Hawke’s Bay Regional

Council

Risk

and Audit Committee

12

February 2025

Subject:

Risk management update

Reason for report)

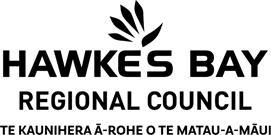

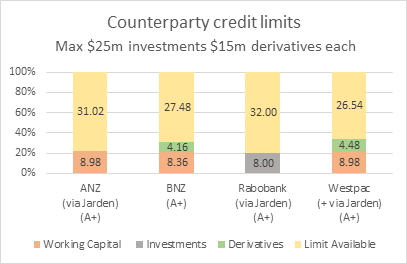

1. This item provides the Risk

and Audit Committee (RAC) with a quarterly update of:

1.1. the strategic risk profile

for HBRC, expressed in terms of HBRC’s purpose, strategic priorities and

definition of success, together with an outline of the major areas of

uncertainty/risk relating to this

1.2. the sentiment of both the

Executive Leadership Team and Councilors as to the aggregate level of

confidence/concern (i.e. risk rating) with respect to the strategic risk

profile of HBRC

1.3. the wider external

environment and specific issues for the attention of the Risk and Audit

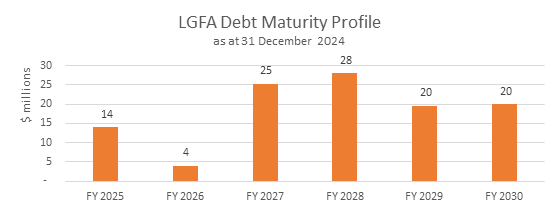

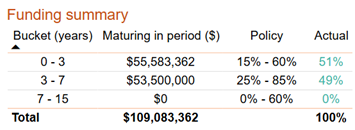

Committee, as well as a draft forward work plan (attachment 1) for

discussion and feedback

1.4. results of assurance work

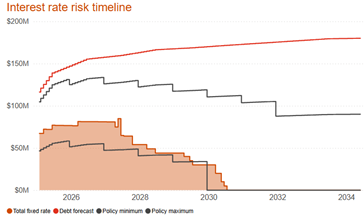

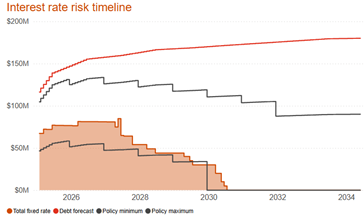

undertaken across key controls

including the external Crowe review of Data Analytics (confidential

attachment 2)

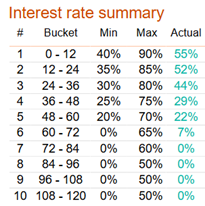

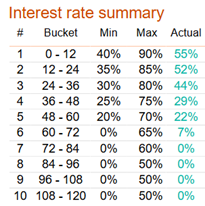

1.5. incidents and events raised

for the attention of the Committee.

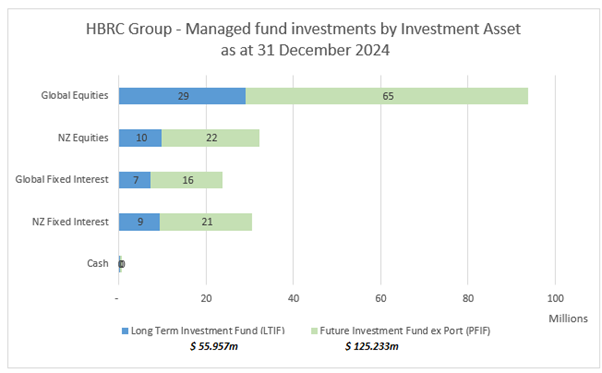

Executive

summary

2. HBRC has experienced a

relatively quiet December quarter with a generally positive rate payer and

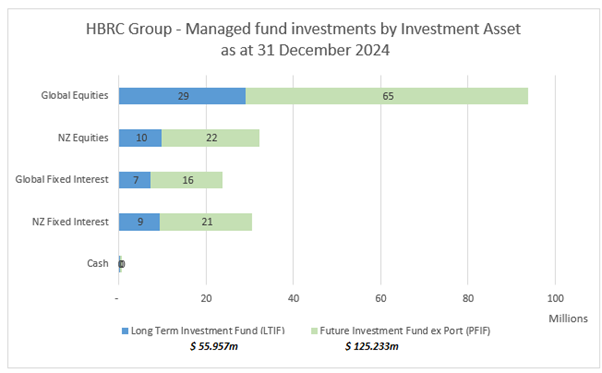

community attitude with few incidents of concern.

