Meeting of the Corporate and Strategic Committee

Date: Wednesday 12 December 2018

Time: 9.00am

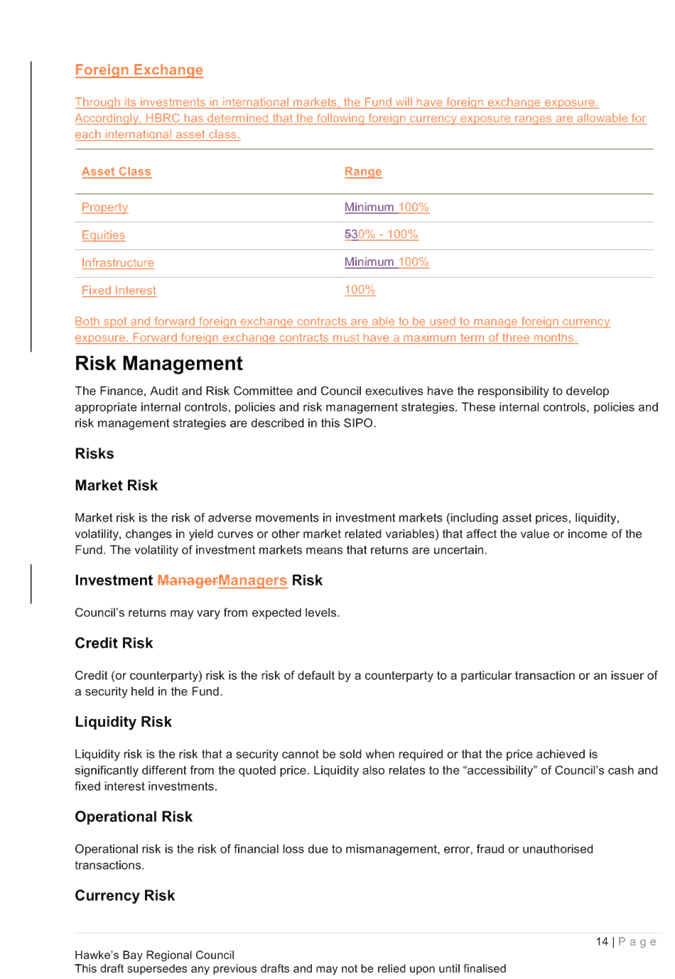

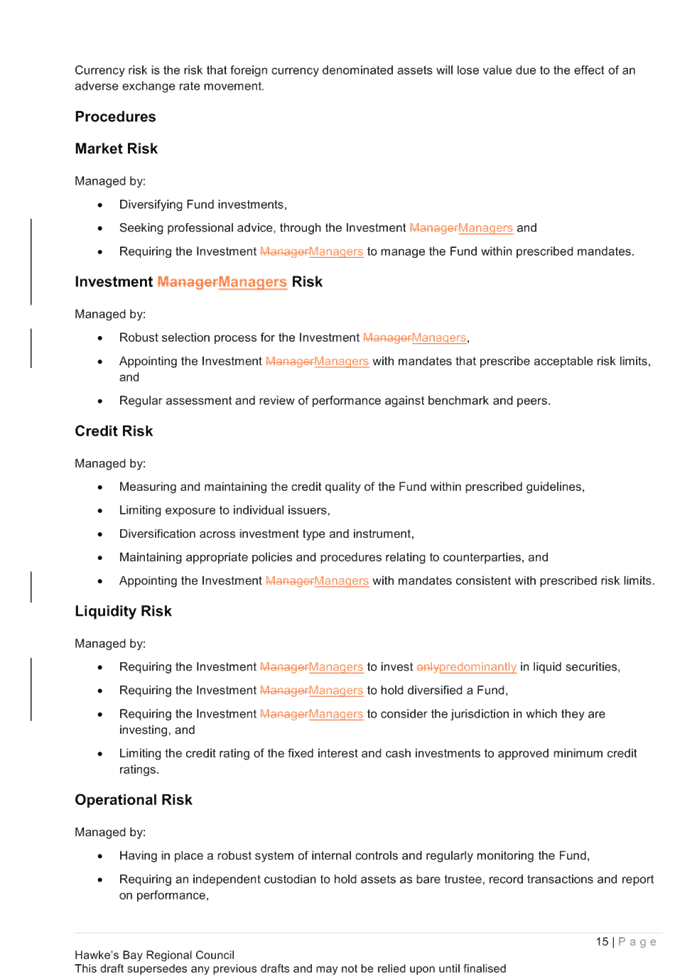

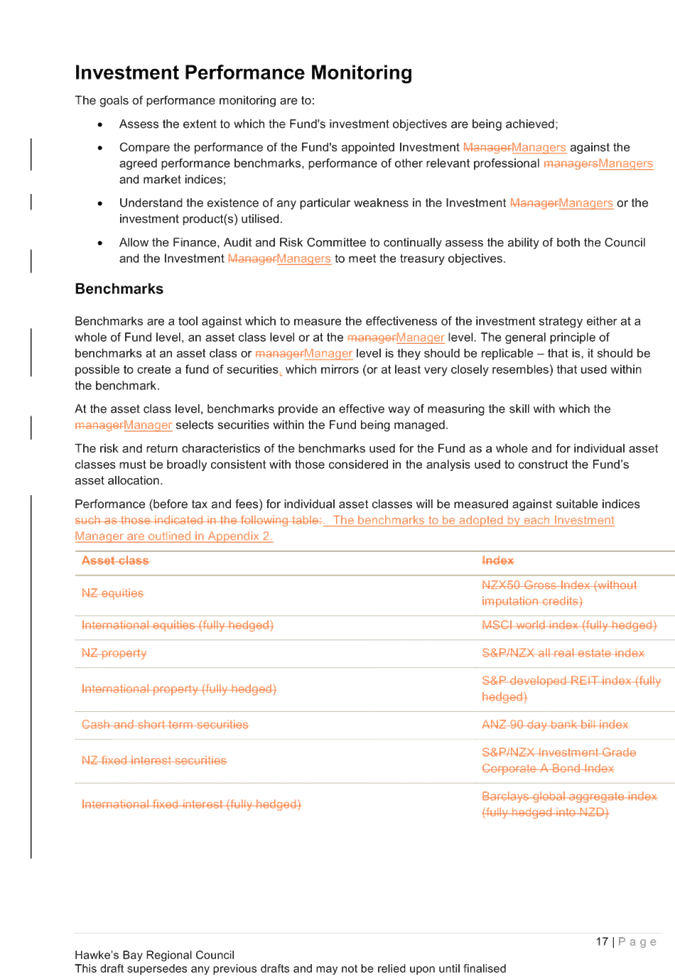

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

Item Subject Page

1. Welcome/Notices/Apologies

2. Conflict

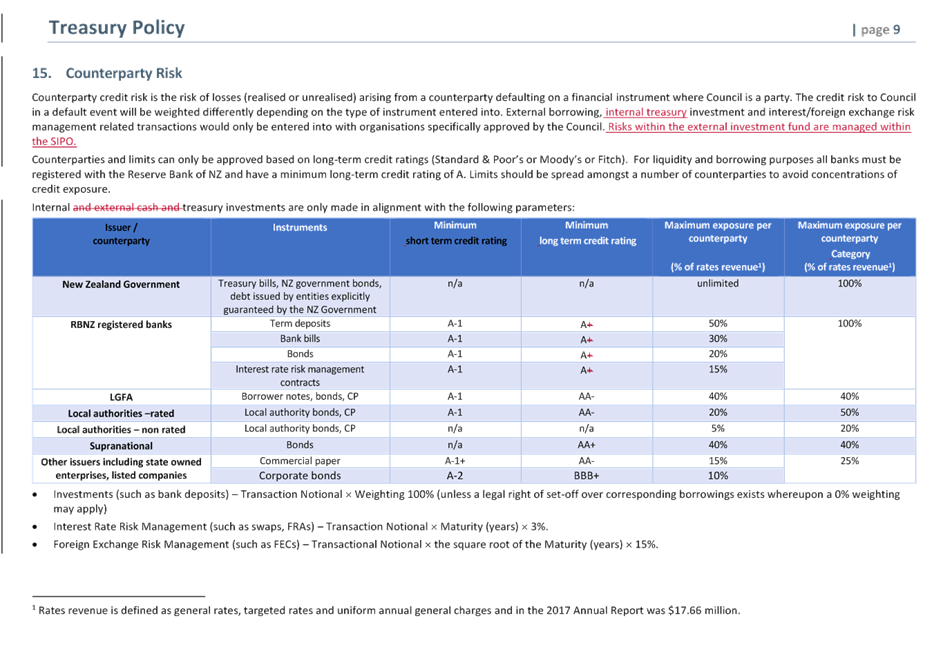

of Interest Declarations

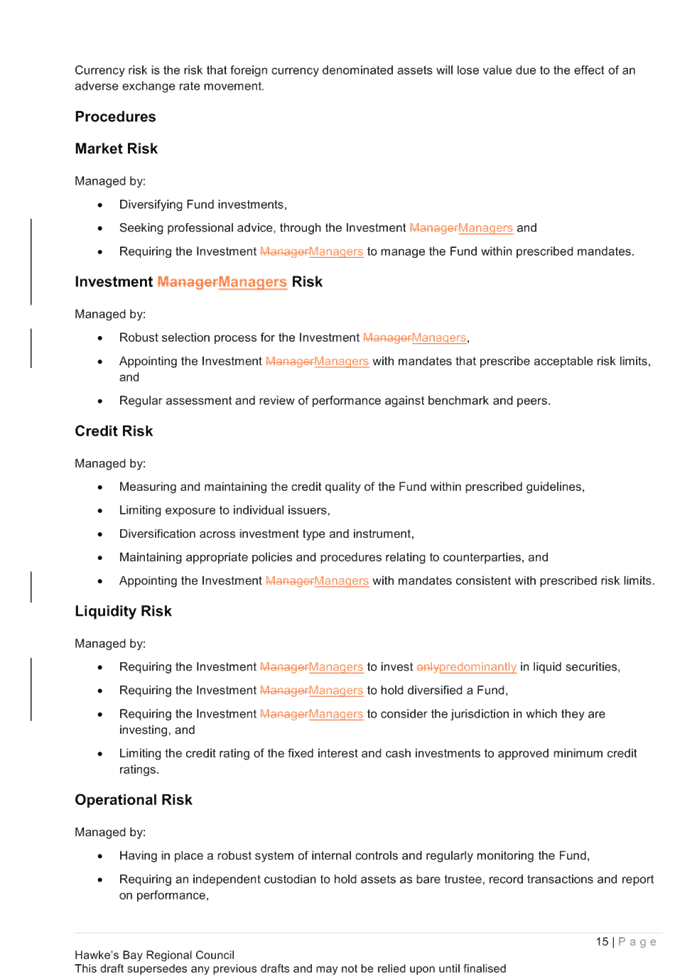

3. Confirmation of

Minutes of the Corporate and Strategic Committee meeting held on 3 October 2018

4. Follow-ups from

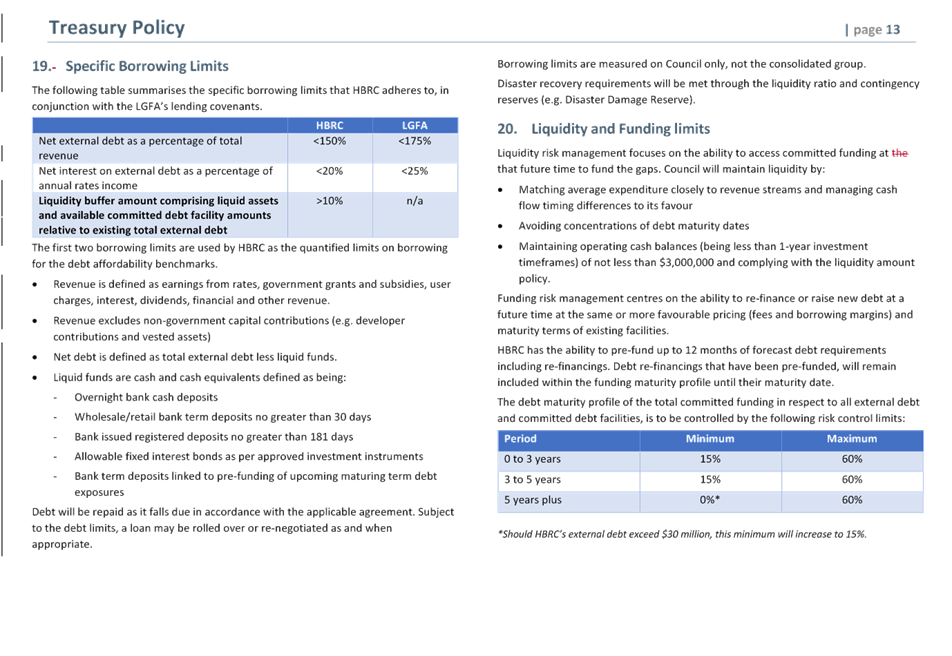

Previous Corporate and Strategic Committee meetings 3

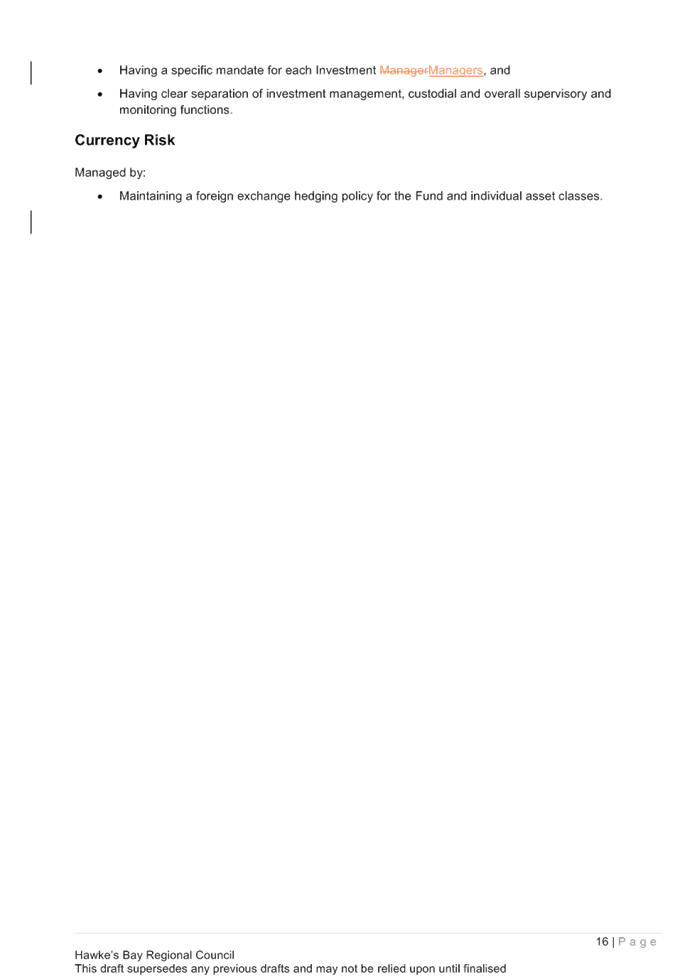

5. Call for Items of

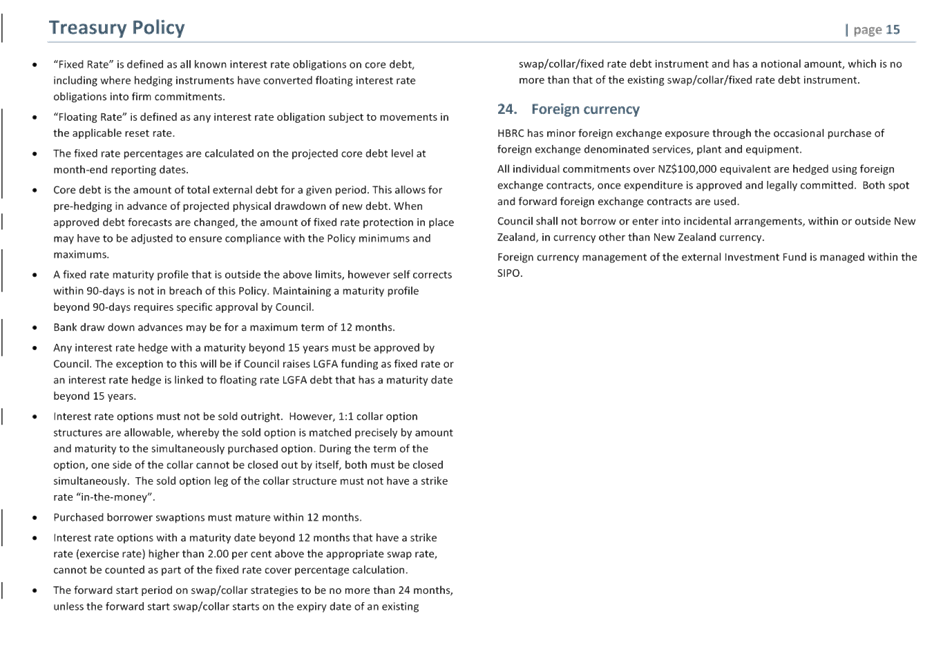

Business Not on the Agenda 7

Decision Items

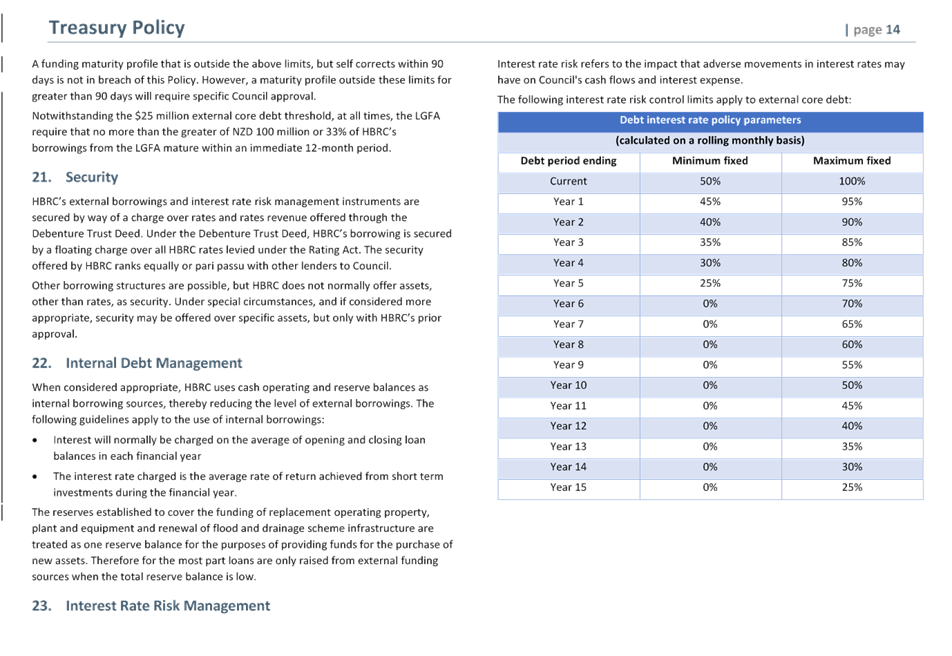

6. Bus Service Update

and Review of Fares 9

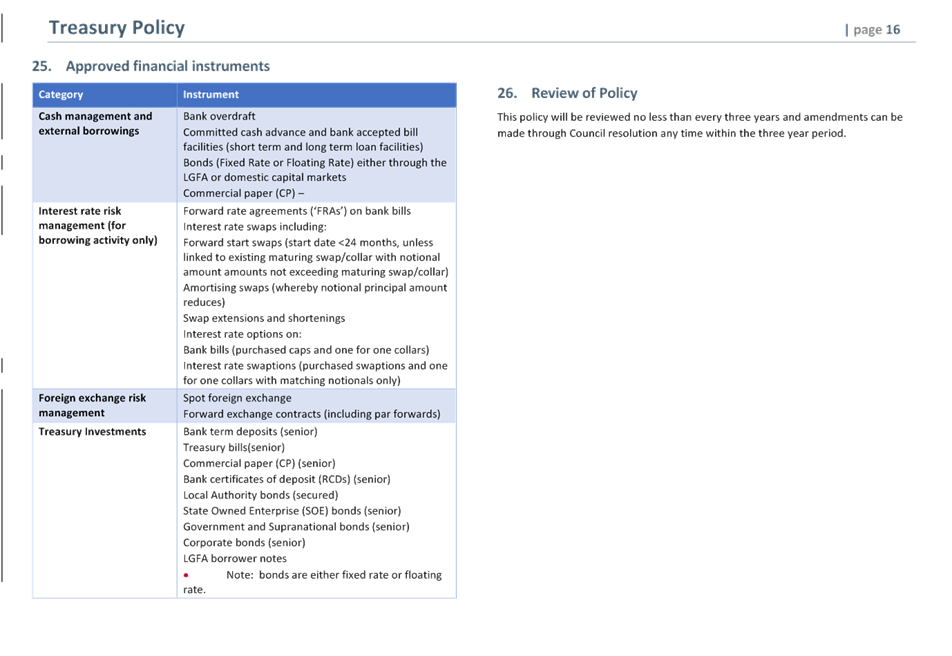

7. Amendment to the

Treasury Policy and Investment Funds Statement of Investment Policy Objectives 17

