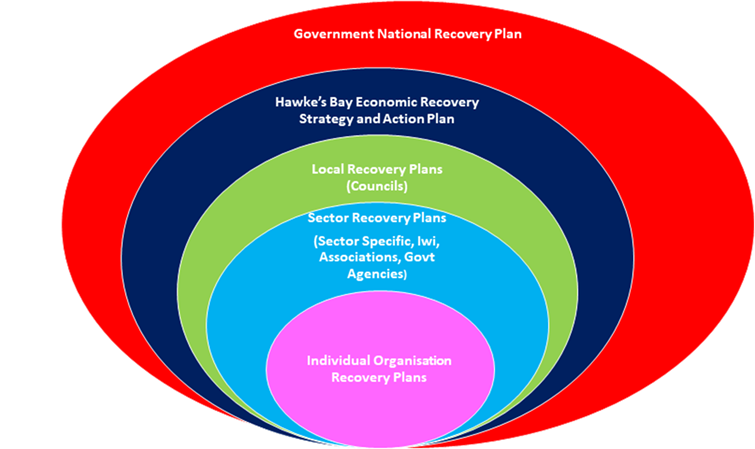

6.1. Continue with

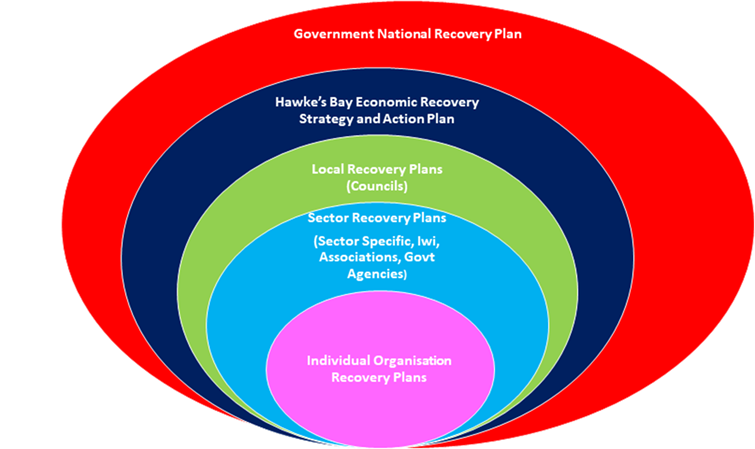

the proposed 7.3% rates increase and service levels and use Council’s

rate remissions policy to remit the increase for some or all ratepayers (a

broad-based or targeted approach)

6.2. Continue with

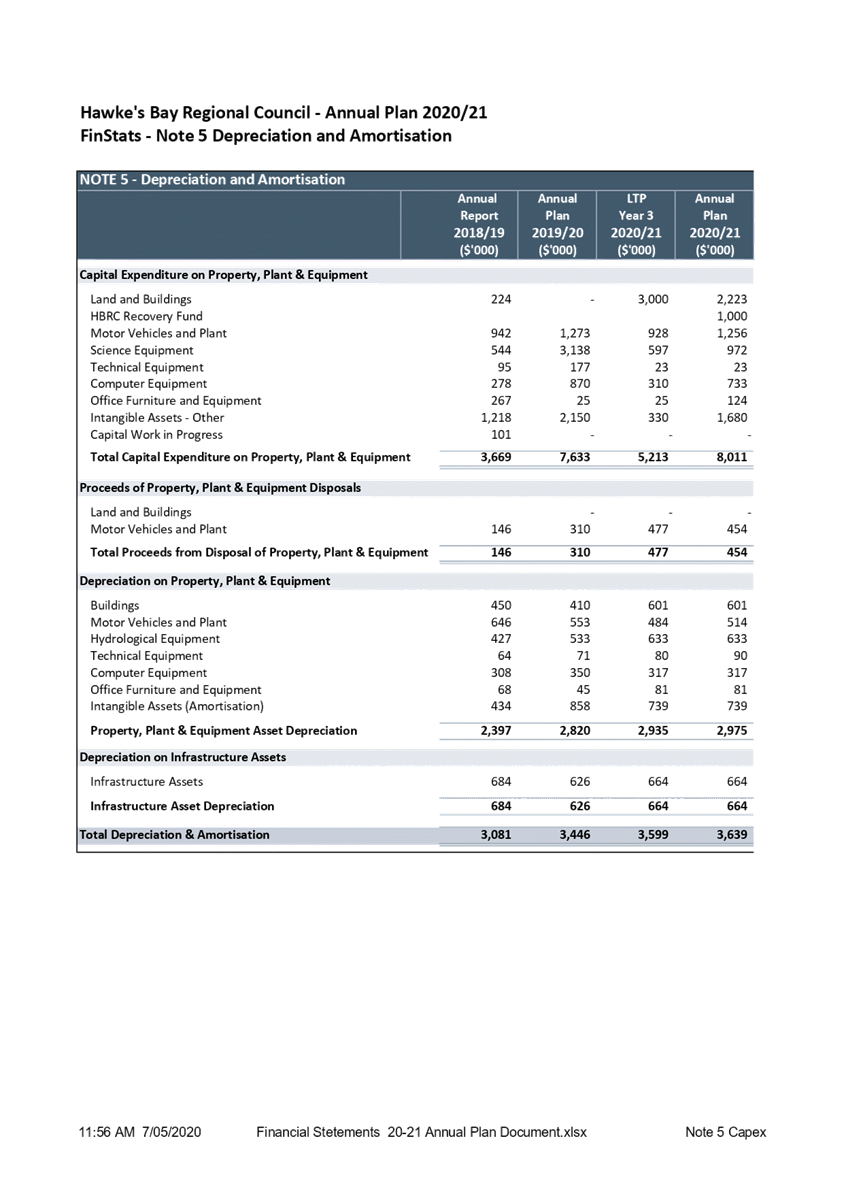

the proposed 7.3% rate increase and service levels and use Council’s

rates postponement policies to postpone the required increase

6.3. Rework the

budgets to reduce service levels and costs to deliver a 0% rate take increase

6.4. Continue with

the proposed levels of service, adjust for known changes in revenue and reduce

rates income to the same level as 2019-20.

7. For all

options, the proposal was to borrow for any revenue shortfall.

8. The potential

impact on Council income, due to the economic downturn, is based on a

Conservative Scenario. Alternative scenario impacts (Ultra Conservative

‘worst’ and Optimistic ‘best’) were also considered for

comparison. The 2020-21 net funding shortfall, excluding any change to the

level of rate, ranged from $4m to $12.4m.

9. The total

change to Council’s budgeted revenues under the modelled scenario sees a

gross revenue reduction of $10.08m with a net funding impact of $8.08m.

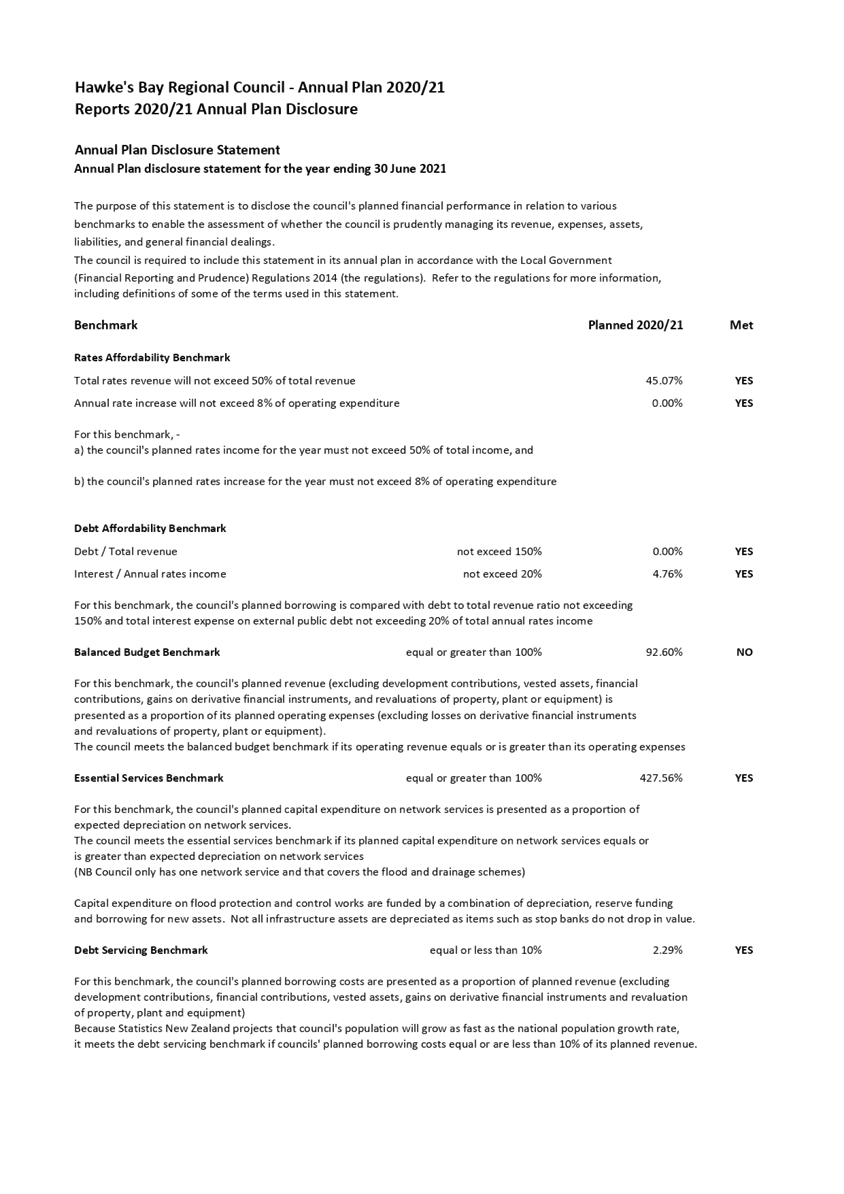

10. Following feedback from

Council, no changes have been made to the Levels of Service provided for in

year 3 of the Long Term Plan on the basis that these are important programmes

of work and delivery should continue.

11. The impact of these

changes to the 2020-21 budgets, based on Council’s preferred options

results in:

11.1. Council planning for an

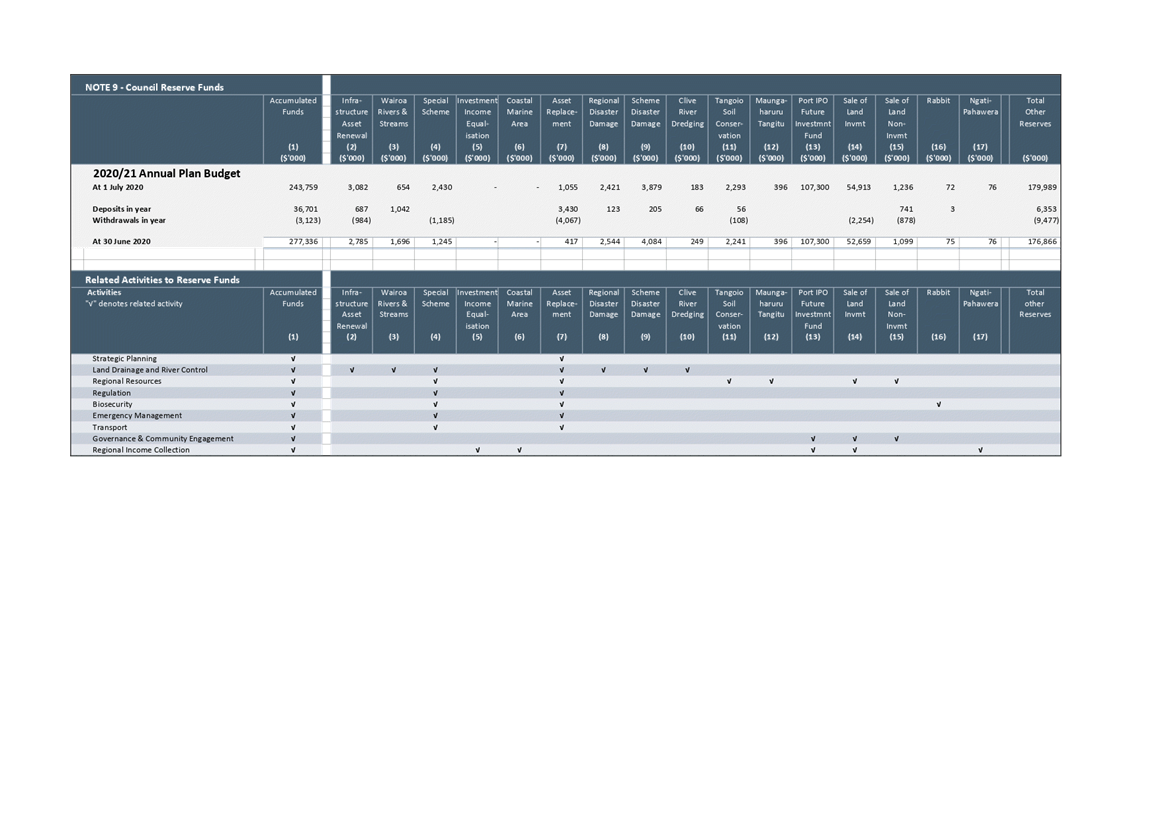

operating deficit of $4.37m in 2020-21. This means that Council does not plan

to balance its budget for the 2020-21 Annual Plan.

