HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 12 February 2020

Subject: Financial Results for

the 2019-20 Financial Year, for the Period to 31 December 2019

Reason for Report

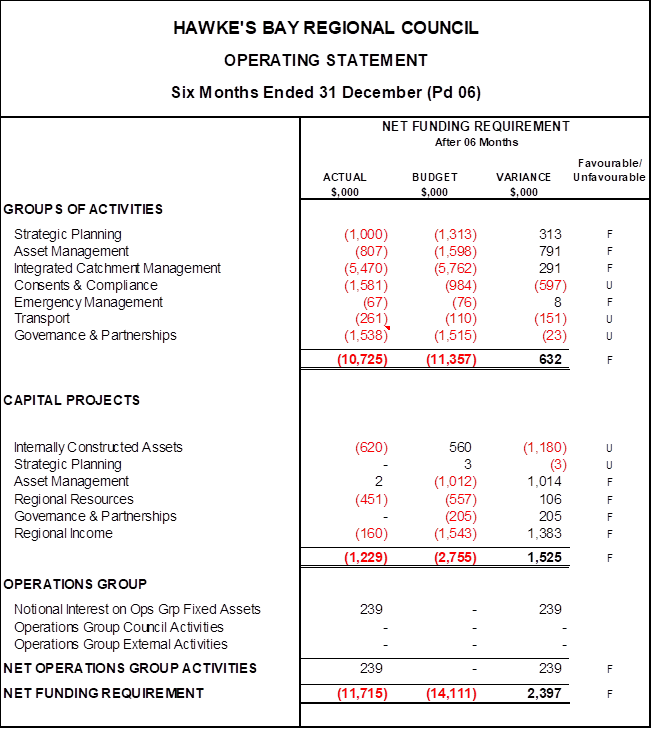

1. To provide the Sub-committee with a financial progress report for

the first six months of the 2019-20 financial year to 31 December 2019.

Financial

Summary to 31 December 2019

2. The financial

results for the first half of the 2019-20 year are detailed in the attachment

with commentary on the high level variations.

3. The budgets are

currently prorated evenly across the year. However, a significant level of operational

expenditure occurs in the second half of the year due to summer work programmes

and planting season. Therefore the funding requirements show a favourable

position however this is to be expected based on the even spread of budgets.

4. Based on the

above, the following could have an overall impacts on the year end position.

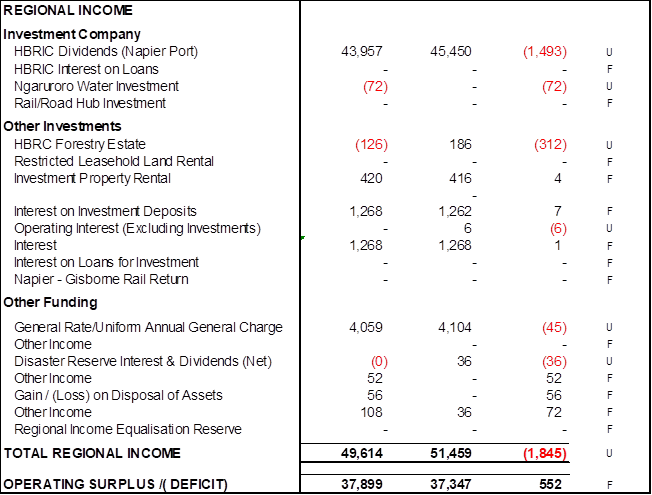

Revenue

4.1. For Consents

and Compliance, the budget assumes an 80% cost recovery from private benefits

(Fees and Charges). While the majority of revenue for this group is received at

the end of the financial year, indications are that this level of cost recovery

will not be met. A more detailed analysis of this has been started to assist

with the requirements of the Long Term Plan and any policy changes that may be

required.

4.2. There is some

potential upside given the year to date performance of the Long Term Investment

Fund (based on expected annualised returns detailed in the Treasury report).

This may be required to offset the above and any additional operational costed

detailed in this report.

Operational Expenditure

4.3. Following the

outcome of the Remuneration Review in June, the financial impact on the 2019-20

financial year was estimated as an increase of 4.4% on staff costs against a

budgeted increase of 2%. This is anticipated to be offset in 2019/20 by the

large number of vacancies (currently 20 vacant positions).

4.4. The IT

infrastructure environment has been moving from on-premise to Infrastructure as

a Service due to a security event which has sped up the transition. As a result

of this additional costs have been identified and are now better understood.

Therefore the budget for 2019/20 was not adequate. It is expected that costs in

this area will exceed budget.

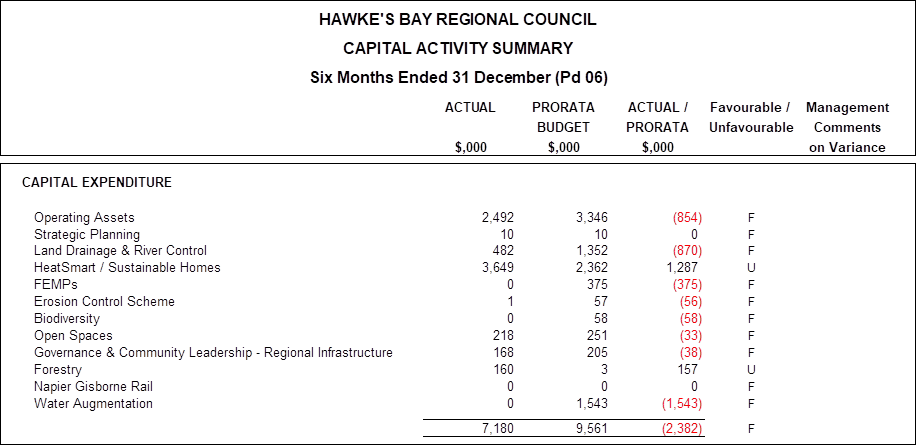

Capital Expenditure

4.5. For Regional

Income (Water Security and Forestry) it is expected that capital expenditure

will be below budget for the 2019-20 year and that any unspent money will be

requested to be carried forward as the overall programme is expected to be on

budget.

