Meeting of the Finance Audit & Risk Sub-committee

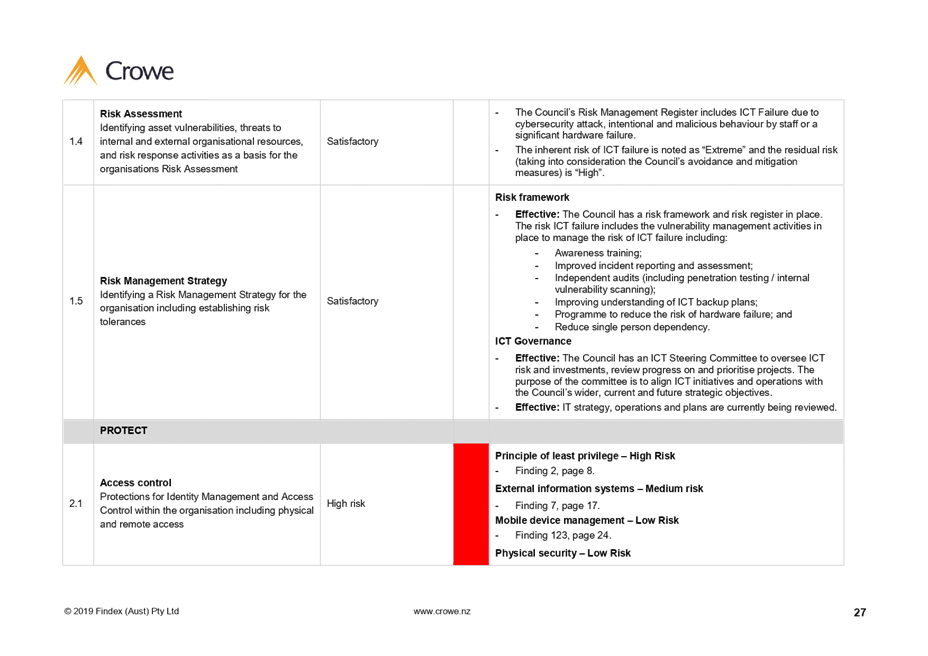

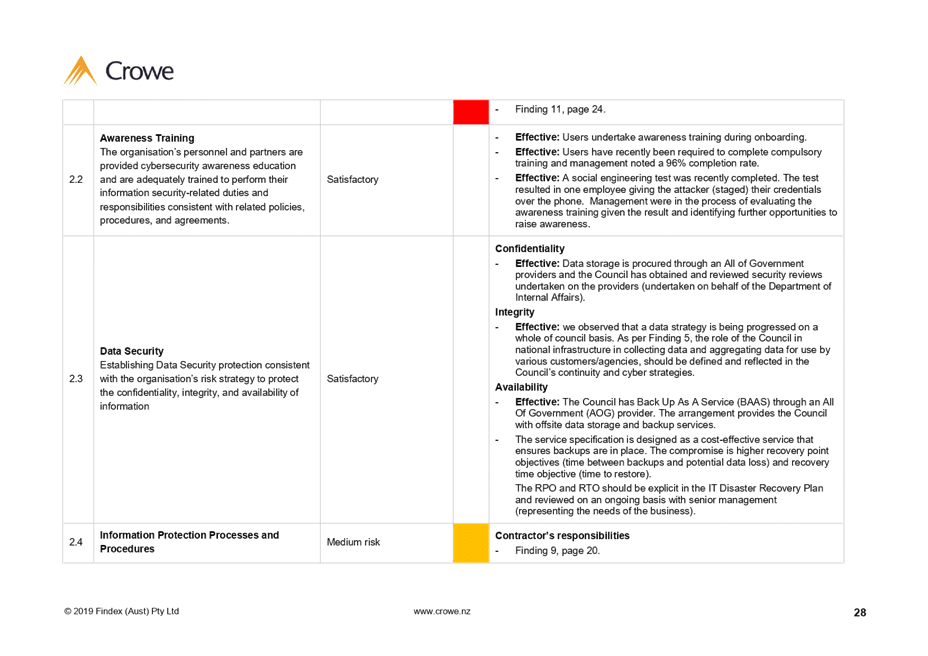

Date: Wednesday 12 February 2020

Time: 9.00am

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

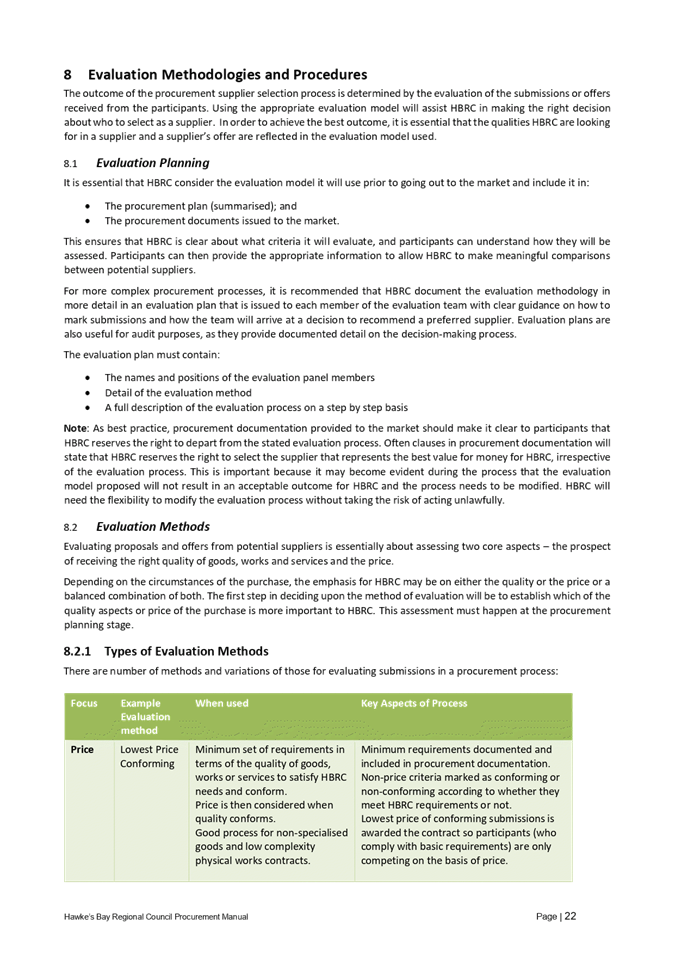

159 Dalton Street

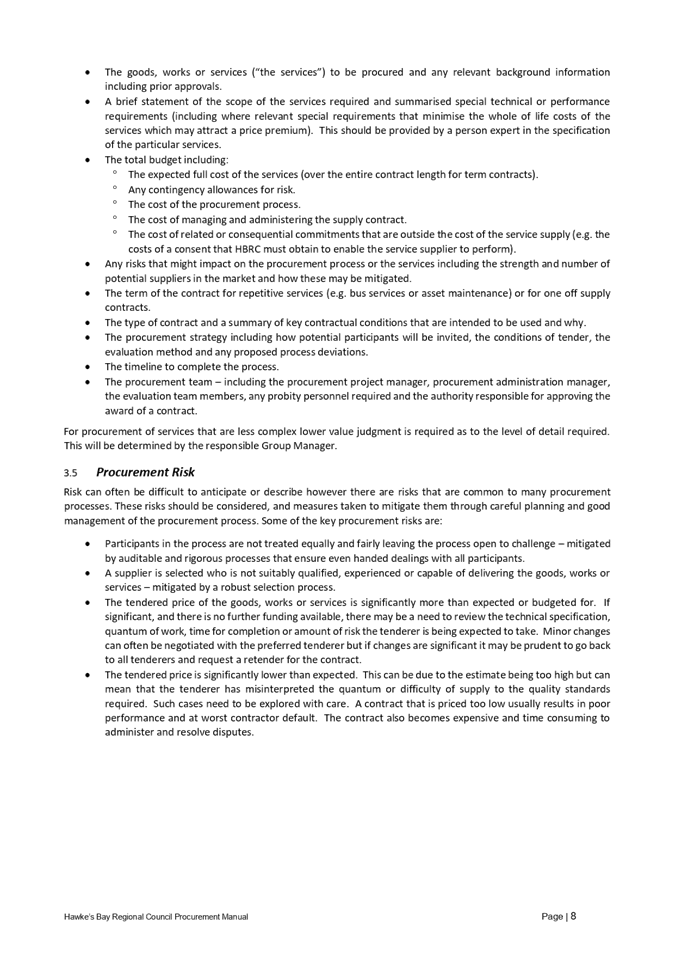

NAPIER

|

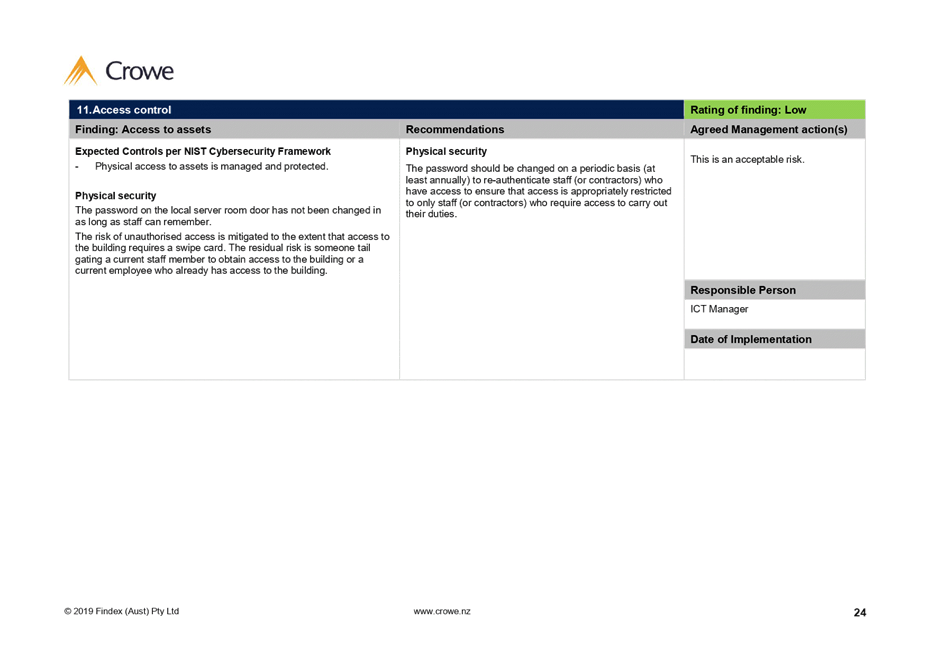

Agenda

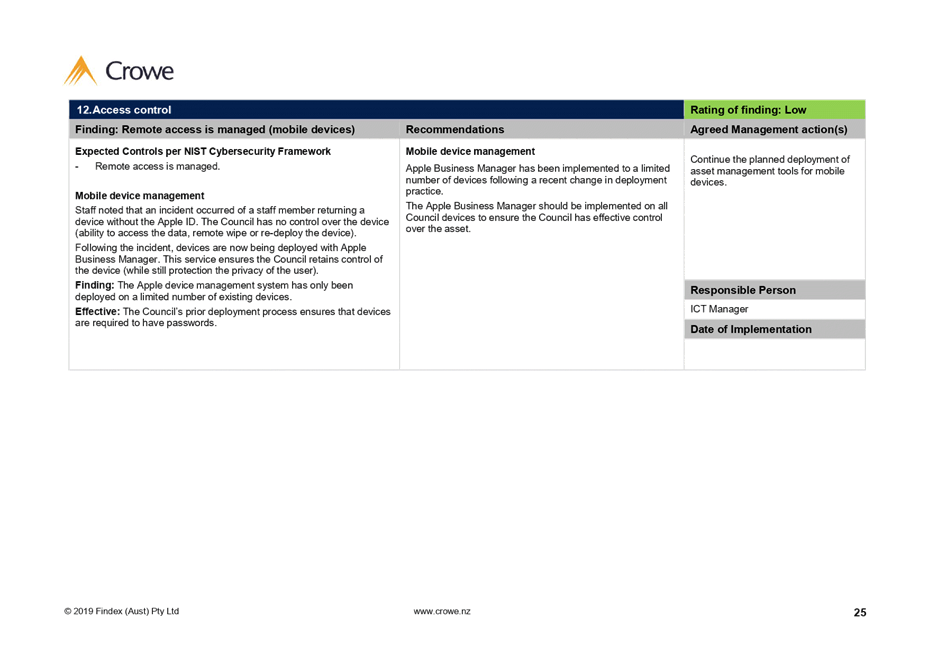

Item Subject Page

1. Welcome/Notices/Apologies

2. Conflict

of Interest Declarations

Decision Items

3. Confirmation

of the Terms of Reference for the Finance, Audit and Risk Sub-committee 3

4. Sub-committee

Work Programme 9

5. Risk

Assessment and Management 15

Information or Performance Monitoring

6. Introduction

of Council’s Audit NZ Auditor, Karen Young

7. Treasury

Report for period to 31 December 2019 23

8. Business

Continuance Plan 45

9. Cyber

Security Internal Audit 81

10. Procurement

Policy and Procurement Manual Update 119

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 12 February 2020

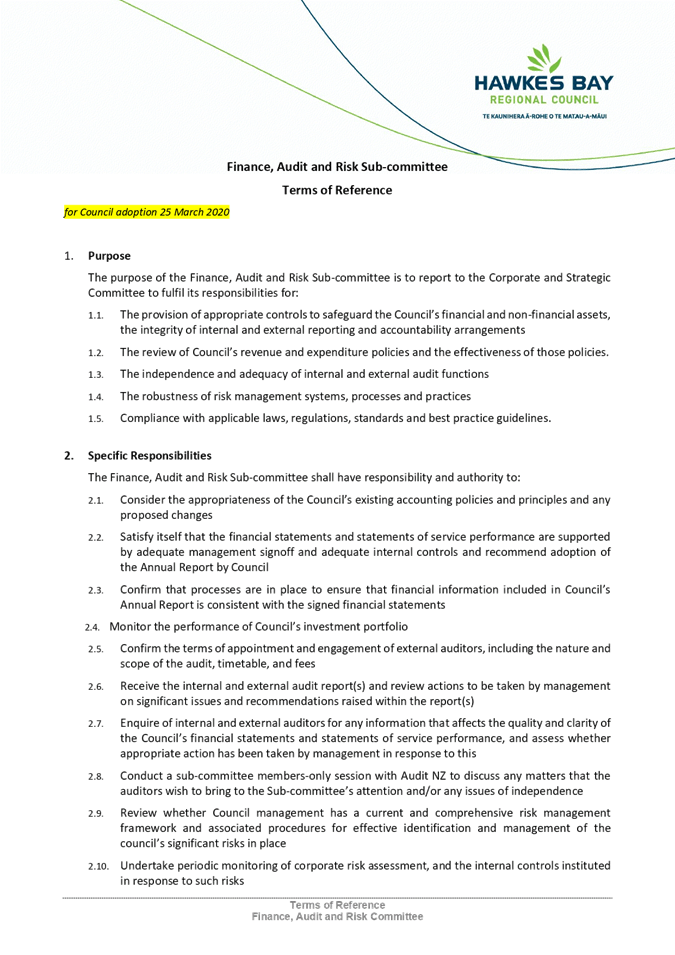

Subject: Confirmation of the

Terms of Reference for the Finance, Audit and Risk Sub-committee

Reason for Report

1. This item provides an opportunity for the Finance, Audit and Risk

Sub-committee (FARS) to review and amend or re-confirm its Terms of Reference

as adopted by Council on 6 November 2019. It is then necessary for the

Sub-committee to recommend the Terms of Reference to the Corporate and

Strategic Committee for confirmation, either as proposed or including agreed

amendments.

Officers’ Recommendation(s)

2. Council officers recommend that the Terms of Reference (ToR) is

reviewed by the Sub-committee and amended to clarify its role and

responsibilities before being recommended to the Corporate and Strategic

Committee for confirmation and further recommendation to Council for adoption.

Background /Discussion

3. The Finance,

Audit and Risk Sub-committee was first established by Hawke’s Bay

Regional Council in June 2015, and the Terms of Reference have remained largely

unaltered since then. At the time of the FARS establishment, a separate Charter

document was also agreed.

4. Following

Council’s decision to re-establish the sub-committee at the beginning of

this triennium, it is the view of staff that this is an opportune time to refine the ToR to ensure it is fit for purpose and accurately

reflects the role of Council’s Governors. To that end, the version of the

Terms of Reference proposed is based on the Terms of Reference adopted for the

last triennium rather than the version proposed for establishment of an Audit

and Risk Committee reporting directly to Council.

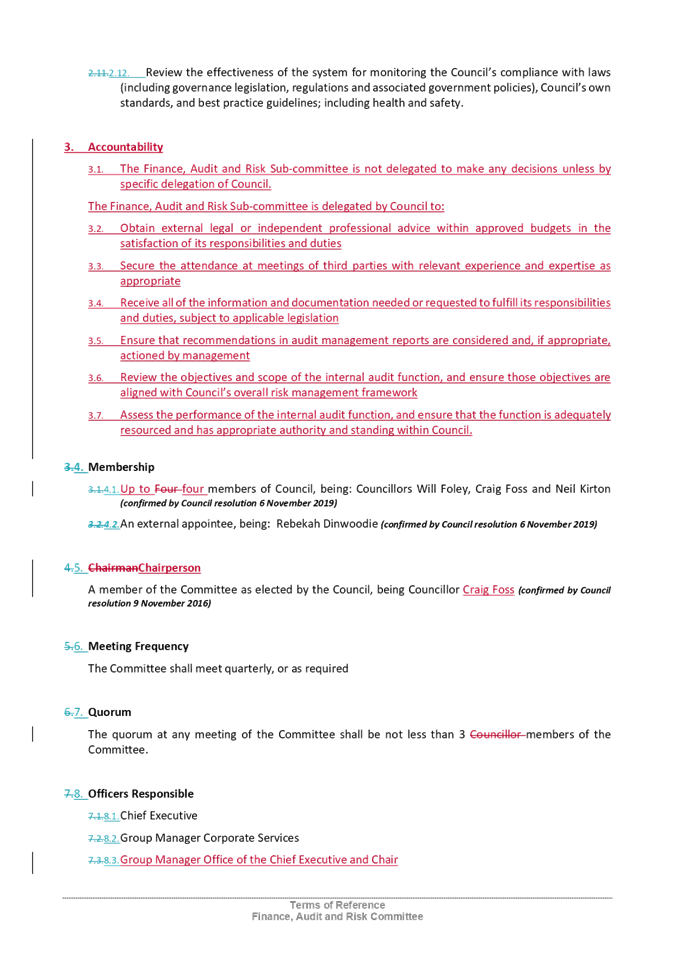

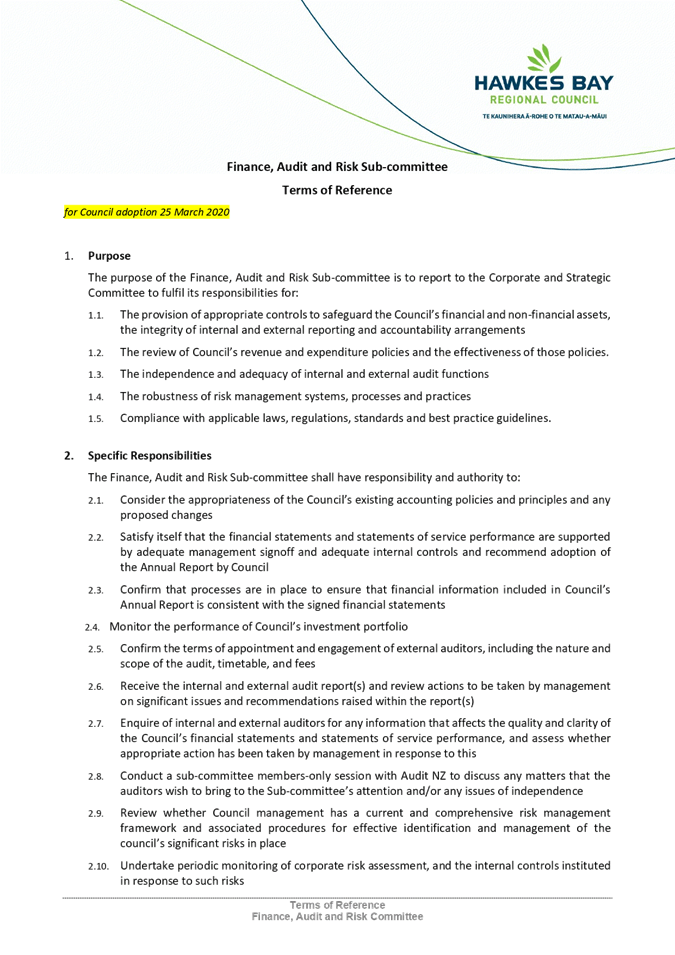

Suggested Amendments

5. Staff have used

tracked changes to suggest some amendments in the attached version of the Terms

of Reference as follows.

5.1. Reformatted

5.2. Updated membership

5.3. Add responsibility to monitor

Investment Portfolio returns

5.4. Added what the FARS is

delegated to determine for itself.

6. Staff also

request that FARS members offer their suggested amendments for potential

agreement and incorporation into the version that will then be recommended to

the Corporate and Strategic Committee for confirmation.

Financial and Resource Implications

7. The work of the

FARS is budgeted for within Council’s “Governance and Community

Representation” activities and changes to the Terms of Reference will

have no effect on those.

Decision Making

Process

8. Council and its committees are required to make every decision in

accordance with the requirements of the Local Government Act 2002 (the Act).