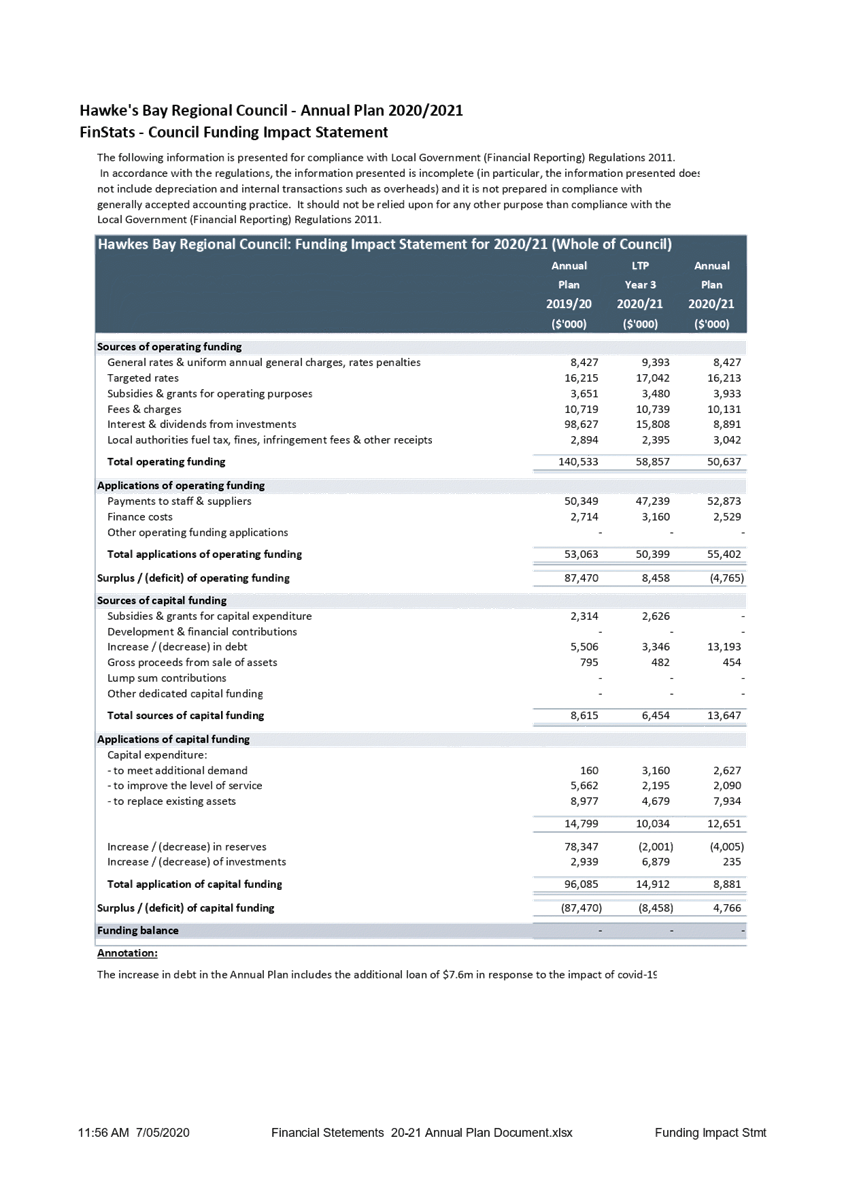

11.2. A need for additional

borrowing of $7.58m to fund the projected funding shortfall (as well as a

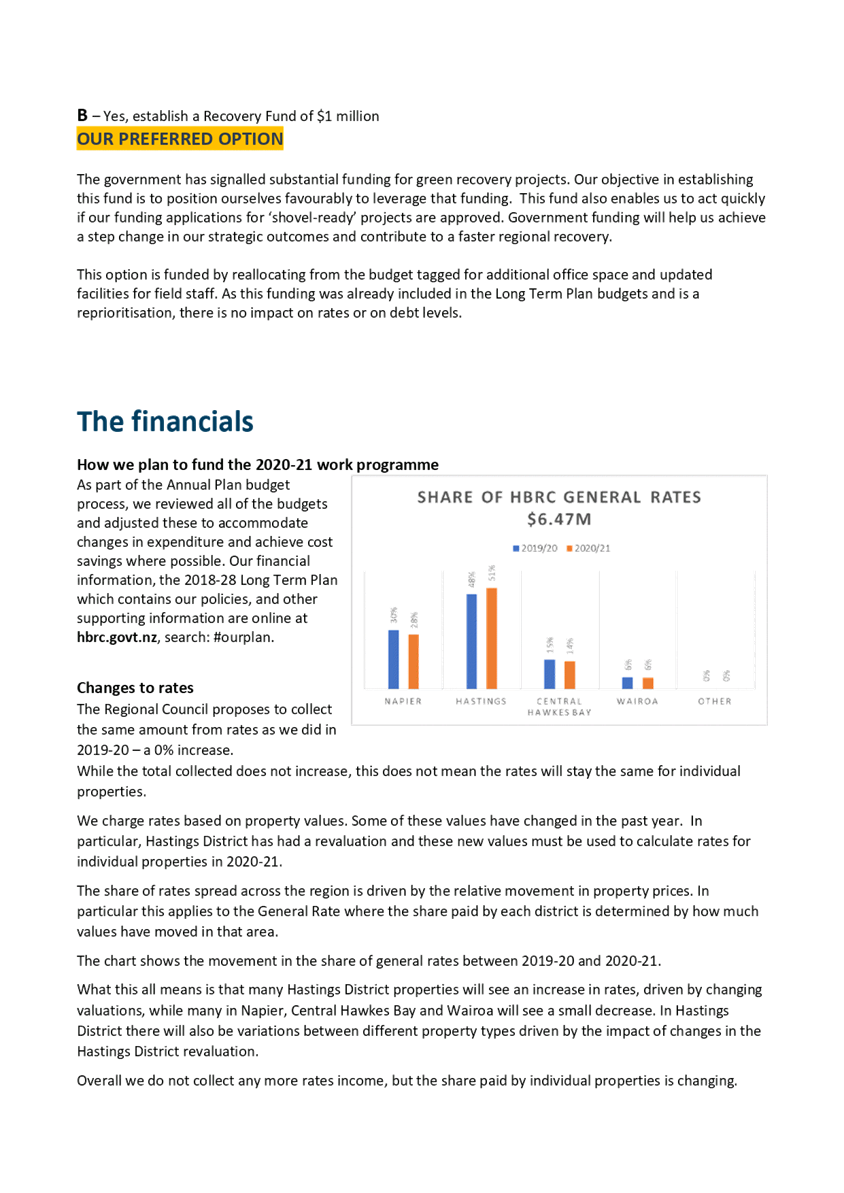

reduction in reserves balances of $0.497m).

