Extraordinary Meeting

of the Hawke's Bay Regional Council

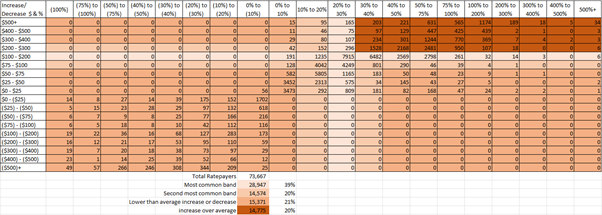

Date: 18 June 2024

Time: 9.00am

|

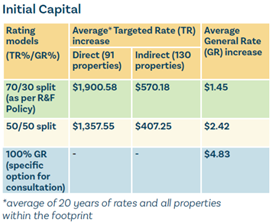

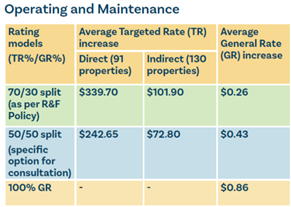

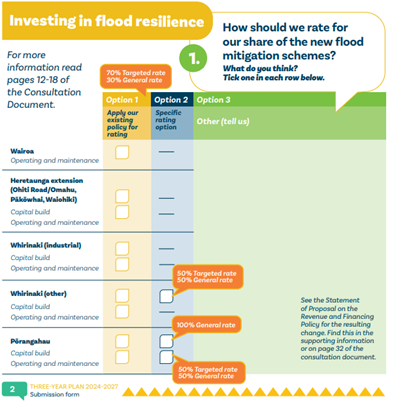

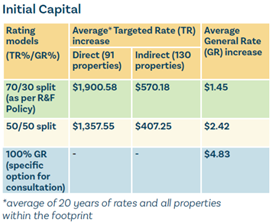

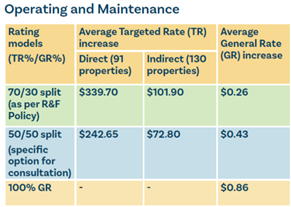

Venue:

|

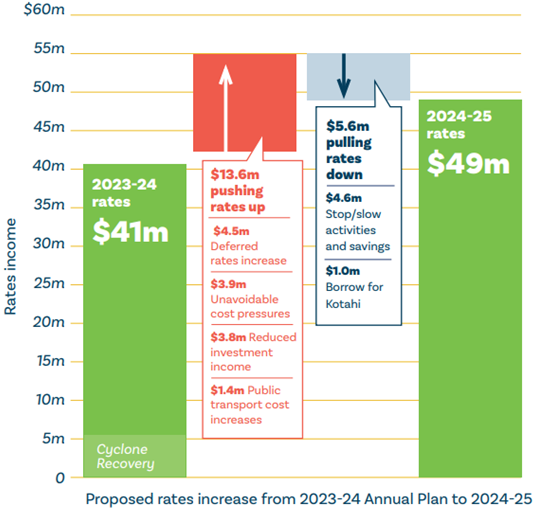

Council

Chamber

Hawke's

Bay Regional Council

159

Dalton Street

NAPIER

|

Agenda

Item Title Page

1. Welcome/Karakia/Housekeeping/Apologies

2. Conflict

of interest declarations

3. Confirmation of Minutes of

the Hawke's Bay Regional Council meeting held on 29 May 2024

Decision

Items

4. Three-Year

Plan 2024-2027 deliberations - Introduction 3

5. Investing

in flood resilience 7

6. Investing

in Resilient Communities 17

7. Public

Transport 21

8. Tough

choices - Hawke’s Bay Tourism 31

9. Tough

choices - Sustainable Homes 39

10. Tough

choices - Erosion Control Scheme and Biodiversity & Biosecurity 47

11. Tough

choices - Regional Parks and Te Mata Park funding 61

12. Infrastructure

Strategy 67

13. Submissions

requesting financial assistance 73

14. Fees

and User Charges Policy 77

15. Rates

Remission and Postponement Policies 83

16. Revenue

and Financing Policy 89

17. Consolidated

Three-Year Plan decisions 95

Hawke’s Bay Regional

Council

18 June

2024

Subject:

Three-Year Plan 2024-2027 deliberations - Introduction

Reason for report

1. This item outlines the

process for decision-making during deliberations and next steps culminating in

the adoption of the final Three-Year Plan 2024-2027 on 3 July 2024.

Process

today

2. The

deliberations reports (13 in total) are written by topic – one for each

of the major matters in the consultation document. A report has also been

written to address funding requests.

3. It is proposed

to go through the 13 reports below in the following order and make provisional

resolutions by topic.

4. The final item in the suite

of deliberation papers – Consolidated Three-year Plan Decisions

draws together all the provisional decisions in the preceding deliberation

reports to consider the overall impact and confirm all decisions.

5. The reports

are:

5.1. Investing in

flood resilience

5.2. Investing in

resilient communities (HBCDEM)

5.3. Public

transport

5.4. Tough choices

– Hawke’s Bay Tourism

5.5. Tough Choices

– Sustainable Homes

5.6. Touch choices

– Erosion Control Scheme and Biodiversity & Biosecurity

5.7. Tough choices

– Regional Parks and Te Mata Park funding

5.8. Infrastructure

Strategy

5.9. Submissions

Requesting Financial Assistance

5.10. Fees and User

Charges Policy

5.11. Rates Remission

and Postponement Policies

5.12. Revenue and

Financing Policy

5.13. Consolidated

Three-Year Plan Decisions

6. Attached to

each deliberations report are the relevant submission points for that topic and

a count for and against.

7. Each

deliberations report references the relevant submissions and includes staff

analysis.

8. Council will be

asked to consider the submission points relating to the topic and any comments

made by Council staff, and to agree or not agree to the proposal consulted on

or a variation.

Scope of decision-making

9. Under the Local Government

Act, the purpose of a long term plan consultation document is to provide an

effective basis for public participation in decision-making related to the

content of a long term plan. The Council must consult on proposals it

considers significant and provide choices including the consequences of those

choices (e.g. on rates, debt and levels of service).

10. In most cases choices are

presented as options with the Council’s preferred option included in the

proposed budget and average rates increase. The status quo is usually an option

along with other possible variations on quantum and funding method.

Council must take a position so budgets can be set for Year 1-3 of the plan and

the rates set for Year 1 (i.e. no decision or deferred decisions are not an

option).

11. The Council is limited in

its ability to make decisions outside of options presented to the community

during consultation. If the consequences are significantly different to any of

the options presented, then the interested and affected parties may be

different or have submitted differently.

12. We use the concept of

“bookends” as shorthand to describe the range of options available

to council in decision-making. As a general rule, if the decision is within the

bookends i.e. within the most impactful and least impactful options consulted

on, the Council can reasonably make that decision without risk of challenge.

The gives Council some ability to demonstrate responsiveness to submissions.

13. Council can set savings

targets if it considers that the impact on rates, debt and levels of service

are not significant. If they are deemed significant under the

Council’s Significance and Engagement Policy, they should be consulted on

to inform decision-making.

14. Council decisions take into

account a variety of factors, including but not exclusively submissions.

Council must consider what is in the best interest for the region as a whole

now and in the future.

Consultation and engagement

15. The deliberations reports

are informed by the comprehensive consultation undertaken on the Three-Year

Plan, including verbal feedback during Councillor drop-in sessions, 822 written

submissions received, social media feedback, 60 verbal submissions at the

Hearing on 29-30 May and reconsideration of submissions received during the

Revenue and Financing Policy review on affordability.

Next steps

16. Following

Council resolutions made at today’s meeting, staff will make any required

changes to the Three-Year Plan 2024-2027. Any changes will need to be applied

to all three years of the plan.

17. The final Three-Year Plan

2024-2027 is scheduled to be adopted at an extraordinary Regional Council

meeting on 3 July 2024.

18. Following the

adoption of the Three-Year Plan 2024-2027, each submitter will receive an email

from the Council within 30 days, setting out Council's resolutions pertinent to

their specific submission.

Decision-making process

19. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision-making

provisions do not apply.

Recommendation

That

the

Hawke’s Bay Regional Council receives and notes the Three-Year Plan

2024-2027 deliberations - Introductionn staff report.

Authored

by:

|

Desiree Cull

Strategy & Governance Manager

|

Mandy Sharpe

Strategy & Corporate Planner

|

Approved by:

Attachment/s

There are no attachments for this

report.

Hawke’s

Bay Regional Council

18 June

2024

Subject: Investing in flood resilience

Reason for report

1. This deliberations report

provides the Council with staff analysis of submissions and seeks a decision of

Council on the consultation topic – Investing in flood resilience.

Staff

recommendations

2. Staff recommend that the

Council considers the submission points attached (and full submissions received by Council resolution on

29-30 May 2024)

on the Investing in flood resilience consultation topic alongside the

staff analysis to enable an informed decision.

Consultation

topic

3. Investing in flood resilience was a key consultation

topic that the Council sought public submissions on described on pages 12-19 of

the Have your say Hawke’s Bay on our recovery focussed Three-Year Plan

2024-2027 consultation document.

4. The key question posed was

“how should we rate for [our share] of Category 2 flood mitigation”

in the four new flood scheme areas ($24M for initial capital and well as

ongoing operating) and general works ($17M).

5. Three rating models for all

properties within the direct/indirect scheme footprint were provided for each

area for comparison. For example, the Pōrangahau flood scheme is shown

below.

6. Tick box options of the

existing Revenue and Financing Policy (R&F Policy) settings for flood

schemes - 70% Targeted Rate and 30% General Rate, based on capital value

(shaded green in the tables) and specific options for Pōrangahau and

part of Whirinaki (shaded blue in the tables) were included as tick box options

in the online submission form as follows:

7. Amendments to our Revenue

and Financing Policy are needed to implement the rating so Council sought

public feedback on the proposed policy change concurrently with the Three-year

Plan.

8. A Statement of Proposal and

marked-up policy was available online and referenced in p19 and 31 of the Have

your say Hawke’s Bay on our recovery focussed Three-year Plan 2024-2021.

9. The marked-up policy as

consulted on is shown below.