Staff have assessed the requirements in relation to this item and have

concluded:

8.1. Council is required to (LGA

sch.7 cl.19(1)) hold the meetings that are necessary for the good government of

its region

8.2. Council may appoint (LGA sch.7

cl. 30(1)(a)) the committees, subcommittees, and other subordinate

decision-making bodies that it considers appropriate

8.3. Given the

provisions above, Council can exercise its discretion and make these decisions

without consulting directly with the community or others having an

interest in the decision.

8.4. The decision

of the sub-committee is in accordance with the Terms of Reference and

decision-making delegations adopted by Hawke’s Bay Regional Council

6 November 2019.

|

Recommendations

1. That the Finance,

Audit and Risk Sub-committee:

1.1. receives and considers the

“Confirmation of the Terms of Reference for the Finance, Audit and Risk

Sub-committee” staff report

1.2. agrees amendments for

incorporation into the Terms of Reference for recommendation to the Corporate

and Strategic Committee, including:

1.2.1. …

1.2.2. …

1.2.3. …

2. The Finance, Audit

and Risk Sub-committee recommends that the Corporate and Strategic Committee:

2.1. confirms the Terms of

Reference for the Finance, Audit and Risk Sub-committee (following),

inclusive of amendments agreed by the Sub-committee on 12 February 2020

2.2. recommends that Hawke’s

Bay Regional Council adopts the Terms of Reference for the Finance, Audit and

Risk Sub-committee as confirmed by the Corporate and Strategic Committee by

resolution on 11 March 2019.

|

Authored by:

|

Leeanne

Hooper

Governance Lead

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

Joanne

Lawrence

Group Manager Office of the Chief Executive

and Chair

|

Attachment/s

|

⇩1

|

draft tracked

changes Finance Audit and Risk Sub-committee Terms of Reference

|

|

|

|

⇩2

|

draft Clean

Finance Audit and Risk Sub-committee Terms of Reference

|

|

|

|

draft

tracked changes Finance Audit and Risk Sub-committee Terms of Reference

|

Attachment 1

|

|

draft Clean Finance Audit

and Risk Sub-committee Terms of Reference

|

Attachment 2

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 12 February 2020

Subject: Sub-committee Work

Programme

Reason for Report

1. This item

provides the opportunity for the sub-committee to influence, in light of its

confirmed Terms of Reference, the work programme for the remainder of the

2019-22 triennium.

Officers’ Recommendations

2. Council staff

recommend that the Sub-committee workshops the internal audit programme with

input from the Internal Auditors and Council staff to develop the work

programme for this triennium for adoption at the May FARS meeting.

3. In the

meantime, staff also recommend that FARS confirms that the Internal Audits

scheduled for remainder of the 2019-20 financial year are to be scoped and/or

undertaken as planned.

Internal Audit

4. In 2017, the

combined HBLASS Councils undertook a request for proposal (RFP) process for

internal audit services process, concluded in June with the successful tenderer

being Crowe Horwath. Crowe Horwath was awarded the highest scoring tender in

unanimous agreement with all HBLASS Council representatives, which assessed

both price and non-price information including capability, capacity, approach

and methodology, and value add. The contract was for a three-year period, with

a possibility of a two-year extension. The contract is valued at $30,000 + GST

per annum, which is in line with Council budget provisions.

5. Responsibility

for the internal audit programme has recently moved from the finance team and

now rests with Joanne Lawrence, Group Manager, Office of the Chief Executive

and Chair (OCEC). Day to day management will form part of the role

responsibilities of the new Risk and Assurance Lead once appointed.

6. Crowe Horwath

(recently renamed Findex) provides Audit services across the Hawke’s Bay

councils and as such is the most cost-effective method of service delivery.

7. Each year the

schedule for the annual Internal Audit programme is agreed within the

sub-committee work programme to align with Council’s risk register. There

are four internal audits conducted each year, with one audit per quarter. Each

Internal Audit report is provided to the FARS for consideration. The Data

Analytics audit is conducted annually which leaves three other internal audits

available for other parts of Council’s business.

8. The audit

schedule for 2019-20 covers:

8.1. IT Security

(completed and to be presented to the 12 February 2020 sub-committee

meeting)

8.2. Data

Analytics (underway and awaiting final audit report) – this is an annual

audit

8.3. Risk

Management and Asset Management audits to be completed by 30 June 2020 with the

audit reports to be provided to FARS at the committee’s meeting in May

2020.

|

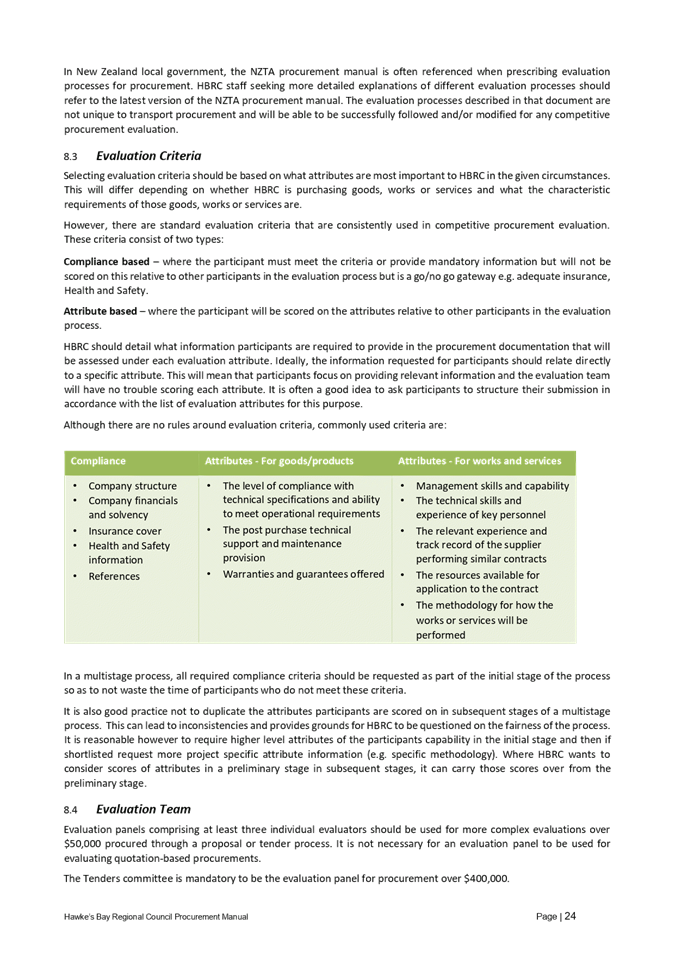

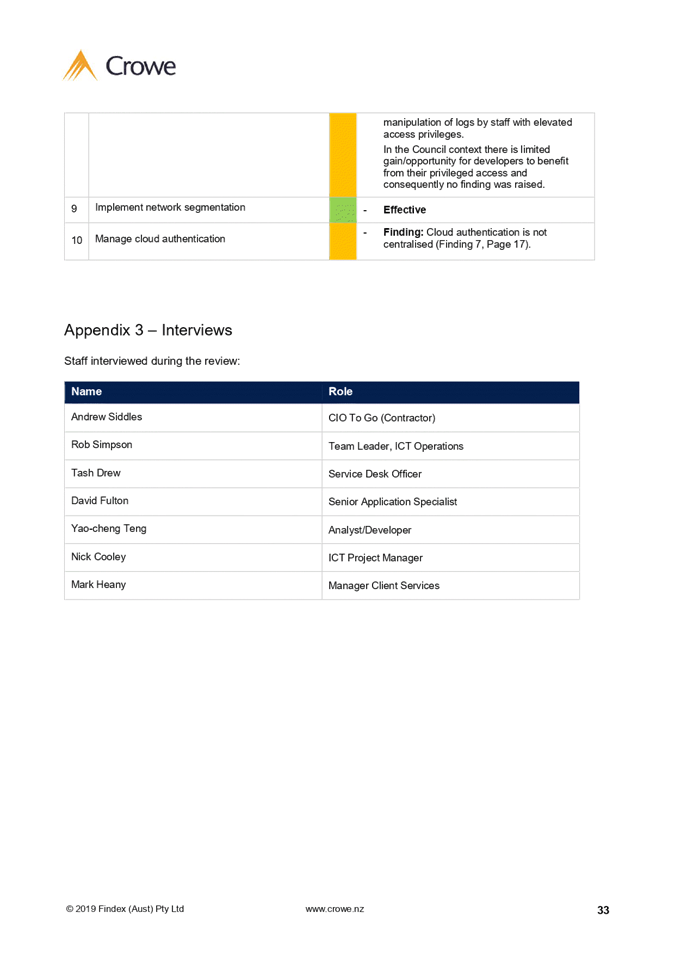

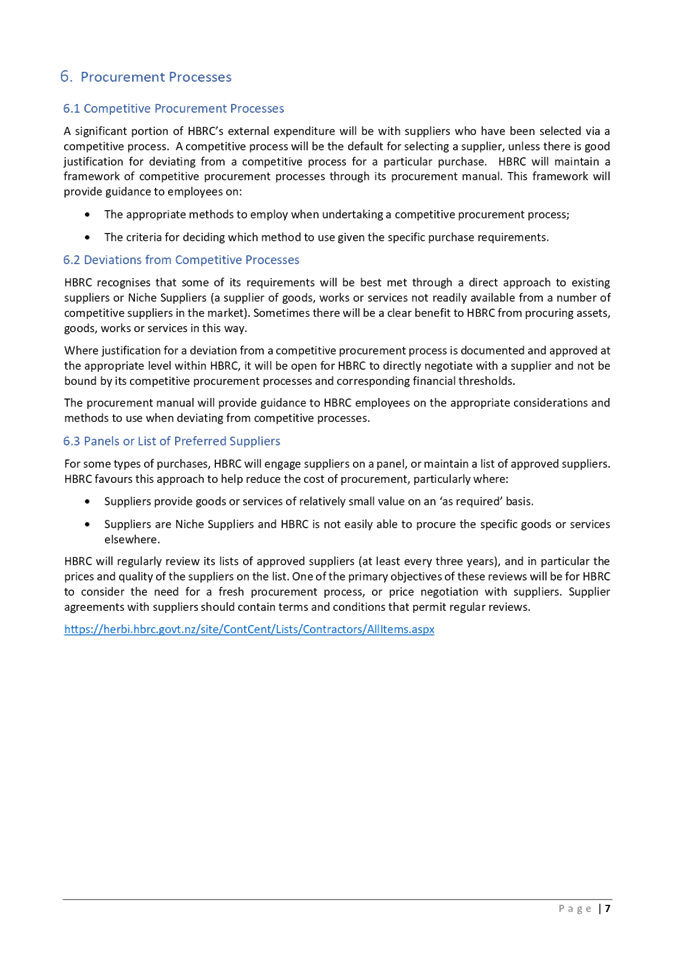

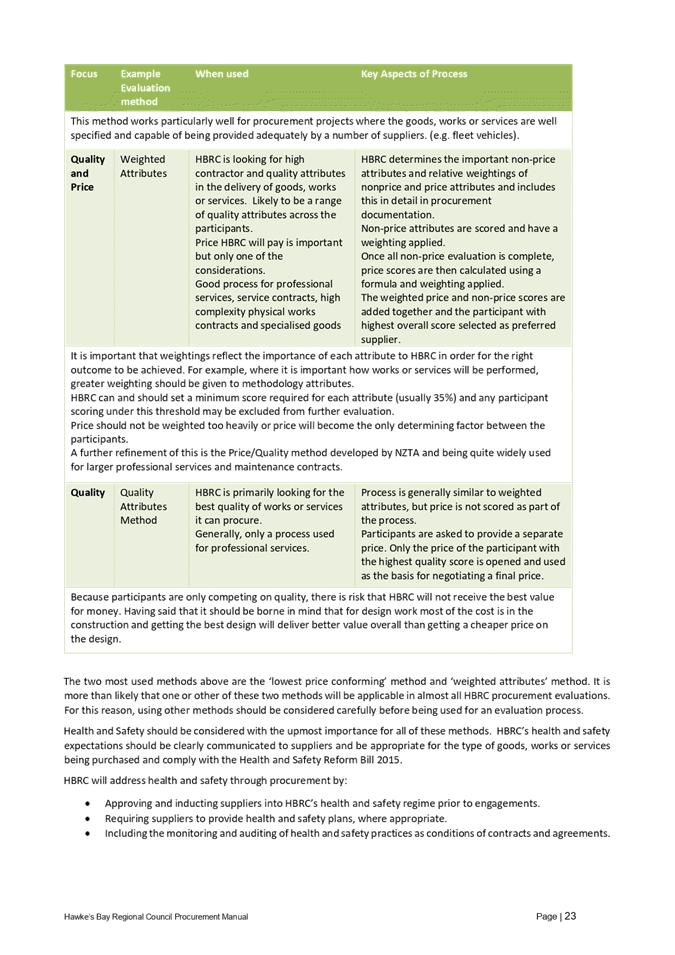

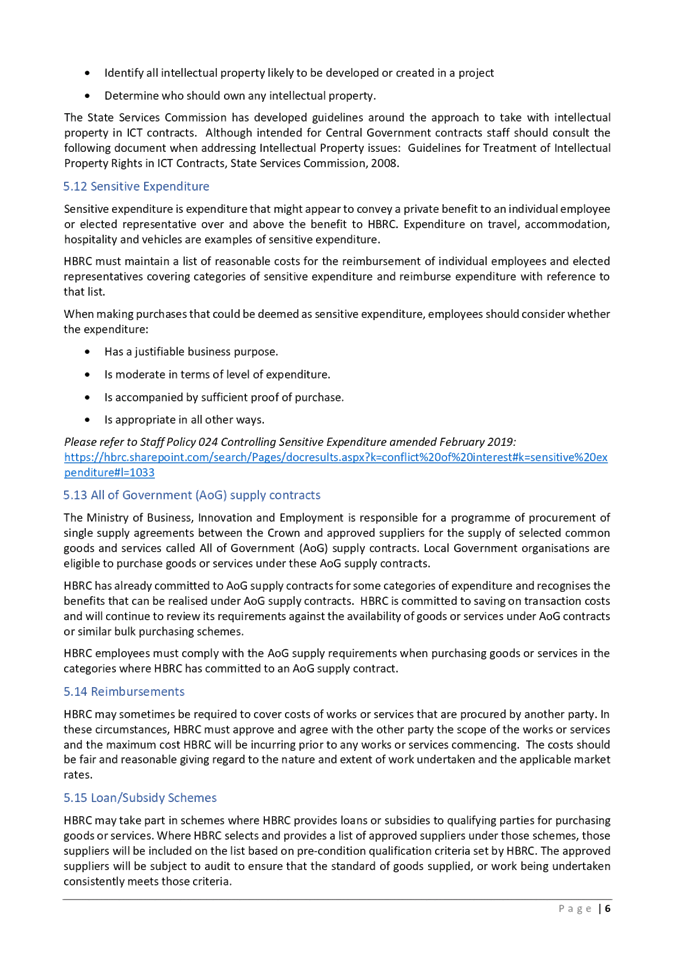

Item

|

Scheduled / Status

|

|

Cyber

Security

|

Report

received – to be presented to first FARS meeting of triennium

|

|

Data Analytics

(annual audit)

|

Completed in

Q2. Final report to FARS Q4 meeting.

|

|

Water

Management – Follow Up Review

|

Report was

presented to 22 May FARS meeting, with further follow up report scheduled to

be presented to the next FARS meeting in collaboration with the Group Manager

Regulation.

|

|

Asset

Management

|

Was

scheduled for Q3 FARS meeting but delayed to Q4 whilst scope is confirmed

with relevant business unit

|

|

Risk

Management

|

Was

scheduled for Q3 FARS meeting but delayed to Q4 whilst scope is confirmed with

relevant business audit

|

9. Compliance with applicable laws, regulations, standards and best

practice guidelines is normally tested through an Internal Audit.

10. The current schedule of

internal audits in the 2019-20 financial year is accommodated within existing

budgets as set by the 2018-28 Long Term Plan, however if the sub-committee

wishes to consider additional work in this area budget allocations may require

reconsideration.

11. The recommendations from

the Internal Audits, along with the External Audits, will form part of the

Audit Action list, that will be provided to the Sub-Committee on a quarterly

basis with details on steps taken to date and actions still required.

External Audit

12. As part of the

requirements of the provision of the Long Term Plan and the Annual Report,

Council is required to have aspects undergo an external audit and the auditors

provide audit opinions on whether the documents give effect to the purpose set

out in the Local Government Act 2002 and the quality of the information and

assumptions, where required, underlying the financial statements.

13. The Auditor-General is

appointed by the Local Government Act to audit the Regional Council and

appoints an auditor to conduct the audit on their behalf. Currently the

External Auditors are Audit New Zealand and the new external auditor, Karen

Young, is attending on 12 February to meet the Sub-Committee.

14. To inform the FAR

Sub-Committee, the auditors will provide an audit plan to detail the processes

to be used and the key areas of focus required by the Auditor-General to

review.

15. Following the audits,

along with the audit opinions, the auditors provide management reports that

provide feedback on the audit processes and recommendations with management

feedback. The recommendations continue to be monitored in subsequent audits to

ensure they are actioned.

16. The recommendations will

form part of the Audit Action list, along with the recommendations from

Internal Audit that will be provided to the Sub-Committee on a quarterly basis

with details on steps taken to date and actions still required.

17. Staff will work with the

auditors to develop the audit plan for the Annual Report 2019/20 and present

this to the next FARS Sub-Committee meeting.

Section 17a activity reviews

18. Section 17a reviews were

introduced as part of the Government’s 2012 Better Local Government

reform programme, designed to encourage and enable local authorities to improve

the efficiency and effectiveness of their operations and processes.

19. Council is required to

give effect to the purpose of local government as prescribed by Section 10 of

the LGA, which is “to meet the current and future needs of communities

for good quality local infrastructure, local public services, and performance

of regulatory functions in a way that is most cost effective for households and

businesses. Good quality means infrastructure, services and performance

that are efficient and effective and appropriate to present and anticipated

future circumstances.”

20. S17a reviews are required:

20.1. Every six years after

previous review

20.2. Before expiry of

contracts related to the delivery of infrastructure, services or regulatory

functions

20.3. When significant changes

to service levels are considered.

21. Initial steps required under

s17a include proposing a materiality threshold value for the reviews. Analysis

has been undertaken and the level for creating exceptions to Section 17a

has been assessed at $300,000 based on peer review and total Council spend

(total budgeted operational and capital expenditure).

22. In the absence of other

factors (e.g. high probability of significant savings, high public interest in

the service), where a service has gross annual expenditure of less than

$300,000 it will be assumed that the costs of undertaking Section 17a reviews

would be in excess of the likely benefits and a review will not be carried out

on those services.

23. A number of reviews have

been undertaken in recent years in various forms and contexts and these are

deemed as completed. The priority for Council should be on repurposing those

reviews and incorporating any Section 17a requirements. Other priorities

will be set by the expiry or renewal of significant contracts where staff

identify opportunities to explore service improvements and efficiency gains.

24. Due to the recent internal

reorganisation and LTP processes, several of Council’s functional

activities have been reviewed more recently. It is therefore proposed that

these be re-reviewed in a few years’ time, once the most recent

restructure and LTP process has matured. It is further proposed that no

reviews are undertaken in Q1 and Q2 of the 2018-19 financial year due to

resourcing constraints. Council has forecast a senior accountant as part of the

realignment of the finance team to assist with these reviews.

25. Staff have undertaken

analysis and sought guidance from the Executive team and have recommended

priority review areas (attached) for the sub-committee to provide feedback on.

These have been sorted by priority and are proposed to begin once the

significant LTP process has been completed.

26. The approach in

determining a work programme is to seek out opportunities to add practical

value to the services and activities that the Council provides or undertakes

for and on behalf of its community, including:

26.1. Understanding the nature

of and rationale for services or activities currently provided or undertaken

26.2. Looking at the context

(including service demand) in which these services are and will be delivered,

now and into the future

26.3. Identifying

opportunities that might arise for improving the efficiency or effectiveness of

the services or activities, including opportunities that might arise from a

collaborative approach with other parties

26.4. Assessing those

opportunities to see if they might add value for the Hawke’s Bay

community.

27. In addition staff have

reviewed external guidance on best practice approaches to determine priority

review areas for Council. SOLGM’s guidance recommends using the

activities (not groups) disclosed for reporting in the Long Term Plans as a

starting point for defining ‘services’ to be reviewed.

Determination of priority options is based on guidance which is highlighted

further in this section below.

28. External advice suggests

the following principles when considering whether an activity should be

reviewed.

28.1. The bigger the budget

the more efficiency gains are possible

28.2. Capital intensive

services are more likely to generate savings

28.3. The greater the cost of

a review as a percentage of the total cost of service, the less value in a

review

28.4. The more generic the

service the more opportunity for economies of scale or scope

28.5. Services which are core

competencies and have non-commercial objectives should be retained in house

28.6. There is value in

conducting a review if it could further Council’s strategic priorities or

responds to a demographic trend or future problem

28.7. The success of many

alternative service delivery methods depends on the existence of a competitive

market

28.8. Services that have been

the subject of comprehensive review under other procurement or legislative

processes are less likely to generate new and better ways of doing things

28.9. A service that

consistently achieves its performance targets is evidence that it meets

customer expectations, and a review is less likely to realise benefits

28.10. If operating costs are comparable with

other suppliers then a review is less likely to realise efficiency gains

28.11. Council will get the most “bang for

buck” by focusing on services that are important to citizens and are

failing to meet their expectations

28.12. The more elapsed time since the last

review, the greater value in a review

28.13. Service reviews realise the most benefits

when there is certainty around the operating environment in which the service

is delivered

28.14. Reviews undertaken jointly with relevant

councils and service providers will realise the most value.

29. Where another Council is

planning to review its similar activities, a joint approach will be

investigated to establish whether it is likely to bring cost efficiencies to

the review process.