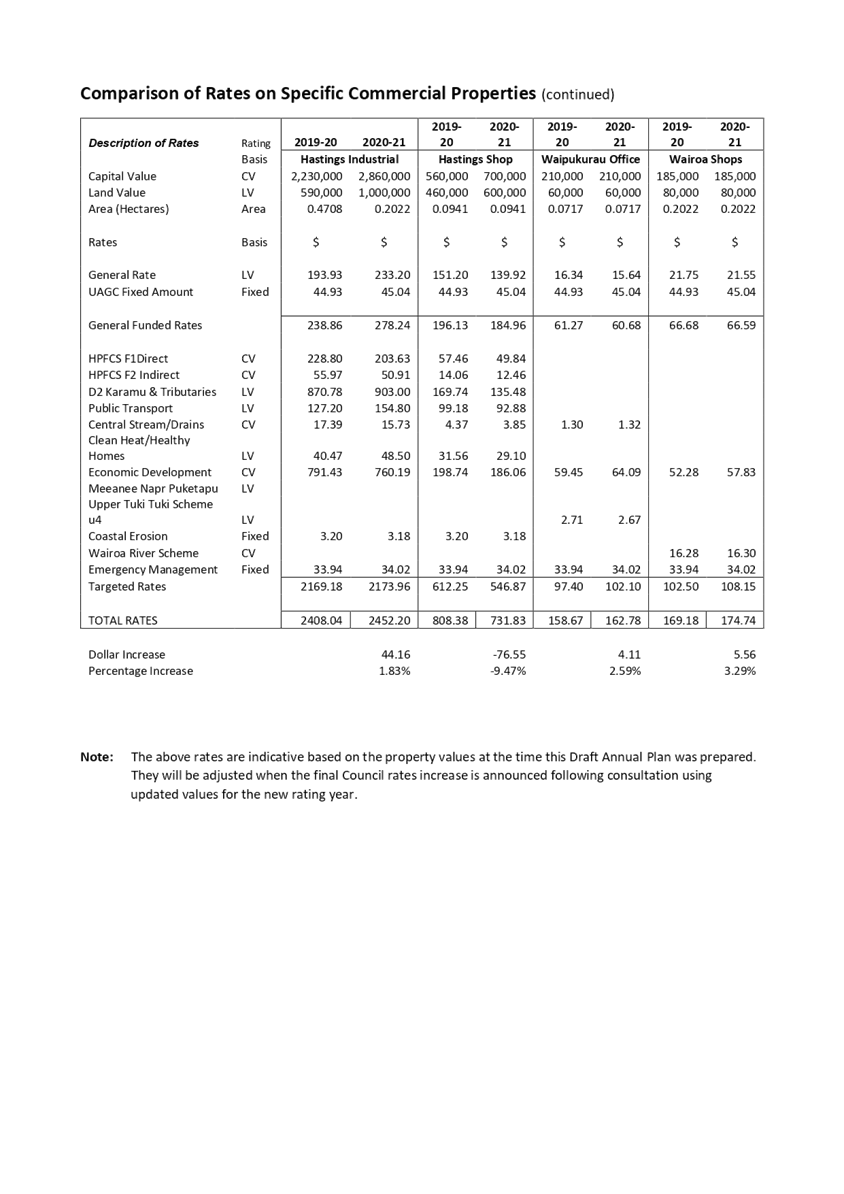

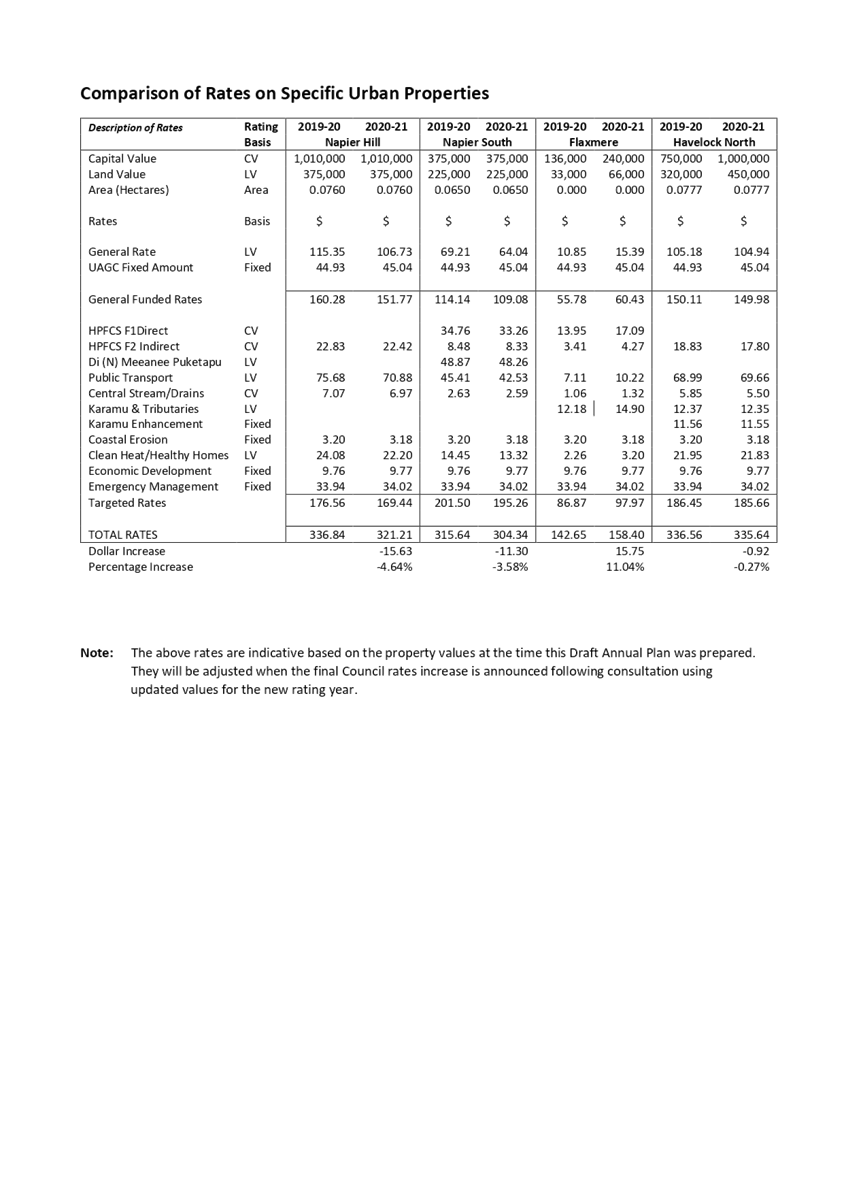

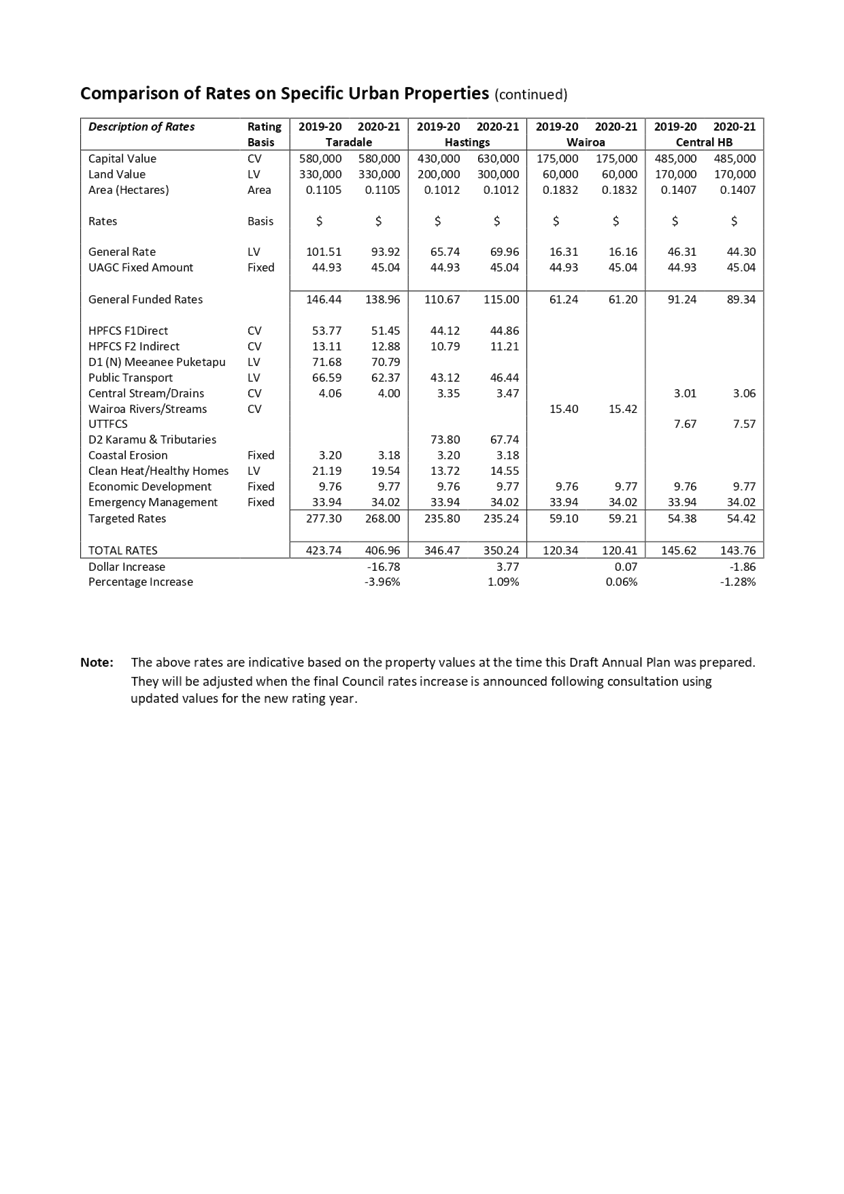

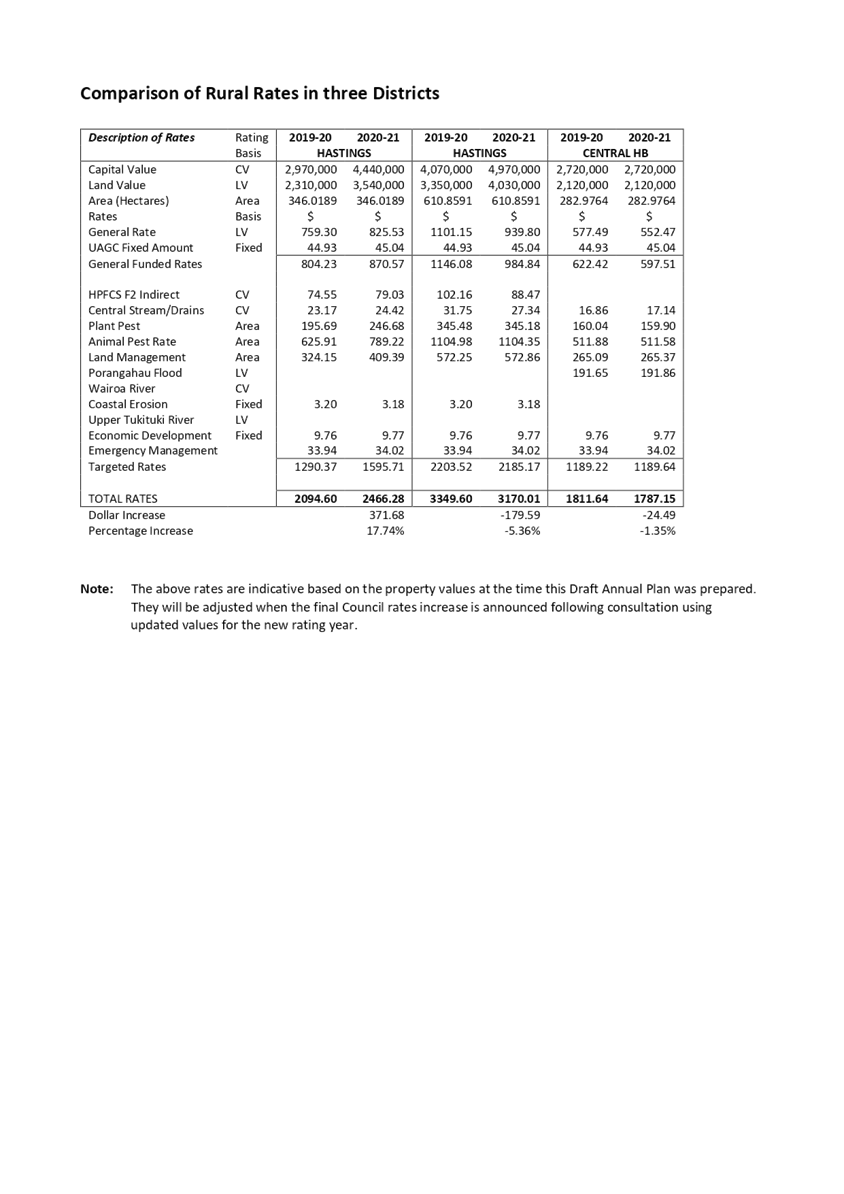

11.3. A significant increase

in the projected rate increase in 2021-22 to pass on the deferred 2020-21 increase,

service the new borrowings and fund existing cost increases for 2021-22.

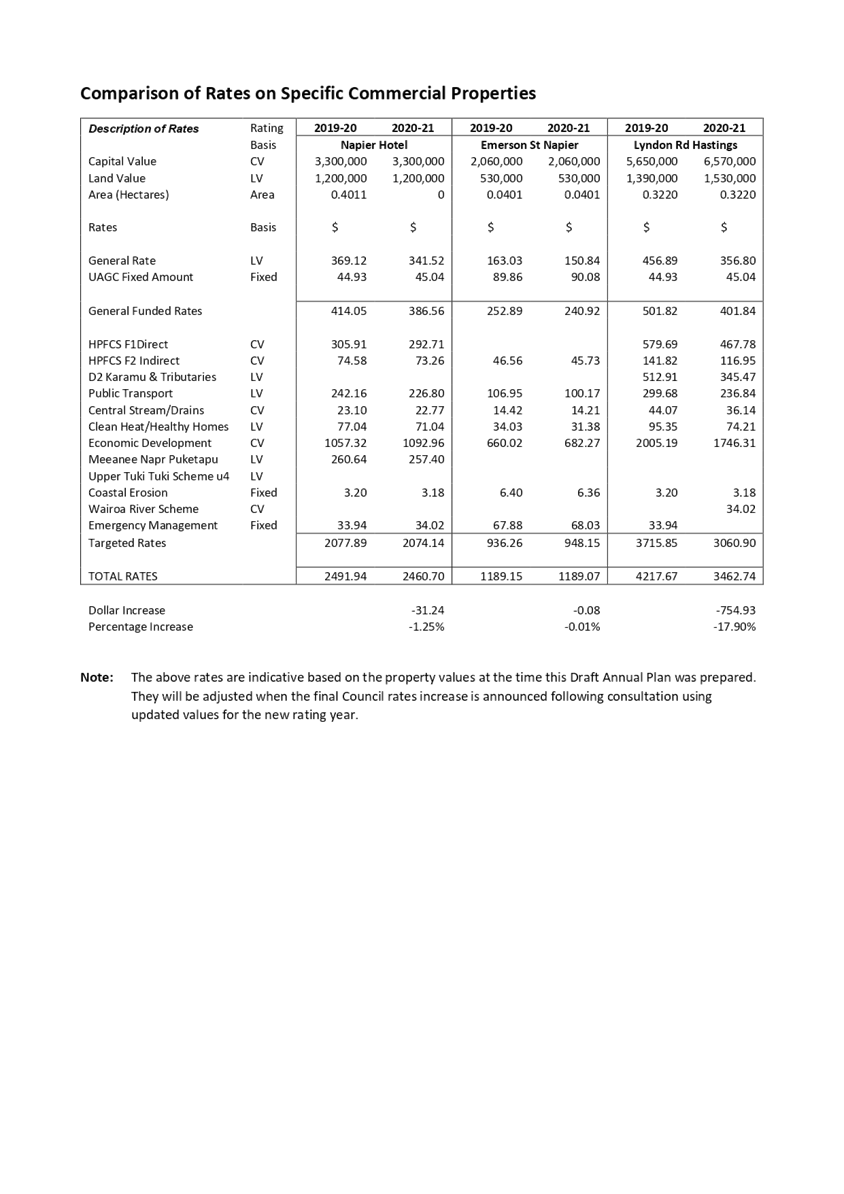

11.4. A requirement for

Council to consult on the proposed 2020-21 Annual Plan, thereby delaying the

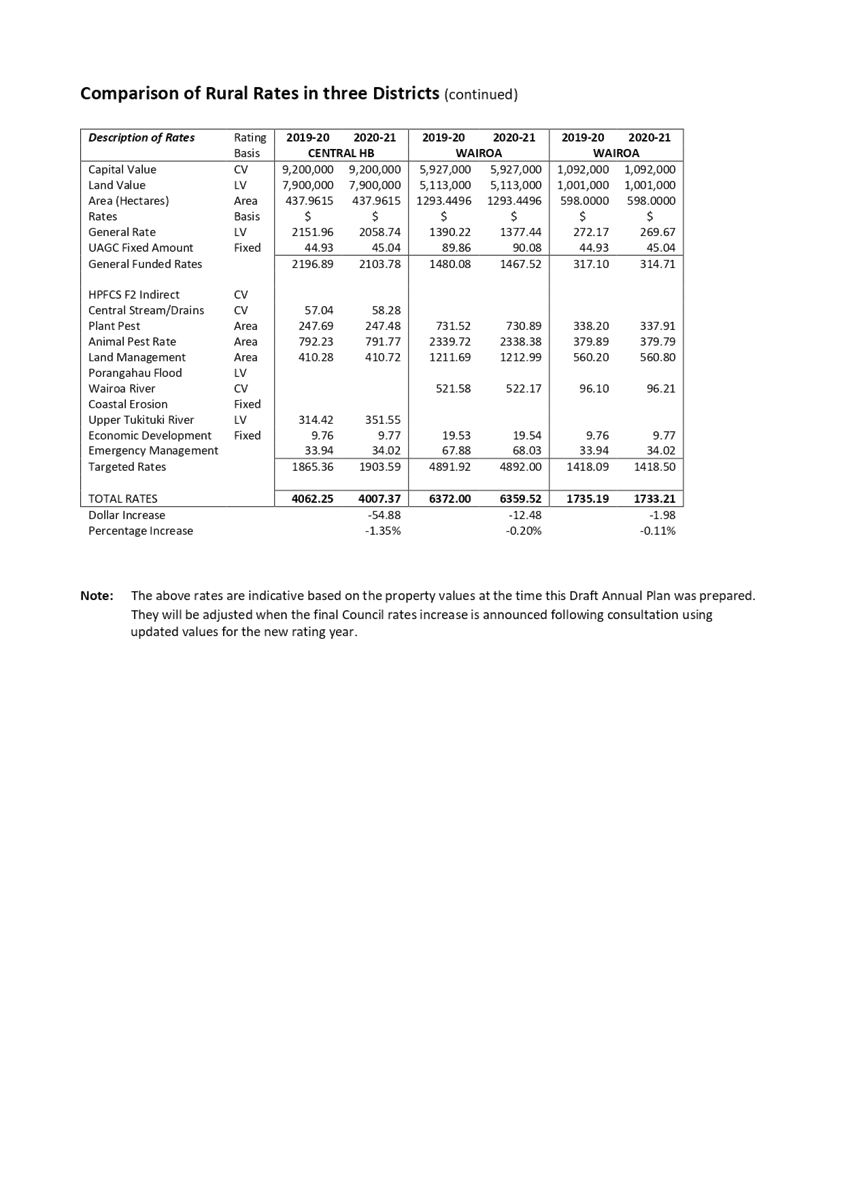

adoption date until after 30 June 2020.

12. A proposed new timeline

has been developed which will see consultation taking place from 8 – 28

June, with the Annual Plan not expected to be adopted until 29 July 2020.

13. Measures will be

implemented to demonstrate fiscal restraint and responsibility wherever

possible. Messaging to address these are included in the consultation material.

Any savings achieved during the 2020-21 year will reduce the borrowing

requirement and should be sought.

14. The Council has two

proposals for the community to consider so the organisation can cushion the

effect of COVID-19 in these challenging times:

14.1. Our approach to rates

charges to provide some relief to ratepayers (three options are provided) while

debt funding the expected shortfall in our income for the year ahead; and

14.2. A proposal to establish

a Recovery Fund to leverage potential central government co-funding into

Council-related capital projects, to support job creation and economic activity

while enhancing our environment.

15. Both proposals are

significant and/or material changes to the activities set out in

Council’s 2018-28 Long Term Plan for 2020-21 (year 3). As per section

95(2) of the LGA 2002 we are required to consult on these changes with our

community.

PART 1: Background and Previous

Workshop Discussions

Background

16. Council is required to

prepare and adopt an Annual Plan for each financial year, except when a Long

Term Plan is developed, which is every three years.

17. At a workshop on 11 March

2020, Council received information outlining the budget requirement for the 2020-21

Annual Plan year. This showed that officers had been able to maintain the rate

requirement to align with that signalled in year 3 of the LTP but it had been

challenging due to significant cost pressures on overheads, specifically

remuneration / people costs and IT.

18. People related costs had

increased due to two factors, an increase in headcount over and above the Long

Term Plan and the partial implementation of a remuneration review which was

conducted in June/July 2019. The review was in response to an internal audit by

a remuneration specialist and a remuneration survey with staff. This

demonstrated that existing remuneration systems and processes did not deliver

fair outcomes, were not in line with the market and were no longer fit for purpose.