Submissions received

10. Of the submissions

received, between 56%-73% supported the Council’s preferred option of

applying existing rating policy across the new schemes, between 12%-16% support

the specified rating options, and between 27%-33% indicated other options. Around

170 of total submitters did not select an option in this

consultation topic.

|

|

70%/30%

rate split

|

Specific rate

|

Other

|

Total

|

|

Wairoa

Operating

& Maintenance

|

132

(71%)

|

-

|

54 (29%)

|

186

|

|

Heretaunga extension

Capital

Operating

& Maintenance

|

128

(67%)

132 (69%)

|

-

-

|

64 (33%)

58 (31%)

|

192

190

|

|

Whirinaki Industrial

Capital

Operating

& Maintenance

|

124

(70%)

124

(72%)

|

-

-

|

53 (30%)

49 (28%)

|

187

173

|

|

Whirinaki Other

Capital

Operating

& Maintenance

|

105

(59%)

125

(73%)

|

22 (12%)

-

|

51 (29%)

47 (27%)

|

178

169

|

|

Pōrangahau

Capital

Operating

& Maintenance

|

97 (56%)

96 (56%)

|

25 (14%)

28 (16%)

|

51 (30%)

47 (28%)

|

173

171

|

11. 133 submitters made a

comment under this topic.

Summary of submissions and staff

analysis

Best rating model for the flood schemes

12. There were a mix of views

in the submissions.

13. Some thought it should all

be 100% general rate funded.

13.1. “In all

Flood schemes fund by 100% General Rates for both Initial Capital and Operating

and Maintenance for Wairoa, Heretaunga, Whirinaki (Industrial), Whirinaki

(Other), and Pōrangahau” (#647)

13.2. “Spread

costs of flood mitigation equally over all rate payers” (#917)

13.3. “All

flood scheme areas should be charged at 100% GR.” (#932)

14. Some ratepayers felt that

only the capital spend should be 100% GR.

14.1. “For

all flood schemes the capital cost should be 100% targeted rate with

maintenance per the standard R& F policy split” (#563)

15. Some thought it should be

100% targeted to those in the affected flood area.

15.1. “The

burden of rates should be targeted to those who benefit or potentially benefit

and people should learn to be accountable for their own choices and if they

build on the coast or low lying land and then if its a hand out…” (#204)

15.2. “No

Dont want to pay more. I have paid my share made the right decisions

didn’t get flooded so why should I pay for others who rebuilt in flood

areas” (#426)

15.3. “…My

views is that the “user should pay”. No cross subsidies, financing

for the life of the resource and costs to be met by the direct beneficiaries of

that resource…” (#856)

15.4. “Ratepayers

in non-affected areas should NOT be required to share or contribute to these

costs. Property owners knew [or ought to have known] the risks associated with

the areas they chose to purchase and the cost of works for their exclusive

geographic benefit should be met exclusively by them with a targeted rate (and

not be part of the general rates burden on property owners outside these

affected areas”

(#870)

16. Most supported using

existing policy settings of 70:30 targeted:general rate proportion.

16.1. “for

each of the areas Initial Capital and Operating and Maintenance rating model:

70/30 split” (#121)

16.2. “For

the Heretaunga flood scheme the 70/30 split makes the most sense to me” (#717)

16.3. Category 2

flood schemes costs should be the same as other flood protection and control

works: 30% general rate and 70% targeted rate” (#1005)

16.4. “Apply

existing policy settings to flood and coastal hazard financing. This is

fair”

(#1068)

16.5. “…in

terms of rating for both the capital and ongoing operating and maintenance for

flood control we believe that Council’s existing policy settings are the

right settings. To this end we wish record our support for the 70/30 split as

per the current Revenue and Financing Policy for all flood protection schemes” (#1091)

17. Some submitters supported a

50/50 rate for all of the schemes.

17.1. “Relates

to all of the above: Apply the 50/50 TR/GR option. Rationale is that

while we have all been impacted by Cyclone Gabrielle in some way those that

lost property and had their livelihoods severely impacted deserve additional

support from the wider constituency” (#571)

17.2. “Wairoa

50/50 split Whirinaki (other) 50/50 split Heretaunga 50/50 split

Pōrangahau 50/50 split” (#1055)

17.3. “Wairoa

- 50/50 Heretaunga O&M - 50/50 Whirinaki (industrial) capital and O&M -

50/50 Whirinaki (other) capital - 50/50” (#1105)

18. A number of submissions

were received that did not fall neatly into the above categories. Some submitters felt that a

greater proportion of targeted rate should apply to the beneficiaries of the

schemes – with the targeted rate proportion varying from 80% to 100%.

Staff

response

19. It is noted that those who

submitted for a greater targeted rating contribution, for the most part,

identified as living outside of areas affected by the new schemes. Conversely,

those who identified as being beneficiaries of the new schemes were most likely

to submit in favour of 100% general rate funding.

20. Flood protection is about

protecting public infrastructure as much as individual properties. Districts

are interwoven so, regardless of where the flooding occurs, it will have wider

economic and social impacts.

21. While cyclone-related

flooding was confined to some areas, the effects of Cyclone Gabrielle were

noticed across the whole region, particularly with regards to key

infrastructure such as roading.

22. As part of the recently

reviewed Revenue and Financing Policy, the Council adopted a consistent

approach for rating flood mitigation schemes which was a 70/30 split.

Consistency was a key factor of the Revenue & Financing Policy review.

23. Due to the fact that these

proposed flood mitigation schemes are in response to a 1 in 500 weather event,

a variation to the consistent 70/30 approach could be warranted.

Bespoke

solutions by area

24. For all four areas where

new schemes are proposed, the consultation document showed three possible

rating models for both capital and operating expenses to give an indication of

affordability. These were 70/30, 50/50 and 100% general rate funded. Bespoke or

specific options for consultation were agreed by the Council for Whirinaki

(Other) – initial capital 50/50 split and for Pōrangahau –

initial capital 100% GR and operating, and maintenance 50/50 split.

Wairoa

25. A small number of

submitters commented specifically on Wairoa

25.1. “For

Wairoa, I think the targeted rates are probably too much for the small town,

and subsidising it with a split biased more towards general rates would help

support Wairoa. I’d be happy to do that” (#330).

Whirinaki

26. A number who submitted on

the Whirinaki Other scheme commented that they believed that a greater portion,

if not the entire capital and operating costs of the scheme, should be paid for

through the Whirinaki Industrial scheme.

26.1. “Whirinaki

Industrial to bear majority of the costs directly” (#516)

26.2. “Whirinaki

(Industrial) Flood Schemes: I think the rating model for this scheme should be

a greater targeted component to reflect the more direct benefit -

90% Targeted Rate and 10% General Rate split” (#1005)

26.3. “Pan

Pac needs to pay for the Whirinaki industrial flood mitigation scheme not rate

payers.” (#1143)

Pōrangahau

27. A number of submitters

responded in favour of alternative arrangements for Pōrangahau.

27.1. “…welcomes

the proposal for a bespoke arrangement for the new Category 2 flood scheme in

Pōrangahau. As presented in the discussion document both the 70/30 split

(as per the Revenue and Financing Policy) and 50/50 split options would present

an unaffordable burden on the majority of the Pōrangahau community given

the small footprint and low-socio economic status of the area” (#153)

27.2. “Pōrangahau

- 100% GR for both” (#248)

27.3. “General

rates increase for everyone - related to Pōrangahau” (#541).

Heretaunga

28. Some submitters commented on the Heretaunga Plains Flood Control Scheme,

with Pākōwhai being of particular focus.

28.1. “Heretaunga

extension - both 100% general” (#671)

28.2. “This

comment relates only to Pākōwhai scheme, with the Waiohiki work

integral in that proposed flood protection work… To lump 70% of the cost

onto landowners, half of which are no longer residents is unfair and a

misunderstanding of the reality of the situation. The cost of the flood scheme

works for Pākōwhai should be rated fully by General Rate, as is

Wairoa and Pōrangahau, who's economic contribution to the province is much

less than Pākōwhai if that is guide to be used” (#1180)

28.3. “…..I

therefore strongly believe that the costs of building this stopbank benefits

all HB residents and we all should equally pay our share”(#935)

29. Hastings District Council

submitted on who should rate for the local share for the enhancement for

Havelock North streams agreed as part of the cost-share agreement with the

Government following Cyclone Gabrielle (#1127).

Staff

response

30. Both Wairoa and

Pōrangahau are predominantly within lower socio-economic zones and

therefore the cost associated with constructing and maintaining flood

protection may not be affordable to these communities.

31. A 100% general rate funding

for the capital portion for Pōrangahau would be in line with the 100%

general rate funding for the capital portion for Wairoa.

32. Many submissions stated

that all of the flood schemes should be 100% general rate funded, with some

suggesting just the capital portion be 100% general rate funded. Council could

choose to adopt either of these options.

33. Some submissions addressed

either 50/50 rating or 100% general rate funding for Whirinaki. A key

consideration that Council undertook as part of the analysis around the

category 2 flood mitigation was that affordability needed to be investigated.

As such, and in regard to submissions stating this preference, Council could

choose to adopt either the 50/50 split or 100% general rate funding for

Whirinaki Other.

34. Many submissions spoke

specifically of Pākōwhai which is a part of the Heretaunga Plains

Flood Control Scheme (HPFCS).

35. Due to the fact that the

Pākōwhai Flood Mitigation makes up a small portion of the HPFCS

scheme, staff recommend maintaining a 70/30 split due to the adoption of this

consistent approach during the Revenue & Financing review.

36. Some submissions questioned

the portion which Whirinaki Industrial would be paying.

37. It is noted that the

industrial ratepayers in the area were the ones who requested the higher level

of service from the flood mitigation. The consultation noted that a 90/10 split

was another option for this scheme. This option was supported by a small number

of submissions.

38. General affordability,

while not expressed explicitly, was implicit in a number of submissions. For

three of the new schemes the capital portion of rates will be set in July

2024. The exception being the Wairoa scheme whose capital build is wholly

government funded.

39. The quantum of the new

rates as of July 2024 are only a small portion of the total as stated in the

consultation document. It is expected that the rates will increase over the

three-year LTP period as the costs of construction are incurred. It is expected

that ratepayers may not notice much change to their annual rates initially.