8. Regional Three

Waters Review 73

Information or Performance Monitoring

9. HB Tourism Update 79

10. Report from the Finance Audit

and Risk Sub-committee 95

11. Annual Plan Progress Report

for the First Four Months of the 2018-2019 Financial Year 97

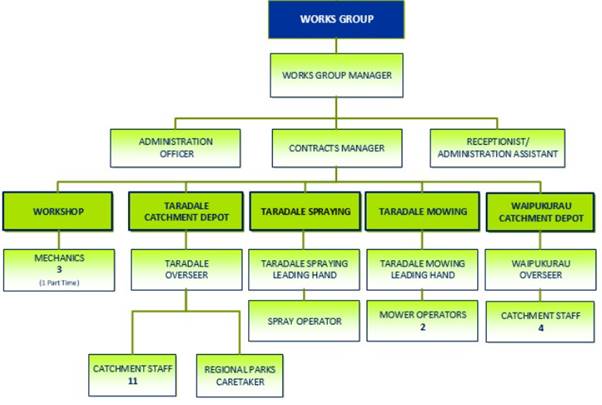

12. HBRC Works Group Six Monthly

Update 109

13. Human Resources and Health

& Safety 2017-18 Annual Reports 111

14. HBRC Response to Water

Management Internal Audit Recommendations 123

15. Future Operational Performance

Reporting 127

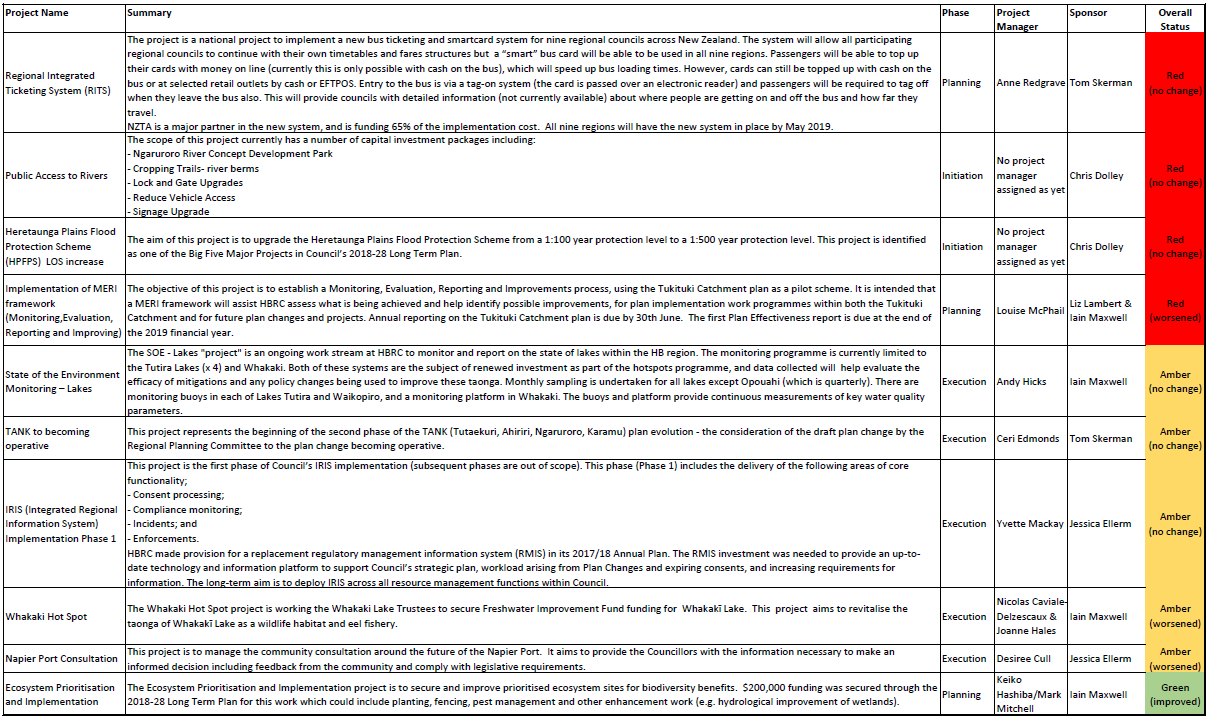

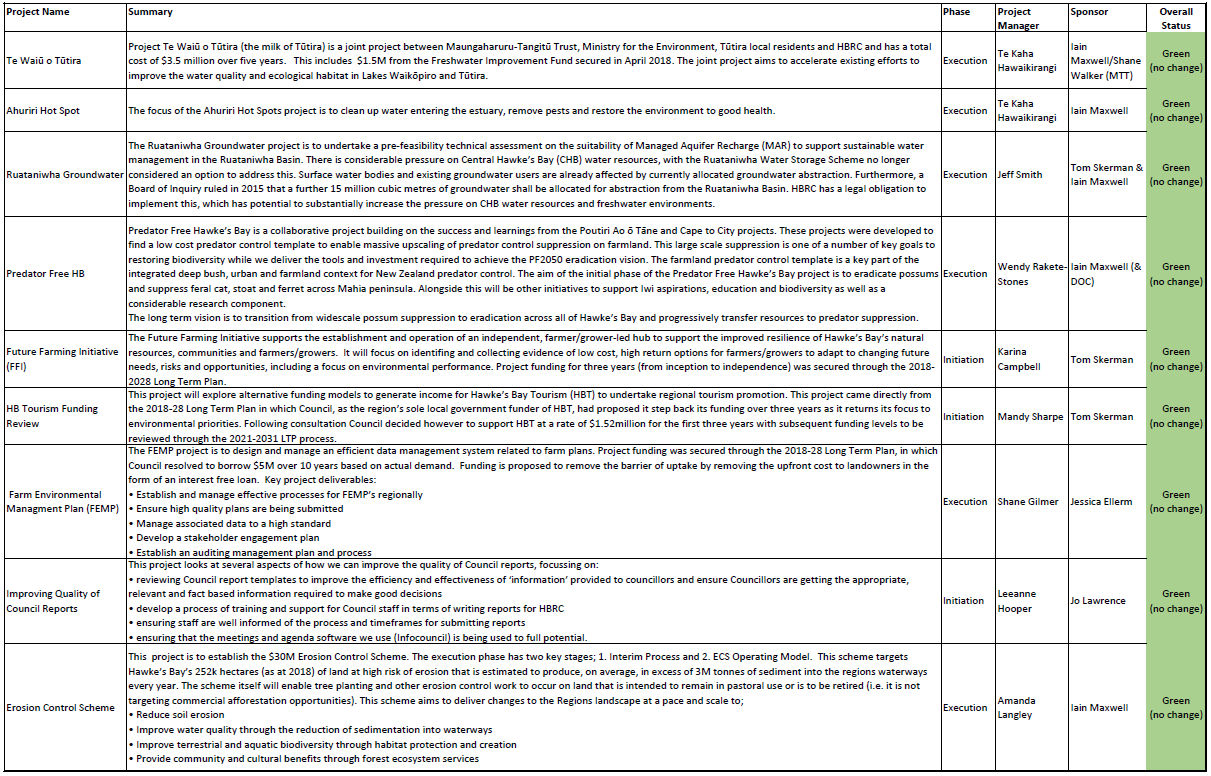

16. PMO Pilot Update and Project

Status Report 131

17. Discussion of Items Not on the

Agenda 137

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 12 December 2018

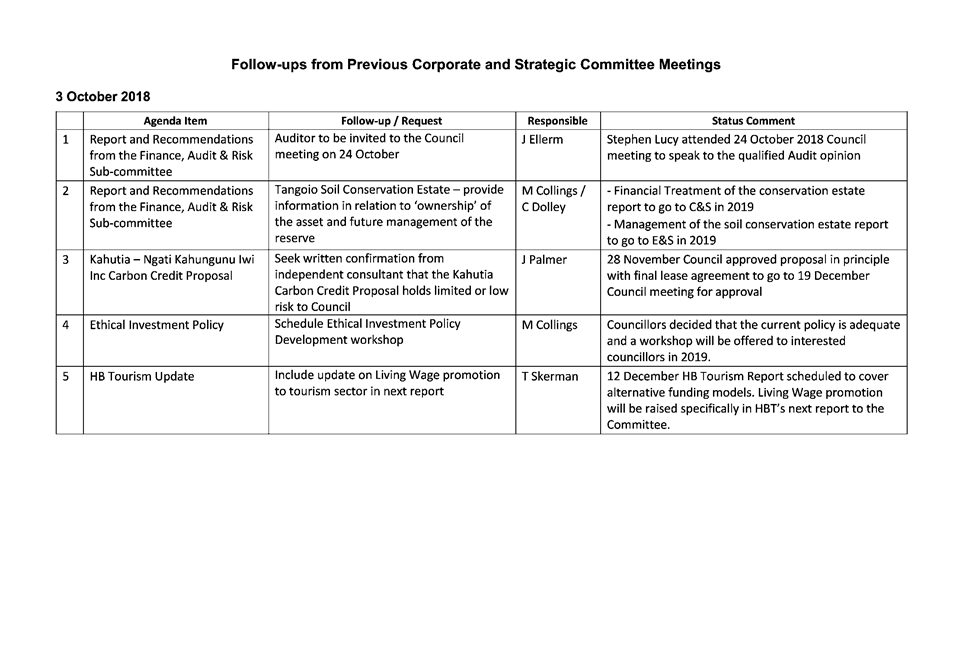

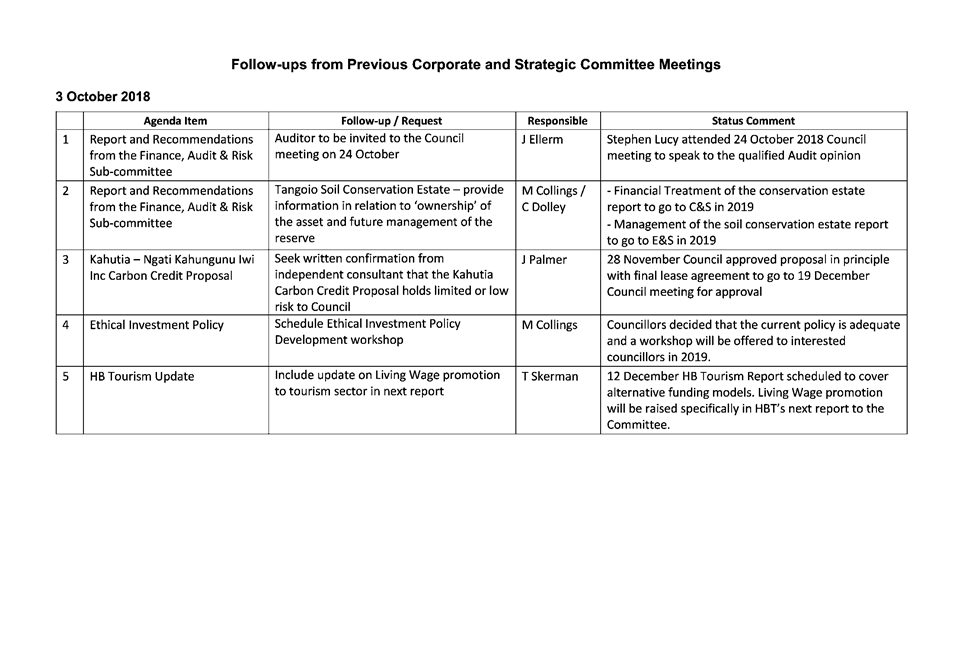

SUBJECT: Follow-ups from Previous Corporate

and Strategic Committee meetings

Reason for Report

1. In order to track items raised at previous meetings that require follow-up,

a list of outstanding items is prepared for each meeting. All follow-up items

indicate who is responsible for each, when it is expected to be completed and a

brief status comment.

2. Once the items have been completed and reported

to the Committee they will be removed from the list.

Decision

Making Process

3. Staff have assessed the requirements of the Local Government Act

2002 in relation to this item and have concluded that, as this report is for

information only, the decision making provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee receives and

notes the “Follow-ups from Previous Corporate and Strategic

Committee Meetings” report.

|

Authored by:

|

Leeanne

Hooper

Principal Advisor Governance

|

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

|

⇩1

|

Follow-ups

from Previous Corporate & Strategic Committee Meetings

|

|

|

|

Follow-ups

from Previous Corporate & Strategic Committee Meetings

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 12 December 2018

Subject: Call for Items of

Business Not on the Agenda

Reason

for Report

1. Standing order 9.12 states:

“A meeting may deal with

an item of business that is not on the agenda where the meeting resolves to

deal with that item and the Chairperson provides the following information

during the public part of the meeting:

(a) the

reason the item is not on the agenda; and

(b) the

reason why the discussion of the item cannot be delayed until a subsequent

meeting.

Items not on the agenda may be brought before the

meeting through a report from either the Chief Executive or the Chairperson.

Please note that nothing in this standing order removes

the requirement to meet the provisions of Part 6, LGA 2002 with regard to

consultation and decision making.”

2. In addition,

standing order 9.13 allows “A meeting may discuss an item that is not

on the agenda only if it is a minor matter relating to the general business of

the meeting and the Chairperson explains at the beginning of the public part of

the meeting that the item will be discussed. However, the meeting may not make

a resolution, decision or recommendation about the item, except to refer it to

a subsequent meeting for further discussion.”

Recommendations

1. That

the Corporate and Strategic Committee accepts the following “Items of

Business Not on the Agenda” for discussion as Item 17.

1.1. Urgent items of Business

|

|

Item

Name

|

Reason not on Agenda

|

Reason discussion cannot be delayed

|

|

1.

|

|

|

|

|

2.

|

|

|

|

1.2. Minor items for discussion

|

Item

|

Topic

|

Councillor

/ Staff

|

|

1.

|

|

|

|

2.

|

|

|

|

3.

|

|

|

|

Leeanne Hooper

PRINCIPAL ADVISOR GOVERNANCE

|

James Palmer

CHIEF EXECUTIVE

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 12 December 2018

Subject: Bus Service Update and

Review of Fares

Reason for Report

1. To update the Committee on the performance of the goBay bus service,

the introduction of the new ticketing system and to review fares

Background

2. HBRC contracts GoBus Transport Ltd. to provide the goBay bus service

in and between Napier, Hastings and surrounding districts.

3. The current contract commenced on 1 August 2016 and will run until

31 July 2025.

goBay Passenger Survey

Results

4. The 2018 goBay Passenger Survey was conducted between 1-24 August,

with a total of 635 people taking part (78% paper based, 22% online):

2.1 90% satisfaction with the overall trip

2.2 88% satisfaction with the public transport system

2.3 77% satisfied with service frequency

2.4 80% considered the service good value for money

2.5 90% satisfaction with personal safety

2.6 91% satisfaction with the ease of getting on/off the bus

2.7 90% satisfaction with the helpfulness and attitude of bus drivers

2.8 the top two main reasons for travel were ‘work’

and ‘school”.

5. Although these results are very good, there is still some room for

improvement, particularly around service frequency and services running to

time. The biggest decline in satisfaction since the 2016 survey related to

information about service delays. HBRC is working to improve delays

through some service and timetable adjustments, and information about service delays

should be improved once the new goBay website goes live in early December.

6. Service

features that mattered most to the community for them to recommend using goBay

public transport were: ‘The bus being on time and keeping to

timetable’, ‘How convenient it is to pay for public

transport’ and ‘The travel time’.

7. Payment systems

will be much improved once the new ticketing system is in place, and we are

also working to improve travel times wherever possible, including with faster

passenger loading once many passengers are using the tag-on, tag-off system.

Bus

Ticketing System

8. The project to implement a new bus ticketing and

smartcard system for nine regional councils across New Zealand is now well into

the implementation phase. The provider is INIT, a company based in Germany but

which has built such systems all over the world.

9. The system will allow all participating regional

councils to continue with their own timetables and fares structures but the bus

card will be able to be used in all nine regions. A clearing-house system will

allocate fares to the correct region.

10. Passengers will be able to top up their cards

online (currently this is only possible with cash on the bus), which will speed

up bus loading times. However, cards can still be topped up with cash on the

bus or at selected retail outlets by cash or EFTPOS.

11. Entry to the bus is via a tag-on system (the

card is passed over an electronic reader) and passengers will be required to

tag off when they leave the bus also. This will provide councils with detailed

information (not currently available) about where people are getting on and off

the bus and how far they travel.

12. People who travel with a concession fare will

need to be registered with HBRC and the concession will then be pre-loaded onto

their card. This will speed up loading times onto the buses considerably

as there will be no need for drivers to verify concessions.

13. We will have special bulk upload processes for

some of the concessions, which should make this registration process

straightforward. However we are anticipating that some people will need

assistance to apply for their concessions, and so we will have temporary staff

placed in HBRC Reception and at Hastings Library to assist people with this.

14. One major change for SuperGold card bus users is

that they will be required to have a bus card; currently users

simply show their SuperGold card to board the bus. However, these will be

provided free to all existing users. This is a national requirement and has

already been implemented in Auckland.

15. All nine regions will have the new system in

place by June 2019.

Bus Patronage and Cost

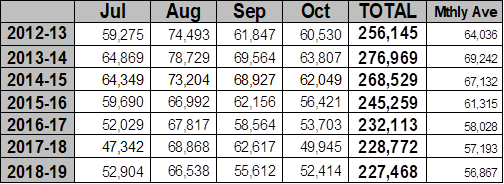

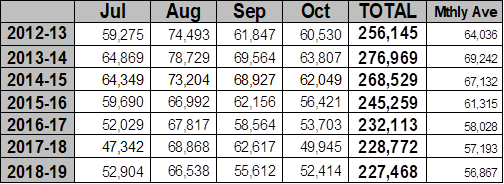

16. Diagram 1

shows the monthly passenger trips and the monthly average, July to October from

2012-13 to 2018-19.

Diagram 1 – Year to date monthly passenger trips, July to

October.

17. During this period, patronage increased on most

of the services between Napier and Hastings, while most of the suburban

services declined, including Route 14 Napier-Maraenui and Route 20 Hastings-Flaxmere.

18. Although we can’t be sure of the reasons

for this, we think that the recent increases in petrol prices have had an

influence on the longer services. As the HB unemployment figures are down to

4.5%, more people may have access to a private vehicle, explaining why numbers

on the suburban services continue to decline.

19. While the overall YTD patronage is still

slightly down on last year, the total passenger-kilometres travelled has

increased by 8% This is a reflection of passenger increases on the longer

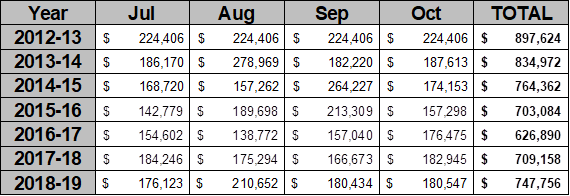

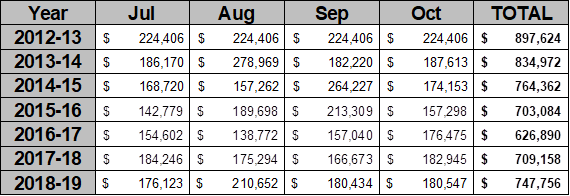

services.

20. Diagram 2 shows the annual net cost (after fares and excluding GST)

of operating the goBay bus service for the year to date from 2012-13 to

2018-19.

Diagram 2 – Year to date net cost, July to October.

51% of this cost is met by the New Zealand Transport Agency)

21. Recent cost increases are largely due to inflationary pressure, as

our bus contract is adjusted by an NZTA index reflecting fuel, labour and

infrastructure prices. However, lower fare revenues have also played a part.

Fare

Review

22. NZ Transport Agency conditions of funding require regional councils

to undertake a fare review annually.

23. The last fare increase, of 3.6%, was implemented in September 2014.

The NZTA Cost Index for Public Transport (which is used to adjust contract

prices to account for inflation) increased by 5.8% from September 2014 to June

2018. However, since June there has been a significant increase in the fuel

price and we are expecting that the September index will increase.

Table 1 - Current Fares and Zones

Single Trip Cash Fares

|

|

Adult

|

Tertiary Student/

Community Services Card

|

Child/High School Student/

Senior

|

|

1

Zone

|

$3.60

|

$2.40

|

$1.80

|

|

2

Zone

|

$4.20

|

$3.60

|

$3.00

|

Single Trip

Smartcard Fares (approx. 20% cheaper than cash fares)

|

|

Adult

|

Tertiary Student/

Community Services Card

|

Child/High School Student/

Senior

|

|

1

Zone

|

$2.88

|

$1.90

|

$1.43

|

|

2

Zone

|

$3.65

|

$2.86

|

$2.14

|

Zones

|

1 Zone Trip

|

2 Zone Trip

|

|

Clive,

Bayview, Napier, Tamatea, Taradale, and EIT

|

Bayview,

Napier, Tamatea and Taradale (before EIT/Clive) to Hastings/Flaxmere/Havelock

North

|

|

Clive,

Hastings, Havelock North, Flaxmere and EIT

|

Hastings,

Havelock North, Flaxmere to Taradale, Tamatea Napier/Bayview (after

EIT/Clive),

|

Table 2 - Passenger Category Percentages 2017-2018

|

2017-2018

|

TRIPS

|

%

|

|

Adult

|

105,830

|

16

|

|

Child

|

200,718

|

30

|

|

Community

Services Cardholder

|

88,708

|

13

|

|

DHB

Appointment Cardholder

|

5,707

|

1

|

|

DHB

Staff

|

6,904

|

1

|

|

Promo/10-trips

(sold directly by HBRC)

|

10,463

|

2

|

|

Senior

|

14,877

|

2

|

|

SuperGold

Cardholder

|

119,089

|

18

|

|

Tertiary

Student

|

78,493

|

12

|

|

Transfer

|

35,176

|

5

|

|

TOTAL

|

666,127

|

100%

|

24. Concessionary Fare Categories are:

24.1. Children under 5 travel free of charge

24.2. Children over 5 and Students in uniform

or with school ID pay a concessionary fare

24.3. EIT students pay only a one zone fare as

EIT is the zone boundary. A single smartcard trip to/from EIT is very good

value at just $1.90 (with EIT student ID).

24.4. SuperGold cardholders travel free

between 9am and 3pm Monday to Friday and anytime on weekend/public holiday

services. HBRC are reimbursed for these fares by the NZ Transport Agency.

Before 9am and after 3pm SuperGold holders pay a ‘senior’

concessionary fare.

24.5. DHB patients travelling to/from

Hawke’s Bay Hospital or the Napier Health Centre, travel free of charge on

production of a valid DHB appointment card/letter.

24.6. DHB staff pay a reduced, subsidised

smartcard fare, with the subsidy reimbursed by the organisation. HBRC has this

month introduced the same scheme on a trial basis.

24.7. Community Services Cards are available

to all people on a low income, and on production of a valid Community Services

card the passenger pays a concessionary fare.

Table 2 - Passenger Category Percentages

2017-2018:

|

2017-2018

|

TRIPS

|

%

|

|

Adult

|

105,830

|

16

|

|

Child

|

200,718

|

30

|

|

Community Services

Cardholder

|

88,708

|

13

|

|

DHB Appointment

Cardholder

|

5,707

|

1

|

|

DHB Staff

|

6,904

|

1

|

|

Promo/10-trips (sold

directly by HBRC)

|

10,463

|

2

|

|

Senior

|

14,877

|

2

|

|

SuperGold Cardholder

|

119,089

|

18

|

|

Tertiary Student

|

78,493

|

12

|

|

Transfer

|

35,176

|

5

|

|

TOTAL

|

666,127

|

100%

|

25. As seen in table 2, almost 82% of goBay fares are concessionary

fares.

26. Table 3 shows fare recovery rates for other regions. Fare recovery

is the portion of the total cost of the service that is covered by fares

(including SuperGold payments from central government). It is not possible to

directly compare fares across regions, due to differences in fare structures

and zone sizes, but the fare recovery rate provides a suitable means of

comparison.

27. Hawke’s Bay, while not among the highest of fare recovery

rates, is similar to other comparable regions. The fare recovery has improved

considerably, from 32% in 2011-12 to 37% in 2017-18.

Table 3: A

comparison with other regions, 2016-17

|

Region/city

|

Fare Recovery

|

|

Auckland

|

47%

|

|

Bay of

Plenty

|

32%

|

|

Canterbury

|

41%

|

|

Wellington

|

53%

|

|

Hawke’s

Bay

|

39%

|

|

Horizons

|

34%

|

|

Southland

|

30%

|

|

Nelson

|

56%

|

|

Otago

|

49%

|

|

Taranaki

|

40%

|

|

Waikato

|

32%

|

Options Assessment

28. The following options are proposed for the committee’s

consideration.

Option 1 - No

change to fares, with a further review in November 2019

28.1. Advantages:

28.1.1. The cost of

bus fares will compare increasingly favourably with the cost of driving as fuel

and other prices increase, helping to encourage more people onto the bus,

especially for longer trips.

28.1.2. Minimises

the degree of change to take place in April 2019, when the new ticketing system

will be introduced.

28.2. Disadvantages:

28.2.1. the fare

recovery rate of the bus service could decline further if

operational costs continue to increase without an increase in patronage,

placing a higher burden on ratepayers and taxpayers.

Option 2 –

a 3% increase on all fares in April 2019, followed by a further 3% increase in

April 2020

28.3. This

would see a ten cent increase per year on all cash fares, due to

the need to round all fares.

28.4. For

card fares, the following would apply.

Card Fares

|

|

Current

|

Proposed 2019

|

Proposed 2020

|

|

Adult 1-zone

|

$2.88

|

$2.96

|

$3.05

|

|

2

zone

|

$3.65

|

$3.75

|

$3.87

|

|

|

|

|

|

|

Tertiary/CSC

1-zone

|

$1.90

|

$1.95

|

$2.02

|

|

2-zone

|

$2.86

|

$2.94

|

$3.03

|

|

|

|

|

|

|

Child/High

School/Senior

1-zone

|

$1.43

|

$1.47

|

$1.51

|

|

2-zone

|

$2.14

|

$2.20

|

$2.27

|

28.5. Advantages:

28.5.1. A 3% increase for each

of two years would equate to an increase in revenues of $91,000 over the two

years, assuming that there is no effect on patronage (based on a 3% increase on

all fares, excluding the SuperGold allocation from central government, which is

fixed).

28.6. Disadvantages:

28.6.1. Fare increases can

result in a patronage decline. Public transport planners use a generally accepted

figure of a 2% decline for a 10% increase in fares. For a 6% fare increase we

could possibly expect a decline of just over 1%, which would then reduce the

amount of revenue collected.

Option 3 –

a 3% increase in cash fares in April 2019 and April 2020, all smartcard fares

held at current rates.

28.7. Advantages:

28.7.1. Increasing cash fares

while holding card fares could encourage more people to use smartcards. This

has significant benefits for the bus service, in that loading times are

quicker; this will improve further when the new tag-on tag-off system comes

into operation

28.7.2. There would be some

benefit to revenues, although significantly less than for Option 2, as around

70% of our passengers use smartcards. We could expect an increase in revenue of

approximately $36,000 over two years assuming no loss of patronage and the same

number of cash ticket purchases.

28.8. Disadvantages:

28.8.1. New users often pay

cash before deciding that they will continue to use the service and then invest

in a smartcard. The increase could discourage some passengers from trying the

bus service.

28.8.2. The overall benefit of

this option to fare revenues is just over 3% over two years, which will not

have a major impact on our fare recovery rate.

Other Regions

29. Over the past four years, Horizons Regional Council introduced fare

increases on two of its services, these fare increases resulted in an almost

instant decline in passenger trips on both services. Due to that decline, the

fare increase on one of the services was reversed and passenger trips have

since recovered. This illustrates how fare increases can impact negatively on

public transport patronage.

30. Taranaki Regional Council has not increased fares for five years,

with patronage static or declining on some routes, the decision has been

made each year to maintain current fares, as it was considered likely an

increase would reduce patronage.

