Meeting of the Hawke's Bay Regional Council

Date: Wednesday 19 December 2018

Time: 10.15am

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

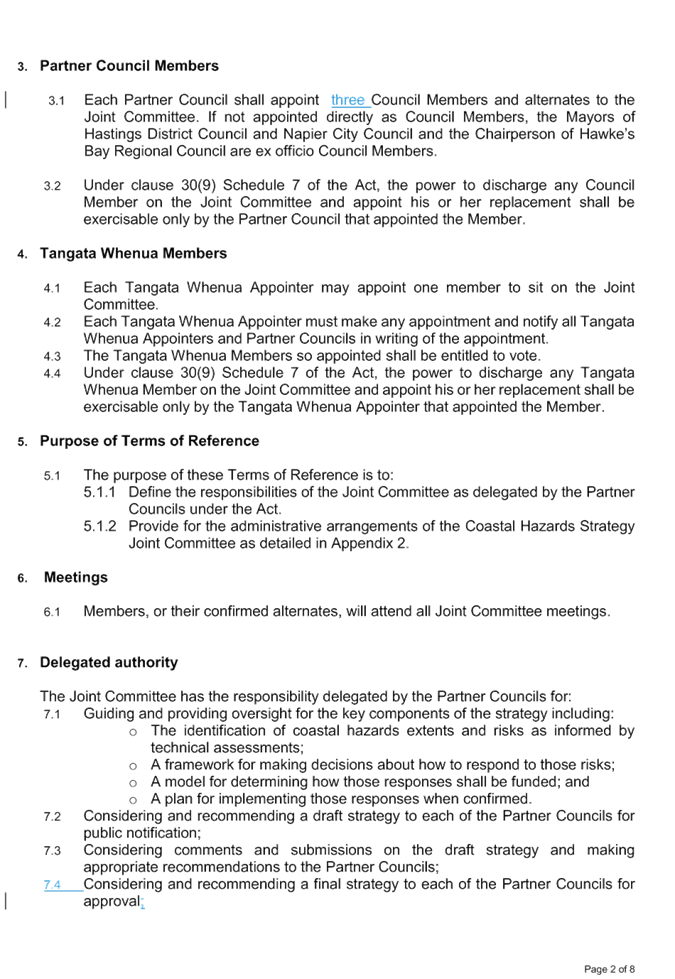

Item Subject Page

1. Welcome/Apologies/Notices

2. Conflict

of Interest Declarations

3. Confirmation of

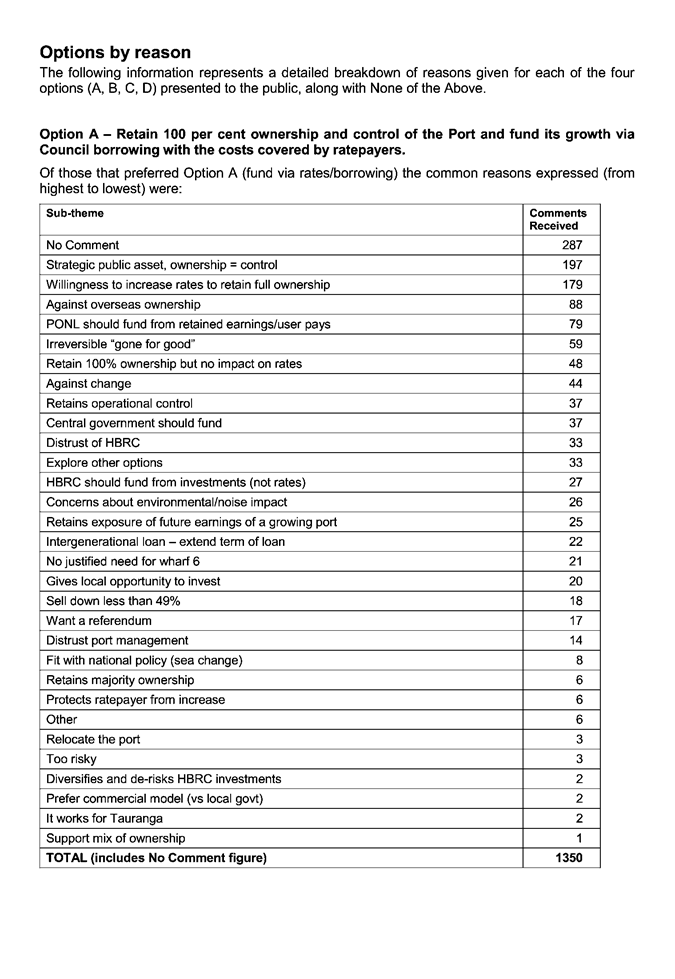

Minutes of the Regional Council MeetingS held on 28 November and 4-5-6 December

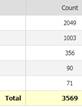

2018

4. Follow-up Items

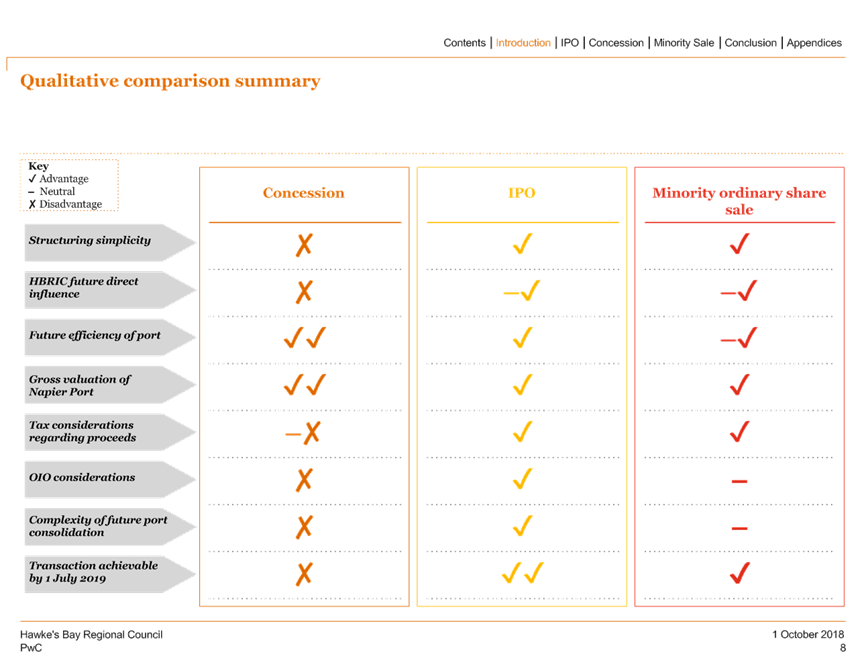

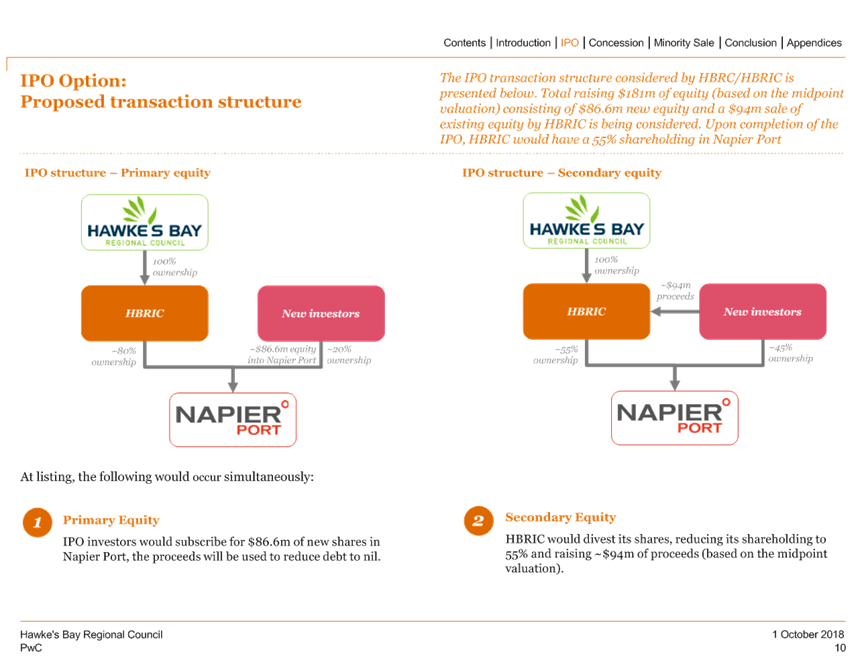

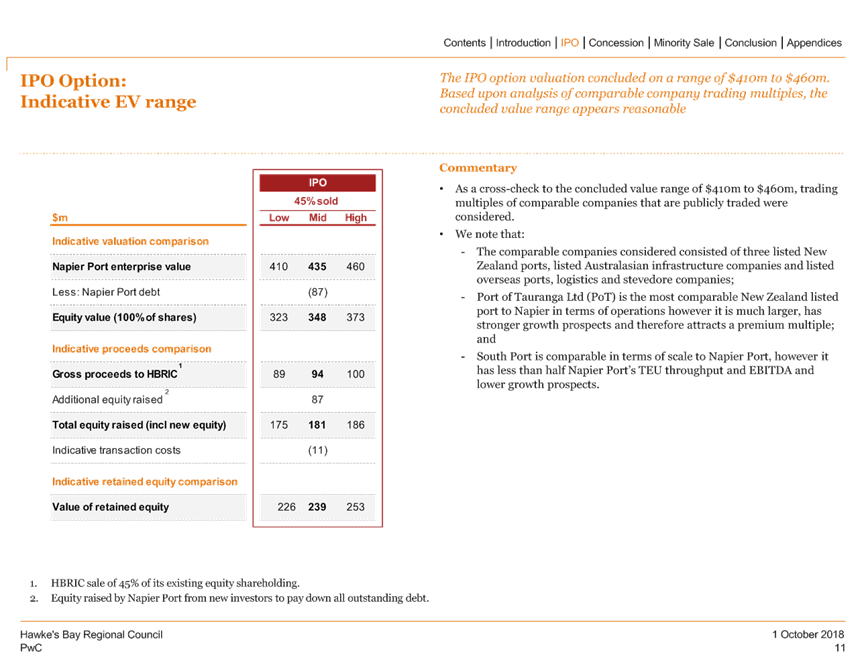

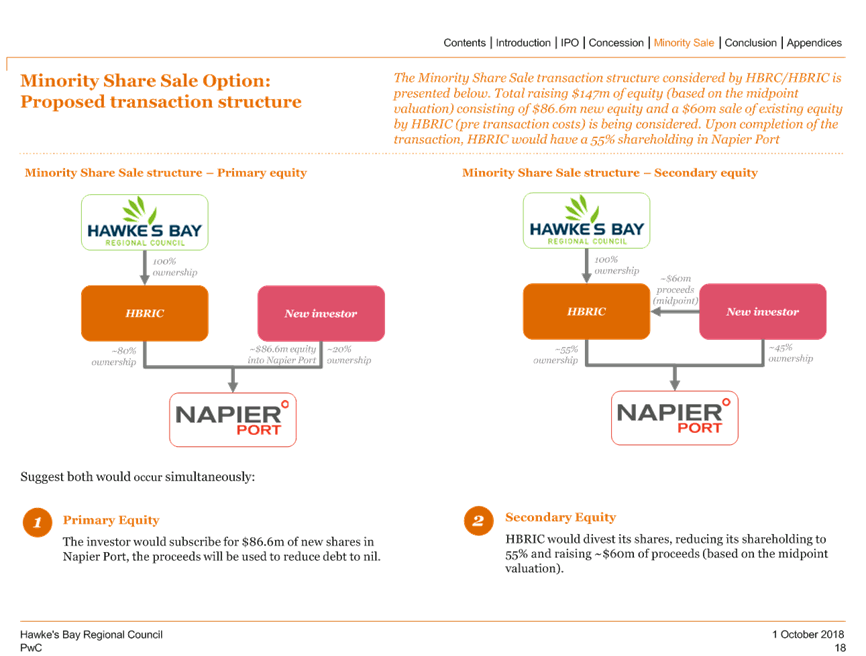

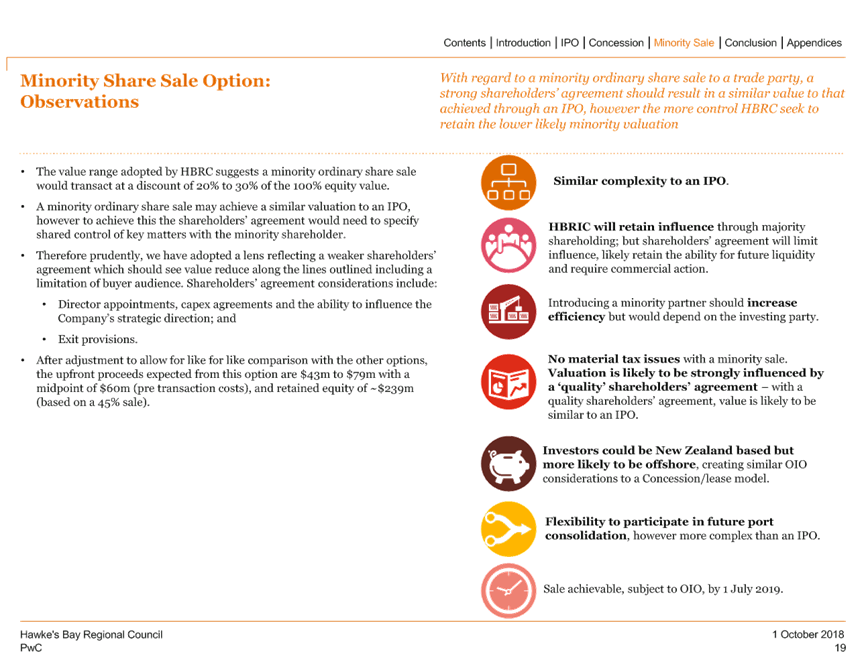

from Previous Regional Council Meetings 3

5. Call for Items of

Business Not on the Agenda 9

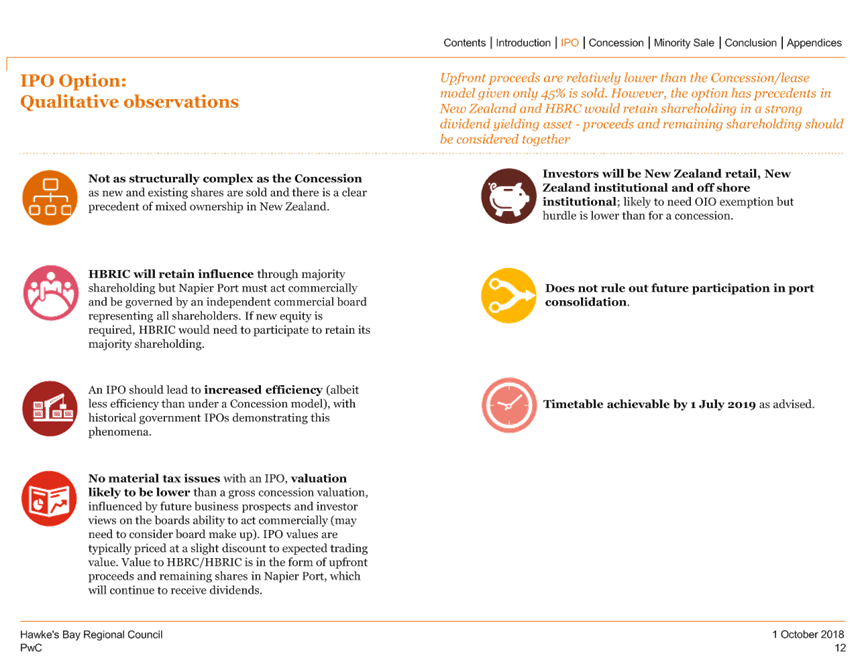

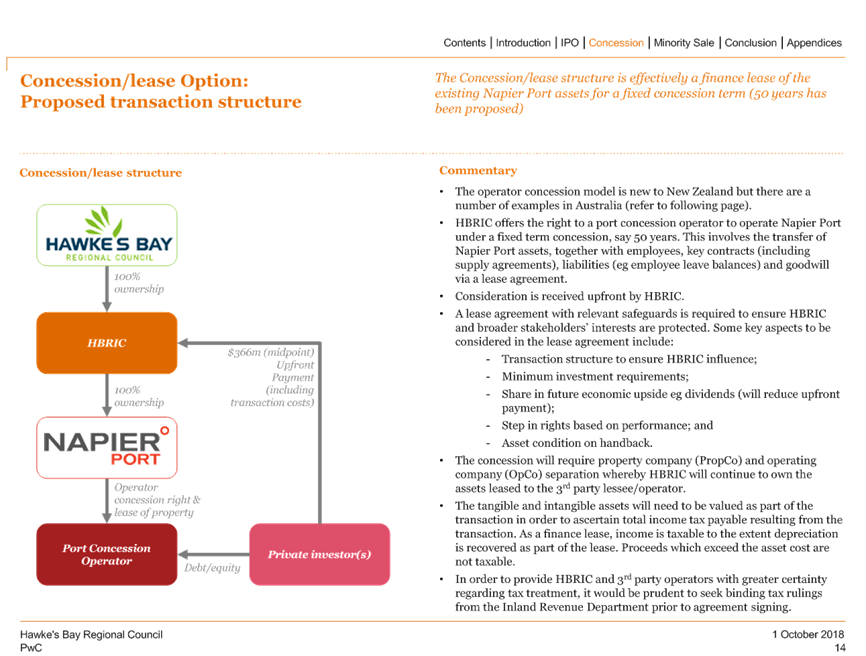

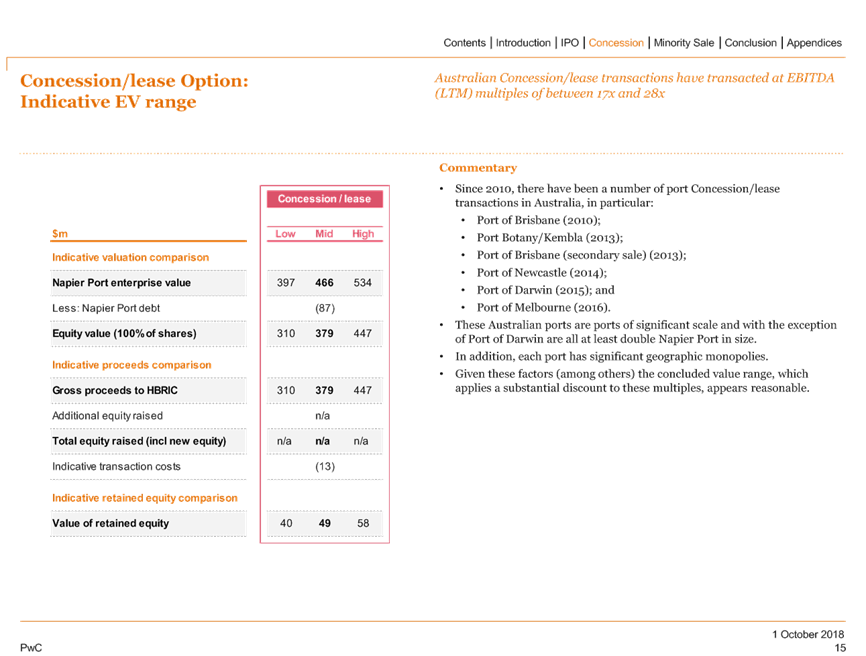

6. 10.15am Award of

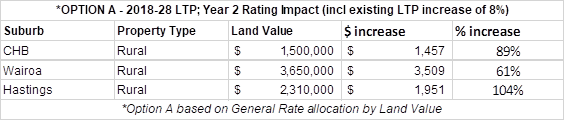

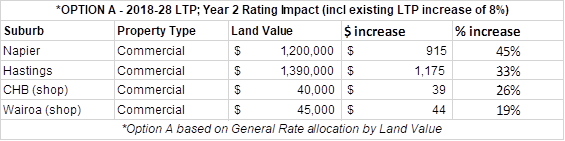

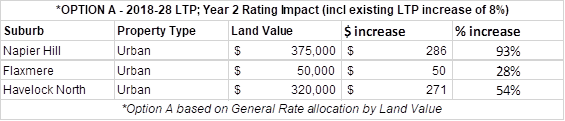

Environmental Certificates of Appreciation

Decision Items

7. Napier Port:

Engagement and consultation undertaken as part of the decision making process 11

8. Analysis of

Feedback and Officers' Responses to Key Themes 23

9. Option Selection

Decision on the Capital Restructure of the Napier Port 79

10. Report and Recommendations

from the Corporate & Strategic Committee 139

