Meeting of the Corporate and Strategic Committee

Date: Wednesday 5 June 2019

Time: 9.00am

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

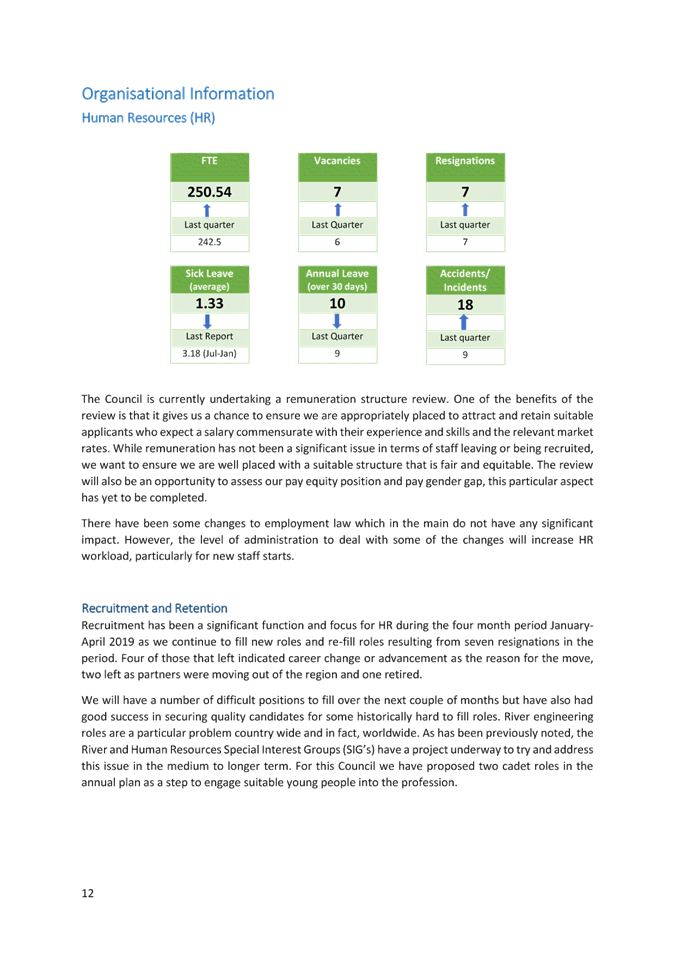

Item Subject Page

1. Welcome/Notices/Apologies

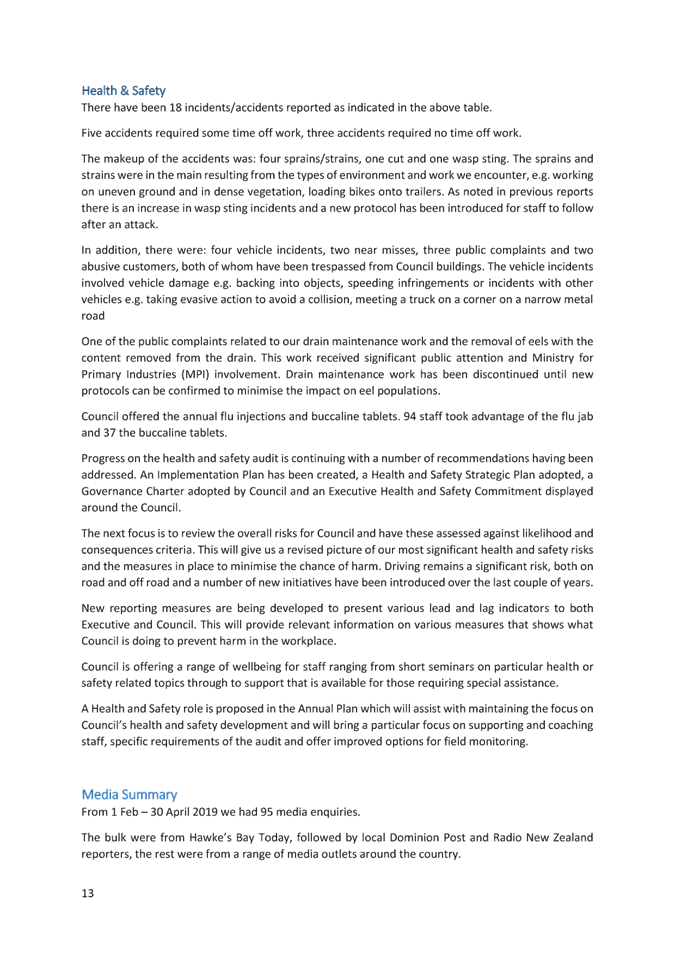

2. Conflict

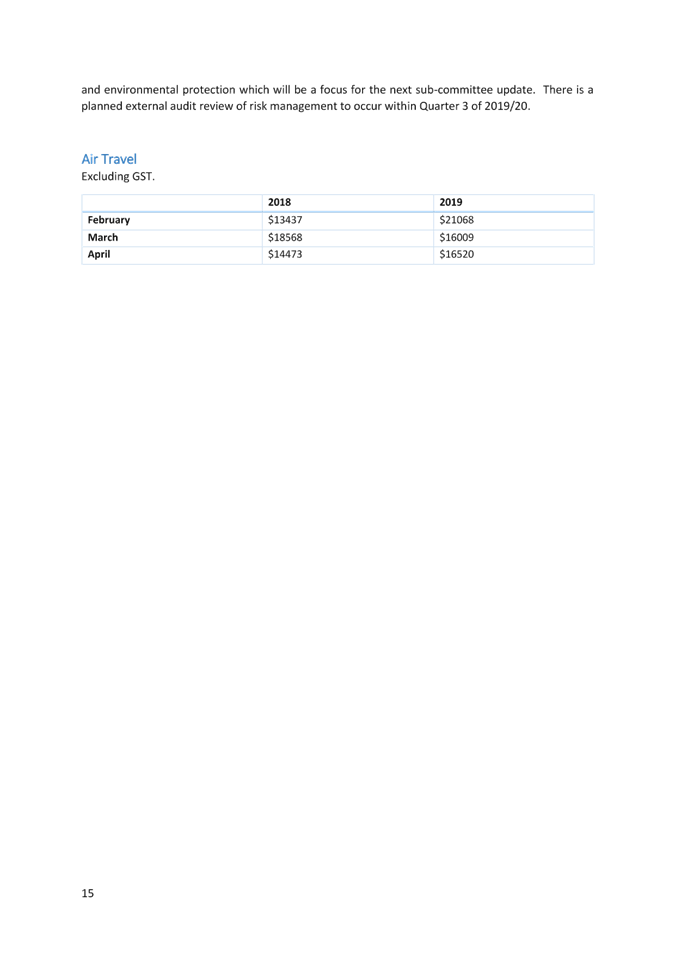

of Interest Declarations

3. Confirmation of

Minutes of the Corporate and Strategic Committee meeting held on 6 March 2019

4. Follow-ups from

Previous Corporate and Strategic Committee meetings 3

5. Call for Minor

Items of Business Not on the Agenda 9

Decision Items

6. Report and

Recommendations from the Finance Audit and Risk Sub-committee 11

7. HBRC 2019-20

Annual Plan 17

8. HB Tourism Funding

Review and Organisational Updates 21

Information or Performance Monitoring

9. Organisational

Performance Report for Period 1 February to 30 April 2019 41

10. Strategic Plan Implementation 75

11. 11am Business HB

Update 79

12. Discussion of Minor Items Not

on the Agenda 87

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 05 June 2019

SUBJECT: Follow-ups from Previous Corporate

and Strategic Committee meetings

Reason for Report

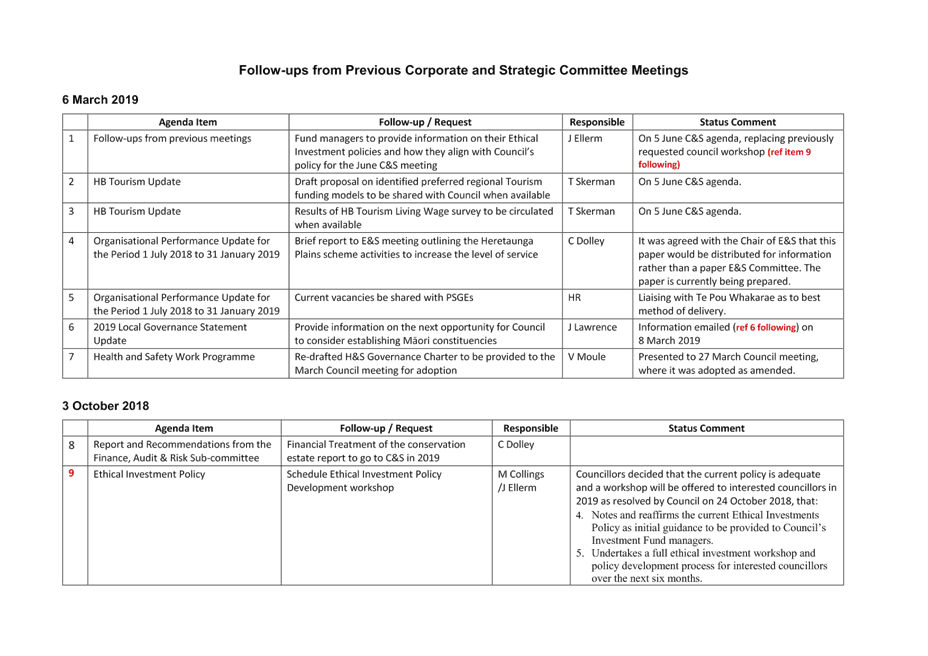

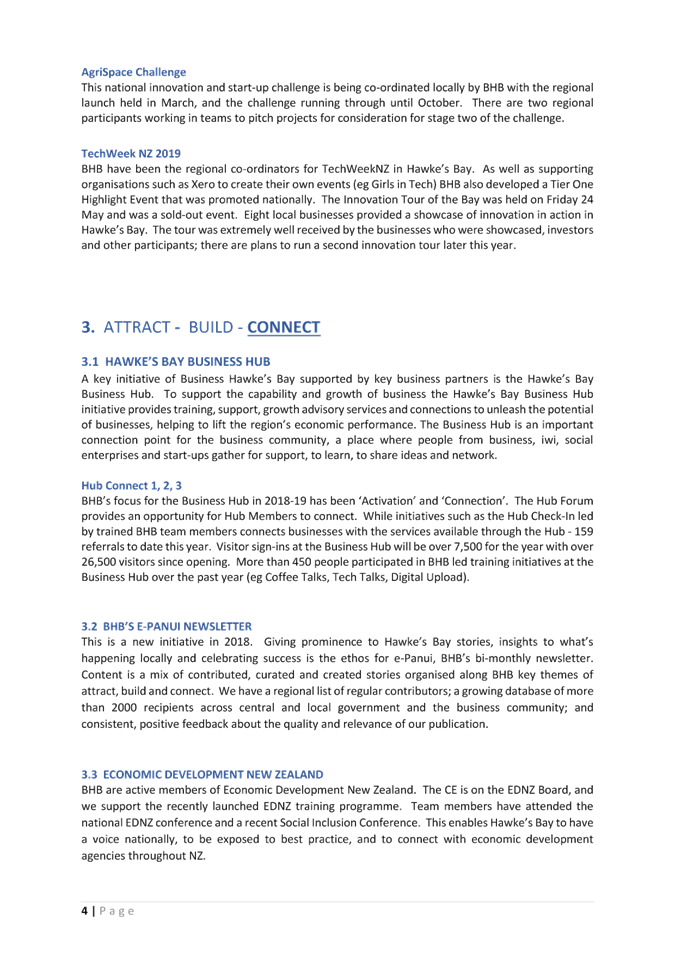

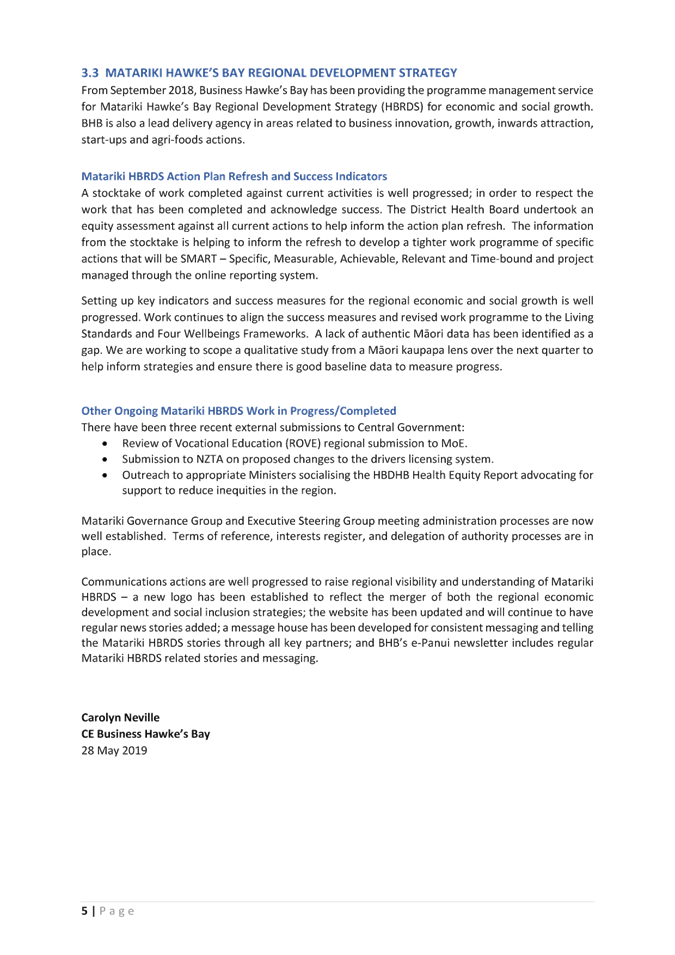

1. In order to track items raised at previous meetings that require

follow-up, a list of outstanding items is prepared for each meeting. All

follow-up items indicate who is responsible for each, when it is expected to be

completed and a brief status comment.

2. Once the items have been completed and reported

to the Committee they will be removed from the list.

Decision

Making Process

3. Staff have assessed the requirements of the Local Government Act

2002 in relation to this item and have concluded that, as this report is for

information only, the decision making provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee receives and

notes the “Follow-ups from Previous Corporate and Strategic

Committee Meetings” report.

|

Authored by:

|

Leeanne

Hooper

Principal Advisor Governance

|

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

|

⇩1

|

Follow-ups

from Previous Corporate & Strategic Committee Meetings

|

|

|

|

Follow-ups

from Previous Corporate & Strategic Committee Meetings

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 05 June 2019

Subject: Call for Minor Items of

Business Not on the Agenda

Reason

for Report

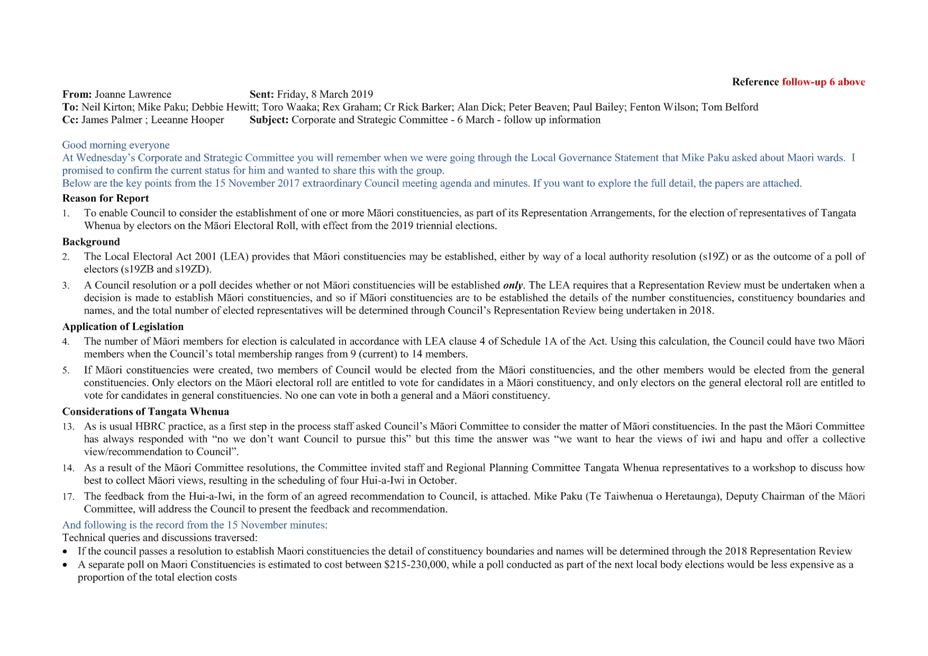

1. Standing order 9.13 allows

“A meeting may discuss an item

that is not on the agenda only if it is a minor matter relating to the general

business of the meeting and the Chairperson explains at the beginning of the

public part of the meeting that the item will be discussed. However, the

meeting may not make a resolution, decision or recommendation about the item,

except to refer it to a subsequent meeting for further discussion.”

Please note that nothing in this standing order removes

the requirement to meet the provisions of Part 6, LGA 2002 with regard to

consultation and decision making.”

Recommendations

That the Corporate and Strategic Committee accepts the following

“Minor Items of Business Not on the Agenda” for discussion as Item 12.

|

Leeanne Hooper

PRINCIPAL ADVISOR GOVERNANCE

|

James Palmer

CHIEF EXECUTIVE

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 05 June 2019

Subject: Report and

Recommendations from the Finance Audit and Risk Sub-committee

Reason

for Report

1. The following

matters were considered by the Finance Audit and Risk Sub-committee meeting on

22 May 2019 and are now presented for the Committee’s consideration.

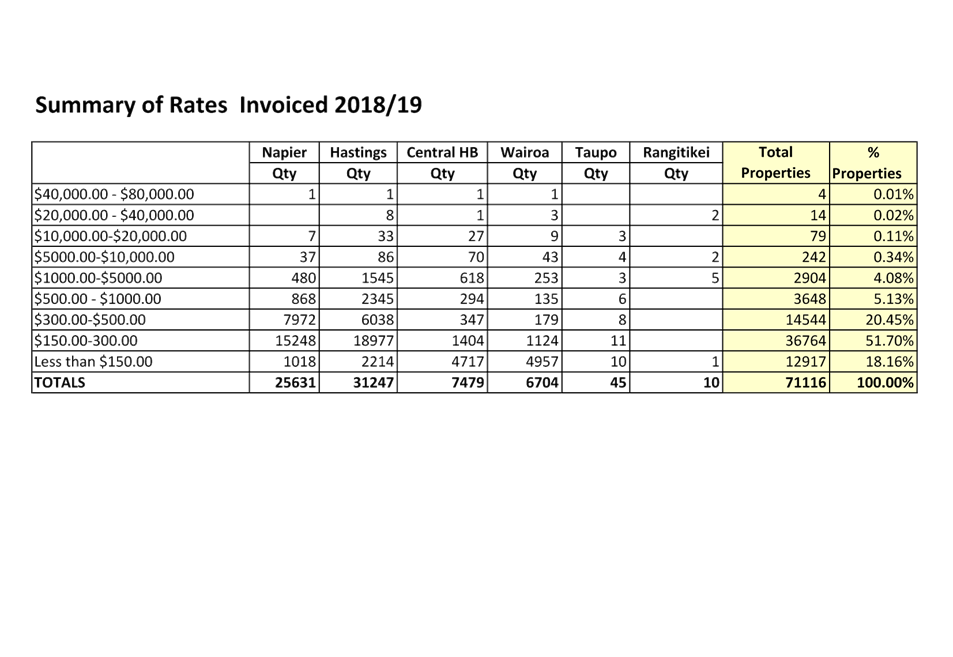

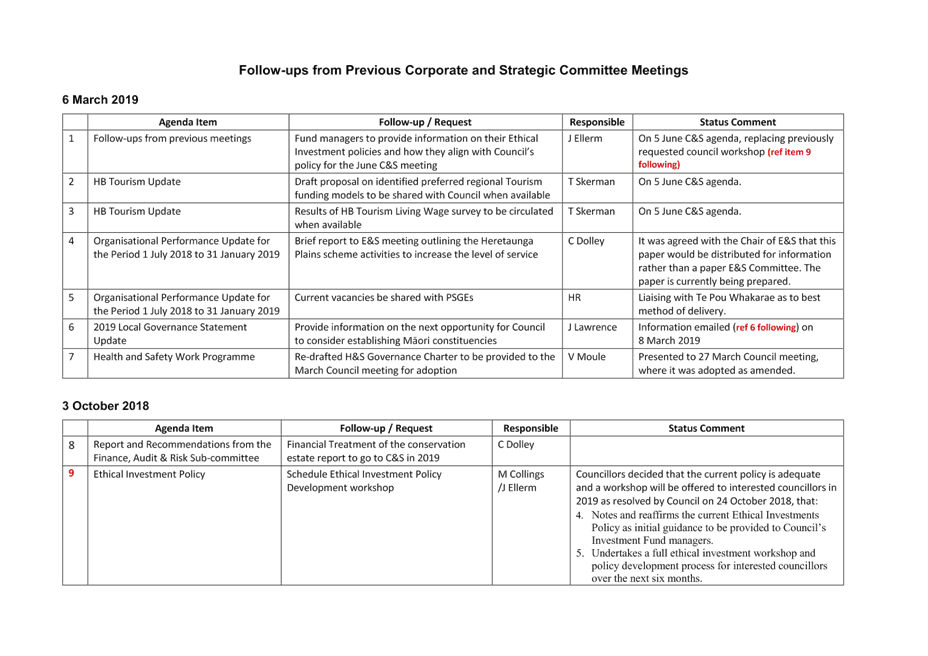

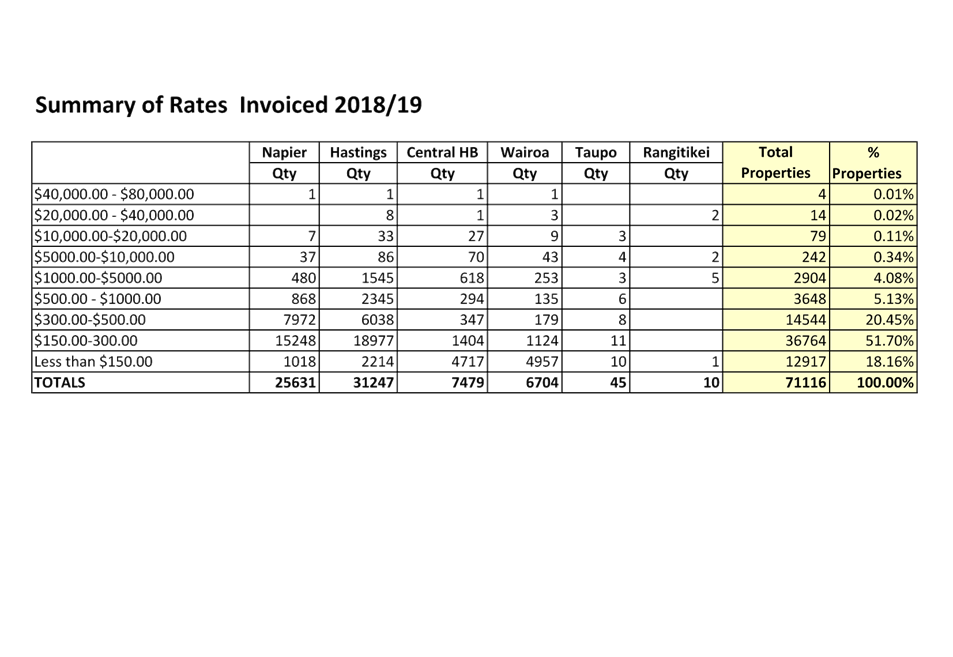

Rating Invoice –

Proposed Issue, Due and Penalty Date Changes

2. This item proposed a change to the date

Hawke’s Bay Regional Council’s rate invoices are sent out and the

date payment is due with the objective of improving Council’s cash flow

as well as lessen payment pressures on ratepayers over the Christmas period.