31. Greater Wellington Regional Council implemented a general 3%

increase in July but also introduced a substantial range of concessions and

fare products that were not previously available.

Discussion

32. The options outlined above are examples only – there are of

course many other possible permutations.

33. Although the cost of running the bus service is increasing, recent

fuel price increases have driven more people to use the longer services, and we

are hopeful that this will continue. A fare increase could affect this positive

trend.

34. Unfortunately, most people only take parking and fuel costs into

consideration when calculating the cost of driving vs. using the bus. Feedback

from potential adult fare-paying passengers (i.e. with no concessions) is

that the 1-zone fare does not compare favourably with the cost of driving and

parking, especially with the amount of available free or cheap parking in both

cities. If we are to increase the number of people using the bus for

commuting to work, an increase in this fare would not be beneficial.

35. The fare recovery rate on our services could also be improved by reducing

costs or increasing patronage. Through the review of the Regional Public

Transport Plan (to be brought to Council for consideration in early 2019), we

are considering a range of ways in which we can increase patronage and improve

the efficiency of the services. Although there are no guarantees of success, we

believe that maintaining fares at current levels will make the service

more attractive and that people do weigh up the fare vs. the cost of driving,

when deciding whether to take the bus or not. The success of the HBDHB staff

scheme is evidence of this, with 115 % growth in patronage as the DHB has

successively increased the subsidy rate for its staff. We therefore support

Option 1 of maintaining fares at current levels, and trying to improve fare

recovery rates through other means.

Decision Making Process

36. Council is required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

36.1. The decision does not significantly alter the service provision or

affect a strategic asset.

36.2. The use of the special consultative procedure is not prescribed by

legislation.

36.3. The decision does not fall within the definition of Council’s

policy on significance.

36.4. The persons affected by this decision are bus users in

Napier-Hastings.

36.5. The decision is not inconsistent with an existing policy or plan.

36.6. Given the nature and significance of the issue to be considered and

decided, and also the persons likely to be affected by, or have an interest in

the decisions made, Council can exercise its discretion and make a decision

without consulting directly with the community or others having an interest in

the decision.

|

Recommendations

1. That the Corporate and Strategic Committee

receives and notes the “Annual Bus Fare Review”

staff report.

2. The Corporate and Strategic Committee recommends that Council:

2.1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that Council can exercise its discretion and make decisions on

this issue without conferring directly with the community.

2.2. Agrees to maintain bus fares at current levels, with a further

review in November 2019.

|

Authored by:

|

Anne

Redgrave

Transport Manager

|

|

Approved by:

|

Tom Skerman

Group Manager Strategic Planning

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 12 December 2018

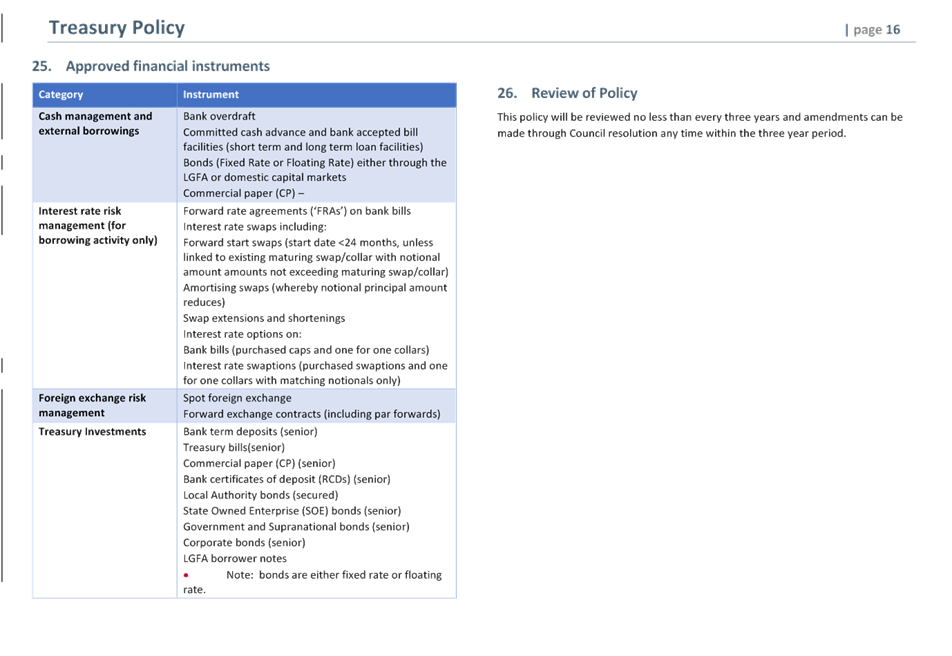

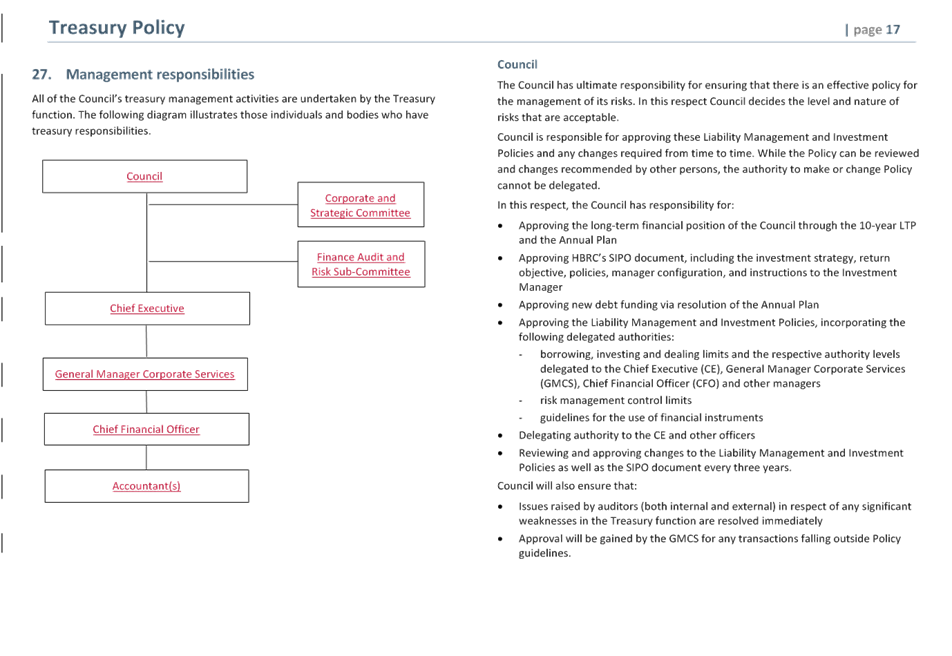

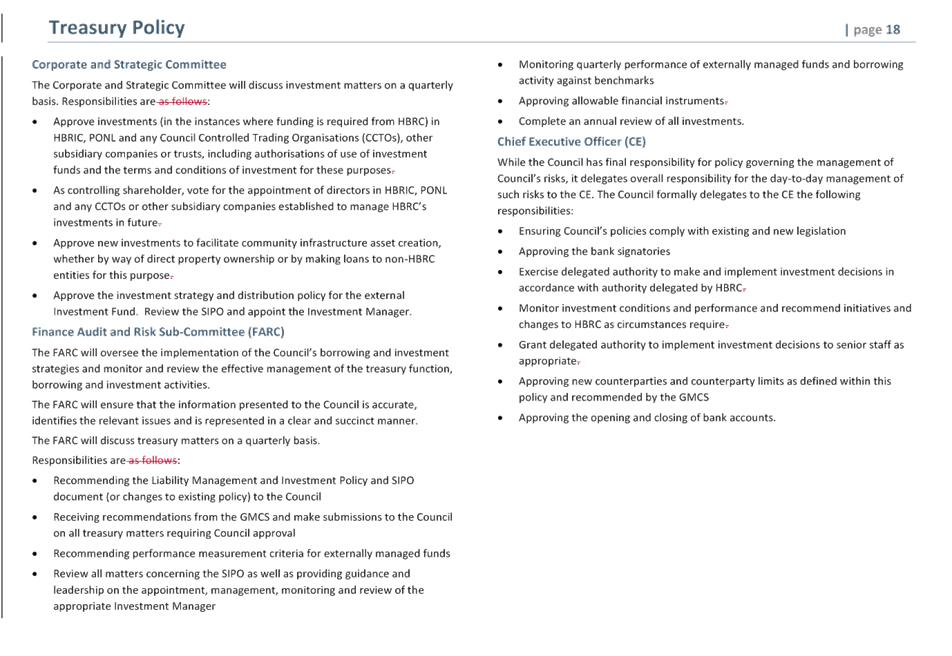

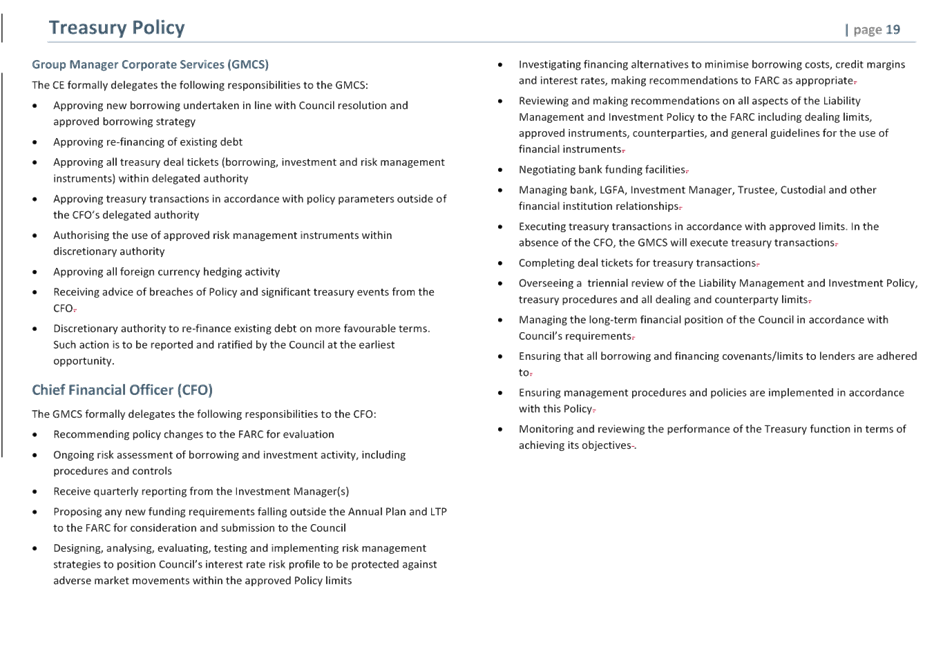

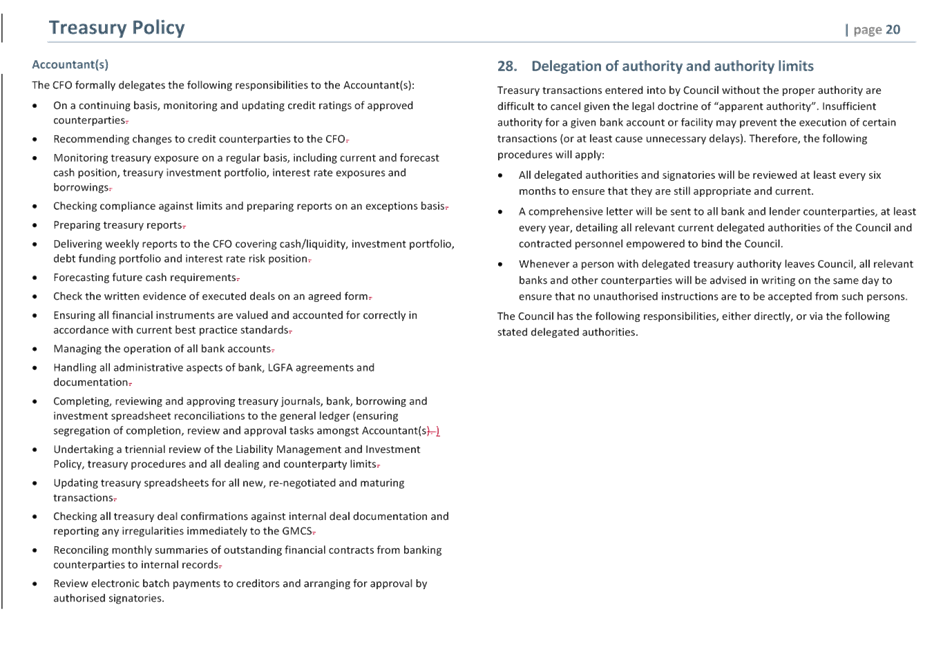

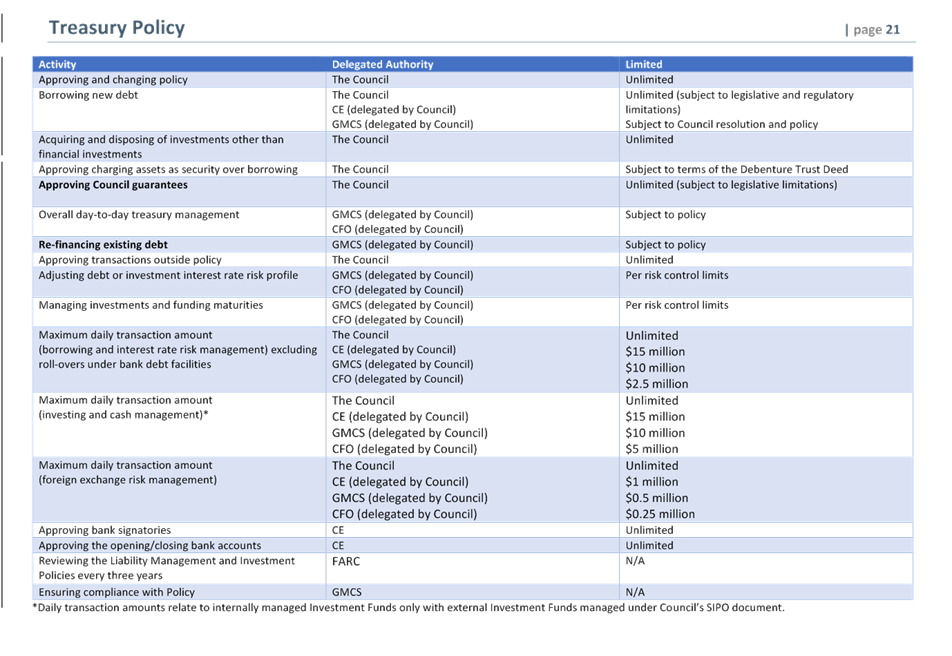

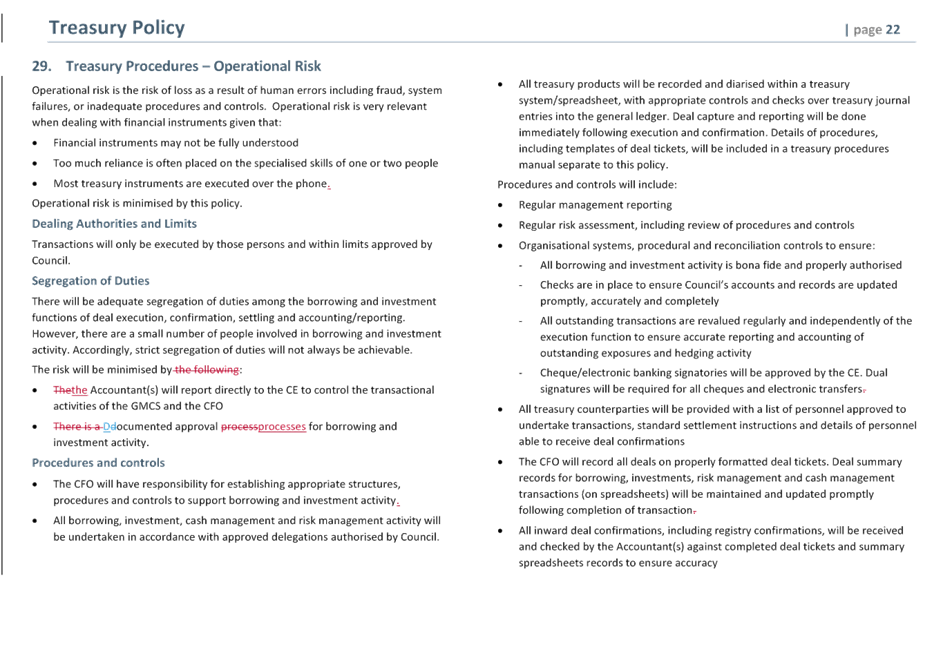

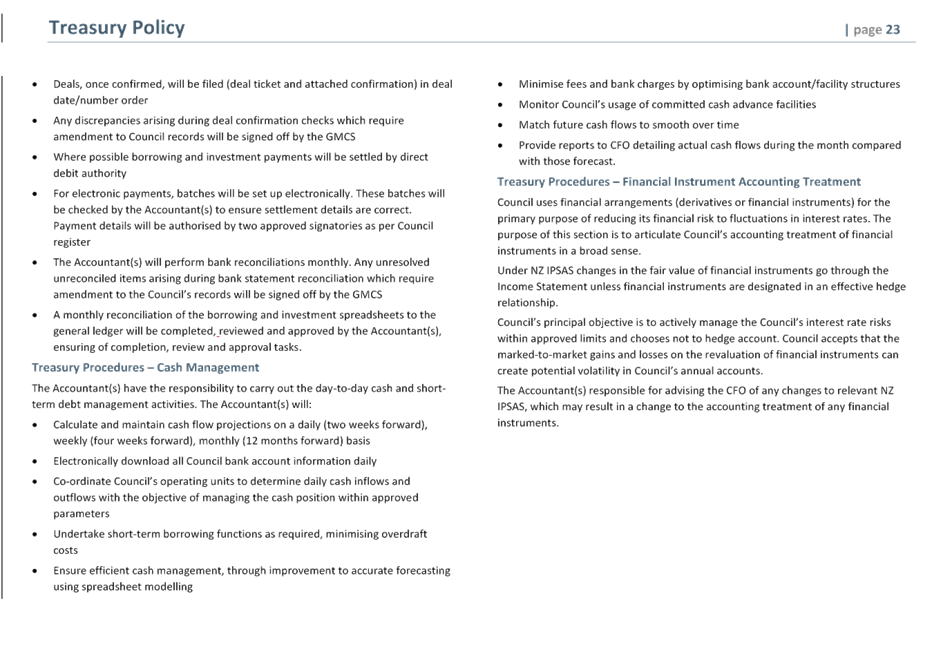

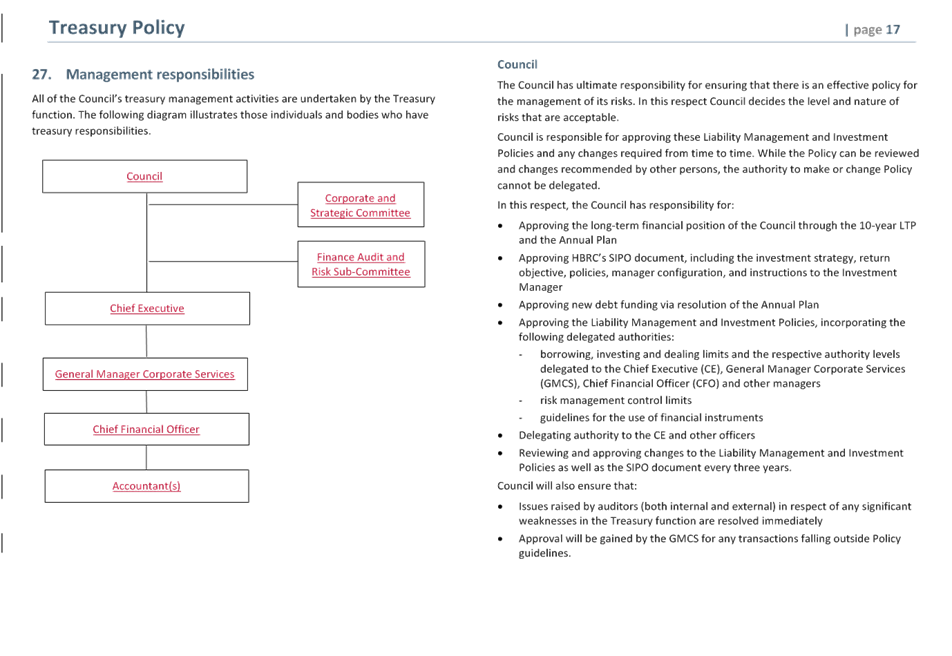

Subject: Amendment to the

Treasury Policy and Investment Funds Statement of Investment Policy Objectives

Reason for Report

1. To provide the committee with an amendment to the Treasury Policy

and the Statement of Investment Policy Objectives (SIPO) for approval and

recommendation to Council.