3. A notable change in the

financial risks and delivery risk from NIWE is reflected in the risk rating for

this programme. Financial Risks are presenting potential over-runs in

particular in Whirinaki. HBRC continues to work with Crown Infrastructure

Programme (CIP) in regard to the allowable transfer of under and overs within

programmes.

4. Council staff have

undertaken control testing on two key controls – Conflicts of Interest

and Gift Registering. Results are positive and outlined within the Assurance

updates.

5. The annual Data Analytics

review (Externally Lead) has also concluded that there have been no

unauthorised or misappropriated funds identified across sample testing.

6. Two operational incidents

occurred in November (driven by one event) when unauthorised access was

obtained into HBRC internal network. This resulted in some malicious activity

occurring, which resulted in personal identifiable information being breached.

(A full review breakdown is in confidential attachment 3).

7. Three medium Health and

Safety Events were noted. However, although this report is for the quarter to

31 December, two concerning, significant H&S incidents occurred in January

2025, involving two attacks on HBRC staff and one of our staff was hospitalised.

Discussion

Wider external context

Legislative and regulatory changes

8. Central Government

continues to publicly highlight the local government reform programme which we

anticipate will remove references to the ‘Four Well-beings’ from

the Local Government Act 2002, restoring a purpose focused on fixing pipes, filling

potholes, and delivering core local services.

9. The intent, amongst other

things, includes refocusing local government on basics, guiding council

decision-making and avoiding duplication of roles with central Government,

including benchmarking councils’ performance.

10. The Department of Internal

Affairs (DIA) will publish a yearly report on key financial and delivery

outcomes, helping ratepayers hold councils accountable. The first

benchmarking report on local councils will be released in the middle of 2025

and is expected to include a number of key council performance metrics such as:

10.1. rates – so that

ratepayers know the number of rates levied per unit, the change in rates since

the previous year, and the forecast change in rates over the next 10 years

10.2. Council debt –

including debt per rating unit, percentage change in council debt since the

previous year, and forecast change over the next 10 years

10.3. a balanced budget –

to show whether a council is balancing its budget or borrowing to support

expenditure.

11. An overhaul of the Resource

Management Act (RMA) continues. The Resource Management (Freshwater and Other

Matters) Amendment Bill returned to Parliament for its final reading and came

into force on 25 October 2024. It was introduced in May to make targeted

amendments to the RMA and a range of national direction instruments.

12. The external rate payer

environment continues to be challenging, in particular the fiscal

environment. In December 2024, New Zealand's annual inflation rate was

2.2% for the quarter. Although lowered, the cost-of-living crisis continues.

North Island Weather Events (NIWE)

Flood Resilience Programme

13. There continues to be

challenge and focus from central government on our ability to deliver critical

category 2 flood mitigation and the NIWE team has put measures in place to

provide assurance to our governors that effective and transparent processes are

put in place.

14. Most recently, leadership

changes have been made within the NIWE programme and Council has endorsed

further funding applications to MBIE to ensure financial support for those

areas which anticipate funding shortfalls outside of the Future of Severely Affected

Land (FOSAL) contracted amounts.

Internal

Council operating environment

Risk Management and strategic risk

themes

15. HBRC continues to adopt a

top down approach to strategic risk management, that considers

‘risk’ in terms of major areas of ‘uncertainty’

presenting both threat and opportunity to HBRC, related to the HBRC’s

purpose, groups of activities and priorities.

16. The ELT continues to

provide a monthly assessment on each of these areas of strategic risk which

enables the collective views of ELT to be considered in conjunction with the

specific risk assessments of staff with business area accountabilities for

these areas. This enables a focus on areas of shared concern or where there are

divergent viewpoints on specific matters.

17. In January 2025, Councilors

were invited to provide their assessment on each of these areas. Of the 11

Councillors, 6 responses were received (compared to 5 from the September 2024

survey). The usefulness of this overall assessment is directly related to the

completeness of responses received.

18. This strategic risk profile

is shown in the attached HBRC Enterprise Dashboard (Attachment 1)

19. Key themes emerging from

the latest assessments are:

19.1. While there is a relatively

high degree of alignment in sentiment across the ELT, there is a relatively low

degree of alignment in sentiment across councillors.

19.2. In several areas there are

very different levels of perceived risk on specific topics between councillors,

ELT and Business Owners with specific accountabilities for these topics/areas

of risk. These are highlighted in Attachment 1.

19.3. Effectiveness of Emergency

Management,

and Connectedness of decision -making remain primary areas of

uncertainty for Council staff. It is anticipated that the recently

approved CDEM transformation strategy will ensure that appropriate controls,

processes and mitigations are proactively and progressively put in place to manage

this risk. In addition, steps have been taken internally to update HBRC

Business Continuance Plan (BCP) documentation and ensure appropriate

scenario-based training is completed.

