Meeting of the Corporate and Strategic Committee

Date: Wednesday 11 March 2020

Time: 1.00pm

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

Item Subject Page

1. Welcome/Notices/Apologies

2. Conflict

of Interest Declarations

3. Call for Minor

Items Not on the Agenda 3

Decision Items

4. Report

and Recommendations from the Finance Audit and Risk Sub-committee 5

5. Investment

Strategy Workshop Follow-up including Statement of Investment Policy Objectives

Review 53

6. Remission

of Penalties on Rates Policy (Fixed Term) Statement of Proposal for

Consultation 83

7. HBRC

2020 Local Governance Statement 93

8. Regional

Water Security 105

9. Strategic

Bi-lateral Arrangements 115

10. HBRC

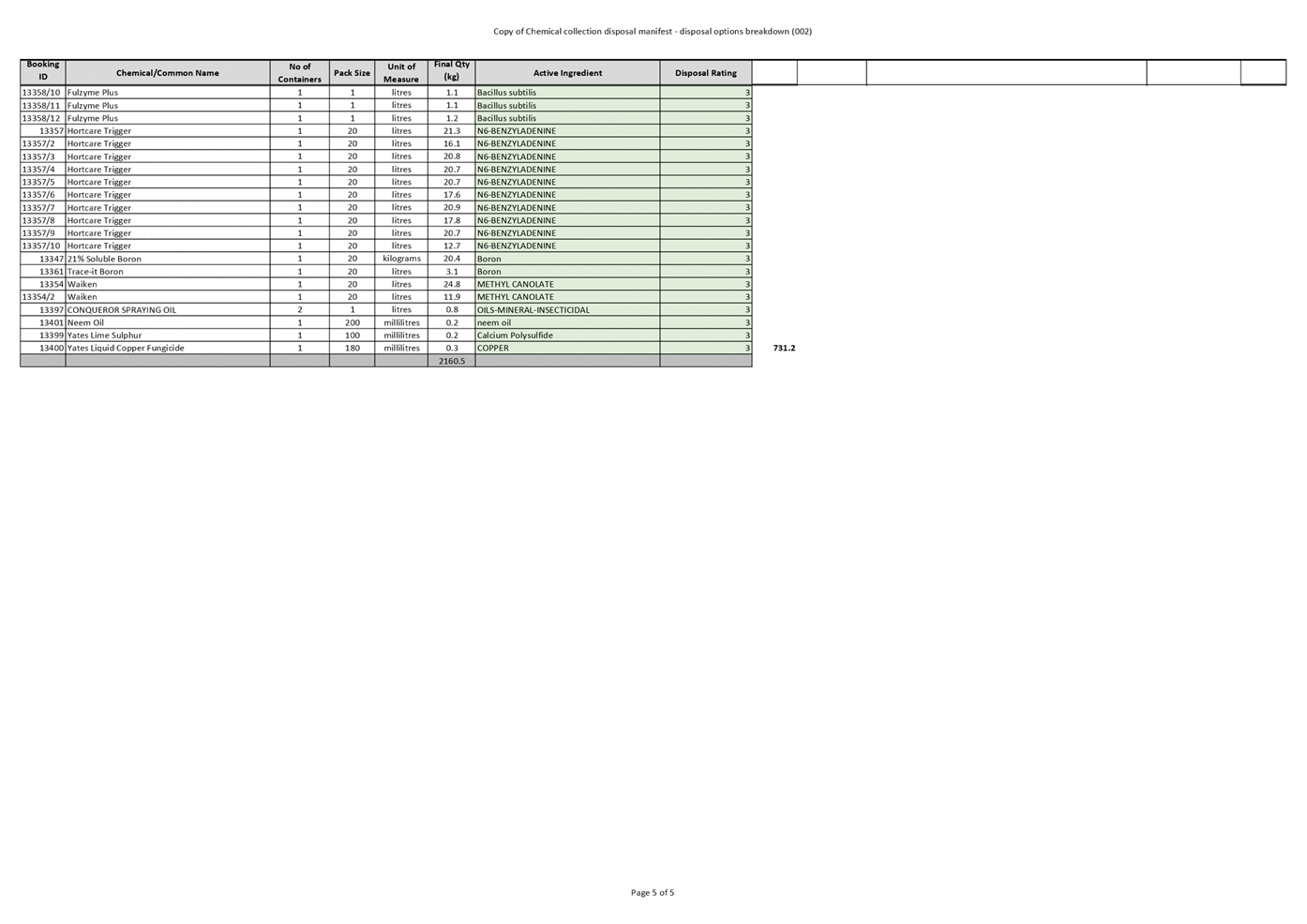

Agrichemical Collection Service Funding 119

Information or Performance Monitoring

11. National

Environment Standards for Plantation Forestry Update 129

12. Organisational

Performance for period to 31 December 2019 133

13. Financial

Results for the 2019-20 Financial Year, for the Period to 31 December 2019 213

14. HB

Tourism Quarterly Update 225

15. 3.30pm

- Jarden Investment Fund Manager Introduction & Presentation 239

16. Discussion

of Minor Matters Not on the Agenda 259

Decision Items (Public Excluded)

17. Proposed

Wellington Leasehold Property Sale 261

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 11 March 2020

Subject: Call for Minor Items

Not on the Agenda

Reason

for Report

1. This item provides the means for committee members to raise minor

matters they wish to bring to the attention of the meeting.

2. Hawke’s Bay Regional Council standing order 9.13

states:

2.1. “A

meeting may discuss an item that is not on the agenda only if it is a minor

matter relating to the general business of the meeting and the Chairperson

explains at the beginning of the public part of the meeting that the item will

be discussed. However, the meeting may not make a resolution, decision or

recommendation about the item, except to refer it to a subsequent meeting for

further discussion.”

Recommendations

3. That the Corporate and Strategic Committee accepts the following

“Minor Items Not on the

Agenda” for discussion as Item 16:

|

Leeanne Hooper

GOVERNANCE LEAD

|

James Palmer

CHIEF EXECUTIVE

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 11 March 2020

Subject: Report and

Recommendations from the Finance Audit and Risk Sub-committee

Reason

for Report

1. The following

matters were considered by the Finance Audit and Risk Sub-committee (FARS)

meeting on 12 February 2020 and subsequently at a workshop with staff and the

Internal Auditor, Crowe, and are now presented for the Committee’s

consideration, alongside any additional commentary the

Sub-committee Chair wishes to offer.

Confirmation of the Terms of Reference

for the FARS

2. This item was taken as read and the Terms of Reference confirmed as

proposed.

Confirmation of the Sub-committee Work

Programme

3. This item provided the opportunity for the sub-committee to

influence, in light of its confirmed Terms of Reference, the work programme for

the remainder of the 2019-22 triennium. Extensive discussions traversed

internal and external audit, potential section 17a activity and Risk Management

framework reviews, and internal processes and controls

to manage financial proposals for investment or funding

requests. Following discussions it was agreed that staff will create an Audit

Action list, as a live document that tracks progress against internal audit

recommendations, and the Sub-committee resolved:

3.1. Agrees that the work programme for the Sub-committee will be

developed through workshops ahead of confirming the schedule of work and budget

allocations at the 13 May FARS meeting, and that in the meantime Internal

Audits agreed in August 2019 will be scoped and/or carried out as planned.

3.2. The internal audits agreed were:

3.2.1. Water

Management follow-up

3.2.2. Asset

Management

3.2.3. Risk

Management.

4. After further

discussions at a workshop on 3 March 2020, the following actions were

proposed. The minutes from the workshop are included with this paper.

4.1. To confirm

the asset management audit, which had been previously scheduled for the 2019-20

audit programme, would be delayed. There is already a review underway by

Waugh Infrastructure so any audit would have more value later. It was

felt more useful to carry out a review on the Water Management follow-up audit

agreed in May 2019. This would be in the form of a recap and closure of

the audit recommendations and management actions in response with the intention

to a future audit once Three Waters legislation and regulation is in

effect.

4.2. In addition

to the inclusion of the Water Management follow-up, any other audit actions

could be included in this piece of work. This will ensure that any

outstanding actions are addressed. The scope for this review is attached for

the Committee’s consideration.

4.3. To seek

confirmation from C&S to the Risk Management review scope (attached). The

scope of the risk management review will include how

risks are identified from across the business.

4.4. The 2020-2021

audit programme to include “Staff attraction/retention and

welfare”, as well as Council’s grants process.

5. Cyber security

internal audit progress on management actions to be reported to FARS.

6. The audit

review on eels management and gantry/lifting equipment processes to be carried

out but will sit outside the scheduled ‘internal audit’ umbrella.

Risk Assessment and Management

7. This item provided the Sub-committee with

the six-monthly review of the risks that Council is exposed to and the

mitigation actions in place to manage Council’s risk profile.

8. Following

discussions about CDEM staff training, initiatives to attract

and retain suitably qualified staff, IT failure, and the organisation’s preparedness in response to

the corona virus, the Sub-committee resolution was:

8.1. Advises staff

of the specific risks (following) that require reassessment to confirm the

level of risk is accurate and internal controls are adequate, for reporting

back to the 13 May 2020 Sub-committee meeting.

8.1.1. ORG002:

Ability to retain and attract appropriately skilled staff

8.1.2. CORP001:

ICT Failure - Business Wide.

Introduction to Council’s Audit NZ

Auditor

9. The

Sub-committee was introduced to Council’s appointed Auditor, Karen Young, who outlined Audit NZ’s role and how her

engagement with Council will occur.

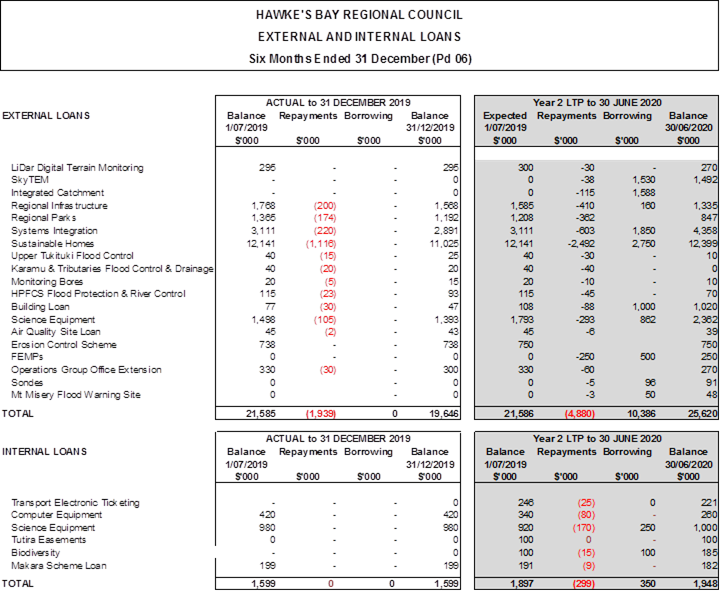

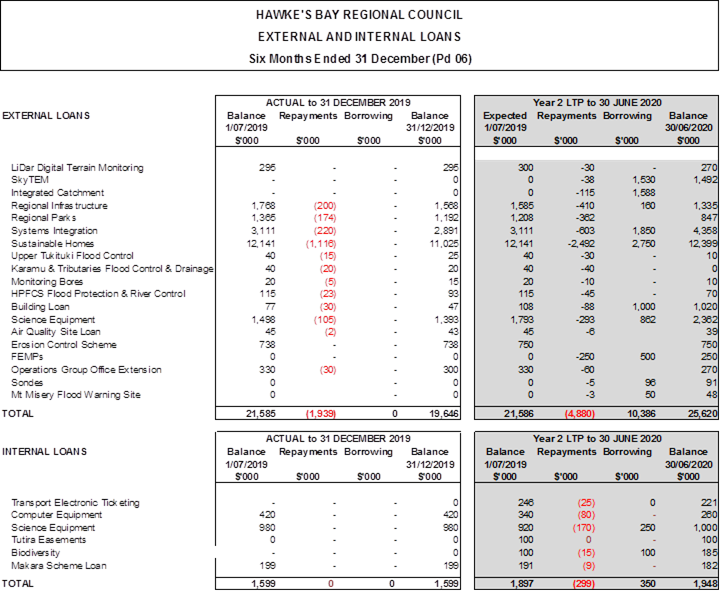

Treasury Report for Period to 31

December 2019

10. This agenda item provided an update on the compliance monitoring of treasury activity and the

performance of Council’s diversified investment portfolios, as presented

by PwC. Discussions traversed the establishment of

council’s current management and reporting framework including the review

and updating of the Treasury Policy, SIPO (reviewed annually), and design of

the Treasury report, Portfolio returns and ethical investments; with the

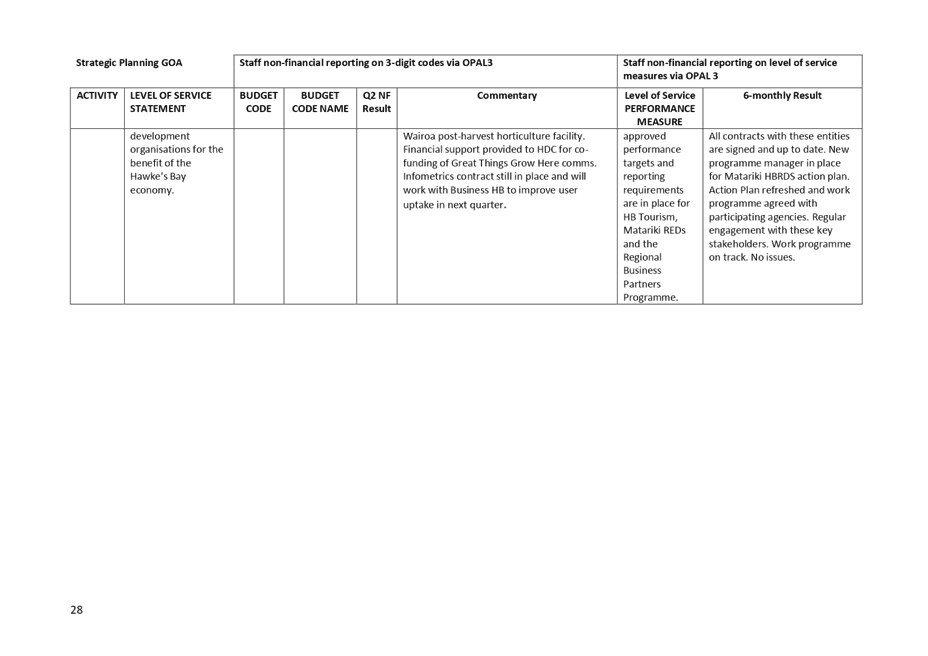

Sub-committee resolution being:

10.1. That

the Finance, Audit and Risk Sub-committee receives and notes the “Treasury

Report for period to 31 December 2019” staff report and that

recommended amendments to the SIPO be provided to the 11 March 2020 Corporate

and Strategic Committee meeting for adoption

Business Continuance Plan

11. This agenda item provided

the Sub-committee with the updated Business Continuance Plan, completed in

response to a series of recommendations from the 2018 independent

review undertaken by Kestrel Group. The item also

provided an update on the ongoing process staff are undertaking to address

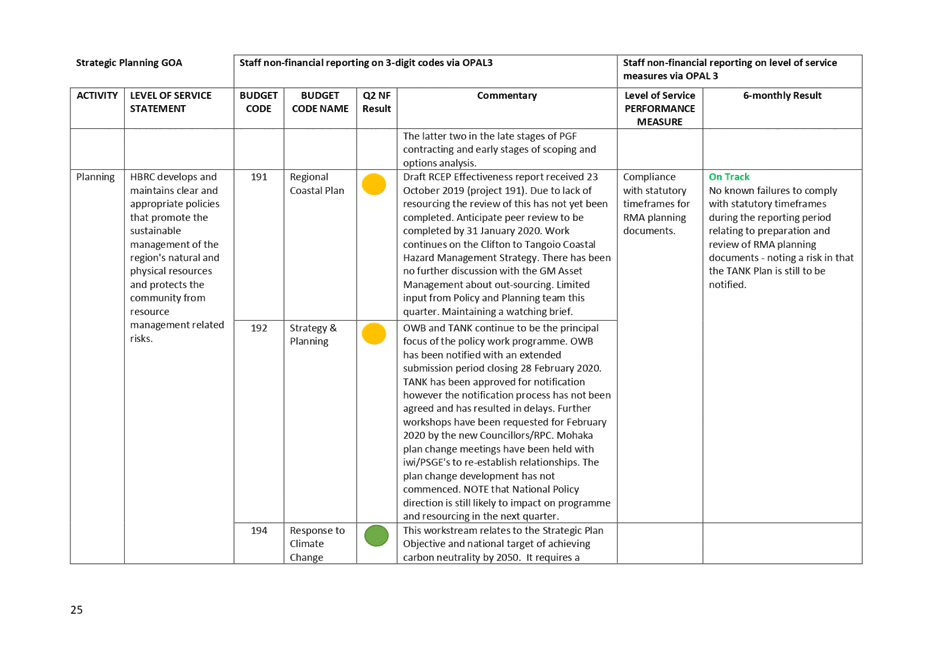

outstanding issues identified through the review.

Cyber Security Internal Audit

12. The item

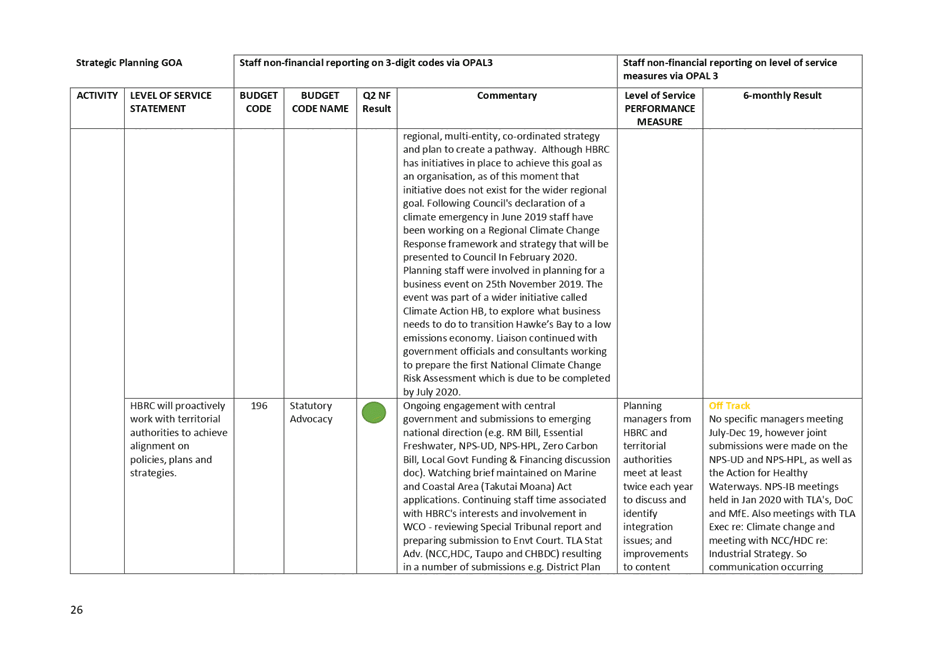

provided the report on the Cyber Security internal audit undertaken by Crowe

Horwath, including descriptions of management actions that have been undertaken

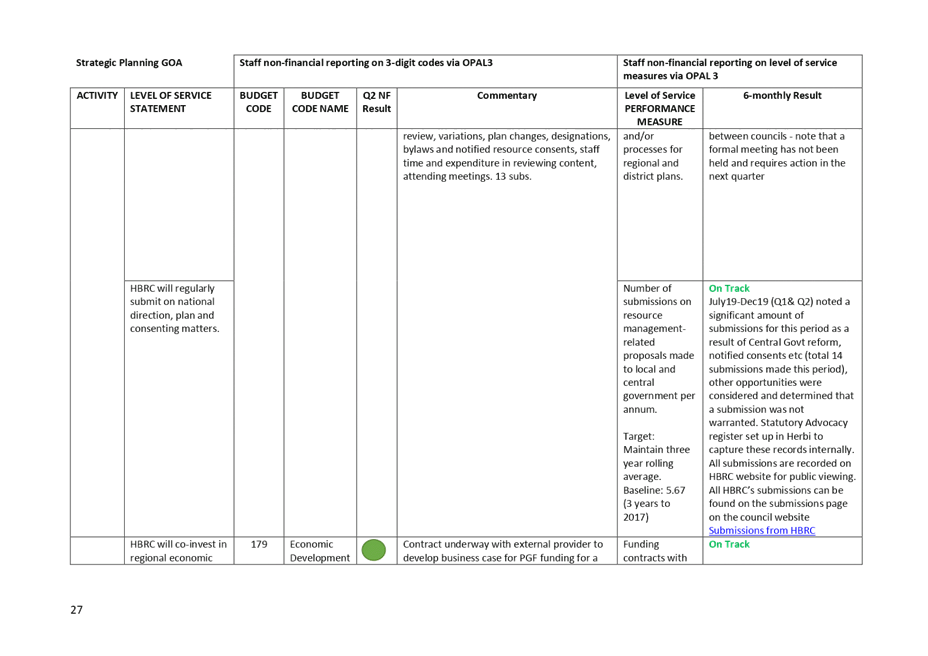

or that are planned for the future in response to the report’s findings

and recommendations. The resolution of the Sub-committee was:

12.1. That

the Finance, Audit & Risk Sub-Committee Committee receives and notes the “Cyber

Security Internal Audit” staff report and requests that staff report

back to the May FARS meeting on progress on management

actions that have been undertaken to respond to the

issues identified and recommendations made in the Crowe

Horwath Cyber Security internal

audit report.

Procurement Policy and

Procurement Manual Update

13. This agenda item was not

considered by the FARS, and deferred to the 13 May 2020 meeting.

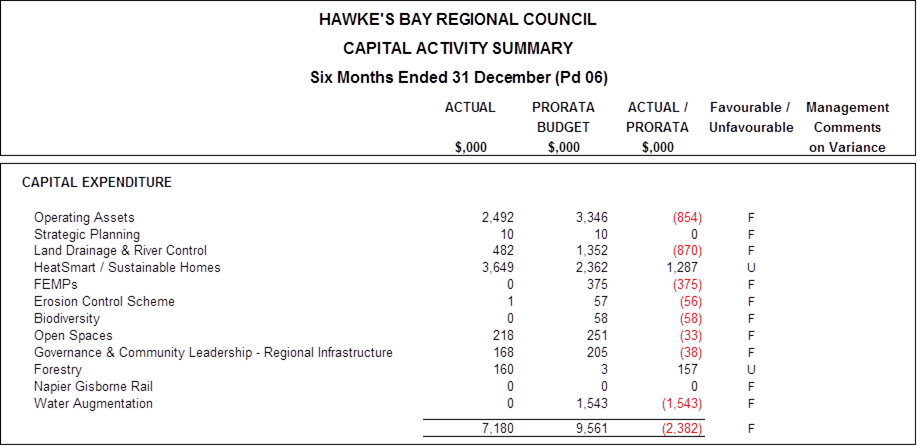

Financial Results for the Period to 31

December 2019

14. This agenda item was not

considered by the FARS, and deferred to the 11 March 2020 meeting of the

Corporate and Strategic Committee.

Decision

Making Process

15. These

items were specifically considered by the Finance, Audit and Risk Sub-committee

on 12 February 2020 and are now the subject of the following recommendations to

the Corporate and Strategic Committee.

|

Recommendations

The Finance,

Audit and Risk Sub-committee recommends that the Corporate and Strategic

Committee:

1. Receives and

notes the “Report and Recommendations from the 12 February

2020 Finance, Audit and Risk Sub-committee Meeting”

2. Agrees that

the decisions to be made are not significant under the criteria contained in

Council’s adopted Significance and Engagement Policy, and that the

Committee can exercise its discretion and make decisions on these items

without conferring directly with the community or persons likely to have an

interest in them.

Confirmation of the Terms

of Reference for the Finance, Audit and Risk Sub-committee

3. Recommends

that Hawke’s Bay Regional Council adopts the Terms of Reference

(attached) as proposed to and confirmed by the 12 February 2020 Finance,

Audit and Risk Sub-committee meeting.

Confirmation of the

Sub-committee Work Programme

4. Agrees the proposed audit scopes (attached) for the 2019/20 Risk

Management Review and the Review of the Follow-up for Water Management and

other previous internal audits incorporating any agreed amendments, being:

4.1. ...

4.2. …

4.3. …

Noting that this would normally occur at

Finance, Audit & Risk Sub-Committee meetings, however, in order to

progress this work within the Calendar year, it is requested that at the

Corporate and Strategic Committee meeting provide feedback and approval.

Risk

Assessment and Management

5. Recommends

that the Corporate and Strategic Committee receives and notes the resolutions

of the Sub-committee, including the specific risks that require reassessment;

being:

5.1. ORG002: Ability to retain and

attract appropriately skilled staff

5.2. CORP001: ICT Failure - Business Wide.

Reports

Received

6. Notes that the following reports were provided to the Finance

Audit and Risk Sub-committee.

6.1. Introduction to Council’s Audit NZ Auditor

6.2. Confirmation of the Sub-committee Work Programme (resolved:

Agrees that the work

programme for the Sub-committee will be developed through workshops ahead of

confirming the schedule of work and budget allocations at the 13 May

2019 FARS meeting, and that in the meantime Internal Audits agreed in August

2019 will be scoped and/or carried out as planned.)

6.3. Treasury Report for Period to 31 December 2019 (resolved:

receives and notes

the “Treasury Report for period to 31 December 2019” staff report

and that recommended amendments to the SIPO be provided to the 11 March 2020

Corporate and Strategic Committee meeting for adoption.)