11. Report and Recommendations

from the Regional Planning Committee 143

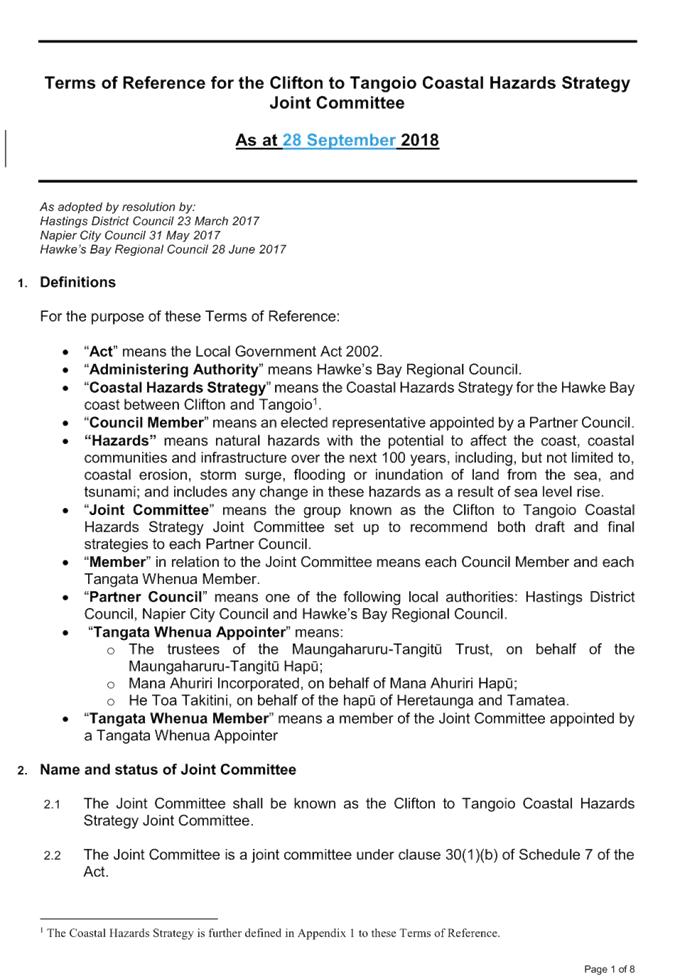

12. Clifton to Tangoio Coastal

Hazards Strategy 2120 Joint Committee Terms of Reference 145

13. Kahutia – Ngati

Kahungunu Iwi Incorporated Carbon Credit Proposal 155

14. Affixing of Common Seal 169

Information or Performance Monitoring

15. Report from 27 November 2018

Māori Committee Meeting 171

16. Report from the 7 December

2018 Regional Transport Committee Meeting 173

17. Discussion of Items Not on the

Agenda 175

Decision Items (Public Excluded)

18. Confirmation of Public

Excluded Minutes of the Meeting held on 28 November 2018 177

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 19 December 2018

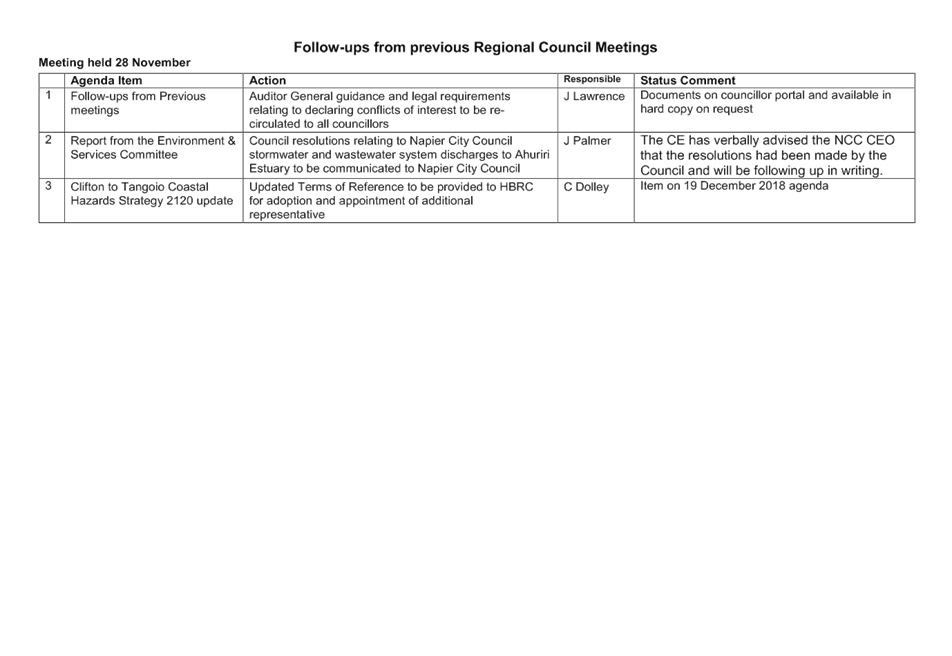

Subject: Follow-up Items from

Previous Regional Council Meetings

Reason for Report

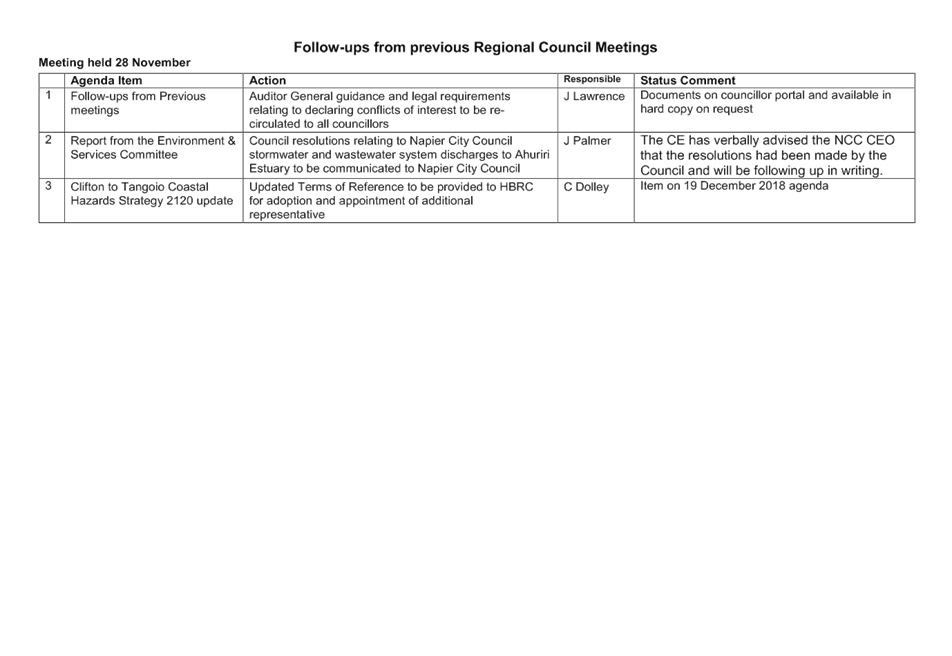

1. On the list attached are

items raised at Council Meetings that staff have followed up on. All items

indicate who is responsible for follow up, and a brief status comment. Once the

items have been report to Council they will be removed from the list.

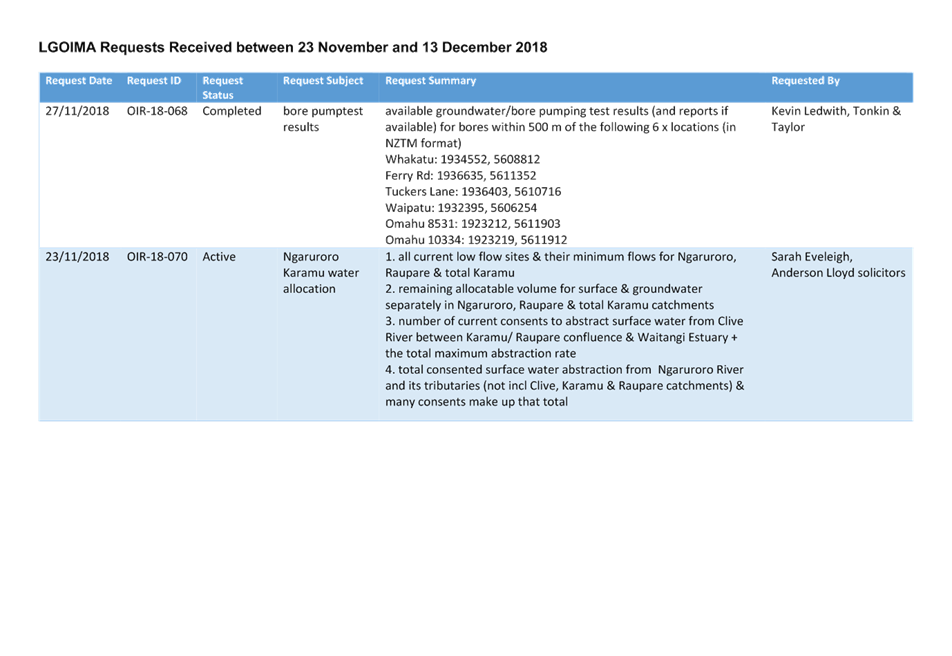

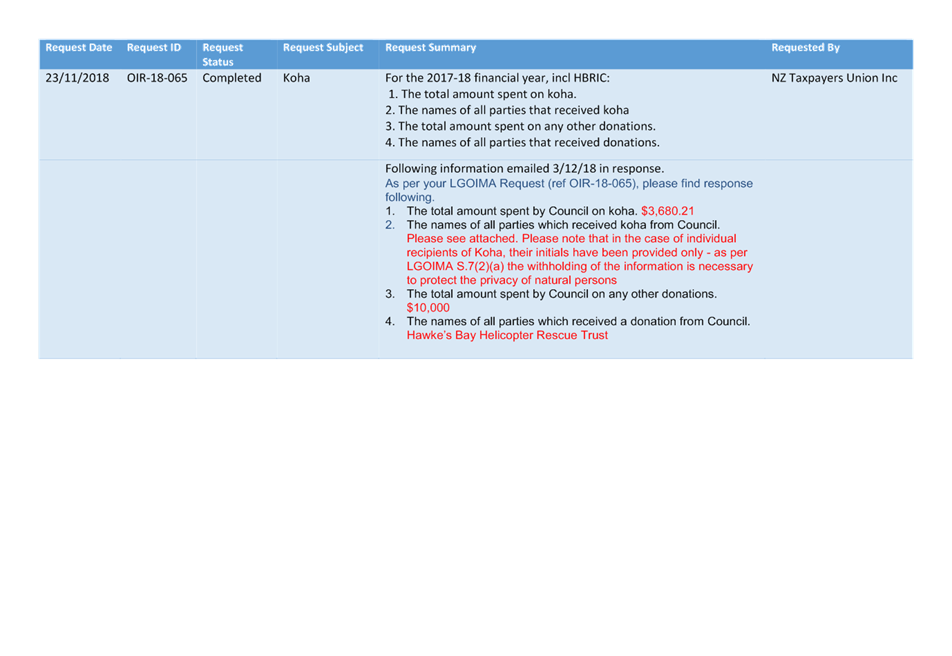

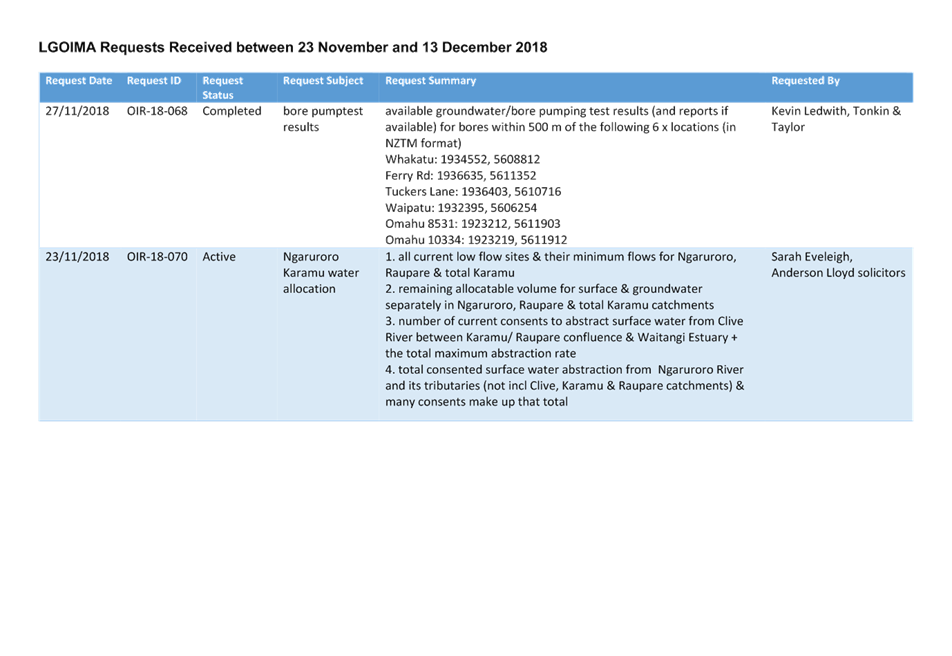

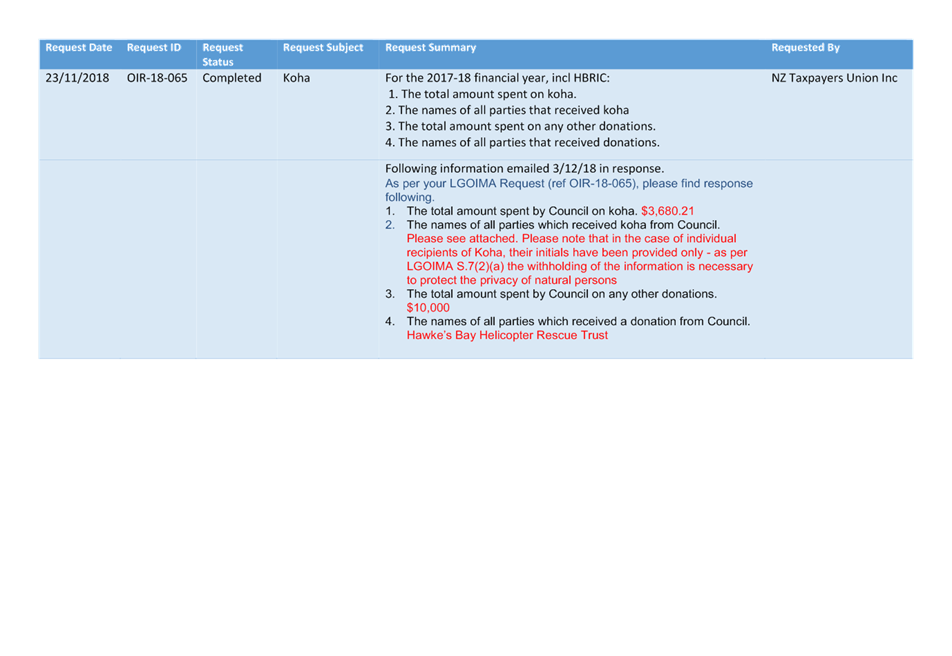

2. Also attached is a list of

LGOIMA requests that have been received since the last Council meeting.

