Meeting of the Finance Audit & Risk Sub-committee

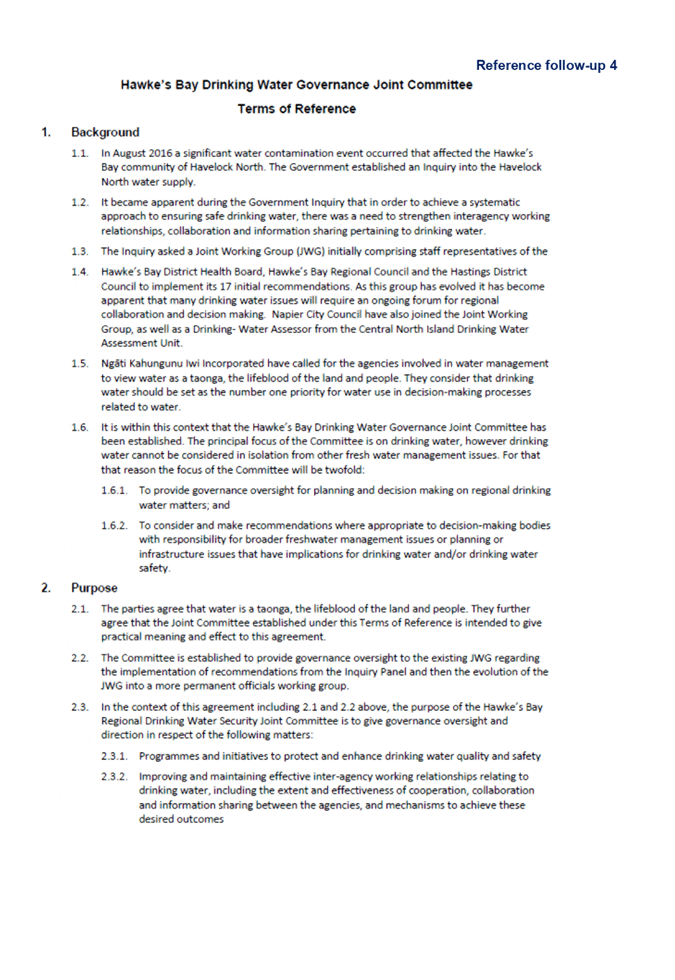

Date: Wednesday 21 August 2019

Time: 9.00am

|

Venue:

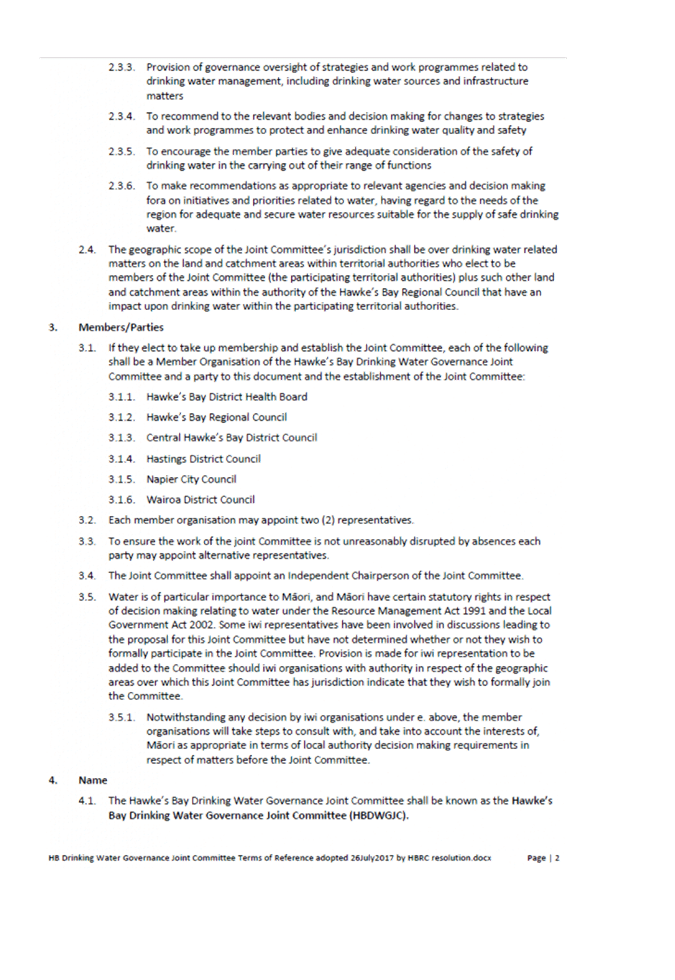

|

Council Chamber

Hawke's Bay Regional Council

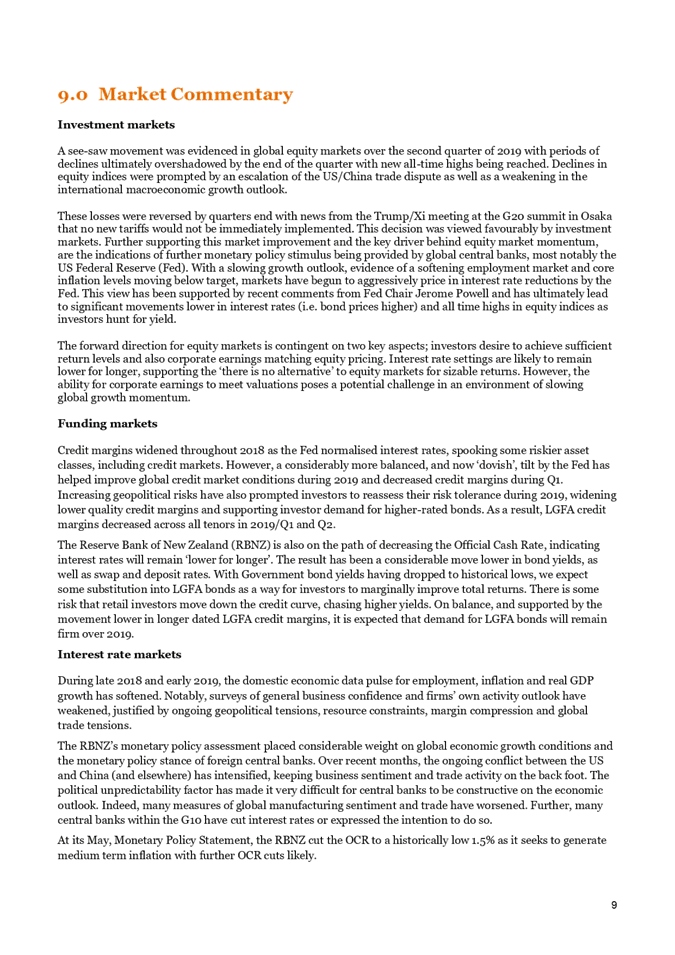

159 Dalton Street

NAPIER

|

Agenda

Item Subject Page

1. Welcome/Notices/Apologies

2. Conflict

of Interest Declarations

3. Confirmation of

Minutes of the Finance Audit & Risk Sub-committee meeting held on 22 May

2019

4. Follow-ups from Previous

Finance Audit & Risk Sub-committee Meetings 3

Decision Items

5. Remission of

Penalties on Rates Policy (Fixed Term) 11

6. Six Monthly Report

on Risk Assessment and Management 15

Information or Performance Monitoring

7. Treasury Report 23

8. Procurement Hub

Update 39

9. August 2019

Sub-committee Work Programme Update 43

Decision Items (Public Excluded)

10. Proposed Local Government Act

Section 17a Review 45

11. Confirmation of the Public

Excluded Minutes of the Finance, Audit and Risk Sub-commitee Meeting held 22

May 2019 47

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 21 August 2019

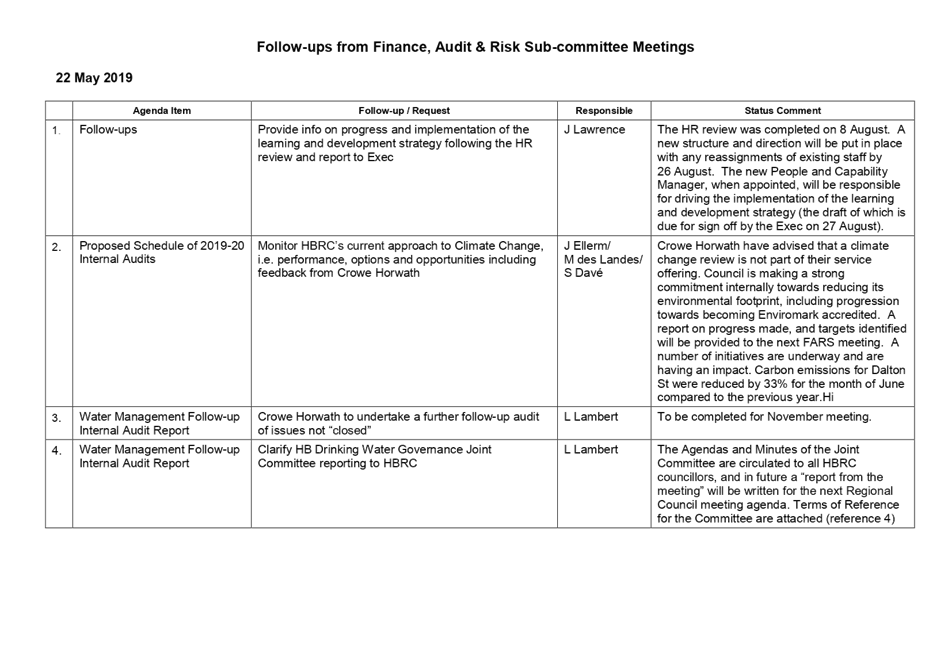

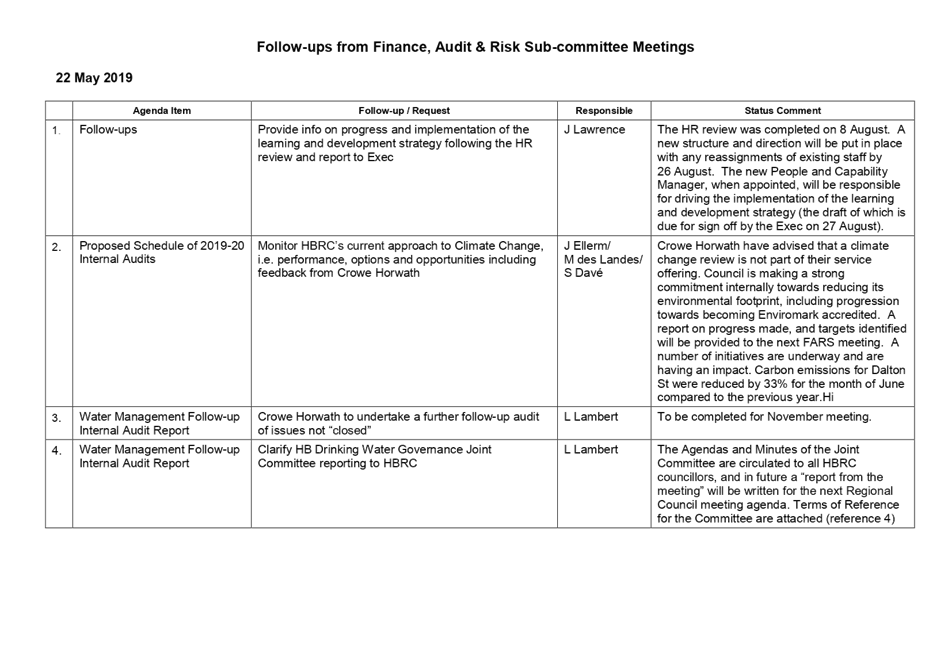

SUBJECT: Follow-ups from Previous Finance

Audit & Risk Sub-committee Meetings

Reason for Report

1. In order to track items raised at previous meetings that require

follow-up, a list of outstanding items is prepared for each meeting. All

follow-up items indicate who is responsible for each, when it is expected to be

completed and a brief status comment. Once the items have been reported to the

Committee they will be removed from the list.