30. Given the inability to

recruit for this role, Risk and Assurance Lead (Office of the CE & Chair),

staff propose to contract an external resource to progress this area of work

and update the next FARS meeting.

Financial and

Resource Implications

31. Staff confirm that the

work programme proposed is accommodated within existing budgets as set by the

2018-28 Long Term Plan, however if the sub-committee wishes to consider

additional work budget allocations may require reconsideration.

Decision Making Process

32. Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

32.1. The

decision does not significantly alter the service provision or affect a

strategic asset.

32.2. The use

of the special consultative procedure is not prescribed by legislation.

32.3. The

decision is not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy.

32.4. The persons directly

affected by this decision are Council staff and members of the Finance, Audit

and Risk Sub-committee.

32.5. The

decision is not inconsistent with an existing policy or plan.

32.6. The

Sub-committee can exercise its discretion and make a decision without

consulting directly with the community or others having an interest in the

decision in accordance with its Terms of Reference.

|

Recommendations

That the

Finance, Audit and Risk Sub-committee:

1. Receives and considers the “Sub-committee Work

Programme” staff report.

2. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that the Sub-committee can exercise its discretion and make

decisions on this item without conferring directly with the community, in

accordance with its Terms of Reference.

3. Agrees that the work programme for the Sub-committee will be

developed through workshops ahead of confirming the schedule of work and

budget allocations at the 3 May FARS meeting, and that in the meantime

Internal Audits agreed in August 2019 will scoped and/or be carried out as

planned.

|

Authored by:

|

Leeanne

Hooper

Governance Lead

|

Bronda Smith

Chief Financial Officer

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

Joanne

Lawrence

Group Manager Office of the Chief Executive

and Chair

|

|

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 12 February 2020

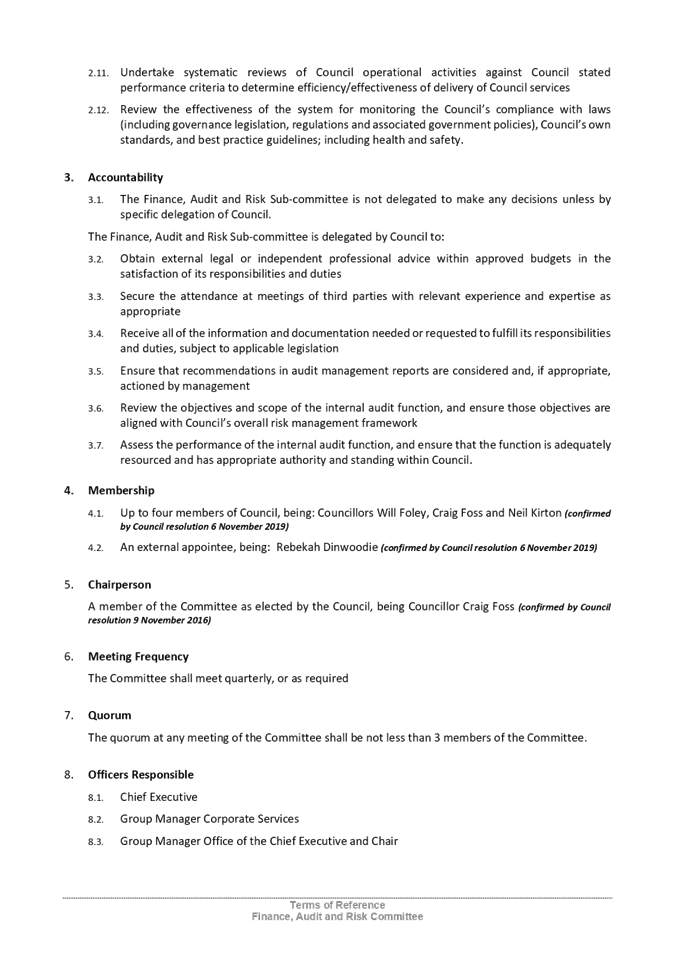

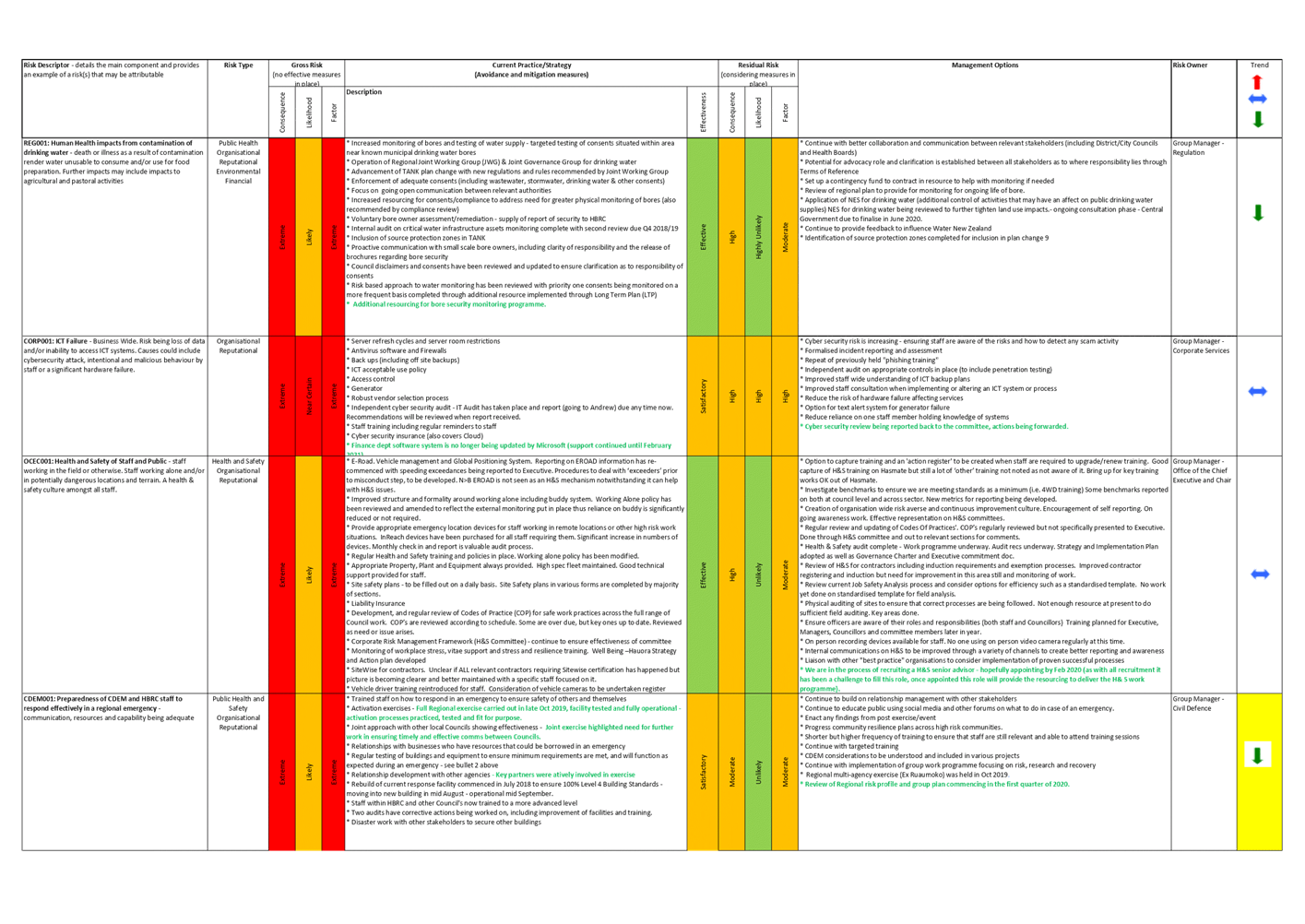

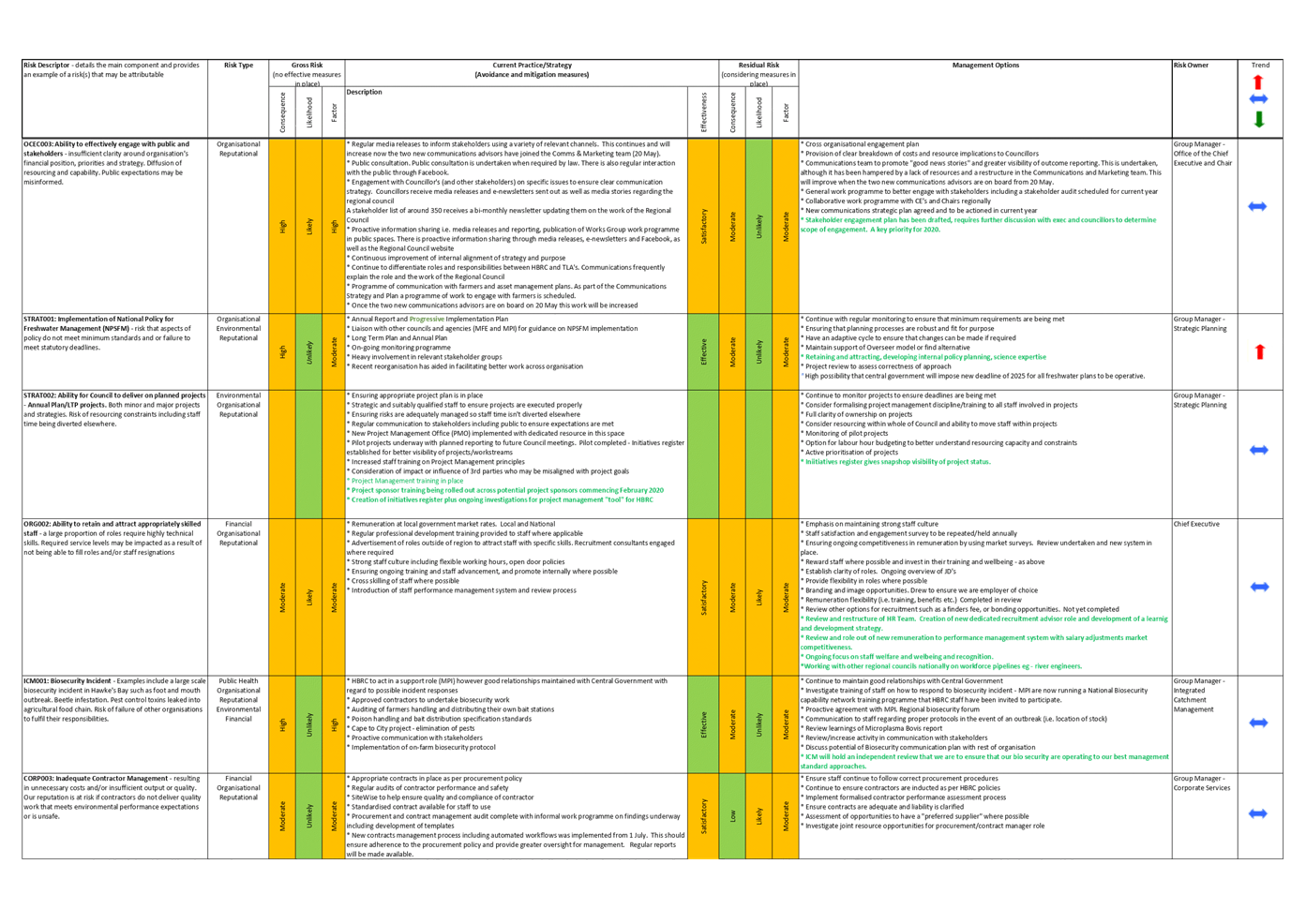

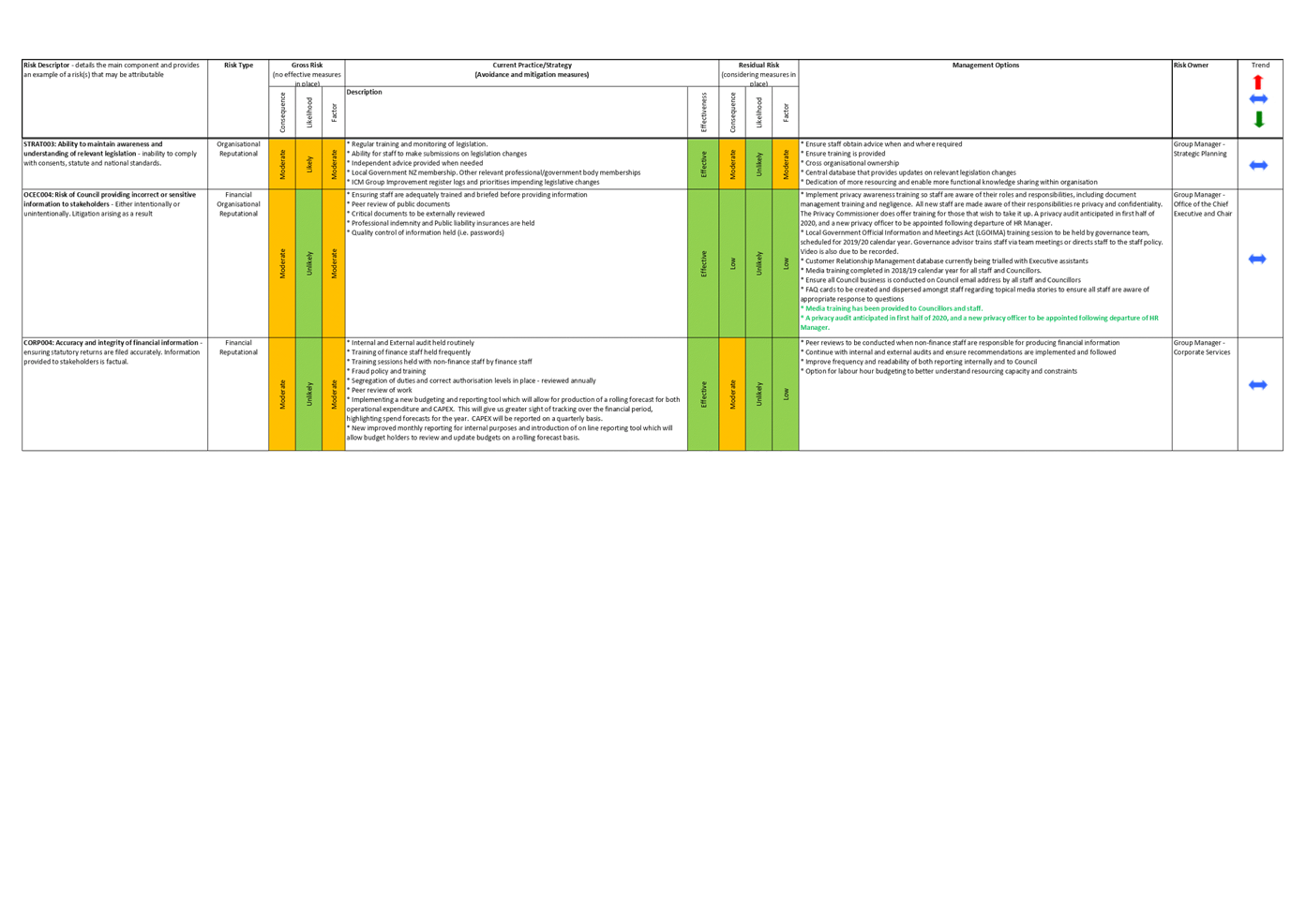

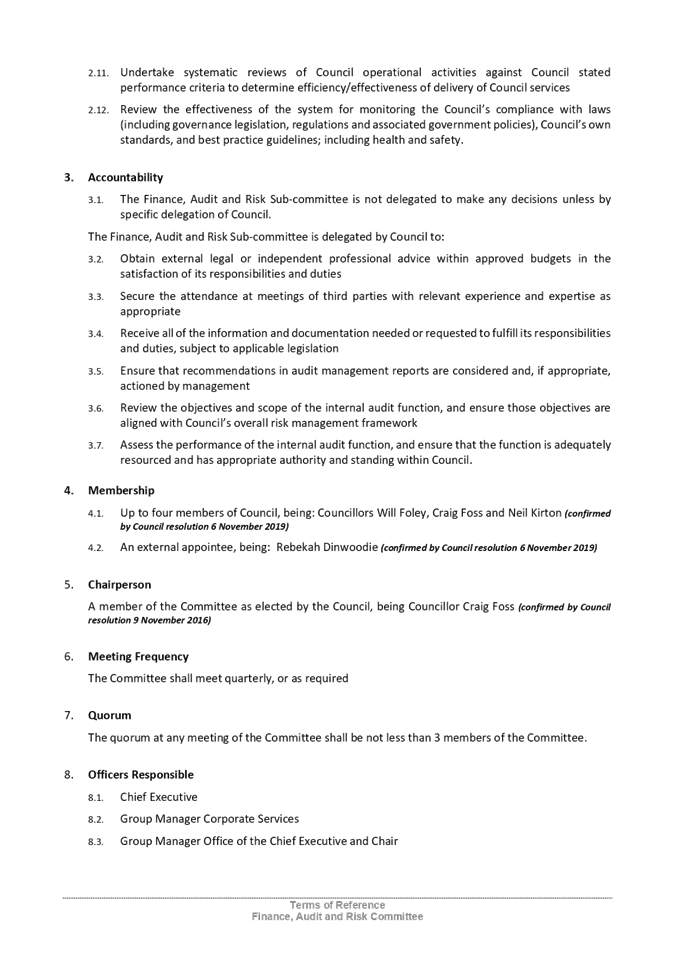

Subject: Risk Assessment and

Management

Reason for Report

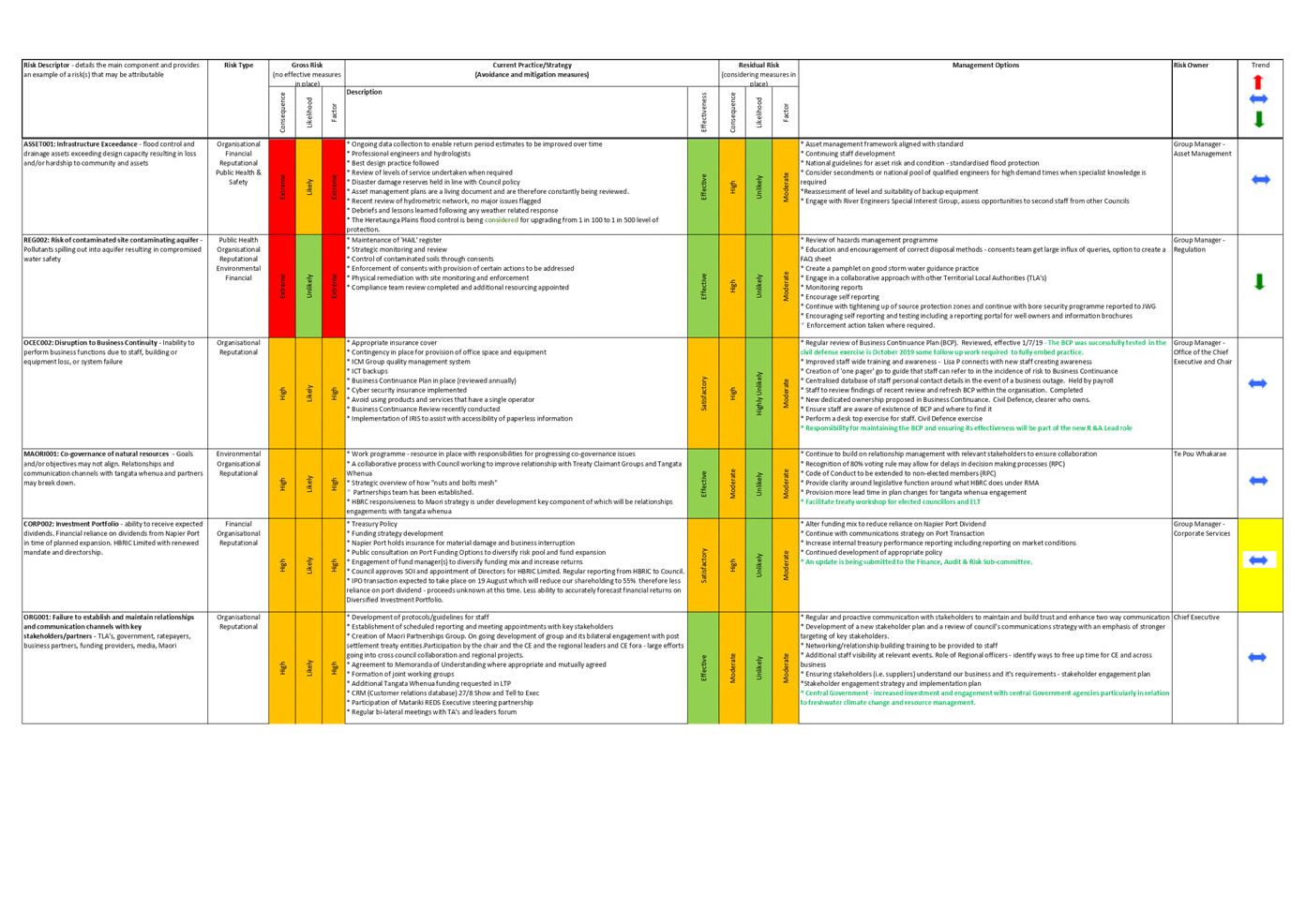

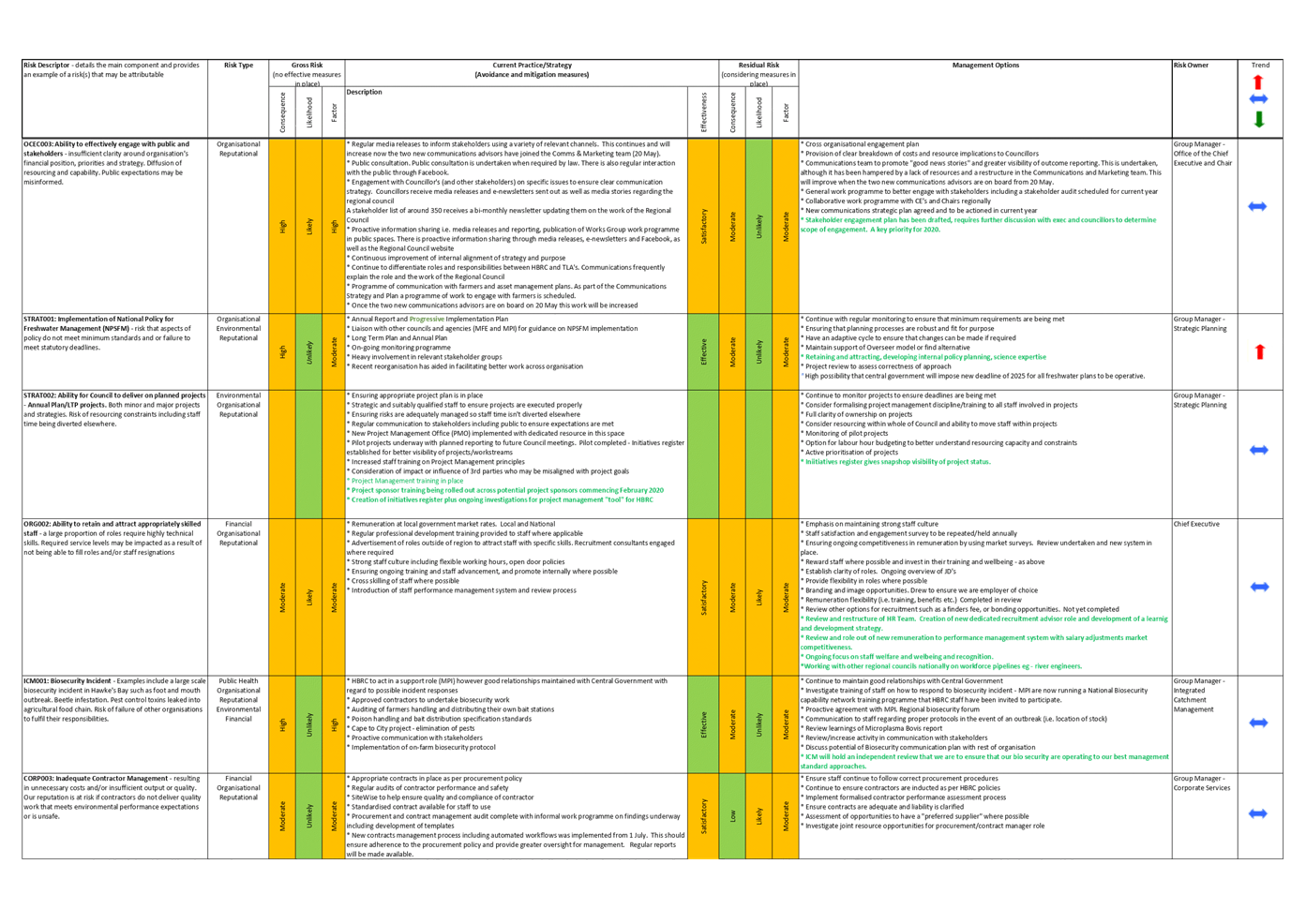

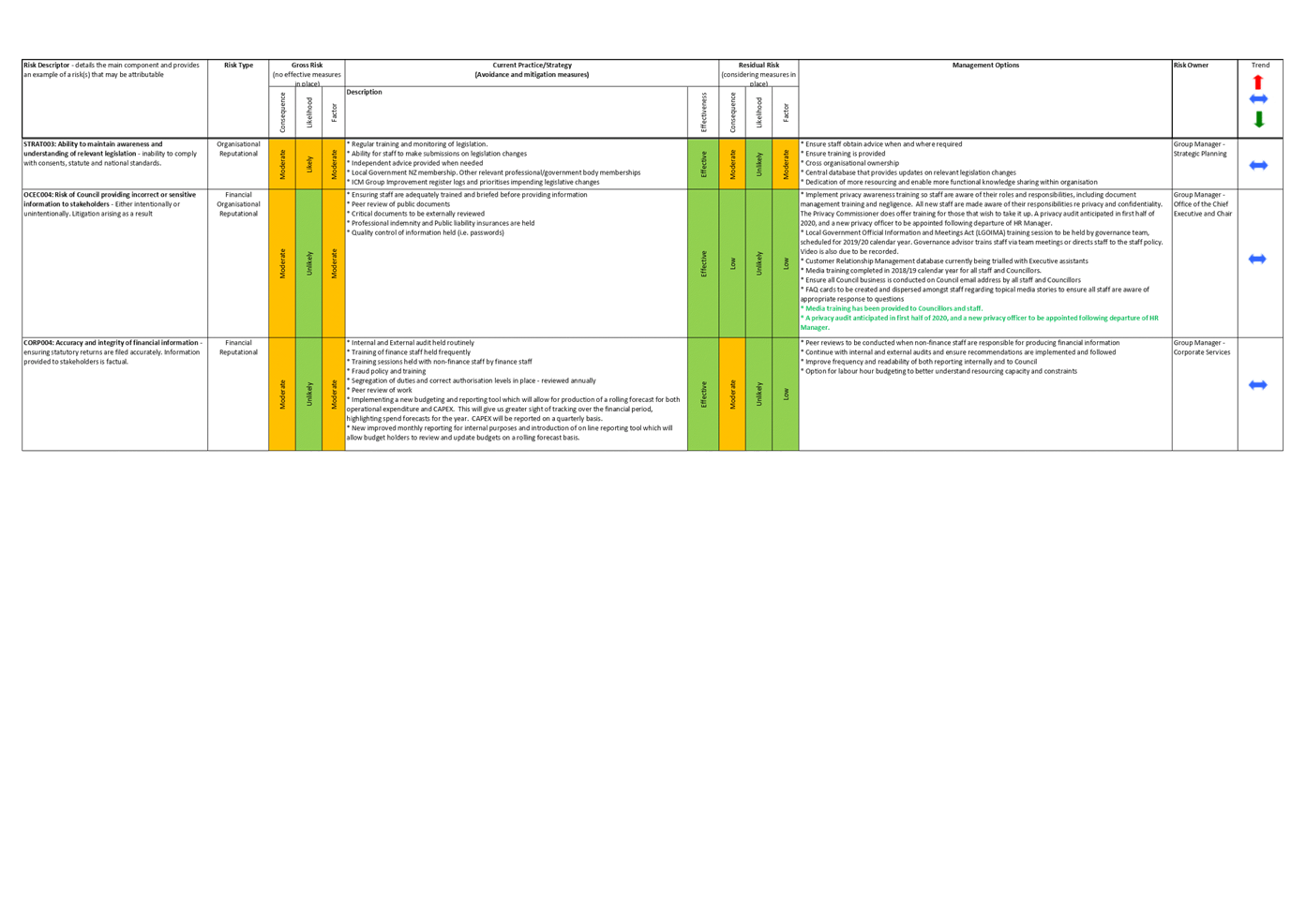

1. This item provides the Sub-committee with the six-monthly review of

the risks that Council is exposed to and the mitigation actions in place to

manage Council’s risk profile.

Officers’ Recommendation

2. Staff recommend

that the Sub-committee confirms its confidence that Council management has a

current and comprehensive risk management framework and associated procedures

for the effective identification and management of the organisation’s

significant risks.

Executive Summary

3. The risk

assessment and management update provides the Finance, Audit and Risk

Sub-Committee (FARS) with a summary of the risks activity over the last six

months. Outlined in the report are the changes to the risk trend ratings

with two risks covering Civil Defence preparedness and Council’s

investment portfolio shifting downwards.

4. Also covered in

this update is the work undertaken to examine some areas of interest raised at

the last FARS meeting on 21 August 2019 around risk of harm to the environment,

staff wellbeing and retention and civil defence. Upon further examination

these risks are well-managed.

Background/Discussion

5. The

Sub-committee last considered the six monthly risk management report at its

21 August 2019 meeting.

6. Subsequent to

this meeting, the Executive Leadership Team has considered the Sub-Committee’s

feedback and reviewed the organisation’s strategic risks with each Group

Manager. Details of any resulting changes to the risk register matrix are

outlined following.

7. During this

period staff resourcing to support this work has continued to be very stretched

as described further on in this item.

Key Changes to the Risk Register

Matrix

8. Following the feedback at the 21 August 2019 Finance, Audit and Risk

Sub-committee (FARS) meeting, staff consideration (summarised following) has

been given to:

8.1. whether to

add a new risk regarding environmental harm

8.2. providing

further detail surrounding the CDEM (Civil Defence) risk

8.3. providing

supplementary information on staff retention and welfare.

Risk of Harm to the Environment

9. That there is

no recognised ‘Risk of Harm to Environment’ general risk was

raised, as relates to harm to the environment generally. Specifically,

this risk would cover Council’s requirement to protect the environment,

and not cause it undue harm. This may occur during Council’s day to

day practices, whereby one or more groups may have conflicting goals.

10. After a discussion within

the Executive, it is considered that Risk of Harm to the Environment sits best

within CORP003 Inadequate Contractor Management with respect to any action or

inaction by Council contractors that causes environmental harm. To

mitigate this risk Council works with its contractors to ensure they follow

environmental Codes of Practice, River Guides and the work is within the

permitted activity rules under the Resource Management Plan (RMP).

Staff Wellbeing and Retention

11. Several

mitigation initiatives have been implemented for Staff Wellbeing and Staff

Retention risks, including:

11.1. the implementation of

the organisational development review and subsequent work programme and

relevant staff resourcing

11.2. Learning and Development

Strategy and Action Plan

11.3. full remuneration review

and recommended changes completed.

12. A focus on recruitment,

talent acquisition and retention will be a key focus for the early part of 2020

by the People and Capability team, and the imminent recruitment of a Senior

Advisor, Health, Safety and Wellbeing will also add valuable support to the

staff wellbeing work programme.

Civil Defence

13. At the 12

February 2019 FARS meeting update, some uncertainty was expressed as to the

level of detail within the risk register and whether this was sufficient or too

excessive. There was also some query as to how much societal risk should

be covered in the register i.e. demographic changes. In addition to the

consideration of Civil Defence risks, both of these questions are being

addressed through a Hazard Risk review currently underway, involving HBRC staff

plus the HBRC Chairman (as the council’s representative on the CDEM Group

Joint Committee).

Risk Register summary update

14. At the last risk update to

FARS, risks trending upwards included the Implementation of the National Policy

for Freshwater Management (STRAT001). Central government is expected to

impose a new deadline of 2025 for all freshwater plans to be operative, and the

Strategic Planning team will continue to monitor this risk closely.

15. The human health impacts

from contamination of drinking water risk (REG002) continues to trend downwards

as a result of the review of National Environment Standards for drinking water

and the identification of source protection zones in Plan Change 9.

16. Suggestions were made that

consideration should be given to the human health risks associated with

swimming and recreational activities in contaminated water and with regard to

landfills not listed on the HAIL register. The Executive team discussed this

and felt that any such human health risks are more appropriately aligned to the

risk “Health and Safety of Staff and Public” (OCEC001). This

Council works with the Hawke’s Bay District Health Board who has the lead

role on the public health risks around swimming.

17. Since the August 2019 FARS

committee meeting, there has been a recent review of the risk register with all

the risk owners. Risk owners are managing their risks actively.

Updates can be seen in green on the

attached risk register.

18. At today’s meeting,

FARS will be provided with separate updates on the three areas of:

18.1. Contracts/Procurement

18.2. Cyber Security

18.3. the Business Continuity

Plan.

Risk Trend ratings

19. There

have been two changes to trend ratings in this review period.

20. CDEM001:

Preparedness of CDEM and HBRC staff to respond effectively in a regional

emergency – communication,

resources and capability being adequate

20.1. Trending down due to the

successful activation exercise carried out in October 2019. In addition,

there is a review of the regional CDEM risk profile and group plan commencing

in the first quarter of 2020.

21. CORP002:

Investment Portfolio

21.1. This risk is no longer

trending upwards. The investment portfolio returns are now projected to

be in line or higher than expected. With the IPO now complete and

bringing financial risk diversification, there is less reliance on the

dividend.

Risk Management function

22. Whilst

the risk management process has gained traction and maturity with regular and

frequent Executive Leadership Team interrogation of all strategic level risks,

it is recognised that further work is required to build the wider

organisation’s risk management knowledge and understanding.

23. A newly

established Risk and Assurance Lead role will have responsibility for the risk

management portfolio. Alongside this they will develop the

Council’s assurance framework which will include responsibility for the

internal audit programme and quality management system (ISO 9001:2015

certification). The recruitment of this lead role is proving challenging,

along with other vacancies with the HBRC. A temporary contract with an

established external entity is currently being examined as an interim

contingency arrangement.

24. A key priority for the

Risk and Assurance Lead role is to progress workshops with staff to fully embed

a whole of organisation understanding around risk management.

25. At a group manager level,

this portfolio will be held by the Group Manager (OCEC).

Decision Making

Process

26. Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have

assessed the requirements in relation to this item and have concluded:

26.1. The

decision does not significantly alter the service provision or affect a

strategic asset.

26.2. The use

of the special consultative procedure is not prescribed by legislation.

26.3. The

decision is not significant under the criteria contained in Council’s

adopted Significance and Engagement Policy.

26.4. The persons directly

affected by this decision are Council staff and members of the Finance, Audit

and Risk Sub-committee.

26.5. The

decision is not inconsistent with an existing policy or plan.

26.6. The Sub-committee can exercise its discretion and make a decision

without consulting directly with the community or others having an

interest in the decision in accordance with its Terms of Reference.

|

Recommendations

The Finance,

Audit and Risk Sub-committee:

1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement Policy,

and that the Sub-committee can exercise its discretion and make decisions on

this item without conferring directly with the community, in accordance with

its Terms of Reference.

2. Receives and considers the “Six Monthly Risk Assessment

and Management” staff report.

and either

3. Confirms its confidence that Council

management has a current and comprehensive risk management framework and

associated procedures for the effective identification and management of the

Council’s significant risks.

4. Recommends that the Corporate and Strategic Committee receives and

notes the resolutions of the Sub-committee, confirming the robustness of Council’s risk management systems,

processes and practices.

OR

5. Advises staff of the specific risks (following) that require

reassessment to confirm the level of risk is accurate and internal controls

are adequate, for reporting back to the 13 May 2020 Sub-committee

meeting.

5.1. …

5.2. …

6. Recommends that the Corporate and Strategic Committee receives and

notes the resolutions of the Sub-committee, including the specific risks that

require reassessment.

|

Authored by:

|

Joanne

Lawrence

Group Manager Office of the Chief Executive

and Chair

|

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

|

⇩1

|

Risk

Management Register February 2020

|

|

|

|

Risk

Management Register February 2020

|

Attachment 1

|

|

Risk

Management Register February 2020

|

Attachment 1

|

|

Risk

Management Register February 2020

|

Attachment 1

|

|

Risk

Management Register February 2020

|

Attachment 1

|

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 12 February 2020

Subject: Treasury Report for

period to 31 December 2019

Reason

for Report

1. This

item provides an update of compliance monitoring of treasury activity and

reports the performance of Council’s diversified investment portfolios.

2. Brett Johanson (Partner) and John Hepburn (Manager Corporate

Treasury) will be in attendance at the 11 February meeting making a short

presentation at 10.30am.

Executive

Summary

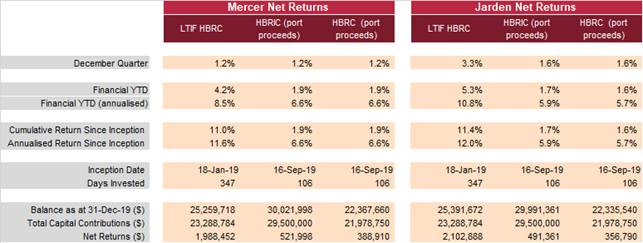

Long Term

Investment Fund (LTIF)

3. The total size of the LTIF portfolio at the end of December 2019 was

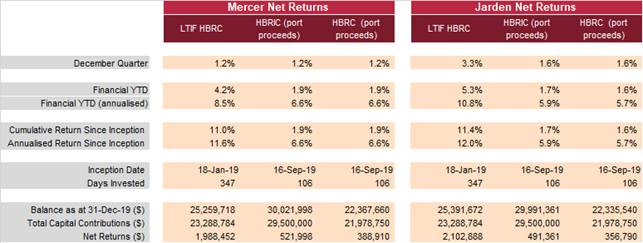

$50.7m, with approximately half invested with Mercer and Jarden respectively.

4. The combined Mercer and Jarden portfolios generated a net return

of approximately 2.2% over the December 19 quarter. The Jarden portfolio was

the biggest contributor due a higher return.

5. The combined LTIF portfolio has generated a net return of

approximately 11.1% since inception in January 2019 which represents 347 days

of investment, just short of one year.

Future Investment Fund

– Port Proceeds (FIF)

6. The total size of the PFIF portfolio at the end of December was

$104.7m, with approximately half invested with Mercer and Jarden respectively.

7. The FIF portfolios were implemented on the 16 September 2019

following the Napier Port IPO, this represents 106 days of investment.

8. The Mercer portfolios performance for the quarter correspond to

annualised returns of 6.6%.

9. The Jarden portfolios performance for the quarter corresponds to

average annualised returns of 5.8%.

10. The Mercer portfolios are compliant with SIPO requirements. Jarden

are adopting a staggered implementation approach, meaning both portfolios (HBRC

and HBRIC) are not yet SIPO compliant with their target asset allocations. The

Jarden portfolios had an allocation to growth assets of 25% at the end of

December versus a target benchmark allocation of 50%.

Background

11. HBRC has

procured Treasury Advice and services from PwC since 2018.

12. Internally,

HBRC’s CFO is developing capability-building programmes to transfer

skills from consultants to staff to build internal capabilities to continuously

improve and provide an adequate and mature treasury function.

13. Staff

have worked with PwC over the past two years during which we have joined the

LGFA providing access to borrowing at reduced rates, developed and adopted the

current SIPO and run an RFP process for the appointment of investment fund

managers.

14. HBRC has

a new dedicated resource in the form of a Treasury and Funding Accountant

joining us in March 2020. This will allow a broader focus to include a more

mature cash-flow function, and as borrowing needs will likely increase over

time debt management is another key area where we look to mature as an

organisation and enhance reporting to this committee.

15. Staff

seek feedback from members of the FARS regarding the level and detail of

treasury reporting sought as we continue to develop the reporting function in

this area.