40. The new rates to cover

operating and maintenance costs for the schemes will not be set until the

completion of the capital works for the new schemes, assumed to be in Year 4 of

the plan.

41. The table below shows the

total annual rate funding required for the capital works for the new schemes

over the life of the Three-Year Plan. The biggest impact will be on Whirinaki

given the small number of ratepayers within the targeted rate.

42. Assuming the funding rules

above, the rating impact will show up as a new line on rates invoices for

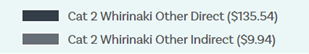

ratepayers within the Whirinaki Industrial and Other scheme footprints only.

See the example below for a property in Pohutukawa Drive in Whirinaki Other.

This is the proposed rates for Year 1 and will increase in future years in line

with the table above.

43. Further work will be

undertaken to identify beneficiaries and exacerbators of the schemes, as the

flood mitigation solutions are confirmed and capital expenditure from the new

delivery programmes ramp up. HBRC has engaged Phillip Jones to facilitate this

work. This work will provide rationale for properties to be included within the

flood protection areas and associated levels of benefit (rating) for each

grouping. Consistency with the approach taken in other river and drainage

schemes will be a consideration. More targeted engagement with scheme

ratepayers will be undertaken on this work.

Havelock North Streams

44. The HBRC contribution to

the Havelock North Streams category 2 project will be the subject of a paper to

Council outside the LTP process. Council is likely to need to rate for the

costs of its contribution retrospectively. The process ahead will need to

consider the issue of rating for this work, which is delivered and managed by

Hastings District Council.

General Works

45. In addition to

the flood schemes, the Regional Council agreed to fund it share of $17 million

of $68 million of general works as part of the cost-share agreement with the

Government. Council must decide how to rate for this work which includes:

45.1. Additional work

to already repaired stopbanks $7.5m (Total $30m)

45.2. Replacing and

upgrading three pumpstations $7.5m (Total $30m)

45.3. Telemetry

network repairs and upgrades $1.25m (Total $5m)

45.4. Accelerating

scheme reviews $750,000 (Total $3m).

46. As these

general works are spread across a range of assets, geographical areas, scheme

type (flood, drainage, and river maintenance) and years, the Council consulted

on 100% general rate funding it.

47. No substantive

submissions were received on this topic. Staff consider the proposed funding

method is sound and recommends no change.

Revenue and Financing Policy change

48. As noted

earlier in point #7 of this report, the Council must amend its Revenue and

Financing Policy to implement the new rating.

49. The Regional

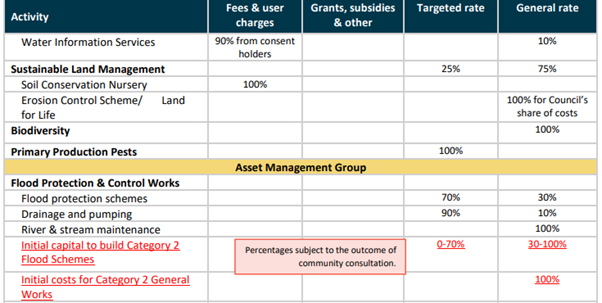

Council consulted on adding two new lines to the table in Section A of the

current Revenue and Financing Policy, shown in red below. The percentages will

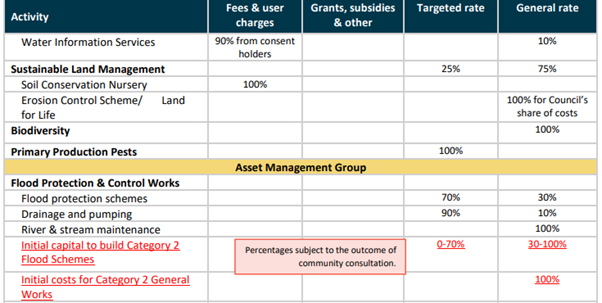

be changed to reflect the Council’s preferred rating model.

|

Activity

|

Targeted rate

|

General rate

|

|

Asset Management

group

|

|

Flood Protection & Control Works

|

|

Flood protection schemes

|

70%

|

30%

|

|

Drainage and pumping

|

90%

|

10%

|

|

River & stream maintenance

|

|

100%

|

|

Initial capital to build Category 2 Flood

Schemes

|

0-70%

|

30-100%

|

|

Initial costs for Category 2 General Works

|

|

100%

|

50. Council also

consulted on the marked-up changes as shown in Attachment 2 Step One

Funding Needs Assessment and Step Two outcomes to show the rationale.

51. The Revenue and

Financing Policy incorporating the decisions made today on rating methods will

be presented to Council for adoption within the final Three-Year Plan on 3 July

2024.

Scope of the decision

52. The scope of the decision

is to decide the preferred rating model for the initial capital and operating

of flood mitigation schemes in Wairoa, Whirinaki, Heretaunga and

Pōrangahau, as well as for the general work agreed as part of the

cost-share agreement.

53. Staff do not recommend

delaying the adoption of this approval so the new capital build rates (except

where fully government funded) can start to be rated from 1 July of the 2024-25

financial year.

Decision-making process

54. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

54.1. The decision does not

significantly alter the service provision or affect a strategic asset, nor is

it inconsistent with an existing policy or plan.

54.2. The use of a consultation process

required under s93 of the Local Government Act 2002 and special temporary

legislation following Cyclone Gabrielle has been undertaken.

54.3. The persons affected by

this decision are the region’s ratepayers.

Recommendations

That Hawke’s Bay Regional

Council:

1. Receives and considers the Investing in flood

resilience

staff report.

2. Agrees that the Council can

exercise its discretion and make decisions on this issue, having undertaken the consultation process

required under s93

of the Local Government Act and special temporary legislation following Cyclone

Gabrielle.

3. Subject to final decisions

on the Three-Year Plan as a whole, to be made in Item 17 Consolidated

Three-Year Plan Decisions:

3.1. Agrees to the rating models

for the Flood Mitigation schemes (agreed as the preferred models by Council on

13 March 2024 and presented in the consultation document) being:

3.1.1. 70/30 split as per the

existing Revenue and Financing Policy settings for flood protection schemes

for:

3.1.1.1. Wairoa Operating and

Maintenance

3.1.1.2. Whirinaki (Industrial)

Capital and Operating and Maintenance

3.1.1.3. Whirinaki (Other) Capital

and Operating and Maintenance

3.1.1.4. HPFCS Capital and Operating

and Maintenance

3.1.1.5. Pōrangahau Operating

and Maintenance.

3.1.2. 100% general rate funding

for Pōrangahau Capital.

OR

4. Agrees to alternative

rating models (as agreed by Council on 13 March 2024 and presented in the

consultation document) of:

4.1. Whirinaki (Other) –

50/50 split for Capital

4.2. Pōrangahau –

50/50 split for Operating and Maintenance.

5. Agrees to 100% general rate

funding our share of the General Works agreed as part of the cost-share

arrangement with the Government following Cyclone Gabrielle, as consulted on.

6. Agrees to amend its Revenue

and Financing Policy to implement the rating decisions related to funding flood

schemes and general works as part of the cost-share agreement with the

Government following Cyclone Gabrielle.

Authored

by:

|

James Feary

Operational

Response Manager

|

Vanessa Fauth

Finance

Manager

|

Approved by:

|

Chris Dolley

Group Manager Asset Management

|

|

Attachment/s

|

1

|

Flood Resilience Programme

submissions feedback

|

|

Under Separate Cover

|

|

2

|

Step One Funding needs assessment

and Step Two outcomes

|

|

Under Separate Cover

|

Hawke’s

Bay Regional Council

18 June

2024

Subject: Investing in Resilient

Communities

Reason for report

1. This deliberations report

provides the Council with staff analysis of submissions and seeks a decision of

Council on the consultation topic – Investing in resilient communities.

Staff

recommendations

2. Staff recommend that the

Council considers the submission points attached (as well as the full submissions

received by Council resolution on 29-30 May 2024) on this topic alongside the staff

analysis to enable an informed decision.

How

we fund this activity

3. Regional Council is part of

and is the administering authority of the Hawke’s Bay Civil Defence

Emergency Management (HBCDEM) Group. We collect a targeted rate for the HBCDEM

Group. We collected $2.9 million in the 2023-24 financial year.

Consultation

topic

4. Investing in resilient

communities

is not a key consultation topic but a major focus of the Have your say

Hawke’s Bay on our recovery focussed Three-Year Plan 2024-2027

consultation document.

5. The topic was presented in

the consultation document as shown following:

Submissions received and staff analysis

6. Around 14 submitters made a

comment under this topic.

6.1. Several submitters were

very critical of Regional Council and/or HBCDEM’s preparedness and/or

response to Cyclone Gabrielle.

6.1.1. “I am

concerned at the lack of response from Civil Defense to Cycloine Gabrielle and

strongly object to my rates being used to support Civil Defense (or similar)

where this provides such minimal benefit or value to my community and to my

property.” (#1076)

6.2. A few submitters were

supportive of the proposed increased funding for HBCDEM. A couple of submitters

talked about the need for further support from central government.

6.2.1. “Following the

impacts from Cyclone Gabrielle and the subsequent Independent External Review

Council supports the increased funding allocation to CDEM activities to bolster

capability and capacity. Council also acknowledges that further support is

going to be required from all councils as well as central government to ensure

our communities are best placed to support and stand-up for future

events… It is also vital that we commit to improving the communication,

technology, monitoring, modelling and warning systems across our key hazard

areas and our key response agencies.” (#153)

6.2.2. “…Please

ensure Council look into obtaining more central government funding to cover

costs where possible to alleviate the burden to Hawke's Bay Regional Council

ratepayers.” (#827)

6.2.3. “Coastal

defense needs to be continued. Funding needs to be required for updating Civil

Defense plans in the future, after Cyclone Gabrielle. More warnings,

sirens, evacuation notices, etc, etc.” (#343)

6.3. A few submitters also made

comments about clarity of roles.

6.3.1. “In the

last Ten Year Plan I submitted about the cost of having five councils in Hawkes

Bay for such a small population base. I believe issues arising out of the

Cyclone Gabrielle, and the response, highlight problems in the existing system.