19.4. Effectiveness of

decision-making

reflects the current uncertainties as we head into the Annual Plan. Budget cuts

and staffing holds are leading to uncertainty of programmes and how to ensure

levels of service are achieved when facing internal constraints and rising

public perception of minimum expectations.

Risk-pool

20. In December 2024 the

Risk-pool Board advised of a likely further call on members in 2025. Risk-pool

is engaged in significant domestic litigation (having been sued by several

members) and is busy attempting to secure confirmation of reinsurance cover in London,

which is consuming considerable in-house and external resources.

21. A call is likely to be made

in March 2025. This call, which we expect to be in the region of

$2.5 million (across the membership, not per individual member), will be

to cover ongoing operational expenses. This compares to a total call of $12.88

million in November 2023. Based on the number of members, this is likely to be

circa $100k cost for HBRC. It is unclear when litigation may be settled, or

close which adds uncertainty for HBRC in budgeting future costs.

Closing

down of the Silt Taskforce and Commercial Funds

22. The Silt and Debris

Taskforce, including the Commercial Silt Programme, is winding down, having 31

December 2024 spend dates. Across the Local Authority Fund to date, 4.6 million

tonnes have been managed. With all collections now complete the Taskforce is

working to complete the remaining site remediation by the end of March 2025 (~2

sites to close).

23. In December, Wairoa

District Council received an extension to the use of funding for silt and

debris to June 2025. This allowed them to continue efforts to remove silt and

debris, but also to assist with establishing a further waste site due to full

capacity of Wairoa waste sites being experienced. The risk around unused money

for WDC rests with Wairoa. Unspent monies will be returned to DIA in due course

should this not occur. HBRC continues to assist with funding/grant money and to

reimburse WDC based on a cost incurred basis.

24. The Commercial Funding

(individual recipients received up to $400k on a 50/50 cost share basis) had a

spend completion date (for applicants) of 31 December. HBRC has been

proactively undertaking an audit of applications on a sample of ~150 basis since

June 2025. The audit programme verifies that actual spend aligned with the

eligible expenses within the programme. To date, 14 applicants have returned a

total of $935k, as monies were not able to be utilised.

25. The audit programme is

expected to be completed by end of February 2025. This programme of work has

been supervised by the Group Manager Corporate Services.

26. Across the programmes there

have been several challenges over 24 months as to the effectiveness of spend.

To remind the Committee, in 2024 HBRC commissioned a review with PWC on silt

payments made to specific contractors to check these key factors (among

others):

26.1. Tickets were reviewed and

assigned (through Silt Taskforce)

26.2. truck loading information

was agreed to and captured at point of pick up, and

26.3. rates charged agreed to the

average rate card utilised and adopted by the Taskforce in 2023.

27. In addition, in 2024 the DIA requested that MBIE review the

procurement process for the onboarding of contractors. Recommendations were

raised to improve controls at the time that were adopted, however, this review

did not result in any changes to contracts already in place.

Progress

on independent reviews

28. In December 2024 and

January 2025, Council received updates on the progress of work to respond to

the recommendations from the Hawke’s Bay Independent Flood Review. HBRC

is progressing with the one-page action plans to accompany the 56 recommendations

made.

29. Council staff are currently

progressing with identifying a third party to scope and provide ongoing

assurance to Council (and our community) that the design of actions being taken

aligns with the intent of the reported recommendations and, when complete,

evidence is sufficient to provide comfort that these have been addressed to a

satisfactory level. The full Council continues to provide oversight of these

recommendations.

Key

internal controls and assurance

Conflicts of Interest control testing

30. At the October 2024 Risk

and Audit Committee meeting, an update was provided on work underway to provide

a consistent and structured approach to define, document and assess key aspects

of HBRC’s internal control environment. From this, a programme of

internal testing has been established assessing the effectiveness of these

critical controls.

31. During this period, testing

was performed on the mechanisms in place to identify, assess, report and manage

the risk of real or perceived conflicts of interest within HBRC.

32. Effective management of

real or perceived conflicts of interest is an important factor in maintaining

trust, confidence, and ensuring the integrity of decision-making and service

delivery.

33. As part of a wider

programme of control testing, a review was undertaken by HBRC’s Quality

and Assurance Advisor on key internal controls within HBRC that manage real or

perceived conflicts of interest.