The remuneration system no longer aligned with the strategic direction and

business imperatives of Council, nor the needs of staff.

19. Also included in the

original budget is an increase in Corporate Support costs for IT of approx.

$780k. This is a result of the following.

19.1. Expectations that some

current costs would disappear when services were moved to Revera and SaaS

(software as a service) products. This hasn’t happened due to

dependencies that were difficult to spot during LTP budgeting.

19.2. Increased data

collection and use of technology across all business units, e.g. drone video

footage replacing site visits with pen and paper. This adds significant cost to

data indexing, processing and storage.

19.3. End-users tend to have

more complex hardware now (instead of PC plus monitor – we’re

purchasing, configuring and supporting laptop + docking station + phone +

tablet for some users giving more ability to work mobile in the field).

19.4. Some improvements to ICT

maturity and resilience come with extra cost – support agreements,

software test environments, cyber-security protections.

19.5. Increase in headcount

over and above original LTP estimates.

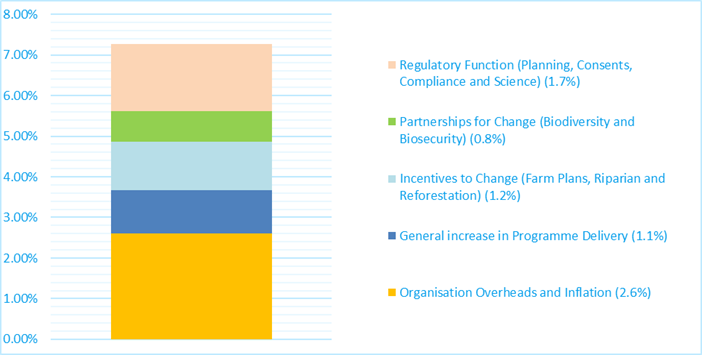

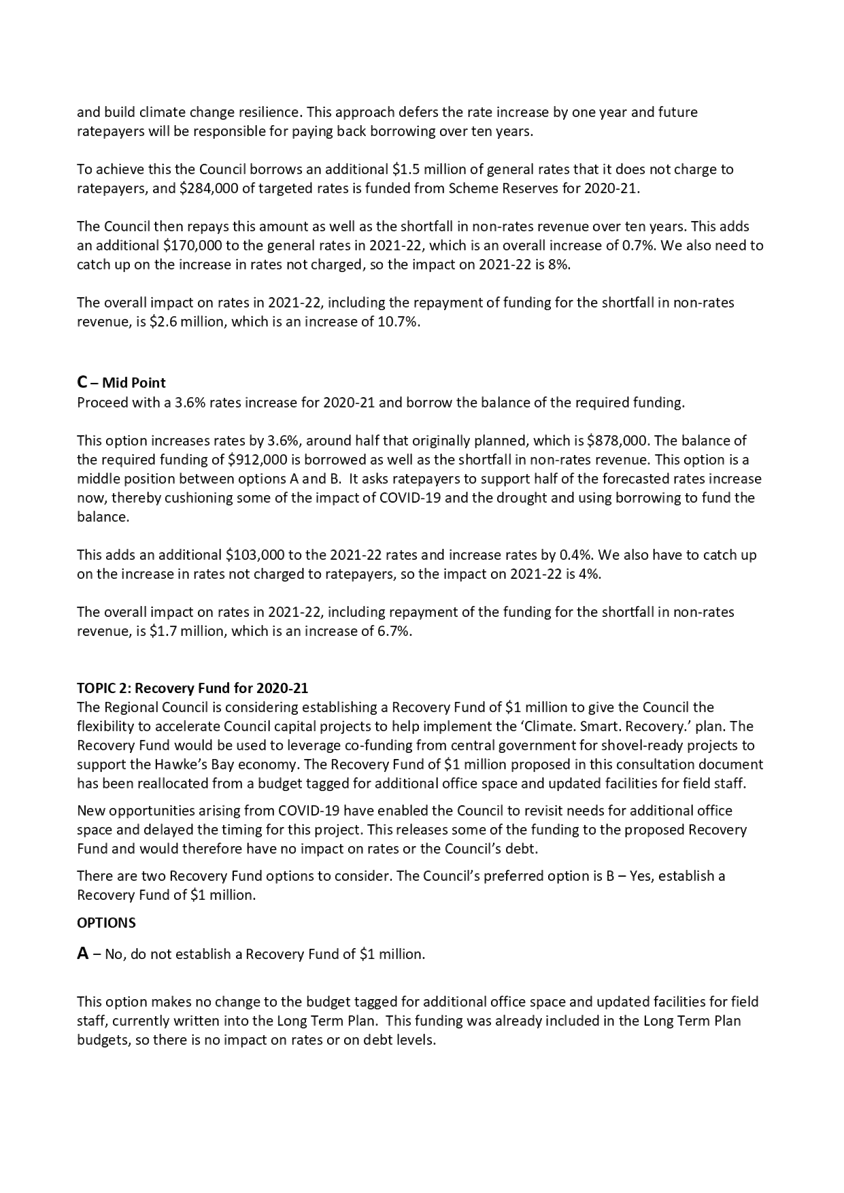

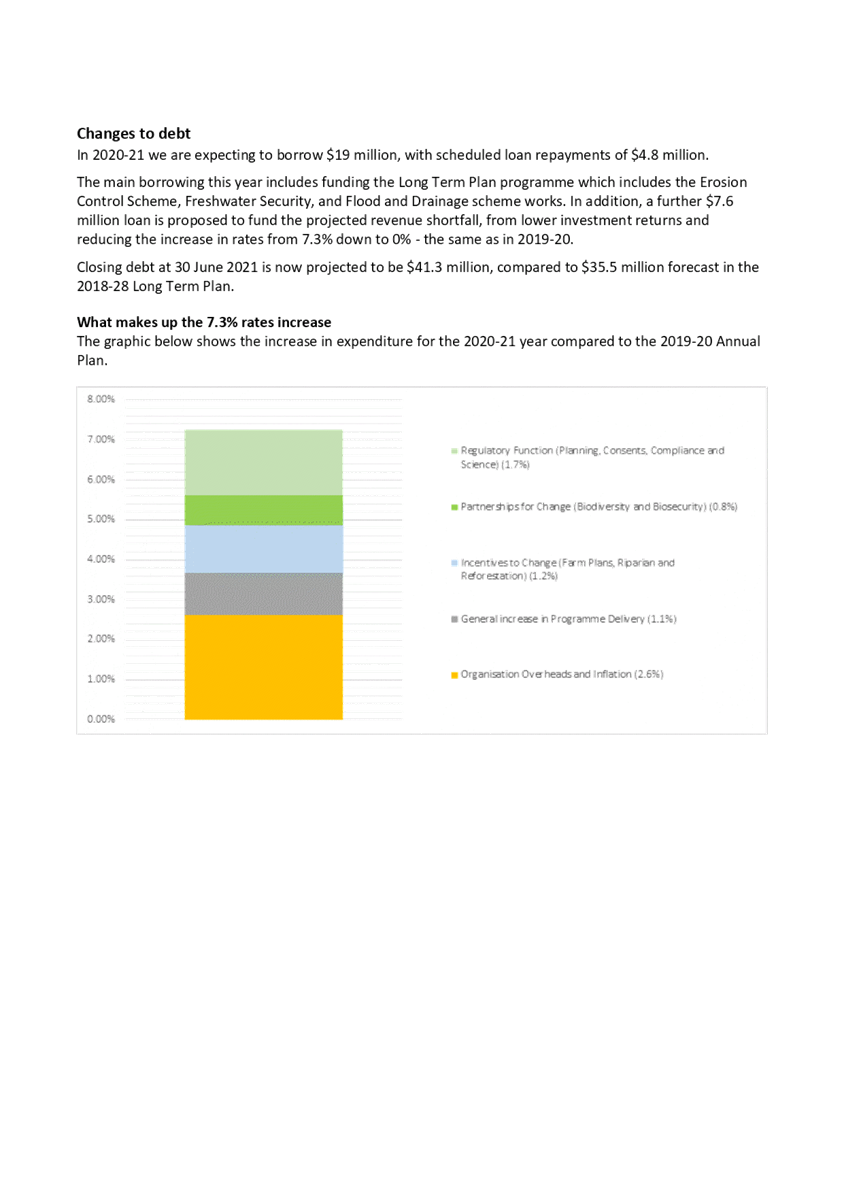

20. The following chart

provides a snapshot of what was driving the need for a 7.3% increase.

2020-21 Annual

Plan (7.3% overall increase vs 2019-20 Annual Plan)

21. Following the 11 March

workshop, and in response to the impact of recent events, Councillors asked

officers to revisit and present a budget which accounts for the proposed 7.3%

rate increase through borrowing (in effect delivering a 0% rate take increase).

The proposed expenditure and service levels were to remain the same with

Council borrowing to pay for:

21.1. The extra 7.3% in rates

that was needed to fund the 2020-21 budget, and

21.2. The reduction of

non-rate revenues as a result of the economic impact.

22. In addition, requested for

community consultation, a $1m Recovery Fund. It is proposed this be funded

through a partial reallocation of a $3m budgeted placeholder for long-term office

accommodation.

Workshop Discussions

The 2020-21 Annual Plan Budget &

Financial Statements

23. The 2020-21 Annual Plan

Budget has been revised to reflect the expectation that Council non-rate

income, including that derived from HBRIC (Napier Port dividend) and managed

investment fund portfolios, including the Future Investment Fund, and Long-Term

Investment Fund will be impacted from the current economic downturn. The NZ

stock market has already seen a significant loss in value and a reduction in

the official cash rate means lower returns on fixed interest securities. In

addition, we have also reviewed revenue budgets for cost recovered consents and

compliance activities and have reflected adjustments to the expected lower

levels of income from these activities.

|

Key Assumptions

– Detailed further in next section

|

|

24. In preparing the revised budget and associated projections and

narrative for the 2020-21 Annual Plan the following assumptions have been

applied:

|

|

24.1. That there will be a

significant economic impact as a result of COVID-19 and many ratepayers and

businesses will be adversely affected during the 2020/21 financial year.

|

|

24.2. HBRC and HBRIC

revenues, in particular its investment revenues, will be impacted with a

resulting reduction in revenue for HBRC.

|

|

24.3. An interest rate of

3.0% on new borrowings for project expenditure with an assumption of 2.5%

used to show the cost of servicing the COVID-19 loan (with a range of

repayment terms as shown at the bottom of Table 1 for comparison for the COVID-19

loan).

|

|

24.4. No allowance of

interest on the COVID-19 loan until the 2021-22 financial year (assumes that

the funds are not borrowed until the end of the financial year).

|

25. Based on changes to

assumptions and a preferred option to collect the same value of rates charged

in 2019-20, Council is budgeting for a deficit of $4.13m in 2020-21. This means

that Council is planning to not balance its budget in the 2020-21 financial

year. Council is entitled to plan for an unbalanced budget, however, in doing

so Council must demonstrate that it is prudent to do so.

26. As proposed in the

modelled scenario, adjustments have not been made to planned expenditure. The

initial budget (presented 11 March) was already ‘tight’ given the

cost pressures (IT overheads, cost of remuneration review, etc.). Therefore,

proceeding with the proposed LTP levels of service requires the budgeted

shortfall in income to be funded.

27. While Council did not ask

officers to review the budget for cost-saving opportunities the executive team

are continuing to discuss their position on, and the possibility of cost

savings which will not significantly impact on the ability to deliver the

services proposed in the LTP such as:

27.1. Travel and accommodation

27.2. Training / Conferences

27.3. Headcount - ceiling or

sinking lid

27.4. Zero market movement /

Salary increases for those already remunerated fairly

27.5. Long Term Accommodation

project deferral

27.6. Use of contractors /

procurement policy settings.

28. Community expectations will

be that the management team demonstrates a high level of fiscal discipline and

responsibility. Councillors have indicated an initial preference for no staff

cuts however management will review the need for new staff appointments and

efforts should be made to reduce expenditure where possible during the year.

29. Any savings achieved by

management will reduce the size of the loan required to bridge the gap between

revenue and expenditure for the 2020-21 Annual Plan year.

30. Rather than delay the budget

process by attempting to make numerous changes to budgets, staff recommend that

the budgets remain largely as they are in the Annual Plan with management asked

to put in place measures to reduce costs wherever possible, without making

changes to the levels of service.

31. When we refer to levels of

service we refer to the Council priorities and work programmes set out and

consulted on as part of the LTP. In an Annual Plan year Council can revise the

budgeted cost to deliver services (and consult if the cost and proposed rates

income differs significantly from that in the LTP). Minor changes with services

are ok provided they do not change the strategic direction or significantly

change the quantum of work agreed upon in the LTP.

Changes to the

Budget

32. The

following table details the changes proposed to key assumptions. The modelled

Conservative Scenario is included in the revised financial statements which

form the basis of the Annual Plan consultation.

