Meeting of the Corporate and Strategic Committee

Date: Wednesday 15 February 2017

Time: 9.00am

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

Item Subject Page

1. Welcome/Notices/Apologies

2. Conflict

of Interest Declarations

3. Confirmation of

Minutes of the Corporate and Strategic Committee held on 13 December 2016

4. Call

for Items of Business Not on the Agenda 3

5. Follow-ups

from Previous Corporate and Strategic Committee meetings 5

Decision Items

6. HBRIC

Ltd Independent Director Recruitments and Appointments 9

7. Recommendations

from the Finance Audit & Risk Sub-committee 13

8. Council

Chambers Upgrades 15

9. Wairoa-Gisborne

Rail Corridor 19

Information or Performance Monitoring

10. HBRC

– ACC: Sale of Leasehold Land Cashflows 27

11. Discussion

of Items Not on the Agenda 31

Decision Items (Public Excluded)

12. Recommendations

from the Finance Audit & Risk Sub-committee 33

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 15 February 2017

Subject: Call for Items of

Business Not on the Agenda

Reason

for Report

1. Standing order 9.12 states:

“A meeting may deal with

an item of business that is not on the agenda where the meeting resolves to

deal with that item and the Chairperson provides the following information

during the public part of the meeting:

(a) the

reason the item is not on the agenda; and

(b) the

reason why the discussion of the item cannot be delayed until a subsequent

meeting.

Items not on the agenda may be brought before the

meeting through a report from either the Chief Executive or the Chairperson.

Please note that nothing in this standing order removes

the requirement to meet the provisions of Part 6, LGA 2002 with regard to

consultation and decision making.”

2. In addition,

standing order 9.13 allows “A meeting may discuss an item that is not

on the agenda only if it is a minor matter relating to the general business of

the meeting and the Chairperson explains at the beginning of the public part of

the meeting that the item will be discussed. However, the meeting may not make

a resolution, decision or recommendation about the item, except to refer it to

a subsequent meeting for further discussion.”

Recommendations

1. That

the Corporate and Strategic Committee accepts the following “Items of

Business Not on the Agenda” for discussion as Item 11:

1.1. Urgent items of Business

|

|

Item

Name

|

Reason not on Agenda

|

Reason discussion cannot be delayed

|

|

1.

|

|

|

|

|

2.

|

|

|

|

1.2. Minor items for discussion

|

Item

|

Topic

|

Councillor

/ Staff

|

|

1.

|

|

|

|

2.

|

|

|

|

3.