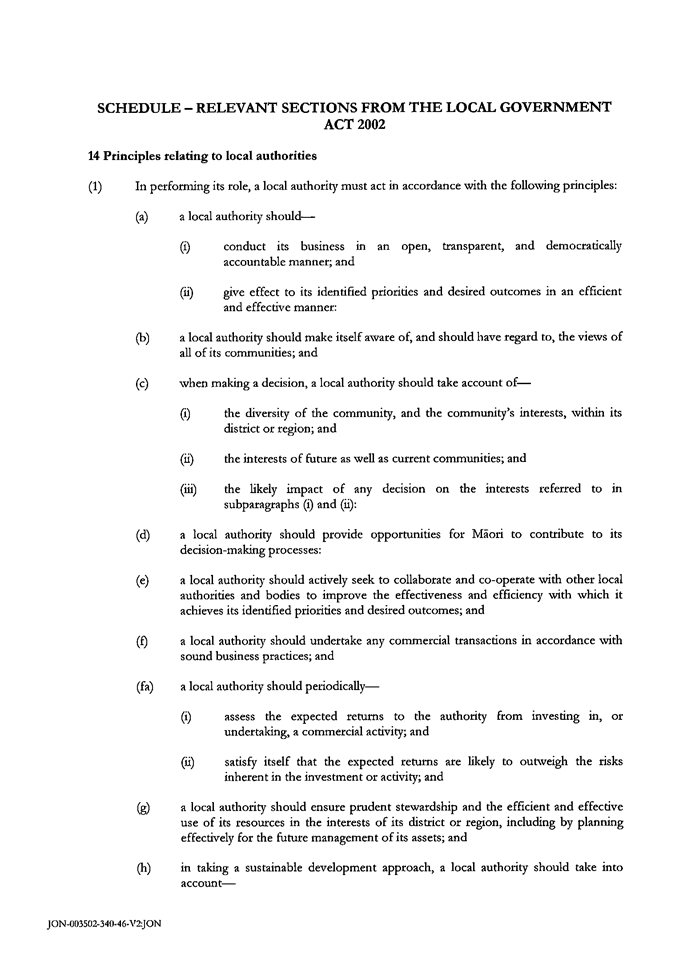

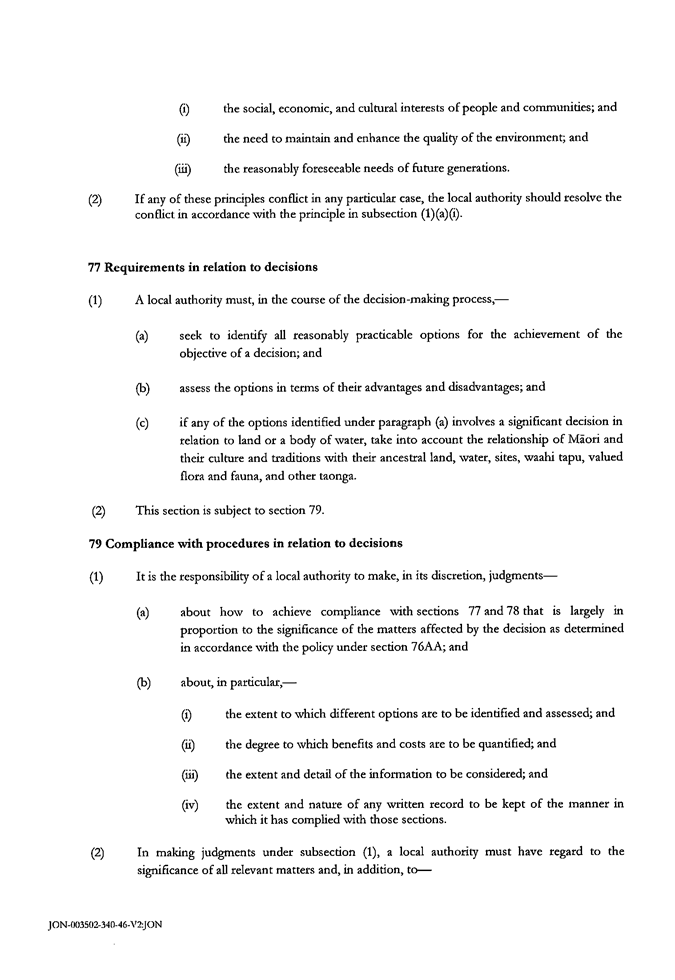

Decision Making Process

3. Staff have assess the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision making

provisions do not apply.

|

Recommendation

That the Council receives and notes the “Follow-up

Items from Previous Meetings” staff report.

|

Authored by:

|

Leeanne

Hooper

Principal Advisor Governance

|

|

Approved by:

|

Joanne

Lawrence

Group Manager Office of the Chief Executive

and Chair

|

|

Attachment/s

|

⇩1

|

Follow-ups

from Previous Regional Council Meetings

|

|

|

|

Follow-ups

from Previous Regional Council Meetings

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 19 December 2018

Subject: Call for Items of

Business Not on the Agenda

Reason

for Report

1. Standing order 9.13 allows:

1.1. “A meeting may discuss an

item that is not on the agenda only if it is a minor matter relating to the

general business of the meeting and the Chairperson explains at the beginning

of the public part of the meeting that the item will be discussed. However, the

meeting may not make a resolution, decision or recommendation about the item,

except to refer it to a subsequent meeting for further discussion.”

Recommendations

2. That Council accepts the following “Minor Items of Business Not on the

Agenda” for discussion as Item 17

|

Item

|

Topic

|

Raised

by

|

|

1.

|

|

|

|

2.

|

|

|

|

3.

|

|

|

|

Leeanne Hooper

PRINCIPAL ADVISOR GOVERNANCE

|

James Palmer

CHIEF EXECUTIVE

|

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 19 December 2018

SUBJECT Napier Port: Engagement and

consultation undertaken as part of the decision making process

Purpose of Report

1. This item outlines the steps taken by the Hawke’s Bay Regional

Council (Council) as part of its decision-making process in determining and

then consulting on the options to fund the growth of the Port of Napier (Napier

Port or Port). This paper focuses on the period in the run-up to the decisions

to be undertaken by the Council at its meeting on 19 December 2018.

2. In particular, this paper provides an overview of the

Council’s engagement and consultation processes, including an overview of

the special consultative procedure undertaken as required by the Local

Government Act 2002 (LGA).

Step 1: Problem

definition/identifying the Council’s objectives

3. The

Council initially identified the need to consider possible options for funding

Napier Port’s growth requirements as a result of the Council hosting a strategy session (in a workshop format) in relation to

Napier Port on 24 January 2017 (Napier Port Strategy Session). The Napier Port

Strategy Session involved all councillors, Council management, Hawke’s

Bay Regional Investment Company Limited (HBRIC) directors and representatives

of the Port (including the Port Chief Executive, Chair, CFO and Port

directors).

4. This

workshop canvassed a number of matters including Wharf 6 operational, timing

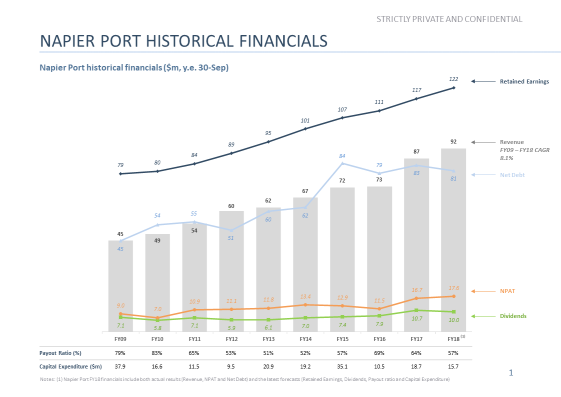

and funding requirements, as well as cargo volume and financial forecasts.

5. On 9 November 2017, the Port Chief Executive formally wrote

to the CE of HBRIC outlining the Port’s capital funding requirements,

providing its assessment of options that could deliver against those funding

requirements and expressing support to the Council in relation to it securing

the required funding for Port development.

6. While there has been a high level of awareness around the

future need for Wharf 6, trade volumes through the Port over the last two years

in particular have exceeded forecasts, compressing the timeframe over which the

Wharf 6 investment was required.

Step 2: Option

identification, and clarification of objectives

Capital Structure Review

7. Following the 24 January 2017 Napier Port Strategy Session,

Council approved the establishment of a Capital Structure Review Panel in March

2017 and the first meeting of the Capital Structure Review Panel was held in

June 2017.

8. The purpose of the Capital Structure Review was to review

the balance sheets and future requirements of all Council entities with the

objective of recommending the optimal financial structure for the group’s

balance sheets in preparation for the development of the Council’s

2018-2028 long-term plan. Napier Port was a significant consideration in the

overall context of the group balance sheet and the strategic environmental and

natural hazard challenges facing the Council and the region.

9. In

outlining its purpose, the Interim Report of the Capital Structure Review Panel

noted that the Council had determined that it needed to:

9.1. Tackle increasing demands to protect and enhance the region’s

environment and improve resilience to natural events. Understanding the

upcoming costs of providing services (existing and new) and how these will be

funded is vital to Council’s planning. Significant cost pressures and

associated pressures on ratepayers are anticipated.

9.2. Explore options to optimise and reshape how it applies capital

across its operational and investment portfolios to deliver more income and

ensure it has enough capital to support Council’s long term objectives

for core services and enhancement initiatives.

9.3. Identify key risks to Council’s income sources and capital

base, including risks associated with its large investment in Napier Port.

10. The Capital Structure Review Panel comprised members

representing Napier Port, the Council, Hawke’s Bay Regional Investment

Company Limited (HBRIC) and independent members with relevant skills and

experience: Chris Tremain (Chair, HBRIC), Rex Graham (Chair, Council), Neil

Kirton (Council), Alasdair MacLeod (Chair, Napier Port), Jim Scotland (former

Port Chair) and David Shand (economist with experience in local government funding).

11. The

Capital Structure Review Panel met 12 times, and procured independent

commercial advice, in the course of preparing its advice to the Council.

12. The

Council made the Capital Structure Review Panel’s reports available to

the public. The interim report was released publicly with an accompanying

Council media statement on 12 December 2017 and the final report, again with

accompanying media statement, was released on 28 March 2018.

Interim report

13. The interim Capital Structure Review Panel report released on 12

December 2017 considered nine possible options in relation to how the Council

could fund the required development at Napier Port. These options were:

13.1. The Port does not

invest, so it can keep paying dividends (do nothing)

13.2. The Port increases its

debt levels to fund Port development needs (e.g. bank debt, shareholder loan or

issuing a bond)

13.3. The Port increases its

revenue and profit to fund Port development

13.4. HBRIC/the Port receives

dividend relief for a defined period

13.5. Council invests more

capital into HBRIC/Port

13.6. Council charges

ratepayers a special targeted rate to fund the Port developments

13.7. Introduce a minority

investment partner to the Port

13.8. The Port is listed on

the New Zealand’s Exchange (NZX), with the Council retaining majority

ownership

13.9. The Port is leased to

another party (with Council maintaining ownership of the Port assets)

14. The interim report determined that options 13.7, 13.8 and 13.9 could

sufficiently meet the objectives of Council.

Final report

15. The final Capital Structure Review Panel report was released on 28

March 2018 and, in relation to the Port, narrowed the nine possible options

identified in the interim report to the following recommendations.

15.1. Council rule out

ratepayer funding of Port development

15.2. Support the Port’s

efforts to increase revenue and profits to ensure adequate return on capital

(current and future).

15.3. Consider pursuing a

minority sale to fund Port development and reduce Council’s current

exposure to commercial and natural disaster risk from this asset.

15.4. Consider pursuing a long

term lease of the Port to fund Port development and reduce Council’s

current exposure to commercial and natural disaster risk from this asset.

16. Following

the publication of the final Capital Structure Review Panel report,

communications from the Council were sent to persons on a distribution list

comprising several hundred of the Council’s external stakeholders.

17. Generally,

this external stakeholder distribution list comprises:

17.1. Local

businesses

17.2. Business

associations

17.3. Environmental

organisations and regulatory authorities

17.4. Iwi and

Māori organisations

17.5. Central

and local government representatives, including officials

17.6. Local

and national media

17.7. Groups

with a particular interest in council issues.

18. The two Capital Structure Review Panel reports, media statements and

Q&A have remained on the Council’s website on a page dedicated to

this review since publication.

Council identification

of all reasonably practicable options for the achievement of its objective and

consider advantages and disadvantages of options

19. Alongside

the Capital Structure Review, councillors also sought feedback on possible

solutions to funding the growth of Napier Port from external parties and

advisors (who suggested other options or variations on options to those

recommended by the Capital Structure Review Panel).

20. Following

the final report from the Capital Structure Review Panel, the Council also

sought and received detailed advice from professional advisors around the

likely discount that would be applied to a minority share sale versus a minority

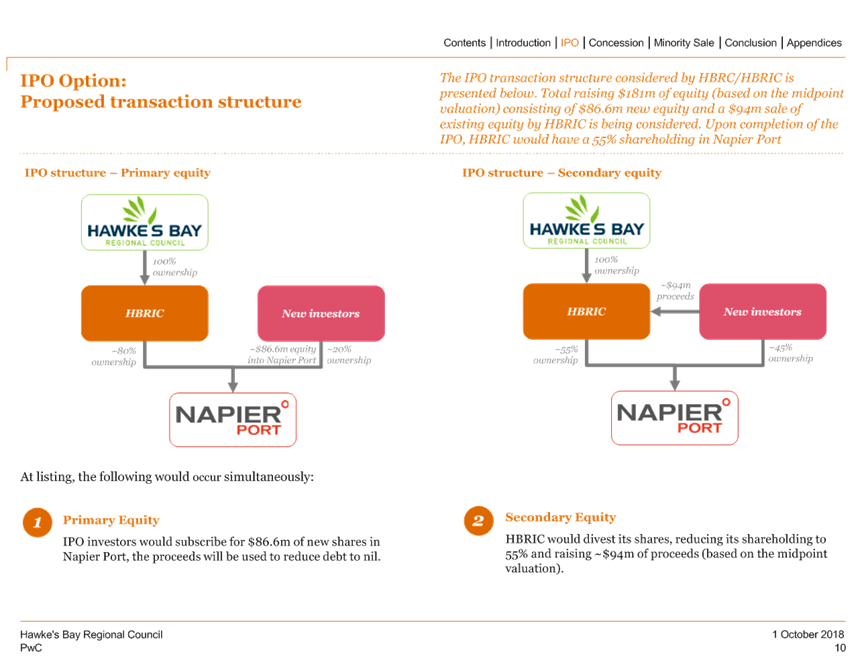

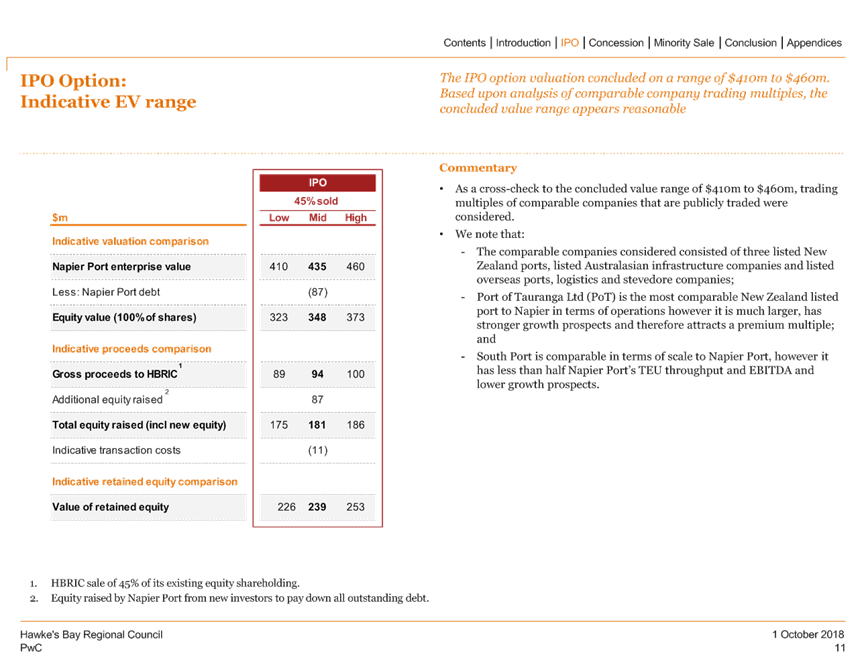

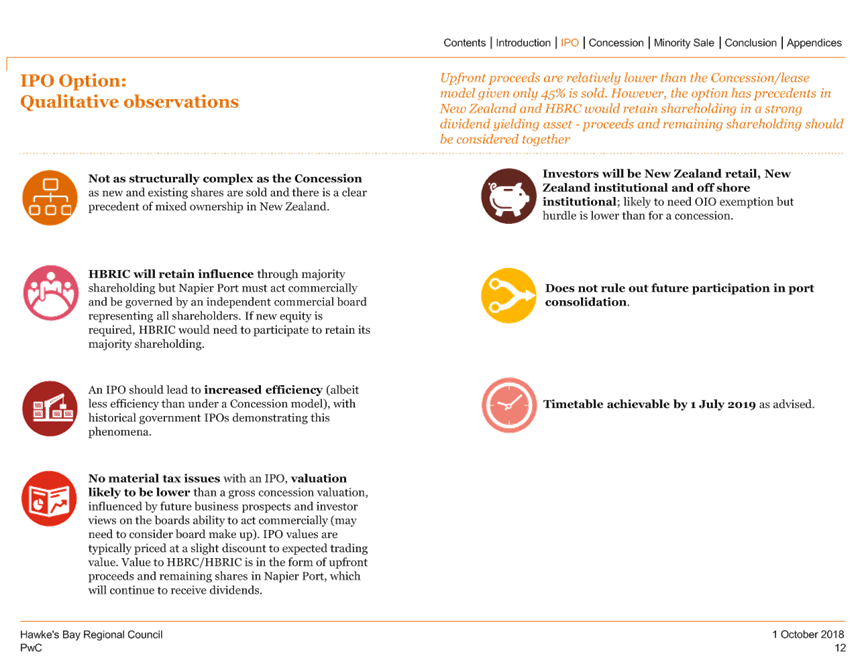

Initial Public Offering (IPO) (with an IPO deemed to offer more competitive

market tension and more accurately reflect the best possible value of the

Port).