Table 1 – Summary of Changes to March

version of 2020-21 Annual Plan Budget

|

Description

|

Note

|

11 March

20-21 AP

($000)

|

Change

Reduction

15 April

20-21 AP

($000)

|

Conservative

Scenario

Reduction ($000)

|

Ultra

Conservative Scenario Reduction

($000)

|

Optimistic

Scenario Reduction

($000)

|

Impact

on Scheme Rate (scheme reserve funded)

|

|

|

|

Conservative Scenario = Scenario reflected in

Financial Statements

|

Alternative Scenarios

|

|

|

Budget items changed

|

|

|

|

|

|

|

|

|

Rates (from 7.3% down to 0%)

|

29.3.1

|

26,430

|

1,790

|

1,506

|

1,506

|

1,506

|

284

|

|

Dividend from Port (HBRIC)

|

29.3.2

|

8,067

|

5,067

|

5,067

|

8,067

|

3,067

|

|

|

Interest\returns from Port IPO Future Investment Fund &

other investments

|

29.3.3

|

6,798

|

1,535

|

1,535

|

2,851

|

219

|

|

|

Compliance Fees & Charges budget

|

29.3.4

|

1,584

|

929

|

929

|

1,229

|

929

|

|

|

Resource Consents Fees & Charges budget

|

29.3.5

|

1,979

|

429

|

429

|

629

|

229

|

|

|

Interest on Reserves and operating cashflows

|

29.3.6

|

858

|

230

|

91

|

121

|

61

|

139

|

|

Rates Penalties

|

29.3.7

|

230

|

100

|

26

|

26

|

26

|

74

|

|

SubTotal – Revenue Items

|

|

45,945

|

10,080

|

9,584

|

14,429

|

6,038

|

497

|

|

Reduction in budgeted transfer to Dividend Equalisation Reserve

|

29.3.8

|

(2,000)

|

(2,000)

|

(2,000)

|

(2,000)

|

(2,000)

|

|

|

Total Budget Changes

|

|

|

8,080

|

7,584

|

12,429

|

4,038

|

497

|

|

|

|

|

|

|

|

|

|

|

Loan Interest Rate Assumption

|

|

2.50%

|

|

|

|

|

|

|

Cost of Servicing Loan ($000’s)

|

|

Loan Term

|

3 Years

|

2,626

|

4,305

|

1,398

|

|

|

|

|

Loan Term

|

5 Years

|

1,615

|

2,647

|

860

|

|

|

|

|

Loan Term

|

10 Years

|

858

|

1,406

|

457

|

|

|

%age impact on Rates

|

|

Loan Term

|

3 Years

|

10.7%

|

16.3%

|

5.3%

|

|

|

|

|

Loan Term

|

5 Years

|

6.1%

|

10.0%

|

3.3%

|

|

|

|

|

Loan Term

|

10 Years

|

3.2%

|

5.3%

|

1.7%

|

|

33. Three scenarios have been

presented to model the potential impacts.

33.1. Conservative Scenario

(Moderate) - $7.58m rates impact

33.2. Ultra Conservative

Scenario (Worst) - $12.4m rates impact

33.3. Optimistic Scenario

(Best) -

$4.04m rates impact

34. The Council has chosen to

prepare the consultation document and financial modelling based on the

Conservative Scenario.

35. The Council has chosen to

model the impact of deferring the rates increase by recovering the cost from

ratepayers over a 10 year period. The treasury policy will determine the actual

borrowing term and conditions.

36. Accurately predicting the

revenues for 2020-21 is difficult at this stage however we are required to make

our projections based on assumptions and the best data we have available at

present so we can present a revised budget to the community.

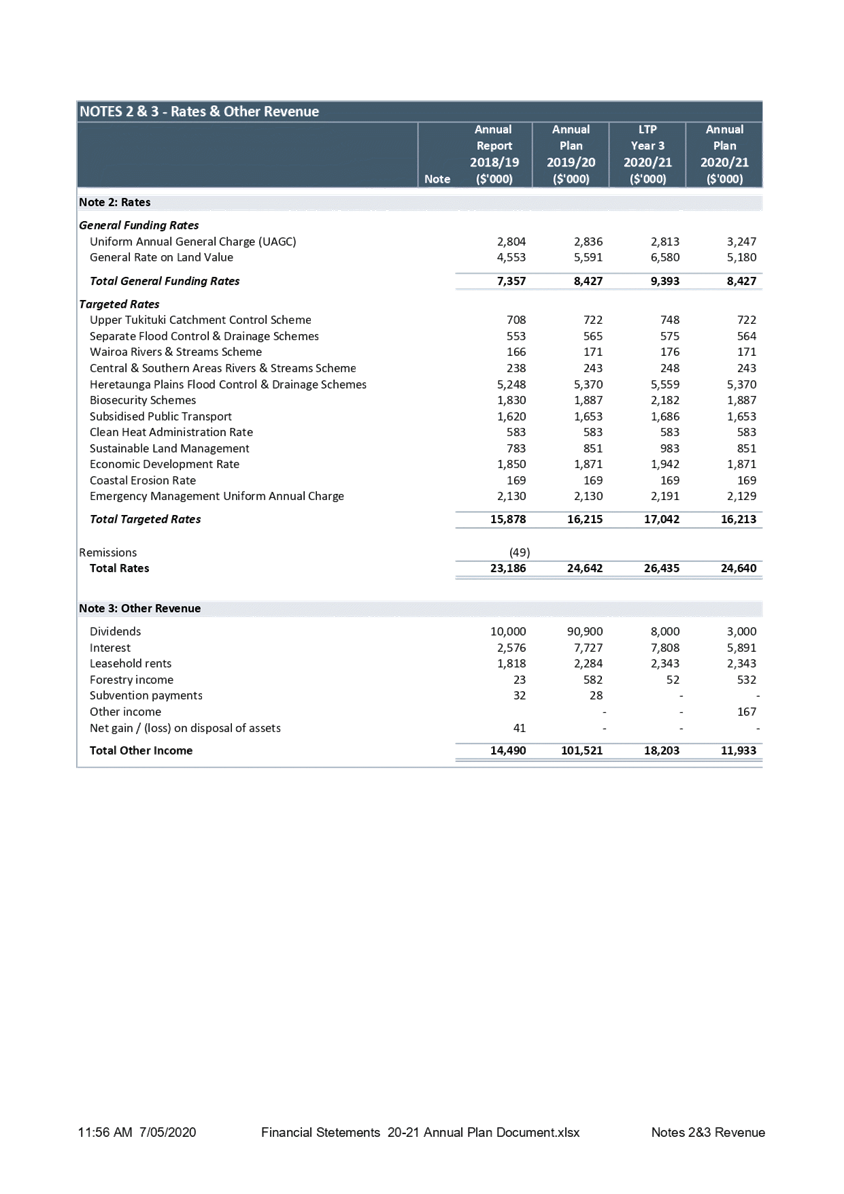

36.1. A reduction in budgeted

rates increase from 7.3% down to 0% results in reduced rates revenue of $1.7m.

Some of the reduction will result in various scheme reserves being depleted while

the remainder ($1.5m) needs to be funded from borrowing.

36.2. Despite being the

majority shareholder, the Council (via HBRIC) cannot access any more financial

data, than is available to all investors for Napier Port. The degree to which

the Port’s 2020-21 profit, and the dividend paid to HBRIC, will be

impacted is unknown, however it is prudent to anticipate that there may be some

impact on the planned dividend from the Port. Treasury advisers PWC, have

indicated that a conservative approach would be to plan for no dividend. At

this stage though, we believe we should anticipate a HBRIC dividend to Council,

utilising funds from a Port dividend, at a lower level than previously planned.

The modelled Conservative Scenario assumes a $3m dividend with the more

Optimistic Scenario assuming a $5m dividend. No dividend is assumed under the

Ultra Conservative Scenario.

36.3. The Council’s

portfolios of managed funds have @31 March 2020 been impacted by the reduction

in share market prices and the drop in interest rates resulting in approx. -2%

loss on the consolidated portfolio which equates to a loss of approx. $9m in

capital value. We expect the most significant impact will be realised in

the current (2019-20) financial year, however returns in 2020-21 will be off a

lower capital base and we should expect continued volatility and lower company

dividends throughout 20-21. The returns for the three scenarios were modelled

off the fund balance as at 31 March 2020, after the impact of a

significant value write-down and projecting the balance forward. Feedback from

one of the fund managers (Jarden) was that it is possible expectations of a 5%

return in 2020-21 could be reasonable, however this is off a lower capital

base. As $60m is invested through HBRIC it is assumed, assuming no

intervention, that tax will be paid on the HBRIC portfolio earnings. The

budgeted return for each scenario is:

36.3.1. Conservative Scenario

= 4%

36.3.2. Ultra Conservative

Scenario = 3.0%

36.3.3. Optimistic Scenario =

5.0%

36.4. Council has increased

the level of its compliance activities in the LTP and Annual Plan. Staff have

reviewed the likely revenues and have assumed that similar levels to those

actually charged last year (2018-19) will be collected. It would be

inappropriate to aggressively seek to increase the actual fees charged in this

area in the 20-21 year. This results in a potential reduction of $928k in

budgeted revenues reflected in the Annual Plan. For the Ultra Conservative

Scenario a further reduction of $300k has been assumed.

36.5. Resource Consents

activity and revenues have increased significantly over the past two years.

Factored is a decline in revenue due to economic conditions. If the volume of

consenting activity declines staff may need to be redeployed i.e. to either

policy or compliance activities. If this occurs resourcing implications will be

reviewed however it is prudent to assume there will be a reduction in the net

revenue for Council. For the Ultra Conservative Scenario, a further reduction

of $200k has been assumed.

36.6. If the Council’s

revenue and reserve levels decline, coupled with possible rates postponements,

the Council’s cash position will be affected. Therefore, due to a

combination of less cash and lower interest rates the Council’s

‘other interest income’ will reduce so an allowance has been made

for a reduction in other interest.

36.7. The LTP budget was

reflected in the 11 March draft Annual Plan budget. This assumed a dividend of

$8m with $2m transferred into the dividend equalization reserve (net $6 used to

reduce the amount collected from rates). A lower dividend projection means

there will be no excess funds to be transferred to the reserve in 2020-21.

37. The Council currently has

a heavy reliance on revenue from its investments to subsidise the cost of

services, thereby reducing the level of rates it needs to collect from the

community. The total derived from dividends, returns on cash investments and

managed funds used to reduce rates is $12.8m which is approximately 50% of

total rates. This means rates would be 50% higher without this source of

revenue.

38. The following table shows

revenue lines which have not been adjusted.

|

Description

|

11 March

20-21 AP

|

15 April

20-21 AP

|

Change

|

Conservative

Scenario

|

Ultra Conservative

Scenario

|

Optimistic

Scenario

|

|

|

(All numbers in $000's)

|

Conservative

Scenario

|

Impact

on Rates

|

Impact

on Rates

(debt funded)

|

|

|

Revenue

Subtotal (Budget Items Changed)

|

45,945

|

35,865

|

10,080

|

9,584

|

14,429

|

6,038

|

|

Revenue Items that have not been adjusted

|

|

|

|

|

|

|

|

Government Grants

|

3,933

|

3,933

|

-

|

-

|

-

|

-

|

|

Recoveries and targeted rates for Heat Smart, Sustainable Homes,

FEMOs and ECS

|

1,100

|

1,100

|

-

|

-

|

-

|

-

|

|

Leasehold rents

|

2,343

|

2,343

|

-

|

-

|

-

|

-

|

|

Forestry Income

|

532

|

532

|

-

|

-

|

-

|

-

|

|

Fees and Charges for Integrated Catchment Management Activities

|

3,621

|

3,621

|

-

|

-

|

-

|

-

|

|

|

|

|

|

|

|

|

Other Activity revenues

|

3,242

|

3,242

|

-

|

-

|

-

|

-

|

|

Non- Cash P & L entries

|

|

|

|

|

|

|

|

Value Gain on Investment Properties & Forestry

|

3,118

|

3,118

|

-

|

-

|

-

|

-

|

|

Reduction in ACC Liability

|

917

|

917

|

-

|

-

|

-

|

-

|

|

|

|

|

|

|

|

|

Total Revenue

|

64,751

|

54,671

|

10,080

|

9,584

|

14,429

|

6,038

|

|

|

|

|

|

|

|

|

|

|

Income in Summary-

Options for Consultation

39. The Council anticipates a

significant reduction in income from investments, dividends and other non-rate

income over the coming year, primarily due to the global impact of COVID-19.

40. This shortfall in funding

is estimated at $6.1m. We believe that debt funding through a loan to manage

the income gap is the most preferable way to support ratepayers and our economy

rather than reduce our work programmes and therefore our levels of service. We

plan to fund this shortfall over 10 years and this will add an additional $687k

to the general rate in the following financial year. This will increase rates

in 2021-22 by 2.6%.

41. Along with funding the

income gap created by the anticipated drop in non-rate income, we are

considering the impact on our community of the proposed 7.3% rates increase

included as part of the Long Term Plan.

42. As the Council has low

external borrowings, we have considered that one way to lessen the financial

impact of COVID-19 on the region is to fund the rates increase by borrowing

rather than increasing rates.

43. The consultation will

offer three rate approach options to consider. The Council’s preferred

option is to keep the rates revenue at the same level as 2019-20 and borrow the

required funding. Alternative options are:

43.1. Proceed with the planned

7.3% rate increase in line with the Council’s 2018-28 Long Term Plan, or

43.2. Proceed with a 3.6%

rates increase for 2020-21 and borrow the balance of the required funding.

Recovery Fund

44. The consultation is about

the establishment of a Regional Council Recovery Fund of $1m. It is

proposed to be debt funded for capital expenditure.

45. The Regional Council is

working with PSGEs, other councils, business and central government through the

Matariki Regional Economic and Social Development vehicle to develop a regional

recovery plan of which the proposed Recovery Fund is intended to make a

contribution.

46. The Recovery Fund would

only be used to supplement any co-funding received from central government for

shovel-ready projects to stimulate the Hawke’s Bay economy. Given

forecasts that Māori will be disproportionately affected by the recession,

it is the Regional Council’s intention to work with tāngata whenua

on opportunities for Māori employment.

47. The money for the proposed

Recovery Fund has been reallocated from a budgeted placeholder to borrow for

the provision of additional office space and updated facilities for field

staff. This would therefore have no impact on rates or the Council’s

debt.

Other Budget Changes

between LTP Year 3, Annual Plan 2019-20 and the 2020-21 Annual Plan

48. There have been some

movements between the year 3 LTP budget and those presented in the 2020-21 AP.