|

|

|

|

Leeanne Hooper

GOVERNANCE & CORPORATE

ADMINISTRATION MANAGER

|

Liz Lambert

GROUP MANAGER

EXTERNAL RELATIONS

|

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 15 February 2017

SUBJECT: Follow-ups from Previous Corporate

and Strategic Committee meetings

Reason for Report

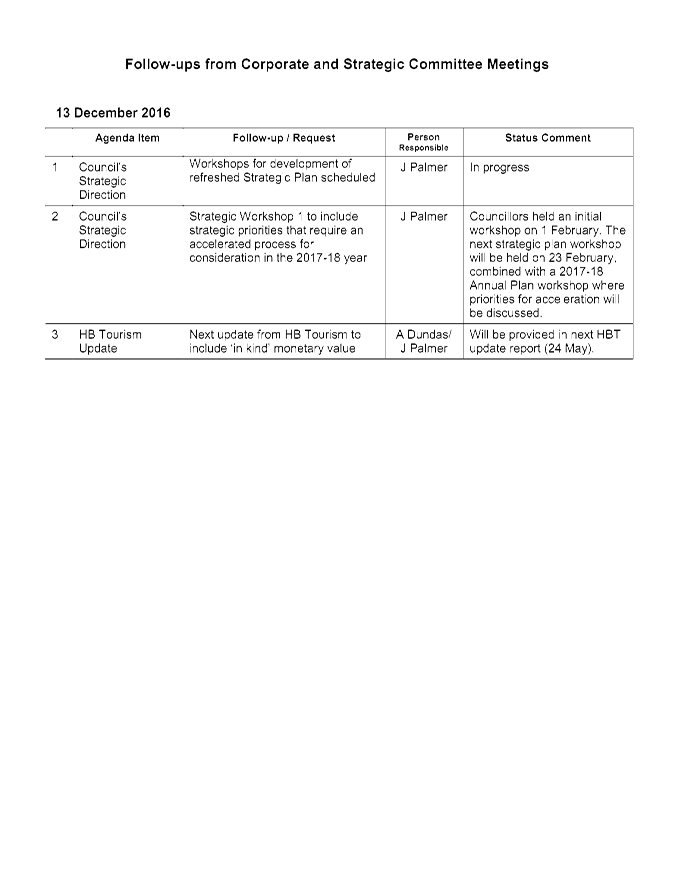

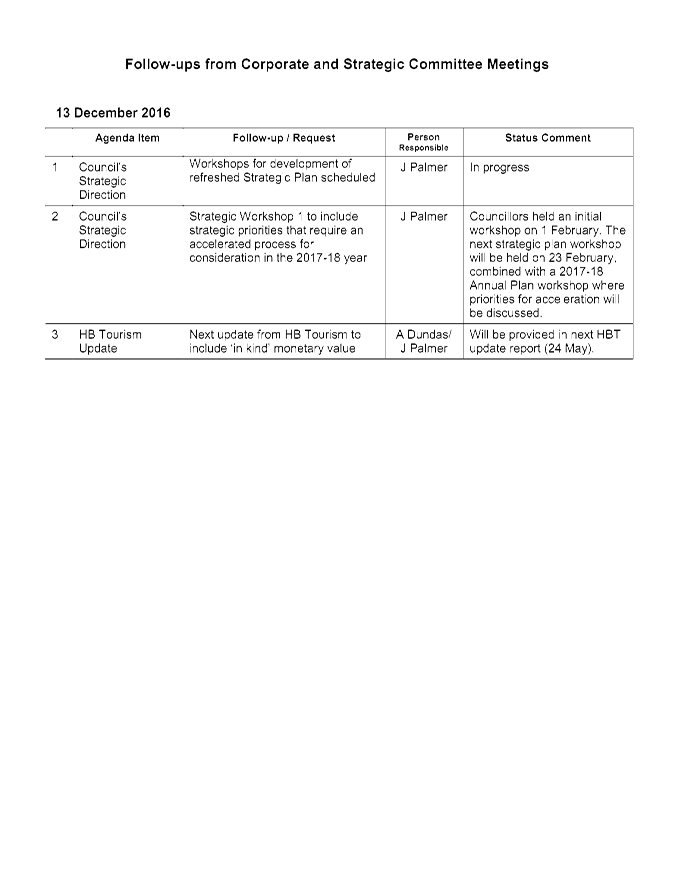

1. In order to track items raised at previous meetings that require

follow-up, a list of outstanding items is prepared for each meeting.

2. All follow-up items from previous Corporate and

Strategic Committee meetings to date have been completed and reported to the

Committee, so there are no follow-ups to address at this meeting.

Decision

Making Process

2. Staff have assessed the requirements of the Local Government Act

2002 in relation to this item and have concluded that, as this report is for

information only, the decision making provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee notes there

are no “Follow-ups from Previous Corporate and Strategic Committee

Meetings” to address at this meeting.

|

Authored by:

|

Leeanne

Hooper

Governance Manager

|

|

Approved by:

|

Liz Lambert

Group Manager

External Relations

|

|

Attachment/s

|

1

|

Follow-ups

from Previous Corporate & Strategic Committee Meetings

|

|

|

|

Follow-ups

from Previous Corporate & Strategic Committee Meetings

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 15 February 2017

Subject: HBRIC Ltd Independent

Director Recruitments and Appointments

Reason for Report

1. At the 14

December 2016 Regional Council meeting, Council resolved:

1.1. That Council

agrees that the Council Appointments Committee reconvene in the New Year to

consider the appointment of a permanent HBRIC Ltd Chairman and an additional

Independent Director.

2. At the

extraordinary Regional Council meeting held on 21 December 2016 to appoint an

interim Chairman to the HBRIC Ltd Board of Directors, it was agreed that the

Council consider options for independent directors in the New Year prior to

embarking on the process of recruiting for director(s) and a permanent

Chairperson for the HBRIC Ltd Board.

3. This report

provides councillors with the opportunity to consider and decide on the process

of recruitment for independent directors for the HBRIC Ltd Board of Directors.

Policy on Appointment and Remuneration of

Directors

4. In accordance

with the Policy, Council established a Council Appointments Committee

comprising Councillors Rex Graham, Paul Bailey and Alan Dick. It is incumbent

upon Council to now include the current Interim Chair of HBRIC Ltd (Sam

Robinson) and an external experienced director to fully comply with

Council’s Policy.

5. In the case of

a vacancy for an independent director appointment, the same procedures will be

followed as apply to the appointment of a director to a CCTO.

6. Independent

directors are selected according to the same criteria as used by HBRIC Ltd in

its assessment of candidates for other CCTOs. In making appointments

every endeavour will be made to ensure that a range of good governance skills

will be available to the HBRIC Ltd board as a whole.

Process for Appointments

7. The HBRIC Ltd

constitution provides for a maximum of seven directors and it is intended that

the Board may comprise a mix of Council and independent directors. It is

critical to the success of this board that it has a composition capable of

maintaining the confidence of both the Council and the subsidiary companies.

8. In the process

of selecting Council and independent directors, the Council Appointments

Committee will first determine the required skills, knowledge and experience

necessary for an effective board. In general terms, the committee will apply

similar criteria to potential candidates to those used by HBRIC Ltd in its

assessment of candidates for other CCTOs. However, where necessary the

committee will also take into account a candidate’s potential to quickly

acquire business and financial skills, as well as his or her existing skills

and experience.

9. The

candidate’s skills must be relevant to the requirements of HBRIC Ltd in

terms of its governance and provide, as far as possible, a suitable cross-

section of skills available at the board table capable of meeting the normal

criteria of good governance.

10. Over the life of HBRIC

Director appointment processes have variously been coordinated by the HBRC CEO

and subsequently through use of a recruitment consultancy with the process being

coordinated via the Chair of HBRIC Ltd.