3. During discussions on the item concerns were raised in relation to

bringing forward the payment due date by six months potentially adding to the

financial burden for some ratepayers. To add context to the discussion, staff

provide the attached table that provides a picture of the rates paid across the

region.

4. The sub-committee resolved:

4.1. That the Finance, Audit and Risk Sub-committee receives and

considers the “Rating Invoice – Proposed Issue, Due and Penalty

Date Changes” staff report.

4.2. The Finance, Audit and Risk Sub-committee recommends that the

Corporate and Strategic Committee:

4.2.1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that the Committee can exercise its discretion and make decisions

on this issue without conferring directly with the community.

4.2.2. Recommends that Hawke’s Bay Regional Council approves the

proposed rates issue, due and penalty dates following, for implementation 1

July 2020.

4.2.2.1 Invoices

sent out – early to mid-August

4.2.2.2 Rate

assessment/invoice date – 20 September

4.2.2.3 Payment

due date – 20 September

4.2.2.4 Penalty

date – 21 September.

Proposed schedule of 2019-20 internal

audits

5. This item provided the sub-committee with a proposed internal

audit programme for the 2019-20 financial year. Discussions of this item

included a suggestion that Council staff consider options and opportunities for

monitoring operational achievements against sustainability targets, and

reporting these through to Council. Agreeing the schedule of internal audits,

the sub-committee resolved:

5.1. Agrees to the

2019-20 schedule of Internal Audits, including associated budget allocations,

being:

5.1.1. IT Security

(subject to inclusion of an assessment of

vendors cyber security in the scope)

5.1.2. Data

Analytics

5.1.3. Risk

Management

5.1.4. Asset

Management.

5.2. The Finance,

Audit and Risk Sub-committee recommends that the Corporate and Strategic

Committee takes note of the agreed 2019-20 schedule of Internal Audits within

associated budget allocations.

Water management

follow-up internal audit report

6. This item provided the Crowe Horwath report on the results of the

follow-up Water Management internal audit undertaken. The discussions at the

meeting covered the matters identified as Partially Implemented and there was a

request for a further audit in six months to determine further progress towards

implementation, with the sub-committee resolving:

6.1. That the

Finance, Audit and Risk Sub-committee receives and notes the “Water

Management Follow-up Internal Audit Report” staff report and that

Crowe Horwath be engaged for a further follow-up audit to be undertaken within

6 months”.

Draft 2019-20 Annual

Plan for feedback

7. The Annual Plan for 2019-20 was presented for review and feedback

and will be presented to the 5 June Corporate and Strategic Committee meeting

for final adoption by Council on 26 June 2019.

Living wage update

8. This item provided the Sub-committee with an update on developments

with living wage provisions including feedback from a survey conducted with

suppliers providing direct services to Council for review and consideration. The

sub-committee resolved:

8.1. That the

Finance, Audit and Risk Sub-committee:

8.1.1. Receives

and notes the “Living Wage Update” staff report

8.1.2. Notes that

considerations of living wage related procurement policy decisions are

addressed in a separate “Procurement and Contract Management”

item.

8.1.3. Continues

to await the feedback of the Public Transport Operating Model report.

8.2. The Finance,

Audit and Risk Sub-committee recommends that the Corporate and Strategic

Committee recommends that Hawke’s Bay Regional Council:

8.2.1. Considers

the addition of a statement in the Procurement Policy that “Council

gives preference to suppliers who pay employees the Living Wage”

8.2.2. If the

inclusion of a weighting for payment of the Living Wage in a contract decision

is to be considered, that the decision will be determined based on the type and

value of the contract, and should also weigh up other best business practices.

8.2.3. If the

inclusion of a weighting for payment of the Living Wage in a contract decision

is to be considered, that the decision will be determined based on the type and

value of the contract, and should also weigh up other best business practices.

Procurement and

Contract Management Update

9. This item provided the sub-committee with an update on progress made

in response to recommendations from the 2018 internal audit to review and amend

the Regional Council’s Procurement Policy and Procurement Manual, with

discussions including the release of new guidelines from the Office of

the Auditor General and the Ministry of Business, Innovation and Employment in

late 2018, HBRC has reviewed and amended the current procurement policy and

manual to reflect current best practice.

10. Staff

presented to the committee the policy and manual which cover the procurement

life cycle, from planning, to selection and contract delivery. National

templates for selection of suppliers and contracting have been adopted and

recommendations for improvement included following and external audit of our

processes and procedures by Crowe Horwath in 2018. The changes also

reflect HBRC being supportive of sustainable purchasing, local buying and the

living wage being included in selection criteria.

11. The

sub-committee resolved:

11.1. That

the Finance, Audit and Risk Sub-committee Receives and considers the “Procurement

and Contract Management Update” staff report and provides feedback to

staff on the Procurement Policy and Procurement Manual documents.

11.2. The

Finance Audit and Risk Sub-committee recommends that the Corporate and

Strategic Committee:

11.2.1. Agrees support for the

proposed Hawke’s Bay Regional Council Procurement Policy May 2019 and

Procurement Manual as revised to reflect the feedback provided by FARS.

11.2.2. Recommends that

Hawke’s Bay Regional Council agrees support for the Hawke’s Bay

Regional Council Procurement Policy May 2019 and Procurement Manual as revised,

including that Policy 5.9 is amended to read “HBRC will give preference

to suppliers who have adopted the living wage and will consider this as part of

the procurement evaluation process”.

May 2019 Sub-committee Work Programme

Update

12. This standing item

provided an overall update on the Sub-committee’s work programme.

Treasury Report

13. This “Late Item”

was received too late for proper consideration, and so is provided to

today’s Committee meeting.

Proposed 2019-20 Council Insurance

Programme

14. This item provided the

Sub-committee with details covering the annual renewal of Council’s

current insurance policies and terms and conditions of renewal.

Decision

Making Process

15. These matters have all

been specifically considered at the Committee level except where specifically

noted.

|

Recommendations

The Finance,

Audit and Risk Sub-committee recommends that the Corporate and Strategic

Committee:

1. Receives and

notes the “Report and Recommendations from the 22 May 2019

Finance, Audit and Risk Sub-committee Meeting”

2. Agrees that

the decisions to be made are not significant under the criteria contained in

Council’s adopted Significance and Engagement Policy, and that Council

can exercise its discretion and make decisions on this issue without

conferring directly with the community or persons likely to be affected by or

have an interest in the decision.

Rating Invoice

– Proposed Issue, Due and Penalty Date Changes

3. Recommends

that Hawke’s Bay Regional Council approves the proposed rates issue,

due and penalty dates following, for implementation 1 July 2020.

3.1. Invoices

sent out – early to mid-August

3.2. Rate

assessment/invoice date – 20 September

3.3. Payment due

date – 20 September

3.4. Penalty

date – 21 September.

Proposed schedule of 2019-20

internal audits

4. Takes

note of the agreed 2019-20 schedule of Internal Audits within associated

budget allocations, being:

4.1. IT

Security

4.2. Data

Analytics

4.3. Risk

Management

4.4. Asset

Management

4.5. Water

Management follow-up.

Living wage update

5. Considers

the addition of a statement in the Procurement Policy that “Council

gives preference to suppliers who pay employees the Living Wage”

6. If

the inclusion of a weighting for payment of the Living Wage in a contract

decision is to be considered, that the decision will be determined based on

the type and value of the contract, and should also weigh up other best

business practices.

7. If

the inclusion of a weighting for payment of the Living Wage in a contract

decision is to be considered, that the decision will be determined based on

the type and value of the contract, and should also weigh up other best

business practices.

Procurement

and Contract Management Update

8. Agrees

support for the proposed Hawke’s Bay Regional Council Procurement

Policy May 2019 and Procurement Manual as revised to reflect the feedback

provided by FARS.

9. Recommends

that Hawke’s Bay Regional Council agrees support for the Hawke’s

Bay Regional Council Procurement Policy May 2019 and Procurement Manual as

revised, including that Policy 5.9 is amended to read “HBRC will give

preference to suppliers who have adopted the living wage and will consider

this as part of the procurement evaluation process”.

Reports

Received

10. Notes

that the following reports were provided to the Finance Audit and Risk

Sub-committee.

10.1. Water

Management Follow-up Internal Audit Report

10.2. Living

wage update

10.3. Draft

2019-20 Annual Plan for review and feedback

10.4. May

2019 Sub-committee Work Programme Update.

|

Authored by:

|

Leeanne

Hooper

Principal Advisor Governance

|

Jessica

Ellerm

Group Manager

Corporate Services

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

|

⇩1

|

Summary of

Rates 2018-19

|

|

|

|

Summary

of Rates 2018-19

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 05 June 2019

Subject: HBRC 2019-20 Annual

Plan

Reason for Report

1. The Annual Plan

full document for 2019-20 is attached (in hard copy for Committee members only)

for review, feedback and recommendation for Council to adopt on 26 June

2019. It has been through the Financial Audit & Risk Sub-Committee

for their feedback which will be incorporated together with any feedback from

the Corporate and Strategic Committee to a final version presented to Council

for adoption on 26 June 2019.

2. As Council

agreed to a no consultation approach due to no material or significant

differences to what was forecast in year 2 of the Long Term Plan (LTP), and the

forecasted average rates increase of 7.9% has not changed, a detailed two page

spread of key highlights will be published (through newspapers and social

media) after the Corporate and Strategic Committee meeting to inform the community.

3. Feedback from

the Finance Audit & Risk Sub-Committee has been incorporated into this two

pager and the updated version is attached. The narrative used in this two

pager will be incorporated into the final version of the Annual Plan 2019-20

document for consistency and presented to Council on 26 June 2019.

4. Requests to

carry forward a number of 2018-19 budgeted operating and capital expenditure

items are detailed for approval to be included in the Annual Plan

2019-20. A summary is provided in this paper and full details are in the

attached document. The Annual Plan document will be updated to reflect

these figures and a summary of key variations to year 2 of the 2018-28 Long

Term Plan presented to Council on 26 June 2019.

Notes

5. Any feedback

received from the Finance Audit and Risk Sub-Committee on the full Annual Plan

document has not yet been implemented as further changes will need to be made

subject to carry forward approvals and any feedback/changes from the Corporate

and Strategic Committee meeting. A final updated version will be

available for adoption by Council on 26 June 2019.

6. However –

the two page spread which will be published on 06 June to inform the community

of key highlights has been updated and is attached for reference. The

information from this two page spread will also be incorporated into the final

Annual Plan document when presented for adoption on 26 June 2019.

7. There are four

attachments to this paper:

7.1. The draft

Annual Plan 2019-20 document

7.2. The two page

spread for public information

7.3. The carry

forwards information for Capital and Operating expenditure

7.4. A copy of the

letter sent out to all commercial entities informing the change in allocation

of the Economic Development rate.

Background

8. The Annual Plan

document has three sections:

8.1. Section 1:

Introduction

8.2. Section 2:

Highlights

8.3. Section 3:

Financial information

9. A draft of

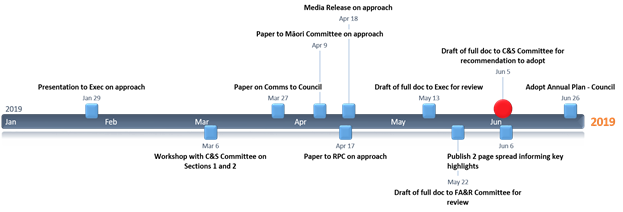

sections 1 and 2 were presented to Council in a workshop early March. A

media release on 18 April 2019 signified our non-consultation approach and

provided a high level overview to the public. The full Annual Plan

document was presented to Finance Audit & Risk Sub-Committee on 22 May for

review and feedback.

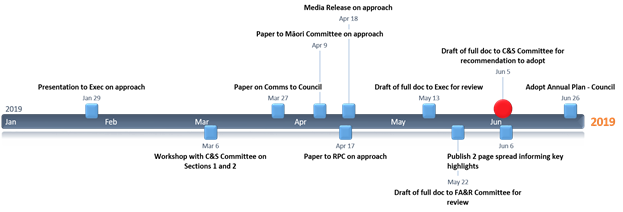

10. A timeline of events for

the Annual Plan is below.

Rates and Rating

Differentials

11. Note that the forecast

average rate increase of 7.9% as forecast from year 2 of the Long Term Plan has

not changed. There are some minor variances as to the spread across

various rating types e.g. the Uniform Annual General Charge (UAGC) has

increased by 5%/$136k, however this is balanced out by a decrease in targeted

rates of 5% including biosecurity schemes by $99k, sustainable land management

by $27k and economic development by $23k.

12. As per the Long Term Plan consultation,

in 2019-20 a larger percentage of the Economic Development rate ratio shifts to

commercial ratepayers; those who benefit the most from this activity. The

ratio shifts from 50:50 commercial:urban to a 70:30 split. A letter was

sent out 28 May to all commercial entities informing of this change and is

attached to this paper.

13. Below is a sample of

property values showing the likely effect on commercial rate-payers, from 1

July 2019.

|

|

CV $210,000

|

CV $560,000

|

CV $850,000

|

CV $1,010,000

|

CV $3,300,000

|

CV $5,650,000

|

|

2018-19

|

$55.26

|

$147.74

|

$188.36

|

$223.82

|

$731.28

|

$1,440.19

|

|

2019-20

|

$59.45

|

$198.74

|

$272.34

|

$323.60

|

$1,057.32

|

$2,005.19

|

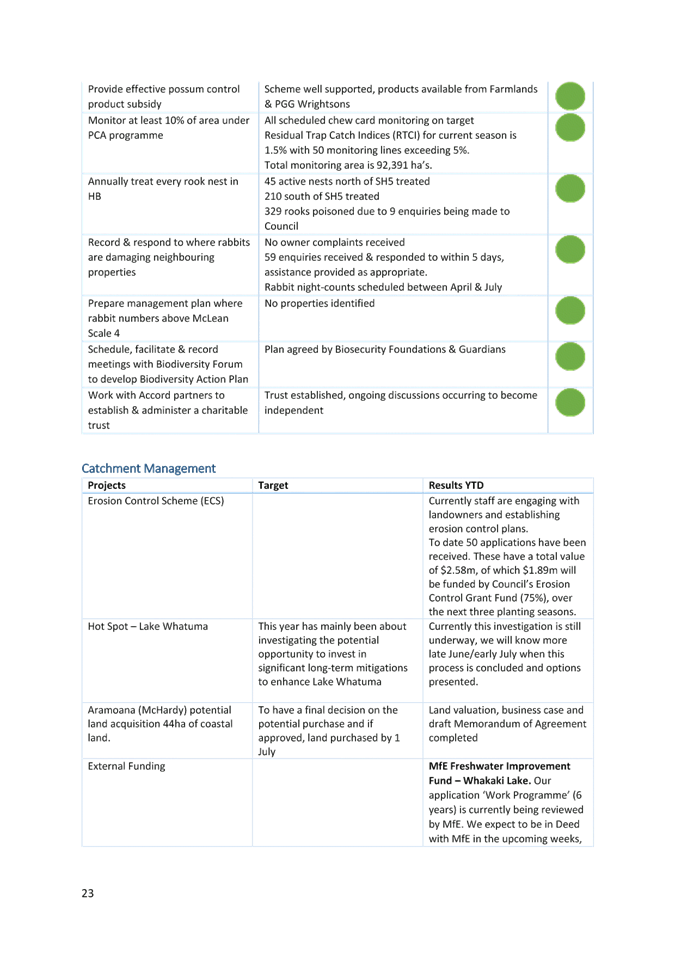

Carry Forward of Expenditure and

Revenue from 2018-19 to 2019-20

14. Operating and capital

expenditure carry forwards from 2018-19 to 2019-20 are detailed in full in the

attachment and a summary in the table below.

15. When considering whether

to approve the carry forwards to expenditure consideration has been taken to

factors such as resourcing, delays in funding approvals etc, with the

understanding that planned work can now take place in the 2019-20 year.

16. Summary of Effects of

Operating expenditure carry forwards on the 2019-20 Annual Plan.

|

Proposed

Carry Forwards OPERATING

|

Expenditure

|

|

Erosion Control Scheme

|

($600,000)

|

|

Hot Spot Tutira

|

($245,000)

|

|

Hot Spot Lake Whatuma

|

($180,000)

|

|

Regional Land Transport

Strategy

|

($146,000)

|

|

Future Farming

Initiative

|

($130,000)

|

|

Heretaunga Plains Flood

Control Scheme

|

($89,000)

|

|

Karamu Drainage

|

($45,000)

|

|

Upper Tuki Tuki

|

($44,000)

|

|

Asset Management

– Minor Items

|

($40,000)

|

|

Heretaunga Plains

Special Projects

|

($34,000)

|

|

Napier, Meannee,

Puketapu Drainage

|

($33,500)

|

|

Muddy Creek

|

($12,000)

|

|

Karamu Enhancement

|

($11,000)

|

|

Central Southern Rivers

|

($10,000)

|

|

TOTAL OPERATING

|

(1,619,500)

|

17. Summary of Effects of

Capital expenditure carry forwards on the 2019-20 Annual Plan.

|

Proposed

Carry Forwards CAPITAL

|

Expenditure

|

|

Ngaruroro Water

Investment (Regional Freshwater Security)

|

($1,420,000)

|

|

IT Infrastructure

Refresh

|

($610,000)

|

|

IRIS Resource Management

System Phase 2

|

($520,000)

|

|

Regional Groundwater

Research

|

($430,000)

|

|

Executive Performance

Management Tool

|

($330,000)

|

|

Heretaunga Plains Flood

and River Control

|

($183,000)

|

|

Environmental Data

Management System

|

($175,000)

|

|

Bus Service Ticketing

System

|

($154,000)

|

|

Customer Relationship

Management (CRM)

|

($75,000)

|

|

Data Warehousing

|

($70,000)

|

|

Regional Cycling

Project

|

($60,000)

|

|

TOTAL CAPITAL

|

($4,027,000)

|

Decision Making

Process

18. Council

is required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

18.1. The decision

does not fall within the definition of Council’s policy on significance.

18.2. The persons affected by this

decision are the region’s ratepayers.

18.3. Given

the nature and significance of the issue to be considered and decided, and also

the persons likely to be affected by, or have an interest in the decisions

made, Council can exercise its discretion and make a decision without

consulting directly with the community or others having an interest in

the decision.

|

Recommendations

1. That the Corporate and Strategic Committee:

1.1. Receives and notes the “HBRC 2019-20 Annual Plan”

staff report.

1.2. Receives and notes the two page public notice informing the

community of key highlights of the 2019-20 Annual Plan included in this staff

report.

1.3. Receives and notes the 2019-20 Annual Plan Carry Forward Budget

Considerations included in this staff report.

2. The Corporate and Strategic Committee recommends that

Hawke’s Bay Regional Council:

2.1. Adopts the 2019-20 Annual Plan, incorporating amendments agreed at

today’s meeting, in accordance with Section 95 and Section 82(A)(3) of

the Local Government Act 2002.

|

Authored by:

|

Karina

Campbell

Senior Project Manager

|

Melissa des

Landes

Acting Chief Financial Officer

|

|

Trudy

Kilkolly

Principal Accountant Rates and Revenue

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

James Palmer

Chief Executive

|

Attachment/s

|

⇨1

|

Draft 2019-20

Annual Plan (for committee members only)

|

|

Under

Separate Cover

|

|

⇨2

|

Annual Plan

Two Page Spread for public information (for committee members only)

|

|

Under

Separate Cover

|

|

⇨3

|

Carry

forwards detail for Capital and Operating Expenditure

|

|

Under

Separate Cover

|

|

⇨4

|

Letter to all

commercial ratepayers explaining the change in ratio

|

|

Under

Separate Cover

|

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 05 June 2019

Subject: HB Tourism Funding

Review and Organisational Updates

Reason for Report

1. This item provides the Corporate and Strategic Committee with an

update on the Hawkes’ Bay Tourism (HBT) funding review, national industry

developments, and seeks feedback on identified options for capturing the peer-to-peer

sector.