6.4. Business Continuity Plan (resolved: receives and accepts the

“Business Continuity Plan” staff report and associated plan)

6.5. Cyber Security Internal Audit (resolved: receives and notes the “Cyber

Security Internal Audit” staff report and requests that staff report

back to the May FARS meeting on progress on management actions that have been undertaken to respond to the issues identified and

recommendations made in the Crowe Horwath

Cyber Security

internal audit report.).

|

Authored by:

|

Leeanne

Hooper

Governance Lead

|

Joanne

Lawrence

Group Manager Office of the Chief Executive

and Chair

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

James Palmer

Chief Executive

|

Attachment/s

|

⇩1

|

3 March 2020

Finance, Audit and Risk Sub-Committee Workshop notes

|

|

|

|

⇩2

|

Scope of HBRC

2020 Risk Managment Review

|

|

|

|

⇩3

|

Scope of HBRC

2020 Follow Up Review

|

|

|

|

⇩4

|

Proposed

Terms of Reference for the Finance, Audit & Risk Sub-committee

|

|

|

|

⇩5

|

HBRC Treasury

Reporting December 2019

|

|

|

|

3

March 2020 Finance, Audit and Risk Sub-Committee Workshop notes

|

Attachment 1

|

|

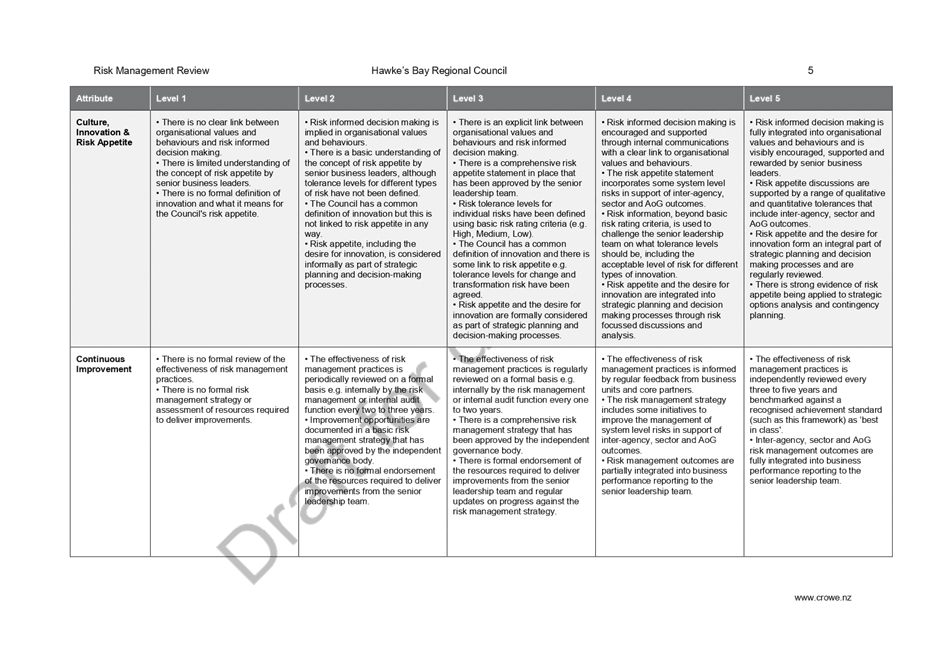

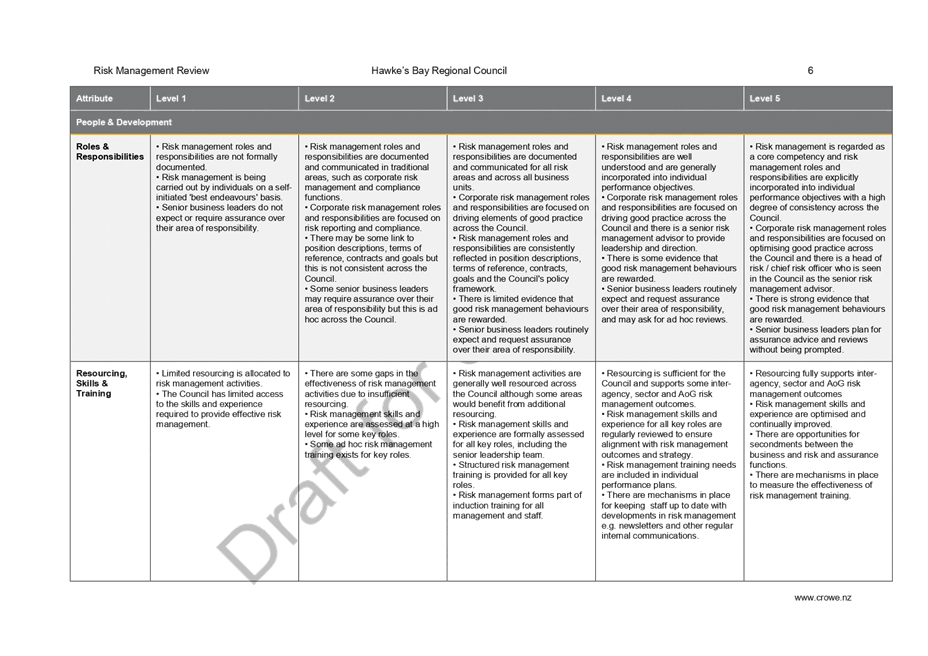

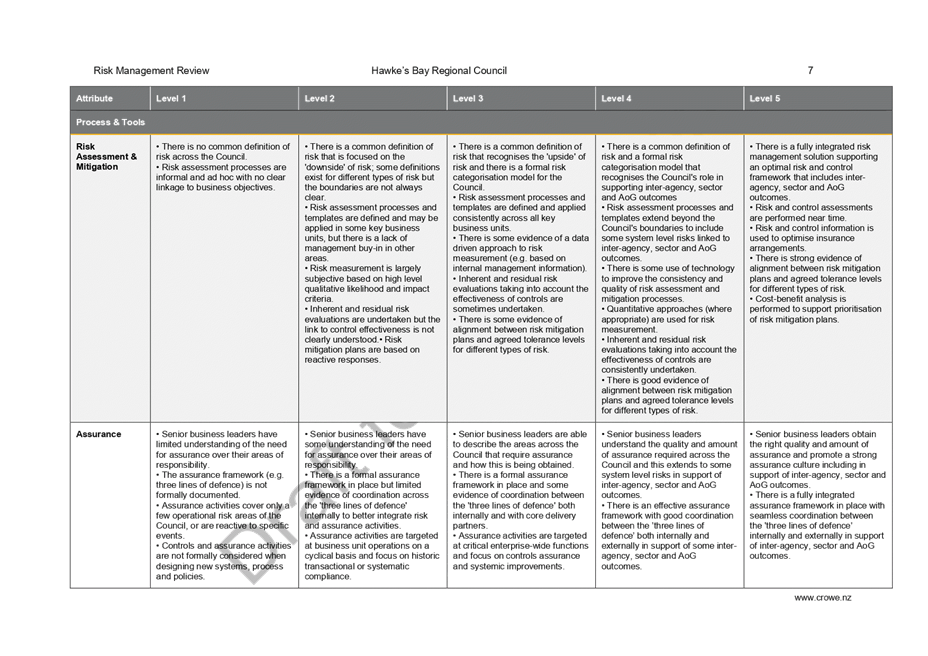

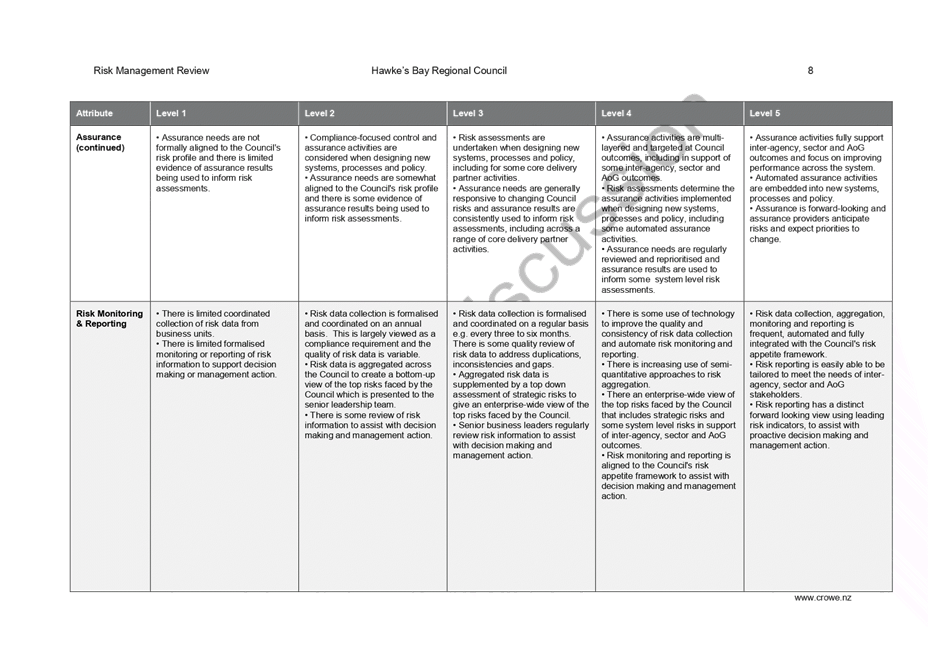

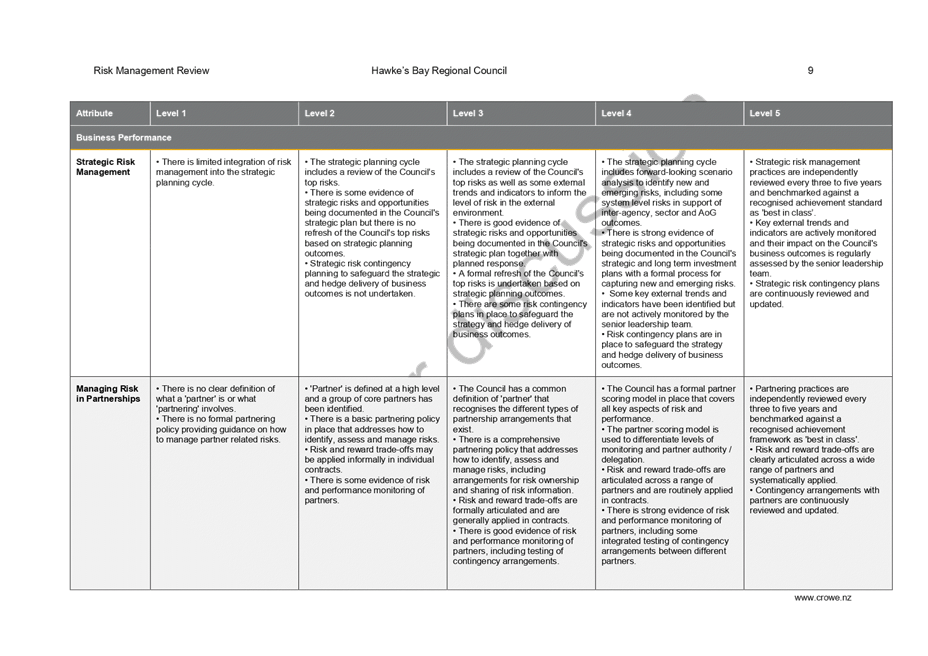

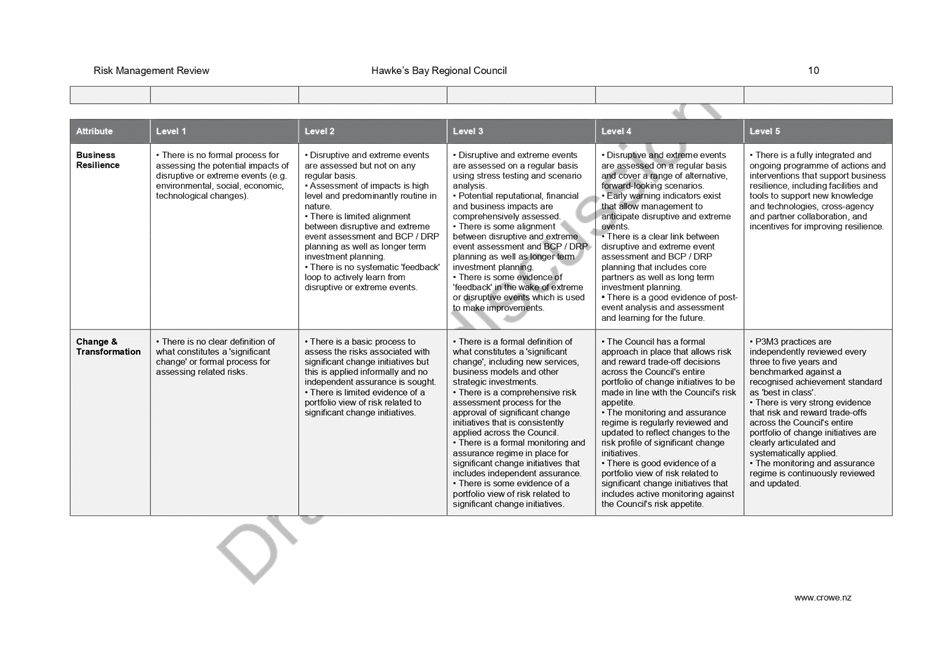

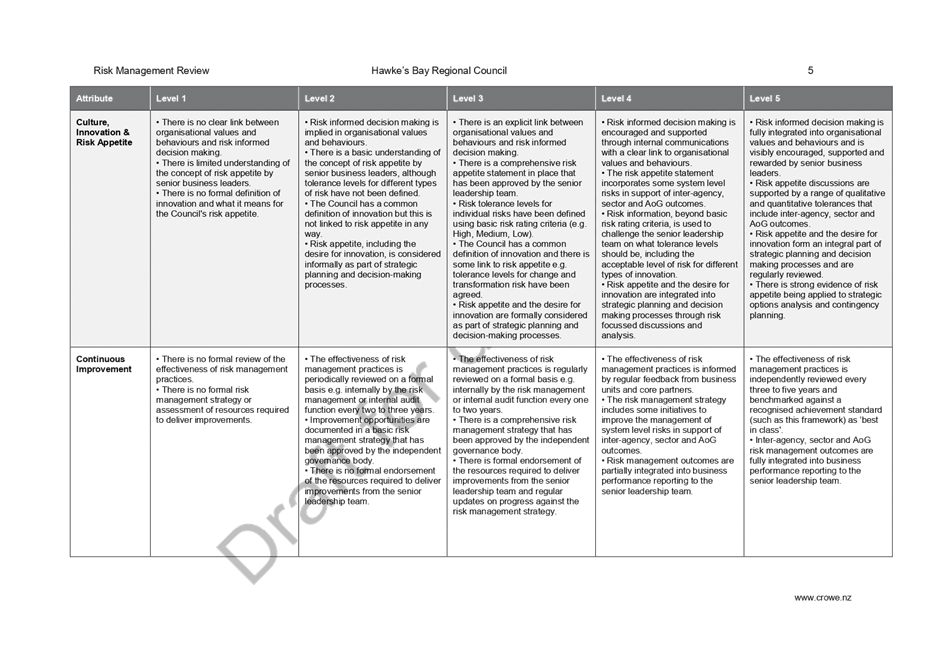

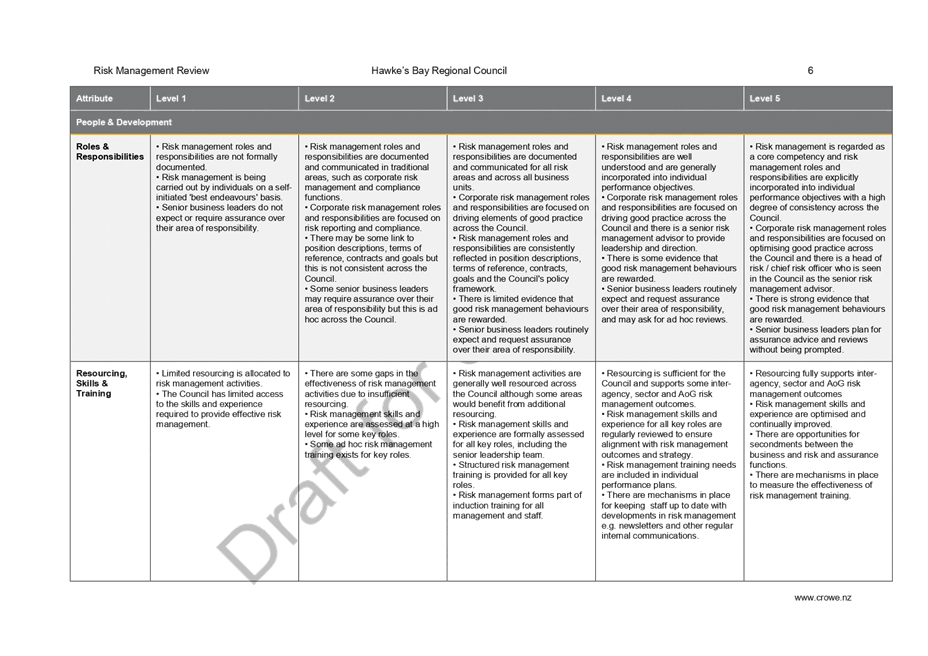

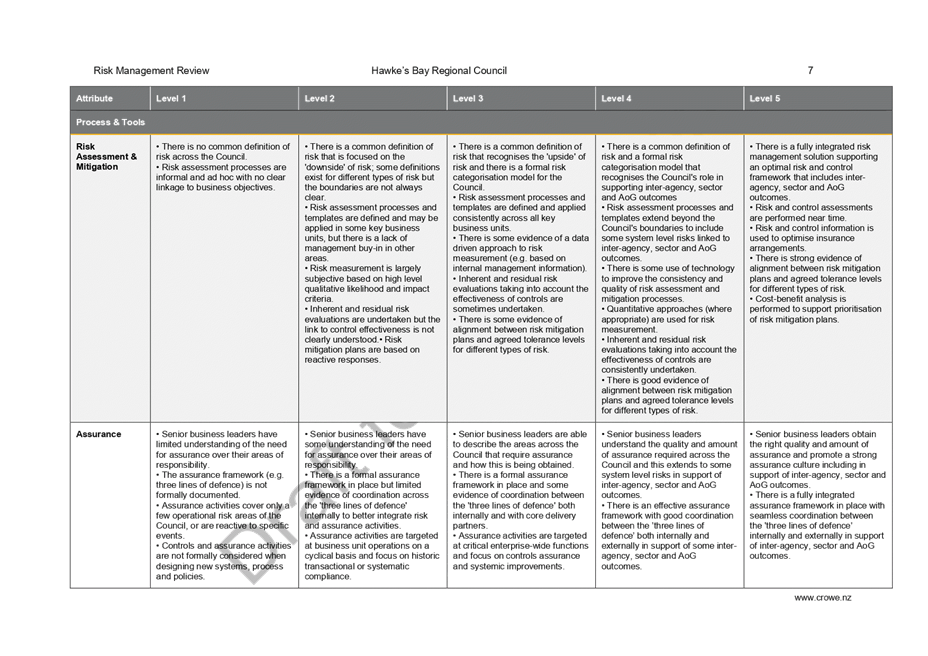

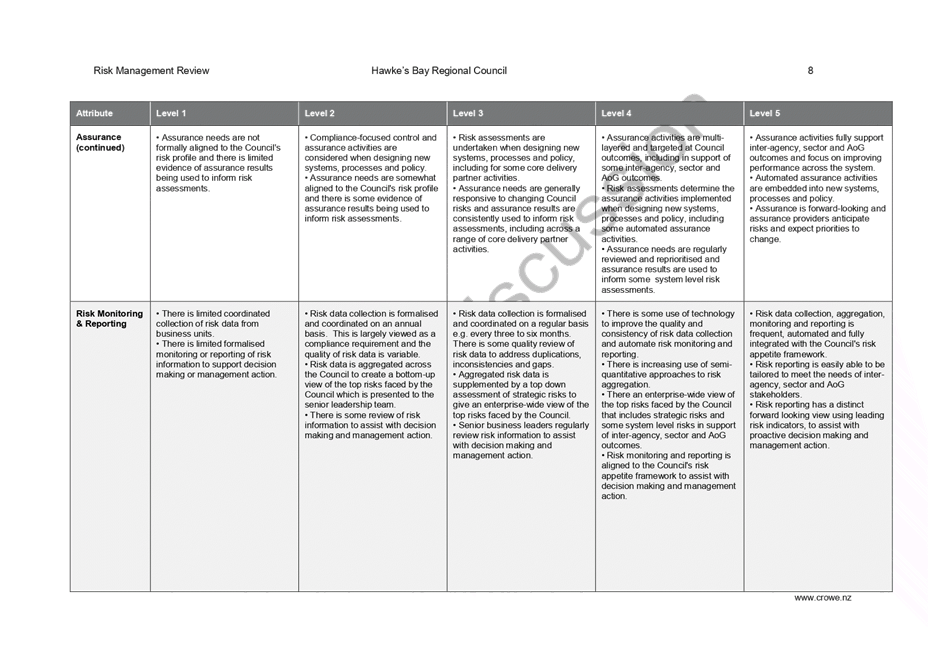

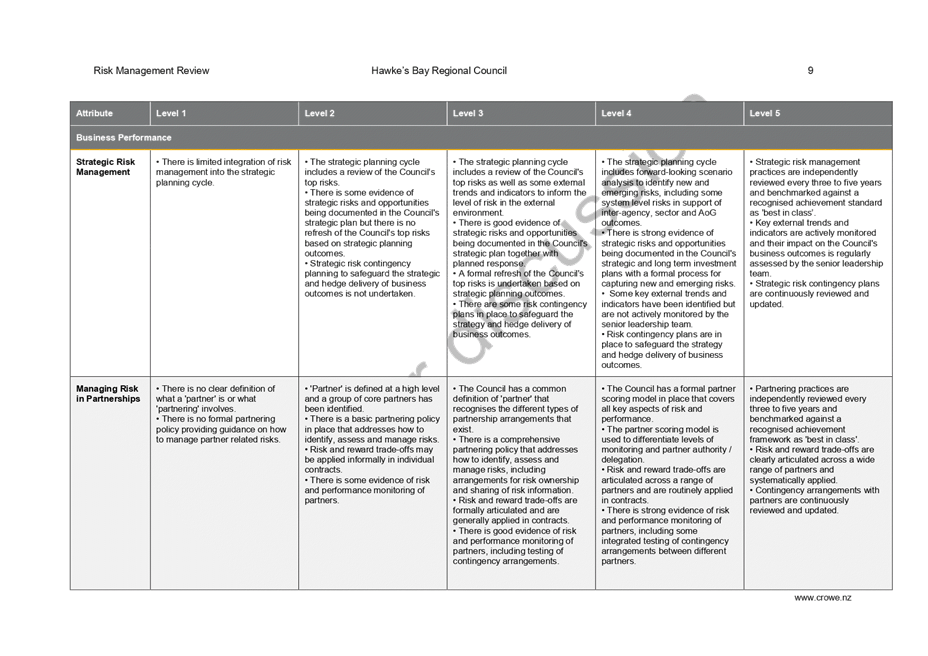

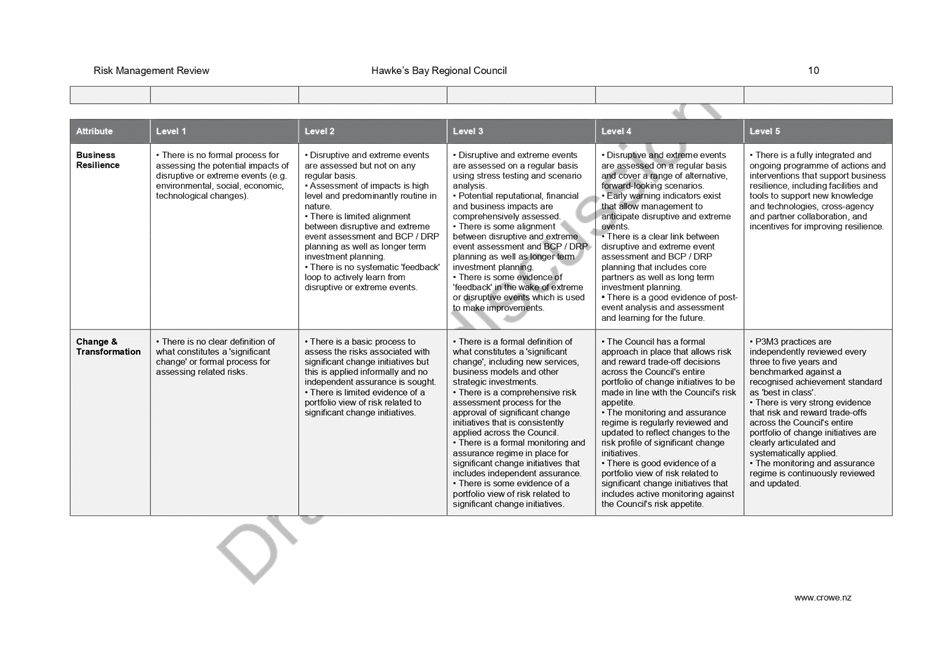

Scope of HBRC 2020 Risk

Managment Review

|

Attachment 2

|

|

Scope

of HBRC 2020 Risk Managment Review

|

Attachment 2

|

|

Scope

of HBRC 2020 Risk Managment Review

|

Attachment 2

|

|

Scope

of HBRC 2020 Follow Up Review

|

Attachment 3

|

|

Proposed Terms of Reference

for the Finance, Audit & Risk Sub-committee

|

Attachment 4

|

Finance,

Audit and Risk Sub-committee

Terms

of Reference

for Council adoption 25

March 2020

1. Purpose

The

purpose of the Finance, Audit and Risk Sub-committee is to report to the

Corporate and Strategic Committee to fulfil its responsibilities for:

1.1. The provision of appropriate controls

to safeguard the Council’s financial and non-financial assets, the

integrity of internal and external reporting and accountability arrangements

1.2. The review of Council’s revenue

and expenditure policies and the effectiveness of those policies.