Decision

Making Process

2. Council is required to make every decision in

accordance with the Local Government Act 2002 (the Act). Staff have assessed

the in relation to this item and have concluded that as this report is for

information only and no decision is required, the decision making procedures

set out in the Act do not apply.

|

Recommendation

That the Finance, Audit and Risk Sub-committee receives

and notes the “Follow-ups from Previous Finance Audit and Risk

Sub-committee Meetings” staff report.

|

Authored by:

|

Shash

Davé

Chief Financial Officer

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

⇩1

|

Followups for

Aug 2019 FARS meeting

|

|

|

|

Followups

for Aug 2019 FARS meeting

|

Attachment 1

|

|

Followups

for Aug 2019 FARS meeting

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 21 August 2019

Subject: Remission of Penalties

on Rates Policy (Fixed Term)

Reason for Report

1. The purpose of

this report is to introduce an additional Remission of Penalties on Rates Policy

(Fixed Term) to assist ratepayers who may experience a financial hardship

caused by Council’s change in our rates payment due date from 31 January

2021 to 20 September 2020.

2. Staff have

begun developing and implementing a comprehensive communications plan with

staggered roll-out over the coming months to advise, inform, and educate the

ratepayers on this change in due date. As a result, Staff proposes to seek the

appropriate decision-making committees of the Council to formalise and adopt

this one-time, fixed term change to the Remission of Penalties on Rates.

3. Our current

Remission of Penalty on Rates Policy ‘conditions and criteria’

allow for one remission every three years for a missed rate payment for

circumstances which are under ratepayer’s control.

4. A change in our

rates due date from January 2021 to September 2020 (4 months earlier) may cause

some ratepayers a financial hardship resulting in a delayed payment.

Council currently applies a 10% penalty on unpaid rates (rates past the due

date). This policy change allows a ratepayer to apply for a remission on

the 10% penalty recognising that some ratepayers will be required to issue two

rate payments in calendar year 2020, which may cause a financial hardship. Any

discretionary decision by the Council granting this special remission will

disregard the ratepayer’s prior missed rate payment history.

5. This policy

will only apply to rates due for the financial year 1 July 2020 to 30 June

2021.

6. The Local

Government Act (LGA), section 103(4), requires an amendment to a rates

remission and postponement policy to be consulted on using the provisions of

section 82. Presenting this report to the FARS is part of the procedure

required to enable its inclusion in next year’s annual plan consultation

process.

Objective

7. The objective

of this additional policy is to enable Council to act fairly and reasonably,

when a rates payment has not been received by the due date to allow for a

one-time remission of penalties for ratepayers who may experience a financial

hardship caused by the requirement to remit two rate payments in one calendar

year (2020).

Background

8. Local

Government (Rating) Act Section 57, states that a local authority may, by

resolution, authorise penalties to be added to rates that are not paid by the

due date. This penalty must not exceed 10% of the amount of the unpaid rates on

the date when the penalty is added. Council applies a 10% penalty for unpaid

rates.

9. Council acts

fairly and reasonably when a rate payment has not been received by the due date

and currently has the following Rates Remission and Postponement policies in

place:

9.1. Māori

Freehold Land, Remission in Special Circumstances

9.2. Remission of

Penalties on Rates

9.3. Remission of

Rates on Properties Affected by Natural Calamity

9.4. Remission for

Uniformed Annual General Charges (UAGC)

9.5. Postponement

in Cases of Financial Hardship or Natural Disaster.

10. To be granted a remission

or postponement under any of the above policies certain ‘conditions and

criteria’ must be met before a penalty remission is granted. All

applications for a remission must be in a written format (including email).

11. Of the policies listed

above, application for remissions from ratepayers fall within one of two of the

following policies.

11.1. Māori Freehold Land

11.2. the Remission of

Penalties on Rates.

12. Māori Freehold Land

Remissions ‘conditions and criteria’ are straightforward and easy

to apply as the entire rate, including penalties, can be remitted.

13. Remission of Penalties on

Rates ‘conditions and criteria’ allows for two types of remissions

under which only the penalty can be remitted.

13.1. matters that are outside

the ratepayer’s control

13.2. matters that fall within

the ratepayer’s control.

14. If the late payment is

caused due to matters outside of the ratepayer’s control, i.e. an error

by the Council, then this penalty would be remitted as soon as it is

identified.

15. Ratepayer controlled

penalty remissions are where there is non-payment at due date with the error

being the ratepayers responsibility. Council’s current policy allows for

one remission every three years, taking into consideration the

ratepayer’s good payment history.

16. As the Council changes the

rates due date, from January 2021 to September in 2020 (4 months earlier),

Council may find that some ratepayers are unable to pay their rates in full by

the accelerated due date of 20 September 2020, resulting in a 10% penalty

on past due rates. Under Council’s current policy, a ratepayer who was

granted a penalty remission in the last two years would be ineligible for

another remission.

17. By introducing an

additional Policy on Remission of Penalties on Rates (Fixed Term) which covers

the first year of our changeover to the new rates due date, all ratepayers who

are unable to issue a payment by the due date will be subject to a

standardised, consistent, and transparent policy of remission on the penalty.

New Fixed Term

Policy - Remission of Penalties on Rates (Fixed

Term)

18. This policy is both a

remission and postponement policy as defined by the Local Government (Rating)

Act 2002 and Local Government Act 2002

Objective

19. To enable HBRC to act

fairly and reasonably when a rates payment has not been received by the due

date as a result of the Council changing the due date from 31 January 2021

to 20 September 2020. This policy will only be in place from 1 July 2020 to 20

September 2021 and is in addition to the existing policy on Remission of

Penalties on Rates, and will apply only to rates due for the financial year 1

July 2020 to 30 June 2021.

20. There

are two parts to this policy.

20.1. Ratepayers on an

existing payment plan

Conditions and

criteria

20.1.1. Upon receipt of an

application from the ratepayer either in written or email format, or if

identified by Council, a penalty may be remitted where all of the conditions

listed below are met

20.1.2. A full payment of

outstanding rates due (excluding a penalty amount) has been made prior 31

January 2021

20.1.3. The ratepayer has an

existing payment plan which has been adhered to over the previous 12 months,

and

20.1.4. The ratepayer amends the

existing payment plan to ensure that the rates for the financial year 1 July

2021 to 30 June 2022 are paid no later than 20 September 2021.

20.2. Ratepayers not on an

existing payment plan

Conditions and criteria

20.2.1. Upon receipt of an

application from the ratepayer either in written or email format, or if

identified by Council, a penalty may be remitted where all of the conditions

listed below are met

20.2.2. Full payment of outstanding

rates due (excluding a penalty amount) has been made prior to the application

(but no later than being 31 January 2021) is received by the Council, and the

ratepayer has previously paid all rates by the due date within the last three

years

20.2.3. The ratepayer pays the rates

for the financial year 1 July 2021 to 30 June 2022 no later than 20 September

2021.

Policy notes

21. The penalties are only

postponed until all the criteria are met.

22. Where there is a

deliberate non-payment, remission will not be granted.

Decision Making

Process

23. Council

is required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

23.1. The decision

does not significantly alter the service provision or affect a strategic asset,

and is not inconsistent with an existing policy or plan.

23.2. LGA section 103(4) requires

that an amendment to a rates remission and postponement policy must be

consulted on using the provisions of LGA section 82. This requires Council to

provide the opportunity for persons who will or may be affected by or have an

interest in the decision to present their views to Council. This

consultation can be undertaken as part of any consultation that Council

undertakes between now and 1 July 2020, including the 2020-21 Annual Plan.

|

Recommendations

1. That the Finance, Audit and Risk Sub-committee receives and

considers the “Remission of Penalties on Rates Policy (Fixed Term)”

staff report.

2. The Finance, Audit and Risk Sub-committee recommends that the

Corporate and Strategic Committee recommends that Hawke’s Bay Regional

Council:

2.1. Agrees the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that Council will consult as required by LGA s103(4) and s82 as

part of either the 2020-21 Annual Plan or with other appropriate consultation

process.

2.2. Subject to consultation as per 2.1 above, agrees to adopt a

Remission of Penalties on Rates Policy (Fixed Term).

|

Authored by: Approved

by:

|

Trudy

Kilkolly

Principal Accountant Rates

and Revenue

|

Jessica

Ellerm

Group

Manager

Corporate Services

|

Attachment/s There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 21 August 2019