34. The scope of this review

included HBRC staff, Councillors and contractors, and focused on the following

aspects of management.

|

Scope

|

Focus

|

|

Policy

framework

|

Identification and assessment of

controls that ensure:

• there is a clear

definition of what is meant by ‘conflicts of interest’

• rules are requirements

with respect to the identification, management and reporting of conflict of

interests are defined

• procedures associated

with the management of conflicts of interest are defined

• accountabilities

associated with independence matters and conflicts of interest are defined.

|

|

Training

and awareness

|

Identification and assessment of

controls that ensure:

• the people that these

expectations apply to (e.g. staff, contractors, councillors and others)

understand the expectations of them and how to meet these expectations.

|

|

Scope

|

Focus

|

|

Declaration

and documentation

|

Identification and assessment of

controls that ensure:

• situations where a real

or perceived conflict of interest might exist are identified

• real or perceived

conflicts are documented in a central place

• confirmation that all

staff, Councillors and contractors are aware of and have complied with

relevant policies and expectations.

|

|

Mitigation

of potential conflicts

|

Identification and assessment of

controls that ensure:

• real or perceived

conflicts of interest are notified to relevant decision makers

• appropriate safeguards

are put in place.

|

|

Monitoring

and reporting

|

Identification and assessment of controls

that ensure:

• there is appropriate

oversight of management of conflicts of interest

• controls, safeguards and

management processes are effective.

|

35. Several policies are in

place that provide guidance to staff including a Conflict of Interests Policy

and a Gifts, Hospitality and Winnings Policy.

36. Interests and gifts are

required to be declared within the Conflicts of Interest or Gifts Register

(staff) or Pecuniary Interests form (councillors).

37. While there is some initial

training for new staff and councillors on policies, this is typically a

one-off, with variable levels of understanding and awareness from people

interviewed. Onboarding of contractors is limited and does not extend to HBRC

policies or wider expectations, including those relating to the management of

real or perceived conflicts of interest.

38. In practice, limited use is

made of the Conflicts of Interest Registers, with 13 entries over the past two

years. Such declarations are made on a point in time basis, and declarations

made are not revisited or updated. The Conflict of Interest Register is

actively monitored by one staff member. There is no record or confirmation that

actions agreed to manage potential conflicts were done with some

‘pending’ from May 2024.

39. One conflict of interest

situation came to light that was not declared or addressed through the policies

or controls expected to be in place. This related to a procurement

situation where a staff member, as part of their normal duties, approved an invoice

for payment to a related family member.

40. While it is difficult to

determine the counter-factual (i.e. how many potential conflict situations

existed that were not registered), the low volume of activity, together with

limited training and awareness activities, suggests that factors that might

compromise the independence of staff or contractors are not top of mind for

all.

Business

and ICT continuity management

41. The refreshed business

continuity plan (BCP) (including merging the Emergency Procedures) was

distributed to all staff in December 2024 and hard copies are distributed

across HBRC buildings and locations. HBRC’s primary response centre is

159 Dalton Street.

42. During February, scenarios

testing, and role play will be undertaken with both ELT and managers to ensure

appropriate awareness and knowledge of actions and operations required is

sufficient.

Data analytics review of transactions

43. Each year the Regional

Council, as part of the internal audit work programme, engages Crowe to conduct

a review of our Data Analytics. This review is used primarily for

identification of fraud or suspicious transactions across our business.

Although historical, it provides management with assurances on processes

followed throughout the reporting period.

44. The agreed scope and

purpose of the audit was to review payables and payroll transactional data for

the financial year ended 30 June 2024 and master data extracted as at 9

September 2024. This data was analysed independently by Crowe for any potential

anomalies or suspicious transactions. The report was then provided to staff,

along with separate spreadsheets listing the transactions that required review,

with final oversight from the Chief Financial Officer .

45. It is important to note

that, when a transaction is identified, it does not necessarily indicate that

there is anything suspicious. There are often legitimate business reasons

for a transaction being identified, such as different types of payments from a

Council (rates credits versus payment for services). These types of

transactions may display in areas such as ‘duplicate address’,

‘GST/non-GST transactions’, or ‘duplicate IRD number’.

46. In addition, some

transactions are listed purely for review purposes due to their deemed higher

risk nature, such as ‘top 50 vendors by amount’. This allows staff

to easily assess whether vendors are in line with expectations and would highlight

any vendors that may appear erroneous.

47. Given the small size of

Hawke’s Bay, there are times when an employee may share the same address

as a vendor, usually a spouse. Transactional processing staff ensure that

employee approvals are not allowed where any known conflicts exist between an

employee and a vendor.

Audit findings

48. The report includes five

high risk results pertaining to:

48.1. purchase orders created

after invoice date

48.2. purchase order approvals

48.3. payments to vendors

approved by a related employee

48.4. employees paid prior to

start date

48.5. employees paid after

termination date.