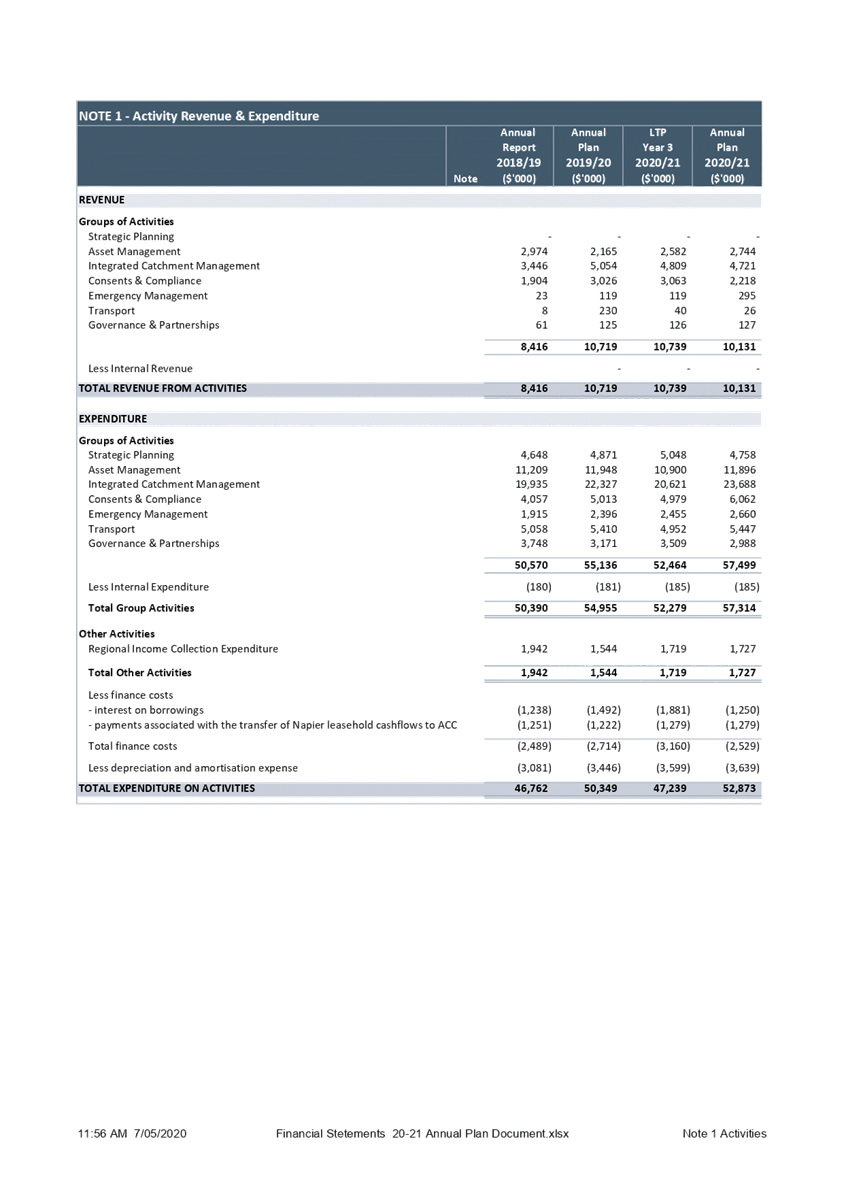

48.1. Most revenue changes

reflect the budget changes outlined above.

48.2. Operating expenditure on

activities is significantly higher that what was presented in the LTP ($52.87m

vs $47.23m - an extra $5.6m).

48.2.1. The biggest impact is

the reclassification of the $3m budget for the Erosion Control Scheme as

Capital Expenditure. As no Council asset is created (the expenditure relates to

erosion control on private farms) this budgeted cost has been reclassified as

operating expenditure in both the 2019-20 Annual Plan and 2020-21 AP

48.2.2. The remaining $2.6m

variance reflects the continuation of the quantum change that occurred in the

2019-20 AP and the additional cost pressures that were outlined to Council on

11 March. The expenditure in the 2019-20 AP was $50.35m compared to the LTP

budget of $45.48m for the same year

48.2.3. Finance costs are

lower due to the use of a lower interest rate assumption (4.5% was used in the

LTP budget projections).

Capital

Expenditure in 2020-21 Annual Plan

49. The proposed Capital

Expenditure $18.7m vs the LTP budget of $19.9m.

50. In addition, due to the

delays caused by the lockdown, it is probable that a number of the 2019-20

projects will continue into 2020-21 with funding requested to be carried

forward when Council considers its end-year report.

Summary of

Capital Expenditure

|

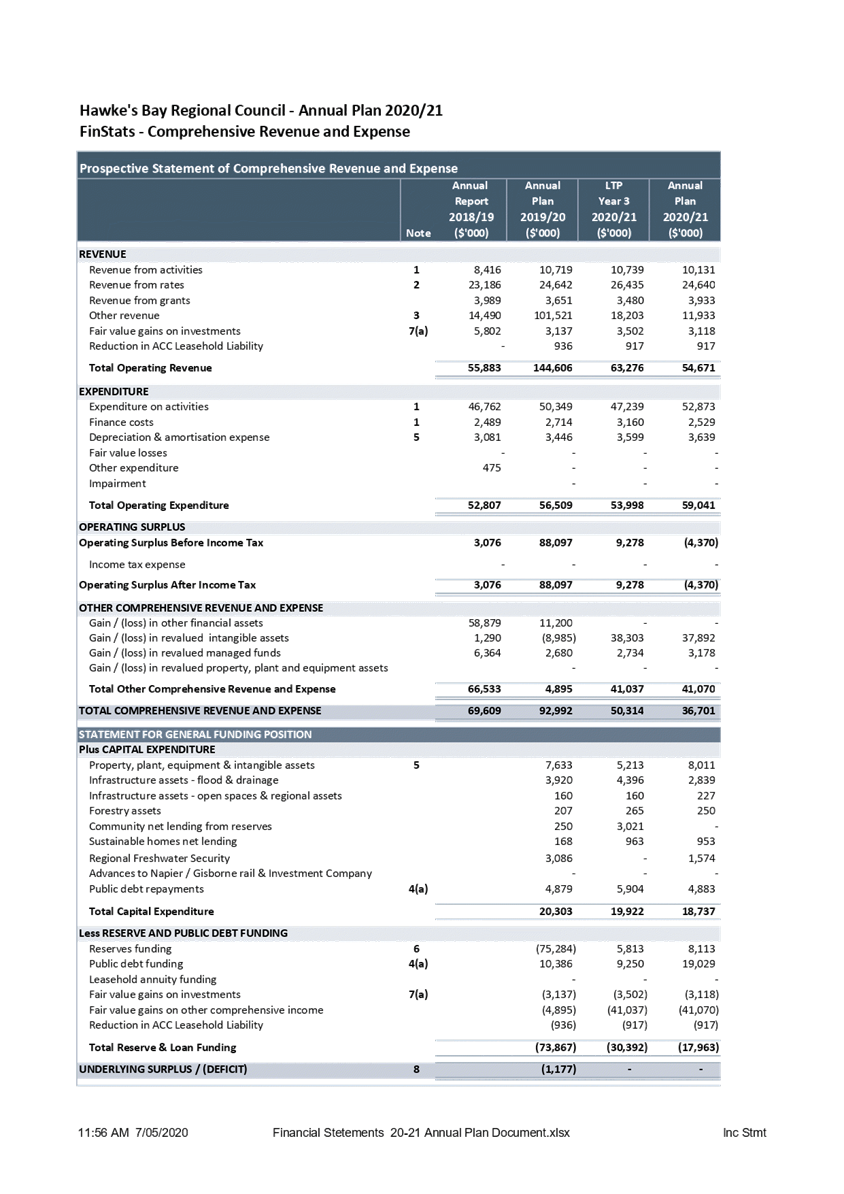

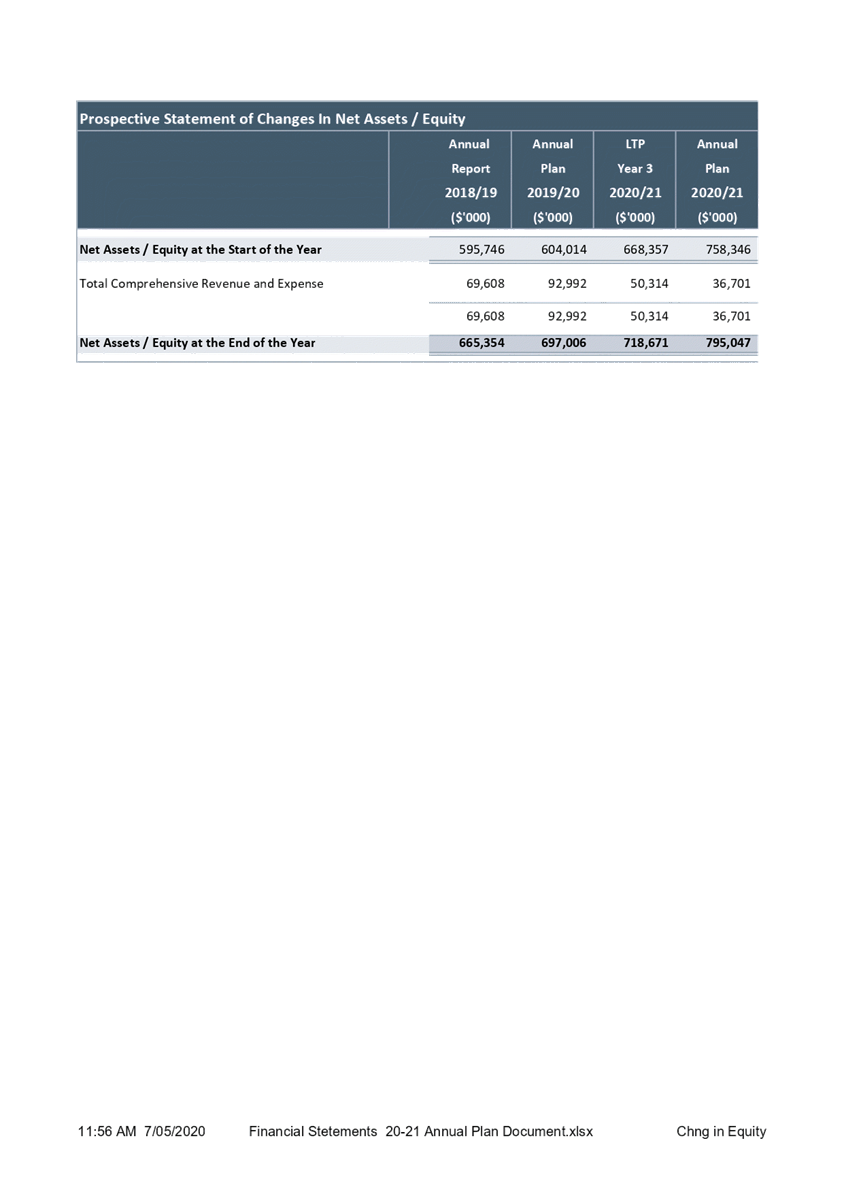

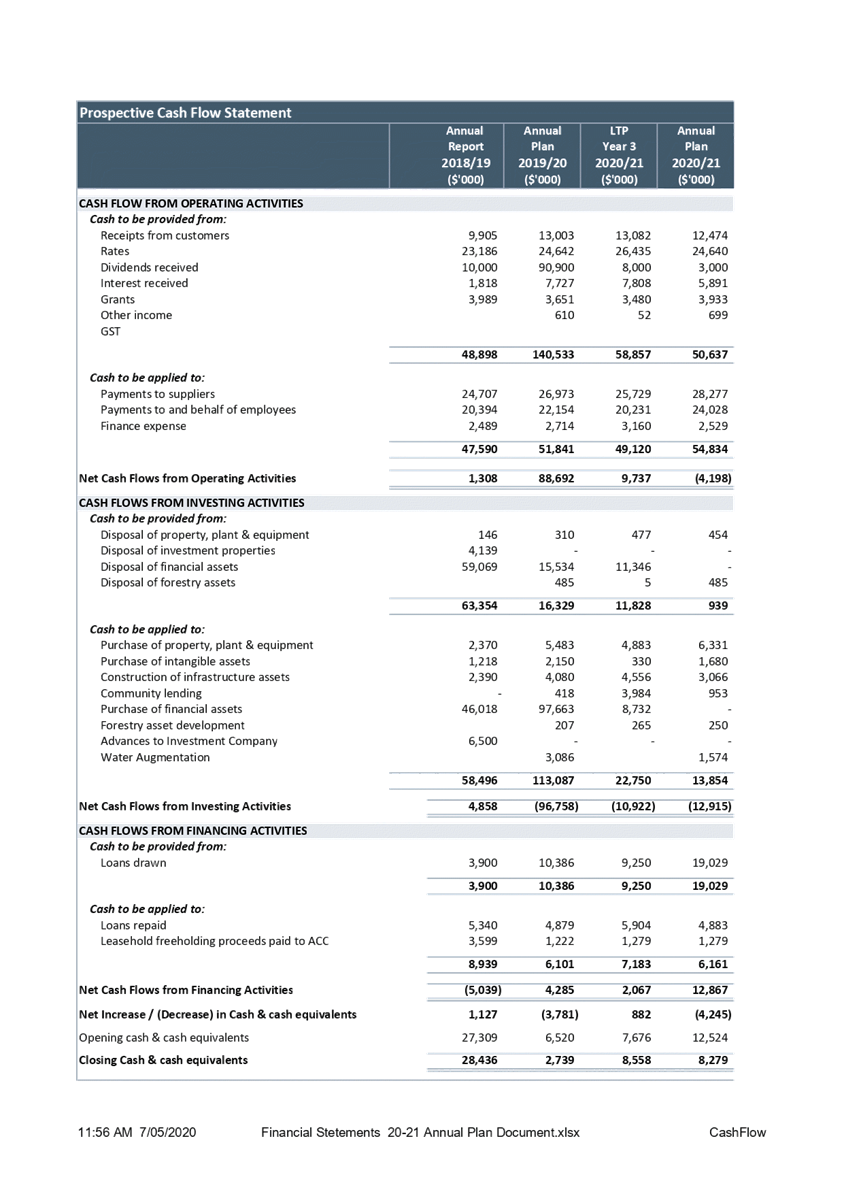

Prospective Statement of Comprehensive Revenue and Expense

|

|

|

|

Annual

|

LTP

|

Annual

|

|

|

|

Plan

|

Year 3

|

Plan

|

|

|

|

2019-20

|

2020-21

|

2020-21

|

|

|

Note

|

($'000)