11. For the recruitment of a

Chairman for HBRIC Ltd, it is proposed that the process be coordinated through

the HBRC Chief Executive. In fulling this task, the following steps are

recommended:

11.1. The HBRC CE schedules a

meeting of the Appointments Committee to establish an agreed position on the

key criteria for the role the HBRIC Ltd Chairman

11.2. Upon agreement of those

criteria, expressions of interest in the role of the HBRIC Ltd Chairman are

sought by way of advertisements in both local and potentially national media

11.3. On receipt of

expressions of interest a short list of candidates is compiled

11.4. Shortlisted candidates

are interviewed by the Appointments Committee with the preferred candidate

being recommended to the full Council for ratification

11.5. Given the significance

of the role it may be that the preferred candidate meets with the full Council

prior to finalisation of the process

11.6. Councillors may have

possible candidates in mind for this role and if this is the case, they should

draw the Appointments Committee attention to potential candidates and encourage

the person(s) to express interest through the process.

Financial and Resource Implications

12. Other than the CE and

support staff time, an advertising process and disbursements, i.e. candidate

expenses to attend an interview, are expected to fall somewhere in the

$5,000-$10,000 range.

Decision Making

Process

13. Council

is required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements

in relation to this item and have concluded:

13.1. The decision

does not significantly alter the service provision or affect a strategic asset.

13.2. The use of

the special consultative procedure is not prescribed by legislation.

13.3. The decision

does not fall within the definition of Council’s policy on significance.

13.4. Options for

consideration are included in the staff report.

13.5. Given

the nature and significance of the issue to be considered and decided, and also

the persons likely to be affected by, or have an interest in the decisions

made, Council can exercise its discretion and make a decision without

consulting directly with the community or others having an interest in

the decision.

|

Recommendations

1. That the Corporate and Strategic Committee receives and notes the

“HBRIC Ltd Independent Director Recruitments and Appointments”

staff report.

2. The Corporate and Strategic Committee recommends that Council:

2.1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that Council can exercise its discretion and make decisions on

this issue without conferring directly with the community and persons likely

to be affected by or to have an interest in the decision.

2.2. Commences the process for recruiting a Chairman of HBRIC Ltd with

urgency using the process outlined in this paper.

|

Authored and Approved

by:

|

Andrew Newman

Chief Executive

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 15 February 2017

Subject: Recommendations from

the Finance Audit & Risk Sub-committee

Reason for Report

1. The following

matter was considered by the Finance Audit and Risk Sub-committee on 31 January

2017, and is now presented for consideration and approval.

Decision Making

Process

2. This item has

been specifically considered at the Sub-committee level.

|

Recommendations

The Finance

Audit & Risk Sub-committee recommends that the Corporate and Strategic

Committee:

1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement Policy.

Six Monthly Report on Risk

Assessment and Management

2. Recommends to Council that the HBRC Risk Assessment and Management

process undergoes a comprehensive review to ensure major strategic risks to

the public and environment are appropriately managed.

Reports Received

3. Notes that the following reports were provided to the Finance

Audit and Risk Sub-committee:

3.1. Health and Safety Update Report for the Period 1 June – 31

December 2016

3.2. Audit NZ Management Report for HBRC Annual Report for Year Ending

30 June 2016

3.3. 2017 Sub-committee Work Programme

3.4. Internal Audit Report – Fraud Policy

|

Authored by:

|

Judy Buttery

Governance Administration Assistant

|

|

Approved by:

|

Liz Lambert

Group Manager

External Relations

|

|

Attachment/s

There are no attachments

for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 15 February 2017

Subject: Council Chambers

Upgrades

Reason for Report

1. An upgrade of

the Council Chamber facilities is under way, with further proposals provided

here for discussion and consideration ahead of making any necessary additional

budget provisions through the 2017-18 Annual Plan process.

Description

2. Frustrations

expressed by councillors and staff to Facilities and IT departments regarding

the functionality of the Council Chamber and the audio visual setup include:

2.1. Poor

visibility of presentations due to the quality of projector and size of the

screen

2.2. Presentations

difficult to see from the visitor seating area

2.3. Inadequate

Conference call facilities

2.4. Presenters

required to remain seated while speaking due to the inflexibility of the

microphone system

2.5. Presentation

equipment clunky to use, immobile and inefficient when trying to keep within

the time restraints of meetings

2.6. Documents

hard to read and refer to while the lighting is dimmed during presentations

2.7. Difficulty

hearing speakers when they don’t speak into the microphone properly

(especially evident when viewing video recordings of meetings)

2.8. Inadequate seating

for Regional Planning, Maori and Regional Transport committee members around

the Council Chamber table

2.9. Aircon vents

blowing cold air onto those seated at the Council Chamber table

2.10. Difficulty rearranging

the Council Chamber to allow “Theatre Style” presentations such as

the Climate Briefing.

3. Quotes for an

audio-visual (AV) solution were sought, in consultation with IT, to ensure the

suitability of the proposed solution, with the successful supplier providing an

upgrade for just under $40,000 including labour. The AV upgrade includes:

3.1. Device

share system - This system allows personal device/PC connection for staff

or visitors to the projection display and eliminates any resolution and

connection issues as it is all completely wireless.

3.2. Visitor

view screen – Installation of a 65” LED monitor to enable the

public gallery to view a duplicate of what is projected onto the main screen.