Subject: Six Monthly Report on

Risk Assessment and Management

Reason

for Report

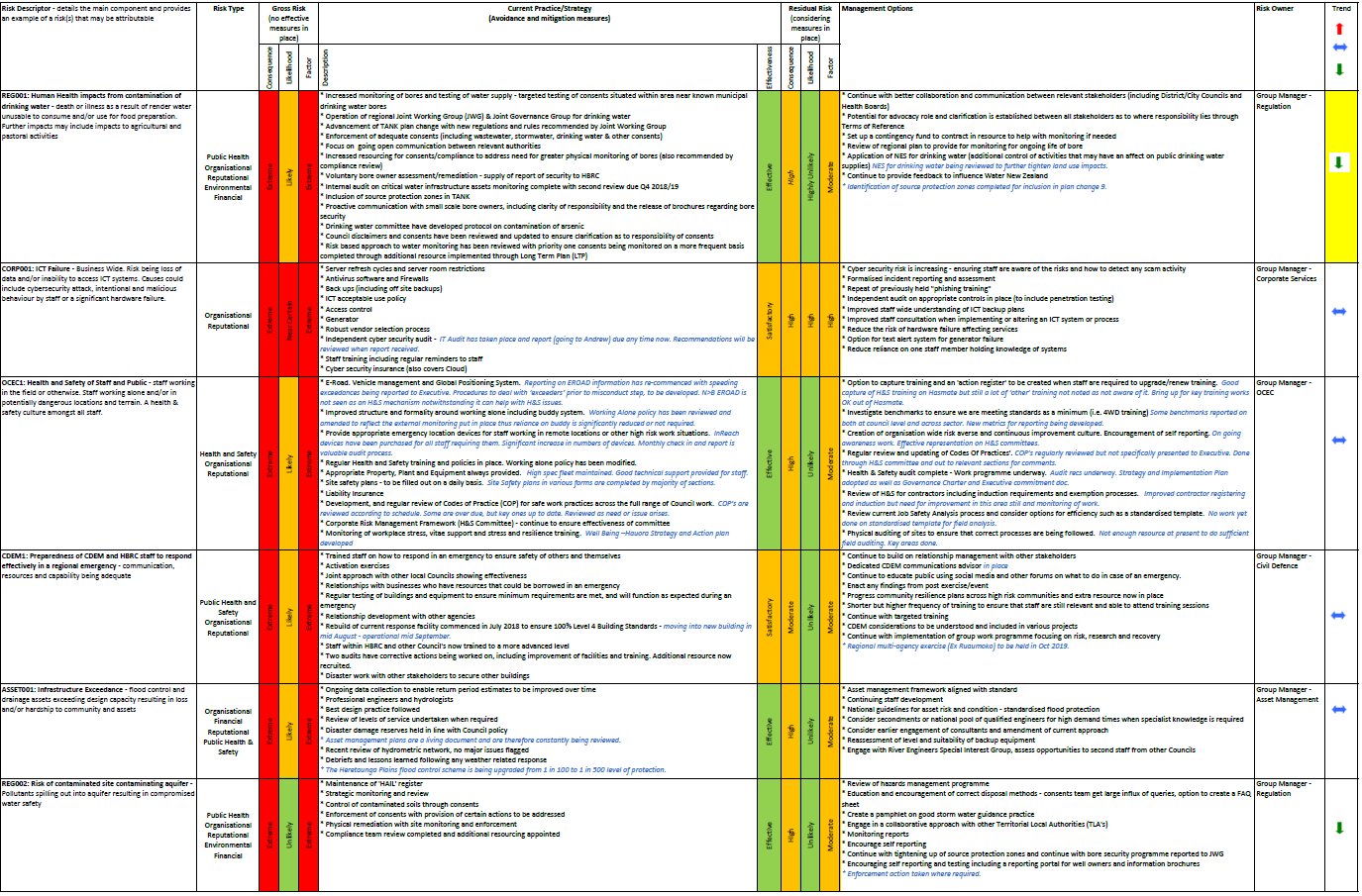

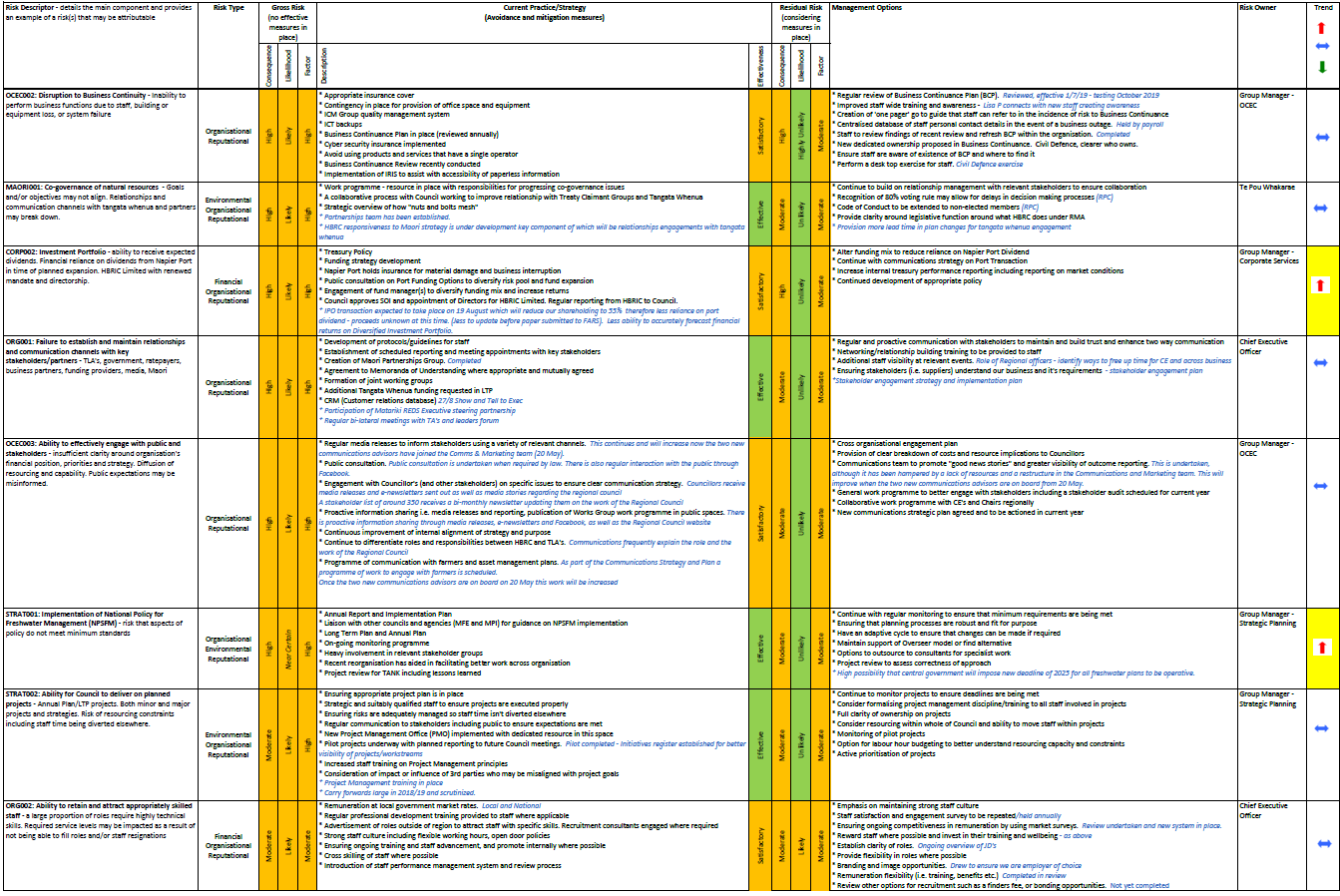

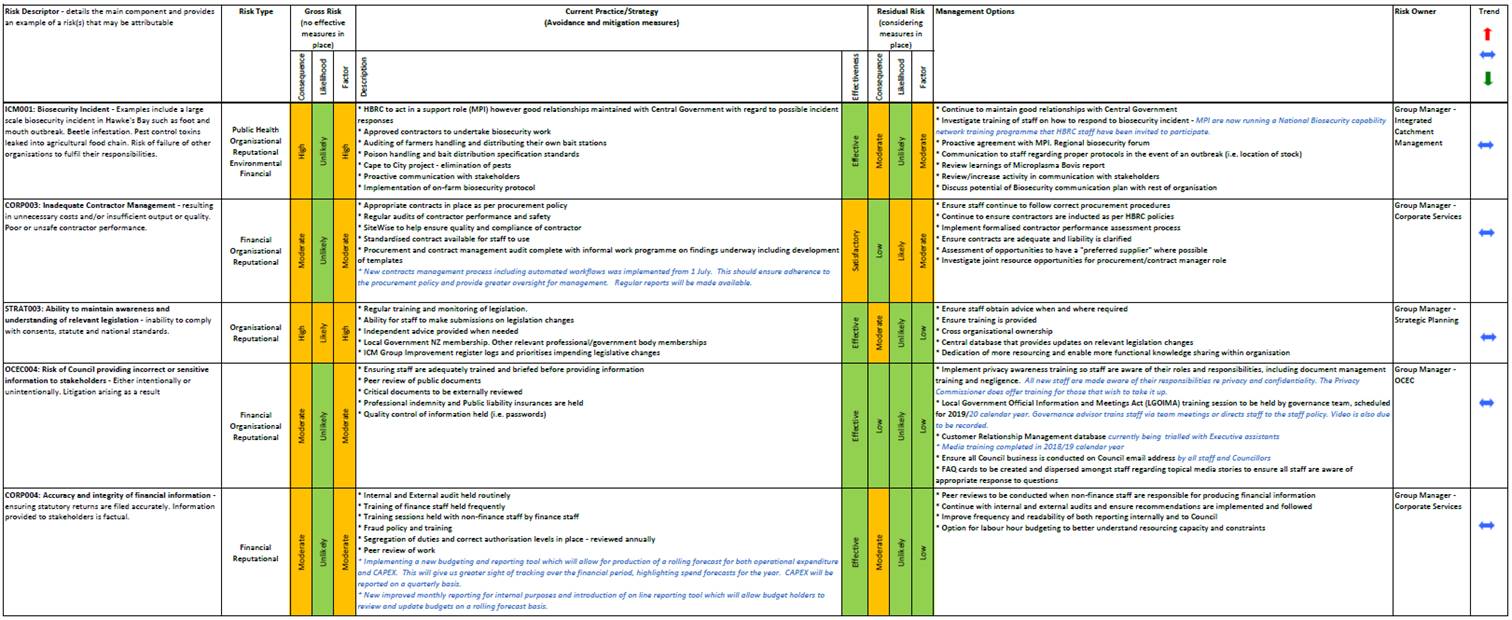

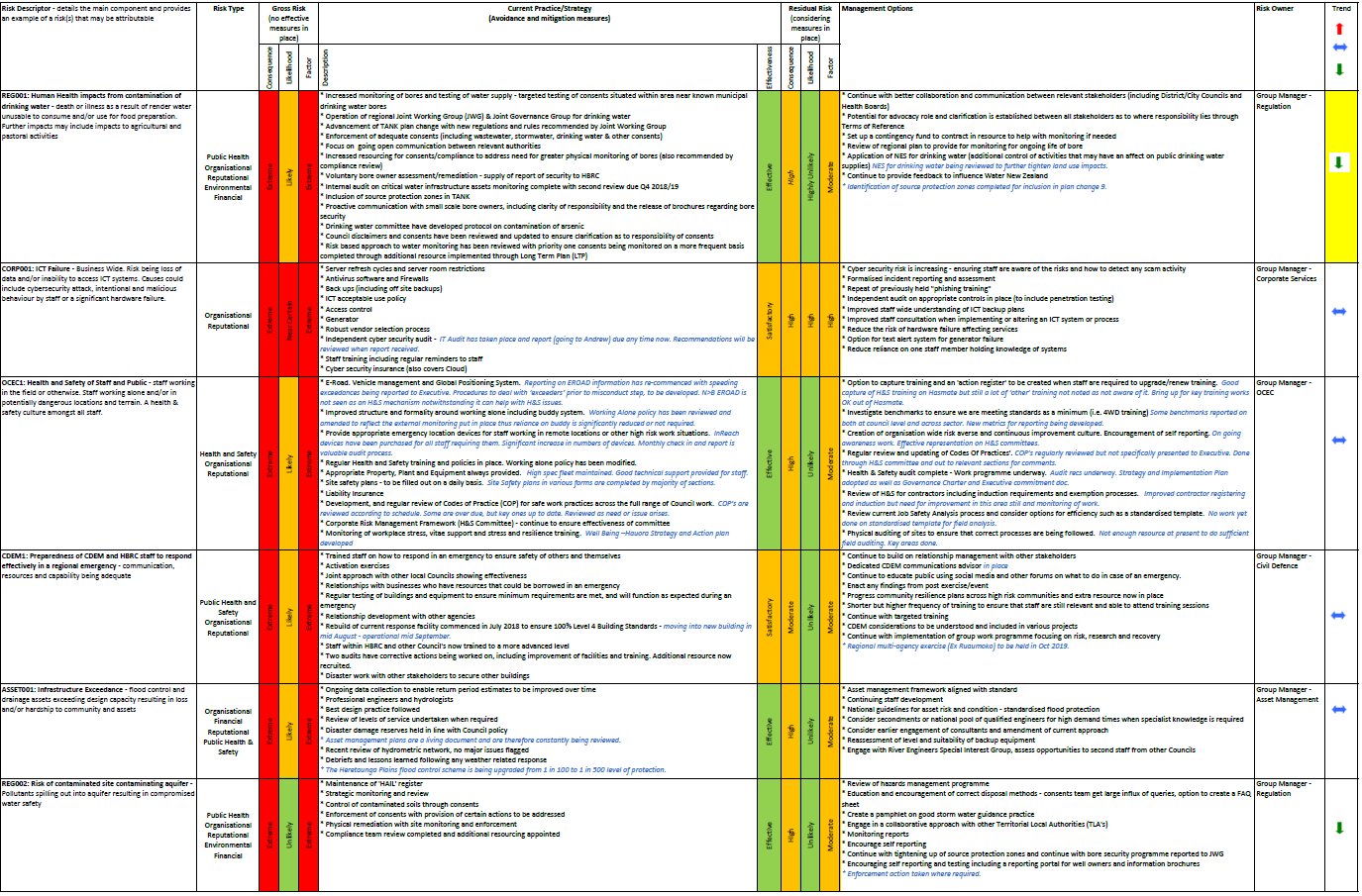

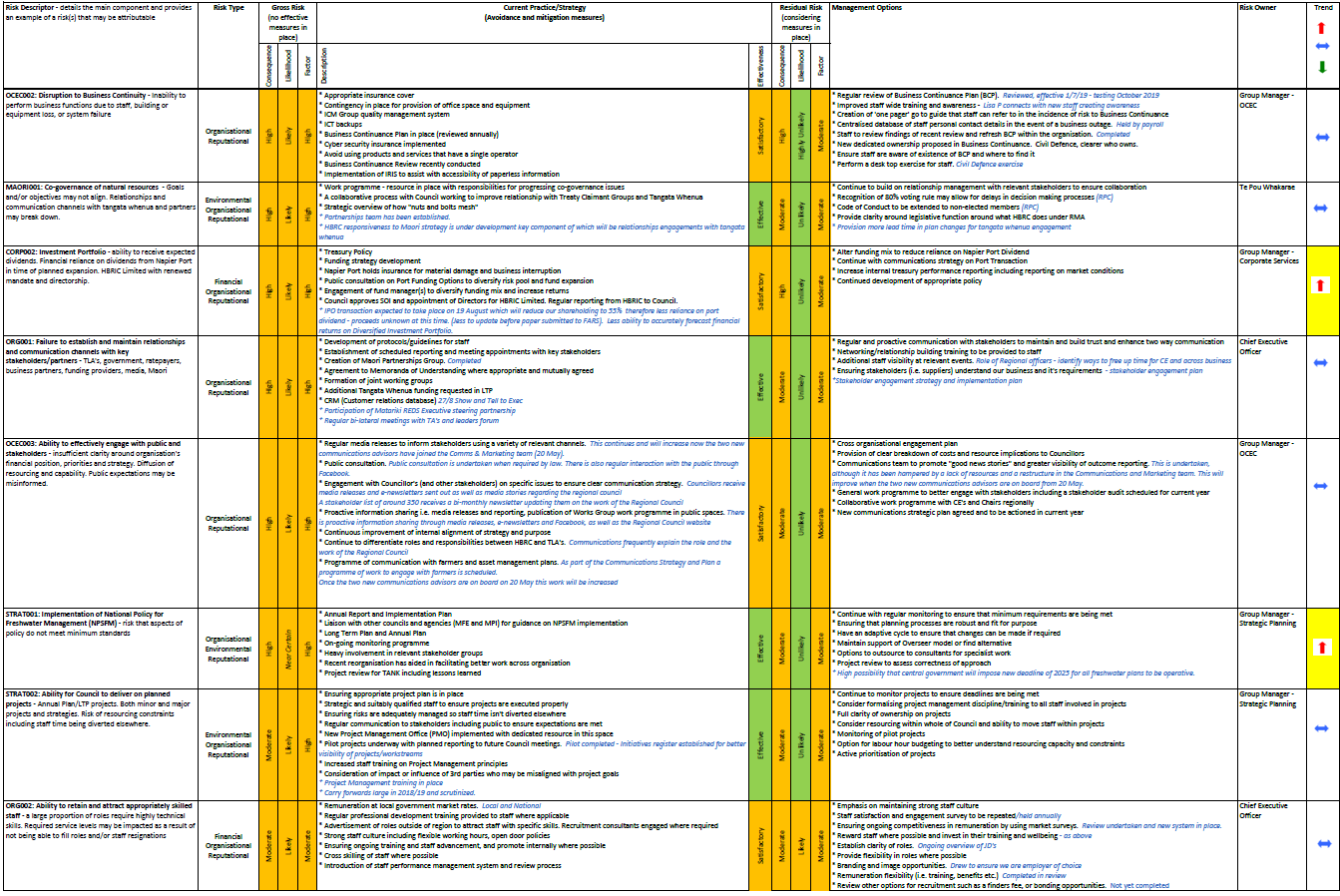

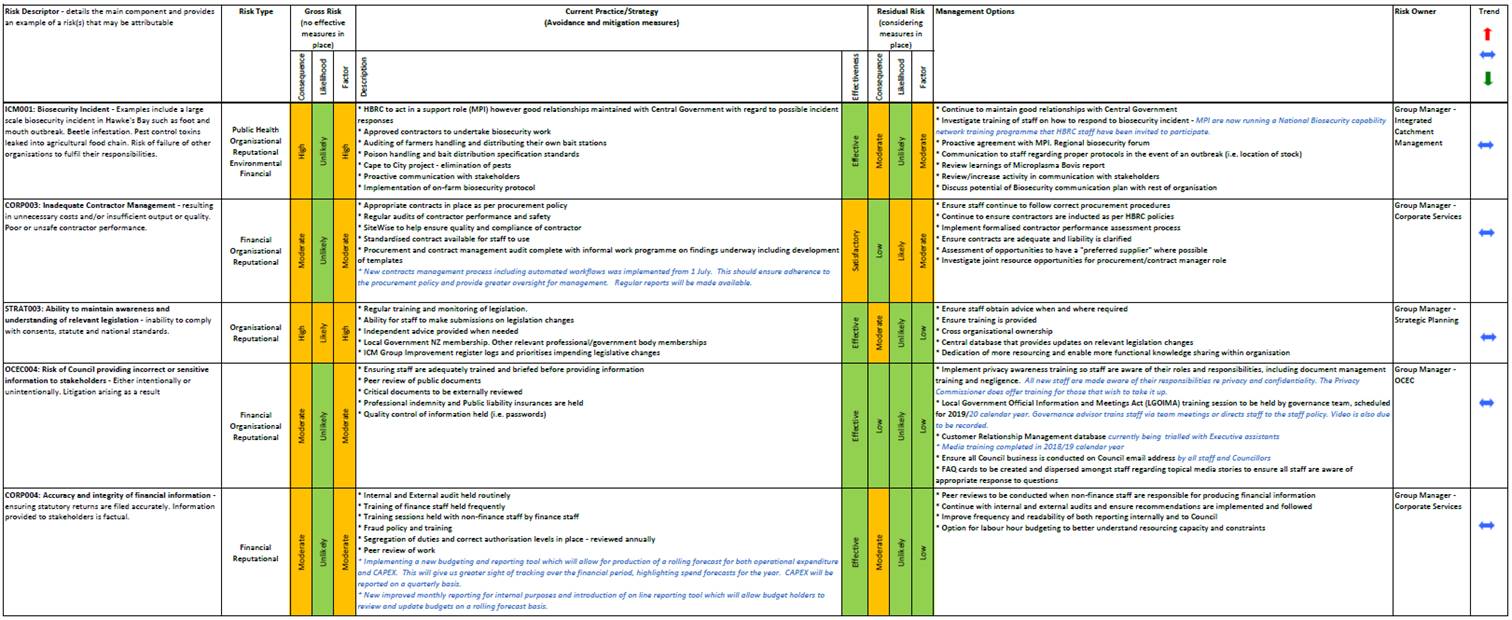

1. This item provides the Sub-committee with the six monthly review of

the risks that Council is exposed to and the mitigation actions in place to

manage Council’s risk profile.

Background

2. The

Sub-committee last considered the risk management report at its 12 February

2019 meeting.

3. Subsequent

to this meeting, the Executive Leadership Team has considered the

Sub-Committee’s feedback and reviewed the organisation’s strategic

risks with each Group Manager. Details of any resulting changes to the risk

register are outlined below.

4. During

this period staff resourcing to support this work has been very stretched due

to competing priorities. This has led to a shift as to how the risk management

function will be resourced internally with changes described further on in this

item.

Key

Changes to the Risk Matrix

5. Following

the feedback at the last discussion on this matter at the Finance, Audit and

Risk Sub-Committee (FARS) on 12 February 2019, consideration has been

given on whether to add a new risk regarding environmental harm, providing

further detail surrounding the CDEM (Civil Defence) risk, and supplementary

information on staff retention and welfare. These are summarised below for your

consideration.

Risk of Harm to

Environment

6. While

there are risks on the register that relate to our region’s drinking

water, it was highlighted at the FARS discussion on 12 February that there is

no recognised risk that relates to harm to the environment generally.

Specifically, this risk would cover Council’s requirement to protect the

environment, and not cause it undue harm. This may occur during Council’s

day to day practices, whereby one or more groups may have conflicting goals.

7. As

an example, the earlier incident of death of eels in our drainage was an

example of harm to the environment caused whilst Council was carrying out its

standard business practices. This risk would recognise any potential gaps

between different group’s aims, and seek to mitigate any potential

conflicts.

8. We

will look to include this as a new risk as “Risk of Harm to the

Environment during Council undertaking its operations”, and the agreed

Risk Owner will be Chris Dolley, Group Manager Asset Management. He will assist

in determining the exact risk descriptor, rating, and current and suggested

mitigation strategies. Examples of mitigation actions will include appropriate

Codes of Practice and training of staff. Further work on shaping up this

risk and the mitigation strategies will be developed over the next few months

and will be presented in the next risk update to FARS.

Civil

Defence

9. While

it is noted that Civil Defence has its own risk management processes, there was

some concern from the FARS committee members as to whether or not these are

sufficiently captured within Council’s own risk register. The

intention is to include this as part of the forthcoming risk management review

later in the financial year.

Staff

Wellbeing and Staff Retention

10. There is

a risk within the register entitled “Risk of Failure to Attract and

Retain Staff”. Several committee members raised questions as to what the

Council is doing to ensure staff wellbeing, and ensure staff are excited to

work at the Council.

11. In

response to this strategies currently being utilised for this risk are the

implementation of the organisational development review and subsequent changes

and work programme (which will pick up a deeper focus on recruitment and

retention strategies), a project focussed on the new Learning & Development

strategy, and the creation of the draft Wellbeing-Hauora Strategy and Action

Plan. This latter plan utilises several initiatives encompassing physical,

social, mental and spiritual wellbeing of staff. In addition, there has