Background

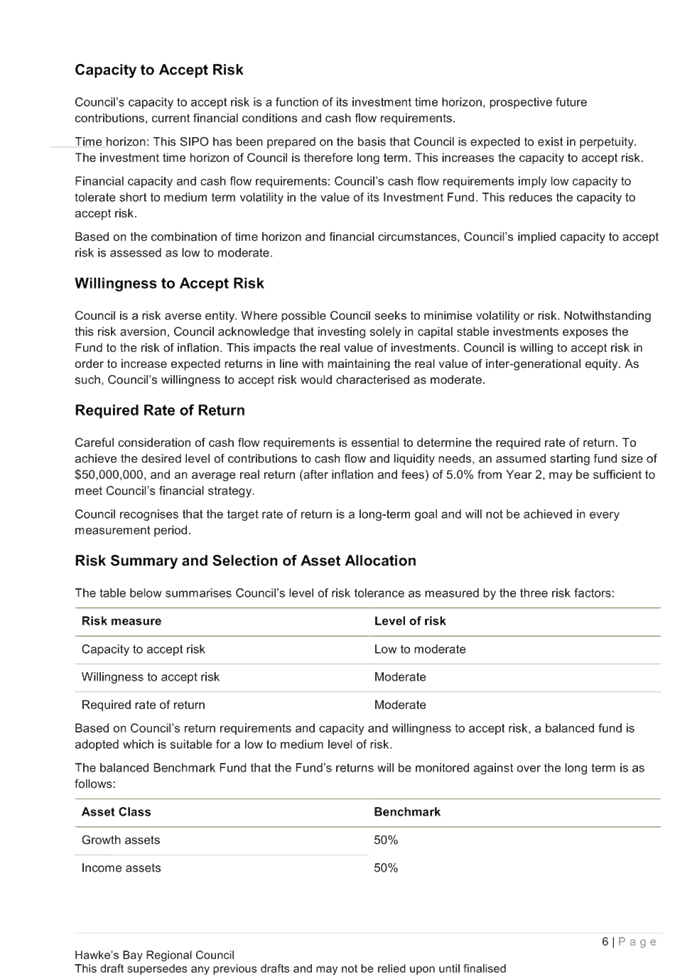

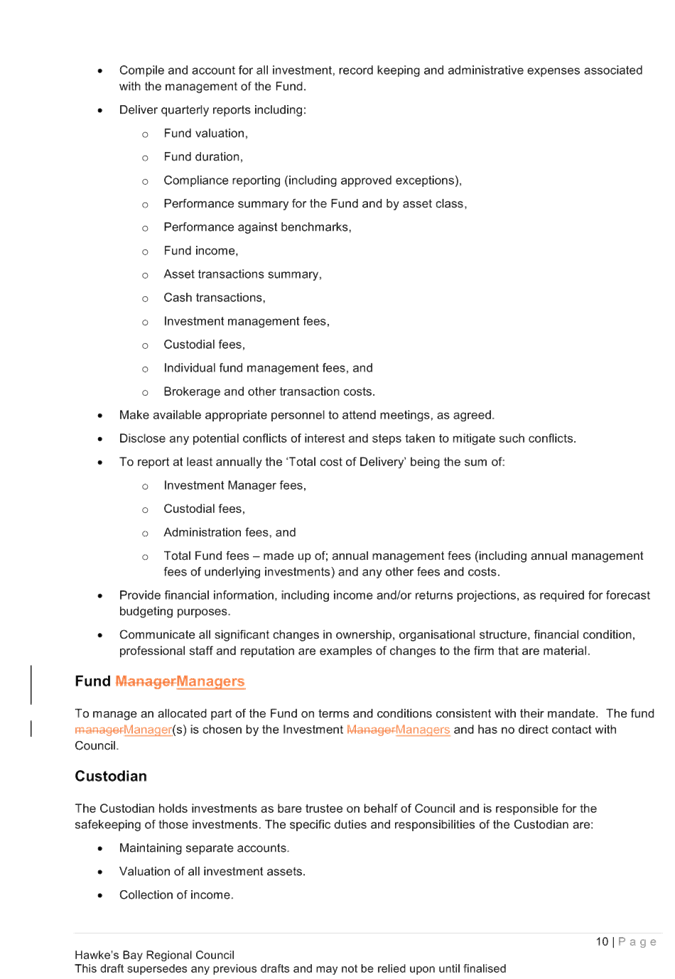

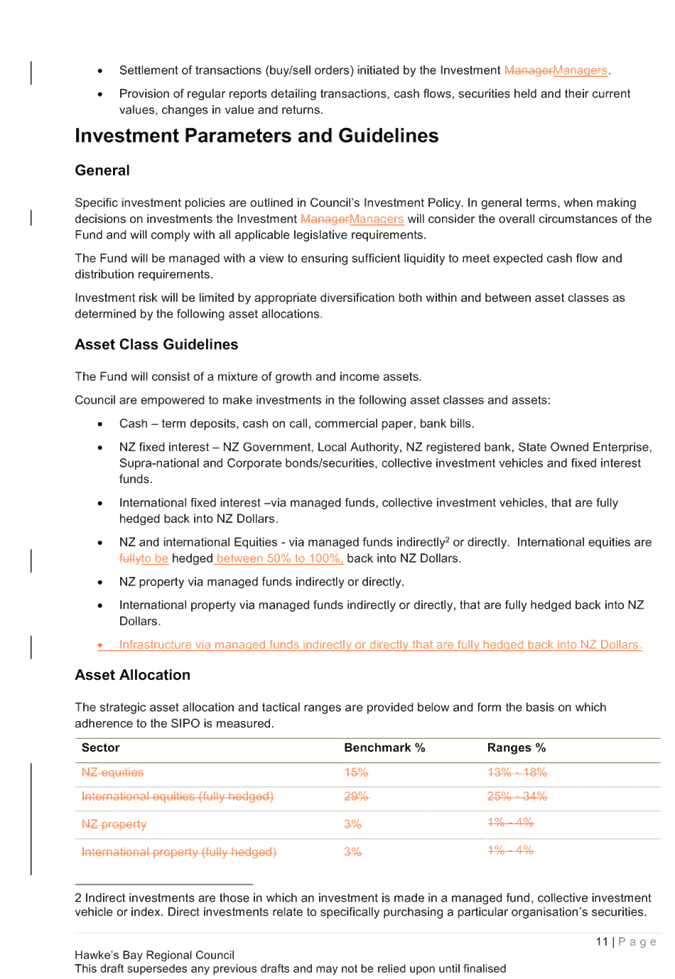

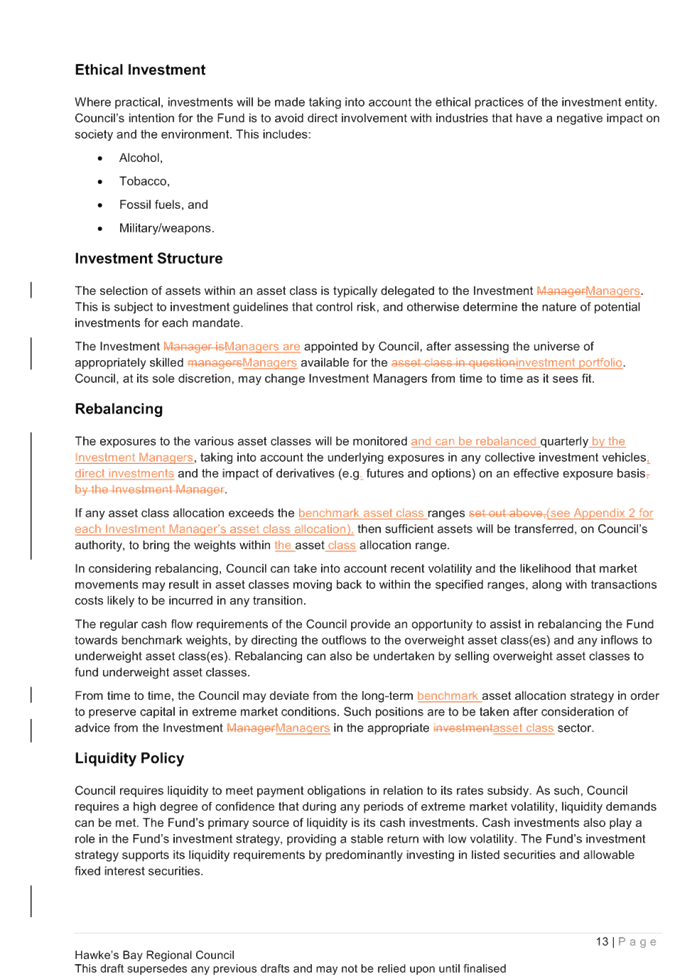

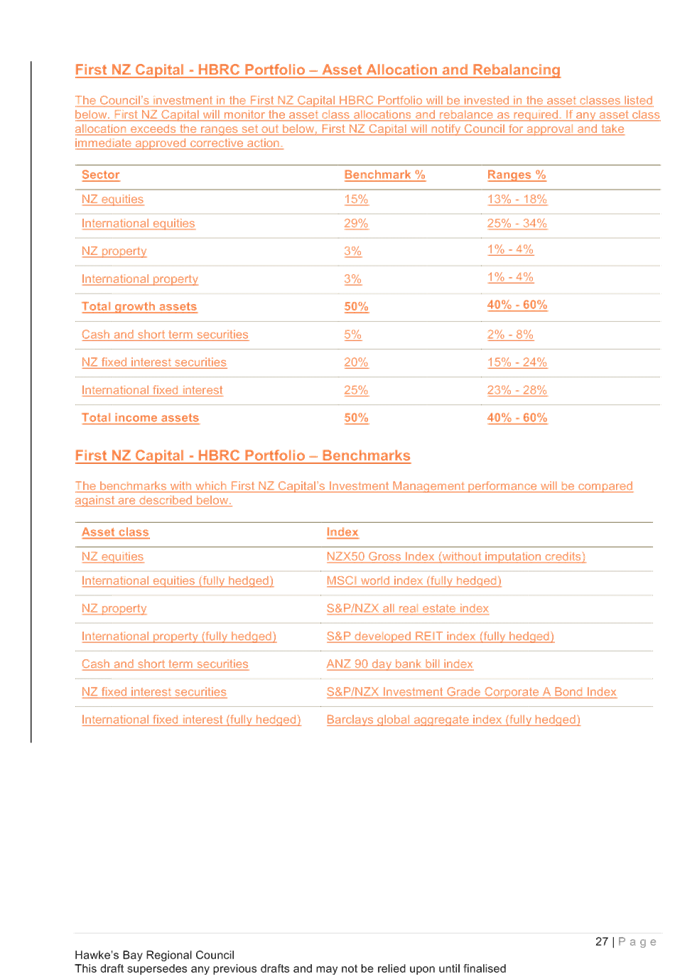

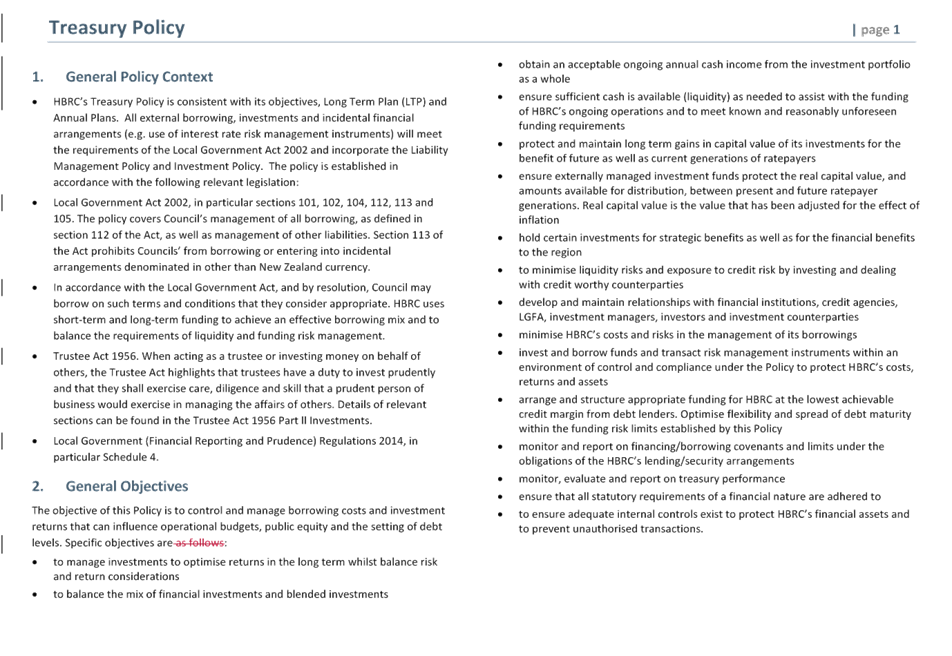

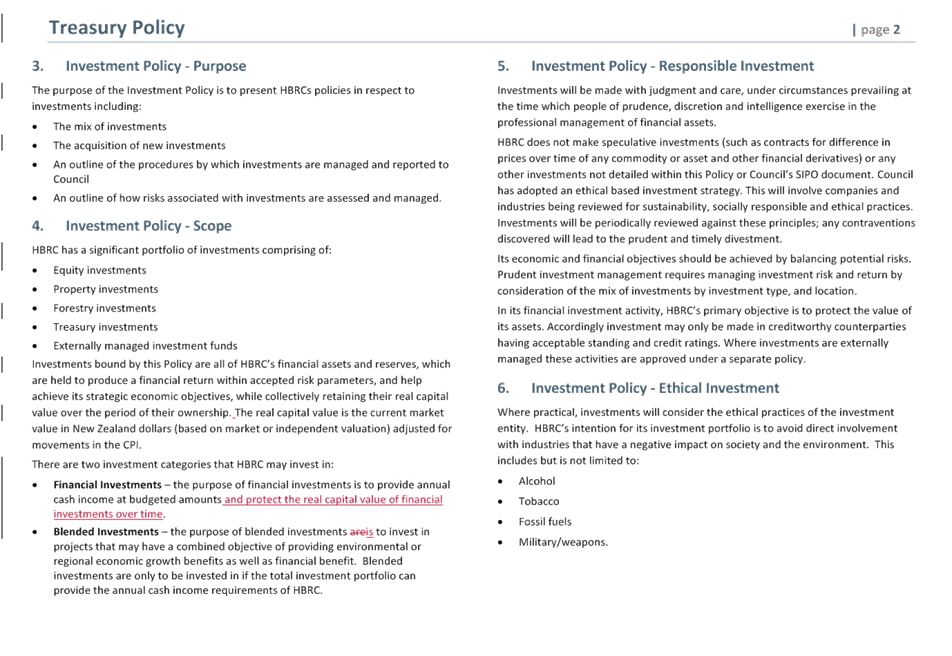

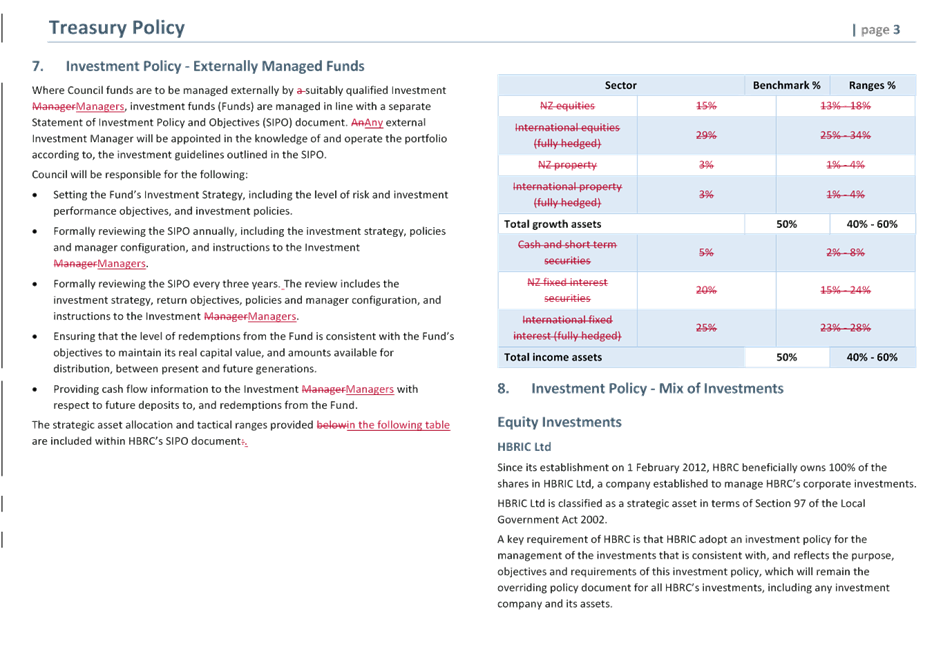

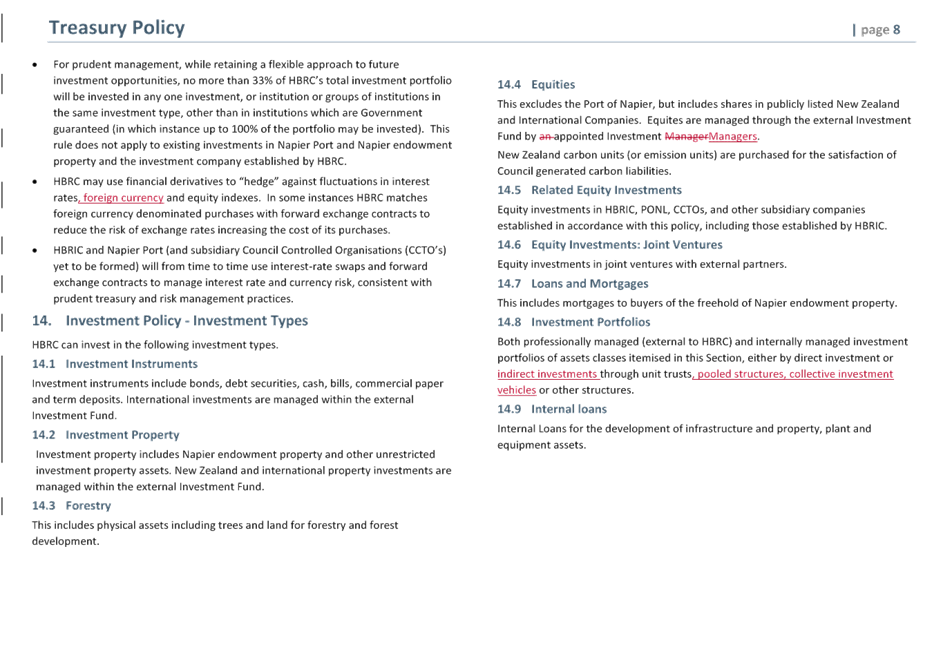

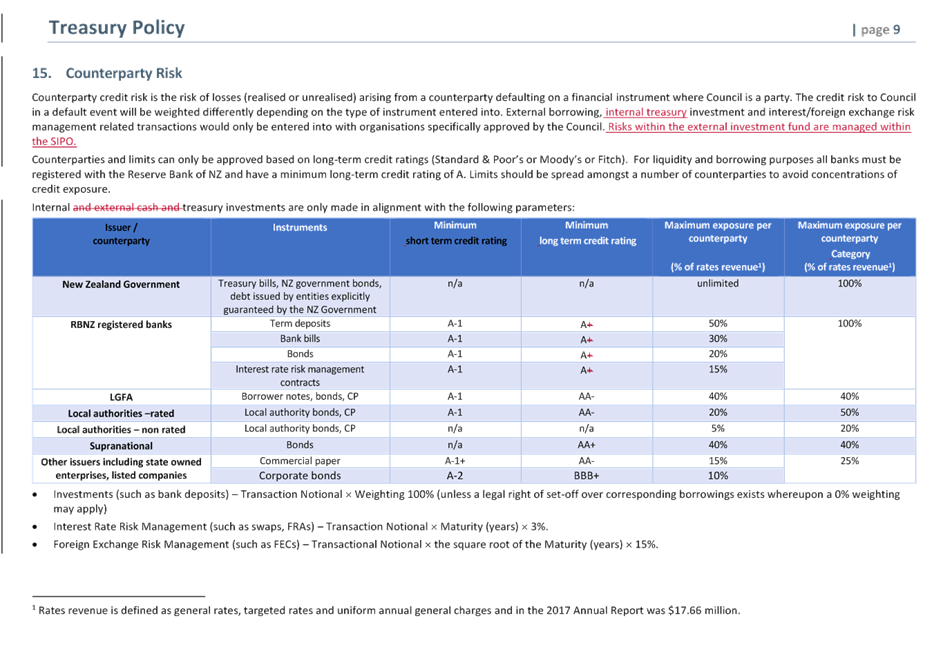

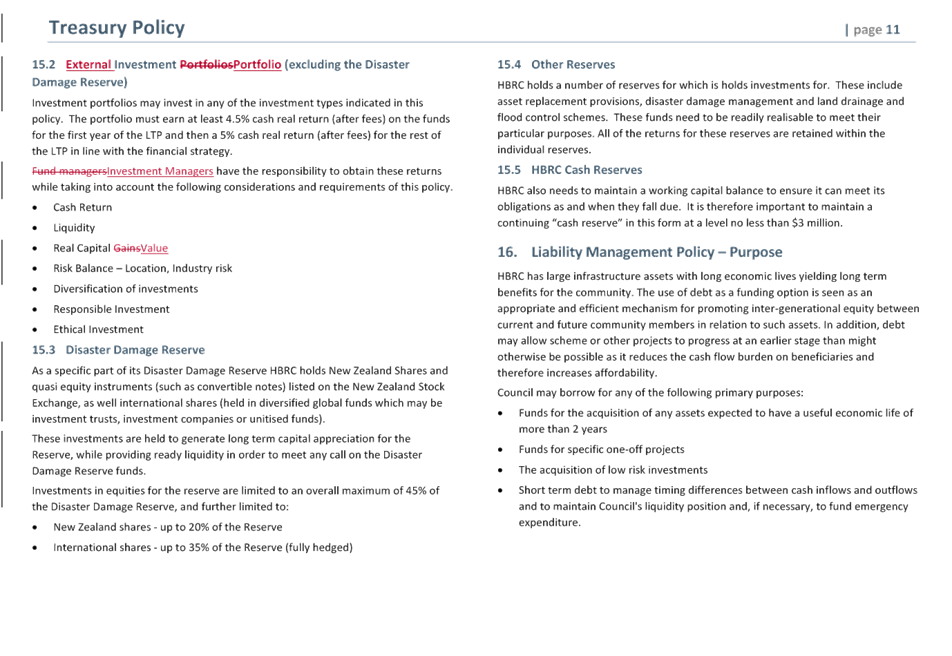

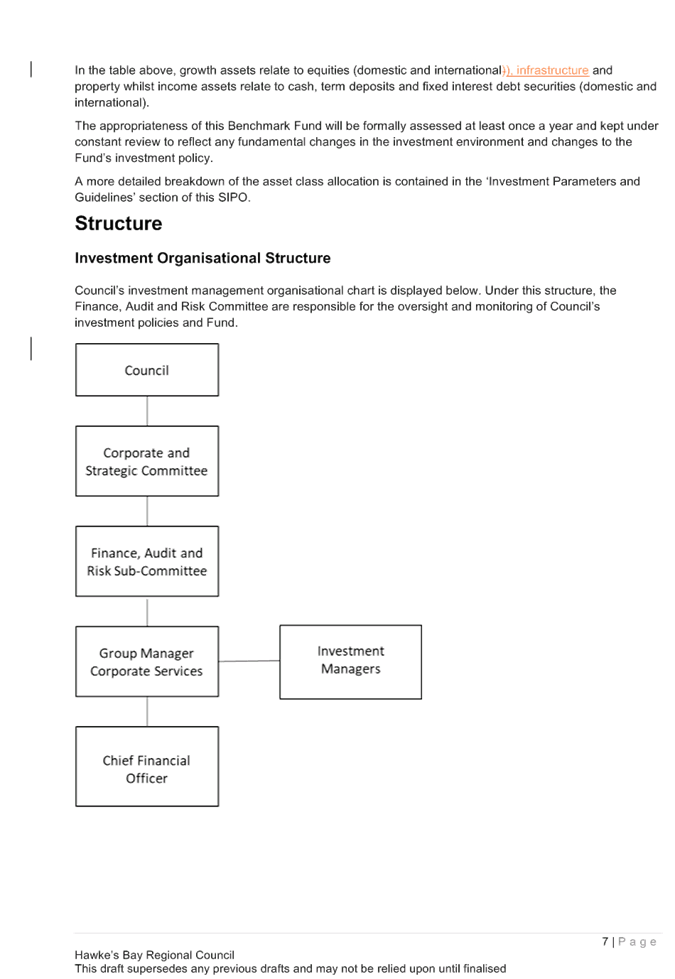

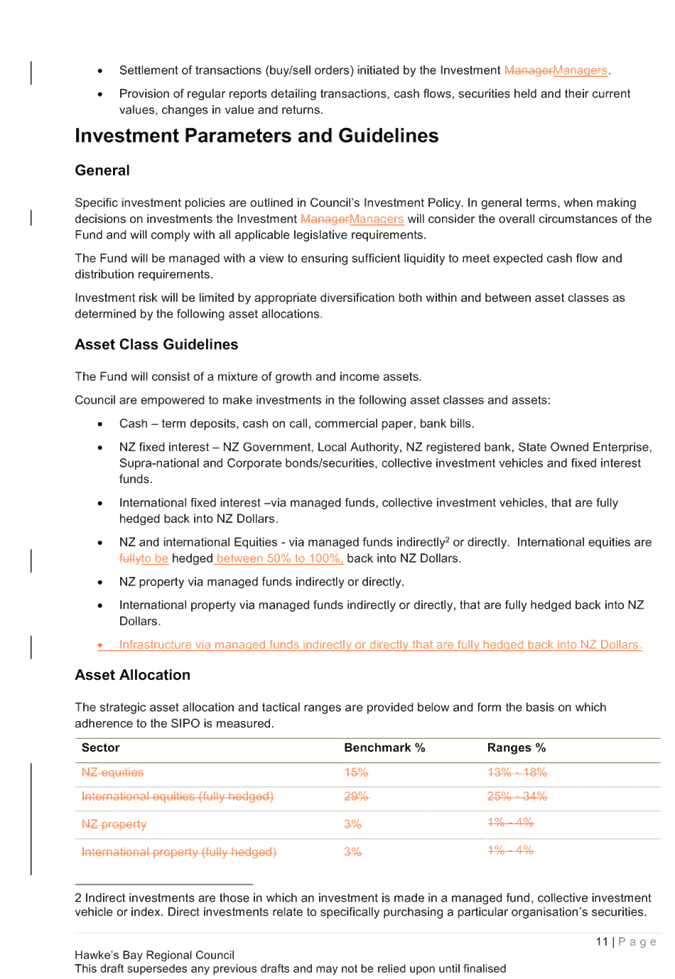

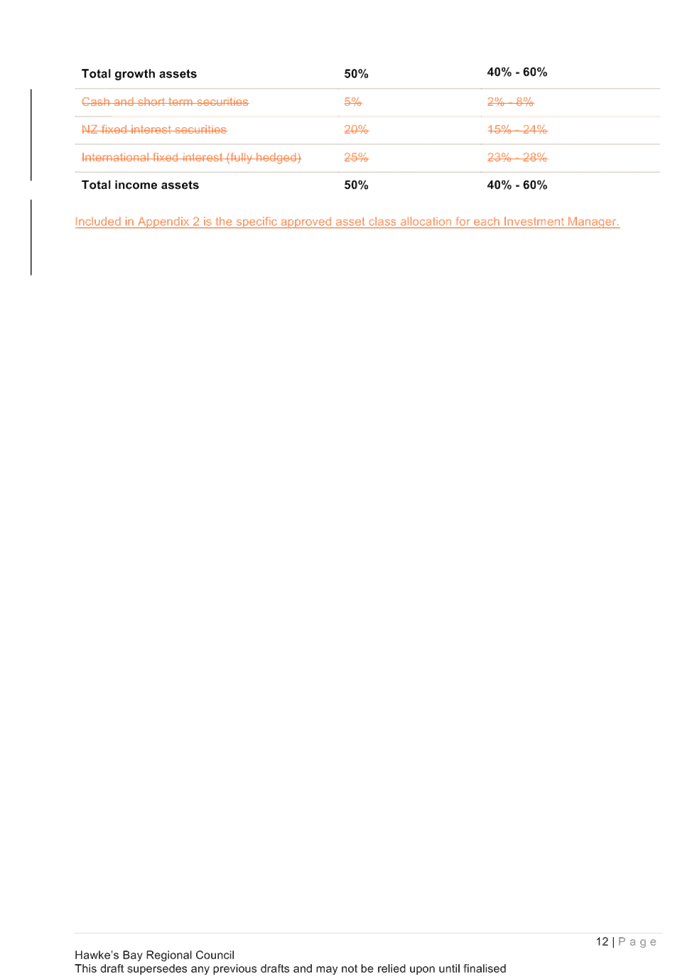

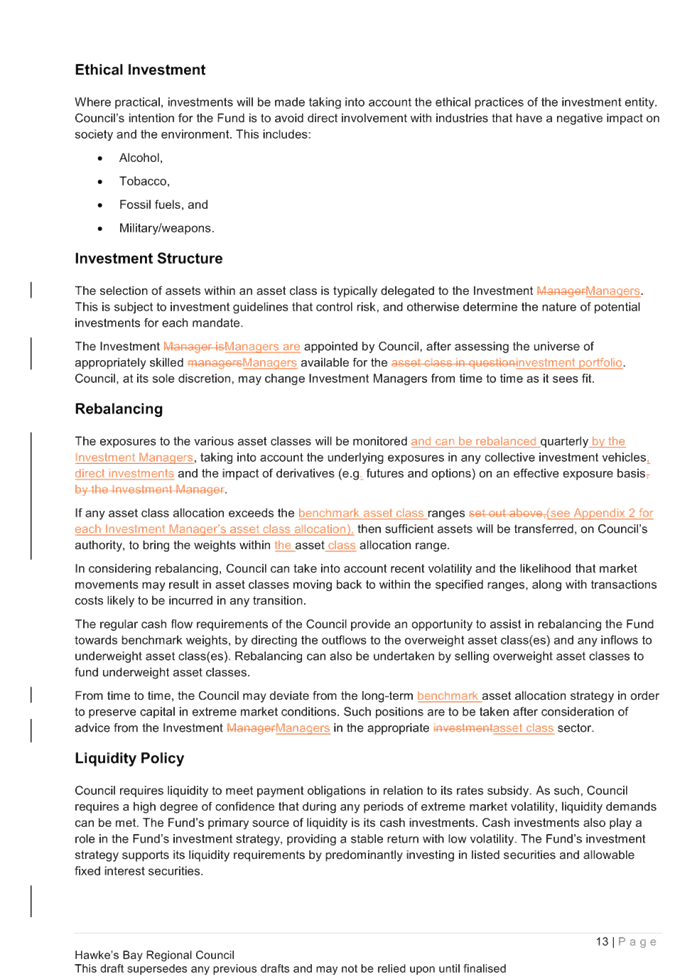

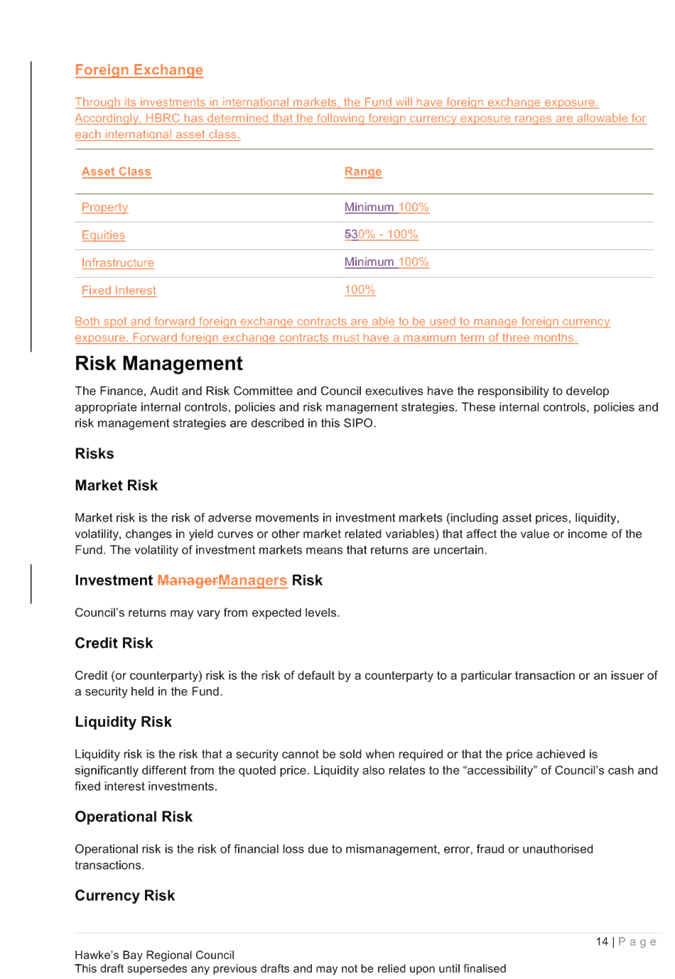

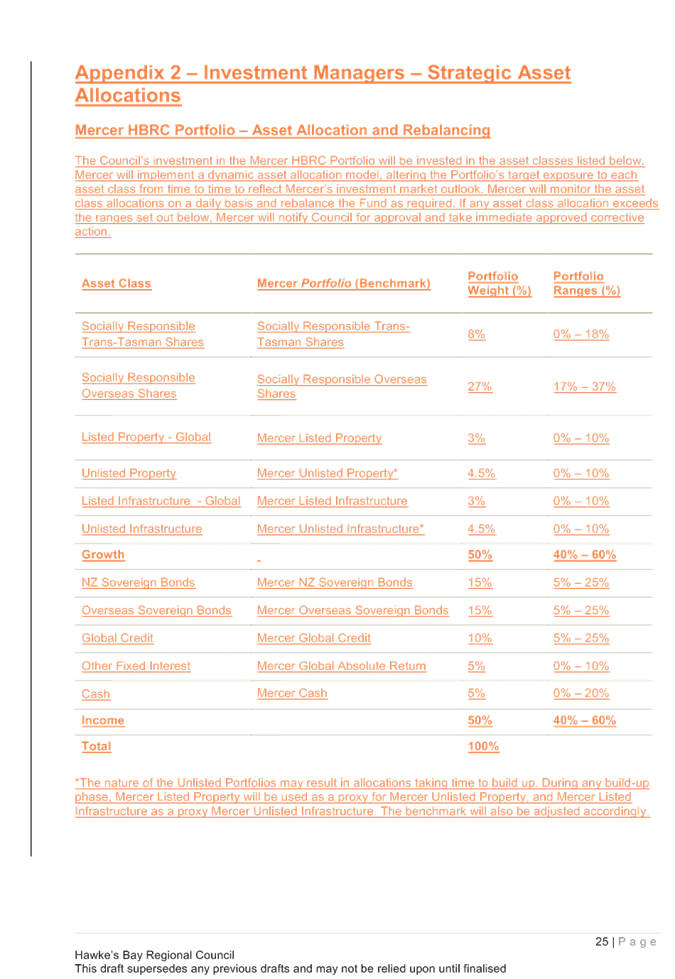

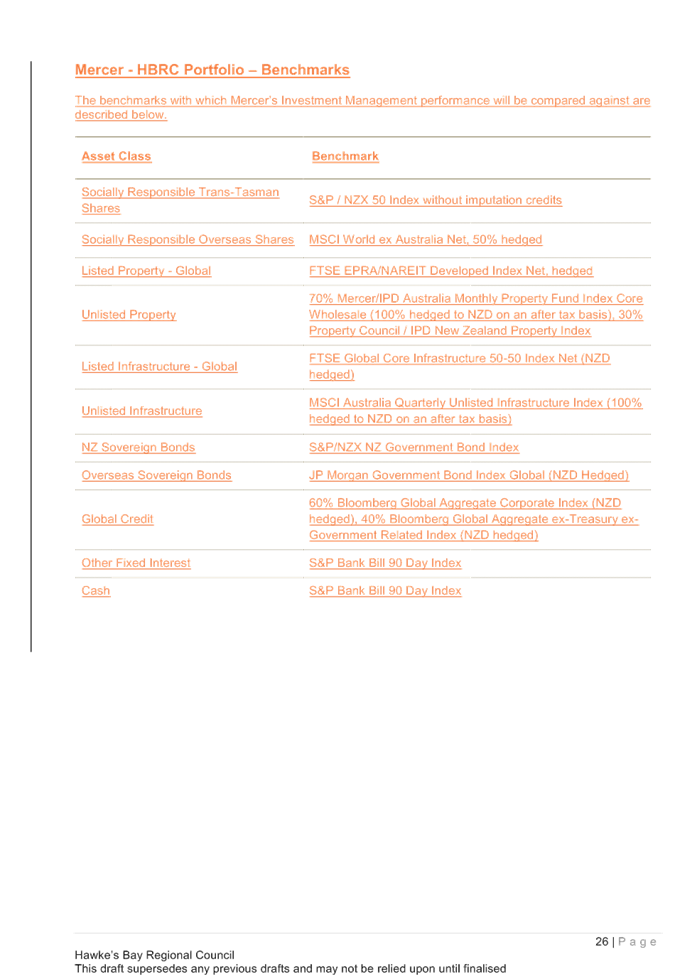

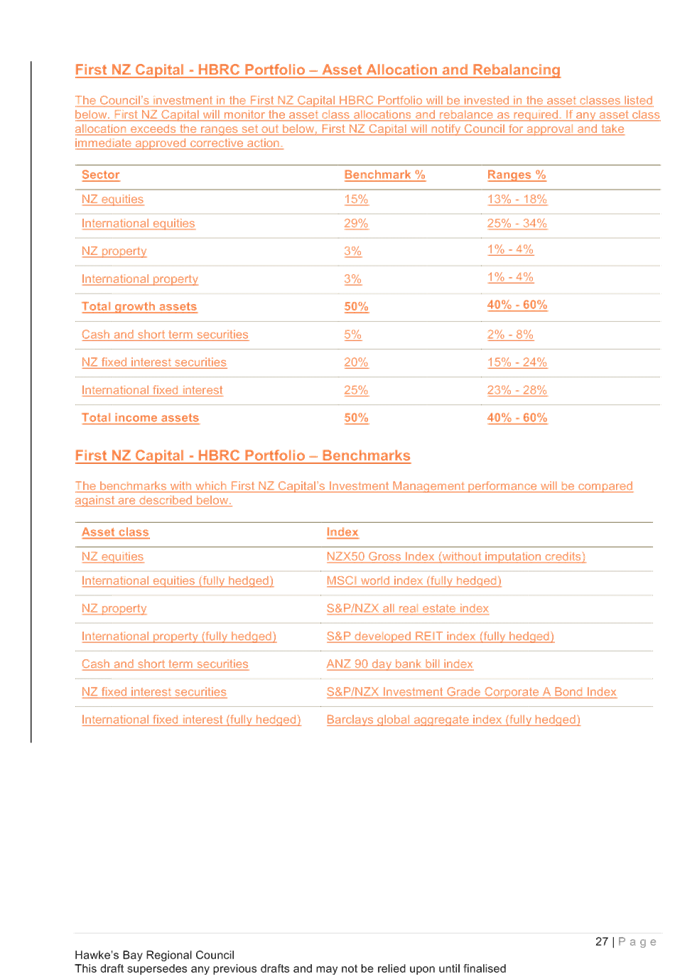

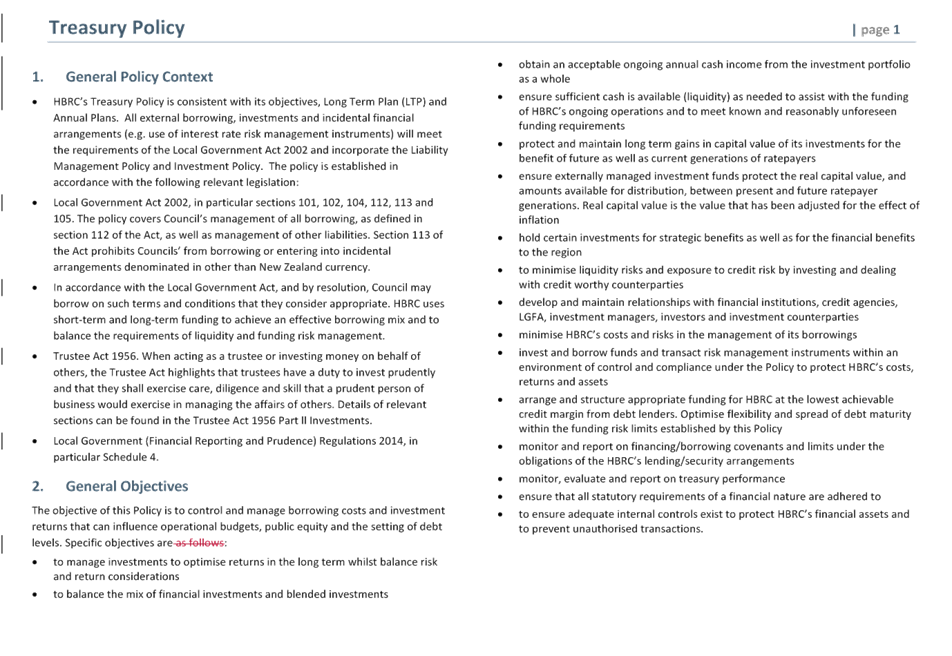

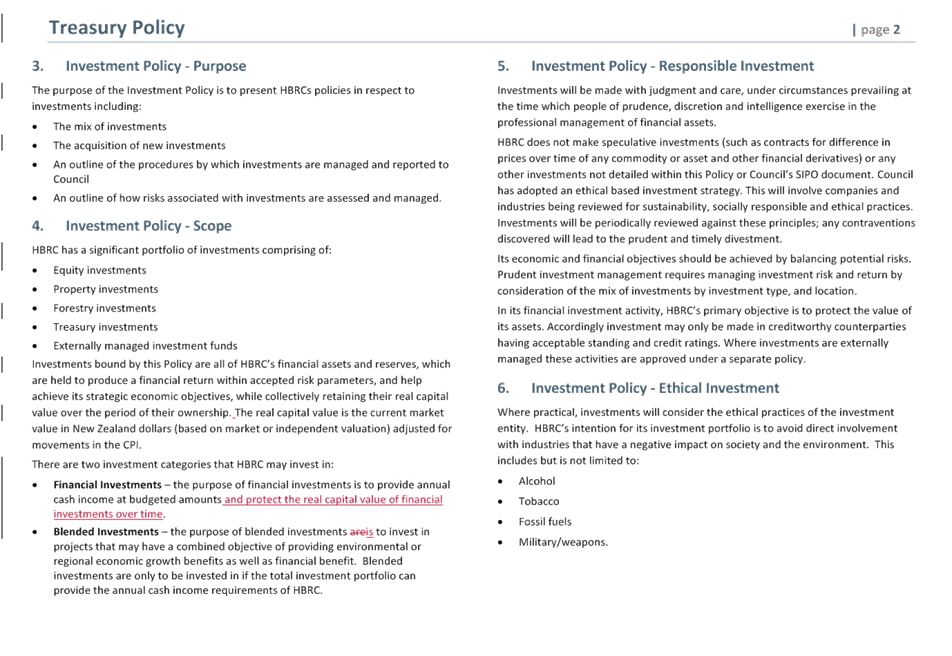

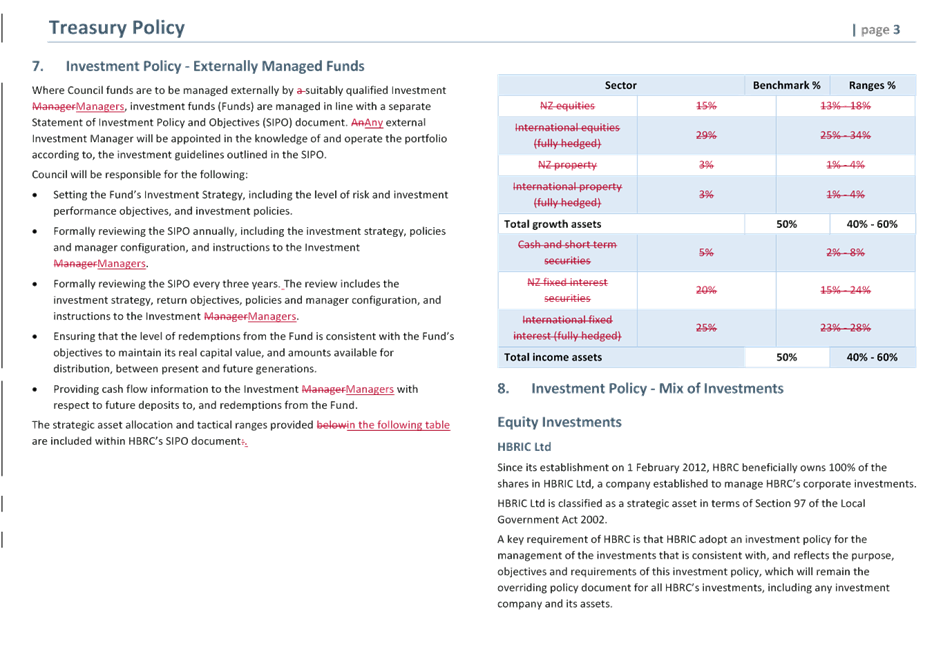

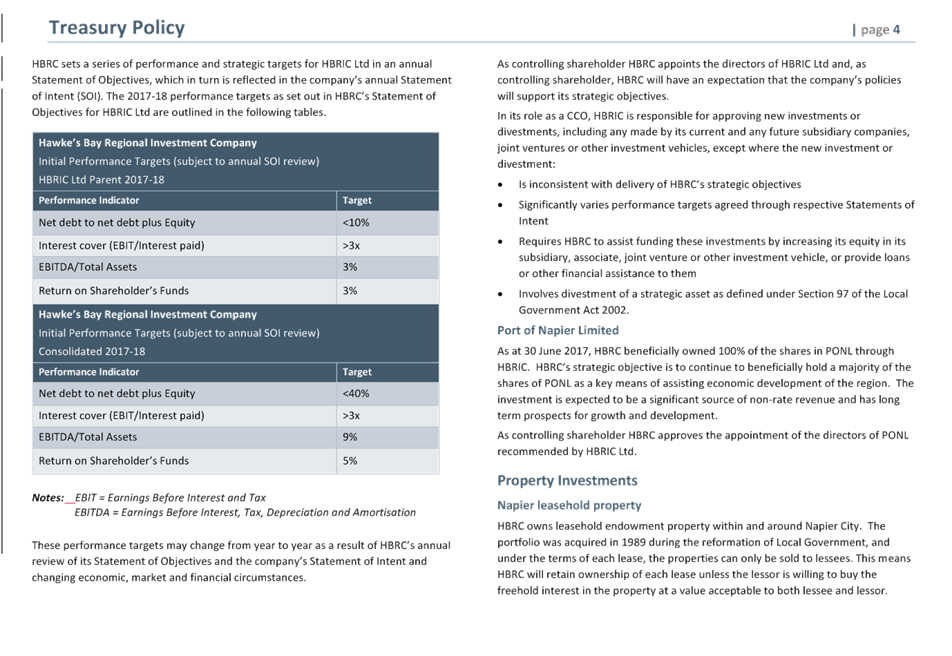

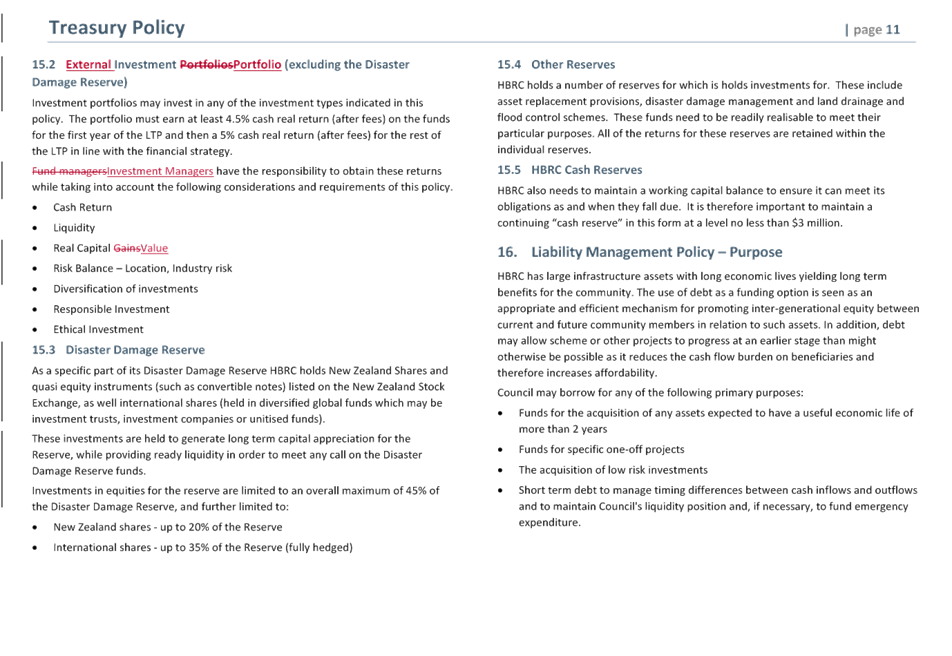

2. During the

process of appointing Council’s investment managers, suggestions have

been made to incorporate minor amendments to the SIPO to allow for more practical

implementation.

3. Amendments

include making reference to having two investment fund managers, allowing some

infrastructure assets in the growth asset mix and allowing some unhedged

equities.

4. These changes

do not impact the overall asset mix or risk profile and have been reviewed by

our Treasury advisors who have provide a view that they are consistent with the

previous SIPO and minor in nature.

5. Amendments to

the SIPO are incorporated into Council’s Treasury Policy which therefore

also requires amendment.

6. The Local

Government Act 2002 allows for the Liability Management Policy and Investment

Policy which are contained in Council’s Treasury Policy to be amended

without consultation.

7. Amended

versions of both the SIPO and Treasury Policy with tracked changes are

attached.

Decision Making

Process

8. Council is required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have assessed

the requirements in relation to this item and have concluded:

8.1. The decision does not significantly alter the service provision or

affect a strategic asset.

8.2. The use of the special consultative procedure is not prescribed by

legislation.

8.3. The decision does not fall within the definition of Council’s

policy on significance.

|

Recommendations

1. That the Corporate and Strategic Committee receives and notes the

“Amendment to the Treasury Policy and Statement of Investment Policy

Objectives” staff report.

2. The Corporate and Strategic Committee recommends that

Hawke’s Bay Regional Council:

2.1. Agrees that the decisions to be made are not significant and

Council can exercise its discretion and make decisions on this issue without

conferring directly with the community.