2. This item also provides the Committee with the Hawke’s Bay

Tourism fourth quarter organisational report and proposed Key Performance

Indicators (KPIs) as attached.

Executive

Summary

3. Nationally and locally, conversations are continuing around tourism

funding, and multiple initiatives are under active consideration and

review. These include:

3.1. Tourism Industry Aotearoa (TIA) recommendation that local government

receive a 20% share of GST from international visitors

3.2. The recently released New Zealand-Aotearoa Government Tourism

Strategy

3.3. The judicial review of Auckland Council’s Accommodation

Provider Targeted Rate (APTR) that commenced May 27

3.4. Queenstown Lakes District Council’s referendum on a proposed

visitor levy, with the last day of voting being 5 June

3.5. A remit to LGNZ proposed by Christchurch City Council to require

registration of short-term accommodation providers is on the agenda for

consideration at the LGNZ Annual General Meeting

3.6. Development of Hawke’s Bay Visitor Strategy &

Destination Management Plan.

4. Notwithstanding these initiatives, staff are continuing to look into

HBT’s current funding mechanism which is via the Economic Development

(ED) rate to ensure those that benefit commercially from tourism (directly or

indirectly) contribute appropriately to the promotion and marketing of the

region.

Background

5. Following

consultation on the 2018-28 Long Term Plan (LTP) Council decided to support HBT

at a rate of $1.52 million (M) per annum, for three years, with subsequent

funding levels to be reviewed through the 2021 - 2031 LTP process. HBRC

also agreed to adjust the economic development rating allocation (where funding

for HBT comes from) to become more weighted to the commercial sector, as consulted

on.

6. As per the LTP Council also requested that:

6.1. Hawke’s Bay Tourism examine levels of accommodation in private

homes achieved through hosting websites to recommend to HBRC possible

differentiated rating levels for accommodation providers based on occupancy

rates.

6.2. HBRC staff work with Hawke’s Bay Tourism to investigate the

possibility of introducing a bed tax via enabling legislation to support the

activities of Hawke’s Bay Tourism.

7. The objectives of the funding review are:

7.1. To develop a long-term sustainable funding model for

Hawke’s Bay Tourism that ensures those who benefit commercially from

tourism contribute to the promotion and marketing of the region

7.2. To lessen the

burden on the Hawke’s Bay ratepayer.

Hawke’s Bay

Visitor Strategy & Destination Management Plan

8. HBT is driving the development of this plan and has the support of

the region’s Mayors and Chairs for an all-of-region approach. HBT

Acting General Manager Hamish Saxton will be at the Corporate and Strategic

meeting and will be available to answer any questions in regards to this.

Funding

Review Developments

Economic Development

Rate Split

9. As the sole local government funder of HBT, HBRC collects funding

through a targeted Economic Development rate on behalf of the region’s

territorial authorities; Napier, Hastings, Central Hawke’s Bay and Wairoa

councils.

10. Of the

approximate $2.1M collected through this rate $1.52M is allocated to HBT as

agreed to in the HBRC’s 2018-28 Long Term Plan. This funding level

was committed to for three years and will be reviewed through the 2021-31 LTP.

11. The

Economic Development rate is charged out using two differentials; residential

ratepayers pay a Uniform Annual Charge (UAC) and organisations classified as

commercial/industrial pay rates based on Capital Value (CV) – the market

value of their land and improvements. In previous years Wairoa ratepayers

have been capped to 5% of the total ED rates collected.

12. As per

HBRC’s Long Term Plan the rating allocation between residential and

commercial/industrial sectors has been adjusted over three years to become more

weighted to the commercial/industrial sector as it is considered this sector

benefits more directly from tourism than urban rated properties.

13. The

rating allocation has moved from 30% commercial/industrial: 70%

residential (2017-18), to a 50:50 split in 2018-19, to, 70%

commercial/industrial: 30% residential for 2019-20, effective from 1

July. Please see the table below for how this has impacted the Economic

Development rate collection.

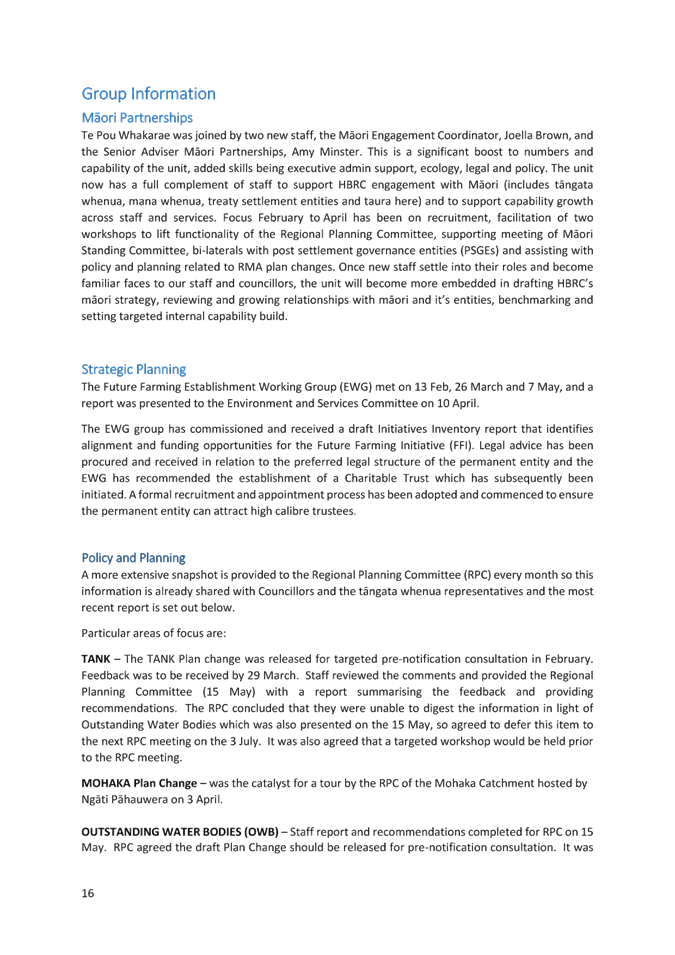

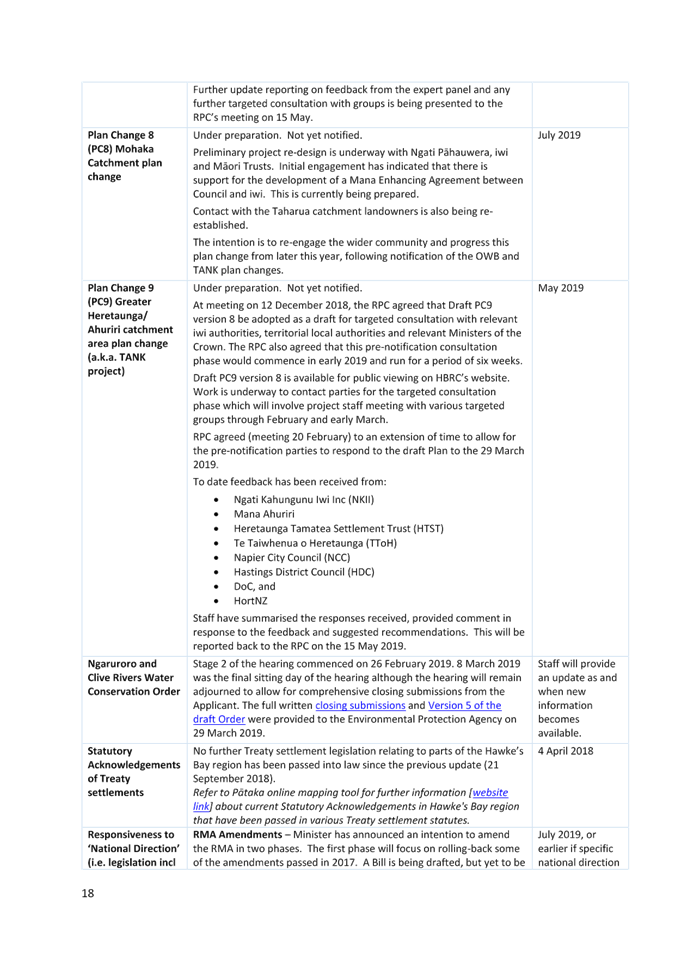

Table 1 – Effects of Rating Split Implementation

|

Sector

Economic Development Rate collected from

|

2017-18

(30:70)

|

2018-19

(50:50)

|

2019-20

(70:30)

|

|

Commercial/Industrial

|

$796,830.00

|

$1,063,792.00

|

$1,506,306.00

|

|

Residential

|

$1,859,270.00

|

$1,063,792.00

|

$645,560.00

|

|

Total Economic Development Rates collected

|

$2,656,100.00*

|

$2,127,584.00

|

$2,151,866.00

|

*This total

amount is higher than the other years as it includes the higher HBT funding

allocation before it was reduced.

14. As part

of this funding review and given the change to the rating allocation, it is

sensible to further analyse this rate to help ensure those that benefit

commercially from tourism contribute more to the promotion and marketing of the

region as a tourism destination.

Capturing the

Peer-to-Peer Sector

15. Councils

around the country, and internationally, are grappling with the issue of how to

capture the peer-to-peer sector.

16. HBT says

the peer-to-peer accommodation market has a long standing presence in

Hawke’s Bay through domestic websites. However, like much of New

Zealand, the growth of the sector in the region has seen a meteoric rise with

the arrival of global player AirBnB.

17. It is

difficult to get an accurate understanding of the total number of properties that

offer peer-to-peer accommodation in the region, however HBT report the number

of entire properties available for rent peaked in February this year at

1,190. This figure comes from AirDNA - a subscription service that

“scrapes” AirBnB for data and more recently also HomeAway (another

international platform). Total listings in March 2019 show there were

1,060 entire places to rent.

18. HBT

reports that the revenue the peer-to-peer sector collects has also

significantly increased. In the 12 months to April 2019, revenue

more than doubled from $13.0M to $26.4M.

19. It does

not appear any research has been done on the wider impact on Hawke’s Bay

of the peer-to-peer sector, which is potentially taking long-term rentals off

the market for more lucrative short-term stays. It is reported the region

is in a housing crisis with a lack of affordable housing.

20. In a

paper to Christchurch City Council’s Regulatory Performance Committee (13

June 2018) Council staff say there are potential benefits and adverse impacts

from a significantly increased use of residential houses for short-term

accommodation. This is particularly the case where units are

predominantly used for accommodation and where the owner is not resident on

site. These impacts can include:

20.1. Reduced

availability and increased cost of long-term rentals

20.2. House

prices may be higher than if all units used for short-term accommodation were

returned to either the long-term rental market of the pool of houses for sale

20.3. Potential

reduced amenity and sense of community for neighbouring properties due to

transience of occupants particularly in neighborhoods where this activity tends

to cluster; and

20.4. Reduced

demand for traditional accommodation types and any subsequent impact on

investment.

21. If

peer-to-peer providers are operating at a commercial level and benefiting from

tourists coming into the region it is fair they contribute through a commercial

differential rather than the smaller residential differential ($9.76 for each

household) to the promotion and marketing of the region.

22. The

challenges however are firstly identifying the providers and secondly deciding

how to treat them – when are they considered to be operating on a

commercial basis and how can this be identified and confirmed?

23. Christchurch

City Council has proposed a remit to LGNZ to give local authorities the ability

to require registration of short-term accommodation providers. The remit

is on the agenda for consideration at its Annual General Meeting in July.

24. The table

below looks at some options available to HBRC in seeking a contribution from

the peer-to-peer sector to tourism.

|

Option 1:

Creating a voluntary subscription/membership group or join HBT’s

membership group

|

|

Peer-to-peer

providers could be written to (or flyers dropped in all homes in the region)

and asked to pay a voluntary annual subscription fee to contribute to tourism

promotion as part of a membership group. A new accommodation providers

group could be formed or it may be that providers could join HBT’s

existing membership group.

|

|

Pros

· Providers may contribute to tourism

promotion.

· Providers may want to belong to

membership group.

· Benefits may be achieved for providers

and the sector though having or being part of a membership group.

· This could be managed externally.

· Would not see a rate increase.

|

|

Cons

· People may choose not to join unless they

perceive a benefit/s for belonging to such a group.

· Wouldn’t expect to raise

significant contribution towards tourism promotion. It was reported to

the Corporate and Strategic Committee in December last year it had at that

time 386 paying members and expected to collect about $120,000 though

membership and support partners for the year.

|

|

Considerations

· Resource to administer/manage a new

membership group if one was formed.

· Would need to incentivize providers to

join e.g. What’s in it for me?

|

|

Option 2:

HBRC invoices a charge or fee to contribute towards Economic

Development/tourism promotion

|

|

Pros

· Provides a mechanism for providers to

contribute.

· Invoiced separate to rates therefore no

rate increase.

|

|

Cons

· Need to identify providers.

· Resource to manage the issue of invoices

and record payment.

· Resource to maintain the peer-to-peer

database.

· The charge or fee may not reflect the

amount of business they do or commercial benefit they receive from promotion

and marketing of the region.

· Not as easy to enforce payment of a

charge or fee, compared to a rates invoice.

|

|

Considerations

· This is a fluctuating sector and

providers may withdraw their property at the time a database is updated and

re-offer/re-register their property at a later date. A way around this could

be invoicing more than once a year. Again, this requires resource.

· Does potential revenue secured this way

justify the costs to set up and operate this option?

· Would need to publicly consult, needs

Council resolution and policy, and amendments to Council plan as required.

|

|

Option 3:

Charge a peer-to-peer targeted rate

|

|

Pros

· Those that benefit from tourism promotion

contribute.

· Rates could be reduced for the indirect

beneficiaries of tourism.

· A new rate can be established if the need

for more expenditure through the ED rate has been identified.

· Ability to charge penalties.

|

|

Cons

· The contribution would not reflect the

level of business they do or the benefit they receive.

· What basis is the rate charged? I.e. is

it a flat fixed rate or is it based on nights (actual, intended or capacity).

· Need to identify providers.

· Need to determine an appropriate fixed

rate.

· Resource to manage the issue of invoices

and record payment.

· Resource to maintain the peer-to-peer

database.

|

|

Considerations

· Would need to publicly consult, needs

Council resolution and policy, and amendments to Council plan as required.

|

|

Option 4:

Treat peer-to-peer providers as commercial entities using the current

Economic Development Rate

|

|

Pros

· Existing ED rate is based on CV so would

be consistent with what is currently applied.

· Assuming whole house is to be rented, CV

would generate more income and reduce the total amount residential ratepayers

would be required to pay.

|

|

Cons

· Need to identify providers.

· Resource to manage enquiries if

implemented.

· Resource to maintain the peer-to-peer

database.

· ED rate is based on capital value for

commercial entities, so this would see a significant rise in rates. For

example, a Napier south home with a CV of $375,000 currently pays $9.76

towards ED. If this home was classified as commercial, the rates would be

$120.15. (Napier commercial rate of $32.04 per $100,000.)

· If the above house was only occasionally

rented out, or part of the house rented out, it could be deemed

disproportionate.

· At what point do homes become

commercial?

· Doesn’t reflect proportion of

property being used for accommodation.

|

|

Considerations

· Need to determine when a house changes

form residential to commercial. Is it number of nights – is so, need to

decide what measurement to use i.e. available nights, intended booked nights

or actual booked nights.

· Would need to publicly consult, needs

Council resolution and policy, and amendments to Council plan as required.

|

|

Option 5:

Treat peer-to-peer providers as commercial entities using a different

differential. i.e. Land value (LV), Improvement Value, fixed charge per SUIP

(Separately Used Inhabited Parts)

|

|

For the

options discussed below HBRC would need to publicly consult, they need

Council resolution and policy, and amendments to Council plan as required.

Land

value

Pros

· Provides a mechanism for providers to

contribute.

· Reflects the value of the location.

· Value is irrespective of whether building

is being used or not.

· Existing ED Rate is based on LV so would

be consistent with what is currently applied.

Cons

· Compared to CV, HBRC would receive less

in rates.

· It doesn’t reflect the use of the

property.

Considerations

· Rural peer-to-peer providers have large

land value, but the property for rent may be a small cottage, but they will

be charged on the LV not the income they receive from renting the place out.

|

|

Improvement

value

Pros

· It reflects the income that is available

– the bigger the house, the more income it is able to generate.

Cons

· It doesn’t reflect income earned.

· It doesn’t reflect location.

· It doesn’t reflect the value of the

land that the improvement is sitting on.

|

|

Fixed

Charge per SUIP (Separate used or inhabited part of a rating unit)

Pros

· Provides a mechanism for providers to

contribute.

· It is simple to rate based on UACS.

· It reflects the number of units to rent.

· Ratepayers must register one or more

SUIPS.

· Can apply a penalty for non-payment.

Cons

· Doesn’t reflect use so ratepayer

would be charged regardless of use.

· Need to establish the number of units.

· Only accurate as at July 1 (start of

financial year).

· Resource required to keep register up to

date.

Considerations

· Need to identify appropriate fixed rate.

|

25. As

illustrated above, there is no clear answer and this is something Councils are

grappling to find an appropriate solution for.

National Tourism

Developments

26. Eyes are on the judicial review of Auckland Council’s

Accommodation Provider Targeted Rate (APTR). A group have come together,

Commercial Accommodation Rate Payers (CARP), and are challenging the legality

of the targeted rate.

27. It was reported the group are seeking to rescind the rate “due

to its unfairness and the lack of consultation by Auckland Council” (NZ

Herald 25 May 2018). High Court action started on 27 May (scheduled to

last a week), with Auckland Council expecting the judgement to be released

around August or September.

28. The last

day of voting for Queenstown Lakes District Council’s non-binding

referendum on a proposed visitor levy is 5 June. The Council has proposed a 5%

charge to the costs of accommodation payable by visitors. A Government

legislation change is required for the levy to be put in place. If the

Government is supportive, the levy would not be introduced until July 1, 2021.

28.1. Tourism

Minister Kelvin Davis has said any levy would be for Queenstown alone.

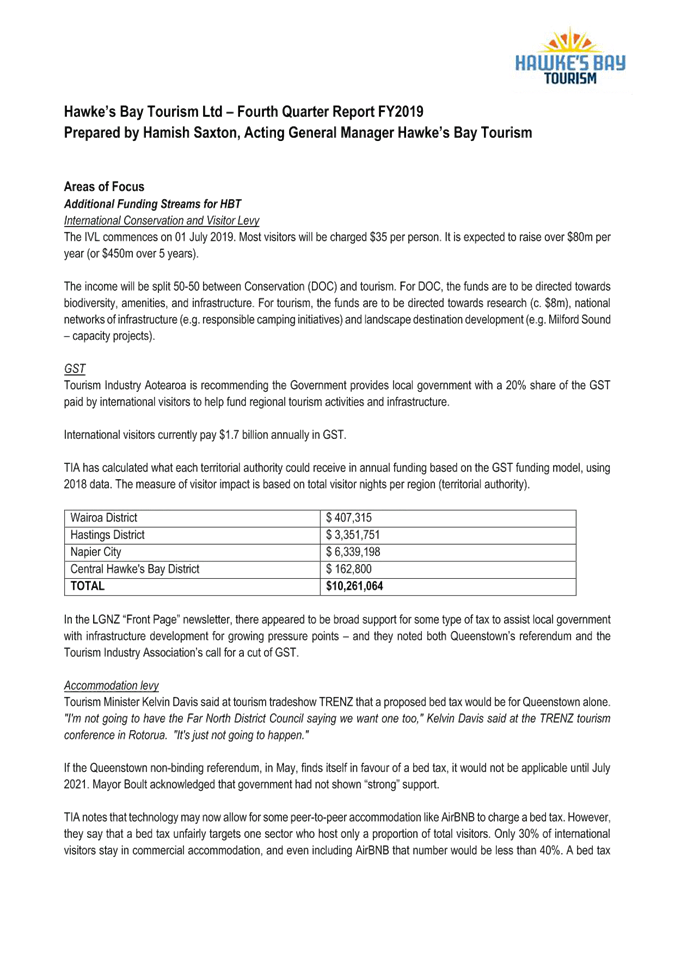

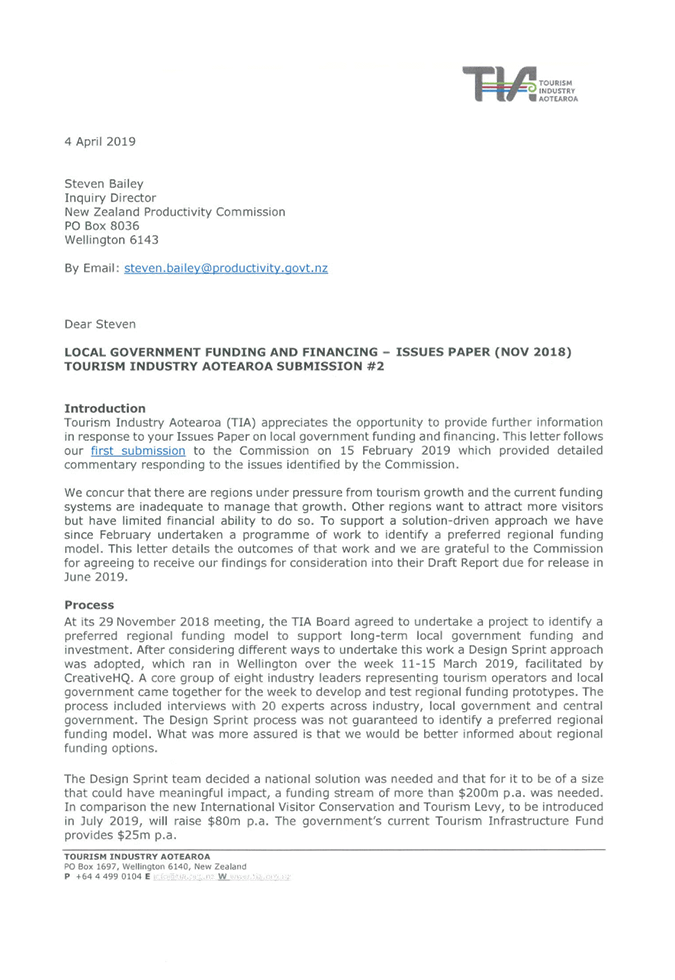

29. Tourism

Industry Aotearoa (TIA) has recently advocated that central government give

local government a 20% share of the GST paid annually by international visitors

to help fund regional tourism activities and infrastructure. This

recommendation was made to the Productivity Commission’s Local Government

Funding and Financing Inquiry (please see Attachment 2), with the draft release

of this report due in June.