1.3. The independence and adequacy of

internal and external audit functions

1.4. The robustness of risk management

systems, processes and practices

1.5. Compliance with applicable laws,

regulations, standards and best practice guidelines.

2. Specific

Responsibilities

The

Finance, Audit and Risk Sub-committee shall have responsibility and authority

to:

2.1. Consider the appropriateness of the

Council’s existing accounting policies and principles and any proposed

changes

2.2. Satisfy itself that the financial

statements and statements of service performance are supported by adequate

management signoff and adequate internal controls and recommend adoption of the

Annual Report by Council

2.3. Confirm that processes are in place to

ensure that financial information included in Council’s Annual Report is

consistent with the signed financial statements

2.4. Monitor the performance of

Council’s investment portfolio

2.5. Confirm the terms of appointment and

engagement of external auditors, including the nature and scope of the audit,

timetable, and fees

2.6. Receive the internal and external

audit report(s) and review actions to be taken by management on significant

issues and recommendations raised within the report(s)

2.7. Enquire of internal and external

auditors for any information that affects the quality and clarity of the Council’s

financial statements and statements of service performance, and assess whether

appropriate action has been taken by management in response to this

2.8. Conduct a sub-committee members-only

session with Audit NZ to discuss any matters that the auditors wish to bring to

the Sub-committee’s attention and/or any issues of independence

2.9. Review whether Council management has

a current and comprehensive risk management framework and associated procedures

for effective identification and management of the council’s significant

risks in place

2.10. Undertake periodic monitoring of

corporate risk assessment, and the internal controls instituted in response to

such risks

2.11. Undertake systematic reviews of

Council operational activities against Council stated performance criteria to determine

efficiency/effectiveness of delivery of Council services

2.12. Review the effectiveness of the system

for monitoring the Council’s compliance with laws (including governance

legislation, regulations and associated government policies), Council’s

own standards, and best practice guidelines; including health and safety.

3. Accountability

3.1. The Finance, Audit and Risk

Sub-committee is not delegated to make any decisions unless by specific

delegation of Council.

The

Finance, Audit and Risk Sub-committee is delegated by Council to:

3.2. Obtain external legal or independent

professional advice within approved budgets in the satisfaction of its

responsibilities and duties

3.3. Secure the attendance at meetings of

third parties with relevant experience and expertise as appropriate

3.4. Receive all of the information

and documentation needed or requested to fulfill its responsibilities and

duties, subject to applicable legislation

3.5. Ensure that recommendations in audit

management reports are considered and, if appropriate, actioned by management

3.6. Review the objectives and scope of the

internal audit function, and ensure those objectives are aligned with

Council’s overall risk management framework

3.7. Assess the performance of the internal

audit function, and ensure that the function is adequately resourced and has

appropriate authority and standing within Council.

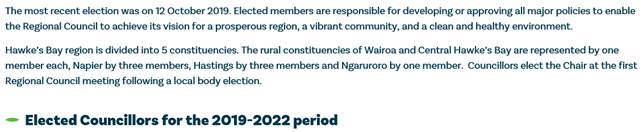

4. Membership

4.1. Up to four members of Council, being:

Councillors Will Foley, Craig Foss and Neil Kirton (confirmed by Council

resolution 6 November 2019)

4.2. An external appointee, being:

Rebekah Dinwoodie (confirmed

by Council resolution 6 November 2019)

5. Chairperson

A member of the Committee as elected

by the Council, being Councillor Craig Foss (confirmed by Council

resolution 9 November 2016)

6. Meeting Frequency

The Committee shall meet quarterly, or

as required

7. Quorum

The quorum at any meeting of the

Committee shall be not less than 3 members of the Committee.