3.3. LED

projector and larger screen – Installation of a projector with high

definition capacity, with a built-in sensor that measures light levels within

the room and adjusts colour and brightness accordingly, meaning room lights can

be left on during presentations if required. LED models require little

maintenance and are more energy efficient than the previous model in use.

3.4. Lapel

microphones – Supply of two microphones with a small portable battery

pack that can be easily attached to the presenters clothing, providing

flexibility while speaking.

3.5. Room

control – A system that controls lighting, various presentation

options and an optional aircon control, wirelessly through an iPad controlled

by the meeting organiser.

3.6. Lighting

– Modify the lighting in the centre oval to illuminate the boardroom

table surface to improve visibility. LED is to be used to lessen replacement

frequency and limit energy consumption.

4. In the Council

Chamber, one of the heating/air conditioning units was repositioned to enable

better air circulation in the room, and the control units serviced and

recalibrated at a cost of $2990 in July 2016.

5. In addition to

planned upgrades, the Chairman had requested some additional work be

considered, however he has now decided against pursuing that request any

further.

Financial and Resource Implications

6. A budget

provision of $70,000 in the 2016-17 financial year was budgeted to cover any

new furniture/fittings for all HBRC offices, including the planned replacement

of the Council Chamber tables and chairs. Due to the decision to prioritise

remedying the Chamber’s audio visual shortfalls, the planned upgrades of

furniture were deferred and budgeted to be undertaken with any monies left

after the AV upgrade has been completed, and then with 2017-18 budget

provisions.

7. To date,

Council has been invoiced $31,028 including GST for the AV upgrade, with the

centre lighting alterations and final adjustments to the sound system yet to be

completed.

8. The following

upgrades are budgeted for completion over the next 2-3 years.

8.1. Replacement

of Council Chamber and Ahuriri Room furniture due to wear and tear and the need

to accommodate larger meetings, such as the Regional Planning, Regional

Transport and Maori committees. Investigations into this component have

included options to recycle any of the existing furniture components to reduce

cost and waste.

8.2. Repair and

reinstallation of the removable wall between the Council Chamber and Ahuriri

Room.

8.3. Replacement

of current microphone system to a wireless model to improve ease of use.

8.4. Replacement

of the carpet in the foyer and Council Chamber.

Decision Making

Process

9. Council is required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have

assessed the requirements in relation to this item and have concluded:

9.1. The decision does not significantly alter the service provision or

affect a strategic asset.

9.2. The use of the special consultative procedure is not prescribed by

legislation.

9.3. The decision does not fall within the definition of Council’s

policy on significance.

9.4. The persons

affected by this decision are the ratepayers in the region.

9.5. Options that have been considered include making no changes

to the areas identified.

9.6. The decision is not inconsistent with an existing policy or plan.

9.7. Given the nature and significance of the issue to be considered and

decided, and also the persons likely to be affected by, or have an interest in

the decisions made, Council can exercise its discretion and make a decision

without consulting directly with the community or others having an

interest in the decision.

|

Recommendations

1. That the Corporate and Strategic Committee receives and notes the

“Council Chamber Upgrades” staff report.

2. The Corporate and Strategic Committee recommends that Council:

2.1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy.

2.2. Approves the upgrades of the Ahuriri Room and Council Chamber

including replacement of the chairs and tables and repainting of the Council

Chamber to be carried out over the remainder of the current financial year

and ensuing years as budgets allow.

|

Authored by:

|

Stacey

Rakiraki

Facilities and Fleet Manager

|

|

Approved by:

|

Liz Lambert

Group Manager

External Relations

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 15 February 2017

Subject: Wairoa-Gisborne Rail

Corridor

Reason for Report

1. Following the

conclusion of an agreement between KiwiRail and Napier Port for the transport

of log freight on the Napier-Wairoa rail line KiwiRail sought expressions of

interest for tourism proposals on the rail line between Wairoa and Gisborne.

2. The Regional

Transport Committee discussed the Wairoa to Gisborne line at its meeting in

December and referred any response to the Regional Council.

3. The Regional

Council supports the ongoing reinstatement of the entire Napier-Gisborne line

for rail freight. Consequently, the Regional Council resolved to

correspond with KiwiRail to communicate the potential issues and problems that

could be created if incompatible uses of the rail corridor between Wairoa and

Gisborne are allowed, and confirm the longer-term goal to re-establish freight services

on that section of the rail corridor.

4. A copy of the

letter from the Chair of the Regional Transport Committee to KiwiRail was

included in the Council agenda papers for 25 January 2017 meeting.