2.2. Adopts the amended HBRC Statement of Investment Policy Objectives

and Treasury Policy as proposed.

|

Authored by:

|

Manton

Collings

Chief Financial Officer

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

|

⇩1

|

Statement of

Investment Policy Objectives with Tracked Changes

|

|

|

|

⇩2

|

Treasury

Policy with Tracked Changes

|

|

|

|

Statement

of Investment Policy Objectives with Tracked Changes

|

Attachment 1

|

|

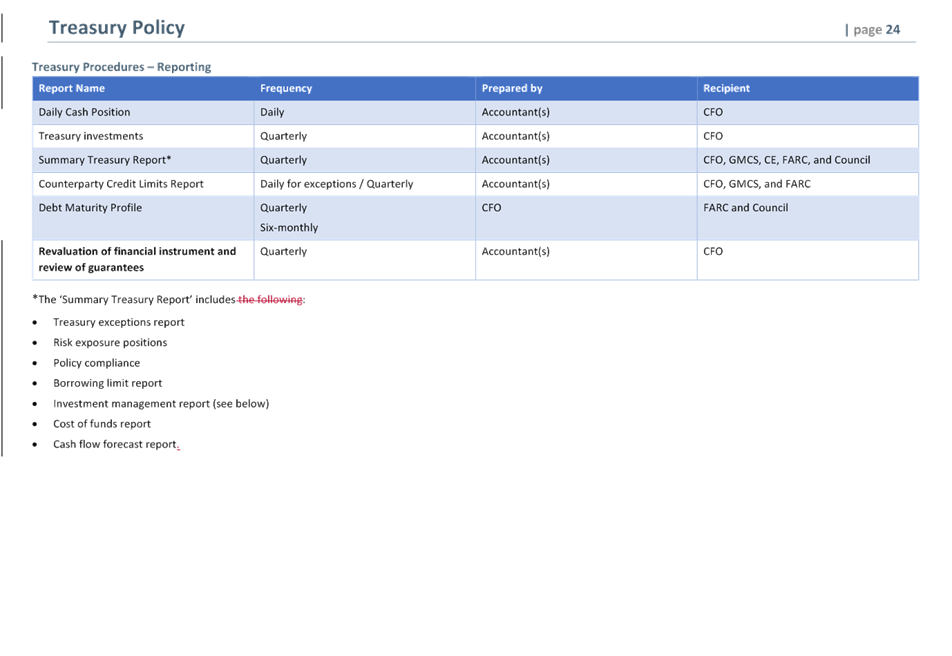

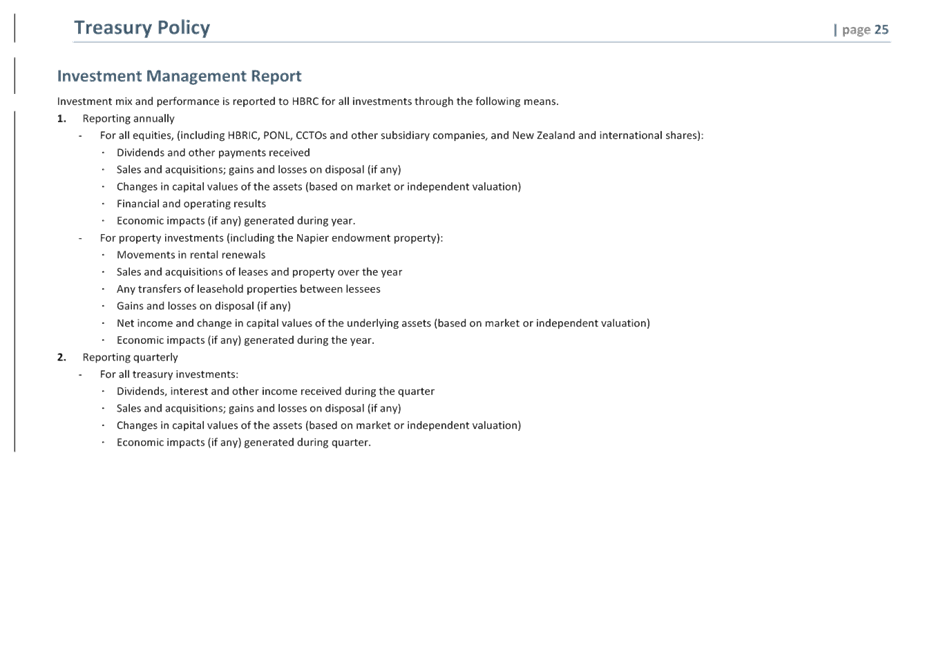

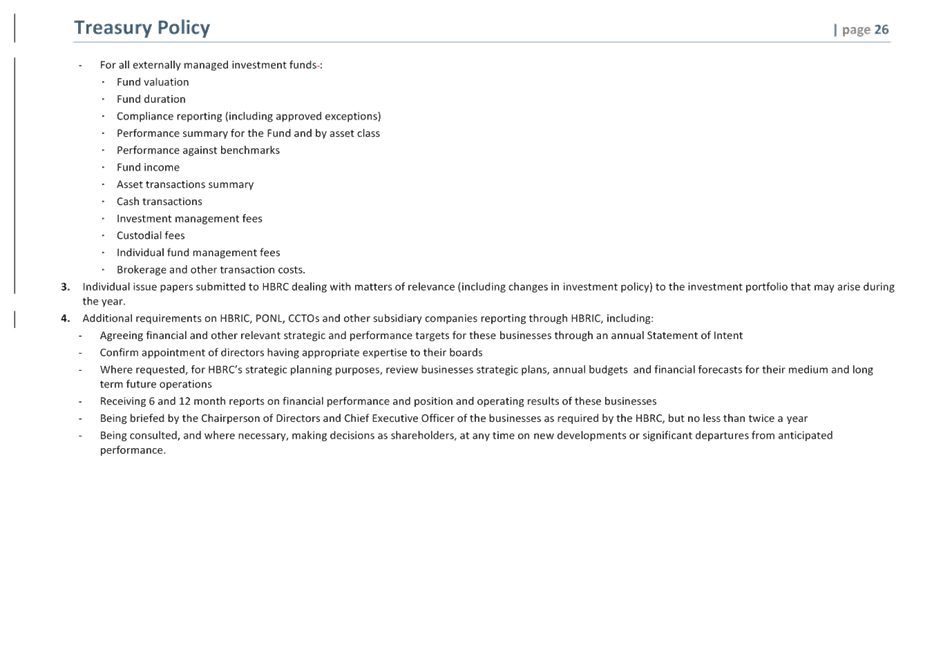

Treasury Policy with

Tracked Changes

|

Attachment 2

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 12 December 2018

Subject: Regional Three Waters

Review

Reason for Report

1. This report

seeks Council approval to work with the region’s four territorial

authorities to develop a regional business case assessing options to improve

the management of drinking water, stormwater and wastewater (Three Waters) in

the Hawke’s Bay region and in doing so, address Central Government

concerns associated with these activities.

2. This review

will develop recommendations for performance improvements to our Regional Three

Waters systems with a view to guiding Central Government’s Three Waters

strategy.

3. It should be

noted that this review is specifically looking at the service delivery function

of Three Waters and does not seek to review the regulatory framework.

Staff

Recommendation

4. Staff recommend

that Council agrees its support for development of a regional business case on

Three Waters management as proposed in Option 1 of this report.

Background Summary

5. The Government is

investigating options on how to improve the management of drinking water,

stormwater and wastewater (three waters) to better support New Zealand’s

prosperity, health, safety and environment. Local Government Minister Nanaia

Mahuta has announced a reform programme to transform drinking, storm and

wastewater. It is focused on the challenges facing the sector, including

funding pressures, rising environmental standards, climate change, seasonal

pressure from tourism, and the recommendations of the Havelock North

Inquiry. The review is in its second stage.

5.1. Stage One

– This stage explored the issues and opportunities with three

waters services by gathering and analysing information. This was completed at

the end of 2017.

5.2. Stage Two

– This stage commenced in March 2018. It is looking at options for

improving the three waters system, including the management, service delivery,

funding, and regulatory arrangements.

6. Central

government has advised that they will work closely with councils, Iwi and all stakeholders

with an interest in three waters services in order to develop options and

recommendations.

7. There is an

opportunity to provide the Hawke’s Bay’s perspective into the

Central Government review on developing options to address the key concerns on

how we can improve the management of drinking water, storm water and wastewater

(“Three Waters”) to better support our community’s

prosperity, health, safety and environment.

8. The Minister

has advised she is supportive of our region’s proposal to complete this

review and how it may be adopted as part of the wider government review.

9. The purpose of

the Hawke’s Bay review is to have developed recommendations for regional

performance improvements to our Three Waters systems to help guide Central Governments

thinking to deliver:

9.1. Safe, NZDWS

compliant and reliable drinking water

9.2. Better

environmental performance for our water services

9.3. Efficient,

sustainable, resilient, and accountable water services

9.4. Achieving

these aims in ways that are efficient and effective for our communities.

10. This review will need to

address the following challenges for our water systems and communities:

10.1. Meeting community

expectations for each of the Three Waters across quality, treatment and

management

10.2. Meeting regulatory

requirements for the Three Waters for quality, treatment and management

10.3. The ability to replace

infrastructure as it ages, and or fund and manage new infrastructure to meet

changing customer and regulatory requirements.

10.4. Declining rating bases

in some areas, high growth in others

10.5. High seasonal demand in

small tourism centres

10.6. Adapting for climate

change and adverse natural events.

11. The review will identify

and develops options for structure and governance models that:

11.1. Develops and confirms

‘Key Principles’ of approach that are shared and agreed by the

respective council’s

11.2. Identifies service and

delivery model opportunities through joint provision of all or some elements of

the Three Waters services. In identifying a range of models these shall be

compared to the status quo including clustering of sub-regional entities.

The models must be flexible enough to future proof for the inclusion of private

water suppliers.

11.3. Develops strategic

capacity and resilience across the water network

11.4. Provides excellence in

strategic and management capability to ensure safe, secure efficient drinking

water, waste water and storm water service outcomes to our communities.

11.5. Provide economic value

and be able to demonstrate how well and why the identified models meet each of

the objectives including benefits analysis, cost of service delivery, funding

requirements, how fees and charges are levied and where the costs are

distributed, and processes.

11.6. Provides capital

efficiency current and future Three Waters assets

11.7. Delivers operational and

maintenance excellence through the most effective service delivery model

11.8. Improves customer

service

11.9. Provides greater

environmental, community and cultural focus

11.10. Recommend the next steps to enable the

entire objectives to be met including a programme and cost/resource estimates

to do this – this should also include transition plans/costs and

timetables for such a transition.

12. Hawke’s Bay Regional

Council’s service delivery functions of drainage and flood protection are

not in scope of this review. However, the involvement of Hawke’s

Bay Regional Council will keep us informed into possible direction of Three

Waters delivery in Hawkes Bay. This is important in managing the interface

between territorial authority and Regional Council drainage and stormwater

schemes. It is also valuable for the Regional Council to be involved given our

interests as regulator of Three Waters and the natural resources this

infrastructure interacts with.

13. In order to undertake the

review it will be necessary to engage the services of an external agency to

support its delivery. We will be seeking a fixed cost engagement via our

procurement process. It is proposed that costs will be attributed on the

following basis:

13.1. NCC 35%

13.2. HDC 35%

13.3. HBRC 15%

13.4. WDC 7.5%

13.5. CHBC 7.5%.

Risk

14. Undertaking the review is

considered the lowest strategic risk option. This option would contribute the

Hawkes Bay regional perspective into the Central Government review on how we

can improve the management of drinking water, stormwater and wastewater (Three

Waters).

Options

Option 1 –

Council confirms its support for the project

15. Financial and Resourcing

Implications

15.1. Additional funding will

not be required to complete the review. Re-allocation of funding from Drainage

and River Control Consultancy Services budget will ensure no changes to overall

budgets or LTP figures.

15.2. The review will be

outsourced to an external consultancy to deliver the report, however the will

be a moderate resourcing impact on council staff to provide information to

complete the analysis and participate in workshops throughout the review

process.

16. Risk Analysis

16.1. This option is

considered the lowest strategic risk option. This option would contribute the

Hawke’s Bay regional perspective into the Central Government review on

how we can improve the management of drinking water, storm water and wastewater

(Three Waters).

17. Promotion or Achievement

of Community Outcomes

17.1. This review demonstrates

our commitment to making sustainable investment in durable infrastructure that

promotes smart growth and ensures we are environmentally responsible.

18. Statutory Responsibilities

18.1. The review will

contribute towards meeting our statutory responsibilities through better

territorial authority asset management and performance, and ultimately

compliance.

19. Consistency with Policies

and Plans

19.1. The project is not part

of the latest LTP, and the budget available is from the existing budget

provision.

20. Community Views and

Preferences

20.1. This option has been

identified as requiring specific engagement Maori. Any significant changes to

activity arising from the review will involve future public engagement and

consultation.

21. Advantages and

Disadvantages

21.1. The advantages of this

option are:

21.1.1. provision of the Hawke’’s

Bay’s regional perspective into the Central Government review to shape

their thinking

21.1.2. working together as a region to develop

the best regional model to deliver a strategic and sustainable approach to

Three Waters.

21.2. There are no perceived

disadvantages of this option relative to option 2.

Option 2 –

Council does not approve the project to complete the review and wait for

Central Government outcome without considered Hawkes Bay regional input.

22. Financial and Resourcing

Implications

22.1. There are no financial

or resourcing implications in choosing to do nothing in the short term.

23. Risk Analysis

23.1. By doing nothing, the

Government may mandate a new regime that does not consider the specific

requirements and concerns of the Hawke’s Bay region & our

communities.

24. Promotion or Achievement

of Community Outcomes

24.1. The Council would

continue progressing against its LTP plan whilst noting that the Government has

a Three Waters review which is subject to change that plan.

25. Statutory Responsibilities

25.1. Not applicable - other

than where territorial authorities may be in breach of meeting standards and

consent obligations

26. Consistency with Policies

and Plans

26.1. Not achieving our

strategic plan objectives for improvements in water quality through poorer

management of Three Waters infrastructure by territorial authorities.

27. Community Views and

Preferences

27.1. This is an opportunity

for the Hawke’s Bay to develop a regional approach and contribute to

Central Government’s review process. If we act independently then

the region may need to adhere to an alternative Central Government imposed

regime. This alternative regime may cost significantly more than this combined

regional approach to the review.

28. Advantages and

Disadvantages

28.1. Disadvantages are

potentially significant and preclude us from developing solutions for our

region to deliver:

28.1.1. Safe, NZDWS compliant and

reliable drinking water

28.1.2. Better environmental

performance for our water services

28.1.3. Efficient, sustainable,

resilient, and accountable water services

28.1.4. Achieving these aims in an

affordable manner.

Next Steps

29. Should Option 1 be

approved our next steps are as follows:

29.1. Commence procurement

process for a suitable consultant to lead the review across the respective

Councils with the expectation that this is completed in late December

29.2. Confirm scope and draft

project & communications plan with a view to completing review by the end

of June 2019.

29.3. Development of Preferred

Option.

Decision Making

Process

30. Council

is required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

30.1. The decision

does not significantly alter the service provision or affect a strategic asset.

30.2. The decision

does not fall within the definition of Council’s policy on significance.

30.3. The decision

is not inconsistent with an existing policy or plan.

|

Recommendations

1. That the Corporate and Strategic Committee receives and notes the

“Regional Three Waters Review” staff report.

2. The Corporate and Strategic Committee recommends that Council:

2.1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that Council can exercise its discretion and make decisions on

this issue without conferring directly with the community.

2.2. Having

considered all matters raised in this report:

2.2.1. Confirms

its support for HBRC participating in the development of a regional business

case on 3 Waters management.

2.2.2. Notes

the cost of the review is apportioned across the Hawke’s Bay councils

as being 35% Napier City Council, 35% Hastings District Council, 15%

Hawke’s Bay Regional Council, 7.5% Wairoa District Council, and 7.5%

Central Hawke’s Bay District Council.

2.2.3. Agrees

that HBRC’s funding contribution come from the Drainage and River

Control Consultancy Services budget.

|

Authored by:

|

Chris

Dolley

Group Manager Asset Management

|

|

Approved by:

|

James Palmer

Chief Executive

|

|

Attachment/s

There are no

attachments for this report.

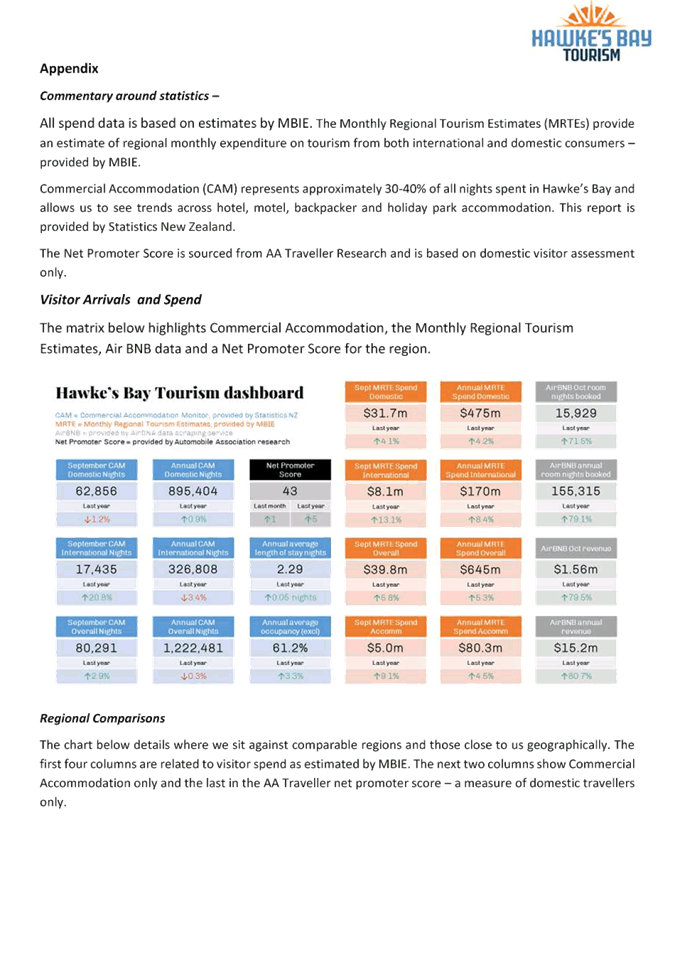

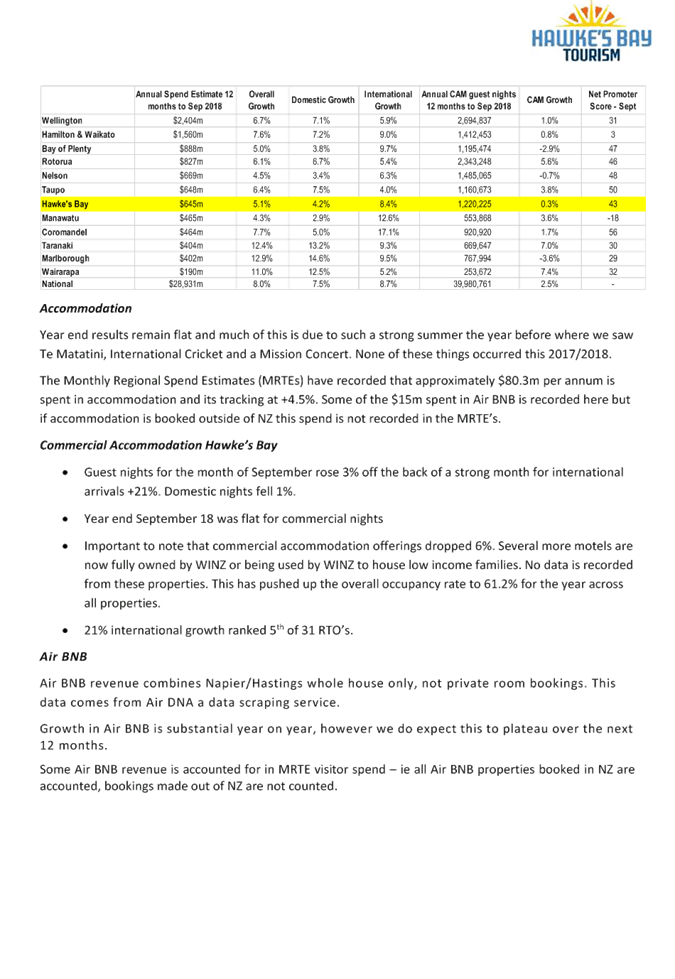

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 12 December 2018

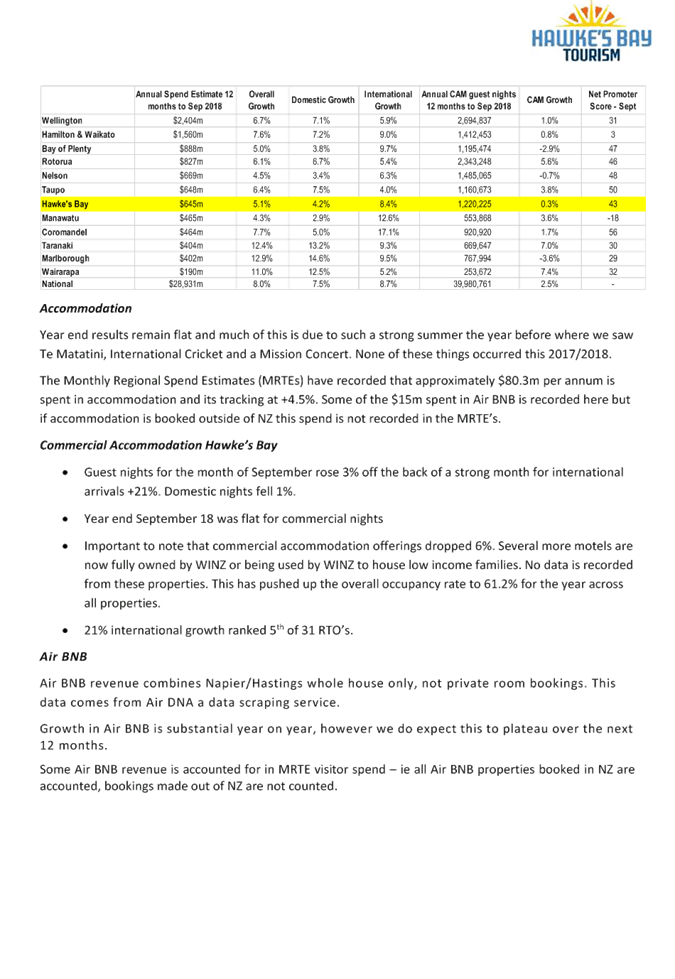

Subject: HB Tourism Update

Reason for Report

1. This joint HB

Tourism (HBT) and HBRC item provides the Corporate and Strategic Committee with:

1.1. The regular

quarterly activities update (attached).

1.2. An update on

investigations of alternative funding options for the long-term funding of

Hawke’s Bay Tourism (HBT).

1.3. An outline of

initiatives HB Tourism would like to further explore.

Executive Summary

2. The objectives

of the Funding Review are:

2.1. To develop a

long-term sustainable funding model for Hawke’s Bay Tourism that ensures

those who benefit commercially from tourism contribute to the promotion and

marketing of the region.

2.2. To lessen the

burden on the Hawke’s Bay ratepayer.

3. The issue of

tourism funding, for both infrastructure and tourism promotion, is a national

issue and one for which there are multiple national and regional initiatives

under active consideration and review.

4. While the

current funding model can be improved to ensure better linkages between HBT

funding and the beneficiaries and/or users of tourism activities, the

complexities, and transaction costs of more targeted funding models,

particularly at a regional level, should not be underestimated and perhaps

point to the need to retain a degree of core community funding via the economic

development rate.

5. There is no

one-size fits all approach. A review of international case studies of

peer-to-peer accommodation and how some councils in New Zealand treat

peer-to-peer accommodation by HBT and council staff has confirmed the

complexity of the issues.

6. The

introduction of a local bed tax/visitor levy would require legislation meaning

change could be slow. Discussions with the region’s Mayors and Chair

indicated strong support for an all-of region approach to the development of a

sustainable funding model and strategy that encompasses not only visitor attraction

but also tourism infrastructure and event management.

7. Committee

members are advised that the interim funding agreement between Hawke’s

Bay Regional Council (HBRC) and HBT has been further extended from 30 October

2018 to 30 June 2019. This extension will allow more time to revise HBT’s

KPI’s to align with the 2018-28 Long Term Plan resolutions and the

outcomes of the funding review.

Background

of Hawke’s Bay Tourism

8. HBT was

formally established in July 2011 after Venture Hawke’s Bay, the

region’s economic development agency was disestablished. The

Hawke’s Bay Tourism Industry Association led this change and developed a

strategy which HBRC adopted. It was based on a contribution from the private

sector while retaining the allocated tourism funds from the economic

development rate collected by HBRC.

9. HBT’s

role is to grow the visitor economy by promoting Hawke’s Bay nationally

and internationally. HBT believes visitors don’t just arrive here –

they have been motivated by friends, seen ads, read magazine articles, found

what they want online or they had a travel agent who knew about Hawke’s

Bay. HBT’s role is to ensure that Hawke’s Bay’s marketing hit

all of those channels on behalf of its 386 contributing members and the wider

region.

Hawke’s

Bay Tourism Funding from HBRC

10. HBRC is the sole local

government funder of HBT. This is the result of agreement with the

region’s territorial authorities; Napier, Hastings, Central Hawke’s

Bay and Wairoa councils.

11. In 2014/15 HBT developed a

regional strategy, in alignment with Tourism 2025 (the national tourism sector

framework) to increase visitor expenditure by an average of 5% per year. To

achieve this HBT developed a funding case to increase strategic marketing

particularly around seasonal events. All councils supported the proposal and

HBRC committed to a new three-year funding agreement which increased

HBT’s funding from $920,000 to $1.82M over three years.