49. The early raising of

purchase orders continues to be an area needing improvement in the

organisation. We continue to provide training on this and are now developing

reports to identify on a timely basis where purchase orders are regularly not

being raised until after the invoice has been received so that focused

additional training can be given or different processes can be put in place

where needed.

50. The results relating to

delegated approvals of purchase orders were all a result of the TechOne

financial system recording higher level approvals against the original

requisition rather than the final purchase order. All of the results identified

were reviewed to ensure that the appropriate level of delegated approval was

given at the requisition stage. We will work with Crowe to ensure that these

approvals are included in their data extract next year.

51. The payments to a vendor

that were authorised by an employee with the same address were all legitimate

work. The employee has been reminded to ensure that requisitions for this

supplier are reassigned to ensure that there is no perceived conflict of interest.

Finance staff will also keep a watch on this particular vendor.

52. The payments to employees

before start date or after termination date all relate to instances where an

employee changed between a permanent contract and a fixed term contract. All

payments made were appropriate.

53. All other findings have

been reviewed in detail, and no unusual or unexpected transactions were

identified.

54. While reviewing the

findings of the audit, corrective action has been taken where needed to remove

unnecessary duplicates and complete any missing details.

55. Finance continues to train

users on processes with the financial system, especially the raising of

requisitions and purchase orders before goods and services are received.

Outstanding audit issues and

recommendations

|

Audit Performed

|

Review

Type

|

Date

|

Total

Issues raised

|

Issues

Closed

|

Issues

Open

|

Comments

|

|

Regional Assets

|

Section 17a

|

March 2020

|

N/A

|

0

|

3

|

Of the three remaining actions, two are on

track and one is at risk.

|

|

ISO45001 - ECAAS

Certification’s Gap Analysis

|

Review

|

30 November 2023

|

19

|

6

|

13

|

All actions on track

|

|

Organisational Change Consolidation and

Prioritisation

|

Internal Audit

|

July 2025

|

5

|

0

|

5

|

Priority had not been given currently to

addressing issues within this report, however dedicated resource has now been

assigned to complete within the next 6 months.

|

56. All recommendations from

prior audit and assurance reviews undertaken are formally captured and progress

to address these recommendations monitored. The following table provides an

update on progress in this area.

Significant events

57. This quarter, notable

events are outlined below.

|

Type

|

Number of Medium / High-Risk Events

|

|

Non-financial

Risk Incidents

|

2

High

|

|

Health

and Safety

|

3

Medium

|

Non-financial incidents

58. High Risk Event: In

November 2024 two Microsoft Office accounts at Hawke’s Bay Regional

Council were identified as having been signed into by an unauthorised malicious

user. Refer to the Account Security Breach Incident Report in (Confidential

Attachment 3) for information.

58.1. Given the extent of

information shared, this is a notifiable event to the Office of the Privacy

Commissioner (OPC). Immediately, Council staff called those high-risk

individuals where bank information was shared informing them recommendations to

change bank passwords. A formal letter was subsequently sent to all other

impacted individuals on 2 and 3 December.

Health and Safety incidents

59. Three medium Health and

Safety incidents were noted as outlined below:

59.1. A number of staff

complained or felt nauseous or unwell during some paint work on exterior walls

when refurbishments at the Dalton Street main building were undertaken. Staff

were advised to move to another office or work from home. The HBRC Facilities

team was alerted and raised the issues immediately with Wallace Developments. A

face-to-face meeting was held with the developer to discuss corrective actions

and on improving communication for future work that may impact HBRC staff. The

developer spoke to contractor involved and the paint product used will be

avoided in the future. They did adhere to the manufacturer application

methodology (being used in a ventilated space) however in future, tenants will

be advised in advance, painting will be completed out of office hours, or

alternatively all venting will be wrapped.

59.2. An HBRC staff member

observed a heavy tool being thrown upwards from the floor below to the second

story by an external contractor who was at Dalton Street undertaking

refurbishment works. The thrown tool missed the intended catch, landing in

front of the staff member as they entered the building. This was

reported as a near miss but could have had serious consequences if it had hit

the person. The contractor advised that the area was cordoned off with

spotters to keep the public away however a firmer requirement regarding the

movement of tools, and any movement around scaffolding and the interaction with

the public were strengthened. Assurance from the developer that health and

safety is taken seriously and feedback for continuous improvement was welcomed

by HBRC.