8. Officers Responsible

8.1. Chief Executive

8.2. Group Manager Corporate Services

8.3. Group Manager Office of the Chief

Executive and Chair

|

HBRC Treasury Reporting

December 2019

|

Attachment 5

|

Hawke’s

Bay Regional Council

Quarterly Treasury Report

As at 31 December 2019

|

HBRC

Treasury Reporting December 2019

|

Attachment 5

|

Contents

1.0 Treasury

Activity Compliance Monitor 2

2.0 Investment

Management Reporting 3

3.0 SIPO

review 8

4.0 Liability

Management Policy Compliance Checklist 10

5.0 Borrowing

Limits 10

6.0 Funding and

Liquidity Risk Position 11

7.0 Interest Rate

Risk Position 11

8.0 Funding

Facility 13

9.0 Cost of Funds

vs Budget 13

10.0 Counterparty

Credit 13

11.0 Market

Commentary 14

12.0 Policy

exceptions 16

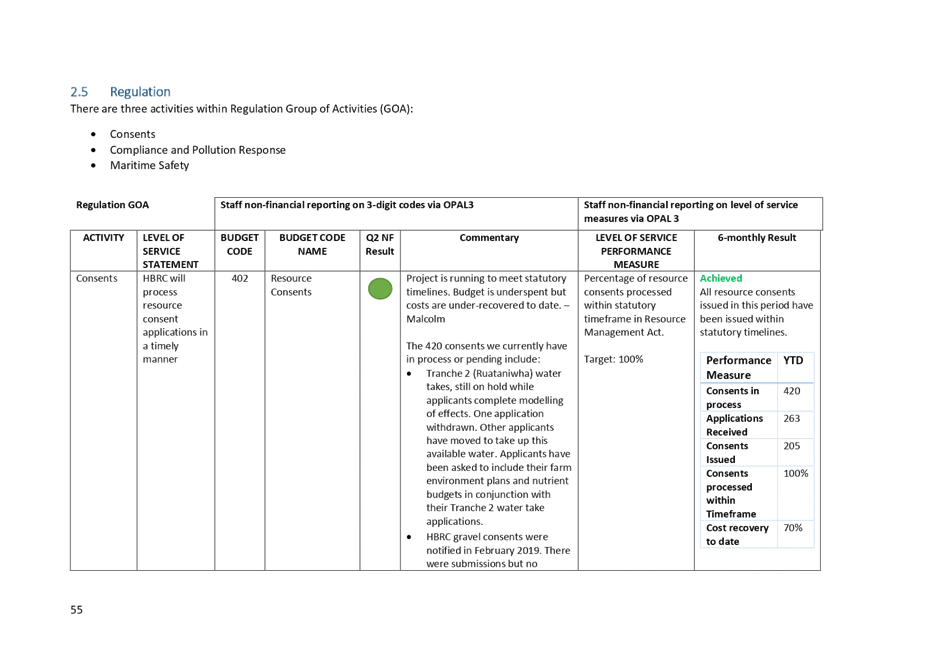

1.0 Treasury Activity

Compliance Monitor

|

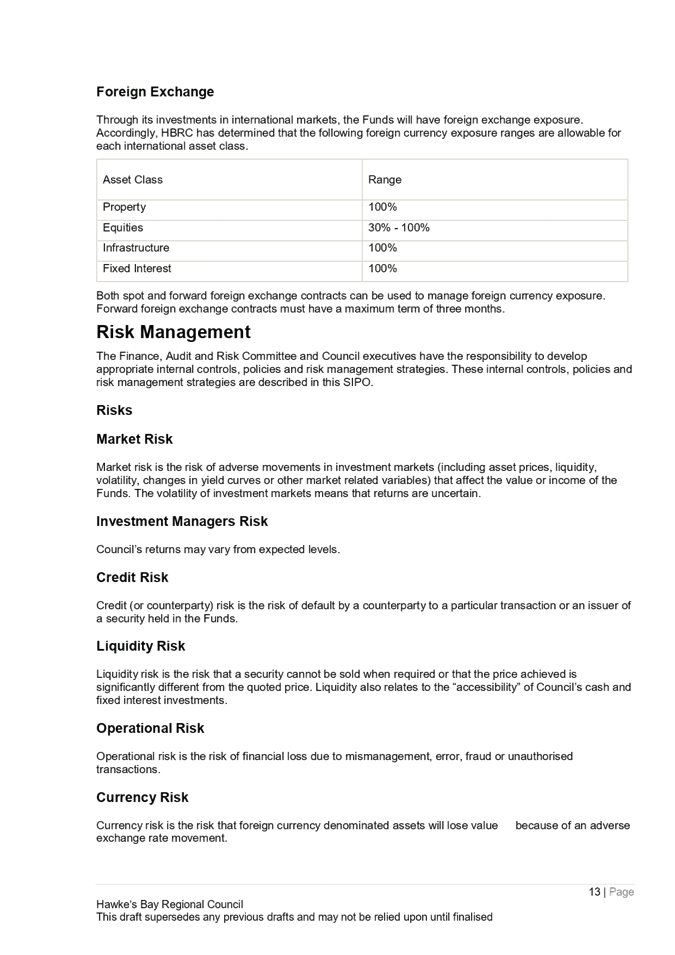

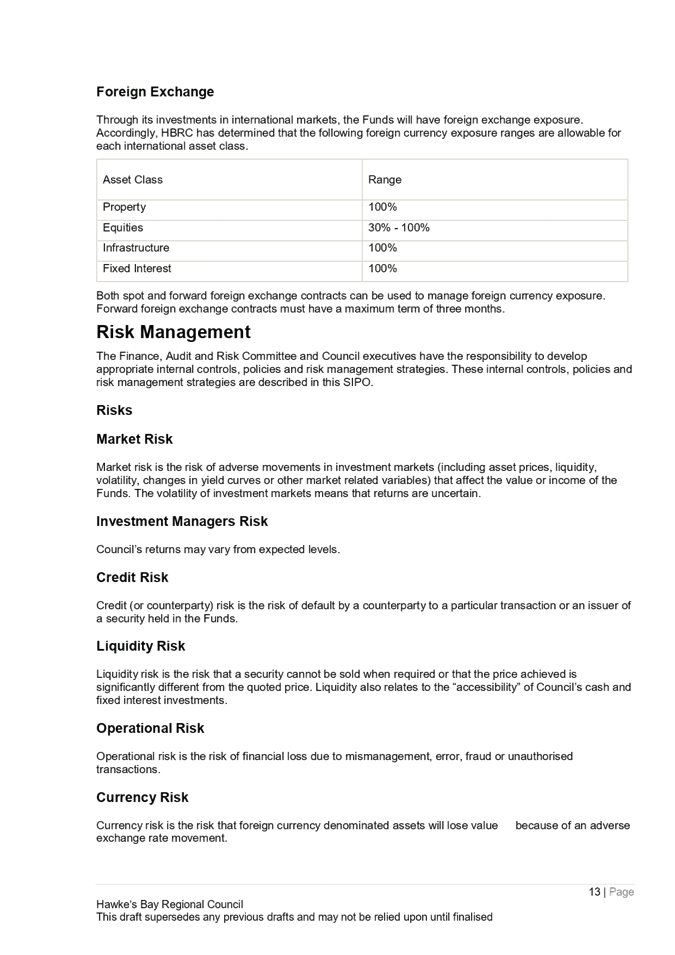

Policy document

|

Policy parameters

|

Compliance

|

|

Treasury

Policy

|

Borrowing

limits

|

Yes

|

|

Funding

risk control limits

|

Yes

|

|

Liquidity

buffer

|

Yes

|

|

Interest

rate risk control limits

|

Yes

|

|

Treasury

investment parameters

|

Yes

|

|

Counterparty

credit limits

|

Yes

|

|

SIPO

|

Asset

allocations

|

No

|

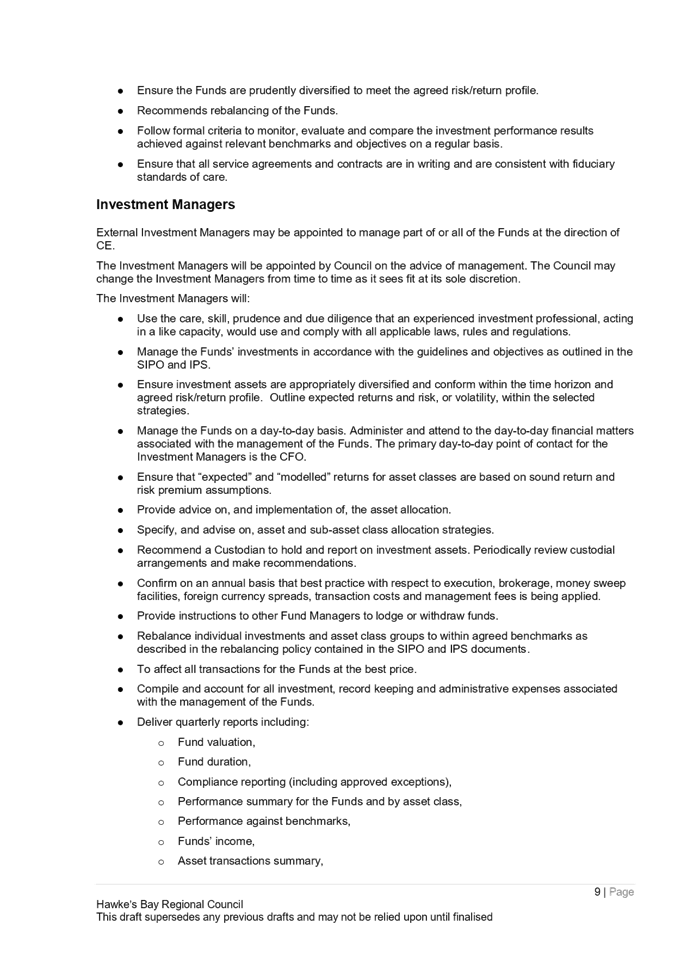

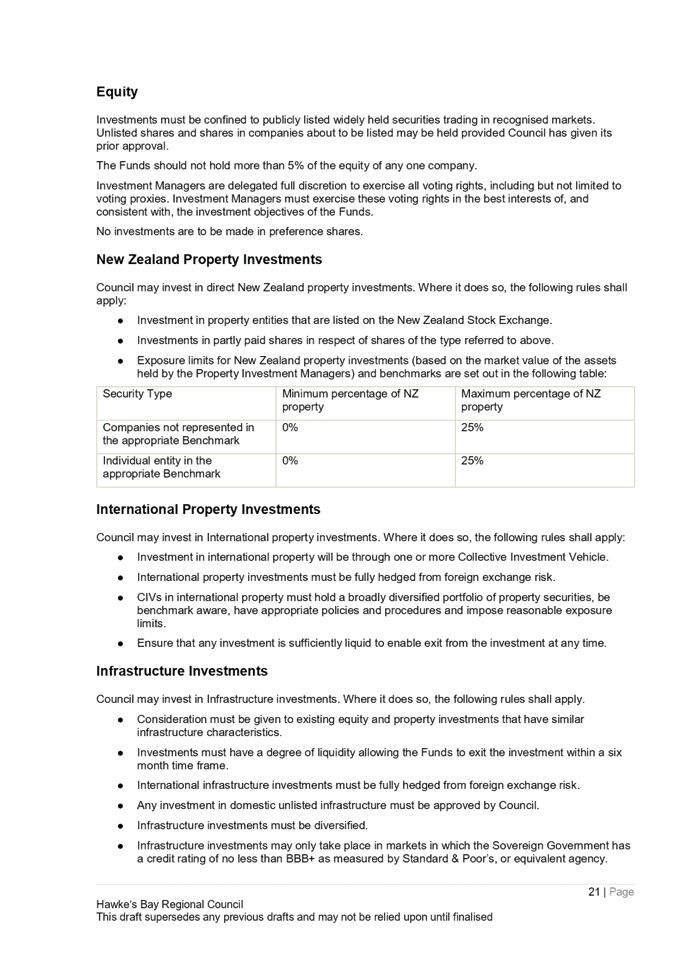

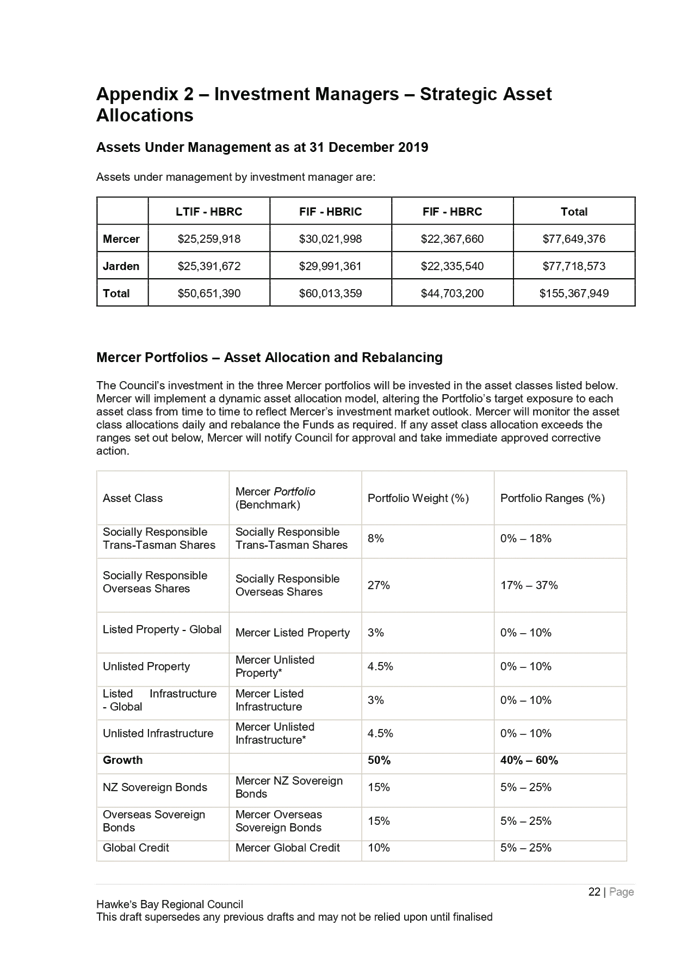

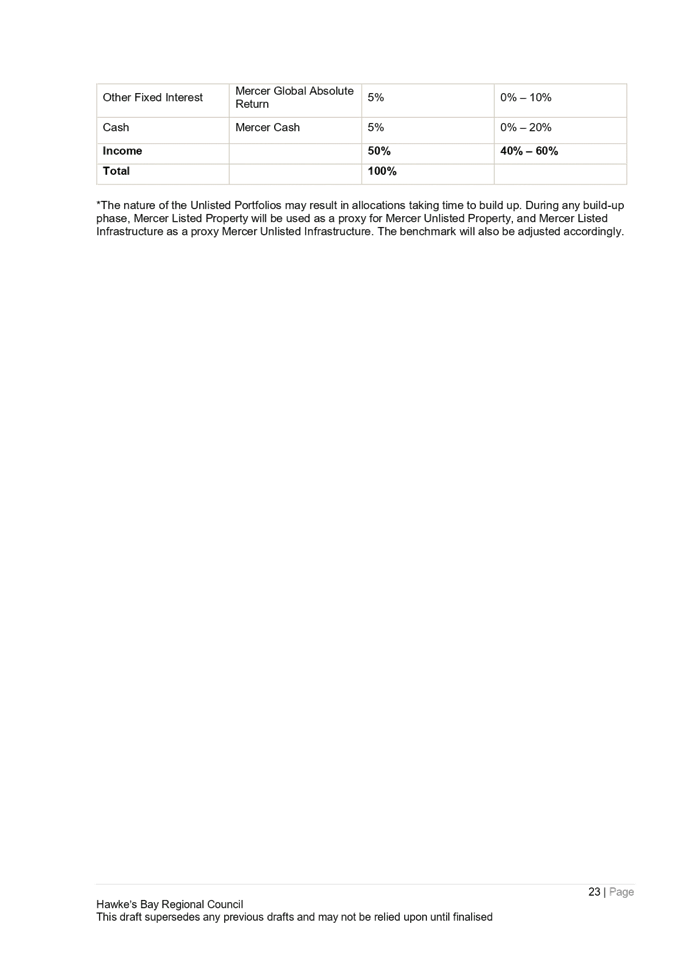

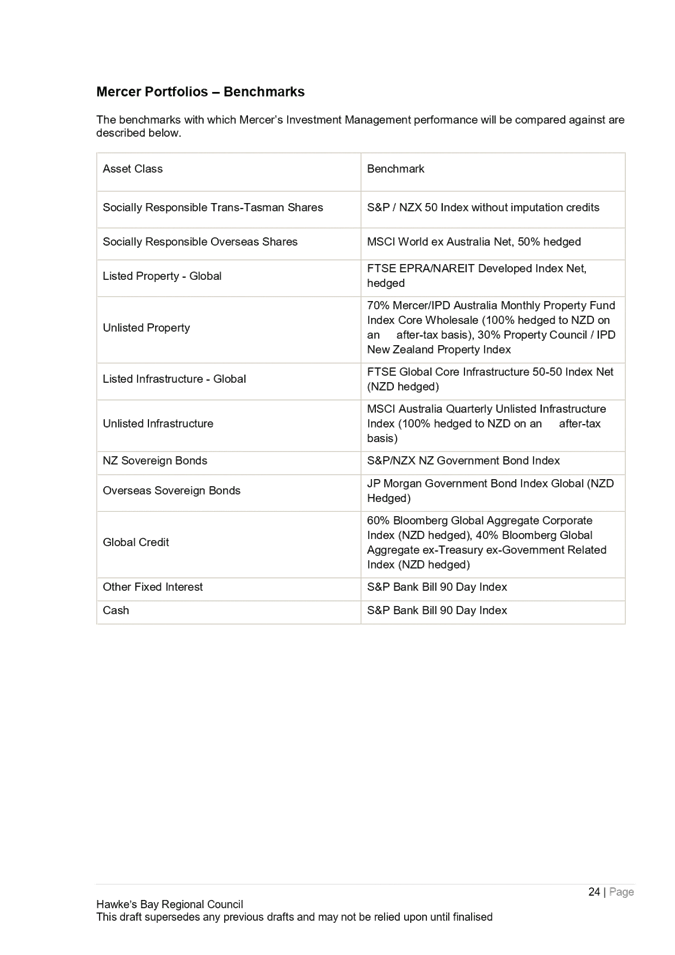

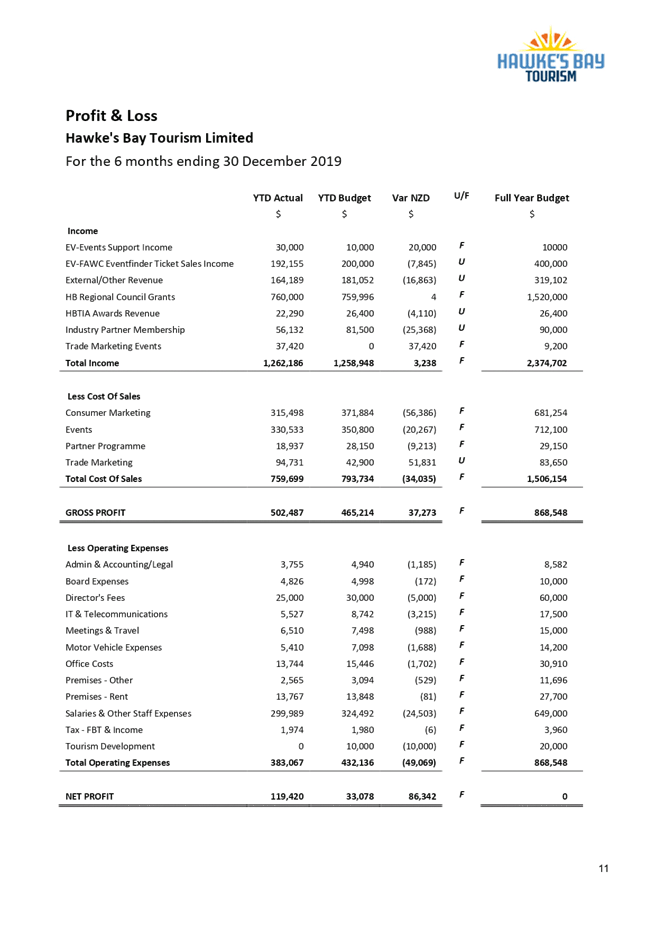

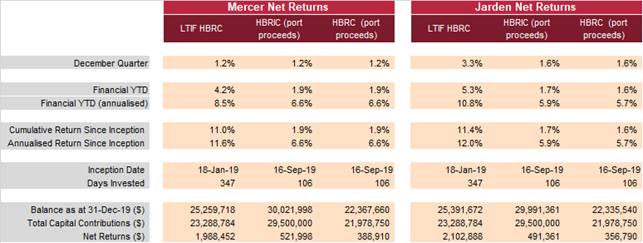

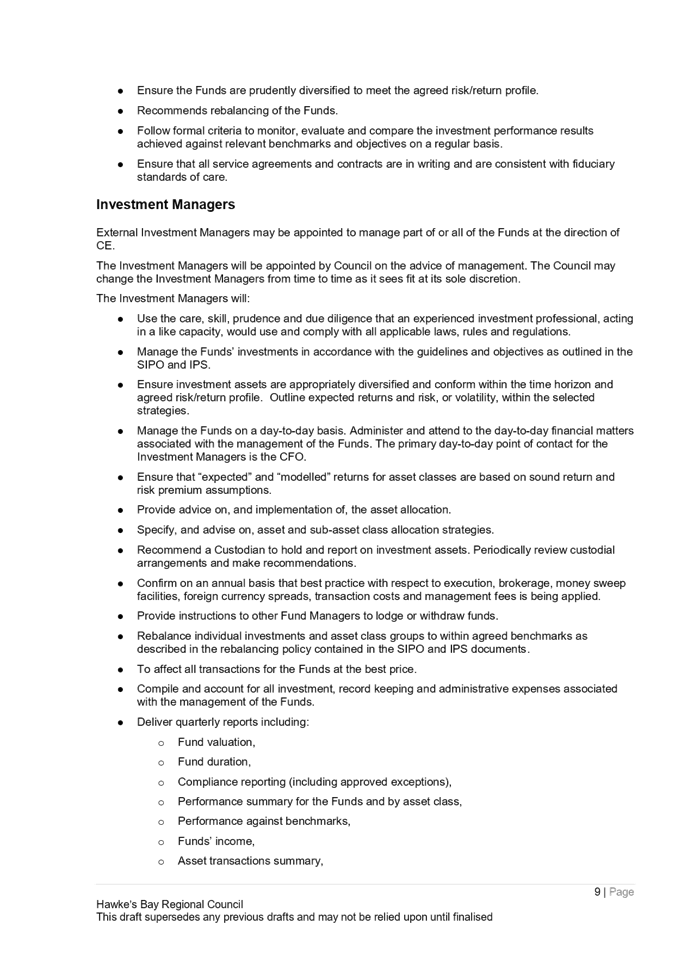

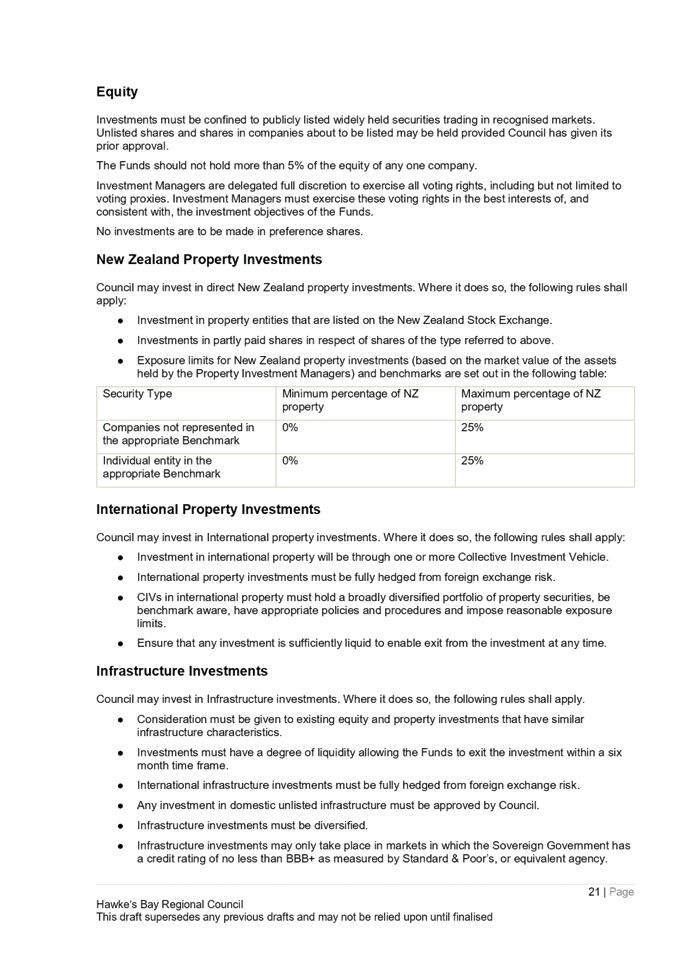

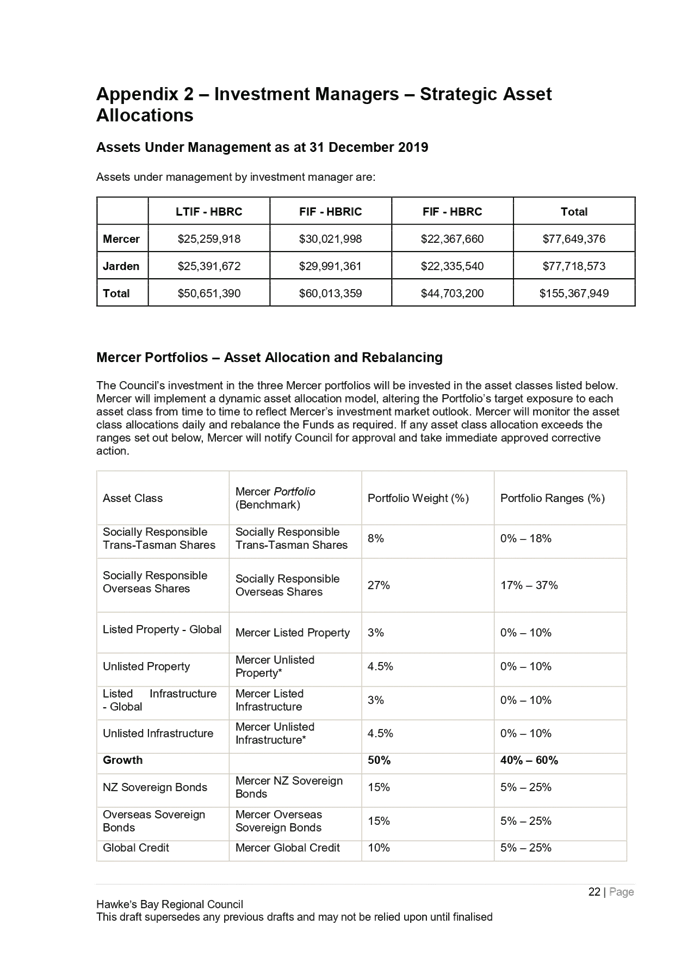

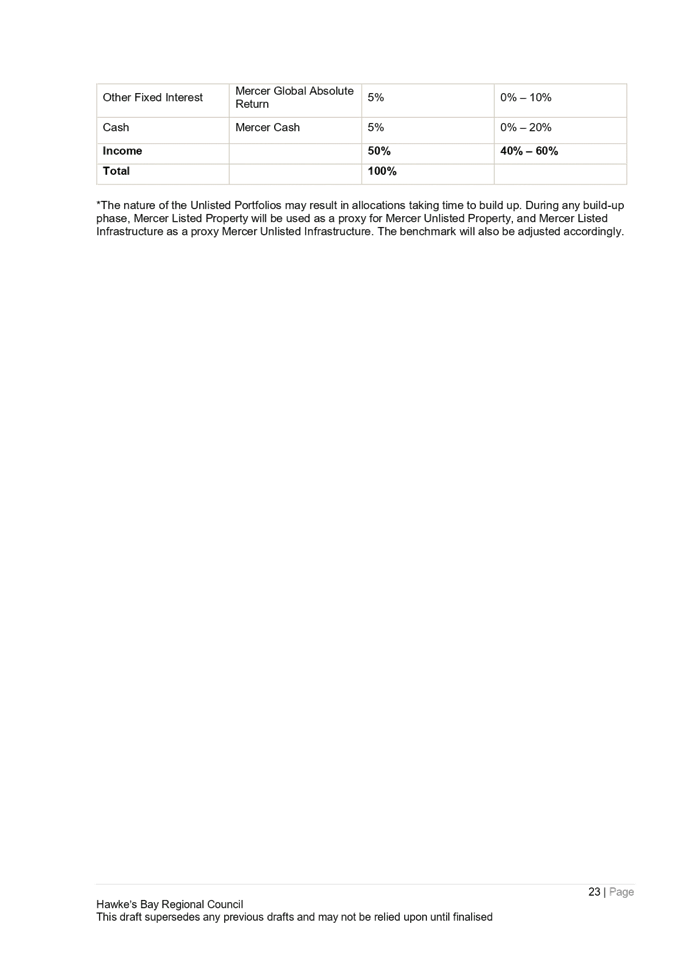

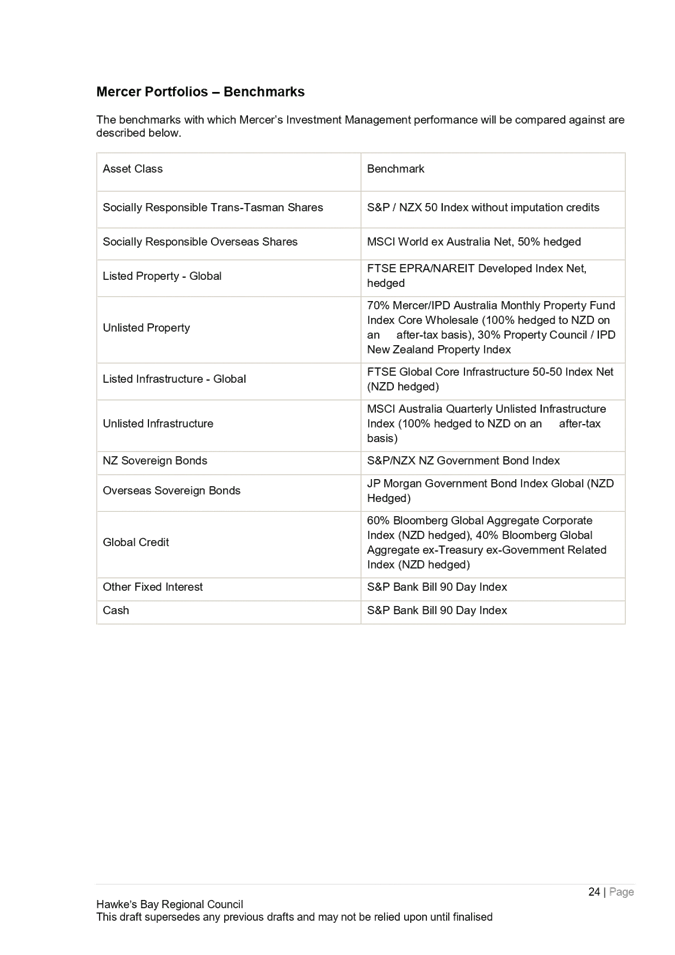

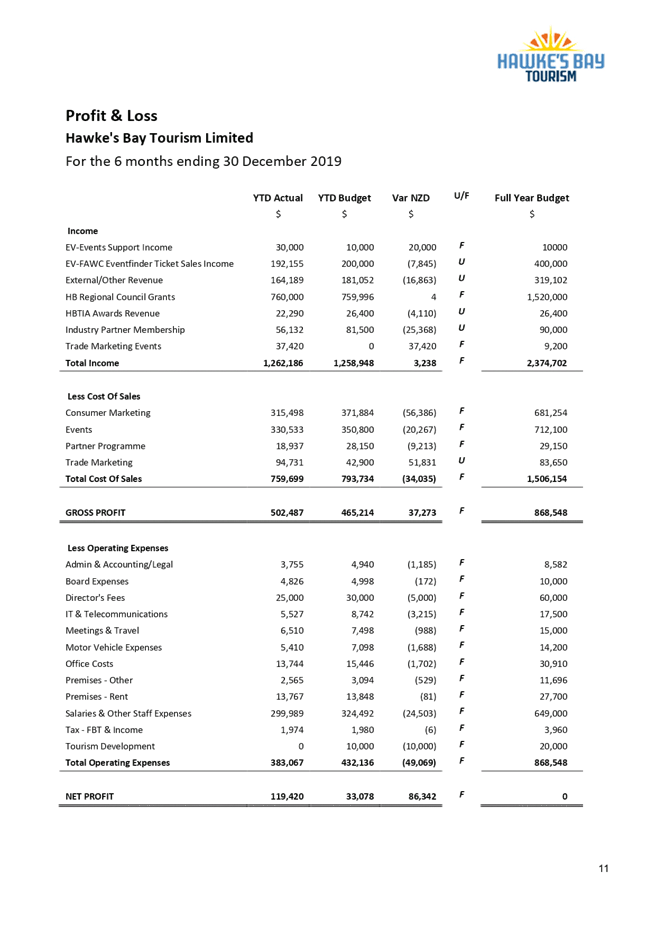

2.0 Investment Management

Reporting

Performance Summary

(net returns – after management and custodial fees)

|

HBRC

Treasury Reporting December 2019

|

Attachment 5

|

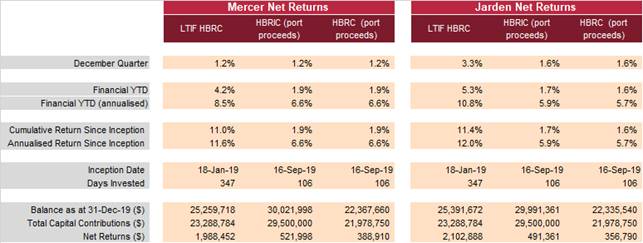

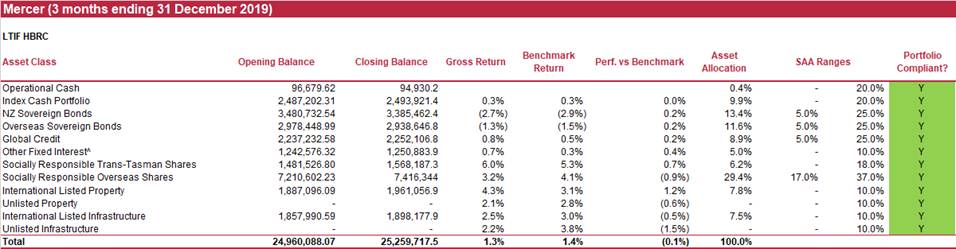

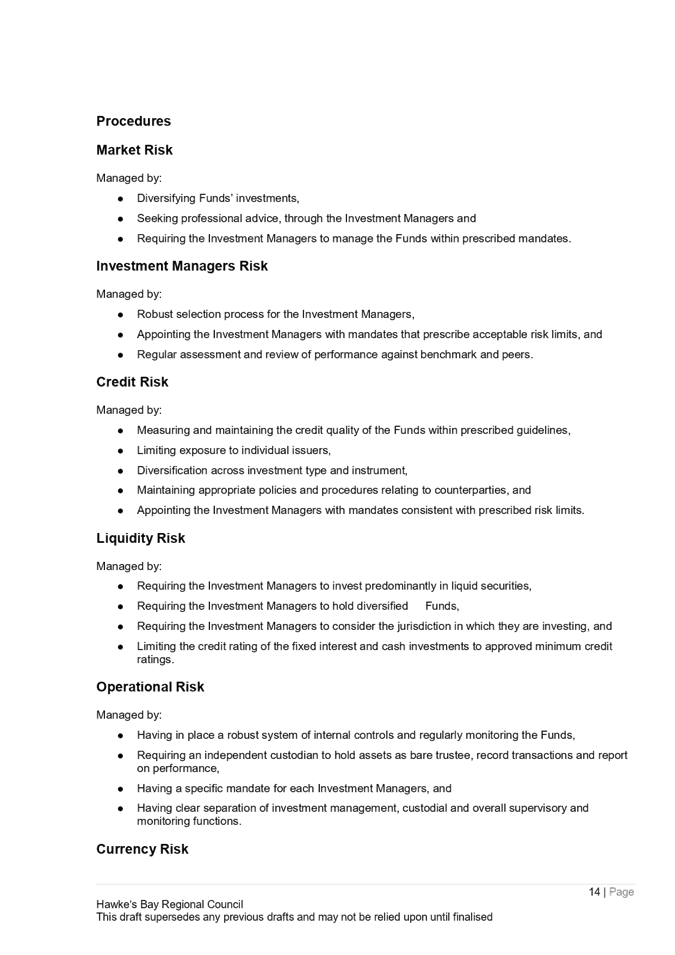

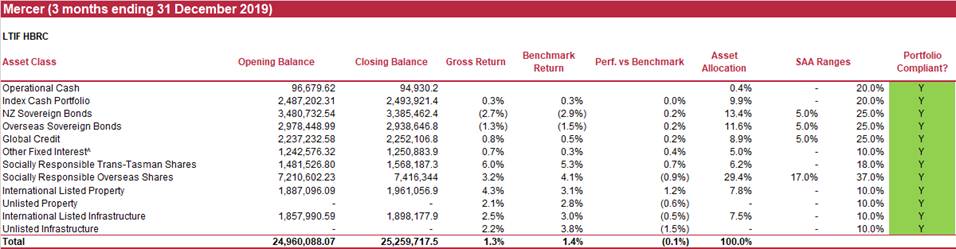

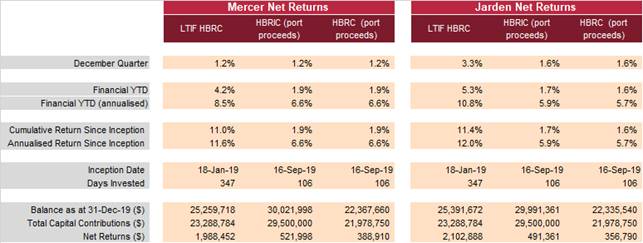

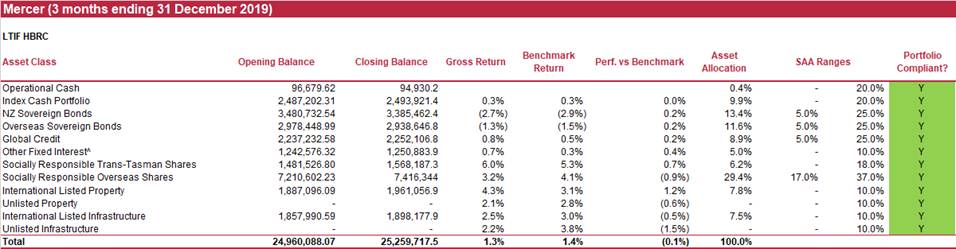

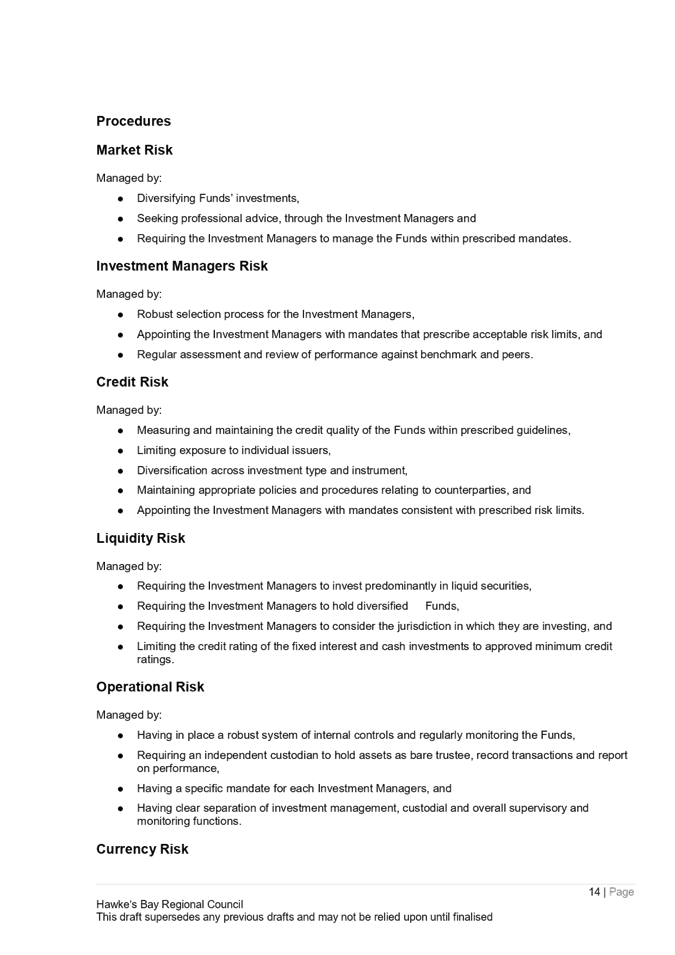

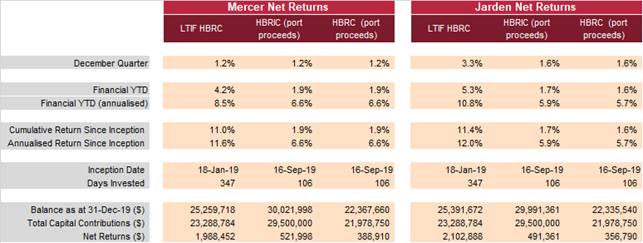

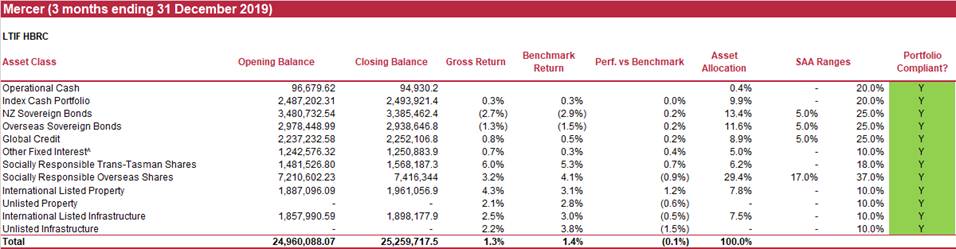

Long

Term Investment Fund (LTIF HBRC)

Mercer portfolio

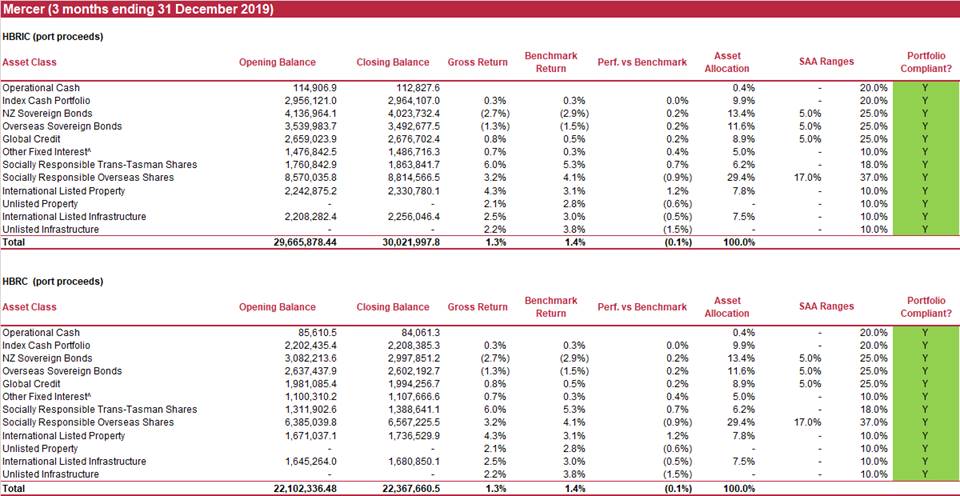

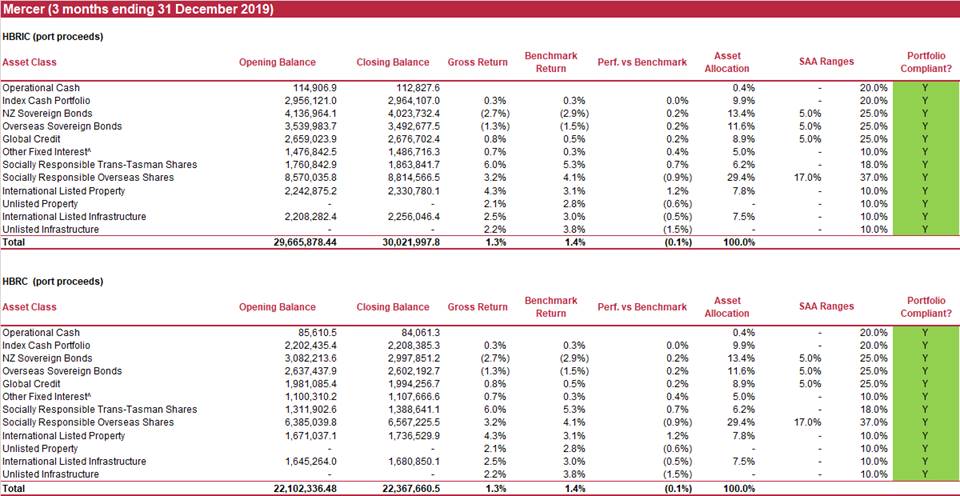

● The Mercer portfolio

generated a gross return (before fees and tax) of 1.3% for the quarter,

marginally trailing their benchmark by 10bp. On a net (after fees and

tax) basis, the portfolio returned 1.2%, trailing the benchmark by 20bp.

● The portfolio has now

achieved a gross return of 11.4% since inception on 18 January 2019,

trailing the benchmark by 1.3%. On a net basis, the portfolio has

returned 11% since inception, trailing the benchmark by 1.7%.

● Over the quarter, the

portfolio performed broadly in line with its benchmark; Socially Responsible

Trans-Tasman Shares (+0.7%) and International Listed Property

(+1.2%) were standout performers both providing a boost to relative

performance, with the former benefitting from an overweight holding to Metlifecare

and Summerset Group.

● The

portfolio remains compliant with the strategic asset allocation (SAA) ranges

stipulated in the SIPO.