29.1. TIA

recommends the money is redistributed to local government in accordance with

the tourism burden borne by each Territorial Local Authority (TLA).

29.2. It says

the distribution could be via a trust, with funds allocated in direct

proportion to visitor impact.

29.3. The

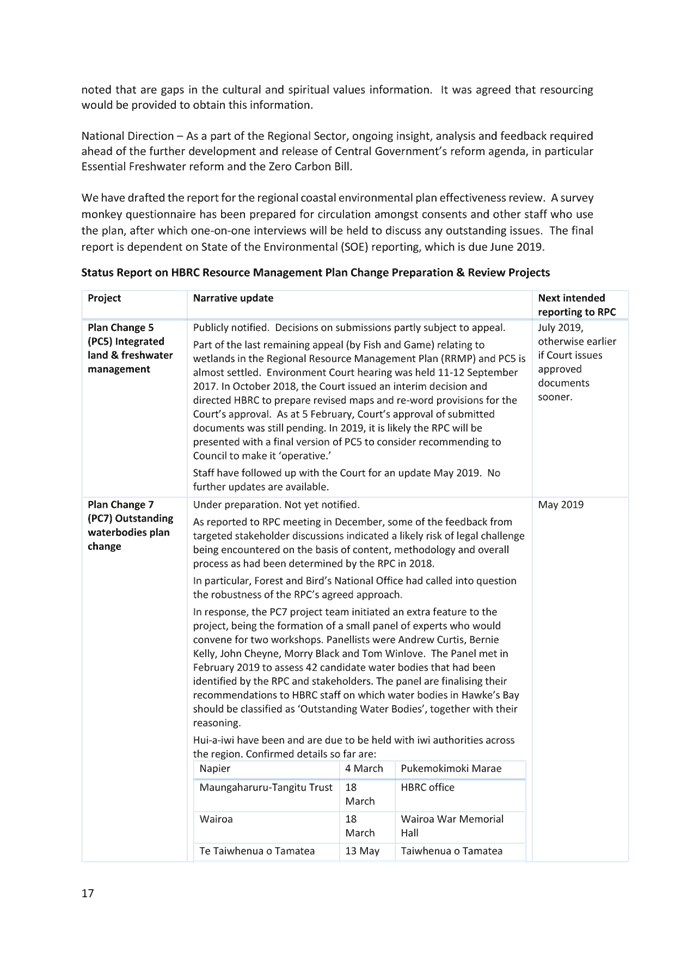

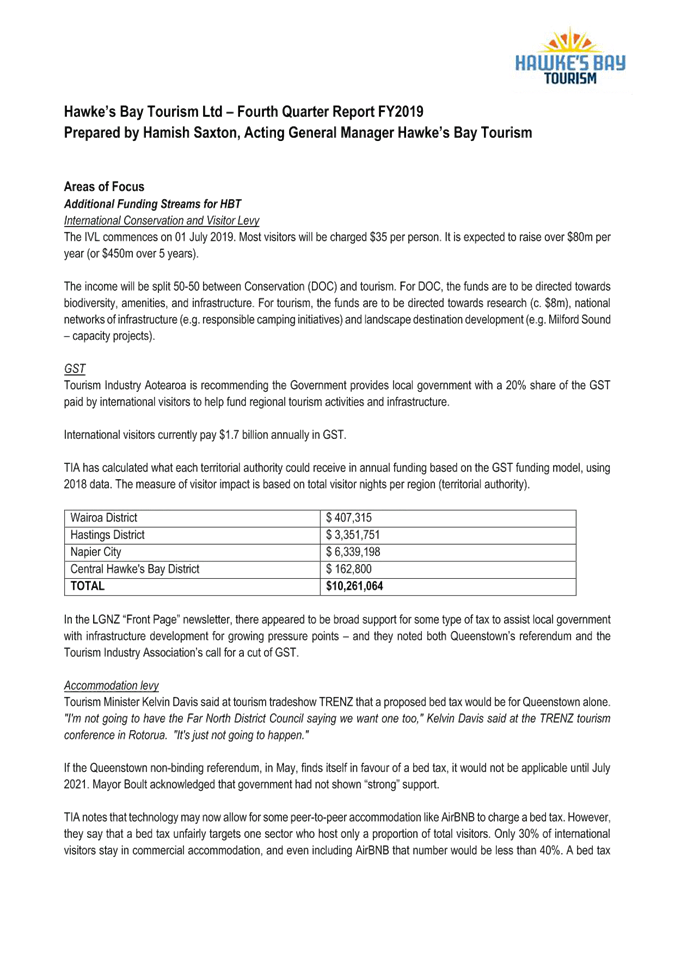

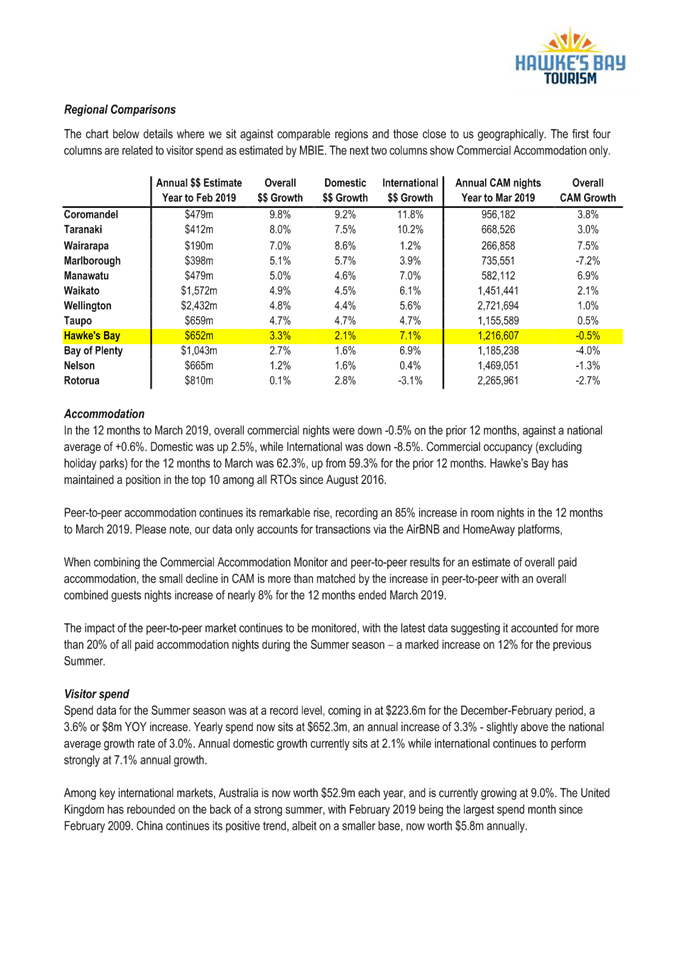

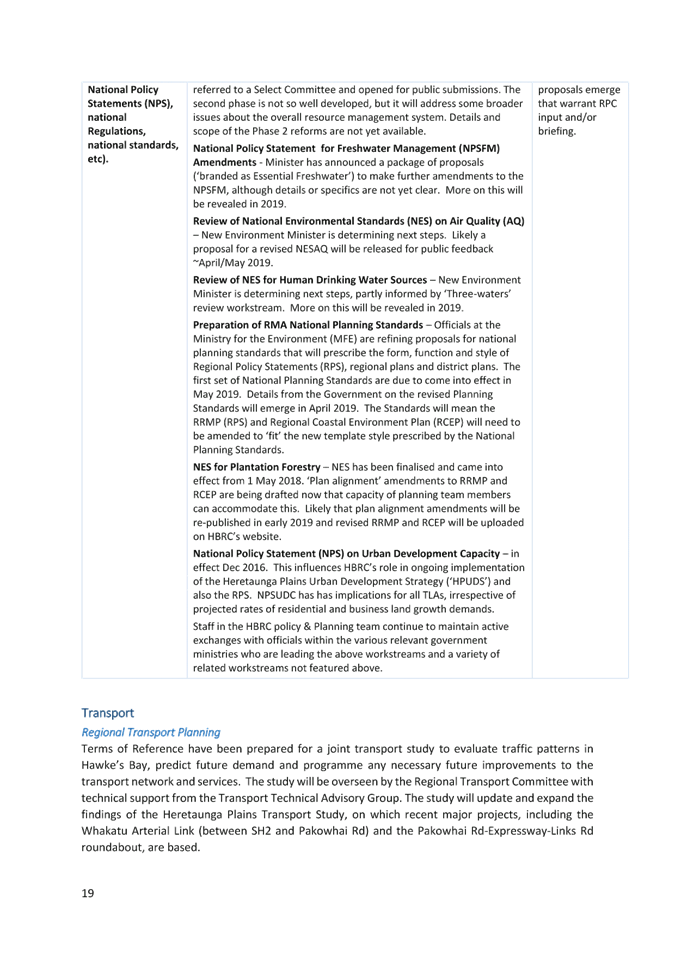

table below shows what each TA in Hawke Bay would receive in annual funding

based on the funding model, using 2018 data. The measure of visitor

impact is based on total visitor nights per region (TA) - (Guest nights data

source – Accommodation Survey/Commercial Accommodation Monitor Year End

March 2018)

Territorial Authority

|

Proportion of International Visitor GST attributed

|

|

Wairoa District

|

$407,315

|

|

Hastings District

|

$3,351,751

|

|

Napier City

|

$6,339,198

|

|

Central Hawke’s Bay District

|

$162,800

|

|

Total

|

$10,261,064

|

30. A

national tourism strategy has been released – New Zealand-Aotearoa

Government Tourism Strategy. One of the top priorities for 2019/20 is

long-term sustainable funding mechanisms, but the strategy does not provide

strong direction in regards to that – it does however include an action

to implement any tourism-related actions arising from the Productivity

Commission’s inquiry.

30.1. Destination

management and planning is another top priority – to work with regions to

take a strategic, coherent approach when deciding how they want to pan, manage

market and develop their destinations.

30.2. It has

actions points around the minimum wage and building capacity in Maori tourism

operators.

31. The tourism industry released its updated growth framework Tourism

2025 & Beyond. A Sustainable Growth Framework Kaupapa Whakapakari

Tāpoi. Managing destinations (“All of New Zealand needs to

be covered by Regional Destination Management Plans”) and investing in

infrastructure and amenities are among the top 10 actions.

32. The

International Visitor Conservation and Tourism levy (IVL) will be implemented

from July 1 2019. The IVL costs $35 and is expected to raise over $450M

over five years.

Next

Steps

33. Based on

feedback today on whether or not to progress a specific solution for

Hawke’s Bay to capture peer-to-peer providers (or wait for a coordinated

approach across local government), HBRC staff will further develop the

Committee’s preferred option/s for capturing the peer-to-peer sector and

methods of identification.

34. HBRC

staff continue to progress analysis of changes to HBT’s targeted rate

formula.

35. HBRC

staff continue to closely track industry developments and report back to the

Corporate and Strategic Committee when new information comes to light.

36. HBRC

staff continue to provide support to Hawke’s Bay Tourism in its

development of the Hawke’s Bay Visitor Strategy & Destination

Management Plan.

Decision

Making Process

37. Council

and its committees are required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

38.1 The

decision does not significantly alter the service provision or affect a

strategic asset.

38.2 The

use of the special consultative procedure is not prescribed by legislation.

38.3 The

decision does not fall within the definition of Council’s policy on

significance.

38.4 The

decision is not inconsistent with an existing policy or plan.

|

Recommendation

1. That the Corporate and Strategic Committee

receives and notes the “HB Tourism Funding Review” staff

report.

2. The Corporate and Strategic Committee

recommends that Hawke’s Bay Regional Council:

2.1 Adopts

the Key Performance Indicators proposed, subject to the Hawke’s Bay

Tourism Board of Directors ratifying them, and incorporating any amendments

agreed by the Committee today.

|

Authored by:

|

Mandy Sharpe

Project Manager

|

Trudy

Kilkolly

Principal Accountant Rates and Revenue

|

Approved by:

|

Tom Skerman

Group Manager Strategic Planning

|

|

Attachment/s

|

⇩1

|

Hawke's Bay

Tourism Quarterly Report April - June 2019

|

|

|

|

⇩2

|

Tourism

Industry Aotearoa Submission

|

|

|

|

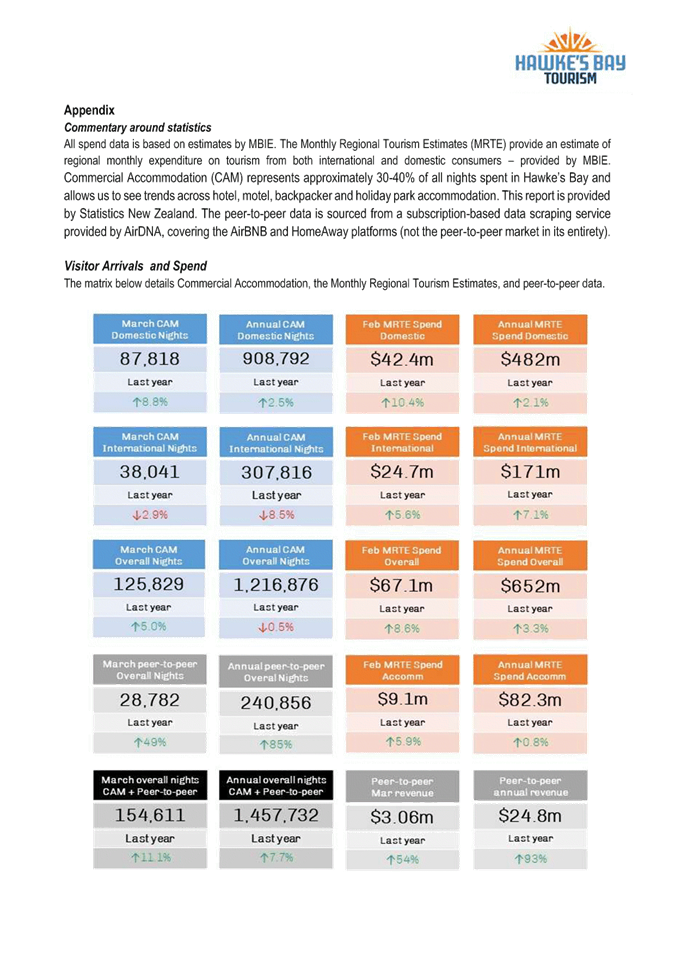

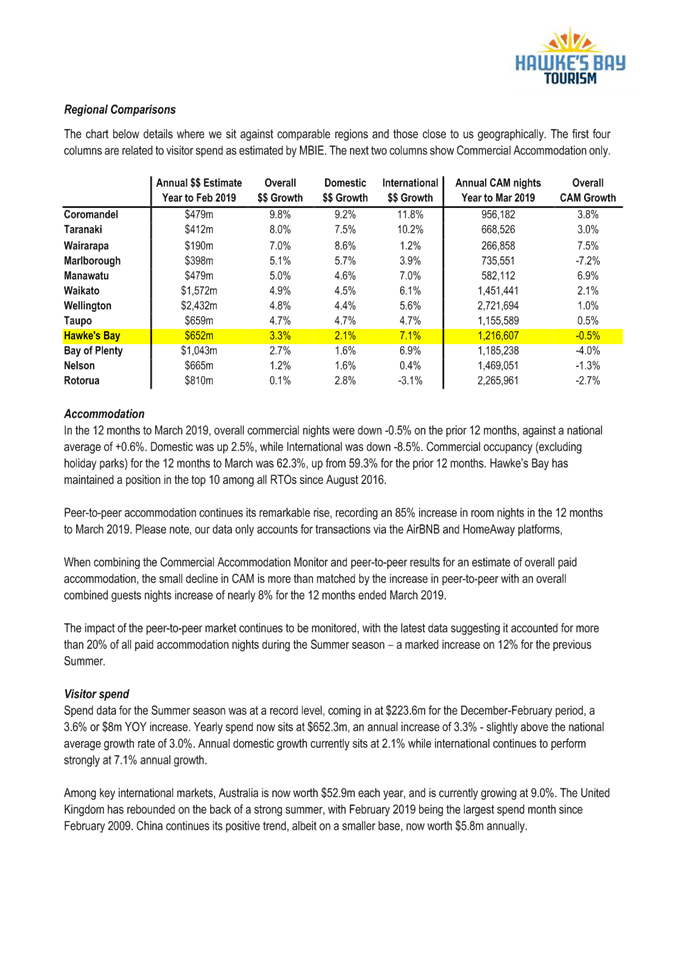

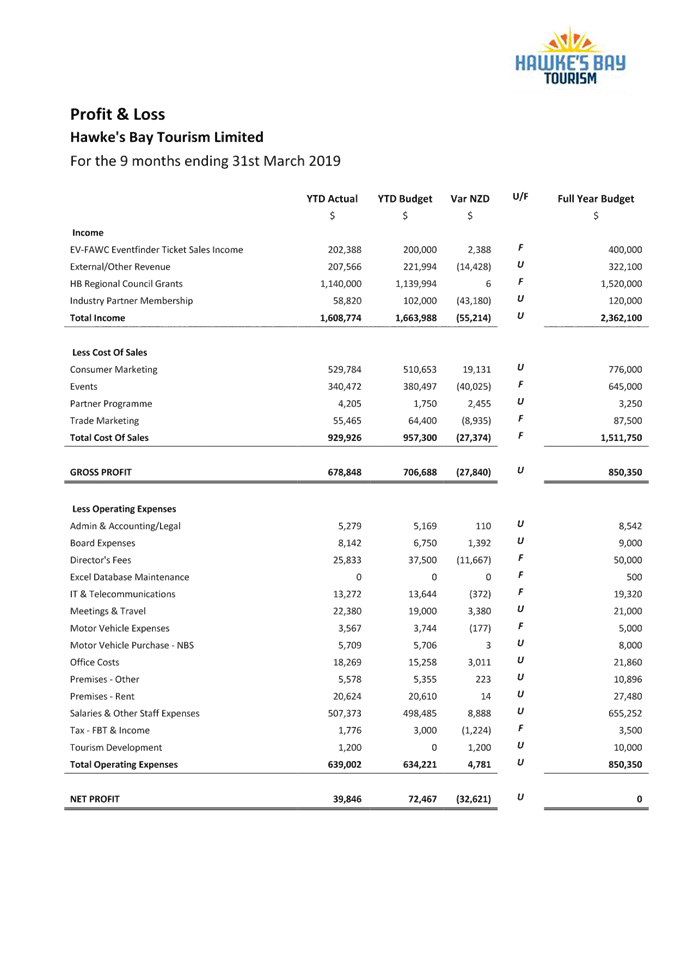

Hawke's

Bay Tourism Quarterly Report April - June 2019

|

Attachment 1

|

|

Tourism Industry Aotearoa

Submission

|

Attachment 2

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 05 June 2019

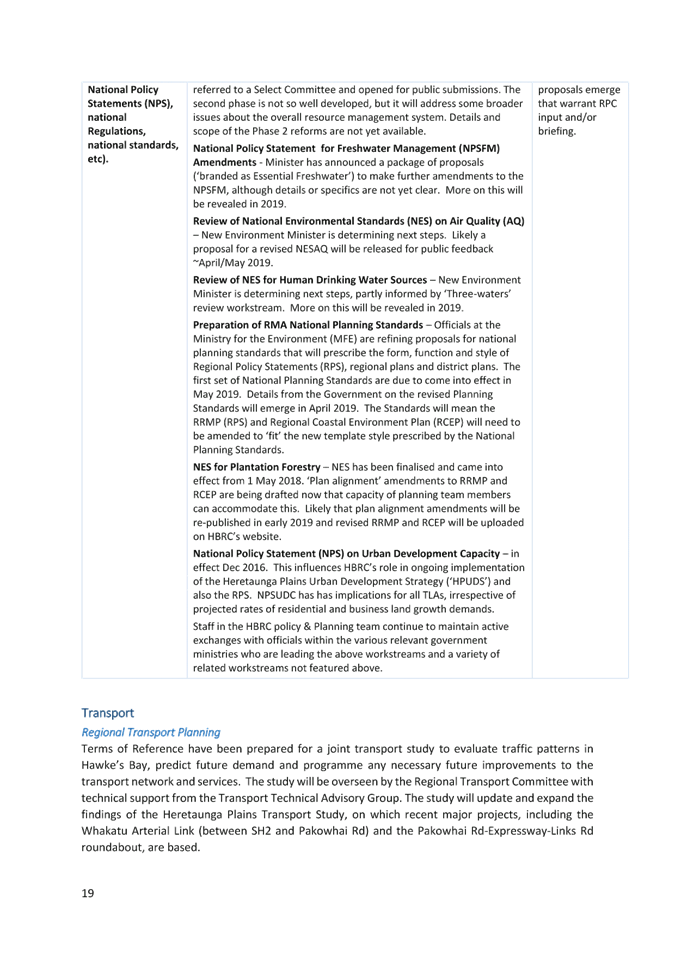

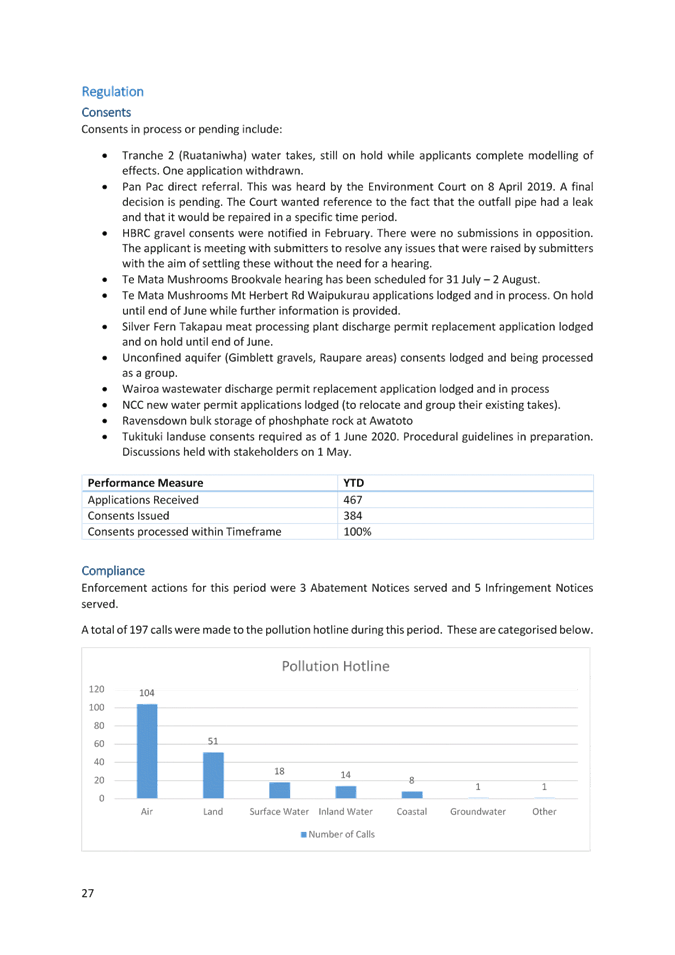

Subject: Organisational

Performance Report for Period 1 February to 30 April 2019

Reason for Report

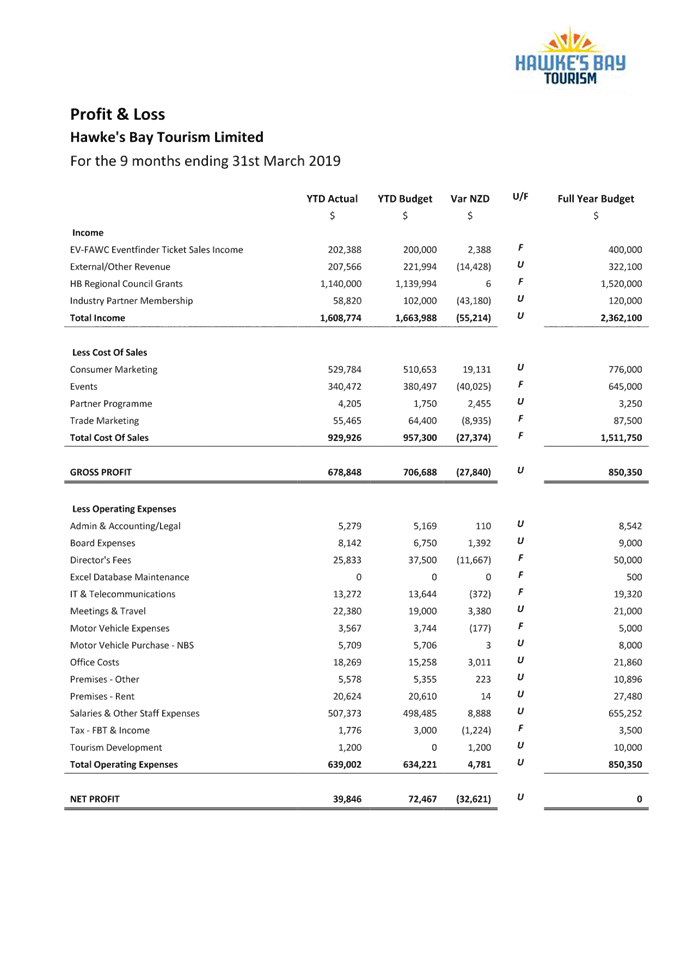

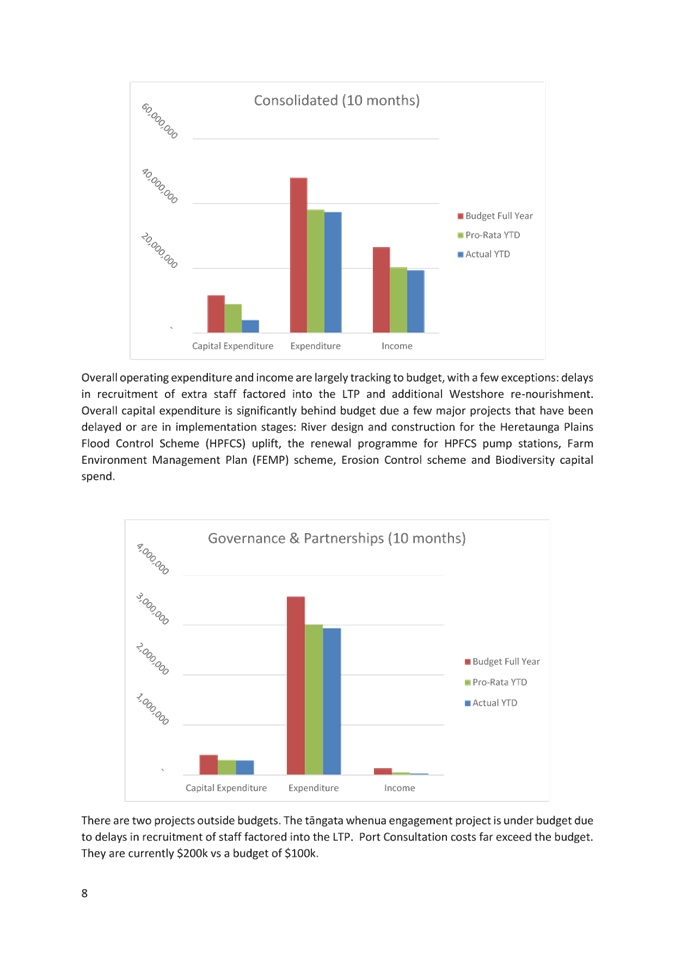

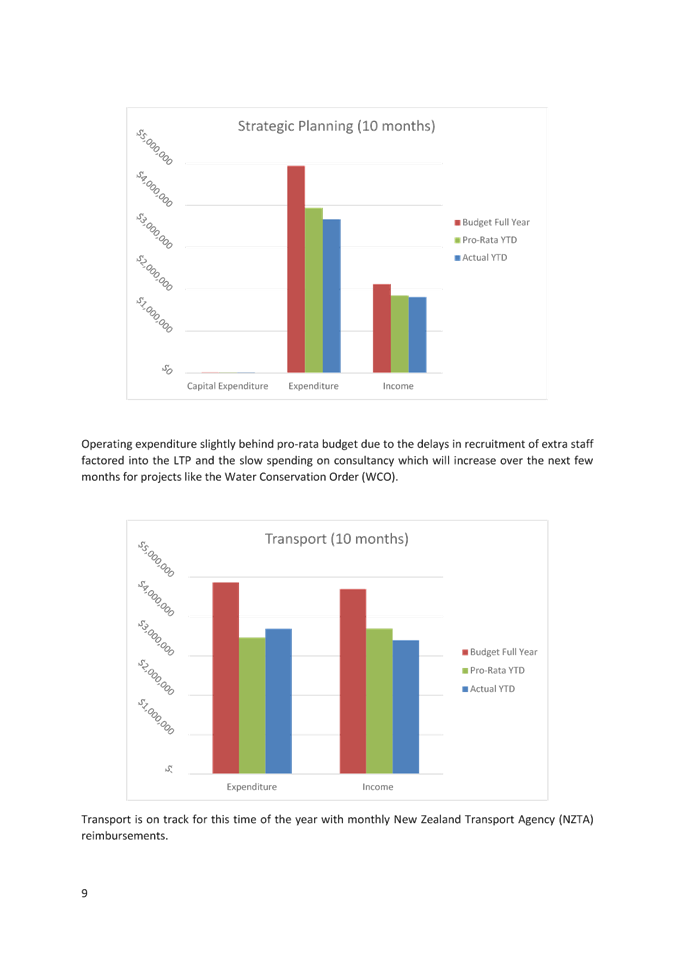

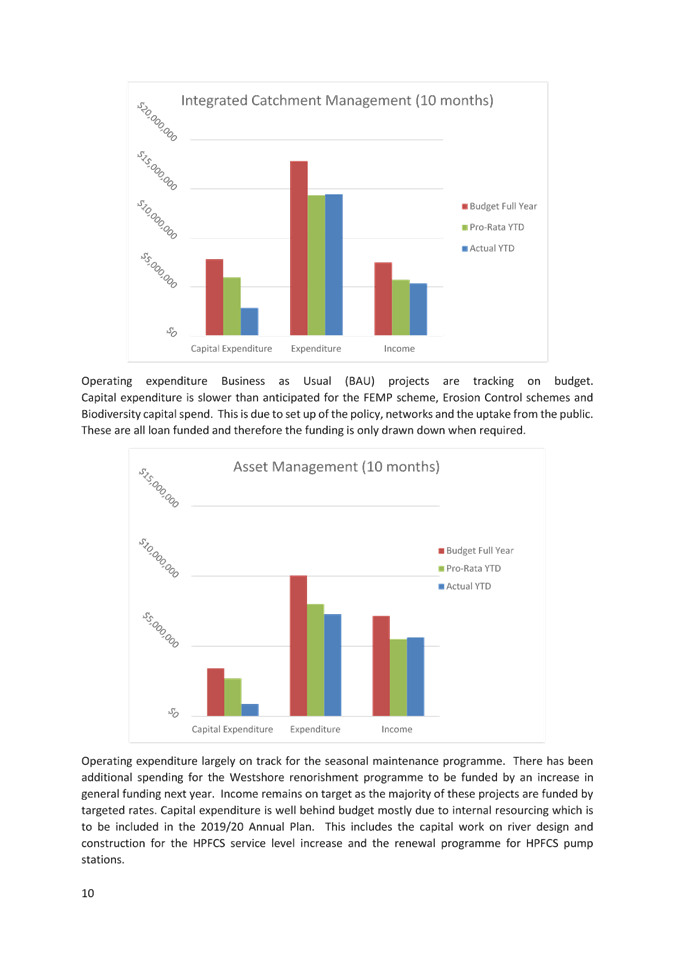

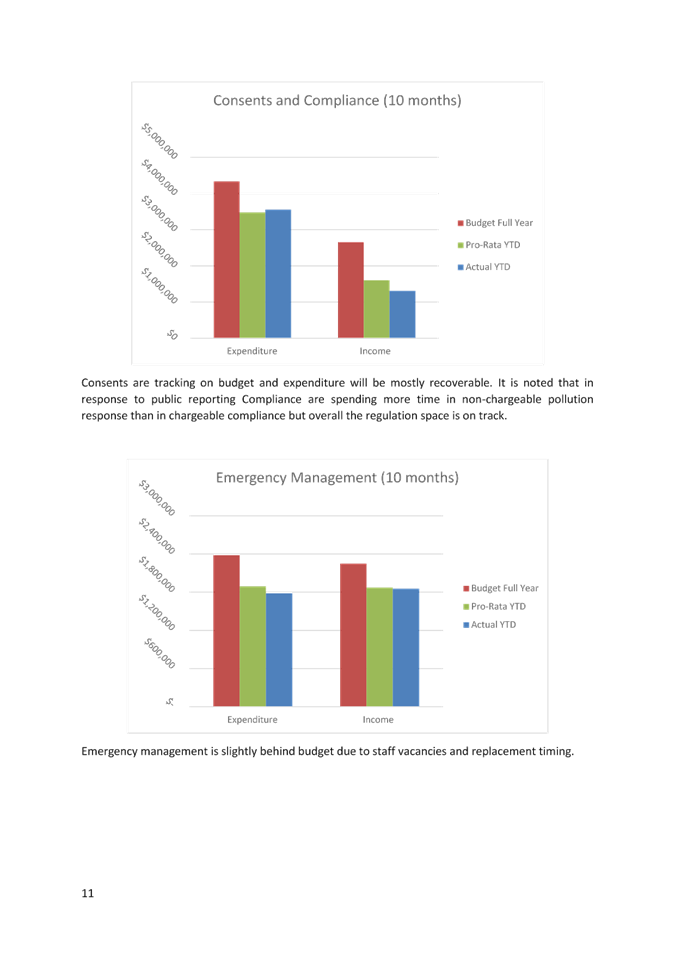

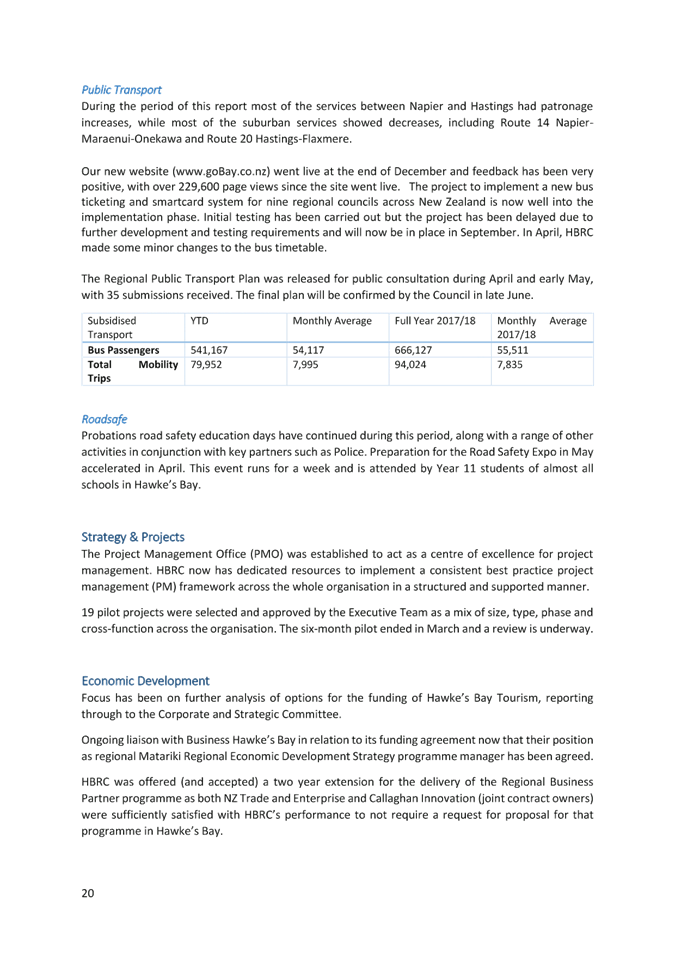

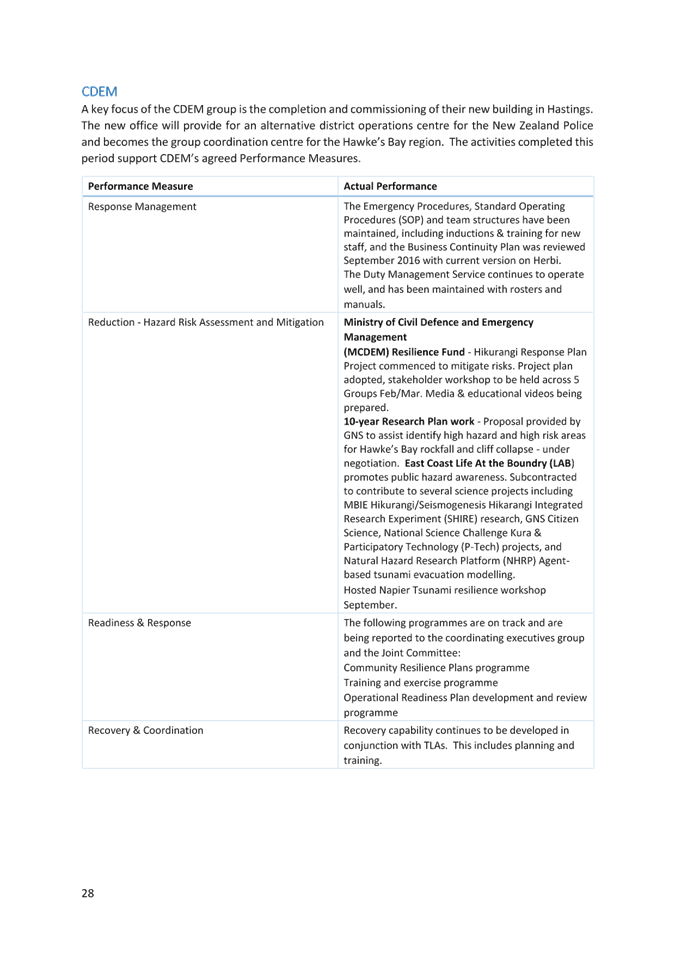

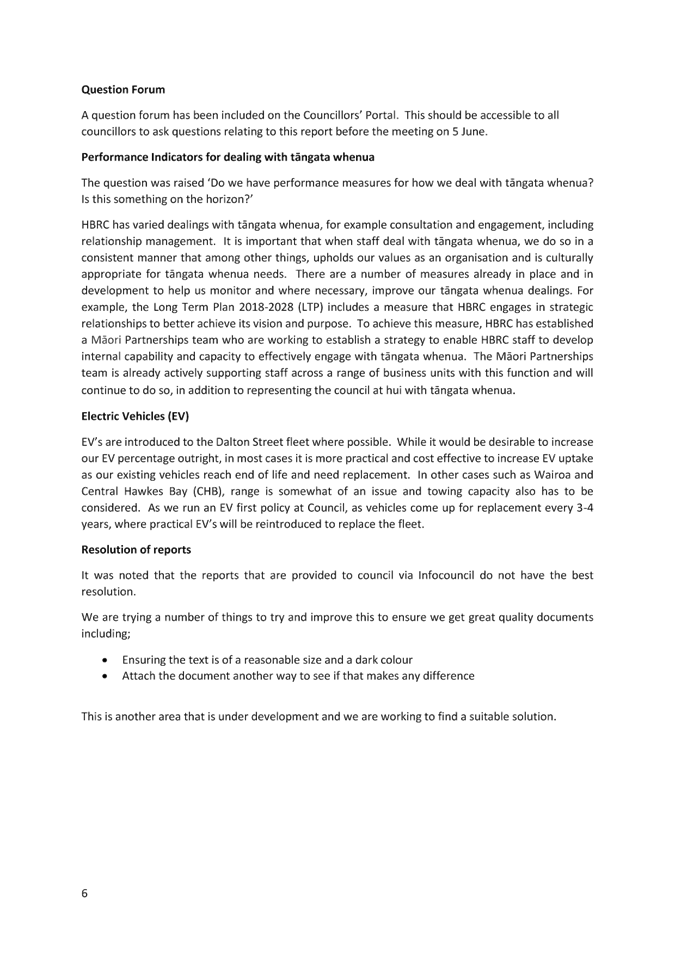

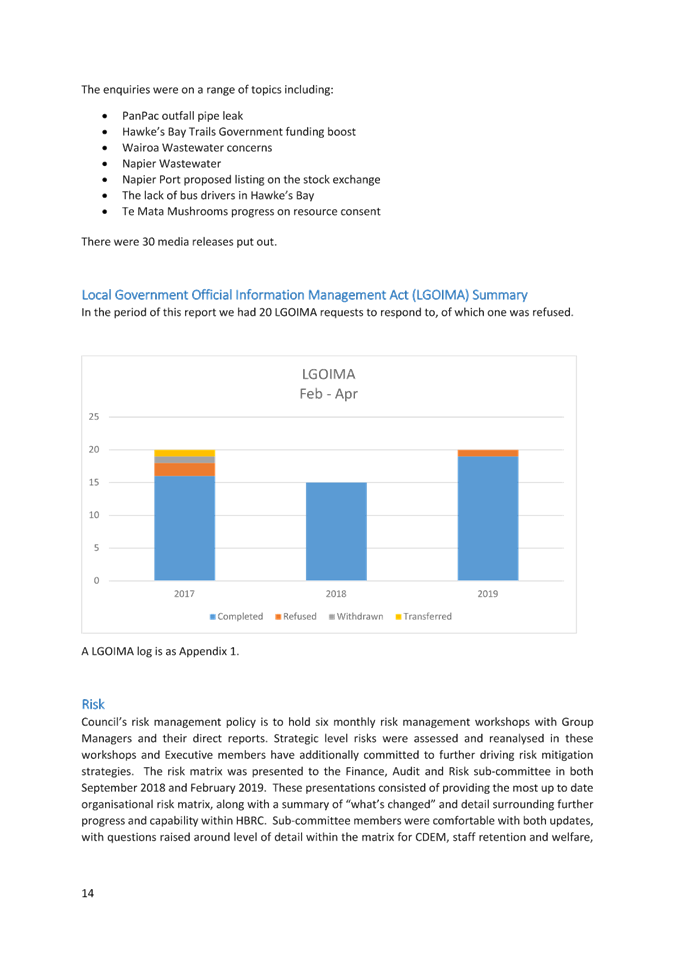

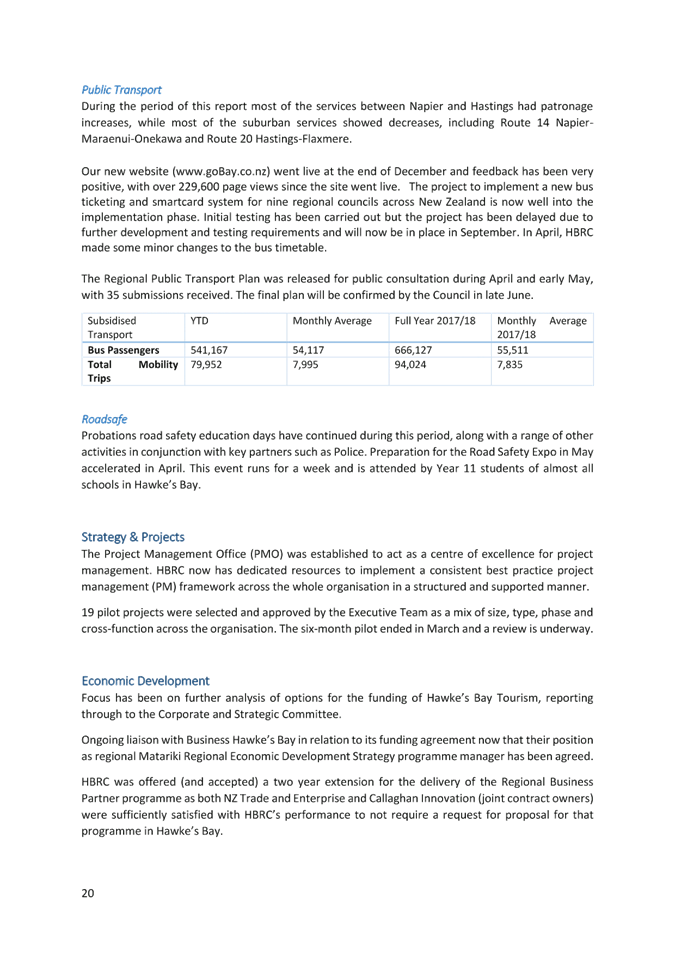

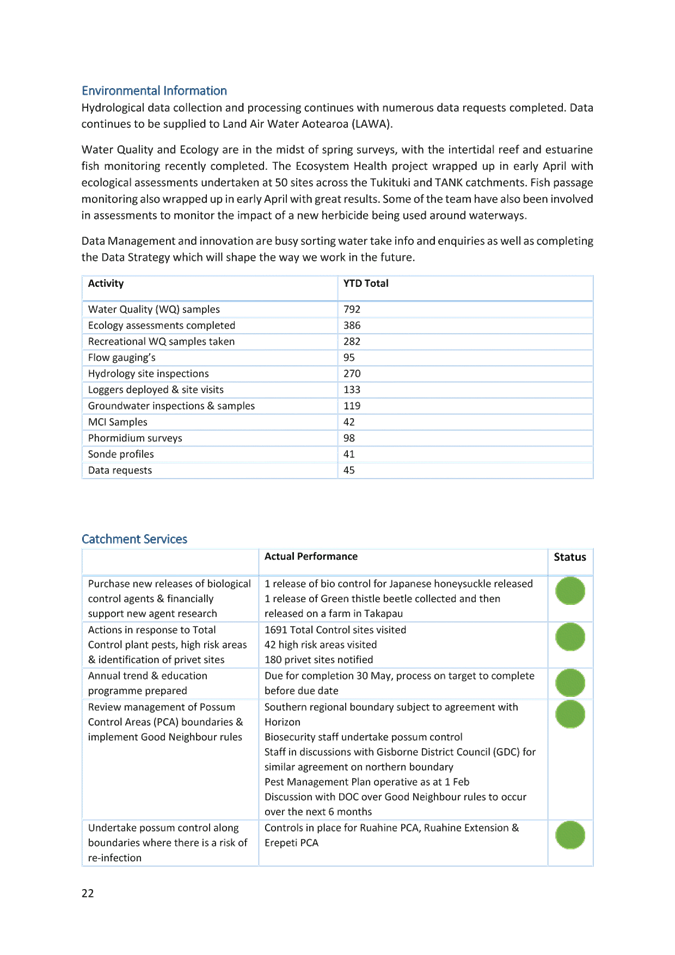

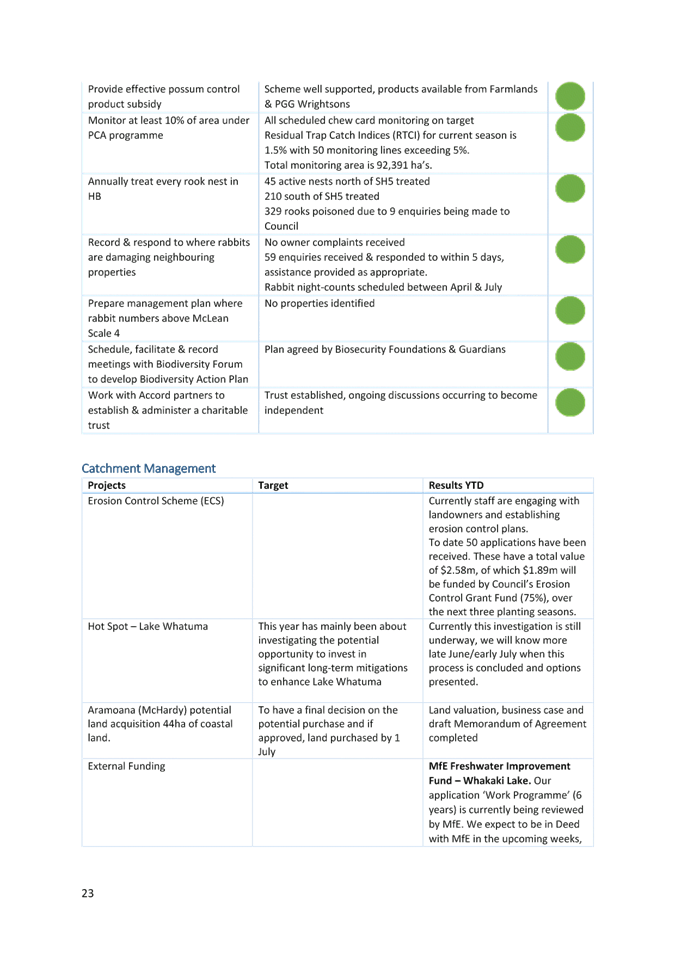

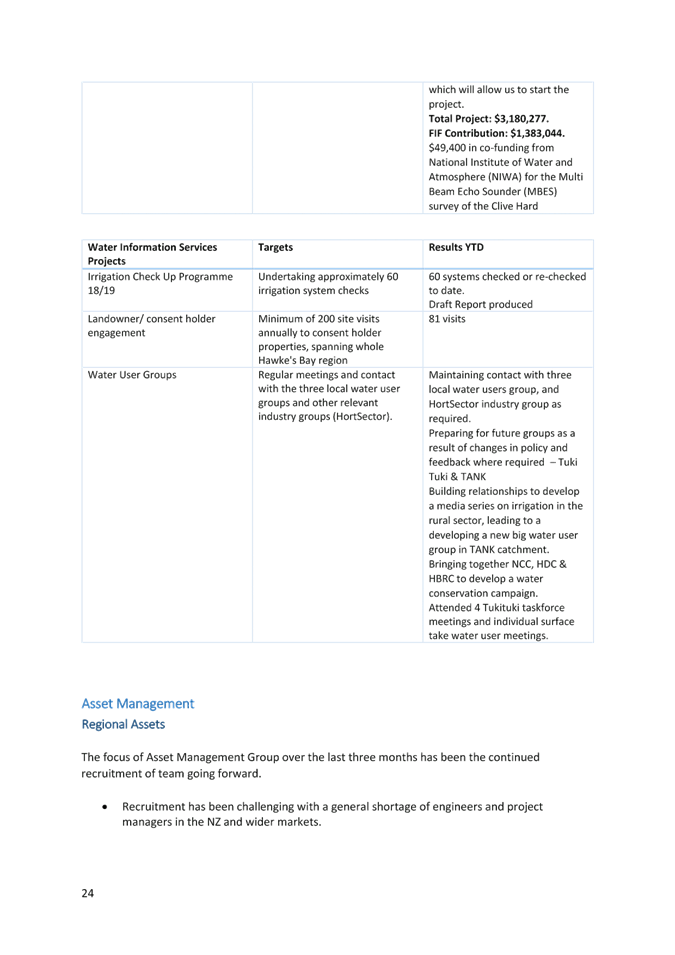

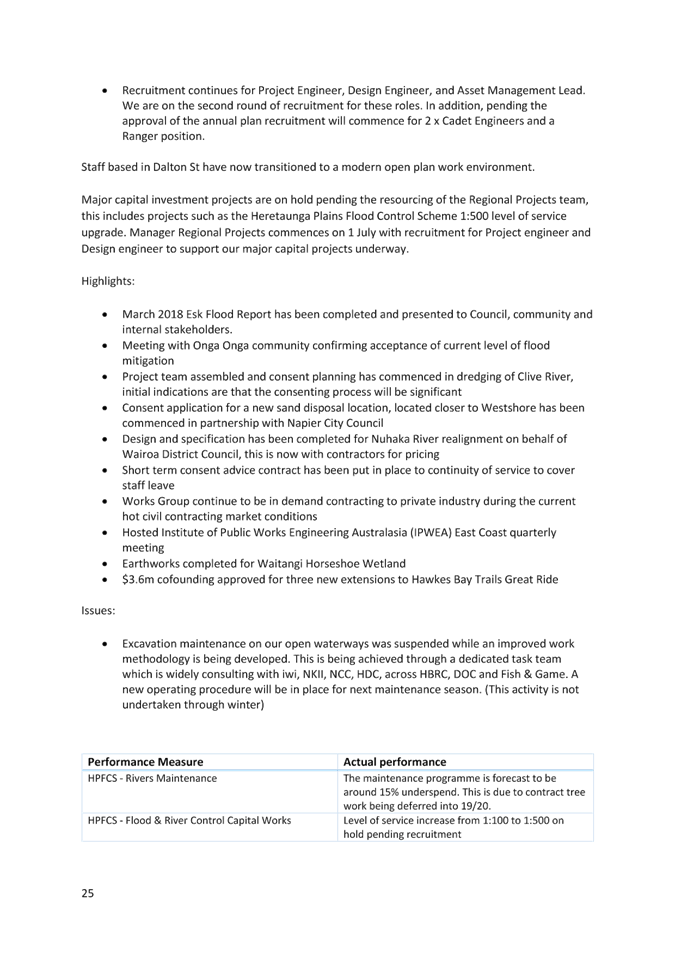

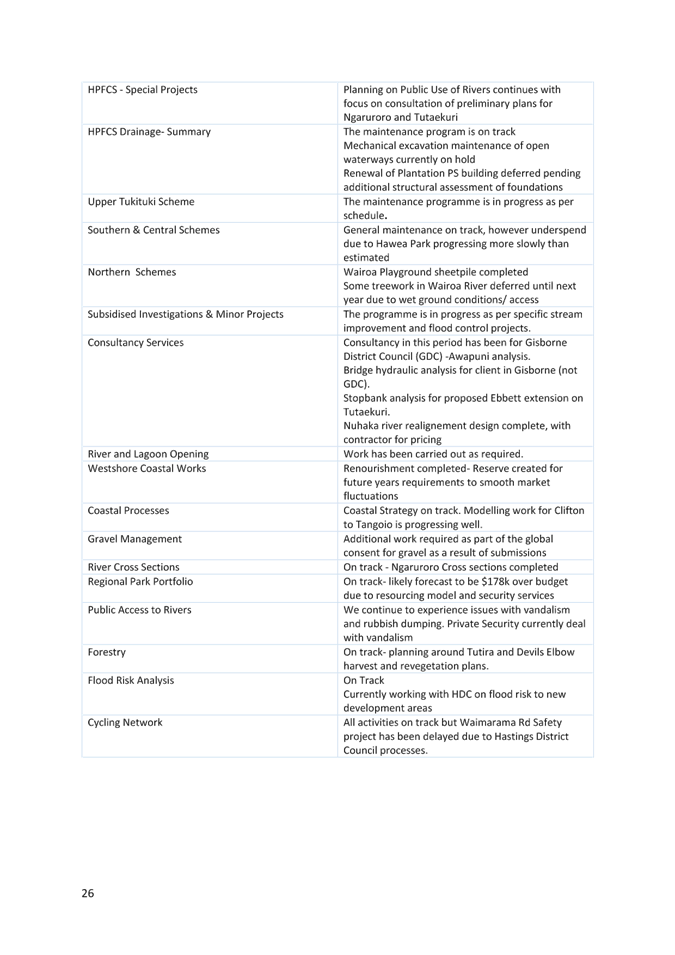

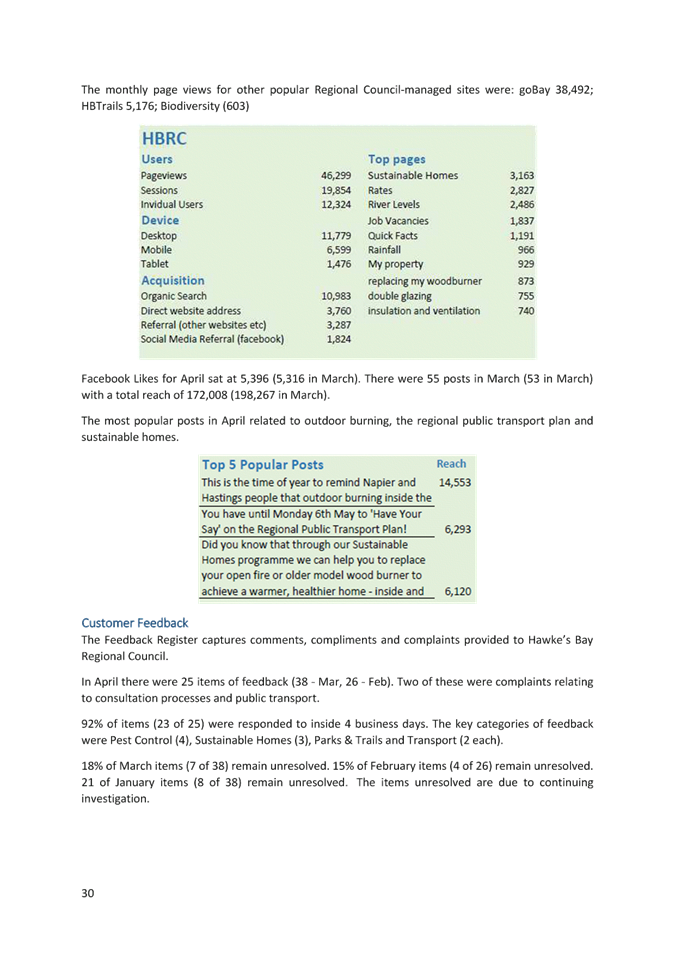

1. This report provides an update on operational activities and

performance (financial and non-financial) for the period 1 February -

30 April 2019.

Background

2. This is the

second organisational performance report since the creation of the