Decision

Making Process

16. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision making

provisions do not apply.

|

Recommendation

That the Finance, Audit and Risk

Sub-committee receives and notes the “Treasury Report for period to

31 December 2019” staff report.

|

Authored by:

|

Bronda Smith

Chief Financial Officer

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

⇩1

|

HBRC Treasury

Report December 2019

|

|

|

|

HBRC

Treasury Report December 2019

|

Attachment 1

|

Hawke’s

Bay Regional Council

Quarterly Treasury Report

As at 31 December 2019

|

HBRC

Treasury Report December 2019

|

Attachment 1

|

Contents

1.0 Treasury

Activity Compliance Monitor 2

2.0 Investment

Management Reporting 3

3.0 SIPO

review 8

4.0 Liability Management

Policy Compliance Checklist 10

5.0 Borrowing

Limits 10

6.0 Funding and

Liquidity Risk Position 11

7.0 Interest Rate

Risk Position 11

8.0 Funding

Facility 13

9.0 Cost of Funds

vs Budget 13

10.0 Counterparty

Credit 13

11.0 Market

Commentary 14

12.0 Policy

exceptions 16

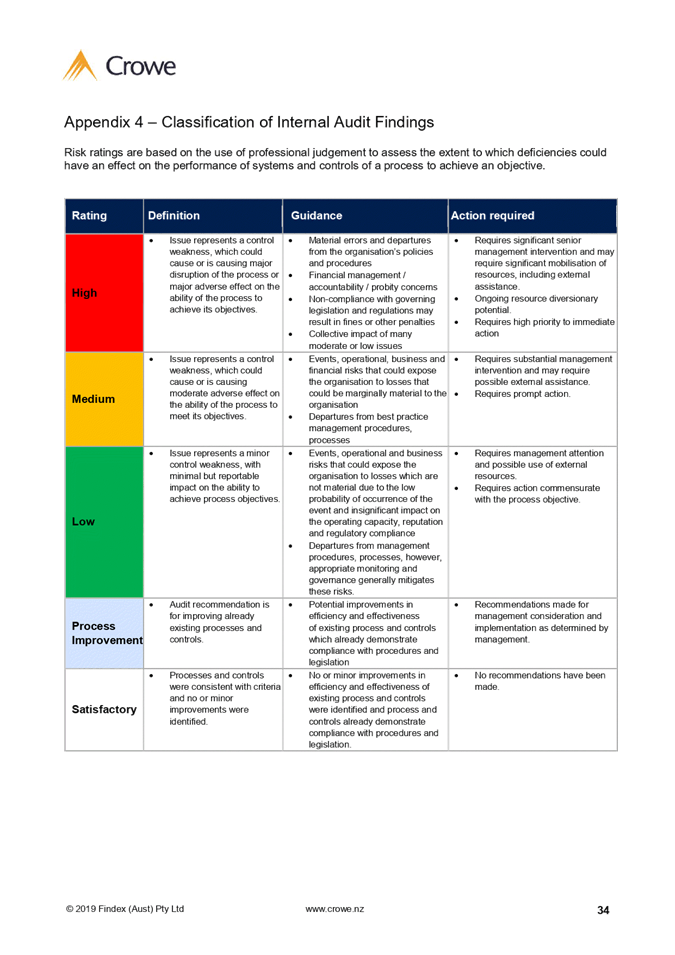

1.0 Treasury Activity

Compliance Monitor

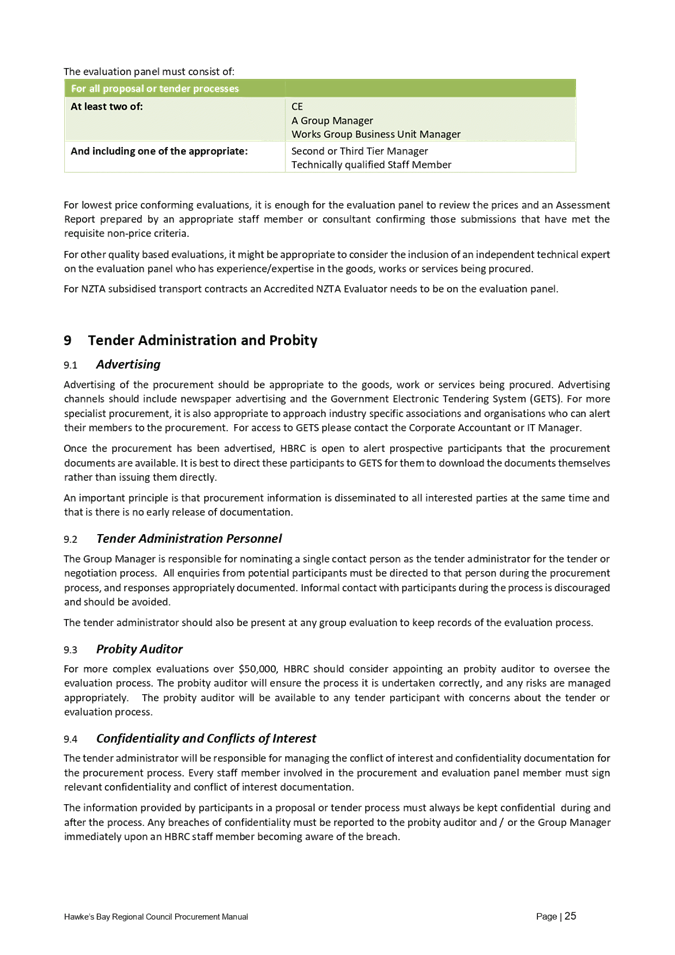

|

Policy document

|

Policy parameters

|

Compliance

|

|

Treasury

Policy

|

Borrowing

limits

|

Yes

|

|

Funding

risk control limits

|

Yes

|

|

Liquidity

buffer

|

Yes

|

|

Interest

rate risk control limits

|

Yes

|

|

Treasury

investment parameters

|

Yes

|

|

Counterparty

credit limits

|

Yes

|

|

SIPO

|

Asset

allocations

|

No

|

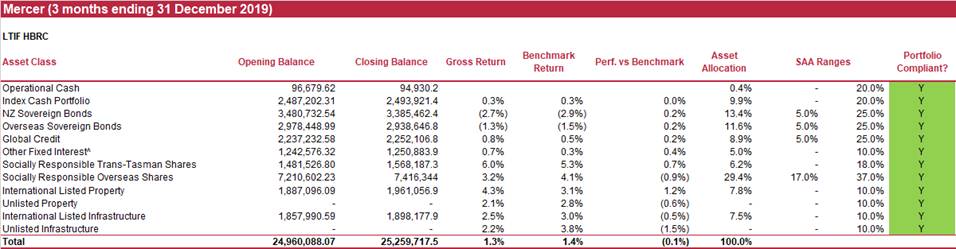

2.0 Investment Management

Reporting

Performance Summary

(net returns – after management and custodial fees)

|

HBRC

Treasury Report December 2019

|

Attachment 1

|

Long

Term Investment Fund (LTIF HBRC)

Mercer portfolio

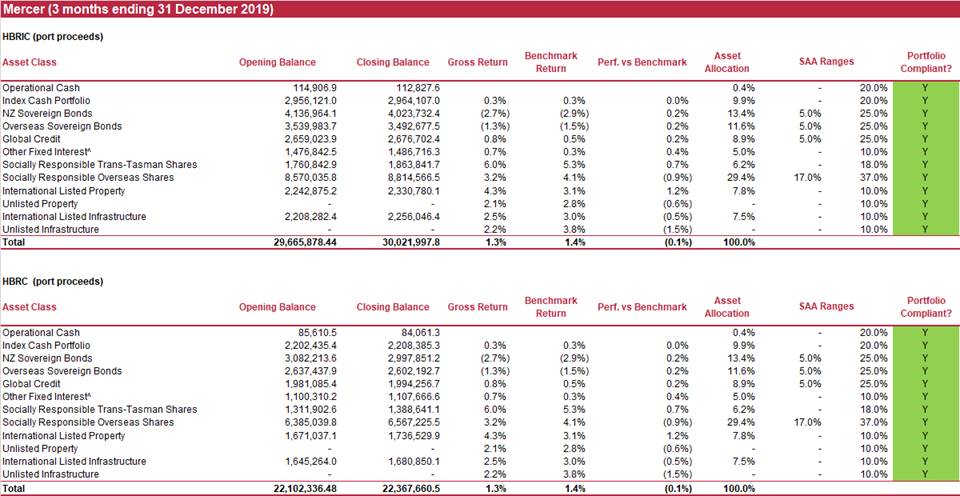

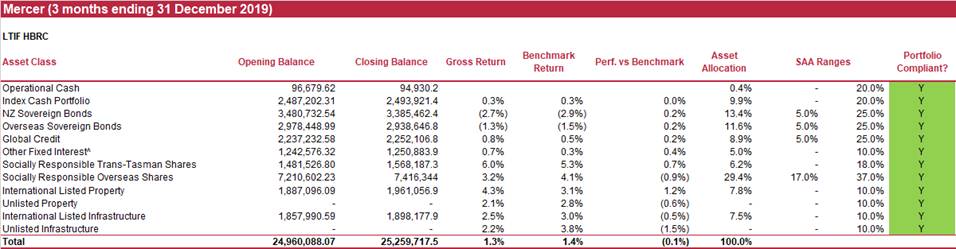

● The Mercer portfolio

generated a gross return (before fees and tax) of 1.3% for the quarter,

marginally trailing their benchmark by 10bp. On a net (after fees and

tax) basis, the portfolio returned 1.2%, trailing the benchmark by 20bp.

● The portfolio has now

achieved a gross return of 11.4% since inception on 18 January 2019,

trailing the benchmark by 1.3%. On a net basis, the portfolio has

returned 11% since inception, trailing the benchmark by 1.7%.

● Over the quarter, the

portfolio performed broadly in line with its benchmark; Socially Responsible

Trans-Tasman Shares (+0.7%) and International Listed Property (+1.2%) were

standout performers both providing a boost to relative performance, with the

former benefitting from an overweight holding to Metlifecare and Summerset

Group.

● The

portfolio remains compliant with the strategic asset allocation (SAA) ranges

stipulated in the SIPO.

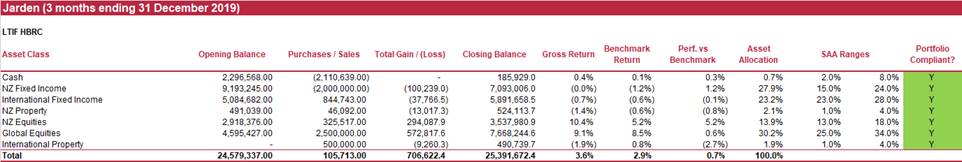

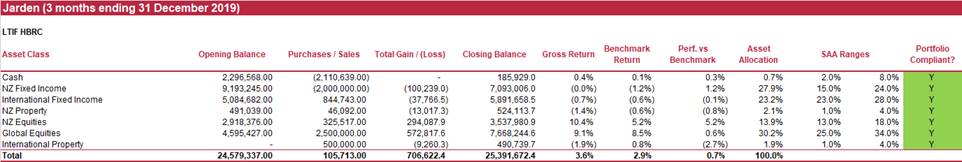

Jarden portfolio

● Jarden generated a gross

return (before fees and tax) of 3.6% for the quarter, leading their

benchmark by 70bp. On a net (after fees and tax) basis, the portfolio

returned 3.3%, leading the benchmark by 40bp. The portfolio has achieved a net

return of 11.4% since inception on 18 January 2019.

● NZ and Global Equities

were the standout performers for the portfolio over the quarter, returning

10.4% and 9.1% respectively. International and NZ Property were the two weakest

asset classes, both declining by 1-2%.

● The

portfolio is now compliant with the strategic asset allocation (SAA) ranges

stipulated in the SIPO.

Combined portfolio

● The combined Mercer and

Jarden portfolios generated a net return of approximately 2.2% over the

December quarter. The Jarden portfolio was the biggest contributor due to its

higher return. The combined LTIF portfolio has generated a net return of

approximately 11.1% since inception.

● The

total size of the LTIF portfolio at the end of December was $50.651m, with

approximately half invested with Mercer and Jarden respectively.

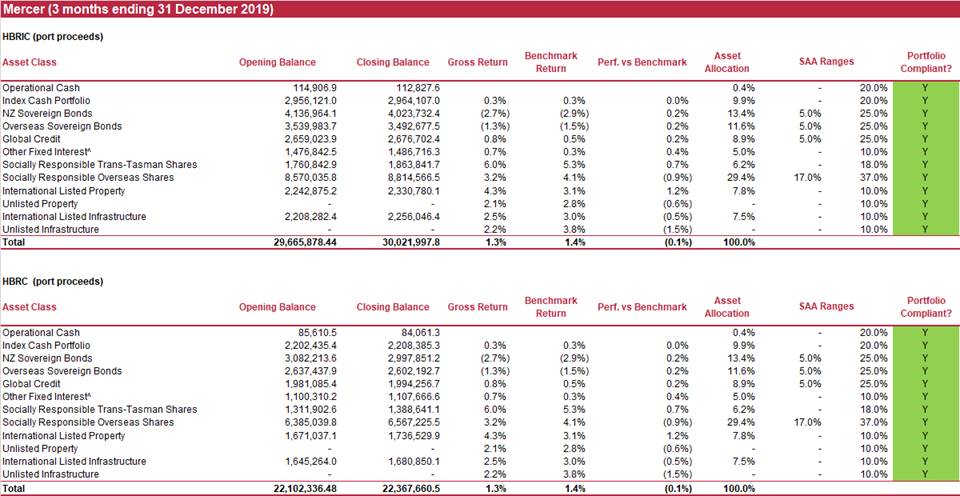

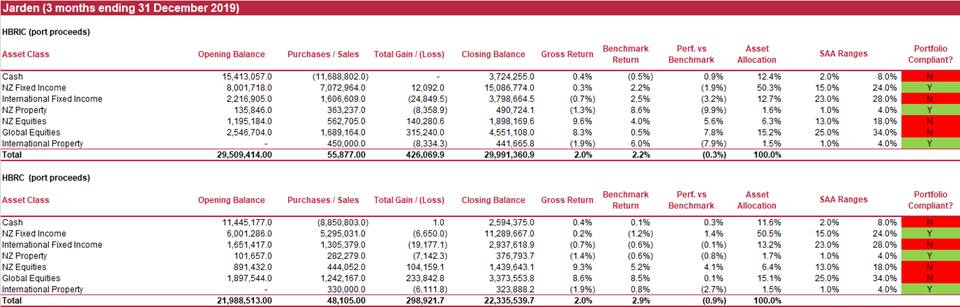

Future Investment Fund – Port Proceeds

● The Future Investment

Fund portfolios were implemented on the 16th of September and the above table

therefore only represents a partial quarter of performance.

● The Mercer portfolios

both 1.9% on a net basis. These correspond to annualised returns of

6.6%.

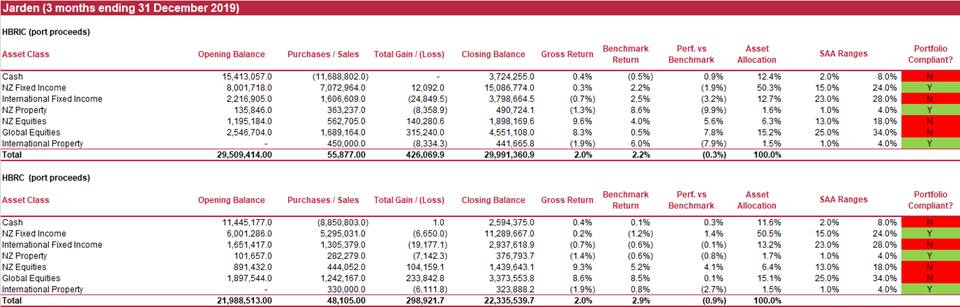

● The Jarden portfolios

1.7% and 1.6% on a net basis. These correspond to annualised returns of

5.9% and 5.7% respectively.

● The Mercer portfolios are

both compliant with their respective SAA SIPO requirements.

● Jarden are again adopting

a staggered implementation approach, meaning both portfolios are not yet SIPO

compliant with their target asset allocations. The Jarden portfolios had an

allocation to growth assets of 25% at the end of December versus a target

benchmark allocation of 50%.

● The total size of the

PFIF portfolio at the end of December was $104.7m, with approximately half

invested with Mercer and Jarden respectively.

|

HBRC

Treasury Report December 2019

|

Attachment 1

|

3.0 SIPO

review

We have undertaken a

review of the SIPO and requested comments from both PwC and the investment

managers. This section highlights areas where the statement could be enhanced.

PwC believe the SIPO remains fit for purpose.

PwC SIPO comments

Whilst PwC agree that

Council’s return target may be more difficult to achieve over coming

years due to the historically low interest rate environment and extended

investment markets, PwC do not believe it prudent to alter the

portfolio’s strategic asset allocation by moderating the risk

profile. This would introduce a level of risk to the portfolio that is

not congruent with Council’s willingness and ability to take risk. It may

also hinder Council’s ability to achieve its investment objectives should

a significant negative event occur in any period.

Comments 7 and 8 below

refer to Jarden’s inability to invest in illiquid assets under the

current SIPO. PwC believe this should be reviewed to ensure it is fairly

aligned with Mercer’s ability to invest up to 10% of the portfolio in

illiquid, ‘unlisted property’ and ‘unlisted

infrastructure’. PwC agree with Jarden’s comment that as long as

there is an expected accelerated return for the additional risk of investing in

illiquid assets that are expected to be held over the medium term, an

acceptable proportion of the Fund should benefit.

Comment 9 by Jarden refers

to the minimum credit rating required for fixed income investments. PwC agree

with Jarden’s view that the minimum rating could be lowered to BBB- from

BBB+. This would continue to maintain a minimum ‘investment grade’

credit rating across the portfolio, enhance the fixed income yield opportunity

and diversification allowing access to a deeper issuance population. There

have been minimal defaults in the global BBB credit rating space over the past

four decades; the highest year was 1% of total BBB issuance in 2002 and has

been close to 0% over the past decade.

Comment 11 by Mercer refers

to a minor wording adjustment around hedging. PwC believe this is a suitable

change.

Comment 13 by Mercer

refers to a more formalised ethical investment policy as part of this SIPO

review. Based on recent discussions with management, PwC believe this issue

will become more important over the coming years and believe it would be

appropriate to start formalising a policy at this juncture. PwC understand that

a discussion with elected councillors to articulate this policy is to be

undertaken.

Comments 12 and 14 by

Mercer are minor administration points that Council may wish to update in the

SIPO.

PwC also recommend

updating the SIPO to reflect there are now three separate portfolios with each

investment manager, including the capital amount invested into each one and the

respective dates of inception.

Conclusion

PwC do not suggest any

further changes to the SIPO to those mentioned above. PwC will wait for the

above changes to be discussed by the Finance and Audit Risk Committee before

formally updating the SIPO.

Jarden’s SIPO

comments

1. Is the asset allocation too conservative? Council have

assessed the capacity to take risk as low to moderate noting: Financial

capacity and cash flow requirements: Council’s cash flow requirements

imply low capacity to tolerate short to medium term volatility in the value of

its Investment Fund. This reduces the capacity to accept risk. This is

unfortunate as it means they are focused on the near term despite the long time

horizon and has to be the factor which limits risk in the portfolio to 50:50

Growth:Income.

2. The willingness to accept

risk is interesting as it says Council is a risk averse entity. Consequently we

feel there is a reluctance to accept risk even though the conclusion is

Council’s willingness to accept risk would characterised as moderate due

to an acknowledgement of the impact of inflation.

3. Given we are looking at a low interest rate environment for some

time the ability for Council to hit its return target in the short term will

likely be challenged. Based on Jarden’s long term forecasts we expect a

60% growth 40% income portfolio to deliver 6.8%pa and a 80% growth 20% income

portfolio to deliver 7.5%pa.

4. If the portfolios are ahead of their target return with respect to

the reserving policy, Council might consider a temporary shift in asset

allocation to growth with the knowledge that they have a buffer, if in fact a

buffer exists?

5. We are happy for International bonds to remain fully hedged, as

currency fluctuation just boost risk without benefiting long term returns for

bonds.

6. We are interested in more investigation on International Equities

hedging. We see historically there has been a gain to be had by NZ investors

hedging offshore currency exposures. Last time Jarden did the exercise there was

zero gain, although admittedly not a cost either. Typically we see the

allocation to global equities left unhedged due to the currency stabiliser if

there is a large NZ specific event. We see some arguments that the best option

is to have 50% hedged and 50% unhedged which means you are indifferent to

changes in the currency. There is no strong reason to change, but worth another

look.

7. Given the long term nature of the fund and its size, we question

the need to invest only in liquid securities. Jarden’s view is that as

long as there is an expected extra return for the additional risk of investing

in illiquid assets, we believe the fund should exploit this.

8. A limit should be imposed on the level of illiquid assets. This

would require a review of Investment in assets other than those contemplated by

this policy statement (including antiques, art, stamps, gold, silver, hedge

funds, commodities, private equity or venture capital investments) are not

permitted without the prior approval of the Council.

9. The minimum BBB+ credit rating seems conservative. We think

consideration should be given to reducing to BBB if not BBB-. If nothing else

this broadens the range of investments available. To ensure the portfolio

doesn’t become over burdened with weaker credits we could set an average

credit rating for the portfolio of say BBB+ and place lower limits on the

holdings of weaker credits?

Mercer’s SIPO comments

10. Investment Performance

Objective: taking current expected returns per asset class into account, we

believe the 5% real return target may be too ambitious. Our modelling indicates

that the Council’s current 50% Growth strategy has a very low (<10%)

probability of achieving this objective over the long term.

11. Asset Class Guidelines

(page 11): 4th bullet states a 50% lower bound for hedging, whereas the Foreign

Exchange section on page 13 correctly notes a 30% bound. We suggest 30% is

noted in both sections.

12. Rebalancing (page 12): the

second paragraph may be interpreted to mean the Council needs to explicitly

approve each rebalancing trade. In practice, this is carried out by Mercer on

an ongoing basis. We would suggest the wording is amended to reflect the

delegation of rebalancing activity.\

13. Ethical Investment (page

12): We understand the Council has given significant consideration to Ethical

Investment issues but the SIPO reads fairly “light” in this regard.

We would suggest formalising a more thorough RI Policy as part of the SIPO

review.

14. Manager Performance (page 16): We would suggest adding SIPO

compliance explicitly as one of the factors to be taken into account when

reviewing the managers.

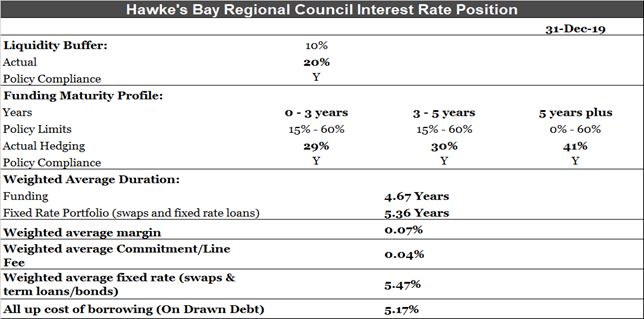

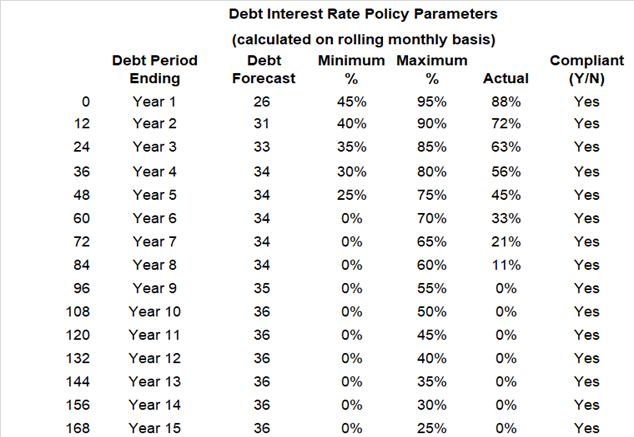

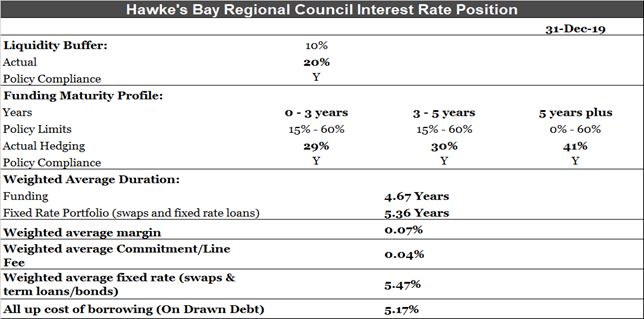

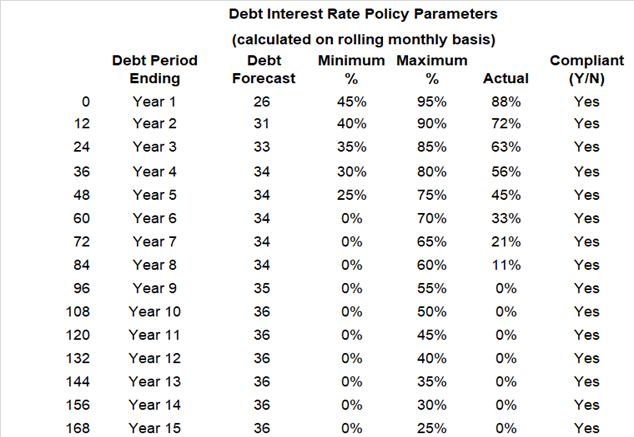

4.0 Liability

Management Policy Compliance Checklist

The

table below illustrates Council’s compliance with funding, interest rate

and liquidity risk parameters set out within the Liability Management Policy. A

snapshot of current funding in place (maturity term and pricing) as well as

interest

rate fixing is

also provided.