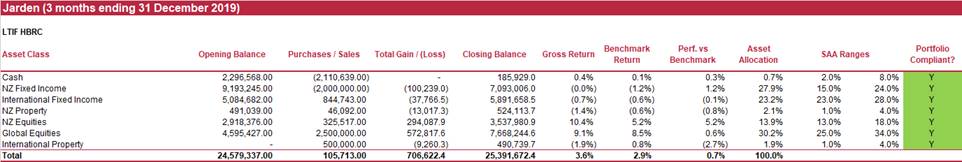

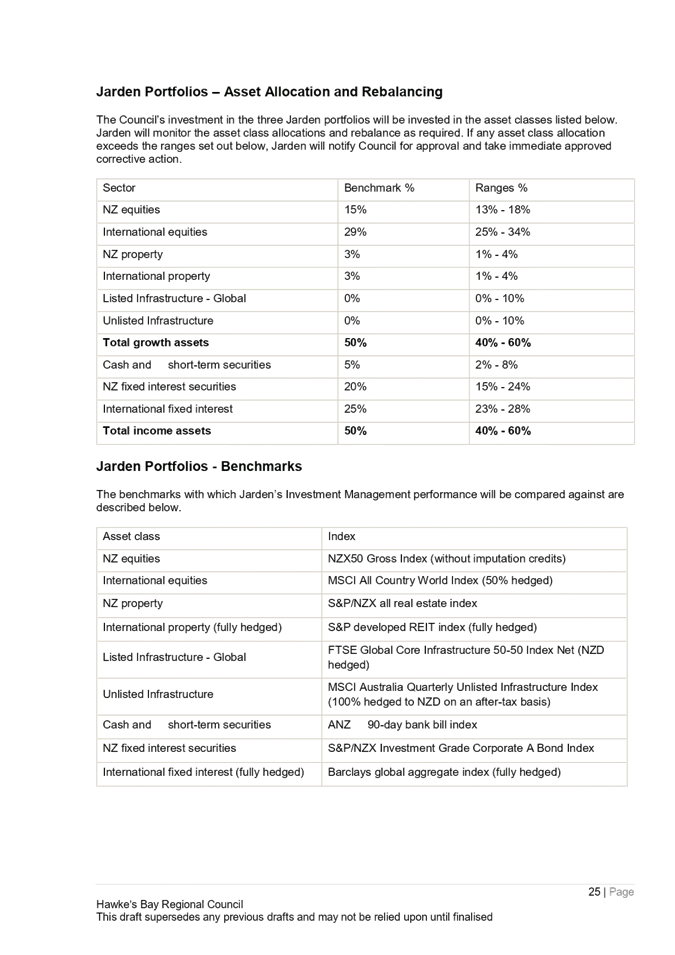

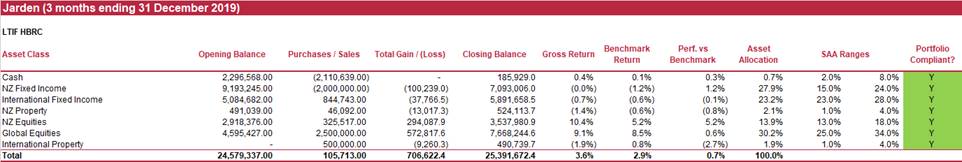

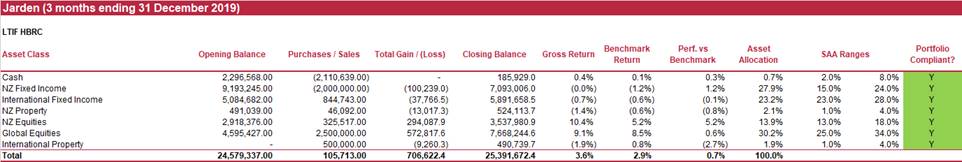

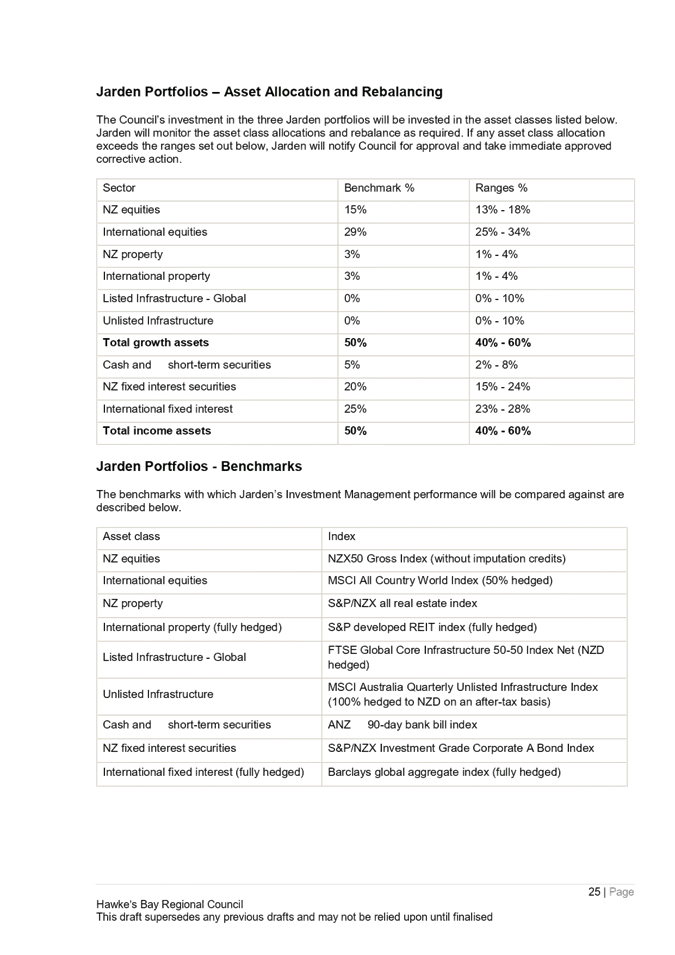

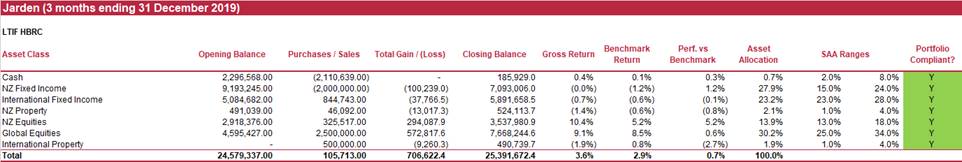

Jarden portfolio

● Jarden generated a gross

return (before fees and tax) of 3.6% for the quarter, leading their

benchmark by 70bp. On a net (after fees and tax) basis, the portfolio

returned 3.3%, leading the benchmark by 40bp. The portfolio has achieved a net

return of 11.4% since inception on 18 January 2019.

● NZ and Global Equities

were the standout performers for the portfolio over the quarter, returning

10.4% and 9.1% respectively. International and NZ Property

were the two weakest asset classes, both declining by 1-2%.

● The

portfolio is now compliant with the strategic asset allocation (SAA) ranges

stipulated in the SIPO.

Combined portfolio

● The combined Mercer and

Jarden portfolios generated a net return of approximately 2.2% over the

December quarter. The Jarden portfolio was the biggest contributor

due to its higher return. The combined LTIF portfolio has generated a net

return of approximately 11.1% since inception.

● The

total size of the LTIF portfolio at the end of December was $50.651m, with

approximately half invested with Mercer and Jarden respectively.

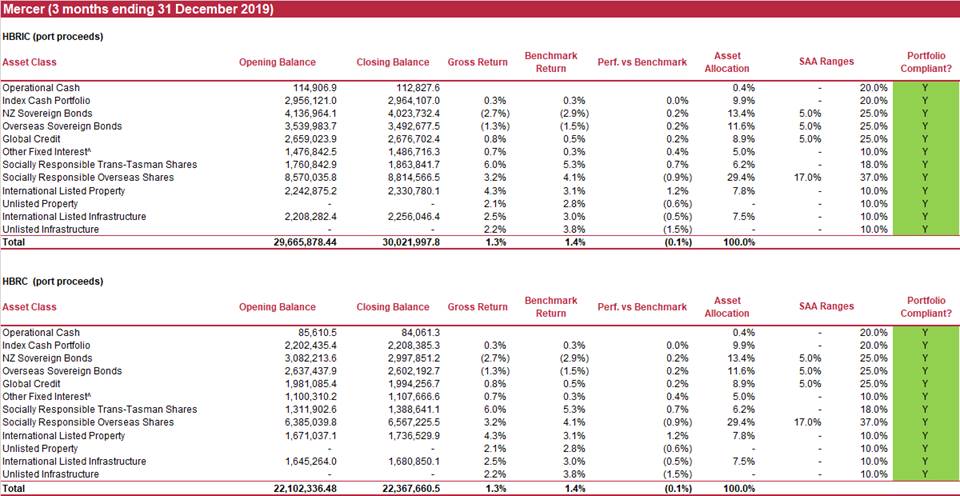

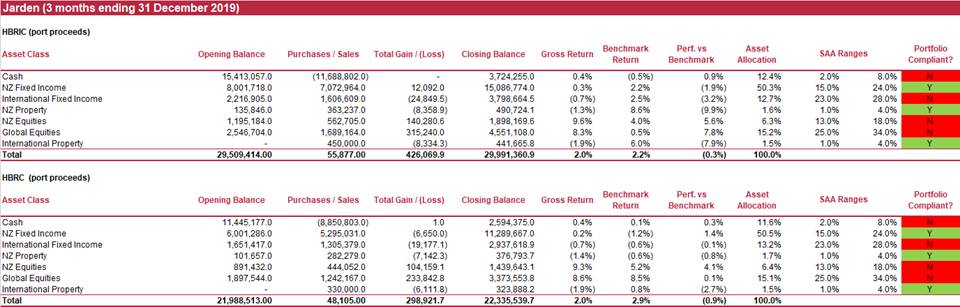

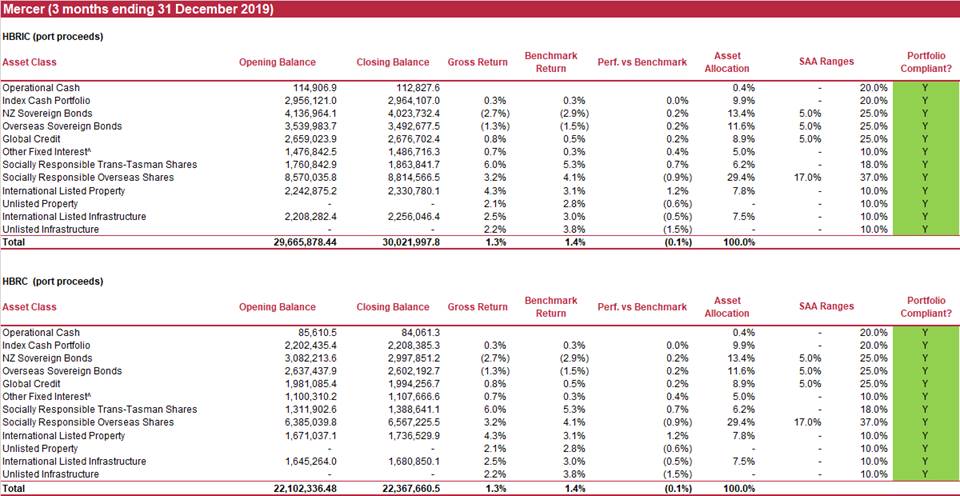

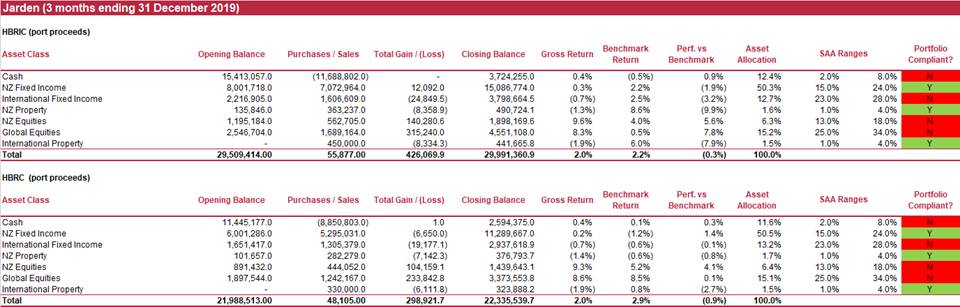

Future Investment Fund – Port Proceeds

● The Future Investment

Fund portfolios were implemented on the 16th of September and the above table

therefore only represents a partial quarter of performance.

● The Mercer portfolios

both 1.9% on a net basis. These correspond to annualised returns of

6.6%.

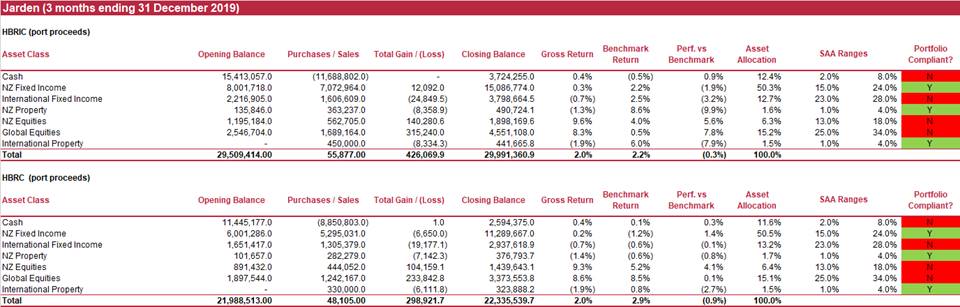

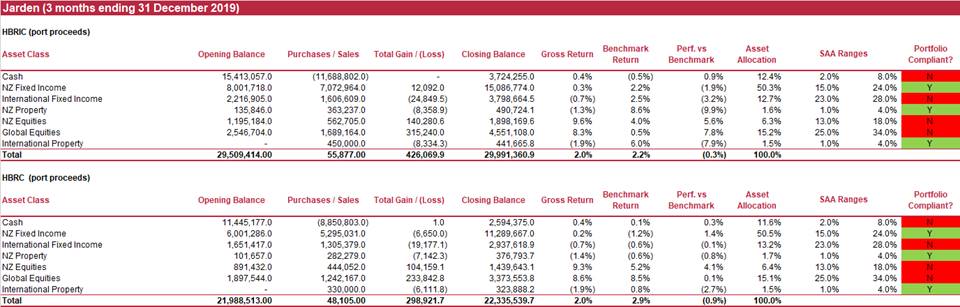

● The Jarden portfolios

1.7% and 1.6% on a net basis. These correspond to annualised returns of

5.9% and 5.7% respectively.

● The Mercer portfolios are

both compliant with their respective SAA SIPO requirements.

● Jarden

are again adopting a staggered implementation approach, meaning both portfolios

are not yet SIPO compliant with their target asset allocations. The Jarden

portfolios had an allocation to growth assets of 25% at the end of December

versus a target benchmark allocation of 50%.

● The

total size of the PFIF portfolio at the end of December was $104.7m, with

approximately half invested with Mercer and Jarden respectively.

|

HBRC

Treasury Reporting December 2019

|

Attachment 5

|

3.0 SIPO

review

We have undertaken a

review of the SIPO and requested comments from both PwC and the investment

managers. This section highlights areas where the statement could be enhanced.

PwC believe the SIPO remains fit for purpose.

PwC SIPO comments

Whilst PwC agree that

Council’s return target may be more difficult to achieve over coming

years due to the historically low interest rate environment and extended

investment markets, PwC do not believe it prudent to alter the

portfolio’s strategic asset allocation by moderating the risk

profile. This would introduce a level of risk to the portfolio that is

not congruent with Council’s willingness and ability to take risk. It may

also hinder Council’s ability to achieve its investment objectives should

a significant negative event occur in any period.

Comments 7 and 8 below

refer to Jarden’s inability to invest in illiquid assets under the

current SIPO. PwC believe this should be reviewed to ensure it is fairly

aligned with Mercer’s ability to invest up to 10% of the portfolio in

illiquid, ‘unlisted property’ and ‘unlisted

infrastructure’. PwC agree with Jarden’s comment that as long as

there is an expected accelerated return for the additional risk of investing in

illiquid assets that are expected to be held over the medium term, an

acceptable proportion of the Fund should benefit.

Comment 9 by Jarden refers

to the minimum credit rating required for fixed income investments. PwC agree

with Jarden’s view that the minimum rating could be lowered to BBB- from

BBB+. This would continue to maintain a minimum ‘investment grade’

credit rating across the portfolio, enhance the fixed income yield opportunity

and diversification allowing access to a deeper issuance population. There

have been minimal defaults in the global BBB credit rating space over the past

four decades; the highest year was 1% of total BBB issuance in 2002 and has

been close to 0% over the past decade.

Comment 11 by Mercer

refers to a minor wording adjustment around hedging. PwC believe this is a

suitable change.

Comment 13 by Mercer

refers to a more formalised ethical investment policy as part of this SIPO

review. Based on recent discussions with management, PwC believe this issue

will become more important over the coming years and believe it would be

appropriate to start formalising a policy at this juncture. PwC understand that

a discussion with elected councillors to articulate this policy is to be

undertaken.

Comments 12 and 14 by

Mercer are minor administration points that Council may wish to update in the

SIPO.

PwC also recommend

updating the SIPO to reflect there are now three separate portfolios with each

investment manager, including the capital amount invested into each one and the

respective dates of inception.

Conclusion

PwC do not suggest any

further changes to the SIPO to those mentioned above. PwC will wait for the

above changes to be discussed by the Finance and Audit Risk Committee before

formally updating the SIPO.

Jarden’s SIPO

comments

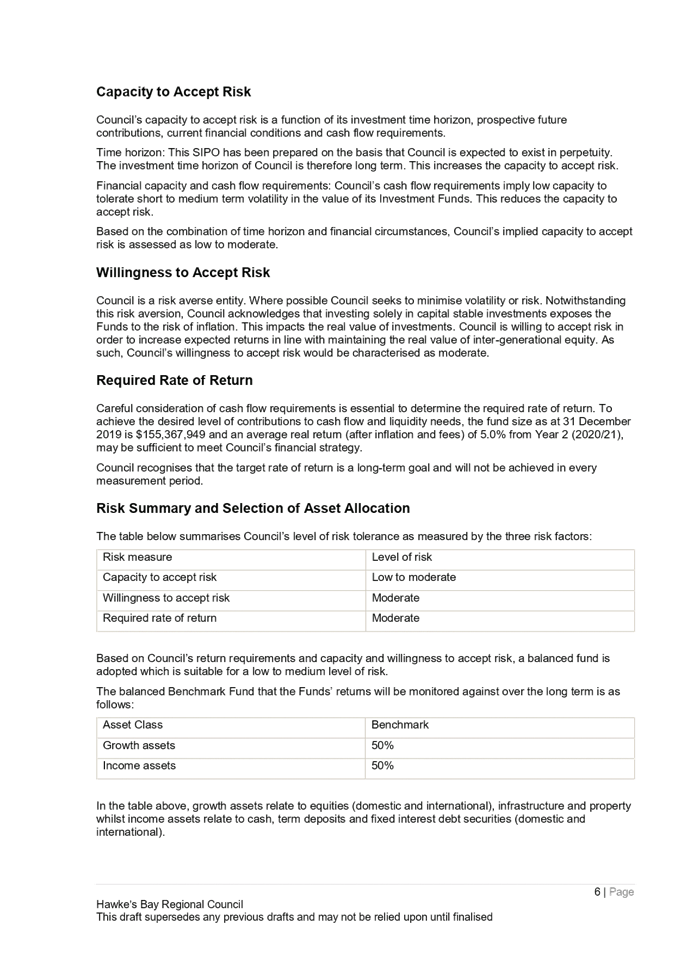

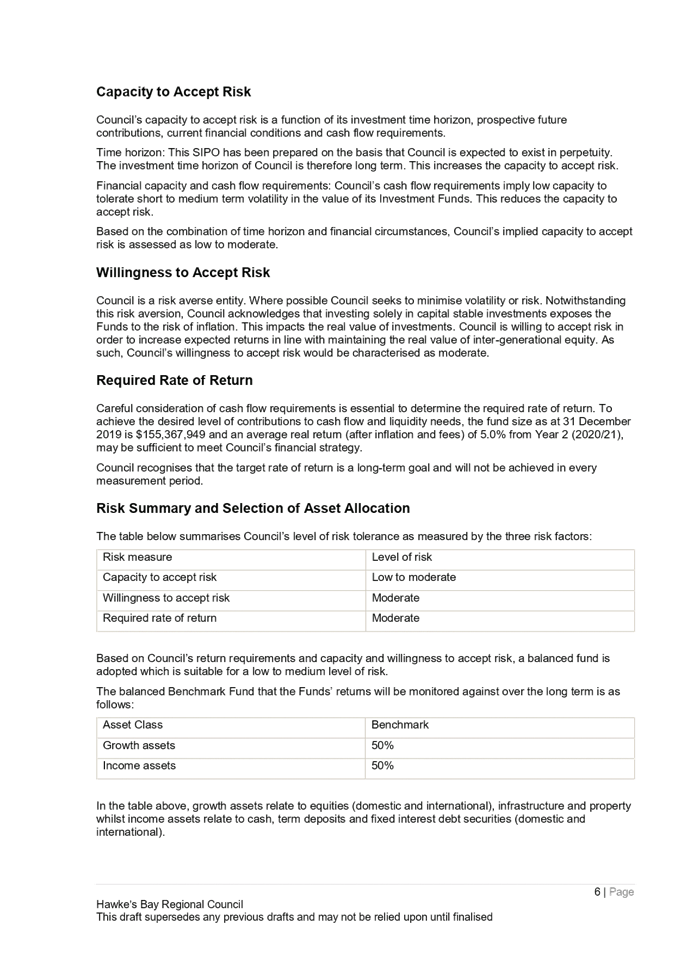

1. Is the asset allocation too conservative? Council have

assessed the capacity to take risk as low to moderate noting: Financial

capacity and cash flow requirements: Council’s cash flow requirements

imply low capacity to tolerate short to medium term volatility in the value of

its Investment Fund. This reduces the capacity to accept risk. This is unfortunate

as it means they are focused on the near term despite the long time horizon and

has to be the factor which limits risk in the portfolio to 50:50 Growth:Income.

2. The willingness to accept risk is interesting as it says Council

is a risk averse entity. Consequently we feel there is

a reluctance to accept risk even though the conclusion is Council’s

willingness to accept risk

would characterised as moderate due to an acknowledgement of the impact of inflation.

3. Given we are looking at a low interest rate environment for some

time the ability for Council to hit its return target in the short term will

likely be challenged. Based on Jarden’s long term forecasts we

expect a 60% growth 40% income portfolio to deliver 6.8%pa and a 80% growth 20%

income portfolio to deliver 7.5%pa.

4. If the portfolios are ahead of their target return with respect to

the reserving policy, Council might consider a temporary shift in asset

allocation to growth with the knowledge that they have a buffer,

if in fact a buffer exists?

5. We are happy for International bonds to remain fully hedged, as

currency fluctuation just boost risk

without benefiting long term returns for bonds.

6. We are interested in more investigation on International Equities

hedging. We see historically there

has been a gain to be had by NZ investors hedging offshore currency exposures.

Last time Jarden did the exercise there was zero gain, although

admittedly not a cost either. Typically we see the

allocation to global equities left unhedged due to the currency stabiliser if

there is a large NZ specific event. We see some arguments that the best option

is to have 50% hedged and 50% unhedged

which means you are indifferent to changes in the currency. There is no strong

reason to change, but worth another look.

7. Given the long term nature of the fund and its size, we question

the need to invest only in liquid securities. Jarden’s view is that as

long as there is an expected extra return for the additional risk of investing

in illiquid assets, we believe the fund should exploit this.

8. A limit should be imposed on the level of illiquid assets. This

would require a review of Investment in assets other than those contemplated by

this policy statement (including antiques, art, stamps, gold, silver, hedge

funds, commodities, private equity or venture capital investments) are not

permitted without the prior approval of the Council.

9. The minimum BBB+ credit rating seems conservative. We think

consideration should be given to reducing to BBB if not BBB-. If nothing else

this broadens the range of investments available. To ensure the portfolio

doesn’t become over burdened with weaker credits we could set an average

credit rating for the portfolio of say BBB+ and place lower limits on the

holdings of weaker credits?

Mercer’s SIPO comments

10. Investment Performance

Objective: taking current expected returns per asset class into account, we

believe the 5% real return target may be too ambitious. Our modelling indicates

that the Council’s current 50% Growth strategy has a very low (<10%)

probability of achieving this objective over the long term.

11. Asset Class Guidelines

(page 11): 4th bullet states a 50% lower bound for hedging, whereas the Foreign

Exchange section on page 13 correctly notes a 30% bound. We suggest 30% is

noted in both sections.

12. Rebalancing (page 12): the

second paragraph may be interpreted to mean the Council needs to explicitly

approve each rebalancing trade. In practice, this is carried out by Mercer on

an ongoing basis. We would suggest the wording is amended to reflect the

delegation of rebalancing activity.\

13. Ethical Investment (page

12): We understand the Council has given significant consideration to Ethical

Investment issues but the SIPO reads fairly “light” in this regard.

We would suggest formalising a more thorough RI Policy as part of the SIPO

review.

14. Manager Performance (page 16): We would suggest adding SIPO

compliance explicitly as one of the factors to be taken into account when

reviewing the managers.