Discussion

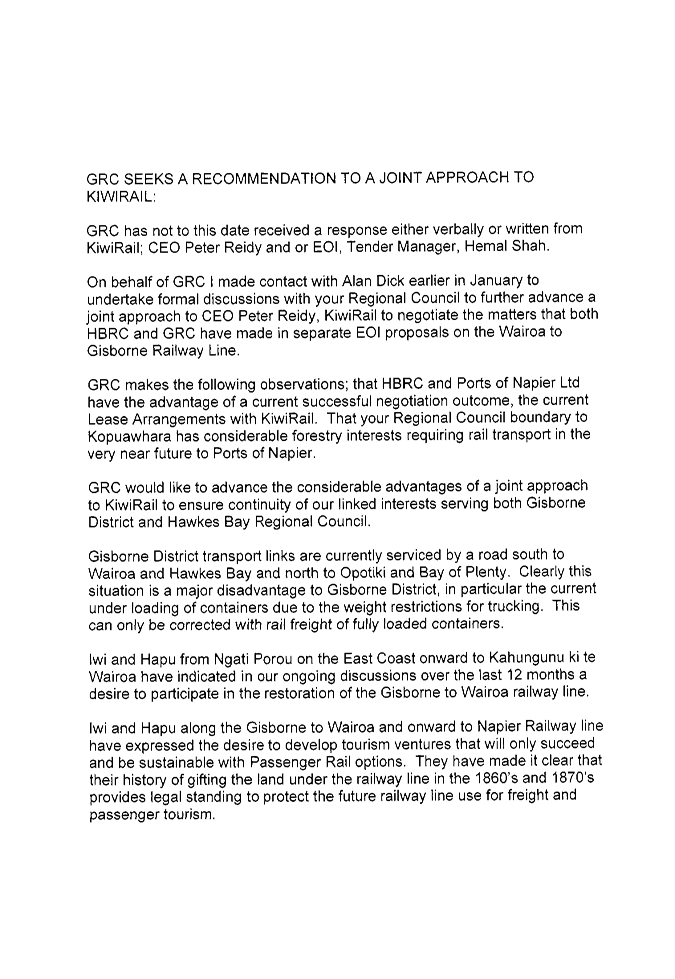

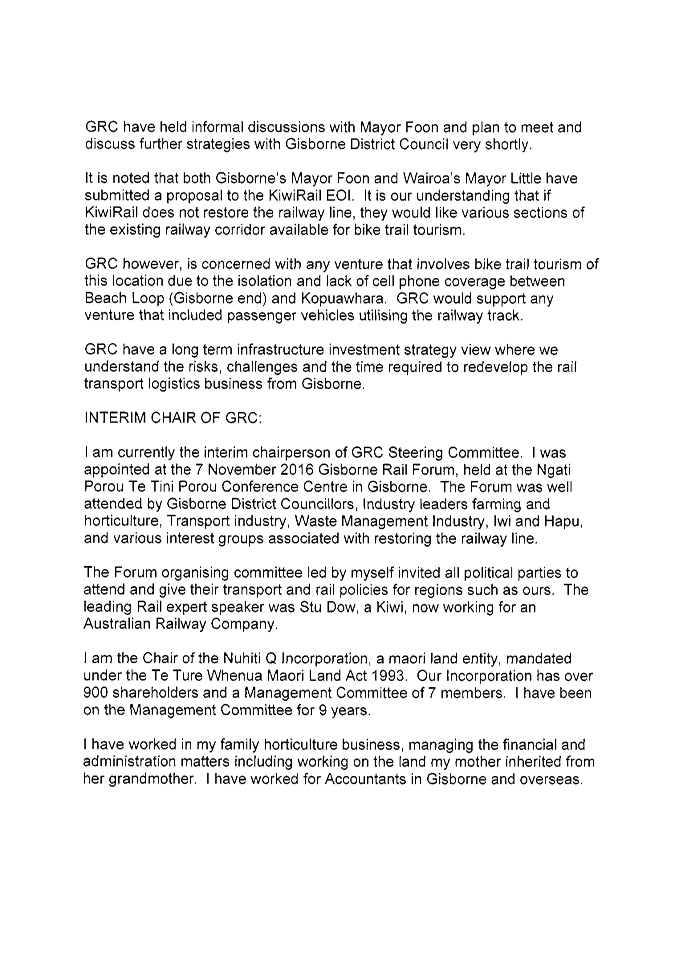

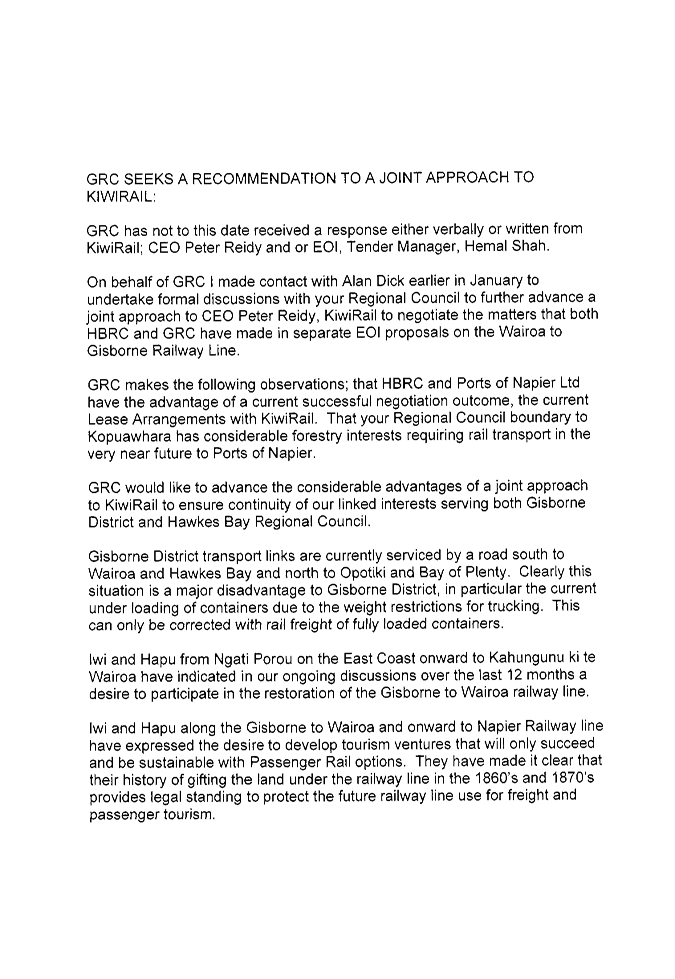

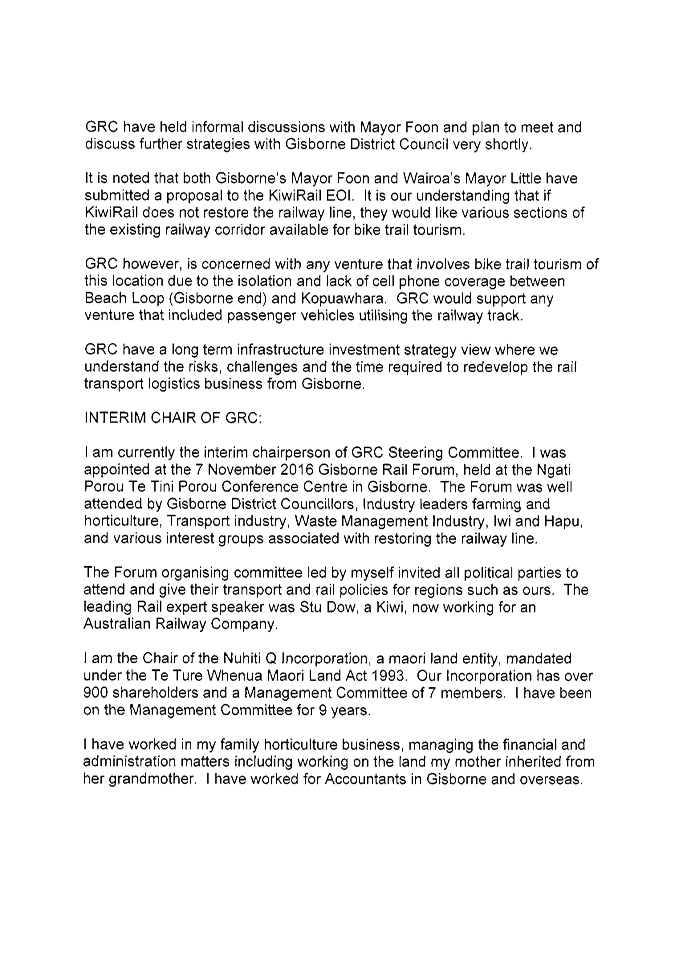

5. The Gisborne

Rail Cooperative (GRC) is an organisation formed to work towards gaining the

reopening of the Gisborne end of the Napier-Gisborne line for freight as well

as for tourism services. They have sought the support of HBRC to make a joint

approach to KiwiRail for consideration of their proposal,

6. The Chair of

the GRC Steering Committee, Nikki Searancke, will be attending the Corporate

and Strategic Committee meeting to speak to their proposal.

7. A copy of a

letter from GRC is appended as Attachment 1.

Financial and Resource Implications

8. As no funding

is being sought from HBRC there are no financial implications.

Decision Making

Process

9. Council is required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have

assessed the requirements in relation to this item and have concluded:

9.1. The decision does not significantly alter the service provision or

affect a strategic asset.

9.2. The use of the special consultative procedure is not prescribed by

legislation.

9.3. The decision does not fall within the definition of Council’s

policy on significance.

9.4. The persons

affected by this decision are residents and businesses of northern

Hawke’s Bay particularly and transport users more widely.

9.5. Options that have been considered include not offering

support to the Gisborne Rail Cooperative.