been a full remuneration review that has made it more aligned to the

market. Remuneration changes are in the process of being implemented now.

Risk

Register summary update

12. Since the

last FARS committee meeting, there has been a recent review of the risk

register with all of the risk owners (or a delegate if needs be). Risk owners

are managing their risks actively. Updates can be seen in blue on the attached

risk register.

13. It should

be noted that there have been a number of actions that have been implemented to

further assist with the management of the Council’s risks especially with

OCEC001 – Health and Safety. This will be further supported by the

upcoming appointment of a health and safety staff resource.

Risk

Trend ratings

14. Risk

trend ratings down have been amended as follows.

REG001 Human

Health impacts from contamination of drinking water

14.1. Trending down due to the National Environment

Standards for drinking water being reviewed to further tighten land use impacts

and the identification of source protection zones complete for inclusion in

plan change 9. As a result the residual risk rating is such that consequence

has been altered from extreme to high.

15. Risk

trend ratings going up are as follows.

CORP002 Investment

Portfolio – the ability to receive expected dividends. Financial

reliance on dividends from Napier Port in time of planned expansion. HBRIC

Limited with renewed mandate and directorship.

15.1. The IPO

transaction is expected to take place on 19 August which will reduce our

shareholding to 55%, therefore there is less reliance on the port dividend

- proceeds are unknown at the time of writing. There will be less ability

to accurately forecast financial returns on the Diversified Investment

Portfolio. Likewise the current $40m funds under management remain subject to

potential market volatility.

STRAT001 Implementation

of National Policy for Freshwater Management (NPSFM): risk that aspects of

policy do not meet minimum standards.

15.2. There is

a high possibility that central government will impose a new deadline of 2025

for all freshwater plans to be operative. Risk trend amended from steady to

trending up.

Risk Management Summary

External Review

16. At the

last risk update to FARS, there was some uncertainty expressed as to the level

of detail within the risk register and whether or not this was sufficient or

too excessive. There was also some query as to how much societal risks should

be covered in the register i.e. demographic changes. In addition to the

consideration of Civil Defence risks, both of these questions will be addressed

through a risk management review that is proposed for the 2019-20 financial

year as part of the Crowe Horwath internal audit programme (and is included in

existing internal audit budgets). The timeline for the review is likely

to be in the third or fourth quarter and will help outline the scope of the

future work programme.

Risk Management

function

17. Whilst

the risk management process has gained traction and maturity with regular and

frequent Executive Leadership Team interrogation of all strategic level risks,

it is recognised that further work is required to build the wider

organisation’s risk management knowledge and understanding.

18. Current

resourcing of the risk management portfolio has been through Melissa Des Landes

in the Finance Team who has developed a strong framework and understanding of

risk management. However resourcing the function has been a continuing

challenge. As Melissa is shifting into a Senior Group Accountant role, it is

anticipated to appoint a risk and assurance role who will lead responsibility

for the risk management portfolio to further build organisational

maturity. Alongside this they will develop the Council’s assurance

framework which will include responsibility for the internal audit programme

and quality management system (ISO business process certification). This role

will be funded through a vacancy created elsewhere in the Office of the CE and

Chair (OCEC) group.