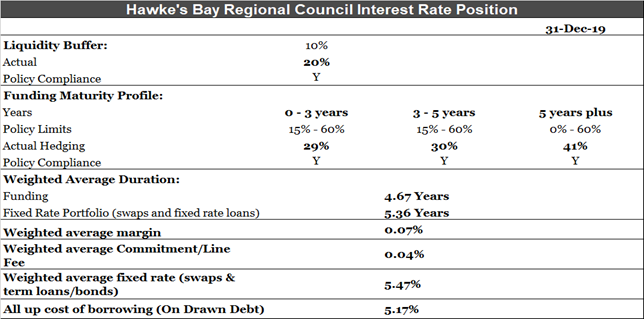

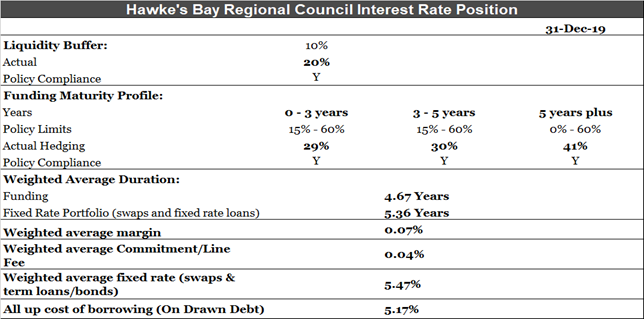

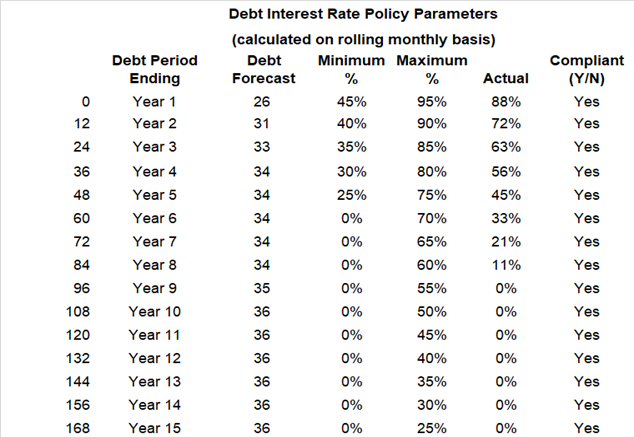

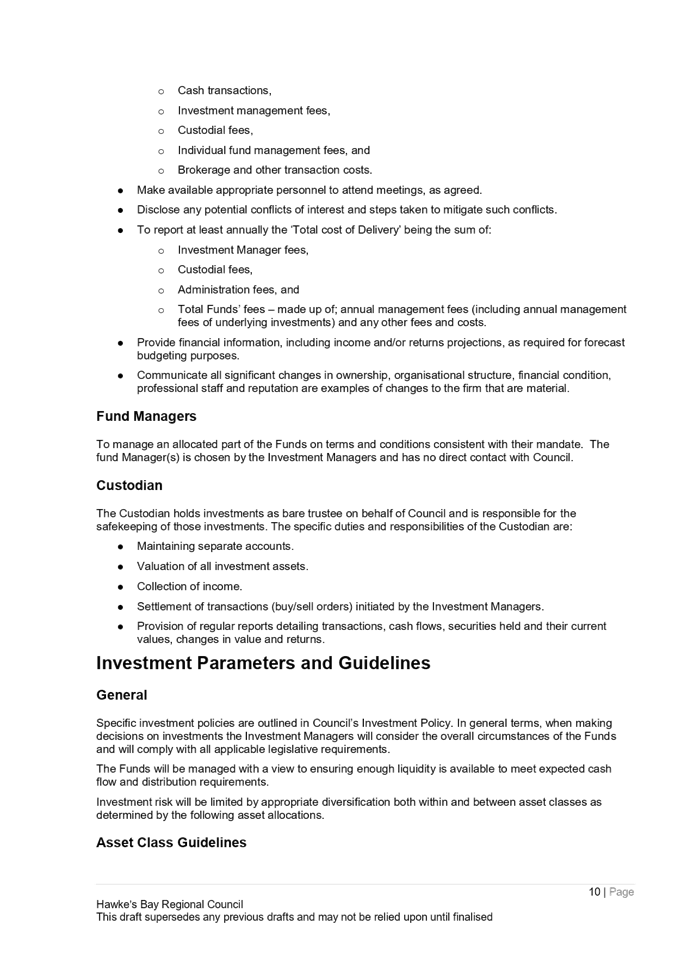

4.0 Liability

Management Policy Compliance Checklist

The

table below illustrates Council’s compliance with funding, interest rate

and liquidity risk parameters set out within the Liability Management Policy. A

snapshot of current funding in place (maturity term and pricing) as well as

interest

rate fixing is

also provided.

The

table below illustrates Council’s compliance with funding, interest rate

and liquidity risk parameters set out within the Liability Management Policy. A

snapshot of current funding in place (maturity term and pricing) as well as

interest

rate fixing is

also provided.

New treasury transactions in the

period are outlined in Appendix 1.

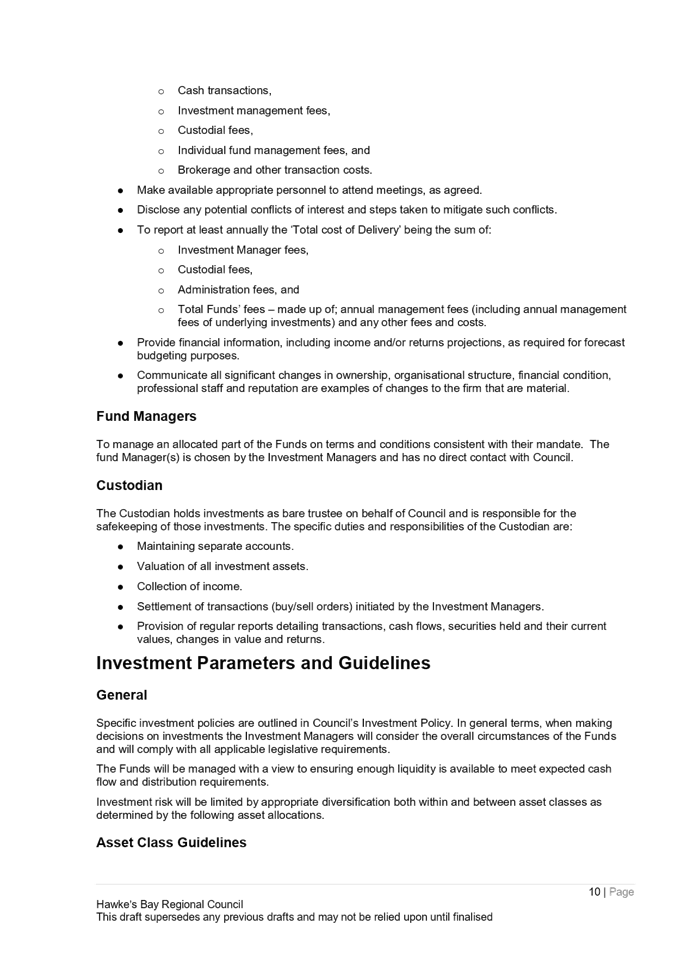

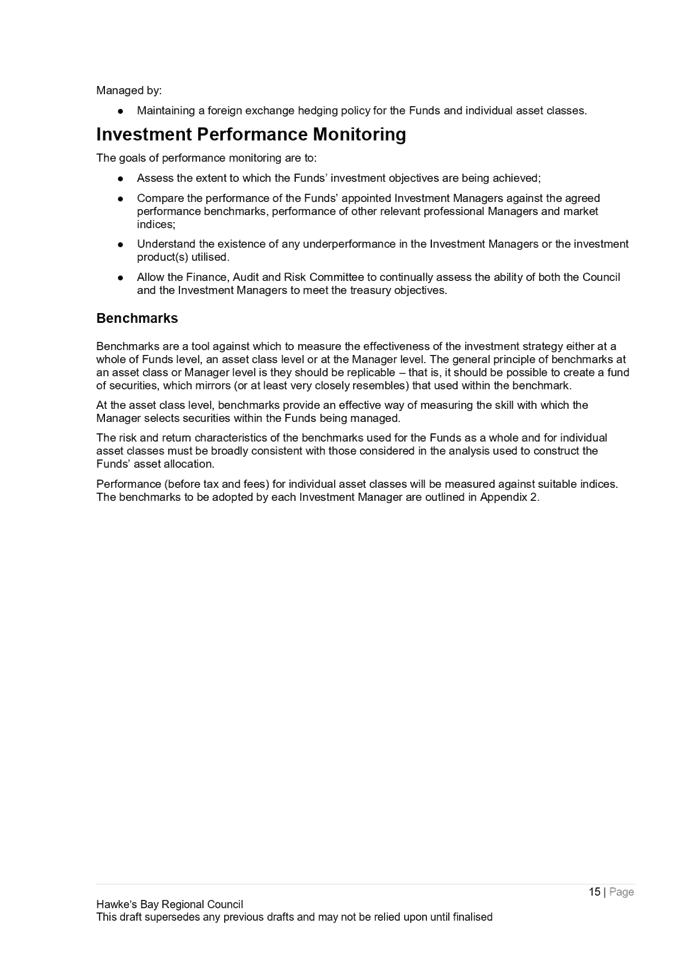

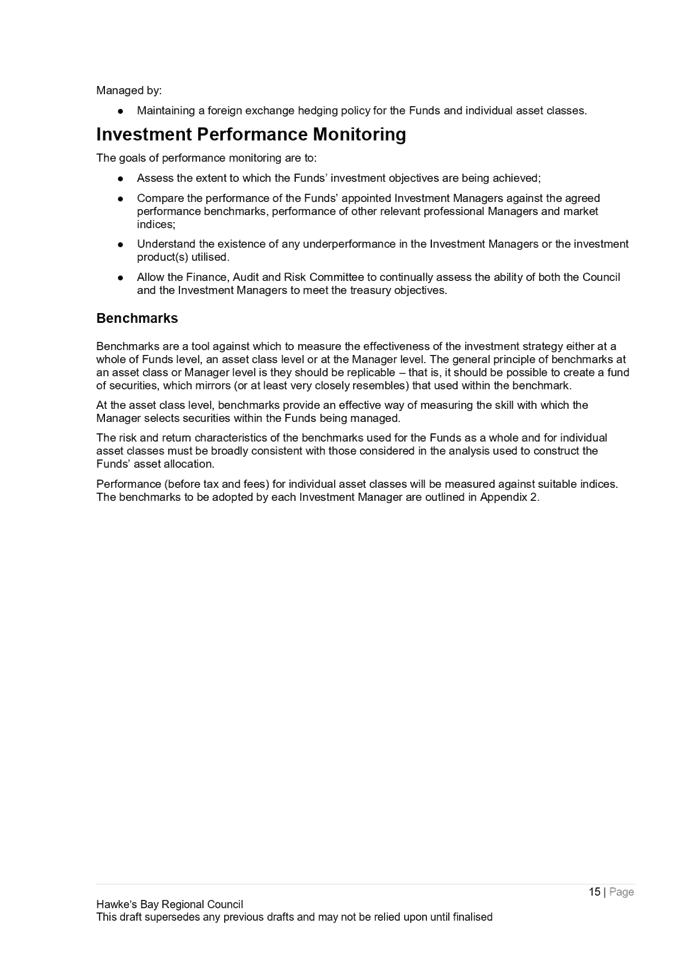

5.0 Borrowing Limits

|

Ratio

|

Hawke’s Bay Regional Council

|

LGFA

Lending

Policy

Covenants

|

Actual

|

|

Net external debt as a percentage of total revenue

|

<150%

|

<175%

|

|

|

Net interest on external debt as a percentage of total revenue

|

<15%

|

<20%

|

|

|

Net interest on external debt as a percentage of annual rates

income

|

<20%

|

<25%

|

|

|

Liquidity buffer amount comprising liquid assets and available

committed debt facility amounts relative to existing total external debt

|

>10%

|

>10%

|

20%

|

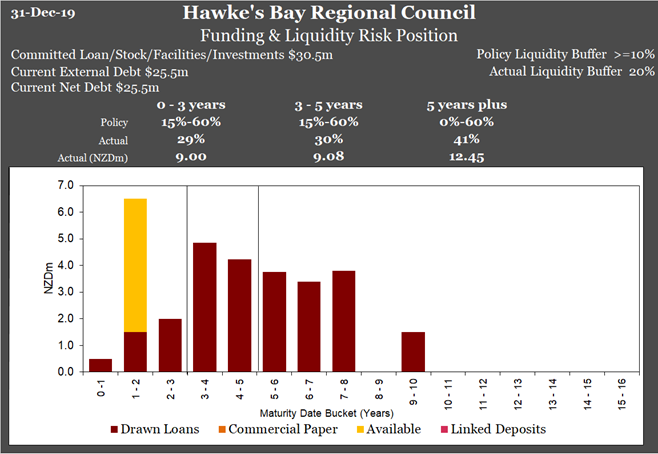

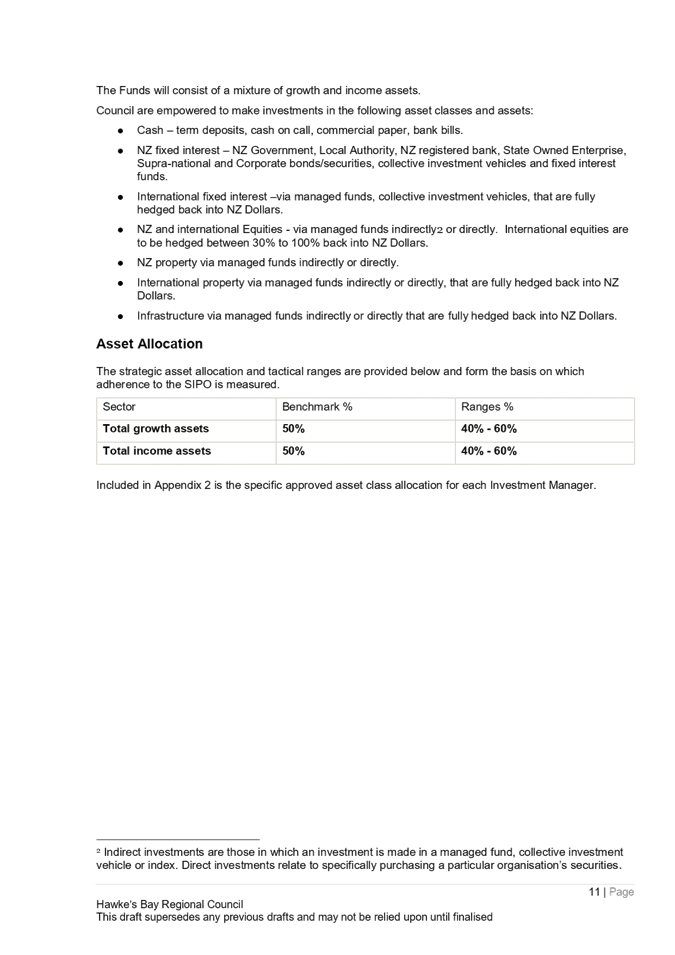

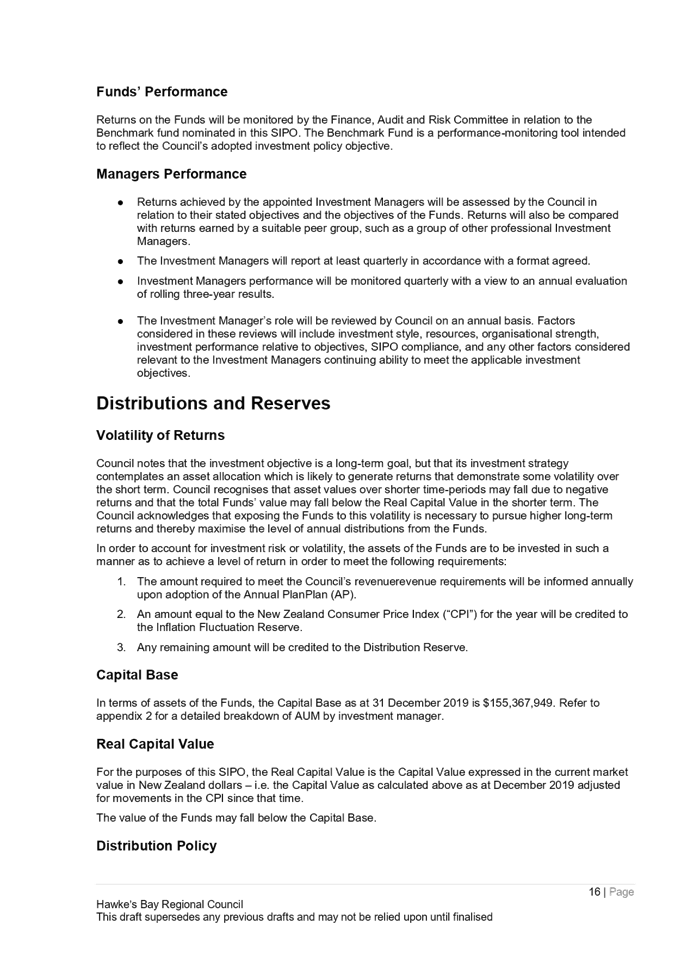

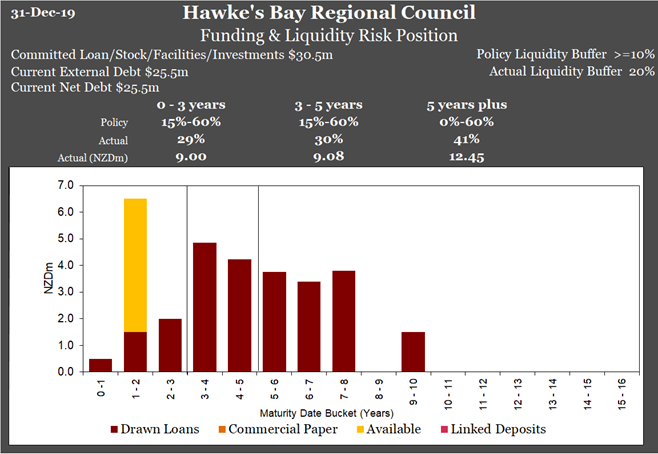

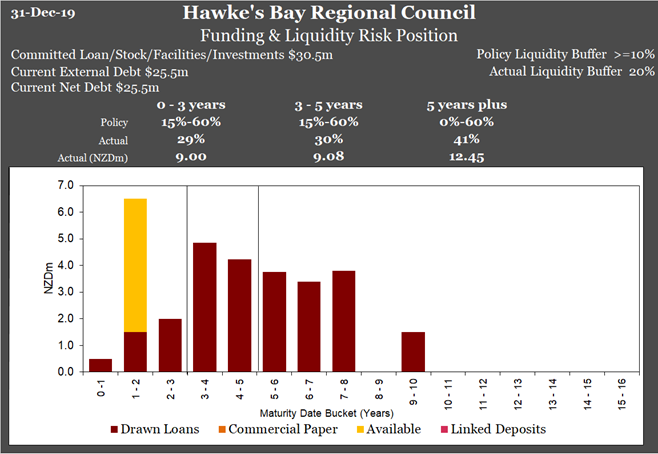

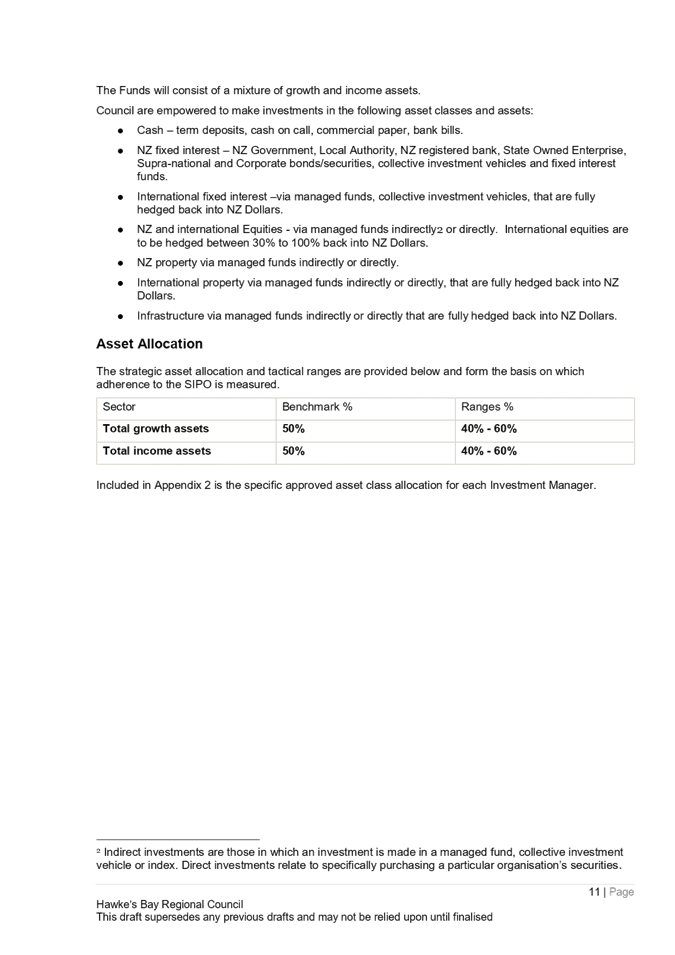

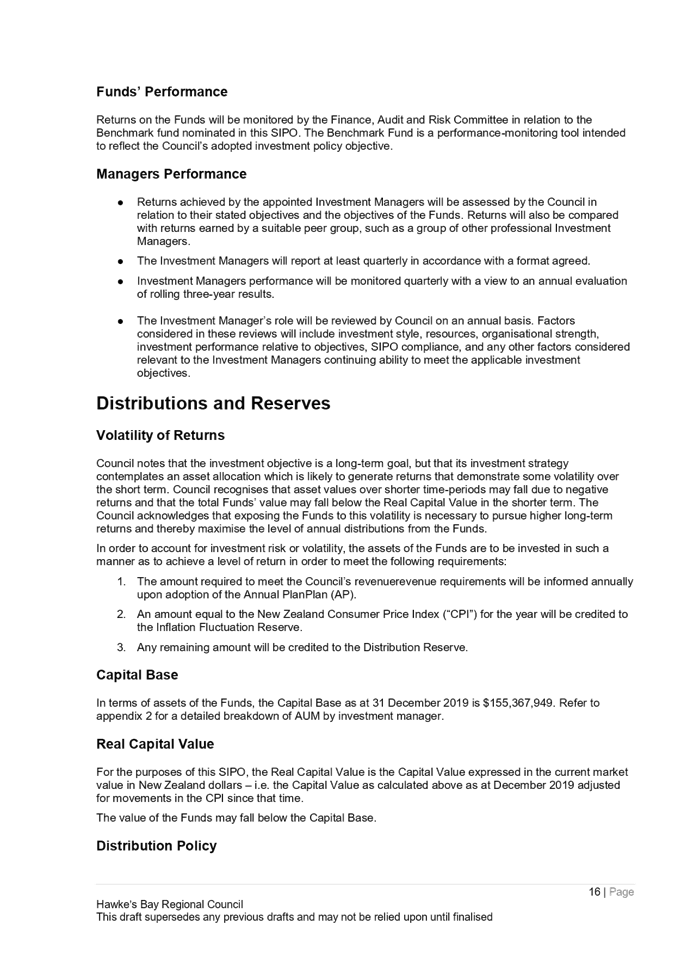

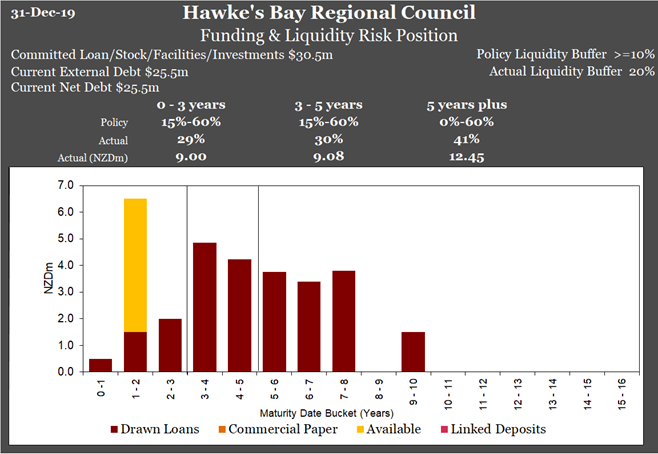

6.0 Funding

and Liquidity Risk Position

The chart below shows the

spread of Council’s current funding maturity terms and positioning within

funding maturity limits set out within the Liability Management Policy.

Council’s liquidity buffer amount is also shown.

Debt Funding Strategy

Council’s

cash flow and debt forecast indicate a requirement for an additional $10

million of core borrowings during this financial year. This level of debt

requirement is a function of FY19 borrowings being $2.5 million of the expected

$7 million. The first tranche of new funding is anticipated to be required in

the second quarter of FY20 (circa $5 million) and is proposed to be met via

participation in upcoming LGFA tenders.