Organisational Performance team. Monthly reports are provided to the Executive

Leadership Team.

3. Feedback

arising from the first report has been addressed below with further information

in the body of the report. In addition there are a wider range of business

activities now covered by the organisational performance report.

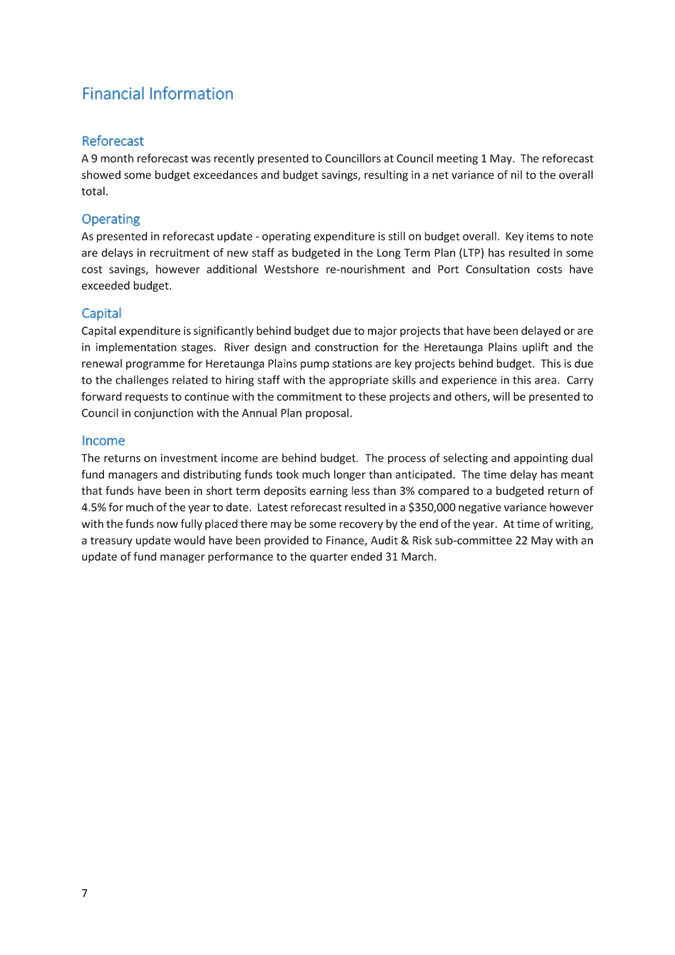

Feedback from 6 March 2019 Corporate and

Strategic Committee Meeting

4. Underperforming

areas – this has been included in this report and the performance team is

working across the business to ensure this information is captured more

significantly in future reports. It is expected that the maturity and

sophistication of analysis will strengthen once the new Principal Advisor

Organisational Performance is on board.

5. Question forum

– this has been created in the Councillors’ Portal and is

accessible to all councillors to ask questions regarding this report ahead of

the meeting. Instructions for participating will be emailed to councillors with

the advice that the Agenda is available on the Portal.

6. Quality of

document resolution – a number of solutions are being trialled to help

improve the resolution quality of reports in the agendas.

7. Performance

indicators for dealing with tāngata whenua – There are a number of

measures already in place and in development to help us monitor and, where

necessary, improve our tāngata whenua engagement. For example, the Long

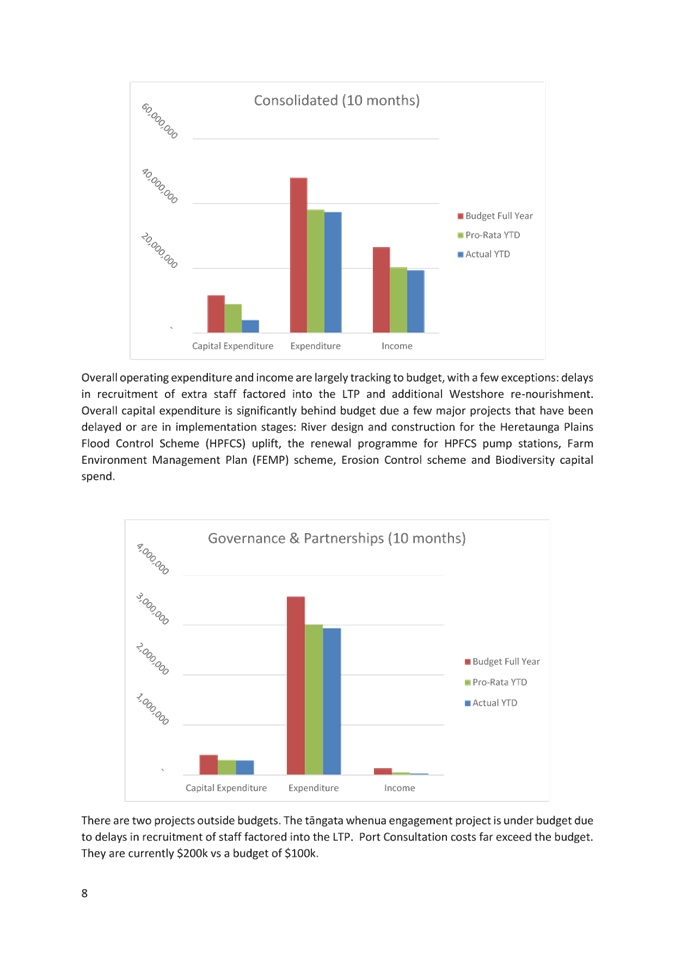

Term Plan 2018-28 includes a measure that HBRC engages in strategic relationships

to better achieve its vision and purpose.