9.6. The decision is not inconsistent with an existing policy or plan.

9.7. Given the nature and significance of the issue to be considered and

decided, and also the persons likely to be affected by, or have an interest in

the decisions made, Council can exercise its discretion and make a decision

without consulting directly with the community or others having an

interest in the decision.

|

Recommendations

1. That the Corporate and Strategic Committee receives and notes the

“Wairoa – Gisborne Rail Corridor” report and the presentation from representatives of the Gisborne Rail

Cooperative.

2. The Corporate and Strategic Committee recommends that Council:

2.1. Agrees that the decision to be made is not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that Council can exercise its discretion and make a decision

without conferring directly with the community and persons likely to be affected

by or to have an interest in the decision.

2.2. Continues to offer its support for the preservation of rail

freight options for the Wairoa to Gisborne section of the Napier-Gisborne

rail line.

|

Authored and Approved

by:

|

Liz Lambert

Group Manager

External Relations

|

|

Attachment/s

|

1

|

Gisborne Rail

Cooperative Letter

|

|

|

|

Gisborne

Rail Collective Letter

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 15 February 2017

Subject: HBRC – ACC: Sale

of Leasehold Land Cashflows

Reason for Report

1. This report provides details of the ACC cash flow arrangement and

related figures for freehold sales as requested by councillors.