19. At a

group manager level, this portfolio will be held by the Group Manager

(OCEC). The newly-appointment Chief Financial Officer, Shash Dave, has a

background in risk management and will retain an advisory link to this

work-stream.

Decision Making Process

20. Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have

assessed the requirements in relation to this item and have concluded:

20.1. The decision

does not significantly alter the service provision or affect a strategic asset,

and is not inconsistent with an existing policy or plan.

20.2. The use of

the special consultative procedure is not prescribed by legislation.

20.3. The decision

does not fall within the definition of Council’s policy on significance.

20.4. The decision

of the sub-committee is in accordance with the Terms of Reference and decision

making delegations adopted by Hawke’s Bay Regional Council

9 November 2016, specifically:

20.4.1. The

Finance, Audit and Risk Sub-committee shall have responsibility and authority

to review whether Council management has a current and comprehensive risk

management framework and associated procedures for effective identification and

management of the council’s significant risks in place, and

20.4.2. undertake

periodic monitoring of corporate risk assessment, and the internal controls

instituted in response to such risks

20.4.3. report on Council’s

risk management systems, processes and practices to the Corporate and Strategic

Committee to fulfil its responsibilities.

|

Recommendations

That the Finance, Audit and Risk Sub-committee:

1. receives and considers the “Six Monthly Risk Assessment

and Management” staff report

AND

2. confirms the Sub-committee’s confidence that Council management has a current and comprehensive risk management

framework and associated procedures for effective identification and

management of the Council’s significant risks

3. recommends that the Corporate and Strategic Committee receives and

notes the resolutions of the sub-committee, confirming the robustness of Council’s risk management systems,

processes and practices.

OR

4. advises staff of the specific risks (following) that require

reassessment to confirm the level of risk is accurate and internal controls

are adequate, for reporting back to the next sub-committee meeting.

4.1. …

4.2. …

5. recommends that the Corporate and Strategic Committee receives and

notes the resolutions of the sub-committee, including the specific risks that

require reassessment.

|

Authored by:

|

Joanne

Lawrence

Group Manager Office of the Chief Executive

and Chair

|

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

|

⇩1

|

Risk

Management Register

|

|

|

|

Risk

Management Register

|

Attachment 1

|

|

Risk

Management Register

|

Attachment 1

|

|

Risk

Management Register

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 21 August 2019

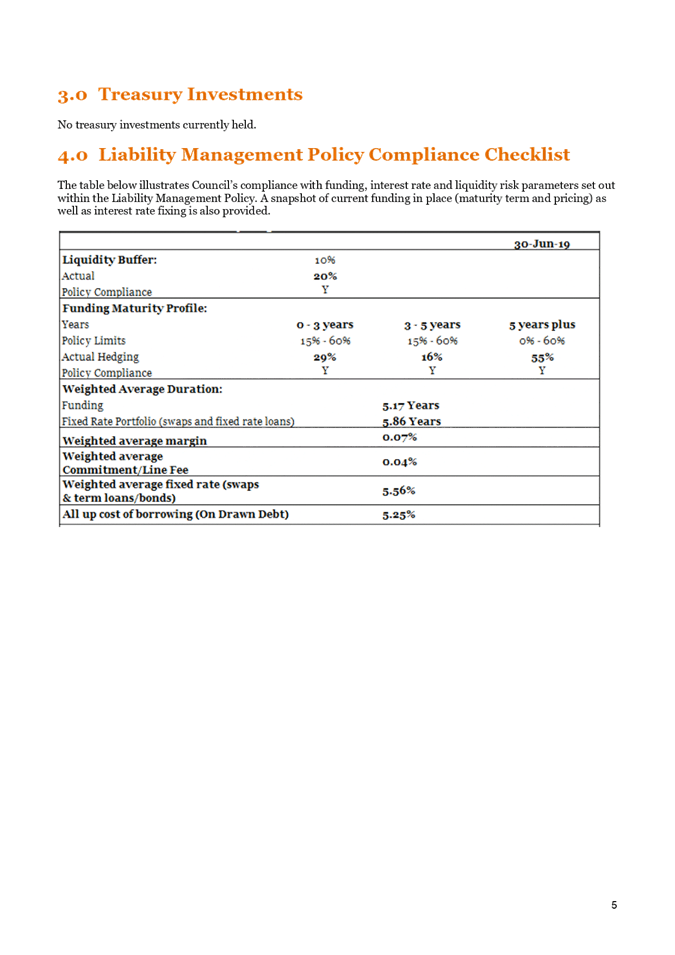

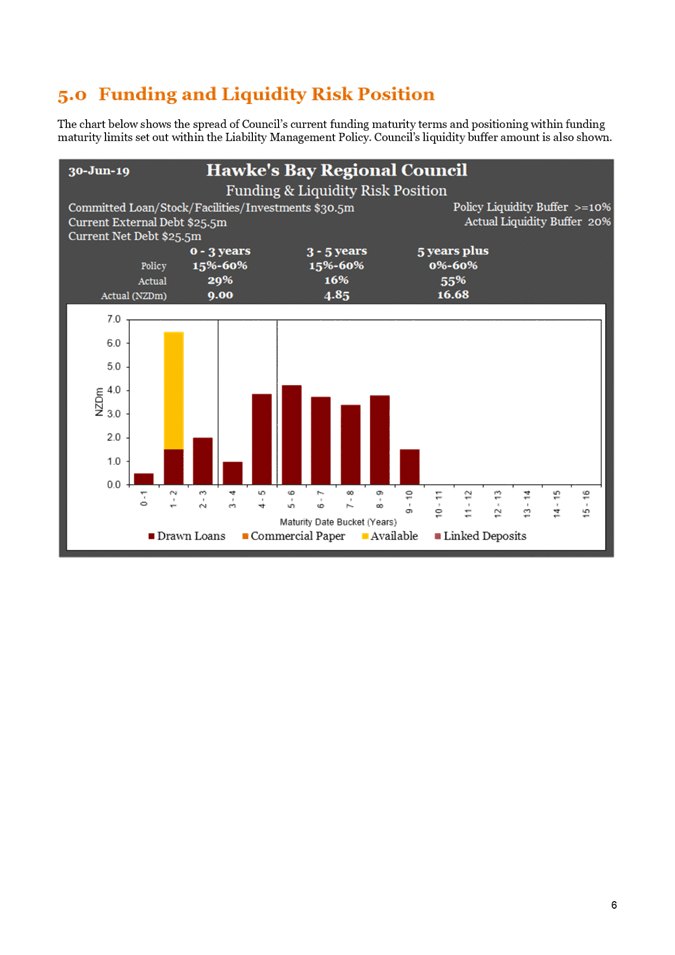

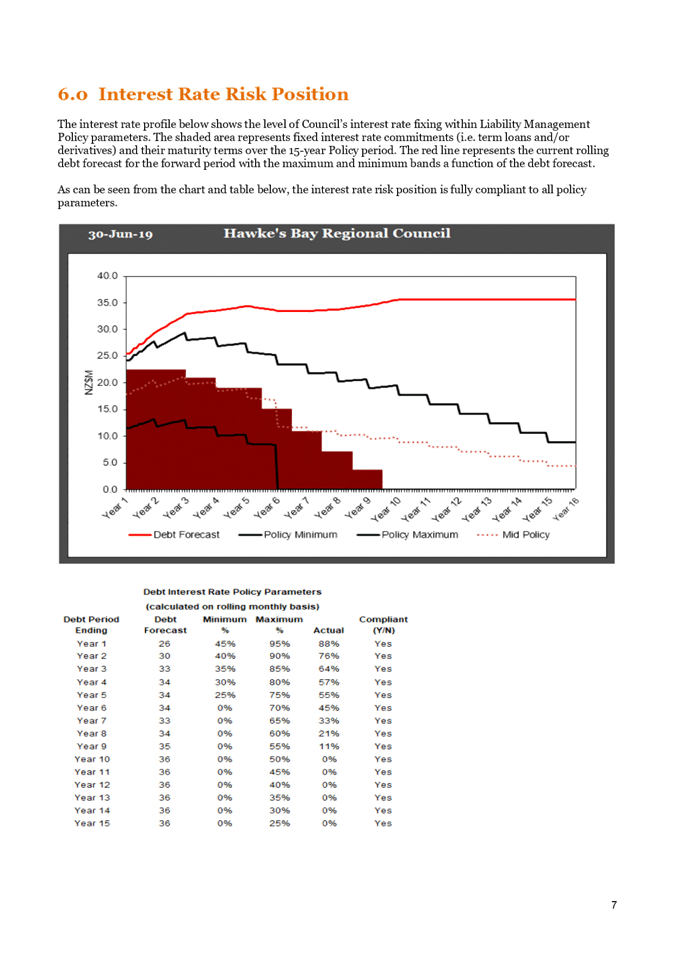

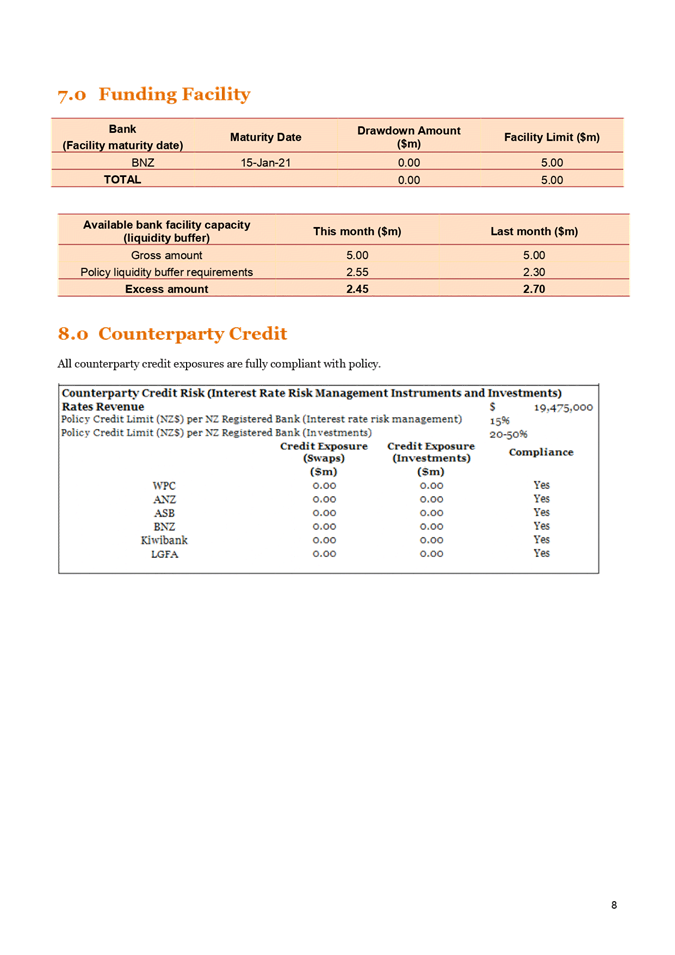

Subject: Treasury Report

Reason

for Report

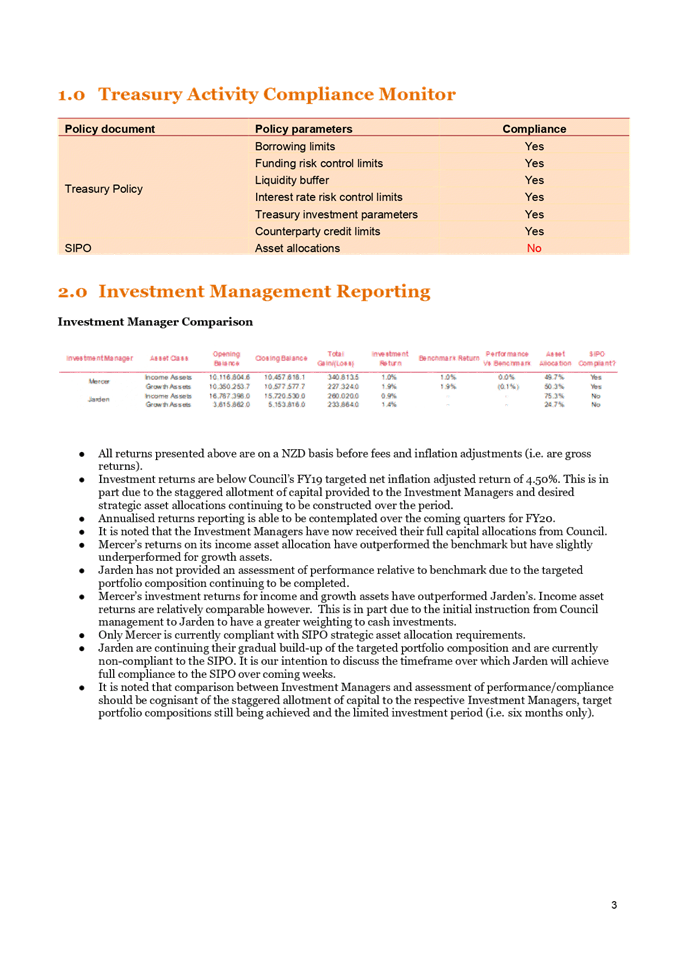

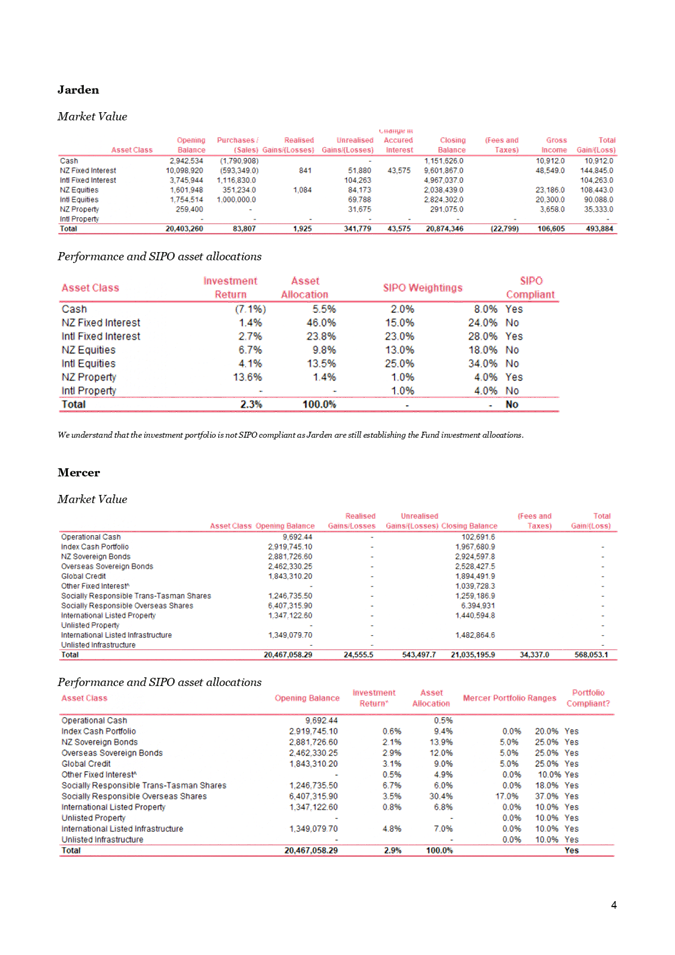

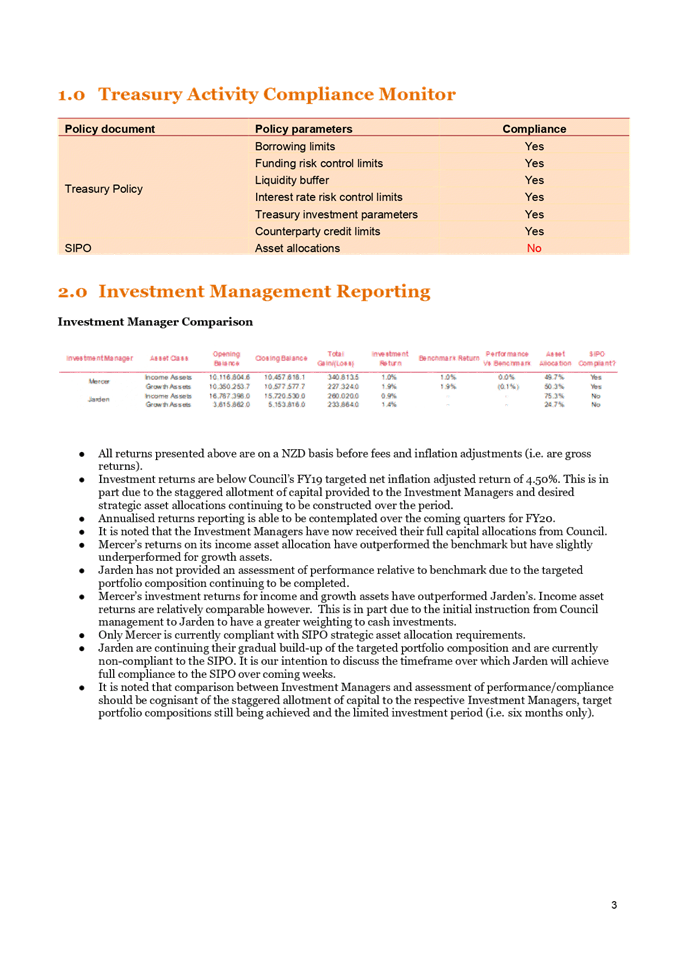

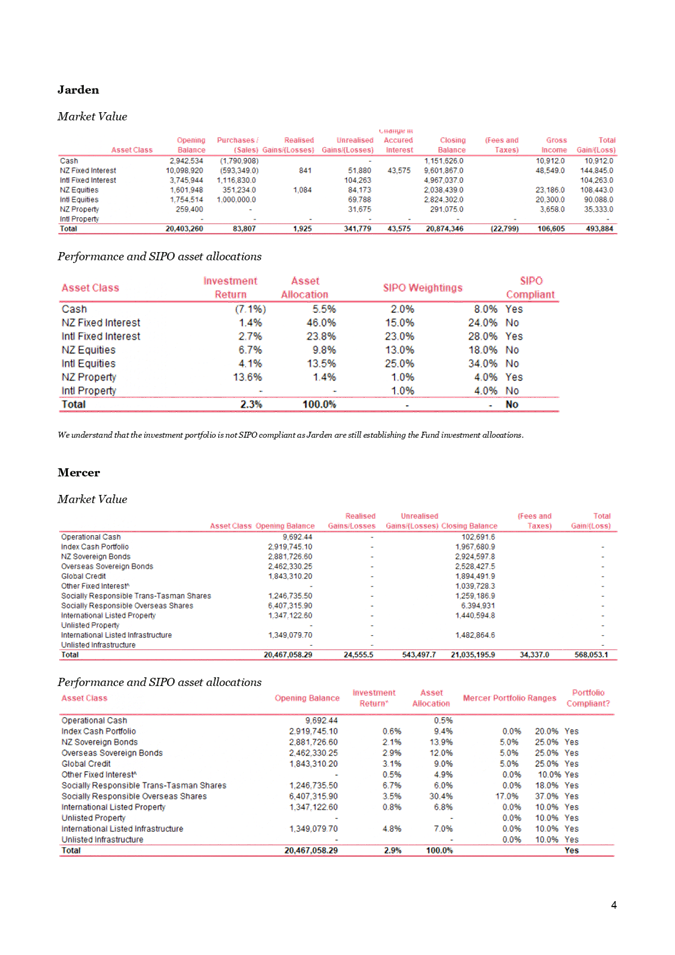

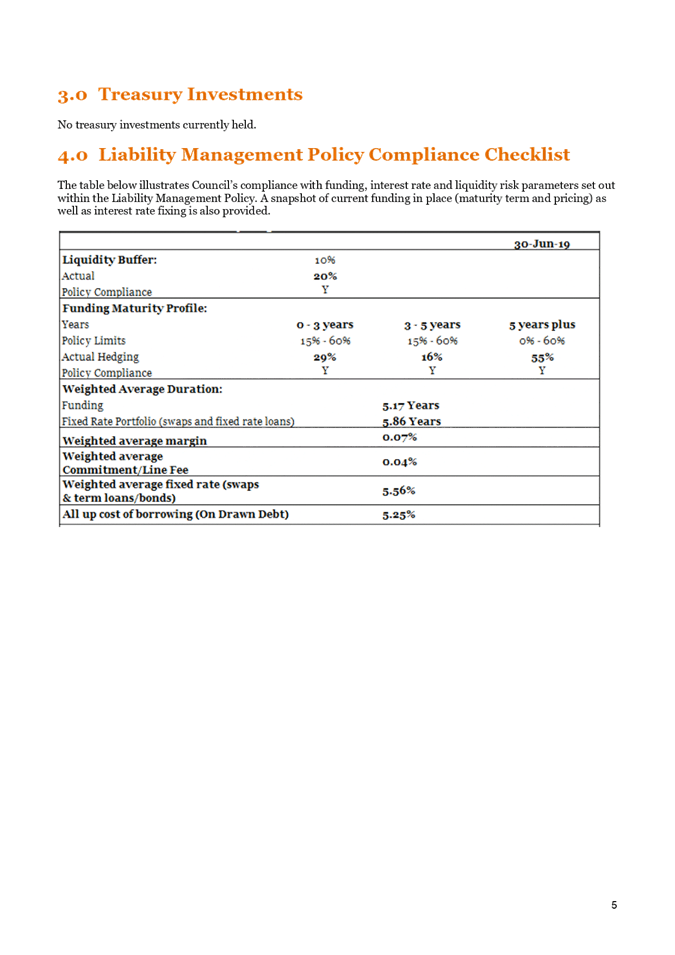

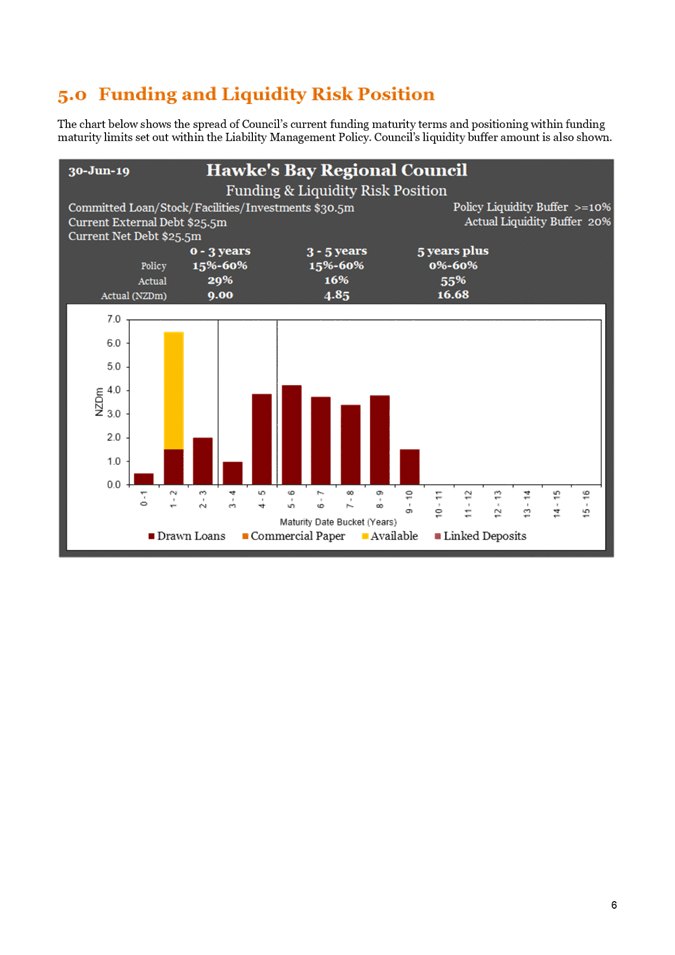

1. This

item provides an update on the development of Council’s diversified

investment portfolio.