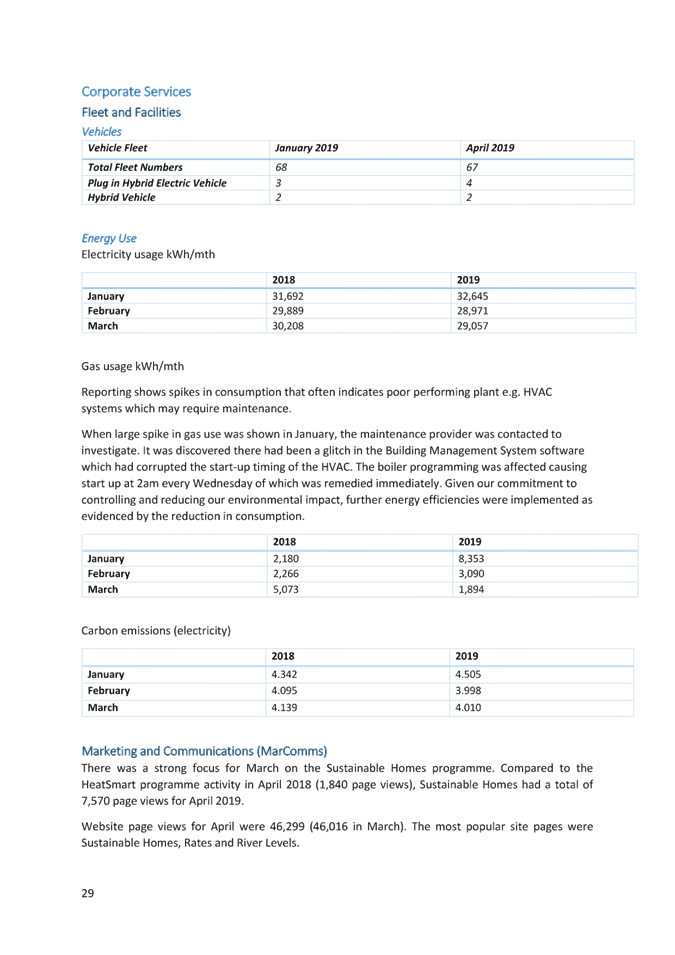

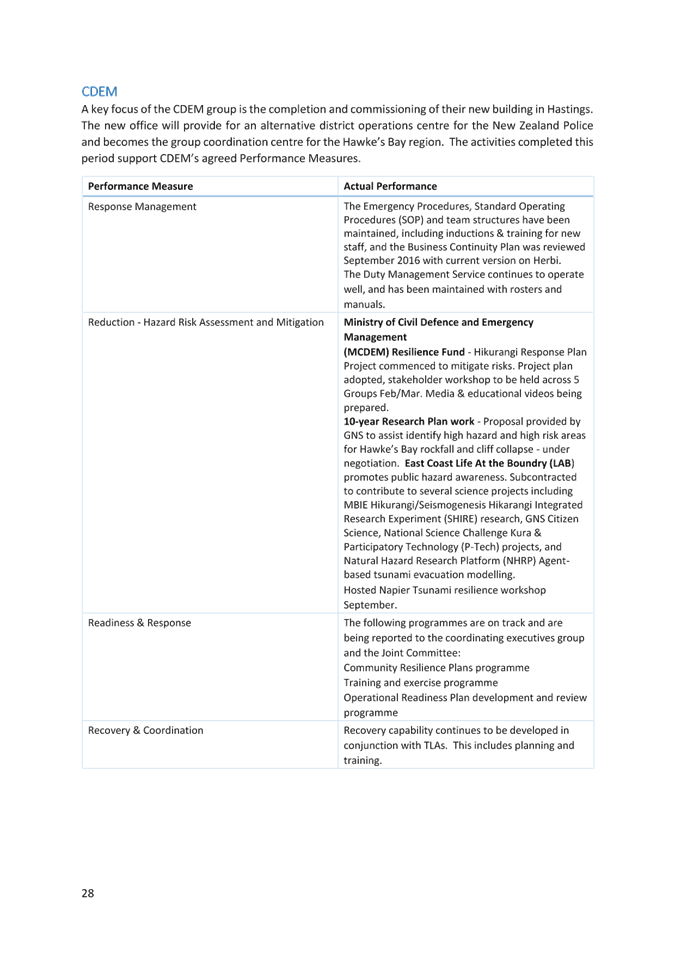

8. Electric

vehicles – Electric vehicles are introduced to the Dalton Street fleet

where possible. While it would be desirable to increase our electric vehicle

percentage outright, in most cases it is more practical and cost effective to

increase electric vehicle uptake as our existing vehicles reach end of life and

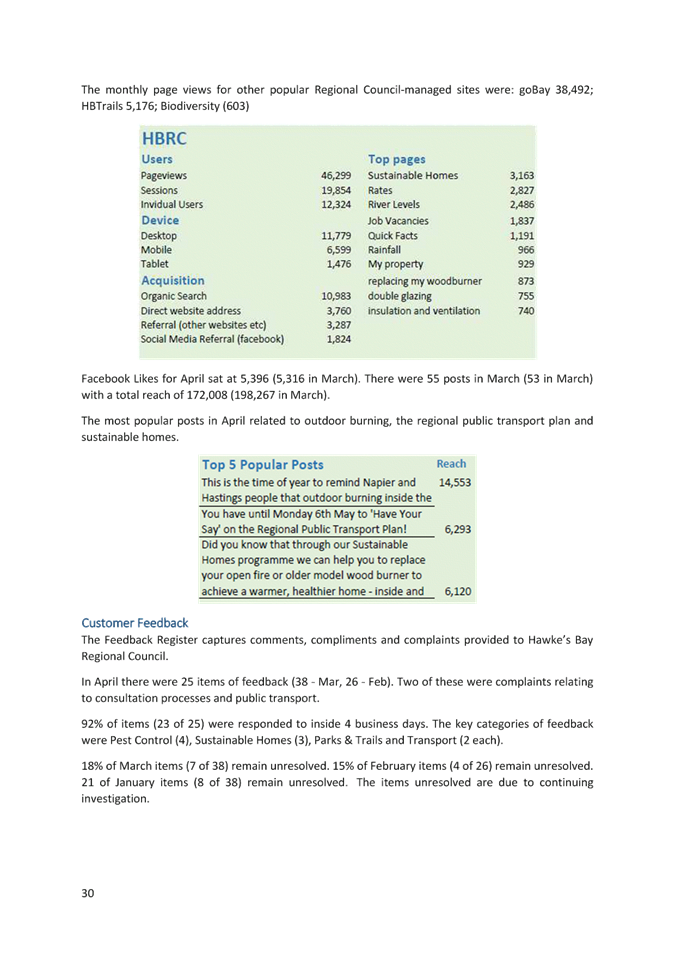

need replacement.

Decision Making Process

9. Staff have

assessed the requirements of the Local Government Act 2002 in relation to this

item and have concluded that, as this report is for information only, the

decision making provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee receives and notes the “Organisational Performance Report for Period 1 February

to 30 April 2019”.

|

Authored by:

|

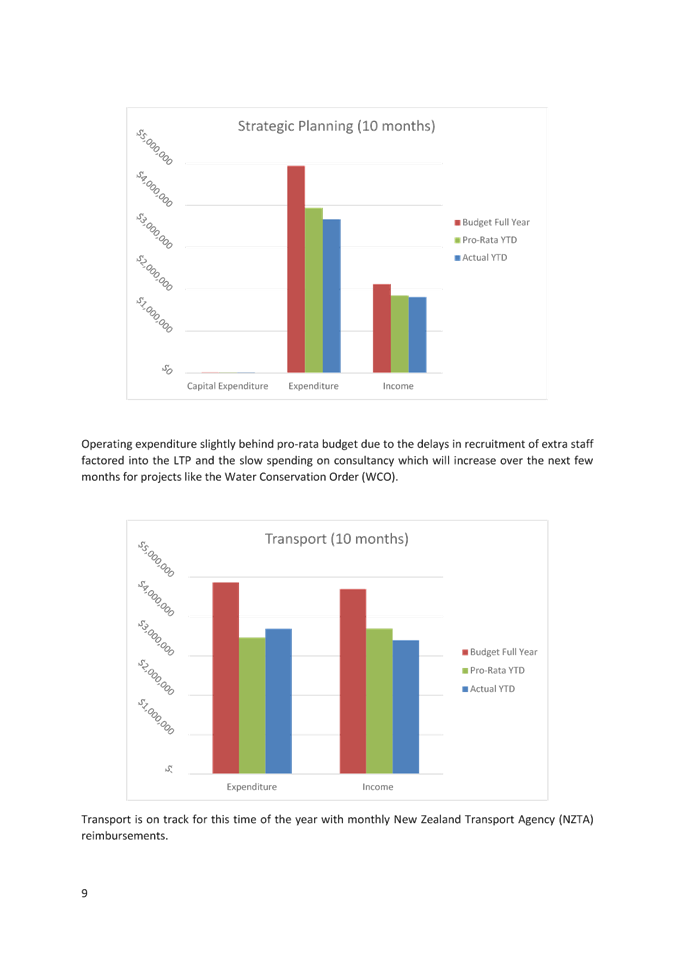

Kelly Burkett

Business Analyst

|

Melissa des

Landes

Acting Chief Financial Officer

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

Joanne

Lawrence

Group Manager Office of the Chief Executive

and Chair

|

|

James Palmer

Chief Executive

|

|

Attachment/s

|

⇩1

|

30 April 2019

HBRC Organisational Report

|

|

|

|

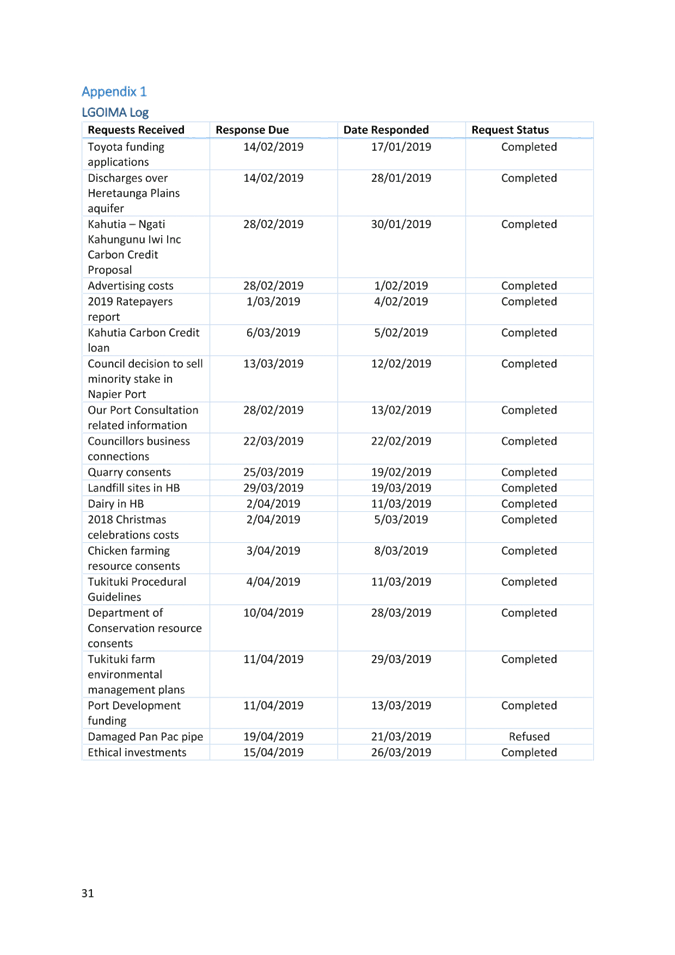

30

April 2019 HBRC Organisational Report

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 05 June 2019

Subject: Strategic Plan

Implementation

Reason

for Report

1. This information paper updates the Committee on progress with the

implementation of Council’s 2017-21 Strategic Plan.

2. This paper also satisfies a new level of service measure in the 2018-28

Long Term Plan for “Annual reporting to Council on the development and/or

implementation of the Strategic Plan to maintain its currency and

relevance”.

Background

3. Hawke’s Bay Regional Council adopted a new 5-year Strategic

Plan in August 2017. It embodies the ambition and aspirations of the new

Council and our new Chief Executive and signalled a significant change in

direction for the organisation. Major differences between the new Strategic

Plan and the old one adopted in 2011 include:

3.1. Our Mission Statement

3.2. Our Purpose

3.3. Our Focus areas

3.4. Strategic Goals for each of the four focus areas.

4. The new mission reinforces HBRC’s core role in environmental

management and deliberately takes a more proactive, forward looking and

aspirational approach. These along with “working together”

are common themes throughout the Strategic Plan. The new purpose

statement signals a greater focus on managing for outcomes (versus a functional

approach) and puts the environment at the centre of everything we do.

5. The introduction of goals with targets for each of the four focus

areas further demonstrates a desire to shift from managing and reporting on

activity to reporting quantifiable outcomes. The intention was for

council to be less granular on activity and more flexible on delivery.

Implementation to date

6. In response to the strategic direction set in the Strategic Plan the

Council has:

6.1. Accelerated and scaled-up activity through the 2018-28 Long Term

Plan via

6.1.1. more staff

including a greater presence in Wairoa and CHB

6.1.2. increased

operating and capital expenditure

6.1.3. increased

incentives and regulation to influence behavior change

6.1.4. increased

debt funding for long term projects with intergenerational benefits

6.1.5. leveraged

all funding sources (fees and charges, investment income, external grant

funding, debt and rates) to fund its new strategic agenda

6.2. Re-organised to better align the organisation to deliver on

strategic outcomes, and

6.3. Referenced the four focus areas and values from the Strategic Plan

in the new Personal Performance and Development Charters and required

all staff to say how their work contributes.

Further implementation

planned

7. Work is underway to monitor and report on the 23 long-term goals in

the Strategic Plan. This will involve defining in detail how the goals

will be measured (what, where, how and when), determining a baseline for each

and setting short to medium term targets to enable us to track progress.

This will tell us if our strategic goals are being achieved.

8. Parallel work is underway to quantify and map our approximately 126

existing budget (or workstream) codes directly to our 60 Level of Service

Measures (LOSM’s) and, ultimately, the twenty three 2017-21 Strategic

Plan goals. This will enable us to better assess over time if what we are

doing (council’s interventions or workstreams and projects) is

contributing to the achievement of our strategic goals. Noting that the

council does not not have full control over whether these outcomes are

achieved, but has a clear statutory role in achieving them, along with others.