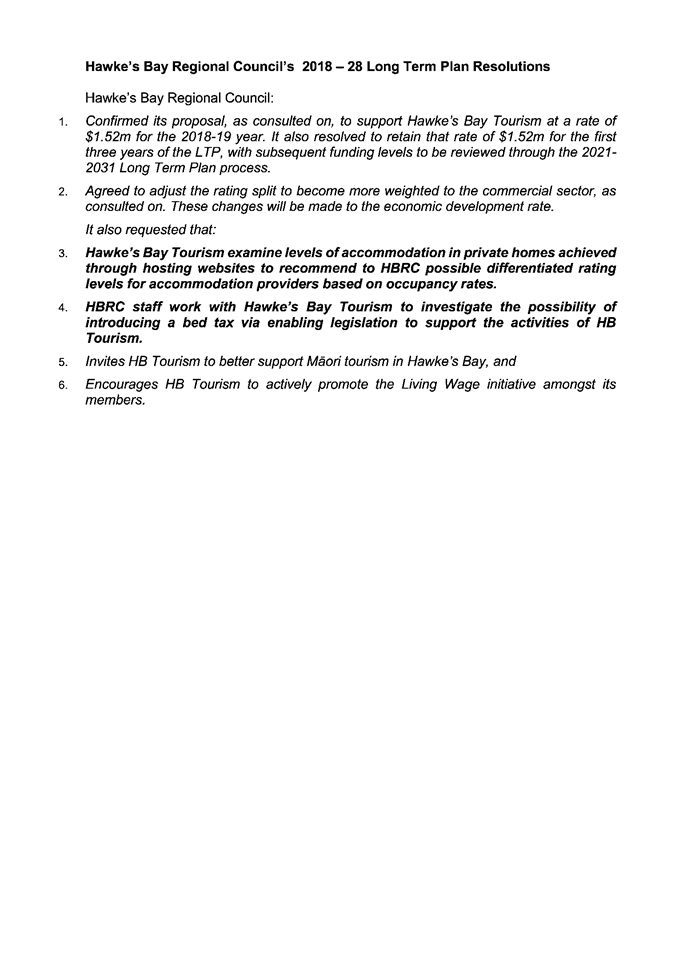

12. Council believes the

investment outlined above has paid off and that the sector should have the

momentum to sustain strong visitor numbers. Accordingly, through the 2018

– 28 Long Term Plan (LTP) process, HBRC consulted on reducing HBT’s

funding back to $920,000pa.

13. Following consultation

Council decided to support HBT at a rate of $1.52M per annum, for three years,

with subsequent funding levels to be reviewed through the 2021-31 LTP process.

HBRC also adjusted the economic development rating split. (Please see Attachment

1 for Council’s 2018-2028 LTP Resolutions.)

14. Funding for Hawke’s Bay

Tourism comes through a targeted economic development rate. (This rate also

contributes to Business Hawke’s Bay and other miscellaneous economic

development opportunities). The economic development rate is charged out at two

different rates; residential ratepayers via a Uniformed Annual Charge (UAC) and

commercial/industrial ratepayers via Capital Value (CV).

15. This rating split between

residential and commercial has changed from 70:30 to 50:50 this year (year 1)

and will change again next year to 30:70 (year 2). The result of this change

means that the commercial sector will predominantly fund the rate. Note that in

both scenarios Wairoa District ratepayers’ contribution is limited to 5%

of the total economic development rate.

16. Hawke’s Bay Tourism

believes it is in a very positive space with widespread public, industry and

political support. It has recorded a 6% annual growth rate in visitor spend for

the past three years. According to MBIE’s latest Monthly Tourism

Estimates visitors generated $646M into the Hawke’s Bay’s economy

(year-end October 2018).

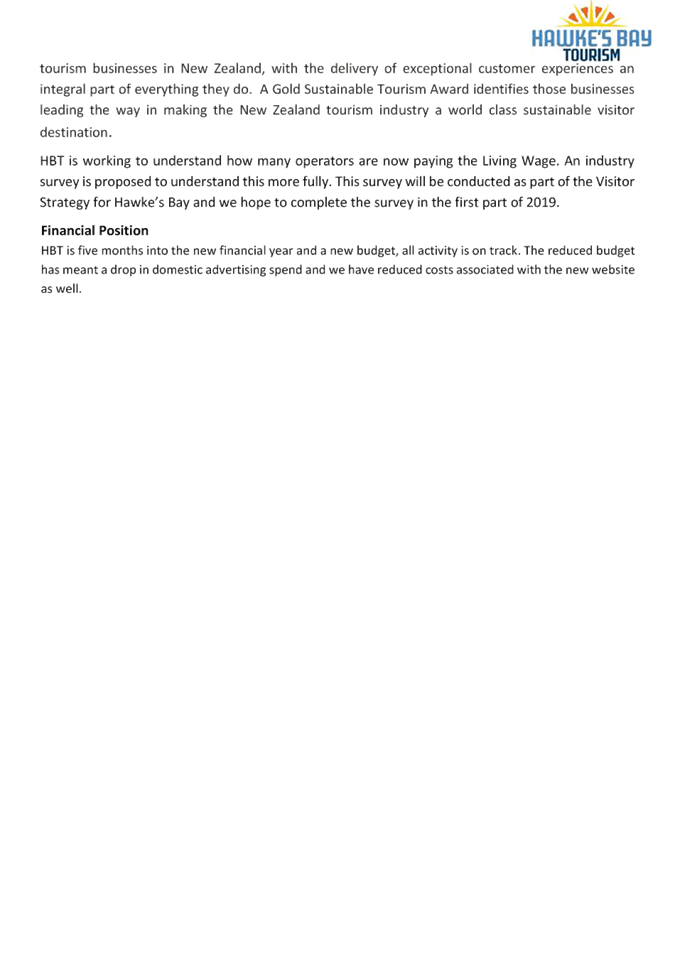

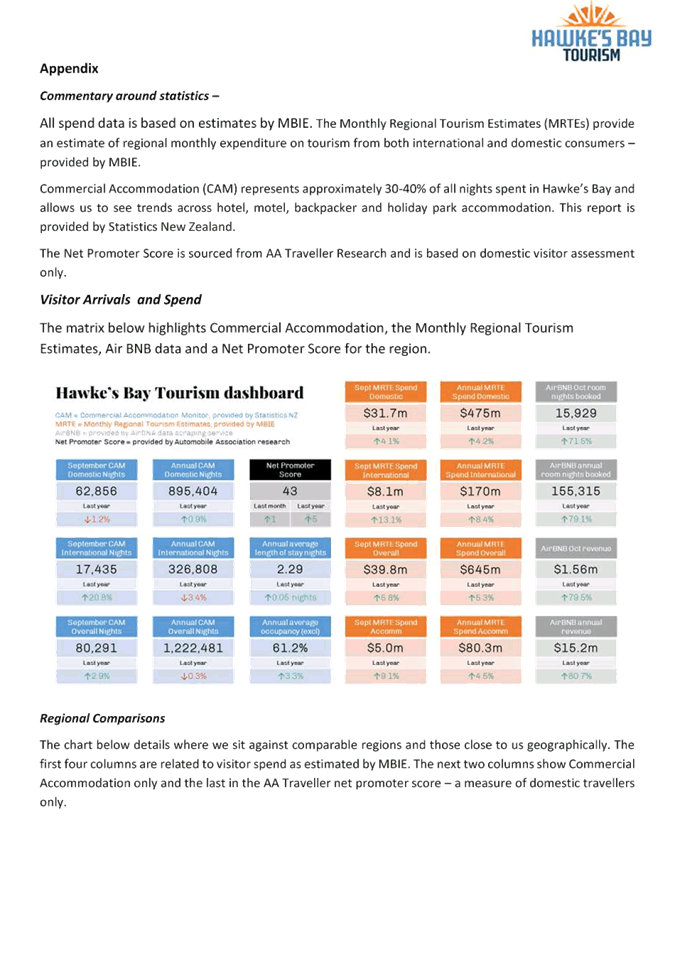

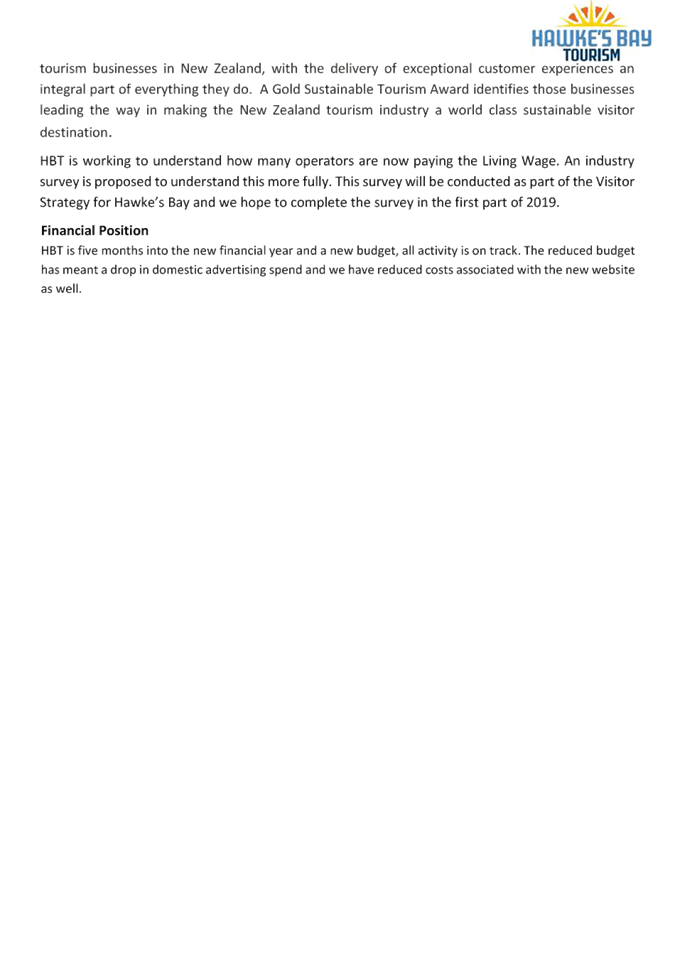

17. The table below provides

an estimated breakdown of the $646M ($1.8M a day) visitor spend into categories

as well as an attempt to match those categories with similar HBRC commercial

rating codes. This allows a comparison between the industries receiving the

tourist revenues and commercial/industrial ratepayer contributing to the

(non-residential) funding of HBT.

18. Please

note there may some differences between the compared categories, but where

possible we have endeavoured to compare like with like.

|

MBIE Visitor Spend Category

|

$ spent & as a % of the $646m spend

|

HBRC Rating Category

|

$ collected for the Economic Development rate &

as a % of HBT funding

|

|

Retail sales –

other

|

$166m

26%

|

Commercial Retailing

use -CR

|

$200,100

19%

|

|

Accommodation:

|

$80m

12%

|

Accommodation (such as

motels and hotels) -CA

|

$55,100

5%

|

|

Retail sales –

fuel and other automotive products

|

$65m

10%

|

Service Stations -CS

|

$14,200

1.0%

|

|

Other tourism products

|

$61m

9%

|

Tourist type

attractions as well as other amenities with an emphasis on leisure activities

of a non-sporting type - CT

|

$1,700

0.2%

|

|

Food and Beverage

servicing services

|

$117m

18%

|

19. Liquor outlets, Taverns -CL

|

20. $11,000

1.0%

|

|

Retail sales alcohol,

food and beverage

|

$84m

13%

|

|

Other passenger

transport

|

$54m

8%

|

|

|

|

Cultural recreation and

gambling

|

$19m

3%

|

|

|

|

Commercial -Resthomes,

Health Operators Education, Motor Vehicle Sales, Office, Parking buildings,

Vacant Land, Other

|

$315,000

29%

|

|

Industrial – Food

processing, Light manufacturing, Services, Vacant Land, Other

|

$494,000

45%

|

21. Based on the above

information, approximately 74% (right-hand column) of the commercial/industrial

rating funding for tourism is sourced from industries not directly benefitting

from the tourist industry. 66% of all spend (left-hand column) is with

businesses not directly in the tourism industry, i.e. fuel. Please note MBIE

record spend by visitors based on credit card use.

Hawke’s Bay Tourism Funding from

Industry

22. Hawke’s Bay Tourism

expects to collect about $120,000 this year through membership and support

partners. It currently has 386 paying members, being:

22.1. 223 Web Listing members

(each pay $100+GST per year)

22.2. 163 Tourism Operator

members (each pay $300+GST per year)

22.3. 28 International

marketing group members (each pay an additional $500+ GST per year)

22.4. HBT also has 16 support partners

(each pay $300+GST per annum). These are businesses who aren’t tourism

operators but who value and support tourism.

23. HBT also expects to secure

around $345,500 from industry through advertising, event sponsorship and event

registration.

24. In addition to the revenue

outlined above HBT receives “in-kind support” from industry to

support HBT activity. HBT hosts over 200 travel agents and journalists each

year. Industry gives a significant amount of free or heavily discounted rooms, flights,

meals and tours each year to offset HBT costs. HBT believes a conservative

estimate of in-kind support is approximately $500,000pa.

25. While HBT acknowledges it

could increase membership fees it believes there needs to be a balance –

some members would absorb an increase, other smaller tourism businesses

(particularly those in CHB or Wairoa) would struggle to pay more than the $100

per annum they pay now. HBT believes there are genuinely only a handful of

tourism players who have the capacity to provide more revenue to Hawke’s

Bay Tourism. These would be the same 15 – 20 businesses who back in 2011

contributed a further $120,000 per year for three years. This money was for

re-establishing the RTO alongside HBRC. HBT is in discussions with the Hawke’s

Bay Airport in terms of more direct support.

26. The tourism industry in

the region is mainly made up of 1-2 person operations so the potential pool of

funding would still be considerably small relative to what’s required to

market the region. Margins are tight mainly because tourism is seasonal. The

majority of visitors come to Hawke’s Bay November – May, therefore

revenue made over summer also must sustain the business over the quieter

months. HBT’s recommendation would be for a stakeholder survey to be

conducted to ask the industry what they believe they can afford to contribute.

Hawke’s Bay Tourism’s

Activities

27. Hawke’s Bay Tourism

has an annual budget of $1,985,600. This excludes event ticketing revenue of

$400k per annum:

27.1. Advertising and

promotion - 47%

27.2. This includes digital

advertising, print ads, search, billboards, creating content, digital video, www.hawkesbaynz.com, social media, public relations, hosting

media, developing collateral, attending consumer shows, training travel agents,

developing tourism product, and attending trade shows to promote Hawke’s

Bay.

27.3. Salaries and expenses

– 29% (In 2018 HBT employs 6.5 staff. In 2011 HBT employed 6 staff)

27.4. Event development,

marketing and promotion - 13%

27.5. Overheads - 11%

28. HBT has led a Regional

Events Strategy to build events in the shoulder seasons. The Hawke’s Bay

Marathon (May), Winter & Summer F.A.W.C! (June and November), The Big &

Little Easy events (Easter), The Spring Fling in CHB (September & October)

are all examples of creating events that drive reasons for people to visit

Hawke’s Bay. HBT also markets and supports a wide range of existing

events including Art Deco Weekend, Horse of the Year and Triple Peaks.

Future Funding

Models

29. HBT’s

objective is to raise $2million per annum to fund the promotion of

Hawke’s Bay and ensure a long-term sustainable approach to marketing of

the region. This is in-line with HBT’s current revenue from all sources.

30. In order

to achieve this it is proposing a model composing of three components:

30.1. Implementing

a regional visitor tax/bed levy;

30.2. Retaining

an element core funding from the Economic Development rate HBRC collects on

behalf of the region’s councils; and

30.3. Maintaining

the industry funding at current or higher levels.

Implementing a regional visitor tax/bed

levy

31. This could include a

regional tax/levy based on a percentage or fixed amount per night added to

accommodation charges for both commercial and peer-to-peer accommodation

providers. Collaboration with both the commercial accommodation sector and

peer-to-peer platforms would be necessary.

32. Local Government New

Zealand (LGNZ) are investigating the notion of a local visitor tax/bed levy and

are investing in a piece of work to understands the costs/benefits and

logistics of such a levy. A scope of work has been developed and an RFP is

expected to be delivered by the end of the year. HBT is a trustee of Regional

Tourism New Zealand and will be part of the working group providing input and

feedback on this paper. It would make sense to closely follow this rather than

duplicate the work they are doing. This is outlined in LGNZ’s submission

on the proposed International Visitor Levy which provides an excellent overview

of the issues under discussion: http://www.lgnz.co.nz/assets/Uploads/IVCTL-Final-submission.pdf

33. If HBT aims to raise $2M

per annum to fund the promotion of Hawkes’ Bay a 2.5% regional tax/bed

levy would be required on each night.

34. This is based on $80M

spent on accommodation in the year-end October 2018. (If bookings were made in

New Zealand the $80m would include revenue gained from the Airbnb sector.)

Retaining core

funding via the Economic Development rate

35. This would include

retaining funding through the economic development rate, but to a lesser extent

as currently allocated. For example - If HBT retained HBRC funding of

approximately $1.0M pa and used a regional tax/bed levy to raise a further

$1.0M a 1.3% levy would be required.

Maintaining the

industry funding at current or higher levels

36. This would see tourism

operators continue to pay for membership, advertising charges and other

partnership marketing contributions. As stated earlier HBT believes there are

only a small number of tourism players who would have the capacity to

contribute more to HBT. Its recommendation would be for a stakeholder survey to

be conducted to ask the industry what they believe they can afford to

contribute.

Considerations for future funding models

|

Component

|

Pros

|

Cons

|

Hawke’s Bay specific issues

|

|

A regional

visitor tax/bed levy administered regionally but adopted nationally.

|

Same

framework across all regions in NZ.

Aims to

create an even playing field by applying the levy on all providing paid

accommodation.

|

Only targets

accommodation sector which receives only 12% of tourism spend.

Cost to

administer to be determined – less for smaller entities but could be

high cost for bigger operators.

Difficulty

in finding all in peer-to-peer category.

Additional

resources may be needed.

Legislative

change is needed so implementing such a levy could be a slow process.

|

Need to take

into account all peer-to-peer properties.

HBRC versus

TLA collection.

|

|

Retain core

funding from the economic development rate HBRC collects on behalf of the

region’s councils.

|

Provides a

means for sectors who are not accommodation providers but who benefit from

tourism promotion to contribute.

Depending on

Council’s vision for the rate, could free up funding to be used for

other sectors.

Lessens the

burden on the ratepayer.

|

Council

feels the sector now has the momentum to sustain strong visitor numbers.

Depending on

the level, may effect Council’s aim of returning to focus on

environmental priorities.

|

|

|

Maintaining

industry funding at current or higher levels

|

This

supports the principle of equity and the case for tourism operators to pay

more than most other businesses, but not all tourism funding.

Public

perception - it is important that industry operators are seen to be paying

their way.

|

The benefits

of destination marketing and tourism development cannot be made exclusive to

those who contribute to the Regional Tourism Organisation (RTO). This

leads to freeloading where beneficiary businesses rely on others

paying. This in-turn demotivates those who are paying, eroding

sustainability of any funding achieved.

Maintaining

membership support is very time consuming to the detriment of destination

marketing activity.

|

HBT already

performs relatively well on this (Third highest of NZ’s RTOs which

reported in 2016 survey. An updated survey is being undertaken in early

2019).

Current

contributions over and above financial contributions include approximately

$500k in in-kind contributions to supporting HBT activity.

Hawke’s

Bay does not have many large-scale tourism businesses compared with other

regions. This will improve if the public investment is made to grow existing

and new businesses.

|

Feedback from

the Hawke’s Bay Local Government Leaders’ Forum

37. HBRC

staff engaged with this forum on 3 December 2018 to ascertain support for a

discussion about a regional visitor tax/bed levy. The forum was supportive of

the funding review and would like potential funding secured through a bed levy

to not focus solely on funding activities of HBT but more broadly focused on

funding tourism activities generally, including infrastructure. The leaders

agreed on the proposed next steps of:

37.1. Formally

convene a Local Government workshop to progress the discussion

37.2. Closely

track industry developments, particularly LGNZ’s work

37.3. Consider

in parallel the development of an all-of-region Tourism Strategy, noting the

possibility of Potential Growth Funding (PGF) for this.

National Context

38. HBRC’s review is

coming at a time when the topic of how best to fund tourism in NZ is under

significant scrutiny, in no small part due to the challenge of managing

industry growth. The following sets out some of the national and regional

discussions, initiatives and reviews currently in play.

Draft Aotearoa New Zealand Government

Tourism Strategy

39. The draft strategy was

released in November with submissions being accepted until 4 February 2019. It

outlines government’s role in its aim to make sure tourism growth is

productive, sustainable and inclusive. In the current environment of rapid

visitor growth the strategy states government needs to take a stronger role in

its stewardship of the tourism system, more actively partner with local

government, iwi and other regional stakeholders on tourism development and

dispersal, and better align its regional tourism-related investments and

interventions.

40. Challenges that have been

exacerbated or created by recent growth predominantly manifest at a local

government level, which provides much of the infrastructure needed to support

tourism.

41. The strategy identifies

five outcomes with its overarching aim to “Enrich New Zealand through

sustainable tourism growth”. Priority work areas include:

41.1. Support local government

and the sector to identify and develop reliable funding streams

41.2. Work with regions to

support them to take a strategic and coherent approach when deciding how they

want to plan, manage, market and develop their destinations.

42. HBT intends to make a

submission to the draft strategy and seek support from HBRC.

Productivity Commission’s Local

Government Funding and Financing Inquiry

43. This is looking at

improvements to the local authority funding and financing environment, including

recommendations in response to tourism pressures. DOC is also thinking about

how best we charge for facilities on public conservation lands, the Draft

Aotearoa New Zealand Government Tourism Strategy states.

International Visitor Conservation and

Tourism Levy

44. This levy will be set at

$35 per visitor and is estimated to raise $80M a year, to be split between

conservation projects and tourism infrastructure. It will be collected through

visa fees and via the new Electronic Travel Authority fee. It was

approved by Cabinet in September and legislation is due to be passed around

mid-2019.

Local Government New Zealand –

Local Tourist Levy

45. LGNZ is investing in a

rigorous piece of economic work to understand the costs and benefits of a

visitor tax/levy up and down the delivery chain. They believe this is the only

way to have a credible conversation across all levels of government and across

the tourism industry and more importantly the people who decide we do this

– government and officials.

46. A scope of work has been

developed and an RFP will be delivered by the end of the year.

Hawke’s Bay Tourism is a trustee of Regional Tourism New Zealand and will

be part of the working group providing input and feedback on this paper.

47. LGNZ made a submission to

the International Visitor Conservation and Tourism Levy saying it supports a

border levy but notes that it will only partially address the

issue of funding mixed-use infrastructure used by tourists as a significant

number of tourists will be exempt from the levy.

48. It says a local tourist

levy would “assist councils to alleviate the unfair burden on local

ratepayers from continuing to subsidise the tourism industry.”

49. It its submission LGNZ

says throughout the world local tourism levies are a common way of meeting the

costs that tourism creates in local communities, citing for example

accommodation levies are commonly used throughout Europe, the United States and

Canada. Currently New Zealand is an outlier in respect of local tourism

funding, it says.

50. A great deal of work has

already been done on this topic as a visitor tax debate started in 1974.

Next Steps

51. Formally convene a

workshop early next year of the Hawke’s Bay councils to progress the

discussion around a regional visitor tax/bed levy. The goal is to have a shared

position for Hawke’s Bay before any further work is undertaken on this.

52. Progress the development

of an all-of-region Tourism Strategy. This would include identifying who will

lead this piece of work and the development of the scope of the strategy.

53. Closely track industry

developments and report back to the Corporate and Strategic Committee when new

information comes to light.

Decision Making

Process

54. Staff

have assessed the requirements of the Local Government Act 2002 in relation to

this item and have concluded that, as this report is for information only, the

decision making provisions do not apply.

|

Recommendations

That the Corporate and Strategic Committee receives and notes the

“HB Tourism Update” joint staff report.

|

Authored by:

|

Annie Dundas

General Manager Hawke's Bay Tourism

|

Mandy Sharpe

Project Manager

|

Approved by:

|

Tom Skerman

Group Manager Strategic Planning

|

|

Attachment/s

|

⇩1

|

LTP HB

Tourism Resolutions

|

|

|

|

⇩2

|

HB Tourism

October-December 2018 Quarterly Report

|

|

|

|

LTP

HB Tourism Resolutions

|

Attachment 1

|

|

HB Tourism October-December

2018 Quarterly Report

|

Attachment 2

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 12 December 2018

Subject: Report from the Finance

Audit and Risk Sub-committee

Reason for Report

1. The following

matters were considered by the Finance Audit and Risk Sub-committee meeting on

21 November 2018 and are now presented for the Committee’s information.

Agenda Items

2. Local Government Funding Agency Accession

presented the documentation necessary to enable Council to execute legal

documents required to implement its 27 June 2018 decision to join LGRA as

an unrated guaranteeing Local Authority, with the sub-committee recommendations

following adopted by Council without change on 28 November 2018.