21. In

informing themselves on the range of possible options, councillors held

multiple workshops, public excluded Council meetings, a number of councillors

visited ports in Australia to observe the leased port model in operation, and

heard presentations from multiple advisors.

22. As

covered in the decision paper, recognising upcoming capital demands and the

effect they may have on the Port, Council, ratepayers and regional economy, the

Council, HBRIC and Napier Port conducted an extensive analysis and due

diligence on the Port’s and Council’s potential capital structure

options over the last two years.

23. This

work has included, but is not limited to:

23.1. Napier Port Strategy

Session hosted by Regional Council – January 2017

23.2. Council establishing a

Capital Structure Review Panel – March 2017

23.3. First meeting of Capital

Structure Review Panel – June 2017

23.4. Napier Port presentation

to Council 2018–28 Long Term Plan Workshop – October 2017

23.5. Capital Structure Review

Decision Steps Paper to Council Workshop – November 2017

23.6. Capital Structure Review

Interim Report – 12 December 2017

23.7. Councillors and Council,

HBRIC and Port staff visit to Australia to meet with Regional Governments to

observe the leased port model – January 2018

23.8. Capital Structure Review

Final Report – 28 March 2018

23.9. Napier Port development

options discussed at Council Workshop – May 2018

23.10. Napier Port Capital Raising Options paper

presented – June 2018

23.11. Potential Port Transaction Approach paper

presented to Council – July 2018

23.12. Independent Valuation Analysis presented

to Council Workshop (Napier Port Summary Review of Capital Structure Options,

PwC) – August 2018

23.13. Napier Port Capital Structure and Project

Update presented to Council – August 2018

23.14. Napier Port Capital Structure Paper

presented to Council – September 2018.

24. Following

consideration and discussion of the Capital Structure Review Panel

recommendations and other inputs from various experts, advisors –

including independent peer review of professional advice – the Council

decided on the options that it believed provided the only reasonably

practicable options to deliver sufficiently against the Council’s

objectives (albeit that the options selected meet the objectives to varying

degrees, for example, while each of the four Council options would provide the

funding the Port requires, provide majority ownership and control of the Port

and retain commercial exposure to the Port, Option A did not provide for any

investment or risk diversification and exposed ratepayers to higher rates to

cover the costs of borrowing.)

25. Following

this engagement, the Council resolved to narrow options for consultation based

on agreed strategic objectives. As confirmed in the audited consultation

document ‘Our Port – Have Your Say’ – the

Council’s agreed objectives are to:

25.1. retain majority

community ownership of the Port

25.2. secure the investment

the Port requires

25.3. protect ratepayers from

the costs of funding this development

25.4. diversify to de-risk the

Regional Council’s investments to better protect ratepayers

25.5. retain exposure to the

future financial performance of a growing strategic asset.

26. In

working through the process of determining its objectives and then seeking

solutions that delivered against them, the Council determined that either:

26.1. Council is required to

borrow and consequently increase rates to eliminate the Port’s debt to

enable it to reinvest in Wharf 6; or

26.2. external capital would

be required – either via a minority IPO, minority share sale or a

long-term lease to a third party.

27. These

four final options for consultation were, as outlined in the consultation

document.

27.1. Option A: Retain 100 per

cent ownership and control of the Port and fund its growth via Council

borrowing with the costs covered by ratepayers.

27.2. Option B: Float a

minority stake – up to 49 per cent – in Napier Port on NZX.

27.3. Option C: Sell a

minority stake – up to 49 per cent – in the Port to a cornerstone

investment partner.

27.4. Option D: Lease the

operation of the Port to a third party operator for a period of up to 50 years.

28. In

considering the options available to satisfy its objectives, Council voted to

adopt Option B (minority IPO of up to 49 per cent) as the preferred option for

consultation at a Council meeting on 29 August 2018 as this option is the

option (out of all options) that meets the objectives to the greatest extent.

29. The

Council also actively considered the advantages and disadvantages associated

with the four options and presented these in the consultation document.

Step 3: Understanding

views: engagement / consultation

Pre-consultation

stakeholder engagement

30. As the Council was going through the process of both selecting its

preferred option upon which to consult and finalising consultation materials,

the Council engaged proactively with a significant number of stakeholders to

ensure understanding of the issues and the process the Council would be

following. Very generally, these stakeholders were deemed to be interested or

potentially interested parties in the Port, as follows.

Ministers, MPs and Central

Government officials

31. Background

meetings were held with six ministers, four local MPs from across the political

spectrum, and a small number of officials and advisors at Central Government

level. The purpose of these meetings was to provide clarity around the process

the Regional Council was following, explain the reasons why this process was

being followed, seek any feedback and ensure lines of communication were open

between the Regional Council and potentially interested Central Government

parties.

32. Meetings

were held with the Ministers of Regional Development, Transport and Economic

Development, among others. Key conversations were held around coastal shipping

/ Port strategy as well as the Provincial Growth Fund. See the Submission

Analysis paper for more detail on both of these points.

Port staff

33. From

early in the planning process, Port staff were identified as particularly

important stakeholders and persons who would be particularly affected and

interested in the matter. The Council Chair and Chief Executive spent three

days – before, during and after the consultation period - based at the

Port with staff as they changed through different work shifts to ensure that as

many Port staff as possible were engaged with. The purpose of these sessions

was to introduce and update staff on what was happening and to follow up and

provide clarity on the Council’s preferred option. These sessions were

conversational with opportunities to ask questions.

34. Additionally,

these sessions gave staff the opportunity to provide feedback on the options

under consideration. Generally, feedback was provided during these sessions in

opposition to the potential for a long-term lease of the Port to a third party.

Feedback from these sessions was communicated back by the Chair and Chief

Executive to the Council, with the Chair noting in open session of the Council

that the feedback from the Port staff had been useful and influential.

Unions

35. Throughout

this process, both pre-consultation and during the consultation process, the

Council, represented by the Chair, Deputy Chair and Chief Executive, engaged

with local Rail and Maritime Union (RMTU) representatives from the Port and met

with national RMTU representatives both in the Council offices, Wellington and

Tauranga.

36. During

the pre-consultation meeting with the RMTU, the Council expressed its

commitment to continuing to engage directly and openly with Port staff and

union representatives, and invited feedback on the proposals which were under

development for consultation.

Other stakeholders

37. A wide

range of other stakeholders have also been engaged with prior to formal

consultation commencing:

37.1. Tangata

whenua: A letter was sent (on 9 August 2018) and a

subsequent meeting was held with Hawke’s Bay iwi groups which have

settled Treaty of Waitangi claims with the Crown. The purpose of this meeting

was to acknowledge potential interest in the process, engage early in the

process prior to consultation, outline the four options under development for

consultation, ensure clarity on the rationale for the Council considering this

course of action and seeking early feedback on the proposed consultation.

37.2. Hawke’s

Bay Regional Council Māori Committee: The

Council’s Māori Committee was originally established in the 1990s

and its purpose is to ensure Māori input into the various activities of

the Council, including active participation in the decision-making process and

the development of sustainable relationships with Māori. The Committee

makes recommendations to the Council on matters of relevance affecting the

tangata whenua of the Hawke’s Bay region, and provides a forum for the

Council to receive input from Māori, in light of Council’s

obligations, particularly those deriving from the principles of the Treaty of

Waitangi, the Local Government Act 2002 (LGA) and the Resource Management Act

1991 (RMA). The Māori Committee comprises 12 representatives

appointed by each of the four Ngāti Kahungunu Taiwhenua / Executive in the

region, being Te Taiwhenua o Tamatea, Te Taiwhenua o Te Whanganui-a-Orotü,

Te Taiwhenua o Heretaunga and Wairoa Taiwhenua, plus up to three councillors.

37.2.1. To ensure

that there is a current understanding of the Port considerations, the

Māori Committee Chair attends all Council meetings and workshops with

speaking (not voting) rights. As well, one tangata whenua representative is

appointed to each of Council’s Environment and Services and Corporate and

Strategic Committee, and two RMA qualified representatives to Council’s

Hearings Committee.

37.2.2. Most

recently, this Committee discussed the Port consultation process, including

Council engagement with various stakeholders, on 27 November 2018. Wharf 6 and Port funding matters were discussed in this forum at the

meetings held on 12 December 2017, 10 April 2018, 7 August 2018, 16 October

2018.

37.3. Depending

on the Council’s decisions regarding options on 19 December, Council will

work closely with Māori and the post-settlement governance entities

(PSGEs) on the detailed design and structure of any

transaction.

37.4. Local

territorial authorities: Letters were sent from the

Chair and Chief Executive of the Regional Council offering briefings to the

Napier City, Hastings District, Central Hawke’s Bay District and Wairoa

District Councils. High level presentations covering the reasons why the

Council was considering the four options, with some analysis of the impacts of

the four options were delivered to the Napier City Council, Hastings District

Council and Central Hawke’s Bay District Council over the consultation

period. These were interactive engagements with feedback and questions taken.

Regular updates were also provided by the Chair, to the HB Leaders Forum. More

detailed, follow-up materials were requested and provided to the Napier City

and Hastings District Councils to aid those councils in making submissions.

37.5. Local

interest groups: Presentations and briefings were

delivered – both before and during the consultation period – to

organisations including Business Hawke’s Bay, Hawke’s Bay Chamber

of Commerce, Karamu Rotary, Grey Power Hastings and Napier. High level

presentations covering the reasons why the Council was considering the four

options, with some analysis of the impacts of each option, were presented.

These were interactive sessions with feedback provided.

37.6. Local

business representative bodies: Background meetings

/ conversations were arranged and held with a range of other stakeholders

representing local organisations with a likely interest in the Port and this

process, including: Federated Farmers, Apples and Pears, Progressive Meats,

Wine Hawke’s Bay, Hawke’s Bay Tourism, Business New Zealand.

37.7. Other

interested persons: Background meetings /

conversations were arranged and held with a range of other stakeholders with an

interest in the Port or this process, such as: Local Government New Zealand,

the Provincial Growth Fund, the New Zealand Securities Exchange (NZX), Pan Pac

and Regional Council staff. All of these engagements were interactive with

feedback sought and provided.

Special consultative procedure

Formal consultation period

38. The

decision was taken that while the formal consultation period would start as

planned on 15 October 2018 and run until 15 November 2018, the consultation

document and supporting material would be made publicly available and promoted

immediately – effectively giving interested parties an additional 12 days

to access and consider the information and then to submit.

39. When

considered against a further week-long extension of the consultation period

that was provided during the consultation period (as outlined below), the

consultation document was publicly available and promoted for a period of over

seven weeks.

Extension of consultation period

40. On 31

October 2018, upon becoming aware that distribution of the consultation

document may not have delivered fully against the Council’s expectations

(see below), the Council decided to extend the consultation period by a further

week, with submissions closing on 22 November 2018, instead of the previously

planned 15 November 2018.

41. A media

statement and Facebook post were released to announce this, with the Council

Chair highlighting how copies of the consultation document could be sourced,

stating that:

41.1. “No

method of distribution is perfect and for those people who have not, for

whatever reason, received a consultation document, this extension provides

further time to digest the information and have their say.”

42. The

Council subsequently posted twice more on its Facebook page promoting access to

the consultation document.

43. Over

this period consultation documents remained available through public libraries

and Council offices, with Council staff routinely ensuring topped up supplies.

Preparation and initial

electronic release of the consultation document

44. Informed by the interim and final Capital Structure Review Panel,

independent expert advice and targeted stakeholder discussions, the Council

deliberations concluded with the commitment to consult with the public through

a special consultative procedure on four potential options that the Council had

determined as being the reasonably practicable options for funding the growth

of Napier Port (as identified above), these being:

44.1. Retain 100 per cent

ownership and control of the Port and fund its growth via Council borrowing

with the costs covered by ratepayers.

44.2. Float a minority stake

– up to 49 per cent – in Napier Port on the New Zealand Securities

Exchange (NZX).

44.3. Sell a minority stake –

up to 49 per cent – in the Port to a cornerstone investment partner.

44.4. Lease the operation of

the Port to a third party operator for a period of up to 50 years.

45. A

consultation document and supporting information was carefully prepared which

provided details of all reasonably practicable options and identified the

Council’s preferred option. All required information was provided,

including in the required form, as specified in the LGA (including the

additional detail required in relation to the adoption of a long-term plan

amendment relating to divesting of ownership or control of a strategic

asset).

46. A draft

consultation document had been in development for several months prior to the

decision to adopt it. It provided an overview of the issue, placing Napier Port

into the context of Hawke’s Bay’s economic growth. It explored why

the Port requires the level of investment that it does and analysed in

consistent detail each of the four options identified by Council as being the

reasonably practicable options, including their potential impacts on the

Council’s 2018-2028 long-term plan.

47. The

consultation document was reviewed by and received sign-off and approval from

Audit New Zealand (and the required Auditor-General report was provided and included

in the consultation document).

48. Stephen

Lucy, on behalf of the Auditor-General stated in the audit opinion that:

“In my

opinion: the information in the consultation document about the proposed

amendment of the LTP provides an effective basis for public participation in

the Council’s decisions about the proposed amendment, because it:

48.1. fairly represents the

reasons for and implications of the proposed amendment;

48.2. identifies and

explains the main issues and choices facing the Council and region, related to

the proposed amendment; and

48.3. identifies and

explains the main issues and choices facing the Council and the region, related

to the proposed amendment; and

48.4. the information and

assumptions underlying the information in the consultation document related to

the proposed amendment are reasonable.”

49. The

consultation document was also reviewed by external legal advisors prior to

finalisation. Feedback from the Auditor-General, the legal review, councillors

and key council advisors was incorporated into the document.

50. On 3

October 2018, the Council adopted and released a consultation document

outlining these four options, with a Council preference stated for Option B

– a minority share float on the NZX. The Council also adopted

supporting information.

51. On 3

October 2018 the consultation document was uploaded to the Council’s

website on a dedicated page with a range of supporting materials including:

51.1. Video comments from the

Chief Executive and Chair of the Council

51.2. Online submission form

51.3. Time lapse video of the

Port in operation

51.4. Drop in session dates

and details

51.5. Hearing dates

51.6. Independent PWC Review

of Port Capital Structure Options

51.7. Wharf 6 Justification

Report from Napier Port

51.8. Proposed amendments to

the 2018 – 2028 long-term plan

51.9. Letter of support from

Napier Port to the Council

51.10. All documents relating to the Capital

Structure Review.

52. A video

recording of a presentation from the Council and Port Chief Executives to a

Hawke’s Bay A&P Show lunch was also later uploaded to the site.

53. From 3 October to 13 December 2018, the dedicated Council Port

consultation web page on which all material was hosted received 3,080 page views.

54. A media

statement was issued and published on the Council’s website, with the

consultation document, and a media briefing was held in the Council offices

involving the Chair and Chief Executive of the Council and the Chief Executive

of the Port.

55. Multiple stakeholder emails were issued at this point, including to

the Council’s stakeholder database (as per point 17) and those

stakeholders with which the Council had engaged prior.

Distribution of hard copy consultation

document

56. Councillors

adopted the consultation document on 3 October 2018 and printing and subsequent

distribution of the hard copy document also started at that point.

57. In the

interests of maximising the reach of the document, the decision was taken to

use a distribution company to deliver the documents to as many household

letterboxes in Hawke’s Bay as achievable. This option was deemed to

be more inclusive as the information would reach renters and the people of

Hawke’s Bay who were not property owners and therefore not on the

Council’s rating database.

58. During

the consultation period, the Council became aware that the distribution of the

hard copy consultation document to households across Hawke’s Bay may not

have reached the distribution levels indicated by the distribution company,

being 90 per cent reach into rural letterboxes and 95 per cent reach into urban

letterboxes. The Council took steps to address this. These steps included

taking legal advice on the Council’s obligations, extending the

consultation period by a further week and posting on media and social media

platforms. These latter steps are explained further below.

59. Over the

course of the consultation period, Council staff have distributed copies of the

consultation document to people who emailed or phoned in. Over this period,

approximately 284 additional hard copy documents were distributed (and several

more by email) following requests through channels promoted by Council.

60. Internet

penetration in Hawke’s Bay is estimated to be similar to the national

average of around 70% of households and therefore availability of the

consultation document online was widespread and Council mass media

communications, outlined further below, directed the public to the Council

website.

Targeted distribution of consultation

document

61. During

the consultation process, hard copy consultation documents and submission forms

were delivered to the Port to encourage staff to have their say.

62. The

Council’s Chief Executive and Chair spoke with Port staff again on 26

November 2018, just post the closing of consultation, to further engage, share

feedback received and to garner additional feedback and comment ahead of the

beginning of hearings in early December 2018.

Promotion of consultation / further

encouraging presentation of views

Summary flyer and postcard reminders distributed

63. With the

release of the consultation document, a local campaign called for the Council

to hold a referendum on the issue. Previous comments from the Council

mistakenly indicated that if five per cent of registered electors signed a

petition, a referendum was required to be held.

64. However,

the Council subsequently determined that this was incorrect, with there in fact

being no requirement that Council undertake a vote or referendum on this issue

(albeit a discretion to do so if it wished). This was communicated to the

primary proponent of a referendum on 15 October 2018 to clarify the statements

previously made.

65. An

additional letterbox drop of a one-page (double-sided) summary document

reminding people to have their say and providing a submission form which could

be free-posted back to Council was produced and distributed using the same

method as the original consultation document from 24 October 2018.

66. Following

distribution, a member of the public queried the fact that Option A was described

as ‘Ratepayer Pays’ instead of ‘Maintaining Ownership and

Control’ as it was described in the consultation document. The wording

was changed as staff felt it was generating some confusion in which some people

favouring Option A did not connect that with increased rates. Following

receipt of the query and having considered and taken legal advice on the

different wording, the Council’s view is that the heading used for Option

A in the summary document fairly described the substance of Option A.