Objectives

2. HBRC’s

objectives in selling the cash flows receivable from its leasehold land

properties in Napier to ACC were to:

3. Provide funds

from an otherwise illiquid asset for investment in other investments likely to

help achieve HBRC’s goals of development of the Hawke’s Bay

region’s economy.

3.1. Improve

return from the leasehold land portfolio that was running at around 2% pa at

the time of the deal with ACC.

3.2. Maintain the

rights of leaseholders under their leases and the Hawke’s Bay Endowment

Land Empowering Act 2002 (HBELEA) limiting sale of freeholds to lessees (or

their nominees) only.

4. Retain ownership and management of the underlying assets.

Agreement with ACC

5. On 17 December

2013 HBRC and ACC executed an Agreement for HBRC to sell the net cashflows

(i.e. after costs of management) receivable from HBRC’s leasehold land

tenants for the period 1 July 2013 to 30 June 2063 (50 years) to ACC for a net

price of $37.651 million. Key elements of the agreement are:

5.1. HBRC retains

ownership of the leasehold properties and manages the portfolio as it had done

prior to sale.

5.2. It is subject

to the HBELEA which limits the sale of freeholds to lessees (or their nominees)

only, at a price equivalent to the lessor’s interest in the relevant

property at the date of sale as determined by independent valuation.

5.3. It sets

minimum net rents payable to ACC, based on rents expected, after deducting

management costs, for the year ended 30 June 2014, and increased each

subsequent year by an independently assessed (by Telfer Young & Co) 1.5% pa

over the term of the Agreement.

5.4. HBRC’s

costs of managing the portfolio are deducted from gross rents before payment is

made to ACC. Costs are determined by a formula under the agreement and are also

assumed to grow over the period at the rate of 1.5% pa.

5.5. Sales of

properties to lessees in accordance with the terms of the HBELEA carry on

unchanged. HBRC collects the sale price of each property and pays to ACC the

net present value of future rents assumed to be payable had the property not

been freeholded.

5.6. Minimum net

rents for the whole portfolio are reset (effectively reduced) every time a

property is freeholded and leaves the portfolio.

5.7. HBRC has a

profit share arrangement under the Agreement with ACC which pays HBRC one-third

of actual rents received in excess of the agreed minimum rents in each year

plus one-third of the sale prices of properties freeholded in excess of the net

present value.

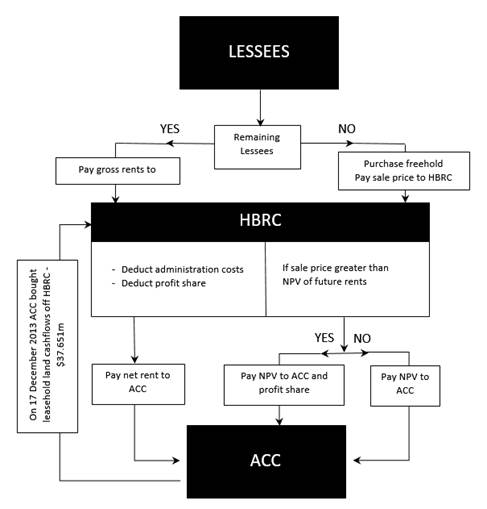

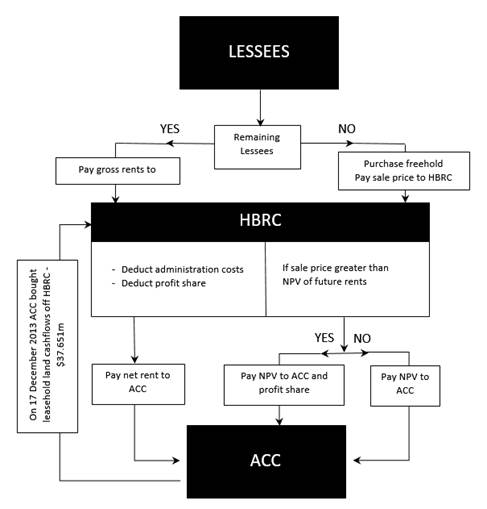

6. Figure 1 below illustrates the way in which this Agreement works,

showing that proceeds received by HBRC from lessee payments of gross rents and

payments when they purchase the freehold of their leasehold property cover

payments to ACC of net rents and proceeds of freehold sales, leaving the

original purchase price of $37.651 million fully available to HBRC for

other investment.

Figure 1:

HBRC-ACC Agreement Cash Flows

Performance to Date

7. HBRC received

$37.651 million plus interest in December 2013. These funds have been held on

deposit, earning interest and earmarked for other investment within

HBRC’s investment portfolio, since receipt.

8. Rents have been

collected by HBRC and paid to ACC (net of costs) twice yearly in accordance

with the terms of the Agreement.

9. HBRC continues

to manage the portfolio undertaking rent renewals, collecting rent arrears and

resolving any other issues with lessees as it has done in the past.

10. Sales of freeholds to

lessees have continued since July 2013 in accordance with the terms of the

HBELEA.

11. The following table

summarises the transactions that have occurred in the portfolio on a year by

year basis over the period 1 July 2013 to 31 December 2016.