59.3. An HBRC mowing tractor

slipped into the drain on Halpin Road while navigating at low-speed between the

drain and apple trees. Conditions at the time were very dry, with longish grass

leading to slippery conditions. The driver endeavoured to avoid damaging

the apple trees, but unfortunately slipped into the open drain onto the

right-hand side. The driver turned the machine off and climbed out. The

driver had no physical injuries and was immediately drug tested, returning a

negative result. The tractor was retrieved with a small dent to the front

fender. HSW assisted with the investigation and discussed the need for the

orchardist to prune back tree growth prior to mowing and that staff ensure they

undertake the “5 min” risk assessment in challenging conditions.

Decision-making considerations

60. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

60.1. The decisions of the

Committee are in accordance with the Terms of Reference and decision-making

delegations adopted by Hawke’s Bay Regional Council 30 August 2023,

specifically the Risk and Audit Committee shall have responsibility and authority

to provide advice and recommend actions, responses, and

changes to the Council about risk management, assurance activities, governance

oversight and internal control matters, including external reporting and audit

matters. Specifically, this includes:

60.1.1. The robustness of

Council’s risk management systems, policies, practice and assurance

processes. (1.1)

60.1.2. Review whether Council

management has a current and comprehensive risk management framework and

associated procedures for effective identification and management of the

Council’s significant risks in place. (2.1)

60.1.3. Undertake periodic

monitoring of corporate risk assessment, and the internal controls instituted

in response to such risks. (2.2)

60.2. Because this report is for

information only, the decision-making provisions do not apply.

Recommendations

That

the Risk and Audit Committee receives and considers the Risk Management

update staff report.

|

David Nalder

Acting

Risk Manager

|

Pip O'connor

Chief

Information Officer

|

|

Jess Bennett

Programme

Finance & Controls Manager

|

Olivia

Giraud-Burrell

Quality

& Assurance Advisor

|

Authored by:

Approved by:

|

Susie Young

Group Manager Corporate Services

|

|

|

1

|

HBRC Enterprise Risk Dashboard -

January 2025

|

|

Under Separate Cover

– online only

|

|

Confidential

Attachments

|

|

2

|

2024 Crowe HBRC Data Analytics

Internal Audit Report

|

|

Under Separate Cover

– online only

|

|

3

|

Incident Report - Email Spoofing and

OPC notification

|

|

Under Separate Cover

– online only

|

Attachment/s

Hawke’s Bay Regional

Council

Risk

and Audit Committee

12

February 2025

Subject: Treasury Compliance Report

for the period 1 October - 31 December 2024

Reason for report

1. This item provides

compliance monitoring of Hawke’s Bay Regional Council’s (HBRC)

Treasury activity and reports the performance of Council’s investment

portfolio for the quarter ended 31 December 2024.

Overview of the quarter ending 30 September 2024

2. On 31 December 2024 and

during the preceding quarter, HBRC was compliant with all measures in its

Treasury Policy.

3. The effects of Cyclone

Gabrielle and its recovery continue to impact both cash balances and borrowing

requirements. Additional ongoing borrowing to fund recovery will continue

over the next 3-4 years, while proceeds from insurance claims are slower than

initially forecast.

4. HBRC completed a tender

process prior to Christmas and appointed ANZ as their new transactional

bank. It is expected HBRC will commence operating ANZ bank accounts from

the beginning of April and will hold BNZ accounts open through the next financial

year.

Background

5. Council’s Treasury

Policy requires a quarterly Treasury Report to be presented to the Risk and

Audit Committee. The policy states that the Treasury Report is to include:

5.1. Treasury exceptions report

5.2. Policy compliance

5.3. Borrowing limit report

5.4. Funding and liquidity

report

5.5. Debt maturity profile

5.6. Interest rate report

5.7. Investment management

report

5.8. Treasury investments

5.9. Cost of funds report, cash

flow and debt forecast report

5.10. Debt and interest rate

strategy and commentary

5.11. Counterparty credit report

5.12. Loan advances.

6. The Investment Management

report has specific requirements outlined in the Treasury Policy. This requires

quarterly reporting on all treasury investments plus annual reporting on all

equities and property investments.

7. In addition to the Treasury

Policy, Council has a Statement of Investment Policy and Objectives (SIPO)

document setting out the parameters required for all HBRC Group funds under

management.

8. Since 2018, HBRC has

procured treasury advice and services from PricewaterhouseCoopers (PwC) who

provide quarterly treasury reporting for internal monitoring purposes.

Treasury

exceptions report and policy compliance

9. HBRC was compliant with the

counterparty risk policy with all banks during the quarter to 31 December

2024.

10. Council staff continue to

maintain the view that management of Recovery Funding held on behalf of others

sits outside HBRC’s Treasury Policy for normal operations and is excluded

from treasury reporting.