67. The

various methods of reaching the community proved successful in encouraging

participation in the process, which was its intent. Of total submissions

received, 1,975 submissions were received via the online submission form, 1,567

via email or hard copy submission form and 27 via text message.

68. Council

management also decided, on 5 November 2018, to use the Council’s rating

database to mail a postcard reminder to every ratepayer in Hawke’s Bay

reminding them to have their say and pointing them to where they could access a

copy of the consultation document and supporting materials.

69. Distribution

of this postcard started around 9 November 2018 to the Council’s rating

database.

Advertising promotion

70. Newspapers:

Eleven full page newspaper adverts were scheduled with Hawke’s Bay

Today and the region’s community newspapers and ran in these publications

from 16 October 2018 until 12 November 2018.

|

Publication

|

Date(s) advertisement ran

|

|

Hawke’s Bay Today

|

16, 24 October; 7, 12 November

|

|

Napier Courier/ Hastings Leader

|

24 October, 7 November

|

|

Central HB Mail

|

23 October, 6 November

|

|

Wairoa Star

|

23 October; 1, 6 November

|

71. Publications:

Two half-page print adverts appeared in local magazines.

|

BayBuzz

|

On sale 2 November

|

|

The Profit

|

On sale 5 November

|

72. Radio:

785 radio adverts were programmed to air on stations across the region, via

NZME (448 - The Hits, Newstalk ZB, Coast, Radio Sport), MediaWorks (237 - the

Breeze, Magic, Sound), Central FM (60) and Wairoa’s More FM (40). The

date range for these advertisements was 22 October – 21 November.

73. Social media: Between

1 October – 25 November, the Facebook social media channel sent 44 posts

concerning Our Port – Have Your Say. Using this

channel, HBRC was able to reach a considerable portion of the community. The

following table demonstrates the social media reach:

|

Individuals reached

|

Post Engagements

|

Link Clicks

|

|

33091

|

18369

|

610

|

Media coverage

74. Alongside

its advertising programme across print, radio and social media, Council

committed to encouraging discussion and debate through conventional media,

particularly local media.

75. This

approach of proactively issuing statements and reports to the media has been in

place since the first interim report of the Capital Structure Review Panel in

December 2017 and continued throughout the consultation period. Council

management had met the (relatively) new editor of Hawke’s Bay Today

in advance of the consultation process beginning, seeking to ensure this was an

issue the paper would plan to cover.

76. There has

been extensive engagement of this issue across a range of media, but

particularly Hawke’s Bay Today. Across all main media over

the consultation period, there have been approximately 50 pieces of coverage

published covering a range of topics and opinions around the Council’s

port funding options, including approximately 15 opinion pieces / Talking

Points published in Hawke’s Bay Today.

77. A number

of submitters specifically referenced opinion pieces published in Hawke’s

Bay Today by others.

78. The opinions

expressed in Hawke’s Bay Today have come from a wide range of

stakeholders, including members of the public, the CEO of the NZX, Apple and

Pears, the local Member of Parliament, the Chair of the Council, other

councillors and various other interested individuals and commentators.

Ways views could be

presented

79. Consultation

closed at 4.00pm on Thursday 22 November 2018. A total of 3,569 formal

submissions were received (including late submissions which were accepted until

12pm on 3 December 2018) via a number of channels including online, email,

posted hard copy and hand delivered. The submissions were published on-line on

28 November 2018. Council resolved to receive and consider all written and

verbal submissions, including social media comments, at the start of the

hearing on 4 December 2018.

80. Any

person indicating a willingness to speak to their submission at a Council

hearing was given the opportunity to use an interpreter. The opportunity was

also available for any submitter to use sign language, with Council providing

an interpreter. The opportunity was also available for any submitter to speak

via video link.

Submission forms

81. Both

hard copy and electronic submissions were promoted through the consultation

document. The summary flyer with a submission form could be free-posted to the

Council. Submission forms were also able to be delivered to the Council

offices.

Online feedback

82. The

Council made an online form available to persons who wished to provide feedback

electronically and this went live on the dedicated Our Port – Have Your

Say Council website on 3 October 2018.

Drop-in sessions and meetings

83. During the formal consultation period beginning on 15 October 2018,

six public ‘drop in’ meetings were held in: Napier, Hastings, Central

Hawke’s Bay, Havelock North, Wairoa and

Flaxmere. Each session was held between 3 – 6pm as part of an effort to

enable people with various childcare / working committments to attend.

84. Each session was attended by a range of councillors and Council

staff and each meeting was promoted via the Council’s Facebook site and

through the consultation document.

|

Date

|

Area

|

Venue

|

Attendance

|

|

25 October

2018

|

Central HB

|

Civic

Theatre, Waipukurau

|

20

|

|

29 October

2018

|

Napier

|

HBRC Chamber

|

52

|

|

30 October

2018

|

Hastings

|

Baptist

Church

|

16

|

|

1 November

2018

|

Havelock Nth

|

Community

Centre

|

32

|

|

6 November

2018

|

Flaxmere

|

Community

Centre

|

11

|

|

8 November

2018

|

Wairoa

|

Presbyterian

Church

|

16

|

|

|

|

|

|

|

Total

|

|

|

147 +

|

85. In addition, a number of public events were held

where the Port consultation was presented and discussed.

|

Date

|

Event

|

Venue

|

Attendance

|

|

5 October

2018

|

Grey Power

Hastings

|

Baptist

Church

|

60

|

|

16 October

2018

|

Grey Power

Napier

|

St

Columba’s

|

190

|

|

17 October

2018

|

Our Port

A&P Show luncheon

|

HB

Showgrounds

|

42

|

86. Generally,

feedback from the attendees at the drop-in meetings tended to favour support

for continued 100 per cent community ownership, whereas feedback via the other

forums was more balanced between Options A and B. Levels of support expressed

throughout the consultation process for Options C and D were relatively

limited.

Public hearings

87. Public

hearings were held on 4, 5 and 6 December 2018 at which 54 people (out of the

91 who registered to present) spoke to the Council about their submission.

These hearings were heard by the full Council, including the Chief Executive

and key senior staff. The hearings were broadcast live on Facebook, with each

submitter invited to speak and take questions for 10 minutes.

Conclusion

88. The

Council has designed and executed a rigorous and multi-faceted community

consultation programme that delivers against the requirements as set out in the

LGA in relation to a special consultative procedure. The level of feedback

received from across the community has shown a high level of engagement and

consideration of the issue, the Council’s objectives and the options it

has consulted on.

Decision Making

Process

89. This report forms part of the information to inform Council’s

overall decision on the capital restructure of the Napier Port.

|

Recommendations

That the

Hawke’s Bay Regional Council receives and notes the “Napier

Port: Engagement and consultation undertaken as part of the decision making

process” staff report.

|

Authored by:

|

Jessica

Ellerm

Group Manager

Corporate Services

|

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

There are no

attachments for this report.

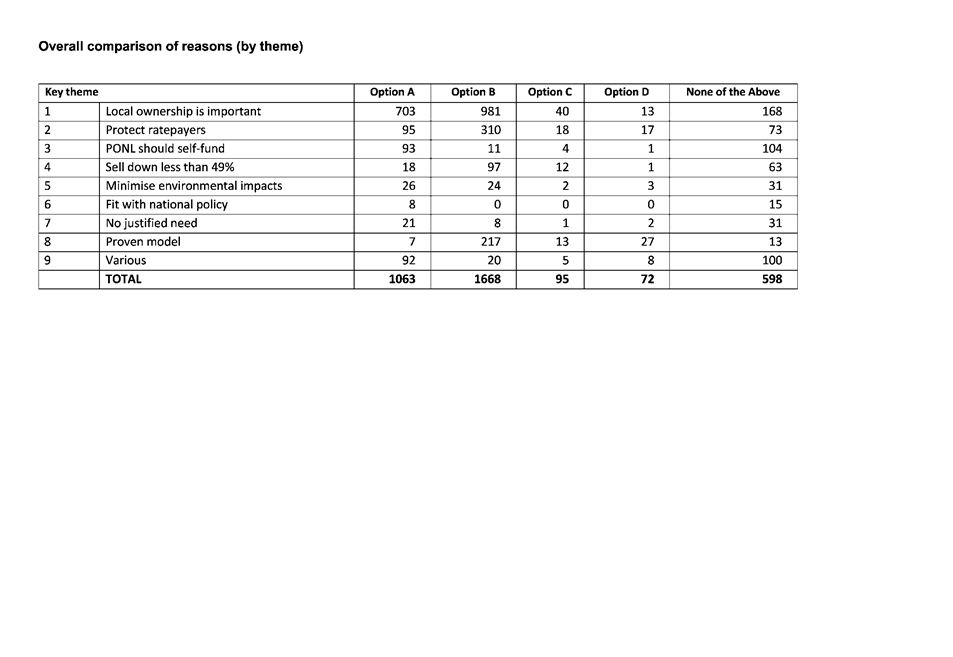

HAWKE’S BAY

REGIONAL COUNCIL

Wednesday 19 December 2018

SUBJECT Analysis of Feedback and Officers'

Responses to Key Themes

Purpose of Report

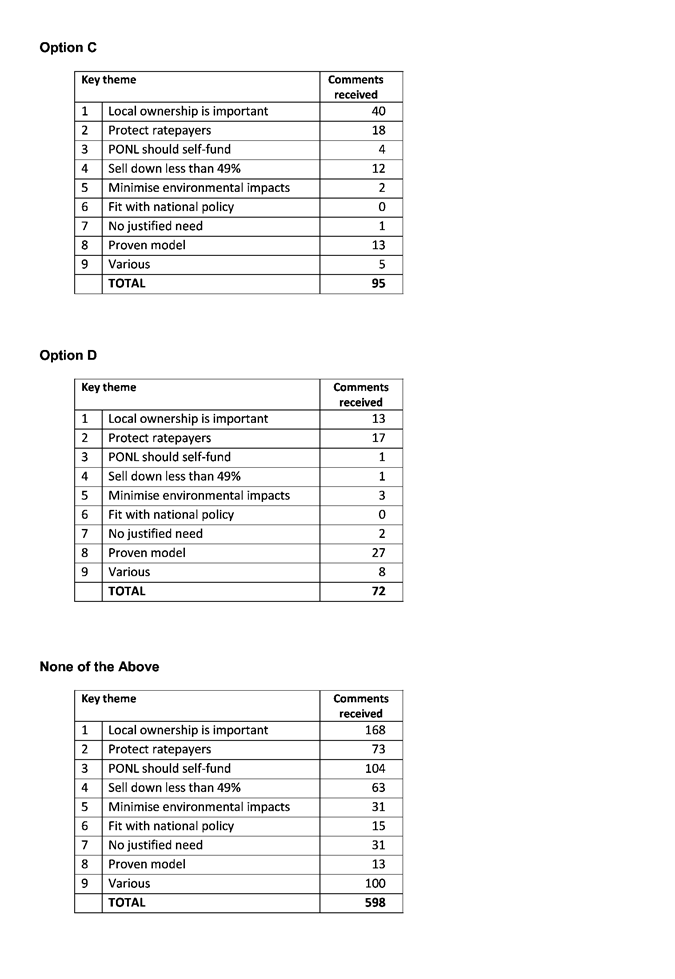

1. This

report provides Council with officers’ analysis of the feedback received

from the community and other interested and affected persons on the options for

funding the future growth of the Port of Napier Ltd (PONL). This feedback was

provided to Council during Council’s stakeholder engagement activities

and its formal consultation on the options.

2. The

purpose of this report is also to identify and respond to key themes, ideas and

suggestions raised by persons who provided feedback to Council in order

to assist Council to make a decision on which option (if any) to progress.

Officers’

approach and process in preparing this report

3. Officers

have carefully considered and analysed all feedback received (including all

comments made by submitters) in order to compile this analysis and their

responses.

4. Officers’

analysis has included using the feedback to prepare statistics on both the

options presented and the common themes raised by submitters through their

comments.

5. This

analysis has been undertaken and presented to assist Council in making an

informed decision.

6. A

significant amount of feedback was received from interested and affected

persons. Officers determined that they best way to present this information to

Council was to focus on key themes that have emerged from that feedback.

In the course of analysing feedback received, officers have had to make

judgement calls about what the key themes are and about how individual comments

made fit within those key themes, in order to present the information in an accessible

way, while still fairly representing the views that have been expressed.

7. Councillors

have also had access to all individual written submissions received.

Stakeholder engagement

and public forums

8. Prior

to and during consultation Council held a number of meetings, briefings and

presentations with a range of external stakeholders such as Ministers, MPs and

central government officials, PONL staff, unions, local iwi, Territorial

Authorities, interest groups, and businesses (Port users).

9. It

also held six drop-in sessions and hosted a stand at the Hawke’s Bay and

Central Hawke’s Bay A&P shows to further reach the general public.

These are described in detail in the accompanying paper entitled “Napier

Port: Engagement and consultation undertaken as part of the decision-making

process.”

10. Generally,

feedback from the attendees at the drop-in meetings tended to favour support

for continued 100 per cent community ownership, whereas feedback via the other

forums was more balanced between Options A and B.

11. Concerns

were expressed to the Council, particularly via Port staff and union

representatives, around the perceived risks of ceding operational control of

the Port via a lease (Option D) for such a long period of time.

12. A

flavour of the feedback provided through these channels is described below

under each theme where it differs from the written submissions received.

Social

and conventional media

13. Between

1 October 2018 – 25 November 2018 the Regional Council’s Facebook

social media channel sent 44 posts concerning “Our Port

– Have Your Say”. Using this channel, HBRC was able to reach

a considerable portion of the community. The following table demonstrates the

social media reach:

|

Individuals reached

|

Post Engagements

|

Link Clicks

|

|

33,091

|

18,369

|

610

|

14. Council’s

goal was to direct traffic to the HBRC Facebook page rather than to attempt to

follow threads and engage in closed groups. A total of 133 Facebook

shares and 769 public comments were received. All feedback including the

social media posts were published online as part of the Agenda for the Hearings

on 4-6 December 2018. Generally the feedback on the Council’s social

media channel tended to reflect the feedback heard during Hearings, with the

majority of questions or comments tending towards an Option A preference. A

number of the more active social media posters on the Regional Council’s

Facebook site also presented their submissions in support of Option A at the

Hearings. The social media posts included a number of questions, which Council

responded to.

15. There

has been extensive engagement of this issue across a range of media, but

particularly in Hawke’s Bay Today. Across all main media

over the consultation period, there have been approximately 50 pieces of

coverage published covering a range of topics and opinions around the

Council’s port funding options, including approximately 15 opinion pieces

/ Talking Points published in Hawke’s Bay Today.

Written Submissions

16. A total of 3,569 written submissions were received. These included

hard copy, on-line submissions and texts. This figure includes late

submissions received until 12 noon on 3 December (the day before the start of

hearings).

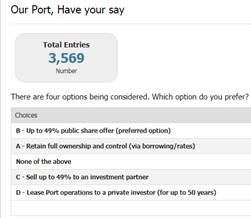

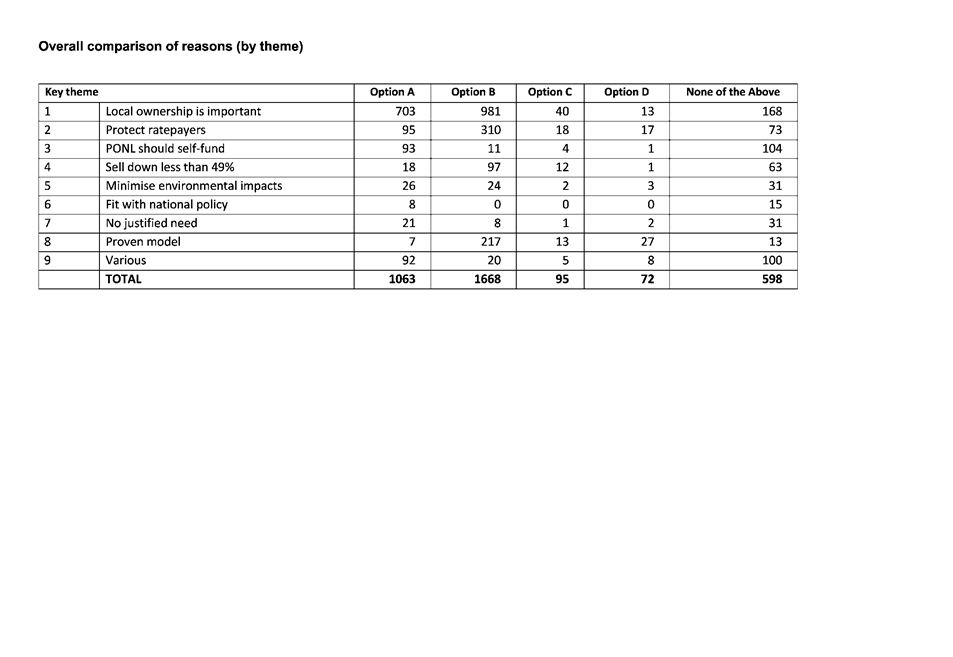

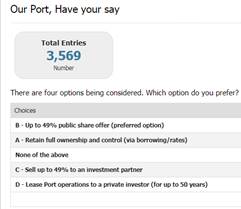

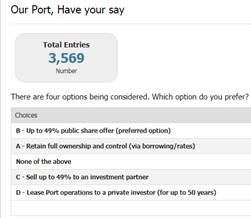

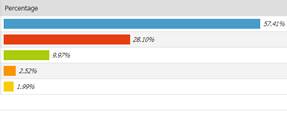

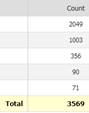

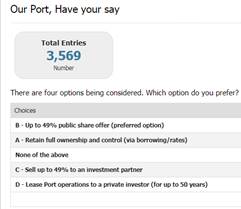

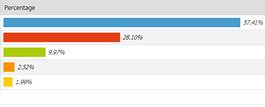

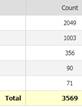

Option Analysis

17. Submitters

were invited to indicate which option, of the four options presented, they

supported (as well as being invited to make any general comments they wished to

make).