• Confusion amongst the public about who runs Civil

Defence and how to find services and from whom during an

emergency….” (#1166)

Staff

response

7. Issues raised relating to

submitters’ experience of the CDEM response to Cyclone Gabrielle, were

taken into consideration as part of the Cyclone Gabrielle reviews.

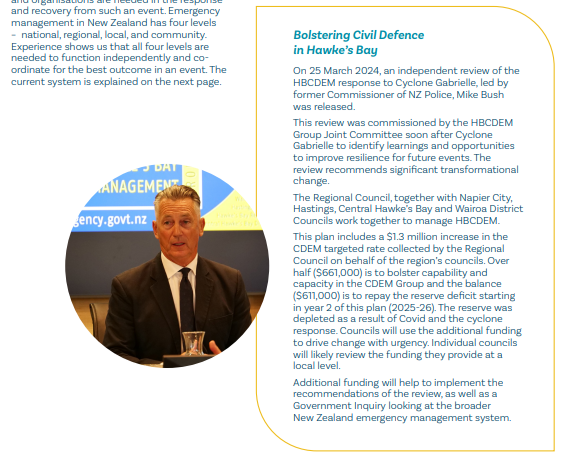

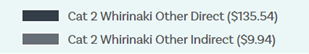

8. Over half of the funding

increase of $1.3 million proposed in our Three-Year Plan, to be collected

through the CDEM targeted rate, is to bolster capability and capacity in the

HBCDEM Group. This will help address recommendations in the independent review HBCDEM

Group Response to Cyclone Gabrielle (Bush International Consulting, March 2024),

and some of the issues identified by some of the submitters.

9. The rest is to repay the

CDEM Group reserve fund. Repaying the reserve deficit will start in Year 2 of

the Three-Year Plan and will be rapid over 10 years.

10. The last four years has

seen unprecedented CDEM Group response activities across Hawke’s Bay

– the Covid-19 national state of emergency in 2020, Napier floods also in

2020, and Cyclone Gabrielle in 2023. Cyclone Gabrielle was also declared a

national state of emergency and was the most complex and large-scale response

Civil Defence staff have ever mounted.

11. The cumulative cost of

responding to these has had a significant financial impact on CDEM budgets and

the CDEM reserve fund. The CDEM Group reserve fund is projected to be around $3

million in deficit at the end of this financial year.

Scope of the decision

12. The scope of the decision

is to confirm whether the Council want to include a $1.3 million increase in

the CDEM targeted rate in the Three-Year Plan 2024-2027 for the HBCDEM Group,

or agree on an alternative, such as reverting to the status quo funding. The

Regional Council collects the targeted rate on behalf of the region’s

councils.

13. Staff consider that

confirming the funding increase for the Three-Year Plan 2024-2027 through the

targeted rate is the appropriate outcome. The proposed additional resourcing

will provide for improved capability and support for communities in improving

their resilience and implementing the community hub model.

14. Staff also consider that

repaying the CDEM Group reserve fund is a priority.

Decision-making process

15. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

15.1. The decision does not

significantly alter the service provision or affect a strategic asset, nor is

it inconsistent with an existing policy or plan.

15.2. The use of a consultation process

required under s93 of the Local Government Act 2002 and special temporary

legislation following Cyclone Gabrielle has been undertaken.

15.3. The persons affected by

this decision are the region’s ratepayers.

Recommendations

That Hawke’s Bay Regional

Council:

1. Receives and considers the Investing

in resilient communities staff report.

2. Agrees that the Council can

exercise its discretion and make decisions on this issue, having undertaken the consultation process

required under s93 of the Local Government Act 2002 and special temporary legislation

following Cyclone Gabrielle.

3. Subject to final decisions

on the Three-Year Plan as a whole, to be made in Item 17 Consolidated

Three-Year Plan Decisions:

3.1. Agrees to the $1.3 million

increase over three years in the CDEM targeted rate for the HBCDEM Group as

consulted on.

Authored by:

|

Audrey Tolua

Emergency Management Team Leader

Engagement

|

|

Approved by:

|

Ian Macdonald

HB CDEM Group Controller / Manager

|

|

Attachment/s

|

1

|

CDEM submissions feedback

|

|

Under Separate Cover

|

Hawke’s

Bay Regional Council

18 June

2024

Subject: Public Transport

Reason for report

1. This deliberations report

provides the Council with submission themes and staff analysis of submissions

and seeks a decision of Council on Public Transport.

Staff

recommendations

2. Staff recommend that the

Council considers the submission points attached (and full submissions received by

Council resolution on 29-30 May 2024) on Public Transport alongside staff analysis to

enable an informed decision.

How

the activity is funded

3. The budget (revenue and

expenditure) for public transport is reported in our Transport Group of

Activities in the Three-Year Plan.

4. After fees and charges (bus

fares and total mobility contribution) and grants and subsidies (NZTA Waka

Kotahi’s share), it is funded by targeted rate based on capital value for

Napier and Hastings ratepayers within a defined footprint.

5. Council through the

development of its Revenue and Financing Policy identified the distribution of

benefits to be:

5.1. individuals who use and

communities who can access public transport services are the primary

beneficiaries

5.2. the community as a whole

which benefits to a lesser degree from less congestion on roads and reduced

emissions.

6. The reasons for this are

that public transport serves the community and has a range of extended

benefits. The primary function of public transport is to provide equitable

access and connection for the community, particularly the transport

disadvantaged. The public transport system in Hawke’s Bay also has the

potential to provide wider benefits to the community, such as emissions

reduction, access to opportunities, and the potential to decongest key

corridors, reducing travel times and easing vehicle movements for freight and

business.

Consultation

topic

7. Although not a consultation

topic in itself, public transport was listed on page 7 in the Consultation

Document as one of five “main drivers pushing rates up”.

8. The increasing costs to

provide public transport was presented in the consultation document as shown

(page 9):

Submissions

received

9. 26 submitters provided

comment in relation to the provision of public transport.

10. Key themes were:

10.1. Theme 1: Affordability

10.2. Theme 2: Method for rating

10.3. Theme 3: New public

transport footprint

10.4. Theme 4: Support for

improved or specific bus routes.

Summary

of submissions and staff analysis

Theme 1: Affordability

11. Several submissions were

received around the level of proposed rate increases for public transport.

Feedback on affordability is closely related to feedback received on the new

rating footprint. One submitter (#932) highlighted the longer-term cost

increases for the service, outlining the overall affordability.

11.1. “I

totally object to the new charge of over $500 for this in my rates. A service

we do not use and do not get any benefit from” (#972)

11.2. “According

to your rates calculator I will now be charged @129.96 this coming year for

public transport. There is no public transport provided in my rural area” (#939)

11.3. “Your

new transport subsidy why is this going from $3.1 million to $7.1 million in

three years. Surely this is not efficient use of money” (#932).

Staff

response

12. The overall cost increases

for public transport are due to a range of factors. Over the past four years,

the transport sector has experienced significant price indexation (cost

inflations), and public transport driver wages have experienced significant

uplift. While the service experienced reduced operations during covid-19

restrictions and cyclone Gabrielle, these additional operator costs were offset

by reduced services. Following reinstatement of full services, these increased

operating costs are applying to the fully contracted service. This has

resulted in an overall increase in cost of the existing service. Future cost

increases signalled in the long-term plan are for the planned implementation of

the new public transport network to be delivered from mid-2025. The new service

is intended to deliver a more frequent bi-directional service that ultimately

has a higher level of service and associated cost.

13. As a result of cost

pressures, the budget for public transport has increased 48% over the previous

year which is accounting for the increases for ratepayers which were on the

footprint prior to the Revenue and Financing Policy review footprint change.

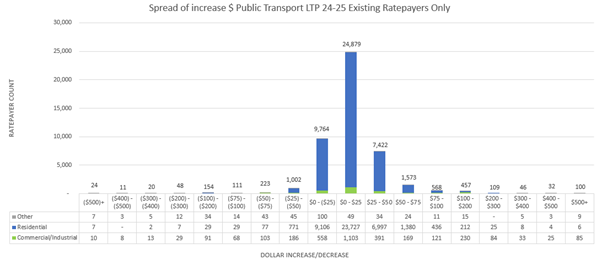

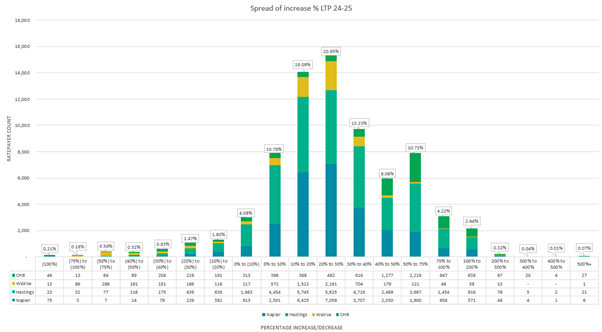

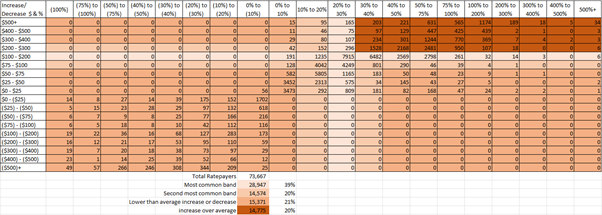

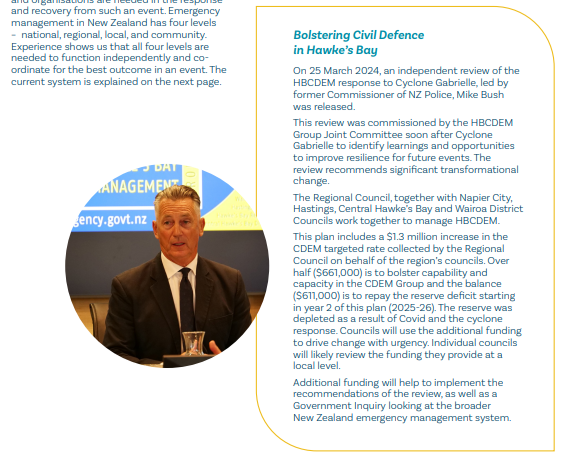

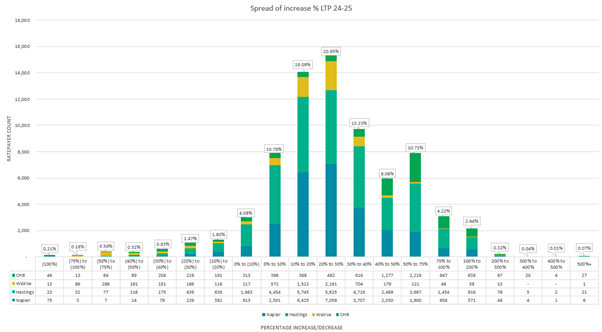

14. As shown in the bell curve

graph below (also attached for improved readability), the majority of existing

ratepayers within the public transport rating footprint are experiencing a

$0-$25 increase to their public transport rate from the previous year. The

outliers who are experiencing larger increases are ratepayers with high capital

values. This is a result of the change from land value to capital value and

budget increases.