Background

2. On 26 September 2018 Council resolved to appoint

dual fund managers, being Mercer and Jarden (formerly First New Zealand

Capital).

3. Council

has engaged PwC to provide treasury advice and reporting, and their quarterly

treasury report for the period ended 30 June 2019 is attached.

Fund

Performance

4. For the quarter ending 30 June 2019, investment returns are below Council’s FY19 targeted net

inflation-adjusted return of 4.50%; at 2.31% for investments managed by Jarden,

and 2.9% for investments managed by Mercer.

5. Investment returns are also slightly below the benchmark for both

fund managers. Specifically, funds managed by Mercer closely tracked the

benchmark, slightly underperforming by 0.2%. Funds under management by

Jarden also closely tracked the benchmark, slightly underperforming by 0.1%.

6. Income assets for both fund managers either tracked the benchmark

(Jarden) or slightly outperformed the benchmark (Mercer +0.7%). This is due to

Mercer’s reallocation of income assets in May 2019 as well as

Mercer’s New Zealand Sovereign Bond portfolio slightly outperforming the

benchmark.

7. Investment returns are below Council’s FY19 targeted net

inflation-adjusted return of 4.50% due to:

7.1 Council’s allotment of capital between Income and Growth

assets

7.2 Target asset allocation and portfolio composition have yet to be

fully realised by one of the two fund managers (Jarden).

8. An analysis of investment performance metrics

may be premature primarily due to the relatively recent capital allocations to

the fund managers, as well as ongoing portfolio composition adjustments. Returns

and performance will continue to be analysed and presented quarterly.

9. Notwithstanding the foregoing, Mercer’s

returns on its income asset allocation have outperformed the benchmark but have

slightly underperformed for growth assets.

10. Any commentary on Jarden’s assessment of

performance relative to the benchmark would be premature due to targeted

portfolio composition continuing to be completed.

11. Mercer’s investment returns for income and

growth assets have outperformed Jarden’s. However, Income asset returns are

relatively comparable. This is in part due to

the initial instruction from Council to Jarden

to assign a greater weighting to cash investments, and in part due to

Jarden’s deliberate and systematic approach to building a portfolio of

Growth Assets in a macro-economic environment where corporate earnings may not

fully support market valuations.

12. Jarden is currently non-compliant with the Statement of Investment

Policy and Objectives (SIPO) with respect to achieving target asset allocation

for funds under management. This is partly due to Jarden’s investment

philosophy of gradually staggering into investment portfolio positions and

partly due to Council’s initial instruction to Jarden assigning greater

weight to cash investments.

13. Council staff have discussed Jarden’s SIPO non-compliance

during in-person meetings with Jarden and PwC representatives, and Jarden has

provided assurances that the strategic asset allocation will achieve SIPO

compliance over the coming months.

14. This staggered approach to target asset allocation over a slightly

elongated time frame may be beneficial as it theoretically allows Jarden to

strategically develop an equity position in Growth assets with a longer-term

view on returns and performance. Despite this investment strategy,

forecast returns could be negatively impacted due to broader macro-economic

factors outlined below.

Additional

Funds under Management

15. With Council’s 45% ownership in Napier Port to be traded

through the New Zealand Stock Exchange (NZX) within the coming days, staff

estimates a $79 million tax-neutral influx of capital being returned to

the Council.

16. The balance of capital influx is to be realised by Hawke's Bay

Regional Investment Company Ltd (HBRIC), a Council Controlled Organisation.

17. Staff have engaged both of the Council-approved fund managers

(Mercer and Jarden) to deploy this additional capital within Council’s

currently managed portfolios, in accordance with the Council’s SIPO.

Staff have received confirmation that Mercer will deploy this additional

capital immediately, while Jarden will continue its staggered, risk-based

approach to capital deployment over the upcoming months. Jarden will likely

remain non-compliant with the SIPO as it pertains to strategic asset allocations

due to its methodical approach to asset allocation.

18. Staff have also engaged both of the Council-approved fund managers

(Mercer and Jarden) to deploy additional HBRIC capital (estimated at $25

million) in mirror funds to those of the Council’s, in accordance with

the Council’s SIPO. Staff will continue to engage with the fund

managers and HBRIC leadership to determine other commercially viable and

cost-efficient capital deployment alternatives that are consistent with the

Council’s ethos and values.

Macro

Overview

19. The

escalation of protectionist measures by the US government continues to

dominate, distract and detract from economic prospects for the US and the rest

of the world. An intensifying

and ongoing conflict between the US and China (and elsewhere) has depressed

consumer sentiment and trade activity. This political unpredictability has

created a challenging environment for central banks to be constructive on the

economic outlook. Consequently, indicators of global manufacturing sentiment

and trade have worsened.

20. Global

equity markets witnessed substantial movements over the second quarter of 2019

with periods of declines being ultimately surpassed. Declines in equity indices

were prompted by an escalation of the US/China trade dispute as well as a

weakening in the international macroeconomic growth outlook. A swift recovery

was followed by the Trump/Xi meeting at the G20 summit in Osaka that new

tariffs would not be immediately implemented. This short-lived equity market

euphoria was quickly tampered by recent statements from the US proposing an

additional 10% tariff on approximately $300 billion of Chinese imports

beginning 1 September 2019. China retaliated by stopping purchases of US

agricultural goods and allowing the yuan to depreciate through the key

psychological level of 7 to the USD.

21. The

future of the equity markets is contingent on the investors’ desire to

achieve sufficient returns and corporations’ earnings matching equity

pricing. With depressed interest rate returns, there remains little alternative

to equity markets for sizeable returns. Although, the ability for corporate

earnings to meet valuations indicated by equity pricing poses a potential

challenge in an environment of slowing global growth.

22. Monetary and fiscal measures could play a vital

role in potentially offsetting the impact of trade deliberations. Most notably,

the US Federal Reserve and the European Central Bank have both relented on

tightening monetary policy this year. Markets have already priced in a 70%

probability of two to three interest rate cuts in the US this year.

23. Governments may be more inclined to use fiscal

policy by implementing tax cuts and/or increase spending, to encourage growth

in the months ahead. An example of this is the Chinese economy which appears to

have stabilised after a period of tight monetary conditions in the first half

of 2018, followed by a reduction in interest rates signifying easier monetary

policy. While the Chinese economy has not responded with the same vigour as it

has in past stimulus cycles, this is emblematic of the impact of the trade

uncertainties, which continue to dampen both business and consumer confidence.

24. Consequently, the Reserve Bank of New Zealand

(RBNZ) had previously indicated easing the monetary policy and further

reduction in the Official Cash Rate (OCR). As at 29 July 2019, market

pricing suggested that the Official Cash Rate (OCR) may reach 1% by

year-end. However, RBNZ dramatically reduced the OCR by 50 bps to 1% in

August 2019. Most economists, expecting the OCR rate to be reach a 1%

“floor” by year-end are left readjusting their forecasts indicating

that a 0.75% OCR rate reduction may be a near eventuality.

25. Nationally, New Zealand business confidence

indicators appear to be falling as evidenced by the ANZ Business Outlook Survey

business confidence index, which has fallen 6 points since June, and commercial

construction intentions falling by a concerning 25 points (to -20%), with a net

33% of firms in the construction sector intending to cut jobs.

Firms’ expectations of their own activity fell to the lowest level in

almost a year, with only a net 5% expecting a lift. As the construction

sector is a substantial provider of employment in New Zealand, this downturn in

activity may further support RBNZ’s rationale for future interest rate

cuts as it continues to focus on its remit of “Maximum Sustainable

Employment.”

26. Although New Zealand commodity prices remain at

well supported levels and interest rates follow a downward trajectory, fears of

a global growth slowdown coupled with credit and cost constraints appear to be

dampening primarily due to a broader easing of monetary policy across Europe,

North America and Australasia along with tightened (and tightening) capital

requirements for banks and financial institutions.

Debt

Funding

27. Council’s debt forecast indicate a requirement of additional

$10 million of core borrowings during FY 2019-20. Staff will evaluate the

borrowing and funding schedule for FY 2019-20 based on an internal analysis of

annual financial statements which are currently being drafted.

28. Staff will also evaluate the FY 2019-20 core borrowing and funding

needs in light of new developments while seeking specialist advice from PwC in

compliance with the Council’s Treasury and Funding Policy. Specifically,

Staff will evaluate the Council’s financial position in relation to any

expected or anticipated return of costs (or capital) arising out of the initial

public offering (IPO) of Napier Port while evaluating the current

macro-economic environment impacting total cost of capital (borrowings).

Foreign

Currency Hedging

29. Council’s current SIPO requires fund managers to mitigate 100%

of Council’s foreign currency exposure in all international asset classes

except equities.

30. Staff’s consultation with fund manager(s) indicate that the

100% mitigation of foreign currency risk across all asset classes (except

equities) utilising spot and forward exchange contracts may not be

cost-efficient due to historical and anticipated currency volatility which may

inherently accompany an easing monetary and fiscal policy.

31. Subsequent to both fund managers meeting their SIPO-mandated asset

allocations, staff and fund managers will evaluate the portfolio as well as

options to present a more cost-effective solution which may require adjustments

to the SIPO.

Decision

Making Process

32. Staff

have assessed the requirements of the Local Government Act 2002 in relation to

this item and have concluded that as this report is for information only, the

decision making provisions do not apply.

|

Recommendation

That the Finance Audit and Risk

Sub-committee receives and notes the “Treasury Report”.

|

Authored by:

|

Shash

Davé

Chief Financial Officer

|

|

Approved by:

|

Jessica

Ellerm

Group Manager

Corporate Services

|

|

Attachment/s

|

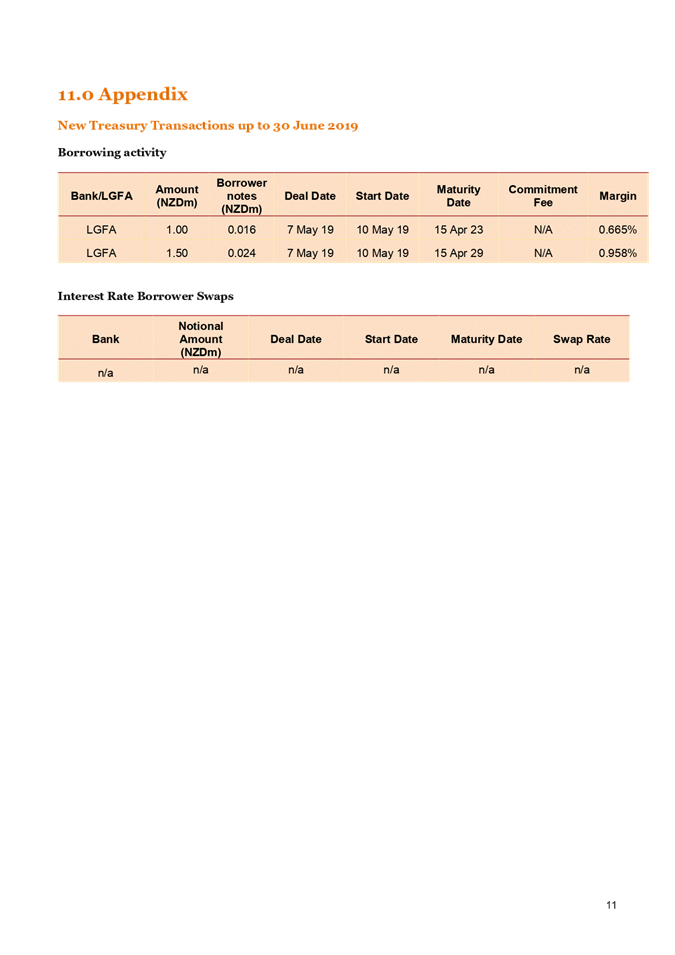

⇩1

|

HBRC Treasury

Reporting to 30 June 2019

|

|

|

|

HBRC

Treasury Reporting to 30 June 2019

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 21 August 2019

Subject: Procurement Hub Update

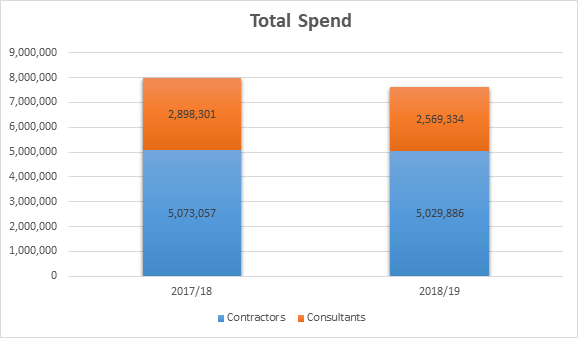

Reason for Report

1. This item provides the sub-committee with an update on progress to

establish Council’s Procurement Hub.