The

table below illustrates Council’s compliance with funding, interest rate

and liquidity risk parameters set out within the Liability Management Policy. A

snapshot of current funding in place (maturity term and pricing) as well as

interest

rate fixing is

also provided.

New treasury transactions in the

period are outlined in Appendix 1.

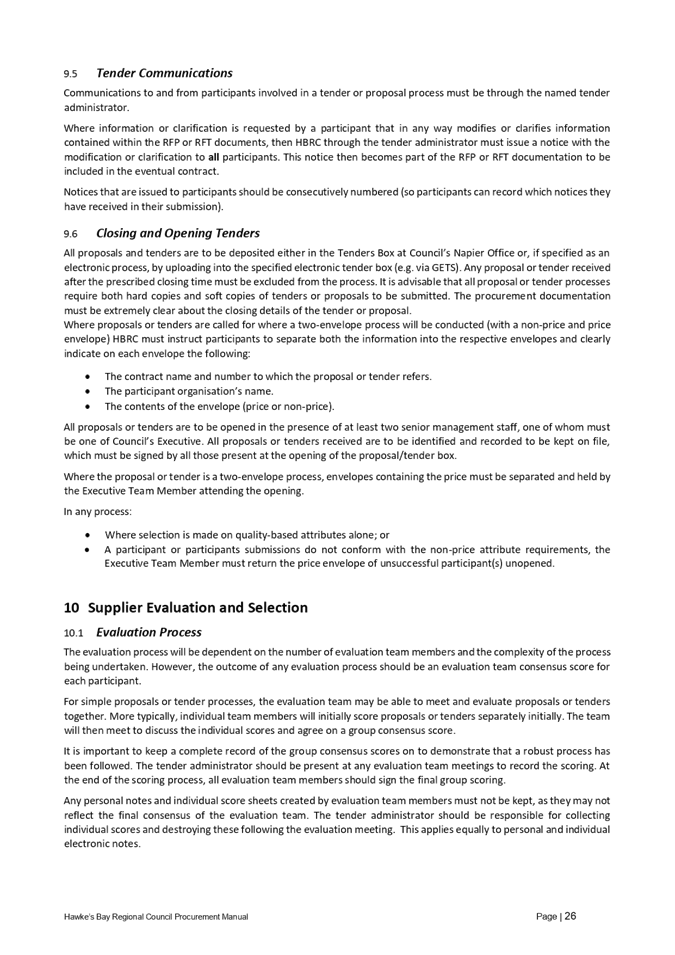

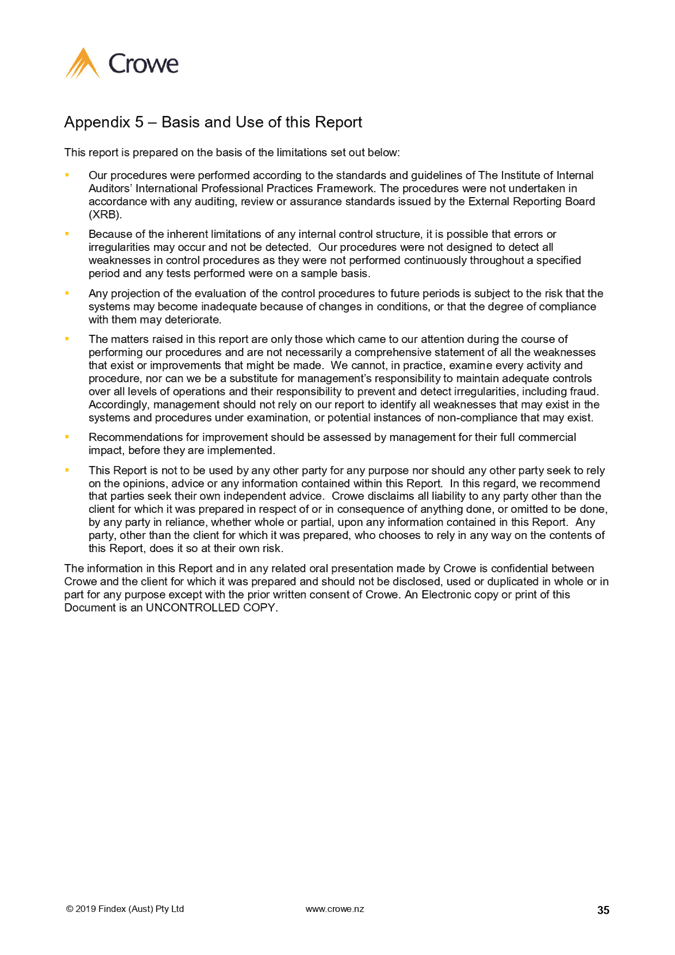

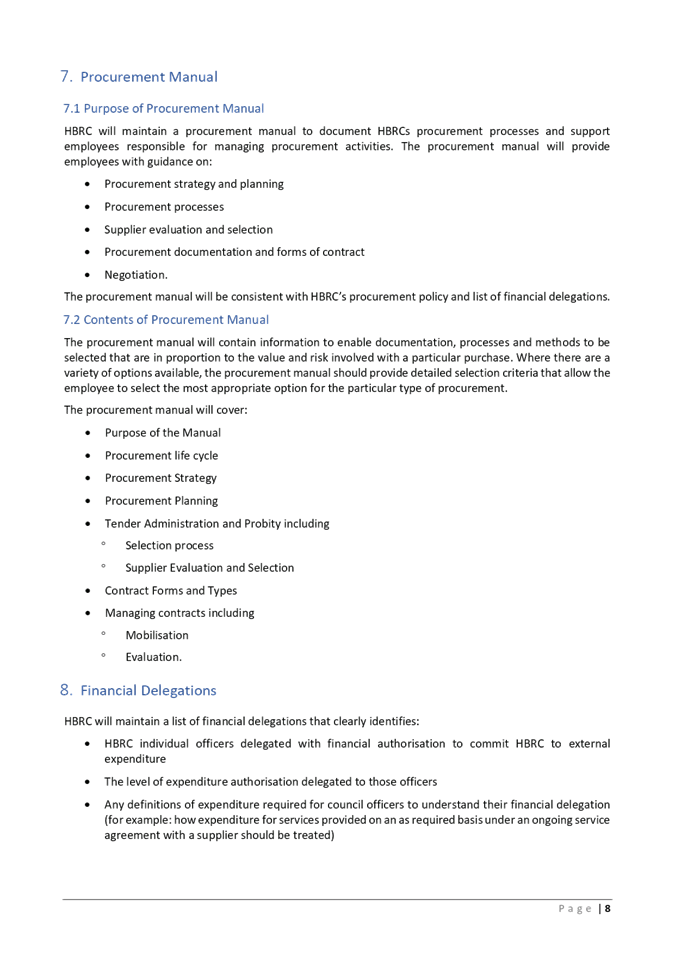

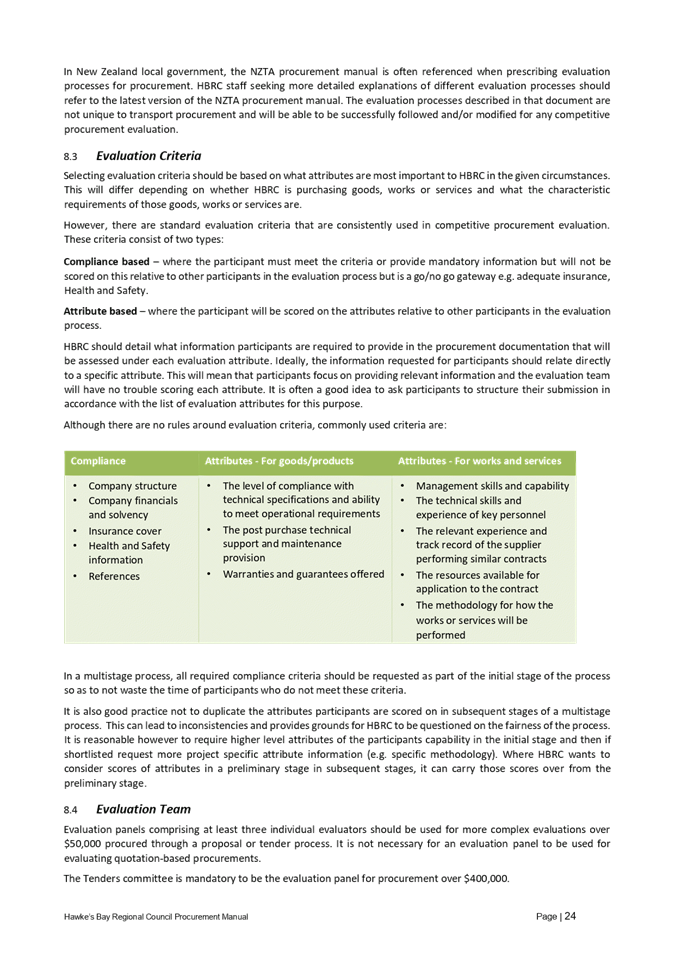

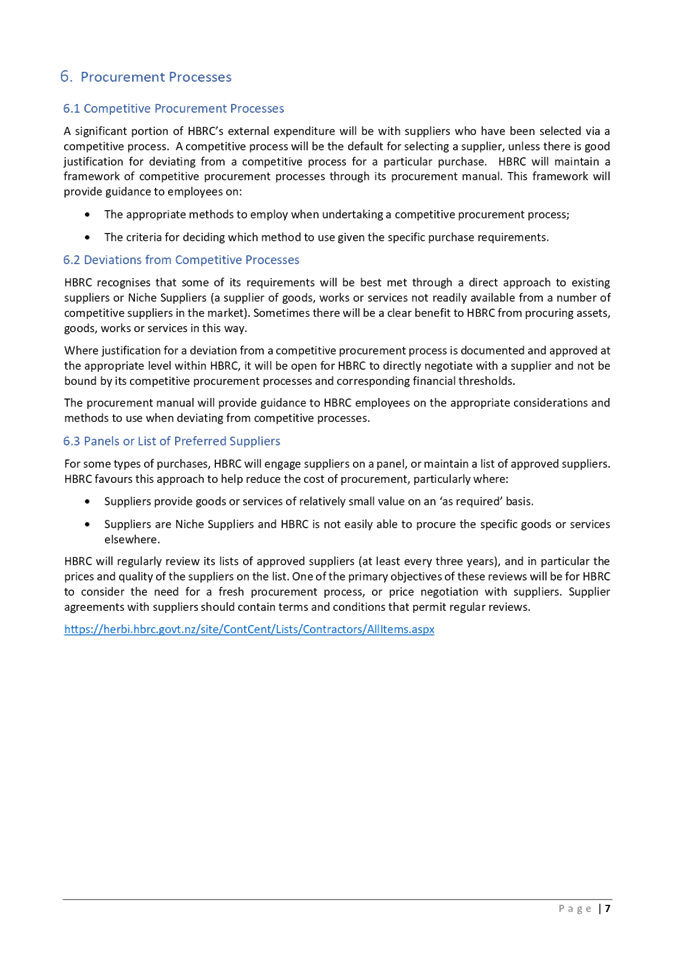

5.0 Borrowing Limits

|

Ratio

|

Hawke’s Bay Regional Council

|

LGFA

Lending

Policy

Covenants

|

Actual

|

|

Net external debt as a percentage of total revenue

|

<150%

|

<175%

|

|

|

Net interest on external debt as a percentage of total revenue

|

<15%

|

<20%

|

|

|

Net interest on external debt as a percentage of annual rates

income

|

<20%

|

<25%

|

|

|

Liquidity buffer amount comprising liquid assets and available

committed debt facility amounts relative to existing total external debt

|

>10%

|

>10%

|

20%

|

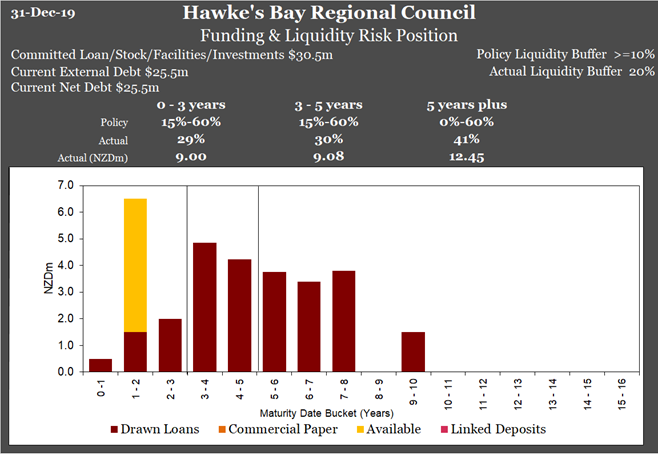

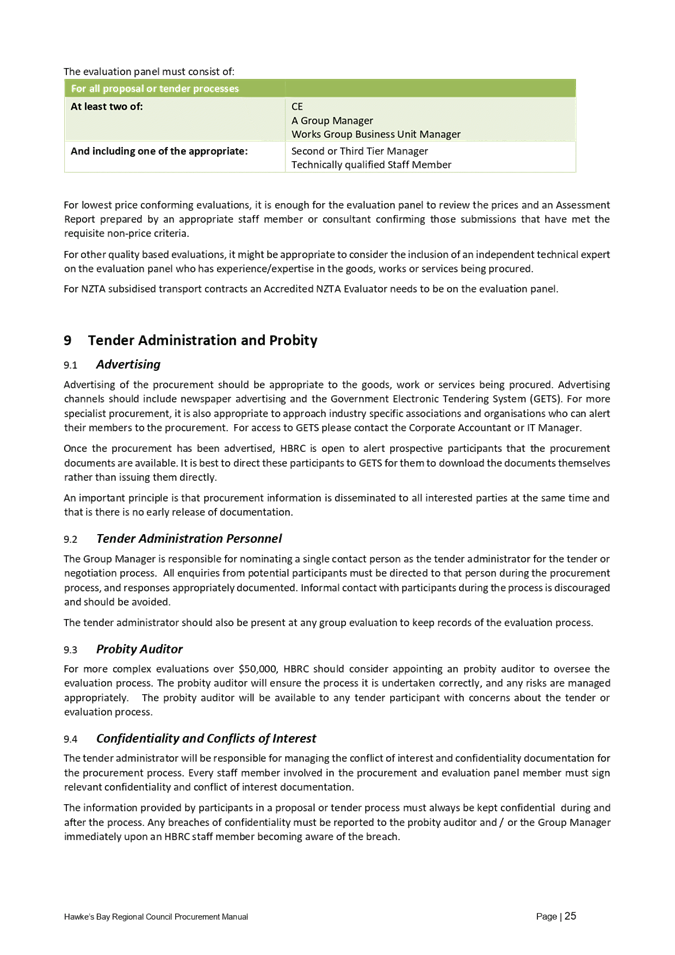

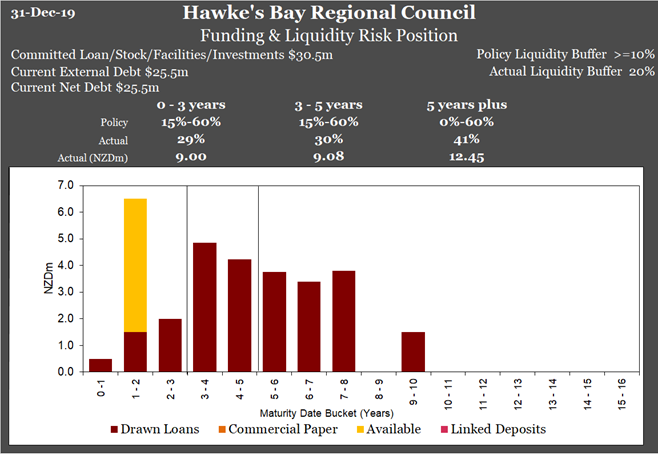

6.0 Funding

and Liquidity Risk Position

The chart below shows the

spread of Council’s current funding maturity terms and positioning within

funding maturity limits set out within the Liability Management Policy.

Council’s liquidity buffer amount is also shown.

Debt Funding Strategy

Council’s

cash flow and debt forecast indicate a requirement for an additional $10

million of core borrowings during this financial year. This level of debt

requirement is a function of FY19 borrowings being $2.5 million of the expected

$7 million. The first tranche of new funding is anticipated to be required in

the second quarter of FY20 (circa $5 million) and is proposed to be met via

participation in upcoming LGFA tenders.

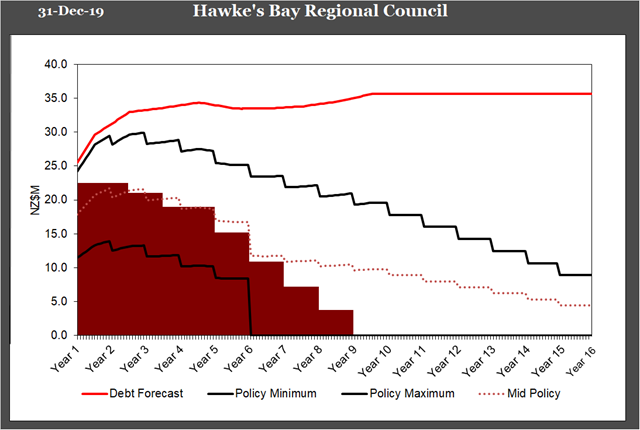

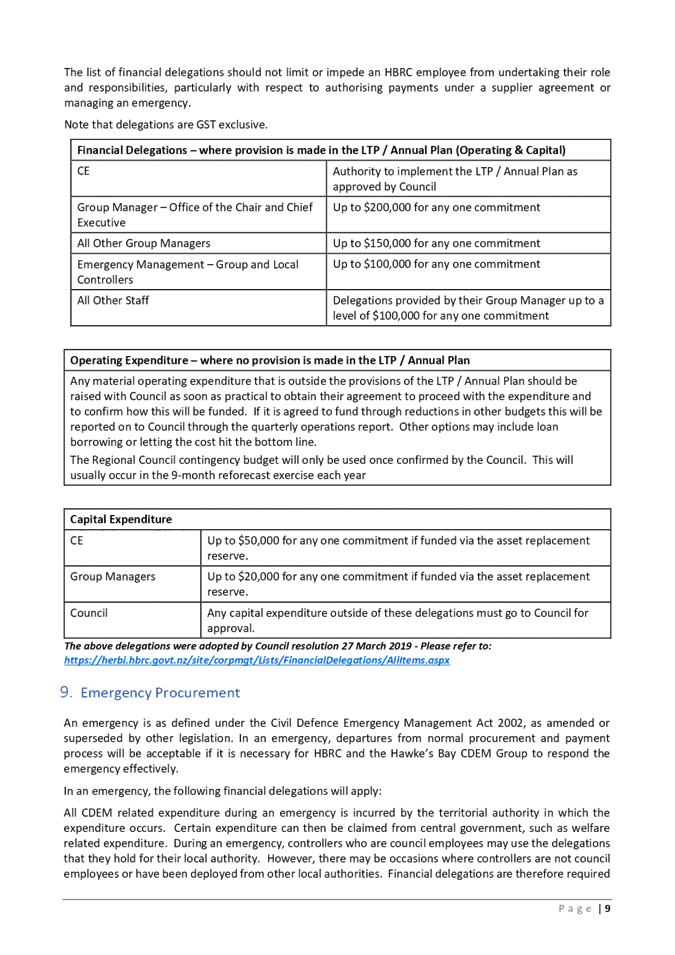

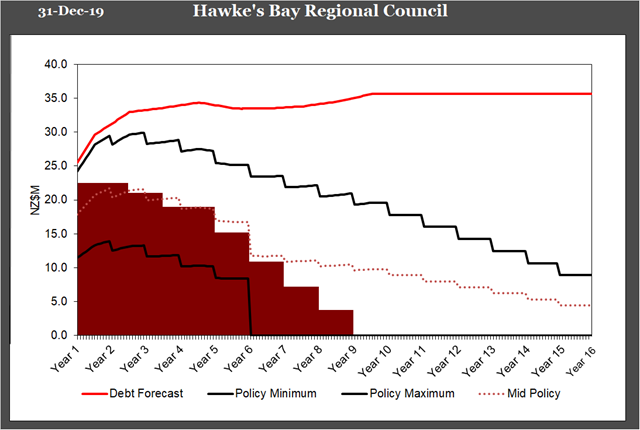

7.0 Interest Rate Risk

Position

The interest rate profile

below shows the level of Council’s interest rate fixing within Liability

Management Policy parameters. The shaded area represents fixed interest rate

commitments (i.e. term loans and/or derivatives) and their maturity terms over

the 15-year Policy period. The red line represents the current rolling debt

forecast for the forward period with the maximum and minimum bands a function

of the debt forecast.