Potential

costs savings

15. As noted above, the current

costs have significantly increased over the past four years. The 2024/25 budget

proposal for public transport is based on the current costs of the service with

an addition for indexation, and driver wage uplift. It is not until 2025/26

financial year that the budget proposal is including costs for new and

additional services.

16. Staff consider that the

costs of the current public transport service for Year 1 are outside the

control of Hawke’s Bay Regional Council.

17. However, there is scope to

reduce costs in Years 2 and 3 of the Three-Year Plan as a result of recently

announced funding from Waka Kotahi/NZTA and if the Regional Public Transport Plan,

due for review including public consultation in 2024-25, is amended.

18. Potential costs

savings also discussed in the Consolidated Three-Year Plan Decisions

agenda item are proposed in the table below.

|

|

Y1

|

Y2

|

Y3

|

Consequences

|

|

Public Transport

|

|

$1.1M

|

$1.76M

|

The proposed

reductions are the amount of additional funding required to provide the new

service as adopted in the Regional Public Transport Plan. The proposed

reductions here are 49% of the cost of that service.

Waka Kotahi contacted

HBRC in the first week of June indicating no additional funding for the new

service is available. Funding has only been provided for the next three years

to support existing levels of expenditure with no improvement funding.

Although changes to funding may occur in the financial year of 26-27, this

will be subject again to the incoming government and revised Government

Position Statement on Transport and associated budgets.

|

19. These savings will reduce

the average rates increase in Year 2 by 2.2% and Year 3 by 3.0%. A large

proportion of our ratepayers (around 51,000) benefit from these cost savings in

their actual rates.

Theme

2: Method for rating

20. “Public

transport should be rated on a unit basis per property (similar to the UAGC)

for residential properties, as the occupants of each property are provided

(theoretically) with the same or similar services.” (#647)

21. More than half of

submitters noted that they lived in rural areas, did not live close enough to a

public transport route, and would not use public transport. The majority of

these submitters live in Esk and Bayview areas. These submitters do not want to

pay for public transport and submit that costs should be borne by urban areas,

or a system of user pays.

22. Three submissions received

called for all ratepayer funding of public transport to cease. A further five

submitters submitted that public transport should be funded through a uniform

annual general charge, general rate, user pays or some other funding mechanism.

23. At the hearings, three

submitters making verbal submissions stated that they believed public transport

should be funded by the general rate.

24. In addition, a submission received

through consultation on the Revenue and Financing Policy review requested a

fixed charge per ratepayer for public transport.

Staff response

25. During the recent rates

review, the Council changed the rating method from land value to capital value

and extended the footprint for public transport. In light of the feedback

received during the consultation, the Council could consider a further review of

the rating method for public transport. While this cannot be undertaken prior

to the 2024-25 financial year, it is possible to undertake such a review during

the 2024-25 financial year to take effect for the following years of the

long-term plan. Like the recently completed rates review, a further review will

need to follow the prescribed process which requires assessing benefits and

modelling options. Any changes resulting from a revised Regional Public

Transport Plan should be considered.

26. Options could include a

differential on distance from a bus service or a fixed charge for some or all

rating categories or applying a general rate component.

27. However, a key point to

consider is that, due to the projected increase in public transport budgeting

requirements for future years, Council may not be able to rate public transport

as a fixed charge because of the cap of 30% for any rates that are set on a

uniform basis. As Council already has some rates set in this method, the cap

would need to be monitored to ensure it is not breached.

28. Moreover, applying a fixed

charge for public transport may have unintended consequences on the overall

impact for ratepayers. Although it could potentially drop a number of

ratepayers public transport rate, if a ratepayer has a higher CV value, they

will experience an increase in their general rate because Council would have to

reduce UAGC to meet the cap imposed of 30% thus pushing more of the general

rate to be covered by CV rating.

Theme

3: New public transport footprint

29. The majority of submissions

received relating to public transport were from rate payers in semi-rural

areas, typically just outside the main urban areas, who will now support a

portion of the costs to deliver public transport. A number of submissions were

received from ratepayers who had not previously been rated for passenger

transport and felt it was unfair as they did not use the bus or live close to a

bus stop or a bus service.

29.1. “…We

and our staff never have or will use public transport. This I see is just a

rate take for the sake of collecting revenue. As council you have changed your

rating take from user pay to who can afford to pay the rates which believe is

not in line with the type of activity you undertake” (#981)

29.2. “Public Transport is not an option for this area so i'm

not sure why we are paying for this” (#932)

29.3. “We object to rural rate payers being levied for transport.

Rural people tend to have their own transport and do no use bus systems the

same as city people” (#972)

29.4. “According to your rates calculator I will now be charged

$129.96 this coming year for public transport. There is no public transport

provided in my rural area. I would also not choose to take public transport as

I would need to drive anywhere to get it,” (#939)

Staff

response

30. As part of the Revenue and

Financing Policy review, Council resolved to extend the public transport

footprint to account for urban development since the policy was last reviewed

and moved to full valuation rolls. This resulted in approximately 5,000 extra

properties paying for passenger transport (46,000 up to 51,000). The rating

basis was also changed from land value to capital value.

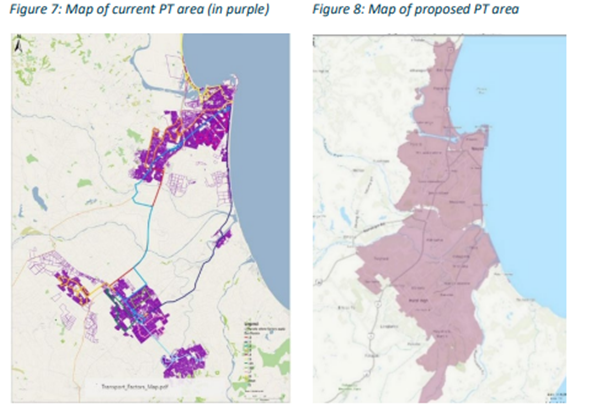

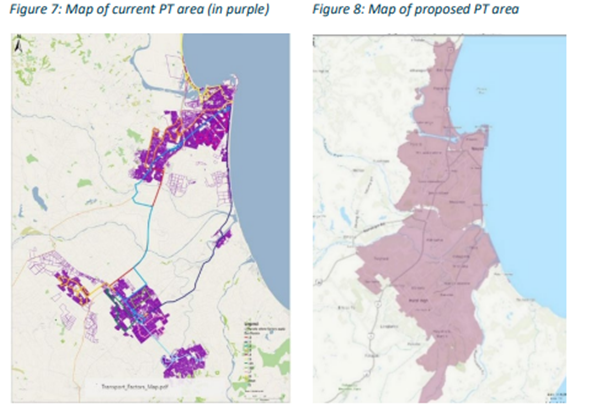

31. The maps below show the

change in footprint.

Maps of extending rating area for

public transport (PT)

32. The footprint

was widened to account for urban development, an additional service proposed to

connect the regional sports park, community benefit, ease of administration,

reduced traffic congestion, and improved air quality from fewer vehicle

emissions.

33. Although

changes to policy are outside the scope of this consultation, Council could

signal that it intends to look further at the footprint in the following year

and consider reinstating manual application to adjust rolls by distance from a

bus route. If Council was to consider the above proposal, staff recommend using

full valuation rolls where possible for ease of administration, as well as

providing consistency in manual application of a rate to specific ratepayers.

Careful analysis is needed to understand the implications of any changes.

34. Staff have

completed random spot checks of the ratepayers who were added to the scheme due

to the change in the footprint and their distance to bus routes. Staff tested

30 randomly selected ratepayers in different rolls, and the result showed that

87% were within a reasonable walking distance to a service - 60% were a 20

minute or less walk to a bus stop, 27% were a 20-to-30-minute walk, with the

remainder being over a 30 minute walk to a bus stop.

35. It should also

be noted that many current bus users are also cyclists and make use of the

buses’ cycle-holding facilities to make multi-modal trips. School

children are also often dropped at bus stops. Therefore, distance in kilometers

from a bus route may be a better assessment to use than walking time.

36. The average

rates for the ratepayers added to the public transport footprint is consistent

to those already on the old footprint. The majority of those added (67%) are

seeing a proposed charge around the average passenger transport charge or less

which is around $100.

37. The bell curve

graph below (also

attached for improved readability), shows the spread of dollar rate increases for

those ratepayers now included in the footprint.

38. There are some

ratepayers experiencing a larger than average rates charge for public

transport, but this is consistent with the number of ratepayers currently being

charged over the average on the existing footprint as well. Since the charge is

based on CV value, properties with a high CV value, such as commercial

businesses, are experiencing a higher public transport rate.

Rates Remission available

39. The Council has an existing

Special Circumstances remission policy that is suitable for use for

outliers resulting from changes in the Public Transport rate. It is separate

from the remission for Hardship resulting from changes to the rating system and

does not require evidence of hardship.

40. Staff are currently working

through a matrix for assessment of this remission. Ratepayers

that are newly added to the Public Transport rate and are experiencing a more

than average increase (around $200), will be eligible to apply which would see a 50% remission

of the increase due to the public transport changes for one year. If the

ratepayer is within a reasonable distance to a bus stop, that 50% remission

will only be on the difference between their current rate compared to the total

from the Revenue and Financing Policy change. If they are not within a

reasonable distance to a bus stop, the 50% remission will be applied to the

full public transport rate including the LTP Year 1 dollars. To qualify for the

remission, ratepayers must have been previously rated by Council, not be a new

build in a pre-existing area for which public transport is already rated, and

not be in a commercial or industrial user category.