18. The

options selected by submitters was as follows

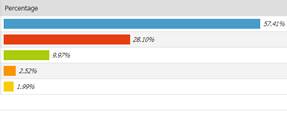

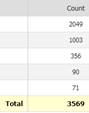

18.1. Option A: 28.10%

or 1003 submitters

18.2. Option B: 57.41%

or 2049 submitters

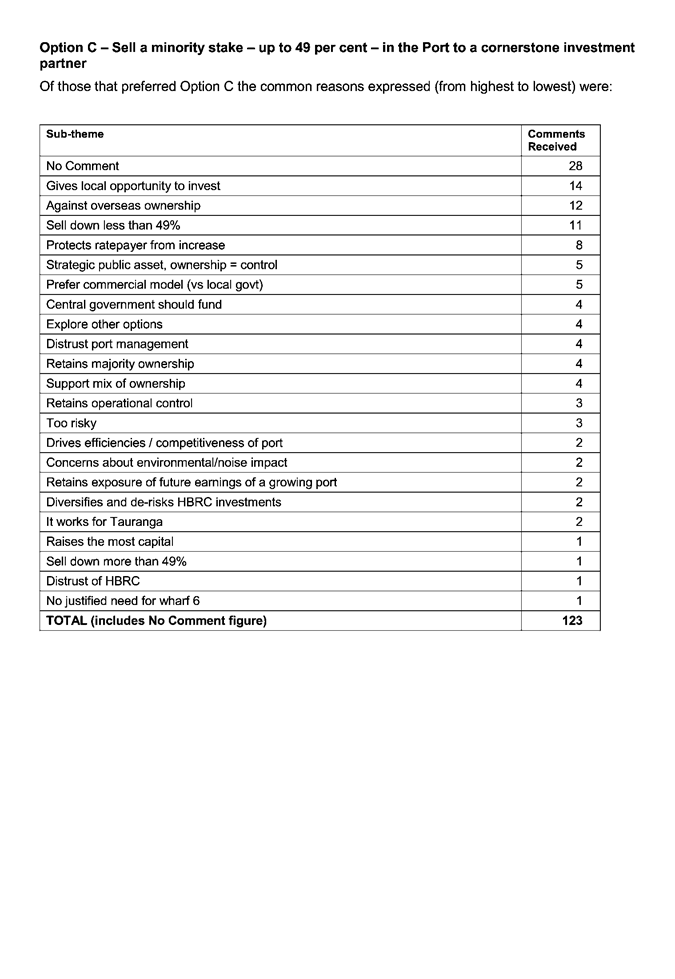

18.3. Option C: 2.52% or

90 submitters

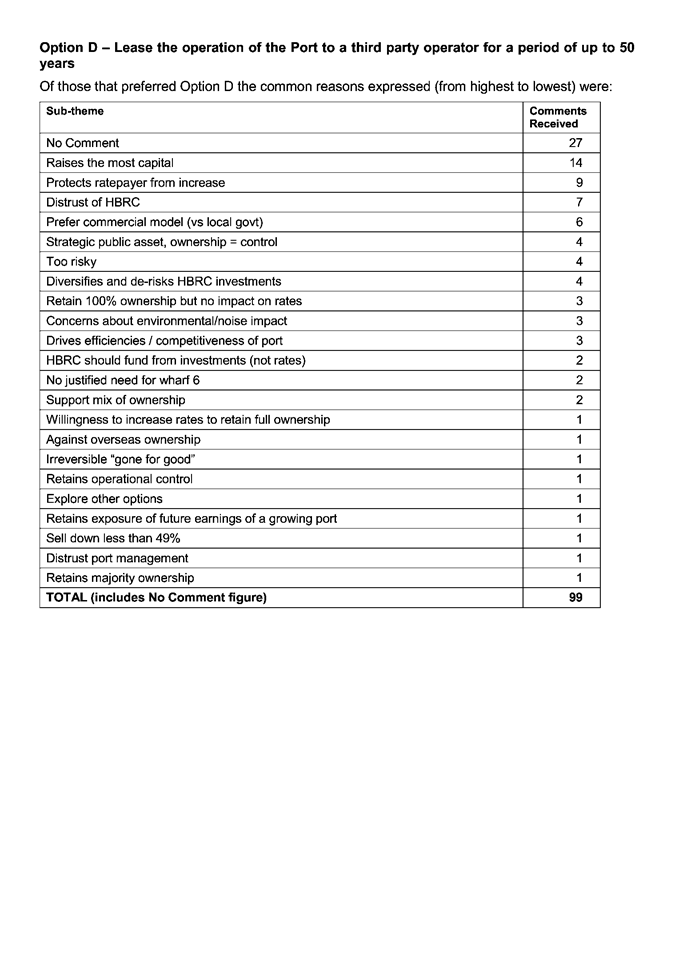

18.4. Option D: 1.99% or

71 submitters

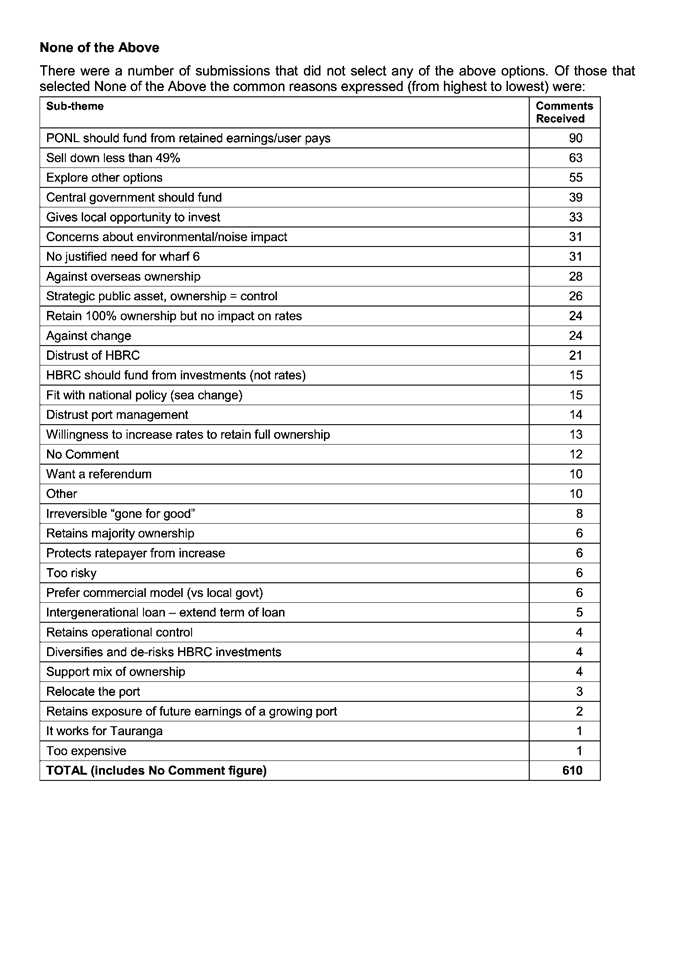

18.5. None of the above:

9.97% or 356 submitters

19. Of the

3,569 submissions, 1,316 made no comment (37 per cent). Where a comment was

made, staff assigned a primary and then where appropriate, a secondary and

third common reason. We then assigned the reasons to key themes.

20. It

should be noted that of the 356 submitters shown as supporting “None of

the above”, 100 submitters did not select “None of the above”

but were give that option by default (i.e. a hardcopy or email submission was

received with no option selected and no obvious preference given).

Selecting an option was a mandatory field for online submissions. Council

should be aware of this as the 9.97% presented above could materially overstate

how many submitters do not support any of the options.

21. Submissions

with comments were read and considered in whole by Councillors and staff.