Background

2. In May 2018 Crowe Horwath completed a

Procurement & Contract Management Review and 28 recommendations were

adopted.

3. Findings of the review determined 5 key areas for improvement, being

to:

3.1. Centralise contract management

3.2. Standardise procurement templates

3.3. Introduce procurement plans

3.4. Introduce monitoring and evaluation tools.

4. Contract Central was originally established for the Resource

Management Group and then extended to other groups. It was confirmed by

Council’s Sharepoint Administrators that Contract Central could not be

migrated to match the new 2018 organisational structure (due to metadata editing),

so the decision was made to archive that database and develop a new database

reflecting the new structure - called the ‘Procurement Hub’.

Progress

5. During July through December 2018 Council’s Contract Central,

‘current’ contracts (655) were cleansed group by group, down to

475, and archived.

6. From January through July 2019, development, building and testing of

the Procurement Hub was undertaken and the 2015 HBRC Procurement Policy &

2016 Operational manual were updated and approved to reflect:

6.1. Combining OAG (Auditor General) principles (2018) and HBRC

procurement principles (2019)

6.2. Providing MBIE standardised templates with best practice guidelines

7. The procurement hub was ‘soft launched’ in July 2019 and

training is now being cascaded by group, with presentations by Hub staff, as an

advice and guidance resource. To date, presentations have been made to the

Executive Leadership Team, Corporate Services and Asset Management groups.

Where required, 1:1 training is being provided as contracts are generated,

ahead of presentations being made to the Strategy and Planning and Integrated

Catchment Management groups.

8. For the 2018-19 year in the now archived Contract Hub there were 236

new contracts as shown in Table 1 following.

Table 1 – Archived

Contracts

|

Group

|

Section

|

# of

Contracts

|

Total

|

|

Integrated Catchment Management

|

Land

Management

|

27

|

|

|

Animal

Pest Management

|

22

|

|

|

Groundwater

|

10

|

|

|

Water

Quality & Ecology

|

9

|

|

|

Plant

Pest Management

|

8

|

|

|

Land

Science

|

5

|

|

|

Hydrology

|

2

|

|

|

Water

Information Services

|

1

|

|

|

Air

Management

|

1

|

85

|

|

Asset Management

|

Land

Drainage & River Control

|

59

|

|

|

Regional

Open Spaces

|

5

|

|

|

Forestry

|

1

|

65

|

|

Corporate Support

|

Financial

Management

|

48

|

|

|

Corporate

Support

|

4

|

|

|

Communications

|

1

|

|

|

Information

Technology

|

1

|

54

|

|

Strategic Planning

|

Plans,

Policy & Strategy

|

14

|

|

|

Transport

Management

|

4

|

18

|

|

CDEM

|

|

7

|

7

|

|

Regulation

|

|

7

|

7

|

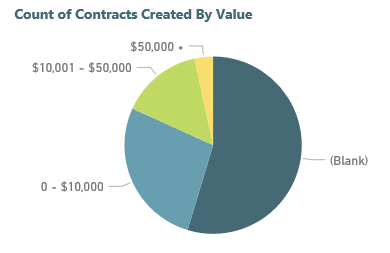

9. The breakdown below shows that up to February 2019 we didn’t

capture value and risk effectively. This has now been included in line with

audit recommendations as mandatory data requirement from February 2019 onwards,

in the Procurement Hub.

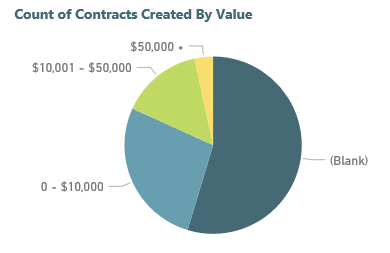

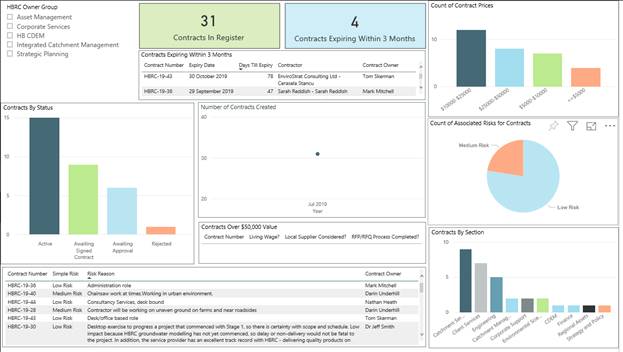

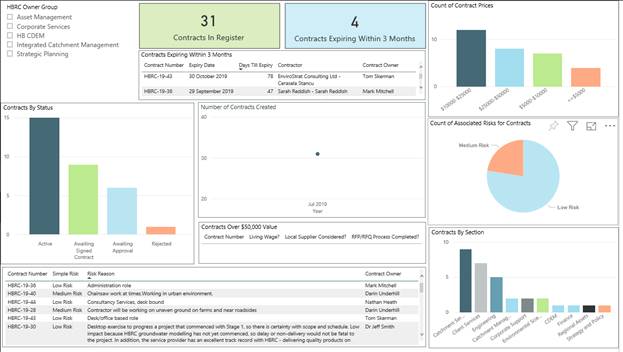

10. Procurement

information is now available (from July 2019) ‘live’ at

organisation and group level utilising a Power BI Dashboard as below.

11. Reports

will be provided monthly to the executive team, and to every Finance Audit and

Risk Committee meeting.

12. So far, a

contract is being generated across the organisation every day, with the

contract being one part in a three stage (planning, sourcing and managing

including evaluation) process.

13. Further

levels of detail are available at group, service and contract manager levels.

14. A

contract expiring triggers an automated evaluation process with the contract

owner, collecting data on advisability of supplier future use based on

timeliness, budget performance, meeting specification, health and safety

performance, shared HBRC environmental vision, professionalism and any

learnings from the project/contract delivery.

15. The

procurement team will continue to apply a continuous improvement ethos to meet

organisational need.

Decision Making

Process

16. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision making

provisions do not apply.

|

Recommendation

That the Finance, Audit and Risk

Sub-committee receives and notes the “Procurement Hub Update”

staff report.

|

Authored by:

|

Mark Heaney

Manager Client Services

|

|

Approved by:

|

Jessica

Ellerm

Group Manager

Corporate Services

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 21 August 2019

Subject: August 2019

Sub-committee Work Programme Update

Reason for Report

1. In order to ensure the sub-committee’s ability to effectively

and efficiently fulfill its role and responsibilities, an overall update on its

work programme is provided following.

|

Task

|

Item

|

Scheduled / Status

|

|

Internal

Audits

|

Cyber

Security

|

Report

received – to be presented to first FARS meeting of triennium

|

|

Data

Analytics

|

Scheduled

for Q2 2019 FARS meeting.

|

|

Water

Management – Follow Up Review

|

Report was

presented to 22 May FARS meeting, with further follow up report scheduled to

be presented to Q3 FARS meeting

|

|

Asset

Management

|

Scheduled

for Q3 FARS meeting

|

|

Risk

Management

|

Scheduled

for Q4 FARS meeting

|

|

Risk

Assessment & Management

|

Reporting on risks

(6-monthly) affecting Council plus noting changes / improvements / areas that

require attention from last report (3-monthly).

|

Presented to

19 September 2018, 12 February and 21 August 2019 meetings.

An internal

risk management advisory team has been created to consider developing a risk

appetite framework for the Council.

A Risk

management review is proposed for the 2019-20 financial year.

|

|

Insurance

|

Council’s

proposed 2018-19 Insurance programme.

|

Update

presented to 22 May FARS meeting. Insurance now placed effective August 2019.

|

|

Annual

Report

|

Discussion on Audit

Management Letter.

Discussion

on the major issues (if any) in the audit report on the Annual Report.

|

Staff to

review the 2019-20 Audit Management Letter, and respond accordingly. Staff

have engaged in discussions with Audit NZ pertaining to the disclosure of

HBRIC financials prior to the Napier Port IPO.

|

|

S17a

Efficiency Reviews (Section 17a Local Government Act)

|

Update on progress and

findings of Section 17a Efficiency Reviews.

|

Staff focus

is on specific areas of the Asset Management team to evaluate areas of

efficiencies and the subject of a Public Excluded item on the 21 August 2019

FARS agenda.

|

|

Investment

Returns & Treasury Monitoring

|

Update on Treasury

function within Council.

|

Treasury

Update standing item on 21 August 2019 FARS meeting

|

|

Living Wage

|

Procurement and

Contract Management

|

Living Wage

weighting is now part of Council’s procurement process.

|

Decision Making

Process

2. Staff have assessed the requirements of the Local Government Act

2002 in relation to this item and have concluded that, as this report is for

information only, the decision making provisions do not apply.

|

Recommendation

That the Finance, Audit and Risk

Sub-committee receives and notes the “August 2019 Sub-committee Work

Programme Update” staff report.

|

Authored by:

|

Shash

Davé

Chief Financial Officer

|

|

Approved by:

|

Jessica Ellerm

Group Manager

Corporate Services

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 21 August 2019

Subject: Proposed Local

Government Act Section 17a Review

That Council excludes the public

from this section of the meeting, being Agenda Item 10 Proposed Local

Government Act Section 17a Review with the general subject of the item to be

considered while the public is excluded; the reasons for passing the resolution

and the specific grounds under Section 48 (1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution being:

|

GENERAL SUBJECT OF THE ITEM TO BE

CONSIDERED

|

REASON FOR PASSING THIS RESOLUTION

|

GROUNDS UNDER SECTION 48(1) FOR THE

PASSING OF THE RESOLUTION

|

|

Proposed Local Government Act Section 17a Review

|

7(2)(f)(ii) The withholding of the information is

necessary to maintain the effective conduct of public affairs through the

protection of such members, officers, employees, and persons from improper

pressure or harassment.

|

The Council is specified, in the First Schedule to this

Act, as a body to which the Act applies.

|

Authored by:

|

Shash

Davé

Chief Financial Officer

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 21 August 2019

SUBJECT: Confirmation

of Public Excluded Minutes of the Finance Audit & Risk Sub-committee meeting

held on 22 May 2019

That the Council excludes the public

from this section of the meeting being Confirmation of Public Excluded Minutes

Agenda Item 11 with the general subject of the item to be considered while the public

is excluded; the reasons for passing the resolution and the specific grounds under

Section 48 (1) of the Local Government Official Information and Meetings Act

1987 for the passing of this resolution being:

|

GENERAL SUBJECT

OF THE ITEM TO BE CONSIDERED

|

REASON FOR

PASSING THIS RESOLUTION

|

GROUNDS UNDER

SECTION 48(1) FOR THE PASSING OF THE RESOLUTION

|

|

Proposed 2019-20

Council Insurance Programme

|

7(2)(i) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to enable

the local authority holding the information to carry out, without prejudice

or disadvantage, negotiations (including commercial and industrial

negotiations).

|

The Council is specified, in

the First Schedule to this Act, as a body to which the Act applies.

|

Authored by:

|

Leeanne

Hooper

Team Leader Governance

|

|

Approved by:

|

Joanne

Lawrence

Group Manager Office of the Chief Executive

and Chair

|

|