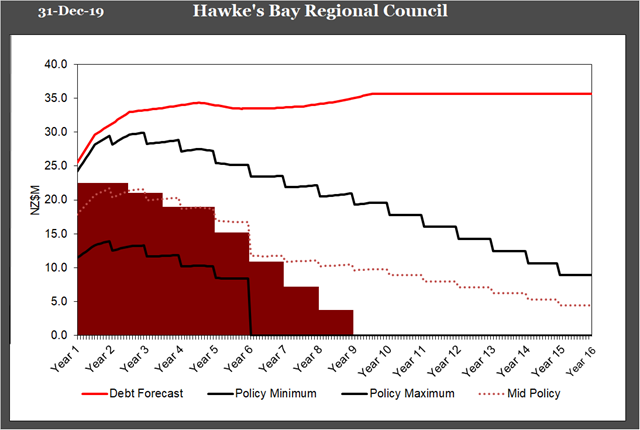

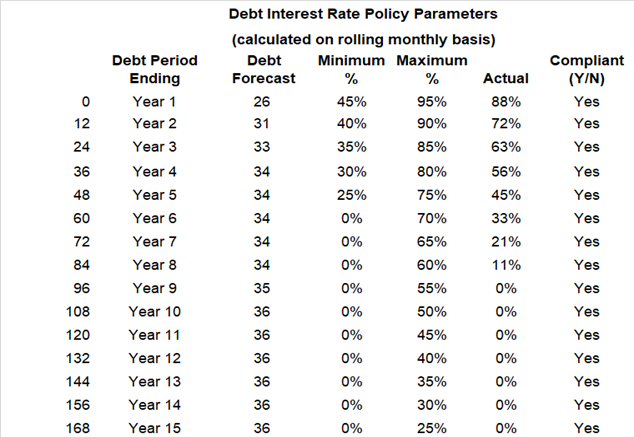

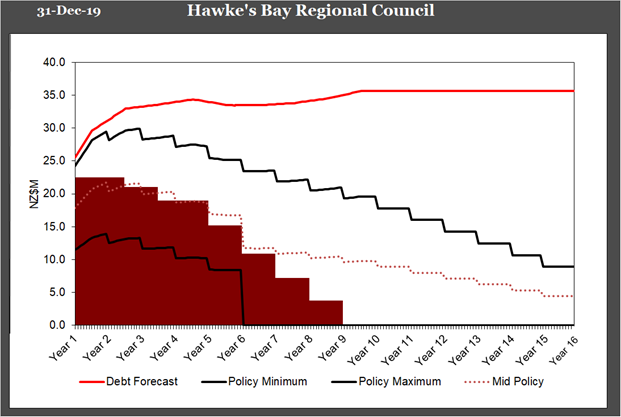

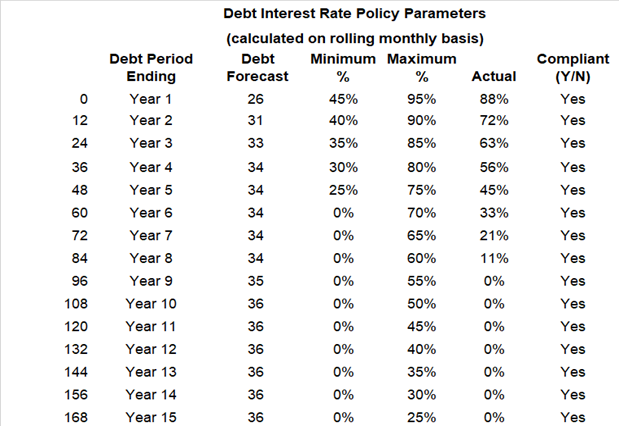

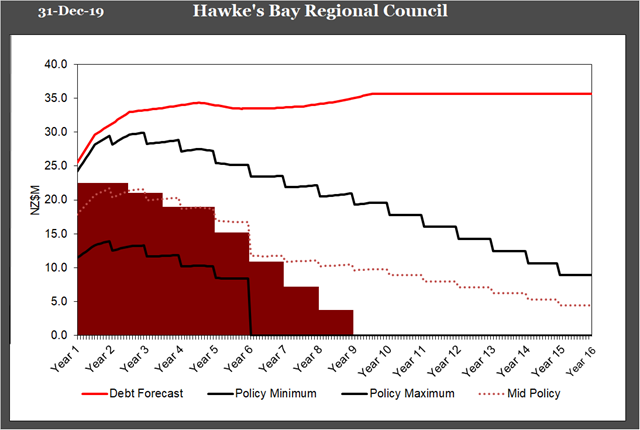

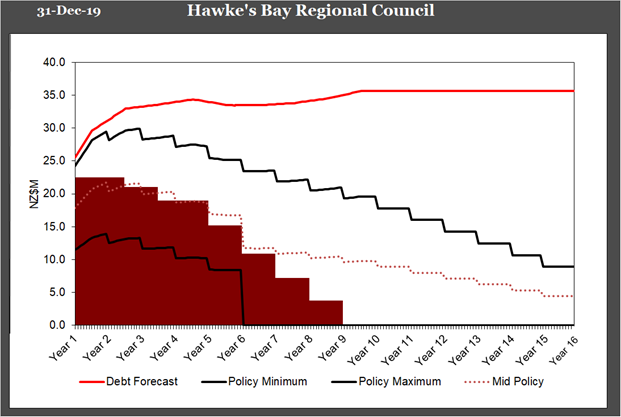

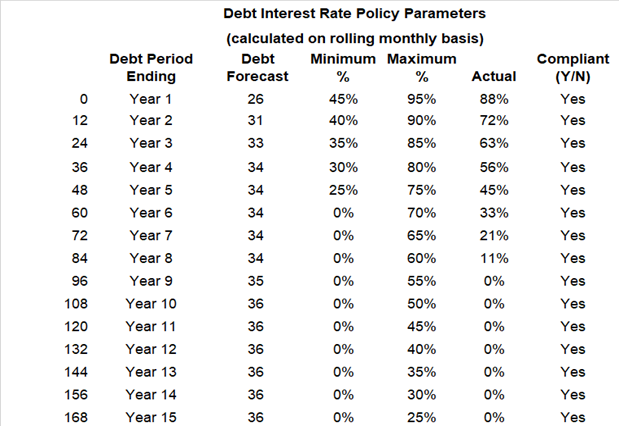

7.0 Interest Rate Risk

Position

The interest rate profile

below shows the level of Council’s interest rate fixing within Liability

Management Policy parameters. The shaded area represents fixed interest rate

commitments (i.e. term loans and/or derivatives) and their maturity terms over

the 15-year Policy period. The red line represents the current rolling debt

forecast for the forward period with the maximum and minimum bands a function

of the debt forecast.

As can be seen from the

chart and table below, the interest rate risk position is fully compliant to

all policy parameters.

Interest rate

strategy

With short term interest

rates expected to be lower for longer, as the RBNZ stimulates with loose

monetary policy settings, the fixed rate position will progressively move

towards minimum policy limits. The strategy is therefore to increase

exposure to short-term floating rates (within policy limits) through issuing

all new debt on a floating rate basis.

Long term interest rates are expected

to remain around current levels as global central banks maintain their loose

monetary policy requirements along with influencing low, longer term interest

rates. The longer term interest rate risk position will be maintained around

minimum policy limits through the use of interest rate swaps or fixed rate debt

issuance.

8.0 Funding Facility

|

Bank

(Facility

maturity date)

|

Maturity

Date

|

Drawdown

Amount ($m)

|

Facility

Limit ($m)

|

|

BNZ

|

15-Jan-21

|

0.00

|

5.00

|

|

TOTAL

|

|

0.00

|

5.00

|

|

Available

bank facility capacity (liquidity buffer)

|

This

month ($m)

|

Last

month ($m)

|

|

Gross

amount

|

5.00

|

5.00

|

|

Policy

liquidity buffer requirements

|

2.55

|

2.30

|

|

Excess

amount

|

2.45

|

2.70

|

9.0 Cost of Funds vs

Budget

|

Month

|

YTD

|

|

Actual ($m)

|

Budget ($m)

|

Actual ($m)

|

Budget ($m)

|

|

|

|

|

|

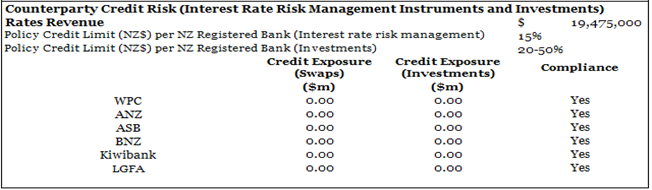

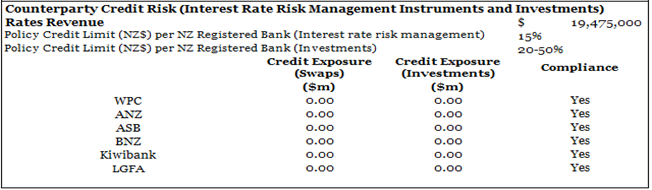

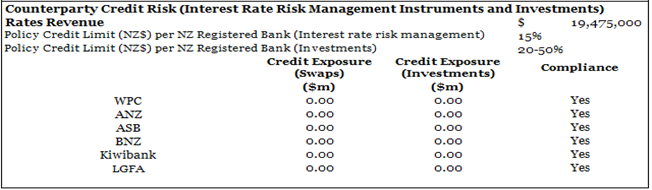

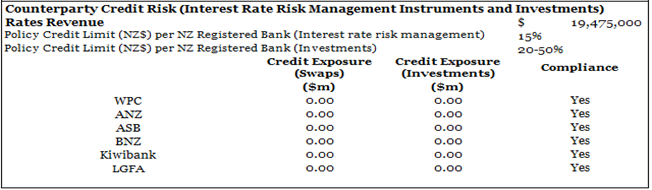

10.0 Counterparty

Credit

All counterparty credit

exposures are fully compliant with policy.

11.0

Market Commentary

Investment

markets

The last quarter of 2019

was a good news quarter, and in broad terms, financial markets responded

accordingly. The monetary stimulus provided by central banks in earlier

quarters has done its job with economic data generally improving. The

improvement is particularly evident in the housing market (rising median sales

prices and lower days to sell). In the US, the number of houses being built has

increased, while in Australia and New Zealand house price inflation has picked

up. This has supported an overall improvement in the economic outlook, which

has bolstered equity markets.

Accompanying the rosier

outlook has been waning expectations of further interest rate cuts, which is

best illustrated by US Federal Reserve (Fed) Chair Jerome Powell’s

comment that “monetary policy is in a good place”. Despite this,

both the Bank of Japan and European Central Bank announced their intention for

an open ended easing bias to deal with stubbornly low inflation. Adding to the

good economic news was the positive progress towards resolving: 1) The US/China

trade dispute, with the announcement of phase one of a trade agreement between the

US and China announced in January 2020; and 2) Brexit, with a decisive election

victory for Boris Johnson’s Conservative Party, which should see an

orderly exit of the United Kingdom from the European Union no later than 31

January 2020.

In this environment,

investors were content to invest in riskier assets types such as equities. This

resulted in the strong performance of New Zealand equities (+5.3%) and global

equities (+7.8%) in local currency over the quarter.

Unfortunately, the global

equity market return in New Zealand dollars (+1.5%) was significantly eroded by

the rise in value of the New Zealand dollar at the end of December, which rose

against all major currencies except GBP (GBP strengthened on the back of a more

favourable Brexit outcome). The NZD benefited from expectations the Official

Cash Rate would not be cut further, more optimistic investor sentiment and

importantly stronger commodity prices.

Increased investor appetite

for riskier assets meant that safe-haven asset values, such as gold and fixed

interest securities/bonds declined.

The stellar performance of

the New Zealand equity market over the quarter and year (+31.6%) warrants

closer examination. Without doubt, there has been increased interest in the New

Zealand equity market as bank term deposit interest rates tumbled from 3.3% in

April 2019 (where they had been since the end of 2015) to the current six month

deposit rate of 2.6%.

There has been an

extraordinarily diverse performance of equities over the quarter – from

Metlifecare (+53%, following a takeover offer) and Summerset (+34%) as

outperformers, down to Sky Network Television (-37%) and Gentrack (-28%) as

underperformers. While the weak performers reflect company specific issues, the

outperformers, except for Fisher & Paykel Healthcare, are all in the aged

care industry, which is benefiting from a reinvigorated housing market. The

other group of companies worth commenting on are the electricity generation

companies, which gave back a chunk of the gains achieved in early months on the

back of investors chasing dividend yields. They fell in price, due to concerns

around Rio Tinto’s review of the Tiwai Point aluminium smelter’s

operation. The smelter consumes 10% of New Zealand’s annual electricity

production, so a decision to shut the smelter down would result in an

electricity oversupply and subsequent drop in the electricity price.

Funding

markets

A

total of 21 local government borrowers raised $413 million in the fourth

quarter (Q4) of 2019. 39 separate funding transactions occurred, of which all

except two were conducted via the LGFA. The two debt issues transacted outside

of the LGFA were from Dunedin City Treasury (not a LGFA member). Borrowing

volumes remained strong in Q4, slightly lower than Q3. A total of 54% of all borrowing

in Q4 was undertaken on a floating rate basis. Over the fourth quarter,

Councils borrowed for a weighted average term of 6.9 years.

Looking

back on the full year, total issuance amounted to $2.40 billion; the highest

level since 2014 ($2.55 billion). Prefunding ahead of the LGFA's April 2020

bond maturity ($1.03 billion) is expected to support borrowing volumes

throughout the first quarter of 2020. We understand that, to date,

approximately 35% of the 2020 bond maturity have been refinanced/prefunded.

However, most councils are currently updating new debt forecasts and this may

push out issuance demand to the second quarter of 2020.

LGFA

credit spreads have continued to creep up since Q3 in the short end (three to

five years) and held reasonably constant for the longer end (7-10 years).

Government

bond yields remain at historically low levels reflecting global yield curves,

supporting the attractiveness of LGFA bonds as a substitute investment to NZ

Government bonds given the higher yields on offer. There was significantly less

Kauri bond issuance in 2019 with a total of $1.4 billion of new issuance

(relative to total issuance of $4.2 billion in 2018). LGFA bond demand (and

pricing) benefits when there is less Kauri issuance competing for the investor

dollar. With the expanded bond issuance program from Kāinga Ora (Housing

NZ) in 2020 of $2.5 billion (up from $1.5 billion in 2019), we expect some

impact on LGFA demand, thus increasing the risk that credit spreads widen

gradually in 2020, primarily for longer-dated tenors. We believe that investor

interest for LGFA bonds will however, remain robust for maturities up to 5

years and that there may be some upward movement on margins for longer dated

issuance.

Interest

rate markets

The

RBNZ surprised financial markets in November by holding the OCR at 1.00%. The

fundamental outlook no longer currently supports another cut to the OCR over

the next six months, although we expect risks remain biased lower. RBNZ note

while inflation remains below the 2 percent target, employment continues to sit

around its maximum sustainable level and other economic developments since the

August MPS “do not warrant a change to the already stimulatory monetary

setting at this time.” However, risks remain “tilted to the

downside.” Domestically, business confidence improved in December but

remains weak overall. Businesses are reluctant to make hiring or investment

decisions, and have struggled to raise prices, crimping sales margins. The

housing market is now showing signs of growth, while inflation pressures are

slightly stronger, however global risks (including the coronavirus) remain.

‘Lower for longer’ interest rate settings to prevail.

Long-term

NZ swap rates are biased lower as global rates are likely to remain under

structural pressure. Global growth remains tepid amid recent (but improving)

trade tensions between US and China, as well as Brexit uncertainty (though

easing following the election). There are signs of growth stabilising (rather

than further weakness) but uncertainty remains. A soft growth outlook from our

key export trading nations, Australia, China and Europe means that central

banks will continue their ‘looser’ monetary policy settings.

Underlying inflation around the globe remains benign. There remains no reason

for structurally higher long-term swap rates over the next twelve months.

12.0 Policy

exceptions

|

Date

|

Detail

|

Approval

|

Action

to rectify

|

|

TBC

|

SIPO

asset allocations non-compliant

|

Y

|

Gradual

staggering into investment portfolio positions will see strategic asset

allocation requirements met over coming months.

|

13.0 Appendix

13.1 New Treasury

Transactions up to 31 December 2019

Borrowing

activity

|

Bank/LGFA

|

Amount

(NZDm)

|

Borrower

notes (NZDm)

|

Deal

Date

|

Start

Date

|

Maturity Date

|

Commitment Fee

|

Margin

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Rate Borrower Swaps

|

Bank

|

Notional

Amount (NZDm)

|

Deal

Date

|

Start

Date

|

Maturity Date

|

Swap

Rate

|

|

n/a

|

n/a

|

n/a

|

n/a

|

n/a

|

n/a

|

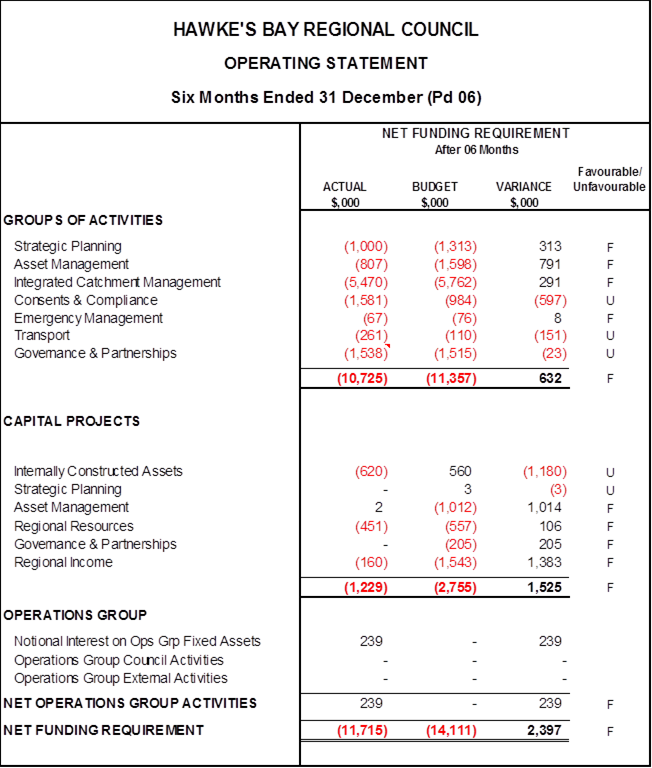

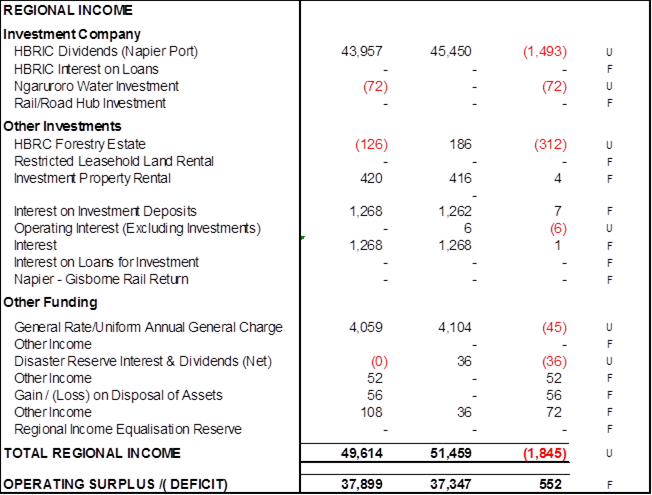

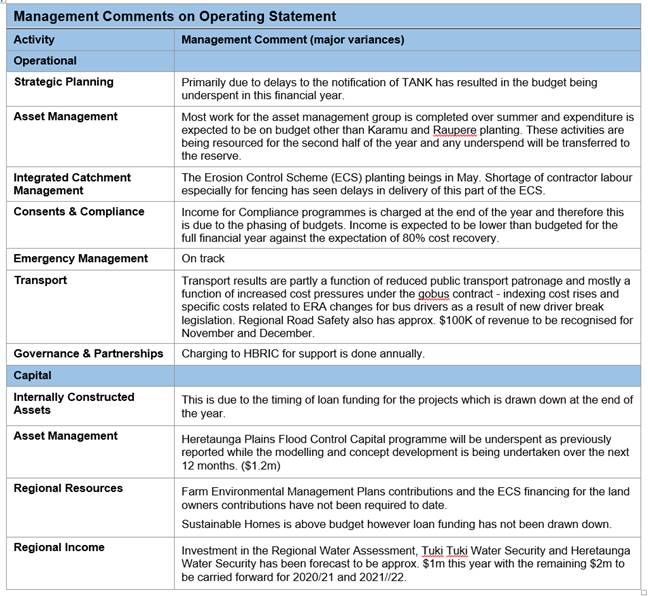

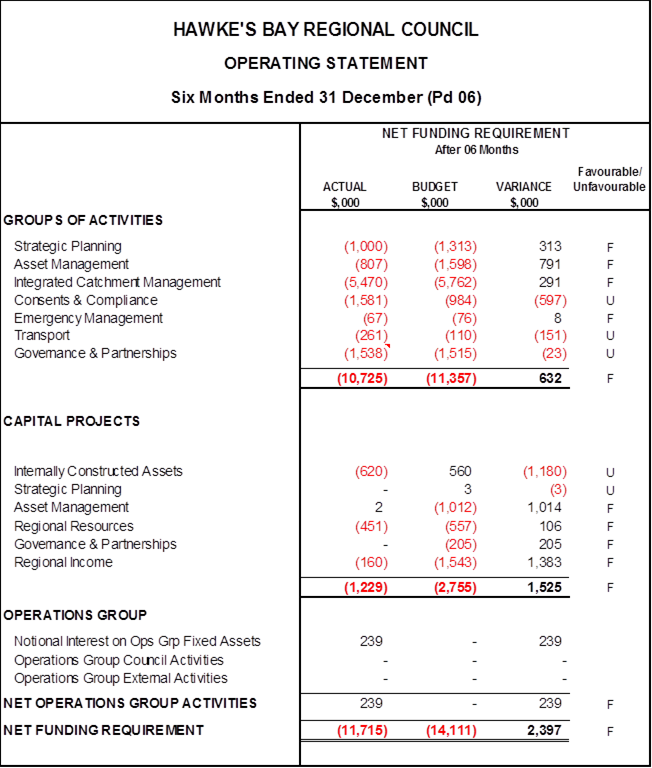

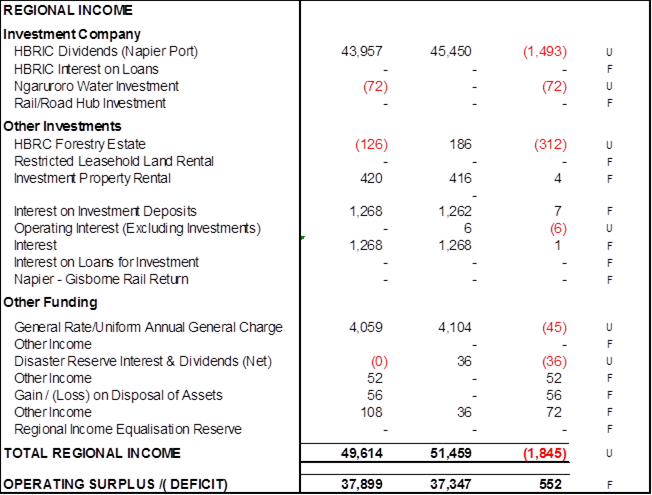

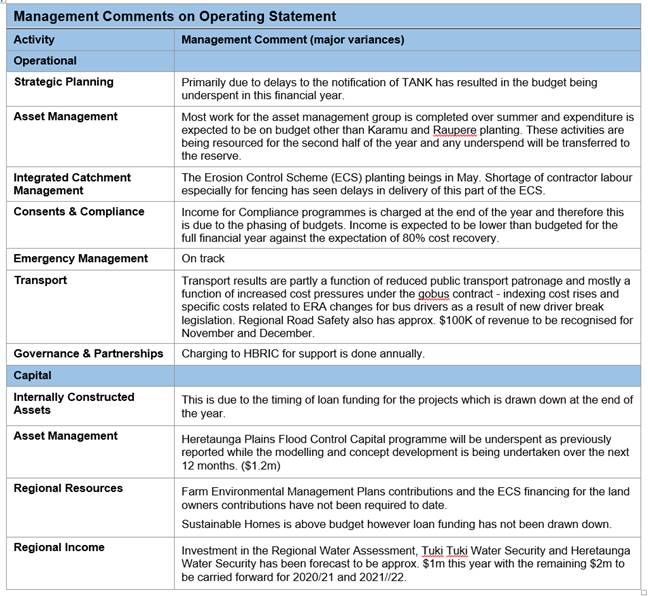

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 11 March 2020

Subject: Investment Strategy

Workshop Follow-up including Statement of Investment Policy Objectives Review

Reason for Report

1. On 5 February 2020 Councillors attended an Investment Strategy

workshop, the focus of which was to provide a brief history of endowed assets

and the pathway to the present asset mix with a focus on Council’s

revenue generating assets.

2. Discussions took place regarding;

2.1. The current and future mix of investments and the role of investment

income in the overall Revenue and Finance Strategy.

2.2. The investment approach of the Hawkes Bay Regional Investment

Company (HBRIC) and specifically any wish to take a more active investment

approach and

2.3. Exploring the role our investment capital should or can have in

driving regional outcomes.

3. The outcome of the workshop was instruction for staff to progress a

number of ‘next steps’ including the immediate review of the

Statement of Investment Policy Objectives (SIPO)

4. This paper also presents proposed changes to the SIPO following

feedback received from Fund Managers (Jarden and Mercer), PwC Treasury and

discussion at the recent 12 February 2020, Finance Audit and Risk Sub-Committee

(FARS) meeting.

5. This report outlines a proposed work programme and timeframes to

progress the identified ‘next steps’ arising from the Investment

Strategy workshop, and seeks Councillor feedback.

Officers

Recommendations

6. Staff recommend the Committee provide feedback on proposed actions

and timeframes to progress ‘next steps’ of the Investment Strategy

Workshop, specifically the additional request from Cr Foss to perform a review of Internal Processes and Controls –

Managing Requests for Funding and Proposals for investment.

7. That the committee discuss and adopts the recommended revisions to

the SIPO.