11. Funds held on behalf of the

Silt & Debris programme are nearing exhaustion and should be either fully

utilised or returned to DIA by the end of March. There will continue to

be funds held on behalf of the HB Recovery Agency to 30 June 2025, or until

they too are spent.

Funding

and liquidity

12. To ensure HBRC can

adequately fund its operations, current policy requires us to maintain a liquid

balance of ‘greater than 10% of existing total external debt’.

Current liquidity ratio is 36.65% and therefore

meets policy.

13. The following table reports

the cash and cash equivalents on 31 December 2024.

|

31 Dec 2024

|

$000

|

|

Cash on Call

|

26,319

|

|

Short-term bank deposits

|

8,000

|

|

Total Cash & Deposits

|

34,319

|

14. To manage liquidity risk,

HBRC retains a Standby Facility with BNZ. This facility provides HBRC

with a same-day draw down option, to any amount between $0.3m-$10m, and with a

7-day minimum draw period. This facility is due to mature in May and in the

interim, while we transition our transactional banking to ANZ, we will look to

establish a facility before the expiry of the existing agreement.

15. Due to the additional

cashflow required to fund the Crown’s portion of the NIWE project we are

looking to increase the council’s Standby Facility value in the near

future.

16. The OCR reduced in both

October and November 2024 to sit currently at 4.25%. The next OCR review

is 19 February 2025, with markets anticipating at 0.50% decrease. Current

returns for on-call funds with Jarden are 4.25% and BNZ 4.20%. These on-call rates

are now returning higher rates than short term deposits.

17. For loan repayment

purposes, we also hold a term deposit of $8m with Rabo, maturing March 2025,

returning 5.90%.

Debt

management

18. On 31 December 2024 the

current external debt for the Council group was $114m of which $8m is due to

mature in April 2025. This has been pre-funded from the 2024 rates intake.

(external debt is $130.7m including loan from HBRIC).

19. Since Q1 of FY25 Council

has borrowed $6m from LGFA as a short-term commercial note to assist in funding

the cashflow of the Crown portion of the NIWE project while HBRC negotiates

with the Crown on repayment terms.

20. The following summarises

the year-to-date movements in Council’s debt position.

Summary of HBRC Debt

|

|

HBRC only

$000

|

HBRC Group

$000

|

|

Opening debt – 1 July 2024 – excluding

HBRIC loan

|

113,500

|

113,500

|

|

New loans raised

|

6,000

|

6,000

|

|

Less amounts repaid

|

(5,450)

|

(5,450)

|

|

Closing Debt 31 December 2024 (excluding

HBRIC loan)

|

114,050

|

114,050

|

|

Plus loan from HBRIC

|

16,663

|

-

|

|

Total Borrowing as at 31 December 2024

|

130,713

|

114,050

|

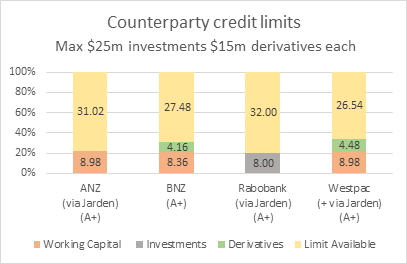

21. Council’s debt

maturity profile remains compliant. The table below includes our current

$10m BNZ overdraft facility in total debt and the planned $8m repayment

utilising term deposit. The internal (HBRIC) debt is excluded. The

short-term borrowing mentioned above will put pressure on our 0-3 year funding

policy and we may need to consider amending this while we hold additional

borrowing for the NIWE project.

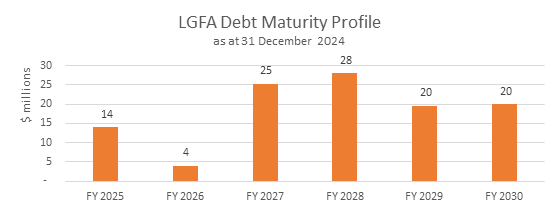

Funding

summary

22. HBRC borrowing in Q2 was to

fund the cashflow of the NIWE project. It is anticipated HBRC will

be required to hold an additional $13m debt throughout the NIWE project to

cover the timelapse between payment of creditors and Crown reimbursement. This

will be on top of the debt required to fund the HBRC share of NIWE costs.

23. HBRC staff continue to work

on firming up the challenging cashflow forecast for the capital projects and

this will inform the timing of any future borrowings.

24. The LTP debt forecast

anticipated debt levels rising to $176m by the end of FY27. However, as the LTP

is only for 3 years, management has updated their debt forecast for 10 years;

with more information available, they now forecast debt to peak in FY27 at

$158m, then reducing to $133m by 2034.