41. After analysis of the

rating, this could potentially see a total remission of around $250K for public

transport.

Theme

4: Support for improved or specific bus routes

42. Four submissions support

the funding of public transport. In addition, there were a number of

submissions calling for specific bus routes to be added to the service,

including a commuter service between Central Hawke’s Bay and Hastings

District and services to and from Napier airport, which is currently not

served.

42.1. “we

badly need a bus service to our airport... can the bus drop passengers at the

airport terminal” (#353)

42.2. “Council

is supportive of the plans included in the Regional Public Transport Plan and

in the Three Year Plan to support a commuter express public transport trial

between Central Hawke’s Bay to Hastings, to provide commuters to and from

Central Hawke’s Bay an alternative, more sustainable option to

Travel…over 50% of our total communities income is generated from

employment outside the district” (#153)

Staff

response

43. The updated Regional Public

Transport Plan (RPTP), adopted in September 2022 following extensive public

consultation, sets out a step change for the provision of public transport

services across our two main urban areas. The new network provides a frequent

and reliable bi-directional network that will get users to where they need to

go more efficiently, reducing travel time and creating more connections. A key

inclusion of the RPTP is a bus servicing Napier airport, ultimately connecting

the airport with the Dalton Street terminus and the wider public transport

network.

44. The RPTP also proposes to

include the Hawke's Bay Regional Sports Park as a new stop, avoiding a

two-kilometre detour to the hospital by opting for a direct route via

Nottingley and Percival Roads in Hastings. Additionally, a new limited-stop

commuter service trial is proposed in the RPTP, connecting Central Hawke's Bay

(CHB) with Hastings. It is proposed the trial will run at peak commuting times.

This is not currently funded in the Three-Year Plan.

Scope of the decision

45. The scope of the decision

is limited to changes that will not affect current levels of services as no

options were provided in the consultation. Council can signal changes for

future years.

Decision-making process

46. Council and its committees

are required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements in

relation to this item and have concluded:

46.1. The decision does not

significantly alter the service provision or affect a strategic asset, however,

if a decision is made to reduce the proposed public transport service, this

would be inconsistent with the Regional Public Transport Plan.

46.2. The use of a consultation process

required under s93 of the Local Government Act 2002 and special temporary

legislation following Cyclone Gabrielle has been undertaken.

46.3. The persons affected by

this decision are the region’s ratepayers.

Recommendations

That Hawke’s Bay Regional

Council:

1. Receives and considers the Public Transport

staff report.

2. Agrees that the Council can

exercise its discretion and make decisions on this issue, having undertaken the consultation process

required under s93

of the Local Government Act and special temporary legislation following Cyclone

Gabrielle.

3. Subject to final decisions

on the Three-Year Plan as a whole, to be made in Item 17 Consolidated

Three-Year Plan Decisions:

3.1. Agrees to the proposed

savings of $1.1M in Year 2 and $1.76M in Year 3 for public transport.

3.2. Agrees that a rates

remission will be available to ratepayers newly added to the public transport

rate experiencing a greater than average impact.

3.3. Agrees to undertake a

further review of rating for public transport for the following financial year.

Authored

by:

|

Bryce Cullen

Transport Strategy & Policy

Analyst

|

Vanessa Fauth

Finance Manager

|

Approved by:

|

Katrina Brunton

Group Manager Policy &

Regulation

|

|

Attachment/s

|

1

|

Transport submissions feedback

|

|

Under Separate Cover

|

|

2

|

Spread of existing ratepayers Public

Transport increases

|

|

Under Separate Cover

|

|

3

|

Public Transport new ratepayers

increases

|

|

Under Separate Cover

|

Hawke’s

Bay Regional Council

18 June

2024

Subject: Tough choices - Hawke’s

Bay Tourism

Reason for report

1. This deliberations report

provides the Council with submission themes and staff analysis of submissions

and seeks a decision of Council on the consultation topic – Tough

choices - Hawke’s Bay Tourism.

Staff

recommendations

2. Staff recommend that the

Council considers the submission points attached (and full submissions received by Council

resolution on 29 May 2024)

on the Tough choices - Hawke’s Bay Tourism consultation topic

alongside the staff analysis to enable an informed decision.

How

we fund this activity

3. Hawke’s Bay Tourism

is funded under our Regional Economic Development activity within the

Governance & Partnerships Group of Activities.

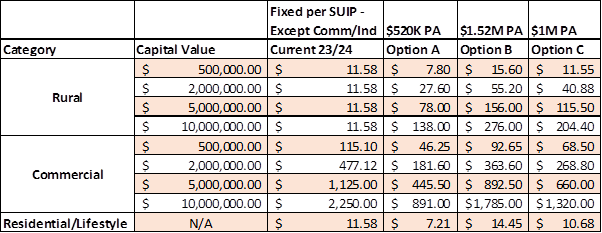

4. Funding for Regional

Economic Development is a differential targeted rate.

4.1. Residential & Lifestyle

properties are rated at 30% of the total yield based on a fixed charge per

SUIP.

4.2. Commercial & Industrial

ratepayers are rated on 75% of the remaining 70% of the total yield based on

capital value.

4.3. All other usage (including

rural properties) are rated on the other 25% of the 70% of the total yield

based on capital value.

5. The total collected for

Regional Economic Development in FY22/23 was $2,683,547. For year 1 of this

Three-Year Plan we are proposing $1,544,233.