4.6. For Asset

Management, the Heretaunga Plains Flood Control Capital programme will be

underspent as previously reported while the modelling and concept development

is being undertaken over the next 12 months. ($1.2m).

5. Overall, we are

expecting there to be variances against full year budgets and the Finance team

will be working with budget holders to quantify the impacts. Details are

anticipated to be reported to the next Sub-Committee meeting.

Financial

Reporting Development

6. A significant program of work is underway to improve and enhance the

capability for financial reporting including the replacement of the Financial

Management System and the redevelopment of the Financial Reporting across

Council. In the future, staff would like to work with the FARS to

develop more robust and transparent reporting to ensure that Council is

provided with financial information that adequately supports governance and

decision making.

7. This programme of work is expected to take place over the following

18 months to 2 years and will include the budget development and reporting

requirements for the Long Term Plan.

8. An update on this project will be provided at the meeting.

Decision Making

Process

9. Staff have assessed the requirements of the Local Government Act

2002 in relation to this item and, as such, the updated Business Continuity

Plan needs to be accepted by the Finance, Audit and Risk Sub-Committee.

|

Recommendation

That the Finance, Audit and Risk Sub-committee receives and notes

the “Financial Results for the 2019-20 Financial Year, for the Period

to 31 December 2019” staff report.

|

Authored by:

|

Bronda Smith

Chief Financial Officer

|

|

Approved by:

|

Jessica

Ellerm

Group Manager

Corporate Services

|

|

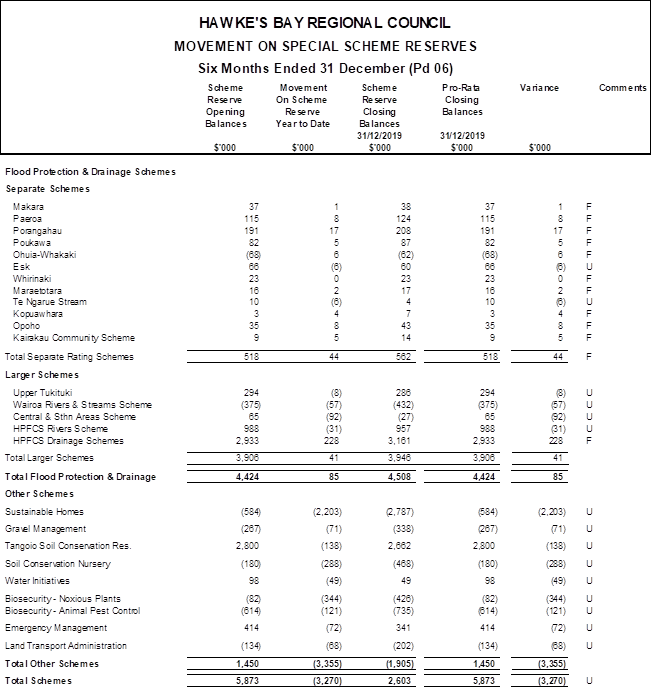

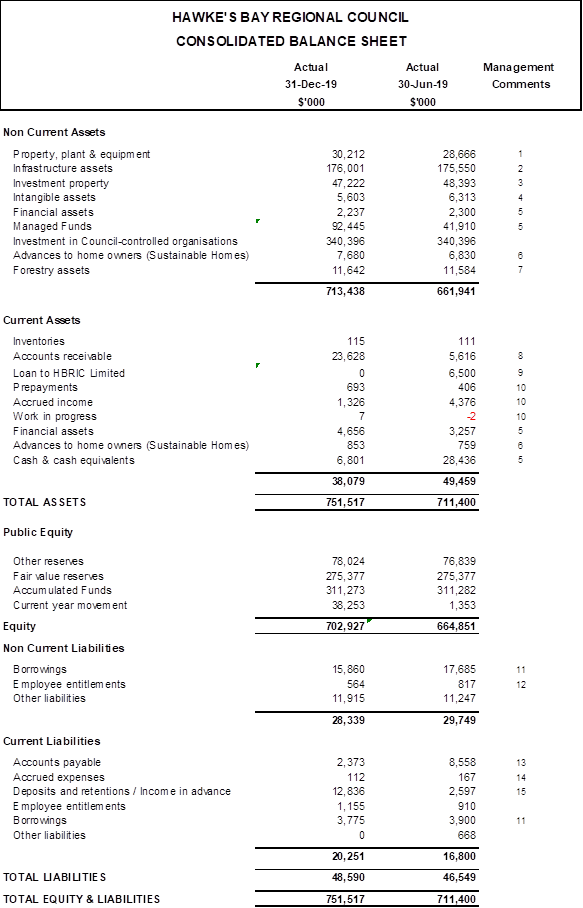

Attachment/s

|

⇩1

|

Financials

for period to 31 December 2019

|

|

|