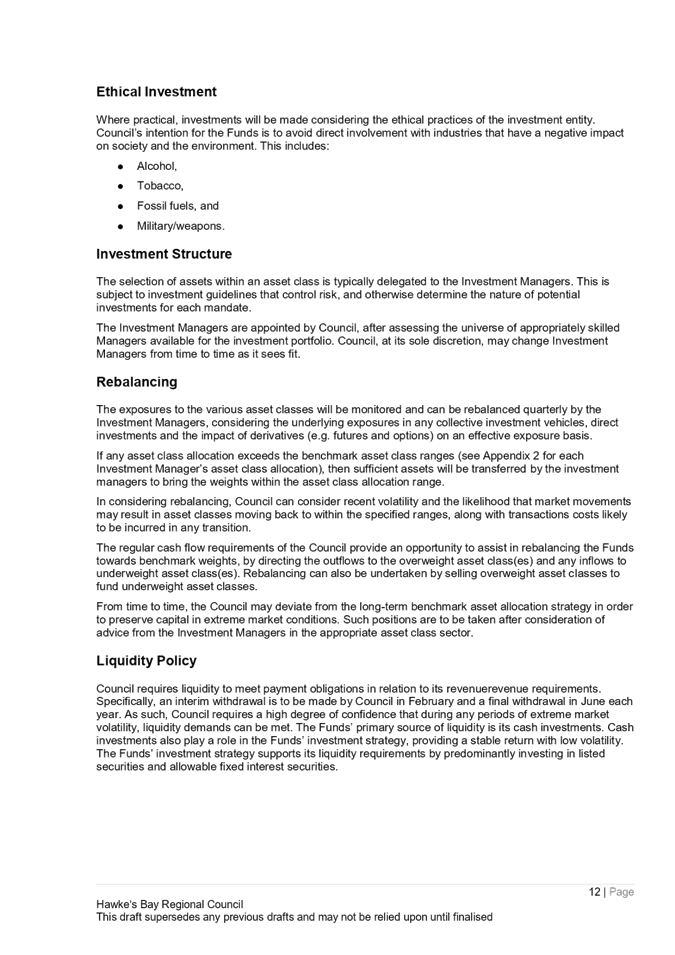

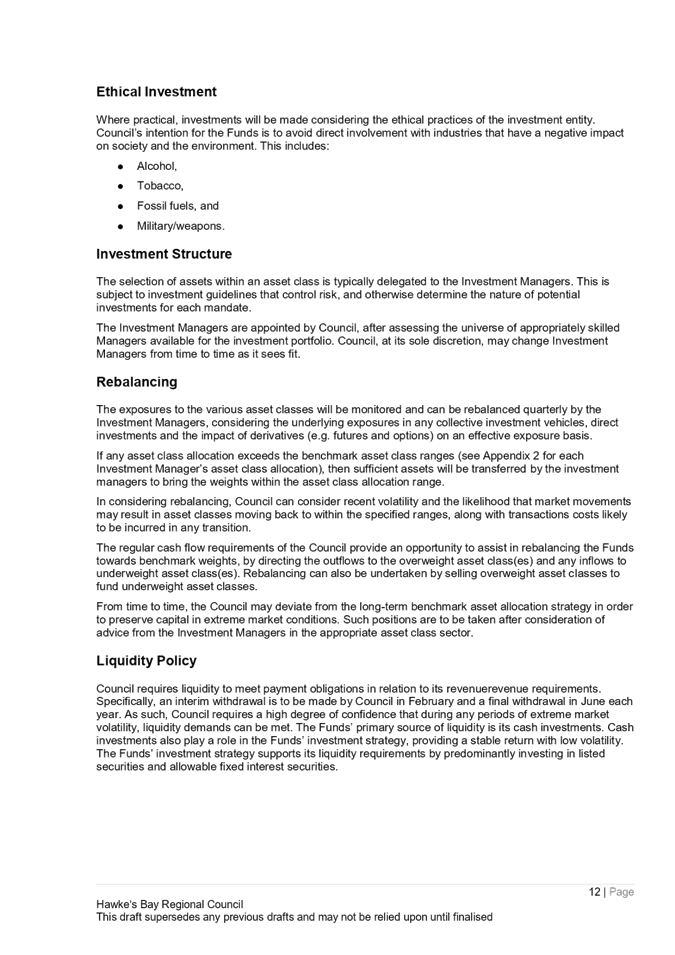

Investment Workshop Next Steps - Update

|

Investment

Workshop - Next Steps

|

Actions

|

|

1. Staff recommended planning a series of workshops to

review and debate current financial policy decisions and strategies including

the Revenue and Financing Policy and Investment Strategy leading up to the

2021-31 LTP, including Councils risk appetite.

|

Plan and timeline to

review will be presented at the 1 April 2020 workshop

|

|

2. SIPO - Staff recommended the Finance, Audit and Risk

Committee begin a process to review, revise and extend the SIPO to include

all financial investment activities and to explicitly reflect the different

policy parameters of the two investment funds.

|

SIPO review has been undertaken by the FARS and recommended changes

are attached and detailed later in this paper.

|

|

3. Policy recommendations for the establishment of an

Investment Income Equalisation Reserve will be presented to the Finance,

Audit and Risk committee in May 2020.

|

Draft policy will be considered by FARS on 13 May 2020. The

2020-21 Annual Plan includes approx. $2mil of income to be attributed

to this reserve.

|

|

4. Opportunities for investment in afforestation will

be considered as part of the Right Tree Right Place project being covered

comprehensively through the Environment and Integrated Catchments Committee

for incorporation into the Investment Strategy as appropriate.

|

Alignment of this

workstream with the Long Term Plan development is supported by the RTRP

Steering Group

|

|

5. A carbon strategy should be developed.

|

To be developed by Ben

Douglas, HBRC Forest Management Advisor, with input and assistance from

Finance and policy staff.

A workshop is currently

being scheduled to agree steps required to develop the policy.

|

|

6. A robust process is developed to ensure elected

members and officers involved in the investments decision making have access

to adequate information to enable them to make informed decisions as to

whether to enter into or progress due diligence of a specific investment.

Significant investment decisions should ideally be considered through

existing planning / budgeting timeframes such as Annual Plan or Long Term

Plan processes.

|

Formal process and

policy to be developed by J Ellerm and B O’Keefe

|

Review of Internal Processes and

Controls – Managing Requests for Funding and Proposals for investment

8. In addition to

the above next steps recommended by Staff at the workshop (detailed above) Cr

Foss has requested staff develop an overview which outlines and maps existing

internal controls, policies and processes used to manage external requests for

funding and / or proposals to council for investment either directly or via the

Hawkes Bay Regional Investment Company (HBRIC). These proposals and

requests are varied and may arise from but not limited to; PGF funding /

co-funding opportunities, requests for sponsorship, requests for funding,

joint-venture and partnership arrangements and opportunities.

9. This review is

intended to demonstrate the necessity for robust processes in this area,

highlight the increasing pressure on Councils fiscal position, and the volume

of financial demands received in any given year / budgeting period.

10. The outcome should provide

assurance around the current process and highlight potential

improvements. It is expected to include a recommendation for the development

of a registry to provide transparency and visibility of all requests that are

made, the response or actions of staff including where funding has been granted

or declined, and why.

11. Staff acknowledge there

are many independent groups and organisations that share Councils objectives,

and in many cases are better placed to deliver on them. However, it

should also be noted that Council does not currently have any budgetary

provision for contestable and discretionary community grants or funding allocations

outside of sponsorship. If this is something Council would like to

explore further it should be channelled through either the Annual Plan and / or

Long Term planning processes.

12. This work, if supported by

the committee, will be progressed and reported through to the 13 May FARS

meeting.

Proposed Changes to the SIPO

13. Following the Investment

Strategy Workshop staff reported feedback and recommended changes to the

current SIPO from Fund Managers, staff and PwC treasury via the Treasury Report

to the 12 February FARS. (Treasury report including fund performance

analysis has been attached to the Report and Recommendations from FARS)

14. The review also addresses

the need to explicitly reflect the different policy parameters of the two

investment funds being the Long Term Investment Fund (post RWSS) and the Future

Investment Fund (Napier Port proceeds).

15. Overall staff believe the

SIPO remains fit for purpose and no fundamental changes have been made or are

required.

16. Further staff acknowledge

and agree that Council’s return target may be more difficult to achieve

over coming years due to the historically low interest rate environment and

extended investment markets. However, we do not believe it prudent to alter the

portfolio’s strategic asset allocation by moderating the risk profile.

This would introduce a level of risk to the portfolio that is not congruent

with Council’s willingness and ability to take risk. It may also hinder

Council’s ability to achieve its investment objectives should a

significant negative event occur in any period.

17. A number of minor edits to

the attached SIPO have been made including minor wording adjustments around

hedging which are deemed suitable, and administrative points that have been

updated or refined in this first review since the policies inception.

More significant changes are detailed and explained below:

18. Illiquid Assets

– addresses Jarden’s inability to invest in illiquid assets under

the current SIPO. We believe this should be reviewed to ensure it is fairly

aligned with Mercer’s ability to invest up to 10% of the portfolio in

illiquid, ‘unlisted property’ and ‘unlisted

infrastructure’. Staff and PwC agree with Jarden’s comment that as

long as there is an expected accelerated return for the additional risk of

investing in illiquid assets, which are expected to be held over the medium

term, an acceptable proportion of the Fund should benefit.

19. Minimum

‘investment grade’ Credit Rating - refers to the minimum credit

rating required for fixed income investments. Staff and PwC agree with

Jarden’s view that the minimum rating could be lowered to BBB- from BBB+.

This would continue to maintain a minimum ‘investment grade’ credit

rating across the portfolio, enhance the fixed income yield opportunity and

diversification allowing access to a deeper issuance population. The

minimum country credit rating requirement remains unchanged. Overall

there has been minimal defaults in the global BBB credit rating space over the

past four decades; the highest year was 1% of total BBB issuance in 2002 and

has been close to 0% over the past decade.

Strategic Fit

20. The purpose of the SIPO is

to assist Council, the Corporate and Strategic Committee, the Finance, Audit

and Risk Committee, Council executives and the Investment Managers in

effectively supervising, monitoring and evaluating the management of Investment

Funds.

21. The revenue or income

derived from invested funds contributes to Councils Investment Income which is

a fundamental element of Councils overall Revenue and Financing Policy.

Financial and Resource Implications

22. No fundamental changes

have been made to the SIPO and specifically no changes to return

expectations. As a result there are no expected financial implications.

Other Considerations

23. Council has previously

given significant consideration to the matter of Ethical Investment however

staff believe the SIPO reads fairly “light” in this regard. It is

noted that Mercer suggested formalising a more thorough Responsible Investing

(RI) Policy as part of the SIPO review.

24. The FARS did not support a

RI review at this time, however it remains topical and Councillors may be

particularly interested in being socially responsible investors who encourage

corporate practices that they believe promote environmental stewardship.

25. Fund Managers

from Jarden will be in attendance at the Corporate and Strategic meeting on 11

March and Councillors can explore this subject if they wish.

Decision

Making Process

26. Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

26.1. The decision

does not significantly alter the service provision or affect a strategic asset.

26.2. The use of

the special consultative procedure is not prescribed by legislation.

26.3. The decision

is not significant under the criteria contained in Council’s adopted

Significance and Engagement Policy.

26.4. The decision

is not inconsistent with an existing policy or plan.

26.5. Given the

nature and significance of the issue to be considered and decided, and also the

persons likely to be affected by, or have an interest in the decisions made,

Council can exercise its discretion and make a decision without consulting

directly with the community or others having an interest in the

decision.

|

Recommendations

That the

Corporate and Strategic Committee:

1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that Council can exercise its discretion and make decisions on

this issue without conferring directly with the community and persons likely

to be affected by or to have an interest in the decision.

2. Supports the proposed actions and timeframes for staff to progress

next steps from the Investment Strategy Workshop.

3. Supports the

request from Cr Foss for staff to perform a review of Internal Processes and

Controls – Managing Requests for Funding and Proposals for Investment;

to be reported back to the Finance Audit and Risk Sub-committee.

4. Recommends that Hawke’s Bay Regional Council accepts the

proposed changes and revisions to the Statement of Investment Objectives for

adoption; following which the Group Manager Corporate Services will provide instructions to the Investment Managers.

|

Authored by:

|

Bronda Smith

Chief Financial Officer

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

⇩1

|

Statement of

Investment Policy and Objectives

|

|

|

|

Statement

of Investment Policy and Objectives

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 11 March 2020

Subject: Remission of Penalties

on Rates Policy (Fixed Term) Statement of Proposal for Consultation

Reason for Report

1. This report

asks the Corporate and Strategic Committee to recommend to Council that it

adopts the Remission of Penalties on Rates Policy (Fixed Term) Statement of

Proposal for consultation.

2. This report

also seeks direction from the Committee on its preference for the make-up of

the hearings panel that will hear submissions on this consultation (set down

for 19 May 2020). A panel could be all of Council, a sub-group of

nominated Councillors or the Hearings Committee.

Officers’ Recommendations

3. Council

officers recommend that the Committee accepts the Remission of Penalties on

Rates Policy (Fixed Term) Statement of Proposal for consultation as proposed,

and recommends its adoption by Council.

4. Officers also

recommend the establishment of a sub-committee made up of three Councillors.

Background

5. The Remission

of Penalties on Rates Policy (Fixed Term) was adopted by Council on

25 September 2019, subject to consultation. The aim of the one-time

policy is to support ratepayers as we transition to a new final rate payment

date; from 31 January 2021 to 20 September 2020.

6. The policy will

enable ratepayers to apply for a waiver of penalties added to their rates for

late payment for the first year of the changeover - 1 July 2020 to 30 June

2021. The policy is in addition to Council’s existing policy on

Remission of Penalties on Rates. Our current Remission of Penalty on

Rates Policy ‘conditions and criteria’ allow for one remission every

three years for a missed rate payment for circumstances which are under the

ratepayer’s control.

7. The Local

Government Act (LGA), Section 102(4) requires an amendment to a rates remission

and postponement policy be consulted on using the provisions of Section 82.

8. The special

one-time, fixed-term penalty remission policy aims to assist ratepayers who may

experience financial difficulty in paying their rates on time as we transition

to a new rate payment date.

9. This follows

Council’s decision on 26 June 2019 when it approved new dates for when

Council’s rate invoices are sent out and when payment is due, effective

from 1 July 2020.

10. Up until this year,

assessments/invoices were sent out mid-September and due 1 October each

year, however HBRC allowed ratepayers until 31 January the following year to

pay before a penalty was applied.

11. From this year rate,

assessments/invoices will be sent out early to mid-August, and the final due

date will be 20 September. After this date penalties will be applied.

12. For ratepayers who choose

to pay their rates on the final payment date, this change effectively brings

the payment due date forward approximately four months and means they will have

two rate invoices in the 2020 calendar year.

13. The policy enables

ratepayers to apply for a waiver of the 10% penalties added to their rates

invoice if they cannot pay their rates on time. The policy will only be

in place from 1 July 2020 to 20 September 2021 and will only apply to rates due

for the financial year 1 July 2020 to 30 June 2021.

14. The objective of moving

the final date for rate payments is to remove the payment pressure on

ratepayers over the holiday period, as well as improve Council’s cash

flow and recover income earlier.

15. Rates are the main direct

source of income for Council. Typically, Council receives approximately

70% of the rates revenue in January and February – seven to eight months

into the financial year.

16. Staff have been

implementing a communications plan to advise, inform and educate ratepayers on

the change to the date payments are due. This has included information in

the previous rates newsletter sent to ratepayers with their invoices in

September 2019, Facebook posts on Regional Council’s Facebook page, information

on Council’s website, information on our email banners, a digital

campaign through the Hawke’s Bay Today and Stuff sites, and adverts in

the Hawke’s Bay Today, CHB Mail and Wairoa Star newspapers.

17. This campaign of rates

communications will be accelerated from March to September 2020.

18. As noted earlier, the

proposed Remission of Penalties on Rates Policy (Fixed Term) is an additional

policy. Council acts fairly and reasonably when a rate payment has not

been received by the due date and has the following rates Remission and

Postponement polices in place.

18.1. Māori Freehold Land

18.2. Remission in Special

Circumstances;

18.2.1. Remission of Rates in

Special Circumstances

18.2.2. Remission of Penalties on

Rates

18.2.3. Remission of Rates of

Properties Affected by Natural Calamity

18.3. Remission for Uniformed

Annual General Charges (UAGC)

18.4. Postponement in Cases of

Financial Hardship or Natural Disaster.

19. To be granted a remission

or postponement under any of the above policies certain ‘conditions and

criteria’ must be met before a penalty remission is granted.

20. Our current Remission of

Penalty on Rates Policy allows for one submission every three years for a

missed rate payment for circumstances which are under the ratepayer’s

control (provided the conditions and criteria are met). The fixed term

policy will allow for an additional Remission in this instance.

Consultation Process

21. As noted earlier, an

amendment to a rates remission and postponement policy requires consultation

under Section 102 (4) of the Local Government Act in a manner that gives effect

to the requirements of Section 82.

22. The proposed policy is

both a remission and postponement policy as defined by the Local Government

(Rating) Act 2002 and Local Government Act 2002.

23. Staff recommend a

condensed consultative process, targeting all ratepayers while still giving

effect to the principles of consultation in Section 82 Local Government

Act. This is based on the likely support by the public and the limited

community effect relating to the adoption of this Statement of Proposal.

24. The Council will invite

submissions and feedback over a period of two weeks. Submissions will be

collated, heard and the final decision made on 24 June 2020.

25. The key dates for

consultation are:

26. 14 April 2020 Consultation

opens

28 April 2020 Consultation

closes

19 May 2020 Set

aside for people to present their views in person

24 June 2020 Decision

made by Regional Council

27. The proposed communication

activities are outlined in the table below. The key messages are:

27.1. The Regional Council

seeks public views on a Statement of Proposal to offer some ratepayers a

one-time late-payment penalty waiver

27.2. This option can help

ratepayers who find it hard to pay this year’s rates on time

27.3. Rates this year are due

four months earlier than last year

28. Supporting messages are:

Regional Rates are due 20 September. Once adopted, this amendment means

that ratepayers experiencing hardship can apply for a one-time waiver of the

late-payment fee on Regional Rates. The Regional Rates team is here to

help: call 835 2955 (8am-5pm) or email rates@hbrc.govt.nz.

|

WHAT

|

WHO BY

|

AUDIENCE

|

DUE

|

|

April

2020

Web page

content – including Statement of Proposal and online form

Email

– Māori & Regional Planning Committee

Media

release – eNews, web, Facebook

Public

notice – Hawke’s Bay Today

Social media

posts

Reception TV

Internal

communication (staff)

|

MarComms

(for all

actions)

|

Public

Tāngata Whenua

Media/ Public

Public

Public

Staff/

visitors

Staff

|

8 April

8 April

8 April

11 April

14 - 28

April

14 - 28

April

8 April

|

|

May -

June 2020

Hearing

– details and related comms TBC

Decision

– factored into Rates communications

|

Governance

MarComms

|

Public

Ratepayers

|

19 May

After 24

June

|

Significance and Engagement Policy

Assessment

29. Staff have considered

Council’s Significance and Engagement Policy as part of the process for

developing the consultation approach for the Statement of Proposal along with

the principles of consultation in Section 82 Local Government Act.

Financial and Resource Implications

30. The Financial and

Resourcing implications for the consultation will be met within existing

budgets.

Decision Making

Process

31. Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have

assessed the requirements in relation to this item and have concluded:

31.1. The

decision does not significantly alter the service provision or affect a

strategic asset.

31.2. The persons affected by

this decision are all ratepayers in the region.

31.3. LGA

section 102(4) requires that an amendment to a rates remission and postponement

policy must be consulted on using the provisions of Section 82. The planned

consultation gives effect to that.

|

Recommendations

1. That the Corporate and Strategic Committee receives and considers

the “Remission of Penalties on Rates Policy (Fixed Term) Statement of

Proposal for Consultation” staff report.

2. The Corporate and Strategic Committee recommends that

Hawke’s Bay Regional Council:

2.1. Adopts the Statement of Proposal for Remission of Penalties on Rates Policy (Fixed Term) consultation

as proposed.

2.2. Establishes

a Hearing Panel made up of three Councillors to hear submissions on 19 May if

required

|

Authored by:

|

Drew Broadley

Community Engagement and Communications

Manager

|

Trudy

Kilkolly

Principal Accountant Rates and Revenue

|

|

Mandy Sharpe

Project Manager

|

Bronda Smith

Chief Financial Officer

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

James Palmer

Chief Executive

|

Attachment/s

|

⇩1

|

Draft

Statement of Proposal - Remission of Penalties on Rates Policy (Fixed Term)

|

|

|

|

Draft

Statement of Proposal - Remission of Penalties on Rates Policy (Fixed Term)

|

Attachment 1

|

Remission

of Penalties on Rates Policy (Fixed Term)

Statement of Proposal

Consultation 14 – 28 April 2019

What is the proposal?

This is a proposal to implement a

one-time policy that provides ratepayers an opportunity to apply for a waiver

of a penalty fee for late payment on their Hawke’s Bay Regional Council

rates.

The objective of this policy is

to support ratepayers who may find it difficult to pay their rates on time due

to Council’s change in date for when rate payments are due.

The policy would be put in place

for one year, to cover the first year of change to the new payment date, and

will apply only to rates due for the financial year 1 July 2020 to 30 June

2021.

Background

On 26 June 2019, Hawke’s

Bay Regional Council approved new dates for when its rate invoices will be sent

out and when rates are due to be paid. These new dates will be in place for the

financial year 1 July 2020 to 30 June 2021.

Up until this year, rate invoices

have been sent out mid-September and due 1 October, with Hawke’s Bay

Regional Council allowing ratepayers until 31 January the following year to pay

their rates before a 10% late-payment penalty is added to their invoice.

For the 2020-21 rating year,

rates invoices will be sent out early to mid-August, with payment due 20

September. Ratepayers that don’t pay their invoice by then will have the

10% late-payment fee added.

For ratepayers who choose to pay

their rates on the final payment date for the 2019/20 rates of 31 January,

this change means they will need to pay their rates invoice four months earlier

and means they will have two rate invoices in the 2020 calendar year.

On 25 September 2019,

Hawke’s Bay Regional Council adopted (subject to consultation) a special

one-time, fixed-term penalty remission policy to help ratepayers who may

struggle to pay their rates on time because of the change to the payment date.

Regional Council already has Rate

Remission and Postponement policies in place so it can act fairly and

reasonably when a rates payment has not been received by the due date.

The current remission of Penalty

on Rates Policy allows one remission every three years for a missed rate

payment for circumstances which are under the ratepayer’s control,

provided they meet the conditions and criteria. Under that policy, a ratepayer

who was granted a penalty remission in the last two year would be ineligible

for another remission.

Introducing this additional

Remission of Penalties on Rates Policy (Fixed Term) would mean ratepayers may

apply for a remission even if they have received a remission in the last two

years as per the standard Remission of Penalties on Rates Policy.

Why are we consulting on this?

This policy is both a remission

and postponement policy as defined by the Local Government (Rating) Act 2002

and Local Government Act (LGA) 2002.

An amendment to a rates remission

and postponement policy requires consultation under Section 102 (4) of the

Local Government Act in a manner that gives effect to the requirements of

Section 82.

The purpose of this consultation

is to seek the views of people who will or may be affected by, or have an

interest in the decision to implement the additional policy.

Scope of the decision

All aspects of the Remission of

Penalties on Rates Policy (Fixed Term) are being consulted on. As a result of

feedback received during the consultation, the Council may decide not to adopt

the policy, or change any aspect of the policy such as the conditions and

criteria.

The submission process

People wishing to submit on this

consultation are invited to do so by 5pm on Tuesday 28 April 2020.

The Regional Council will support

you to present your views in a manner that best suits your preferences,

including sign language or any other language.

This includes one of the

following ways:

§ Online: through the

Regional Council website: hbrc.govt.nz (search #XXXX)

§ Email: info@hbrc.govt.nz

§ Post to: Leone Andrews, Hawke’s Bay Regional Council, Private Bag

6006, Napier 4142

§ Deliver to: HBRC offices in Napier, Taradale, Waipawa or Wairoa.

The submission form on the back

of this proposal is also available from the Regional Council offices in Napier,

Taradale, Waipawa or Wairoa.

If you have any queries please

contact Leone Andrews, Executive Assistant to Group Manager Corporate Services.

Email: leone.andrews@hbrc.govt.nz

Phone: (06) 833 8010

What is the process from here?

§ 14 April 2020 Consultation

opens

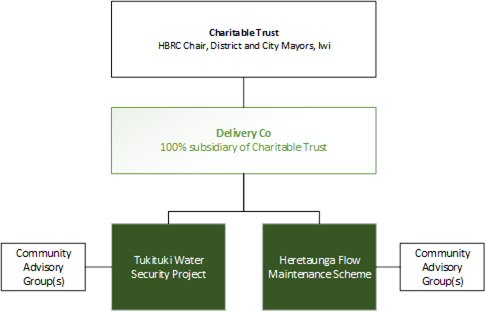

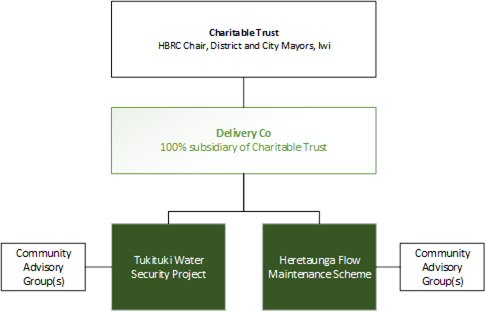

§ 28 April 2020 Consultation