However, for the purposes of this analysis, the submissions are sorted and

considered by reason. Submitters may have covered multiple topics within the

same submission so the total number of reasons given is greater than the total

number of submissions received. The analysis provides a general overview of the

comments received and does not represent every comment made. A comprehensive

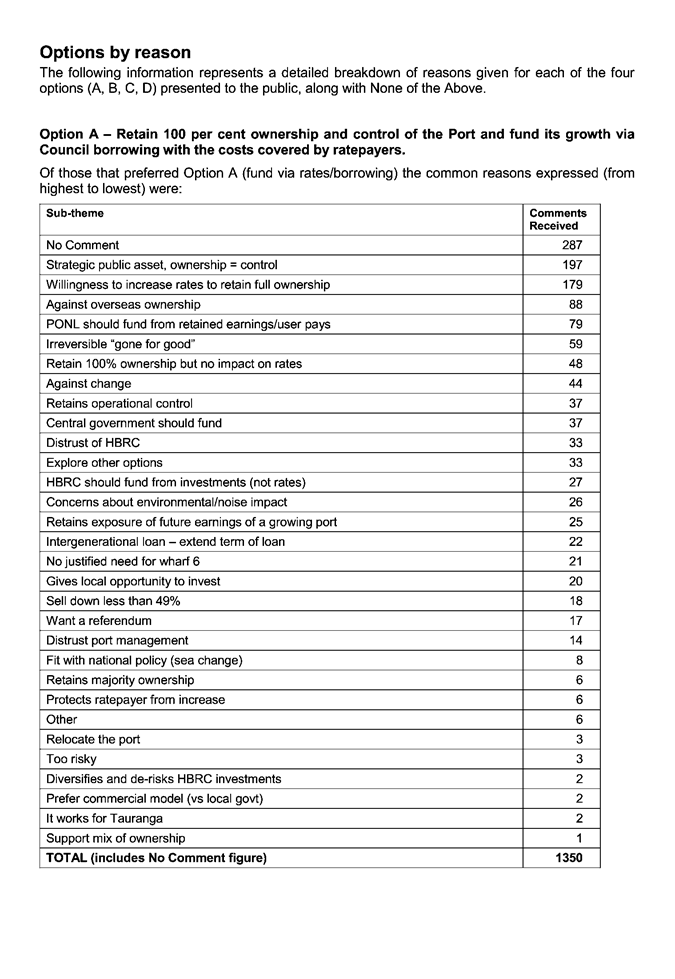

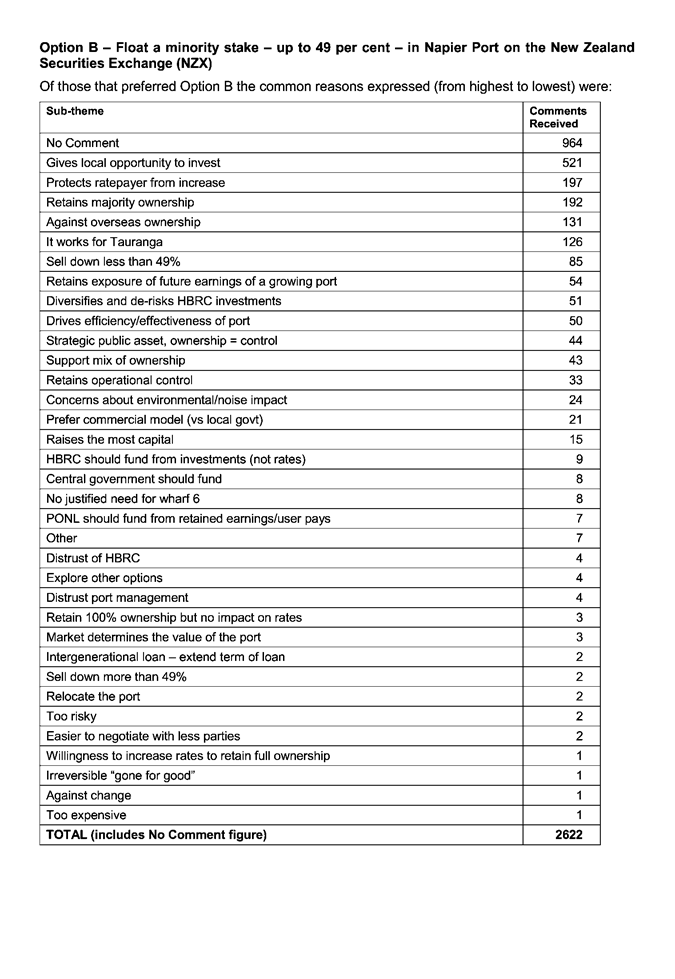

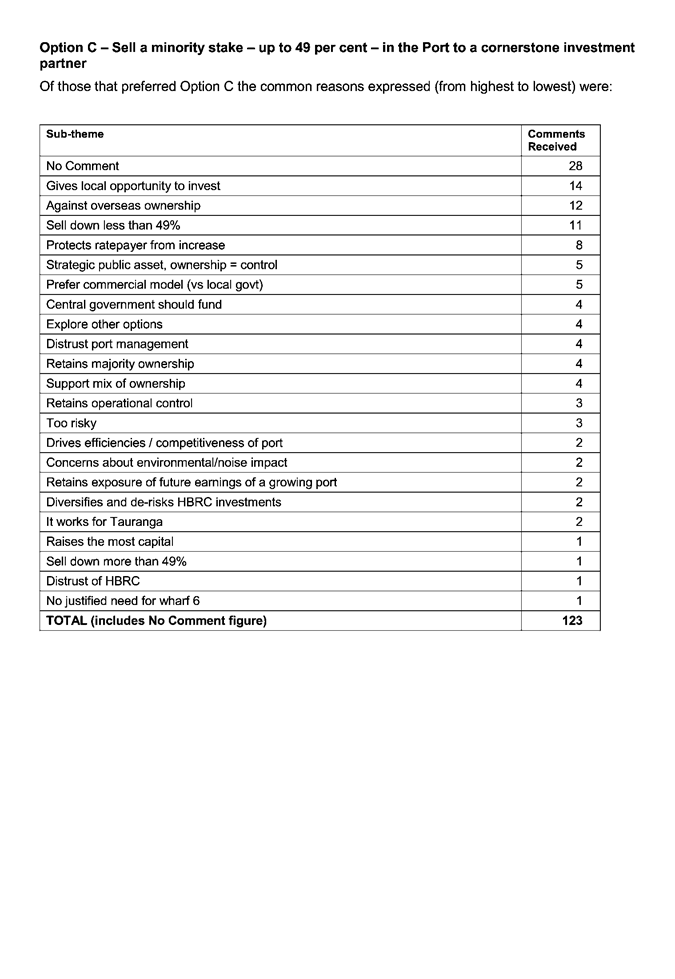

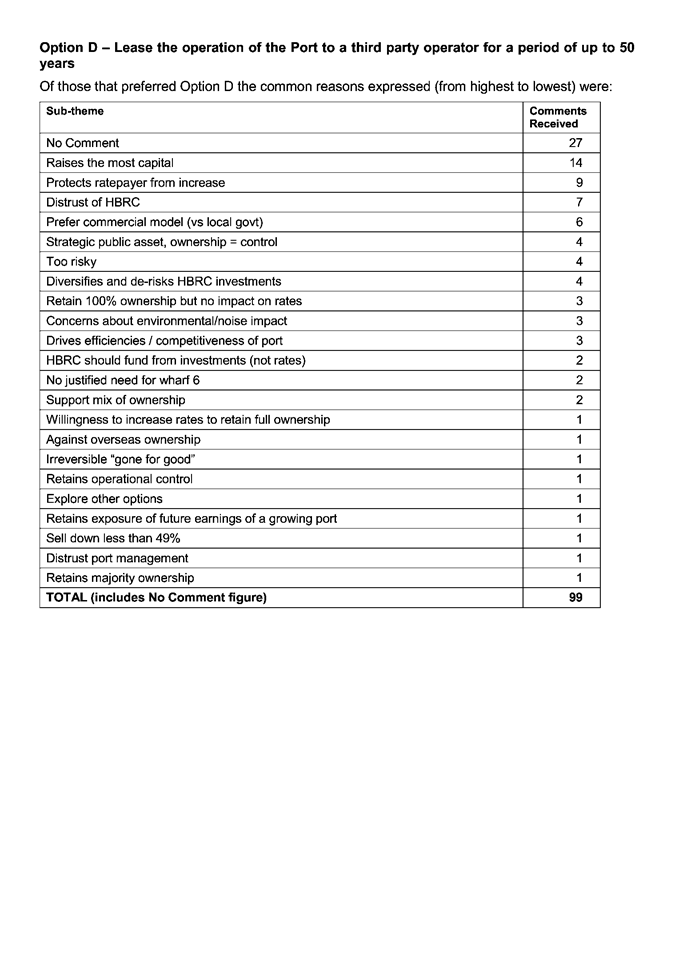

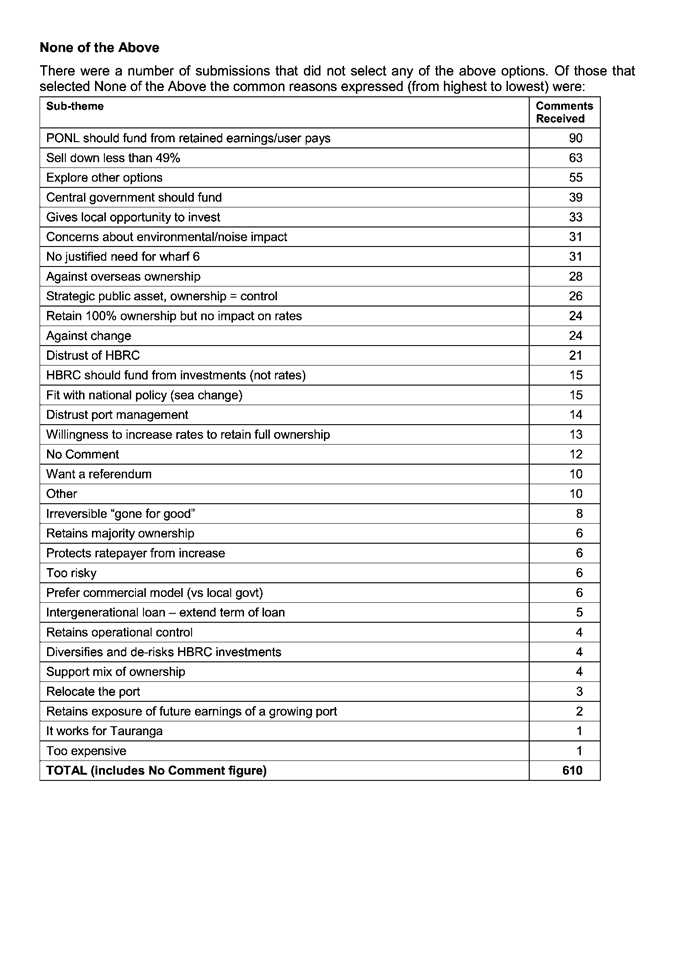

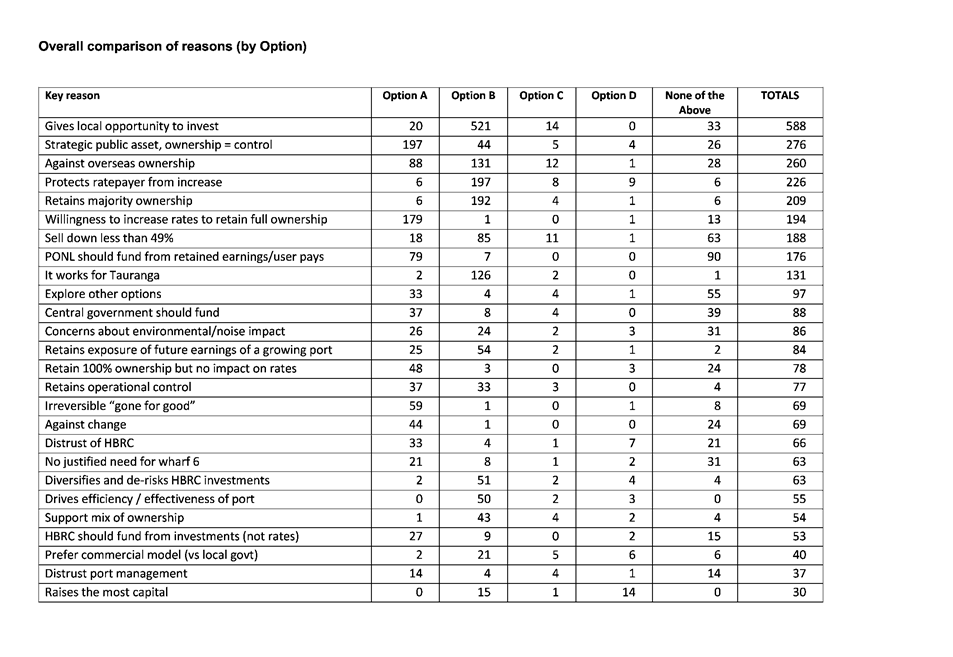

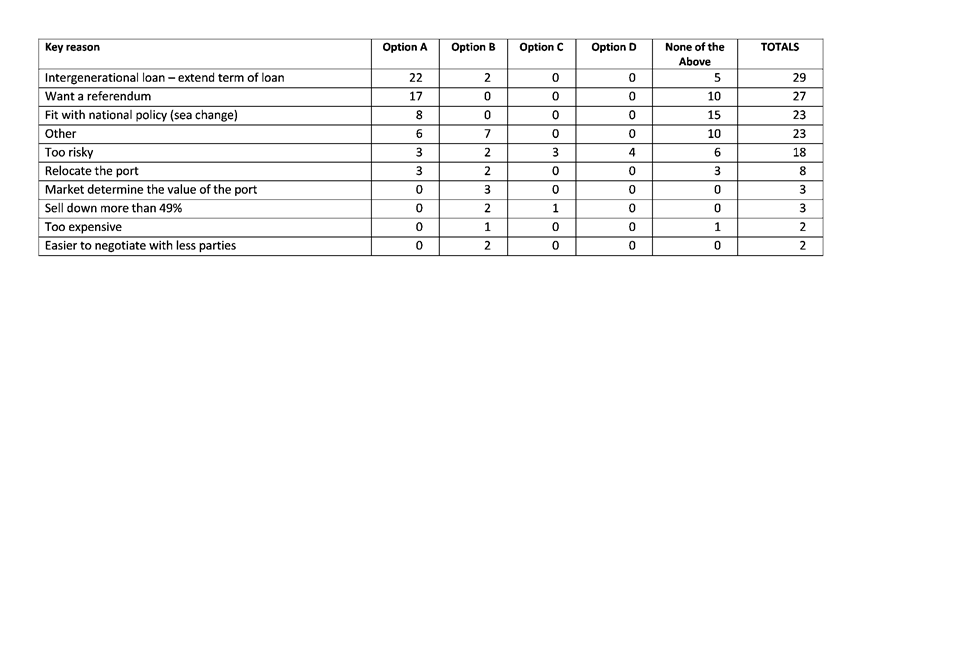

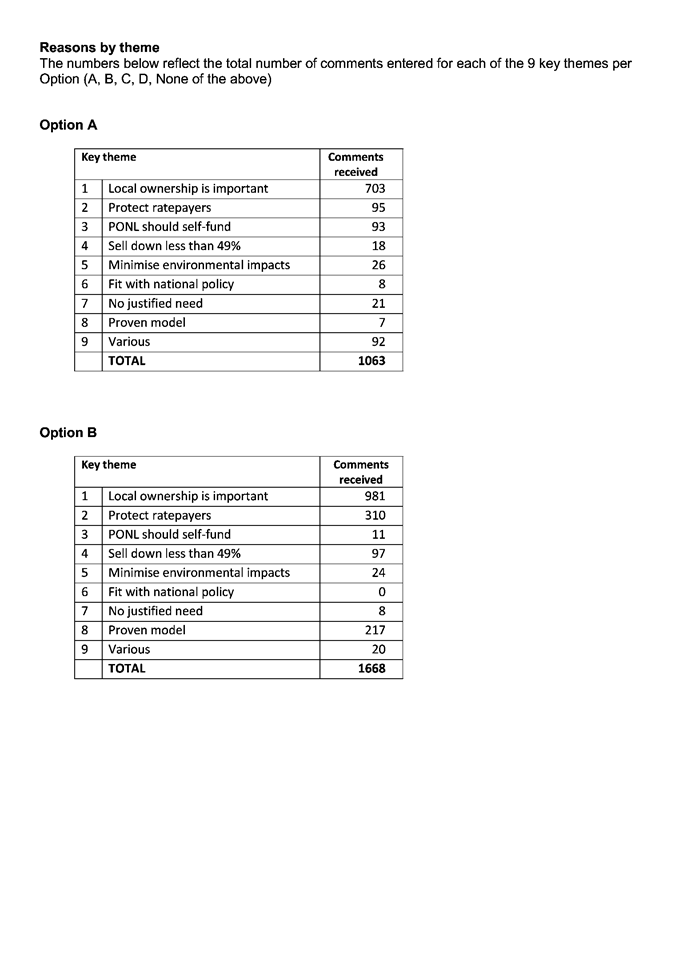

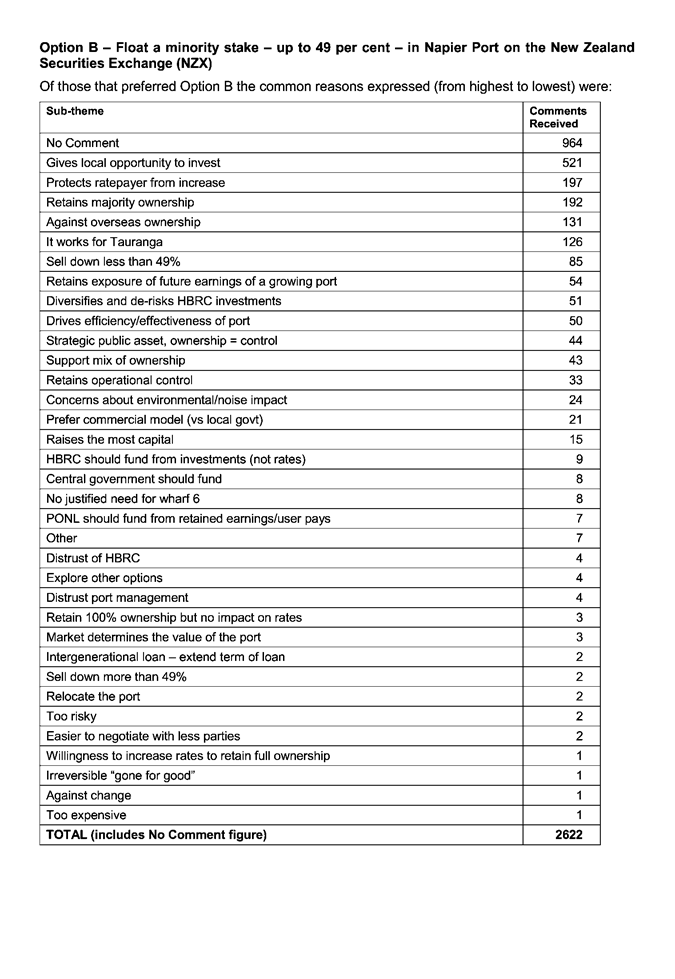

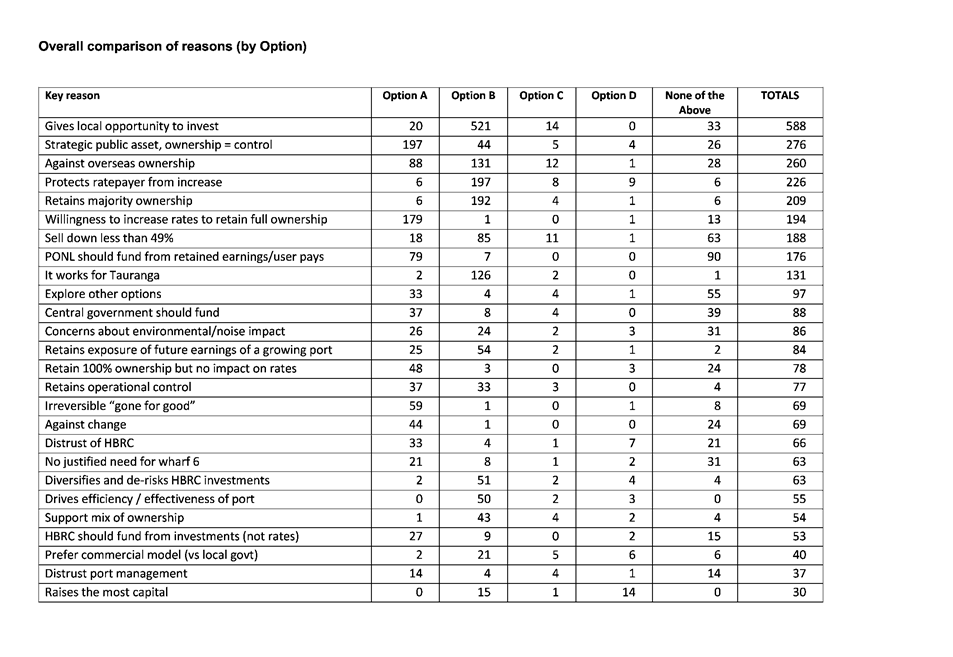

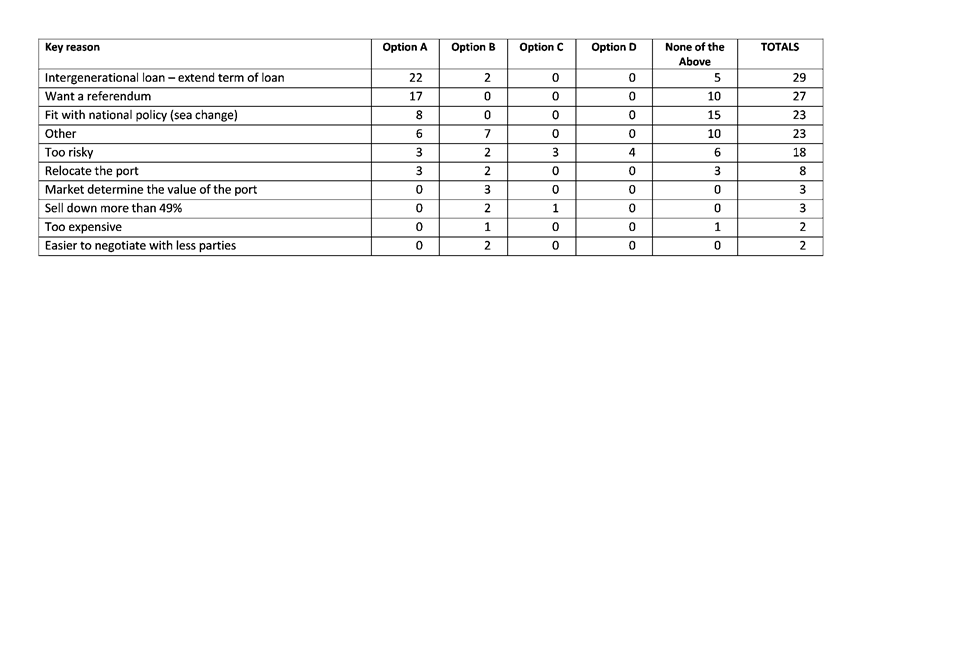

breakdown of the options by reason is attached.

22. The headline conclusions drawn from the officers’ analysis of

the written submissions are:

22.1. A majority of

submitters support Council’s preferred option (option B). However,

Council must take into consideration that many submitters selected

“Option B” with conditions or caveated, such as wanting to see preferential

shares for locals, floating less than 49 per cent or a staggered float.

22.2. Local ownership

and the opportunity for locals to invest is an important theme. 521 of the 2049

who support Council’s preferred option said it ‘gives locals the

opportunity to invest’. Council should reflect on this in making its

decision.

22.3. 57% support for a

minority IPO could be understated because some who did not select Option B

commented that should certain conditions be met, Option B would then become

acceptable. From the analysis of comments at least 103 submitters (who chose an

option other than the preferred option), commented in support of selling down

less than “up to 49%”. These 103 submitters choose option A (18), C

(11), D (1) and None of the above (63).

22.4. Of the 2049 who

support Council’s preferred option, 131 explicitly state a dislike of the

concept of overseas ownership and 85 want to see sell-down at a level less than

49%. If the preferred option proceeded without addressing these comments,

and it is assumed that the 207 submitters with these views would then no longer

support this option on this basis, the analysis shows that the support for

Option B would drop to 52% of all written submissions.*There were 207 unique

submitters in these two categories (from 216 total comments)

22.5. Roughly one in

three submitters (1003) chose Option A. This demonstrates a strong desire and

commitment to local ownership. At least 179 said that they were willing

to pay for it via increased rates, in contrast at least 48 said they want to

retain ownership but do not think ratepayers should be burdened with this cost.

22.6. There is limited

public support for a minority strategic sale to an investment partner (Option

C) or long term lease (Option D).

22.7. Around 10% of

submitters did not support the four options consulted on. Of the 356 submitters

who chose “none of the above”, at least 104 submissions made

comment to "Option E" and / or “user pays”. The

idea of an Option E was introduced by Cr Bailey in an editorial published in

October 2018 in which he described a structure which allowed Council to retain

100% ownership via a Port user pays model.

22.8. There are a wide

range of views held in the community, many of which directly contradict each

other. An example of this is many people show support for the growth and

development of the Port, saying “Port needs to grow. To have a vision.

Embrace the future” while others are against change “Bigger is not

necessarily better”.