Consultation

topic

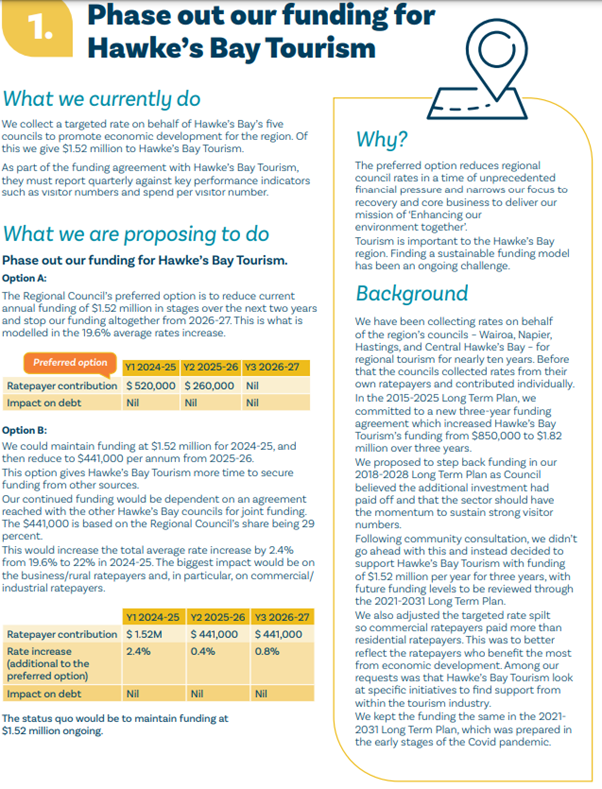

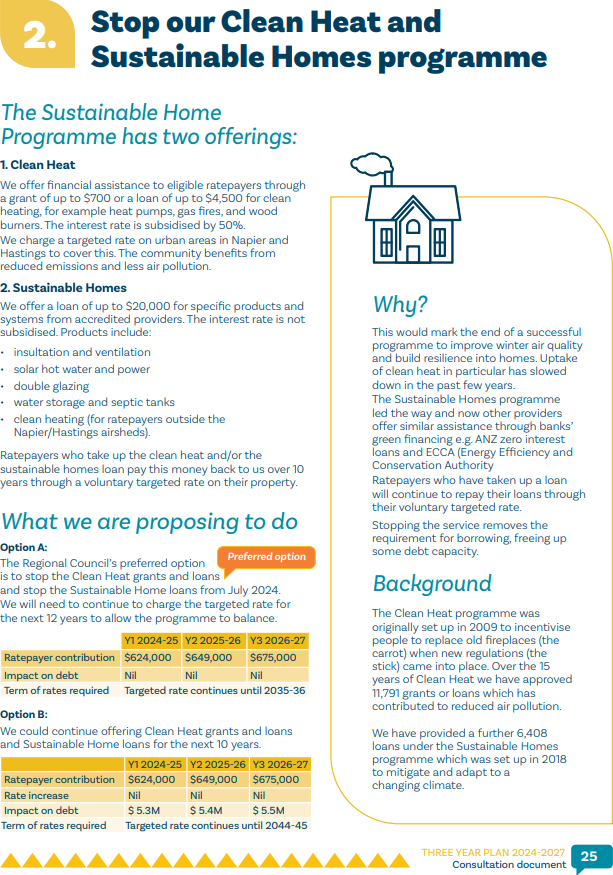

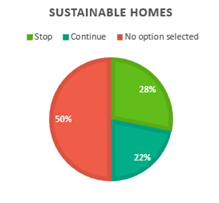

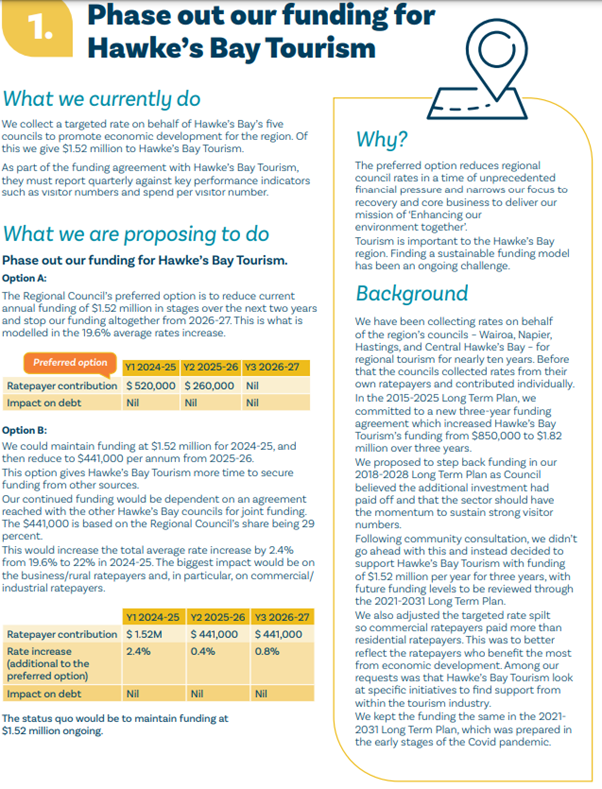

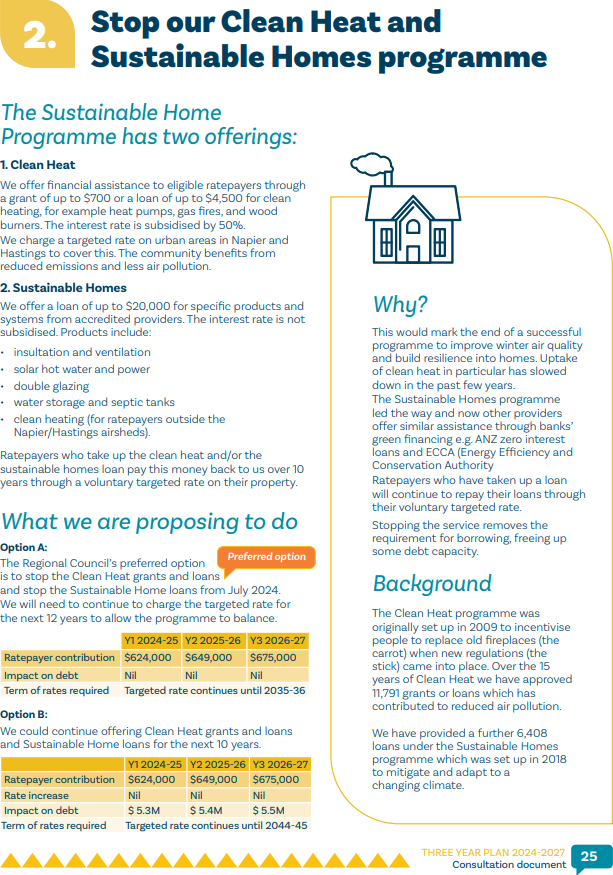

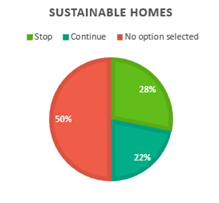

6. The Tough choices -

Hawke’s Bay Tourism proposal was one of four key consultation topics

that the Council sought public submissions on through Have your say

Hawke’s Bay on our recovery focussed Three-Year Plan 2024-2027

consultation document.

7. The proposal was presented

in the consultation document as shown following:

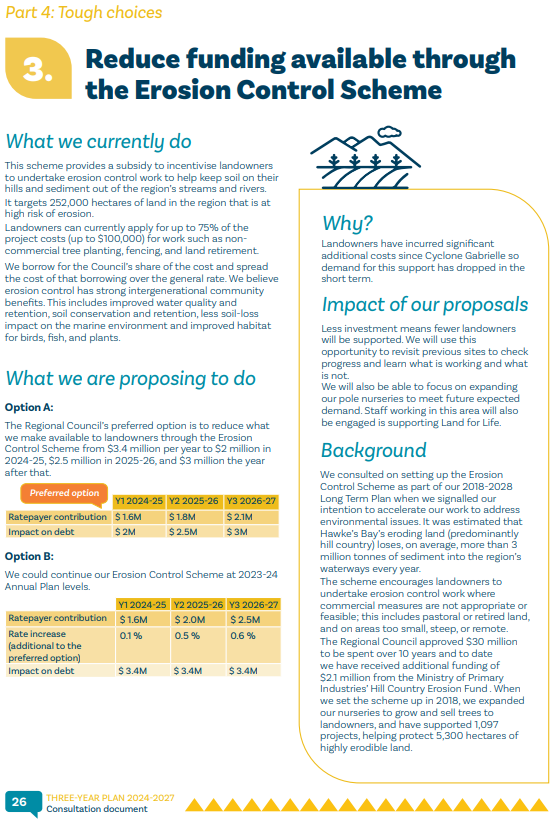

Submissions

received

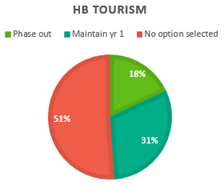

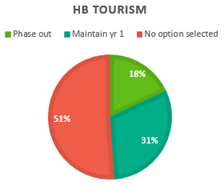

8. Of the submissions received

on this topic, 149 supported the Council’s preferred option for phase out

funding over two years and 253 support the maintenance of funding for year 1. A

further 126 commented in support of continued funding, 12 commented in support

of a reduction and 8 made other comments.

9. 375 submitters made a

comment under this topic.

10. Key themes were:

10.1. Theme 1: Overwhelming

support from submitters for the continued funding for Hawke’s Bay Tourism

given the importance to the region (including the Regional Council through the

port revenues) and the broader impacts on the economy and lifeline support for

business. It was commonly communicated to us by multiple submitters that

the $1.52m contribution brings in $775m of revenue to the region and supports 1

in 10 jobs.

10.2. Theme 2: There was concern

expressed that options did not allow enough time for HBT to seek alternative

further funding sources and eliminating funding too quickly would cause the

closure of HBT before 30 June 2025.

10.3. Theme 3: Smaller amounts of

support for eliminating funding given lack of certainty of value for money and

the need for HBRC to focus on core activities such as flood mitigation post

cyclone and the desire for Hawke’s Bay Tourism to stand on their own

feet.

Background

Funding

to date for Hawke’s Bay Tourism and comparative funding mechanisms across

NZ

11. Hawke’s Bay Tourism

was incorporated under the Companies Act 1993 on 20 June 2011.

12. Since 2010 (last year of

Venture Hawke’s Bay), HBRC has funded Hawke’s Bay Tourism

$18,210,000m as outlined below.

|

Year

|

$

|

Year

|

$

|

|

2010-11

|

1,100,000

|

2017-18

|

1,850,000

|

|

2011-12

|

850,000

|

2018-19

|

1,520,000

|

|

2012-13

|

850,000

|

2019-20

|

1,520,000

|

|

2013-14

|

850,000

|

2020-21

|

1,520,000

|

|

2014-15

|

850,000

|

2021-22

|

1,520,000

|

|

2015-16

|

1,220,000

|

2022-23

|

1,520,000

|

|

2016-17

|

1,520,000

|

2023-24

|

1,520,000

|

13. HBRC took on the role of a

single rating entity in 2010 to remove inefficiencies and ineffective ways of

which rates for this purpose were collected in the past across multiple

entities.

14. Importantly, it should be

noted that stepping back funding from $1.8M to $900,000 for Hawke’s Bay

Tourism was proposed in the 2018-2028 Long Term Plan. Submissions were

marginally (54%) in support of no change to Hawke’s Bay Tourism’s

funding. Council agreed to drop funding back to $1.52M and hold it for

three years subject to the tourism industry investigating other sources of

funding.

15. Council staff have checked

with 13 other regional councils. Of these 8 regional councils do not fund

Regional Tourism Organisations (RTOs) directly. A varying degree of support was

noted in the other areas, for example from $60k per annum in Bay of Plenty up

to $2m in Northland. Funding is inconsistent across New Zealand.

16. HBRC has obtained a copy of

the executed Hawke’s Bay Tourism Cyclone Recovery Programme contact

(signed Sept 2023). In good faith, HB Tourism entered into a funding agreement

with MBIE for the potential contestable funding of up to $1.2M in FY24/FY25. Of

particular note within this contract it states “No Funding is payable

under this Agreement until the Ministry has confirmed to the Recipient in

writing that it has received, and found, in its sole discretion, to be

satisfactory to it in form and substance, the following documents and evidence:

written acknowledgement that this funding will augment activity and that

existing funding from other sources will not be reduced below current levels as

at the commencement date of this agreement.” Of the $1.2M in the

total fund, there is $500k yet to be invested.

17. A ‘tourist’ is

classed as a ‘visitor’ and is measured by way of visitor spend (for

example, if you travel more than 40km from your home address and pay for

something by card/electronic transaction, that is classed as visitor

spend).

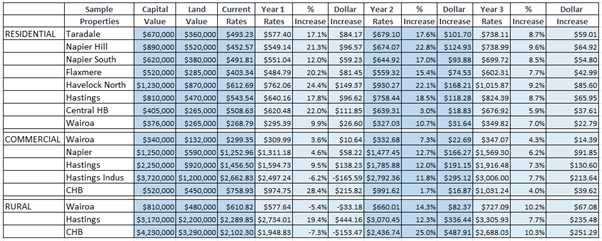

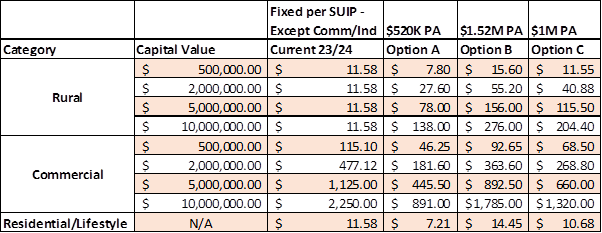

18. Analysis of options and

average rates per property is outlined below. Option C has been included here

for comparison with option A and B as consulted on. Option C would reduce

funding by $520,000 in year 1 (compared to $1M in option A) to $1M and then

$441K from year 2 onwards.

Summary

of submissions and staff analysis

Theme 1

19. Overwhelming support from

submitters for the continued funding for Hawke’s Bay Tourism given the

importance to the region and the broader impacts on the economy and lifeline

support for business.