|

($'000)

|

($'000)

|

|

CAPITAL

EXPENDITURE

|

|

|

|

|

|

Property, plant, equipment & intangible

assets

|

5

|

7,633

|

5,213

|

8,011

|

|

Infrastructure assets - flood &

drainage

|

|

3,920

|

4,396

|

2,839

|

|

Infrastructure assets - open spaces &

regional assets

|

|

160

|

160

|

227

|

|

Forestry assets

|

|

207

|

265

|

250

|

|

Community net lending from reserves

|

|

250

|

3,021

|

-

|

|

Sustainable homes net lending

|

|

168

|

963

|

953

|

|

Regional Freshwater Security

|

|

3,086

|

-

|

1,574

|

|

Advances to Napier / Gisborne rail &

Investment Company

|

|

-

|

-

|

-

|

|

Public debt repayments

|

4(a)

|

4,879

|

5,904

|

4,883

|

|

|

|

|

|

|

|

Total Capital Expenditure

|

|

20,303

|

19,922

|

18,737

|

|

NOTE 5 - Depreciation and Amortisation

|

|

|

|

Annual

|

Annual

|

LTP

|

Annual

|

|

|

|

Report

|

Plan

|

Year 3

|

Plan

|

|

|

|

2018-19

|

2019-20

|

2020-21

|

2020-21

|

|

|

|

($'000)

|

($'000)

|

($'000)

|

($'000)

|

|

|

|

|

|

|

|

|

Capital

Expenditure on Property, Plant & Equipment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Land and Buildings

|

|

224

|

-

|

3,000

|

3,223

|

|

Motor Vehicles and Plant

|

|

942

|

1,273

|

928

|

1,256

|

|

Science Equipment

|

|

544

|

3,138

|

597

|

972

|

|

Technical Equipment

|

|

95

|

177

|

23

|

23

|

|

Computer Equipment

|

|

278

|

870

|

310

|

733

|

|

Office Furniture and Equipment

|

|

267

|

25

|

25

|

124

|

|

Intangible Assets – Other

|

|

1,218

|

2,150

|

330

|

1,680

|

|

Capital Work in Progress

|

|

101

|

-

|

-

|

-

|

|

|

|

|

|

|

|

|

Total Capital Expenditure on Property,

Plant & Equipment

|

3,669

|

7,633

|

5,213

|

8,011

|

51. The above tables set out

the proposed Capital Expenditure in the 2020-21 Annual Plan. The key capital

projects and variances are following:

Property Plant & Equipment

(Note 5)

52. This includes a $2m

provision for as a place holder for long-term office accommodation.

53. Some minor building asset

renewal items totaling $223k have been identified and included in the budget.

This includes a security system upgrade, Council Chamber technology and meeting

table replacements.

54. Some additional items of

plant are proposed, mainly for Works operations.

55. In the LTP additional

funding for SKYTEM was incorrectly included in the operating budget.

$375k is included for 2020-21.

56. A more detailed needs

assessment has resulted in additional budgets being proposed for computer

equipment and intangibles (software).

56.1. The additional computer

equipment items include a backup\disaster recovery solution ($150k) and new

aerial photography ($250k)

56.2. A number of software

enhancements are proposed including a replacement Finance

System, Asset Management System & Electronic Document management System.

Infrastructure Assets –

Flood & Drainage

57. This mainly reflects

changes in the proposed timing for projects. $1.2m in asset renewal

projects have been deferred as has $400,000 for new works on the Heretaunga

Plains Flood Control Scheme.

58. Community Net Lending ($3m

in LTP) is the Erosion Control Scheme funding which has been reclassified as

operating expenditure.

59. The Regional Freshwater

Security Project was included in the LTP however it did not appear in the

summary of Capital expenditure. It was classified as Council acquiring an

investment in the LTP.

60. During 2020-21 a

disciplined approach will be taken to delivering the proposed capital

programme. Preference will be given to projects that will underpin the economic

recovery. Council does have the ability to modify and accelerate the capital

programme as long as the projects proposed are in the LTP.

Impact of

Borrowing to Fund the 2020-21 Revenue Shortfall

61. Borrowing to fund the

shortfall in 2020-21 will have an impact on future years.

62. In 2021-22, year 1 of the

2021-31 LTP, Council’s rates requirement, based on the preferred option

will be:

62.1. The proposed 2020-21

increase of 7.3%, plus

62.2. Any additional increase

needed to fund Councils operations in 2021-22, plus

62.3. The cost of servicing

and repaying the $7.58m loan raised in 2020-21

63. The overall impact on

rates in 2021-22, including the repayment of the funding for the shortfall in

non-rates revenue, would be $2.6m, which is an increase of 10.7%.

64. As 2021-22 is an LTP year

Council does have the opportunity to reset the proposed service levels and

consider options such as smoothing the impact, by phasing in the increases over

more than one year.

65. We expect that, based on

our cashflow forecast, we will not need to borrow for the 2020-21 shortfall of

$7.8m until the later part of the year. Therefore, no debt servicing costs have

been included in the 20-21 year.

Financial

Prudence Obligations under LGA 2002

66. Financial prudence and

impact of decision to budget for a deficit and to borrow to fund the 2020-21

budget deficit.

67. Council is planning to not

balance its budget in 2020-21 with an operating deficit of $4.37m forecast in

the statement of comprehensive income.

68. This means that Council is

not able to achieve the balanced budget benchmark (of 100%) for the 2020-21

financial year. The projected ratio is 92.6%. This means that Council’s

revenues are only 92.6% of the amount required to balance the budget.

69. In addition, Councils cash

deficit, which is proposed to be funded from additional borrowings, under the

conservative scenario, is $7.58m.

69.1. The impact of borrowing

to balance the budget in 2020-21 is that future ratepayers will be asked to pay

more. They will be asked to:

69.1.1. Repay the loan taken

out to fund the shortfall in 2020-21, plus

69.1.2. Step back up to the

level of rates that should have been charged, plus

69.1.3. Fund any projected

increase in the cost of delivering services between 2020-21 and 2021-22.

70. Council is able to set an

unbalanced budget for 2020-21 if it considers it financially prudent to do so

after considering:

70.1. section 101(1) and (2)

of the LGA 02, and

70.2. the matters stated in

section 100(2)(a) to (d) of the LGA 02.

HBRC Financial

Position and Ability to Debt Fund a Deficit in 2020-21

71. Raising additional debt

will not breach any of the debt affordability benchmarks nor the covenants in

the treasury policy. Council has enough headroom in terms of its ability to

raise additional debt.

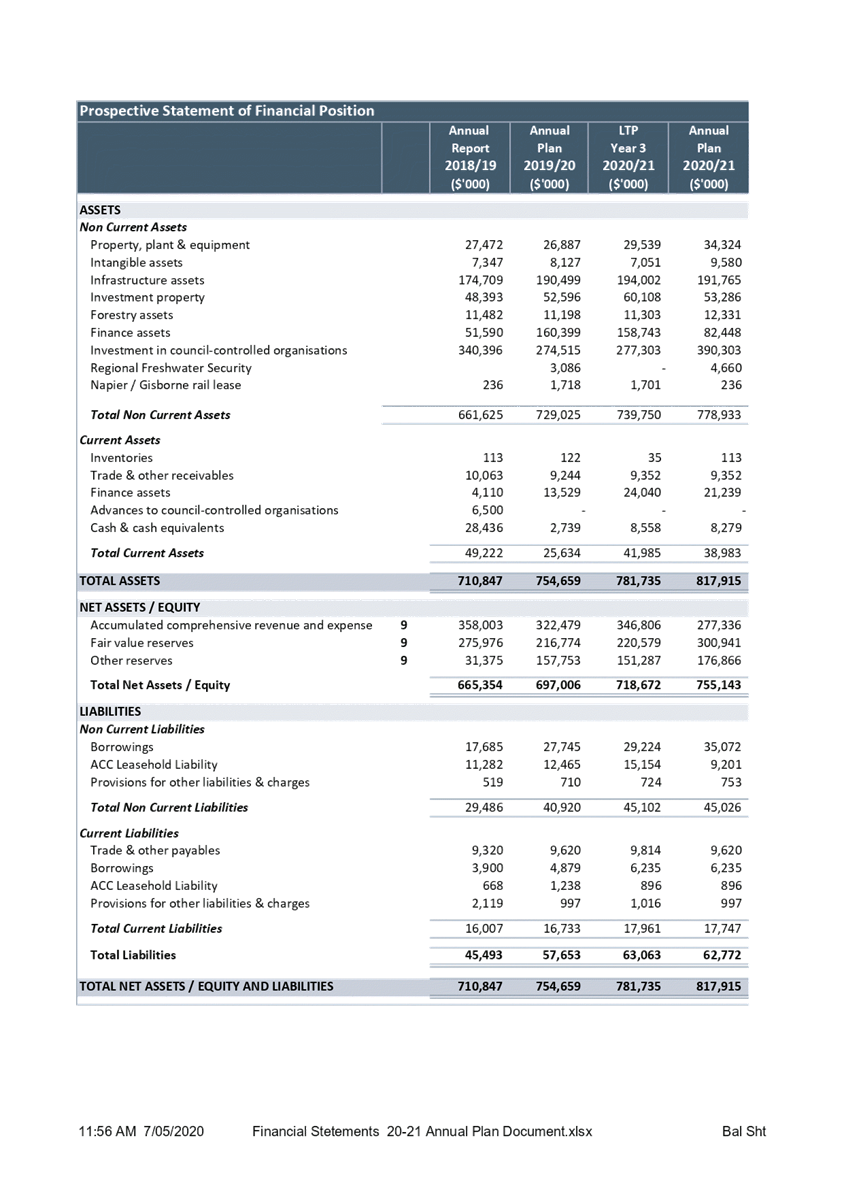

72. HBRC has significant

assets with large levels of investments that could be sold / divested and

converted into cash if required. The 2020-21 balance sheet projects that

Council will have investment assets of almost $500m:

72.1. Finance

Assets and cash totaling $109m

72.2. Investment

in HBRIC worth $390m comprising

72.2.1. Port

shareholding of $330m (at $3 per share)

72.2.2. HBRIC

managed funds invested of $60m.

72.3. This, plus relatively

low debt levels means that HBRC will have no trouble accessing funds to finance

its activities.

73. However, Council relies

heavily on investment returns to fund its activities and effectively subsidize

the amount collected from ratepayers.

73.1. Any

reduction in capital invested will have a cost.

73.2. For

example, further divestment of shareholding in Napier Port, or divestment of

invested funds would result in either the share of port dividend being reduced

or the return from managed funds will be reduced. (Note: We could not

reduce our shareholding of Napier Port, to less than 51%, without a special

consultation.)

73.3. This

means that any use of funds on an activity that does not deliver a return that

is at least equivalent to the current budgeted returns will result in an

additional cost that will in the longer term, need to be recovered from higher

rates.

73.4. This is

why the proposed funding of the projected budget deficit has been based on the

equivalent cost of borrowing and repaying a loan. This approach preserves

the current level of investments that Council relies on to fund services and

keep the level of rates down.

74. Officers recommend debt

funding particularly given the historically low cost of borrowing at the

present time.

Summary of Port

IPO Proceeds

75. Council

received $103.7m in net proceeds from the sell down in the port shareholding.

The following table shows the funds currently invested for the Long-Term

Investment Fund (ex RWSS) and Port Proceeds.

|

Description

|

Total Capital contributed

$

|

Value

31 Dec 2019

$

|

Value

31 March 2020

$

|

|

LTIF – HBRC

|

46,620,291

|

50,651,390

|

46,305,031

|

|

HBRIC (port Proceeds)

|

59,013,403

|

60,013,359

|

58,452,263

|

|

HBRC (Port Proceeds)

|

43,967,485

|

44,703,200

|

41,711,848

|

|

Total

|

149,601,179

|

155,367,949

|

146,469,142

|

76. These funds have been

invested in managed funds by HBRC and HBRIC as required by Council resolution.

Council resolved to place the funds into the Napier Port IPO Future Investment

Fund reserves. These funds are expected to deliver a 5% average annual return

in addition to growing by 2% per annum (to inflation adjust the capital base).

Difference

between the P & L and Cashflow position

77. The Statement of

Comprehensive Income presents the traditional P & L view which presents

both cash and non-cash transactions that impact on Council’s statement of

financial position (Balance sheet).

77.1. The statement of general

funding position, at the bottom of the Statement of Comprehensive Income links

the P & L view back to the funding view.

78. In addition, the statement

of cashflows, and the Funding Impact statement present Council with the true

view from a funding perspective – how much cash are we spending and where

does it come from.

What does a 0%

increase mean for HBRC ratepayers?

79. For every rate factor that

HBRC charges we are charging the same amount of rates as we did for the current

2019-20 year. However as rating unit circumstances (e.g. subdivision,

revaluation, building extensions) change the rates allocation changes for

individual properties.

80. In 2019-20 the HBRC ratepayer

base comprised a total 71,067 rating units:

80.1. 51,352 Urban properties

paying an average of $328.19 each ($16.853m in total)

80.2. 19,715 Rural properties

paying an average of $592.25 each ($11.676m in total)

81. Rates vary from property

to property based on the relative property value and as there are approximately

116 different rate factors this is a complicated calculation that affects

different properties in different ways. For example, the sample

properties in the 2019-20 Annual Plan show that while the sample properties on

the Napier Hill and in Havelock North were paying $336, a property in Flaxmere

was paying $142 and the sample properties in Wairoa and Central Hawkes Bay were

paying $135 and $146.