Borrowing

limits

25. Council continues to

monitor and work within the agreed borrowing limits set by both Council and the

LGFA.

26. The ratios below exclude

all HB Recovery cash & cash equivalents held and any return on these funds

but does include LTIF managed funds as a liquid asset for assessing net debt.

|

Ratio

|

HBRC

|

LGFA

|

Actual

to 31 December 2024

|

|

Net external debt as a percentage of revenue

|

<250%

|

<285%

|

31.0%

|

|

Net interest on external debt as a percentage of total revenue

|

<20%

|

<20%

|

1.9%

|

|

Net interest on external debt as a percentage of annual rates

income

|

<30%

|

<25%

|

6.9%

|

|

Liquidity buffer amount comprising liquid assets and available

committed debt facility amounts relative to existing total external debt

|

>110%

|

>110%

|

131.7%

|

Interest

rate risk

27. Council currently holds

$67m in fixed rate instruments, hedging 60% of current external debt, and

remains compliant to policy. This is based on the FY2025-2027 LTP plan.

28. These hedging instruments

are currently held with two banks, Westpac and BNZ. Staff are currently

reviewing options with a view to further hedging.

Managed

funds

29. Total Group Investment Fund

portfolios capital at 31 December 2024 is $181m. This is $9.7m above the

inflation-adjusted contribution target and the result of positive performance

of global equities.

30. All Managed Fund portfolios

now reside with Harbour Asset Management. Market returns to date,

combined with capital gains on transfer have resulted in the portfolio’s

achieving the required rate of return for the financial year, as stipulated in

the HBRC Group’s SIPO, with 6 months potential income still to come.

31. No divestments have been

made from managed funds this year, although they may be required to deliver the

investment cash dividend requested. The strategy on divestments now sits

within HBRICs mandate under the statement of expectations to manage the

group’s investments, while maintaining their inflation protected values.

32. Markets are expected to

remain steady, although there may be some volatility as a result of the

commencement of President Trump’s second term. HBRC must be mindful their

strategy on investments is a long-term one, therefore returns are assessed on a

rolling 5-year average.

|

|

30 June 2023

|

30 June 2024

|

31 Dec 2024

|

|

Fund Balances HBRC

|

$000

|

$000

|

$000

|

|

Fund Balance HBRC

|

110,828

|

118,722

|

128,093

|

|

Capital Protected Amount HBRC (2% compounded since

inception, increasing to 2.5% from 1 July 2024)

|

115,895

|

118,890

|

120,376

|

|

Current HBRC value above/(below) capital protected amount

|

(5,067)

|

(168)

|

7,717

|

|

Funds Balances (HBRC + HBRIC)

|

|

Long-Term Investment Fund (HBRC)

|

48,400

|

51,847

|

55,957

|

|

Future Investment Fund (HBRC)

|

62,428

|

66,875

|

72,136

|

|

Total HBRC

|

110,828

|

118,722

|

128,093

|

|

Plus HBRIC Managed Funds (FIF)

|

45,638

|

48,854

|

53,098

|

|

Total Group Managed Funds

|

156,466

|

167,576

|

181,191

|

|

Capital Protected Amount (2%/2.5% from 1 July 2024

compound inflation)

|

164,798

|

169,343

|

171,466

|

|

Current group value above/(below) protected amount

|

(8,332)

|

(1,768)

|

9,725

|

33. The following table summarises the fund balances at the

end of each period and the graph illustrates the asset allocations within each

fund on 31 December 2024.

Cost of funds

34. Rolling 12 months to 31

December 2024, Gross Cost of Funds (COF), interest spend, was $4.3m and 4.12%

of the average debt in the last 12 months, while Net COF after offsetting

interest received was $4.0m equating to 3.88%.

HBRIC

Ltd

35. In accordance with Council

policy, HBRIC provides separate quarterly updates to the Corporate and Strategic

Committee.

Decision-making process

36. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

36.1. The decisions of the

Committee are in accordance with the Terms of Reference and decision-making

delegations adopted by Hawke’s Bay Regional Council 30 August 2023,

specifically the Risk and Audit Committee shall have responsibility and authority

to:

36.1.1. Review the Council’s revenue and

expenditure policies, amongst others, and the effectiveness of those policies

in ensuring limited risk is generated. (1.3)

36.2. Because this report is for

information only, the decision-making provisions do not apply.

Recommendation

That

the Risk and Audit Committee receives and notes the Treasury Compliance

Report for the period 1 October – 31 December 2024.

Authored

by: Approved

by)

|

Tracey O'Shaughnessy

Treasury & Investments

Accountant

|

Susie Young

Group

Manager Corporate Services

|

Attachment/s There are no attachments

for this report.