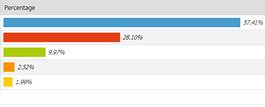

Recurring themes

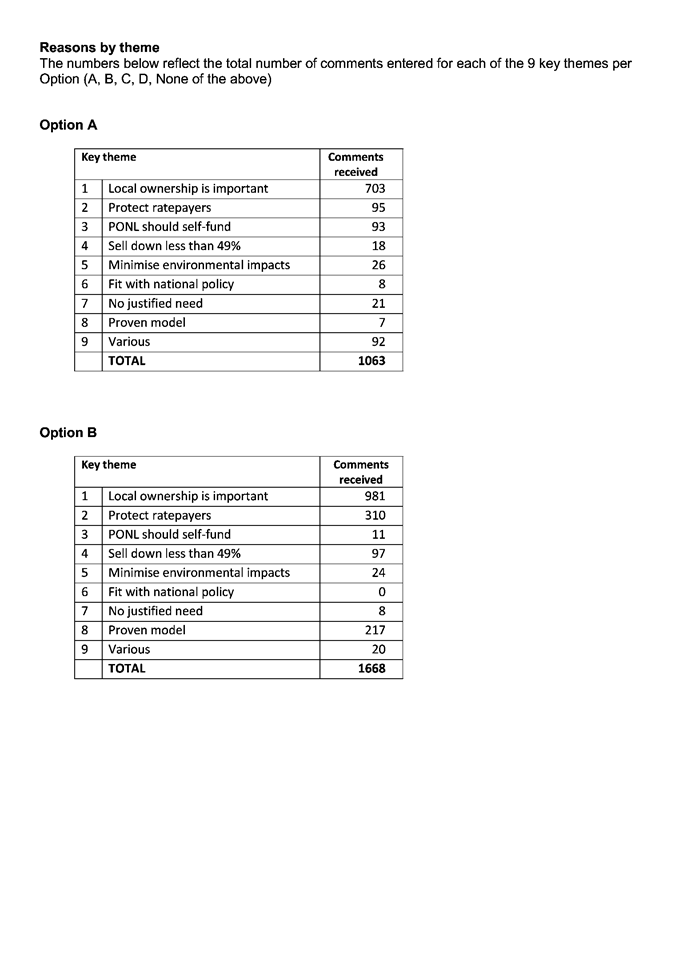

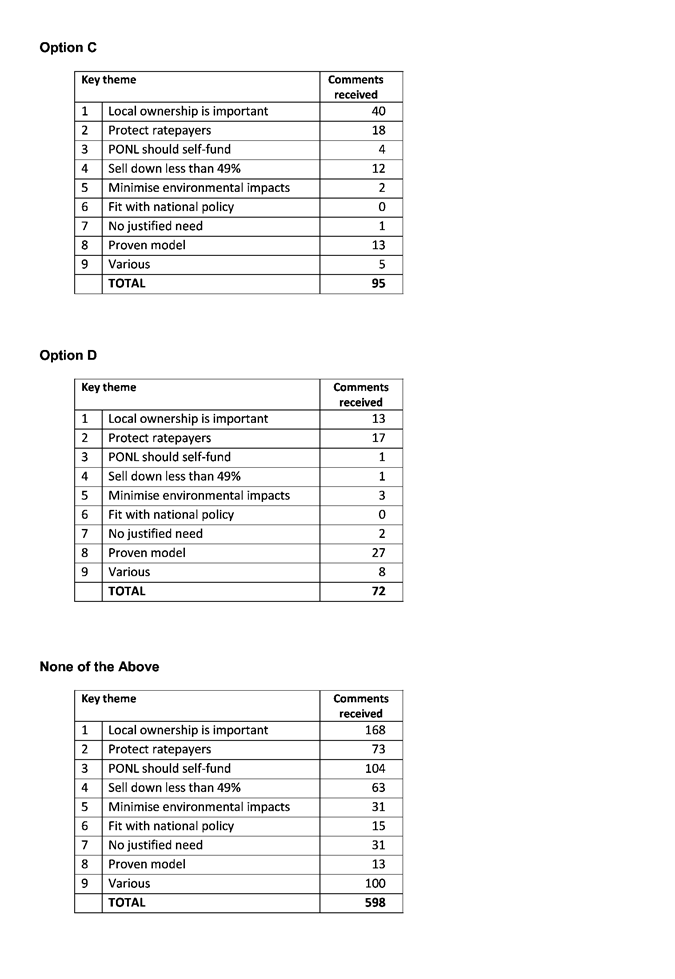

23. To summarise the commonly raised reasons and provide officers’

responses we have grouped the feedback into the following 9 themes. These

themes were raised irrespective of the option selected and for the purpose of

this analysis, officers have bundled similar sub-themes (or reasons given)

together in the analysis under each theme (later in this report) to give a flavour

of the comments received that support each theme.

|

Key theme

|

Comments

received

|

|

1

|

Local ownership is important

|

1905

|

|

2

|

Protect ratepayers

|

513

|

|

3

|

PONL should self-fund

|

213

|

|

4

|

Sell down less than 49%

|

191

|

|

5

|

Minimise environmental impacts

|

87

|

|

6

|

Fit with national policy

|

23

|

|

7

|

No justified need

|

63

|

|

8

|

Proven model

|

277

|

|

9

|

Various

|

159

|

24. Each of the 9 key themes are covered in a section following.

Each section notes how many submitters commented on that theme, gives some

extracts from submission relevant to the theme and provides an officers’

response.

Key theme 1. Local

ownership is important

25. “Keeping

it in local hands” was the most common theme that emerged through

submissions – both in the context of retaining 100 per cent ownership and

control of the Port and, particularly, in support of locals having an

opportunity to invest directly in the Port.

26. More

than half of the comments related to this theme (54.45%). This sentiment was

raised by submitters in favour of Options A, B, C and None of the Above.

27. The

table below shows the range of comments related to local ownership.

|

Sub-theme

|

Comments received

(all options)

|

|

Give local

opportunity to invest

|

588

|

|

Ownership =

control

|

277

|

|

Against

overseas ownership

|

260

|

|

Retains

majority ownership

|

209

|

|

Willingness

to increase rates to retain full ownership

|

194

|

|

Retain 100%

ownership but no impact on rates

|

78

|

|

Irreversible

"gone for good"

|

69

|

|

Against

change

|

69

|

|

Retains

operational control

|

78

|

|

Retains

exposure of future ownership to growing port

|

83

|

|

Total

|

1905

|

28. At least

521 of these comments were in support of Council’s preferred option

(Option B) and expressed a general view that the option of a minority IPO

provided a positive opportunity for locals to invest in a growing strategic

regional asset.

29. In this

context, the opportunities for locals to invest directly and share in the

results of a core regional asset are rare. Wide public participation in

ownership of Napier Port was identified as an important attribute of

Council’s preferred option. As the Chair and Chief Executive noted in the

consultation document around Option B: “This will enable continued

community ownership and control, fund the Port’s growth, and give the

people of Hawke’s Bay, Port staff and tangata whenua the opportunity to

invest in this core community asset.”

30. Through

the submissions it is also evident that many people in the community see the

Port as a strategic regional asset bestowed upon HBRC to act as the

“steward”, rather than as a commercially-run company that is a

financial asset of the Council. A number of submitters stated their belief that

the perceived public good of owning a strategic asset and enabling regional

growth enabled the Council to “control our own destiny”.

31. Submissions

demonstrated a level of emotional connection to the Port. Some submitters

expressed this connection as a desire not to sell their shares while some

questioned the legality of HBRC selling shares to ratepayers.

32. Several

submissions were fundamentally against any sale of community assets, or

privatisation. Reasons given included perceived social polarisation when equity

is transferred from public to private ownership, consolidation at the expense

of local investors and evidence of bad outcomes from

past experiences at the national or international level. During the Hearings,

one submitter noted their view that the IPO listing for the Port of

Tauranga has resulted in ownership consolidated into the hands of a small

number of holdings, as opposed to so-called “Mum and Dad”

investors.

33. At least

78 submitters expressed a desire to retain 100% ownership but did not want any

impact on rates.

34. Another

theme that emerged was in relation to the link between ownership and control of

the Port, with a number of submitters urging the

Council to maintain control of the Port either through retaining a

majority stake or via 100 per cent continued ownership.

Quotes from submitters

35. “Give

the Hawkes Bay / New Zealand public a chance to invest in their

community” (sub#7).

36. “Having

external input into the running of the port via shareholders should also

increase the performance of the port. Still allows the council to have control

and is a nice balance between those that want the port sold and those that want

to retain the port” (sub#163)

37. “Keep

the benefit in The Bay. Please give HB ratepayers the first opportunity to

purchase and/or give them priority shares over other NZ residents and a third

tier of international investors only if necessary” (sub#1114)

38. “Local

Hawke's Bay residents should be offered first chance to buy shares in

affordable blocks.” (sub#2358)

39. “Option

b means losing up to 49% profit forever. Use profit to pay debt when debt

is repaid then rates can be reduced”. (sub #2526)

40. “I

like the thought of local people being able to buy shares and support the port.

I would love to have the opportunity to invest in something local. The living

costs in NZ are already too high and we struggle to pay our bills week-to-week.

The thought of rates increasing is overwhelming and I'm sure many other people

feel the same, therefore, I don't see this as a good option. I would hate for

the local council to loose control over the port, or have a large overseas

investor involved.” (sub#2541)

41. “I

support your preferred option with one proviso! Is it lawful to limit the

number of shares any one individual, company or institution can purchase to

reduce the likelihood of a takeover further down the track” (sub#2664)

42. “Hawke’s

Bay Regional Council’s shares in the Port of Napier are our region's

"family silver". They are an inheritance passed down to us by

previous generations and it is essential that today's decision makers protect

this inheritance for the benefit of future generations. Please reconsider

the percentage of shares to be sold and leave the balance invested in the Port

of Napier, our region's most significant strategic asset”. (sub#3235)

43. “It

has been proven in this country that selling assets does not work, think Kiwi

Rail, Government sold it, then bought it back at twice the price & stripped

of its assets, Air New Zealand sold then bailed out so not to go broke, Power

generating companies de-regulated sold off and look at the price of power

now!” (sub # 3237)

Officers’

response to the key theme “Local ownership is important”

44. Staff

have analysed the submissions related to local ownership. It is apparent that

Hawke’s Bay ownership of Napier Port is the most important issue for the

local community. This is aligned with one of the Council’s core

objectives of retaining majority community ownership of the Port.

45. In light

of the volume of submissions which reflect the high value placed on local

ownership, Council should reflect on this when making its decision. For

example, should the Council decide to proceed with a minority IPO, this

sentiment should be reflected in the design of any IPO structure and share

allocation decisions.

46. Option A

provides the structure to retain 100% ownership, however other capital

structure transaction options considered in the Consultation Document are also

technically capable of being structured to enable some level of direct

community ownership in addition to ongoing Council control on behalf of the

region.

47. Some

submitters appeared to be unaware that the Port is currently run as a profit-motivated

company with a board of independent directors and no direct operational

influence by the Council, and that the principal levers of control –

board appointment and shareholder ordinary resolutions – would remain in

the Council’s control under Option B: sharemarket listing of a minority

stake.

48. A number

of submitters also compared the Council’s proposal to historic Central

Government privatisations where a full sale and consequential loss of control

of the enterprise occurred, which is not comparable to that contemplated by the

Council and indeed was ruled out by the Council’s objectives. The

‘mixed ownership model’ involving a share market listing of a

minority stake in three electricity companies by the Central Government was mistakenly

conflated with increases in electricity charges. It is widely understood within

the electricity sector that the overwhelming majority of increased electricity

charges for residential customers occurred under full government ownership of

these companies through the reform of the electricity sector and

corporatisation, rather than privatisation. Anecdotal evidence suggests the

rate of increase in residential electricity charges has decreased since the

‘mixed ownership model’ share market listings, while the returns on

equity to Central Government have increased.

49. Notwithstanding

the misunderstandings about the nature of the current Port enterprise and the

Council’s current control there are a number of options available for the

Council to address this key theme within the preferred option to encourage and

facilitate ongoing local investment beyond the Council’s own majority.

These include:

50. Preference

pools / Priority allocation - In the context of an IPO the normal approach

would be to structure an offering to enable Hawke’s Bay residents to

apply for a priority allocation of shares.

51. In New

Zealand, priority allocations have typically been 1% - 3% of offer size,

although there has been precedent as high as 6%. There is no limit to any

priority allocation and Council or its delegated body will need to balance

local priority share allocations with the need to deliver value to investors

and any desire for liquidity in the stock.

52. The

advantage of a priority allocation is that there is greater assured supply of

shares to interest groups, including residents, and these groups are not

crowded out by demand from other retail and institutional investors.

53. To the

extent that demand is not taken up by those entitled under the priority

allocation, demand is met by other retail and institutional investors.

54. Post

IPO, all shares trade on the same basis in the after-market in a single share

pool enabling residents to trade shares freely without trading restrictions in

an open liquid market and at a transparent market price.

55. Parcel

size and ease of purchase – New NZX Listing Rules (which come into

force from 1 January 2019 and will apply) have a $1,000 minimum parcel size

requirement. However, Council could seek a waiver from the NZX to use a

lower value, to assist in encouraging local participation (although it is for

the NZX to determine whether such a waiver would be granted).

56. Allocation

split between international and domestic markets – It is the right of

the Council or its delegated body to allocate shares as it sees fit, in-line

with its strategic objectives. For example, in allocating shares, decisions

will be taken around the split between retail and institutional investors as

well as domestic versus offshore allocations. As per considering priority

pools, the Council will have the opportunity to consider levels of local

ownership alongside the need to create value and liquidity for investors.

57. In

regards to restricting large international holdings it is recommended that

expert advice be taken to consider any constitutional or share sale

restrictions that may support local ownership. This should include the impact

they may have on short and long term value to Council, risk to local investors

and the ultimate distribution of shareholding amongst listed shares to support

a successful listed company.

58. Share

Buy-Backs – Council has the objective of raising capital over and

above that required by Napier Port in order to diversify its investment and

risk profile. If in the future, for whatever reason Council wished to

purchase back shares in the Port it may be able to do so through the market.

However, to effect this outcome, Council would need access to the

available funds and would likely need to acquire shares at a material premium

(20%-30%) to the prevailing market price, hence there would be a material

transaction cost in doing so. Any share buyback would be subject to the

decision of the selling shareholders (including major shareholders who have

acquired material stakes) to participate in any offer for the shares by

Council.

59. Community

shares - A community listed share class could be considered to ensure a

minimum enduring holding of shares owned by the community (port employees, iwi,

residents). A separate community share class would have the same rights

as an ordinary share (voting rights, dividend entitlement) however ownership

would be restricted to community members (as defined).

60. The

benefits of such a structure would be to ensure a portion of share ownership be

reserved for community shareholders with these

shares being able to be traded in a transparent observable manner on a listed

exchange.

61. However,

creating separate share classes would complicate the listed company’s

shareholding structure, particularly if preferential voting or other rights

were offered to the community shares. In addition, community shareholders

would be restricted on how they would be able to deal with their shares as

trading would be restricted to other community members. Trading

restrictions will necessarily reduce the liquidity and attractiveness of

holding community shares, with the result that community shares would be

expected to trade at a discount potentially significant, to unrestricted listed

shares and thereby affect the value of the Port company and balance sheet

strength.

62. Increasing

accessibility for the community to purchase shares – There is no

precedent over the last eight years for shares being sold to ratepayers and the

issue price being levied against rates invoices, multi-year payment plans or

something similar in a New Zealand IPO. Any deferred payment would represent a

debt obligation of the shareholder to settle the future sum owing on the

shares.

63. Instalment

Receipts however are a common mechanism to enable shareholders to part pay for

shares. Instalment receipts would allow investors to pay for their shares

in two stages. An initial payment on application with a final payment at

a nominated point in the future. This reduces the upfront cost and could

provide for greater accessibility for community members to participate.

64. Instalment

Receipts would typically trade at a discount to full share value, reflecting

the future instalment owed. Once the final instalment is paid, the Offer shares

relating to the instalment receipts would be allocated to investors.

65. Local

Cornerstone Investor – across all options, 65 submitters made

specific mention of Unison and several others talk about opportunity for iwi

investment – only 90 submitters expressed support for Option C. However, having

a local cornerstone investor is also something that could be possible under an

IPO given the community support for this option.

66. The

Council Chair has undertaken discussions with the Unison Chair and the CEO of

the Council has also undertake discussions with the Unison CEO. These

discussion have revealed that Unison sees little strategic alignment, and

therefore synergistic benefits, between their electricity business and the port

business. Discussions also highlighted that the current debt and leverage

levels of Unison are a major constraint on Unison being able to take a major

stake in the Port, and the current returns on capital being achieved by the

Port – and ports in general – fall short of the return expectations

of Unison. As option C has received very little support from community

consultation these discussions have progressed no further.

67. During

the consultation Council staff also had discussion with New Zealand’s

largest private infrastructure investor, which revealed that they would be

seeking a shareholder’s agreement with rights essentially equal to that

of the Council. In this respect such a minority sale to such an investor should

be seen as a partnership and not a scenario that retains Council control.

Key theme 2. Protect

ratepayers from rate increases

68. Protecting

ratepayers from significant rate increases was another key theme. Many

submissions supported Council’s preferred option, or one of mixed

ownership, because it both funds the development of the Port and protects ratepayers

from rate increases, while others wanted to retain ownership but did not want

to pay for this. Those who wanted other funding options explored suggested

alternatives such as the Government’s Provincial Growth Fund or

reallocation of Council’s existing investments with a view this would

avoid rates increases.

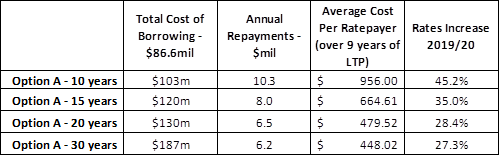

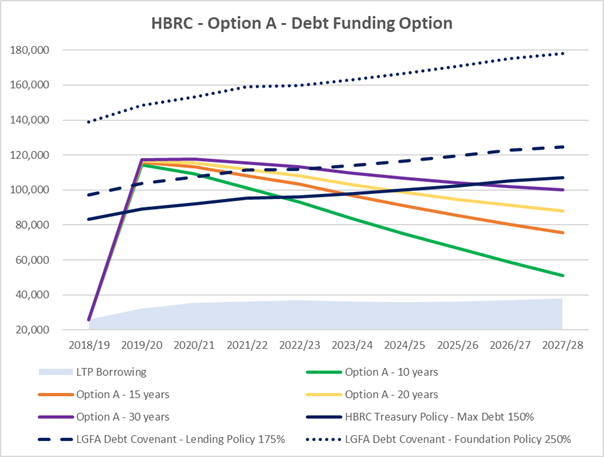

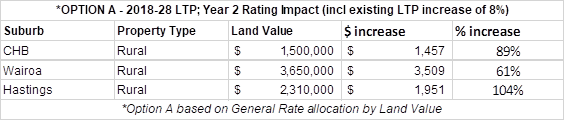

69. At least

29 submitters questioned why the forecast Council borrowing under option A

could not be extended over a longer term to match the benefit of an

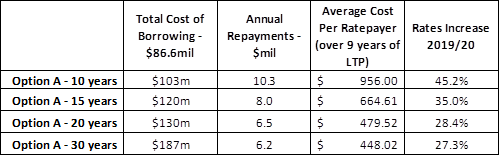

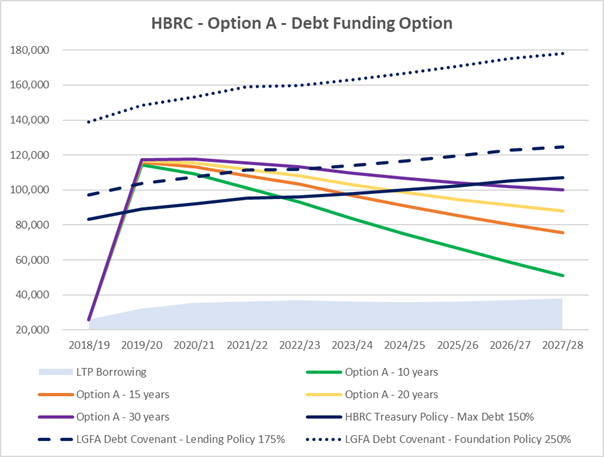

intergenerational investment and reduce and smooth rates impacts.

70. The

table below shows the range of comments related to protecting ratepayers

|

Sub-theme

|

Comments received

|

|

Protects

ratepayers from increase

|

226

|

|

Central

government should fund

|