2. The Finance,

Audit and Risk Sub-committee recommends that Hawke’s Bay Regional

Council:

2.1. Confirms

Council’s intention to join the Local Government Funding Agency as an

unrated guaranteeing Local Authority.

2.2. Delegates

authority to the Chief Executive to execute the following documents for the

purposes of recommendation 2.1. above.

2.2.1. Letter from

Council to Computershare Investor Services Limited (to amend and restate

Council’s 21 October 2009 Registrar and Paying Agent Services Agreement)

2.2.2. Security

Stock Certificate (in relation to the Multi-Issuer Deed)

2.2.3. Security

Stock Certificate (in relation to the Equity Commitment Deed)

2.2.4. Security

Stock Certificate (in relation to the Guarantee); and

2.2.5. Stock

Issuance Certificate (in relation to the documents noted at recommendation 2.2.2. – 2.2.4.).

2.3. Authorises

Council’s elected members (Chairperson and Deputy Chairperson) to execute

the following deeds for the purposes of recommendation 2.1 above:

2.3.1. Deed of

Amendment and Restatement of Debenture Trust Deed

2.3.2. Accession

Deed to Multi-Issuer Deed

2.3.3. Accession

Deed to Notes Subscription Agreement

2.3.4. Accession

Deed to Equity Commitment Deed, and

2.3.5. Accession

Deed to Guarantee and Indemnity.

2.4. Delegates

authority to the Chief Executive to execute such other documents and take such

other steps on behalf of Council as the Chief Executive considers it is

necessary or desirable to execute or take to give effect to recommendation 2.1

above.

3. Health & Safety Internal Audit Report provided the H&S Internal Audit report and findings as well as the proposed work

programme for implementing and monitoring the recommendations. A follow-up report on implementation of

the work programme including critical

risks and the controls, processes and monitoring of these. In addition, the sub-committee requested that staff provide the Draft Strategic Plan, including Council’s overarching

philosophical positioning, to its February 2019 meeting.

4. Internal Audit update provided a status report on the internal audit work programme and

sought agreement from the sub-committee to either defer

the Business Continuance Plan audit or note it as a follow up for a future

financial year. The sub-committee requested that staff

investigate, with Crowe Horwath, whether it is viable

for any of the proposed future internal audits to be brought forward in the

work programme and report back to the next FA&RS meeting. In relation to

the ‘living wage’, the sub-committee was advised a small percentage

of staff salaries that fell below the threshold were adjusted to align with

Council’s recently adopted Living Wage Policy, and that a review of

Council’s Procurement Policy, to include a weighting for contractors who

comply with Council’s Living Wage Policy, will be reported to a future sub-committee

meeting.

5. It is proposed to review the Procurement Policy to include a

weighting for contractors who comply with Council’s Living Wage Policy

and staff will prepare a report for a future sub-committee meeting

6. Treasury Update provided progress on the

development of council’s diversified investment portfolio, advising that

the process of transferring funds has taken longer than anticipated and may

have an effect on the budgeted returns, and that staff

will update Council on the effects and any mitigation that may be needed.

Further, staff advised that the full transfer of funds is expected to be

completed by the end of January 2019. A Treasury report (to the

sub-committee and full Council) including forecast vs

actual returns of all investments, will be prepared for the February 2019

sub-committee meeting.

7. Appointment of an Independent Member of the Finance, Audit &

Risk Sub-committee following the recruitment and

interview process, the sub-committee recommended an appointment to Council,

which was agreed on 28 November 2018.

Decision Making Process

8. These matters

have all been specifically considered at the Committee level except where

specifically noted.

|

Recommendations

That the

Corporate and Strategic Committee receives and notes the “Report from

the 21 November 2018 Finance, Audit and Risk Sub-committee

Meeting”

|

Authored by:

|

Leeanne

Hooper

Principal Advisor Governance

|

|

Approved by:

|

Jessica

Ellerm

Group Manager Corporate Services

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 12 December 2018

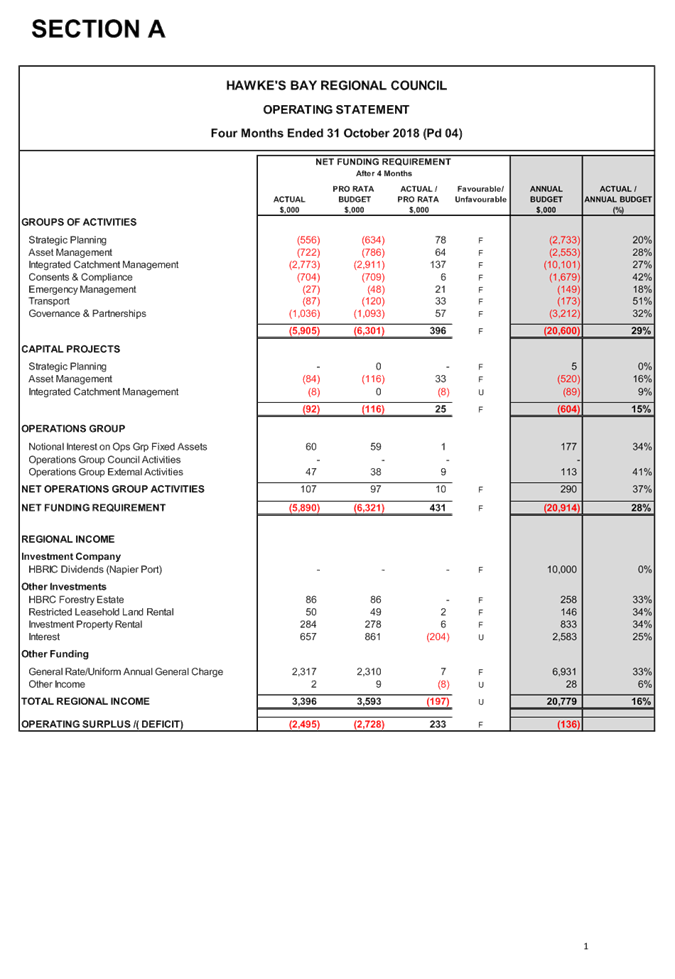

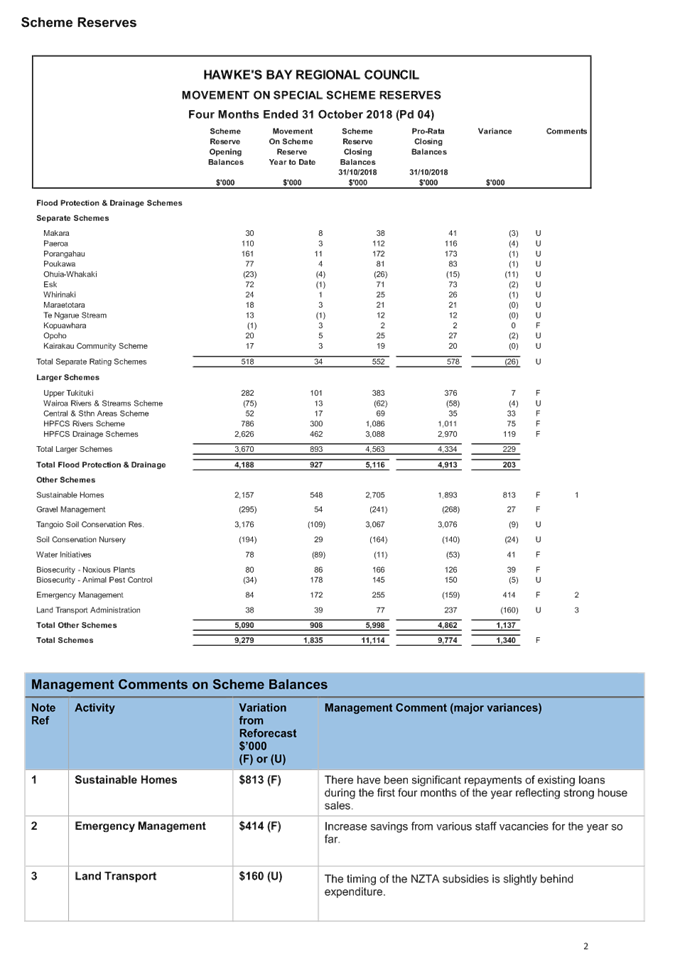

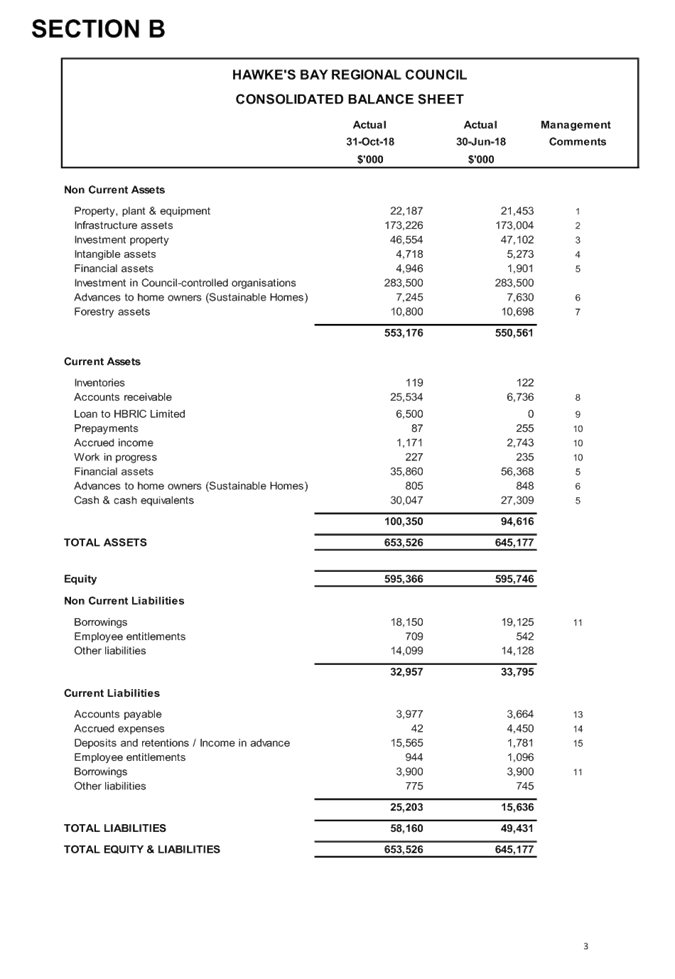

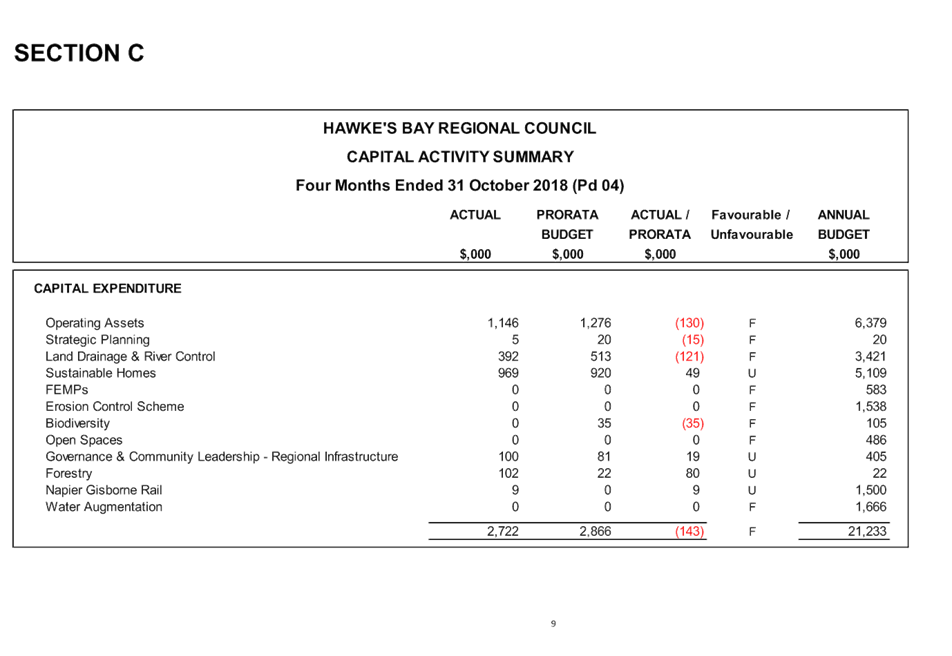

SUBJECT: Annual Plan Progress Report for the First Four Months of

the 2018-2019 Financial Year

Reason for Report

1. To provide

Council with a financial progress report for the first four months of the

2018-2019 financial year to 31 October 2018.

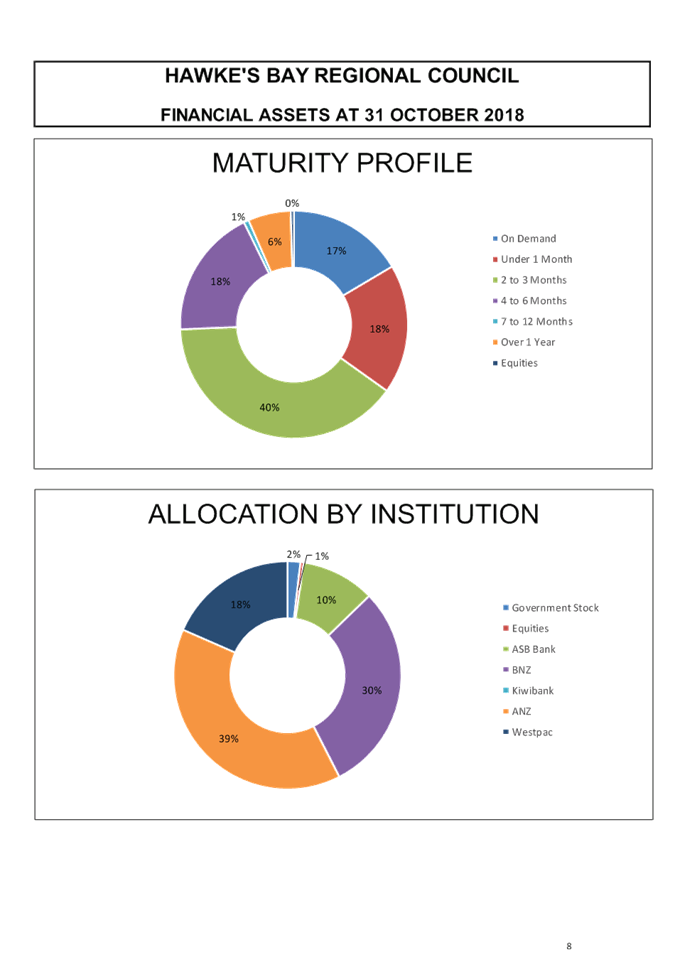

Financial Summary to 31 October

2018

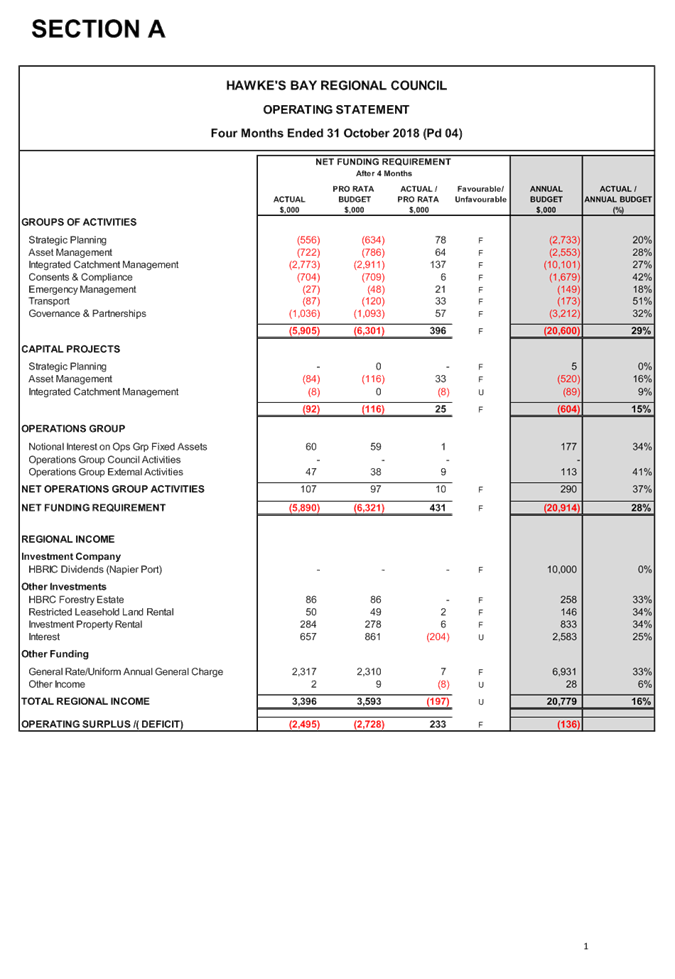

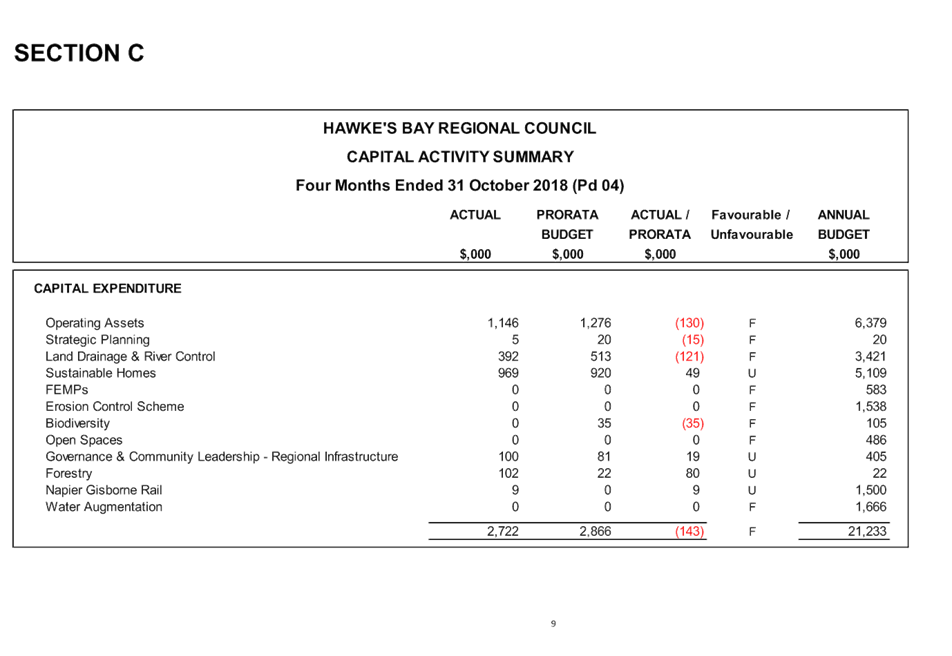

2. The financial results for the first four months of the 2018-19

financial year are tracking to budget. There are no significant concerns

at the moment however a few pressure points outlined below will be monitored

closely as the year progresses.

Our Port Consultation Costs

2.1. The 2018-28

Long Term Plan (LTP) included $100,000 funding for the development and

communication of the Port consultation.

2.2. As the process

has progressed this budget has been exceeded due to un-forecast expenses

associated with procuring out of scope legal and other professional advice in

addition to the planned costs for auditing of the LTP amendment, communications

advice, postage and delivery.

2.3. Some of the

above costs are yet to be finalised, but are estimated to total $250,000.

A full update will be provided at the next financial report in the New

Year. It is possible a significant amount of the over-spend can be absorbed

within the phase 1 project budget approved for HBRIC.

Investment Income

2.4. The LTP

provided for the transfer of $50 million previously set aside for the

Ruataniwha Water Storage Scheme (RWSS) to a diversified managed investment fund

in order to preserve the capital and grow investment income to help fund the

increase in Council’s operating activities.

2.5. The process of

selecting and then finalising arrangements with the appointed fund managers has

taken longer than initially expected, exacerbated by a decision to appoint two

fund managers. Full year forecast returns could be unachievable because

of the delay in placing these funds which forecast a return of 4.5% compared to

term deposit rates at around 3%. There is currently a $204,000 negative

variance to budget assumptions which will fluctuate depending on the

performance of funds in the next six months. Staff will continue to

update Council on the overall performance of investment income and any

mitigation that maybe required.

Reorganisation Costs

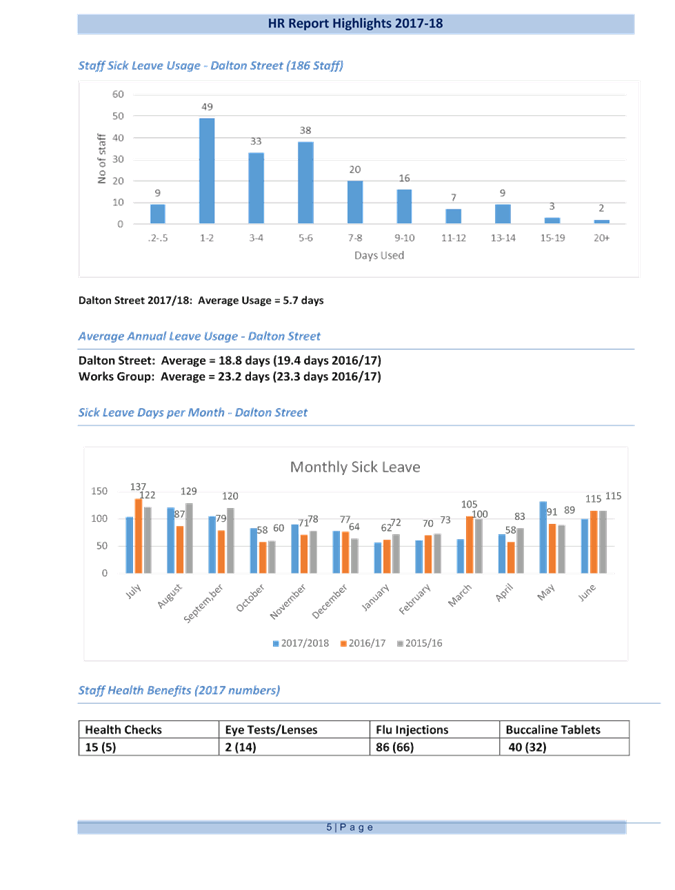

2.6. The 2018-28

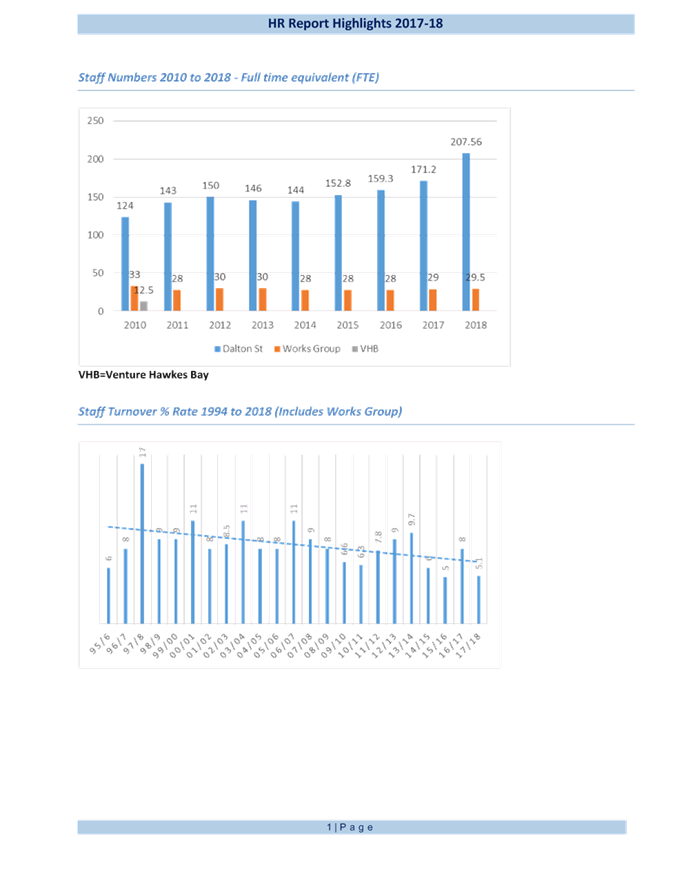

LTP included a number of new roles to support the increase in operating