As can be seen from the

chart and table below, the interest rate risk position is fully compliant to

all policy parameters.

Interest rate strategy

With short term interest

rates expected to be lower for longer, as the RBNZ stimulates with loose

monetary policy settings, the fixed rate position will progressively move

towards minimum policy limits. The strategy is therefore to increase

exposure to short-term floating rates (within policy limits) through issuing

all new debt on a floating rate basis.

Long term interest rates are expected

to remain around current levels as global central banks maintain their loose

monetary policy requirements along with influencing low, longer term interest

rates. The longer term interest rate risk position will be maintained

around minimum policy limits through the use of interest rate swaps or fixed

rate debt issuance.

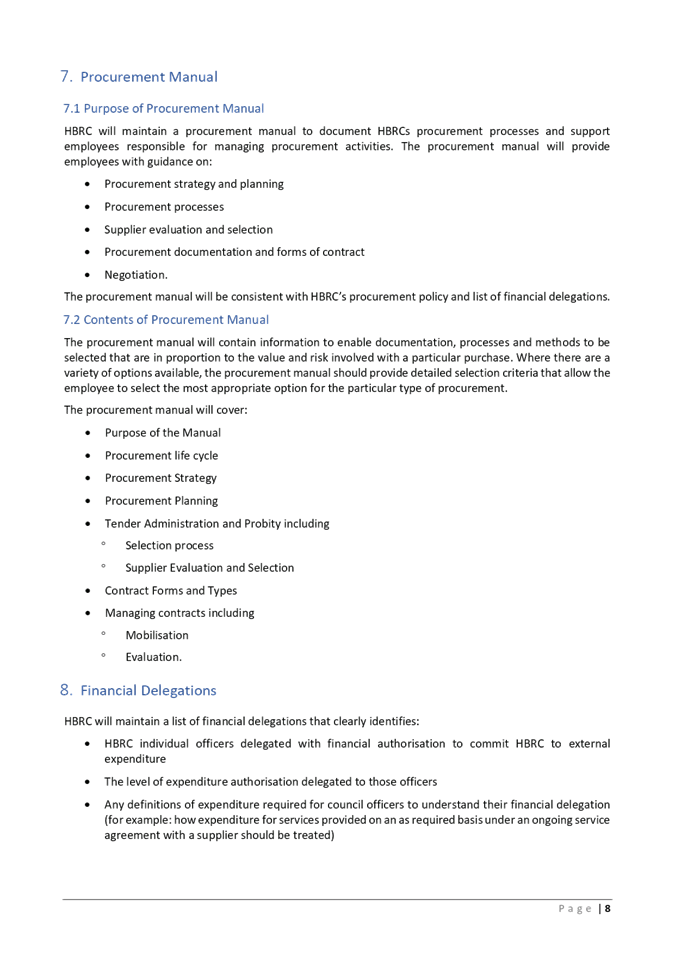

8.0 Funding Facility

|

Bank

(Facility

maturity date)

|

Maturity

Date

|

Drawdown

Amount ($m)

|

Facility

Limit ($m)

|

|

BNZ

|

15-Jan-21

|

0.00

|

5.00

|

|

TOTAL

|

|

0.00

|

5.00

|

|

Available

bank facility capacity (liquidity buffer)

|

This

month ($m)

|

Last

month ($m)

|

|

Gross

amount

|

5.00

|

5.00

|

|

Policy

liquidity buffer requirements

|

2.55

|

2.30

|

|

Excess

amount

|

2.45

|

2.70

|

9.0 Cost of Funds vs

Budget

|

Month

|

YTD

|

|

Actual ($m)

|

Budget ($m)

|

Actual ($m)

|

Budget ($m)

|

|

|

|

|

|

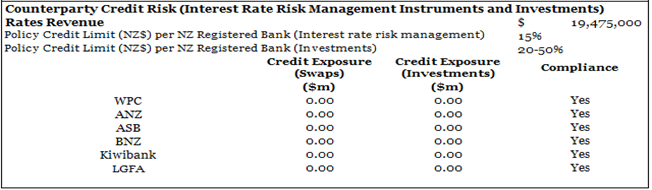

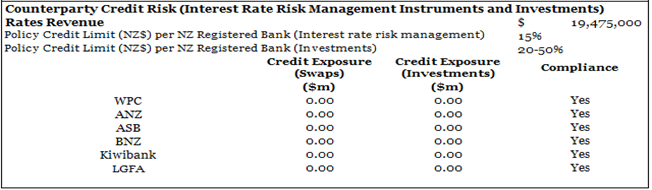

10.0 Counterparty

Credit

All counterparty credit

exposures are fully compliant with policy.

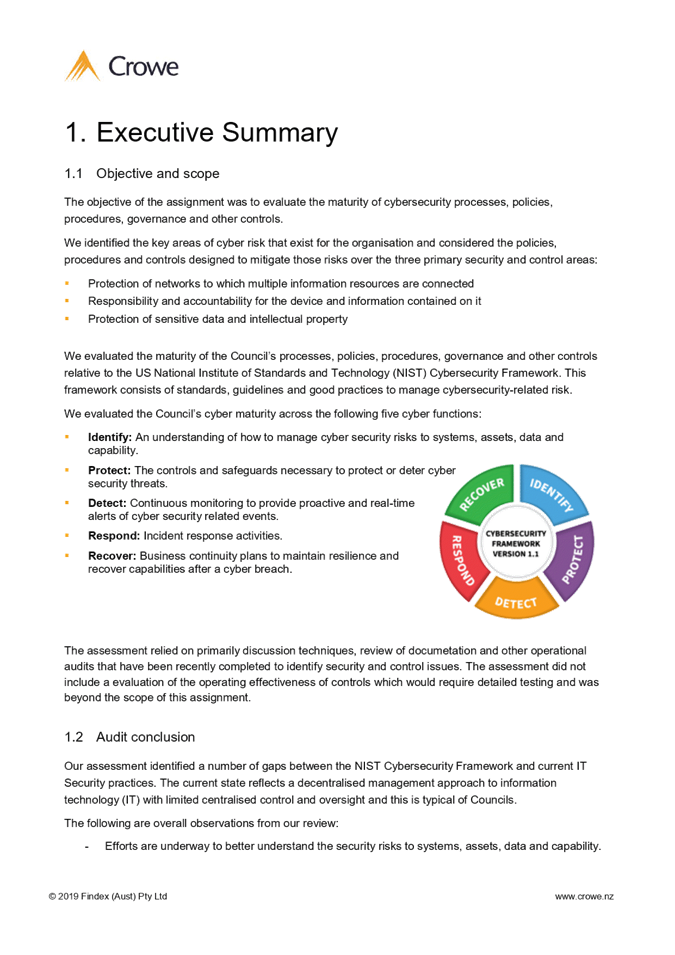

11.0

Market Commentary

Investment

markets

The last quarter of 2019

was a good news quarter, and in broad terms, financial markets responded

accordingly. The monetary stimulus provided by central banks in earlier

quarters has done its job with economic data generally improving. The improvement

is particularly evident in the housing market (rising median sales prices and

lower days to sell). In the US, the number of houses being built has increased,

while in Australia and New Zealand house price inflation has picked up. This

has supported an overall improvement in the economic outlook, which has

bolstered equity markets.

Accompanying the rosier

outlook has been waning expectations of further interest rate cuts, which is

best illustrated by US Federal Reserve (Fed) Chair Jerome Powell’s

comment that “monetary policy is in a good place”. Despite this,

both the Bank of Japan and European Central Bank announced their intention for

an open ended easing bias to deal with stubbornly low inflation. Adding to the

good economic news was the positive progress towards resolving: 1) The US/China

trade dispute, with the announcement of phase one of a trade agreement between

the US and China announced in January 2020; and 2) Brexit, with a decisive

election victory for Boris Johnson’s Conservative Party, which should see

an orderly exit of the United Kingdom from the European Union no later than 31

January 2020.

In this environment,

investors were content to invest in riskier assets types such as equities. This

resulted in the strong performance of New Zealand equities (+5.3%) and global

equities (+7.8%) in local currency over the quarter.

Unfortunately, the global

equity market return in New Zealand dollars (+1.5%) was significantly eroded by

the rise in value of the New Zealand dollar at the end of December, which rose

against all major currencies except GBP (GBP strengthened on the back of a more

favourable Brexit outcome). The NZD benefited from expectations the Official

Cash Rate would not be cut further, more optimistic investor sentiment and

importantly stronger commodity prices.

Increased investor appetite

for riskier assets meant that safe-haven asset values, such as gold and fixed

interest securities/bonds declined.

The stellar performance of

the New Zealand equity market over the quarter and year (+31.6%) warrants

closer examination. Without doubt, there has been increased interest in the New

Zealand equity market as bank term deposit interest rates tumbled from 3.3% in

April 2019 (where they had been since the end of 2015) to the current six month

deposit rate of 2.6%.

There has been an

extraordinarily diverse performance of equities over the quarter – from

Metlifecare (+53%, following a takeover offer) and Summerset (+34%) as

outperformers, down to Sky Network Television (-37%) and Gentrack (-28%) as

underperformers. While the weak performers reflect company specific issues, the

outperformers, except for Fisher & Paykel Healthcare, are all in the aged

care industry, which is benefiting from a reinvigorated housing market. The

other group of companies worth commenting on are the electricity generation

companies, which gave back a chunk of the gains achieved in early months on the

back of investors chasing dividend yields. They fell in price, due to concerns

around Rio Tinto’s review of the Tiwai Point aluminium smelter’s

operation. The smelter consumes 10% of New Zealand’s annual electricity

production, so a decision to shut the smelter down would result in an

electricity oversupply and subsequent drop in the electricity price.

Funding

markets

A

total of 21 local government borrowers raised $413 million in the fourth

quarter (Q4) of 2019. 39 separate funding transactions occurred, of which all

except two were conducted via the LGFA. The two debt issues transacted outside

of the LGFA were from Dunedin City Treasury (not a LGFA member). Borrowing

volumes remained strong in Q4, slightly lower than Q3. A total of 54% of all

borrowing in Q4 was undertaken on a floating rate basis. Over the fourth

quarter, Councils borrowed for a weighted average term of 6.9 years.

Looking

back on the full year, total issuance amounted to $2.40 billion; the highest

level since 2014 ($2.55 billion). Prefunding ahead of the LGFA's April 2020

bond maturity ($1.03 billion) is expected to support borrowing volumes

throughout the first quarter of 2020. We understand that, to date,

approximately 35% of the 2020 bond maturity have been refinanced/prefunded.

However, most councils are currently updating new debt forecasts and this may

push out issuance demand to the second quarter of 2020.

LGFA

credit spreads have continued to creep up since Q3 in the short end (three to

five years) and held reasonably constant for the longer end (7-10 years).

Government

bond yields remain at historically low levels reflecting global yield curves,

supporting the attractiveness of LGFA bonds as a substitute investment to NZ

Government bonds given the higher yields on offer. There was significantly less

Kauri bond issuance in 2019 with a total of $1.4 billion of new issuance

(relative to total issuance of $4.2 billion in 2018). LGFA bond demand (and

pricing) benefits when there is less Kauri issuance competing for the investor

dollar. With the expanded bond issuance program from Kāinga Ora (Housing

NZ) in 2020 of $2.5 billion (up from $1.5 billion in 2019), we expect some

impact on LGFA demand, thus increasing the risk that credit spreads widen

gradually in 2020, primarily for longer-dated tenors. We believe that investor

interest for LGFA bonds will however, remain robust for maturities up to 5

years and that there may be some upward movement on margins for longer dated

issuance.

Interest

rate markets

The

RBNZ surprised financial markets in November by holding the OCR at 1.00%. The

fundamental outlook no longer currently supports another cut to the OCR over

the next six months, although we expect risks remain biased lower. RBNZ note

while inflation remains below the 2 percent target, employment continues to sit

around its maximum sustainable level and other economic developments since the

August MPS “do not warrant a change to the already stimulatory monetary

setting at this time.” However, risks remain “tilted to the

downside.” Domestically, business confidence improved in December but

remains weak overall. Businesses are reluctant to make hiring or investment decisions,

and have struggled to raise prices, crimping sales margins. The housing market

is now showing signs of growth, while inflation pressures are slightly

stronger, however global risks (including the coronavirus) remain. ‘Lower

for longer’ interest rate settings to prevail.

Long-term

NZ swap rates are biased lower as global rates are likely to remain under

structural pressure. Global growth remains tepid amid recent (but improving)

trade tensions between US and China, as well as Brexit uncertainty (though

easing following the election). There are signs of growth stabilising (rather

than further weakness) but uncertainty remains. A soft growth outlook from our

key export trading nations, Australia, China and Europe means that central

banks will continue their ‘looser’ monetary policy settings.

Underlying inflation around the globe remains benign. There remains no reason

for structurally higher long-term swap rates over the next twelve months.

12.0 Policy

exceptions

|

Date

|

Detail

|

Approval

|

Action

to rectify

|

|

TBC

|

SIPO

asset allocations non-compliant

|

Y

|

Gradual

staggering into investment portfolio positions will see strategic asset

allocation requirements met over coming months.

|

13.0 Appendix

13.1 New Treasury

Transactions up to 31 December 2019

Borrowing

activity

|

Bank/LGFA

|

Amount

(NZDm)

|

Borrower

notes (NZDm)

|

Deal

Date

|

Start

Date

|

Maturity Date

|

Commitment Fee

|

Margin

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Rate Borrower Swaps

|

Bank

|

Notional

Amount (NZDm)

|

Deal

Date

|

Start

Date

|

Maturity Date

|

Swap

Rate

|

|

n/a

|

n/a

|

n/a

|

n/a

|

n/a

|

n/a

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 12 February 2020

Subject: Business Continuance

Plan

Reason for Report

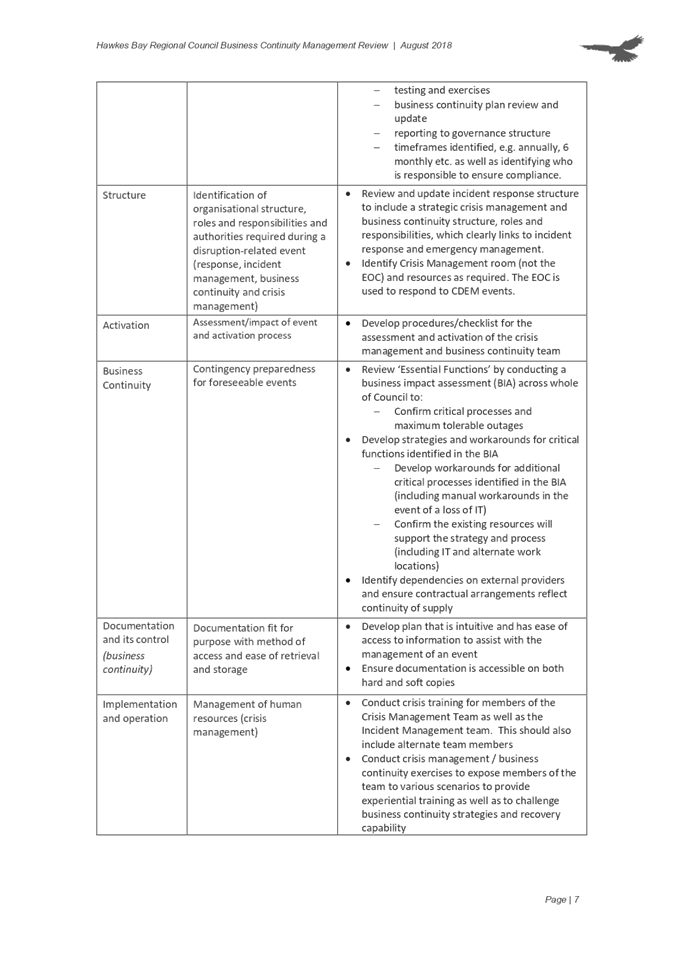

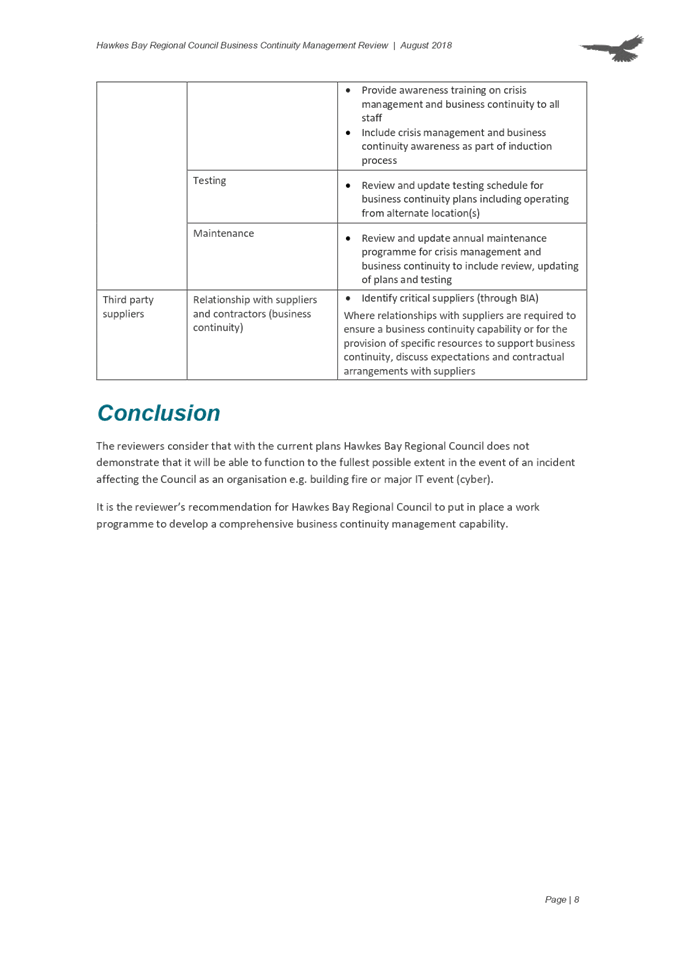

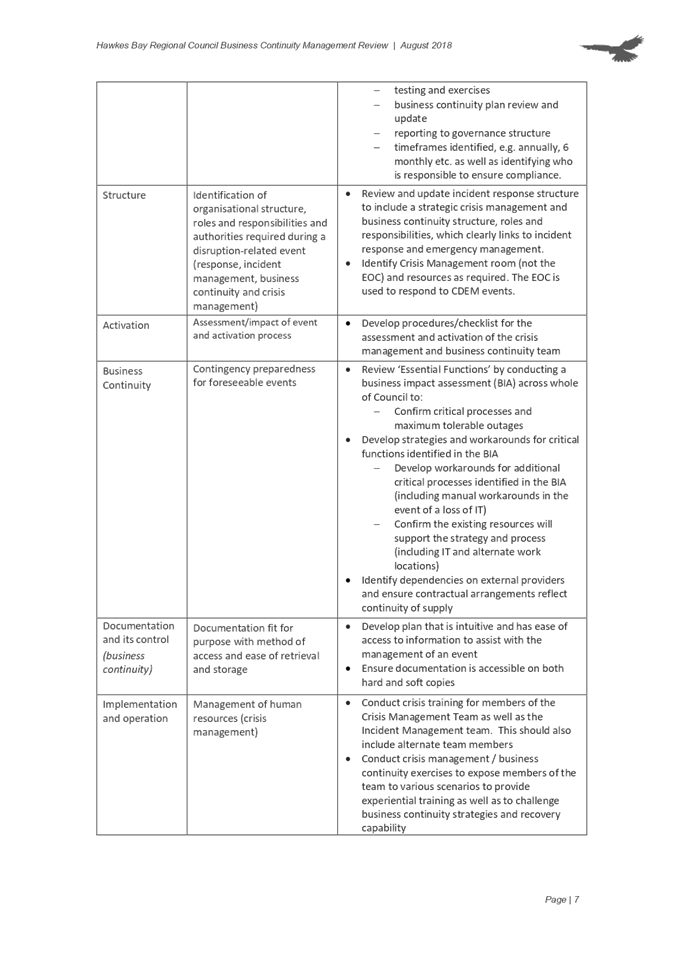

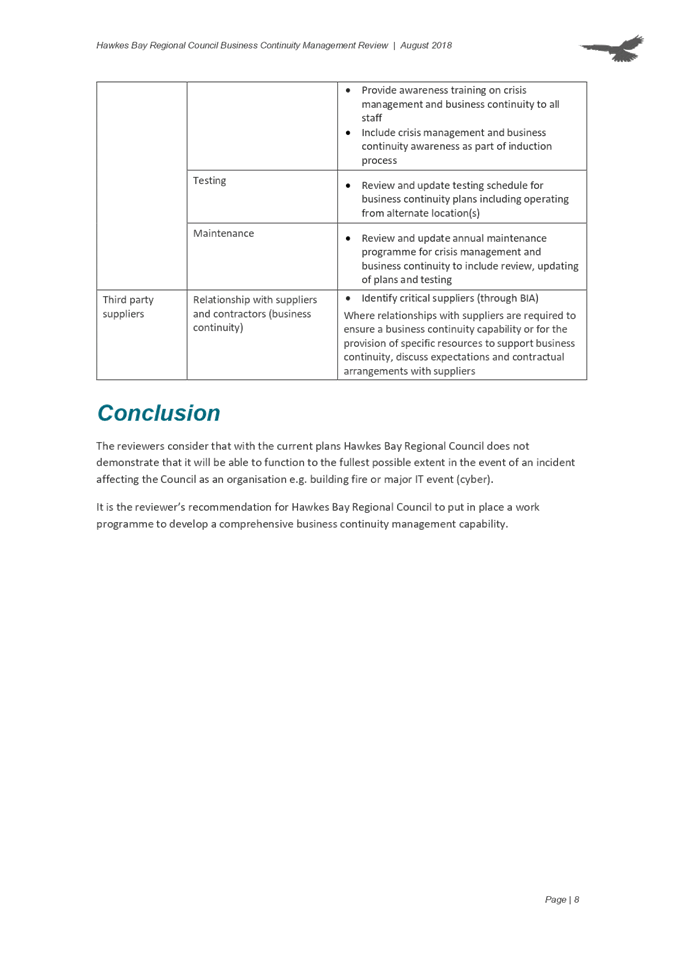

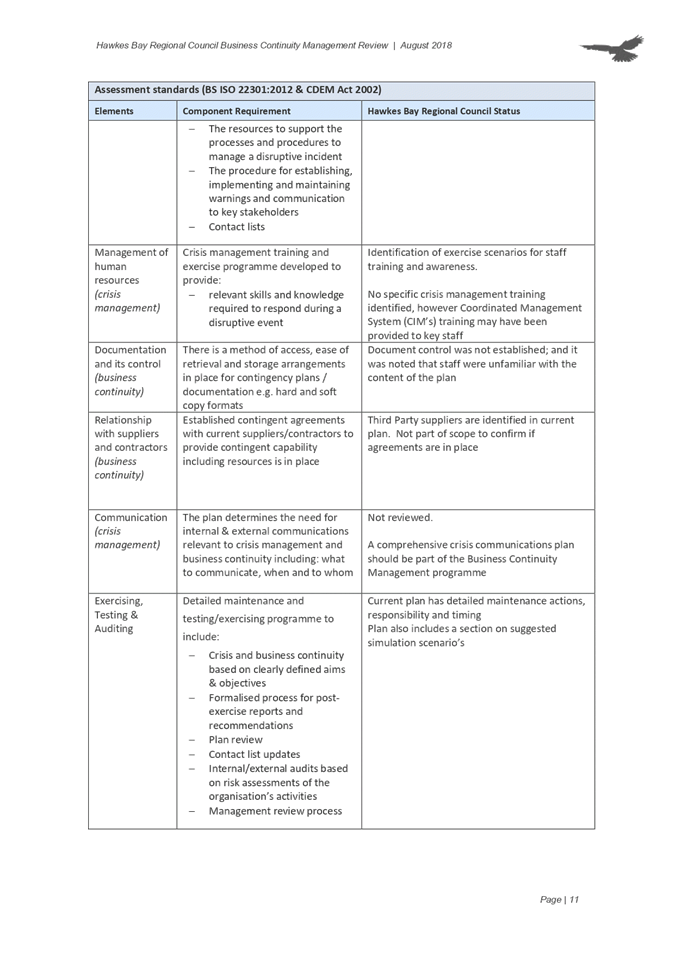

1. This committee asked for an independent review of the

Council’s Business Continuance Plan in 2018 as it was due for an

update. The plan is now completed and tested, and ready for the

Committee’s acceptance.