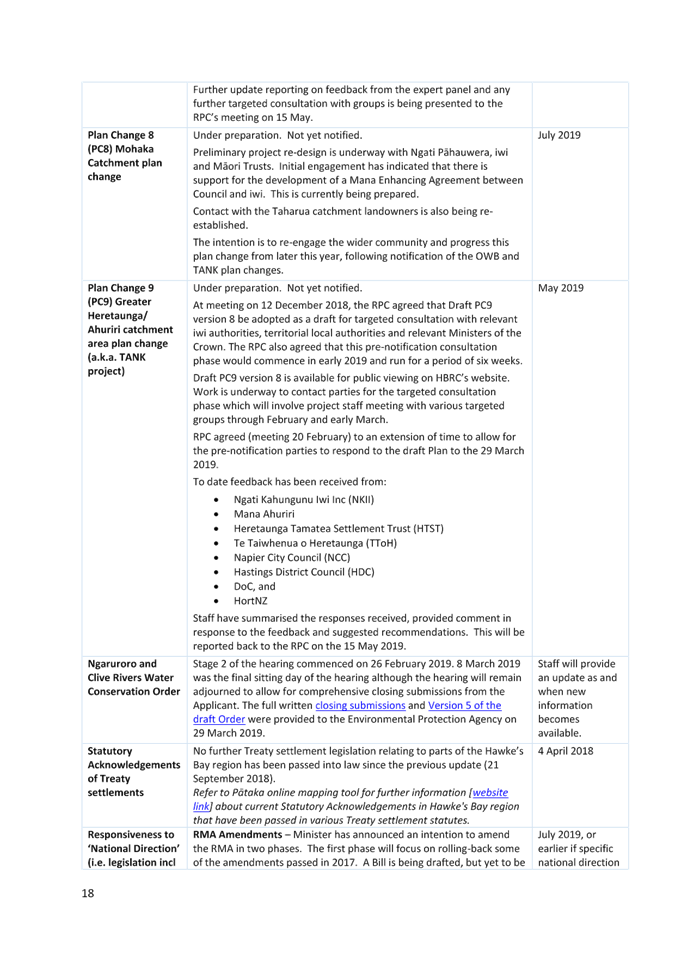

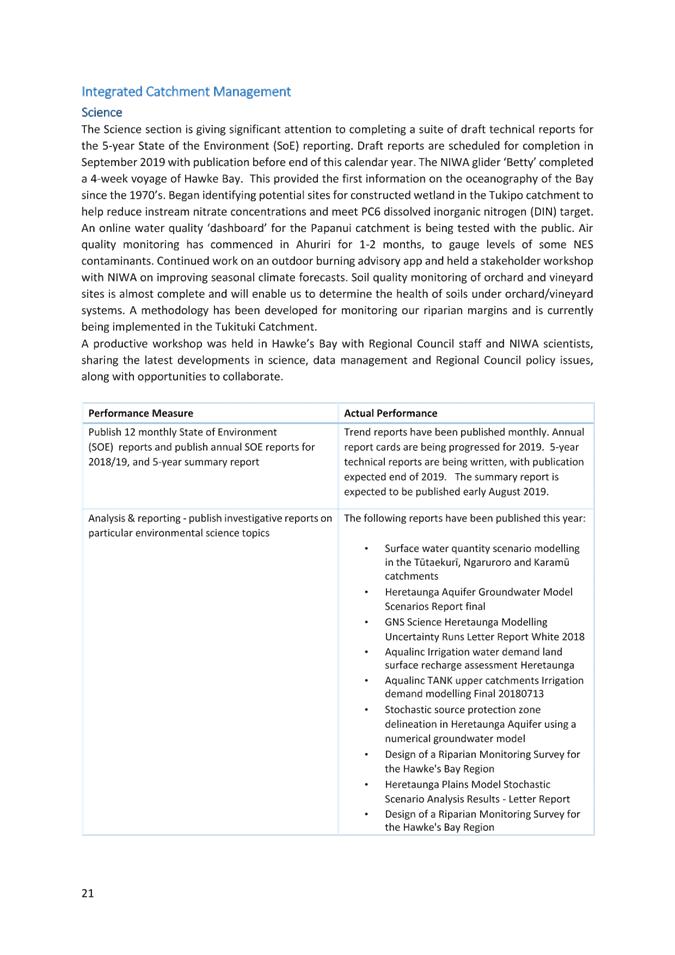

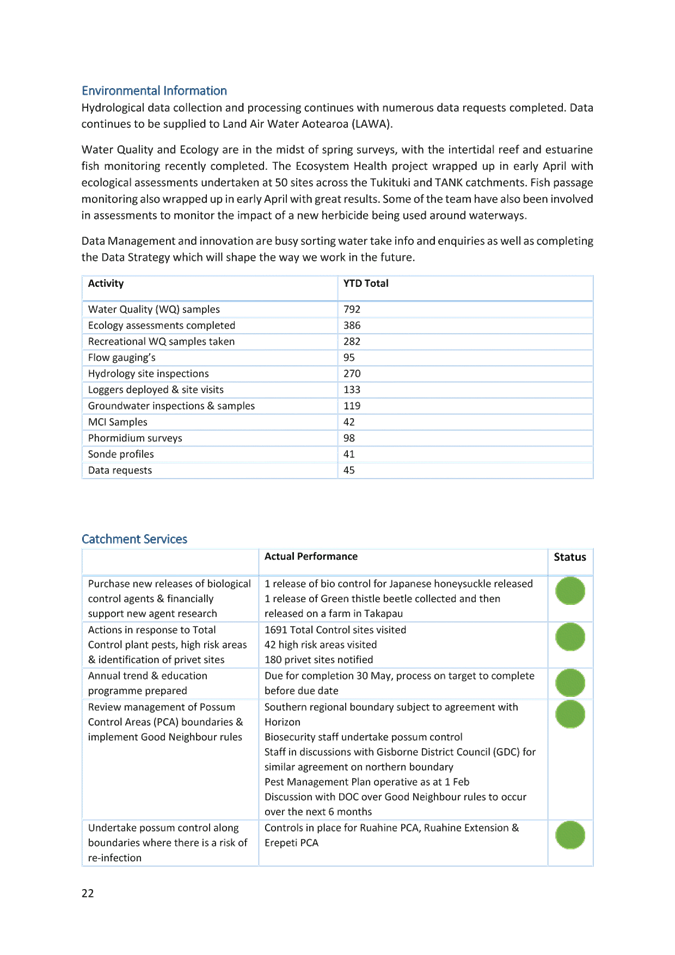

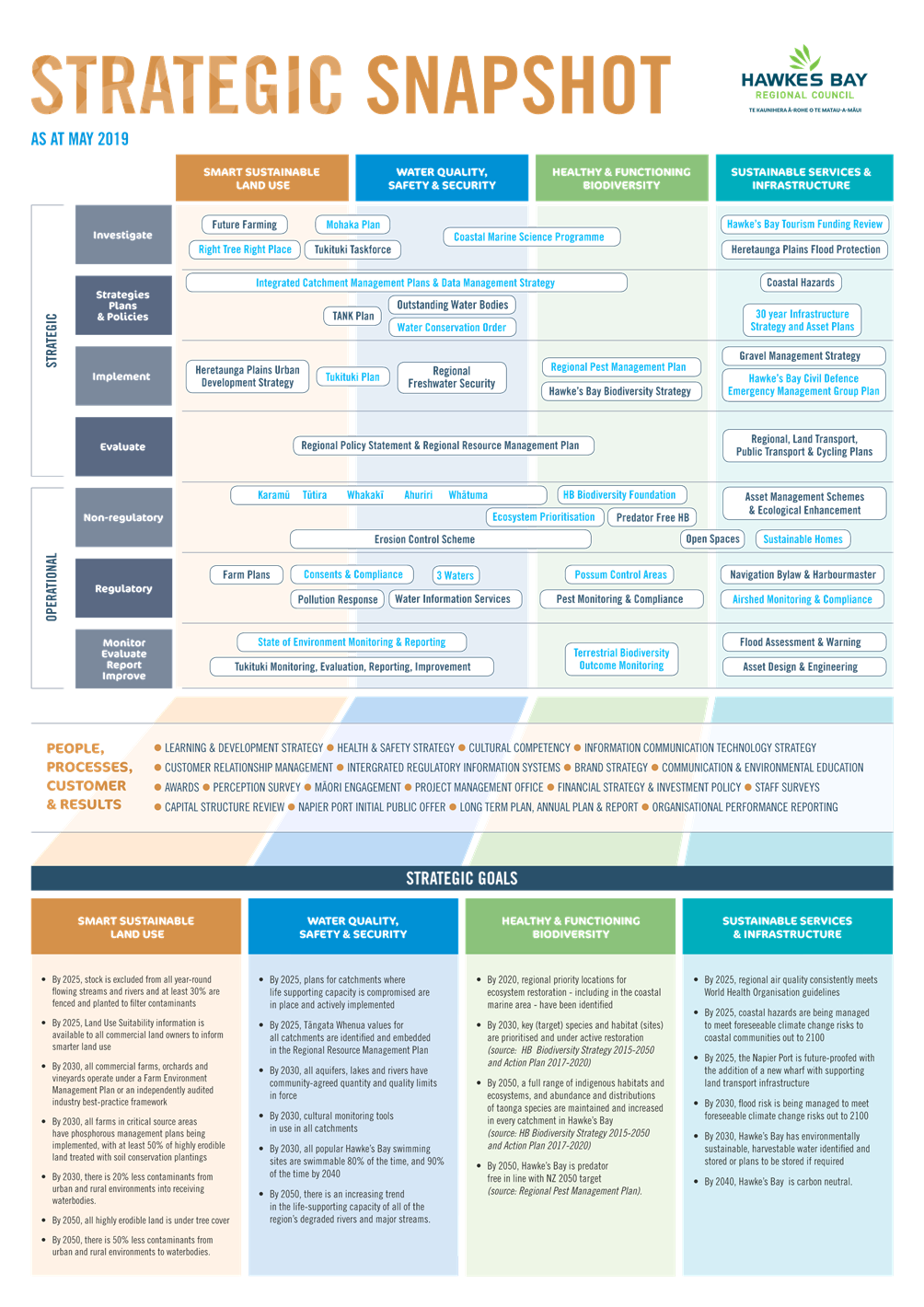

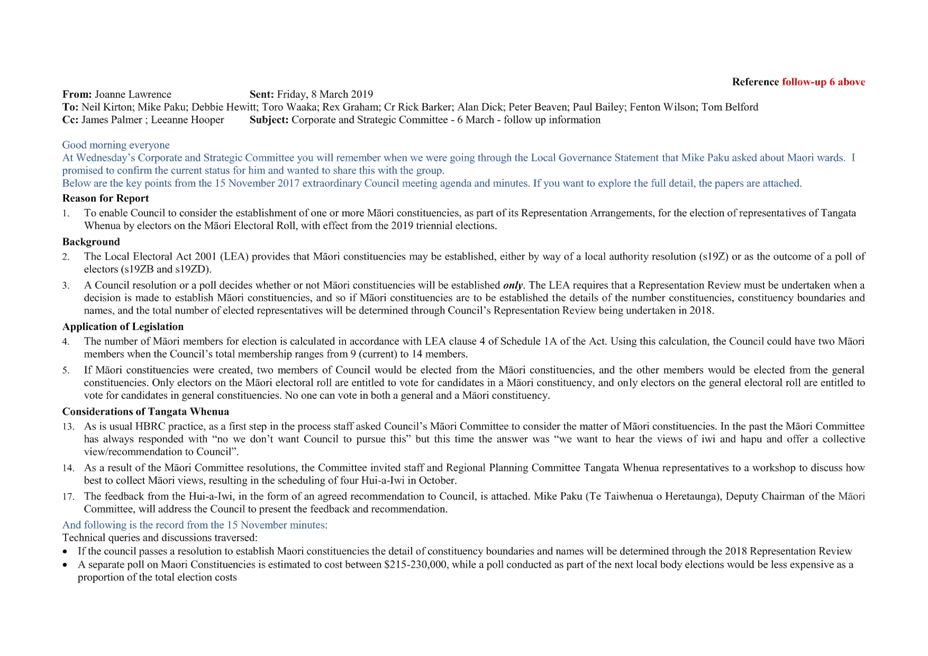

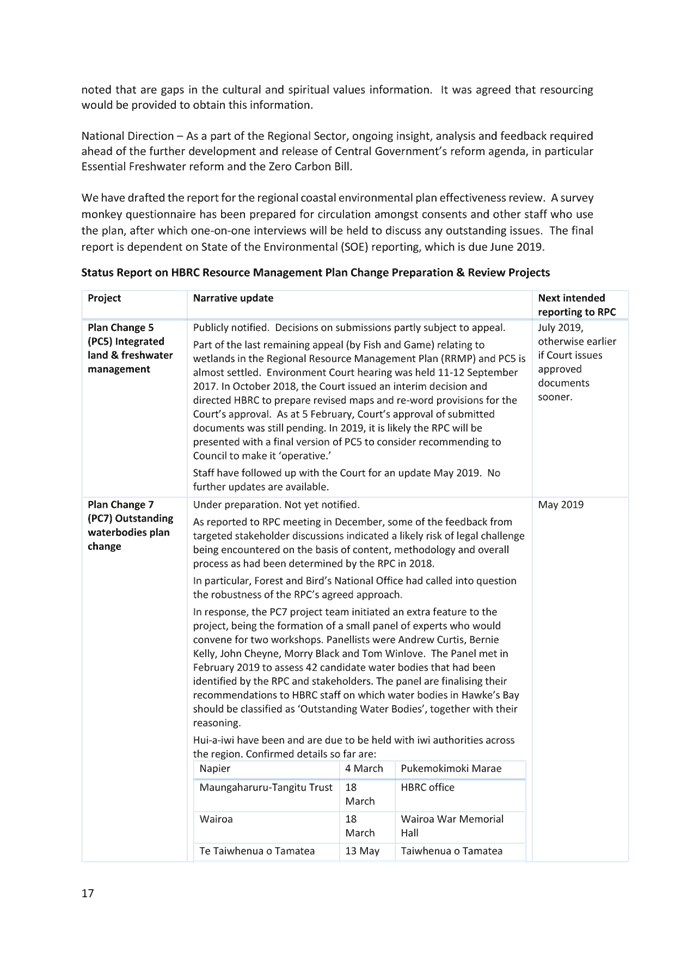

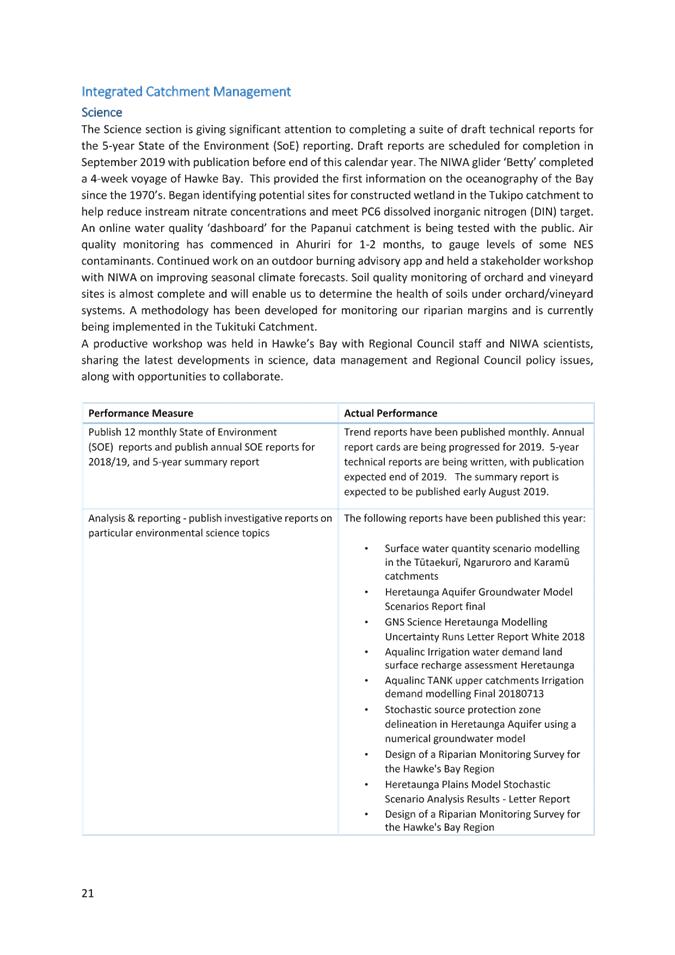

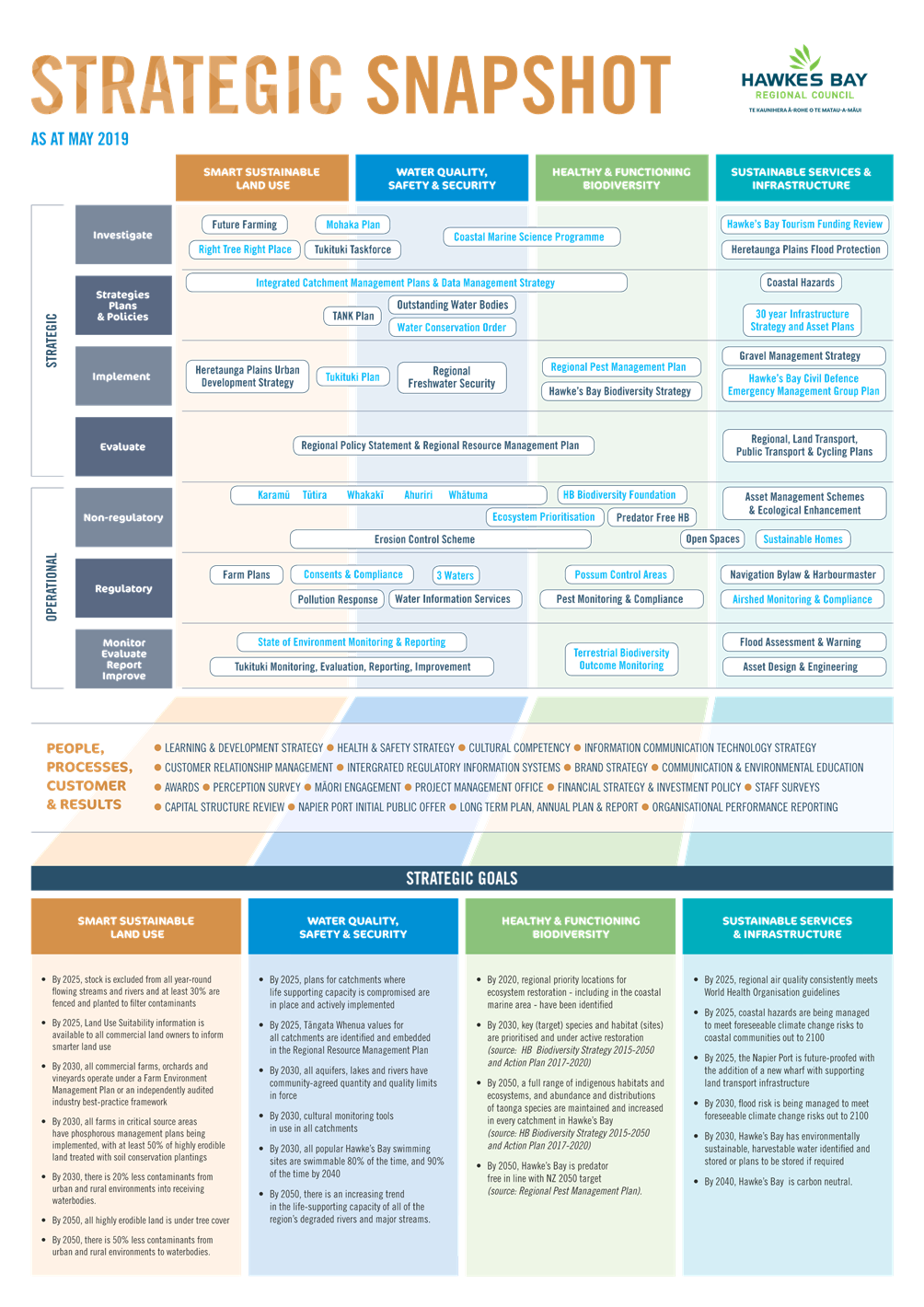

Strategic Snapshot

9. In the interim, the attached Strategy Snapshot has been produced to

give an holistic view of council “activity” at a point in time

(i.e. May 2019). The four colored columns represent the four focus areas

from the 2017-2021 Strategic Plan.

10. The Y

axis uses the policy cycle as an indicator of time for strategic work (i.e.

where in the cycle is a plan, strategy or policy) and the method (e.g.

non/regulatory) to display operational work. Across the bottom are a

range of initiatives that underpin all four focus areas categorized

“People, Processes, Customer and Results”.

11. Together

these constitute the programme of work for council at this point in time. It

attempts to be exhaustive (i.e. cover everything we do) with the caveat that it

focuses on big outputs or services (e.g. plan changes vs stat advocacy).

12. It is

designed to demonstrate how all the pieces contribute to achieving the 23 strategic

goals from the Strategic Plan (listed at the bottom of the page) and to aid in

a discussion about resourcing and future pressure points for the organisation.

13. The Chief

Executive will take Councillors through the snapshot as part of this meeting.

Decision

Making Process

14. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision making

provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee

receives and notes the “Strategic Plan Implementation”

staff report.

|

Authored by:

|

Desiree Cull

Strategy and Projects Leader

|

|

Approved by:

|

Joanne

Lawrence

Group Manager Office of the Chief Executive

and Chair

|

Tom Skerman

Group Manager Strategic Planning

|

Attachment/s

|

Strategic

Snapshot

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 05 June 2019

Subject: Business HB Update

Reason for Report

1. Business Hawke’s Bay will update the Committee on its recent

activities and work programme ahead.

Background

2. Hawke’s Bay Regional Council has provided financial support

for Business Hawke’s Bay (BHB) since 2013. BHB also receives

funding from Territorial Authorities and the private sector and is governed by

a board of local business leaders – see https://www.businesshb.nz/ for a

comprehensive summary of BHB’s services and activities.

3. To date, HBRC’s support for funding has been predicated on

providing BHB with the resources to champion and support all-of-region economic

development activity. This contrasts with, for example, territorial

authority support which can logically focus on localized outcomes. HBRC

funding KPI’s were linked to BHB’s management of the then 2013

Regional Economic Development Strategy.

4. Following the development of the 2016 Matariki Regional Economic

Development Strategy, BHB has continued to focus on its core activities of

Business Attraction, Business Enabling and Business Growth in anticipation of a

final decision on Matariki programme management by the Matariki Governance

Group.

5. During this interim period, BHB and HBRC have operated under a

funding extension agreement that allowed HBRC to terminate BHB’s funding

in the event that Matariki’s confirmed delivery model resulted in a

restructure of regional economic development activity that negatively impacted

BHB.

6. BHB has recently been confirmed as programme manager. Accordingly,

the regions local government CE’s and BHB are developing a single Service

Level Agreement that encapsulates all local government funding under a single

set of KPI’s for the period 1.7.18 to 20.6.21. At the time of

writing it is premature to provide this committee with draft terms for review,

but worthy of note are the following intentions:

6.1. Full quarterly P&L financial reporting.

6.2. Quarterly reporting against KPI’s

6.3. Service commitments in areas including Matariki programme

management, business diversity and sector development, inwards investment and

skills attraction, support for Great Things Grow Here economic development

brand platform and key project reporting.

7. BHB’s report is attached.

Decision

Making Process

8. Staff have

assessed the requirements of the Local Government Act 2002 in relation to this

item and have concluded that, as this report is for information only, the

decision making provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee

receives and notes the “Business HB Update” report.

|

Authored by:

|

Tom Skerman

Group Manager Strategic Planning

|

|

Approved by:

|

Tom Skerman

Group Manager Strategic Planning

|

|

Attachment/s

|

⇩1

|

Business

Hawke's Bay Annual Report to Councils June 2019

|

|

|

|

Business

Hawke's Bay Annual Report to Councils June 2019

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 05 June 2019

Subject: Discussion of Minor

Items Not on the Agenda

Reason for Report

1. This document has been prepared to assist

Committee Members to note the Minor Items of Business

Not on the Agenda to be discussed as determined

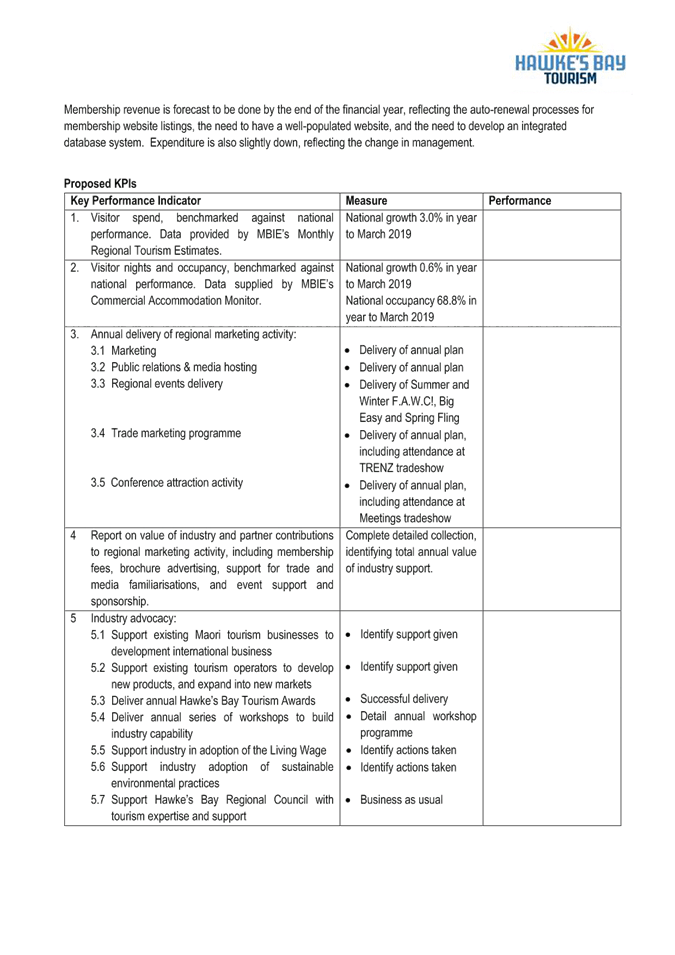

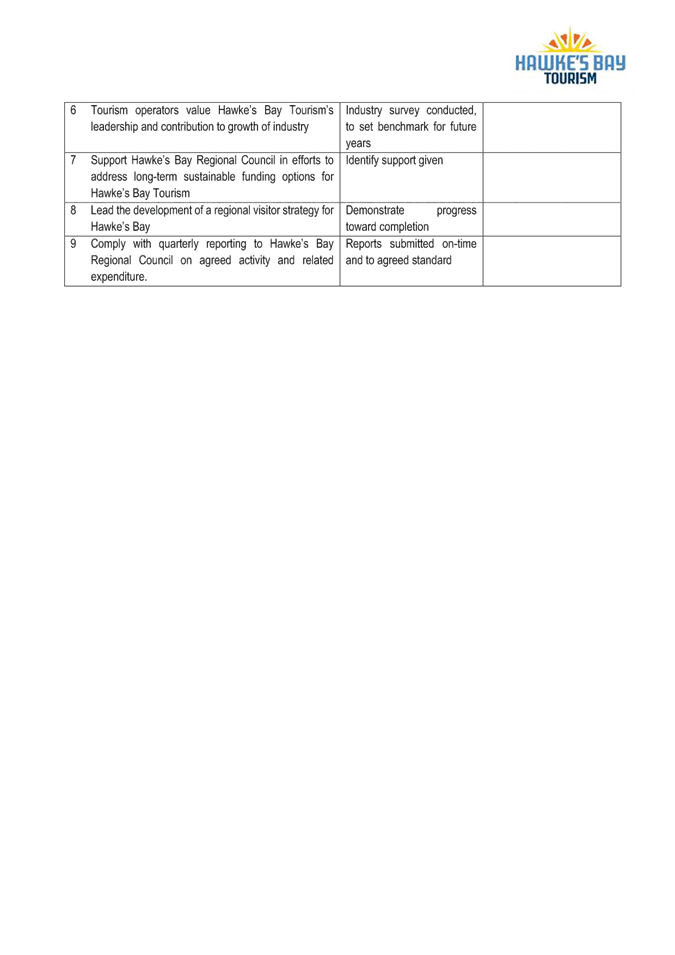

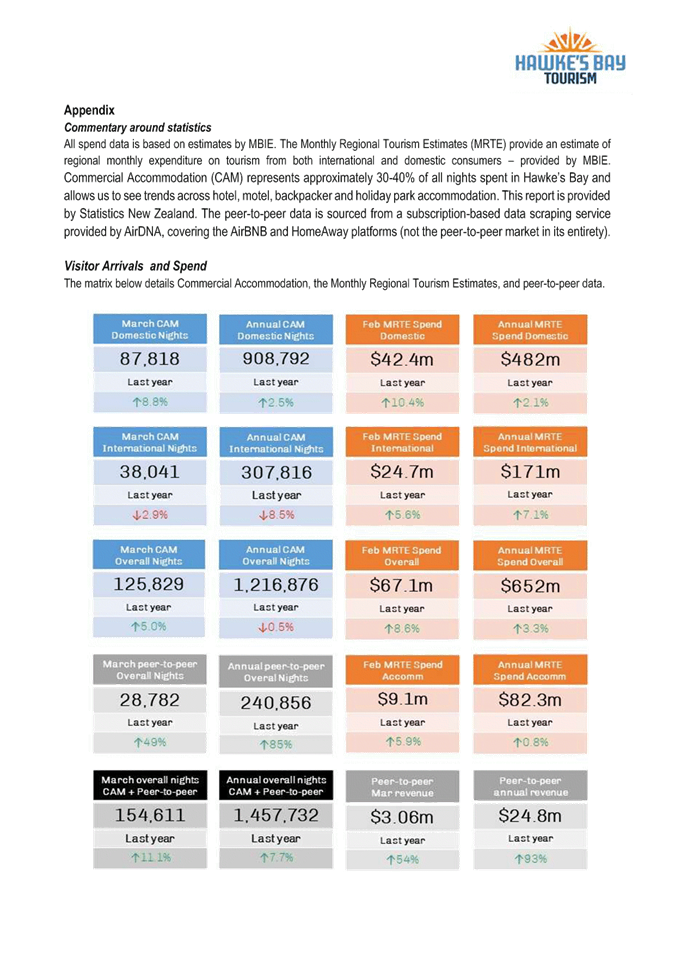

earlier in Agenda Item 5.