19.1. “Tourism makes a substantive contribution to the Hawkes Bay

region’s economy, is worth $1.3bn, 7% of regional GDP, and is the third

largest regional earner. Tourism generates $775m of new revenue and equates to

1 in 10 jobs". ...” (#392

and #400)

19.2. “…There are also many indirect beneficiaries as employees, etc and through

the economic activity multiplier effect. Some of the beneficiaries probably

contribute more than they receive in benefit. … I recognise the difficult

choices that the Councils in the region are facing which have been massively

accentuated by Cyclone Gabrielle. However, the Councils have a responsibility

to facilitate the long-term economic health of the region and its ongoing

competitiveness. I believe that any reduction in the level of contribution by

the Councils would be extremely detrimental to the region in the long term with

the first signs of this emerging quite quickly.” (#313)

19.3. “If Hawke’s Bay Tourism isn’t around, who’s

going to: Curate, keep current and promote the several thousand pages of

content on www.hawkesbaynz.com? Promote Hawke’s Bay to potential domestic

travellers in markets such as Auckland and Wellington? Work with Air New

Zealand and other airlines to promote the region’s strengths to support

marketing campaigns and sales, and supply content for Kia Ora magazine? Bid for

regional events and conferences? … The answer to all of these very

important questions is NO ONE. All of this work will stop, people who want to

go on holiday will go elsewhere, and Hawke’s Bay will slowly, but surely,

fade from people’s consciousness.” (#492)

19.4. “If we invest in tourism, we benefit from tourism

…” (#370)

Staff

response

20. Tourism is significant to

the wider HB economy and community.

21. It was noted, based on

presentation from Fizzypop at hearings on 29 May 2024 (using a sample size of

12 retailers within Hawkes Bay from ANZ bank) that where there are events held

in our cities in any one month, there is 8.1% increase in spending (through

merchant facilities) across that month in our region.

22. Using NZ stats information

on tourism spend to March 2023 there are a wide variety of industries that

benefit from visitor spend namely, specifically:

8% accommodation

12% restaurants/cafes/bars

11% airlines

9% buses/rental

cars/motorhomes

3% holiday

home rental

7% tours

– cultural, recreational, travel, and tour services

37% retail

8% supermarkets

and bottle stores

6% fuel

and automotive services

23% other

retail (farmers markets/clothing)

3% education

services

10% other tourism

products (generally retail products made/purchased offshore for sale/purchase

in NZ).

23. In addition to regional

benefits, HBRC relies on income from the port (by way of dividend) and should

HBRC impact revenue streams such as cruise ships, this may have a negative

impact on future proposed dividends, ultimately flowing through to our rate

payers.

Theme

2

24. There was concern expressed

that options did not allow enough time for HBT to seek alternative further

funding options and eliminating funding too quickly would cause the closure of

HBT before 30 June 2025.

24.1. Tourism is a long term strategy, and the effects of activity can take

time to build, and the same happens when funding is pulled. The visitor numbers

gently slow down and as it is not a sudden stop, it appears to be OK, until 2-3

years down the track the numbers dwindle away because there is no one to remind

them to visit us. Whilst I understand that HBRC funding is finite, and post

cyclone difficult decisions need to be made, there has to be a compromise that

enables some form of tourism organisation or officers to continue with

delivering the message that we are here and ready to welcome visitors. It does

not necessarily need to cost $1.52m per year…” (#611)

24.2. Once you lose this momentum you will find it very difficult to bring

back (#756)

24.3. “Two years is not enough time to find alternative funding and try to also

maintain a presence among other destinations. Allowing for HB Tourism to

maintain the funding for the first year will help retain knowledge and

experience within its staff. It also gives space for the team to come up with

other revenue or funding alternatives to acquire and have in place for the

phasing of HBRC funding. (#420)

Staff response

25. HBRC funding for HB Tourism

represents 53% of their annual funding (taken from their 2023 financial

report). Removal of this amount of money without time for HBT to seek and

finalise additional support may be detrimental the longevity of this

organisation.

26. It should be noted that any

decrease in current funding arrangements will put at risk additional funds as

noted in para 6 of this report, potentially $500k for Hawke’s Bay

Tourism.

27. Given the timing of the

Three-Year Plan announcement, a number of comments have been received that this

came as a surprise, and there has not been enough time (due to other

commitments and ongoing cyclone impacts to businesses) to source alternative

funding in Year 1. However, the need to investigate alternate funding has been

signalled a number of times.

28. Below is an exert from the

2018-2028 LTP, which shows HBT’s commitment to look at other options.

28.1. “Hawke’s Bay

Tourism submitted an alternative option which was to step back funding by

$300,000 in Year 1 from $1.8M to $1.5M and then hold it for three years whilst

the industry and the regional council investigate the best way to transition to

a stainable funding model. This would include undertaking an assessment of

“Peer to Peer” properties, such as AirBnB, and consideration of

adjusting their residential rate contribution upwards so that these properties

are treated on either a quasi-commercial or full commercial basis for the

purpose of this targeted rate. It also promoted research into the introduction

of a visitor tax at a regional level, subject to what is decided at a national

level.” (p20 of the 2018-2018 Long Term Plan)

29. Council agreed to this

option in its final 2018-2028 Long Term Plan.

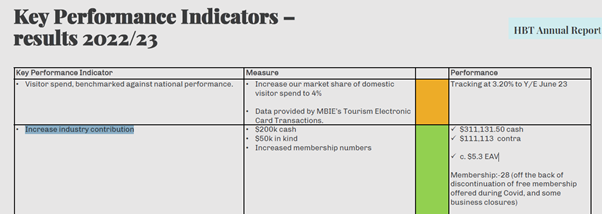

30. KPIs were put in place

between HBRC and HB Tourism that reflected the need to increase industry

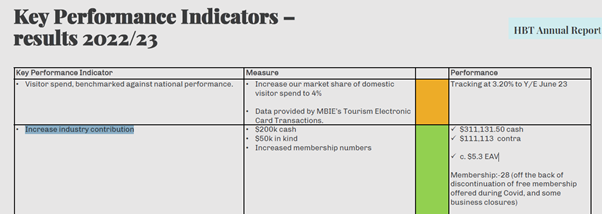

contributions. An example of that reporting is outlined below.

31. In 2020 Hawke’s Bay

Tourism offered businesses free membership as a means of bringing the sector

together for purposes of capability and communications throughout the Covid-19

period. Paid membership was reintroduced from 22/23 and resulted in a

reduction in membership (with the majority being businesses that either closed

or sold).

32. Other possible avenues to

ensure support could be adding margin to ticket prices for FAWC or Art Deco

weekend activities.

33. Option B gives

Hawke’s Bay Tourism more time to secure funding from other sources. Our

continued funding would be dependent on an agreement reached with the other

Hawke’s Bay councils for joint funding. The $441,000 is based on the

existing Regional Economic Development Agency funding split between councils.

The Regional Council’s share is 29 percent. This would increase the

total average rate increase by 2.4% from 19.6% to 22% in 2024-25. The biggest

impact would be on the business/rural community and, in particular, on

commercial/industrial ratepayers.

Funding implications of

Option B

34. If Option B is

funded under existing Revenue and Financing Policy settings it would increase

average rates (in addition to the proposed average rates increase) by:

34.1. Year 1 = 2.4%

34.2. Year 2 = 0.4%

34.3. Year 3 = 0.8%

35. There are

options for Council to offset all or part of this rates increase. Options are

discussed in more detail in the

Consolidated Three-Year Plan Decisions agenda item.

Theme

3

36. Smaller amounts of support

for eliminating funding given lack of certainty of value for money and the need

for HBRC to focus on core activities and the desire for Tourism Hawkes Bay to

stand on their own feet.

36.1. “The flood management needs to take priority over tourism. Much of HB is

a mess. Then once rebuilt, parks, wineries etc will take tourists again. Napier

and Hastings are beautiful as they are. But the rural areas have suffered.”

(#189)

36.2. “Money is tight and it’s more important we invest in infrastructure

especially as bridges have been destroyed, culverts,

drainage need to be installed and local roads need either resurfacing or

restructuring.” (#258)

Staff response

37. HBRC’s mission is

“Enhancing our environment together”. The Council’s

Strategic Plan, focusing on land, water, air and infrastructure reflects a

desire by the current Council to deliver strong, visible and connected regional

leadership, protect and enhance Hawke’s Bay’s remarkable

environment and focus on achieving real results in areas of core business. The

core business refers to the unique functions, skills and resources provided by

the Regional Council that are ‘mission critical’ to the region’s

wellbeing. The Regional Council has significant roles and responsibilities

required by law, particularly in natural resources (land, water, air, coast and

biosecurity), hazard management and transport.

38. Our activities and responsibilities

are governed by a wide range of legislation. We operate according to policies

and rules contained in the:

38.1. Regional Resource

Management Act 1991

38.2. Regional Coastal

Environment Plan

38.3. Biosecurity Act 1993

38.4. Local Government Act 2002

38.5. Land Transport Act 1998

38.6. Civil Defence Emergency

Management Act 2002.

39. Funding tourism marketing

is not considered a core function of the regional council.

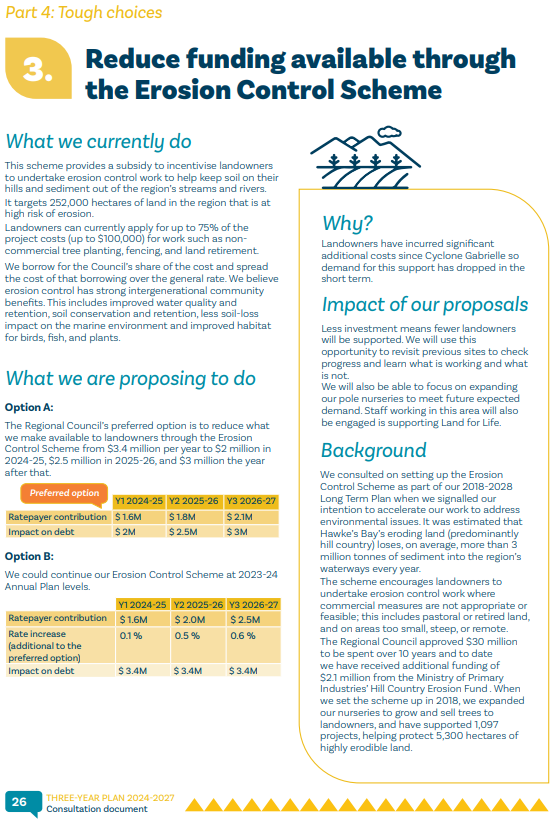

Scope of the decision

40. The scope of the decision

is to adopt the proposal or option B as consulted on, or revert to the status

quo or a variation. Options available to Council to mitigate the impact on

ratepayers resulting from its preferred option are covered in the Consolidated

Three-Year Plan decisions agenda item.

Decision-making process

41. Council and its committees