82. Regional Councils are

unique in that their ratepayers come from multiple district or territorial

councils. Each council has a different revaluation date which means that the

relative rateable values used for rating can vary widely relative to the

current market values. To ensure there is an even playing field with properties

in each territorial council treated equally a value equalization needs to occur

so that relativities are maintained.

83. Hastings District

properties were revalued in 2019 and the new property values must be applied in

the 2020-21 rating year. This means that changes in value between properties in

the Hastings District will mean that some properties will pay more, while

others pay less.

84. In addition, the value

equalization process can and does create fluctuations in the share of rates

paid by each territorial council area. This year, due to the equalization

process we are seeing Hastings District properties, as a group, paying more and

properties from the other council areas (Napier, Central Hawkes Bay and Wairoa)

paying less. In particular, the change is more significant for rates changed on

a land value basis where Hastings land values have increased by 26% compared to

only a 9% increase in Napier.

85. The following table shows

the movements in value based on the equalization certificate provided by QVNZ.

|

Movement in Equalised

Values 2018 to 2019

|

|

Council Area

|

No of

Assessments

|

Growth

in assessments

|

Capital

Value Movement

|

Land

Value Movement

|

|

Hastings

|

31,358

|

227

|

14.40%

|

26.20%

|

|

Napier

|

25,679

|

87

|

11.50%

|

9.00%

|

|

Central Hawkes Bay

|

7,498

|

114

|

16.00%

|

12.60%

|

|

Wairoa

|

6,657

|

6

|

18.30%

|

16.80%

|

|

Taupo

|

47

|

-

|

-10.70%

|

-11.00%

|

|

Rangitikei

|

22

|

-

|

3.60%

|

8.50%

|

|

Total

|

71,261

|

434

|

13.72%

|

18.24%

|

Rates Postponement and

Rates Remission Policies

86. The Council has existing

policies that apply to the remission or postponement of rates on rating units.

87. Under the legislation

there is a key difference between how policies for remission must be applied

compared to policies for postponement.

87.1. Where a property meets

the criteria for remission Council may grant a remission.

87.2. Where a property meets

the criteria for postponement Council must grant a postponement.

88. In addition, a remission

results in a permanent loss of income by Council (means other ratepayers pay

for the amount remitted). A postponement is just that, the date when the

rates must be paid is postponed but the rates still remain payable.

89. A general outline of what

Council has current rate remission policies for is:

89.1. Remission of Rates on Māori

Freehold Land – Where no occupier is receiving financial benefit from the

land.

89.2. Remission of Rates in

Special Circumstances – Provides flexibility where Council wishes to

grant remission to a rating unit(s) where remission is not able to be granted

under any other policy

89.3. Remission of Rate

Penalties – Provides some flexibility where payment has been missed and a

ratepayer pays the full rates or enters into a payment plan.

89.4. Remission of Rates for

Ratepayers Affected by Natural Calamity – For those experiencing financial

hardship where a natural calamity has affected the use or occupation of land.

89.5. Remission of UAGC

(Uniform Annual General Changes) – Where a ratepayer has several near

adjacent rating units and the statutory exemption does not apply or where a

developer holds multiple titles as part of an urban development.

90. Council currently has a

single policy that provides for the postponement of rates on a rating unit.

90.1. This applies in cases of

financial hardship or natural disaster. The Chief Executive has been delegated

the power to implement this policy.

91. As we move into uncertain

times for Council and our ratepayers, the important thing for Council is to

ensure it has in place policies on the remission or postponement of rates that

give Council the ability to respond to changes in the ability of ratepayers to

pay their rates.

92. The current policies do

appear to give Council an ability to respond where a ratepayer is experiencing

financial hardship.

92.1. The ability to grant a

remission in certain circumstance is a broad “catch all’”

policy where Council wishes to grant remission. The key to applying this policy

is to have clear criteria and to apply it consistently.

92.2. The postponement policy

applies where there is either financial hardship or a natural disaster.

92.3. Both require a ratepayer

to apply and both require an assessment of the ratepayer’s ability to

pay. Council does have the ability to define how rigorously any criteria are to

be applied.

93. The recommended mechanism

if Council wants to provide relief is through the rate postponement policy

where the payment of rates is deferred.

94. Officers recommend a paper

specifically reviewing the existing polices is prepared for Council discussion

at the 24 June 2020 Council meeting, any required amendments can therefore be

resolved on or before adoption of the annual plan.

PART 2:

Discussion for 27 May 2020 Meeting

Payment Dates

and Penalties

95. Staff have considered the

impact of the COVID-19 and the timing of the penalties that had been previously

adopted by Council to apply in the 2020-21 year. Following this analysis, the

following payment dates and penalty dates have been included within Funding

Impact Statement (attached):

95.1. The payment date for

2020-21 has been kept as 20 September as adopted by Council on 26 June 2019.

95.2. Penalties for

non-payment of the current rates invoice has been moved from 20 September back

to the 2019-20 date of 1 February 2021. This allows more time for ratepayers to

pay their rates or organise a payment plan with Rates Staff.

95.3. The key message to be

conveyed through communications following the adoption of the Annual Plan and

during the Rates process will be that Council will work with ratepayers in

setting up payment plans with consideration to individual circumstances.

95.4. Any ratepayers who have

agreed a payment plan / process with Council staff will not be charged

penalties.

95.5. Postponement of rates

payments could allow for payment over the 2020-21 rating year and beyond if

necessary.

96. Officers recommend this be

discussed in detail at the 24 June 2020 Council meeting as part of the

remissions / postponements policy review.

Annual

Plan Legislation Requirements and Consultation

97. The Regional Council had

not intended to consult on this year’s Annual Plan as our programmes of

work and budget were on track with our Long Term Plan until COVID-19 and the

drought. Changes to the Local Government Act in 2014 enabled councils to adopt

an Annual Plan without consultation unless there are significant or material

differences from the content of the Long Term Plan for the financial year to

which the proposed Annual Plan relates, of if the local authority chooses

to.

98. A change in the proposed

Rates Approach and establishing a Recovery Fund are significant and/ or

material changes to what was planned for year 3 of the Council’s 2018-28

LTP and therefore require consultation.

99. Consultation must give

effect to section 82 of the LGA. Additionally, a Local Government New Zealand

(LGNZ) and Society of Local Government Managers (SOLGM) Guidance Paper for

Covid-19 Local Government Response articulates that online engagement is

sensible, but consultation using only the internet is unlikely to be adequate

in terms of section 82. Councils should provide consultation information in

their usual ways except by any means which would breach COVID-19 lockdown

rules, or which are no longer available due to external constraints, i.e.

community newspapers no longer being published/delivered.

100. Councils should also consider

alternatives to the internet, such as:

100.1. using local radio stations to raise

awareness and provide information about engagement and participation

opportunities;

100.2. options for contacting people by

telephone and enabling telephone submissions;

100.3. household mailouts and/or special

deliveries of printed documents under certain circumstances; and

100.4. accepting and processing hard copy

submissions by post with reference to advice from health authorities.

101. Section 82 does not specify a

required period for consultation, however advice sought by the Regional Council

advises that three weeks is appropriate for the proposed consultation. We are

also advised that the variances do not trigger the need to amend our Long Term

Plan, which would require a special consultative procedure.

102. As provided for in section 97 the

triggers for a LTP amendment are:

102.1. A decision to significantly alter

the intended level of service provision for any significant activity undertaken

by or on behalf of the local authority, including a decision to commence or

cease any such activity, or a decision to transfer the ownership or control of

a strategic asset to or from the local authority, unless the decision is

explicitly provided for in the Long Term Plan and the proposal was consulted on

in a LTP consultation document.

103. Officers consider the planned

consultation process meets the requirements of section 82 of the LGA 2002, the

topics do not require an amendment to the LTP, the process gives effect to the

guidance provided by LGNZ and SOLGM, and legal advice sought independently by

Hawke’s Bay Regional Council.

104. The timeline for consultation is:

|

8 June 2020

|

Consultation opens

|

|

28 June 2020

|

Consultation closes

|

|

15 July 2020

|

Hearing and deliberations

|

|

29 July 2020

|

Council adopts Annual

Plan

(COVID-19 guidance may

affect the way we hear submissions).

|

105. People will be able to make

submissions to the Regional Council in the following ways: online, email, the

Council’s facebook page, text, voicemail, and hardcopy submission. The

intention is also to make submission forms available at our offices (Napier,

Taradale, Waipawa and Wairoa) and at the region’s libraries – which

are open under COVID-19 Alert Level 2 guidance.

106. A communications plan has been

prepared and will be circulated prior to, and presented for feedback on 27 May.

This outlines the tools that will be used to inform people that consultation is

taking place and advise people how they can have their say. Due to COVID-19, the

plan is geared toward digital rather than physical engagement. Two digital

public meetings are planned for June, through Facebook Live using Zoom, giving

people the opportunity to ask questions about the proposals in the consultation

document. These will be attended by Council’s Chief Executive, Chair and

Councillors.

107. The key messages in the communication

plan are:

107.1. Hawke’s Bay people have been

personally and financially affected by COVID-19 and the drought

107.2. People facing hardship may need

extra support this year

107.3. We intend to maximise leveraging

external funding to support the regional recovery and accelerate projects

107.4. Have your say on this year’s

rates and a recovery fund by 28 June.

Consultation

Document

108. The consultation document is an

exceptions document and focuses on the key proposed variances to year 3 of the

2018-28 LTP. It therefore should be read in conjunction with the LTP.

109. Section 95A of the LGA 2002 sets out

the purpose and content requirements for the consultation document. Officers

consider that the proposed draft consultation document meets the requirements

of the Act. Section 95A(4) requires Council to adopt the supporting information

before its adopts the consultation document. This is reflected in the order of

the recommendations in this report.

110. The consultation document and

supporting information will be made available on Council’s website. The

intention is to also make these available to the public at Regional Council

offices and at the region’s libraries - which are open under COVID-19

Alert Level 2 guidance.

Options Assessment

111. Council can either adopt the

consultation document and supporting information today requesting minor

changes, or request substantial changes if it believes the consultation

document does not meet the needs of Council or the community. Not adopting at

this meeting could further delay adoption of the draft Annual Plan.

|

Option 1: Adopt the consultation document and

supporting information today, agreeing on small changes if required

|

|

Advantages:

|

· Meets the requirements of the

LGA 2002.

· Consultation can begin as

scheduled and the process can remain on track for the new proposed adoption

date of 29 July 2020.

|

|

Disadvantages:

|

None

|

|

Option 2: Do not adopt the consultation document and

supporting information today, and/or request substantial changes

|

|

Advantages:

|

Council can

direct officers to make changes if Council believes the consultation document

does not meet its needs or the needs of the community.

|

|

Disadvantages:

|

Substantive

changes could further delay the adoption date of the draft Annual Plan. Any

delay in the adoption of the Annual Plan would mean that invoicing of this

year’s rates could be delayed or require 2 invoices to be raised based

on the requirement.

|

Significance and Engagement Policy Assessment

112. Council officers have determined that

the changes proposed to the Annual Plan are significantly and/or materially

different from what was forecast for year 3 of the 2018-28 Long Term Plan.

Council is therefore required to consult in accordance with section 82 of the

LGA 2002. The decisions sought in this paper are to initiate the consultation.

Considerations of Tangata Whenua

113. As stated earlier on this report

Regional Council is working with PSGEs, other councils, business and central

government through the Matariki Regional Economic and Social Development

vehicle to develop a regional recovery plan of which the proposed Recovery Fund

is intended to make a contribution.

114. Given forecasts that Māori will

be disproportionately affected by the recession, it is Regional Council’s

intention to work with tāngata whenua on opportunities for Māori

employment.

Financial and Resource Implications

115. The cost to implement the

communications plan for community consultation is estimated at $46,045 + GST.

The most significant cost is the postcard drop to all ratepayer mailboxes at

$34,275. A physical postcard delivered to every ratepayer satisfies the intent

to reasonably consult with our community, who may not otherwise be reached by

digital, print and radio advertising

116. It also helps to give effect to

advice from LGNZ and SOLGM that consultation using the internet only is

unlikely to be adequate and alternative options should be considered. A

household mailout was one of the alternatives recommended for consideration,

the alternate option of a postcard provides significant cost savings.

Decision Making Process

117. The Local Government Act 2002,

section 82(a)(3) sets out the consultation required for an Annual Plan and

states that a Consultation Document is required where there are significant or

material differences between the proposed Annual Plan and the content of the

LTP for the financial year to which the Annual Plan relates.

118. Council has determined that there are

some material and significant issues and these are covered in the Consultation

Document prepared for the special consultative procedure.

|

Recommendations

That

Hawke’s Bay Regional Council:

1. Receives and considers the “Adoption of 2020-21 Annual Plan

Consultation Document and Supporting Information” staff report.

2. Adopts the following supporting

information and, as amended at this meeting, to the 2020-21 Annual Plan and

Consultation Document:

2.1. Financial Statements

2.2. Draft 2020-21 Funding Impact Statement including sample rates for

specific properties

2.3. Group of Activity proposed performance measures

3. Adopts the

Consultation Document for the 2020-21 Annual Plan, incorporating any

amendments made at the 27 May 2020 Regional Council meeting.

4. Agrees that

the Chief Executive and Group Manager Corporate Services are delegated to

approve any minor amendments and edits required to the supporting information

and the consultation document prior to publication for consultation.

|

Authored by:

|

Drew Broadley

Community Engagement and Communications

Manager

|

Ross Franklin

Contractor, Finance

|

|

Mandy Sharpe

Project Manager

|

Bronda Smith

Chief Financial Officer

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

⇩1

|

Financial

Statements for the Draft 2020-21 Annual Plan

|

|

|

|

⇩2

|

Draft 2020-21

Funding Impact Statement

|

|

|

|

⇩3

|

Council

Activities

|

|

|

|

⇩4

|

Draft

Consultation Document

|

|

|

|

⇩5

|

HBRC

Climate.Smart.Recovery. Presentation

|

|

|