Executive Summary

2. The independent review was commissioned through Kestrel Group and a

series of recommendations were provided. A copy of the original Kestrel review

report is enclosed with this paper for your reference. Since the review the

main recommendations have been implemented. There remain some additional

mitigations which are in train.

3. The plan was tested during the recent Civil Defence exercise in

October 2019 and was effective. Some areas for further improvement were

identified and will be progressed.

4. The last Finance, Audit and Risk Sub-Committee (FARS) was on 21

August 2019 and the preference was to bring the Business Continuity Plan to the

first FARS meeting following the regional Civil Defence exercise. Due to the

recent election and re-establishment of committee structure, today’s

meeting is the first opportunity to bring this plan for your consideration.

Background

5. Hawke’s Bay Regional Council has both local government

statutory obligations and specific requirements under the CDEM Act 2002 to be

able to fulfil their responsibilities albeit this maybe at a reduced level in

any crisis event.

6. To ensure the organisation has a robust response to an event

affecting its ability to manage business as usual, it is essential that it has

a comprehensive business continuity management programme in place.

7. Hawkes Bay Regional Council’s current Business Continuity Plan

was last updated in September 2016 and recognised the need to review plans.

Kestrel Group were engaged to review the current status, identify any gaps in

the current business continuity planning, and to provide recommendations to

ensure that Hawkes Bay Regional Council is aligned with international business

continuity management standards and compliant with the Civil Defence Emergency

Management Act 2002 (CDEM Act 2002)

8. These recommendations were received in late 2018, with

recommendations implemented over the course of 2019 and put to the test in the

regional civil defence exercise in October 2019.

9. Kestrel Group provided a series of recommendations with a way

forward to implement a comprehensive business continuity management

programme.

10. These

recommendations have been concluded and are summarised as follows.

Governance –

Develop Business Continuity Management Policy

11. Policy

prepared, considered by Executive and adopted and approved by the Chief

Executive in June 2019

Structure &

activation - Review & develop activation checklist

12. Incident

response structure was reviewed and updated, incident room designated and

checklist included.

Business Continuity

– Review contingency preparedness for foreseeable events and identify

critical suppliers

13. All

essential functions were reviewed by conducting a business impact assessment to

confirm critical processes, maximum tolerable outages and critical

suppliers. Identified risks/workarounds were assigned to designated staff

to mitigate during business as usual, and to implement in any crisis event.

Documentation –

Make fit for purpose with method of access and ease of retrieval and storage

14. Plan was

reviewed and updated to make it easier to navigate, and once approved will be

made available electronically and in hard copies for the Executive and

designated staff responsible for essential functions to reference when

required.

Implementation and

operation – conduct crisis training and exercise

15. Business

continuity training was provided for staff over May – June 2019, and the

plan exercised successfully alongside the CDEM earthquake exercise in October

2019.

Testing &

maintenance– Set schedule for testing and annual review

16. Ongoing

maintenance & testing is to be managed by the Office of the Chief Executive

and Chair.

Next Steps

17. As

highlighted in 9.3 the review identified several risks for on-going mitigation,

including some engineering design files missing electronic back-ups and some

critical documents not available on share drives; the need to review

contractual obligations to further minimize risks; the need to improve

capabilities to account for employees and their status in a sudden on-set

crisis; and the need to phase out the Mitel phone network within the Dalton

Street building as if hardware damaged HBRC calls will not be answered and

there are no replacements as Mitel system is too old. These tasks have

been assigned to designated staff to resolve as soon as possible with oversight

from Group Managers.

18. Once

adopted by the Committee, the plan will be scheduled for an annual review by

the Office of the Chief Executive and Chair (OCEC), along with ongoing

maintenance and testing. Day to day management will sit with the Risk and

Assurance Lead role within the OCEC team, which is currently under recruitment.

Decision Making

Process

19. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and, as

such, the updated Business Continuity Plan needs to be accepted by the Finance,

Audit and Risk Sub-Committee.

|

Recommendations

That the Finance, Audit and Risk Sub-committee receives and

accepts the “Business Continuity Plan” staff report and

associated plan.

|

Authored by:

|

Lisa Pearse

Team Leader Hazard Reduction

|

|

Approved by:

|

Joanne

Lawrence

Group Manager Office of the Chief Executive

and Chair

|

|

Attachment/s

|

⇩1

|

HBRC Business

Continuance Plan

|

|

|

|

⇩2

|

Kestrel Group

HBRC Business Continuity Management Review Report

|

|

|

|

HBRC

Business Continuance Plan

|

Attachment 1

|

Business Continuance Plan

“To continue operating essential

functions and services during and following an interruption”

FEBRUARY

2020

Accepted by Finance, Audit and Risk Committee resolution on 12

February 2020

|

HBRC

Business Continuance Plan

|

Attachment 1

|

Executive Summary

1 Procedure

Flow Chart & Checklist

2 Events

Record Log

3 Essential

Functions and Services

4 Non-Essential

Functions and Services

5 Business

Continuance Plan Overview

6 Preparation

7 Response

Appendices

Essential

Functions Continuance Strategies

External References

Emergency Procedures Manual - Copies held by

Senior Managers, Incident Room and on Herbi

HB CDEM Group Plan - Copies held by Chief

Executive, Group Managers, Incident Room and on Website

Oil Spill Contingency Plan - Copies held by

On-Scene Commanders, and in Incident Room

Information Services Disaster Recovery Plan

- Copy held by ICT Manager and on Herbi

Contacts Database - Held in Computer Database

|

HBRC

Business Continuance Plan

|

Attachment 1

|

Executive Summary

Business continuance is a strategy for

putting processes in place that an organisation requires to operate during and

after an interruption. Business continuance plans not only reestablish full

operations as swiftly and smoothly as possible, but also seek to prevent

essential services from being interrupted through various annual maintenance

tasks.

Even though the probability of a major

regional crisis is not high, the effect of such a crisis may seriously affect

the ability of the council to continue to fulfil its statutory obligations, and

its obligations to the regional community. It is important to understand that

our business can be disrupted by not just a national or regional disaster, but

also by local and isolated events which can result in parts of our business

becoming unworkable and not being able to meet our obligations. Therefore, it

is necessary for the business to identify the essential functions that the

business needs to operate and meet is statutory obligations.

The Executive team have identified our

essential functions. Each of these functions are individual appendices at the

back of this plan which prompt staff on how to re-establish full operations as

swiftly and smoothly as possible. They outline; essential duties and

requirements, alternative solutions and the positions responsible. It is

important to note that staff wellbeing is paramount and as part of the

Emergency Procedures the Safety Team are responsible for monitoring safety of

staff, supporting welfare of staff and families, checking rosters and

coordinating First Aid requirements (Reference Emergency Procedures Manual JD

3).

A member of the Executive

team can activate this plan, when any of the essential functions or services

are affected. Or more broadly when:

· serious physical damage has occurred, or threatens to

occur, to our premises or our ability to effectively operate from our premises

· substantial event or activity has occurred, or threatens

to occur, to interrupt our business.

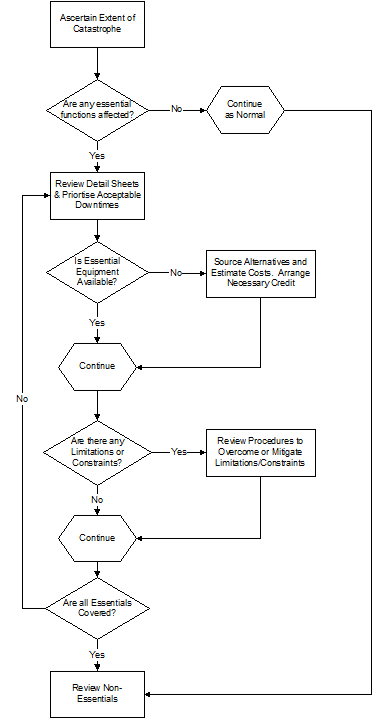

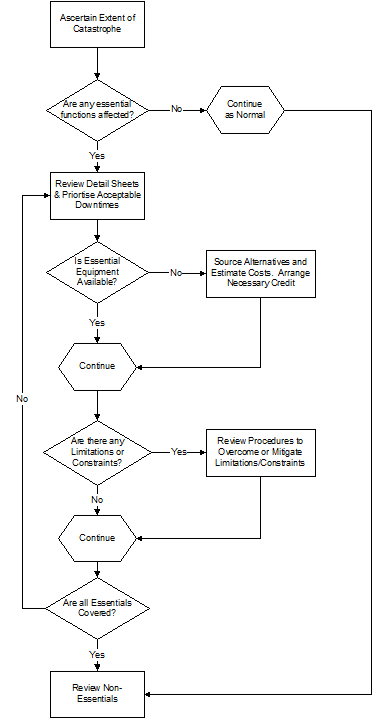

The Executive will use the flow chart,

checklist and the events record log (next two pages) in this document to

execute the plan. The flowchart is used to follow the procedure until HBRC is

operating all essential functions and services and meeting statutory

obligations. The decisions made during this process will be recorded on the

events record log.

It is important staff understand:

1. By

activating this plan, the business gives priority to functions and services

that have been identified as essential and allocates these acceptable

downtimes

2. Non-essential

functions of the business will not be addressed until all essential functions

and services have been re-established

3. Staff in non-essential functions and

services will be deployed to other areas of the business as a priority to

establish essential functions and services.

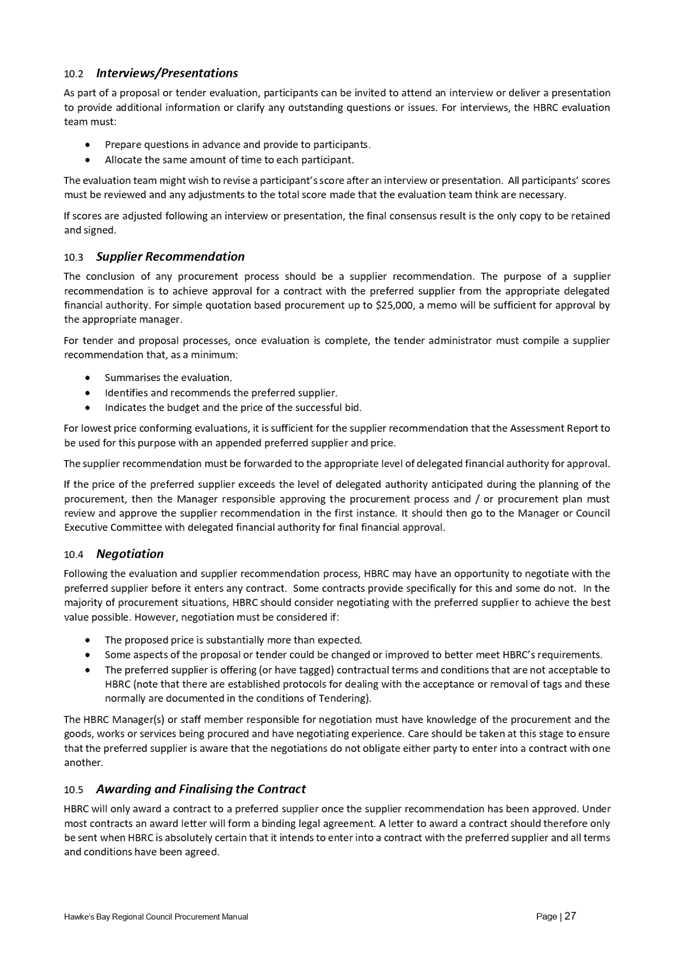

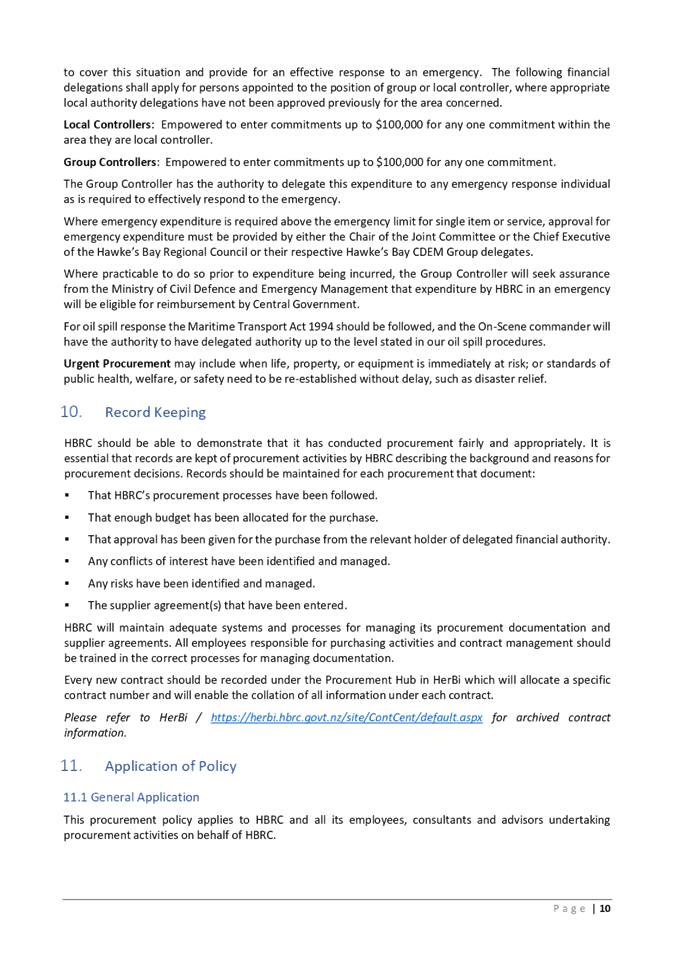

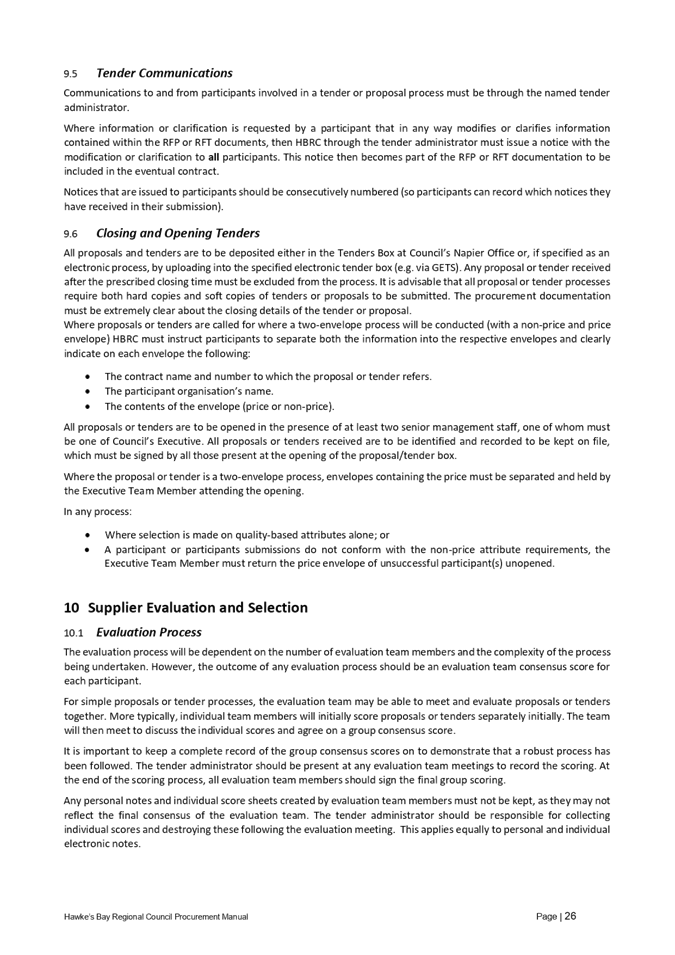

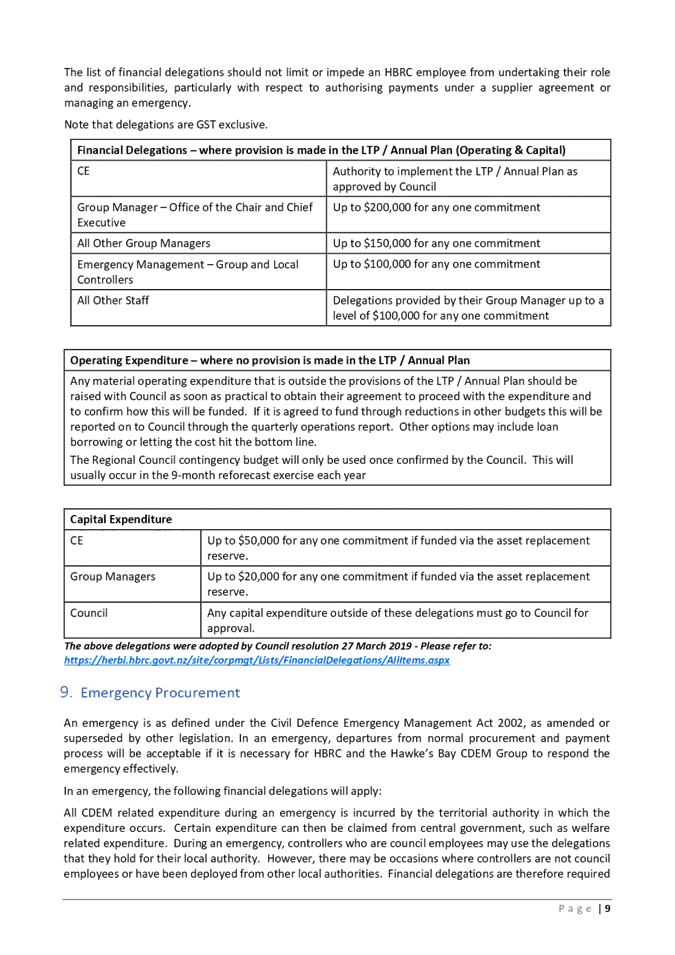

1. Procedure Flow Chart & Checklist

|

|

Any

member of the Executive Team can activate this plan (Refer to Section 7) if

any of the essential functions* are affected:

o Identify an

appropriate Incident Room with communication support

o Notify

essential leads and/or other applicable staff of the nominated Incident Room.

o Account for

employees and their status using HR, and maintain health and safety.

o Mobilise

essential leads & Incident Management Team who can physically come to the

Incident Room, and personnel that can provide support.

o Establish

command structure with alternatives for all positions. (Ref Emergency

Procedures Manual)

o Appoint

responsible personnel to review essential function detail sheets*, and

prioritise acceptable downtimes and report back to IMT

1. Pollution

Response

2. Marine

Oil Spill Response

3. Hydrology

Flood Warning

4. Duty

Management

5. Alt

GECC & HBRC Incident Room

6. Asset

Mgt Assessment

7. Managing

Contractual Obligations

8. Public

Transport

9. Coordinate

Recovery incl HR, Health and Safety

10. Computer

Services

11. Records

Management Access

12. Finance

(Payroll)

13. Vehicles

& Generator

14. Radio

Communications