Table 1: HBRC

- ACC Leasehold Land Transactions Summary 1 July 2013 to 31 December 2016

|

Year

|

Number of Lessees

|

Freeholds Sold

|

Minimum Rents Due Next Year $000

|

Value of Remaining Properties $000

|

|

Number Sold (Lessees)

|

Sale Price

$000

|

HBRC Profit Share $000

|

Amount Paid to ACC

$000

|

|

Opening

1 Jul

2013

|

628

|

N/A

|

N/A

|

N/A

|

N/A

|

1,722

|

48,000

|

|

30

Jun 2014

|

594

|

34

|

3,288

|

66

|

3,222

|

1,703

|

45,500

|

|

30

Jun 2015

|

549

|

45

|

4,158

|

64

|

4,094

|

1,646

|

40,100

|

|

30

Jun 2016

|

482

|

67

|

6,532

|

94

|

6,438

|

1,365

|

36,200

|

|

31

Dec 2016

|

431

|

51

|

5,077

|

98

|

4,979

|

1,099

|

30,700*

|

|

TOTALS

|

|

197

|

19,055

|

322

|

18,733

|

|

|

Sources: HBRC, Telfer Young

& Co (values of properties 1/07/2013 - 30/06/2016 inclusive)

Notes: * HBRC estimate

12. Table 1 shows:

12.1. Around 31% of the

portfolio has been sold to lessees since 1 July 2013 (197 lessees), and

the rate of sale is accelerating. This likely reflects the availability of

mortgage finance and financing costs falling below rate of rental increases

(5% ‑ 6.25%) provided for in HBRC’s leases with lessees.

12.2. ACC has received

payments from freeholds sold equal to around 50% of the purchase price it paid

HBRC.

12.3. The remaining properties

still have significant value for HBRC. At 30 June 2016 these assets were

independently valued at $36.2 million.

Summary

13. HBRC’s agreement

with ACC provided almost $38 million in cash for alternative investment in its

portfolio. This cash is still available to HBRC today.

14. Rental payments to ACC

have been fully funded by rents received from lessees.

15. Sales proceeds received from

lessees freeholding properties have been received and paid to ACC.

16. Around 31% of properties

have been freeholded since July 2013, leaving 69% (431 lessees) of those owned

by HBRC at the commencement of the Agreement (628 lessees) still owned by HBRC.

17. Net receipts by HBRC (i.e.

gross receipts of rents and sale proceeds of freeholds paid to HBRC) exceeded

total payments to ACC since 1 July 2013 by around $1 million – this sum

representing a profit share on rentals and freeholding. This is additional to

purchase price of $38 million paid by ACC.

18. Substantial value remains

for HBRC in the remaining properties.

19. At the end of the

agreement with ACC (Year 2063), the Napier leasehold reverts back to HBRC and

all rentals accrue to HBRC.

20. To date

HBRC’s objectives in making the agreement with ACC have been met.

Decision Making

Process

21. Staff have assessed the

requirements of the Local Government Act 2002 in relation to this item and have

concluded that, as this report is for information only, the decision making

provisions do not apply.

|

Recommendation

That the Corporate and Strategic Committee

receives and notes the “HBRC – ACC: Sale

of Leasehold Land Cashflows” report.

|

Authored by:

|

Trudy

Kilkolly

Financial Accountant

|

|

Approved by:

|

Paul Drury

Group Manager

Corporate Services

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 15 February 2017

Subject: Discussion of Items Not

on the Agenda

Reason for Report

1. This document has been prepared to assist

Committee Members to note the Items of Business Not on

the Agenda to be discussed as determined earlier in Agenda

Item 4.

1.1. Urgent items of Business (supported by tabled CE or Chairman’s

report)

|

|

Item

Name

|

Reason not on Agenda

|

Reason discussion cannot be delayed

|

|

1.

|

|

|

|

|

2.

|

|

|

|

1.2. Minor items (for discussion only)

|

Item

|

Topic

|

Councillor

/ Staff

|

|

1.

|

|

|

|

2.

|

|

|

|

3.

|

|

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 15 February 2017

Subject: Recommendations from

the Finance Audit & Risk Sub-committee

That Council excludes the public

from this section of the meeting, being Agenda Item 13 Recommendations from the

Finance Audit & Risk Sub-committee with the general subject of the item to

be considered while the public is excluded; the reasons for passing the

resolution and the specific grounds under Section 48 (1) of the Local

Government Official Information and Meetings Act 1987 for the passing of this

resolution being:

|

GENERAL SUBJECT OF THE ITEM TO BE

CONSIDERED

|

REASON FOR PASSING THIS RESOLUTION

|

GROUNDS UNDER SECTION 48(1) FOR THE

PASSING OF THE RESOLUTION

|

|

Recommendations from the Finance Audit & Risk

Sub-committee

|

7(2)(a) That the public conduct of this agenda item would

be likely to result in the disclosure of information where the withholding of

the information is necessary to protect the privacy of natural persons.

|

The Council is specified, in the First Schedule to this

Act, as a body to which the Act applies.

|

Authored by:

|

Judy Buttery

Governance Administration Assistant

|

|

Approved by:

|

Liz Lambert

Group Manager

External Relations

|

|